2-14 End of Day: Markets Red Across the Board on “Risk Off” Day in the Grains

All prices as of 2:00 pm Central Time

Grain Market Highlights

- Weekly ethanol production numbers were strong, but not enough to shake off the weakness from neighboring wheat and soybeans as March corn drifted to a new contract low before recovering somewhat going into the close.

- News of the Rosario Grain Exchange raising its forecast for Argentina’s soybean crop added pressure to the market after early strength in March soybeans faded and turned lower to trade the lowest spot month close since December 2020.

- The higher forecast of Argentina’s soybean crop also added pressure to soybean meal, which saw two-sided trade before closing lower on the day. Whereas soybean oil came under pressure from sharply lower energy prices, although March Board crush margins remained relatively steady posting a 2-cent gain.

- The Wheat complex came under pressure from an International Grains Council report stating that weekly wheat prices had dropped in many global nations. Additionally, Ukraine is on track to export its estimated 50 mmt wheat surplus. All three wheat classes posted losses for the day, with Chicago leading the way.

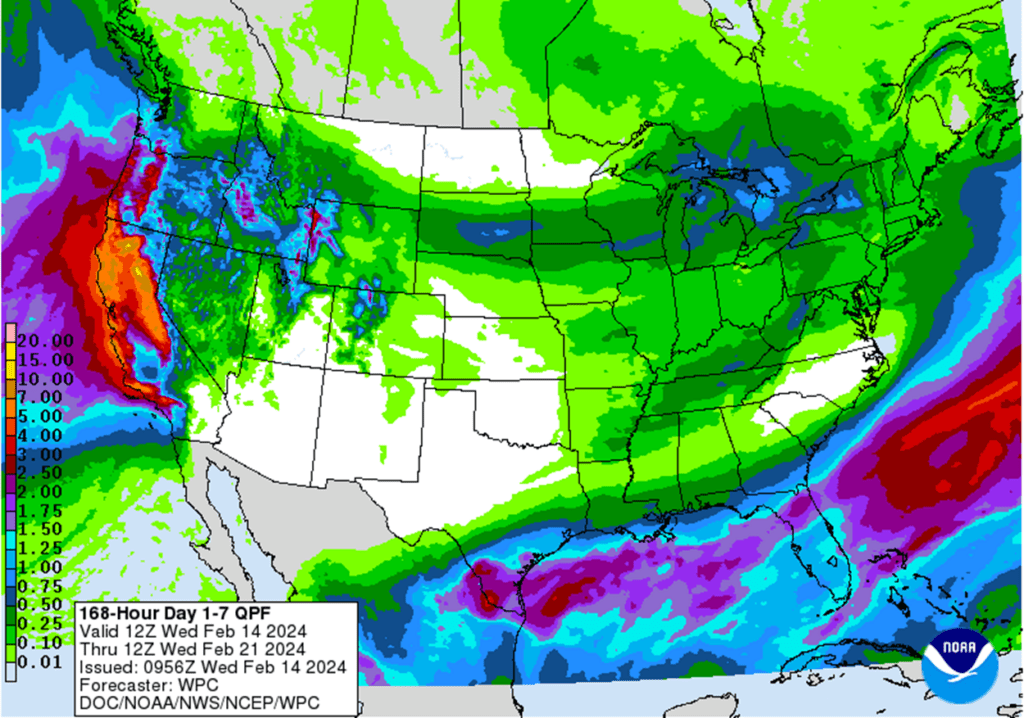

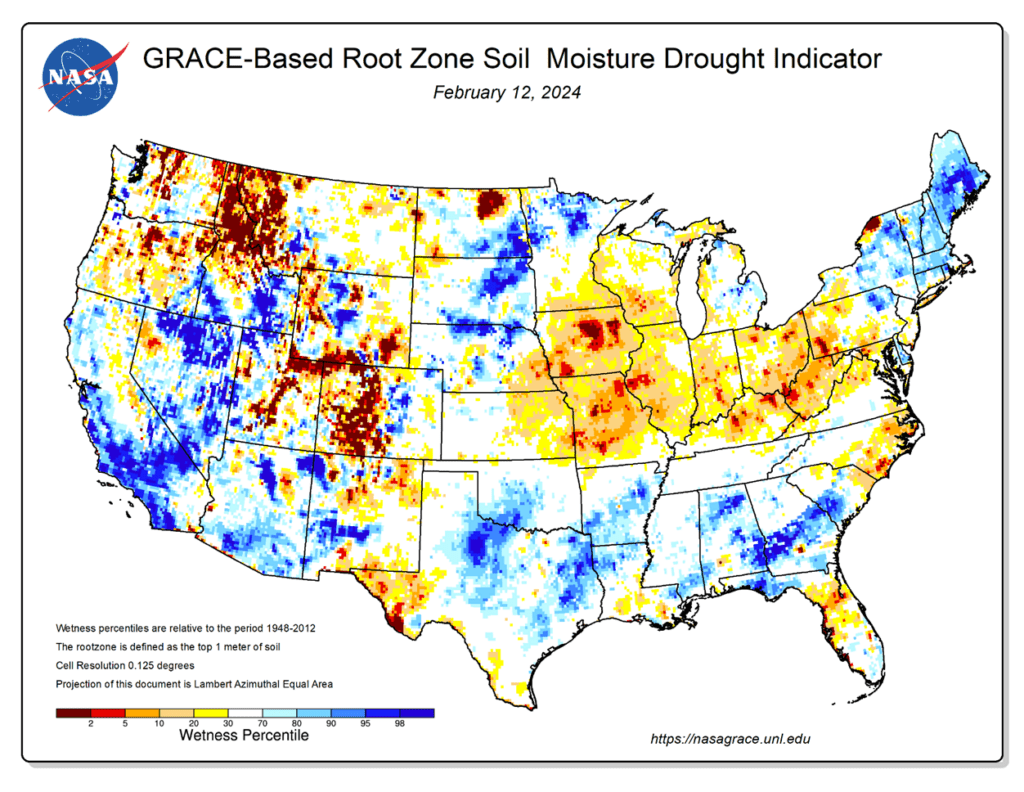

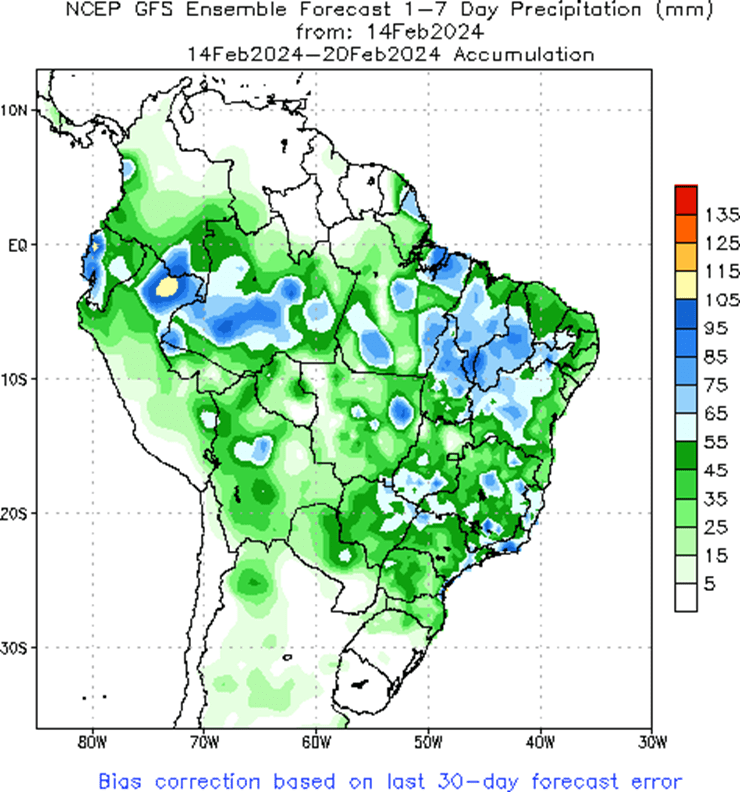

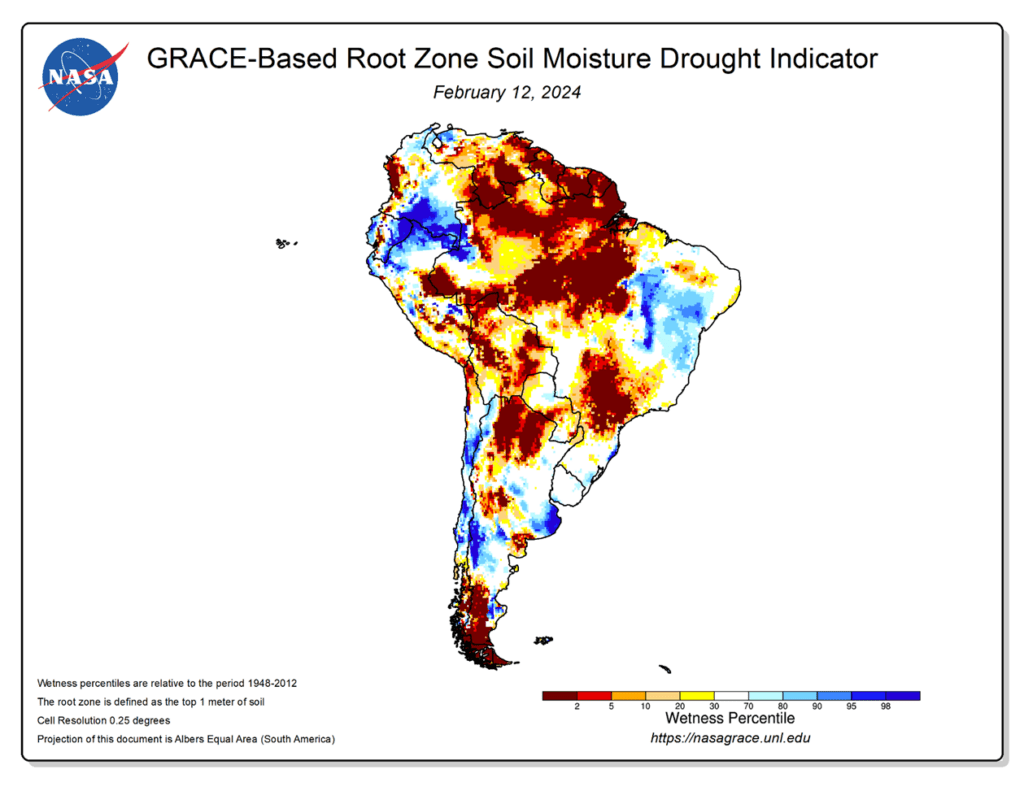

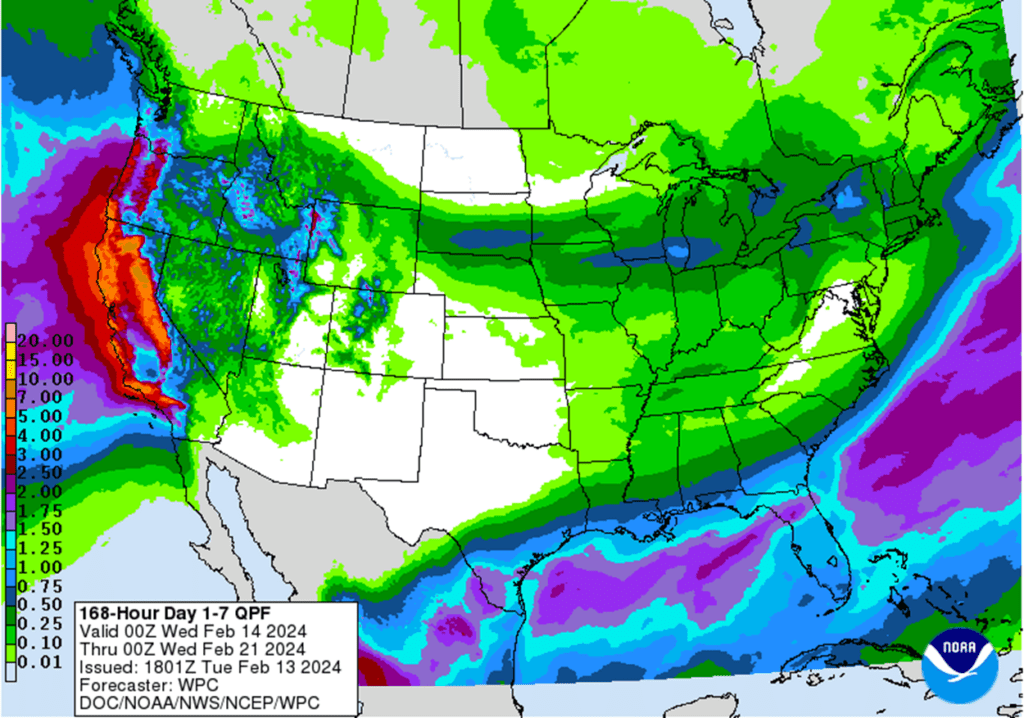

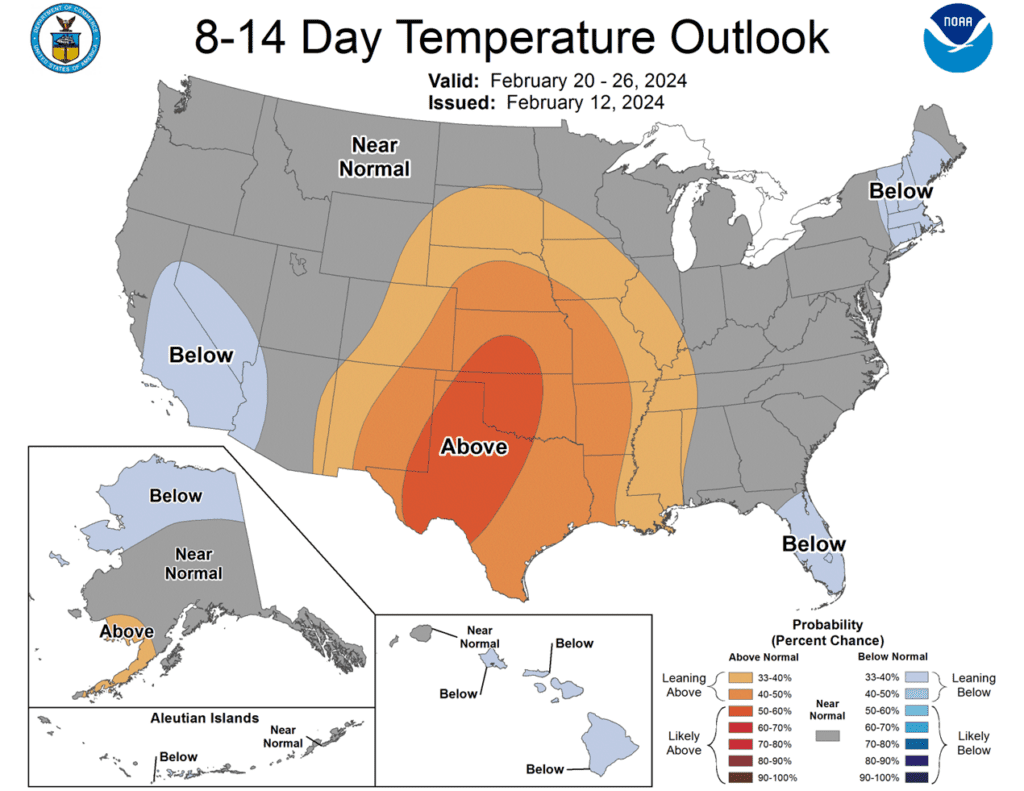

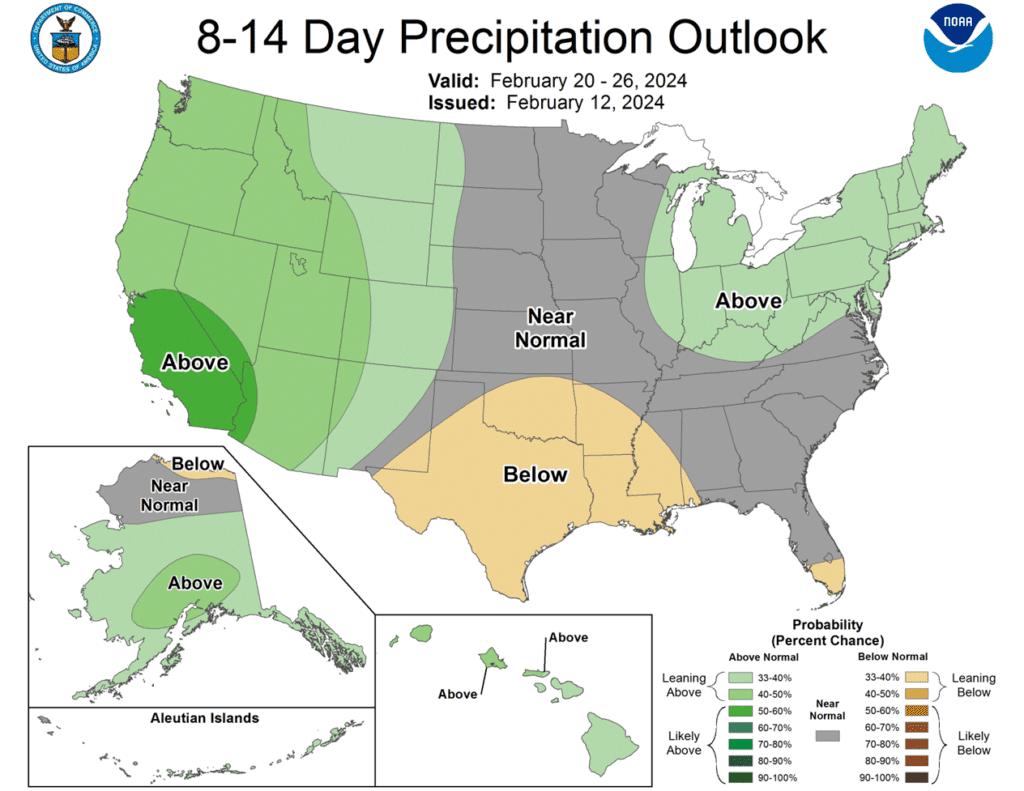

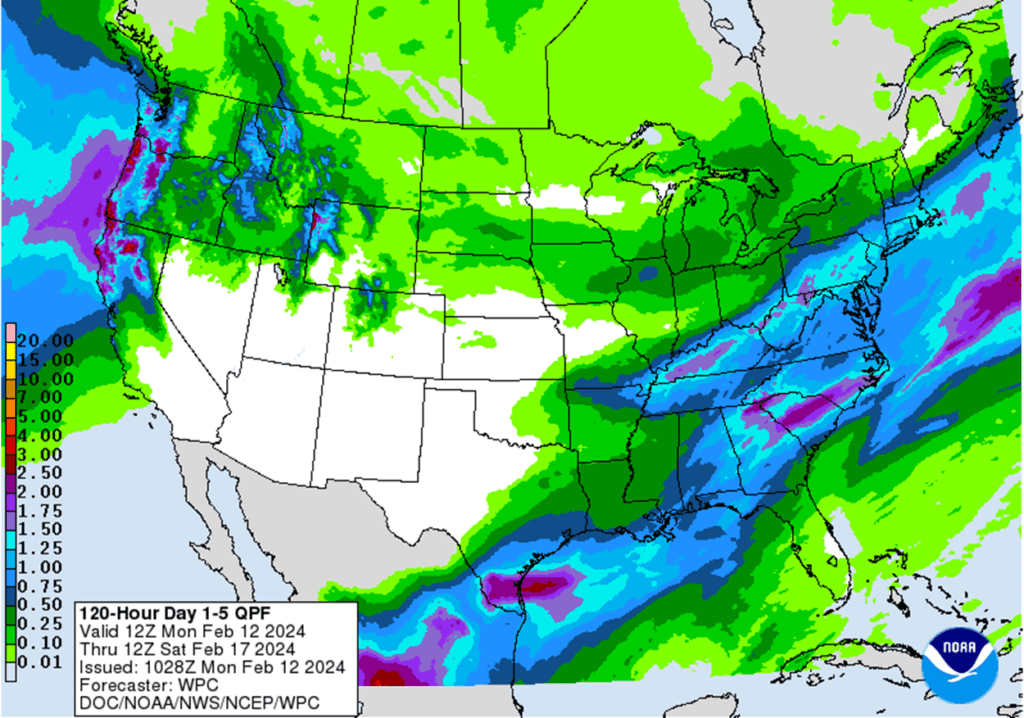

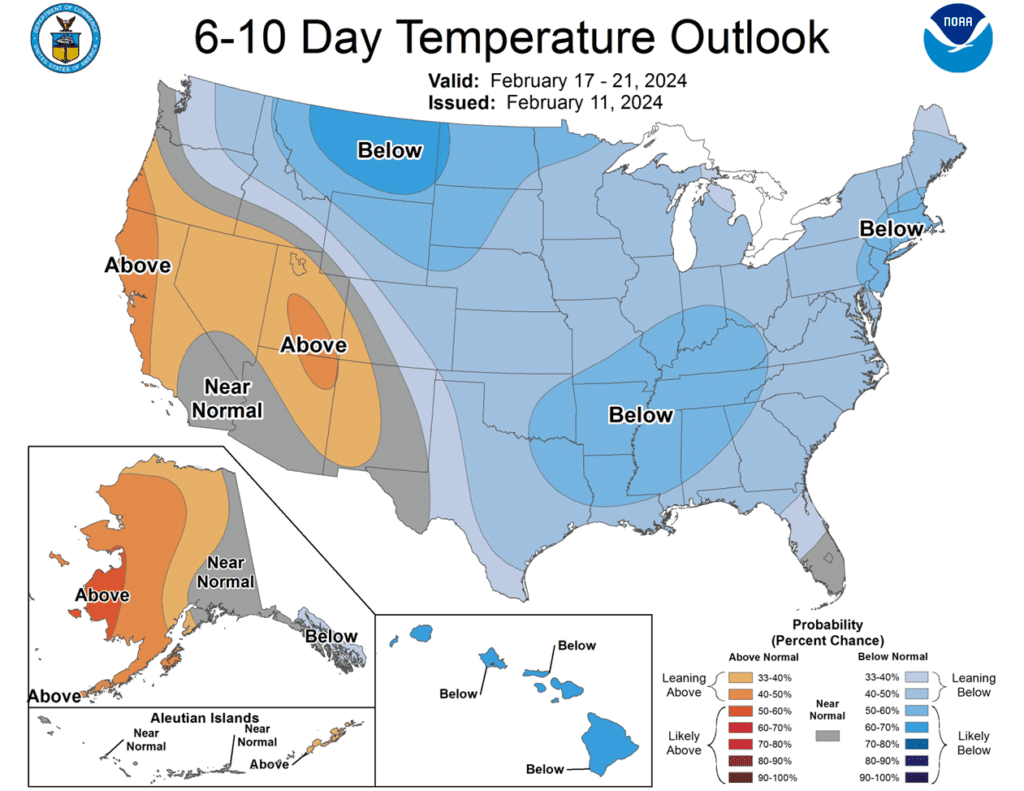

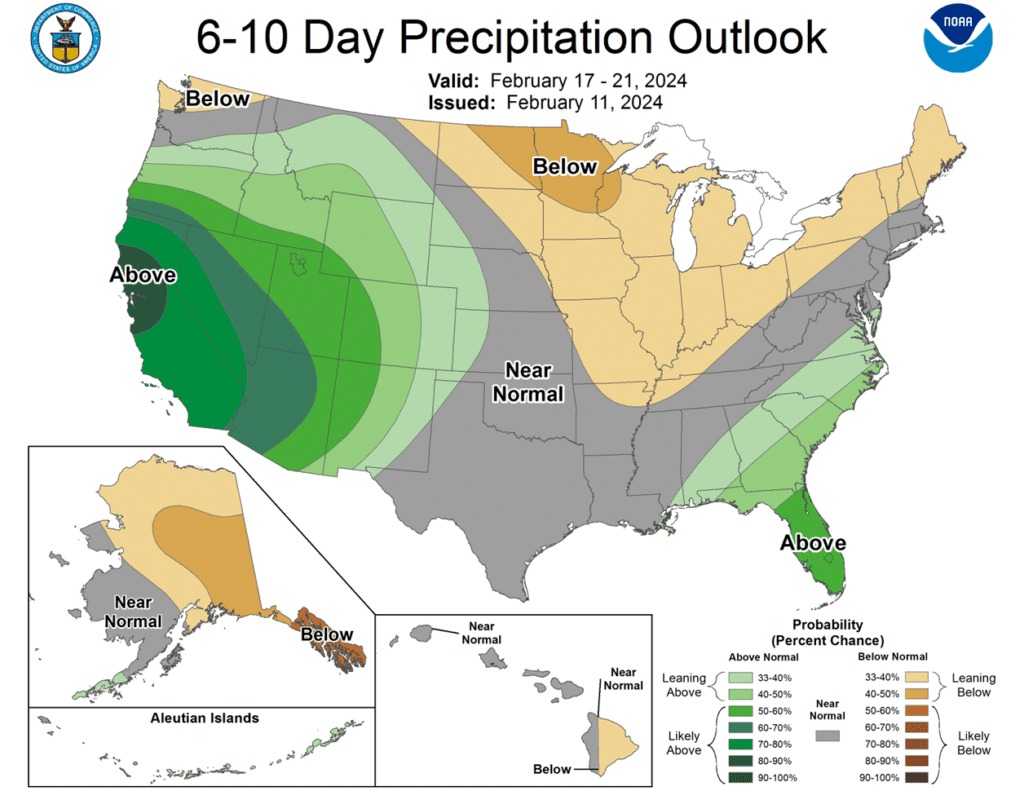

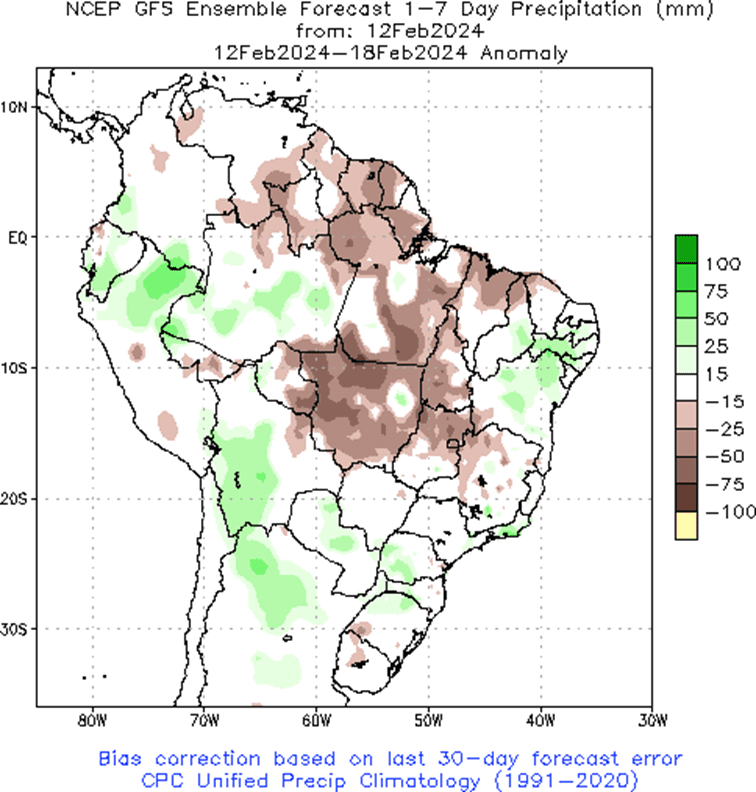

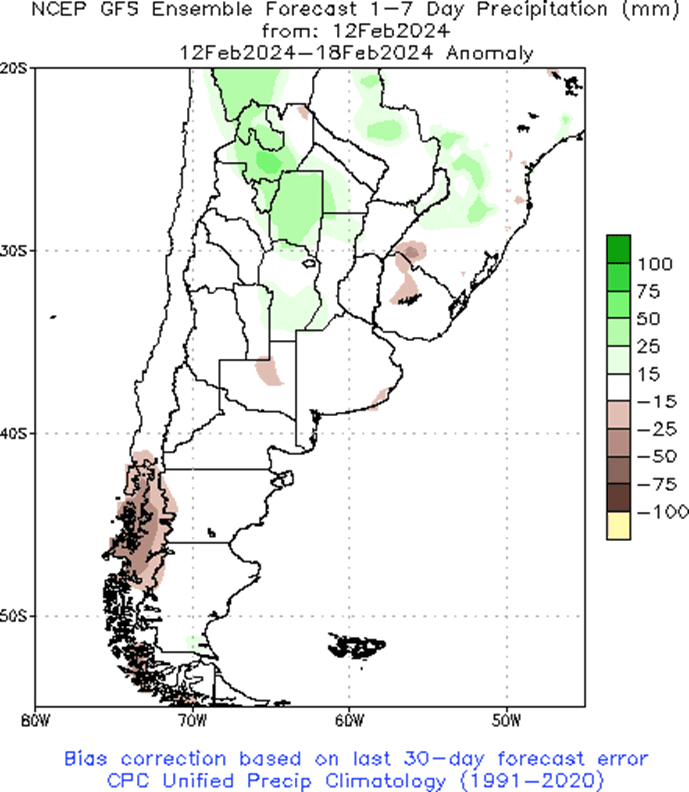

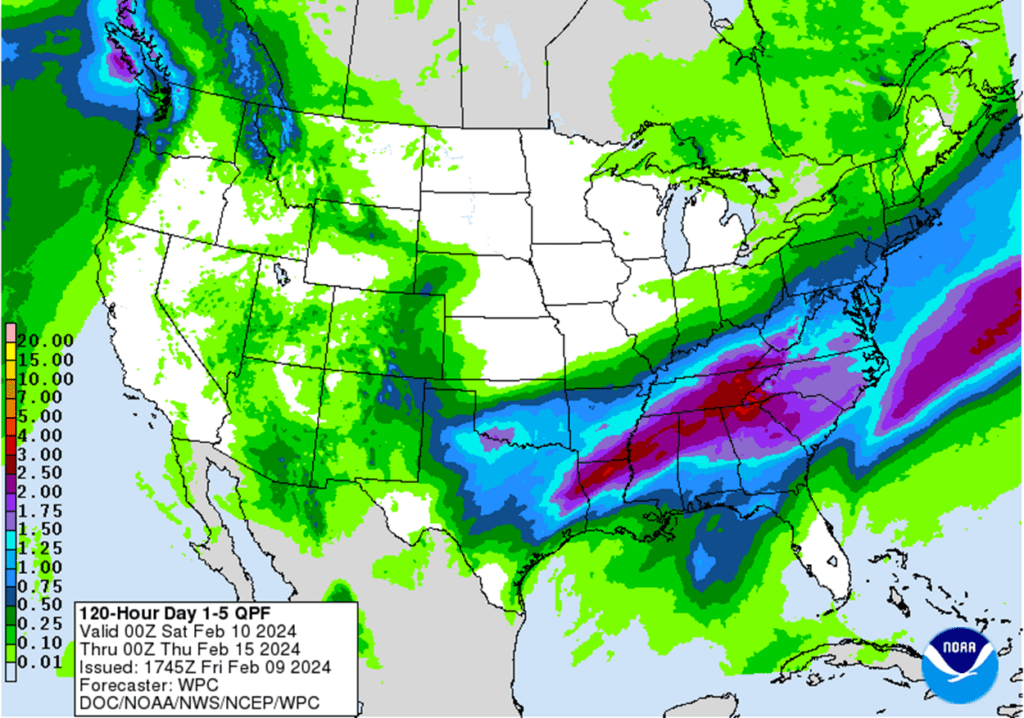

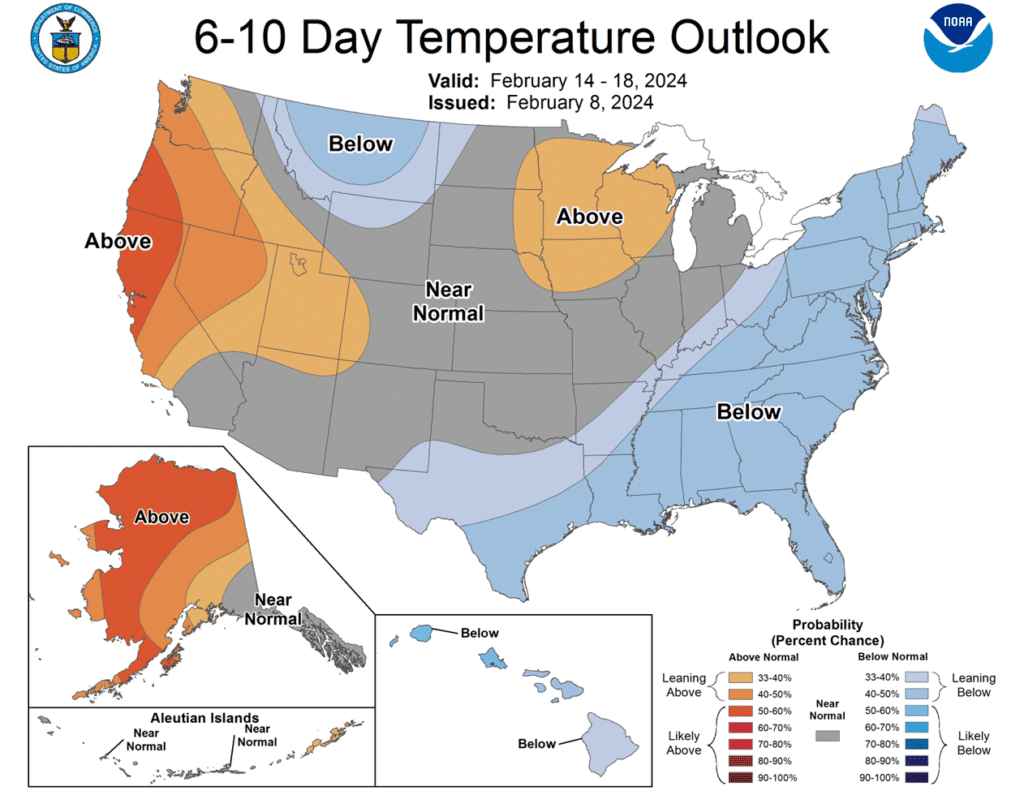

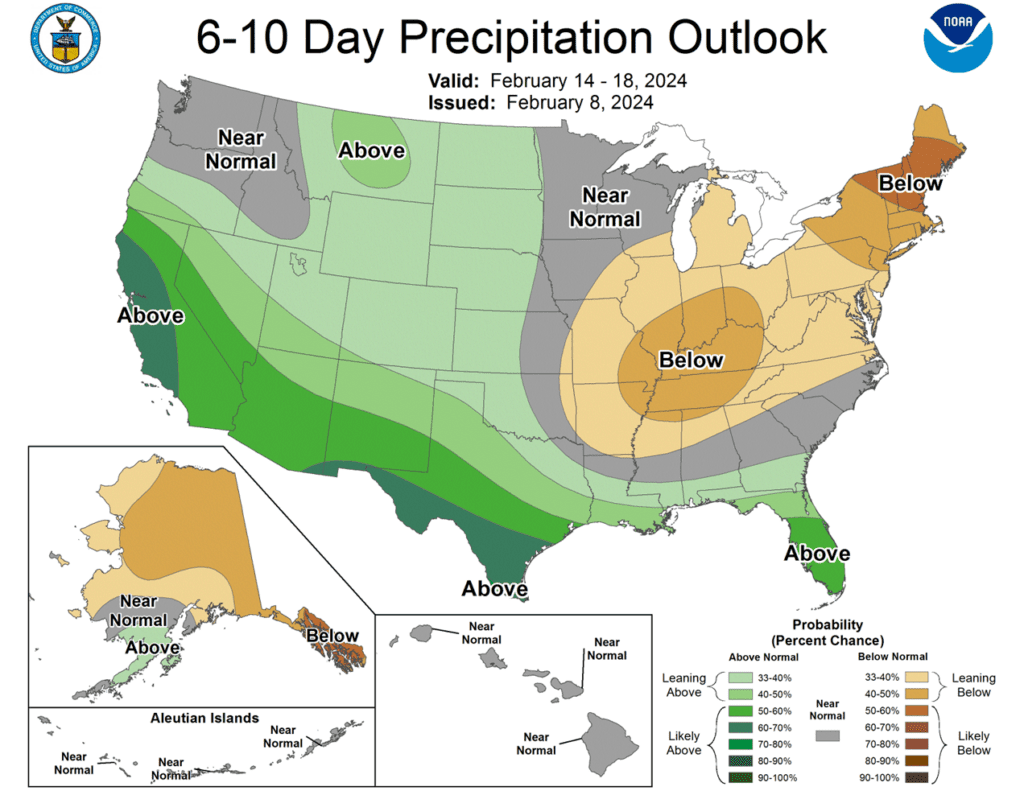

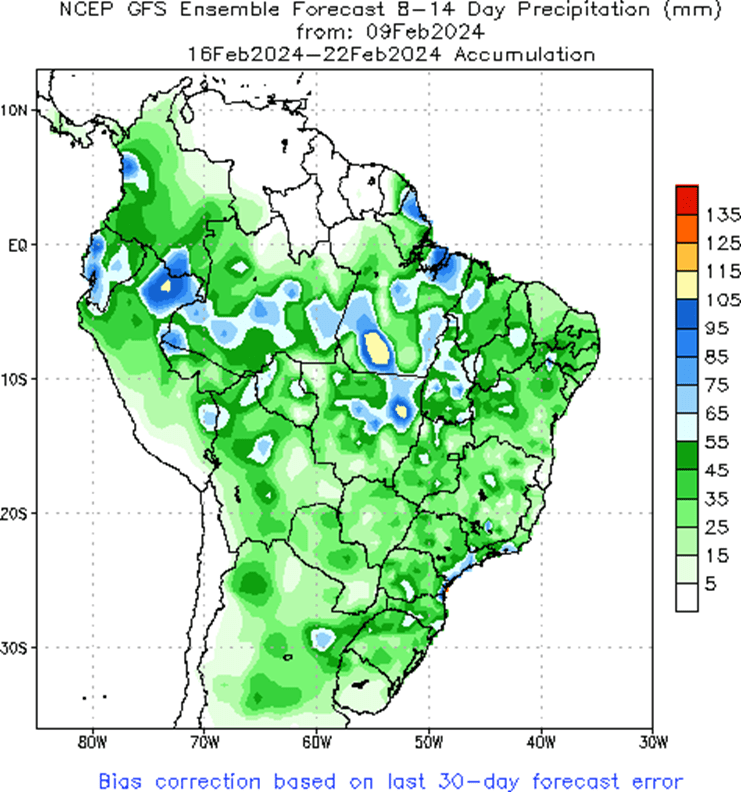

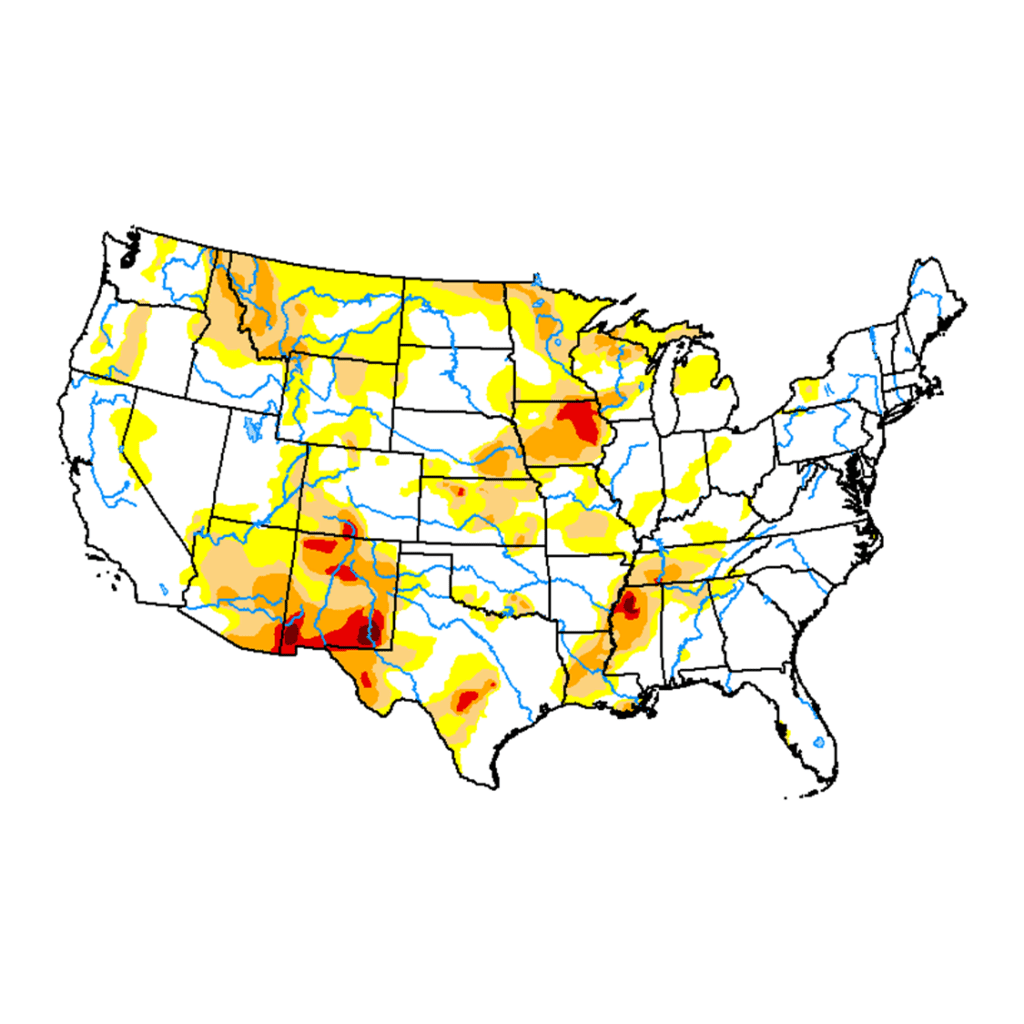

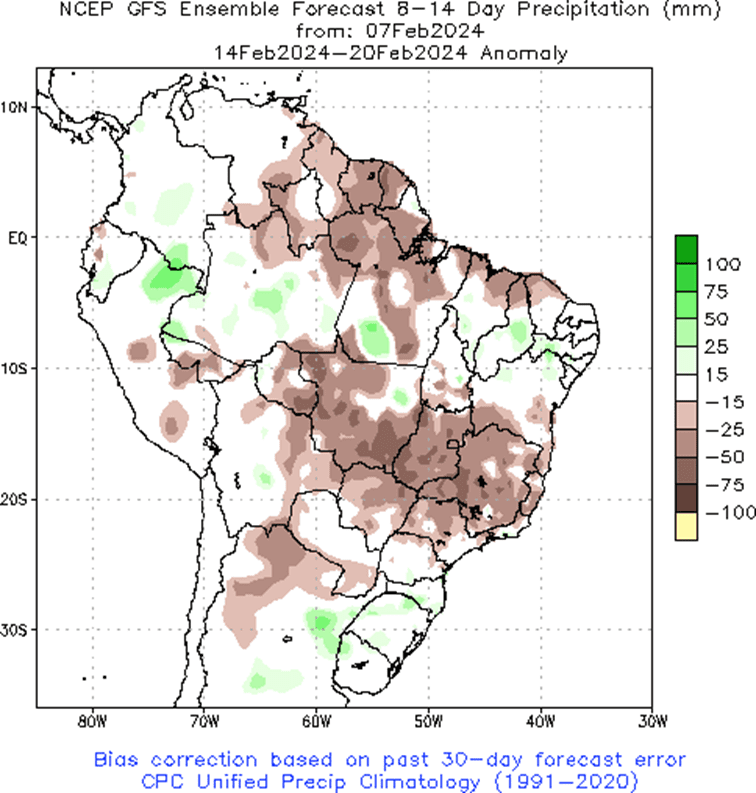

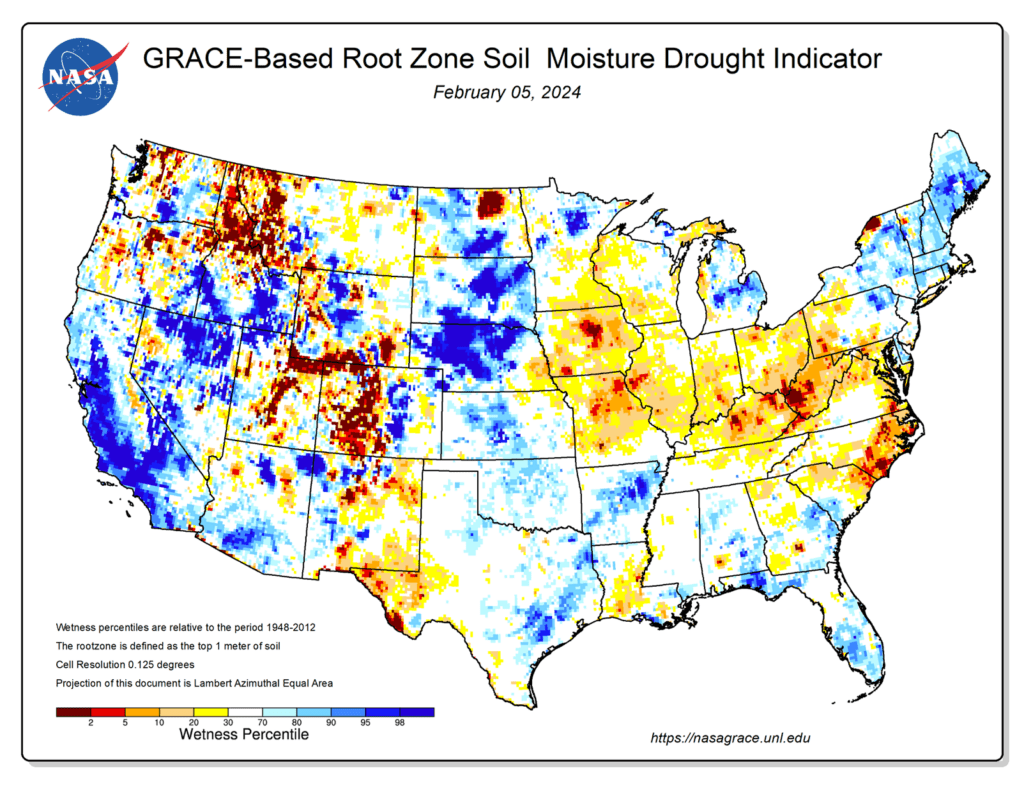

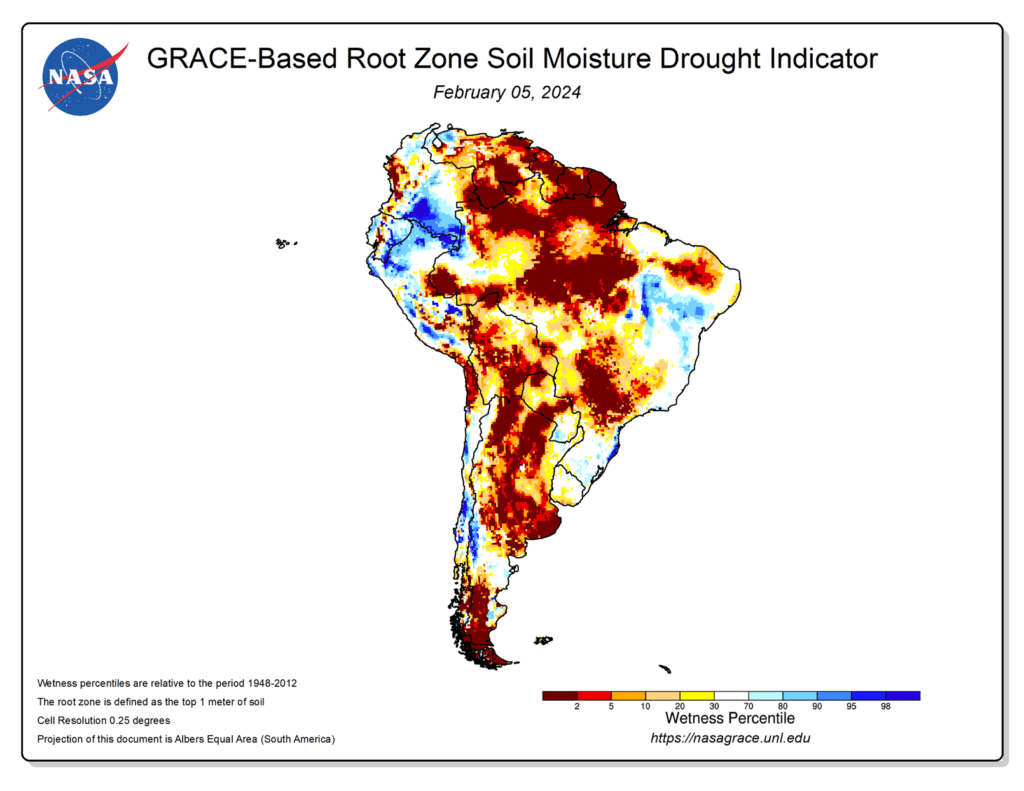

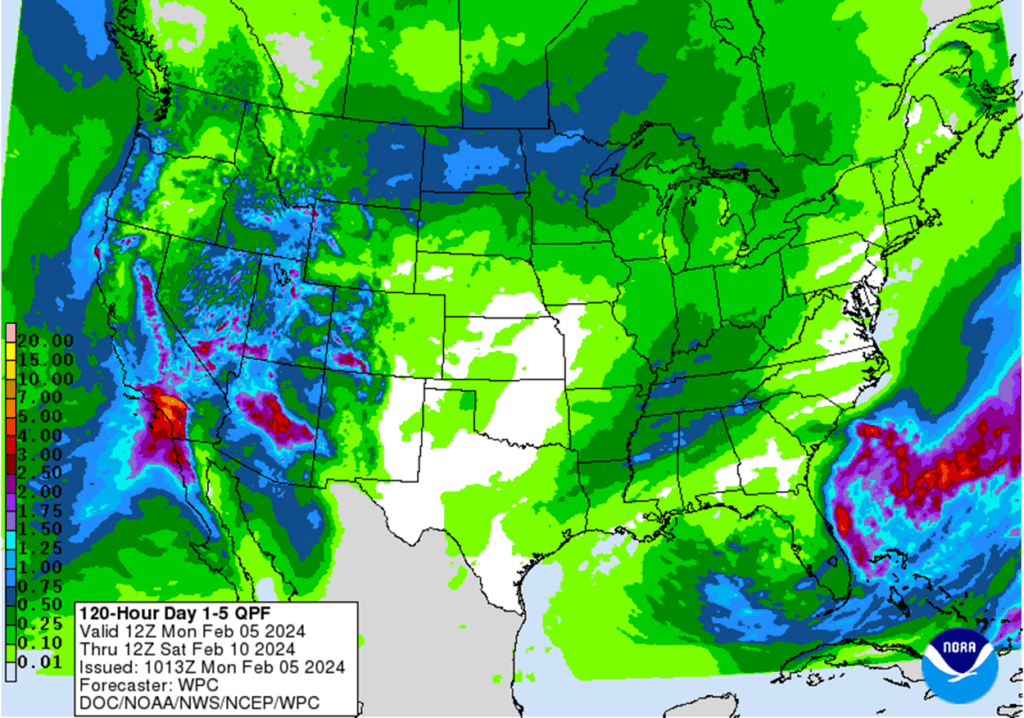

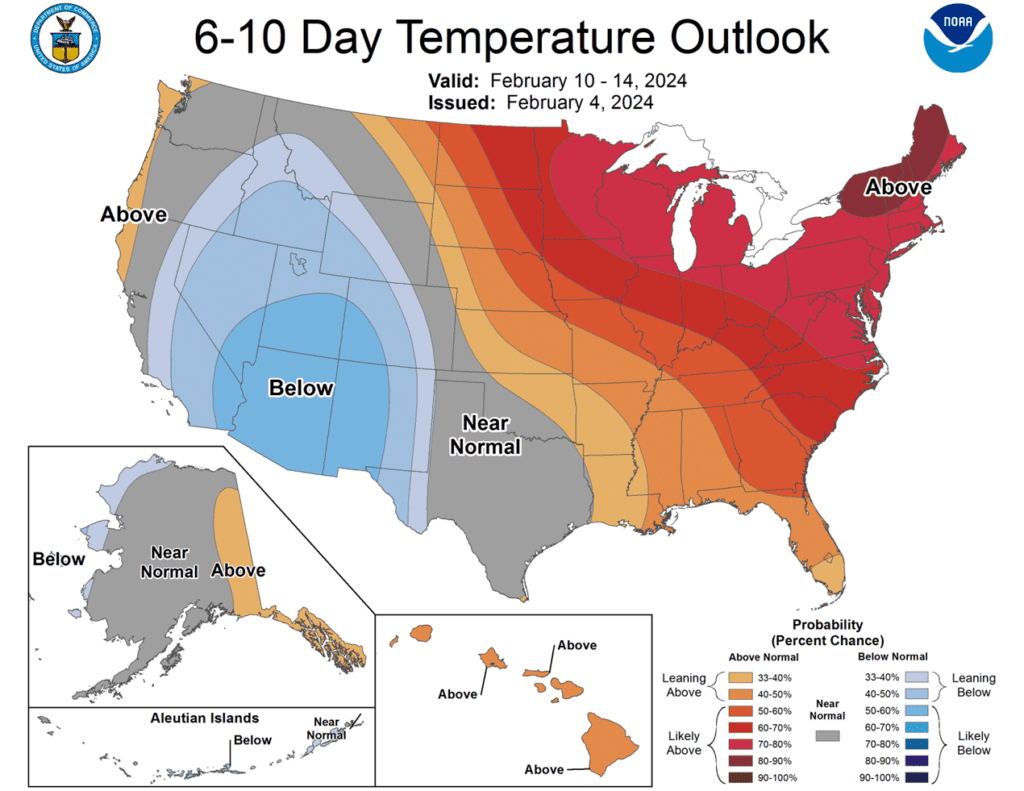

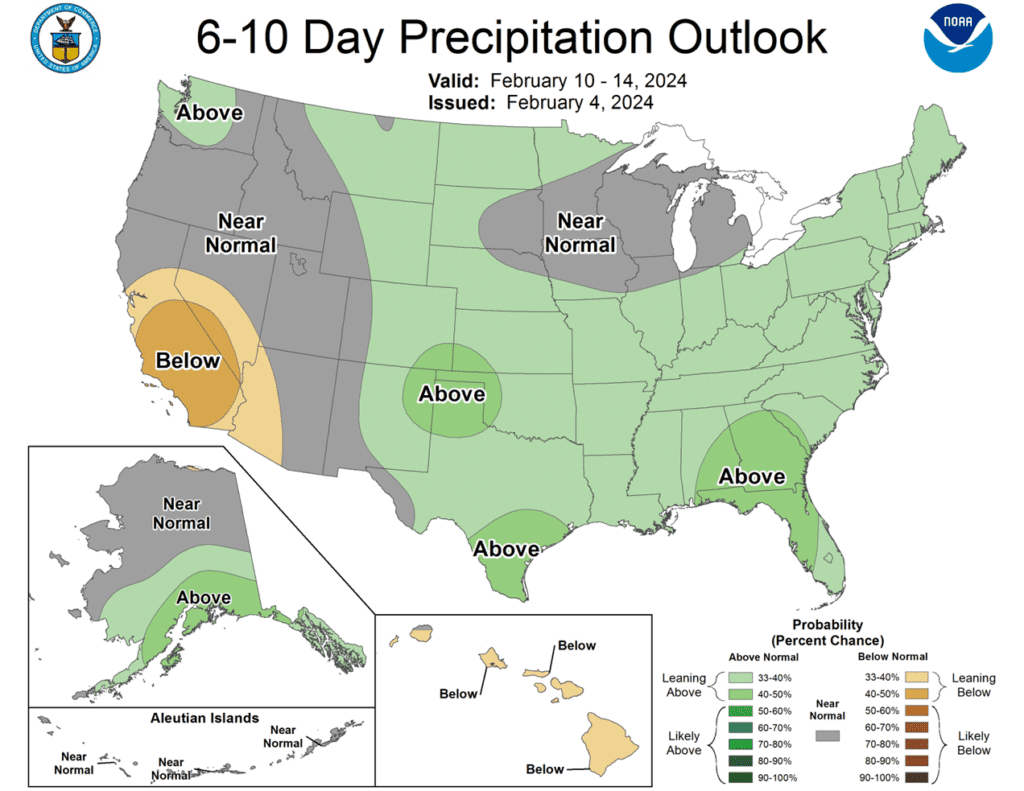

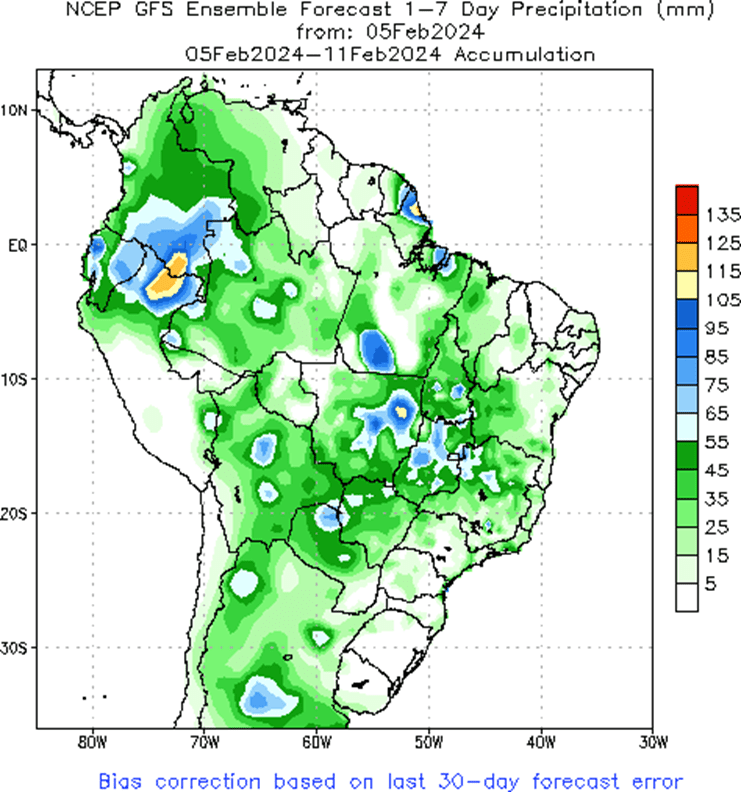

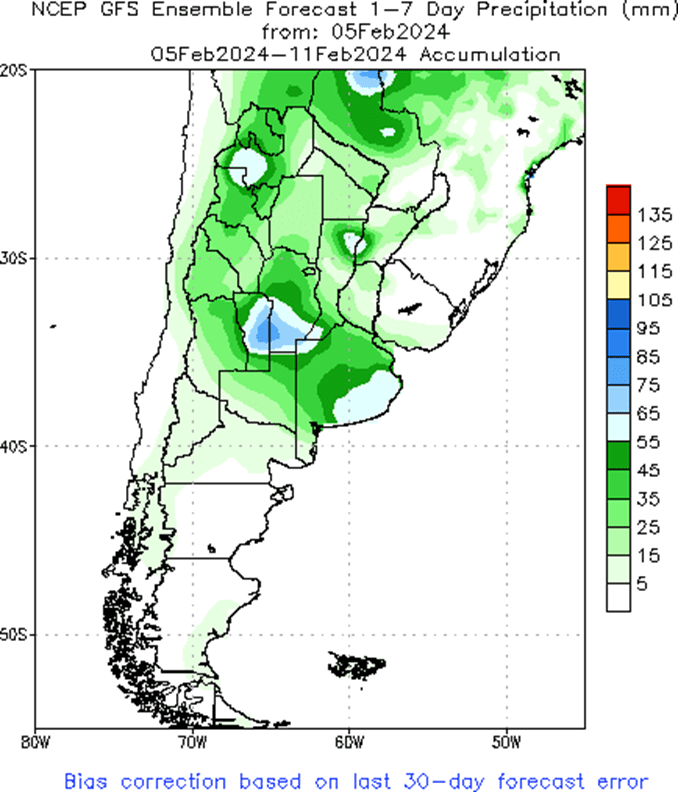

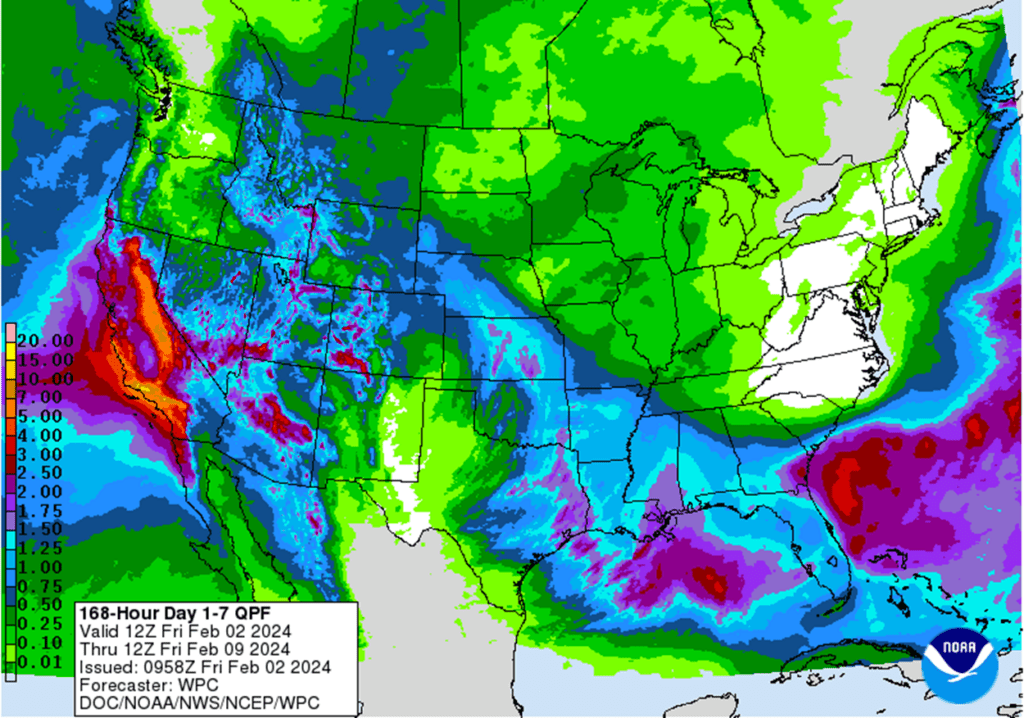

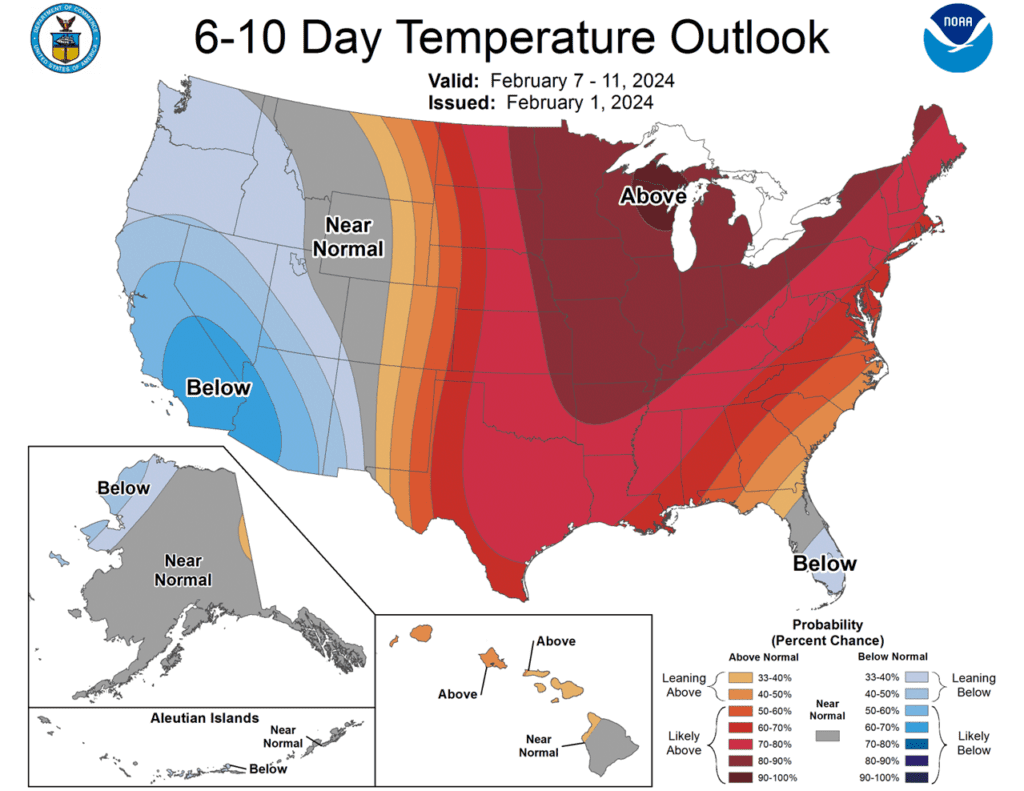

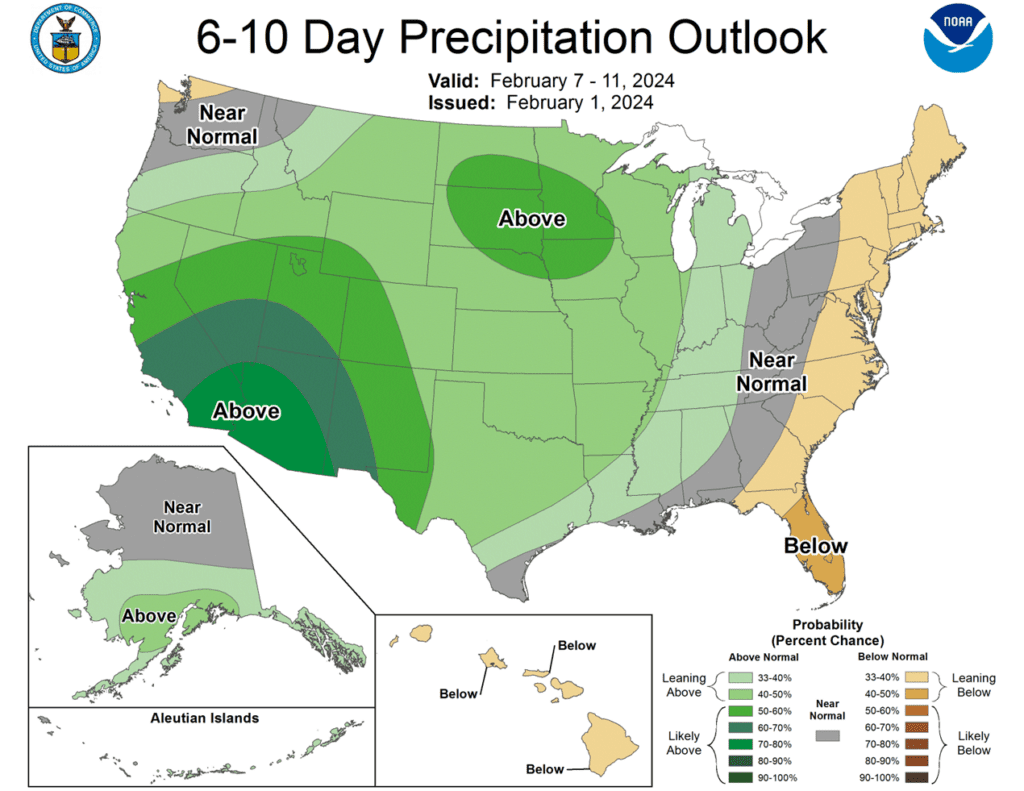

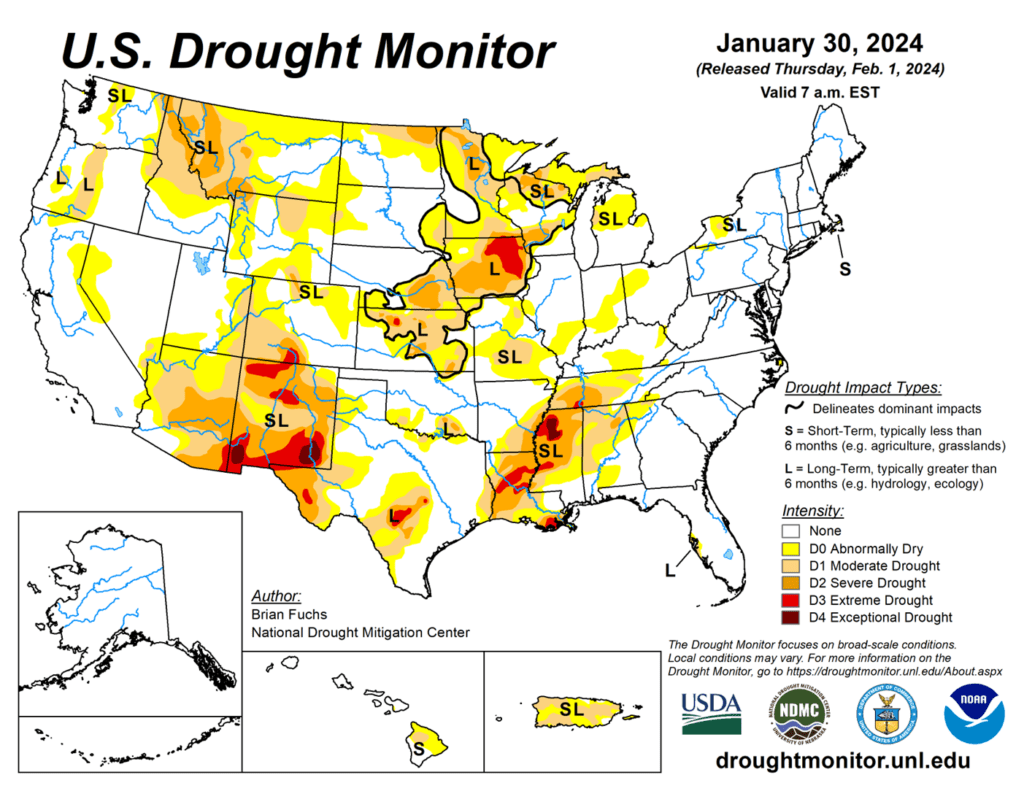

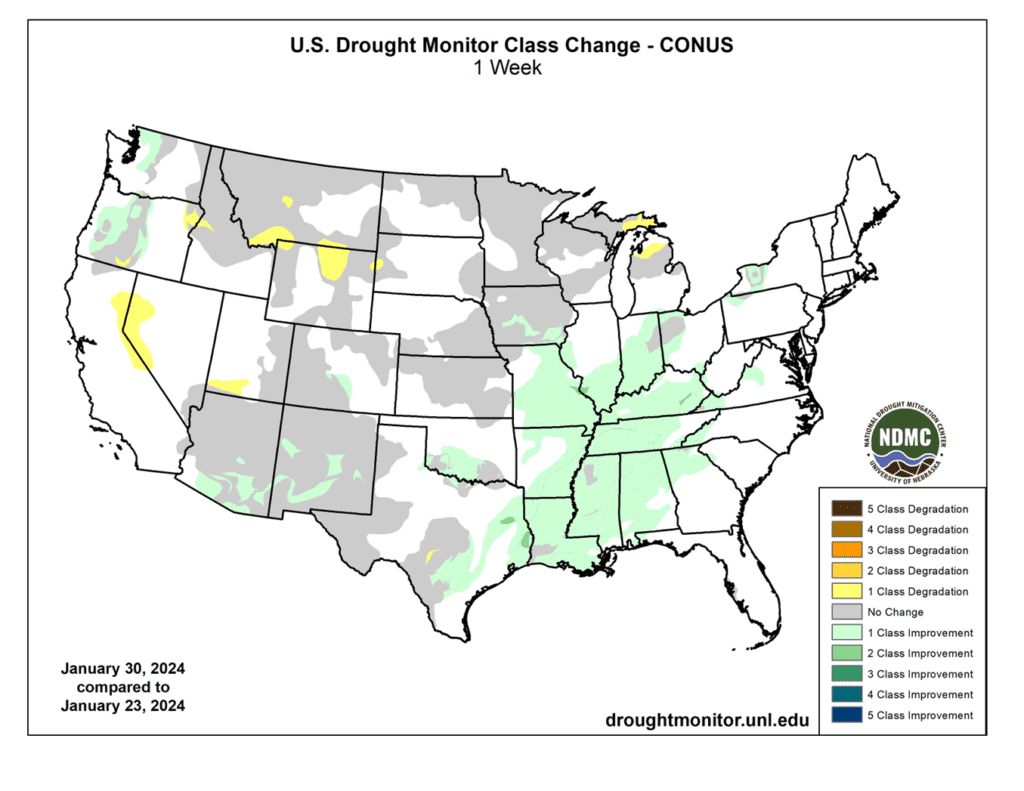

- To see the updated US 7-day total precipitation forecast, NASA-Grace Drought Indicators for the US and South America, and Brazil’s 1-week precipitation forecast, courtesy of the National Weather Service and the Climate Prediction Center, and NASA-Grace, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

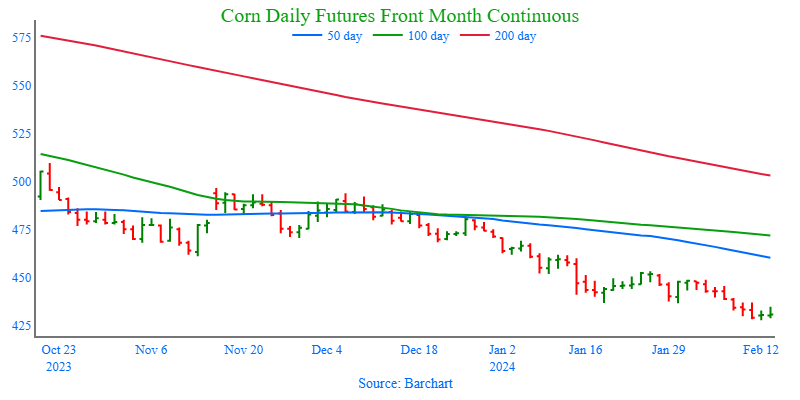

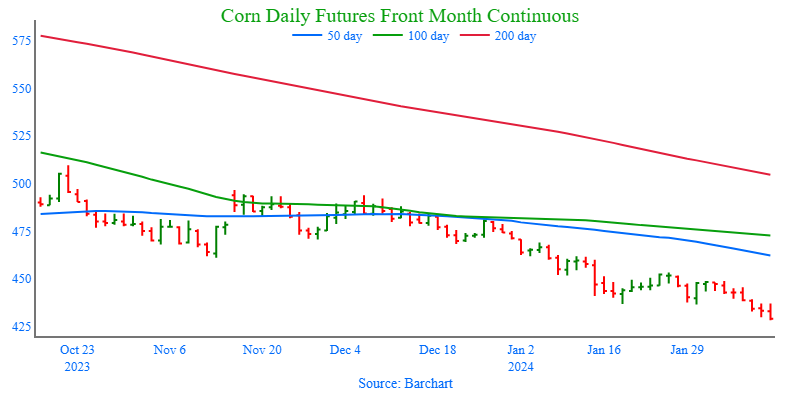

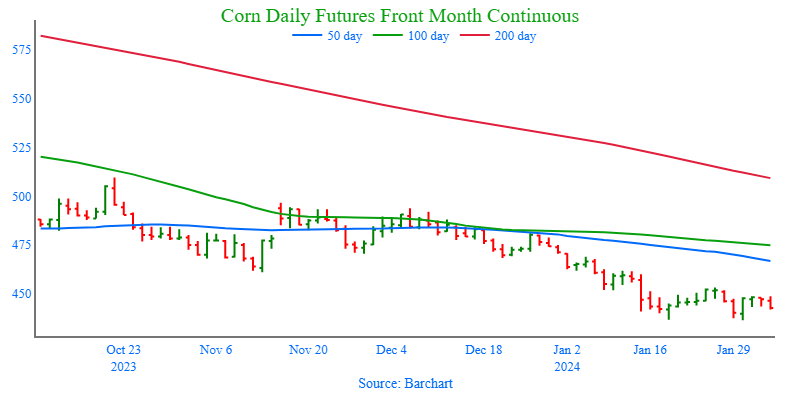

Corn

Corn Action Plan Summary

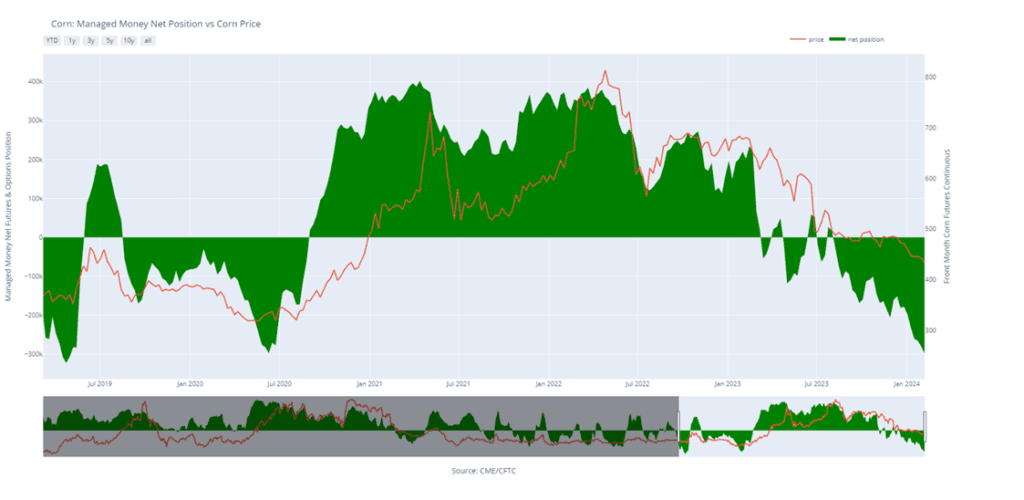

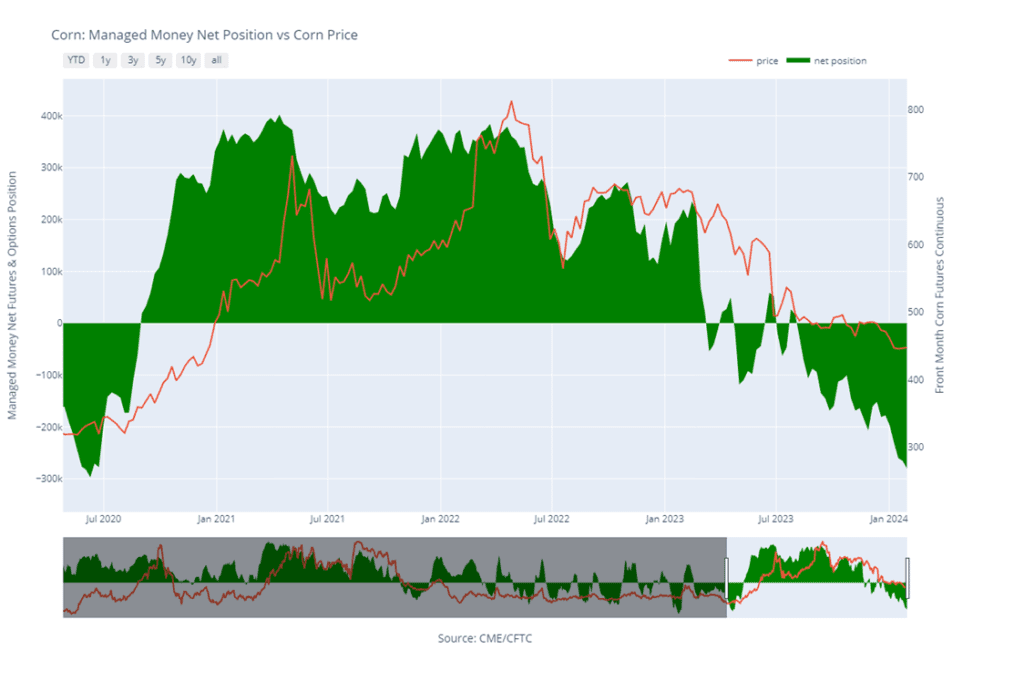

- No new action is recommended for 2023 corn. With a general lack of bullish news and an estimated US carryout over 2.1 billion bushels, front month corn has languished in a sideways to lower trend since printing a high last October. While the lack of a bullish catalyst has been disappointing, the market is in a significantly oversold condition, and managed funds continue to hold a sizable net short position. Either or both could trigger a short covering rally at any time heading into the spring planting window. For now, Grain Market Insider continues to sit tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring or even summer.

- No new action is recommended for 2024 corn. In January, Dec ’24 broke through the bottom end of the 485 ¾ to 602 range that had been in place since February ’22. While this was a disappointing development, bear spreading has allowed Dec ’24 to maintain more of its value versus old crop as traders attempt to price in a larger 2023 carryout with more uncertainty ahead for the 2024 crop. Additionally, Dec ’24 is significantly oversold on the weekly chart, which is supportive for a technical rally to begin at any time as the spring planting window quickly approaches. Given the amount of time and uncertainty that remains for the 2024 crop, Grain Market Insider will consider recommending additional sales on a retracement toward the low to mid 500 level.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

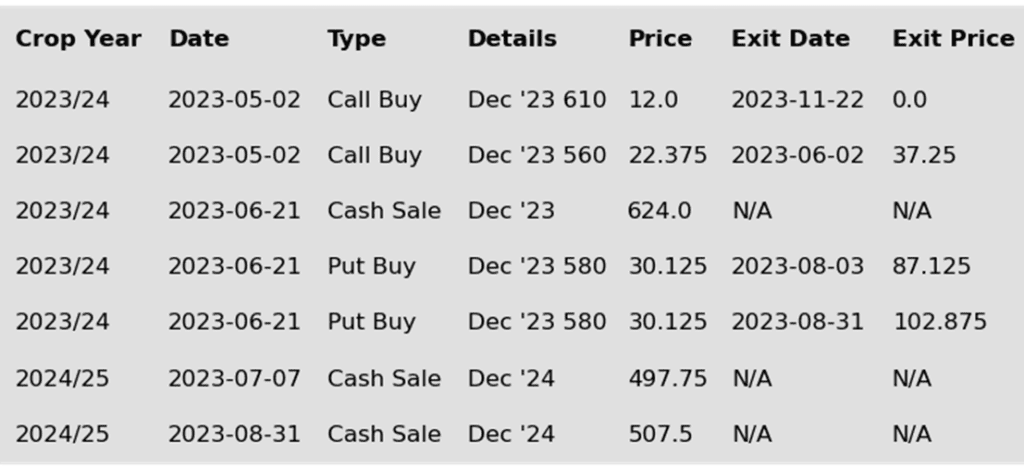

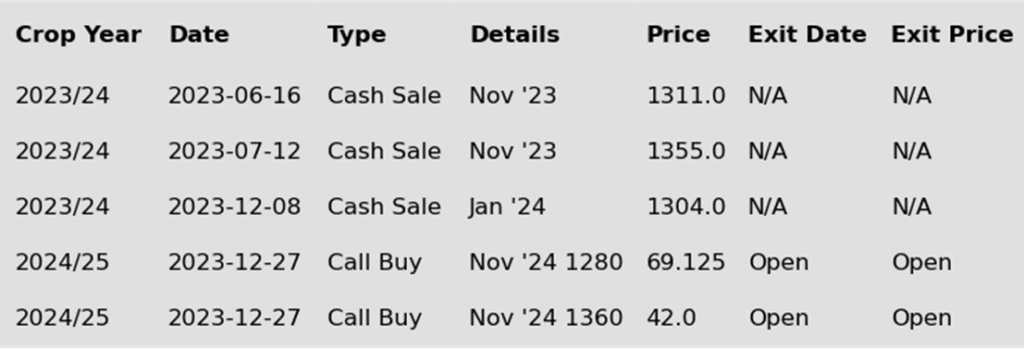

To date, Grain Market Insider has issued the following corn recommendations:

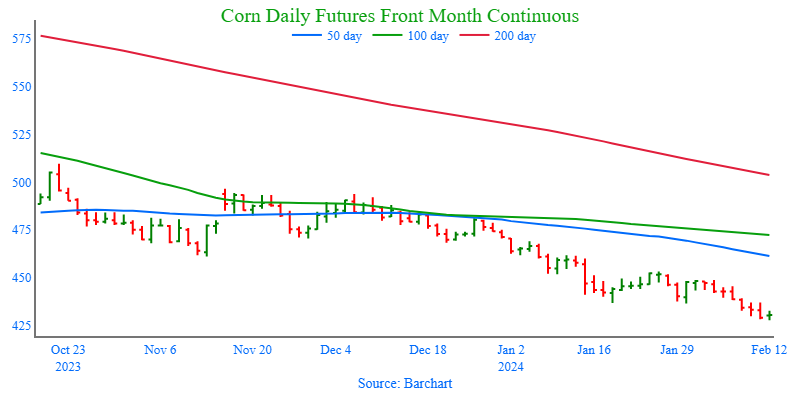

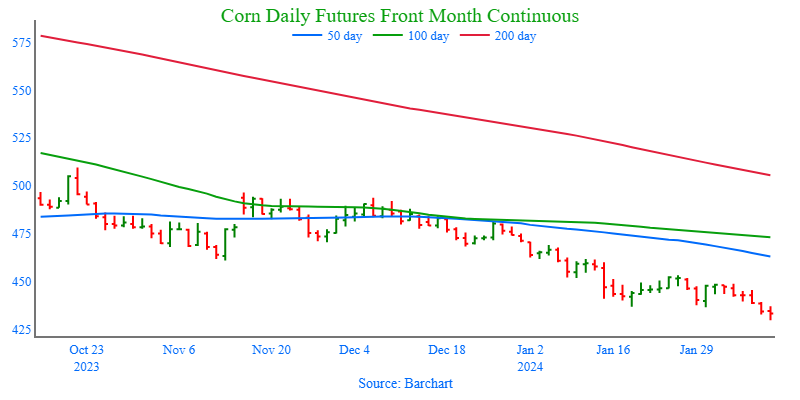

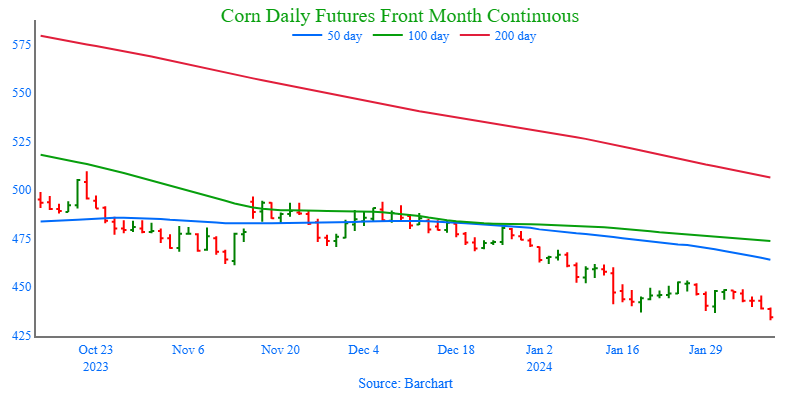

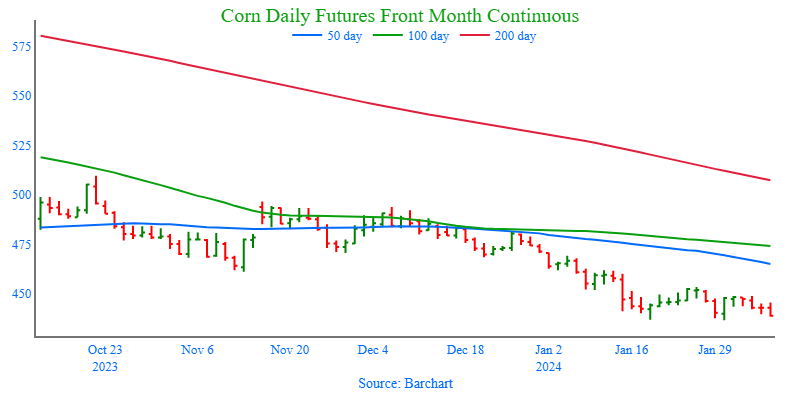

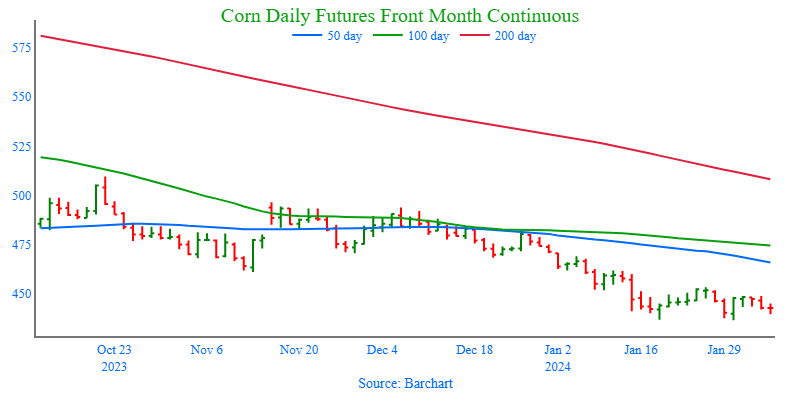

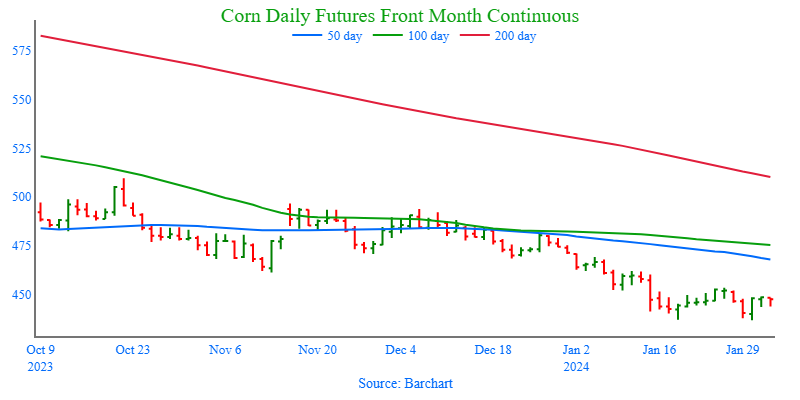

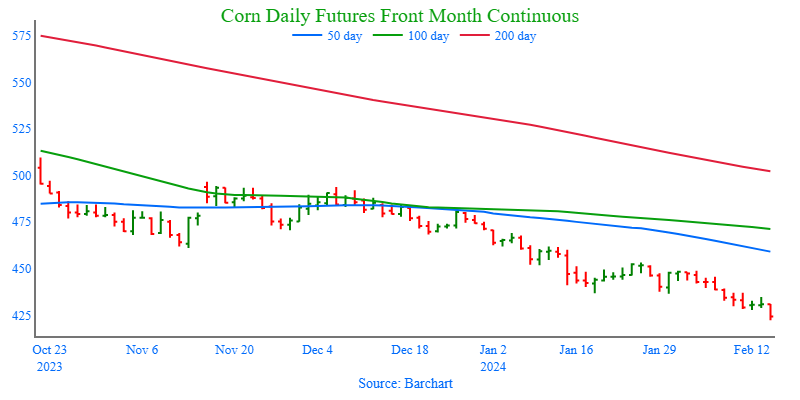

- With carryover weakness from wheat and soybeans, and only minor support from today’s positive ethanol numbers, March corn broke through downside congestion from the past few days and printed a new contract low and fresh closing low at prices not seen since December of 2020.

- Adding to the pressure in the corn market was word that the Rosario Grain Exchange raised its estimate of Argentina’s corn crop by 3 mmt to 59 mmt. This is 4 mmt above the USDA’s current forecast of 55 mmt. Additionally, Argentina’s current March – May export prices are below US offers, though Ukraine’s are currently the cheapest on the world market for February.

- Ethanol production for the week ending February 9 came in at a strong 7.581 million barrels, averaging 1.083 mbbl/day. This represents a 4.8% increase from last week and a 6.8% increase from last year. Estimated corn usage for the week was 107.5 mb, which is well ahead of the pace needed to reach the USDA’s forecast of 5.375 bb.

- The USDA will hold its annual Ag Outlook Forum Thursday and Friday. Expectations are often for bearish numbers since the board typically uses trendline yields. For this year, the average trade guess for the Board’s 24/25 carryout is 2.493 bb with 91.6 ma planted, versus 2.172 bb from 94.6 ma this year.

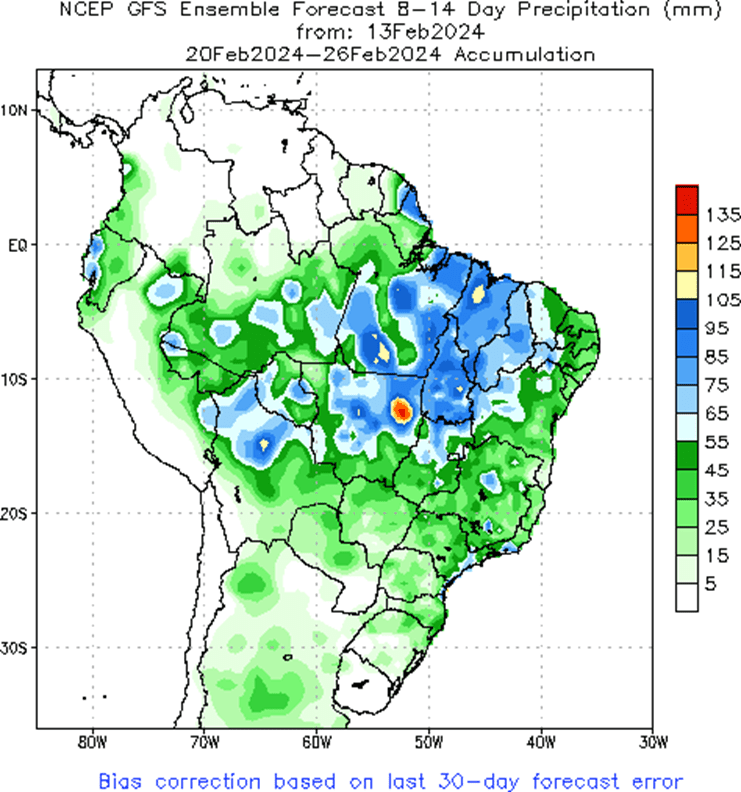

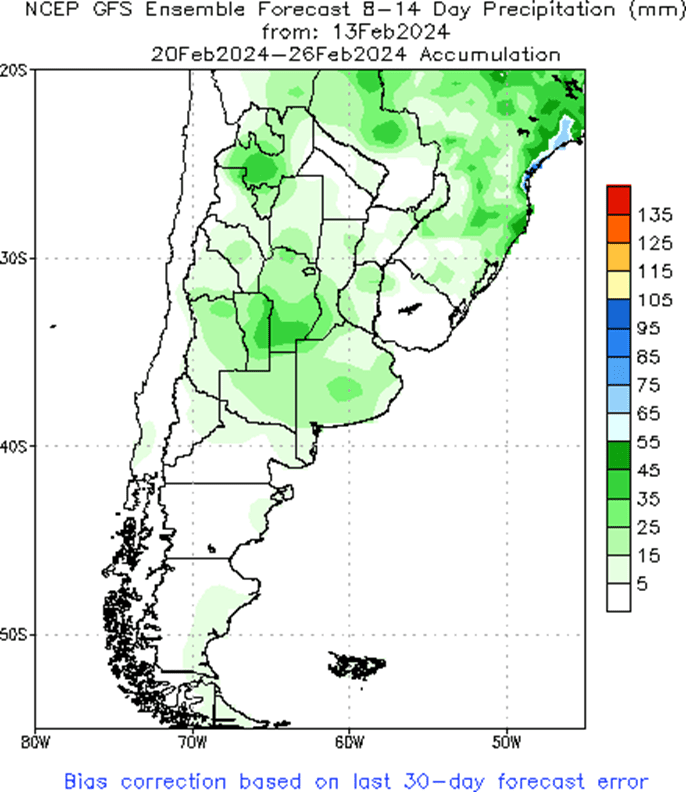

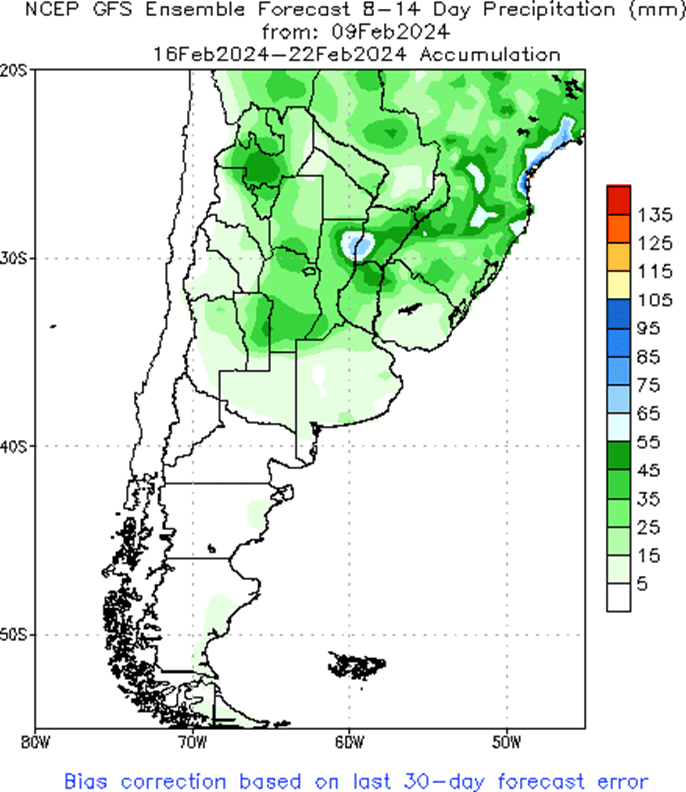

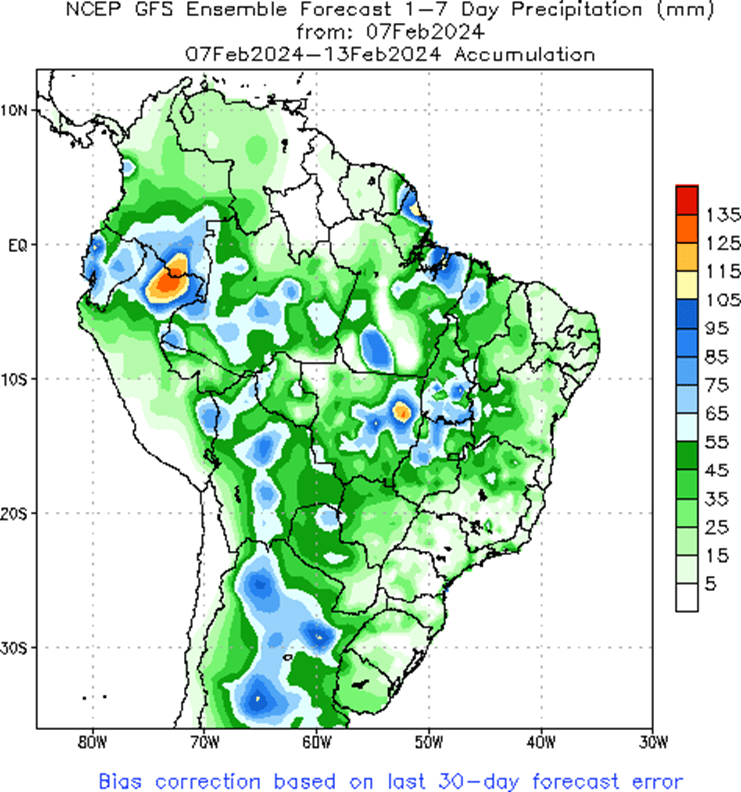

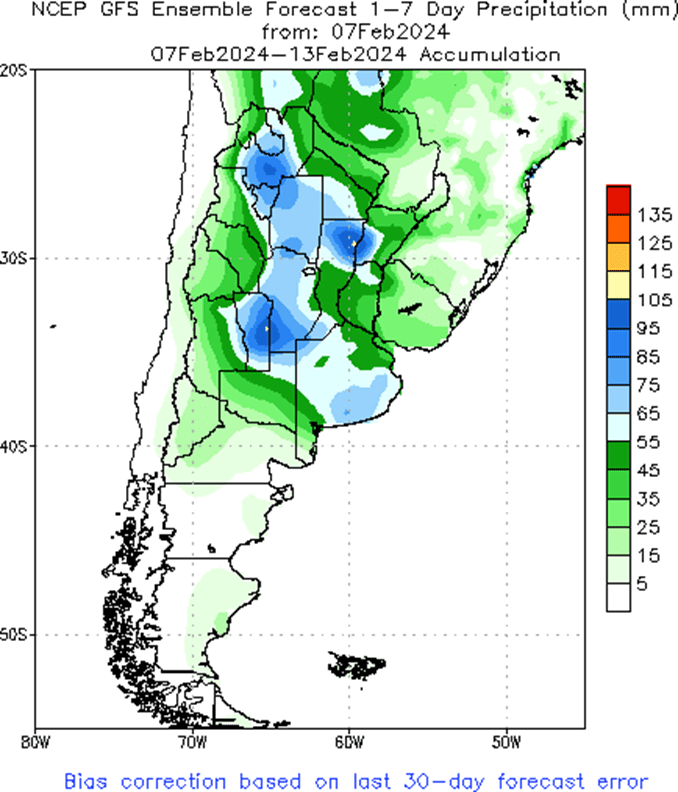

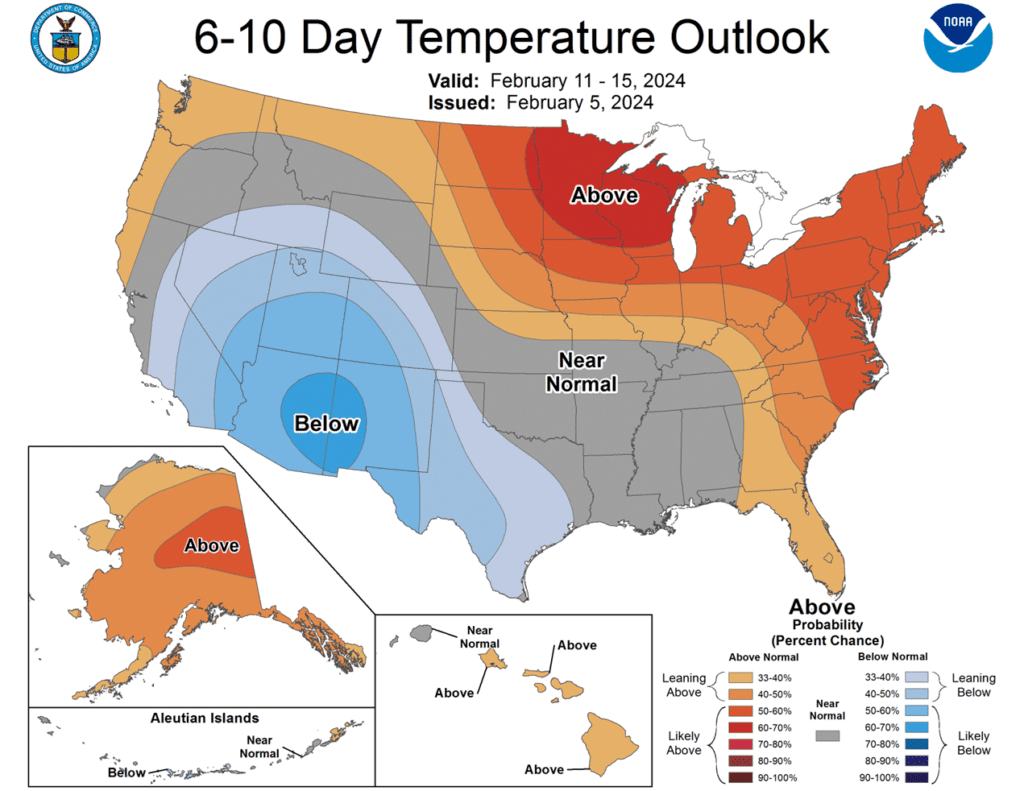

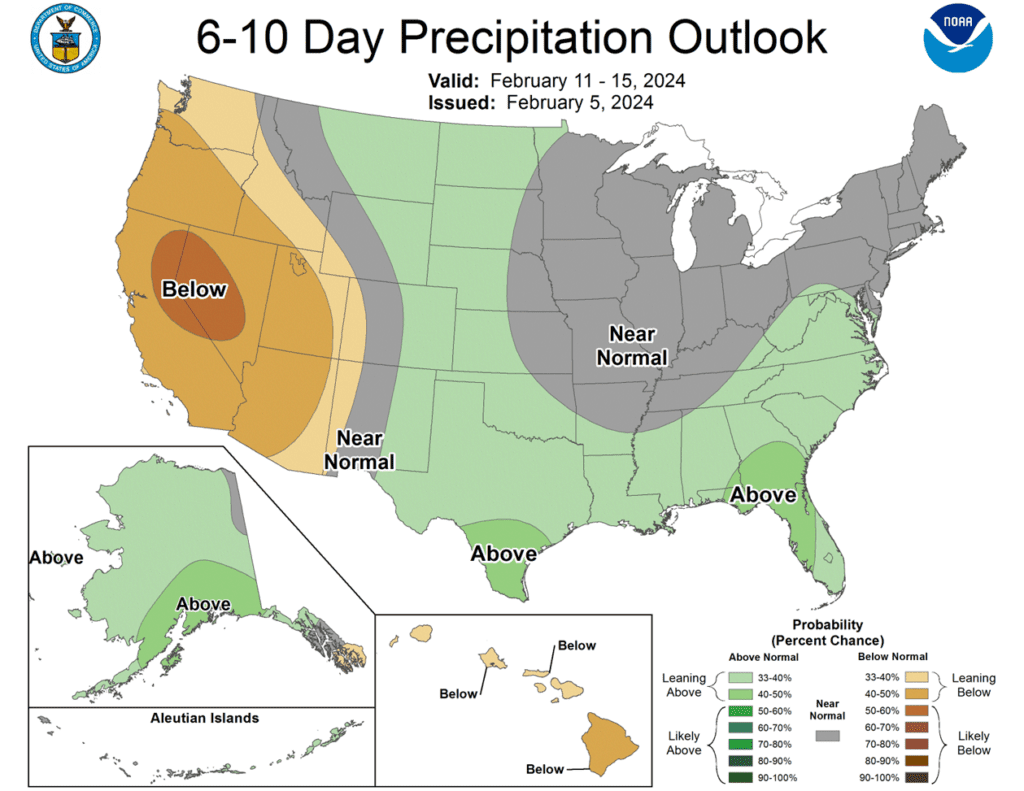

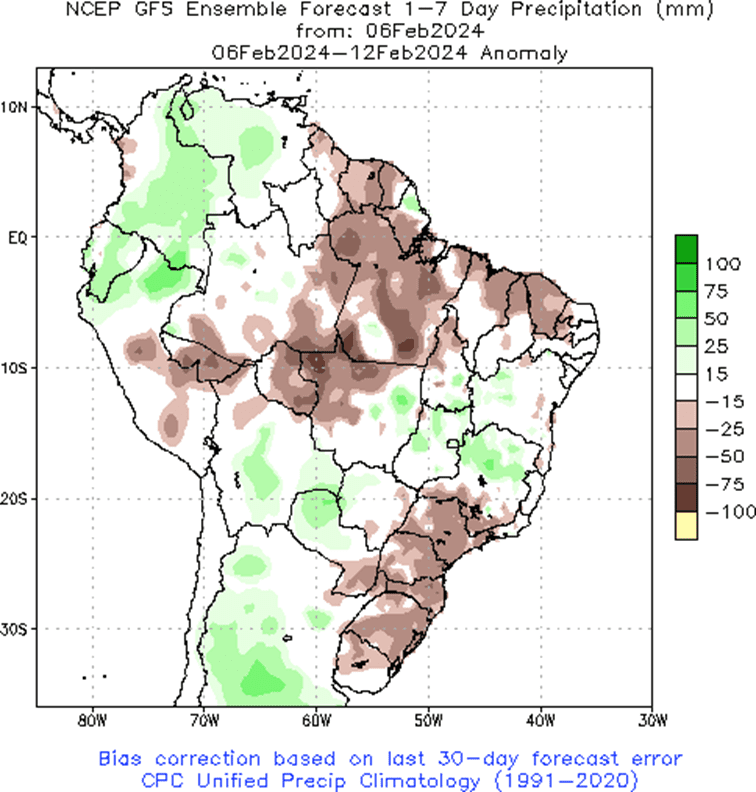

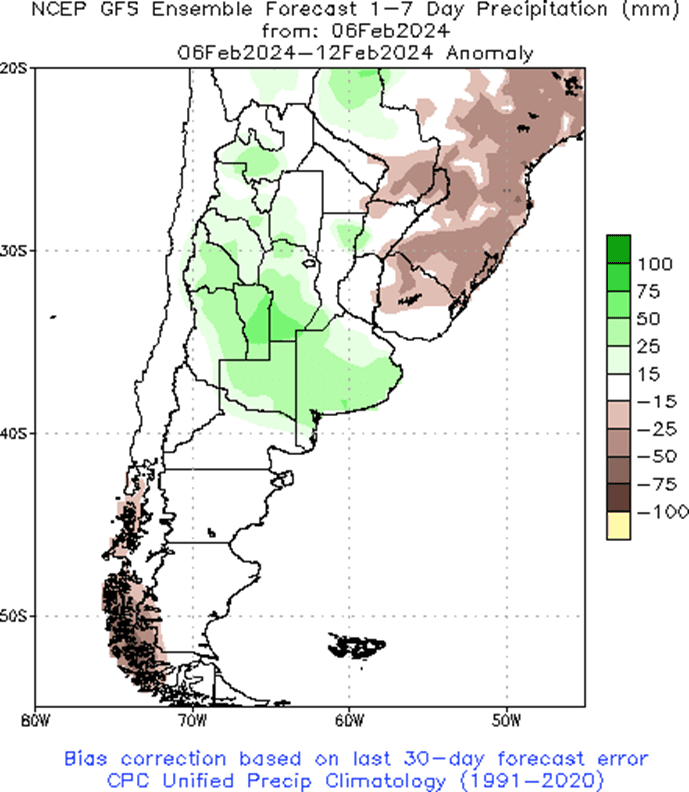

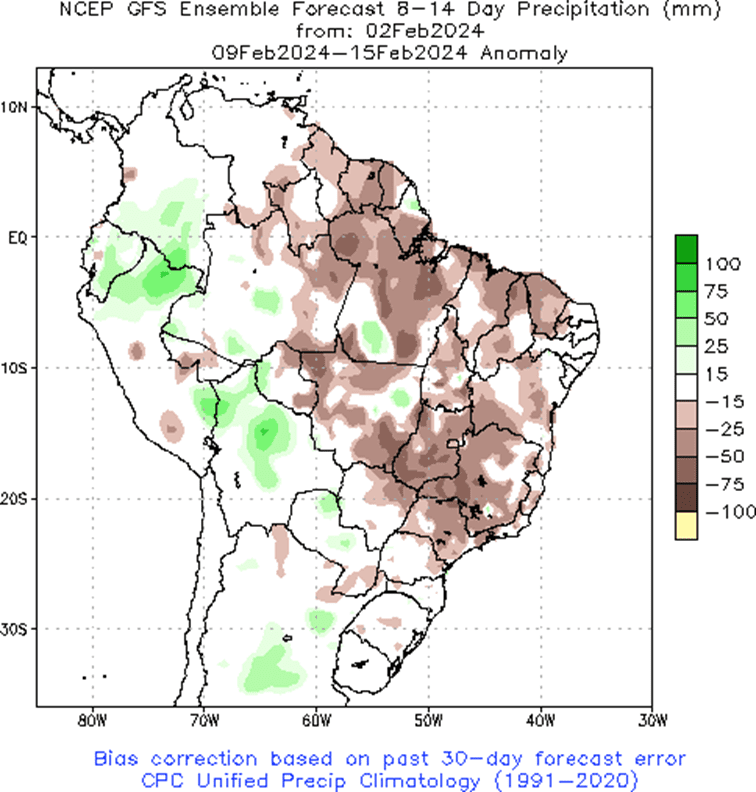

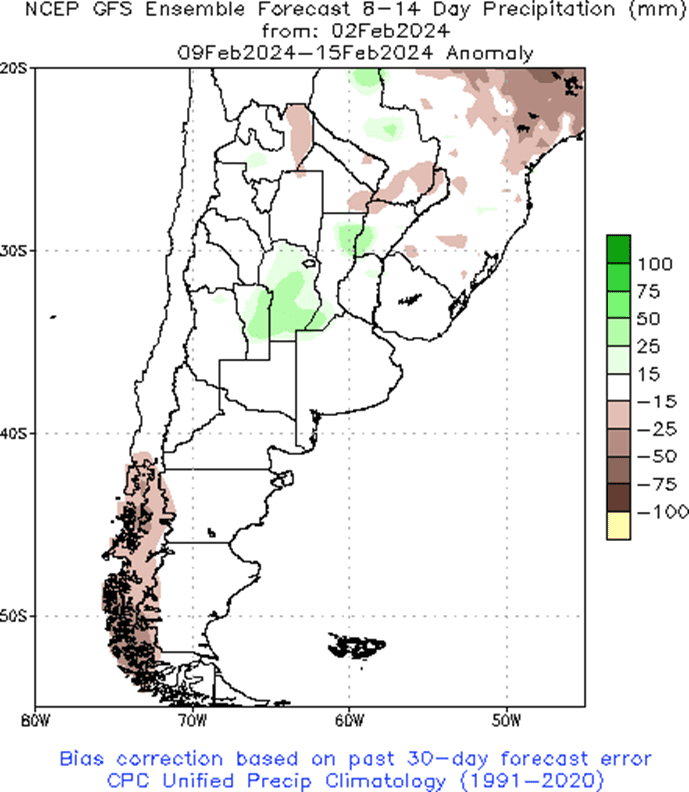

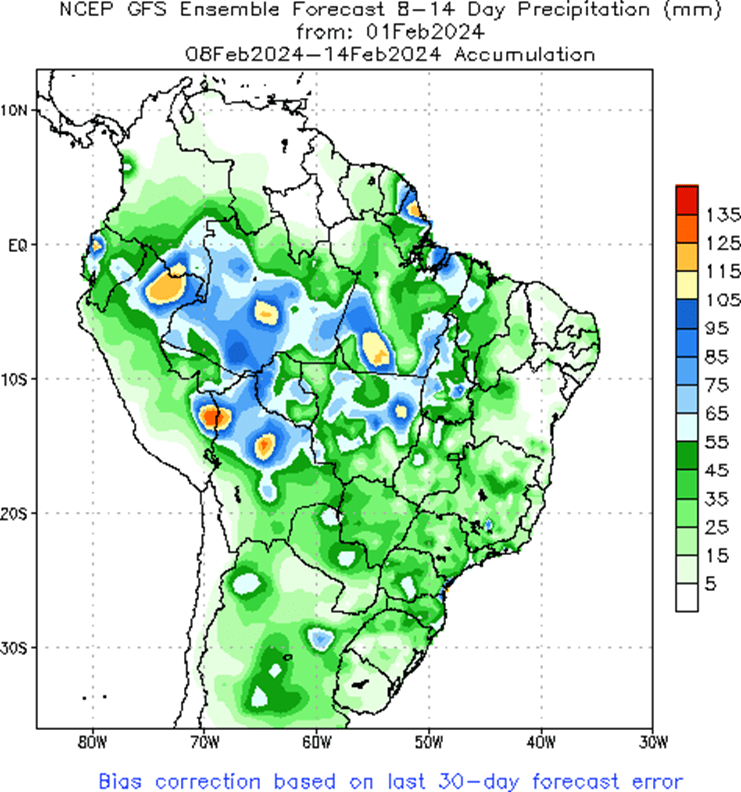

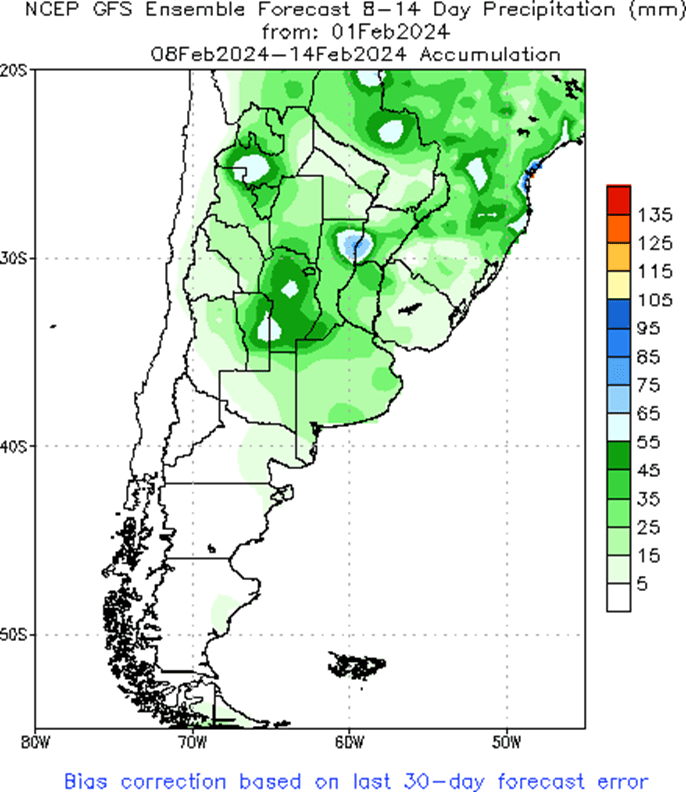

- Showers are expected to be widespread and heavy for much of Brazil by this weekend. The southern areas of Brazil, which is in need of rain the most, is expected to return to a drier pattern next week. In Argentina, heavy rain returned to the area and provided much needed moisture to stabilize the crop.

Above: Front month corn is showing signs of being very oversold and has uncovered support near 425, and any new bullish input could trigger a short covering rally toward the 450 – 460 resistance area. If prices fail to hold above initial 425 support, the next level of support remains near 415.

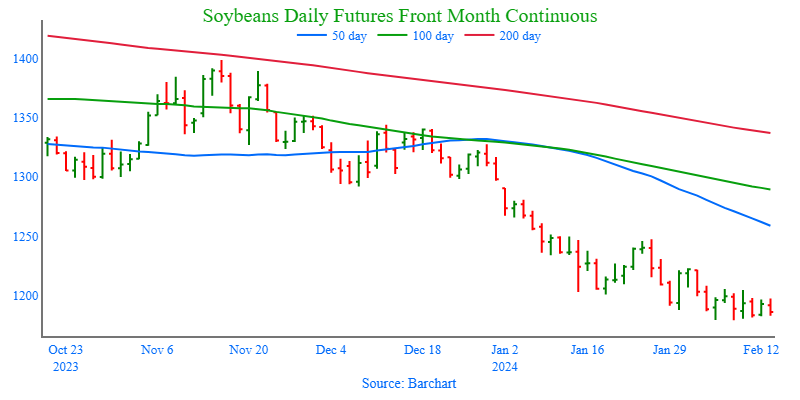

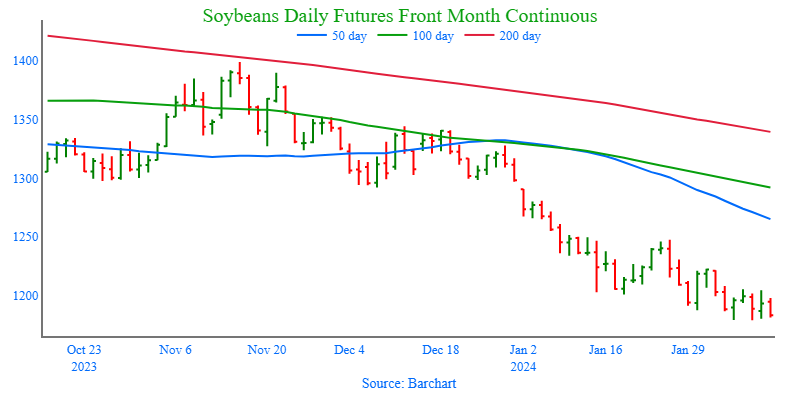

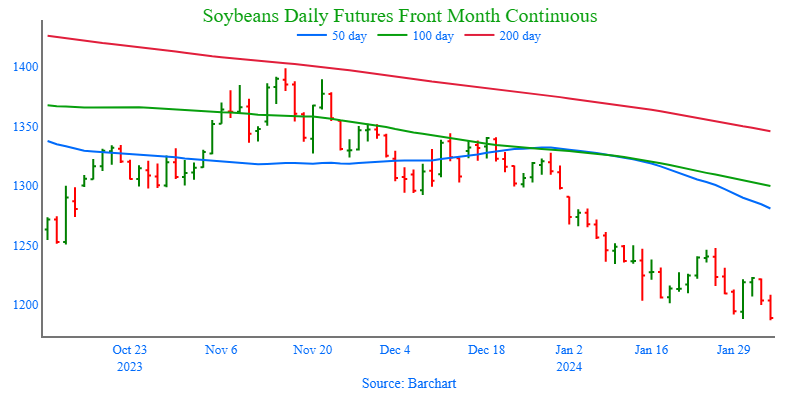

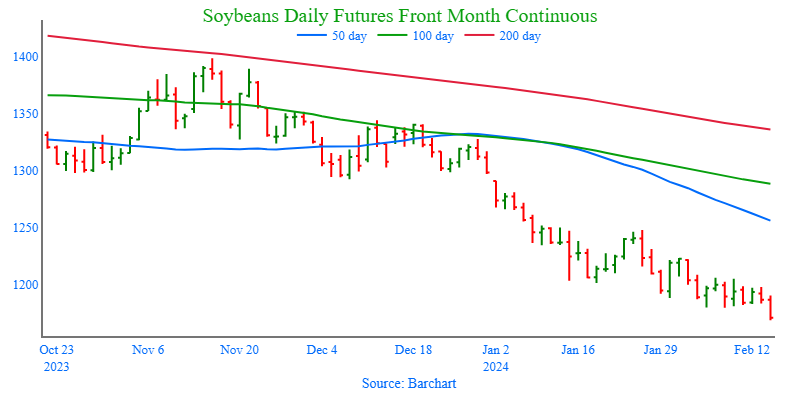

Soybeans

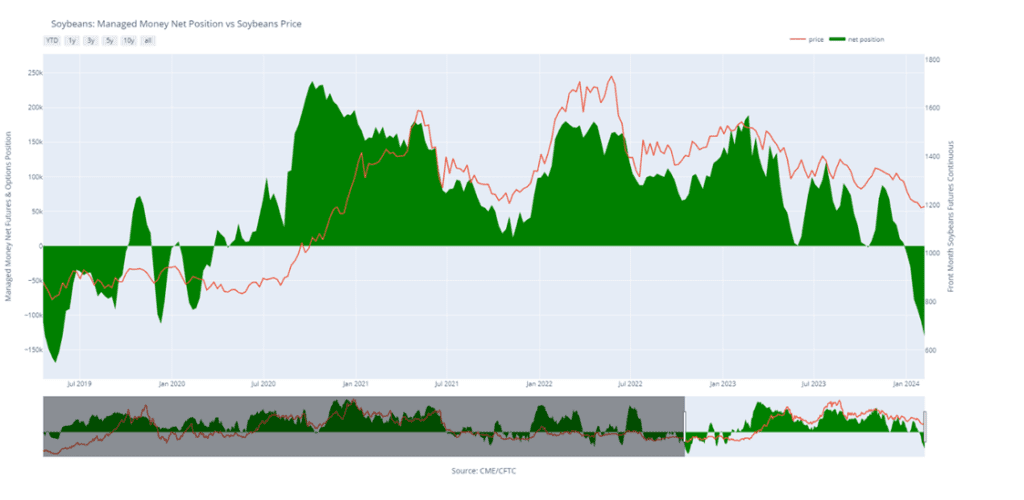

Soybeans Action Plan Summary

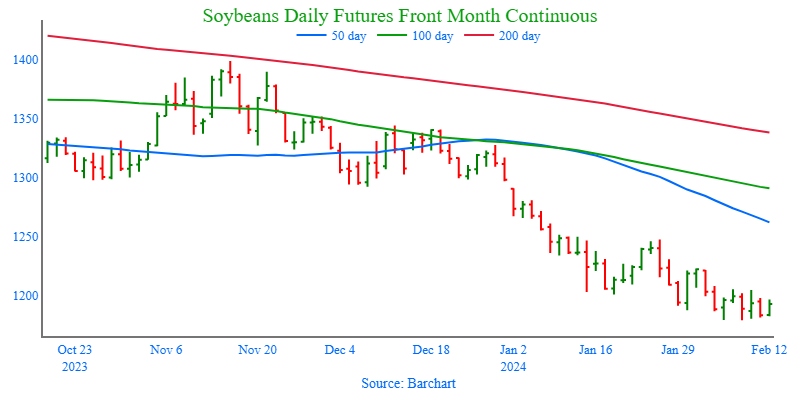

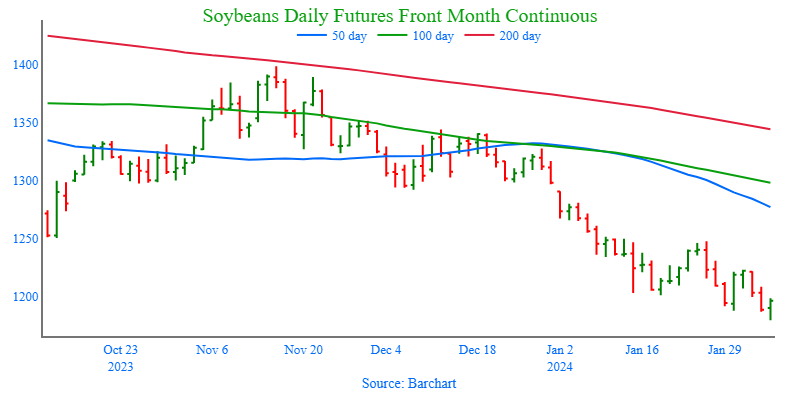

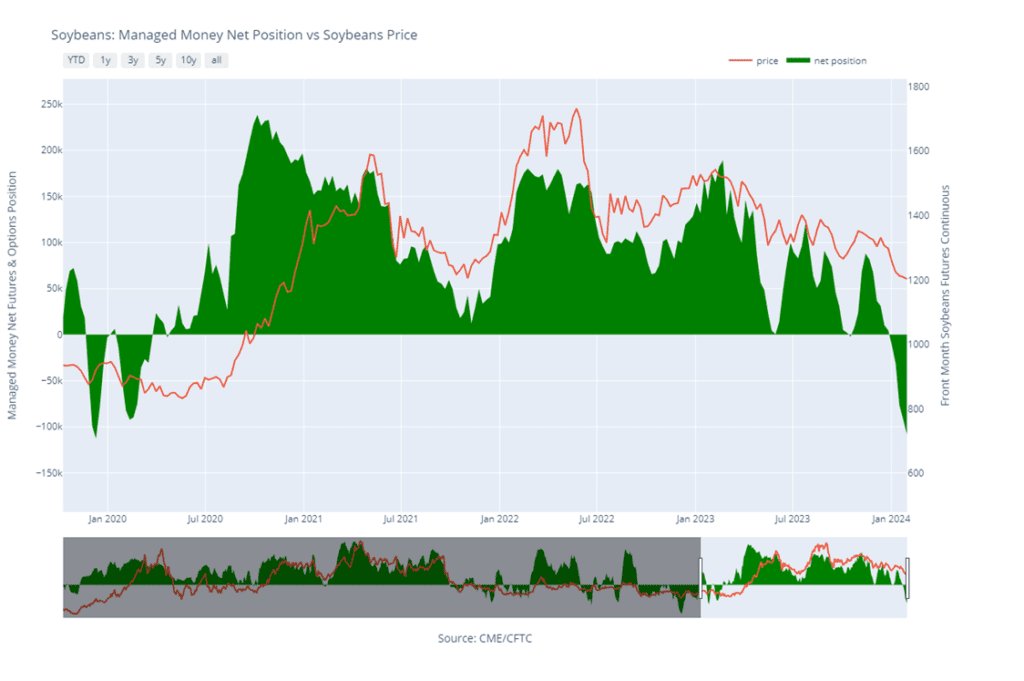

- No new action is recommended for 2023 soybeans. In early January, front month soybeans broke through the bottom side of the 1290 – 1400 range that had been in place since mid-October. As South American weather forecasts improved, the potential for a reduction in the record large global carryout also lessened, bringing prices down toward the 1180 support level. For now, 1180 support appears to be holding, and though the weak price action has been disappointing, time remains in the South American growing season, and the old crop marketing year, for unforeseen changes to push prices back higher. Given the potential of a downside breakout back in December, Grain Market Insider recommended adding to sales as prices remained historically good, and Grain Market Insider will continue to look at additional sales opportunities heading into spring.

- No new action is recommended for the 2024 crop. After the Nov ’24 contract broke through the bottom side of the 1233 – 1320 range, prices continued to retreat as South American weather conditions improved. Even though Nov ’24 runs similar downside risks as the front month contracts, which could press new crop prices toward 1150 or possibly the May ’23 low near 1115, plenty of time remains to market this crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, Grain Market Insider recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production, and to protect any sales in an extended rally. Additionally, the possibility remains that prices could retest the 2022 highs, at which point Grain Market Insider may consider recommending additional sales.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

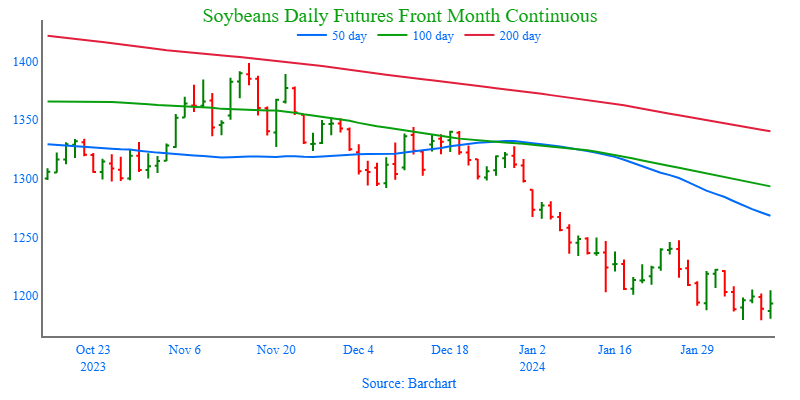

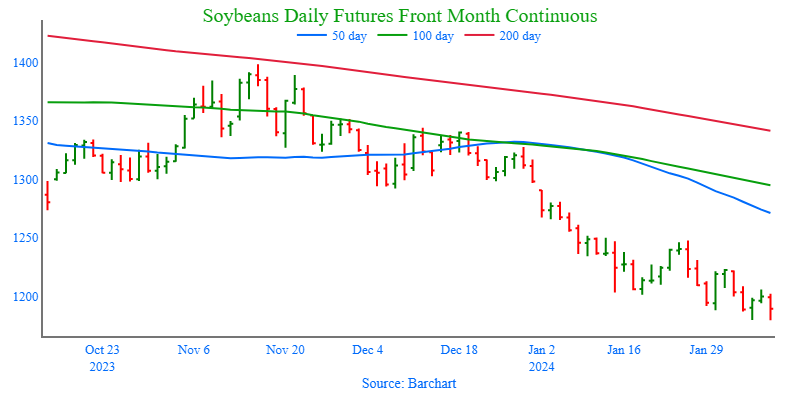

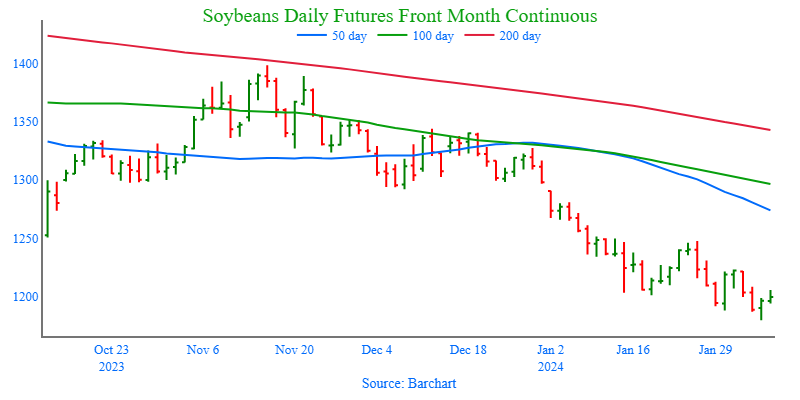

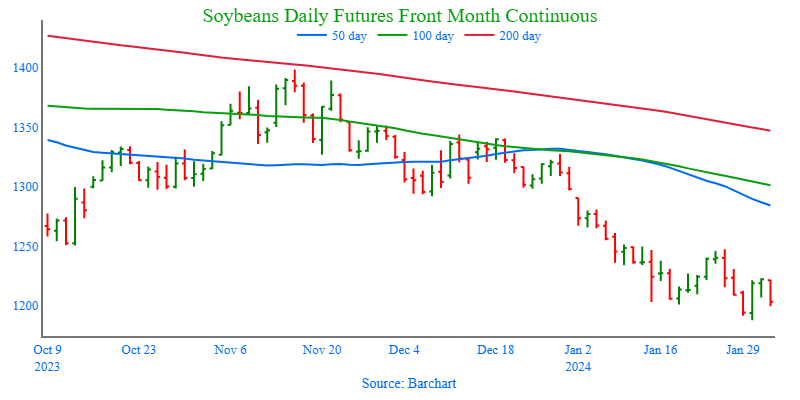

- Soybeans ended the day significantly lower to make new lows for the year as pressure from an anticipated large soy crop from South America pressures the market. Both soybean meal and oil ended the day lower as well with lower soybean oil pressured by lower crude and heating oil (diesel).

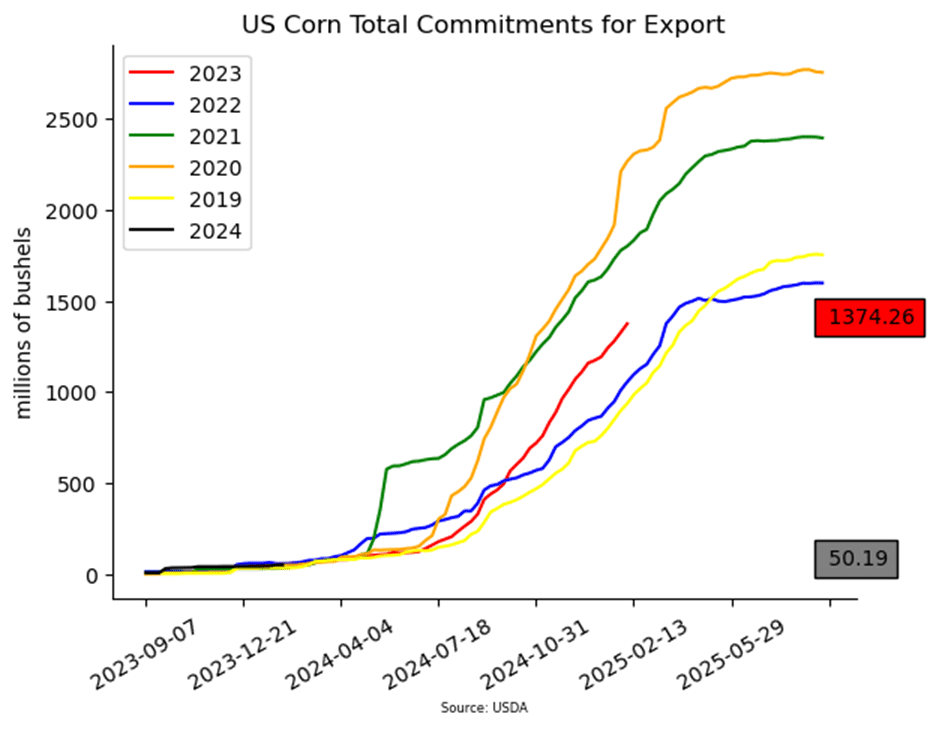

- This morning, the Rosario Grain Exchange in Argentina increased their estimate for soybean production by 2 mmt to 52 mmt on improved weather following the recent dry spell. This estimate is above the USDA’s most recent 50 mmt guess, and many analysts have Brazilian production pegged near 149 mmt, below the USDA’s 157 mmt estimate.

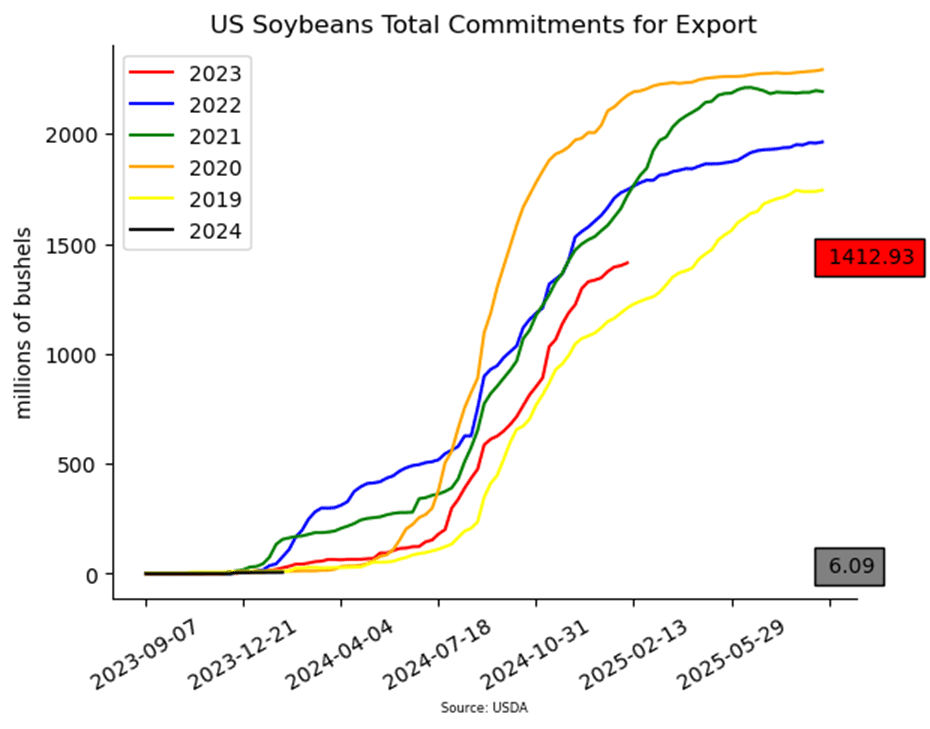

- No flash sales have been reported this week and weekly export sales tomorrow are expected to be on the lower side around 300,000 metric tons. On the positive side, domestic crush demand has been firm, and crush premiums remain profitable enough to incentivize processors.

- On Thursday, the USDA will begin its annual Outlook Forum and they will release their initial estimates for 24/25. Analysts are expecting that corn acres will be lowered by 3 million acres and that soybean acres will increase by 3.1 million acres to 86.7 ma.

Above: With the failure of 1180 support, it appears that front month soybeans could continue to drift lower towards 1140 – 1145 without fresh bullish input to turn the market around. The market continues to show signs of being oversold which can add support if a reversal happens. Overhead, nearby resistance may come in between 1200 and 1205, with additional resistance around 1220 – 1225.

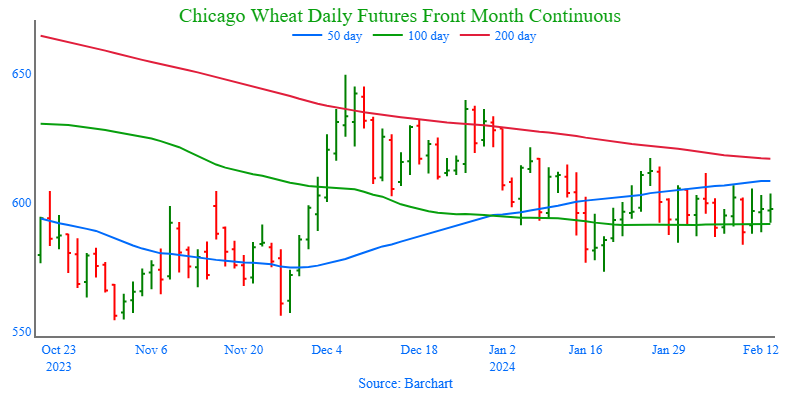

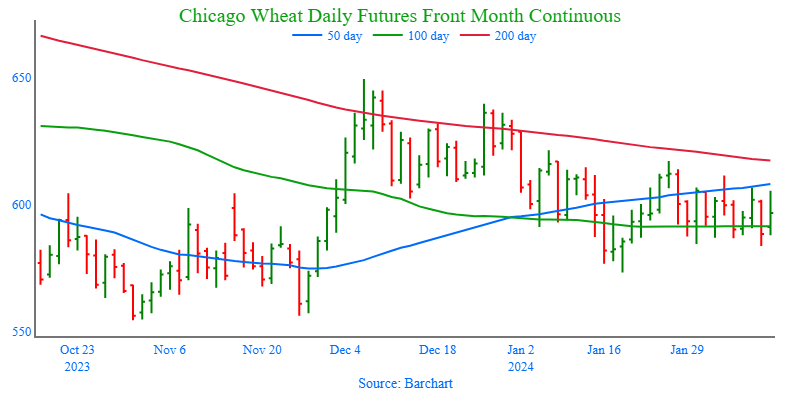

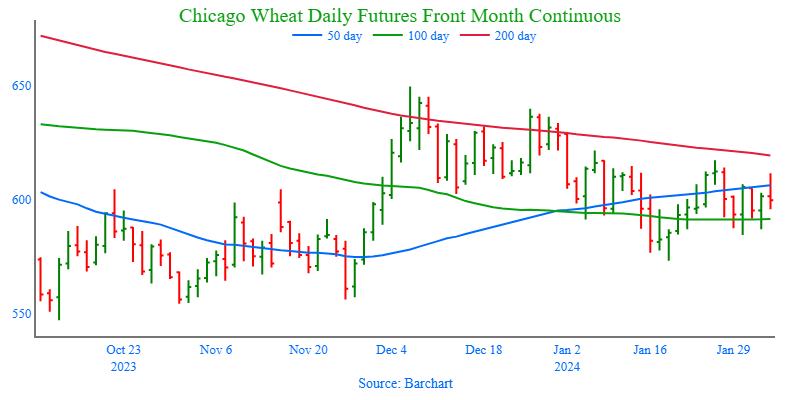

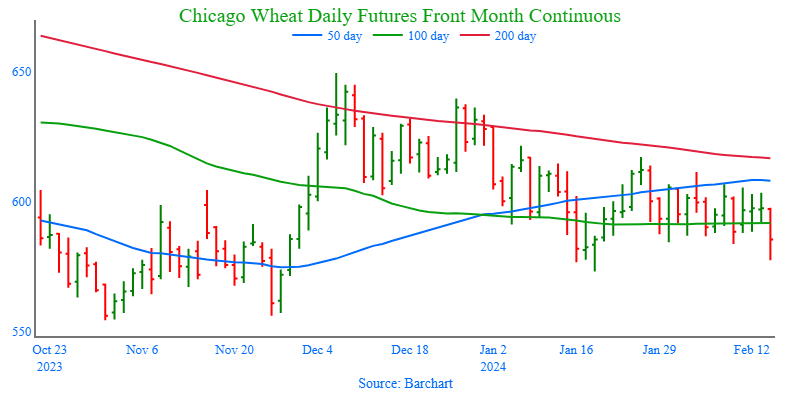

Wheat

Market Notes: Wheat

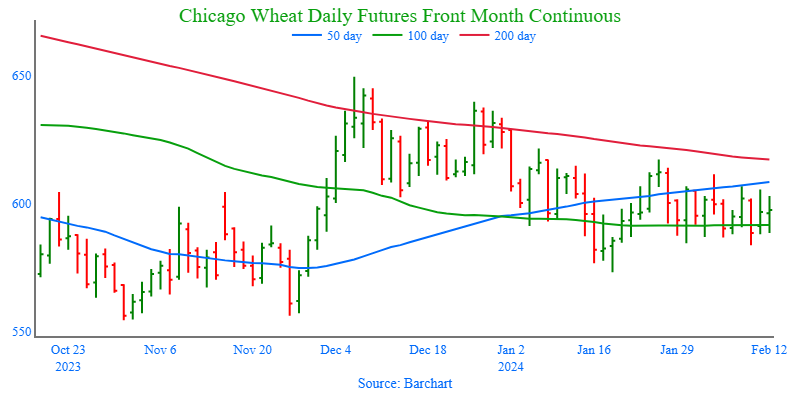

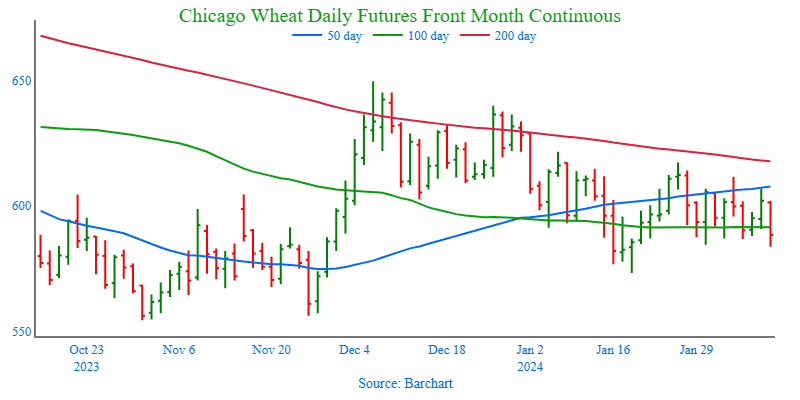

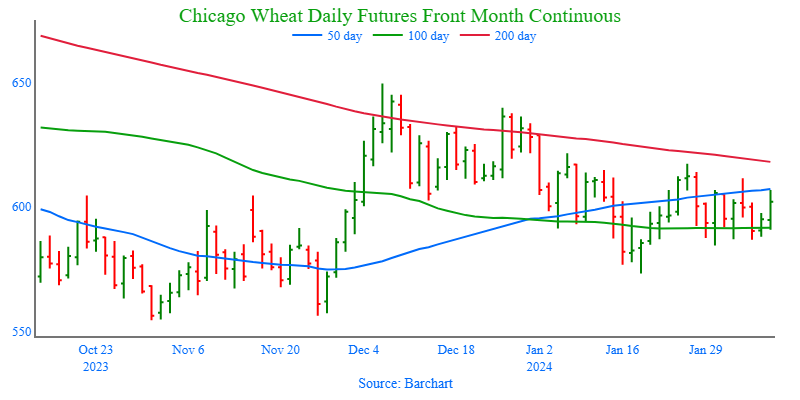

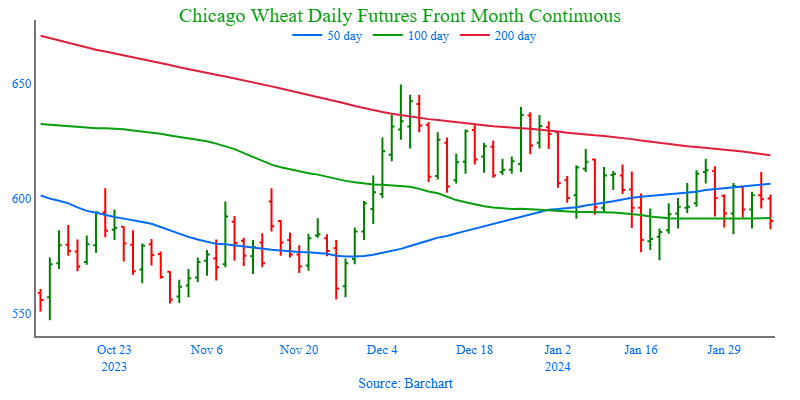

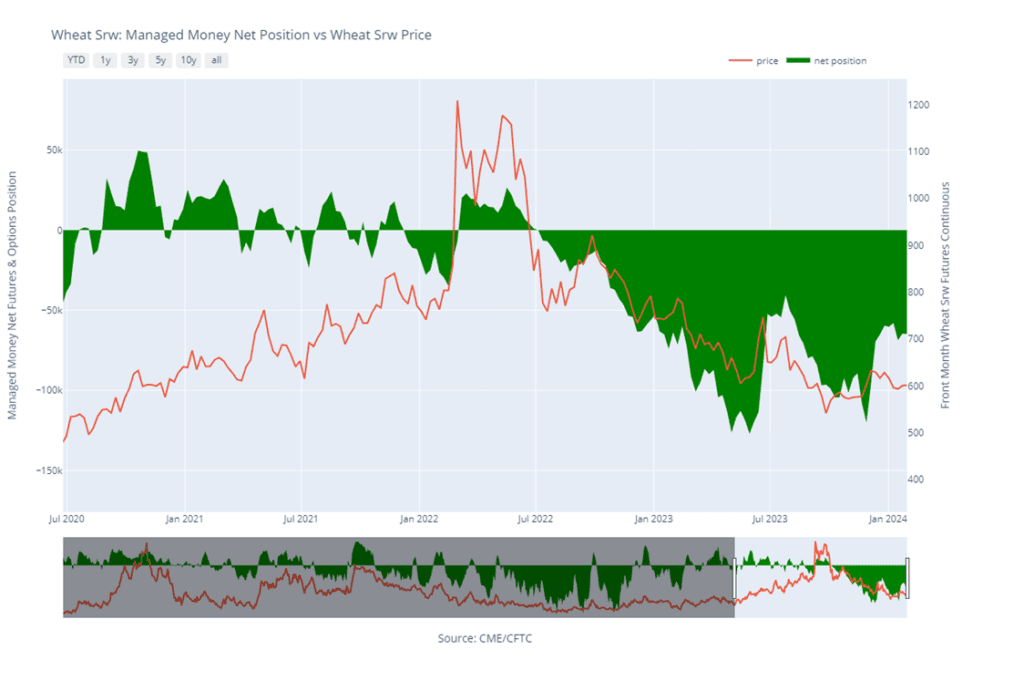

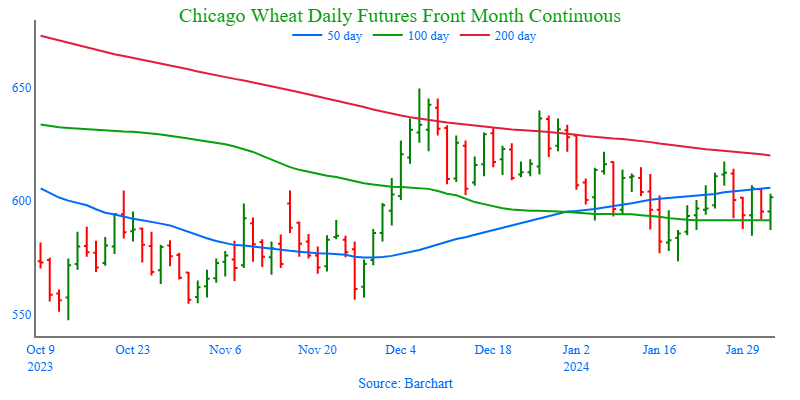

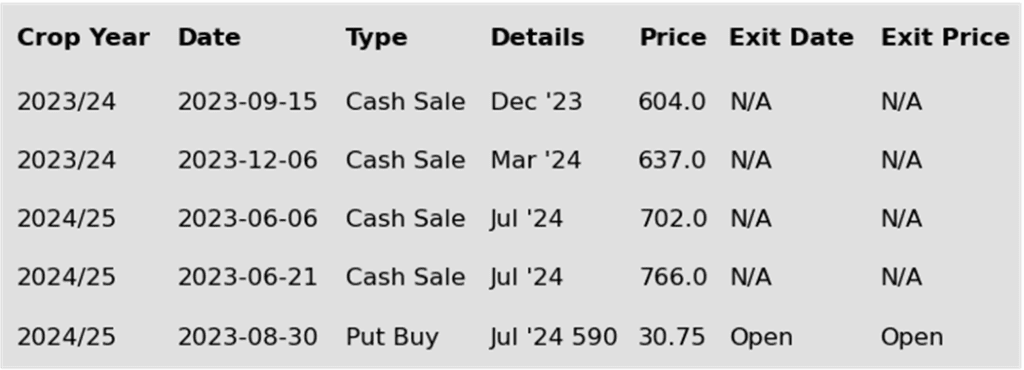

- Chicago Wheat led the charge lower this morning. And while still posting sharp losses for the day, it managed to come back to close near the middle of the daily range. In any case, much of the commodity complex was under pressure today in tandem with the grains. Some of this negativity may be a result of anticipated bearish numbers at the USDA during the Ag Outlook Forum tomorrow and Friday.

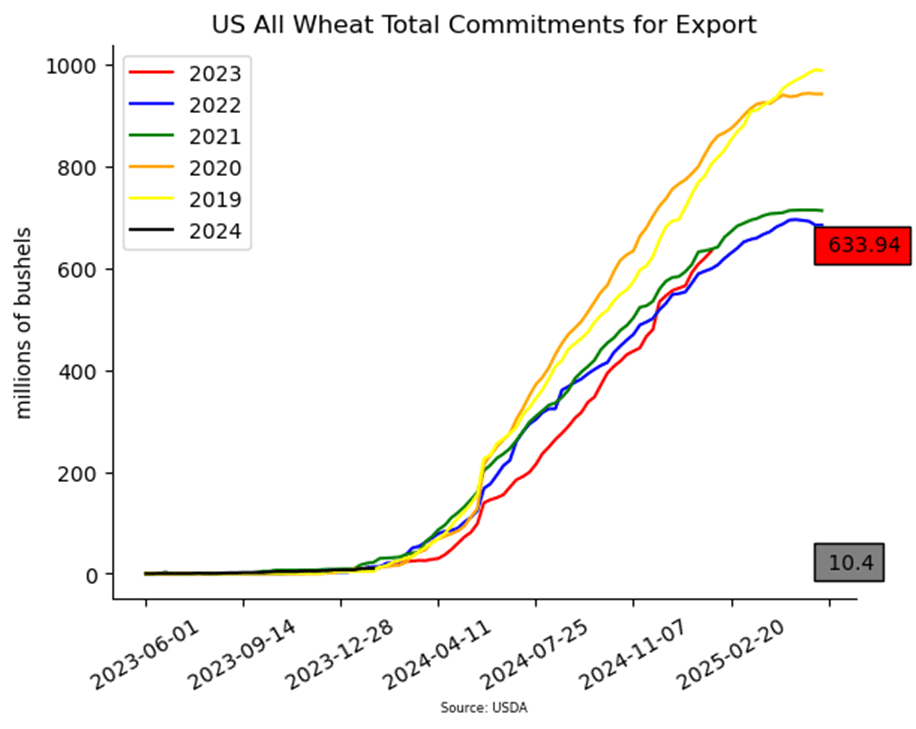

- Also weighing on wheat today in particular was the International Grains Council stating that weekly wheat prices dropped in many nations globally. These include Argentina, Canada, Europe, Australia, Russia, and Ukraine. To boot, Ukraine is reportedly on track to export their entire surplus of 50 mmt of grain before their season ends in June (80 mmt of grain was harvested in 2023). This is despite the infrastructure damage caused by Russian attacks. According to consultancy APK-Inform, the Ukrainian grain harvest has reached 25.2 mmt as of February 9. And, according to Ukraine’s Ag Ministry, they are anticipating planting 2% more wheat this spring.

- According to a Bloomberg analyst survey, 24/25 wheat planted acreage is expected to decline by 2.1 to 47.5 million acres. Additionally, carryout is expected to increase for wheat, corn, and soybeans. Wheat carryout in particular is expected to be at 720 mb, up 62 mb from 23/24. It should be noted that these numbers are separate from what will be released by the USDA at this week’s Outlook Forum.

- European Union soft wheat exports totaled 18.6 mmt as of February 2. This is down about 8% year on year, compared to the 20.2 mmt last year, according to the European Commission. The top destinations were to north African nations, with Morocco in the lead at 2.67 mmt, followed by Nigeria and then Algeria.

- As of February 14, the export duty for Russian wheat is said to have increased by 11.8%, from 3,804.6 to 4,058.9 Rubles per mt, according to their Ag Ministry. In June of 2021 the Russian government implemented a “grain damper” mechanism, essentially requiring export duties on wheat, corn, and barley, with the funds used to subsidize ag producers.

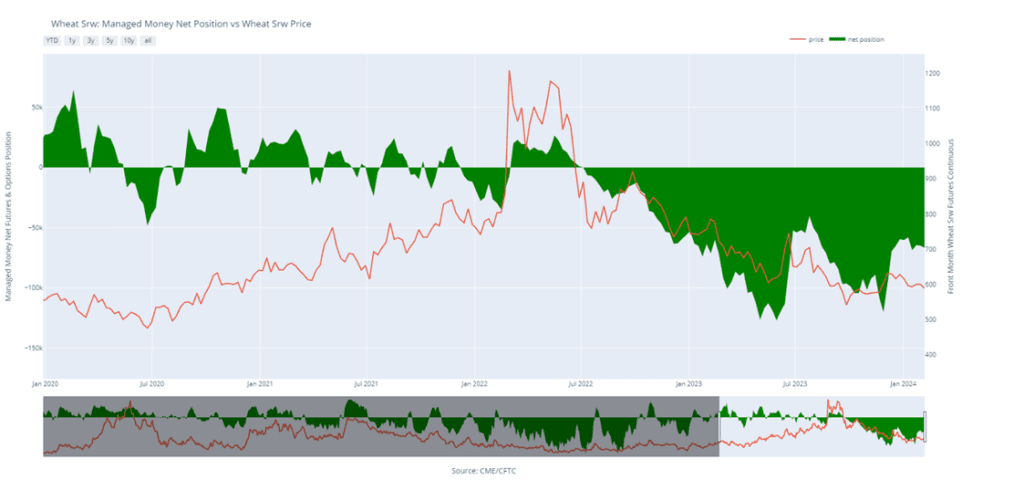

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The wheat market has continued to be dominated by lower world export prices that have stymied US export sales and depressed US prices. In early December, Grain Market Insider recommended taking advantage and making a sale on a short covering rally which was sparked by several Chinese purchases of US wheat. Since then, China has been silent in the US wheat export market, and prices remain somewhat elevated. Any remaining 2023 soft red winter wheat should be getting priced into market strength with the goal of having zero bushels unpriced by the end of January. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Since early December, the July ’24 contract has traded mostly sideways to slightly lower after its brief short covering runup on Chinese buying. Although China has since been absent from the US wheat export market, prices appear to have found support above 585, and managed funds continue to hold a sizeable, short position that could trigger another short covering rally if a bullish impetus enters the market. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion. Although, if the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Since early September, the July ’25 contract has been mostly rangebound with 632 at the low end and 685 at the top. Grain Market Insider’s strategy for the 2025 crop year up to this point has been to sit tight. Though if prices rally toward the upper end of this range, we will consider taking advantage of the rally’s historically good prices to make sales recommendations.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

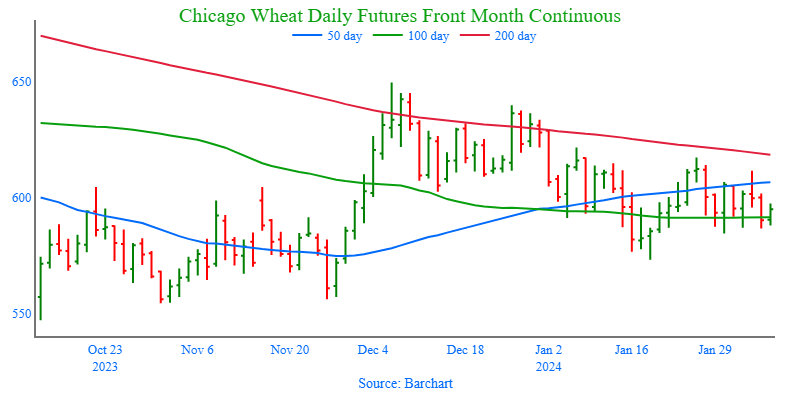

Above: Chicago wheat has been in a congestion pattern bordered between 614-618 on the top and 584 on the bottom. A breakout through the top end could send prices toward the 640 – 650 resistance area, while a downside breakout may find initial support around 573 with more support around 556.

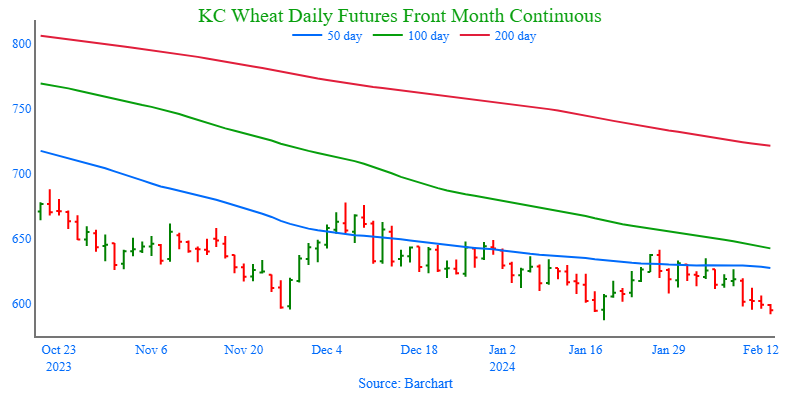

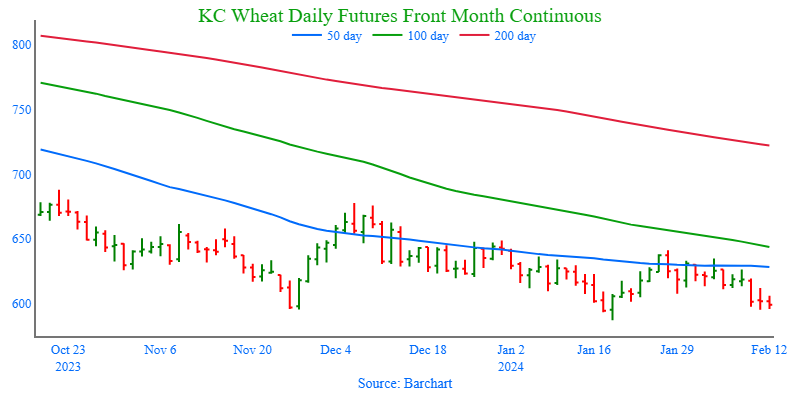

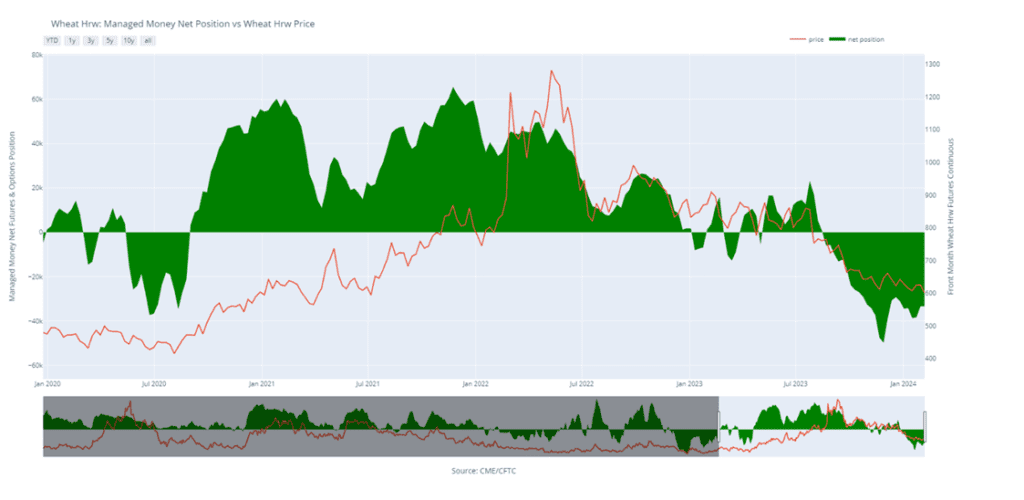

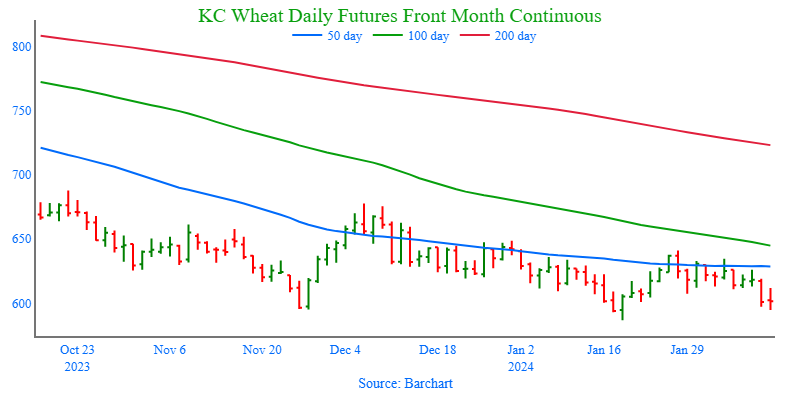

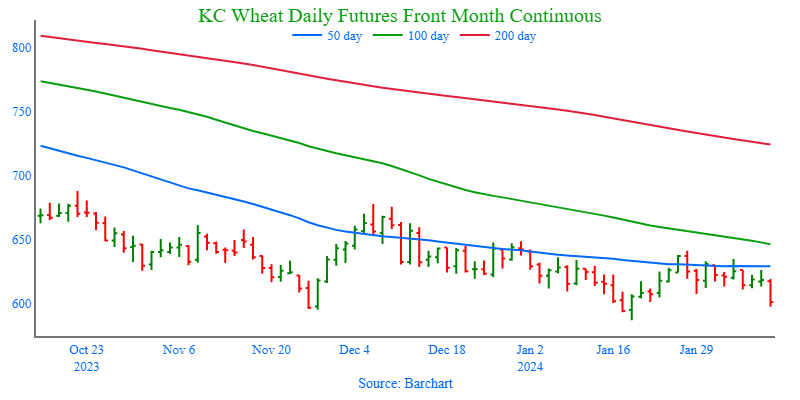

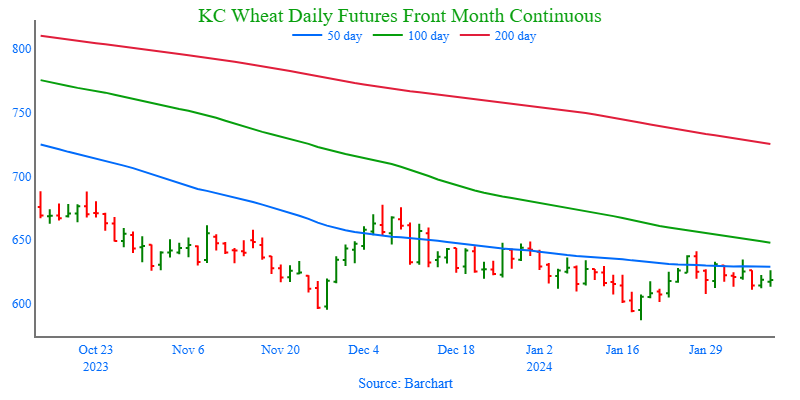

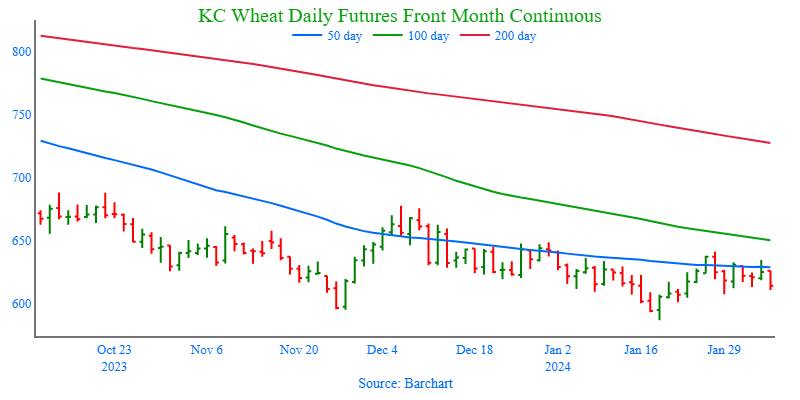

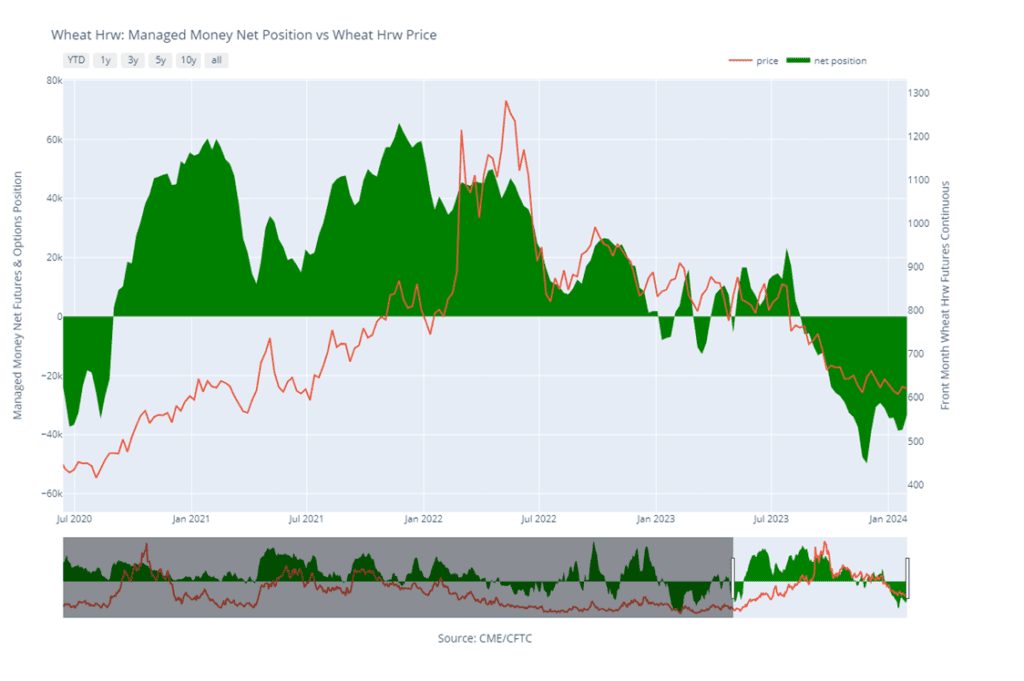

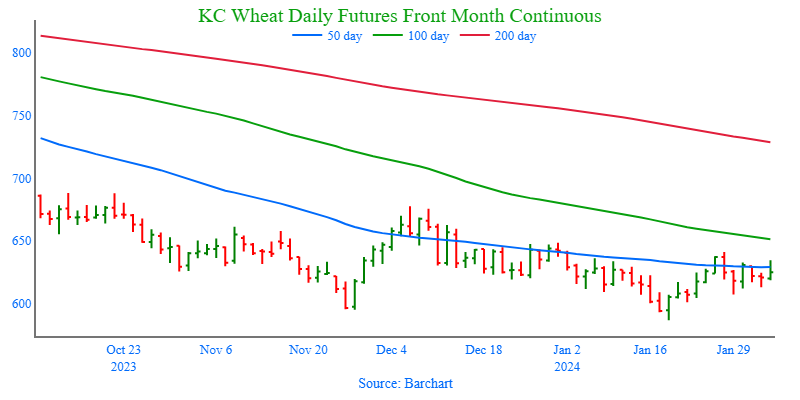

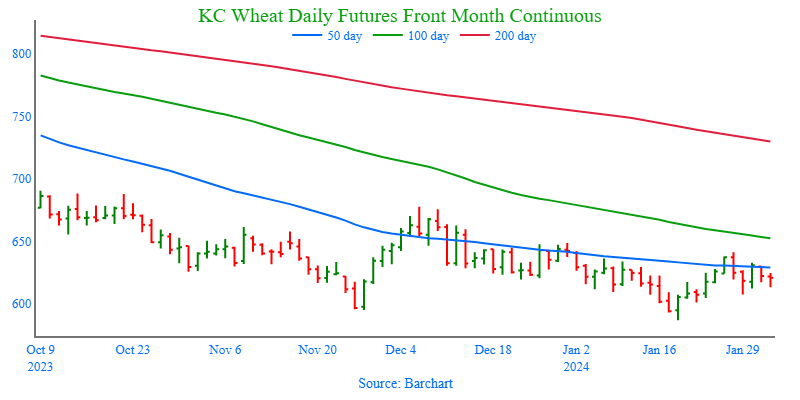

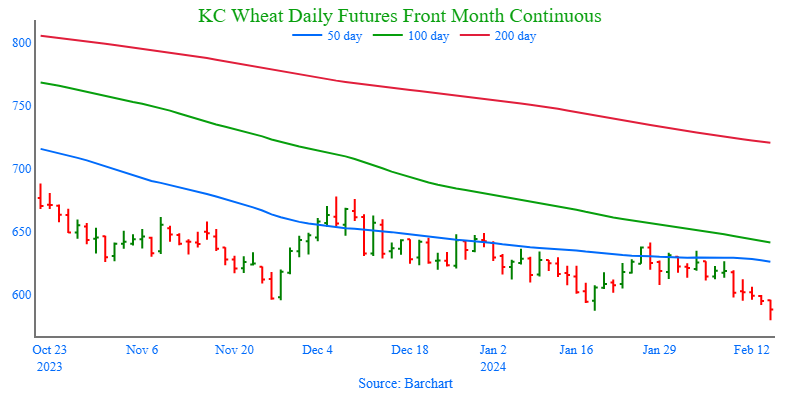

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since last fall, front month KC wheat has been mostly rangebound between 678 up top and the 590 area down below. The latter has held as support for the past three months. Although fundamentals remain weak, considering support lies just below the market and managed funds continue to carry a sizable short position, these factors could trigger a return to higher prices if any unforeseen risks enter the market. Grain Market Insider’s strategy is to look for price appreciation as weather becomes a more prominent market mover and may consider suggesting additional sales if prices make a modest 20% retracement of the 2022 highs back toward 730.

- No new action is recommended for 2024 KC wheat. At the end of August, the July ’24 contract broke out of roughly a one-year trading range and stepped down to a 609 ¼ low in late November, largely driven by managed fund selling in the front month on weak US export demand and lower world wheat prices. Since then, the funds covered part of their large short position which also rallied prices in the July ’24 contract. While bearish headwinds remain, managed funds continue to hold a sizable, short position, and price seasonals remain positive for adding weather risk premium. These are two factors that could fuel additional short covering and rally prices in the months ahead. Back in August, Grain Market Insider recommended buying Jul’24 KC wheat 660 puts to protect the downside following the range breakout. As the market recently got further extended into oversold territory and the July contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Moving forward, Grain Market Insider is prepared to recommend exiting the last 25% on any further supportive market developments.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

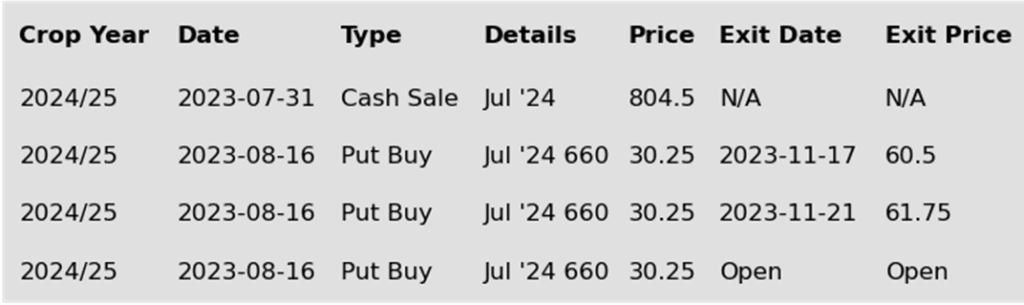

To date, Grain Market Insider has issued the following KC recommendations:

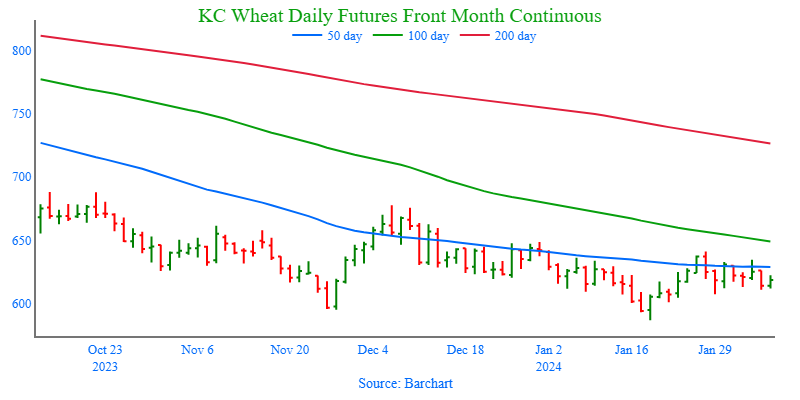

Above: Front month Minneapolis wheat broke through nearby downside support of 688 and may continue to drift lower to test the January low of 678 ¾. If the 678 ¾ area fails, the next major support level may come in around 669. Overhead, resistance remains between 710 and 720.

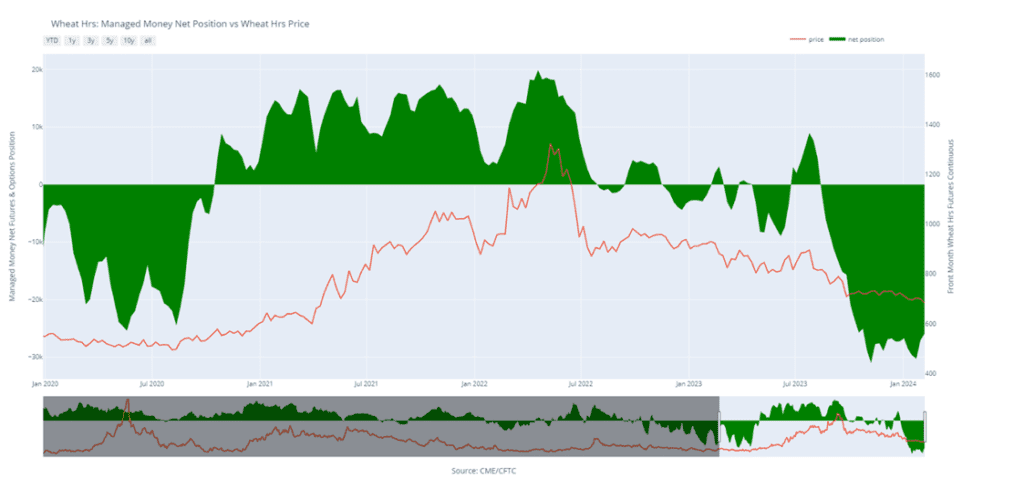

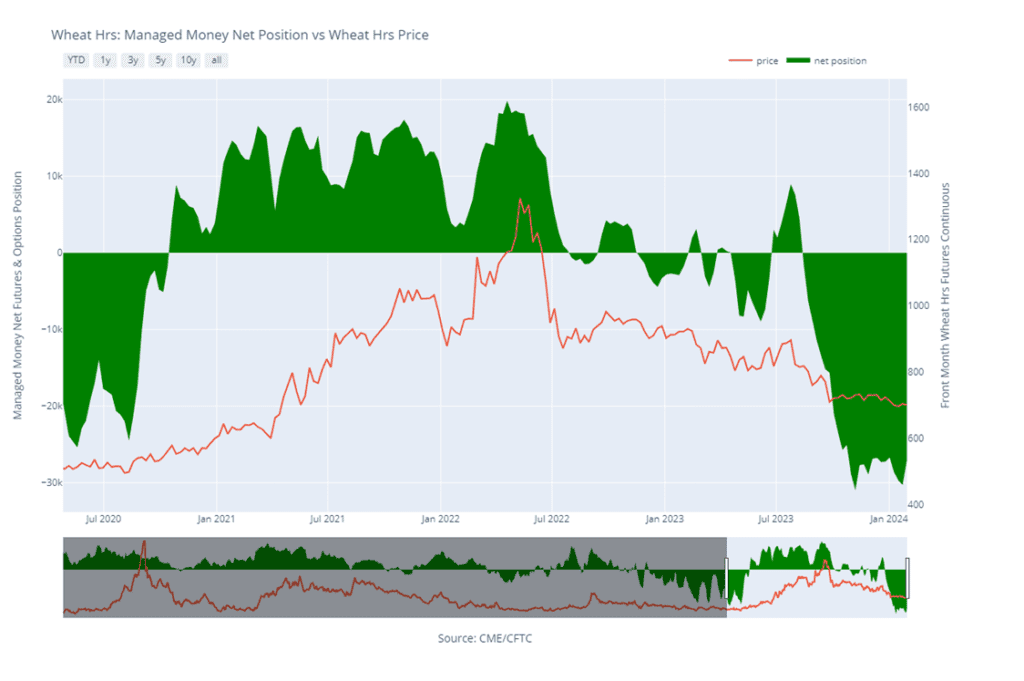

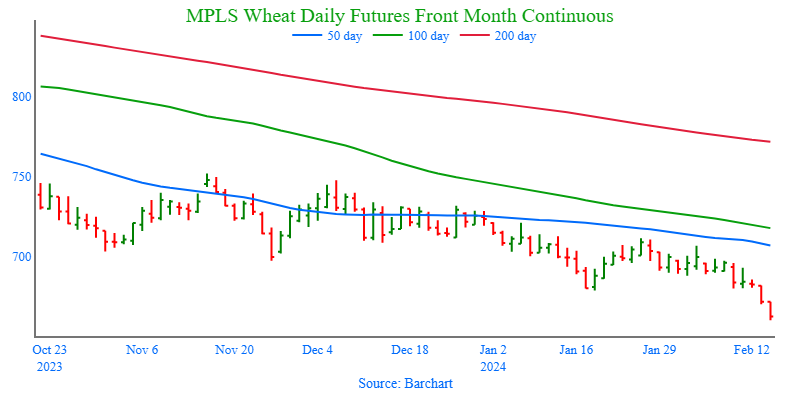

Mpls Wheat Action Plan Summary

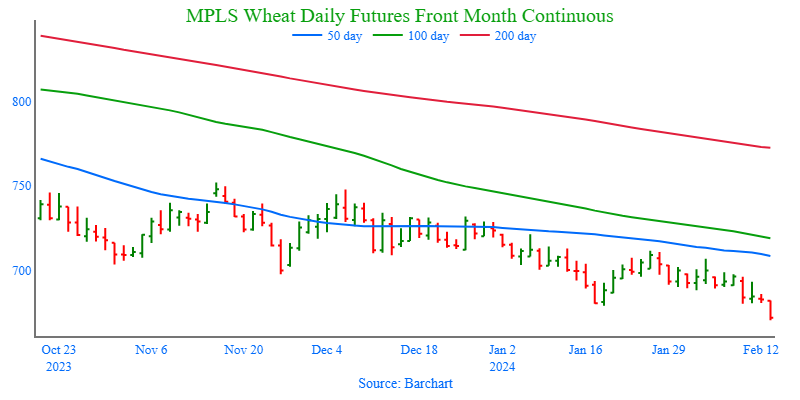

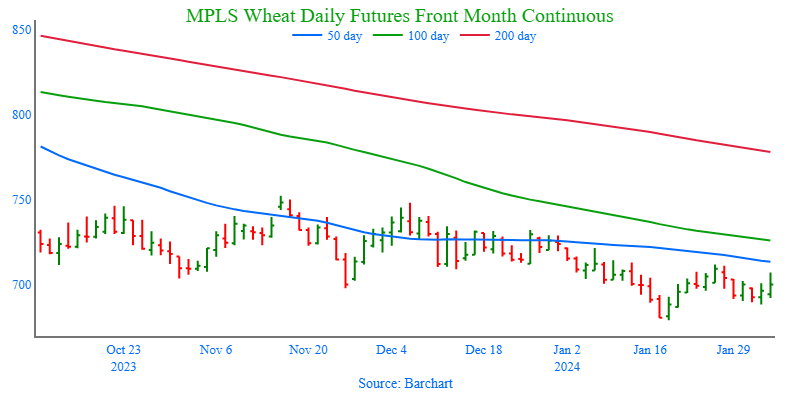

- No new action is currently recommended for 2023 Minneapolis wheat. Since last summer, front month Minneapolis wheat has slowly stair-stepped lower with weaker world prices and little bullish news to move markets higher. During this time, the 50-day moving average has acted as resistance, above which the market has not been able to hold for very long. Managed funds have also established and maintained a record (or near record) short position for much of the same time. Although bullish headwinds remain, the market has become very oversold, and the large fund net short position continues to leave the market susceptible to a short-covering rally at any time here. Grain Market Insider’s strategy is to look for a modest retracement of the July high and consider additional sales around 725 – 750.

- No new action is recommended for 2024 Minneapolis wheat. Much like the front month contracts, Sept ’24 has been in a downward trend since last summer. And just as Sept ’24 has been influenced to the downside by the front months, it could be similarly influenced to the upside by the front months if a bullish impetus enters the scene and triggers a short covering rally due to the fund’s large short position. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside following a 1-year range breakout in KC wheat, and in November recommended exiting 75% of the originally recommended position as July ’24 KC wheat showed signs of support around 630. While in the same time frame, Grain Market Insider also recommended making an additional sale as the Sept ’24 Minneapolis contract broke long time 743 support. Grain Market Insider remains prepared to recommend exiting the last 25% of the open puts on any further supportive market developments and consider recommending additional sales if prices make a modest retracement of the 2022 highs.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Front month Minneapolis wheat continues to drift lower, and with the failure of 669 support, the market is at risk of drifting lower toward the next major support level around 595 unless a bullish catalyst enters the scene. Although, prices are trending lower. The market is showing signs of being oversold, which can be supportive if prices reverse from fresh bullish input. If that happens, the first level of resistance may come in around 680 – 690.

Other Charts / Weather