Opening Update: August 17, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| SEP ’23 | 466 | -3.5 |

| DEC ’23 | 478.5 | -3 |

| DEC ’24 | 505.5 | -2.25 |

|

Soybeans |

||

| NOV ’23 | 1325.75 | 2.25 |

| JAN ’24 | 1336 | 2.25 |

| NOV ’24 | 1276 | 5.25 |

|

Chicago Wheat |

||

| SEP ’23 | 590.75 | -7 |

| DEC ’23 | 616.5 | -6.5 |

| JUL ’24 | 666.5 | -5.5 |

|

K.C. Wheat |

||

| SEP ’23 | 743 | 0 |

| DEC ’23 | 751.5 | -1 |

| JUL ’24 | 741.5 | 0.5 |

|

Mpls Wheat |

||

| SEP ’23 | 791.5 | 0.5 |

| DEC ’23 | 806.75 | 0.5 |

| SEP ’24 | 807.5 | 7.25 |

|

S&P 500 |

||

| SEP ’23 | 4430.25 | 10.25 |

|

Crude Oil |

||

| OCT ’23 | 79.8 | 0.78 |

|

Gold |

||

| OCT ’23 | 1908.5 | -1.3 |

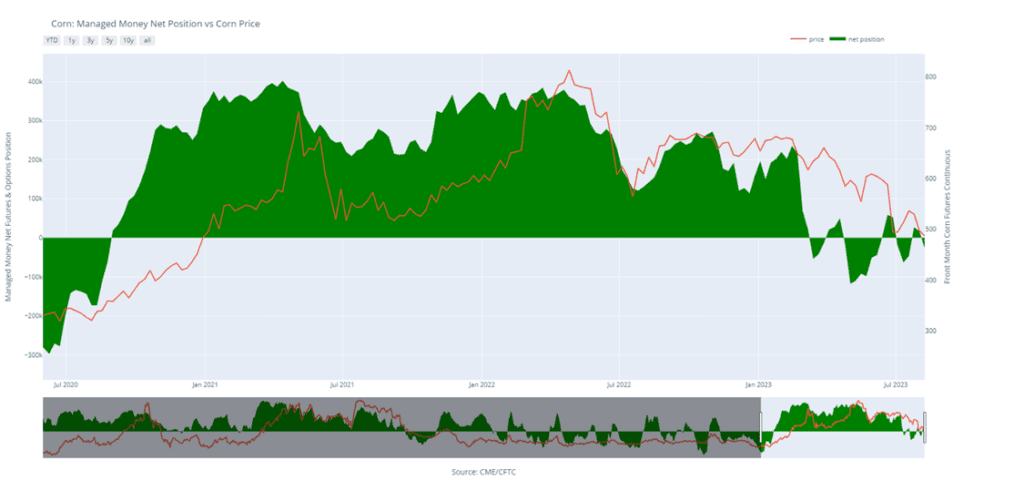

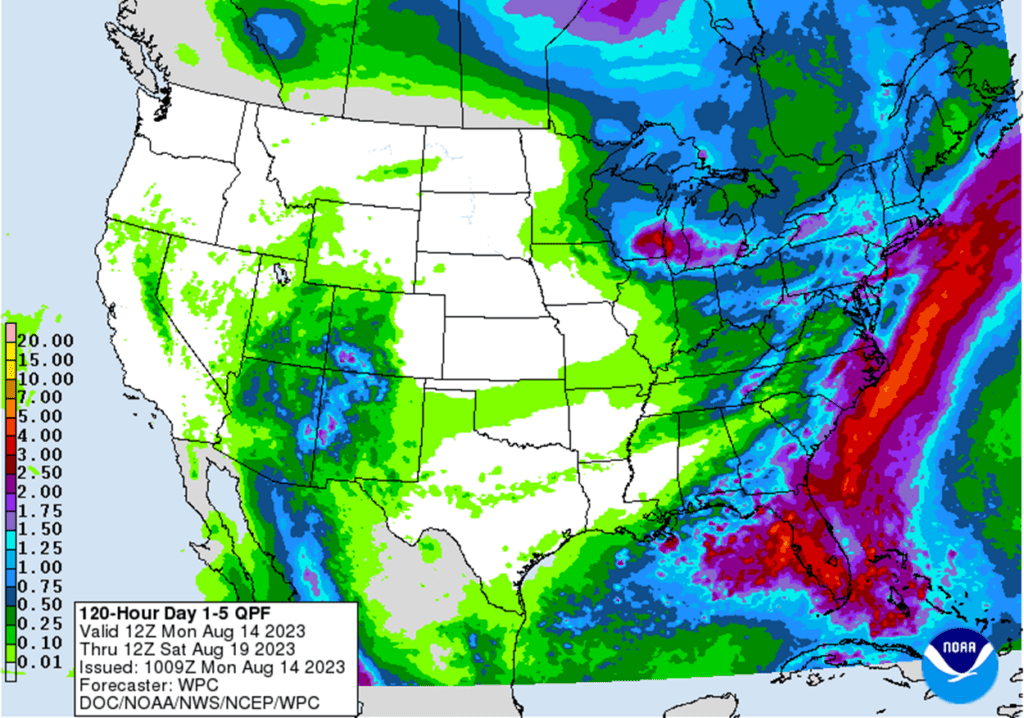

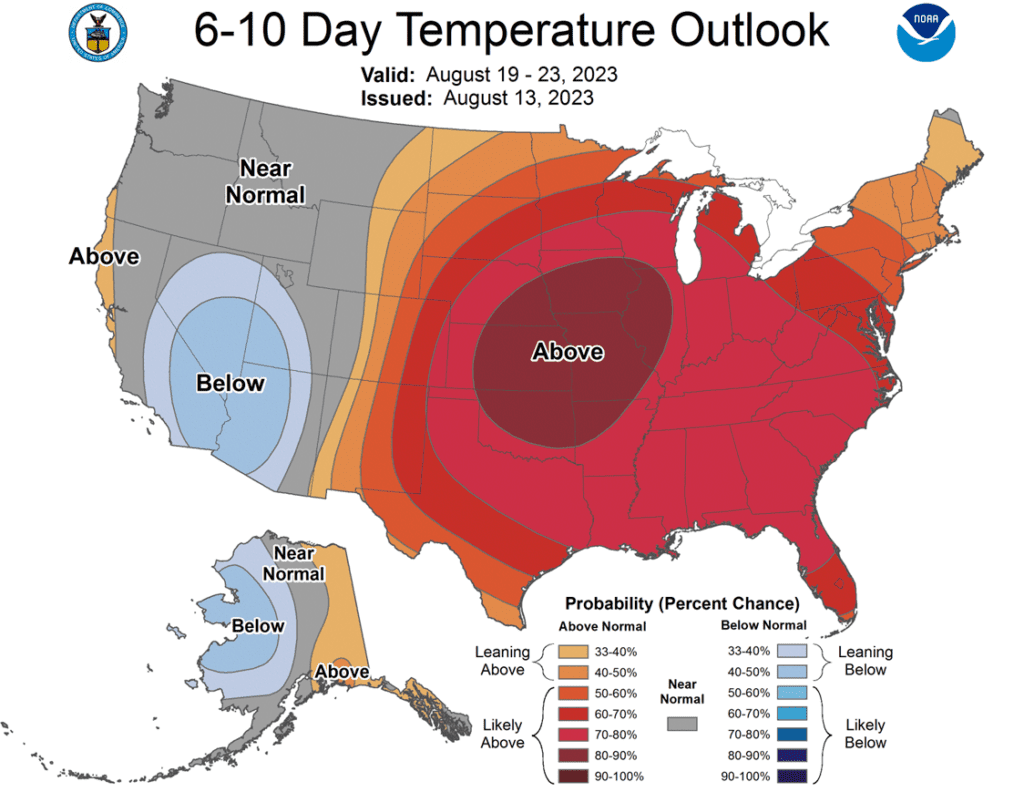

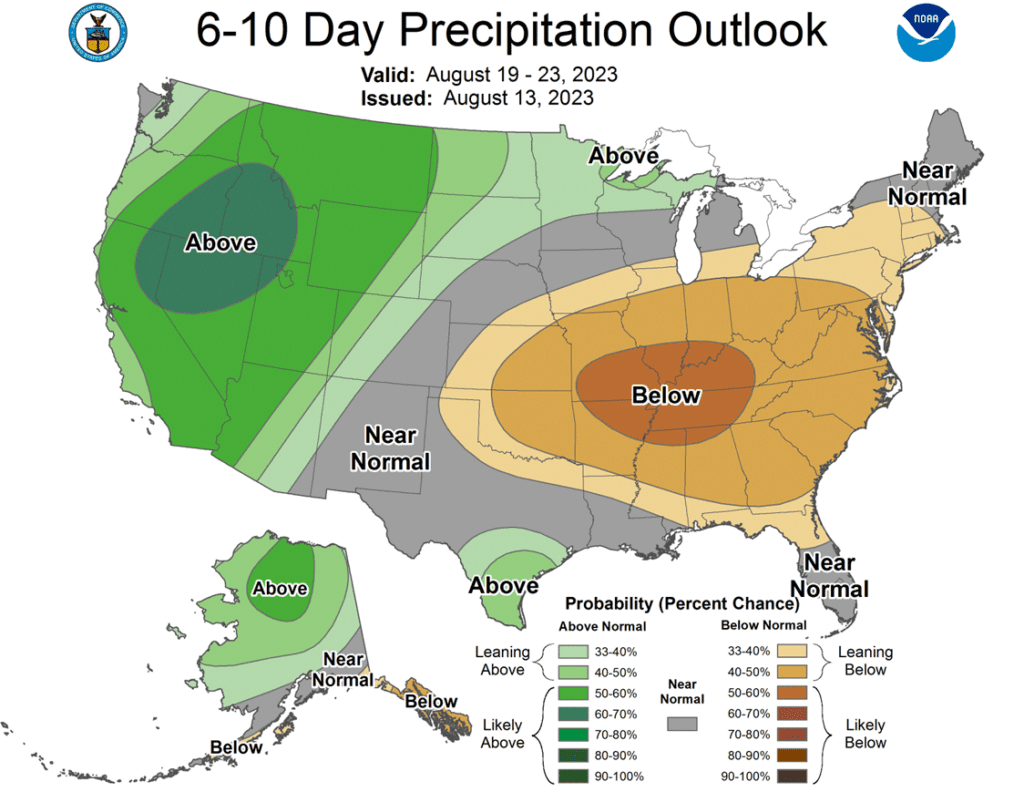

- Corn is trading lower this morning along with wheat as prices seem to slide downwards whenever Russia doesn’t launch a new attack on Ukraine’s ports.

- Export sales will be released today and are expected to be slow, but new crop sales have picked up slightly over the past month as US corn prices fall.

- US ethanol stocks rose by 2.4% to 23.435 m bbl, but analysts were expecting 22.83. Plant production was 1.069 m b/d compared to the survey average of 1.035.

- The US is preparing to request a dispute resolution panel with Mexico claiming that their corn policy banning GMO corn violates the trade deal.

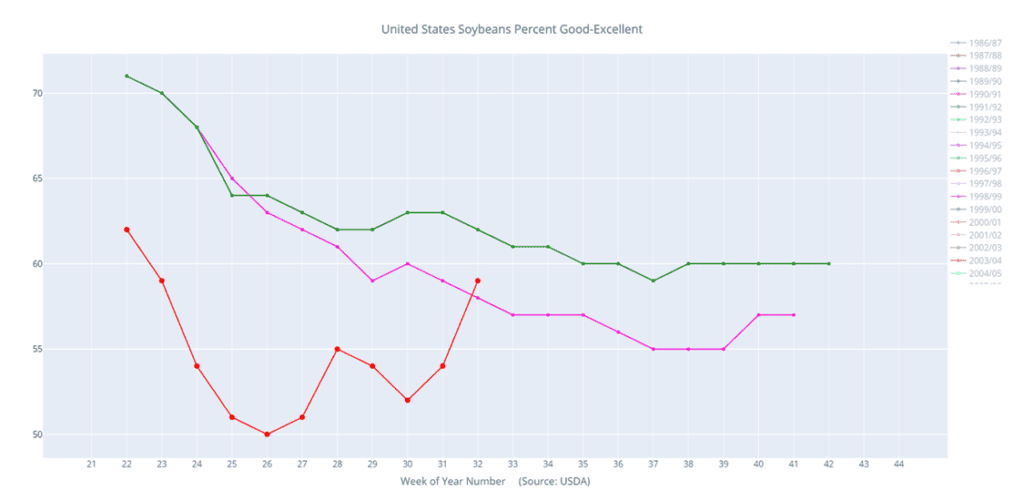

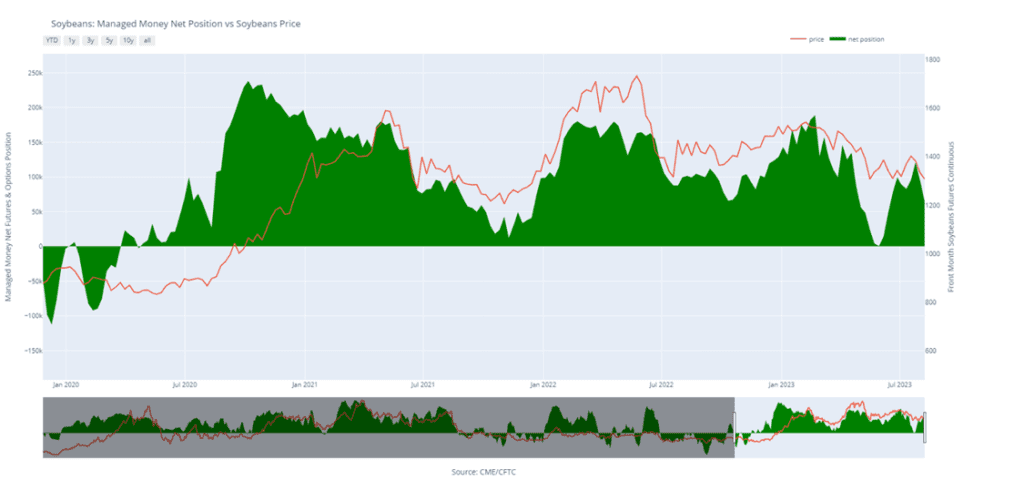

- Soybeans are trading quietly this morning and are essentially unchanged as soybean meal slips lower but soybean oil continues on higher.

- Soybean oil prices are getting a boost from higher palm oil on talk of increased imports from India, helping to firm soybean oil’s percent of crush value to 6-month highs, while also adding support to soybeans.

- Brazilian food and fuel processor Caramuru Alimentos has started selling soybean based ethanol at one of its plants in Brazil.

- In the EU, soybean imports were down slightly from the previous year at 1.33 mmt by August 13 compared to 1.58 mmt a year earlier.

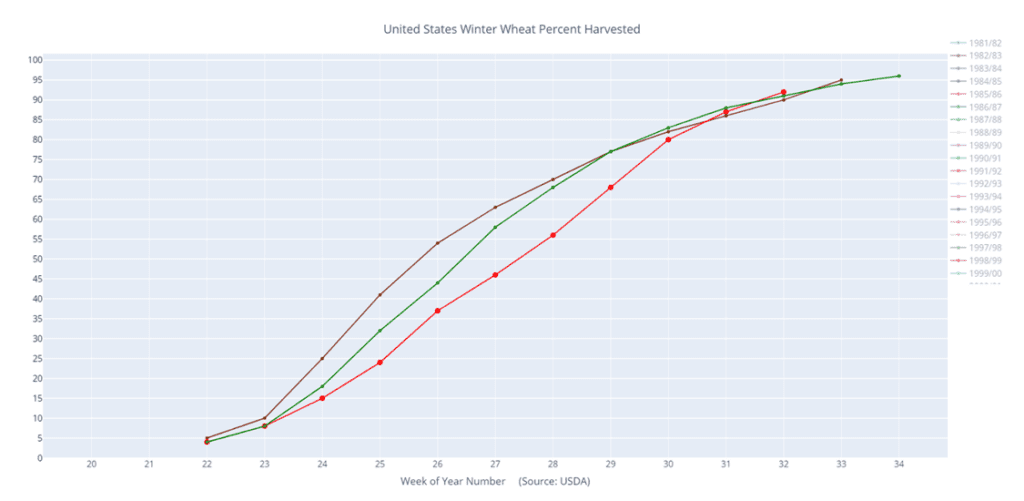

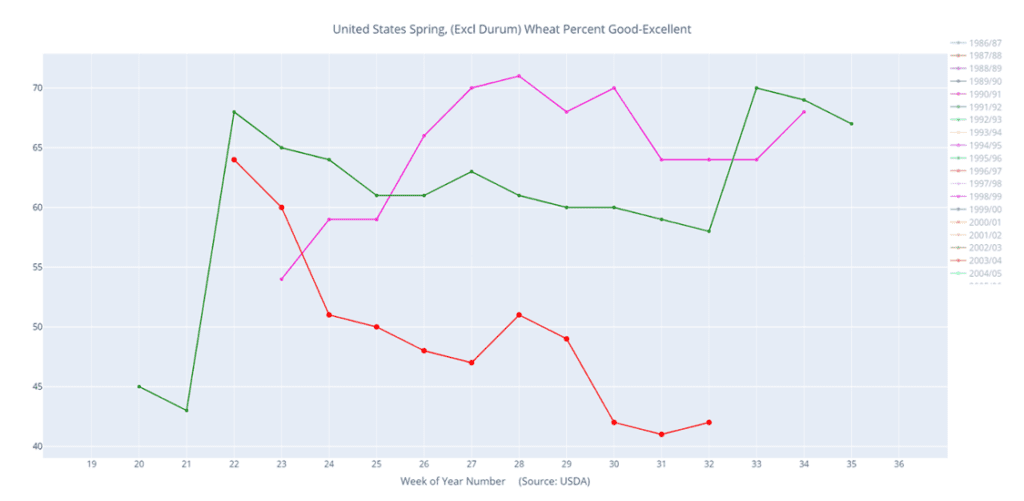

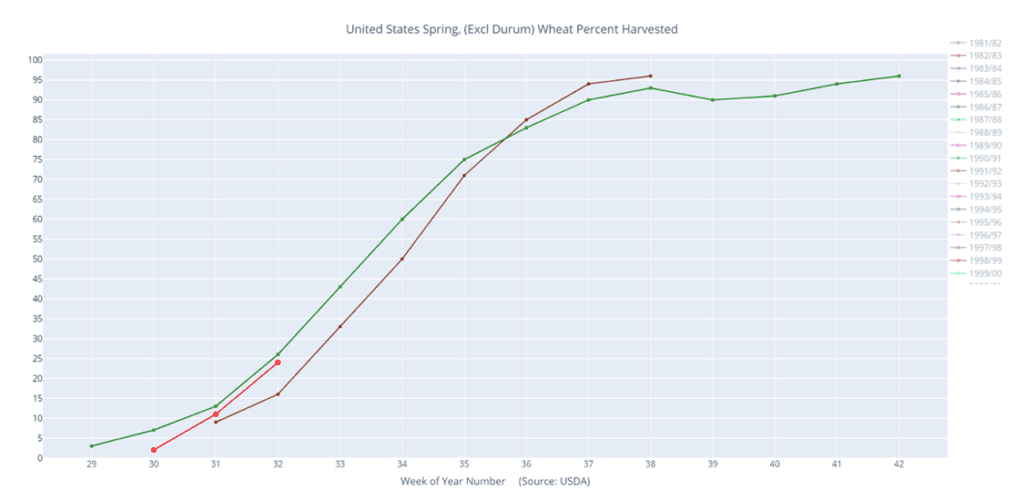

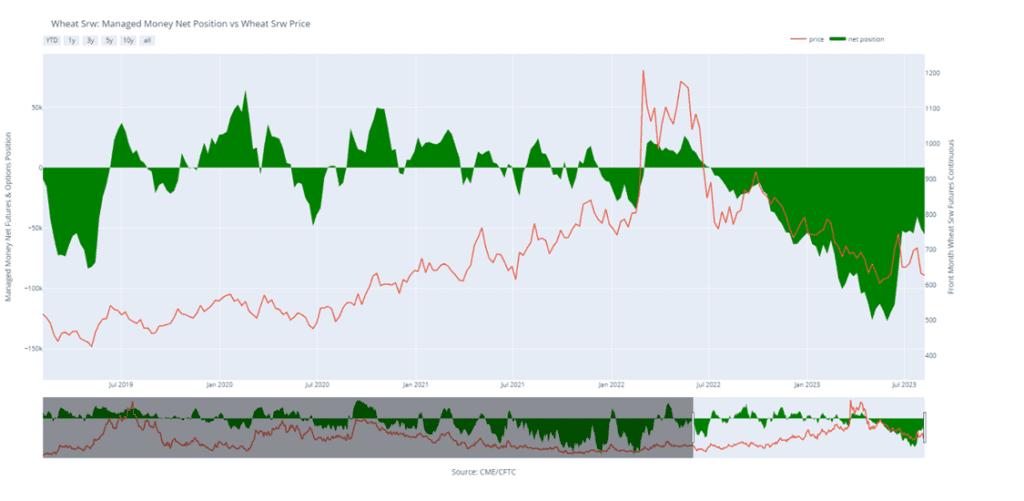

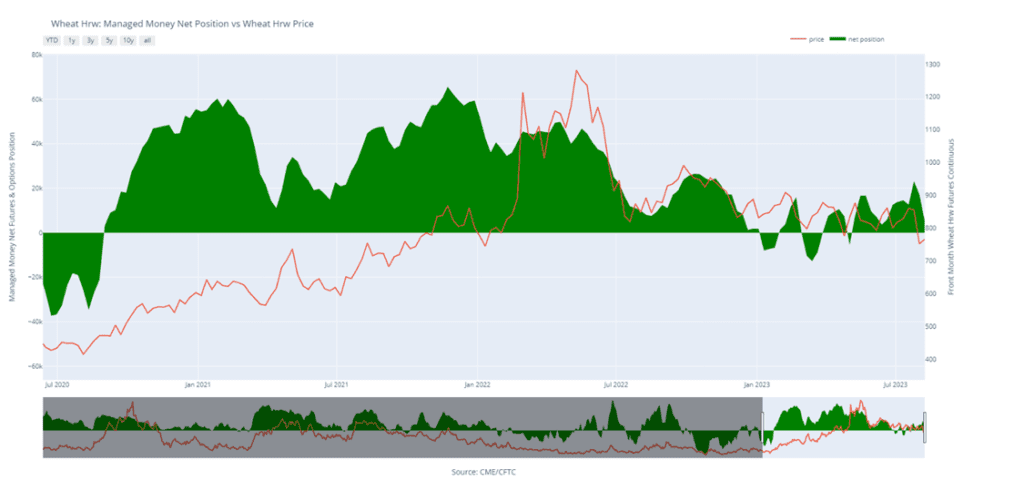

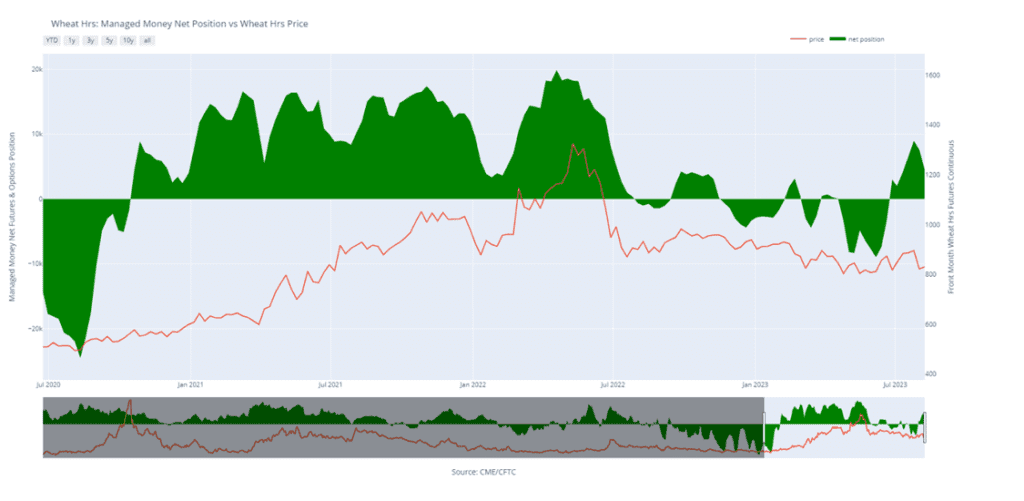

- All three wheat products are lower after a lack of activity in the Black Sea region last night. The progression of US harvest is also weighing on prices.

- Brazil’s wheat crop is now seen at 11.19 mmt which is down 2.3% from the previous estimate. Their imports were unchanged at 5.77 mmt.

- Ukraine’s August grain exports out of the Danube River are reported at 820,000 metric tons so far as the river becomes Ukraine’s main export route.

- India is considering wheat imports from Russia of 9 mmt to calm local prices which have reached a 7-month high due to their own low wheat stocks.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.