Grain Market Insider: August 11, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

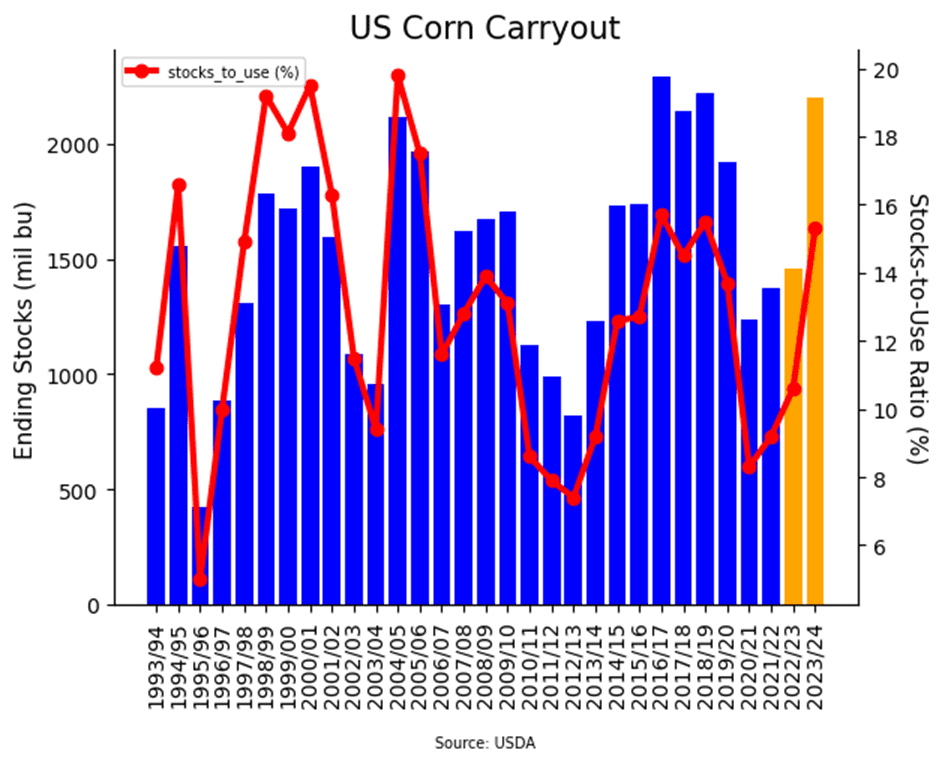

- Updated supply and demand numbers in today’s USDA WASDE report came in above market expectations for both old and new crop corn carryout. The initial reaction resulted in a 14-cent low to high range, with corn losing its gains to settle just over 4 cents off the day’s low.

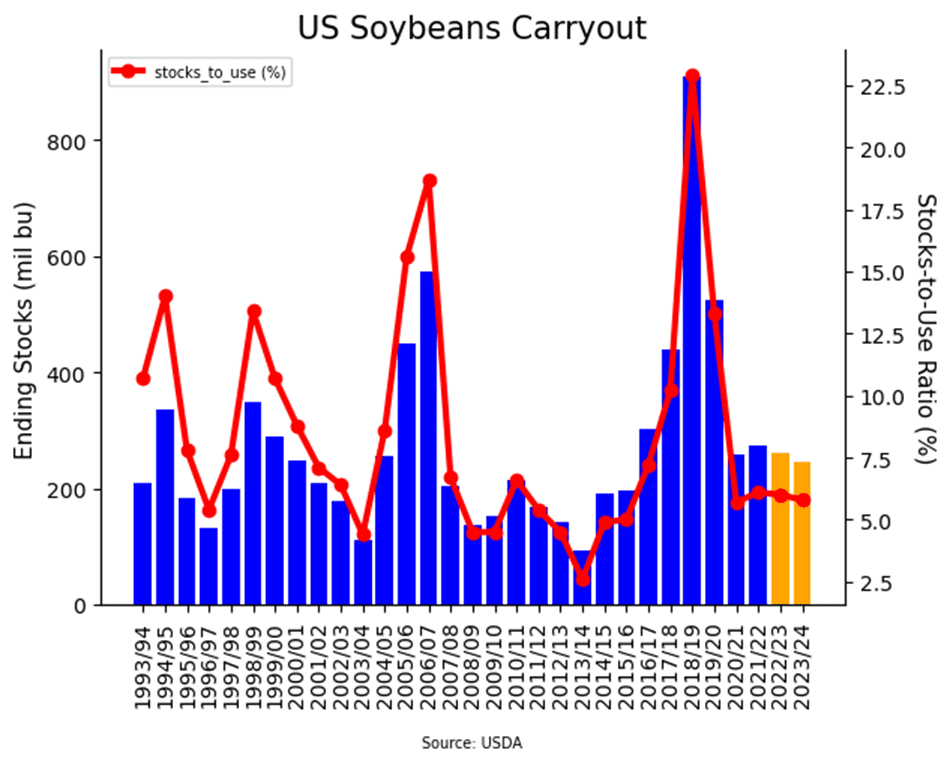

- Old crop soybean ending stocks in today’s report came in just above expectations, while new crop ending stocks were 22 mb below the average trade guess. Despite the news, soybeans lost ground and traded lower into the close, with the focus likely moving back to weather.

- Despite a 100 mil lb increase in soybean oil usage for biofuels, and an increase in soybean meal exports, both soybean oil and meal followed soybeans lower on the day.

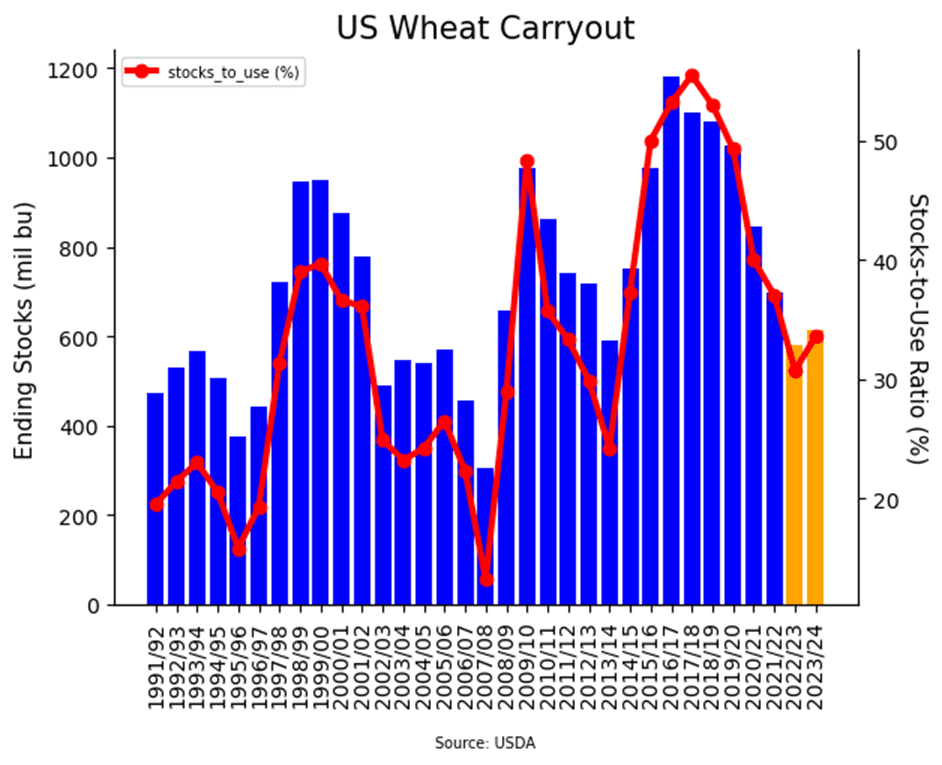

- All three wheat classes finished the day lower, led by the KC contracts as 23/24 US wheat ending stocks came in above expectations, and 23 mb higher in today’s USDA update than last month’s.

- To see the updated US Carryout and Stocks to Use charts for corn, soybeans, and wheat, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

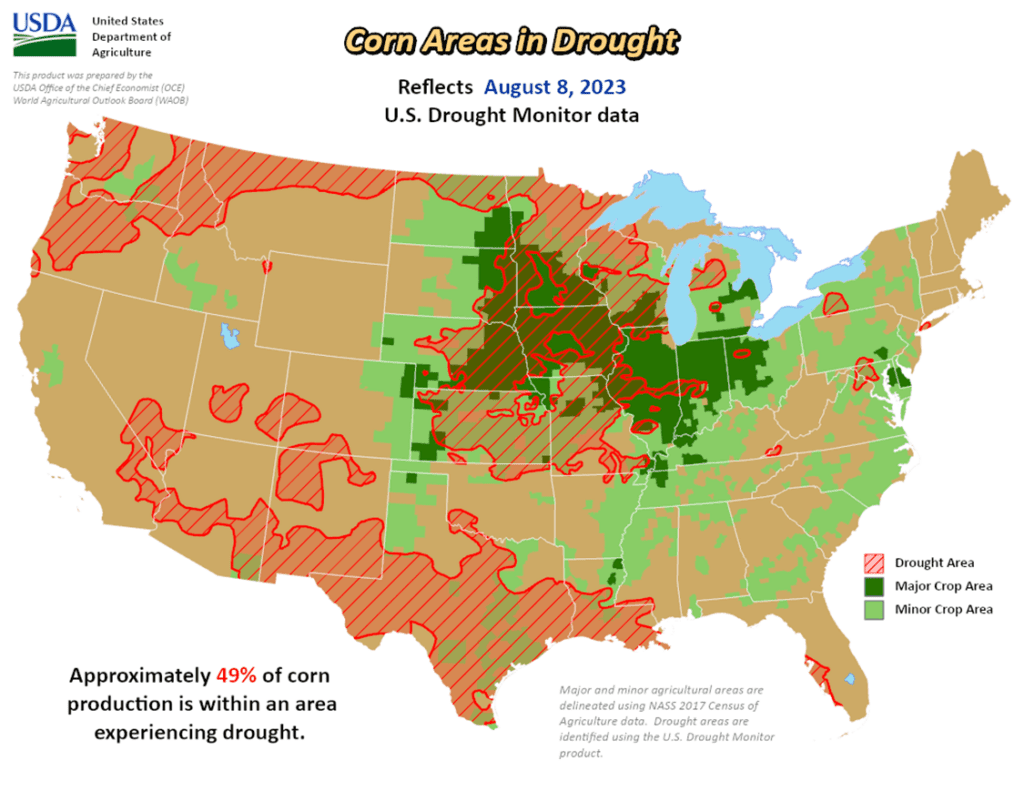

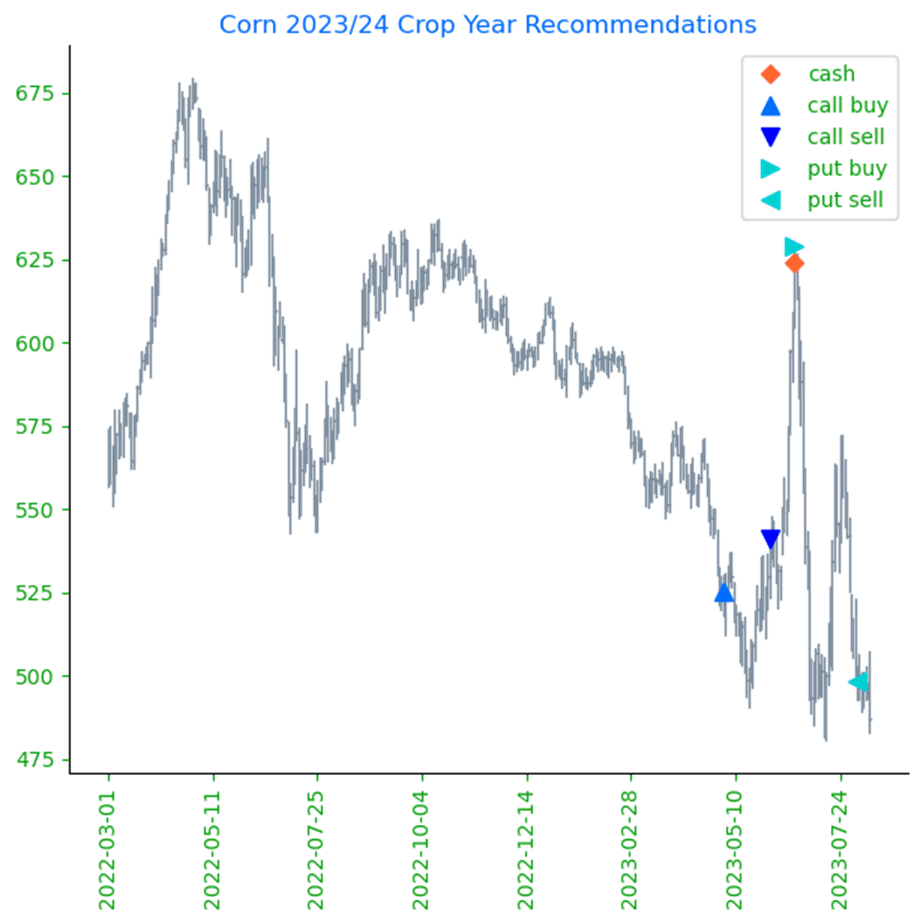

- No action is recommended for the 2023 corn crop. This year’s growing season has been marked by dry conditions and changing weather forecasts, which have swung prices nearly 150 cents from high to low. Though dry conditions remain with a great amount of variability in crop conditions from region to region, weather forecasts remain favorable for now, and it may not be until after harvest before we know the full effect this growing season had on yields. Just as Insider recently recommended selling half of the previously recommended DEC 580 puts to lock in gains in case the market turns higher, Insider will continue to monitor market conditions and may consider recommending selling the remaining DEC 580 puts if conditions warrant it. While many unknowns could still shock the market higher, seasonality and current trends suggest we may not see a shift to higher prices until after harvest.

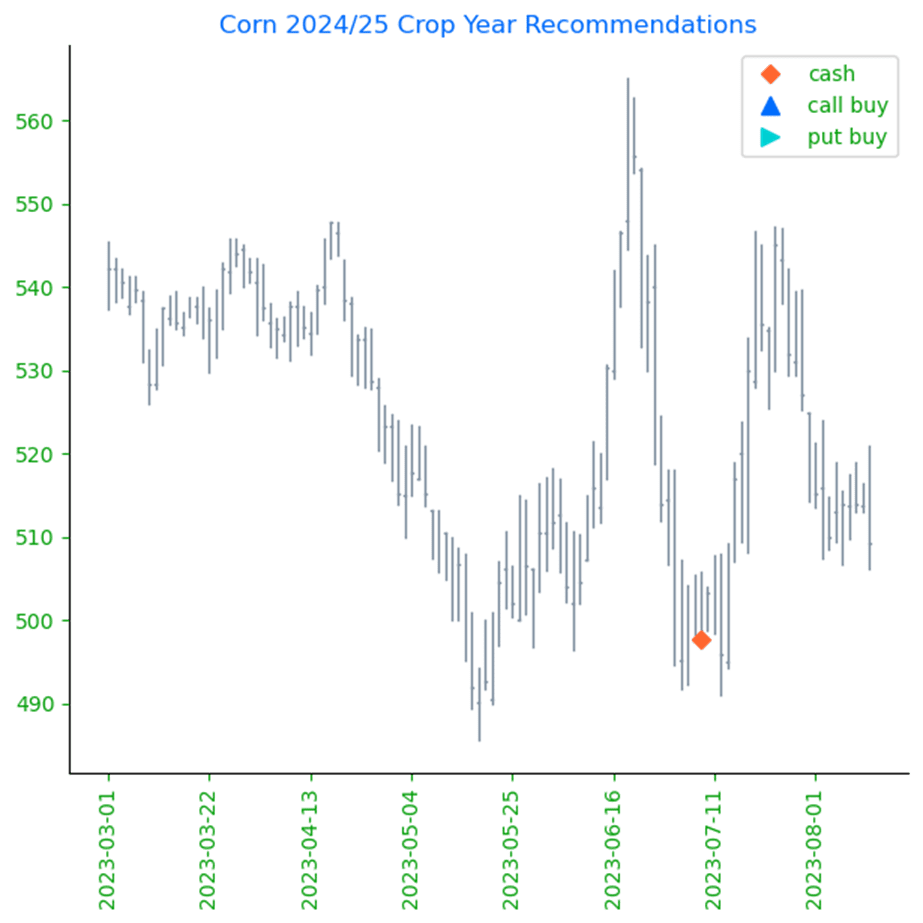

- No action is currently recommended for 2024 corn. In 2012, the best pricing opportunities for Dec 2013 corn were during the 2012 summer runup. Despite the significant yield losses to the 2012 crop, and the fear of running out of corn, the Dec 2013 contract peaked in the summer of 2012, and by Jan 2 of 2013, the price was already down about 12% from the high. We continue to watch the calendar for 2024 corn as this 2023 summer volatility could provide some additional opportunities to get some good early sales on the books in the event of a 2013 type repeat. Insider recently recommended making a sale on your 2024 crop, and we’ll be watching for another opportunity to suggest adding to prior early sales levels between now and the beginning of September.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

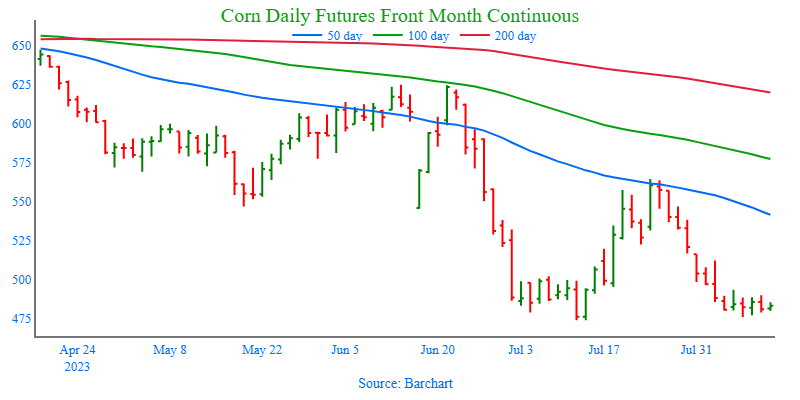

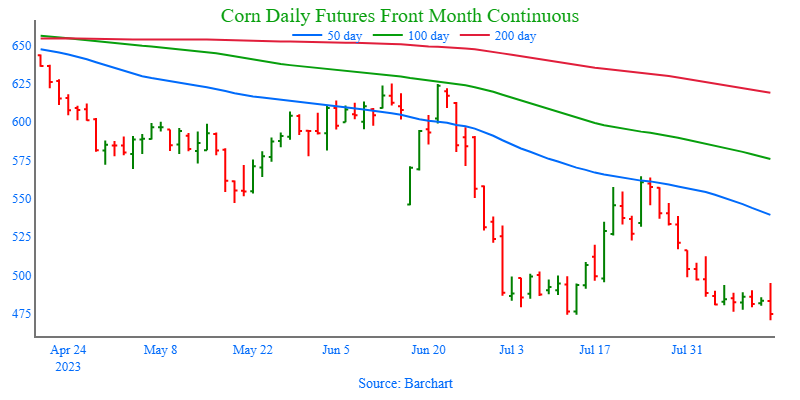

- Corn futures ended the week under selling pressure as the USDA Crop Production report still forecasts overall heavy corn supplies for the 2023-24 marketing year. December corn closed the day losing 9 cents and was 10 cents lower on the week. Most importantly, Friday’s price action was weak, with December closing 20-1/4 cents off the session high.

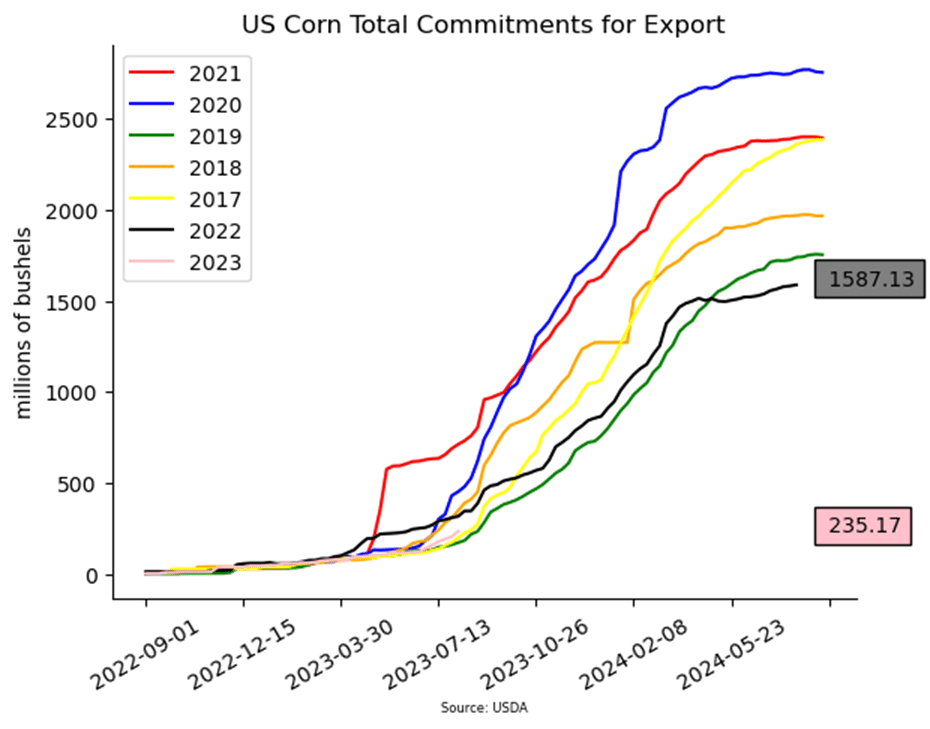

- The USDA lowered projected yield to 175.1 bushels/acre on the August Crop Production report this morning, but the drop in production was offset by demand adjustments. The USDA removed 75 mb from old and new crop export demand, and 25 mb from new crop feed usage to maintain a carryout at 2.202 billion bushels for the next marketing year, about 40 mb above expectations.

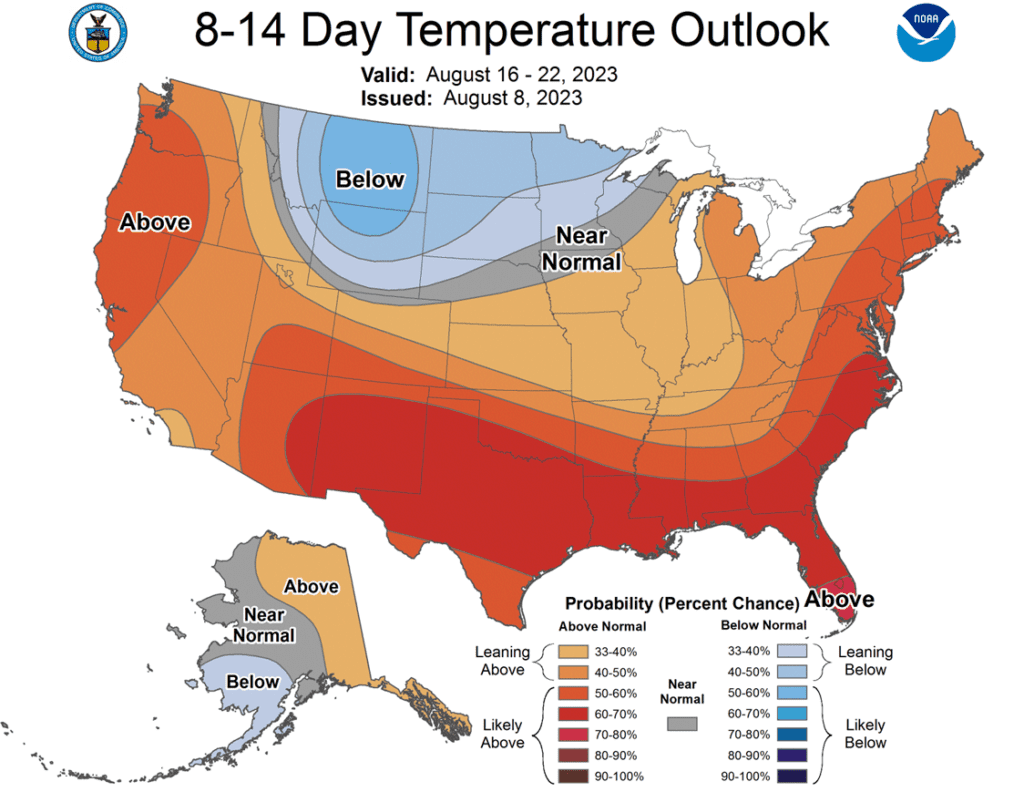

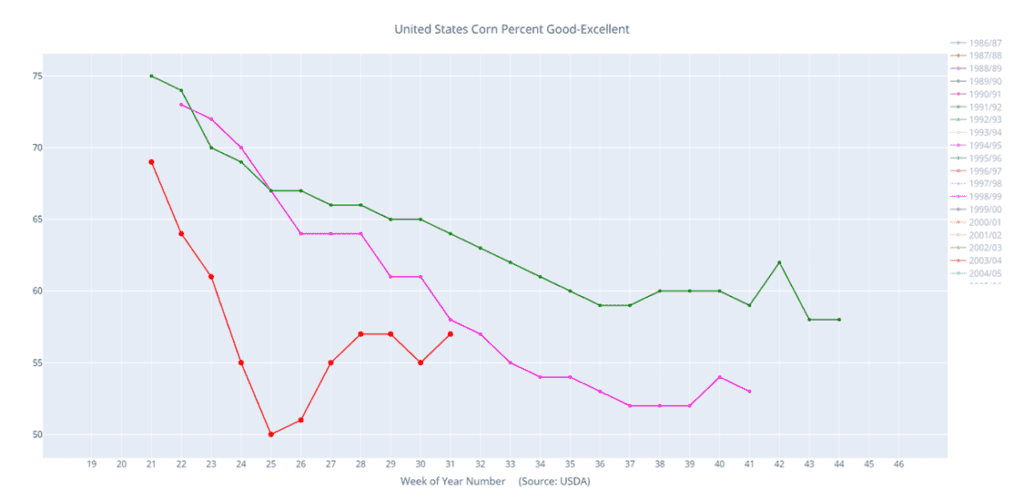

- Concern for market participants is that yield projections could work higher in future reports as August weather has become more crop friendly, and that has been reflected in improved crop ratings in key corn producing states. Illinois corn crop ratings have improved for 6 consecutive weeks, likely adding to yield potential.

- Export news is still lacking overall, but Mexico has been a key buyer of US corn. Last week, Mexico bought 421,000 MT of new crop corn, and on a morning flash sale announcement added an additional 143,000 MT this week.

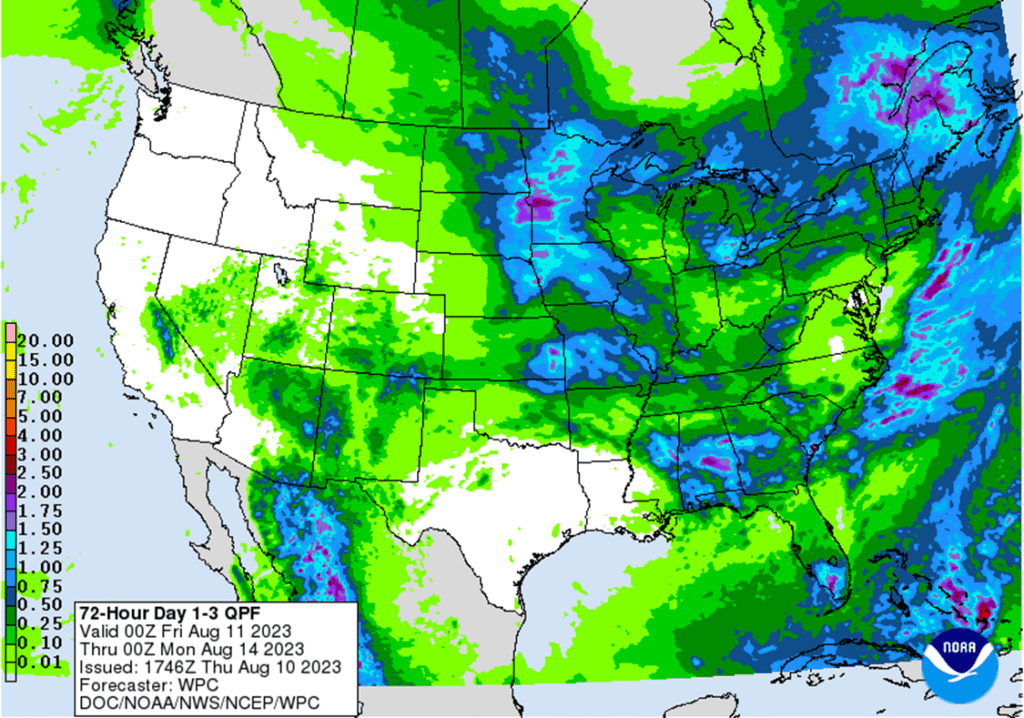

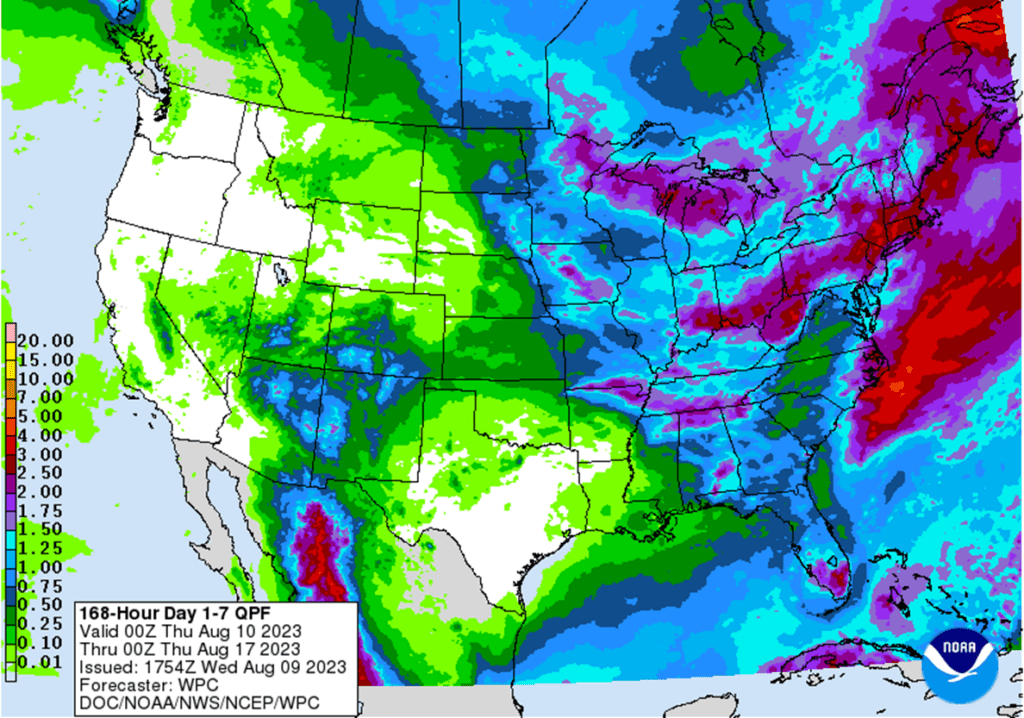

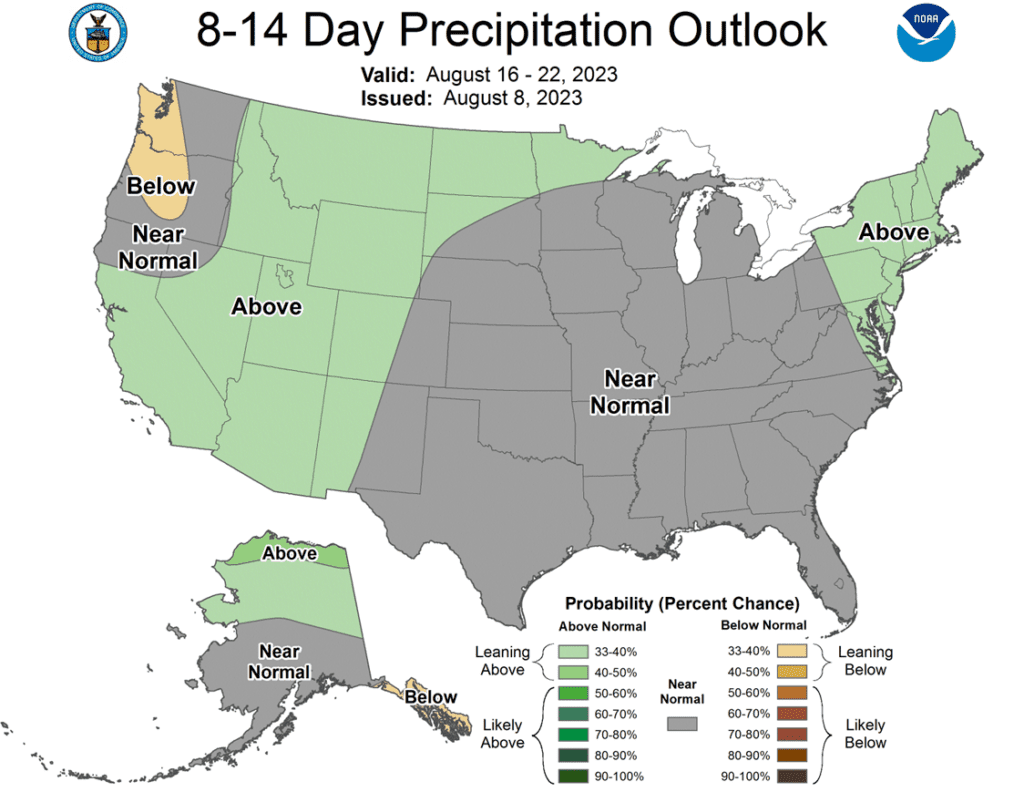

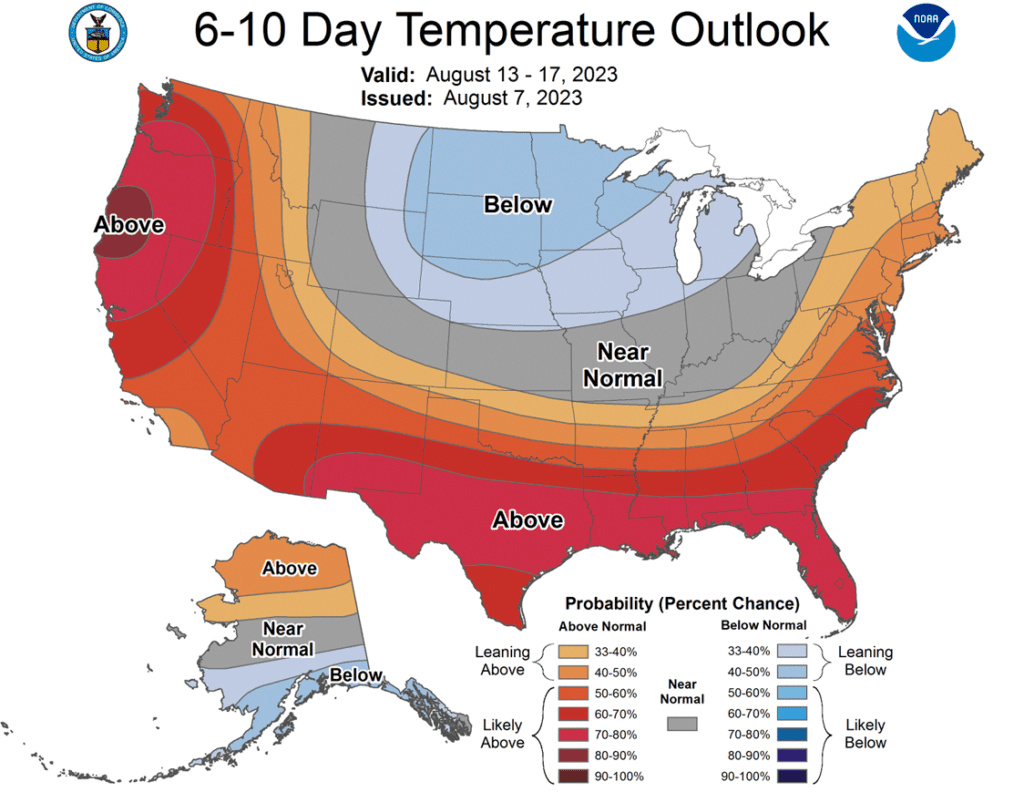

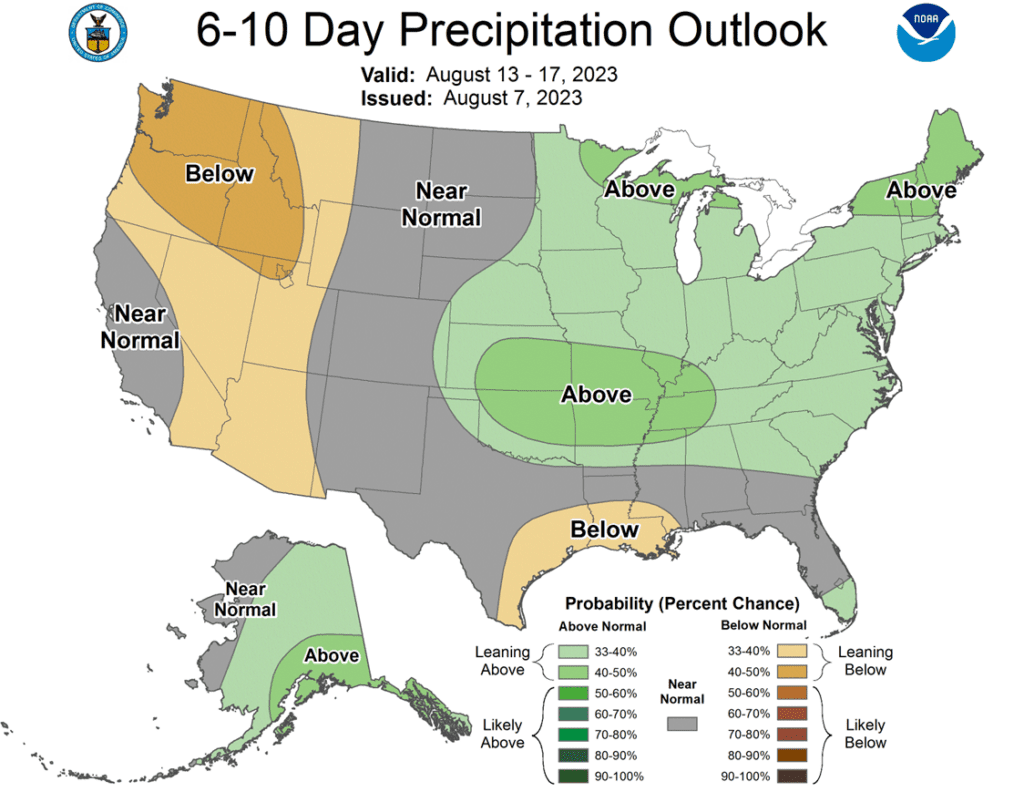

- Weather forecasts remain non-threatening overall, but a warmer drier trend at the end of next week may have some impacts on corn stress in the southern Corn Belt.

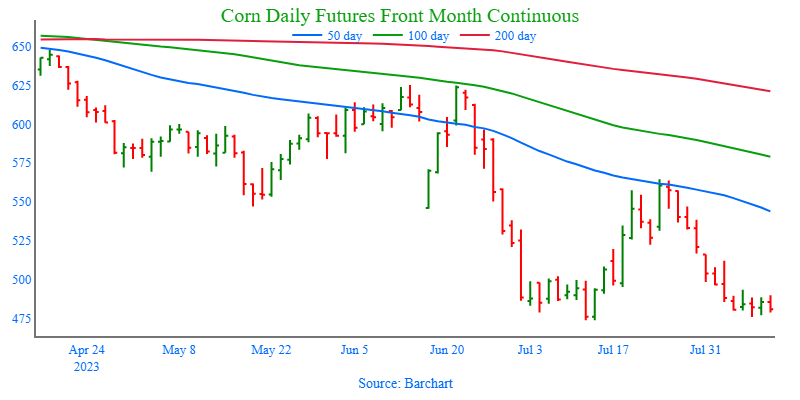

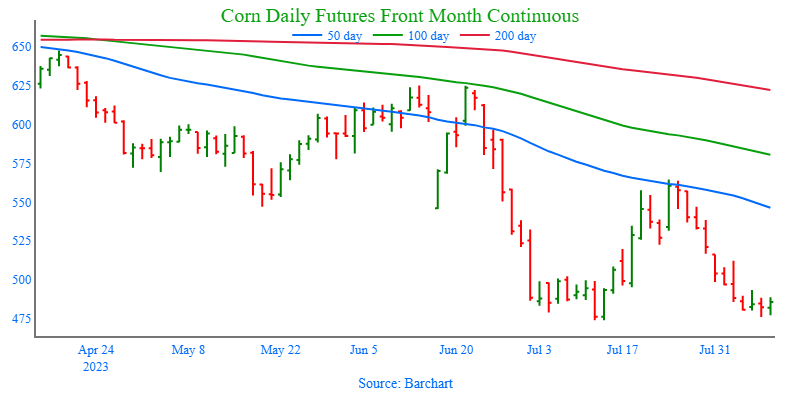

Above: Since the market’s retreat from the 550 – 560 resistance area, the market has been consolidating just above the September contract’s July low of 474 and is showing signs of being oversold. Being oversold is considered supportive if reversal action occurs. If the market receives more bullish input and turns back higher, heavy resistance lies near 555 – 565. If not, and the market retreats past 474 support, the next area of major support may be found near 415.

Soybeans

Soybeans Action Plan Summary

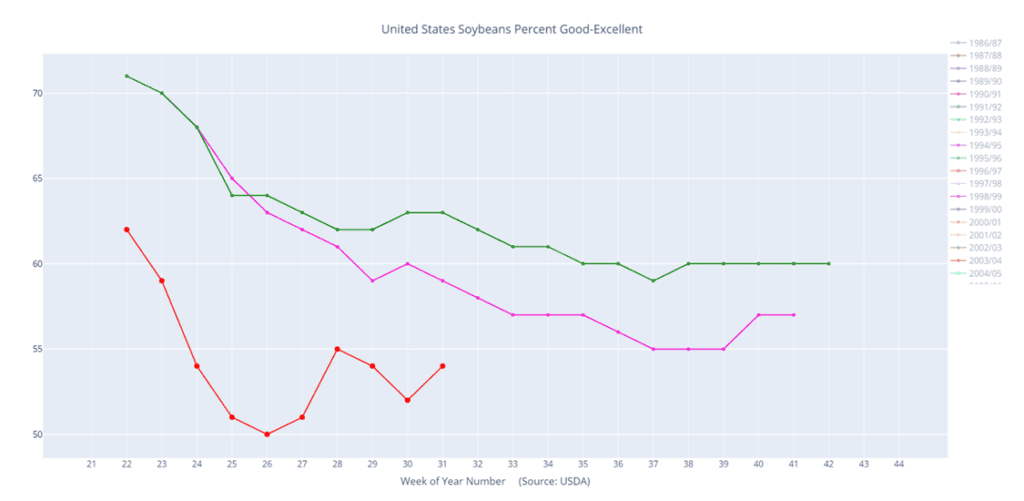

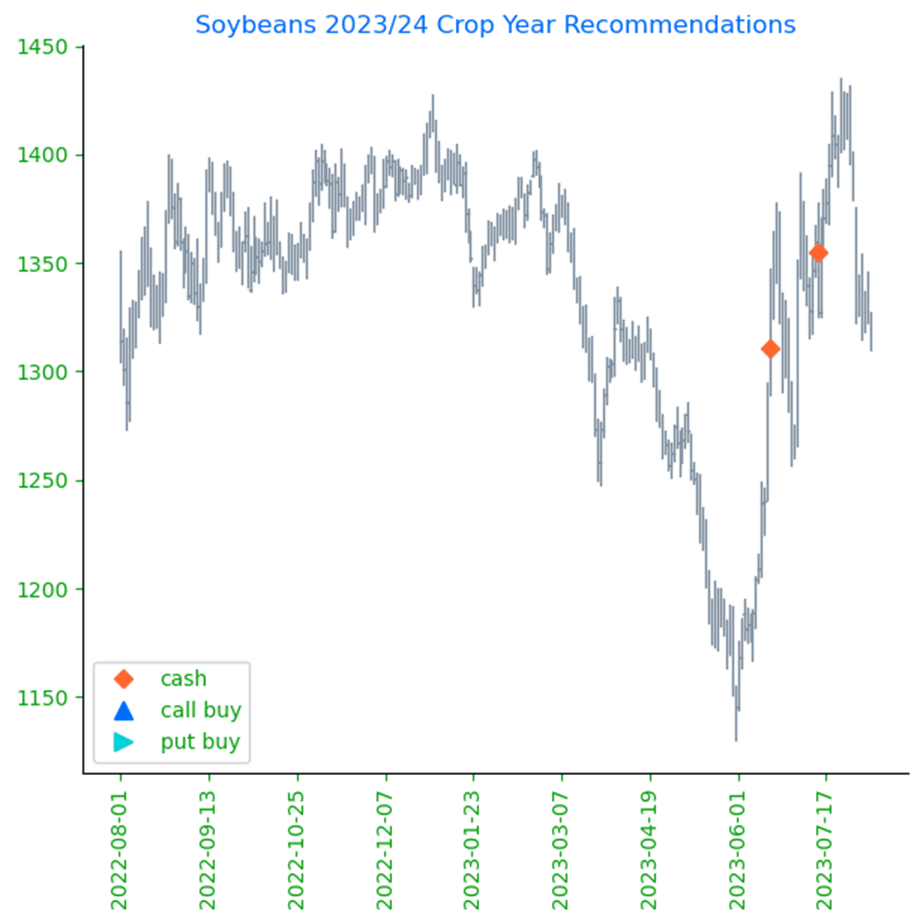

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from the changing weather forecasts, crop conditions, and export sales. We ended the month of July experiencing hot conditions with little rainfall and weak export sales. Since then, conditions have become more favorable, and export sales have picked up. While much of the crop remains in drought conditions, which can maintain upside potential, timely rains may come and push prices lower. Much like in 2012, when July was dry, and the pattern changed in August, when decent rain fell in parts of the western Corn Belt and IL, sending Nov ’12 soybeans down 20%. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

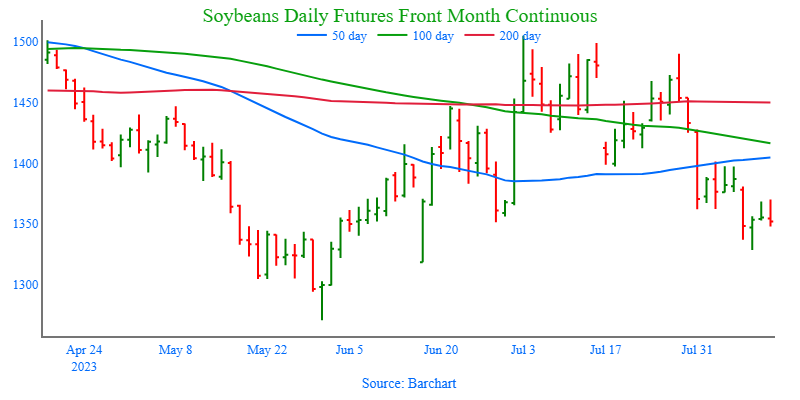

- Soybeans traded both sides of unchanged today, beginning the day lower but gaining directly after the USDA report. In about the last hour of trading, prices slipped and soybeans, soybean meal, and oil all closed lower.

- The WASDE report was fairly neutral with most estimates coming in as expected. The USDA lowered their expected soybean yield to 50.9 bpa, slightly below the average trade guess, and 23/24 ending stocks were pegged at 245 mb, a little less than expected.

- Soybean production is forecast at 4.21 billion bushels, down 2% from the previous year. The yield estimate of 50.9 bpa would be up 1.4 bushels from 2022, and the area harvested for soybeans in the US is forecast at 82.7 million acres, unchanged from the previous forecast but down 4% from 2022.

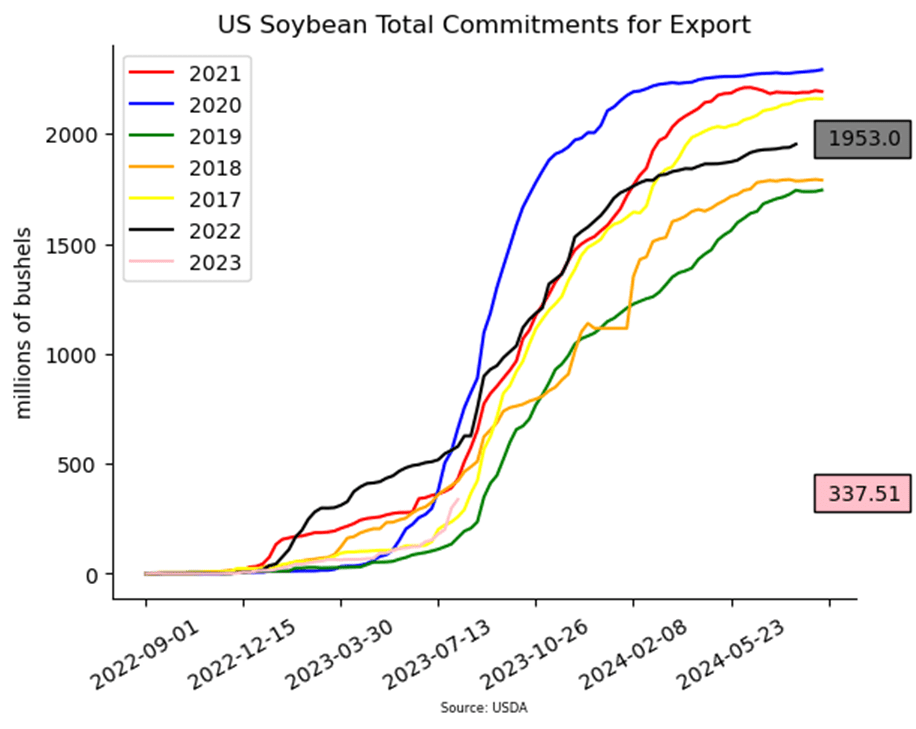

- Soybean sales to China have improved slightly and another sale of 9.9 mb was reported earlier this week, but new crop soybean sales are far less than a year ago at only 338 mb compared to 577 mb a year ago. Last week’s soymeal exports were decent, and soybean oil demand has been good.

- For the week, November soybeans lost 25-3/4 cents, December soybean meal lost 9.0, and soybean oil lost 1.30 for December.

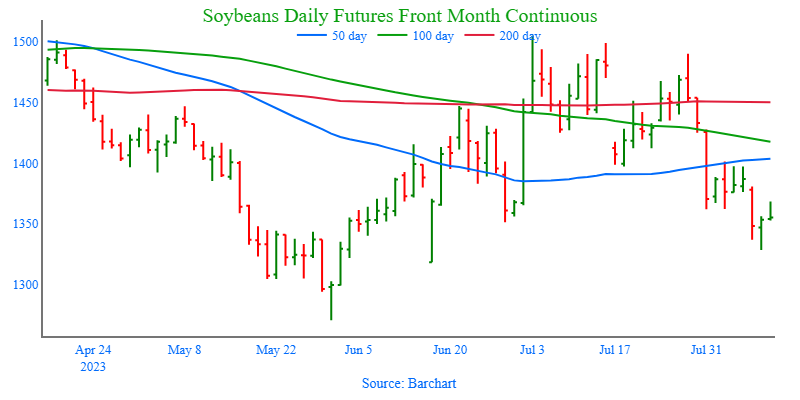

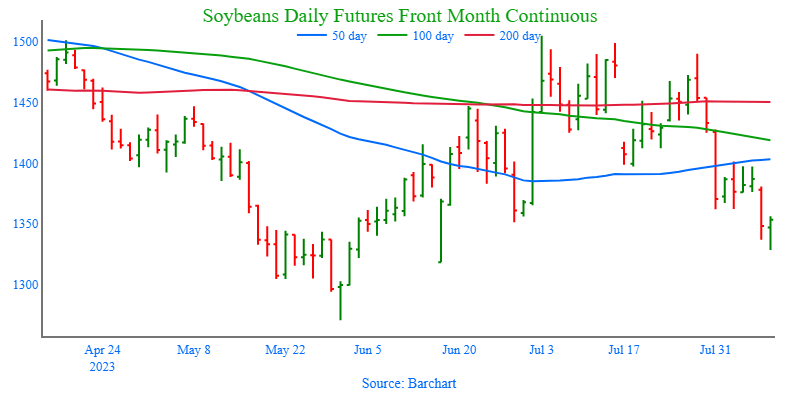

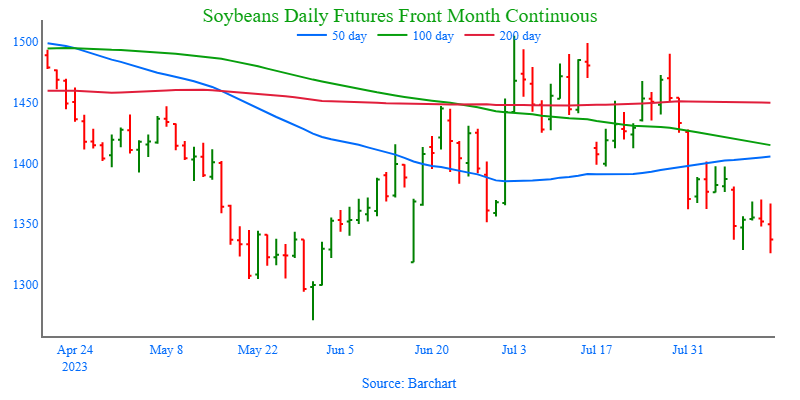

Above: The market posted a bullish reversal on 8/08 after trending lower since 7/27 and trading through 1350 support. Additionally, the fact that the market is showing signs of being oversold is supportive to prices. If prices continue to the upside, resistance can be found near 1400 and again around 1450. If not, initial support below the market may be found near 1328 with further support between 1318 – 1300.

Wheat

Market Notes: Wheat

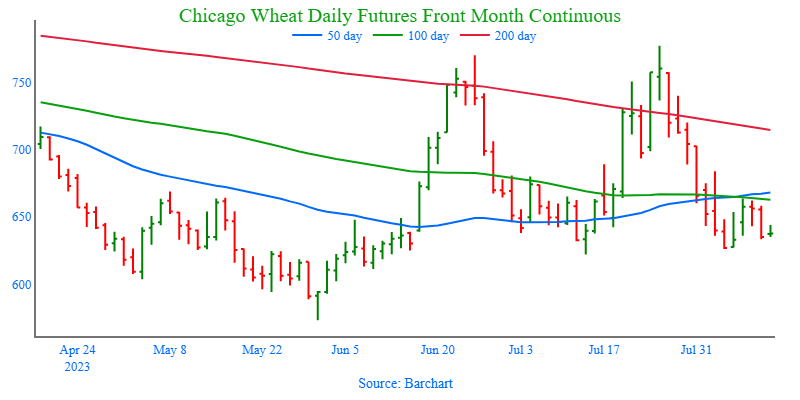

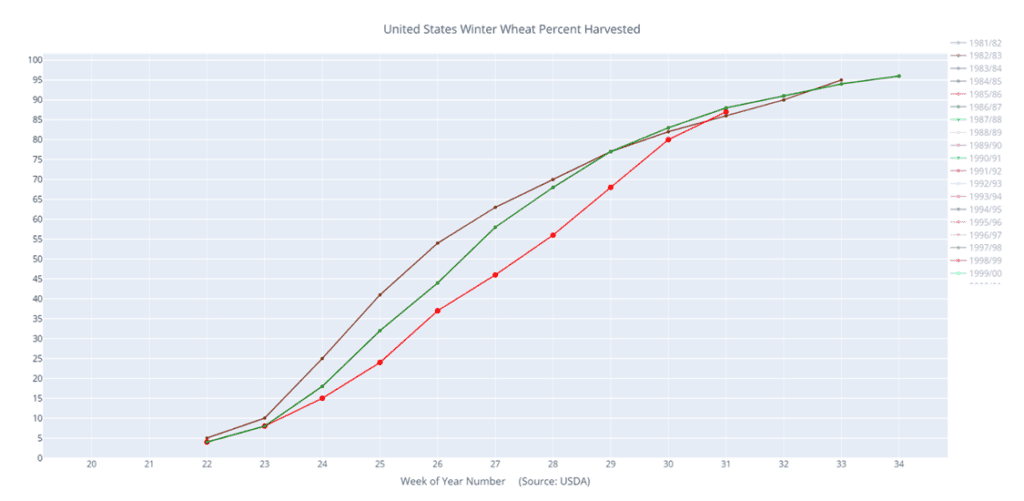

- The USDA pegged 22/23 US wheat carryout at 580 mb, in line with the trade expectation of 579 mb and unchanged from July. As for 23/24, the USDA came up with 615 mb, above the trade expectation of 594 mb, versus a 592 mb carryout in the July report. The USDA estimated all US wheat production at 1.734 bb, down from 1.739 bb in July. The trade was looking for 1.740 bb.

- Despite thoughts that India’s wheat production might be cut on today’s report, it was kept unchanged from July at 113.5 mmt. Russian production was also unchanged at 85.0 mmt.

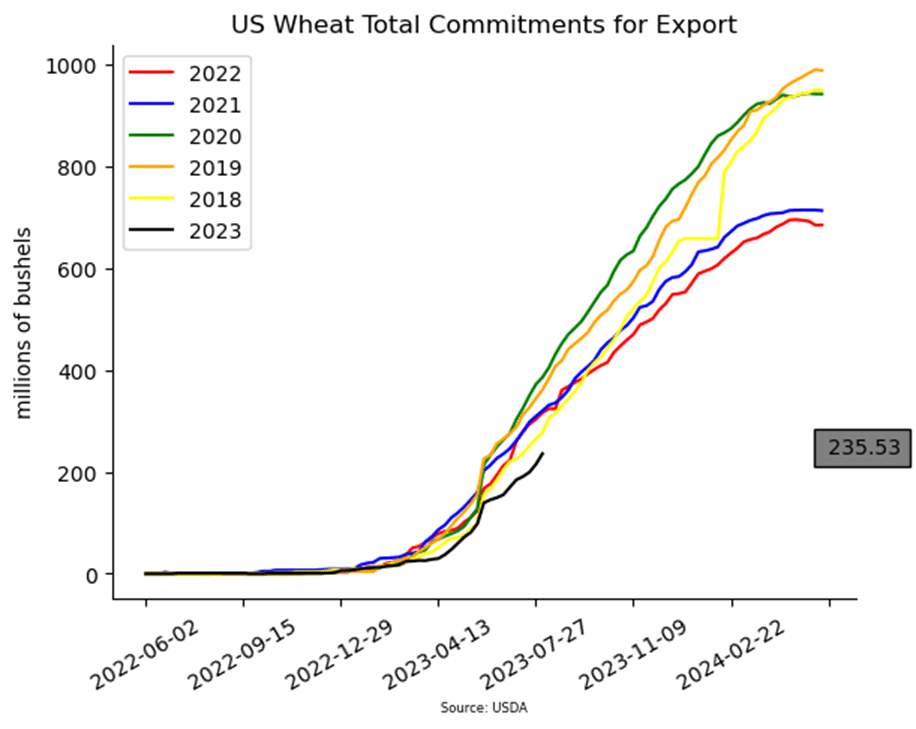

- Russian wheat export FOB prices have risen to $255 per ton, but this is still cheaper than most other origins, keeping pressure on the US export front.

- According to the US Climate Prediction Center, the El Nino weather pattern is expected to persist though the US winter and into 2024. If accurate, this could lead to drier conditions in India and Australia, ultimately limiting their wheat production.

- All three US wheat futures classes could be considered oversold on stochastics. This does not necessarily mean that a bottom is in, but it could mean that one is close.

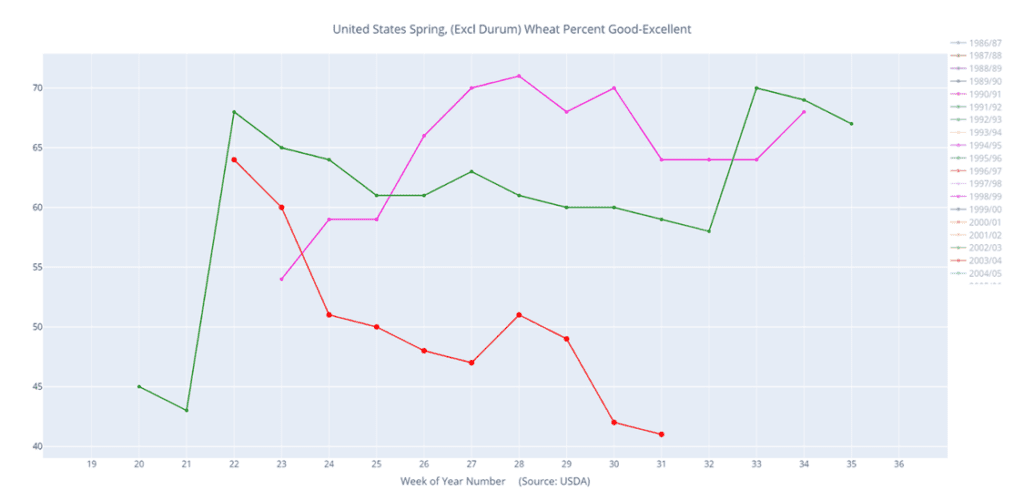

- As of August 8th, about 52% of the US spring wheat crop is said to be in an area of drought.

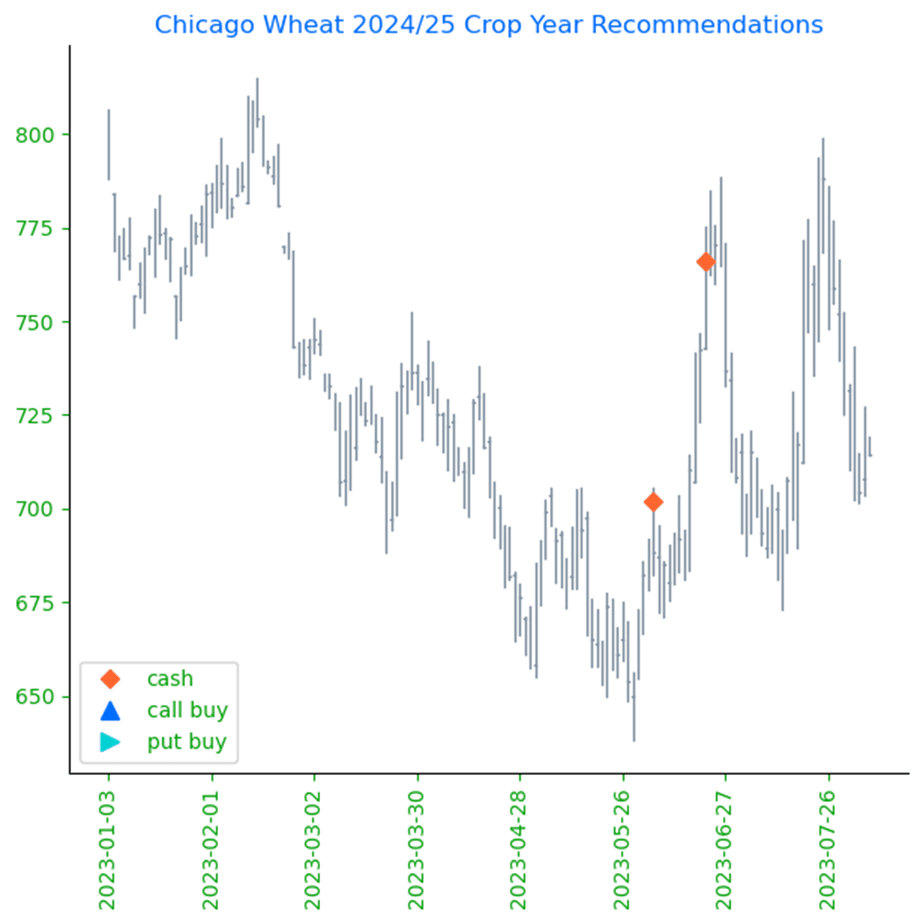

Chicago Wheat Action Plan Summary

- No new action is recommended for 2023 crop. Since the end of May, the wheat market has been largely rangebound, influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest mostly in the rearview mirror, US production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward the 700 level before considering any additional sales.

- No action is currently recommended for 2024 Chicago wheat. Since the middle of June, price volatility has risen with updated USDA reports, changing weather forecasts, and current events in the Black Sea. While prices continue to be volatile, plenty of time remains to market the 2024 crop. The war continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, and while keeping an eye on the market to see if any major support is broken, Grain Market Insider would need to see prices north of 800 before considering recommending any additional sales.

- No Action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

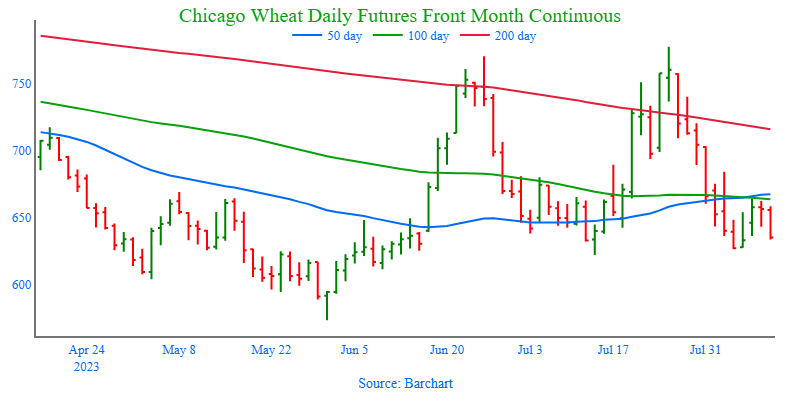

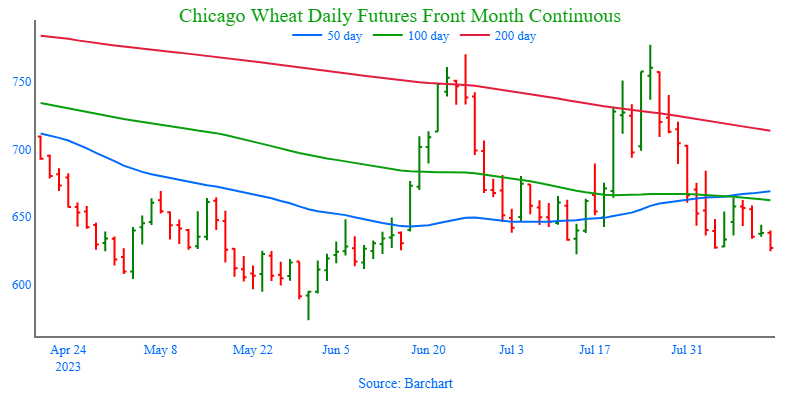

Above: Since testing the June high on 7/25, the market has retreated and support near 620 has held. September wheat is oversold and appears to be consolidating at the lower end of the 622 – 777 range. If the market breaks out to the downside, psychological support could be found near 600 with key support near 573, while heavy resistance remains above the market around 777 – 808.

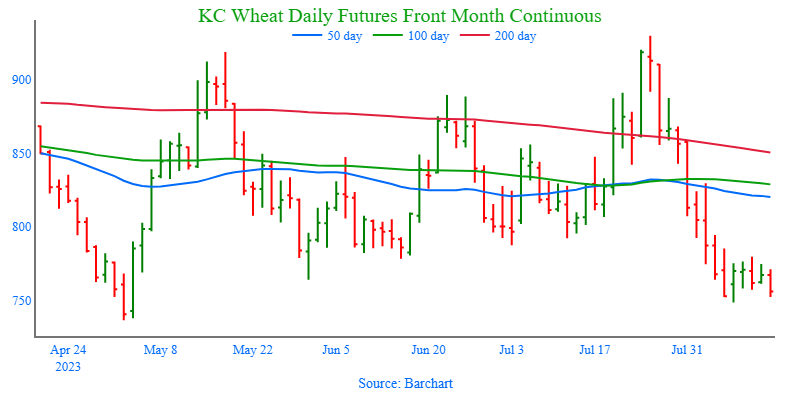

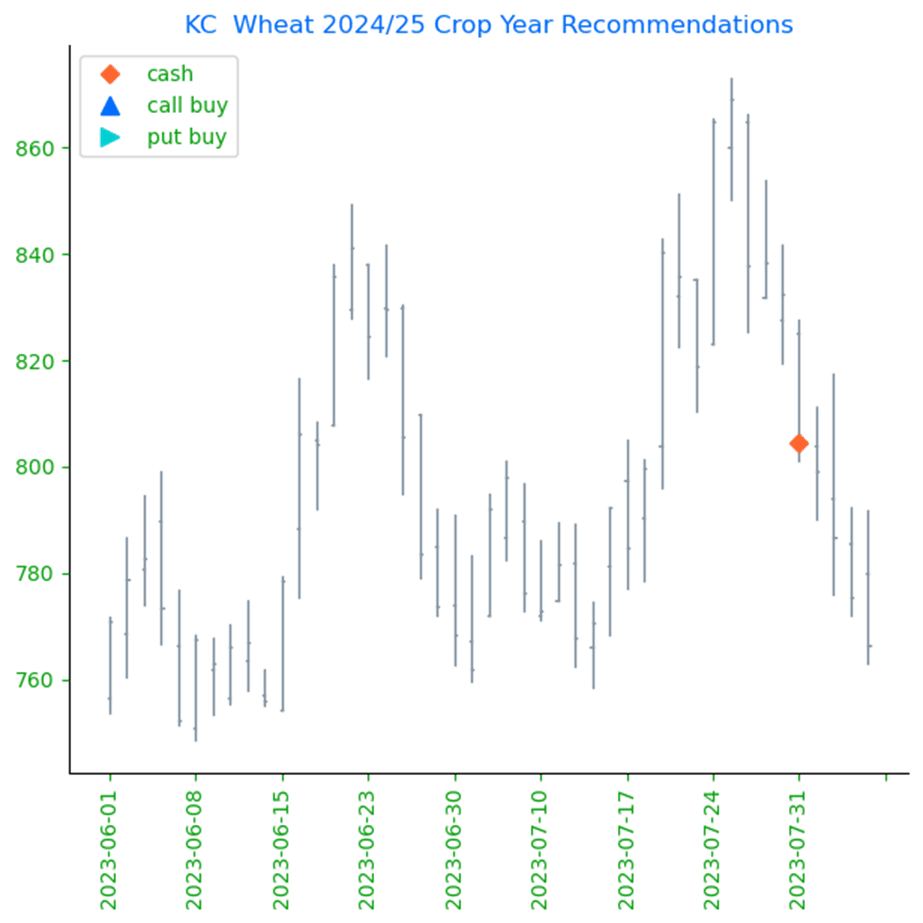

KC Wheat Action Plan Summary

- We continue to look for better prices before making any 2023 sales. As harvest winds down and more becomes known about this year’s crop with some reports of better-than-expected yields, questions remain about the world wheat supply. The war continues in the Black Sea region, Ukraine’s export capabilities remain uncertain, and dryness continues in key production areas of the world. With world supplies currently seen at 11-year lows, we continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales. At the same time, we continue to watch the bottom end of the range that prices have traded in since late 2022. A close below the bottom end would reduce the probability of getting to 950 – 1000 and would increase the risk of prices falling into the 600 – 650 range.

- No action is currently recommended for the 2024 crop. Demand and supply concerns out of the Black Sea continue to dominate the market right now, and Insider suggested making a sale as prices closed below 817 to protect from further downside erosion due to a potential change in trend with cheap supplies continuing to flow from Russia and Ukraine hampering US export demand. While prices continue to be volatile, plenty of time remains to market the 2024 crop. The war continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, Grain Market Insider would need to see prices north of 850 before considering recommending any additional sales, while also keeping an eye on the market to see if any major support is broken.

- No Action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

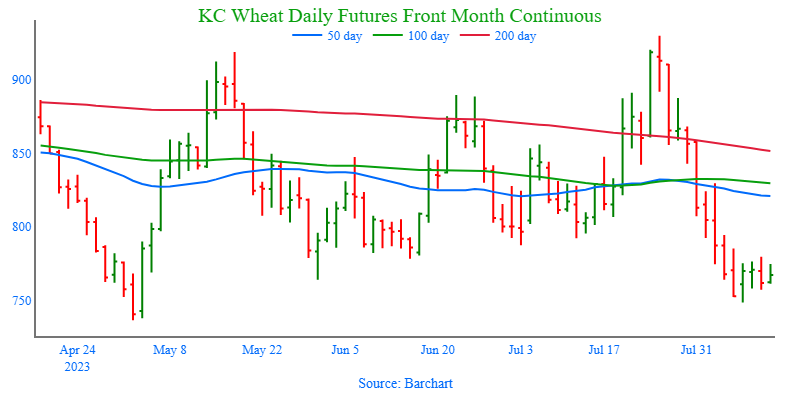

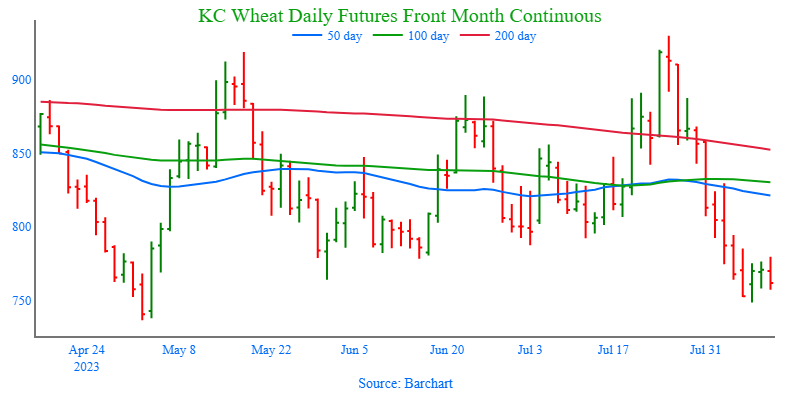

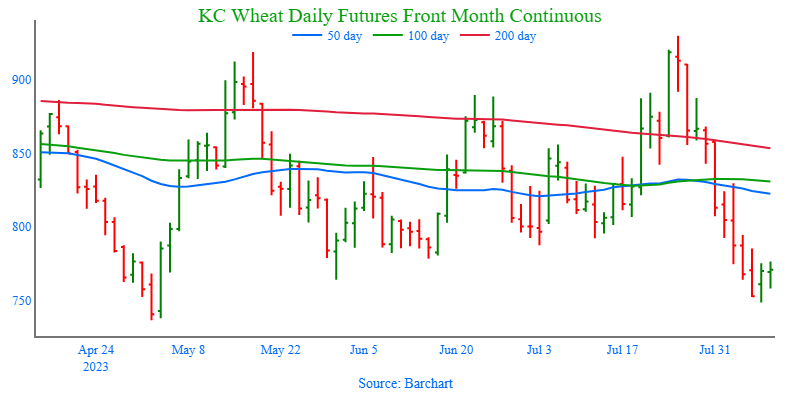

Above: September KC wheat has retreated following the key reversal on 7/25 and is poised to test the 735 – 745 support area, which coincides with this year’s lows. Additionally, the market is showing signs of being oversold, and is considered supportive if prices reverse higher. If prices do reverse to the upside, overhead resistance lies near 830.

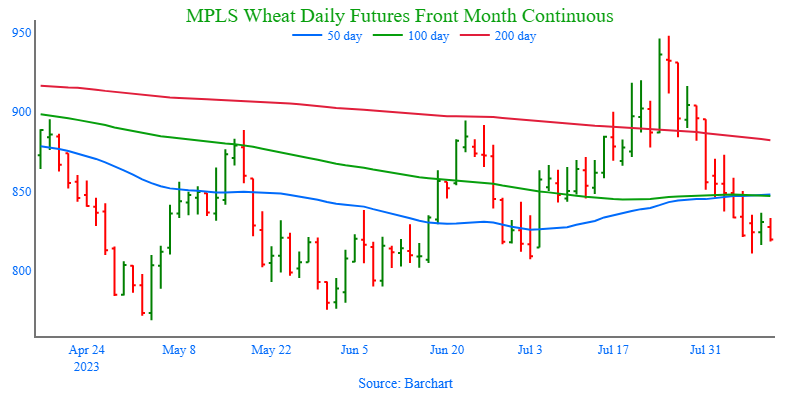

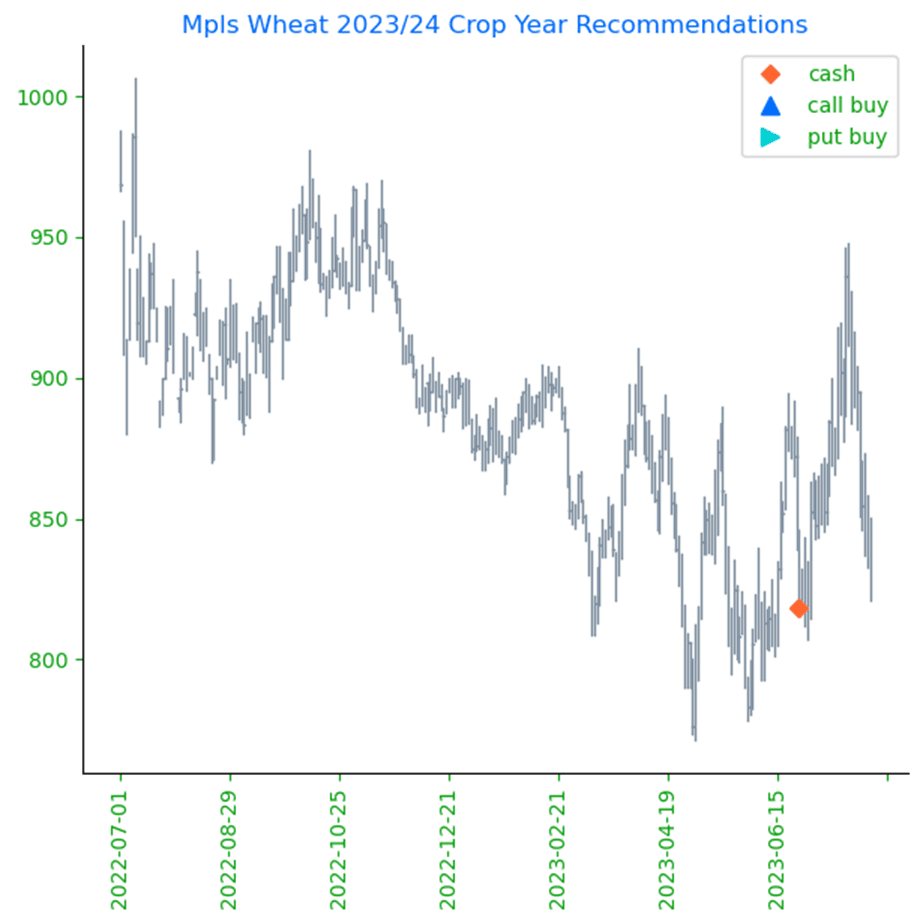

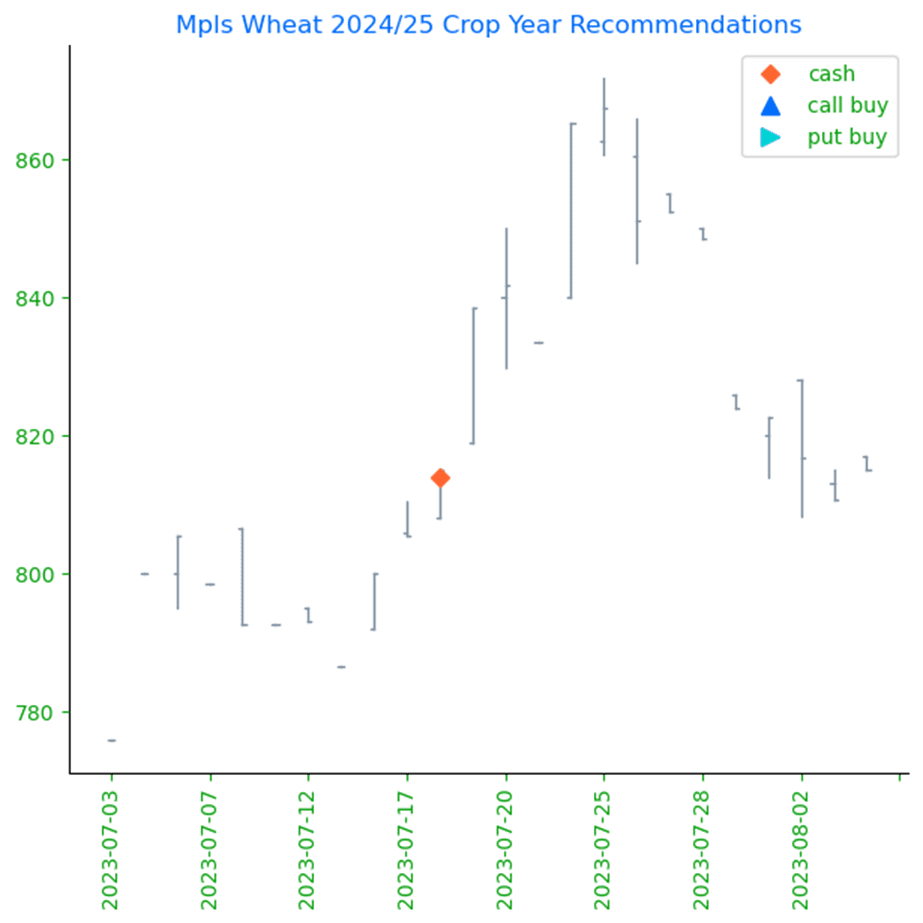

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature to price volatility this growing season with continued dryness concerns in not only the US, but also Canada and Australia. As we enter harvest season, there isn’t a strong likelihood of higher prices until after harvest, although both weather and geopolitical events can change suddenly to move prices higher. Insider will consider making sales suggestions if prices improve, while also continuing to watch the downside for any further violations of support.

- No action is recommended for the 2024 crop. This year has been marked with volatility from adverse weather to geopolitical disruptions and has given us historically good prices to begin making early sales. While prices continue to be volatile, plenty of time remains to market the 2024 crop. The war continues in the Black Sea region, major exporting countries’ stocks are at 11-year lows, and no one knows what the weather will bring, leaving the market vulnerable to many uncertainties. For now, after recommending making a sale for the 2024 crop, Grain Market Insider will continue to consider making sales recommendations if prices improve, while also keeping an eye on the downside should prices break support.

- No Action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the bearish reversal on 7/25, the market has retreated and is oversold, which could be supportive if prices reverse higher. For now, support below the market may be found near the psychological support level of 800, while resistance remains above the market near 950.

Other Charts / Weather