7-08 Opening Update: Grains Flat Following Two Day Slide

All prices as of 6:30 am Central Time

|

Corn |

||

| SEP ’25 | 398 | 0 |

| DEC ’25 | 413.25 | -1 |

| DEC ’26 | 451.5 | 0.25 |

|

Soybeans |

||

| AUG ’25 | 1020 | -1.25 |

| NOV ’25 | 1016.5 | -1 |

| NOV ’26 | 1047 | -0.75 |

|

Chicago Wheat |

||

| SEP ’25 | 548.75 | 1 |

| DEC ’25 | 569.25 | 0.75 |

| JUL ’26 | 607 | 1.75 |

|

K.C. Wheat |

||

| SEP ’25 | 522.5 | 0 |

| DEC ’25 | 547.25 | 0 |

| JUL ’26 | 594.75 | 1 |

|

Mpls Wheat |

||

| SEP ’25 | 6.31 | 0.0125 |

| DEC ’25 | 6.53 | 0.04 |

| SEP ’26 | 6.765 | 0 |

|

S&P 500 |

||

| SEP ’25 | 6282.5 | 10.5 |

|

Crude Oil |

||

| SEP ’25 | 67.06 | 0.08 |

|

Gold |

||

| OCT ’25 | 3328 | -16.7 |

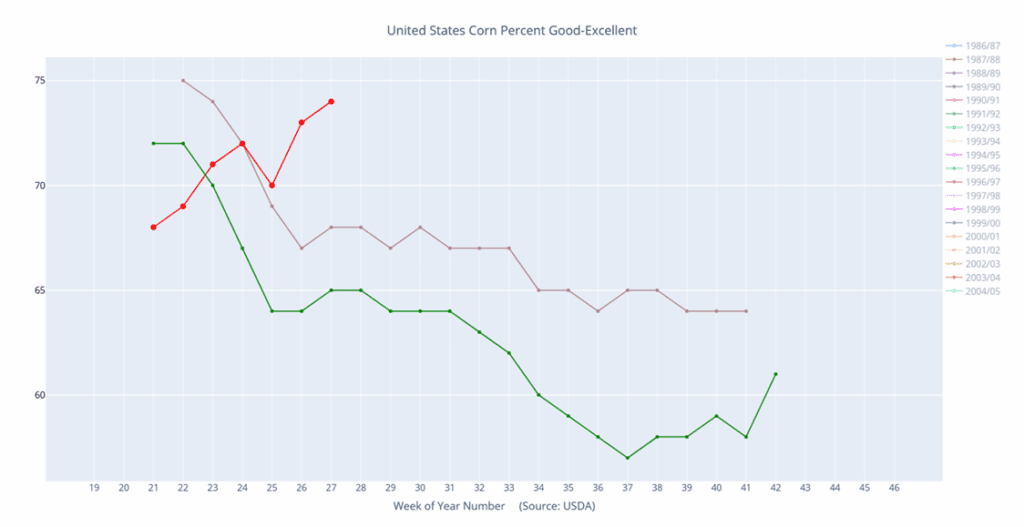

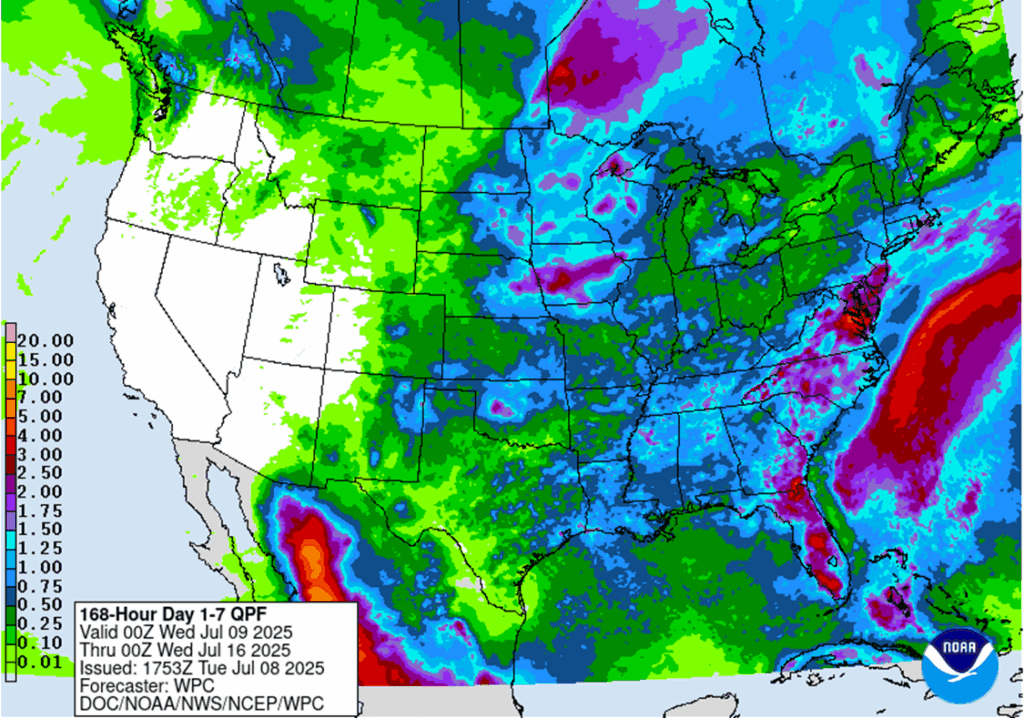

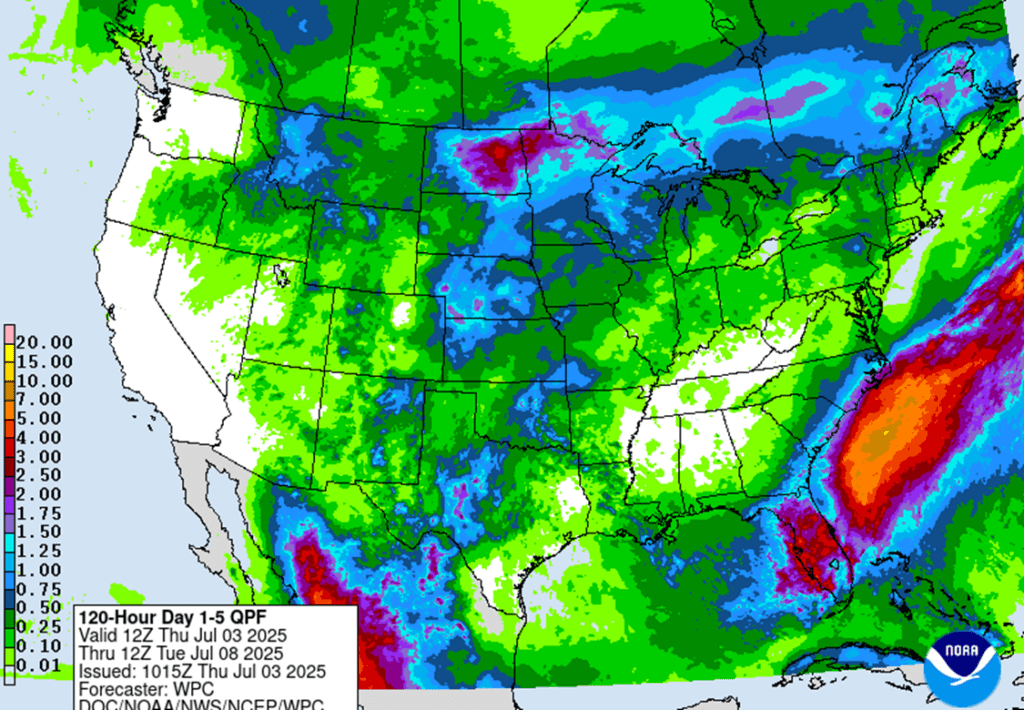

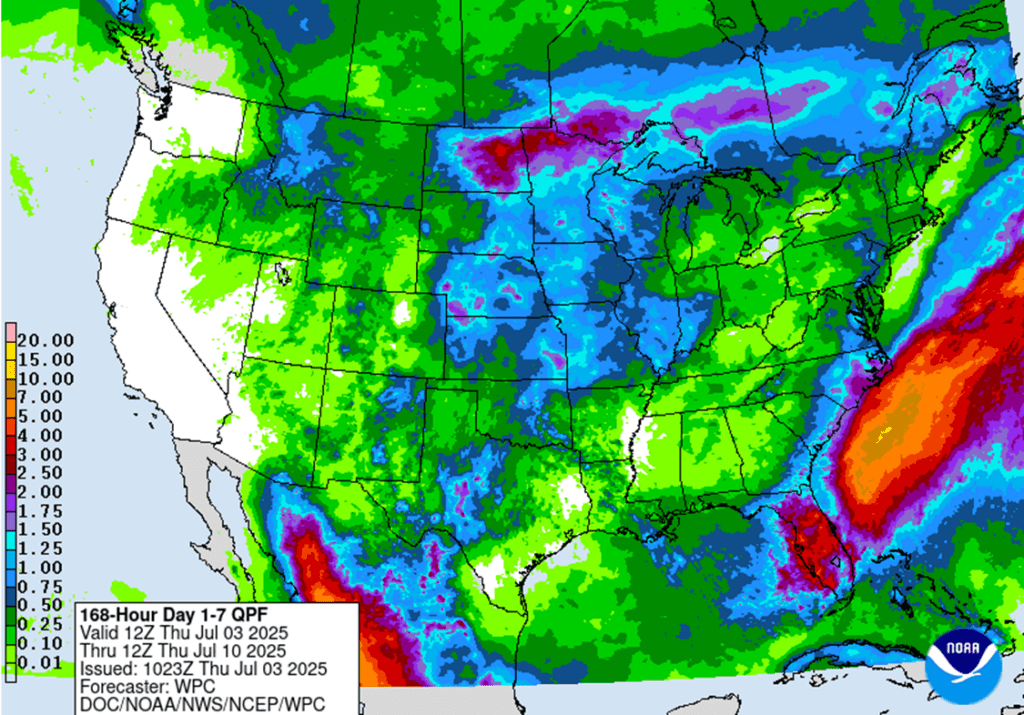

- Corn overnight low hit 398 vs Sep; Sep-Dec corn spread held support near -15 as Dalian corn futures dropped to 6-week lows on higher China supply talk.

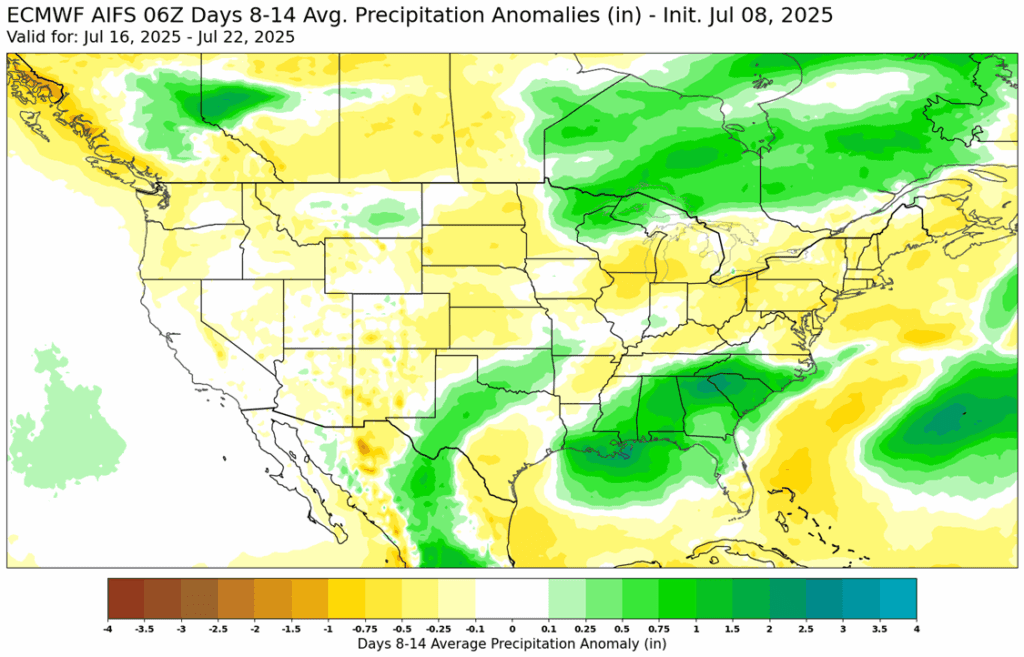

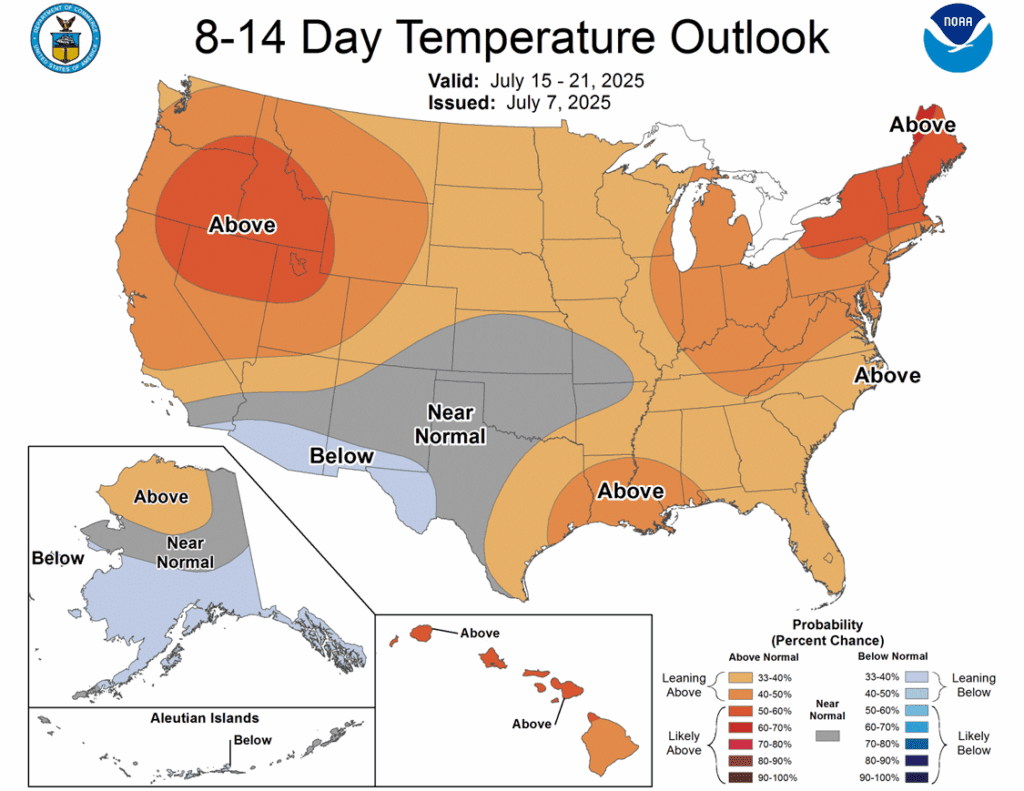

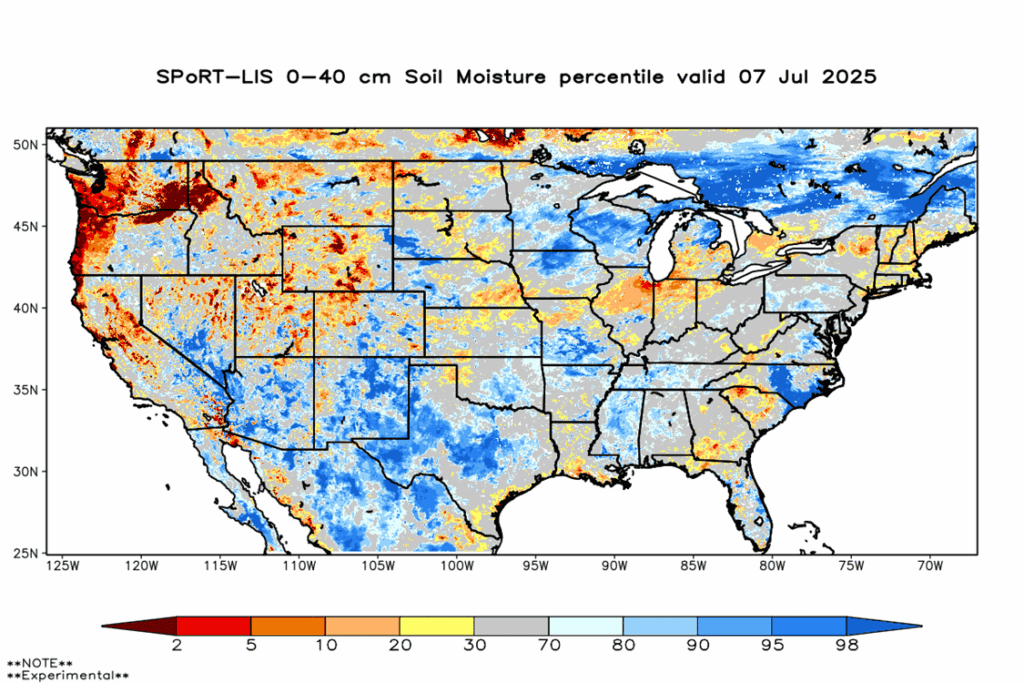

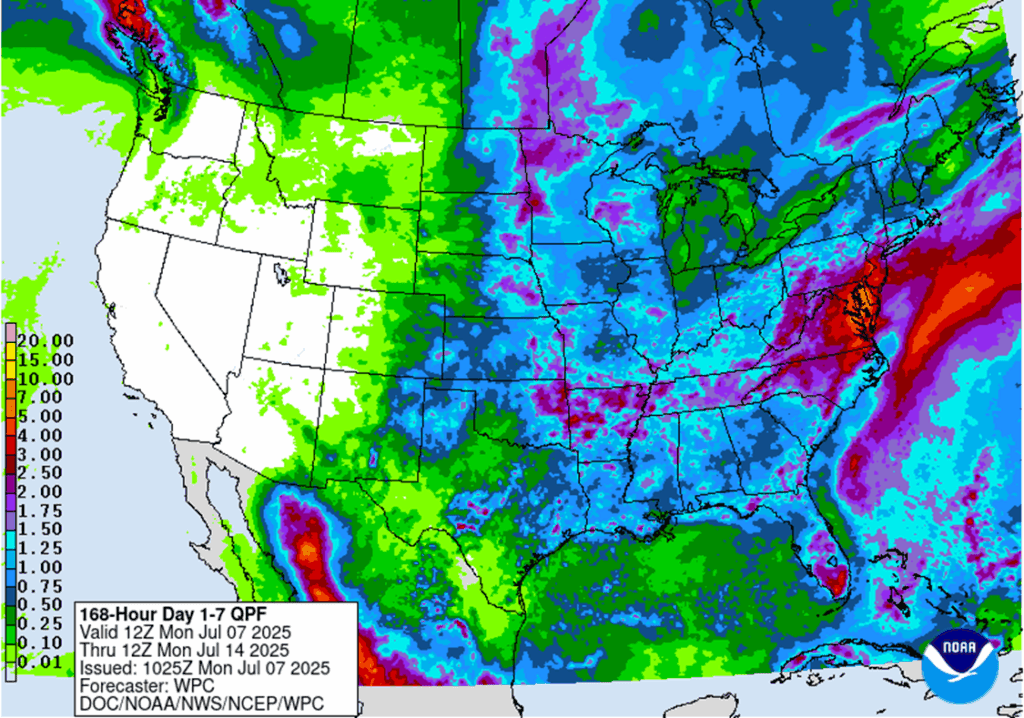

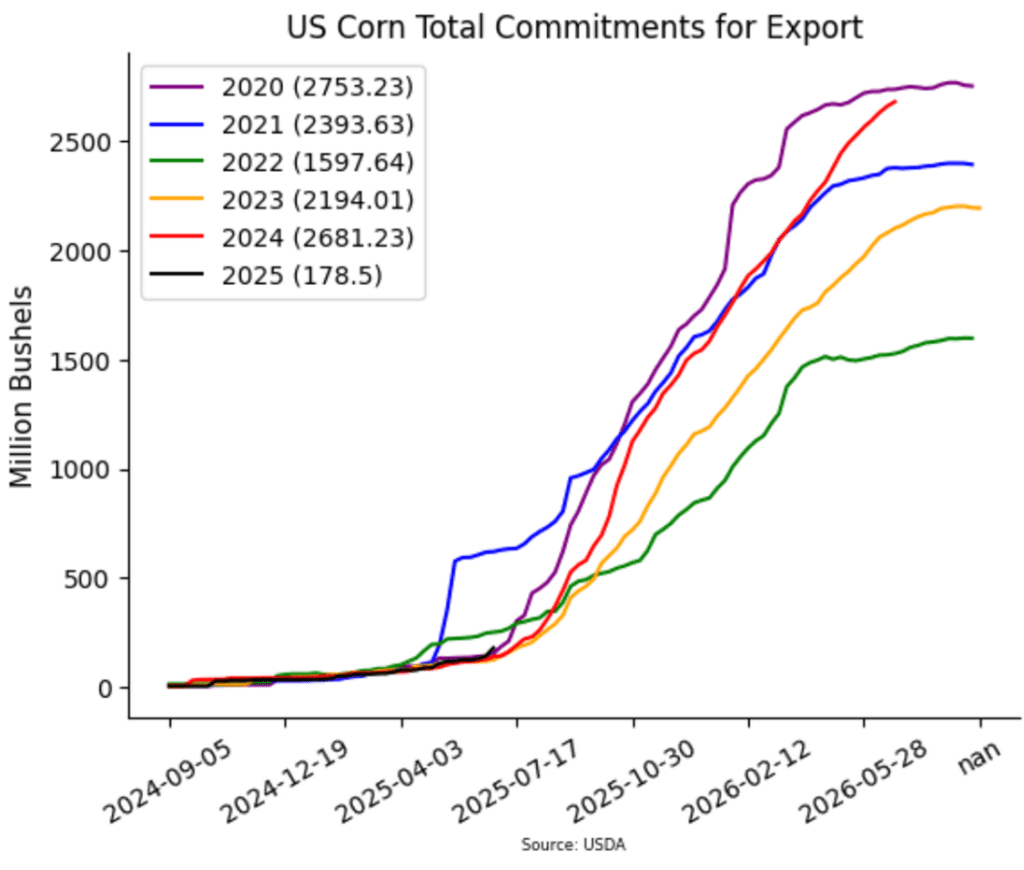

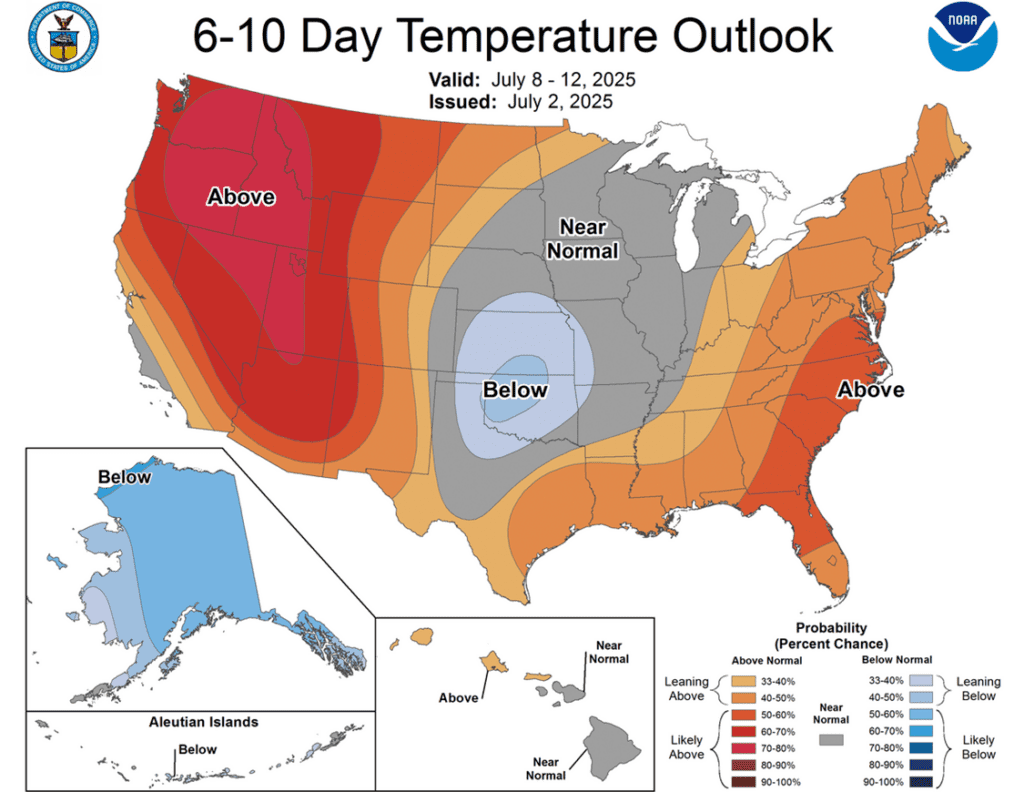

- Favorable U.S. Midwest weather during pollination have some looking for harvest lows toward 360; South American supplies weigh on U.S. export outlook.

- Trump’s tariff hike on S. Korea and Japan adds trade risk; EU corn imports up 4%, while exports down 41% year-over-year.

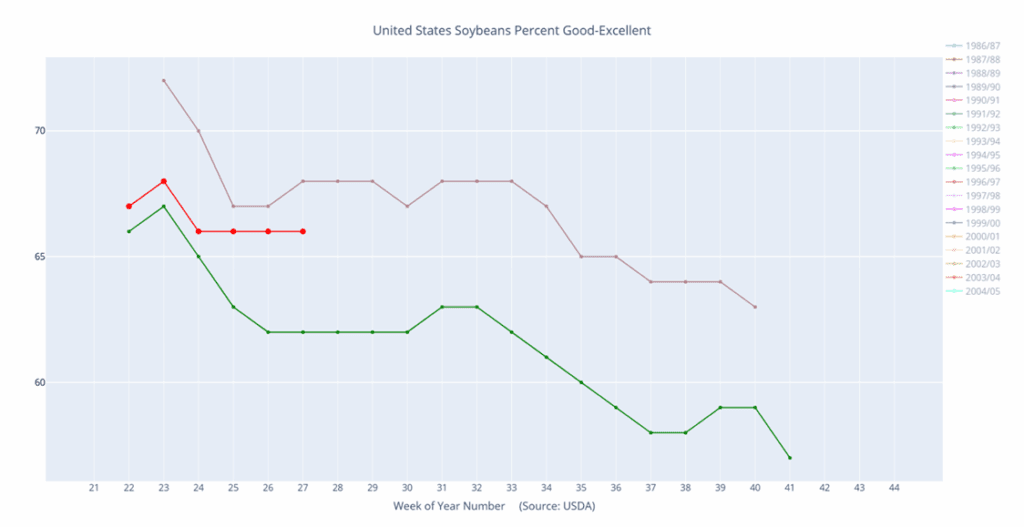

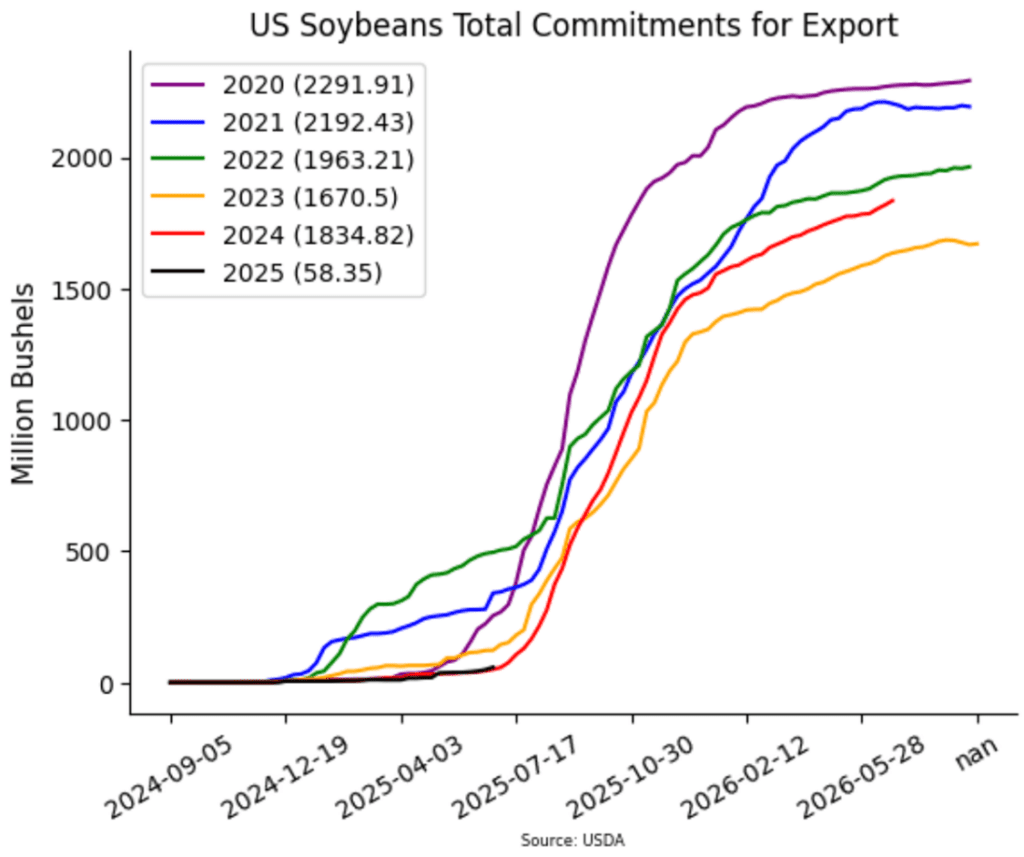

- U.S. new crop soybean export sales hit multi-decade lows; Dec-Mar soymeal spread hits record -10.

- Global oilseed markets active: Dalian soy complex higher, lifting palm and soyoil; Brazil and Argentina soybean stocks above last year.

- Traders eye EPA ruling on refinery exemptions; EU oilseed and meal imports up 13% and 14% year-over-year.

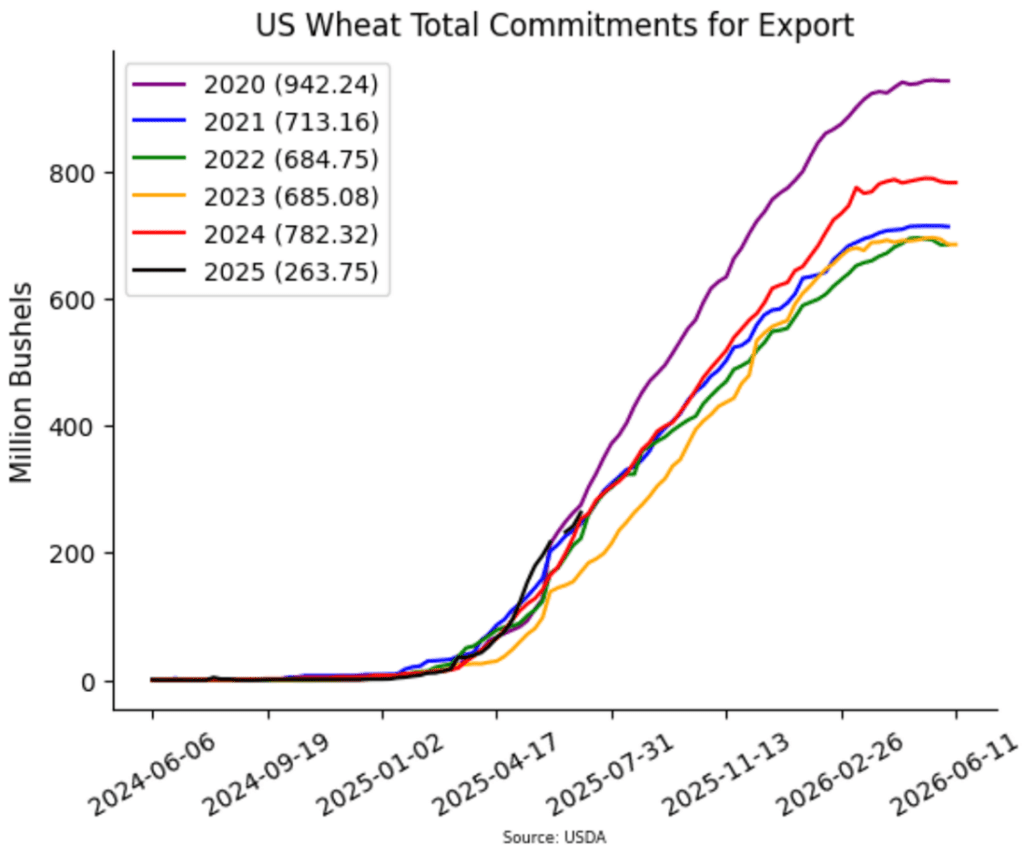

- EU protein concerns are boosting talk of stronger milling wheat demand, while a smaller EU corn crop may increase wheat feeding.

- EU 24/25 wheat exports seen at 21.6 MMT, down 34% from last year; current season exports also down 19% year-over-year.

- Canadian wheat crop conditions strong: Manitoba 90% good/excellent, Saskatchewan 65% good/excellent, and Alberta 62% good/excellent.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.