Opening Update: September 7, 2023

All prices as of 6:30 am Central Time

|

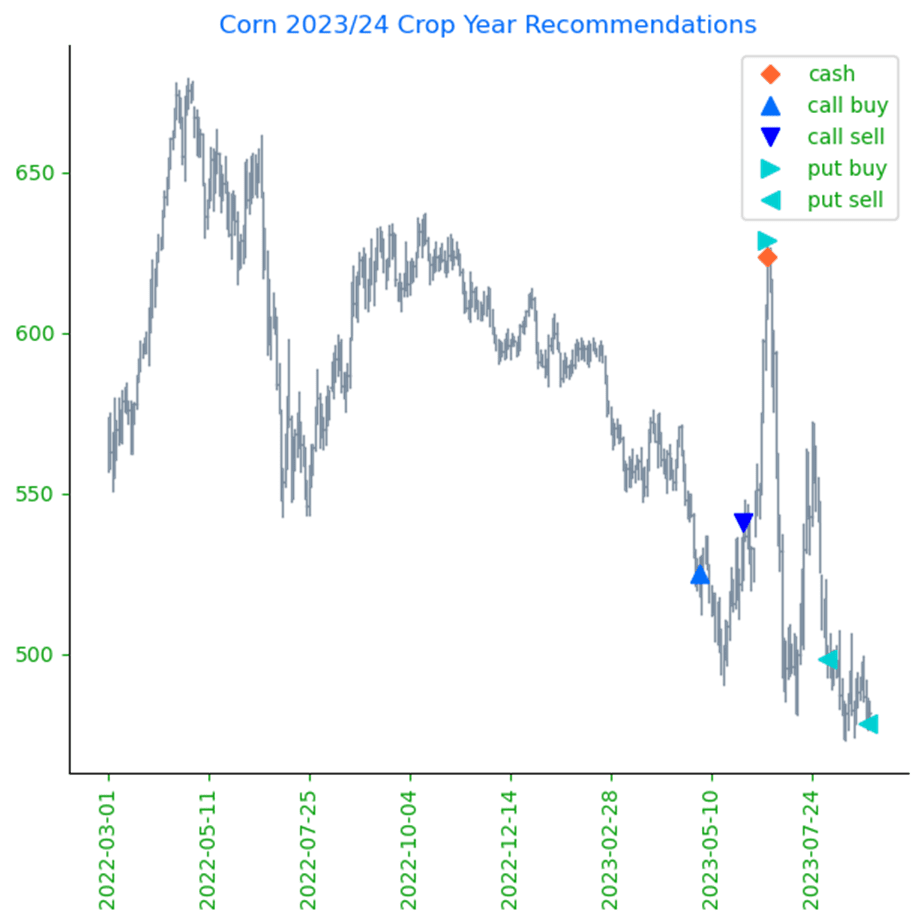

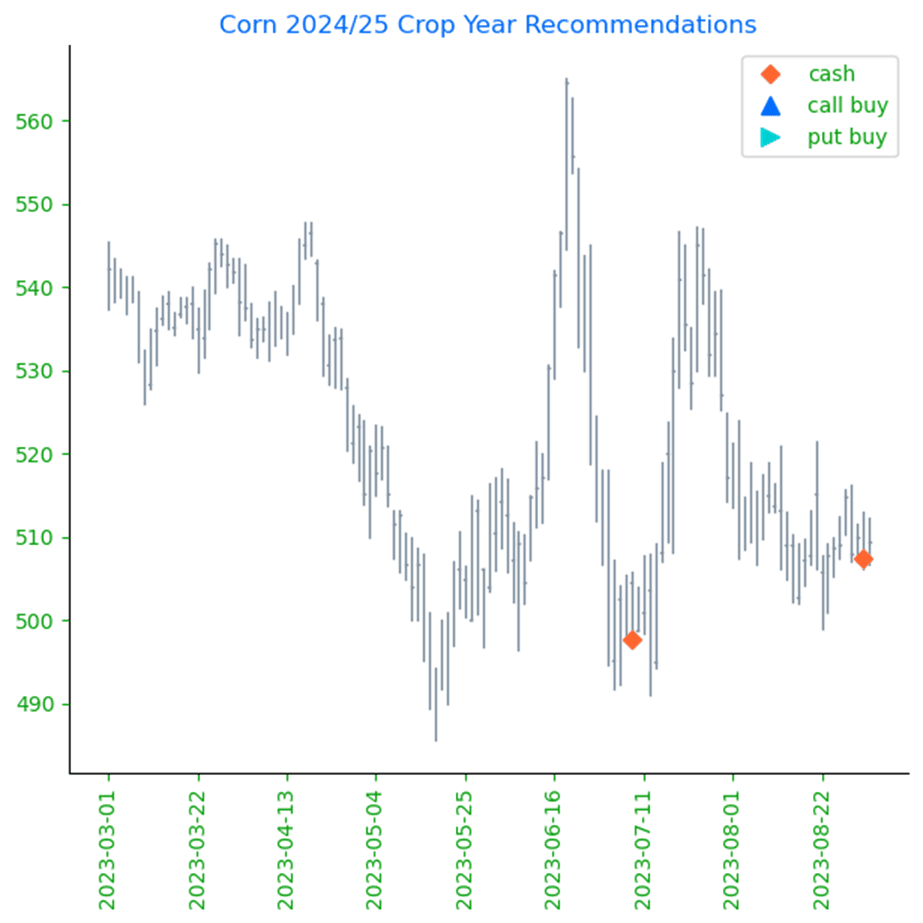

Corn |

||

| DEC ’23 | 486 | 0.25 |

| MAR ’24 | 500.5 | 0.5 |

| DEC ’24 | 511.5 | 0.5 |

|

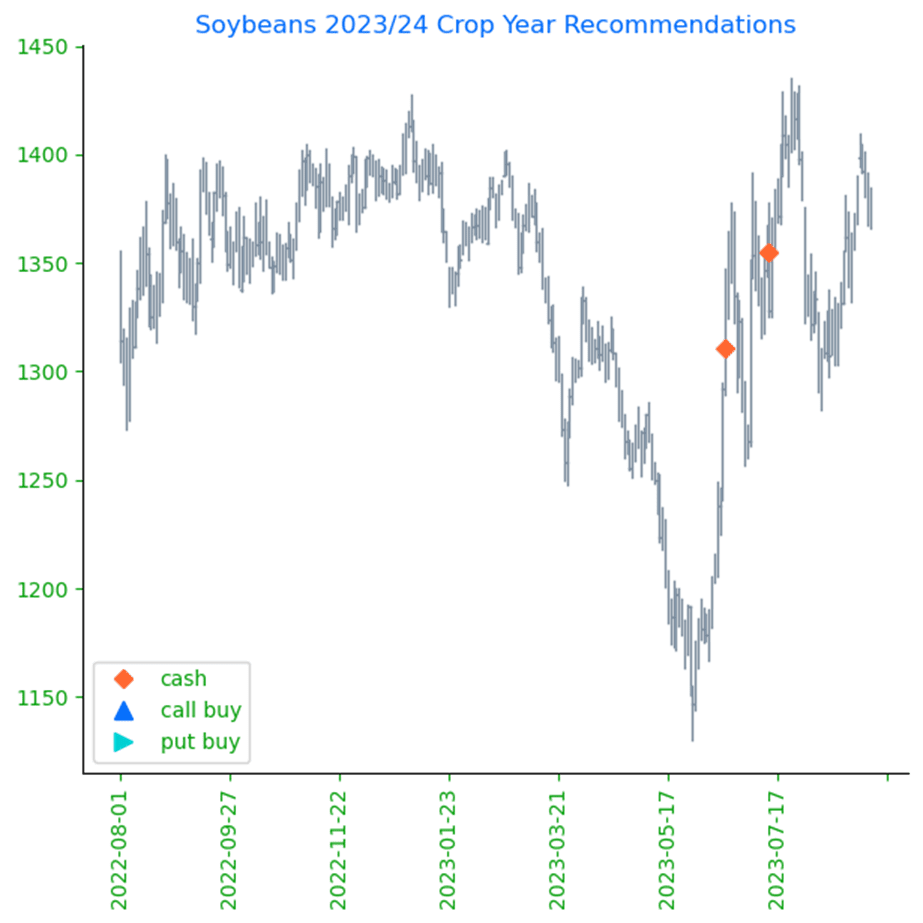

Soybeans |

||

| NOV ’23 | 1370.75 | -5.5 |

| JAN ’24 | 1384 | -5.25 |

| NOV ’24 | 1293.25 | -4.25 |

|

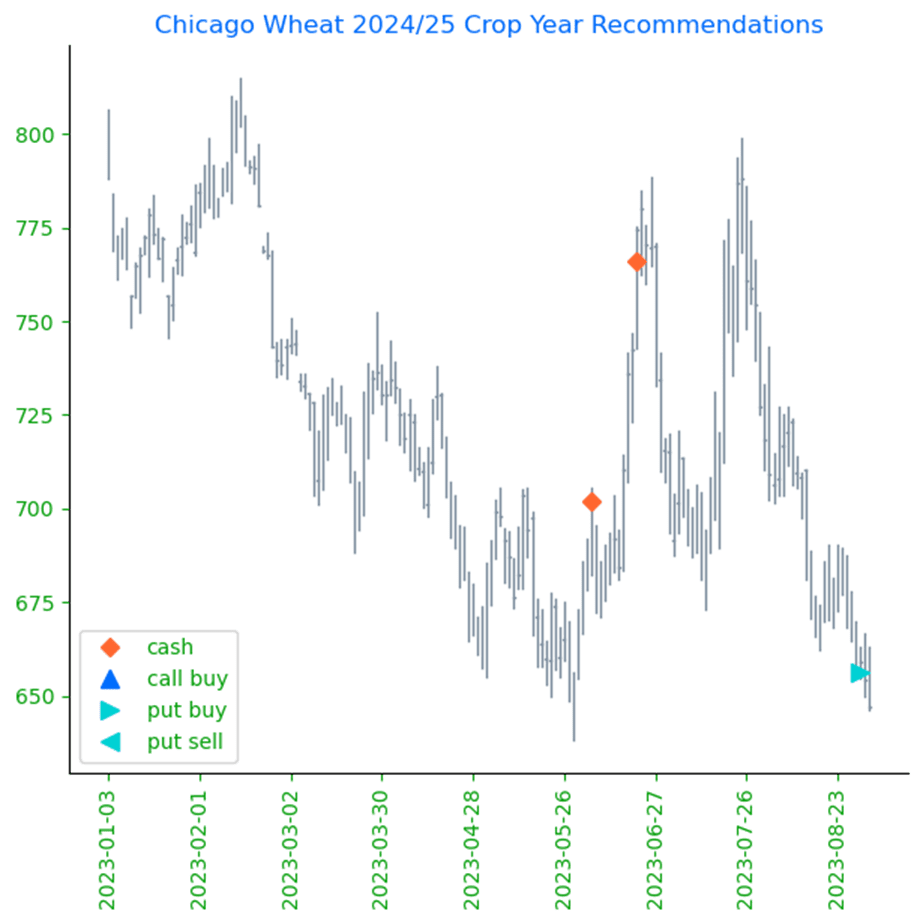

Chicago Wheat |

||

| DEC ’23 | 608.75 | -0.25 |

| MAR ’24 | 634.75 | 0.25 |

| JUL ’24 | 660.25 | 1.25 |

|

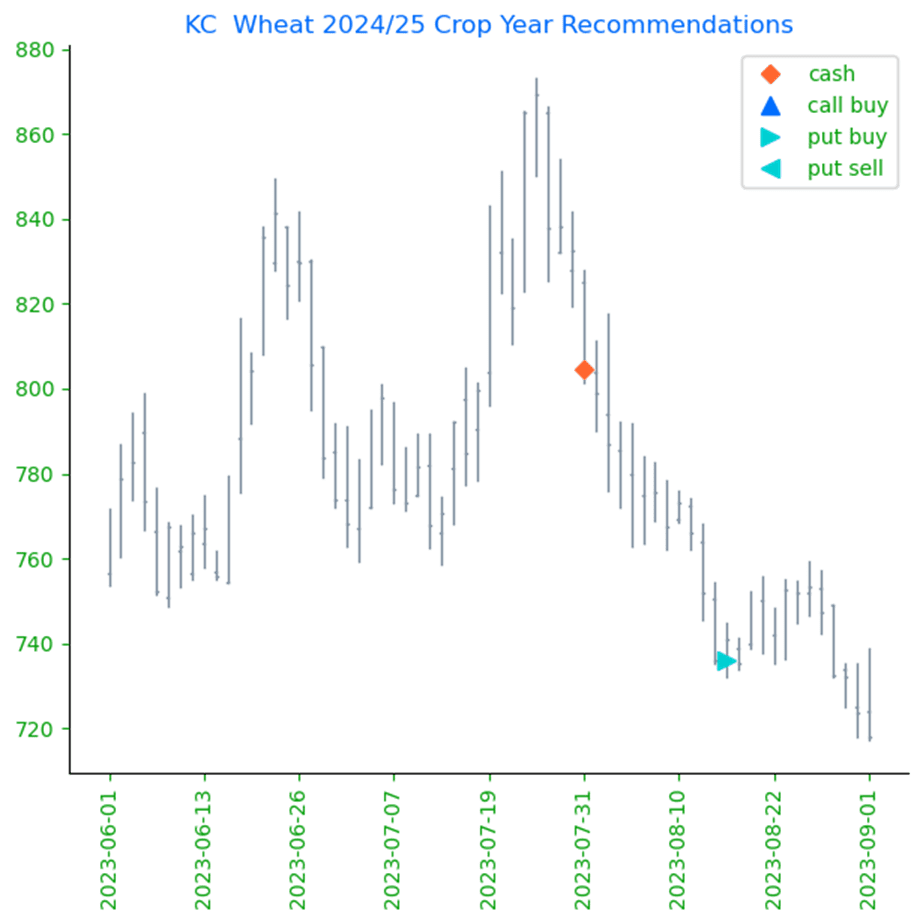

K.C. Wheat |

||

| DEC ’23 | 746.25 | -3.25 |

| MAR ’24 | 749.75 | -2.25 |

| JUL ’24 | 733 | -4 |

|

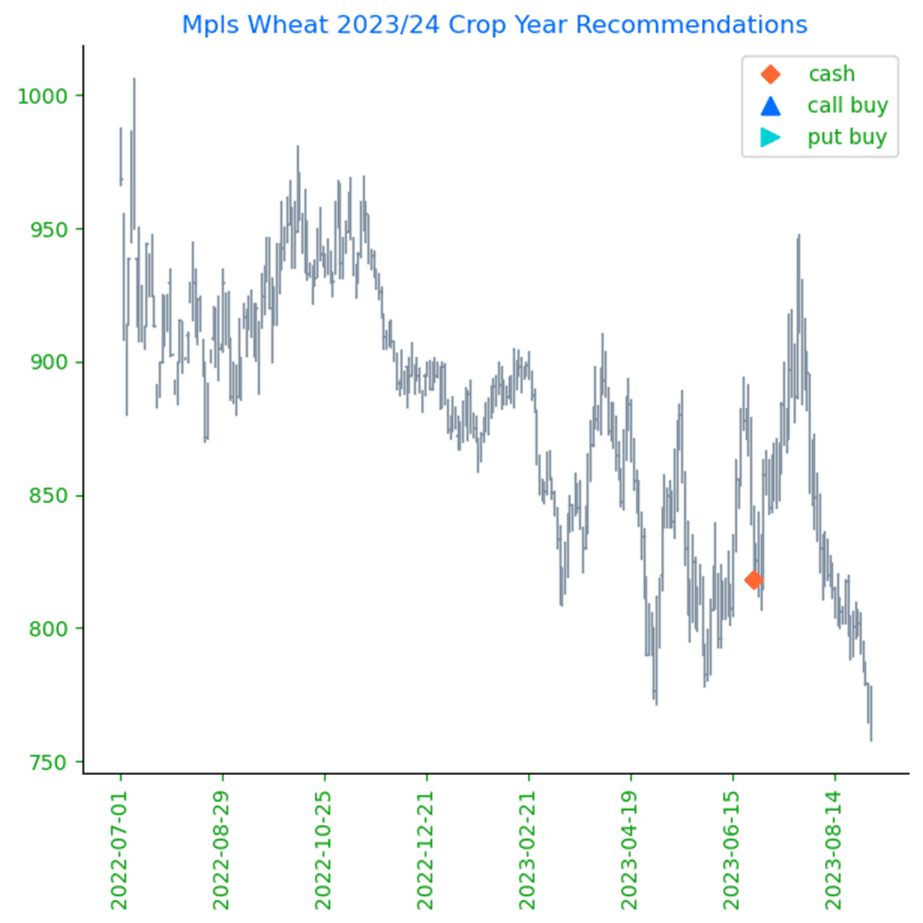

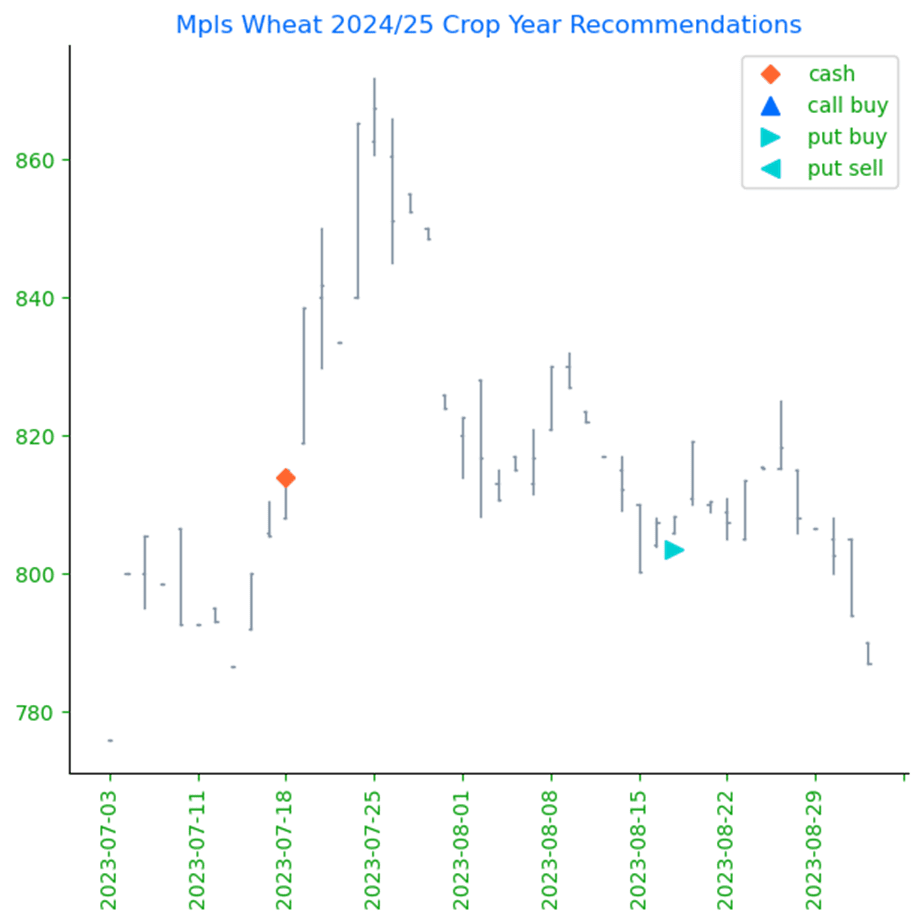

Mpls Wheat |

||

| DEC ’23 | 785.5 | 3 |

| MAR ’24 | 803.75 | 3.25 |

| SEP ’24 | 810 | 16.5 |

|

S&P 500 |

||

| DEC ’23 | 4505.5 | -15 |

|

Crude Oil |

||

| NOV ’23 | 86.29 | -0.5 |

|

Gold |

||

| DEC ’23 | 1945.1 | 0.9 |

If you missed our latest strategy update, click here: Grain Market Insider Strategy Update

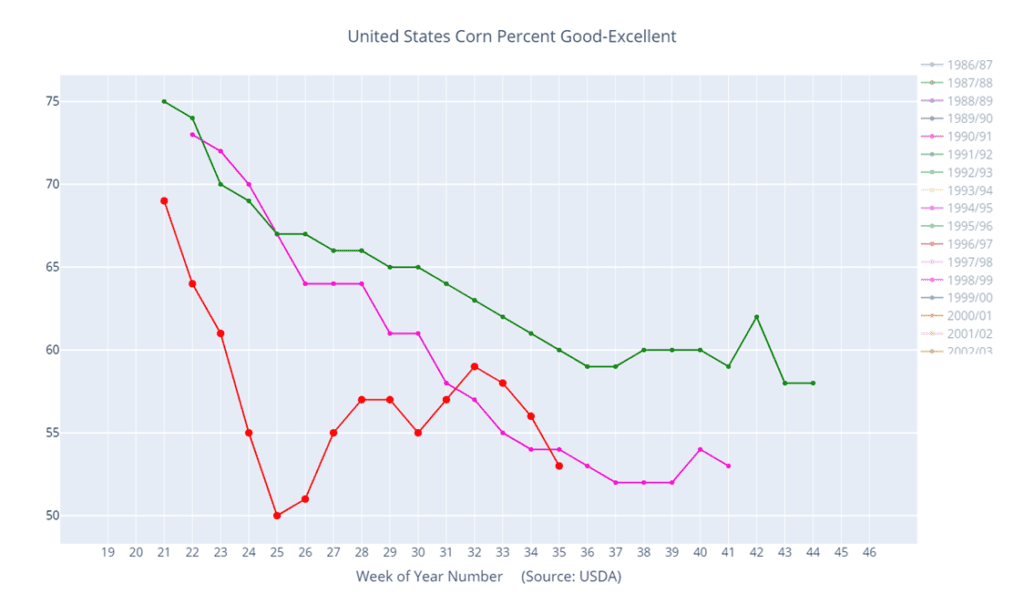

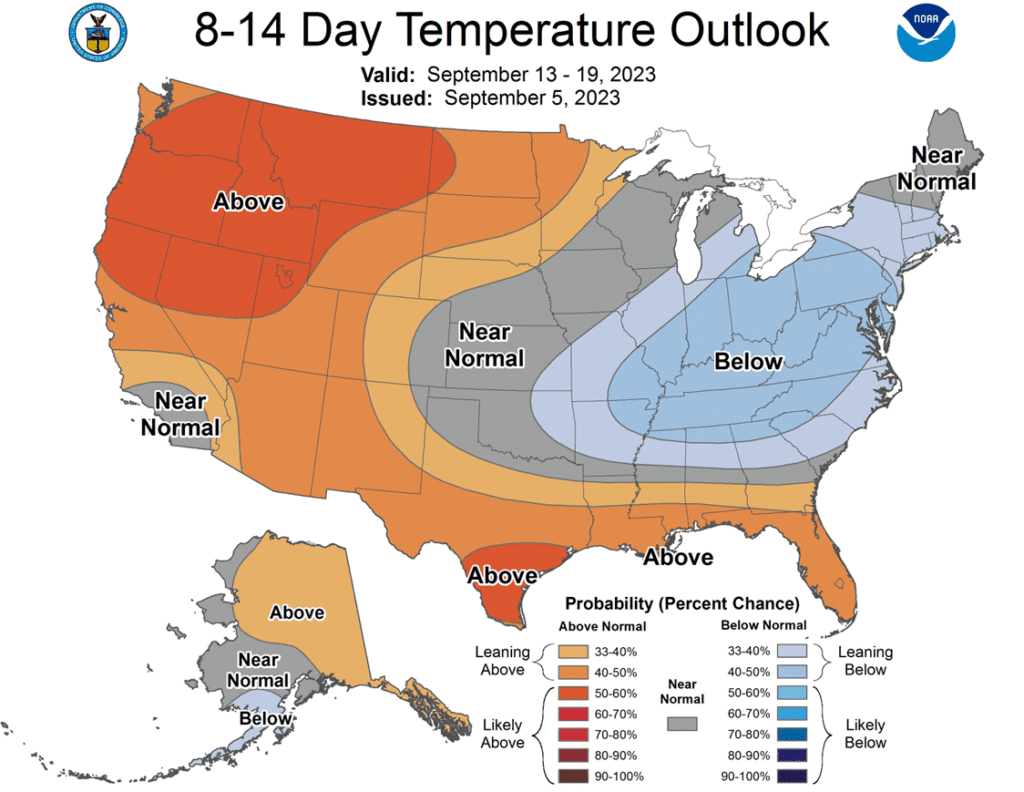

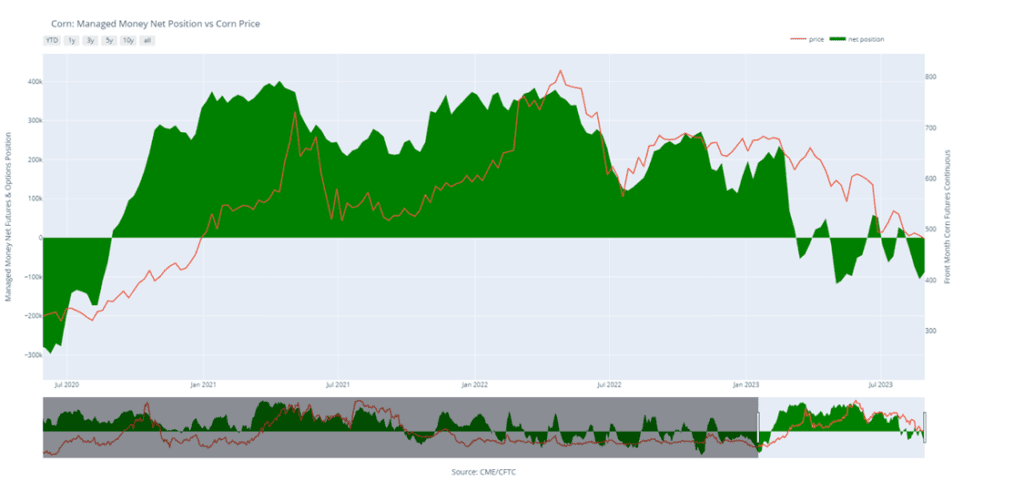

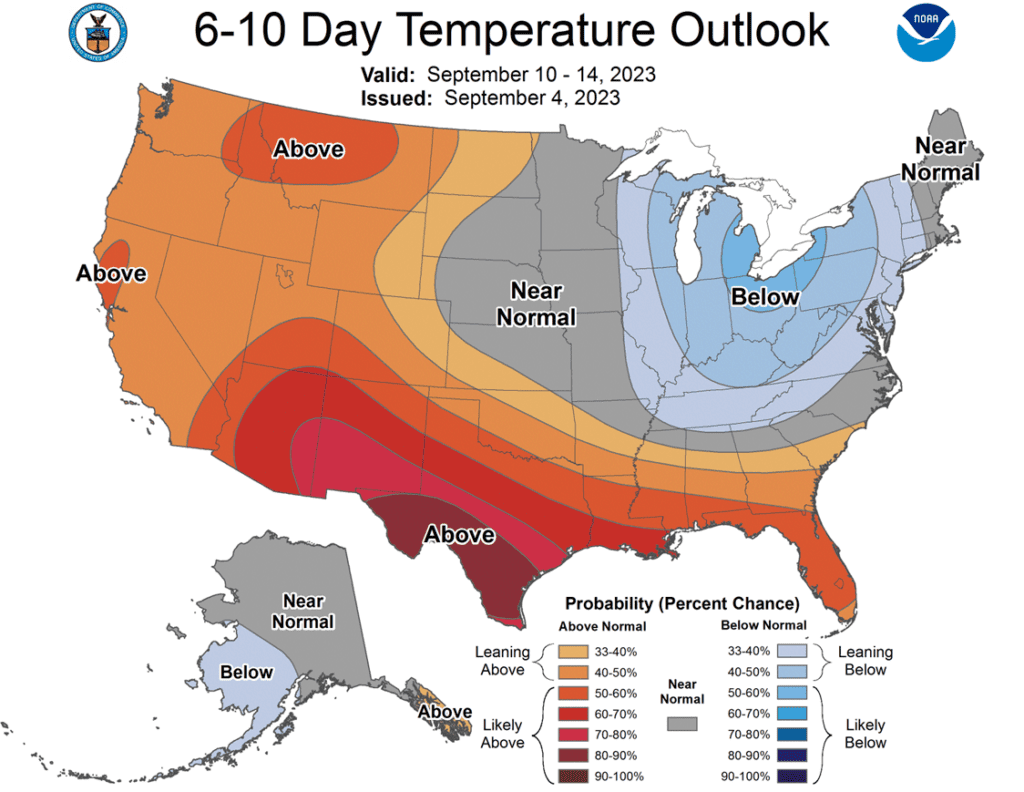

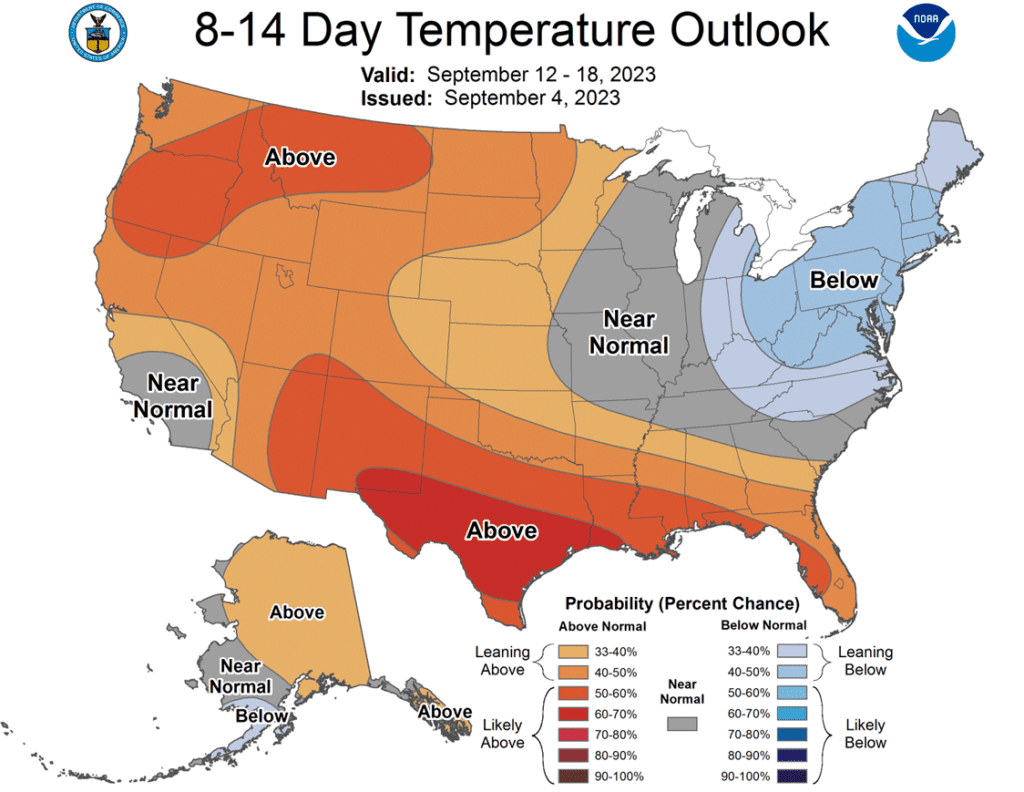

- Corn is unchanged to start the day with little reaction to the hot and dry conditions. Harvest is nearing and the crop is pretty well made at this point.

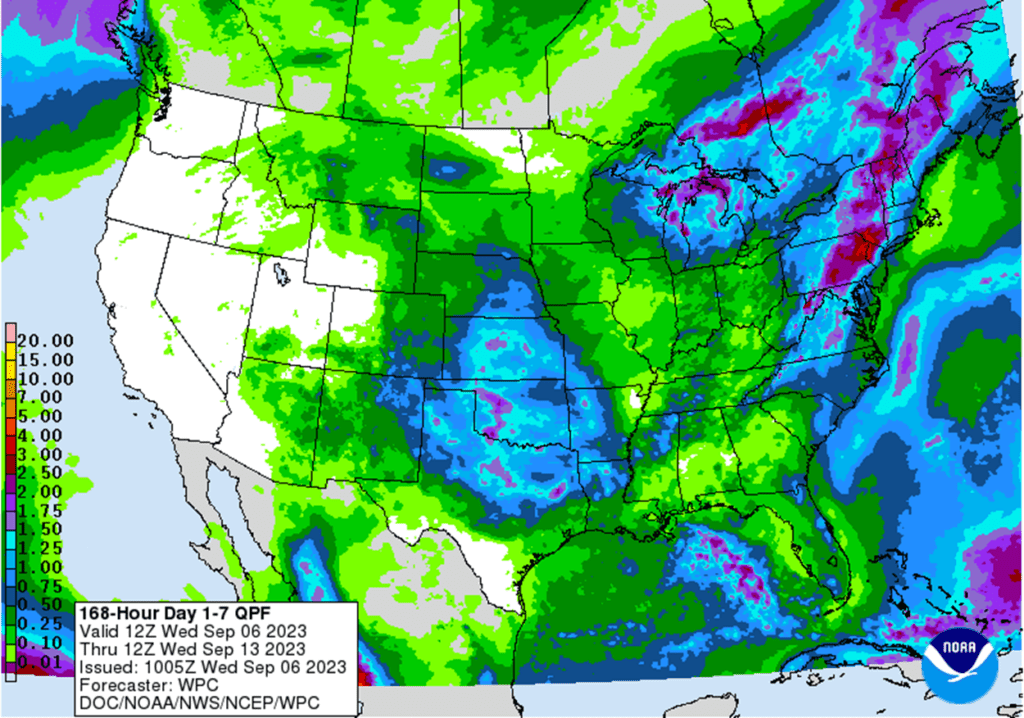

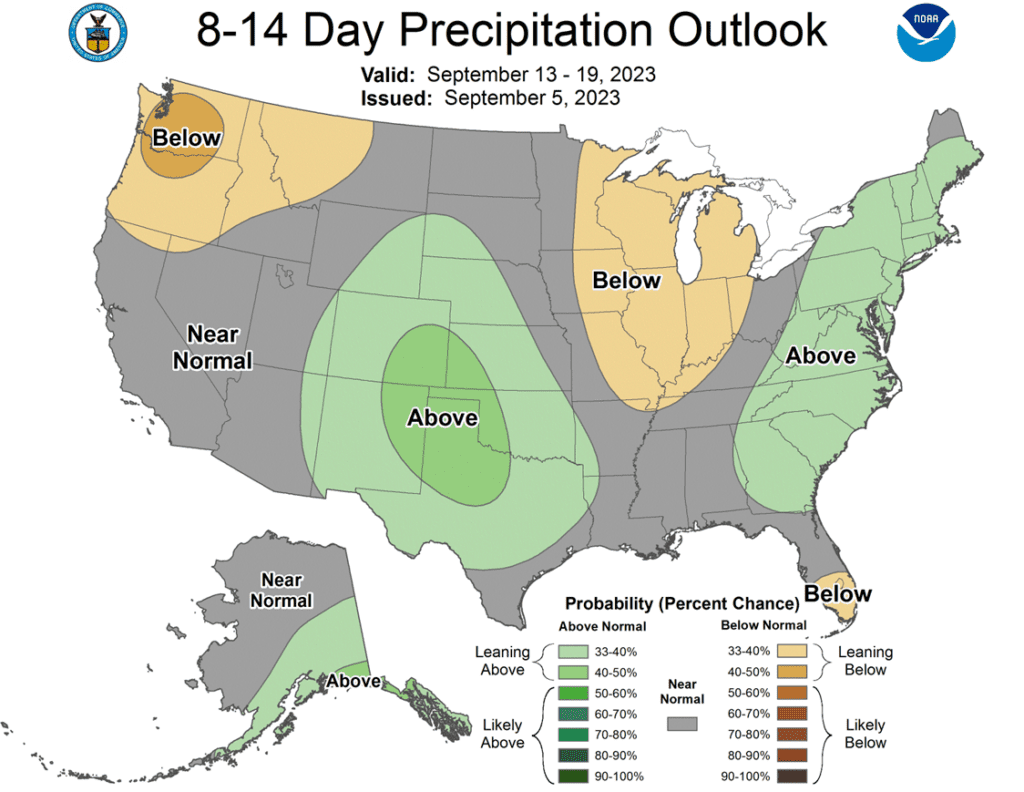

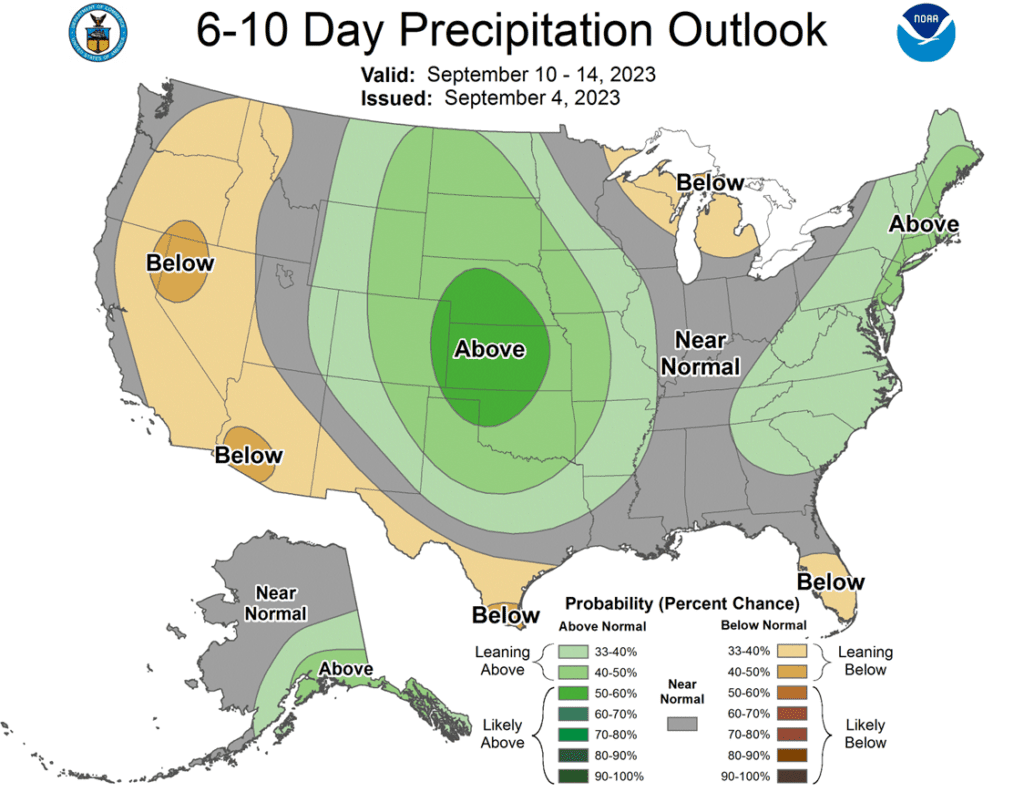

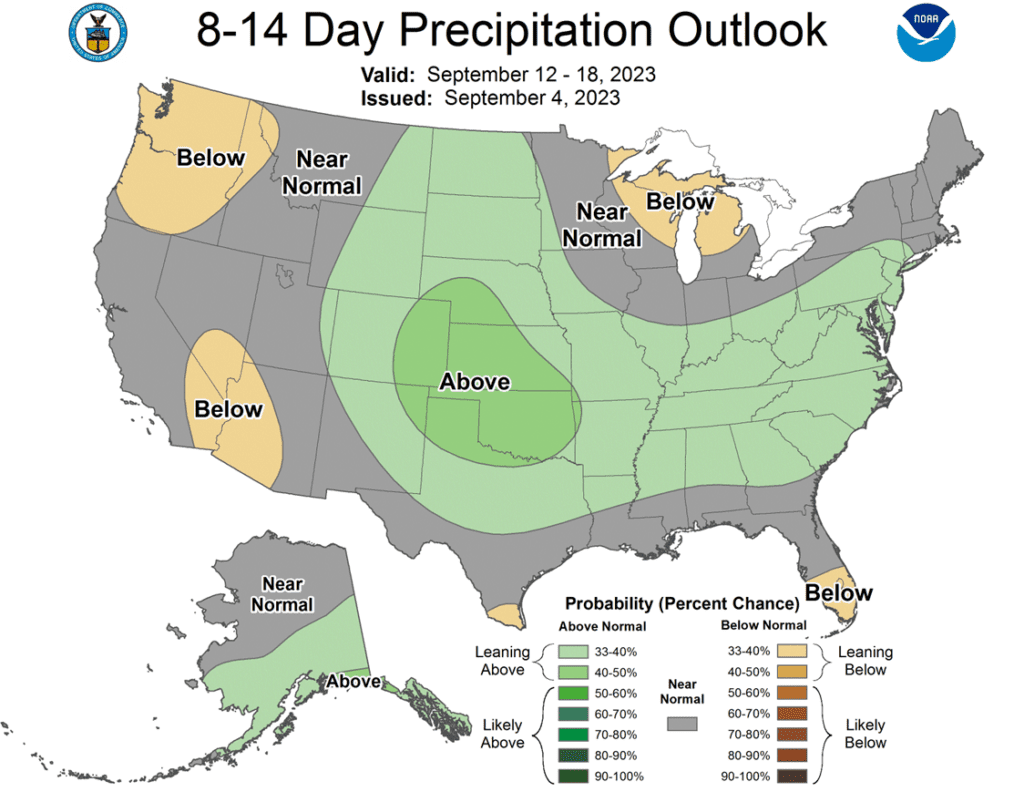

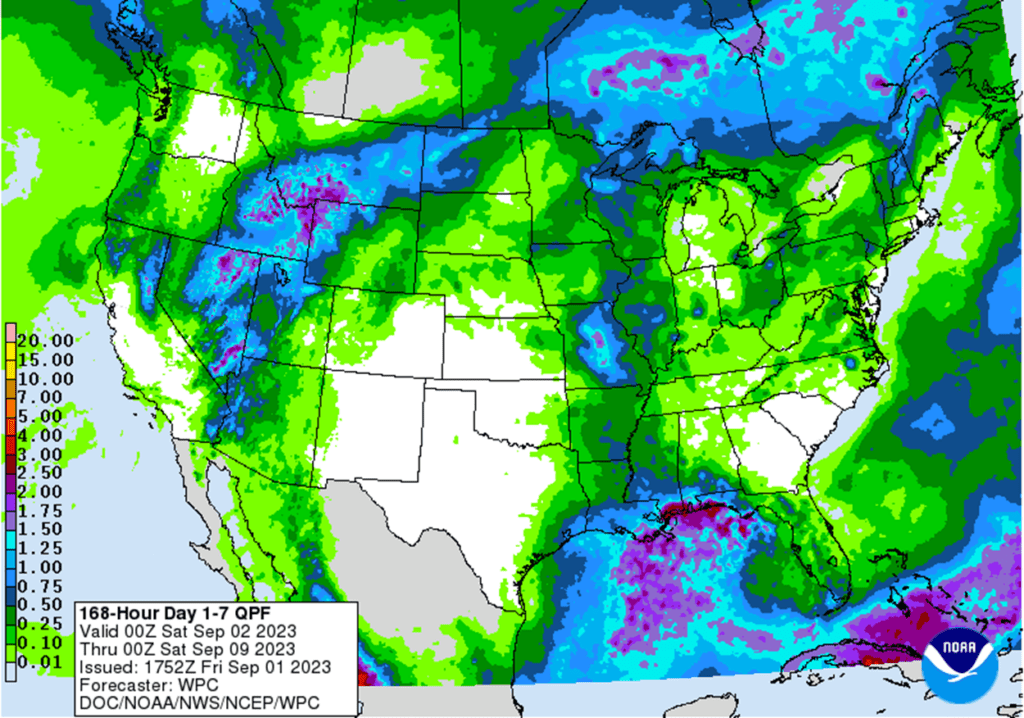

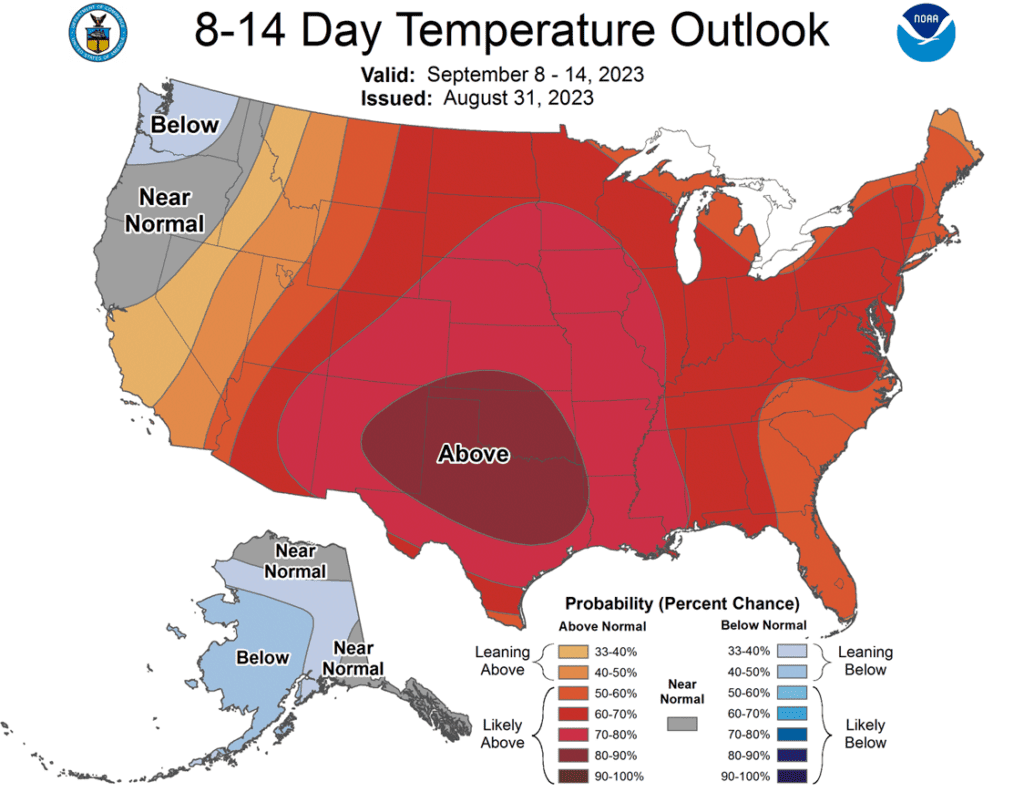

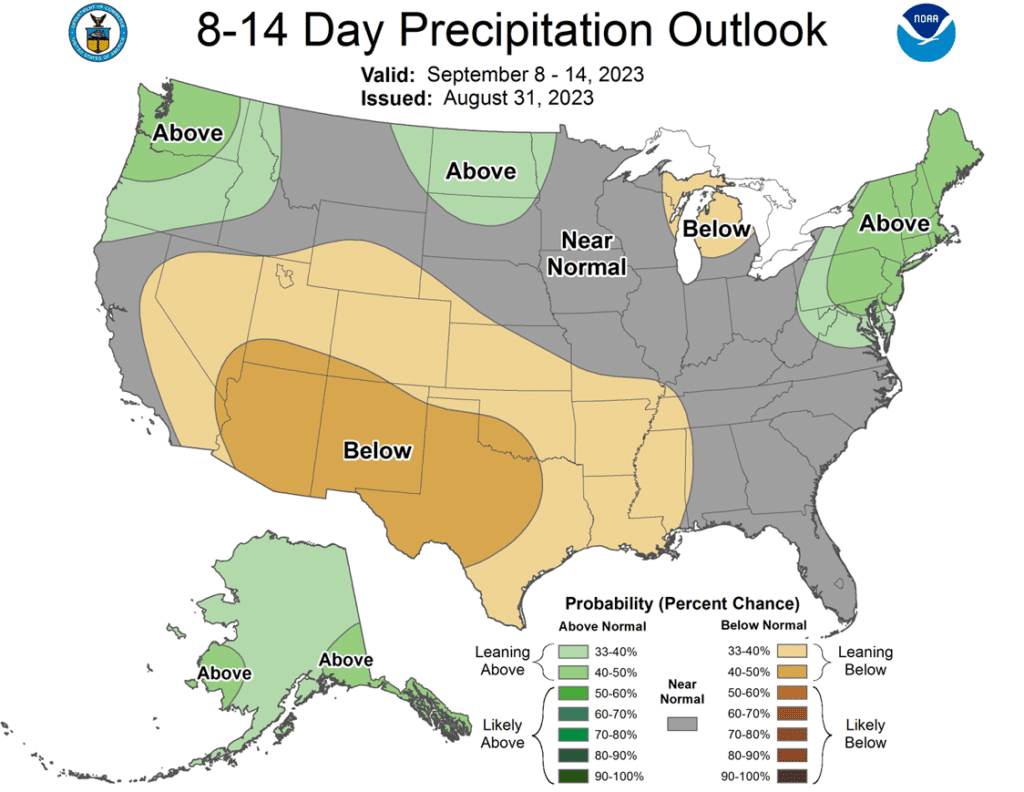

- The 7-day forecast features better chances for rain in the western Corn Belt while the rest of the Belt is expected to receive very limited showers.

- Most private analysts are estimating yields above 170 bpa, but things could change quickly when the USDA updates their estimates on Tuesday.

- The USDA has previously estimated 94.1 million acres of planted corn which could be adjusted in the WASDE report. This comes at the same time that Brazil harvests a record crop.

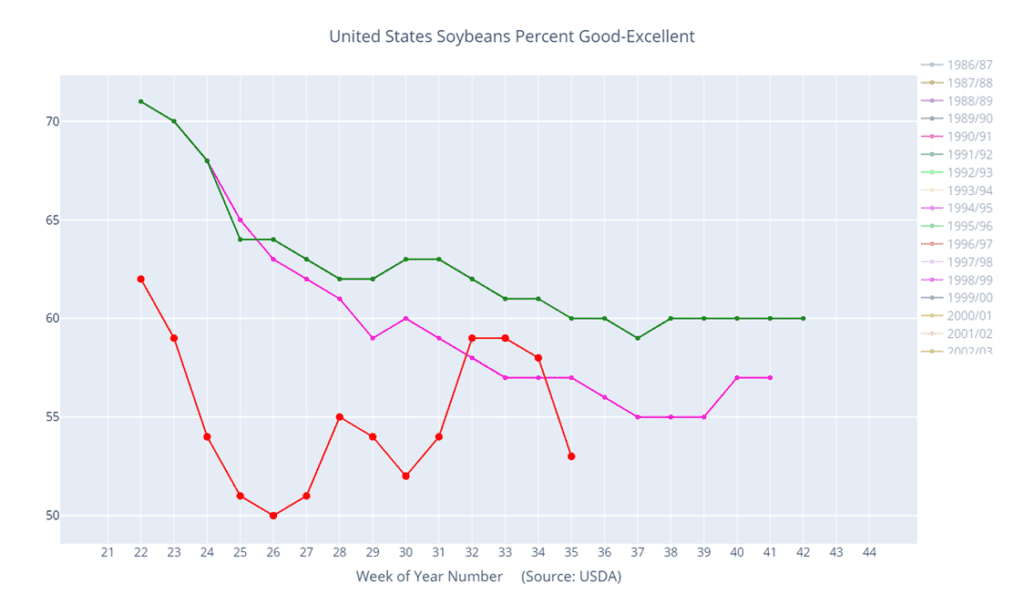

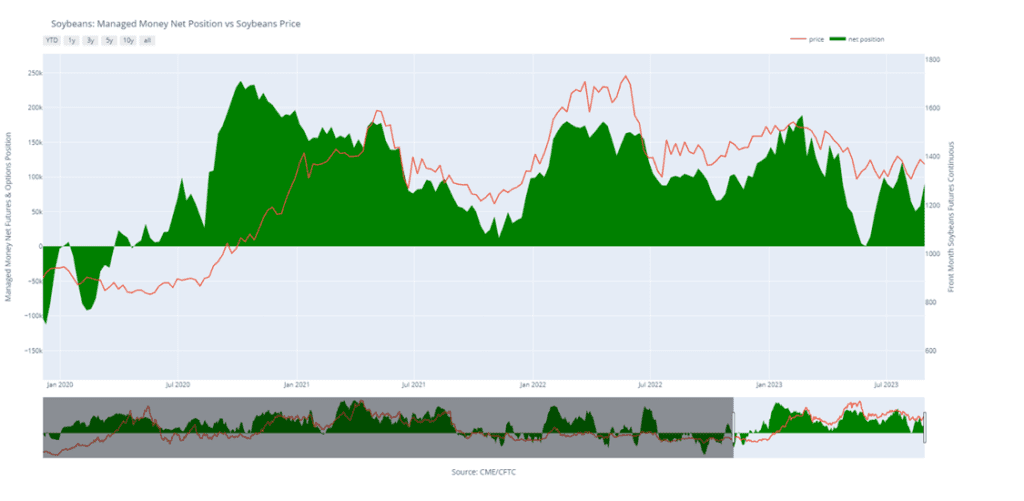

- Soybeans are trading lower this morning after yesterday’s higher close with both soybean meal and oil lower. Trade has been rangebound and will likely continue that way until the USDA report is released.

- Analysts are anticipating yields between 49 and 50 bpa, but the planting estimate of just 83.5 million acres could lead to an even tighter carryout unless the USDA finds more soybean acres.

- Export sales have been active with total new crop sales up to 526 mb so far, and tomorrow’s weekly export sales are expected to be solid.

- November soybeans on the Dalian exchange ended lower by 0.4% today, but are still very expensive at the equivalent of $18.80 per bushel.

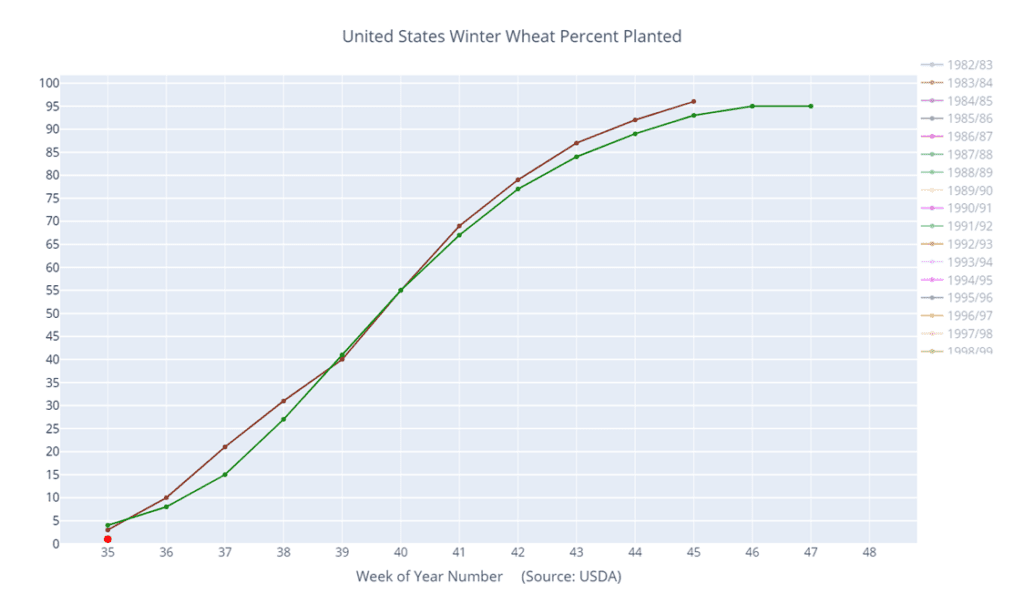

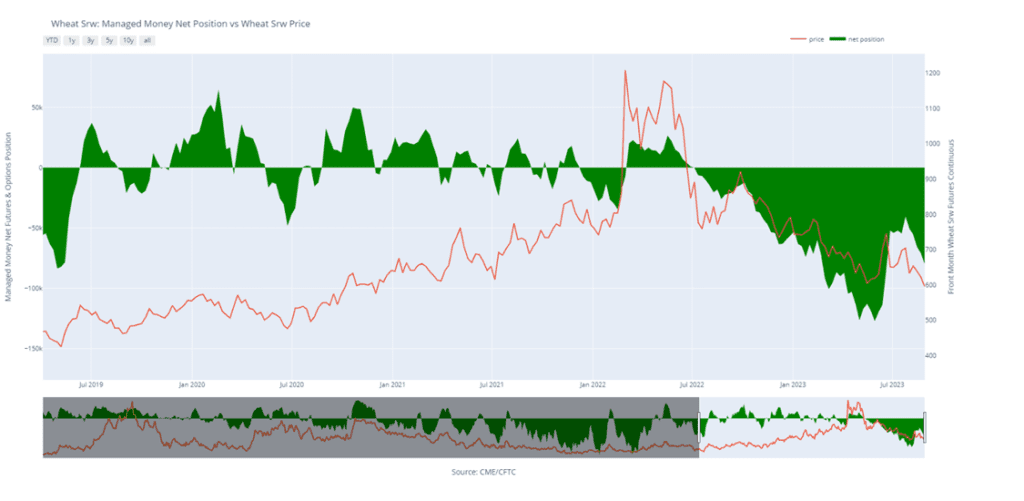

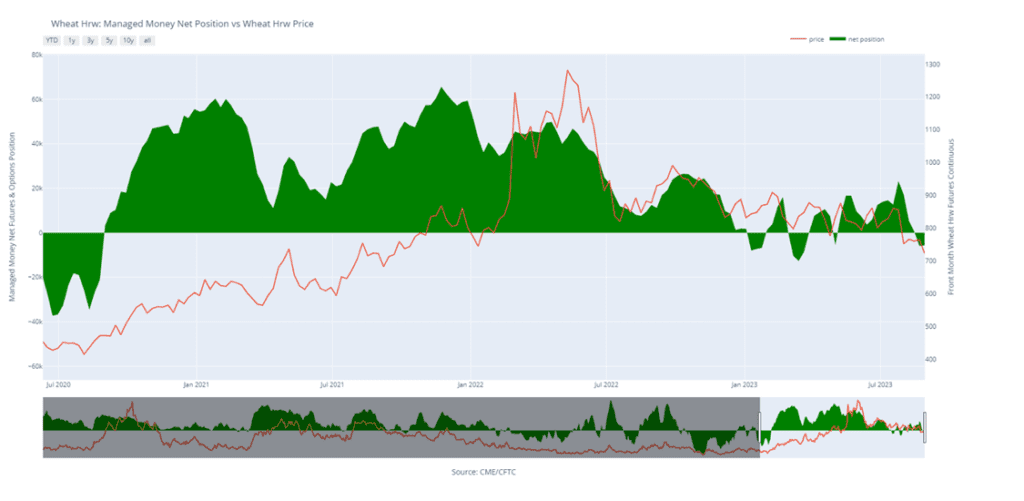

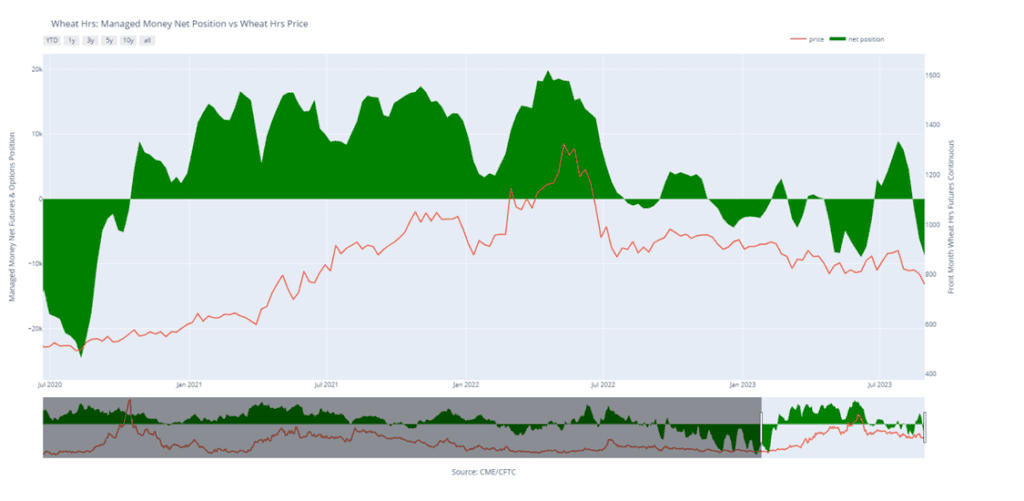

- Wheat posted solid gains yesterday but is starting the day softer. Yesterday’s rally may have been due to the attacks on Ukrainian port cities.

- Russia has made it clear that they would not return to the Black Sea grain deal any time soon, but Ukraine appears to be letting ships carrying grain trickle out of their own humanitarian corridor.

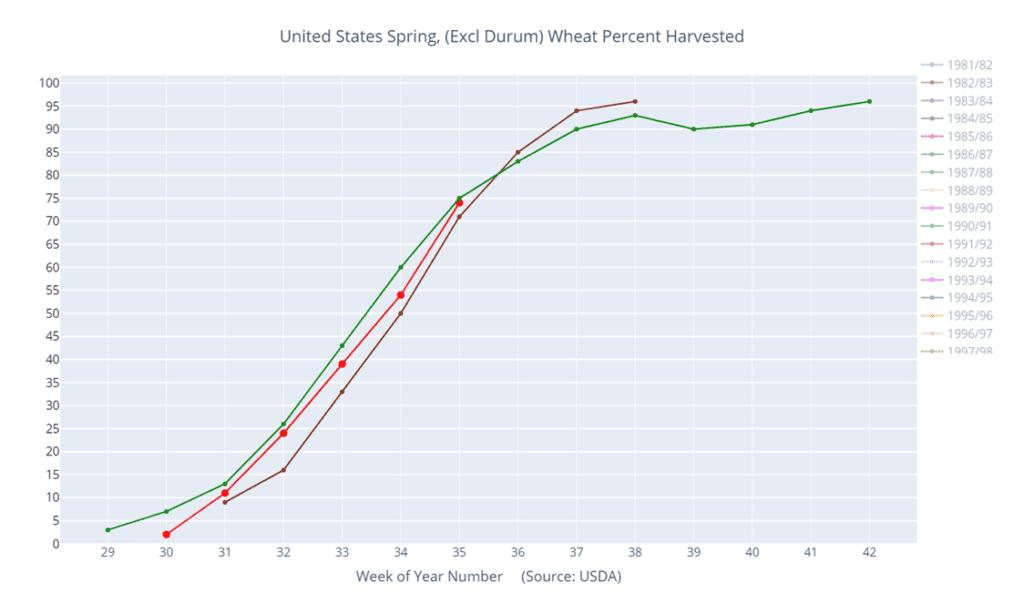

- Spring wheat harvest in the US is going well and will be helped along by a dry forecast for the northwestern US. In HRW wheat regions, upcoming rains will be needed to improve soil moisture.

- Overnight there were no new attacks reported in Ukraine, but a blast was reported at Russian headquarters in Rostov, and Ukrainian forces are reportedly making progress against Russian forces.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.