12-28 Opening Update: Grains Unchanged to Lower on Thin Volume and Lack of Fresh News

All prices as of 6:30 am Central Time

|

Corn |

||

| MAR ’24 | 476.25 | -0.25 |

| JUL ’24 | 497 | -1 |

| DEC ’24 | 506 | -0.5 |

|

Soybeans |

||

| JAN ’24 | 1315.5 | -1.25 |

| MAR ’24 | 1319 | -1.5 |

| NOV ’24 | 1263.25 | -2 |

|

Chicago Wheat |

||

| MAR ’24 | 625 | 2 |

| MAY ’24 | 636 | 2.25 |

| JUL ’24 | 640.25 | 0.75 |

|

K.C. Wheat |

||

| MAR ’24 | 635 | 0 |

| MAY ’24 | 638.25 | 0.75 |

| JUL ’24 | 639.5 | -0.5 |

|

Mpls Wheat |

||

| MAR ’24 | 723.5 | 1.75 |

| JUL ’24 | 740 | -7.5 |

| SEP ’24 | 747.75 | -8 |

|

S&P 500 |

||

| MAR ’24 | 4834 | 0.5 |

|

Crude Oil |

||

| FEB ’24 | 73.17 | -0.94 |

|

Gold |

||

| FEB ’24 | 2083 | -10.1 |

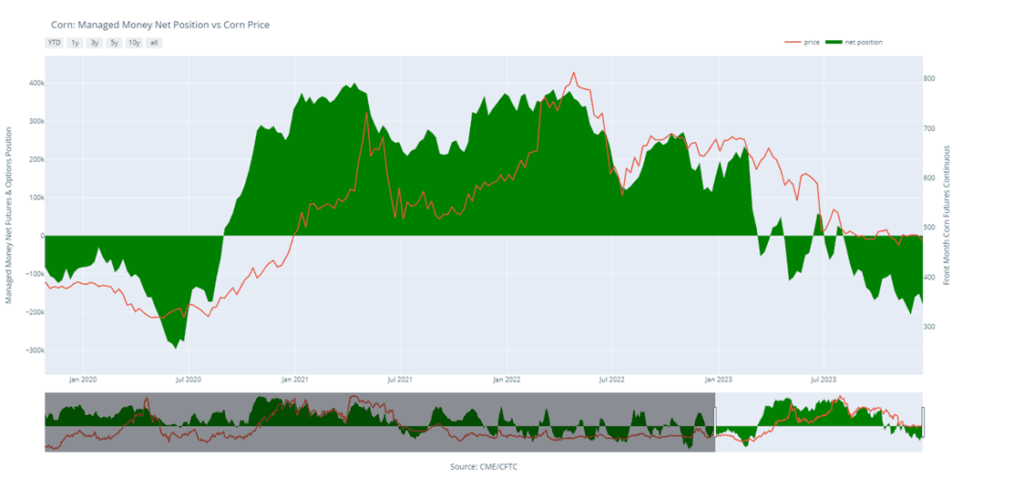

- Corn is unchanged to start the day with the March contract continuing to trade rangebound to slightly lower. Large US ending stocks and an upcoming South American harvest are adding pressure.

- Demand for ethanol as well as good export demand has kept prices from falling much lower. Expectations for today’s EIA report see production lower at 1.062m b/d and stockpiles at 22.923 m bbl.

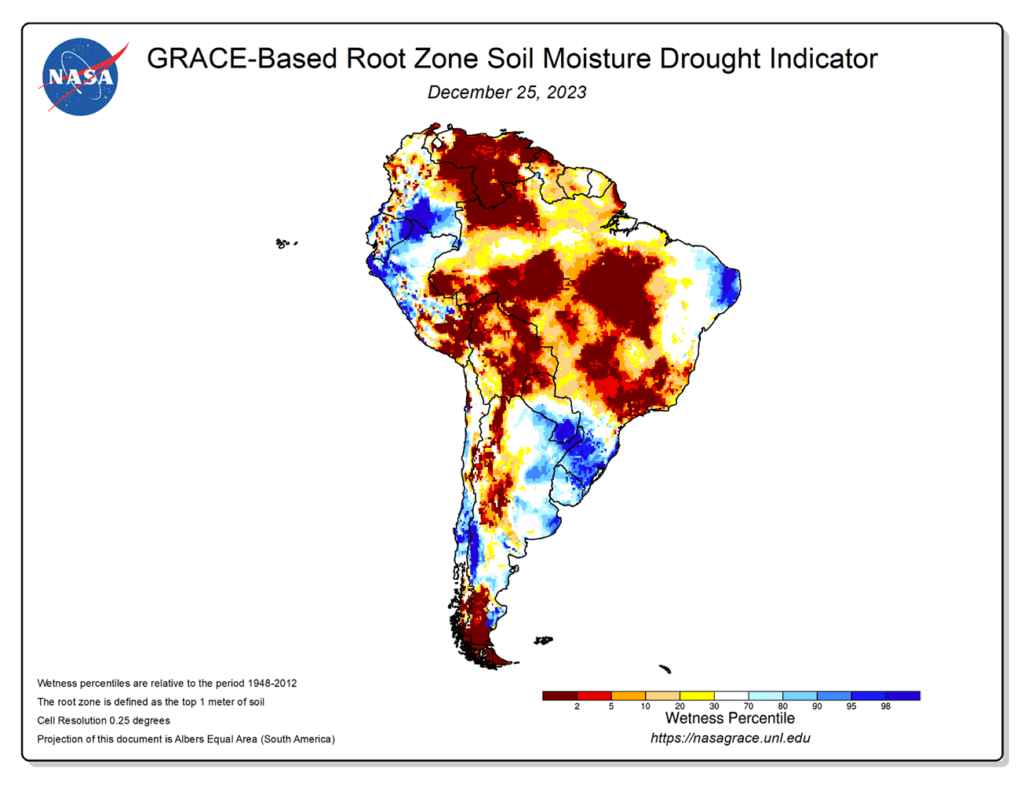

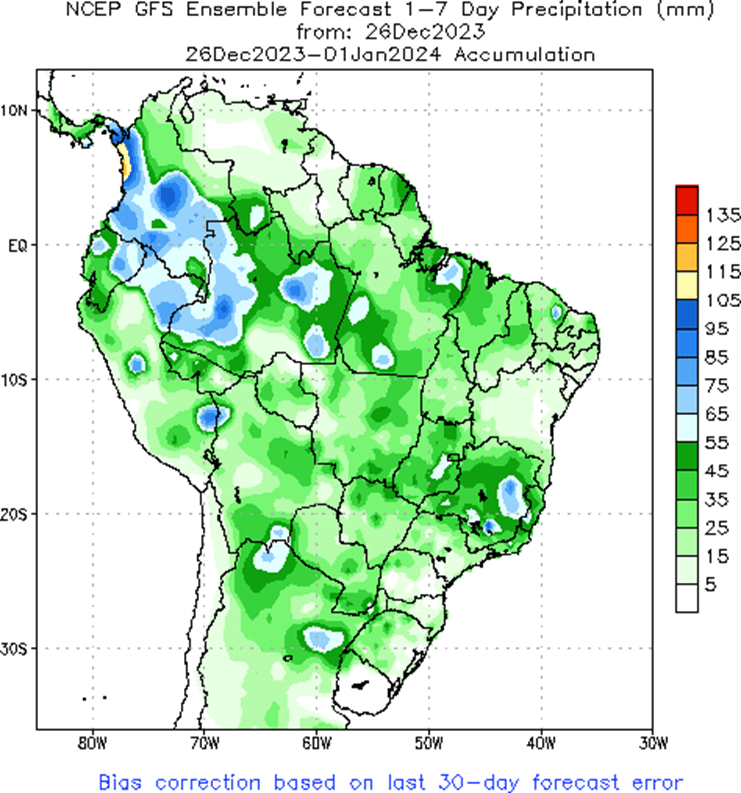

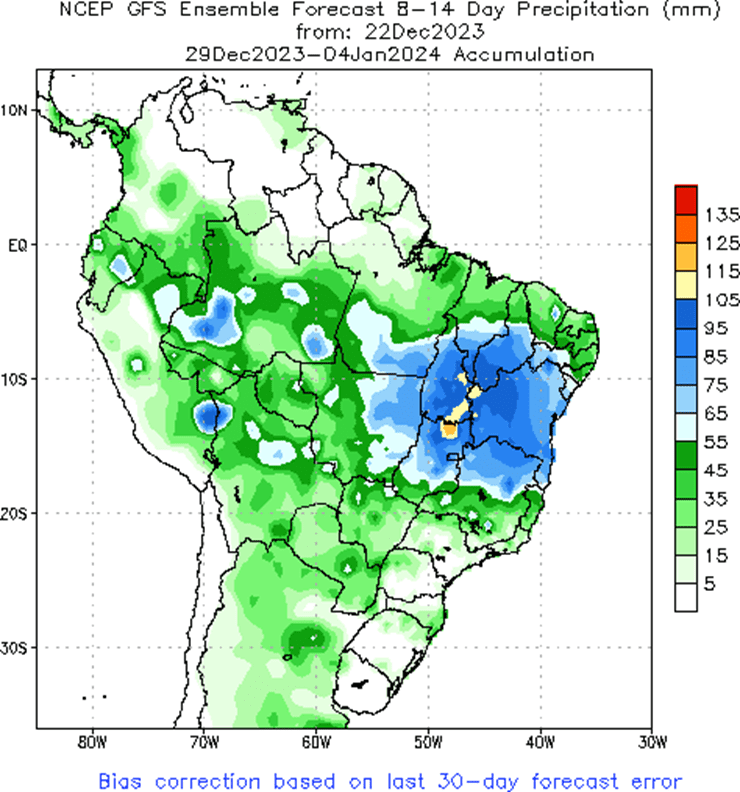

- The USDA’s last estimate for Brazilian corn production was 129 mmt, but Brazil’s estimates are lower at 118 mmt. Estimates for Argentina were at 55 mmt, but their final production could be higher.

- The decline in estimates for Brazilian corn production is due to planting delays of the first crop and likely planting delays of the second crop as the soybean harvest will be late.

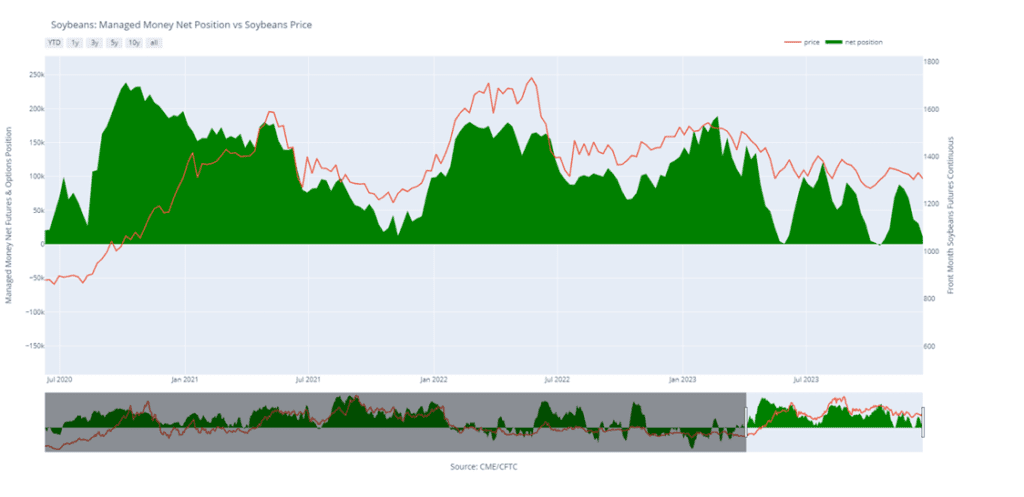

- Soybeans are trading slightly lower today but had three consecutively higher closes over the past few days as the US expects tight ending stocks.

- Dr. Michael Cordonnier has lowered his estimate of the Brazilian soybean crop to 153 mmt which is below the USDA’s last guess of 161 mmt.

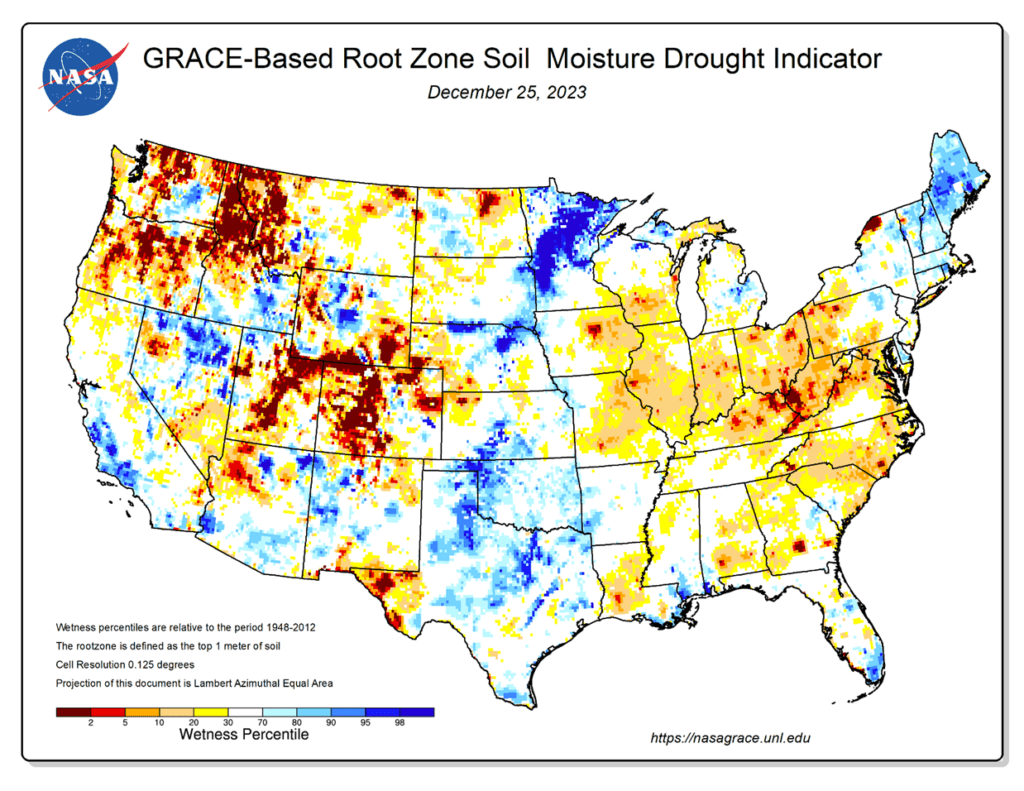

- Argentina’s soy crop is estimated at 48 mmt or potentially higher thanks to very good weather conditions early in the season and good soil moisture.

- While both soybean meal and oil are slightly higher this morning, the recent selloff has caused crush incentives to fall with the value of crushed beans exceeding uncrushed by $1.81 per bushel based off January futures.

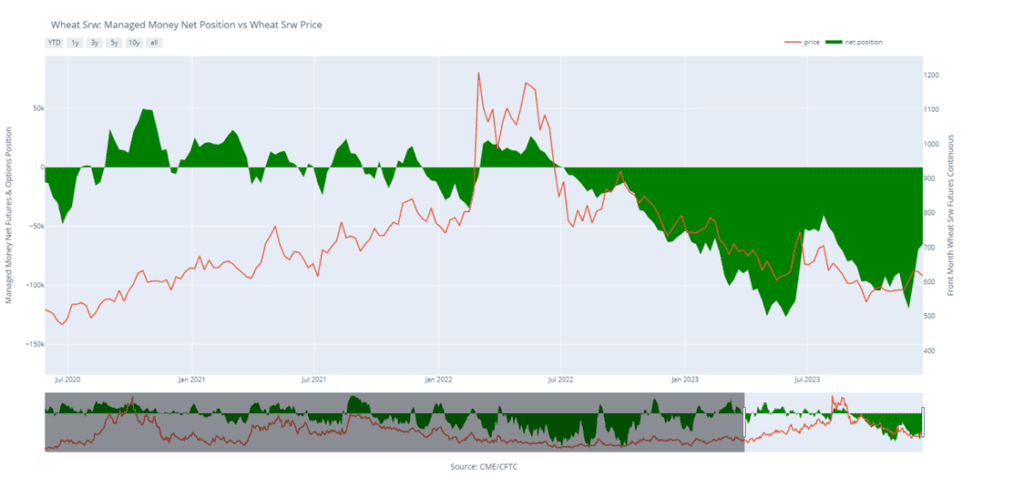

- All three wheat classes are trading higher this morning after they broke to the upside on Tuesday and may be putting a squeeze on the managed funds.

- The March contract of Chicago wheat is on track for a 30-cent plus gain on the month which would be the largest monthly gain since 2022.

- SovEcon has cut their Russian wheat export estimates to 48.6 mmt which compares to a previous estimate of 48.8 mmt as increasing freight rates cause weaker shipment numbers.

- Yesterday, managed funds were net sellers of Chicago wheat, selling an estimated 4,000 contracts. They currently hold an estimated short position of 54,000 contracts.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.