7-23 Opening Update: Corn, Soybeans Rise; Wheat Softens

All prices as of 6:30 am Central Time

|

Corn |

||

| SEP ’25 | 400.75 | 1.5 |

| DEC ’25 | 419 | 1 |

| DEC ’26 | 457.5 | 0.75 |

|

Soybeans |

||

| AUG ’25 | 1016.25 | 6 |

| NOV ’25 | 1032 | 6.5 |

| NOV ’26 | 1068.5 | 6.25 |

|

Chicago Wheat |

||

| SEP ’25 | 548.5 | -1 |

| DEC ’25 | 568.25 | -1.25 |

| JUL ’26 | 603 | -1 |

|

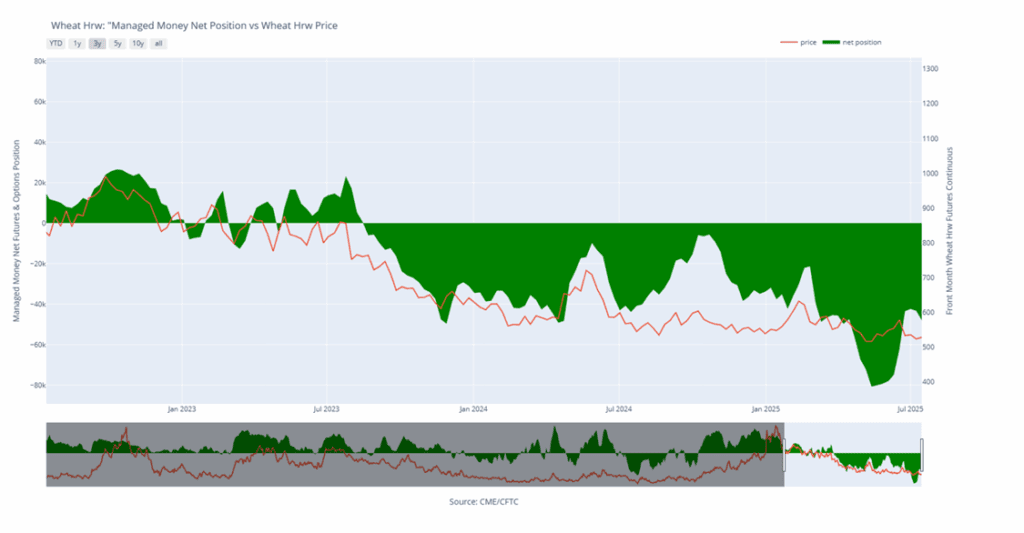

K.C. Wheat |

||

| SEP ’25 | 532 | -1.25 |

| DEC ’25 | 553.5 | -1.5 |

| JUL ’26 | 596.25 | -1.75 |

|

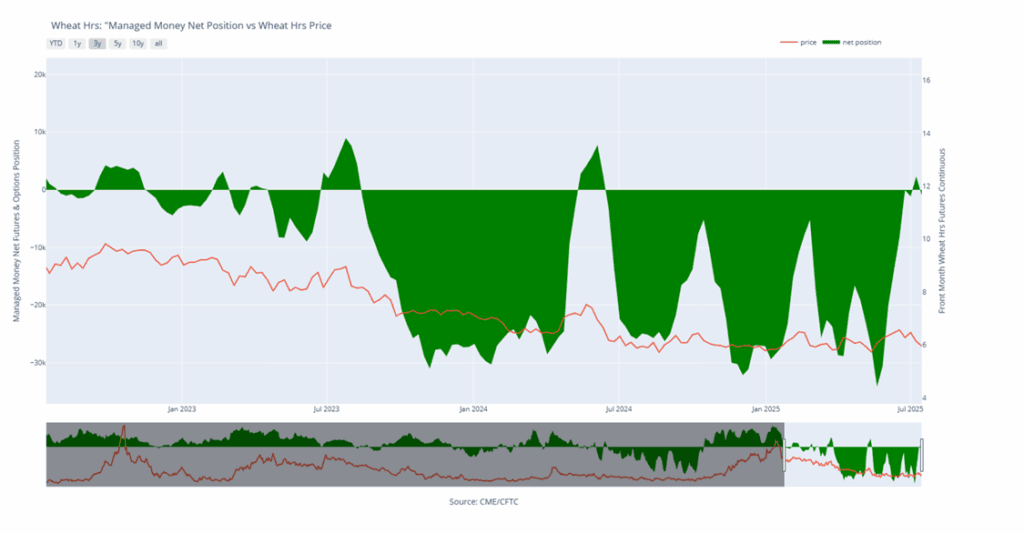

Mpls Wheat |

||

| SEP ’25 | 5.925 | 0.0075 |

| DEC ’25 | 6.13 | 0.0125 |

| SEP ’26 | 6.505 | 0 |

|

S&P 500 |

||

| SEP ’25 | 6366.75 | 20 |

|

Crude Oil |

||

| SEP ’25 | 64.85 | -0.46 |

|

Gold |

||

| OCT ’25 | 3462 | -10.1 |

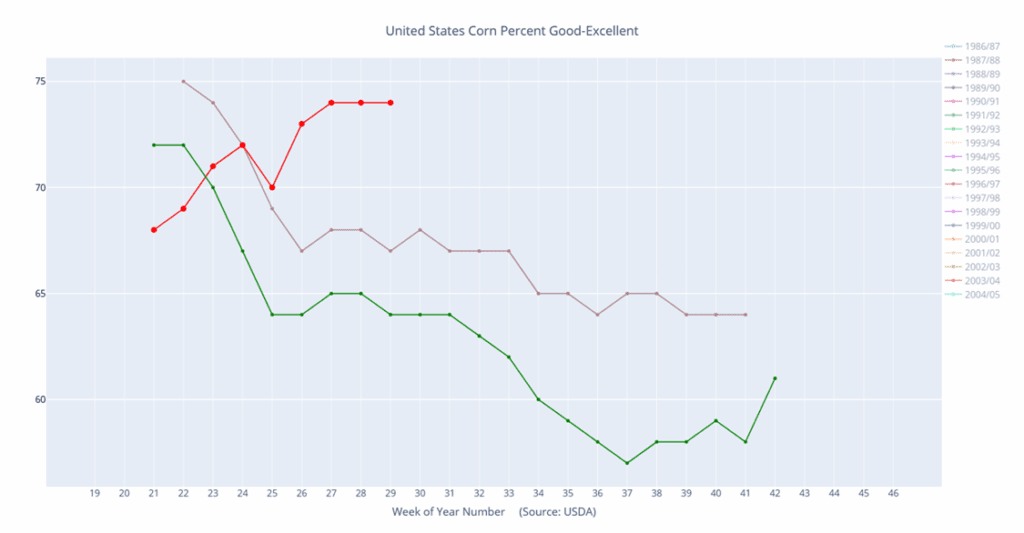

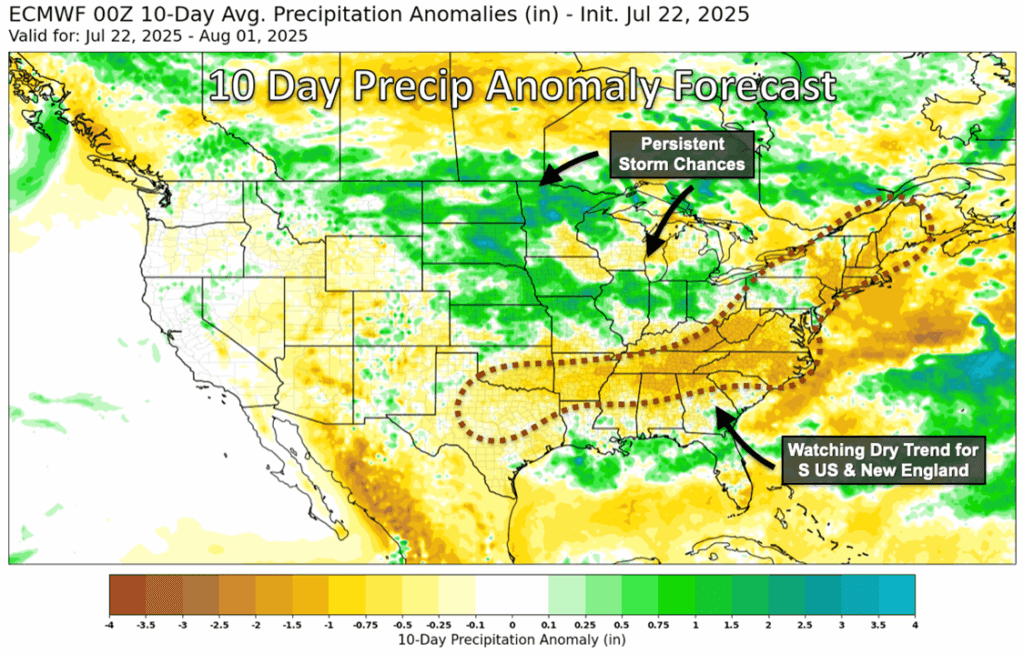

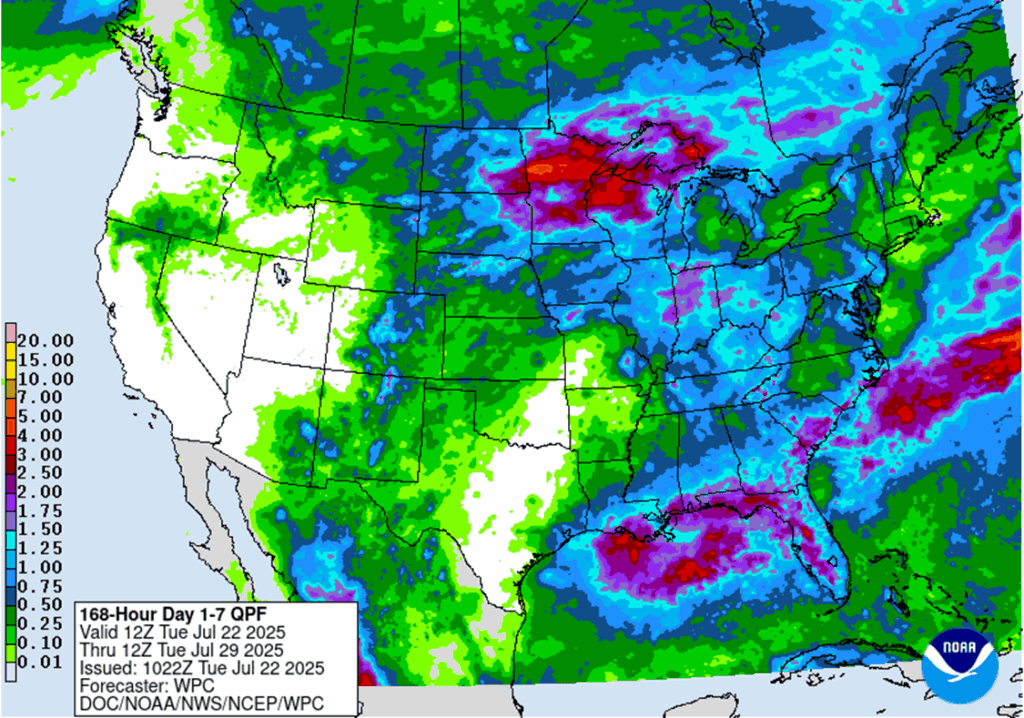

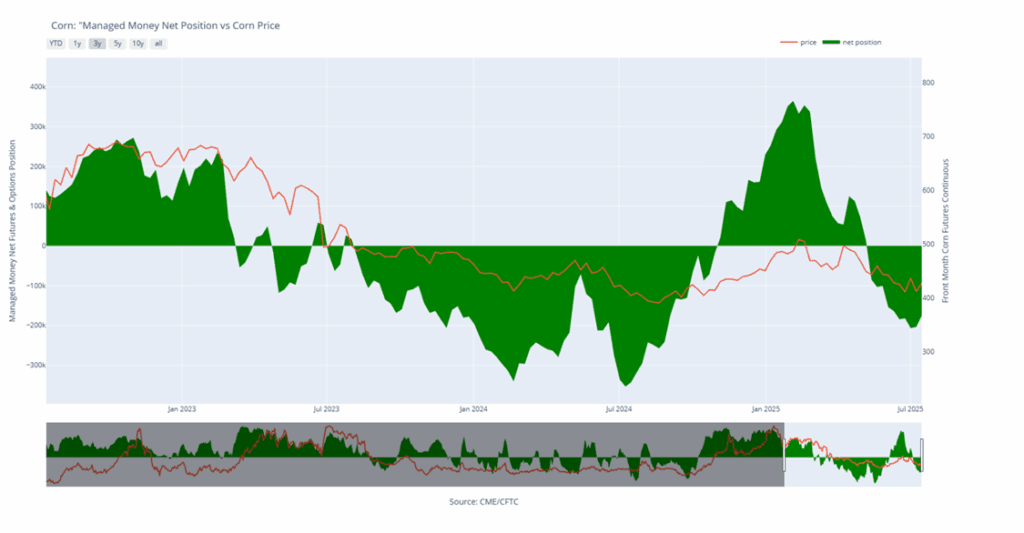

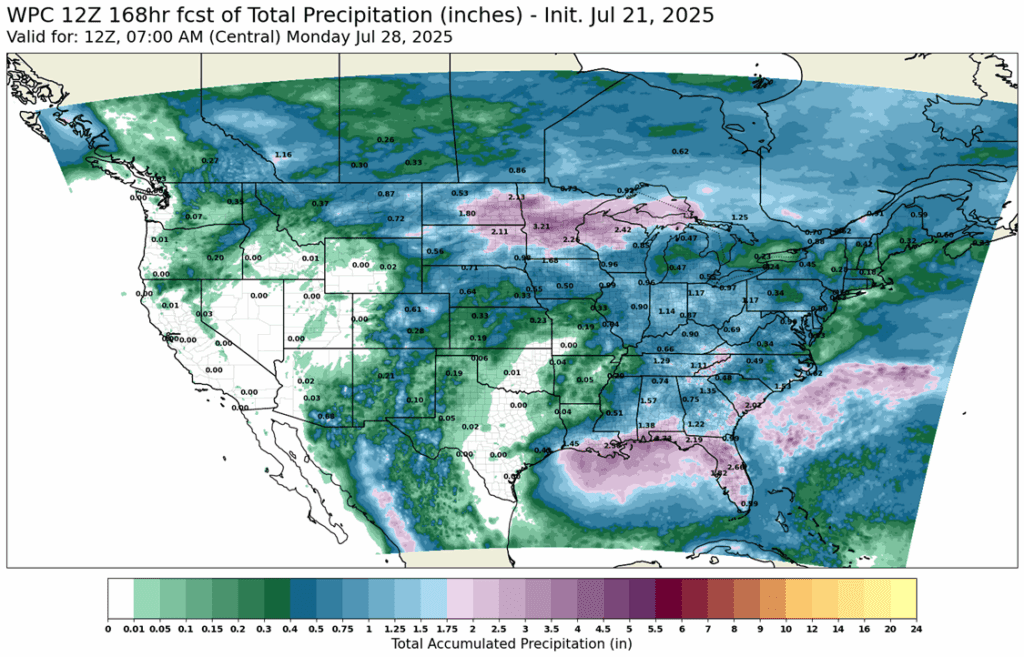

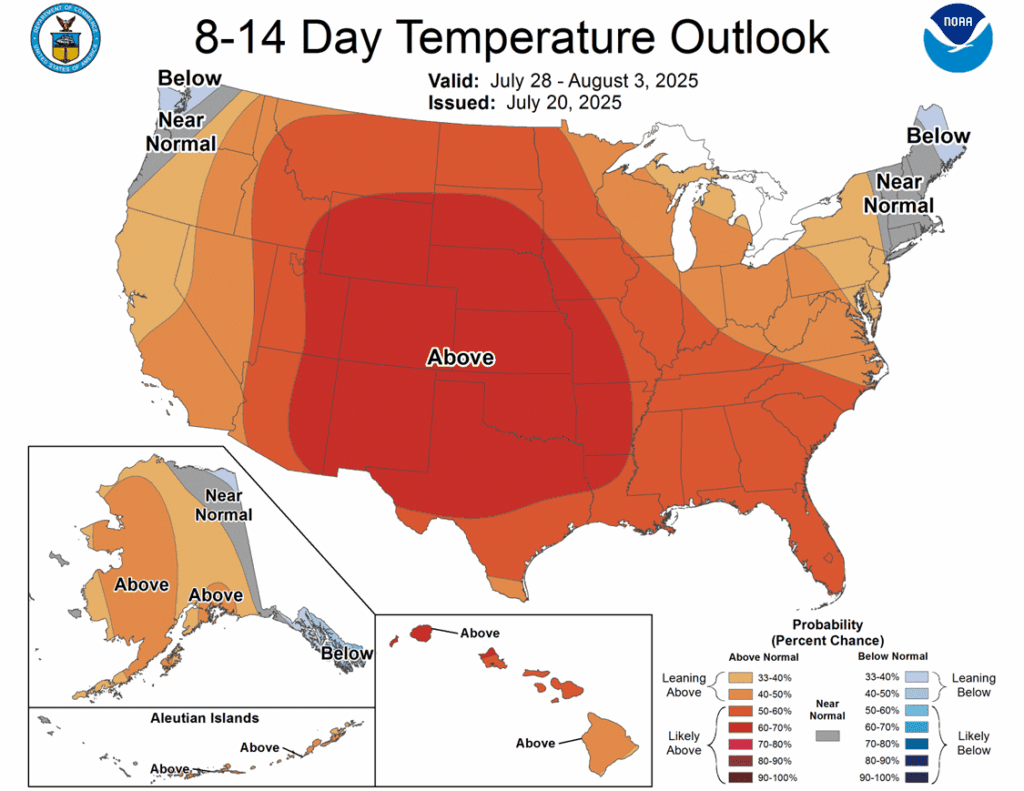

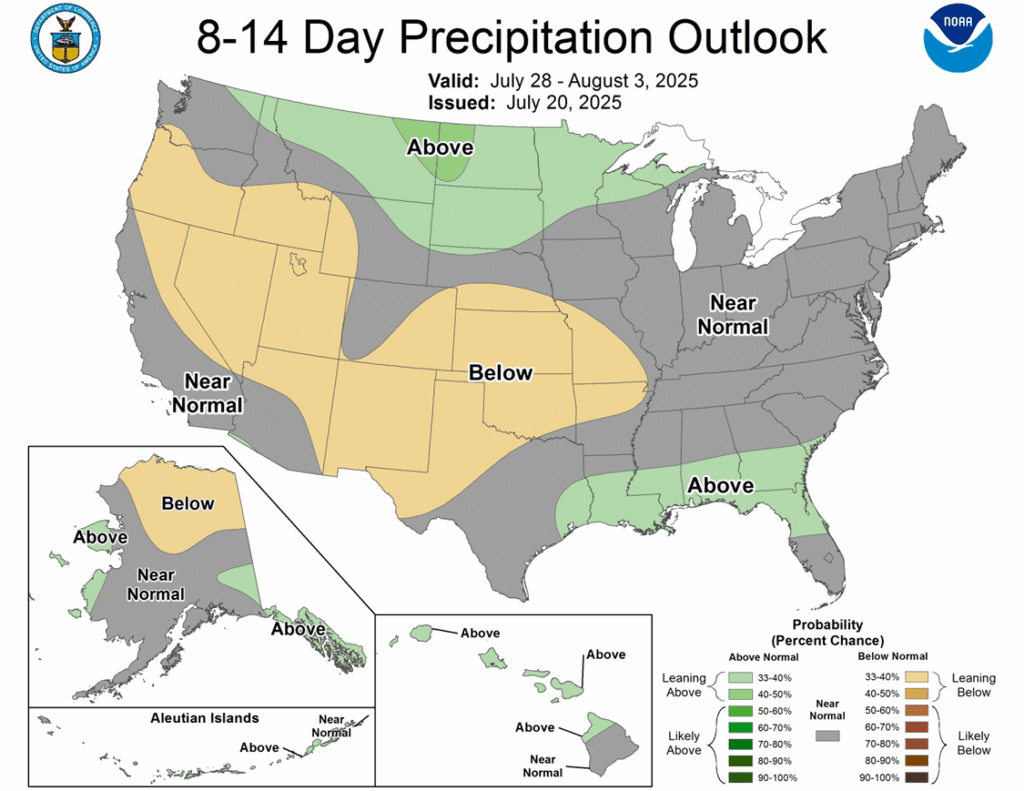

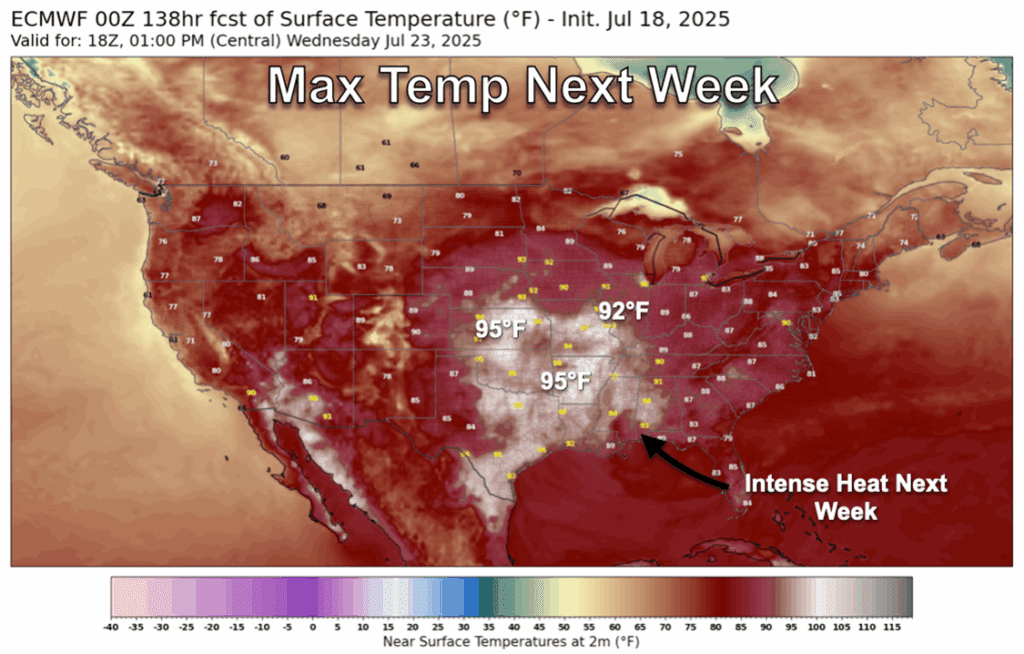

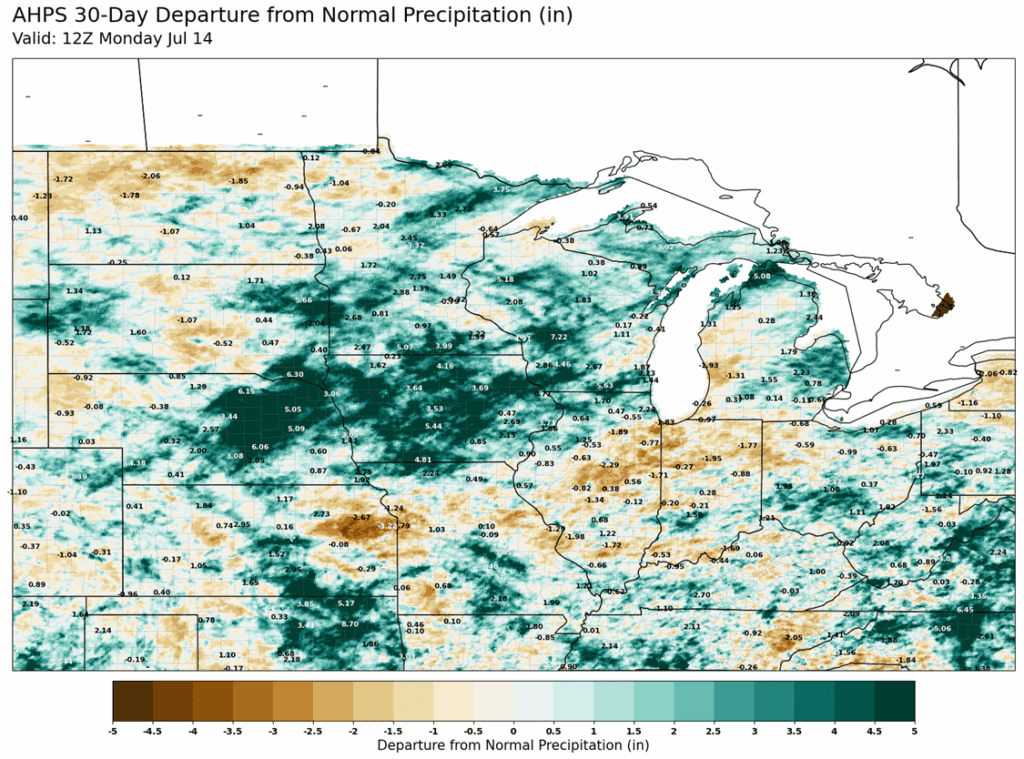

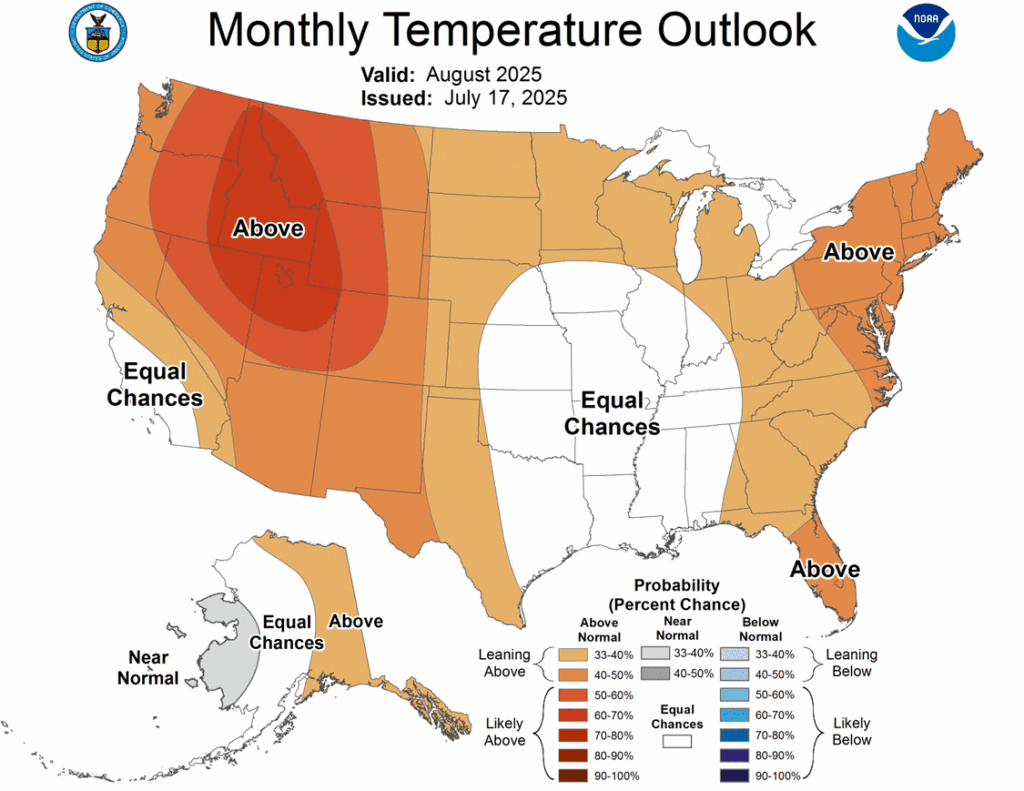

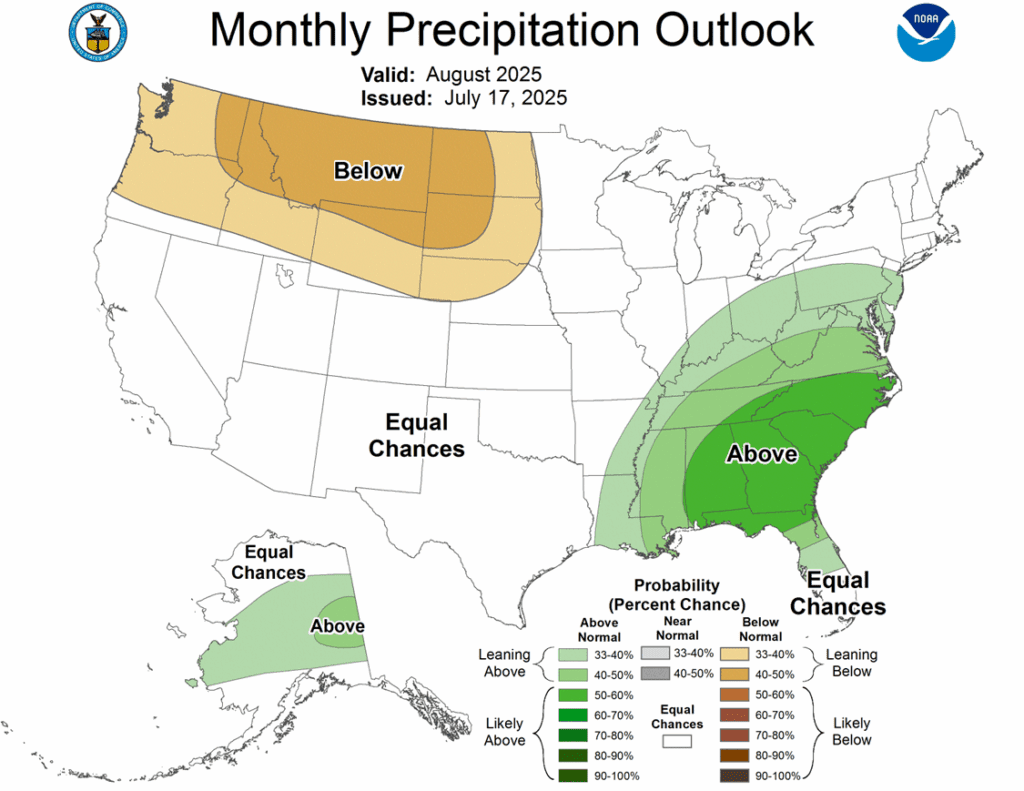

- Dalian corn futures fell and U.S. rains are aiding crop prospects amid expectations for a strong U.S. and record Brazil crop.

- Weaker U.S. corn export outlook could lift 25/26 carryout to 2,085M bu vs USDA’s 1,660M, despite higher feed and ethanol use estimates.

- Delayed Brazil safrinha harvest and logistics issues are firming Brazilian corn basis.

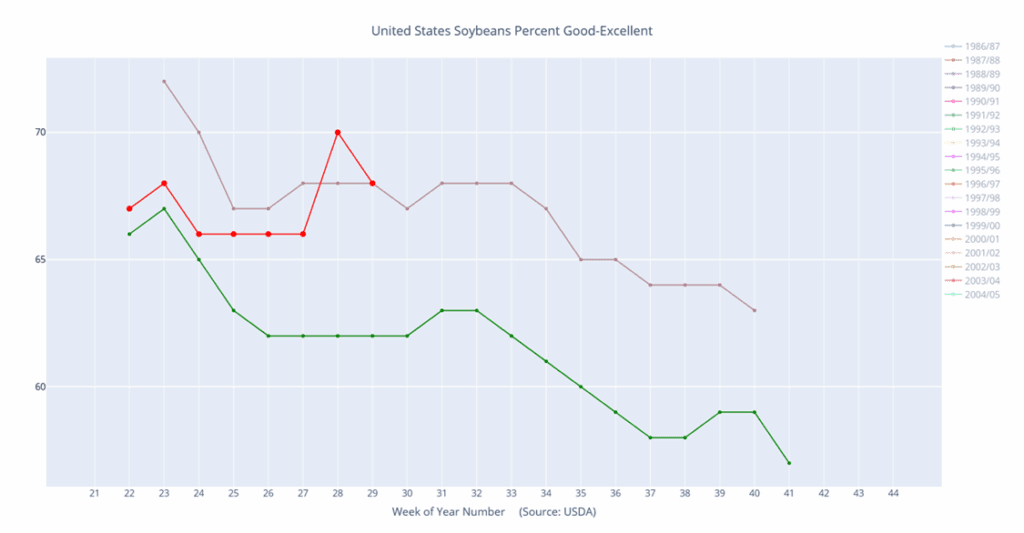

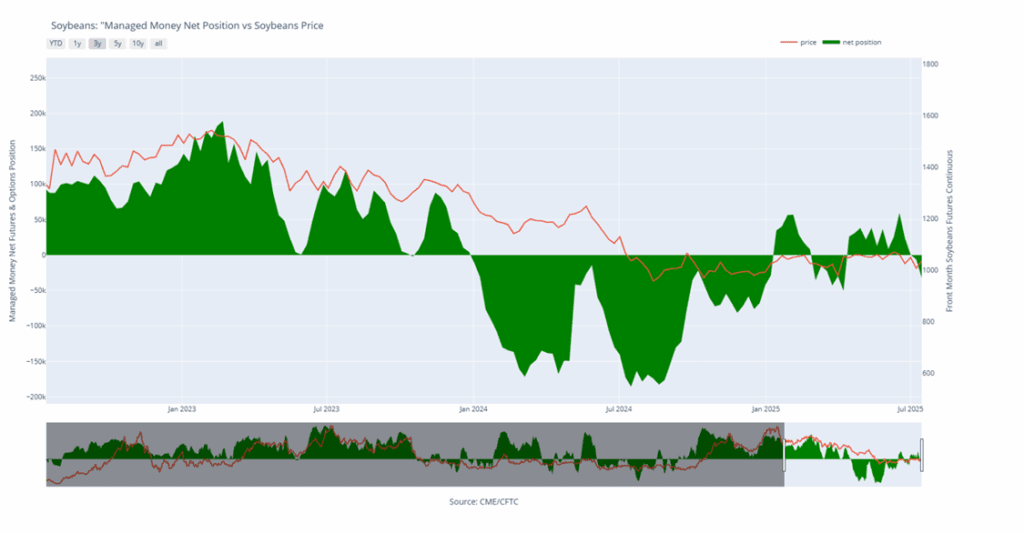

- Dalian soy complex futures rose, while North and East Corn Belt rains are expected to support U.S. soybean yields.

- Crop optimism and uncertain U.S. soybean demand, with lower export estimates, could push 25/26 carryout to 510M bu vs USDA’s 310M.

- Brazil basis strengthened on reports of increased Chinese buying and slower farmer selling.

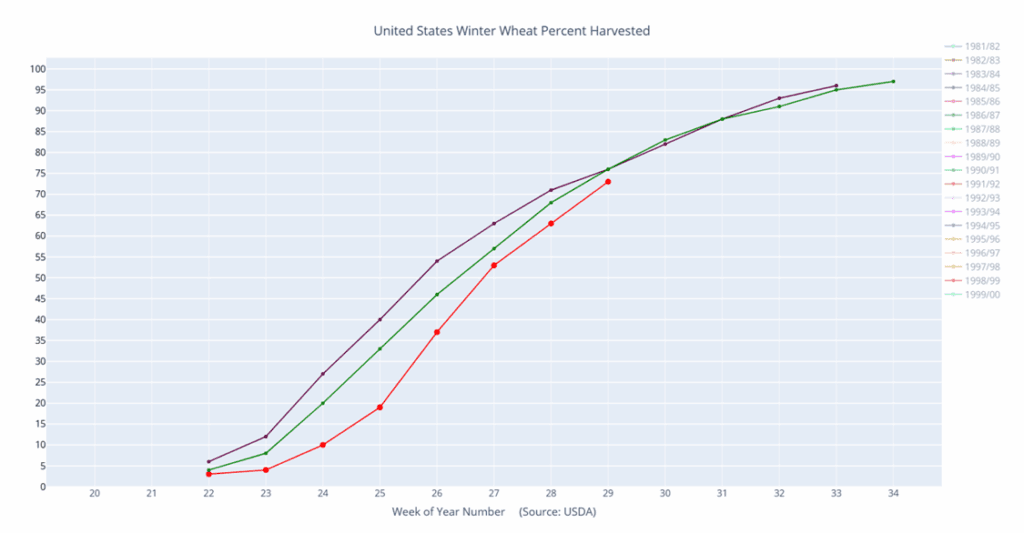

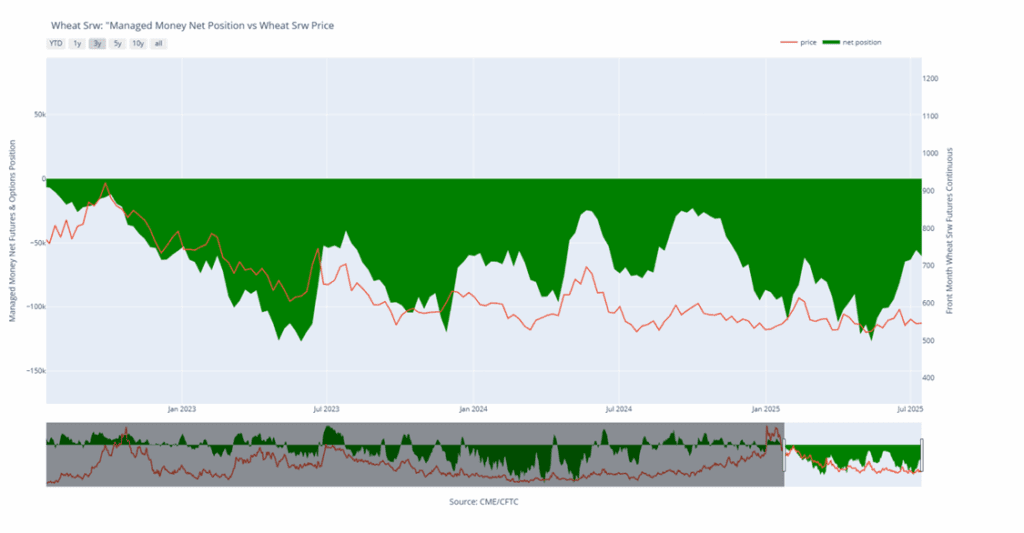

- Rising Russian wheat export prices on lower yield concerns and firm cash markets may boost U.S. and EU export demand.

- Southern Hemisphere crop prospects are providing resistance to global wheat prices.

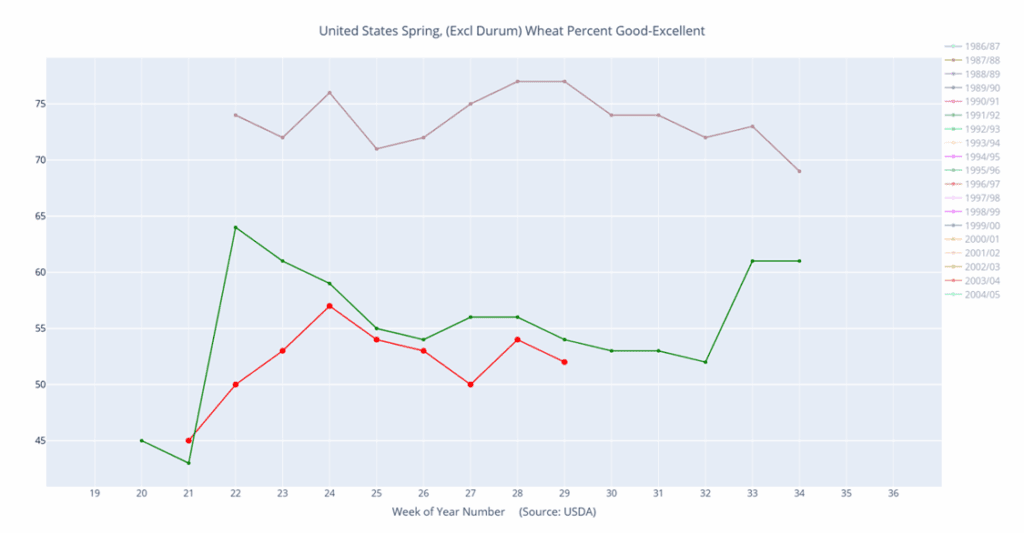

- U.S. ND wheat tour pegs first-day yield at 50 bpa (vs 52 last year, 45 avg); U.S. carryout seen at 895M bu with higher exports offsetting lower feed use.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.