Grain Market Insider: May 11, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

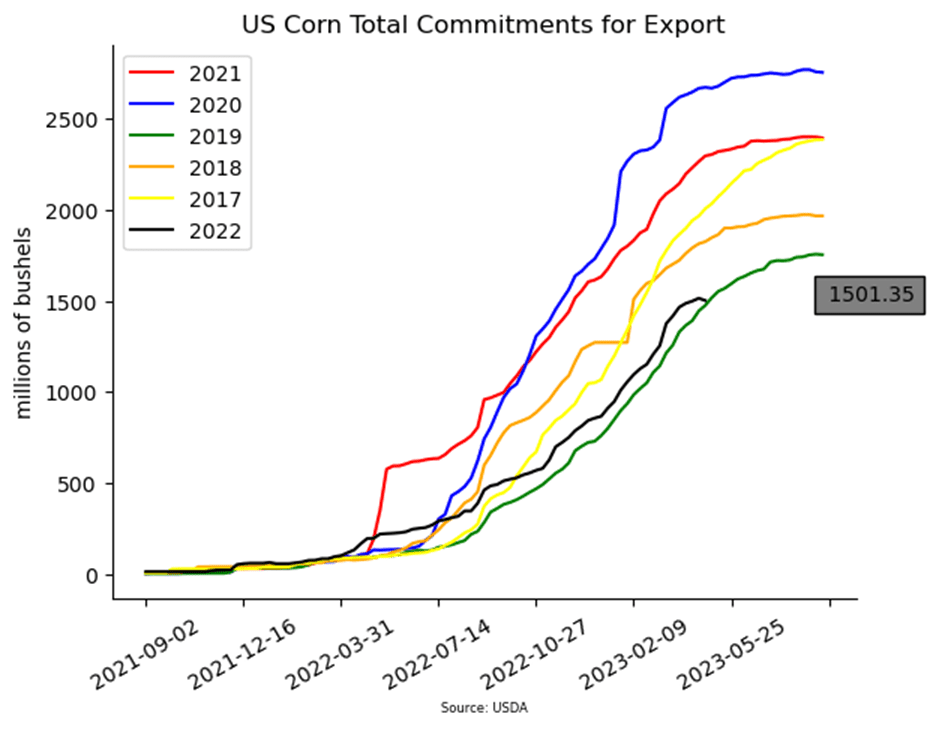

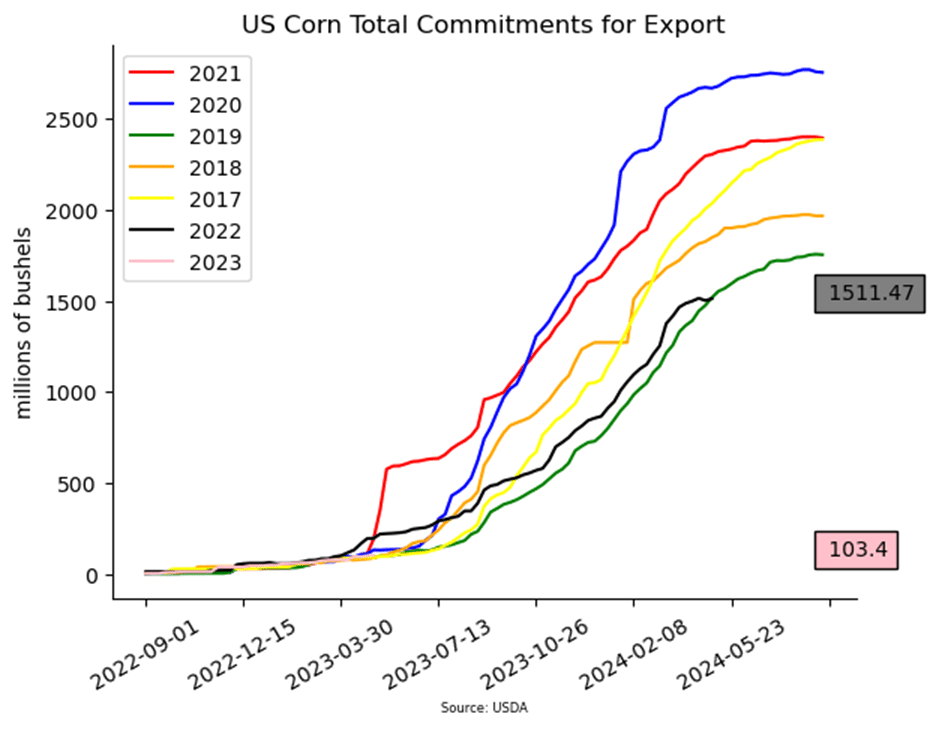

- Anticipated lowered exports and increased ending stocks in tomorrow’s USDA WASDE pushed corn prices back down near their recent lows.

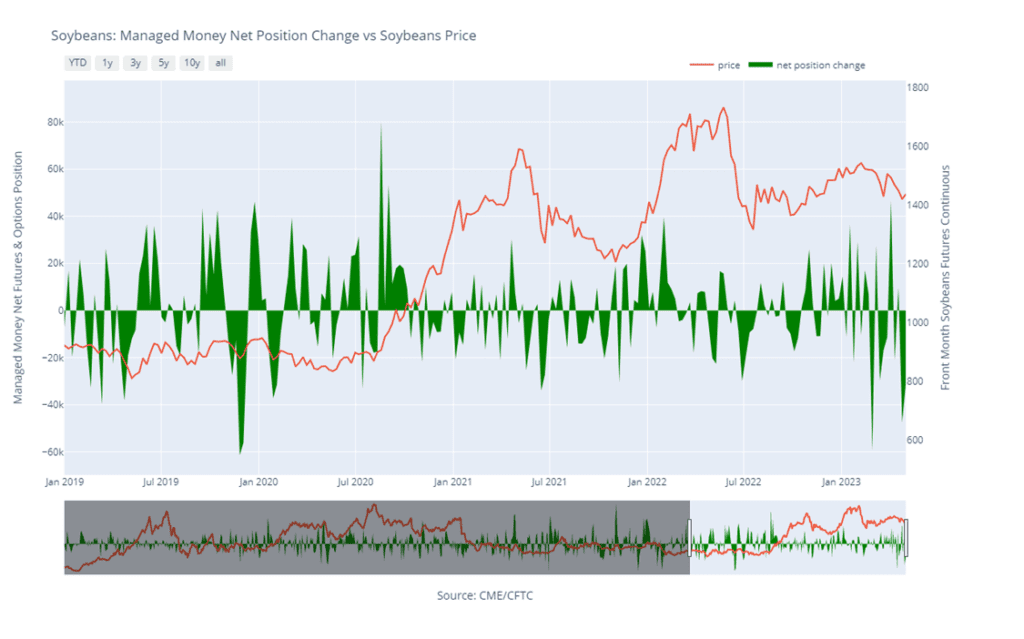

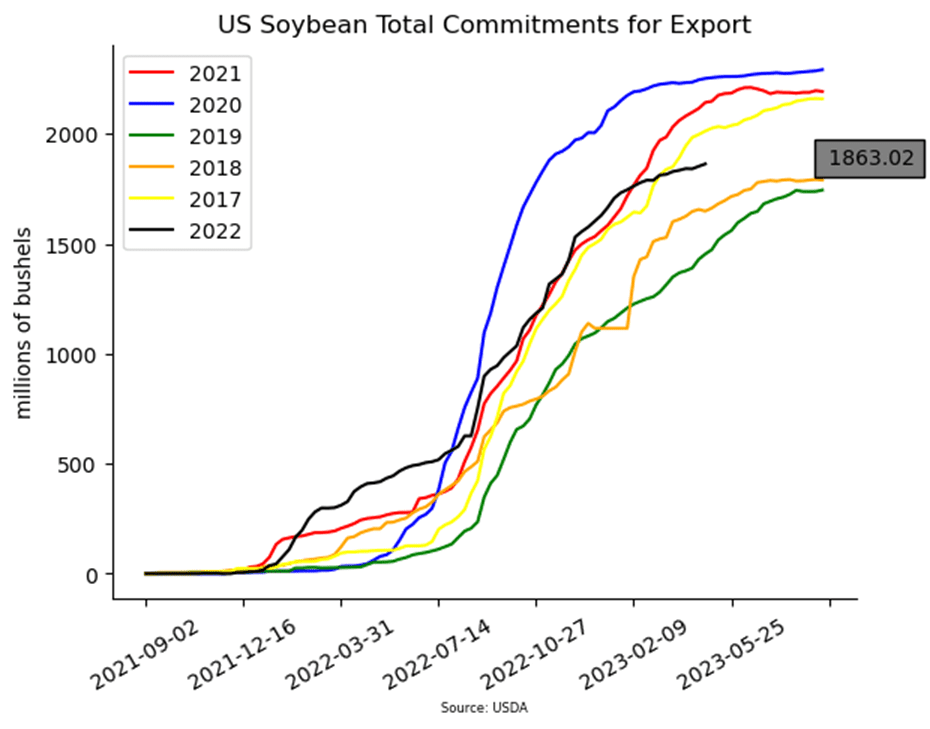

- The confirmed sale of 132,000 tons of US soybeans to unknown destinations for the 2023/24 marketing year by the USDA this morning helped support the soybean complex.

- Soybean meal prices moved sharply higher while soybean oil prices followed crude oil lower again.

- Disappointing export sales and continued profit taking ahead of tomorrow’s USDA WASDE in K.C. and Minneapolis weighed on all three wheats.

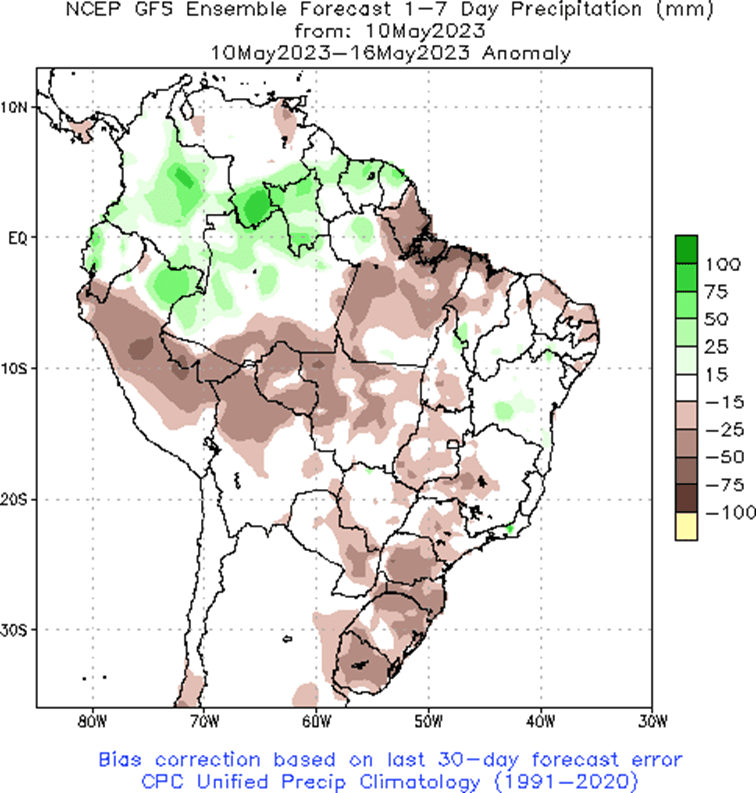

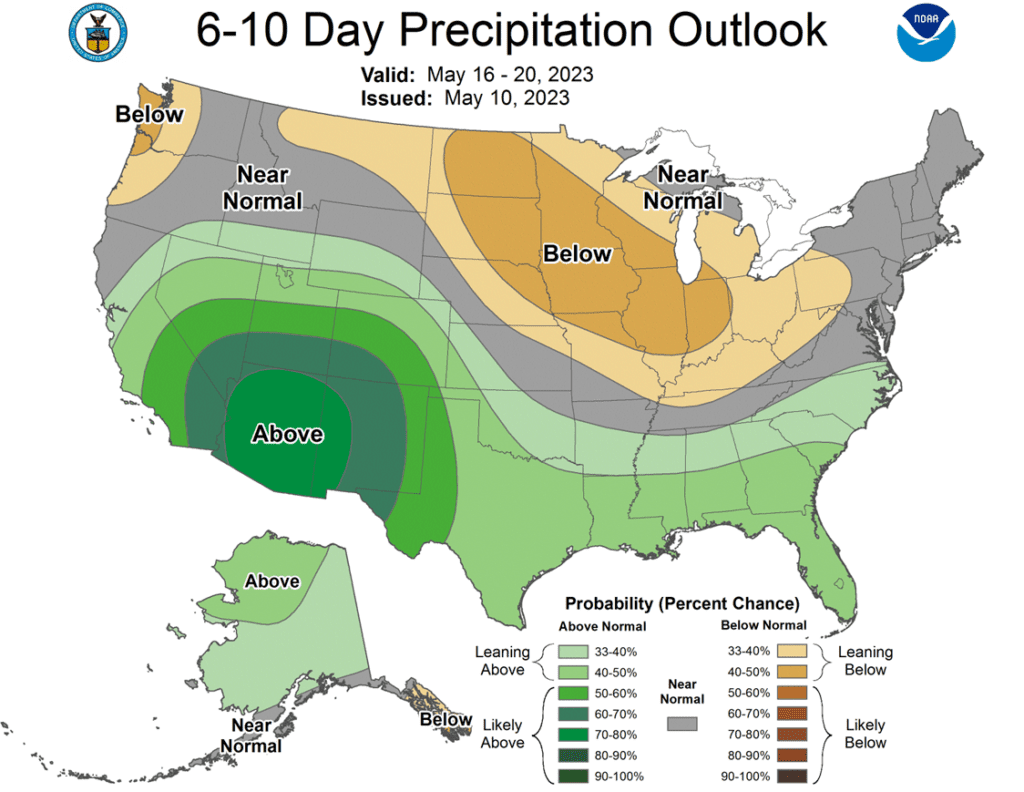

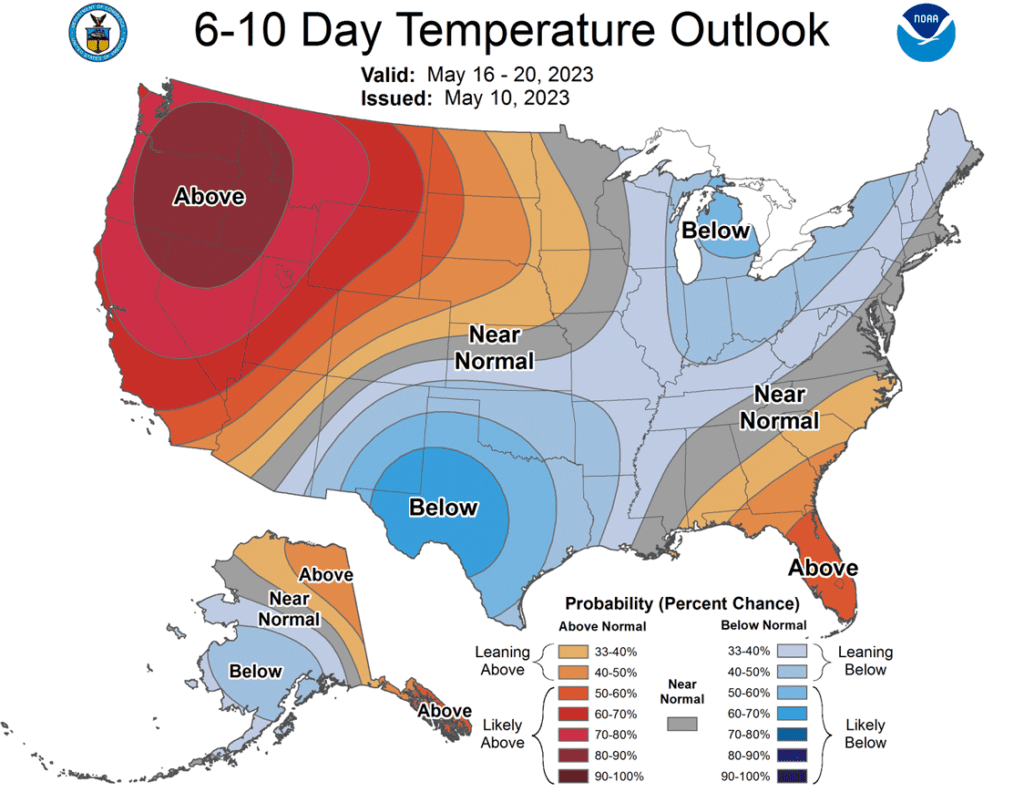

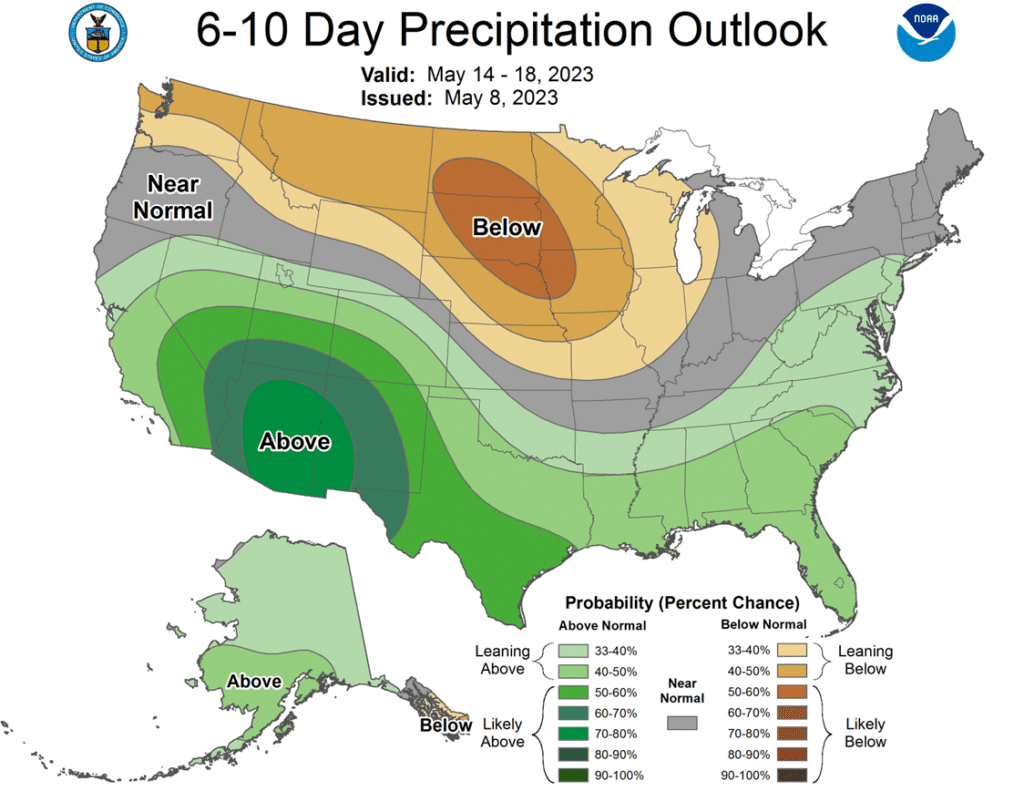

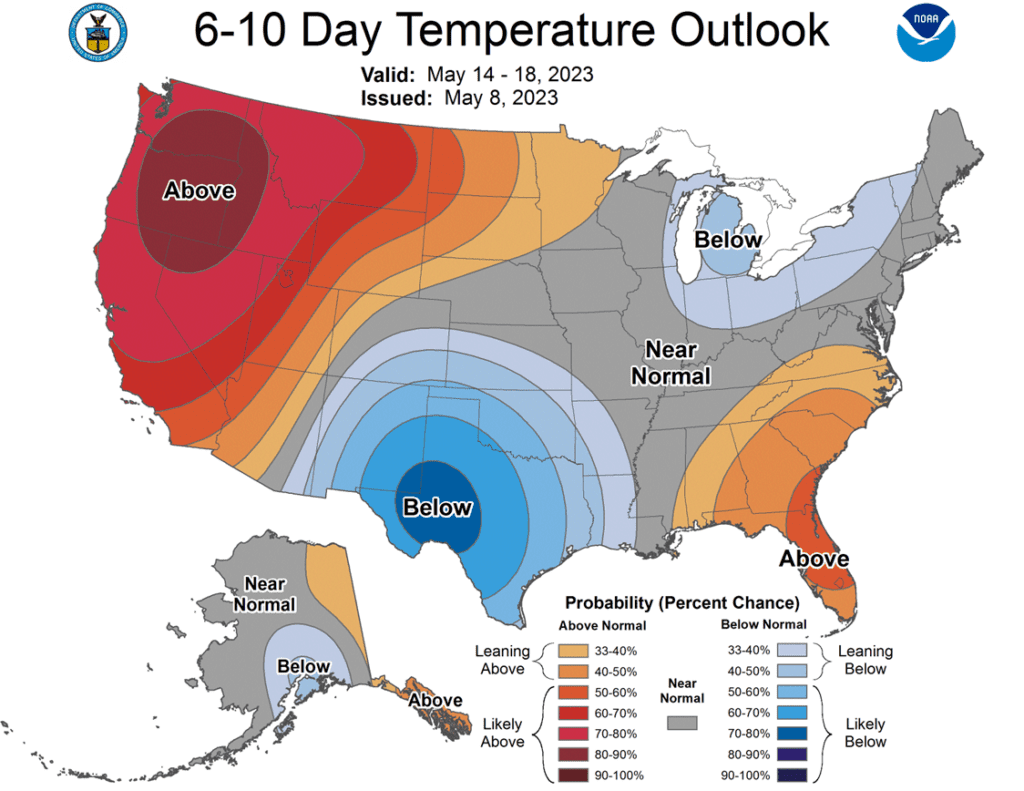

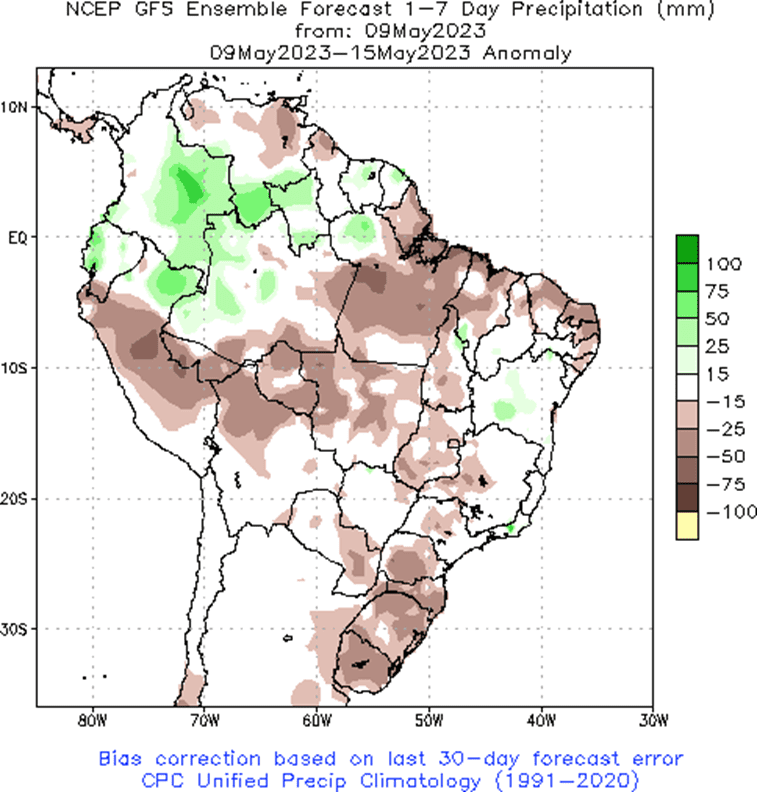

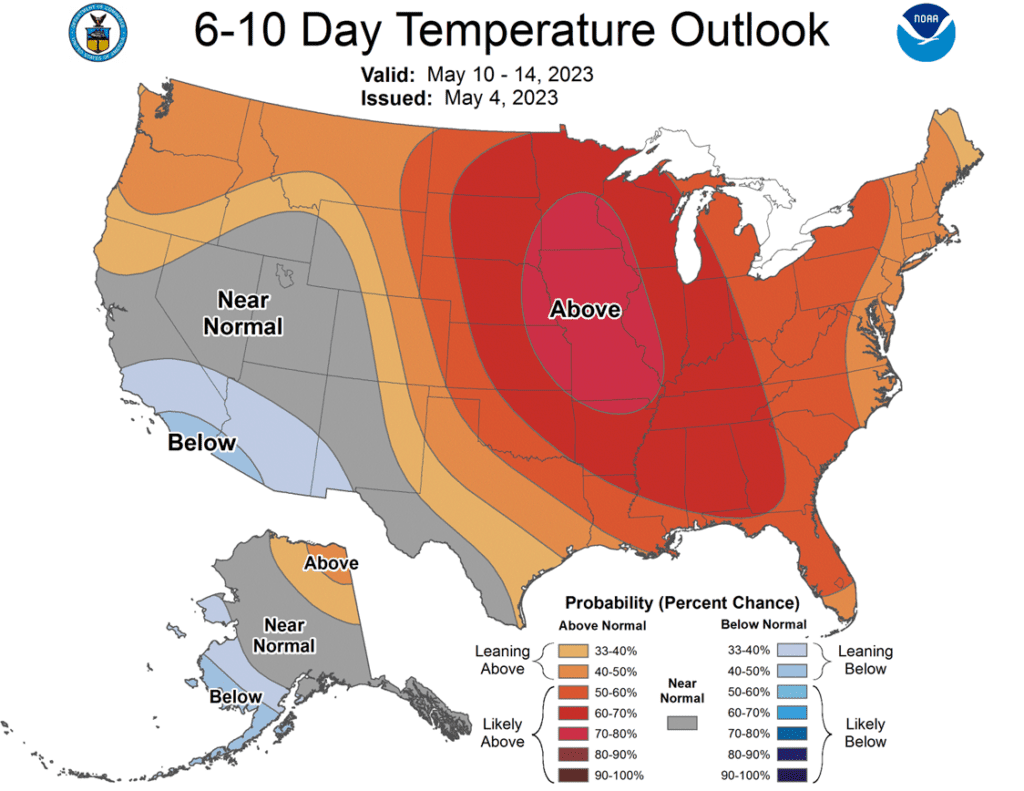

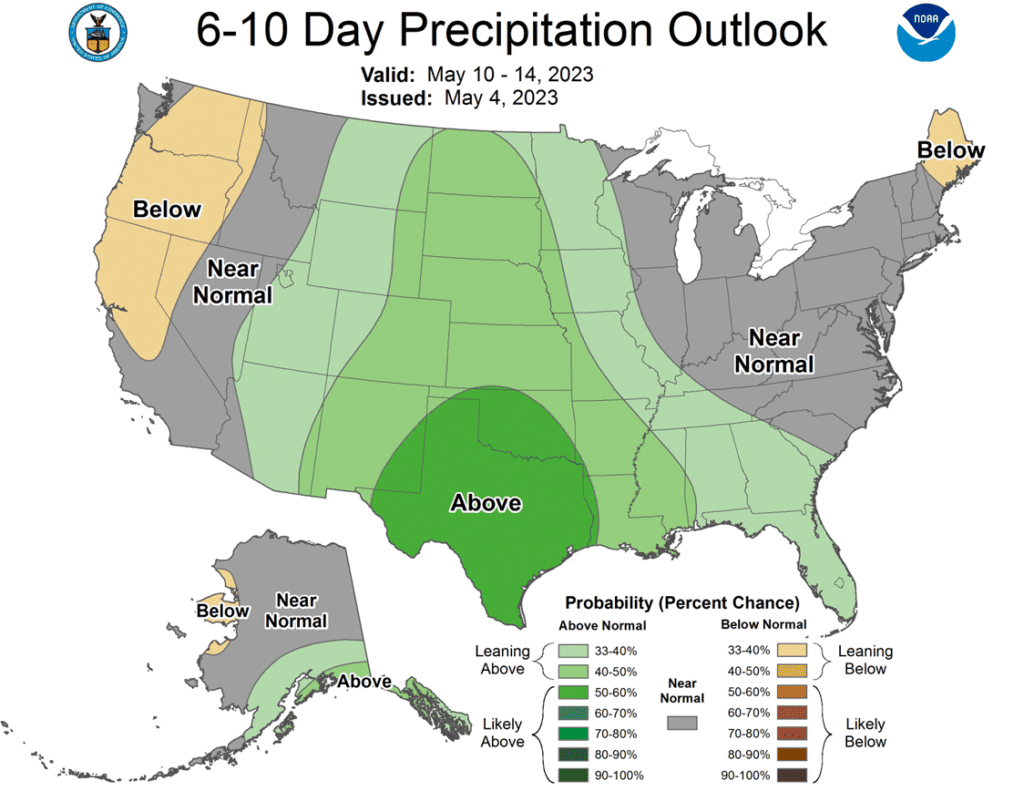

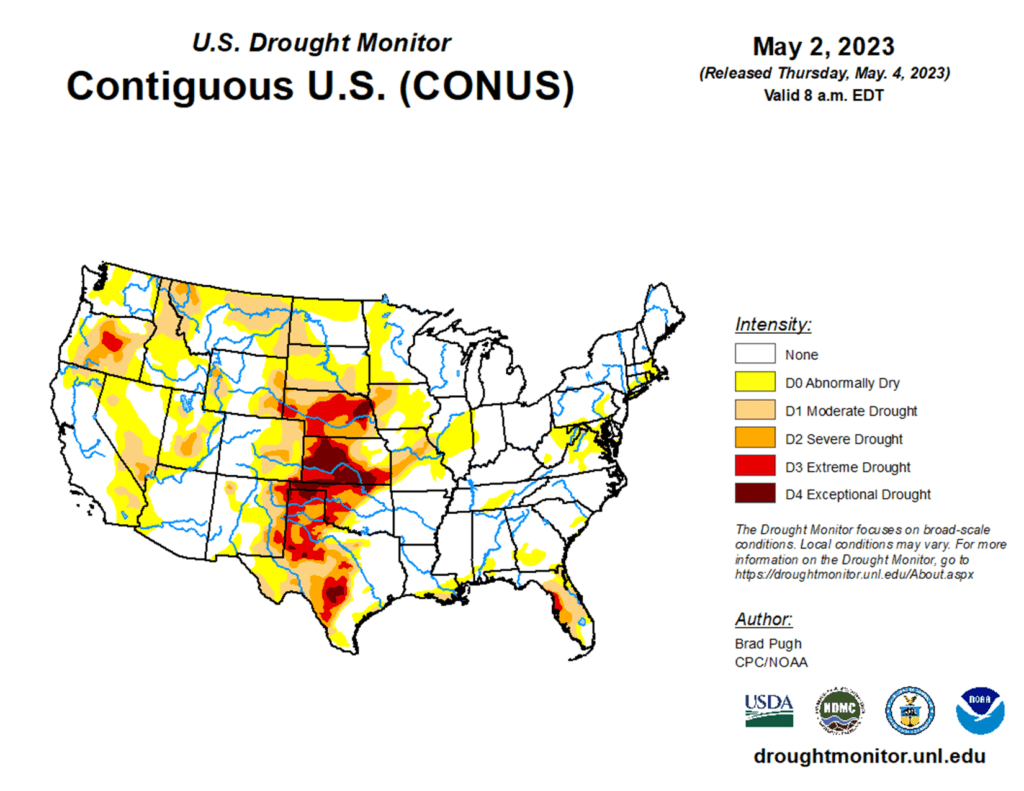

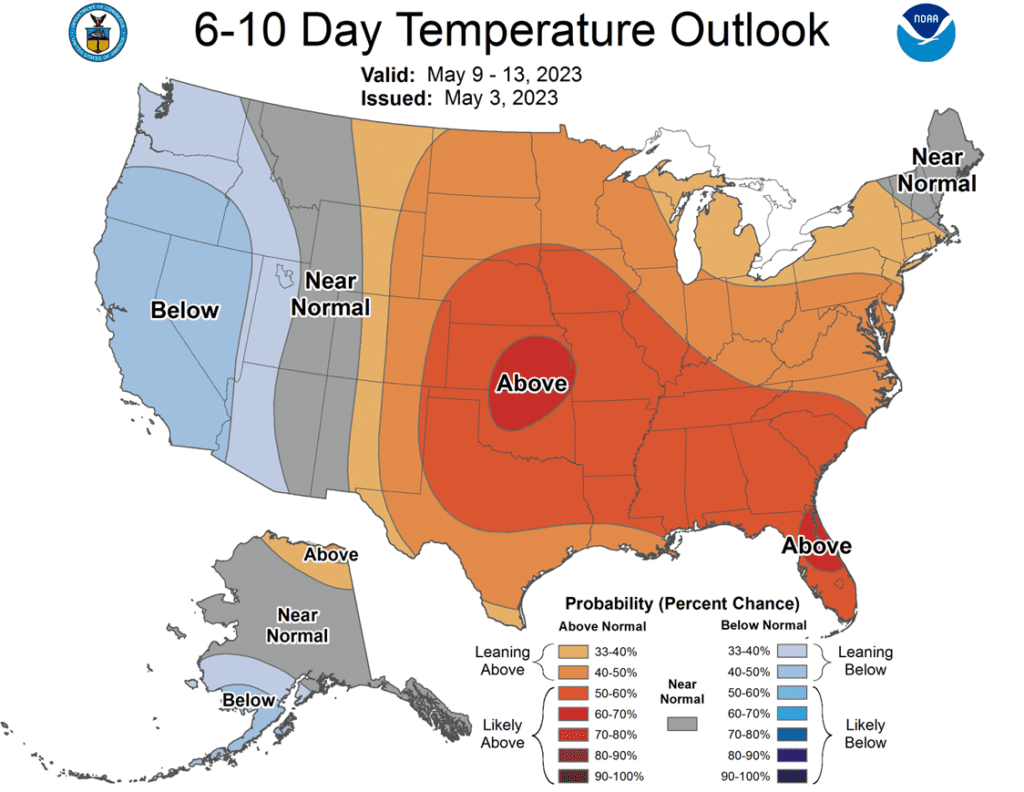

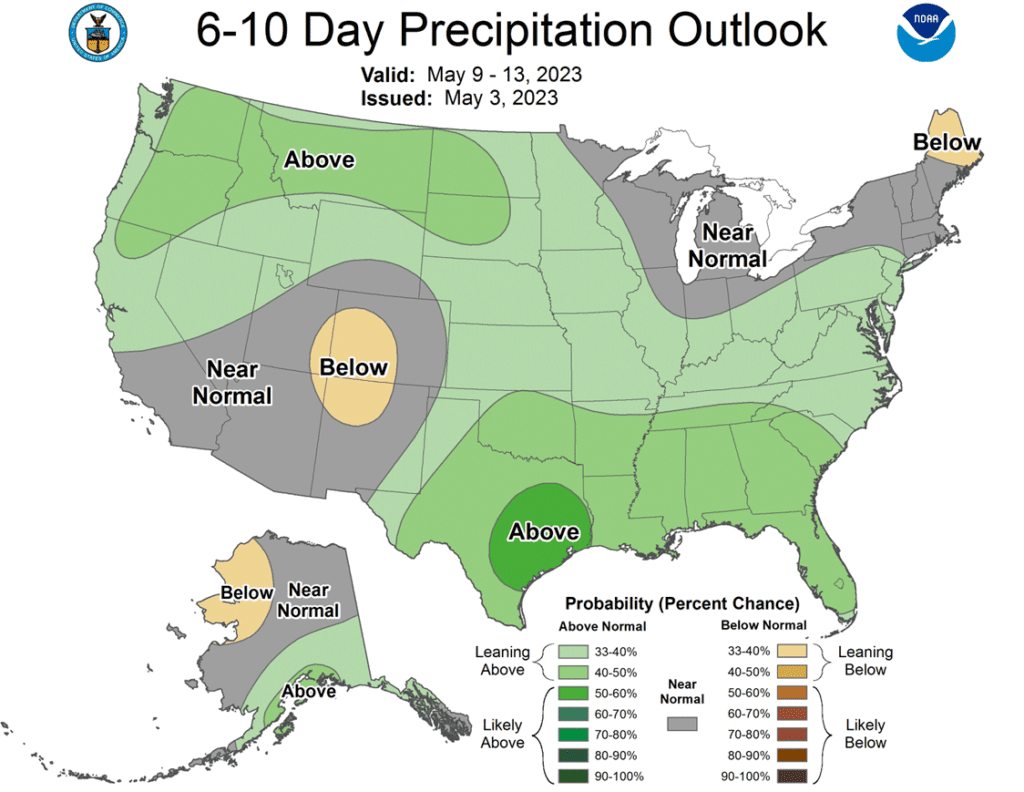

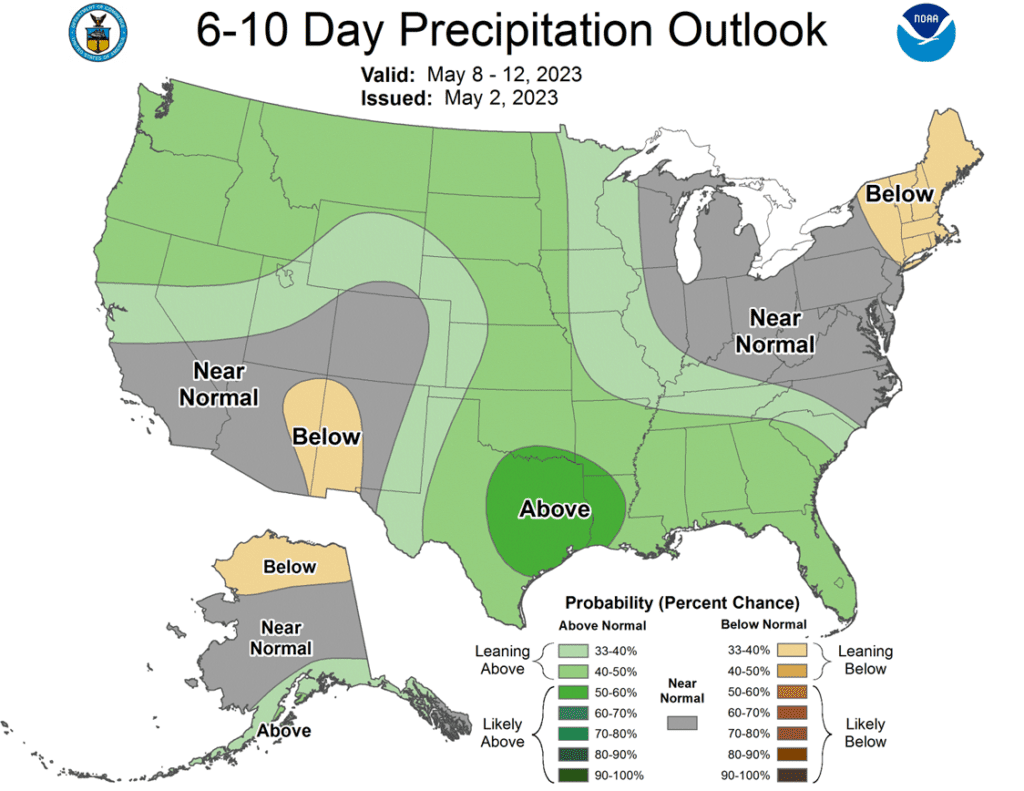

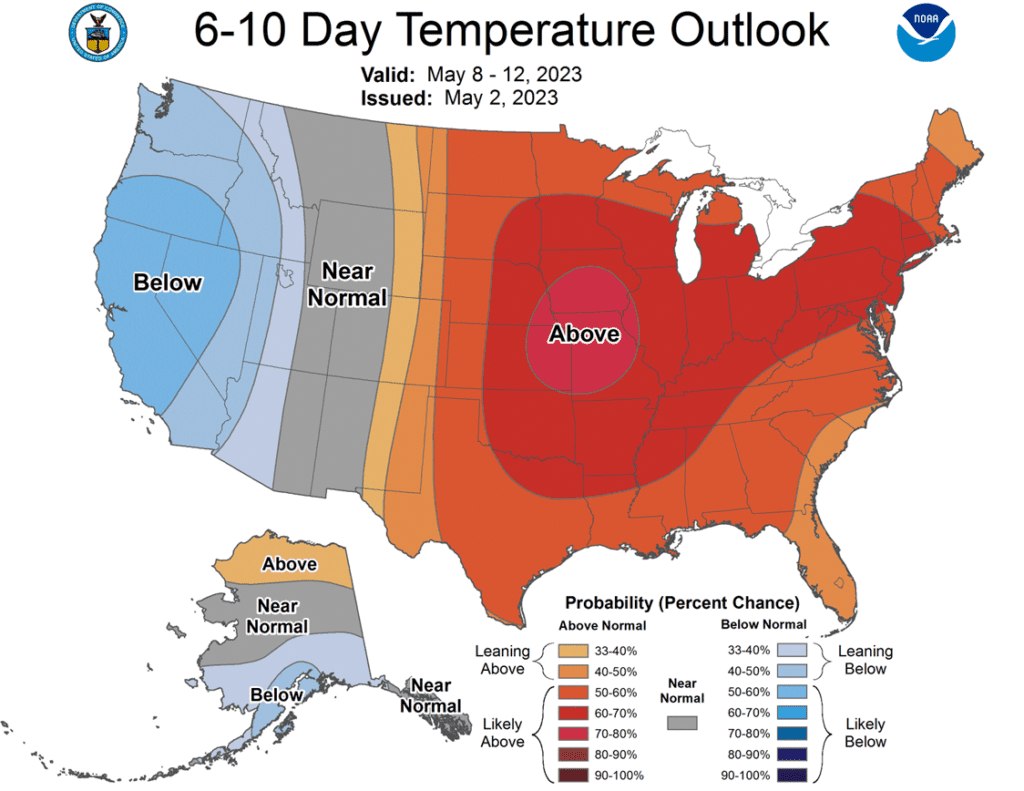

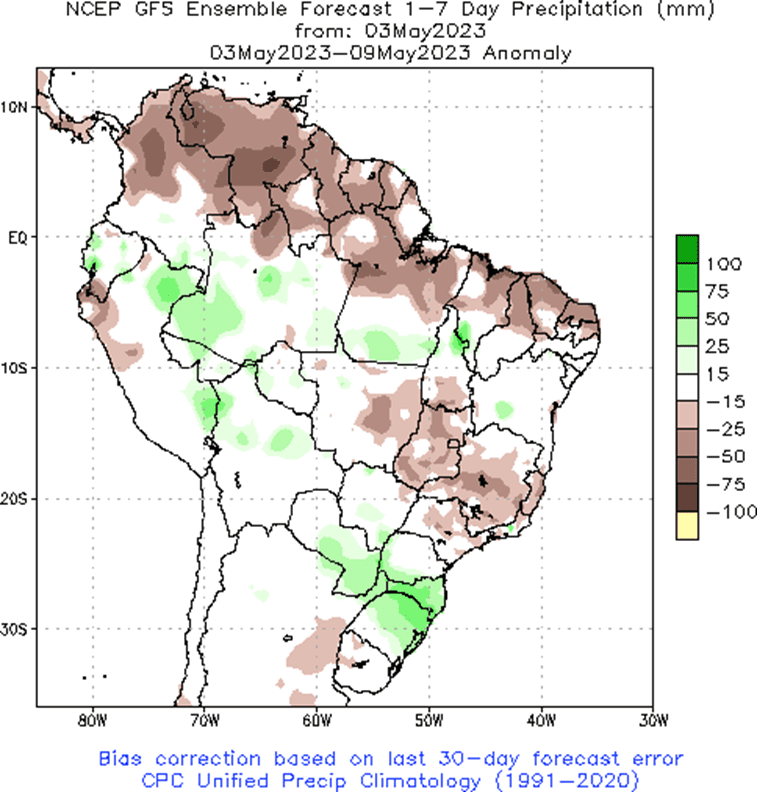

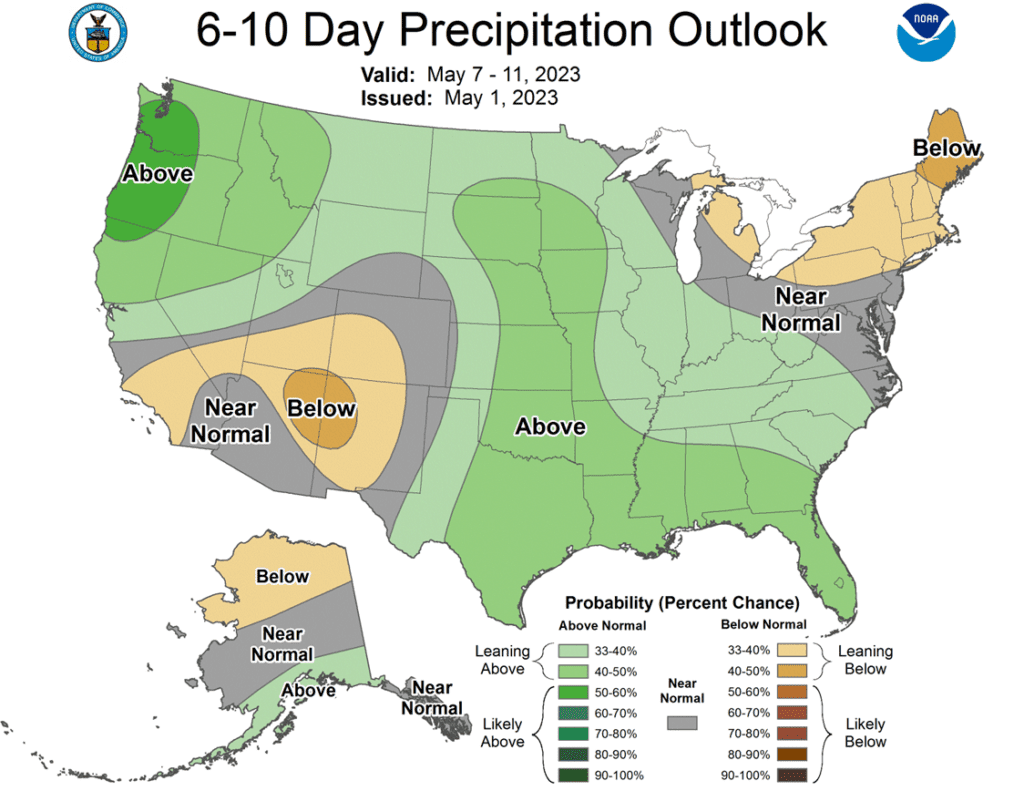

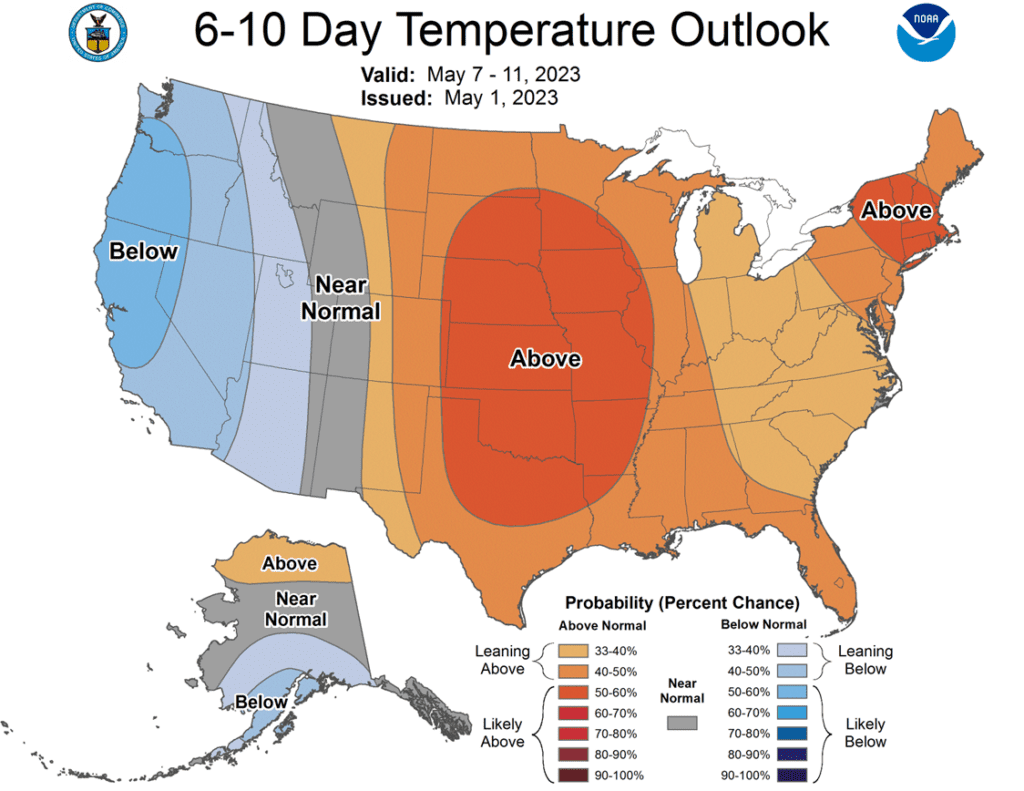

- To see the updated 1–7-day GFS Ensemble Forecast Precipitation for South America and updated 6-to-10-day NOAA precipitation and temperature outlooks scroll down to the Other Charts / Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

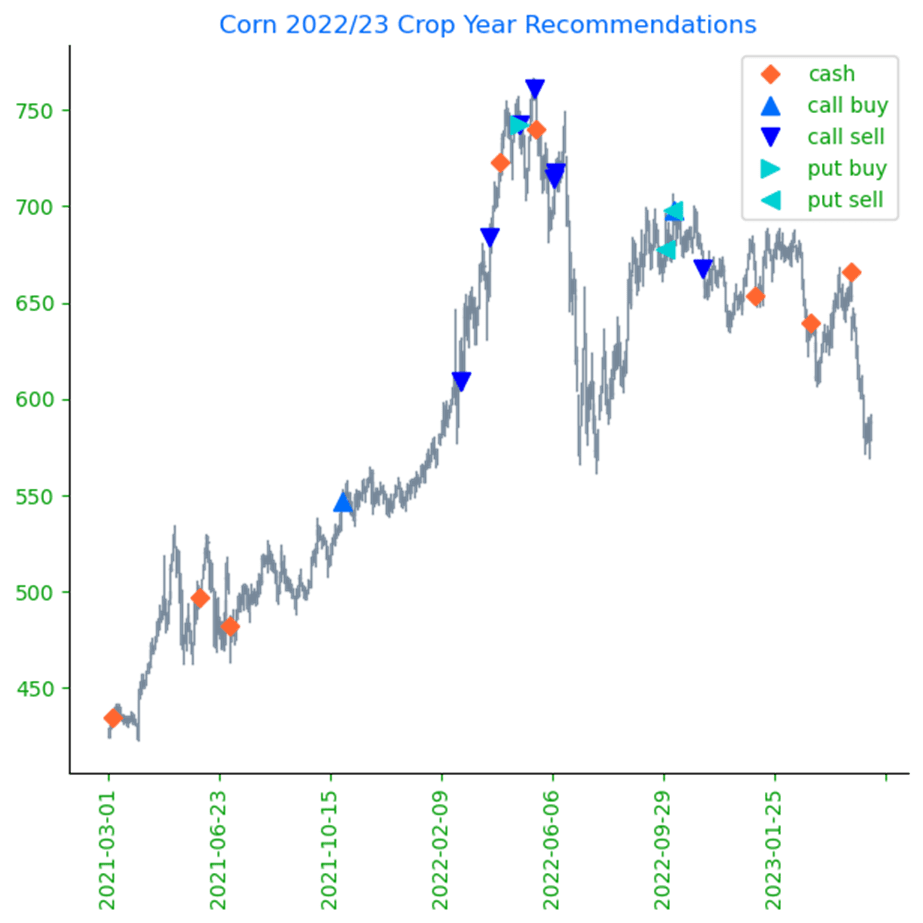

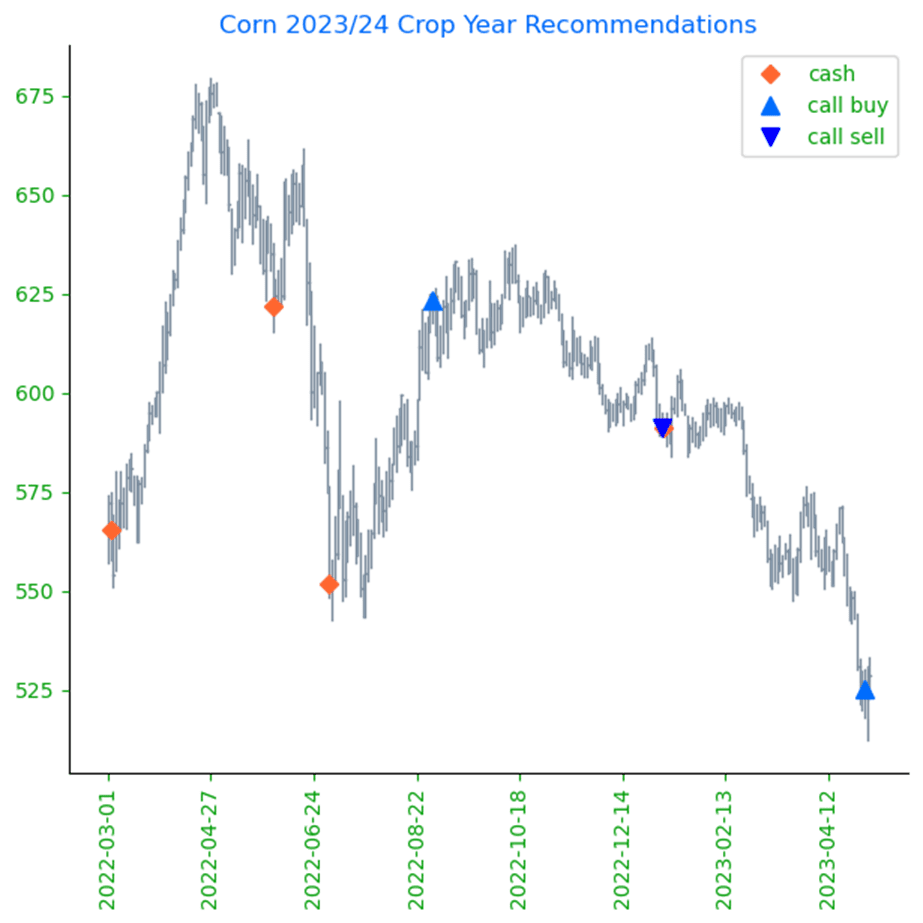

Corn

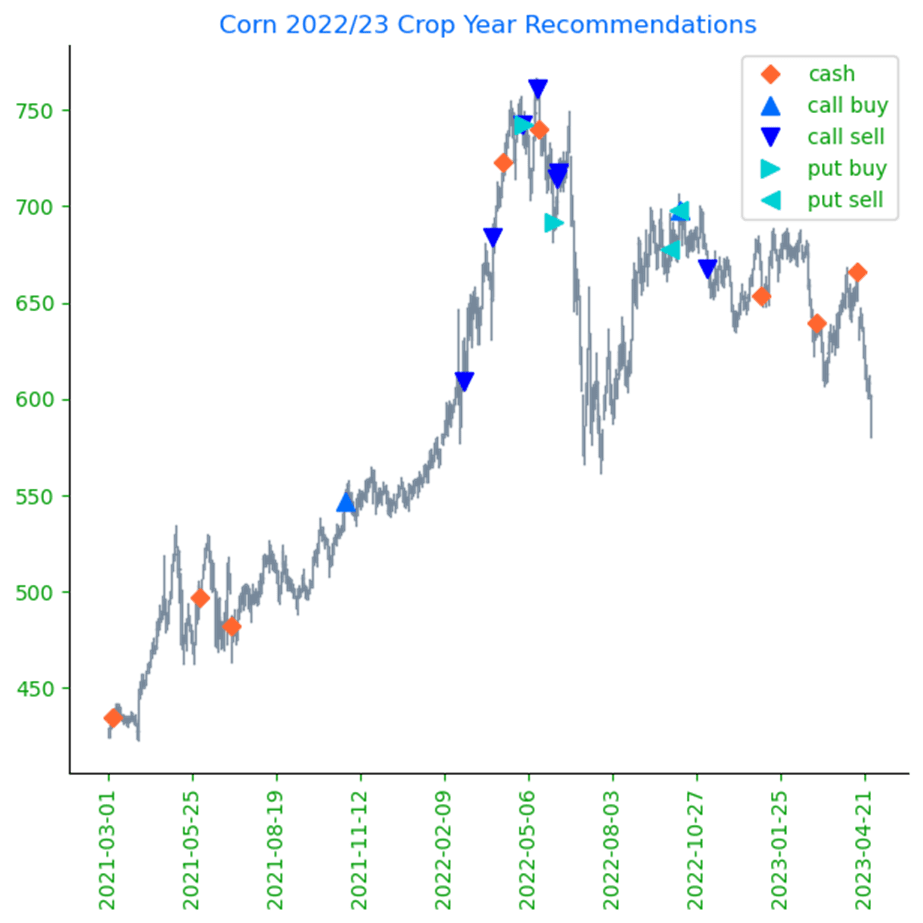

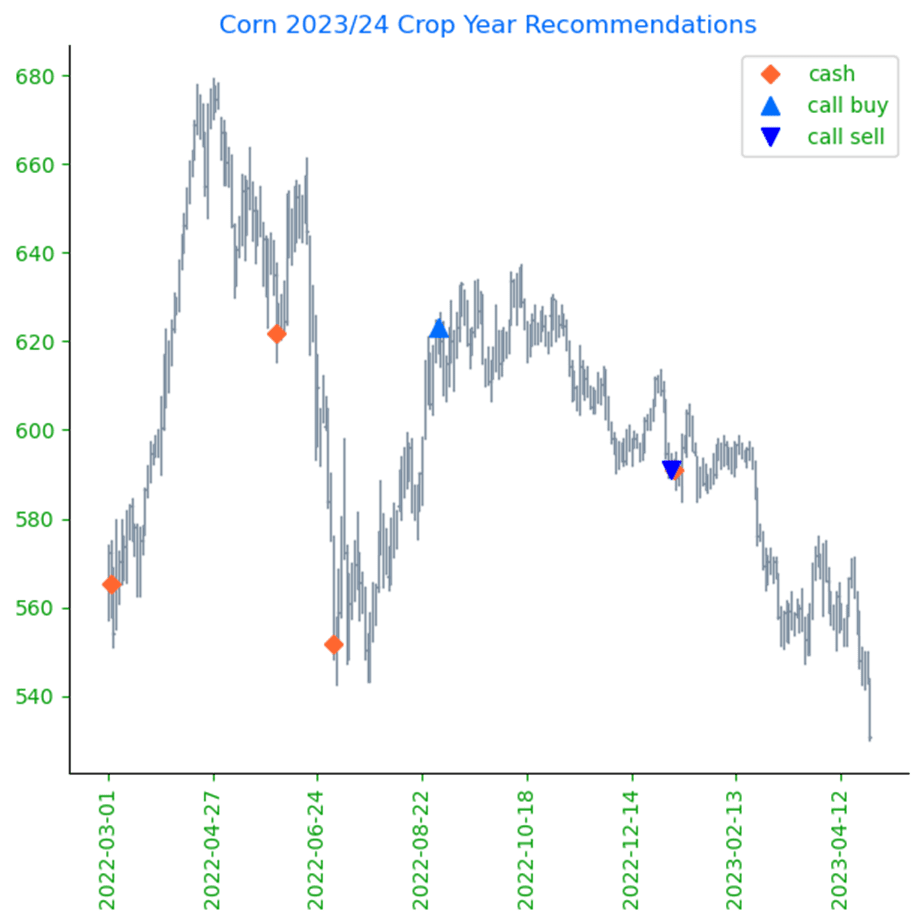

Corn Action Plan Summary

Updated as of 5/10/2023

- No action is recommended at this time for Old Crop. At this point in the crop marketing year most, if not all, of your Old Crop 2022 corn should be sold out. With the substantial inverse between old and new crop contract months, large rallies for Old Crop corn may be difficult to come by as we move forward. Consider using 40 to 50-cent rallies to sell any remaining inventory.

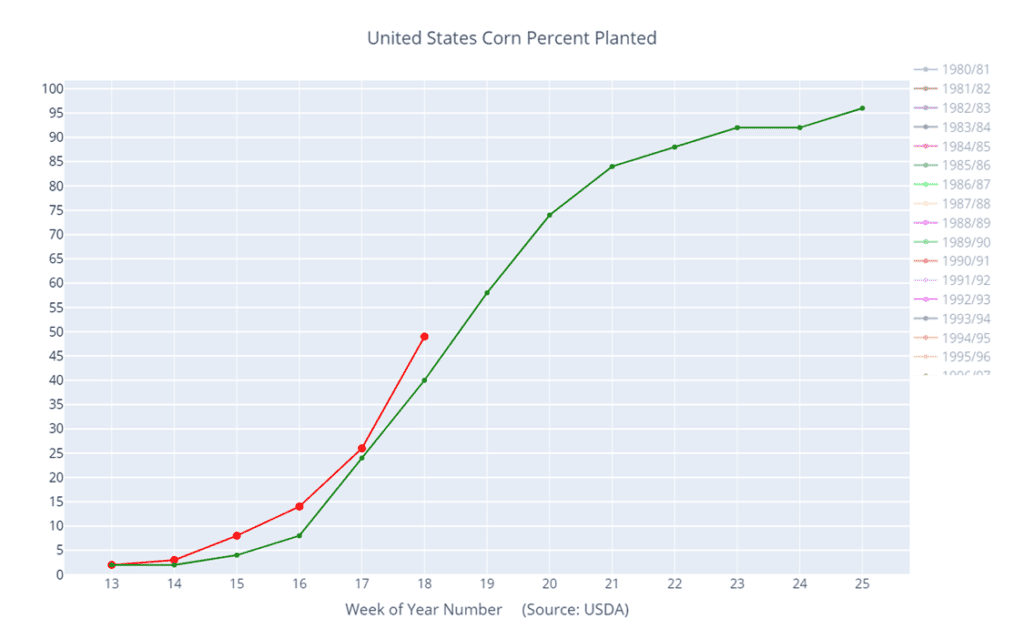

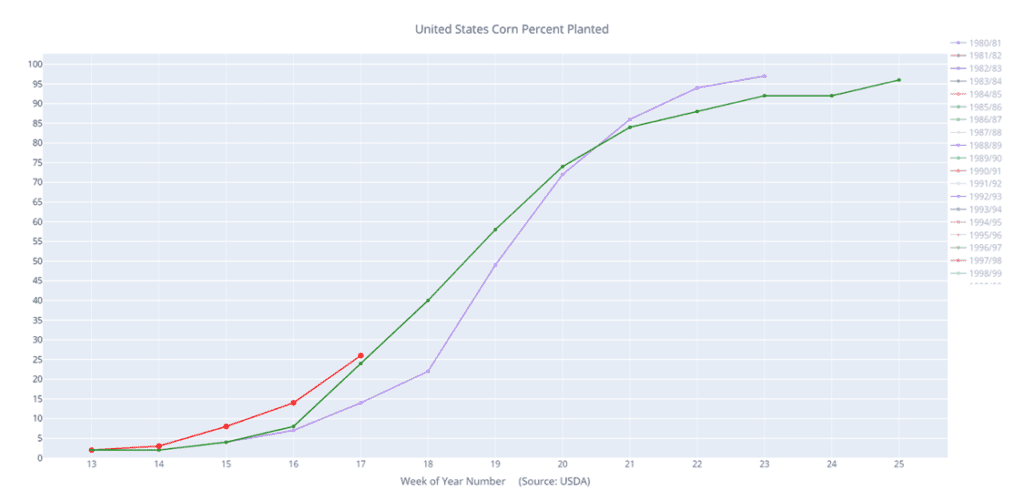

- No action is currently recommended for the 2023 new crop. While the crop is going in the ground fast, the most volatile part of the growing season remains ahead. We’re going to maintain an opportunistic posture for now, targeting 590 – 630 versus December corn to suggest any further cash sales.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

- Corn market saw risk off trade on Thursday as the market prepares for Friday’s USDA WASDE report. Prices were in consolidation, trading within Wednesday’s large price range, but closed near the low end of that range.

- Friday’s WASDE report will show the first projections for the 2023-24 marketing year with an expected carryout projection of just over 2.000 billion bushels. A softer demand tone is expected to cause old crop carryout to rise to 1.366 billion bushels, up slightly from last month.

- Weekly export sales were disappointing at 10.13 mb for 22/23 and 3.27 mb for 23/24. U.S. exports continue to struggle against the cheaper Brazilian corn. Exports sales for 22/23 need to average 17.4 mb per week to meet the USDA’s current estimate.

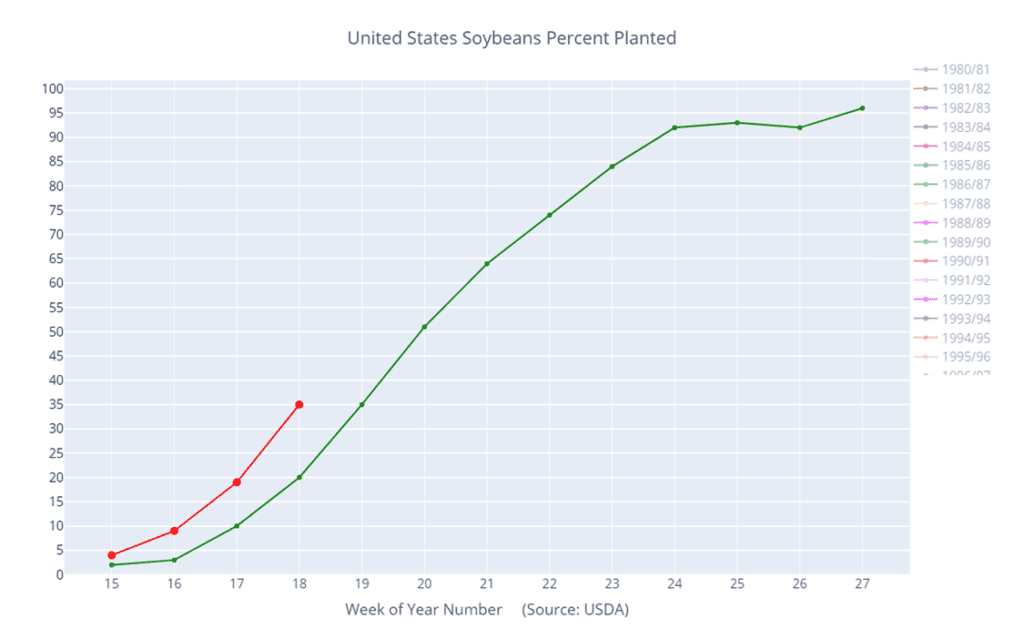

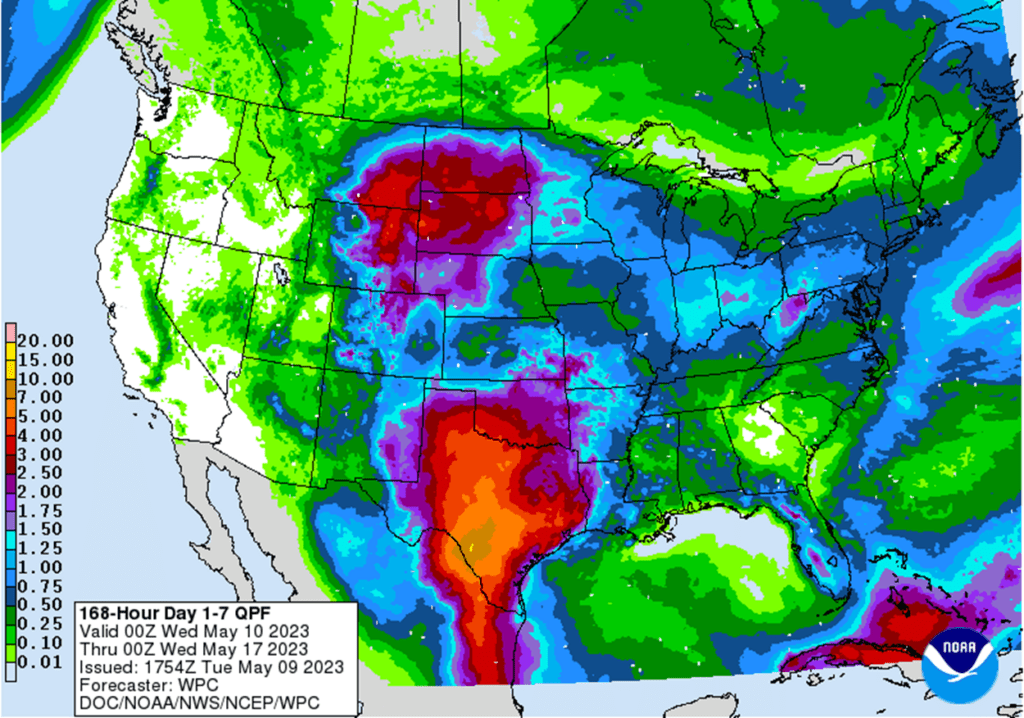

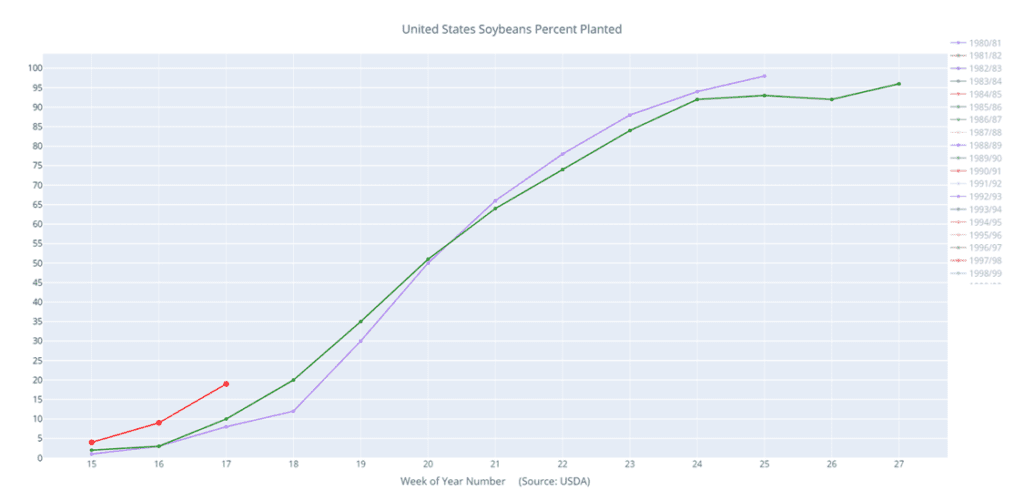

- Overall, weather forecasts appear mostly favorable for planting pace while still providing adequate moisture to allow this year’s crop to have a strong start.

- CONAB raised their expected Brazilian corn crop projections for the 22/23 marketing year to 125.54 MMT, up slightly from last month, but over 12 MMT higher than last year’s total production.

Above: The market is recovering from being oversold and continues to be under the influence of the bullish reversal from 5/03. Nearby resistance sits near 612 and again near the 50-day moving average, while support for the July contract rests between the recent low of 569 and the July ’22 low near 562.

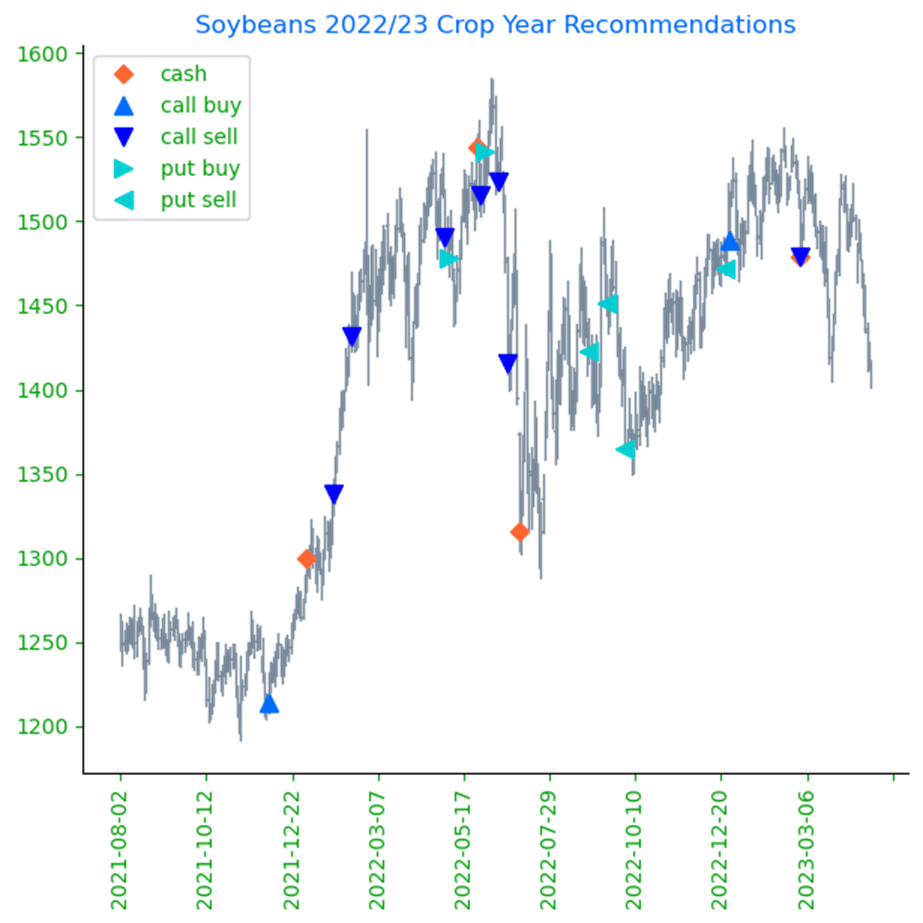

Soybeans

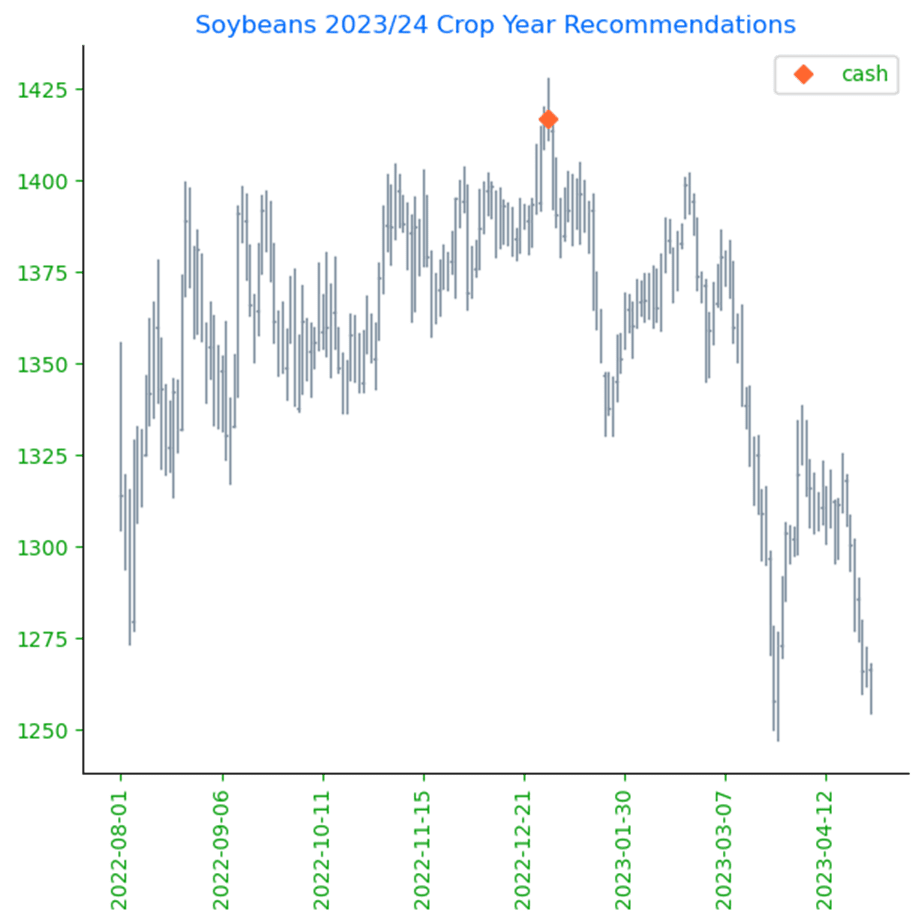

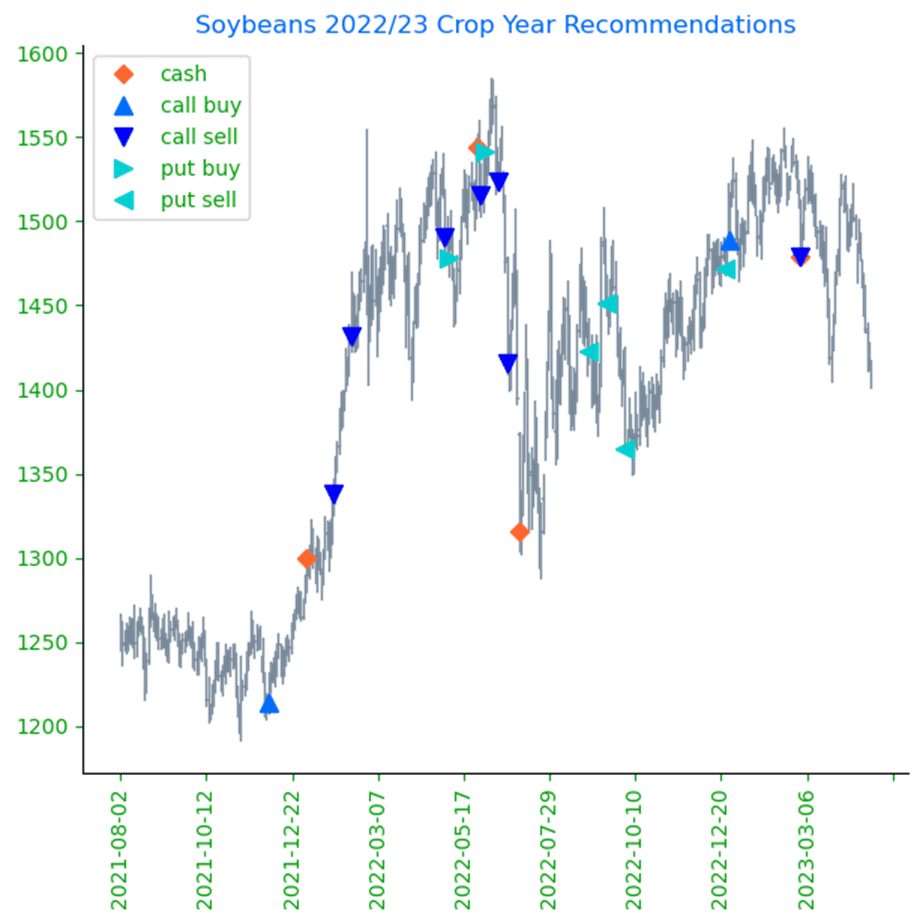

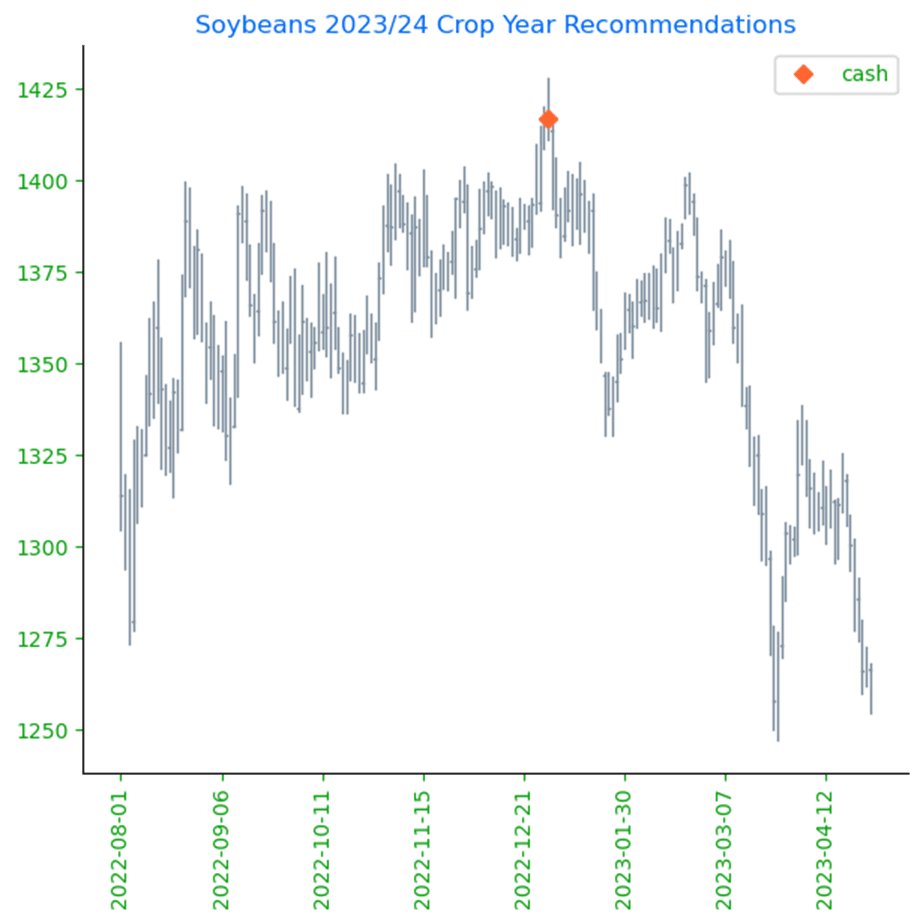

Soybeans Action Plan Summary

Updated as of 05/09/2023

- We recommend holding current sales levels for Old Crop. We are beginning to push into the May-June seasonal window of opportunity, where prices could bounce as processors begin to push to keep tight on-hand supplies flowing, and seasonal weather concerns can get priced into the market.

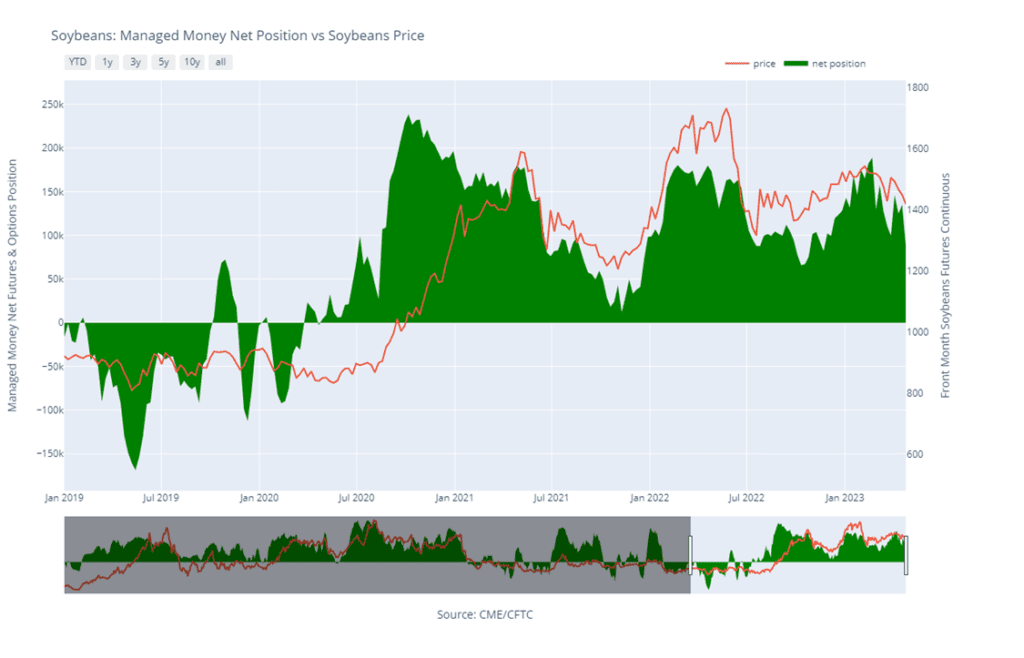

- We recommend not adding to current sales levels for the new 2023 crop at this time. As we work through planting season, our research indicates there is a 66% likelihood of better prices moving into early June. Additionally, weather conditions will begin to dominate the market as we begin to move into the growing season, and we may consider recommending sales in the 1400 to 1450 area if any significant concerns arise.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

- Soybeans ended the day higher in the front months but posted a slight loss for the Nov contract. Soybean meal rallied at the close while soybean oil was dragged lower by crude oil.

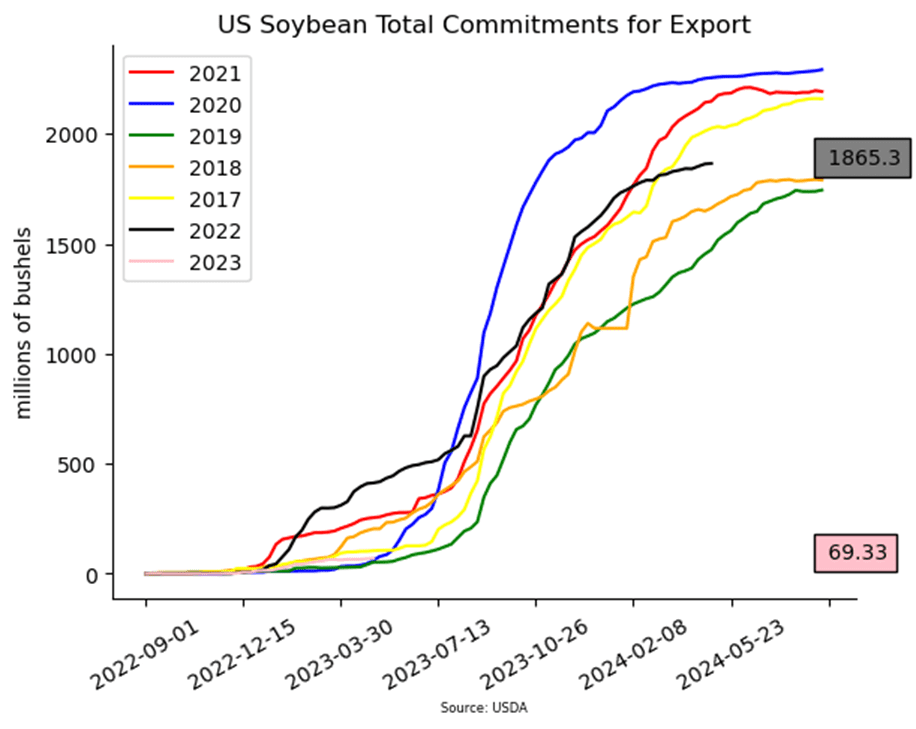

- Export sales were very poor at just 2.3 mb for 22/23, down 70% from the previous week and 68% from the prior 4-week average. Shipments were 15.1 mb, just above the 12.8 mb needed each week to meet the USDA’s current marketing year estimate.

- Weekly soybean meal export sales for 22/23 came in near the top end of expectations with Vietnam and Romania as top destinations. This helped move front month soybean meal futures higher by over 2.8%.

- Despite the poor export sales, the USDA did confirm a sale of soybeans to unknown destinations of 132,000 tons for the 23/24 marketing year, which was supportive.

- Tomorrow’s USDA report is expected to raise the soybean carryout slightly and estimate new crop production around 4.494 bb. Argentina’s production is expected to be lowered while Brazil’s is expected to rise.

Above: July soybeans have recovered from being severely oversold and posted a bearish reversal on 5/08 which indicates recent buying could be exhausted and the market may turn lower. Support lies near the recent low of 1385 with further support near 1350. With support holding buyers may enter the market, resistance may be found between 1450 and 1460, and again near 1500.

Wheat

Market Notes: Wheat

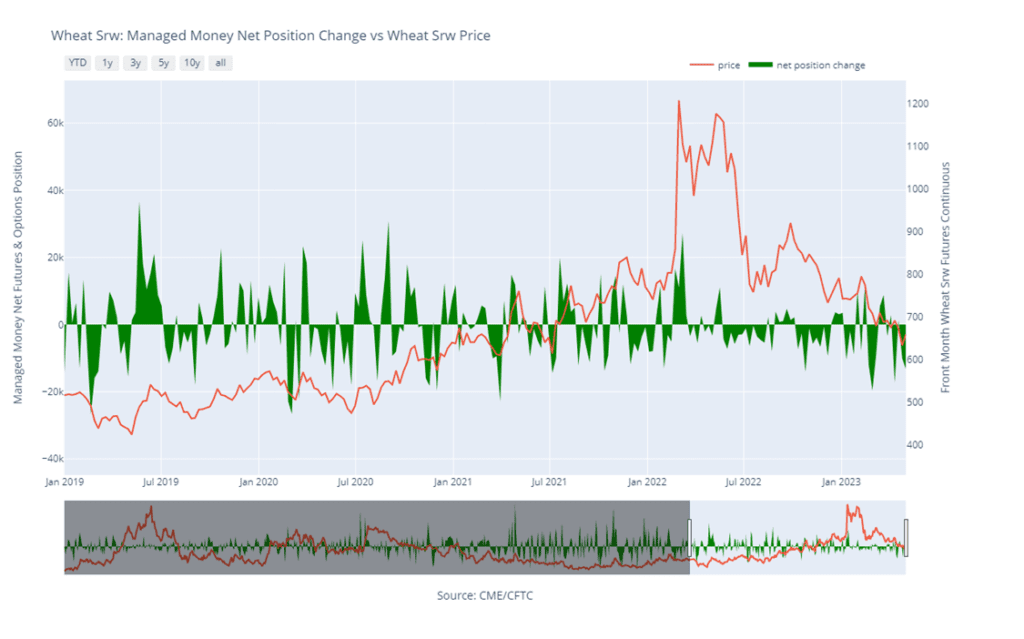

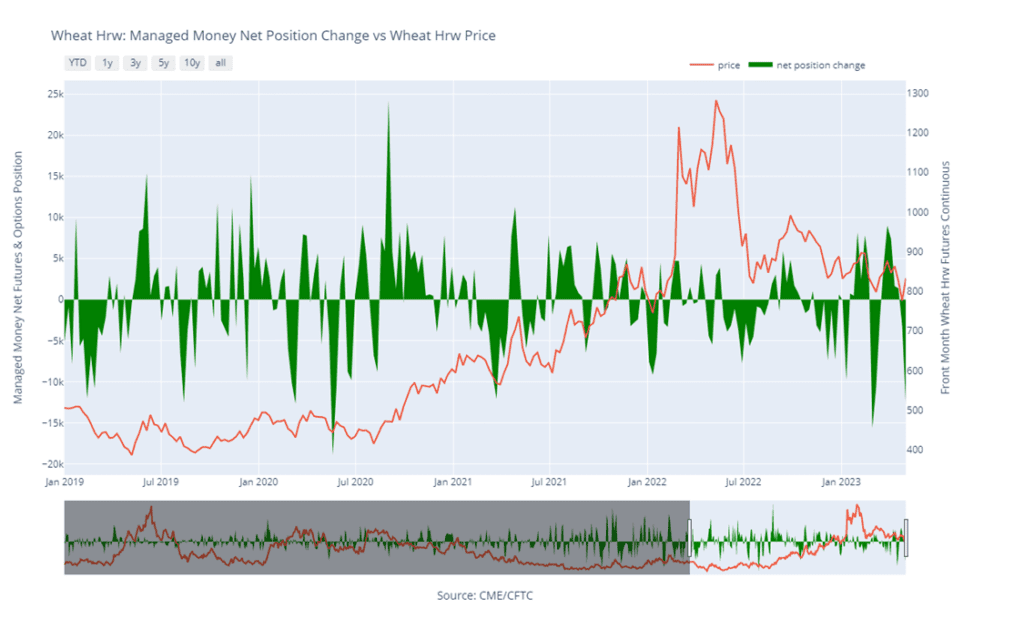

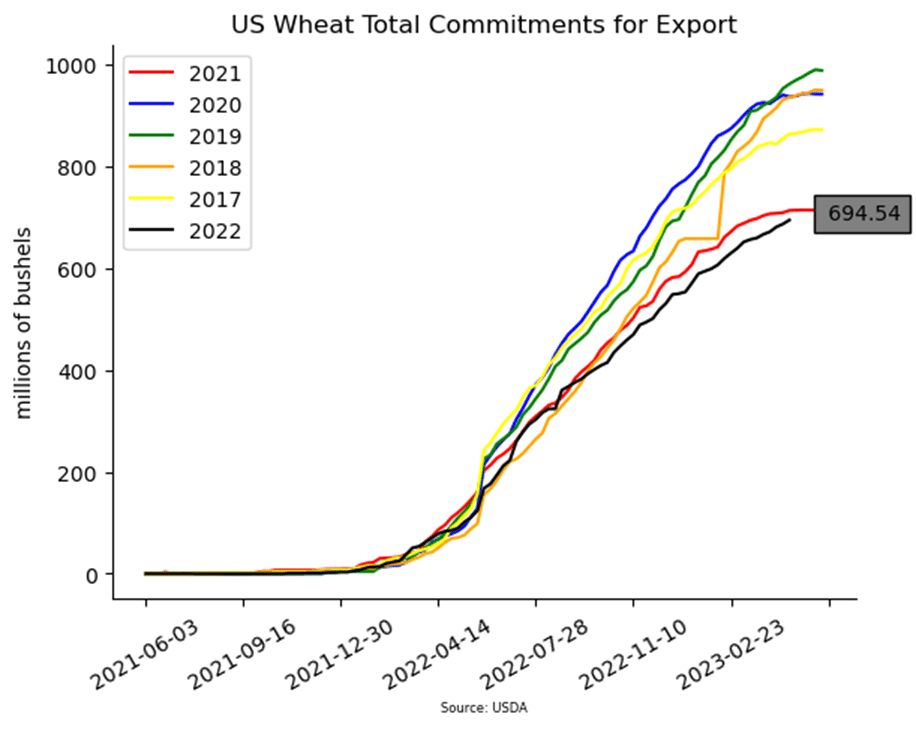

- Wheat export sales were disappointing with the USDA reporting an increase of only 1.0 mb for 22/23. For 23/24 the USDA reported an increase of 12.3 mb.

- Recent rainfall in the Plains states added pressure to wheat futures. Even some of the driest areas of Western Kansas have received measurable precipitation in the last 72 hours.

- Another day of talks between the UN, Turkey, Russia, and Ukraine took place as they look for a resolution. As it currently stands, the deal will expire on May 18th.

- Despite Russia offering FOB wheat at $245 per ton, Algeria backed away from that tender, as Balkan prices were lower.

- The Buenos Aires Grain Exchange said that heavy rains for Argentina’s wheat areas may not come until September.

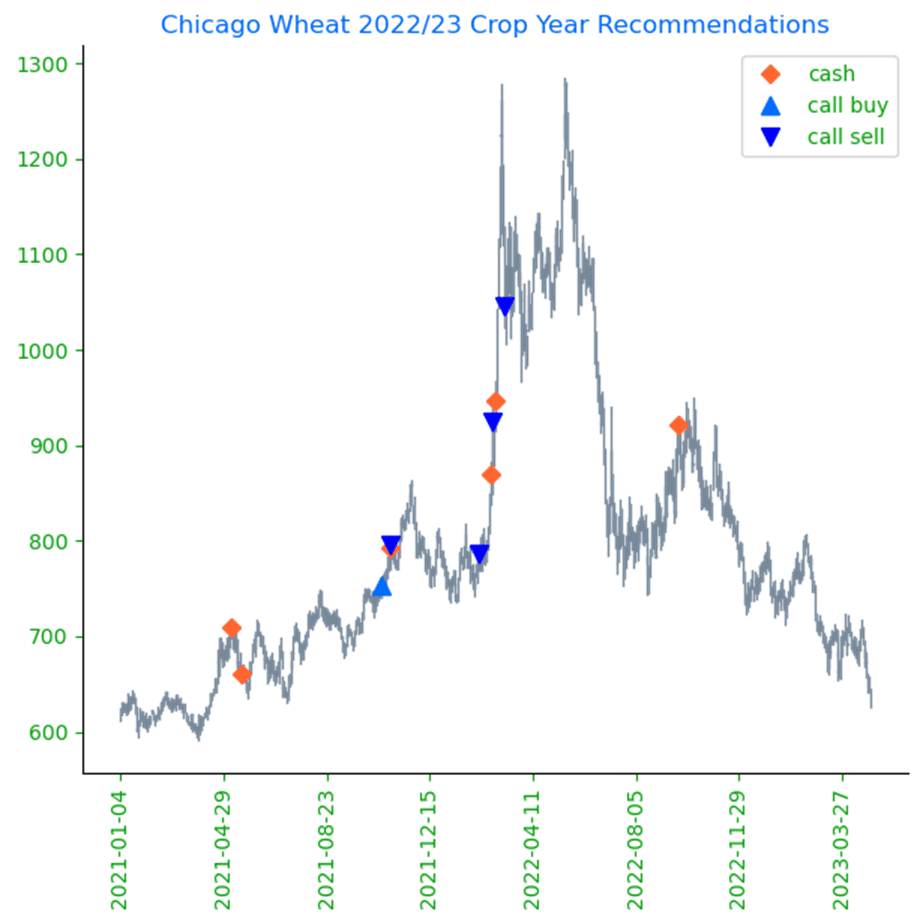

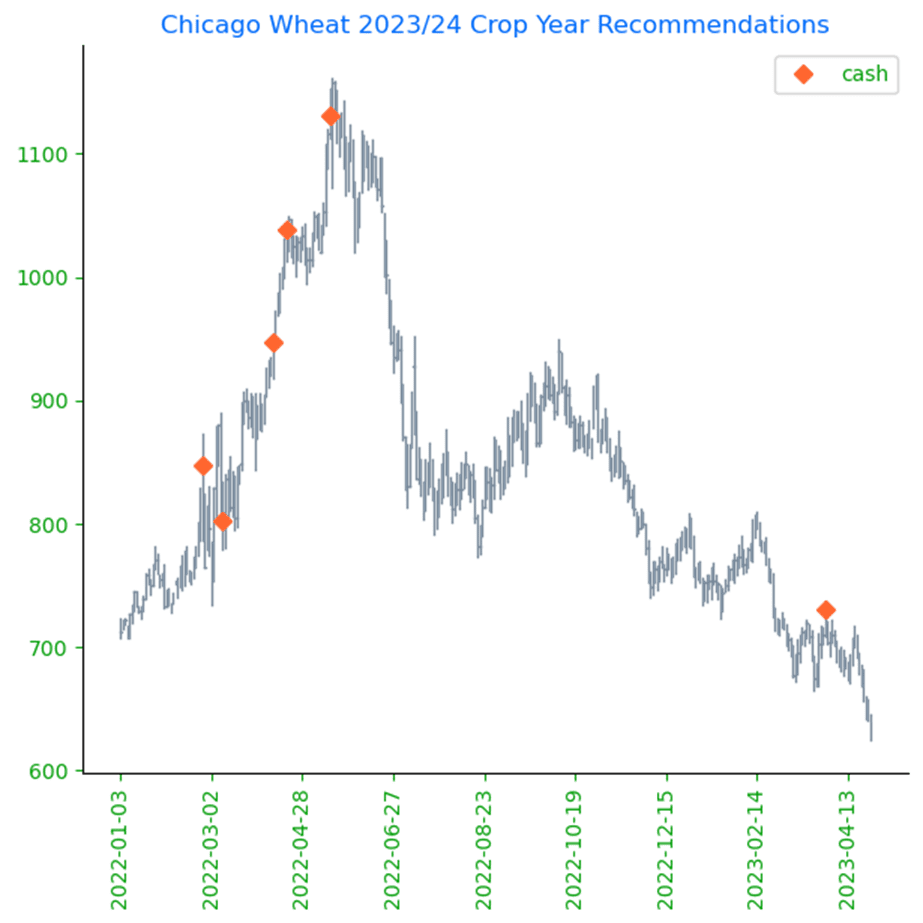

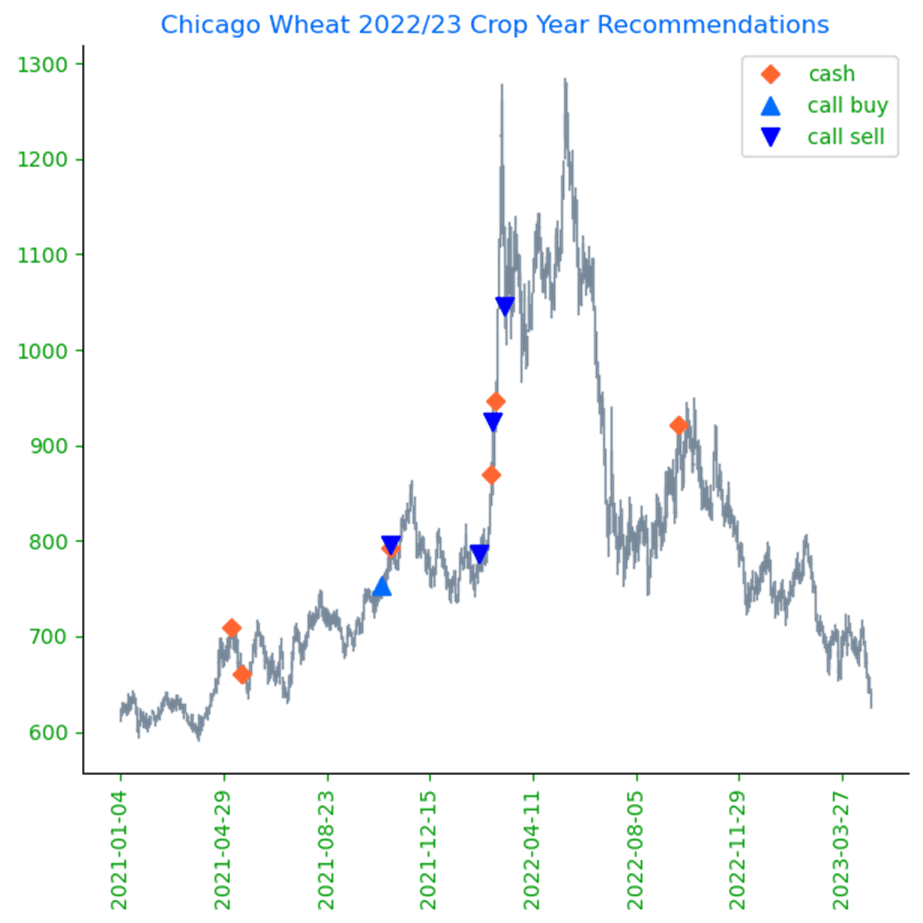

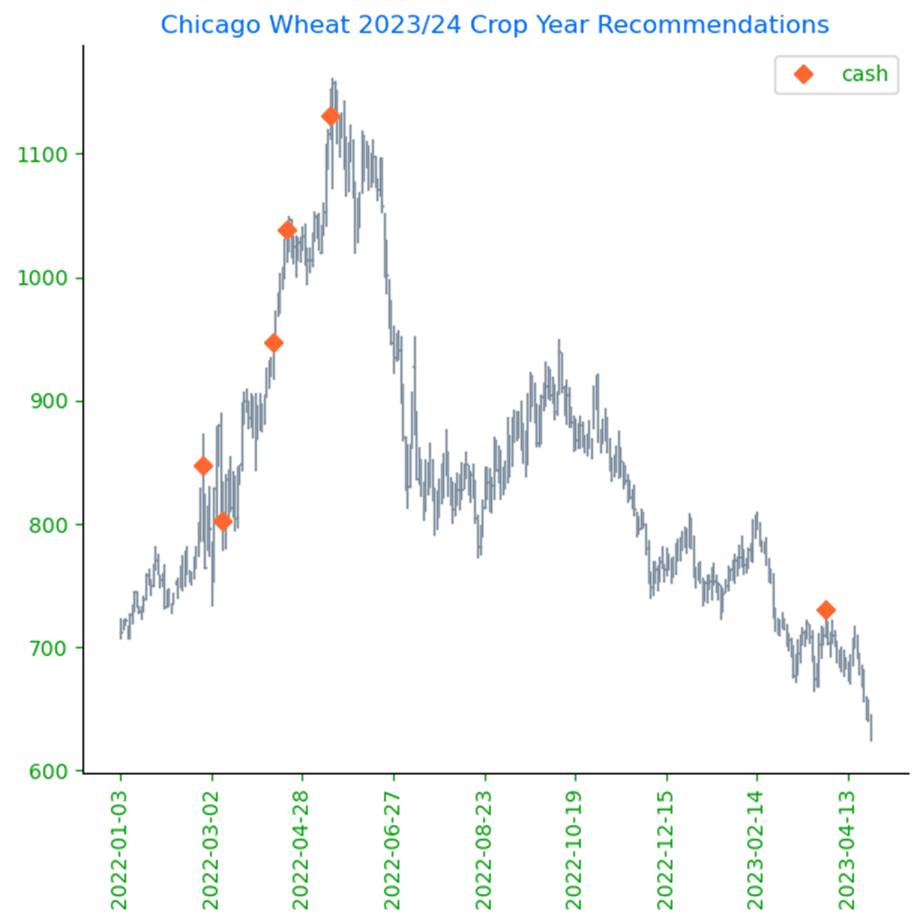

Chicago Wheat Action Plan Summary

Updated as of 05/09/2023

- No new action is recommended for the 2022 crop. At this point in the crop marketing year most, if not all, of your Old Crop 2022 wheat should be sold out. With large rallies difficult to come by at this time of year, consider using 40 to 50-cent rallies to sell any remaining inventory.

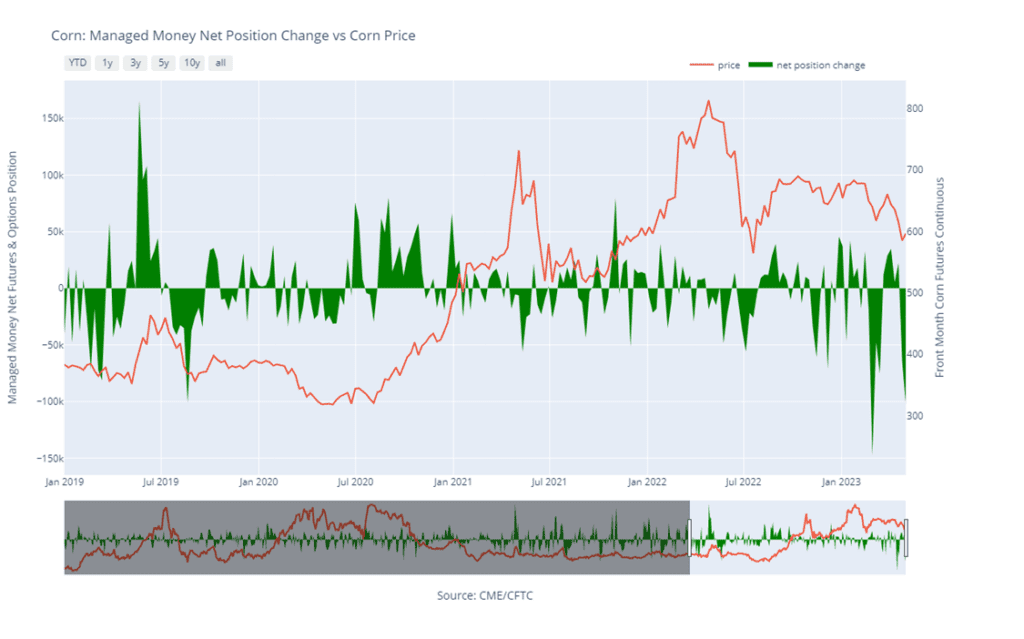

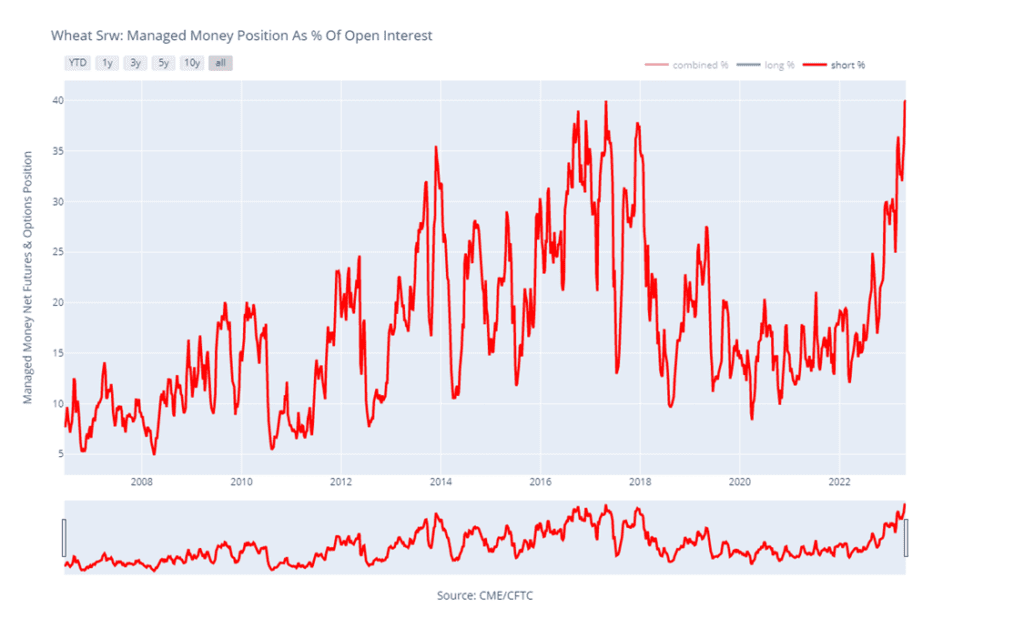

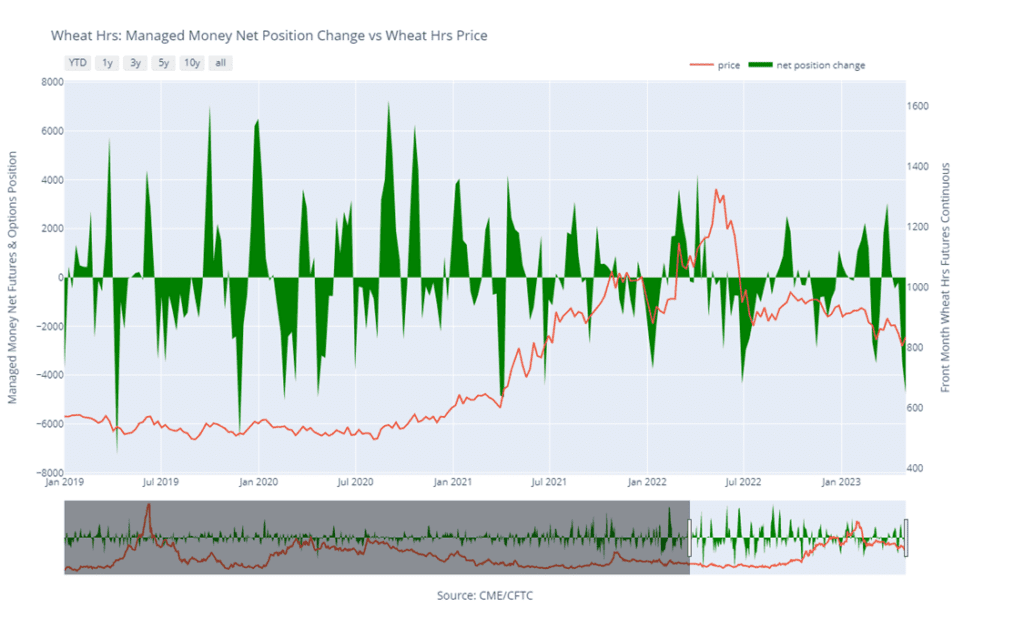

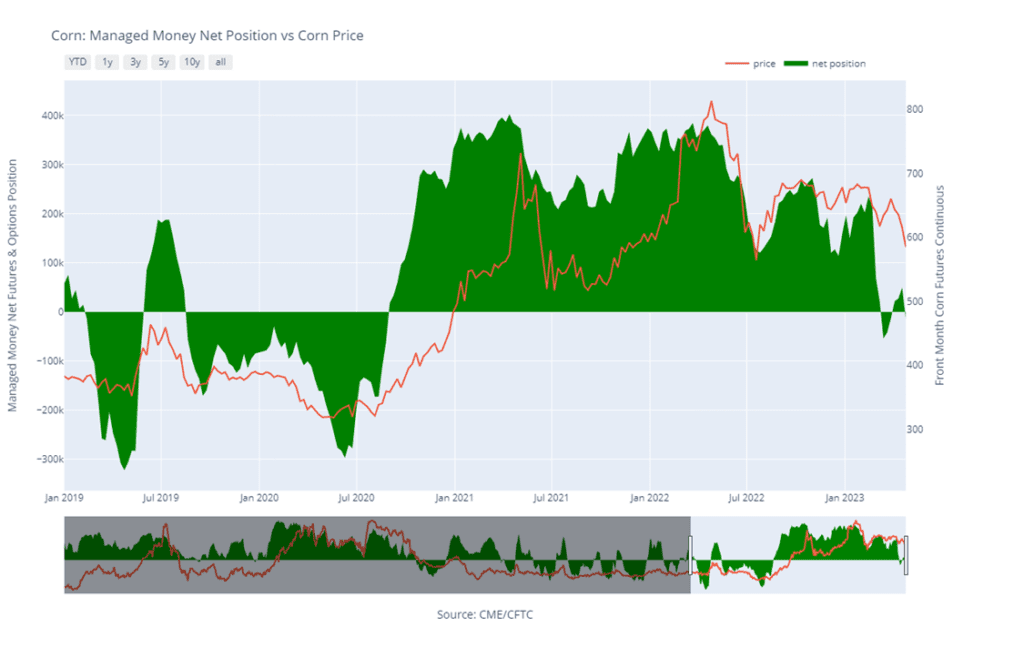

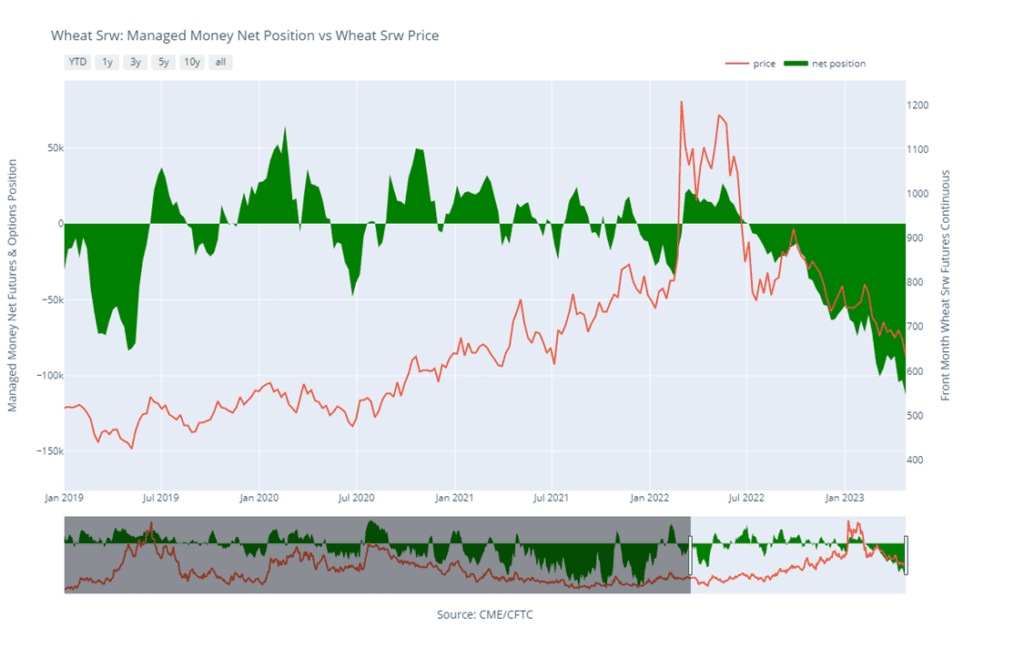

- We recommend not taking any action on the 2023 crop at this time. Managed Money funds currently hold their largest net short position since 2018, with a near record of about 40% of the total open interest in the Chicago contracts. Such a large position could be very supportive should the funds buy back their positions if market dynamics change due to HRW concerns or supply concerns in corn.

- No action is currently recommended for the 2024 crop. While we are looking for stronger markets to present themselves in this currently weak environment, there are factors that could be supportive, should they occur. Such as any escalation of the Ukraine war or disruption of grain movement in the Black Sea, or a significant devaluation of the US Dollar back to 2021 levels, as that market is showing characteristics of a potential drop.

Above: The market experienced a bearish reversal on 5/08 with follow through selling. Currently, the slow stochastics indicator may be crossing over to the downside, indicating upward momentum has slowed for the time being. Nearby resistance can be found between the recent high of 669 and 718, while key support may be found near 592.

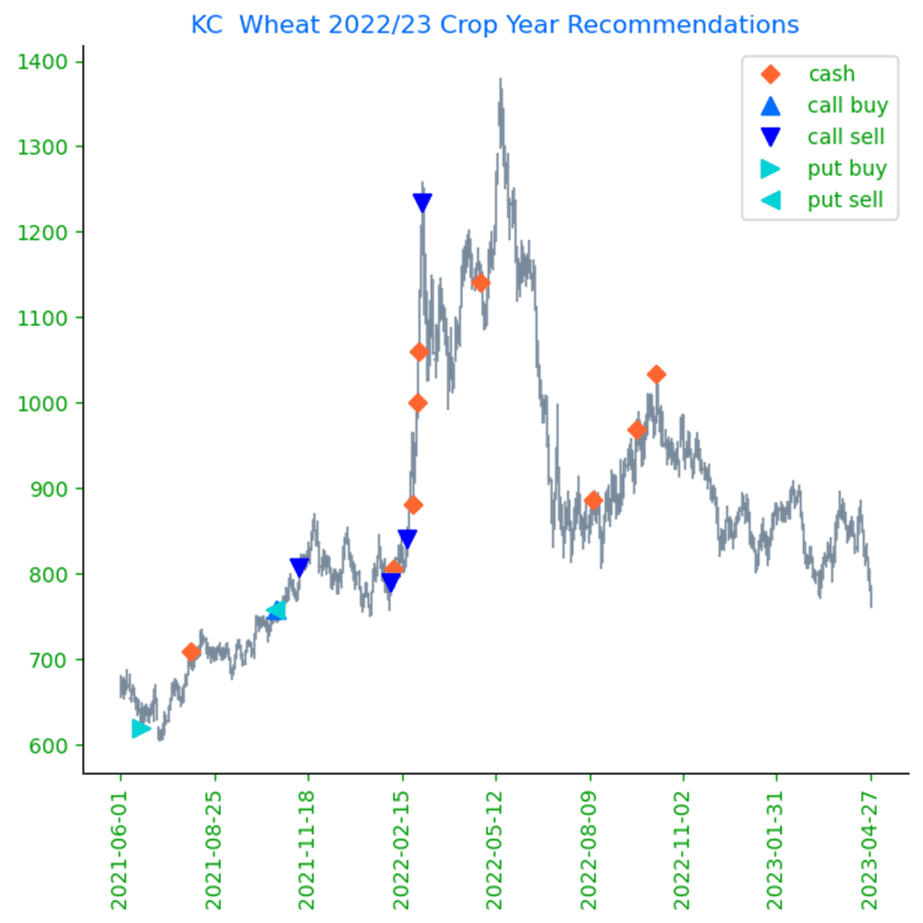

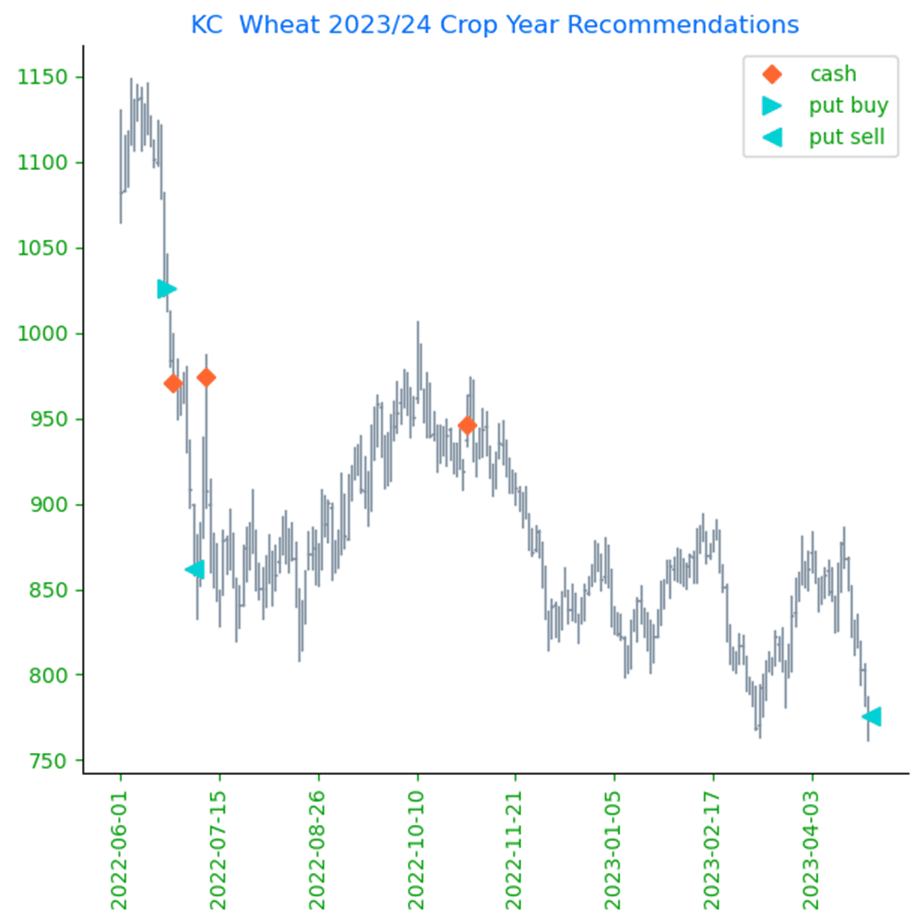

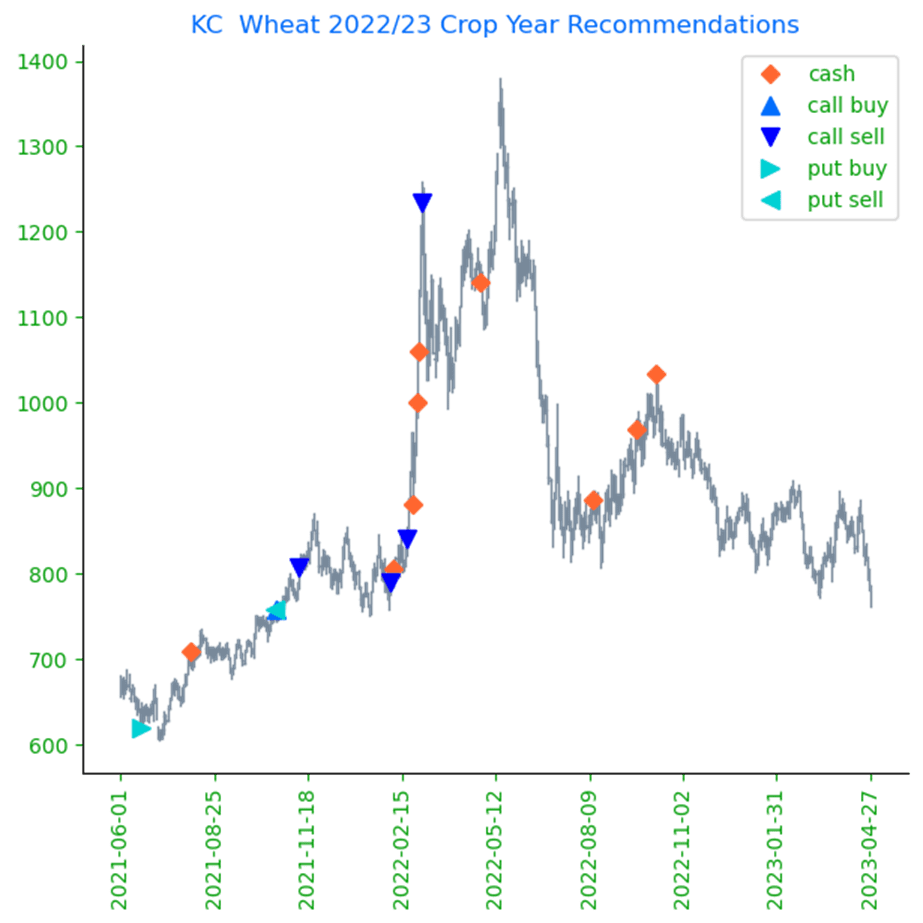

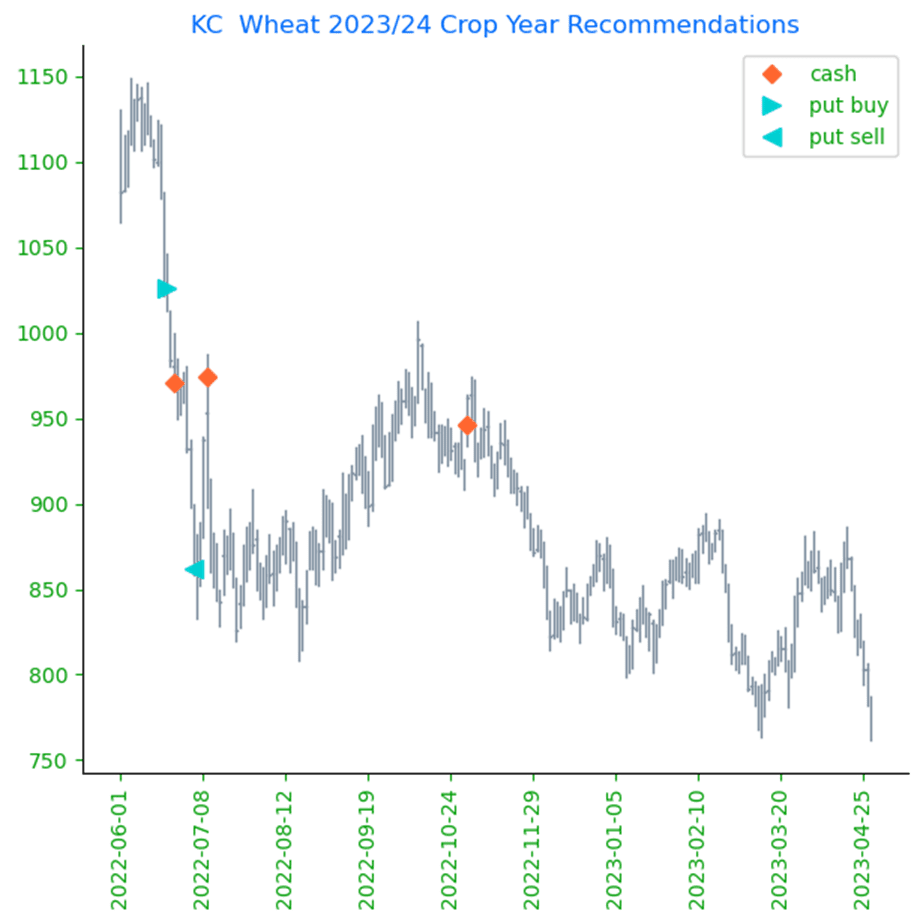

KC Wheat Action Plan Summary

Updated as of 05/09/2023

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

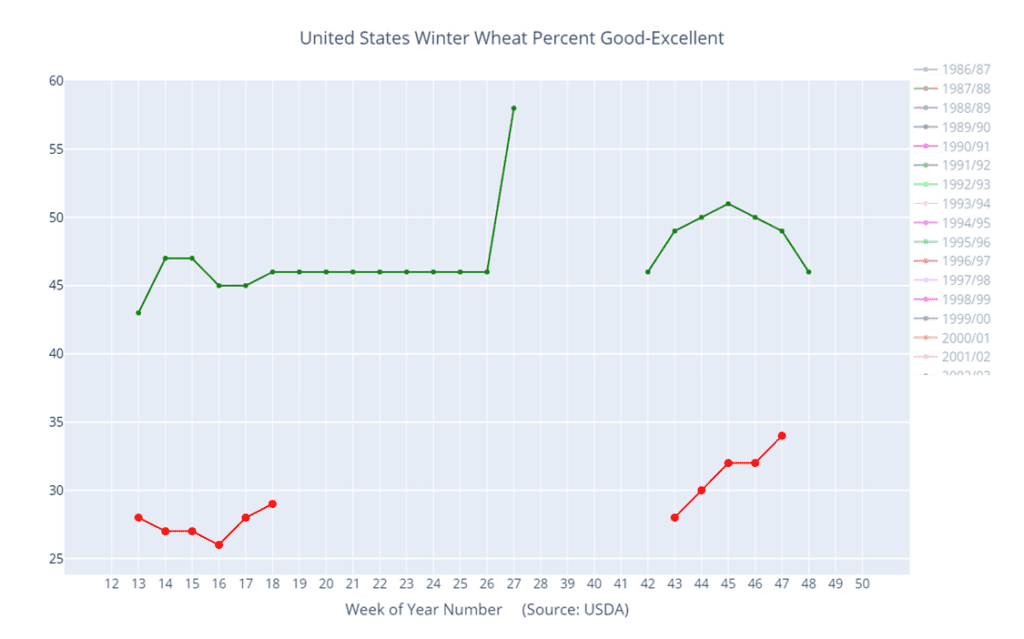

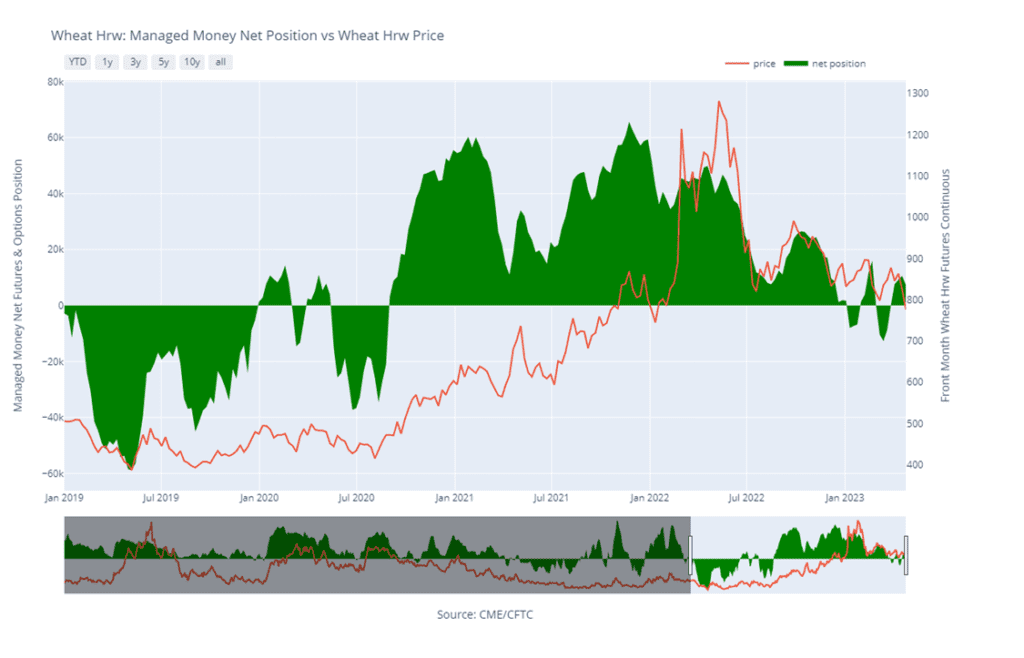

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. The 2024 market has limited liquidity, and it may be until mid-summer before recommendations are posted.

Above: The July contract continues to show upward momentum, though open interest has fallen off somewhat, indicating some profit taking. If the market can break through nearby resistance, it could further test the 886 to 902 resistance area. Otherwise, initial support may be found near 769, with key support near 740.

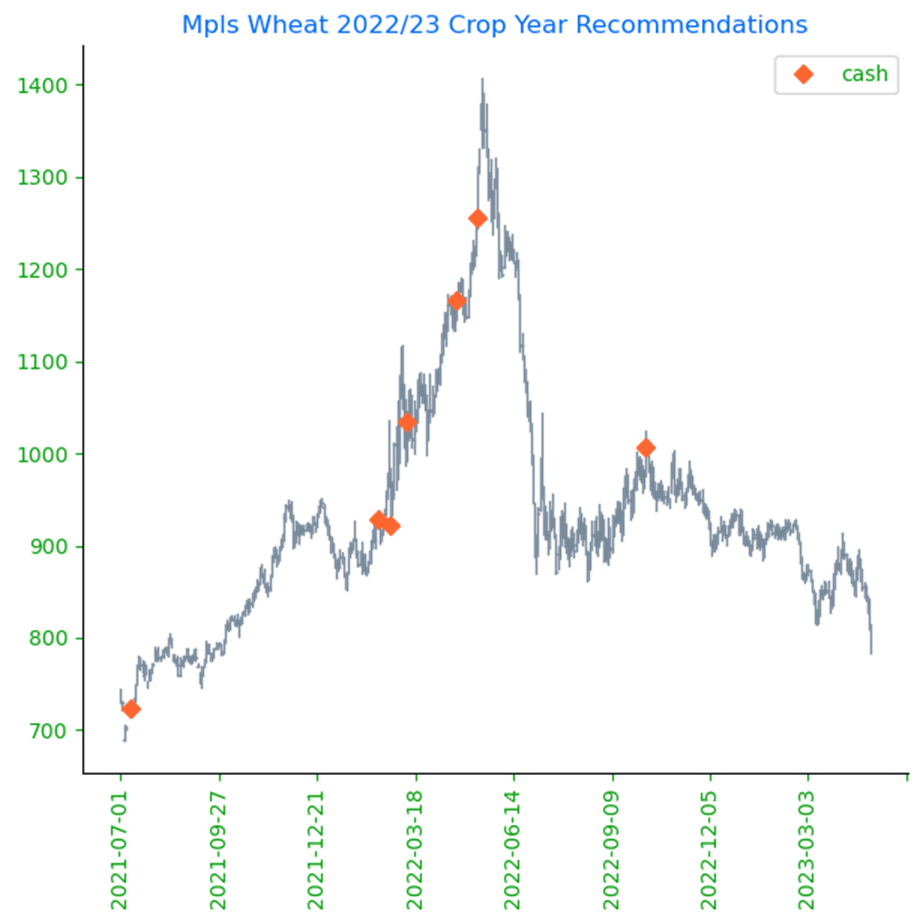

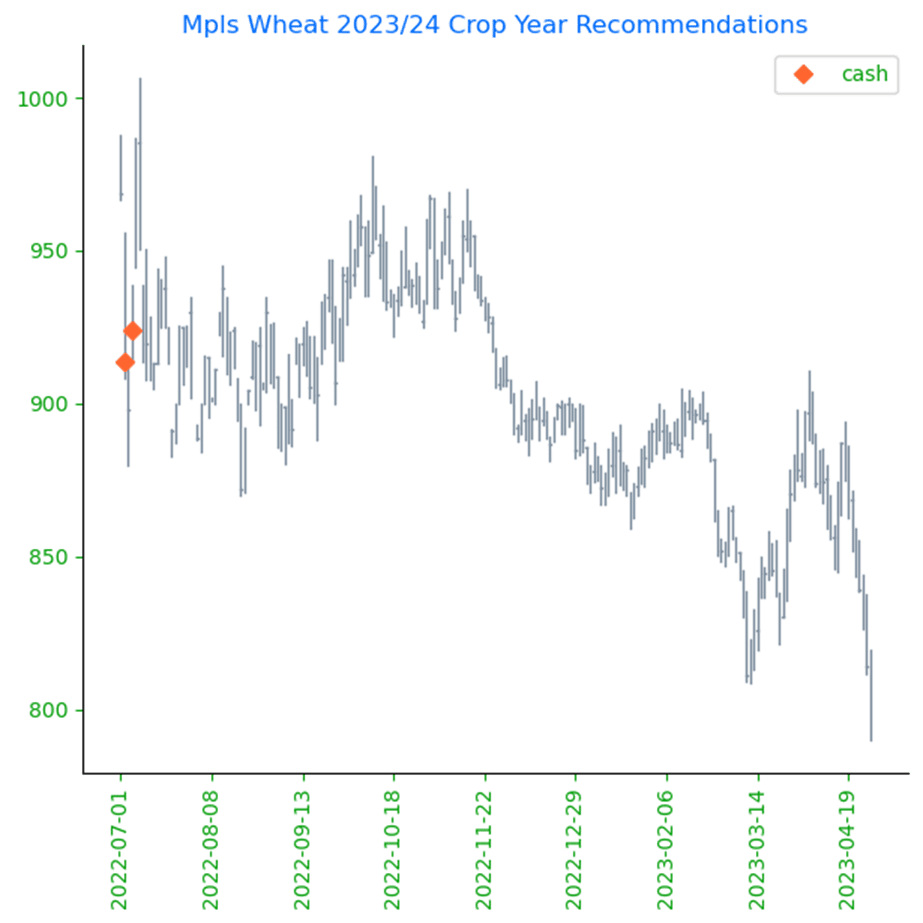

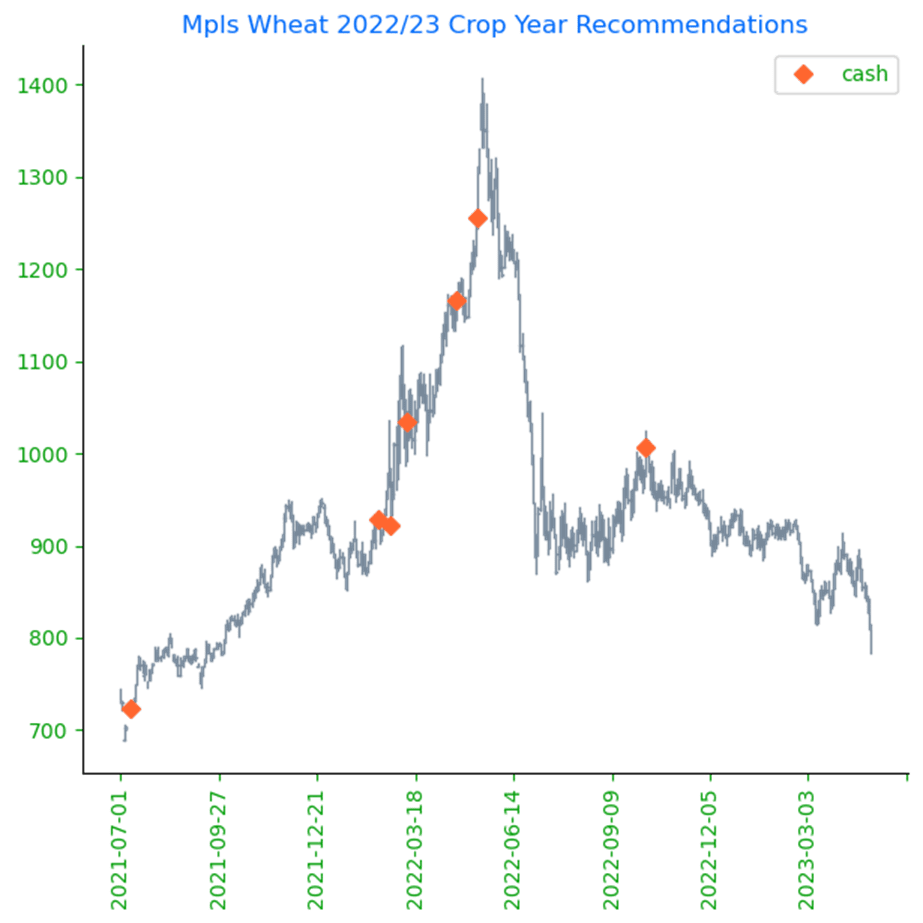

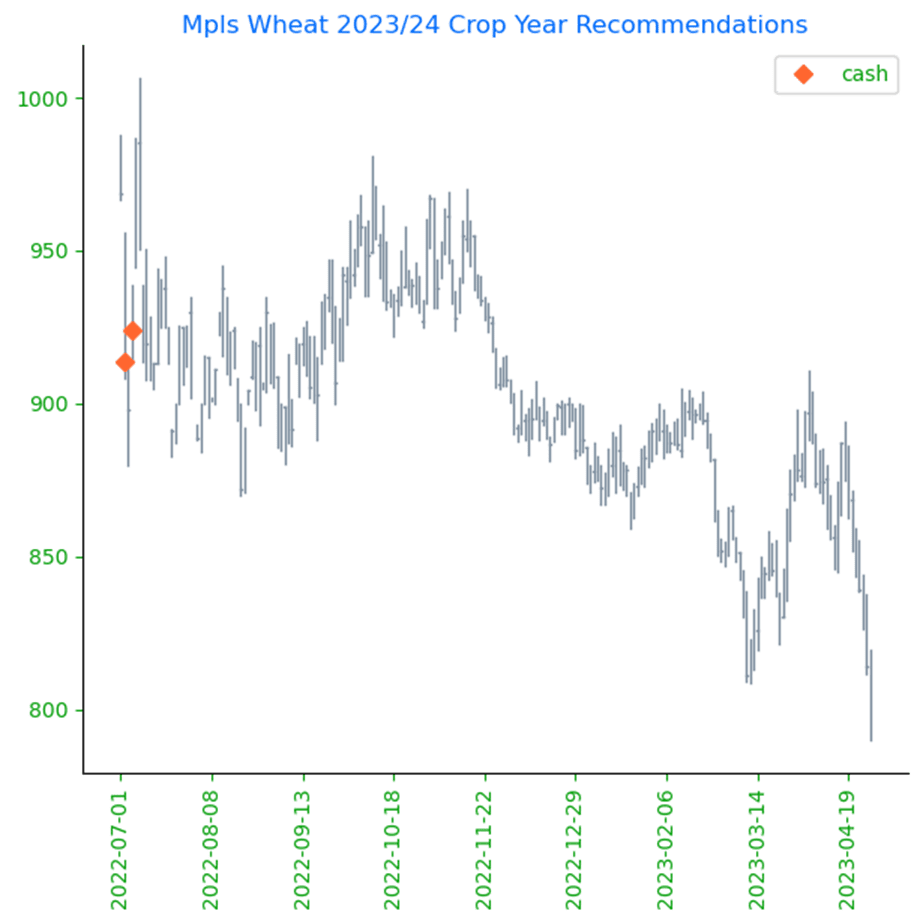

Mpls Wheat Action Plan Summary

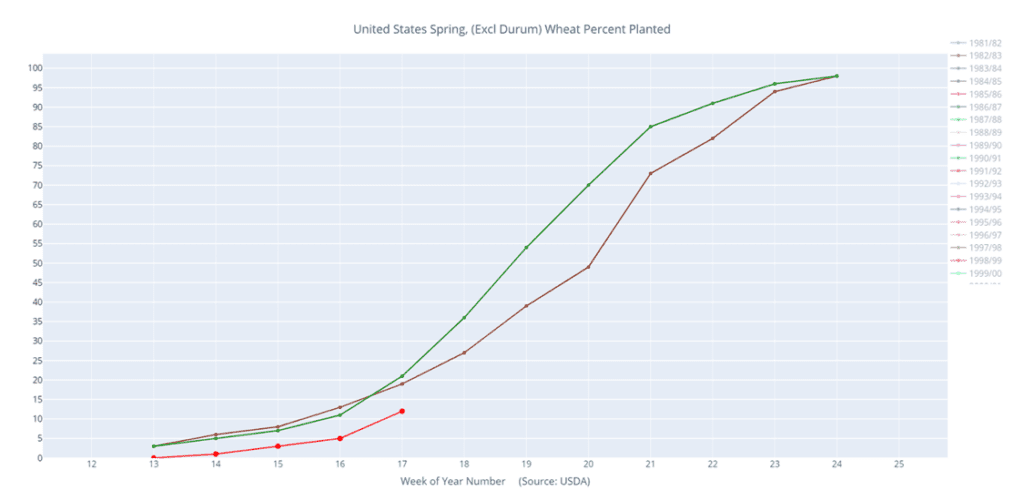

Updated as of 05/10/2023

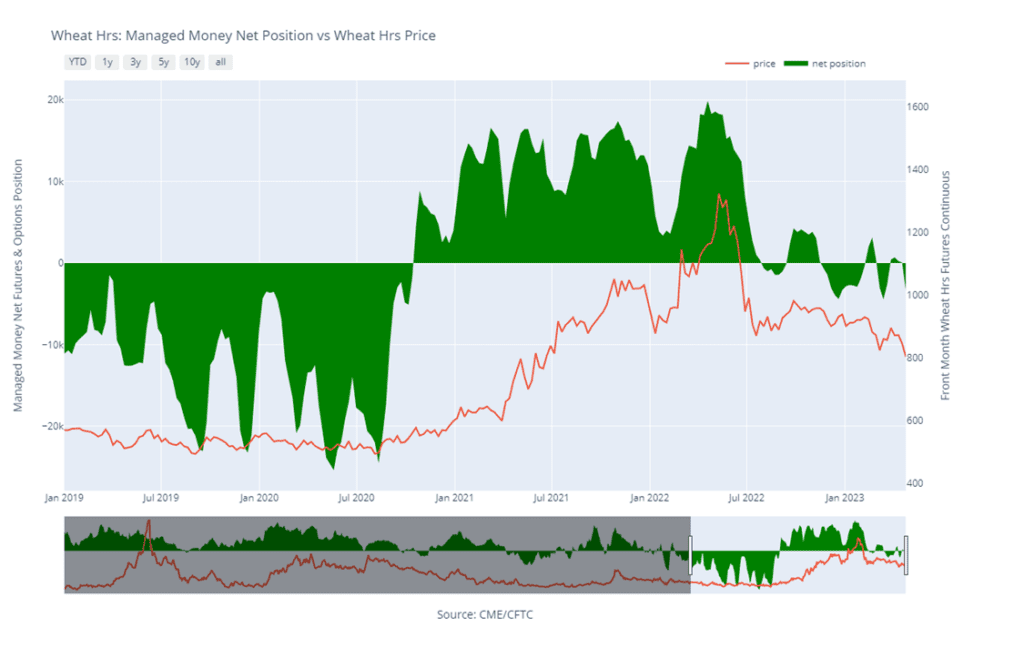

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

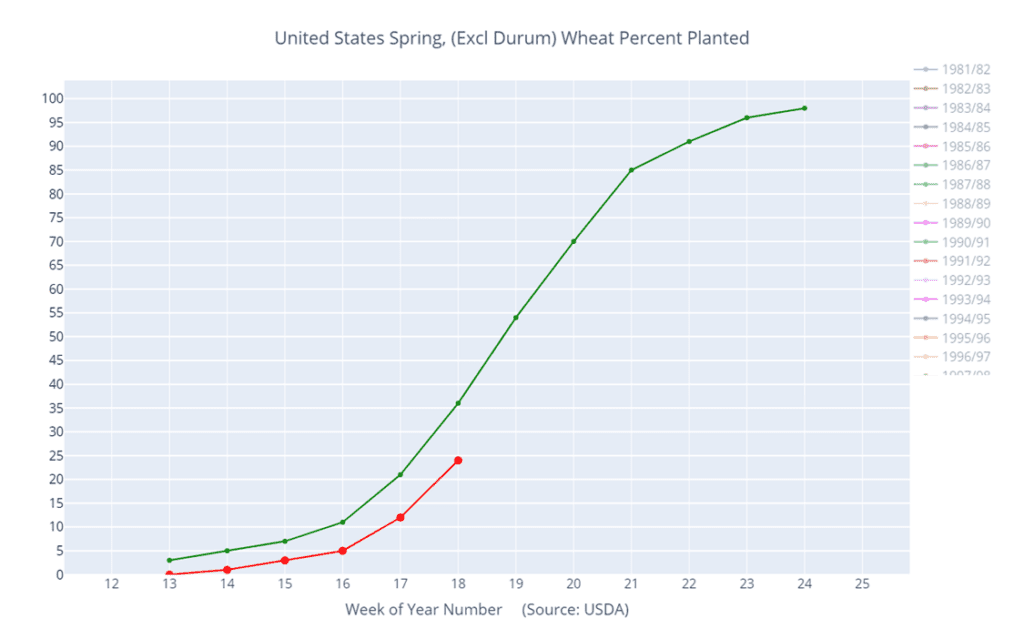

- No action is recommended on the 2023 crop at this time. Wet conditions have delayed some planting and raised some prevent planting concerns which could continue to influence the market and generate better selling opportunities in the coming months. We are in no hurry to sell right now with everything going on.

- We continue to be patient to market any of the 2024 crop. Due to the lack of liquidity for the 2024 crop, there may not be any recommendations until late spring or early summer. This is the time for patience, not action.

Above: The market continues to show upward momentum, though open interest has fallen off somewhat, indicating some profit taking. Resistance still resides above the market near 870 and 895, while support may be found between 770 and 760.

Other Charts / Weather