Grain Market Insider: June 28, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

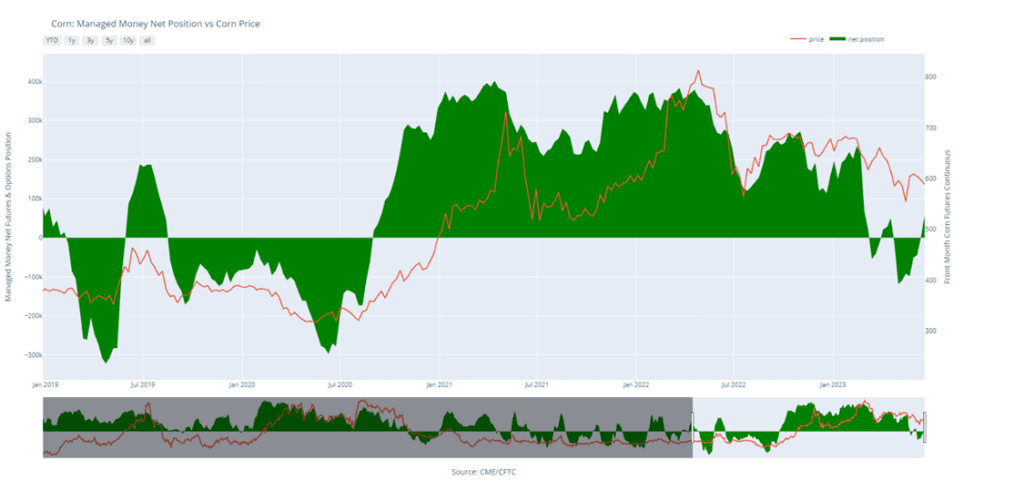

- Long liquidation dominated the corn market, led by the July contract, as traders began moving out of their long positions ahead of Friday’s First Notice Day when long July position holders will be notified of delivery.

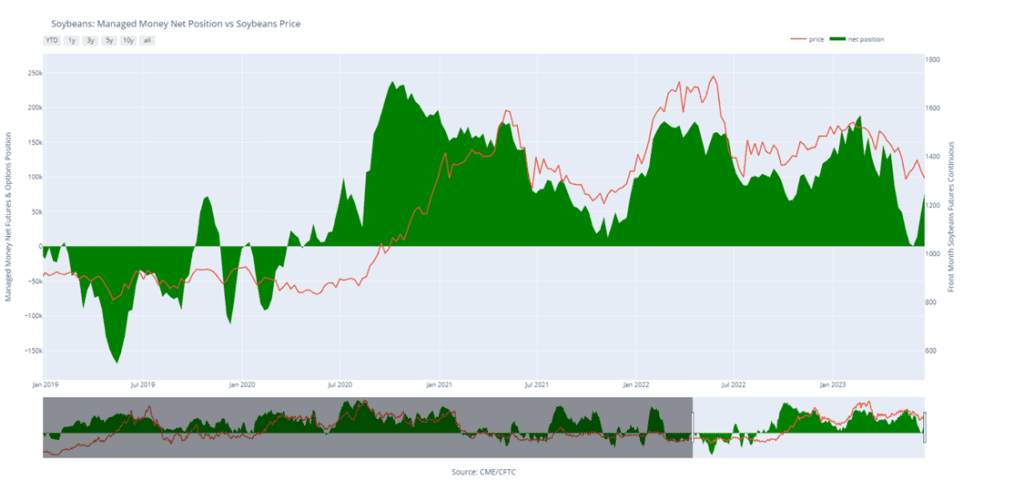

- Like the corn market, soybeans were held hostage by sellers liquidating July positions ahead of Friday’s First Notice Day, as the July/August spread lost 9-1/2 cents.

- Sharply lower soybean meal and oil added to the negativity in soybeans, as Stats Canada reported an increase of 500k acres to Canada’s Canola crop.

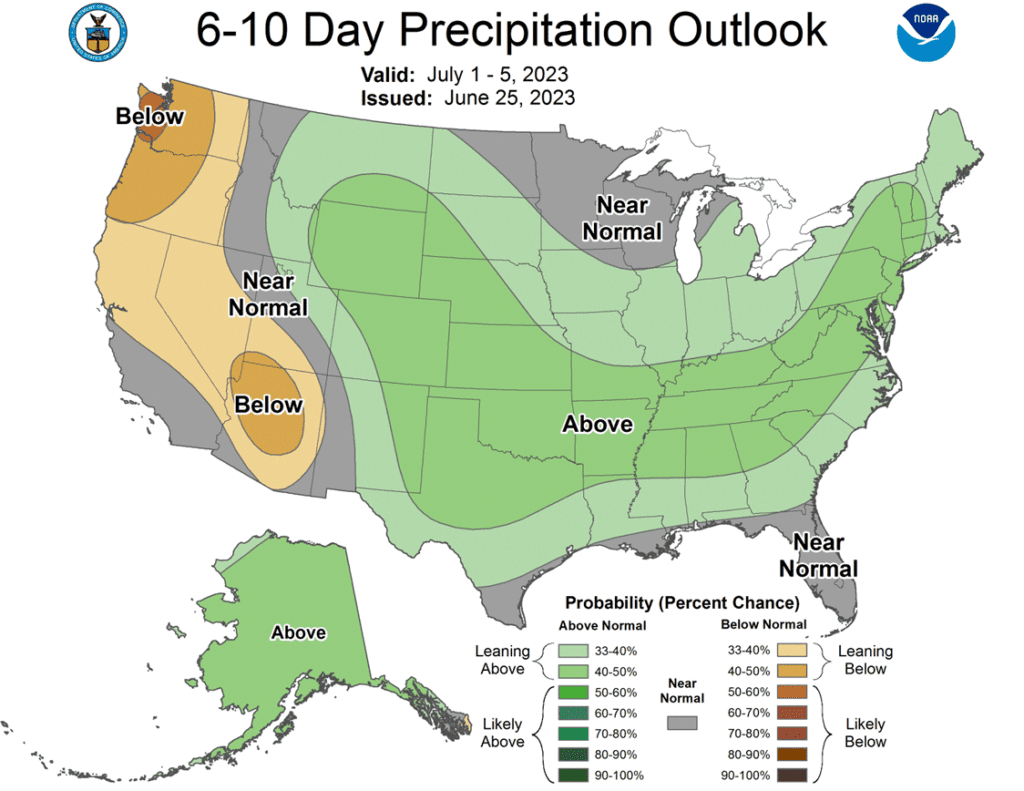

- Sharply lower corn and beans add downward pressure to the wheat complex as Funds likely add to short positions on a more favorable weather forecast for the Midwest.

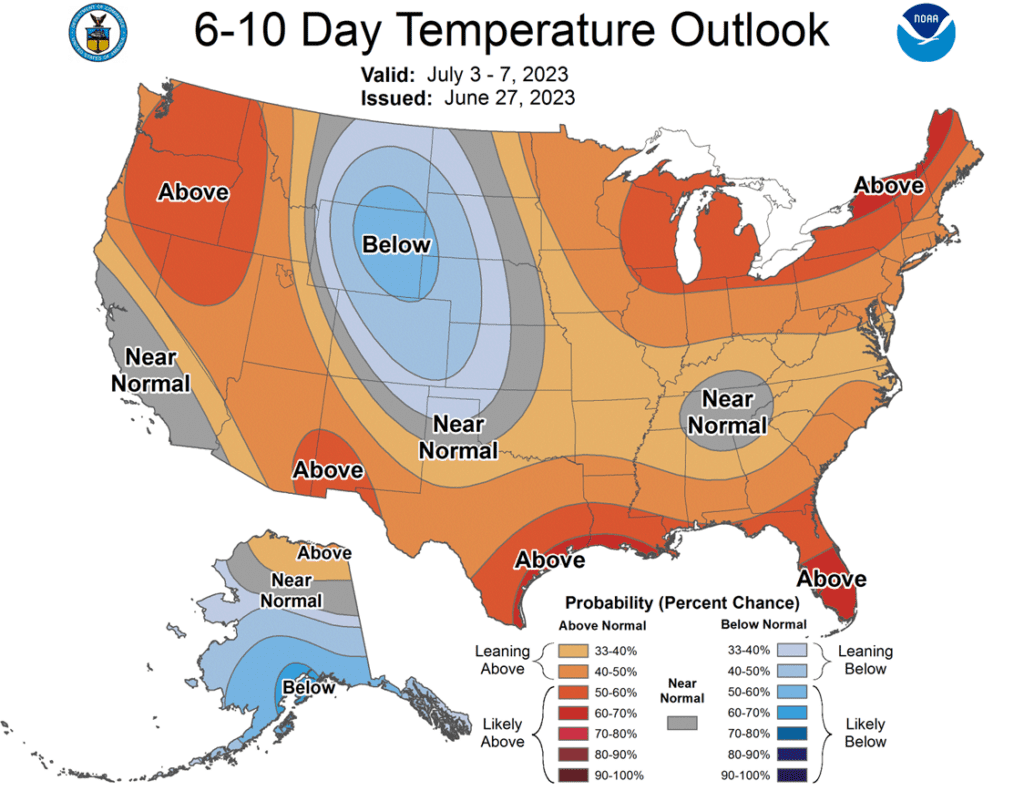

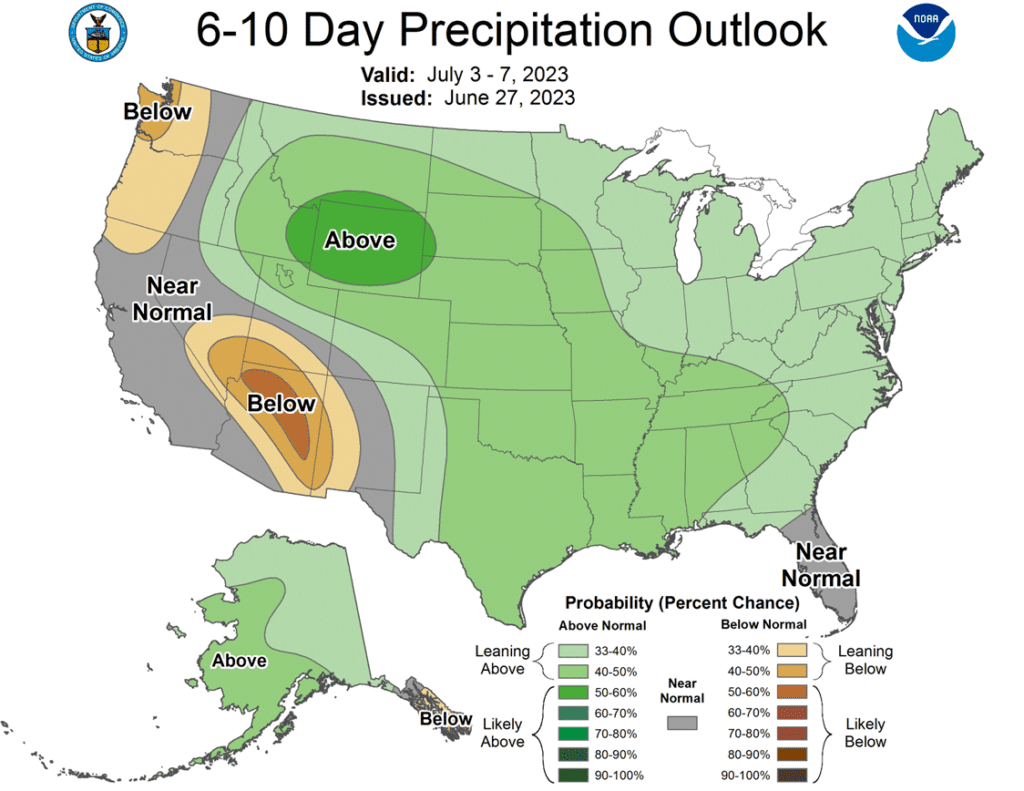

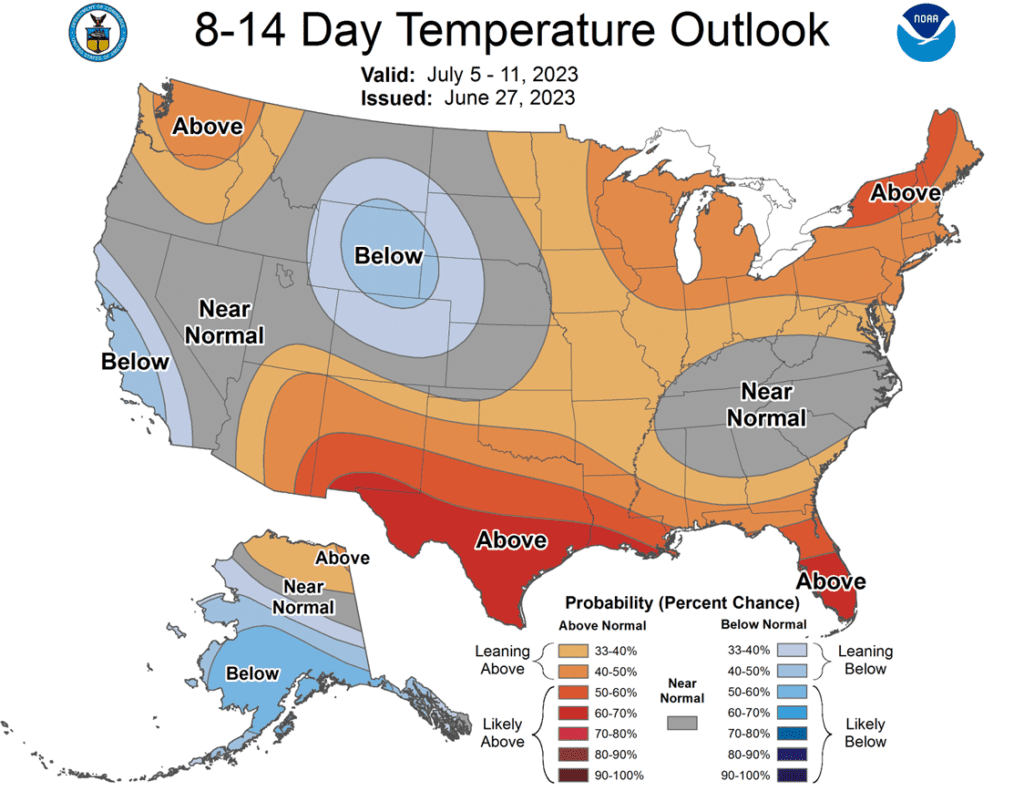

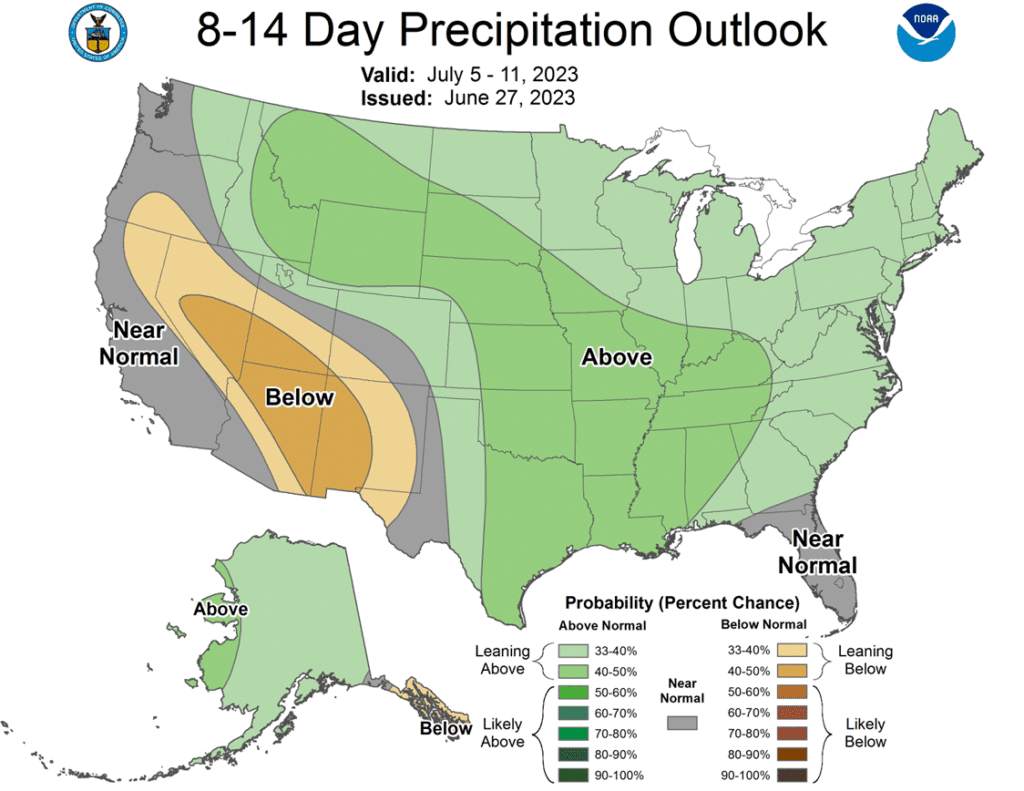

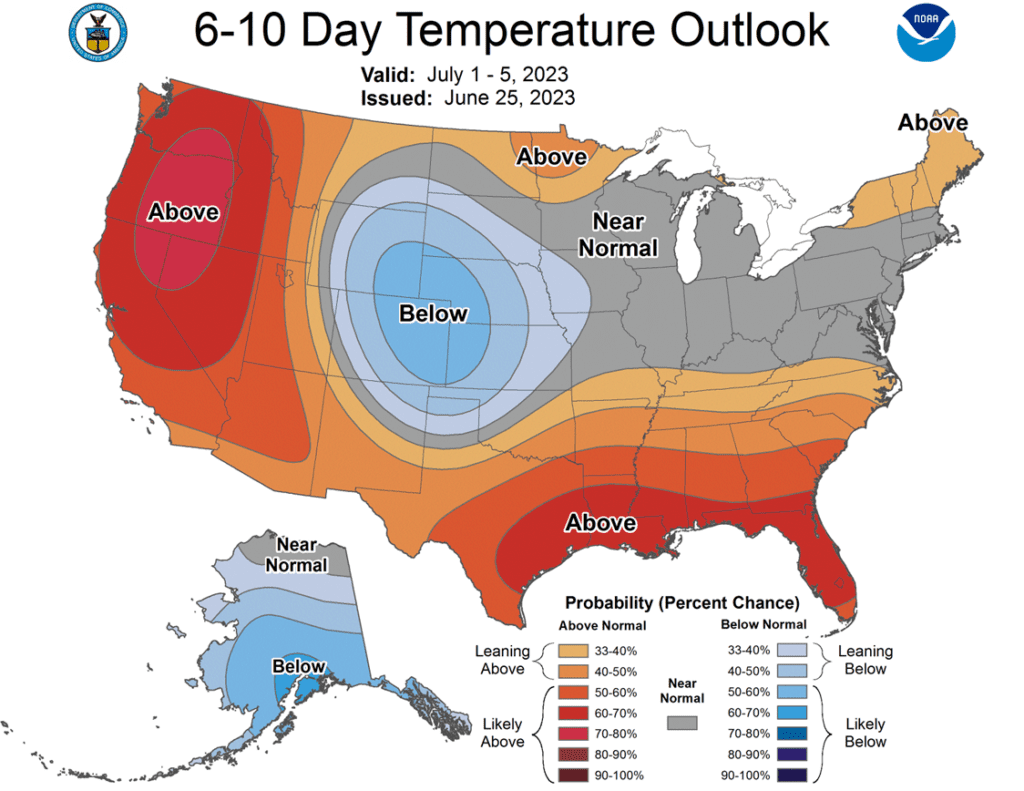

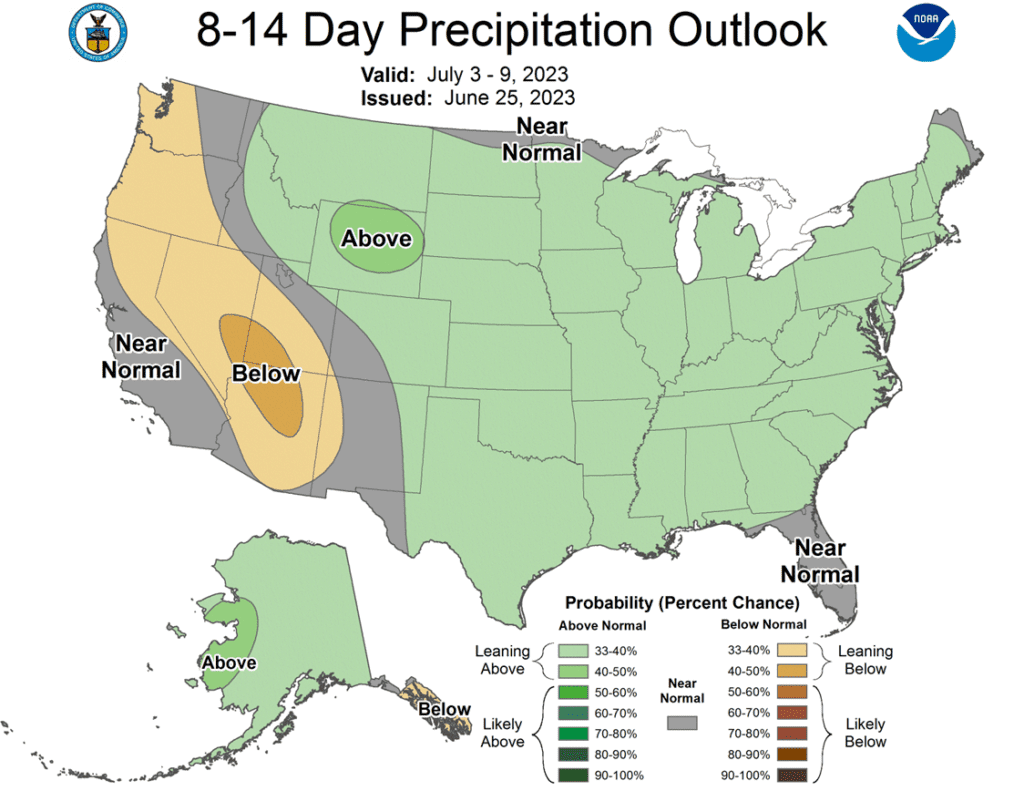

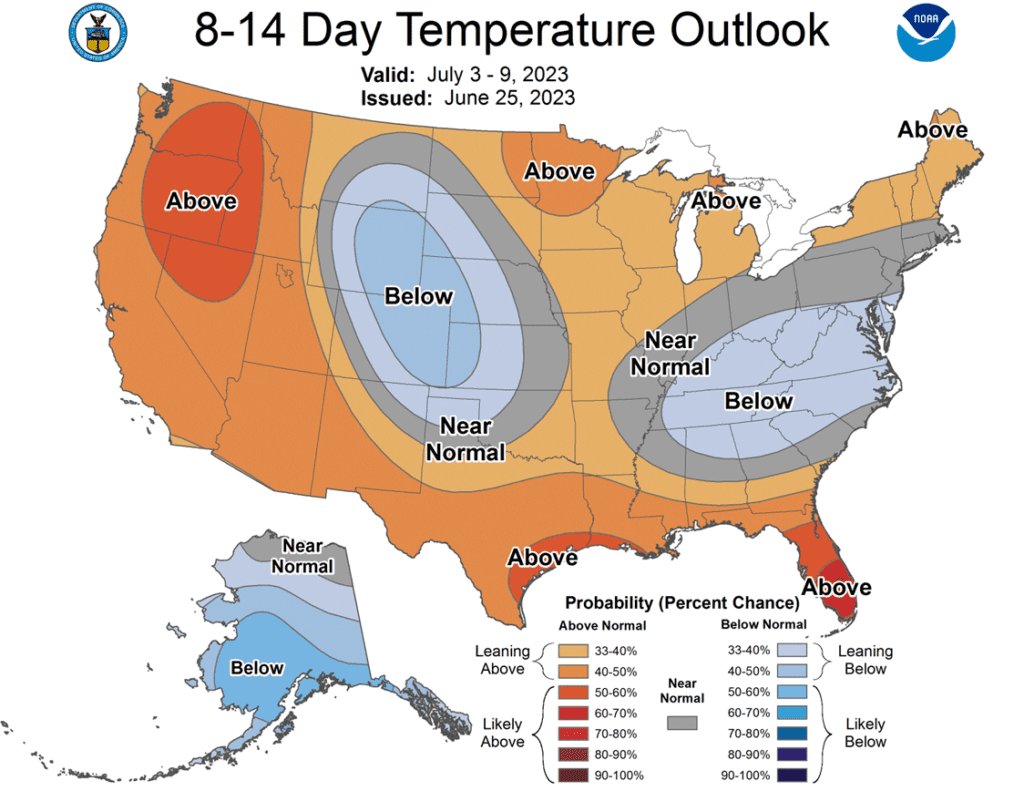

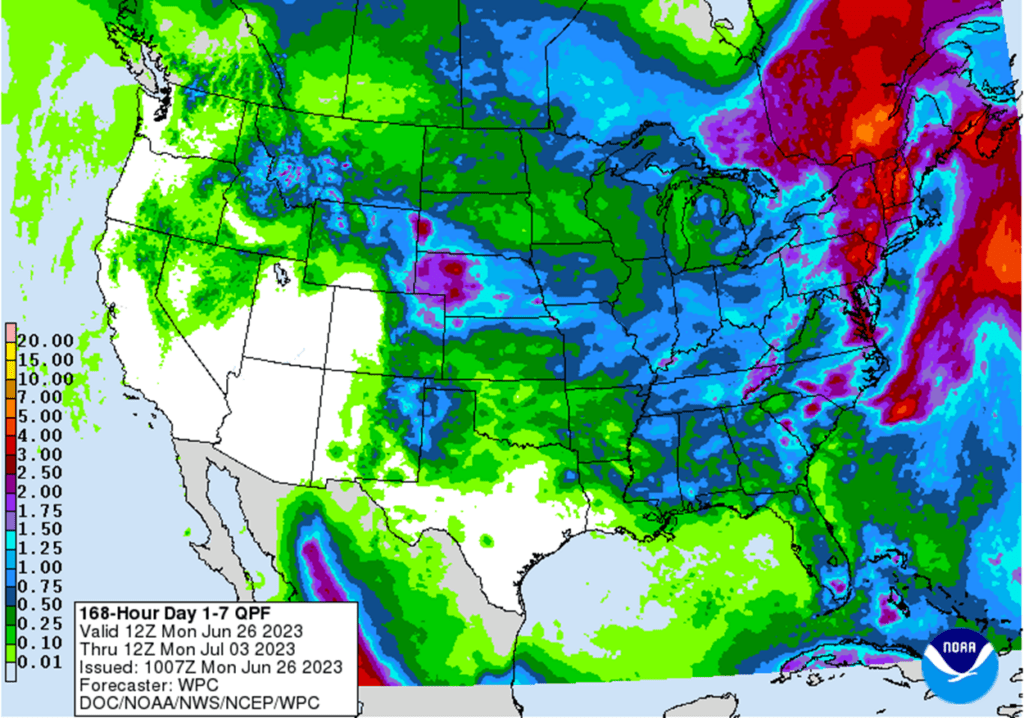

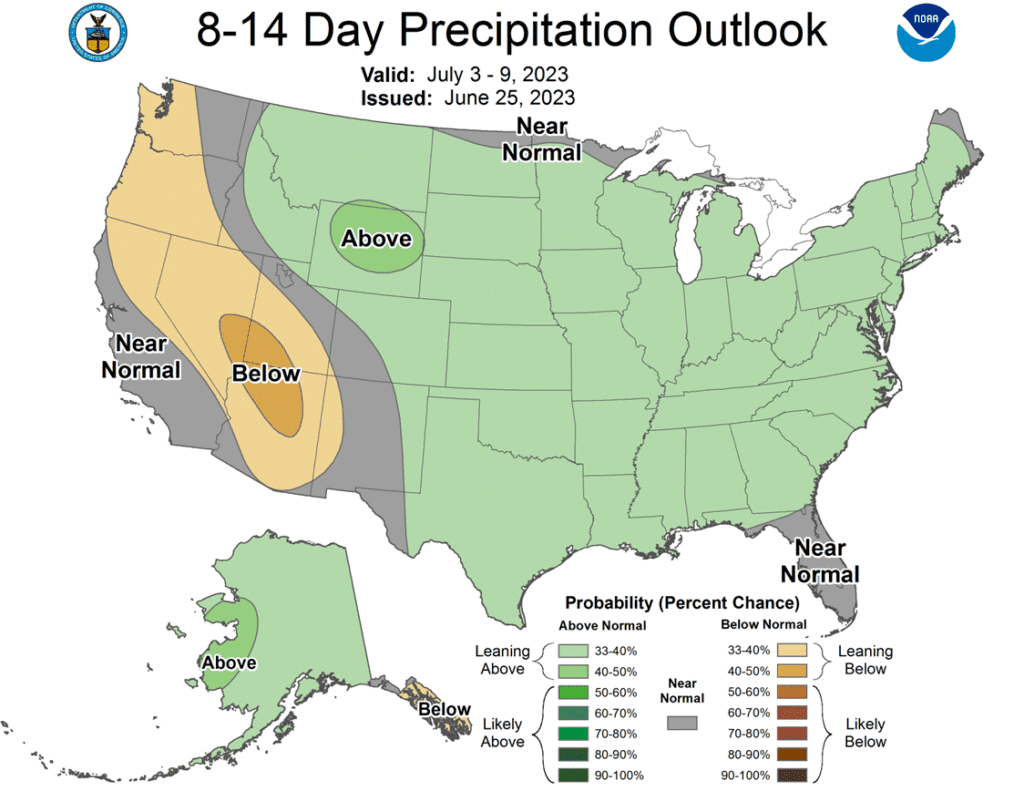

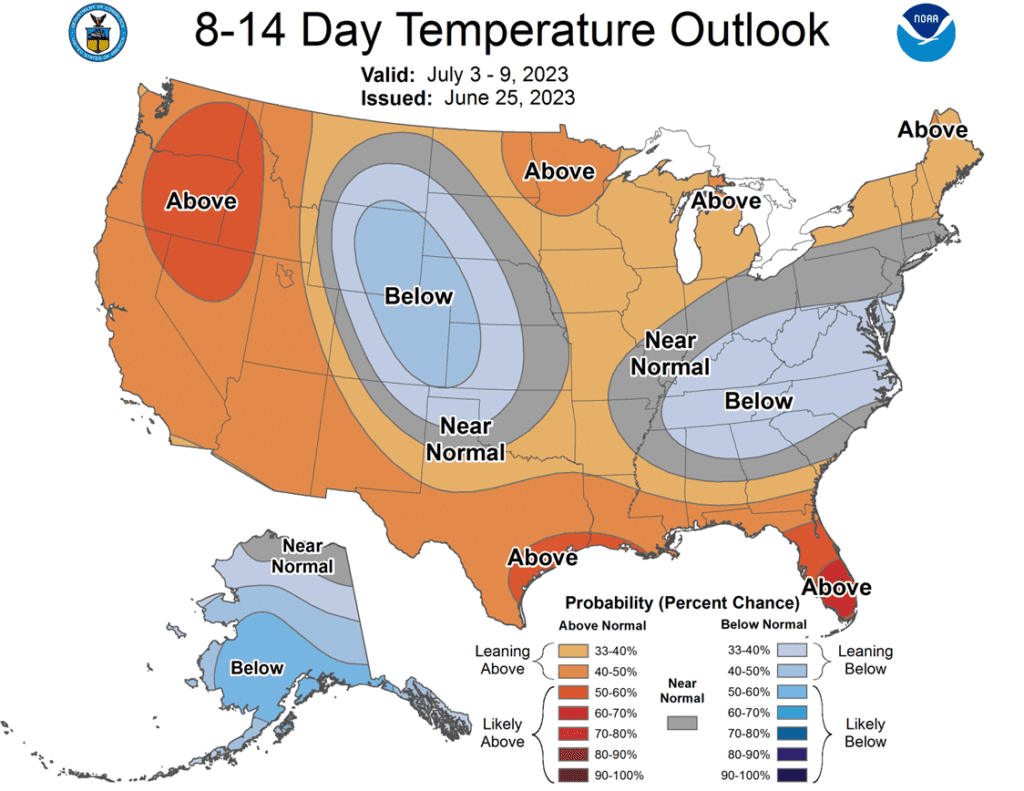

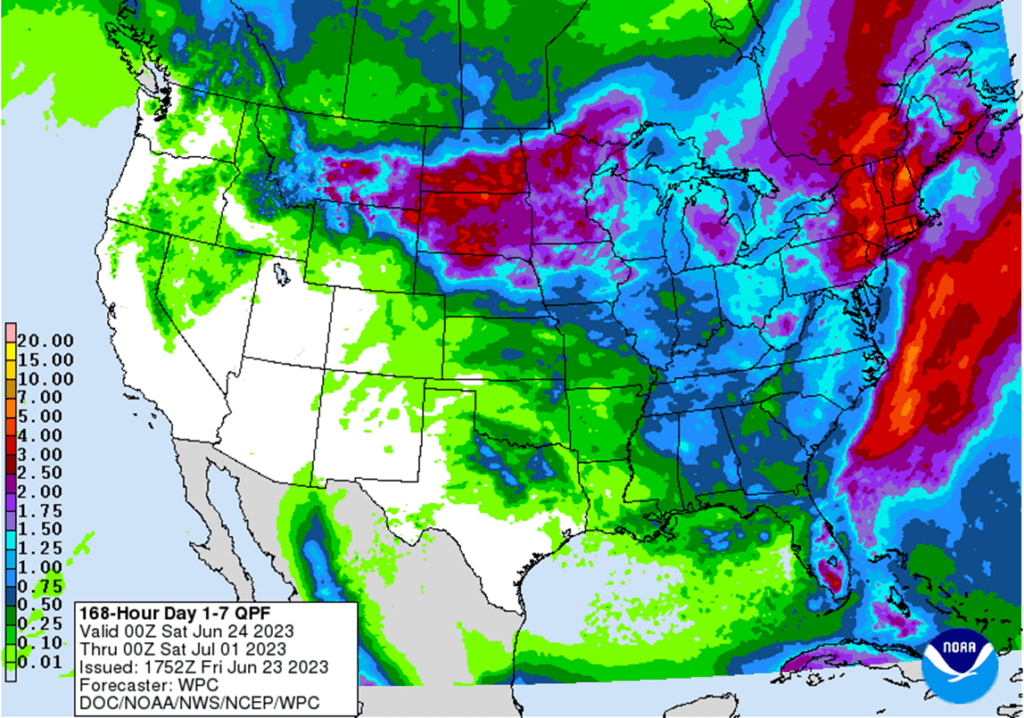

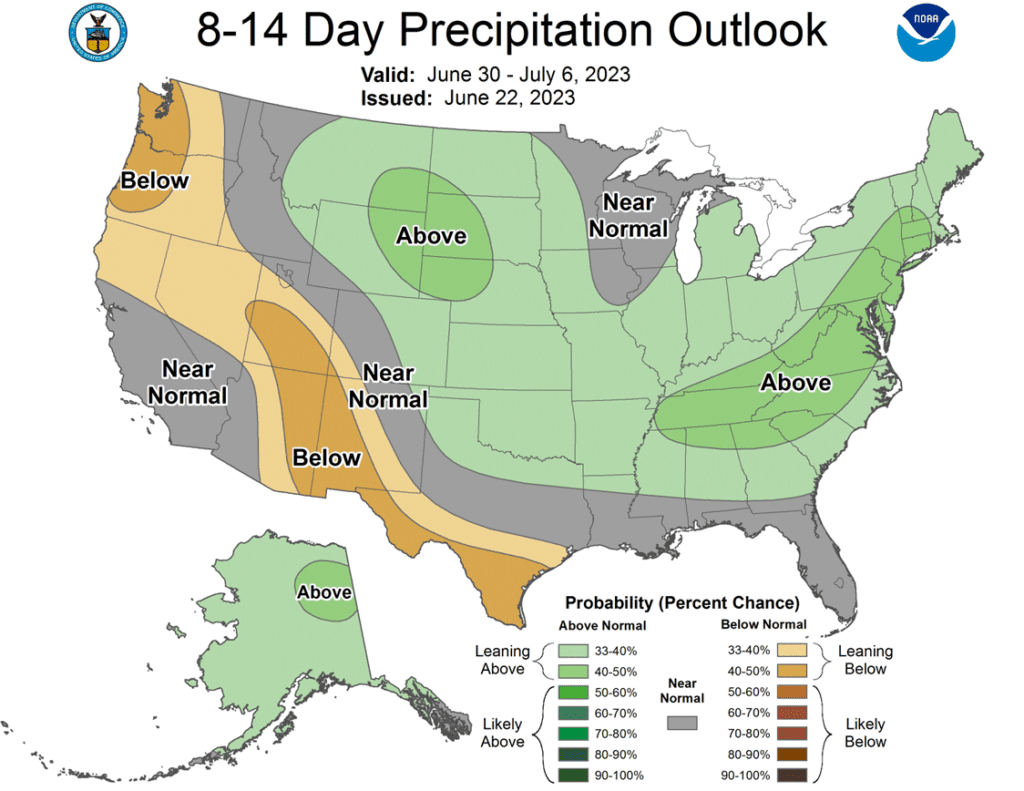

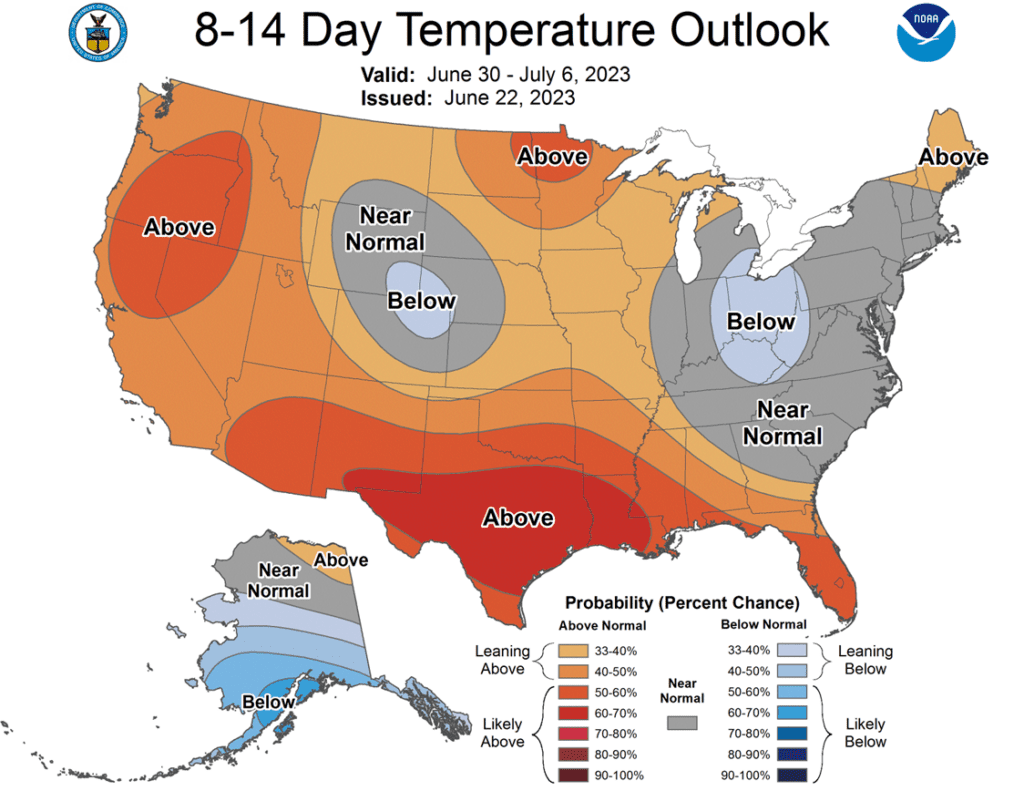

- To see the current US NOAA 6 – 10 and 8 – 14 day Temperature and Precipitation Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

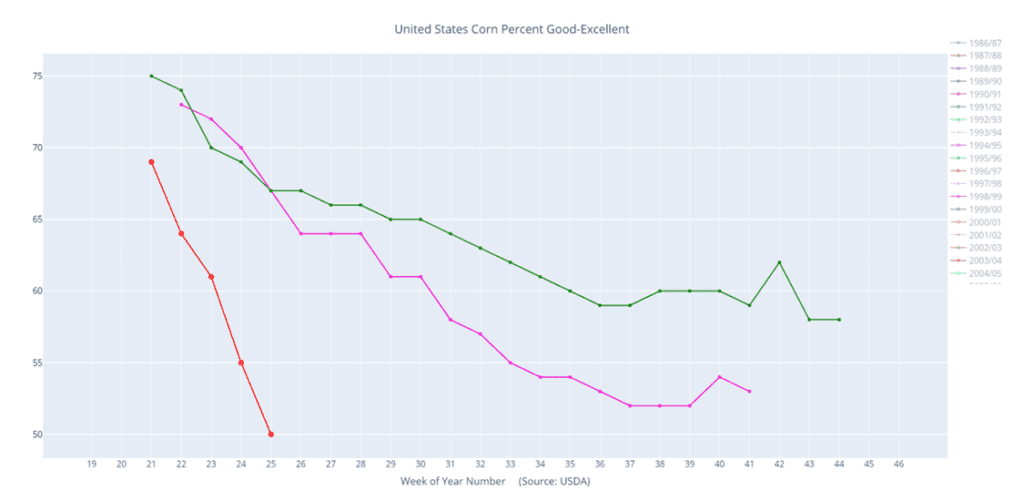

Corn

Corn Action Plan Summary

- No new action is recommended for Old Crop. Any remaining old crop bushels that you may have should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Corn — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

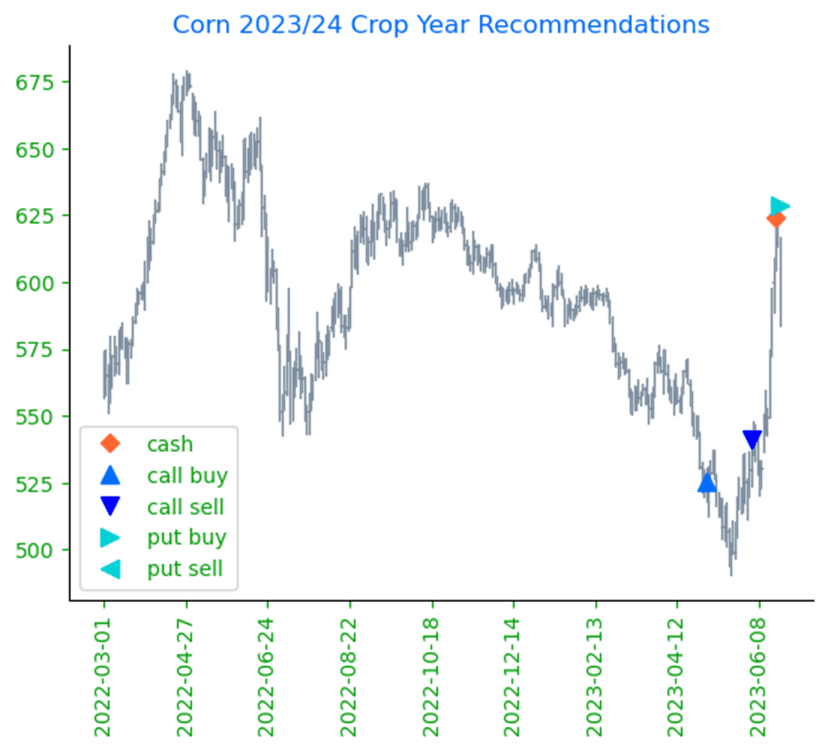

- No action is recommended for New Crop 2023 corn. December corn rallied 139 cents from its May 18 low to its high on June 21 on weather and production concerns. The market is currently off that high on poor export sales figures and a forecast that shows increased chances of rain in the next couple of weeks. When Dec corn was trading over 620, Grain Market Insider recommended making a cash sale and buying Dec 580 puts to cover more downside. The Dec 580 puts, paired with the previously recommended Dec 610 calls, yields a combination of options commonly known as a Strangle, which benefits from dramatic market moves either up or down. Considering it is still early in the season, with drought and crop production uncertainty it is too soon to know if the market high is in or not. Either way, the Strangle position is prepared. If conditions improve from here and prices make new lows, unsold bushels will be protected with the 580 puts. If it doesn’t rain again and prices skyrocket to new highs, already sold bushels will be protected by the 610 calls.

- Continue to hold current sales levels for the 2024 crop year. The Dec 24 contract is trading weather much like the rest of the market and posted nearly an eighty-cent range between 5/18 and 6/21 as dry conditions affect the ’23 crop and the potential carryout for the 2024 crop year. For now, continue to be patient as Grain Market Insider would like to see prices in the 570 – 600 level before considering making additional sales recommendations for the 2024 crop.

- Sellers stayed in control in the corn market as prices finished with strong double-digit losses, dropping another 4% again on Wednesday. Since peaking at $6.29-3/4 on June 16, December corn has lost 93 cents into today’s close.

- Technical selling and long liquidation gripped the corn market as prices pushed through support levels. Selling pressure was only fueled by the weather forecast staying on the wetter side for the next couple weeks, which could provide some severely needed moisture in key growing areas.

- The USDA announced an export sale of corn to Mexico this morning. Mexico bought 170,706 MT of corn. Of that total, 21,340 MT was old crop, and 149,366 MT was new crop. This was the first published export corn sale since April 14.

- The market may turn choppy as traders look to this Friday’s USDA Planted Acreage and Grain Stocks report. Expectations are for corn acres to be at 91.8 million acres, down slightly from the March planting estimates. Grain stocks for the quarter are expected to be near 4.25 billion bushels, down 2.3% from last year.

Above: Weather continues to dominate price discovery with every change in the weather forecast. Corn rallied into the 625 resistance area and reversed lower to test 580 – 540 support level. Should this support area fail, further support may be found below the market between 505 and 490. With resistance above 625 coming in near the March highs between 650 – 670.

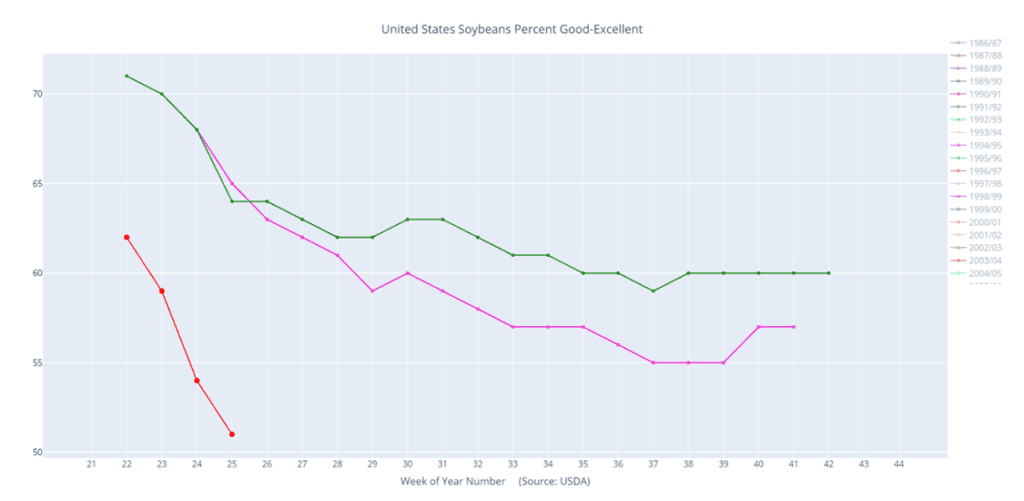

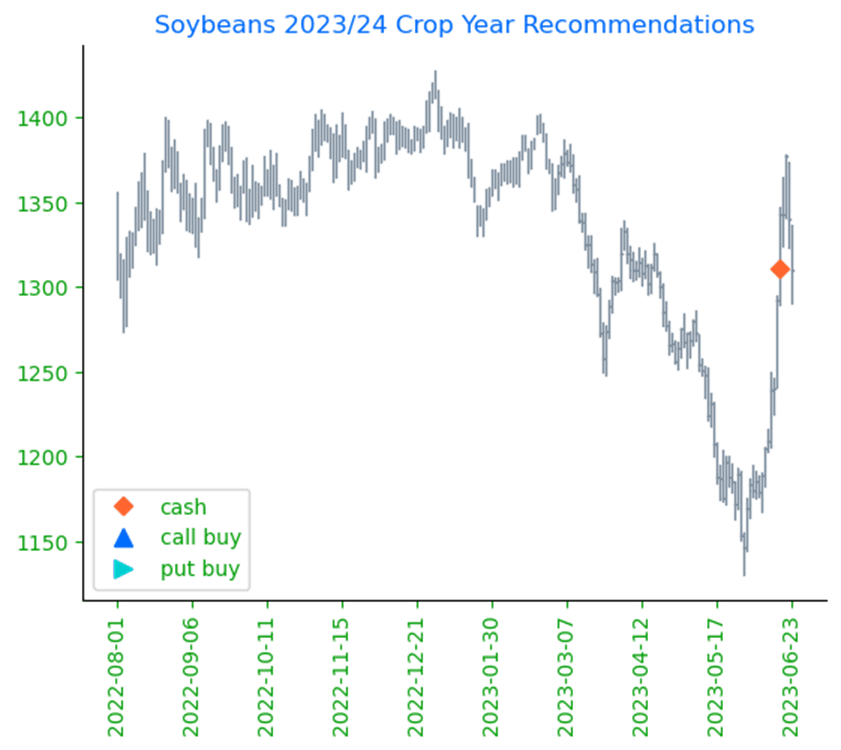

Soybeans

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is being recommended for New Crop 2023 soybeans. Changes in weather forecasts and crop conditions will continue to dominate the market. With having just recommended making a cash sale, and with one of the most volatile USDA report days of the year coming this Friday, we would need to see the market rally to 1400 – 1450 area before we would consider recommending any additional sales for the 2023 crop. Otherwise, in light of current crop conditions, we will suggest holding tight on further cash sales for now.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

- Soybeans closed sharply lower again, along with both soybean meal and oil, as weather forecasts continue to predict needed rains over the next 5 days in the Corn Belt. Illinois and Indiana are slated to receive the most rain followed by Iowa.

- Next week’s Crop Progress report will be interesting in that we will see how much help the crop received from this week’s rain. Monday’s report showed good to excellent ratings at just 51% and Illinois’ ratings at just 25%.

- Brazil’s soybean crop has been estimated higher yet again, now at 156 mmt. They increased their soy exports as well to a record large 97.3 mmt, up 1.3 mmt from their last estimate.

- On Friday, the Planted Acreage report will be released, and the Dow Jones survey expects the USDA to say that 97.7 million acres of soybeans were planted in 2023 and 808 mb of soybeans were on hand as of June 1.

Above: The market’s eye is squarely on the weather at this time. The August contract rallied through the 50-day moving average and hit resistance near 1450 and the 100-day moving average. If the market can rally beyond this point, the resistance area between 1500 and 1550 could be its next target. If the market drops back, support could be found between 1340 and 1300 with further support near 1270.

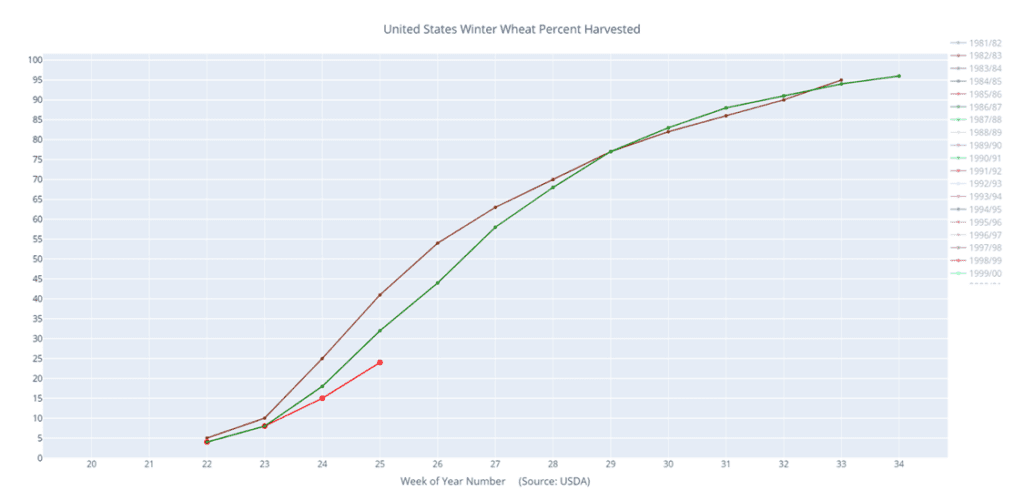

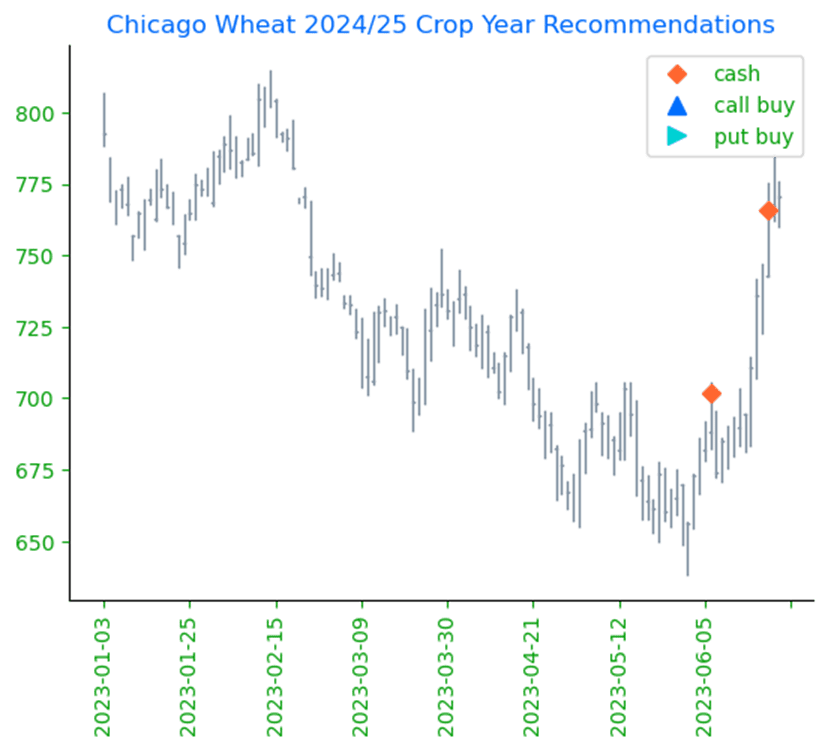

Wheat

Market Notes: Wheat

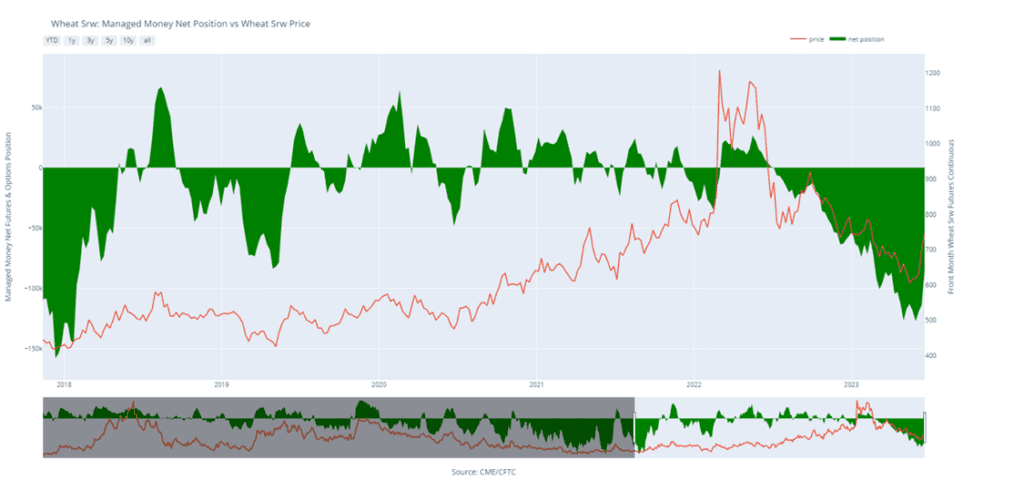

- Neither the higher US Dollar today, nor lower Matif wheat futures offered any support to the US wheat complex. Funds are likely adding short positions due to the shift in weather towards a wetter forecast. Additionally, lower row crop futures do not help the wheat price situation.

- Major weather models are all putting more rain in the forecast for the driest parts of the Midwest. This may slow winter wheat harvest, which is already behind the normal pace. But it may also bring some moisture to northern spring wheat areas, improving crop conditions there. Spring wheat is currently rated 50% good to excellent.

- Within the past week, two cargoes of wheat have left Ukraine along with 5 cargoes of corn, destined for Europe and China. While there have been reports of Russia blocking shipments in the Black Sea, some grain still appears to be flowing. This is also despite the recent developments in Russia and the Wagner group’s attempted coup.

- The Ukraine Grain Traders Union is estimating Ukraine’s wheat crop at 24.4 mmt, which is higher than other estimates ranging from 16-18 mmt. If the Black Sea corridor is renewed on July 18th (still an uncertainty at this point), increased exports out of that region could further pressure US markets.

- On Friday, traders will receive the quarterly Stocks and Acreage reports from the USDA. All wheat acreage is expected to be down slightly at 49.647 million acres, compared to 49.855 on the March report. The pre-report average stocks estimate is at 611 mb, vs 946 in March, and vs 698 at this time last year.

- December Chicago wheat broke through support at the 100-day moving average today but did hold support at 5.85, the 21-day moving average. Technically, momentum is down on daily stochastics and the RSI.

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Grain Market Insider is done with the 2022 crop, and there will be no New Alerts posted for the 2022 crop going forward.

- No new action is recommended for 2023 New Crop. In the month of June, the September Chicago wheat contract posted a 163 cent range and has largely been a follower of the corn market which has been mostly driven by weather. While demand remains weak, production concerns in parts of the country remain, as does uncertainty surrounding the Black Sea region and the potential for major exporting countries’ inventory to hit 16-year lows. While Grain Market Insider will continue to monitor the downside for any violation of major support, following the recent sales recommendation it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

- No action is currently recommended for 2024 Chicago wheat. Price volatility has risen in the last couple of weeks due to the changing weather forecasts and current events in the Black Sea. While prices have fallen off their recent highs, plenty of time remains to market next year’s crop. War continues in the Black Sea region, major exporting countries’ stocks expected to fall to 16-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recently recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

Above: September wheat rallied nearly 200 cents from the May low to its June high when it encountered heavy resistance and posted a bearish reversal. This technical formation on the price chart is considered bearish and momentum may be adding to the bearish tone. Support below the market may be found near 670 with further support coming in between 650 – 610. While resistance above the market rests between 770 – 810.

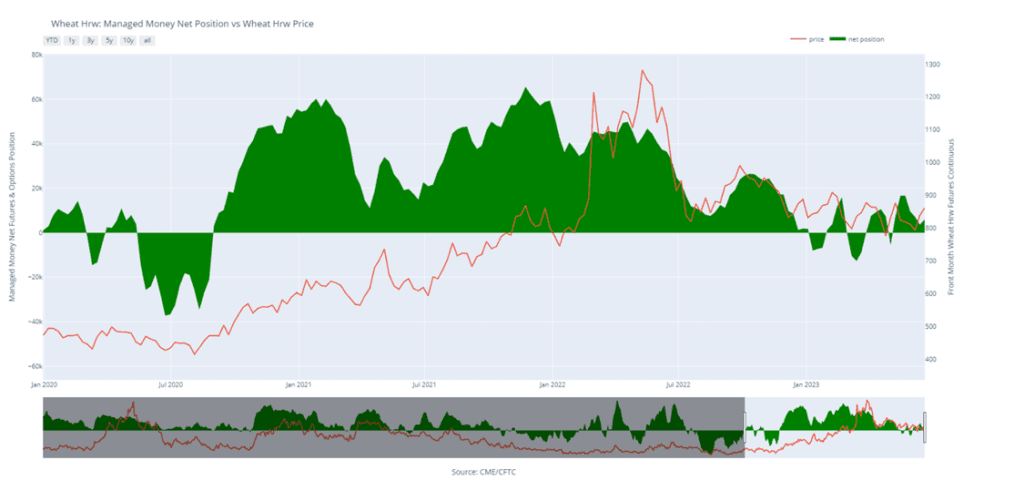

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The September contract continues to trade within the 736 – 919 range established in May, balancing both production and demand concerns. The recent downturn in the market has established heavy resistance above the market between 890 – 920, with initial support coming in between 778 – 763, with key support near the May low of 736.

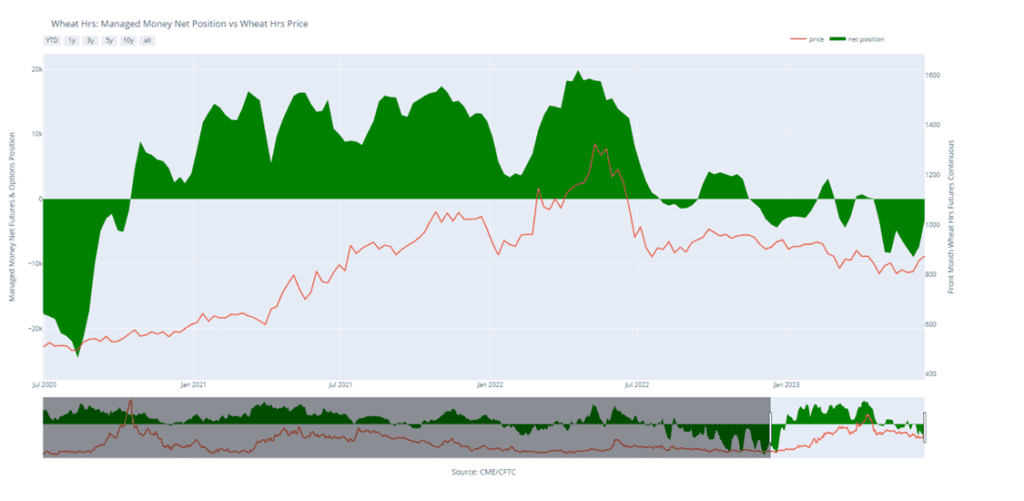

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks, and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract, and there is currently no carry offered.

- Grain Market Insider recommends selling 2023 New Crop MINNEAPOLIS Wheat today. Weather dominates the market right now and friendlier forecasts have pushed prices below the 822 support level. Closing below that 822 support signals that the recent uptrend off the May lows may have ended, which poses the risk that the change in trend could erode the price further in the weeks ahead. The first risk being price drops to the May low of 771, which is where first support comes in. If that level doesn’t hold, then the next risk could be in the 680 – 710 window. Although making a sale in a down market may be uncomfortable, it’s important at times to have a Plan B with the objective of trying to avoid having to sell bushels at even lower prices in the future if a downtrend takes hold.

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

Above: The September contract rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average and into resistance between 889 and 940, the April and December highs respectively. With the market trading lower, it will need additional bullish news to turn it back around. Should the market continue to fall, support may be found between 770 and 730.

Other Charts / Weather