Opening Update: June 20, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| JUL ’23 | 640 | -0.25 |

| DEC ’23 | 591.5 | -6 |

| DEC ’24 | 541.75 | 0.25 |

|

Soybeans |

||

| JUL ’23 | 1466 | -0.5 |

| NOV ’23 | 1331 | -11.25 |

| NOV ’24 | 1234 | -4.75 |

|

Chicago Wheat |

||

| JUL ’23 | 678.25 | -9.75 |

| SEP ’23 | 691.5 | -10 |

| JUL ’24 | 726.75 | -9.25 |

|

K.C. Wheat |

||

| JUL ’23 | 832.25 | -9.75 |

| SEP ’23 | 828.5 | -10.5 |

| JUL ’24 | 805 | -1.25 |

|

Mpls Wheat |

||

| JUL ’23 | 844.25 | -9.25 |

| SEP ’23 | 848.25 | -8.25 |

| SEP ’24 | 798.5 | 8.25 |

|

S&P 500 |

||

| SEP ’23 | 4439 | -14.75 |

|

Crude Oil |

||

| AUG ’23 | 72.09 | 0.16 |

|

Gold |

||

| AUG ’23 | 1964.5 | -6.7 |

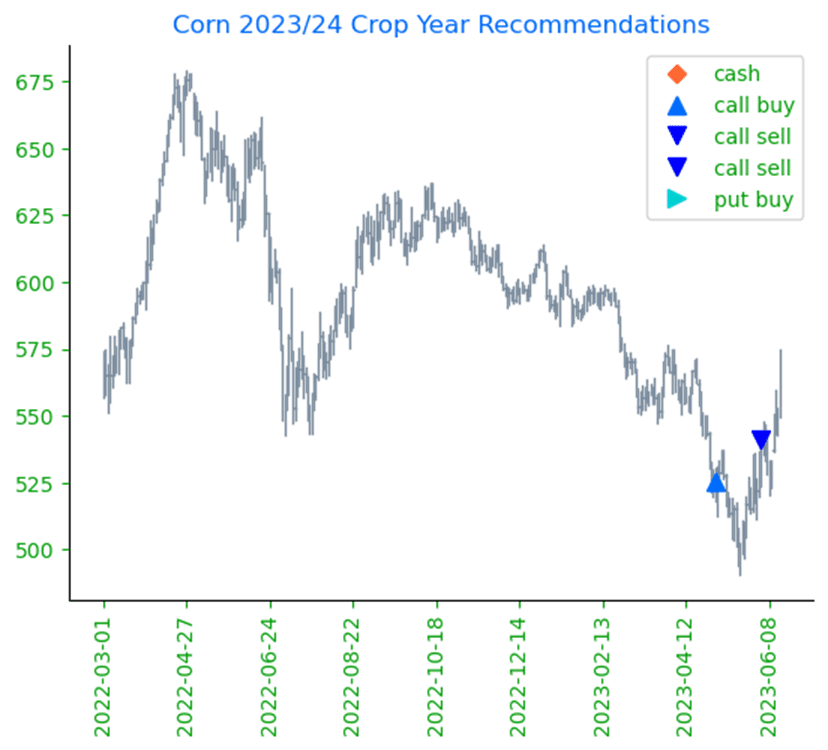

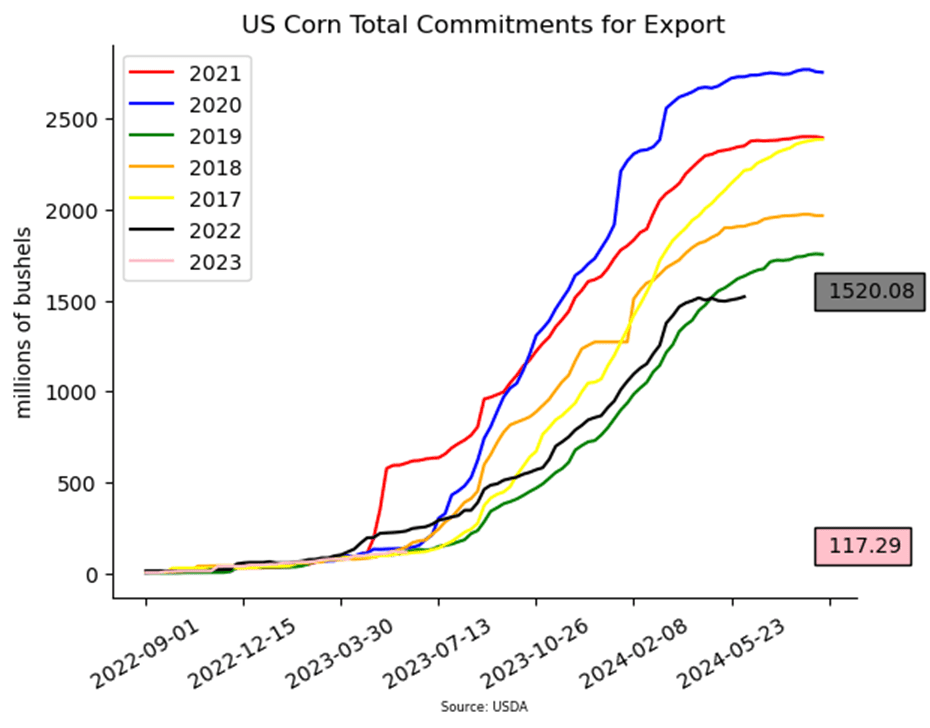

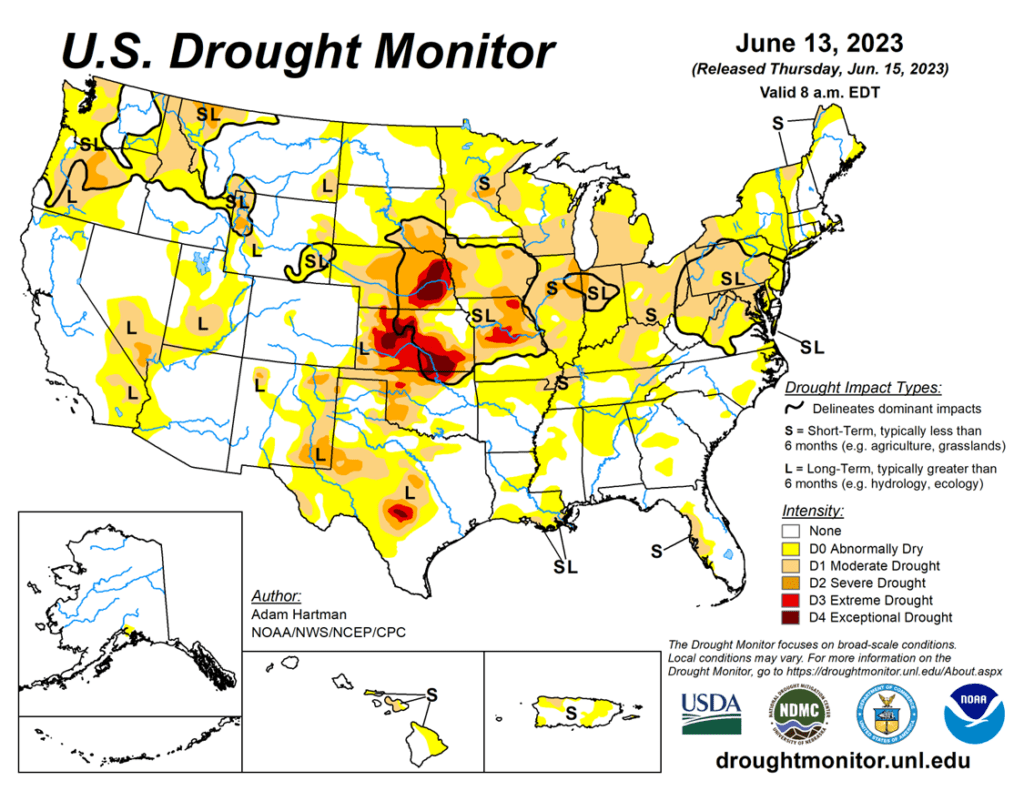

- Corn gapped higher on last night’s open with Dec corn getting through the 6 dollar mark but has slowly faded since and is now trading lower.

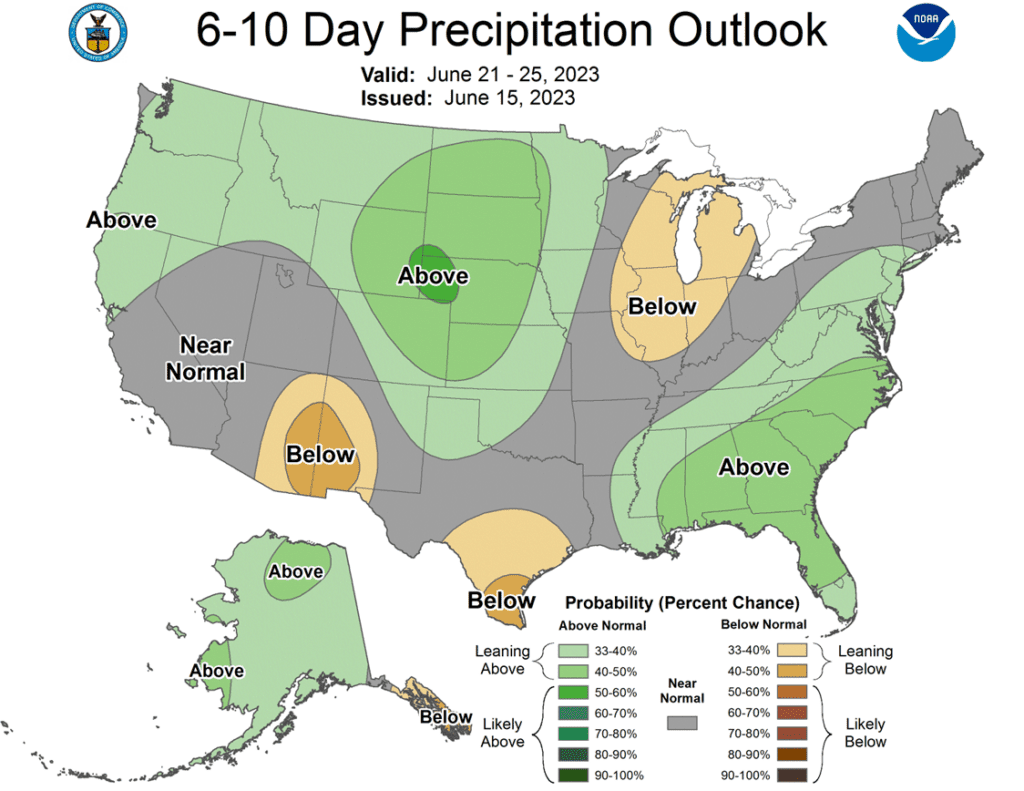

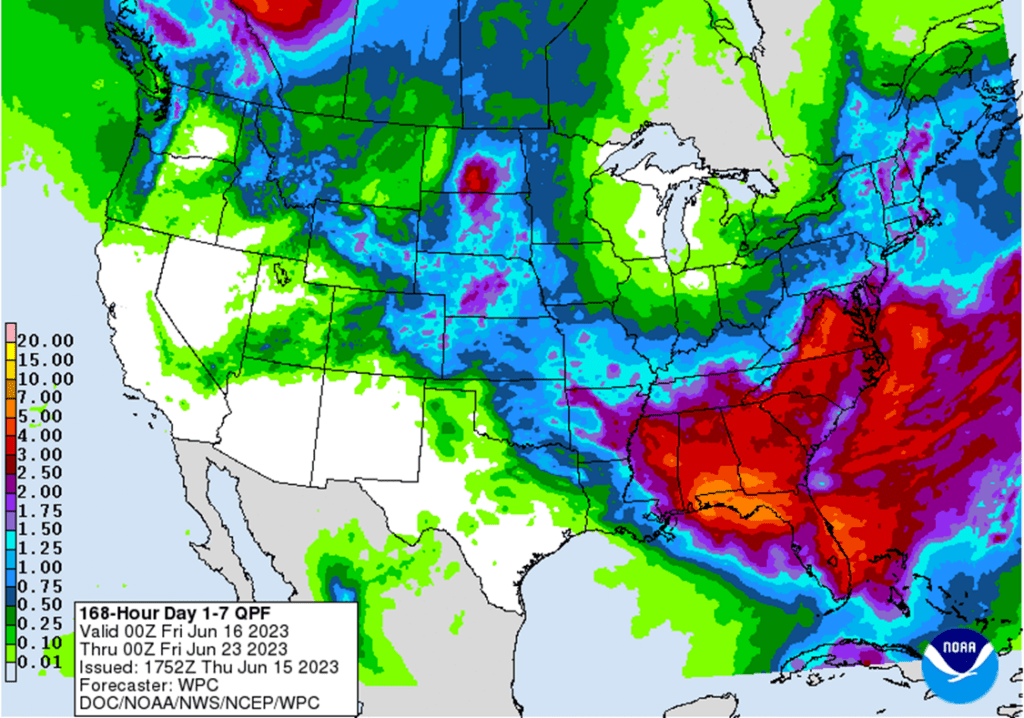

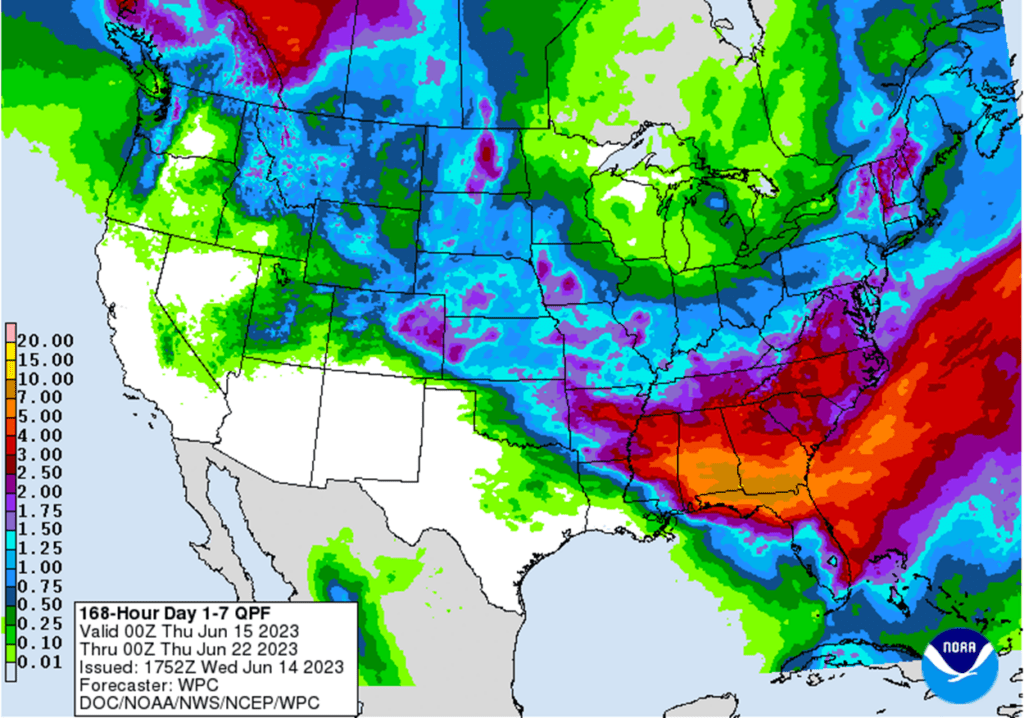

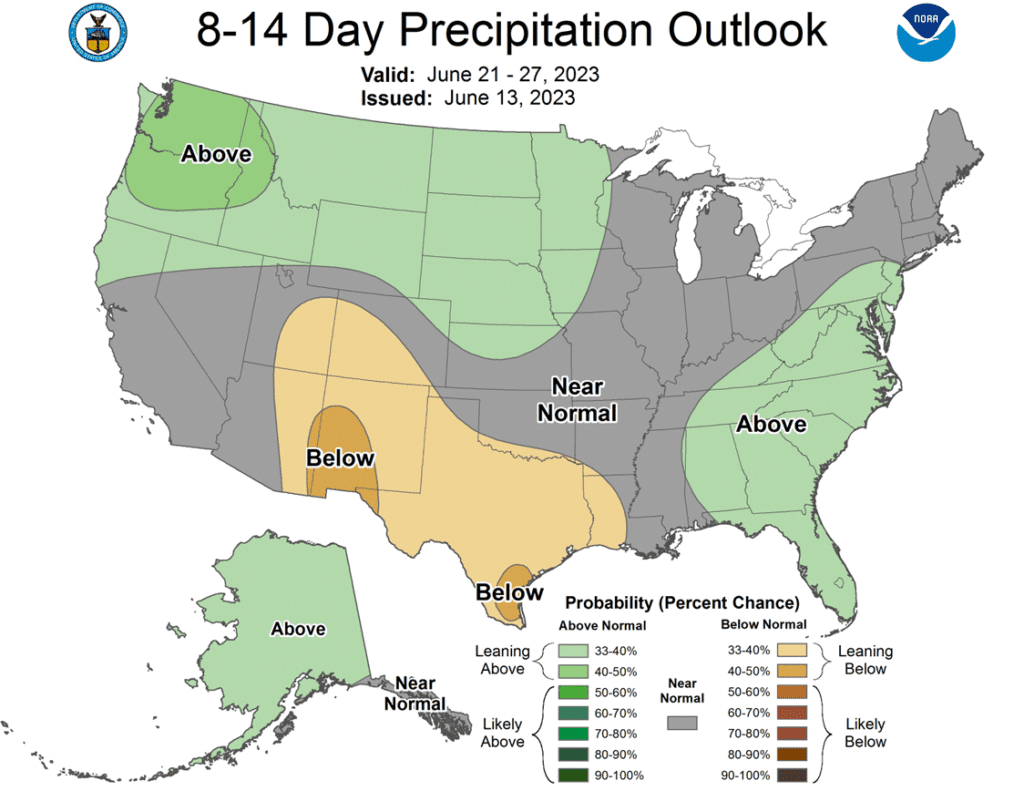

- Rains over the weekend were spotty with decent coverage in Iowa but below expected and spotty rains in the rest of the Corn Belt.

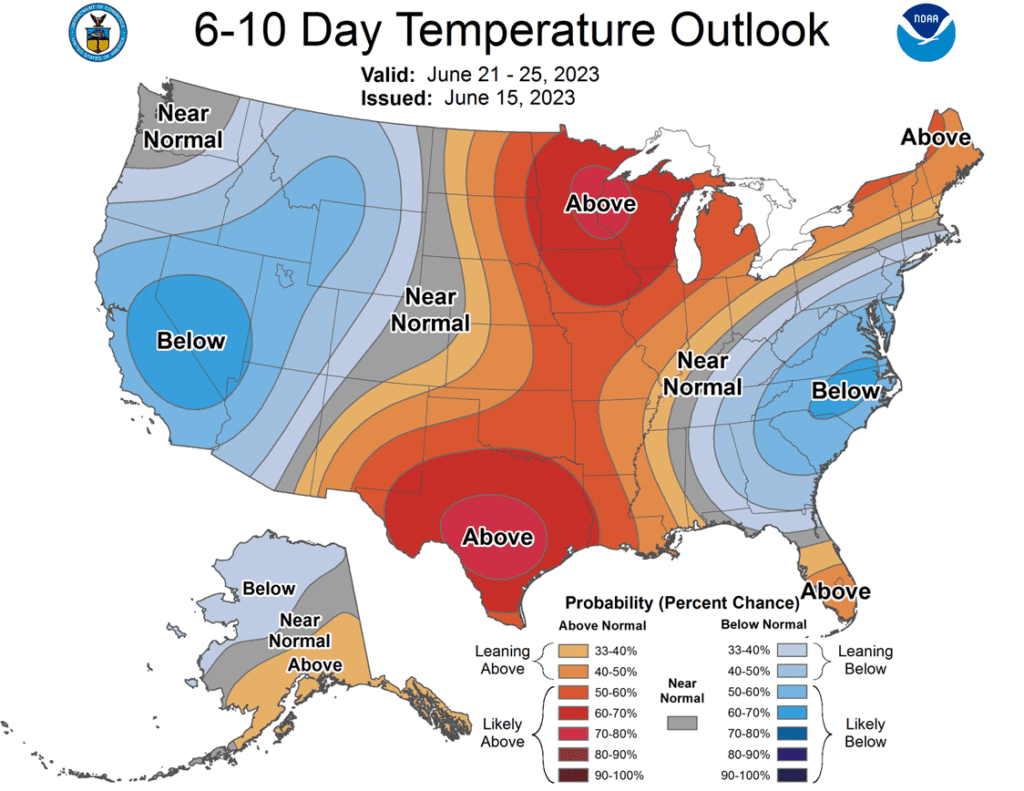

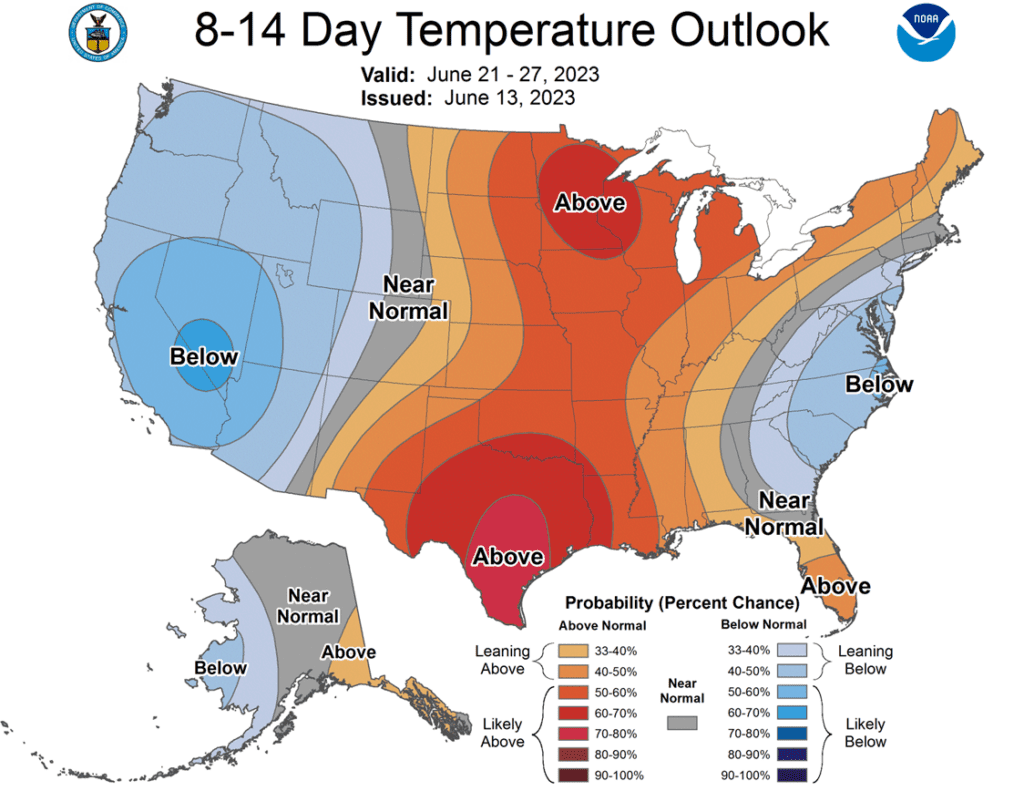

- Rain chances for Iowa, Illinois, and Indiana look light over the next 7 days, and temperatures are expected to get into the 90’s which could stress already low soil moisture.

- Last week funds became buyers buying back 46,637 contracts leaving them with a net long position of 2,145 contracts.

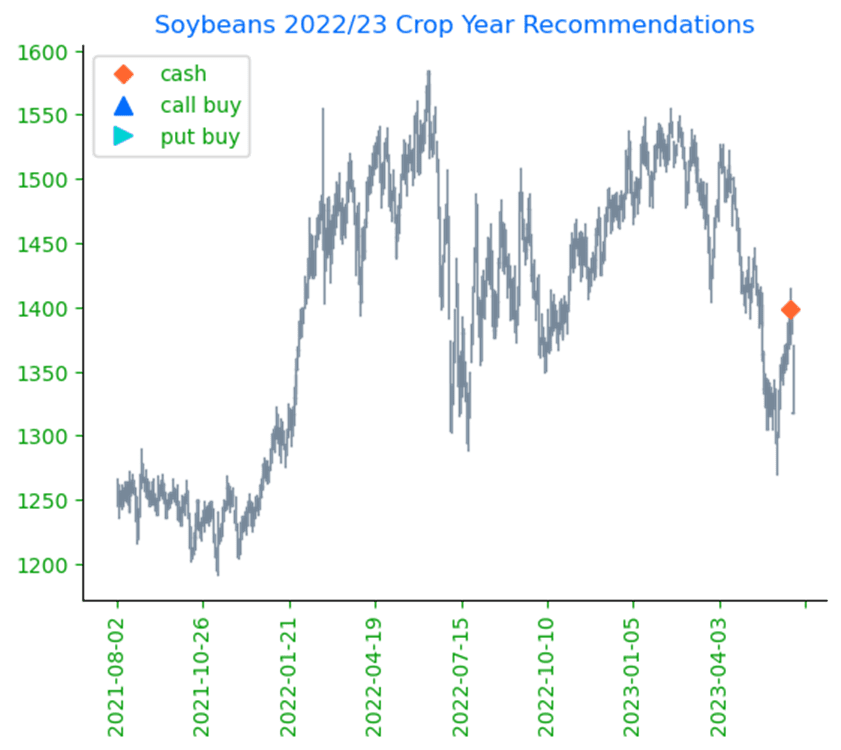

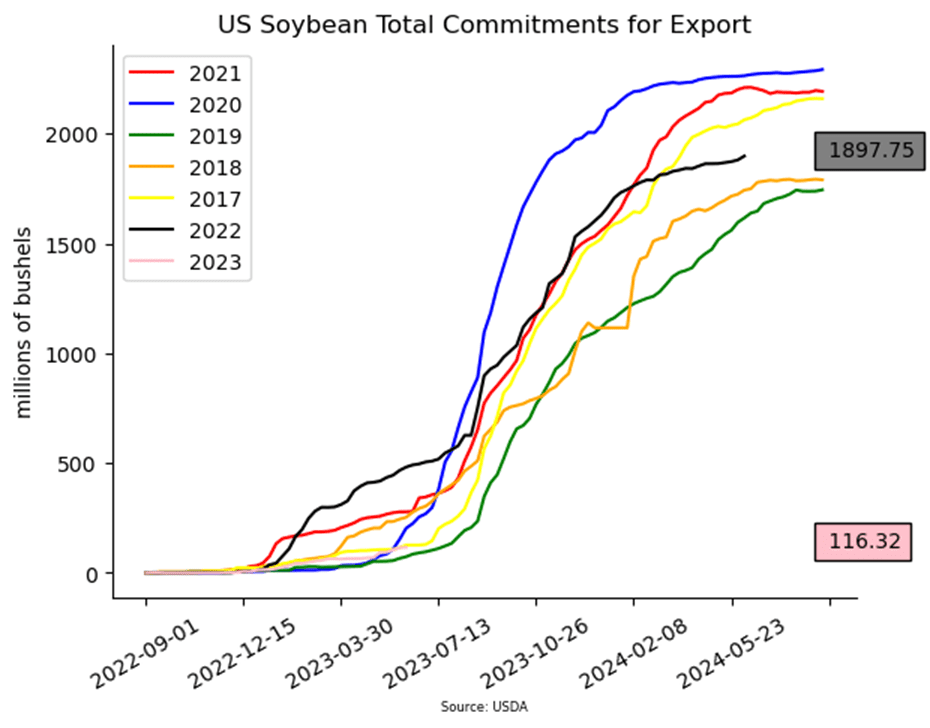

- Soybeans opened strong last night along with corn but have slipped since as funds take profits and producers who received decent rains made cash sales.

- Goldman Sachs downgraded their forecast of Chinese GDP growth which traders think could curt soybean demand.

- Deferred soybean meal contracts turned lower overnight as well as soybean oil, but crude oil is unchanged so far on the day.

- Funds were buyers of soybeans by 33,901 contracts last week increasing their net long position to 47,882 contracts.

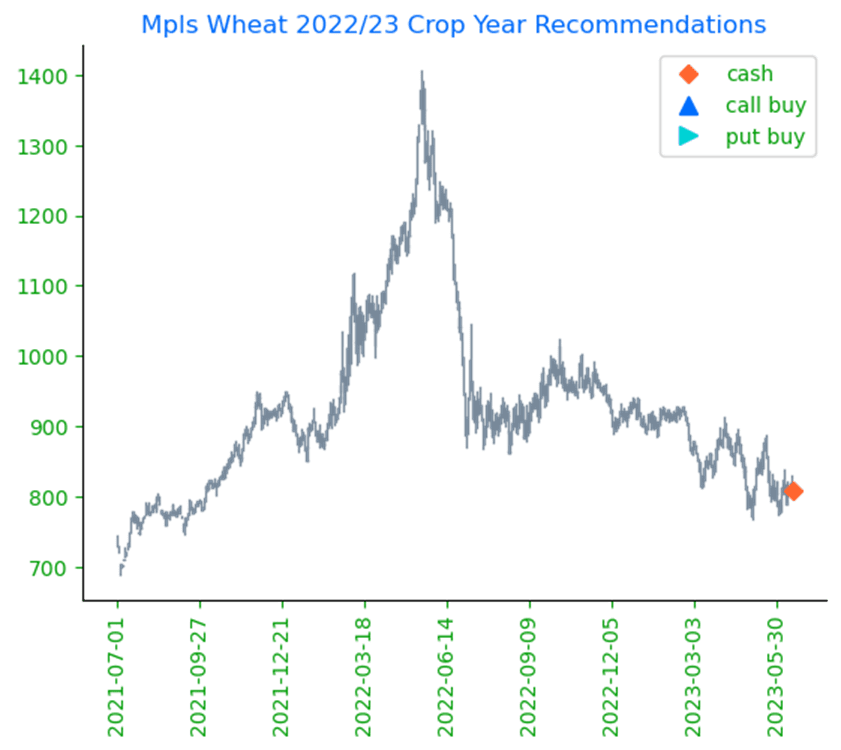

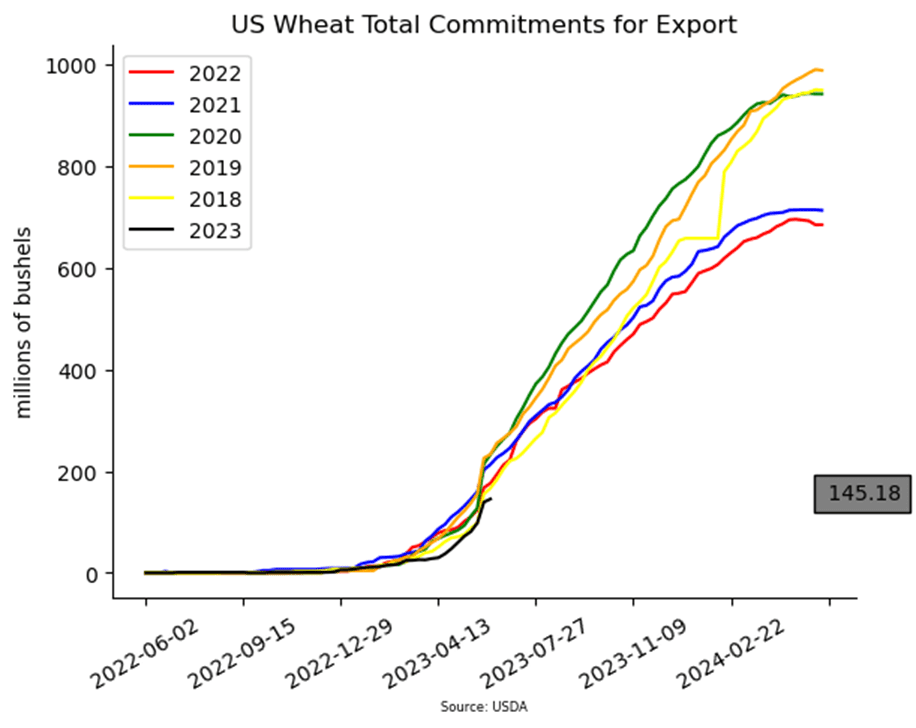

- Wheat futures are lower this morning along with corn and beans but have not seen the rally corn has enjoyed and has remained in a sideways trading range.

- Weather has not been supportive for wheat futures as the southern Plains have received plenty of rainfall over the past month and the Dakota’s as well for spring wheat.

- Russia has stated that the Ukrainian export corridor will not be extended, but at this point traders have heard this so often it has become an idle threat.

- Funds were buyers of wheat last week by 6,044 contracts, reducing their net short position to 113,430 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.