Opening Update: October 25, 2023

All prices as of 6:30 am Central Time

|

Corn |

||

| DEC ’23 | 483.25 | -0.75 |

| MAR ’24 | 497.75 | -0.25 |

| DEC ’24 | 512.5 | -1.25 |

|

Soybeans |

||

| NOV ’23 | 1295.75 | 0.5 |

| JAN ’24 | 1315 | 0.5 |

| NOV ’24 | 1263.25 | 1 |

|

Chicago Wheat |

||

| DEC ’23 | 582 | 1.5 |

| MAR ’24 | 609.5 | 2 |

| JUL ’24 | 638.5 | 1 |

|

K.C. Wheat |

||

| DEC ’23 | 663 | 0 |

| MAR ’24 | 671.75 | 0 |

| JUL ’24 | 681.75 | 0 |

|

Mpls Wheat |

||

| DEC ’23 | 733.75 | 5.5 |

| MAR ’24 | 752.5 | 5.25 |

| SEP ’24 | 774.75 | -9.25 |

|

S&P 500 |

||

| DEC ’23 | 4258.25 | -13 |

|

Crude Oil |

||

| DEC ’23 | 83.59 | -0.15 |

|

Gold |

||

| DEC ’23 | 1983.6 | -2.5 |

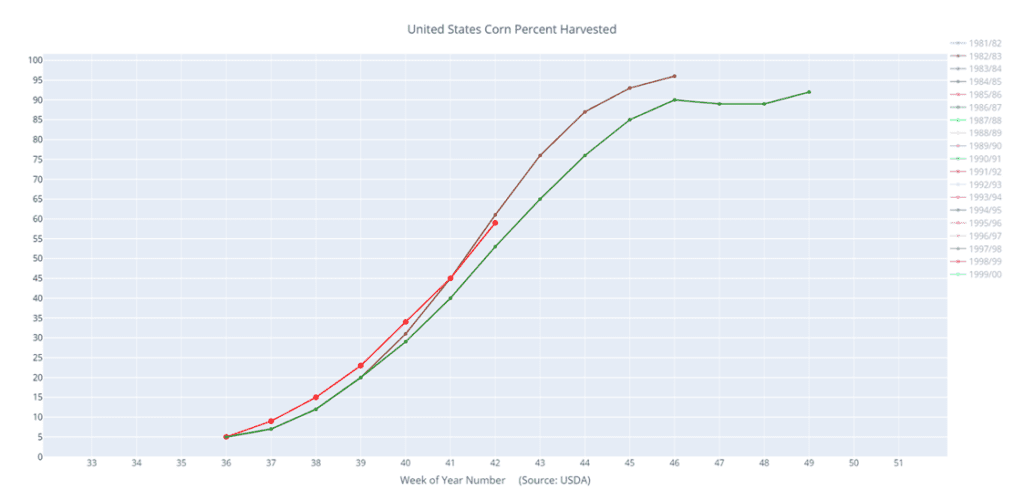

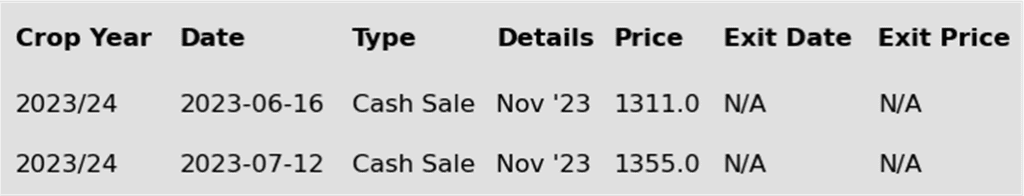

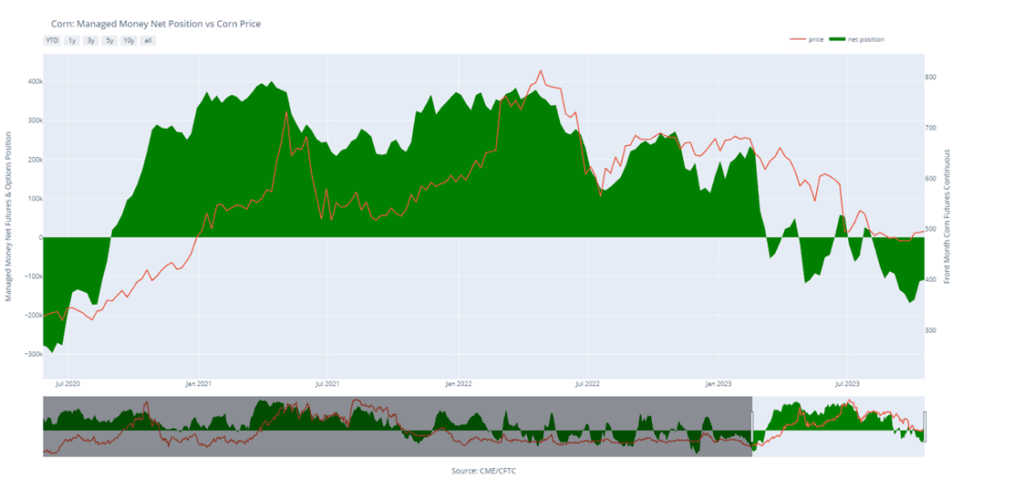

- Corn is trading lower this morning after three consecutively lower closes due to harvest pressure and some outside pressure from lower crude oil.

- Yesterday, private exporters reported to the USDA export sales of 117,200 mt of corn for delivery to Mexico during the 23/24 marketing year, but this sale didn’t have much effect on the market as traders look for exports to destinations like China.

- Ethanol production for the week ending October 20 is expected to be higher than last week at 1.043 m b/d with the stockpile average estimate at 21.236 m bbl vs 21.112m a week ago.

- The USDA attaché in Ukraine sees its 23/24 corn crop at 30.7 mmt which would be a larger production amount than the previous year.

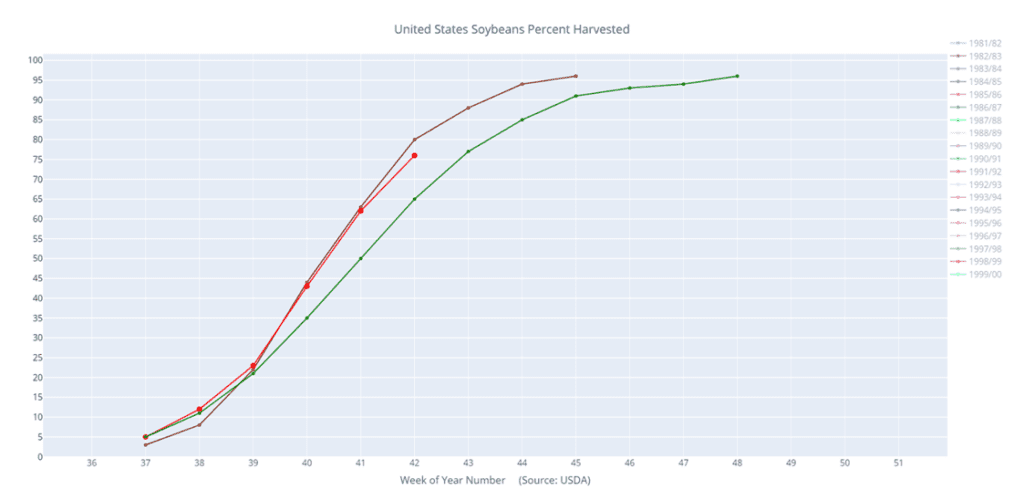

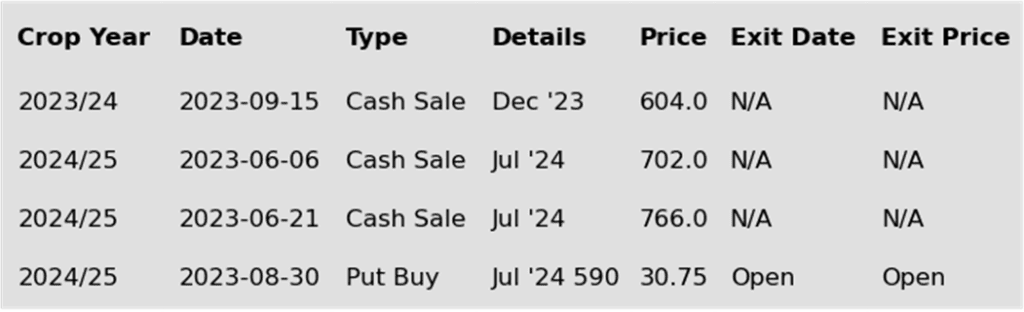

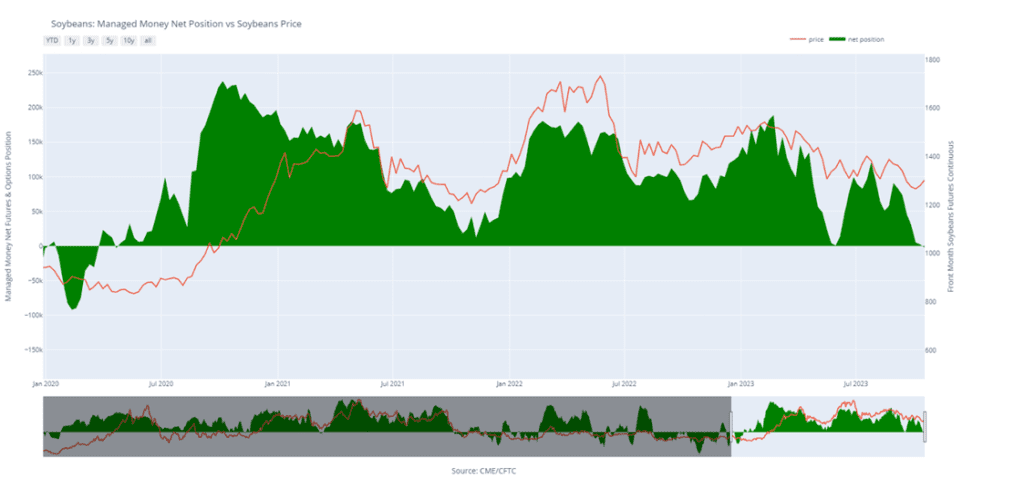

- Soybeans are mixed this morning with the two front months slightly lower but deferred contracts higher after yesterday’s solid gains. Both soybean meal and oil are trading higher.

- December soybean meal made new contract highs overnight as momentum from strong US exports of meal continues.

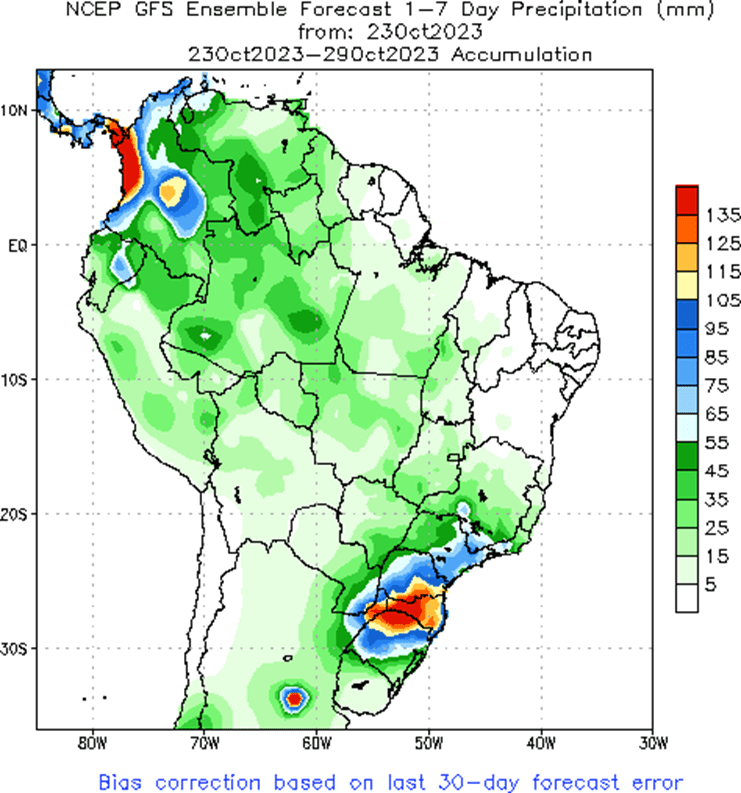

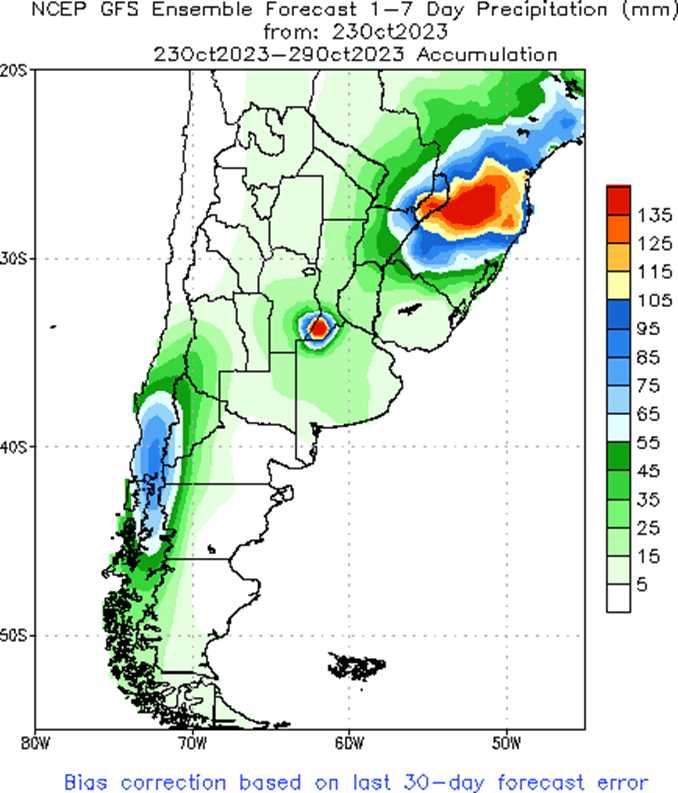

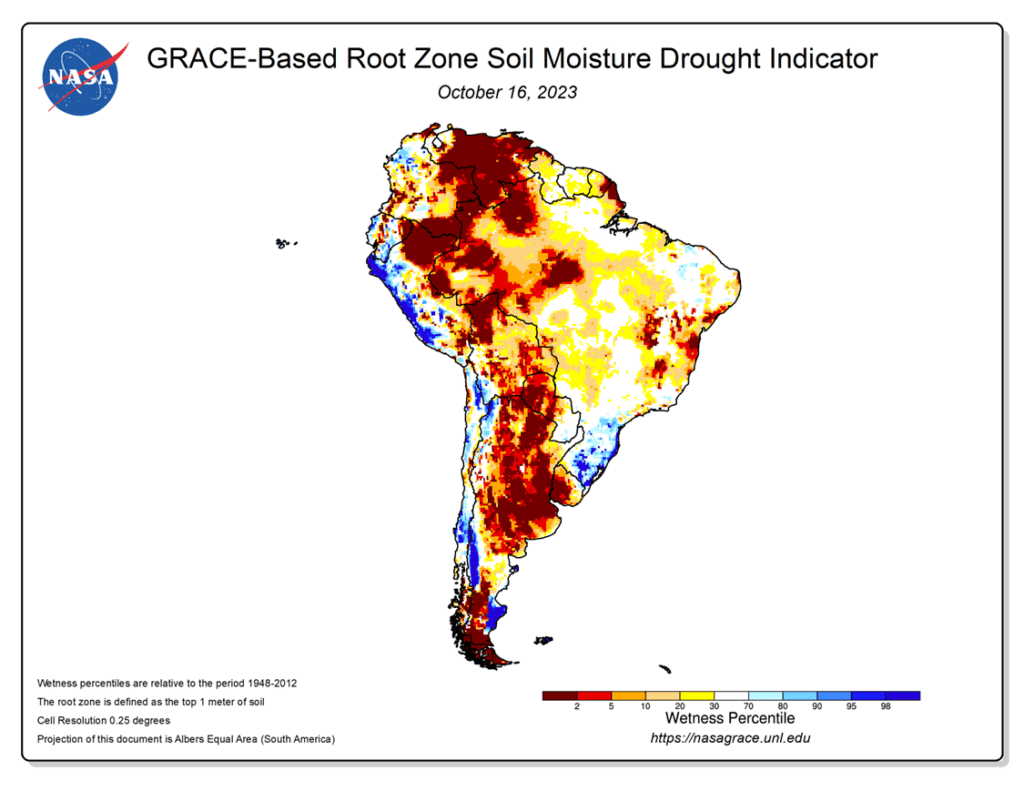

- Some analysts are already revising their estimates of South American production to be lower amid the dry conditions that Argentina and northern Brazil are dealing with during planting.

- Yesterday, China signed a US agricultural purchase agreement that would include them buying billions of dollars worth of agricultural goods, mostly soybeans, during a ceremony in Iowa.

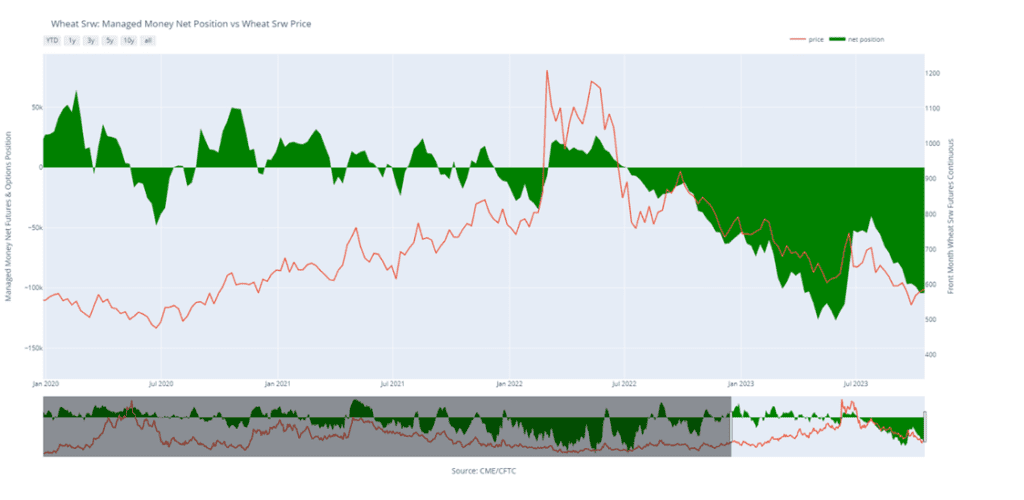

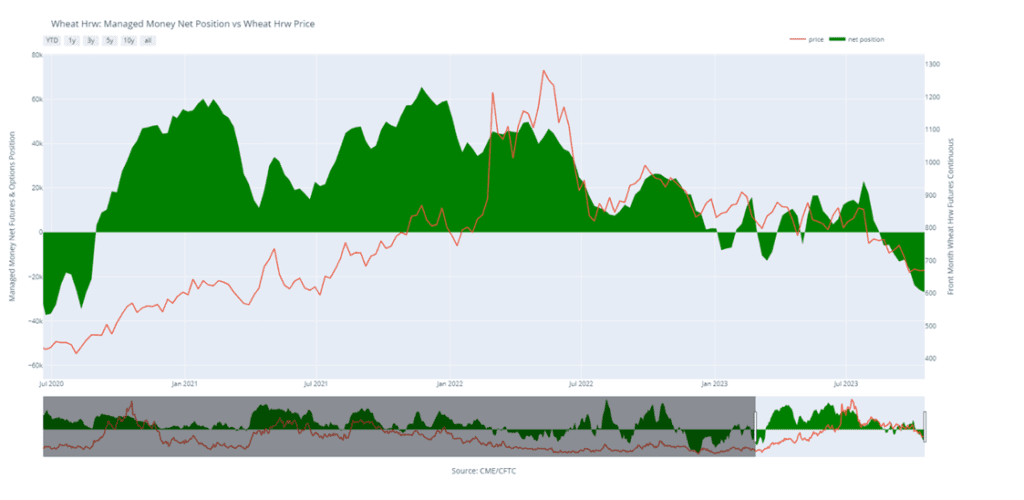

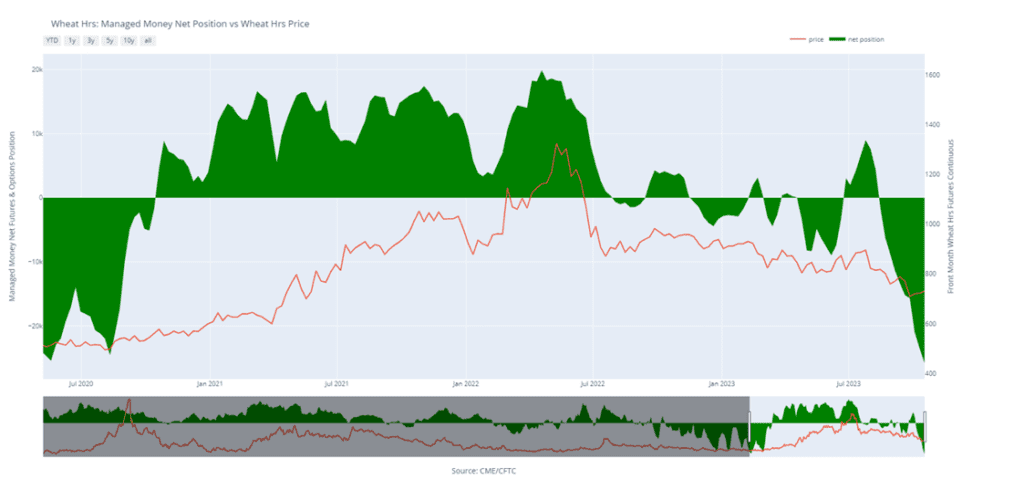

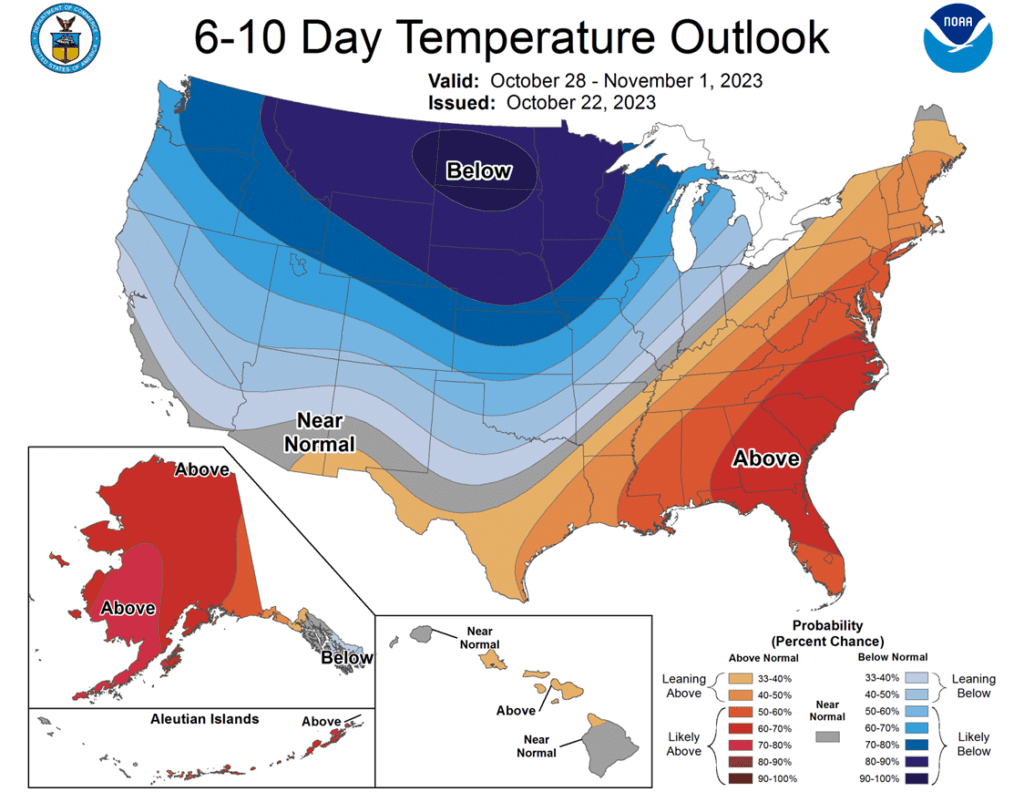

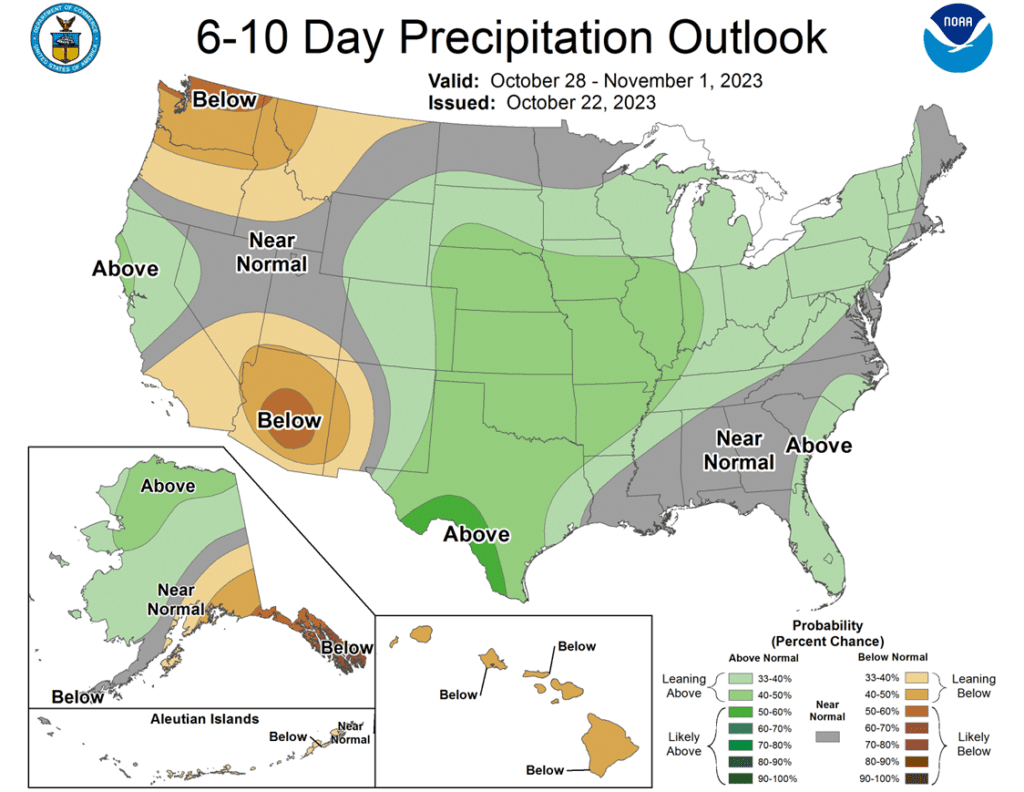

- Wheat is mixed this morning with Chicago and KC lower but Minneapolis higher. KC is nearing contract lows while Minn is faring better due to better demand for high protein wheat.

- Ukraine announced that 700,000 tons of grain have been exported through their own humanitarian corridor since August, with 30 ships having left Ukrainian ports.

- EU soft wheat exports fell by 22% in the season through October 22 at just 9.33 mt vs 12 mt last year.

- Russian grain production is expected to rise further to 600,000 tons this year as many other countries deal with lower production due poor weather. Russia continues to dominate export sales.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.