Opening Update: October 16, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| DEC ’23 | 493.5 | 0.25 |

| MAR ’24 | 508.75 | 0.25 |

| DEC ’24 | 520.5 | -0.75 |

|

Soybeans |

||

| NOV ’23 | 1282.5 | 2.25 |

| JAN ’24 | 1302.25 | 2.25 |

| NOV ’24 | 1251.25 | -0.5 |

|

Chicago Wheat |

||

| DEC ’23 | 587.5 | 7.75 |

| MAR ’24 | 613.25 | 7 |

| JUL ’24 | 640.25 | 3.5 |

|

K.C. Wheat |

||

| DEC ’23 | 672.75 | 3.75 |

| MAR ’24 | 682.5 | 4 |

| JUL ’24 | 691 | 2.75 |

|

Mpls Wheat |

||

| DEC ’23 | 725.25 | 3.25 |

| MAR ’24 | 749 | 3 |

| SEP ’24 | 778.75 | -3 |

|

S&P 500 |

||

| DEC ’23 | 4369.75 | 12.5 |

|

Crude Oil |

||

| DEC ’23 | 86.45 | 0.1 |

|

Gold |

||

| DEC ’23 | 1928.3 | -13.2 |

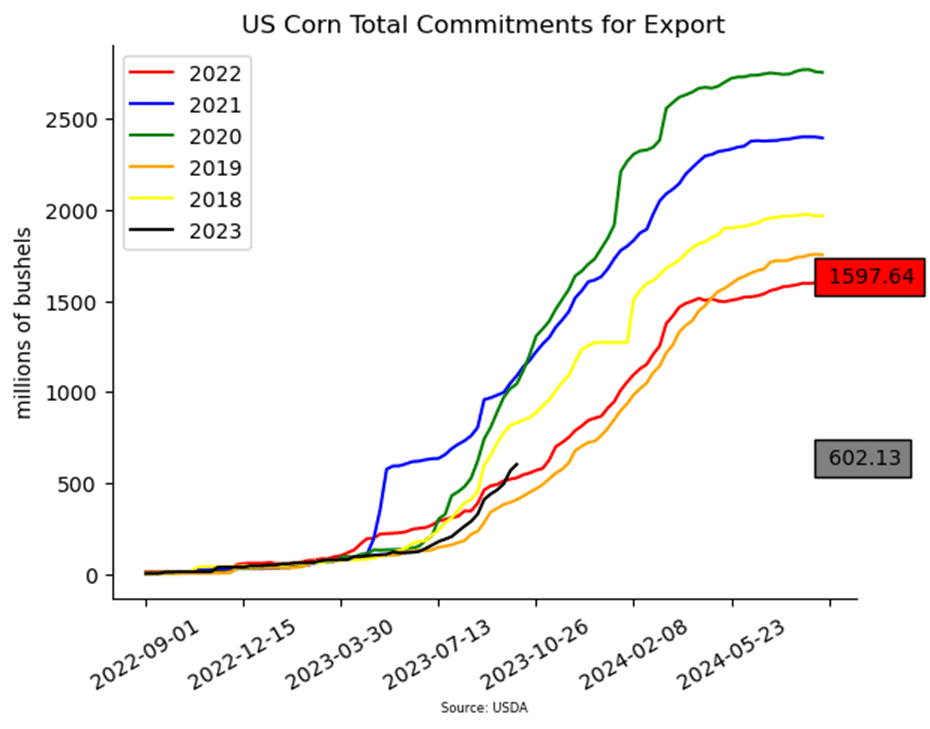

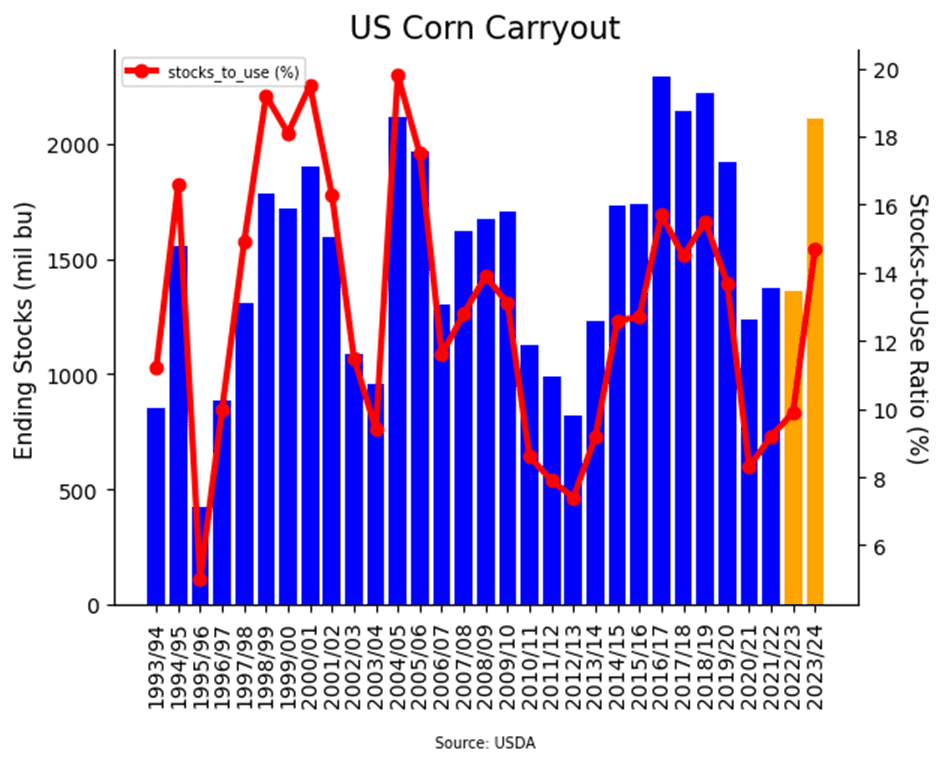

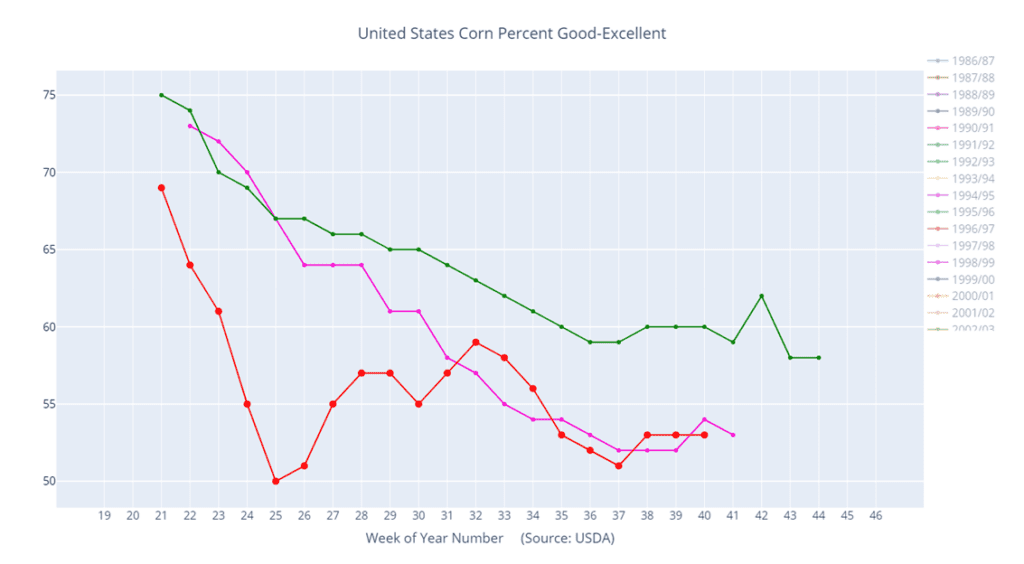

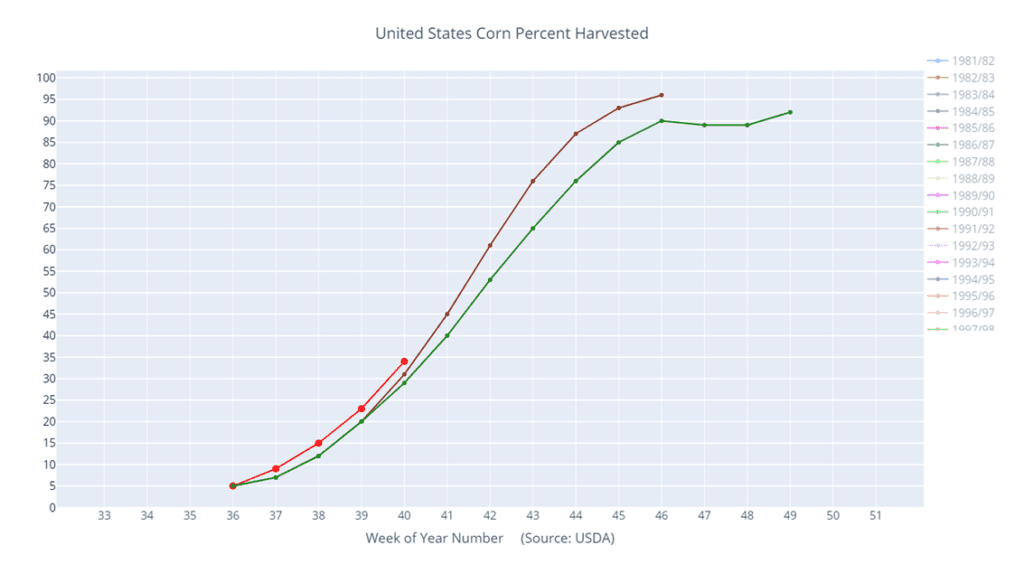

- Corn is starting off the week relatively unchanged as the December contract struggles to break 5 dollars amid producer selling.

- Last week’s WASDE report was friendly with a national yield guess of 173.0 bpa. Some producers reported better than expected yields, but original expectations likely weren’t that good.

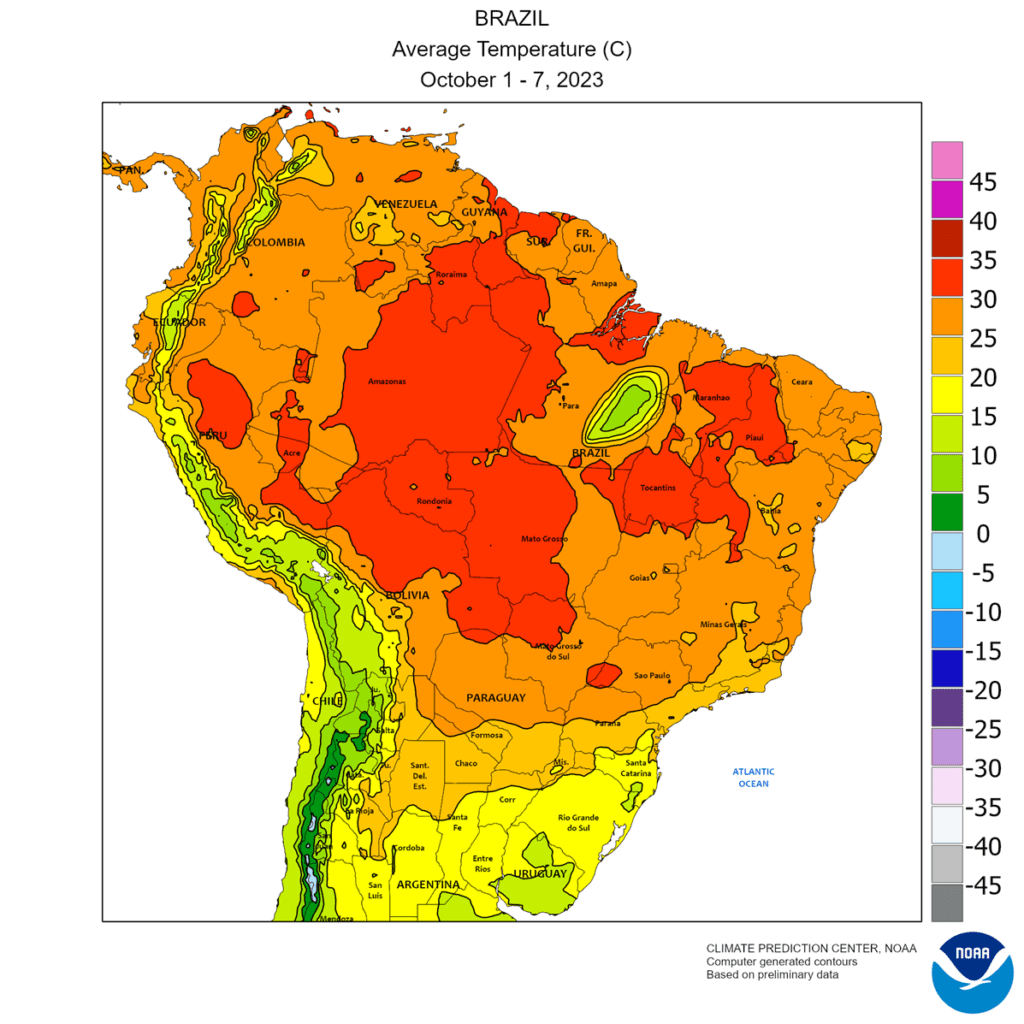

- In Brazil, a severe drought is disrupting barge traffic on a river in the Amazon, and barges are having to reduce their loads by as much as 50% to navigate safely in the shallow waters.

- Non-commercials began to unwind part of their net short position last week buying back 46,742 contracts and reducing their short position to 112,691 contracts.

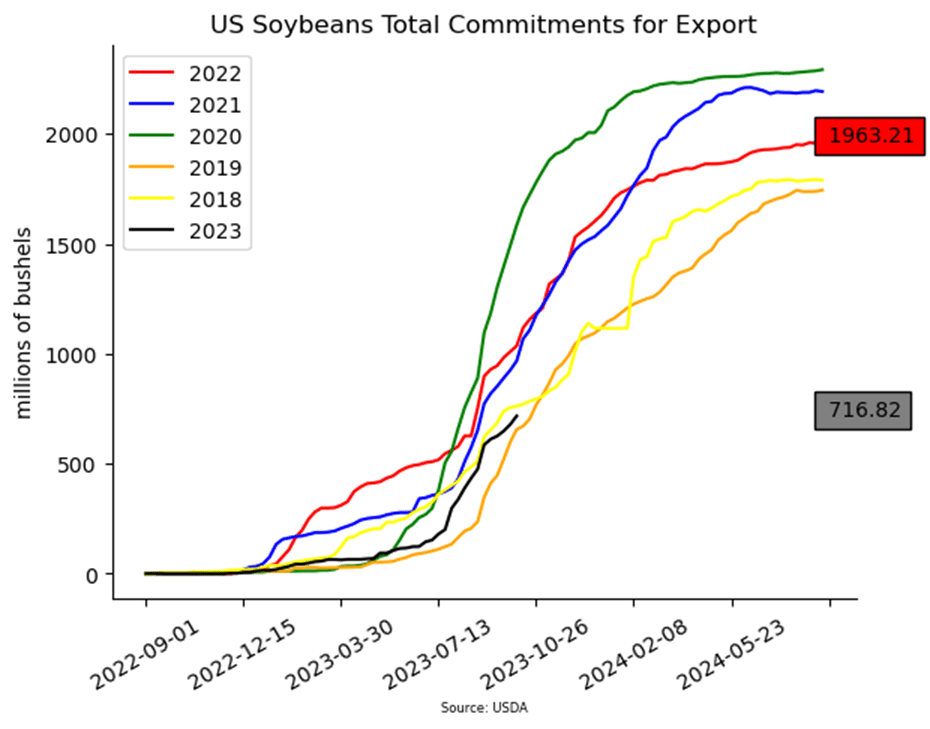

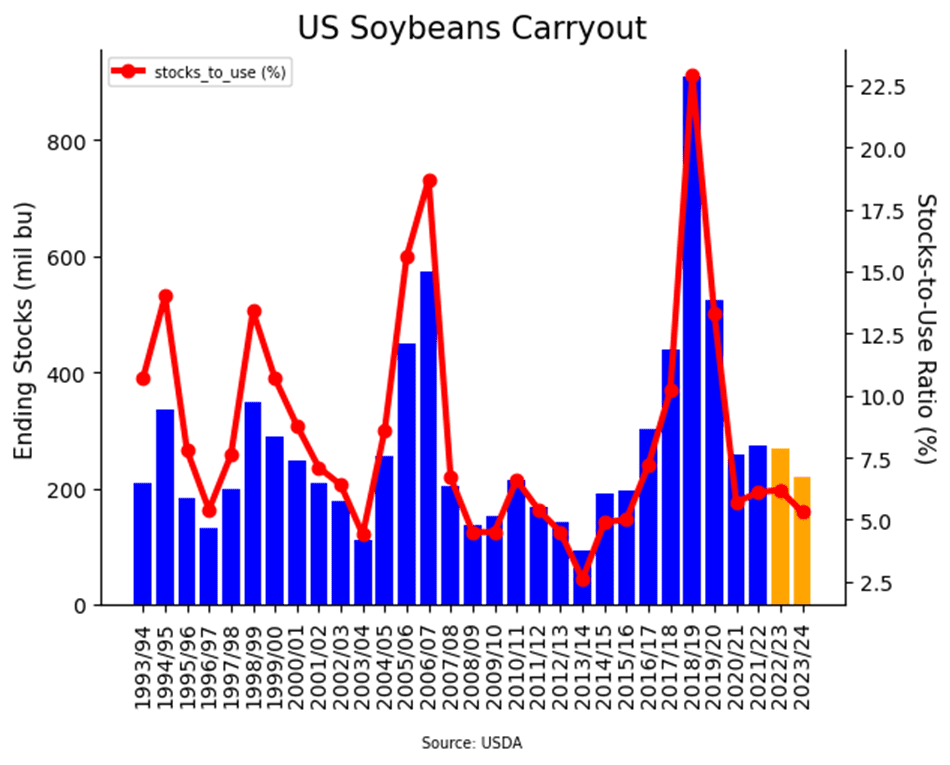

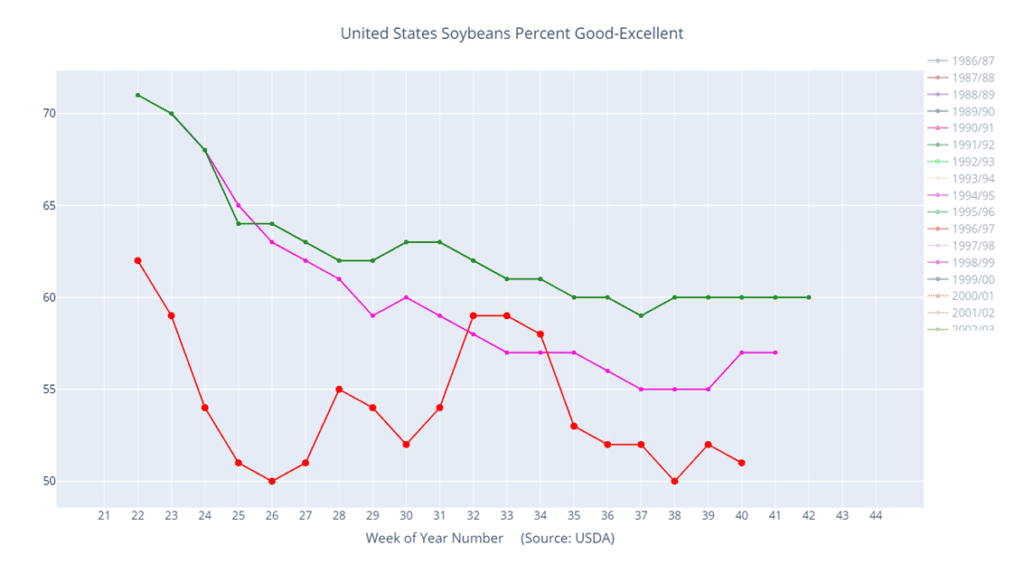

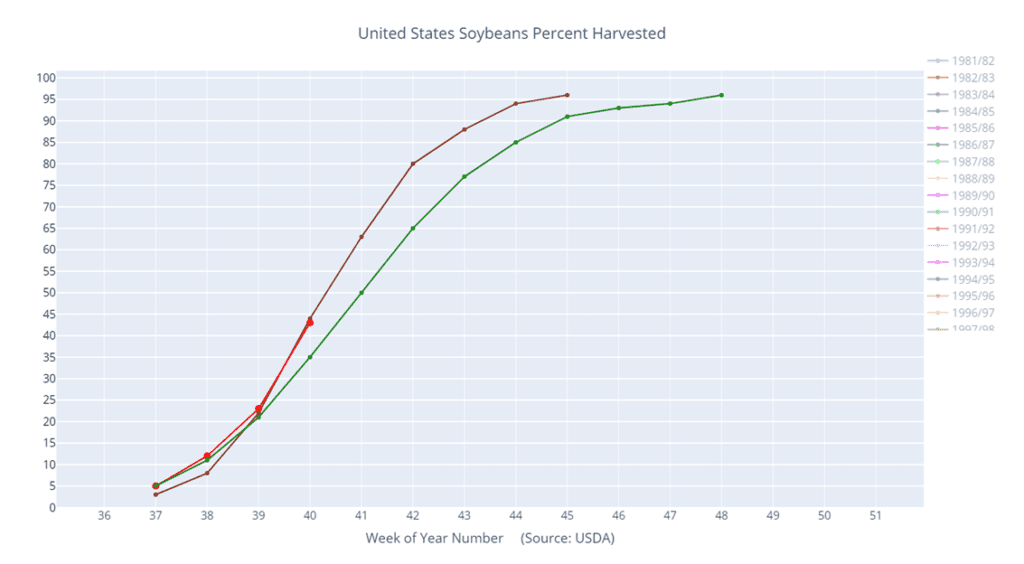

- Soybeans are trading higher this morning but have backed off a few cents from their overnight highs. Soybean meal is lower while soybean oil is higher thanks to higher palm oil.

- US September soybean crush is expected near 160.5 mb which would be 1.5% higher compared to September of last year, but 0.6% lower than a month ago.

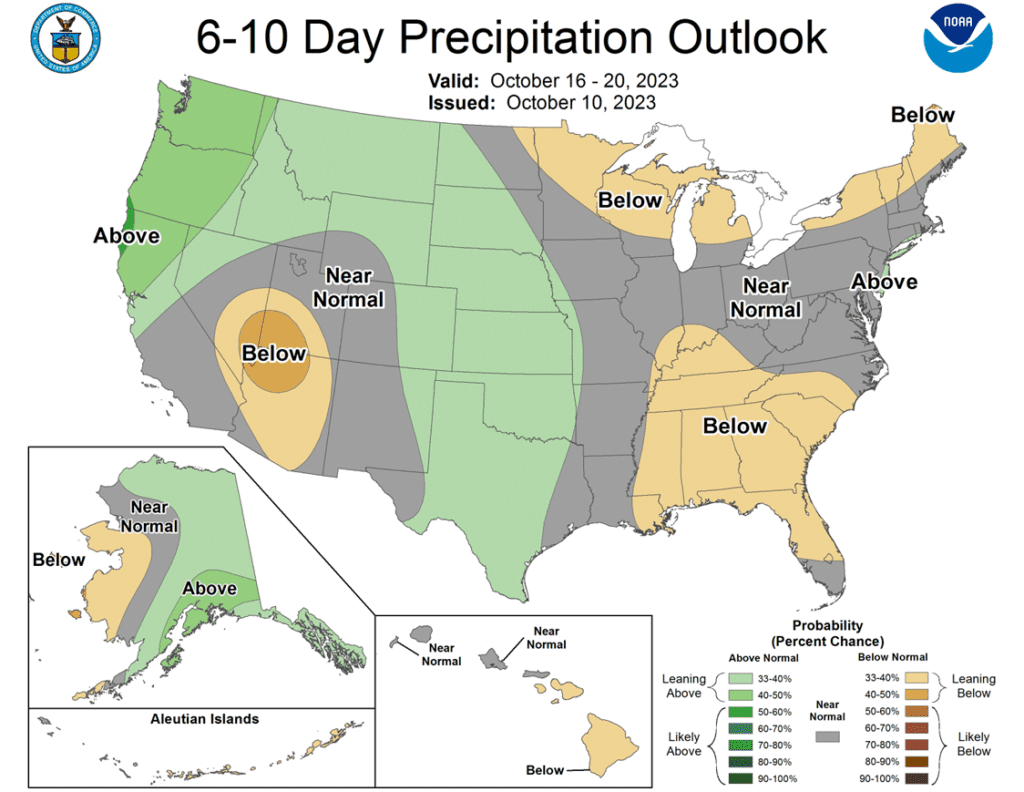

- Brazilian farmers have planted 17.35% of the 23/24 soybean area which compares with 22.60% at this time last year. Conditions are very dry in northern Brazil which is likely causing delays.

- Friday’s CFTC report showed funds whittling away at their long position by selling 2,831 contracts and leaving them net long just 2,170 contracts.

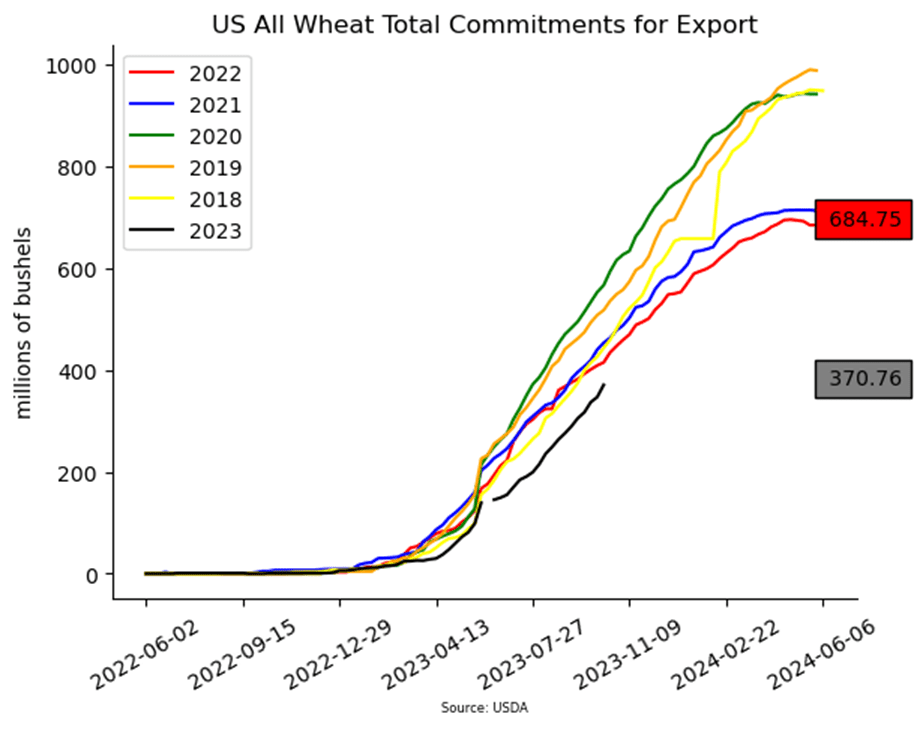

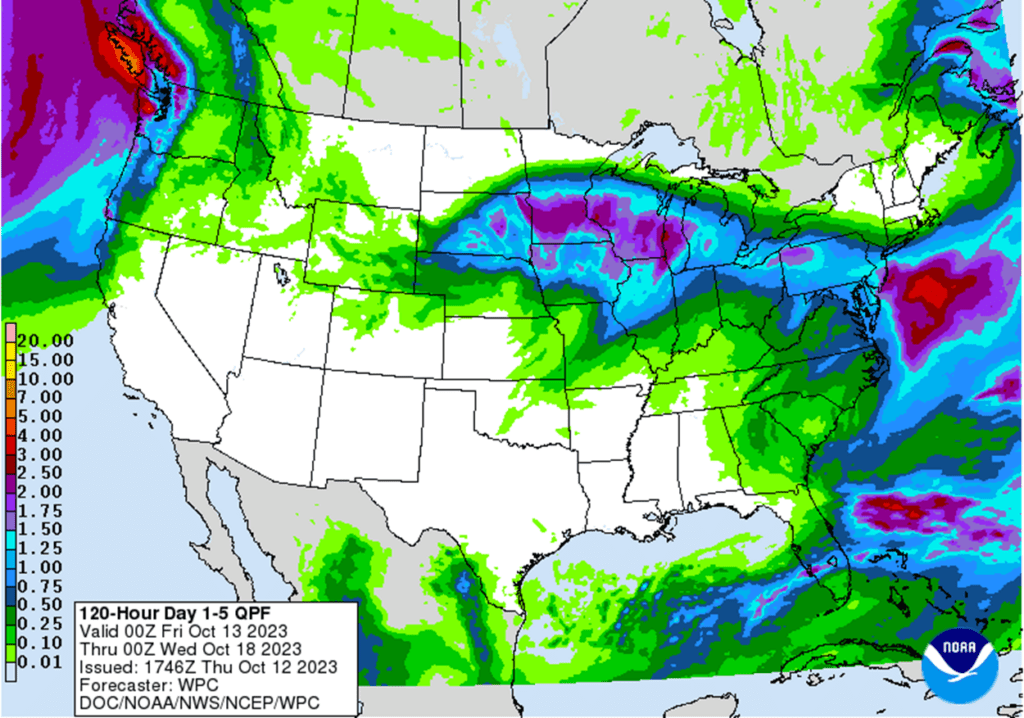

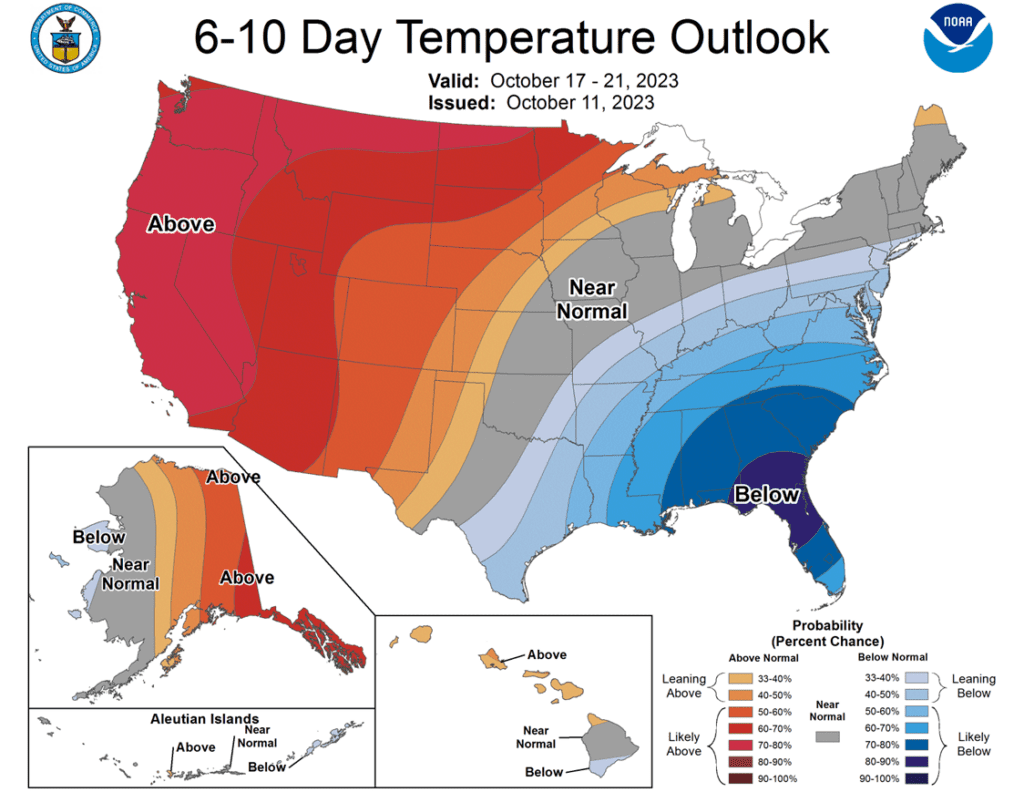

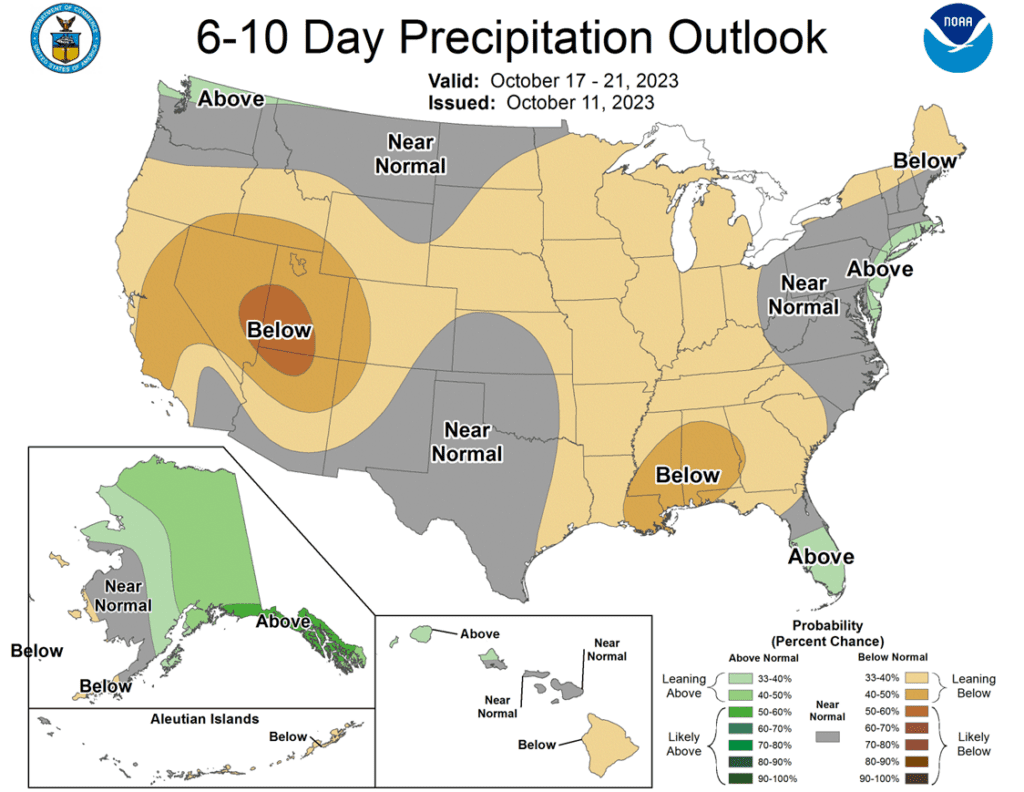

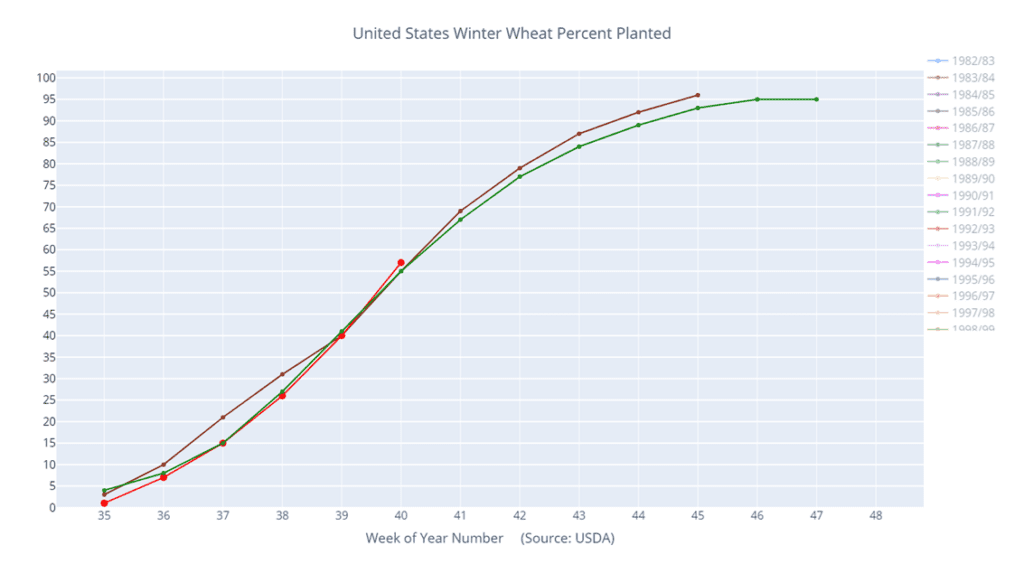

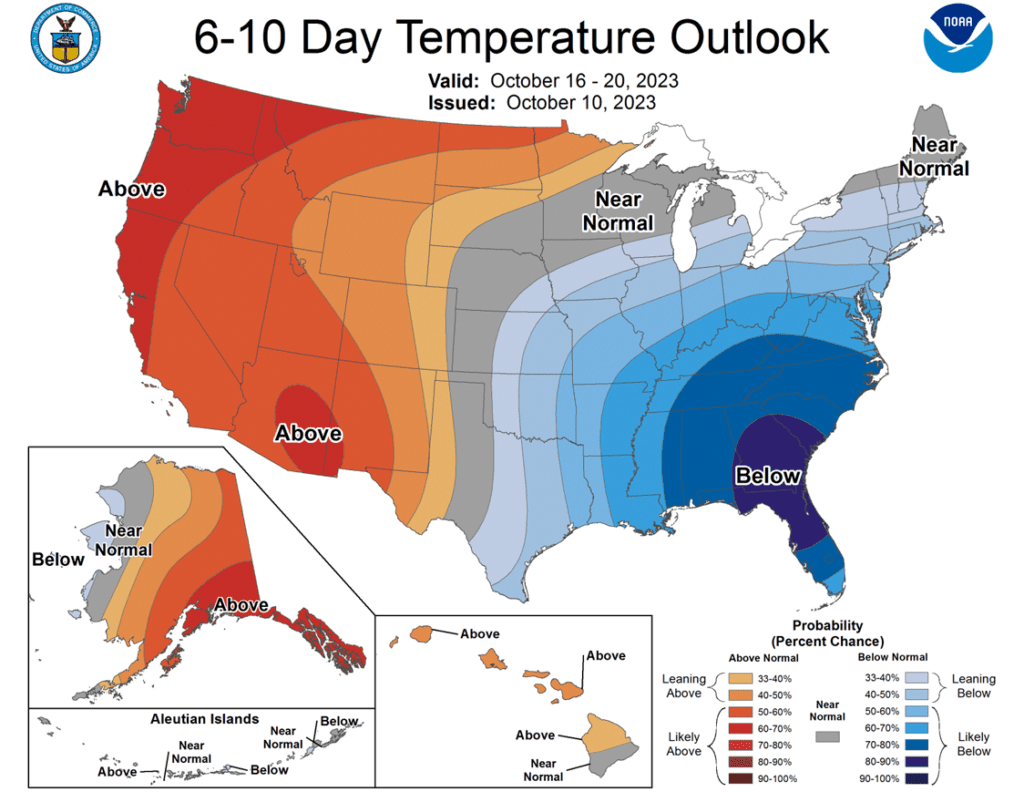

- Wheat is trading higher this morning with Chicago leading the way with gains amid global weather issues in major wheat producing countries.

- Russia has reportedly destroyed 300,000 tons of grain since July between attacks on ships and ports. Despite Russia backing out of the grain deal, Ukraine is still shipping out grains via their own corridor.

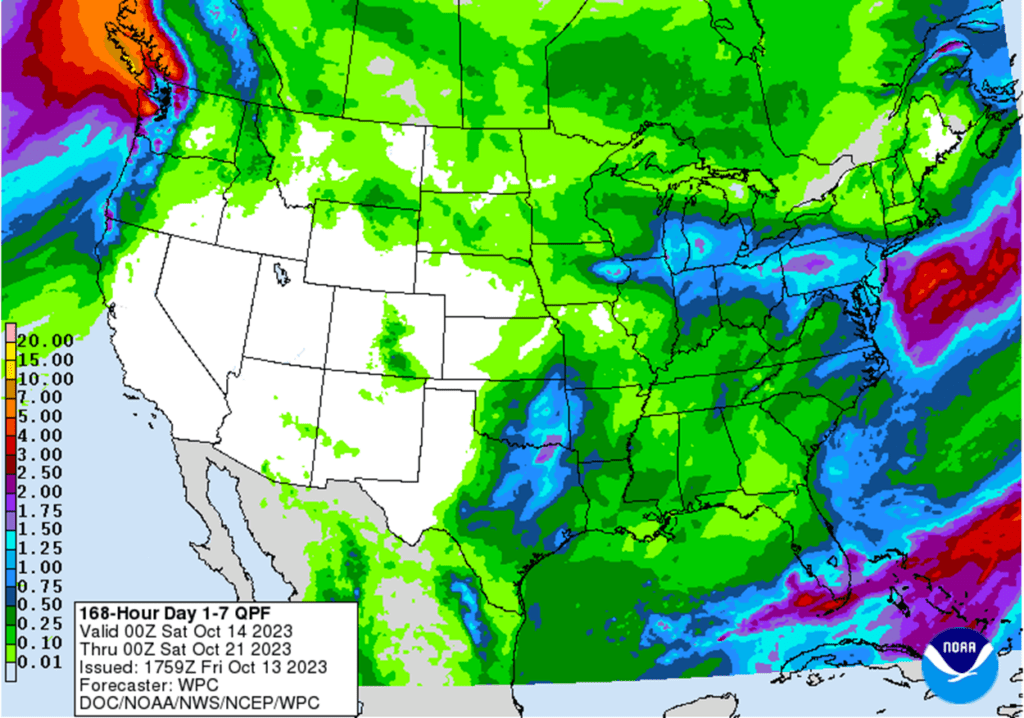

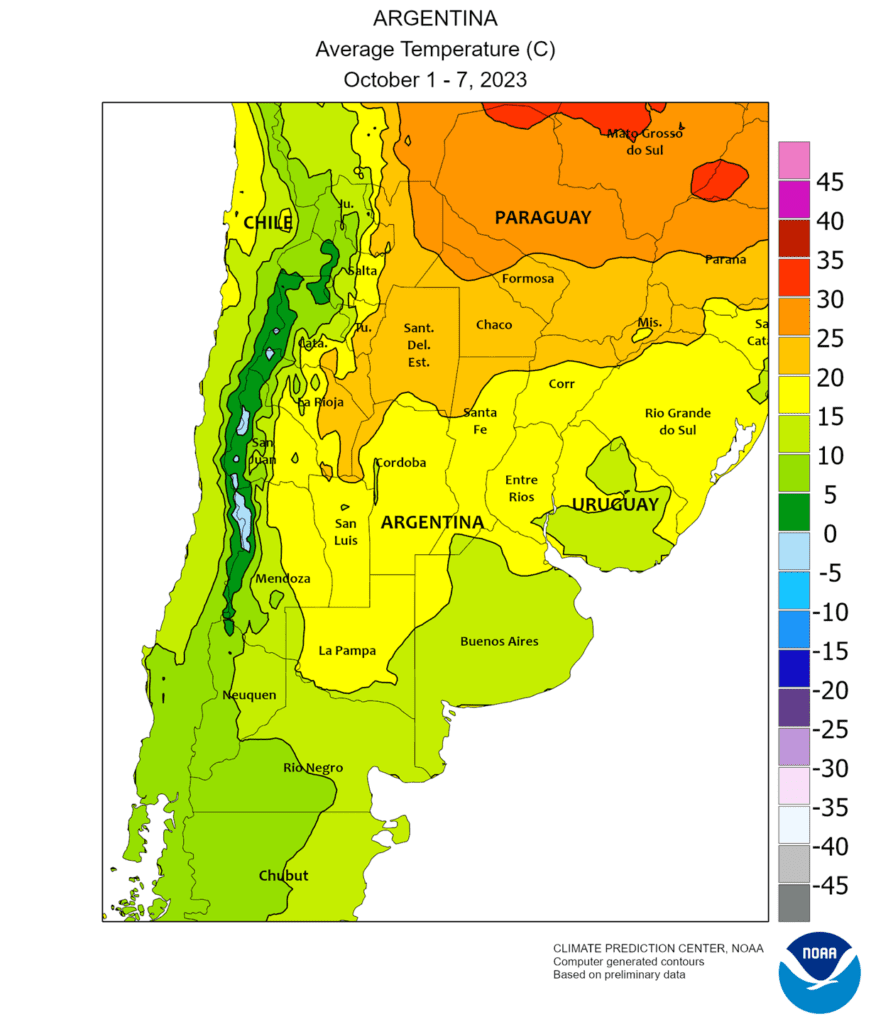

- Heavy rains in China are expected to disrupt wheat planting over the next 10 days. This comes as Australia and Argentina, two large exporters, deal with severe dryness.

- Last Friday’s CFTC report showed non-commercials adding to their short position by selling 5,547 contracts and increasing their net short position to 104,335 contracts, unusually large for this time of year.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.