Grain Market Insider: June 26, 2023

All prices as of 1:45 pm Central Time

Grain Market Highlights

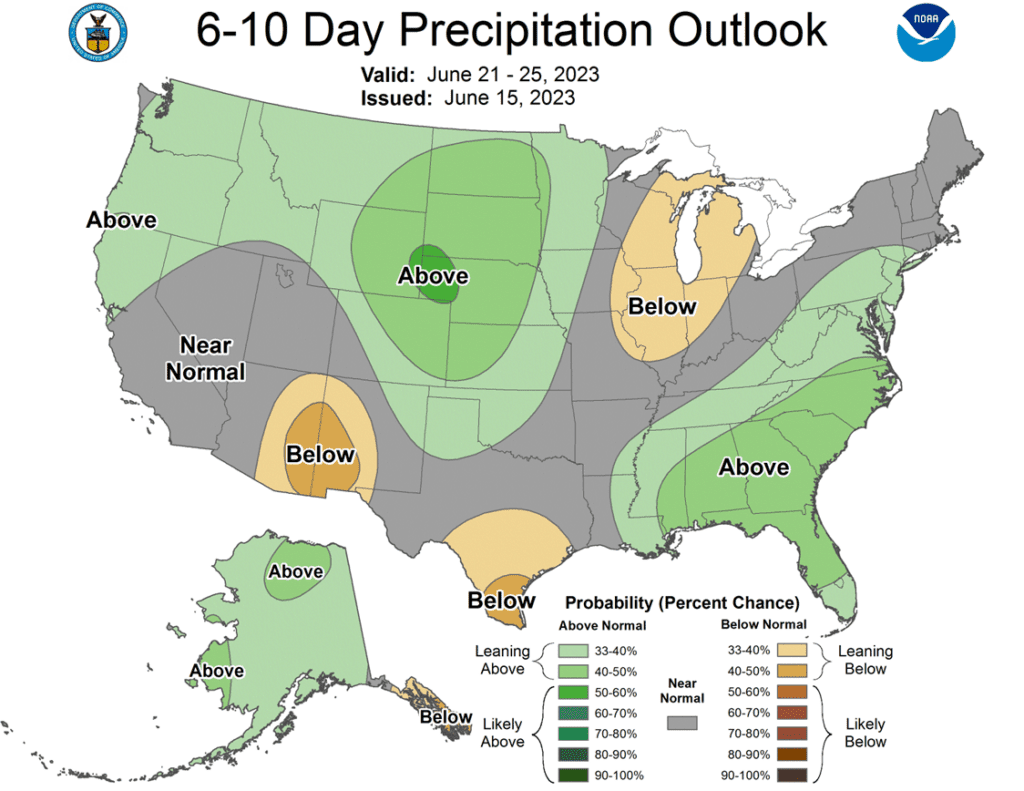

- Disappointing rainfall and the anticipation of lower crop ratings in this afternoon’s Crop Progress report kept the corn market on the positive side of unchanged for most of the day, while weak export inspections weighed on the market.

- Gaining support from a lack of rain in some key soybean growing areas and a strong soybean oil market, soybeans closed the day higher with Old Crop leading New Crop.

- Soybean oil continued its rally from last Thursday’s bullish reversal, with additional support from higher palm oil. As for soybean meal, it saw both sides of unchanged and up to $6.10 higher before settling back to close in the green by 60 cents.

- Globally, central banks are hawkish and continue to talk about raising rates which could trigger a recession, lowering demand for food and energy.

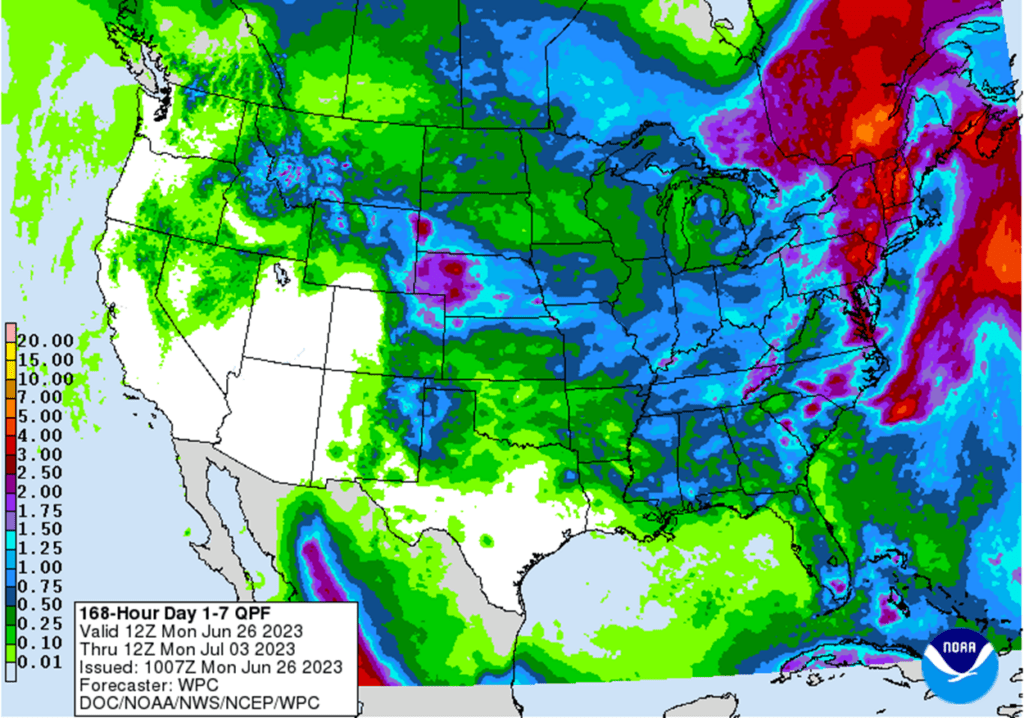

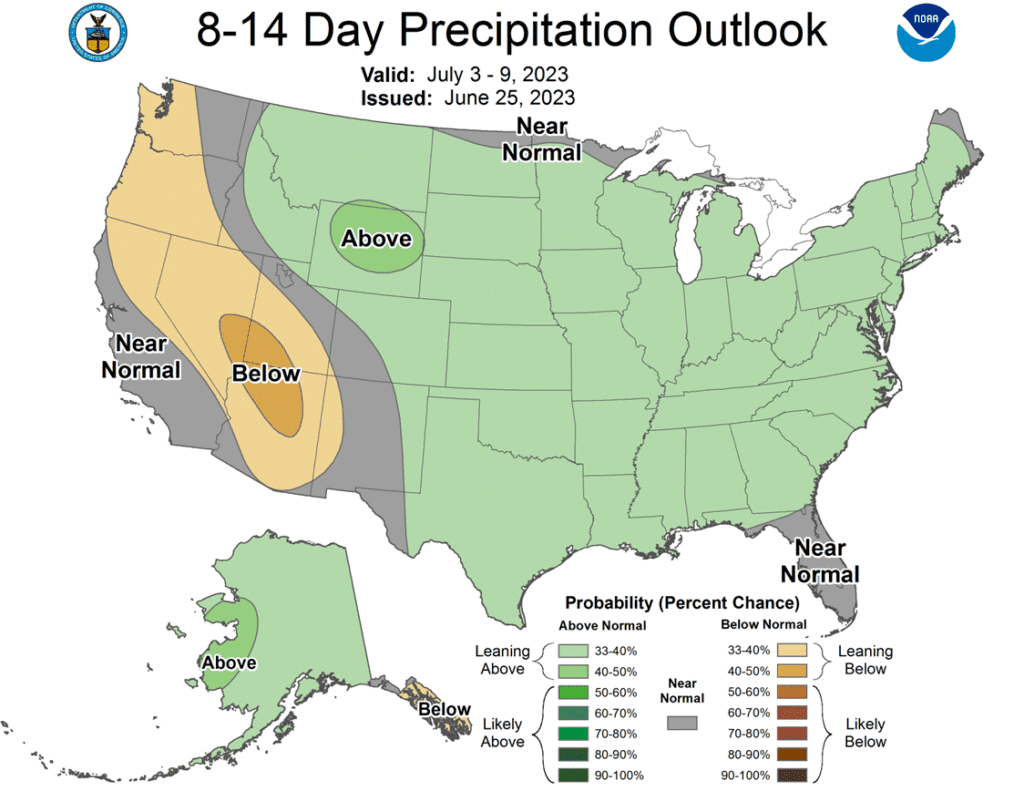

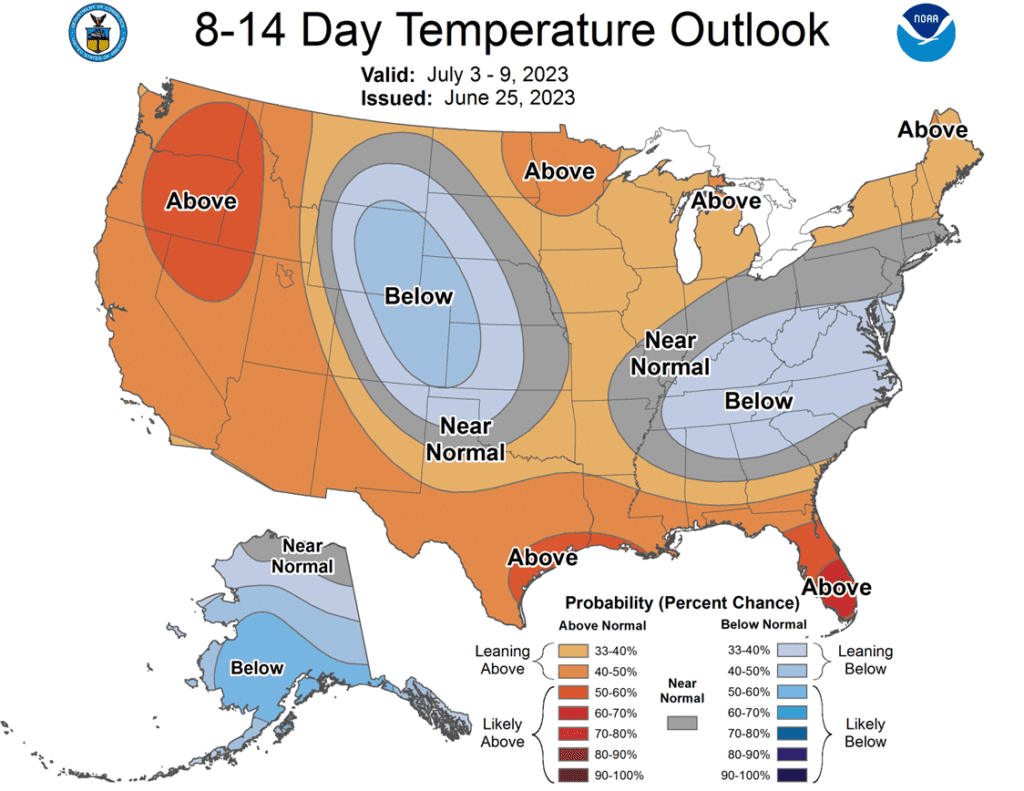

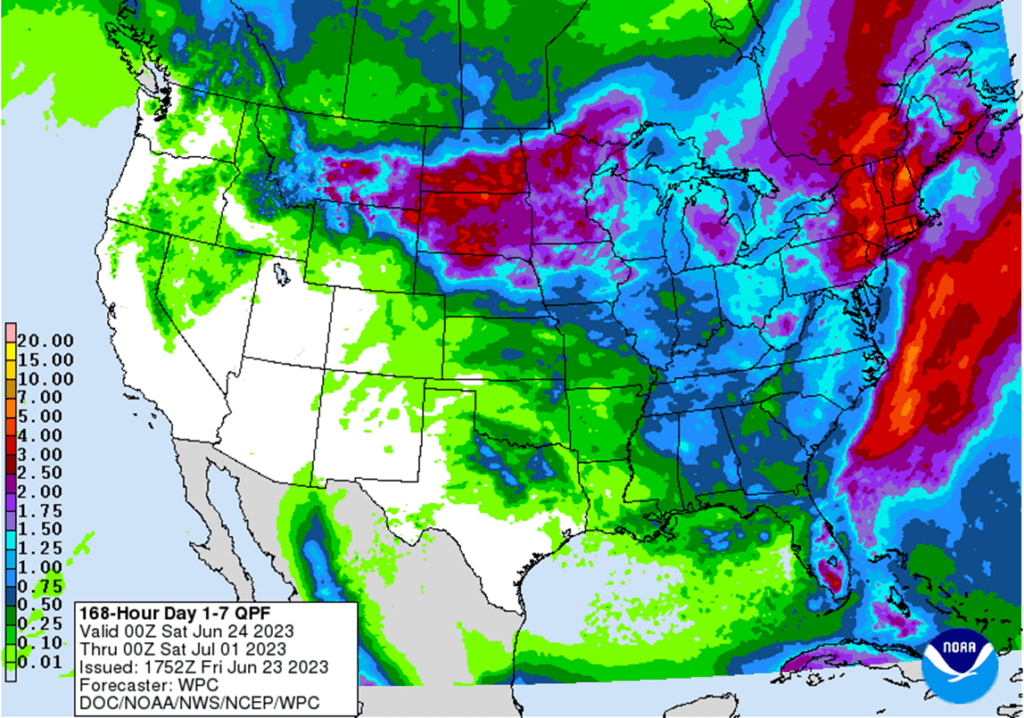

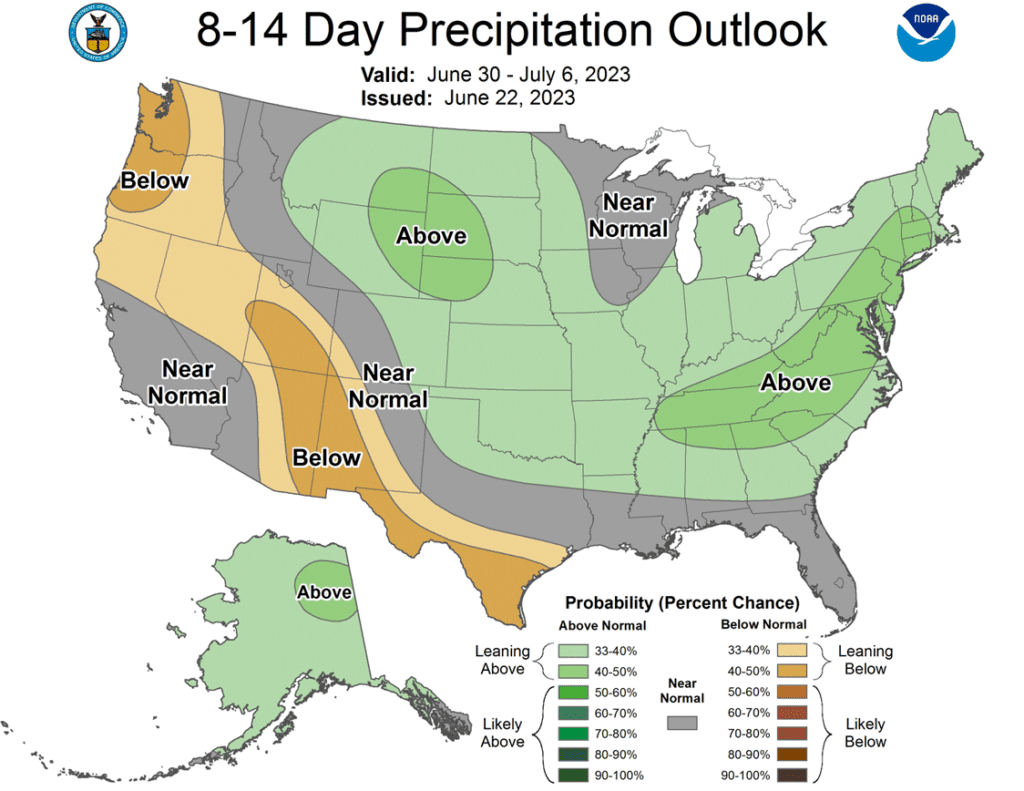

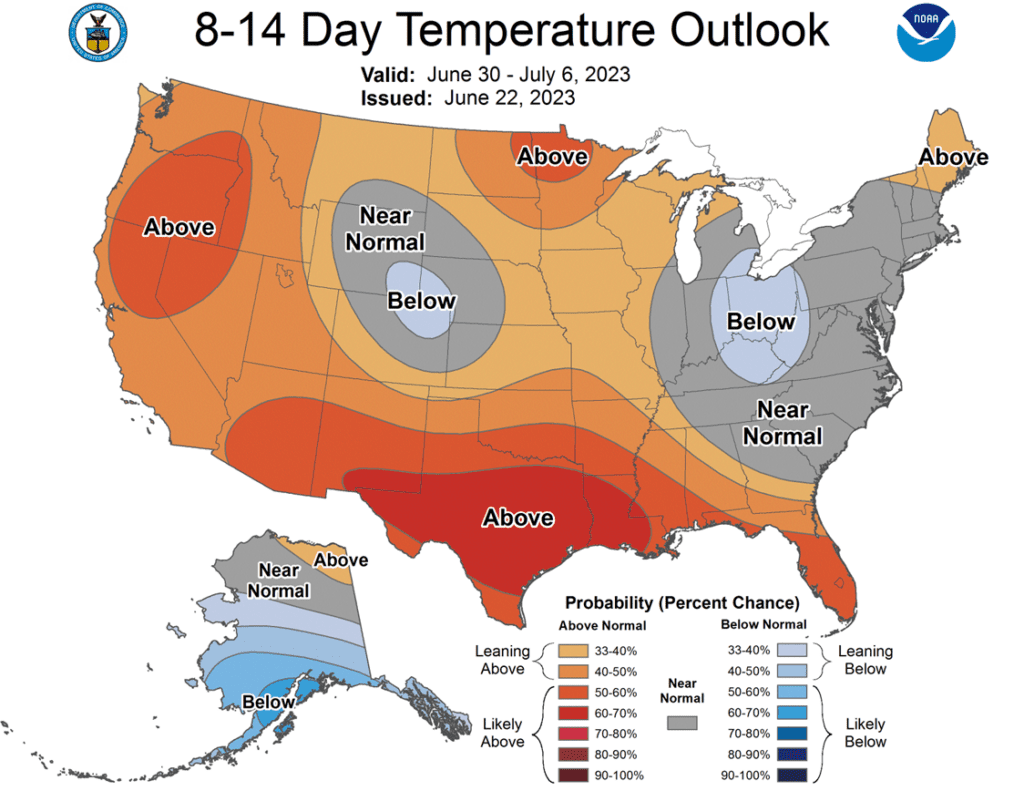

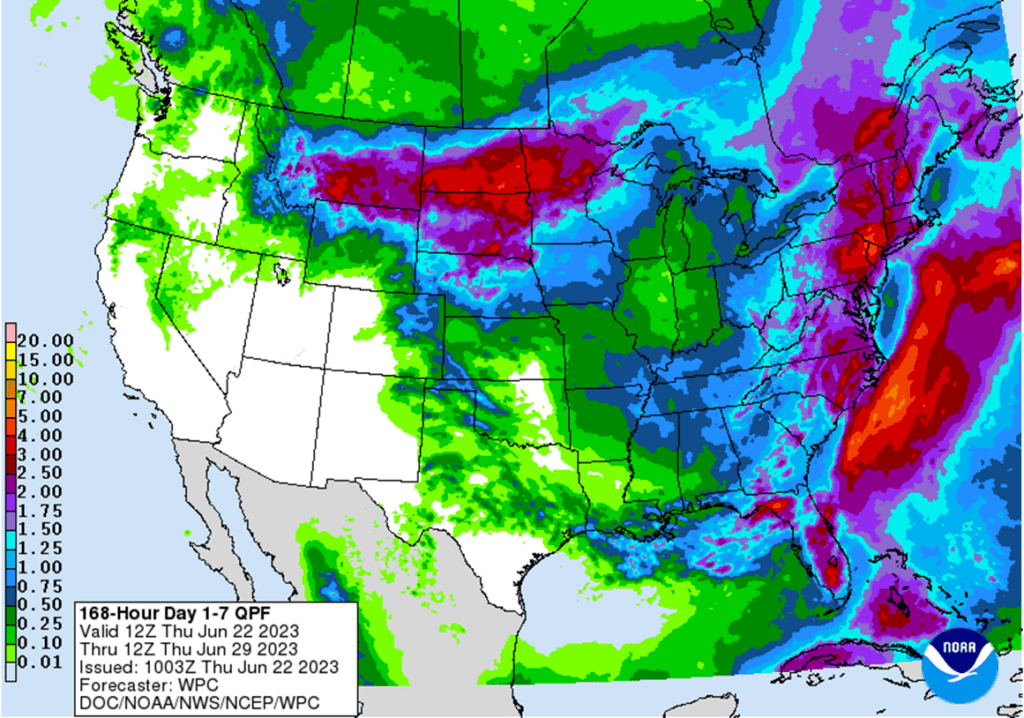

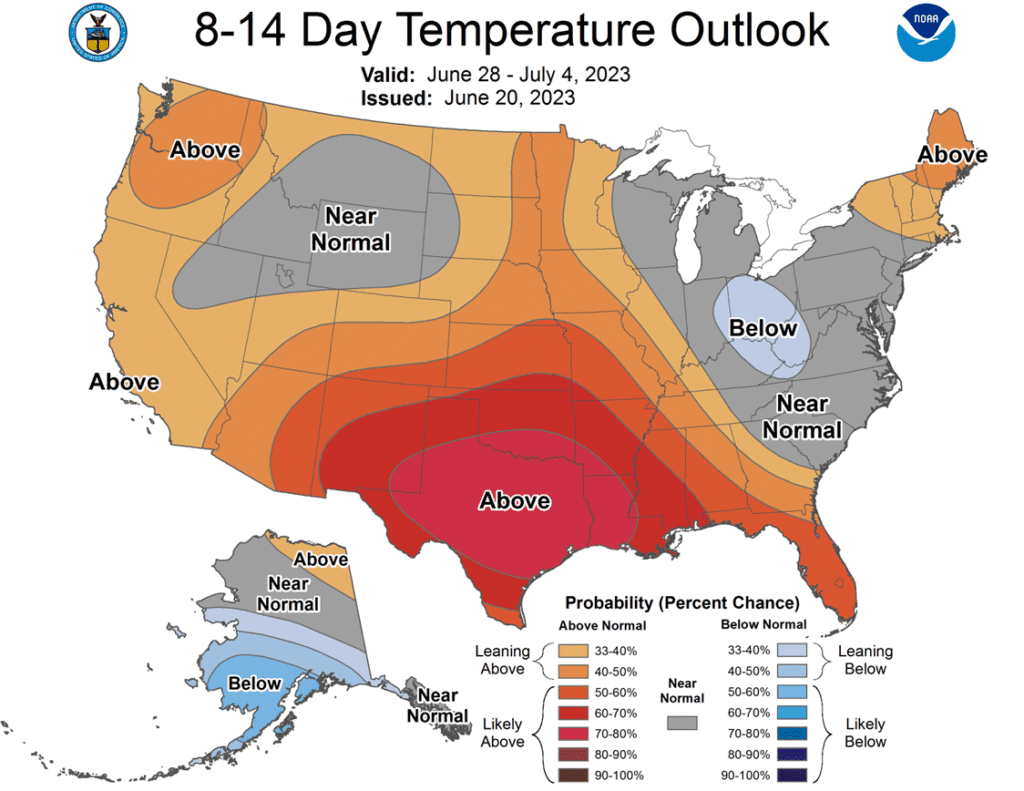

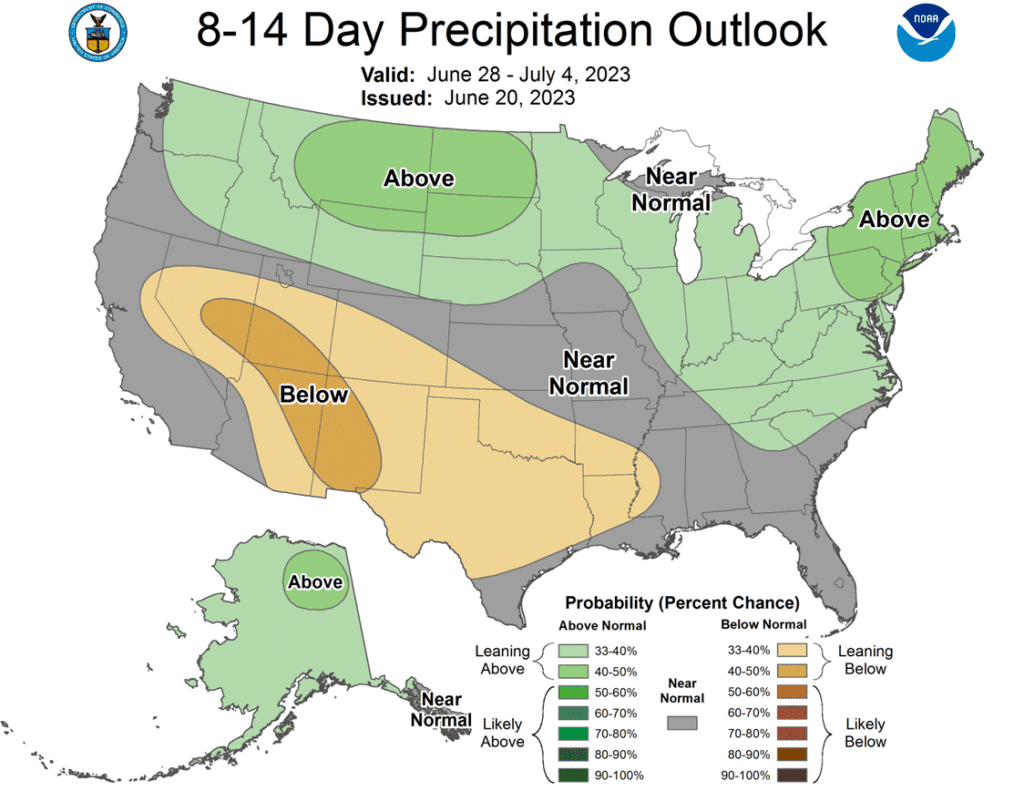

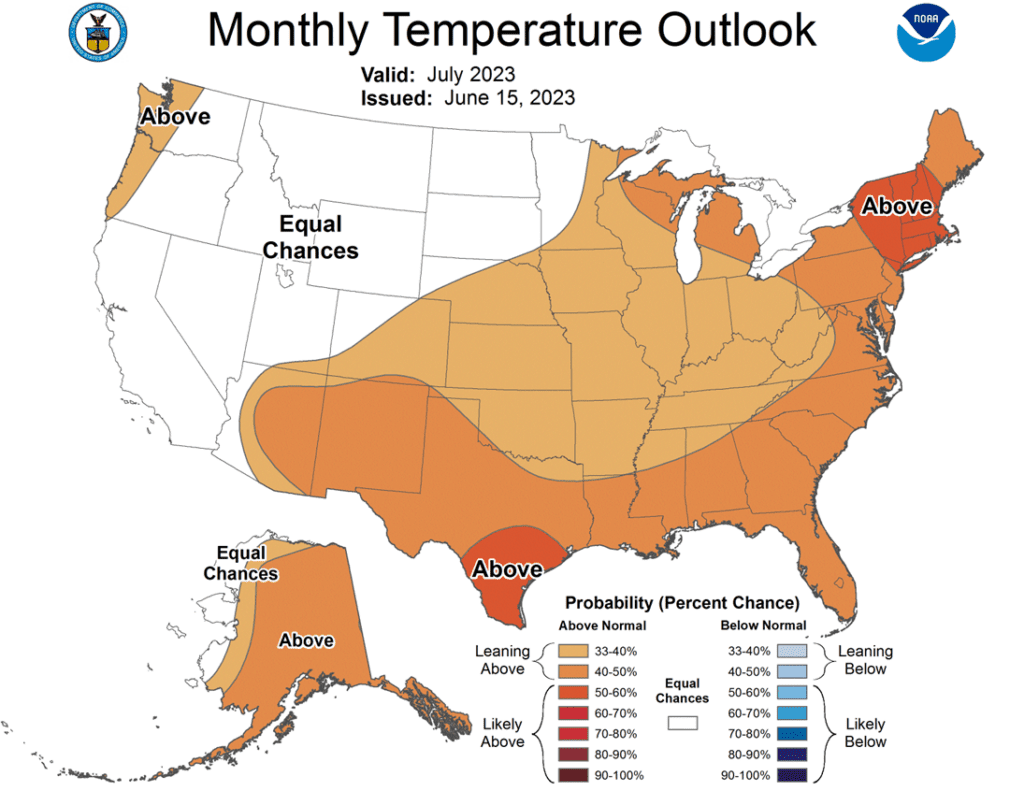

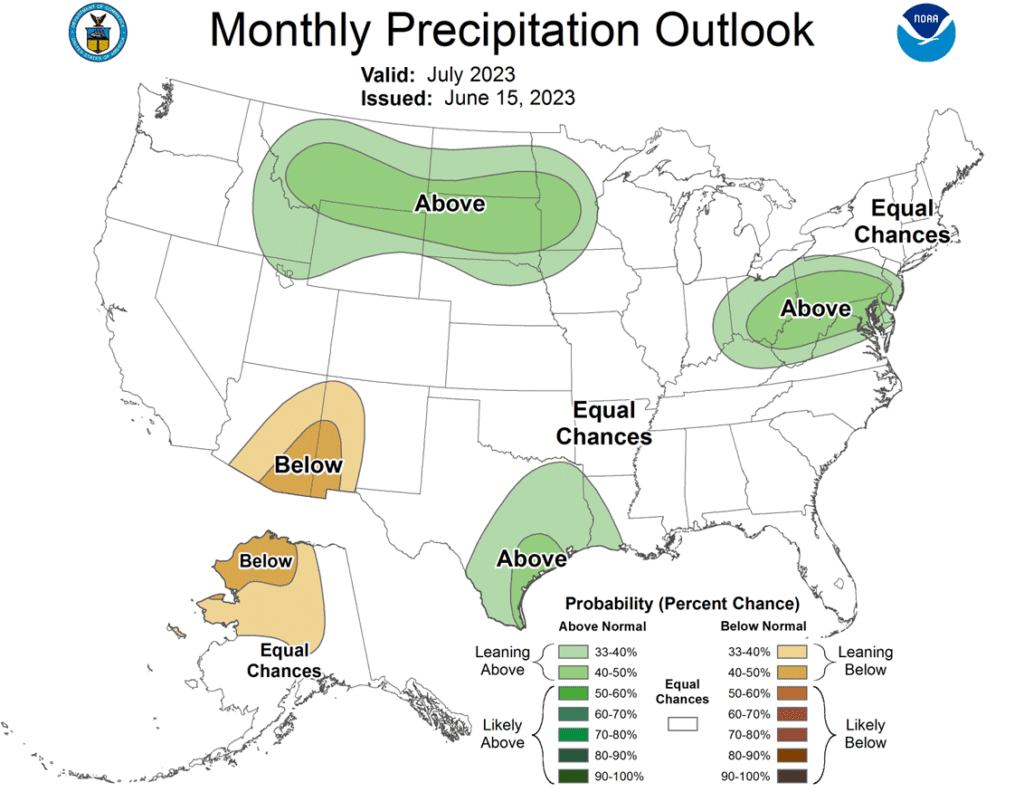

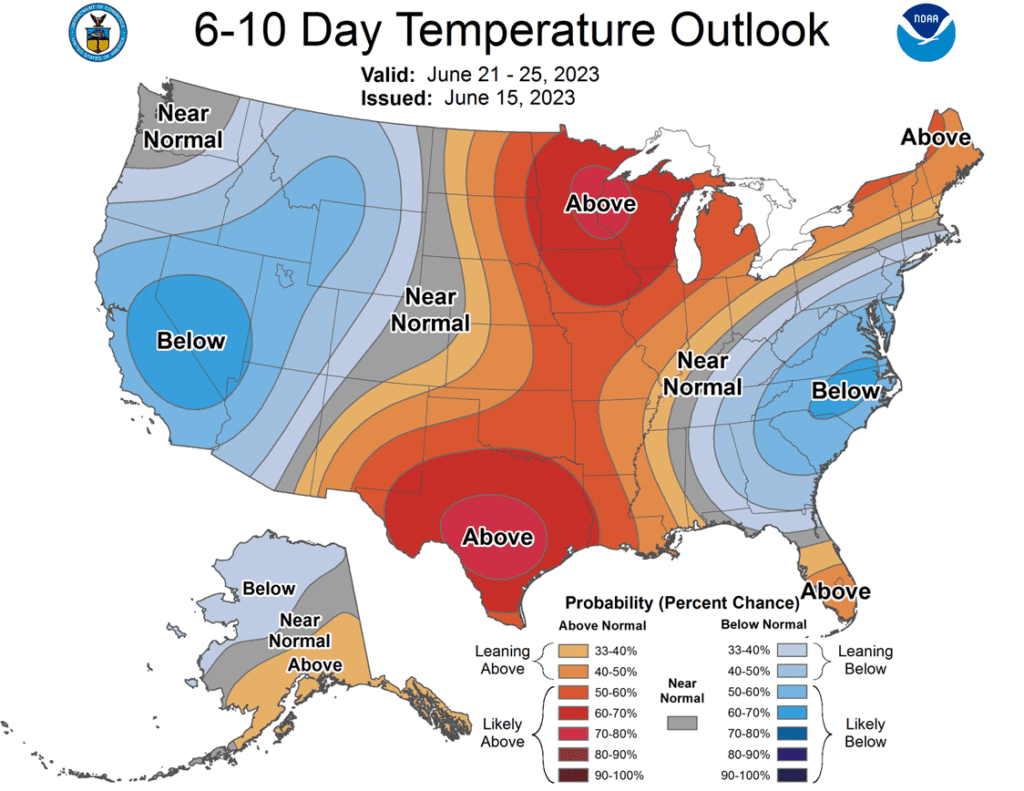

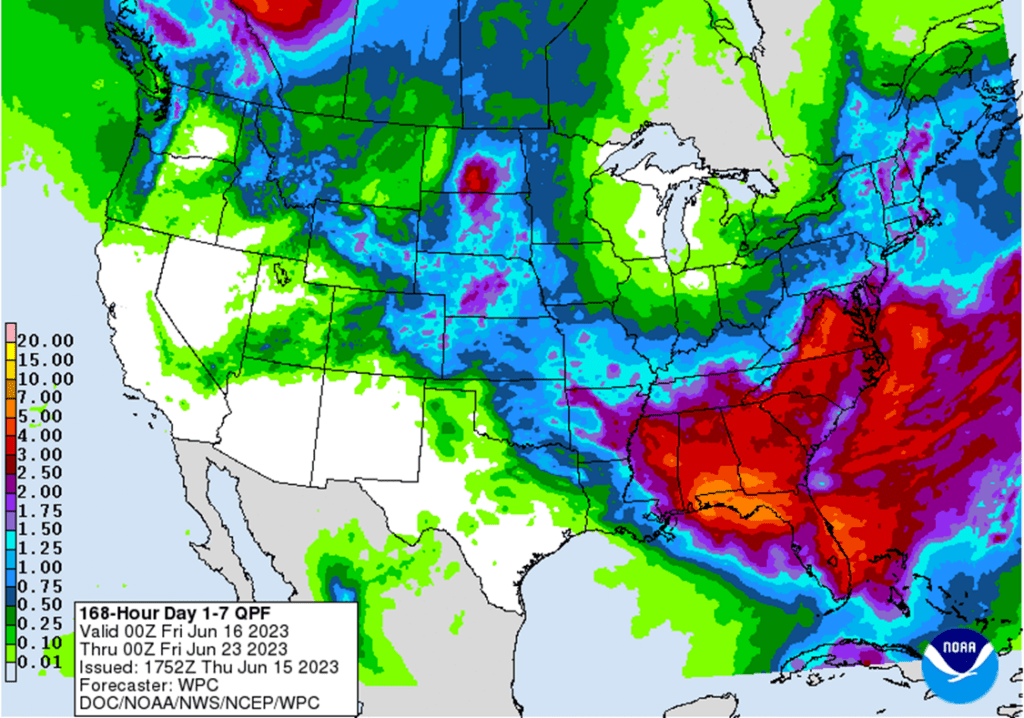

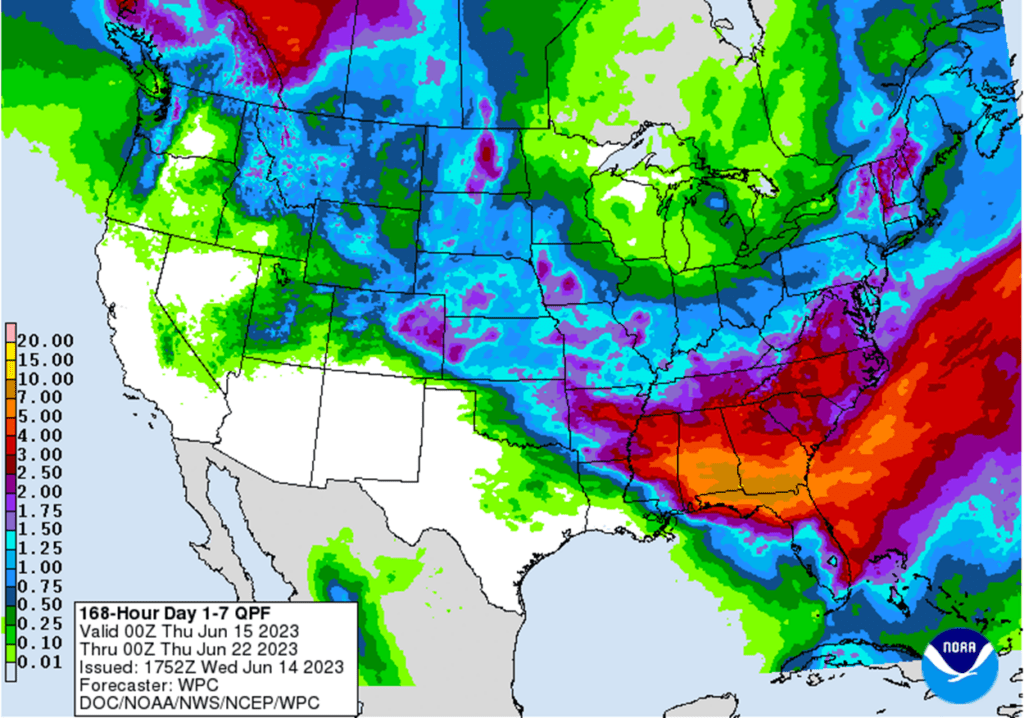

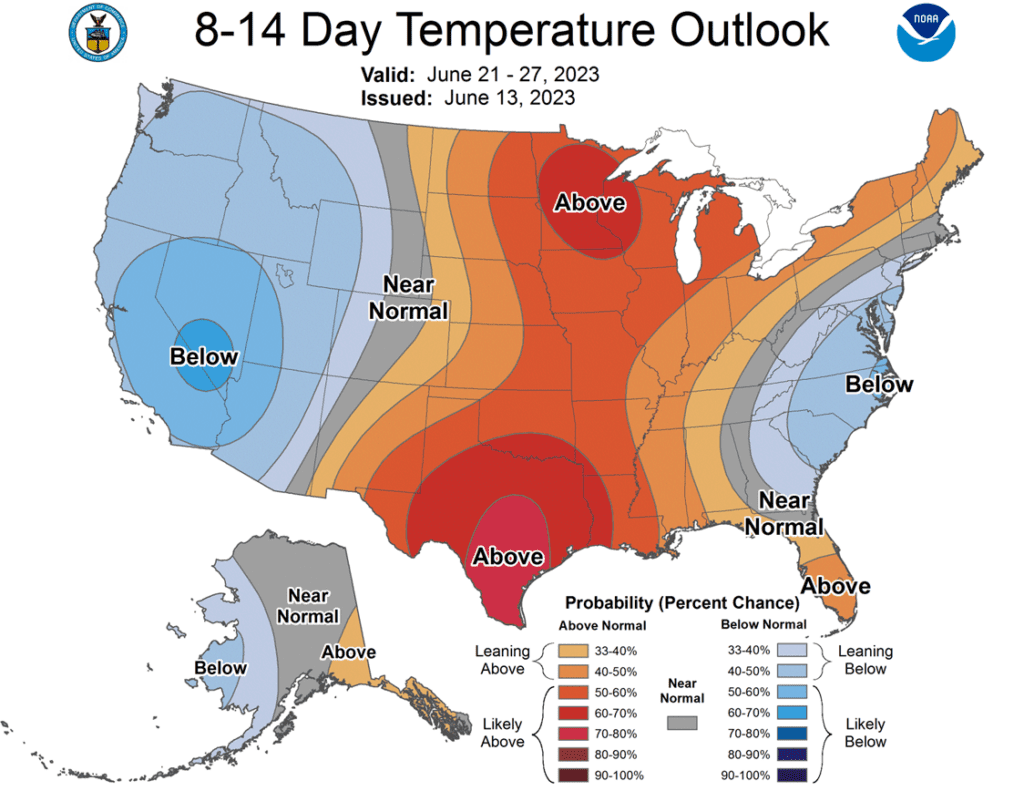

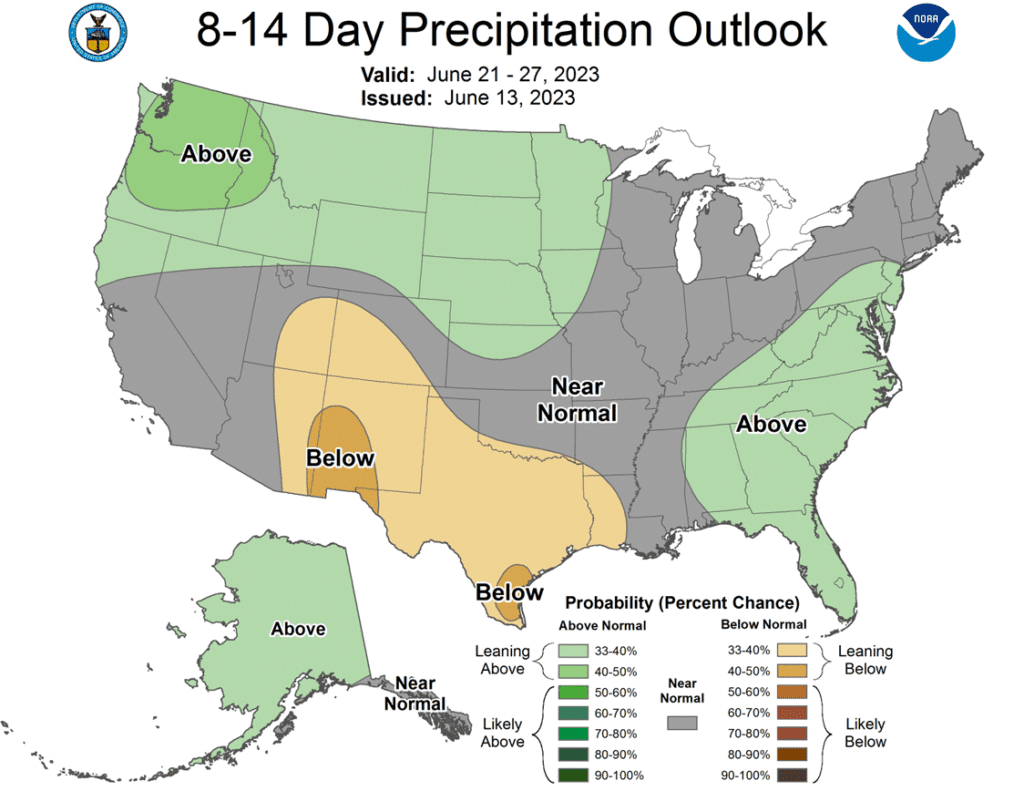

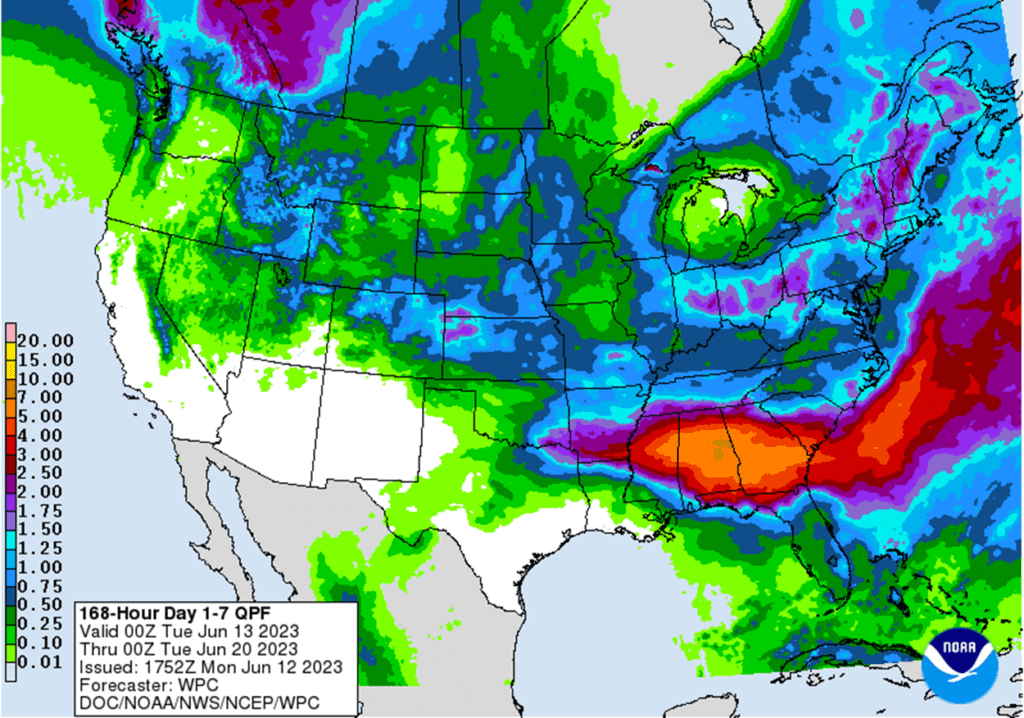

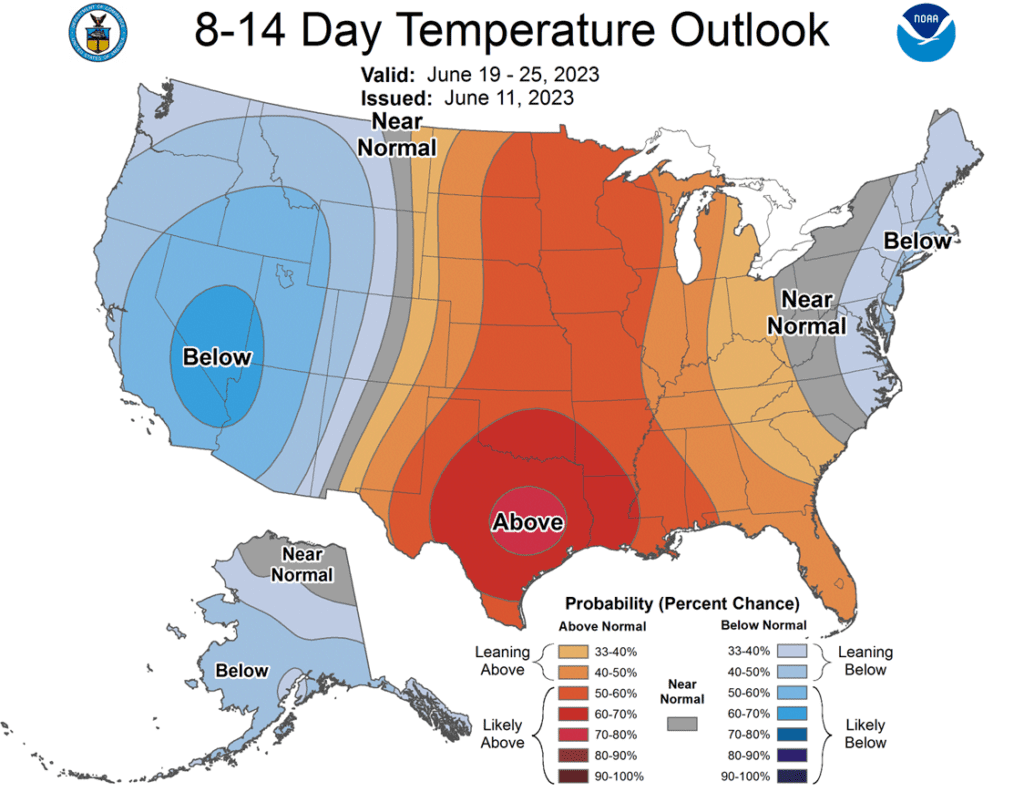

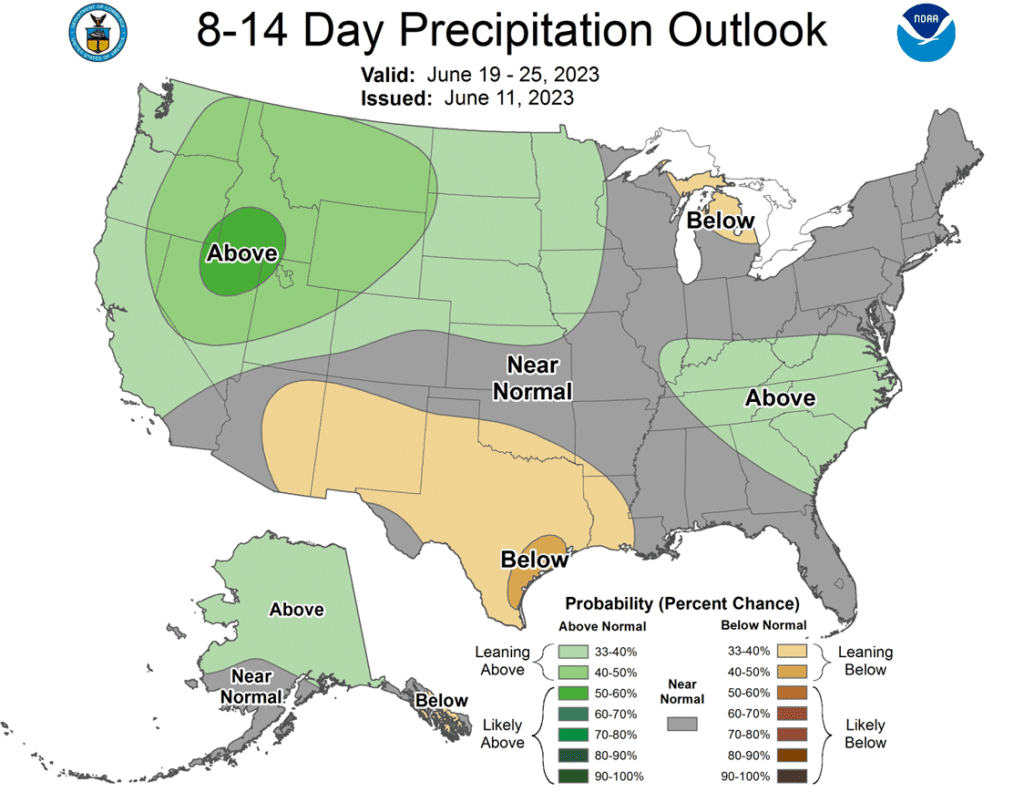

- To see the current US 7 – day precipitation forecast and the US NOAA 8 – 14 day Precipitation and Temperature Outlooks scroll down to the Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

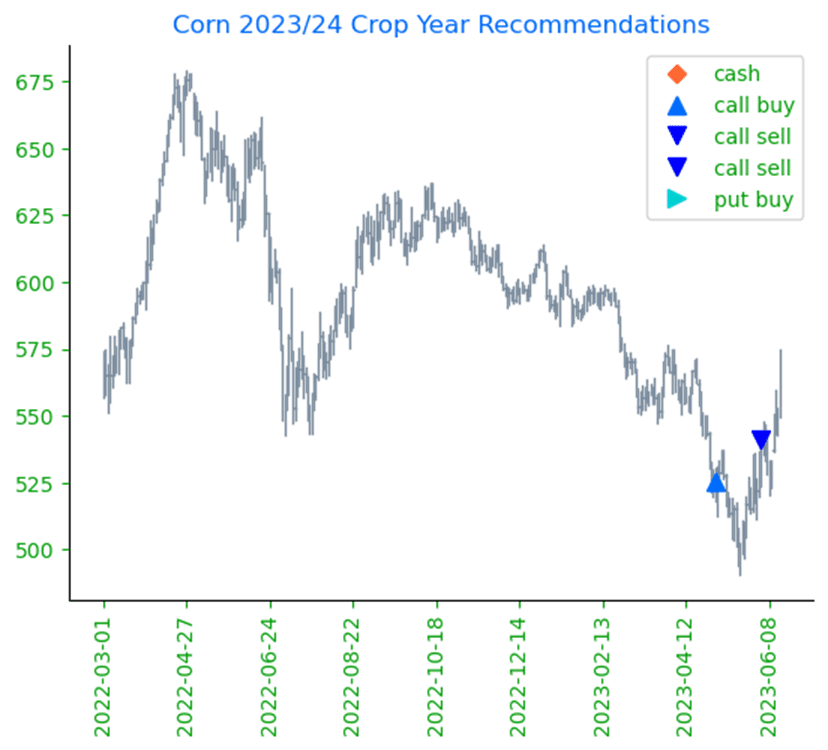

Corn

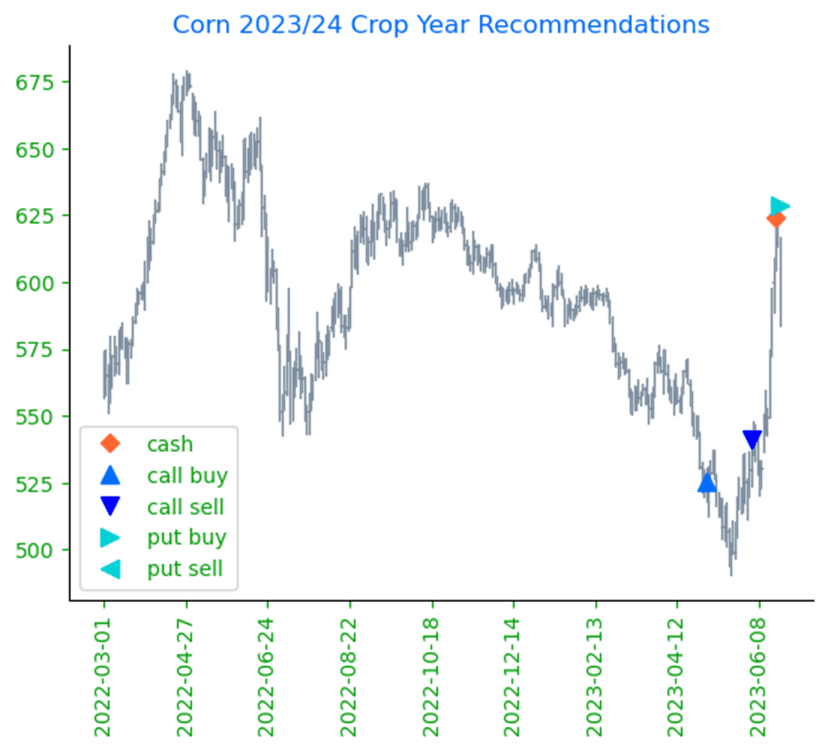

Corn Action Plan Summary

- No new action is recommended for Old Crop. Any remaining old crop bushels that you may have should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Corn — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

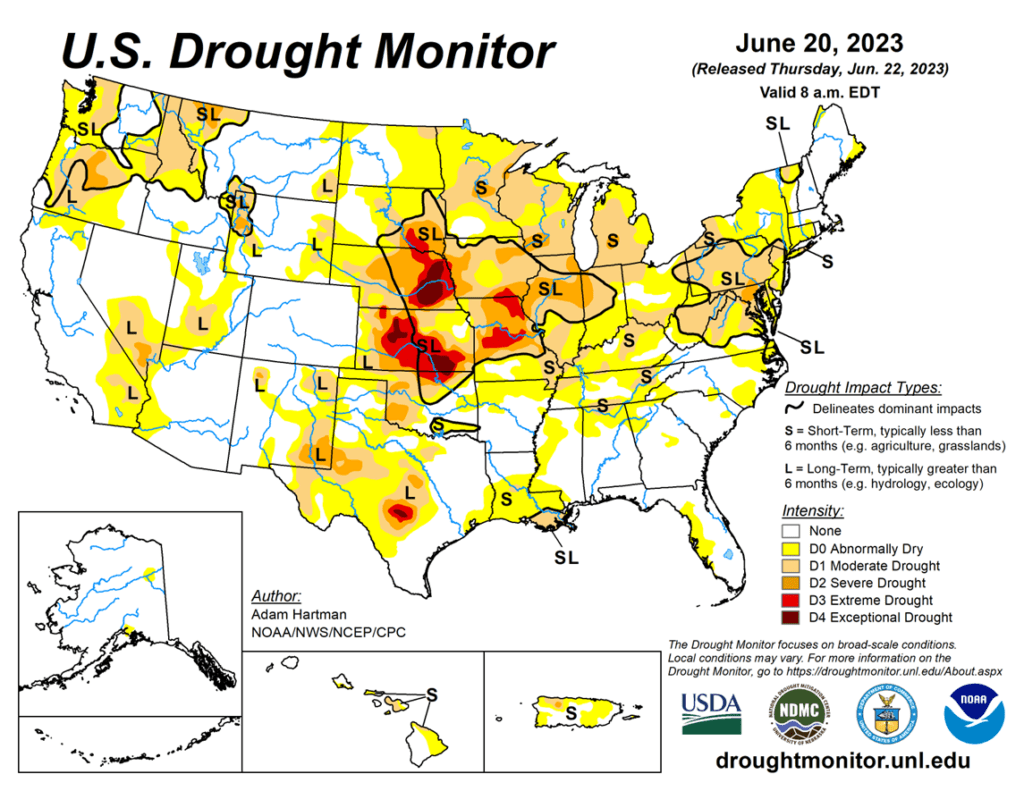

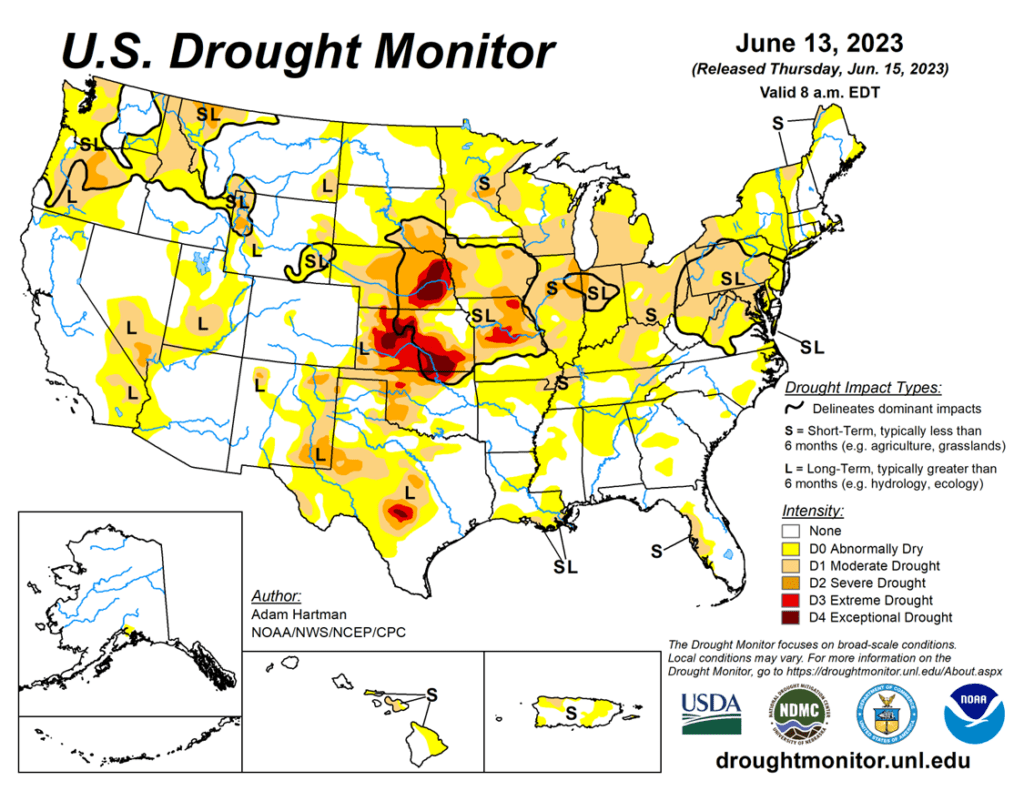

- No action is recommended for New Crop 2023 corn. December corn rallied 139 cents from its May 18 low to its high on June 21 on weather and productions concerns. The market is currently about 40 cents off that high as traders book profits and liquidate long positions on poor export sales figures and a forecast that shows increased chances of rain in the next two weeks. The US Drought Monitor still shows drought conditions across much of the Midwest and it is estimated that 64% of the corn crop is experiencing some level of drought and is in desperate need of rain. If you missed getting any sales made or adding Dec 23 580 puts before today’s sharp break, for now we are looking at a level north of 610 as a catchup opportunity.

- Continue to hold current sales levels for the 2024 crop year. The Dec 24 contract is trading weather much like the rest of the market and posted nearly an eighty-cent range between 5/18 and 6/21 as dry conditions affect the ’23 crop and the potential carryout for the 2024 crop year. We are currently eyeing the 670 – 700 level before we consider making additional sales recommendations for the 2024 crop.

- Corn futures finished the day mostly higher as prices tried to find a near-term bottom after last week’s disappointing end to the week. Corn futures were supported by overall weekend rainfall not hitting all key areas of the Corn Belt and the expectations of crop ratings slipping again this week.

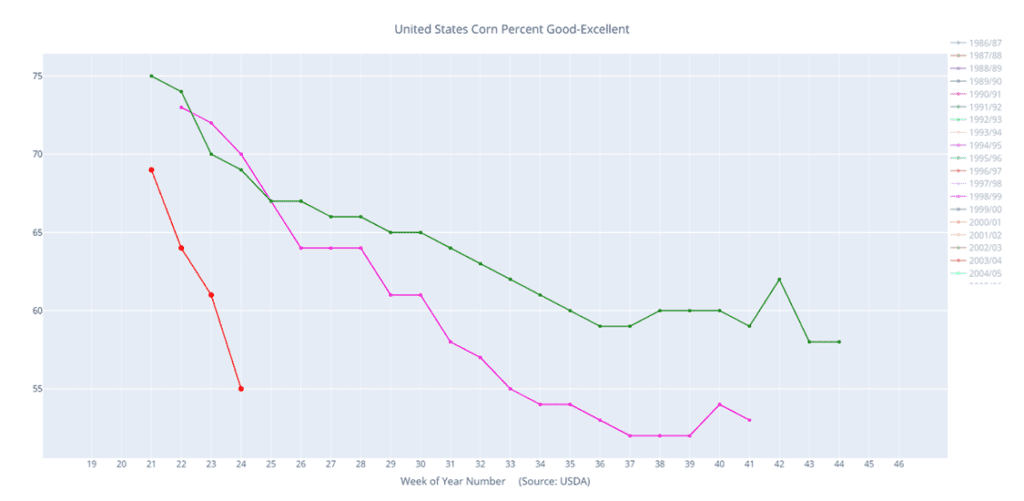

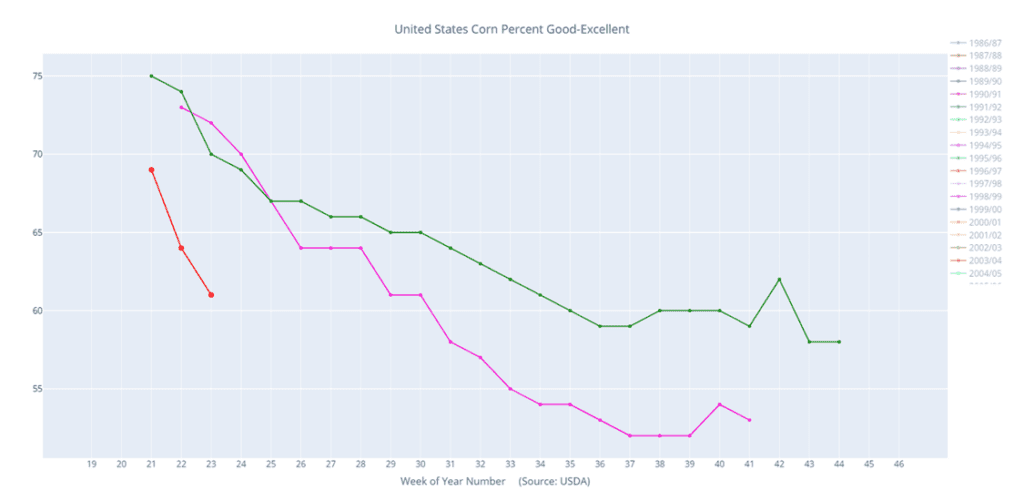

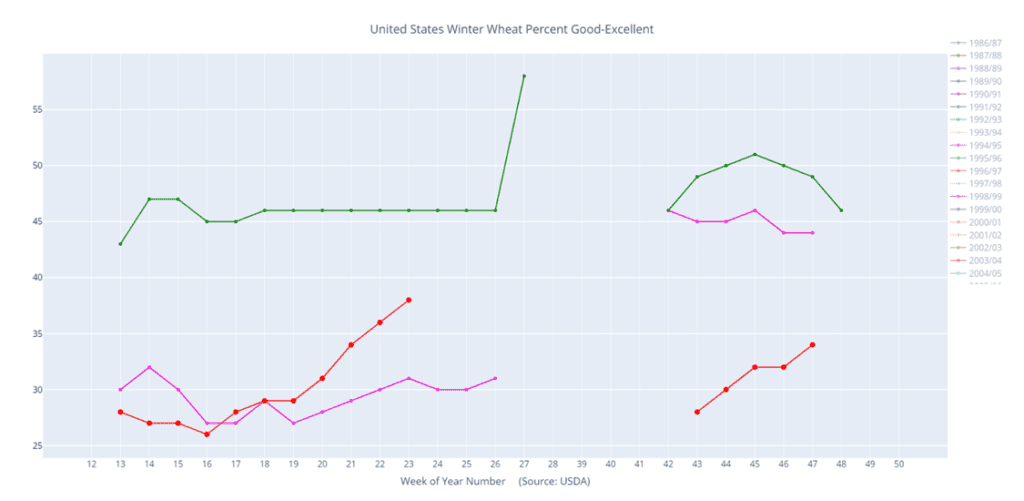

- The USDA will release weekly corn crop ratings on Monday afternoon. Expectations are for an additional drop to 52% good/excellent, down 3% from last week. The state of Illinois will stay as a focus of the market as rainfall missed many areas of the state and ratings were at 36% good/excellent last week, down 29% from the 5-year average.

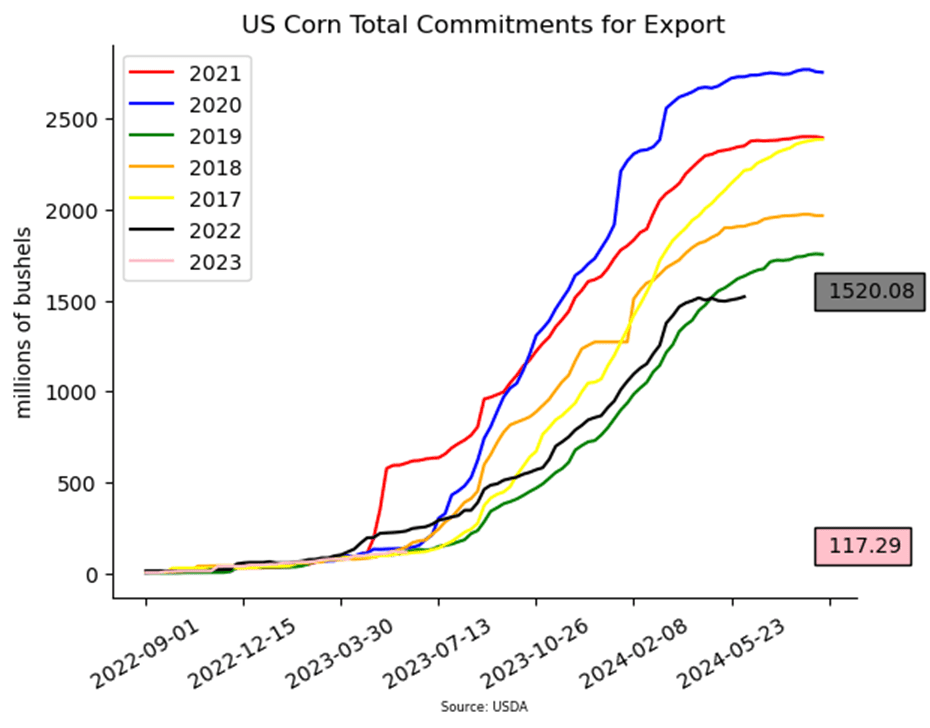

- Weekly corn export inspections were disappointing at 543,000 MT, and below market expectations. Year to date, corn inspections are still running 32% under last year’s pace.

- Weather models in the longer term are trying to build a wetter forecast, which could limit market gains if realized. The key to all forecasts will be the coverage and location of rainfall.

- The market may likely remain choppy as traders look to this Friday’s USDA Planted Acreage and Grain Stocks report.

Above: Weather is the dominant force for the corn market at this time. If the market can push through the 100-day moving average and the recent 625 high, it may be able to make a run for the March highs between 650 – 670. If not, support may be found between 580 and 540.

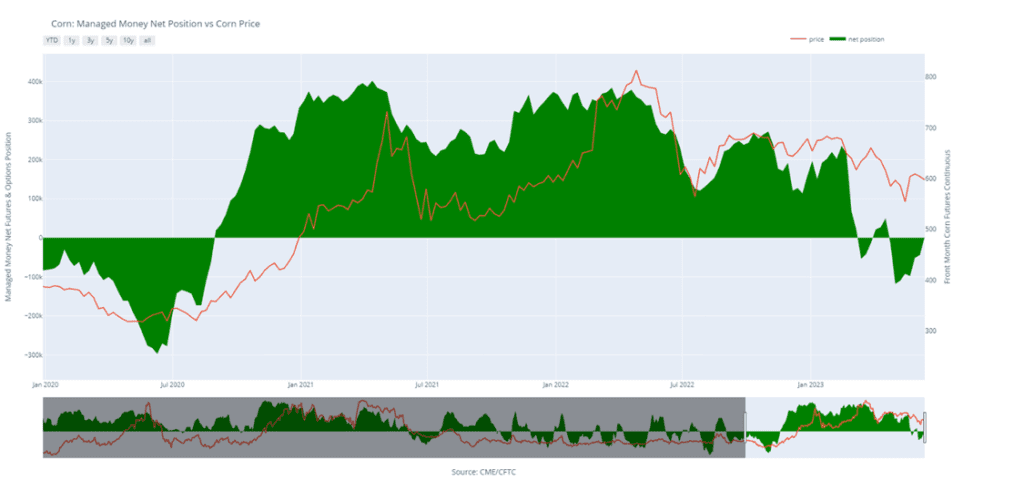

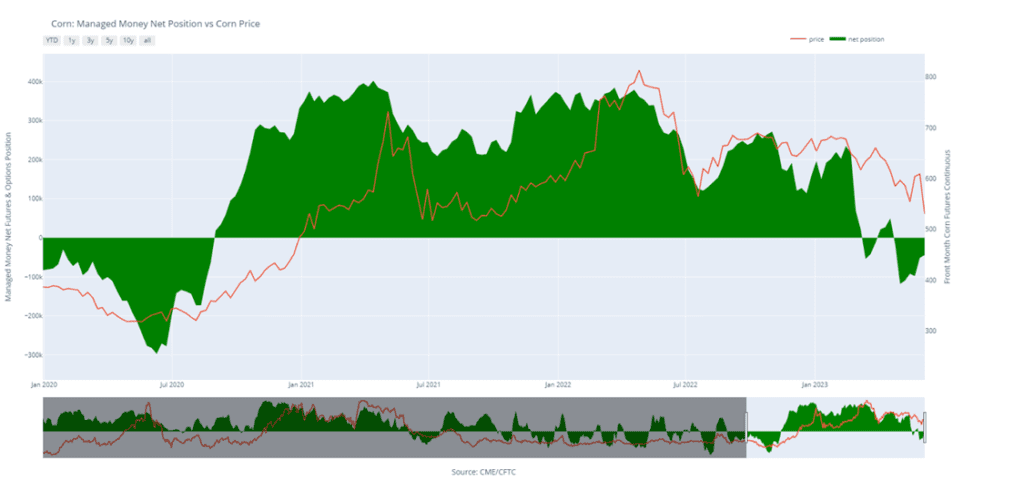

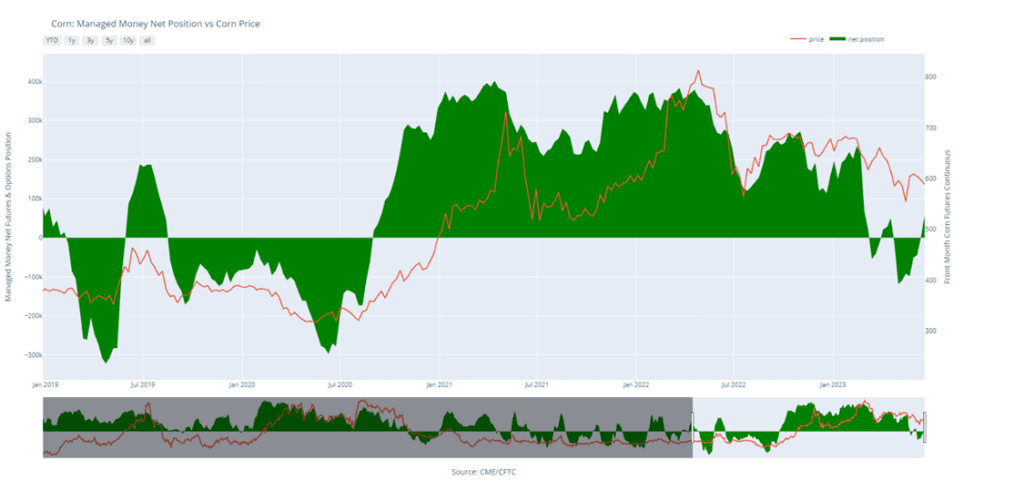

Above: Corn Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 56,154 contracts between June 13 – June 20, bringing their total position to a net long 58,299 contracts.

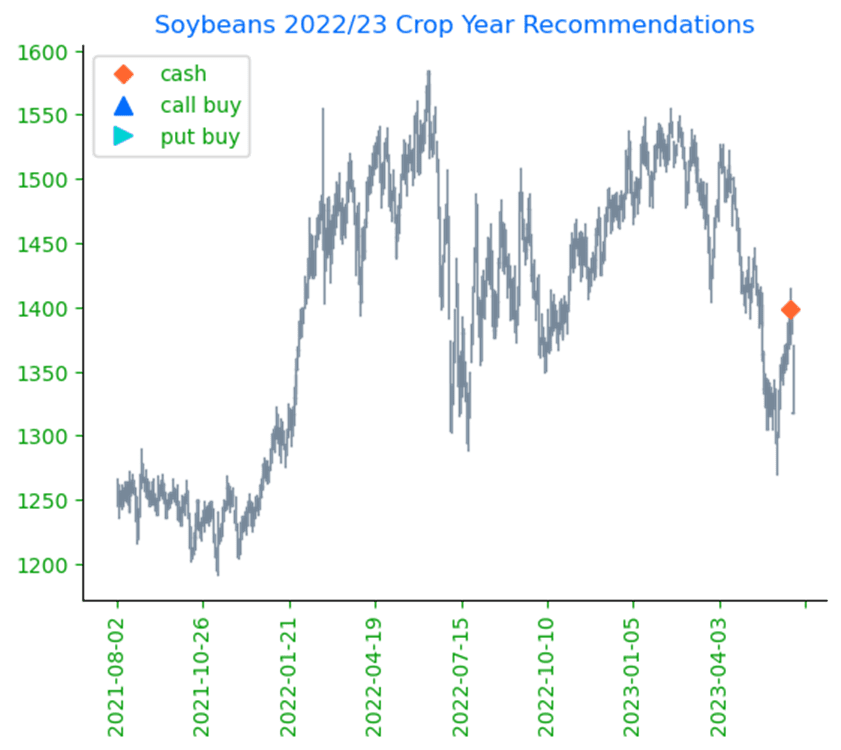

Soybeans

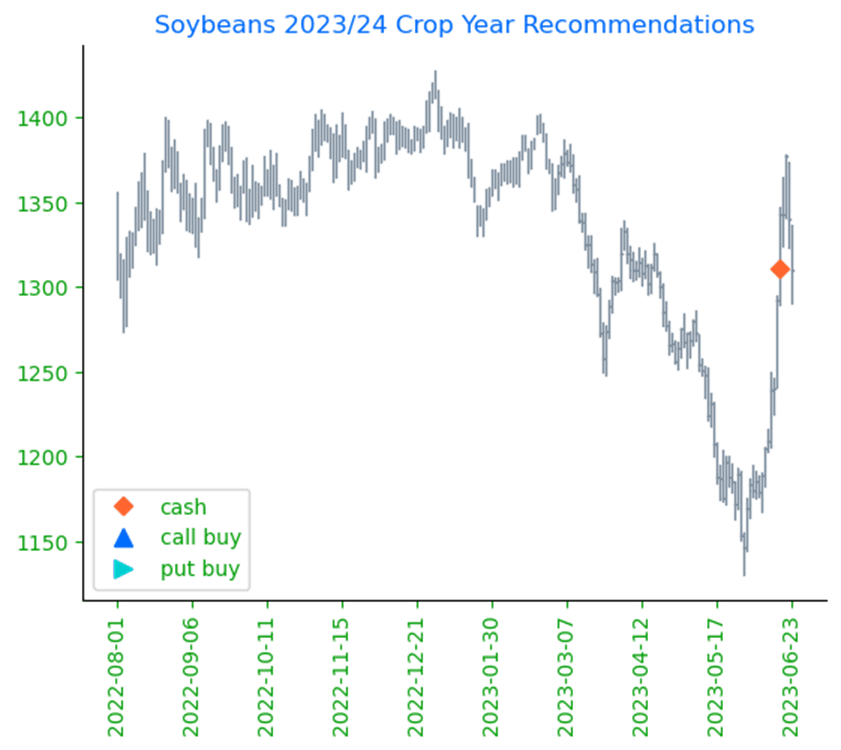

Soybeans Action Plan Summary

- No new action is being recommended for Old Crop. Any remaining old crop bushels should be getting priced into this rally. We won’t have any “New Alerts” for 2022 Soybeans — either Cash, Calls, or Puts, as we have moved focus onto 2023 and 2024 Crop Year Opportunities.

- No action is being recommended for New Crop 2023 soybeans. Changes in weather forecasts and crop conditions will continue to dominate the market. With having just recommended making a cash sale, and with one of the most volatile USDA report days of the year coming this Friday, we would need to see the market rally to 1400 – 1450 area before we would consider recommending any additional sales for the 2023 crop. Otherwise, in light of current crop conditions, we will suggest holding tight on further cash sales for now.

- Continue to hold off on pricing the 2024 crop. We look to make sales further into the 2023 growing season when selling opportunities tend to improve seasonally.

- Soybeans closed higher today along with both soybean meal and oil after rainfall this weekend missed crucial dry regions including southern Illinois, and tensions within Russia grew which could affect veg oil exports.

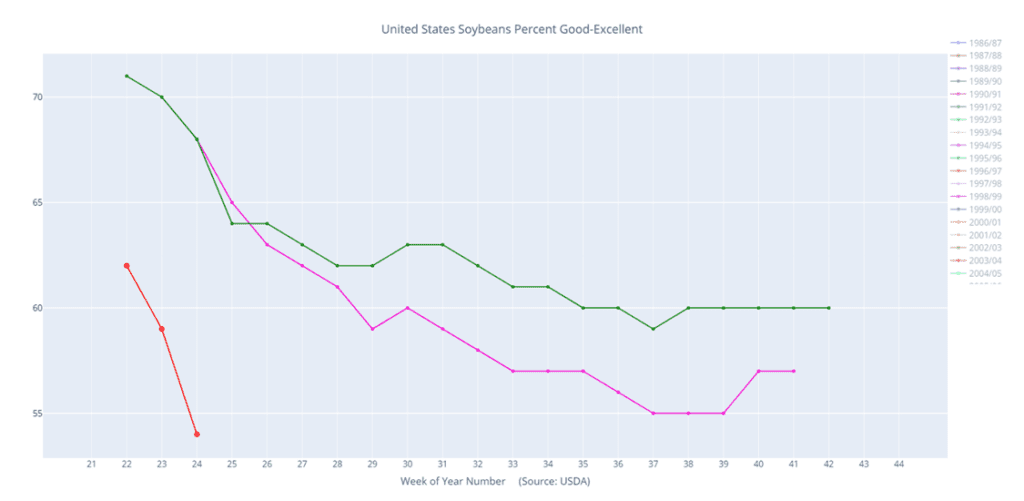

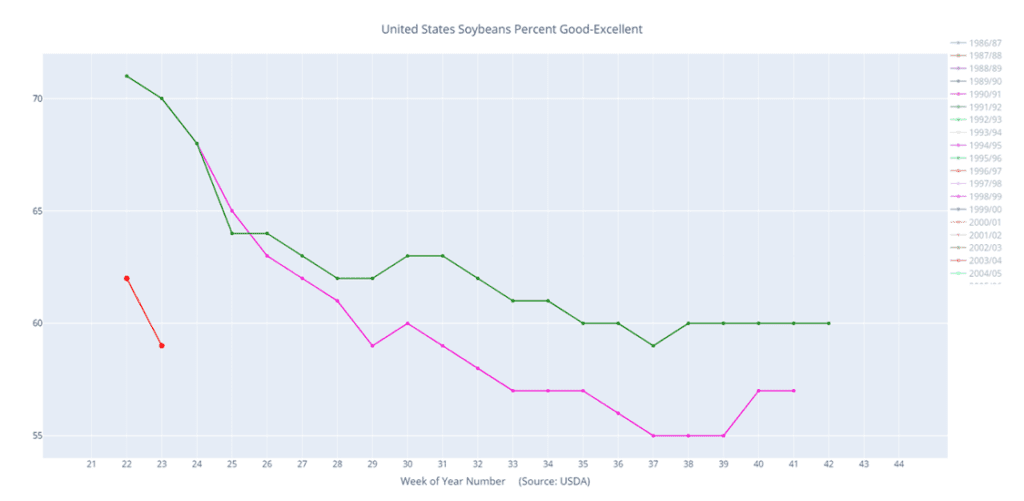

- Crop progress will be released shortly, and expectations are that good to excellent ratings will fall by another 3 to 4%, but the weekend rains may have helped limit the decline. Last week, Illinois’ rating fell by 14% to just 33% good to excellent.

- Soybean oil was supportive for soybeans as palm oil rallied 2.65% today along with other veg oils. Palm oil supplies may end up being tight due to weather issues, and exports from other countries may be limited.

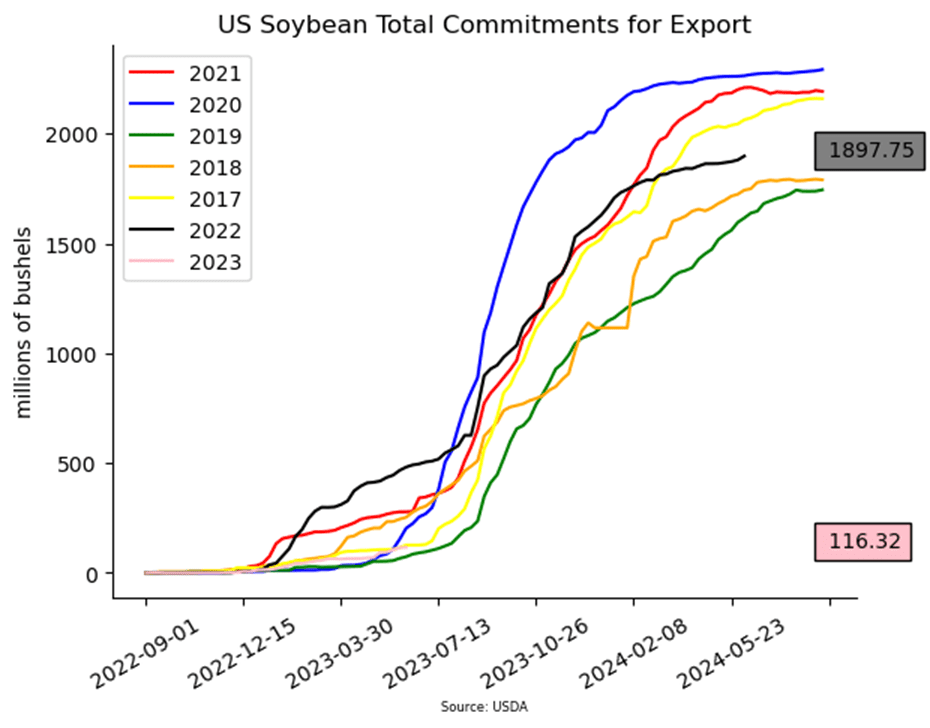

- Soybean export inspections were poor for last week and could be a wet blanket over the market even with dry weather in the US. Inspections totaled 5.2 mb for 22/23 and put total inspections at 1.807 bb which is down 4% from the previous year.

Above: The market’s eye is squarely on the weather at this time. The August contract rallied through the 50-day moving average and hit resistance near 1450 and the 100-day moving average. If the market can rally beyond this point, the resistance area between 1500 and 1550 could be its next target. If the market drops back, support could be found between 1340 and 1300 with further support near 1270.

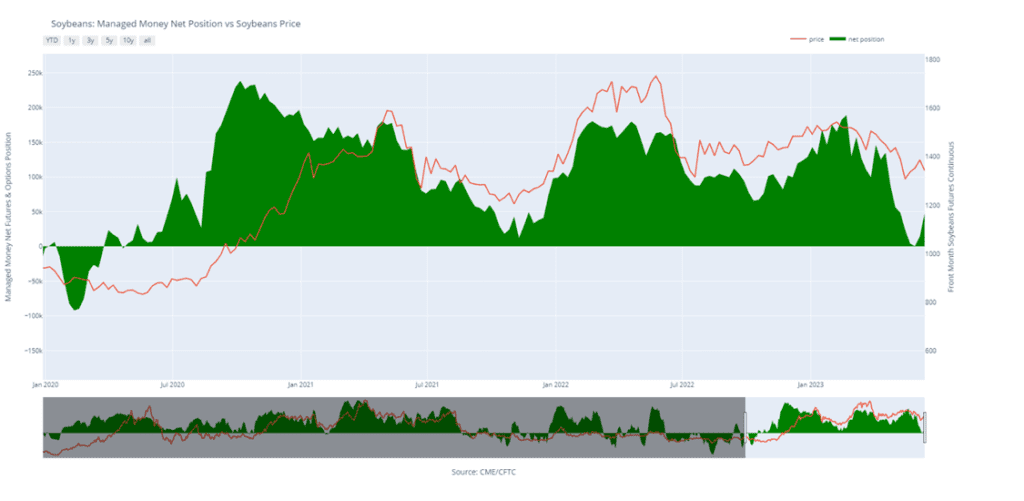

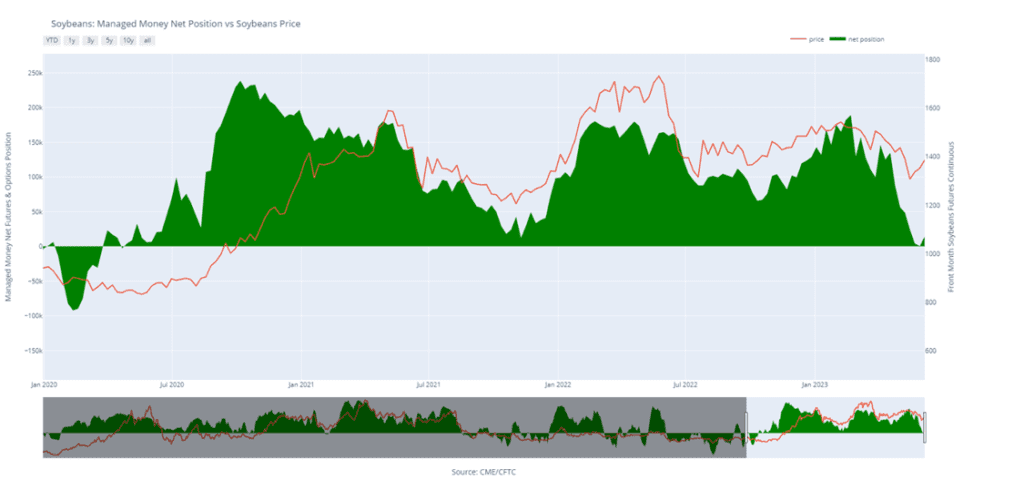

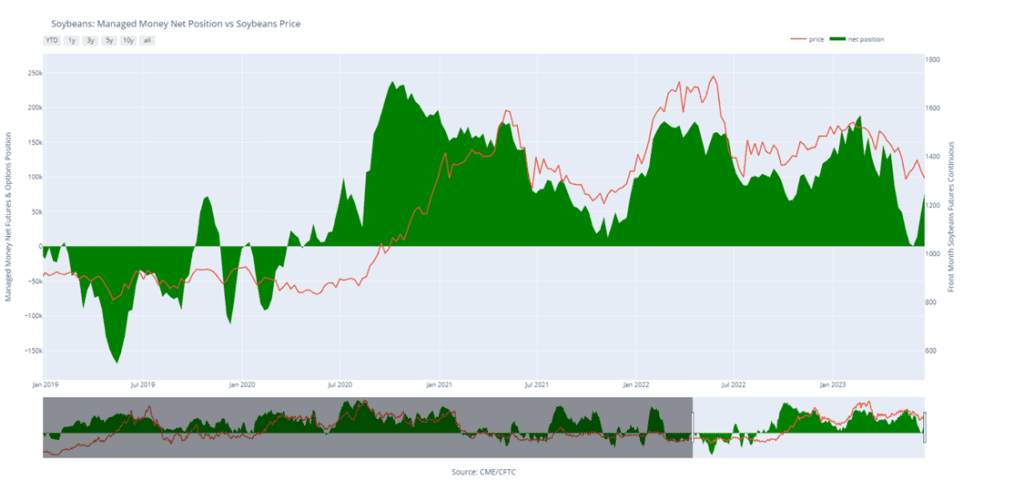

Above: Soybeans Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 29,068 contracts between June 13 – June 20, bringing their total position to a net long 76,950 contracts.

Wheat

Market Notes: Wheat

- News of a mutiny by a private Russian fighting group, the Wagner Group, against the Russian government may be tied to early strength in the wheat market. However, it is believed that some sort of deal was reached, because the group was no longer headed to Moscow, but instead back to Ukraine. This could explain why wheat faded into the close.

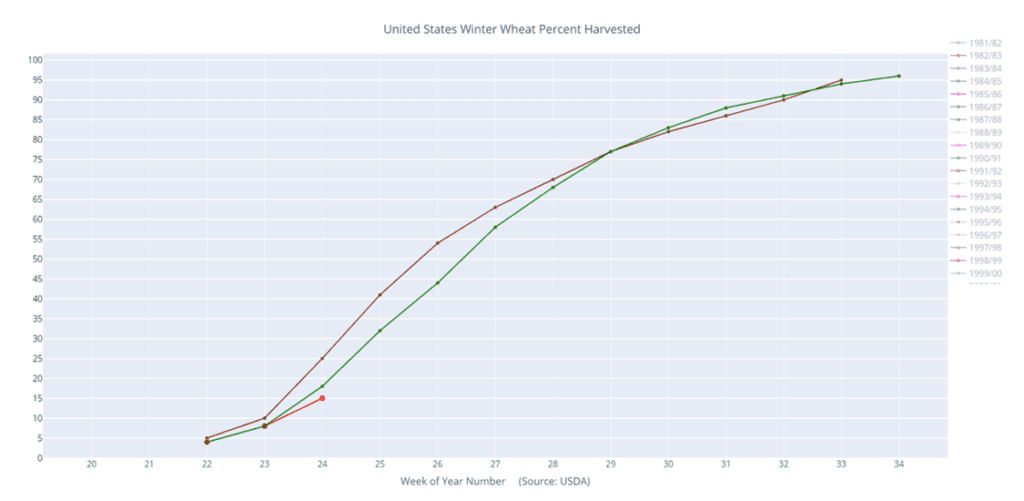

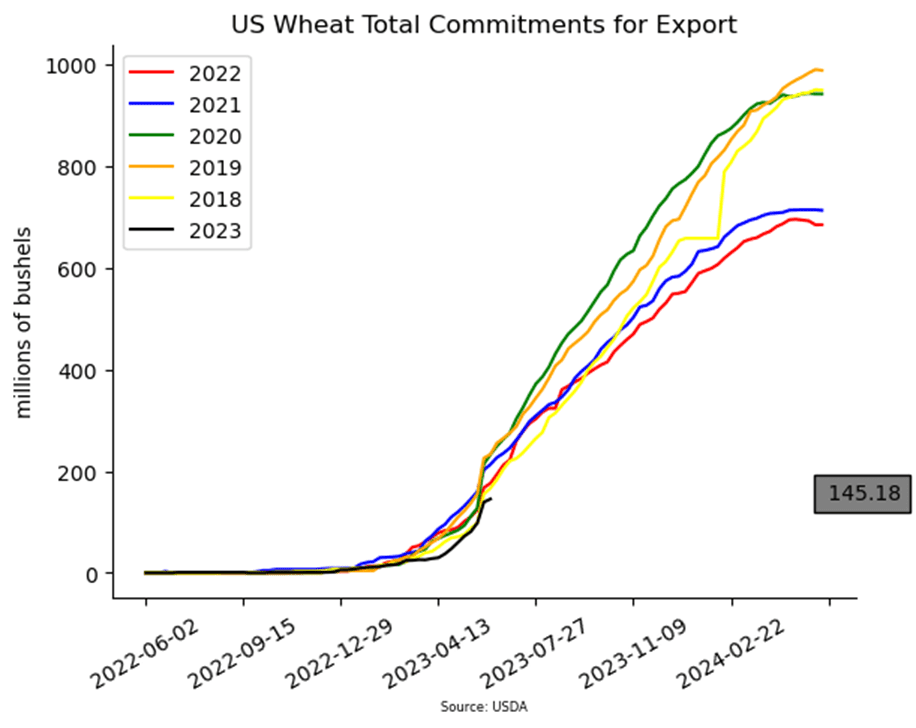

- Weekly wheat inspections at 7.5 mb bring the total 23/24 inspections to 28 mb. This total is down 43% from this time last year.

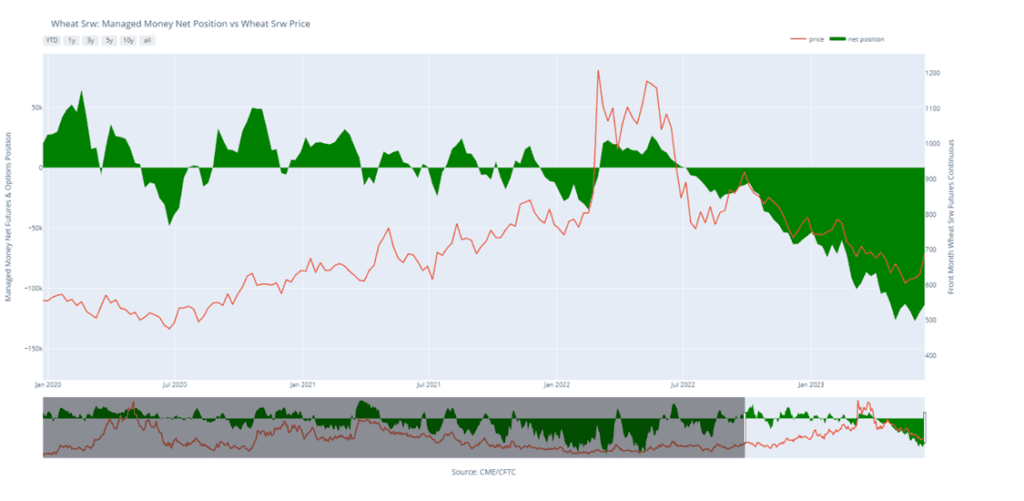

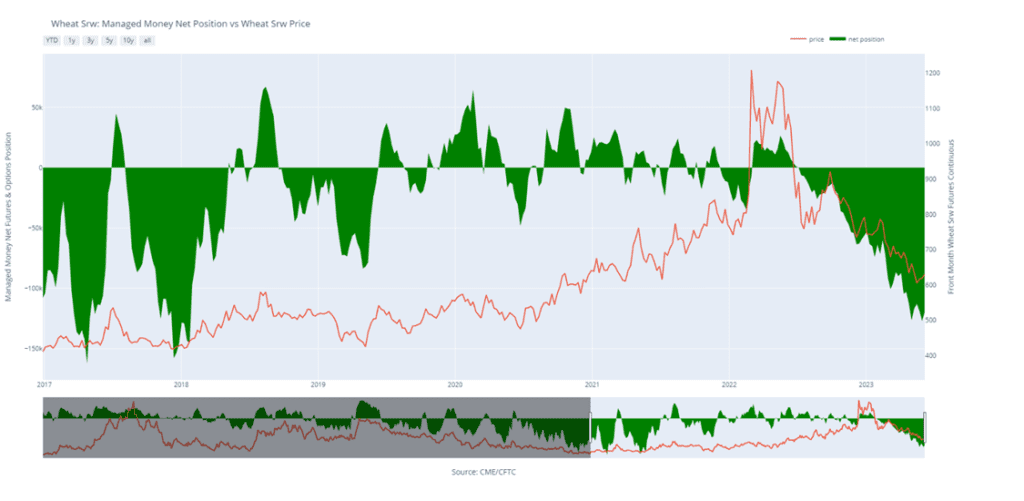

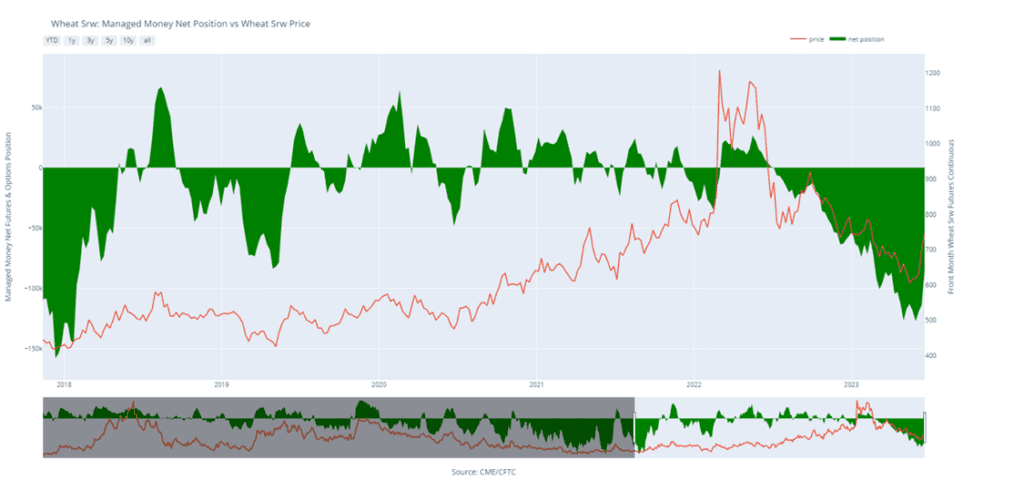

- Managed funds are still said to be net short about 84,000 contracts of Chicago wheat as of last Tuesday. This could lead to more of a short covering rally if there is a catalyst in the form of friendly news.

- Russia will reportedly reduce their wheat export tax from 2,613 rubles per ton to 2,473, equivalent to roughly $31 vs $29 per ton. While not a huge move, the fact that they continue to dominate on the export front with low prices does not bode well for US exports and prices.

- Paris milling wheat futures gapped higher on the open, likely due to the uncertainty of the Russia news. However, they finished with losses and closed the gap, offering no support to the US markets.

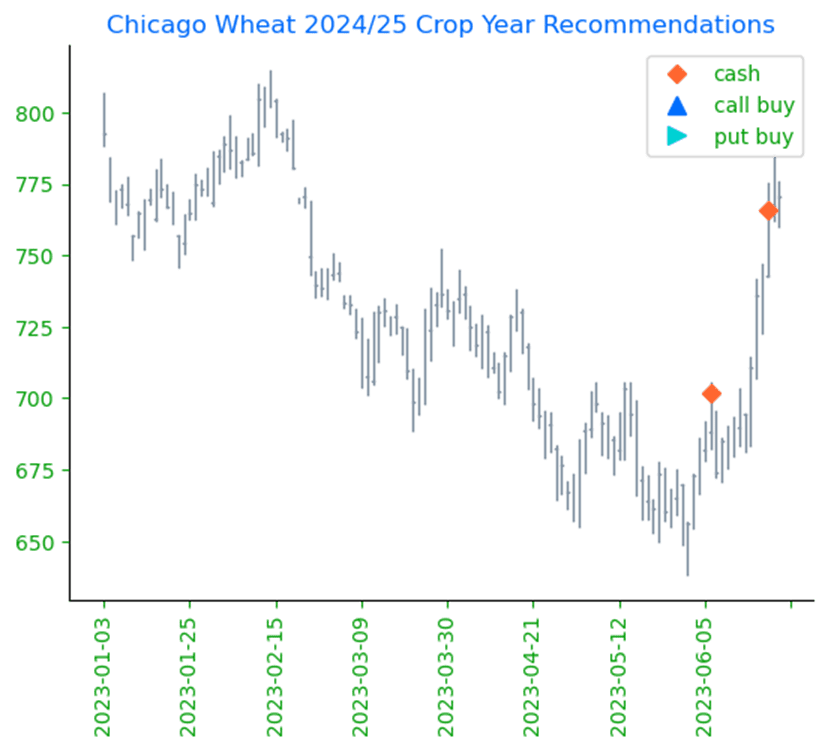

Chicago Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Grain Market Insider is done with the 2022 crop, and there will be no New Alerts posted for the 2022 crop going forward.

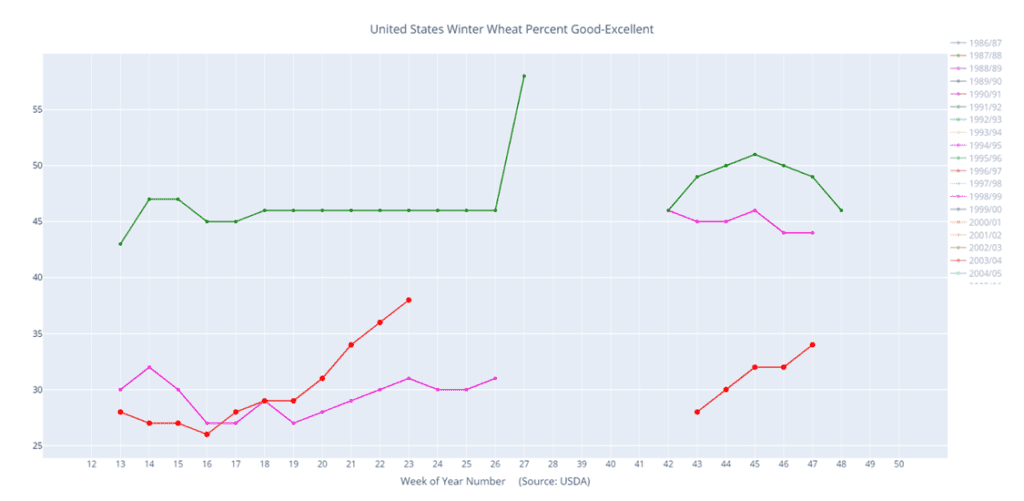

- Grain Market Insider sees an active opportunity to sell 2023 New Crop. We are in a weather market and with the US Drought Monitor showing dryness across the Midwest, September Chicago Wheat has now rallied about 22% from its May 31 low into the March – April resistance area and is overbought. As of late, the wheat market has largely been a follower of the corn market, and this rally has been fueled in part by the Funds exiting their short positions. While there are production concerns in parts of the country, demand has been weak, and the potential remains for a rising carryout. Any change to a more favorable weather forecast could easily erase much, if not all, of the weather premium that has been added to prices. With the dry conditions and great uncertainty that many of you are experiencing about how much you will have to harvest, we understand there’s hesitancy to sell anything here. If you are concerned about committing physical bushels with a cash sale, consider selling futures or buying put options.

- Grain Market Insider sees an active opportunity to sell 2024 Chicago wheat. Prices for the 2024 crop have largely followed prices for the 2023 crop and are currently about 20% above the low set on May 31. Weather and production concerns have been the primary driver of prices lately, and the funds have likely been covering short positions, further feeding the rally. As we all know, weather markets can be fickle beasts, and any change in the forecast or crop conditions can quickly turn traders from buyers to sellers, quickly erasing much, if not all, of the premium priced into the market. Grain Market Insider recommends making a sale on next year’s 2024 Chicago wheat crop and using either a July ’24 futures contract or a July 24 HTA contract so basis can be set at a later date, as it should improve in time.

Above: September wheat has had a strong run and is near the 200-day moving average around 750, which it hasn’t seen since last October. Above there, resistance may be found between the psychological resistance point of 800 and 865. With further resistance coming in between 900 – 950. Should prices turn lower, initial support may be found near 670 and then again near 611.

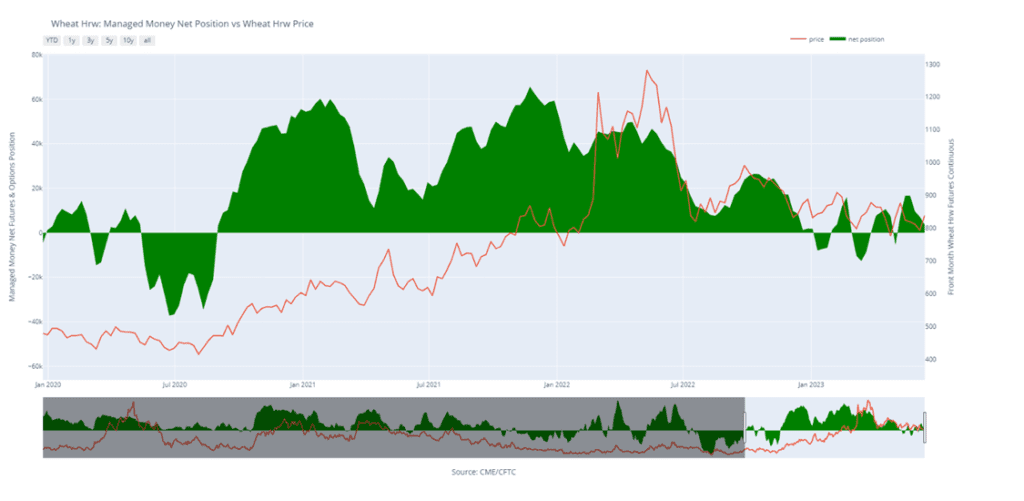

Above: Chicago Wheat Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 29,296 contracts between June 13 – June 20, bringing their total position to a net short 84,134 contracts.

KC Wheat Action Plan Summary

- No new action is recommended for the 2022 crop. Though most, if not all, of your Old Crop 2022 wheat may be sold, consider storing any remaining Old Crop, if possible, in anticipation of a short new crop this year, and marketing it along with the new crop.

- We continue to look for better prices before making any 2023 sales. While Crop ratings have improved and the Black Sea export corridor remains open, questions remain about the size of the HRW crop, whether Russia will continue to agree to keep the Black Sea corridor open, and what production looks like in Europe and Australia. We continue to target 950 – 1000 in the July futures as a potential level to suggest the next round of New Crop sales.

- Patience is warranted for the 2024 crop. With continued issues in the Black Sea region and with major exporting countries’ stocks expected to fall to 16-year lows, we are willing to be patient with further sales of New Crop HRW wheat. We are targeting just below the 900 level on the upside while keeping an eye on recent lows for any violation of support.

Above: The market has been able to trade out of the recent congestion area to near the 200-day moving average and into the 870 – 920 resistance area. If the market can push through, 970 – 1000 is the next major point of resistance. If it falls back, initial support could be near 825 with further support between 778 and 764.

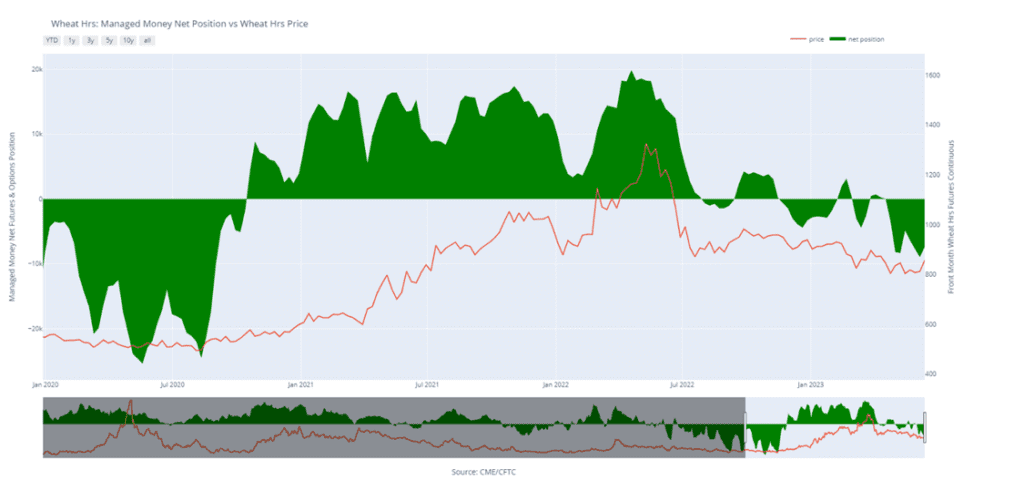

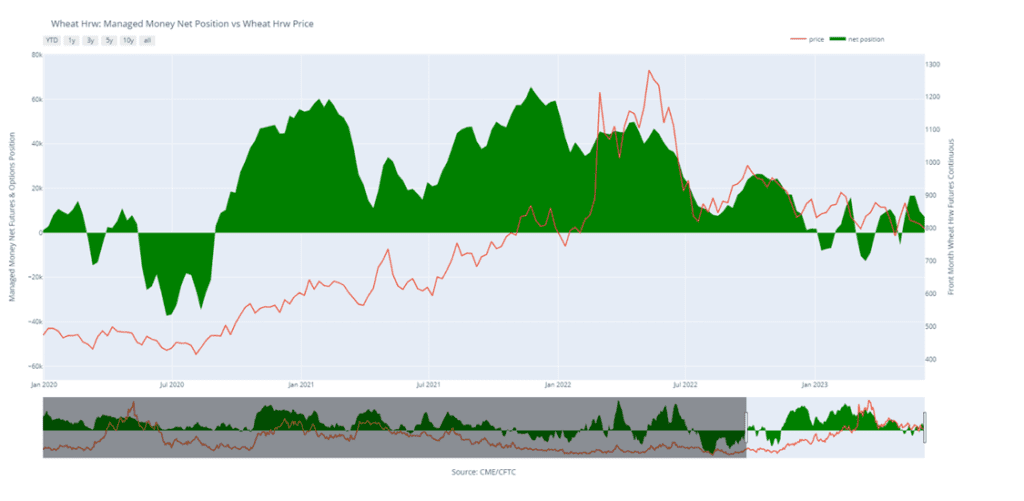

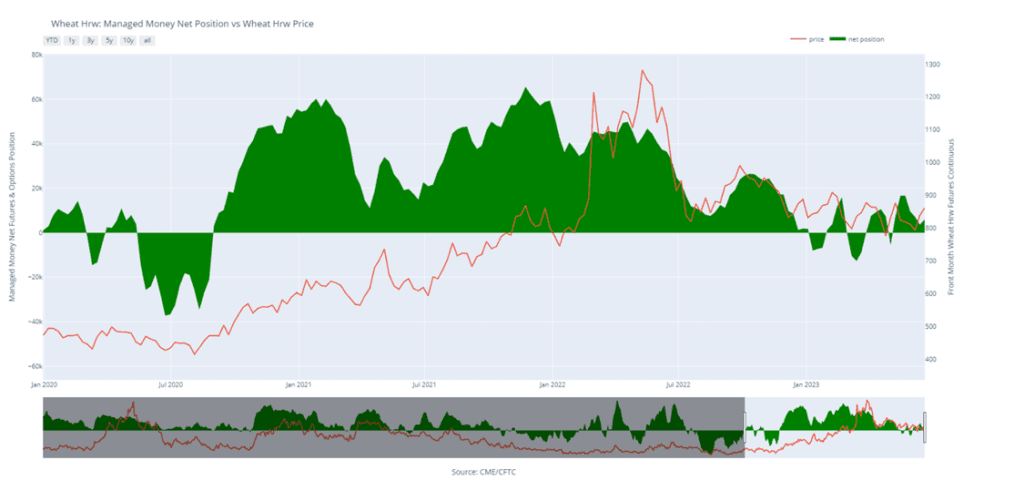

Above: K.C. Wheat Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 2,328 contracts between June 13 – 20, bringing their total position to a net long 5,944 contracts.

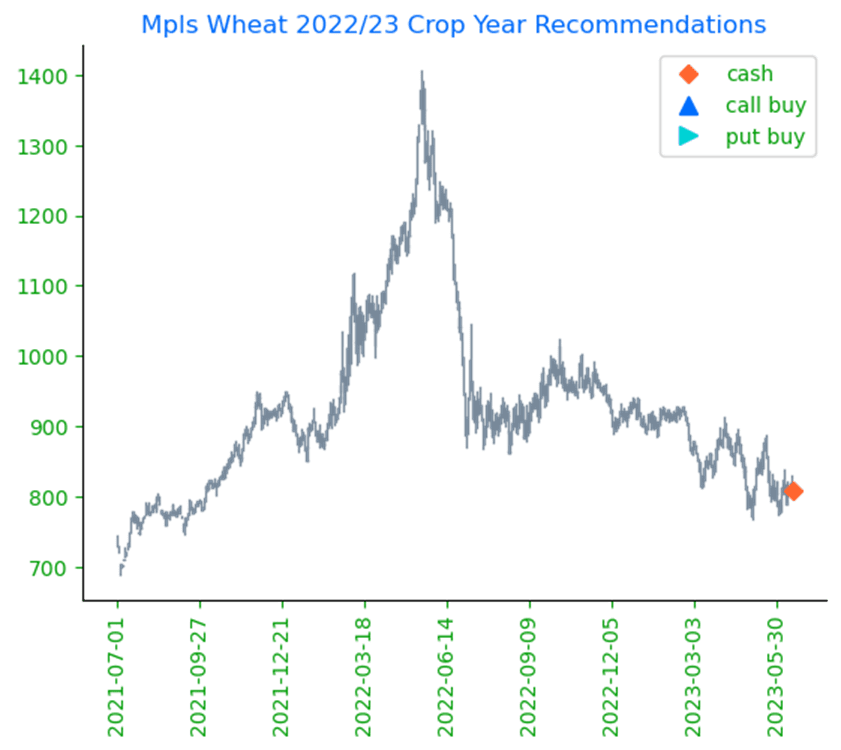

Mpls Wheat Action Plan Summary

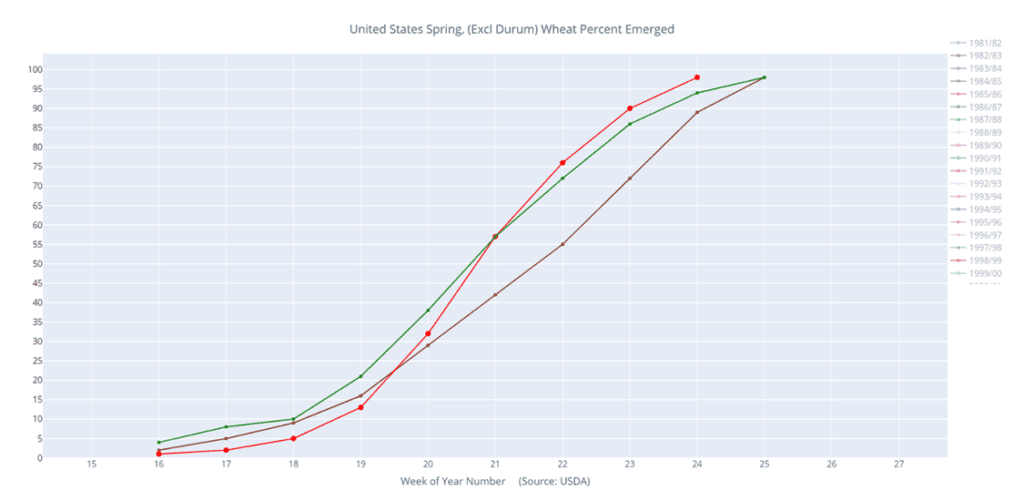

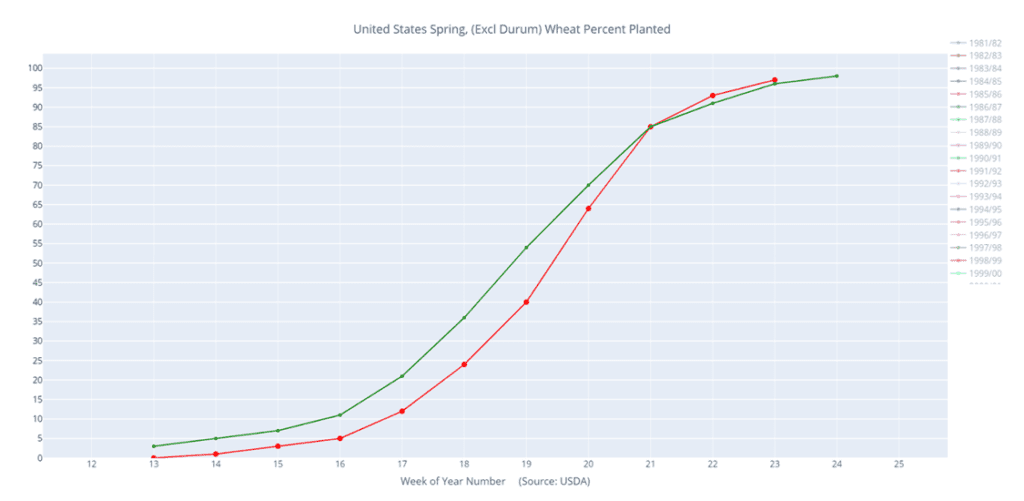

- No new action for 2022 Old Crop MINNEAPOLIS Wheat. Prices haven’t moved much over the last couple of weeks, and it’s disappointing to see the lack of upside opportunities that the market has offered following the large snowfall and the late start to planting this spring. Yet, the marketing year for Old Crop is quickly winding down, and any additional upside opportunities may be more difficult to come by before New Crop harvest, especially given record European wheat shipments and falling Russian prices. Also, we typically recommend finishing up sales on any remaining Old Crop bushels by mid-June, as bids will soon shift from the July to September contract, and there is currently no carry offered.

- K.C. Wheat Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 2,328 contracts between June 13 – 20, bringing their total position to a net long 5,944 contracts.

- We continue to hold on pricing the 2024 crop. With the September ‘24 contract about 60 cents from its May 22 low, continued issues in the Black Sea region and major exporting countries’ stocks expected to fall to 16-year lows, we are entering the time frame where we would consider suggesting making sales recommendations while also keeping an eye on the recent lows for any violation of support.

Above: The September contract has rallied out of its congestion area on the Front Month Continuous chart towards the 200-day moving average. Resistance may be found above the market between 889 and 940, the April and December highs respectively. While the upside breakout is a positive sign, the market will need additional bullish news to keep it moving. Should the market reverse course and turn lower, support below the market may be found between 770 and 760.

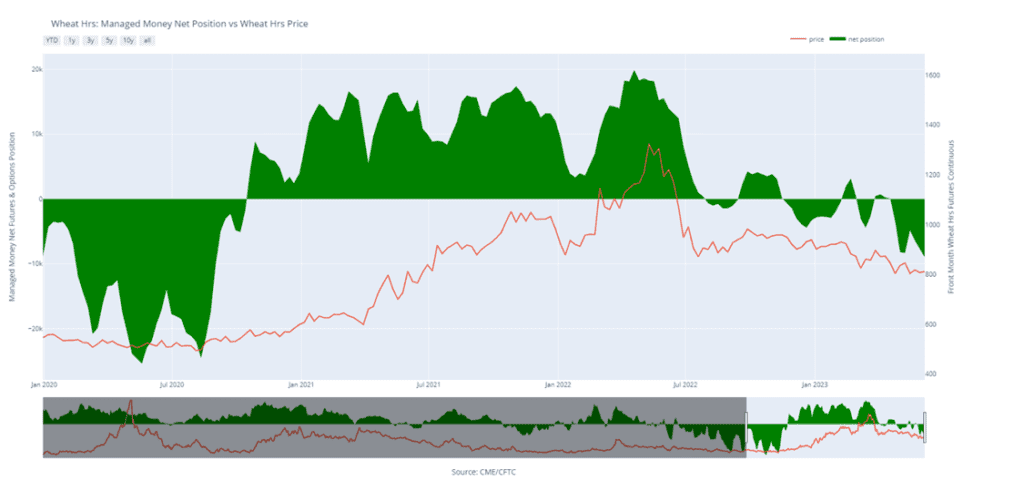

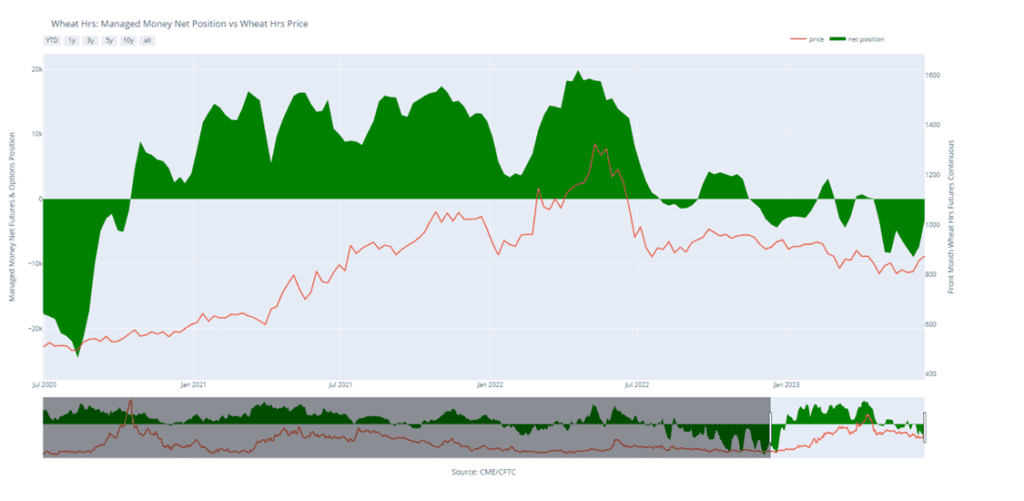

Above: Minneapolis Wheat Managed Money Funds net position as of Tuesday, June 20. Net position in Green versus price in Red. Money Managers net bought 4,160 contracts between June 13 – June 20, bringing their total position to a net short 3,262 contracts.

Other Charts / Weather