Opening Update: July 5, 2023

Markets are closed until 8:30 am Central Time

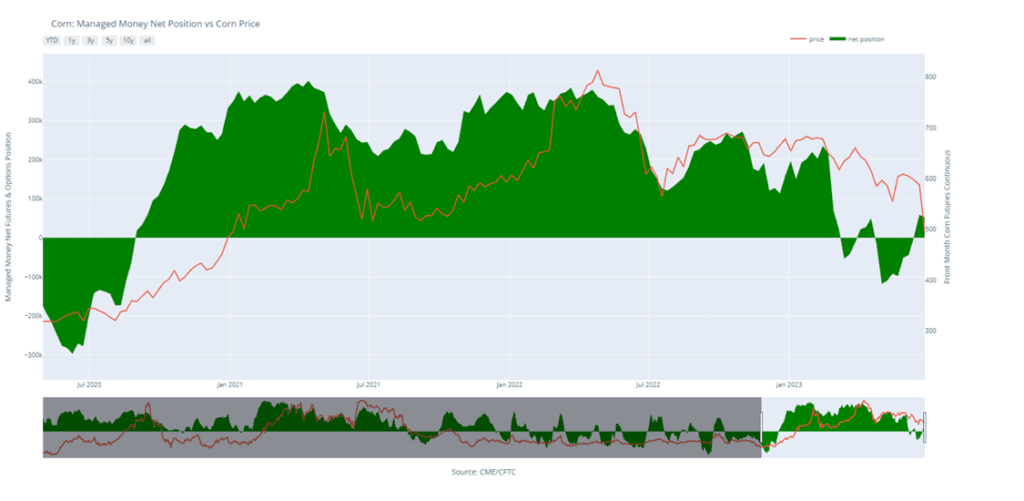

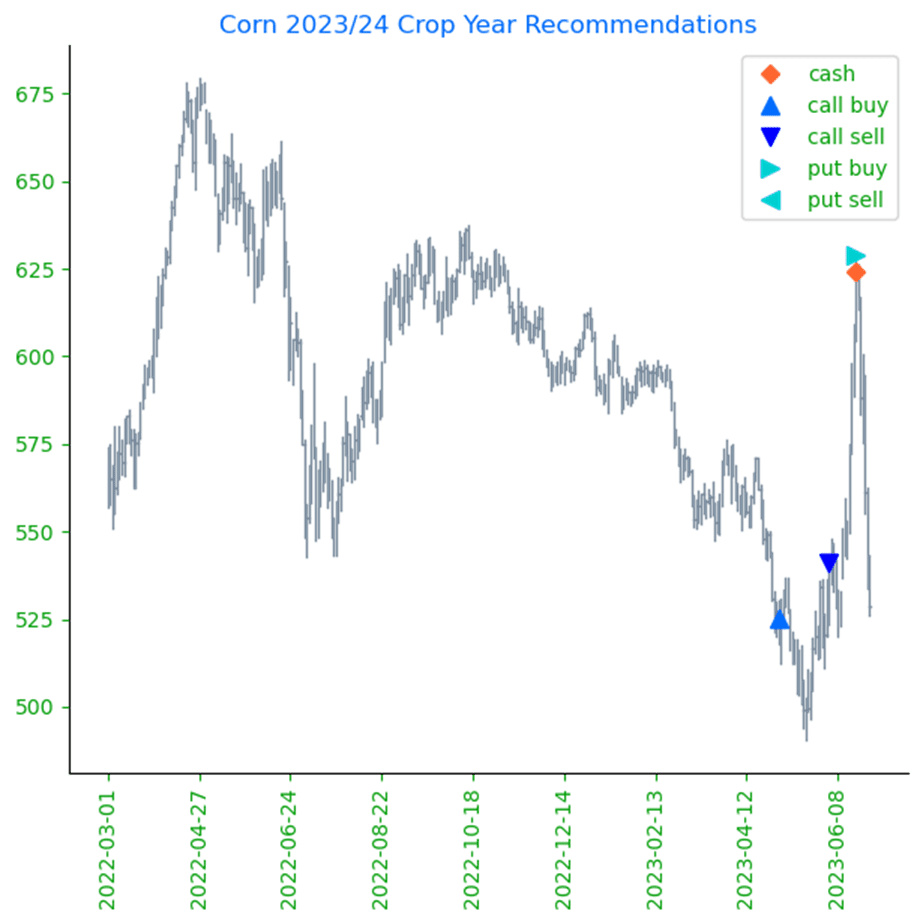

- On Monday, corn traded higher throughout the day before ultimately settling lower on continued pressure from the bearish USDA report.

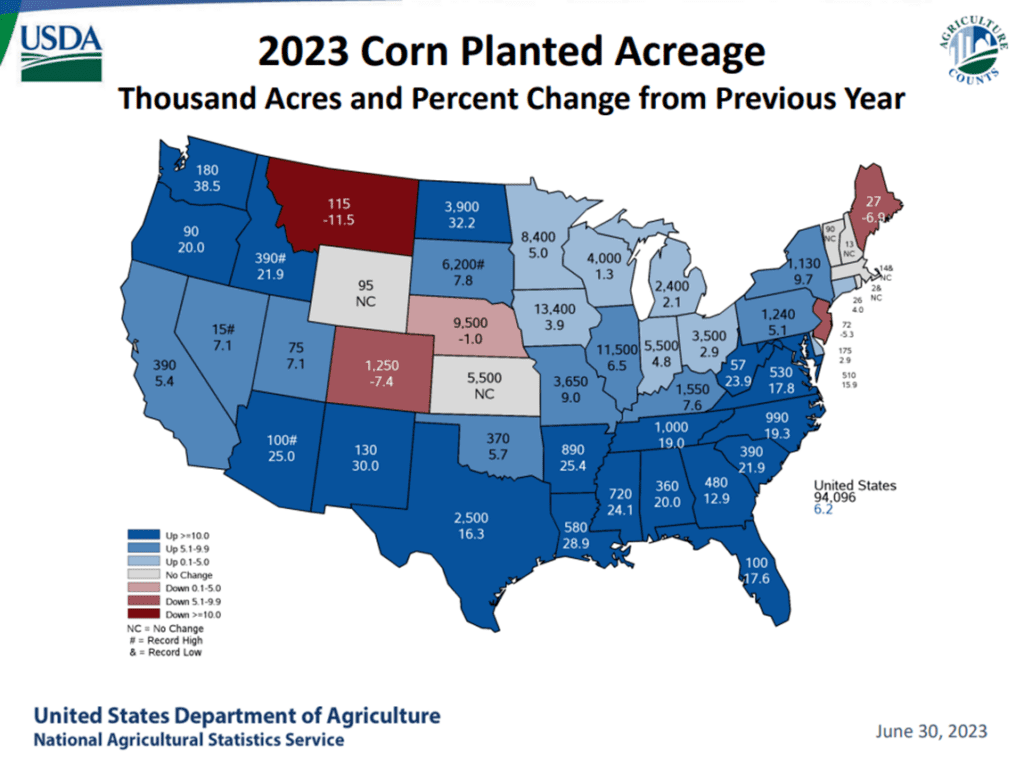

- The USDA said that the planting estimate for corn was 94.1 million acres which would increase ending stocks and has caused selling in corn futures.

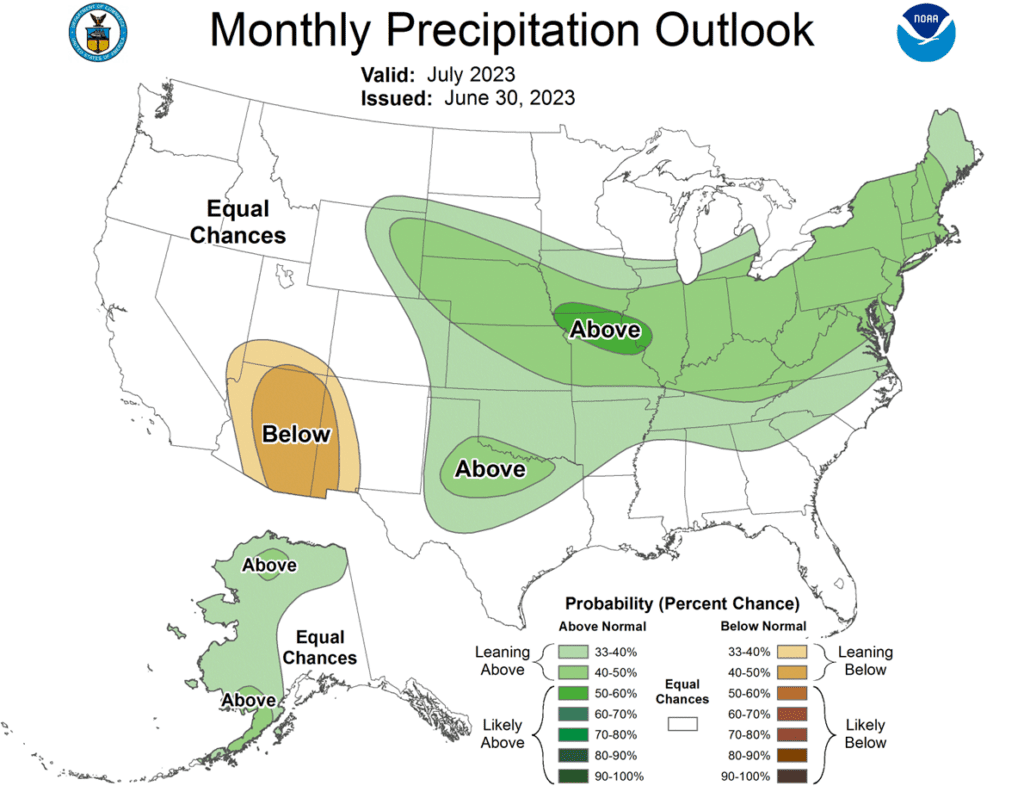

- On Friday, crop progress was released showing the corn crop rated 51% good to excellent, up just one point from a week ago. Illinois, Iowa, and Indiana showed improvement from a week ago.

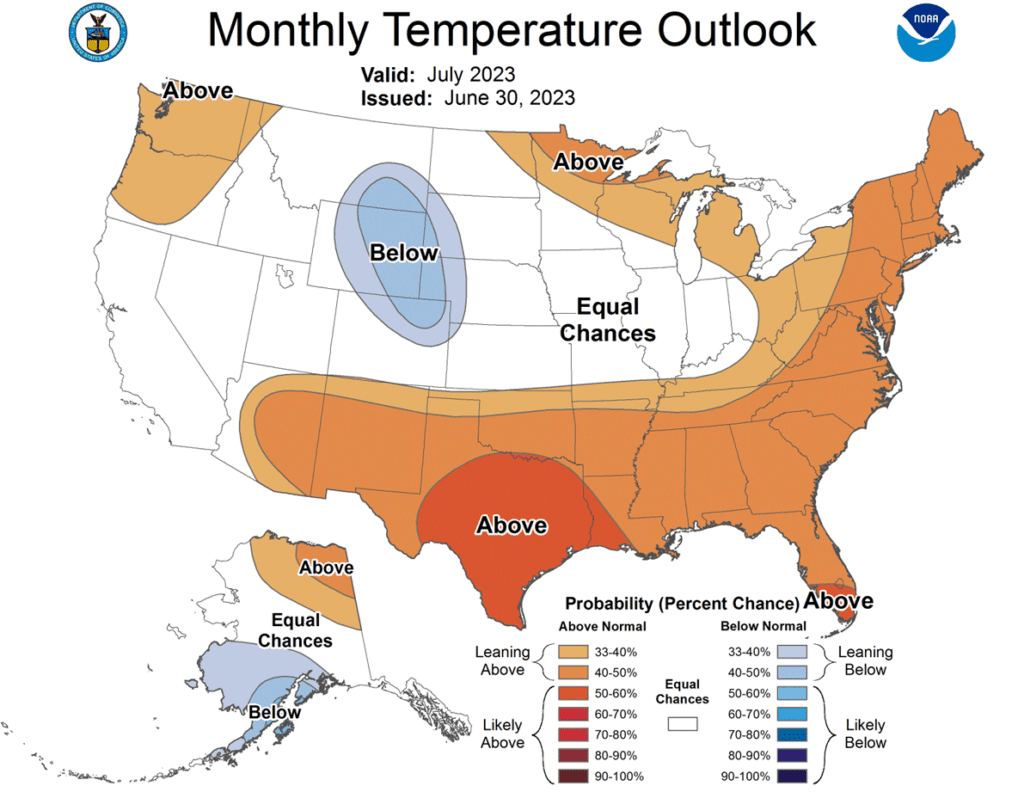

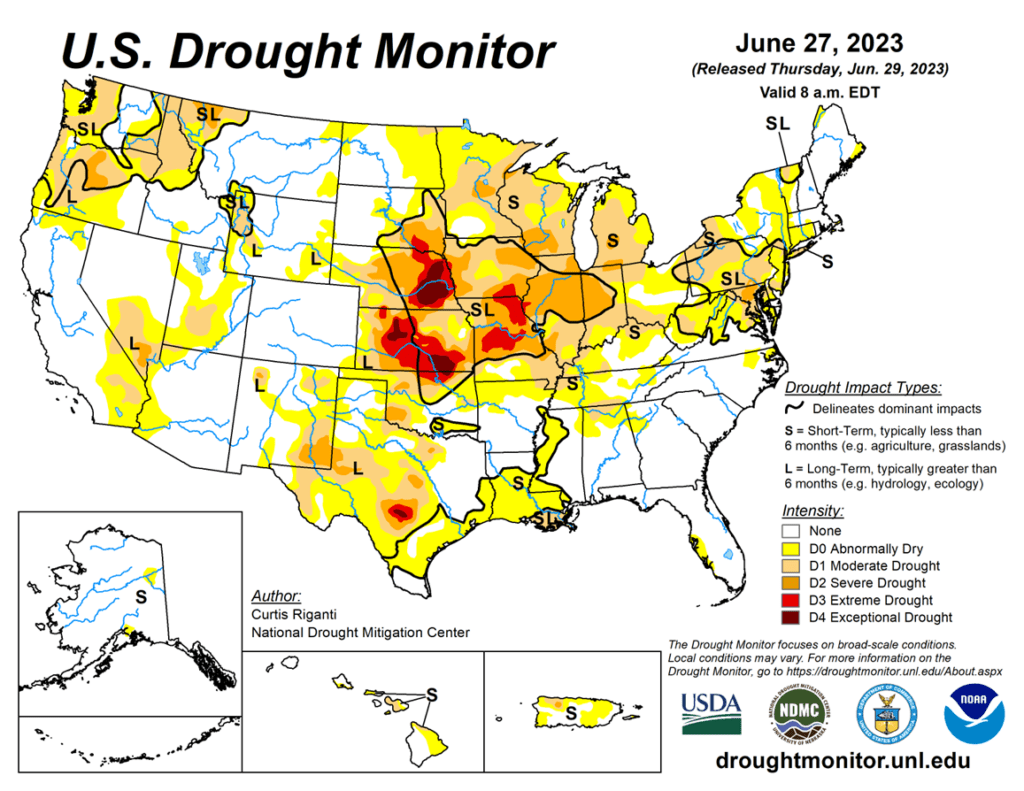

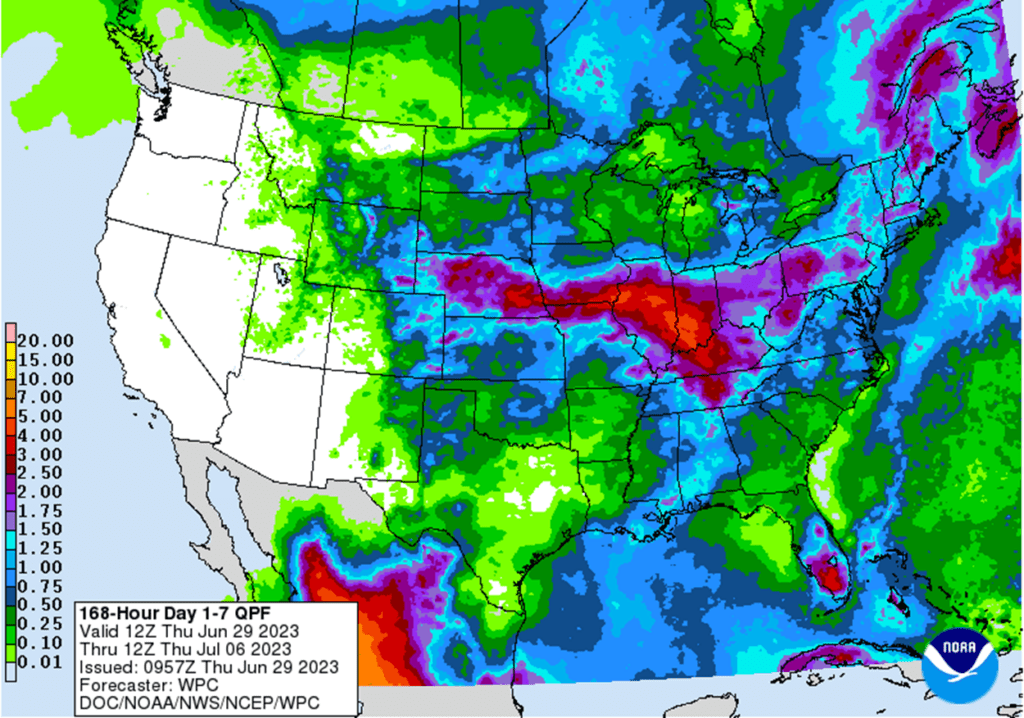

- Rains fell in the western Plains yesterday, and Kansas and Missouri are expecting heavy rain amounts over the next five days, and good rain in the Corn Belt as a whole.

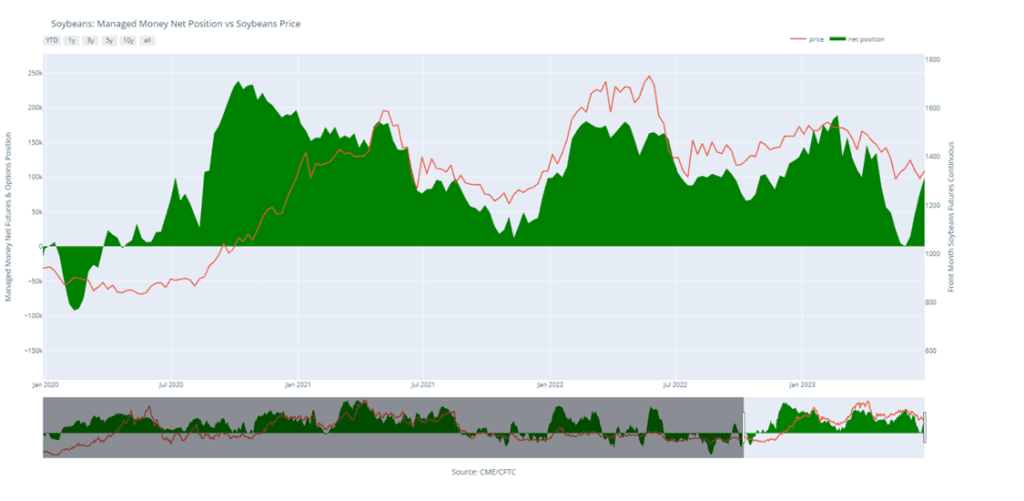

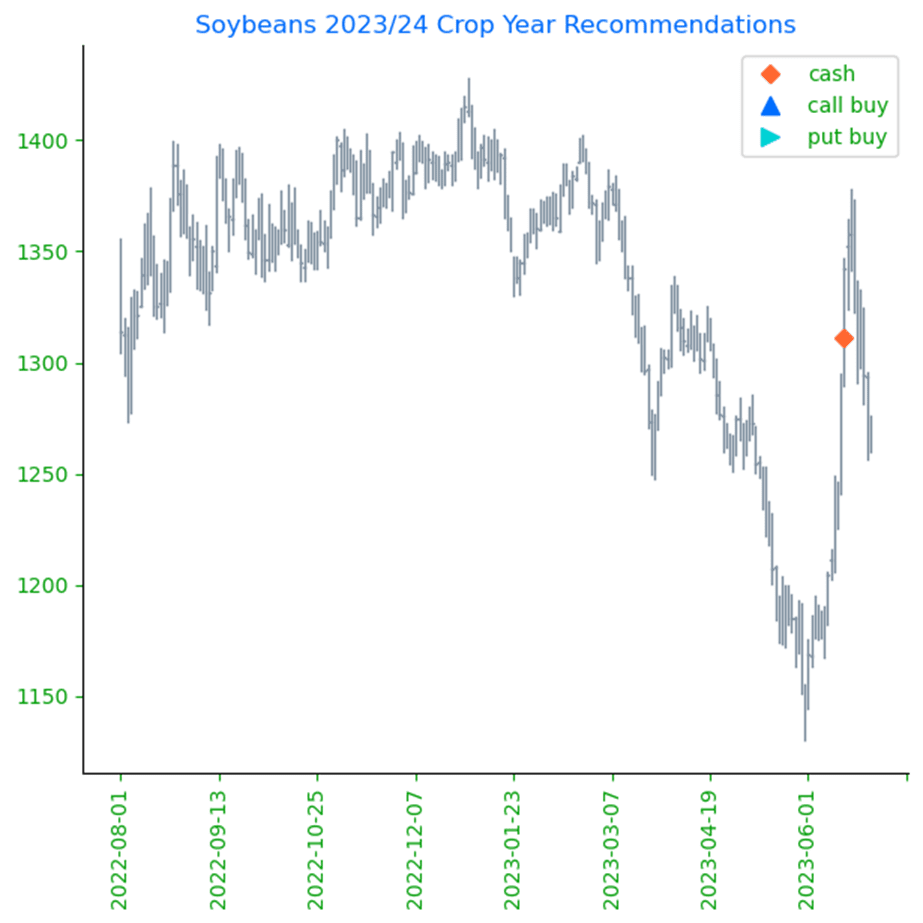

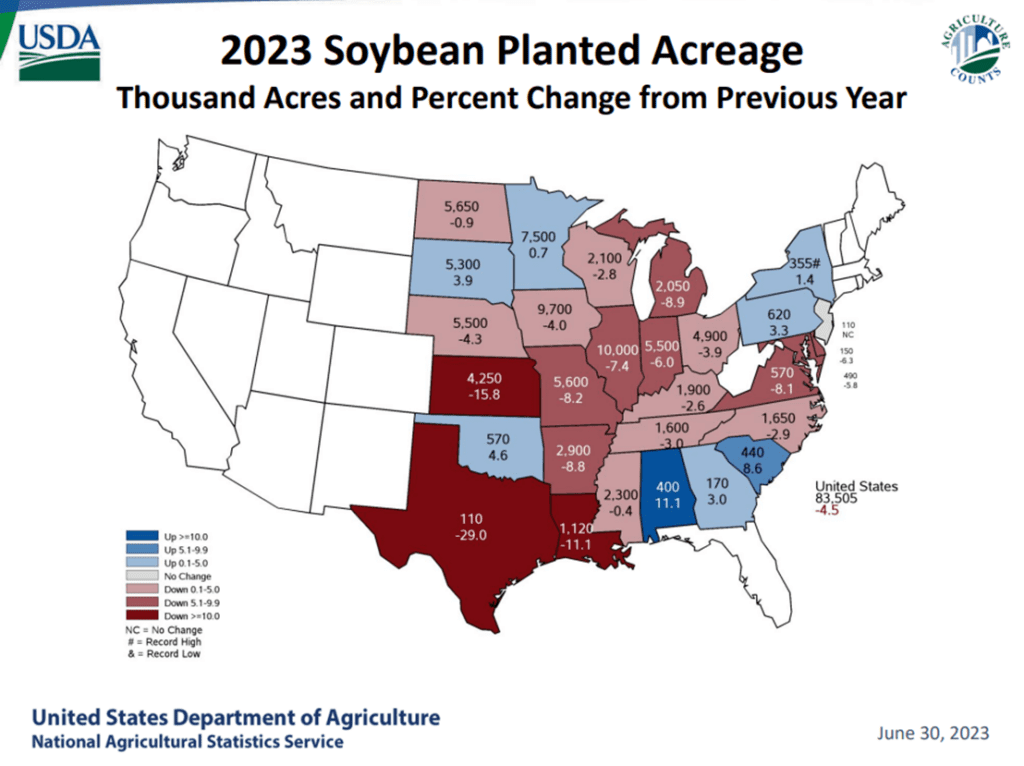

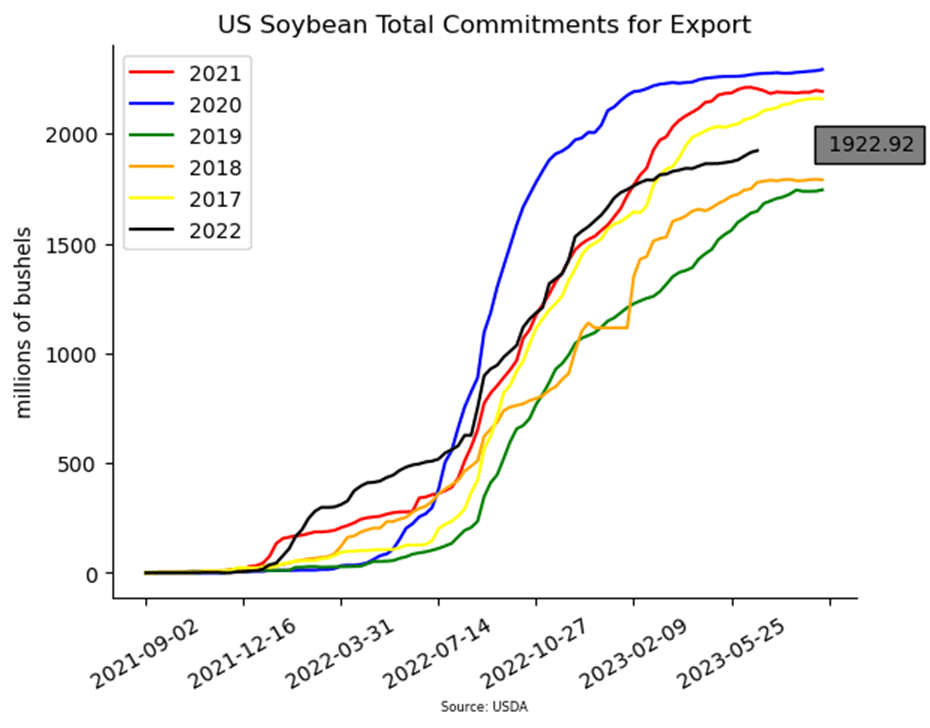

- On the flip side of corn, soybeans ended higher on Friday with continued support from the USDA report with planting estimates at just 83.5 million acres.

- August soybean oil closed at a new high for the year on Monday as demand picks up. Yesterday, both canola and rapeseed traded higher.

- Despite the recent beneficial rains in the driest areas of the Corn Belt, crop progress showed soybeans falling by 1% in the good to excellent rating and is now at 50%, the lowest rating for this time of year since 2012.

- With soybean futures in the US surging, China has taken notice, and September beans on the Dalian exchange closed 2.9% higher yesterday to a four month high.

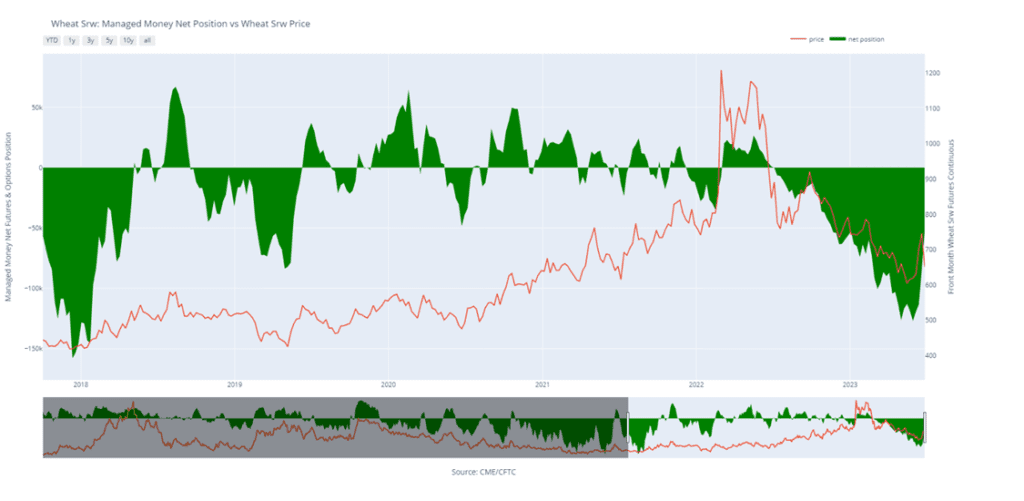

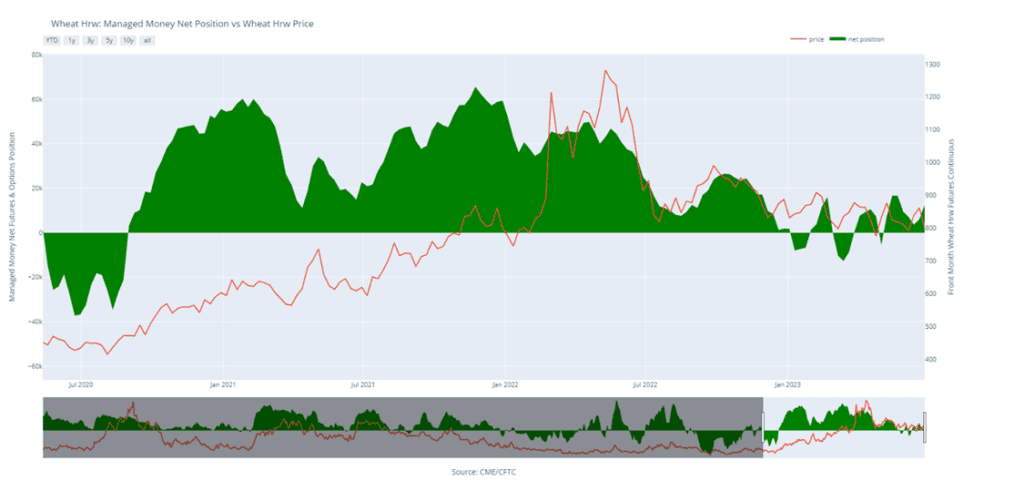

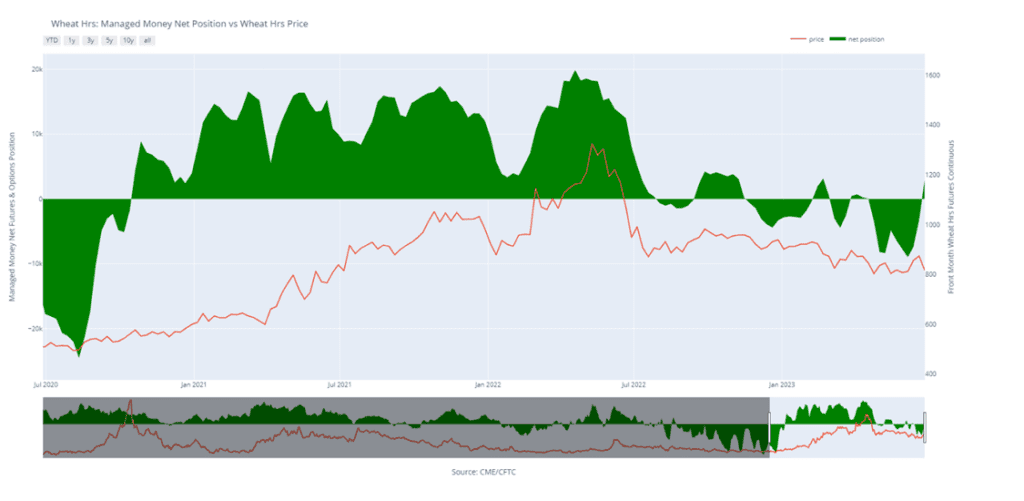

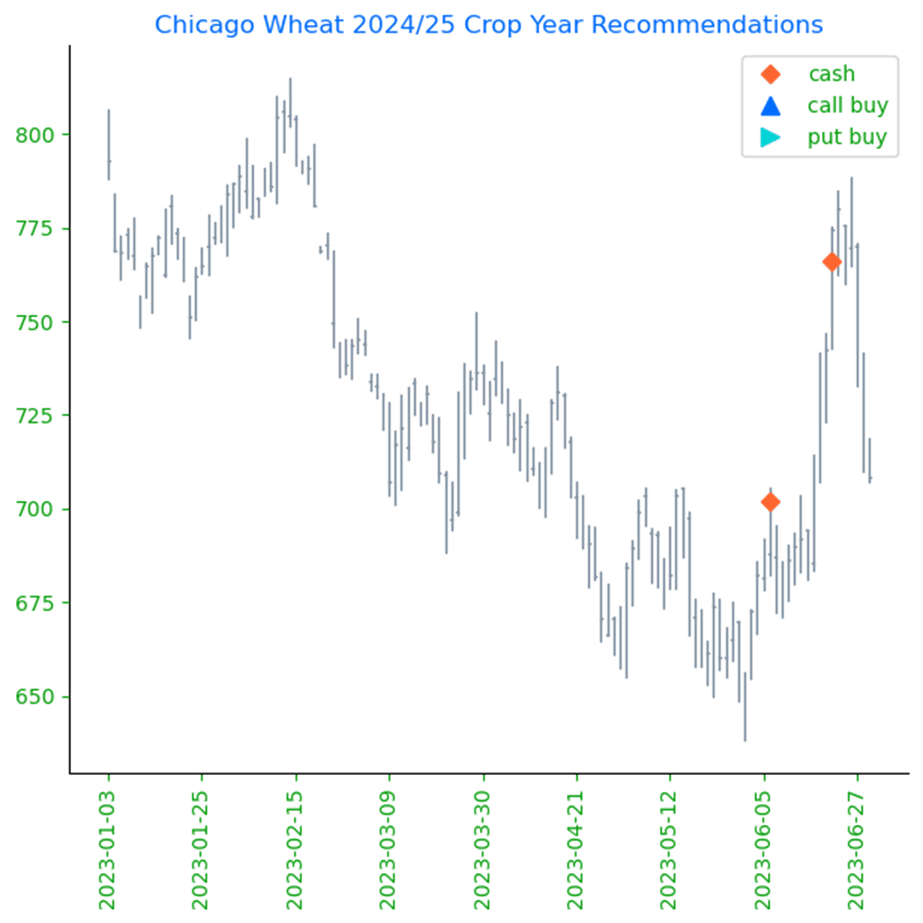

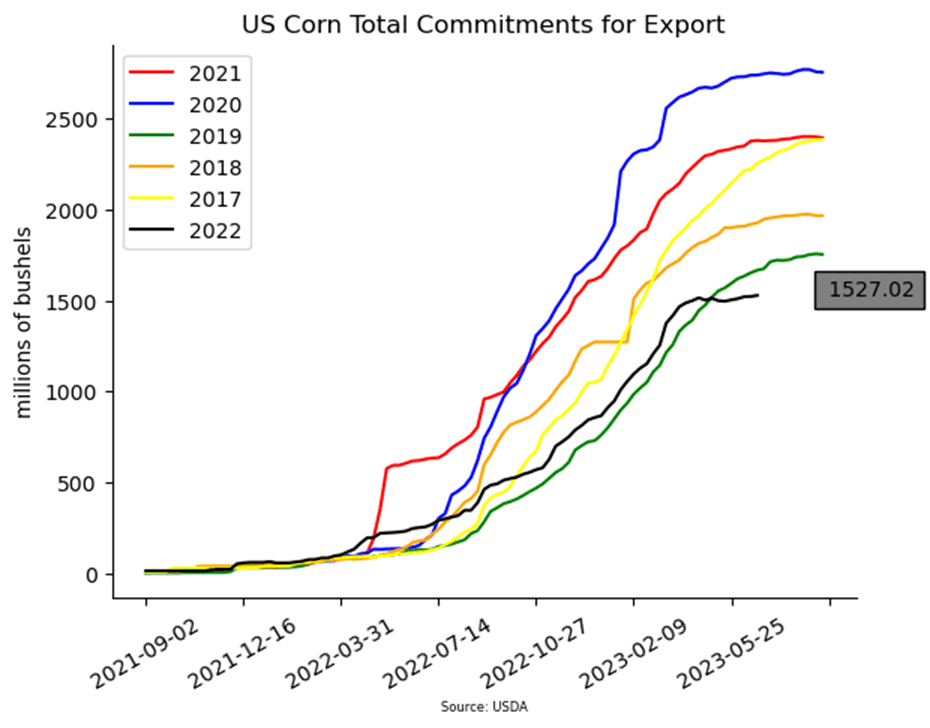

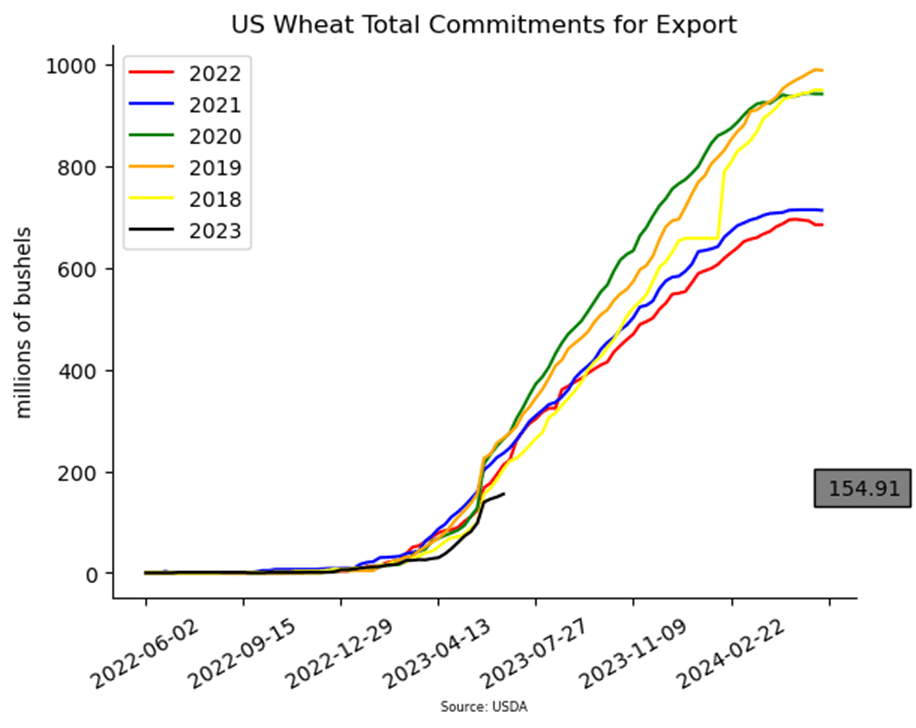

- Wheat ended Monday lower after being pulled down by falling corn prices and poor export demand.

- Yesterday, September milling wheat closed up 0.8% and early today those prices were up another 1.6%, so it is possible that US futures open higher.

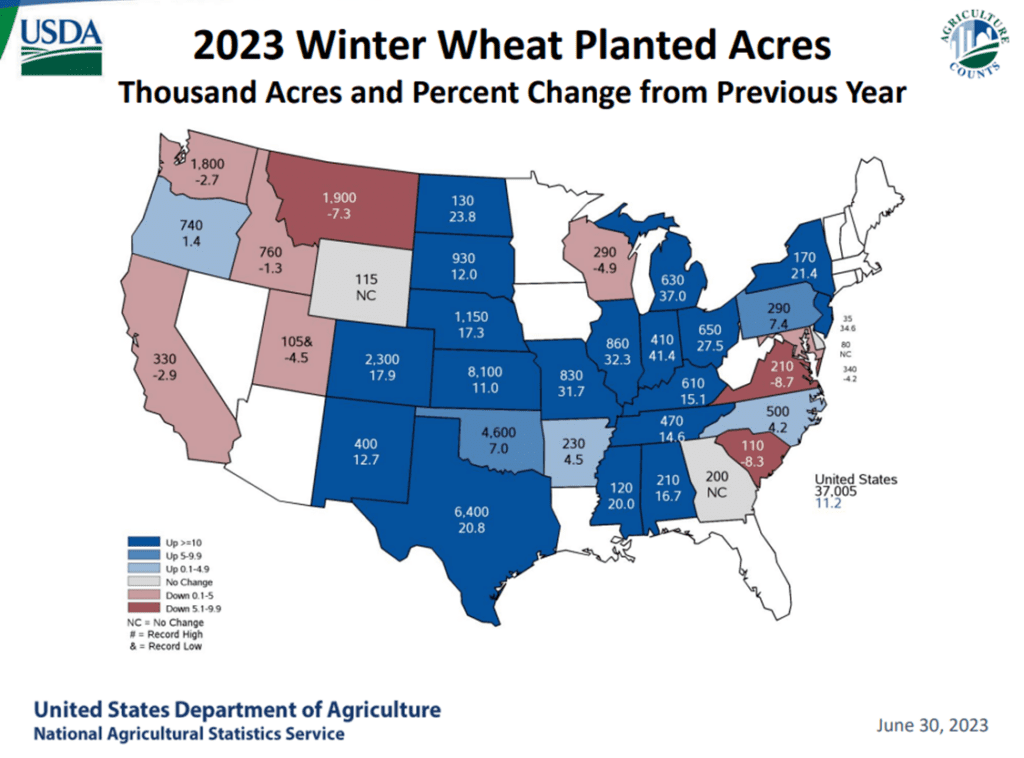

- On Monday, the USDA said that 37% of winter wheat was harvested which is down from a five year average of 46% for this time of year. Winter wheat good to excellent ratings were steady at 40%.

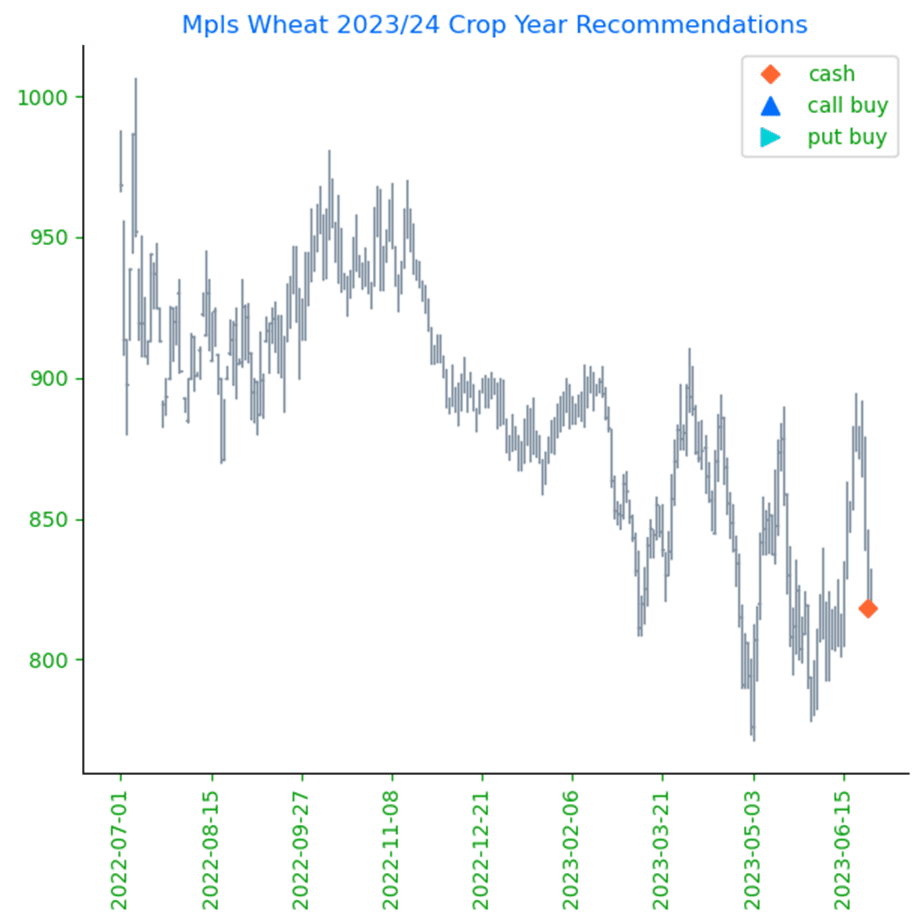

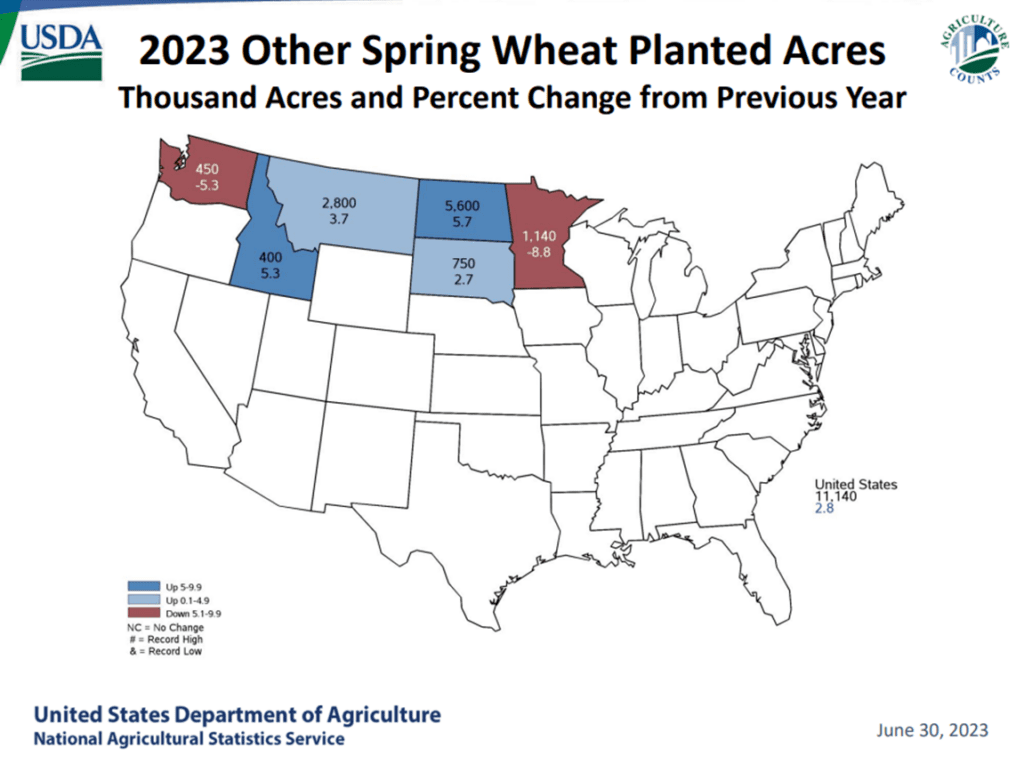

- Spring wheat good to excellent ratings slipped 2% to 48% good to excellent, and in North Dakota, ratings slipped from 49% to 40%.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.