7-2 End of Day: Grains Surge on Trade Optimism Ahead of Holiday

The CME and Total Farm Marketing Offices will be closed Friday, July 4, in Observance of Independence Day

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- 🌽 Corn: Corn futures posted strong gains Wednesday, supported by short covering and technical buying as traders squared positions ahead of the long weekend.

- 🌱 Soybeans: Soybean futures closed sharply higher Wednesday, lifted by strong crush data, short covering ahead of the holiday weekend, and trade optimism following President Trump’s announcement of a U.S.-Vietnam deal.

- 🌾 Wheat: Wheat futures posted double-digit gains across all classes Wednesday, buoyed by short covering and spillover strength from soybeans amid rumors of renewed Chinese buying interest.

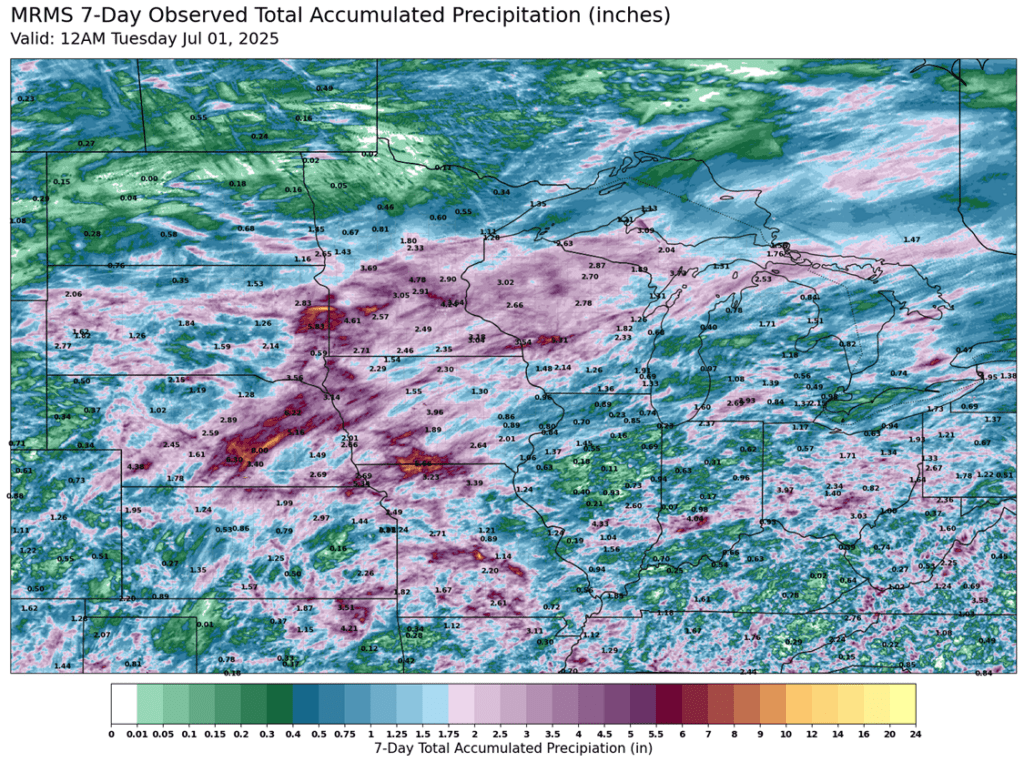

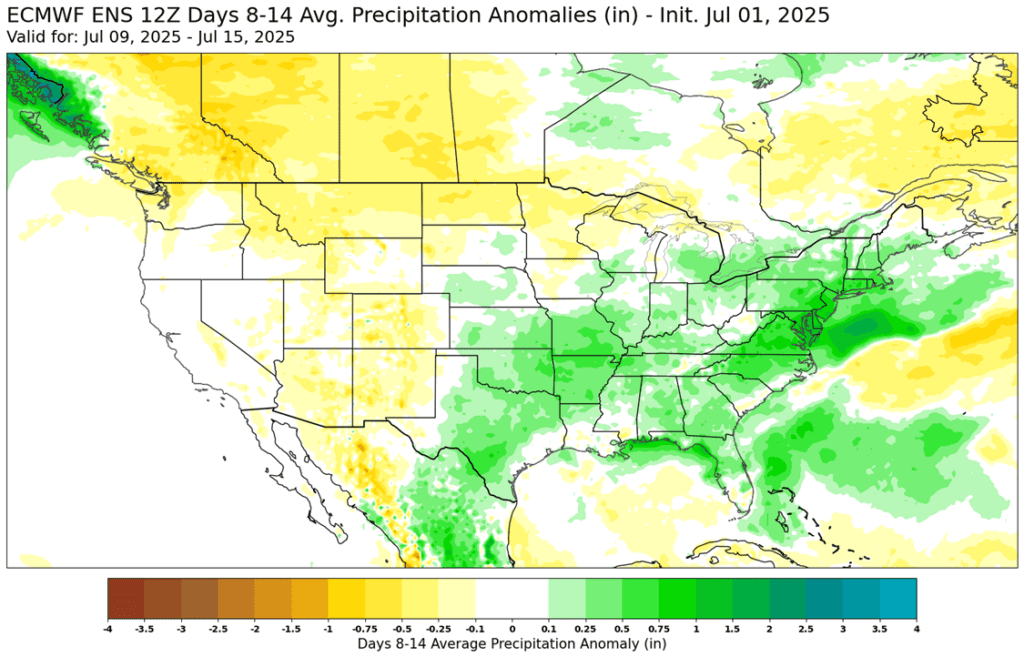

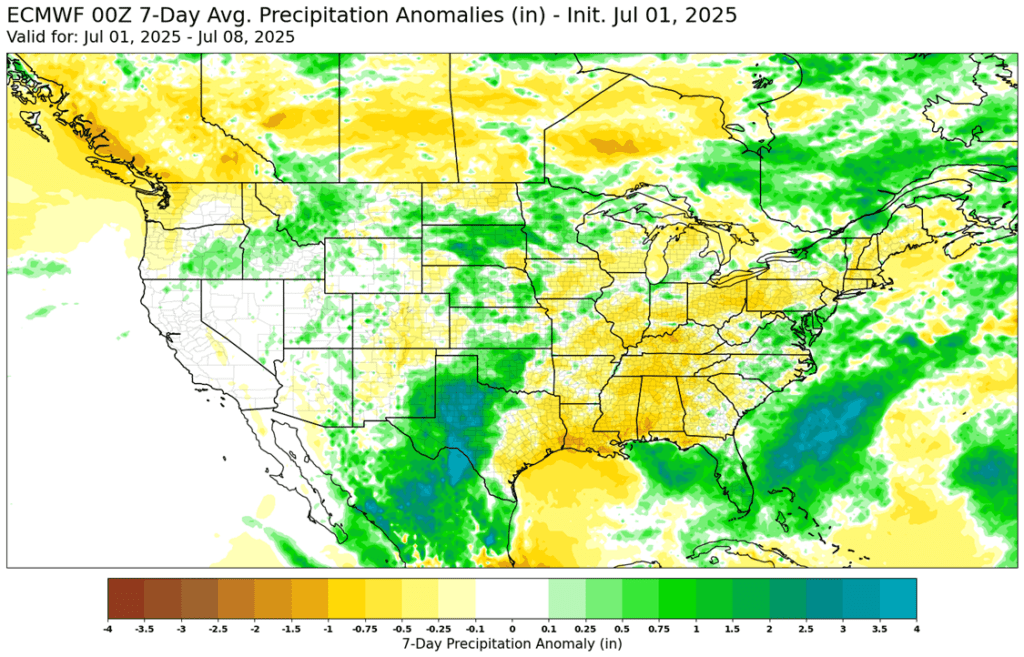

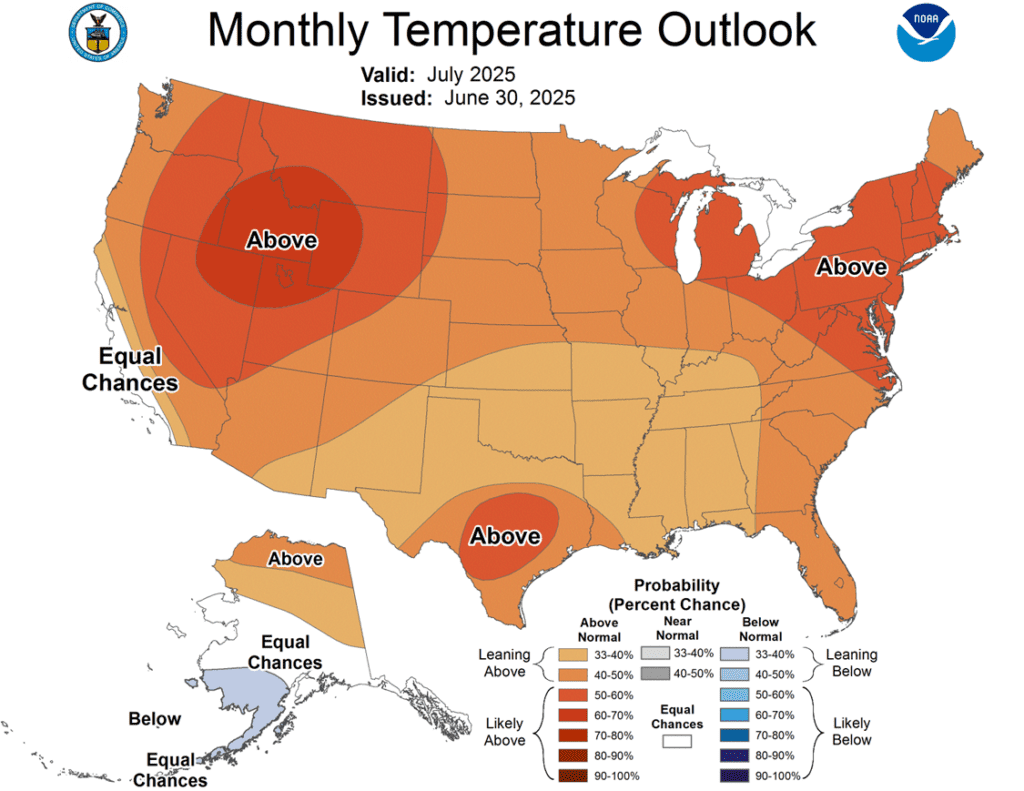

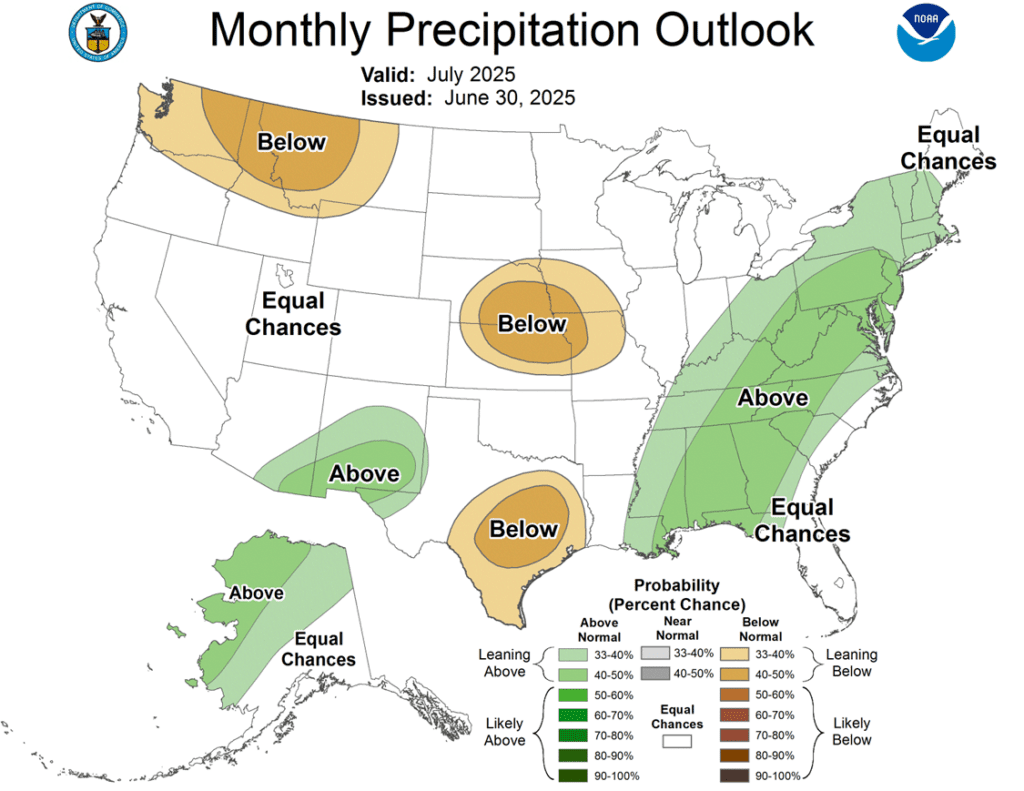

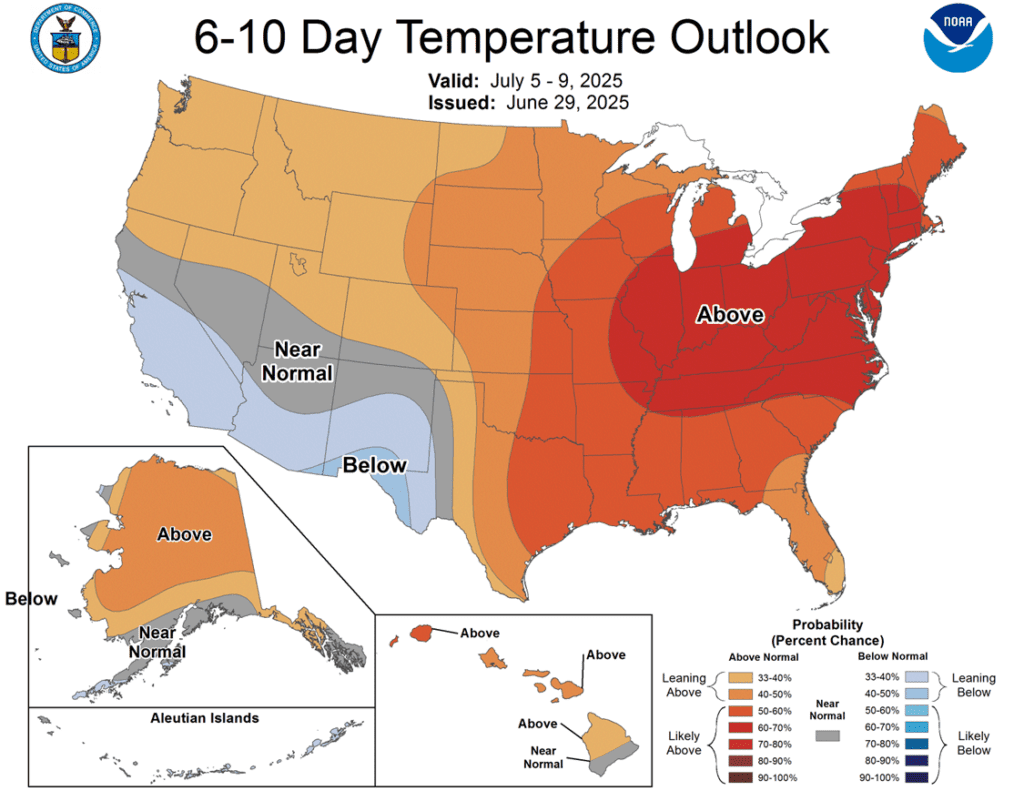

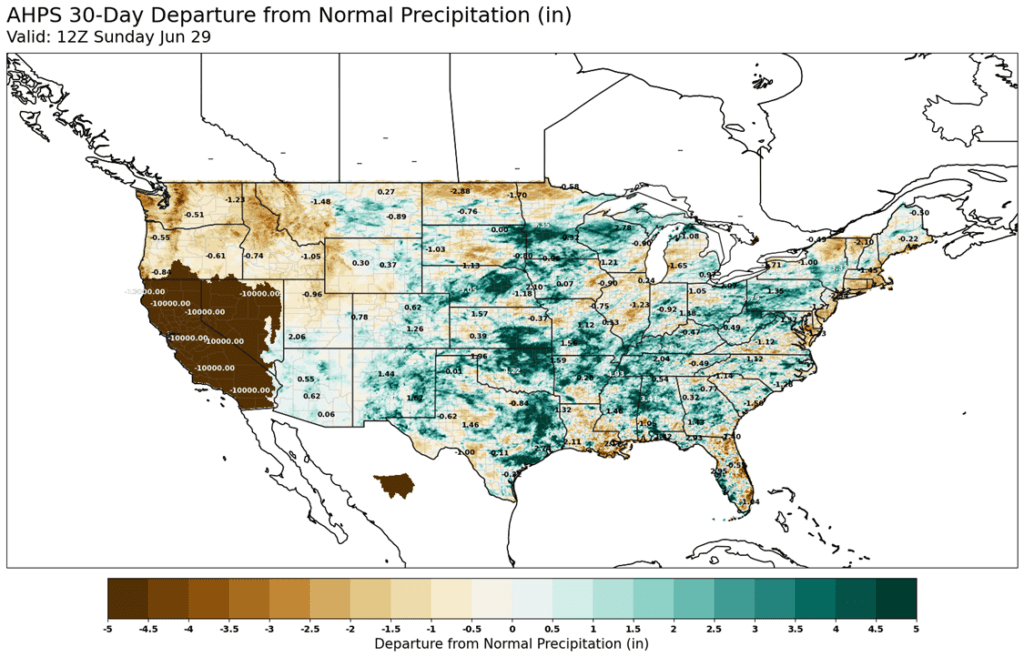

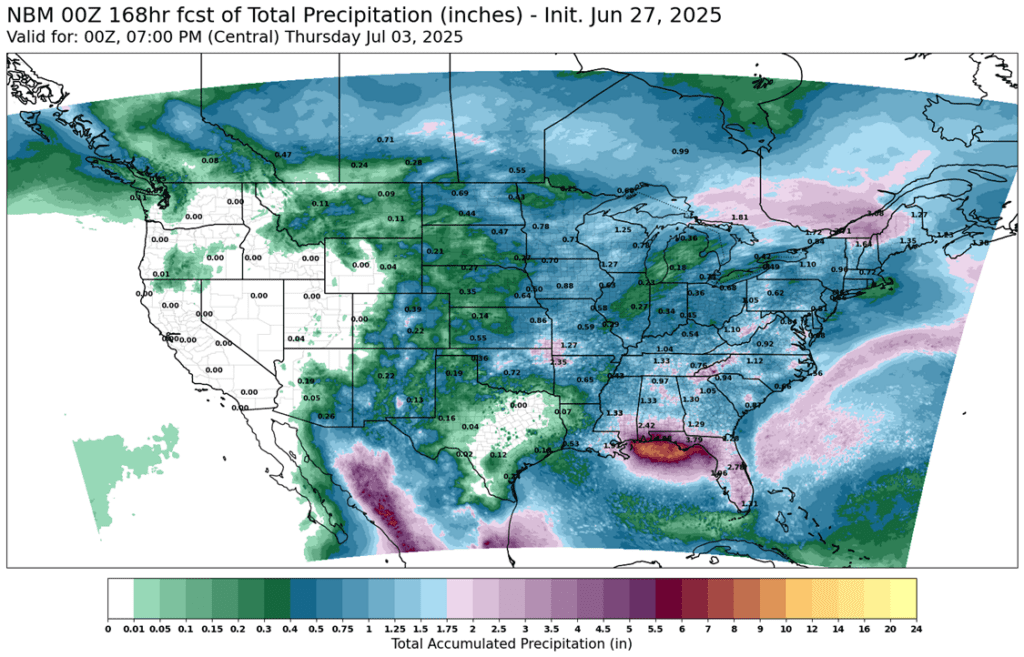

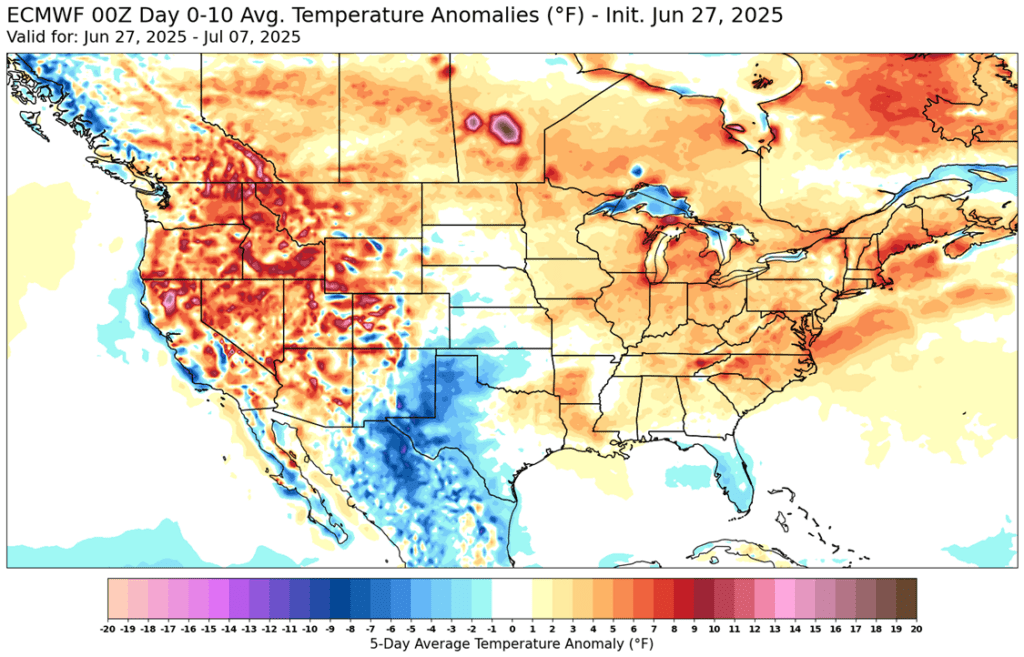

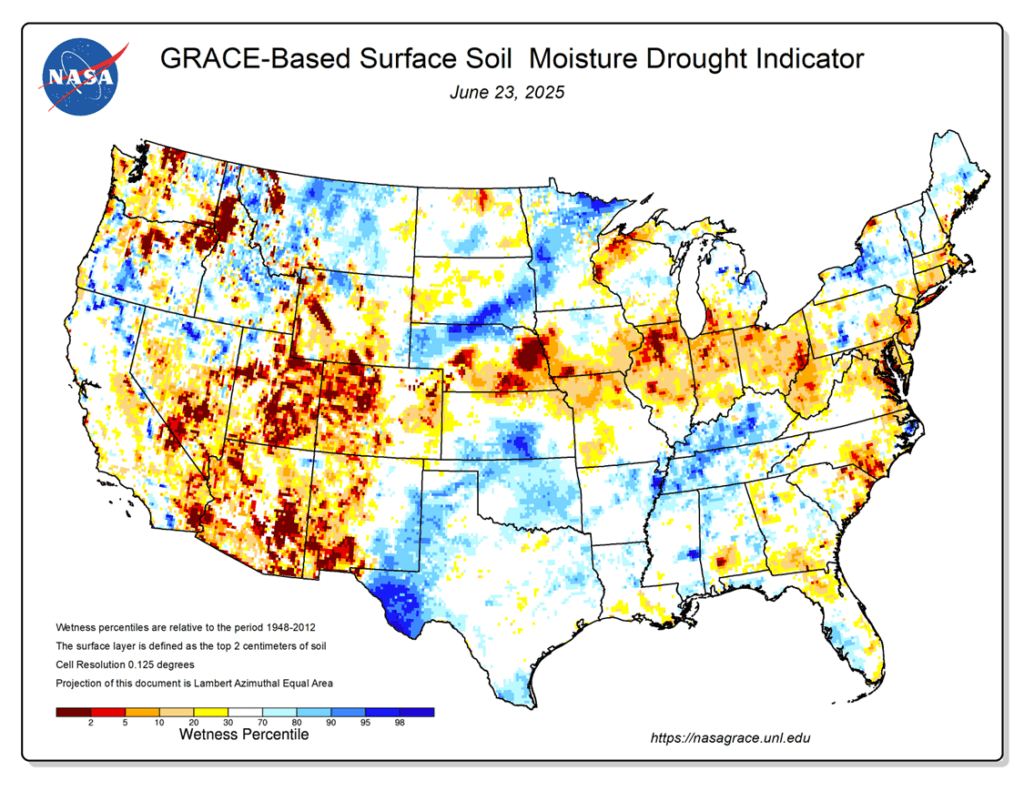

- To see updated U.S. weather forecasts scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

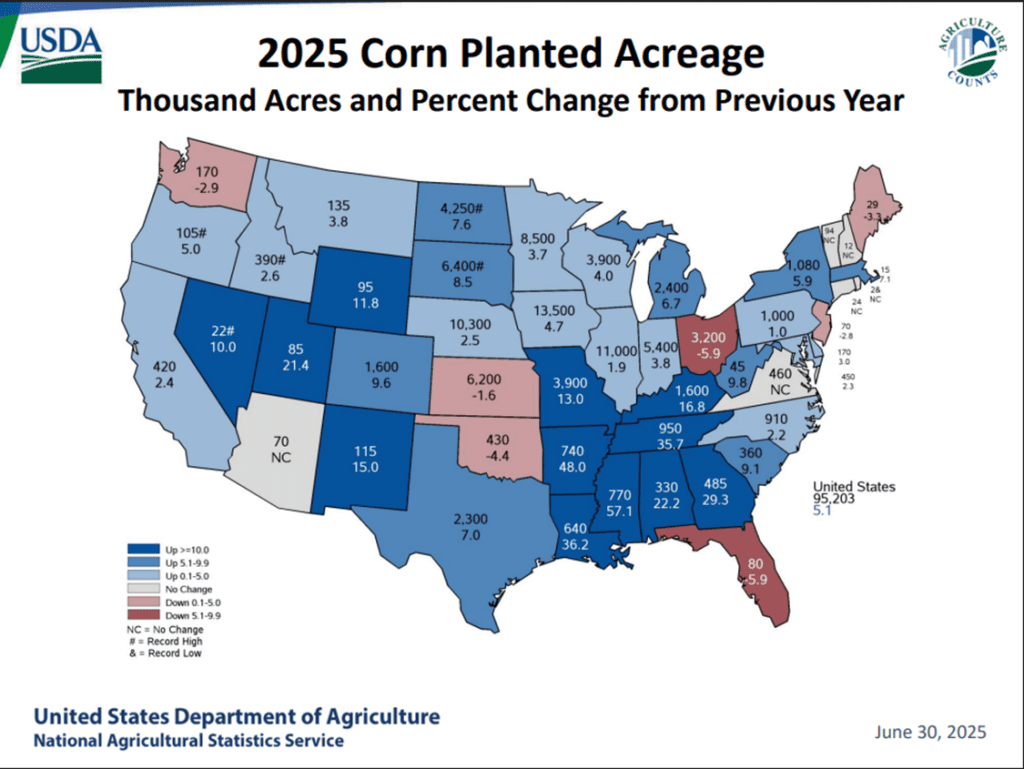

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

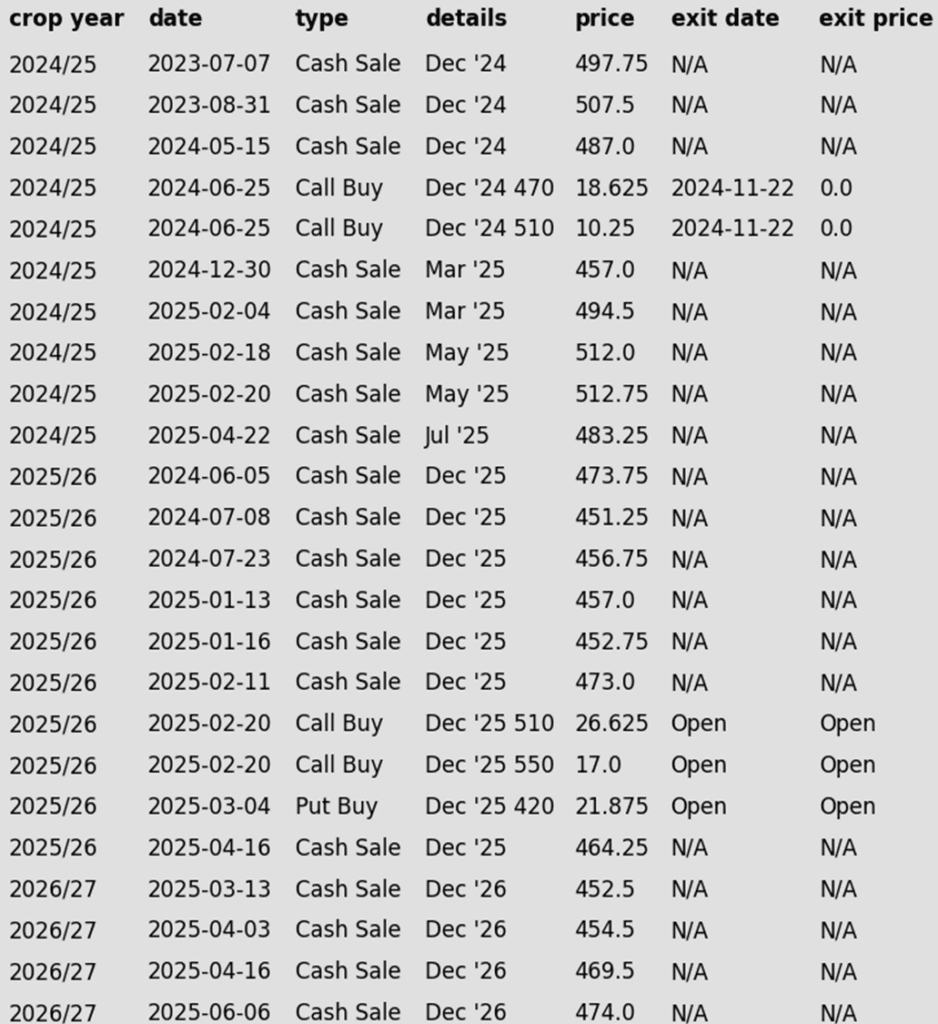

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

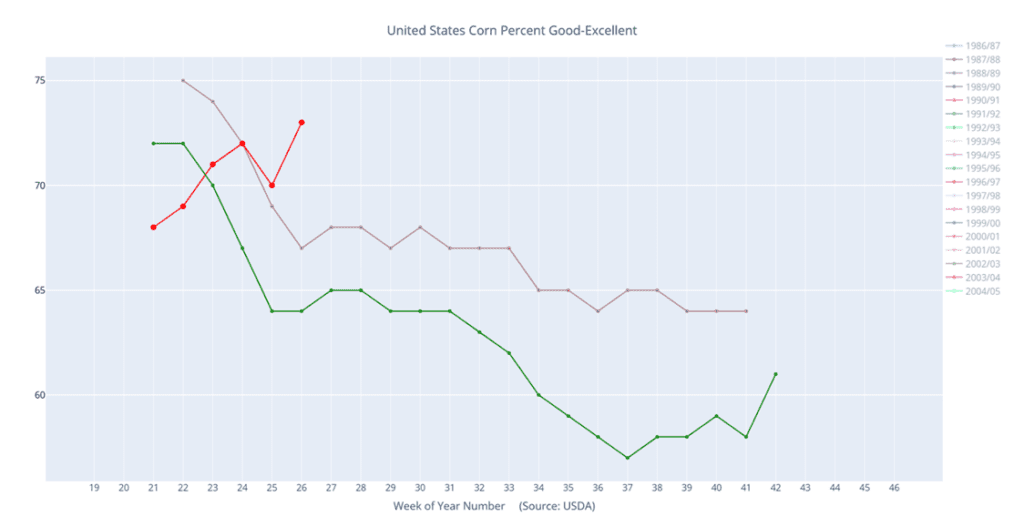

- None. Still no active targets to report. So far, typical growing season volatility has yet to materialize and generate additional selling opportunities. The next 2–3 weeks will be critical, as the likelihood of weather-driven price spikes tends to drop off significantly after that window.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None. The strategy remains ready for weather-related volatility, but so far the markets have yet to experience anything significant enough to trigger action.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

- Corn futures posted strong gains Wednesday, supported by short covering and technical buying as traders squared positions ahead of the long weekend.

- Weekly ethanol production dipped to 1.076 million barrels per day, down slightly from the prior week, but still enough to keep corn usage on pace to meet USDA’s annual target.

- U.S. corn is regaining competitiveness on the global market as a weaker dollar and lower prices improve its value relative to South American offers. Brazil’s slower-than-usual harvest is also offering modest support.

- StoneX raised their production forecast for the Brazil corn crop to 136.1 MMT, up 2.1 MMT from their last forecast. USDA is still holding a 130 MMT projection.

- Thursday’s USDA weekly export sales report is expected to show corn sales ranging from 400,000–1.0 MMT (old crop) and 500,000–900,000 MT (new crop), following 1.46 MMT in total sales last week.

Corn Futures Break Lower end of Recent Range

Front-month corn futures struggled throughout June, breaking key support and leaving an unfilled chart gap following the roll to September. That gap near 430 now stands as the first upside target. On the downside, last week’s low of 404 offers initial support, with stronger support seen at 394.

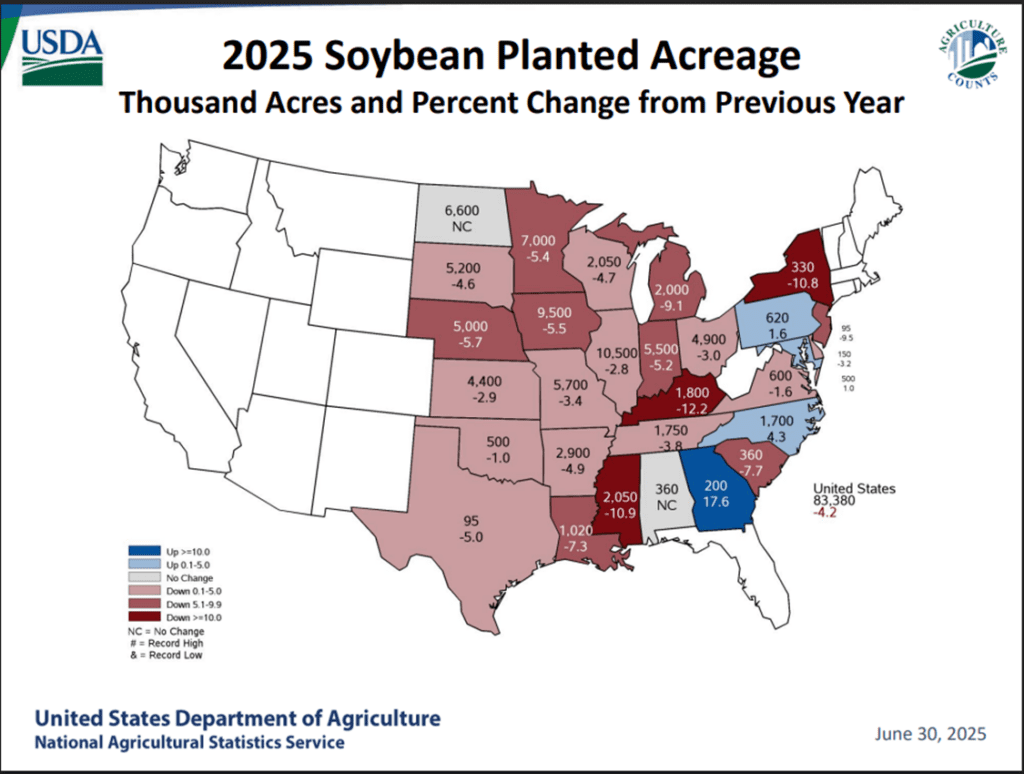

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

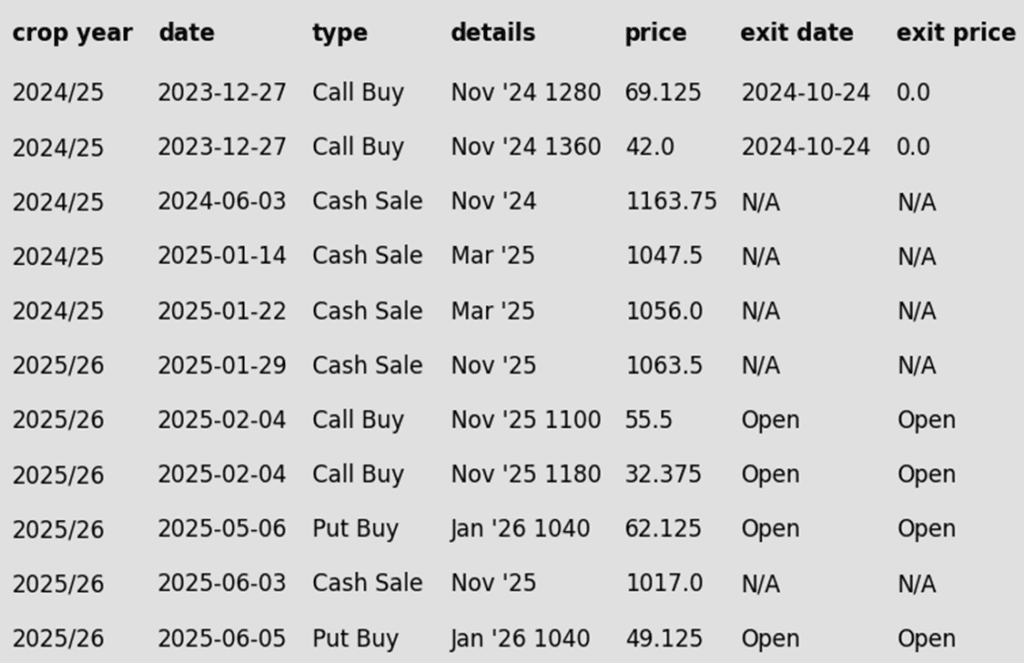

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None. No adjustment to the 1107 target, as it remains a feasible objective for this time of year based on historical weather-driven rally patterns.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

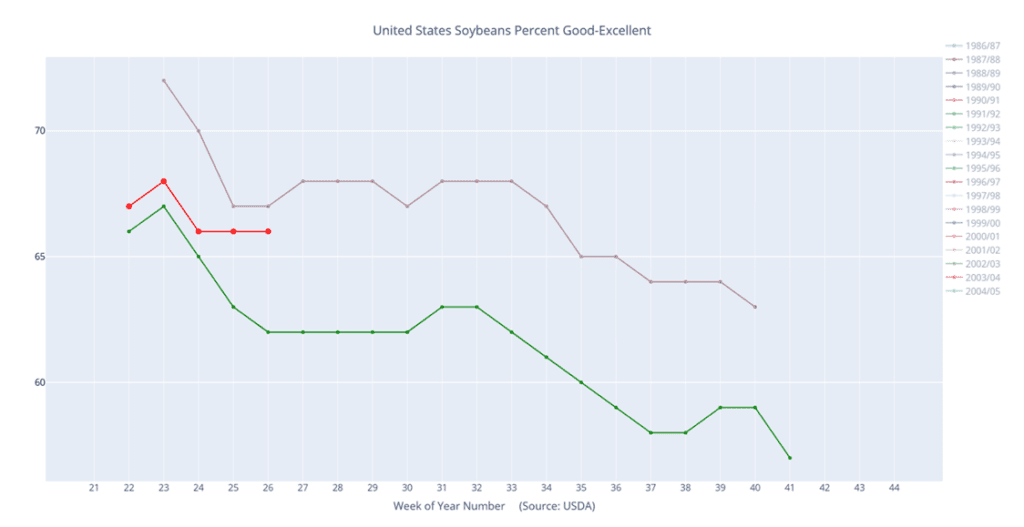

- Changes:

- None. Same approach as with 2025 corn and 2024 soybeans — the strategy remains positioned for significant volatility, though nothing substantial has developed yet. The 1114 upside target also remains unchanged, as it continues to be a realistic objective based on historical rally patterns for this time of year.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still no posted targets yet.

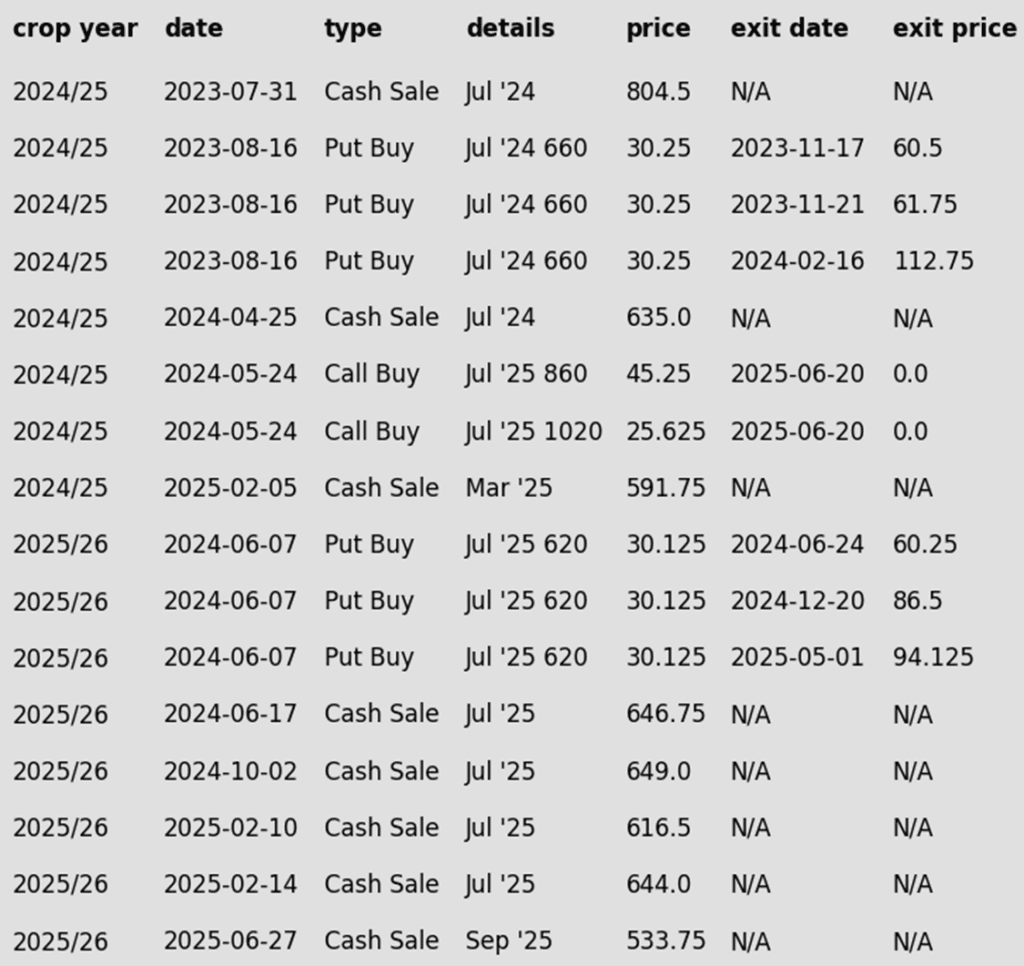

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybean futures closed sharply higher Wednesday, lifted by strong crush data, short covering ahead of the holiday weekend, and trade optimism following President Trump’s announcement of a U.S.-Vietnam deal. Soybean meal and oil also posted solid gains.

- The USDA released its monthly oilseed report which showed soybean crushings for May at 203.7 million bushels. This was up 6.3% from the same period last year and up from the previous month. Crude oil production was 6.5% higher.

- The new U.S.-Vietnam trade agreement allows U.S. goods to enter Vietnam tariff-free, while Vietnamese goods face a 20% tariff into the U.S. — a potential boost for U.S. ag exports.

- In India, palm oil imports shot higher by 61% to hit an 11-month high for the month of June because of lower domestic inventories. This is bullish for all veg oils.

Soybeans Retreat from Recent Highs

Soybeans failed to close above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A breakout above 1082 would open the door toward filling the June 2023 gap between 1161 and 1177. Soybean futures found support last week at the 200-day moving average and the bottom end of the recent range near 1030. A break below the 200-day would likely open the door to a test of the April lows near 980.

Wheat

Market Notes: Wheat

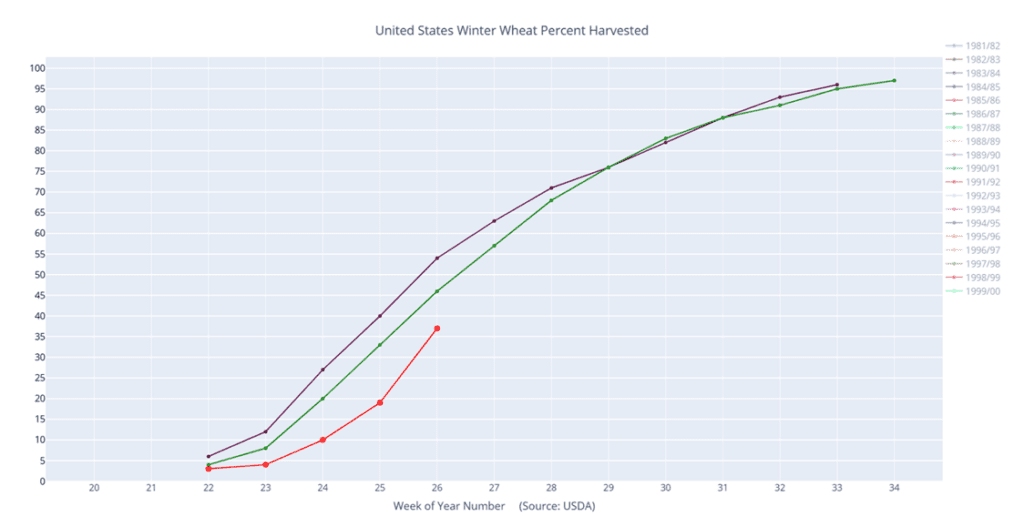

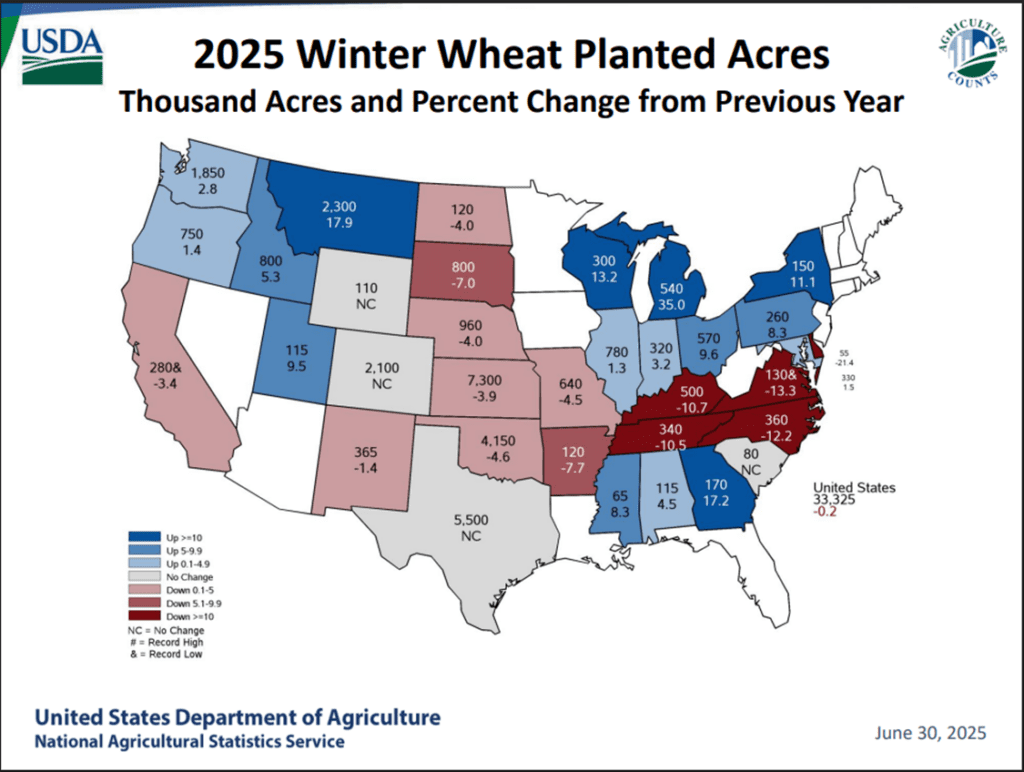

- Wheat posted double digit gains across the board, likely following soybeans higher after rumors that China is looking to buy beans from the U.S. This may have caused some short covering in the grain markets. A weaker U.S. Dollar and earlier USDA cuts to harvested acreage also supported the rally.

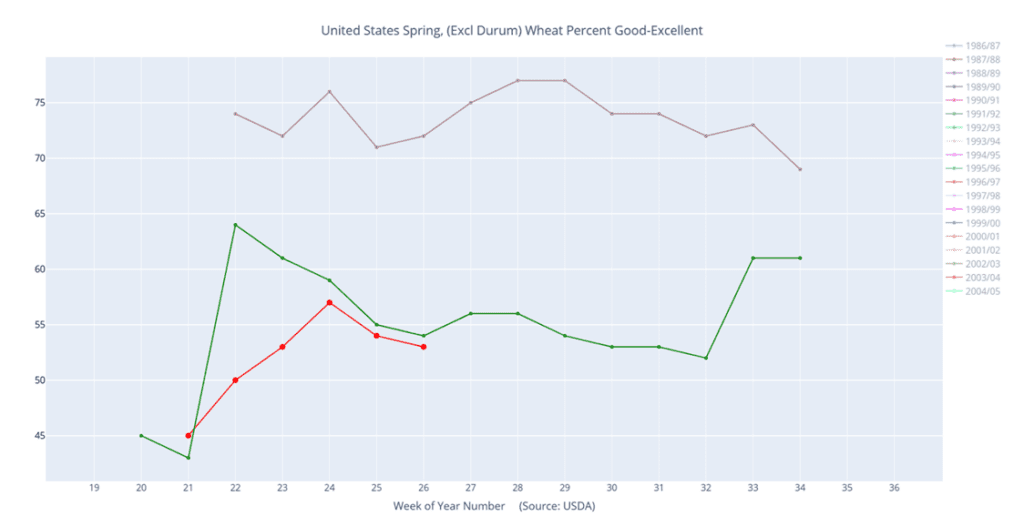

- Forecasts call for a Canadian storm system next week, but rainfall may be patchy, potentially missing key areas in the southern and eastern Prairies. This dryness could lend support to spring wheat prices.

- Argentina exported a record 23.5 MMT of grain in June, rushing to beat a tax hike on corn and soybean exports effective July 1. Wheat exports were not subject to the change, which may pressure prices going forward.

- President Trump announced a trade agreement with Vietnam Wednesday. While details remain limited, broader trade optimism added support to grain markets.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

2027 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

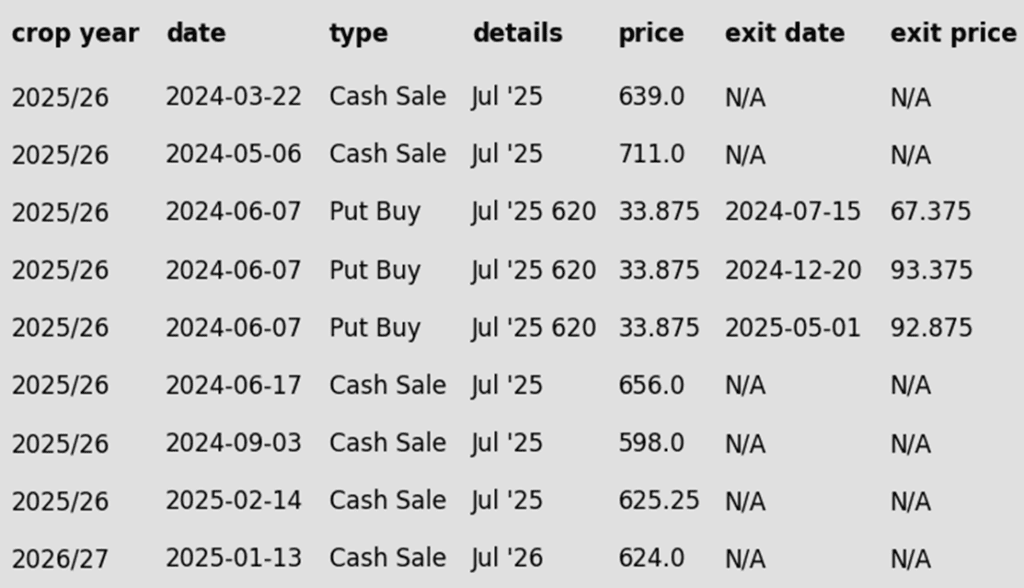

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

A sharp rally in mid-June was short lived for Chicago wheat futures. Prices have now returned back to the upper end of the range that has held prices for much of 2025. Initial support is at the June low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a test of the recent highs near 590.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

2027 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

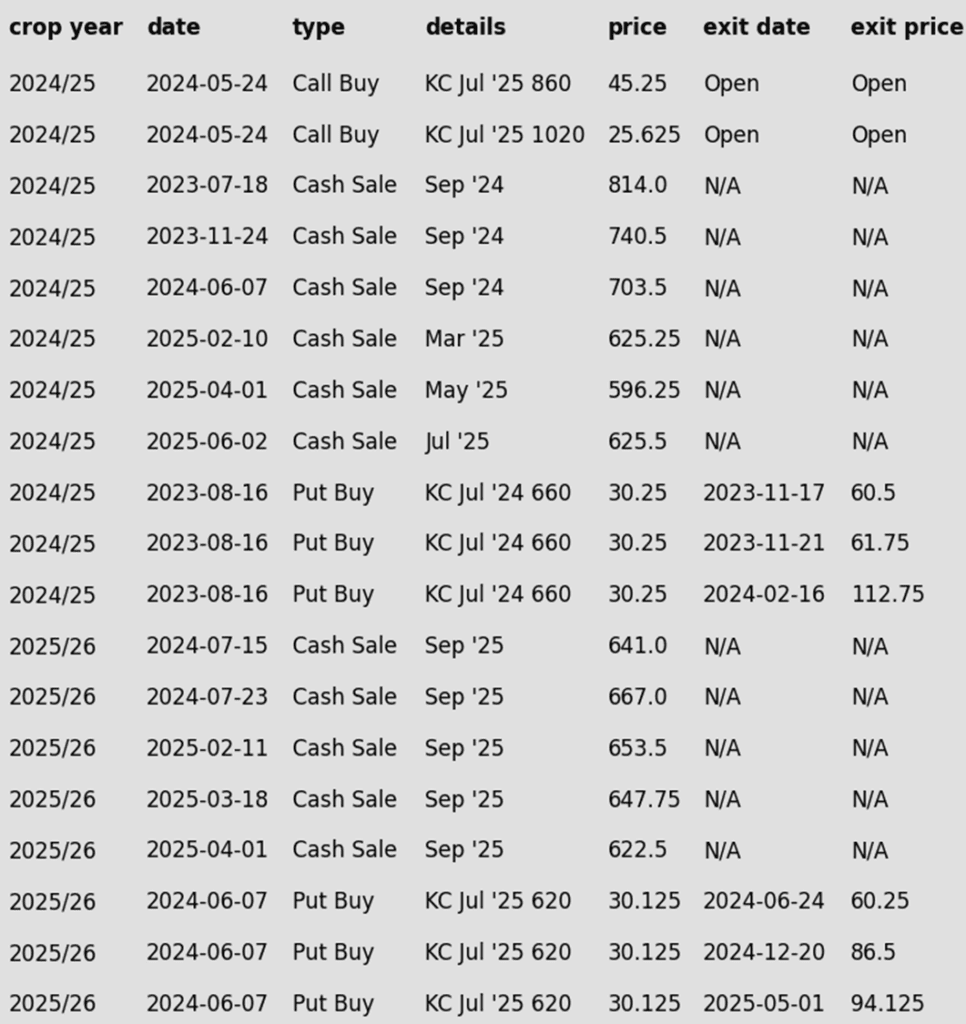

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Struggles Above Major Moving Averages

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat on the Move Higher

Spring wheat futures spent nearly all of June above the upper end of the previous range and above a confluence of major moving averages. The first resistance and upside target would be the June high near 665. Key support now sits at the 200-day moving average near 607. A close below that level — and especially beneath the May low of 572.50 — would open the door to further downside risk.

Other Charts / Weather