Grain Market Insider: June 9, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

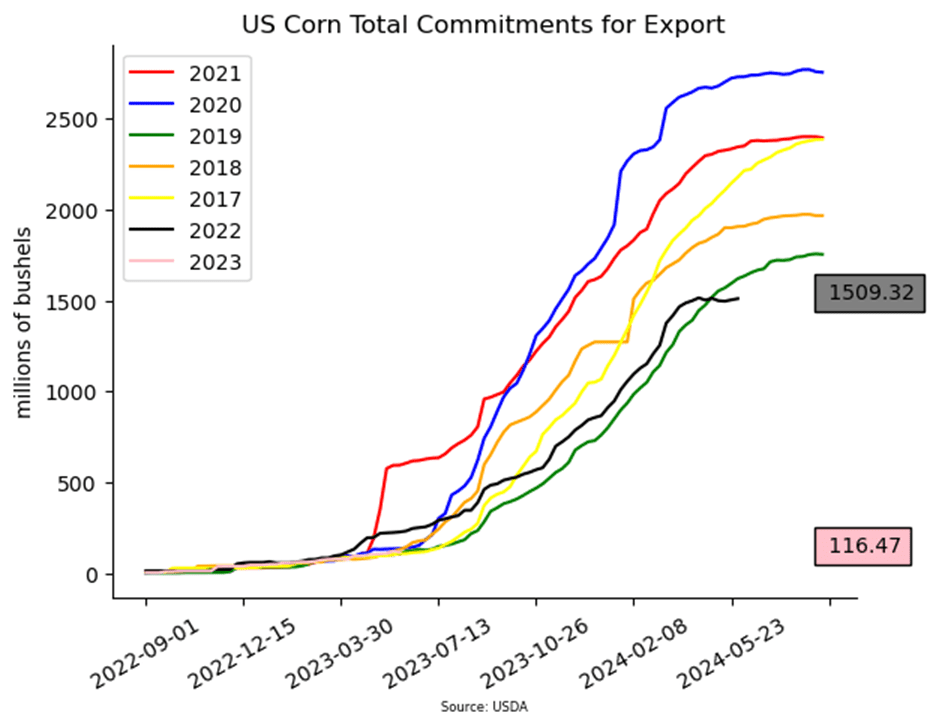

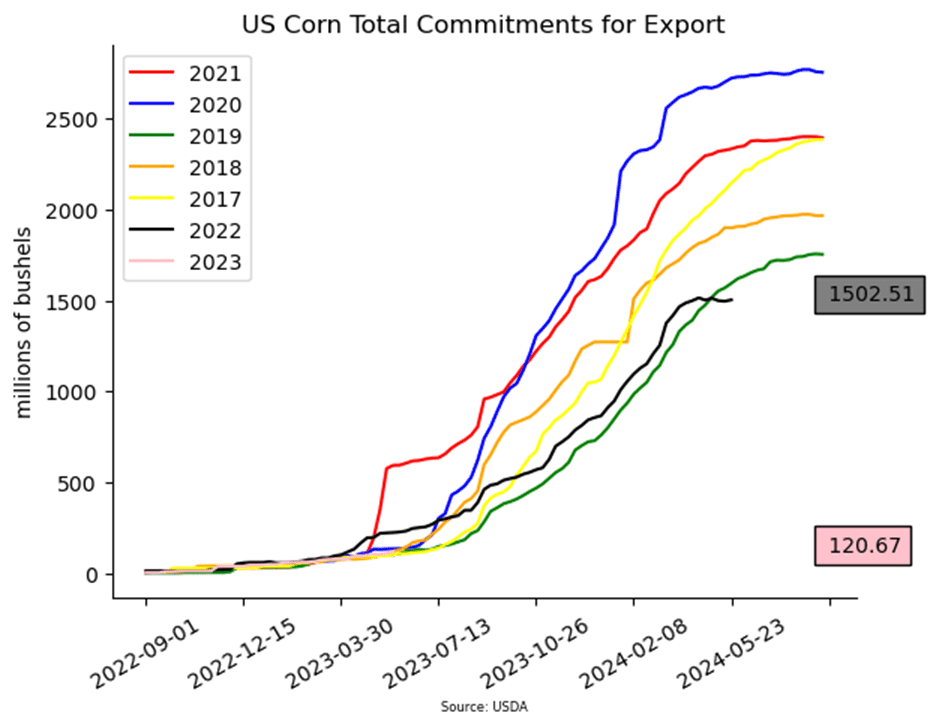

- Corn was lower to end the week after the USDA lowered 22/23 corn exports by 50 million bushels bringing ending stocks in line with pre-report estimates, but still higher than the May estimate.

- Soybeans closed sharply higher with help once again from higher soybean oil prices. July Soybean Oil futures have closed higher in five of the first seven trading days to start the month of June.

- Wheat was mixed with Chicago contacts moving higher while K.C. and Minneapolis contracts slid lower. Overall, the WASDE report was viewed as neutral to the wheat market with only minor changes from last month’s numbers.

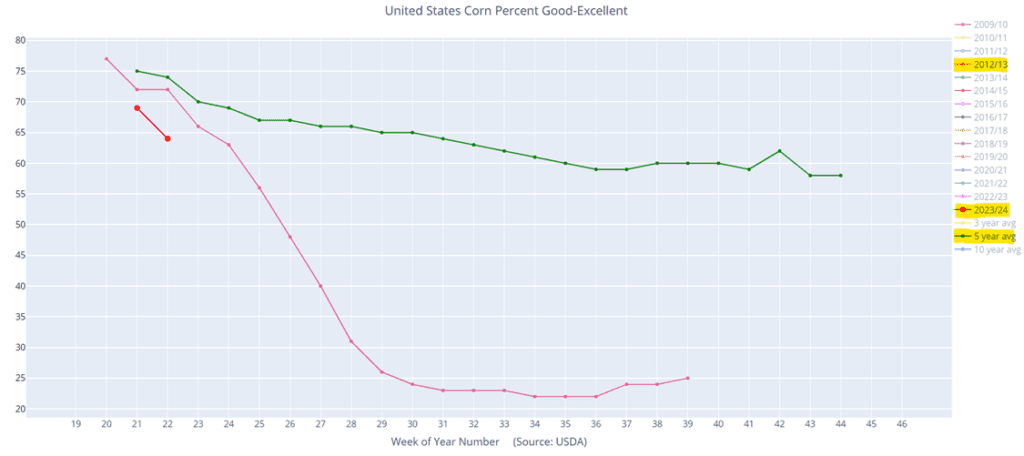

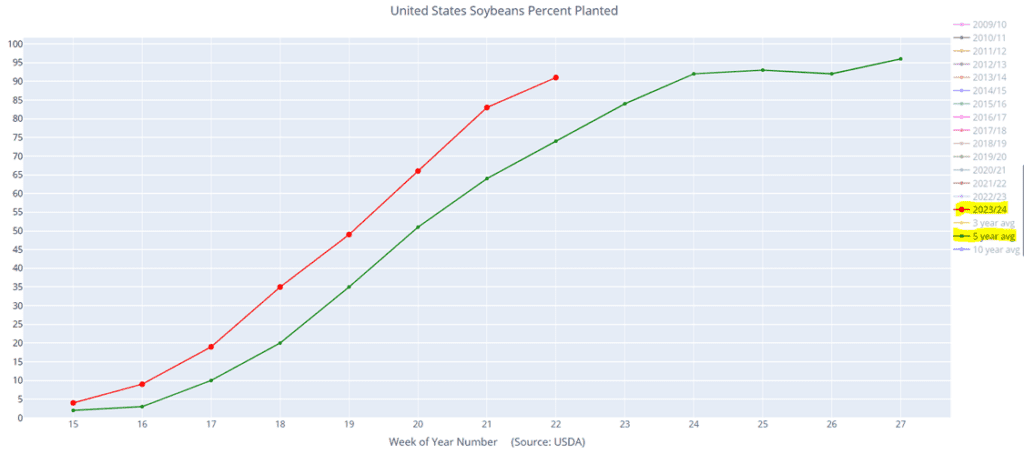

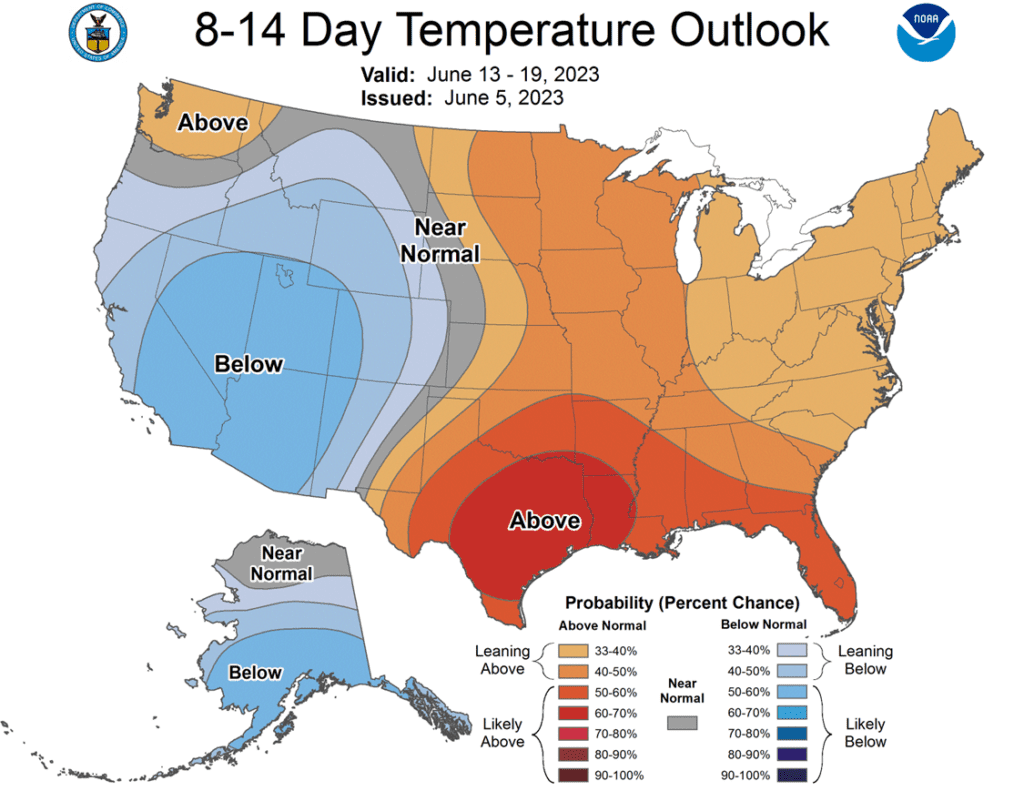

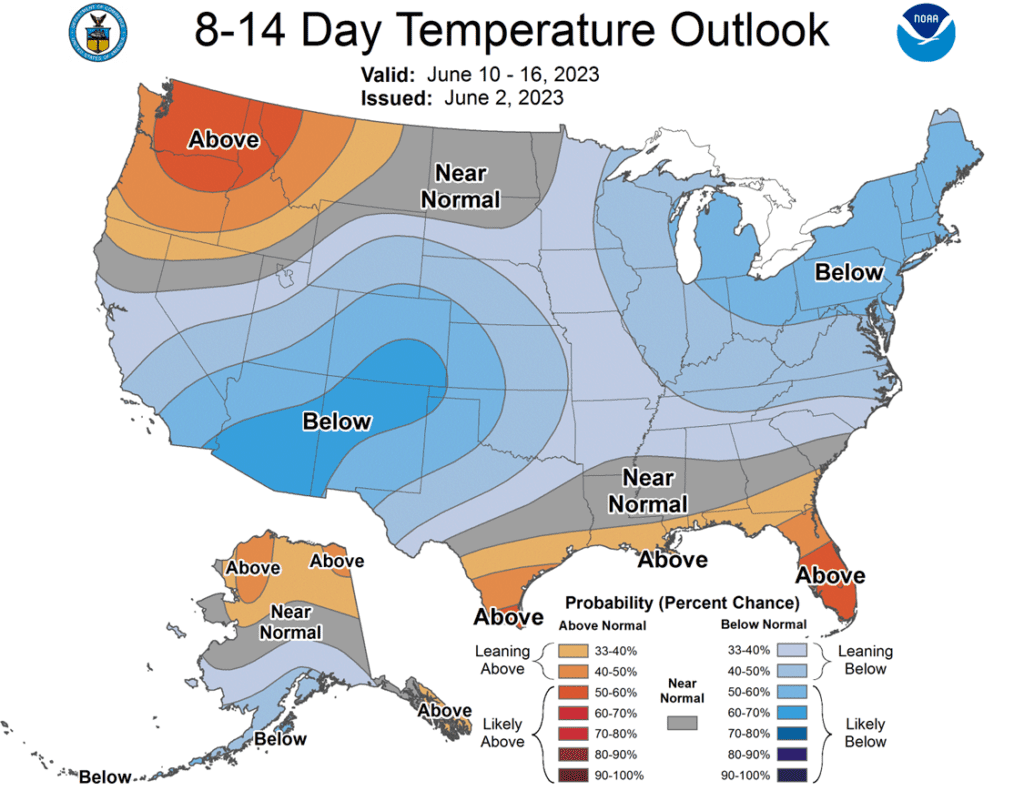

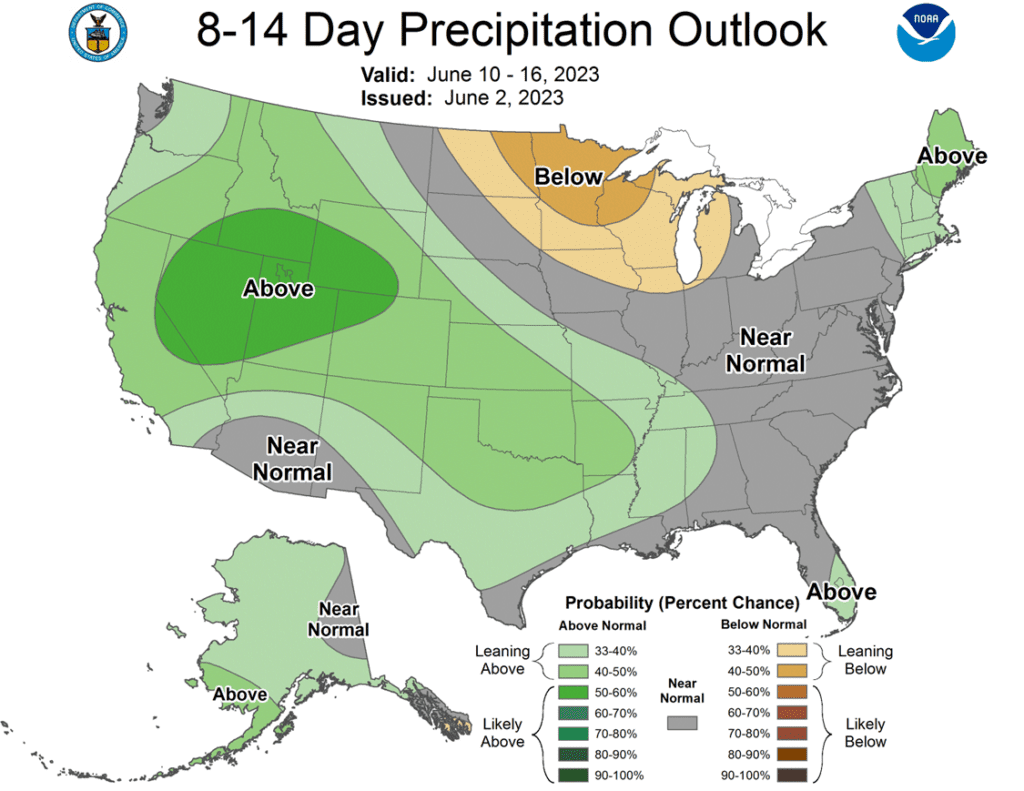

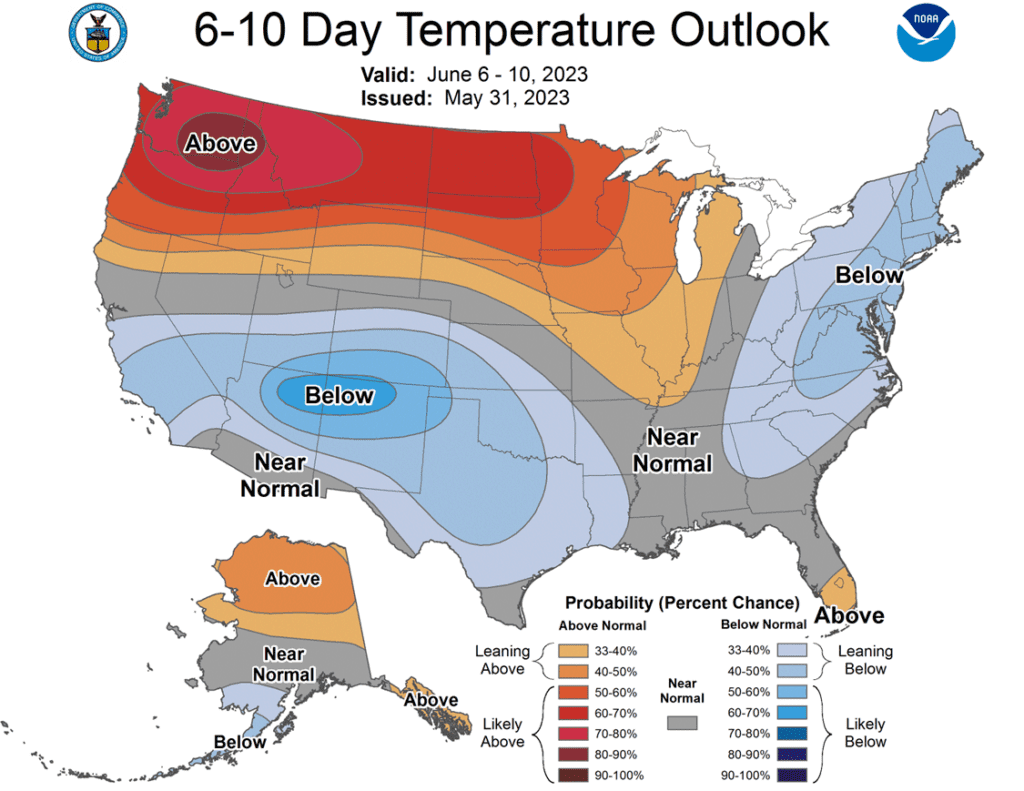

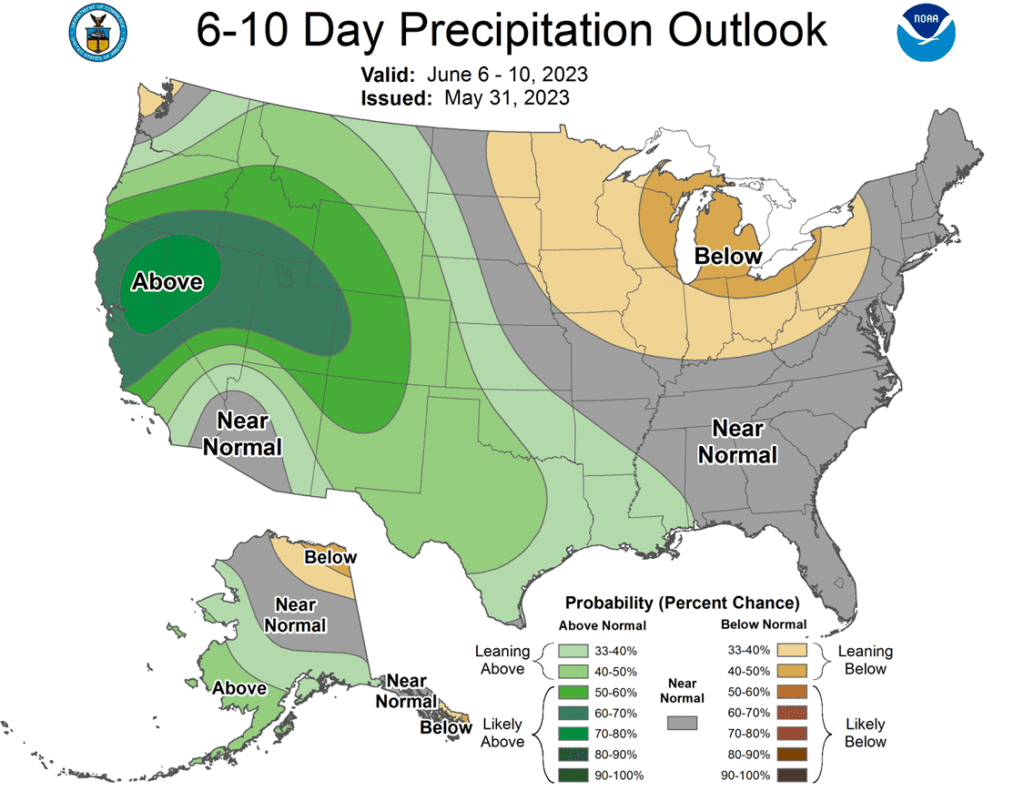

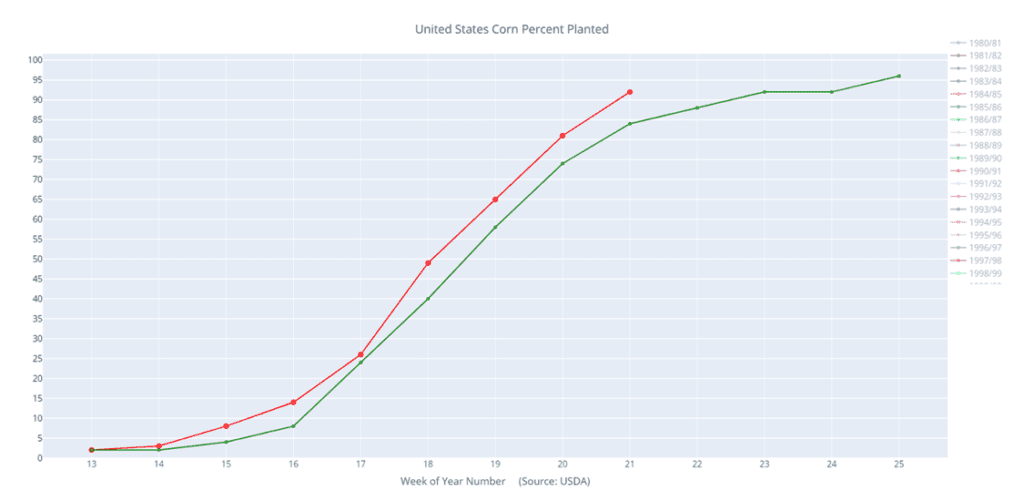

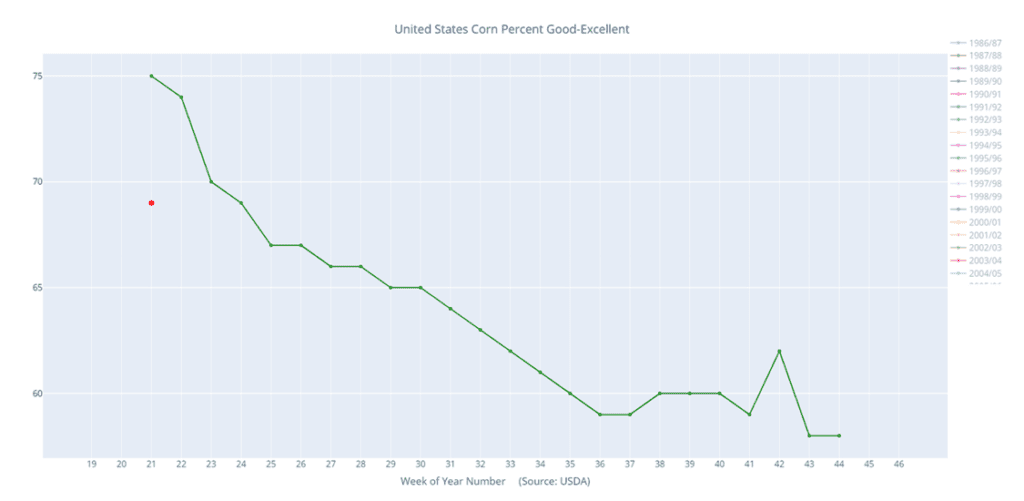

- With the June WASDE report in the rearview mirror, the trade will turn its attention back to weather as we enter critical weeks of crop development for corn and soybeans.

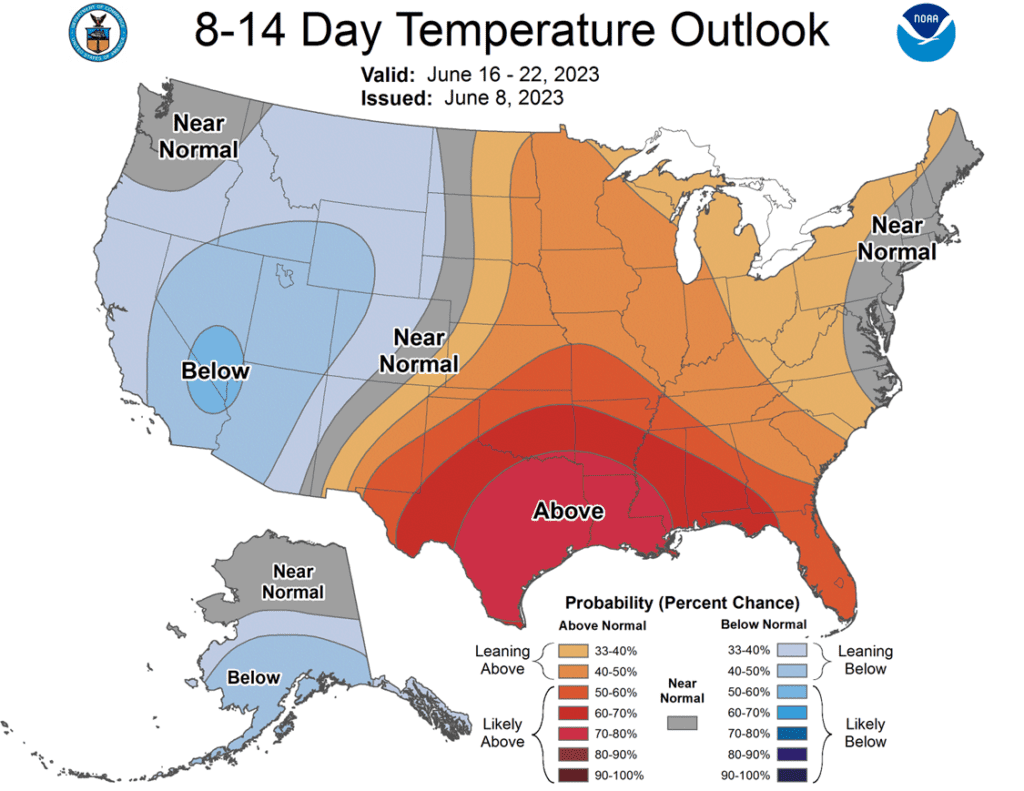

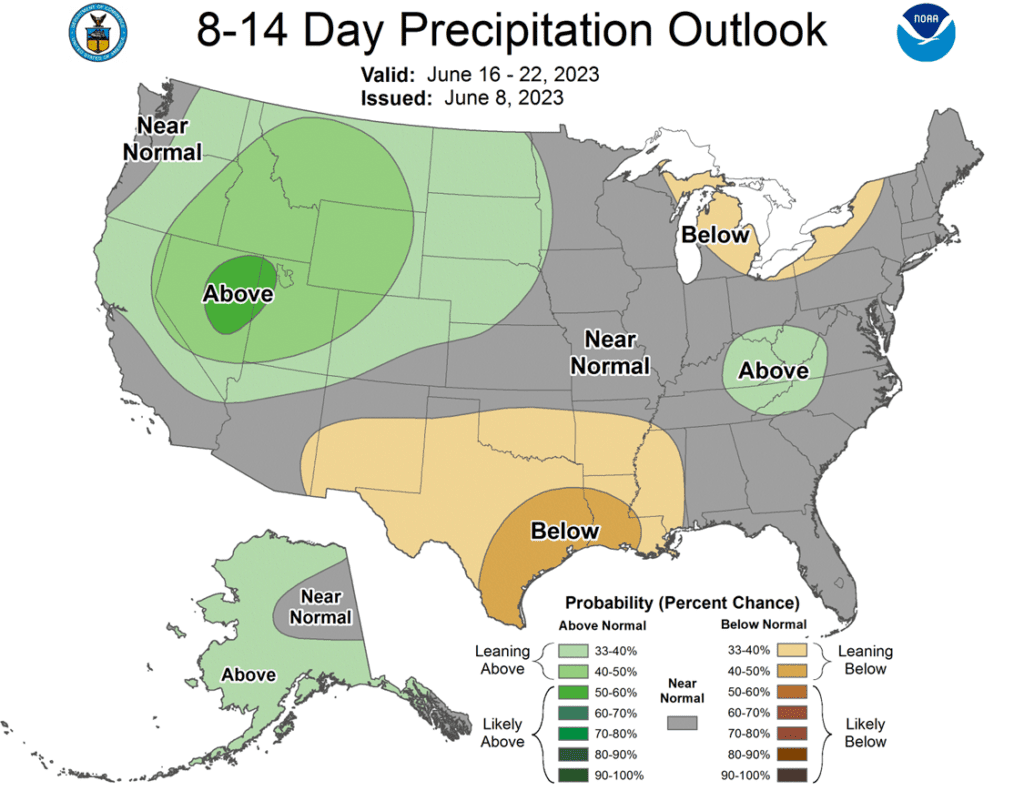

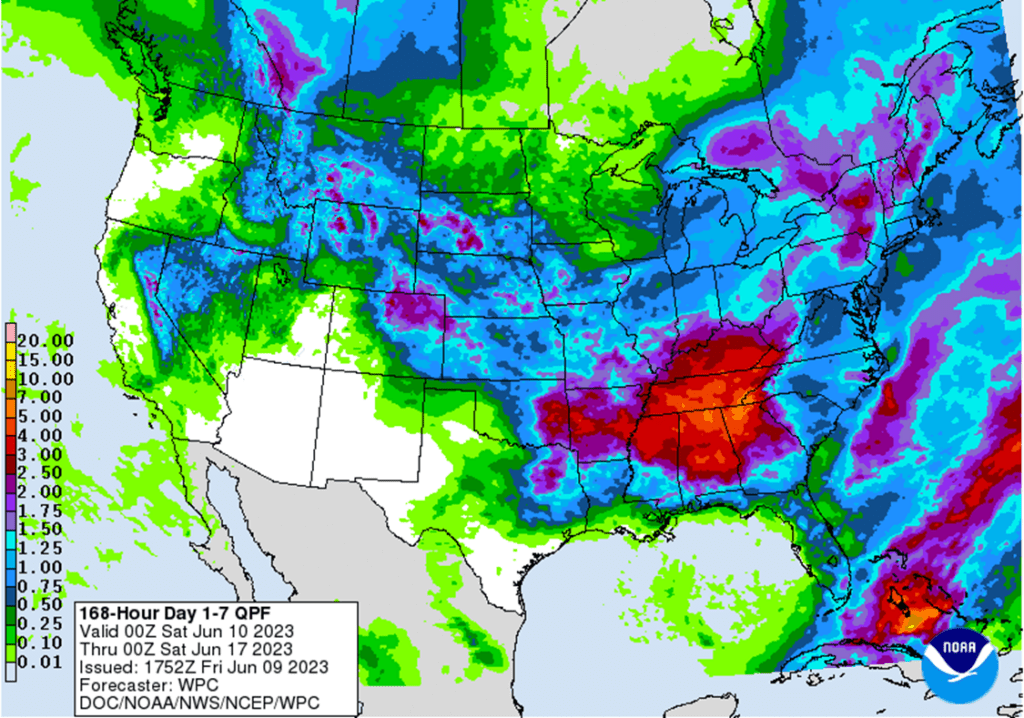

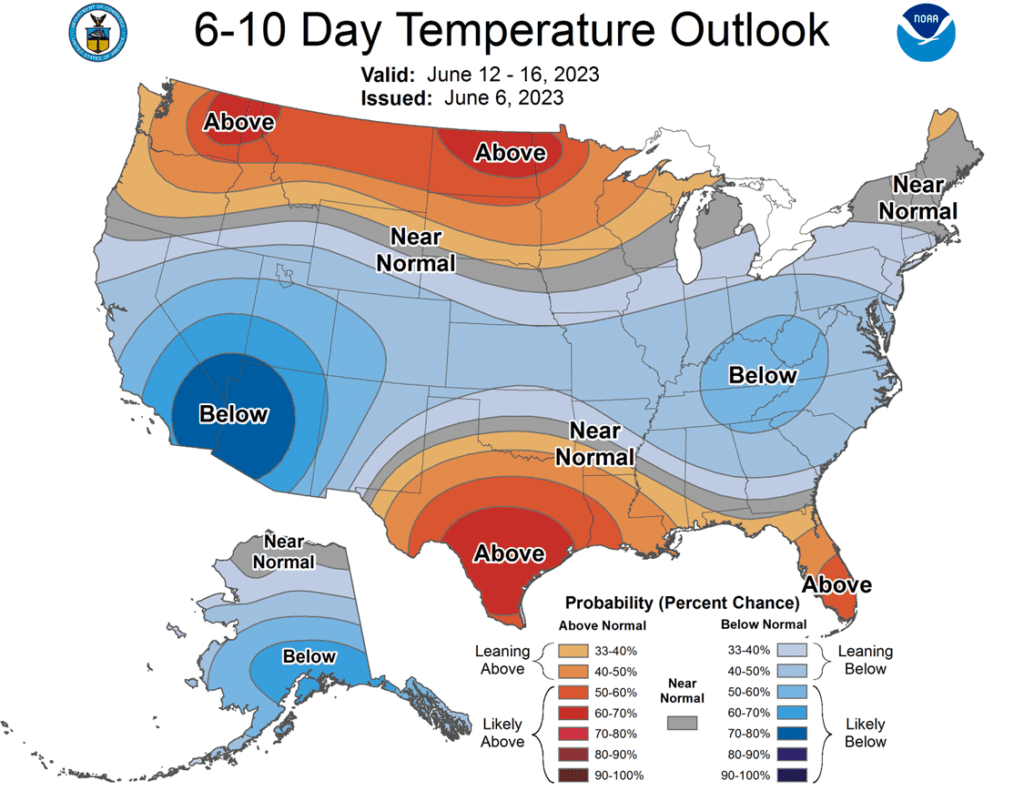

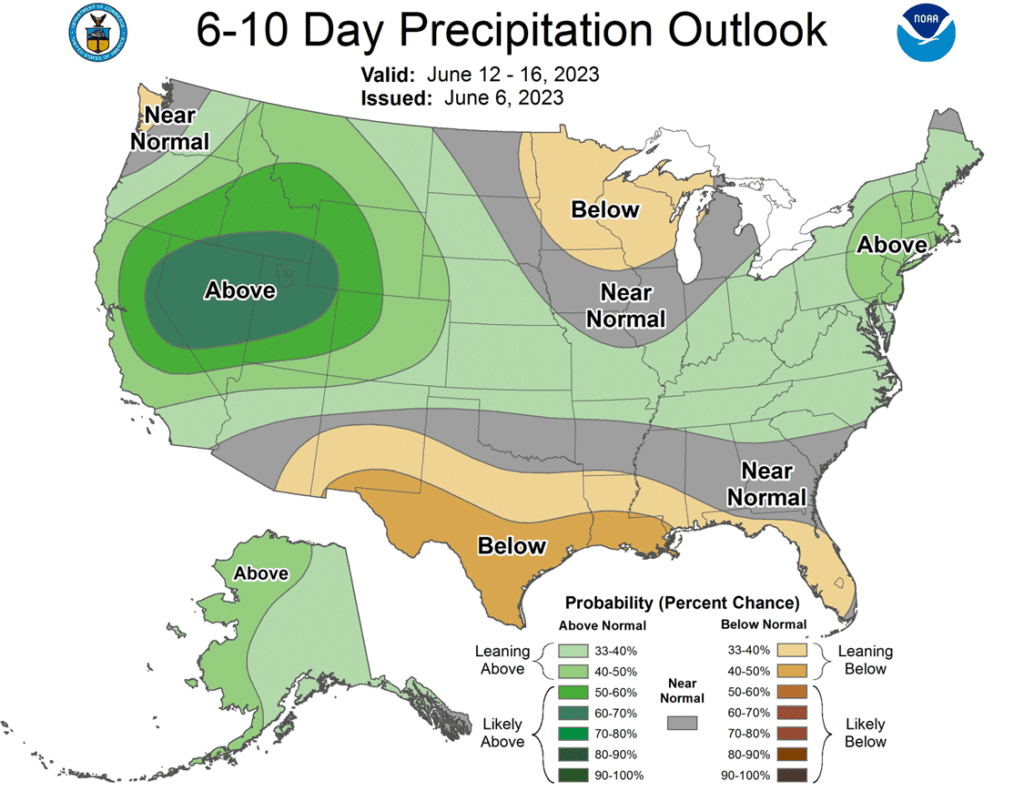

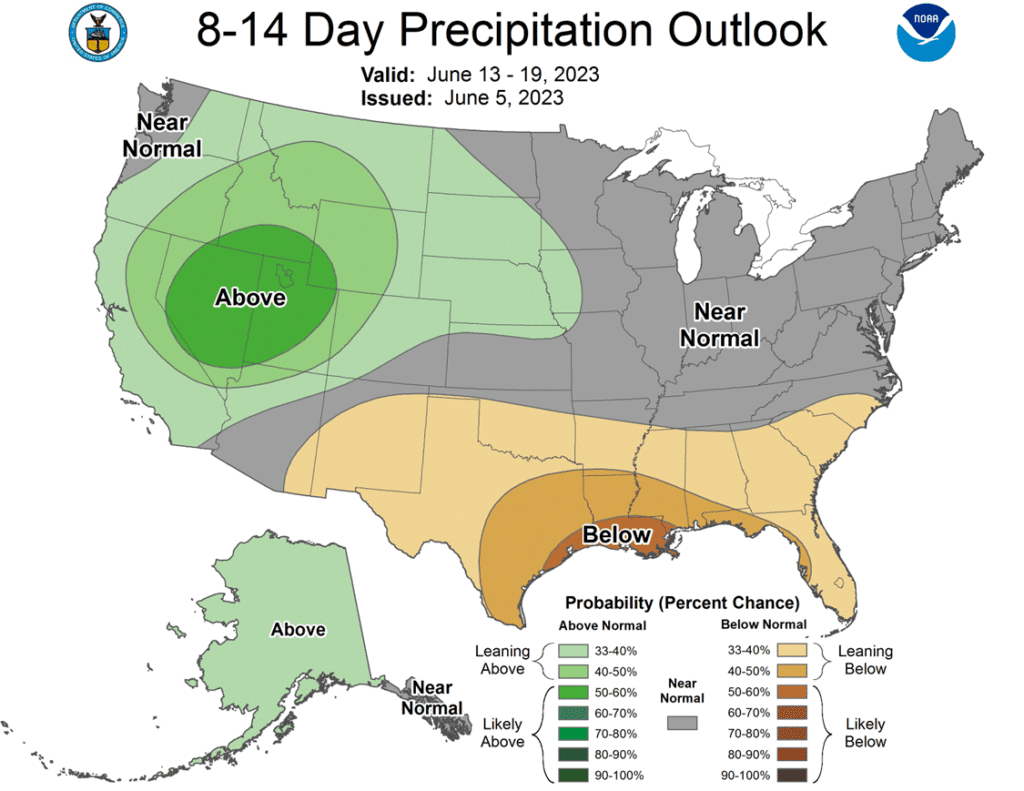

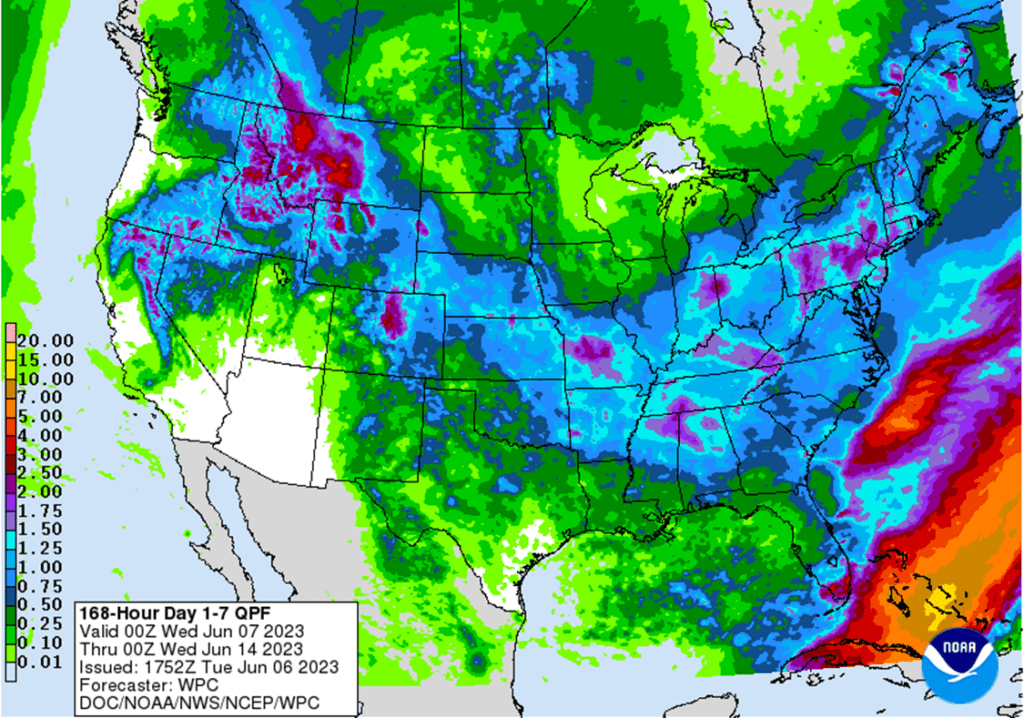

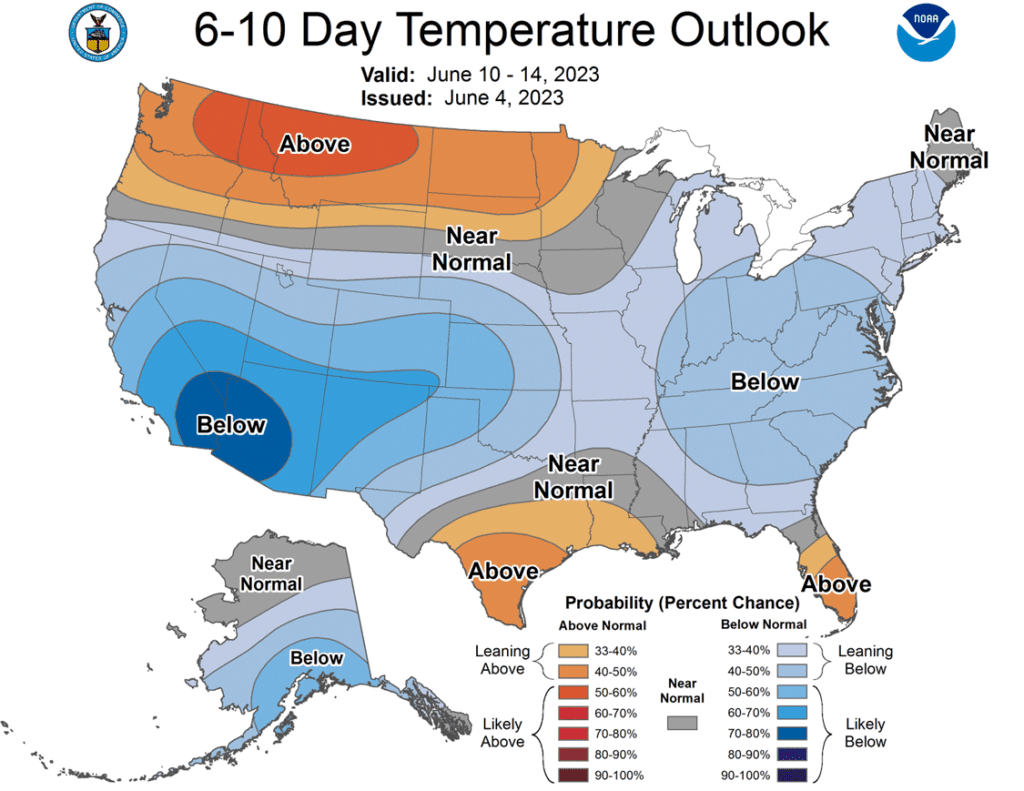

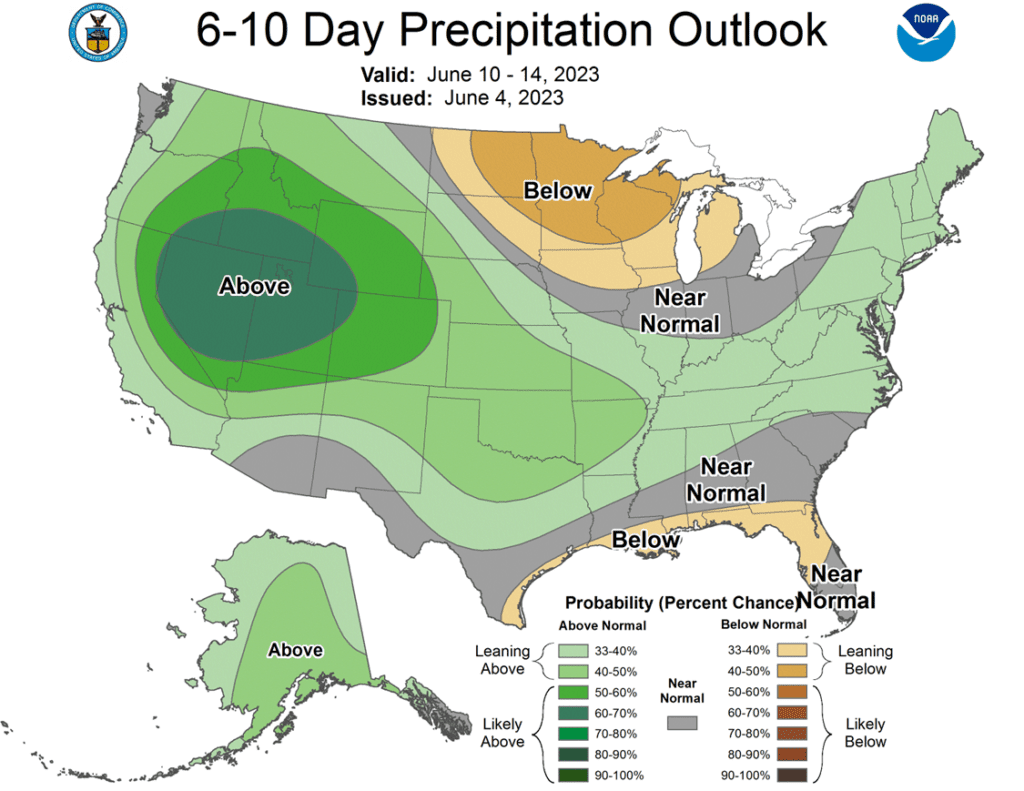

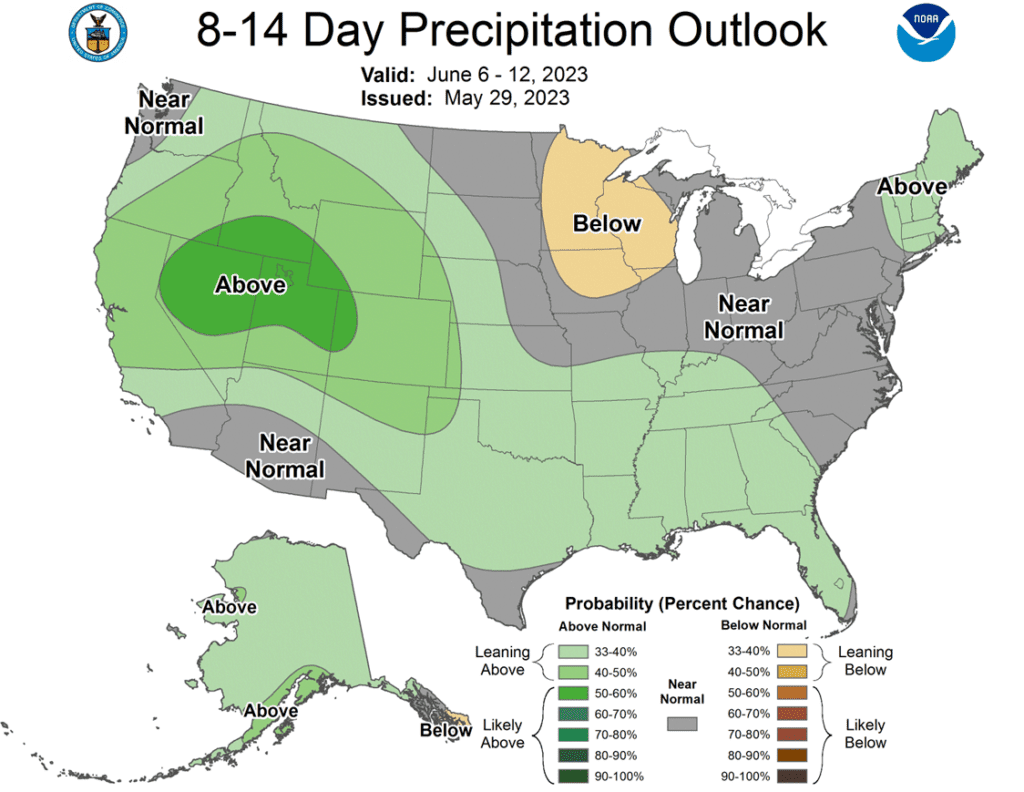

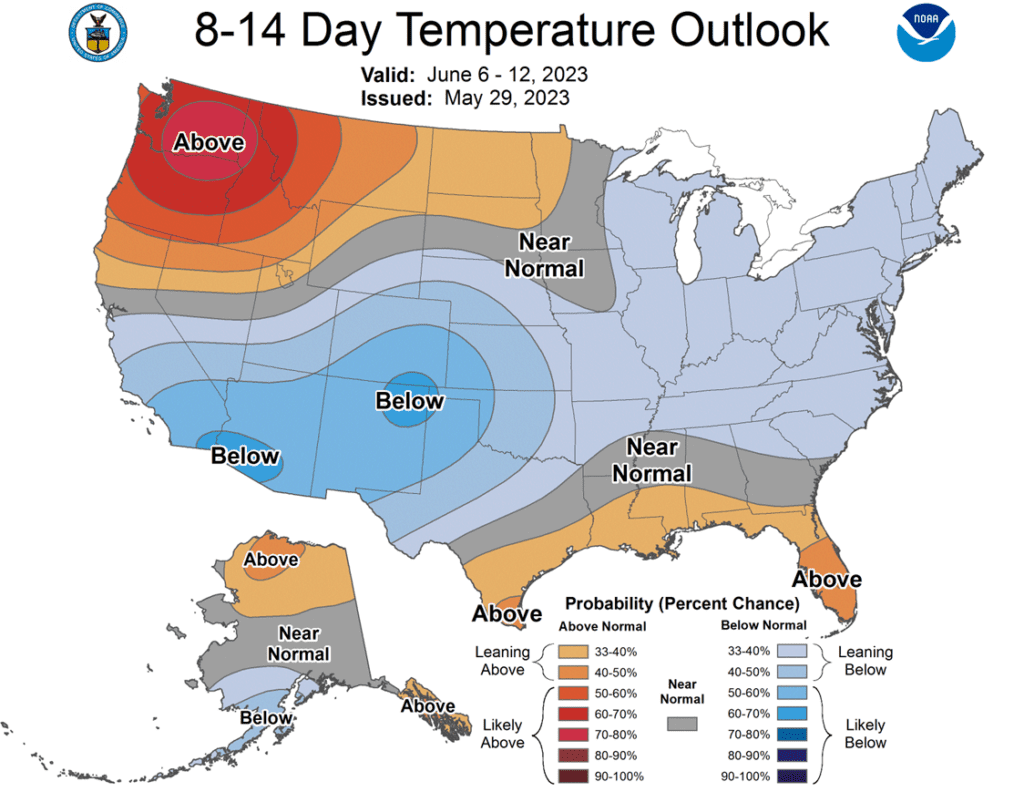

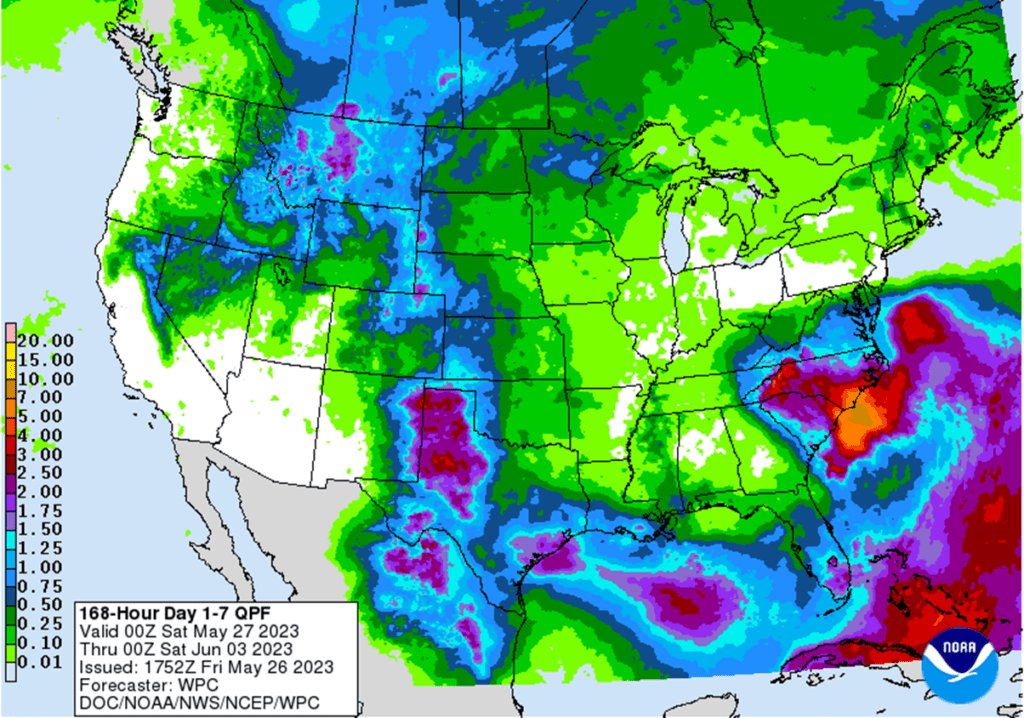

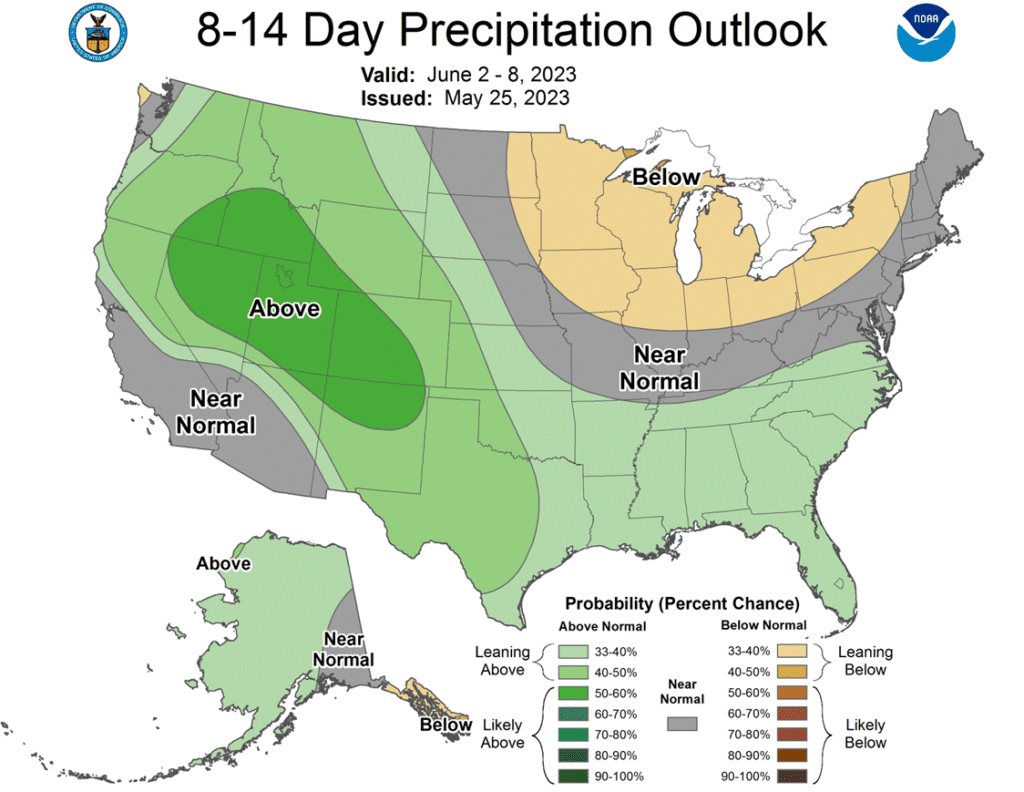

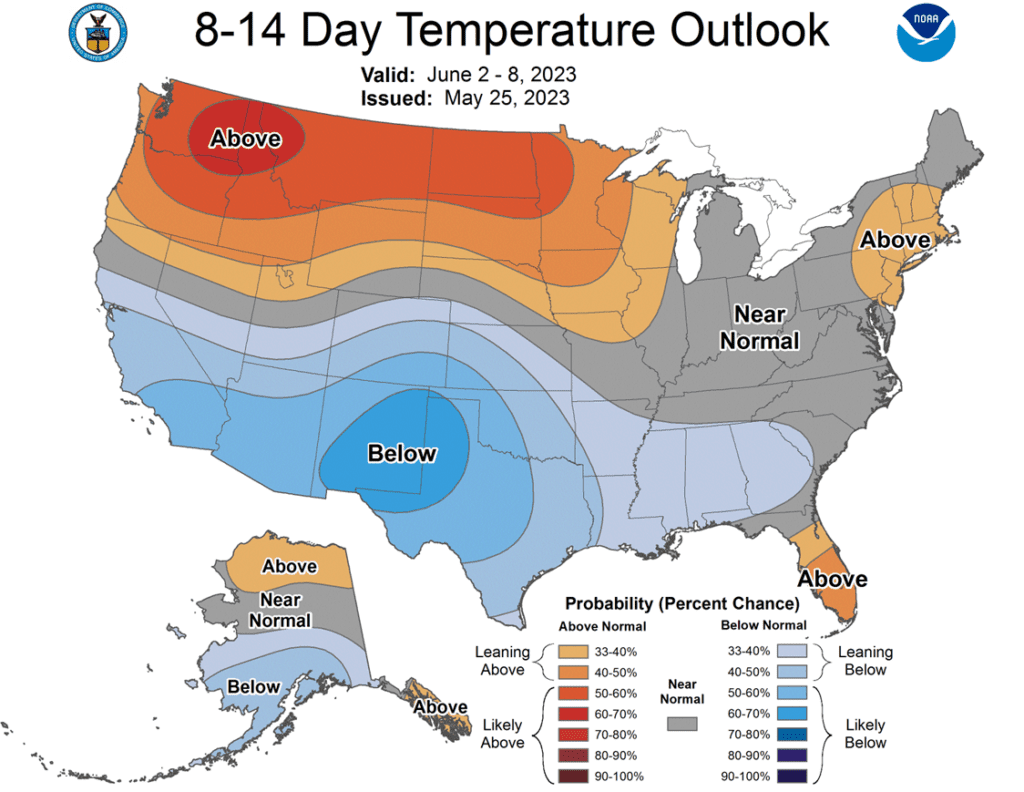

- To see the updated NOAA 8-14 Day Temperature and Precipitation Outlooks and 7-day NOAA Precipitation Outlook scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

- No action is recommended at this time for Old Crop. July corn has had nearly a 60-cent rally in the last couple of weeks. Expect volatility to remain in the market, a changing weather forecast can push the market significantly in either direction. If you still have Old Crop to sell, consider using this rally to begin pricing some of those bushels. Don’t forget, there is about an 80-cent inverse between the July and September futures contracts, which could be lost when bids get rolled from one contract to the next in the next few weeks.

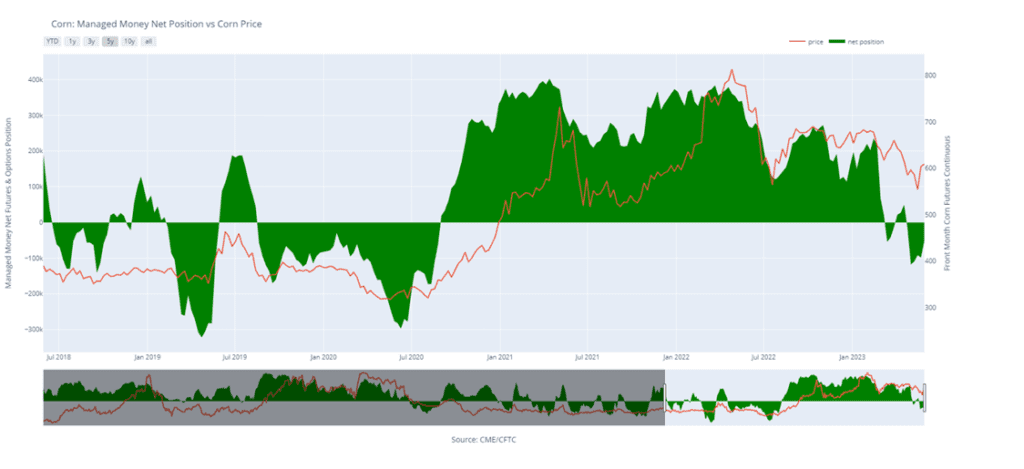

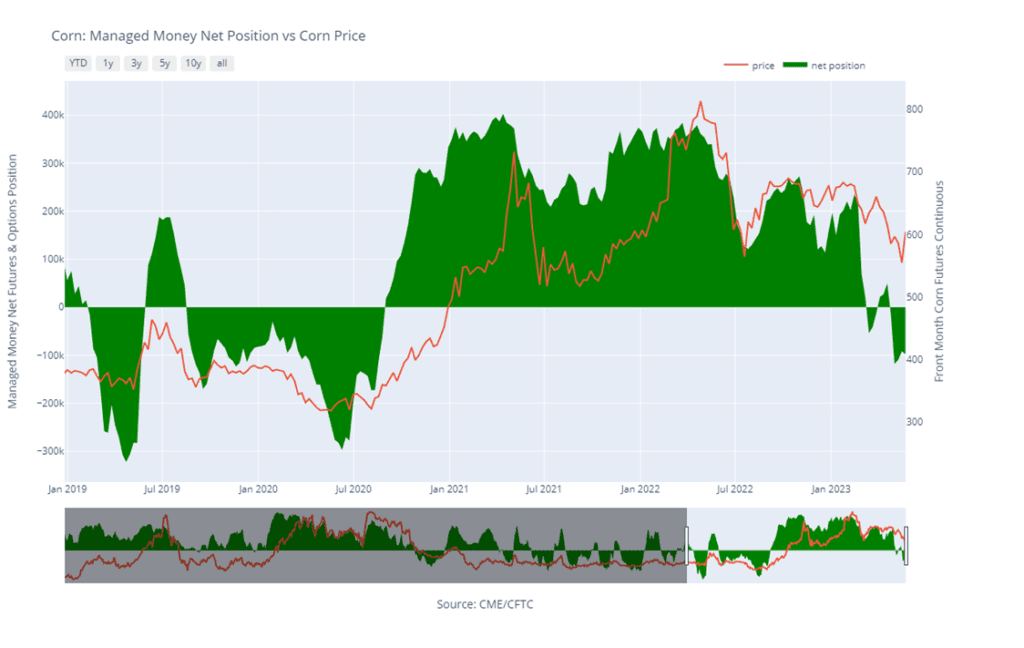

- No action is recommended at this time for New Crop. With dryness building in the Midwest and an estimated fund short position in excess of 40k contracts, we continue to target the 590 – 630 range in the December futures to suggest adding cash sales. If you don’t happen to have any New Crop sold, you should consider targeting the 550 – 560 area to begin pricing bushels.

- Continue to hold current sales levels for the 2024 crop year. We will look for opportunities to make further sales as we move through the 2023 growing season as weather volatility builds.

- Corn futures finished lower on Friday as a confirmed growing supply picture and potential weather pattern shifts limited buying support. July corn futures closed the week 4-3/4 cents lower and December lost 10-3/4 cents.

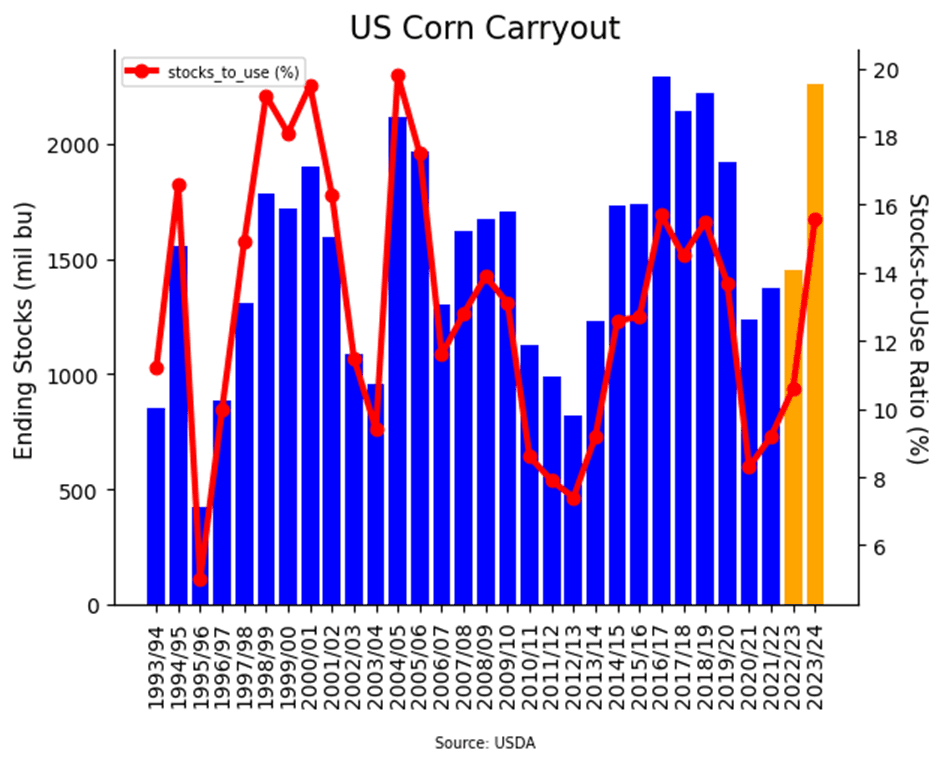

- The USDA June WASDE report lowered old crop corn export demand by 50 MB but decreased corn imports by 15 MB to add a difference of 35 MB to projected carryout. Old crop carryout is now at 1.452 BB and New crop was raised to 2.257 BB. The report was close to analysts’ expectations, but still confirmed a weaker demand tone and larger supply picture.

- The USDA raised their projection for Brazilian corn production to 132 MMT (approx. 5.118 BB) by adding 2 MMT (79MB) over last month’s projections, this was larger than analyst expectations.

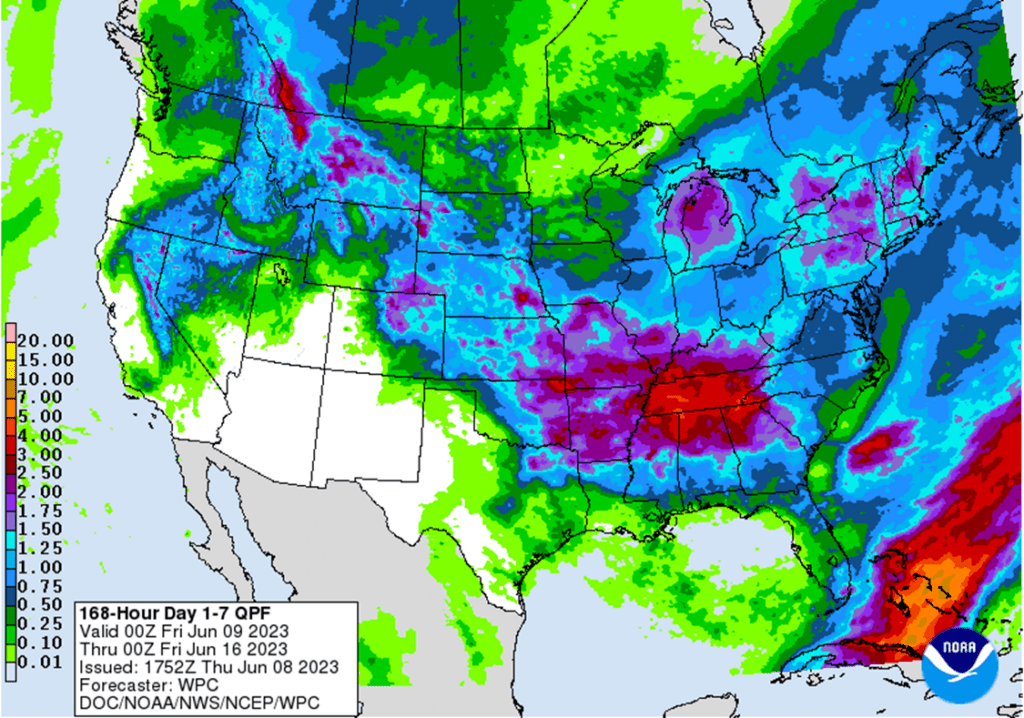

- Now with the report behind the market, traders will shift focus back to the weather. Models are showing a potential change overall to a cooler and wetter pattern, but the market will be watching precipitation totals and locations over the weekend.

- Corn future weakness may have been limited late today by buying strength in the soybean markets, and the Chicago wheat market trading off the lows of the session.

Above: Prices have continued to run into resistance at the 610 area. If current prices can hold and close above the 50-day moving average near 604, the market would be poised to test April’s high of 647-1/2. Support below the market rests between 550 and 530, and again near the 2021 September low of 497-1/2.

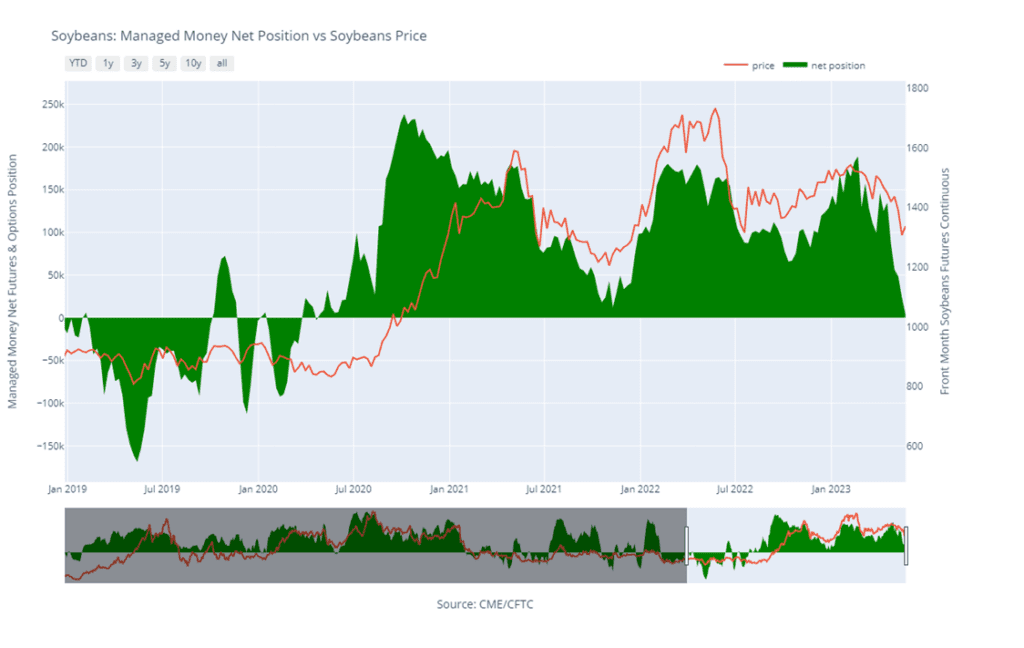

Soybeans

Soybeans Action Plan Summary

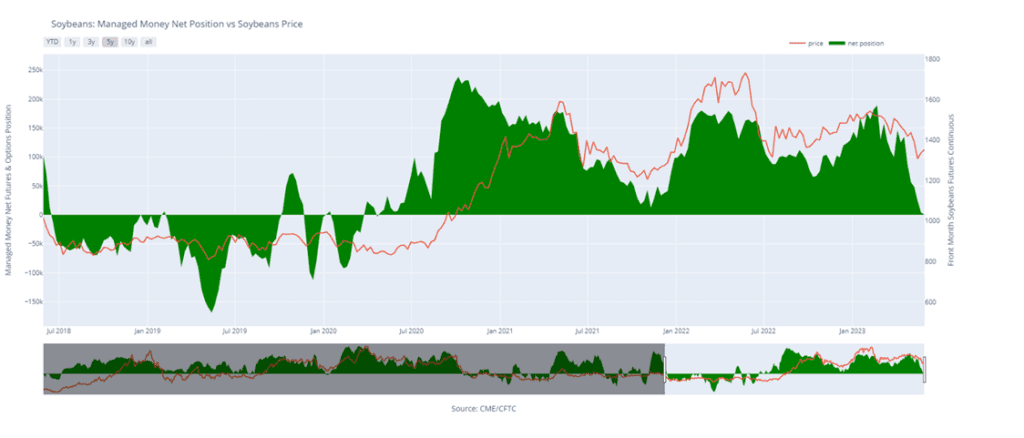

- May was a rough month for soybeans with a 175-cent range, but the market is consolidating, and found support just above 1270. July soybeans continue to be oversold with a tight Old Crop balance sheet, and with dryness concerns building and a seasonal window that is conducive for upside volatility and opportunity, continue to hold on progressing any Old Crop sales for now.

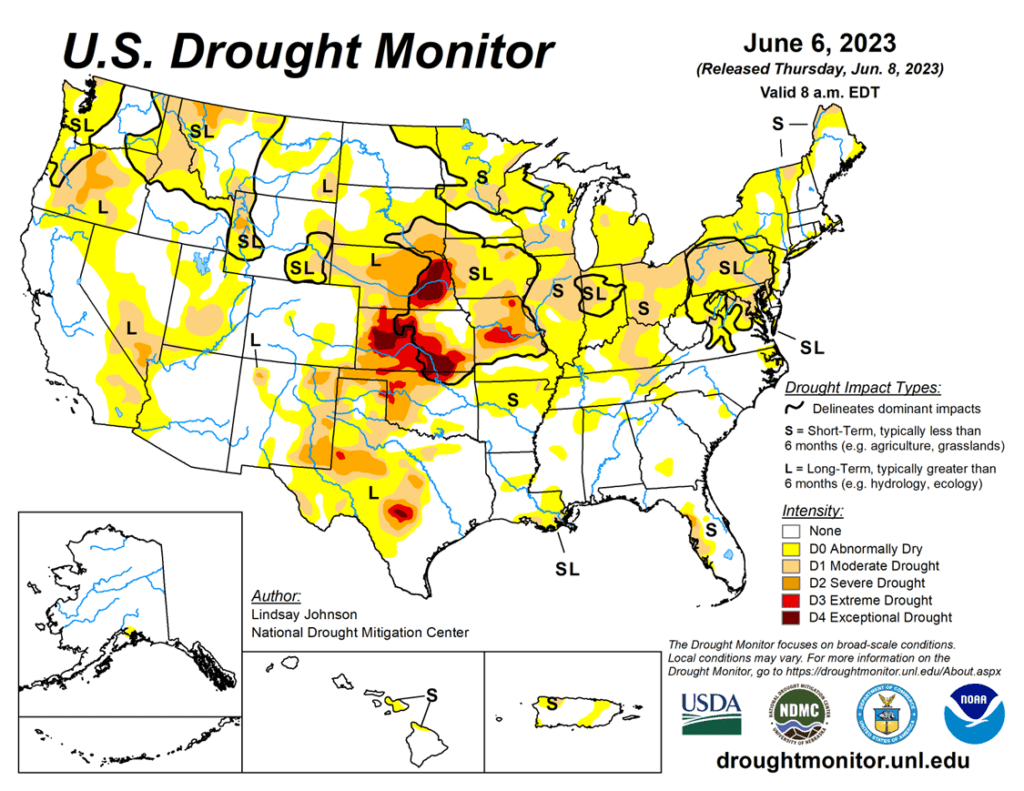

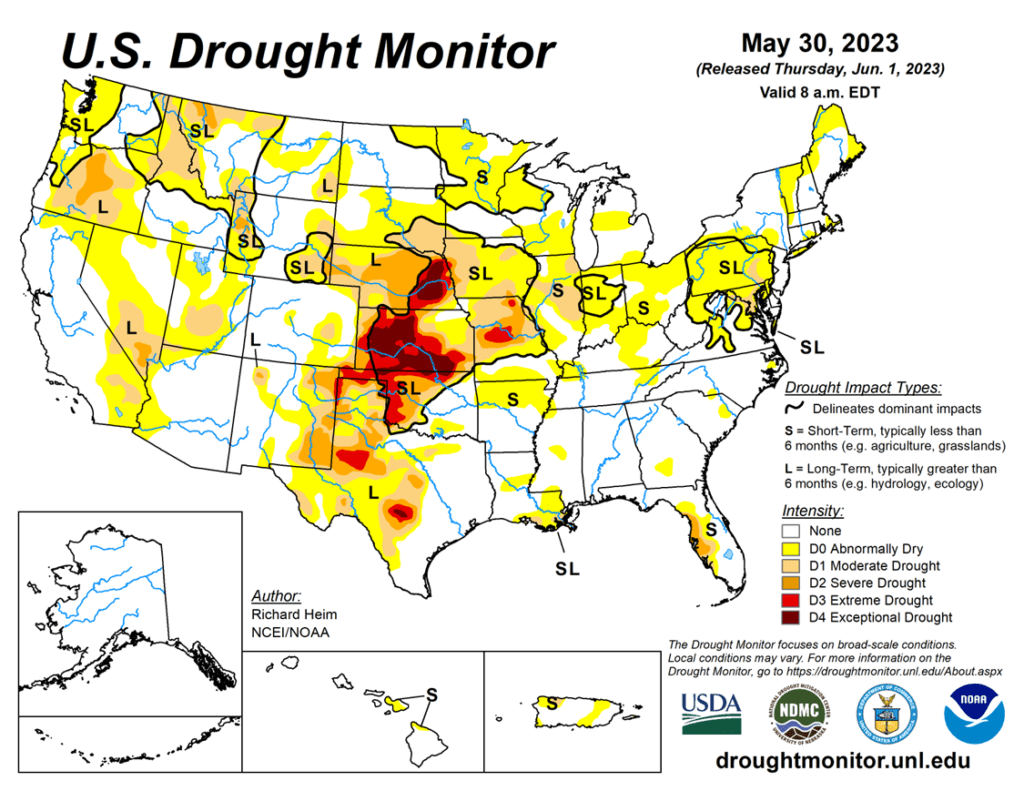

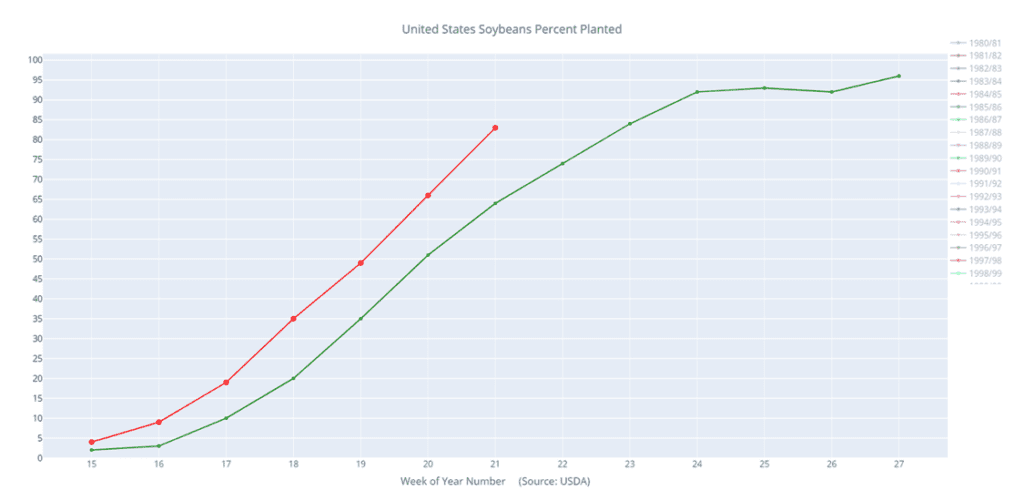

- We recommend not adding to current sales levels for the new 2023 crop at this time. A quick planting pace with favorable conditions and South American competition greatly pressured soybeans in April and May. The potential remains for a tighter New Crop balance sheet, as the US Drought Monitor map remains concerning. We would consider recommending the next sales in the 1300 to 1350 area.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

- Soybeans ended significantly higher on the day despite a neutral WASDE report. Soybean meal closed lower in the front months, while soybean oil closed higher as palm oil begins to recover.

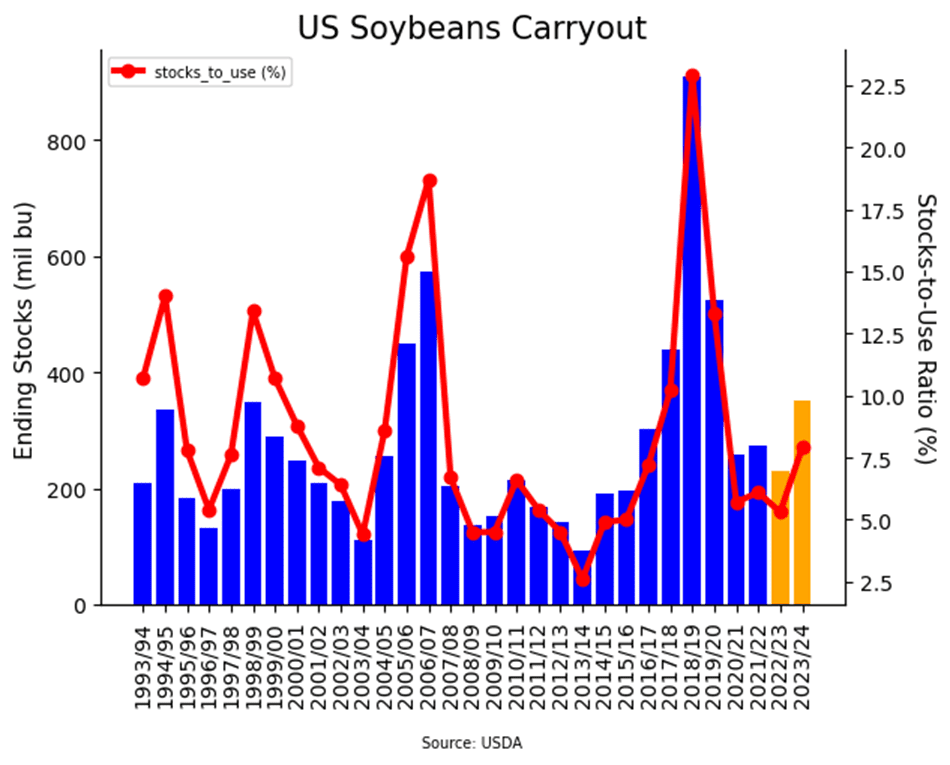

- Today’s WASDE report held essentially no surprises. The USDA lowered Argentinian production to 25 mmt from their previous estimate of 27 mmt, but that is likely still too high. Brazilian production was increased by 1 mmt to 156 mmt. In the US, soybean ending stocks were increased to 350 mb which was higher than the average trade guess.

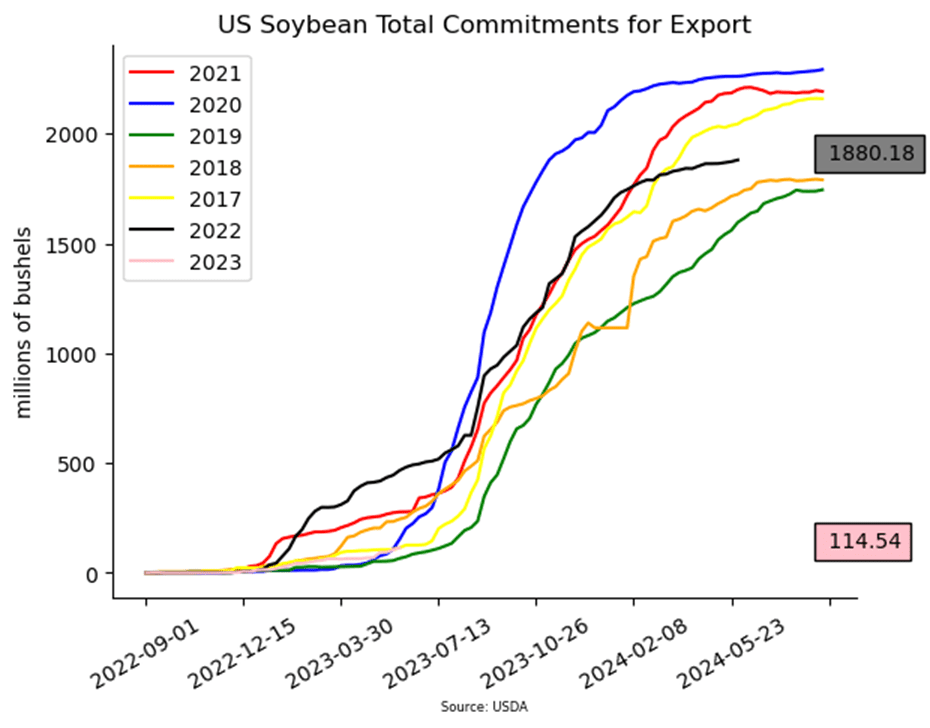

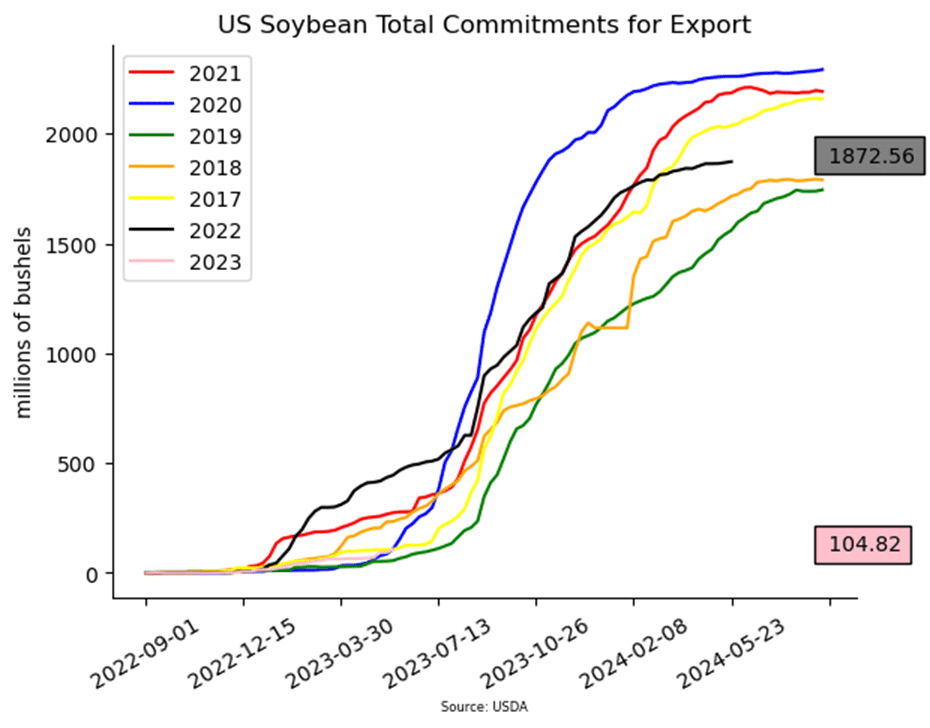

- Private exporters reported to the USDA export sales of 197,000 mt of soybeans for delivery to unknown destinations for the 22/23 marketing year. The marketing year for soybeans began on September 1.

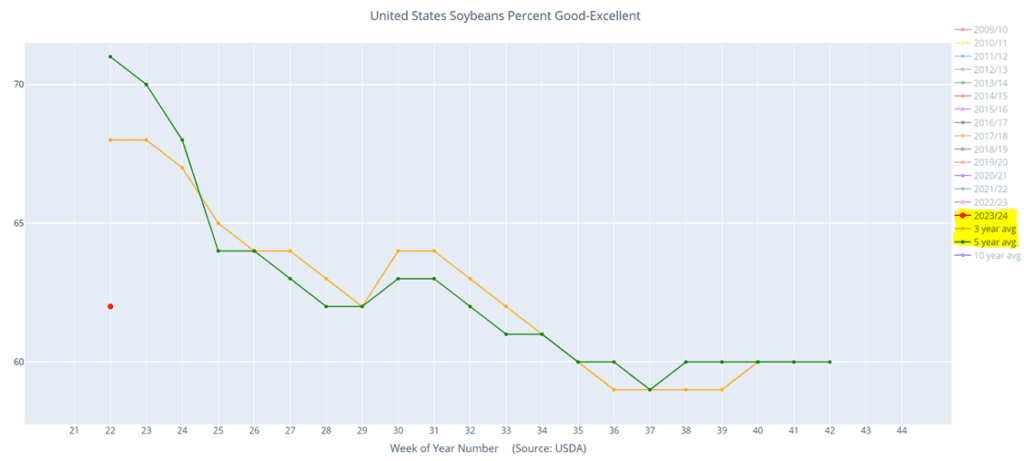

- Now that the WASDE is out of the way with very little reaction, traders will turn their focus back to weather. Forecasts for the Corn Belt this weekend and into the next week call for rain, but it may only be around 1 inch. If rains don’t fall this weekend, prices could easily move higher.

Above: After a strong close last week, July soybeans will look for follow-through momentum to turn around a down-trend that has been in place since April. This week’s strong close above the 20-day moving average is a great sign of a short-term trend change higher. If prices were to set back, support should be found near 1340 with nearby resistance near the 1420 area.

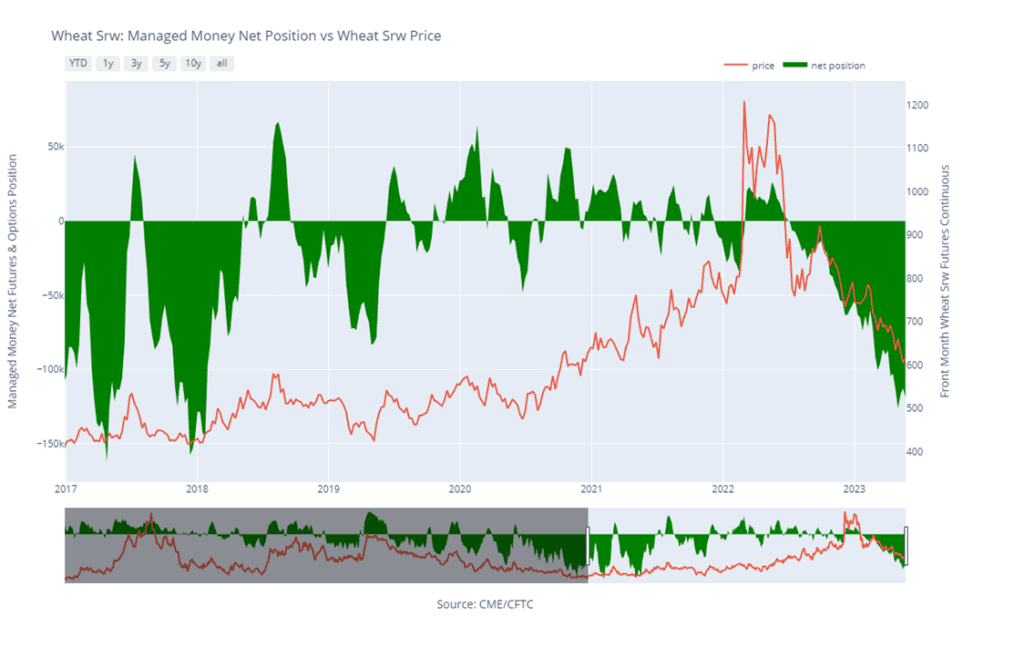

Wheat

Market Notes: Wheat

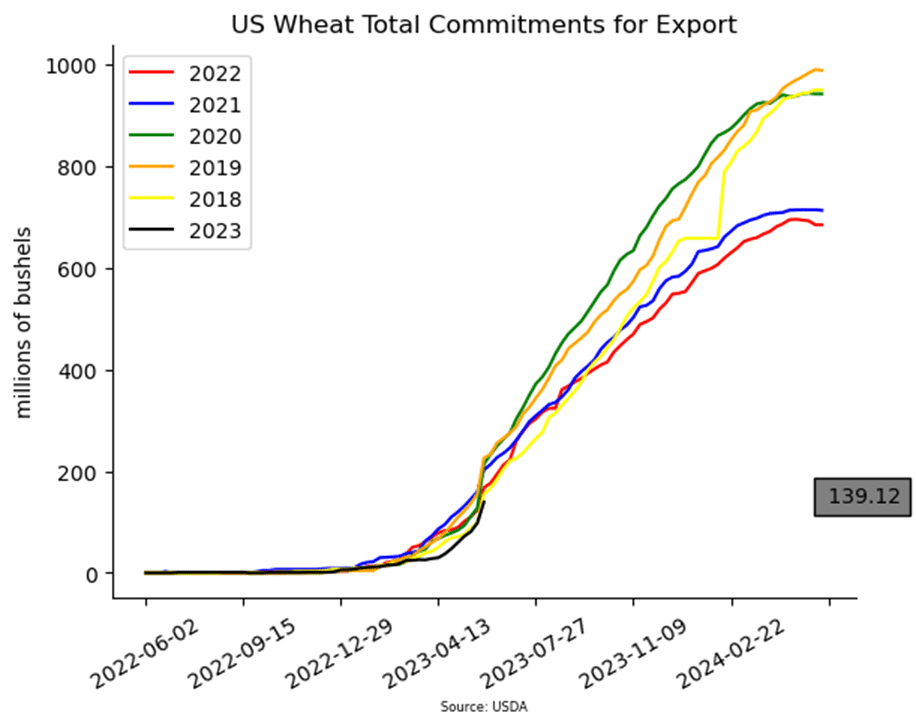

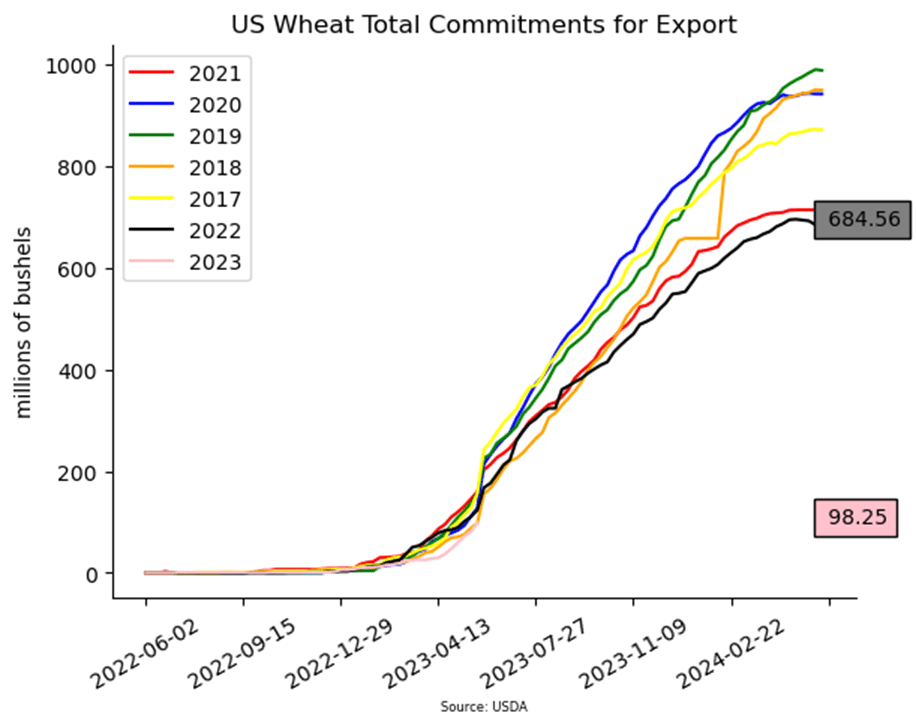

- All eyes were on today’s USDA report which was overall neutral. Despite this, Chicago wheat posted small gains at the close alongside Paris milling wheat futures. Kansas City and Minneapolis contracts were lower, however.

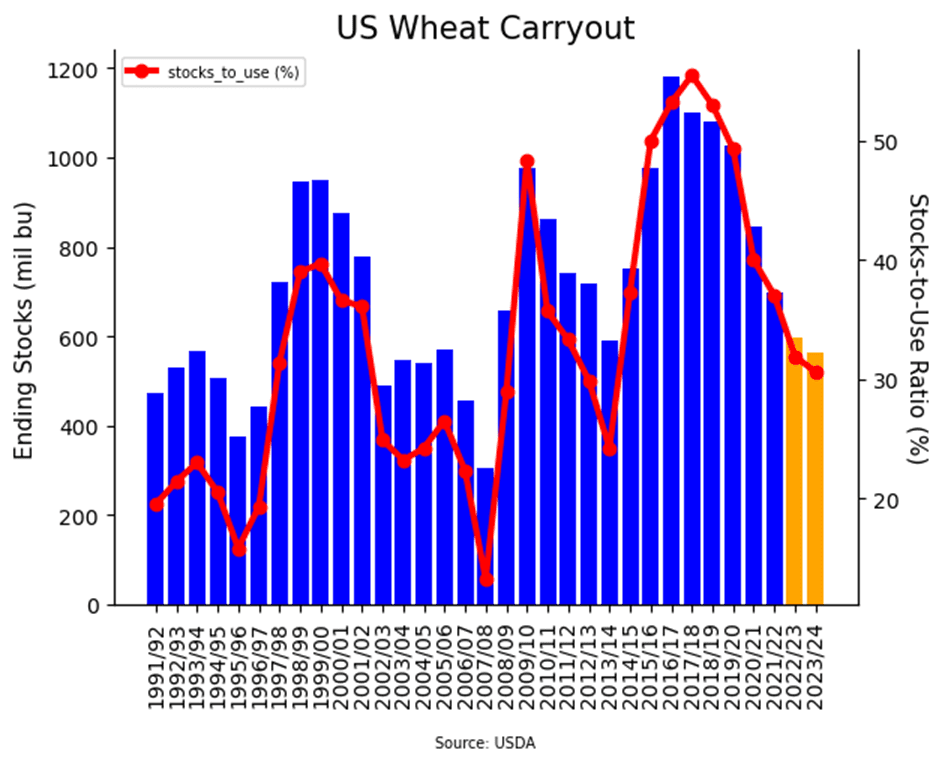

- The US 23/24 all wheat production was raised slightly from 1.659 bb in May, to 1.665 bb on today’s report.

- The US 22/23 wheat carryout was unchanged at 598 mb. However, it was raised slightly for 23/24, from 556 mb in May to 562 mb in June, due to a slight increase in overall production.

- The USDA estimated the average US wheat yield at 44.9 bpa, up from 44.7 last month. However, this is lower than the average yield last year of 47.0 bpa.

- Russian wheat production was raised by 3.5 mmt to 85.0 mmt, and Ukraine was raised 1.0 mmt to 17.5 mmt. India and the European Union also saw increases to their overall wheat harvest estimates.

Chicago Wheat Action Plan Summary

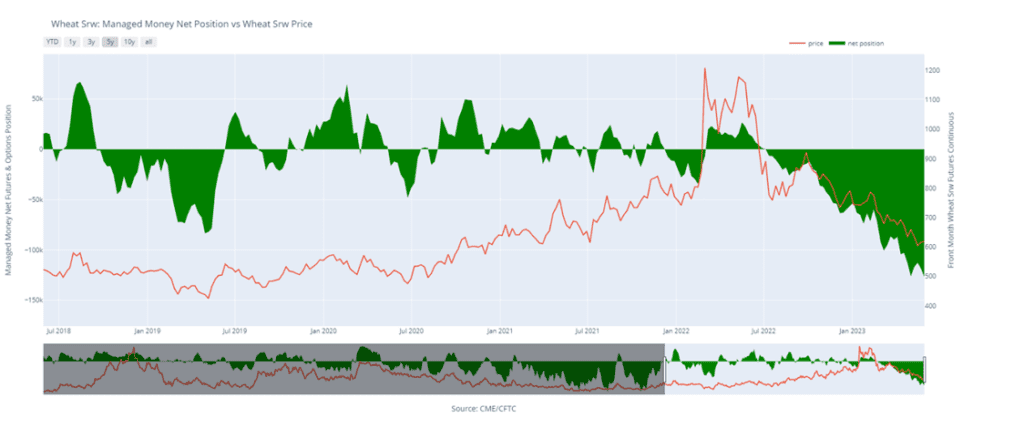

- No new action is recommended for the 2022 crop. The market is down more than 300 cents from its October high and has become extremely oversold. With good price action to start June, the market may be positioned for a short covering rally as new crop harvest quickly approaches. We continue to eye the 640 – 670 range to clean up and market any remaining Old Crop inventory.

- We recommend not taking any action on the 2023 crop at this time. While the window of opportunity is quickly closing for Old Crop, it is still wide open for better opportunities ahead for New Crop. We are currently targeting a more aggressive window of 720 – 800 to suggest advancing sales and move more New Crop inventory.

- No new action is recommended for the 2024 crop at this time. Prices have rallied nicely off of lows to start the month of June. With continued Black Sea tensions July of 2024 futures prices should be able to build off of the recent lows. We are currently targeting the 750-775 area to advance further on sales.

Above: The market appears to have put in short-term lows to end the month of May near the 575 level. A close above the 660 area would be a supportive sign of a trend change to higher. The next area of possible support, if the late May lows do not hold, would be below the market near the September ’20 low of 533-1/4. Resistance above the market could be found between 670 and 724.

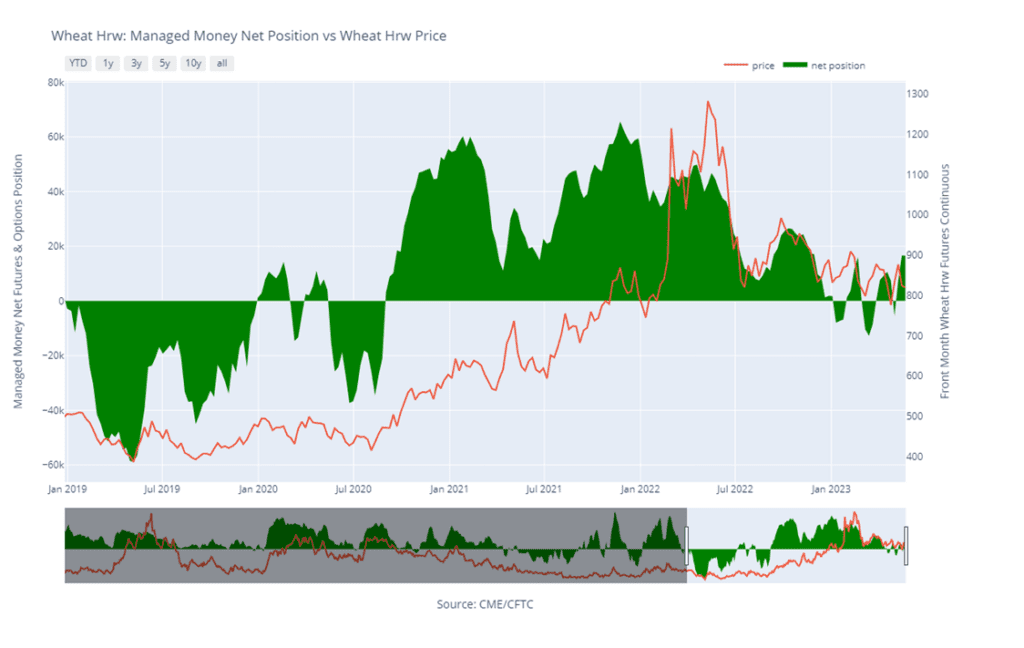

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

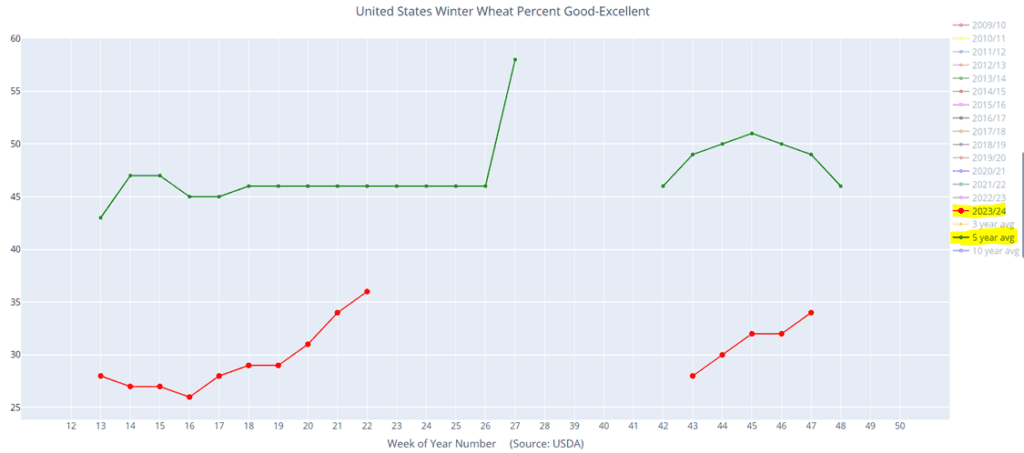

- We continue to look for better prices before making any 2023 sales. Crop ratings overall are at historically low levels, and production concerns persist. Additionally, any unforeseen geopolitical changes in the Black Sea region could cause the market to bounce and retrace 25% towards the 2022 high.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: Last week Wednesday’s bullish reversal indicates that there is support near 760. US harvest selling pressure should keep upside limited to any near-term rallies. Resistance may be found above the market between 833 and 850, with further support resting below the market near 736-1/4.

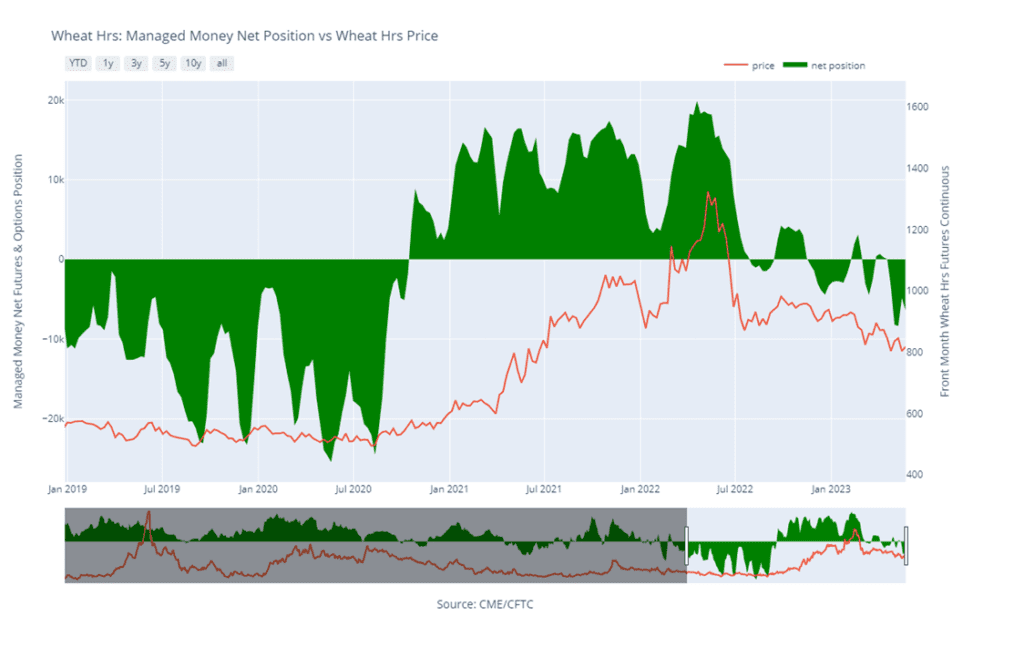

Mpls Wheat Action Plan Summary

- No action is currently recommended for the 2022 crop. With planting concerns and a seasonal tendency for old crop prices to increase over the next 4-5 weeks, we are continuing to wait for better prices to develop. The calendar is becoming a constraint though, and we’ll be looking to part with any remaining old crop bushels by mid-June or so.

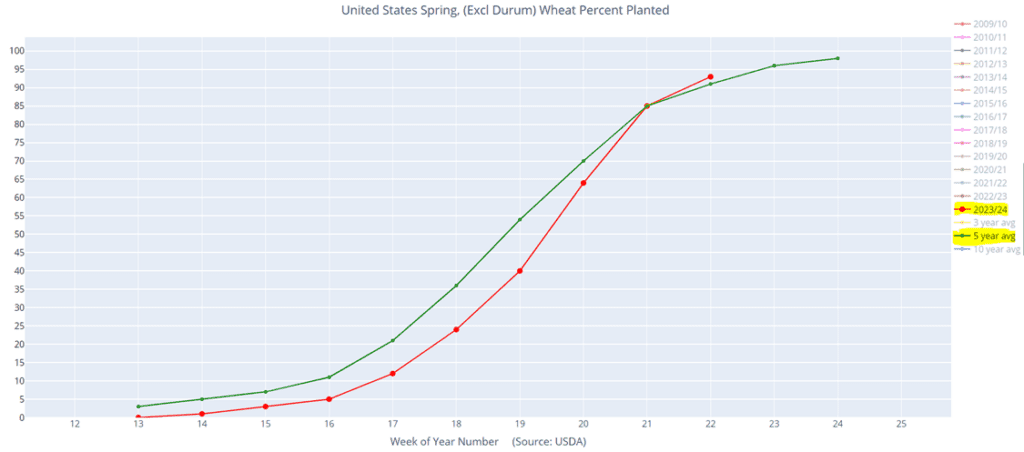

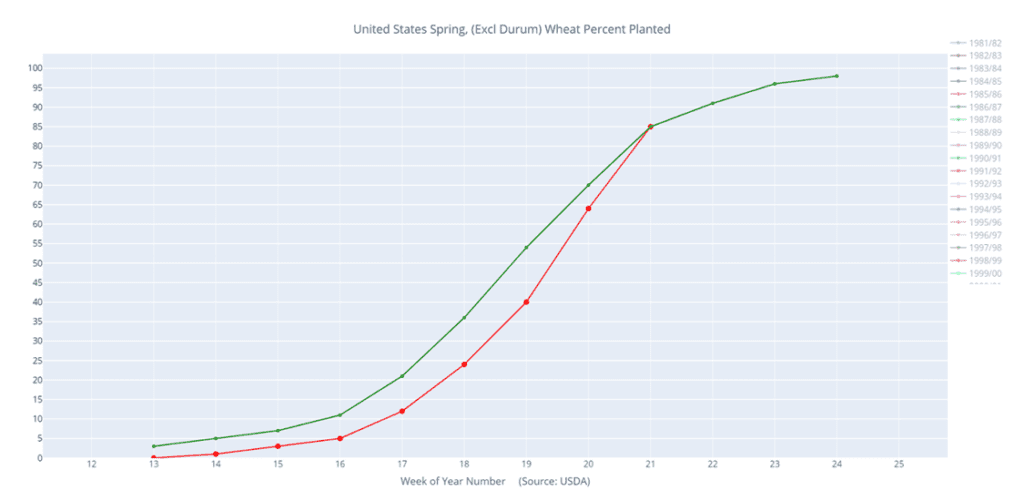

- No action is recommended on the 2023 crop at this time. The September ’23 contract had a 120-cent range in the month of May where it found support just above 770. While the planting pace has largely caught up to the 5-year average, dryness in some areas is increasing. With the market still largely oversold and a full growing season ahead of us, we are not looking to make any sales right now.

- We continue to be patient to market any of the 2024 crop. The market for the 2024 crop continues to be illiquid, and it may be early summer before we post any recommendations, continue to be patient.

Above: The July contract continues to be weak and showing signs of being oversold after breaking back below the 800 level this week. With winter wheat harvest on the horizon, spill over selling pressure could plague the spring wheat market in the weeks to come. Resistance currently sits between 820 and 855 and then the recent high of 888-1/2. Support below the market may be found between 770 and 760.

Other Charts / Weather