Opening Update: September 18, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| DEC ’23 | 476.25 | 0 |

| MAR ’24 | 490 | -0.5 |

| DEC ’24 | 508.25 | -0.25 |

|

Soybeans |

||

| NOV ’23 | 1336.25 | -4 |

| JAN ’24 | 1351.75 | -4 |

| NOV ’24 | 1279.75 | -2.75 |

|

Chicago Wheat |

||

| DEC ’23 | 595.5 | -8.75 |

| MAR ’24 | 621.75 | -7.75 |

| JUL ’24 | 645.75 | -6.25 |

|

K.C. Wheat |

||

| DEC ’23 | 736 | -10.5 |

| MAR ’24 | 739.75 | -11.75 |

| JUL ’24 | 725.5 | -10.75 |

|

Mpls Wheat |

||

| DEC ’23 | 784 | -5 |

| MAR ’24 | 800.5 | -3.5 |

| SEP ’24 | 808.25 | 2.25 |

|

S&P 500 |

||

| DEC ’23 | 4500.75 | 2.75 |

|

Crude Oil |

||

| NOV ’23 | 90.48 | 0.46 |

|

Gold |

||

| DEC ’23 | 1948.8 | 2.6 |

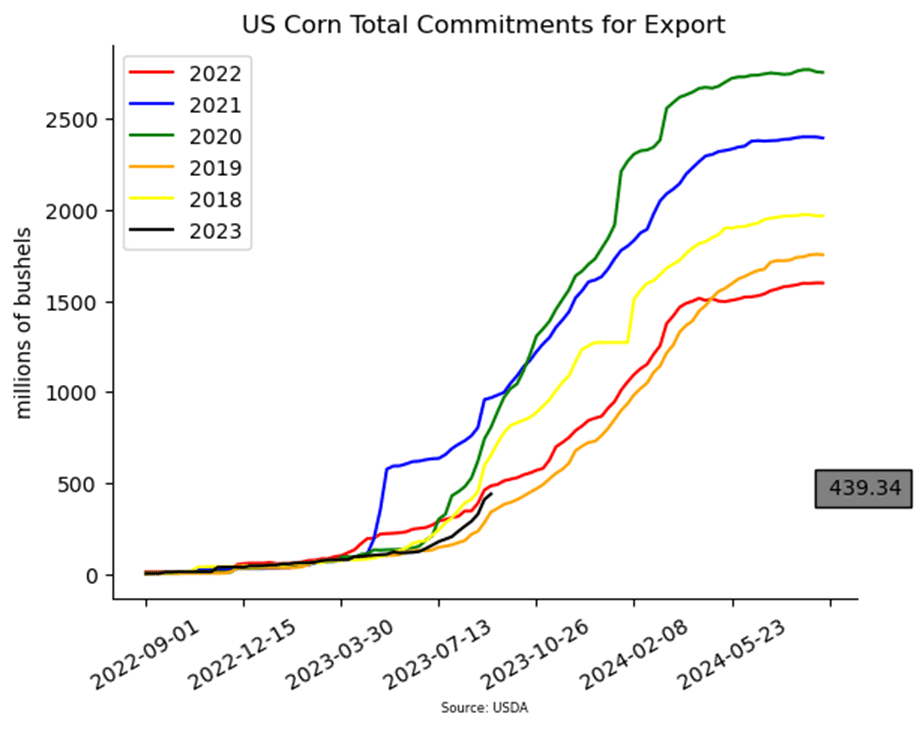

- Corn is trading unchanged to slightly lower this morning as it remains rangebound. December corn has managed to stay just above its 2023 low of 4.73-1/2.

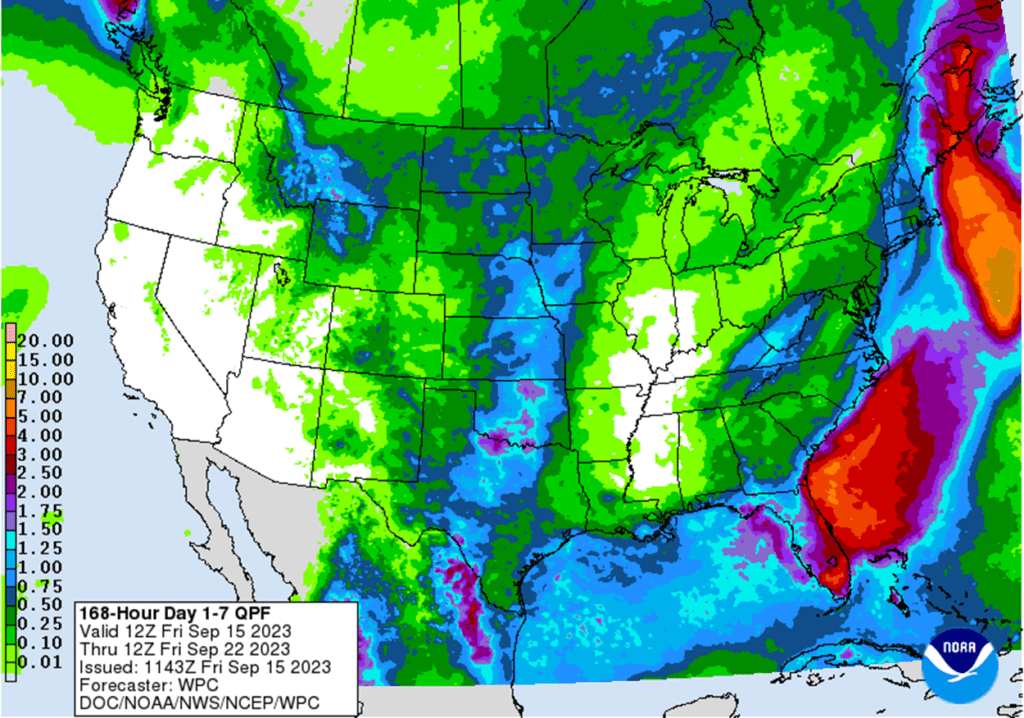

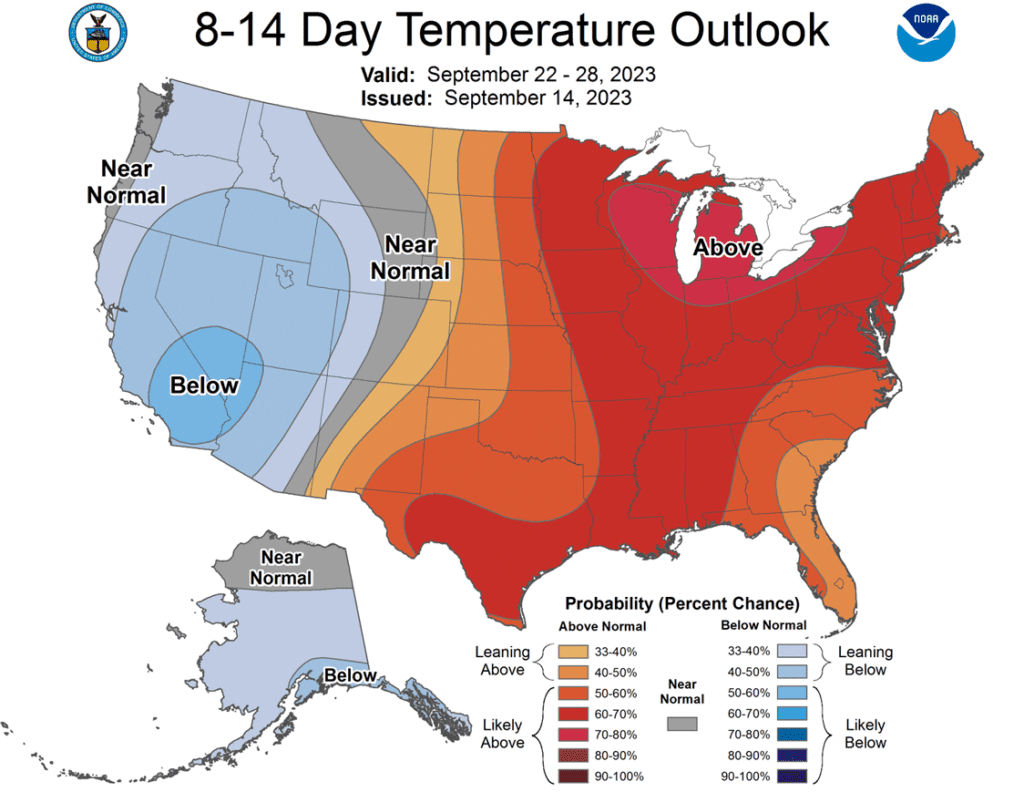

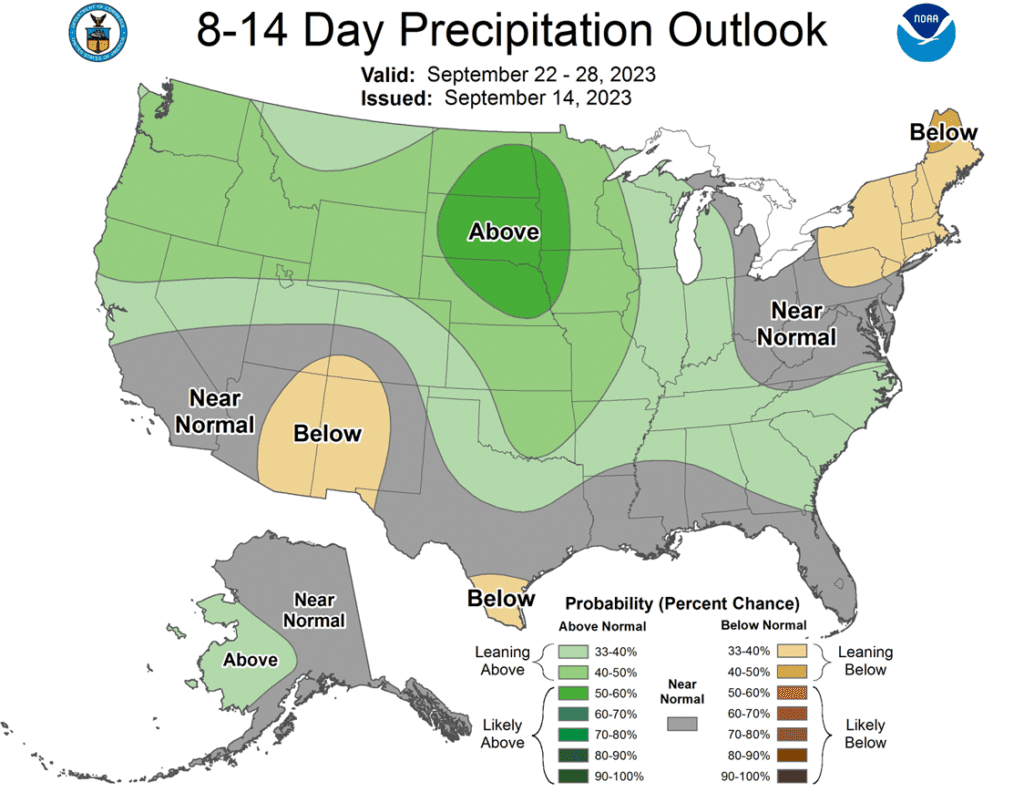

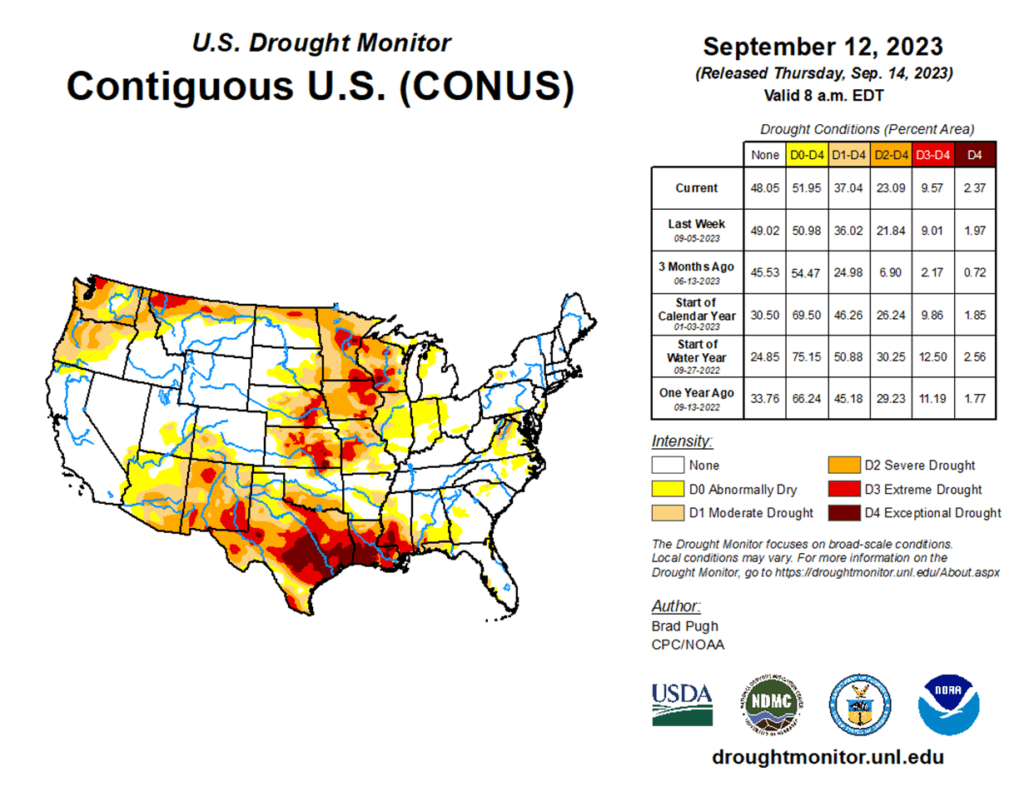

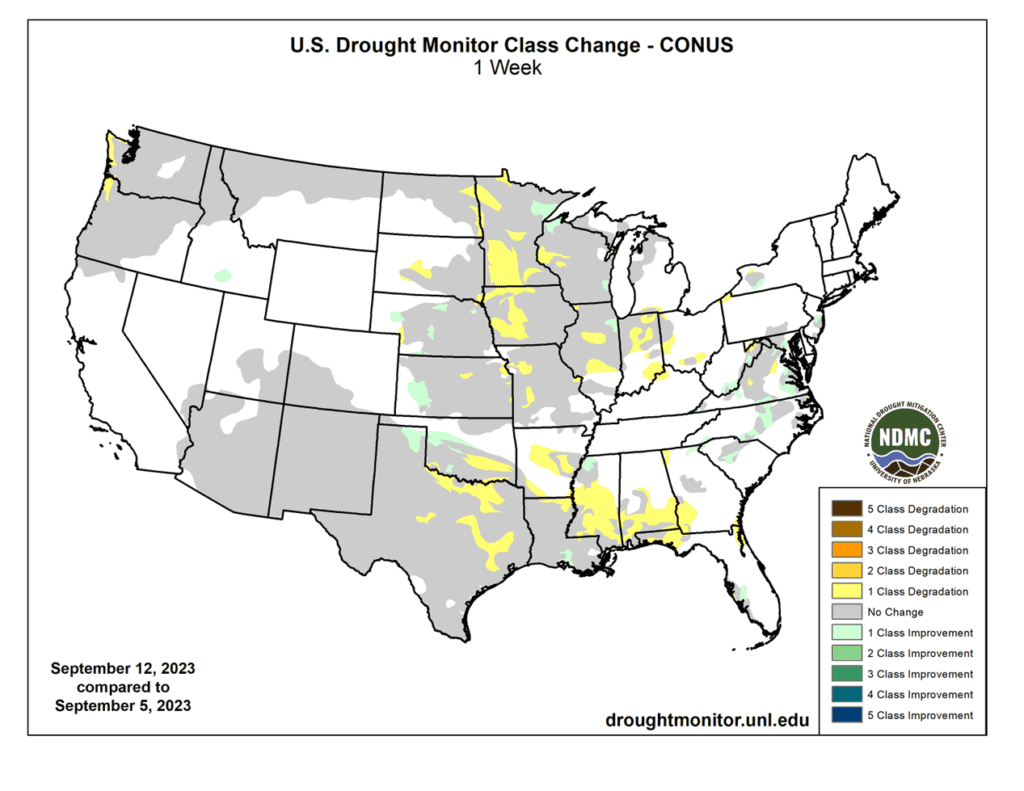

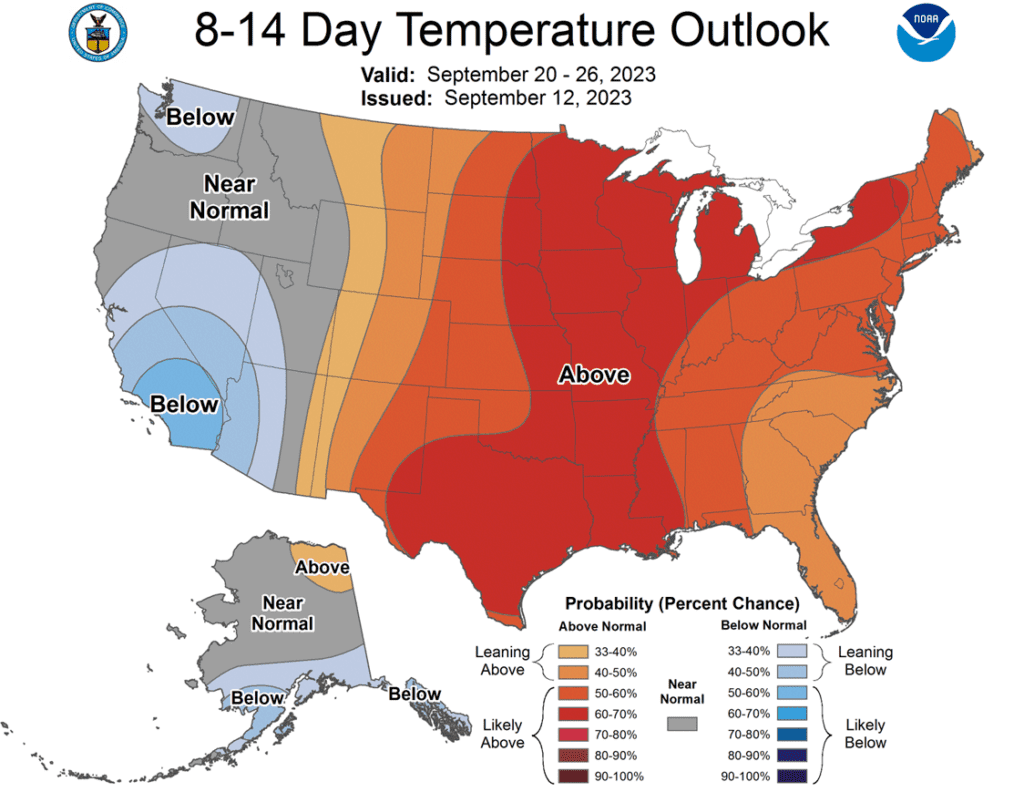

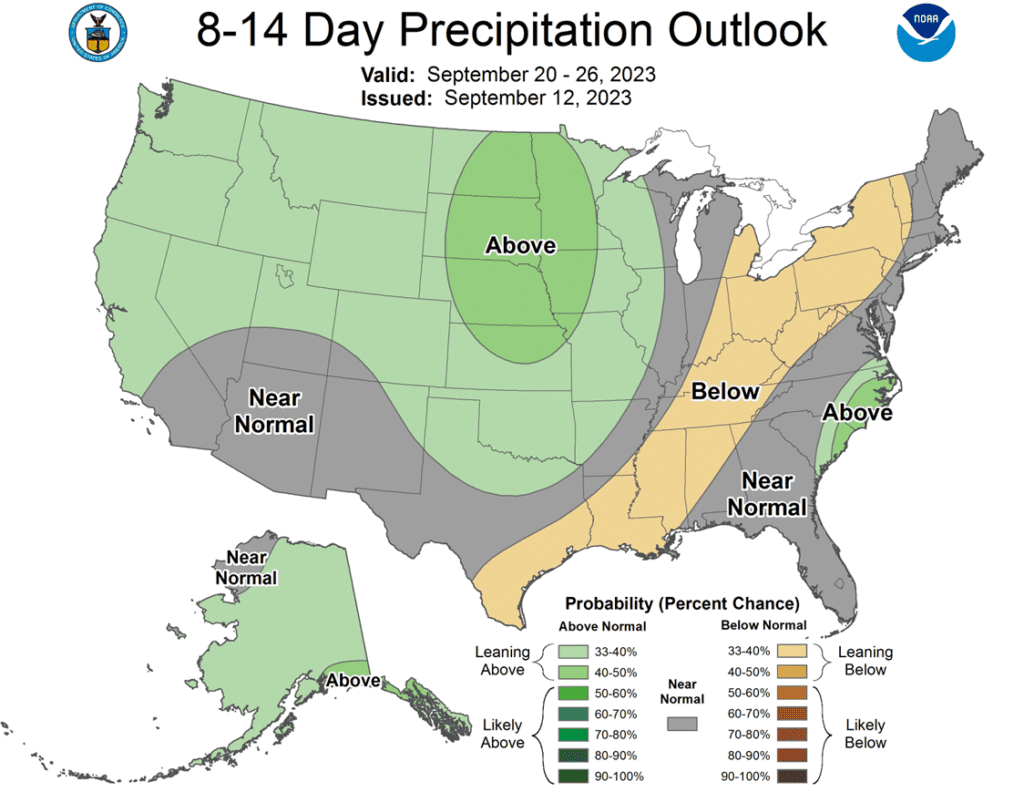

- Crop progress will be released this afternoon and trade is expecting another 1-2 point drop in good to excellent ratings due to the hot and dry conditions.

- The USDA has pegged this year’s corn crop at a near record 15.134 billion bushels based on a yield of 173.8 bpa, but that may end up being too high.

- Friday’s CFTC data showed funds increasing their net short position by 40,996 contracts leaving them net short 134,909 contracts.

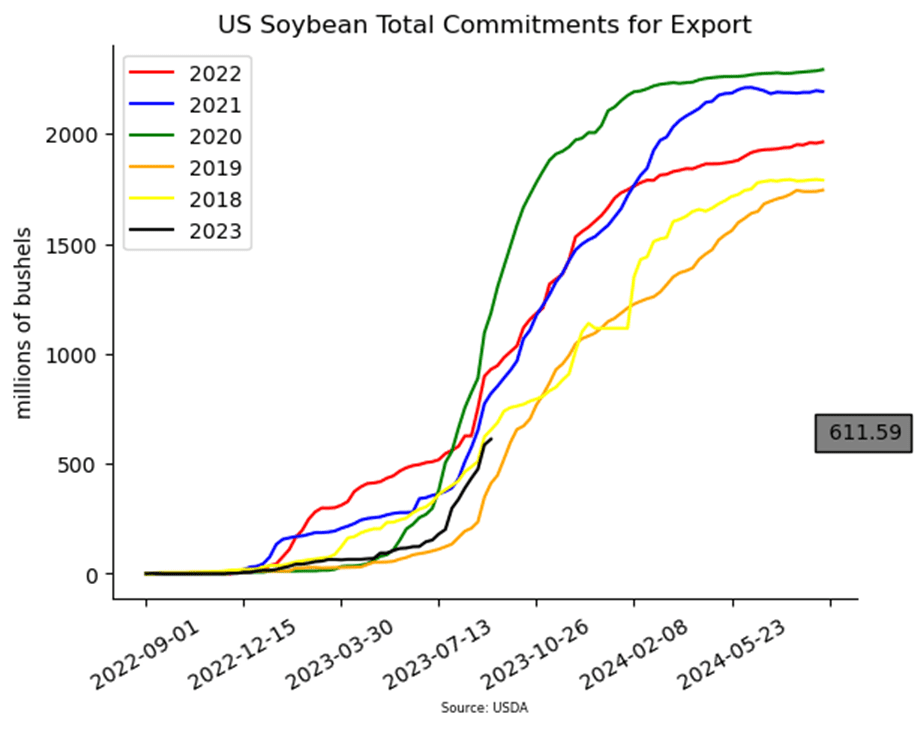

- Soybeans are trading lower this morning along with soybean oil while soybean meal trades higher. Soybeans are beginning to feel some harvest pressure.

- Good to excellent ratings for the soybean crop are also expected to decline later today and could make the already small projected crop of 4.146 bb smaller.

- The NOPA crush report for August showed a smaller crush than was anticipated and pressured prices but crush margins are still profitable right now.

- Friday’s CFTC data showed funds selling 8,995 contracts of soybean which reduced their net long position to 73,815 contracts.

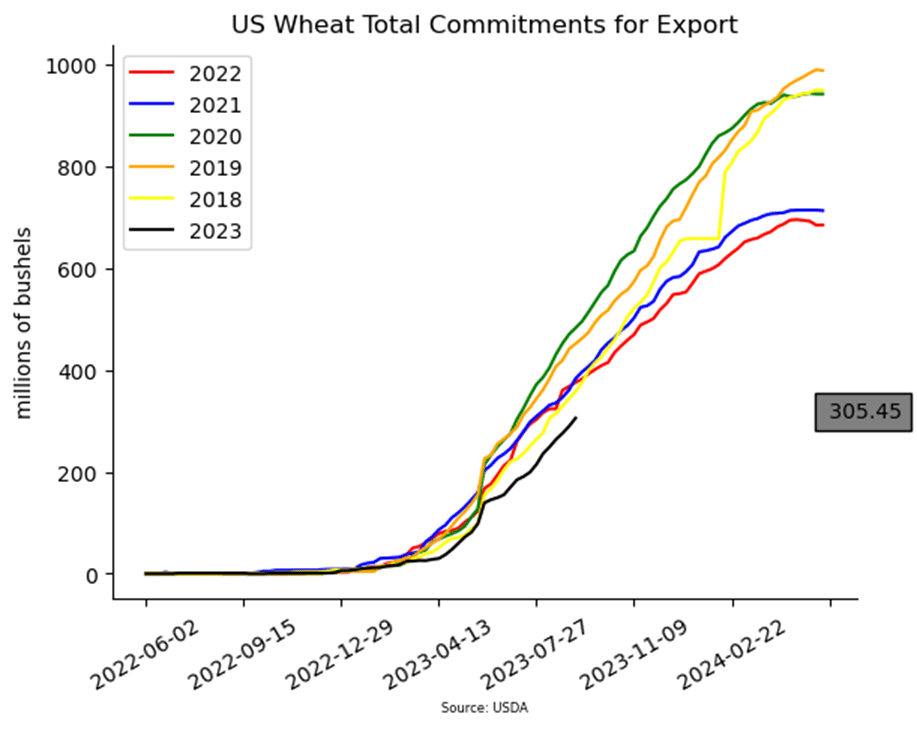

- All three wheat products are trading lower this morning with the most losses in KC wheat. French milling wheat fell by 1.6% overnight which pressured US wheat.

- Two cargo ships arrived in Ukraine over the weekend with the intent to export wheat along the western coast of the Black Sea despite the end of the grain deal.

- The southwestern Plains received needed rains over the weekend, but more will be needed as planting starts to pick up for the winter wheat crop.

- Friday’s CFTC data showed funds increasing their net short position by 5,458 contracts leaving them short 84,139 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.