Midday Update June 2, 2023

All prices as of 10:30 am Central Tim

|

Corn |

||

| JUL ’23 | 587.25 | -5.25 |

| DEC ’23 | 527.5 | -2.5 |

| DEC ’24 | 509 | -1.5 |

|

Soybeans |

||

| JUL ’23 | 1345.75 | 16.25 |

| NOV ’23 | 1178.25 | 9.25 |

| NOV ’24 | 1145.75 | 10.75 |

|

Chicago Wheat |

||

| JUL ’23 | 607 | -3.75 |

| SEP ’23 | 620.5 | -3.75 |

| JUL ’24 | 672.25 | -0.5 |

|

K.C. Wheat |

||

| JUL ’23 | 794.25 | -8.25 |

| SEP ’23 | 790.5 | -7 |

| JUL ’24 | 763 | -8 |

|

Mpls Wheat |

||

| JUL ’23 | 794.75 | 5.75 |

| SEP ’23 | 793.25 | 2.5 |

| SEP ’24 | 767.25 | 6 |

|

S&P 500 |

||

| SEP ’23 | 4327 | 57.25 |

|

Crude Oil |

||

| AUG ’23 | 71.77 | 1.57 |

|

Gold |

||

| AUG ’23 | 1979.7 | -15.8 |

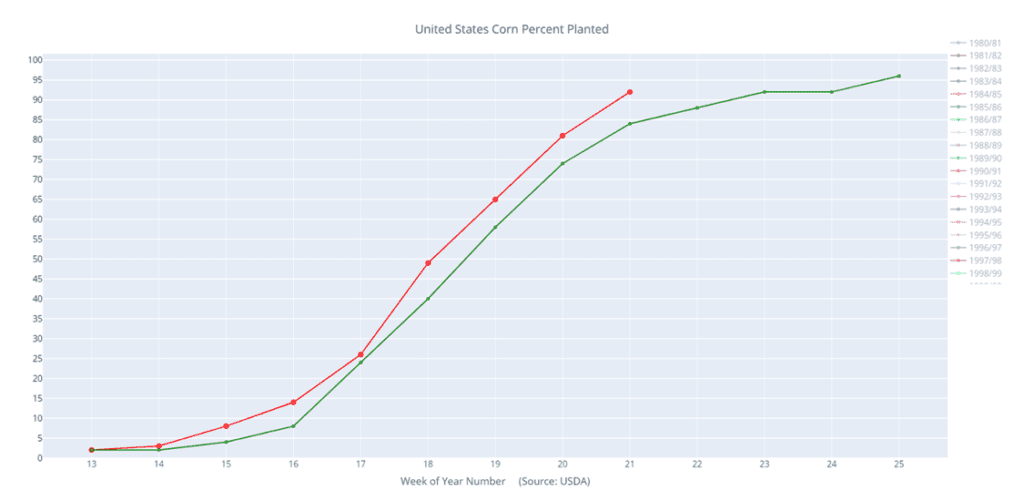

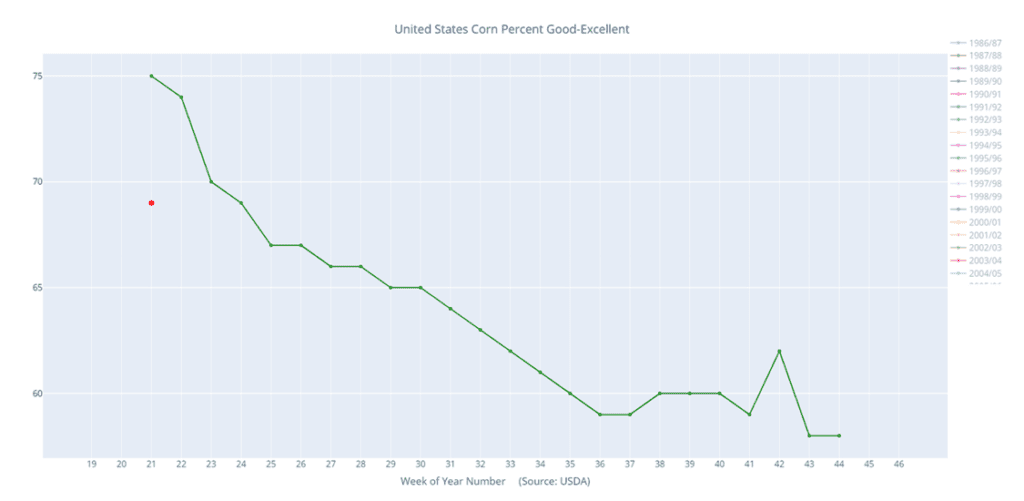

- The USDA reported an increase of 7.4 mb of corn export sales for 22/23 and an increase of 12.3 mb for 23/24.

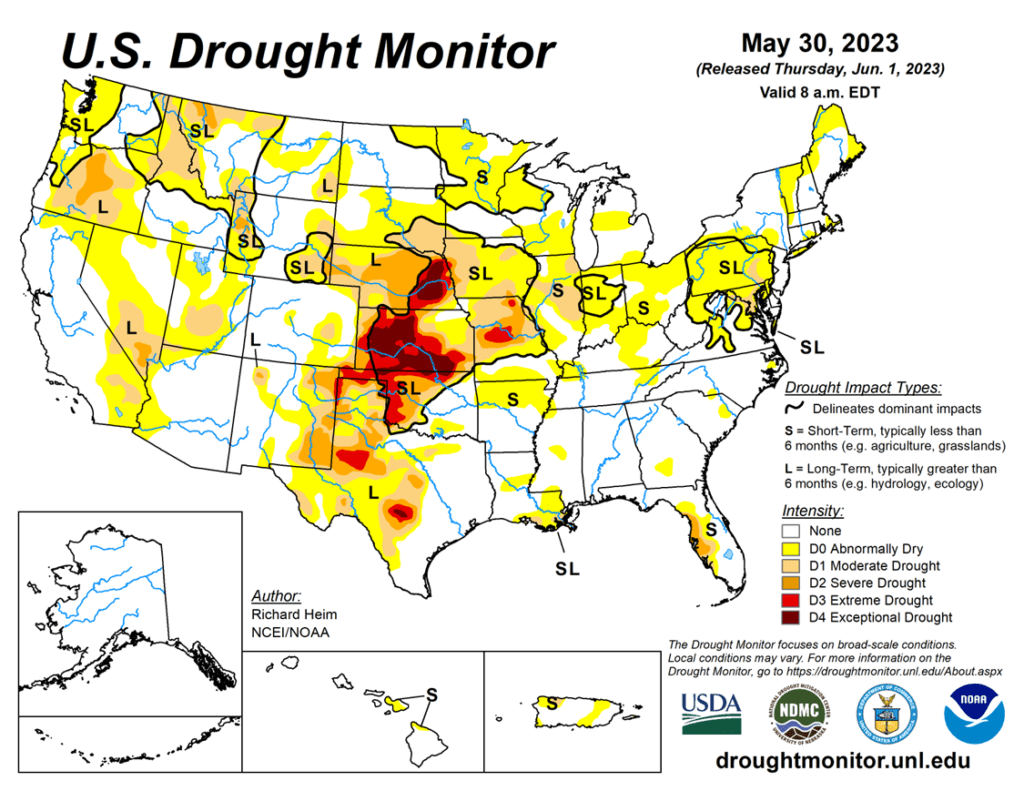

- According to the USDA, about 34% of US corn production areas are in drought as of May 30th.

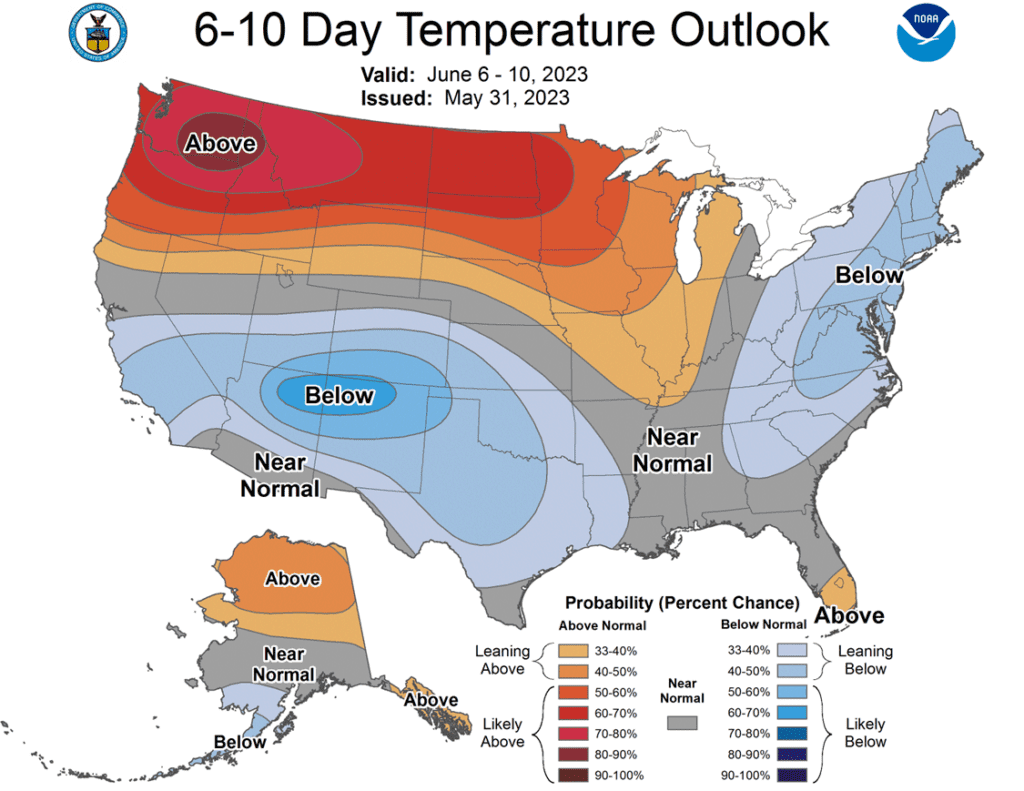

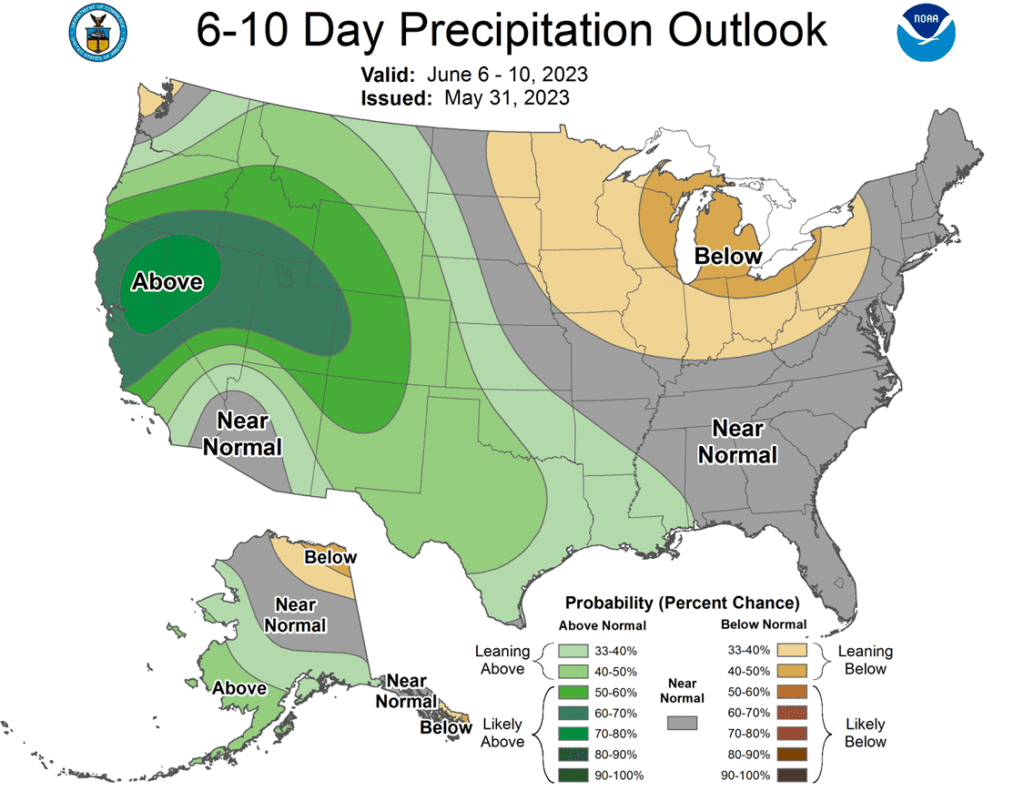

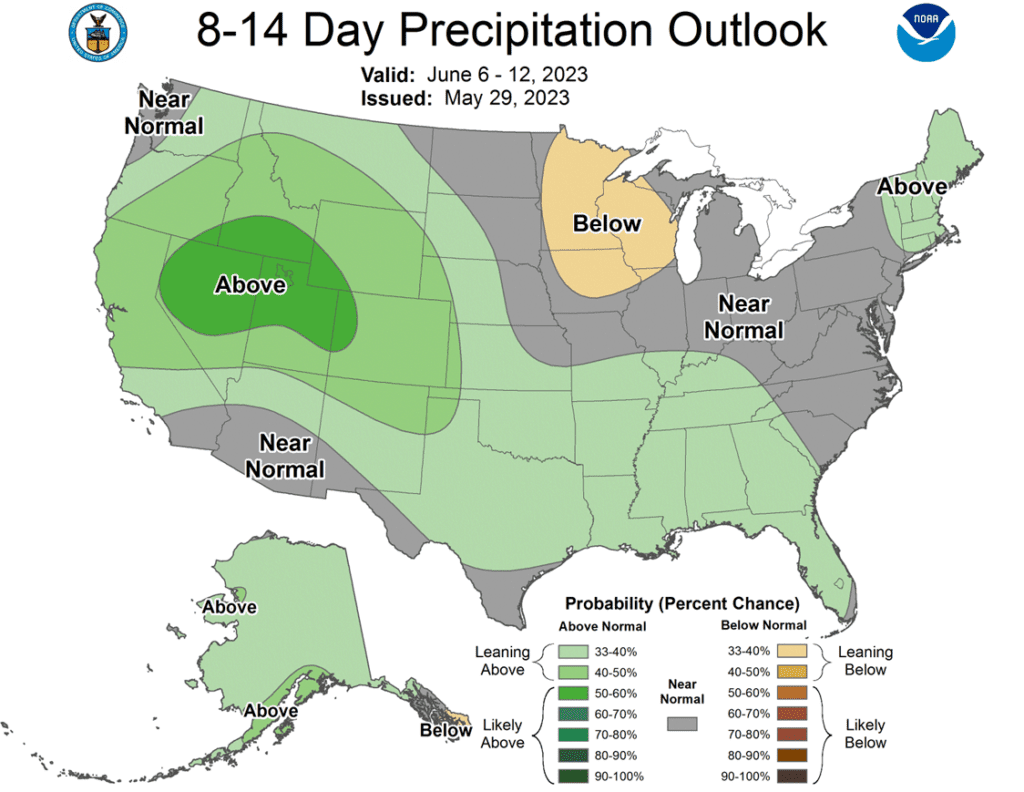

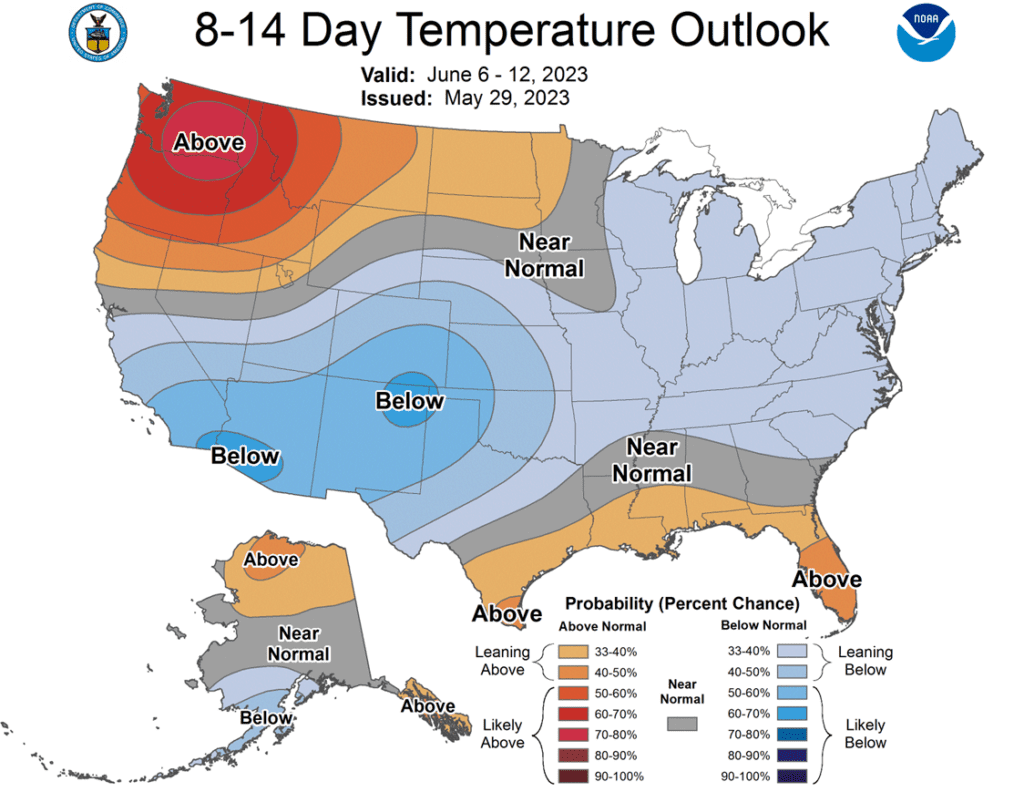

- Today’s weather forecast is mostly dry for the next 10 days in the Midwest, but the western Plains look like they will have better chances for rain. In fact, there are flash flood warnings around the Texas panhandle.

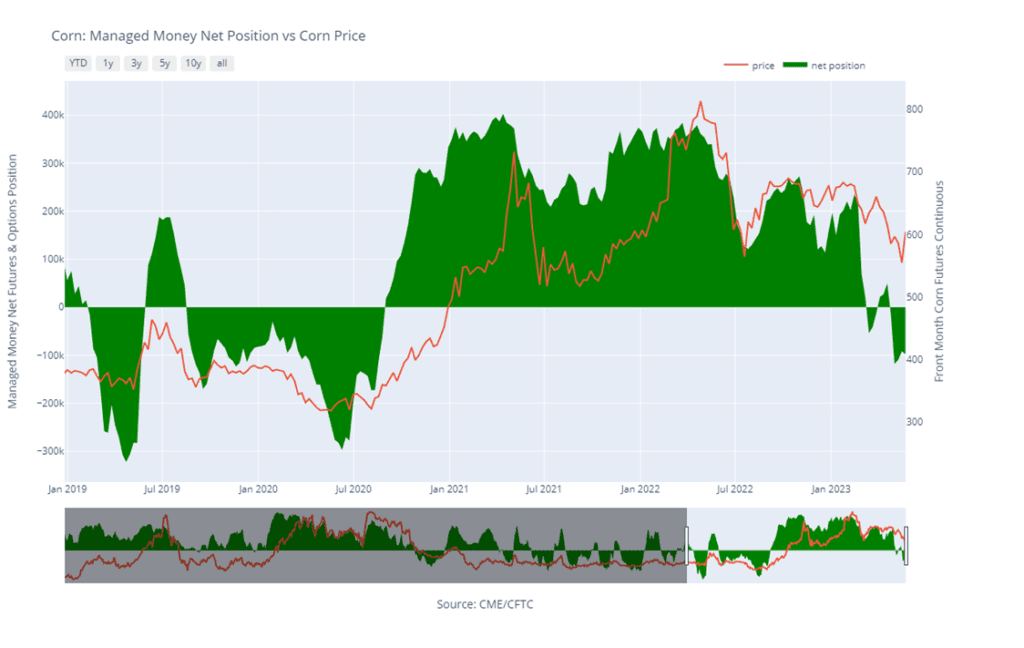

- July corn is seeing more price pressure vs new crop. This is likely due to the start of Brazil’s safrinha crop harvest and the fact that their prices are lower than the US.

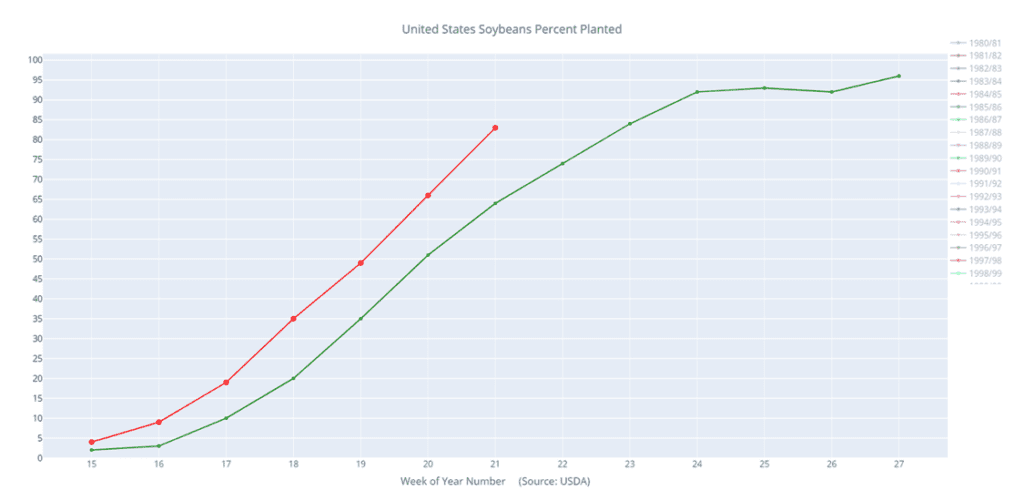

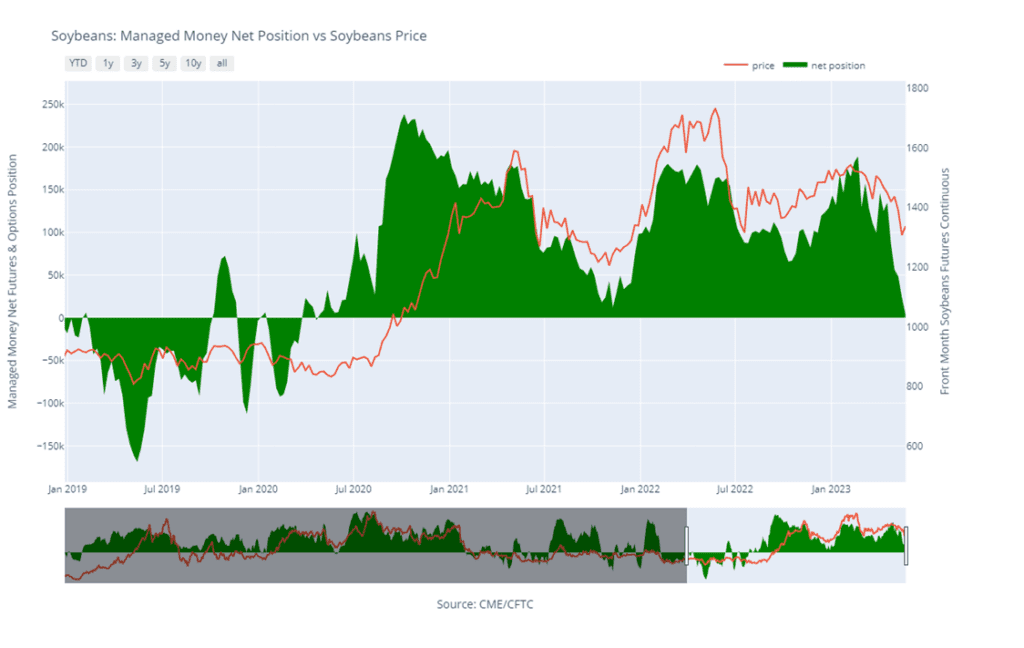

- The USDA reported an increase of 4.5 mb of soybean export sales for 22/23 and an increase of 11.1 mb for 23/24.

- According to the USDA, about 28% of US soybean production areas are in drought as of May 30th.

- The NASS Crush report showed 187 mb of US soybeans were crushed in April. In addition, soybean oil stocks at the end of April were up 3% from (vs last year) and meal stocks were up 28% for the same time frame.

- Brazil is said to have harvested 5.7 billion bushels of soybeans, which would be the most on record for a single country. Additionally, they are said to have exported 15.1 mmt in May, which is 40% above last year.

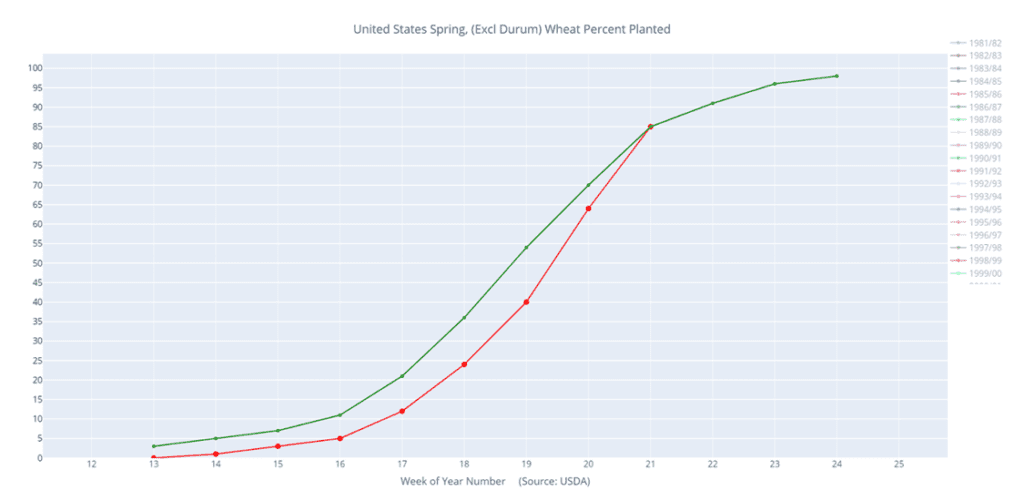

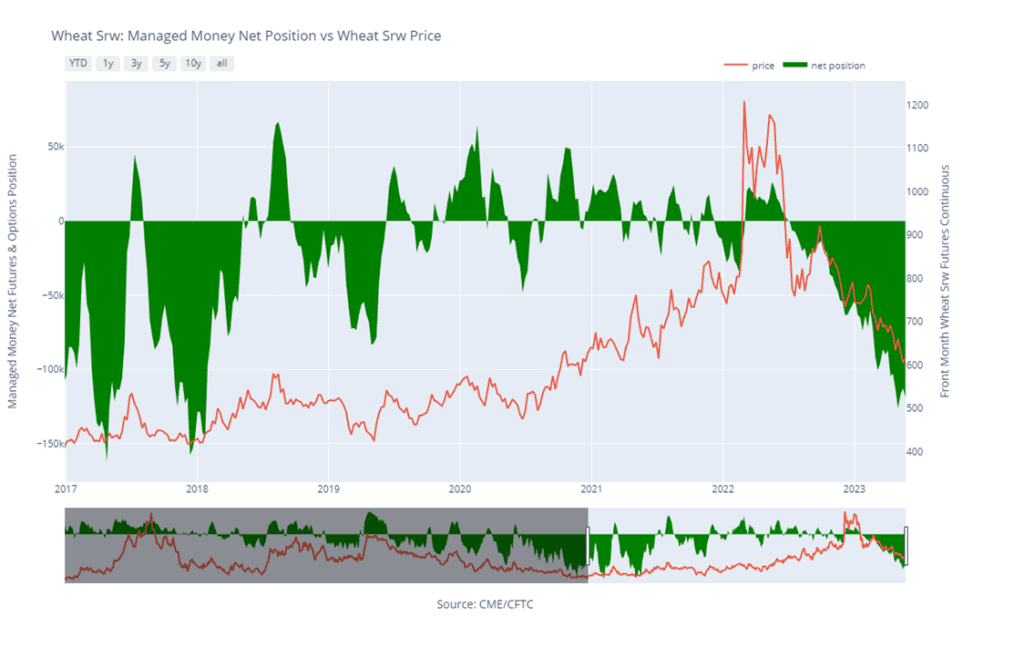

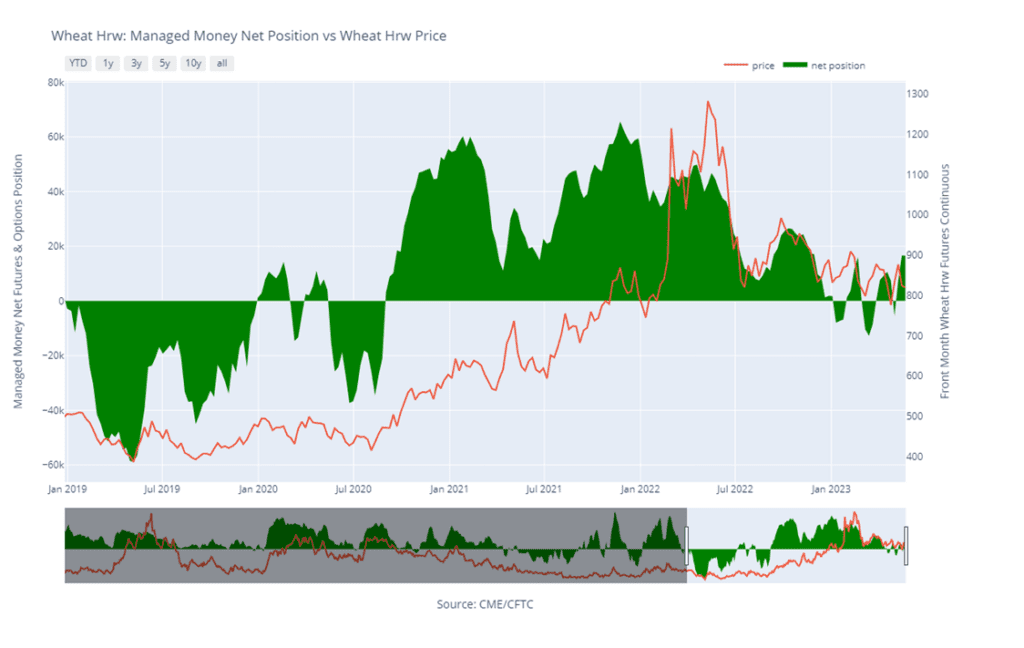

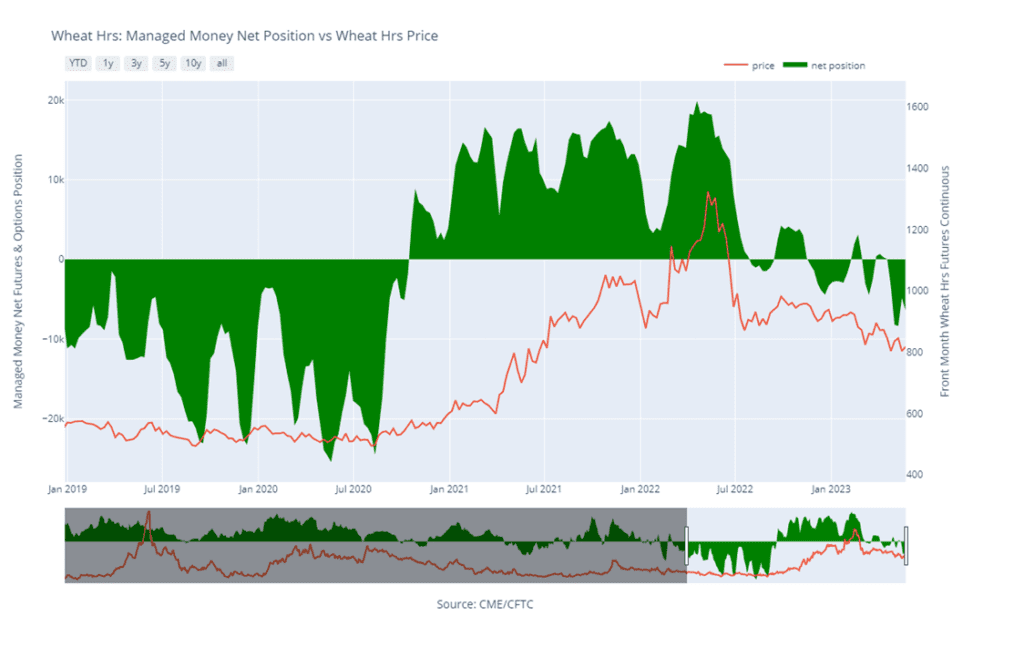

- The USDA reported net cancellations of 7.7 mb of wheat export sales for 22/23 and an increase of 17.1 mb for 23/24.

- According to Ukrainian officials, Russia is reportedly refusing to register Ukrainian grain vessels. This is not the first time this news has surfaced, but it signifies that there is still much tension between the two nations, even after the Black Sea deal was last extended.

- The wet weather has subsided for now in China’s wheat growing regions. However, the recent heavy rains could cause quality reductions, or even crop loss.

- As of the latest Commitments of Traders report, funds are said to be short 605 mb of SRW wheat. For reference, the USDA is estimating US production of that crop at 406 mb in 2023.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.