Opening Update: October 2nd, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| DEC ’23 | 480.75 | 4 |

| MAR ’24 | 495.75 | 4 |

| DEC ’24 | 509.5 | 2.25 |

|

Soybeans |

||

| NOV ’23 | 1271.25 | -3.75 |

| JAN ’24 | 1290 | -4.5 |

| NOV ’24 | 1255.25 | -4.75 |

|

Chicago Wheat |

||

| DEC ’23 | 549 | 7.5 |

| MAR ’24 | 580.5 | 7 |

| JUL ’24 | 617.25 | 5 |

|

K.C. Wheat |

||

| DEC ’23 | 671.25 | 7.5 |

| MAR ’24 | 679 | 6.75 |

| JUL ’24 | 683.5 | 3 |

|

Mpls Wheat |

||

| DEC ’23 | 719 | 9.75 |

| MAR ’24 | 741.25 | 7.75 |

| SEP ’24 | 775 | -0.5 |

|

S&P 500 |

||

| DEC ’23 | 4327.5 | 2 |

|

Crude Oil |

||

| DEC ’23 | 89.79 | 0.99 |

|

Gold |

||

| DEC ’23 | 1851.3 | -14.8 |

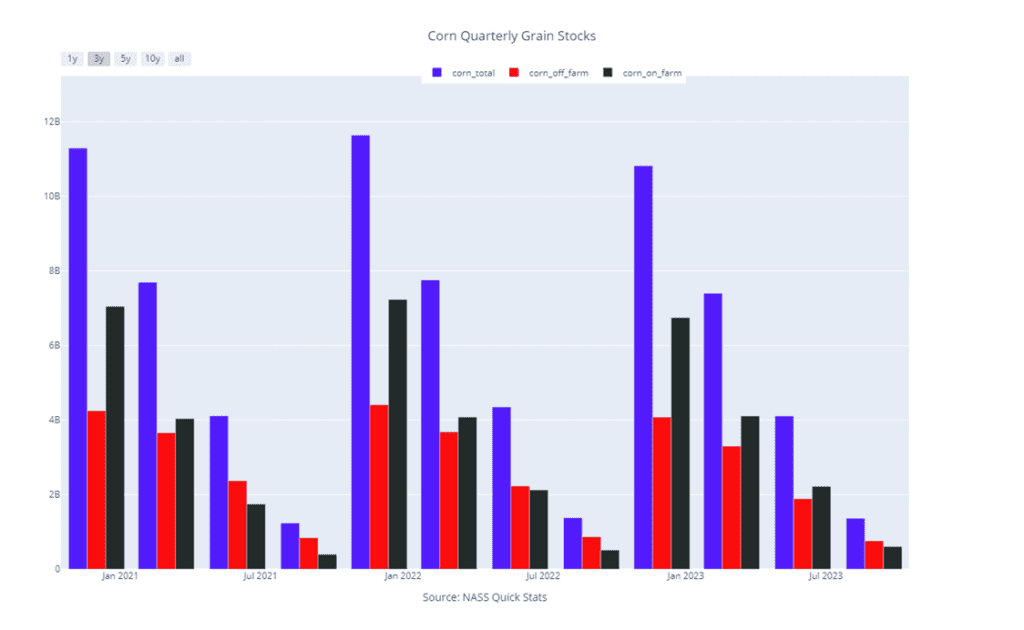

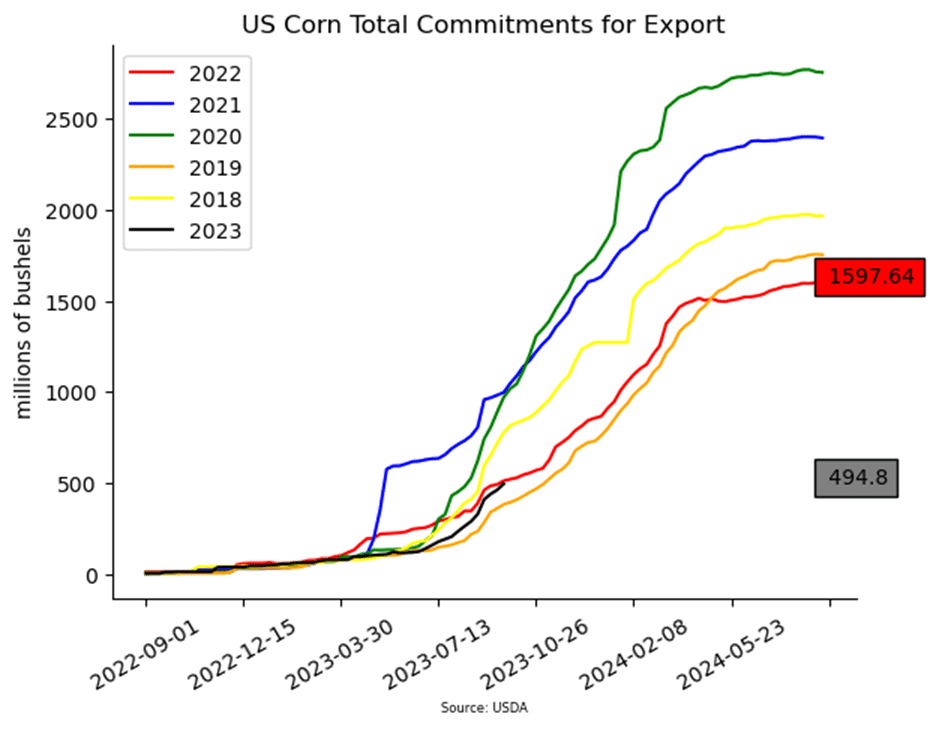

- Corn is trading higher this morning after a large selloff on Friday to end the month and quarter. The quarterly stocks report was not bearish for corn, and prices seem to be coming back.

- Corn stocks came in at 1.361 billion bushels on Friday which was less than expected and 91 mb below the USDA’s ending stocks estimate.

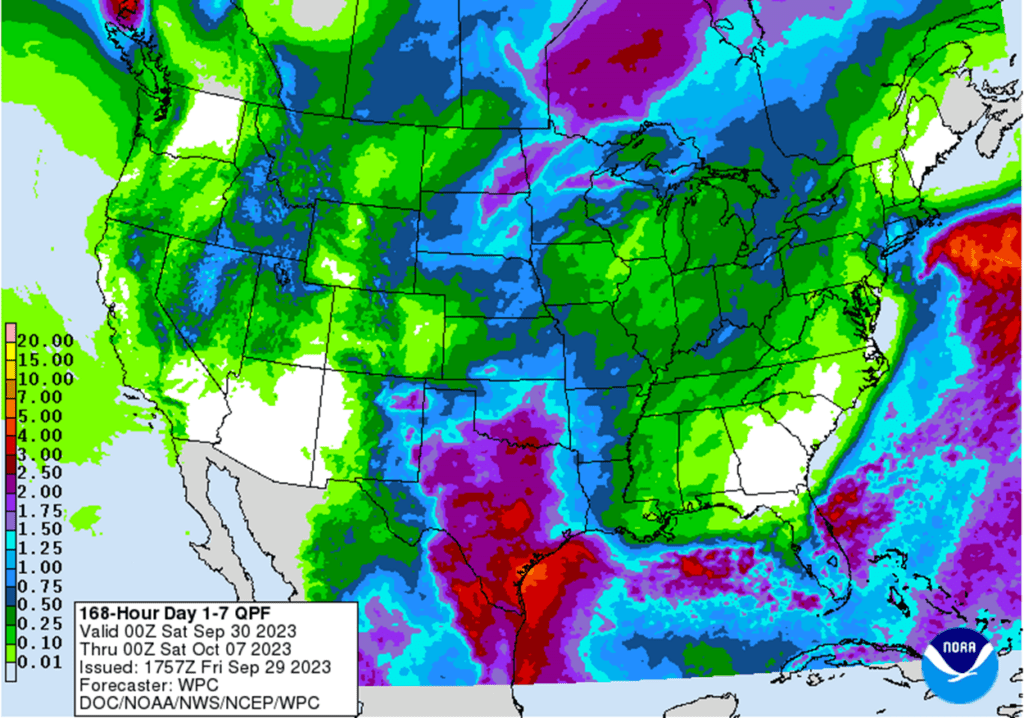

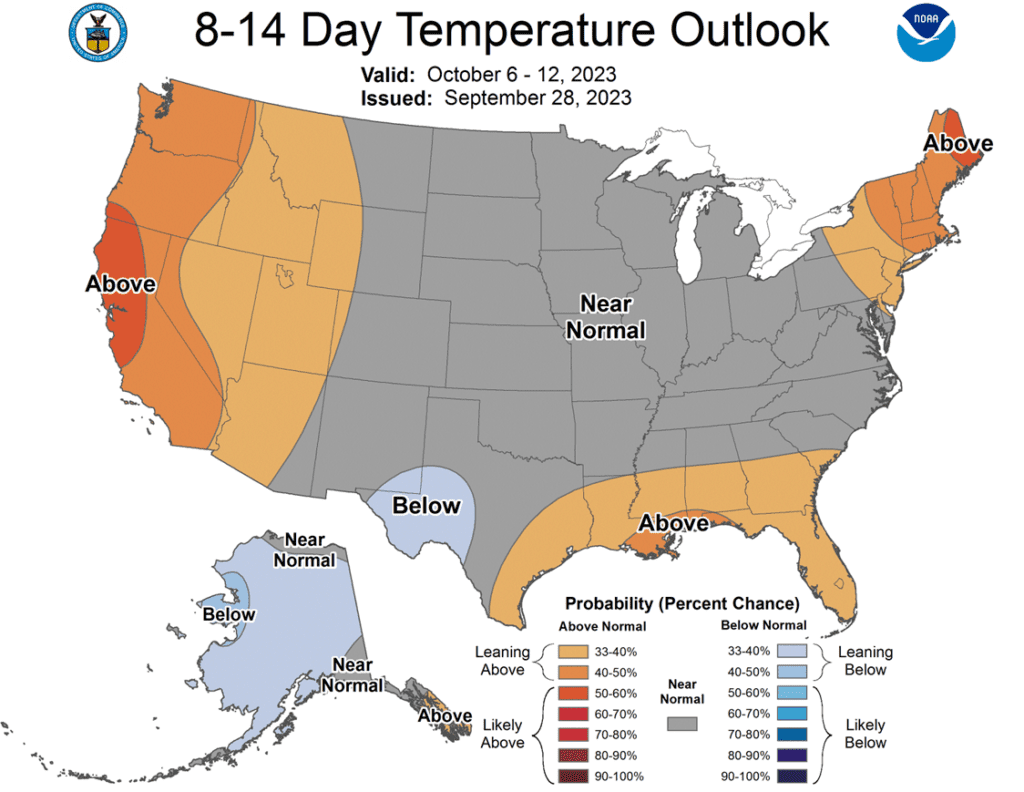

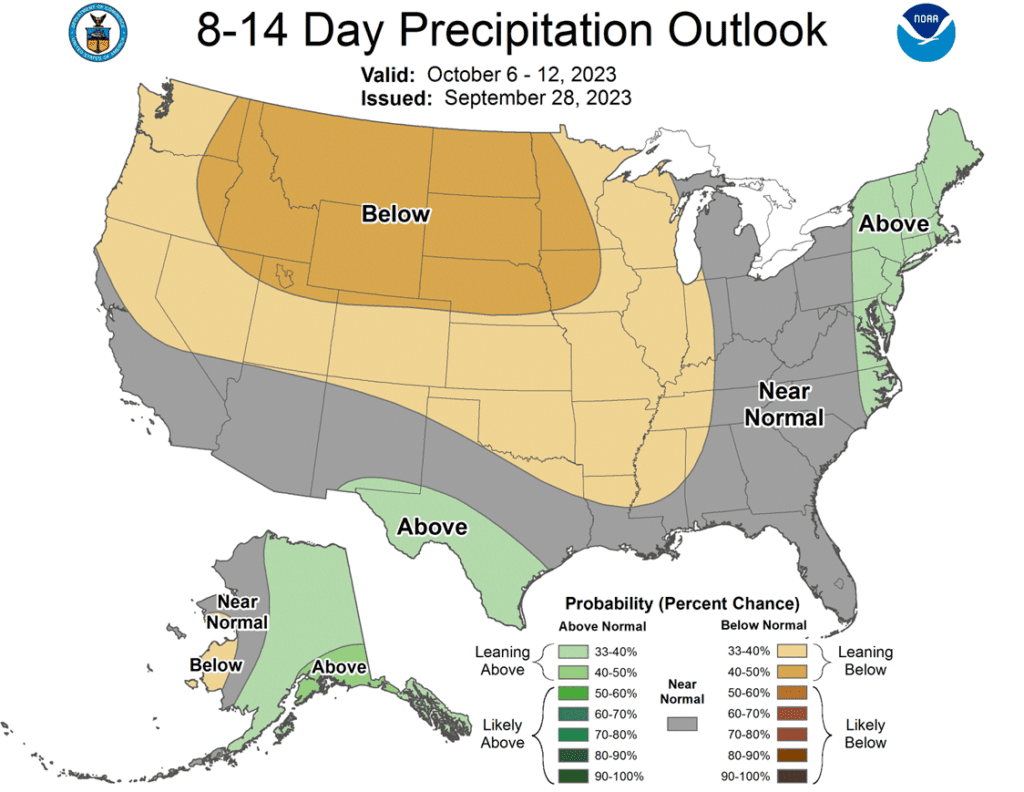

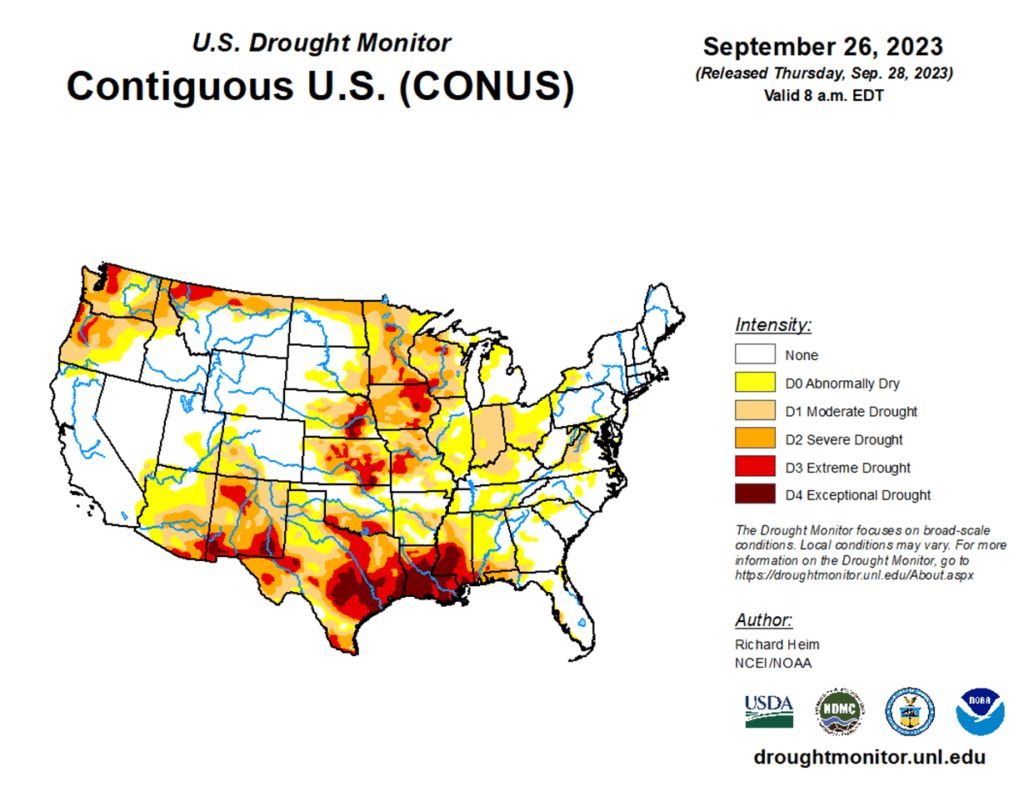

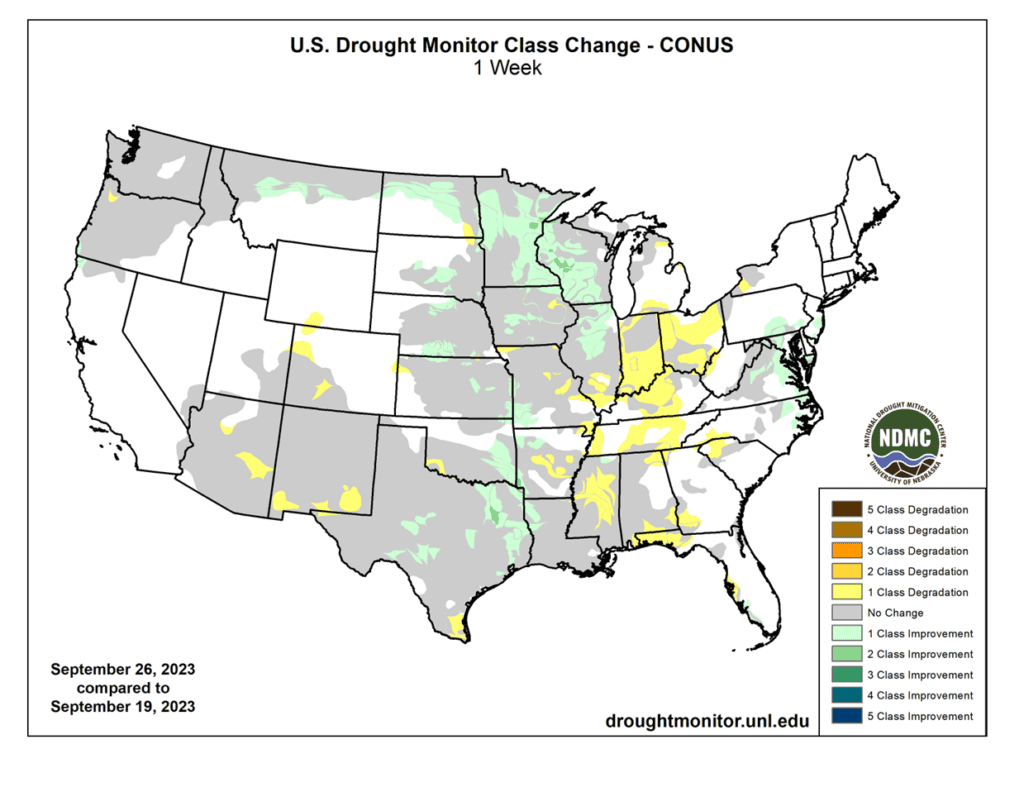

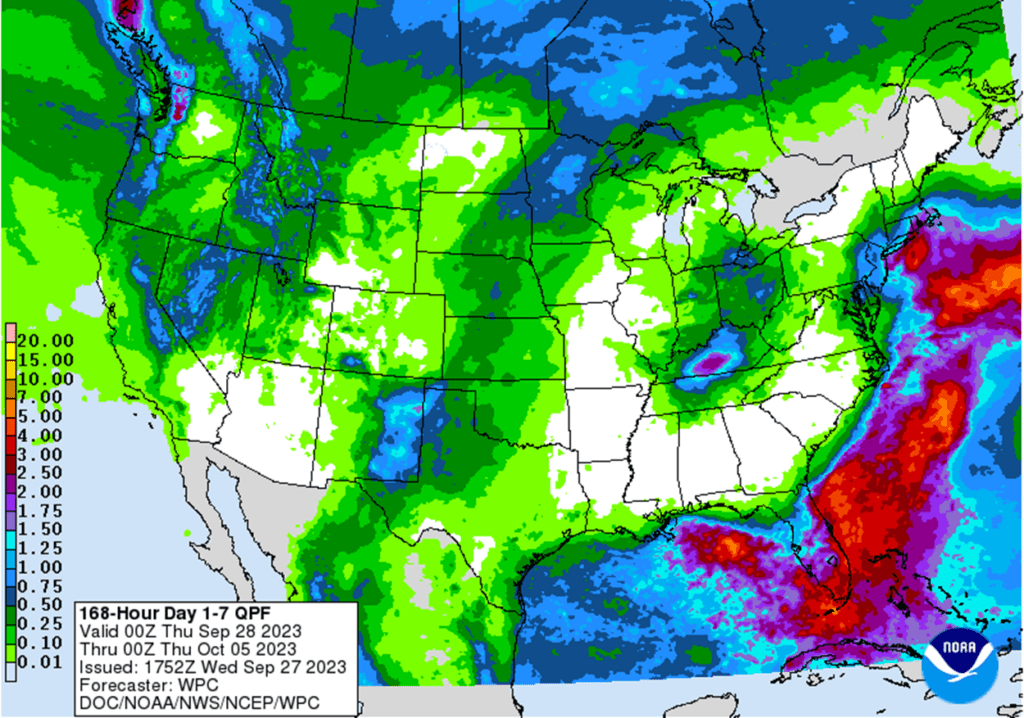

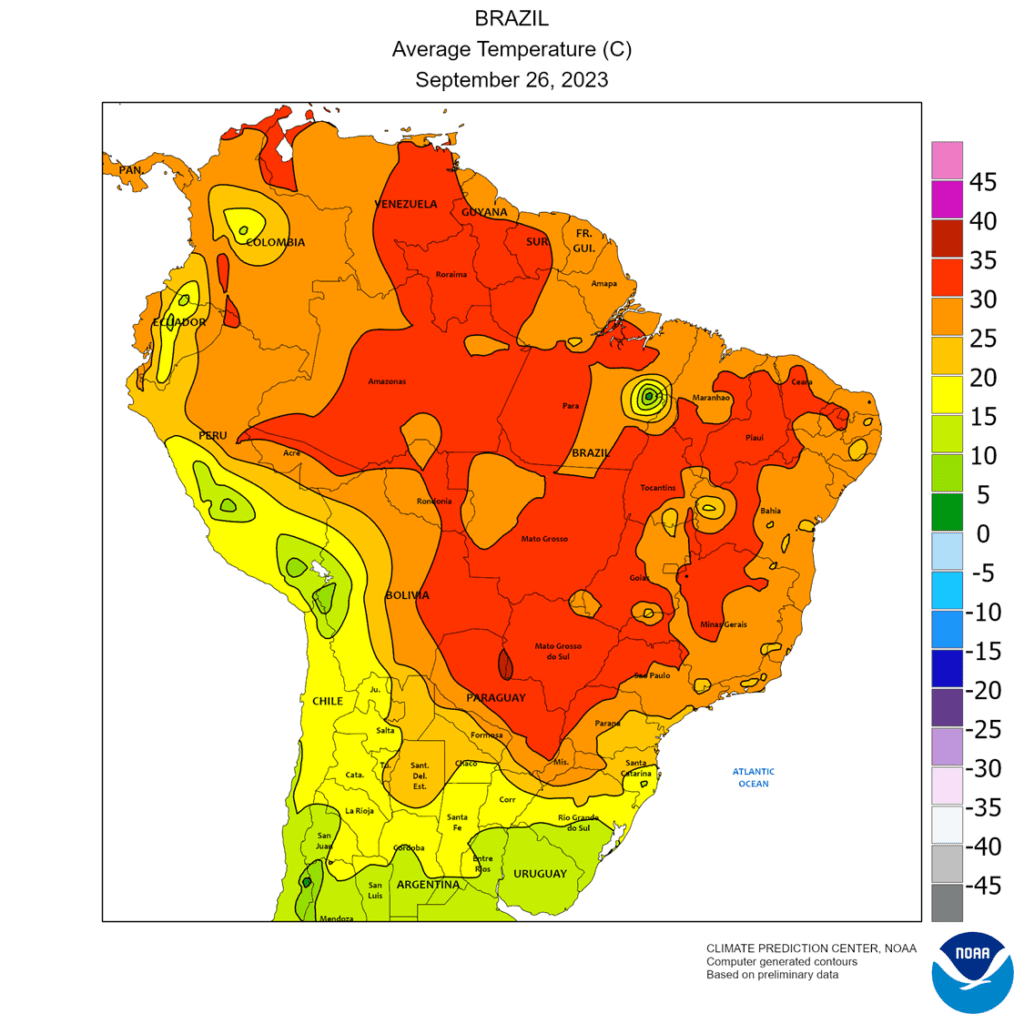

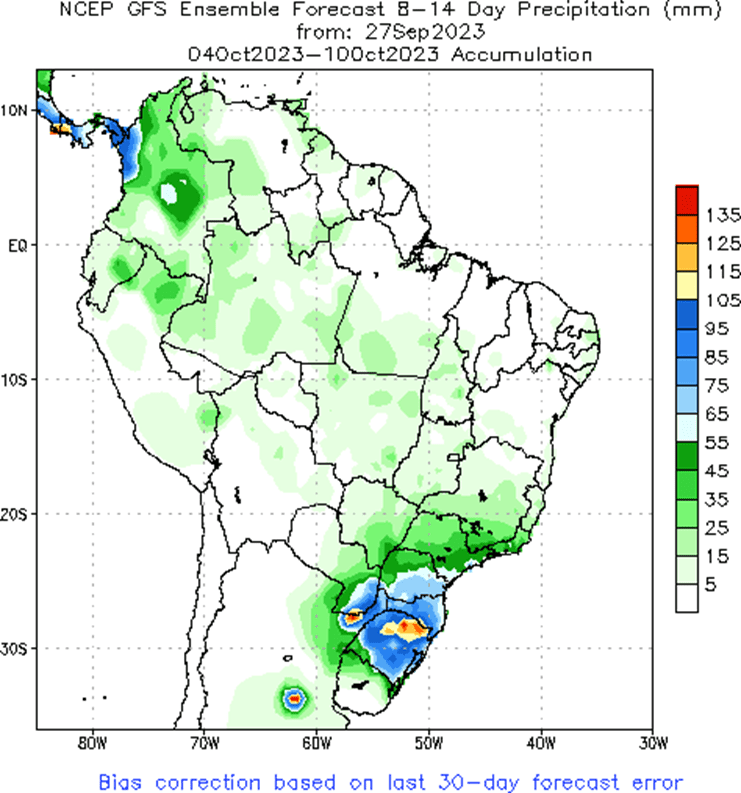

- Harvest made good progress over the weekend as rains were mainly confined to Minnesota and Wisconsin. Temperatures were hot in the western Plains and northern Midwest.

- Friday’s CFTC data showed non-commercials as sellers of corn again by 23,791 contracts which increased their net short position to 168,606 contracts.

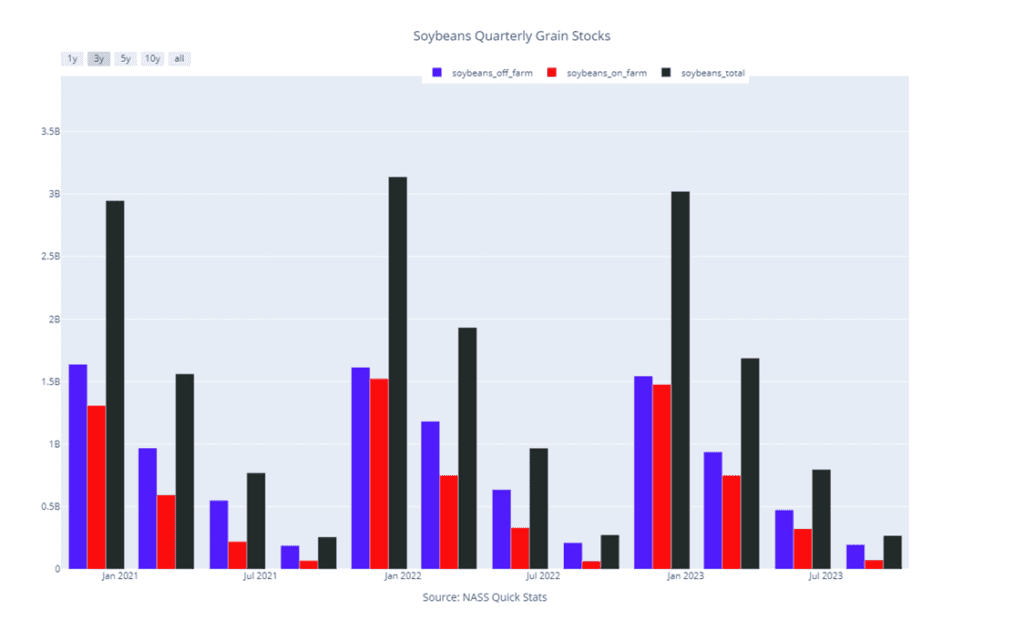

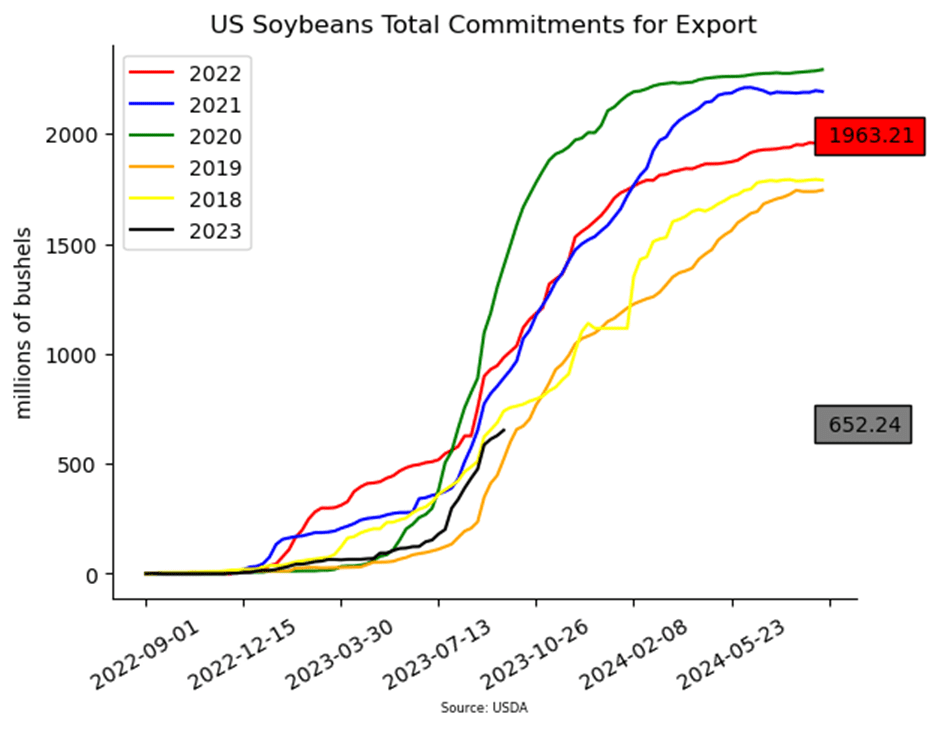

- Soybeans are trading lower this morning after big losses last week despite a grain stocks report that wasn’t particularly bearish. Soybean meal is lower while soybean oil is higher.

- Friday’s soybean stocks saw 268 mb of beans on hand September 1 which was above the trade estimate of 242 mb, but still a very tight number.

- There were 275 deliveries of October soybean meal for Friday and another 59 for Monday which added to bearish pressure.

- Friday’s CFTC report showed funds whittling away their net long position by selling 15,774 contracts. This leaves them net long just 30,058 contracts.

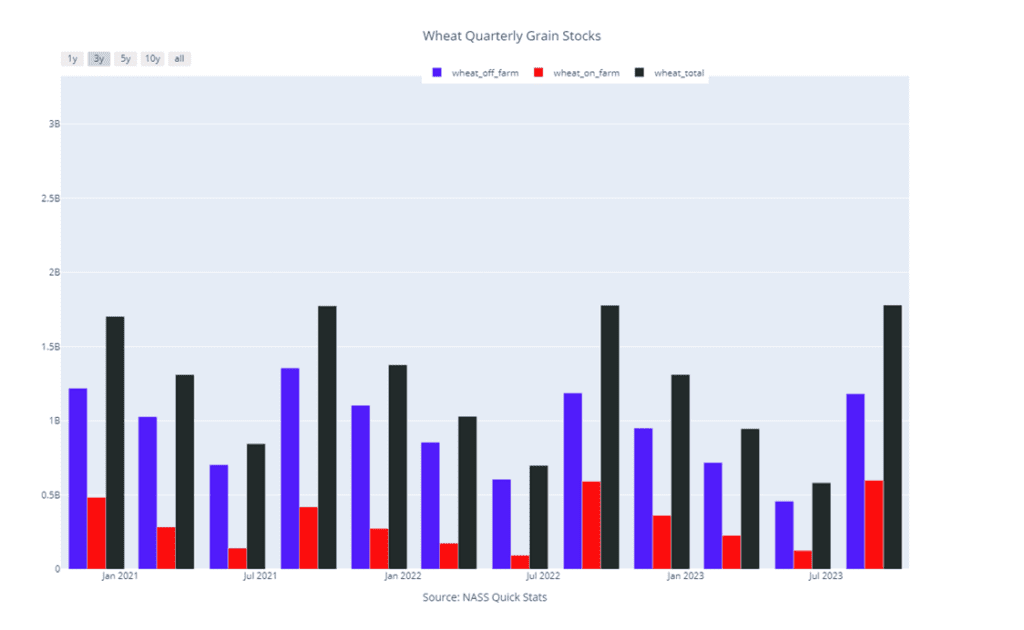

- All three wheat products are trading higher this morning which is likely helping out corn. The government avoided shutdown which is likely supporting the market.

- Friday’s Small Grains Summary was not helpful to wheat with US production being estimated at 1.812 bb for 23/24, the highest in three years.

- Over the weekend, more Russian drones reportedly damaged grain storage facilities in central Ukraine in the City of Uman. On the other hand, five more ships are reportedly heading to Ukraine to take on grain through the Black Sea route.

- Friday’s CFTC data showed funds buying back a small portion of their wheat position by 413 contracts, reducing their net short position to 96,392 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.