8-6 End of Day: Grain Markets Mixed as Corn and Soy Struggle Under Supply Pressure, Wheat Finds Support in Export Strength

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- 🌽 Corn: Corn futures pushed to fresh lows on Wednesday, testing key psychological levels of $3.80 for September and $4.00 for December. A firmer wheat market and late-session profit-taking helped prices recover slightly into the close.

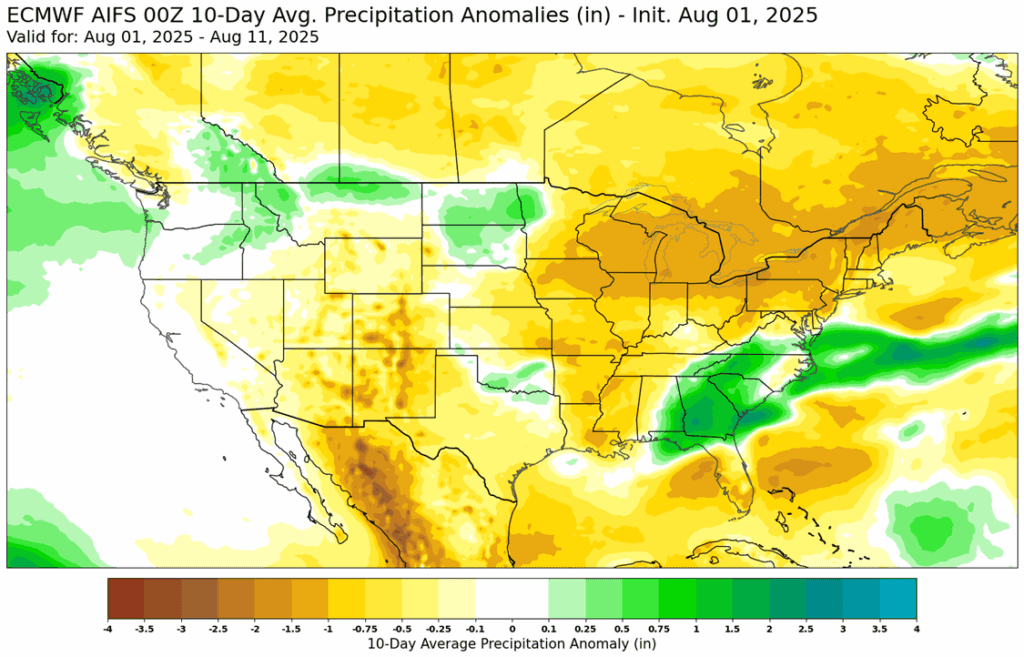

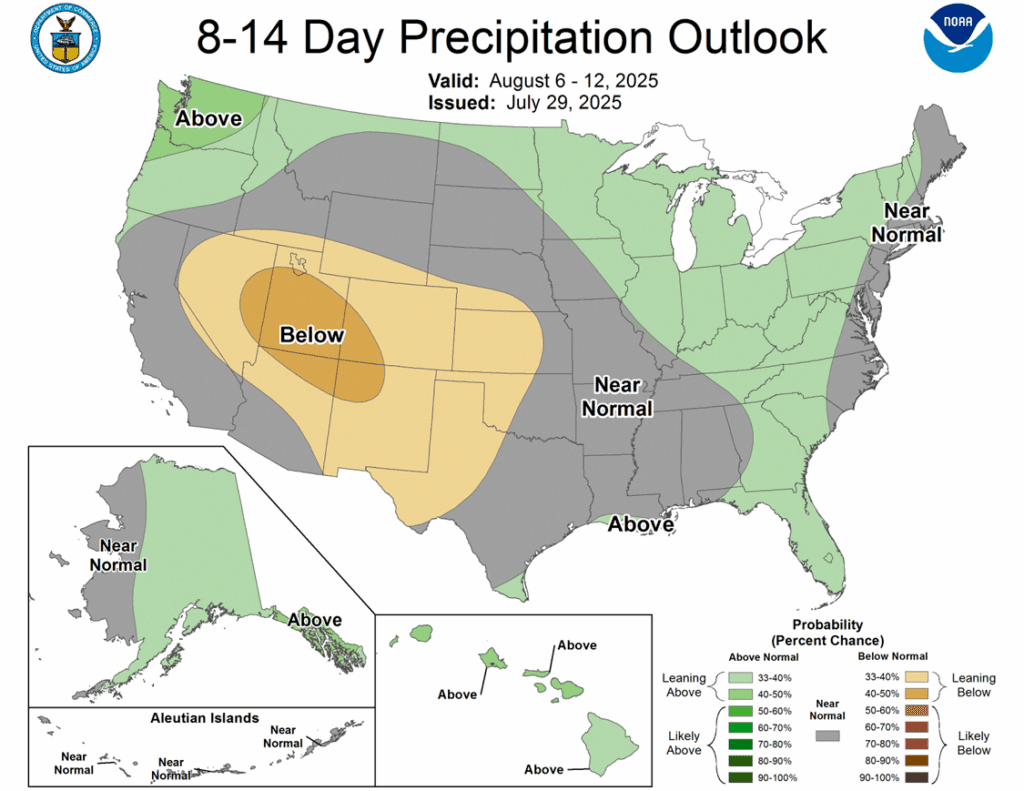

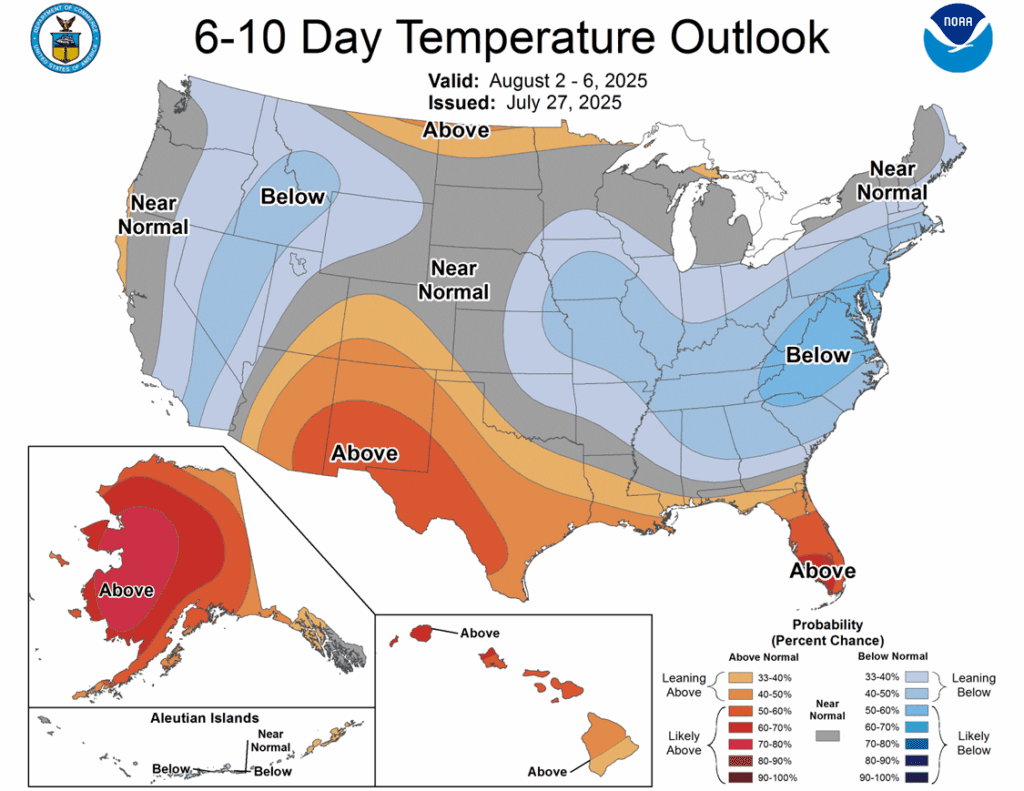

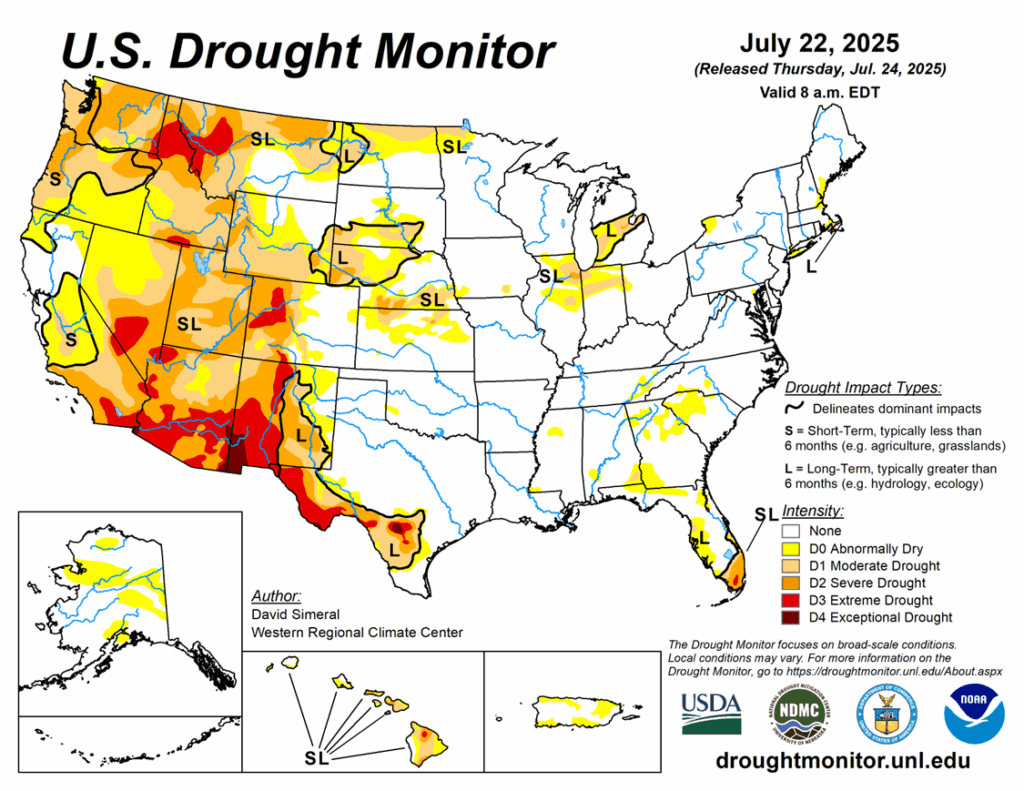

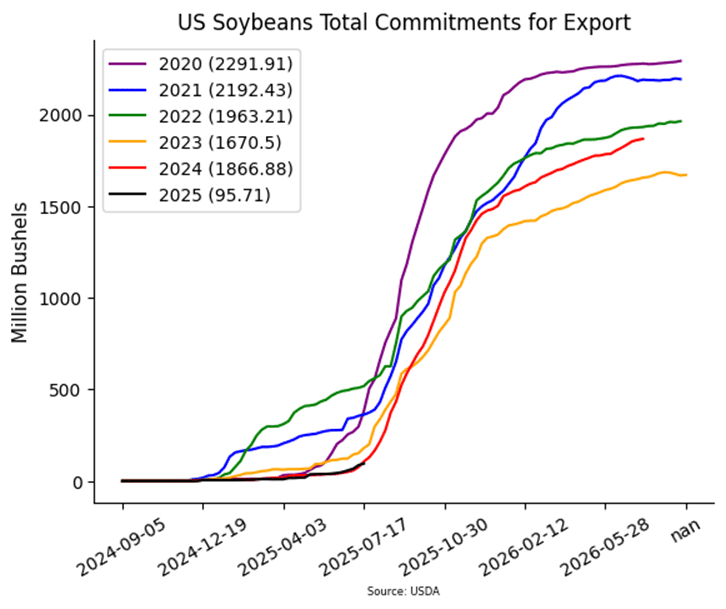

- 🌱 Soybeans: Soybeans closed lower for a second straight session, giving up early gains once again. Forecasts for better August rains and expectations for high yields in next week’s WASDE pressured the soy complex.

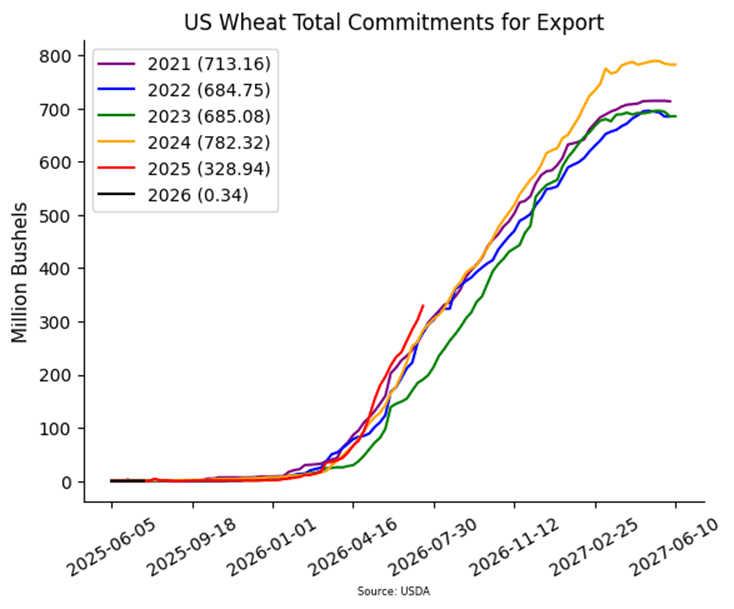

- 🌾 Wheat: Wheat futures ended higher Wednesday, snapping a five-day losing streak, supported by a strong start to U.S. export demand in the 2025/26 marketing year.

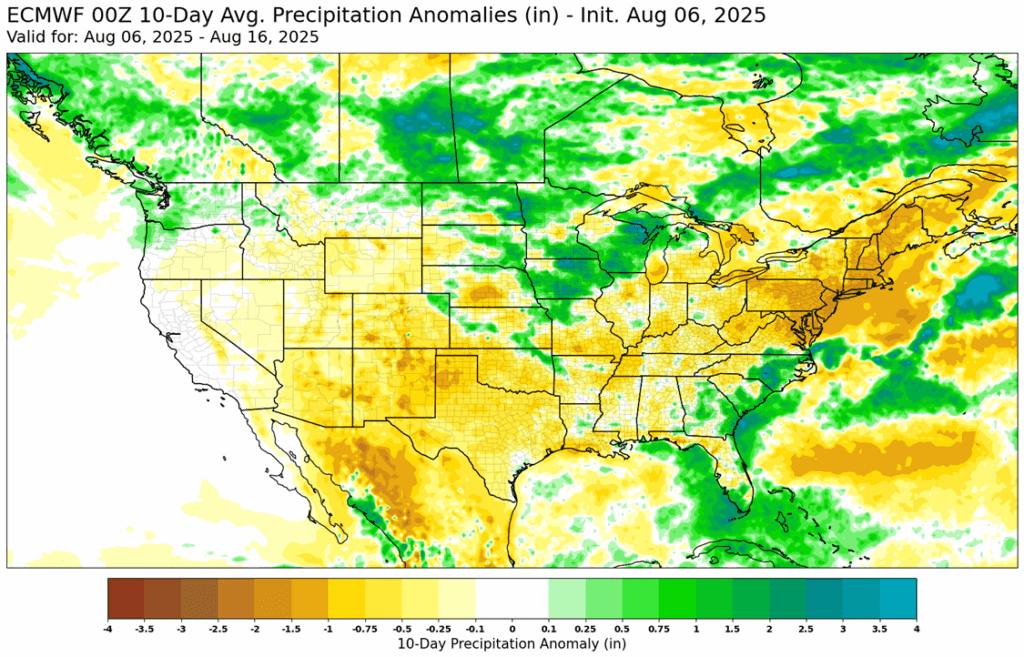

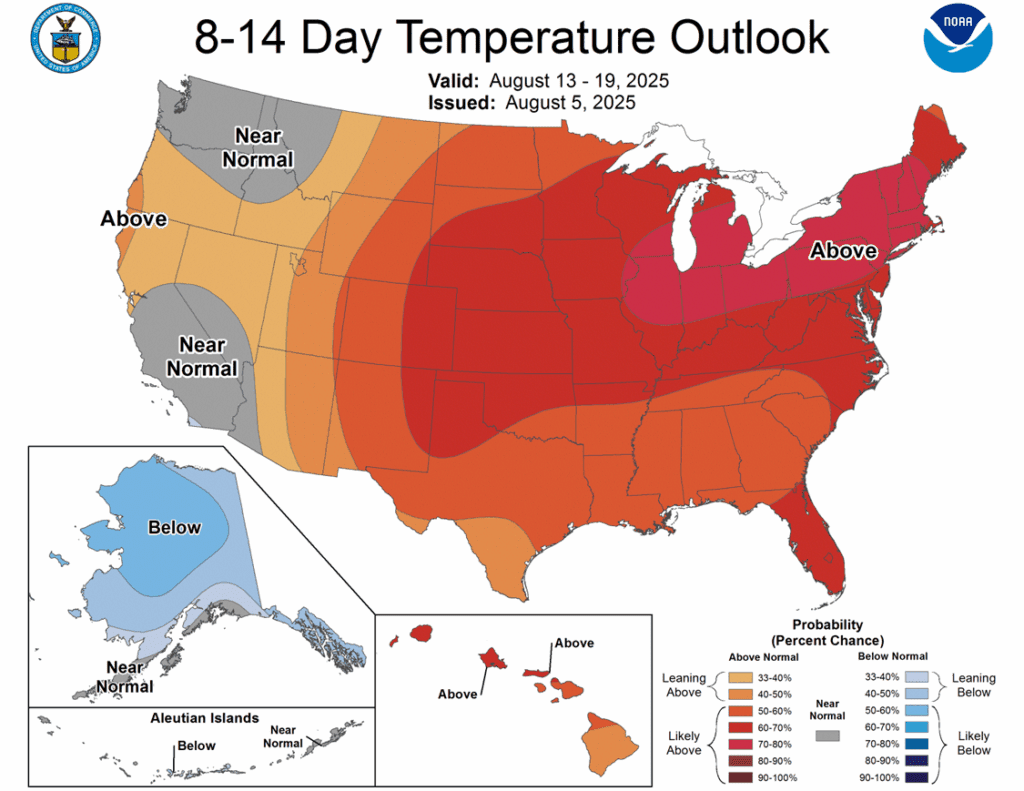

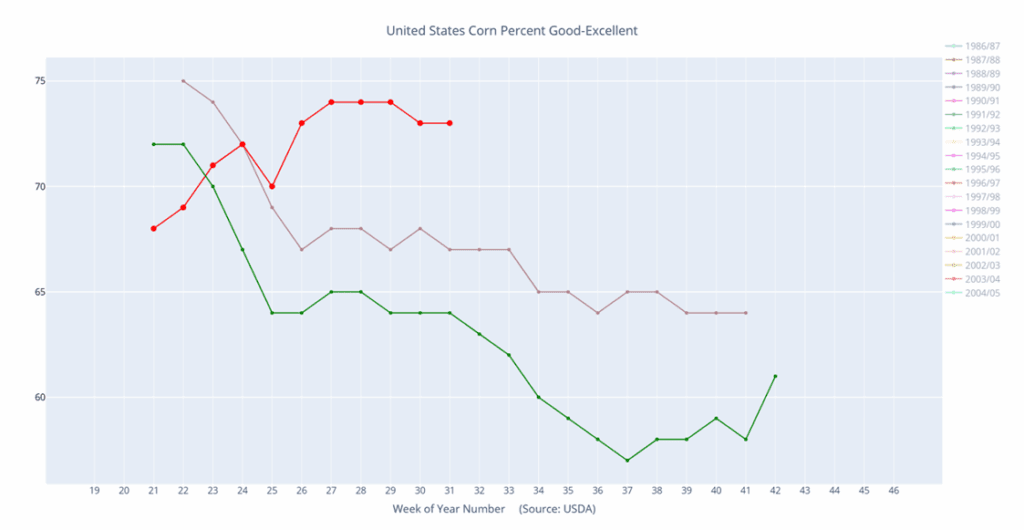

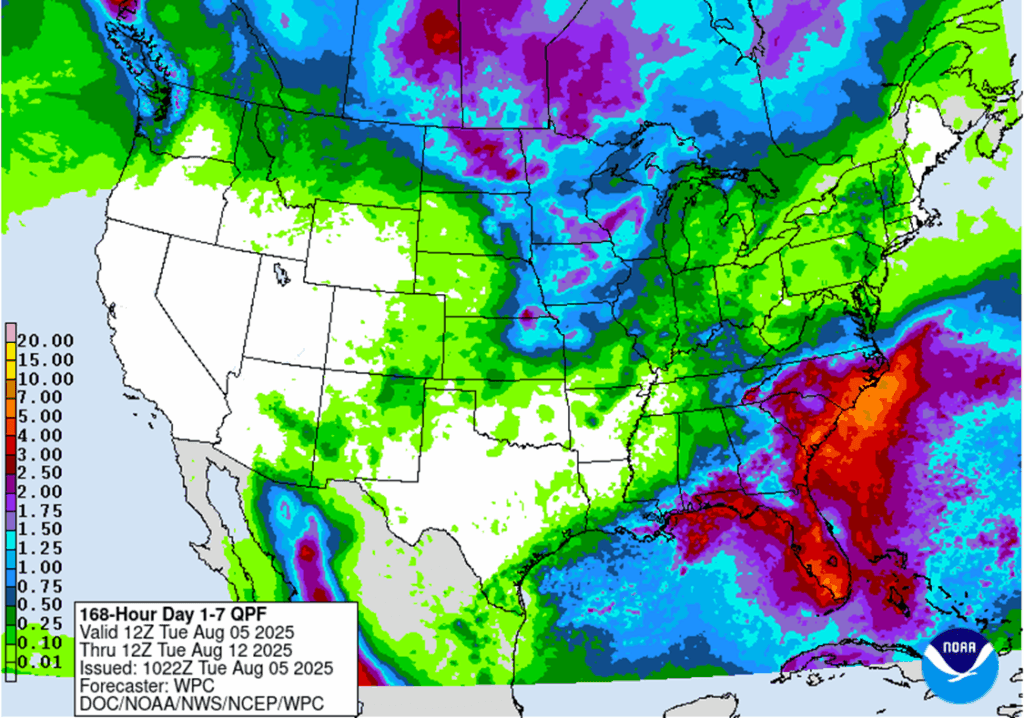

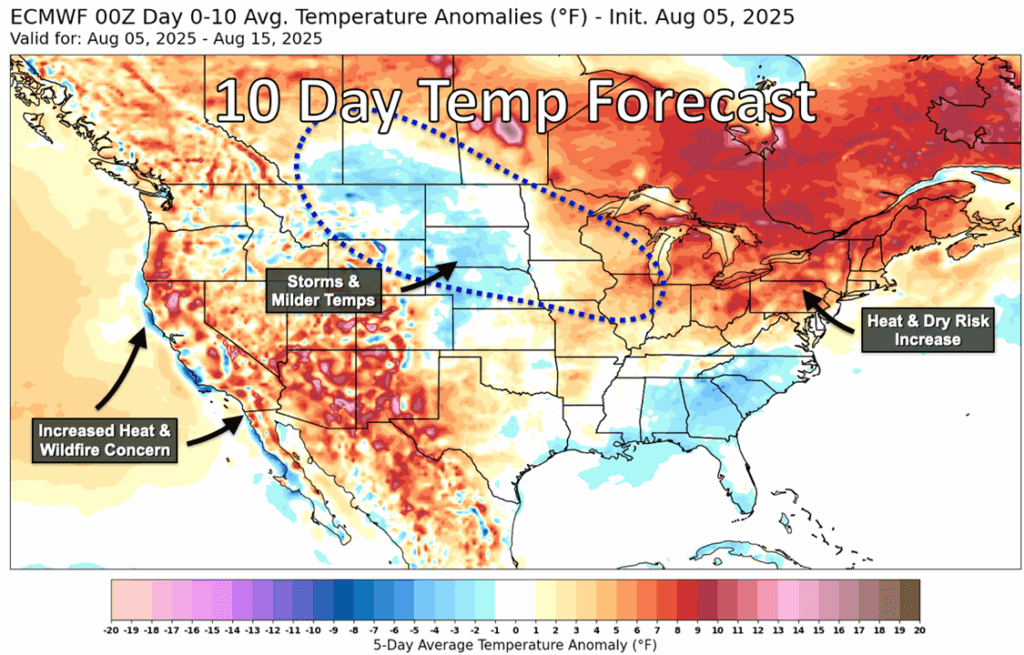

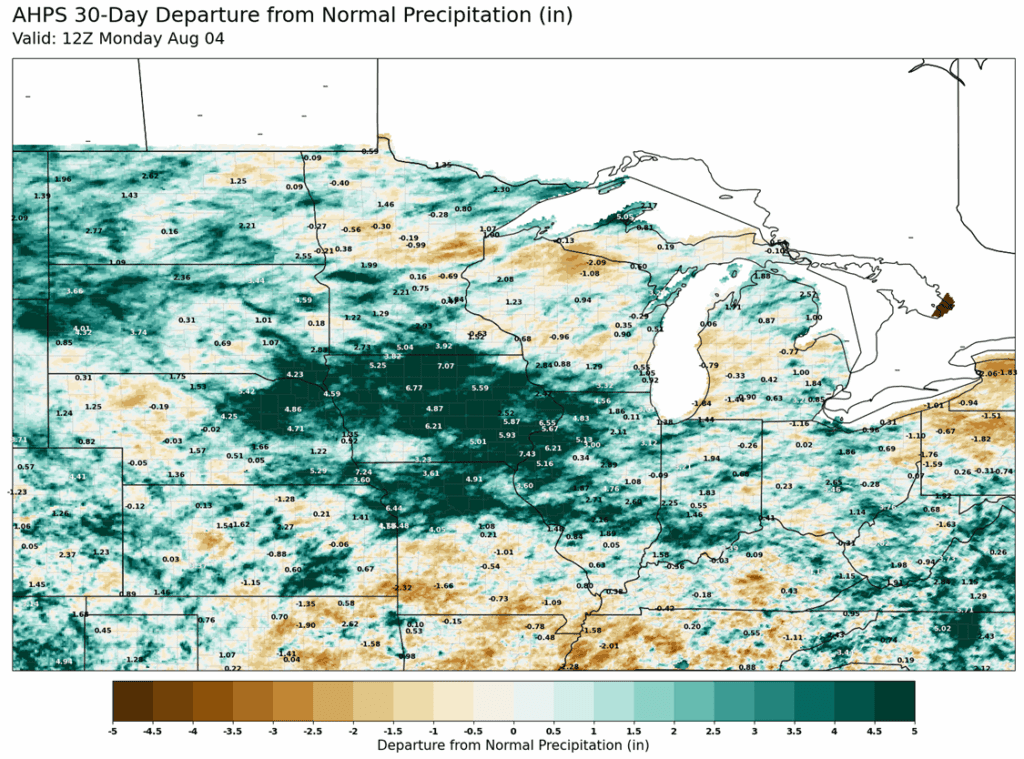

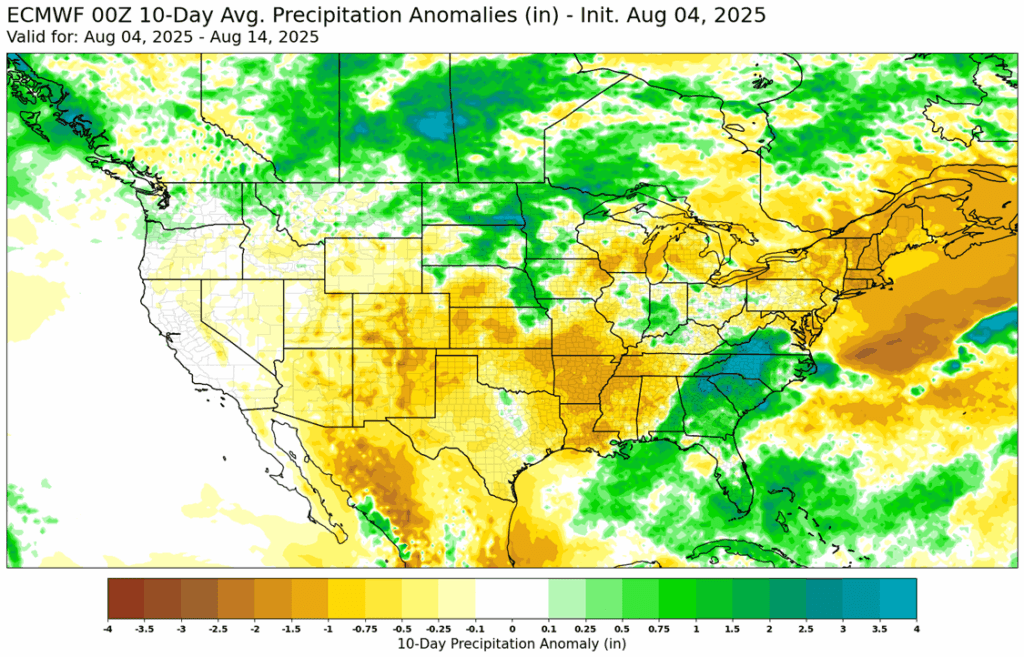

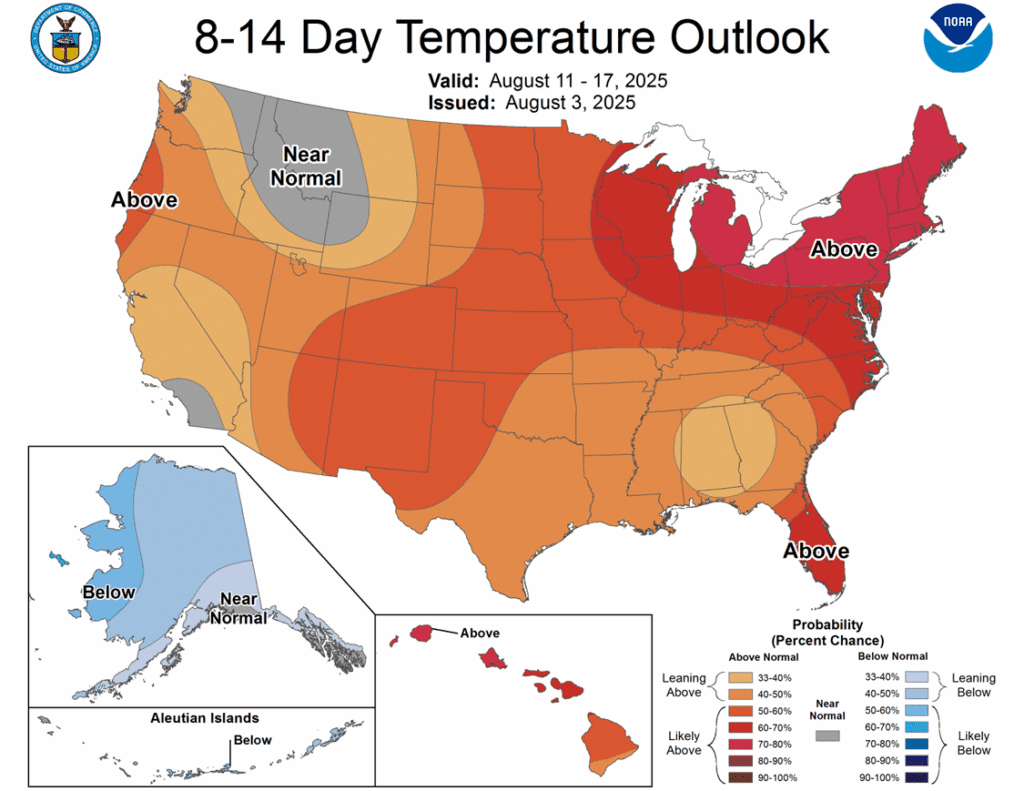

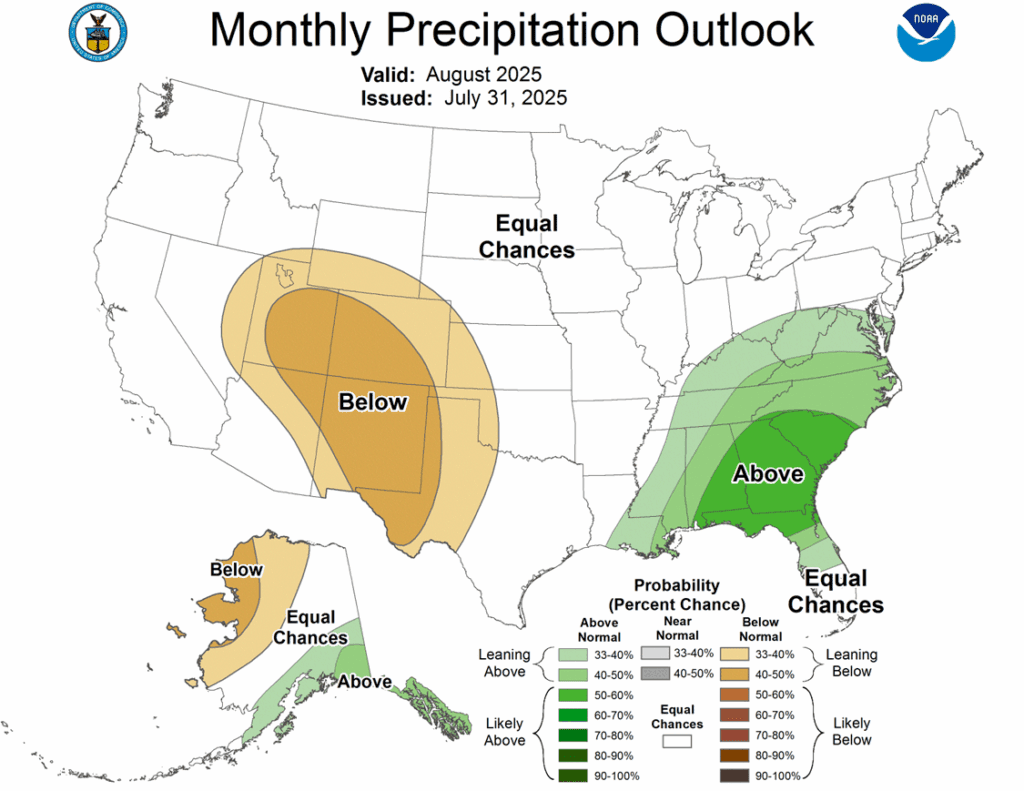

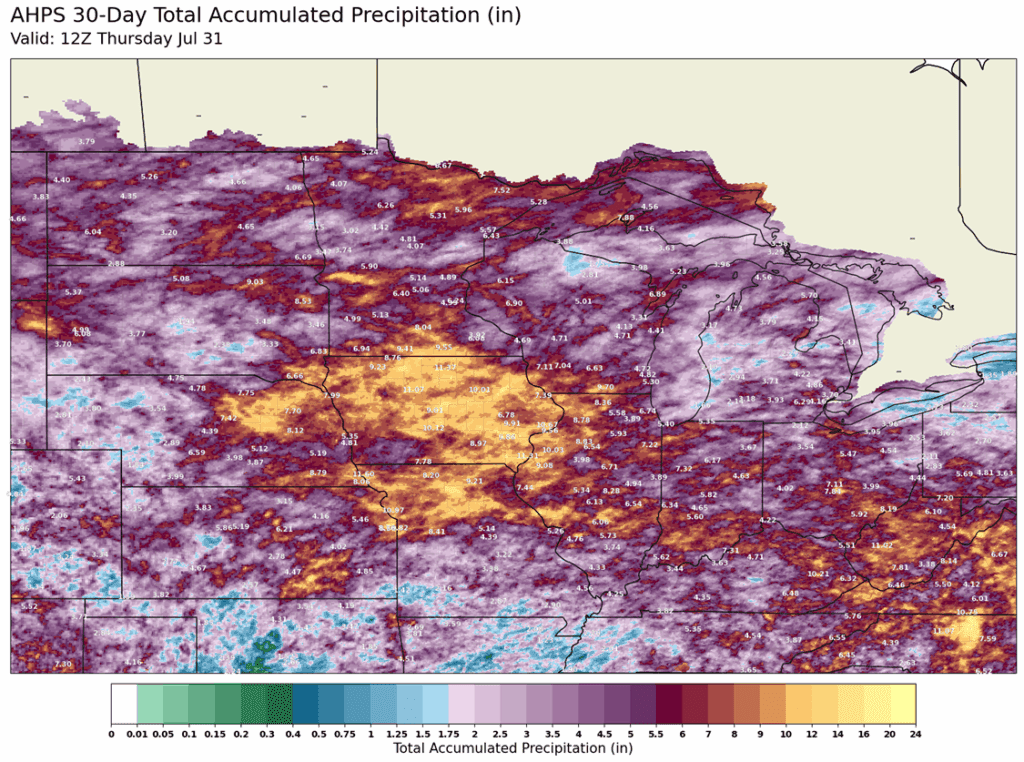

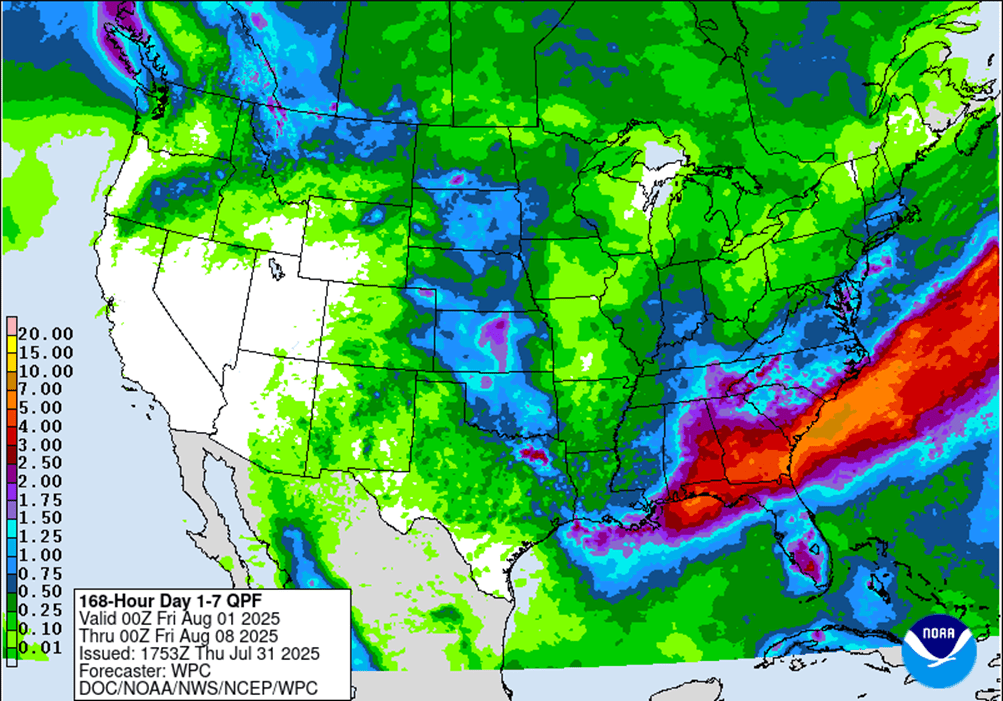

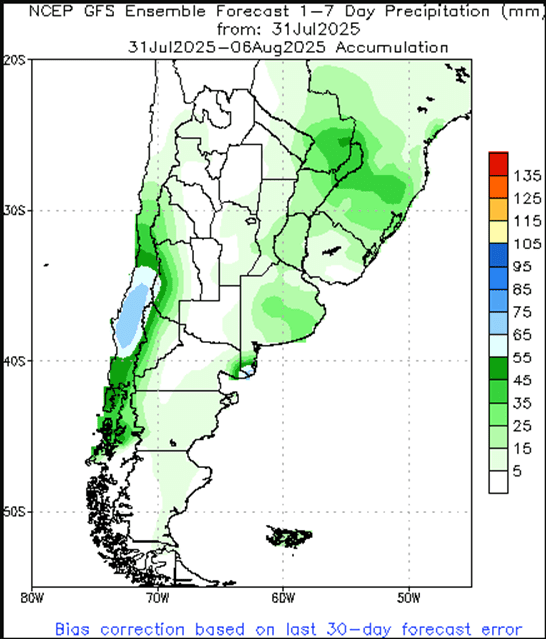

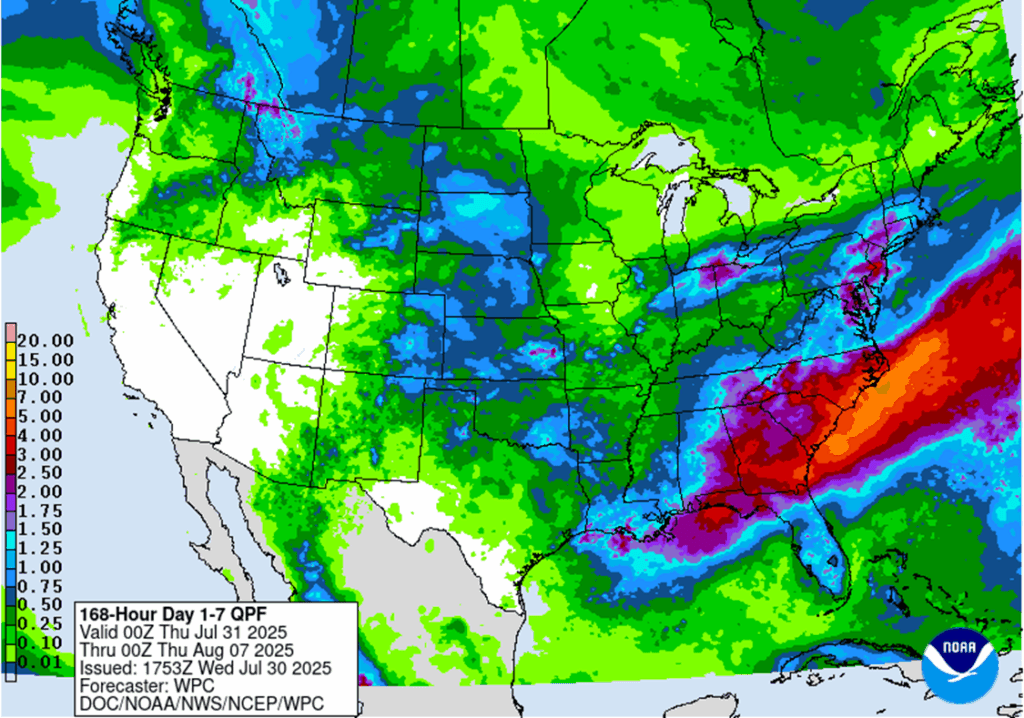

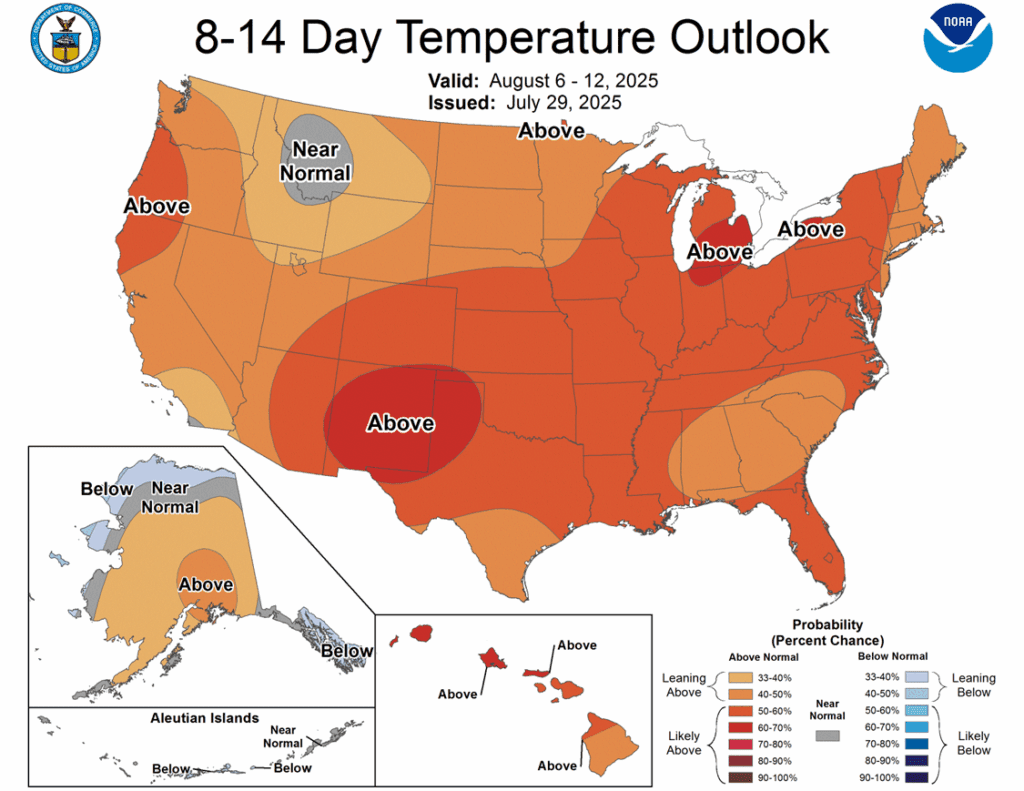

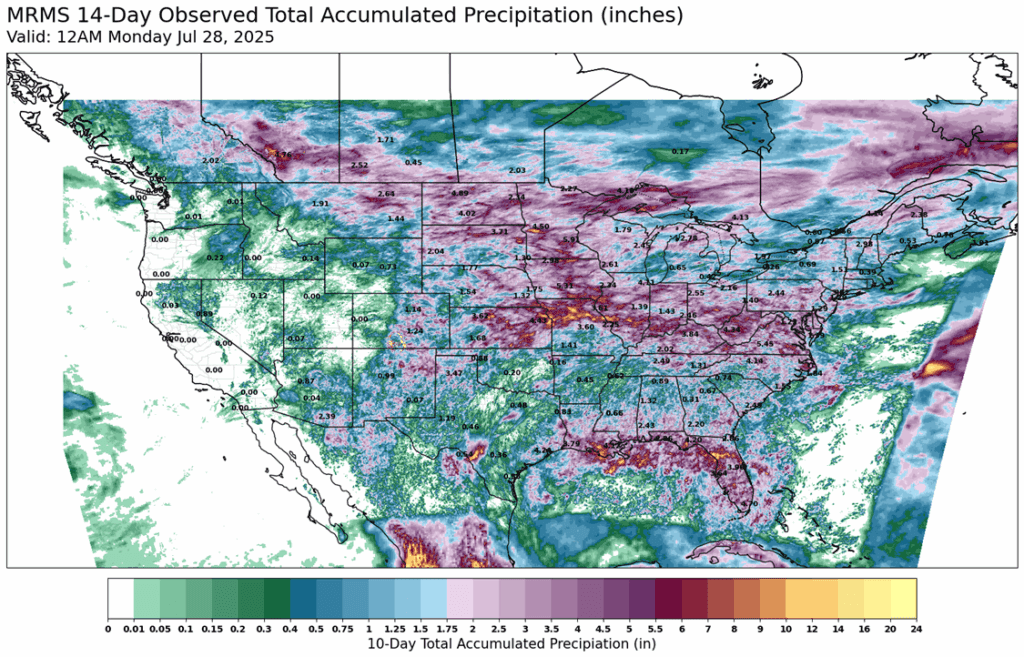

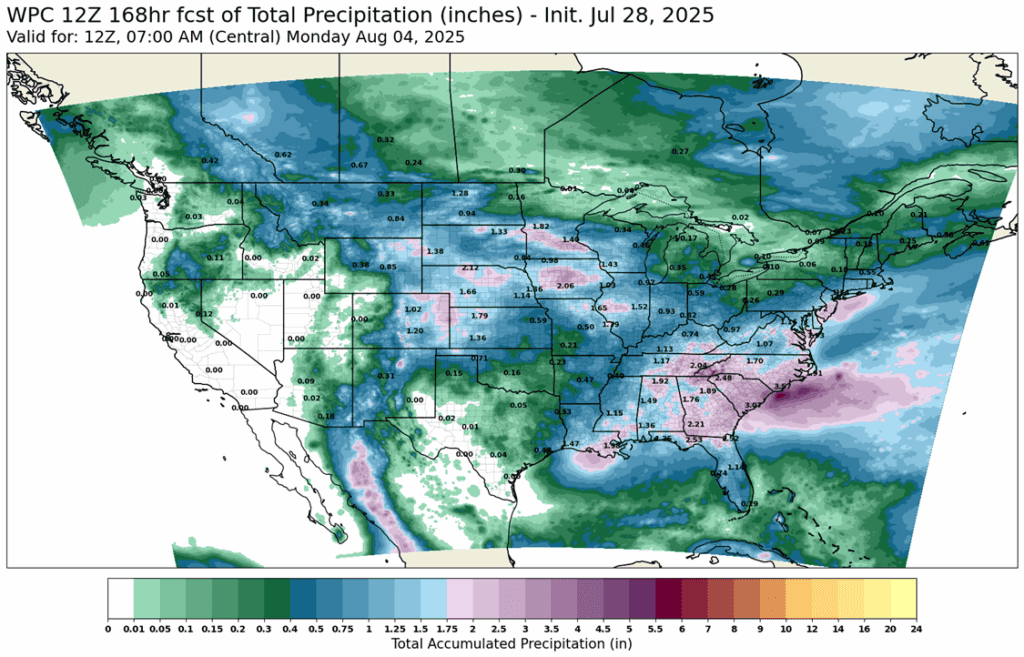

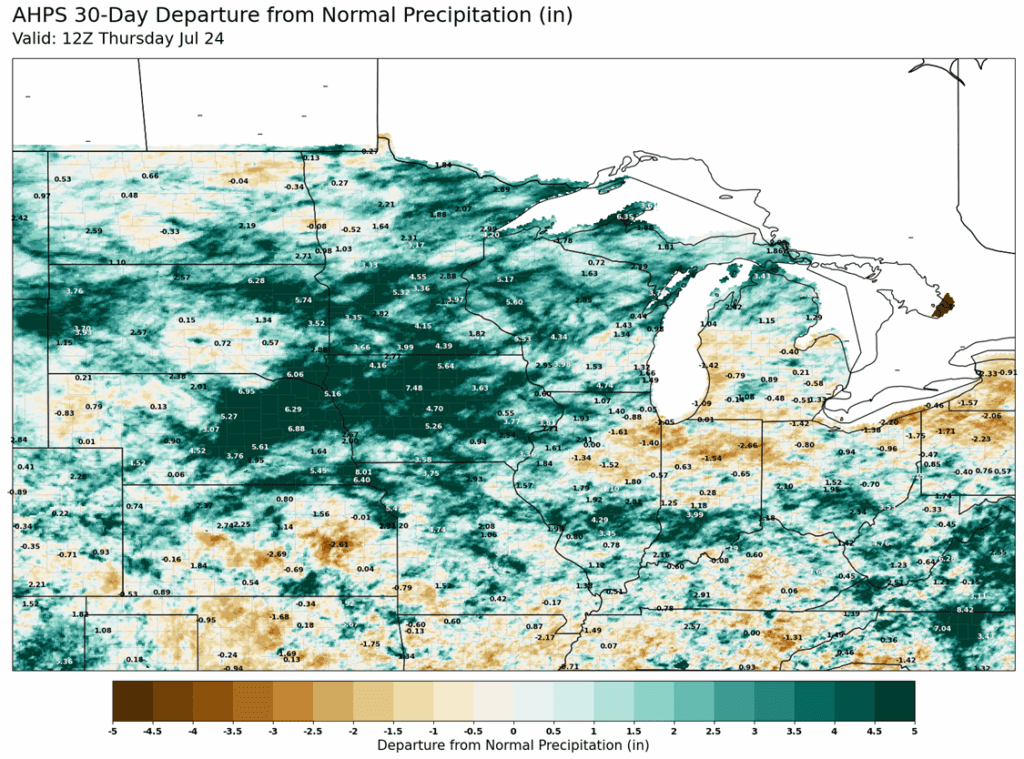

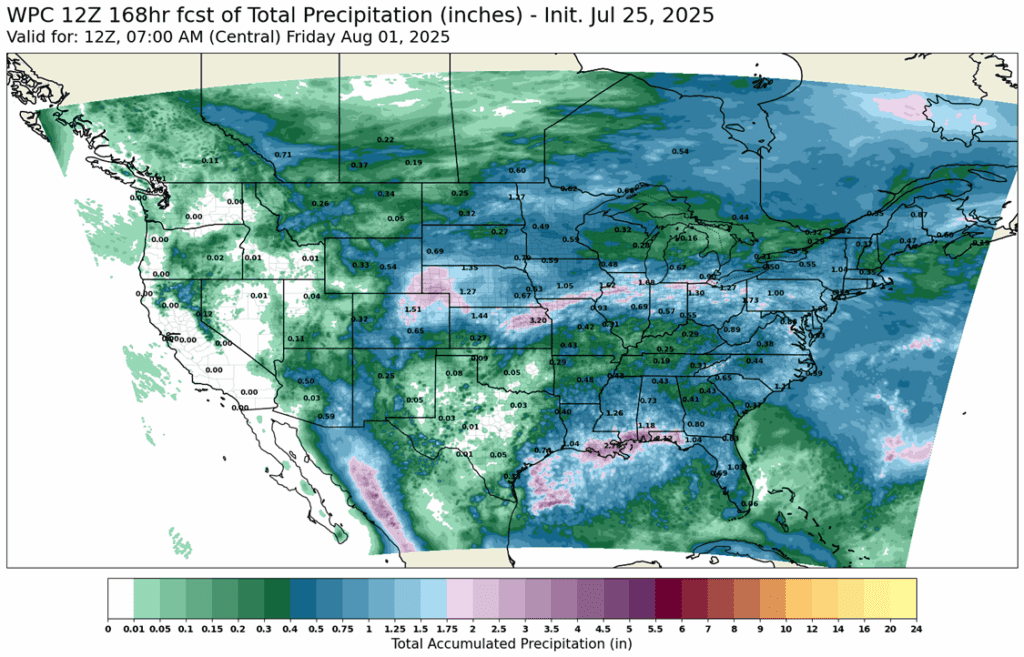

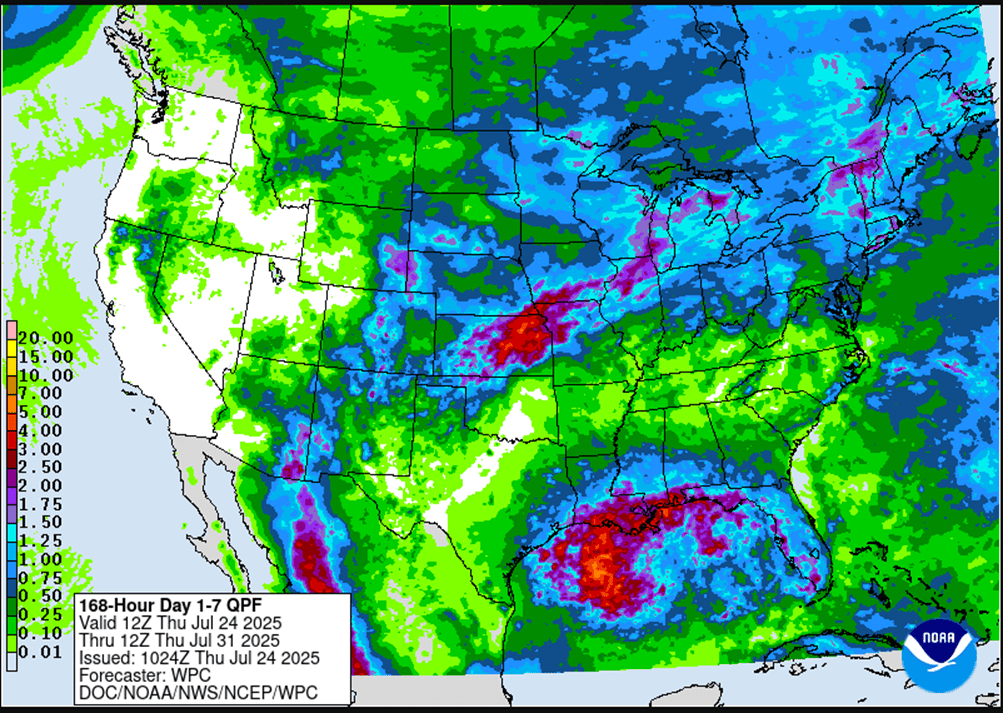

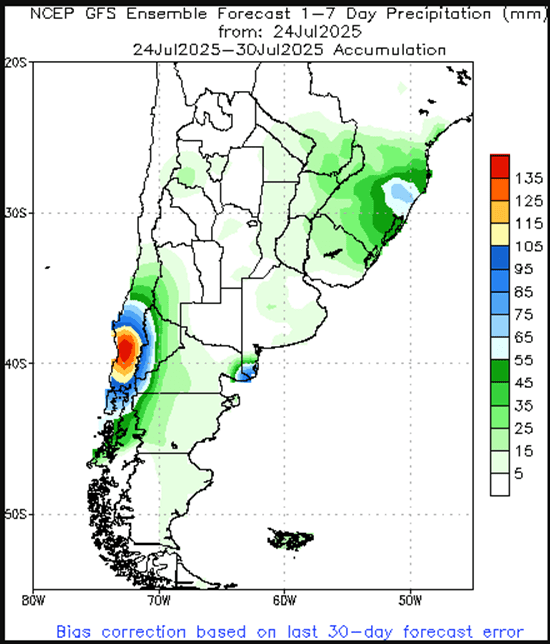

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- The exit target for the 510 call options has been cancelled, given the significant rally that would be required to reach it.

- For the 420 puts to achieve the 43 ¾ cent target, the December ’25 contract would need to fall to roughly the 380 area.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- The 483 sales target has been cancelled, and an upside Plan B call buy stop has been added at 482. Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-to-lower, with no immediate need for call option coverage to protect the four prior sales recommendations.

To date, Grain Market Insider has issued the following corn recommendations:

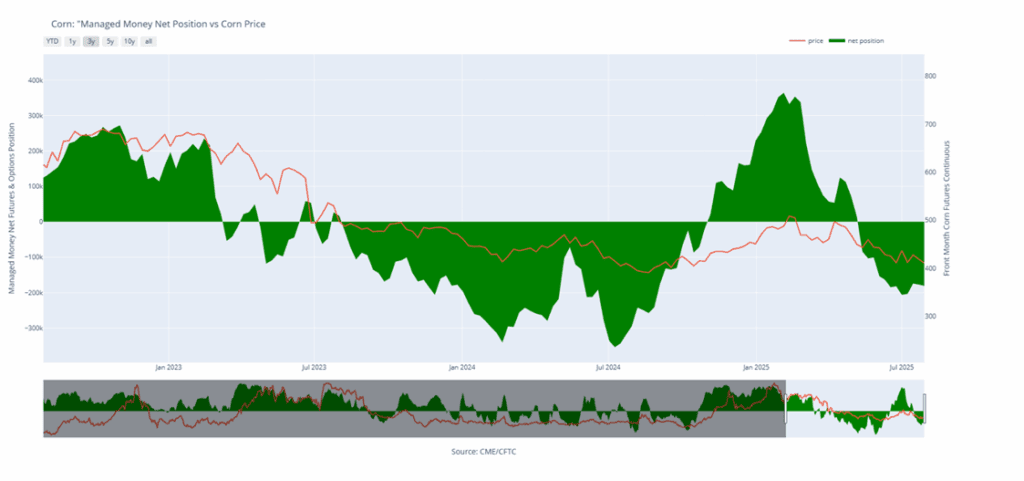

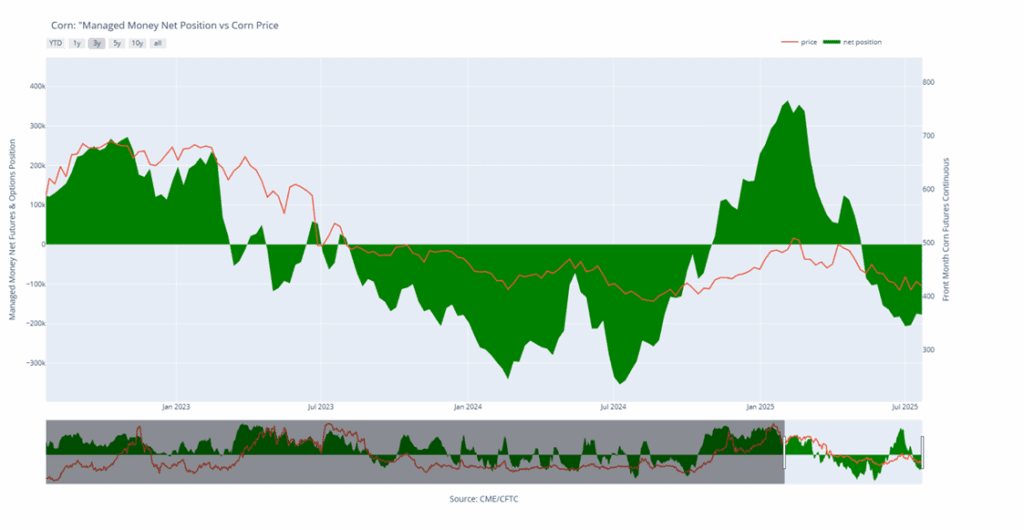

- Corn futures pushed to fresh lows on Wednesday, testing key psychological levels of $3.80 for September and $4.00 for December. The potential for a record harvest continues to outweigh a strong demand tone, keeping downside momentum intact.

- December corn futures, the most actively traded contract, spent much of the session below $4.00. However, a firmer wheat market and late-session profit-taking helped prices recover slightly into the close.

- Weekly ethanol production fell to 318 million gallons/day last week, down from 322 last week, but still 1% higher over last year. An estimated 108 mb of corn was used last week for ethanol production. This was below the estimates needed to reach the USDA 2024-25 ethanol targets. USDA will likely lower ethanol usage slightly in next week’s report for old crop corn.

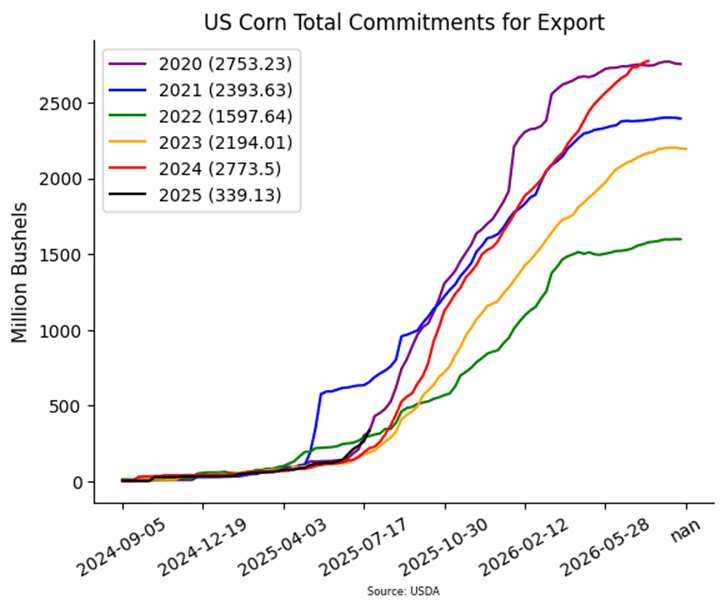

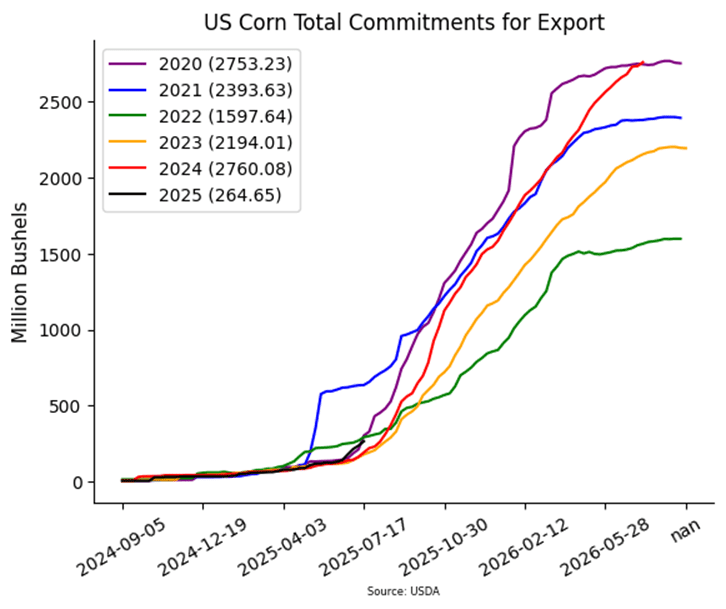

- Corn export demand remains robust. U.S. Census data showed June corn exports at 256.6 million bushels, the second-largest on record. July shipments remain strong, and new crop sales are off to their best start in several years amid firm global demand.

- USDA will release weekly export sales data on Thursday morning. Old crop sales are expected to remain softer with the marketing year coming to a close on August 30, but new crop sales should remain strong. With published sales, approximately 862,000 MT of new crop sales were published for the week ending July 31.

Corn Futures Slump to start August

After a quiet May–July stretch, corn futures broke support near 391 to start August. A weekly close below this level could shift focus to the August 2024 low near 360, while upside targets include an unfilled gap at 413, resistance at 420, and a second gap at 430.

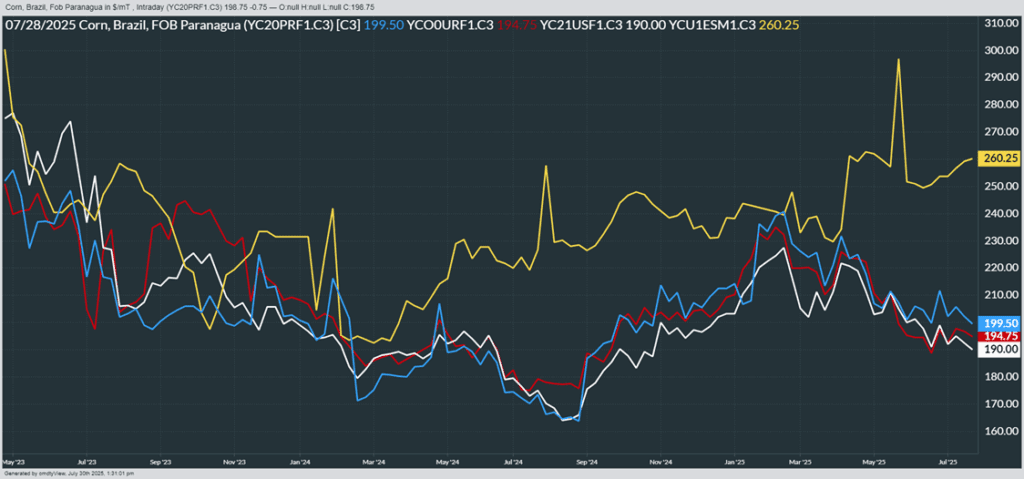

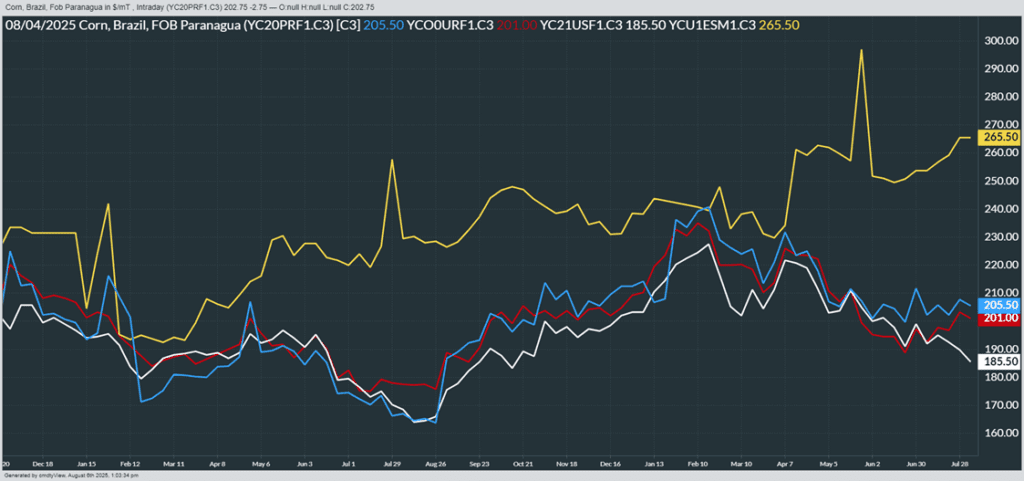

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- With the move into August and additional price weakness, the 1114 upside sales target has been cancelled.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

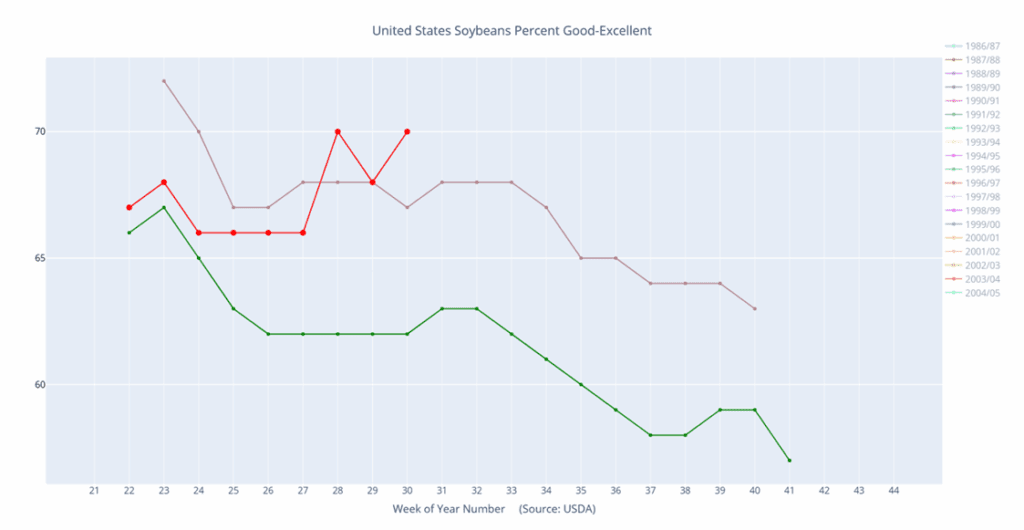

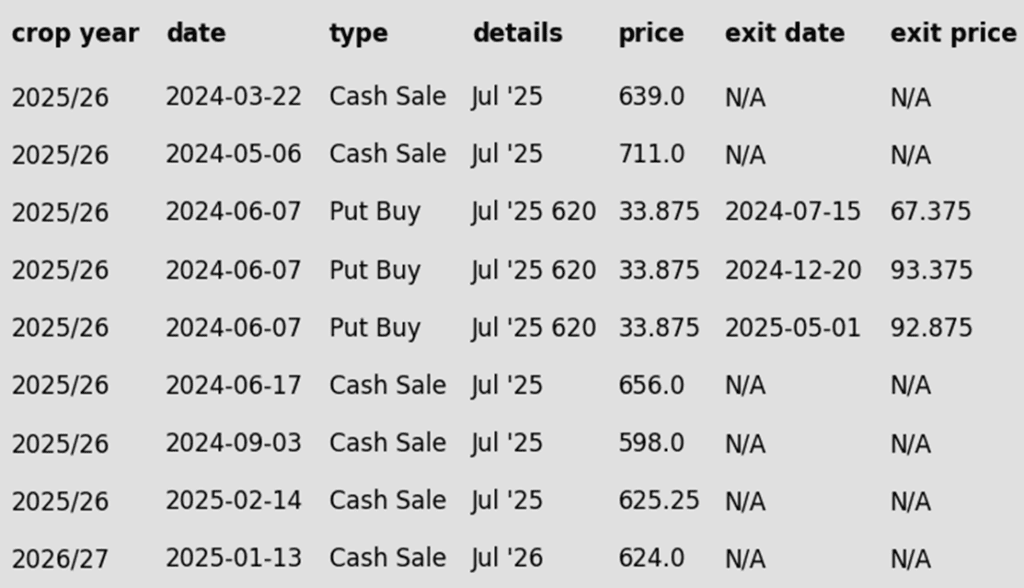

To date, Grain Market Insider has issued the following soybean recommendations:

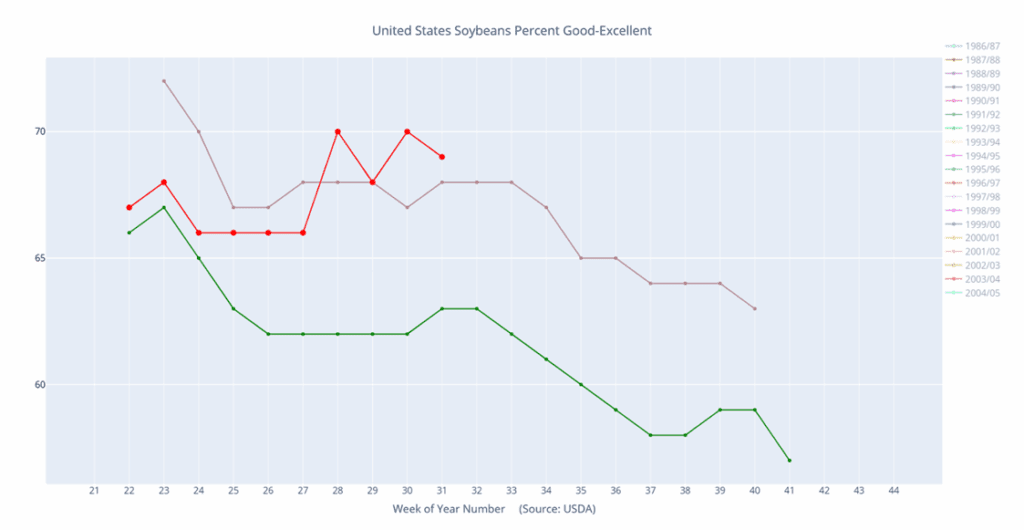

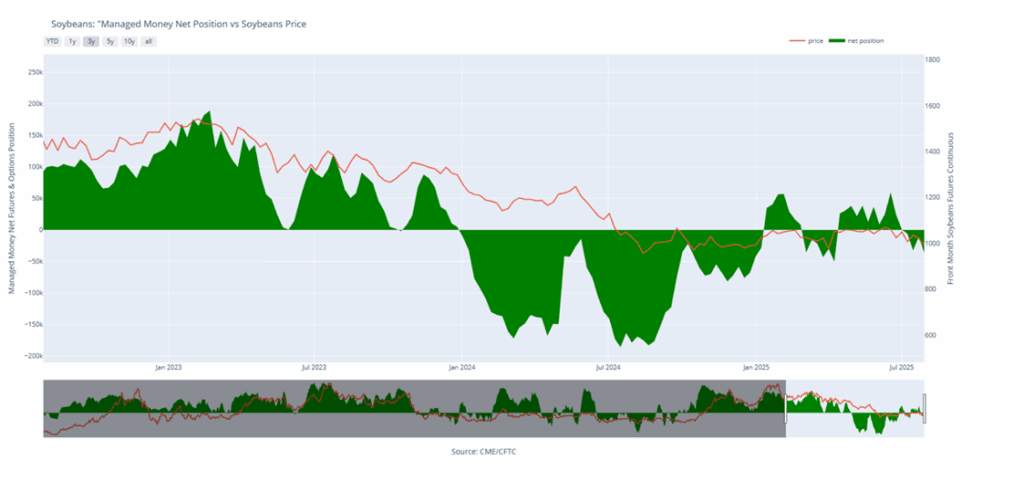

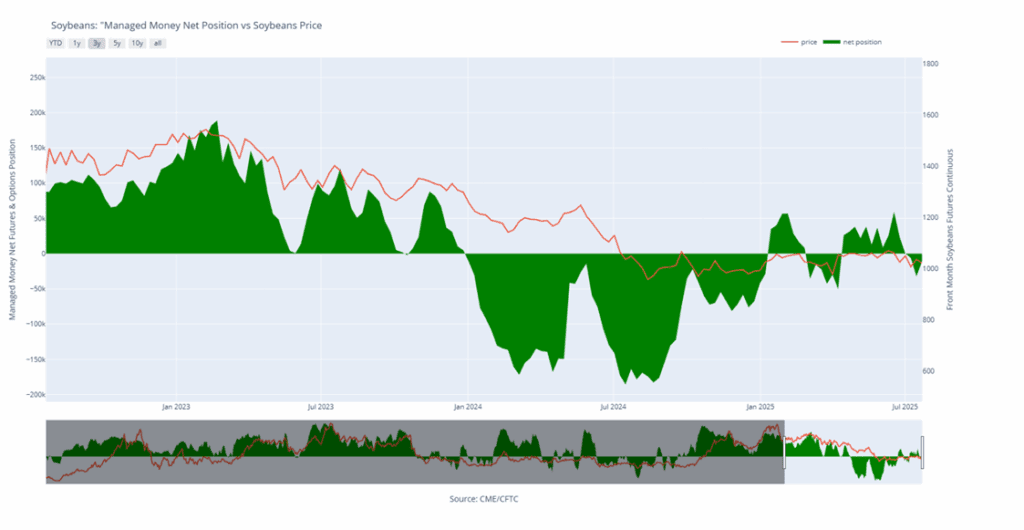

- Soybeans closed lower for the second consecutive day and once again started the day with gains before giving them up into the close. Better chances for August rains along with expectations for high yields in next week’s WASDE report pressured the soy complex. Soybean meal was lower while bean oil was mixed with the two front months lower and back months higher.

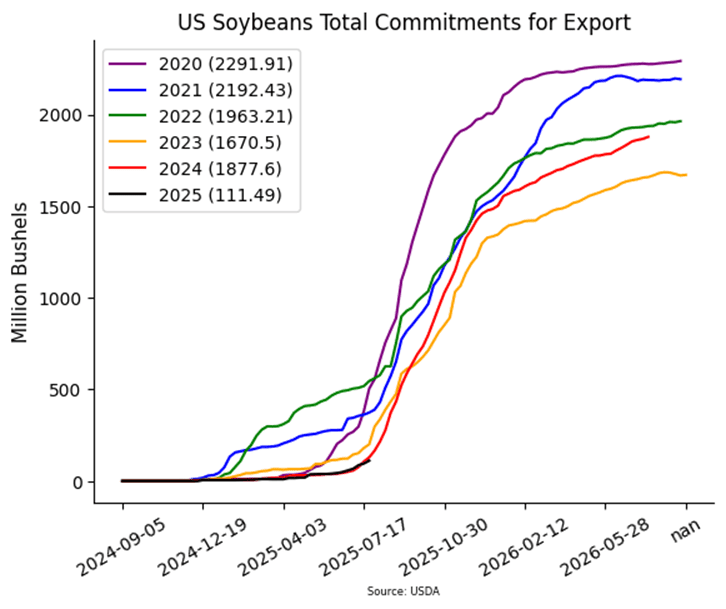

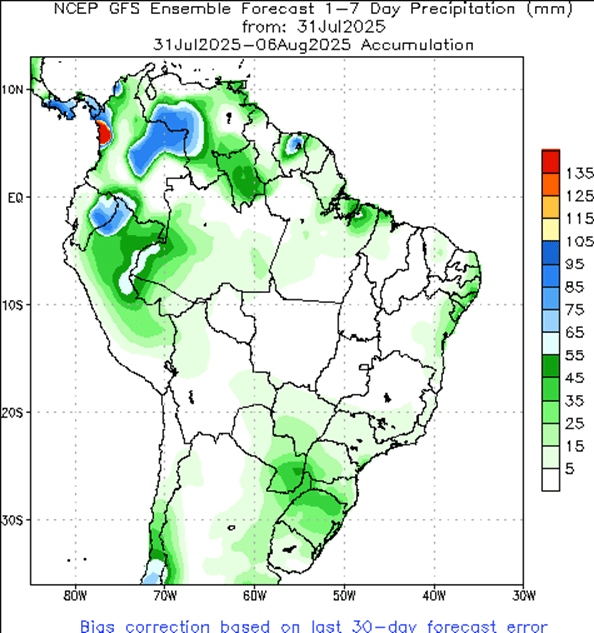

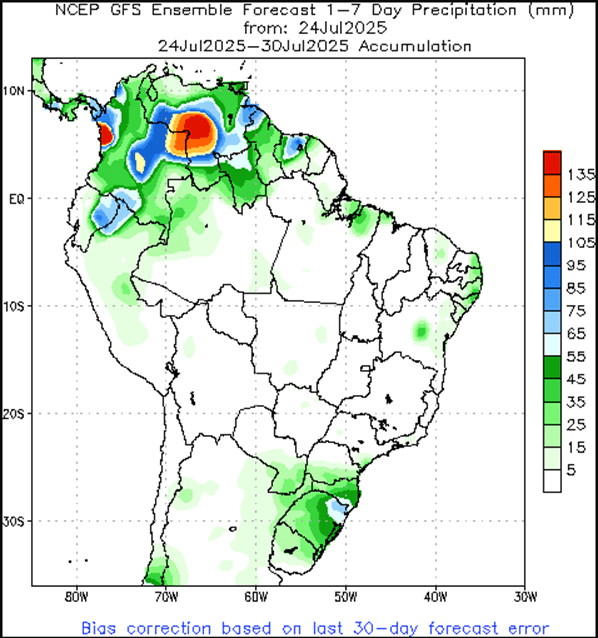

- Brazilian soybean sales for the 2024/25 season are 78.4% complete as of August 5, down from 82.2% sold a year ago, according to Safras & Mercado. Sales for the 2025/26 crop are at 16.6% of expected output.

- Brazilian soybean farmers are expected to plant 120 million acres in the 25/26 season according to consulting firm Celeres. StoneX anticipates that this will cause production to rise by 5.6% from the previous season to 178.2 mmt. For the 24/25 season, StoneX raised its production forecast to 111.7 mmt

- Trade rumors of a potential U.S.-China agreement offered early support, but with China still absent from the U.S. soybean market, trader confidence may be fading. Additionally, President Trump’s move to raise tariffs on India to 50% may add downside pressure to soy prices.

Soybeans Test April Lows

Soybean futures remain locked in a broader sideways trend after failing to clear key resistance at the May high of $10.82 in mid-June. With largely favorable weather throughout much of the growing season, the market has struggled to build bullish momentum, and the path of least resistance has remained lower. Technically, a breakout above the 100-day moving average could open the door to filling the gap left over the July 4th weekend near $10.50. On the downside, initial support is seen around the $10.00 mark, with stronger technical support at the April lows near $9.80.

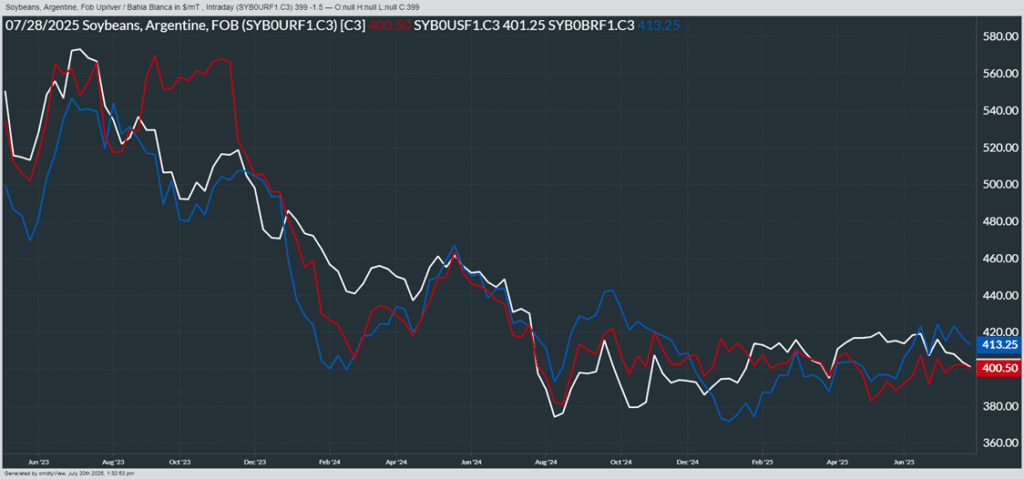

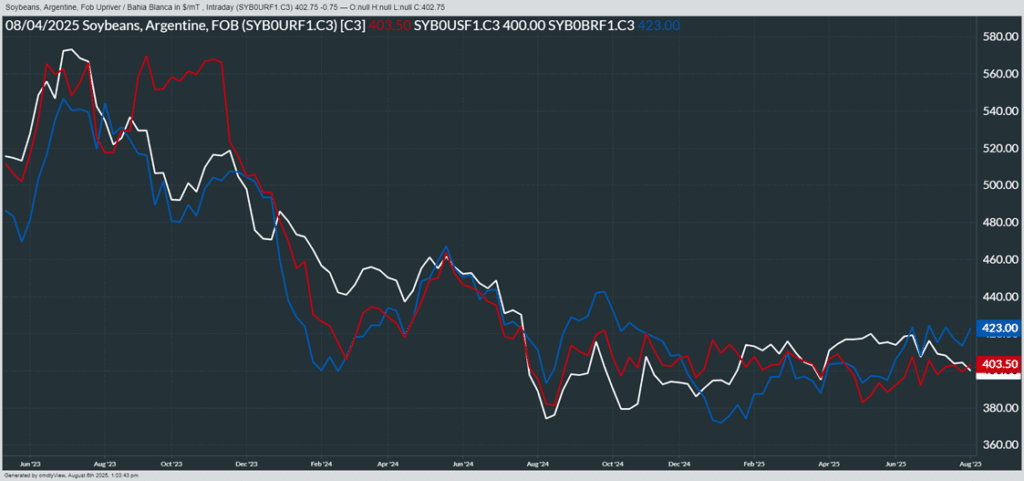

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

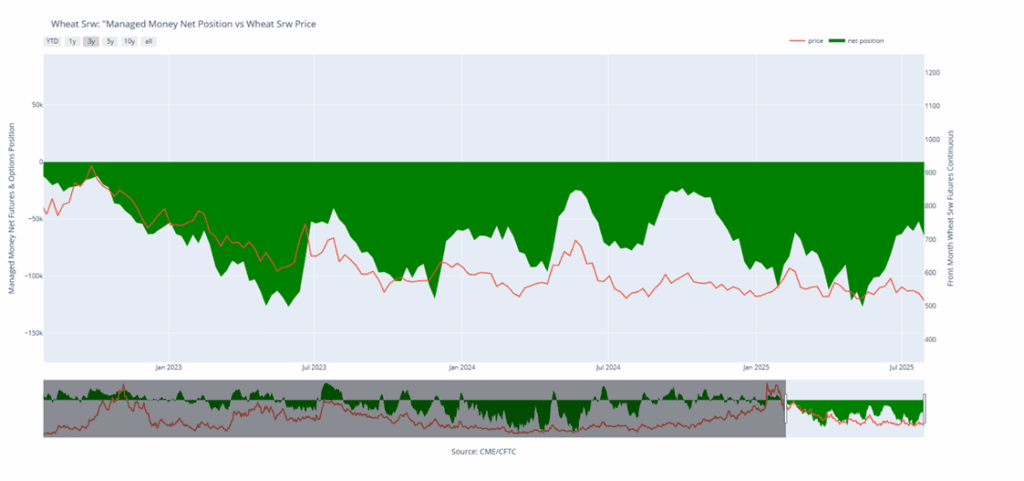

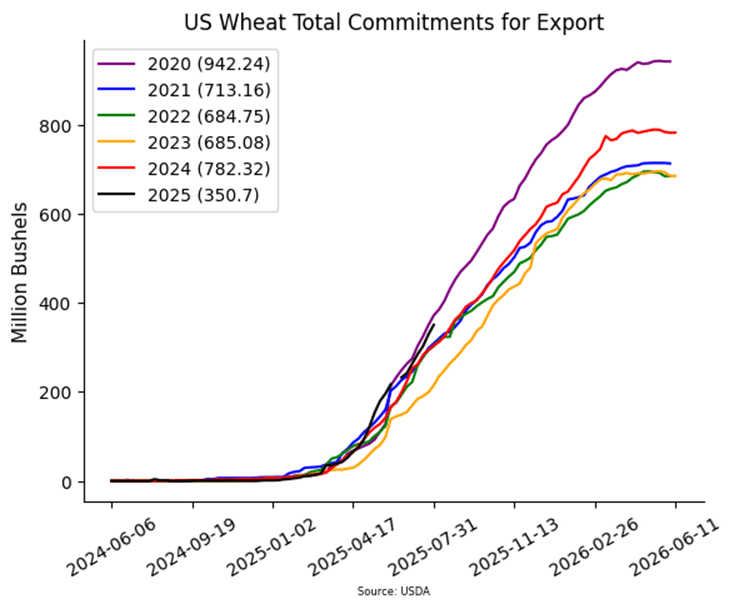

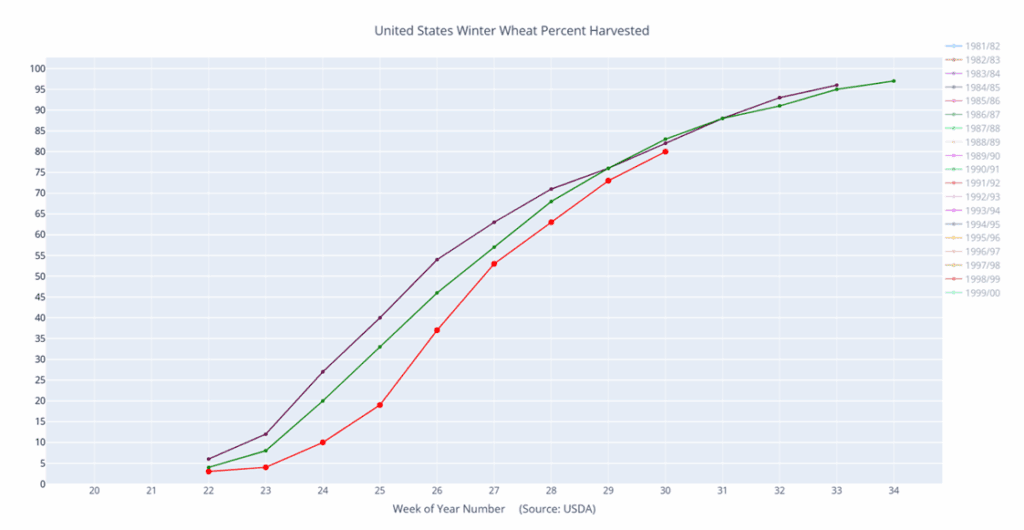

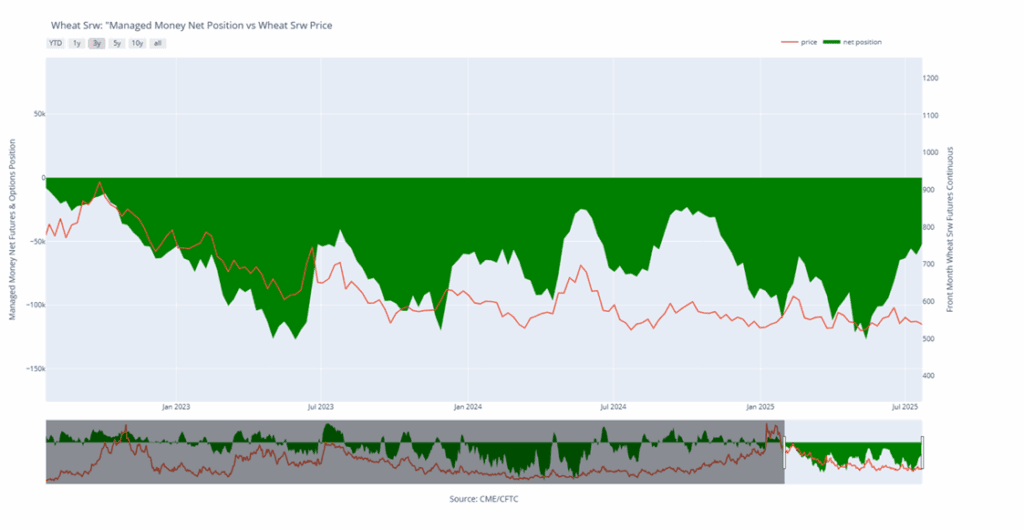

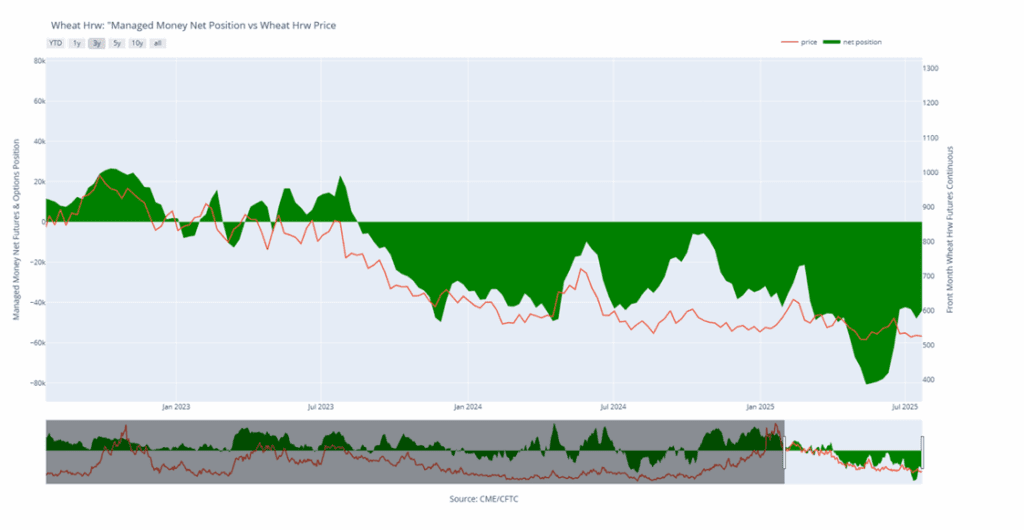

- After five consecutive days of losses, the wheat markets finally posted gains by the close of Wednesday’s trading session, supported by a strong start to U.S. export demand for the 2025–2026 marketing year.

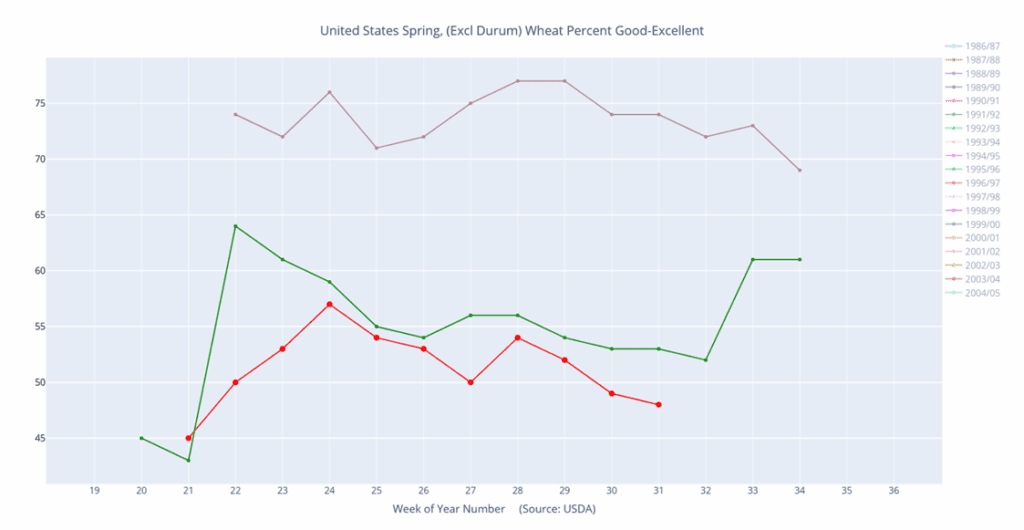

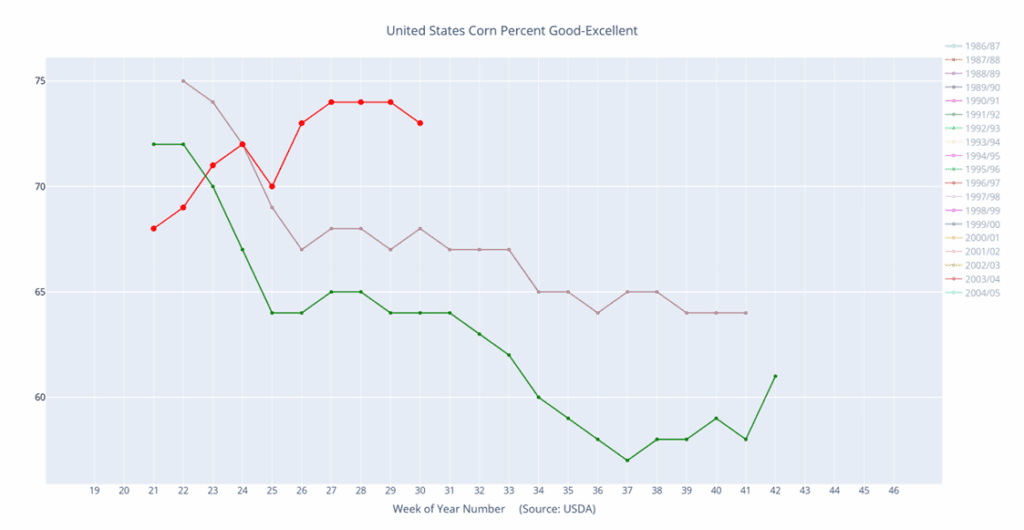

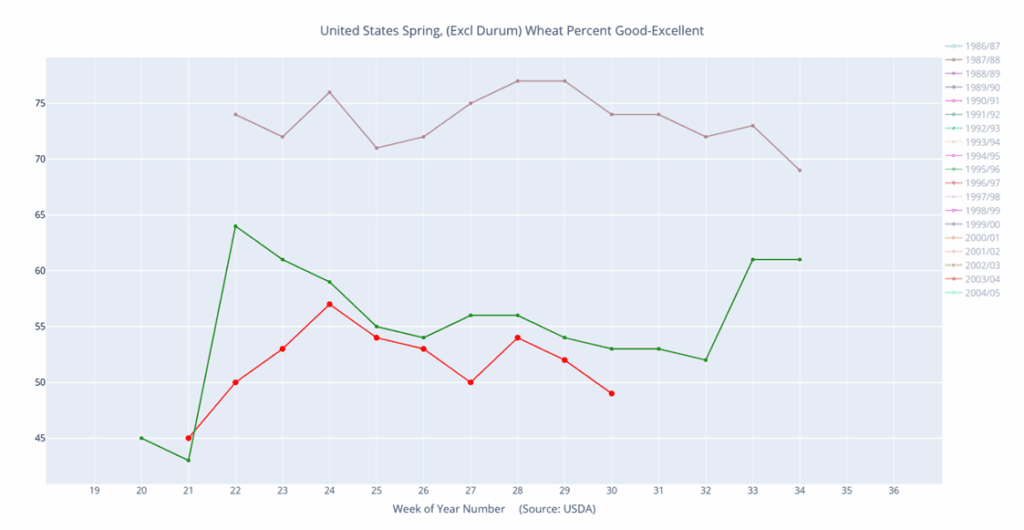

- While most U.S. crops are thriving, spring wheat continues to face challenges. The crop’s good-to-excellent rating fell to 48%, down 1% from the previous week and significantly lower than last year’s rating of 74%. However, the top-producing state, North Dakota, is showing more favorable conditions, with 64% of its crop rated good to excellent.

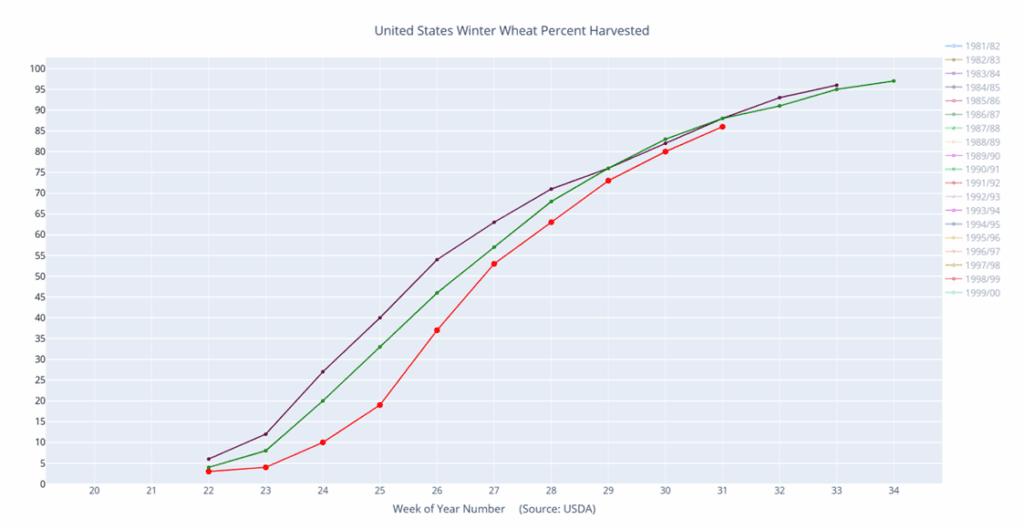

- U.S. wheat exports reached 63 million bushels in June, marking a 13% increase year over year. The top export destinations included the Philippines, Mexico, Nigeria, and Japan. With the U.S. wheat harvest nearing completion, traders are hopeful that the current export momentum will continue into the coming months.

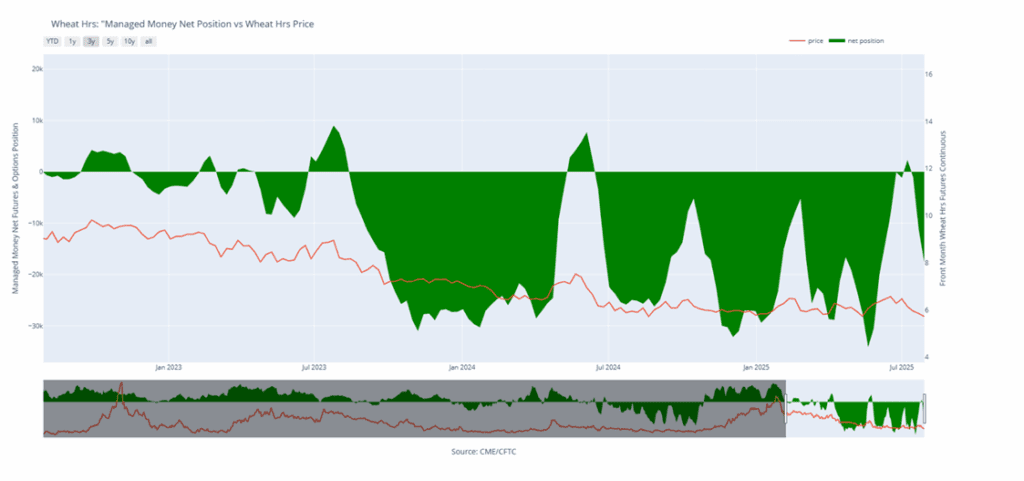

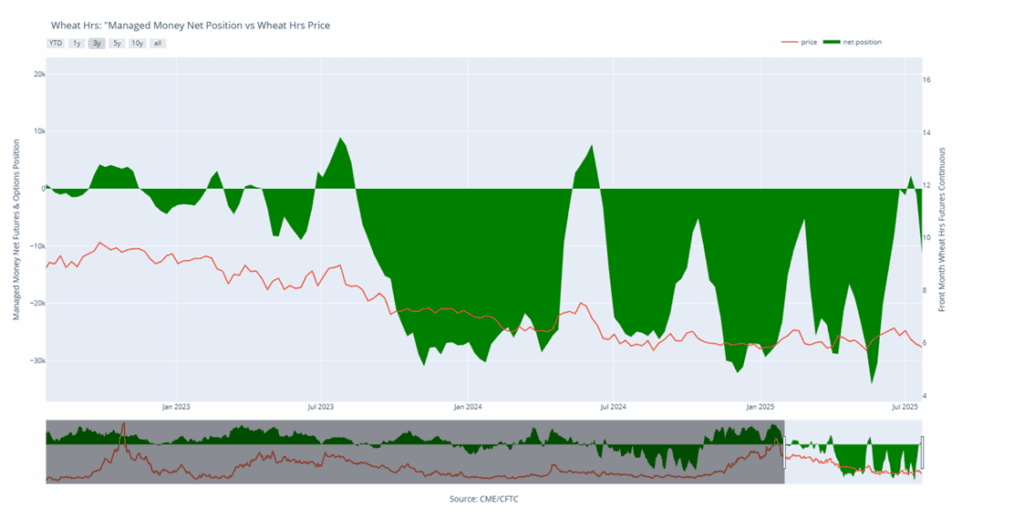

- Combined open interest in Chicago and Kansas City wheat rose by nearly 9,000 contracts yesterday, even as prices dropped to new lows. While the market is showing increasingly oversold conditions, this alone does not necessarily signal an imminent rally from a technical standpoint.

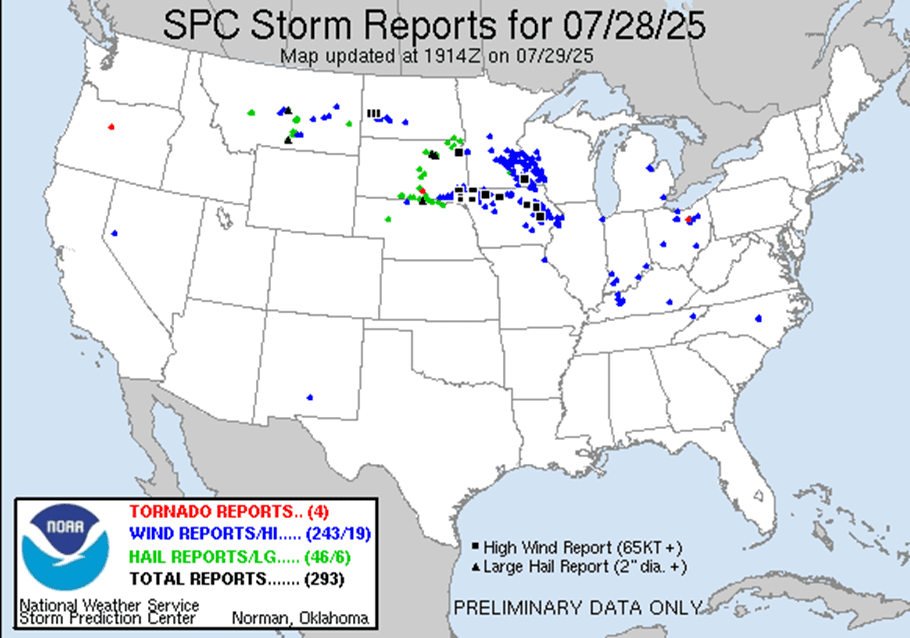

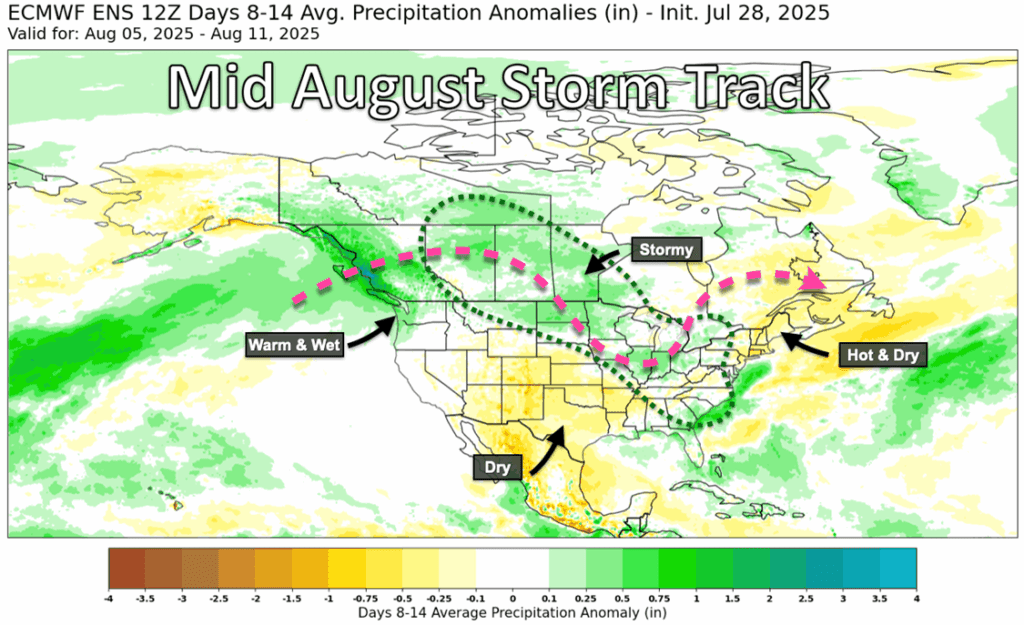

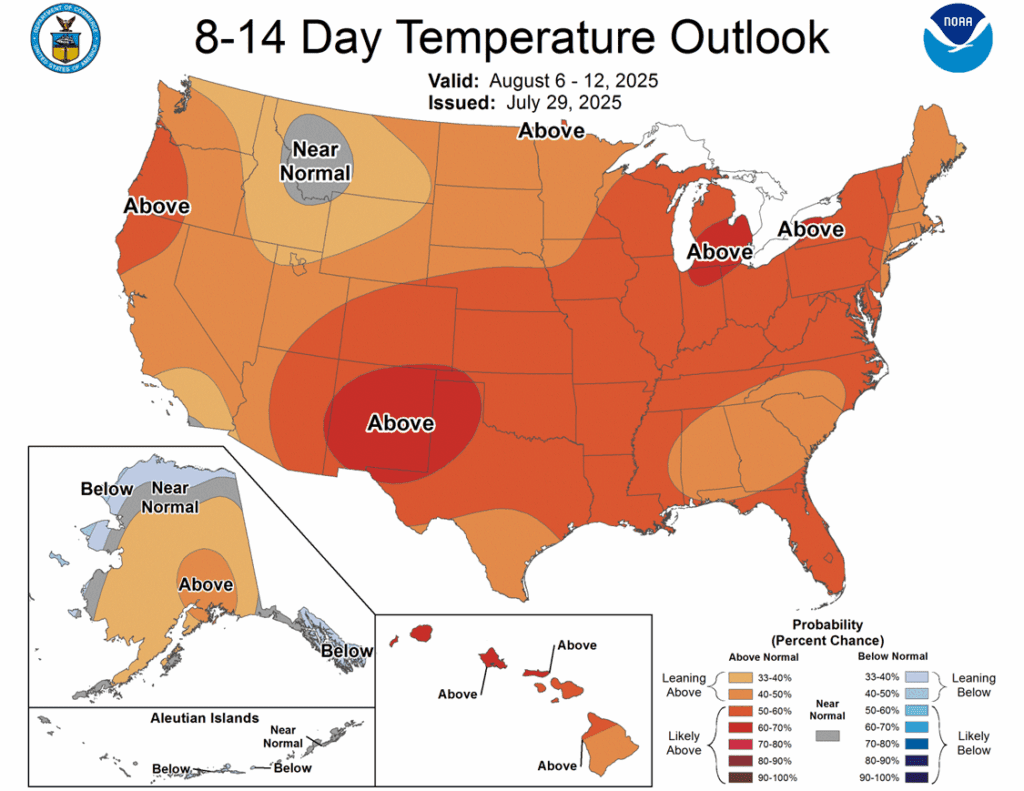

- The spring wheat harvest is expected to continue in the near term, as producers work around forecasted storms across parts of the Plains. While weather disruptions may slow progress in some areas, harvest activity remains steady overall. U.S. spring wheat harvest stands at 86% complete, just one point below the five-year average.

2025 Crop:

- Plan A:

- Target 599.75 vs September for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- New upside sales target.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a second portion of your 2026 Chicago wheat crop

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

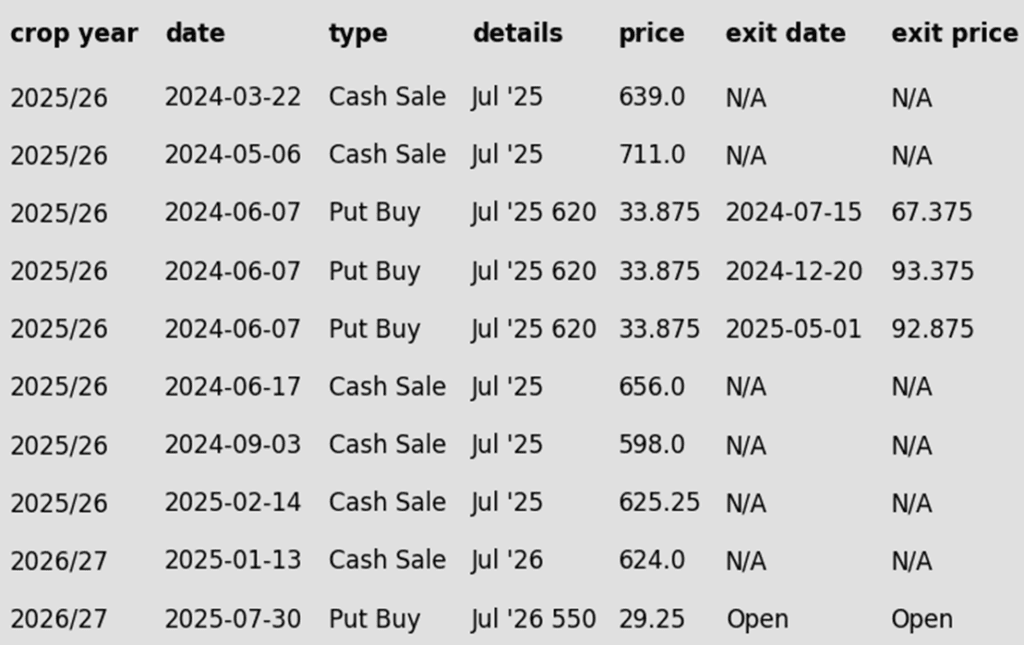

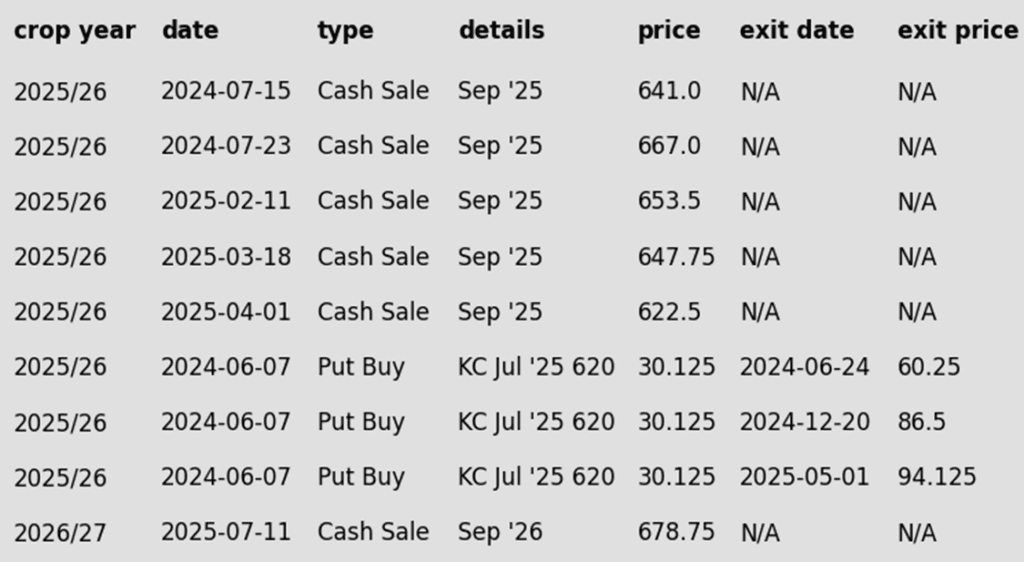

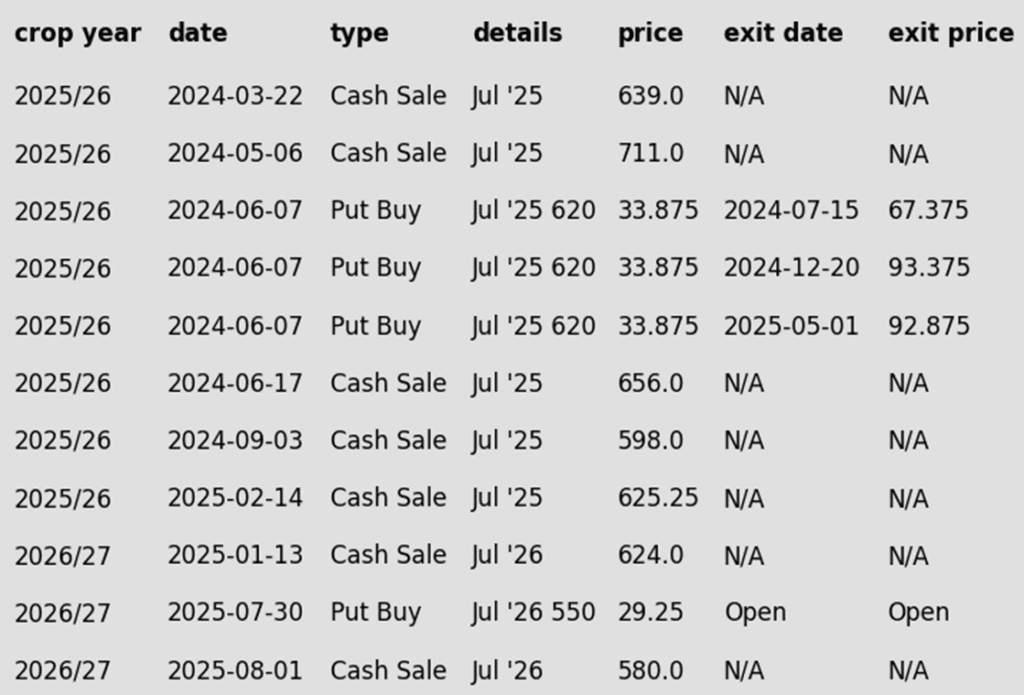

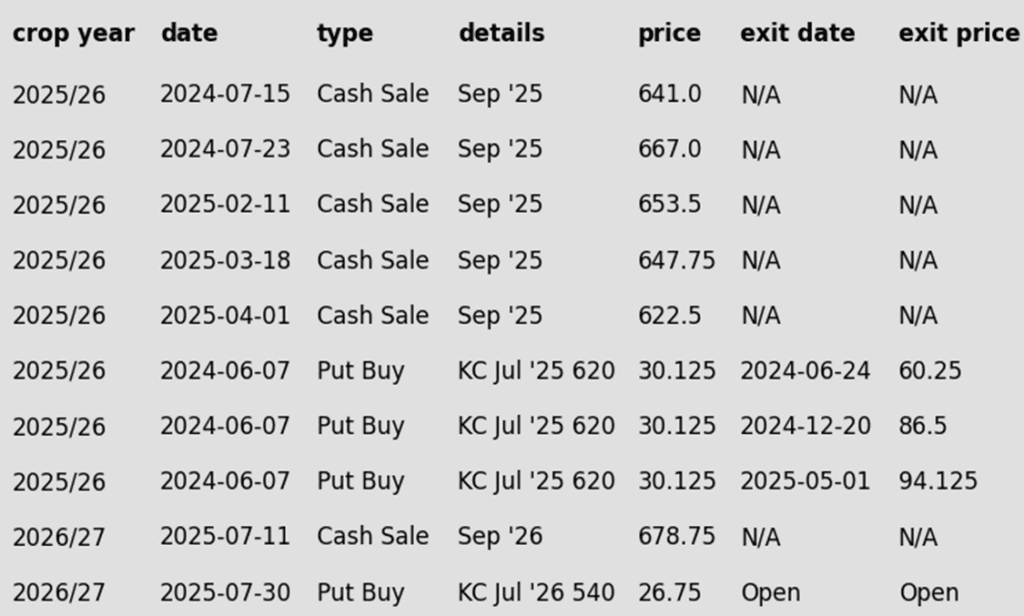

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range

Chicago wheat’s sharp rally in mid-June proved short-lived, with futures retreating toward the upper end of their 2025 trading range. Initial support is expected just above the 500 level, which marked the lows back in May and has since acted as a solid floor. On the upside, a weekly close above 558 would be seen as a constructive technical signal and could open the door for a retest of the recent highs near 590.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. No new active sales targets to report yet.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRW crop for approximately 26 cents in premium, plus commission and fees.

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Close below 584 support and buy July ‘26 put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Heads up that the July ‘26 contract is nearing the 584 Plan B stop, which if hit, would prompt buying July ‘26 put options.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still no new active sales targets to report yet.

- FYI – KC options are used for better liquidity.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRS crop for approximately 26 cents in premium, plus commission and fees.

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).– Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

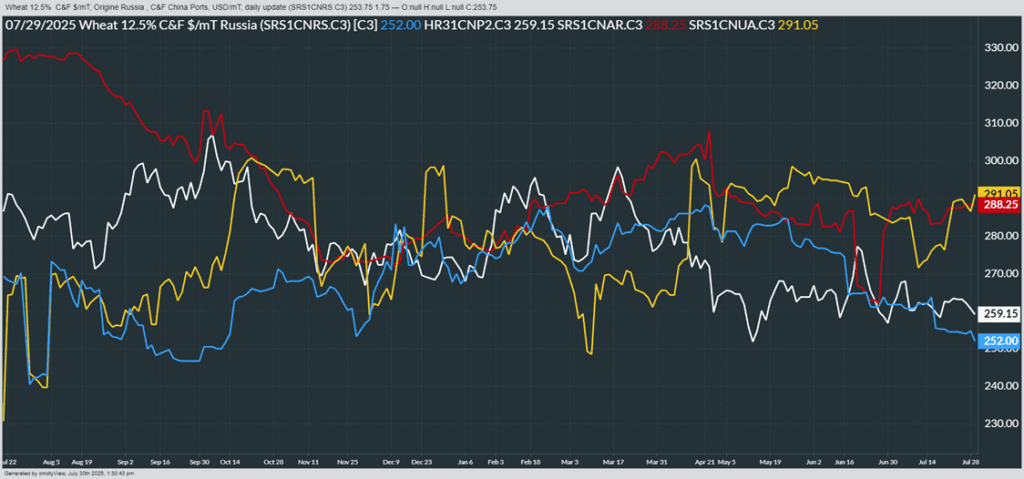

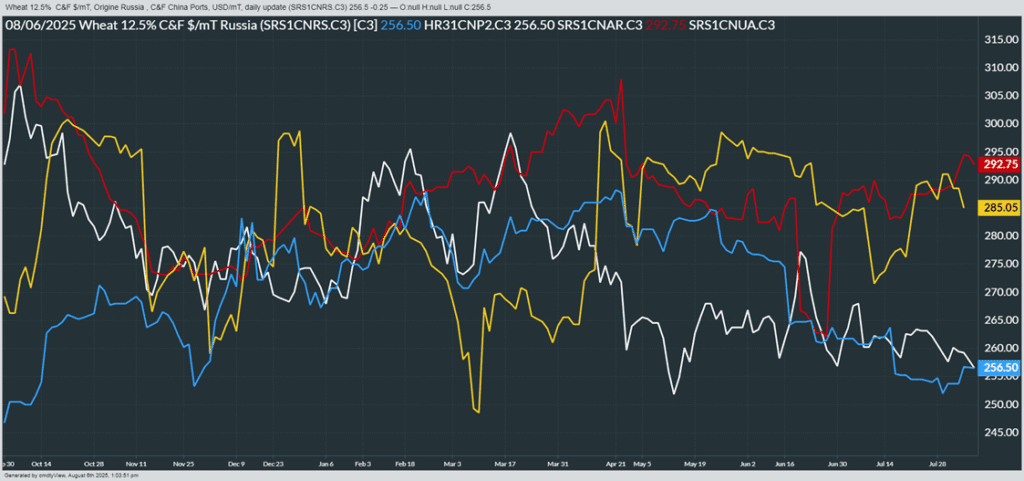

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather