5-28 End of Day: Markets Reverse from Earlier Highs with Corn and Beans lower; Wheat Higher

All prices as of 2:00 pm Central Time

Grain Market Highlights

- The corn market initially showed early strength, which faded as the wheat market declined. Selling pressure increased further due to weakness in soybeans. Although corn opened strong, it closed near the bottom of its range by the end of the day, resulting in a bearish reversal on the daily chart.

- Soybeans opened strong in the overnight session, but they closed with a bearish reversal due to carryover weakness from sharply lower soybean meal, which also ended with a bearish reversal after hitting a new recent high.

- The wheat complex saw strong gains in the overnight session on renewed concern regarding wheat production in the Black Sea region as IKAR reduced Russia’s wheat crop another 2 mmt. Despite this, all three classes settled well off session highs, with weakness from lower Matif wheat.

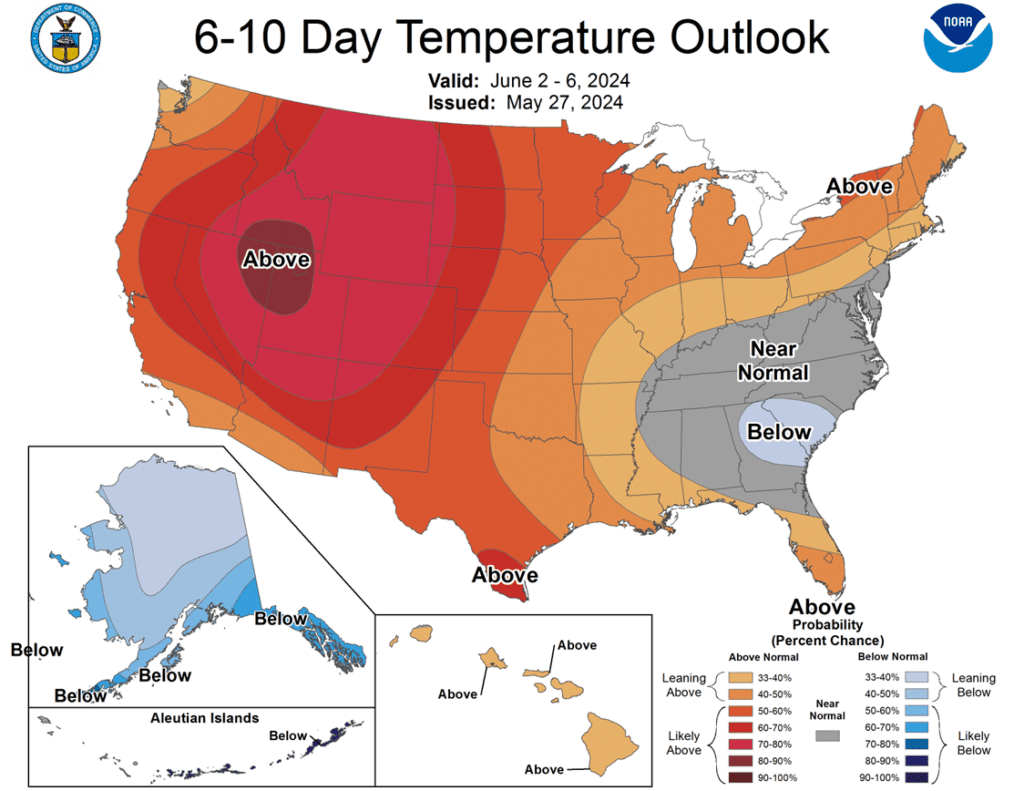

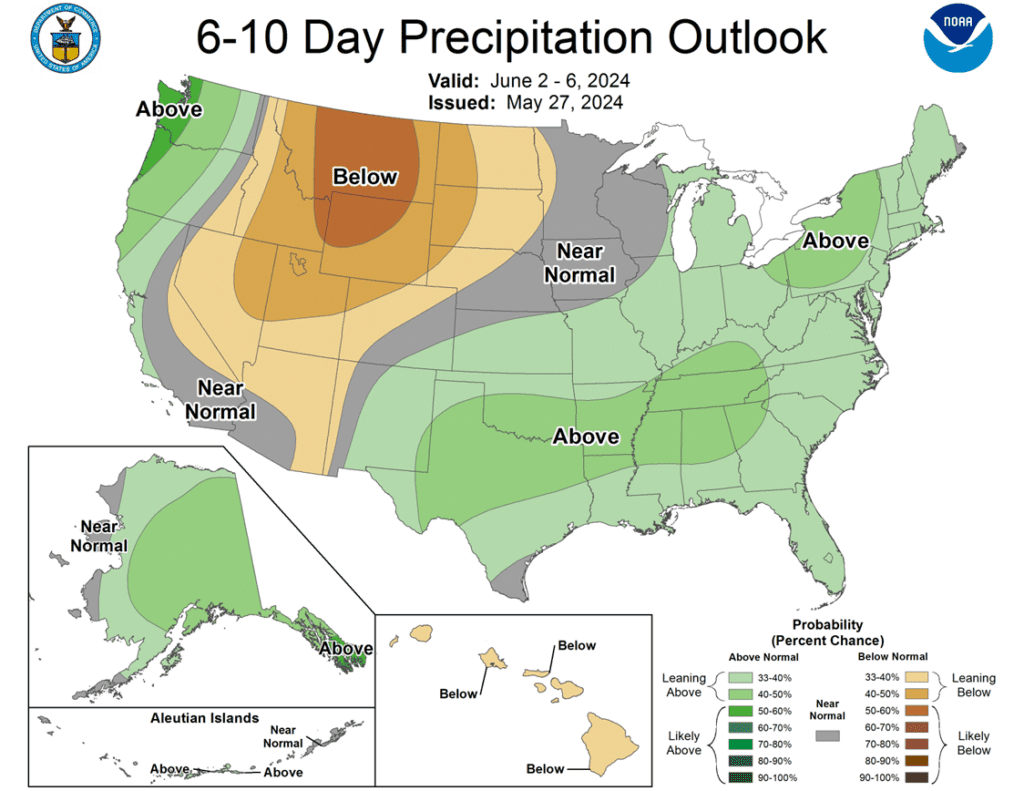

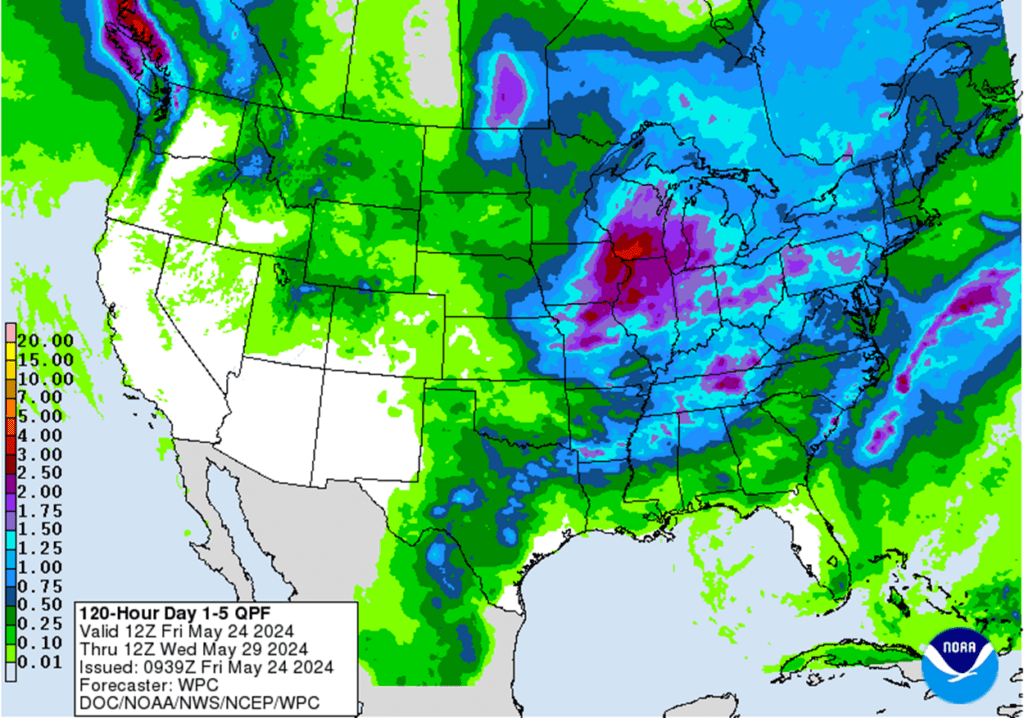

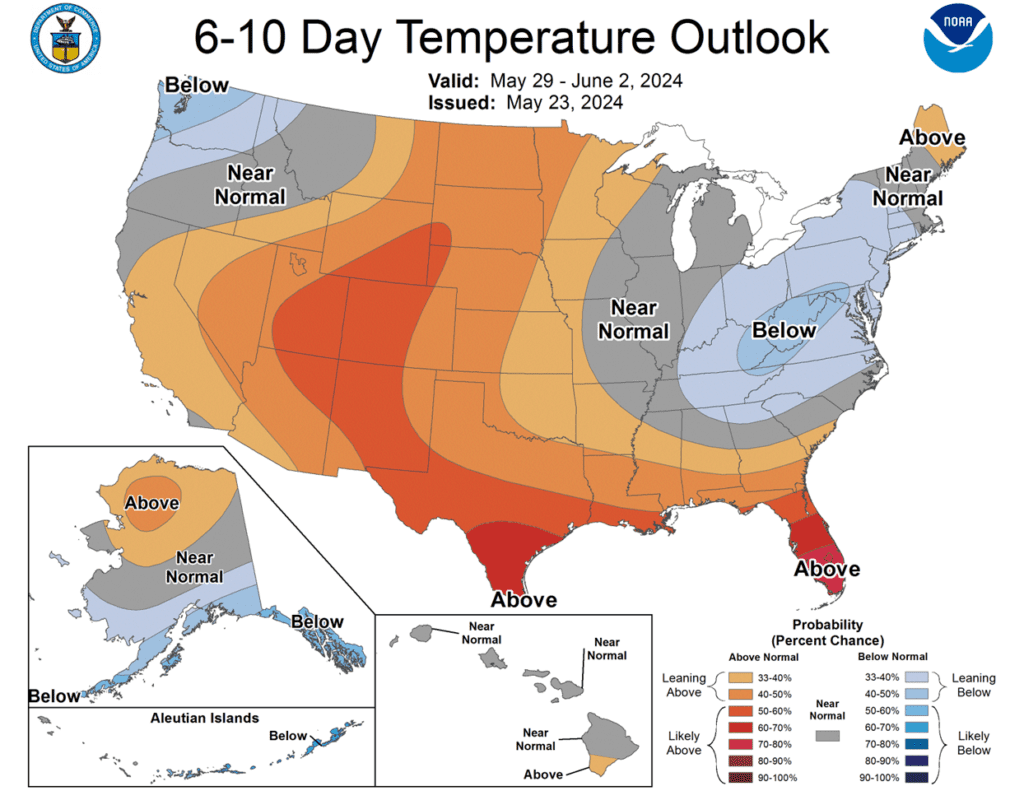

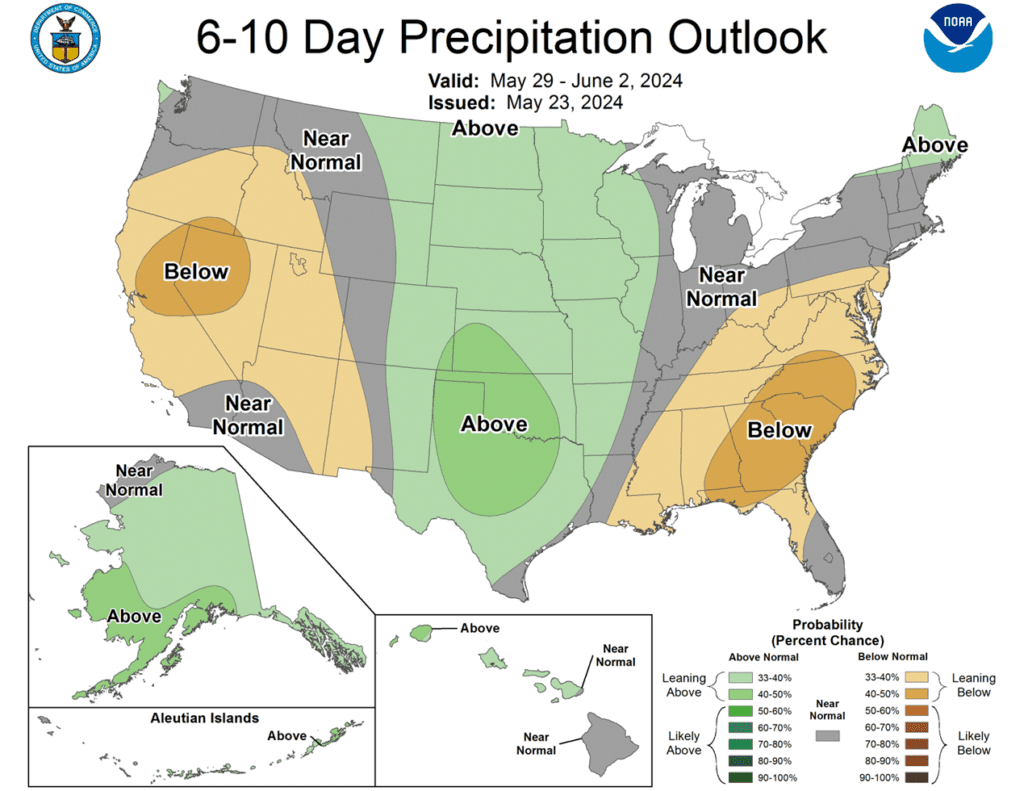

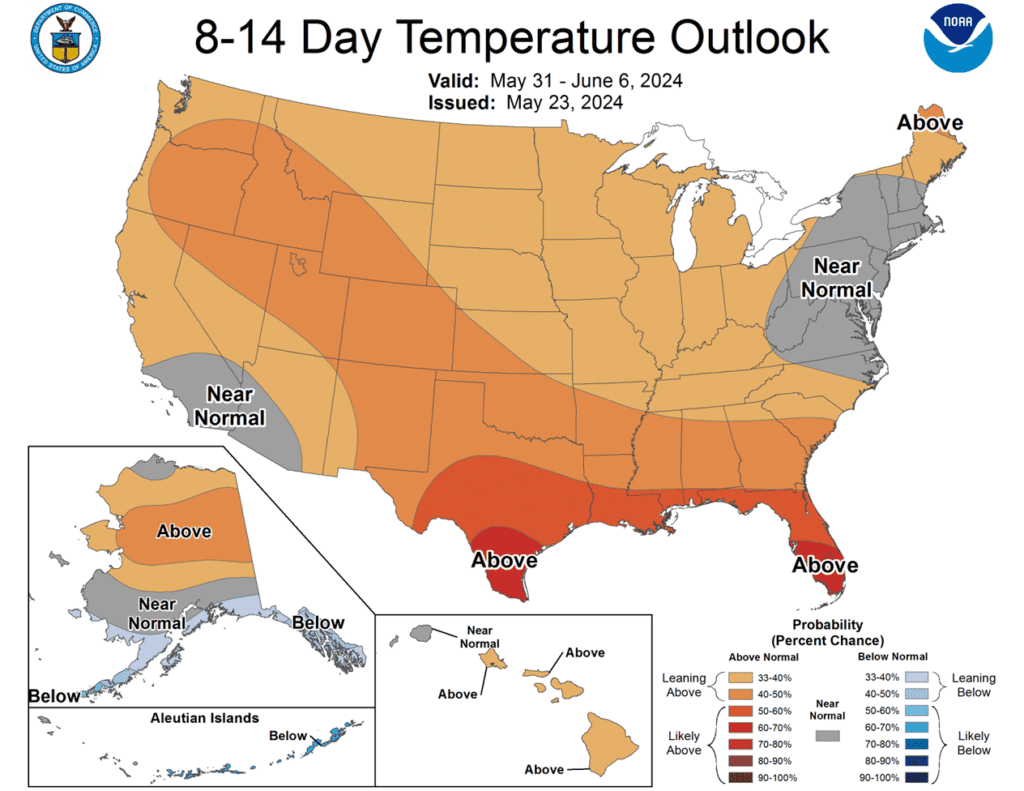

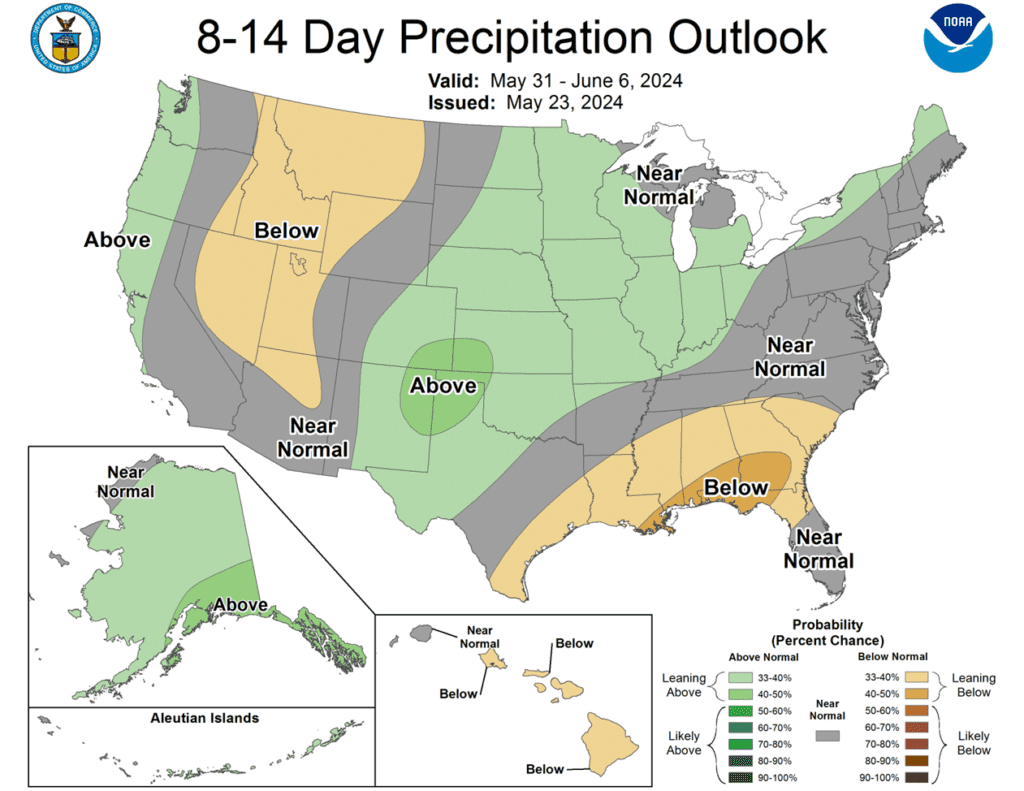

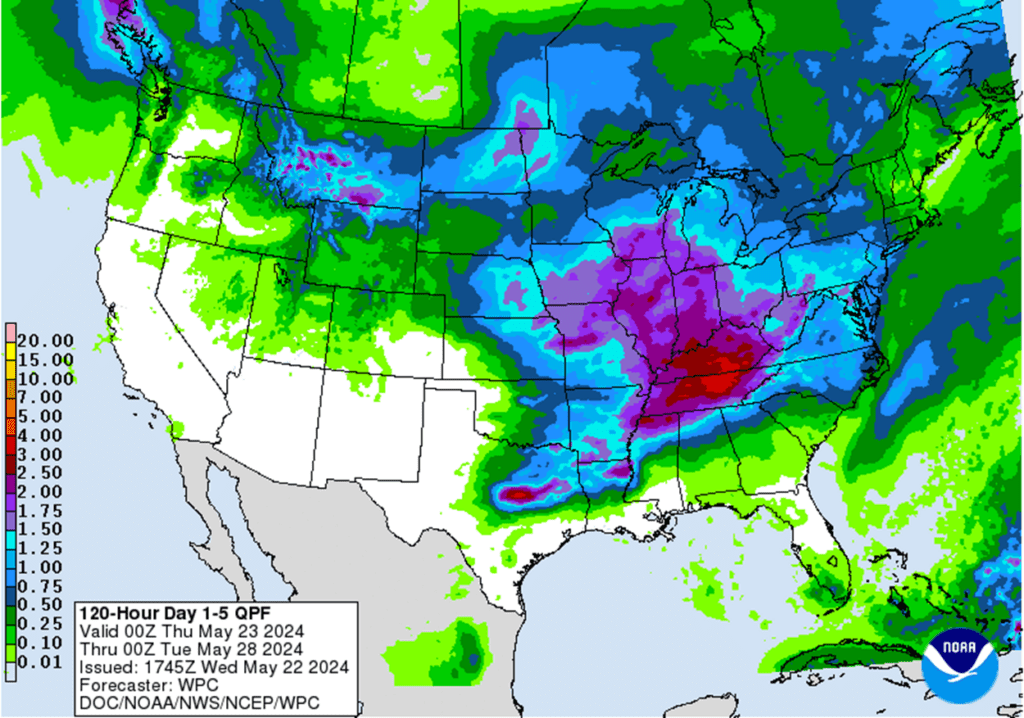

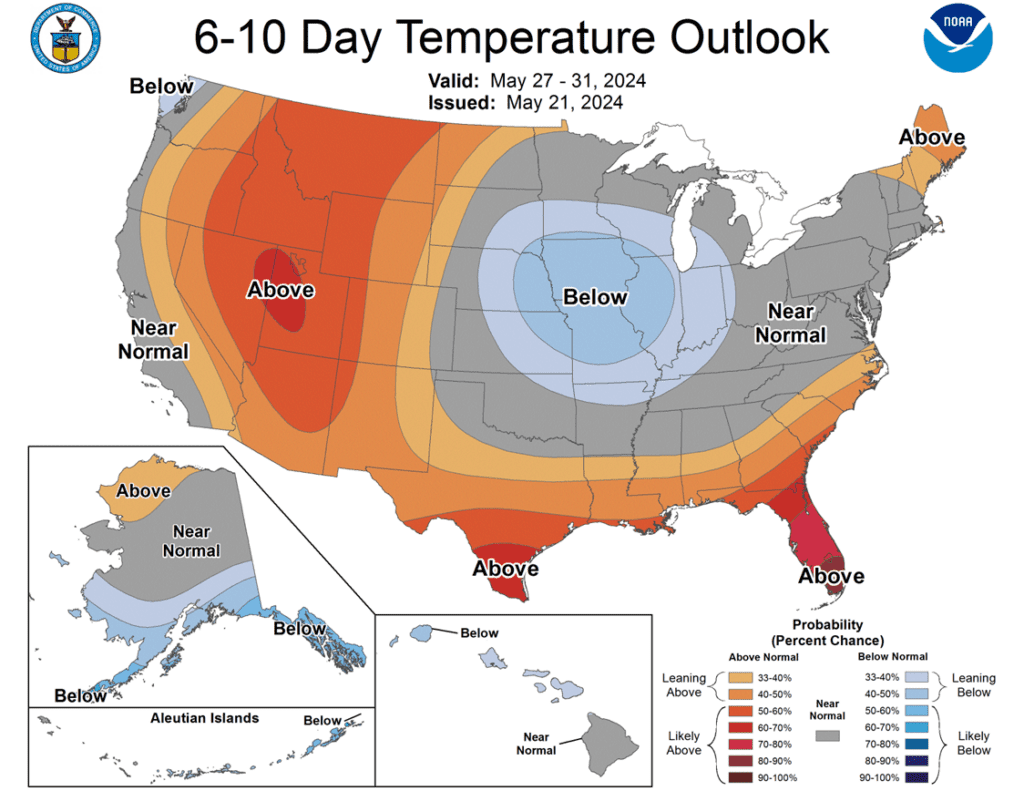

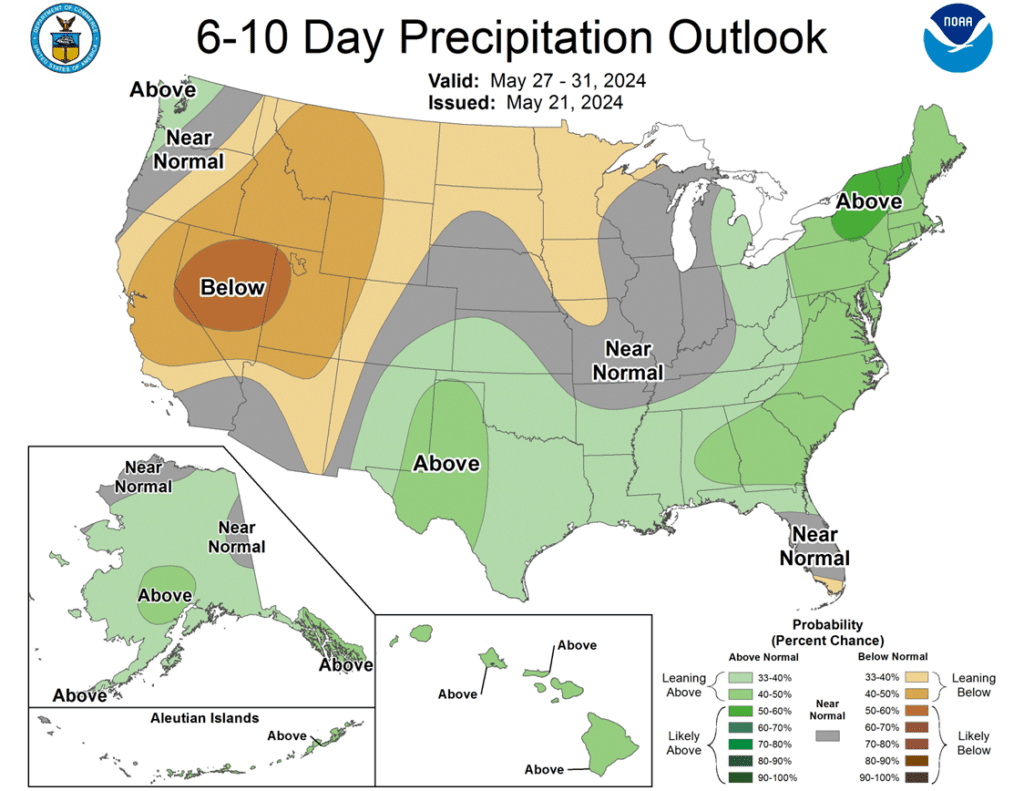

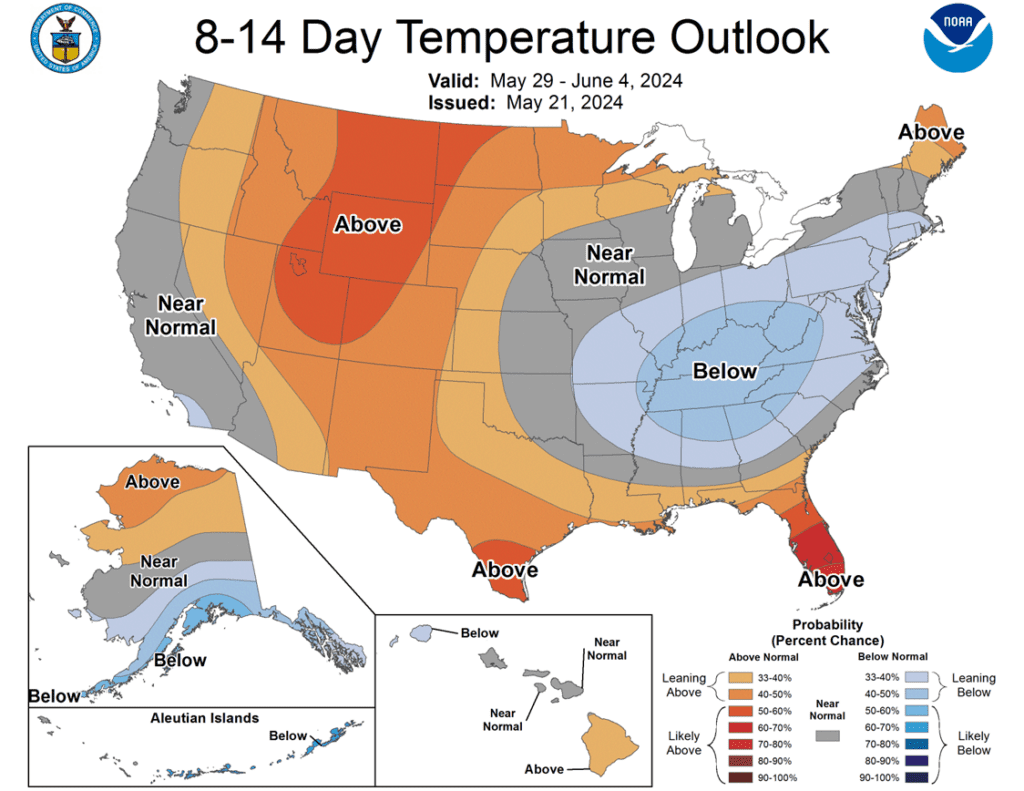

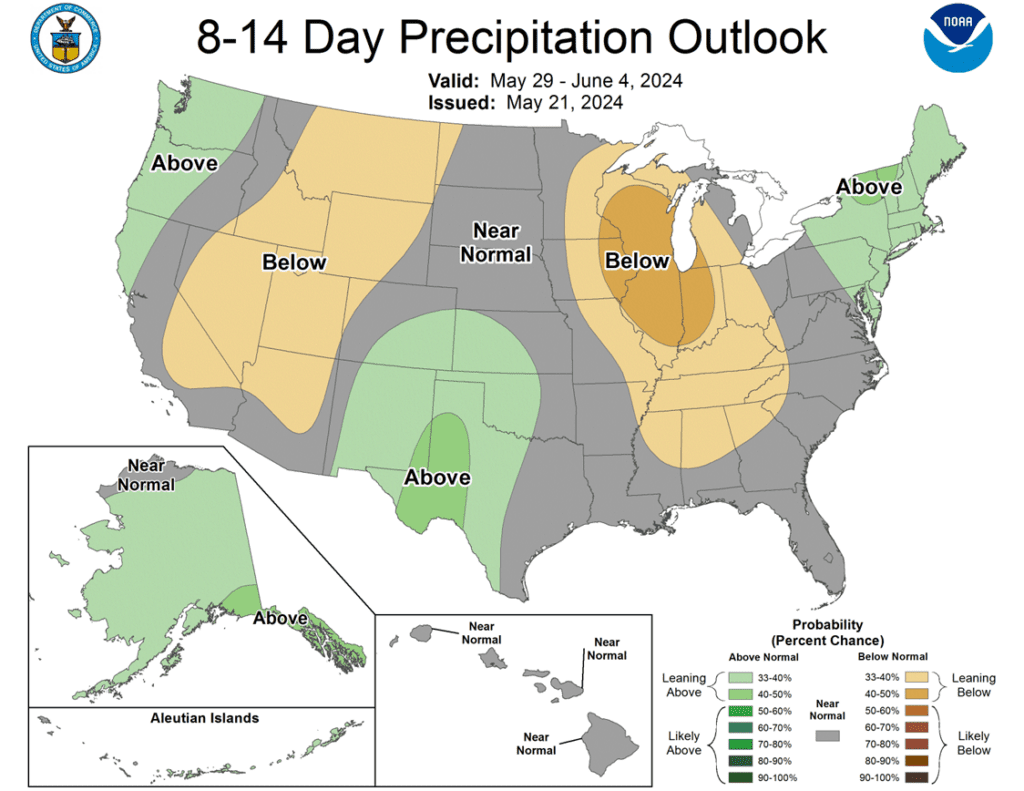

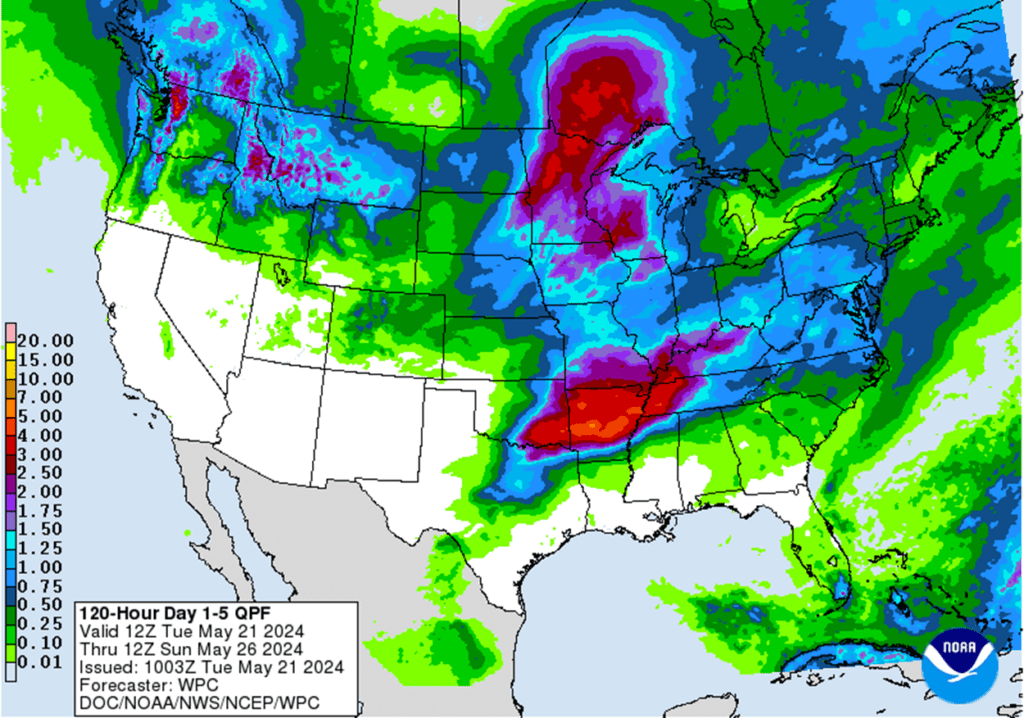

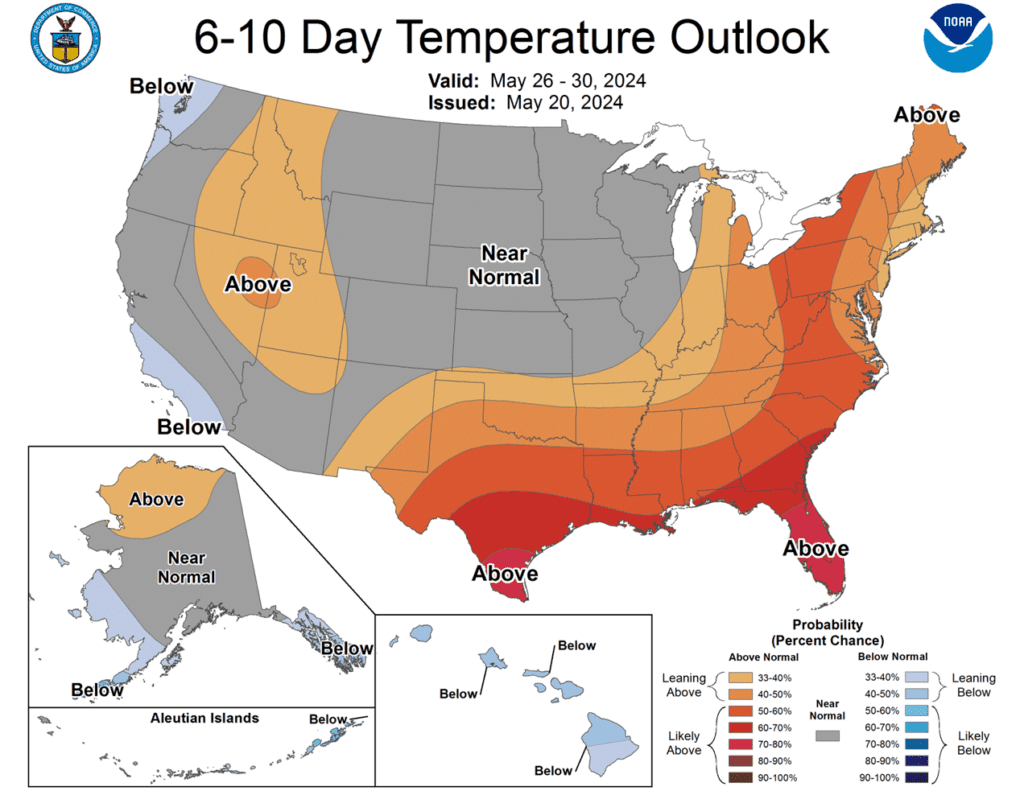

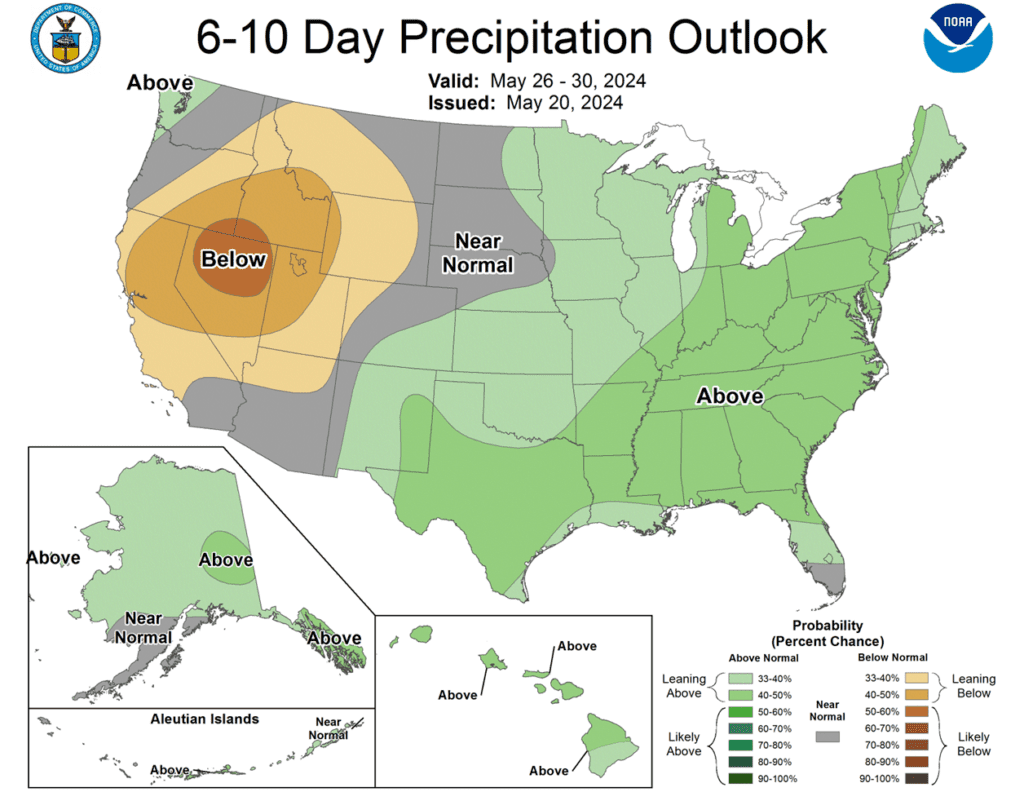

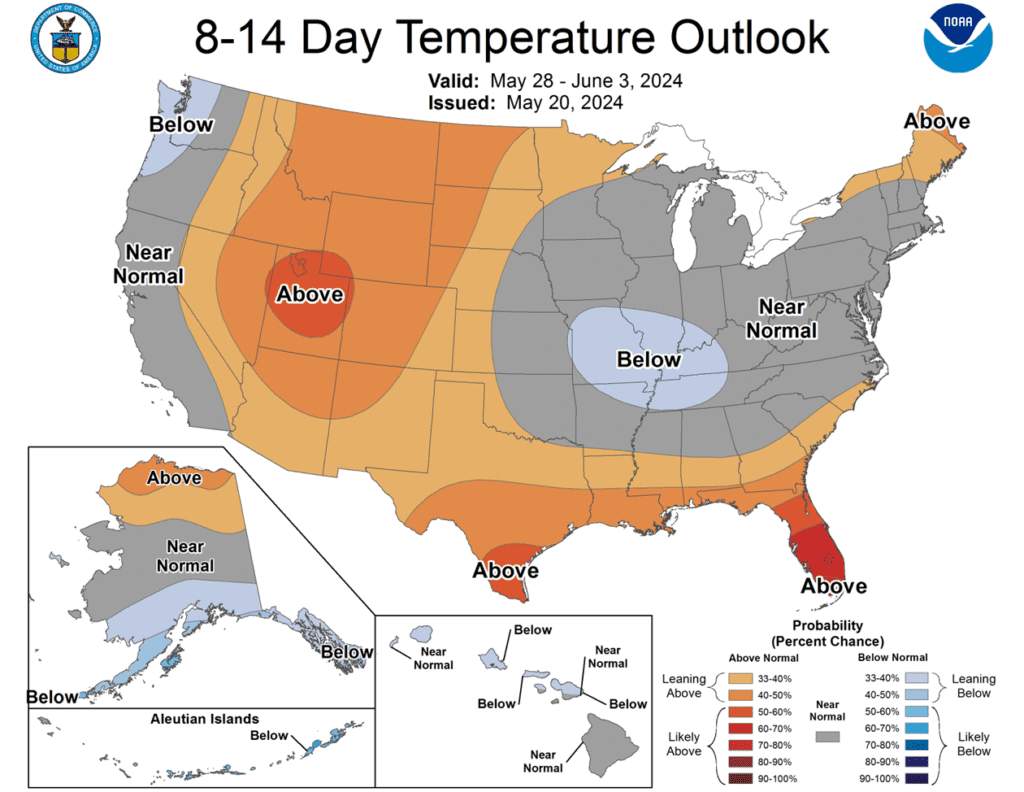

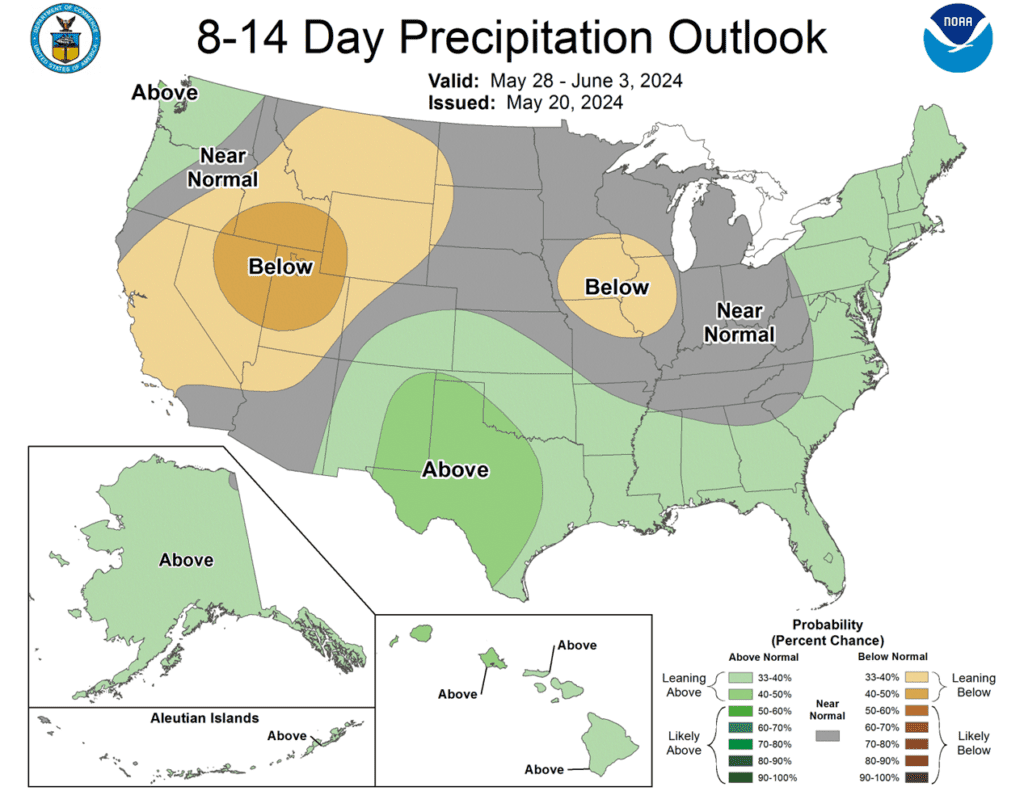

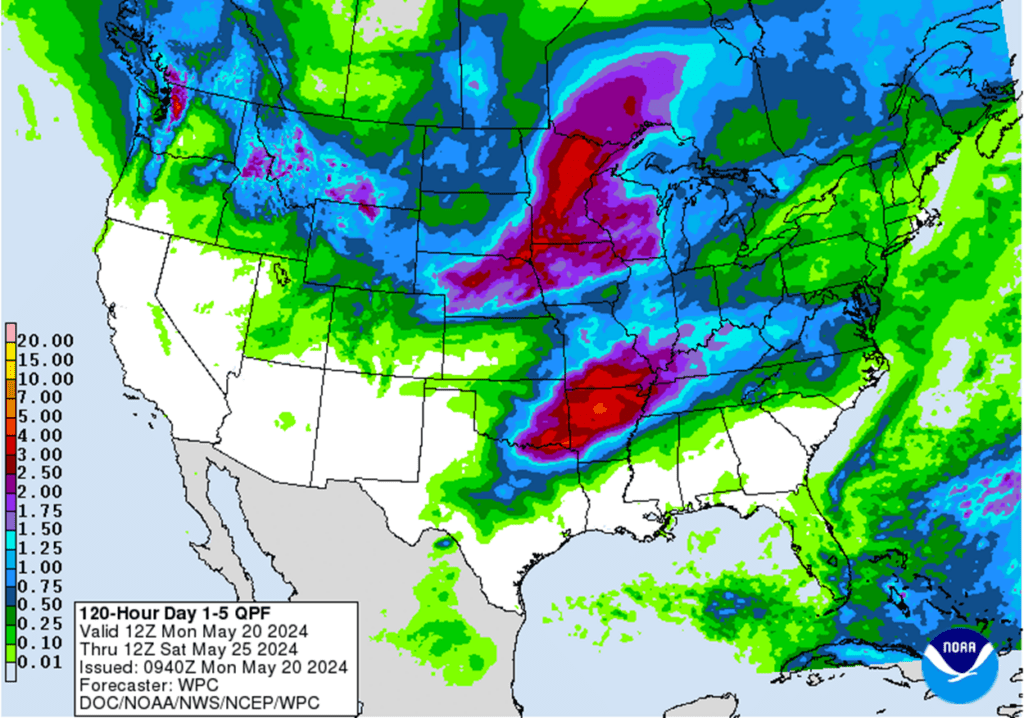

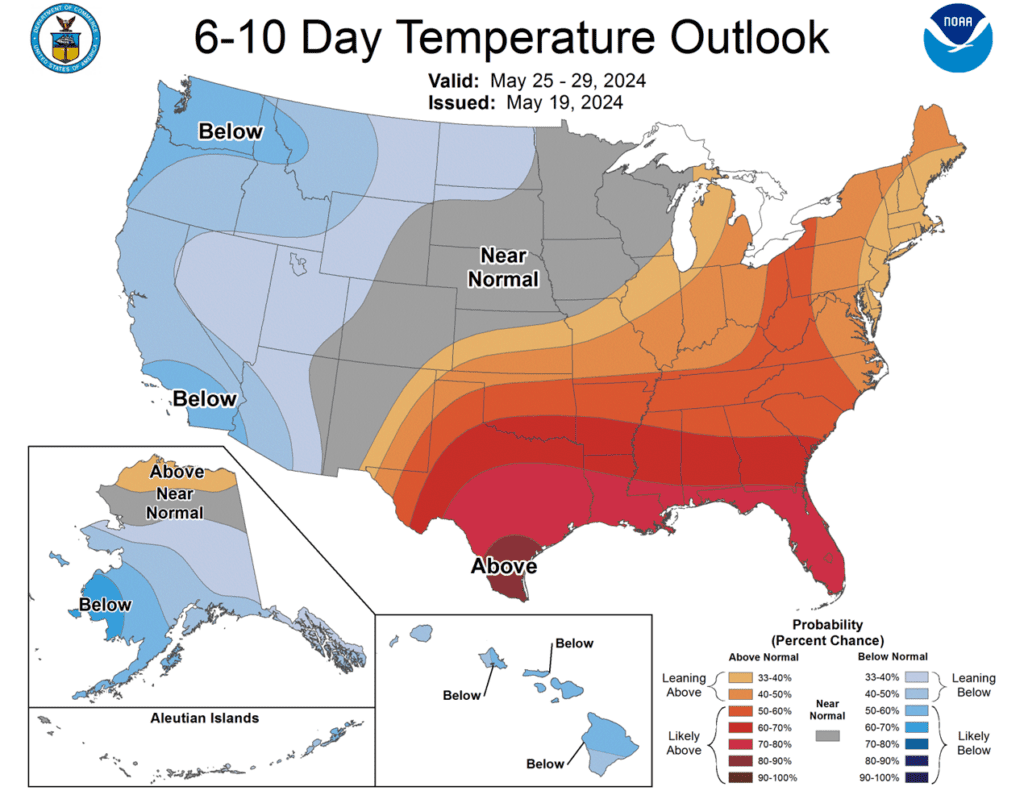

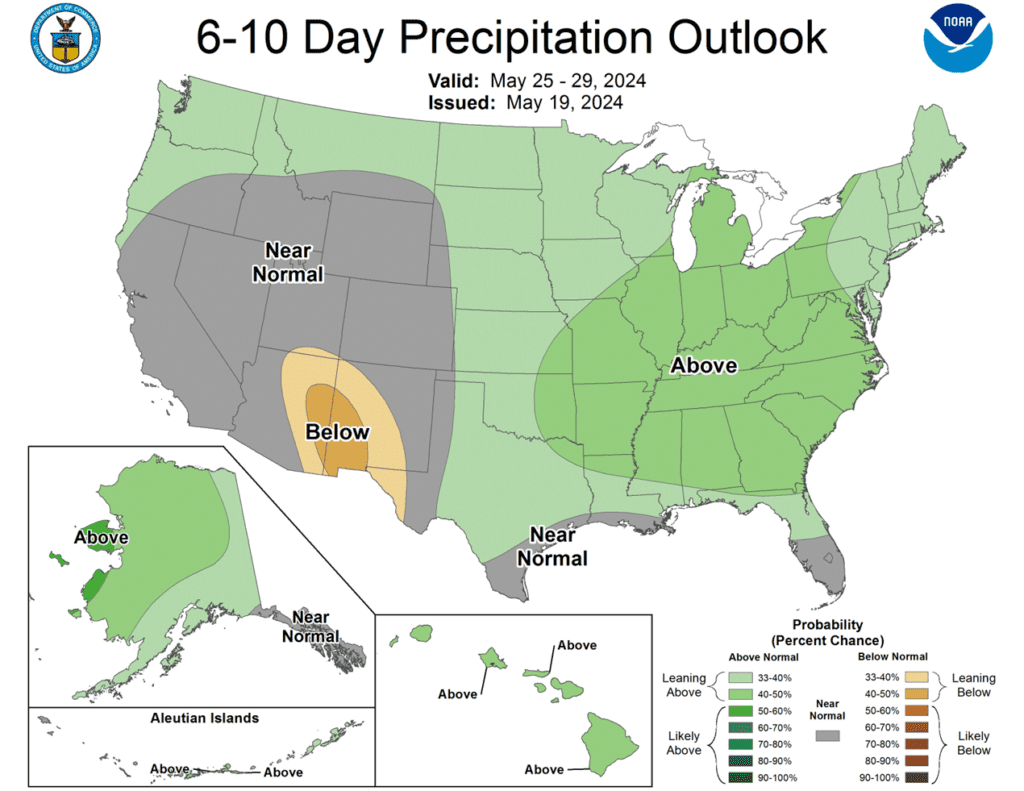

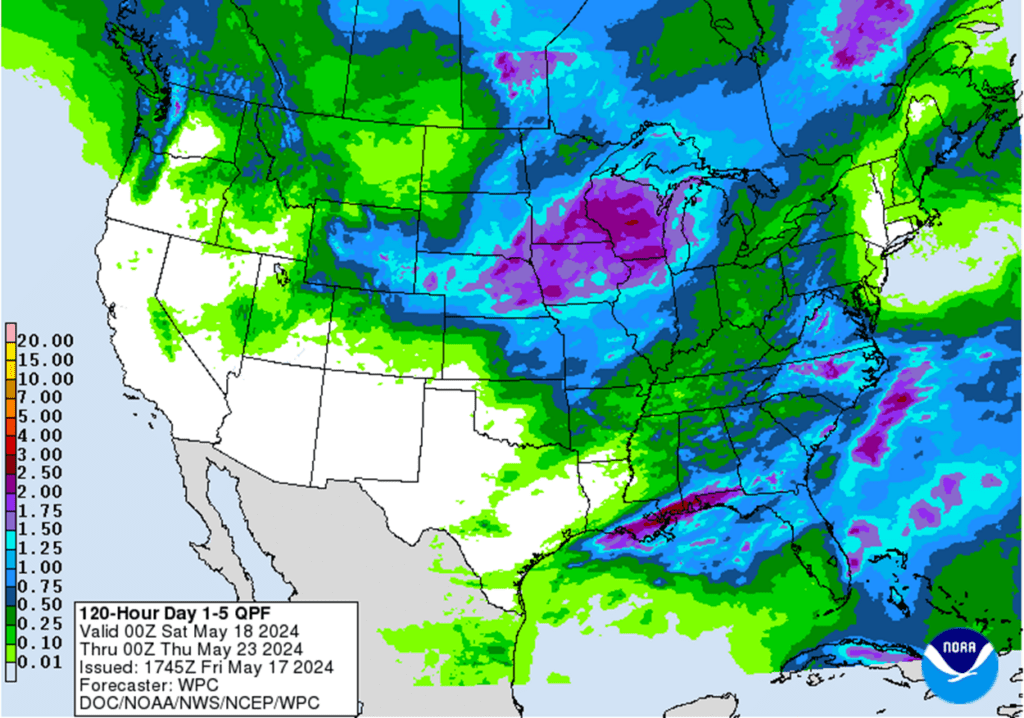

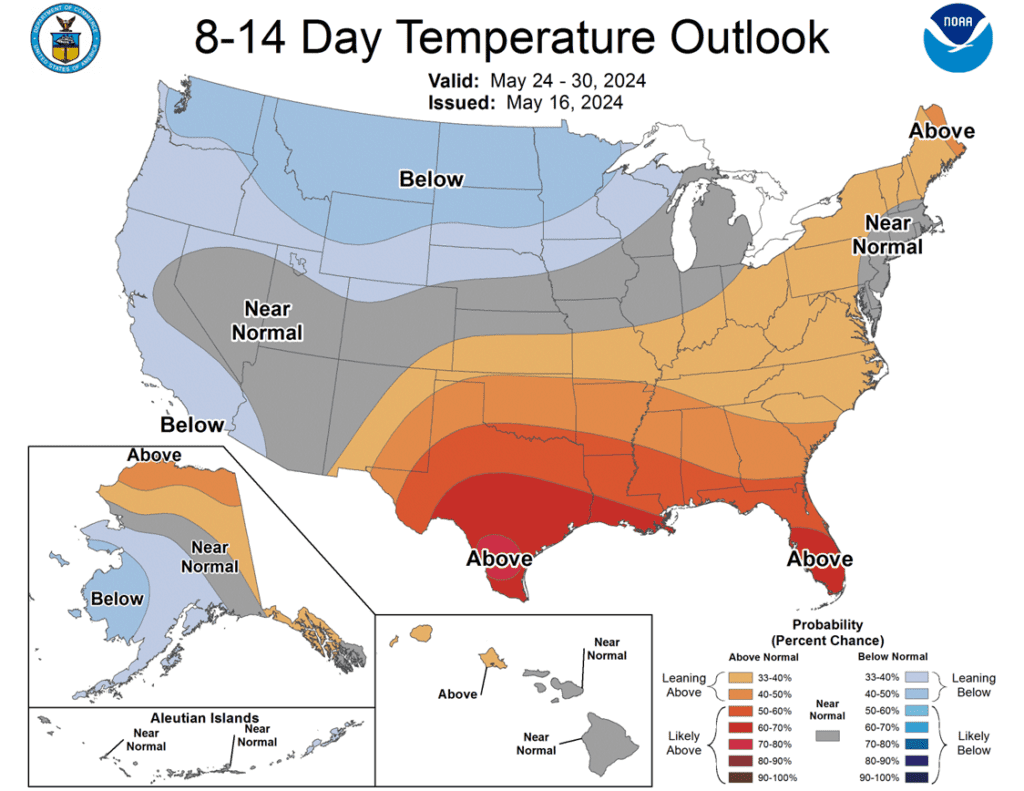

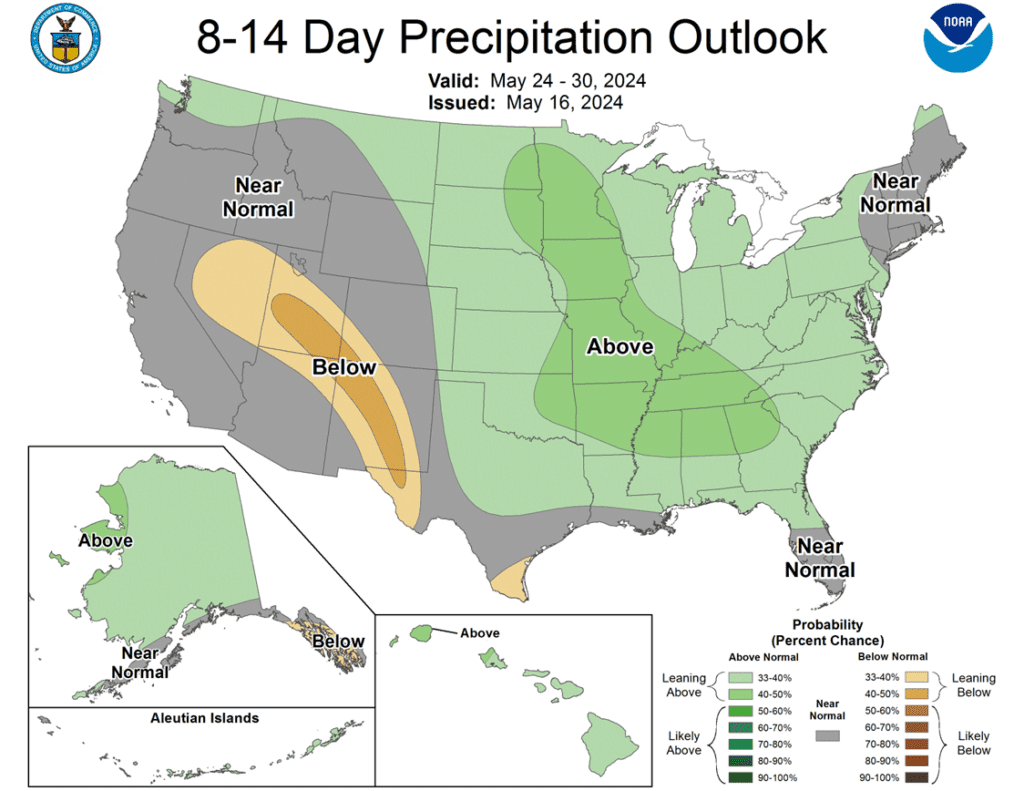

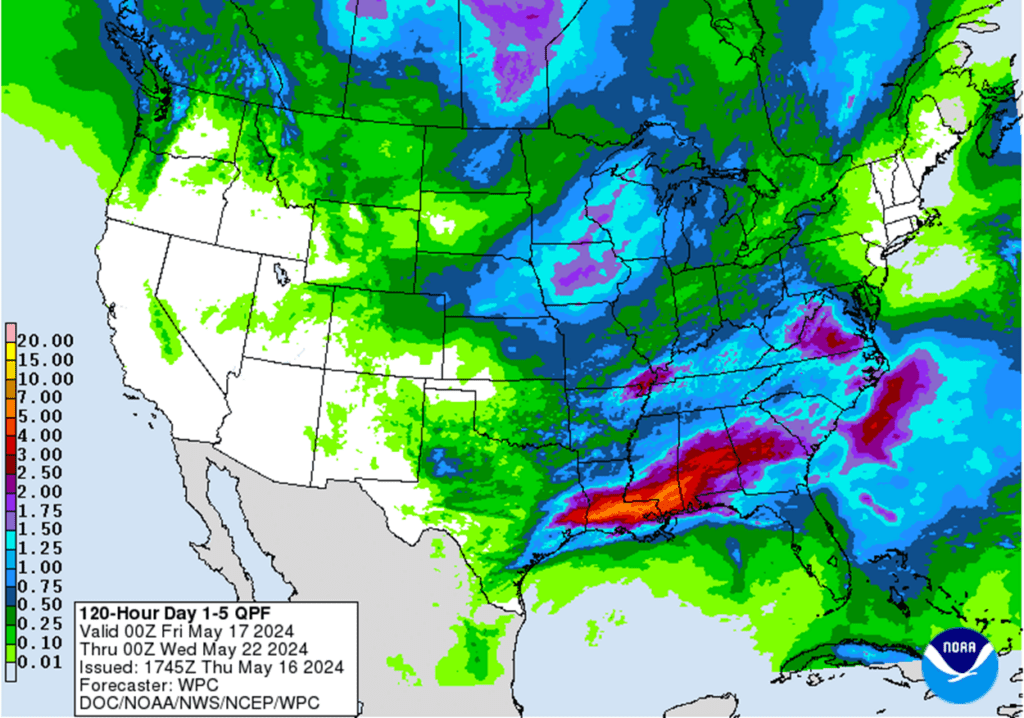

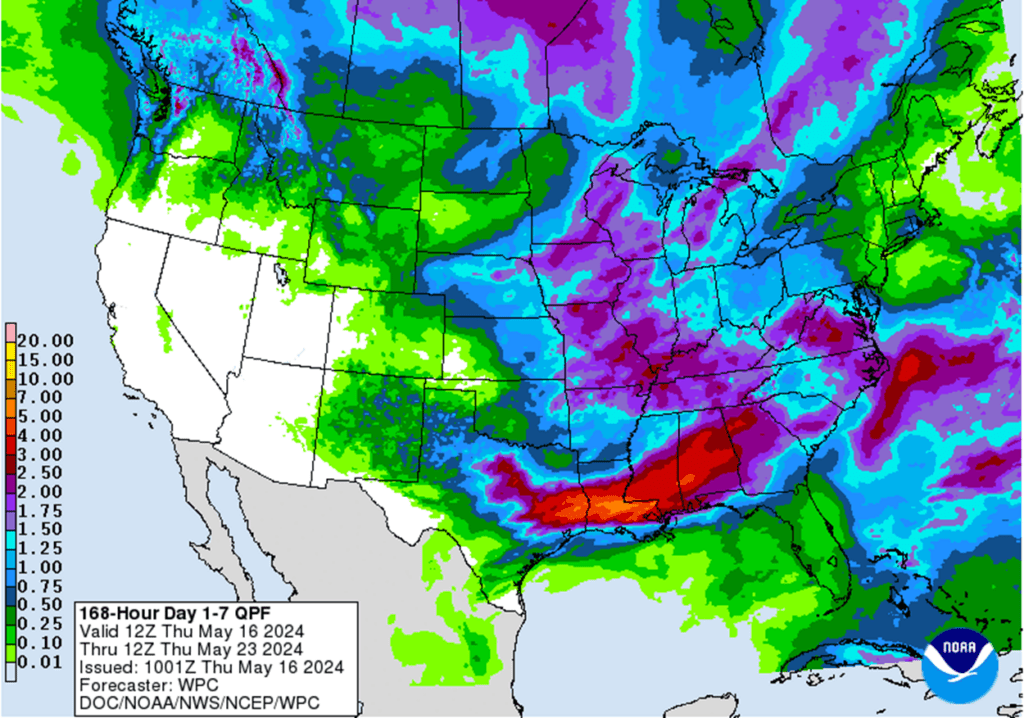

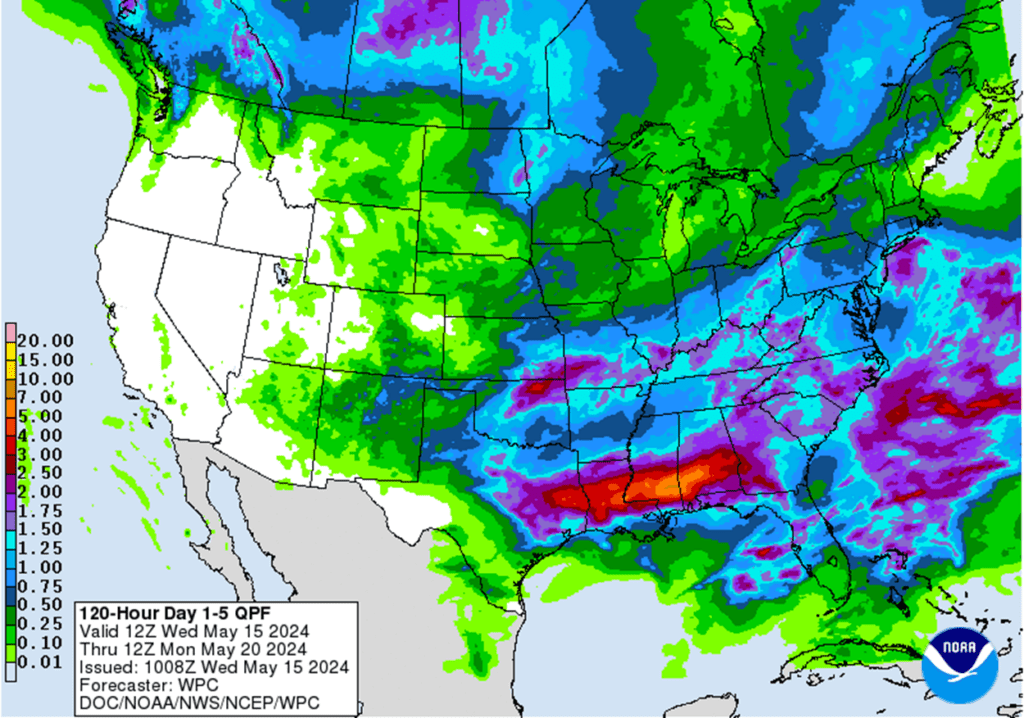

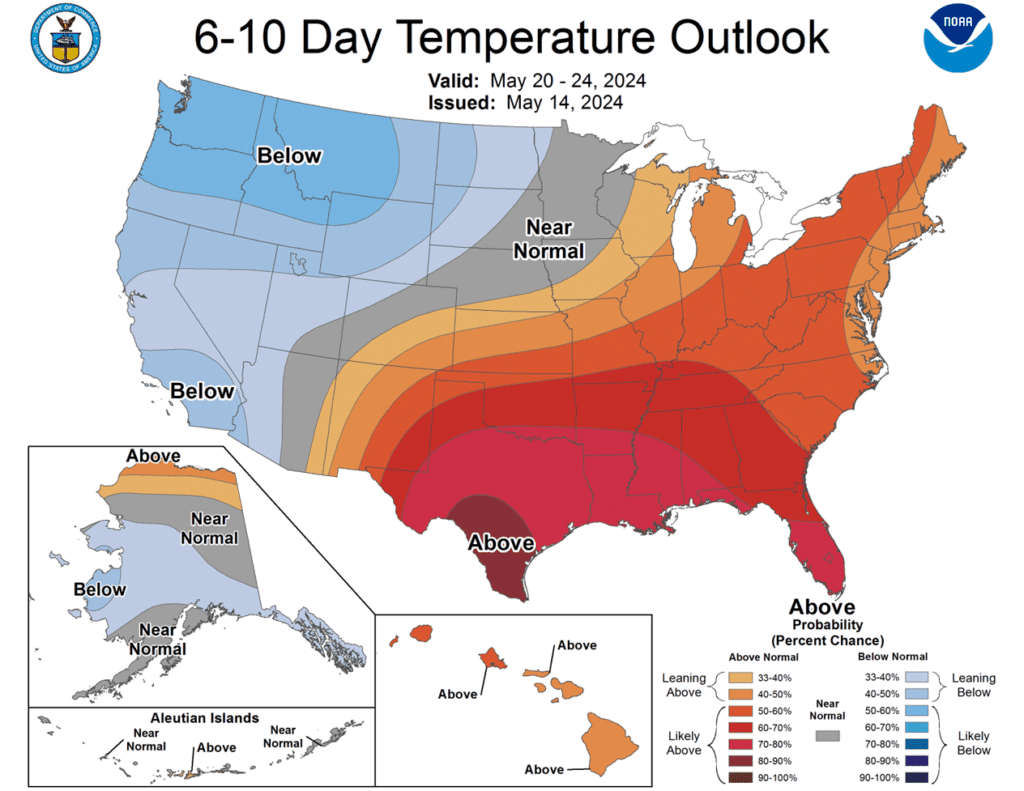

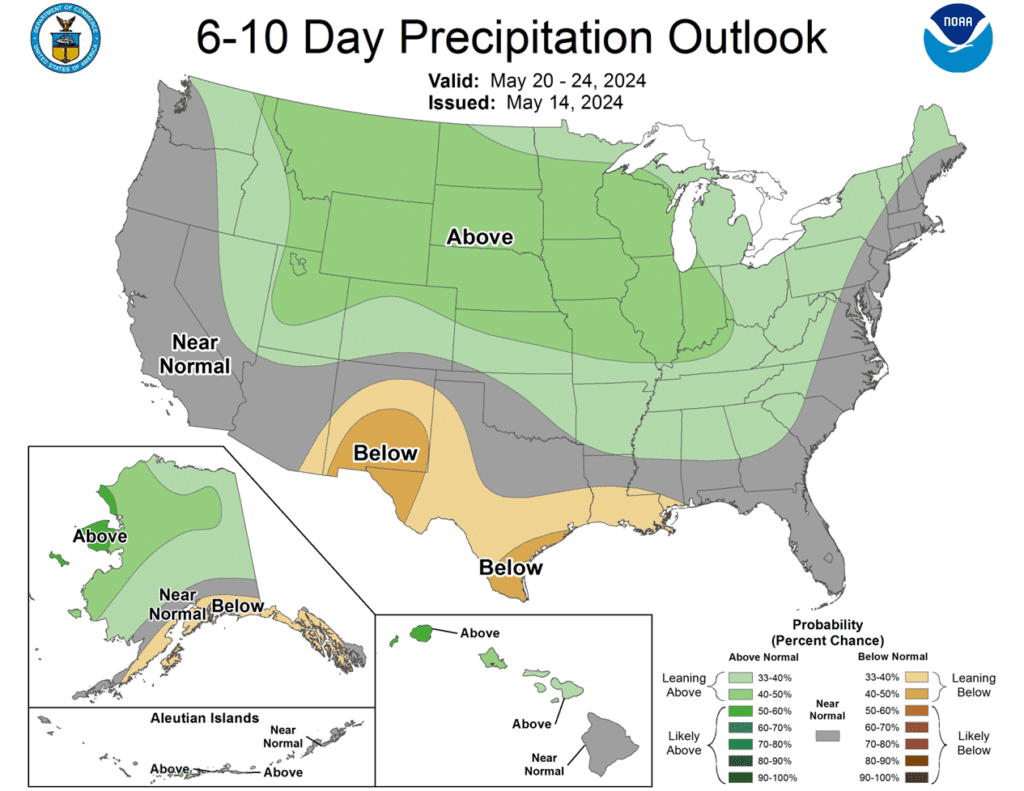

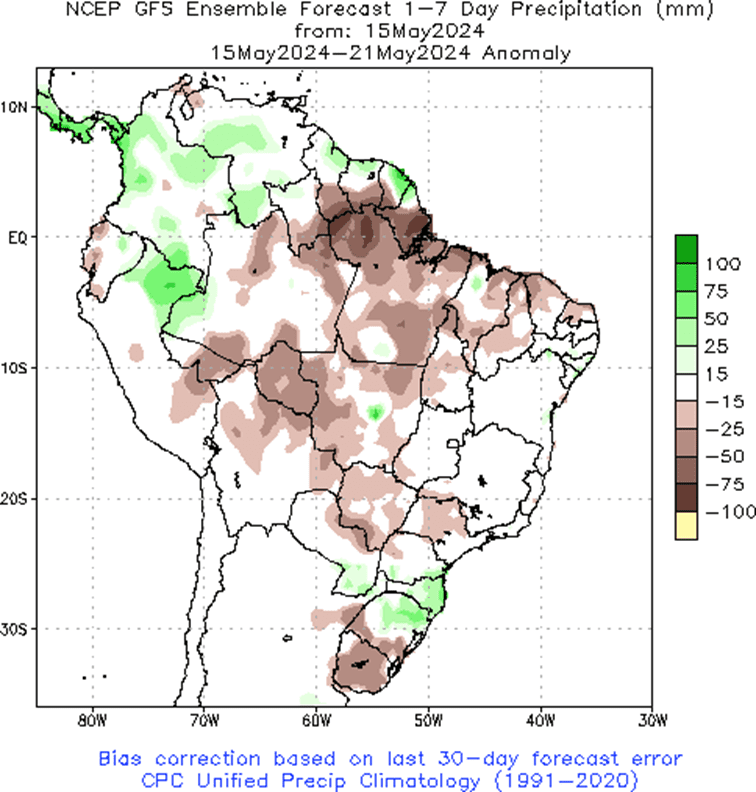

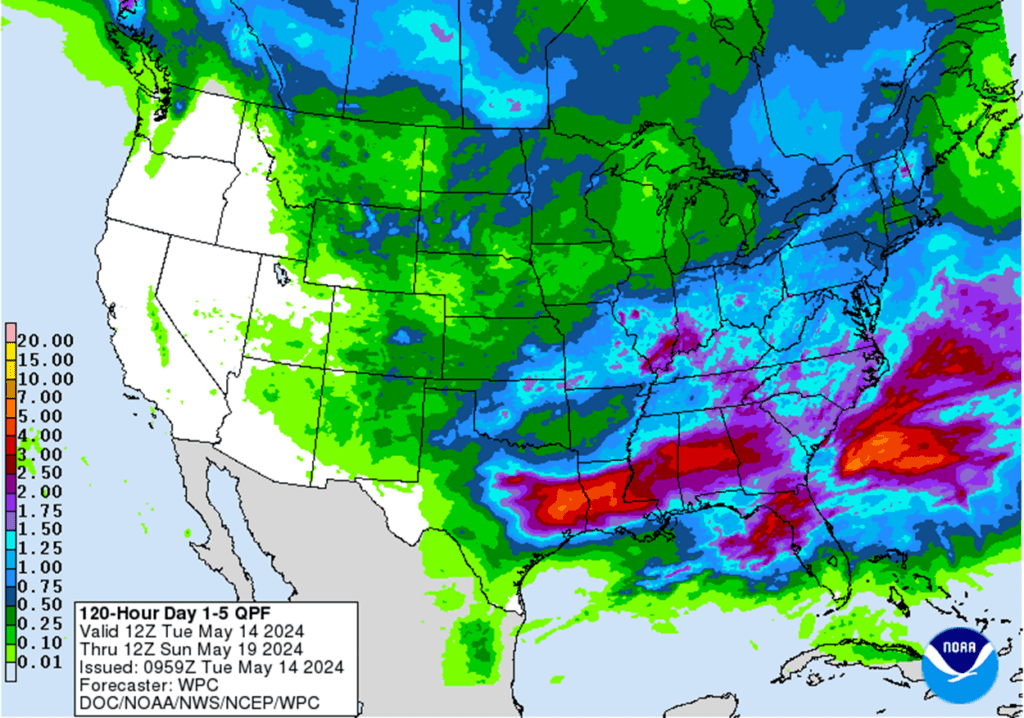

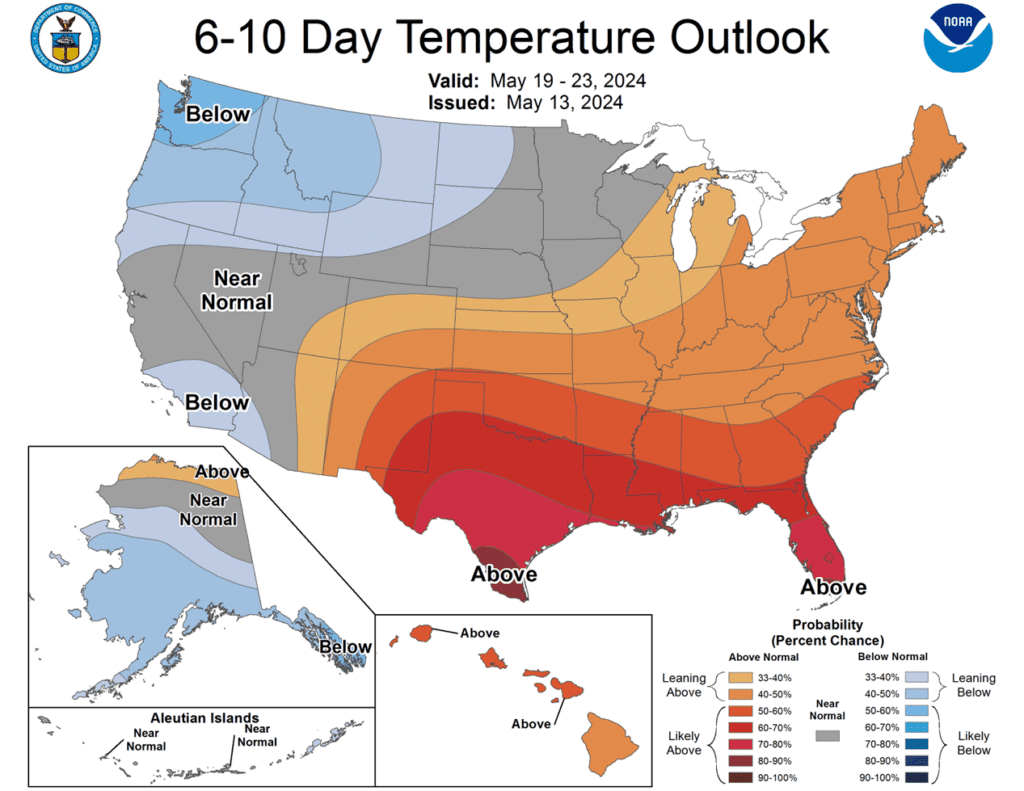

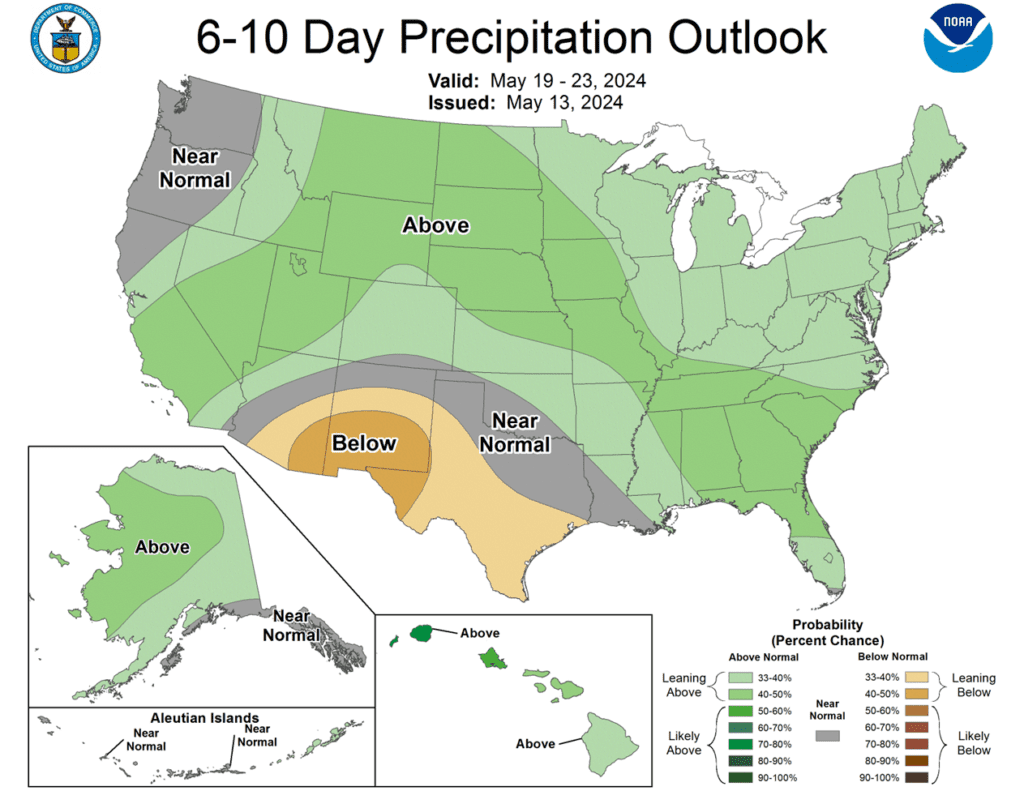

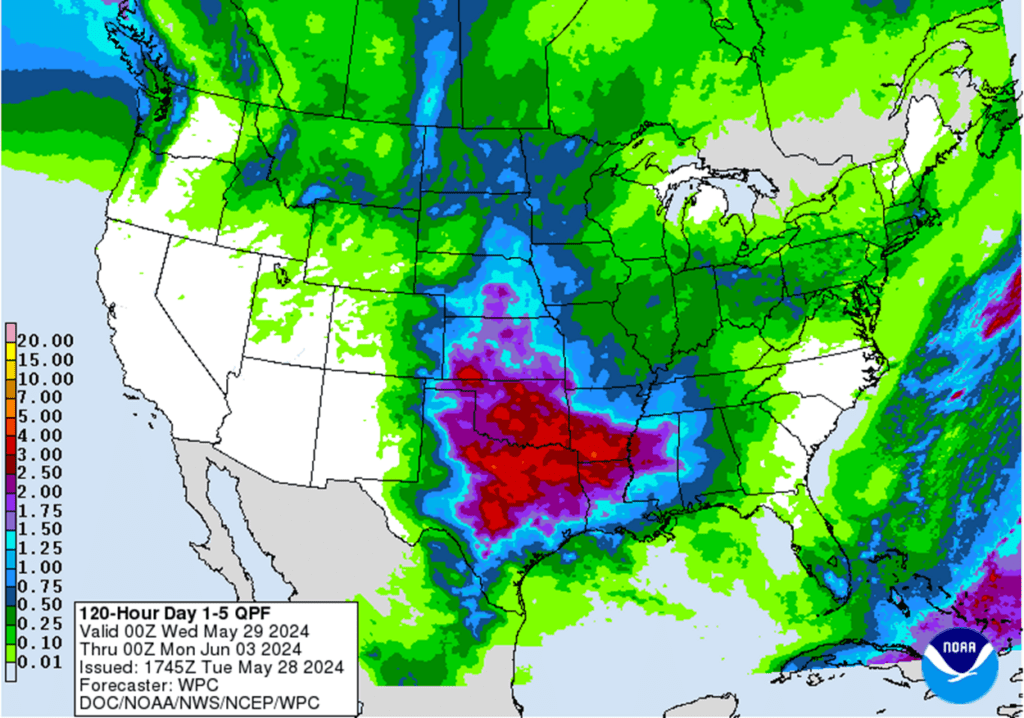

- To see the updated US 5-day precipitation forecast, well as the US 6 – 10 day Temperature and Precipitation Outlooks courtesy of the CPC and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

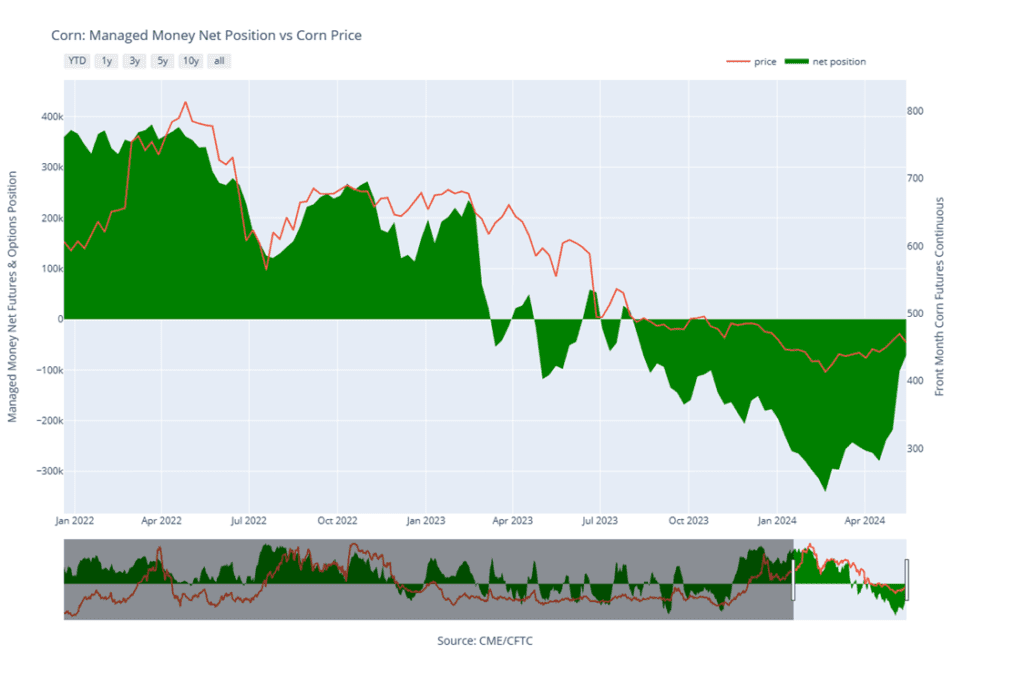

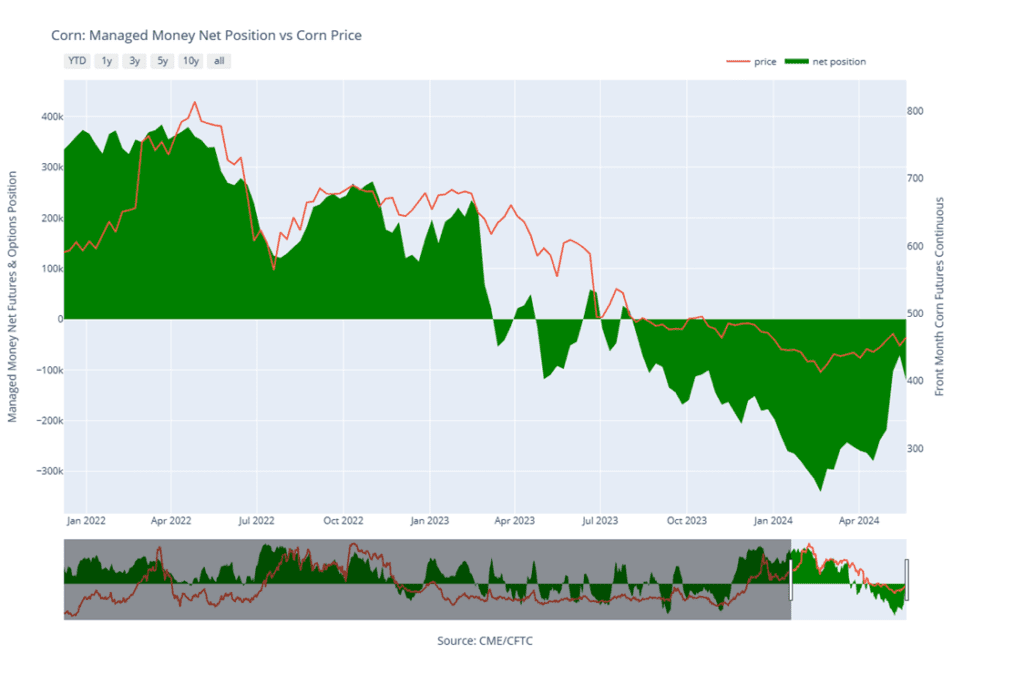

As July ’24 corn rallied beyond the congestion range on the front-month continuous charts, it began showing signs of being overbought, suggesting potential resistance to higher prices. Although managed funds have covered a significant portion of their net short position (sparking the recent rally) their remaining net short position could provide fuel for a more substantial upside move as planting transitions into the growing season. While obstacles persist for higher prices, overall market conditions and seasonal tendencies continue to support a sustained price recovery into May and June.

- No new action is recommended for 2023 corn. Given the recent weakness in the July ’24 contract, and that we are at the time of year when the perception of any improving weather can move prices lower very quickly, we recently employed our Plan B stop strategy and recommended making additional sales. Although the technical picture could look better, weather remains a dominant factor and could still move prices back higher if conditions deteriorate. Therefore, we are currently targeting the 480 – 520 range versus July ’24 to make what will likely be our final sales recommendation for the 2023 crop.

- No new action is recommended for 2024 corn. After the Dec ’24 contract posted a bearish key reversal in mid-May, we implemented our Plan B stop strategy and advised making additional sales considering we are in the time of year when changes in weather, actual or perceived, can move the market swiftly in either direction. Also considering the volatility that this time of year can bring, our current strategy is to have several targets in place to provide both upside coverage as well as downside. While targeting 520 – 540 to recommend additional sales versus Dec ’24, we are targeting the 510 – 520 area to buy puts on any production that cannot be priced ahead of harvest. We are also targeting a close below 467 in Dec ’24 to buy upside calls for their value to protect any existing or future new crop sales.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

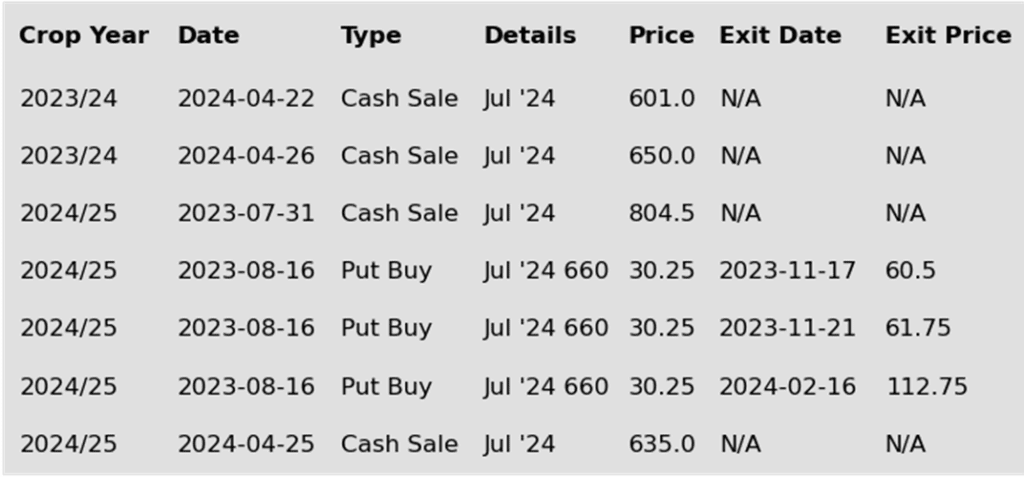

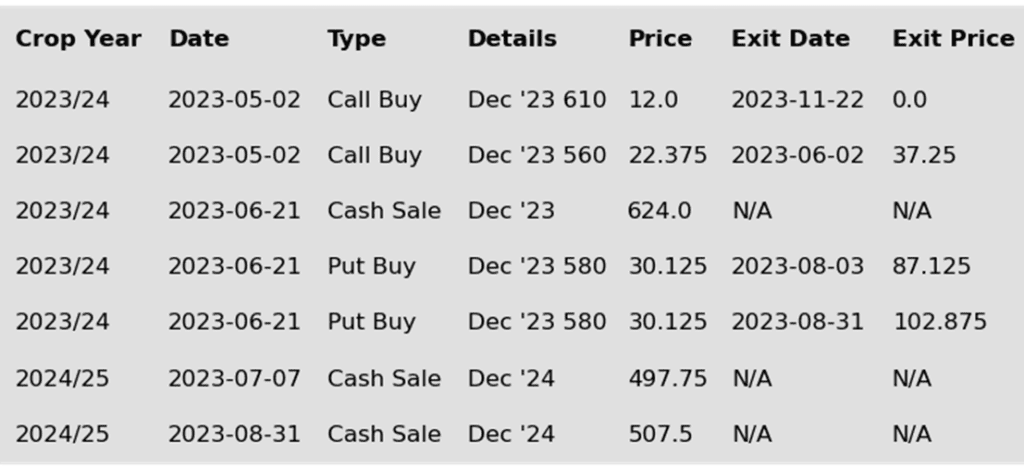

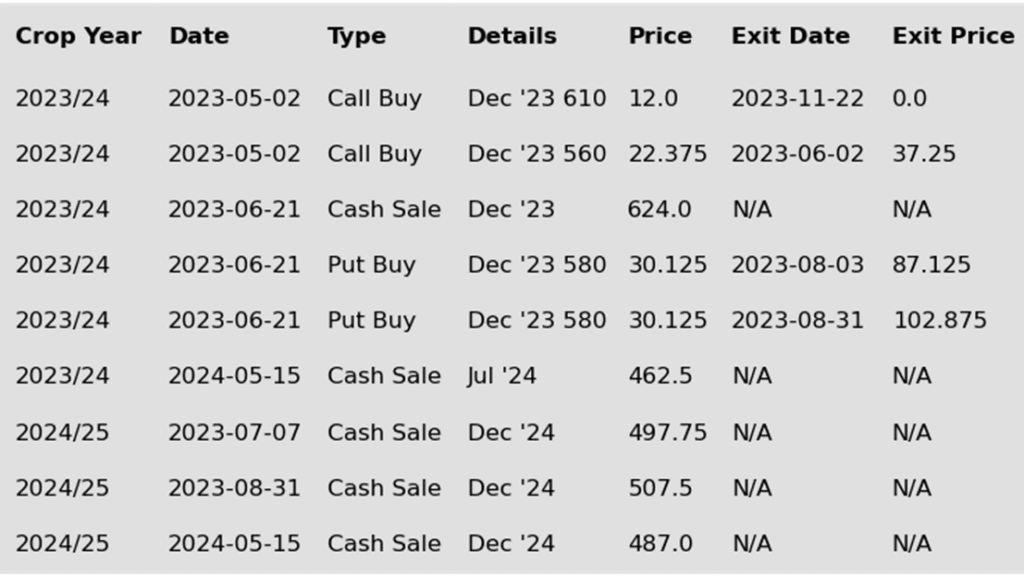

To date, Grain Market Insider has issued the following corn recommendations:

- Disappointing price action started the trading week in the corn market as prices faded off overnight highs to finish the day lower overall. On the charts, corn futures posted a reversal day by trading past Friday’s high and low prices and settling in the bottom of the trading range for the day. The negative price action at the close could leave the door open for follow-through selling going into Wednesday.

- Corn futures are followers to other grains. Wheat futures had a strong overnight session on continued fears of Russian dryness affecting the wheat crop, but as prices faded, corn futures slipped during the session. Soybean futures saw strong selling pressure during the session, and that limited the potential for gains in the corn market on Tuesday.

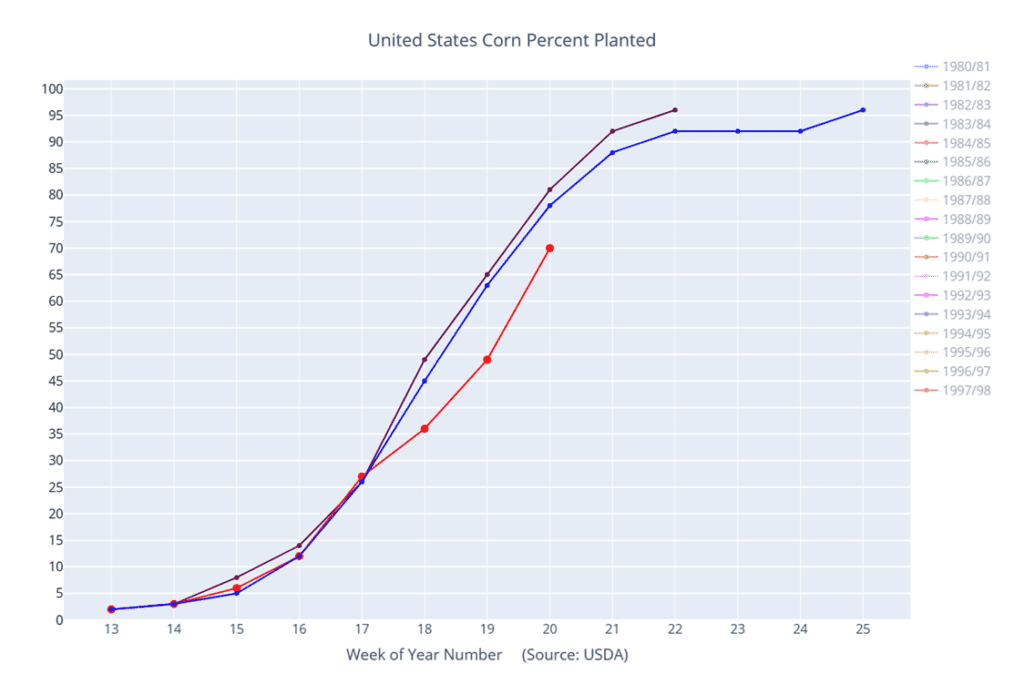

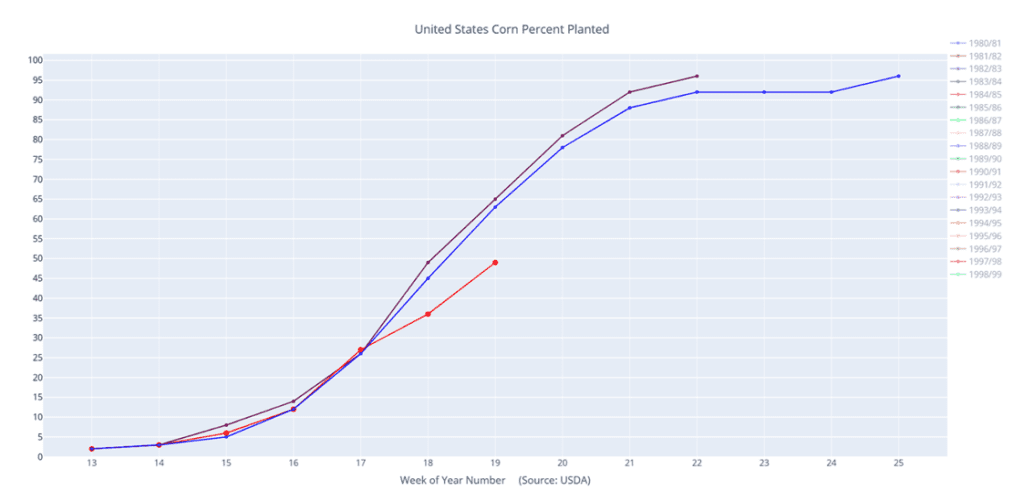

- The USDA will release the latest round of crop planting progress this afternoon. Expectations are for corn planting to advance by 13% to 83% complete. This would keep corn planting close to the 5-year average for this date. While the last 10-15% of planting may be difficult due to wet weather, the market may be shifting its focus away from planting and looking to summer weather and crop development.

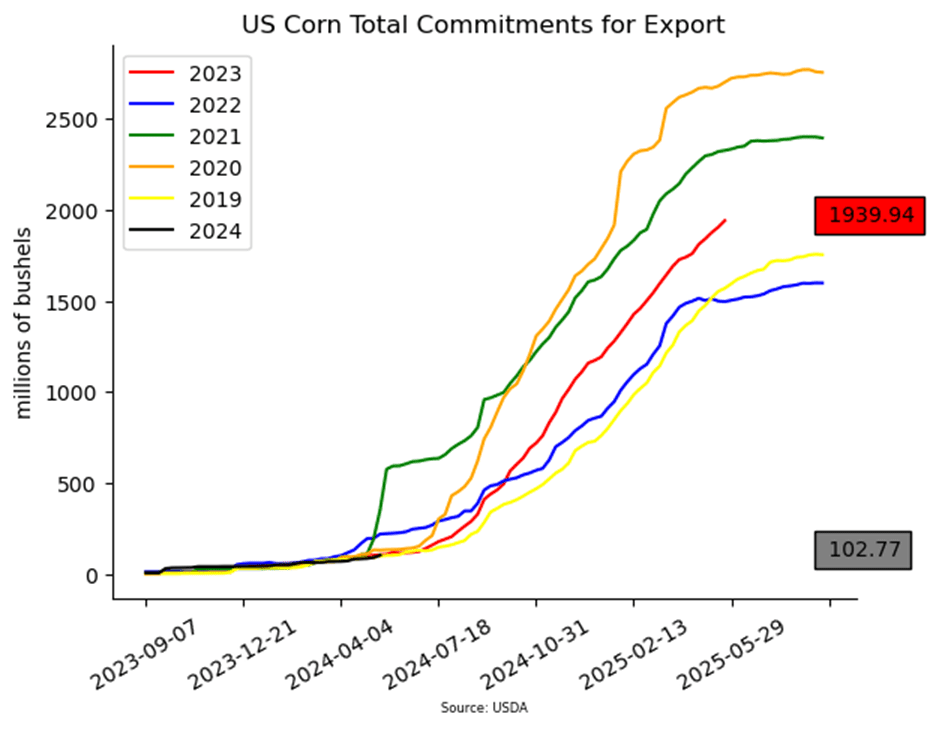

- Weekly export inspections for corn remain strong. Last week, US exporters shipped 42.4 mb (1.077 mmt) of corn last week. This brings total inspections in 23/24 up to 1.429 bb, up 26% from last year.

- The USDA announced a flash sale of corn to Mexico this morning. Mexico purchased 8.5 mb (215,000 mt) of corn with the total split between marketing years. Of the total, 165,000 mt is for the 23/24 marketing year and 50,000 mt is for delivery during the 24/25 marketing year.

Above: The corn market did an about face and rallied higher on May 20 following four consecutive lower closes and finding support near 452. Should prices continue higher, heavy resistance remains overhead near the recent high of 474 ½. Should the market close below 452, further support may come in towards 445 – 440.

Above: Corn Managed Money Funds net position as of Tuesday, May 21. Net position in Green versus price in Red. Managers net sold 49,991 contracts between May 15 – 21, bringing their total position to a net short 121,162 contracts.

Soybeans

Soybeans Action Plan Summary

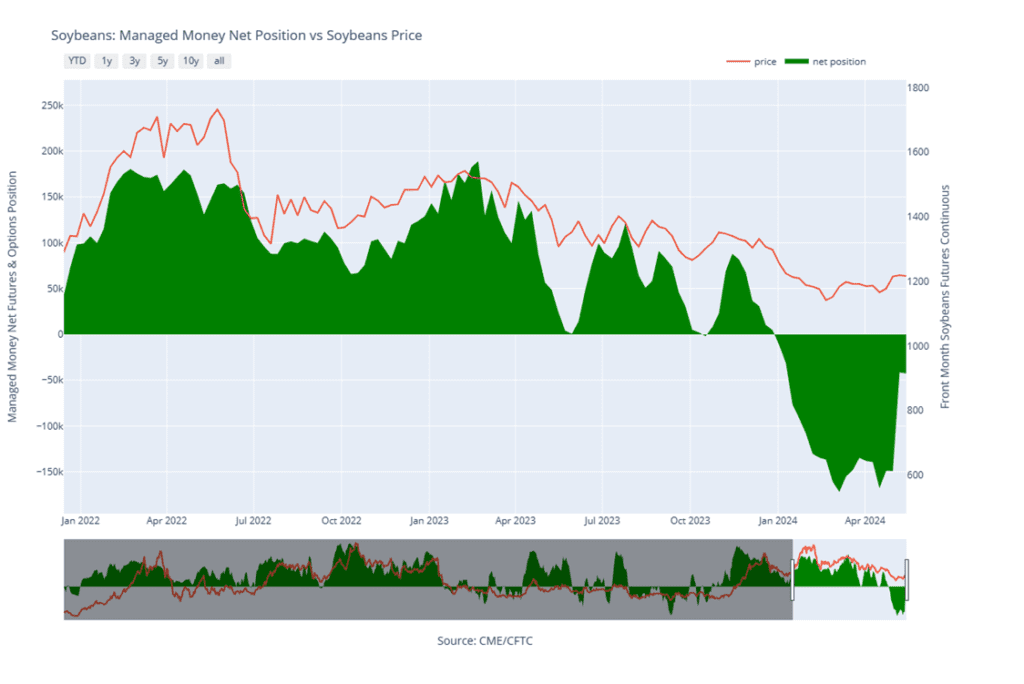

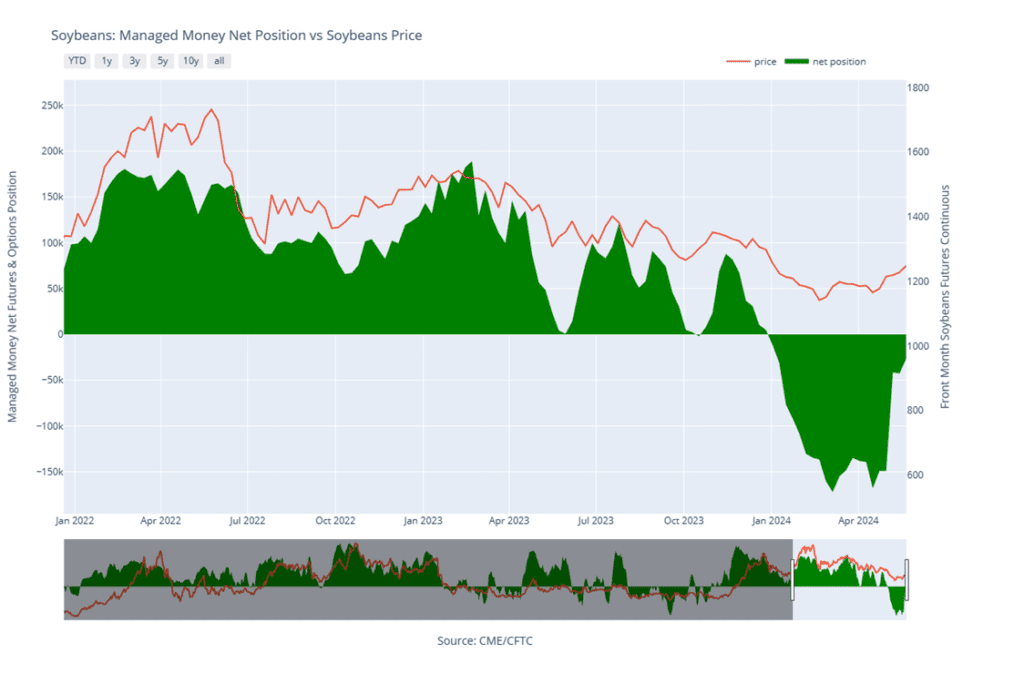

In early May the soybean market rallied out of its congestion range and above the March highs as Managed funds likely covered some of their net short positions. While the current supply/demand situation remains somewhat bearish, Managed funds remain net short the market and this breakout opens the door for a run towards the 1290 ¾ – 1296 ¾ chart gap and resistance area just above there if further production concerns arise in the coming weeks. Otherwise, if weather conditions cooperate and planting progresses without major issues, prices could remain susceptible to a reversal from the recent highs.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus July ’24 futures for what will likely be our final sales recommendation for the 2023 crop. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the amount of uncertainty in the 2024 soybean crop and to give you confidence to make sales and protect those sales in an extended rally. Given that the market has retreated since that time, we are targeting the mid-1200s versus Nov ’24 futures to exit 1/3 of the 1280 calls to help preserve equity, while also targeting the 1280 – 1320 range, a modest retracement back to the 2022 highs, to recommend making additional sales. We are also targeting a close at or above 1253 after June 1 to buy puts on any production that cannot be priced ahead of harvest.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

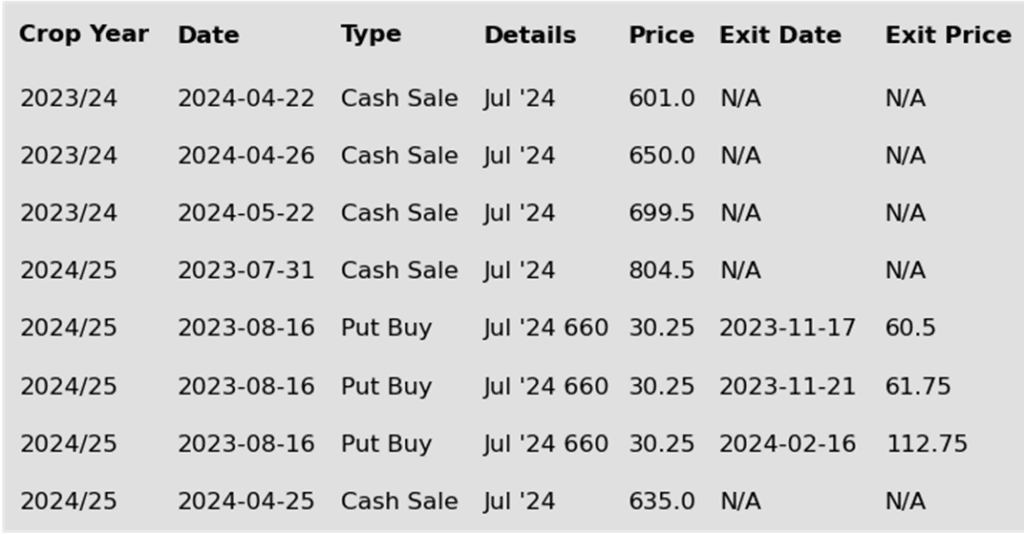

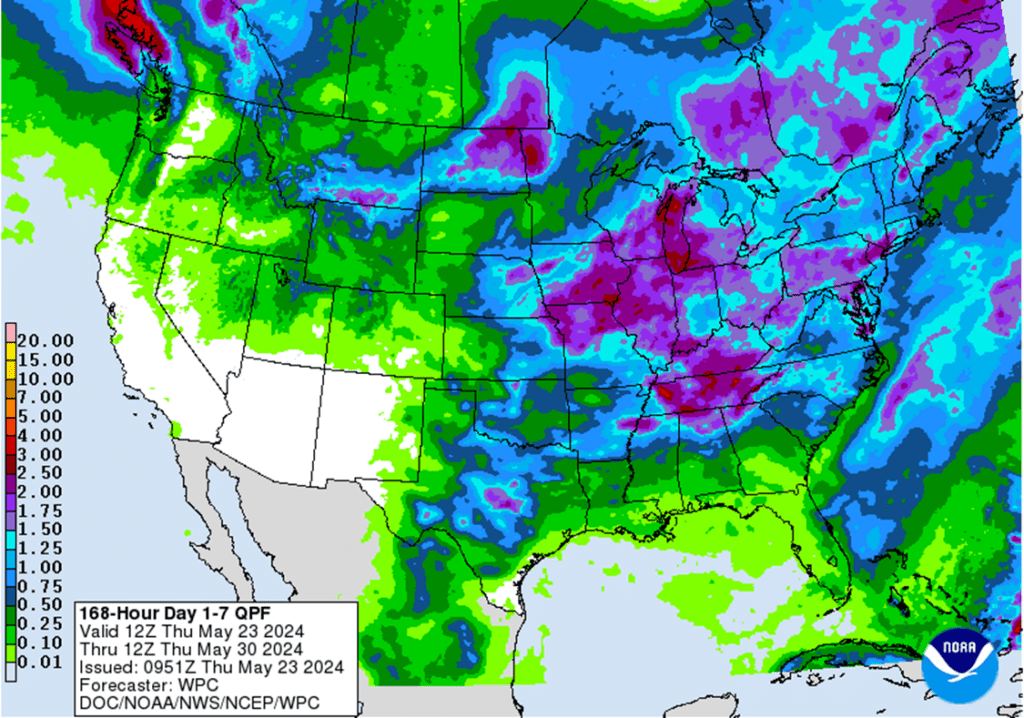

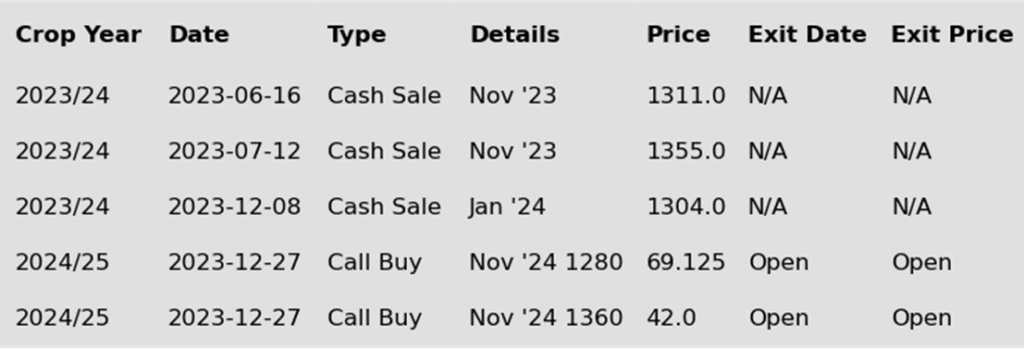

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans ended the day lower to start the week as they followed the sharp selloff in soybean meal in which the July contract posted a loss of 2.56%. Soybeans had been trading higher overnight but began fading this morning and continued the downward trend. Soybean oil was higher by 1.27% in the July contract.

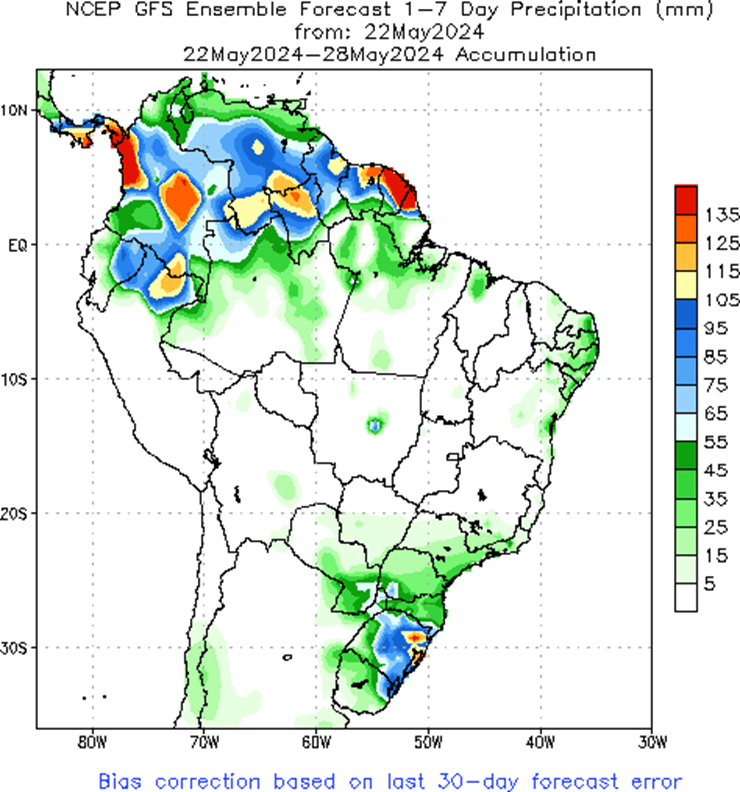

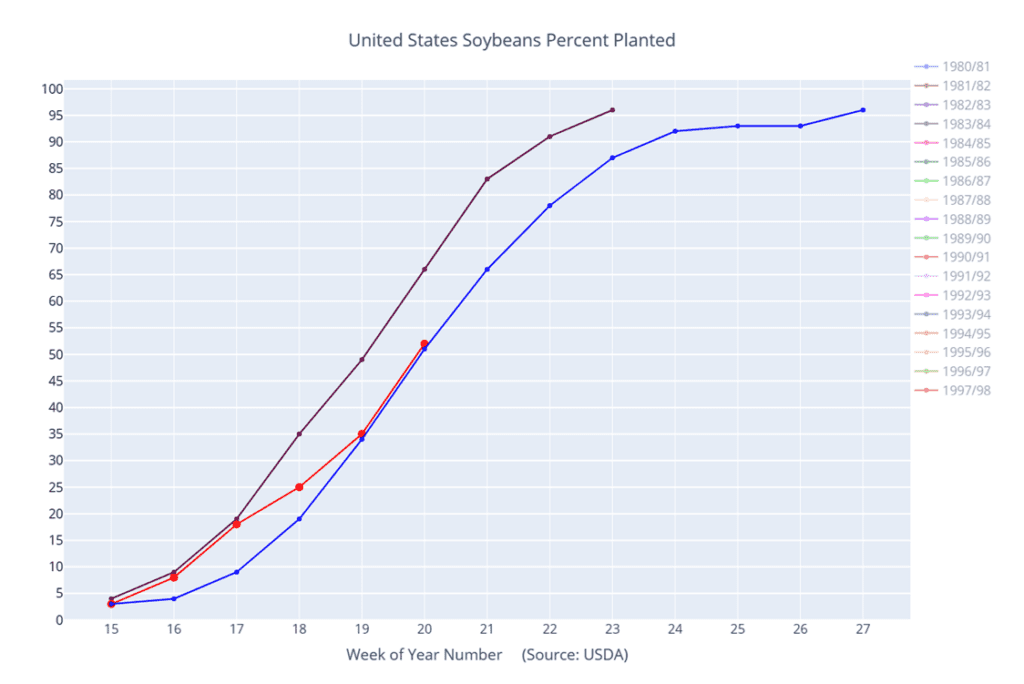

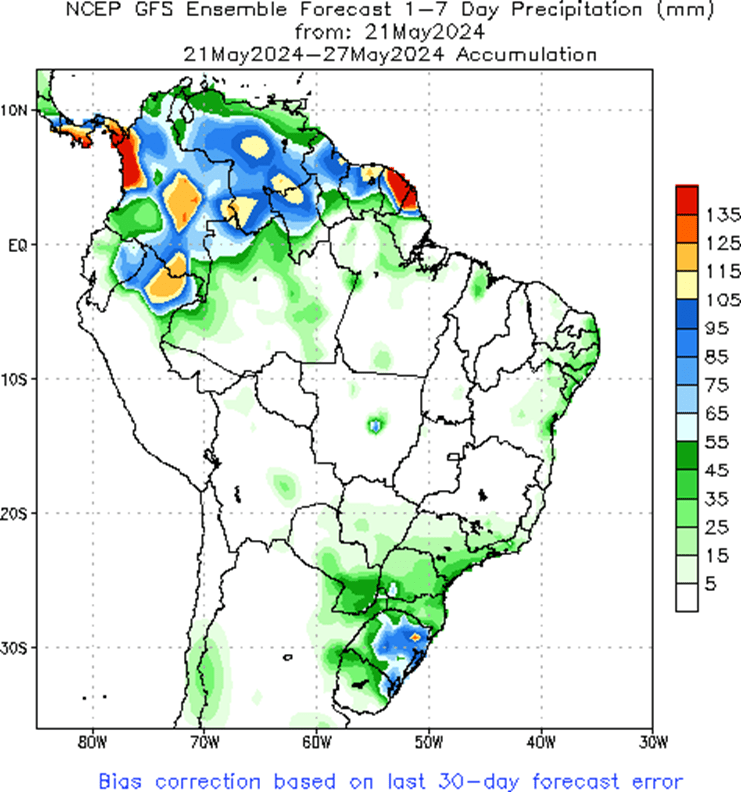

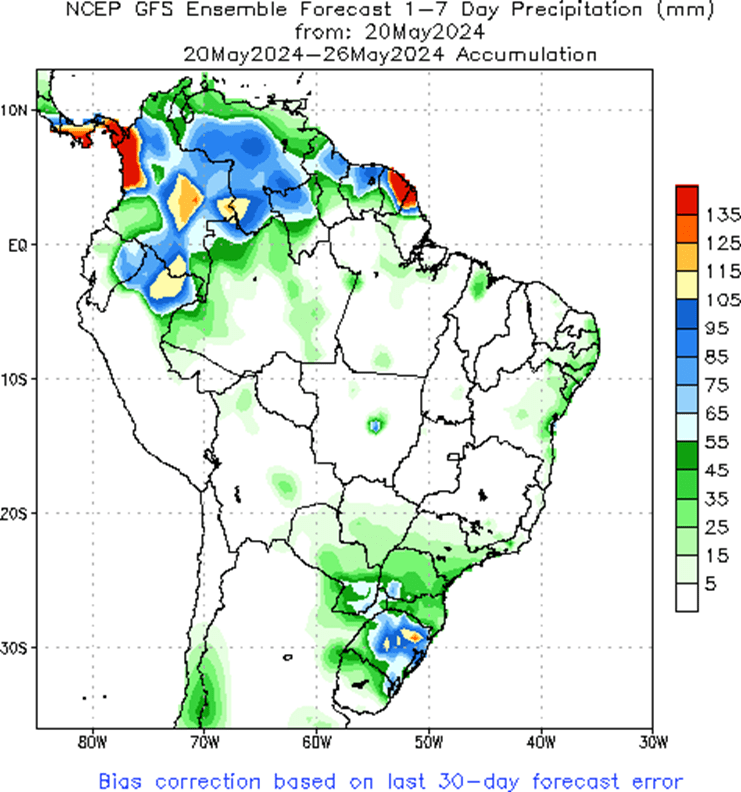

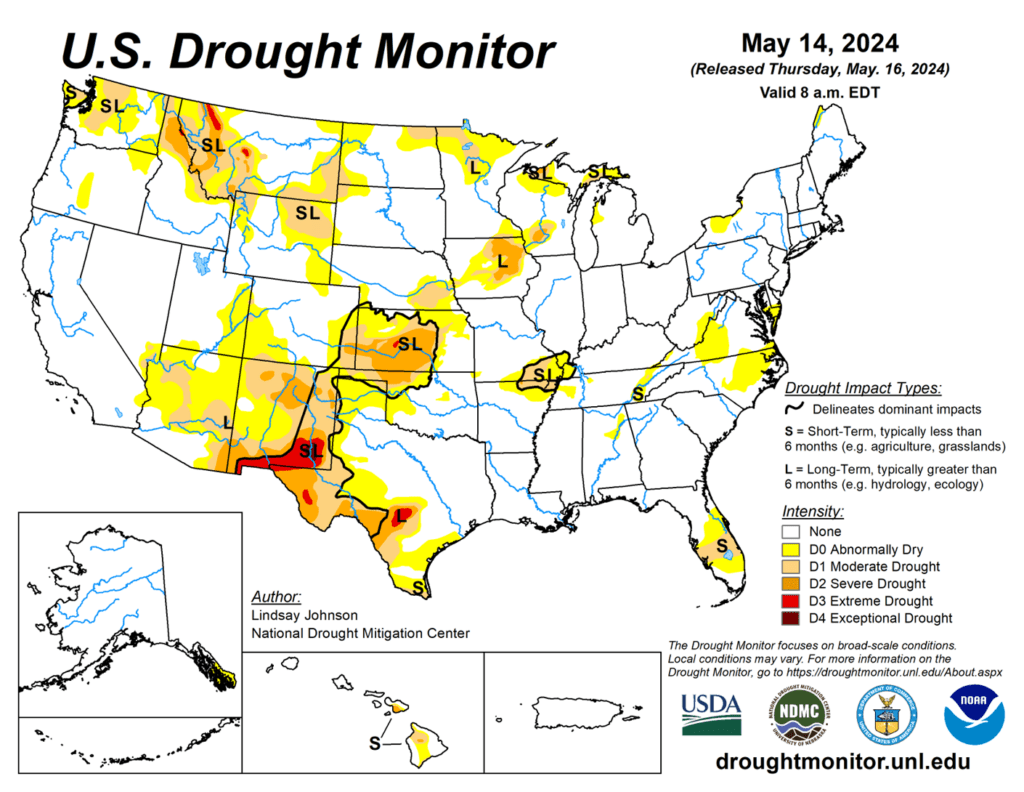

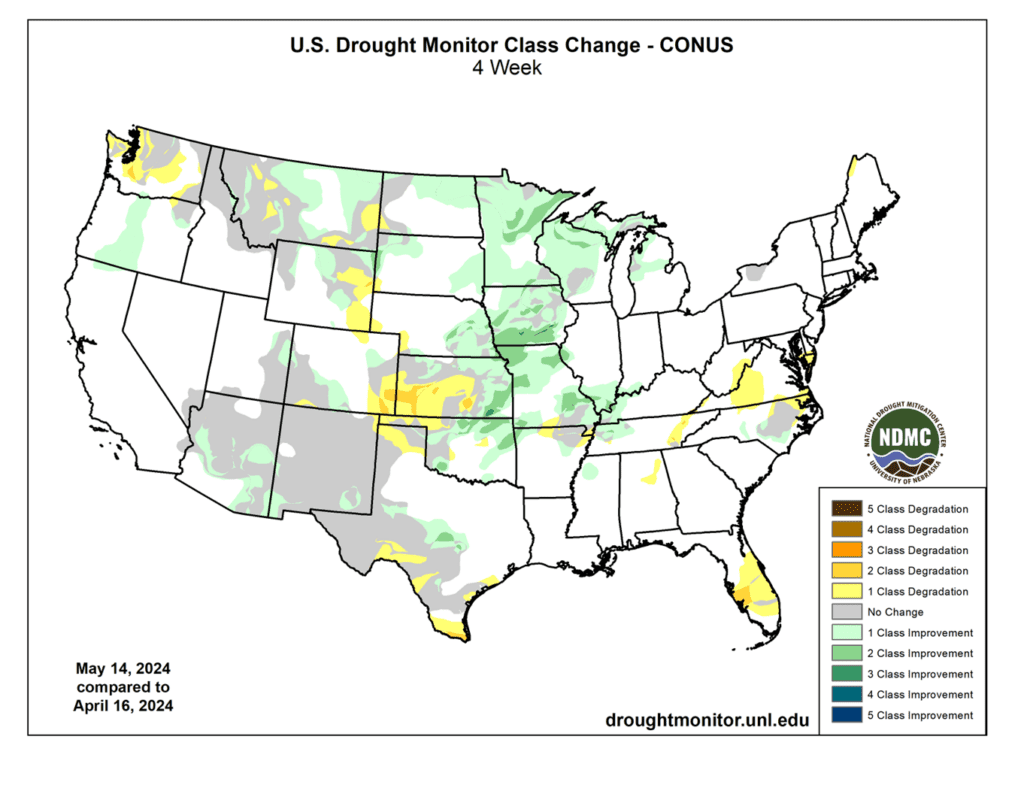

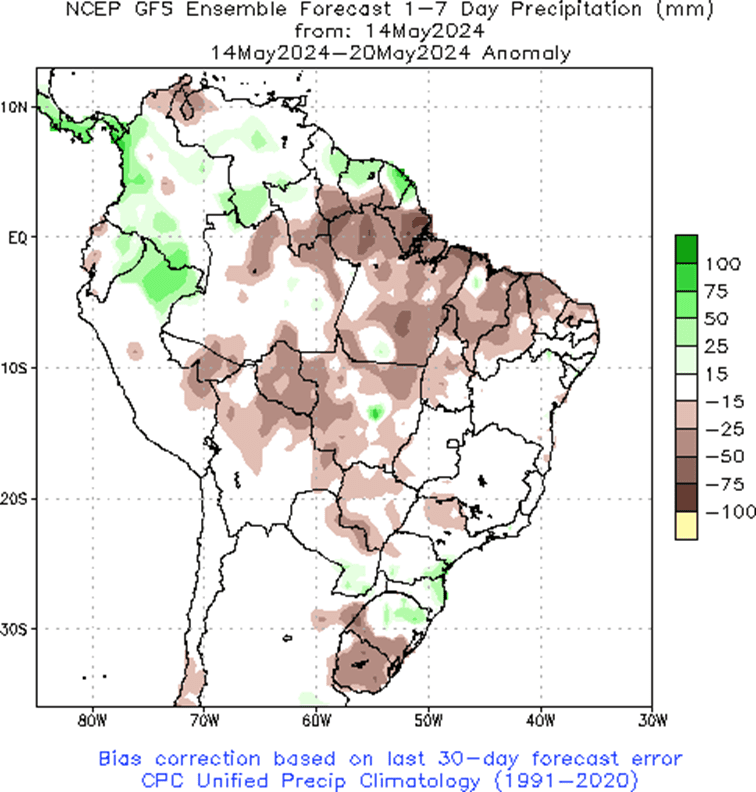

- With the wet weather delaying corn plantings, there is some concern that soybean plantings may increase past the USDA’s initial estimate of 86.5 million acres. The Midwest received significant rains last week and there are more in the forecast for this week.

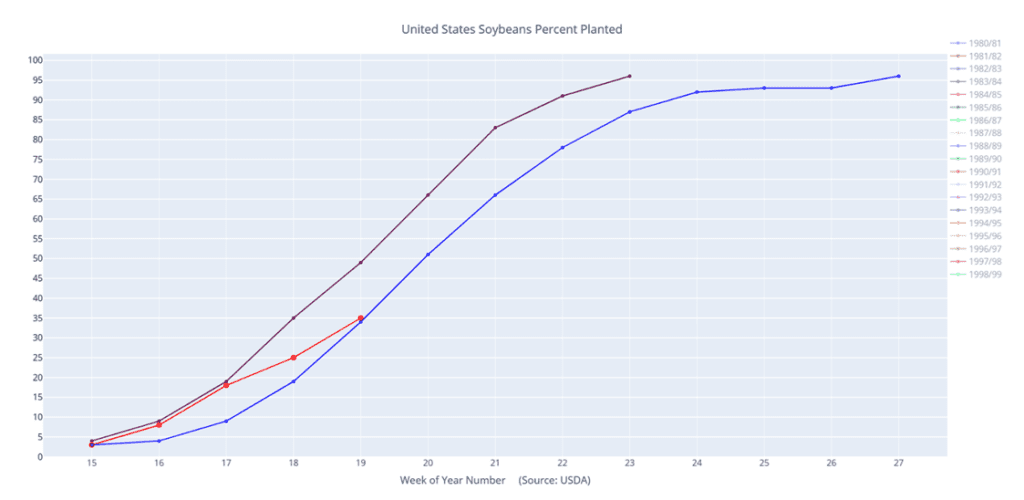

- Later today, the USDA will release its Crop Progress report in which analysts are estimating that soybean plantings will be 67% complete. This would be in line with the 5-year average and would compare with 52% last week and 83% at this time a year ago.

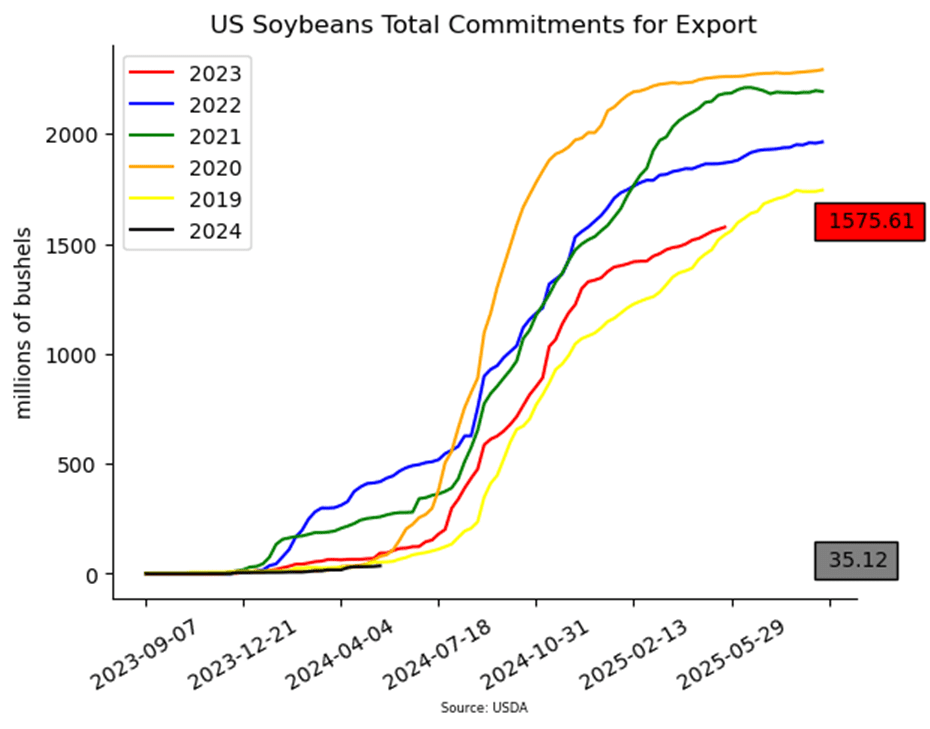

- Today’s weekly export inspections showed an increase for soybean inspections totaling 7.8 mb for the week ending May 23. This was slightly above last week but still puts total inspections for 23/24 down 18% from the previous year at 1.469 bb.

Above: On May 23, July soybeans traded through the May 7 high but closed lower, posting a bearish reversal. Support below the market remains near the 1200 level with both the 50 and 100-day moving averages just below that, around 1195. Should this support hold and prices close above the May 23 high, they may again be poised to close the 1290 ¾ – 1296 ¾ gap and test the 1328 – 1352 resistance area. A close below the 100-day ma could set the market up for further declines with support between 1192 – 1146.

Above: Soybean Managed Money Funds net position as of Tuesday, May 21. Net position in Green versus price in Red. Money Managers net bought 15,609 contracts between May 15 – 21, bringing their total position to a net short 26,426 contracts.

Wheat

Market Notes: Wheat

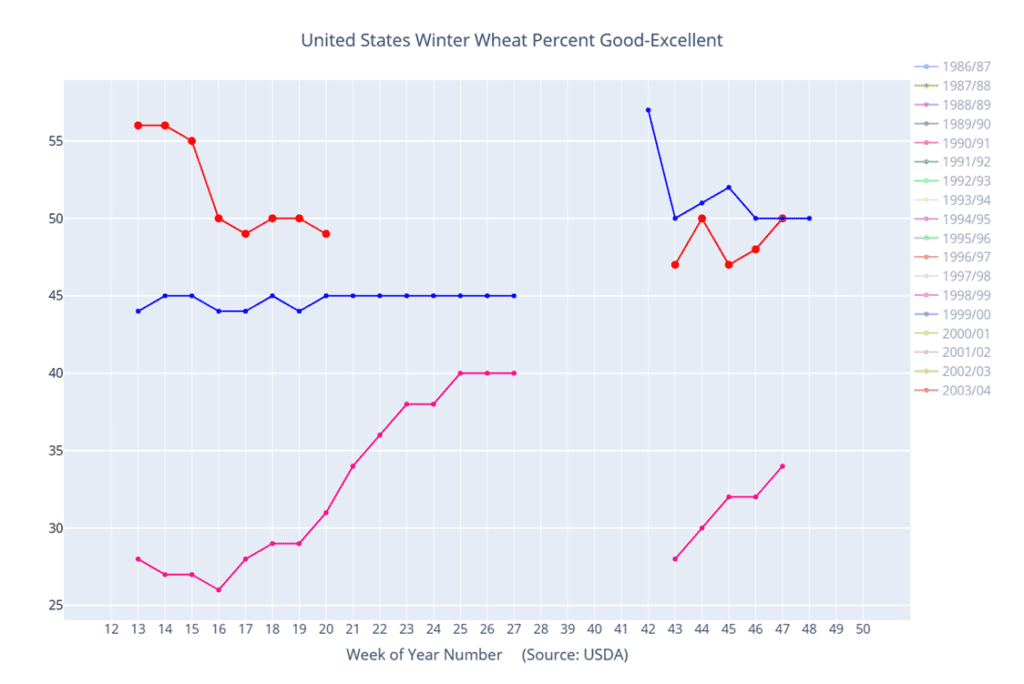

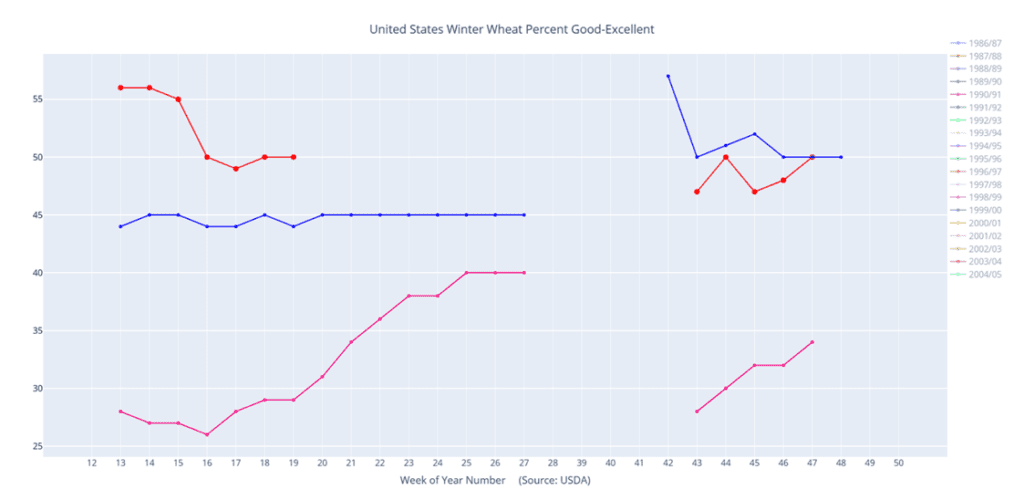

- Wheat closed with gains in all three US classes, led by the Kansas City futures, with support coming from global concerns about production in the Black Sea region and parts of Europe. However, the wheat complex closed well off session highs, with pressure coming from lower Paris milling wheat futures and the US Dollar strengthening throughout the session.

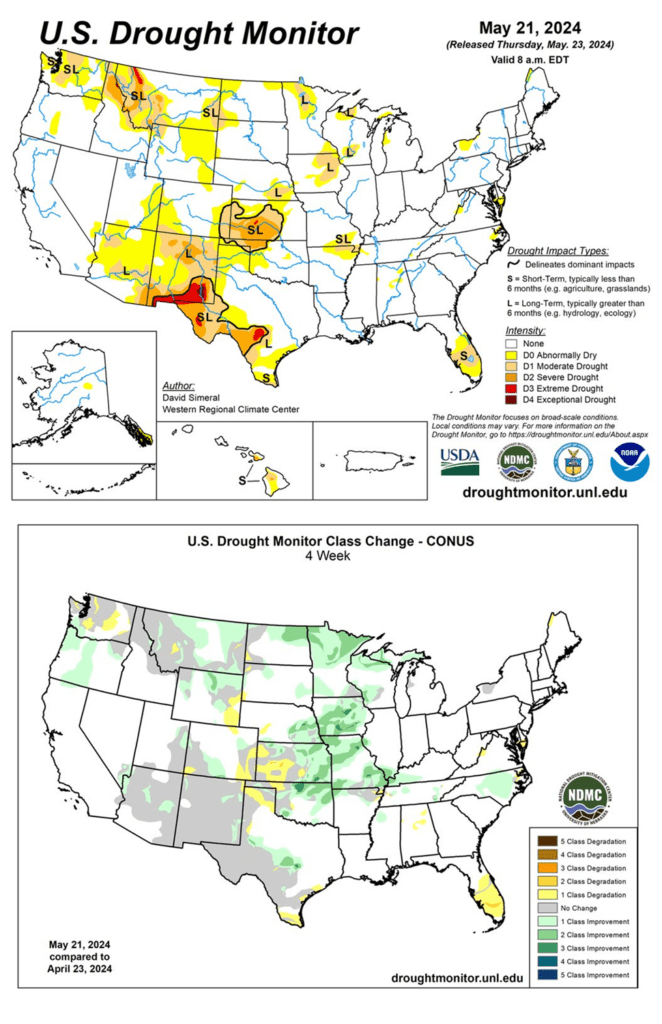

- IKAR reportedly lowered their estimate of Russian wheat production by another 2 mmt to 81.5 mmt. Their estimate is now 11.5 mmt below where it was a year ago. For reference, the USDA is using an 88 mmt figure. Additionally, the European Grain Union lowered their European wheat production forecast by about 3 mmt to 19.2 mmt due to recent drought conditions.

- The Ukrainian Grain Association reduced their 2024 grain outlook for Ukraine from 76.1 mmt to 74.6 mmt. This is said to be a result of reductions to the planted area as well as unfavorable prices, logistics issues, and dryness during May in the south and eastern parts of the nation. Of that total 19.1 mmt of wheat is forecasted to be harvested, versus 22 mmt in 2023.

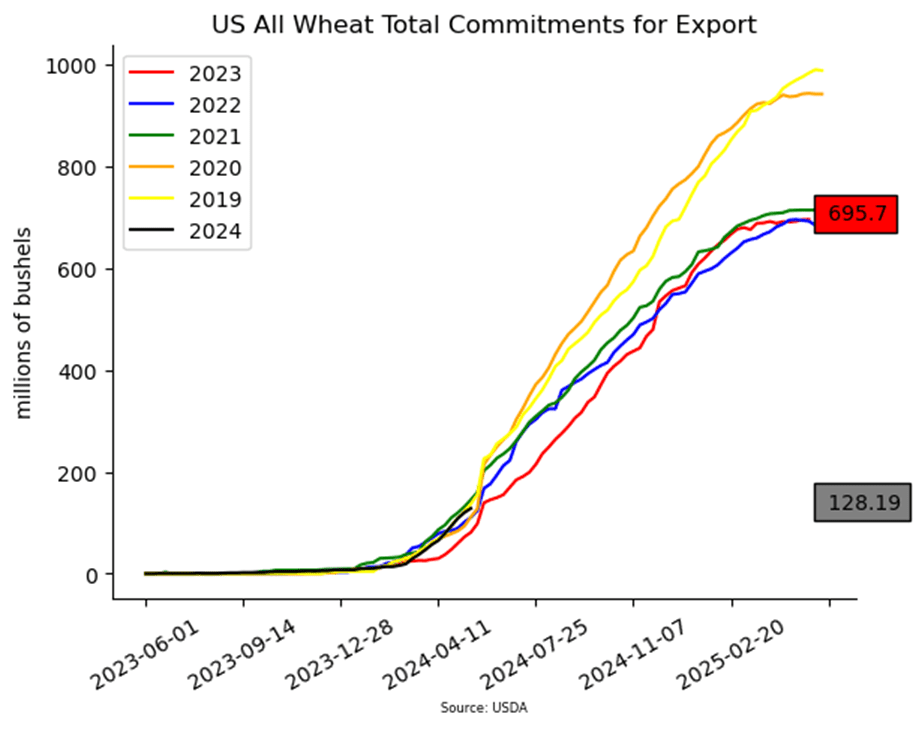

- Weekly wheat inspections at 14.7 mb bring the total 23/24 inspections to 672 mb, which is down 7% from last year. With the USDA estimating 720 mb of wheat exports, inspections for 23/24 are running behind the USDA’s estimated pace.

- Short term weather in the US southern Plains may cause some early harvest delays with the forecast looking wet. However, areas to the north will also get this rain that will help to finish the crop.

Chicago Wheat Action Plan Summary

In late April, Chicago wheat staged a rally, fueled mostly by Managed fund short covering on dryness in the southwestern Plains and potential damage to the Russian wheat crop, that took it through the major moving averages on the continuous chart, and last December highs. Although the market is showing signs of being overbought, which adds downside risk, the world wheat crop remains vulnerable which has the potential to drive an extended rally should production concerns linger or intensify.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- Grain Market Insider sees a continued opportunity to sell another portion of your 2024 SRW wheat crop. July ’24 Chicago wheat is now about 160 cents from the March low, as world production concerns have driven Managed funds to cover much of their extensive short positions. With July ’24 Chicago wheat having retraced 62% of its range back toward the July 2023 contract high and trading near 700 psychological resistance, we recommend taking advantage of these higher prices to make another sale on your estimated 2024 SRW wheat production.

- Grain Market Insider sees a continued opportunity to buy July ‘25 860 and 1020 Chicago wheat calls in equal quantities on a portion of your 2024 SRW wheat crop for approximately 73 cents plus commission and fees. Considering that the market is still attempting to assess the impact of the weather situations on the wheat crops both here in the US and abroad, the close above the recent 697 high in July ’24 Chicago wheat opens the door for a potentially extended rally. Purchasing call options now will give you confidence to make sales against the 2024 crop, and they will also help to protect sales in the event prices continue to rally further.

- No new action is currently recommended for 2025 Chicago Wheat. This spring, Grain Market Insider issued two sales recommendations to capitalize on the recent rally in July ’25 Chicago wheat prices for next year’s crop. To take further action, Plan A is to recommend making additional sales in the 775 – 800 range. In case the market comes up short of this upside target range, our current Plan B is a downside stop at 667. As long as the Jul ’25 contract remains above 667 support, the trend looks up to us and we will continue to target 775 – 800. If the Jul ’25 contract were to close below 667, it could be a sign that the trend is changing and 775 – 800 may no longer be an upside opportunity. Thus, a break of support would trigger an additional sale immediately.

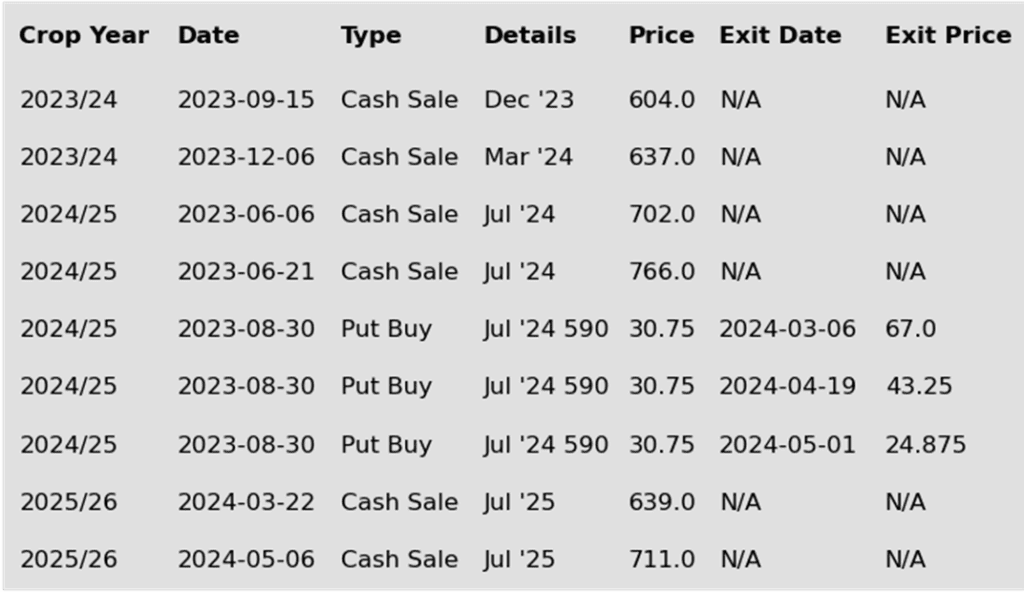

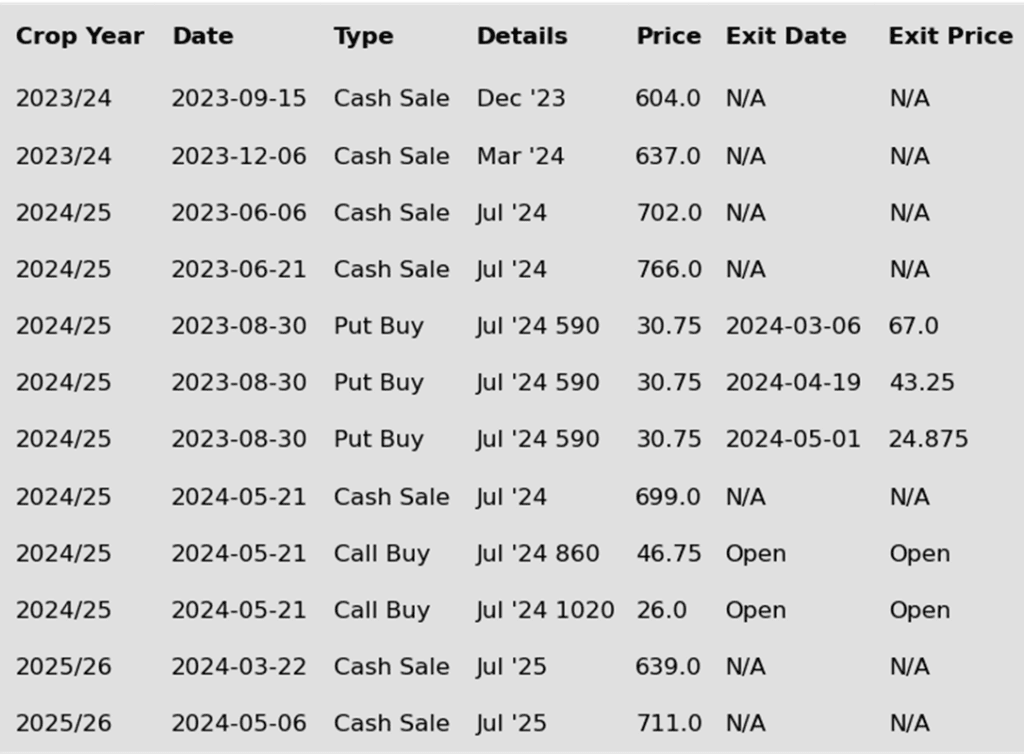

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: After setting a 720 high and closing lower on May 28, July Chicago could be set up to test nearby downside support near 650. If support holds and prices close above 720, they could be on track to test the 770 – 777 resistance area. Otherwise, further support may be found near 628.

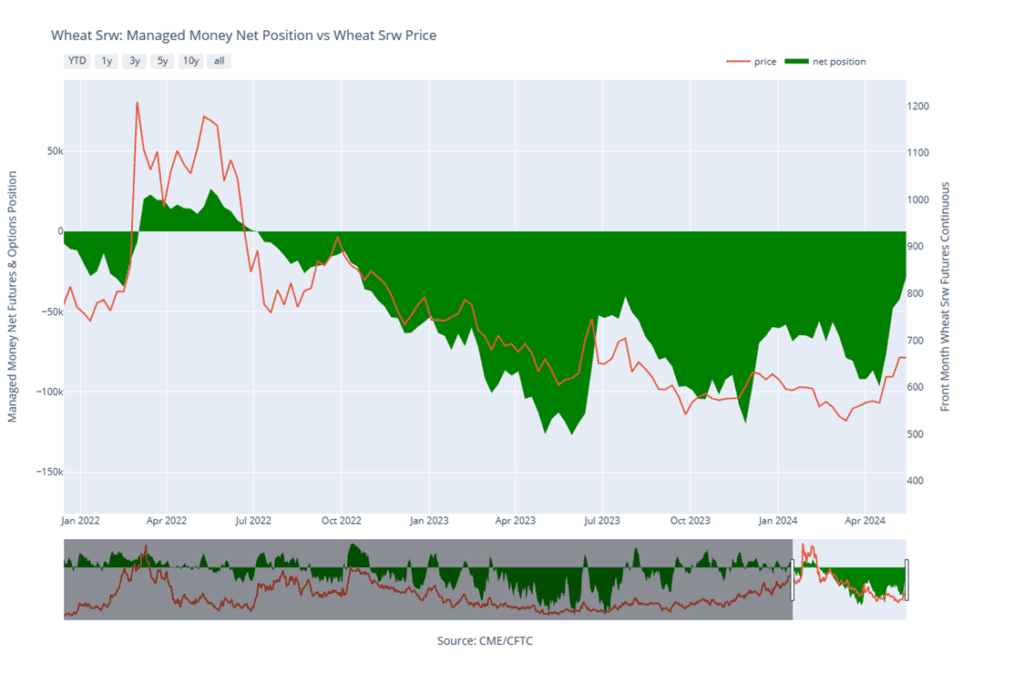

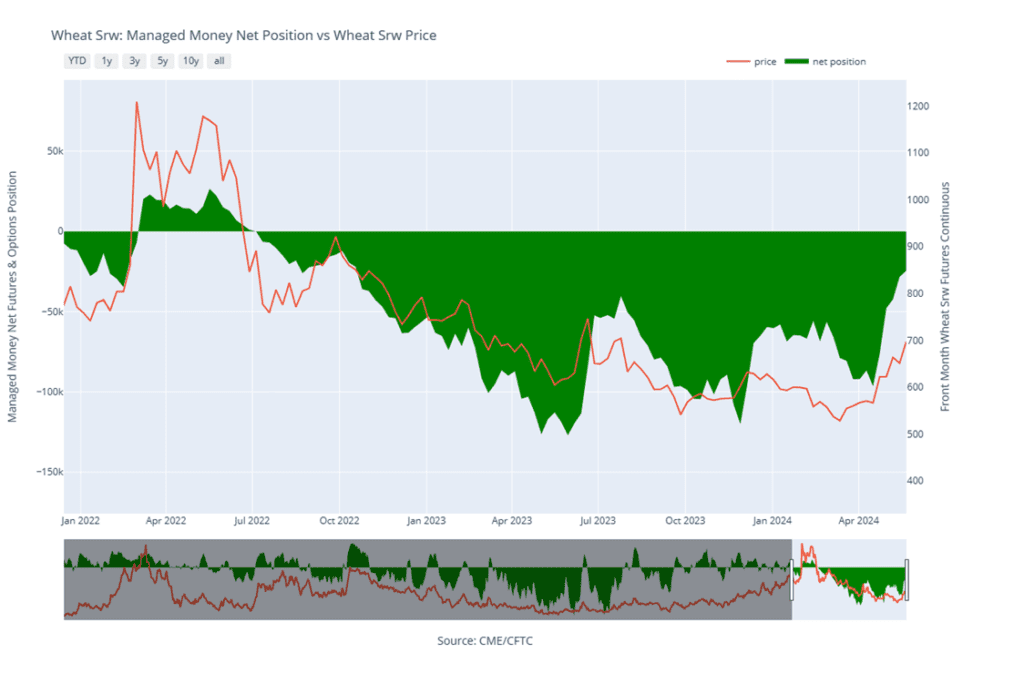

Above: Chicago Wheat Managed Money Funds net position as of Tuesday, May 21. Net position in Green versus price in Red. Money Managers net bought 3,658 contracts between May 15 – 21, bringing their total position to a net short 24,593 contracts.

KC Wheat Action Plan Summary

Between the end of February and the middle of April, KC wheat was mostly rangebound between the mid-590s on the topside and mid 550s down low, with little to move prices higher, all the while Managed funds continued adding to their large net short positions. Toward the end of April, dryness in the Black Sea region and the US HRW growing areas started becoming more concerning and triggered a short covering rally across the wheat complex, driving prices to levels not seen in over six months. Although US wheat exports continue to struggle to compete on the world market, which can keep a lid on US prices, they could still push higher if world production concerns persist.

- Grain Market Insider sees a continued opportunity to sell another portion of your 2023 HRW wheat crop. Since the middle of April, July ’24 KC wheat has rallied in excess of 150 cents to a high of 719 ¼, mostly on dryness in the US HRW growing areas and concerns regarding Russia’s wheat crop. However, the bearish reversal from Wednesday’s 719 ¼ high, suggests that prices may begin to move lower. Also, considering that time is getting limited to market the remainder of this crop, Grain Market Insider recommends selling another portion of your 2023 HRW production in what will likely be our last sales recommendation for this crop year.

- Grain Market Insider sees a continuing opportunity to buy July ‘25 860 and 1020 KC wheat calls in equal quantities on a portion of your 2024 HRW wheat crop for 70 cents plus commission and fees. Considering that the market is still attempting to assess the impact of the weather situations on the wheat crops both here in the US and abroad, the close above the recent 719 ¼ high in July ’24 KC wheat opens the door for a potentially extended rally. Purchasing call options now will give you confidence to make sales further against the 2024 crop at higher prices, and they will also help to protect sales in the event prices continue to rally further.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

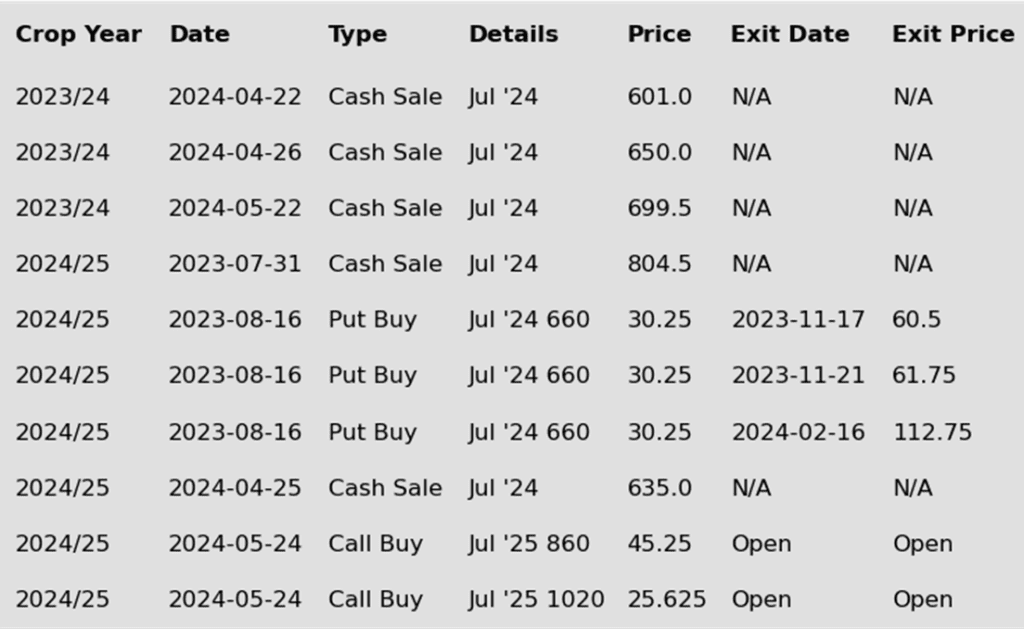

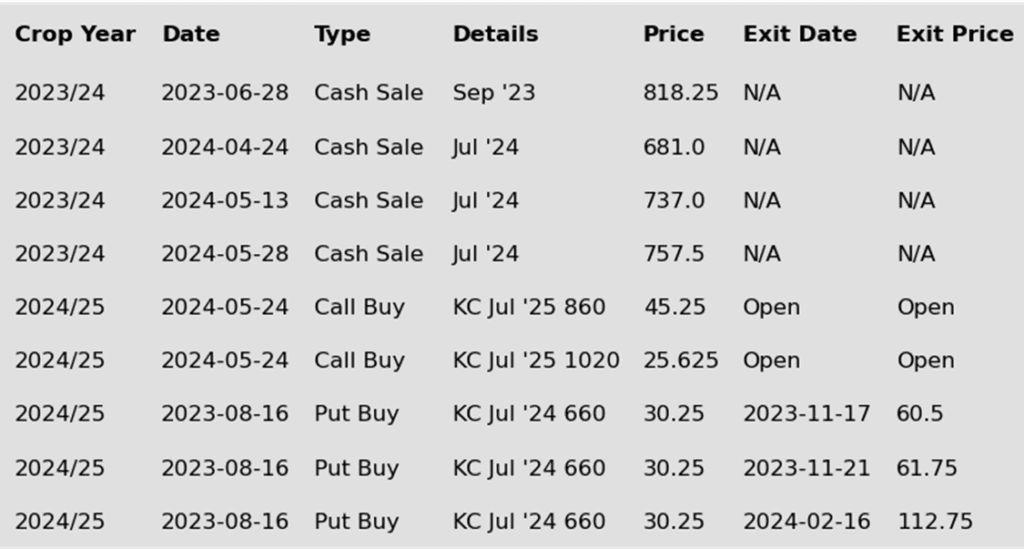

To date, Grain Market Insider has issued the following KC recommendations:

Above: May 28, July ’24 gapped higher and closed below its open in a bearish reversal after piercing the 720 – 754 congestion area. For now, resistance remains just overhead between 746 and 754, a close above which could put the market on track towards 780. If prices retreat, initial support may come in near 689, with further support between 660 and 646.

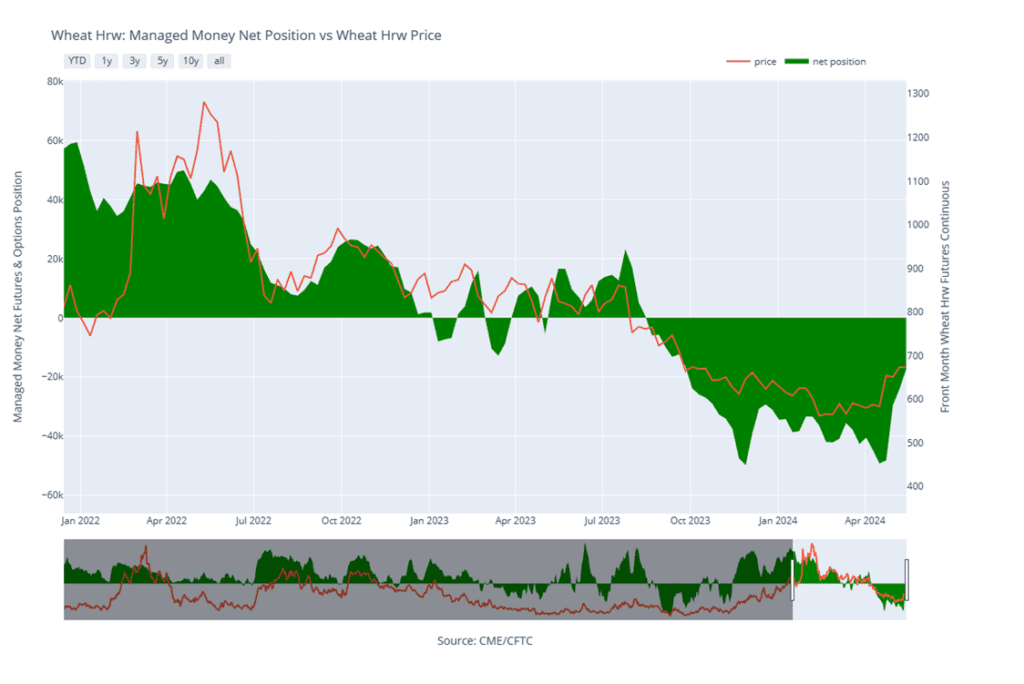

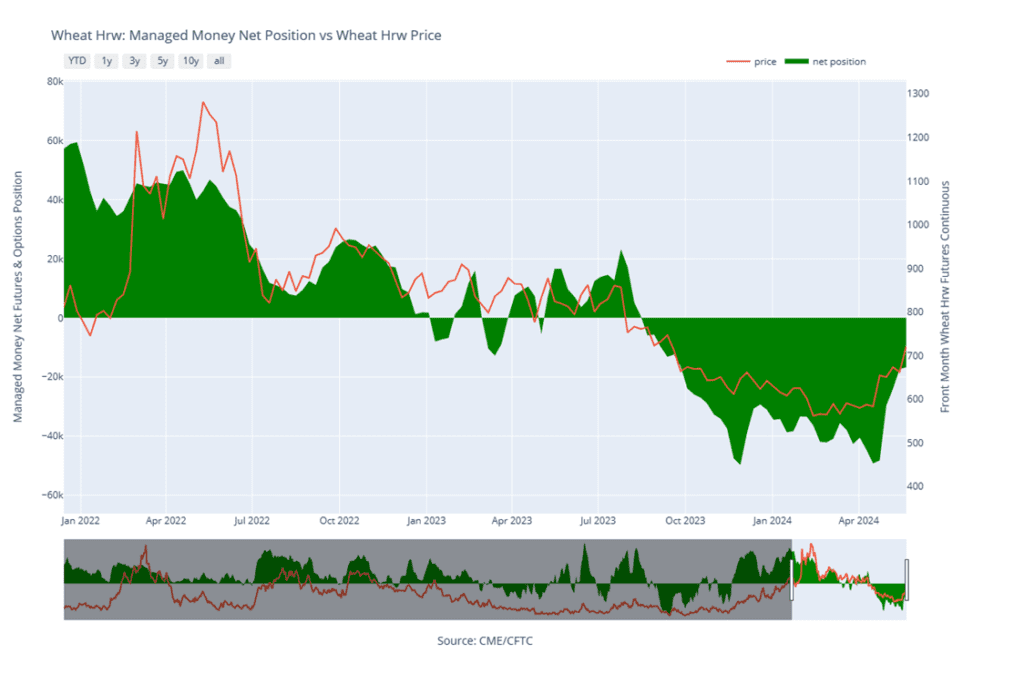

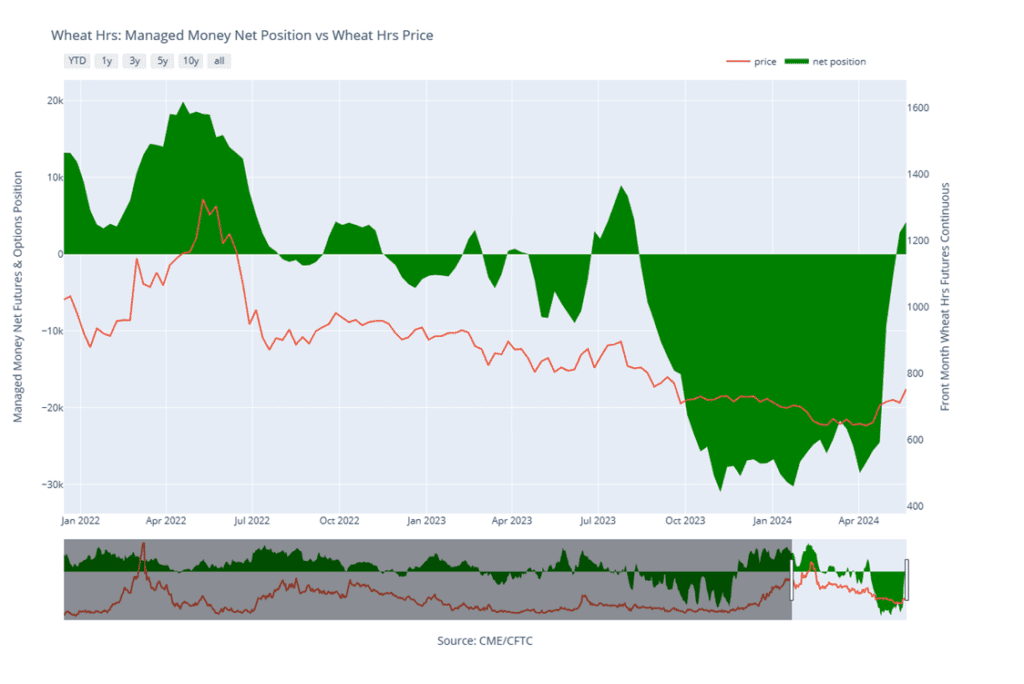

Above: KC Wheat Managed Money Funds net position as of Tuesday, May 21. Net position in Green versus price in Red. Money Managers net bought 503 contracts between May 15 – 21, bringing their total position to a net short 16,764 contracts.

Mpls Wheat Action Plan Summary

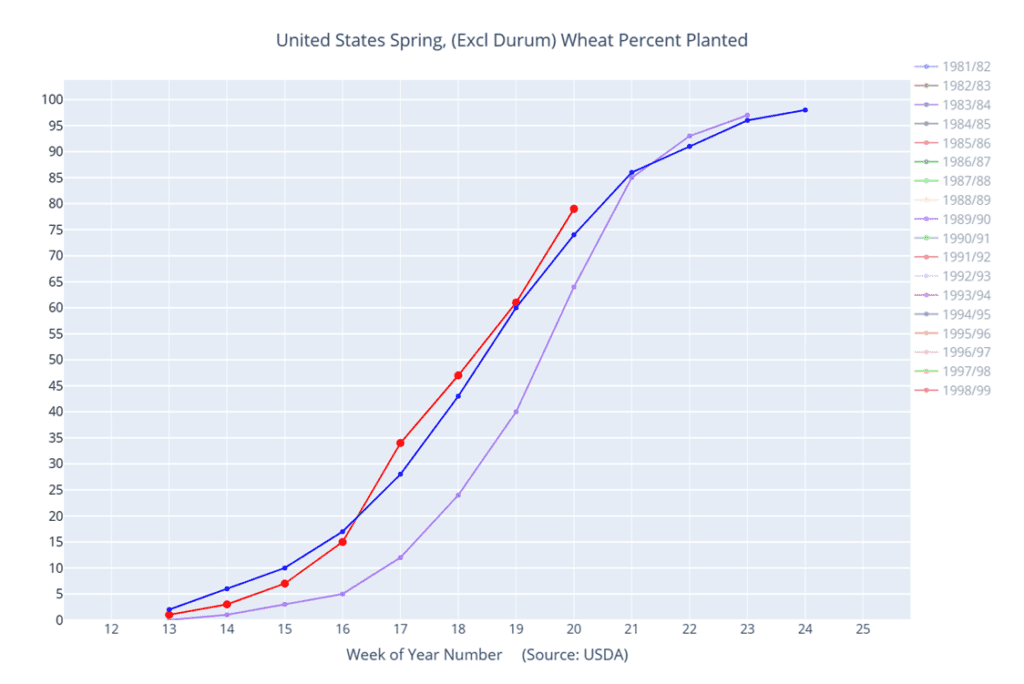

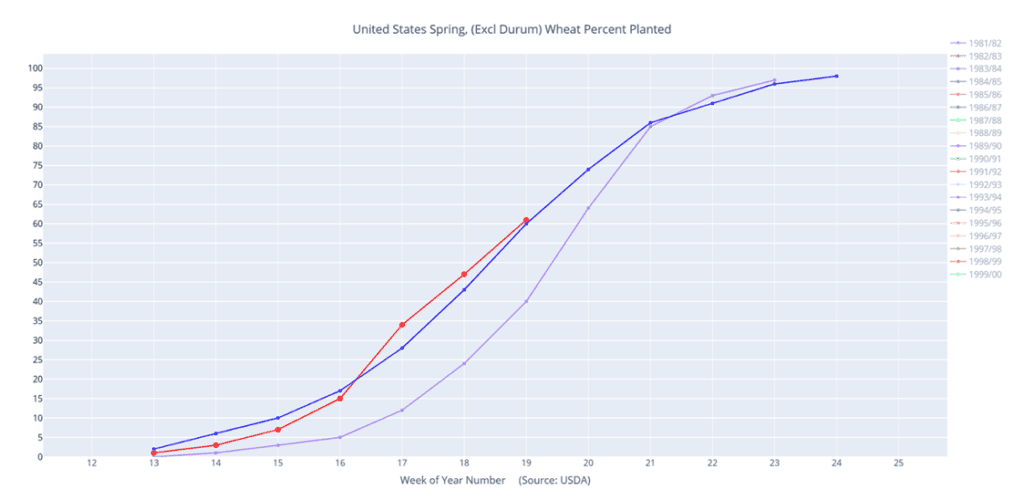

From mid-February through most of April, Minneapolis wheat traded mostly sideways to lower, lacking significant bullish fundamental news to drive prices upward. However, in late April, spurred by concerns over the world wheat crop and dry conditions in the HRW growing regions, Minneapolis wheat experienced a rally back towards last fall’s highs. Despite lingering obstacles for the US wheat market, historical seasonal trends typically strengthen in late spring and early summer, and production concerns remain in Russia and Europe that could potentially feed an extended rally if they intensify.

- Grain Market Insider recommends selling another portion of your 2023 Spring wheat crop. Since our last sales recommendation for the 2023 spring wheat crop, prices rallied almost 31 cents to today’s new recent high of 767 ¾ in the July ‘24 contract. After posting that high, prices dropped significantly and closed in a bearish reversal, suggesting exhaustive buying and a potential change to a lower trend. Also, considering that time is getting limited to market the remainder of this crop, Grain Market Insider recommends selling another portion of your 2023 spring wheat production in what will likely be our last sales recommendation for this crop year.

- Grain Market Insider sees a continuing opportunity to buy July ‘25 860 and 1020 KC wheat calls in equal quantities on a portion of your 2024 HRW wheat crop for 70 cents plus commission and fees. Considering that the market is still attempting to assess the impact of the weather situations on the wheat crops both here in the US and abroad, the close above the recent 719 ¼ high in July ’24 KC wheat opens the door for a potentially extended rally. Purchasing call options now will give you confidence to make sales further against the 2024 crop at higher prices, and they will also help to protect sales in the event prices continue to rally further. The KC wheat market has a high correlation with Minneapolis wheat’s price movements, and Grain Market Insider recommends buying July ’25 KC Wheat calls in lieu of Minneapolis calls due to the significantly higher liquidity levels in the KC wheat market versus that of the Minneapolis wheat market.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After gapping higher and trading to a 767 ¾ high on May 28, July ’24 closed below its open price creating a bearish reversal. Overhead resistance remains between the 767 ¾ high and 790, a close above which could allow prices to test the 837 level. A slide lower could run into support near 729 and again between 710 and 697.

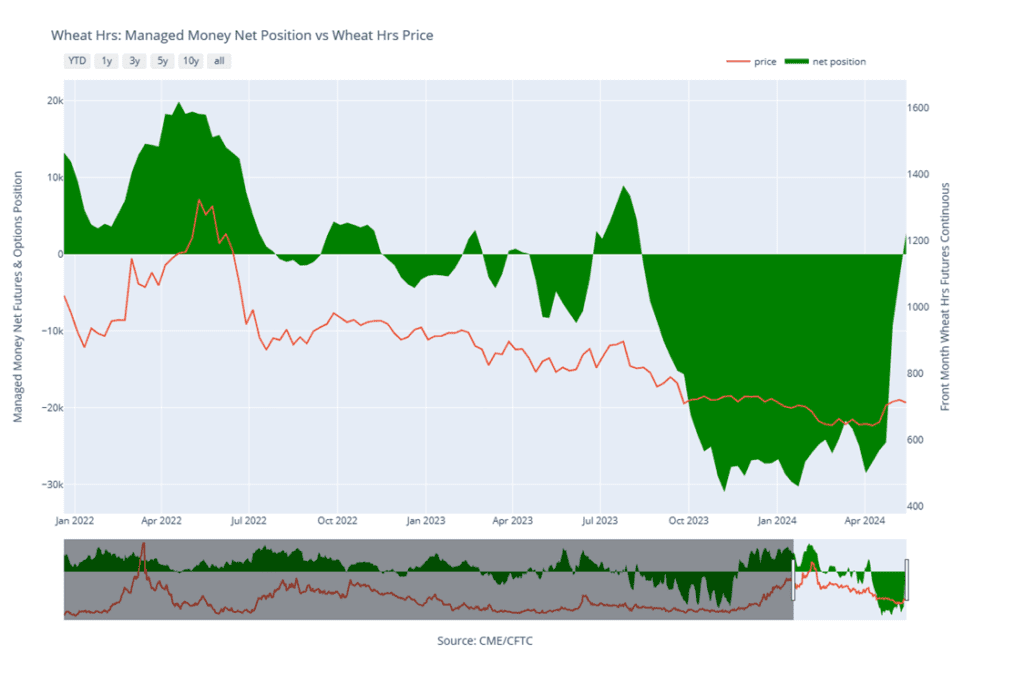

Above: Minneapolis Wheat Managed Money Funds net position as of Tuesday, May 21. Net position in Green versus price in Red. Money Managers net bought 1,406 contracts between May 15 – 21, bringing their total position to a net long 4,179 contracts.

Other Charts / Weather

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.