12-13 Opening Update: Grains Lower, Reversing some of Yesterday’s Gains

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’24 | 481.5 | -3.75 |

| JUL ’24 | 502.75 | -3.25 |

| DEC ’24 | 509 | -2.5 |

|

Soybeans |

||

| JAN ’24 | 1314.75 | -9 |

| MAR ’24 | 1333.5 | -9.25 |

| NOV ’24 | 1273.5 | -8 |

|

Chicago Wheat |

||

| MAR ’24 | 616 | -9.5 |

| MAY ’24 | 626 | -9.5 |

| JUL ’24 | 633.5 | -8.5 |

|

K.C. Wheat |

||

| MAR ’24 | 646.5 | -10.25 |

| MAY ’24 | 650.75 | -9.5 |

| JUL ’24 | 652.5 | -10 |

|

Mpls Wheat |

||

| MAR ’24 | 721.5 | -8 |

| JUL ’24 | 739.5 | -6.5 |

| SEP ’24 | 753.5 | 16.5 |

|

S&P 500 |

||

| MAR ’24 | 4703.25 | 6 |

|

Crude Oil |

||

| FEB ’24 | 69.07 | 0.22 |

|

Gold |

||

| FEB ’24 | 1996.3 | 3.1 |

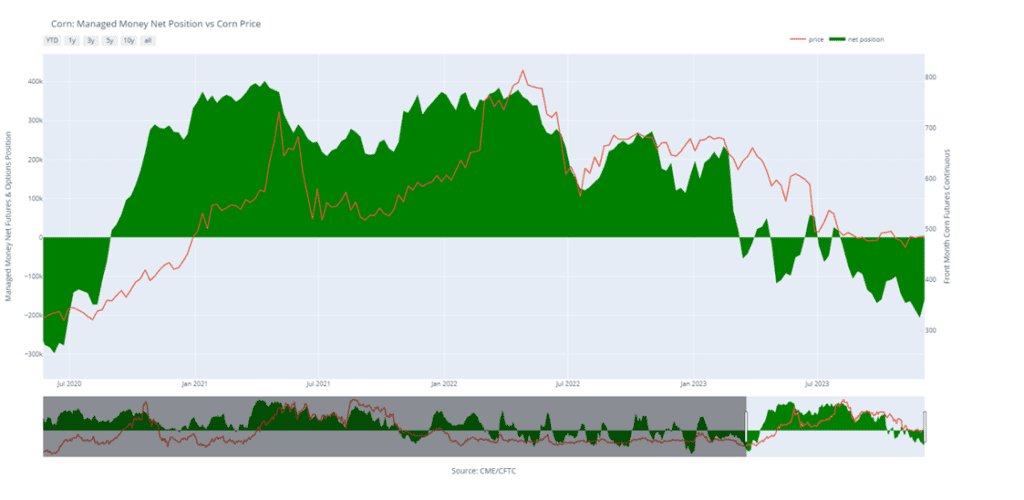

- Corn is trading lower this morning giving back most of the gains posted yesterday.

- Today’s EIA ethanol report is expected to show ethanol production backing off from last week’s 5 month high, with ethanol stocks growing slightly week over week.

- The Biden Administration is expected to announce this week guidance on whether corn-based sustainable aviation fuel will qualify for government subsidies.

- Brazil’s Agrivest says purchases of fertilizer and corn seed are down 18-20% compared to a year ago as farmers eye second crop corn planting in early 2024.

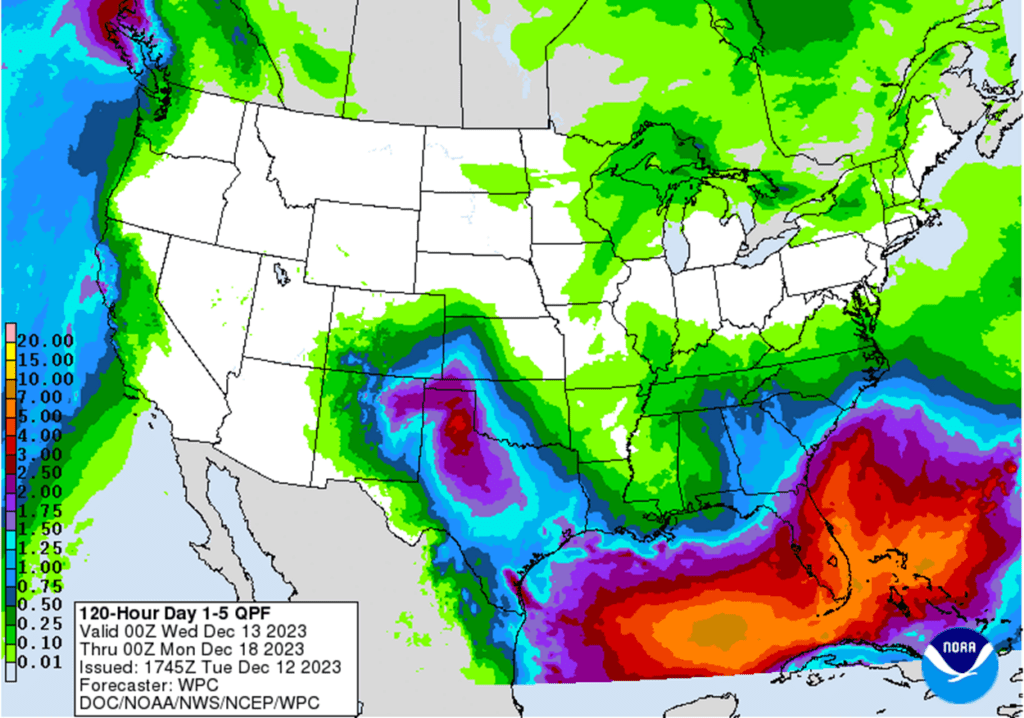

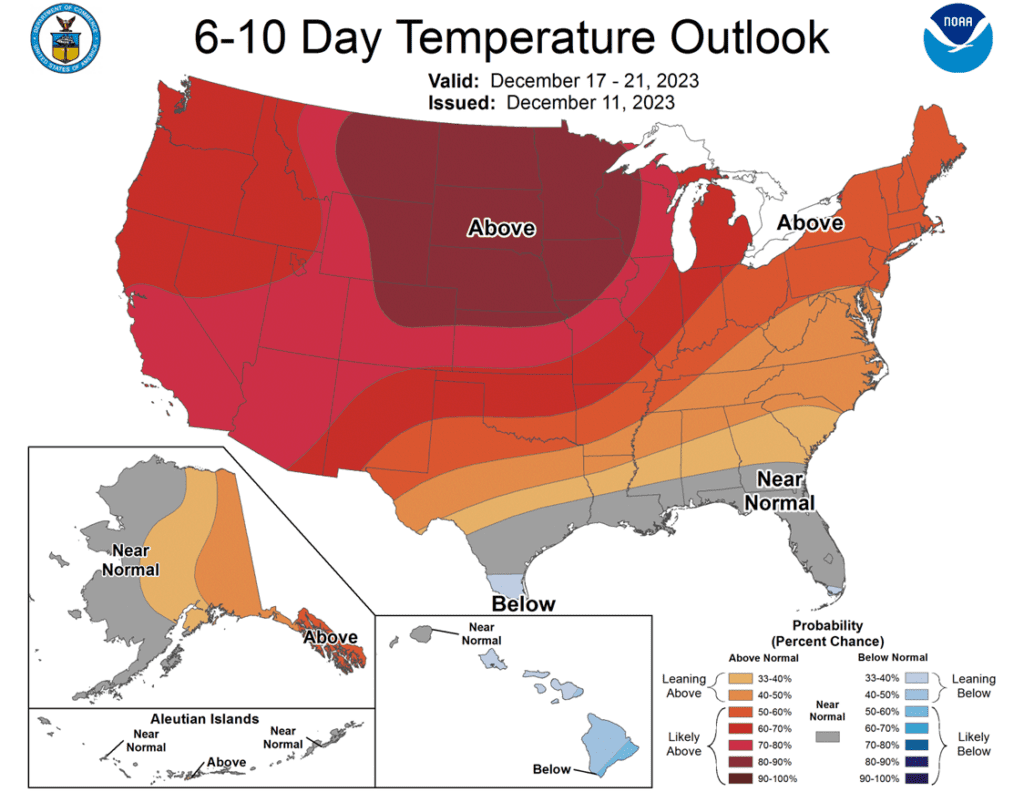

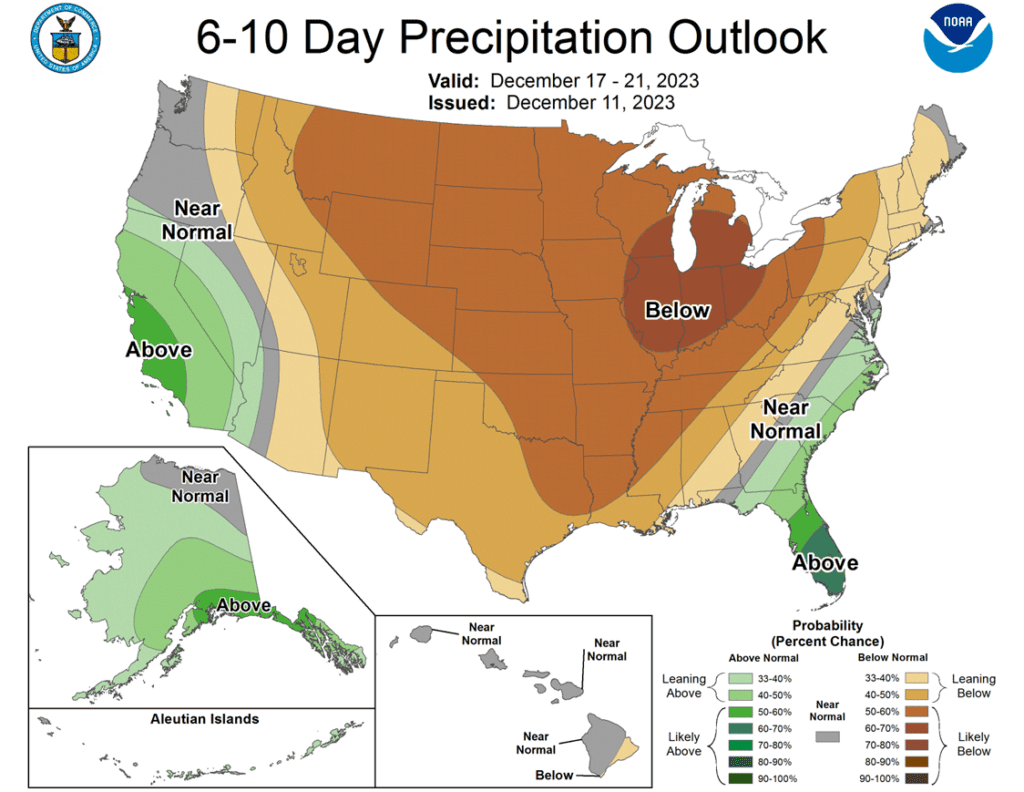

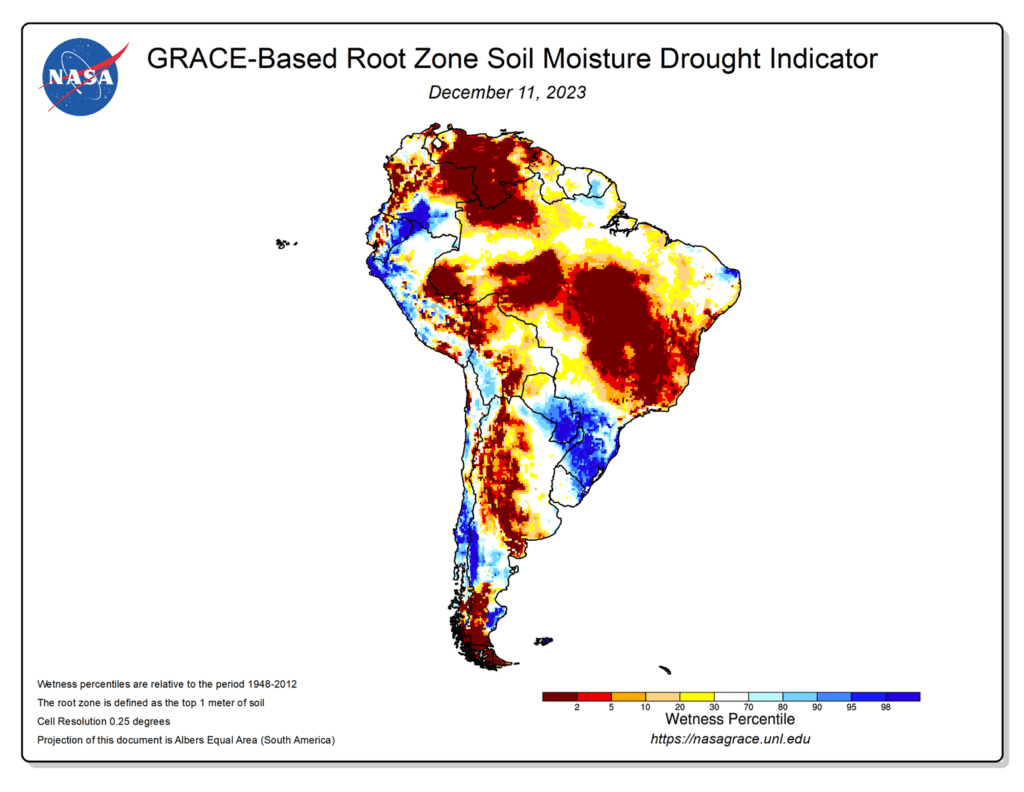

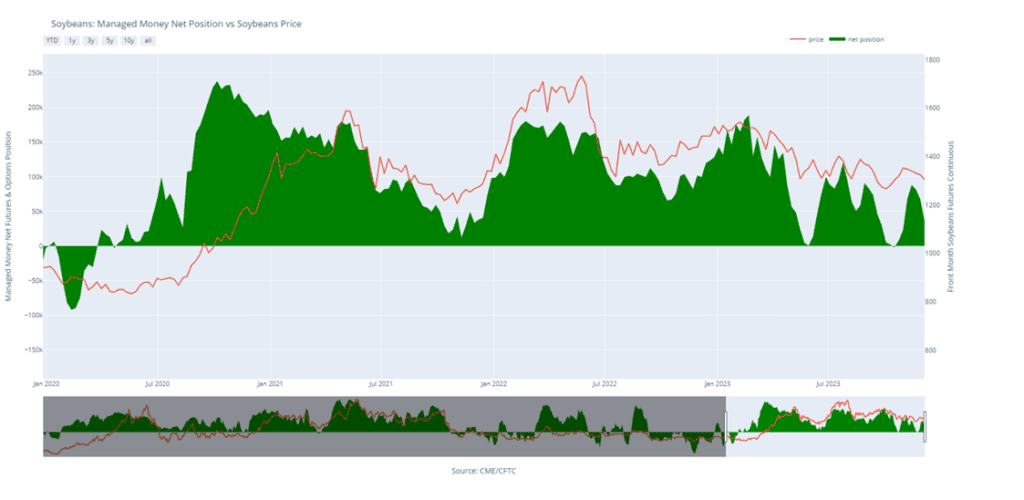

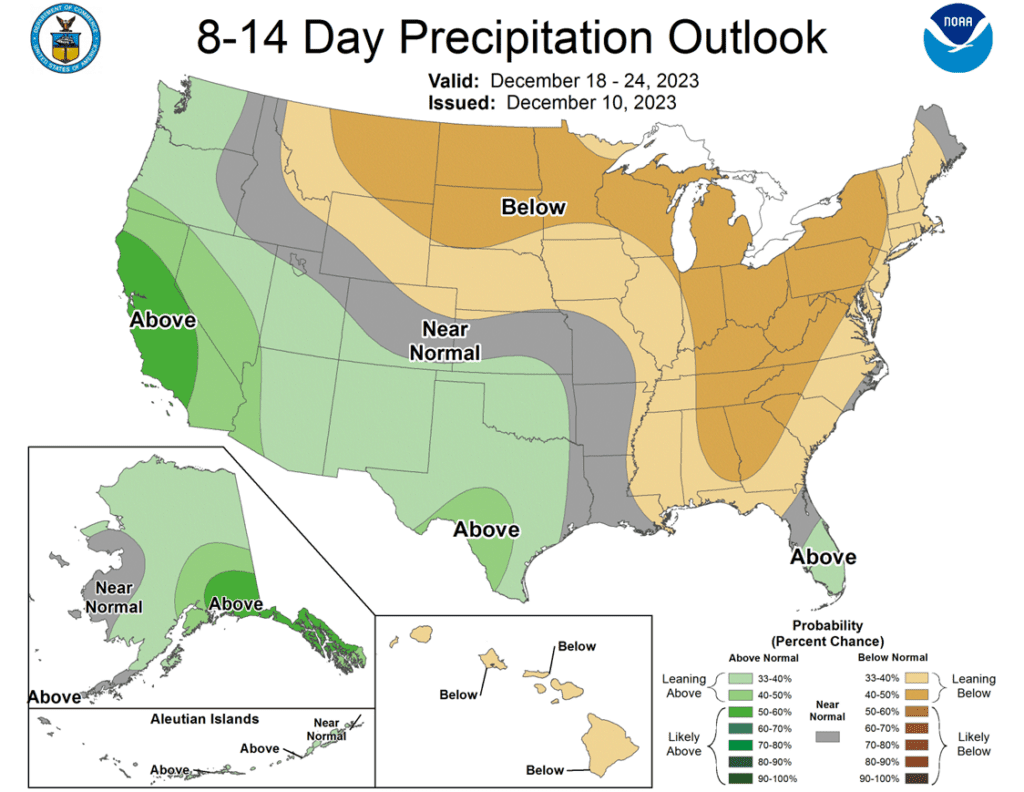

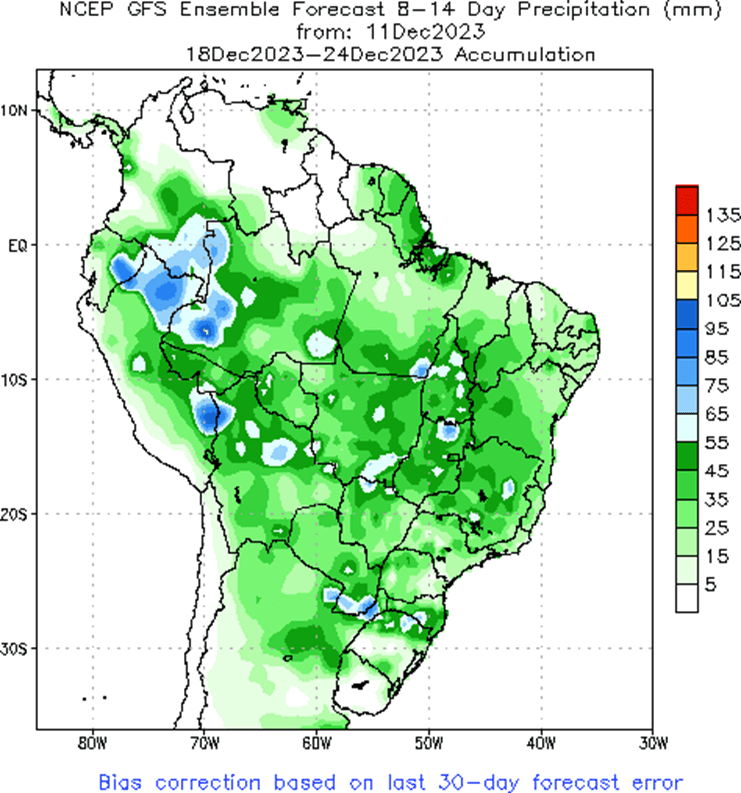

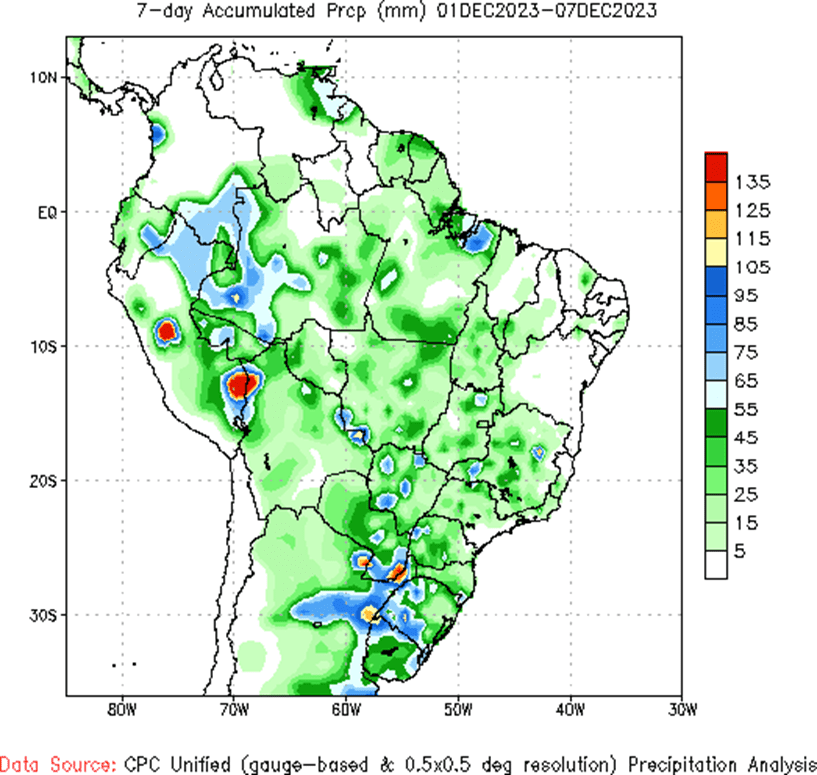

- Soybeans are trading lower this morning as heavier rain totals are forecast in the driest regions of Brazil starting late next week through January.

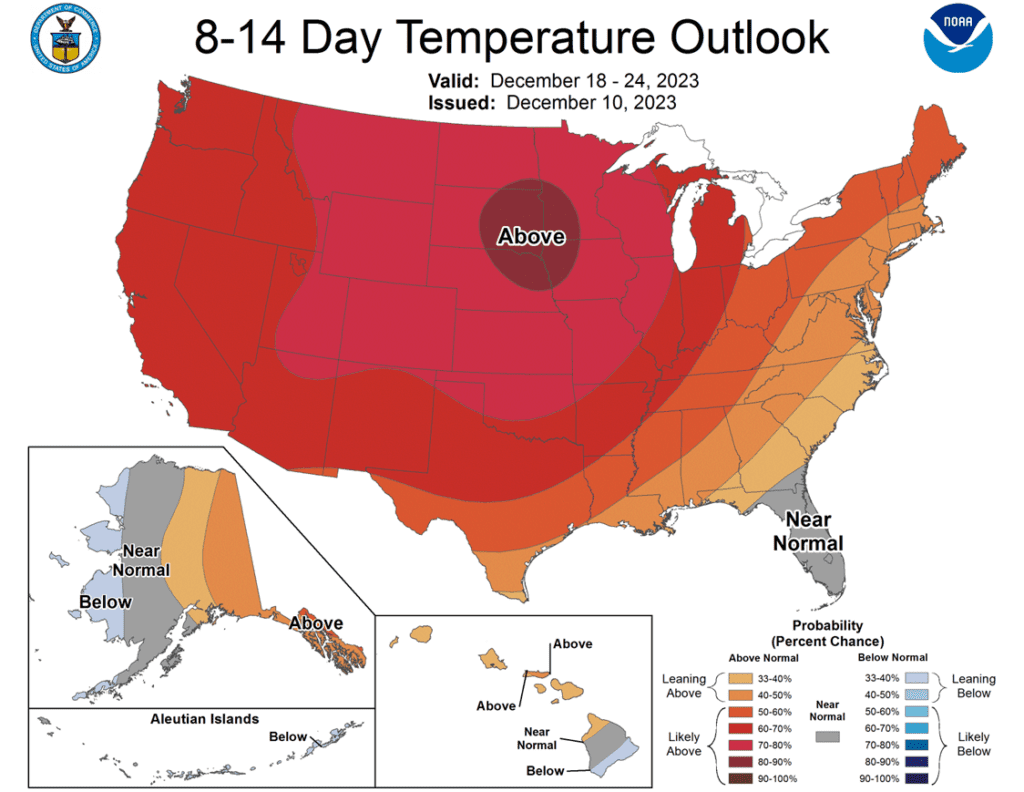

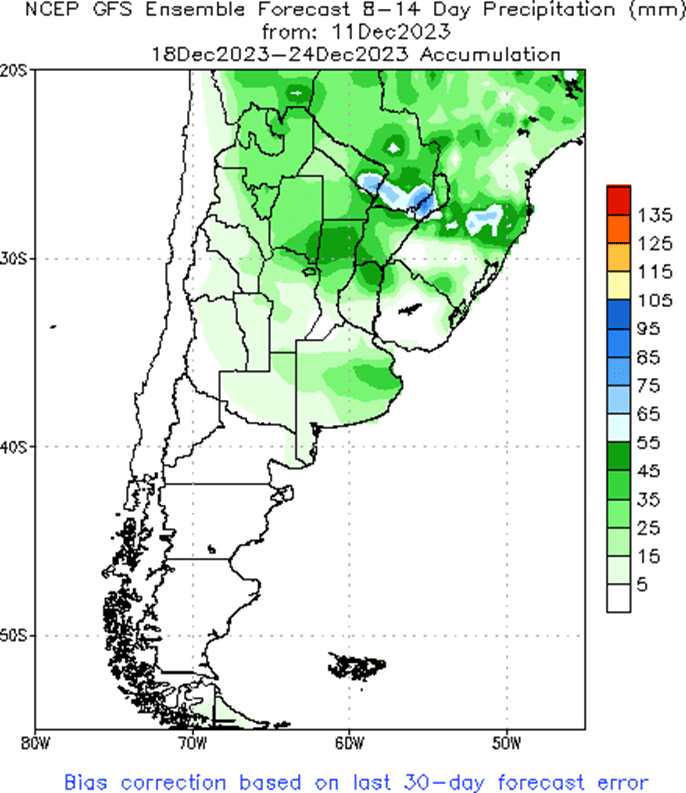

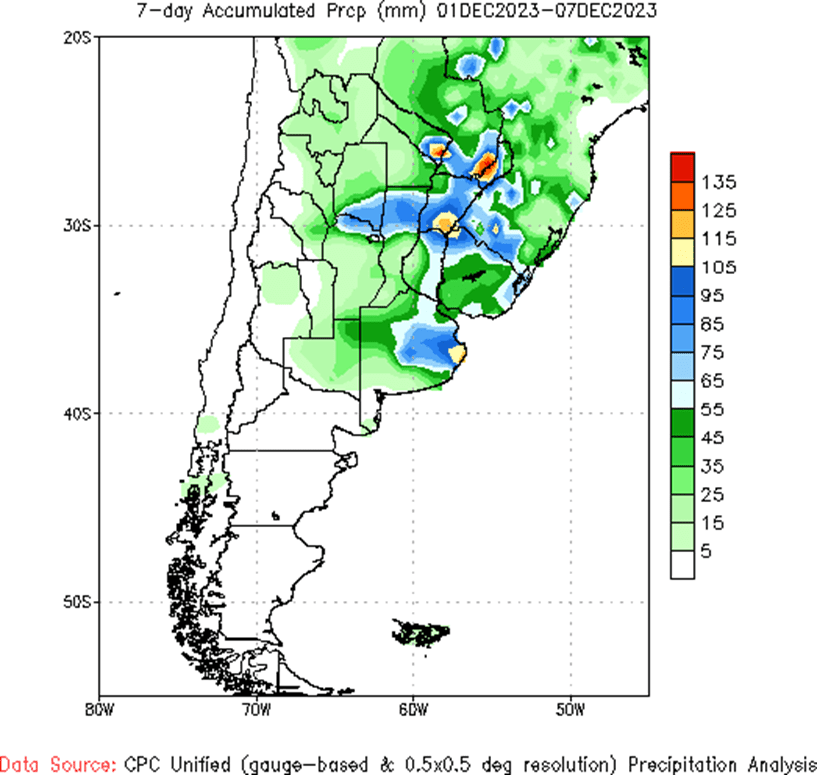

- Weather conditions look to remain mostly favorable for Argentina over the next two weeks continuing to support early crop development.

- Newly elect Argentine President Milei is expected to announce this week many of his reforms which could have an impact on global soybean meal trade given Argentina’s large impact in that market.

- Brazil’s ABIOVE lowered their Brazilian soybean production forecast to 161.9 million tons this week, down 2.8 million tons from their previous estimate, but above the USDA’s December estimate of 161 million tons.

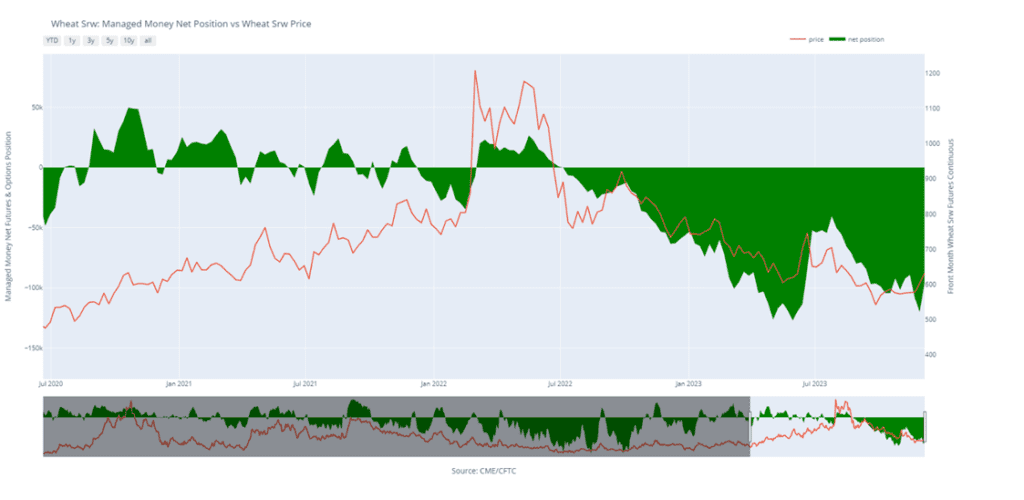

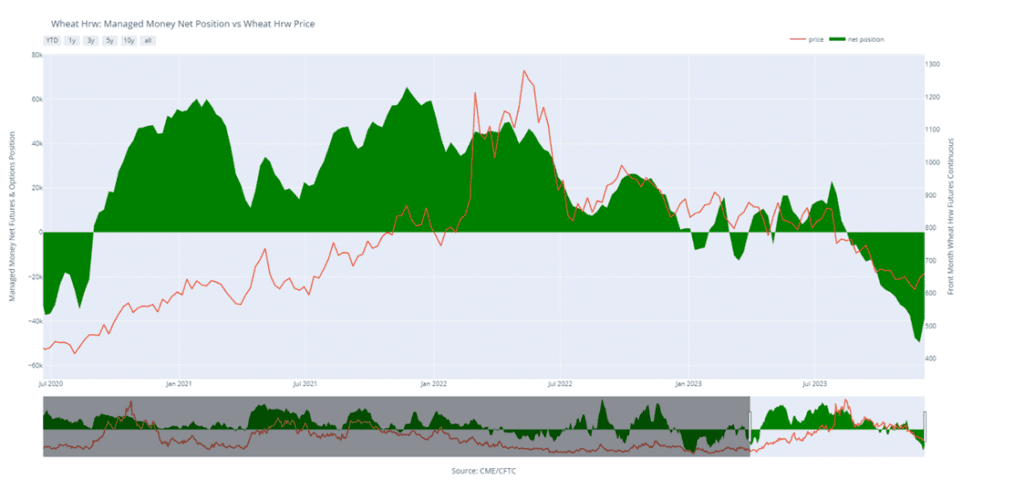

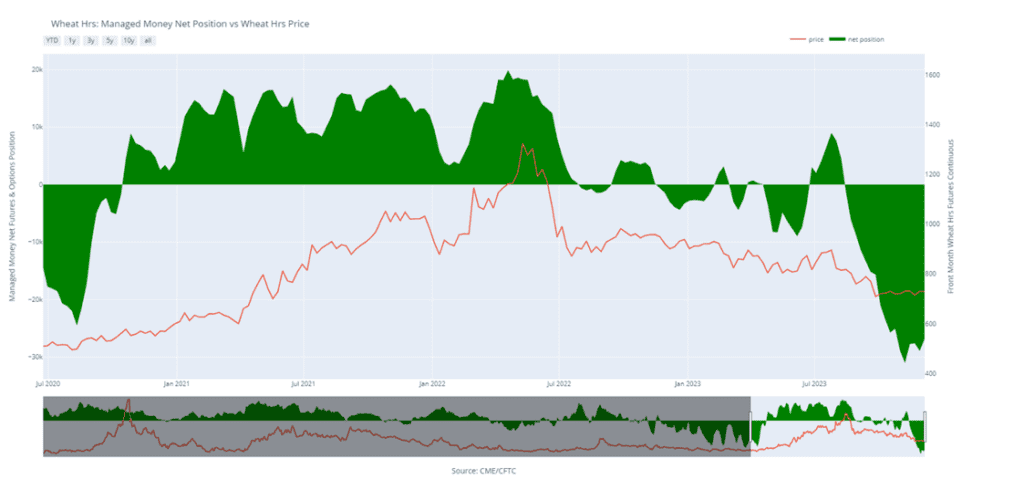

- All three wheat classes are trading lower this morning after yesterday’s rally.

- Argus said this week that Ukraine’s wheat production could be a 12-year low in 2024 due to lower planted area.

- EU soft red wheat exports through December 10 were estimated at 13.61 million tons compared to 15.85 million a year ago.

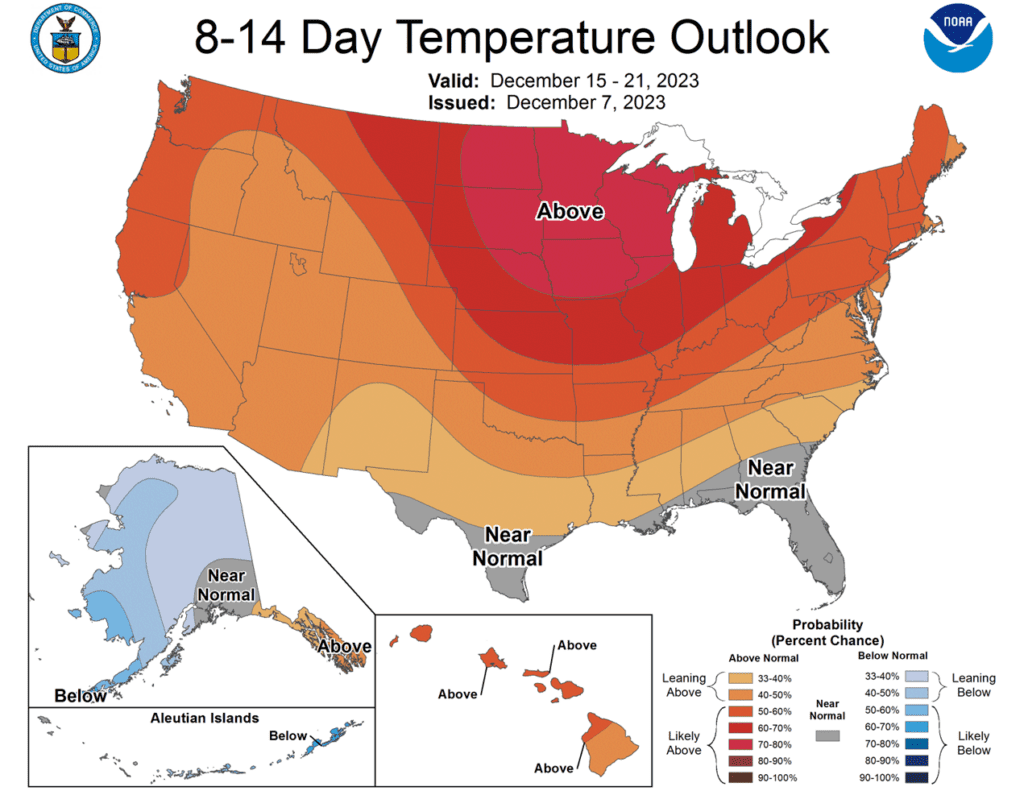

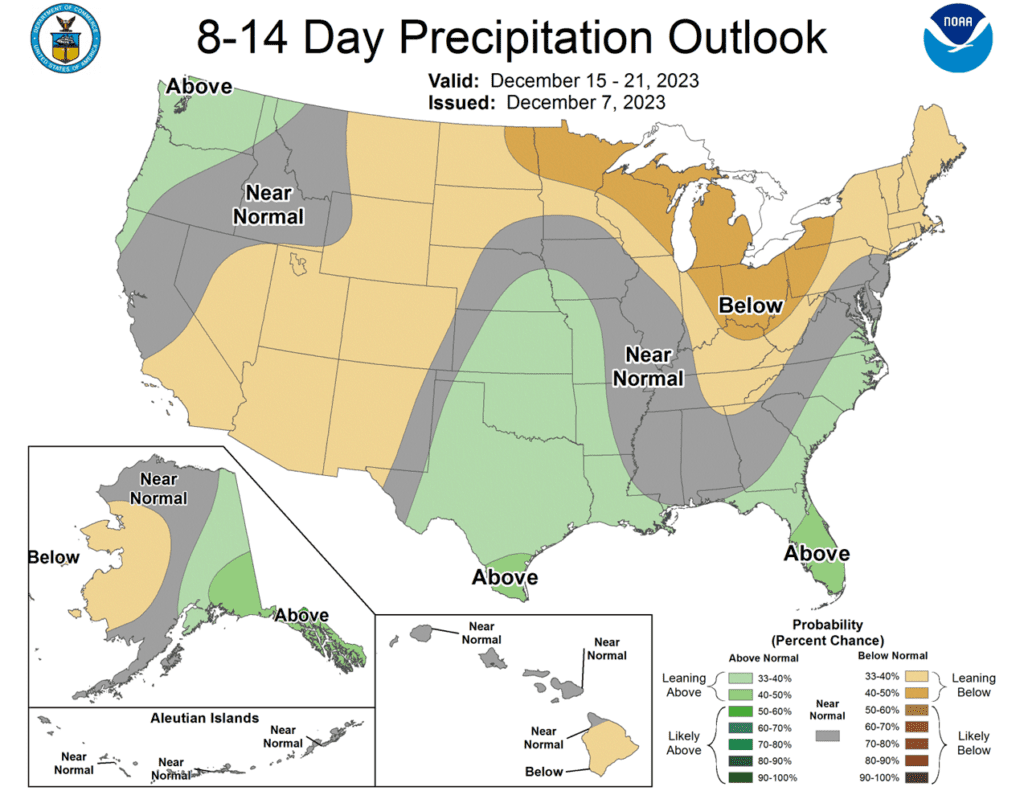

- A low pressure system is expected to move slowly across much of the US central plains this week bringing welcome moisture.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.