9-3 End of Day: Midweek Grain Markets See Corn, Soybeans, and Wheat Move Lower

Grain Market Insider Interactive Quote Board

Grain Market Highlights

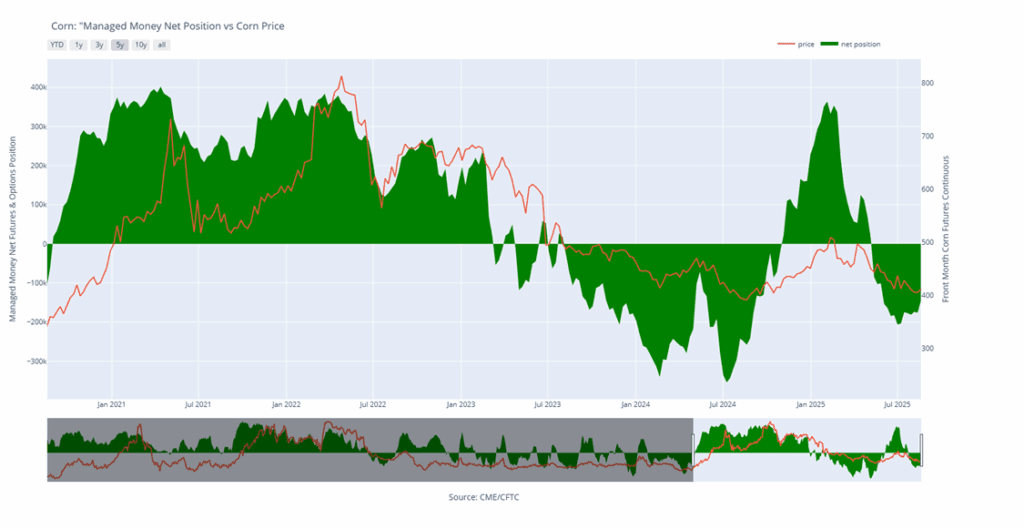

- 🌽 Corn: Corn futures ended the day lower, pressured by declines in soybeans and wheat, as ongoing economic concerns and tariff talks weighed on the grain markets.

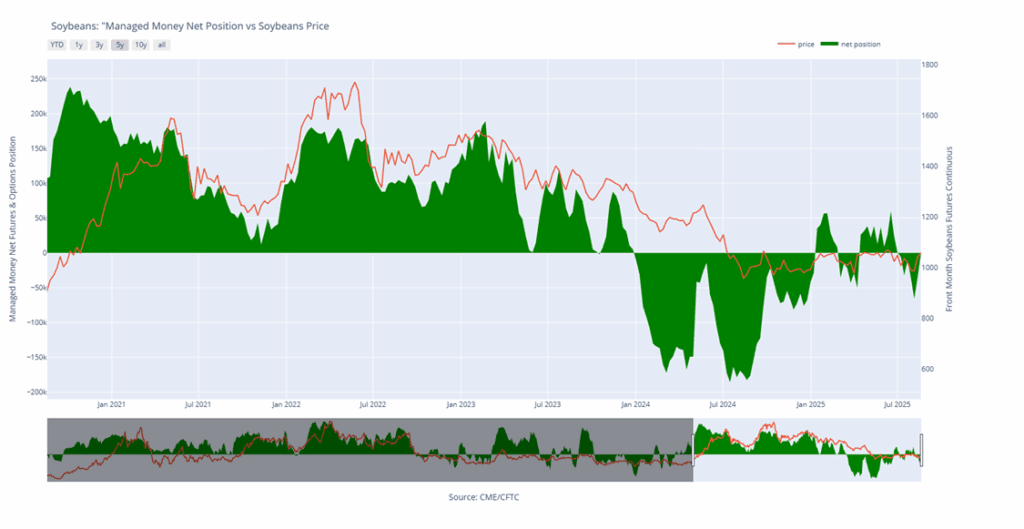

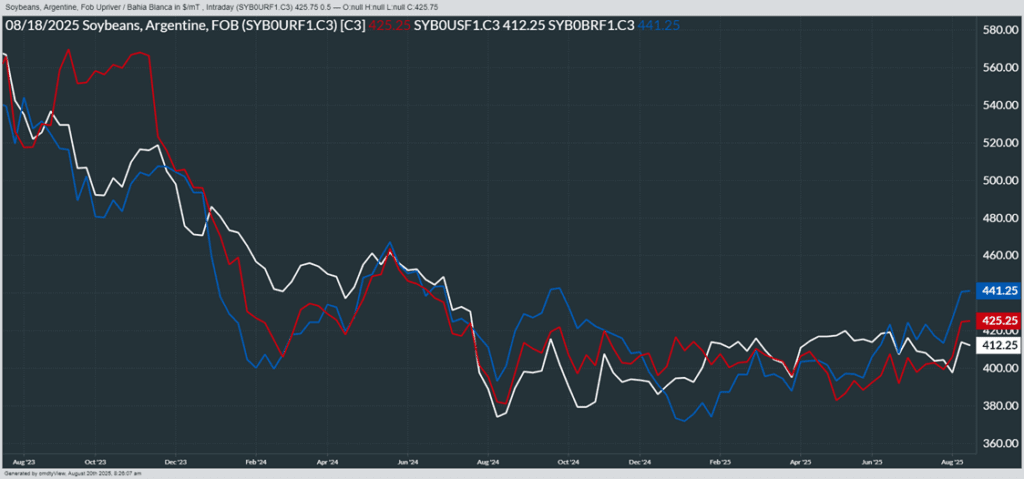

- 🌱 Soybeans: Soybeans closed lower amid growing concerns over the absence of a Chinese trade deal, as the market moves deeper into the usual export window for Chinese soybean demand.

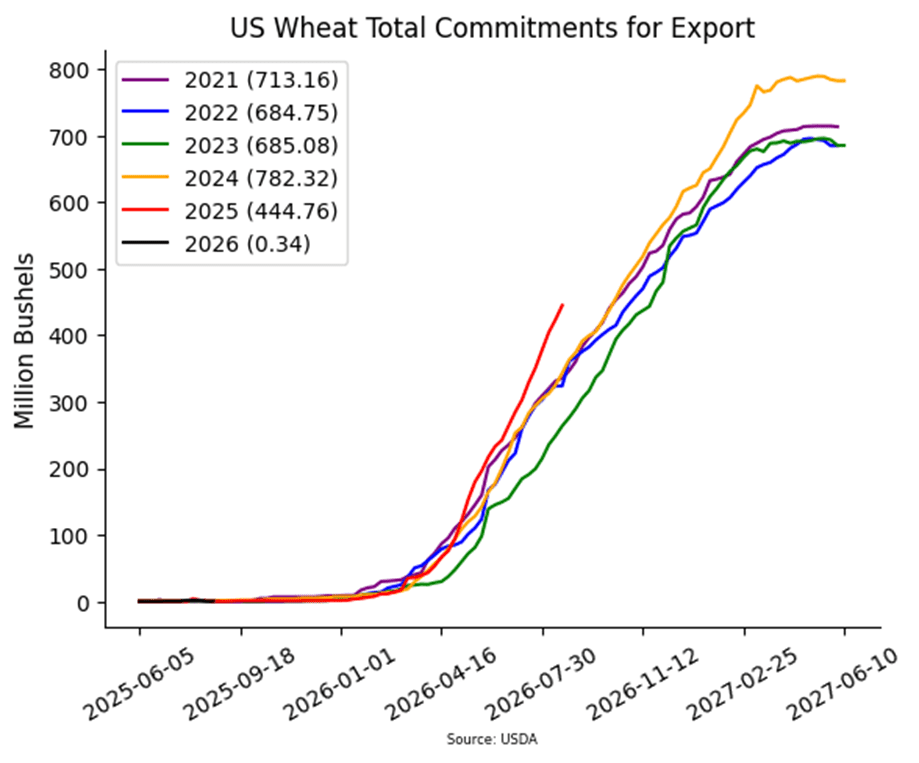

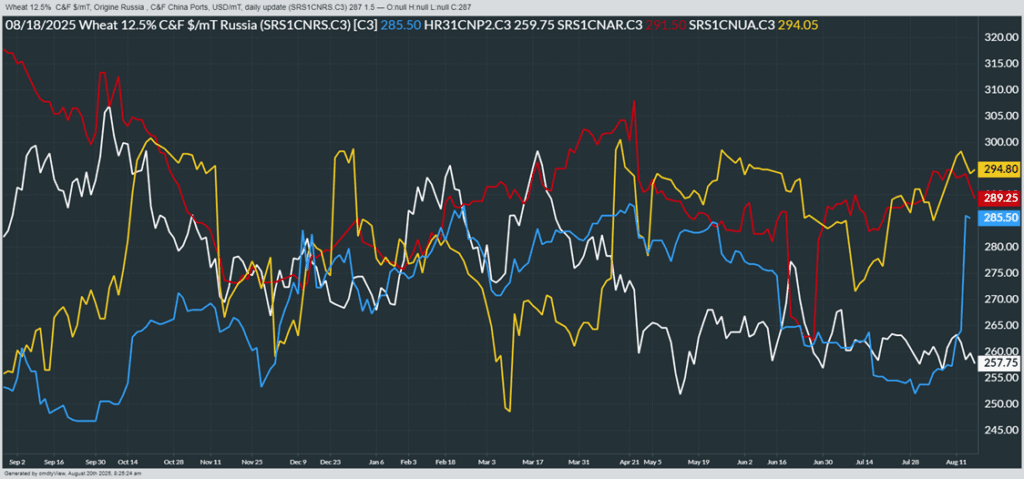

- 🌾 Wheat: Wheat futures closed lower on Wednesday, pressured by rising global supply estimates as harvest progresses, raising concerns about whether demand can keep pace with growing supplies.

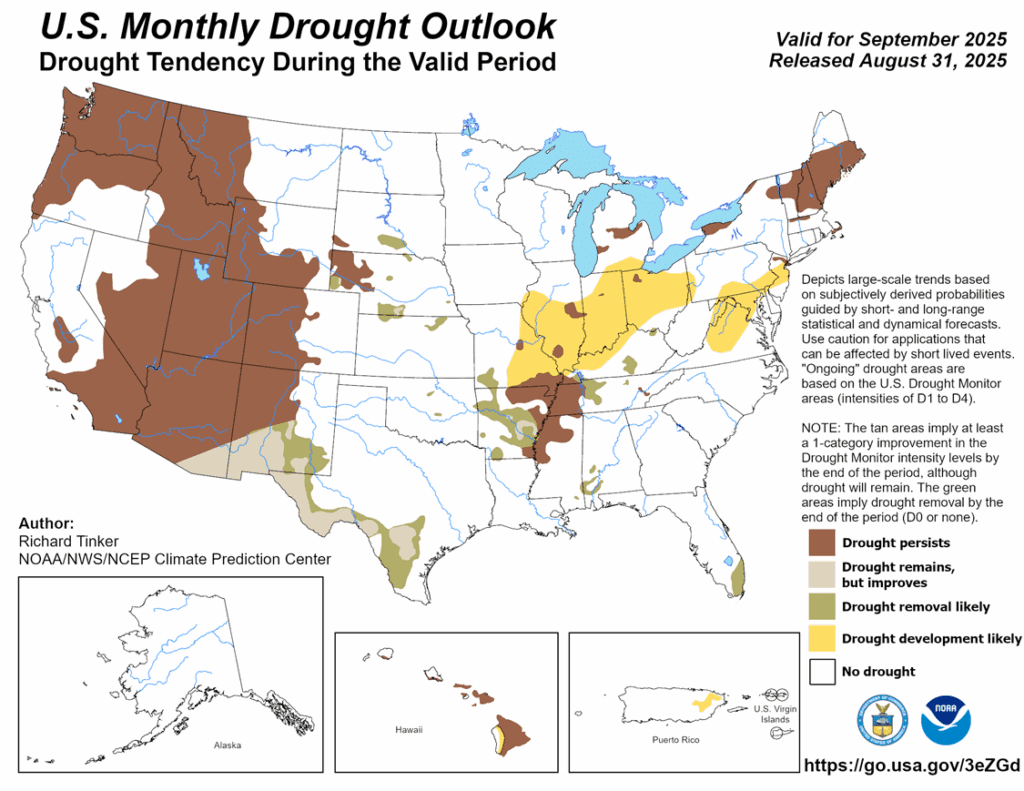

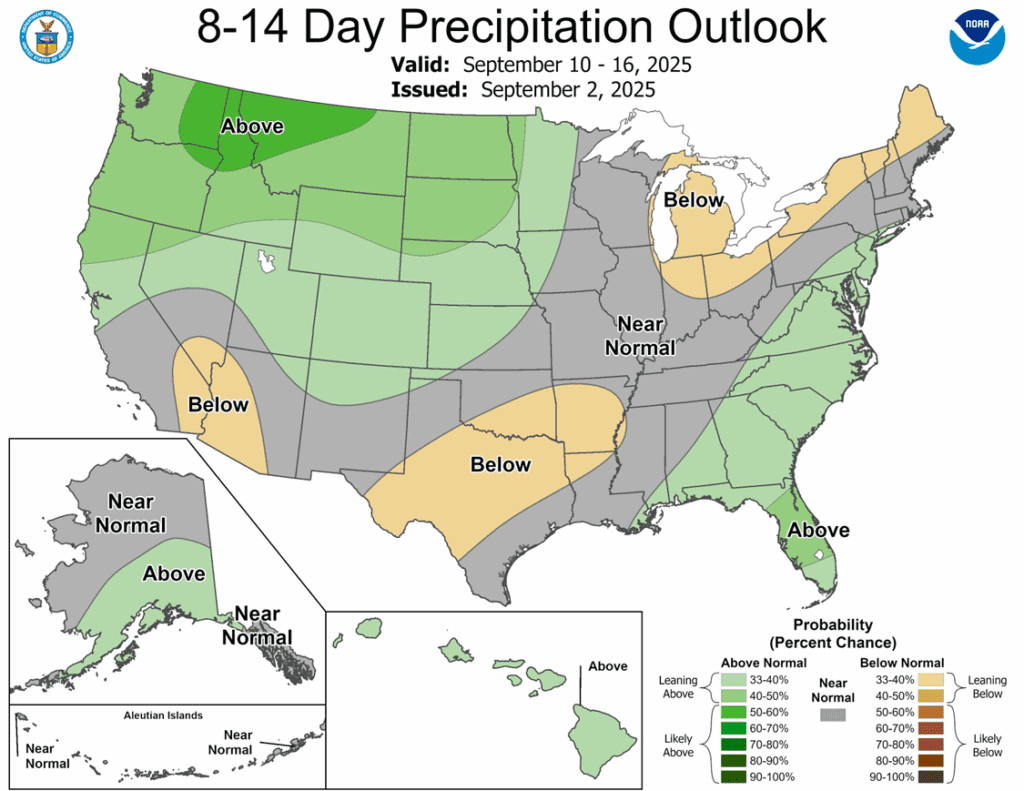

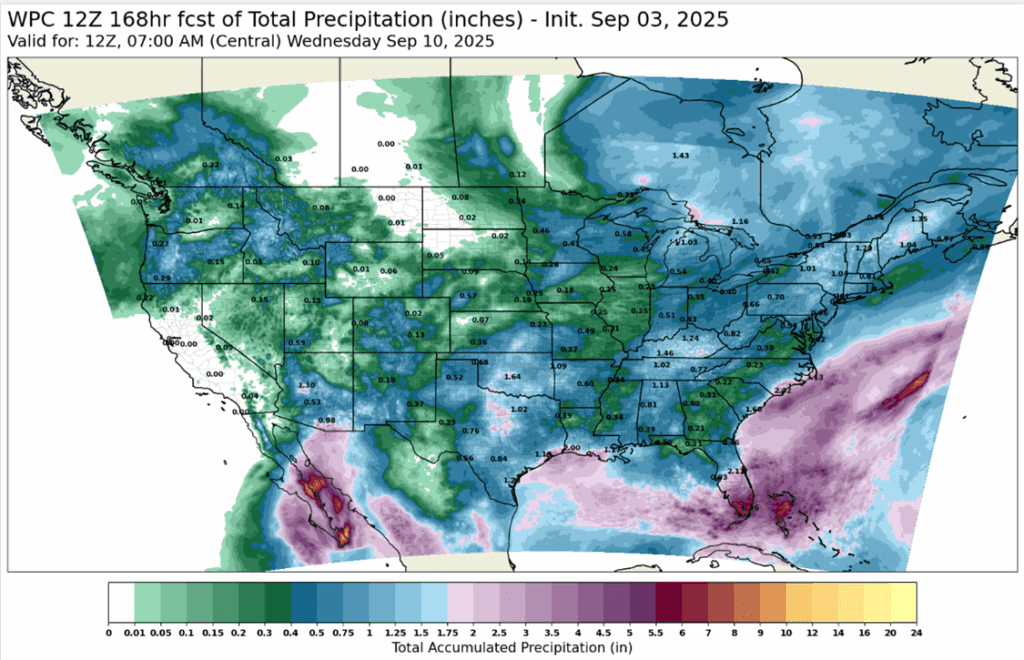

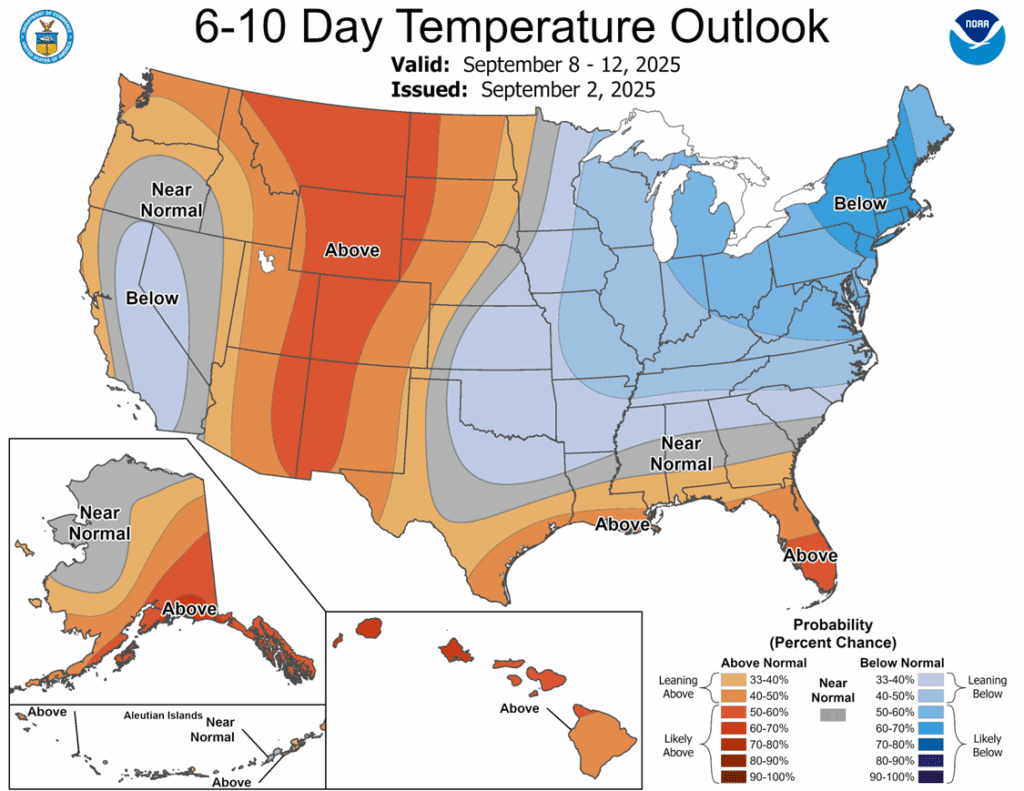

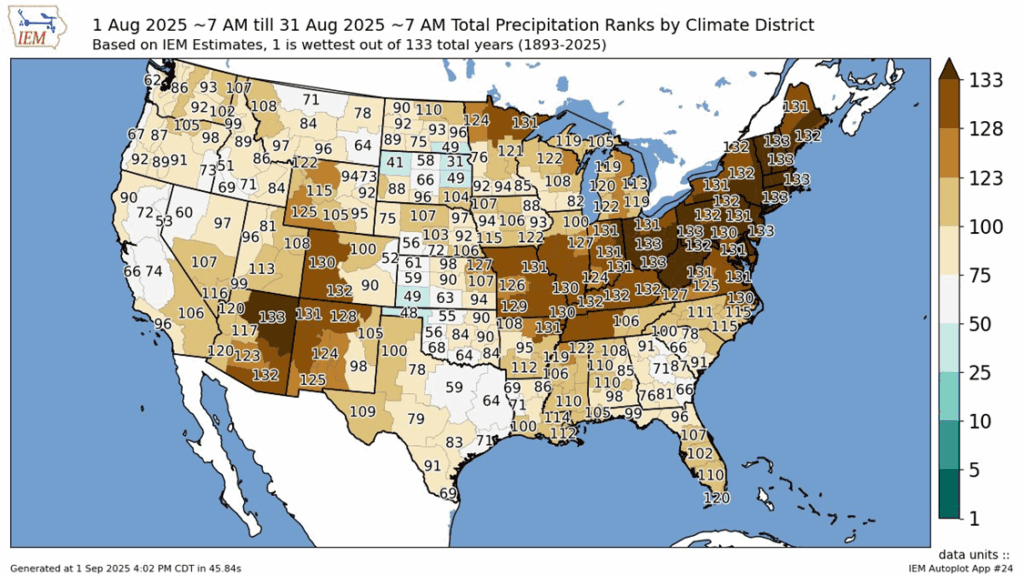

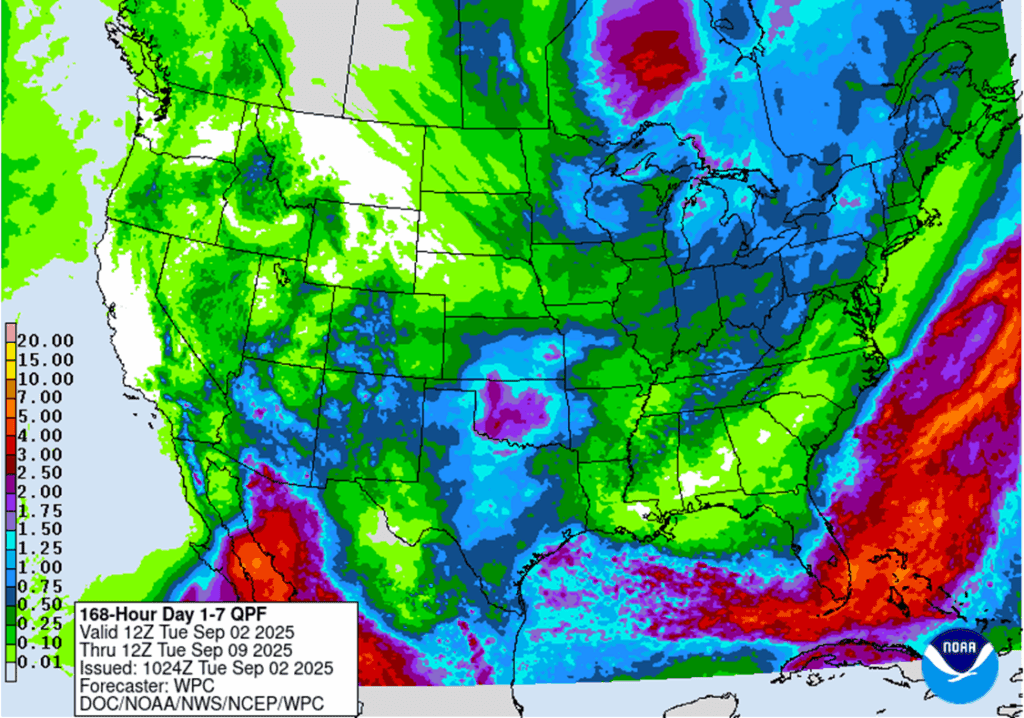

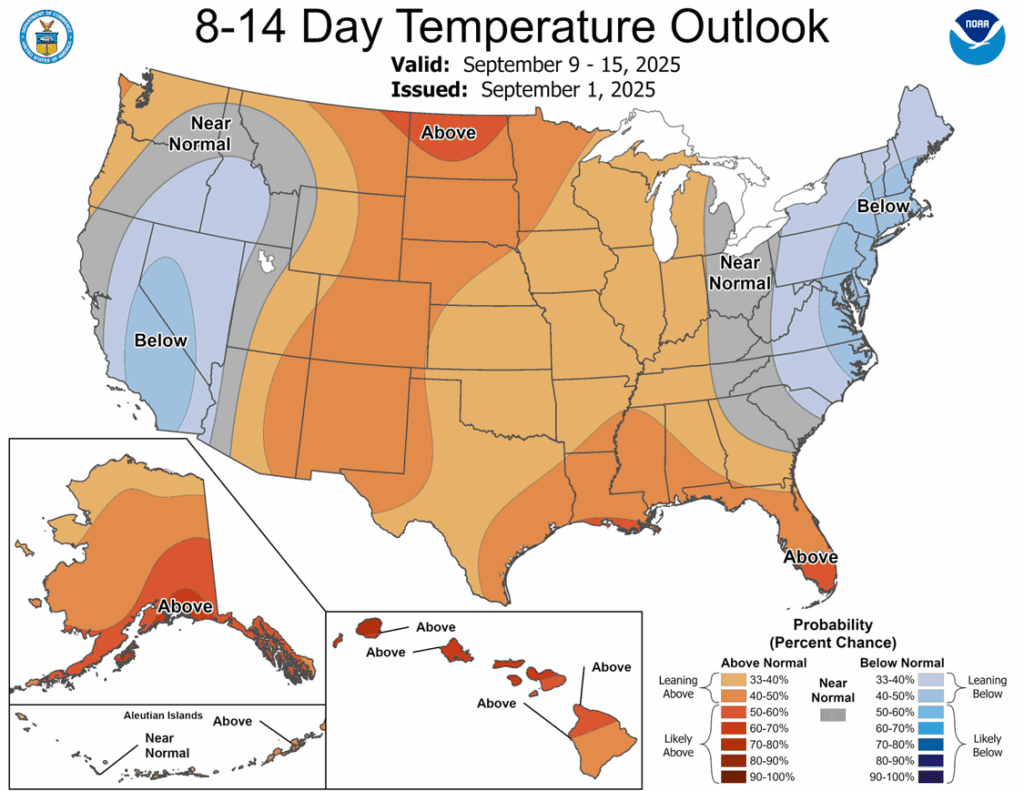

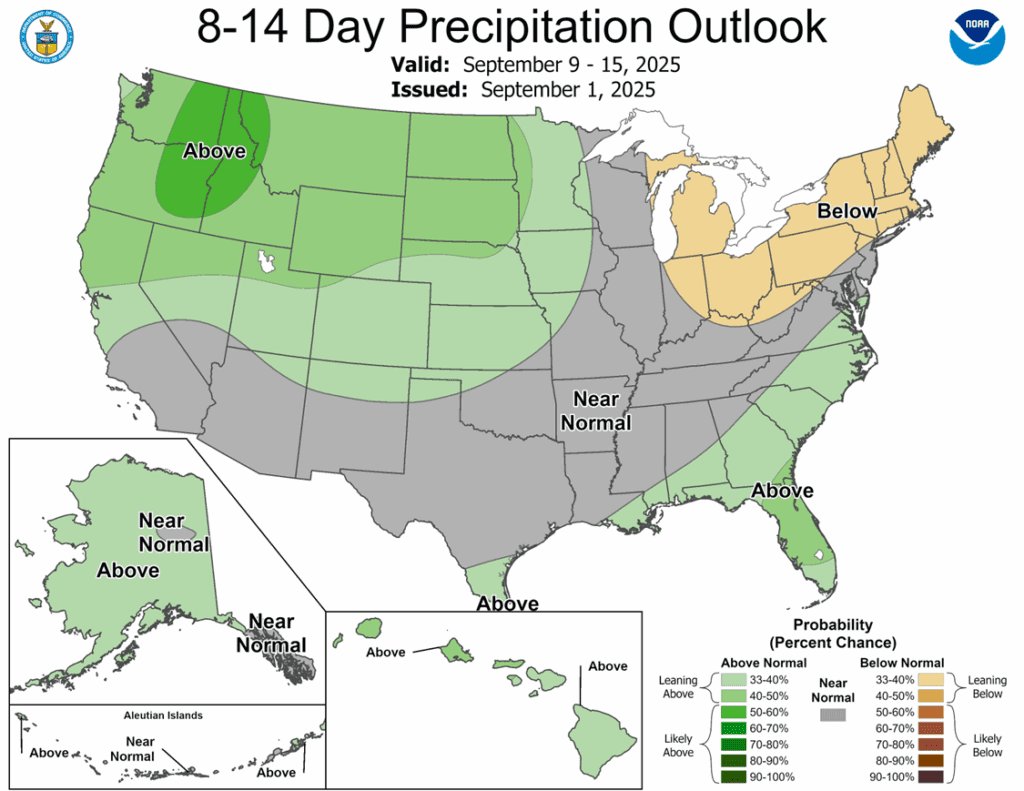

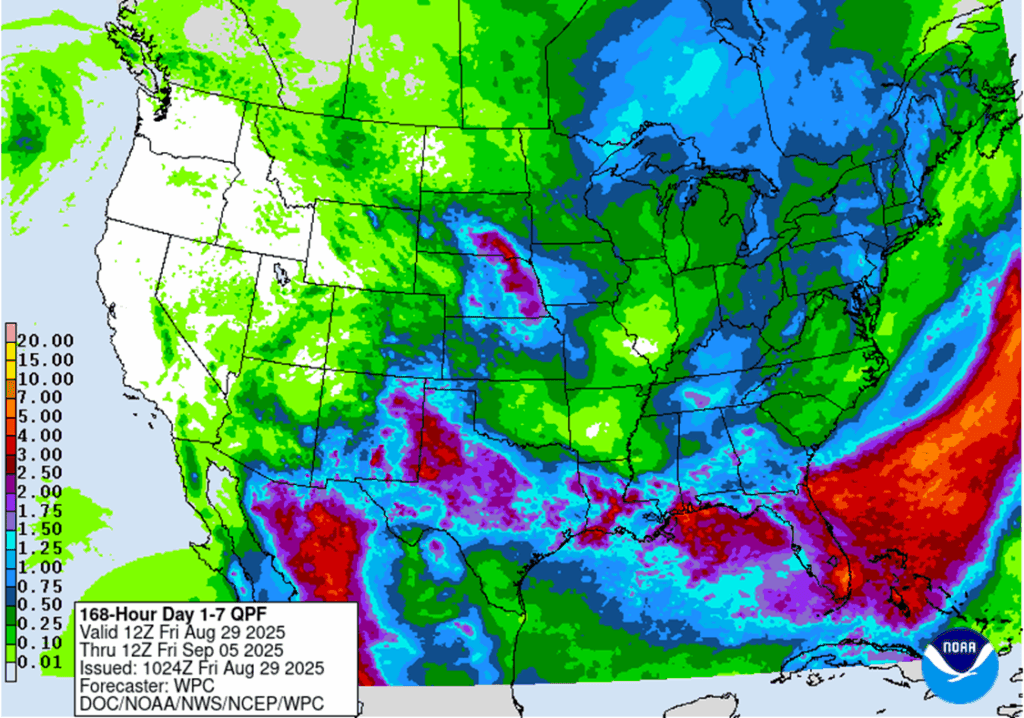

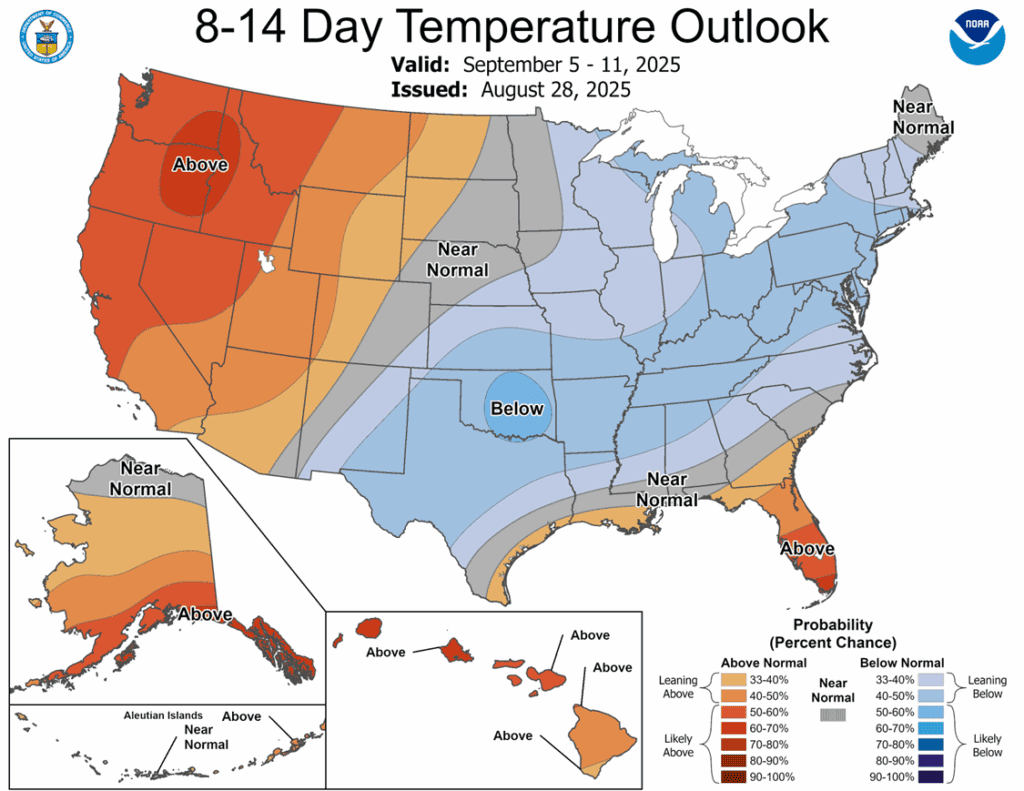

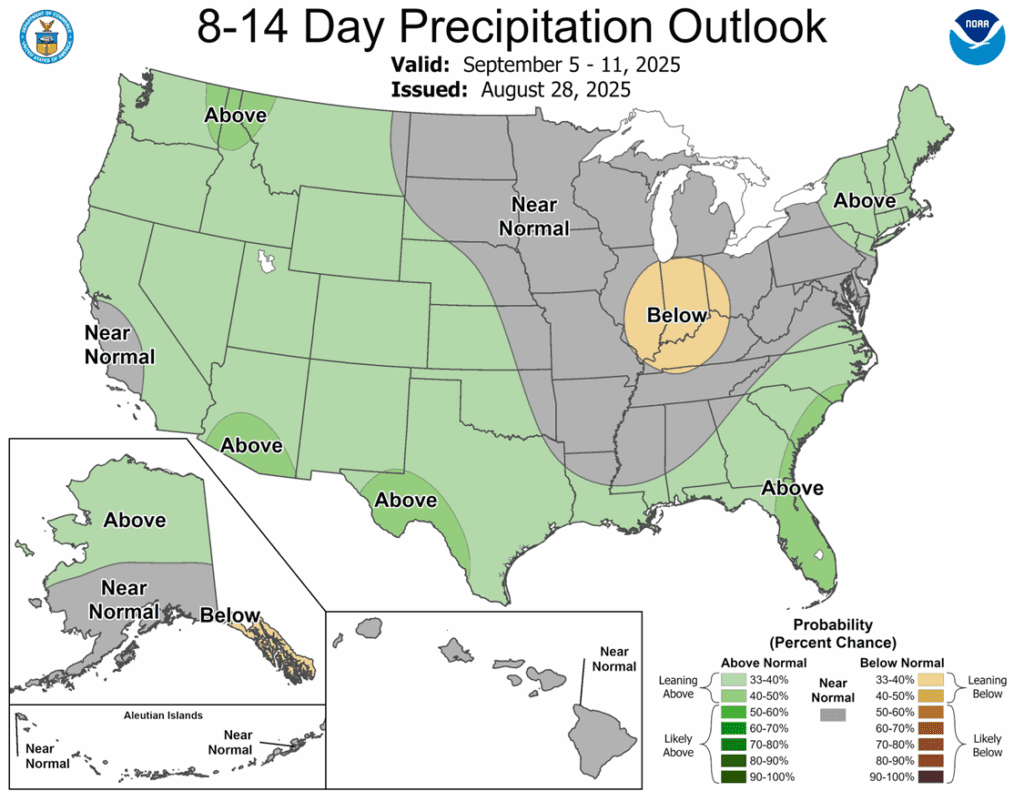

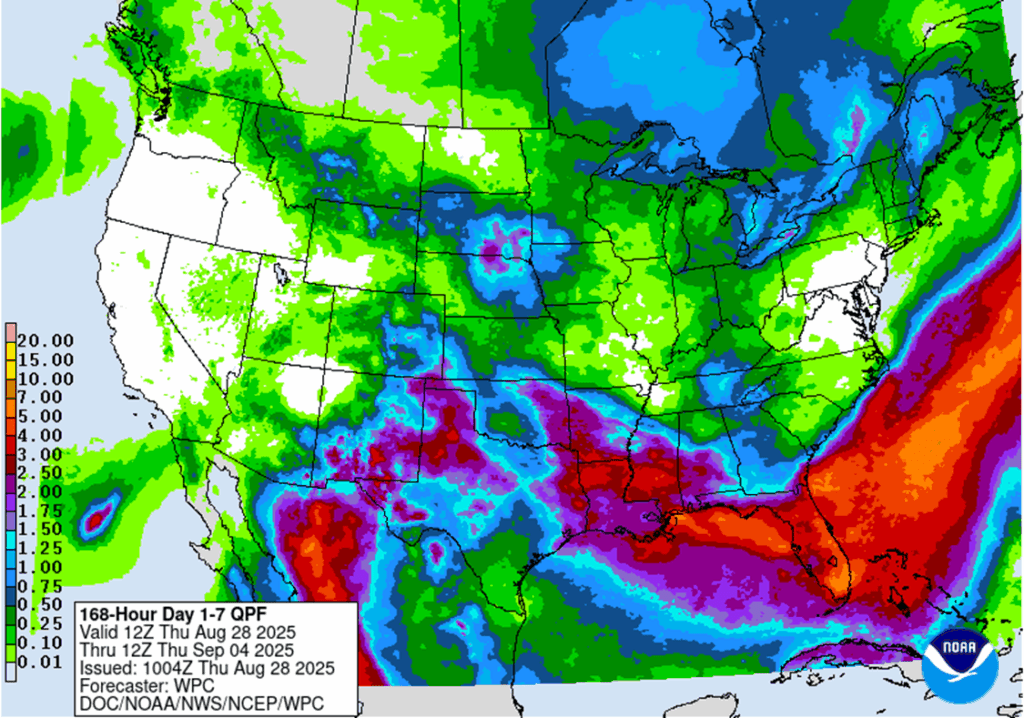

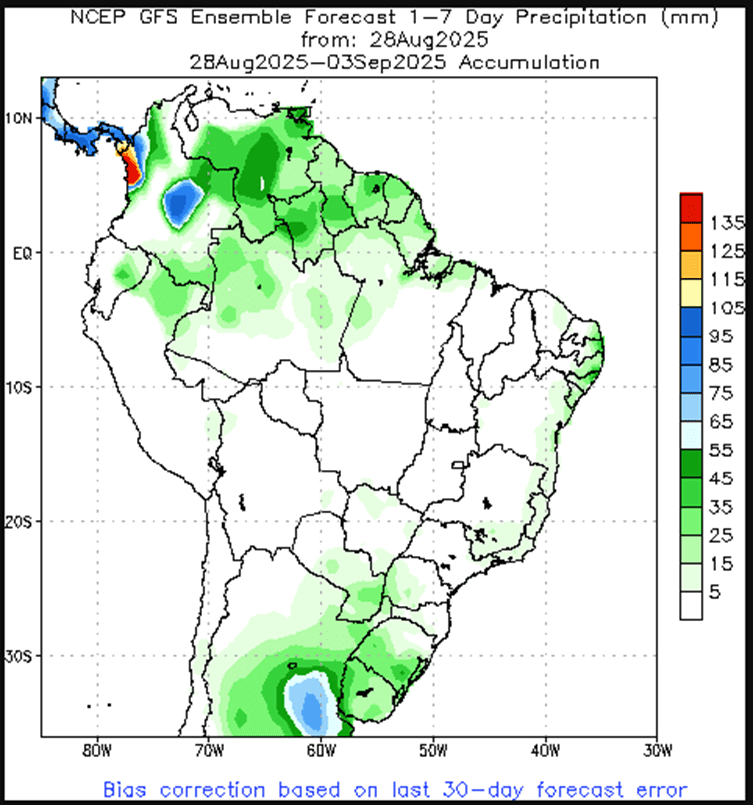

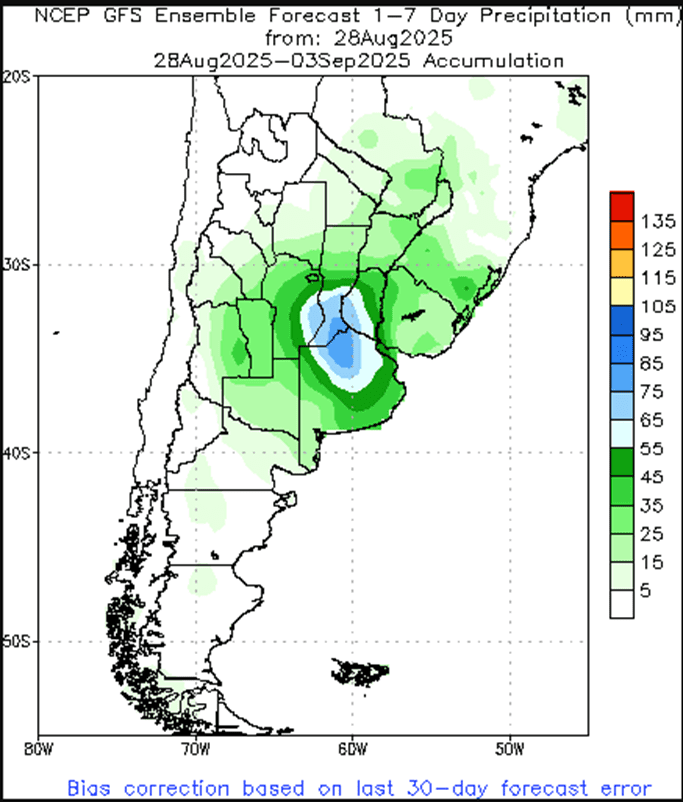

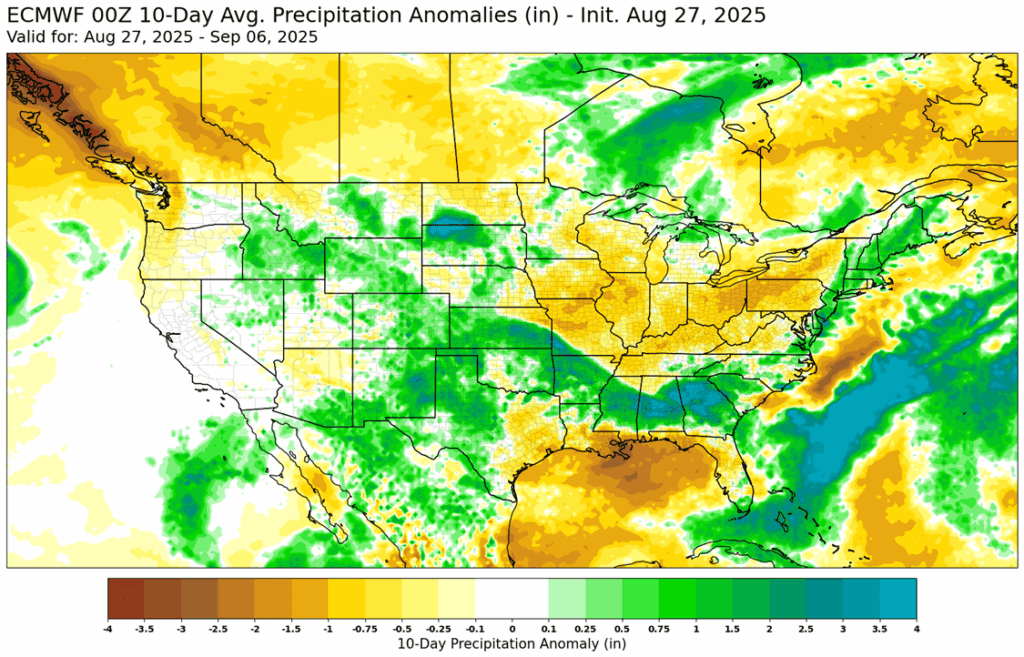

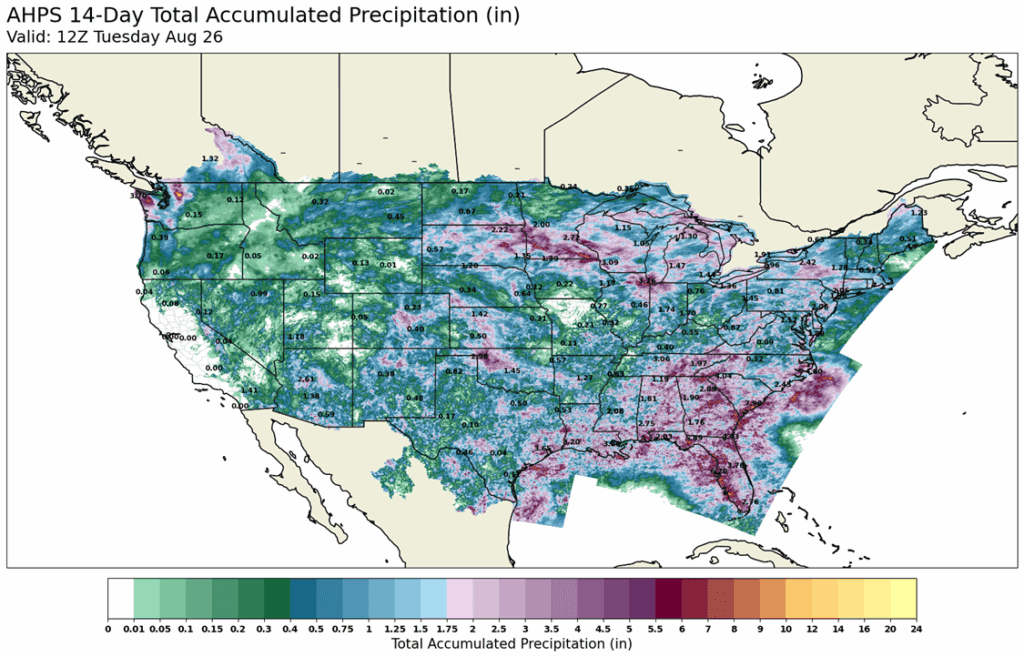

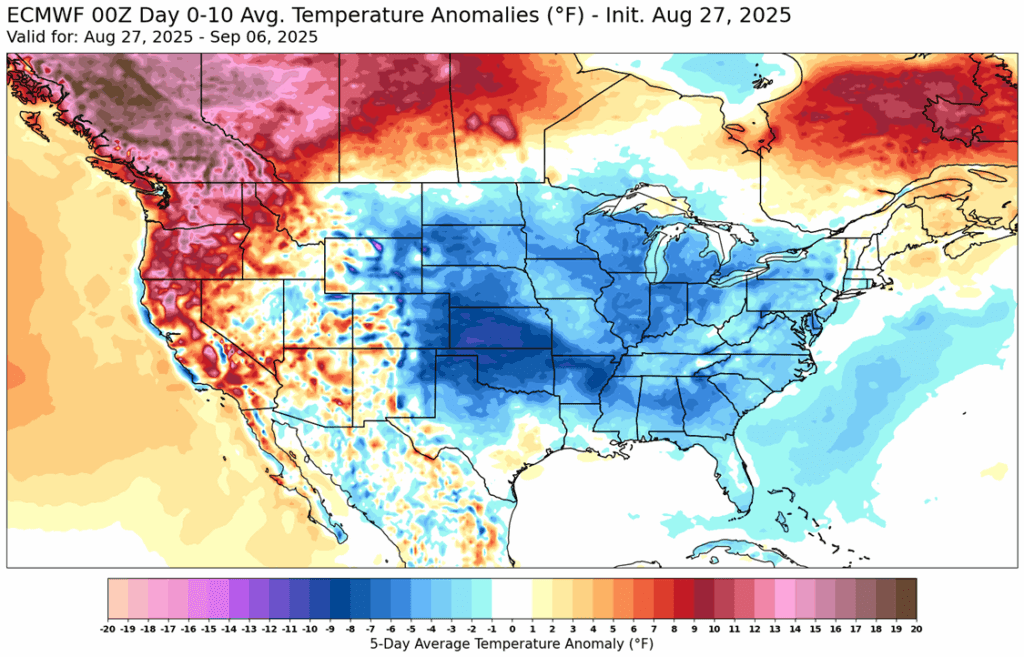

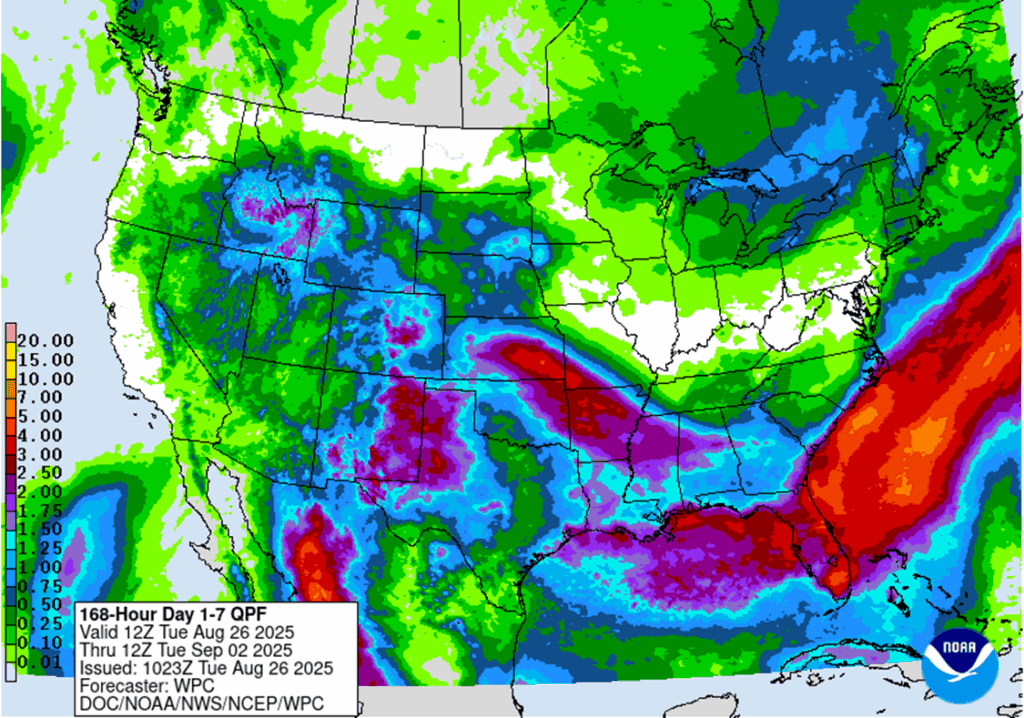

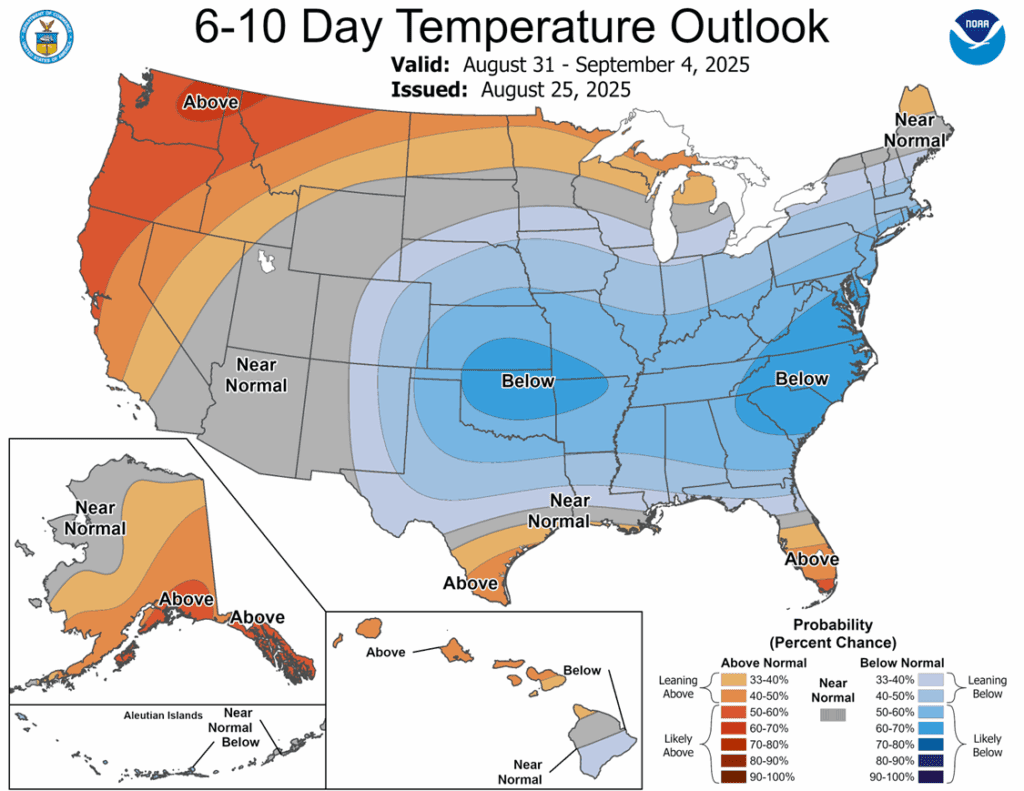

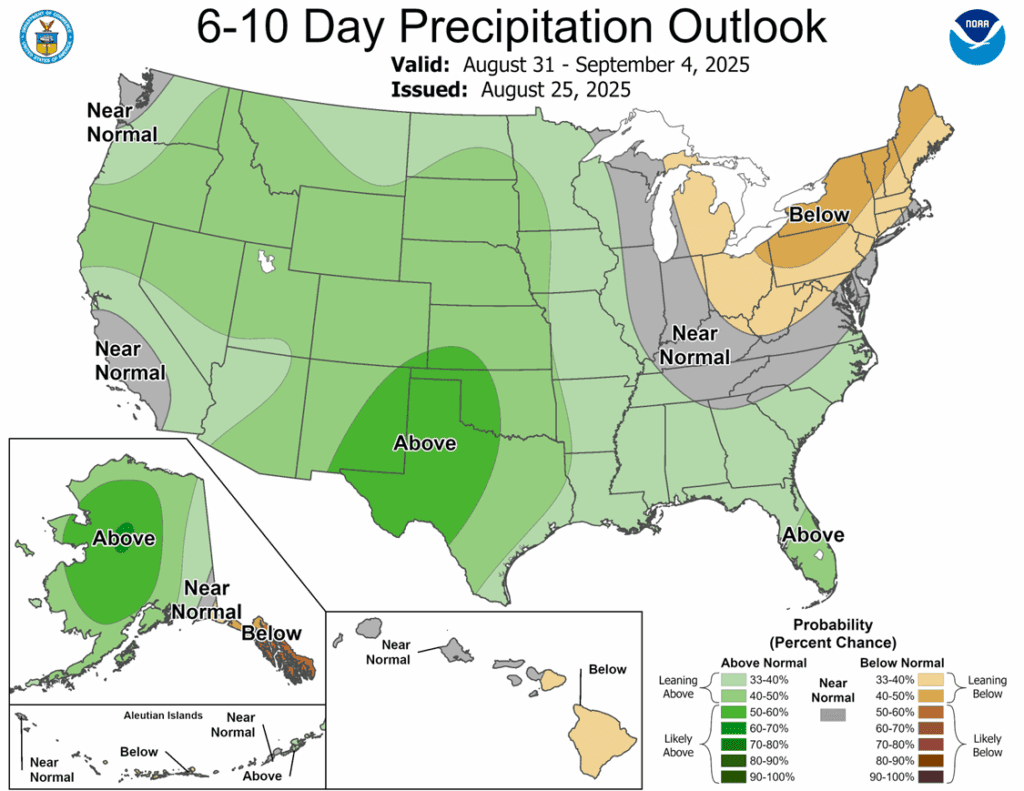

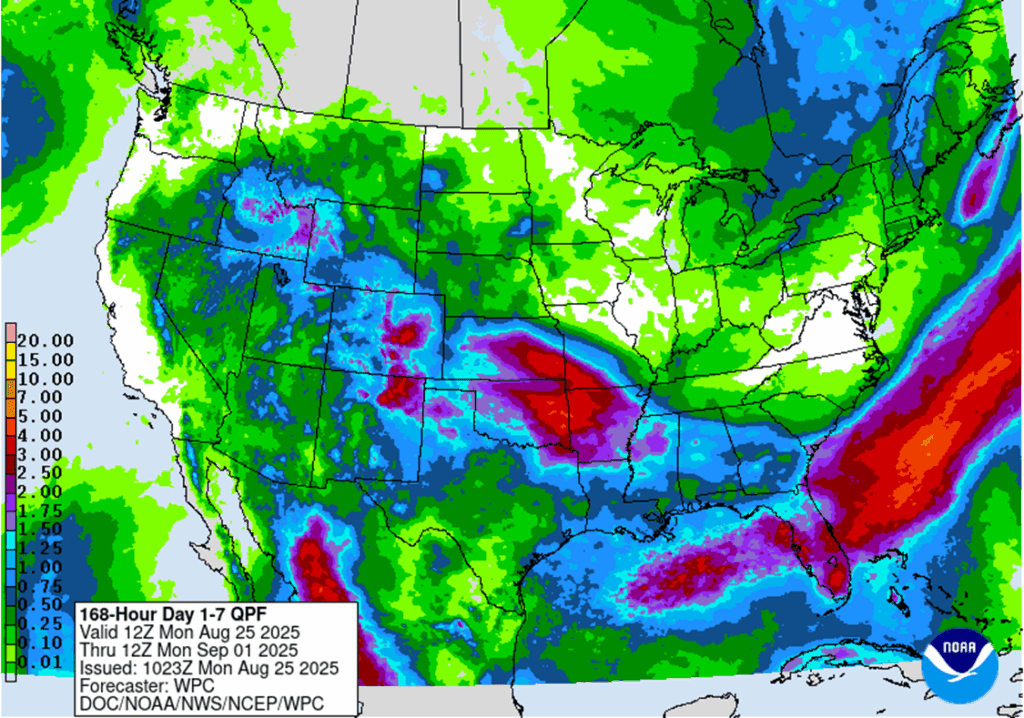

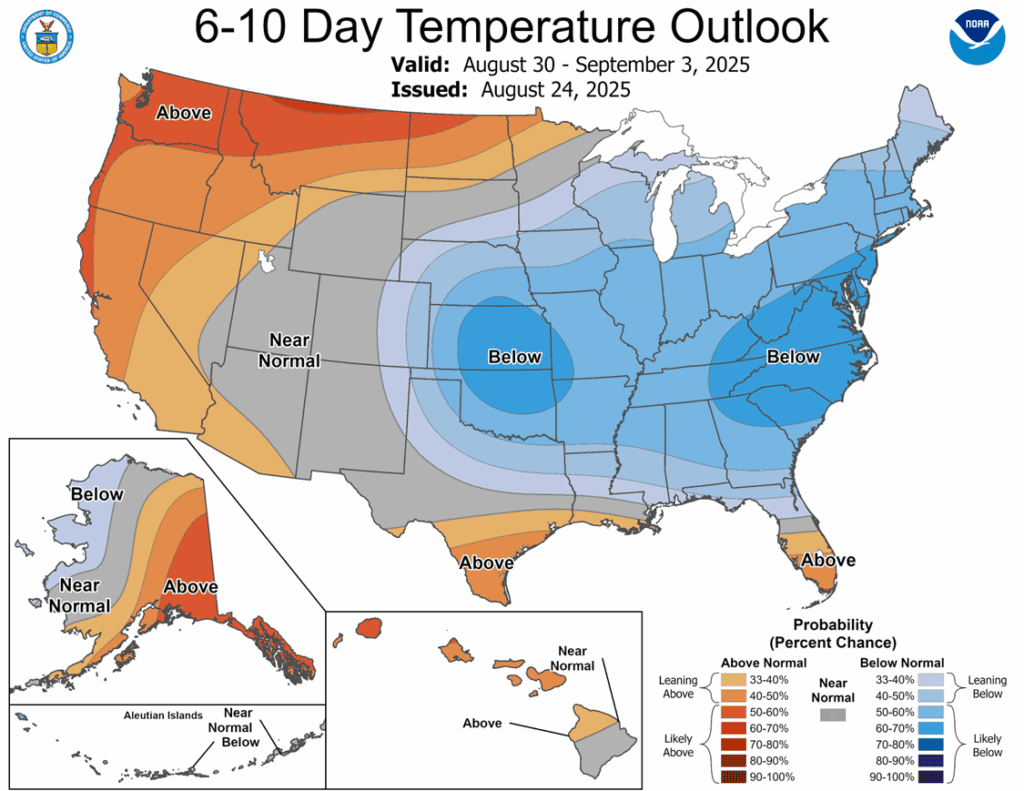

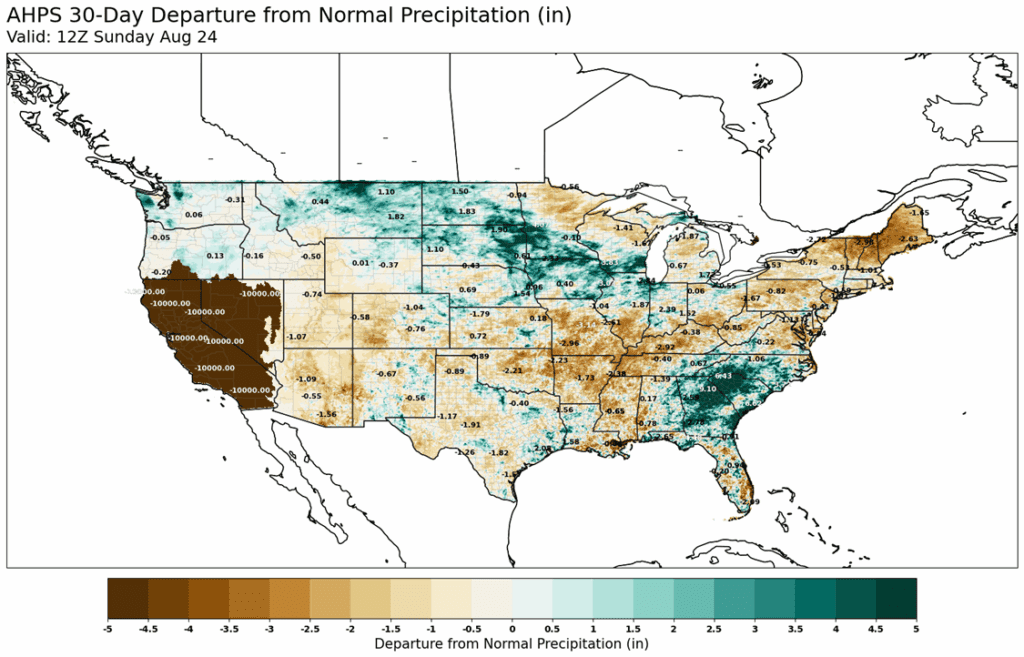

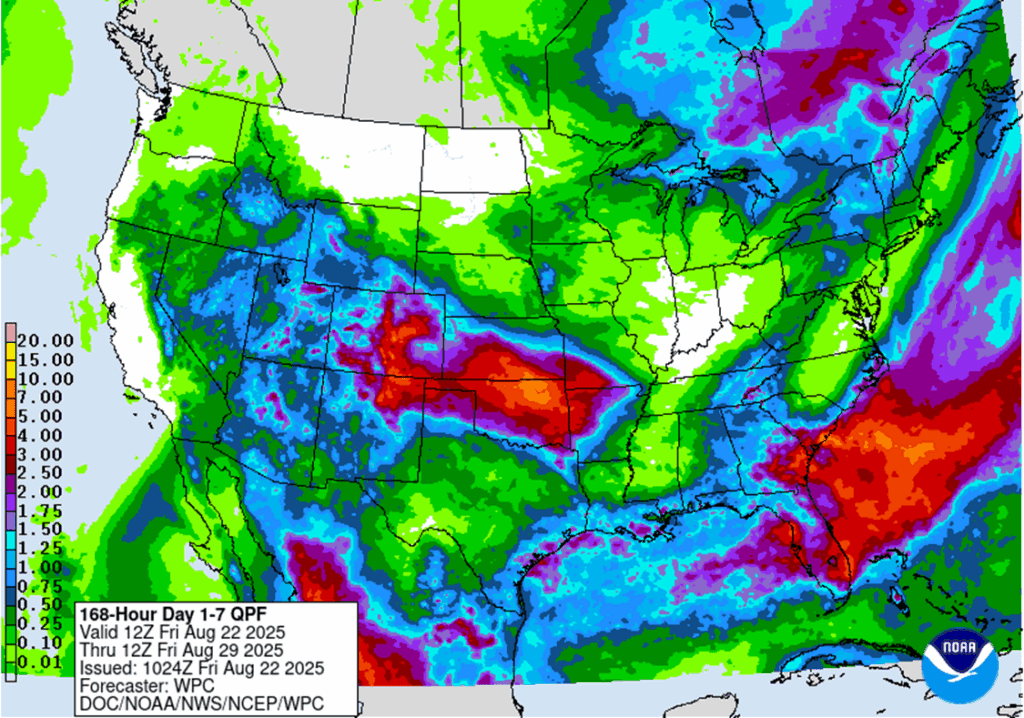

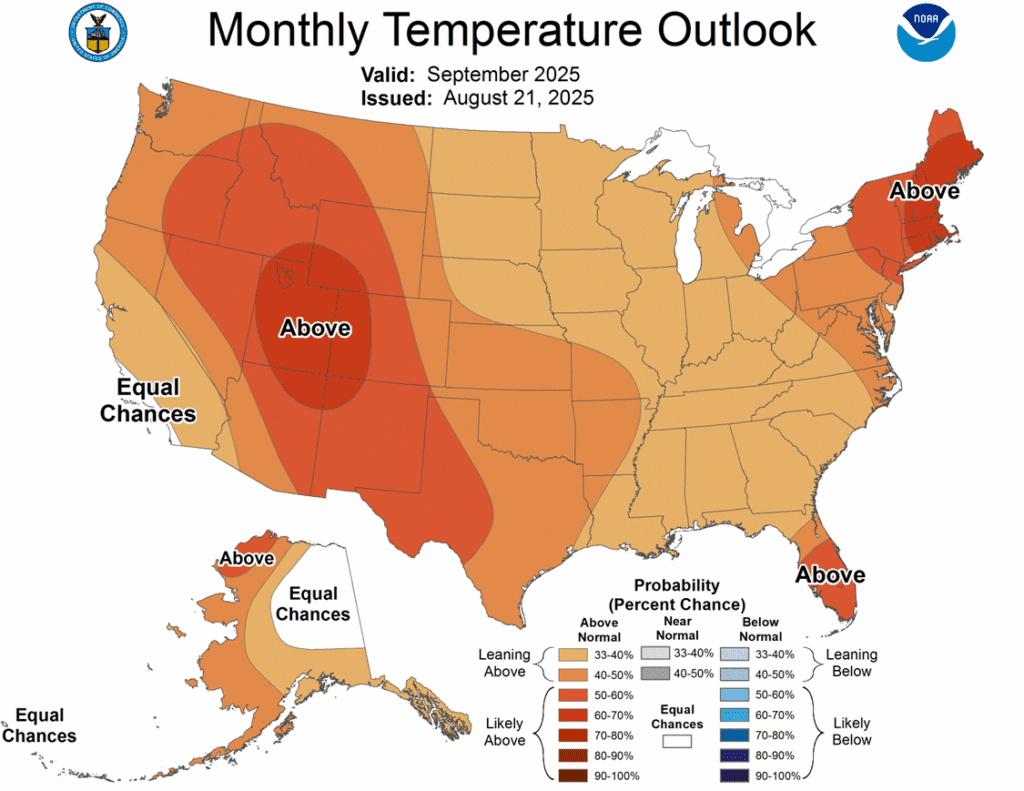

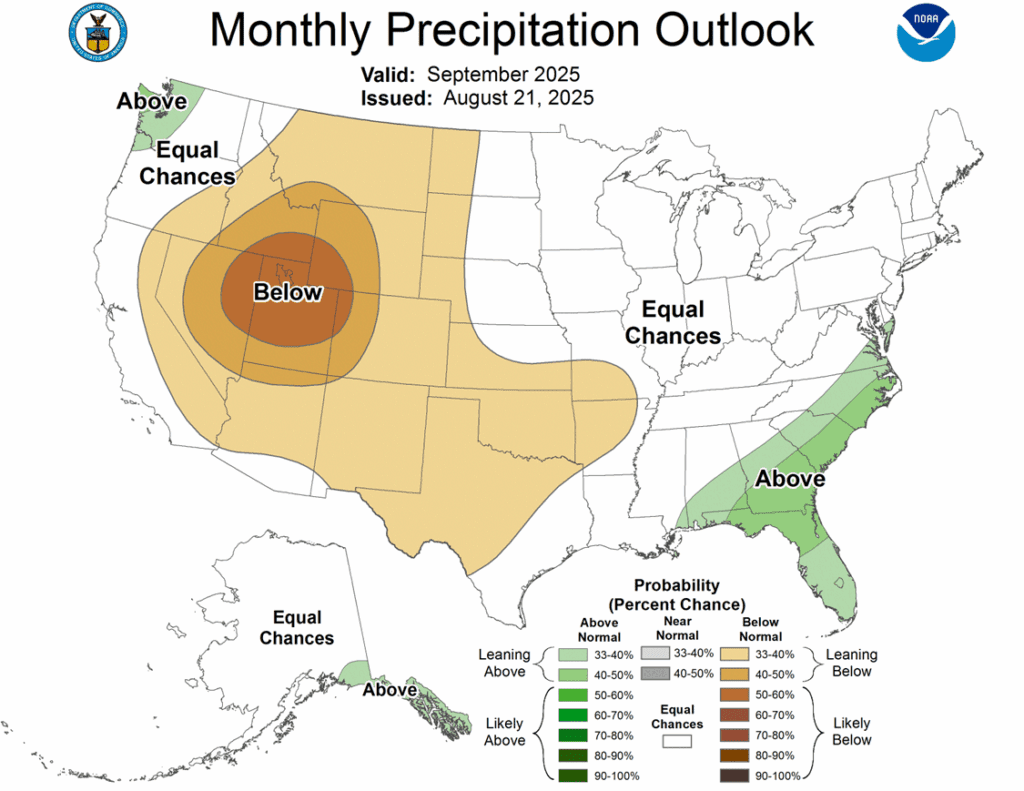

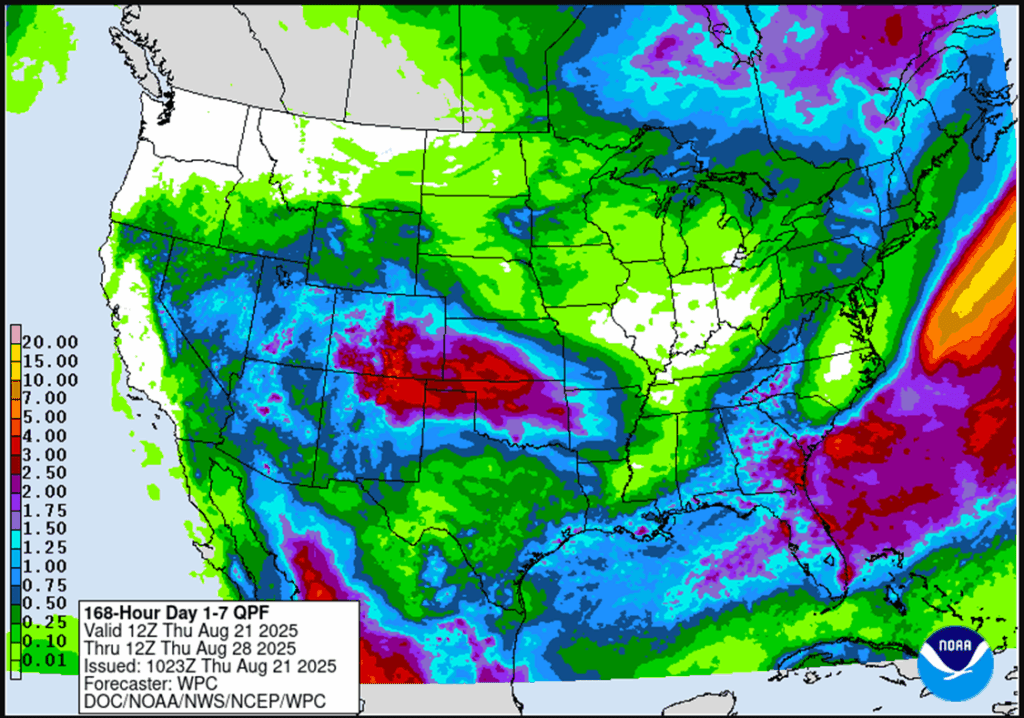

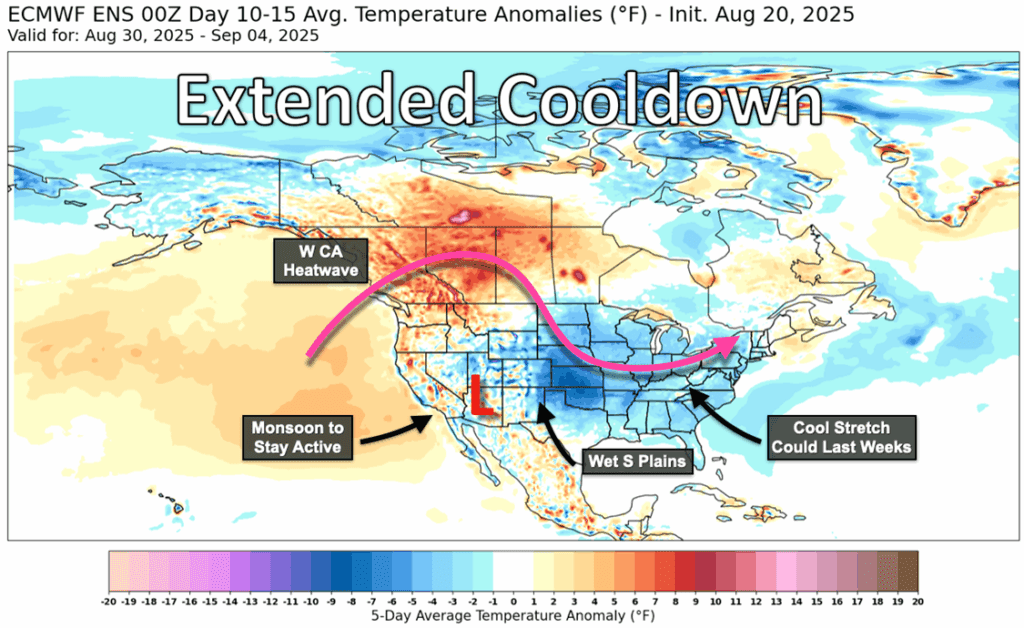

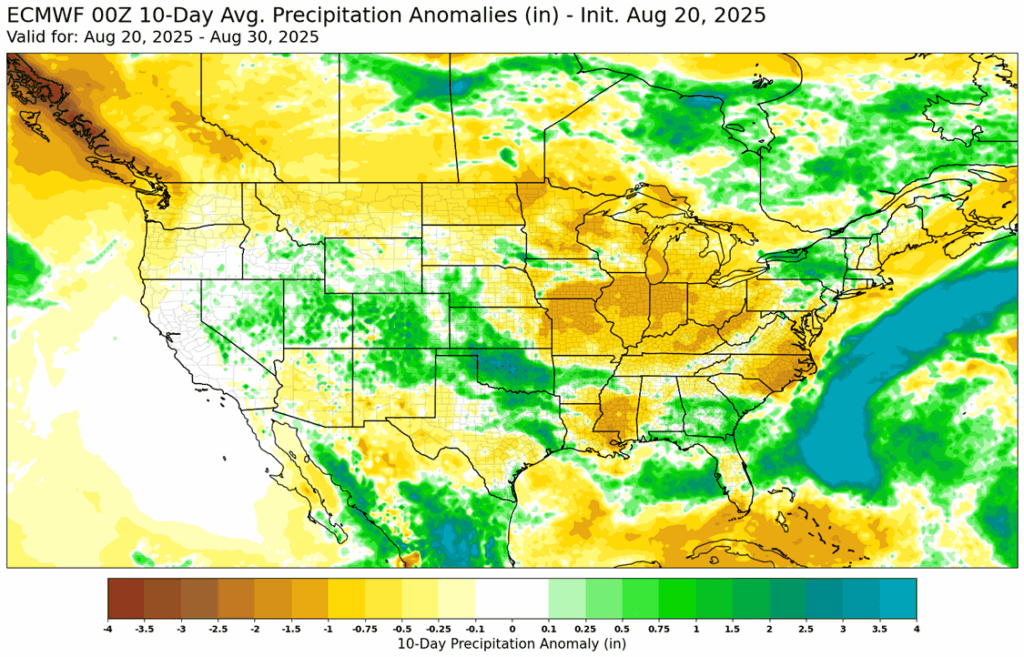

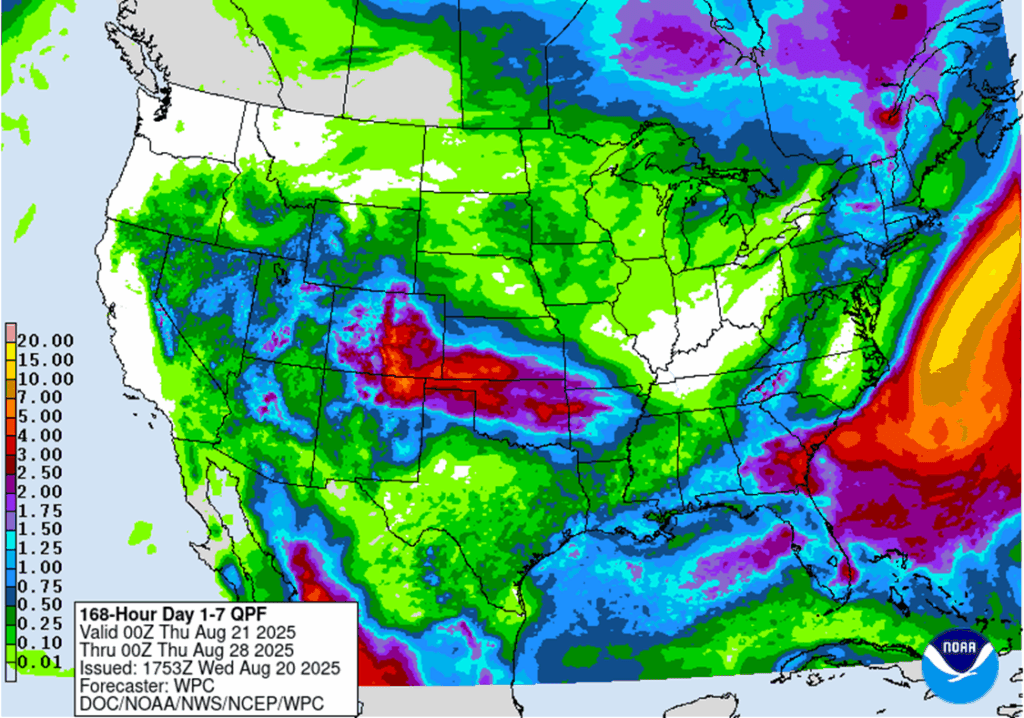

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

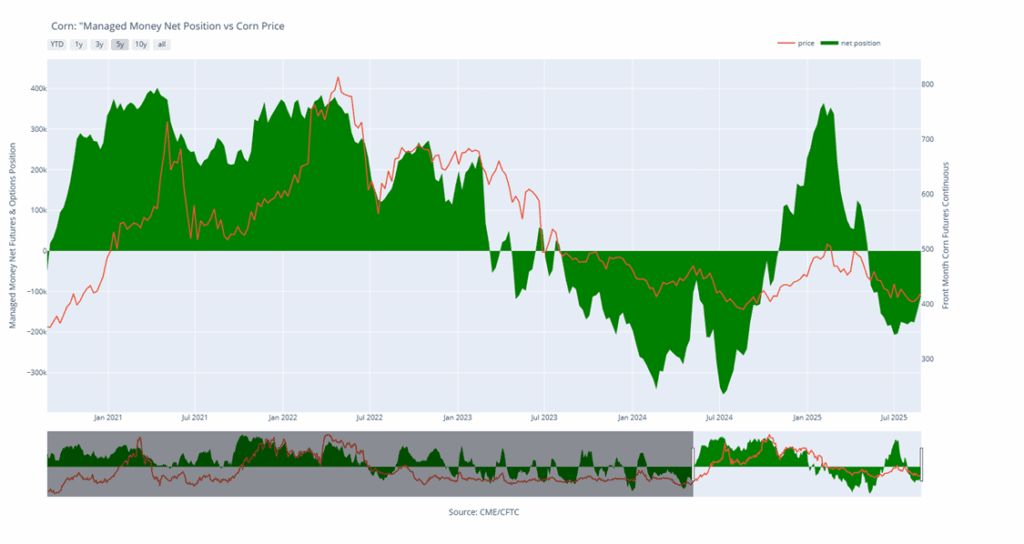

Corn

Corn Action Plan Summary

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B:

- Exit 1/4 of the December 420 puts within the next two days.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- 1/4 of 420 puts will be exited soon to lighten the position in case upside momentum continues through September. In four prior years with similar price action leading into August, three of the four posted their contract lows in the month of August.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

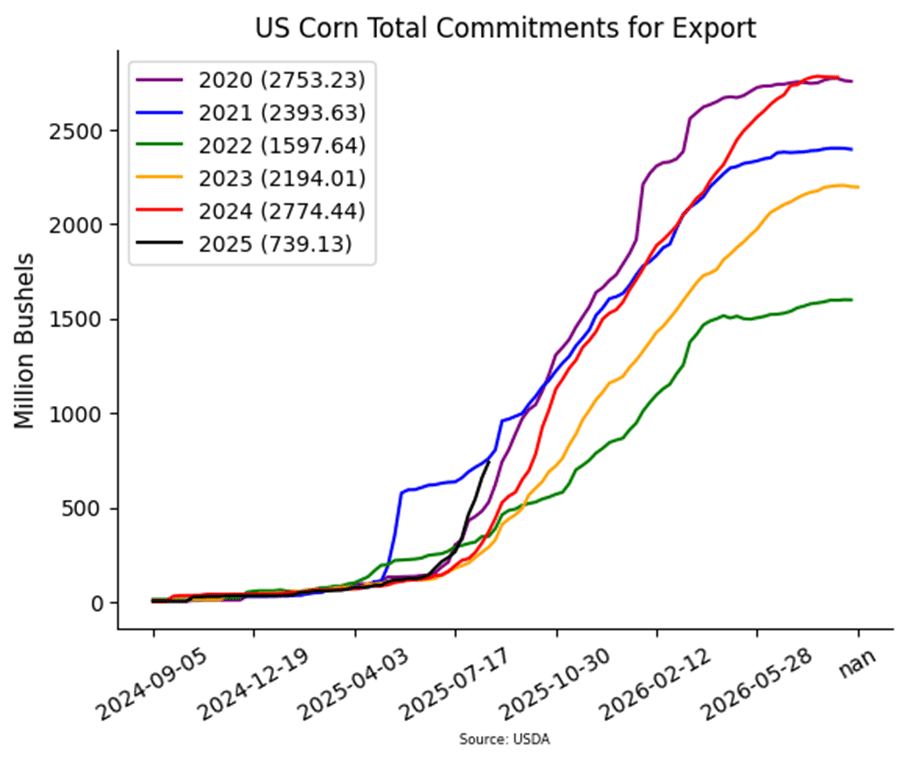

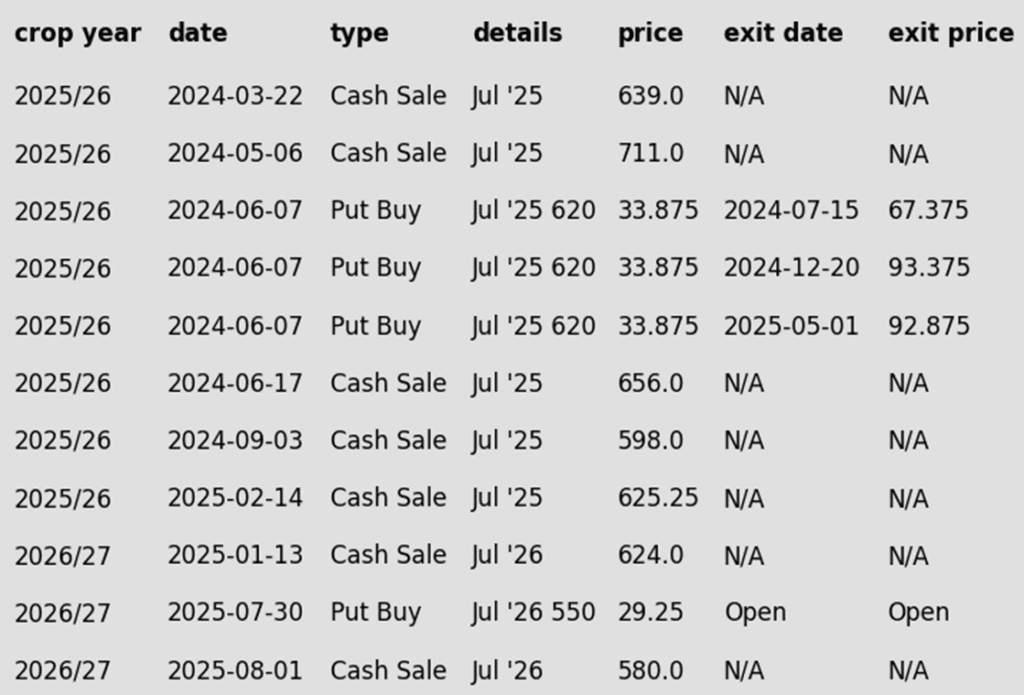

To date, Grain Market Insider has issued the following corn recommendations:

- Corn futures traded lower on Wednesday, weighed down by broad market weakness and additional pressure from declines in soybean and wheat futures. Prices tested support but are still in a near-term uptrend. December corn lost 5 cents to 418 and March slipped 4 ¾ cents to 436.

- Markets in general, commodities and Equity markets were under pressure on Wednesday. Economic concerns, the impact of tariffs, and a weaker than expected labor market report helped cause a risk off mentality across multiple markets during the session.

- The next USDA WASDE report and crop production estimates are on September 12. The market will start seeing private analyst groups make their predictions for the corn crop on that report. One private analyst group forecasted the September corn yield at 187.52 bu/a. This is down from the USDA projection of 188.8 bu/a from the August report.

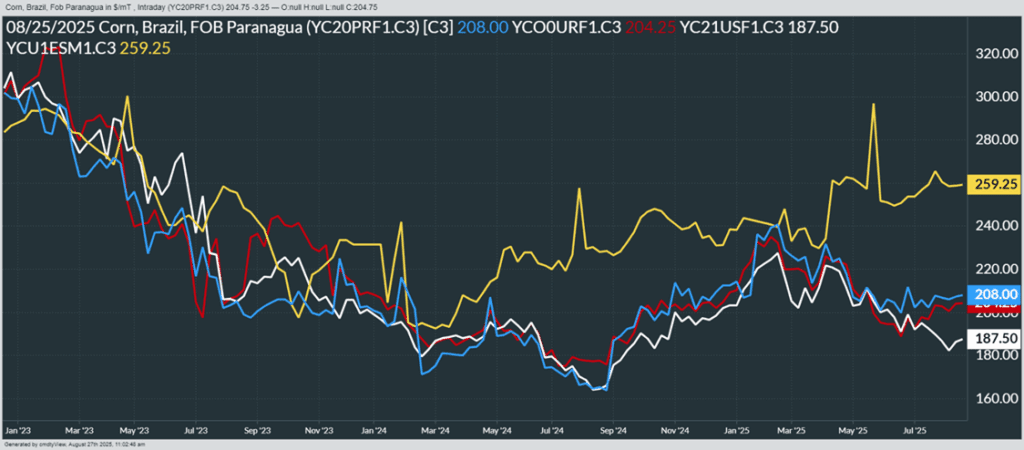

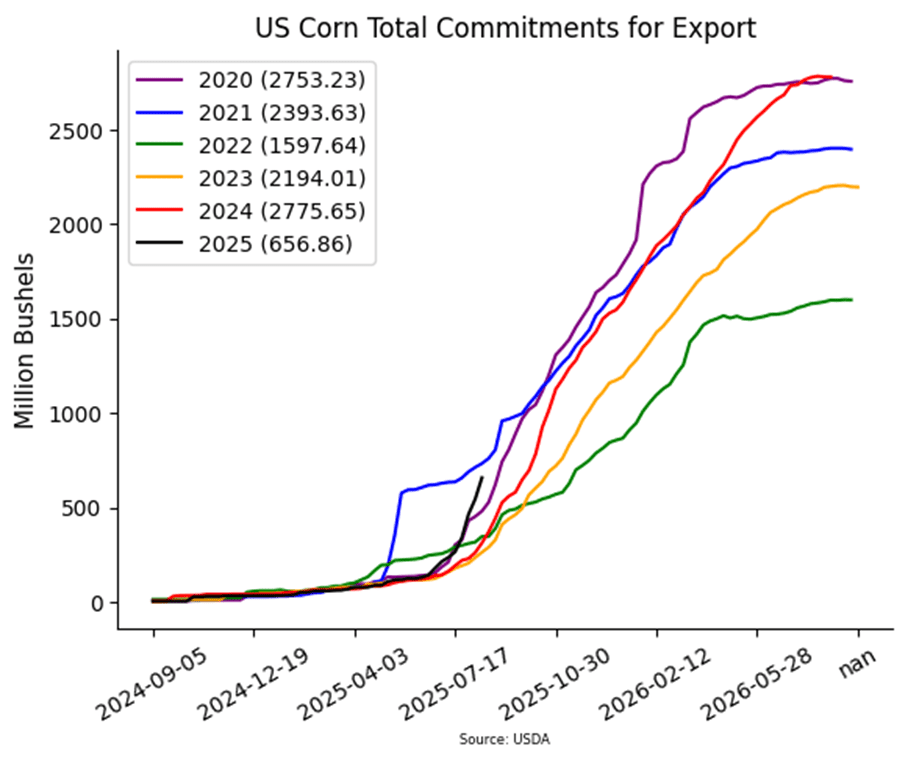

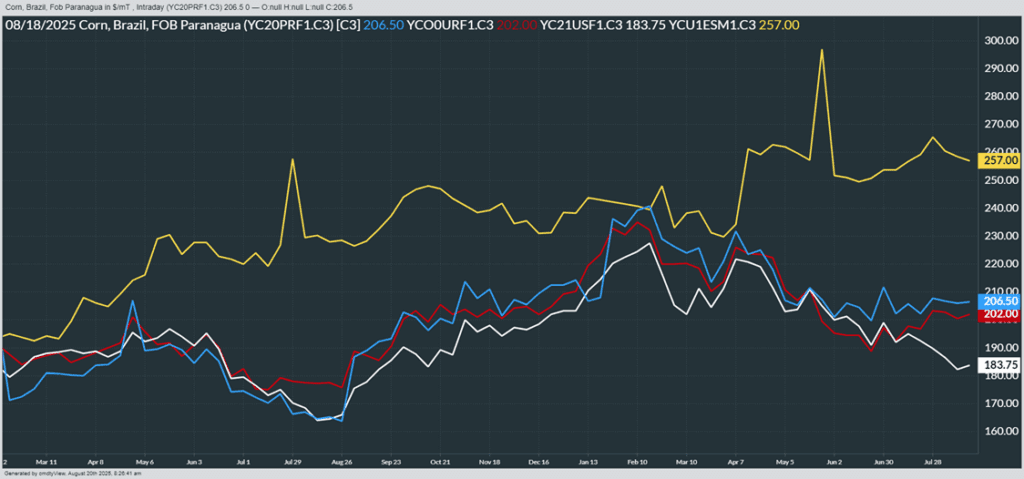

- Demand remains a key factor for corn prices this fall. Recent price gains have narrowed the strong advantage U.S. corn held over South American supplies. Additionally, the USDA has not reported any flash sales of corn exports since August 22.

- Brazil is growing its ethanol industry and increasing their domestic demand for corn. The growth will shift more bushels away from export demand for the use of Brazilian bushels, allowing stronger opportunities for U.S. corn exports.

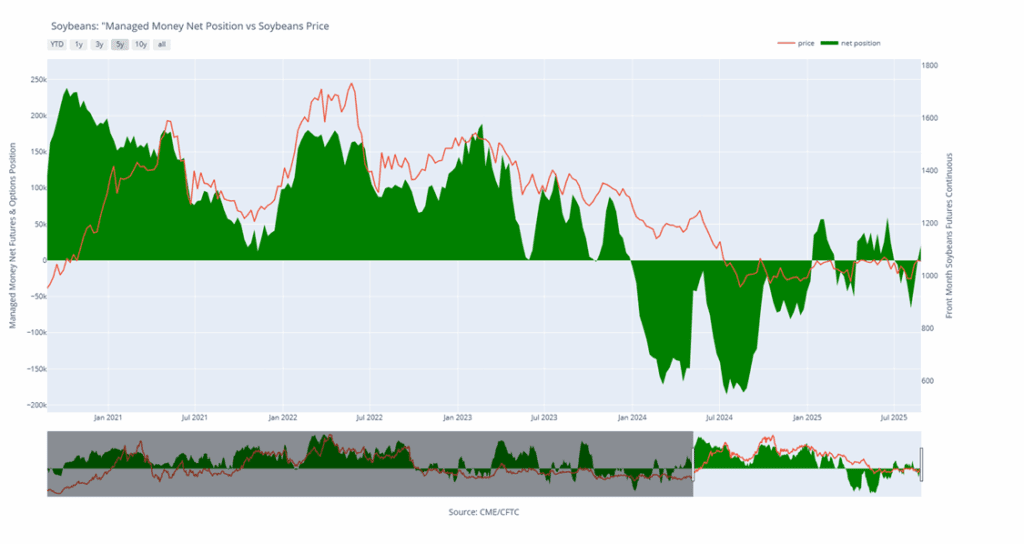

Soybeans

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- Exit one-quarter of 1040 puts options if November futures close at or below 1022.25.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A Plan B target has been added to Exit one-quarter of the January 1040 puts options if November futures close at or below 1022.25.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

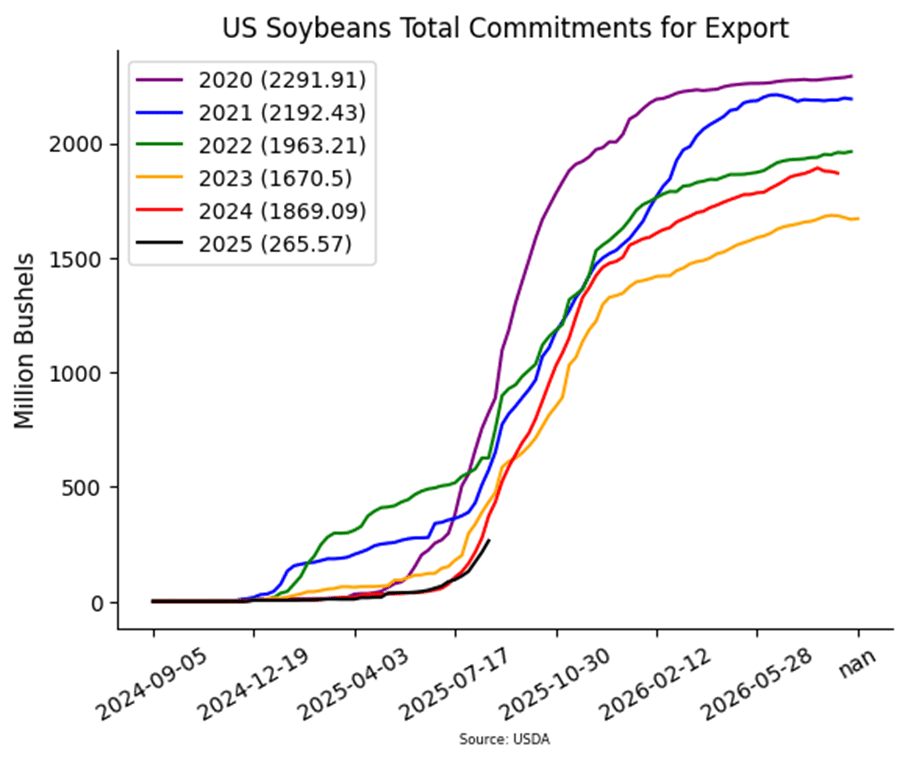

To date, Grain Market Insider has issued the following soybean recommendations:

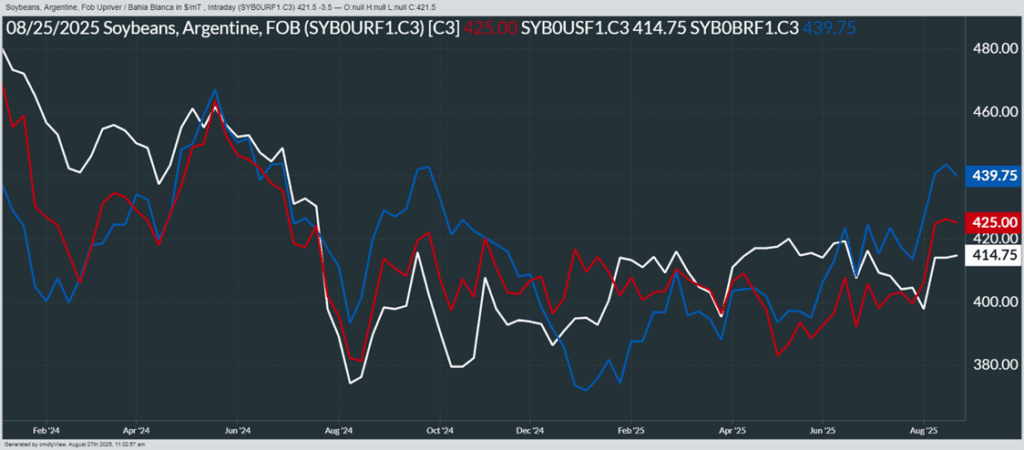

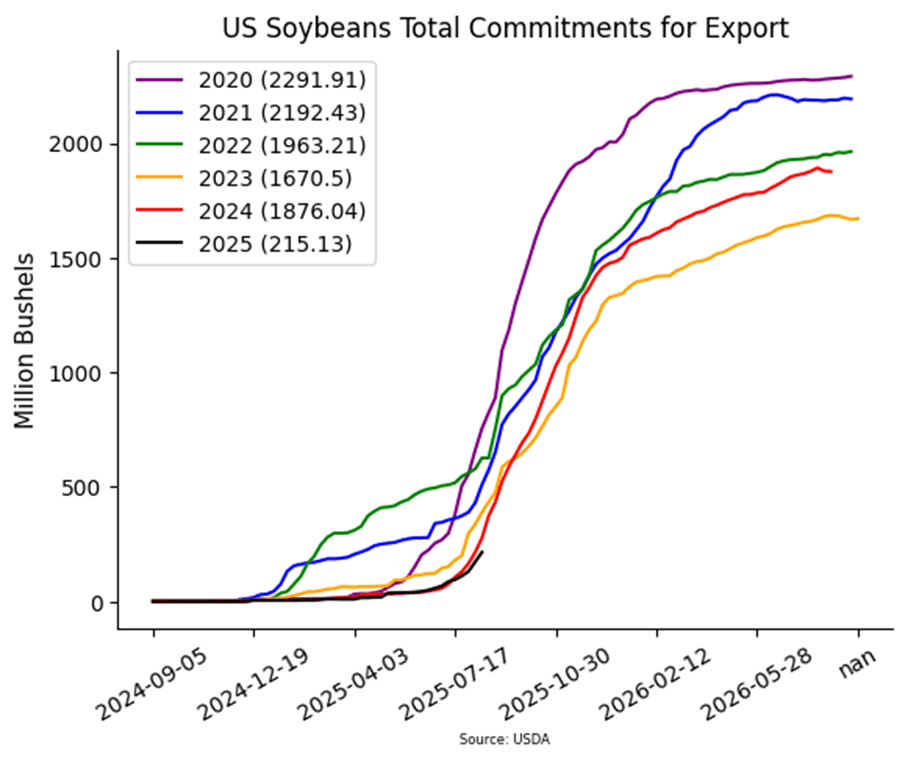

- Soybeans ended the day lower for the second consecutive day as concerns over lack of a Chinese trade deal weigh on markets. November soybeans lost 9-1/2 cents to $10.31-1/2 and March lost 9-1/4 cents to $10.65-3/4. October soybean meal lost $0.70 to $277.60 and October bean oil lost 0.82 cents to 51.44 cents.

- This morning, private exporters reported sales of 185,000 metric tons of soybean cake and meal for delivery to the Philippines during the 2025/2026 marketing year. This is encouraging, considering the large volume of soybeans being crushed has resulted in a surplus of meal.

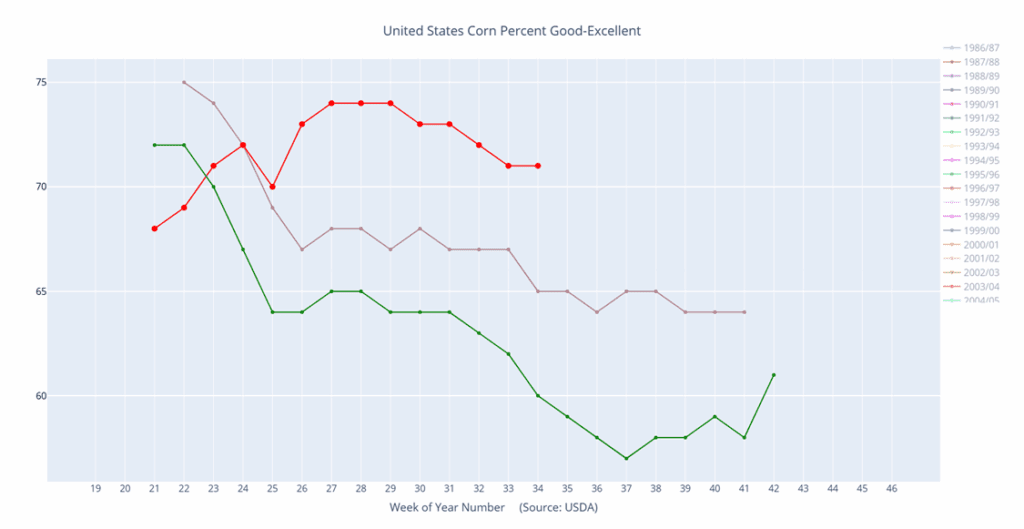

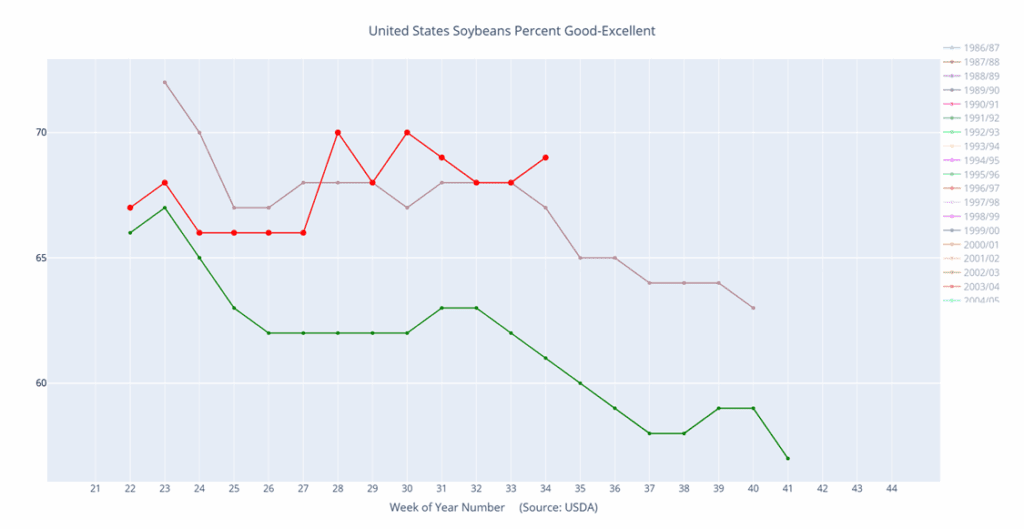

- Soybean crop ratings fell more than expected from last week, dropping 4 points to 65% good to excellent. 94% of the crop is setting pods and 11% is dropping leaves. The USDA will release the September WASDE report next Friday and will reveal if changes are made to yield expectations.

- U.S. soybean crushings were seen at 204.8 million bushels in July which was up 5.9% from the same period last year and above June crushings of 196.9 mb. This strong domestic demand should be supportive relative to slow export demand.

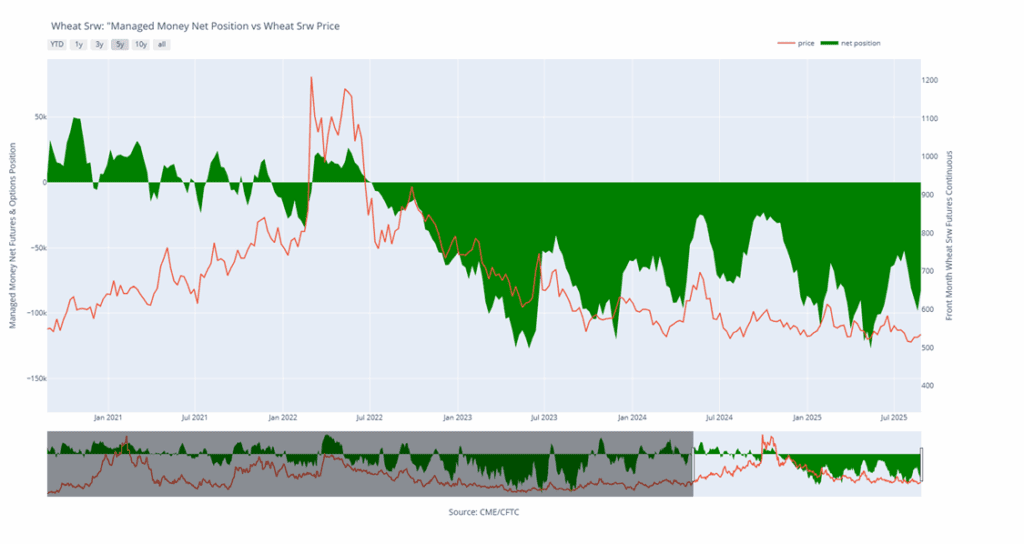

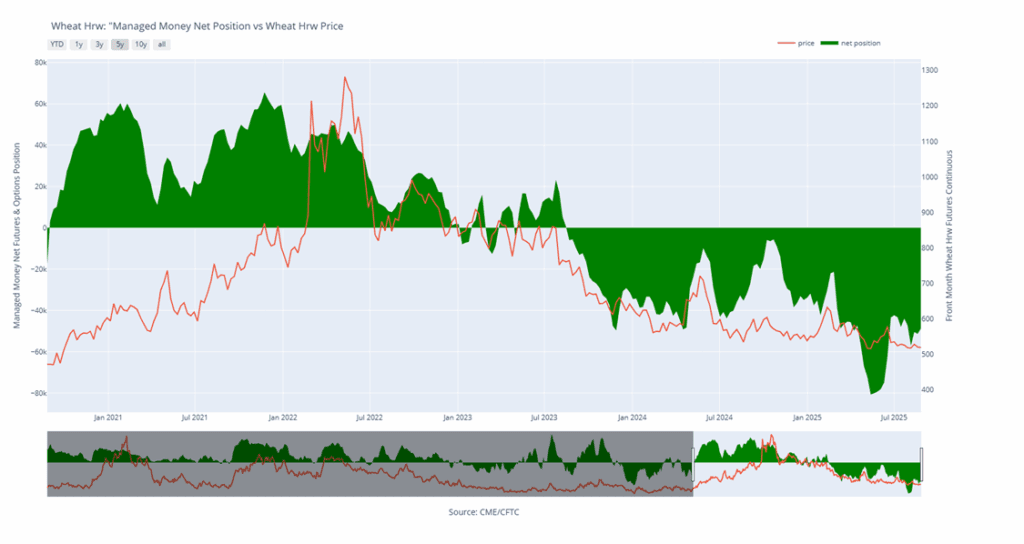

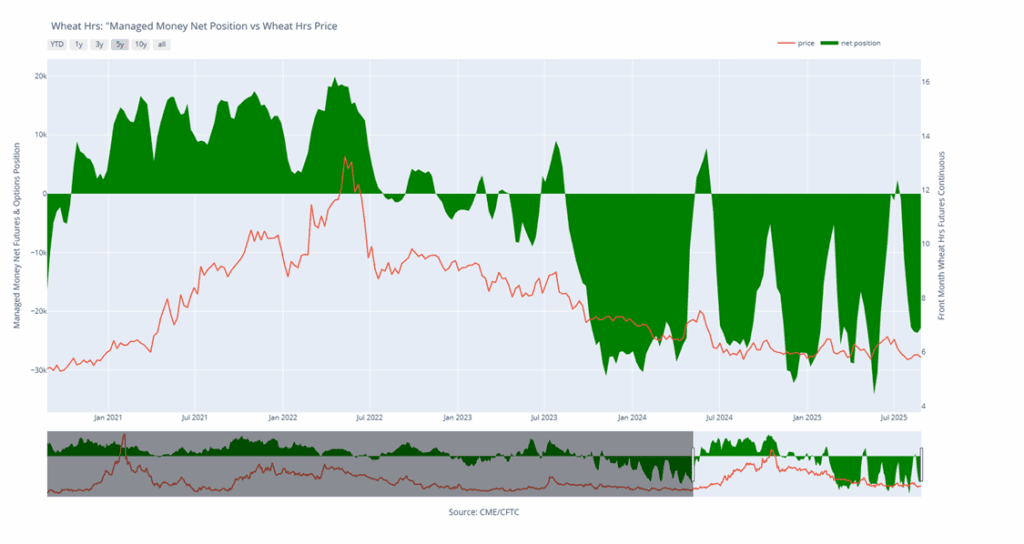

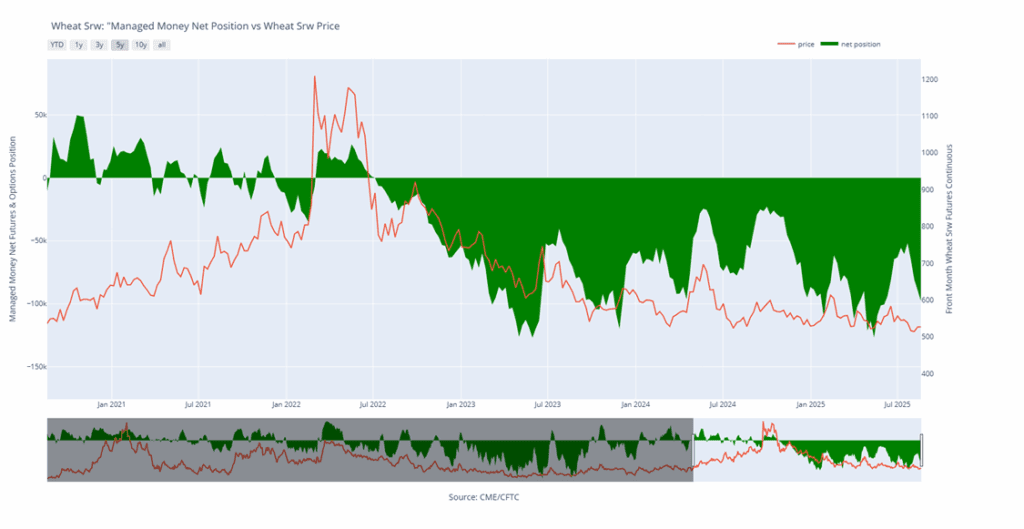

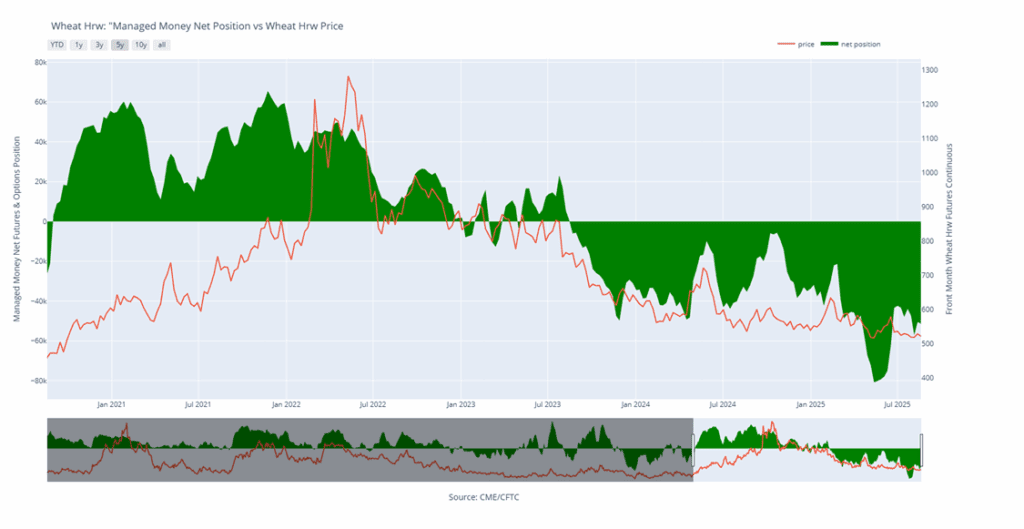

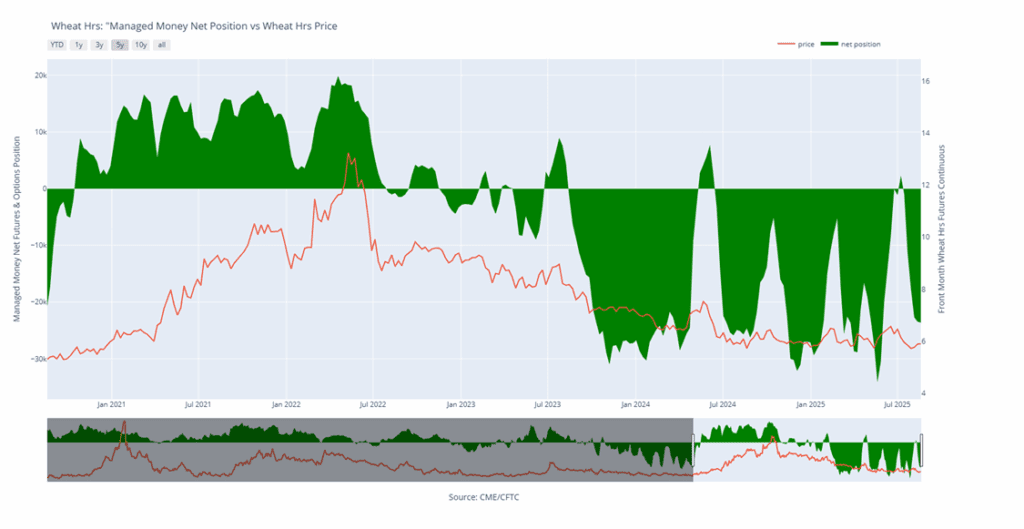

Wheat

Market Notes: Wheat

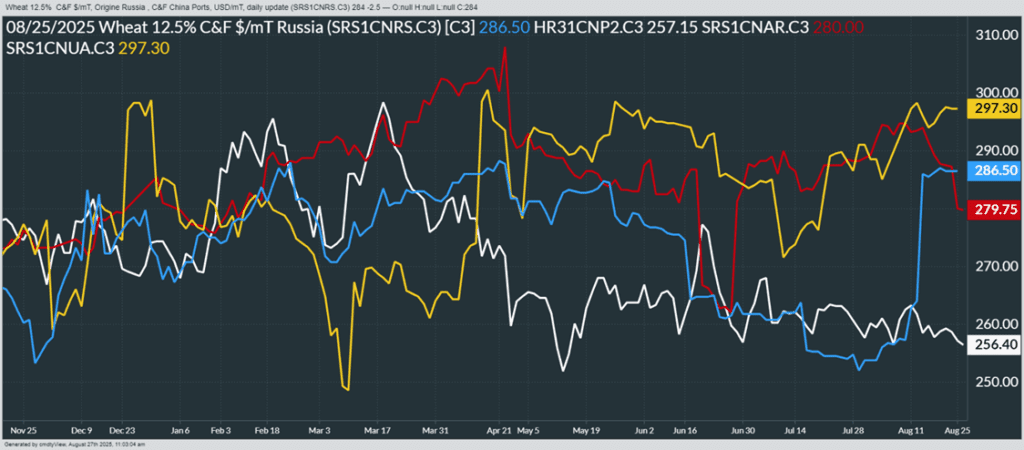

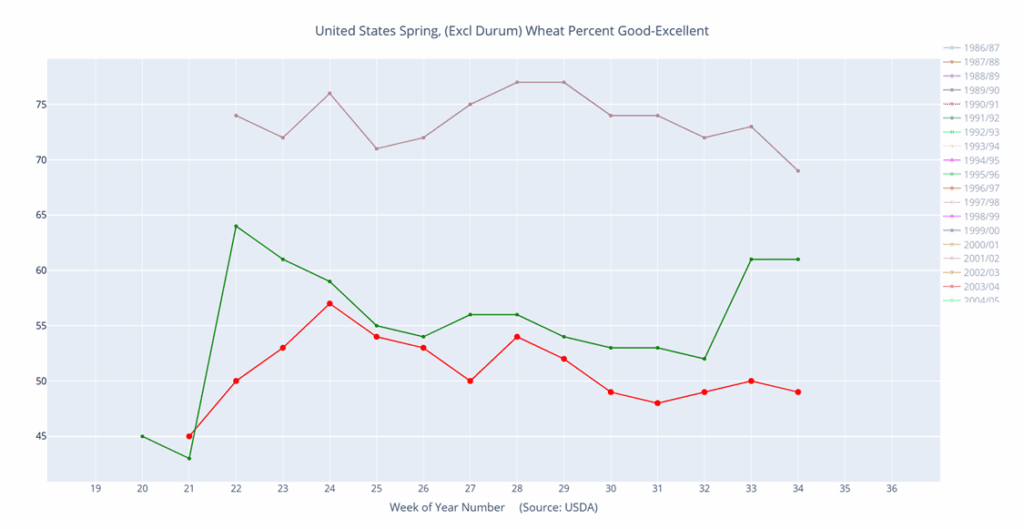

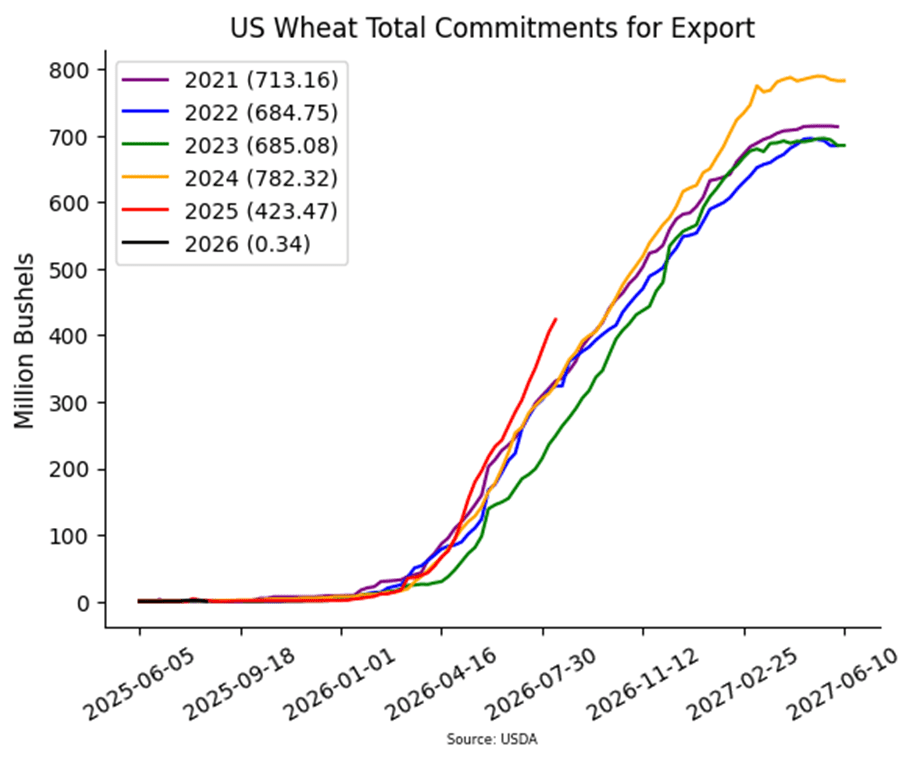

- Wheat closed lower in tandem with corn and soybean futures. Chicago led the way down, with the December contract losing 6-1/4 cents to 522. Meanwhile, December Kansas City lost only 1 cent at 510-1/4 and December Minneapolis was down 1-1/4 cents to 573. It was a generally risk-off day amid a lack of fresh news, as the lower trade came despite a weaker U.S. Dollar Index and mostly higher Matif wheat prices.

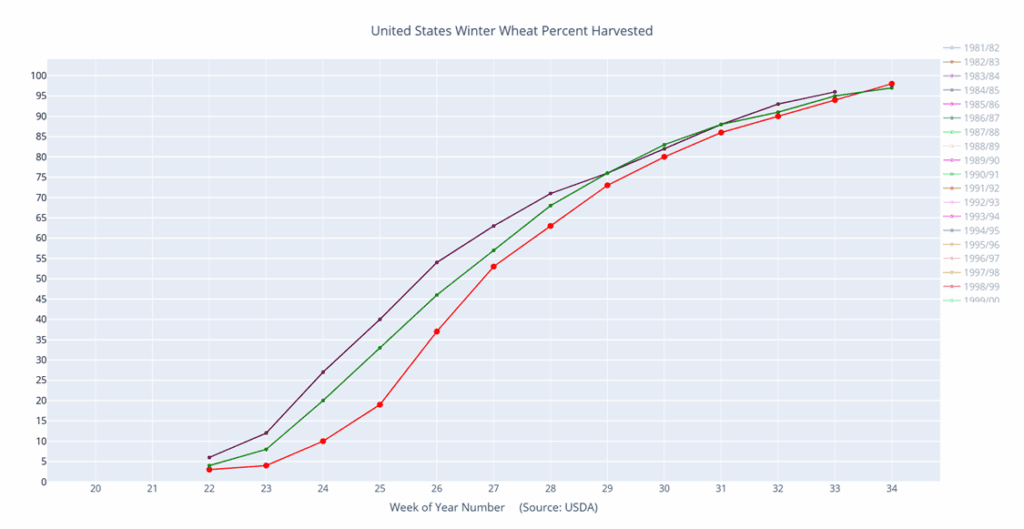

- According to yesterday’s USDA Crop Progress report, the spring wheat crop is 72% harvested as of August 31. This is up 19% from last week and up 5% from the same time last year. This is also 1% ahead of the five-year average.

- German 2025 all wheat production is expected to increase by 15% to 44.73 mmt. Winter wheat production specifically is expected to rise by 26% to 22.45 mmt, accounting for roughly half of their total wheat harvest.

- Russian wheat export values are said to remain relatively steady around $230-$232 per mt on a FOB basis. However, demand may be lacking – Russian July and August shipments totaled 6.1 mmt, which falls well under the 9.9 mmt exported during that time last year.

- SovEcon raised their estimate of Russian 25/26 wheat exports by 0.4 mmt to 43.7 mmt. This is said to be due to improved crop prospects and production potential. However, they are reportedly cautious about further increases due to the slow start of exports so far.

- According to the European Commission, EU soft wheat exports as of August 31 totaled 2.57 mmt; the export season began on July 1. This represents about a 44% decline from the 4.6 mmt shipped during the same timeframe last year. The top importer of EU wheat was Saudia Arabia at 380,000 mt, followed by smaller amounts from Morocco and the UK.

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

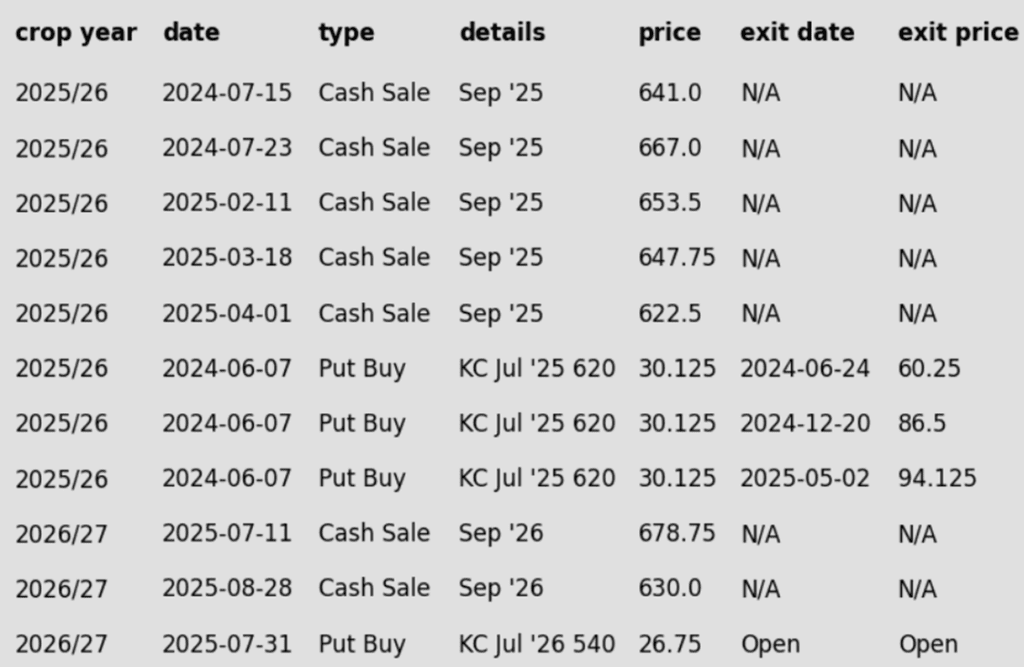

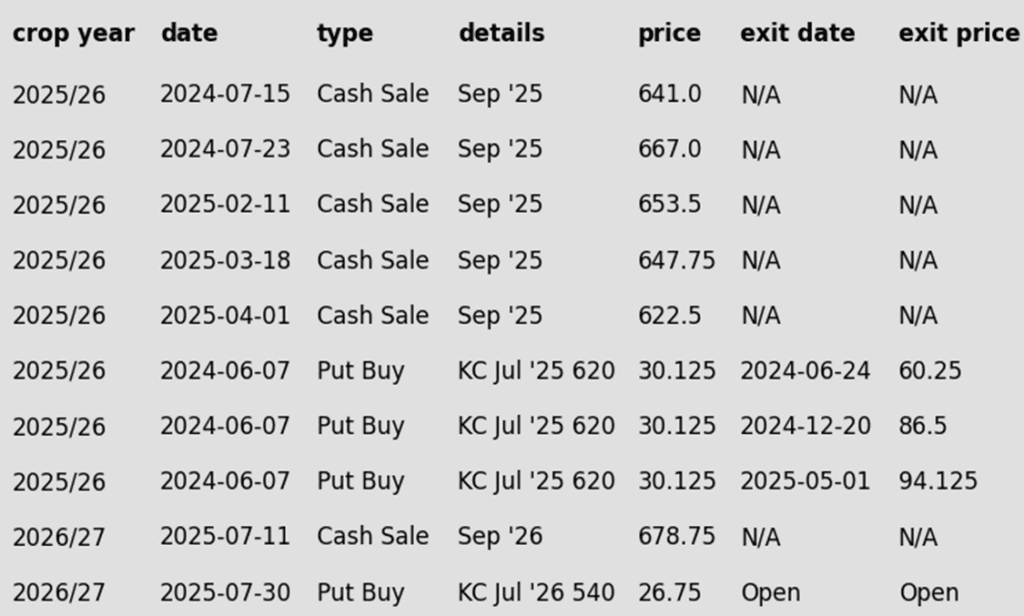

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 647 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 656 target has been lowered to 647.

To date, Grain Market Insider has issued the following KC recommendations:

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Continued Opportunity – Sell a second portion of your 2026 Minneapolis wheat crop today.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather