Grain Market Insider: September 21, 2023

All prices as of 2:00 pm Central Time

Grain Market Highlights

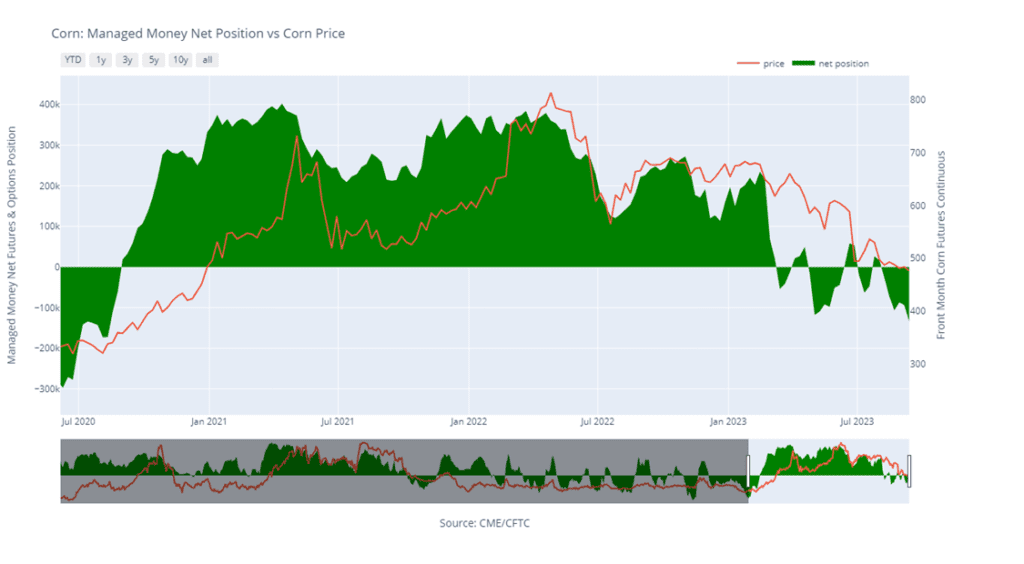

- Disappointing export sales, and expectations of higher interest rates for a longer period of time, as indicated by Federal Reserve comments yesterday, brought a pall over the markets with a “risk off” sentiment that sent the corn market lower alongside neighboring soybeans and wheat.

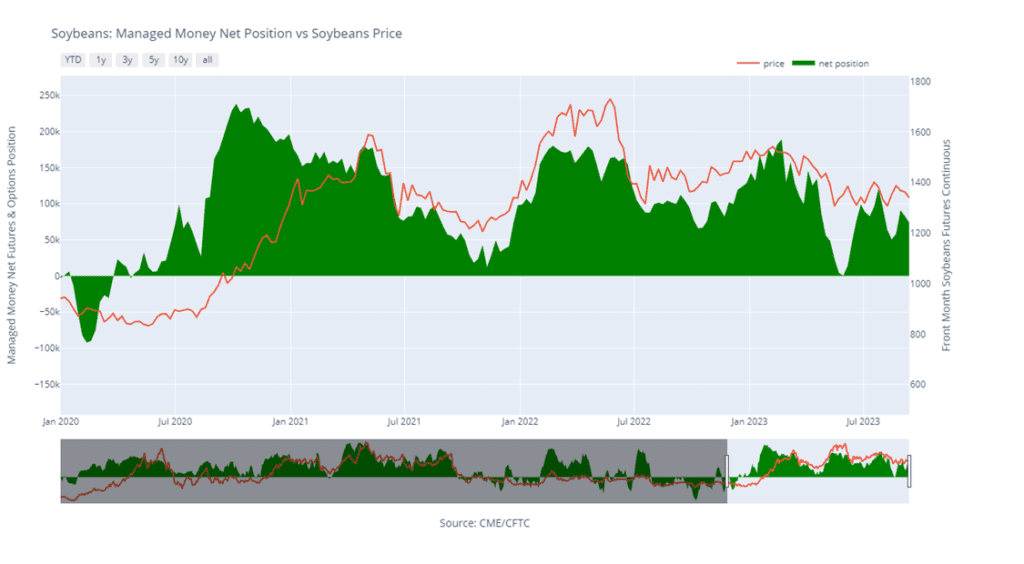

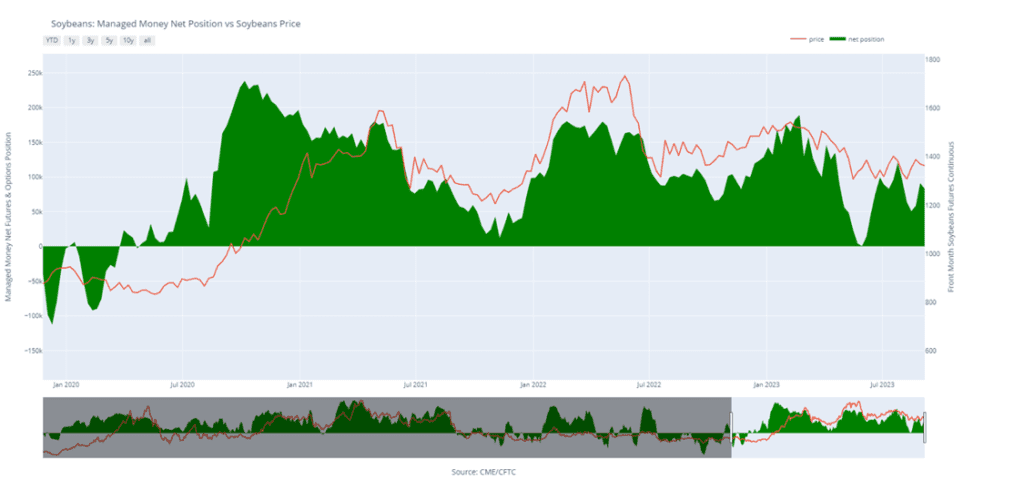

- Poor weekly export sales helped drive the soybean market sharply lower as the November contract broke through its 100-day moving average to close below 1300 for the first time since late June.

- Both soybean meal and oil were followers of soybeans to the downside as December Board Crush margins firmed a penny on the break. While meal sales for last week came in at the upper end of expectations, soybean oil sales came in as expected.

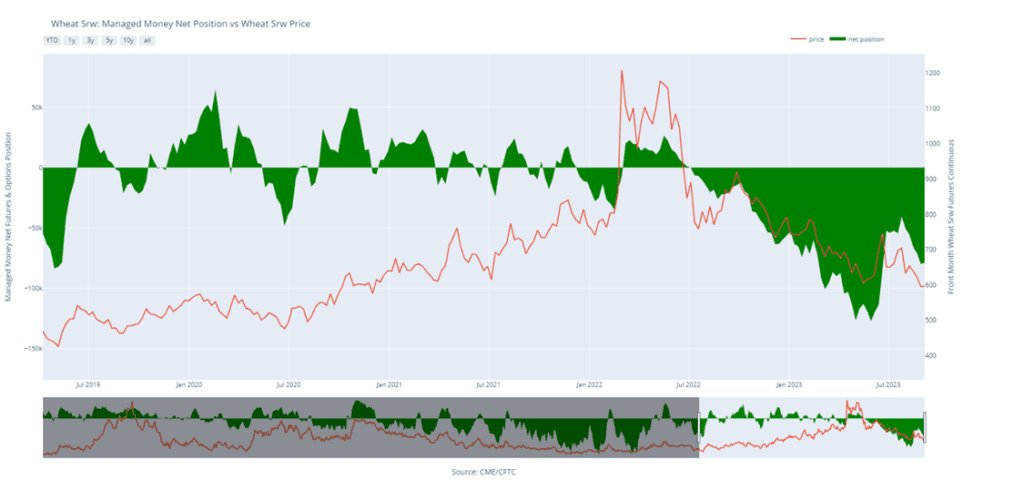

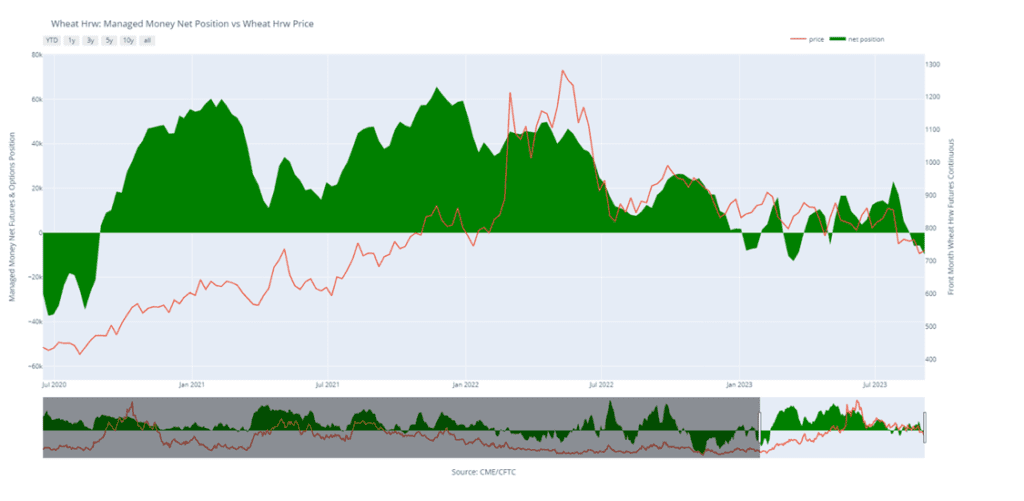

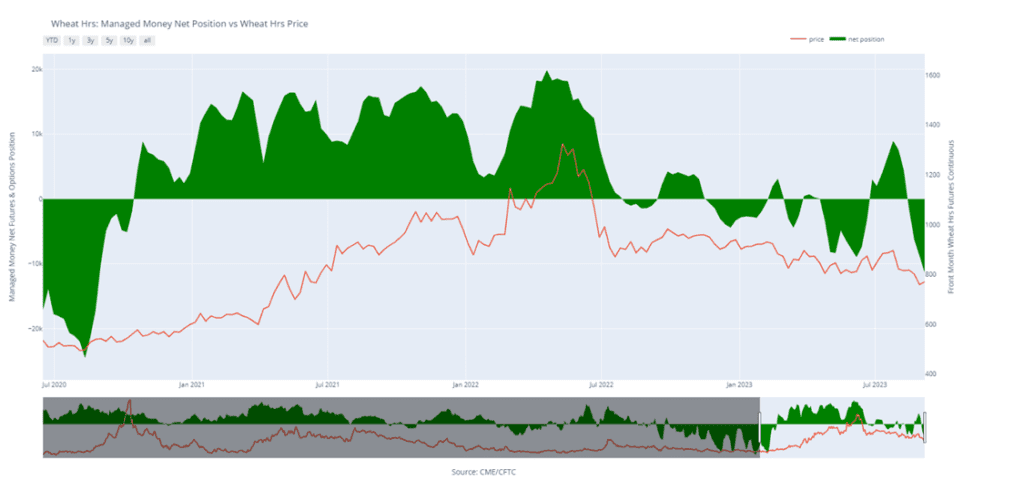

- Weak export sales and shipments that fell below the pace needed to reach the USDA’s goals added to the weakness in today’s wheat markets that were already feeling the strain of the higher US Dollar and interest rates, as all three classes of wheat closed lower led by the K.C. contracts.

- As of this writing, the US Dollar index has posted a bearish reversal in today’s trade after reaching its highest level in 6 months. If it follows through to the downside, US commodities may find some relief in the export market.

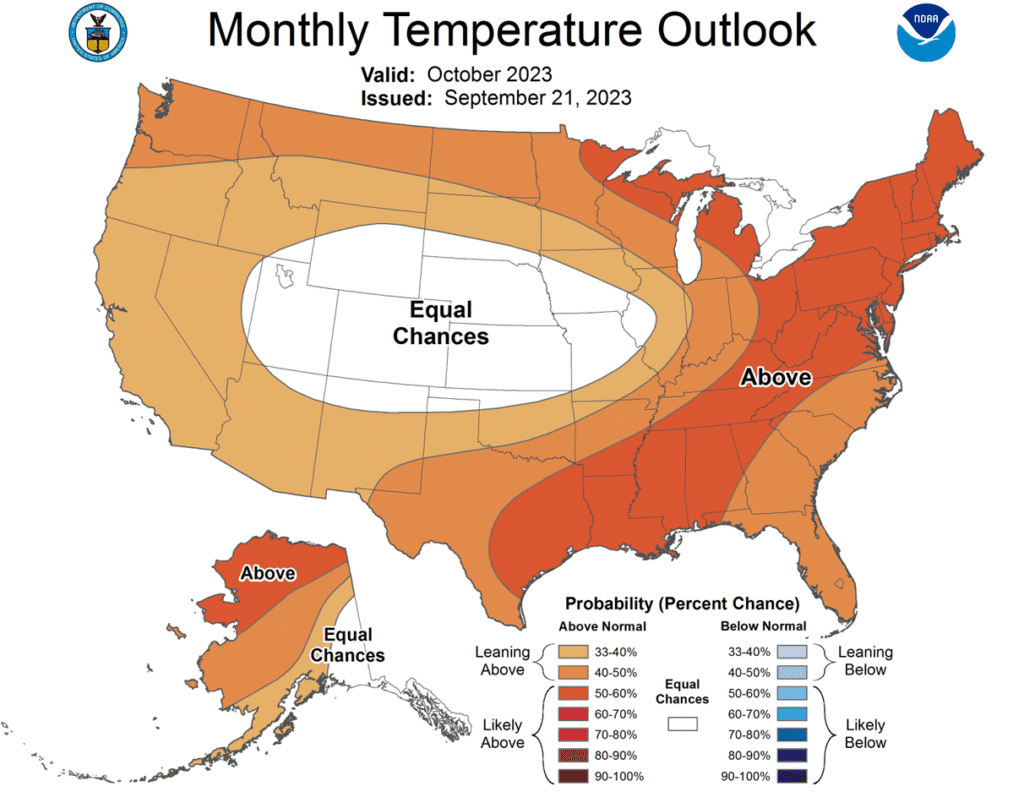

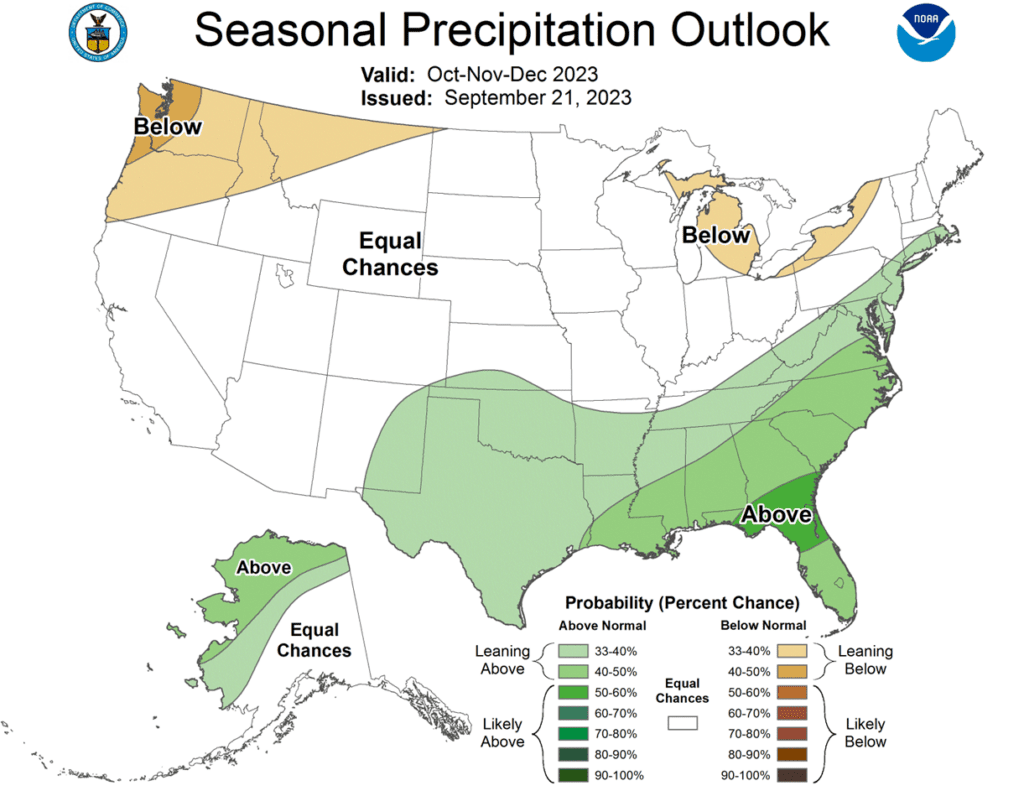

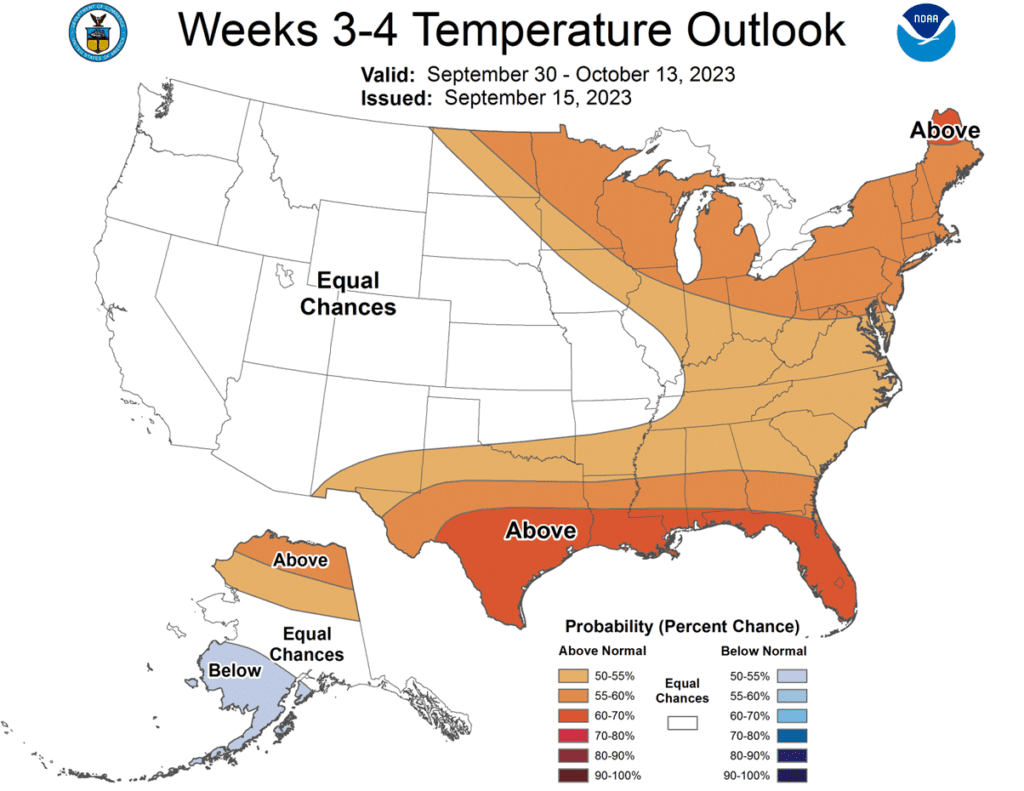

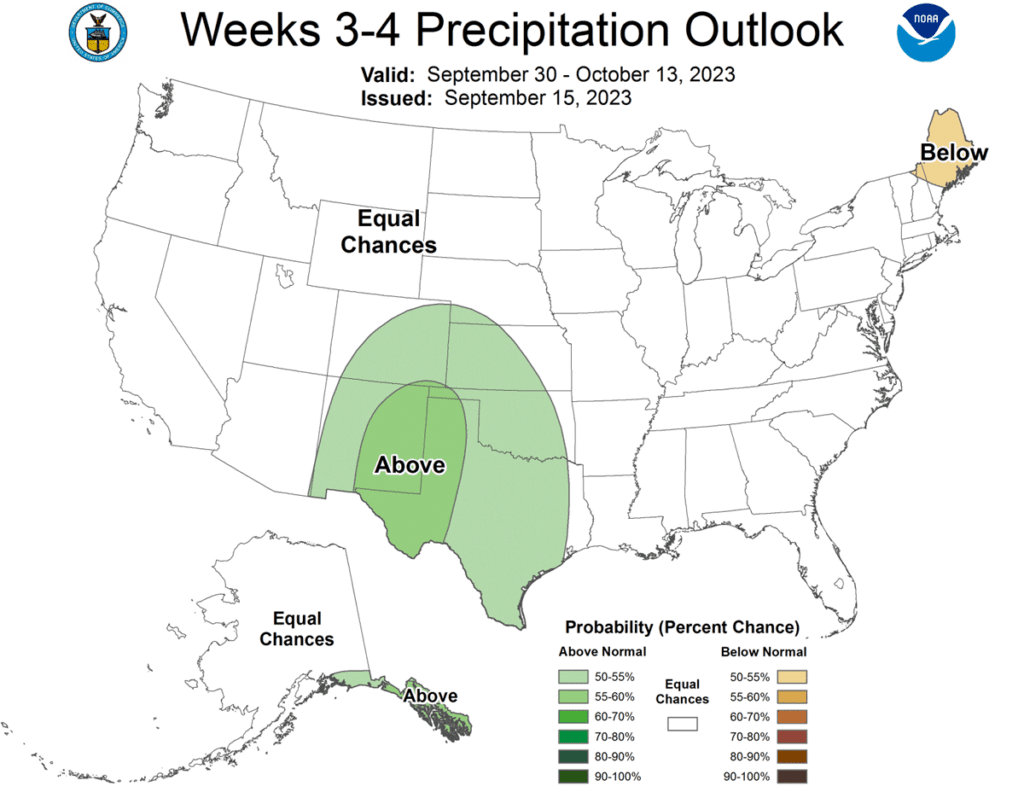

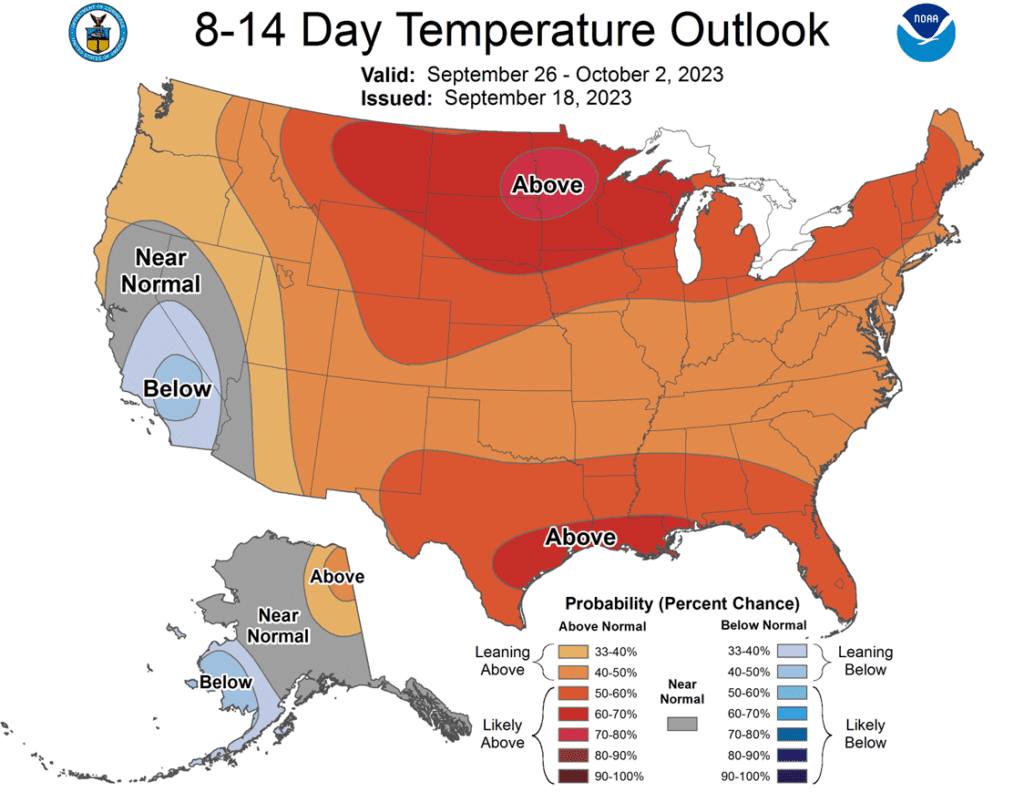

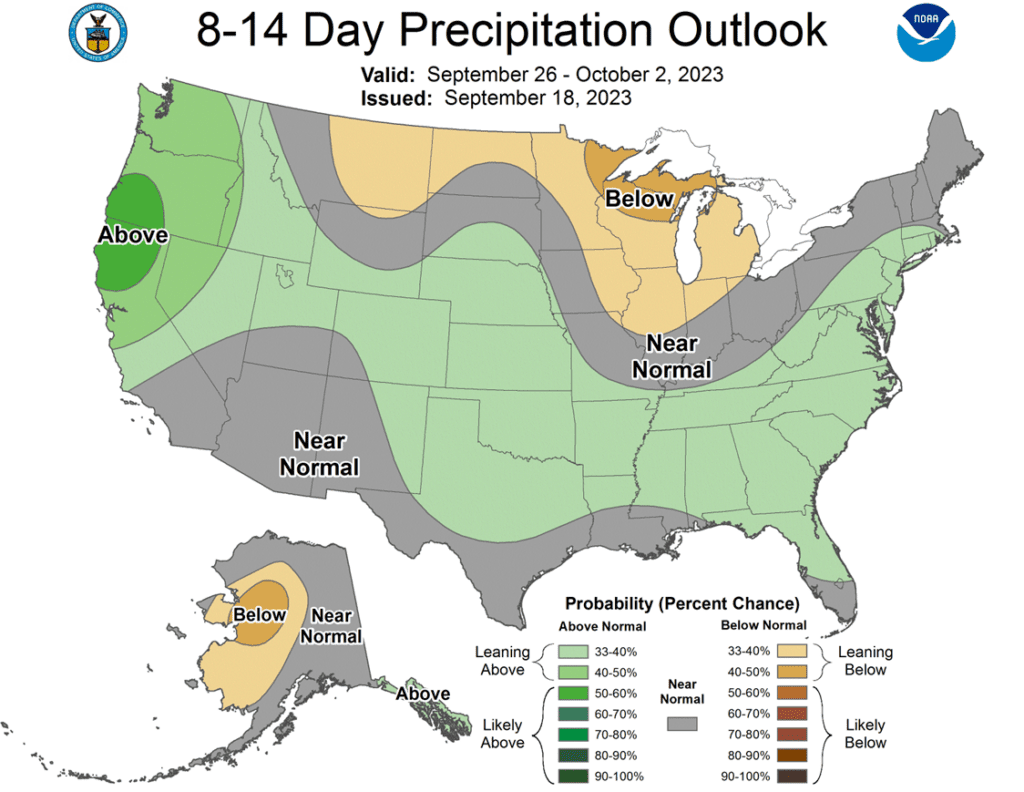

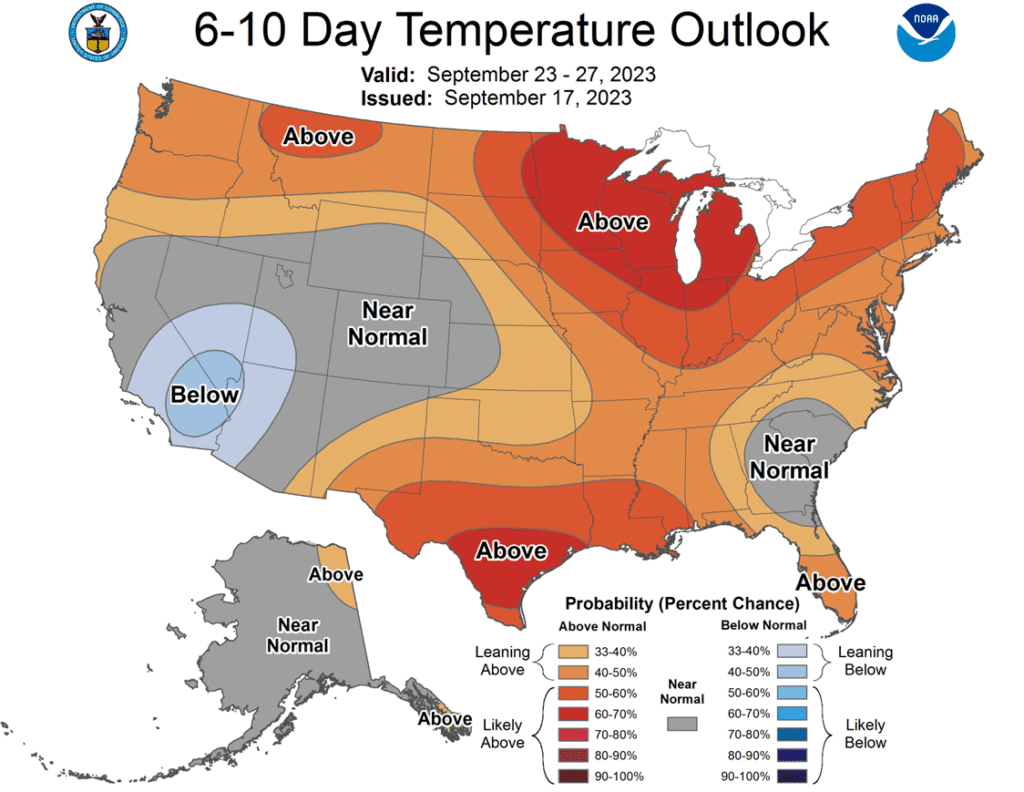

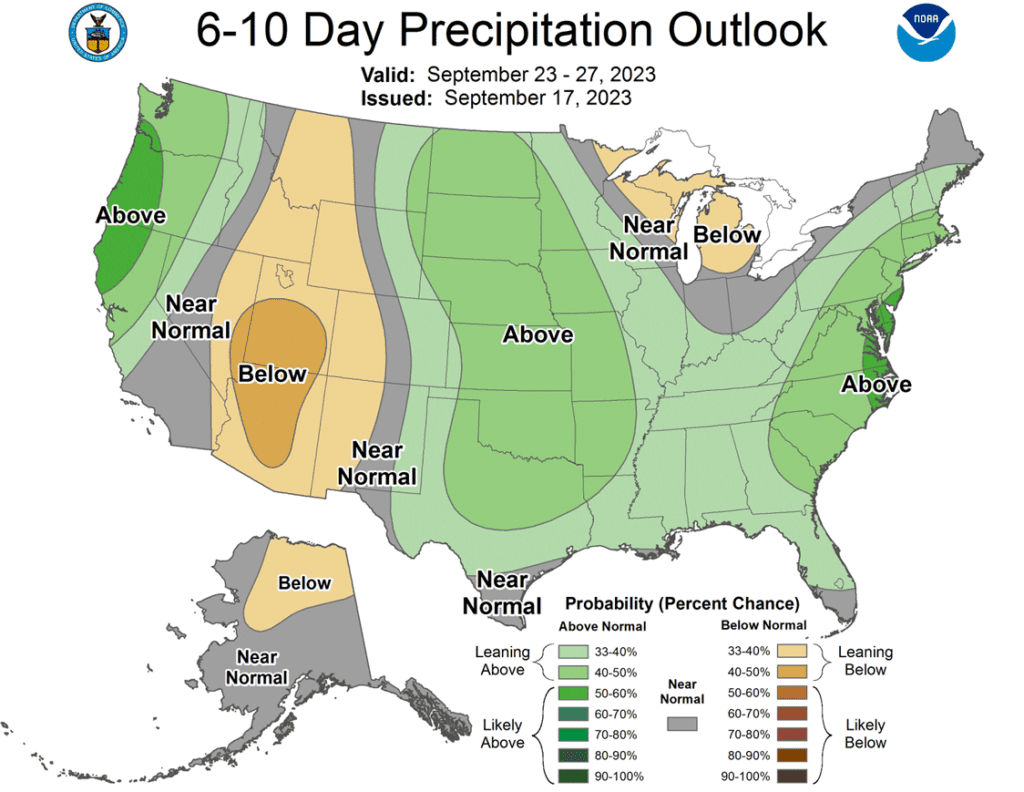

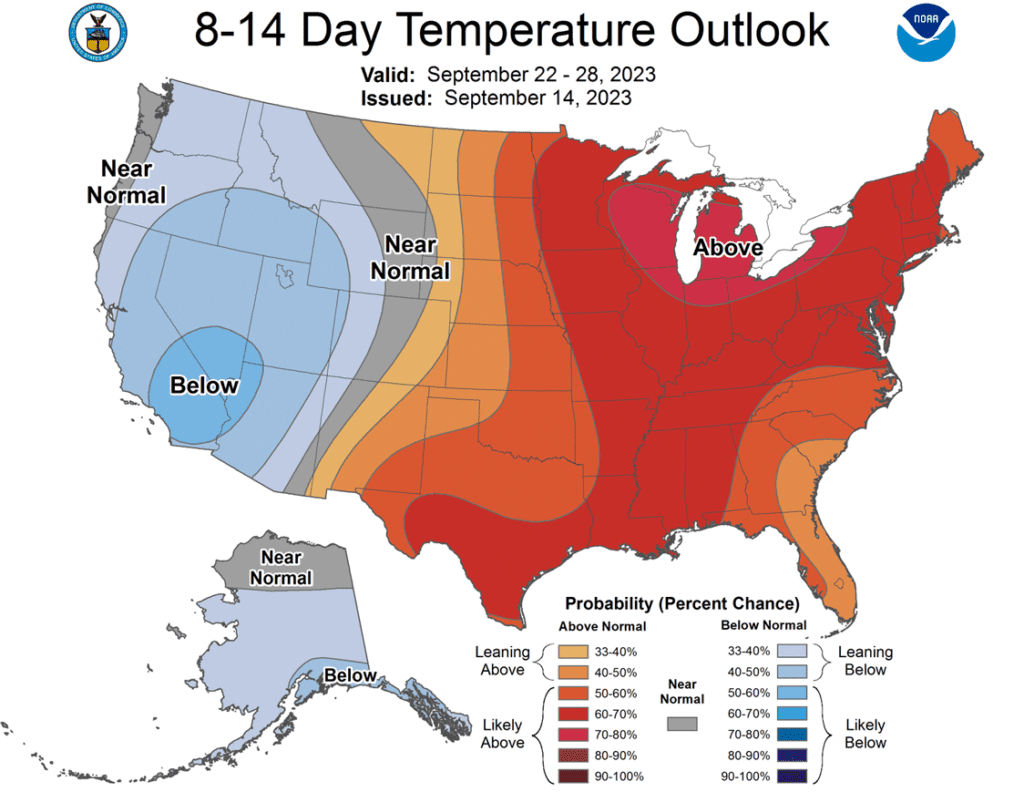

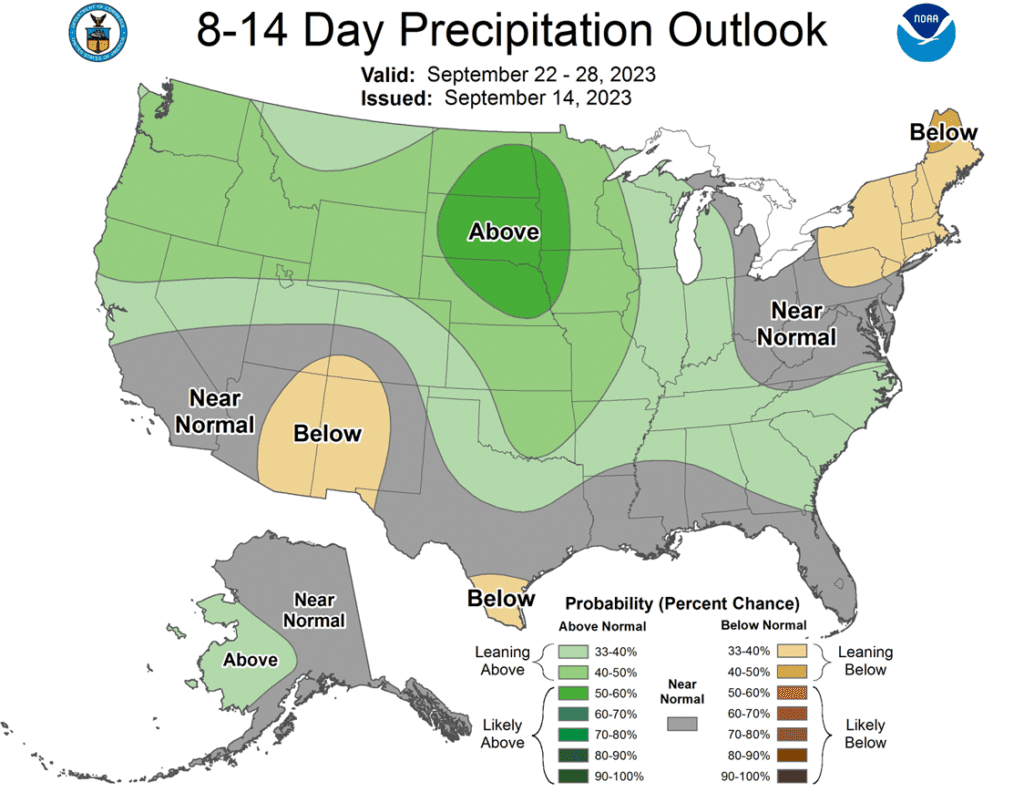

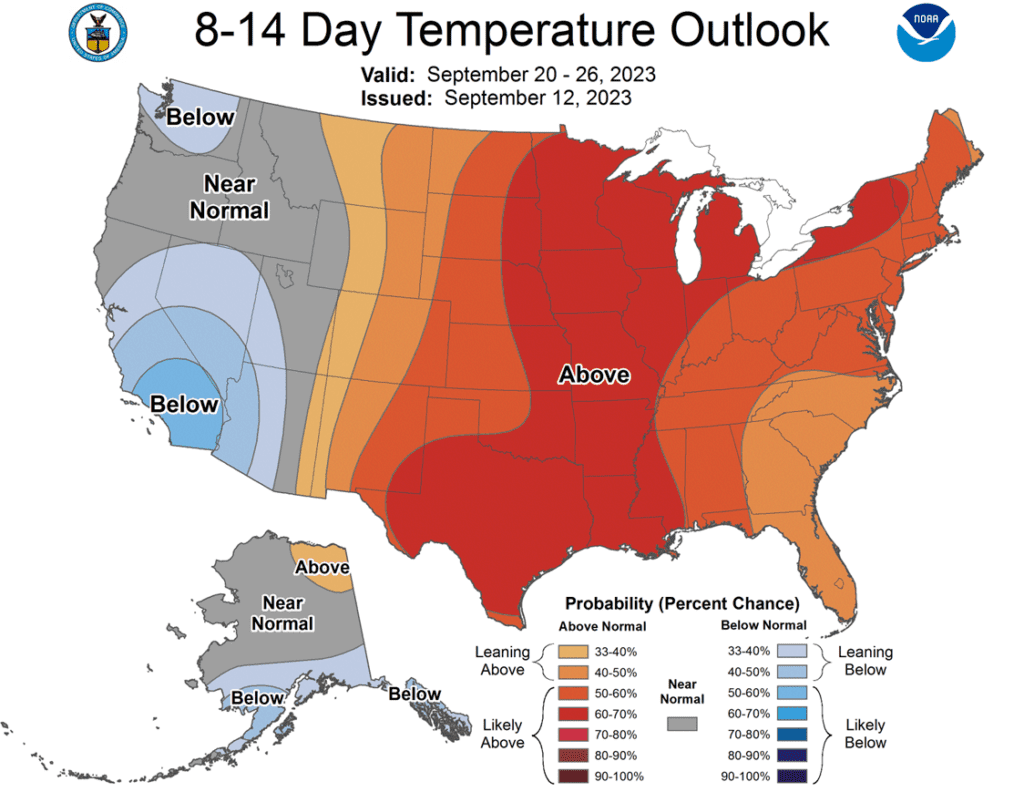

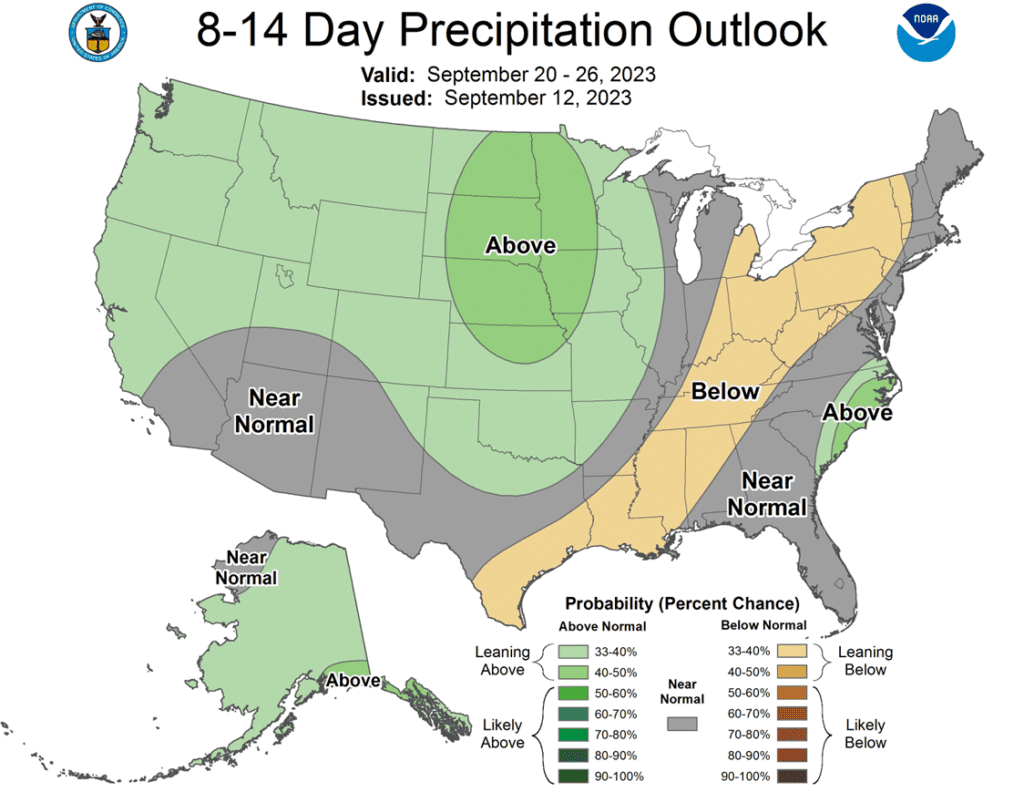

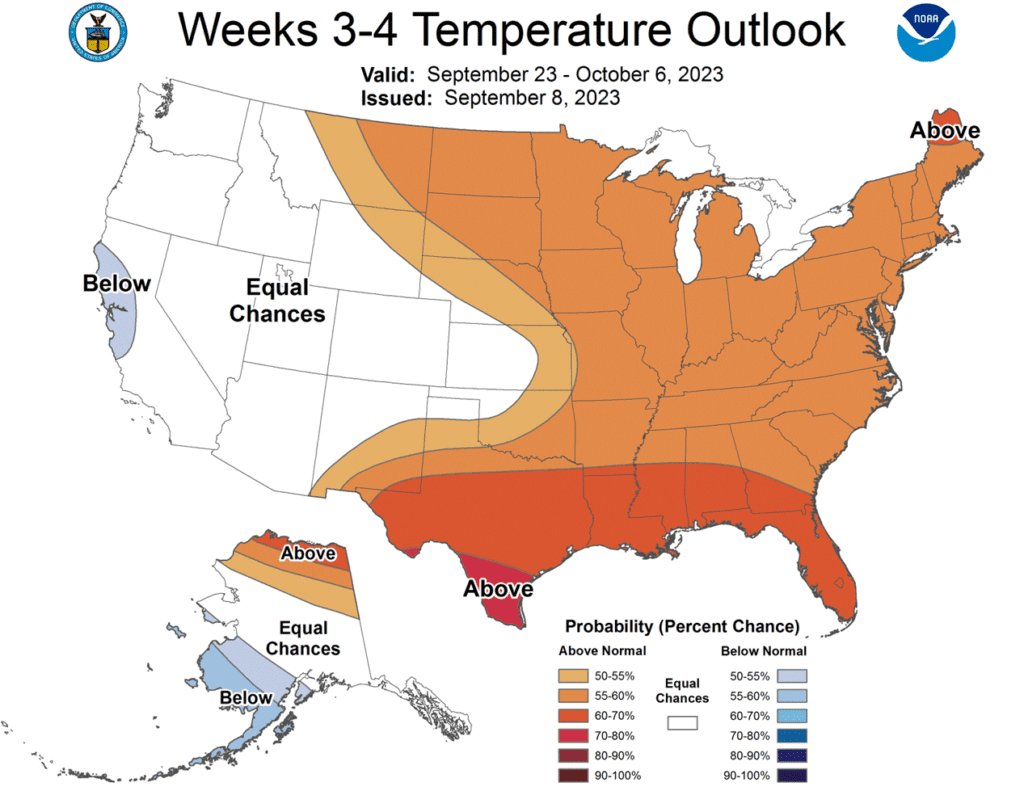

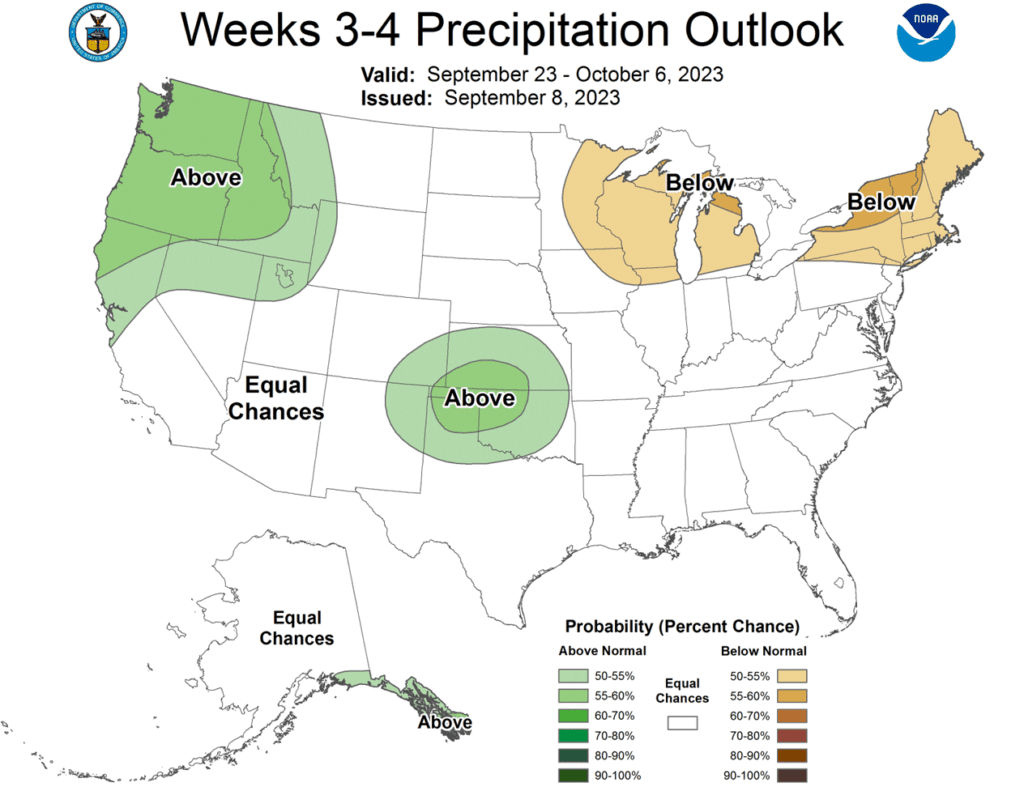

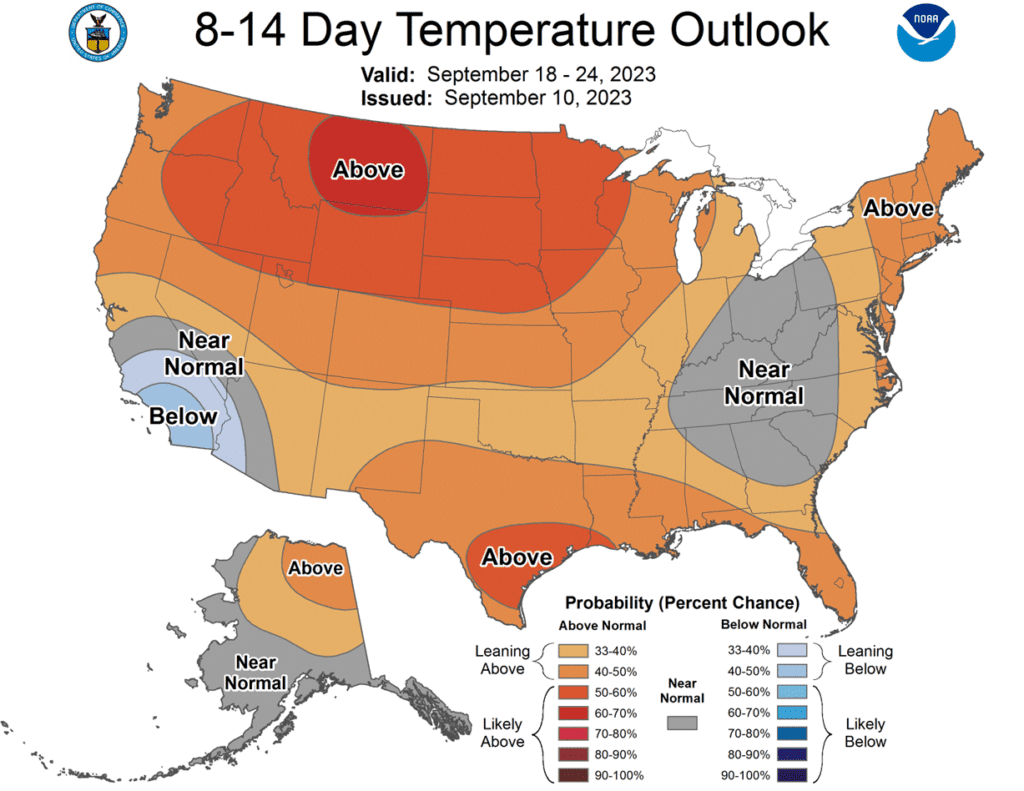

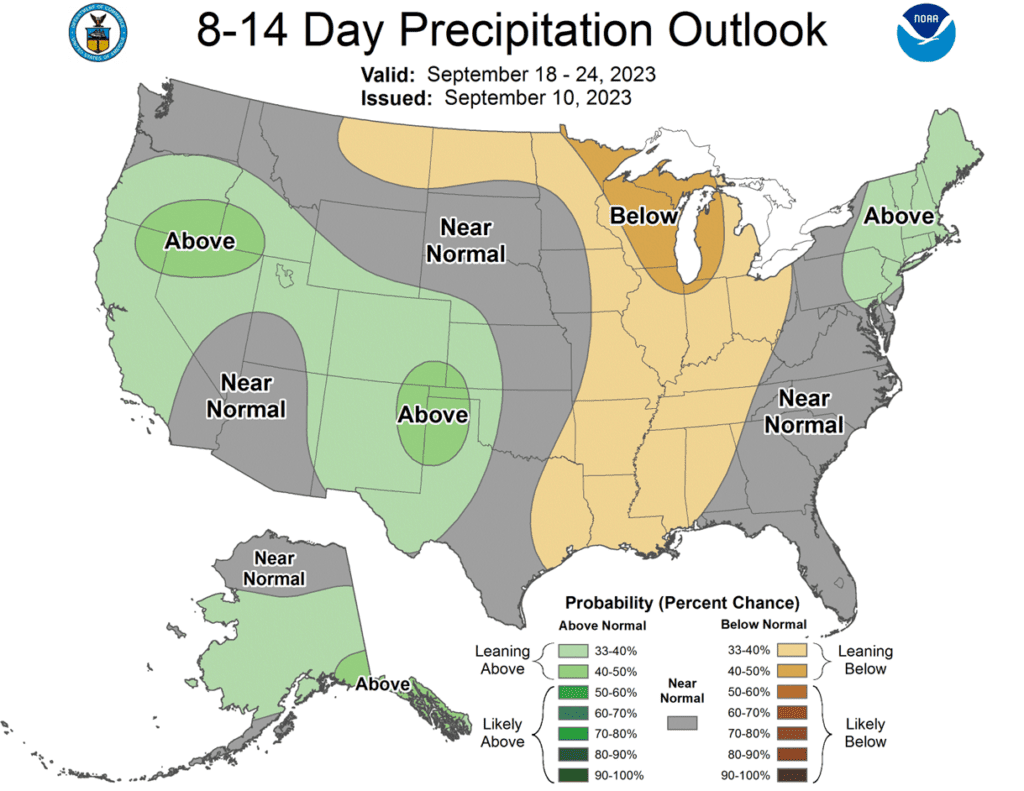

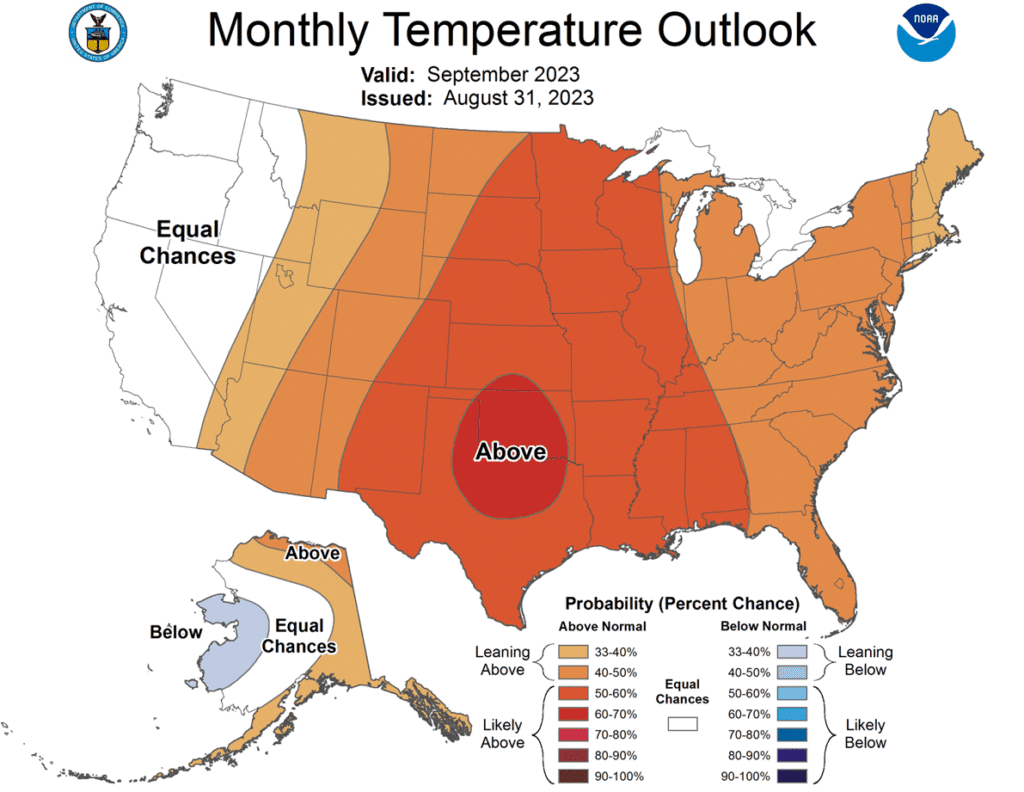

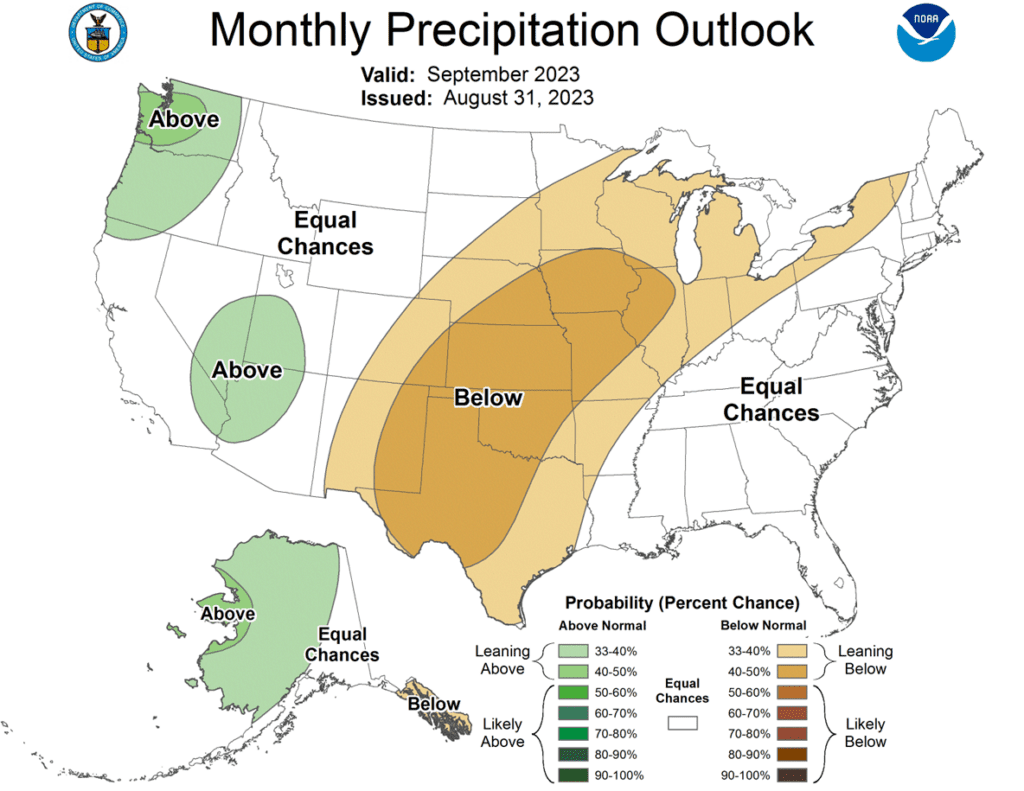

- To see the current US Temperature and Precipitation Outlooks for October, courtesy of the Climate Prediction Center, scroll down to the other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

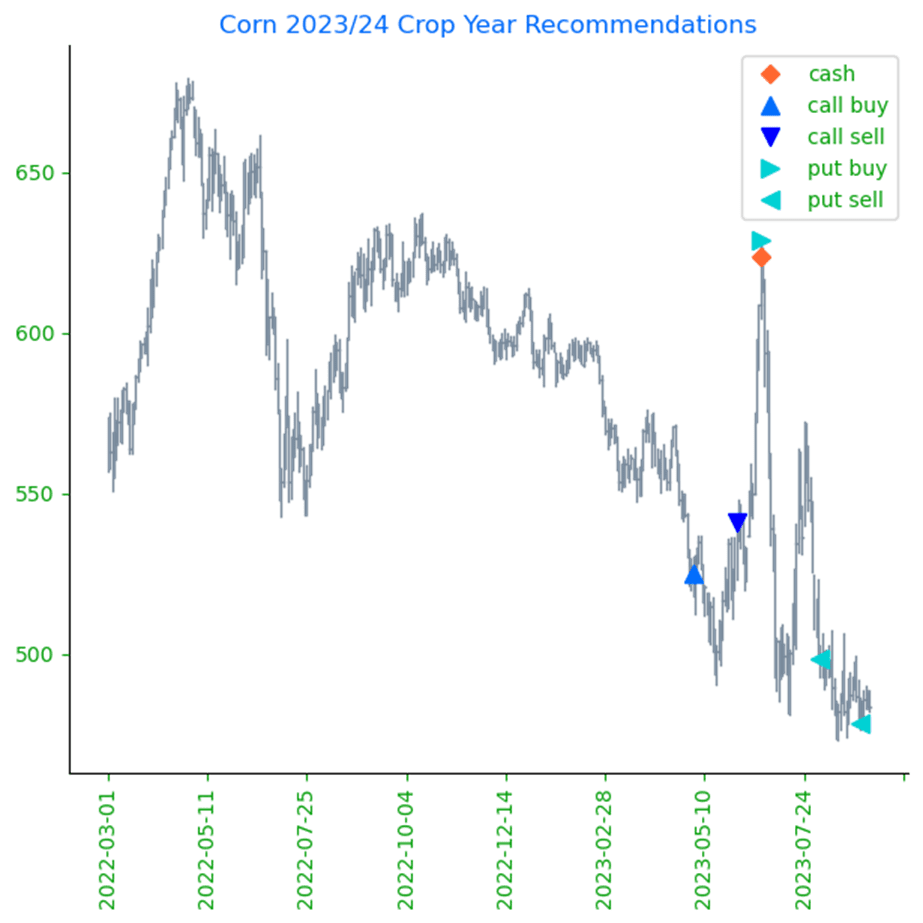

Corn

Corn Action Plan Summary

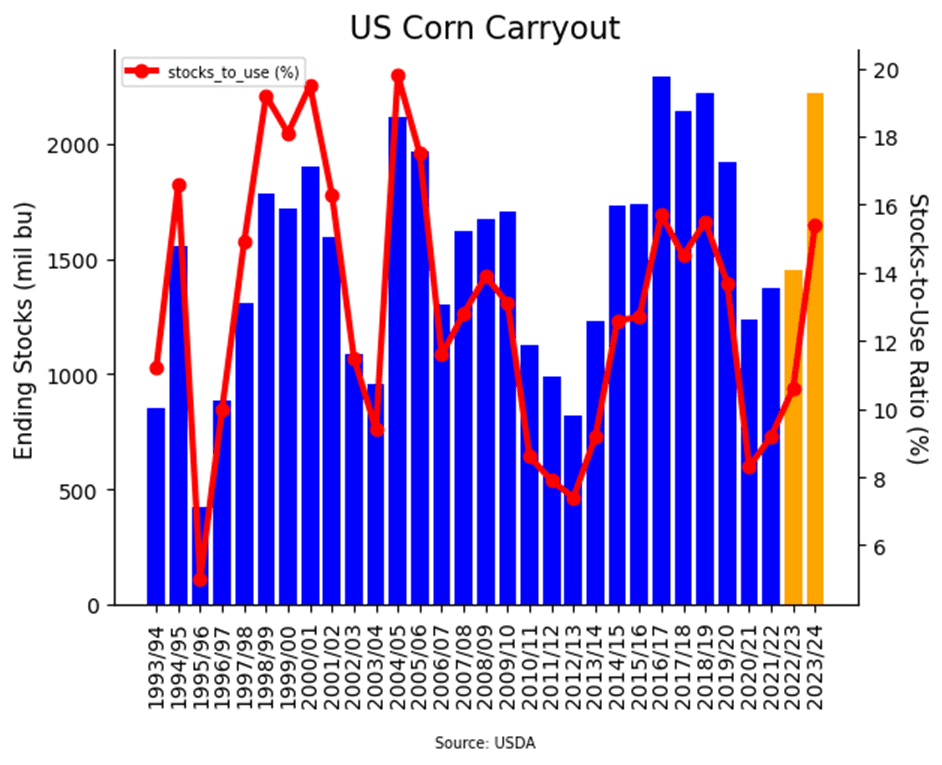

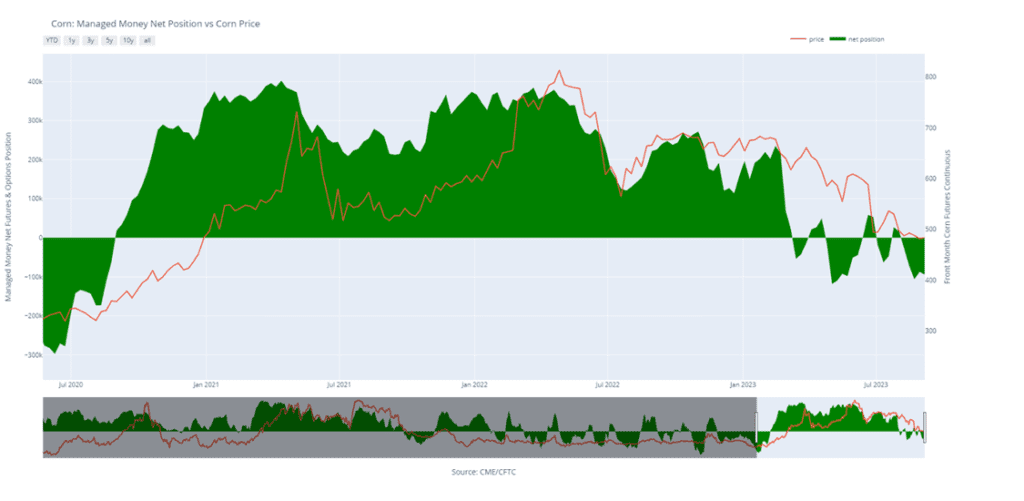

- No action is recommended for 2023 corn. Volatility has been a dominant feature this growing season with slow demand and increased planted acres, followed by hot and dry growing conditions that rallied prices nearly 140 cents and back down again. With the growing season mostly behind us, we are at the time of year when market lows are often made, and while the market may continue to recede into harvest, it is still subject to unforeseen influences that could move prices higher. For now, after locking in gains from the previously recommended purchased 580 puts, Insider is content to wait until after harvest when markets tend to strengthen before considering suggesting any additional sales.

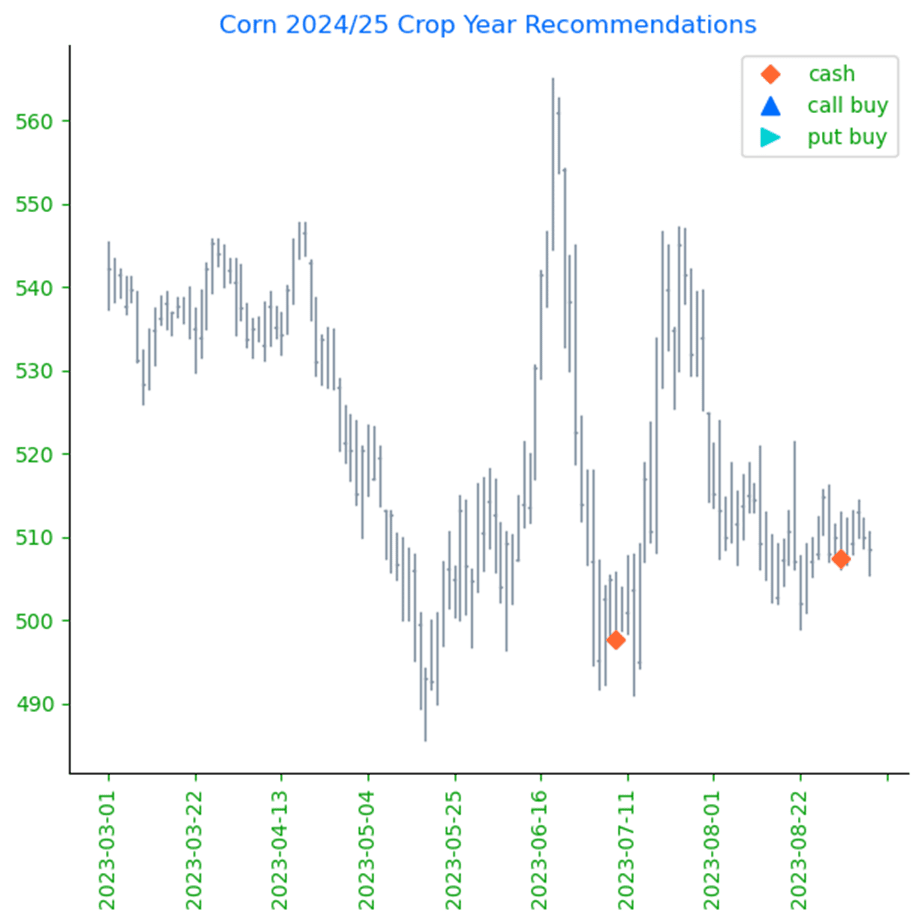

- No action is recommended for 2024 corn. Like the 2023 corn market, prices for the 2024 crop have been dominated by volatility from slow exports and adverse growing conditions which led to a near 80 cent trading range during the summer months. Plenty of time remains to market the crop, and while demand continues to be slow, many uncertainties remain that can move prices higher. After recommending an additional sale for the 2024 crop, Insider may not consider suggesting any further sales until later this winter or possibly even spring. We will continue to monitor the market for any upside opportunities in the coming weeks.

- No Action is currently recommended for 2025 corn. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

- Risk off trade on Thursday as the market saw fallout from the Fed’s commentary regarding holding a longer-term view of a high-interest rate environment. This brought selling across most equity and agriculture markets on the day. December corn gave back Wednesday’s gains, losing 7 cents on the session.

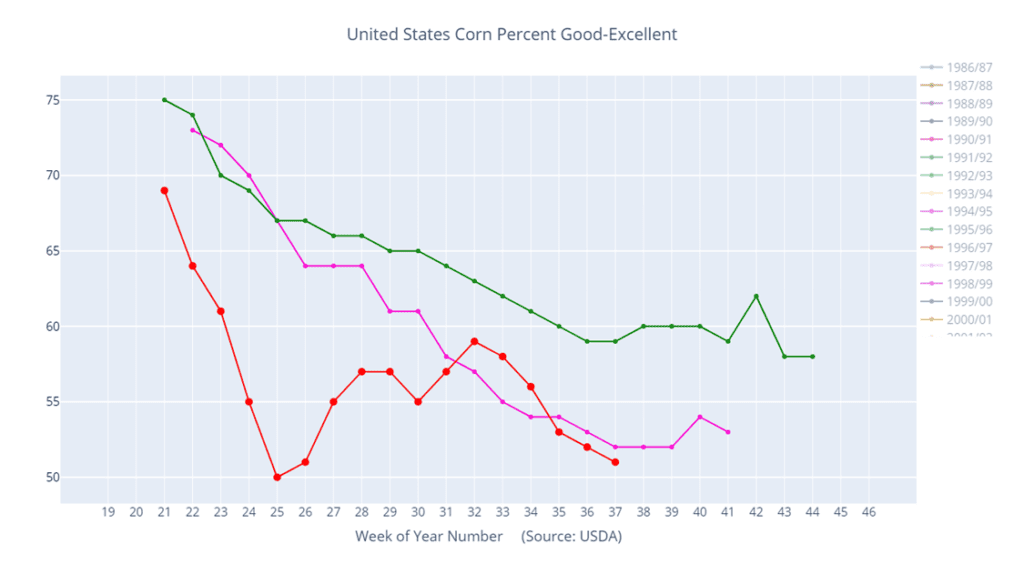

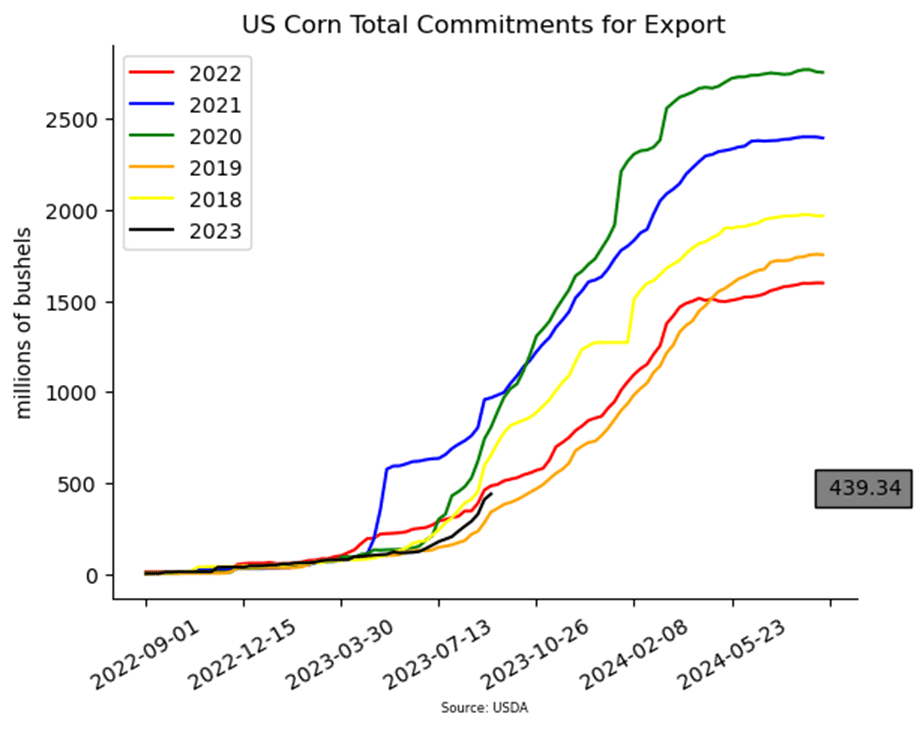

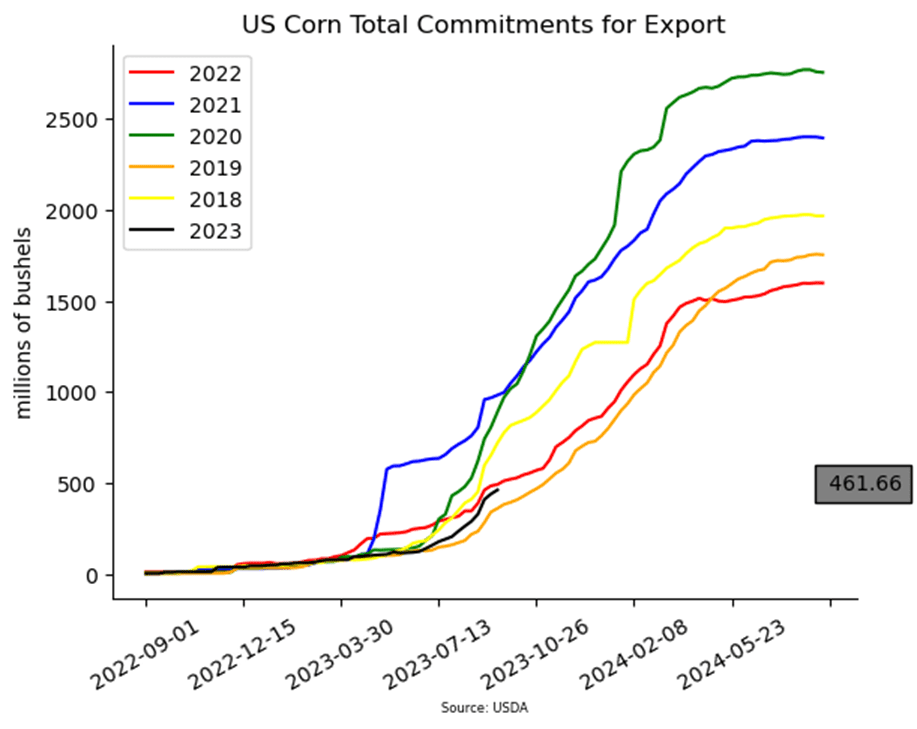

- Weekly export sales for corn are still disappointing. Last week totaled new sales of 567,000 MT (22.3 mb). Current corn sales commitments for the marketing year are down 6% from last year, and the USDA is forecasting a gain in potential exports.

- The USDA announced a flash export sale of corn overnight. Mexico bought 137,160 MT of corn, split at 121,920 MT for the 2023-24 marketing year and 15,240 MT for the 2024-25 marketing year. The total was 5.4 mb.

- The International Grain Council (IGC) raised its yearly global corn stocks forecast. The IGC is forecasting global carryover stocks at 289 mmt, up 14 mmt from last year’s estimates, reflecting the increase in projected global production.

- Corn harvest continues to ramp up, with early yield results being extremely variable based on the weather for the past growing season. Harvest pressure will likely affect the cash basis.

Above: The corn market has largely been rangebound since the beginning of August, and it continues to be under the influence of two bearish reversals, one posted on 8/21 and the other on 8/29. Above the market, resistance remains between 495 – 516, and below the market, support may be found near 460 and again near 415.

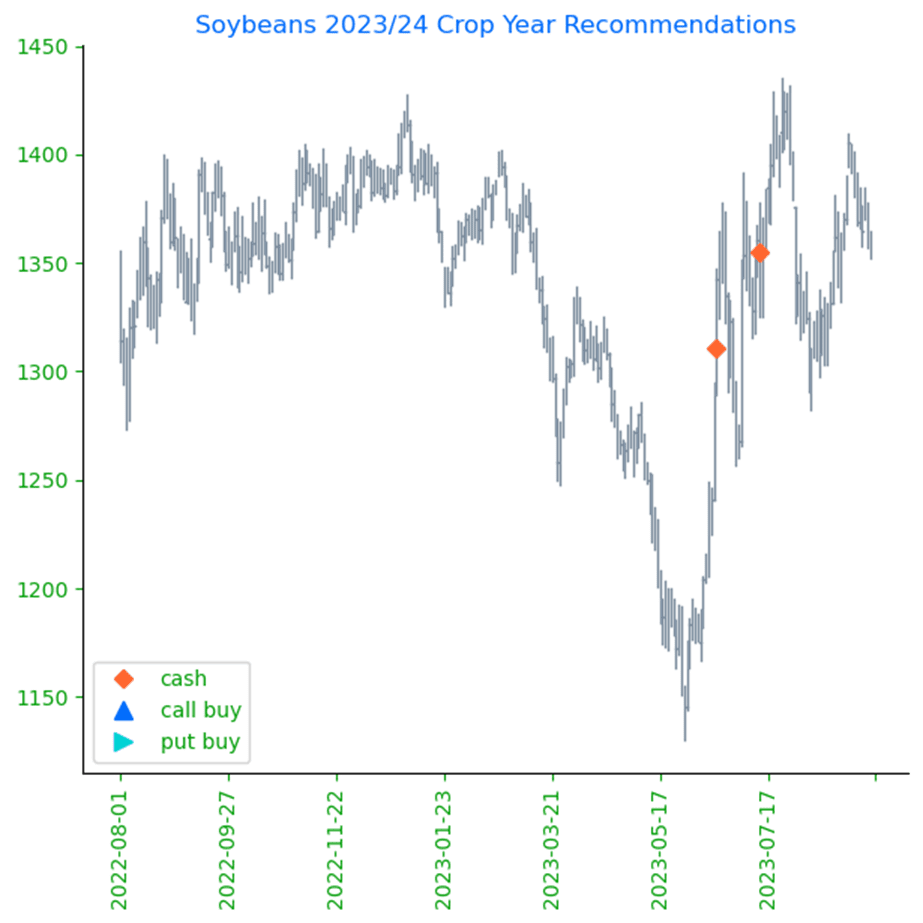

Soybeans

Soybeans Action Plan Summary

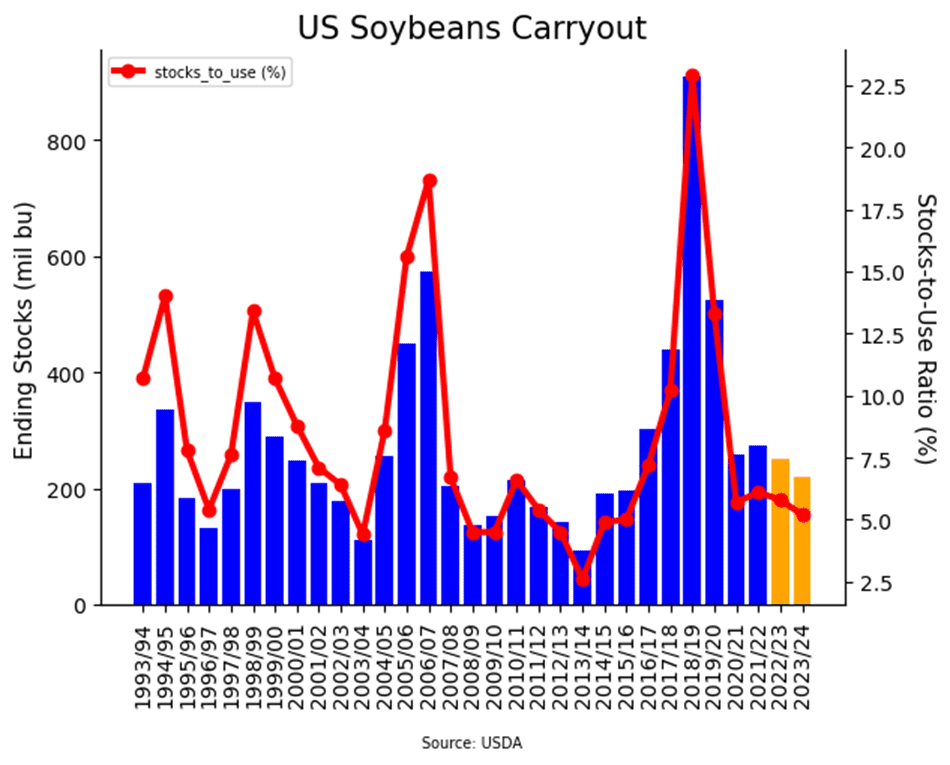

- No action is recommended for 2023 soybeans. This season the market has experienced a lot of volatility, not only from USDA reports but also from changing weather patterns, crop conditions, and export sales. While export demand currently lags last year’s numbers, ending stocks are also currently estimated at a tight 220 million bushels. For now, Insider may not consider suggesting any additional sales until after harvest. Although, we will continue to monitor the market for any upside opportunities in the coming weeks.

- No action is recommended for 2024 crop. Grain Market Insider continues to monitor any developments for the 2024 crop, though it may not be until after harvest or toward year’s end before we will consider recommending any 2024 crop sales.

- No Action is currently recommended for 2025 Soybeans. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

- Soybeans ended the day sharply lower, and below its 100-day moving average, following a poor export sales report for last week, anticipation of a large Brazilian crop next season, and harvest pressure within the US. Both soy products closed lower today as well.

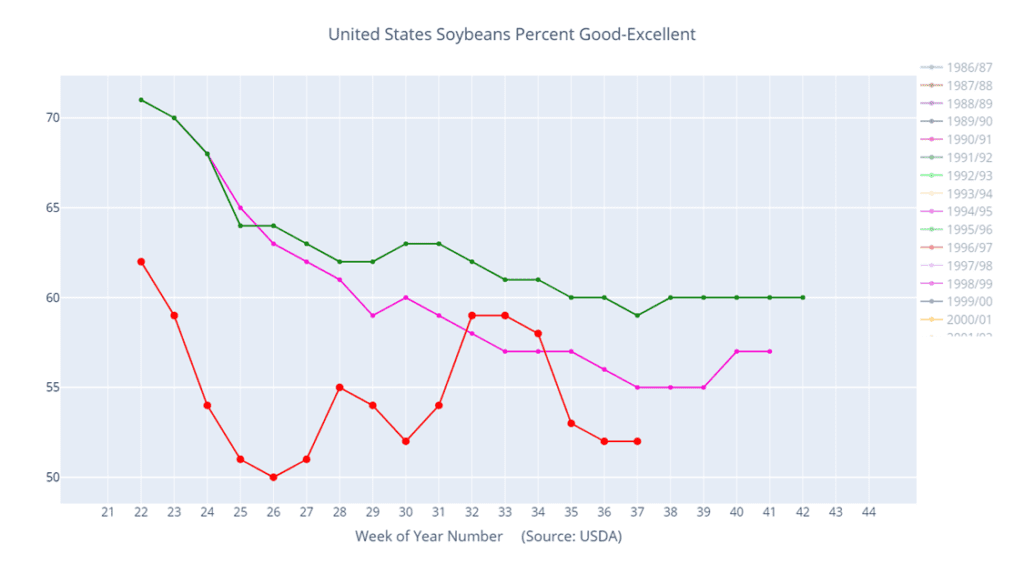

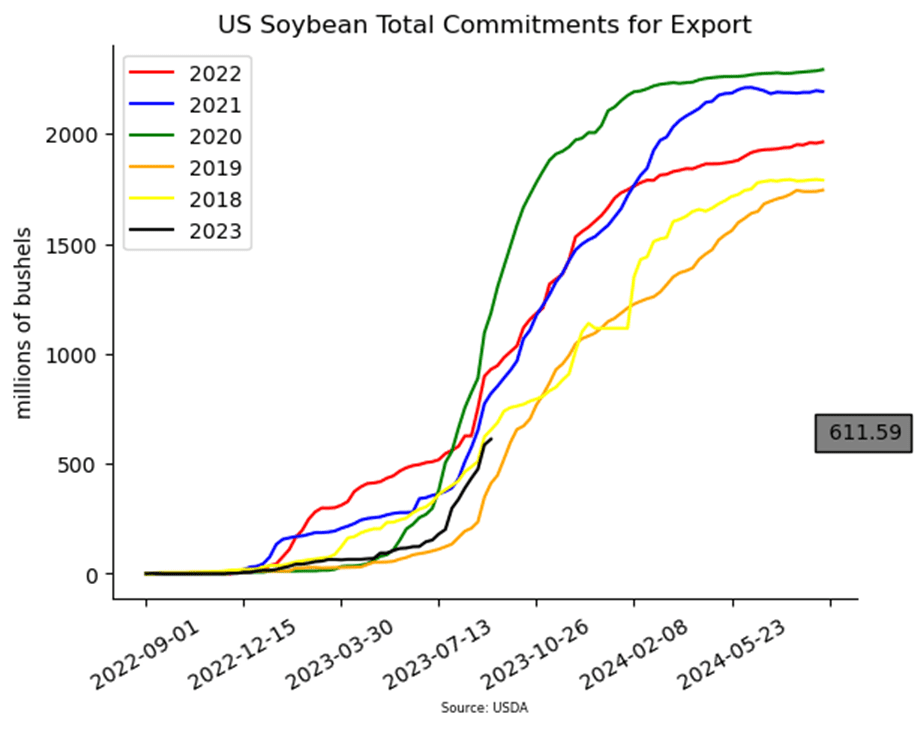

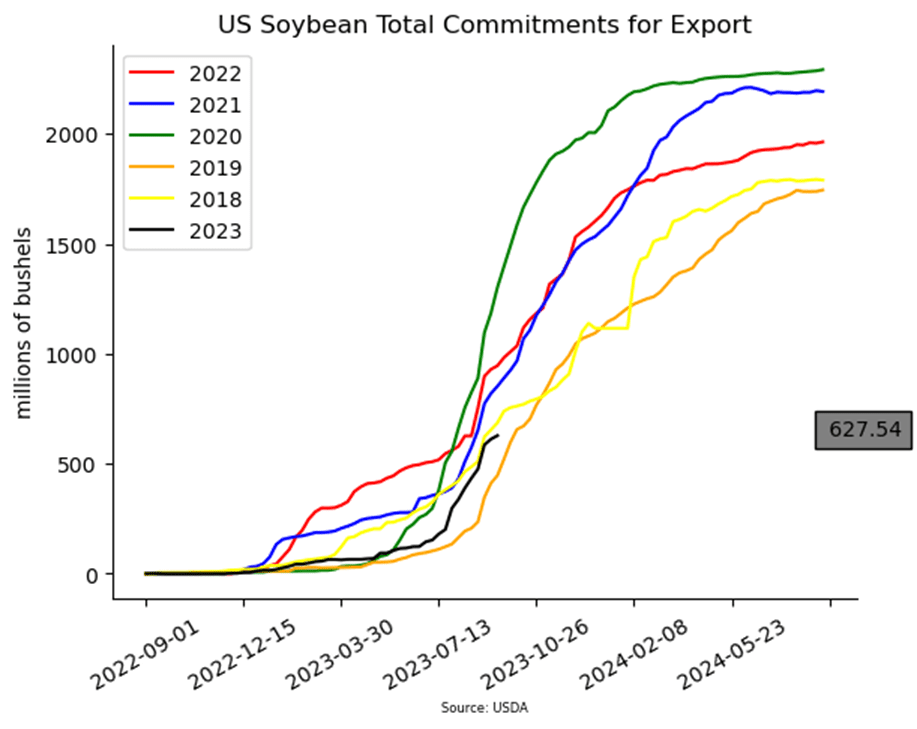

- For the week ending September 14, 2023, the USDA reported an increase of 16 mb of soybean export sales in 23/24, which came in below the low end of the estimate range. Last week’s export shipments of 20.0 mb were below the 34.8 mb needed each week to meet the USDA’s estimates and were primarily to China, Japan, and Mexico.

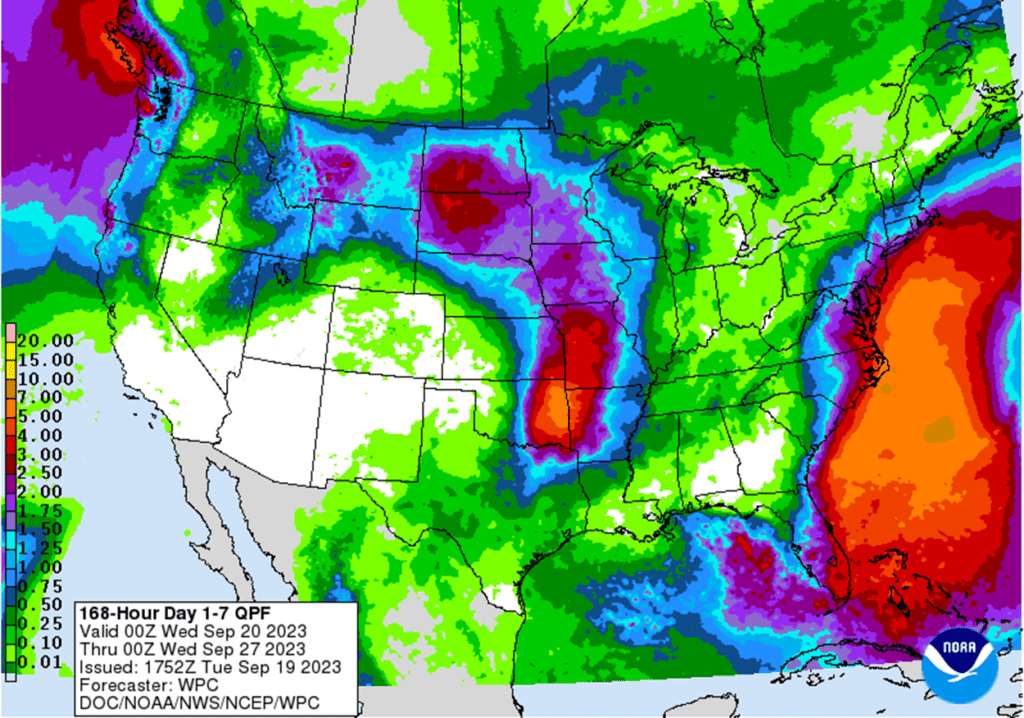

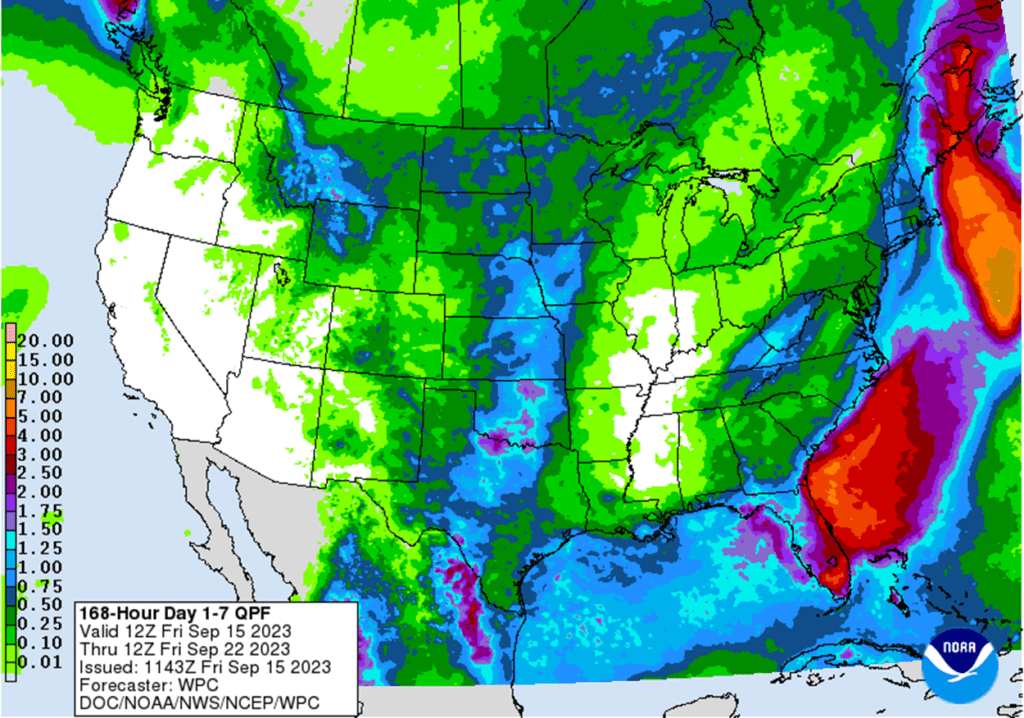

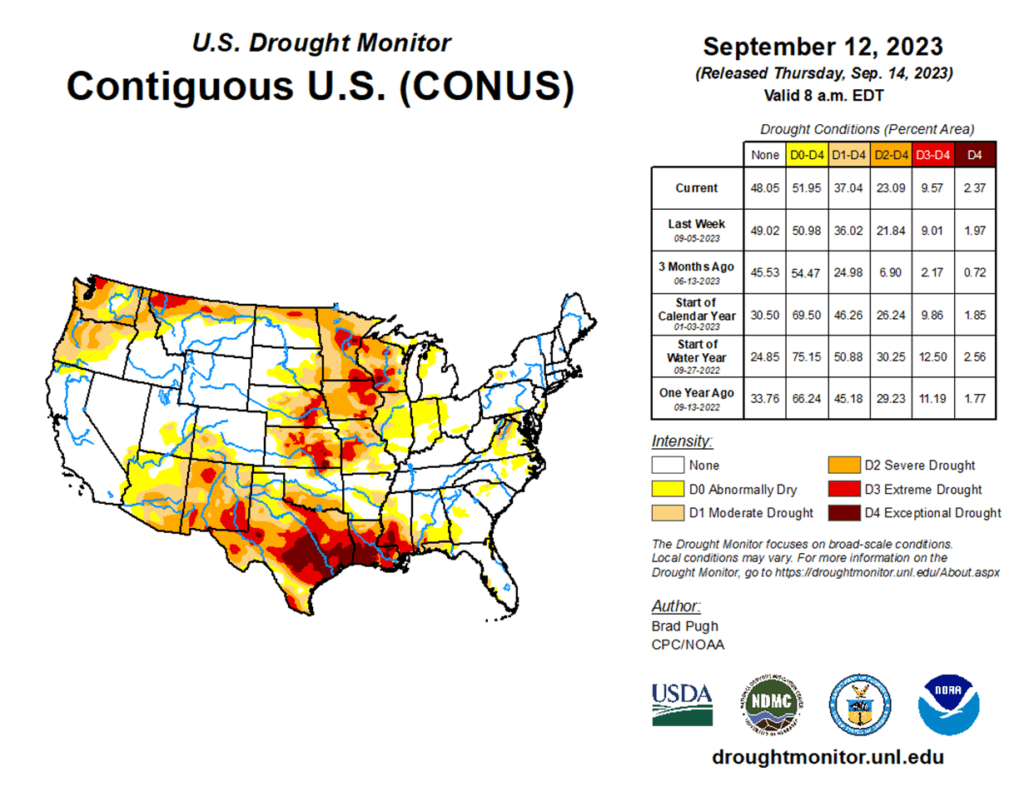

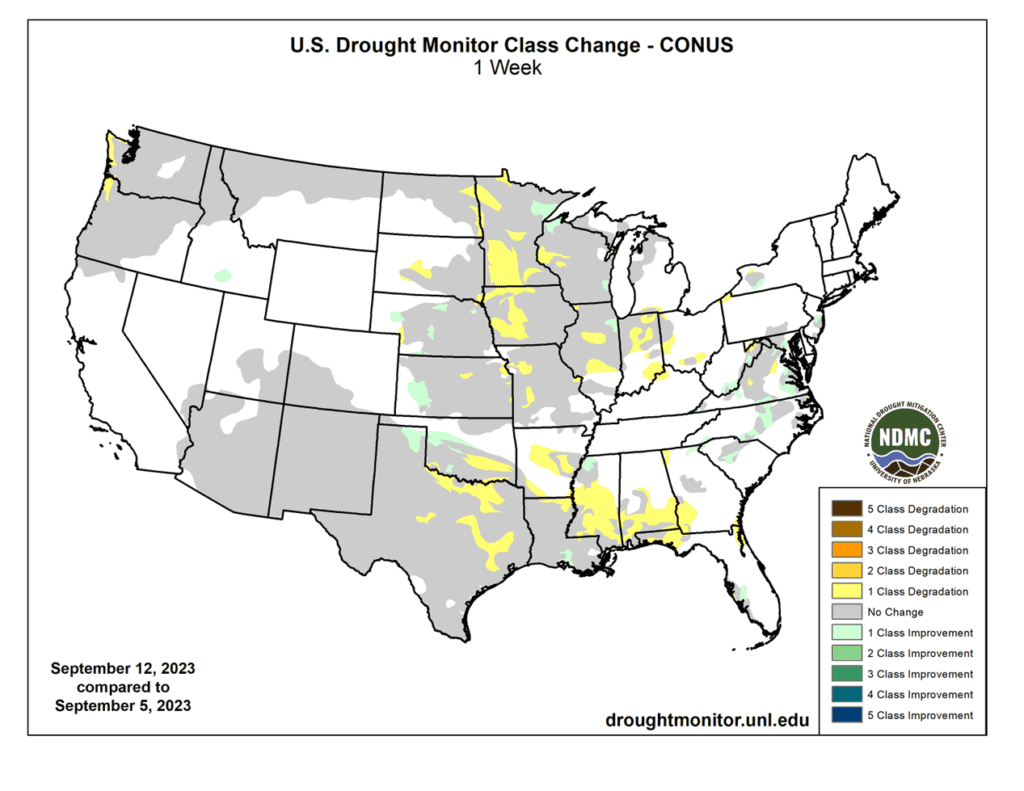

- Basis is expected to erode further into harvest as low water levels on the Mississippi River once again affect barge traffic. Heavy rains are expected from the northwestern Plains through Texas and Arkansas over the week which could help improve water levels.

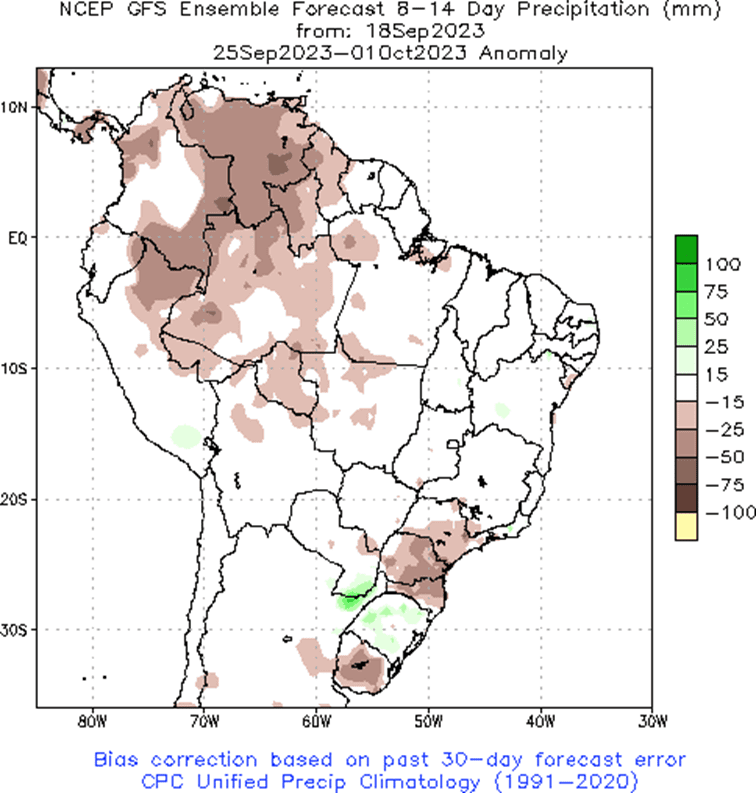

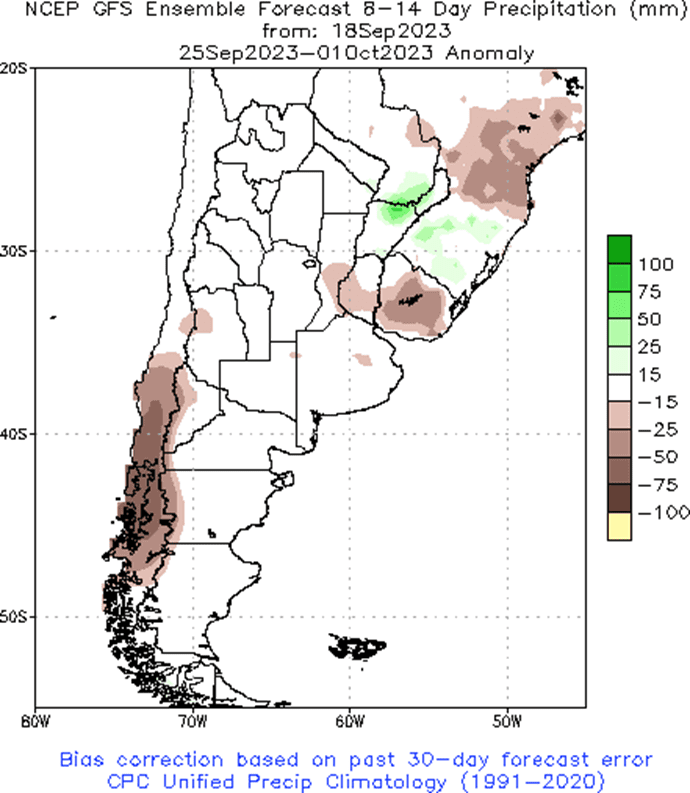

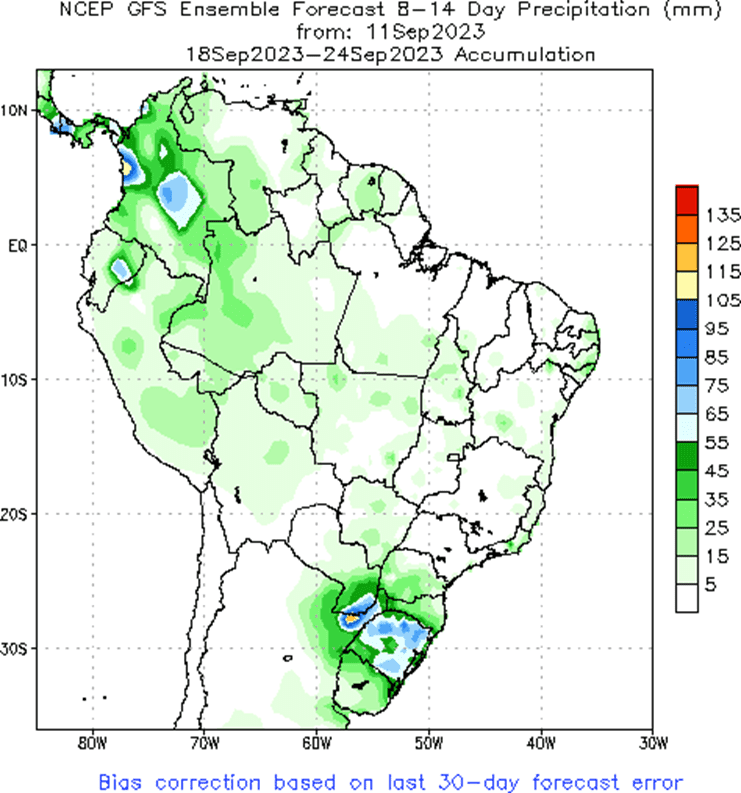

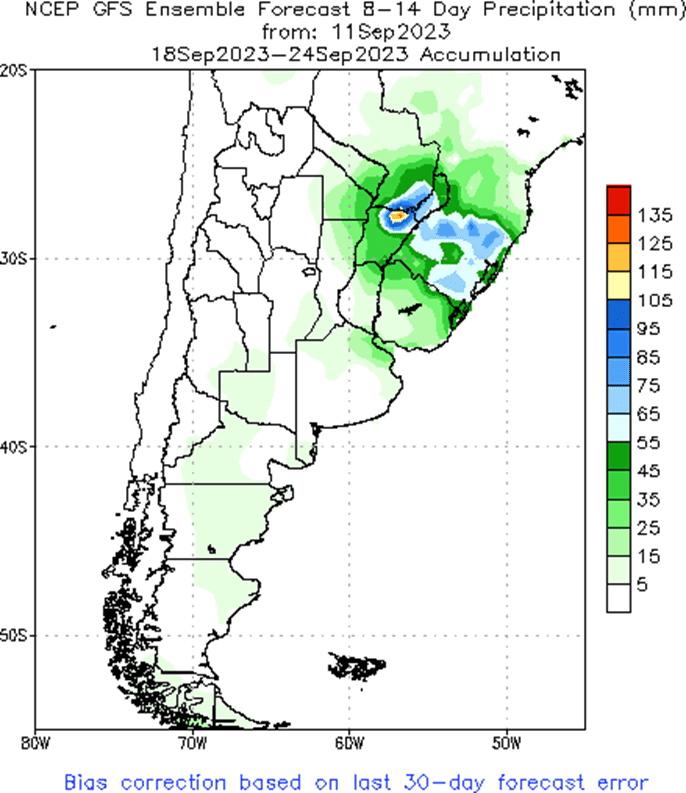

- While Brazil increased their estimated planted area of soybeans by 2.8% and are now expecting a new record crop of 162.4 mmt, there is an El Nino pattern developing which is already causing some dry weather in areas where soybeans were just planted. This dry weather could continue through the growing season.

Above: While the soybean market recently broke through the 1300 level of support, it continues to show signs of being oversold, which can be supportive. Currently, the next level of support lies near the May 31 low of 1270, with initial resistance above the market may be found near 1325 and again near the 50-day moving average.

Wheat

Market Notes: Wheat

- The markets took a risk off posture today with lower closes in grains, livestock, some soft commodities, and, as of writing, crude oil is still positive but is about a dollar off the daily high. The negative tone today appears to be spurred on in part by yesterday’s Fed meeting in which they indicated that interest rates down the road would continue to increase.

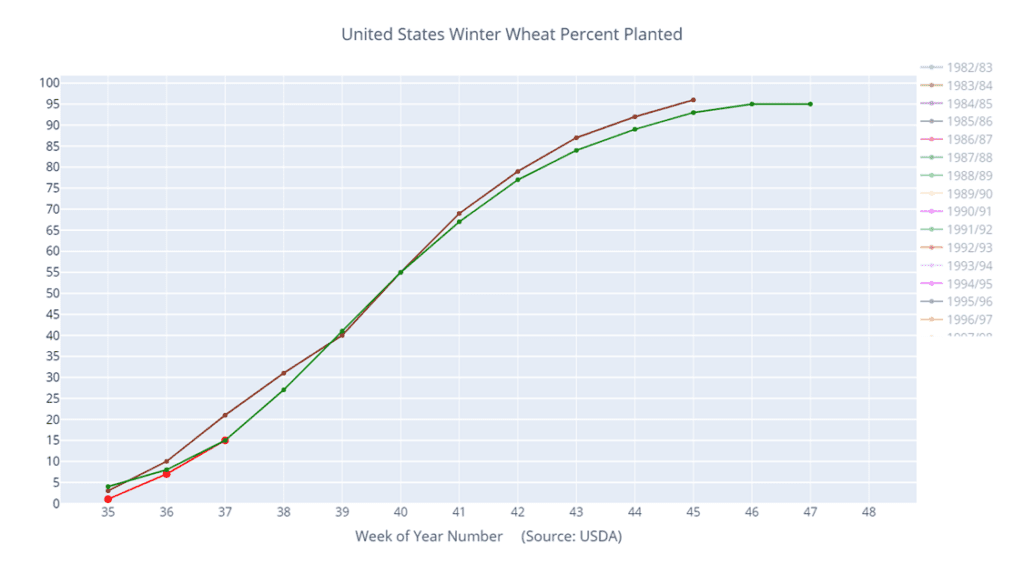

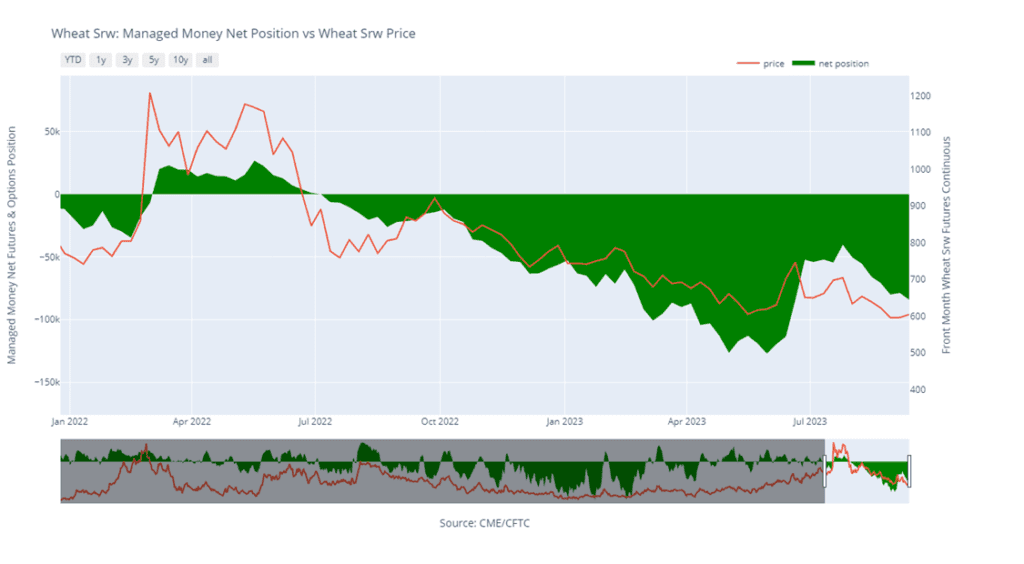

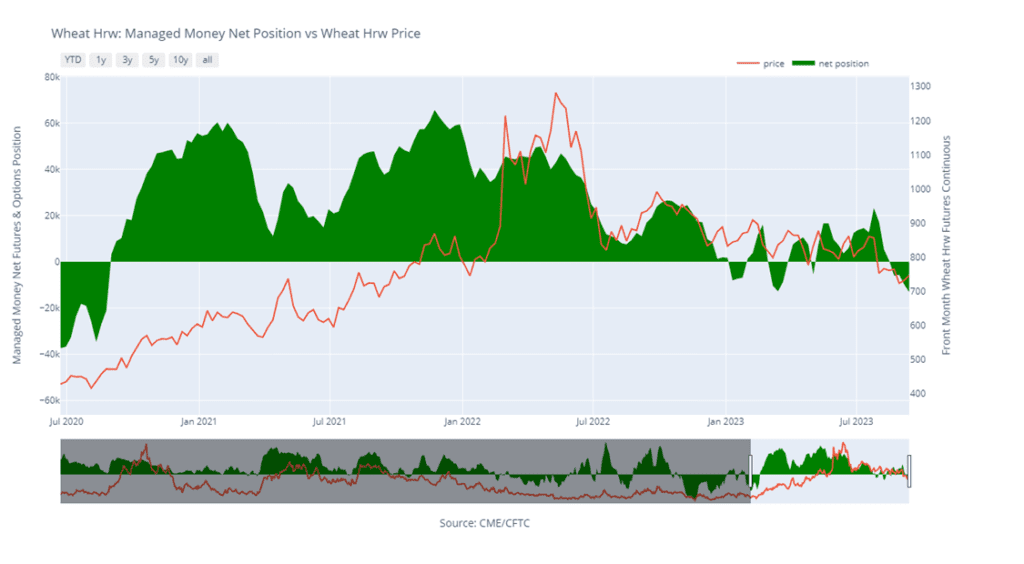

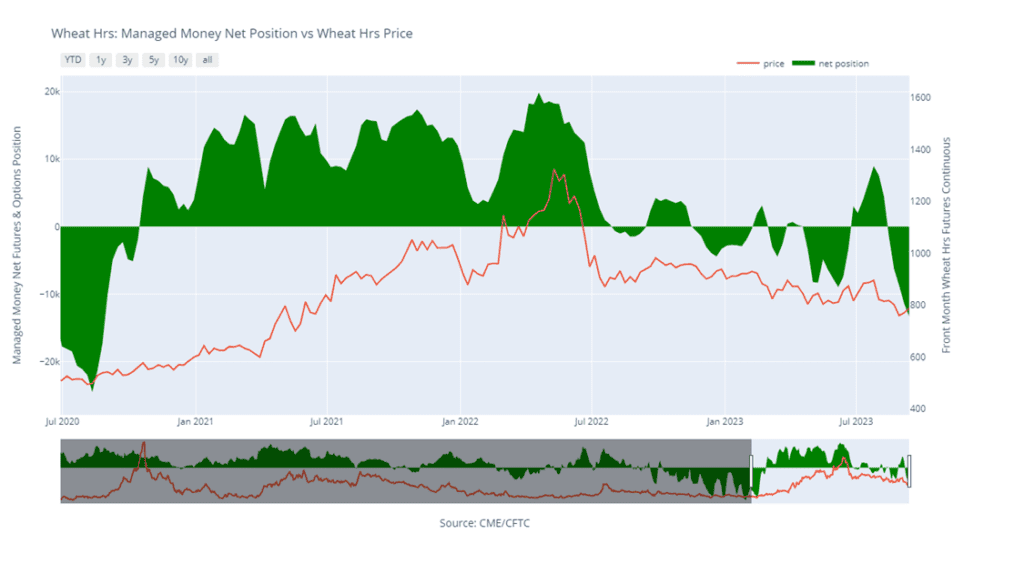

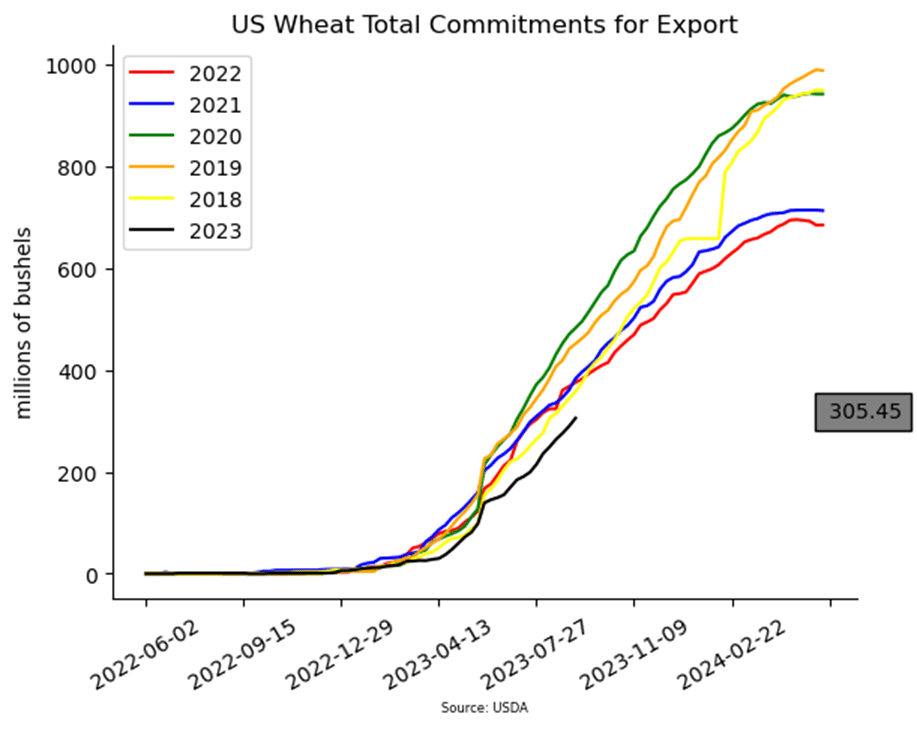

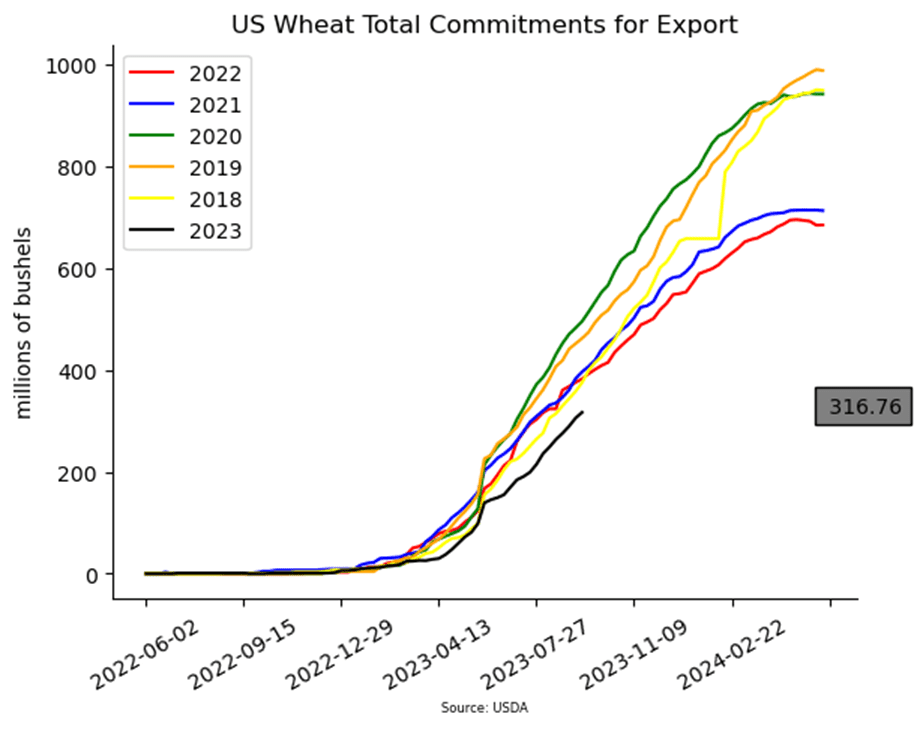

- The USDA reported an increase of 11.3 mb of wheat export sales for 23/24 and an increase of 0.5 mb for 24/25. Each week 14 mb needs to be shipped to reach the USDA’s goal of 700 mb of exports, but last week’s shipments were only 10.9 mb.

- The US Dollar Index made a new near-term high today and is hitting levels not seen since March. While it is overbought and may be due for a correction downward, it has been inching higher since mid-July, keeping constant pressure on the export market.

- According to Sov Econ, their estimate of 2023 Russian wheat production was reduced to 91.6 mmt, versus 92.1 mmt, due to expectations for a reduced Siberian crop.

- Ukraine’s Ag minister talked with the Polish Ag minister to discuss a resolution to the grain dispute between the two nations. Poland has banned imports from Ukraine to protect domestic prices, so the goal of the talks is to resolve the dispute on shipments.

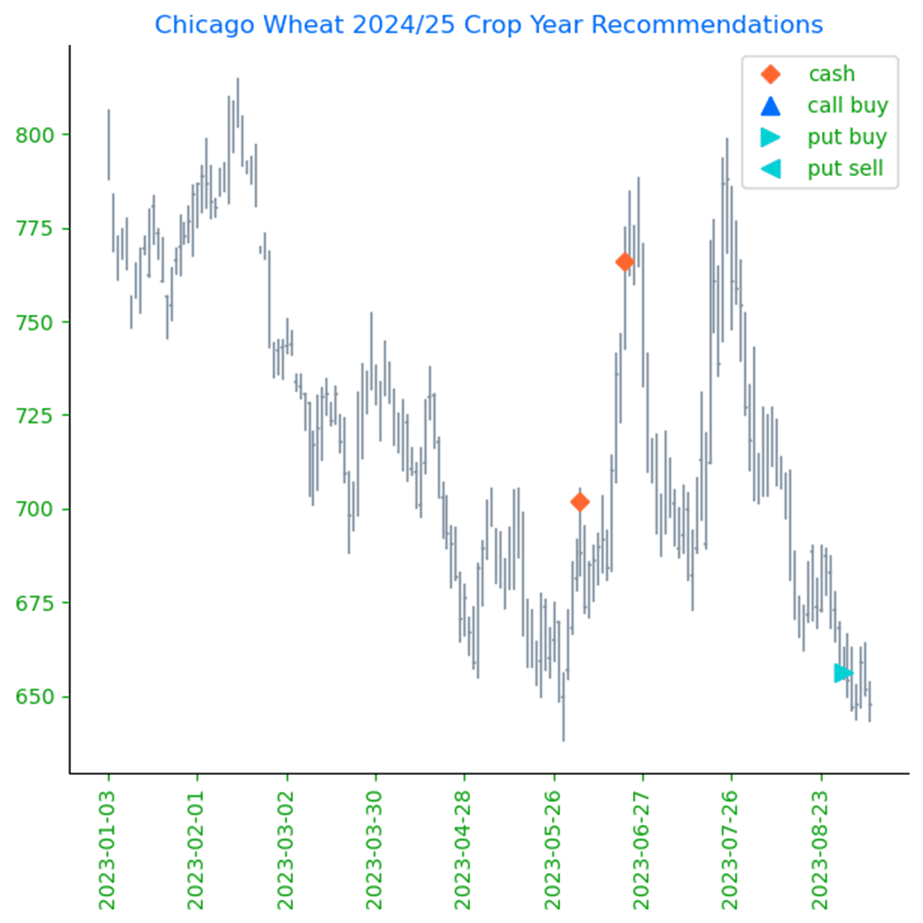

Chicago Wheat Action Plan Summary

- No action is currently recommended for 2023 Chicago wheat. The wheat market in recent weeks has been sensitive to slow export demand, weather, and headlines regarding the Black Sea region. Now with harvest behind us, and new crop planting upon us, markets can still change suddenly due to El Nino and unforeseen geopolitical events, even though export demand remains weak. Following the recent recommendation to make an additional sale for the 2023 crop, Insider will continue to watch for any violations of support while also looking for prices to reach 650 – 700 before suggesting any further sales.

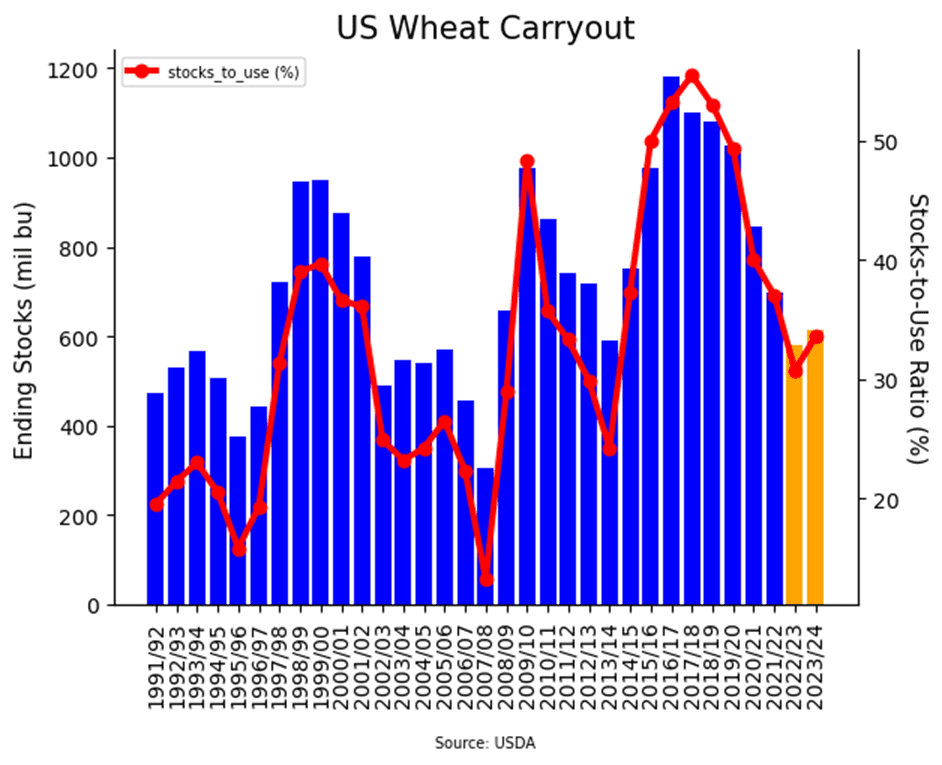

- No action is recommended for 2024 Chicago wheat. Considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices, Insider recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. Plenty of time remains to market the 2024 crop with many uncertainties that could shock prices higher, like the world stocks to use ratio at an 8-year low, war in the Black Sea and production concerns in the southern hemisphere. If prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800, if not, and prices make new lows, unsold bushels will be protected by the recommended July ’24 590 puts.

- No action is currently recommended for 2025 Chicago Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the USDA’s 9/12 update, the market posted a bullish reversal and traded into the 590 – 615 resistance area. If the market breaks through to the upside, further resistance could be found between 645 – 665. Otherwise, if the market turns lower, the next level of support lies between 570 and the December 2020 low of 565.

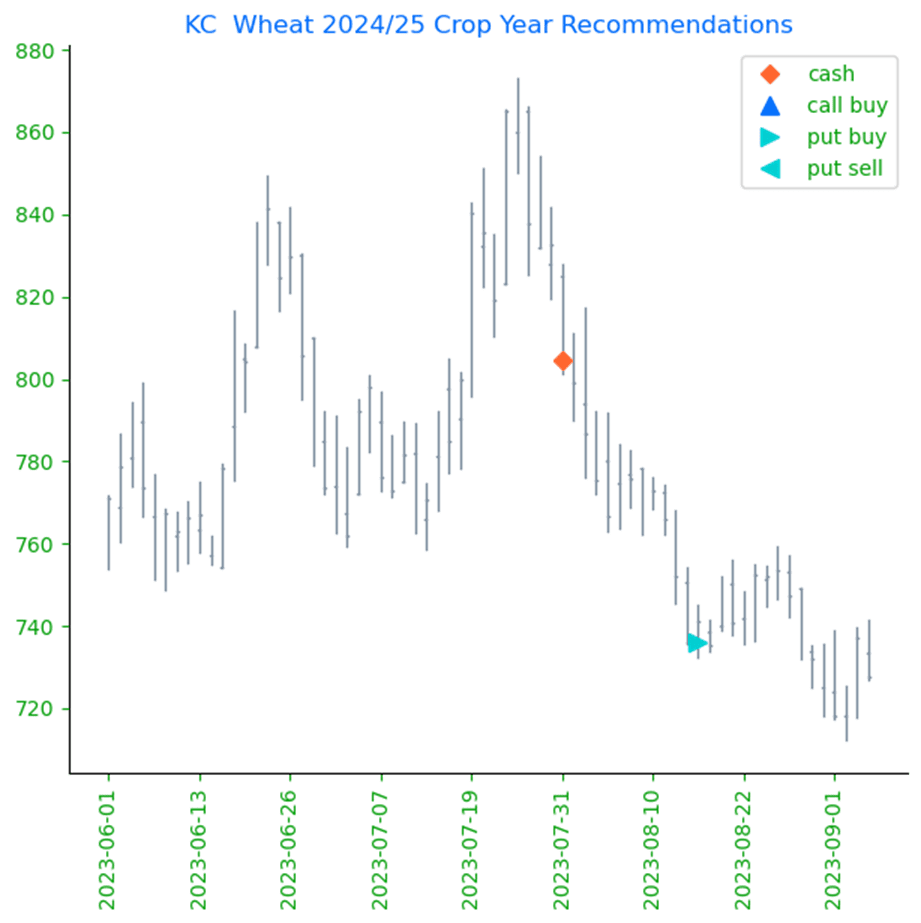

KC Wheat Action Plan Summary

- No action is recommended for 2023 K.C wheat crop. Since the end of May, the wheat market has been influenced by weak demand, changing headlines from the Black Sea region, and the corn market with its own demand and weather concerns. With harvest in the bin, U.S. production has been better than expected and demand remains weak. Still, many supply questions remain unanswered from the Black Sea region and the southern hemisphere, which could push prices in either direction. While Insider will continue to monitor the downside for any breach of major support, we would need to see prices pushed toward 750 – 800 before considering any additional sales.

- No action is recommended for 2024 K.C. wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for U.S. prices. Insider recently recommended buying July ’24 puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 660 puts, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for 2025 KC Wheat. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: Following the USDA update on September 12, the December contract posted a bullish key reversal, where the market made a new low for the move, yet closed higher. If prices continue higher, resistance above the market remains near 770 – 780. Otherwise, support below the market rests near the September 12 low of 709, and again near the September ’21 low of 670.

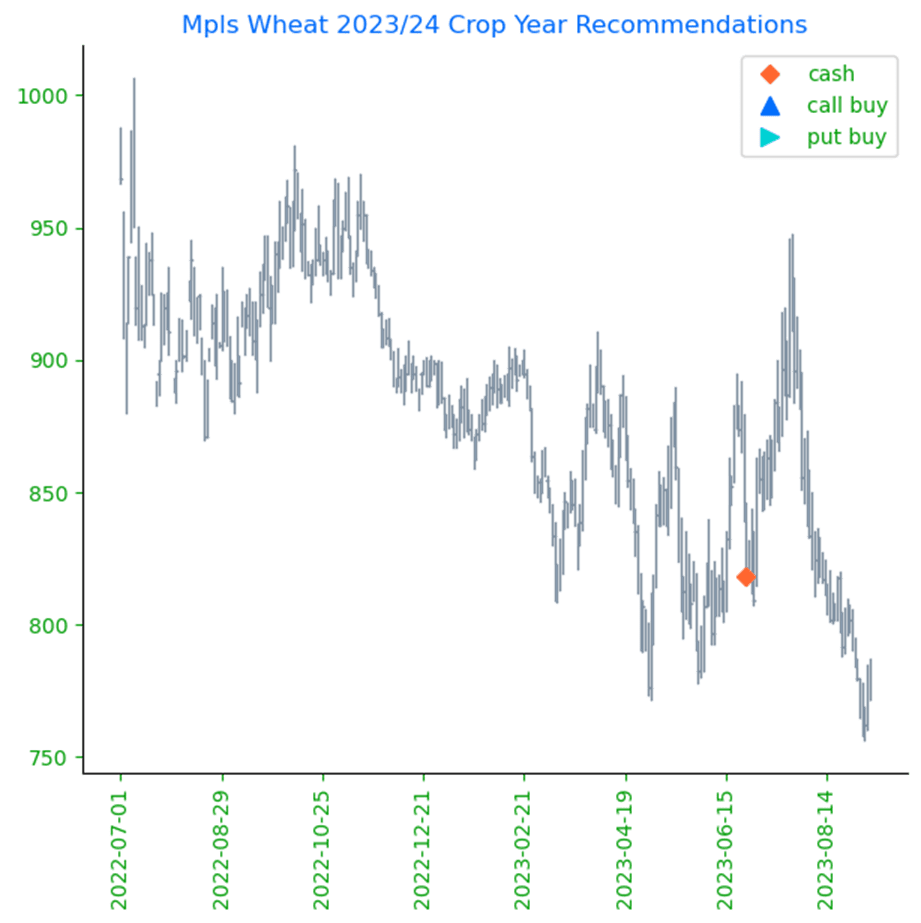

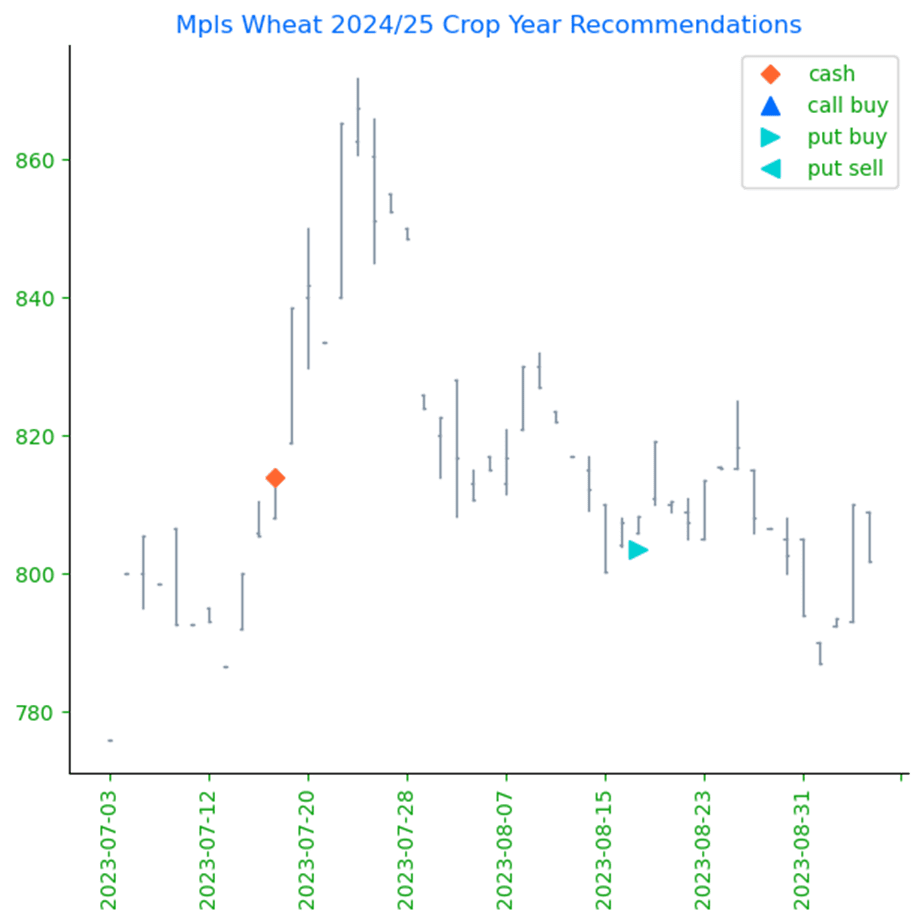

Mpls Wheat Action Plan Summary

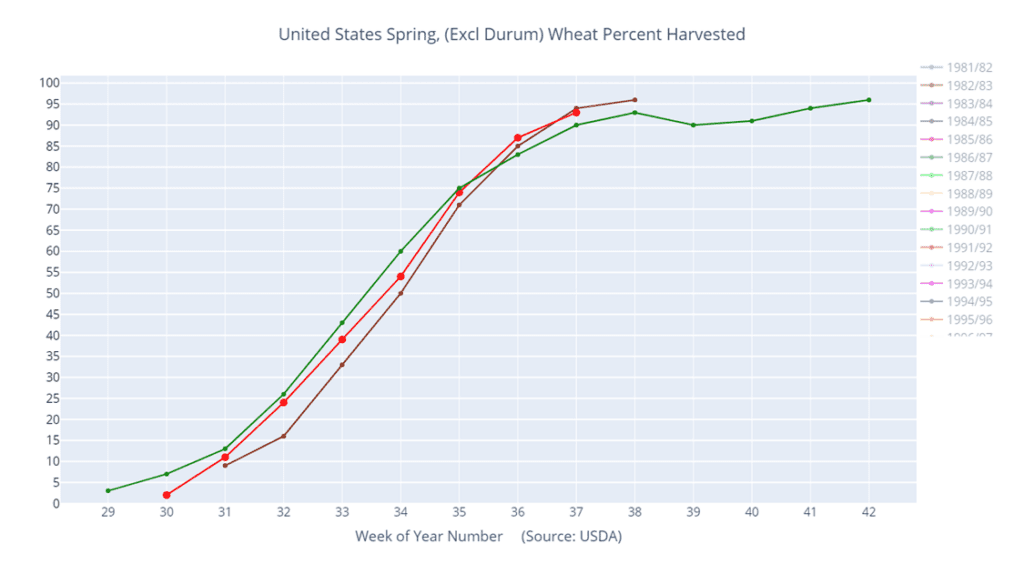

- No action is currently recommended for the 2023 New Crop. Weather has been a dominant feature this season with production concerns not only in the U.S., but also Canada and Australia. While prices have been weak due to low export demand, weather and geopolitical events can change suddenly to move prices higher. If prices begin to improve, Insider will consider making sales suggestions, while also continuing to watch the downside for any further violations of support.

- No action is currently recommended for 2024 Minneapolis wheat. This year has been dominated by production concerns regarding the 2023 crop, and considering slow export demand and cheap Russian prices continue to be major headwinds for prices. Insider recently recommended buying July ’24 K.C. wheat puts to protect unsold grain if prices continue to retreat further. While war persists in the Black Sea region, production concerns continue in the southern hemisphere due to El Nino, and the world stocks to use ratio remains at an 8-year low. There are still many uncertainties that could shock prices higher, and plenty of time remains to market the 2024 crop. After recommending buying July ’24 K.C. wheat 660 puts for the liquidity and high correlation to Minneapolis wheat’s price movements, unsold bushels will be protected if prices make new lows, and if prices turn around and rally higher, Insider will be looking for opportunities to consider recommending additional sales north of 800.

- No action is currently recommended for the 2025 Minneapolis wheat crop. 2025 markets are very illiquid right now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

Above: On September 5, the December contract posted a bullish reversal from oversold conditions, and while the market initially retreated, the reversal was not negated. Currently, nearby resistance remains near 785 – 795 and again around 810 – 820. The next support level below the market remains near the September 5 low of 756-3/4, and then near the June ’21 low of 730.

Other Charts / Weather