Opening Update: August 3, 2023

All prices as of 6:30 am Central Time

|

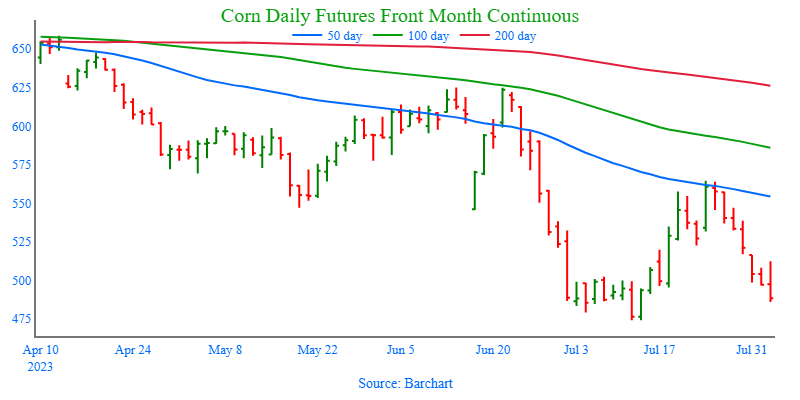

Corn |

||

| SEP ’23 | 487.75 | -0.5 |

| DEC ’23 | 500.25 | -0.25 |

| DEC ’24 | 512.75 | -0.5 |

|

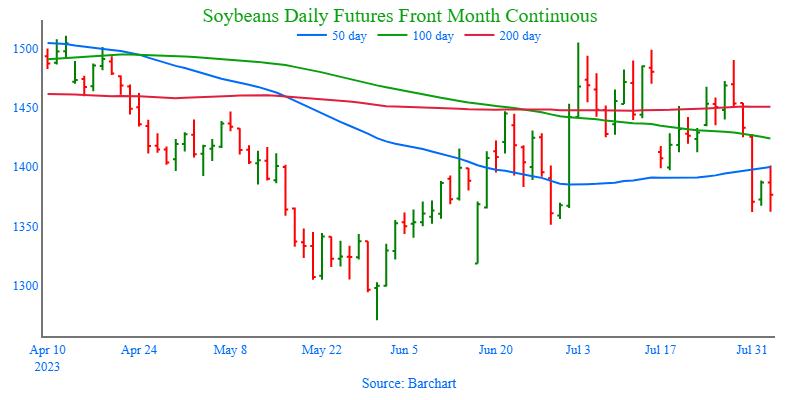

Soybeans |

||

| NOV ’23 | 1329 | 7.75 |

| JAN ’24 | 1338 | 8 |

| NOV ’24 | 1257.25 | 8 |

|

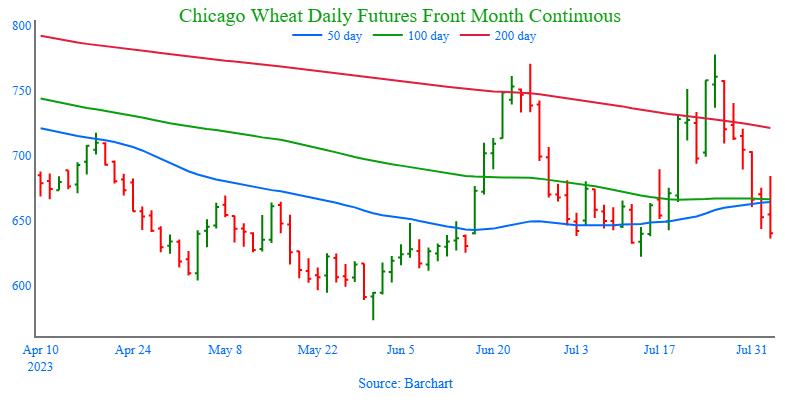

Chicago Wheat |

||

| SEP ’23 | 643 | 3 |

| DEC ’23 | 670.5 | 3.25 |

| JUL ’24 | 711 | 1.75 |

|

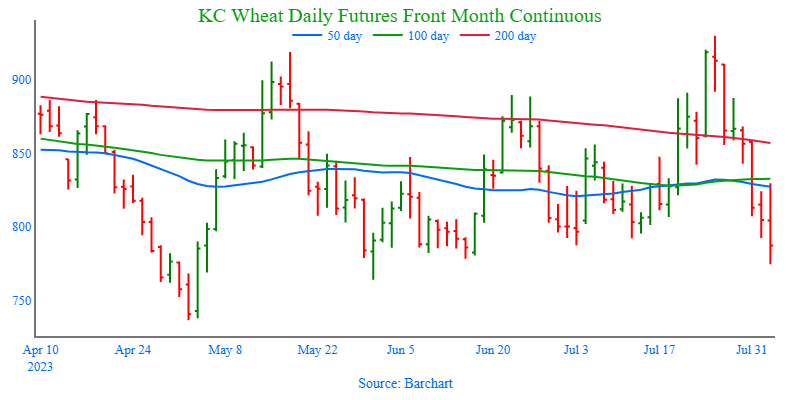

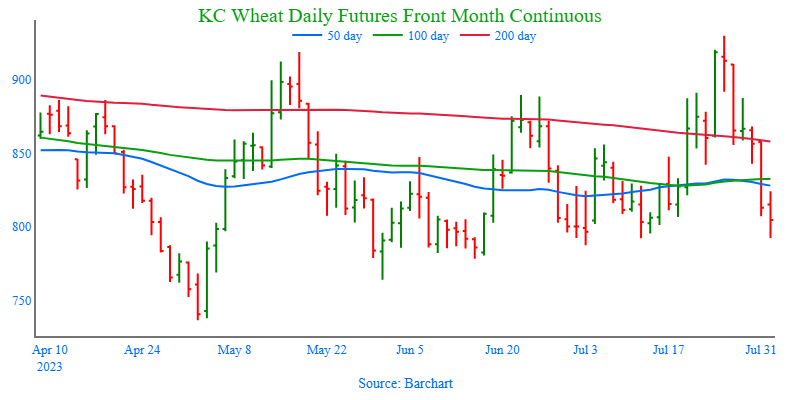

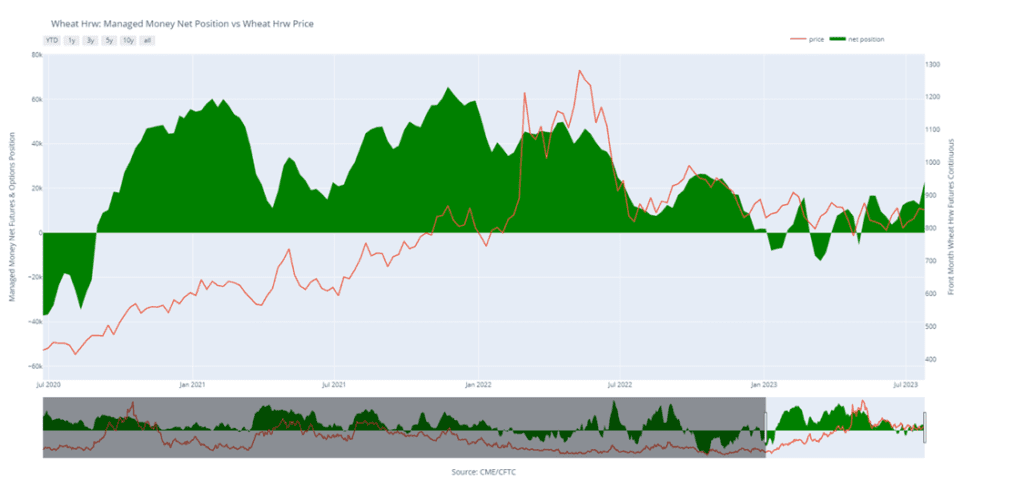

K.C. Wheat |

||

| SEP ’23 | 787.75 | 0.75 |

| DEC ’23 | 803 | 2 |

| JUL ’24 | 786.5 | -0.25 |

|

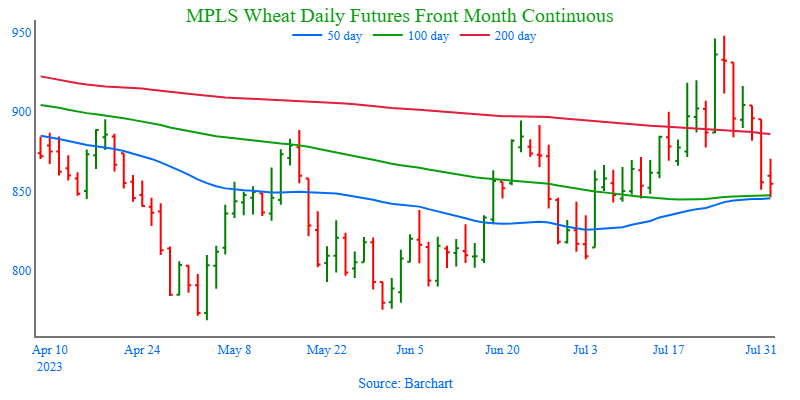

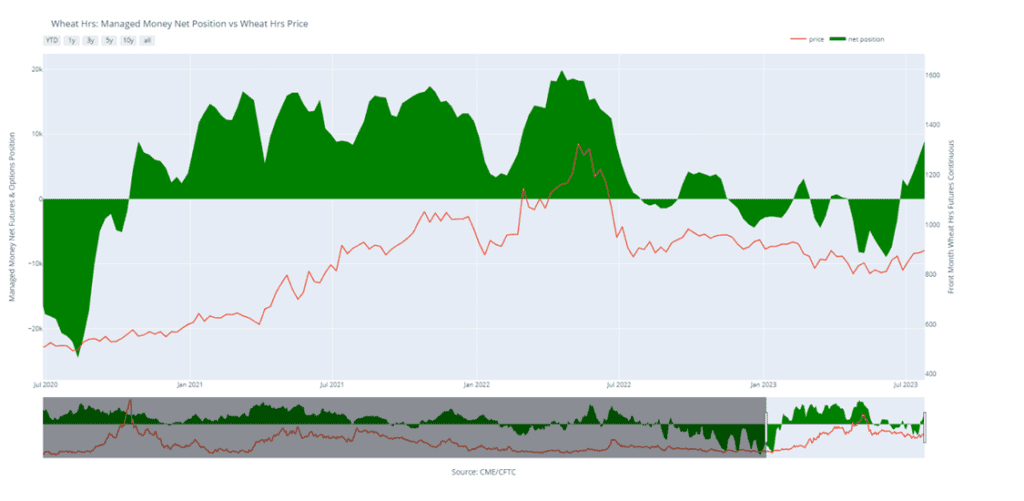

Mpls Wheat |

||

| SEP ’23 | 855.5 | 6.5 |

| DEC ’23 | 872 | 9.75 |

| SEP ’24 | 816.75 | -6 |

|

S&P 500 |

||

| SEP ’23 | 4528.75 | -8.5 |

|

Crude Oil |

||

| OCT ’23 | 79.19 | 0.06 |

|

Gold |

||

| OCT ’23 | 1952.6 | -2.9 |

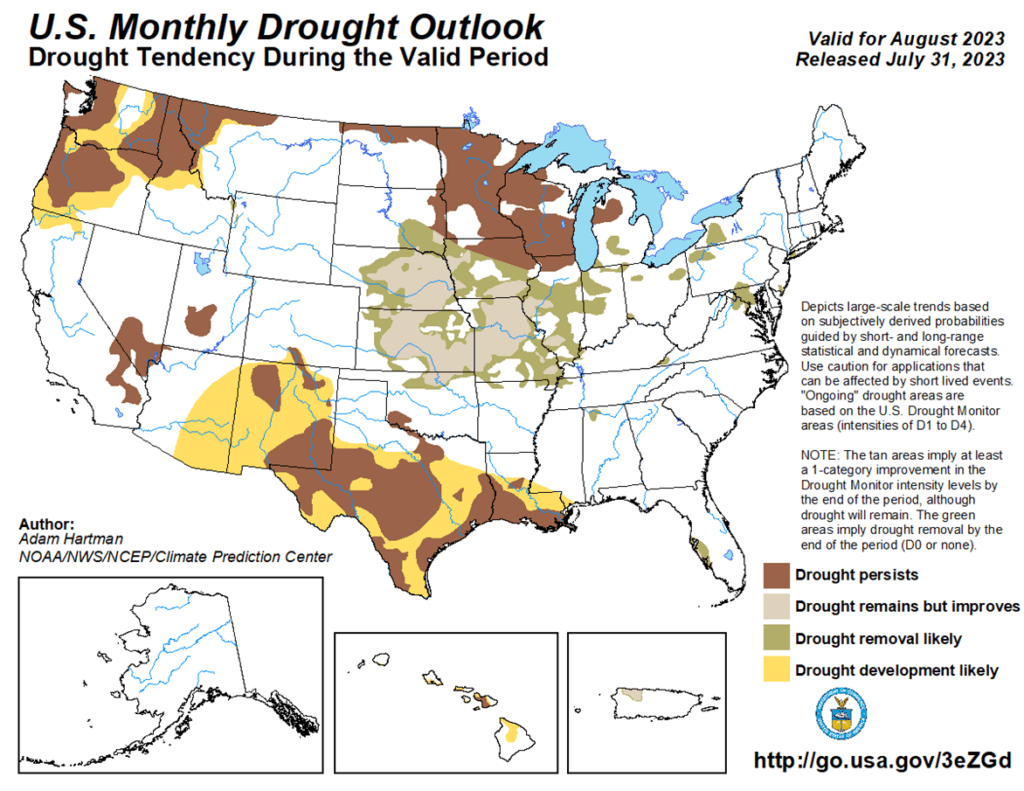

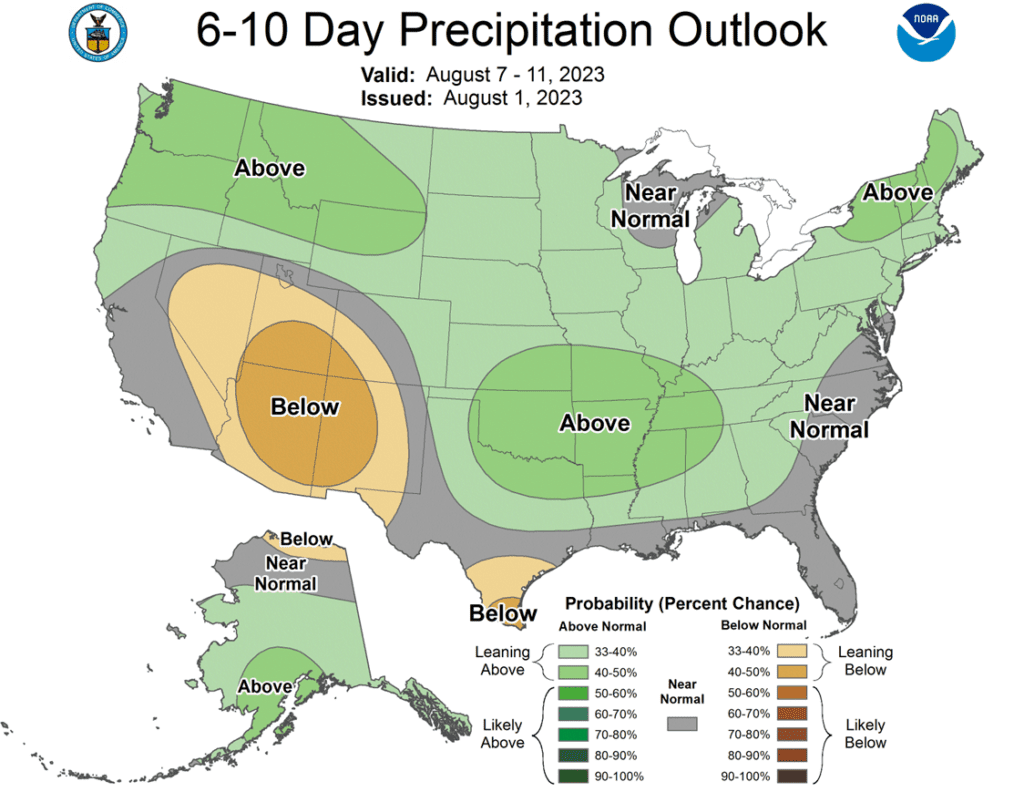

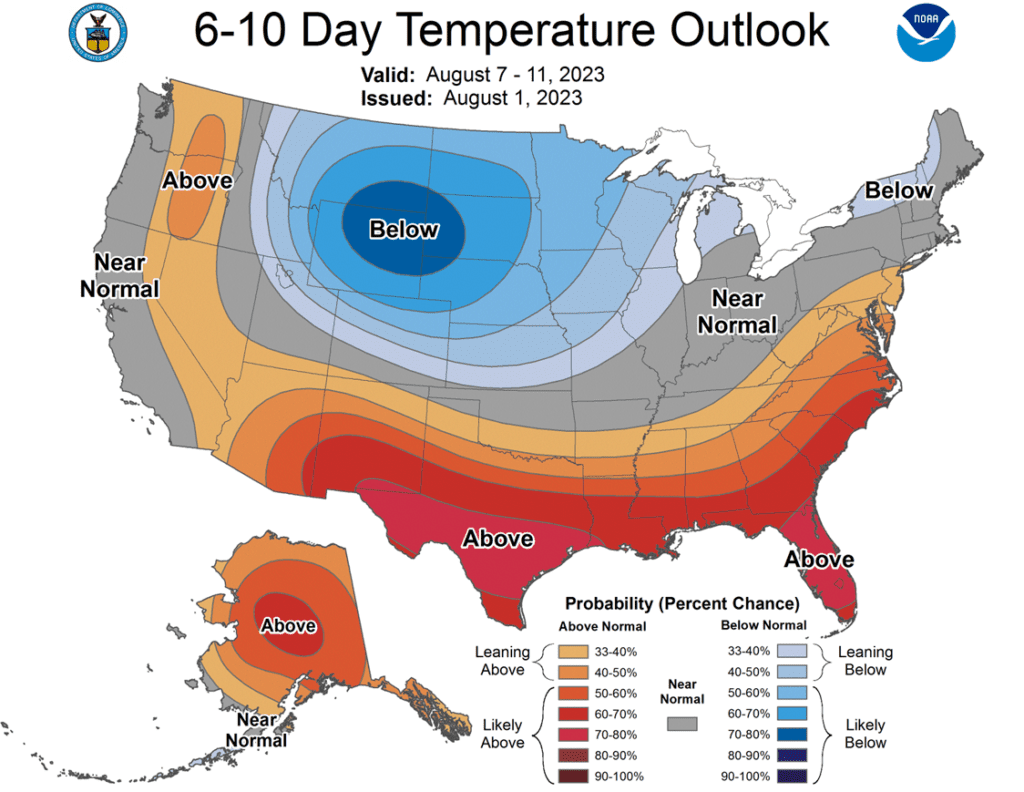

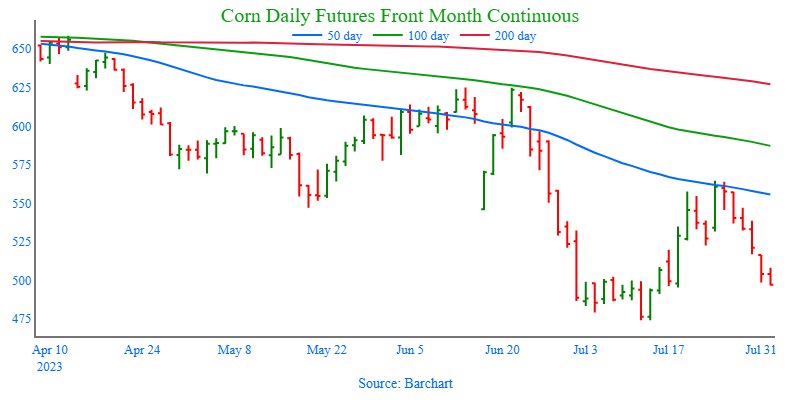

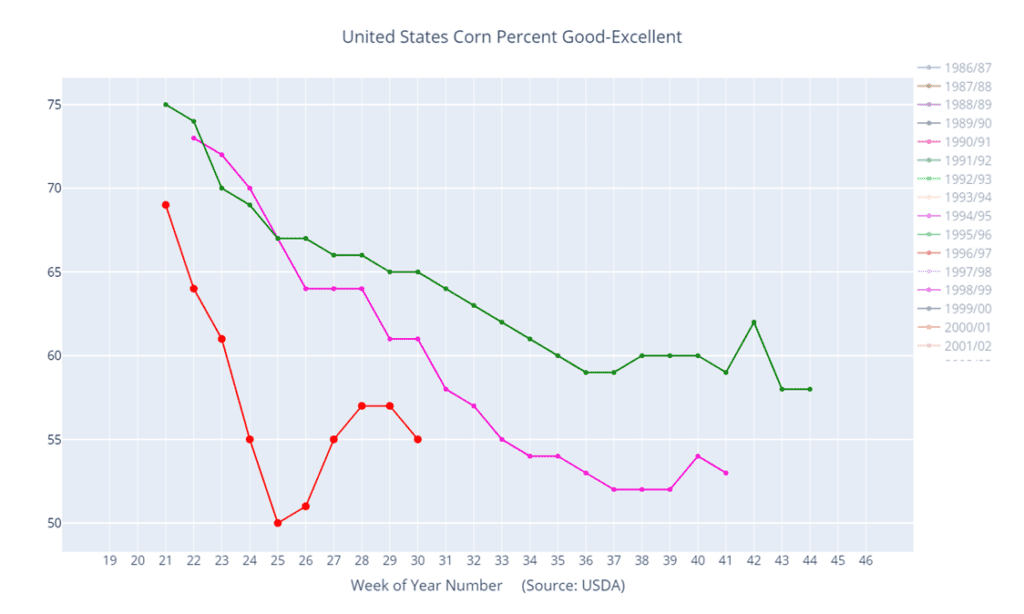

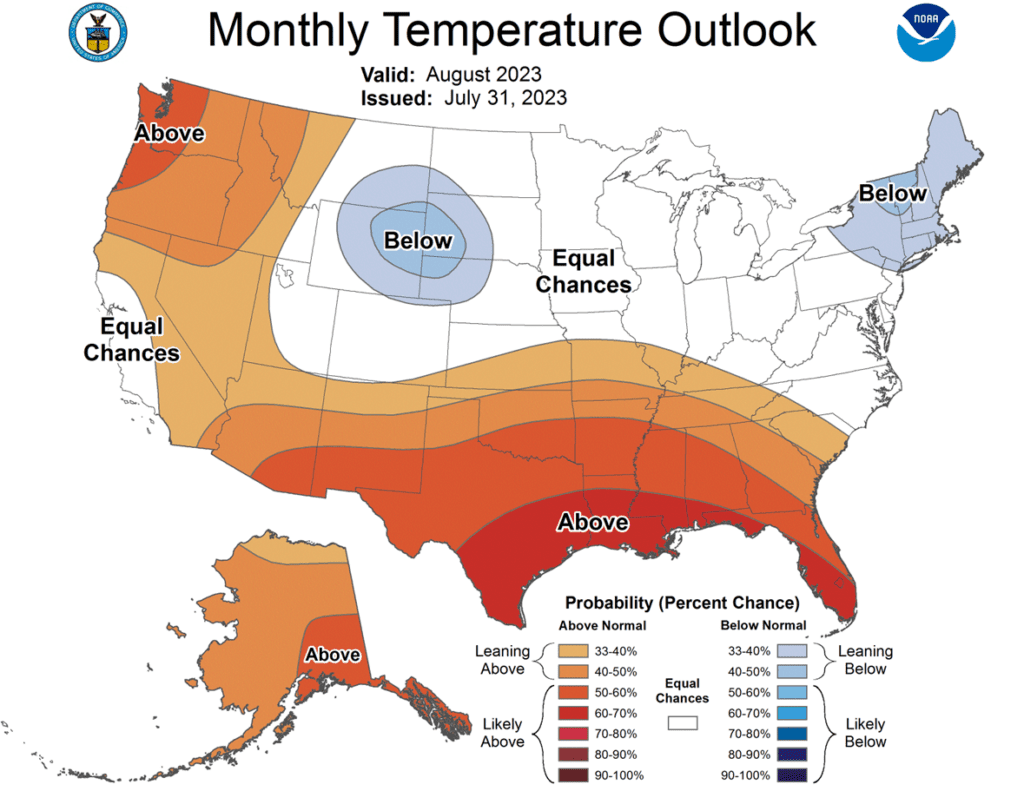

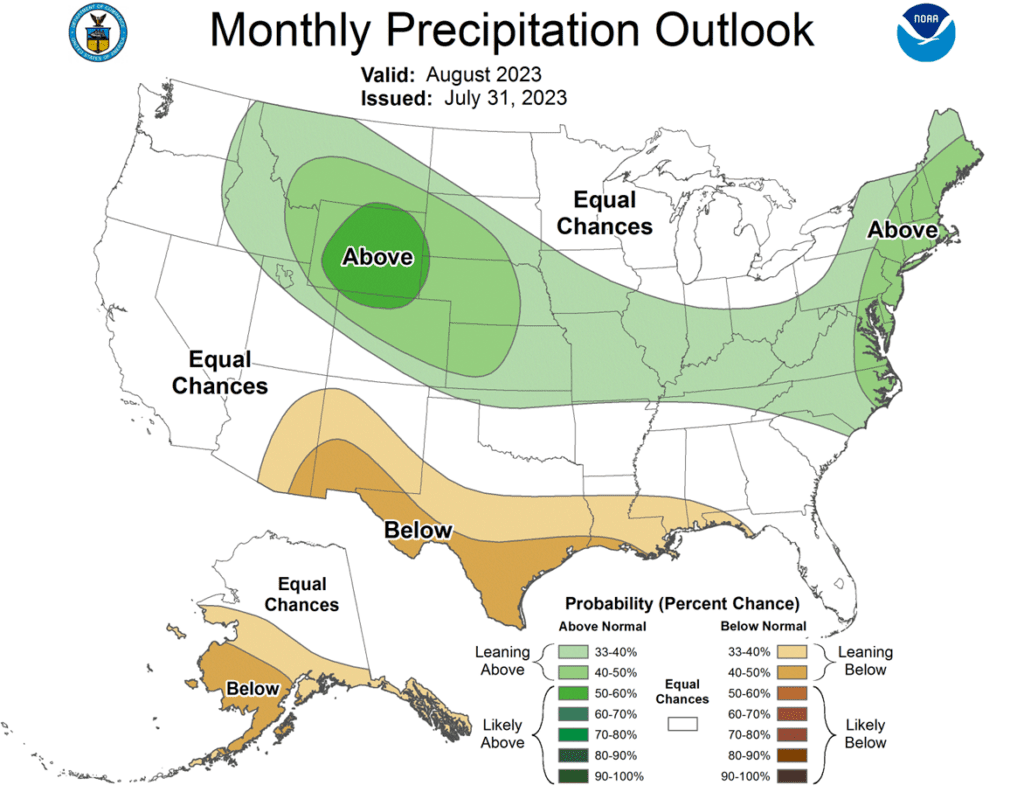

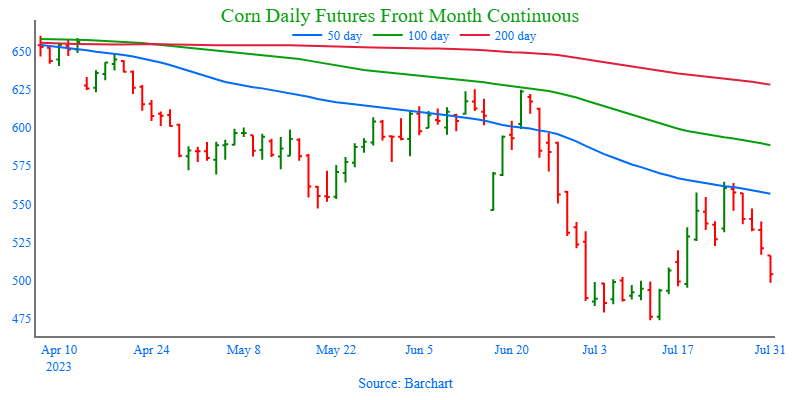

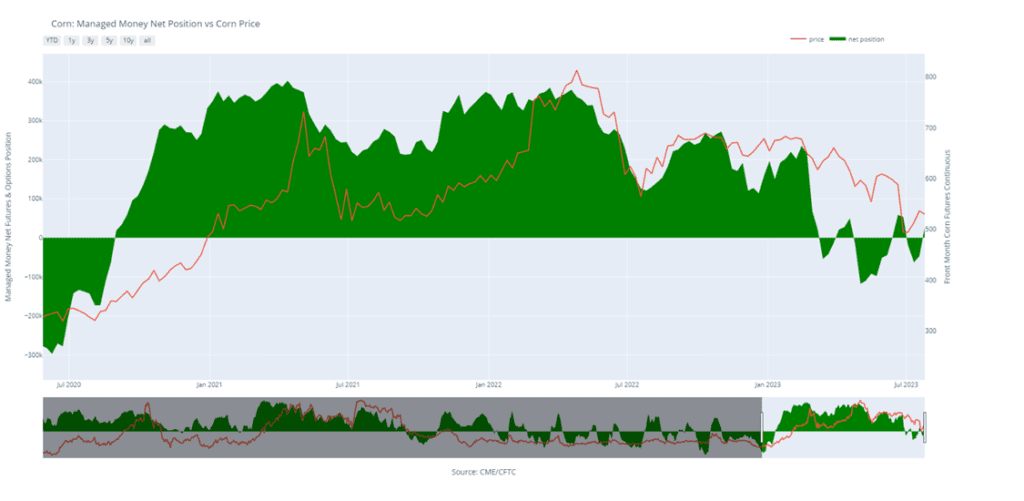

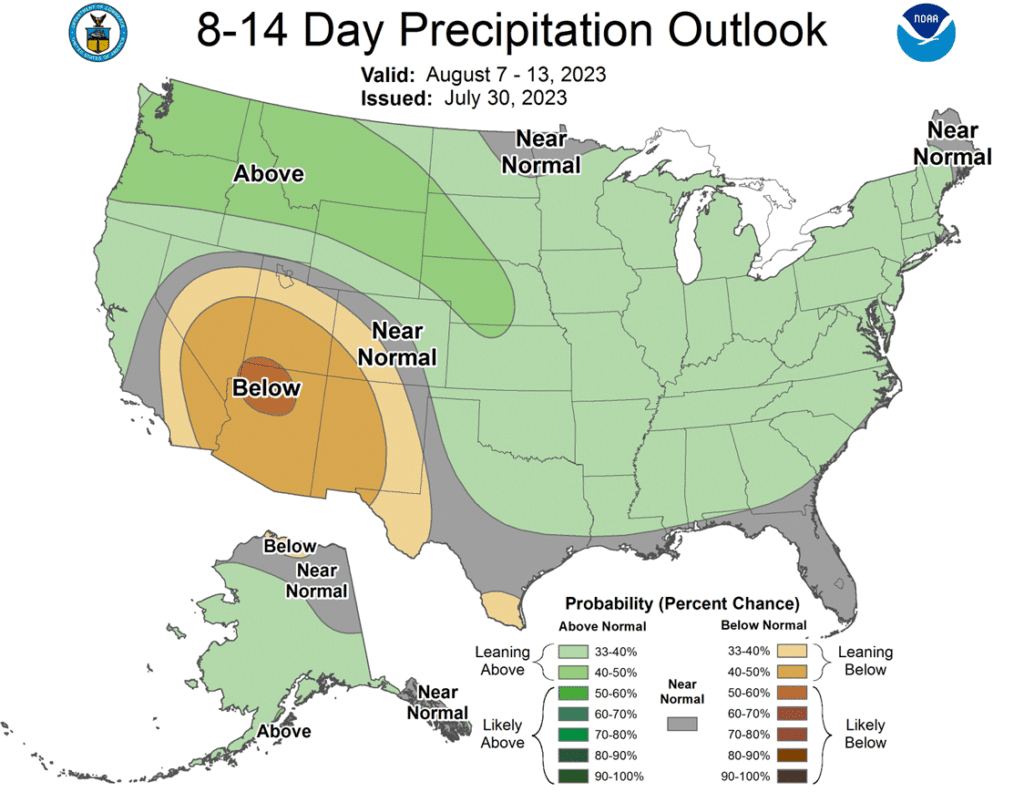

- Corn is trading unchanged to lower on a lack of fresh news and with traders focusing on the forecast which is wet and cool over the next two weeks.

- Yesterday’s ethanol production report was a highlight with production being the best on this date compared to the past five years. Stocks fell on good demand.

- The average estimate for today’s export sales in corn is 658k tons, but may be less as export demand has been very sluggish.

- Yesterday evening, StoneX revised their estimates for US corn yields higher to 177 bpa, a lofty estimate, but below the USDA’s last estimate of 177.5 bpa.

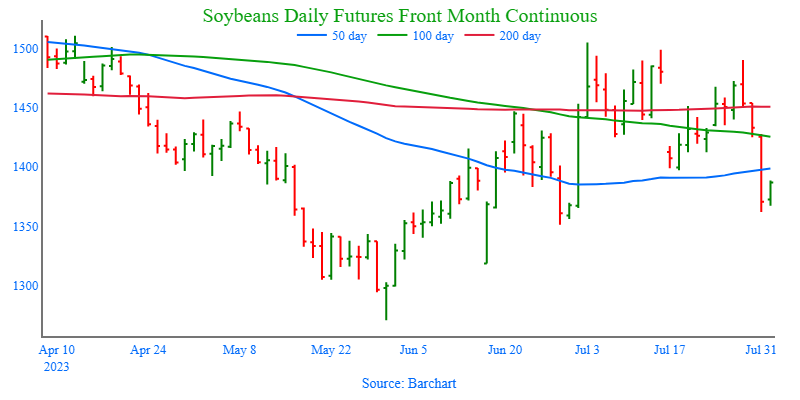

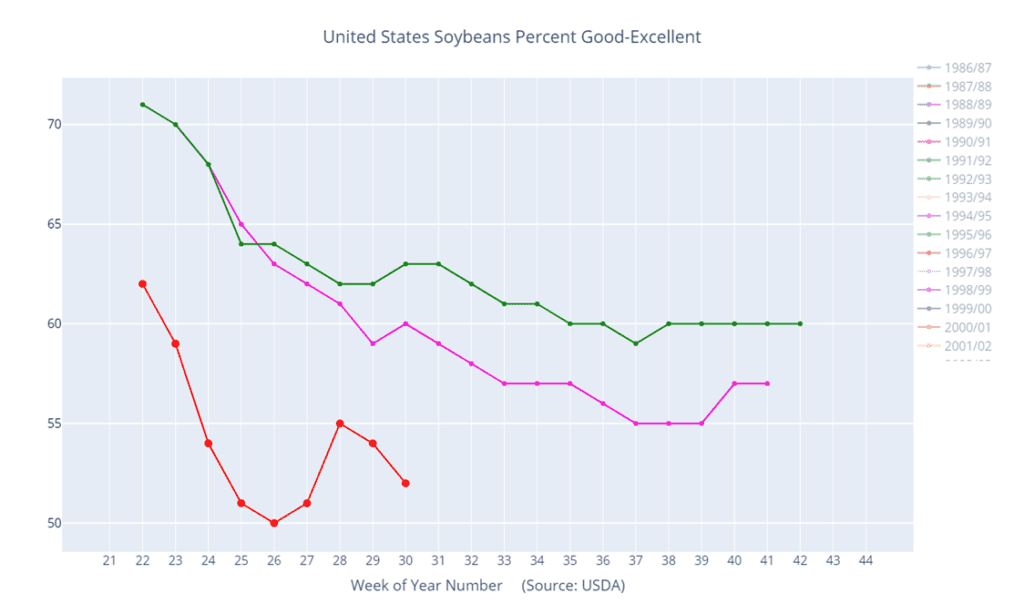

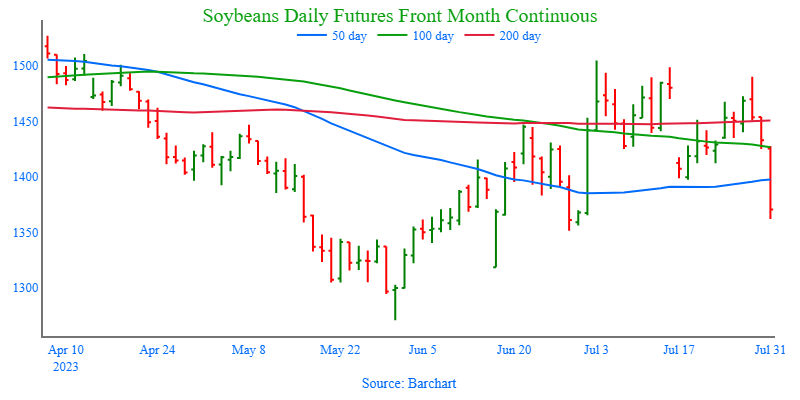

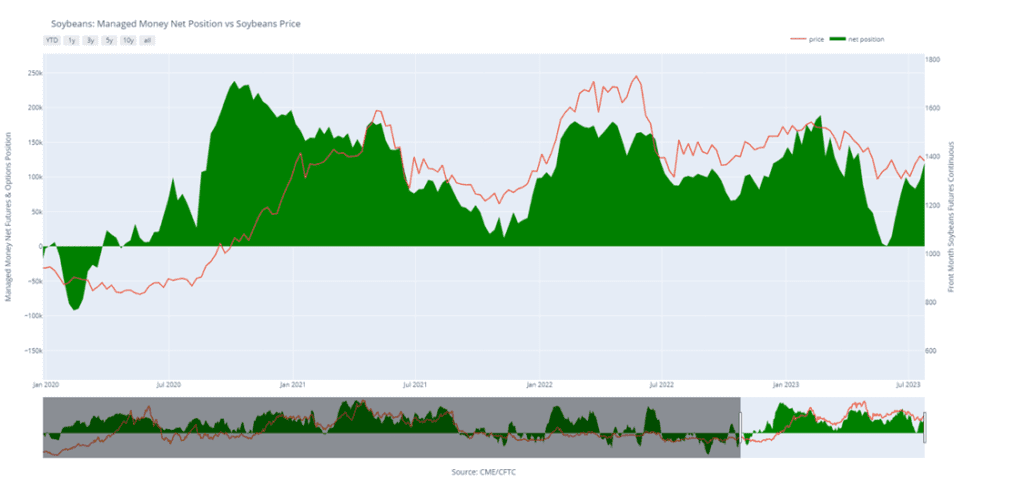

- Soybeans are higher this morning after yesterday’s sharp selloff in anticipation of the export sales report which will reflect a solid number of flash sales to China and unknown destinations that occurred recently.

- Soybean meal is trading higher this morning while soybean oil is lower on pressure from crude oil and world veg oil prices.

- The average trade guess for today’s export sales report is 2,115k tons which would be one of the strongest weeks the US has seen in a awhile.

- While StoneX increased their estimate for the corn yield, they surprisingly lowered their estimate for the soybean yield to 50.5 bpa despite the friendly August forecast.

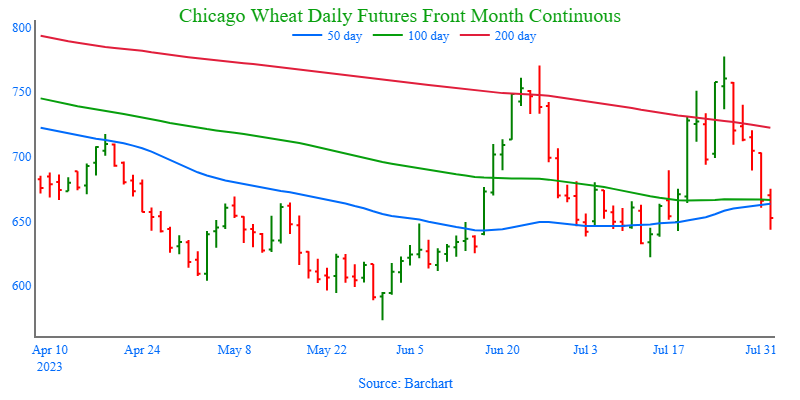

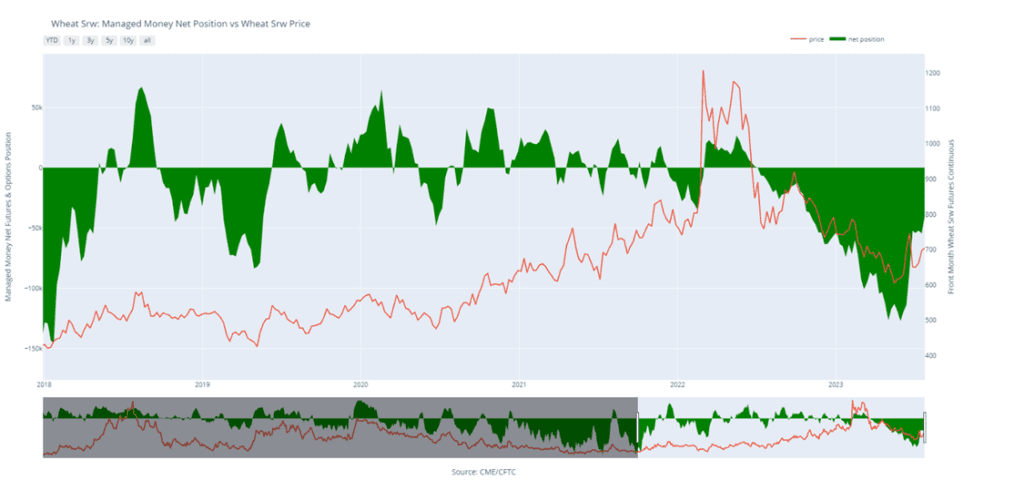

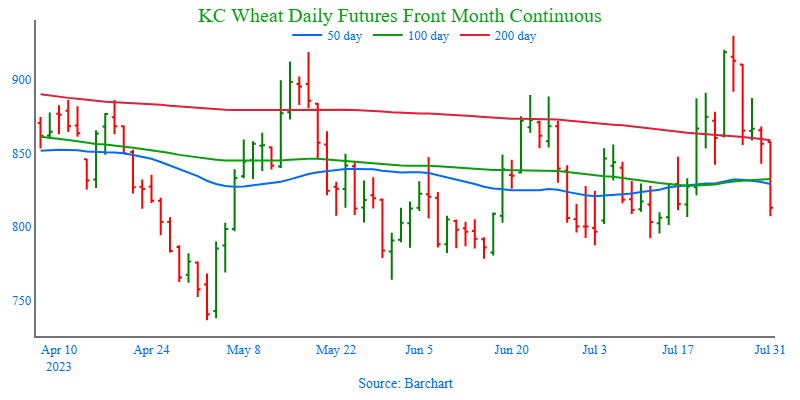

- Wheat is mixed this morning with Chicago and Minn slightly higher and KC wheat lower despite more attacks on Ukraine’s port cities.

- Today’s export sales report is expected to show another slow week for wheat with the average trade guess at 300k tons as Russia dominates global sales.

- Vladimir Putin seems to be floating the idea of reinstating the Black Sea grain deal but only if their requirements are met, but last time they renewed the deal they still made it difficult for Ukraine to get ships moving.

- India is seeking to import 9 mmt of wheat from Russia in an attempt to boost their domestic stockpiles and fight rising prices in the country.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.