Grain Market Insider: June 13, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

- The rolling of long positions from the July to the New Crop contracts likely added to the weakness in the July, while December held onto some of its gains from a drop in the good to excellent ratings to 61%.

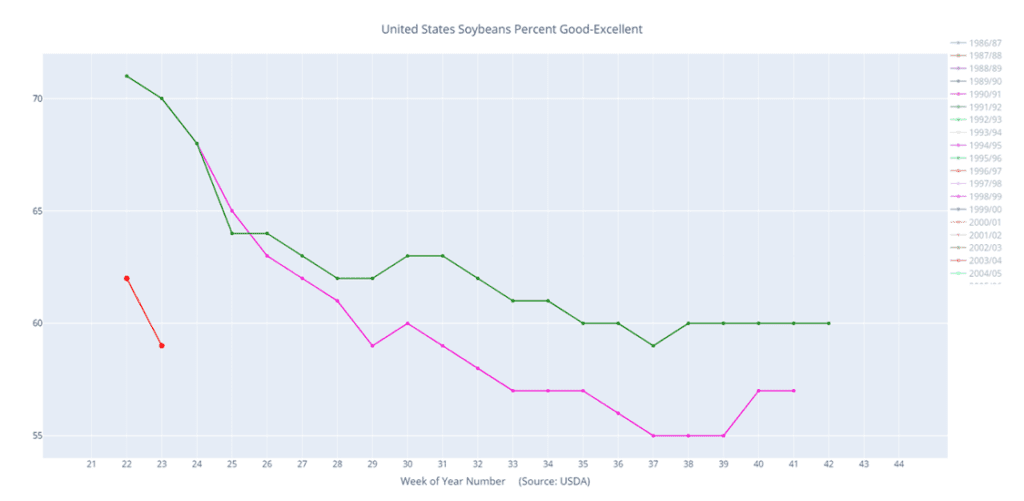

- The lowest good to excellent rating for this time since 2013, 59% according to the USDA, and sharp gains in soybean oil, gave soybeans the energy to rally sharply on the day.

- Soybean oil followed Malaysian palm oil and crude oil higher, and while soybean meal saw significant gains for New Crop, the mere 10-cent gain in July was not enough to keep pace with soybeans as July Board Crush margins fell 10-1/4 cents.

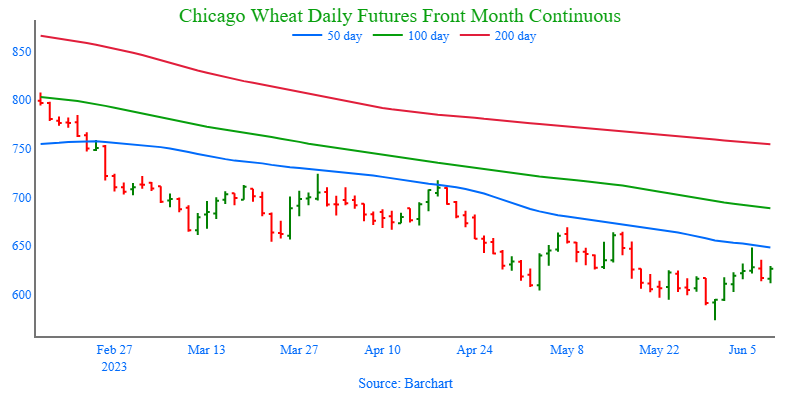

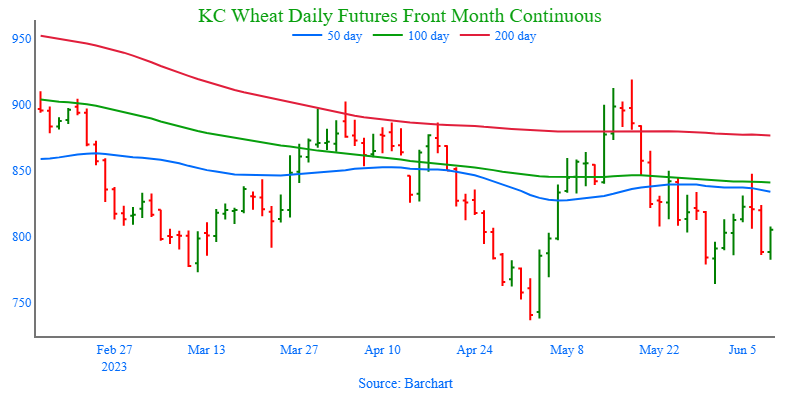

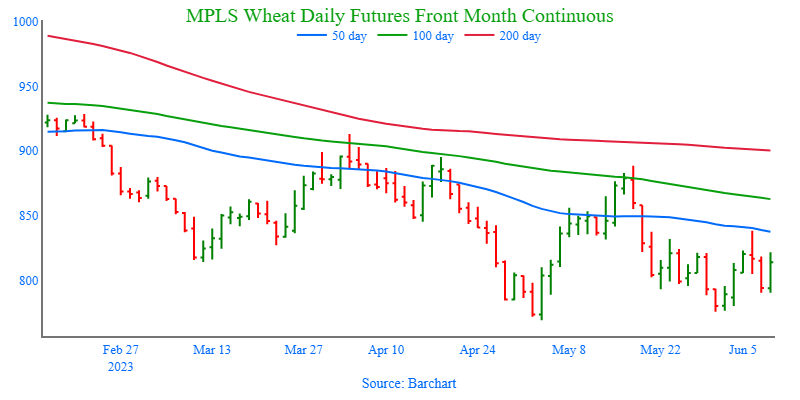

- All three wheat classes traded on both sides of unchanged today but succumbed to pressure as corn prices faded with K.C. and Minneapolis contracts finishing lower on the day while Chicago held some strength with some mild short covering.

- The US Dollar closed lower today, likely in anticipation of no change in interest rates at the end of the Federal Reserve meeting that is being held today and tomorrow. As of now the market is estimating a 95% chance that rates will remain unchanged, with a 5% chance of a 0.25% increase.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

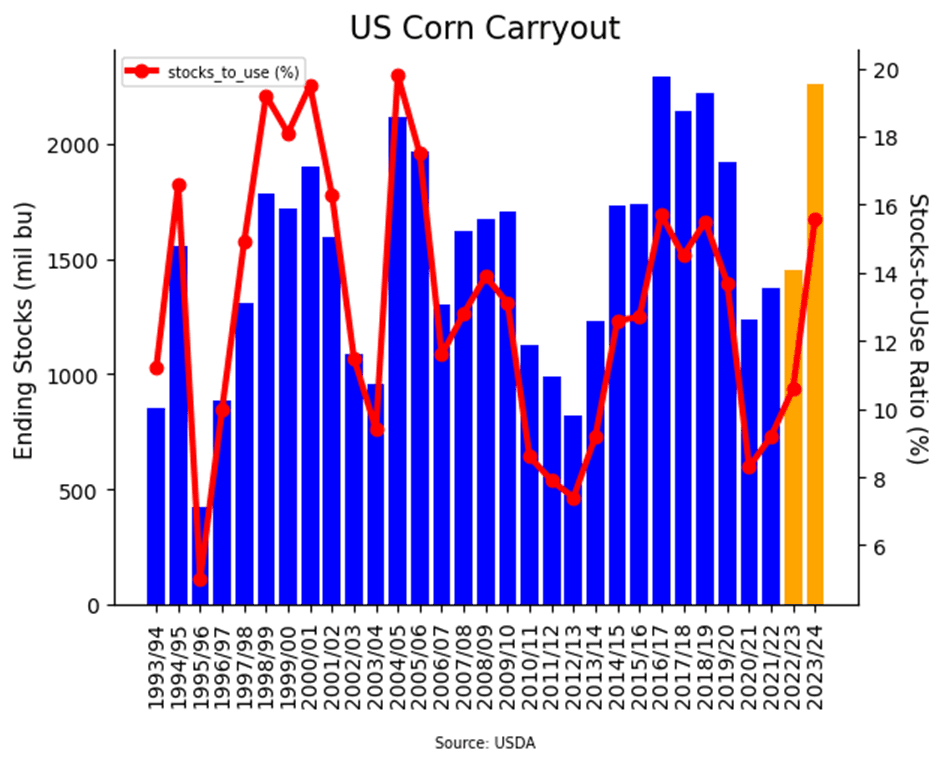

- No action is recommended at this time for Old Crop. July corn has had nearly a 60-cent rally in the last couple of weeks. Expect volatility to remain in the market; a changing weather forecast can push the market significantly in either direction. If you still have Old Crop to sell, consider using this rally to begin pricing some of those bushels. Don’t forget, there is a significant inverse between the July and September futures contracts, which could be lost when bids get rolled from one contract to the next in the next couple of weeks.

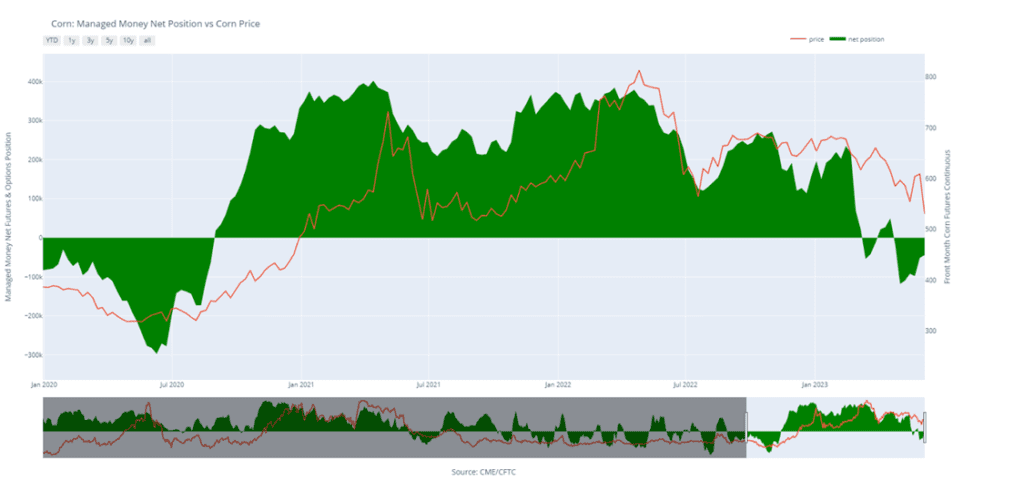

- No action is recommended at this time for New Crop. With dryness building in the Midwest and an estimated fund short position in excess of 40k contracts, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you don’t happen to have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

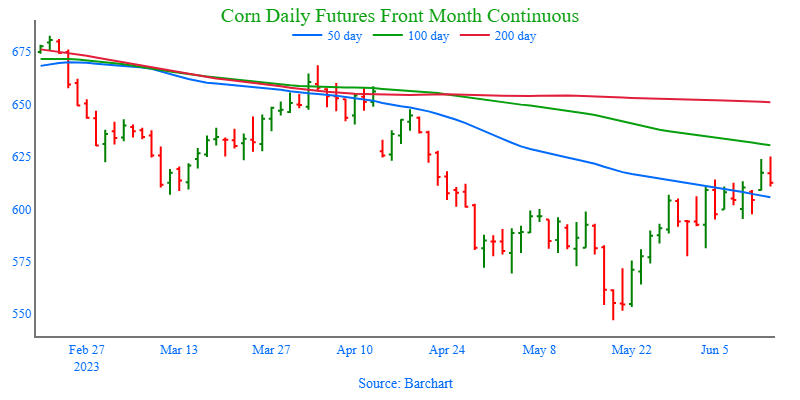

- Corn prices finished mixed on the day as prices faded off early session strength supported by a further reduction in crop ratings.

- Spread activity in the later part of the session pressured prices as traders moved long positions out of the July contract. The spread between July and September corn futures has dropped 20 cents from 85 cents to 65 cents in the past four trading sessions.

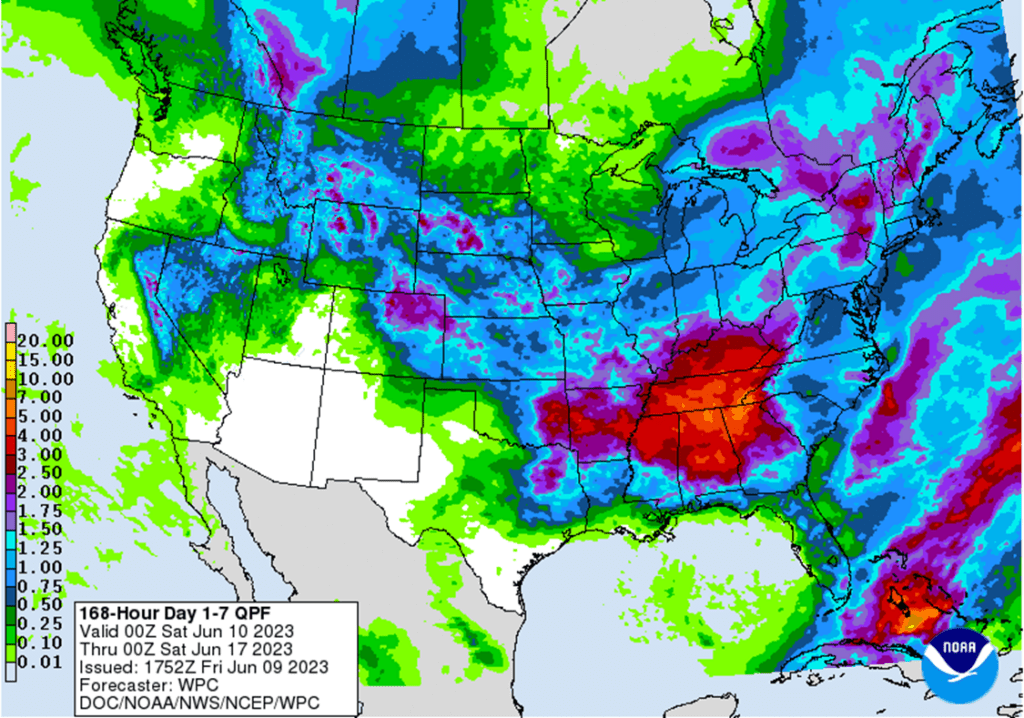

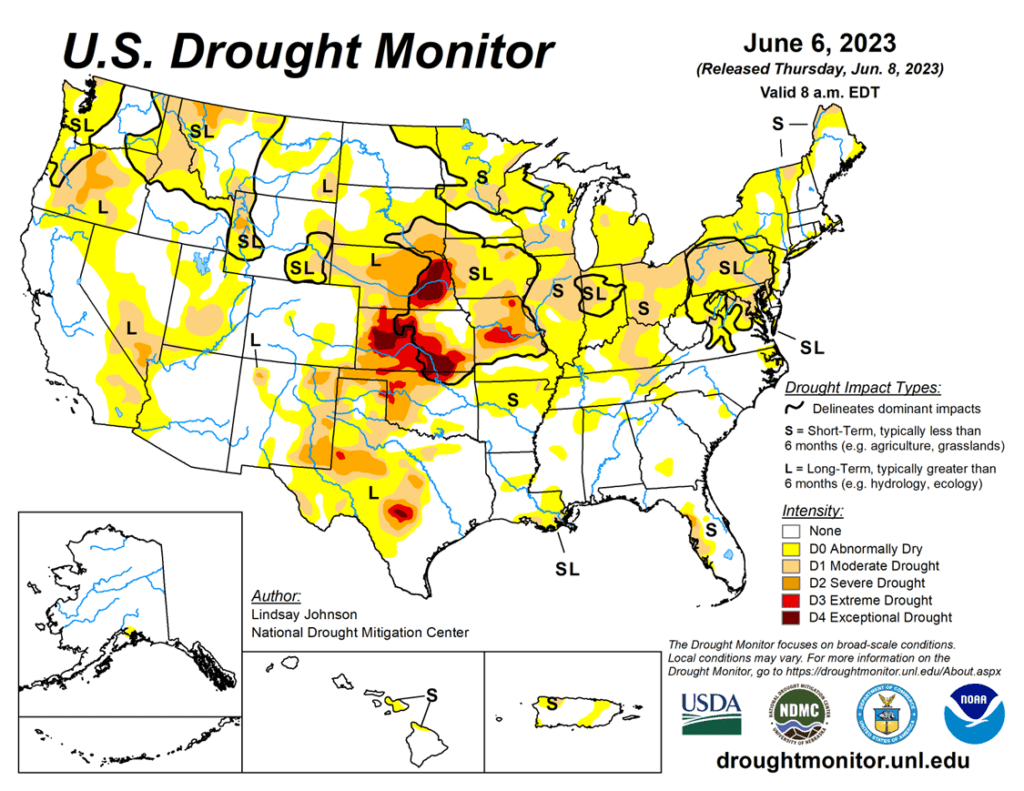

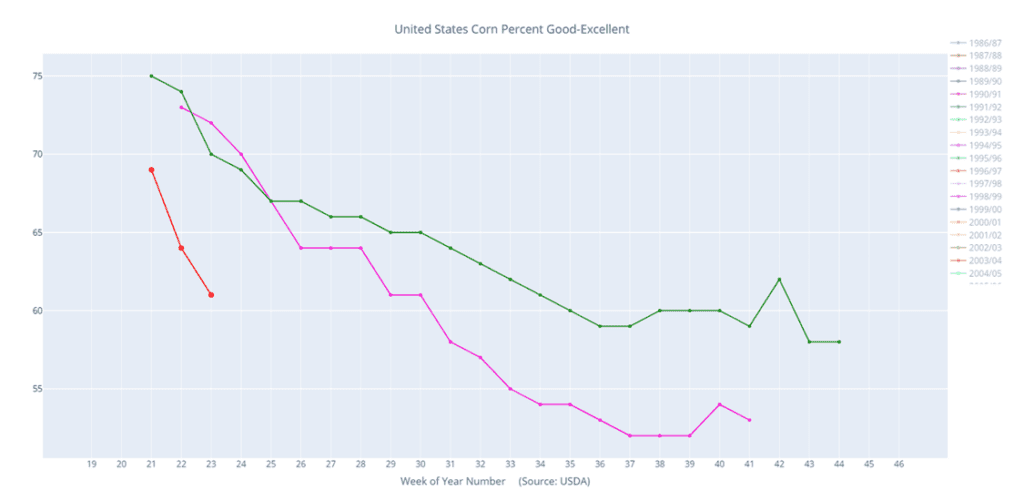

- Weekly Crop ratings slipped again on the USDA Crop Progress report, dropping an additional 3% to 61% good/excellent. Analysts were expecting 62% good/excellent as dry conditions still pressure the crop.

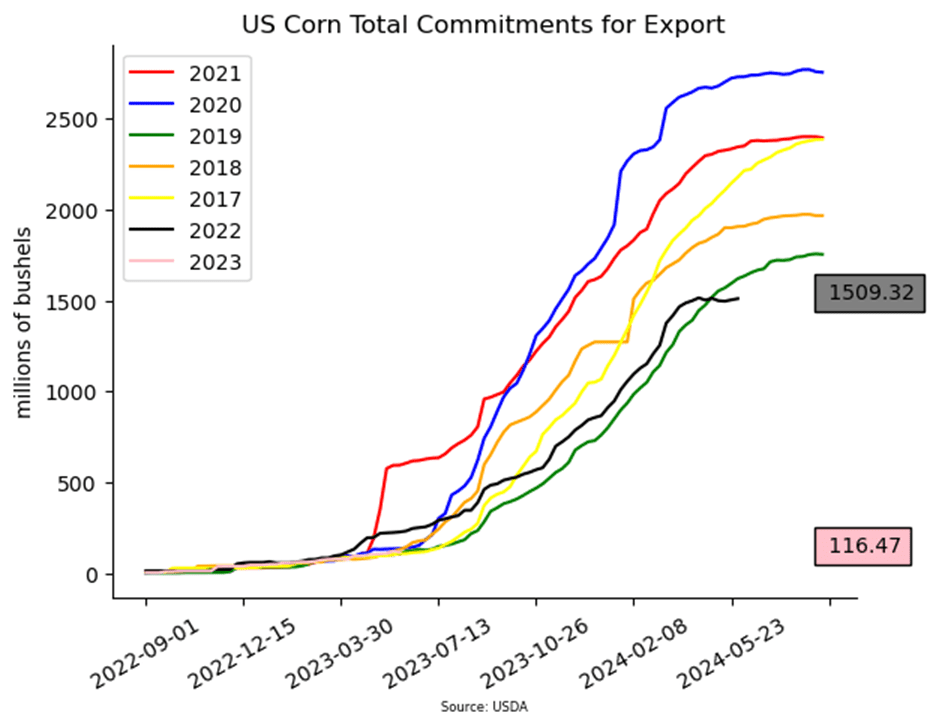

- Brazilian corn harvest is starting to pick up, and the push of cheaper, fresh corn supplies hitting the market may limit the front end of the corn market as U.S. prices are well above global competition for export demand.

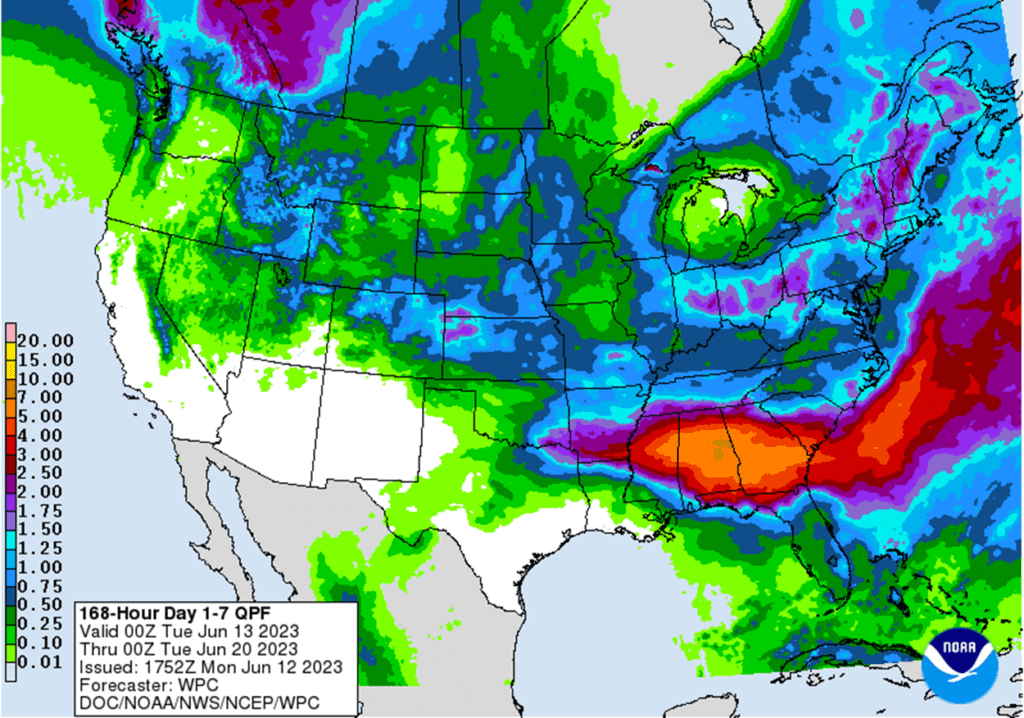

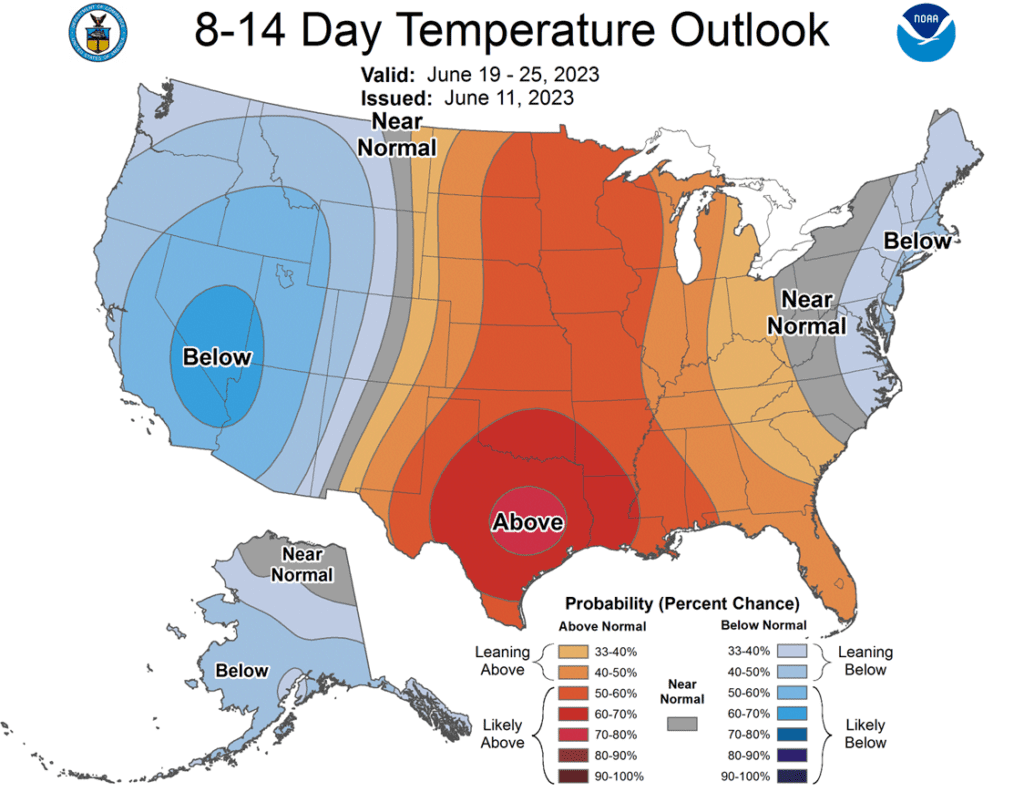

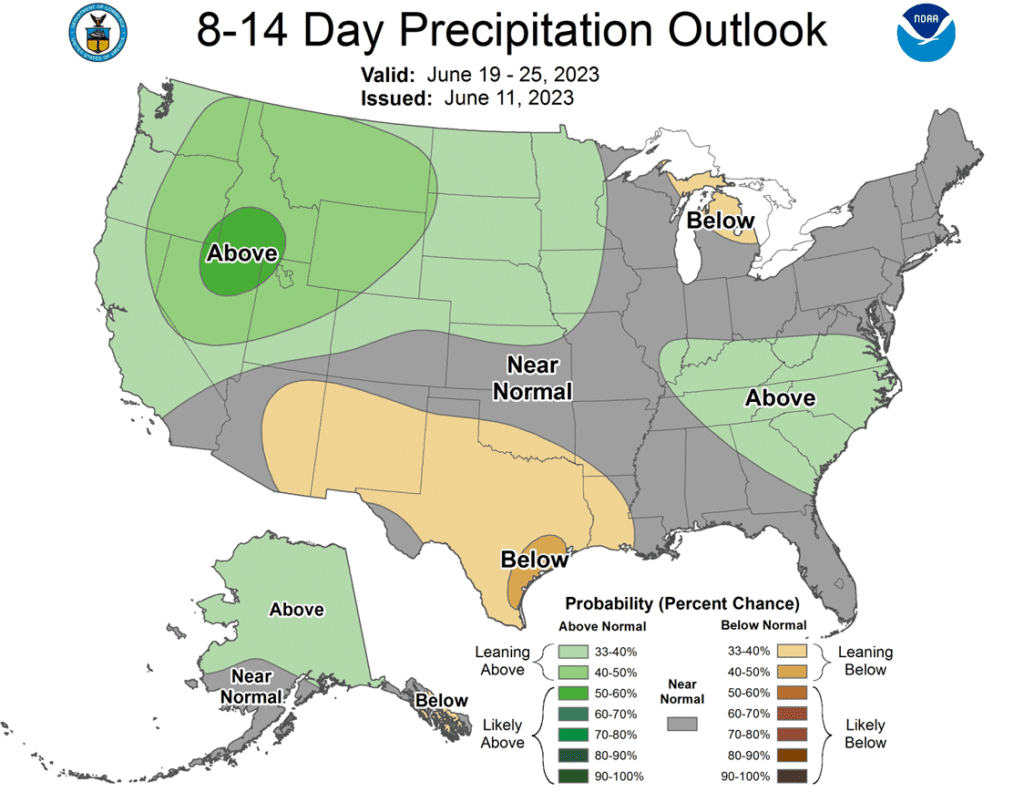

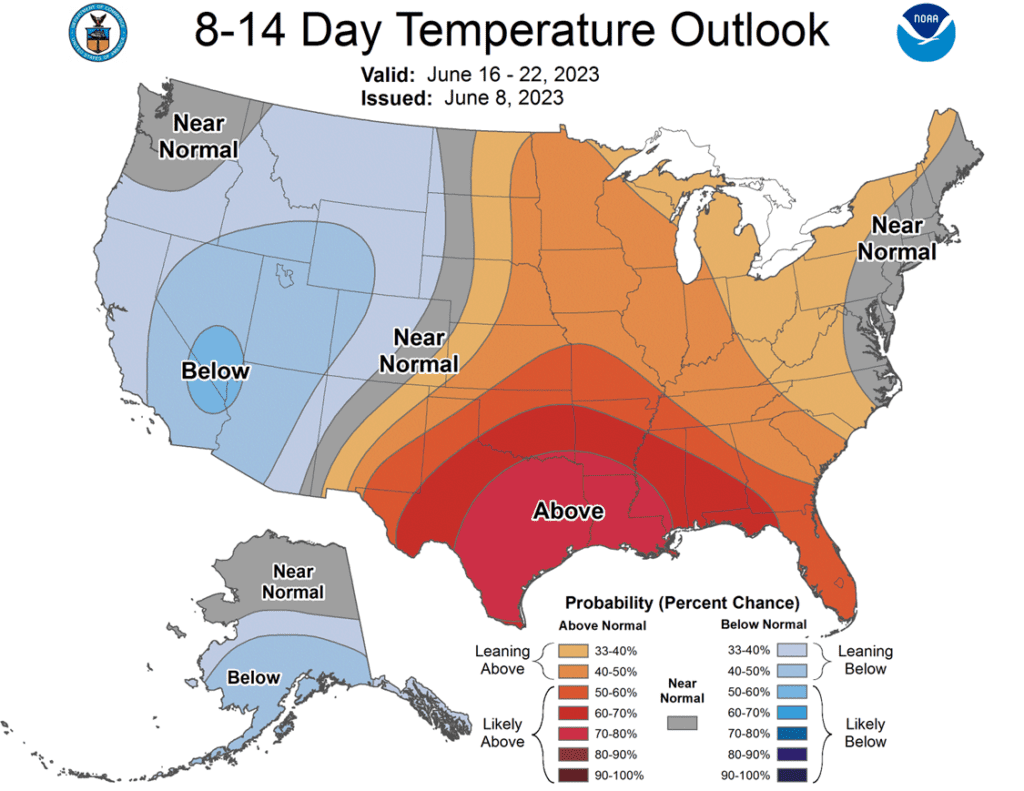

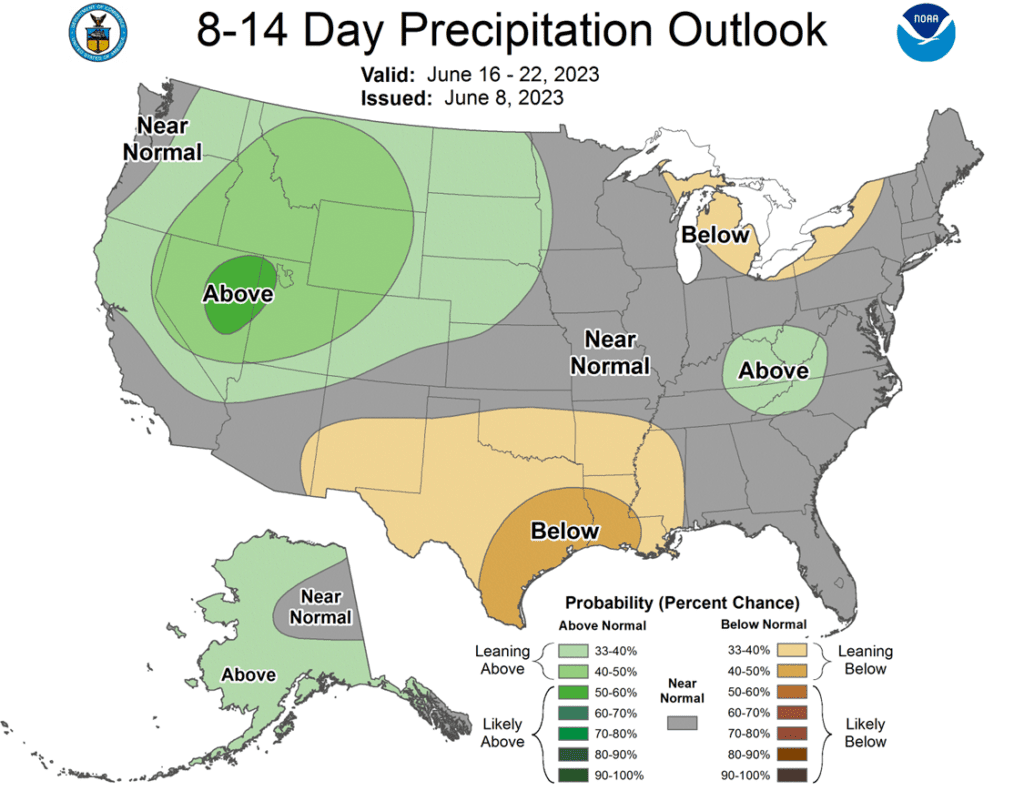

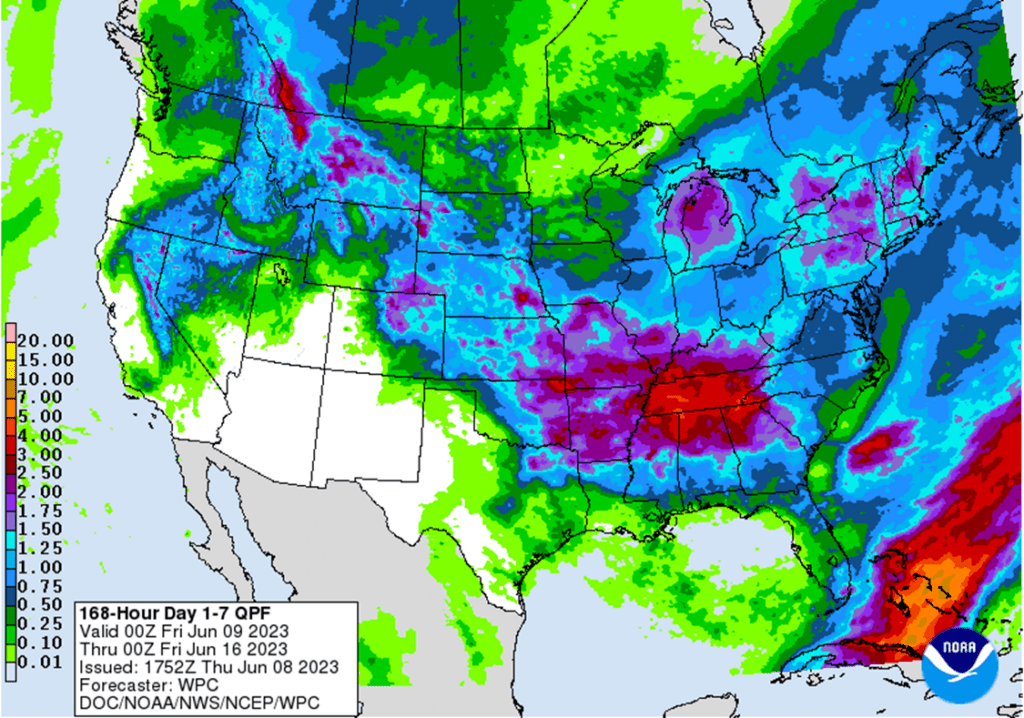

- The weather forecast overall remains spotty as rainfall coverage is expected to be hit-or-miss for the next seven days.

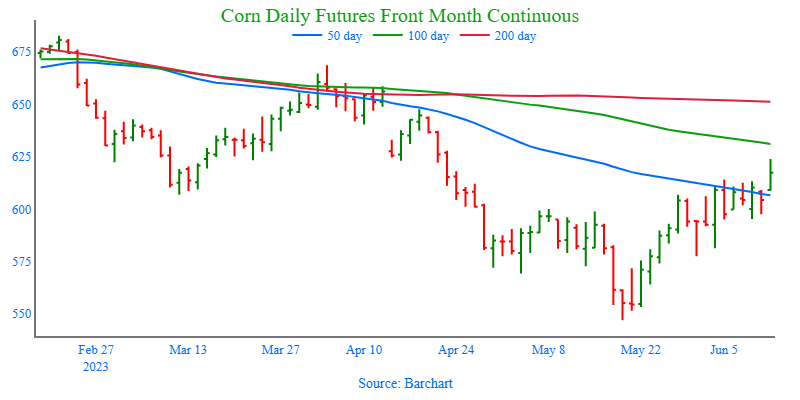

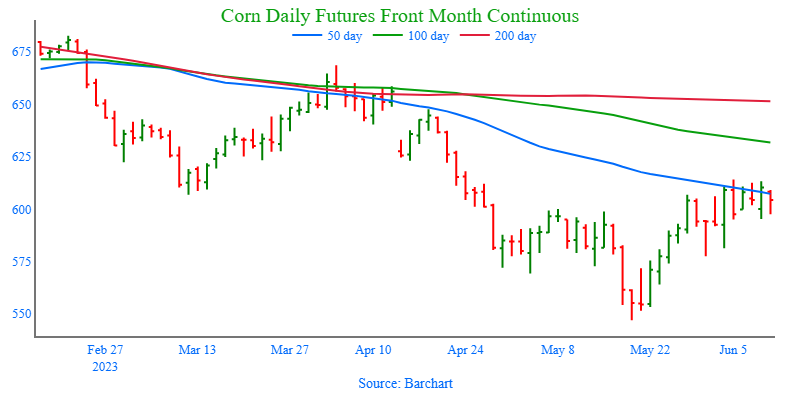

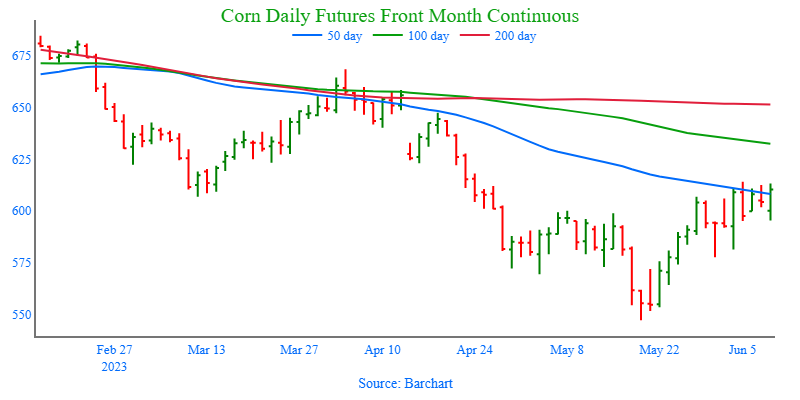

Above: The breakout above the recent congestion area has the market knocking on the door of the next resistance area between the 100-day moving average near 630 and the April high of 647-1/2, and while a test of the April high is within reach, the market is showing some signs of being overbought. Initial support below the market rests between 595 and 575, with additional support near 550.

2023/24 Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Soybeans Action Plan Summary

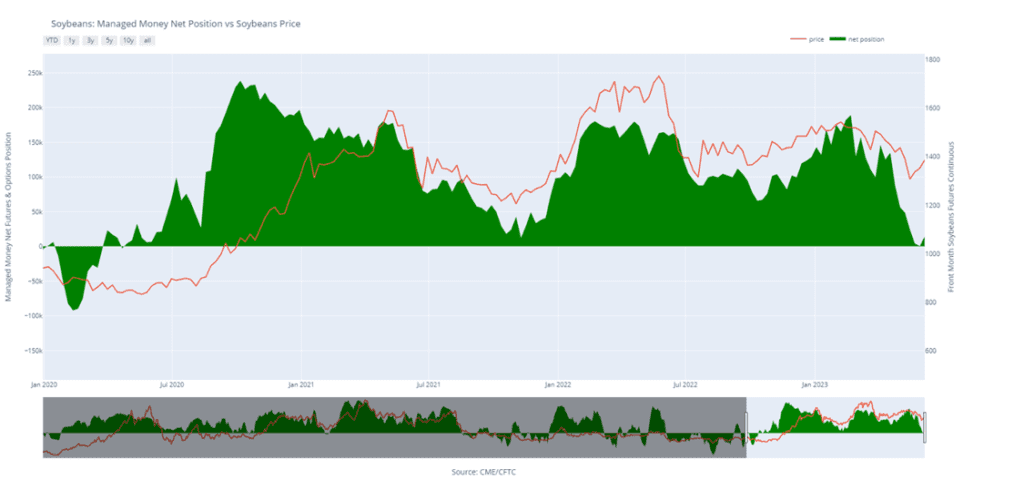

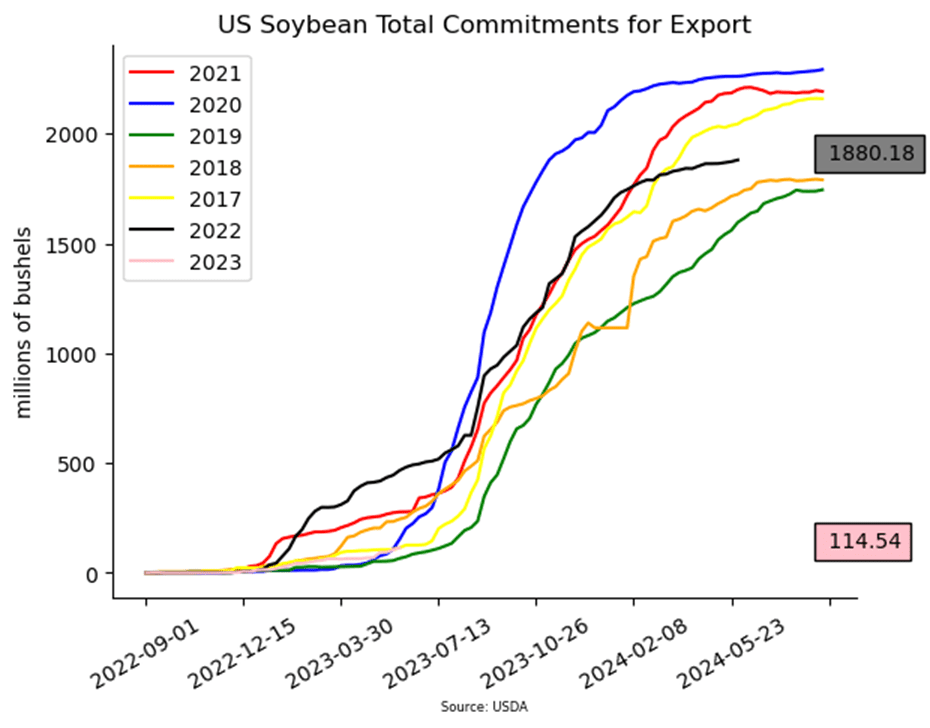

- July soybeans have rallied 128 cents from the May low and are approaching 1400 psychological resistance. With a 78 cent inversion to the August contract, Grain Market Insider recommends taking advantage of the recent rally to make a sale for the old 2022 soybean crop.

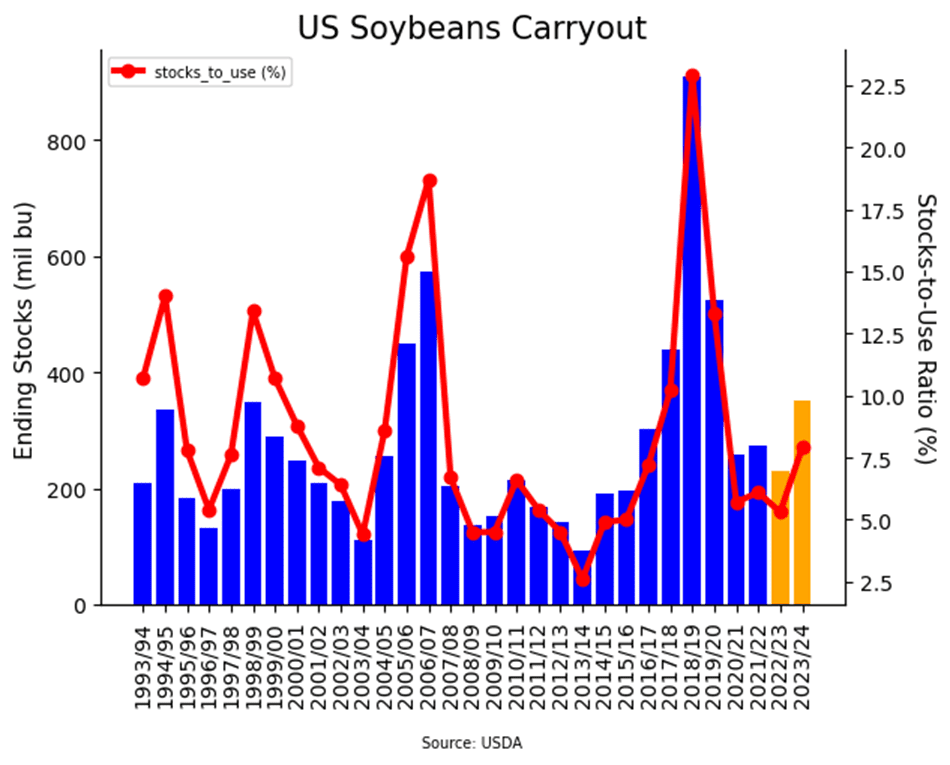

- We recommend not adding to current sales levels for the new 2023 crop at this time. A quick planting pace with favorable conditions and South American competition greatly pressured soybeans in April and May. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1300 to 1350 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

- Soybeans closed significantly higher today thanks to gains in soybean oil, crop progress that showed conditions declining, and an EPA decision that will be announced tomorrow about biofuel mandates that could be bullish for the soy complex.

- Planting progress showed that the soy crop is 96% planted (which is above 86% on average) and 86% emerged vs 70% on average. The good to excellent rating fell by 3 points to 59% due to dry conditions, and the poor to very poor rating rose to 9%.

- The Environmental Protection Agency has a June 14 deadline for announcing final renewable volume obligations that will impact the profitability of renewable diesel. The outcome of this decision could be very supportive to the soy complex.

- Soybean oil was supported by a jump in crude oil and an increase in palm oil which gained 2.5% today. Soybean oil has become overbought, but it has followed palm oil very closely and will likely continue to do so.

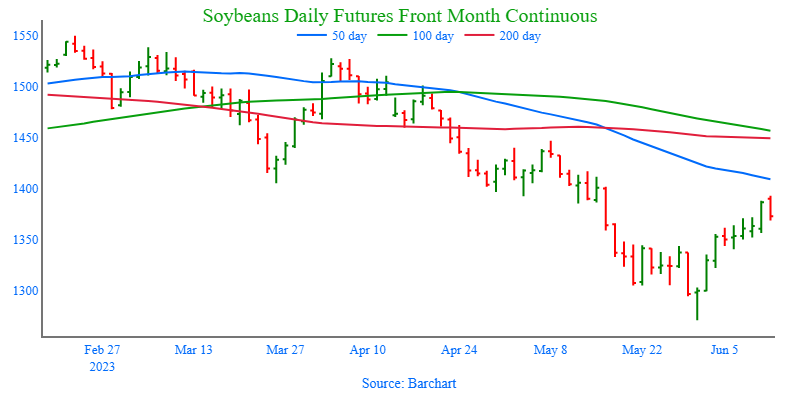

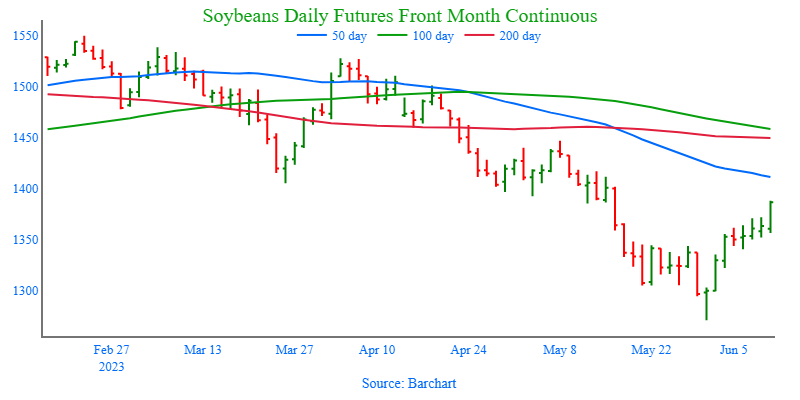

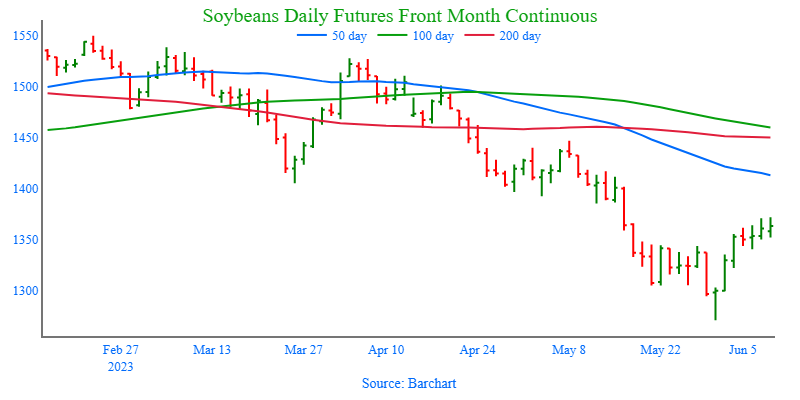

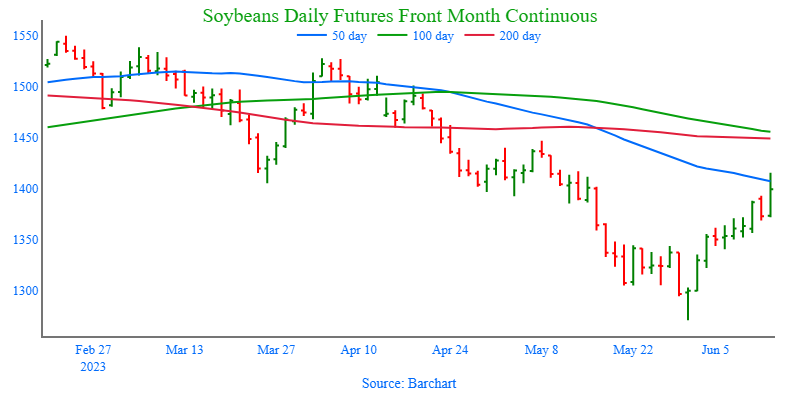

Above: After a strong close last week, July soybeans will look for follow-through momentum to turn around a down-trend that has been in place since April. The strong close above the 20-day moving average is a great sign of a short-term trend change higher. If prices were to set back, support should be found near 1340 with nearby resistance near the 1420 area.

2023/24 Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

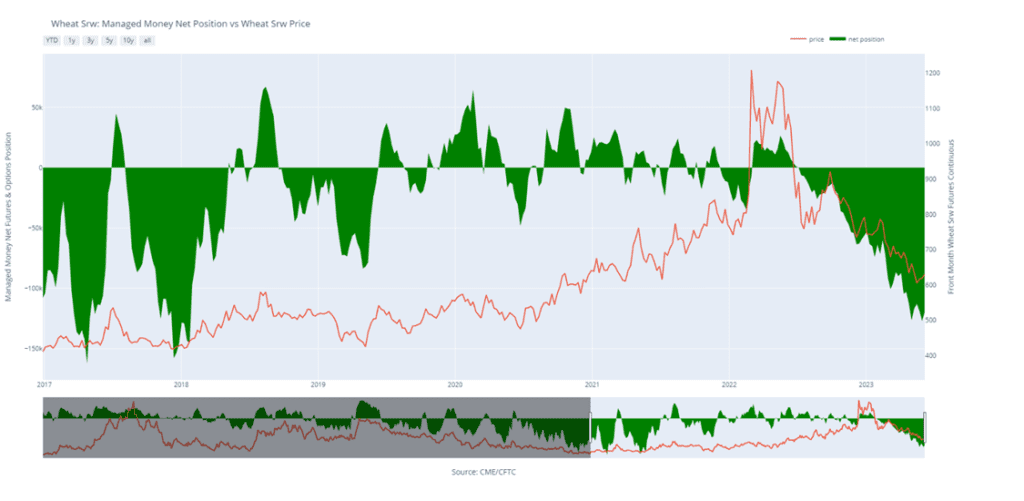

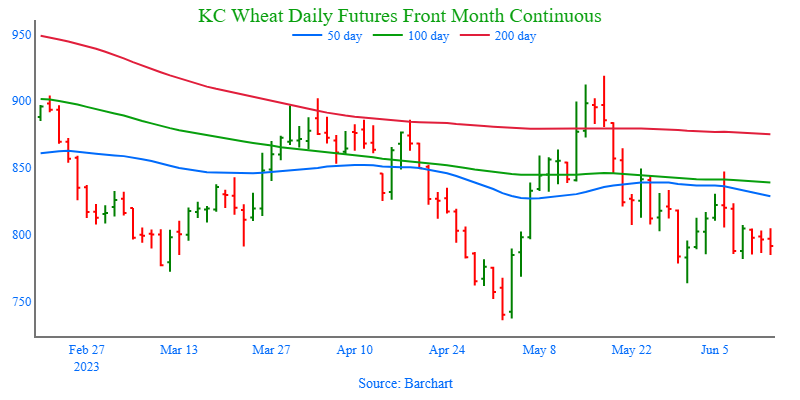

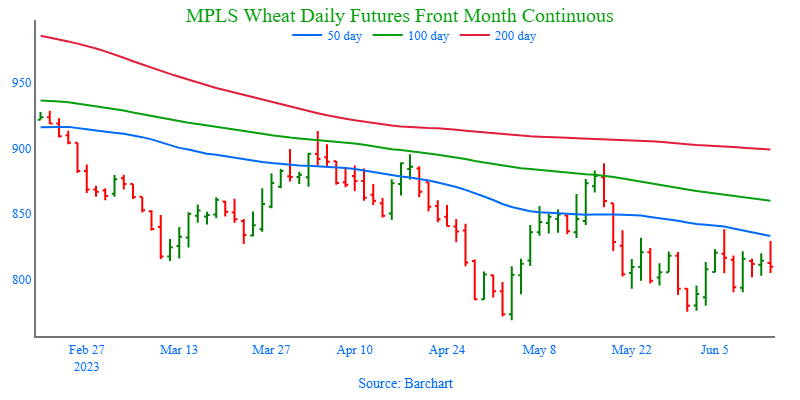

- Despite earlier strength, wheat posted gains of just a couple cents in the Chicago contract, while Kansas City and Minneapolis contracts were mostly lower. This is likely because wheat acted as a follower today, and as the gains in corn faded, so did wheat.

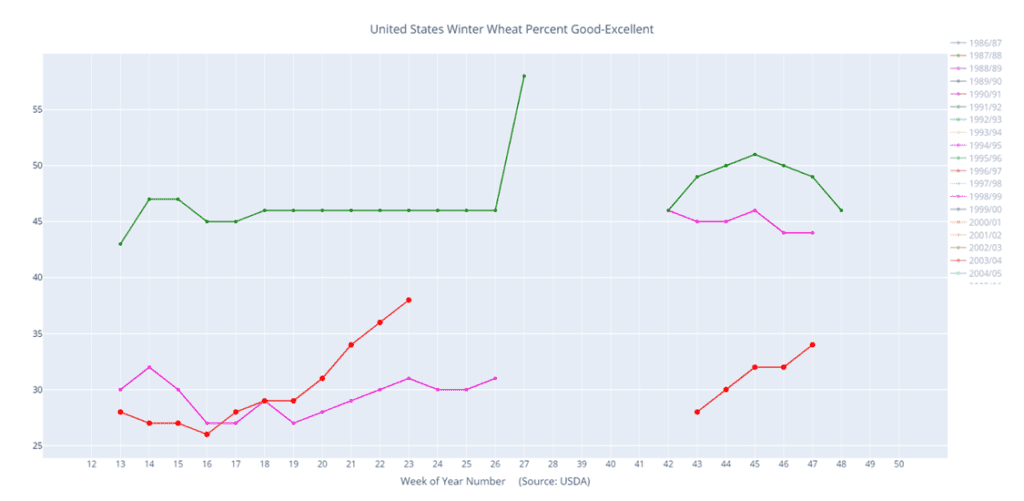

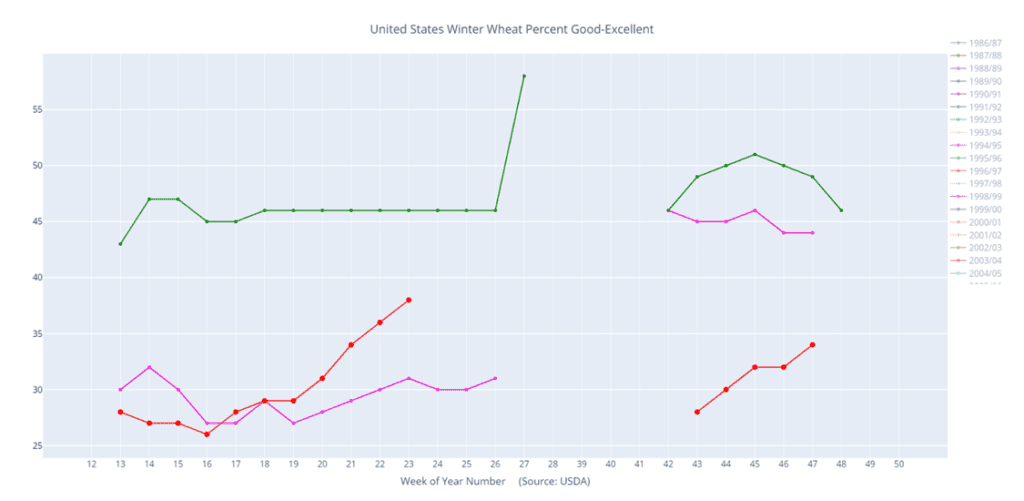

- According to the USDA, 38% of the winter wheat crop is rated good to excellent vs 36% last week. Also, 8% of the crop is harvested vs 9% average.

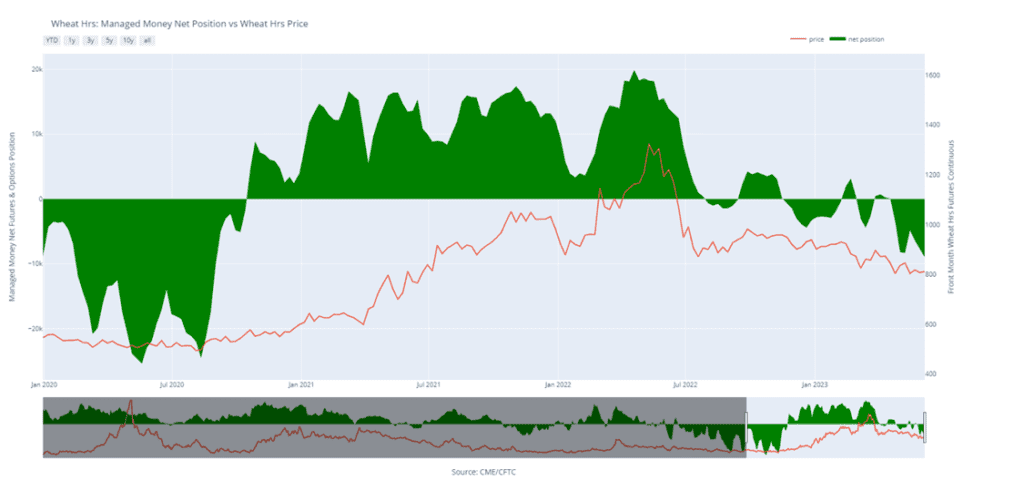

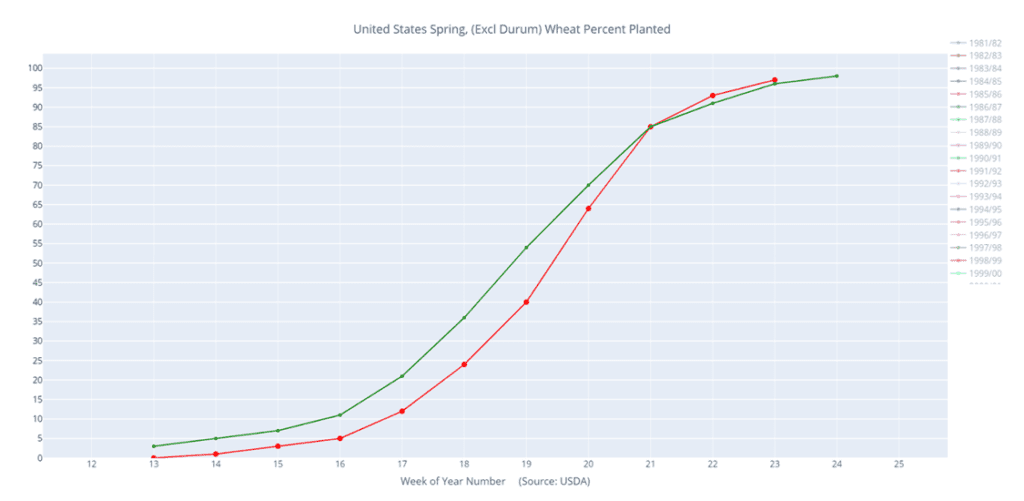

- The USDA also said that 97% of the spring wheat crop is planted which is in line with average. Only 60% of that crop is rated good to excellent, compared with 64% last week.

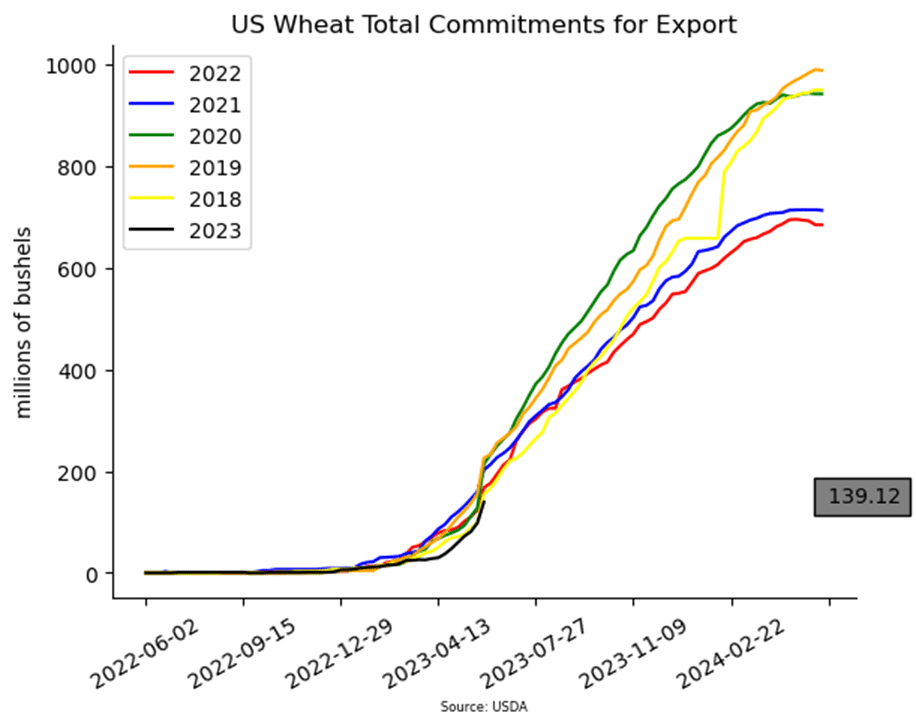

- Russian export values continue to fall, with reports that they are talking about lowering the floor to $230 per metric ton. This is below current offers of $235-$240 and is well below the $275 floor that was encouraged a couple months ago.

- The developing El Nino weather pattern is expected to cause drought in Australia, lowering their wheat production.

- Despite a large wheat crop in India which is expected to be 113.5 mmt, tight stocks may mean that they don’t export much wheat this year, if any at all. This could contribute to tighter global availability.

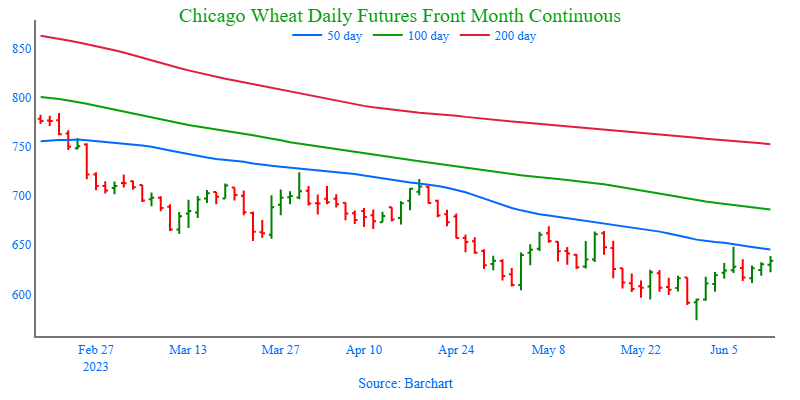

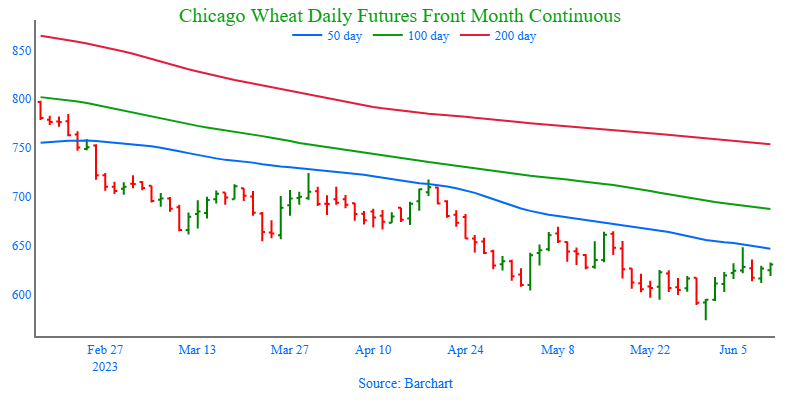

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. With good price action to start June, the market may be positioned for a short covering rally as new crop harvest quickly approaches. We continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No new action is recommended for the 2024 crop at this time. Prices have rallied nicely off of lows to start the month of June. With continued Black Sea tensions July of 2024 futures prices should be able to build off of the recent lows. We are currently targeting the 750-775 area to advance further on sales.

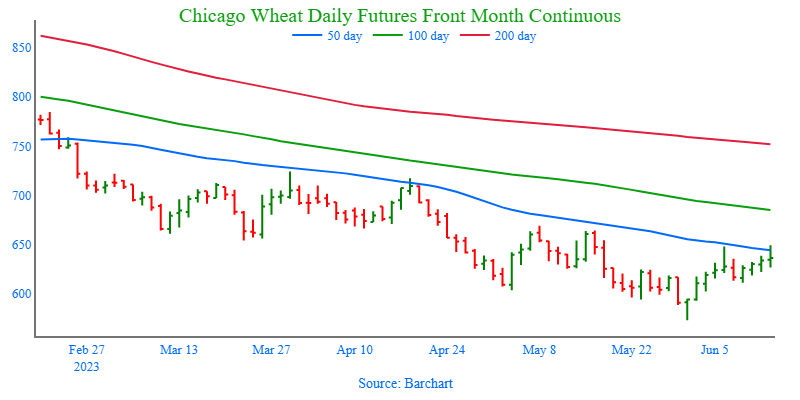

Above: The bullish reversal from May 31 indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

2023/24 Spring wheat condition percent good-excellent (red) versus the 5-year average (green).

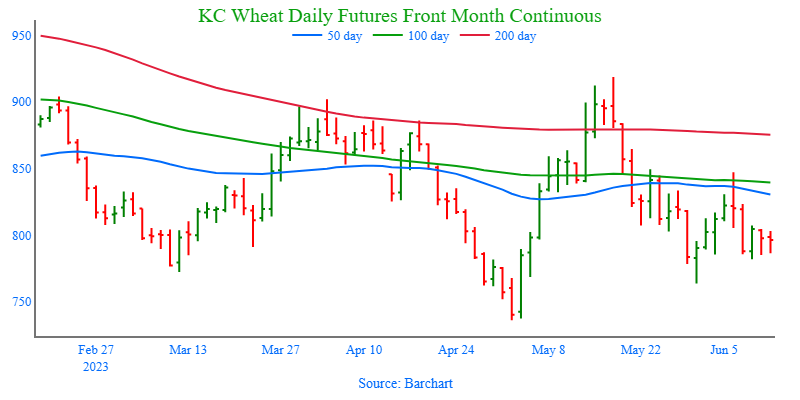

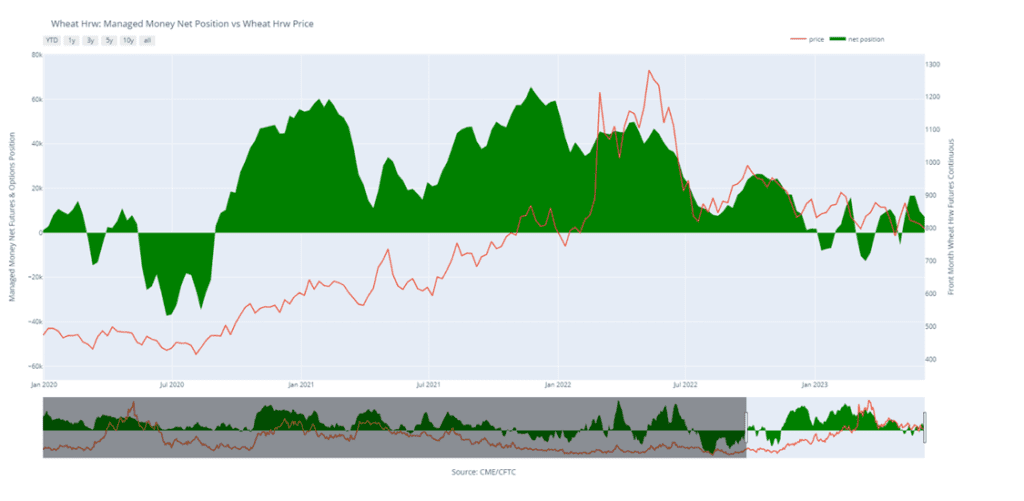

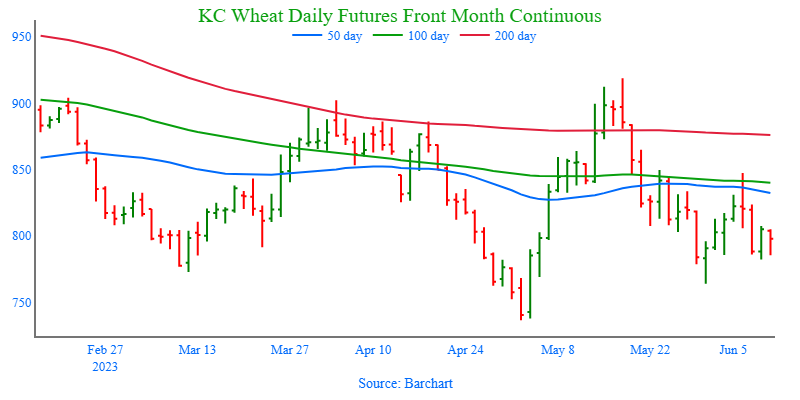

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

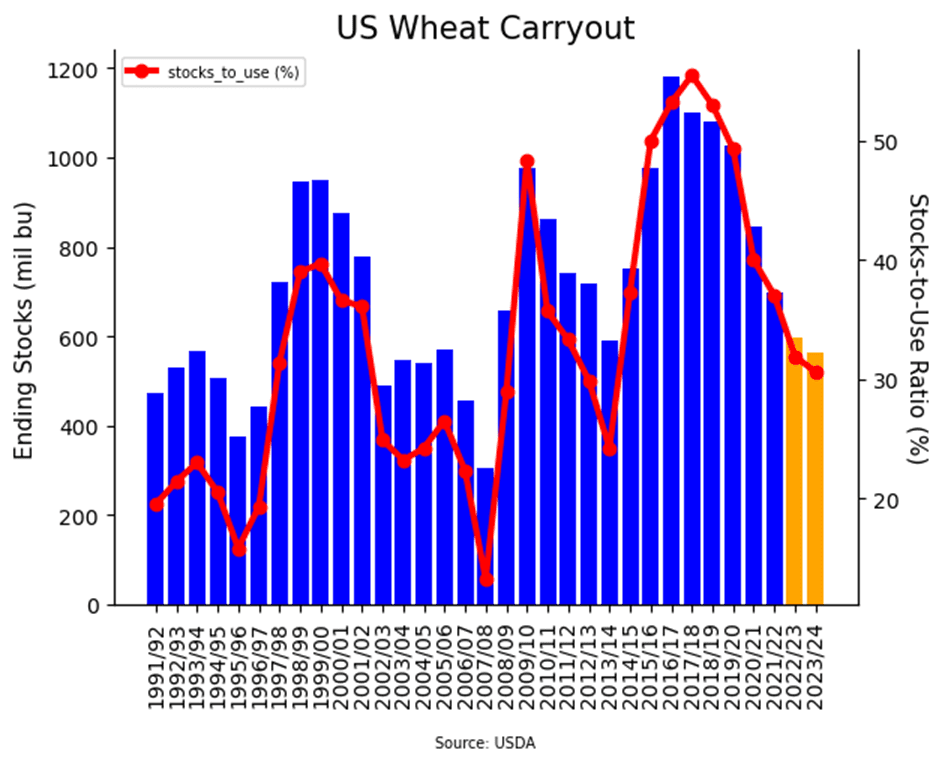

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The bullish reversal from May 31 indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

2023/24 Winter wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

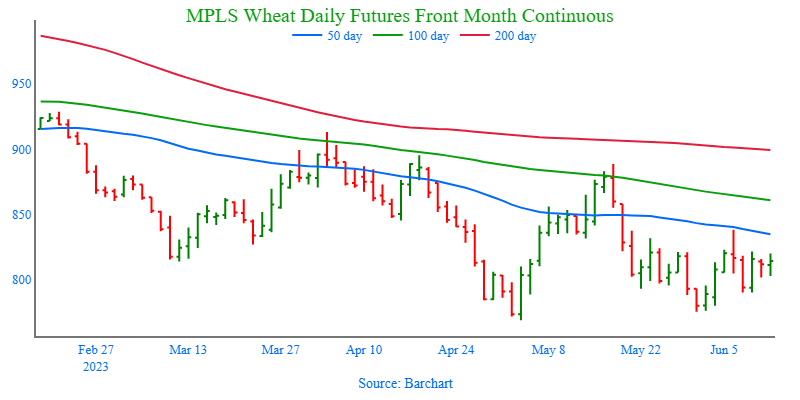

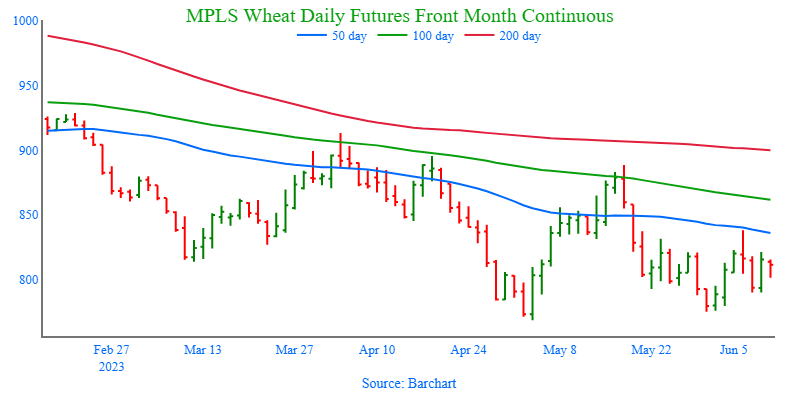

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting has largely been completed, dryness in some areas is increasing. With the market still largely oversold on the weekly charts and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract continues to be weak and continues to consolidate. With winter wheat harvest on the horizon, spillover selling pressure could plague the spring wheat market in the weeks to come. Resistance currently sits between 820 and 855 and then the recent high of 888-1/2. Support below the market may be found between 770 and 760.

2023/24 Spring wheat condition percent good-excellent (red) versus the 5-year average (green).