Opening Update: May 4, 2023

All prices as of 6:30 am Central Time

|

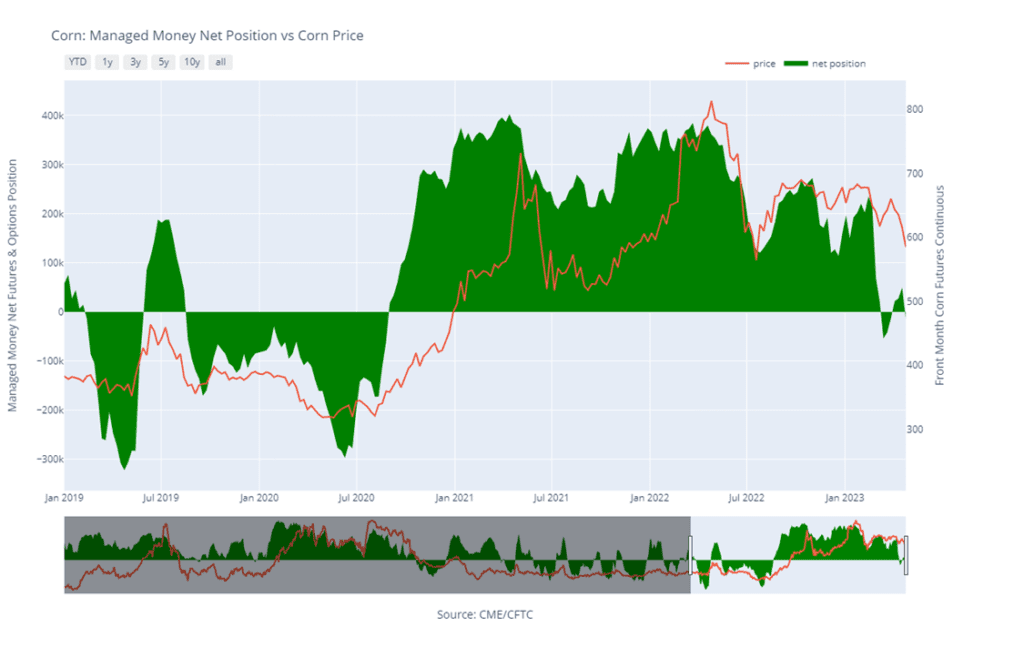

Corn |

||

| JUL ’23 | 585.5 |

-3 |

| DEC ’23 | 527 |

-3.5 |

| DEC ’24 | 519.25 |

-1.25 |

|

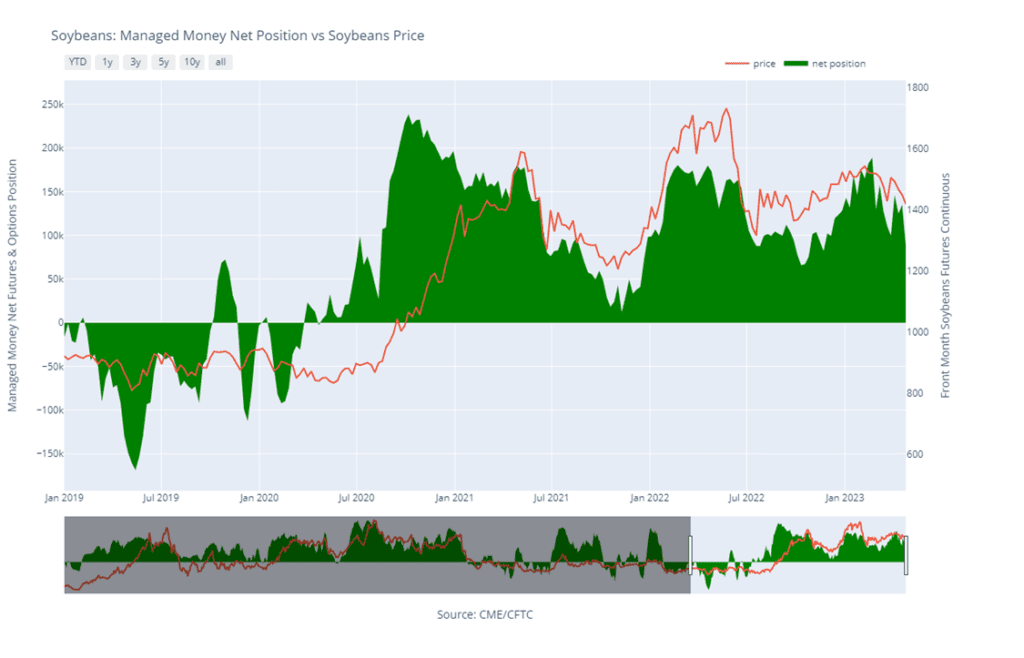

Soybeans |

||

| JUL ’23 | 1413 |

-4.5 |

| NOV ’23 | 1265 |

-7.25 |

| NOV ’24 | 1235.5 |

-3.25 |

|

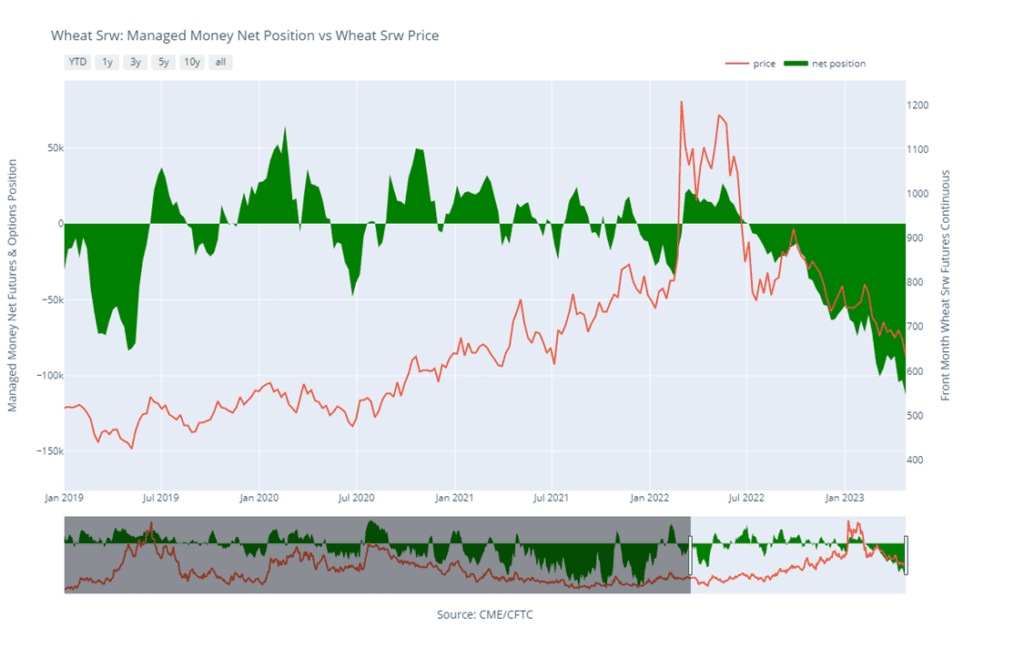

Chicago Wheat |

||

| JUL ’23 | 635.75 |

-4 |

| SEP ’23 | 647 |

-3.75 |

| JUL ’24 | 683 |

-1.5 |

|

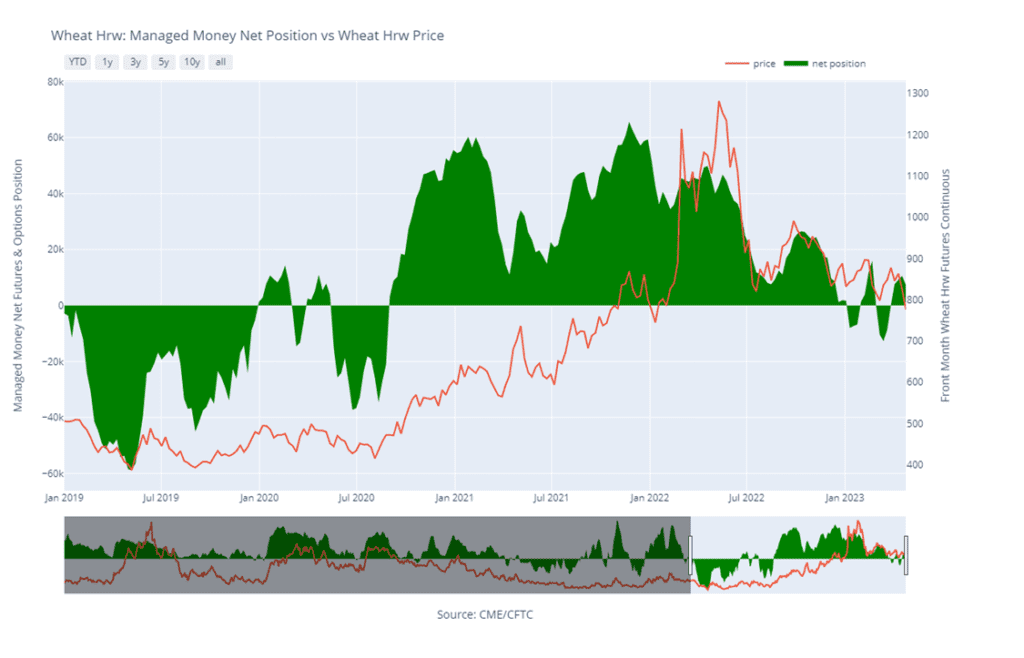

K.C. Wheat |

||

| JUL ’23 | 777.25 |

-7.75 |

| SEP ’23 | 770.75 |

-7.25 |

| JUL ’24 | 760.75 |

-2 |

|

Mpls Wheat |

||

| JUL ’23 | 798.75 |

-4.75 |

| SEP ’23 | 805.5 |

-1.5 |

| SEP ’24 | 762.5 |

2.5 |

|

S&P 500 |

||

| JUN ’23 | 4092 |

-15.5 |

|

Crude Oil |

||

| JUL ’23 | 68.46 |

-0.09 |

|

Gold |

||

| AUG ’23 | 2069.7 |

13.5 |

- Corn is a bit lower this morning after rallying yesterday following an alleged assassination attempt by Ukraine on Vladimir Putin and attack on the Kremlin. No one was hurt and it is unclear who was behind the attack.

- Estimates for today’s export sales report for corn are between negative 300k and 900k tons with an average of 175k. Net sales cancellations could pressure prices.

- Ethanol stocks have fallen by 3.9% to 23.363 mln bbl while analysts were expecting 24.423. Plant production is at 0.976 m b/d vs the survey average of 0.963 m

- Unfavorable weather and harvest delays have cut Argentinian corn production with an average estimate of 34.6 mmt, down 1% from the previous update.

- Soybeans are trading lower this morning but essentially have gone nowhere in the past week despite plenty of volatility. Both soybean meal and oil are lower while crude oil is slightly lower.

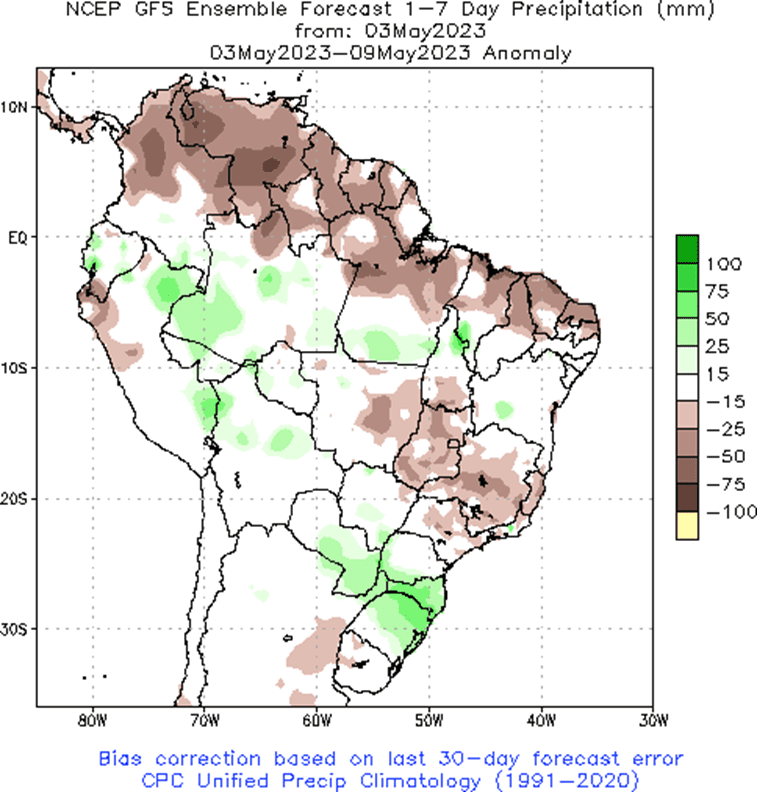

- Estimates for today’s USDA export sales report in soybeans are between 100k and 500k tons with an average of 332k. Good exports for soybeans may begin to trend slightly higher as Brazilian farmers begin to slow sales.

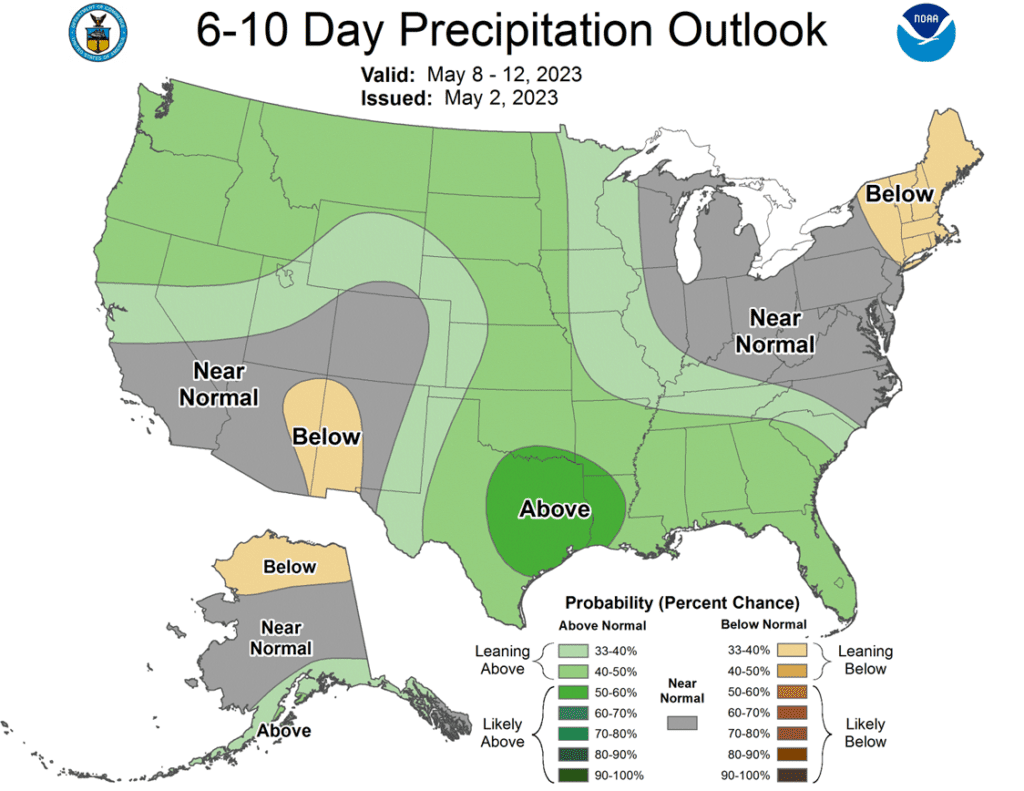

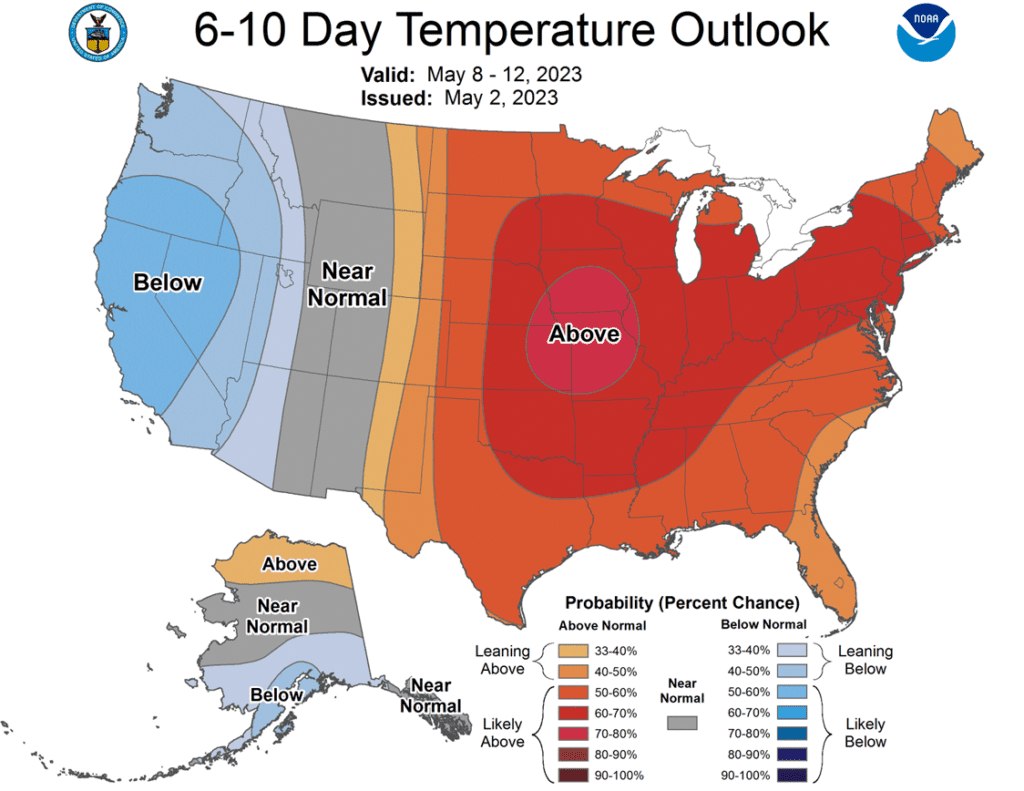

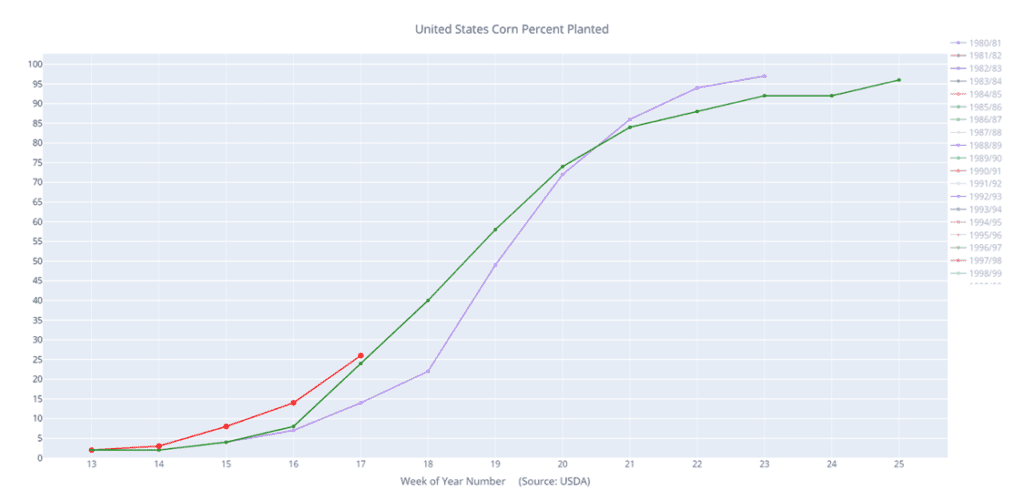

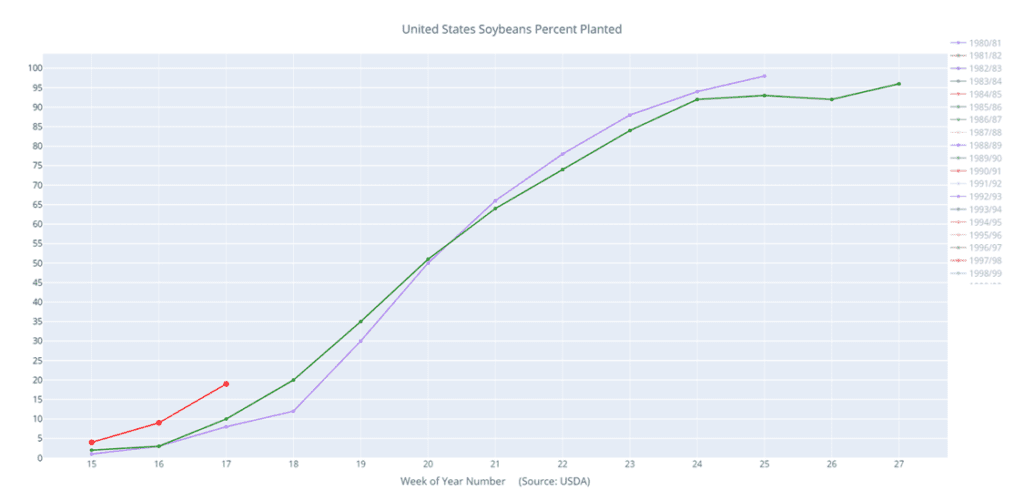

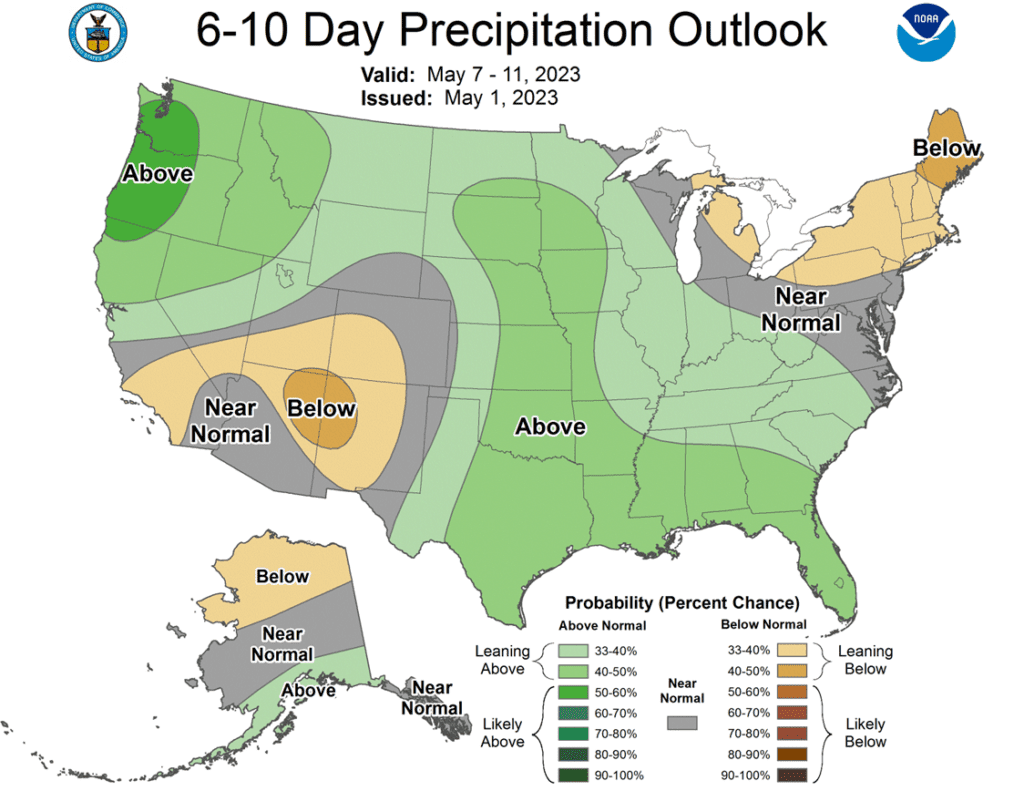

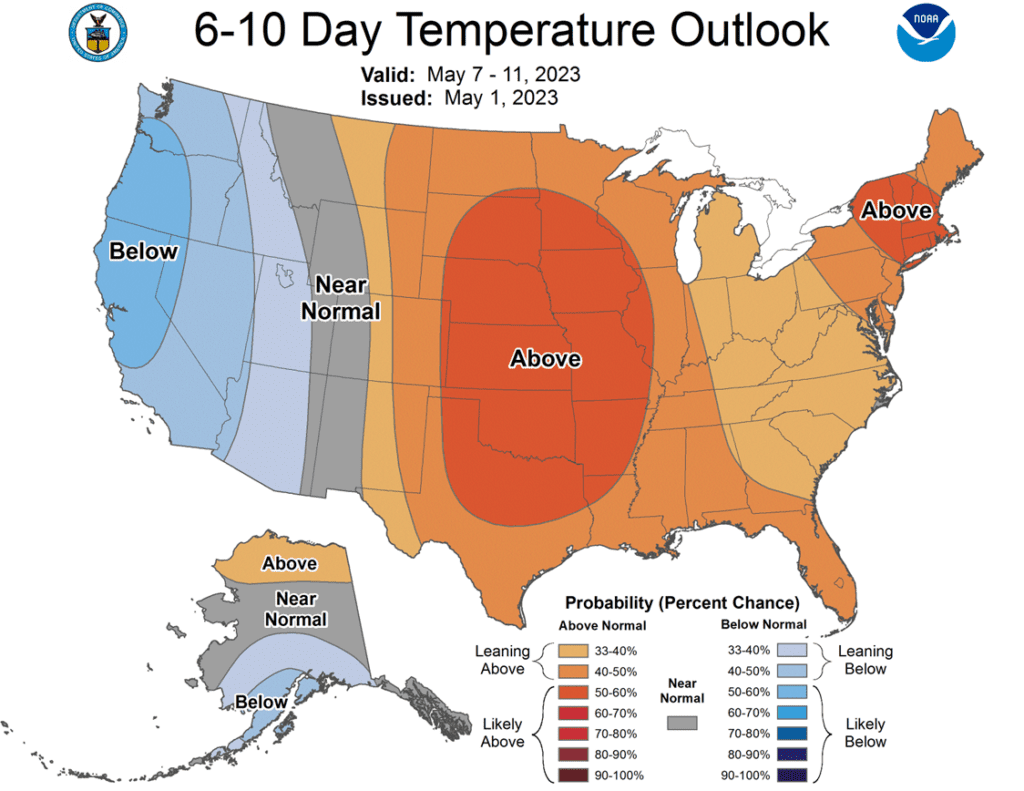

- The 6-day forecast for most of the Corn Belt calls for slightly above average precipitation but warmer than normal temperatures with the warm temperatures moving North as well.

- July soybean meal closed at a new 5-month low yesterday and crush premiums have continued to slide lower, near the lowest in a year.

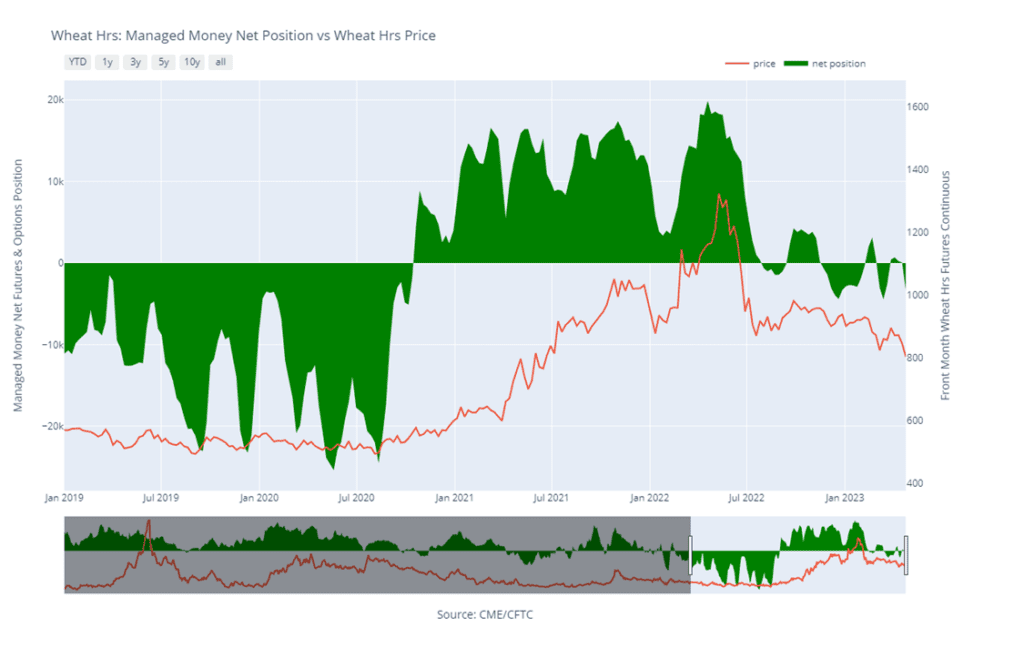

- Wheat rallied sharply yesterday after the Kremlin accused Ukraine of launching a drone attack in order to assassinate Putin. The attack was shot down and no one was hurt, but it is unclear if Ukraine was even involved.

- The deadline for the Black Sea grain deal is approaching on May 18, and yesterday’s stunt doesn’t lend much confidence that Russia will agree to extend the deal.

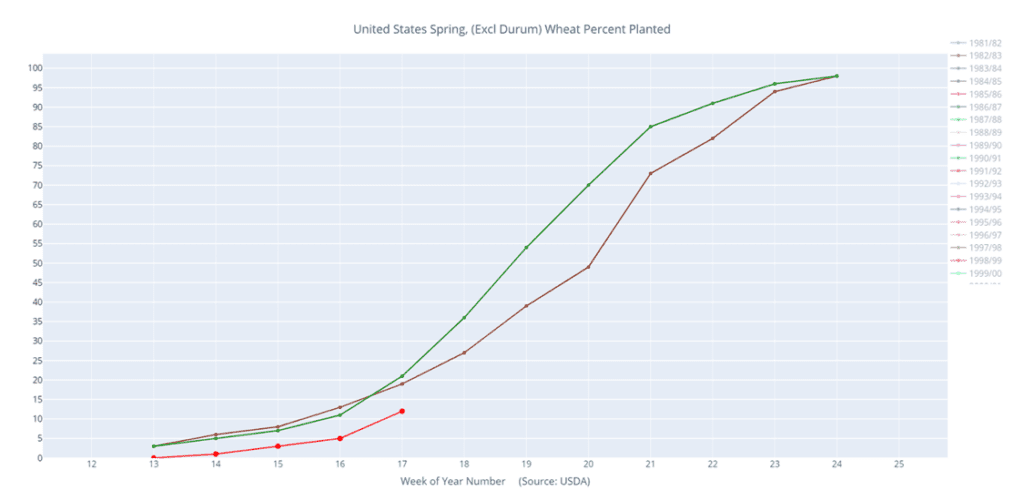

- Ukraine’s next wheat crop is expected to be the lowest since 2012/13 at just 15.04 mmt, and yield estimates are below the 5-year average.

- Adding more support to the wheat complex yesterday was the crop tour which expects Oklahoma to raise the smallest wheat crop since 1955 due to the extreme drought.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.