7-17 End of Day: Grains End Mixed Following Weekly Export Report

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- 🌽 Corn: Corn futures ended Thursday’s trading session lower, snapping a three-day winning streak, as a disappointing export sales report weighed on the market.

- 🌱 Soybeans: Soybeans were the only major grain to end in positive territory, posting gains at the close, supported by a favorable export sales report.

- 🌾 Wheat: Wheat futures closed lower across the board today, pressured by a strengthening U.S. dollar and ongoing global harvest activity.

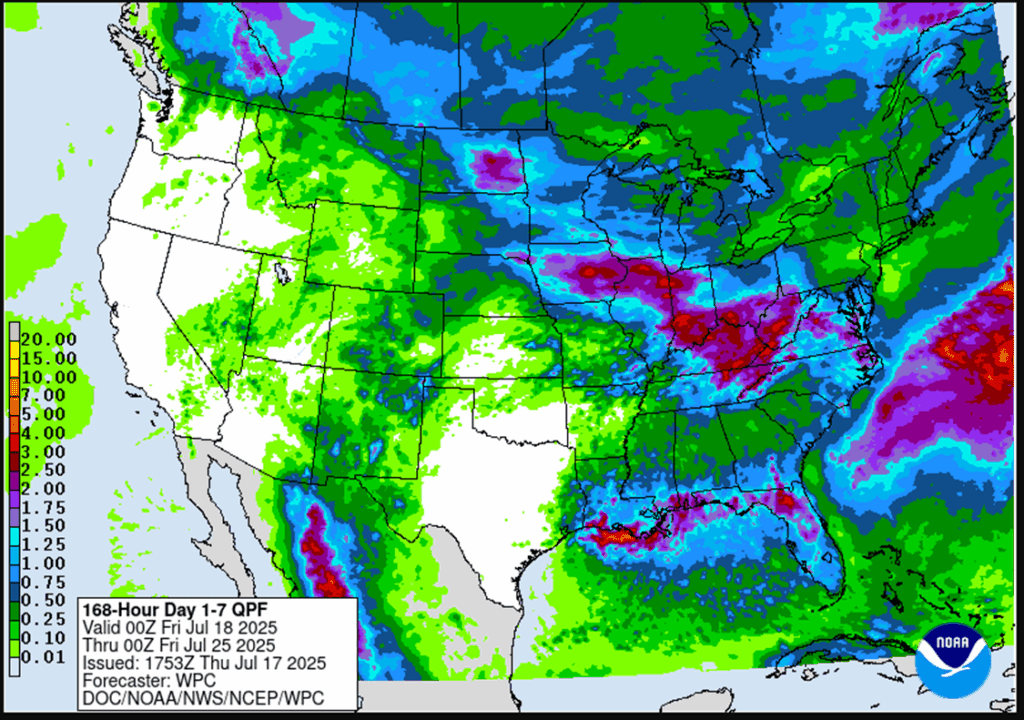

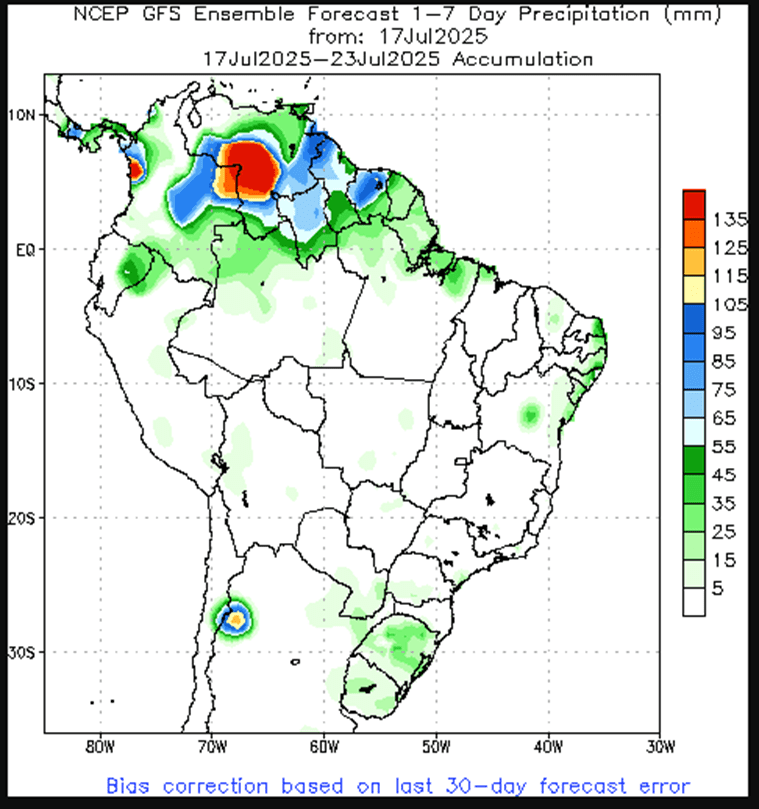

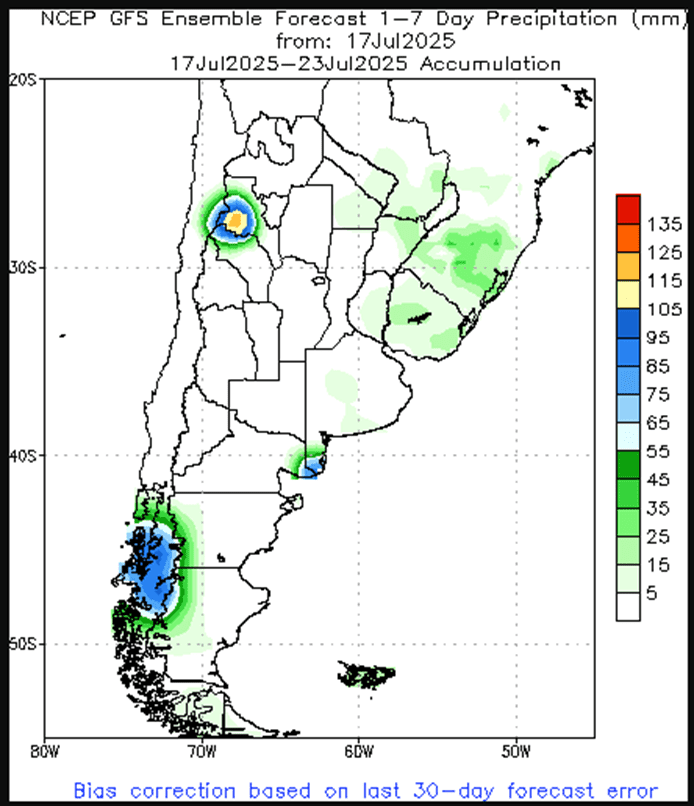

- To see updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

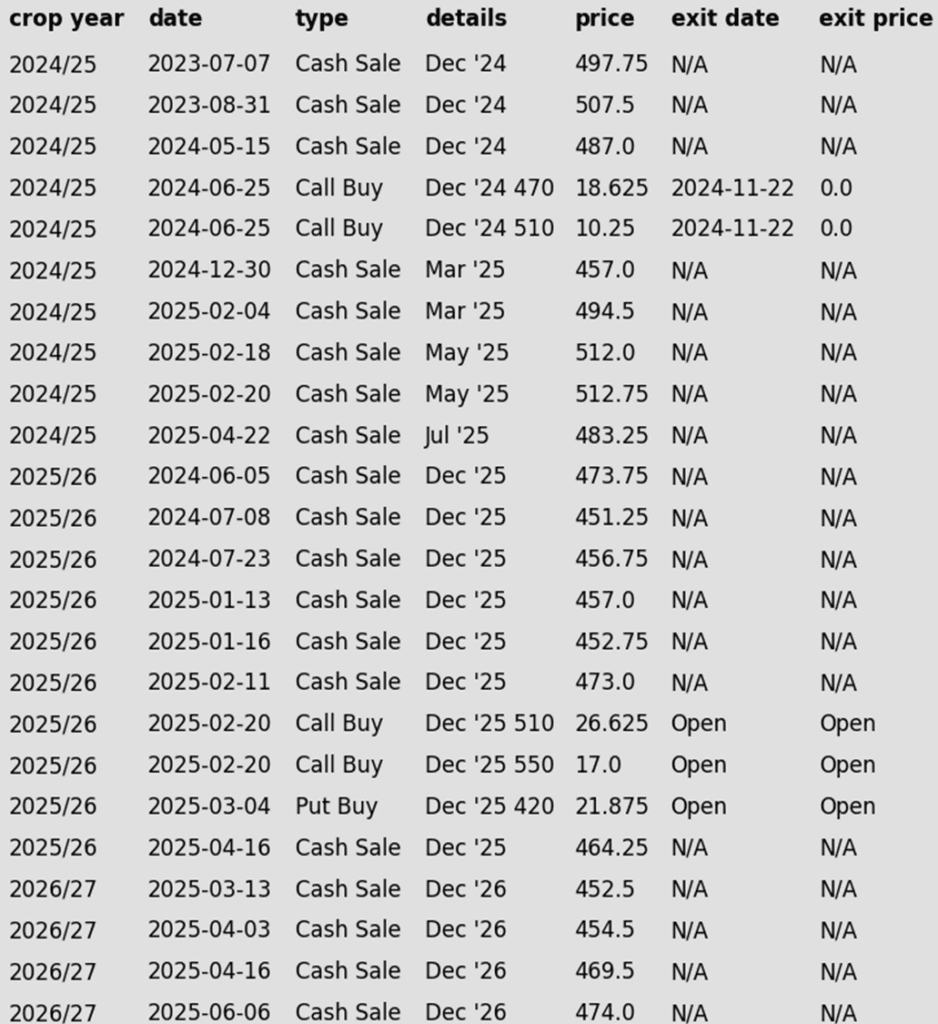

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

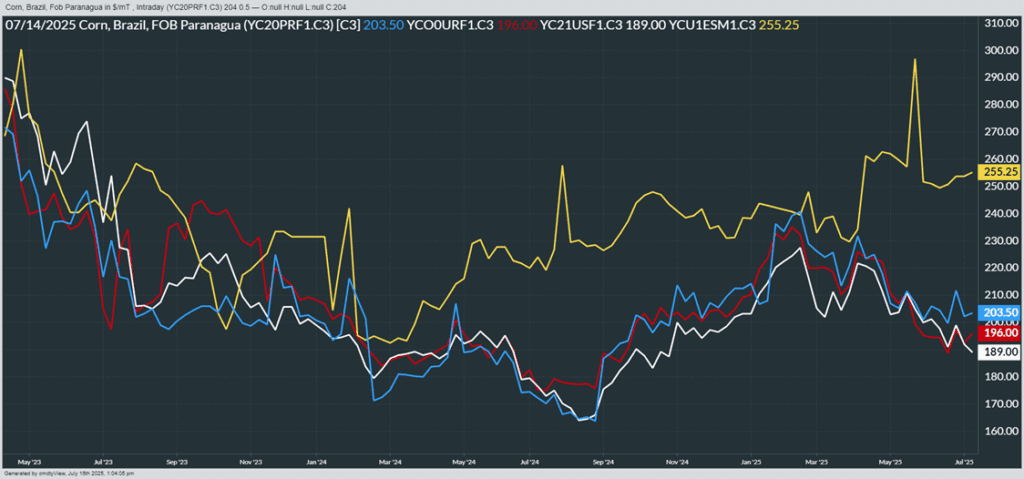

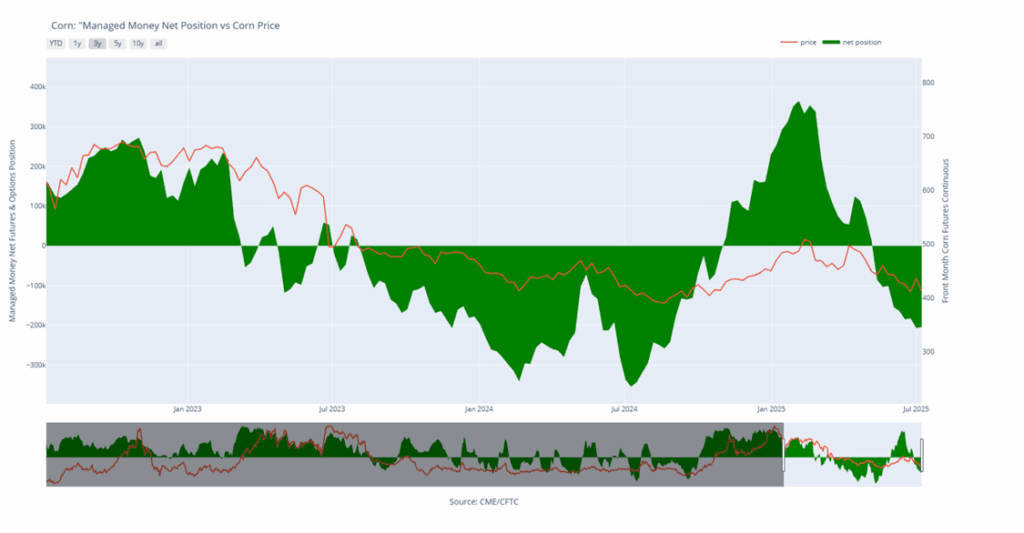

- Corn futures ended the three-session winning streak as the market posted marginal losses on Thursday. A disappointing export sales report and weakness in the wheat market pressured corn futures in the session.

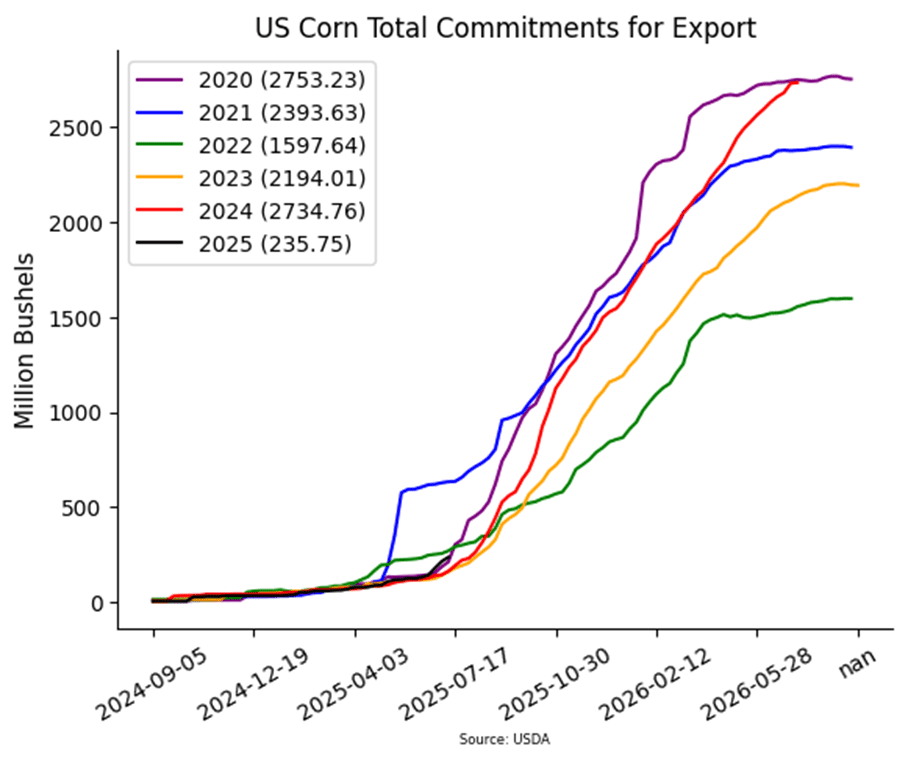

- The USDA released weekly corn export sales on Thursday morning. For the week ending July 10, U.S. exporters sold 97,600 Mt (3.8 mb) for the 2024-25 marketing year. This total was well below expectations and a marketing year low. New sales were lacking, but a large portion of sales to unknown destinations were switched to a known sale in the week. New sales for the 2025-26 marketing year were 565,900 MT (22.3 mb), which was within expectations.

- Wheat futures pressured the corn market, as wheat prices traded to 2-month lows. A firming U.S. dollar and global harvest pressure limited the market. The technical picture of the wheat market looks weak, which could limit potential gains in the corn market.

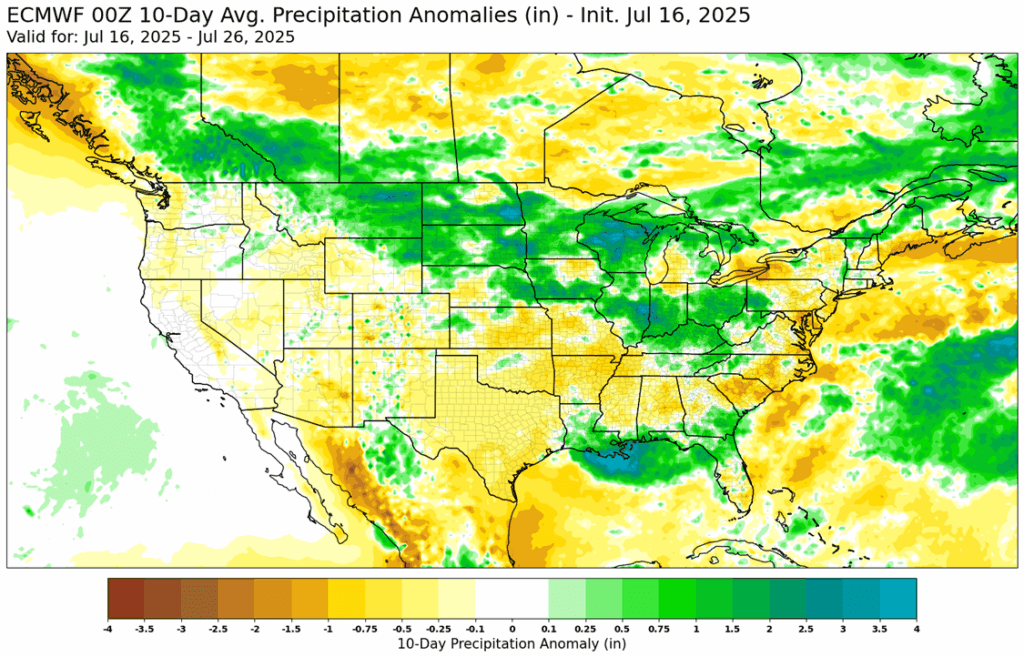

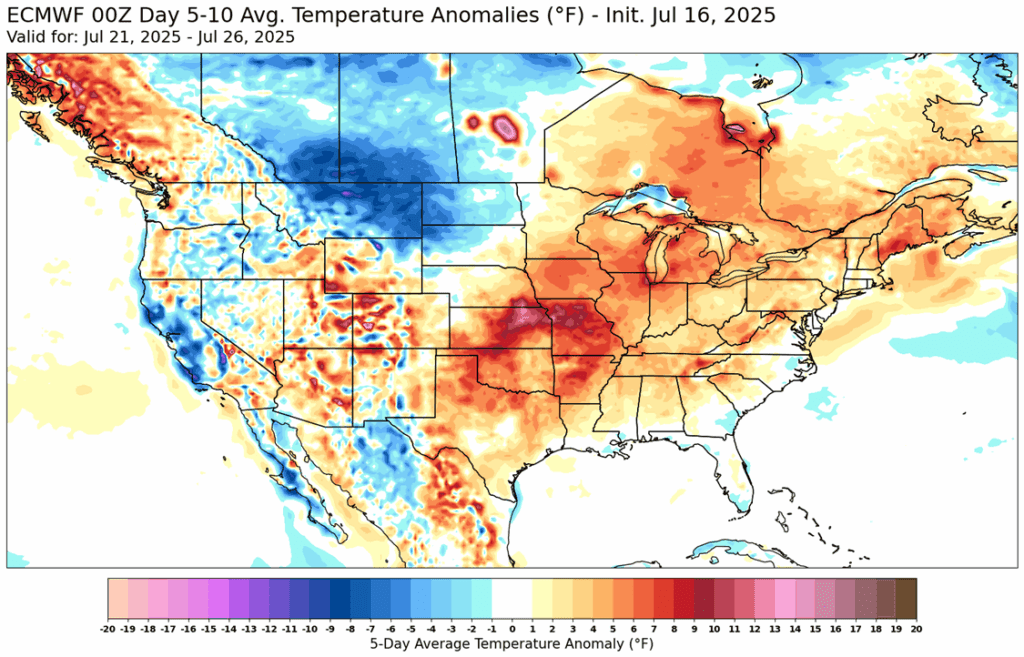

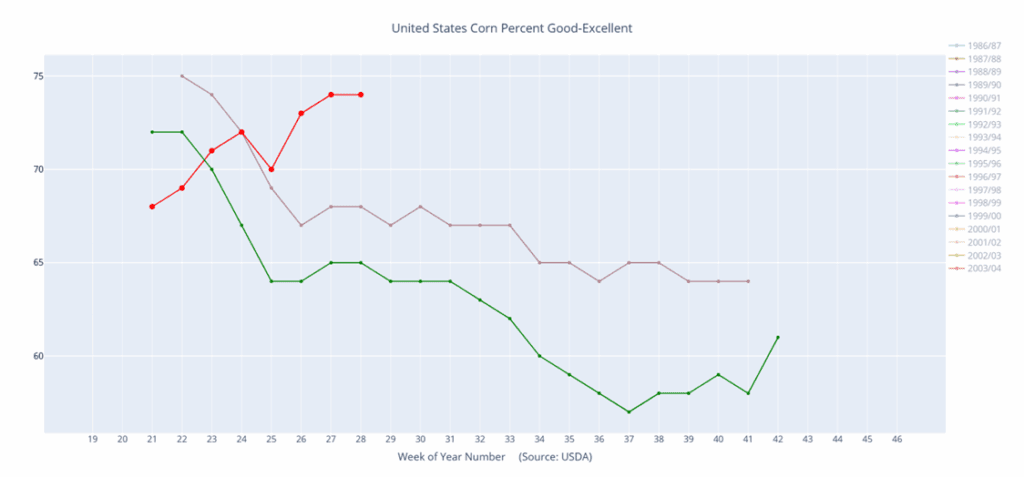

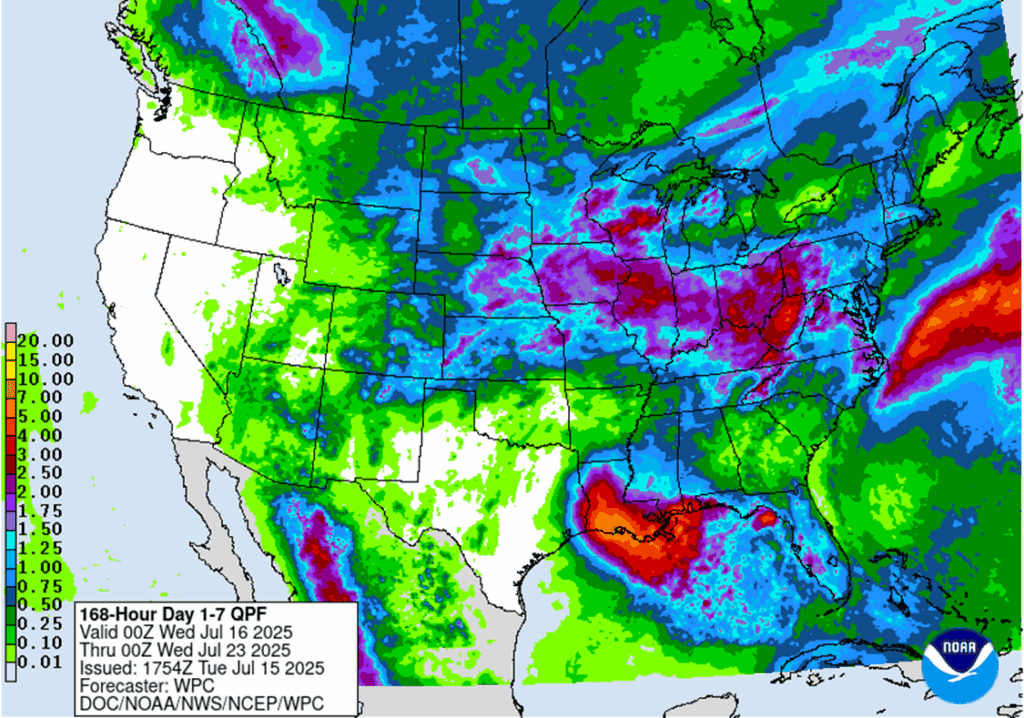

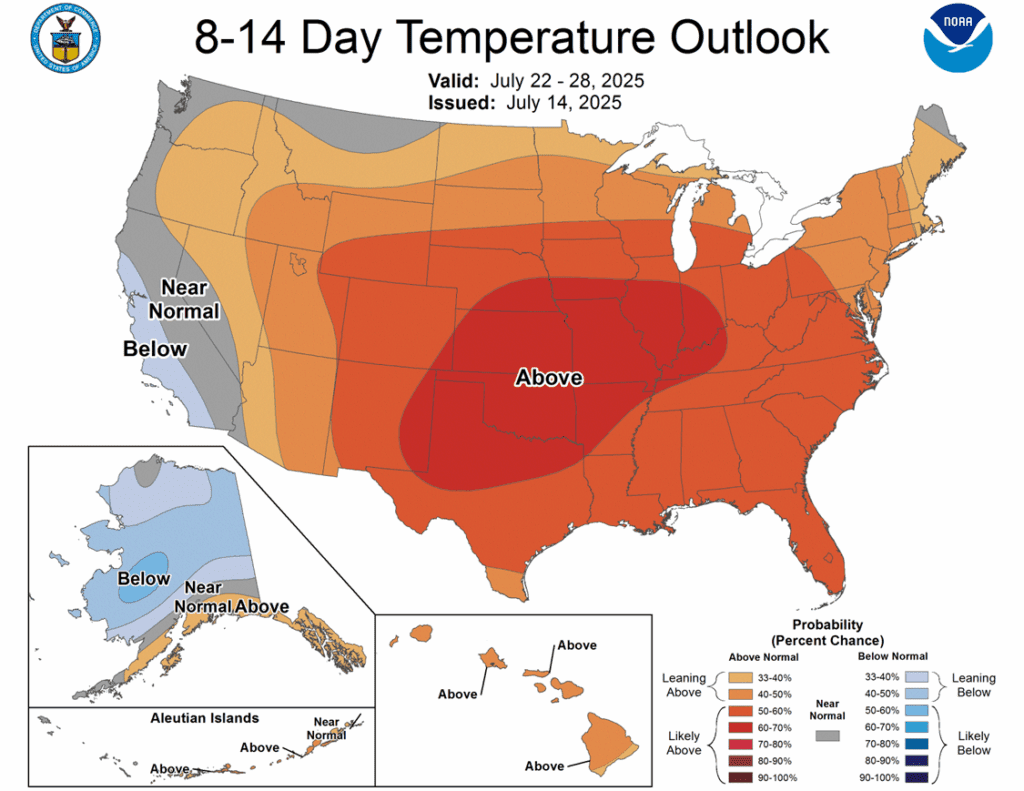

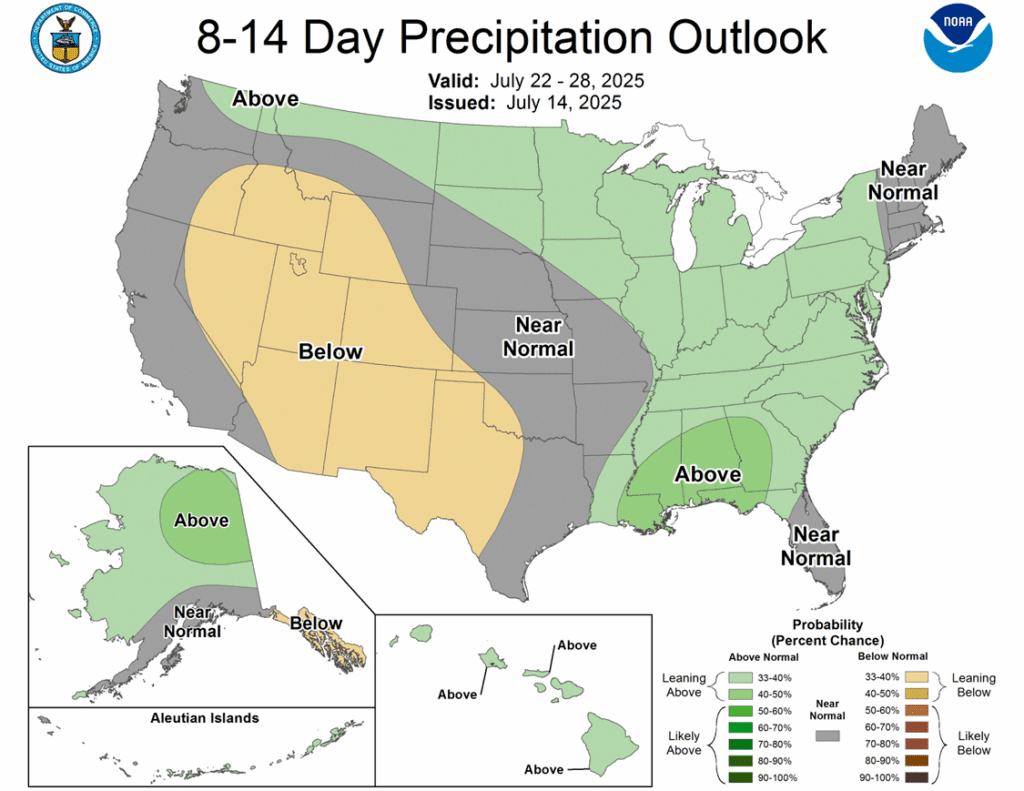

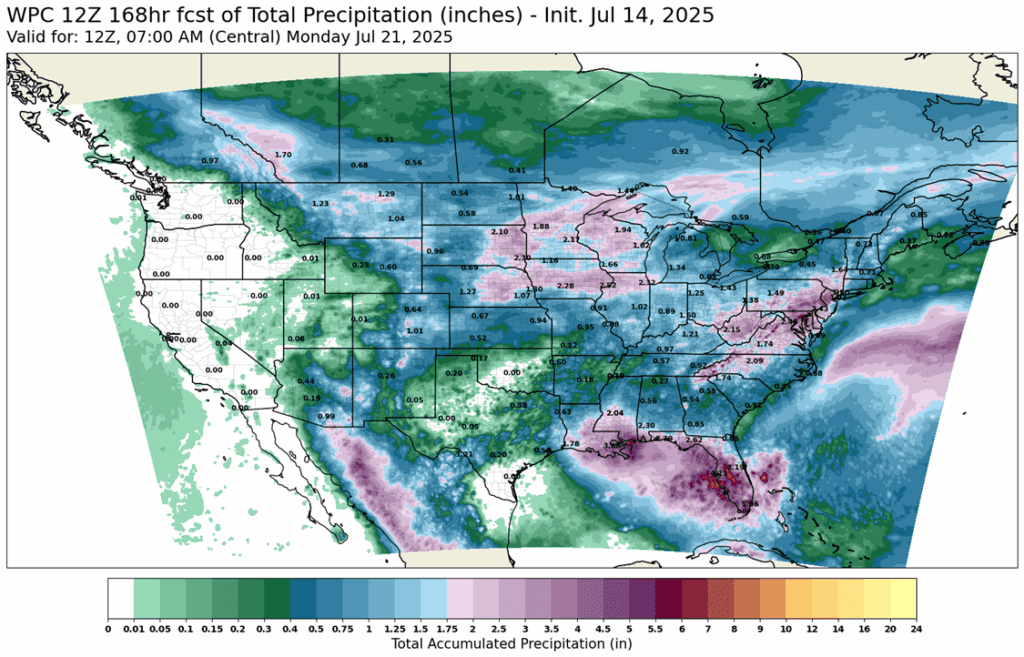

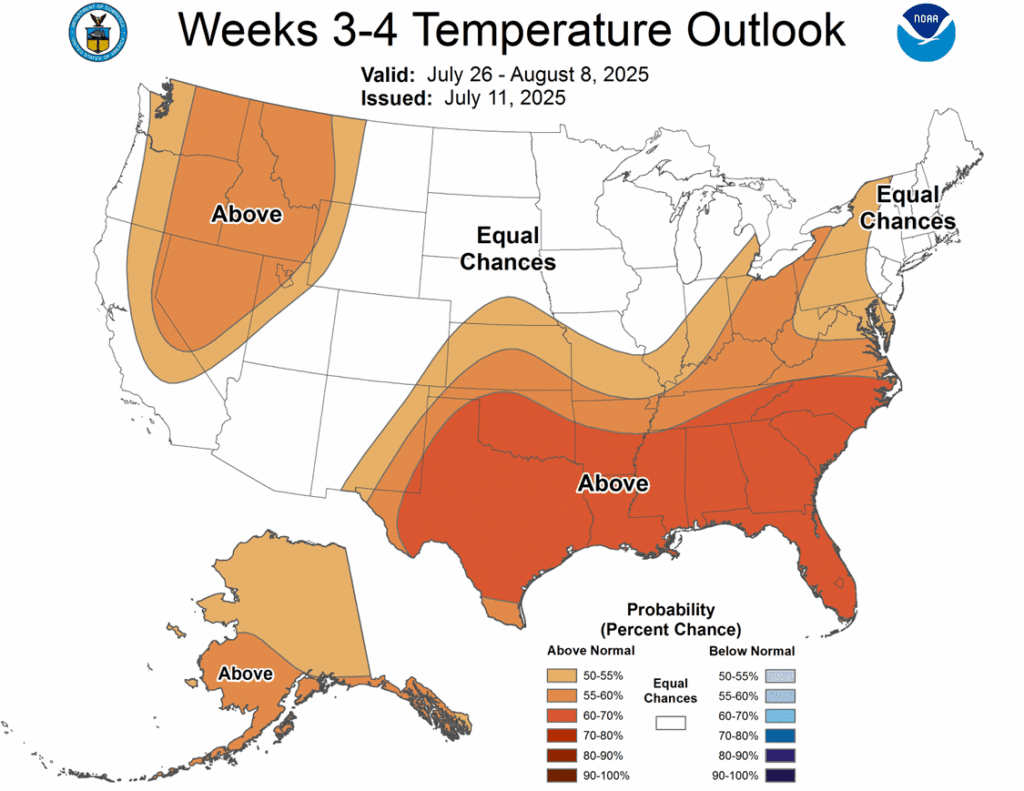

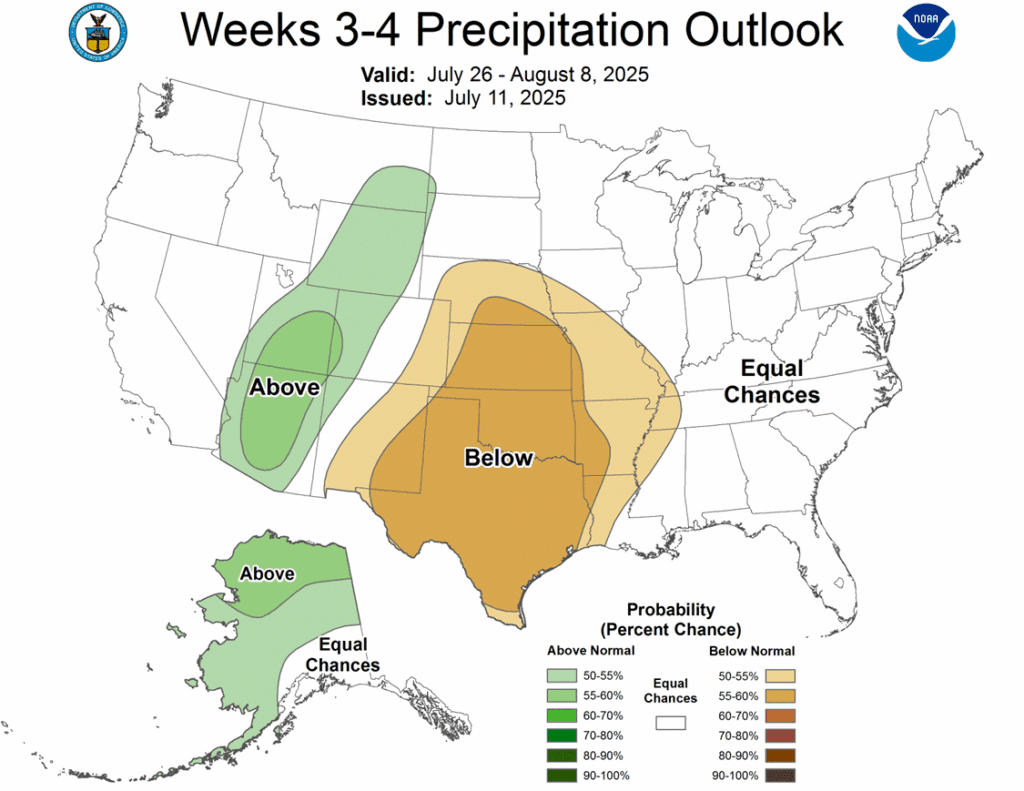

- Over the next 7 days, the forecast for the Corn Belt looks to remain warm and wet. Temperatures are expected to trend above normal, but it is predicted that most of the Corn Belt will see 140% of normal rainfall according to forecast maps.

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start the week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at this week’s low of 391.

Soybeans

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

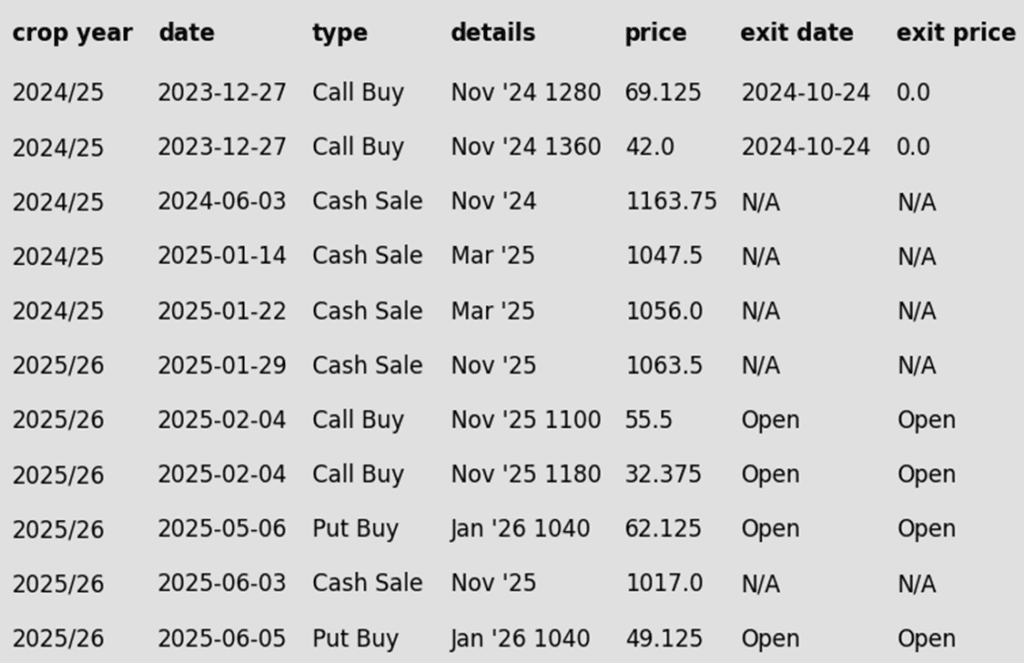

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

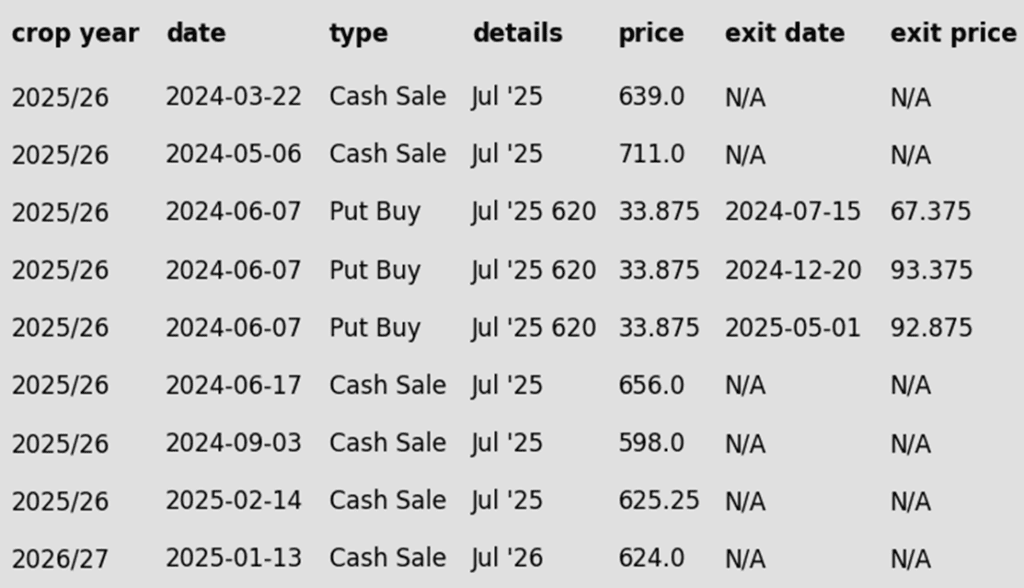

To date, Grain Market Insider has issued the following soybean recommendations:

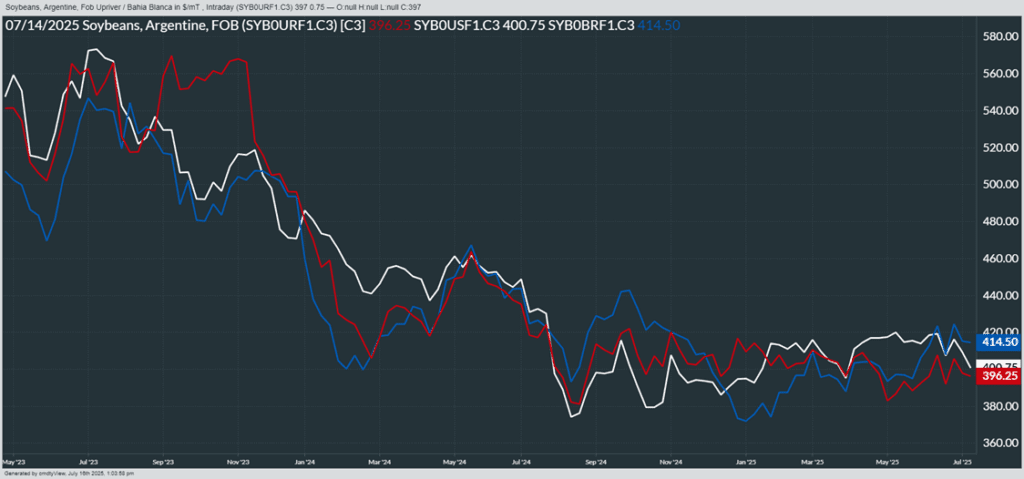

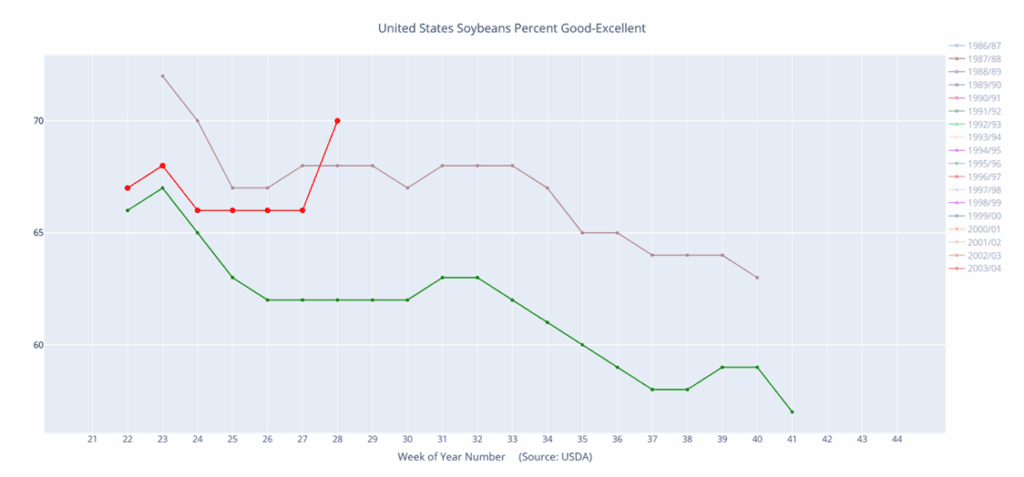

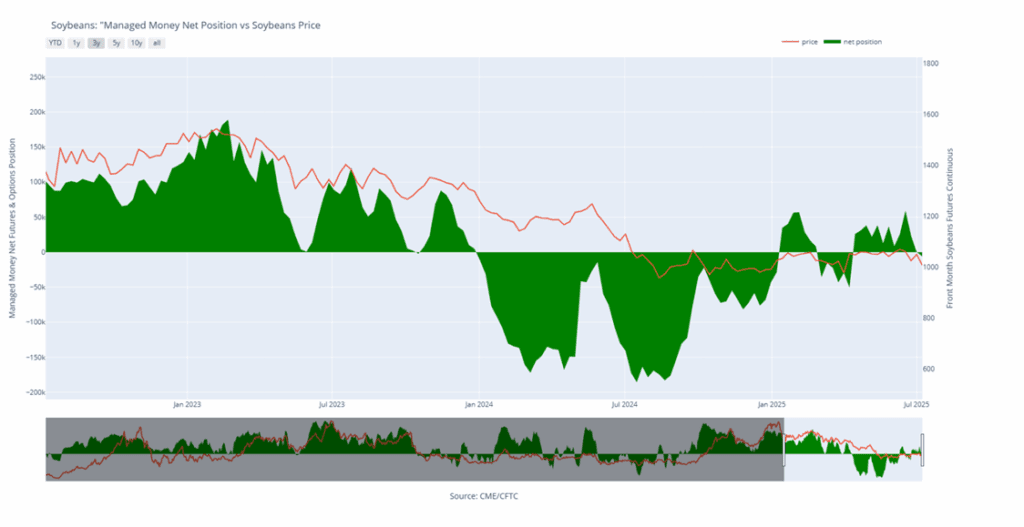

- Soybeans ended the day higher for the second consecutive day but may have hit some technical resistance at the 200-day moving average in the November contract at $10.30. Weather models have not turned dry for August, so funds may be taking profits on short positions. Both soybean meal and oil ended the day higher.

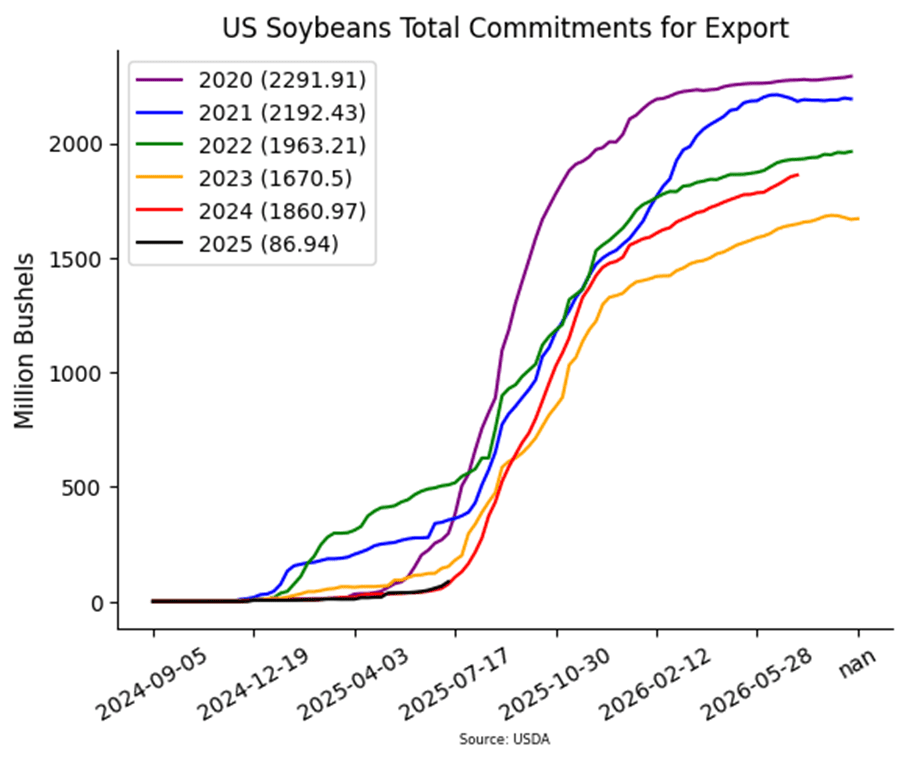

- Today’s export sales report saw bean sales within trade expectations with an increase of 10.0 mb for 24/25 and an increase of 29.5 mb for 25/26. Primary destinations were to Taiwan, Germany, and Algeria. Last week’s export shipments of 10.2 mb were below the 15.9 mb needed each week.

- U.S. soybean yields are reported steady with improving condition scores thanks to favorable weather so far in July. Production is estimated at 118 mmt on average, but a heatwave forecast at the end of the month could negatively impact the crop during prime growth period.

- Indonesia’s biodiesel consumption has reached 48% of its target as of July 16, and the Indonesian government is reportedly running tests to increase the mandatory biodiesel mix to 50%. Indonesian palm oil exports for June rose by 30.5%.

Soybeans Break Below 200-day

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A close above that level would target the June 2023 gap between 1161 and 1177. On the downside, futures recently slipped below the 200-day moving average, with next support at the April low near 980.

Wheat

Market Notes: Wheat

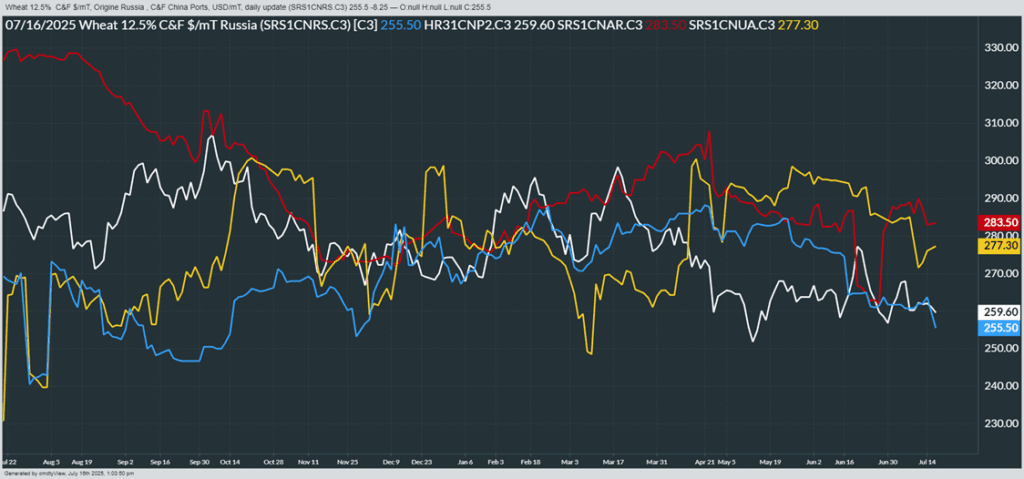

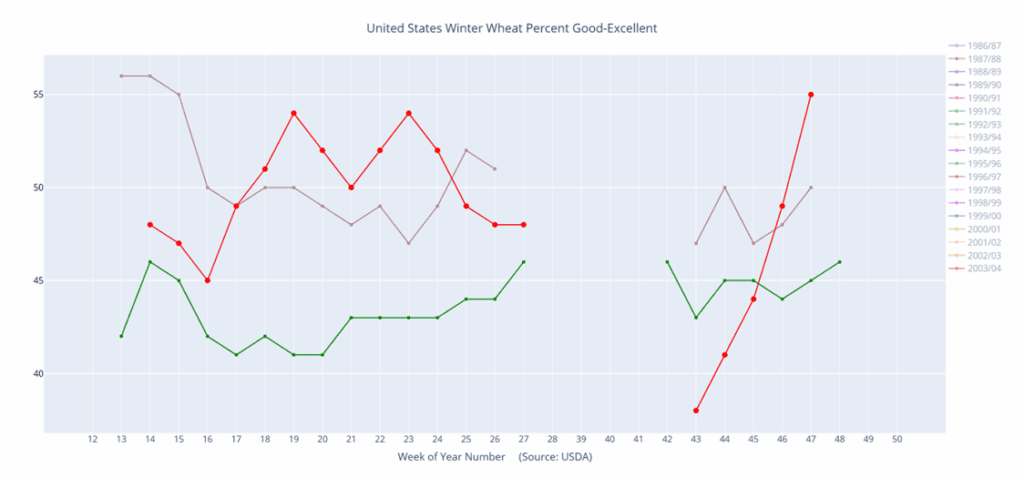

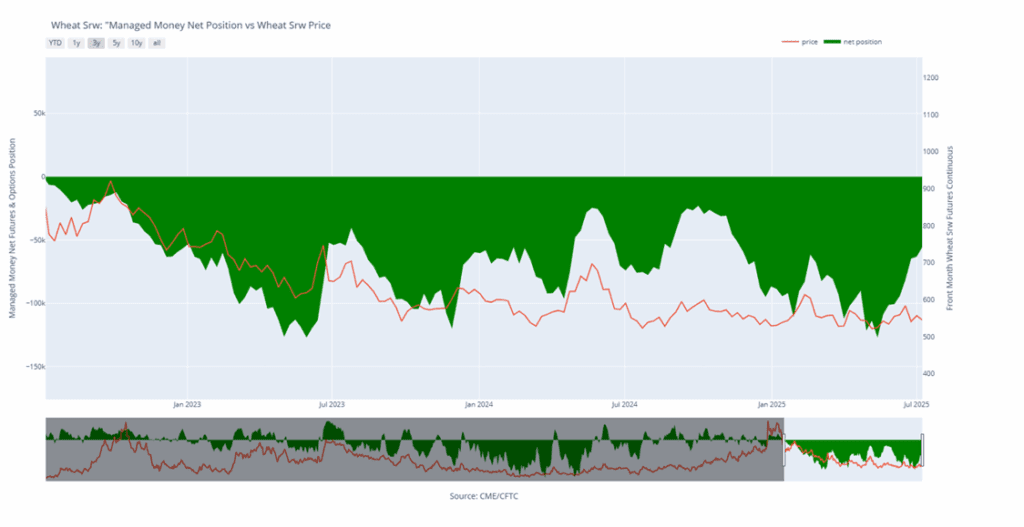

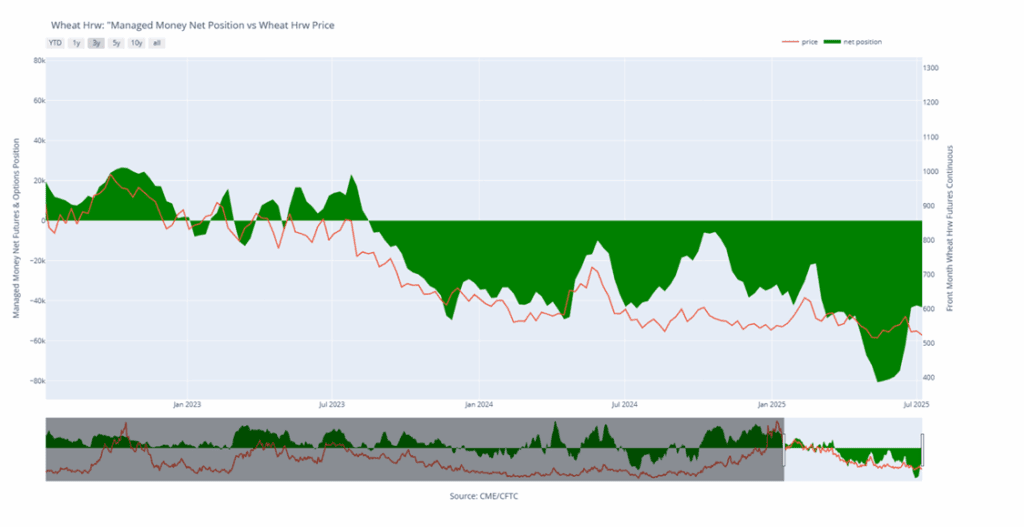

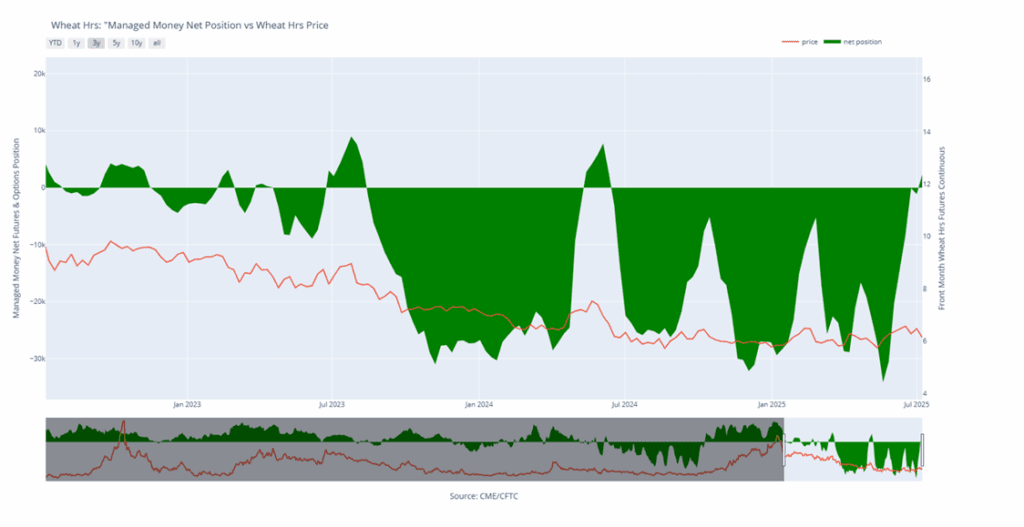

- Wheat closed with modest losses across the board, pressured by a recovery and a new near-term high for the U.S. Dollar Index. Additionally, Russia currently holds the most competitive wheat prices globally, and there is speculation that it may become more aggressive in targeting sales to the Asian market.

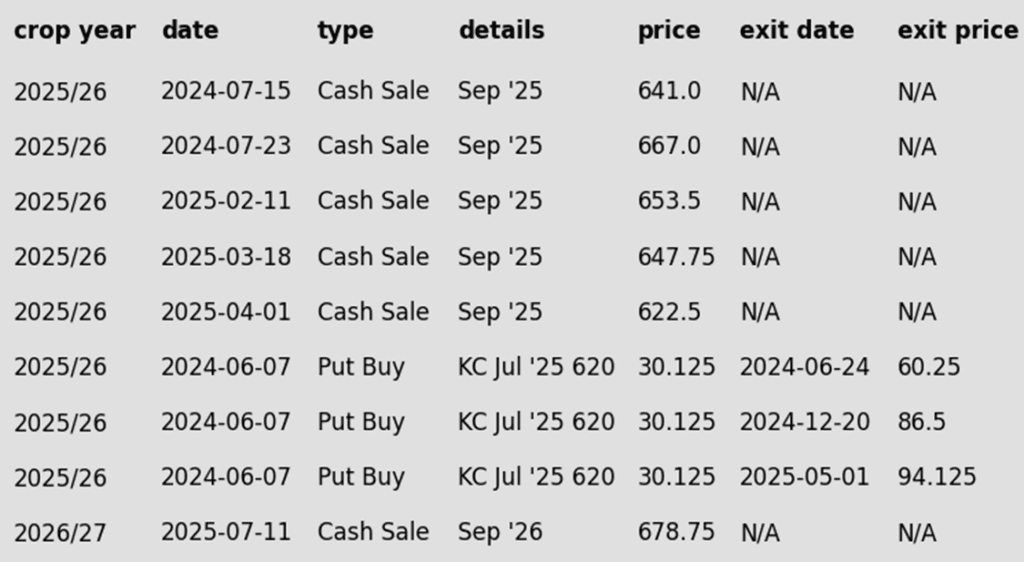

- The USDA reported an increase of 18.2 mb of wheat export sales for 25/26. Shipments last week totaled 15.9 mb, which falls under the 16.7 mb pace needed per week to reach their export goal of 850 mb. Total 25/26 export commitments are now at 303 mb, up 7% from last year.

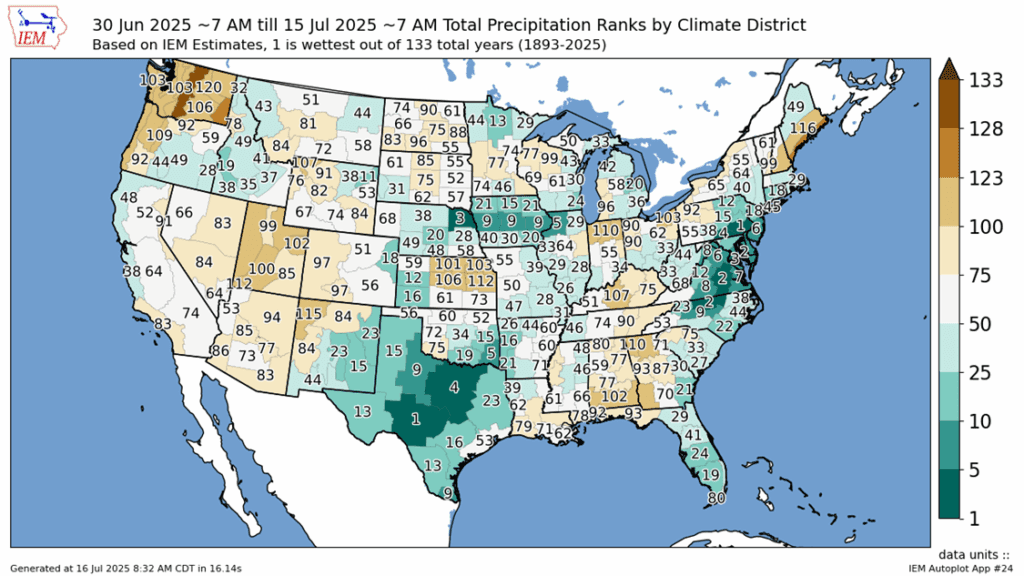

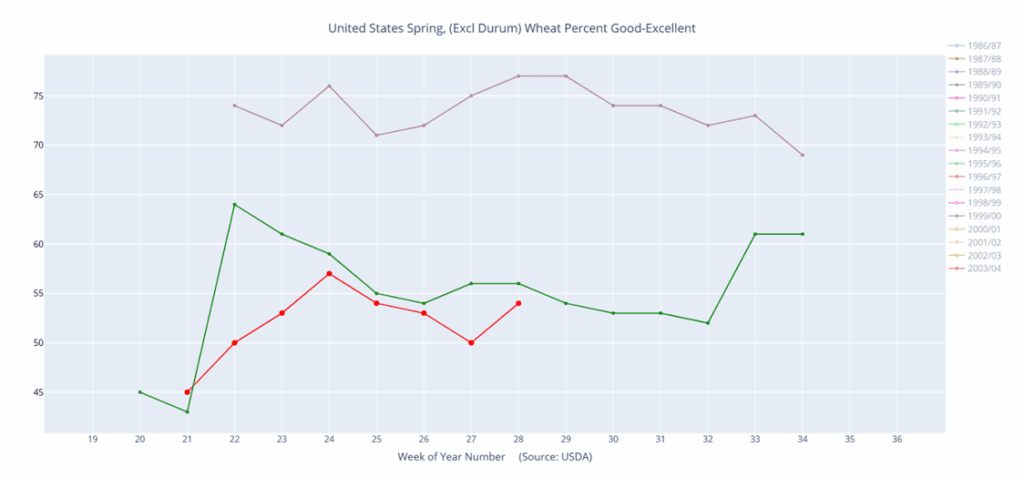

- As of July 15, drought readings increased for both U.S. winter and spring wheat areas. An estimated 36% of the spring wheat crop is experiencing drought, up 1% from last week. During the same period, winter wheat area drought conditions rose from 26% to 30%.

- On a bullish note, the Rosario Grain Exchange has revised their estimate of Argentine wheat production, lowering it by 700,000 mt to 20 mmt. Elsewhere, Turkey’s wheat harvest is also expected to fall by 3 mmt to 18 mmt due to drought.

- FranceAgriMer has said that French wheat stocks for the 25/26 season are expected to grow 66% year over year to 3.87 mmt. If realized, this would also be a 20-year high. Additionally, they are projecting that 25/26 soft wheat exports will total 14.32 mmt, compared with 10.36 mmt shipped during the 24/25 marketing year.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

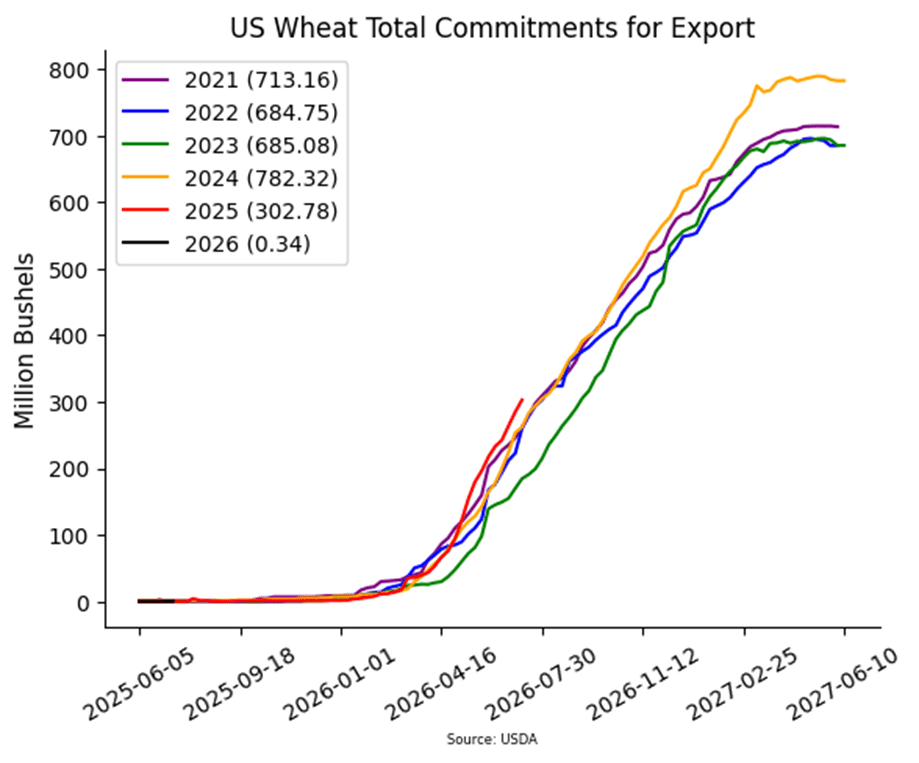

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.