Opening Update: July 19, 2023

All prices as of 6:30 am Central Time

|

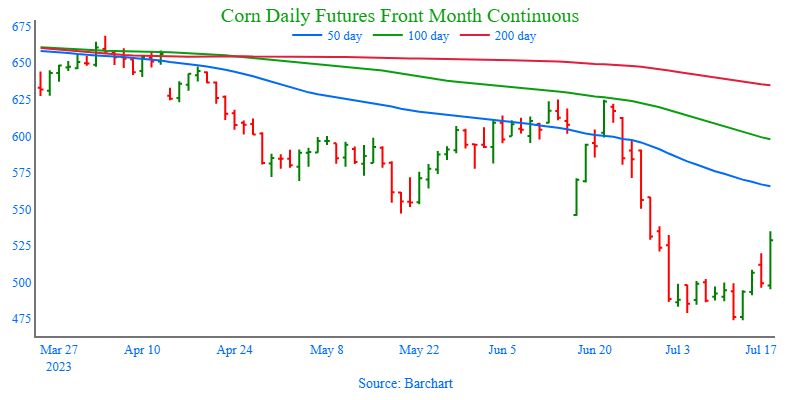

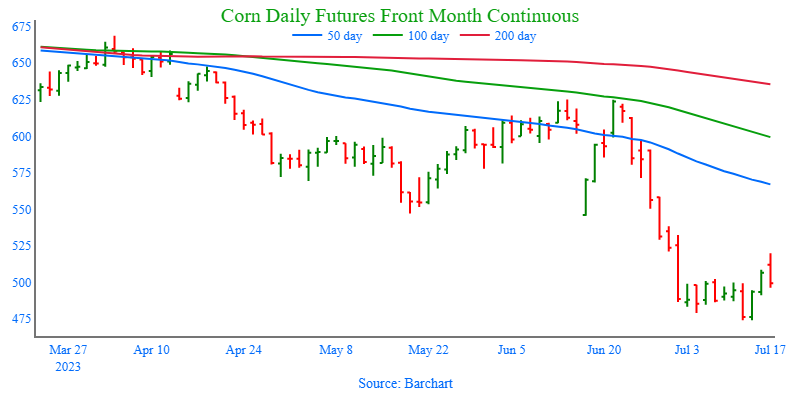

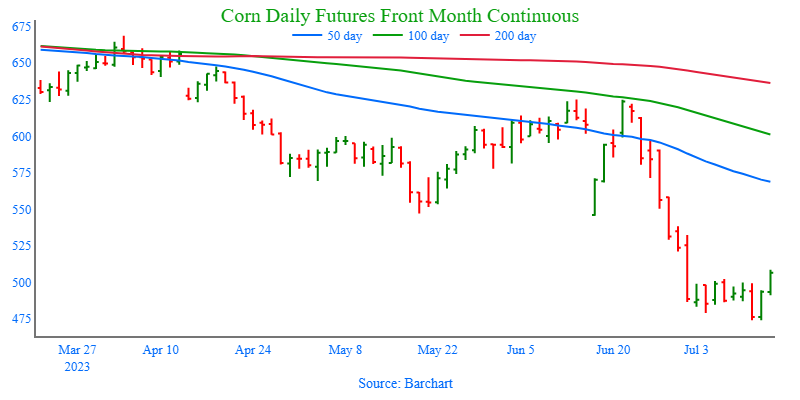

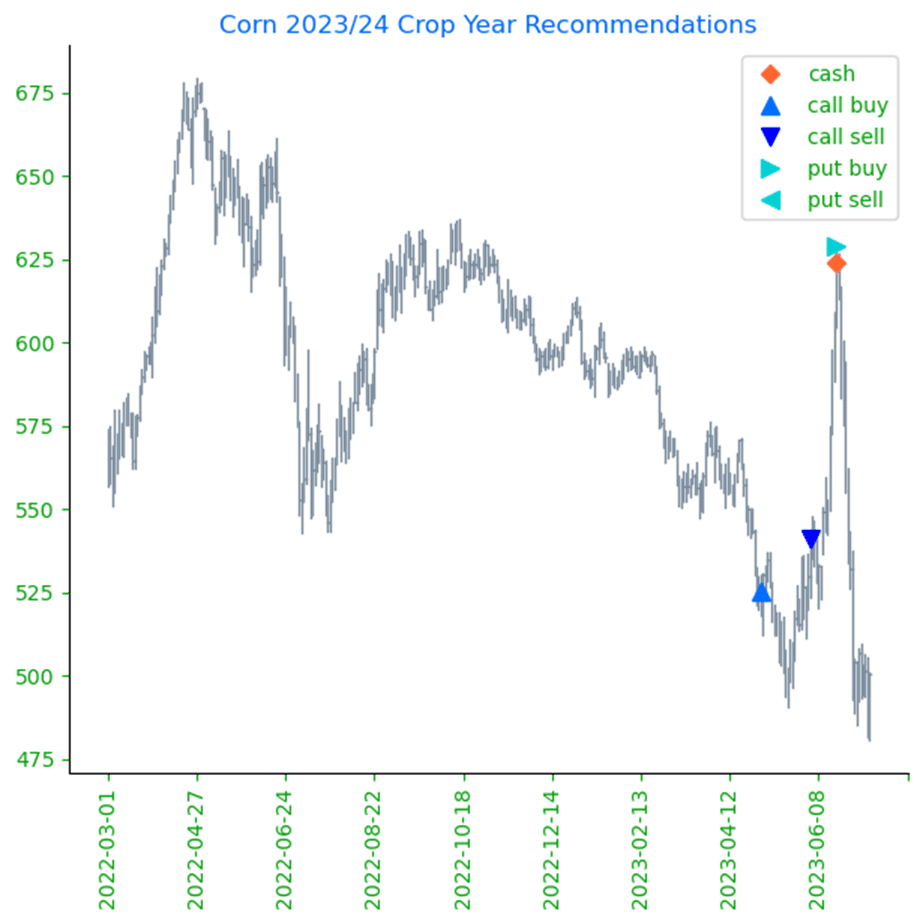

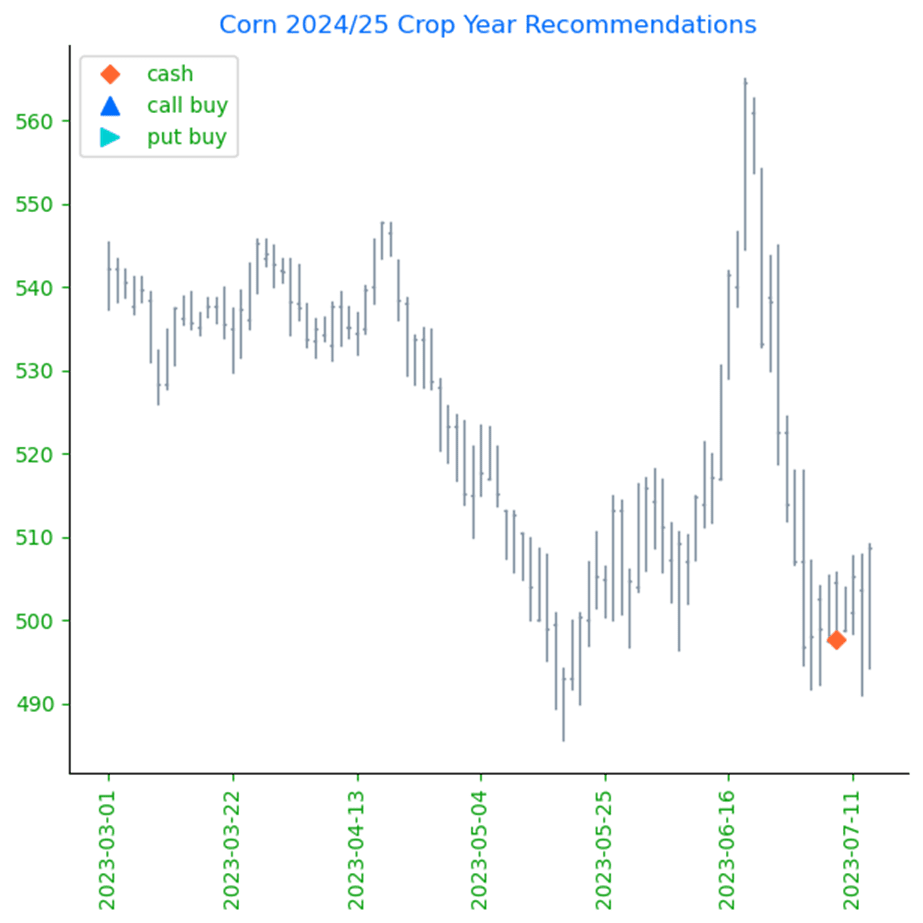

Corn |

||

| SEP ’23 | 546 | 17.25 |

| DEC ’23 | 552.25 | 17.75 |

| DEC ’24 | 540 | 10 |

|

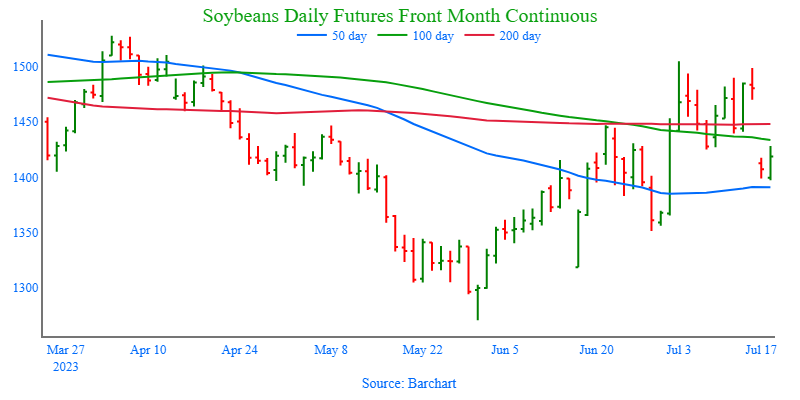

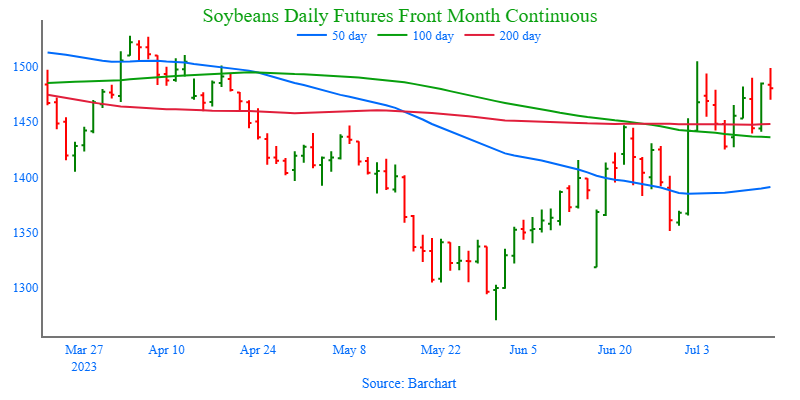

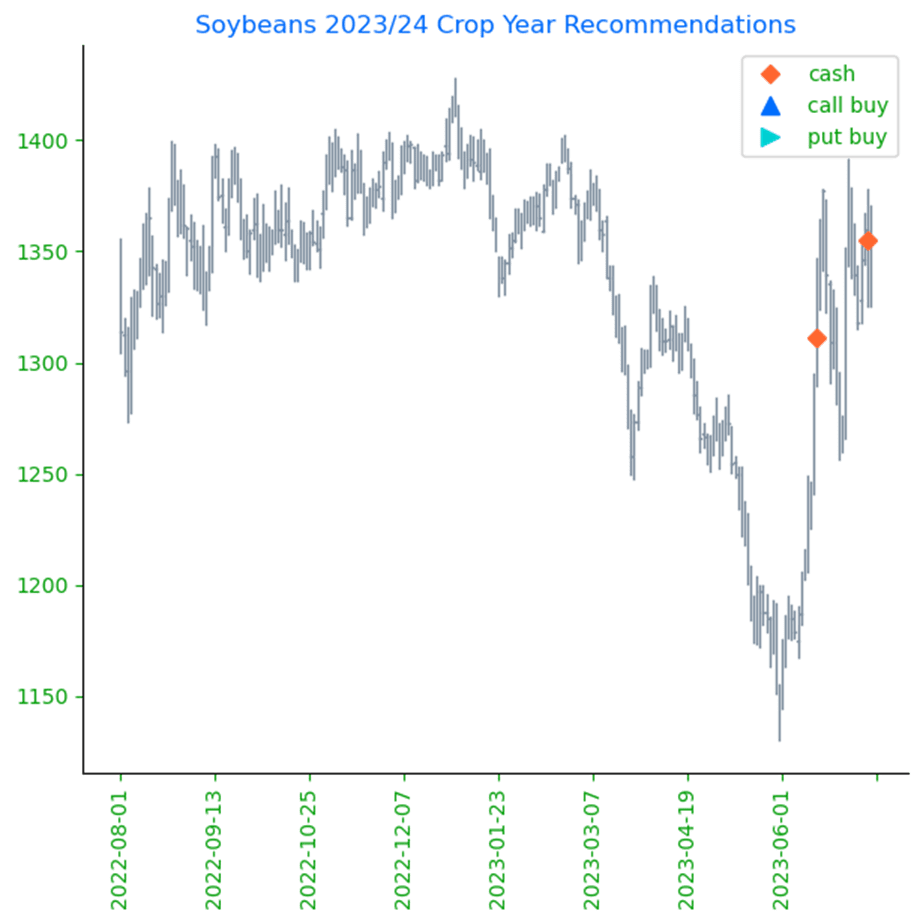

Soybeans |

||

| AUG ’23 | 1510 | 18 |

| NOV ’23 | 1413.75 | 18.5 |

| NOV ’24 | 1293.5 | 12.25 |

|

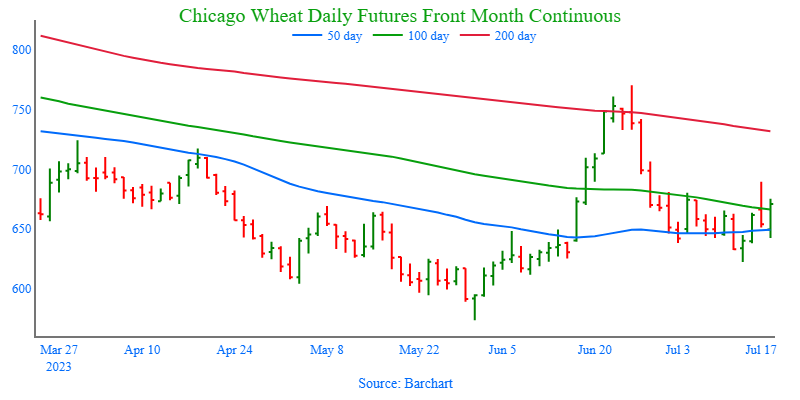

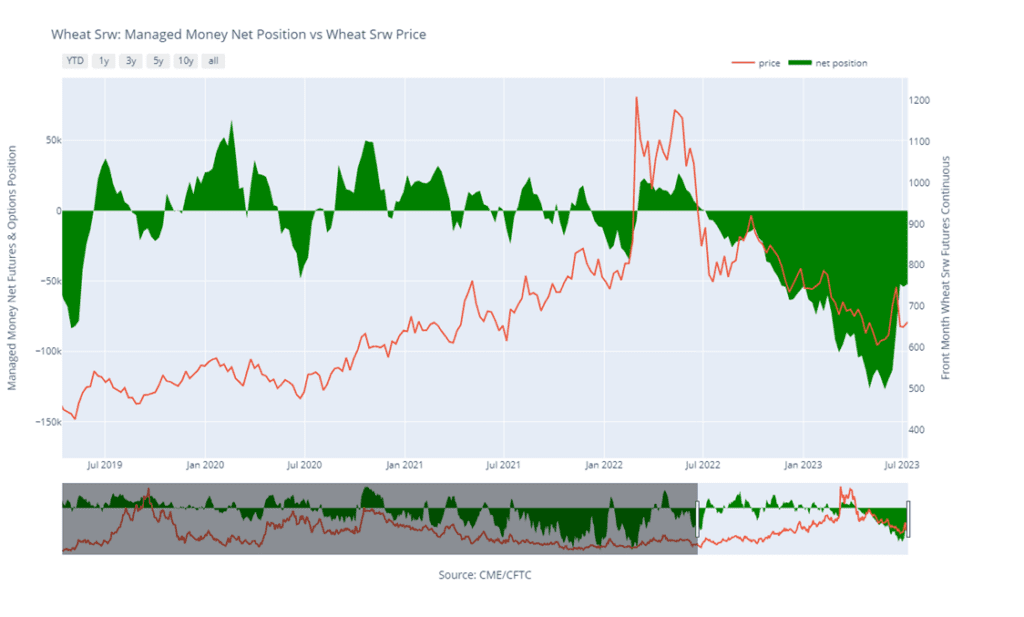

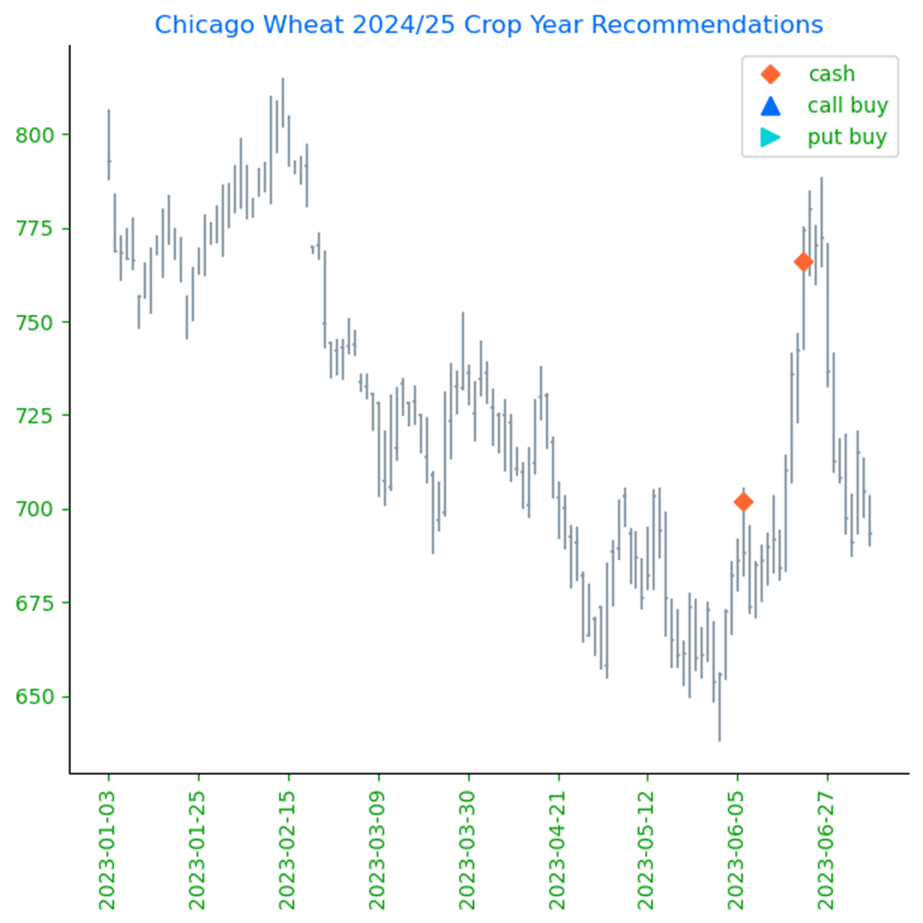

Chicago Wheat |

||

| SEP ’23 | 693.75 | 23 |

| DEC ’23 | 713.25 | 22.75 |

| JUL ’24 | 739 | 21.75 |

|

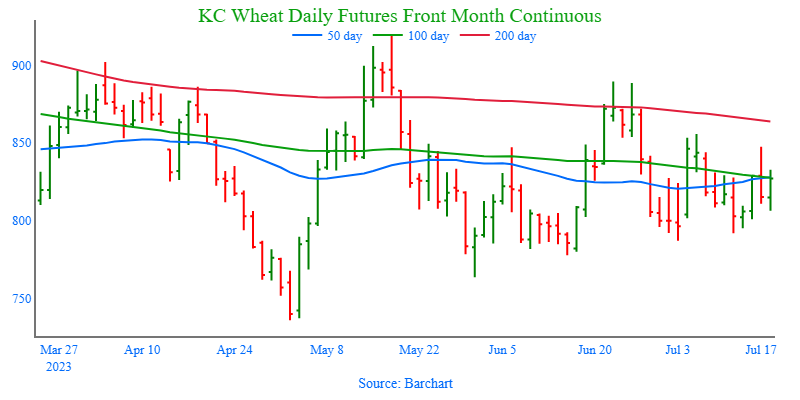

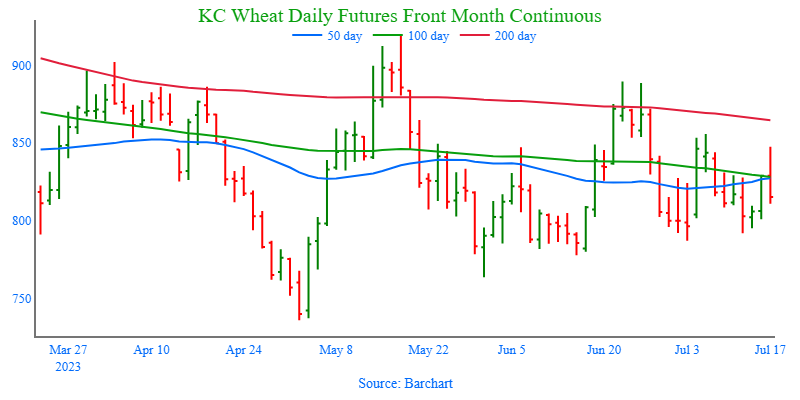

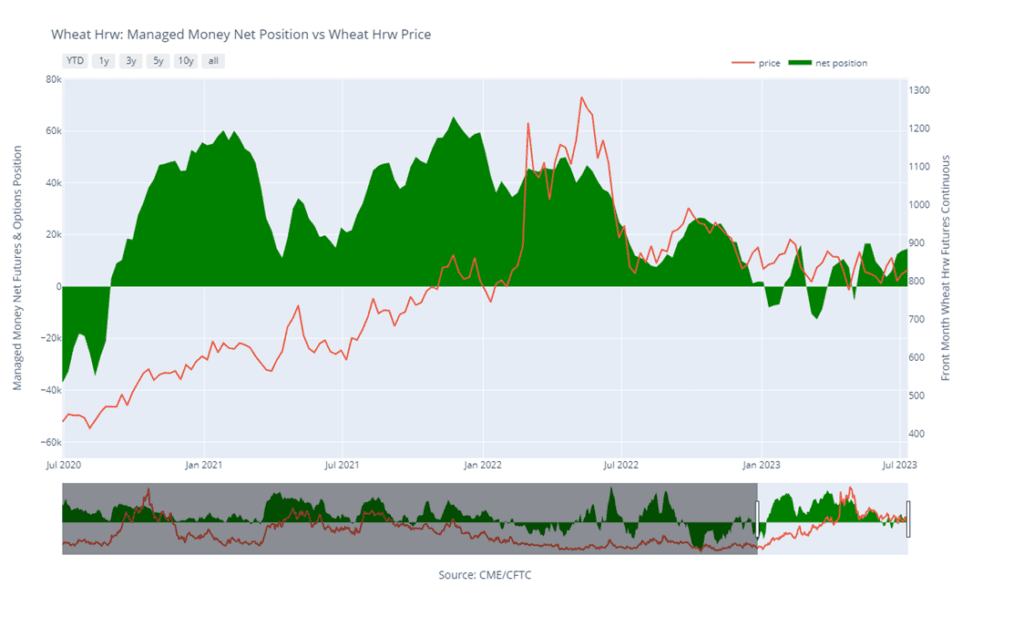

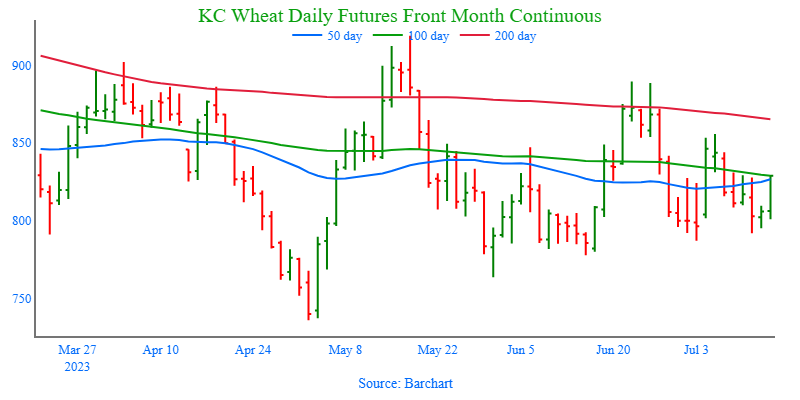

K.C. Wheat |

||

| SEP ’23 | 844.5 | 17.25 |

| DEC ’23 | 849.5 | 17.25 |

| JUL ’24 | 817.5 | 17.75 |

|

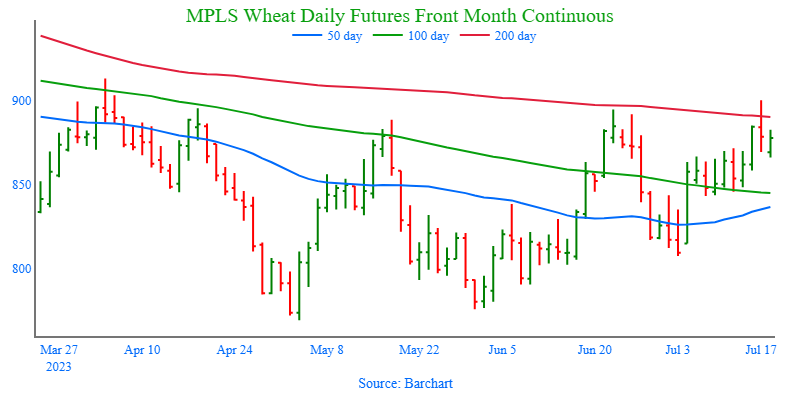

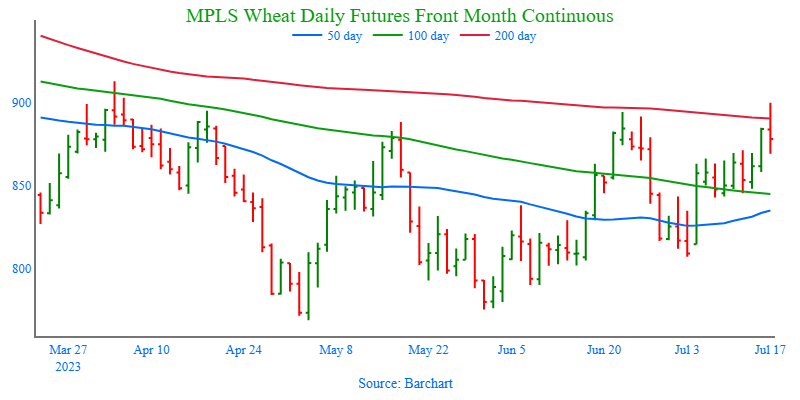

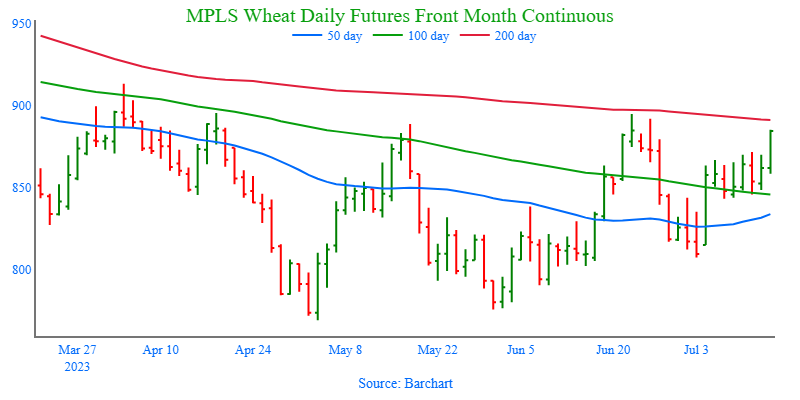

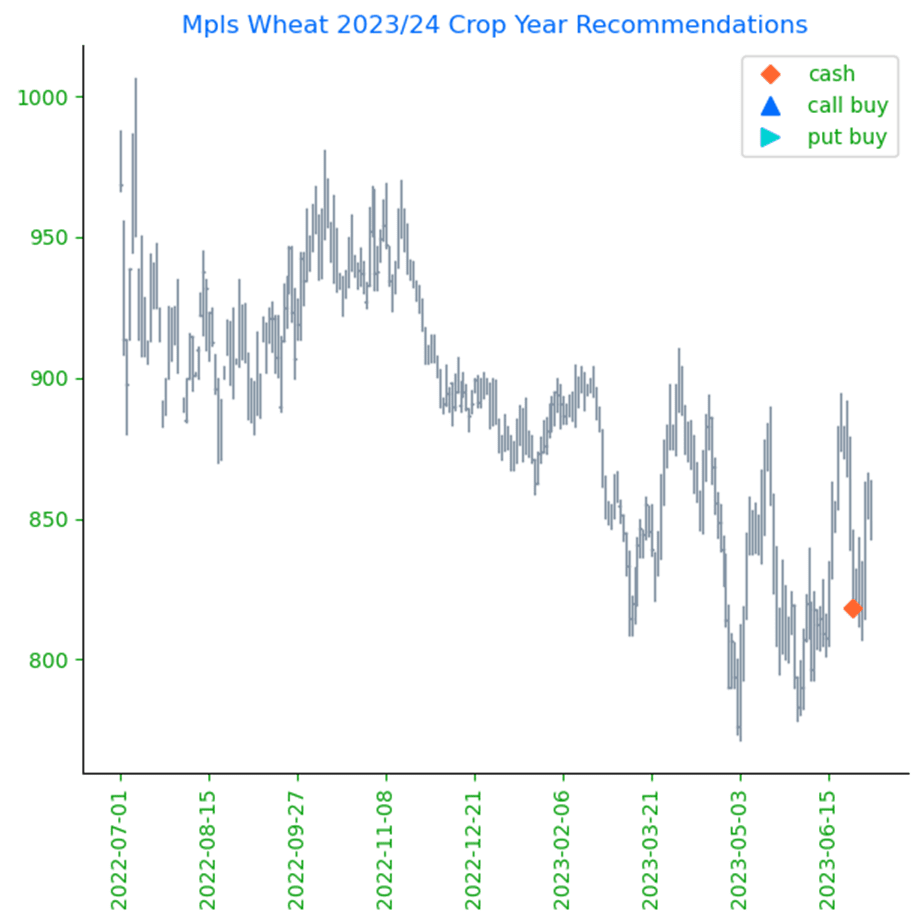

Mpls Wheat |

||

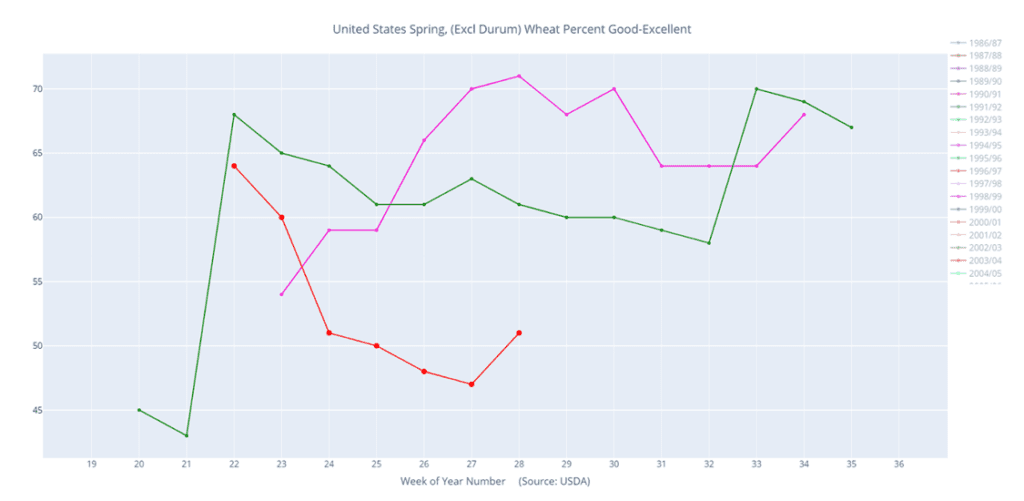

| SEP ’23 | 889 | 11.5 |

| DEC ’23 | 898.5 | 12 |

| SEP ’24 | 822.5 | 7.5 |

|

S&P 500 |

||

| SEP ’23 | 4586.25 | -1.5 |

|

Crude Oil |

||

| SEP ’23 | 75.77 | 0.11 |

|

Gold |

||

| OCT ’23 | 1995 | -4.8 |

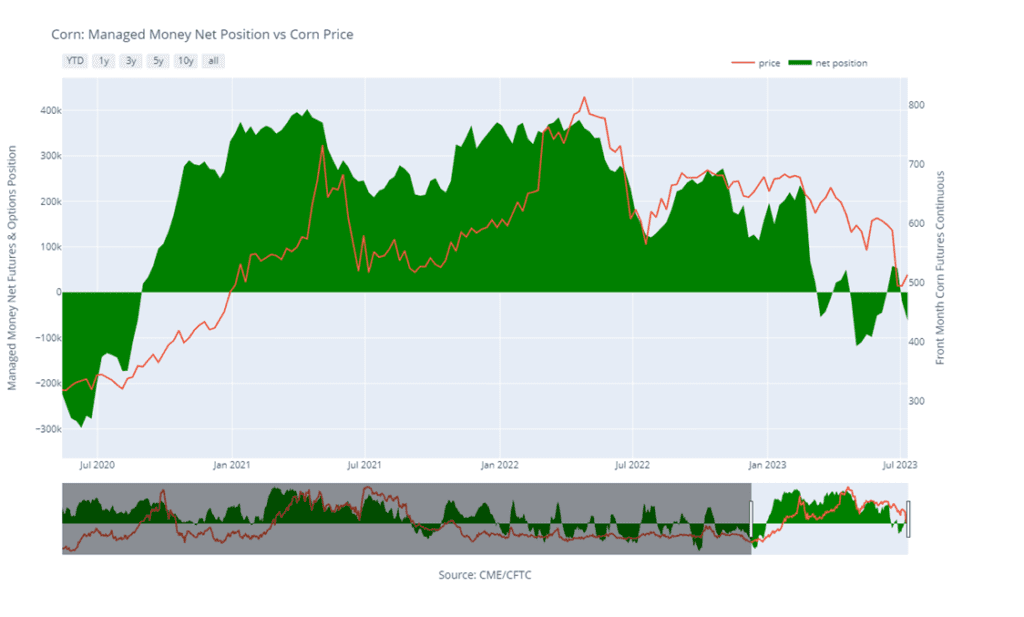

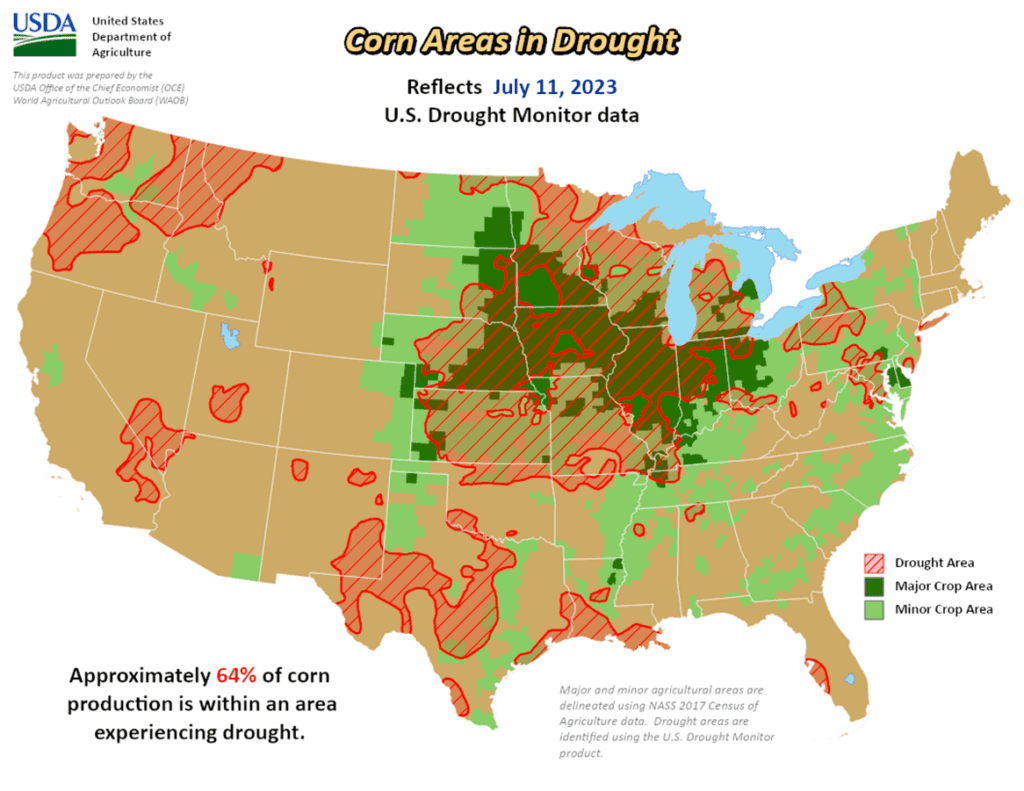

- Corn is trading higher again today continuing its rally after Russia attacked Ukraine’s port city of Odessa again last night inflicting much more damage than the previous night.

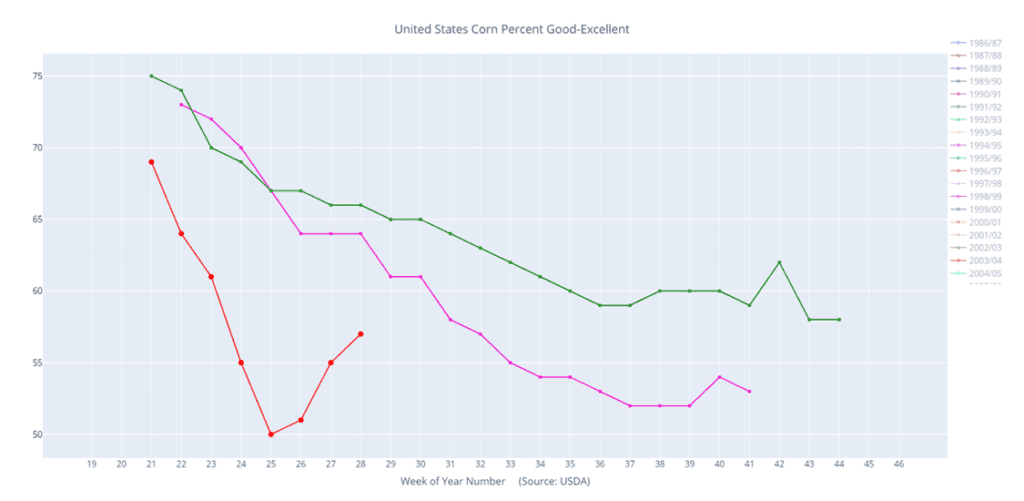

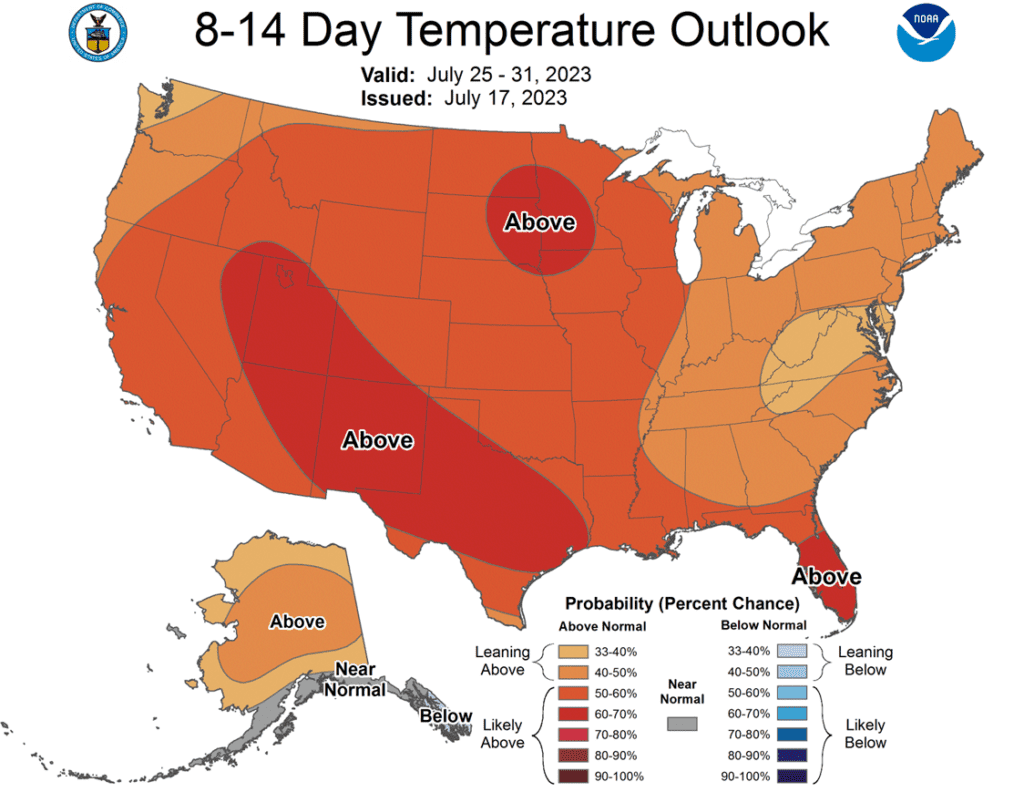

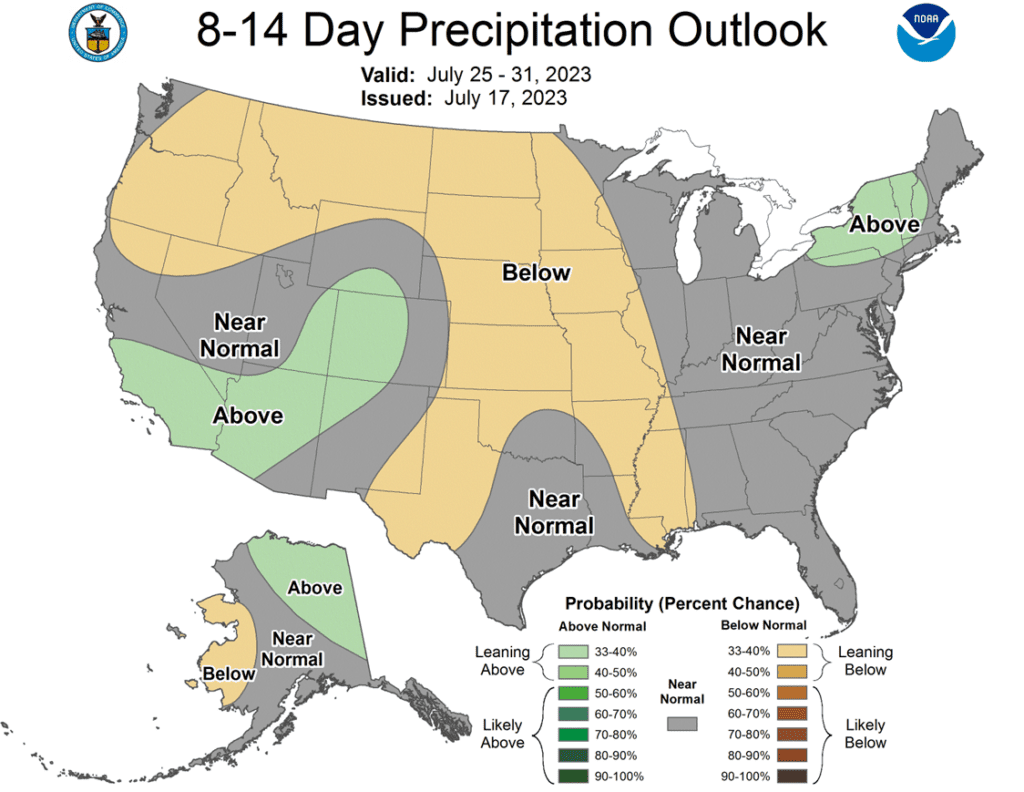

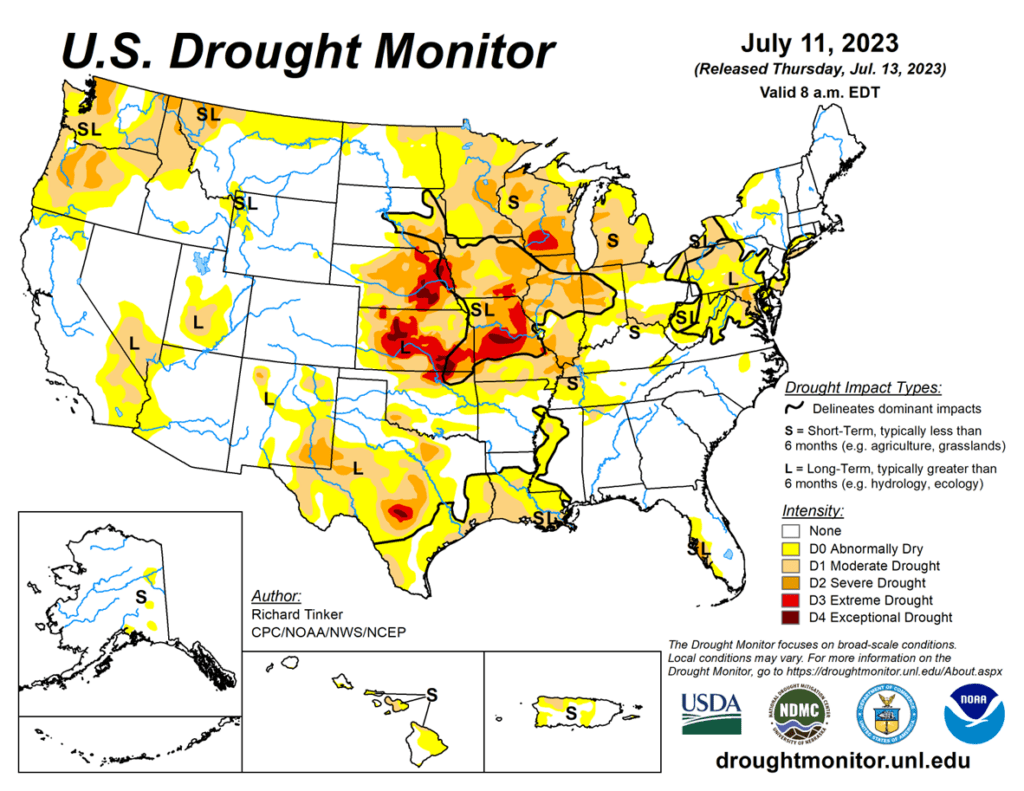

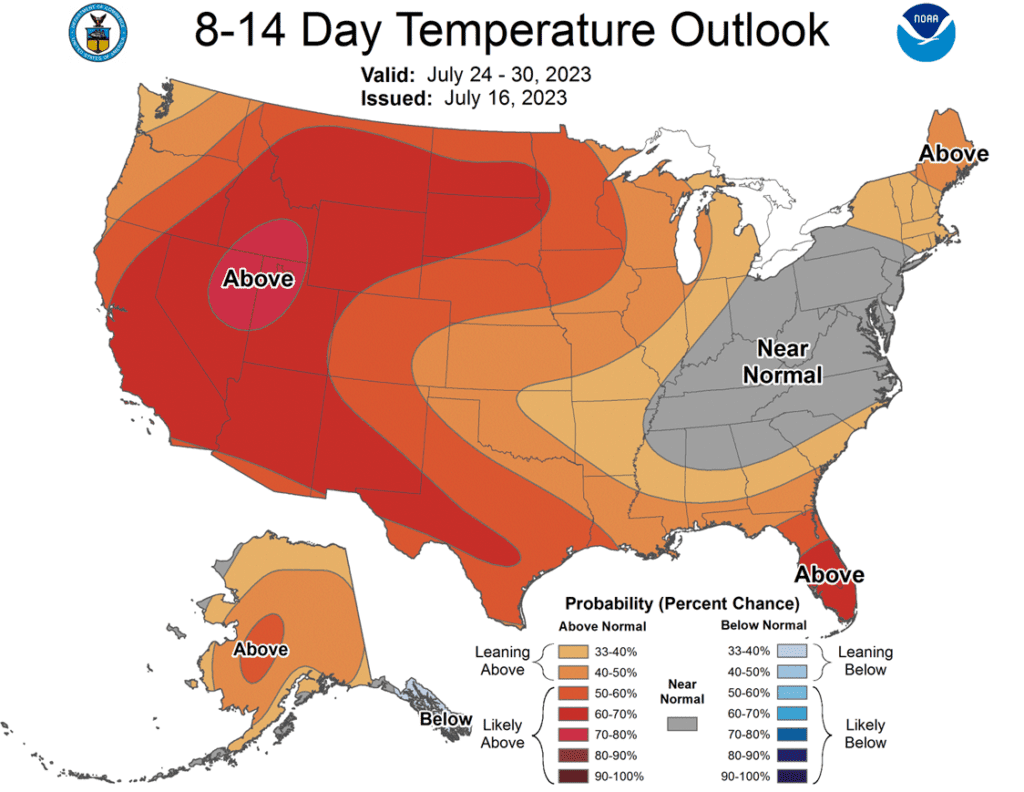

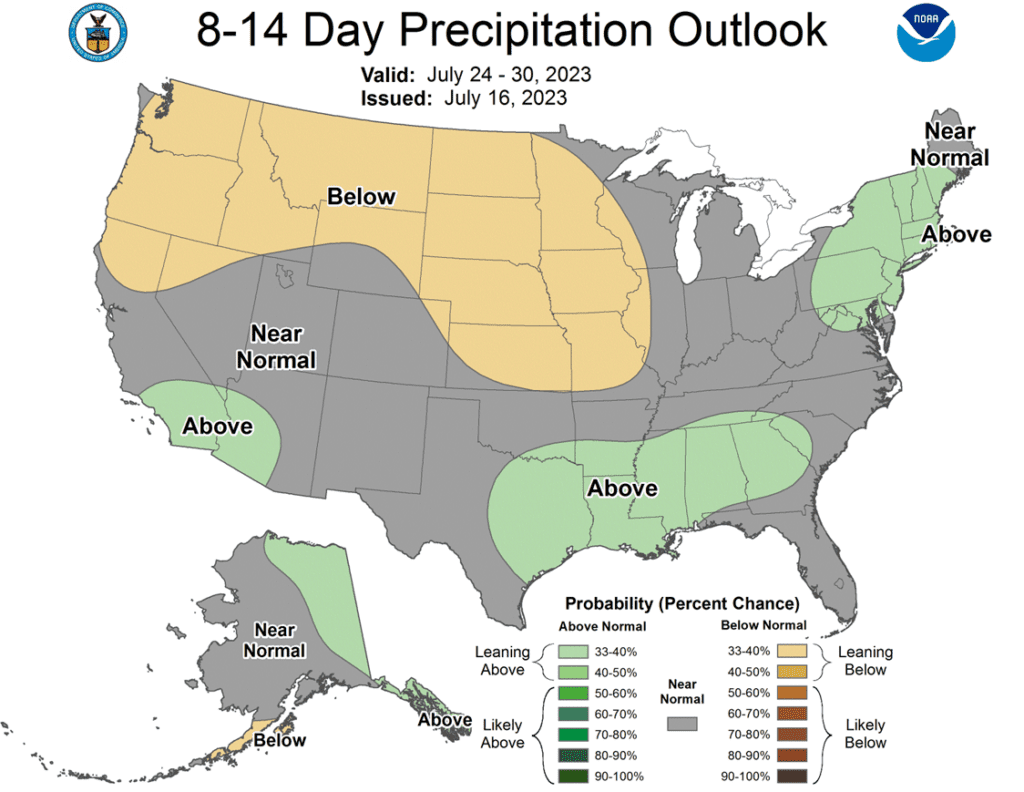

- The 10-day forecast for the Corn Belt is still showing dry conditions with temperatures turning the hottest of the season beginning this weekend. Minnesota received some light showers overnight.

- Projections for ethanol production for the week ending July 14 is showing production higher than the previous week at 1.042 million b/d with the stockpile average estimate above a week ago.

- Barchart has raised their corn yield estimates to a yield of 177.97 bpa which compares the the USDA’s most recent forecast of 177.76 bpa.

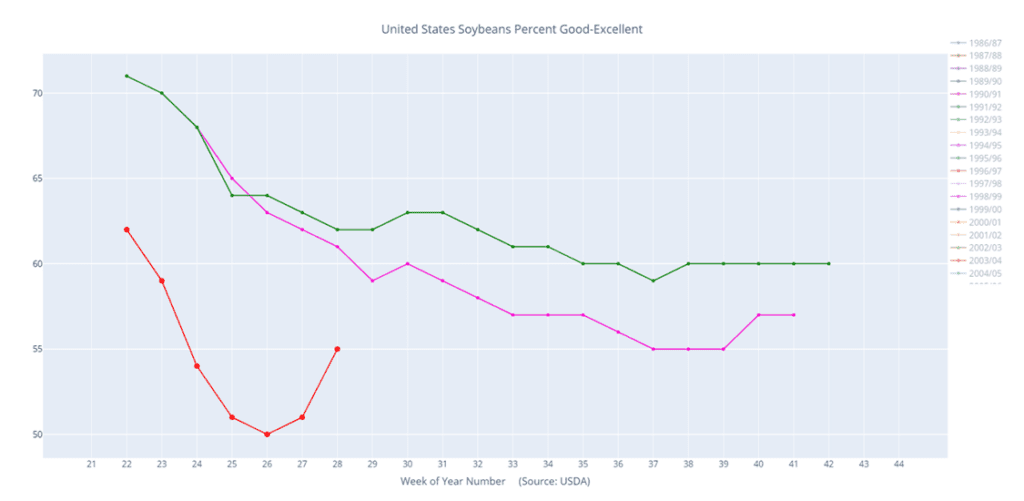

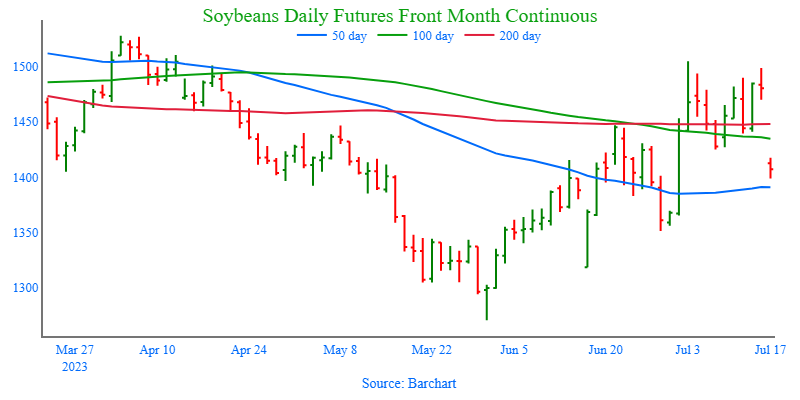

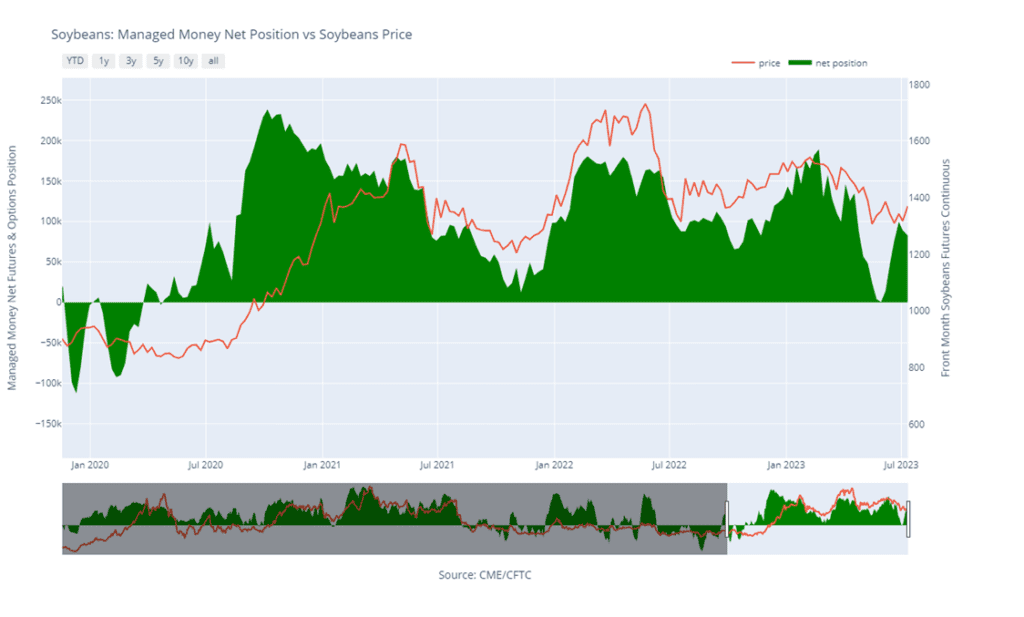

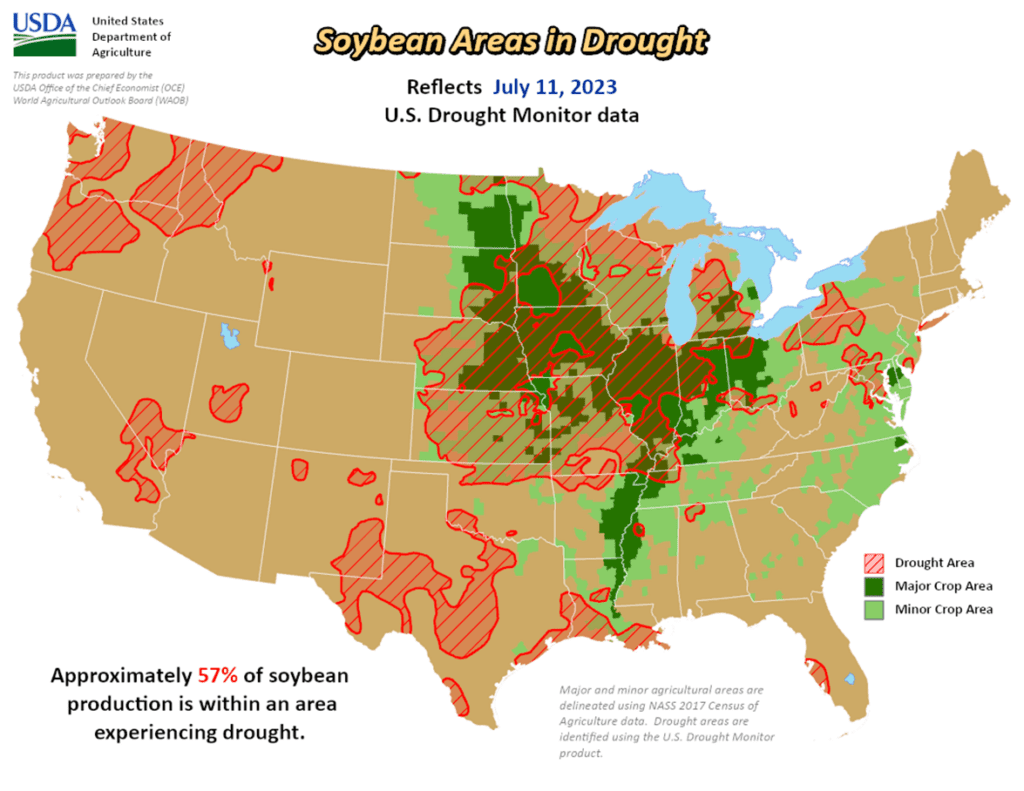

- Soybeans are trading higher again this morning with the Nov contract making a new high for 2023. Soybean meal’s gains are helping this rally, and soybean oil is higher as well.

- Forecasts are predicting that August will begin with higher than normal temperatures in the Western Corn Belt, so rainfall will be important to shore up the poor current soil moisture levels.

- The NWS will likely release their 30 and 90-day forecasts this week which the soy complex will watch closely for an idea on moisture and temperature into pod fill season.

- India’s oilmeals exports fell to 280,001 tons in June from 436,596 tons in May.

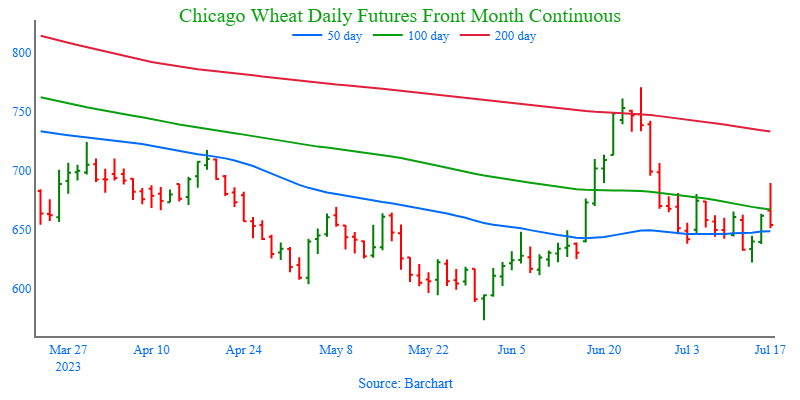

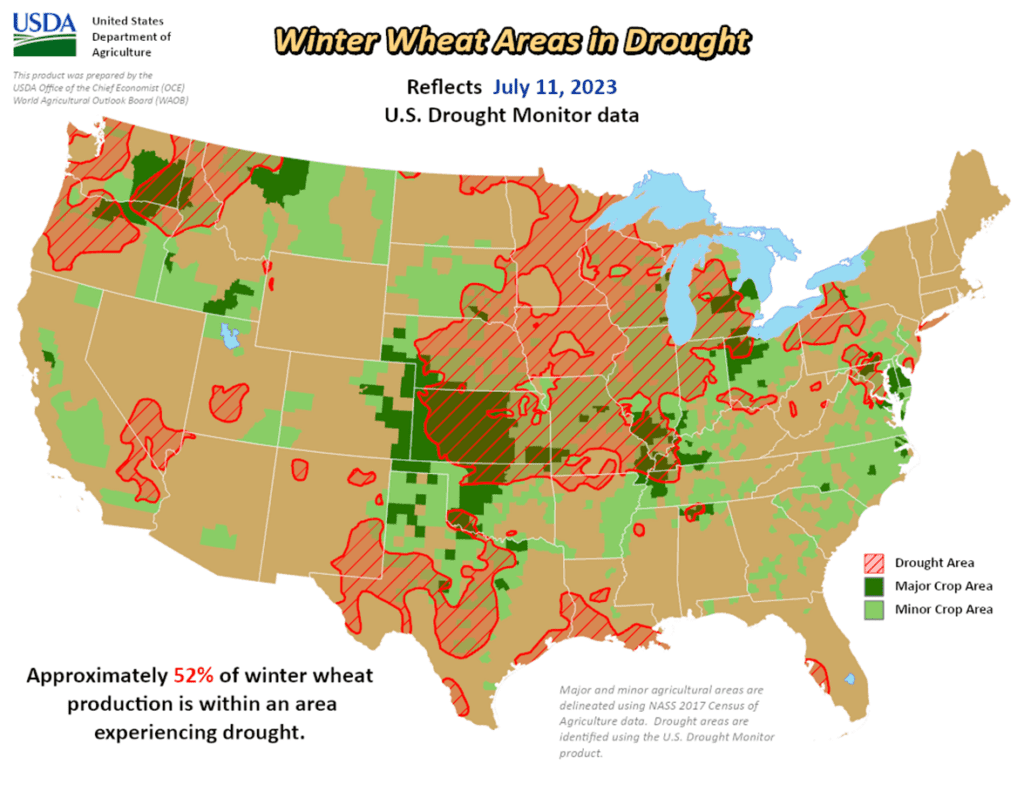

- Wheat is beginning the day higher with Chicago wheat leading the way followed by KC and Minn following news of last nights Russian attack on Ukraine’s port city.

- After Russia withdrew from the grain deal they attacked Ukraine’s port city of Odessa with minimal damage and no casualties, but reports have come in of a second attack from last night which a spokesperson from Odessa called it a “hellish night”. It is assumed much more damage was done during this attack.

- This morning, Russia said that ships in the Black Sea would be “in danger”, but they have also said that they would be willing to come back to negotiate in 3 months if the UN makes good on Russian demands.

- The UN is apparently “floating” ideas on how to get Ukrainian and Russia grain out to the rest of the world as the Black Sea is closed.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.