5-13 End of Day: Sharply Higher Wheat Lends Support to Corn and Beans

All prices as of 2:00 pm Central Time

Grain Market Highlights

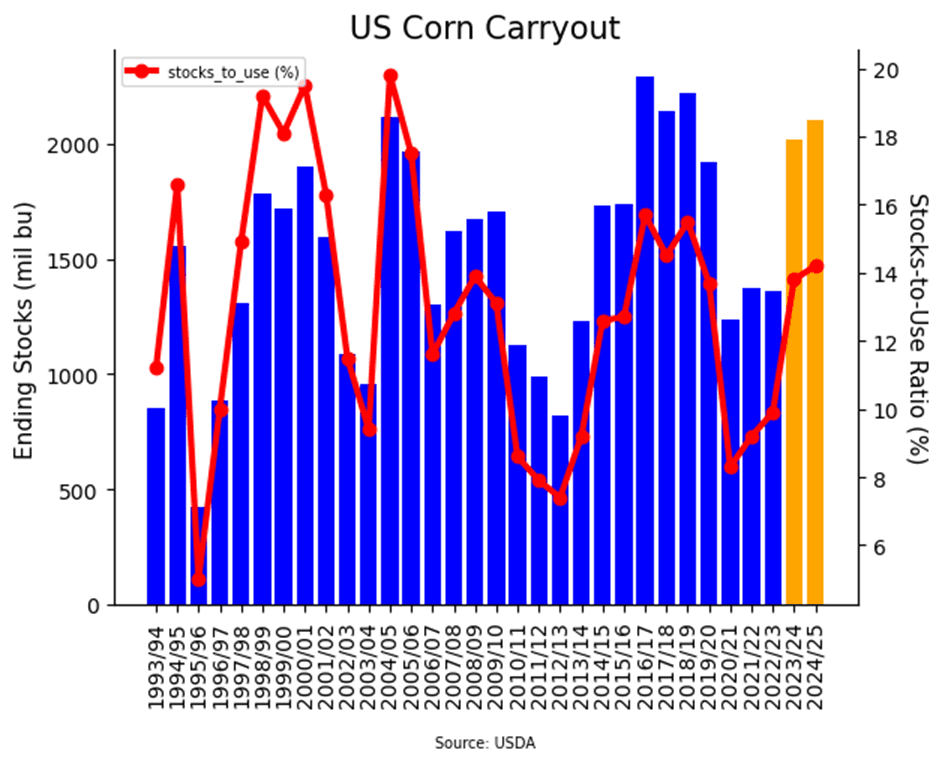

- After an initial surge higher on the 8:30 cdt open of the day session, July corn chopped mostly sideways in a tight three-cent range, caught between a strong wheat market, a potentially concerning planting pace, and heavy supply picture.

- Despite lower soybean meal, higher soybean oil, sharply higher wheat, and solid weekly soybean export inspections, helped July soybeans to close in the green, after a day of choppy two-sided trade.

- Soybean meal closed lower for the fourth consecutive day and just off the day’s low as it followed through on technical weakness from last week. Soybean oil on the other hand likely saw support from higher palm oil and continued support from higher potential import duties on used cooking oil (ucd) for biofuel use.

- Higher Matif wheat and lower wheat production and export projections for Russia fed the bull in the wheat complex today, potentially leading to more short covering across all three classes. July Chicago posted its highest close since early August, while July KC had its highest close since early October.

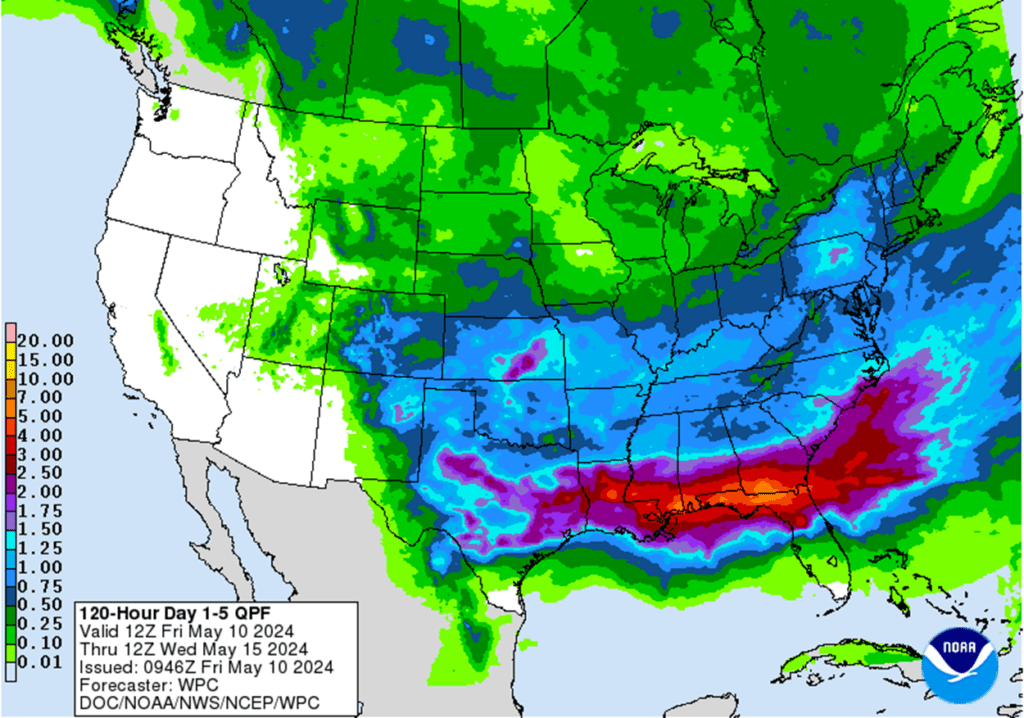

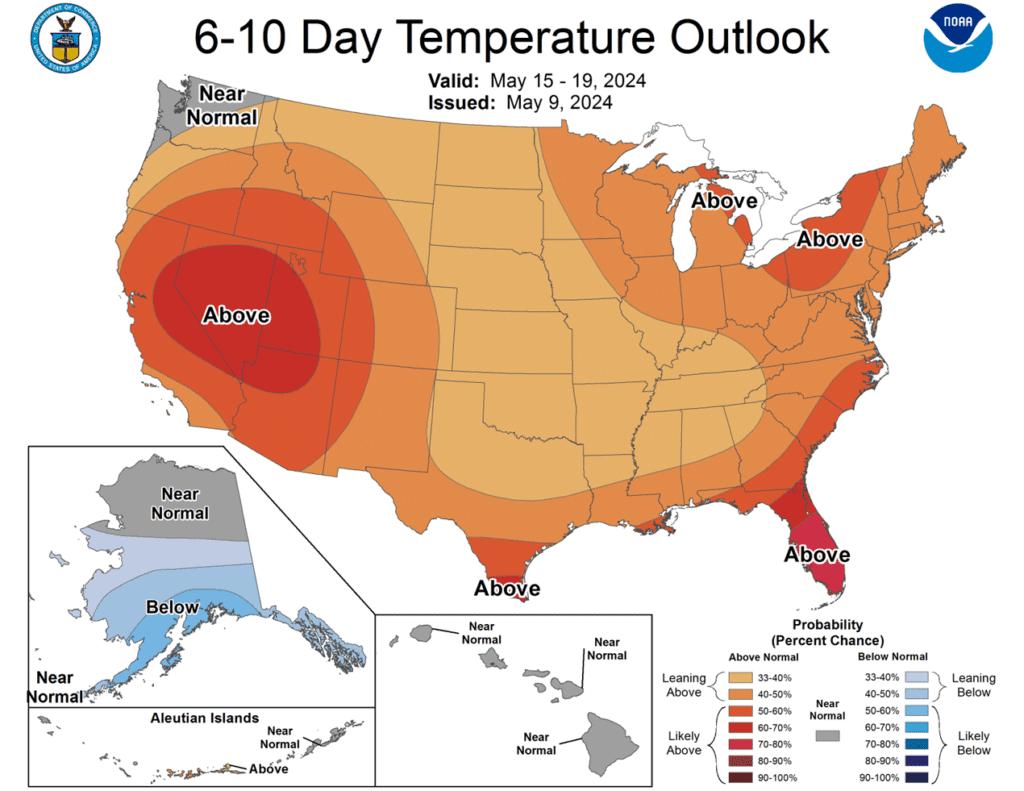

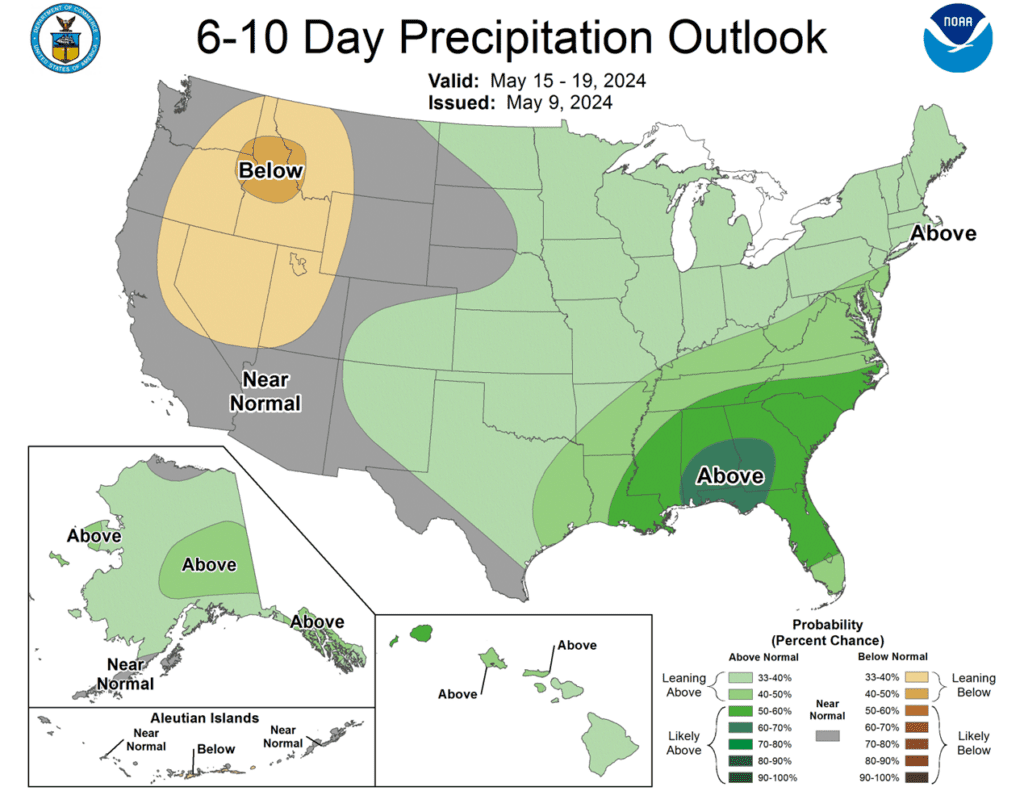

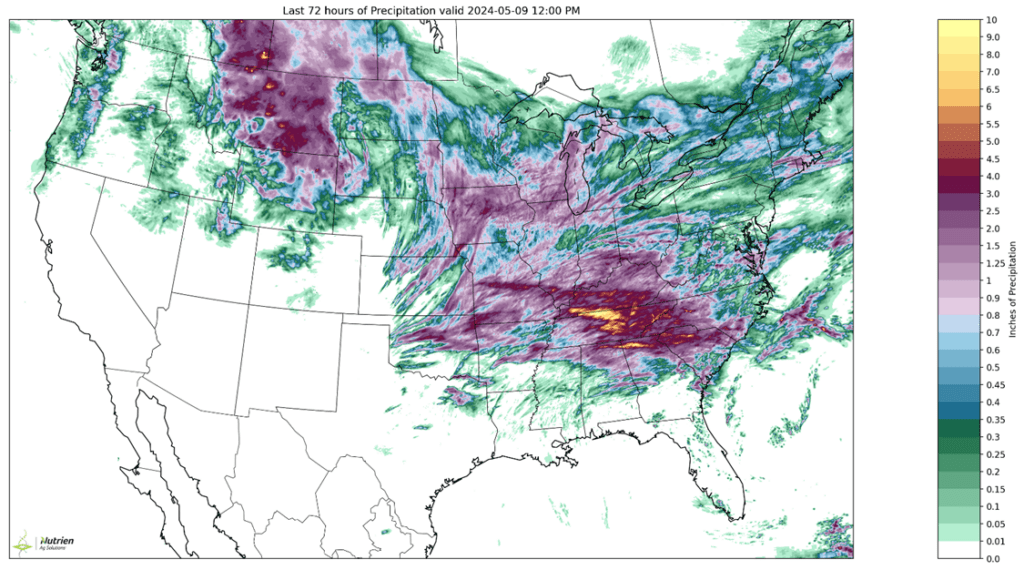

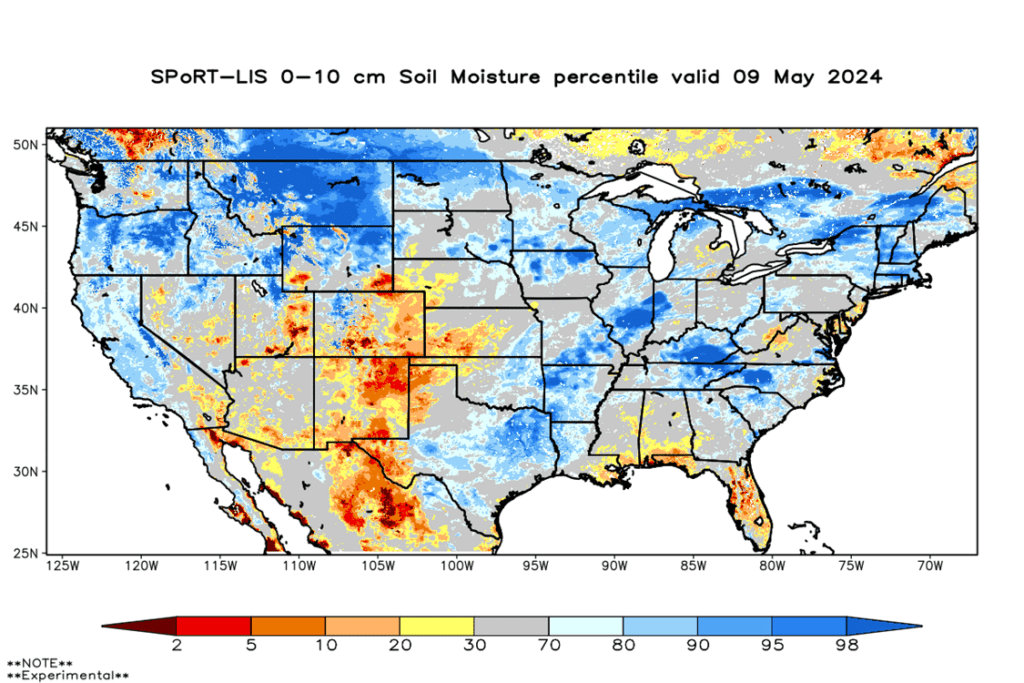

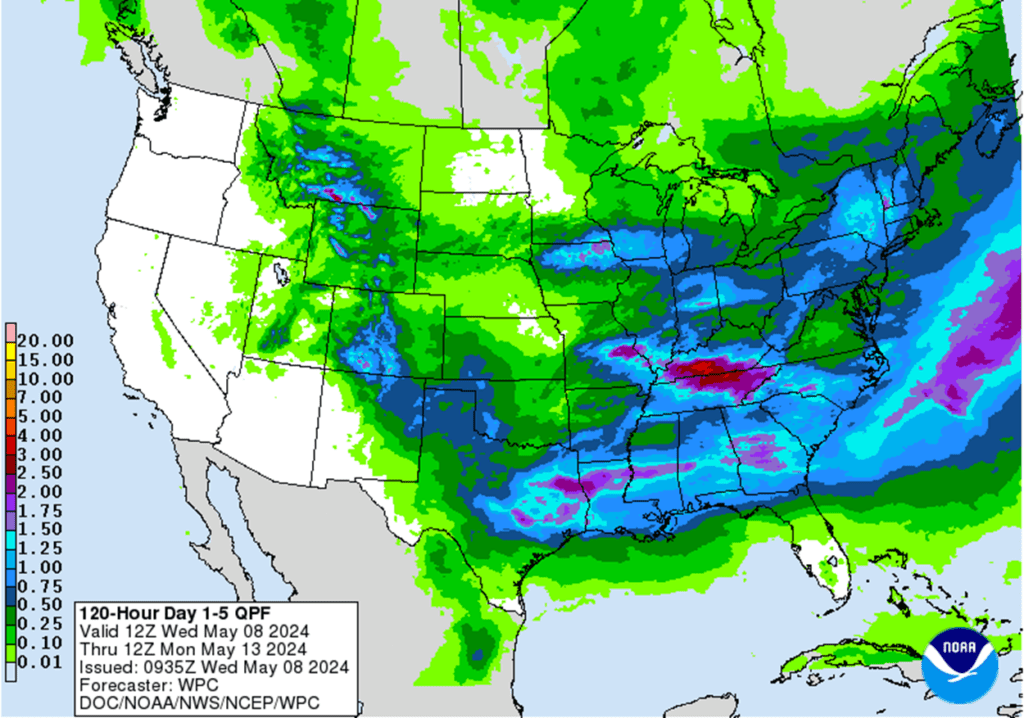

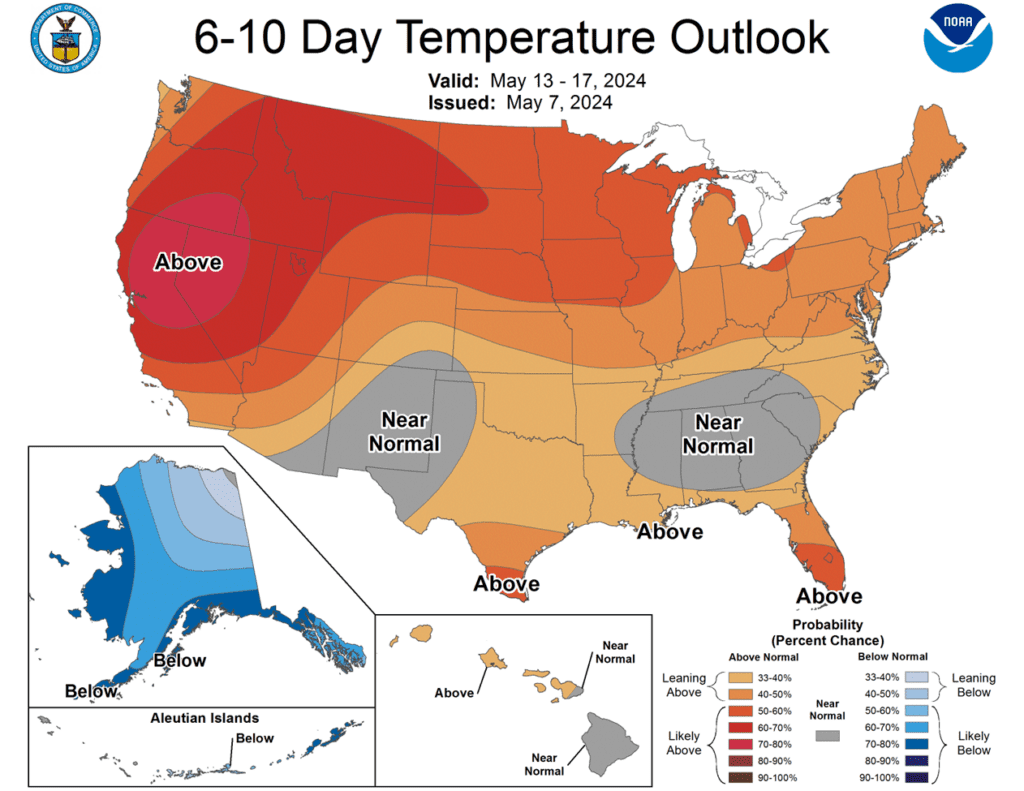

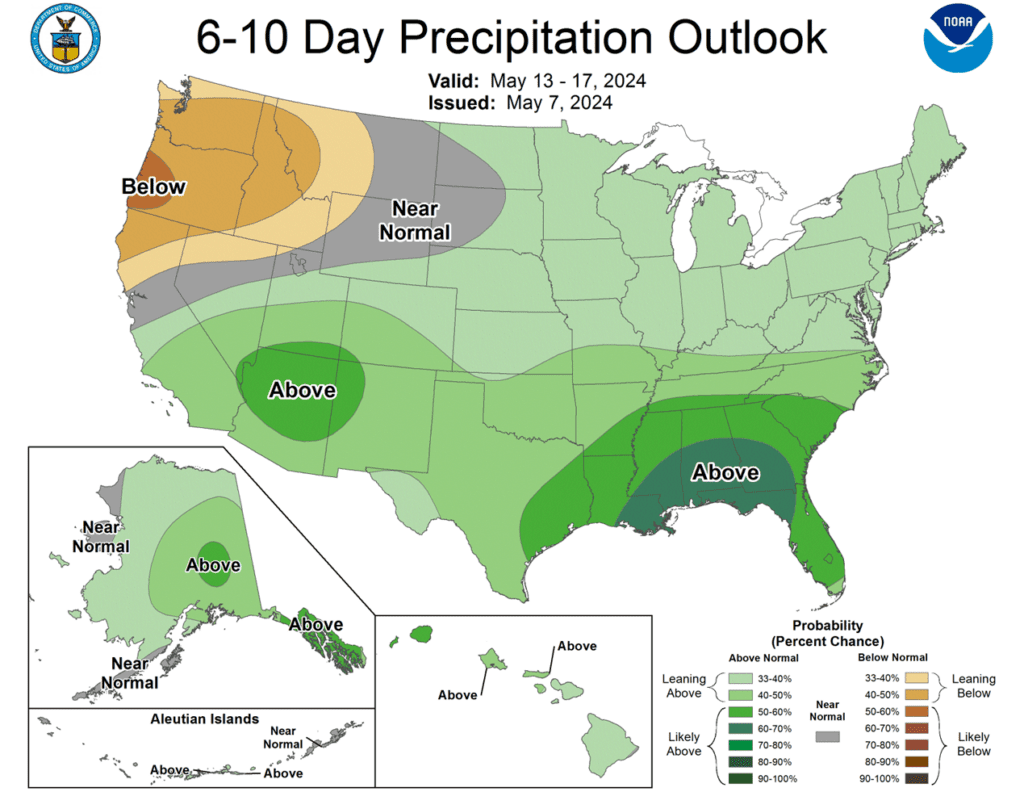

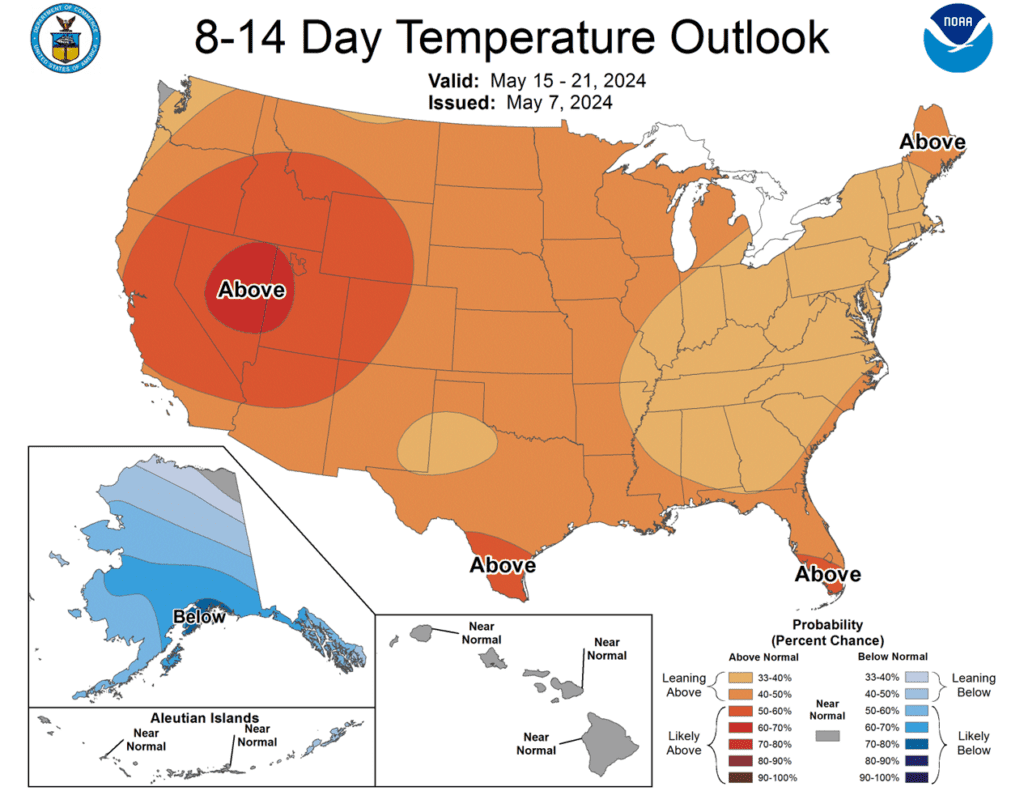

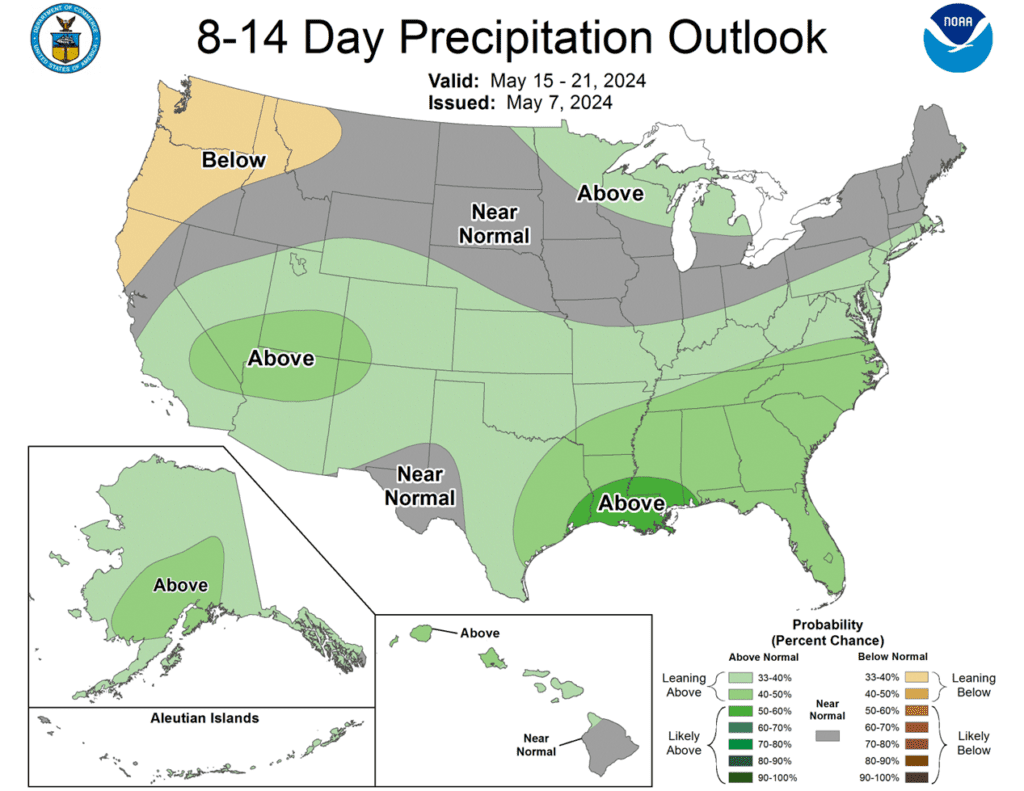

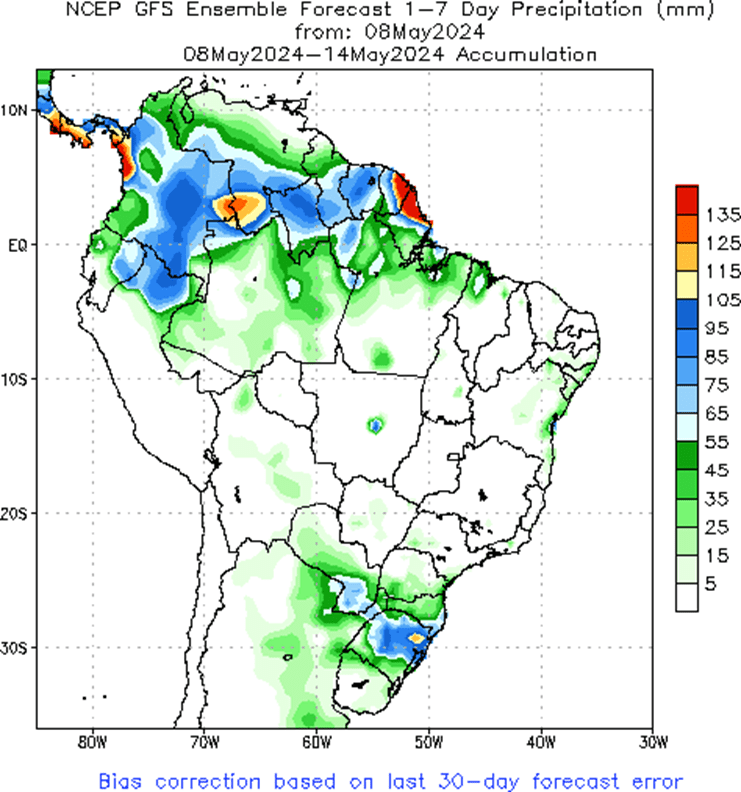

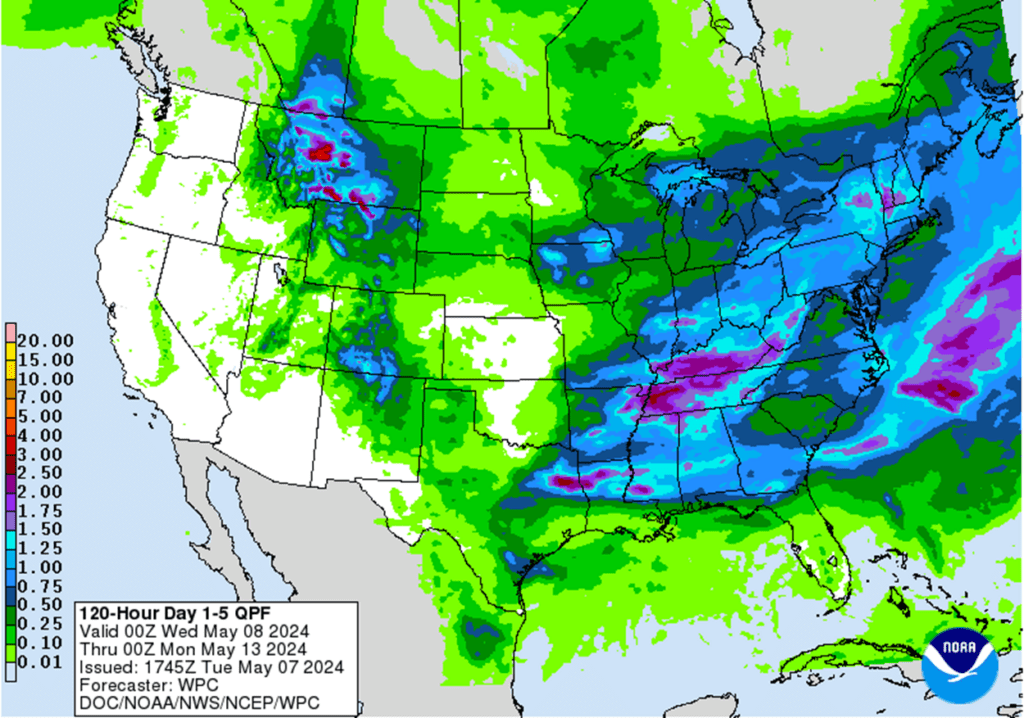

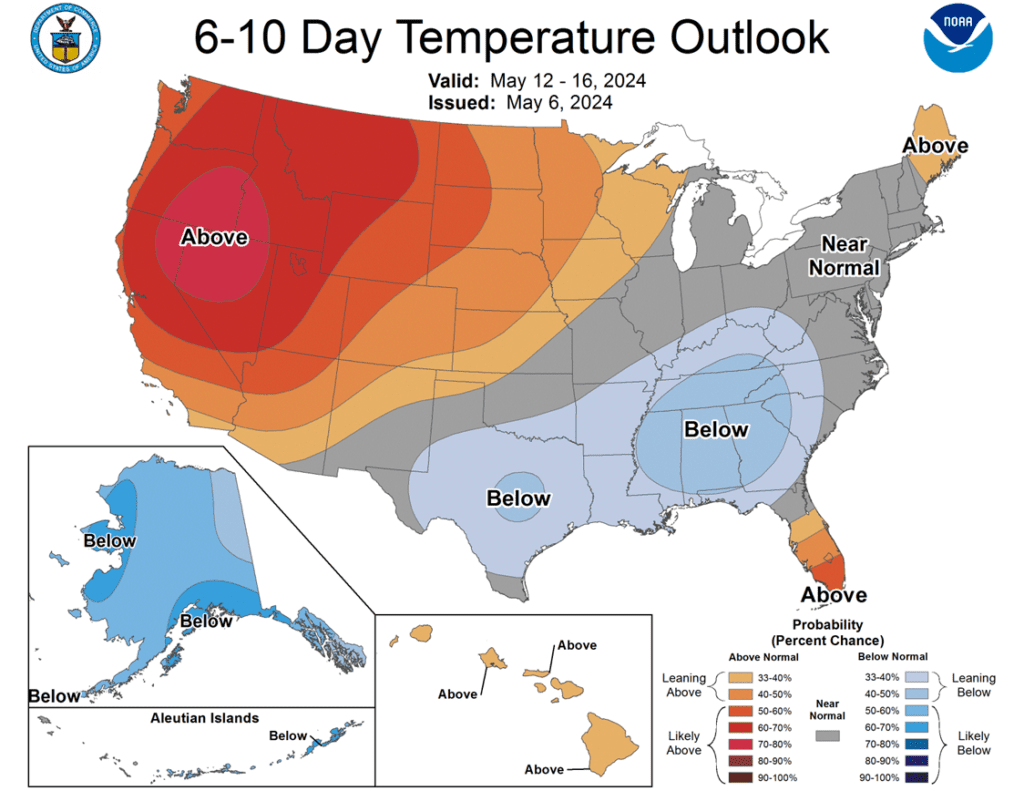

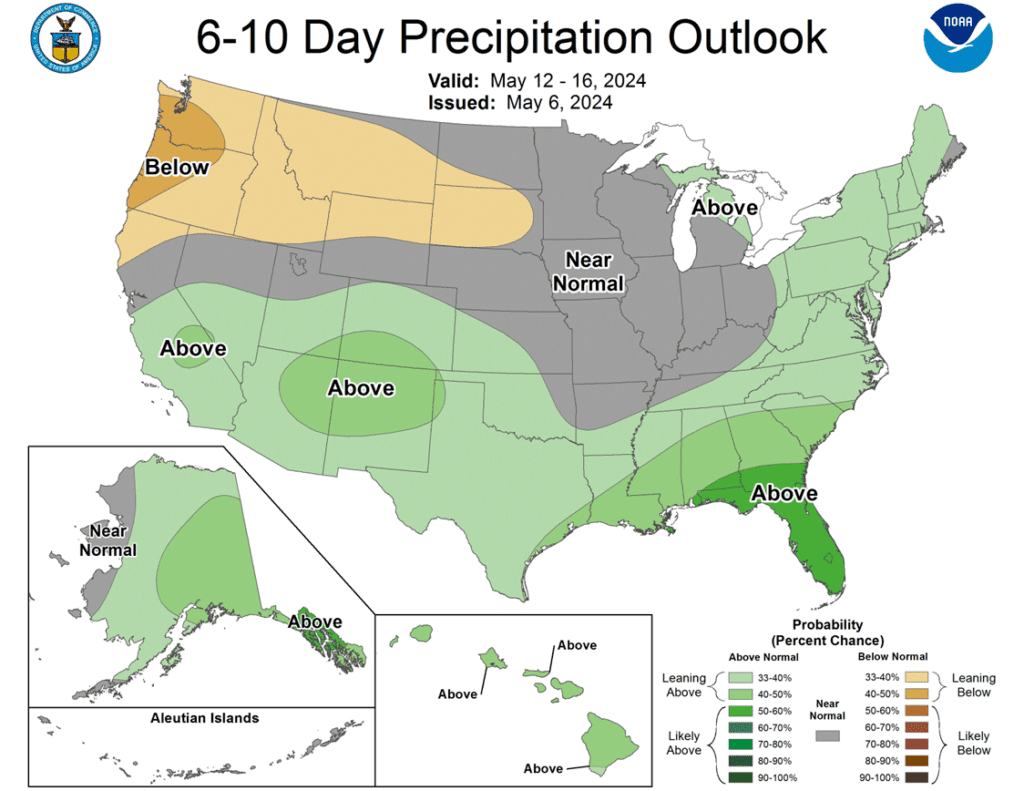

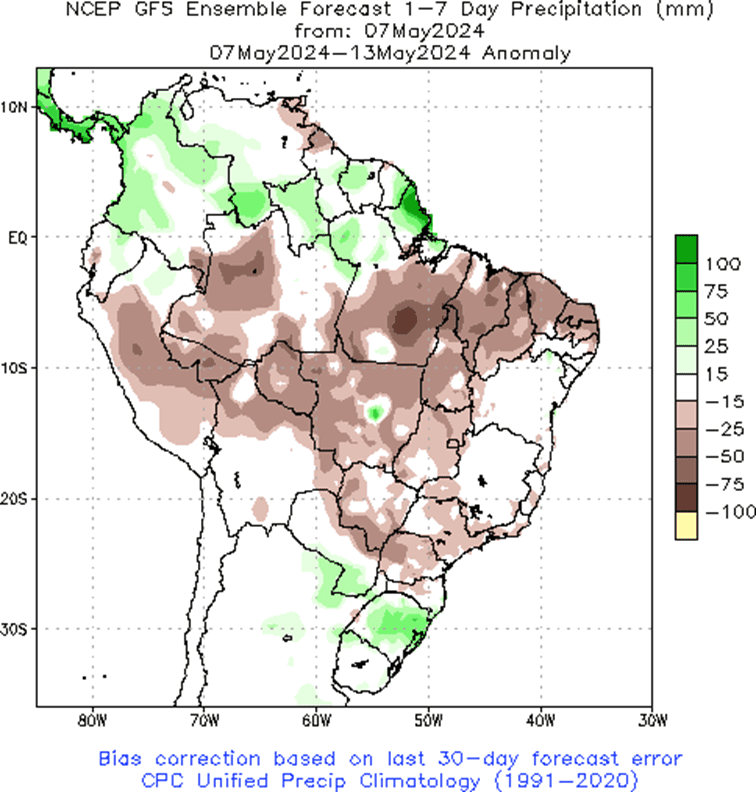

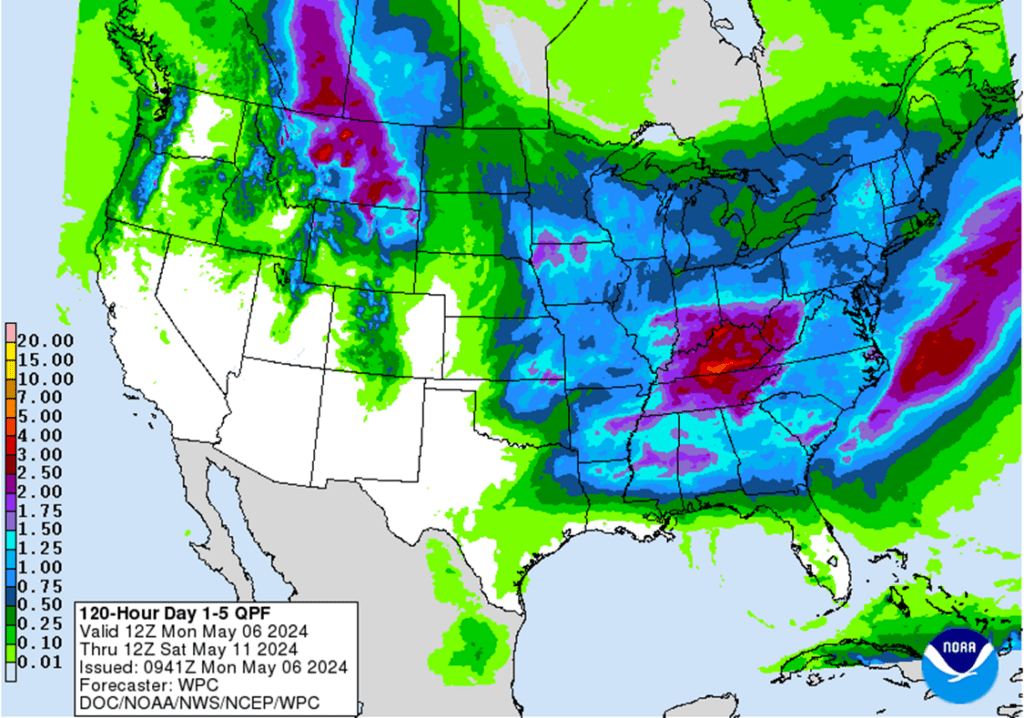

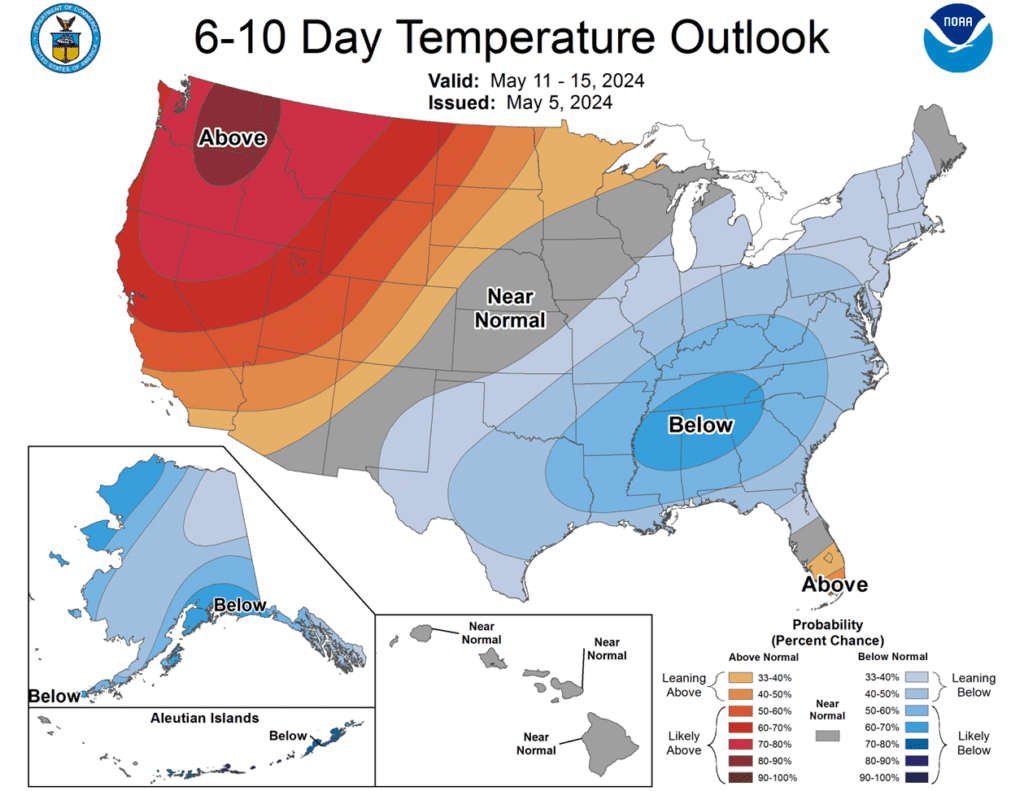

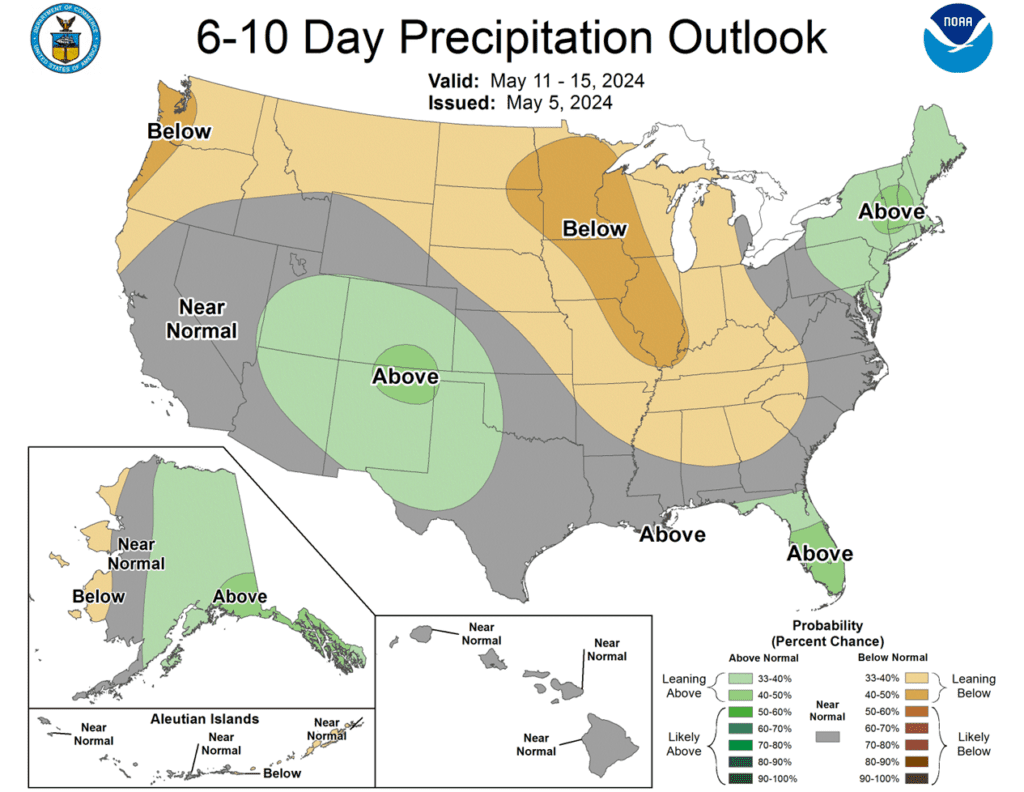

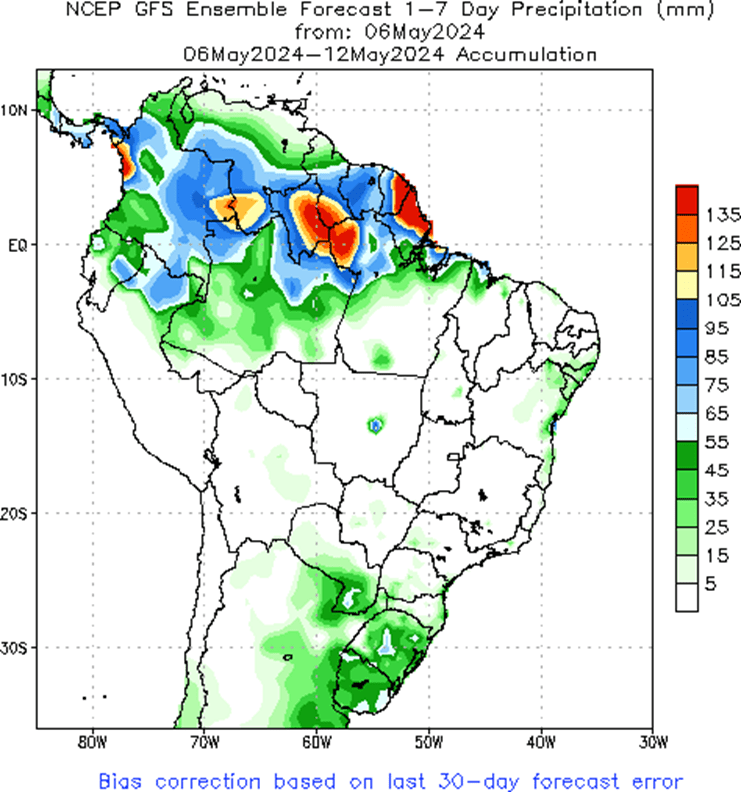

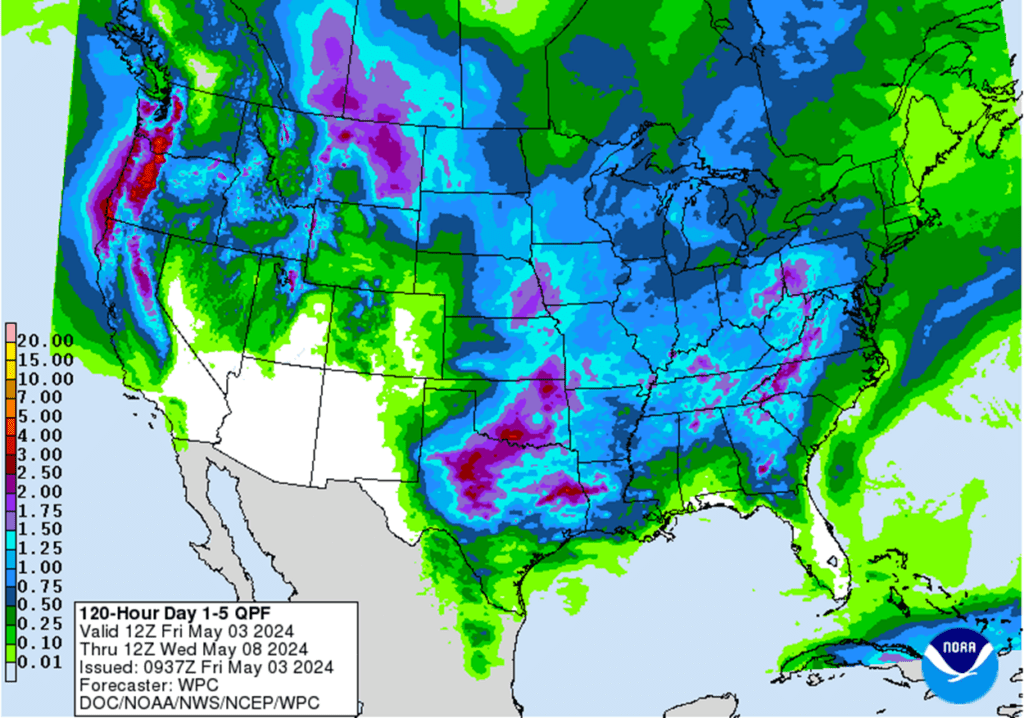

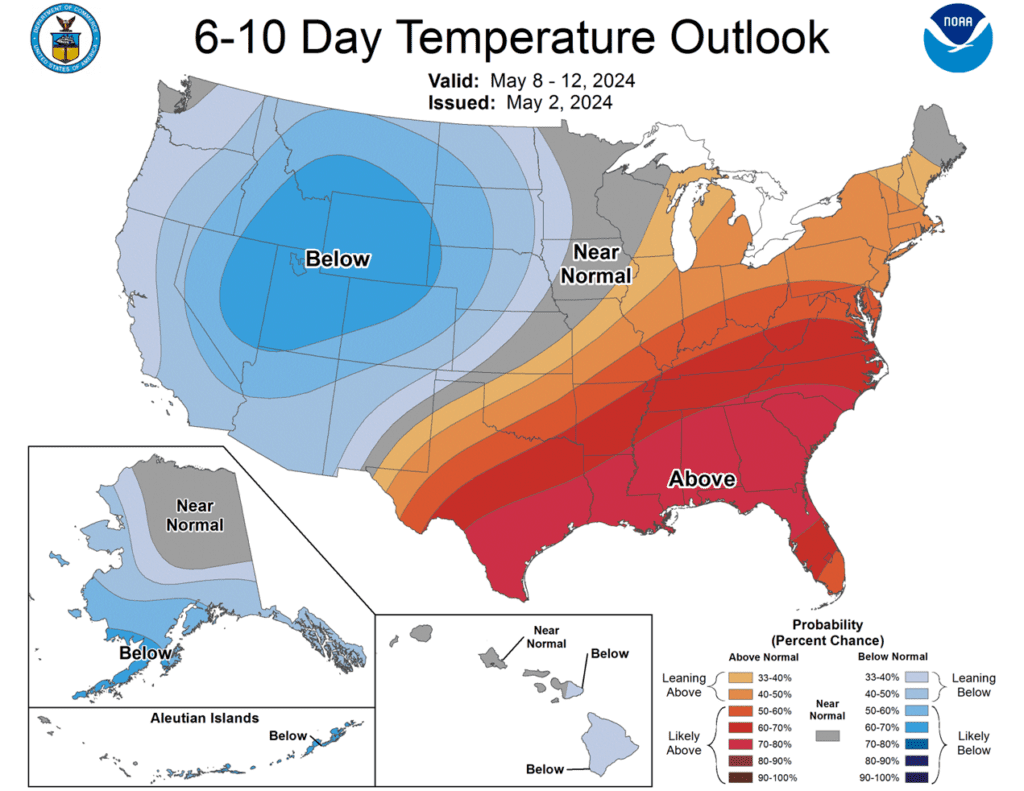

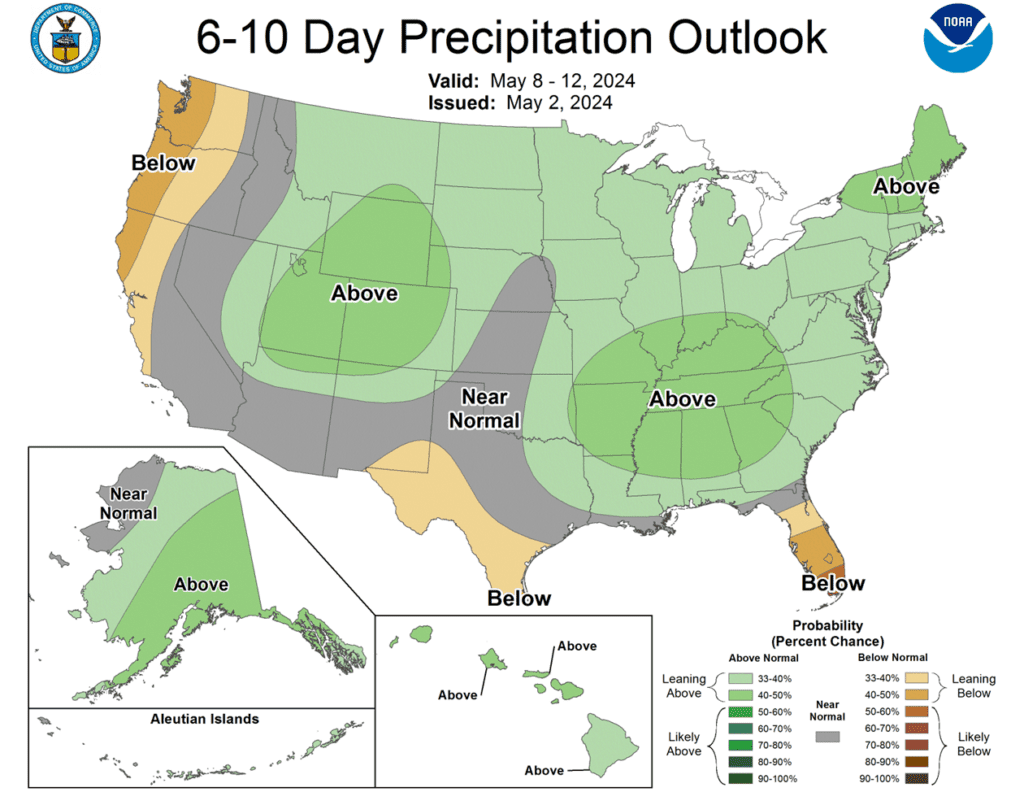

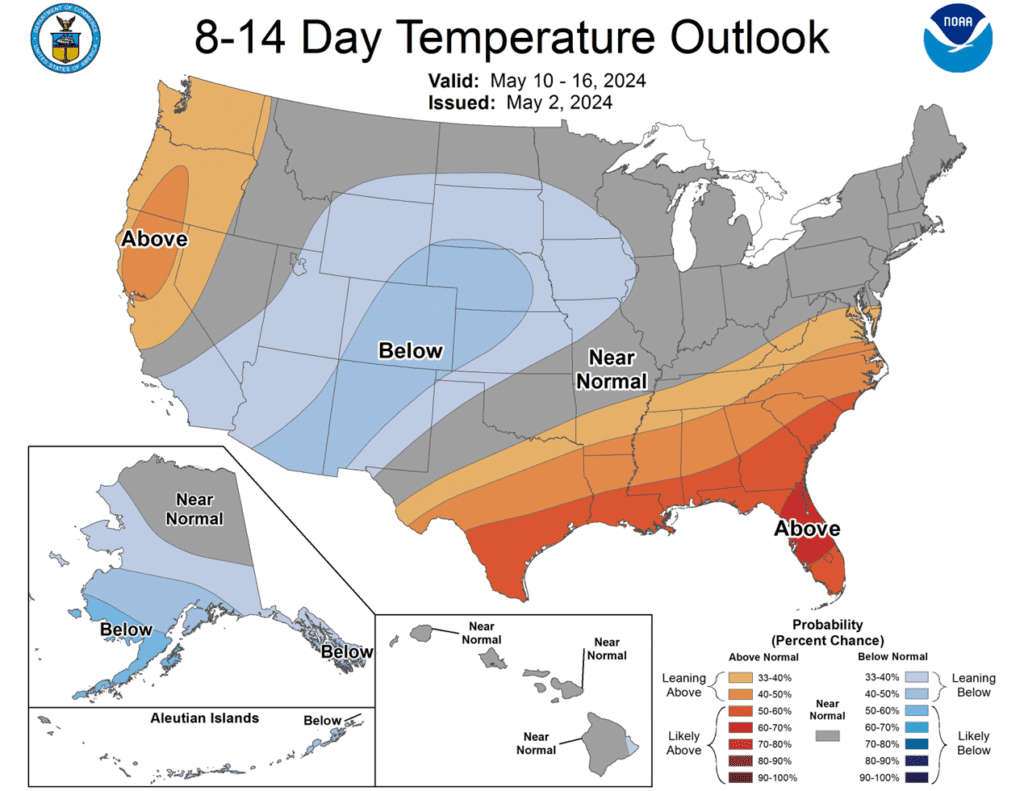

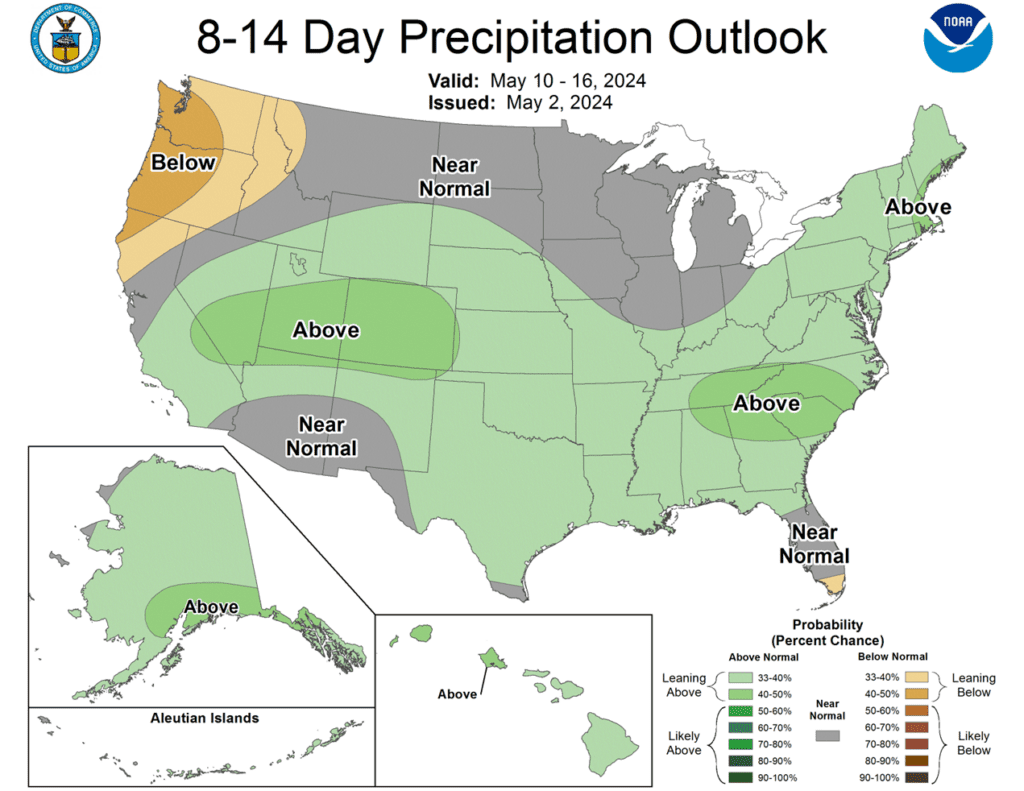

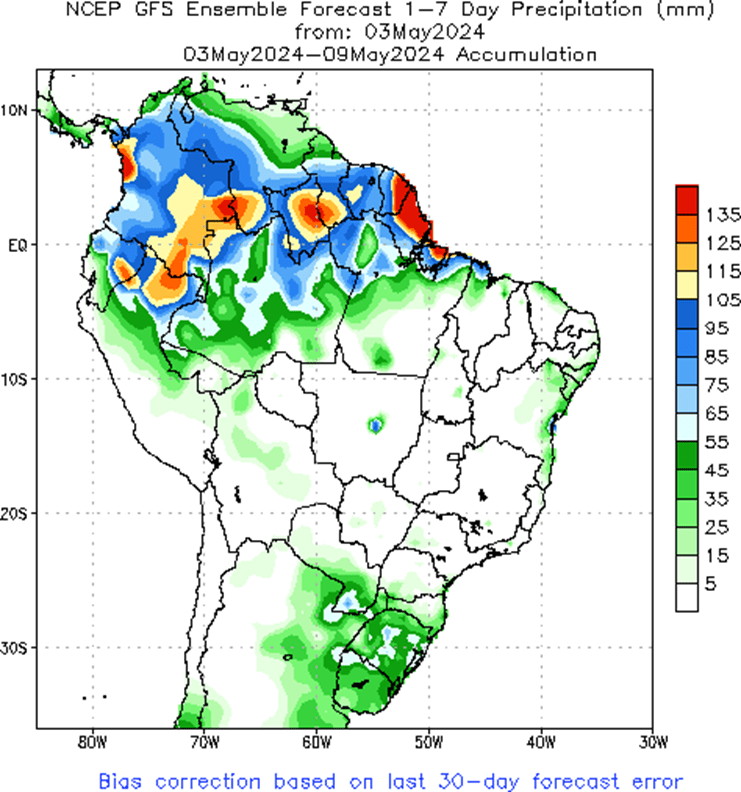

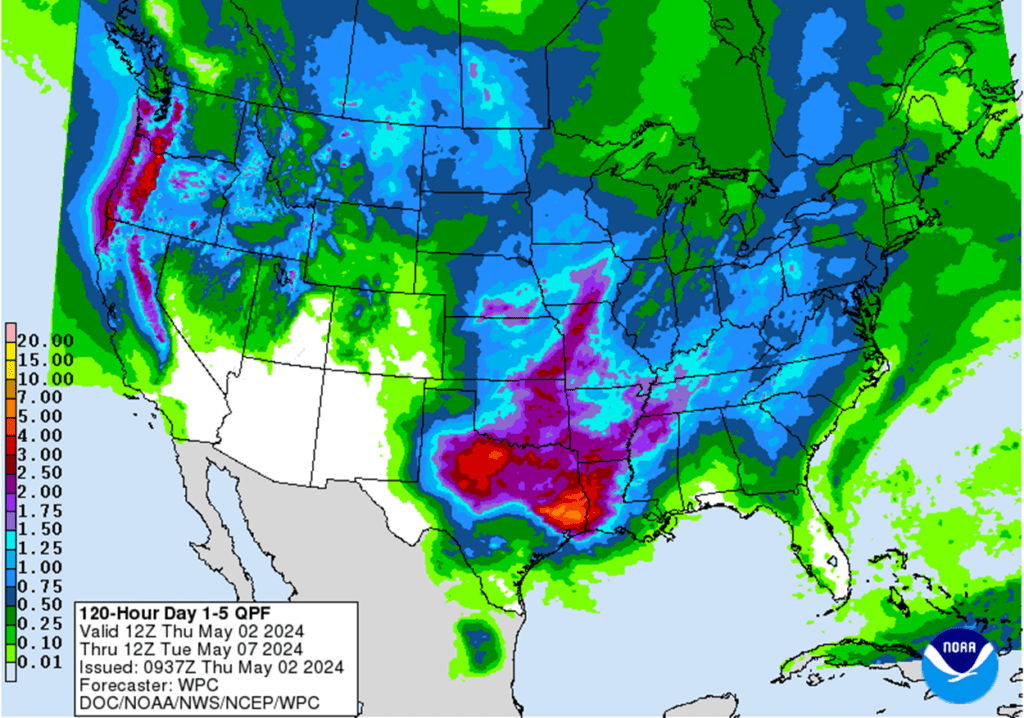

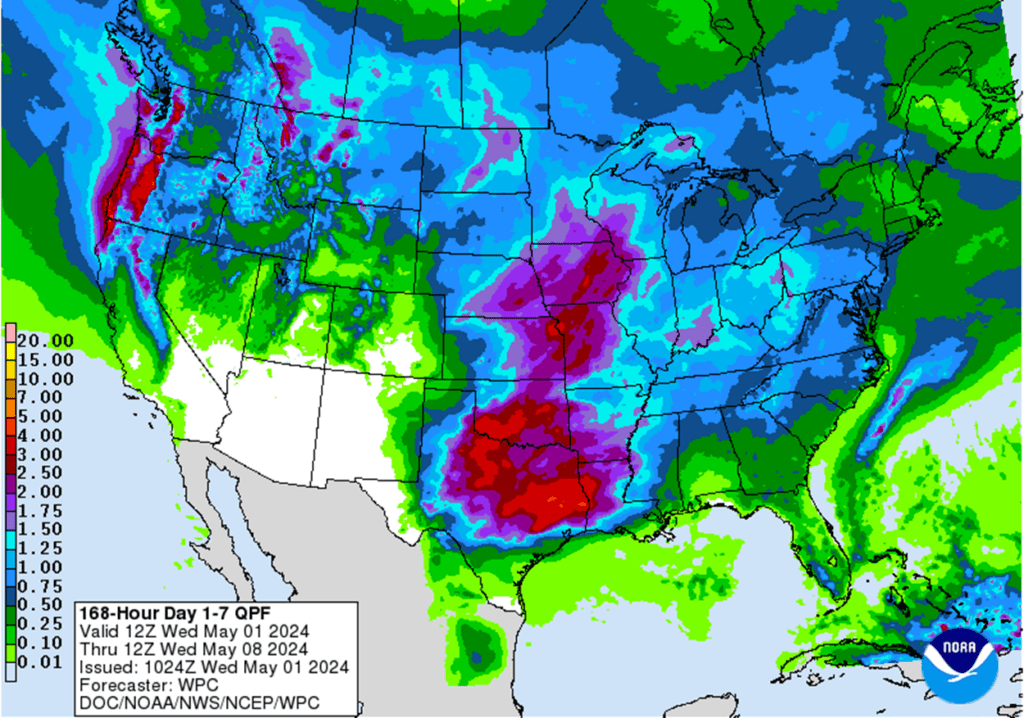

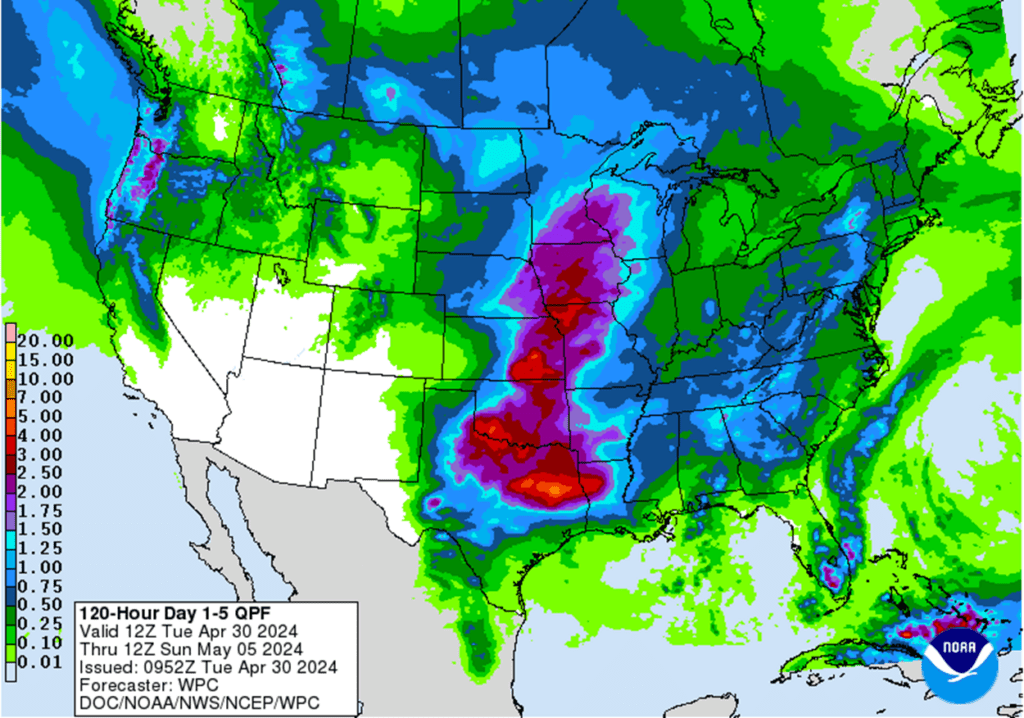

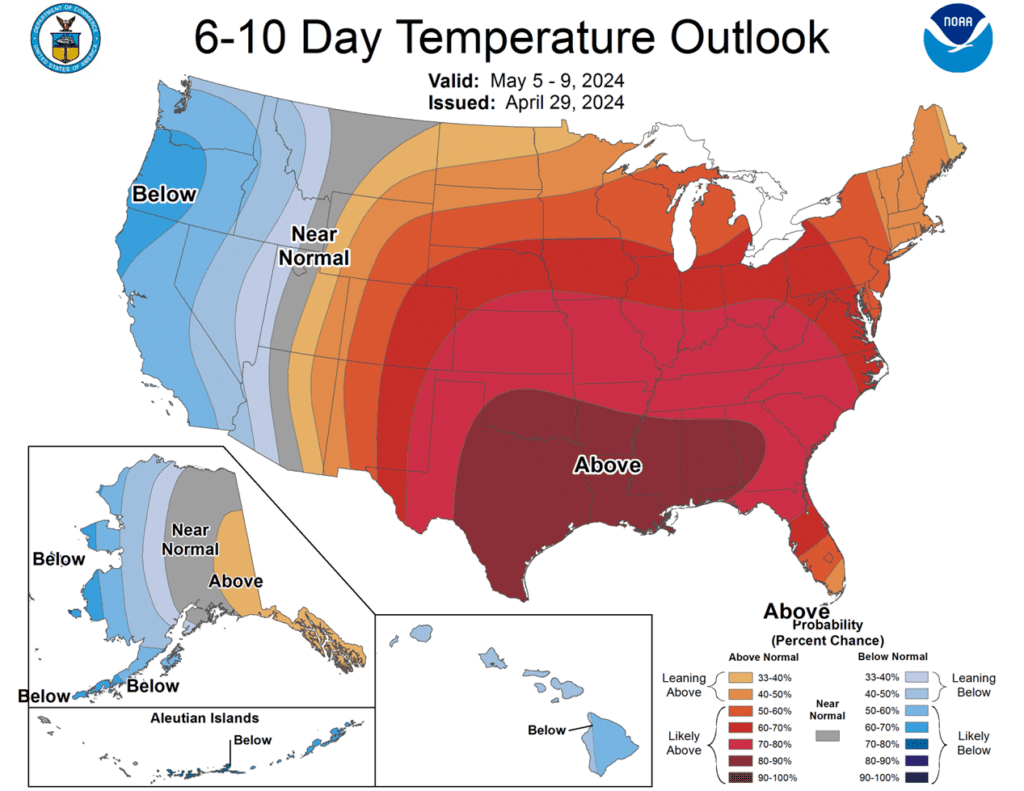

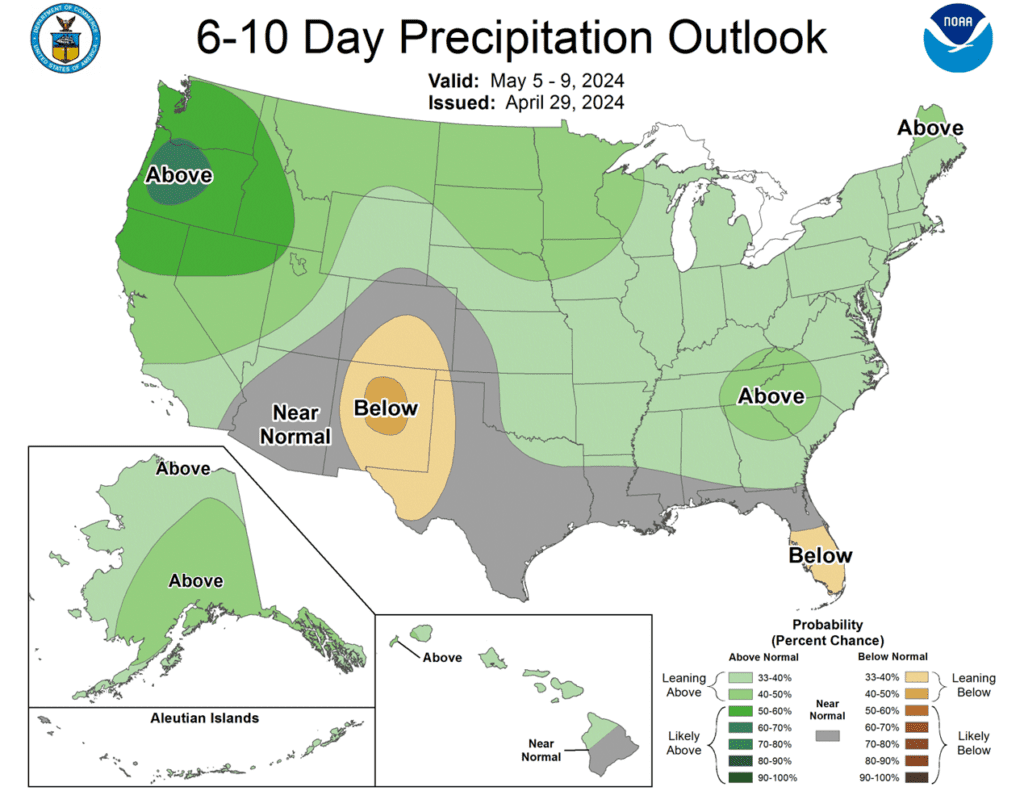

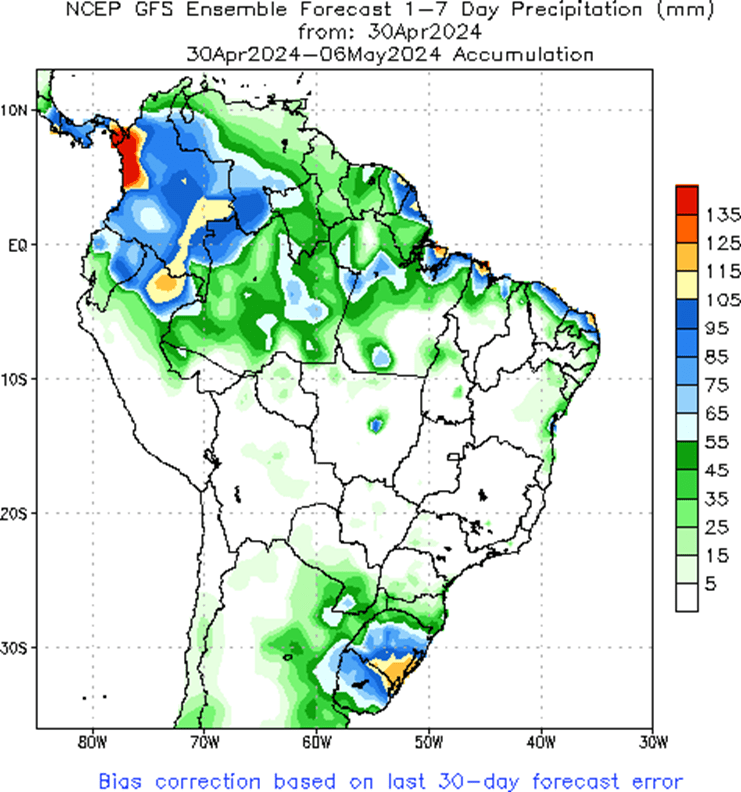

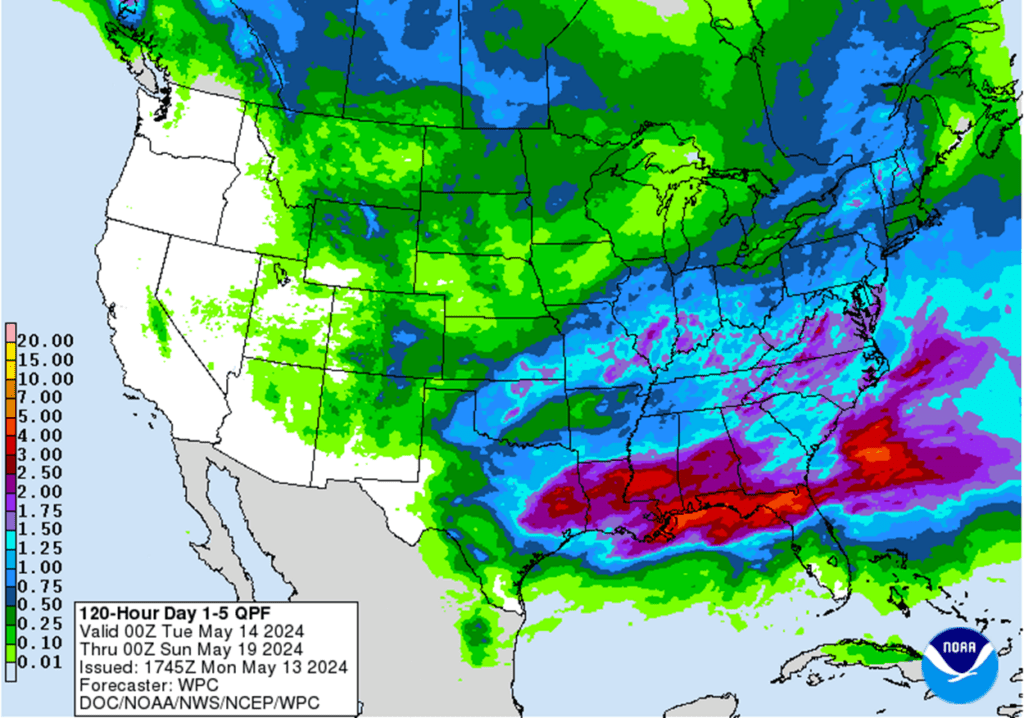

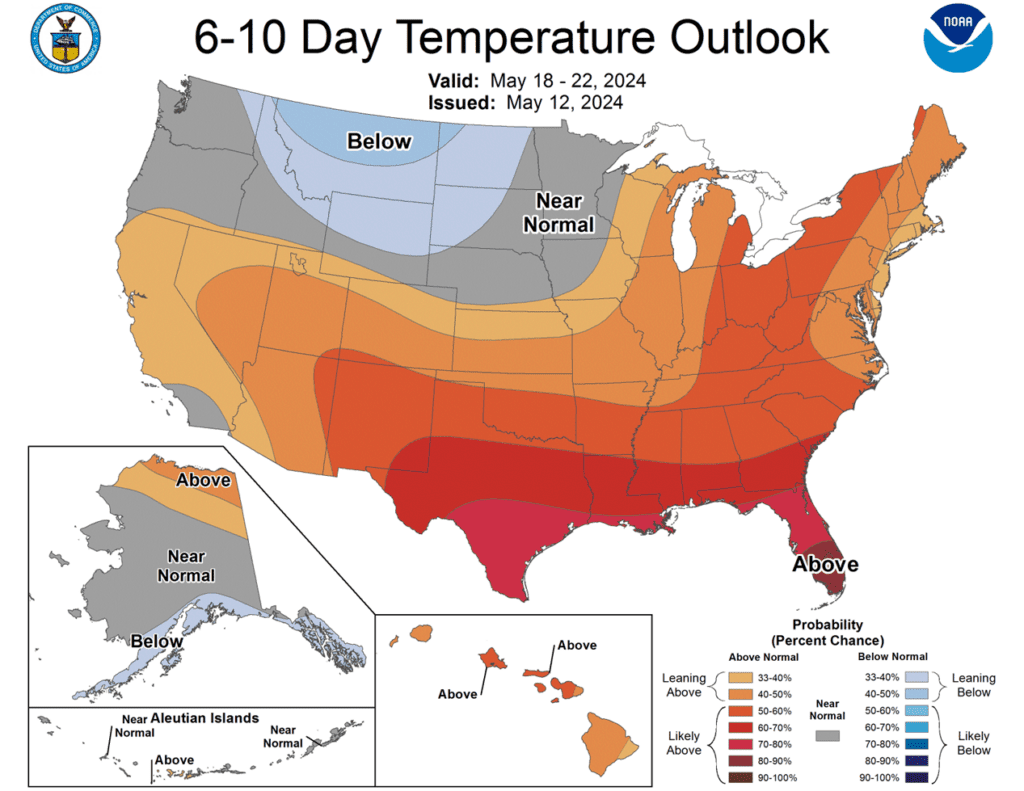

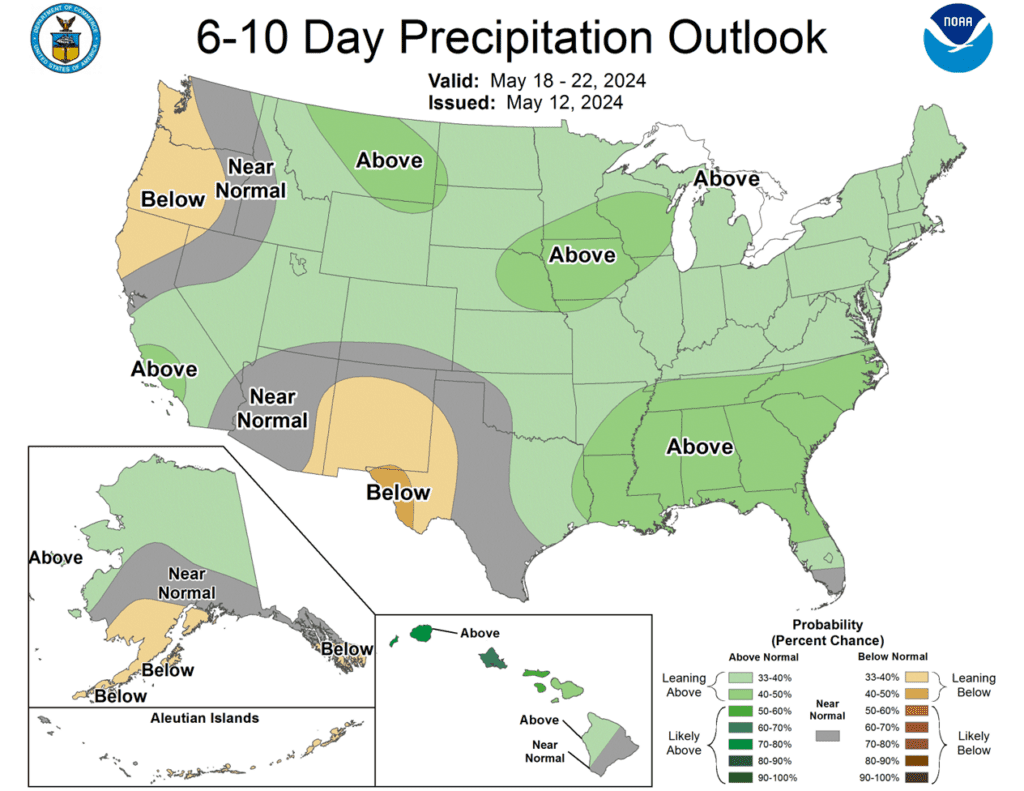

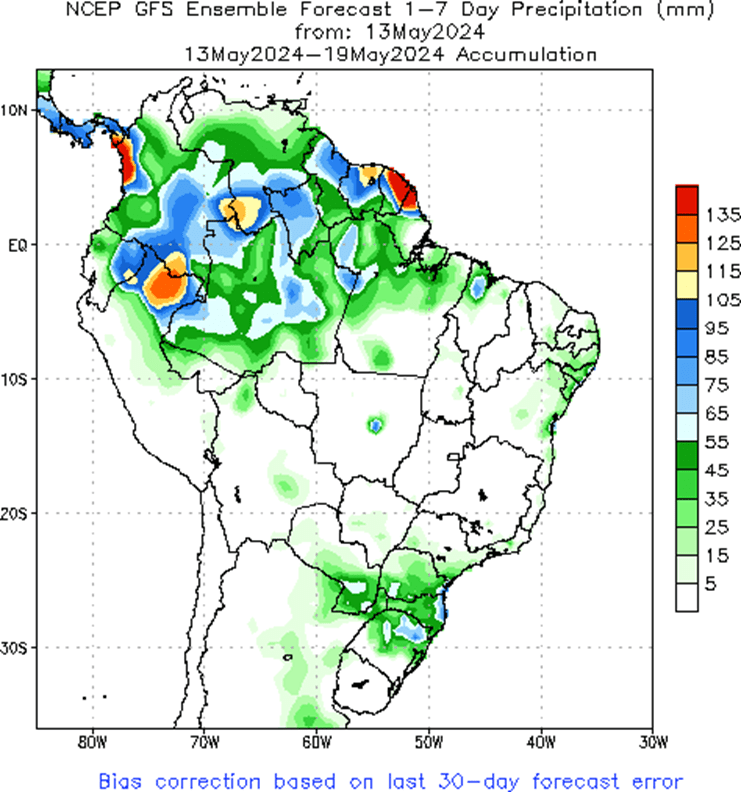

- To see the updated US 5-day precipitation forecast, 6 – 10 day Temperature and Precipitation Outlooks, and the 1-week precipitation forecast for Brazil and N. Argentina, courtesy of NWS, CPC, and NOAA, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

As July ’24 corn rallied beyond the congestion range on the front-month continuous charts, it began showing signs of being overbought, suggesting potential resistance to higher prices. Although managed funds have covered a significant portion of their net short position (sparking the recent rally) their remaining net short position could provide fuel for a more substantial upside move as planting progresses into the growing season. While obstacles persist for higher prices, overall market conditions and seasonal tendencies continue to support a sustained price recovery into May and June.

- No new action is recommended for 2023 corn. The target range to make additional sales is 480 – 520 versus July ’24 futures. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. We are targeting 520 – 560 to recommend making additional sales versus Dec ‘24 futures. For put option hedges, we are looking for 500 – 520 versus Dec ‘24 before recommending buying put options on production that cannot be forward priced prior to harvest.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

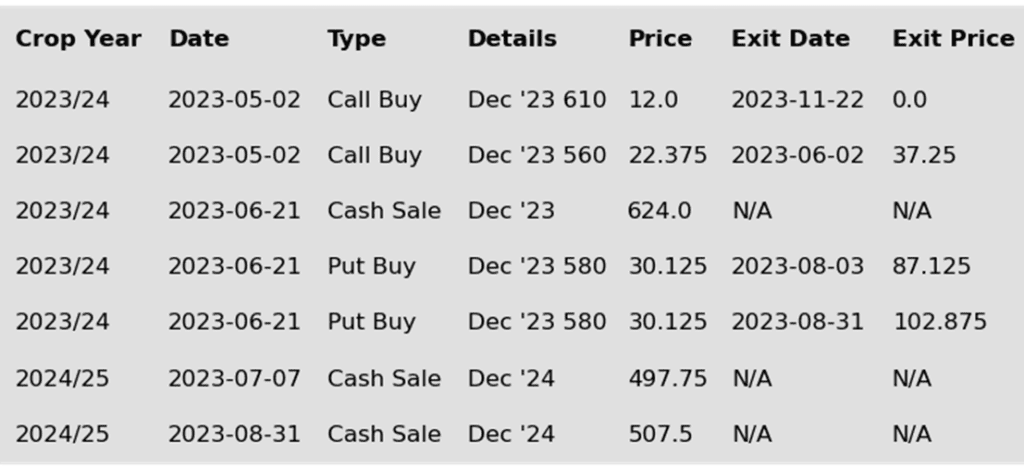

To date, Grain Market Insider has issued the following corn recommendations:

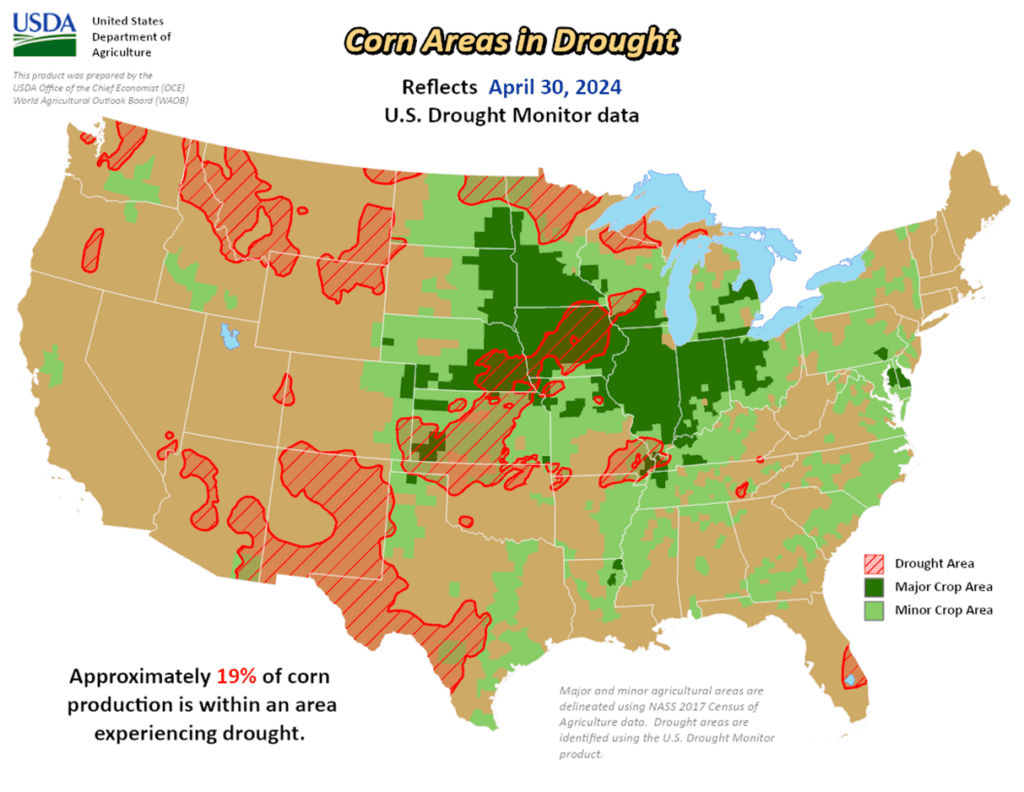

- Despite strong wheat and soybean markets to start the week, corn futures only posted slight gains as the market is trying to balance out the forecasted heavy supply picture, planting progress, and the overall demand for corn.

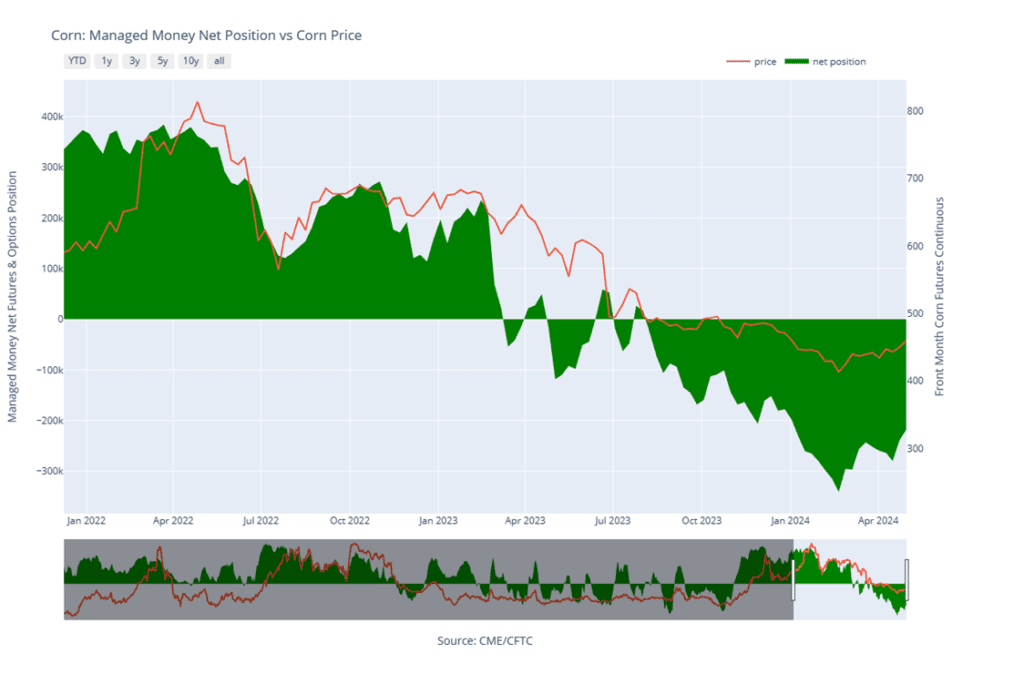

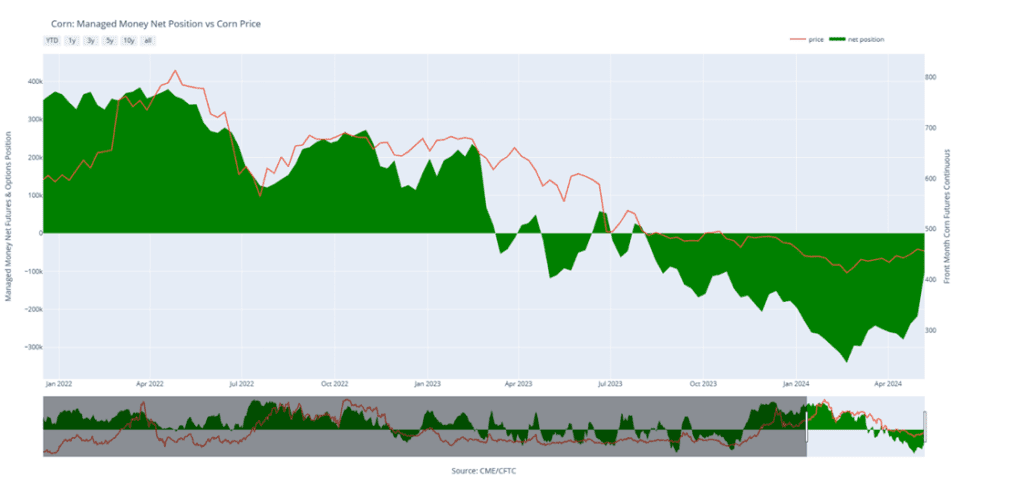

- Managed funds drastically reduced their net short position in the corn market last week. On last week’s Commitment of Traders report, funds reduced their total net short positions by 115,527 contracts to 102,513 contracts. In total, managed money has removed nearly 240,000 contracts since the February price low.

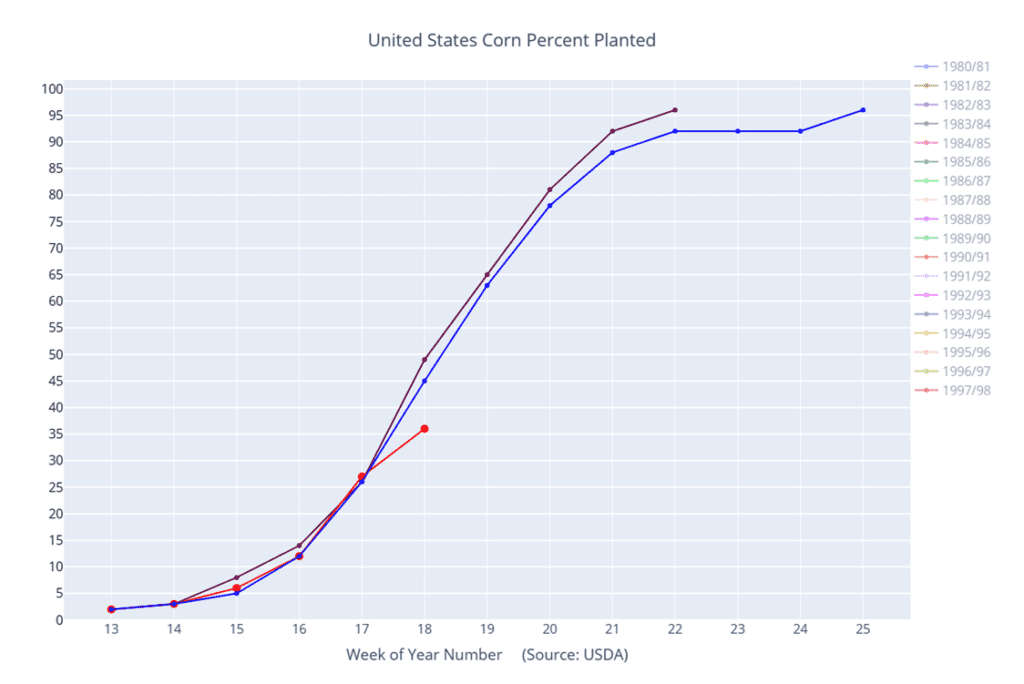

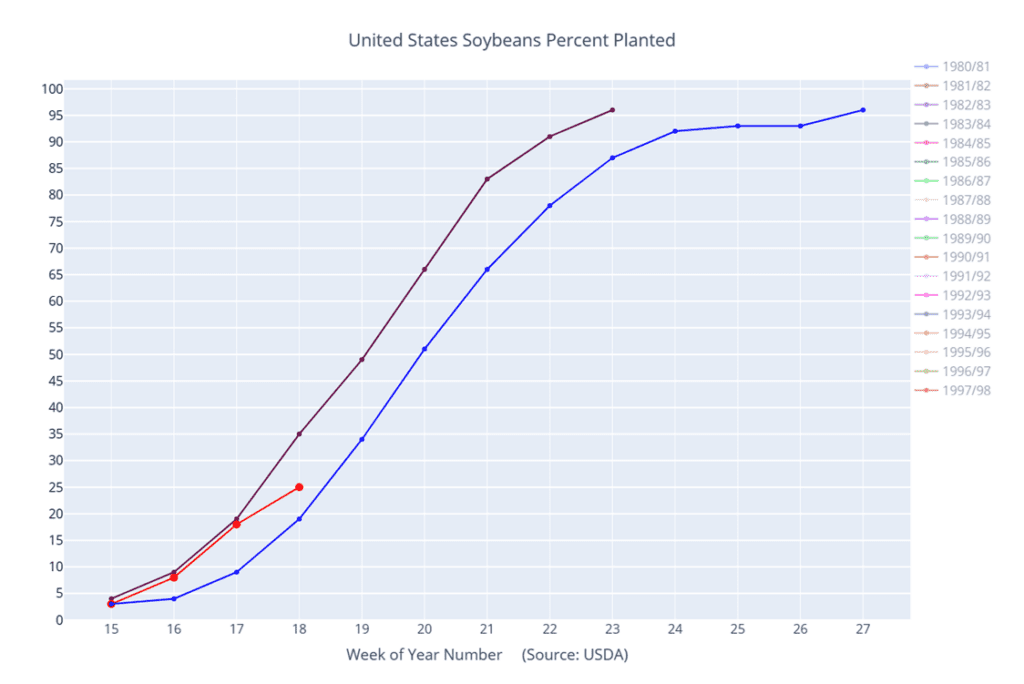

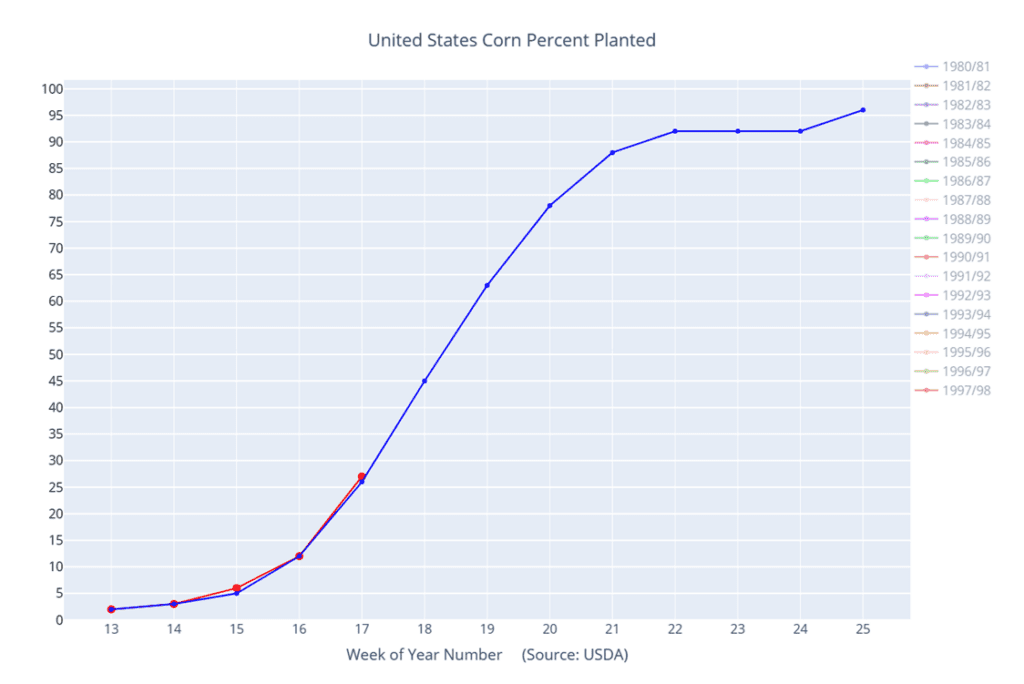

- USDA will release weekly planting progress this afternoon. Expectations are for corn planting to reach 49% complete, up 13% from last week. The planting pace could be limited toward that target with wet weather over the corn belt in the past week, but the pace likely improved going into the weekend in some areas.

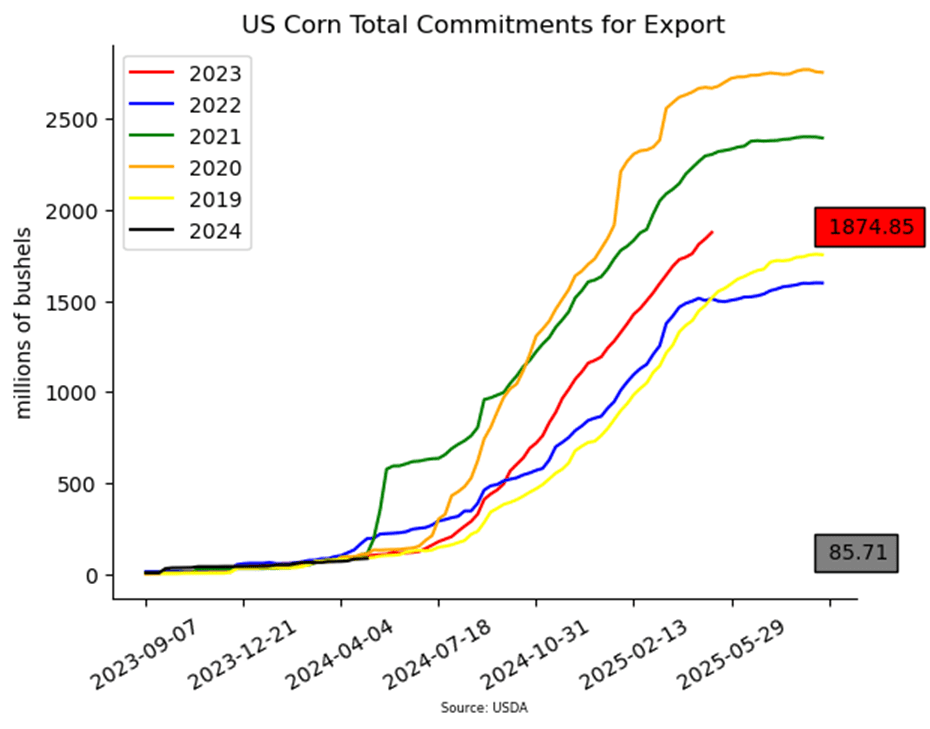

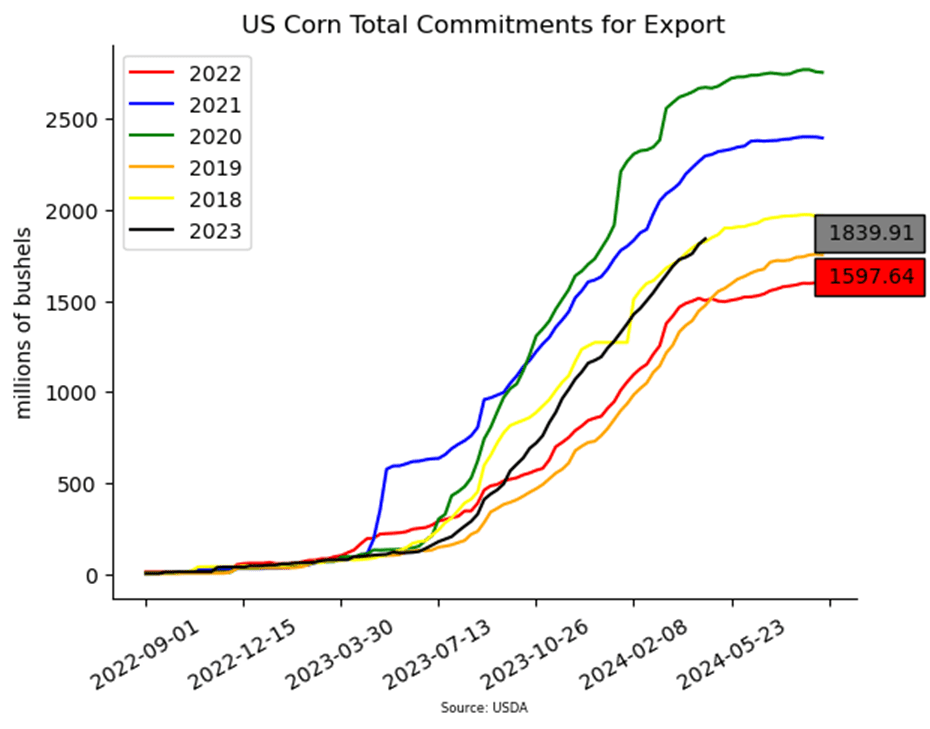

- Weekly Export inspections for corn were within market expectations. Last week, US exporters shipped 36.9 mb (938,000 mt) of corn. Total exports have reached 1.336 billion bushels, up 30% from last year. The USDA has forecasted a 29% increase year over year.

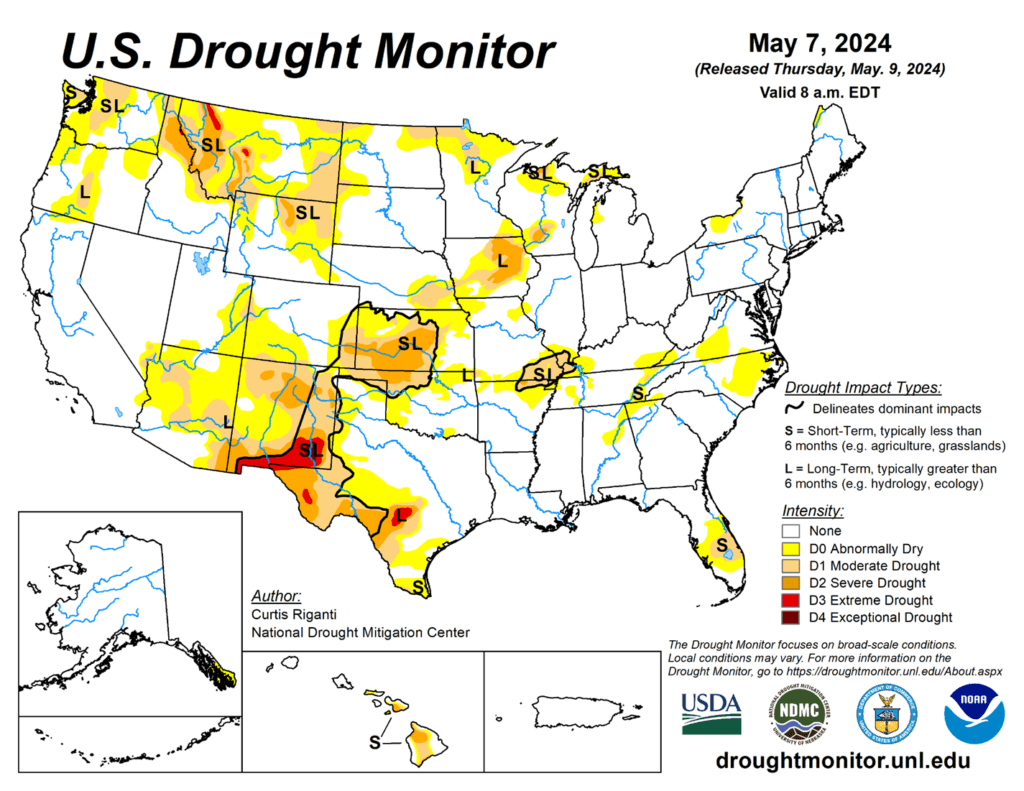

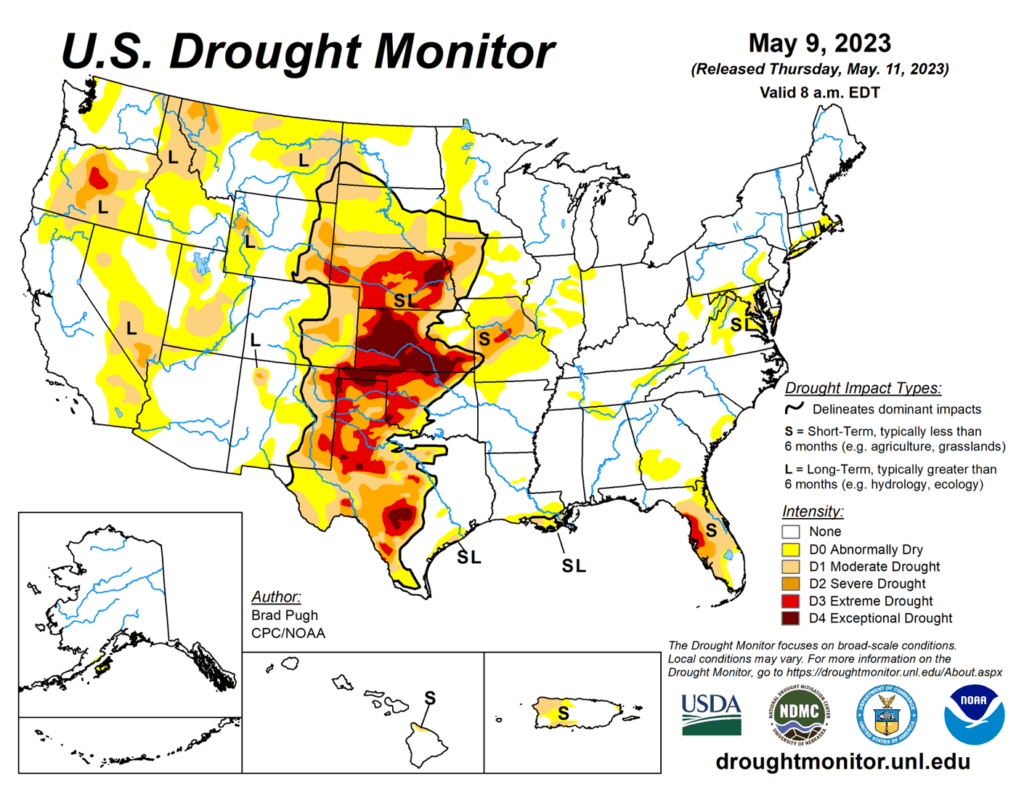

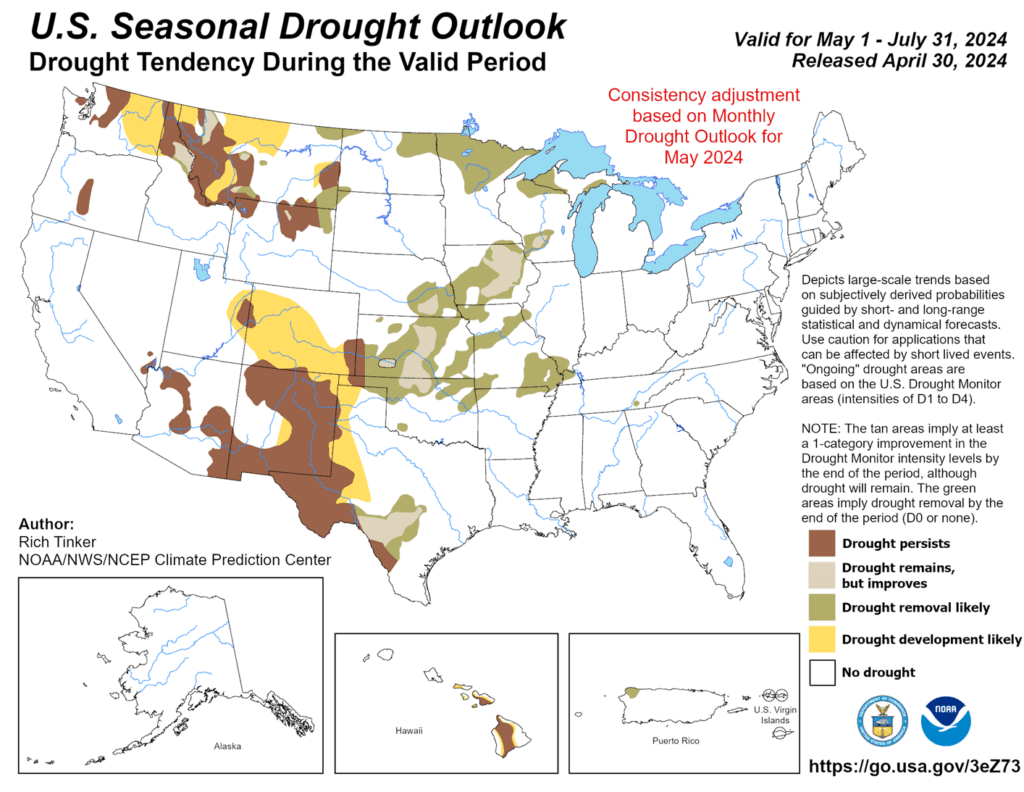

- The grain markets will be focused on weather for the next couple of weeks. Forecasts look mixed across the corn belt as some producers have struggled to stay on pace with planting this spring’s crop.

Above: A close above the May 7 high of 472 suggests the market could run toward the 495 – 510 resistance area from last fall. However, a reversal lower and a close below 454 initial support, could lead the market to test heavier support in the 445 – 440 range.

Corn Managed Money Funds net position as of Tuesday, May 7. Net position in Green versus price in Red. Managers net bought 115,527 contracts between May 1 – 7, bringing their total position to a net short 102,513 contracts.

Soybeans

Soybeans Action Plan Summary

In early May the soybean market rallied out of its congestion range and above the March highs as Managed funds likely covered some of their net short positions. While the current supply/demand situation remains somewhat bearish, Managed funds remain net short the market and this breakout opens the door for a run towards the 1290 ¾ – 1296 ¾ chart gap and resistance area just above there if further production concerns arise in the coming weeks. Otherwise, if weather conditions cooperate and planting progresses without major issues, prices could remain susceptible to a reversal from the recent highs.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus July ’24 futures to recommend making further sales. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

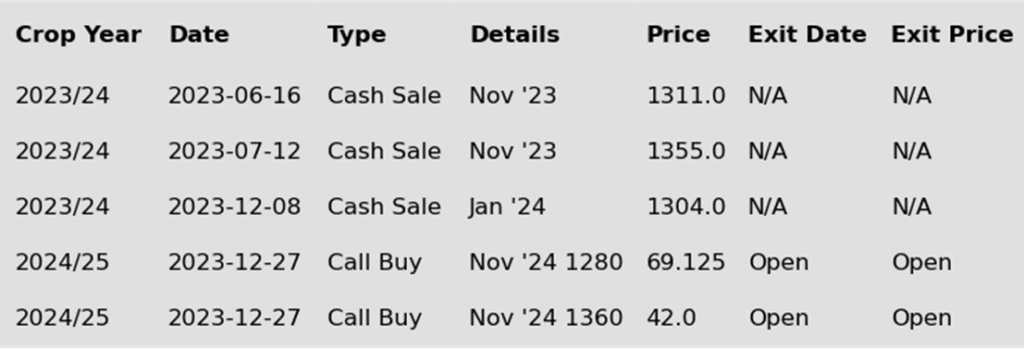

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. We are currently targeting the 1280 – 1320 range versus Nov ’24 futures, which is a modest retracement toward the 2022 highs, to recommend making additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

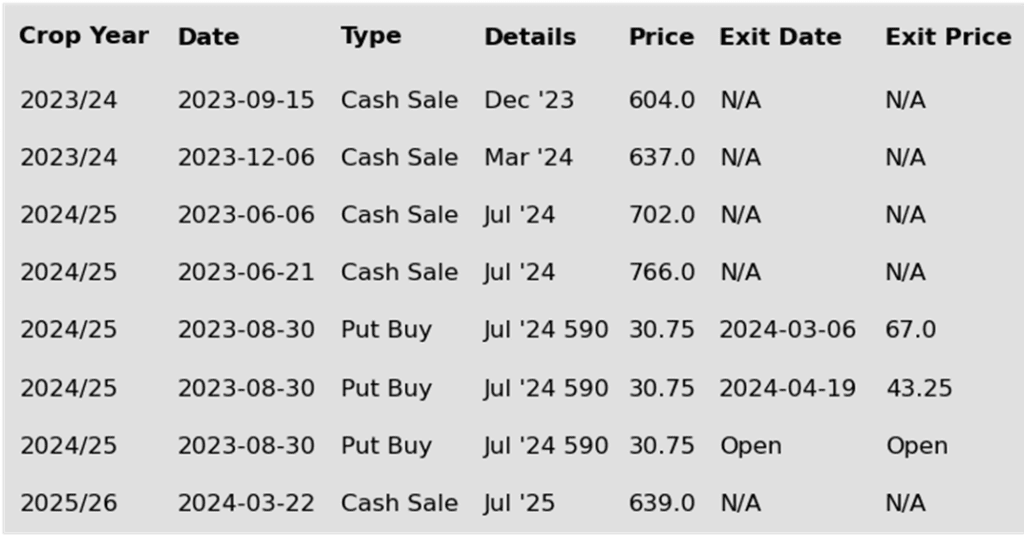

To date, Grain Market Insider has issued the following soybean recommendations:

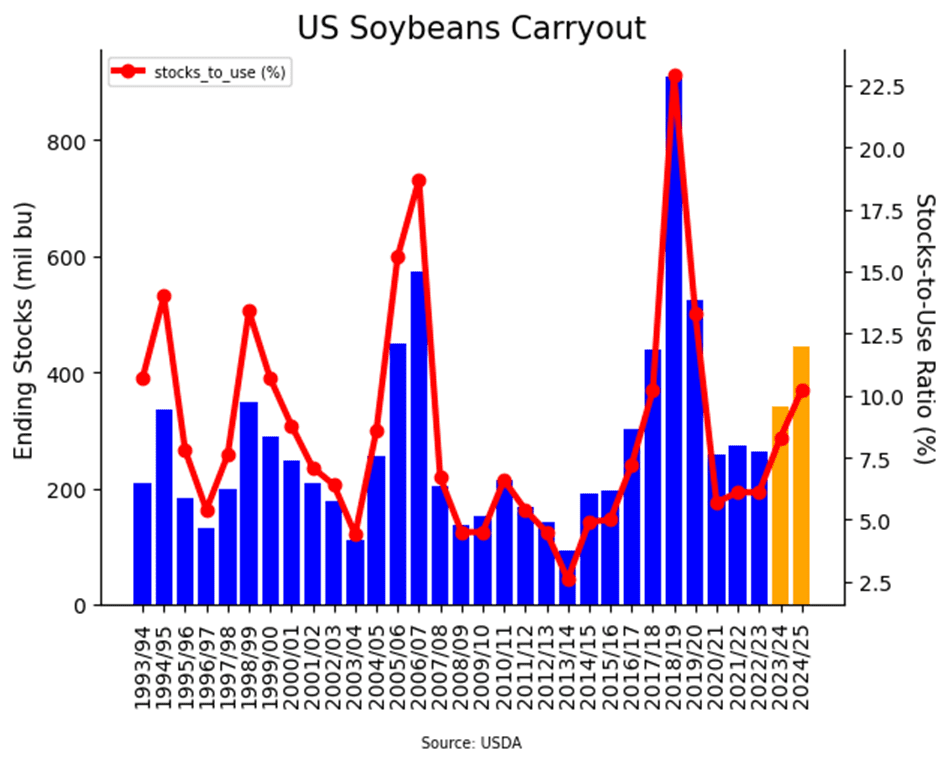

- Soybeans closed higher for the day despite initially trading lower overnight. However, they also settled 9 cents below their midday highs. Soybean meal closed significantly lower while soybean oil ended higher by 1.60%. Both July and November soybeans closed above the 100-day moving average.

- Friday’s WASDE report was relatively neutral for soybeans, but they got a boost from sharply higher soybean oil and friendly numbers for corn and wheat. Once again, the USDA was very conservative with adjusting Brazilian production and only lowered it by 1 mmt. CONAB maintains a much lower estimate that will be updated tomorrow.

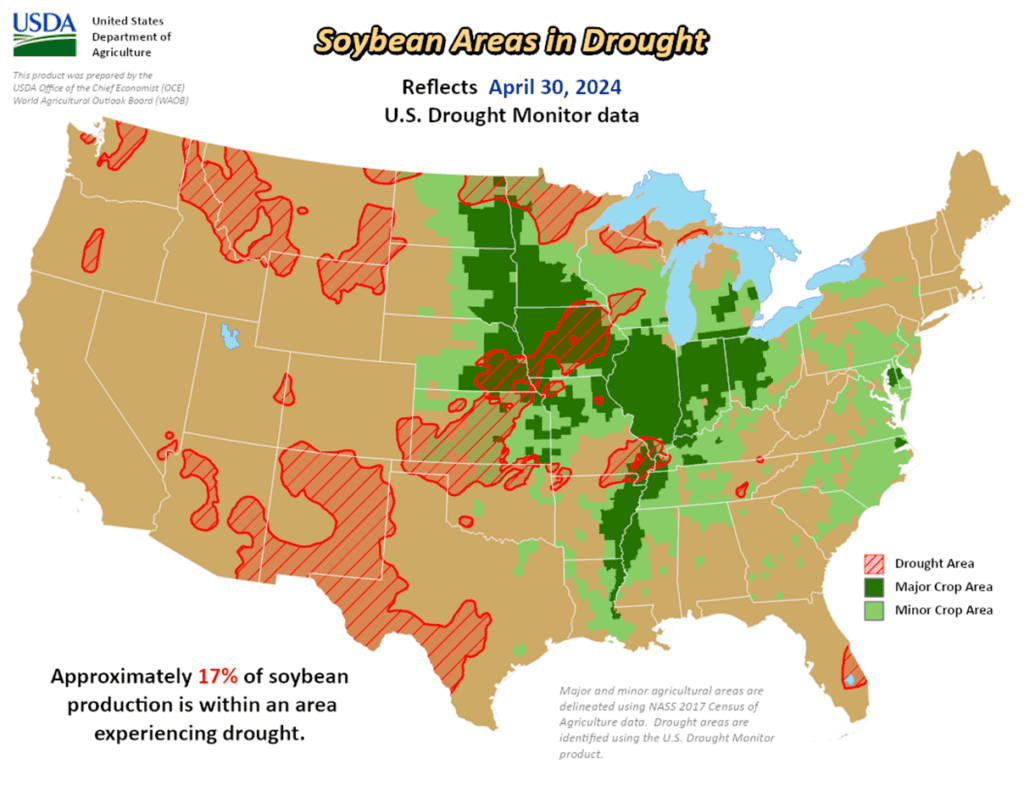

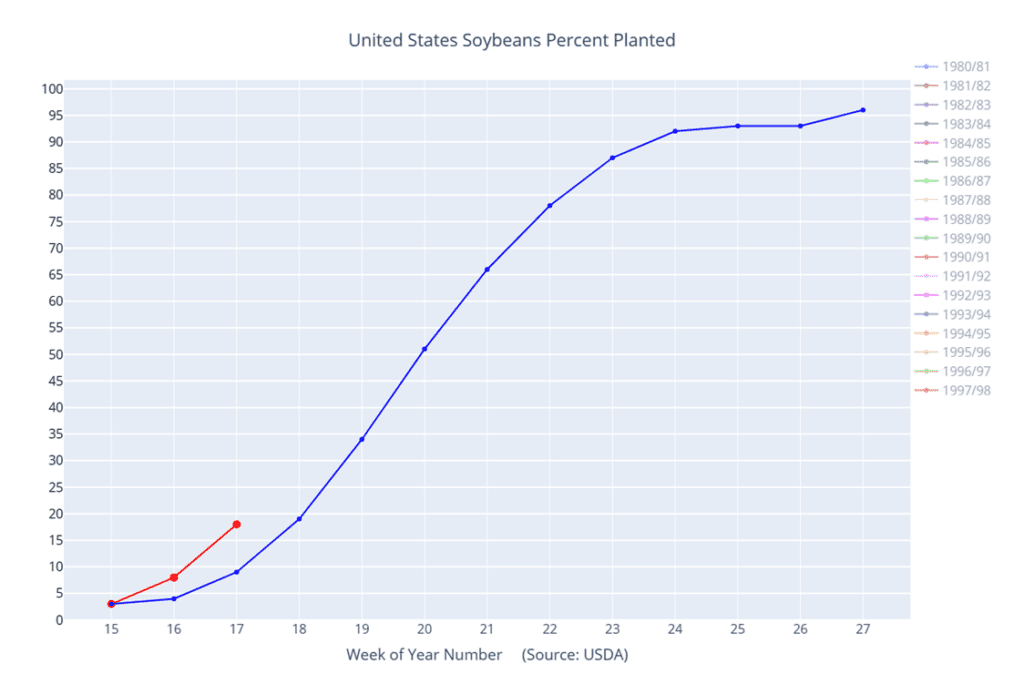

- Planting faced challenges again last week with rain across most of the Midwest, but some work was able to get done over the weekend. The USDA will release its crop progress report later today, and analysts expect that 38% will have been planted as of Sunday which compares to 25% last week and 49% last year.

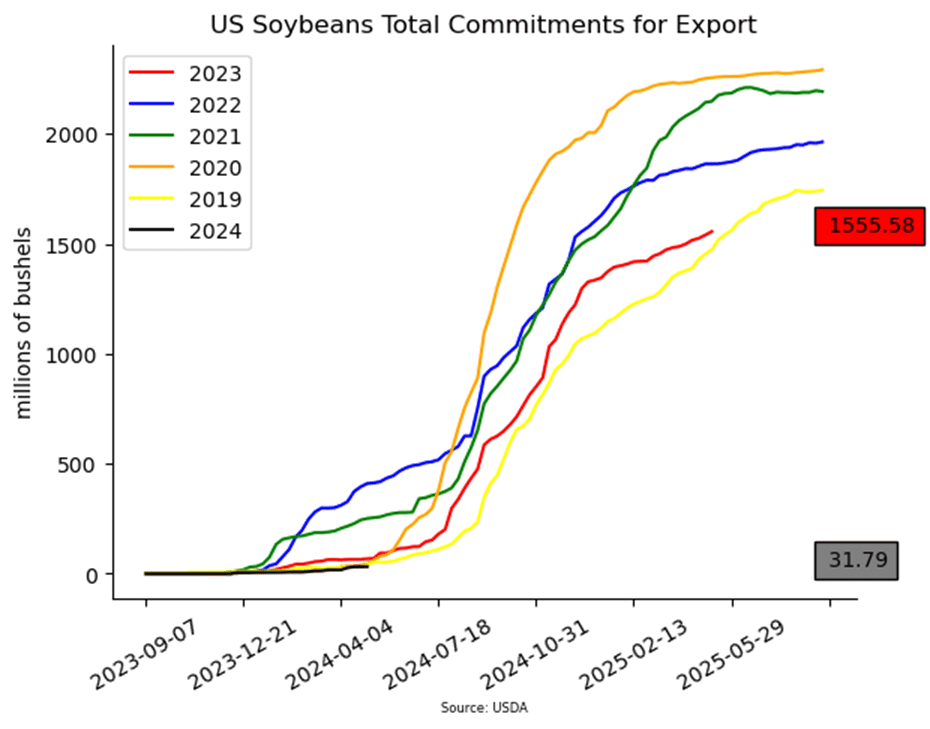

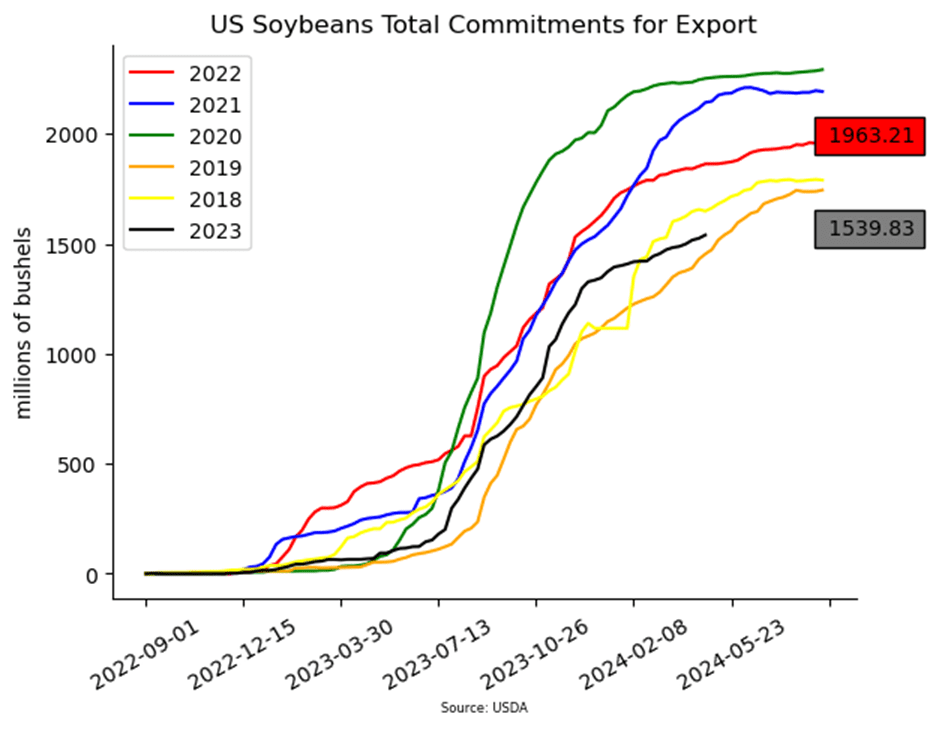

- Today’s export inspections report showed an increase of 14.9 mb of soybeans which puts total inspections at 1.453 billion bushels which is down 18% from the previous year.

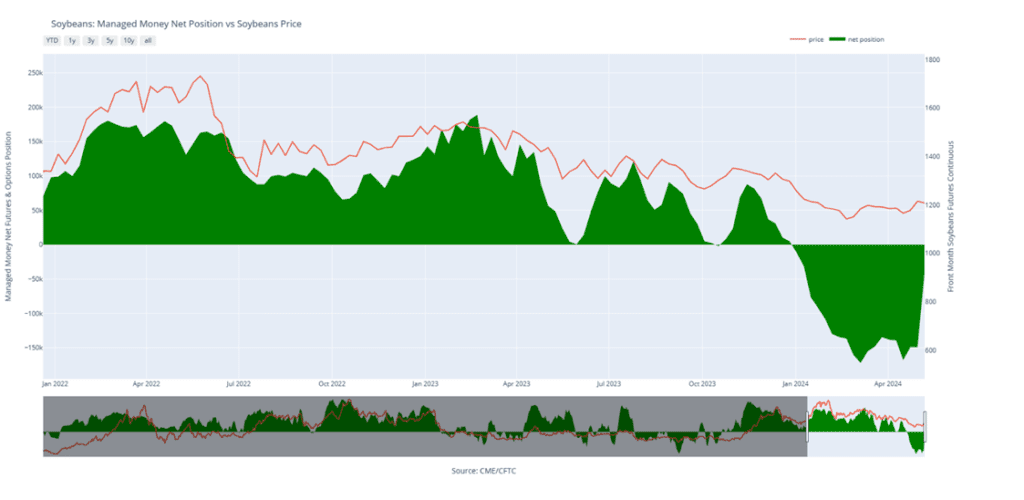

- Friday’s CFTC report showed funds covering a huge portion of their short position buying back 107,783 contracts, leaving them net short just 41,453 contracts. That short covering resulted in a rally of about a dollar.

Above: July soybeans found nearby support at the 100-day moving average after reversing lower from the 1256 ½ high on May 7. Should this support hold and prices close above the May 7 high, they may again be poised to close the 1290 ¾ – 1296 ¾ gap and test the 1328 – 1352 resistance area. A close below the 100-day ma could set the market up for further declines with support between 1192 – 1146.

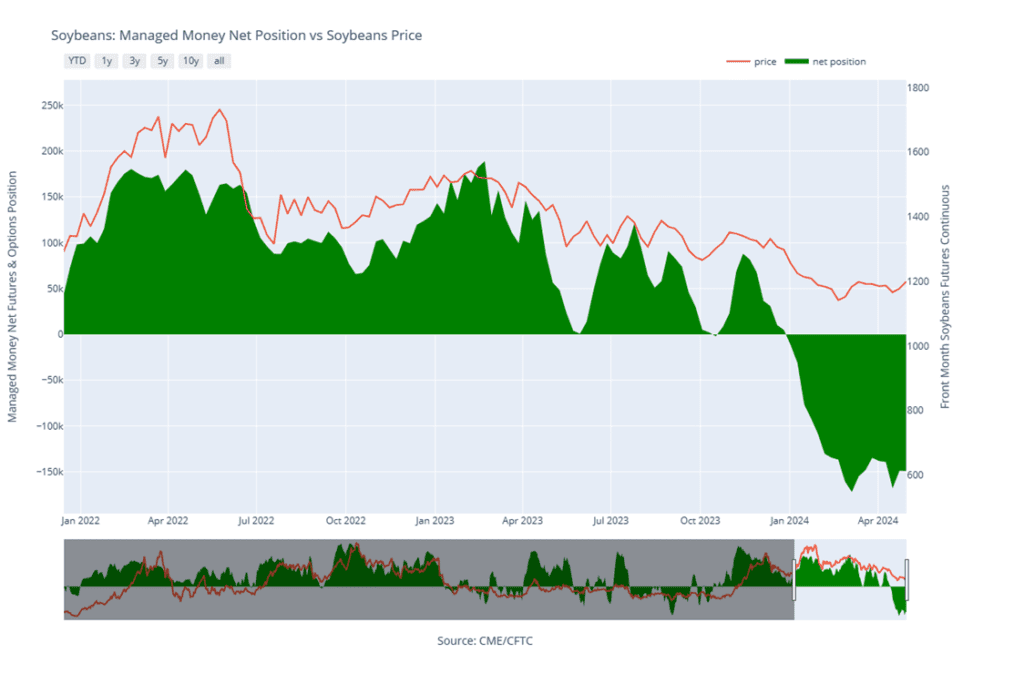

Soybean Managed Money Funds net position as of Tuesday, May 7. Net position in Green versus price in Red. Money Managers net bought 107,783 contracts between May 1 – 7, bringing their total position to a net short 41,453 contracts.

Wheat

Market Notes: Wheat

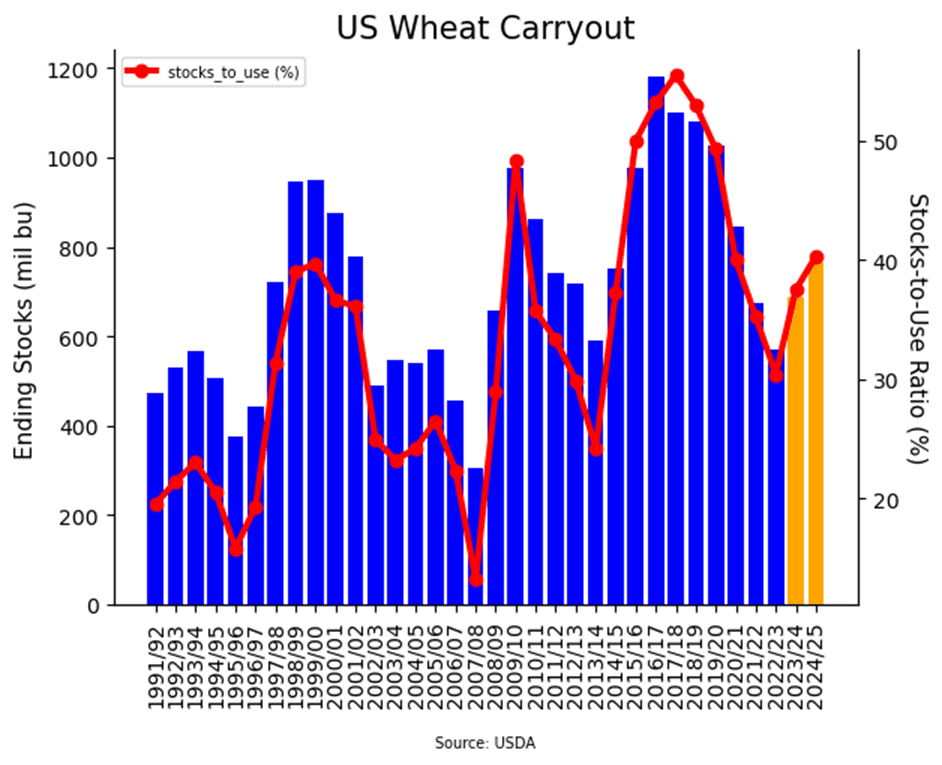

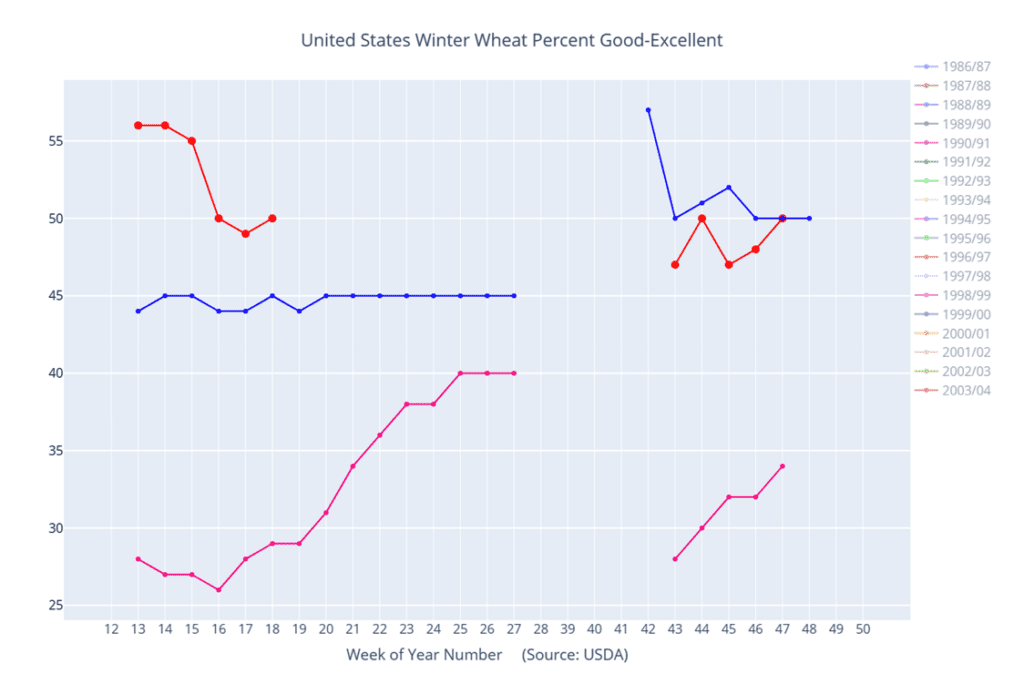

- Wheat closed sharply higher today in all three categories. With the US Dollar Index down and front month September Matif wheat futures reaching the highest level since late July of last year, funds are believed to be continuing to buy back their short positions in the wheat complex.

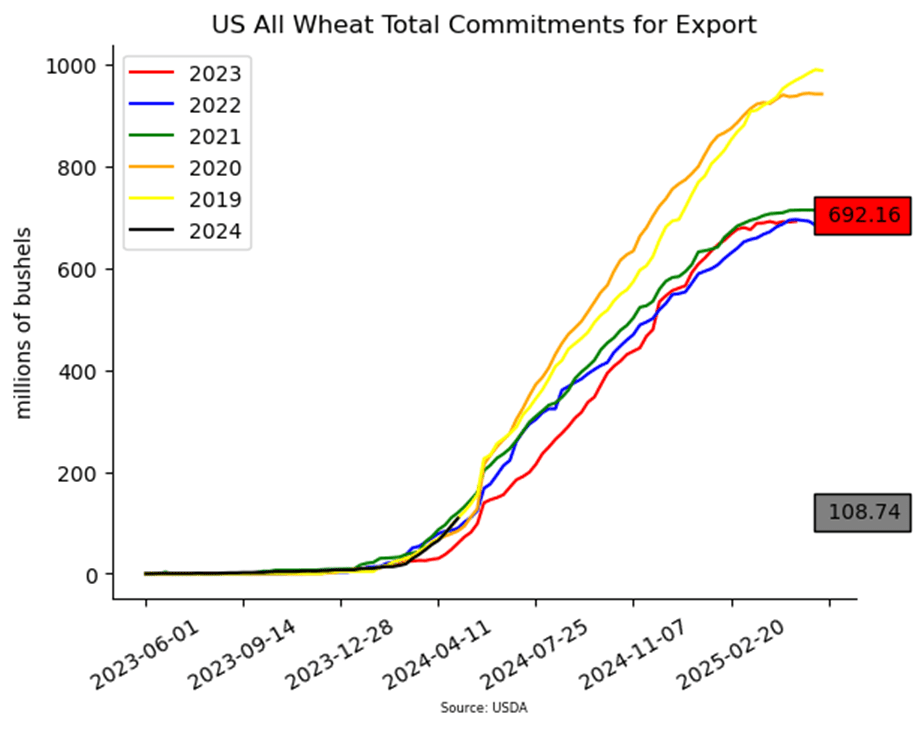

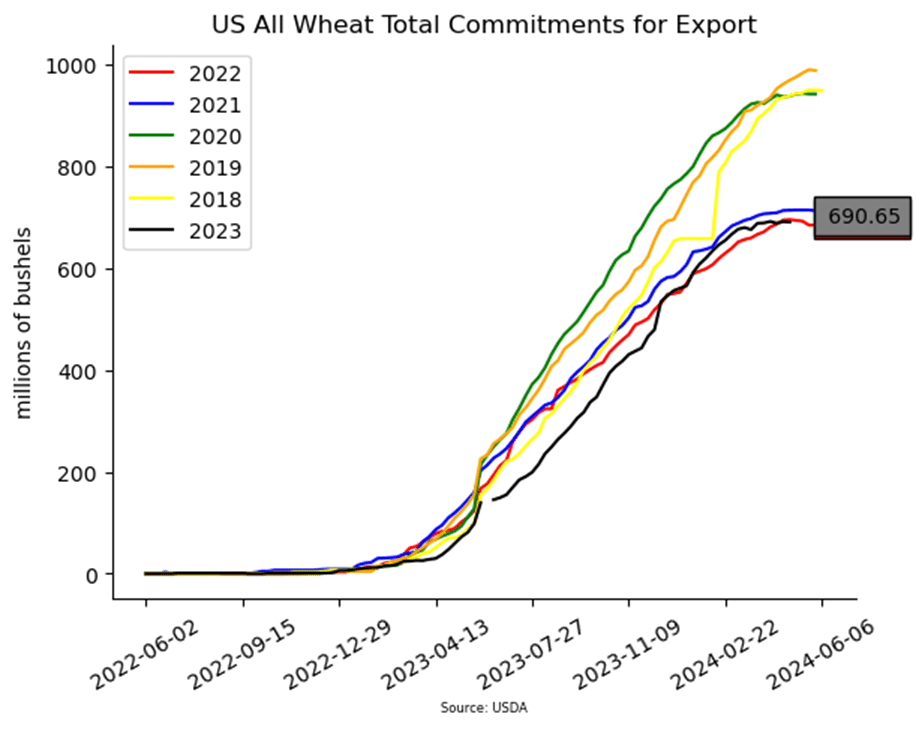

- Weekly wheat export inspections at 13.5 mb bring the total 23/24 inspections to 649 mb, which is down 6% from a year ago. The USDA is now estimating 23/24 exports at 720 mb, up 10 mb from the previous estimate, but still down 5% compared to last year.

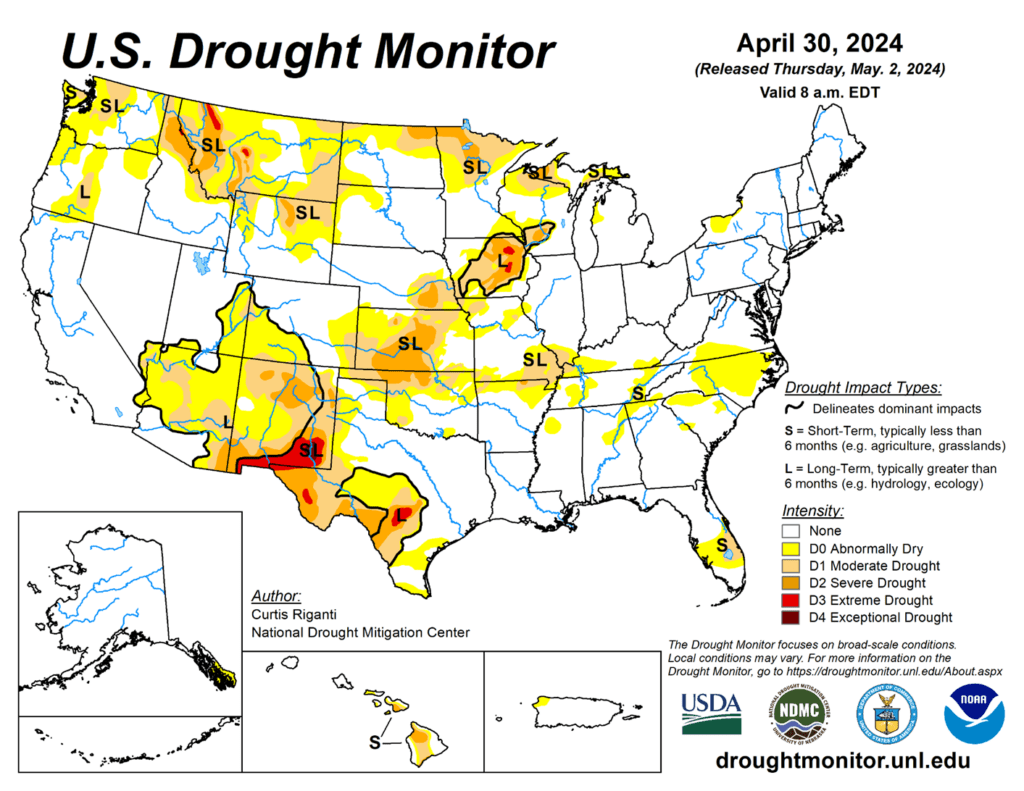

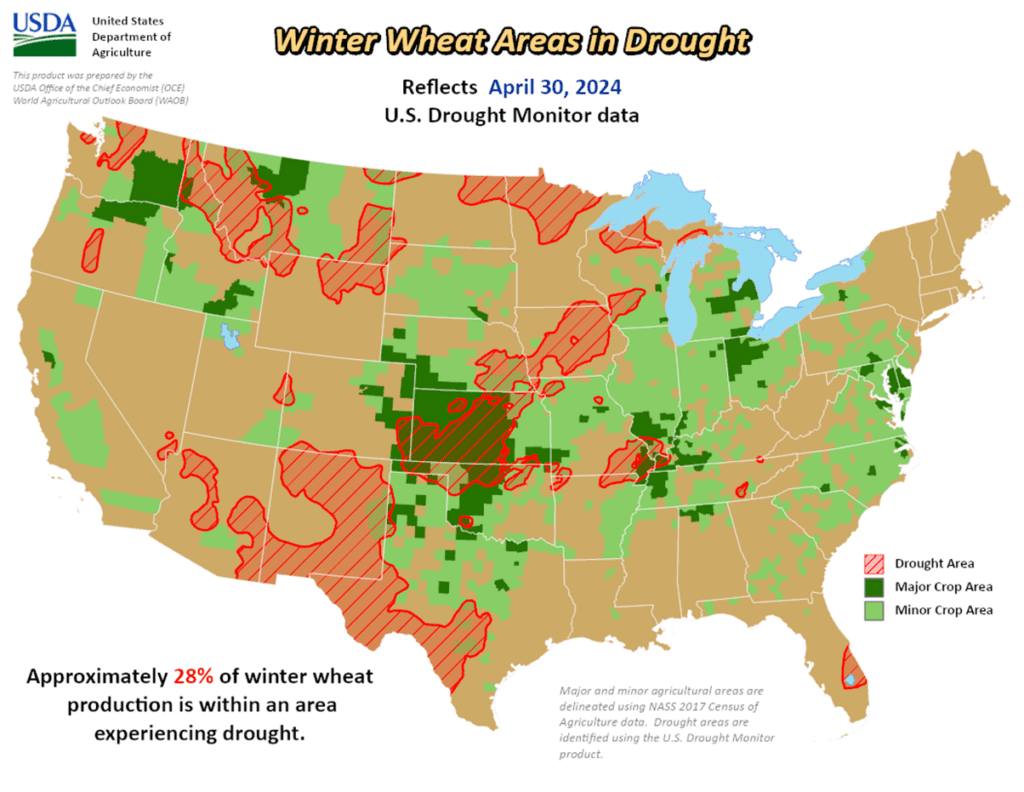

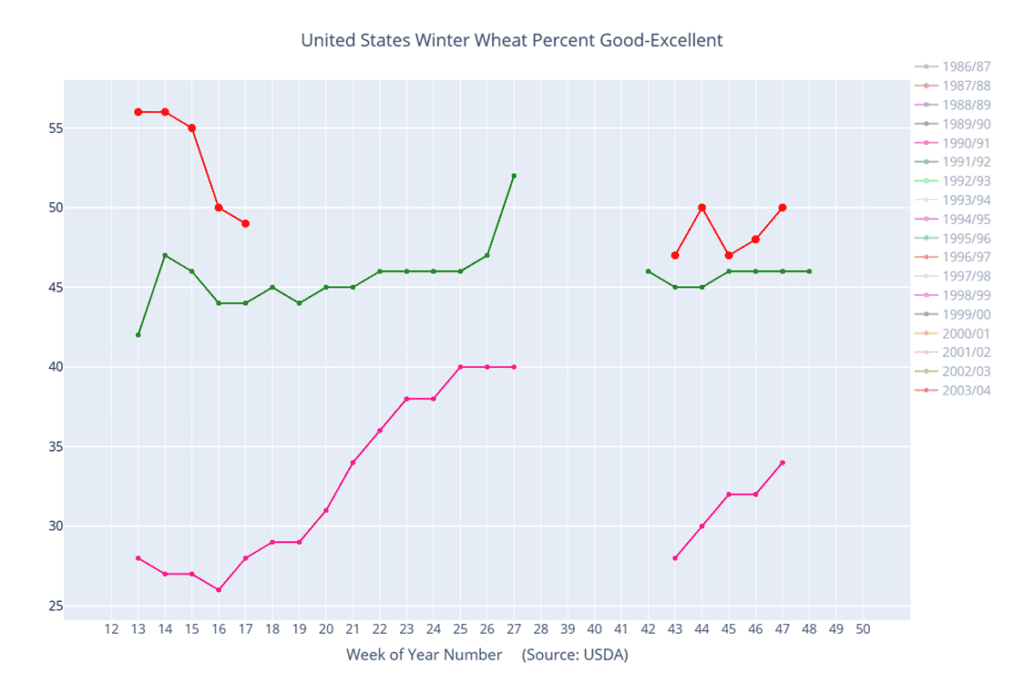

- New threats of freeze damage in Russia over the weekend may have caused some additional fund short covering today, with SovEcon reducing their estimate of Russian wheat production by 3.5 mmt to 89.6 mmt. Dryness in the Black Sea area remains a concern as well.

- India’s wheat stocks are said to have hit a 16-year low; their government has made record sales from its reserves in an effort to lower food prices and inflation. This could mean that India will be a net importer of wheat, which would add bullishness to the market.

- In the southern hemisphere, weather concerns are arising that could impact wheat. Cold conditions in Argentina have led to frost, potentially affecting recently planted winter wheat. Meanwhile, in Australia, most areas remain too dry. Although New South Wales received some rainfall over the weekend, conditions outside of this region haven’t been favorable for winter wheat. Farmers in these areas are anticipating improved soil moisture as the transition to La Niña unfolds in the coming months.

Chicago Wheat Action Plan Summary

Support near the 200-day moving average has held, and the close above 633 ¼ opens the door for the market to test the area of 664 and then 684 as it moves toward the July high of 777 ¼. A slide lower and a close below 593 ½ may encounter support around the 50-day moving average with 548 support below that.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Since weather became a much more dominant story for the wheat market, it appears that Chicago wheat may have established a springtime low. In light of this, Grain Market Insider has issued two separate recommendations to exit the second half of the July ’24 Chicago wheat 590 puts that were recommended for purchase last August. Considering that the crop is still developing, and weather remains a factor, we are aiming to recommend further sales within the 685 – 715 range versus July ’24 futures.

- Grain Market Insider sees a continued opportunity to sell another portion of your estimated 2025 SRW wheat production. Since our last sales recommendation for next year’s SRW wheat crop, July ’25 Chicago has rallied over 70 cents and is approaching the 62% retracement level from the March low back to contract highs, as Managed funds cover their extensive net short positions on world production concerns for this year’s crop. While plenty of time remains for other bullish factors to enter the scene that could push prices further, this rally may primarily be weather driven and short-lived, and we advise you to take advantage of these elevated prices to sell another portion of your estimated 2025 SRW production.

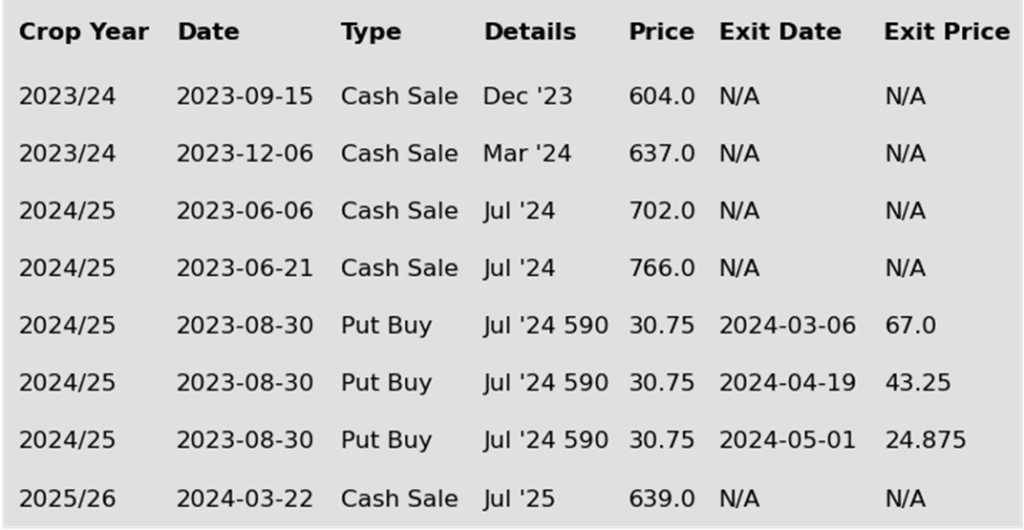

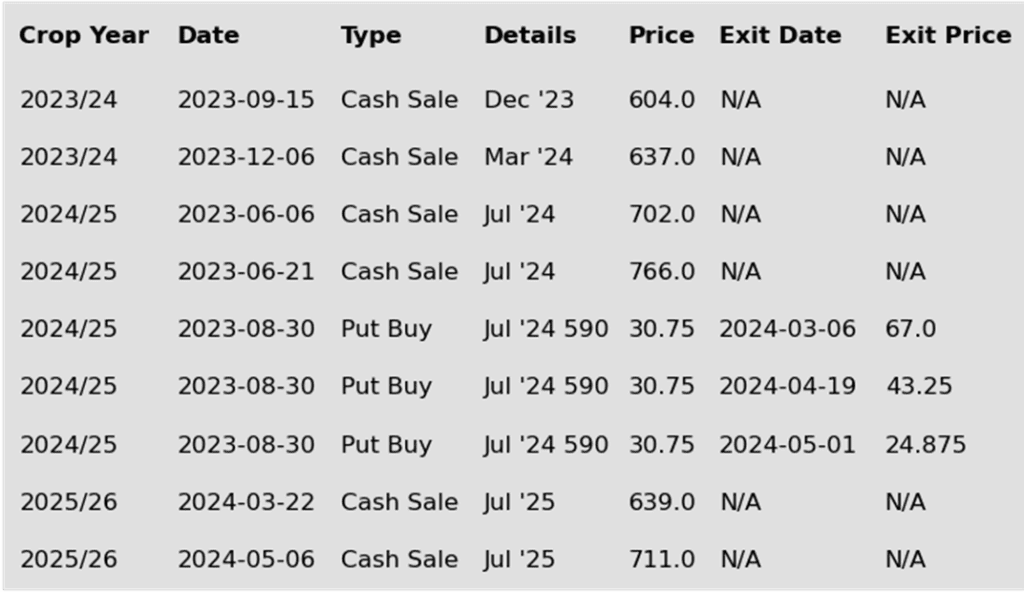

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: With the market close above 684, it remains on track to move toward the July high of 777 ¼, though it may encounter psychological resistance around 700. A slide lower and a close below 628 nearby support puts the market at risk of testing the 593 area from late April.

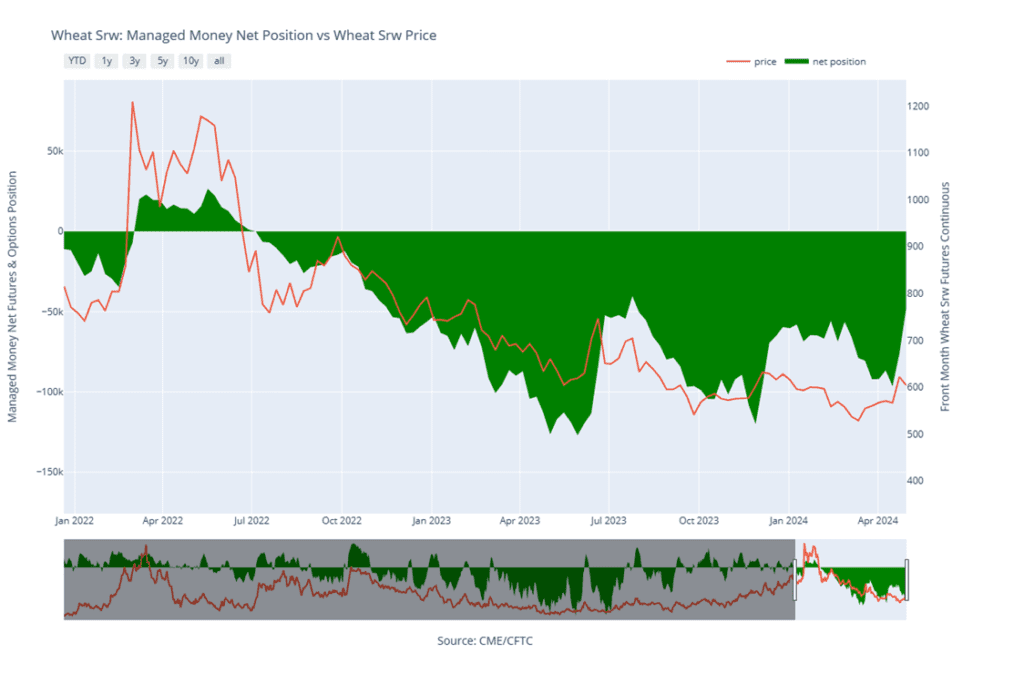

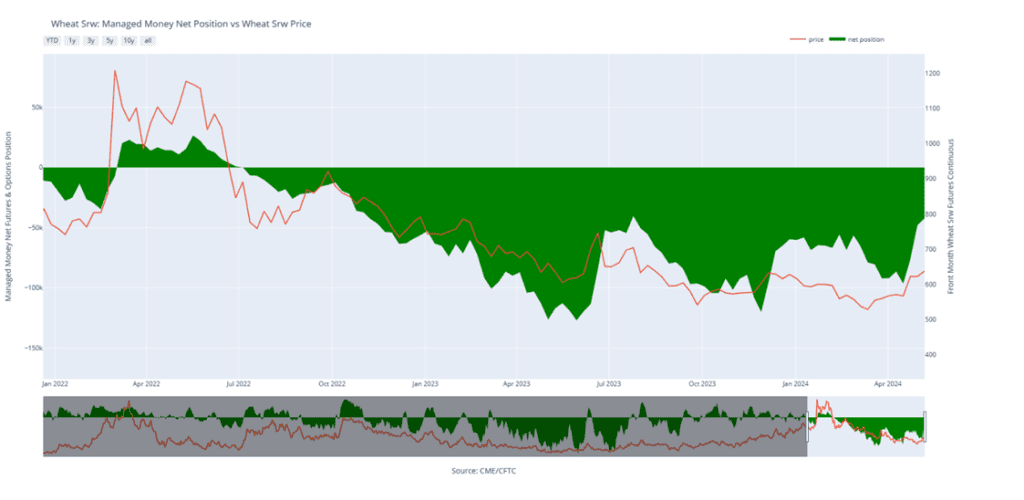

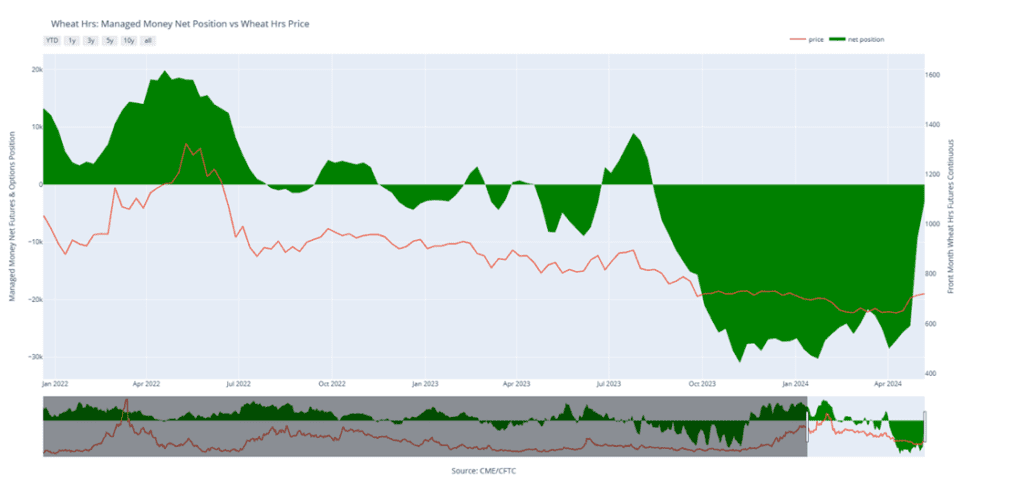

Chicago Wheat Managed Money Funds net position as of Tuesday, May 7. Net position in Green versus price in Red. Money Managers net bought 5,506 contracts between May 1 – 7, bringing their total position to a net short 42,360 contracts.

KC Wheat Action Plan Summary

Between the end of February and the middle of April, KC wheat was mostly rangebound between the mid 590s on the topside and mid 550s down low, with little to move prices higher, all the while Managed funds continued adding to their large net short positions. Toward the end of April, dryness in the Black Sea region and the US HRW growing areas started becoming more concerning and triggered a short covering rally across the wheat complex, driving prices to levels not seen since last December. Although US wheat exports continue to struggle to compete on the world market, which can keep a lid on US prices, and while Managed funds covered a significant portion of their net short positions, they remain short the market, which could still push prices higher if production concerns persist.

- No new action is recommended for 2023 KC wheat. Considering time is getting limited before the ’24 crop harvest, we recommended two sales on this most recent runup in prices to get old crop HRW wheat marketed. With that said, we are currently evaluating the market situation before setting a target for what will likely be our last sales recommendation for the 2023 HRW crop year.

- No new action is recommended for 2024 KC wheat. Since weather has become a much more dominant driver, marked by the market breaking out of its 2-month long 552 – 605 trading range, we recently recommended making a sale for the 2024 crop considering weather rallies can be short lived. Seeing that the crop is still developing, and weather has become a larger factor, we are currently targeting the 760 – 780 range versus July ’24 futures to recommend additional sales.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

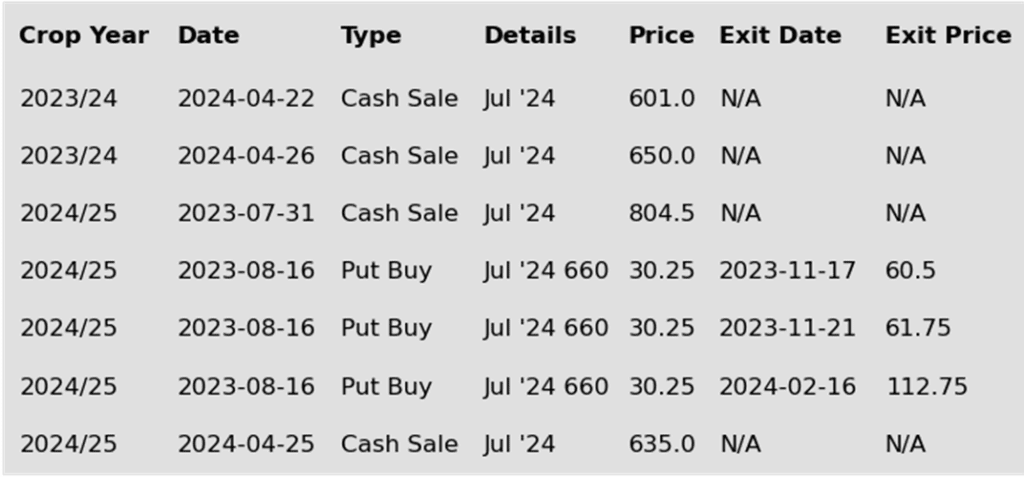

To date, Grain Market Insider has issued the following KC recommendations:

Above: The market close above 679 led it to test the 700 psychological resistance area, a solid close above which could open the door for a rally toward the 720 – 754 congestion area from last September. If the market reverses to the downside, support may be found near 646 and again near 623.

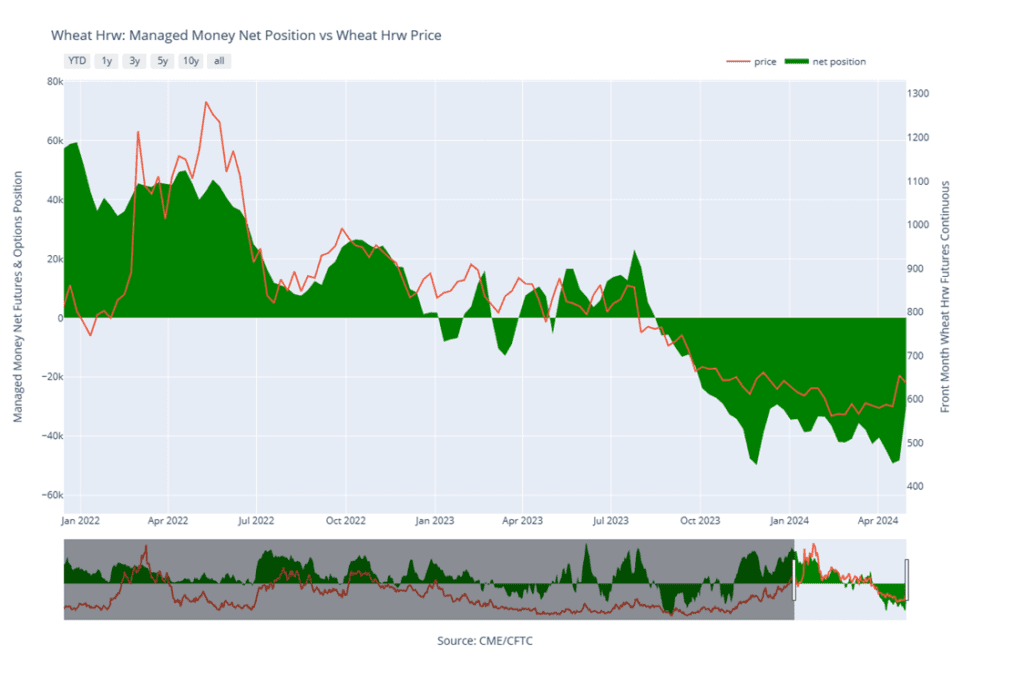

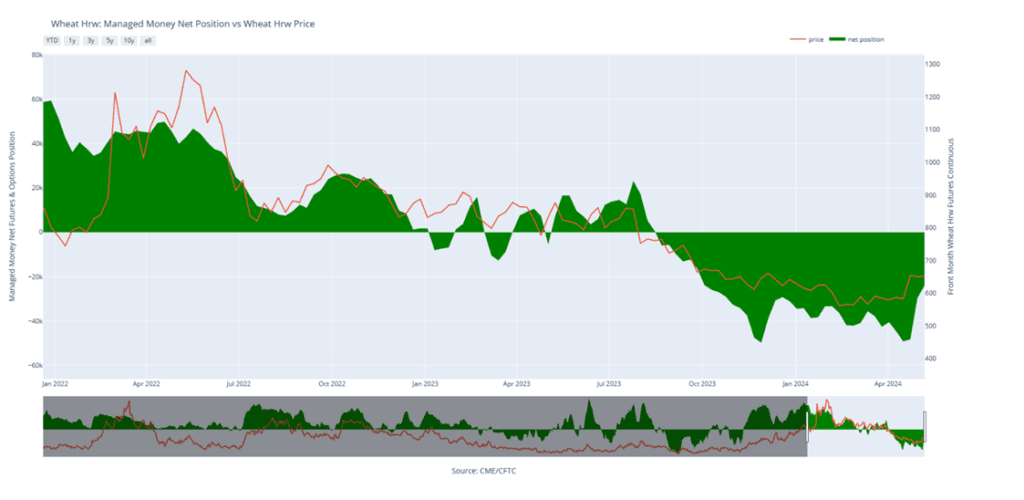

KC Wheat Managed Money Funds net position as of Tuesday, May 7. Net position in Green versus price in Red. Money Managers net bought 5,597 contracts between May 1 – 7, bringing their total position to a net short 24,013 contracts.

Mpls Wheat Action Plan Summary

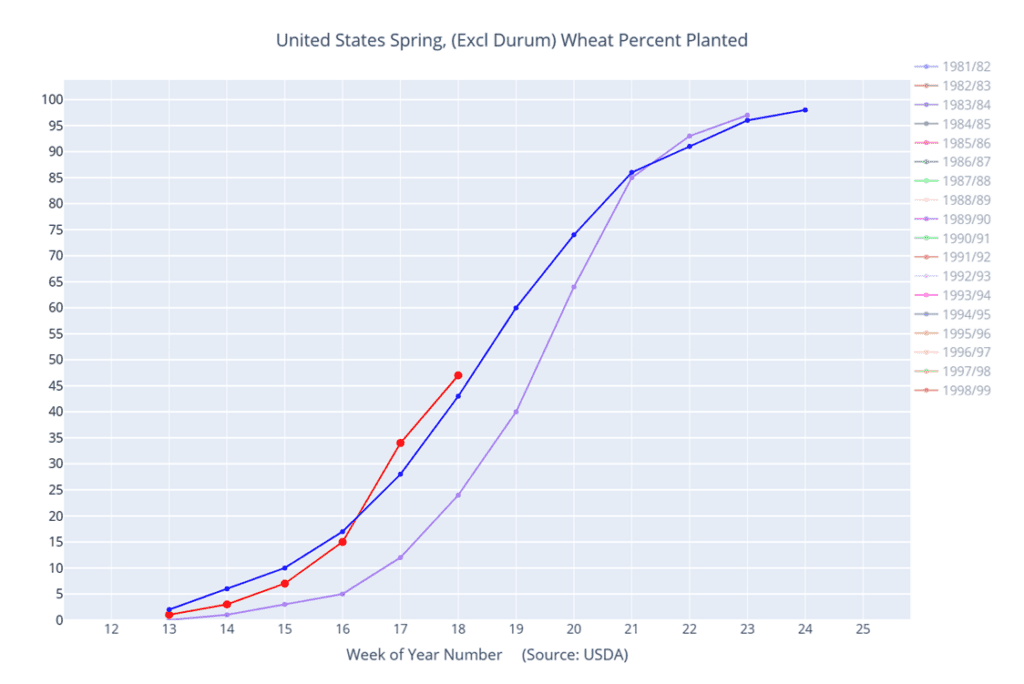

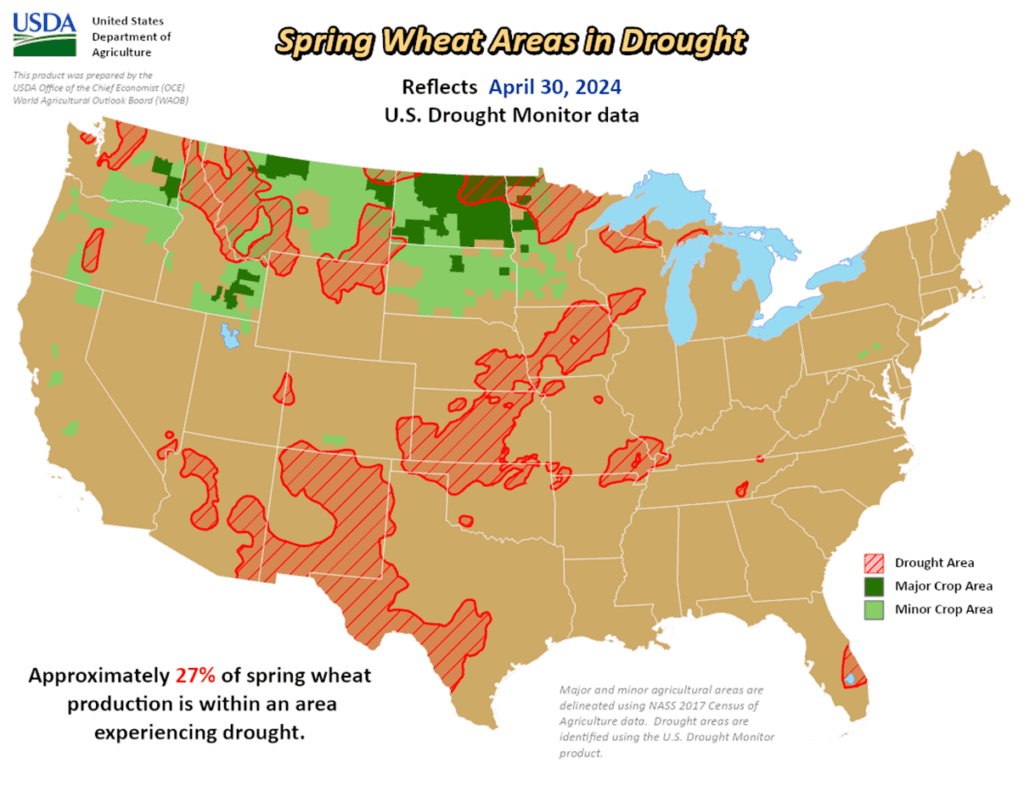

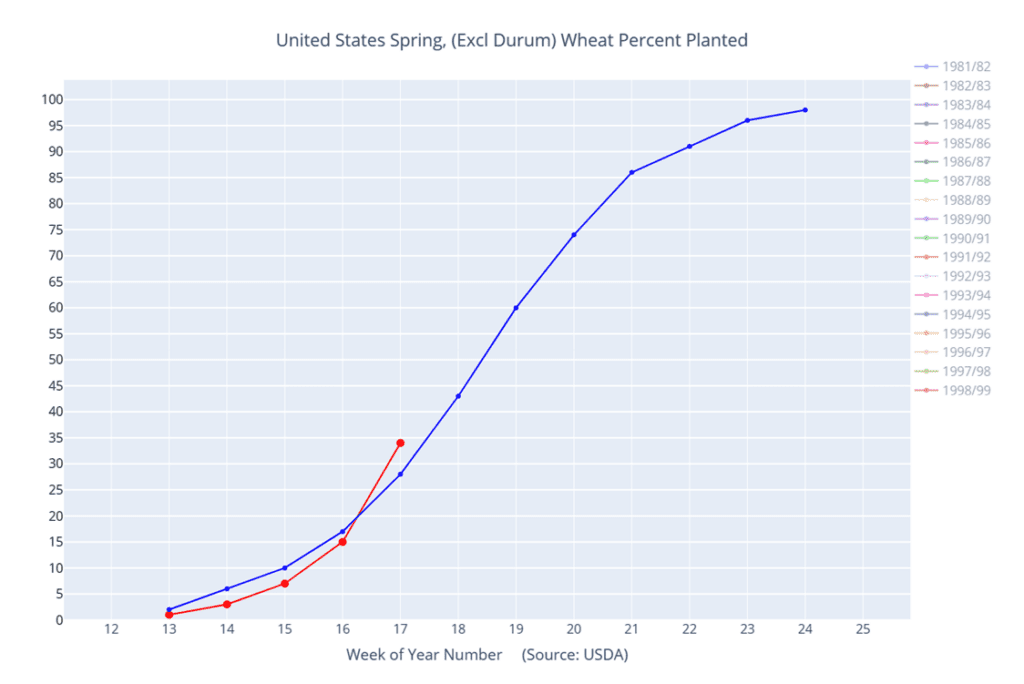

From mid-February through most of April, Minneapolis wheat traded mostly sideways to lower, lacking significant bullish fundamental news to drive prices upward. However, in late April, spurred by concerns over the world wheat crop and dry conditions in the HRW growing regions, Minneapolis wheat experienced a rally back towards last fall’s highs. Despite lingering obstacles for the US wheat market and indications of overbought conditions, historical seasonal trends typically strengthen in late spring and early summer. Moreover, the fact that Managed funds still maintain a net short position suggests the potential for an extended rally if further production concerns emerge.

- Grain Market Insider recommends selling a portion of your 2023 Spring wheat crop. Since mid-April July ’24 Minneapolis wheat has rallied more than 110 cents from the springtime low and is now near last fall’s highs. Given that this rally is likely driven by world supply side concerns and weather, we recommend capitalizing on these elevated prices by selling another portion of your 2023 spring wheat production.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is targeting the 775 – 815 area versus Sept ’24 to recommend making additional sales. We are also targeting the 850 – 900 area to recommend buying upside calls to help protect any sales that would have been made.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The close above 731 could put the July ’24 contract on track to test the November high of 752, and then the 767 – 791 congestion area from last September. Below the market, nearby support remains around 697 – 690 ½, a close below which could signal a further decline toward support levels at 675 and 660.

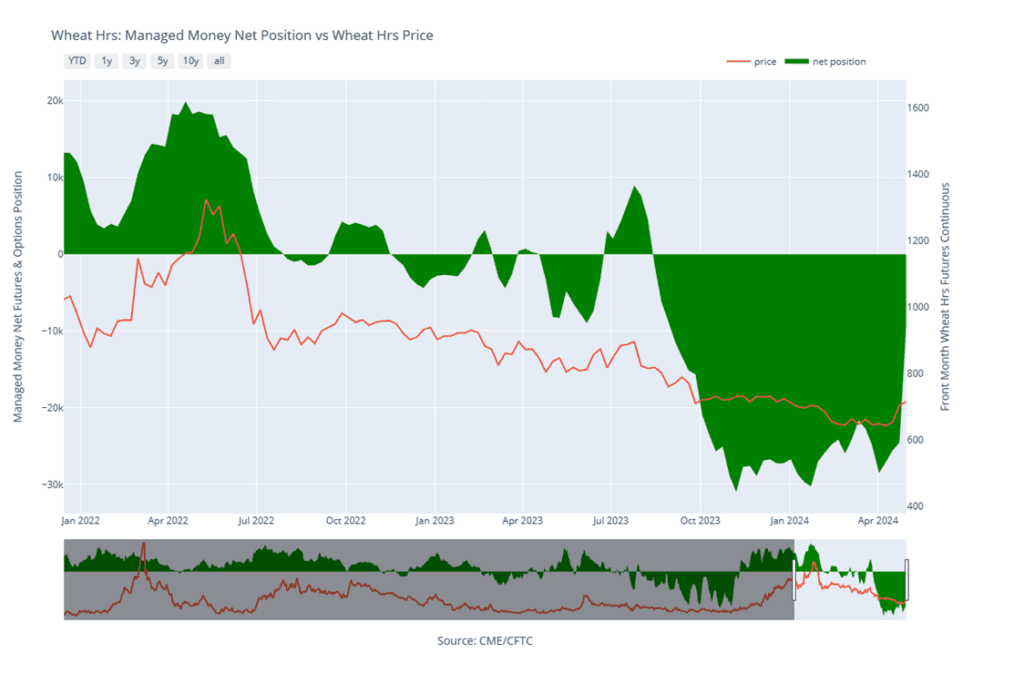

Minneapolis Wheat Managed Money Funds net position as of Tuesday, May 7. Net position in Green versus price in Red. Money Managers net bought 6,284 contracts between May 1 – 7, bringing their total position to a net short 3,010 contracts.

Other Charts / Weather

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Brazil and N. Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.