Grain Market Insider: April 26, 2023

Grain Market Highlights

- The corn market opened the day session in the green and quickly traded lower on improved planting weather and slow demand.

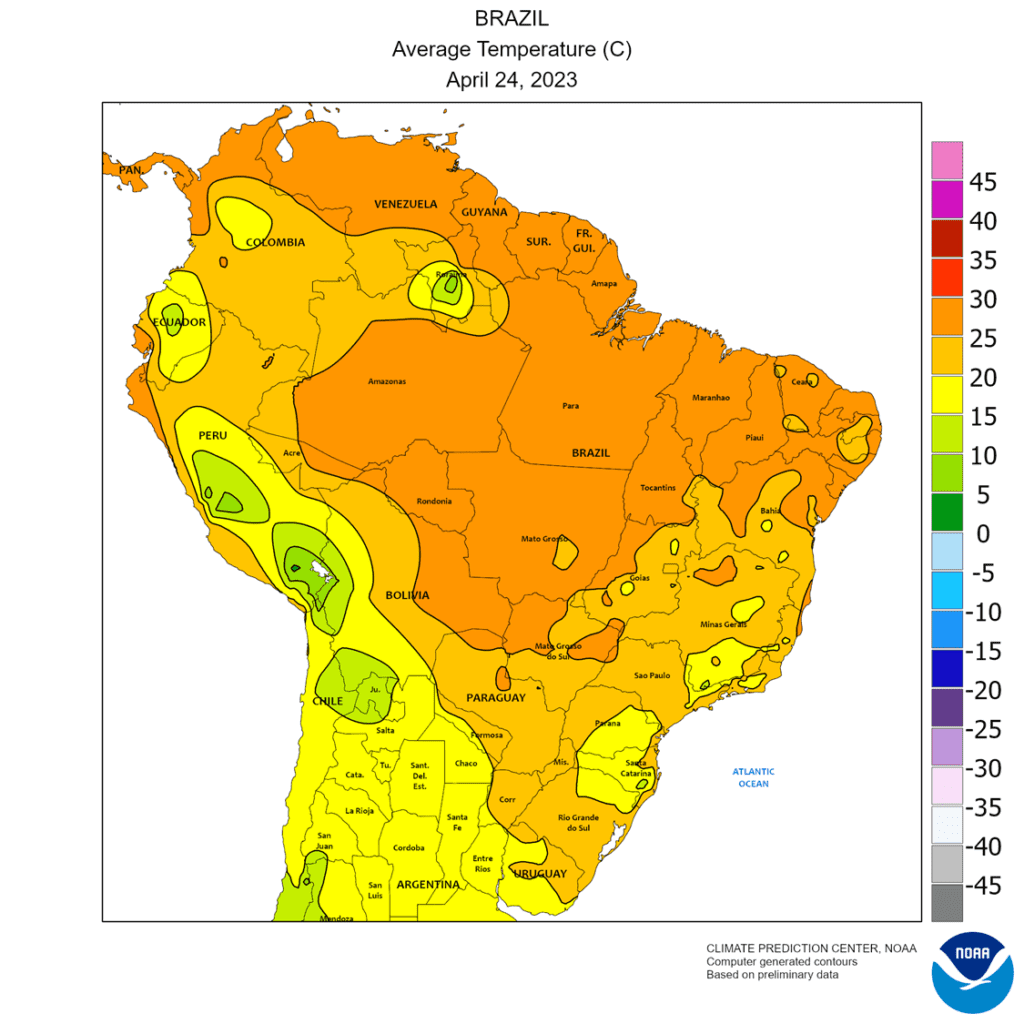

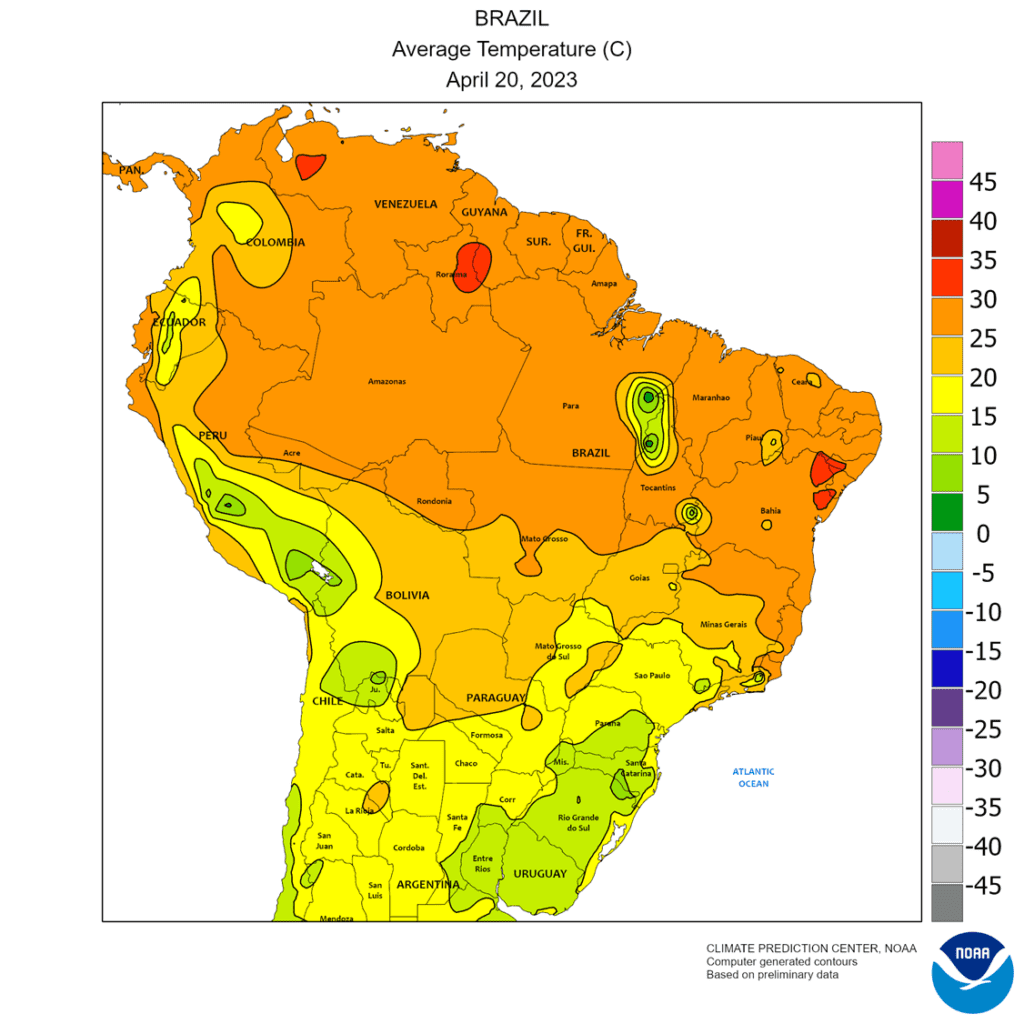

- Soybeans ended the day mixed with Old Crop trading weaker versus the New Crop, as cheaper Brazilian supplies dominate the world export market.

- The soybean products ended the day mixed while weighing on Board Crush margins, with the July Crush losing 10 cents/bu.

- All three wheat closed in the red as rain falls in some of the driest HRW areas, and Stats Canada’s acreage estimates came in above expectations.

Note – For the best viewing experience, some Grain Market Insider content may be best viewed in horizontal mode.

Corn

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. China’s recent purchases have slowed, weighing on prices. Our intent is to maximize any remaining opportunities the market may present as we begin to move towards the latter stages of the marketing year when end-users vie for tightly held supplies and weather concerns can build premium.

- Be patient to take further action for New Crop. We are moving into a time of year when we may be looking for option-buying opportunities and given market factors that could move the price of corn above $7 or below $5, owning both calls and puts could be warranted for a period of time.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

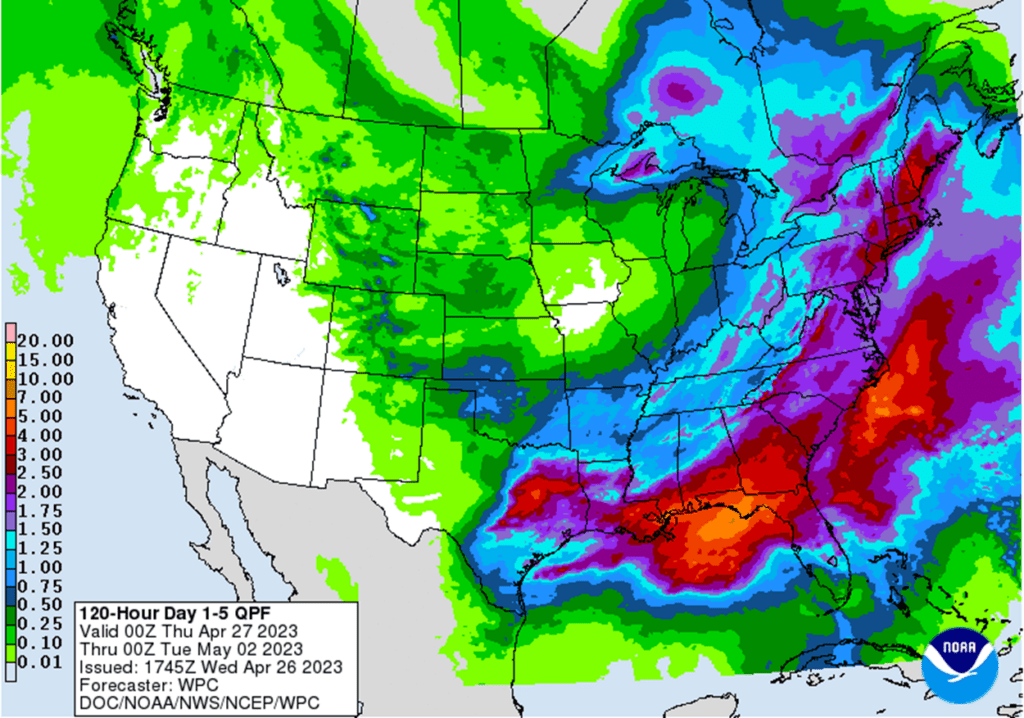

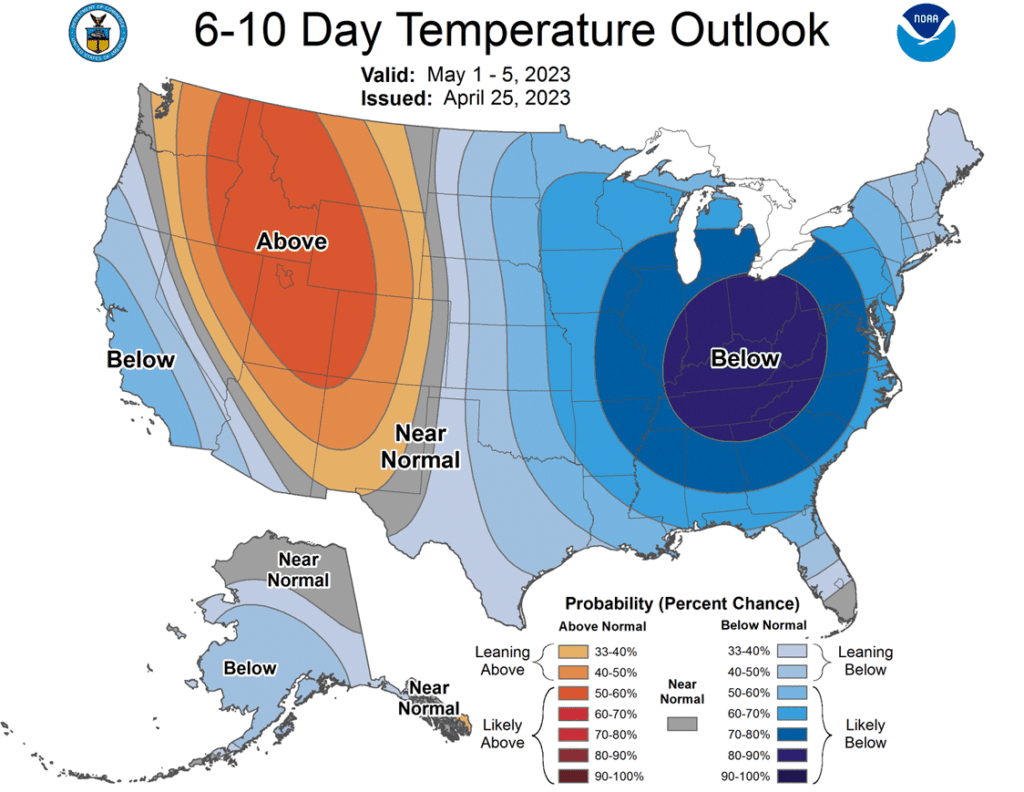

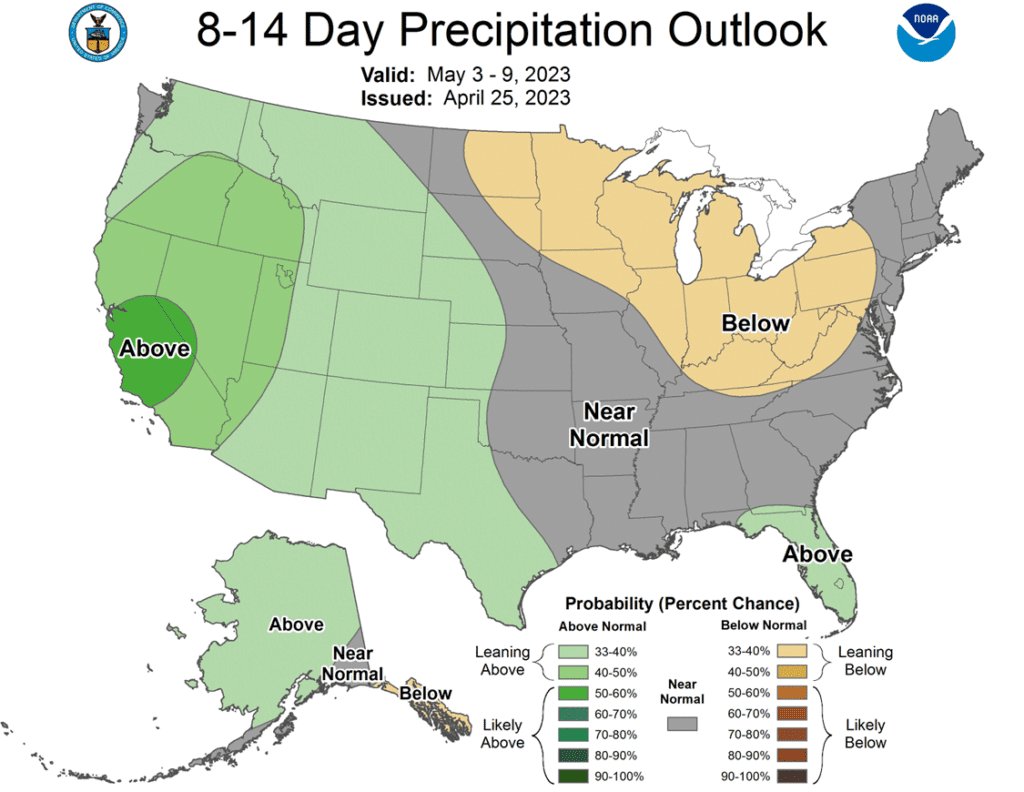

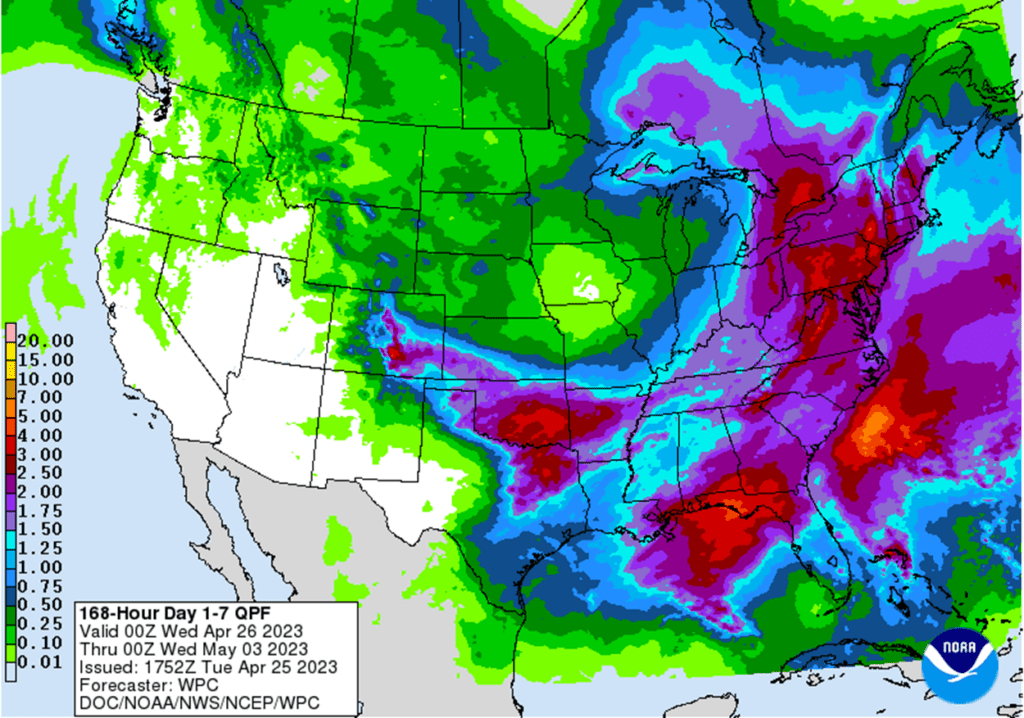

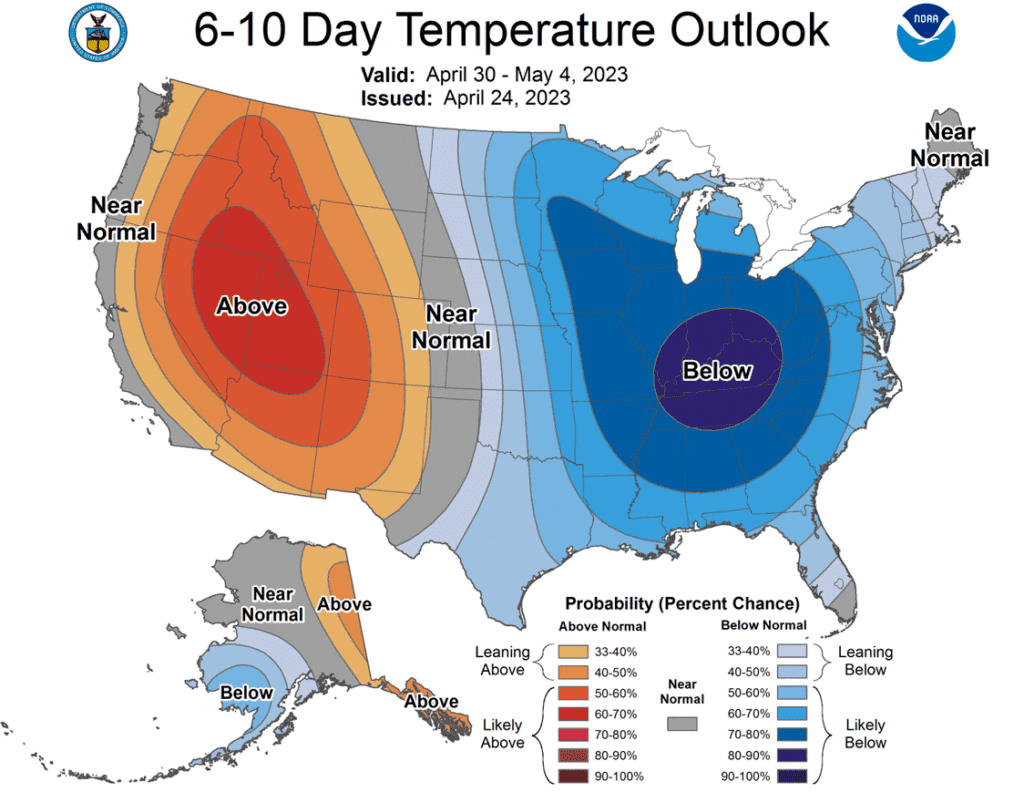

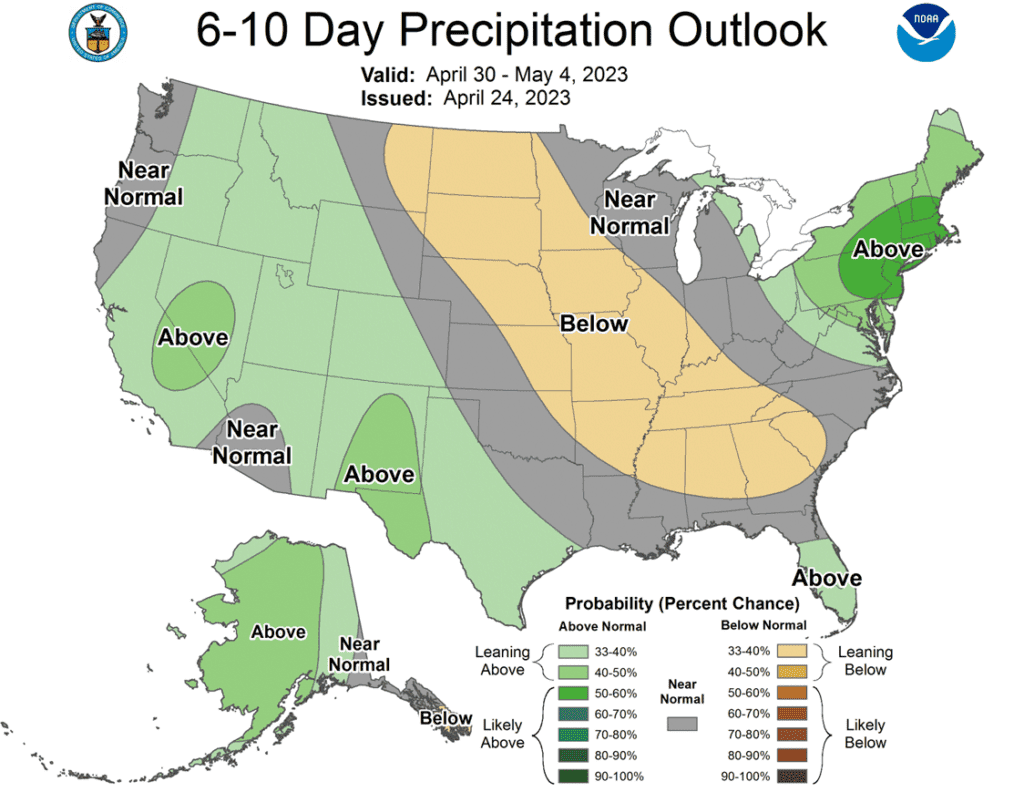

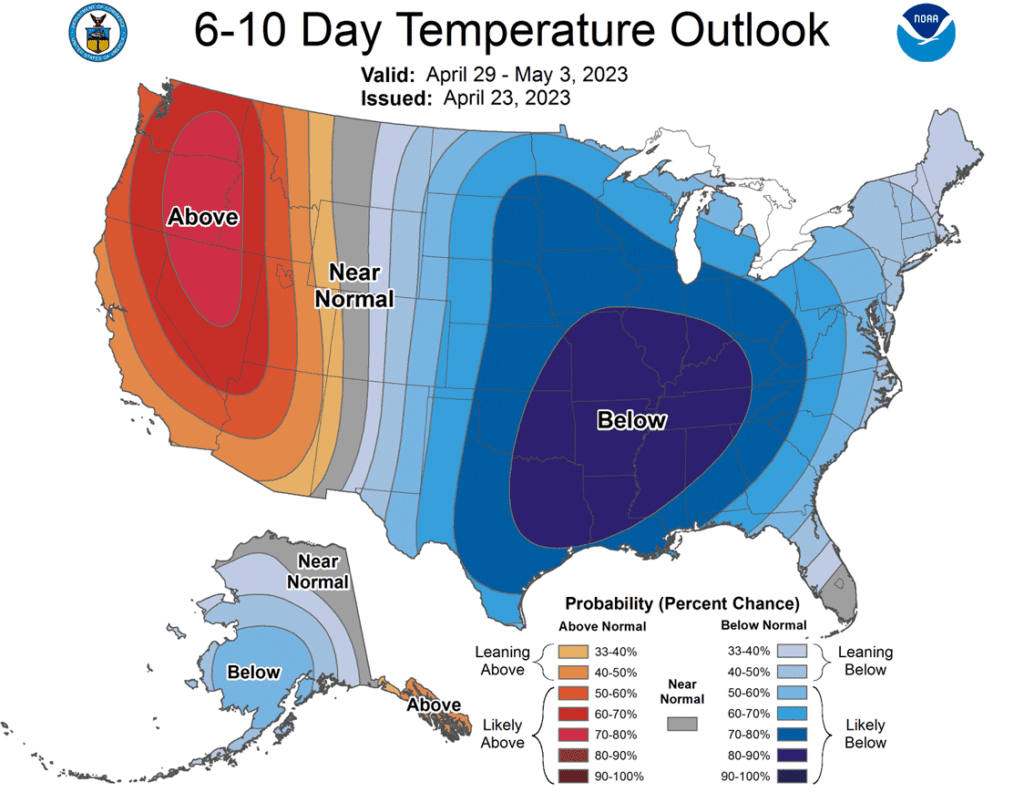

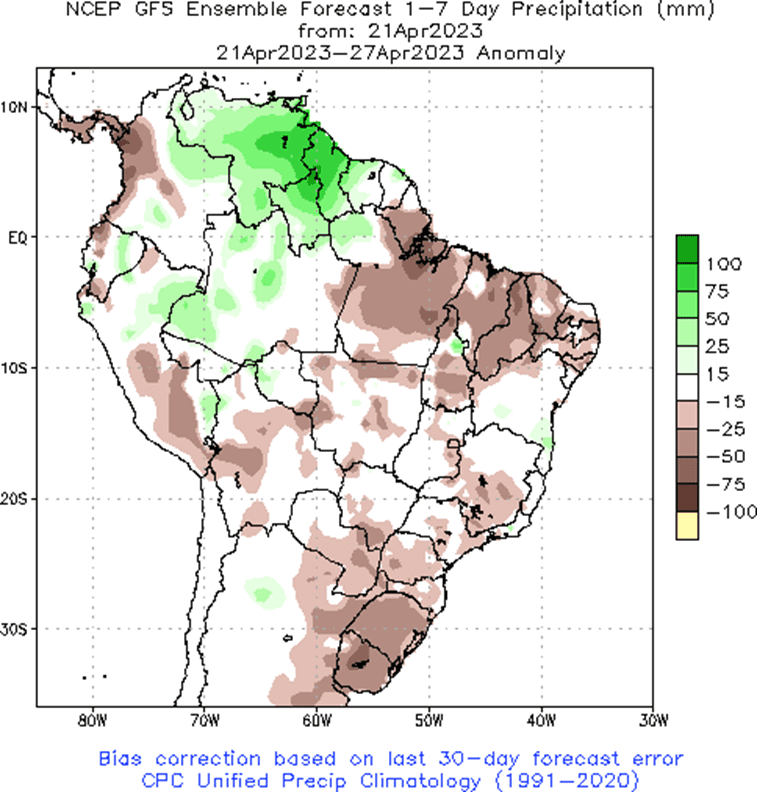

- A cool but drier forecast should allow for planting to remain mostly on schedule. Though not an ideal end of April/early May for many. The fact is that based on a five-year average, planting this past week is ahead of schedule, especially in key corn-producing states.

- Weekly corn used for ethanol production last week at 97 million bushels was lower than expected and below the pace needed to meet the USDA projection of 5.250 billion bushels.

- Spillover weakness from yesterday’s export cancellation of over 12 million bushels likely added to today’s sluggish price tone.

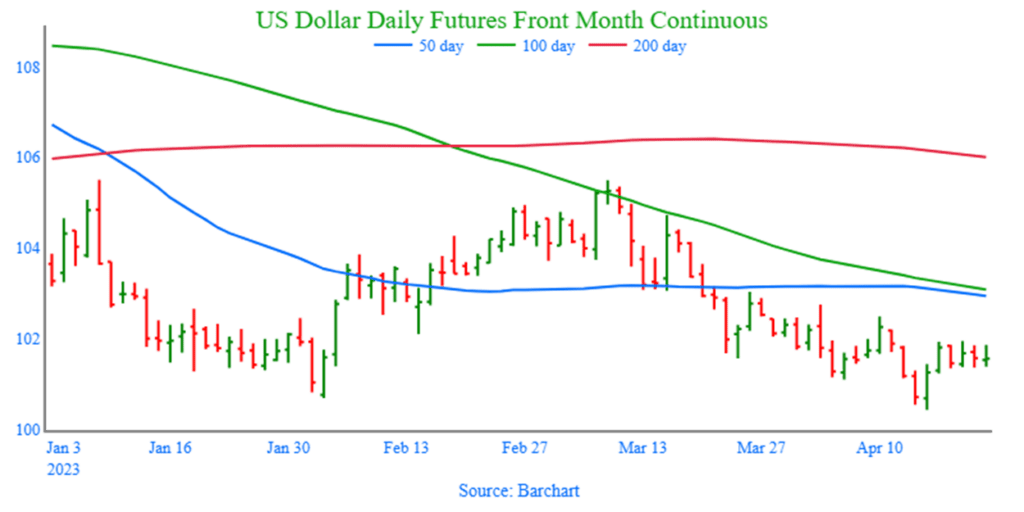

- U.S. corn prices (at the Gulf) are still over-priced compared to Brazil and Argentina. Expect exports to remain slow. A potential downgrade from USDA is a likely reality.

- Wheat’s sixth day in a row lower, and double-digit loss also weighed on corn prices.

Above: While the near-term trend is down, and the market is oversold, resistance now lies near the recent high of 647-1/2, with further resistance between 660 and 670. Support below the market for the July contract rests between 607 and 600, and then again between 568 and 562.

Soybeans

Soybeans Action Plan Summary

- We recommend holding current sales levels for Old Crop. We are beginning to push into the May-June seasonal window of opportunity, where prices could bounce as processors begin to push to keep supplies flowing.

- We recommend not adding to current sales levels for the new 2023 crop. Our research indicates there is about a 74% likelihood of improved prices moving into the June time frame as weather premium is built into the market.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

- Soybeans traded either side of unchanged today before ultimately selling off to make a 6th consecutive lower close.

- Soybean meal moved to its lowest levels since December, while soybean oil closed higher despite a drop in crude oil of over 2.50 a barrel.

- Crop consultant, Dr. Michael Cordonnier, said today that he expects soybean planting in the US to reach 88.0 million acres, 500,000 acres above the USDA’s estimate, with a trendline yield of 52 bpa.

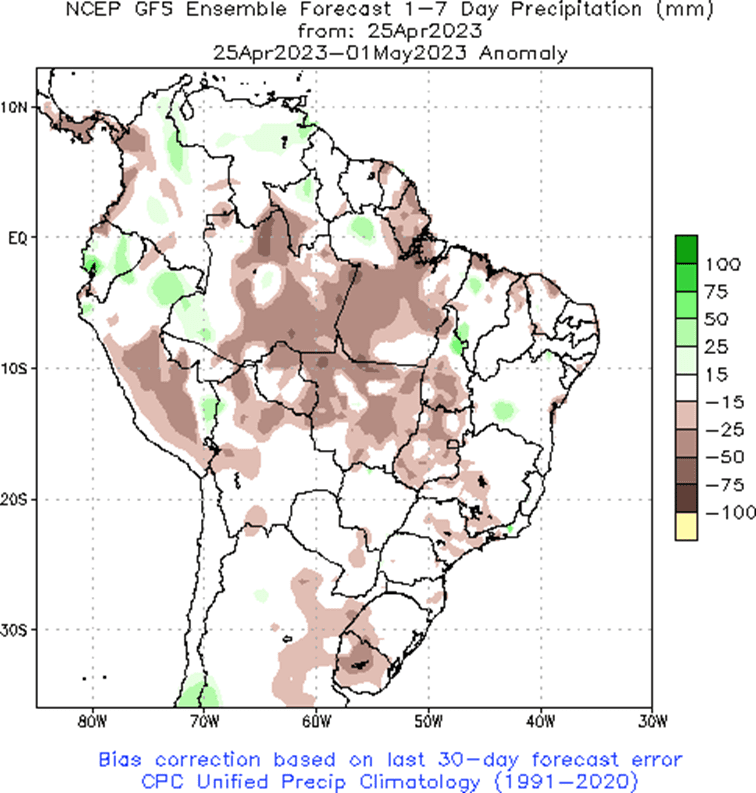

- With Brazil’s soybean harvest nearly concluded at over 95% complete, their soybean premiums have stopped falling this week, which could be supportive of US prices.

- Early soybean planting should pick up a bit in the middle of the Corn Belt this week, as more favorable weather is forecast in the 7-day outlook.

Above: The market has given back most of the gains from the rally off the March lows. The near-term trend is down, and key support lies near 1405 with further support near 1350. Should support hold and buyers enter the market, resistance may be found between 1460 and 1501.

Wheat

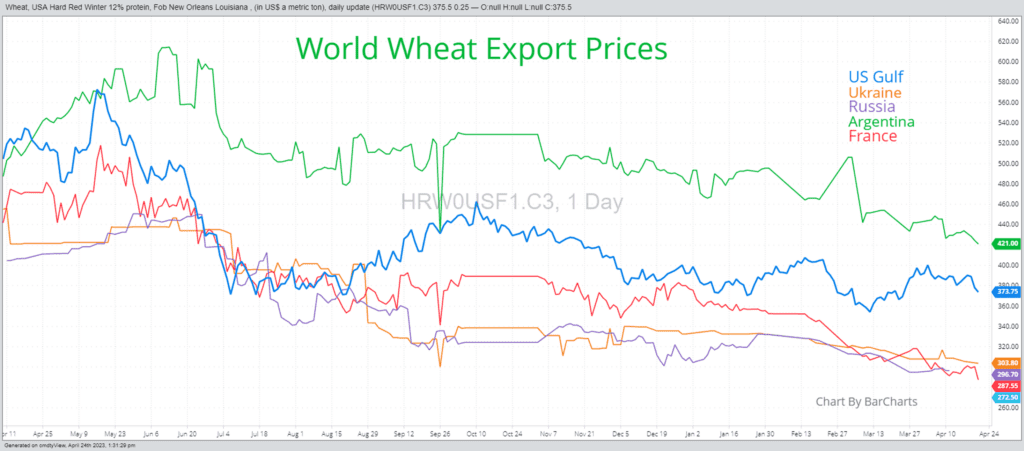

Market Notes: Wheat

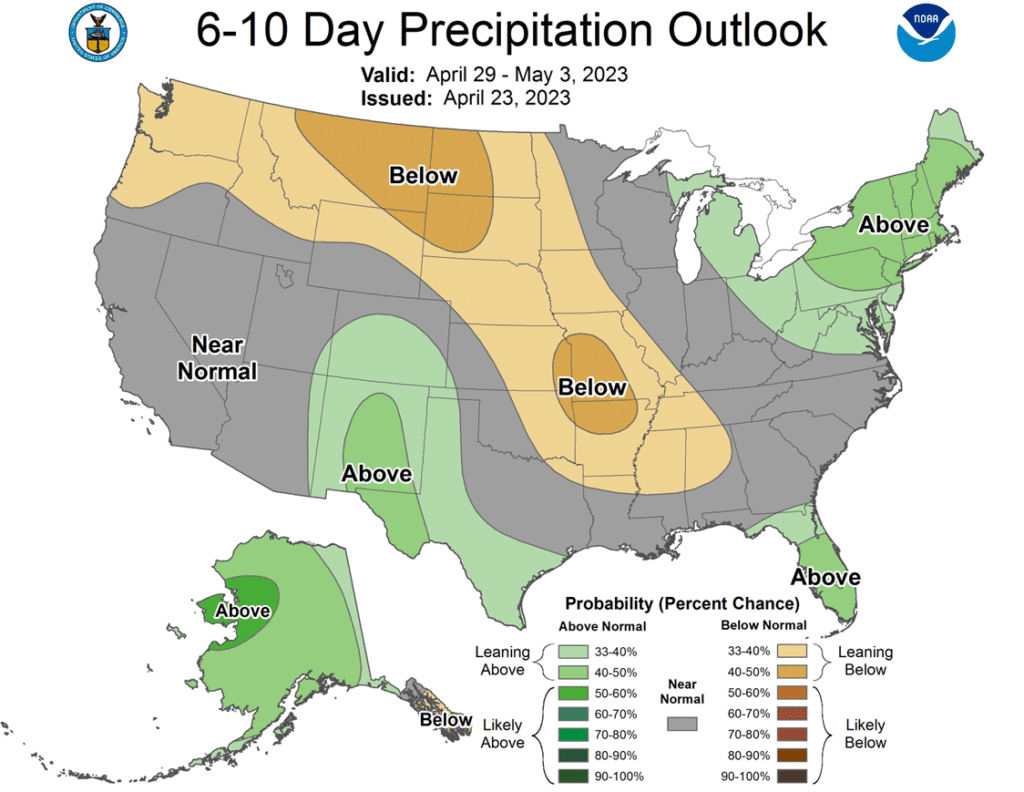

- An improved weather forecast and rain falling in the Southern Plains pressured the wheat markets lower.

- Stats Canada’s seeding intentions showed all wheat acres up by 1 million (to 27 ma) and that is 6.2% above last year.

- Offering little support, a group of millers estimated US soft wheat production up 20% at 400 mb this year, up from last year’s roughly 337 mb.

- Reportedly, Russia has asked vessel owners and captains in the Black Sea to sign a letter, with the understanding that the export corridor deal will be ended on May 18.

- Russia is also asking to be let back into the SWIFT program and for sanctions against their banks to be dropped before any consideration of renewing the export corridor.

- Funds are suspected of adding to their already sizable short positions in wheat, which may be confirmed in the next Commitments of Traders report, and could be supportive if the market receives friendly news.

Chicago Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. The Chicago wheat contracts are oversold, which can be supportive to prices should buying enter the market to cover short positions. We continue to look for any remaining opportunities the market may present as the marketing year begins winding down.

- We recommend not taking any action on the 2023 crop at this time. Corn and K.C. wheat are near historic premiums to Chicago wheat, which could lend support to the Chicago contracts if HRW production concerns persist, or if any production concerns develop for corn.

- No action is recommended at this time for the 2024 crop. We are looking for stronger markets to present themselves as we move further into the marketing year.

Above: The market broke below the March low of 654 and is oversold. The reversal off the 642-1/2 low could add further support if buyers come into the market to cover short positions. Initial resistance could be found near 668 and again between 718 and 724. While initial support may be found near 642-1/2 and again near 610.

KC Wheat Action Plan Summary

- We continue to look for any remaining opportunities the market may present as the marketing year begins winding down for Old Crop. No action is recommended at this time for the 2022 Old Crop.

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist despite the recent rain.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: The July contract continues to be under the bearish influence of the key reversal left on 4/03. Support may be found near 791 and again near 772. While initial resistance lies near 835 and then near 886.

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. We look for better pricing opportunities for the 2022 crop with potential planting concerns and a seasonal tendency for better prices as we move through springtime.

- No action is recommended on the 2023 crop at this time. The snowy and cold winter has given rise to wet conditions and planting concerns which may present good selling opportunities in the coming weeks.

- We continue to be patient to market any of the 2024 crop. Due to the lack of liquidity for the 2024 crop, there may not be any recommendations until late spring or early summer. This is the time for patience, not action.

Above: The short-term trend is down, though the July contract is oversold, which can be supportive should buying return to the market. Nearby support may be found near 778 and again near 760, while resistance may be found near 870 and 895.

Other Charts / Weather