Opening Update: May 30, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| JUL ’23 | 604 | 0 |

| DEC ’23 | 531 | -3.5 |

| DEC ’24 | 510 | -3.25 |

|

Soybeans |

||

| JUL ’23 | 1324.25 | -13 |

| NOV ’23 | 1176.5 | -13 |

| NOV ’24 | 1150 | -10.75 |

|

Chicago Wheat |

||

| JUL ’23 | 607.75 | -8.25 |

| SEP ’23 | 622 | -7.5 |

| JUL ’24 | 665.25 | -7.75 |

|

K.C. Wheat |

||

| JUL ’23 | 803.25 | -16 |

| SEP ’23 | 798 | -16.25 |

| JUL ’24 | 763 | -3.5 |

|

Mpls Wheat |

||

| JUL ’23 | 809 | -9 |

| SEP ’23 | 810 | -9.25 |

| SEP ’24 | 783.5 | 9.25 |

|

S&P 500 |

||

| JUN ’23 | 4231.5 | 18.25 |

|

Crude Oil |

||

| JUL ’23 | 71.82 | -0.85 |

|

Gold |

||

| AUG ’23 | 1974.2 | 11.1 |

- Corn is trading quietly with front month July slightly higher but deferred months a bit lower.

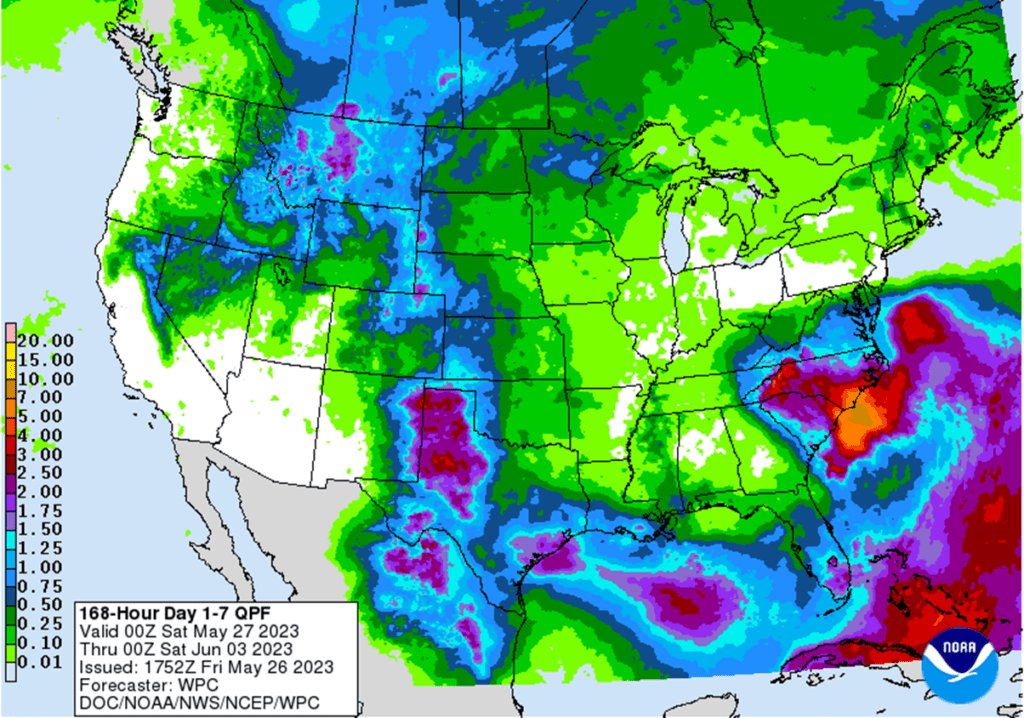

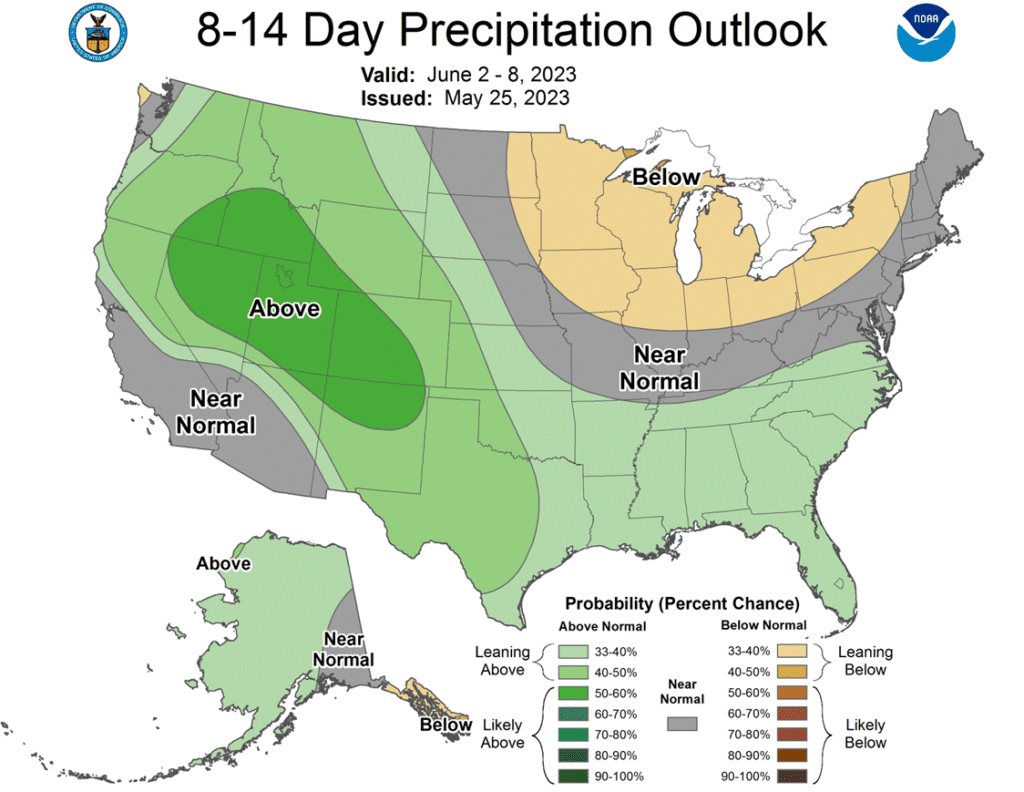

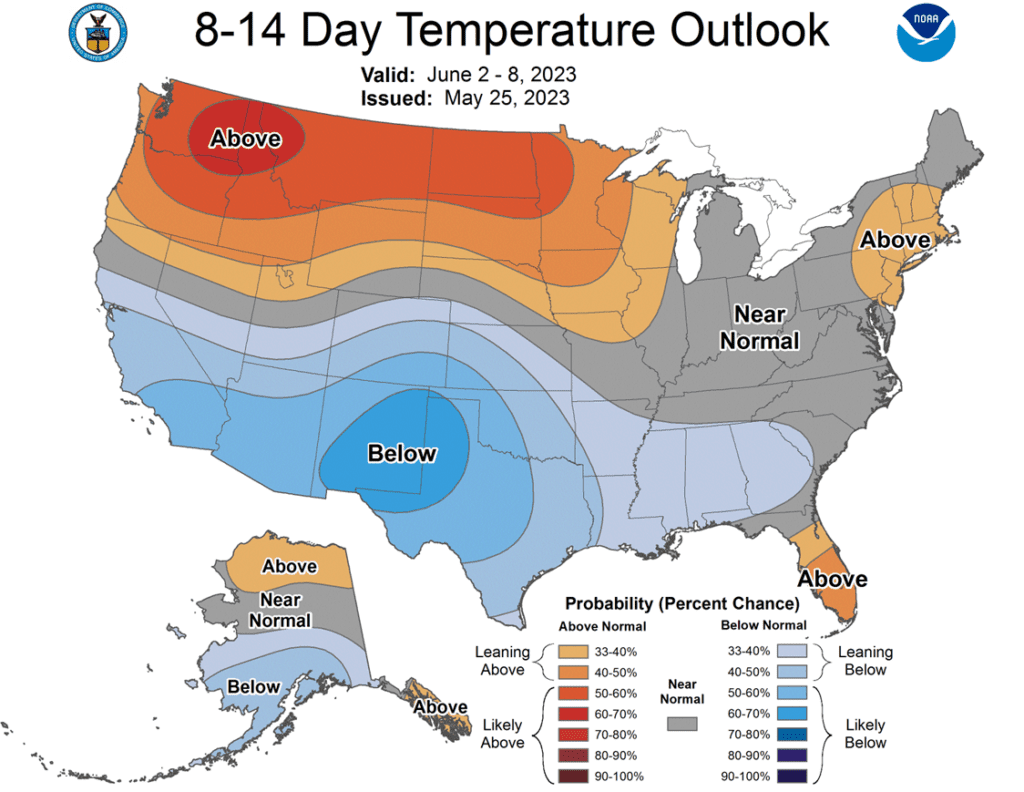

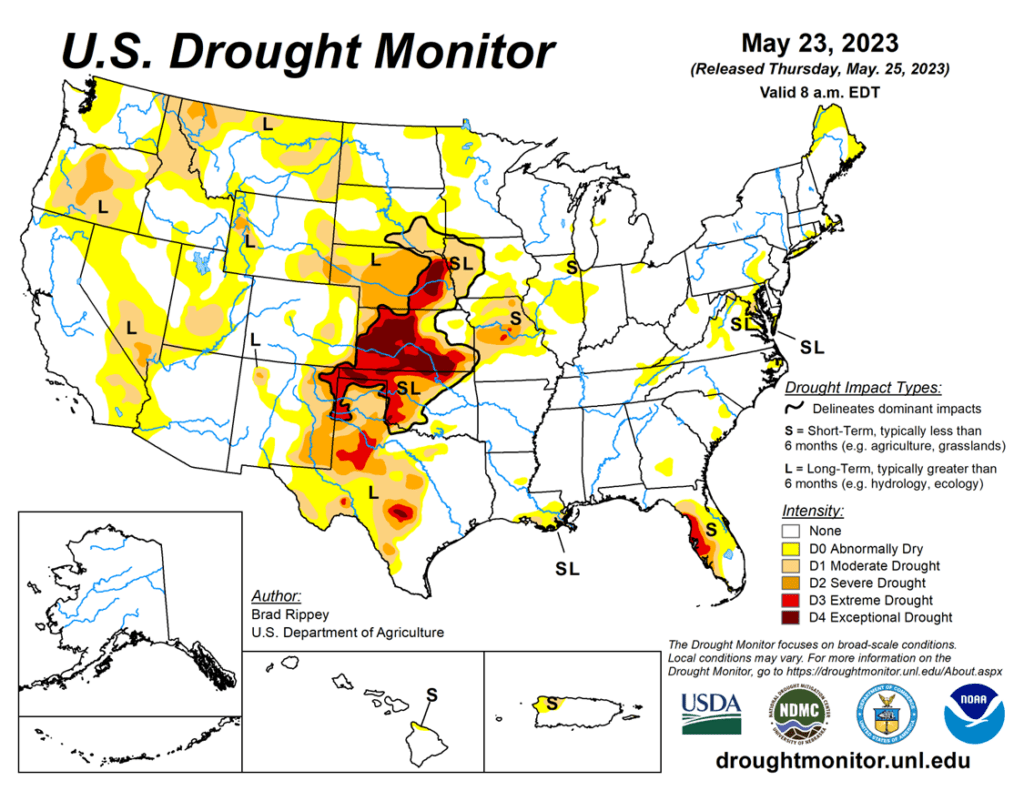

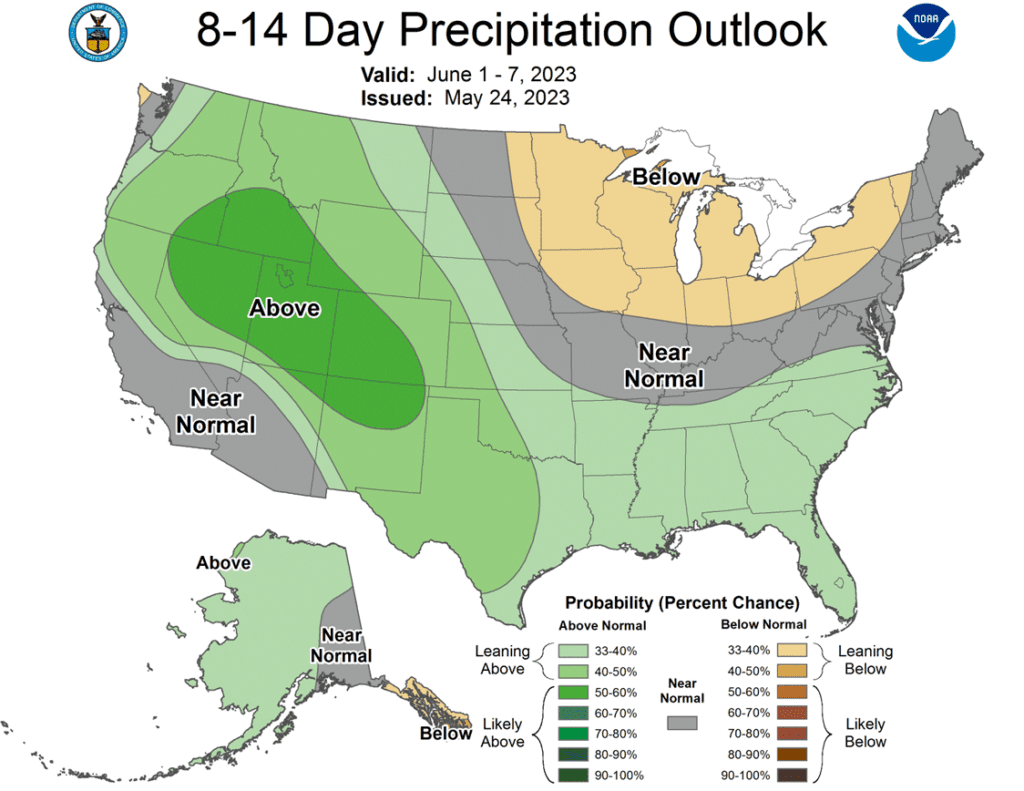

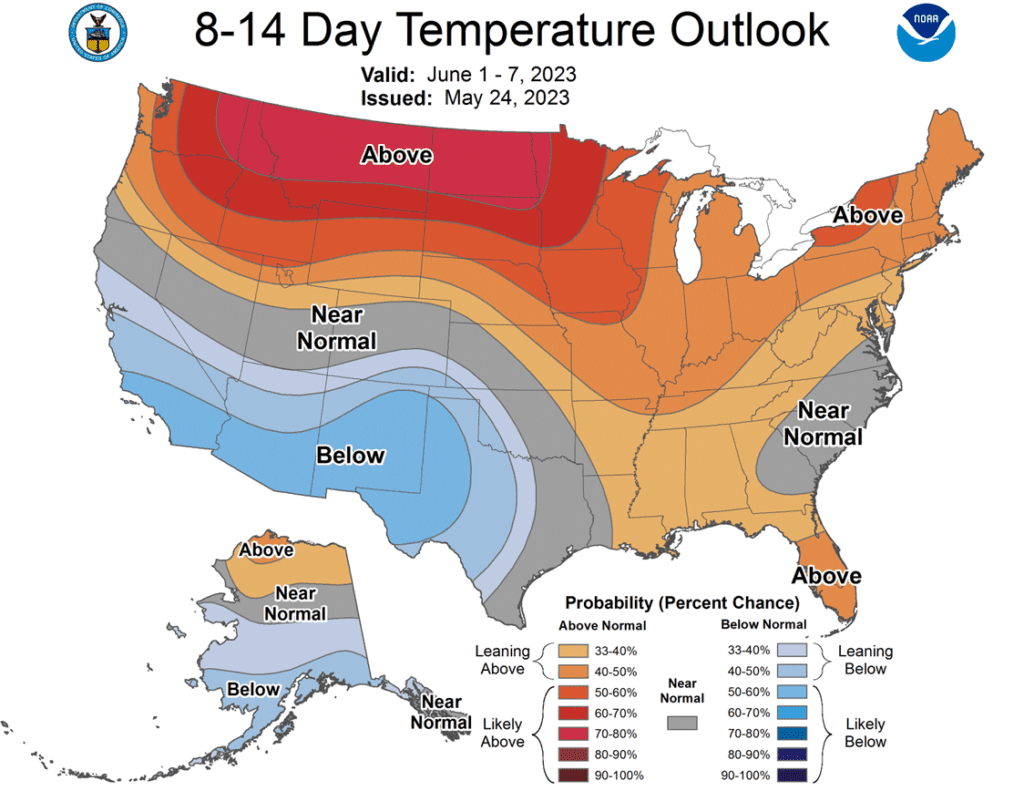

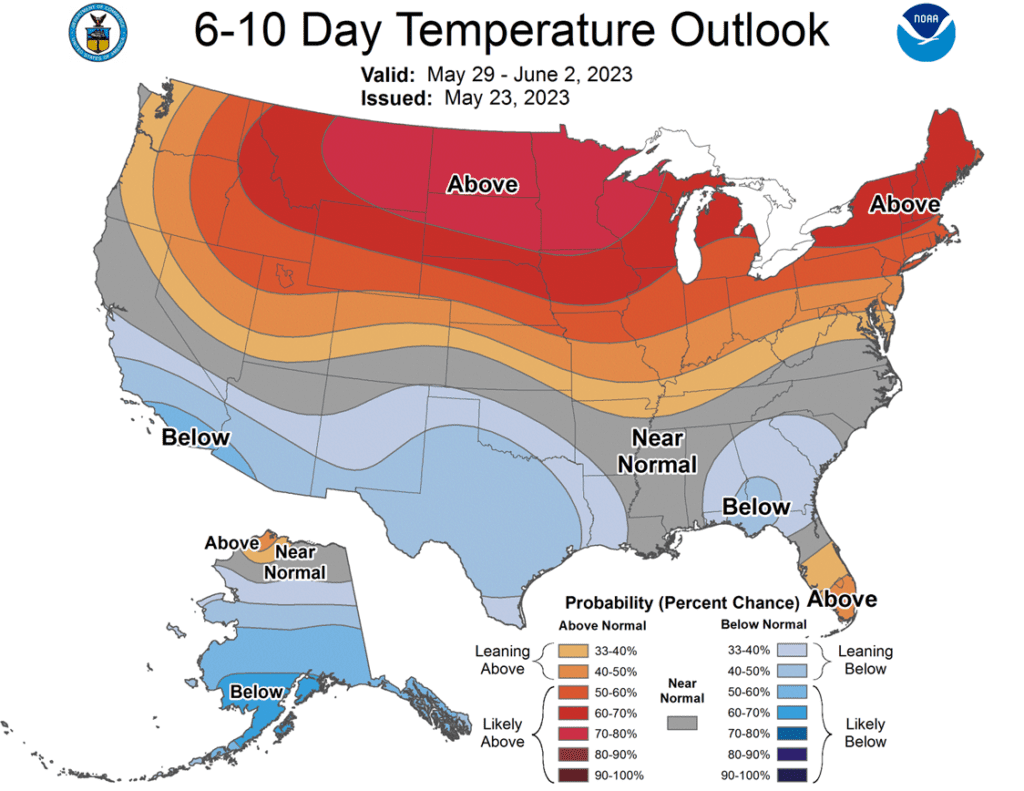

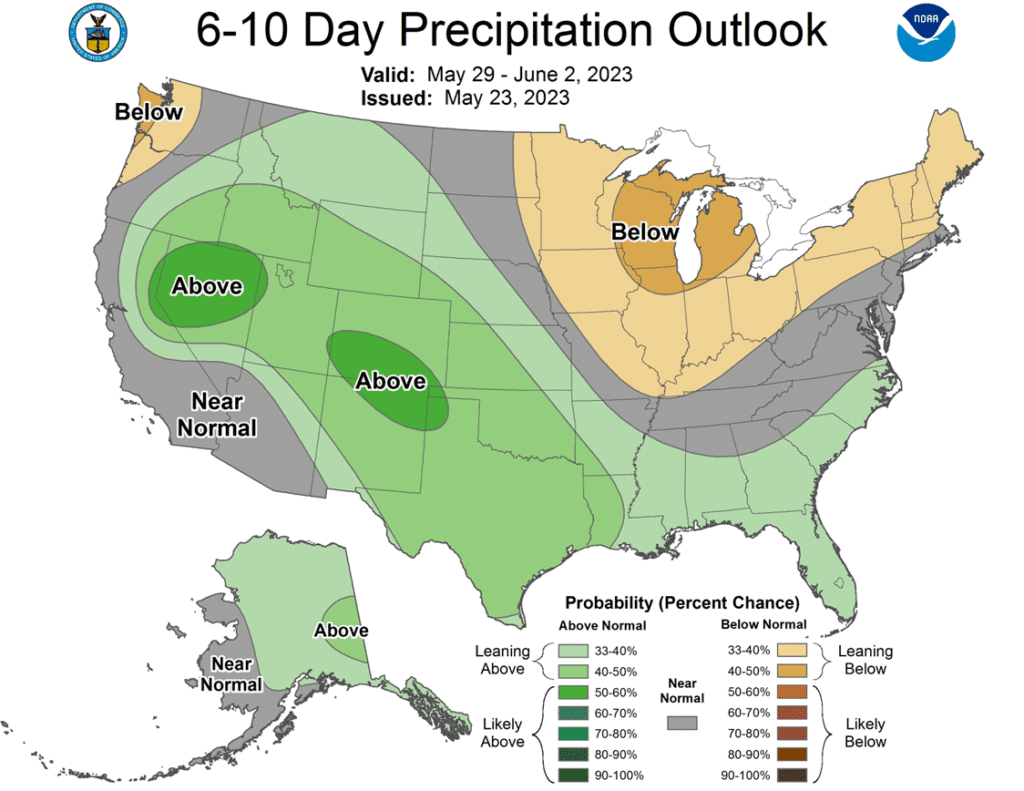

- Weather forecasts have begun to show models turning cool and wet for the second half of June, but it should remain dry before then.

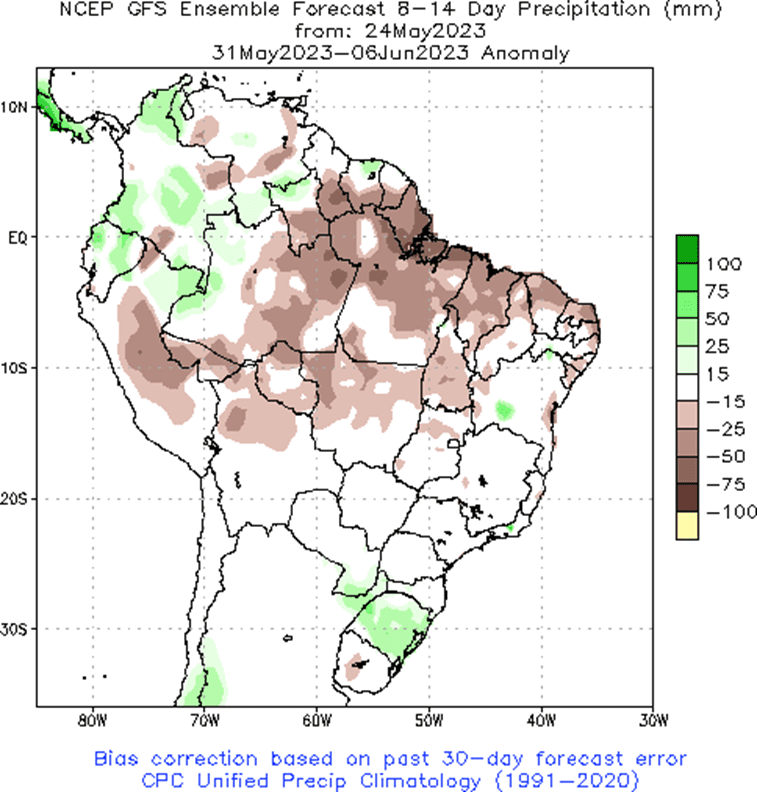

- Brazil’s corn production has been estimated higher to 137 mmt by Safras & Mercado, and their previous estimate was 130 mmt.

- July corn on the Bovespa exchange in Brazil ended at the equivalent of $4.95 while July corn on the Dalian exchange was lower at the equivalent of $9.38 a bushel, down 7% on the year.

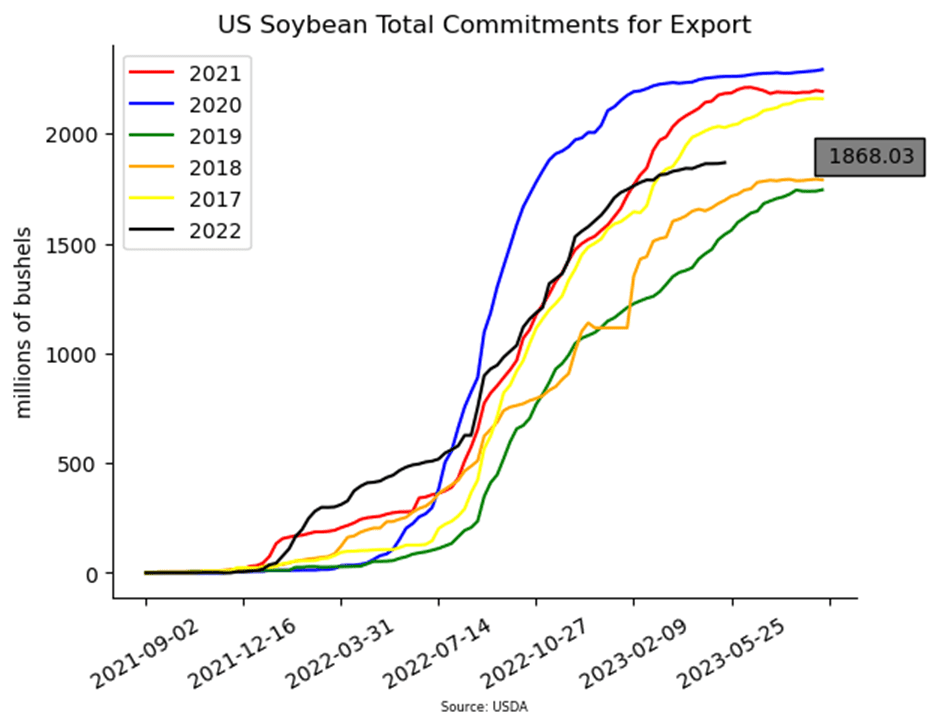

- Soybeans and both soy products are lower this morning as well as crude oil, possibly due to the favorable forecast in the second half of June.

- For the moment, trade appears to be expecting a record crop from the US and has already priced in Brazil’s record crop, but weather could still be a factor in the US.

- Soybean meal is taking a hit this morning and is still under pressure from California’s Proposition 12 requirements.

- Friday’s CFTC data showed funds as sellers of soybeans by 19,795 contracts reducing their net long position to just 4,147 contracts.

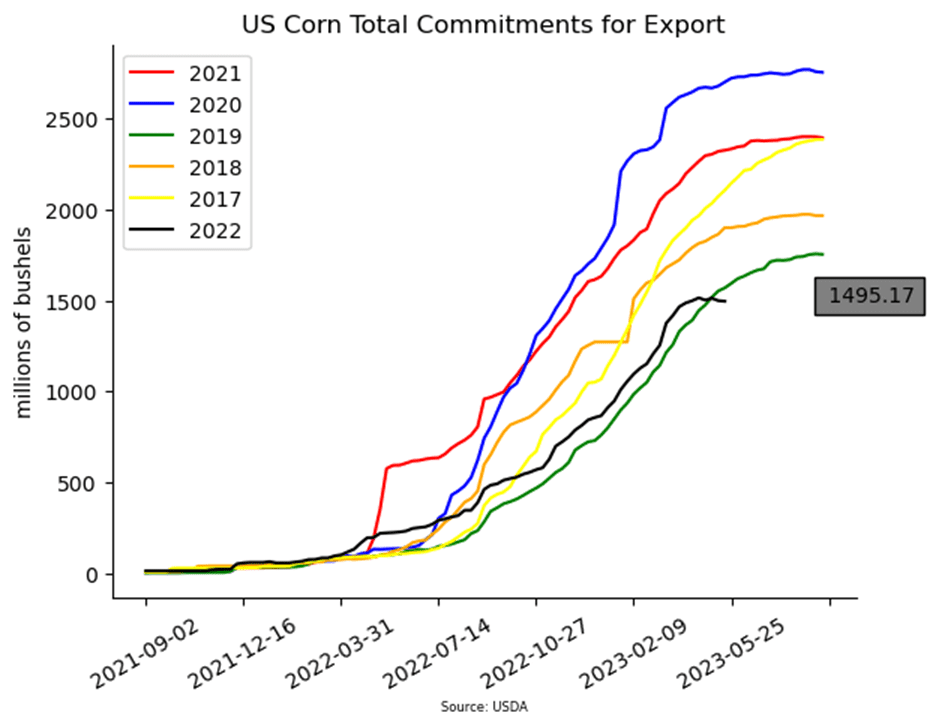

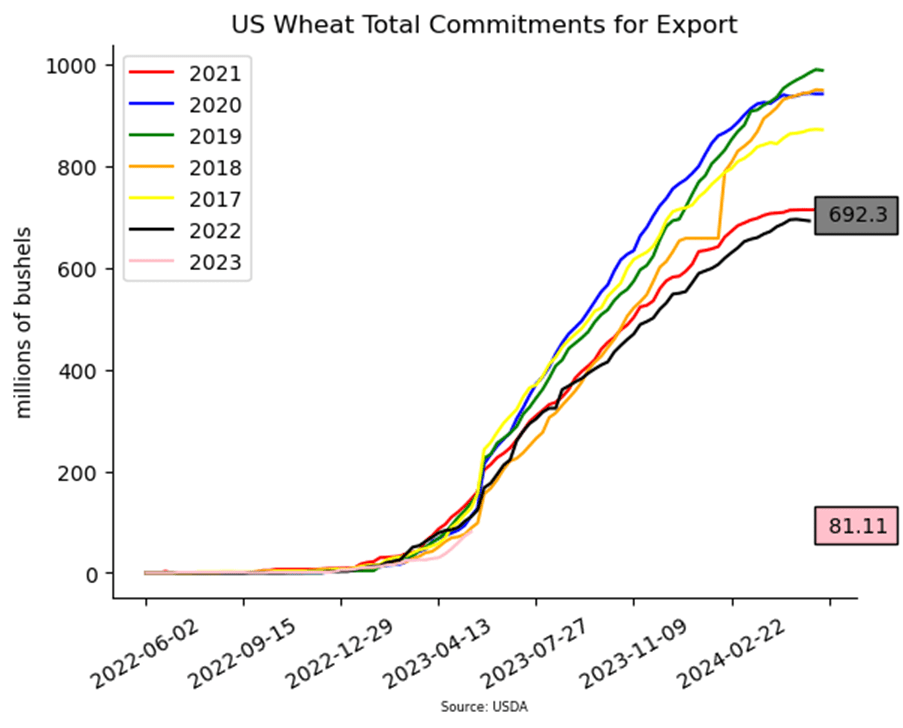

- Wheat is trading lower along with the rest of the grain complex as recent rains in HRW wheat areas have fallen, and export demand remains poor.

- Russia reportedly attacked central Ukraine with Iranian drones on Sunday which was the 1,500th anniversary of Ukraine’s capital. Attacks were also directed at the port of Odesa.

- Crop exports out of the Black Sea corridor are the slowest they have been since the agreement was originally struck with only 3 vessels being completed for inspections per day.

- Friday’s CFTC report showed funds adding to their net short position. They sold 6,019 contracts increasing their short position to 118,788 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.