Grain Market Insider: July 28, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

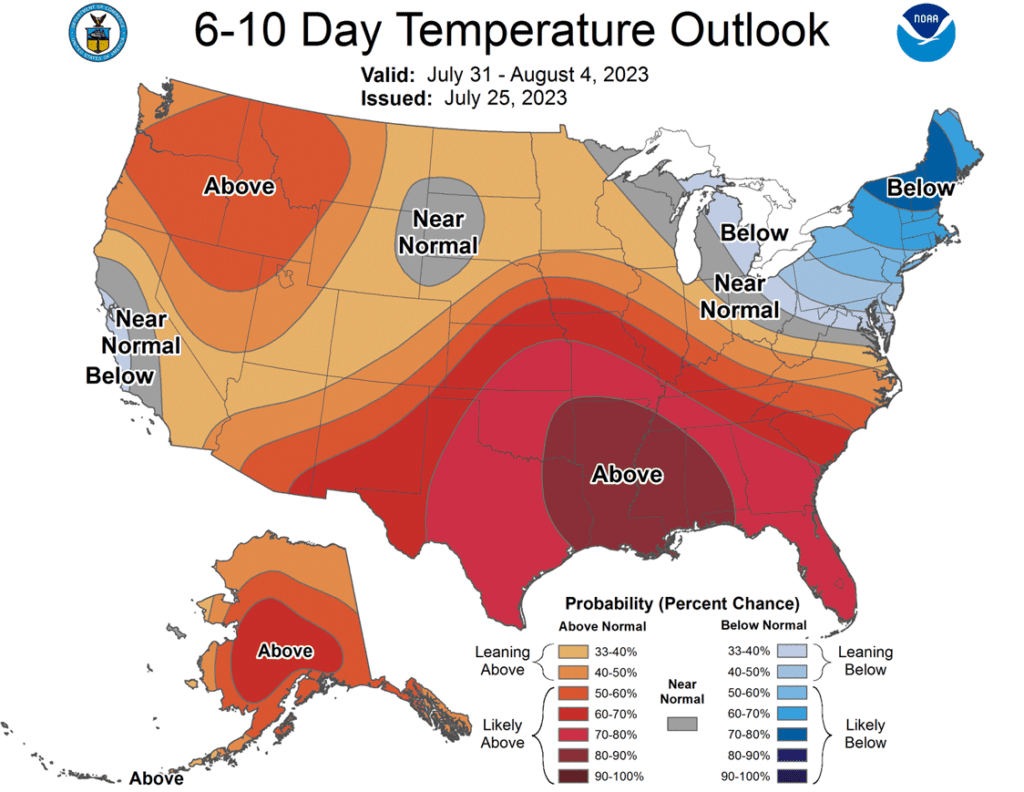

- The corn market traded on both sides of unchanged, but settled near the lower end of the range, and below most major moving averages as traders began to focus on more favorable weather ahead.

- Despite another round of flash sales totaling 33 mb, soybeans closed lower on the day as slow 23/24 export demand, down 60% from year ago levels, weighs on prices.

- Weakness from soybean meal also carried over to pressure the soybean market lower, as meal saw follow through selling following yesterday’s bearish reversal, while New Crop prices for soybean oil saw gains on reports of increased usage for biofuel.

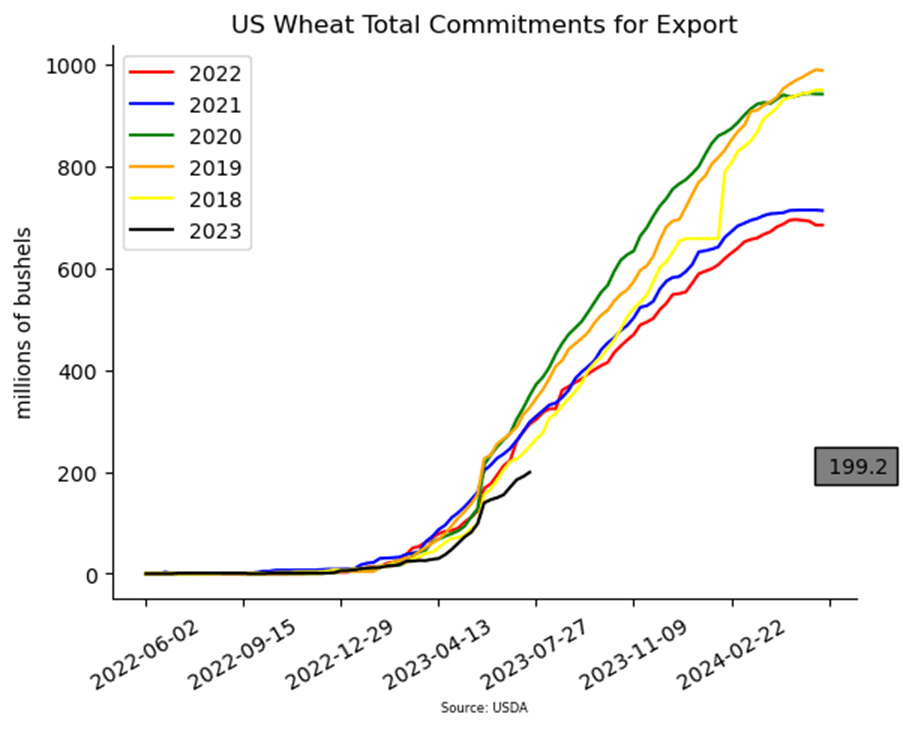

- All three wheat markets closed weaker, though mid-range, after trading on both sides of unchanged. The market spiked higher momentarily, possibly on rumors of explosions at a Russian port, but settled back lower on a lack of confirmation.

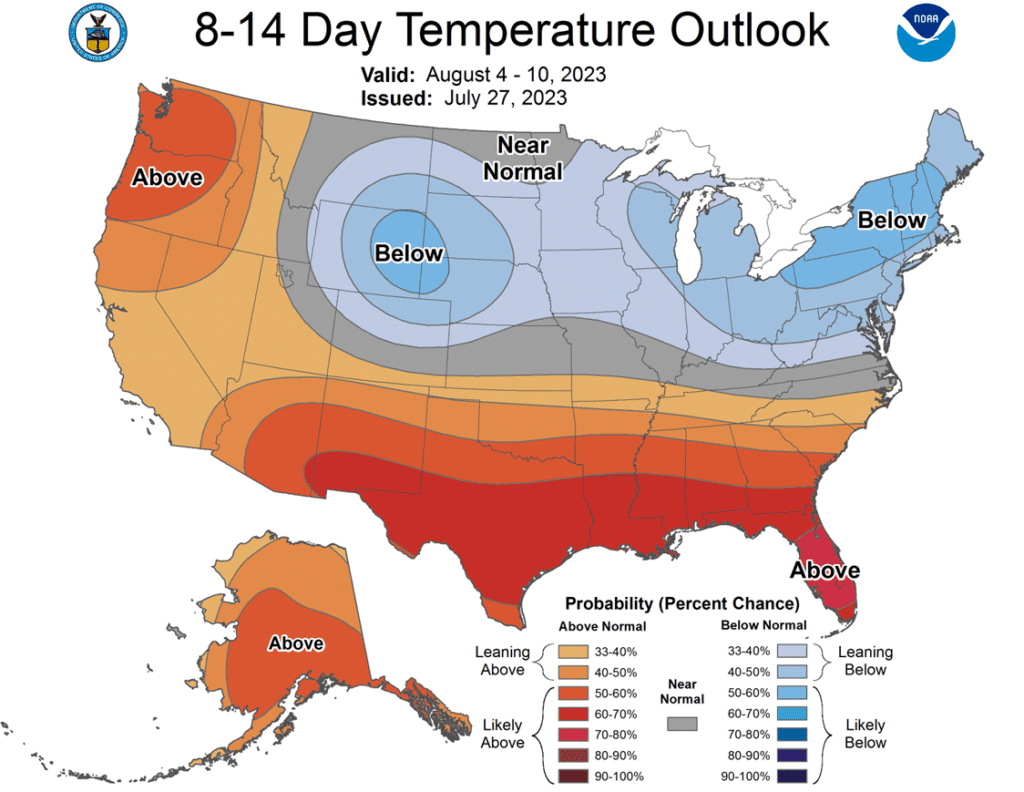

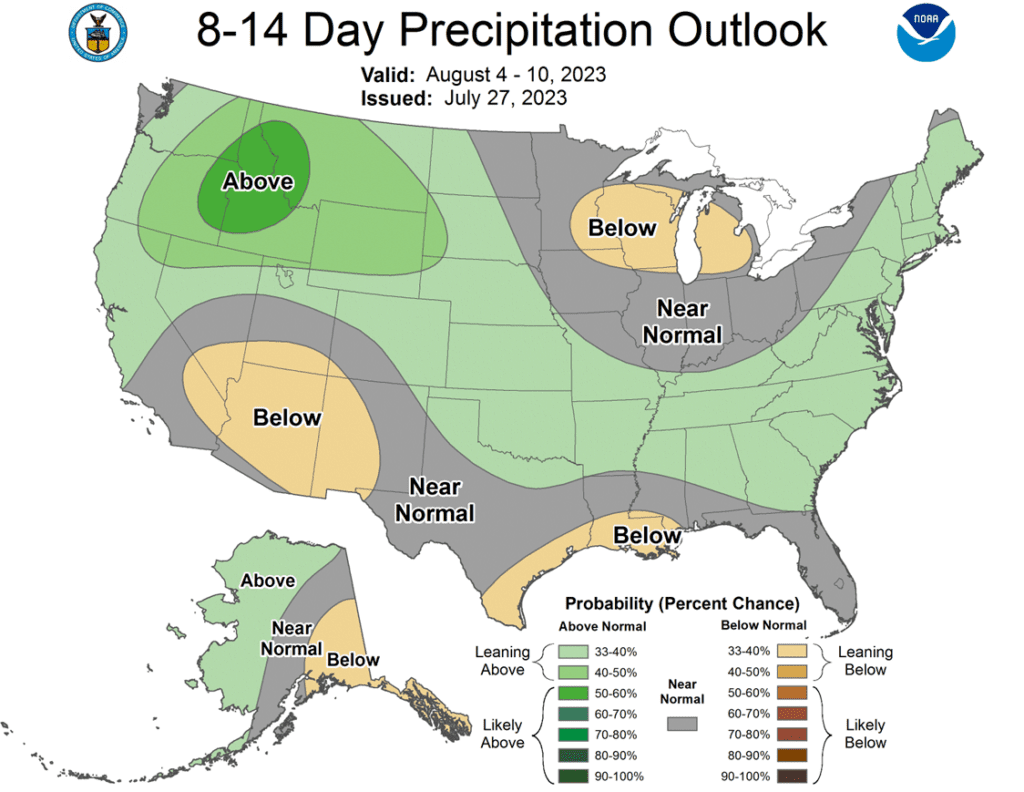

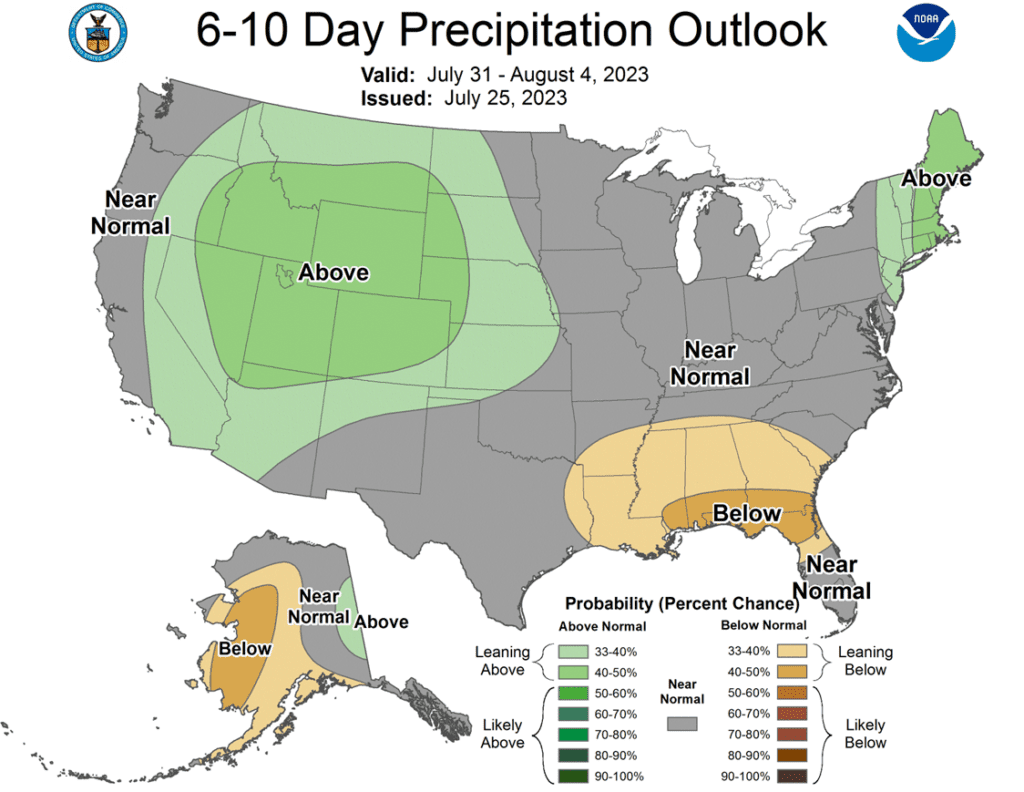

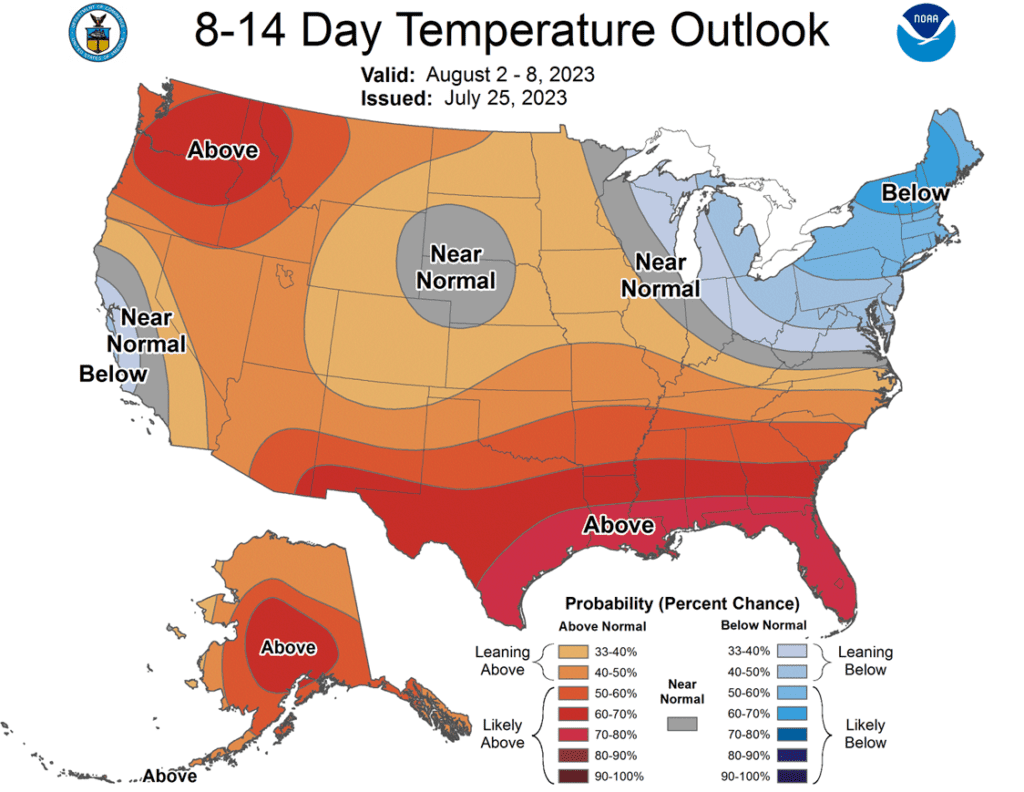

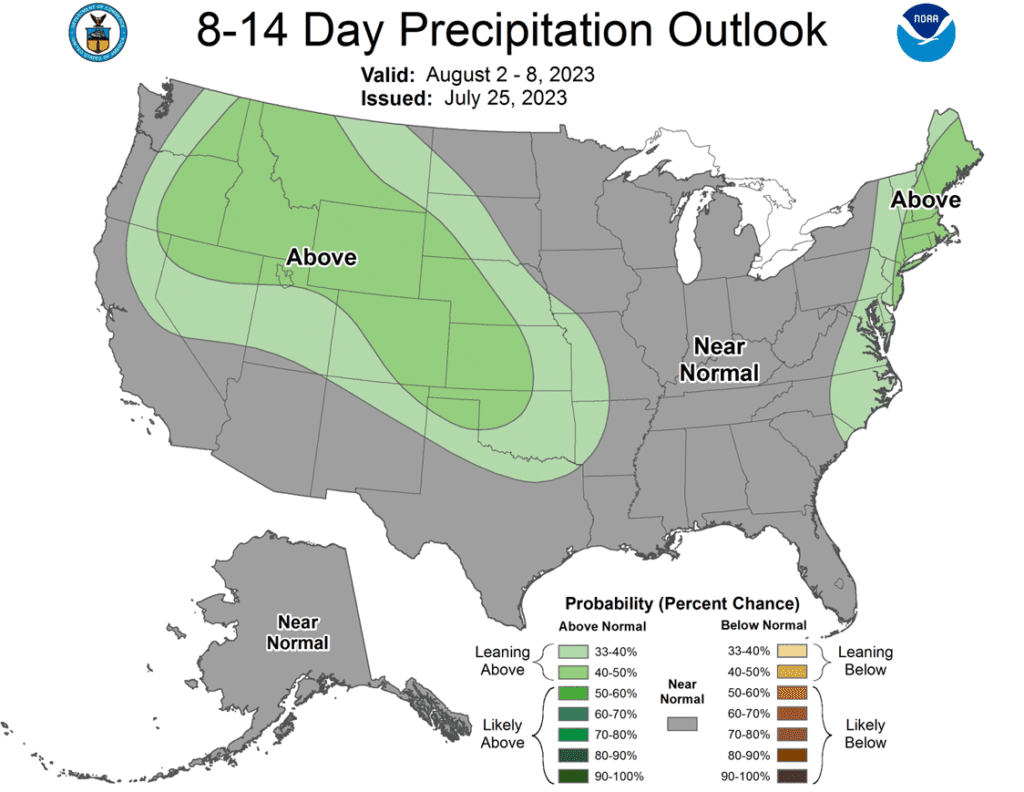

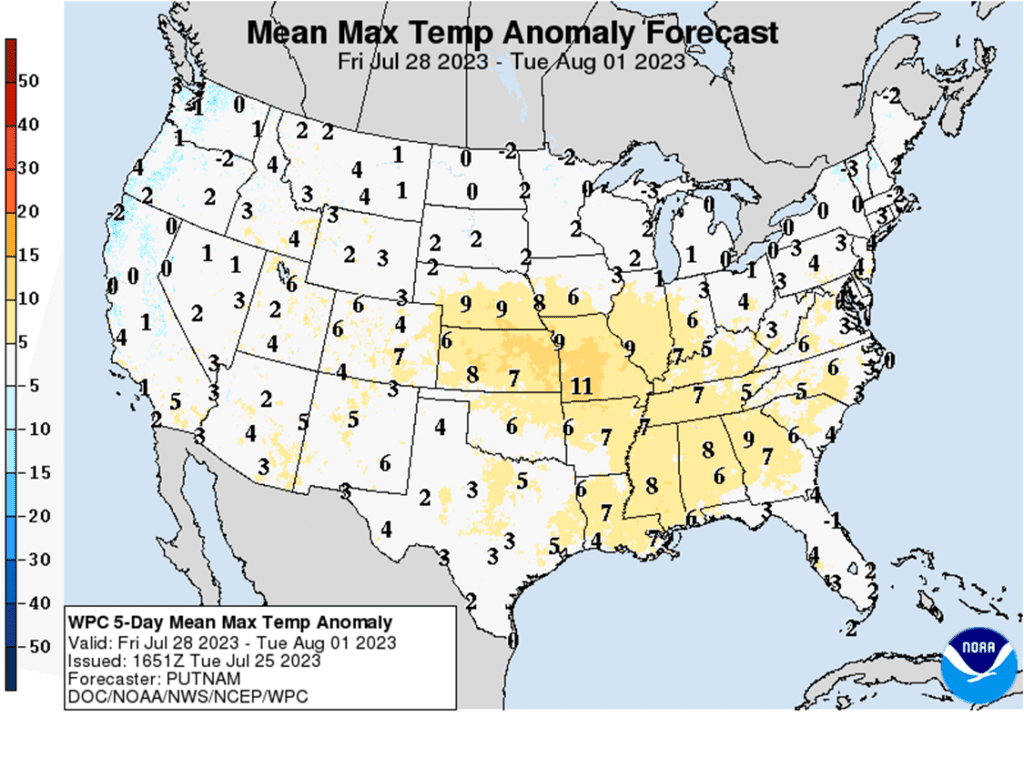

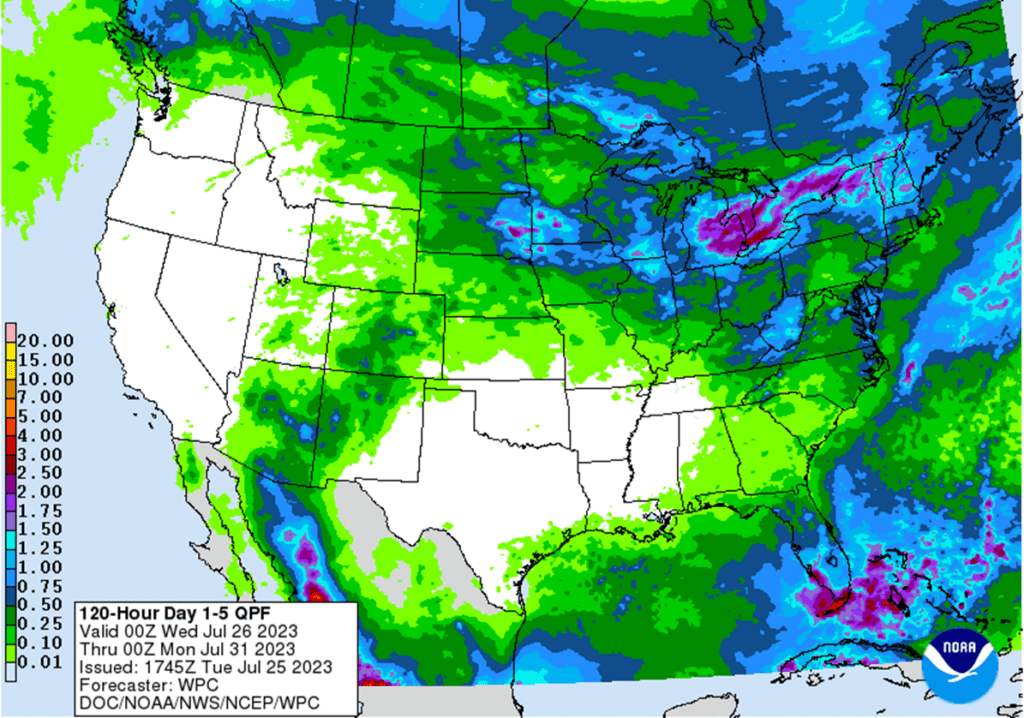

- To see the current 8–14-day temperature and precipitation outlooks courtesy of the Climate Prediction Center, scroll down to the other Charts/Weather Section.

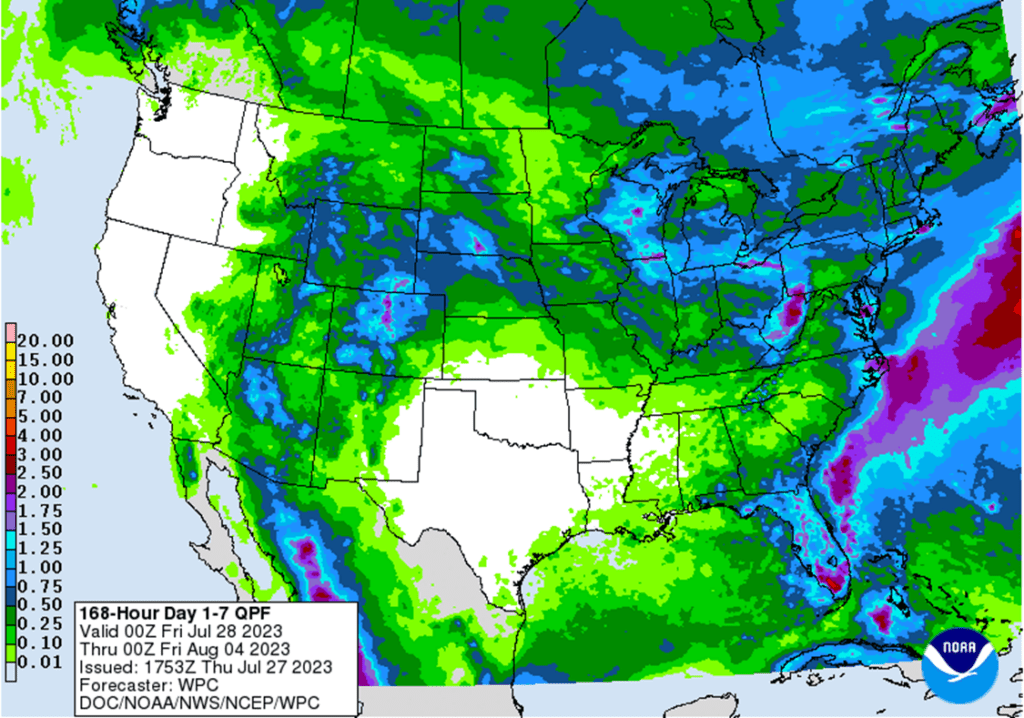

- To see the current 1–7-day precipitation outlook courtesy of the Weather Prediction Center, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

- No new action is recommended for Old Crop. The market had a nearly 140-cent swing from the May low to the June high and back on weather. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for 2022 Corn (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

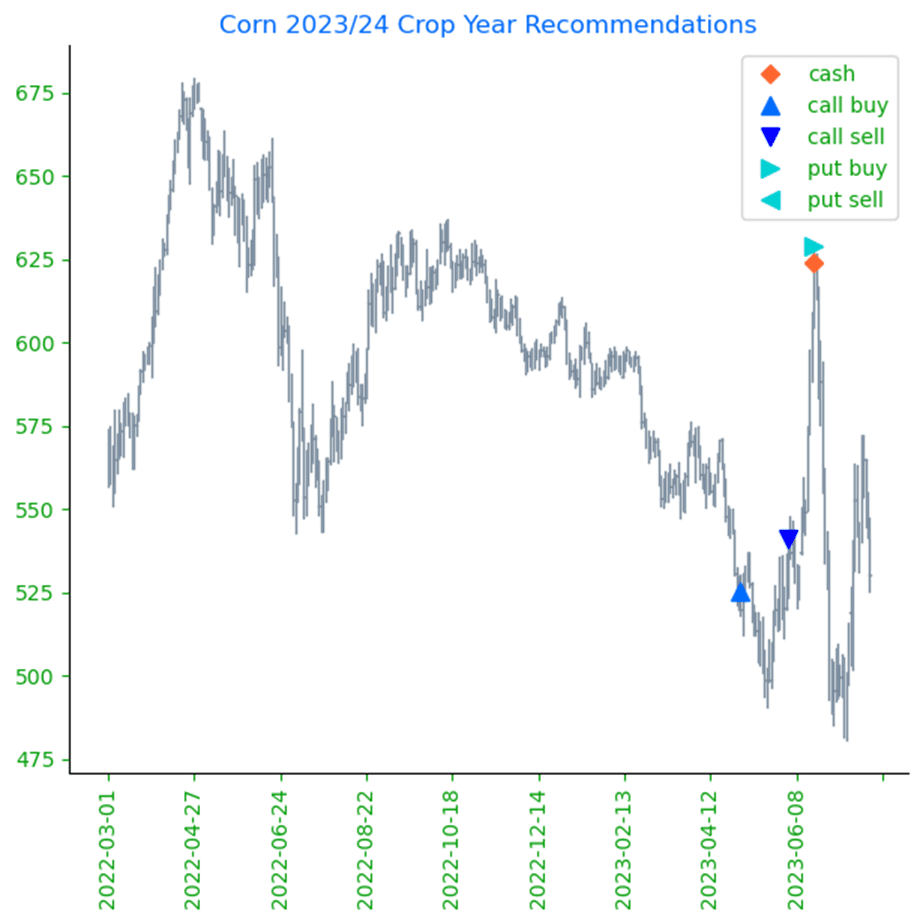

- No action is recommended for New Crop 2023 corn. The future price potential for Dec 23 corn continues to be at the mercy of each new weather forecast. Dryness and dry weather forecasts pushed Dec corn from the May low to the June high with a gain of 137 cents, which was promptly erased and then some by mid-July, leaving the market 149 cents off that June high, with a surprise jump in acres and more favorable forecasts. Now, the threat of dry weather and heightened tensions in the Black Sea region has rallied Dec corn sharply off that July 13 low. During the runup in early June, we warned that any change in the forecast to wetter weather could erase all the gains, as corn didn’t have much of a bullish fundamental story without a supply side shock fueled by lower yields. Overall, our thought process has not changed from a month ago and with the tremendous uncertainty, and subsequent volatility still in front of us, we continue to recommend holding the Strangle options position, comprised of the previously bought Dec 610 calls and Dec 580 puts. A turn back to wetter weather and we wouldn’t be surprised to see sub-500 corn again, and if dry weather persists, we wouldn’t be surprised to see corn prices north of 700. Under either of these scenarios the Strangle will benefit and doesn’t require trying to outguess the weather.

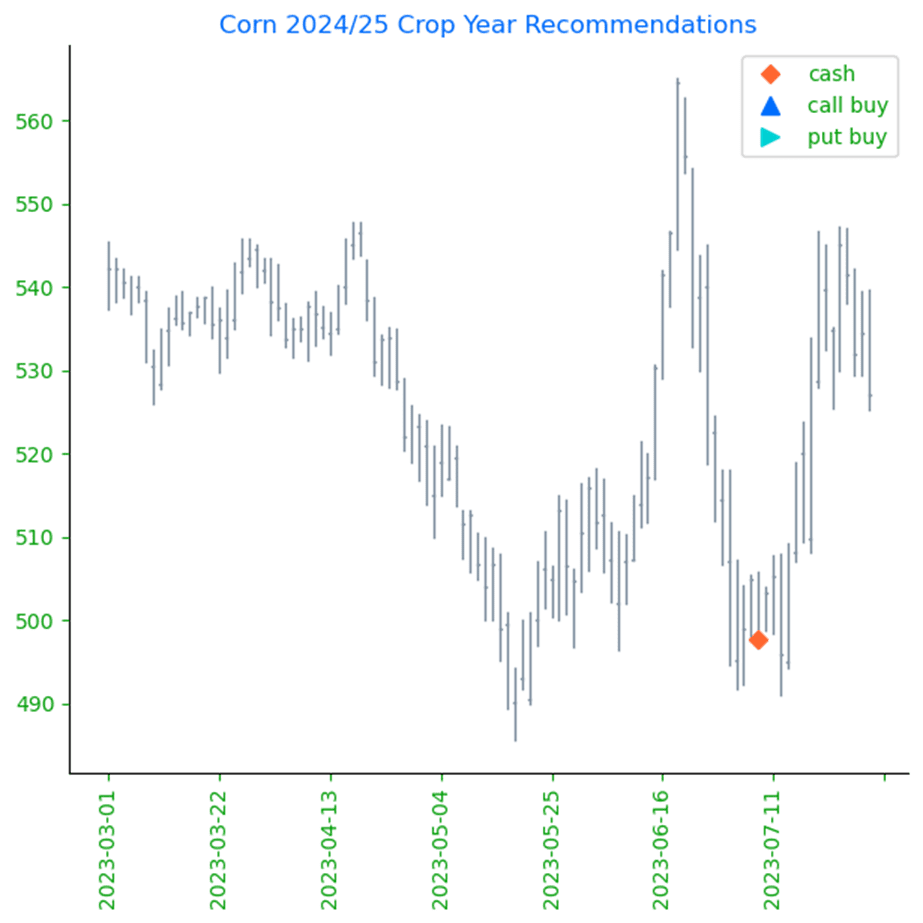

- No action is currently recommended for 2024 corn. In 2012, the best pricing opportunities for Dec 2013 corn were during the 2012 summer runup. Despite the significant yield losses to the 2012 crop, and the fear of running out of corn, the Dec 2013 contract peaked in the summer of 2012, and by January 2, 2013, the price was already down about 12% from the high. We continue to watch the calendar for 2024 corn as this 2023 summer volatility could provide some additional opportunities to get some good early sales on the books in the event of a 2013-type repeat. Insider recently recommended making a sale on your 2024 crop, and we’ll be watching for another opportunity to suggest adding to prior early sales levels between now and the beginning of September.

- Friday saw selling pressure in the corn market, as the market moved past the hot weather and focused on a more friendly overall forecast. Price broke through key support levels, closing below the 40, 50, and 100-day moving averages on the day. December corn traded 6 cents lower on the week, but a disappointing 40 cents off the week’s high of $5.72-¼.

- Friday morning started with rain on the radar, which saw moderately good coverage from western Illinois through the Ohio River valley. Additional forecasts are looking for more precipitation to build on Friday night into Saturday.

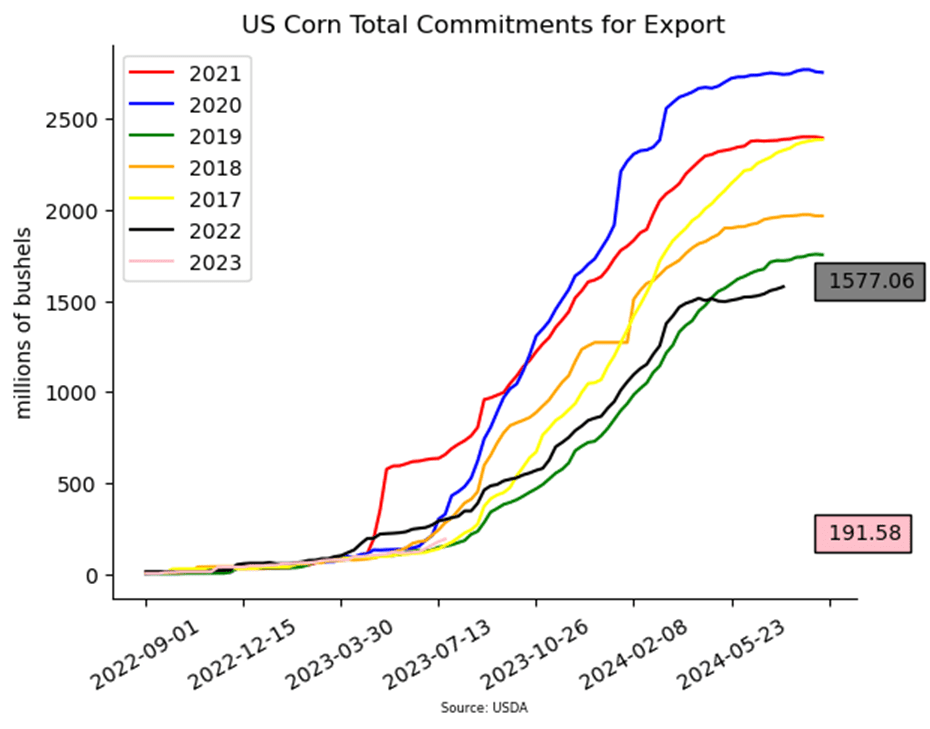

- Argentina saw good producer movement in their latest “Pesos for Maize” program, providing incentive for producers to sell grain. The three-day program netted nearly 100 mb of sales for the export market. U.S. corn exports still struggle to be competitive versus cheaper Brazil and competitive Argentina corn prices.

- The wheat market saw additional long liquidation as prices have fallen off the most recent highs and global wheat prices are keeping U.S. wheat at a competitive disadvantage. The weakness in wheat spilled over into the corn market.

- Weekend weather will be closely watched. With the weak price action on Friday, a wet forecast will likely bring additional selling pressure to start the week.

Above: Since mid-July, the market retraced about 62% of the prior down move, hit resistance around the 50-day moving average and turned lower. The market appears to be correcting from being overbought, and if it breaks through the 520 support level, there may not be much support above the 474 low. Should the market turn back higher, heavy resistance lies near 555 – 565.

Soybeans

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

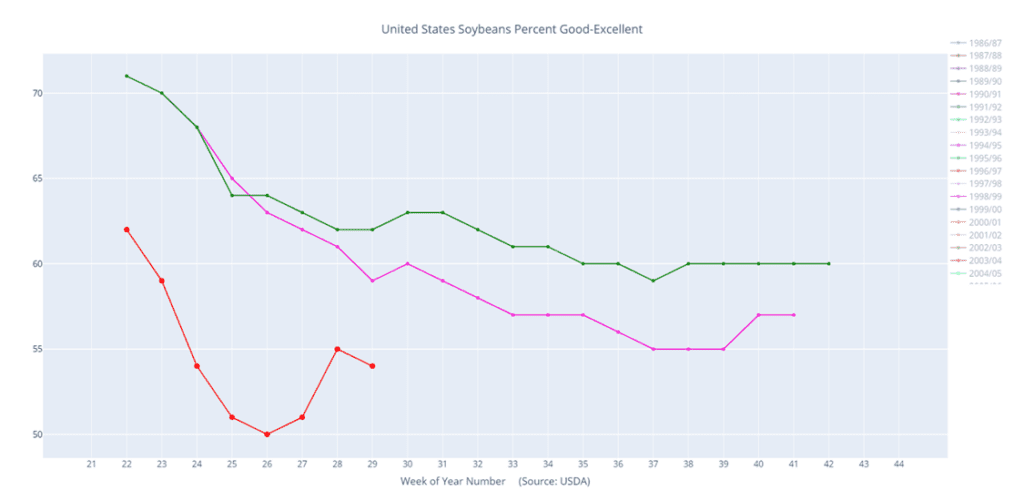

- No action is recommended for 2023 soybeans. The USDA injected a lot of volatility into this market beginning with a much lower-than-expected planted acreage estimate, followed by a much larger-than-expected 300mb carryout estimate in its July WASDE. While demand has been weak, we have a bona fide weather market during a crucial period for soybeans and there is little wiggle room for lost yield in this year’s crop. While a drier forecast can still maintain upside potential, plenty of time remains for rain to come and push prices lower, much like in 2012, when July was dry. Then the pattern changed in August, and decent rain fell in parts of the western Corn Belt and IL, sending Nov ’12 soybeans down 20%. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- Soybeans ended the day lower with front month August posting significant losses while deferred months were down, but not by as much. Soybean meal ended lower by over 2%, but soybean oil was bear spread with the two front months closing lower while deferred months were higher. Some of the extreme price action in the August contracts could be because they will be entering the delivery phase with the first notice day for delivery on long position holders being Monday, July 31.

- Today, pressure came from overnight scattered showers in the Midwest and more favorable forecasts for August with more rain and more forgiving temperatures. August will be a critical time for soybean yields and weather will be a large focus for many traders.

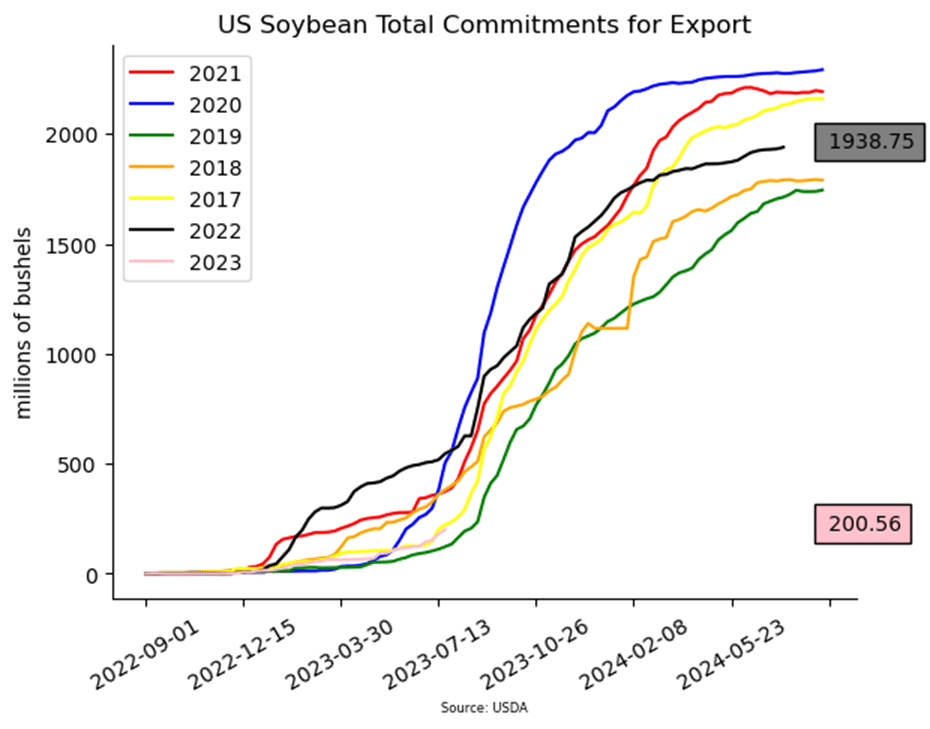

- Soybeans have gotten some friendly news this week with three flash sales to unknown destinations, but prices were unable to hold. With current 23/24 sales 60% behind last year’s pace, it is possible that Nov soybeans met with resistance after coming very close to the contract highs and spurred selling.

- While Brazil is dominating global exports, the US will become more competitive in October, which could explain the recent sales for 23/24. Even with poor exports, domestic demand has been firm with profitable crush margins.

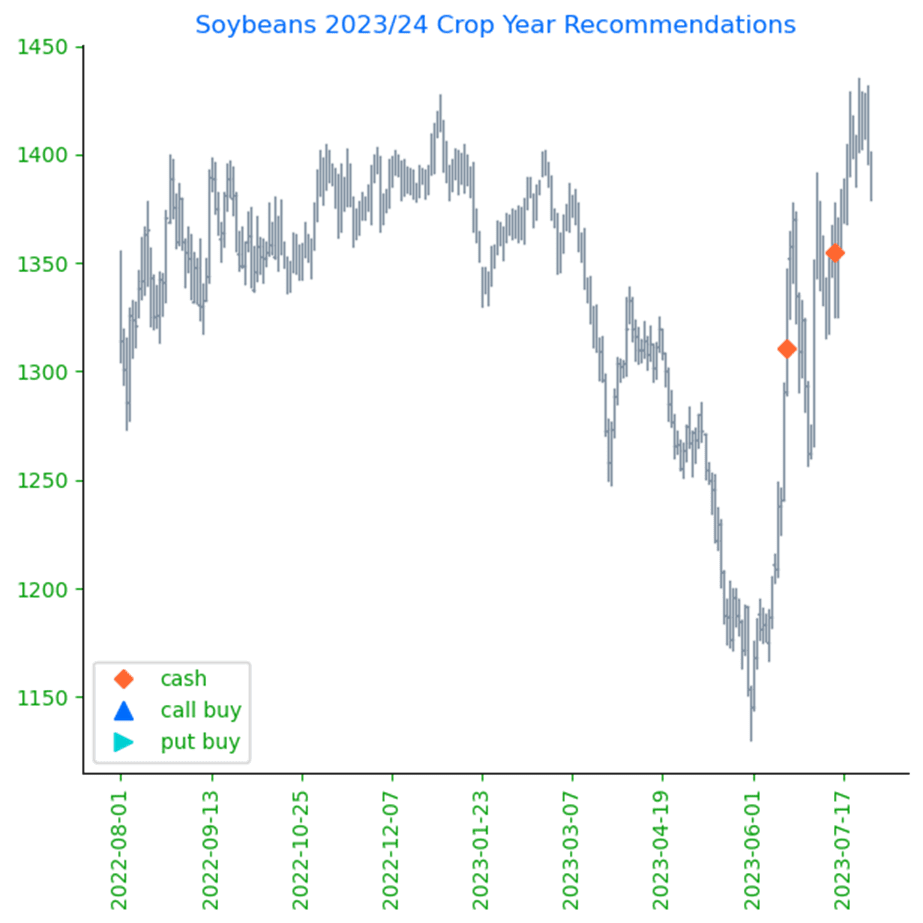

Above:

Add Comment Below Following the market’s roll from the August to September contract, it rallied to and tested the 1490 – 1505 heavy resistance level on the Continuous chart and posted a bearish reversal on 7/28. If the trend turns lower, initial support may be found near 1390 – 1410, with further support coming in near 1350.

Wheat

Market Notes: Wheat

- Wheat traded both sides of unchanged, but struggled to hold onto any gains. All three US futures classes closed lower, alongside Paris milling wheat futures, which were lower for the fourth session in a row.

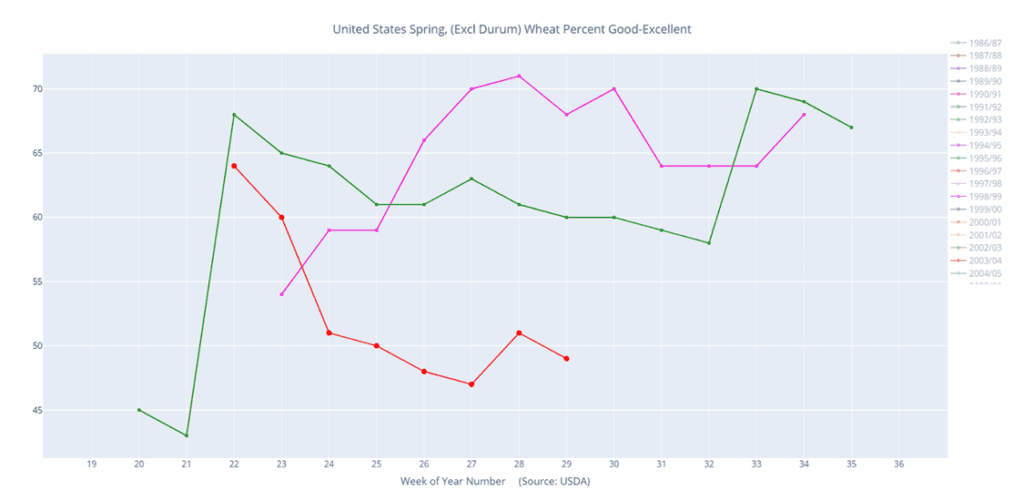

- The spring wheat crop tour in North Dakota came up with a final yield of 47.4 bpa. This compares with the USDA’s projected yield of 47, last year’s yield of 49.1 and the average of 40 bpa.

- The Buenos Aires Grain Exchange kept their 23/24 wheat crop planted area unchanged at 6.0 million hectares.

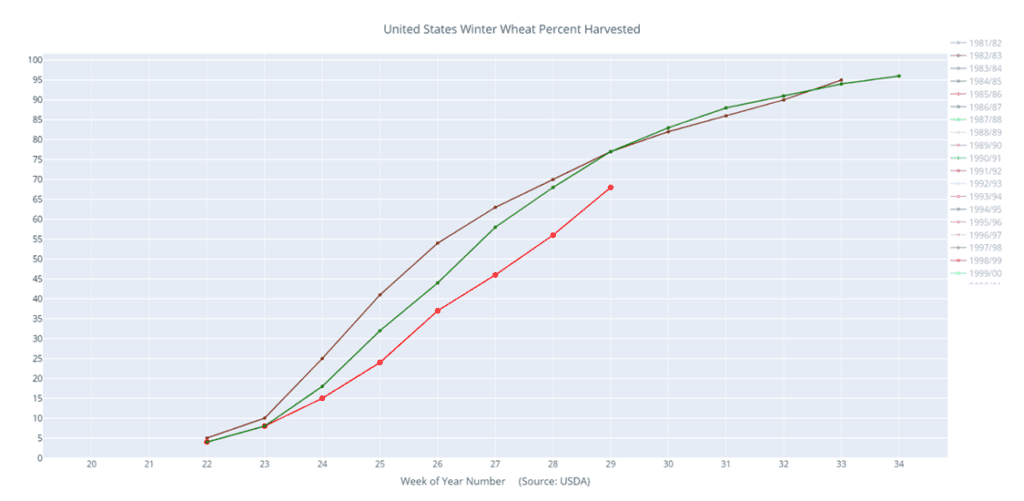

- There is some concern starting to develop about the wheat crop in the dry areas of Australia. In Canada, the spring wheat crop could be affected by dry conditions, and here in the U.S., 43% of spring wheat and 47% of winter wheat are said to be experiencing drought.

- The US Dollar Index continues to trend higher after bottoming in mid-July. This is keeping pressure on the export market, and thus, futures.

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 New Crop. The wheat market has seen a great amount of volatility in recent weeks and has primarily been a follower of corn which has been driven by weather. Although demand remains weak, the recent closure of the Black Sea corridor, and continued weather concerns in the northern Plains, Canada, Europe, and Russia, still leave many supply questions unanswered. While Grain Market Insider will continue to monitor the downside for any violation of major support following the recent sales recommendation, it may be after harvest or near the end of summer before we consider recommending any additional sales for the 2023 crop.

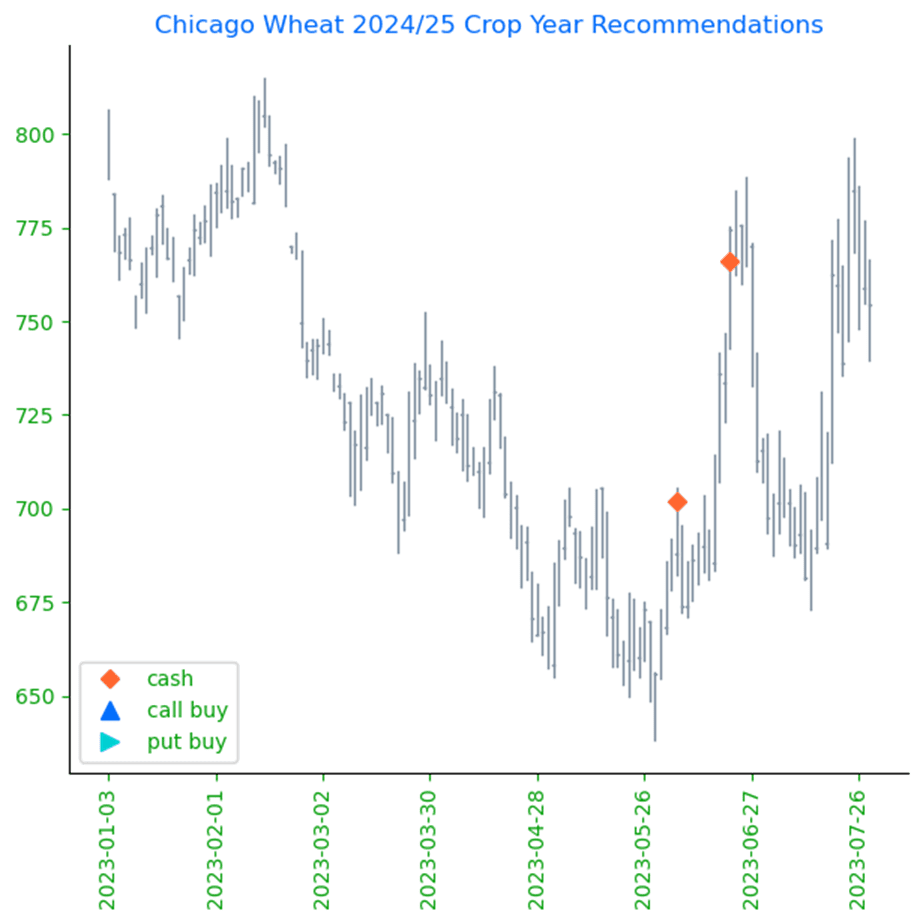

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June, price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices continue to be volatile, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Rising tensions in the Black Sea have fed the rally that tested the June high. Prices have become overbought and retreated. New bullish input will likely be needed to turn prices back higher and test the heavy resistance area of 777 – 807-1/2 between the recent high and the February high. If prices do retreat, initial support may be found near 690 – 700, and again around 610 – 650.

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. While crop conditions have improved and there are reports of better-than-expected US yields, questions remain about the world wheat supply with the closure of the Black Sea corridor, dryness in Russia, the Canadian Prairies/Northern US Plains, and Europe. With world supplies currently seen at 11-year lows, we continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks at 11-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

- No Action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: The September K.C. wheat contract posted a bearish reversal on 7/25 after testing heavy resistance near 920. Prices have become over bought and retreated. Support below the market is near 830 – 842, with further support near 763 – 778. Should prices reverse higher, heavy resistance remains in the 920 – 930 area.

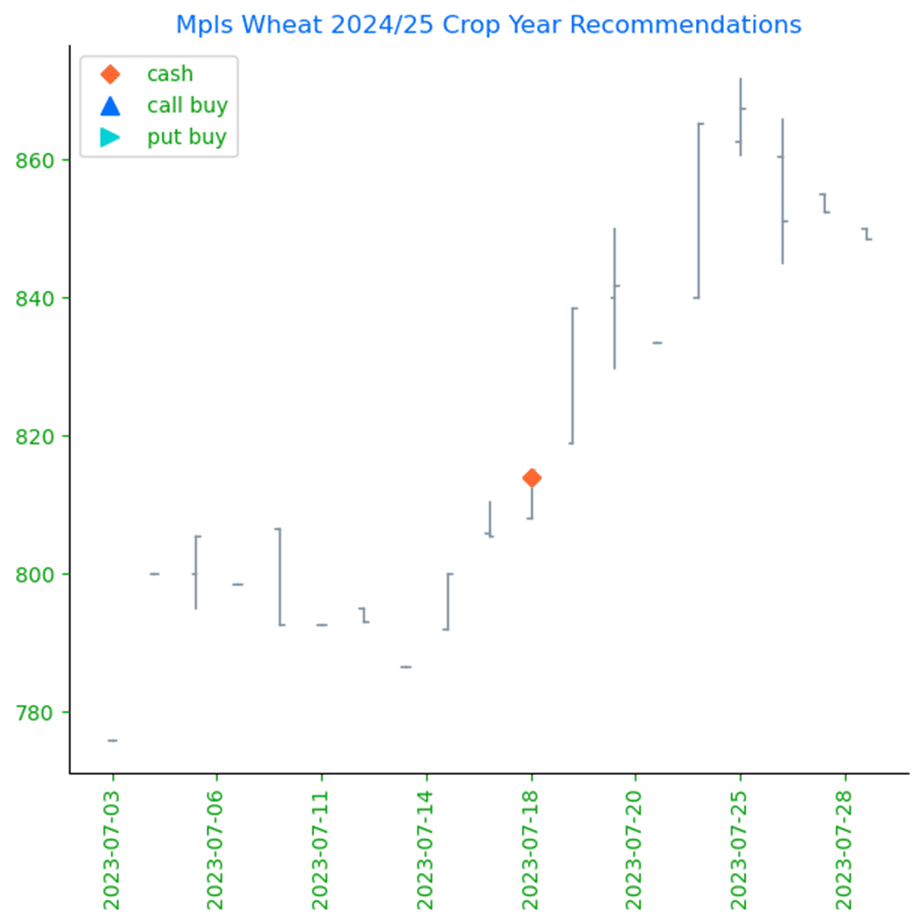

Mpls Wheat Action Plan Summary

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. The market had a nearly 116-cent swing from the May low to the June high and back on weather. While weather and geopolitical events can still affect Old Crop prices, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest. Use any remaining bounces in the market to price what Old Crop bushels you may have, if any. We won’t have any “New Alerts” for the 2022 crop (Cash, Calls, or Puts) as we have moved focus onto 2023 and 2024 Crop Year opportunities.

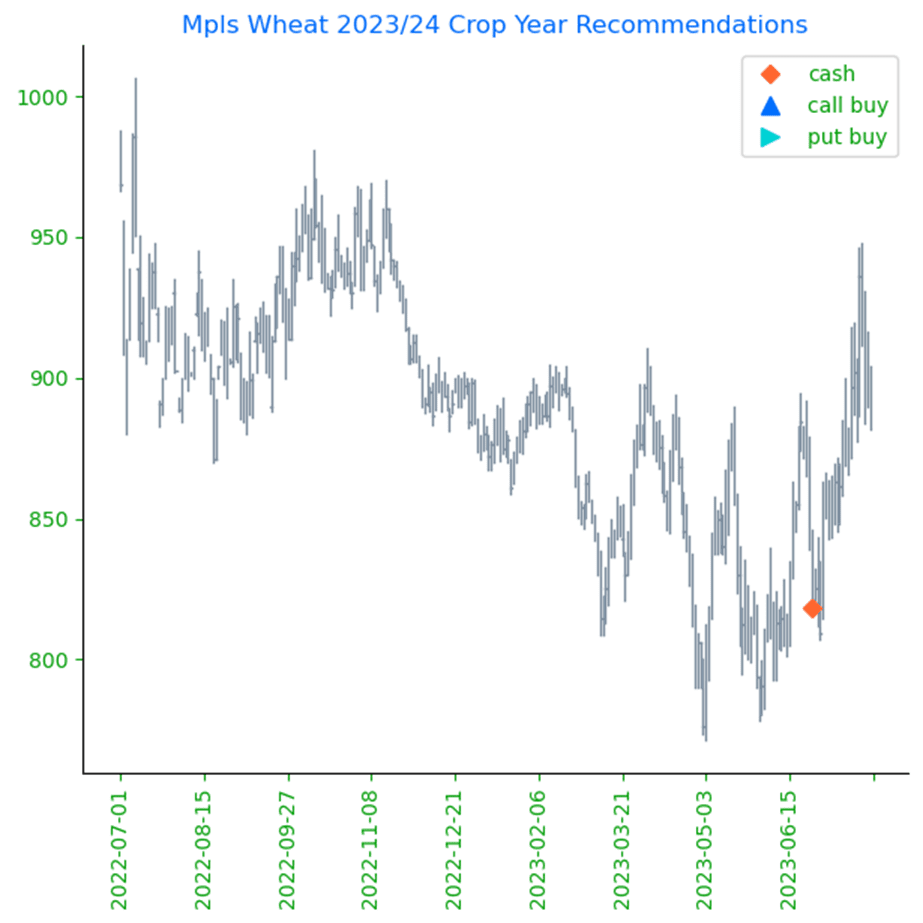

- No action is currently recommended for the 2023 New Crop. Weather dominates the market right now, and though much of the growing season remains, Grain Market Insider suggested making a sale as prices closed below 822 to protect from further downside erosion due to a potential trend change. Seasonally, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to shock the market higher. Insider will consider making sales suggestions if prices improve through this growing season, while also continuing to watch the downside for any further violations of support.

- No action is recommended for the 2024 crop. This year has been marked with volatility from adverse weather to geopolitical disruptions and has given us historically good prices to begin making early sales. While prices continue to be volatile, plenty of time remains to market the 2024 crop. War continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, Grain Market Insider will continue to consider making sales recommendations if prices improve while also keeping an eye on the downside should prices break support.

Above: September Minn. wheat’s rally of nearly 180 cents to test last winter’s highs culminated in a bearish reversal after the contract became mildly overbought. Prices have since retreated and may test the 865 – 845 initial support area, with further support near 800. If more bullish input is received, the market could turn higher again to retest the heavy resistance area near 950.

Other Charts / Weather