10-01 End of Day: Government Shutdown Adds Uncertainty to Grain Market Activity

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn prices made a sharp turnaround, ending the day with gains despite the volatile trading following yesterday’s USDA report.

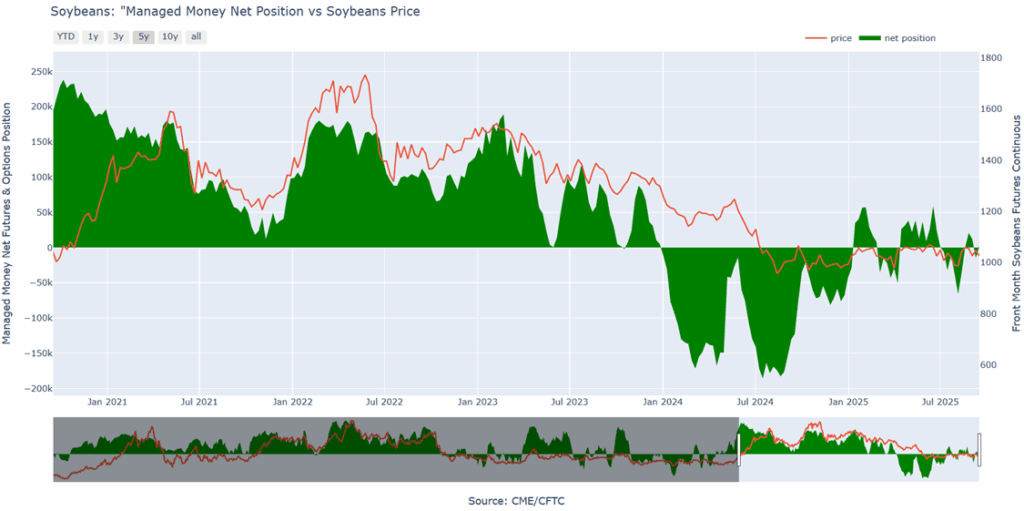

- 🌱 Soybeans: Soybeans closed higher mid-week following a tweet from President Trump regarding tariffs and potential support for producers.

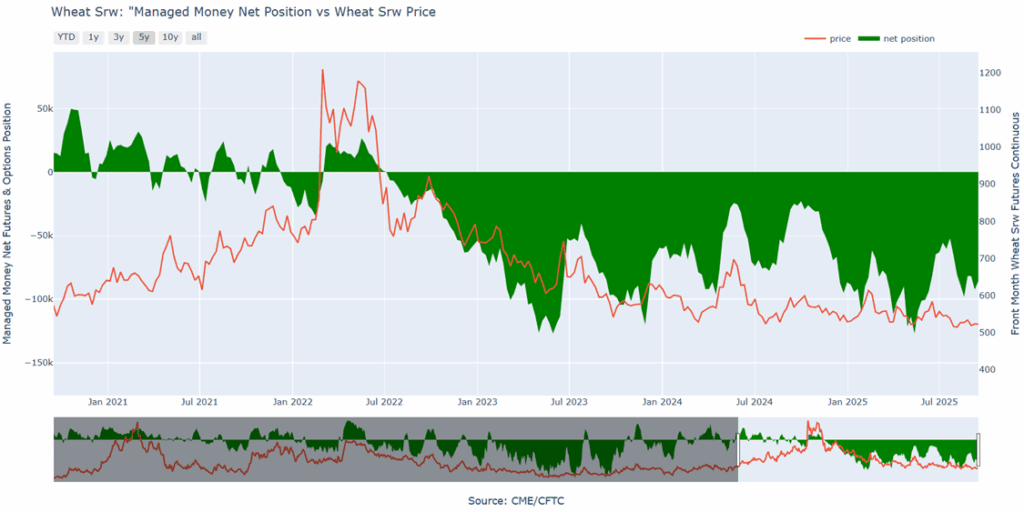

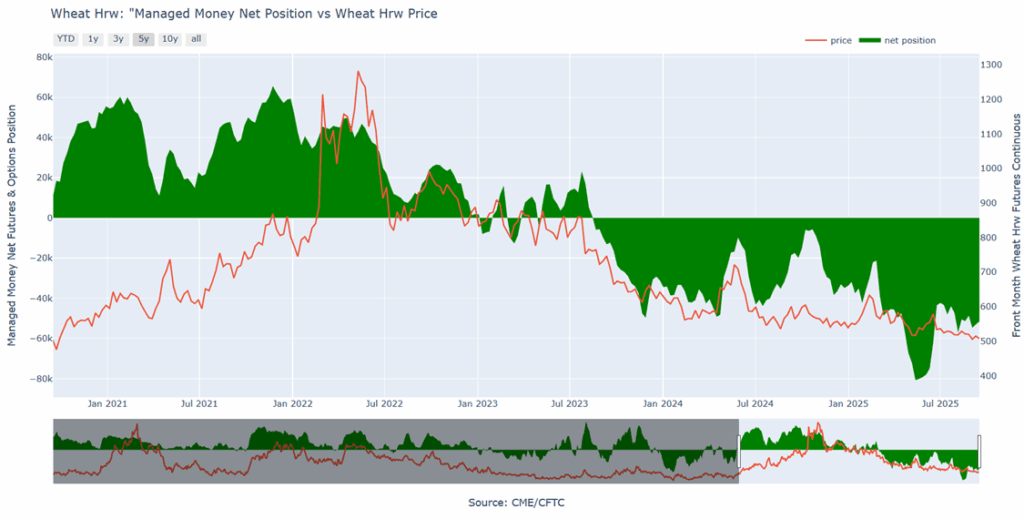

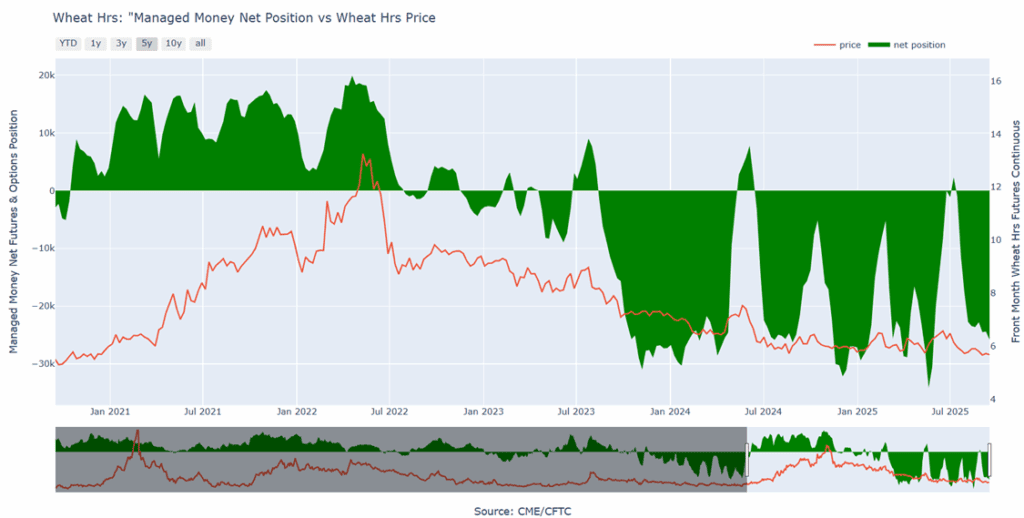

- 🌾 Wheat: Wheat ended the day mixed, with Chicago wheat leading gains while Kansas City wheat fell, as the government shutdown and a weak U.S. dollar contributed to market volatility.

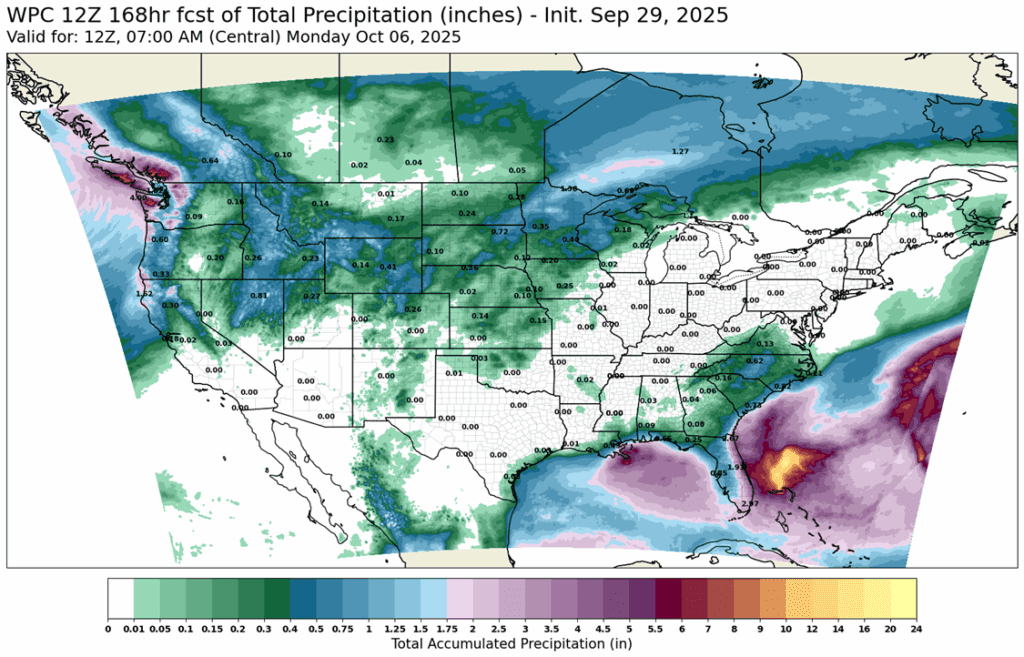

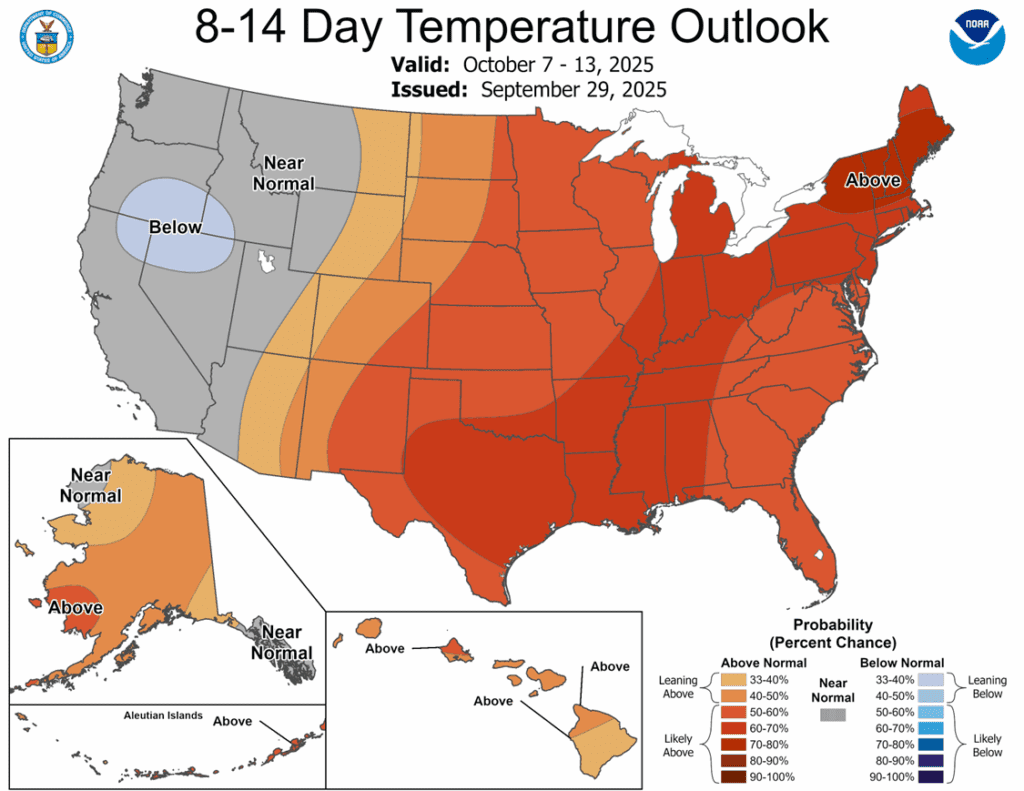

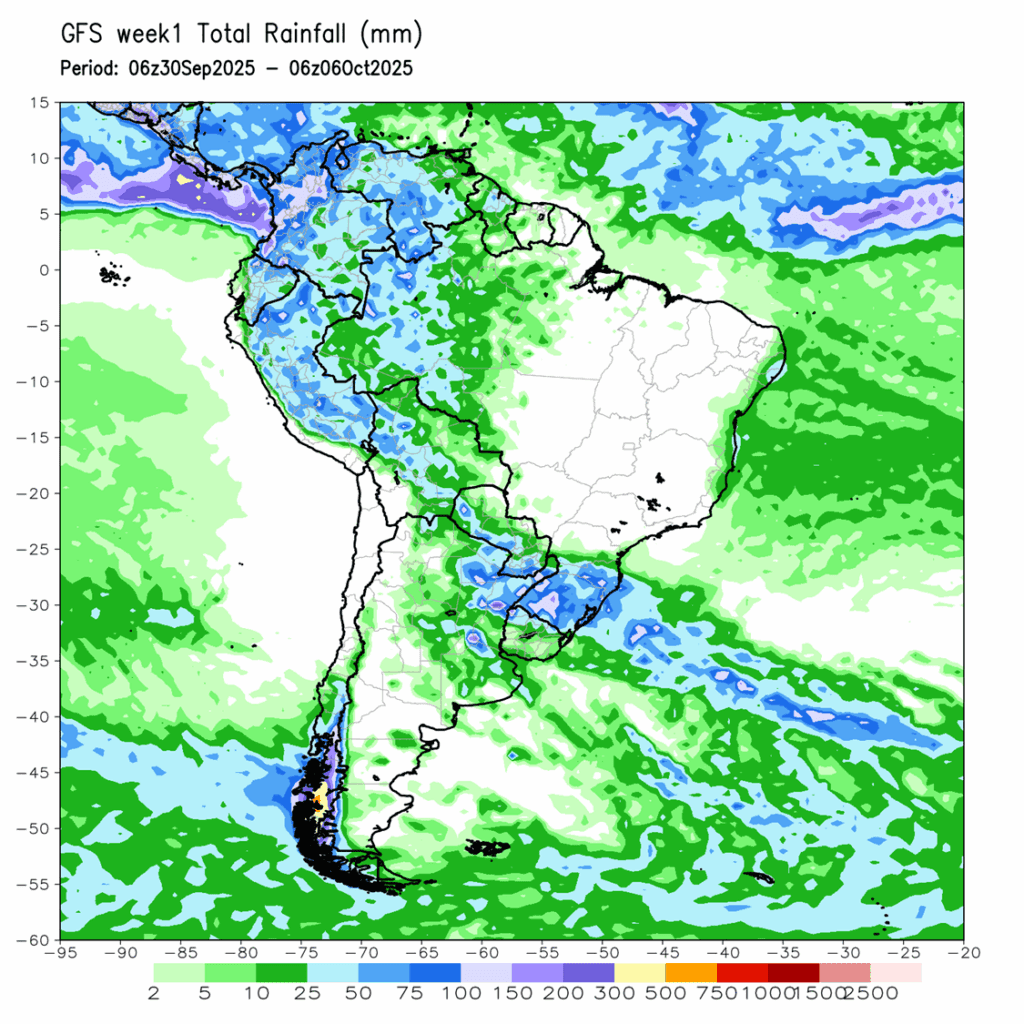

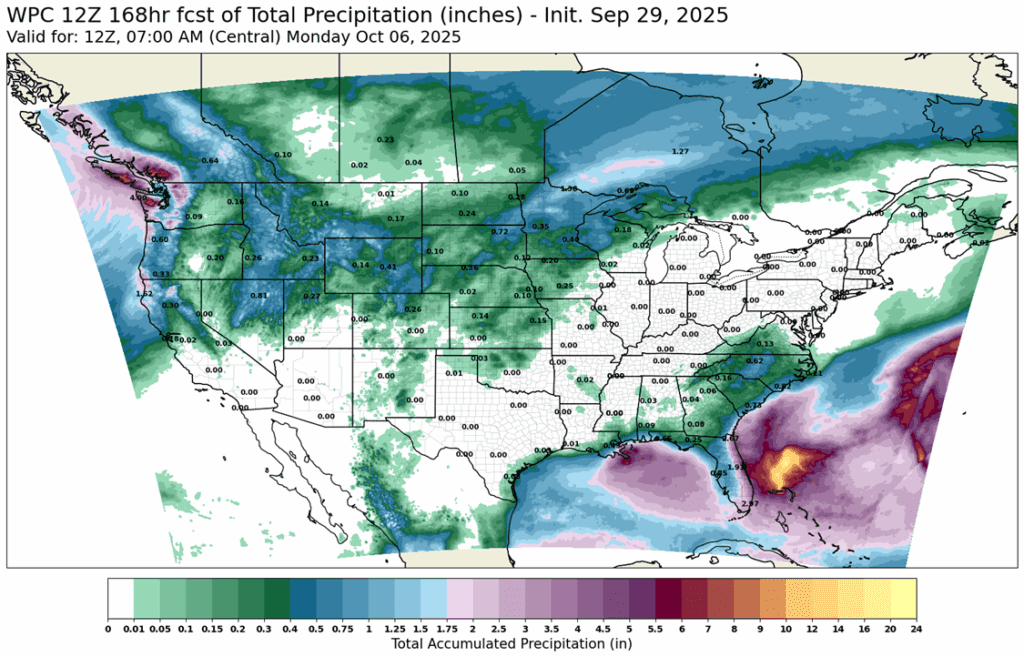

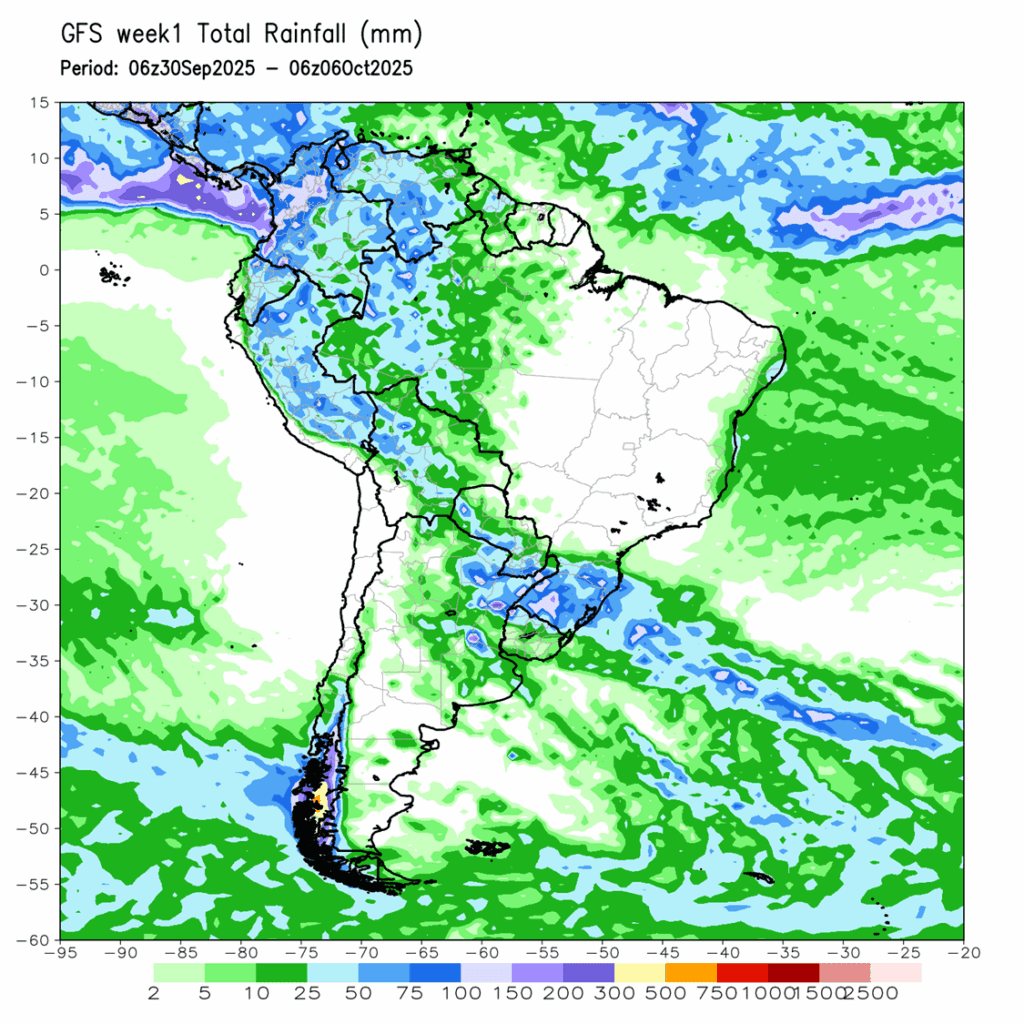

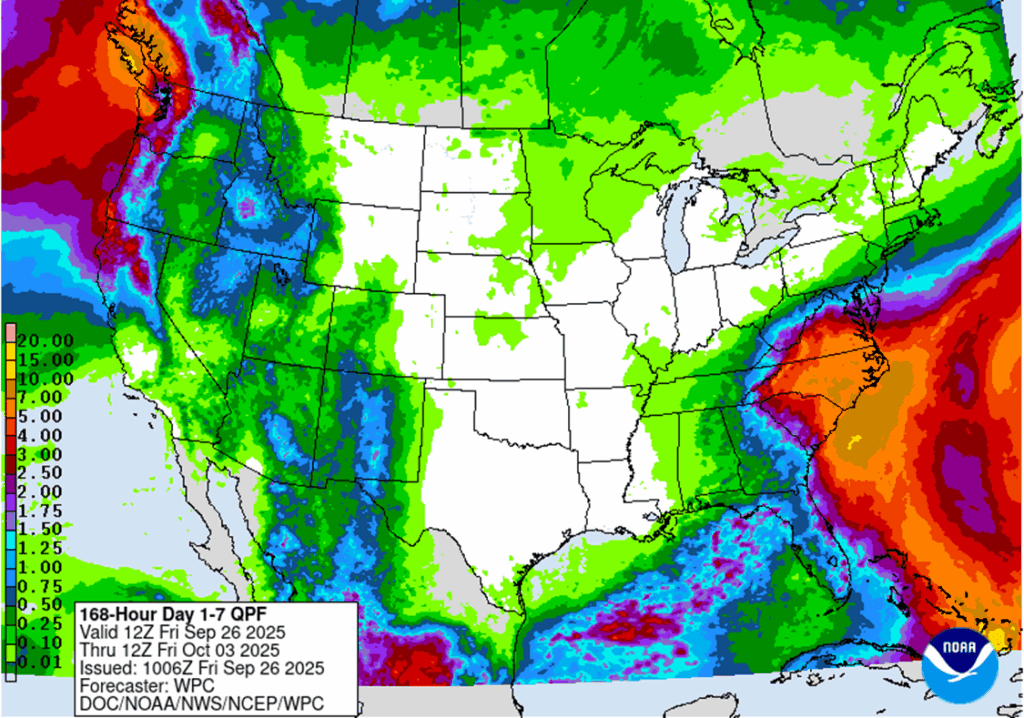

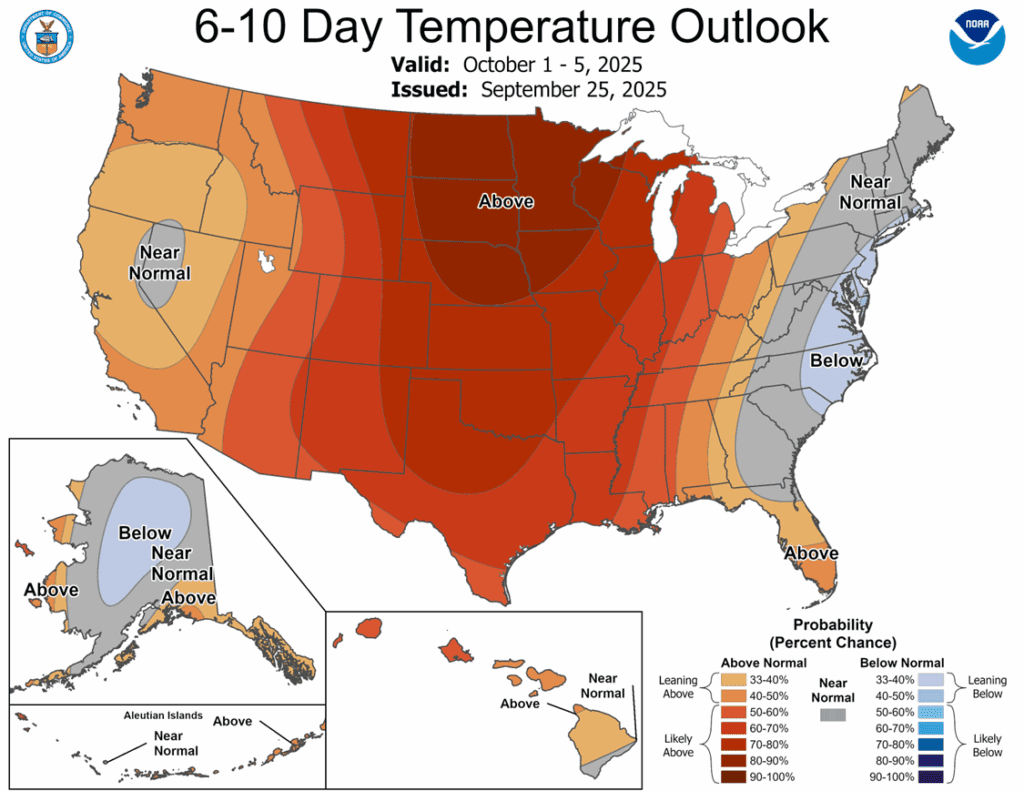

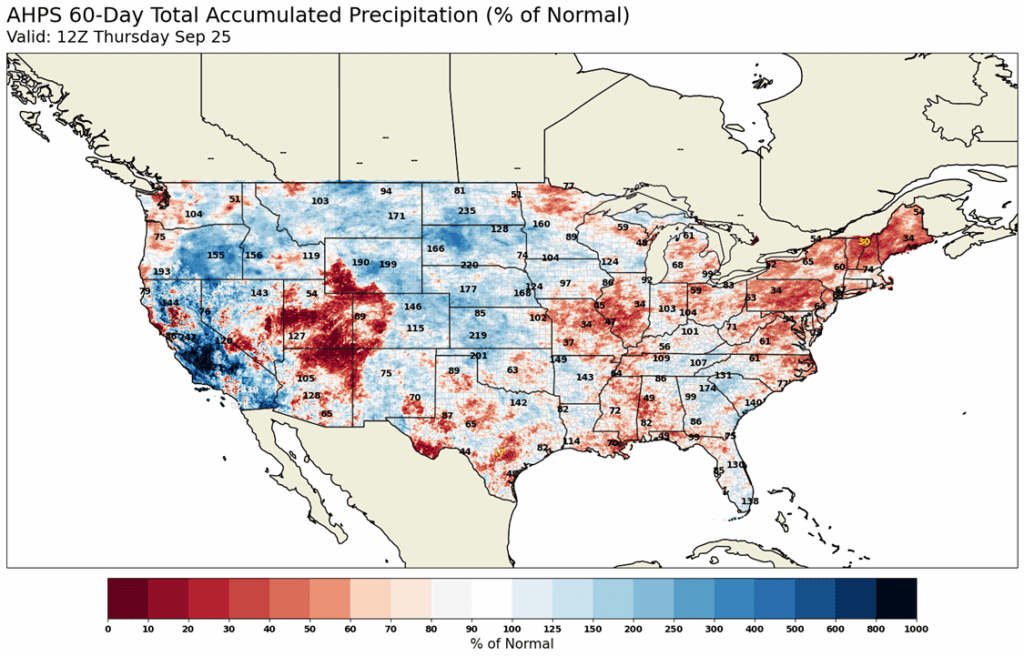

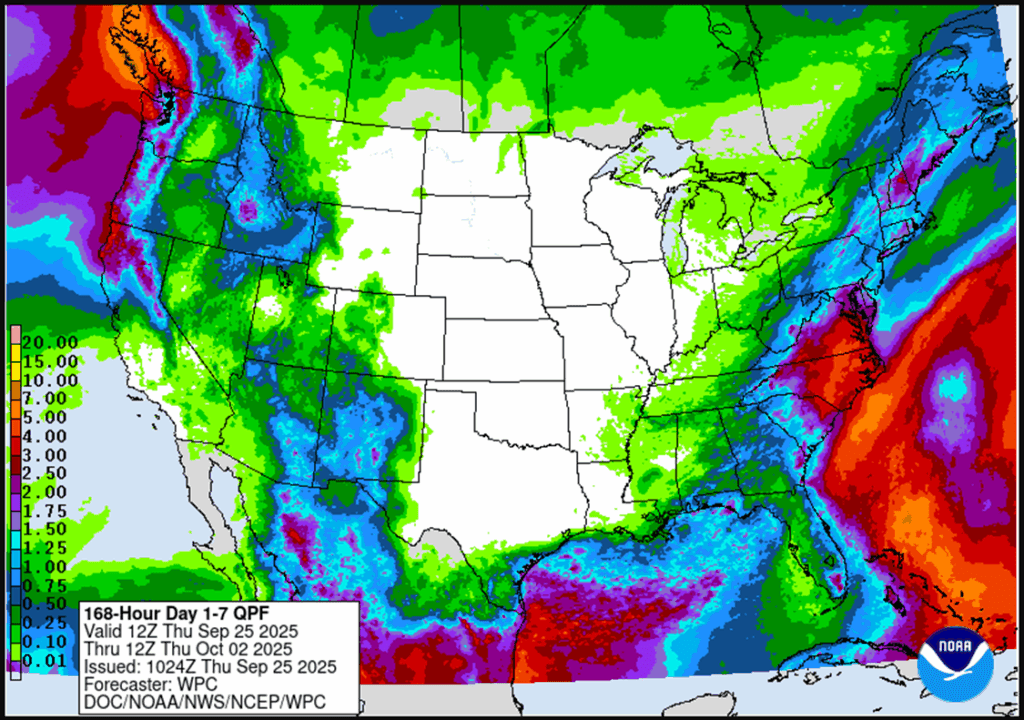

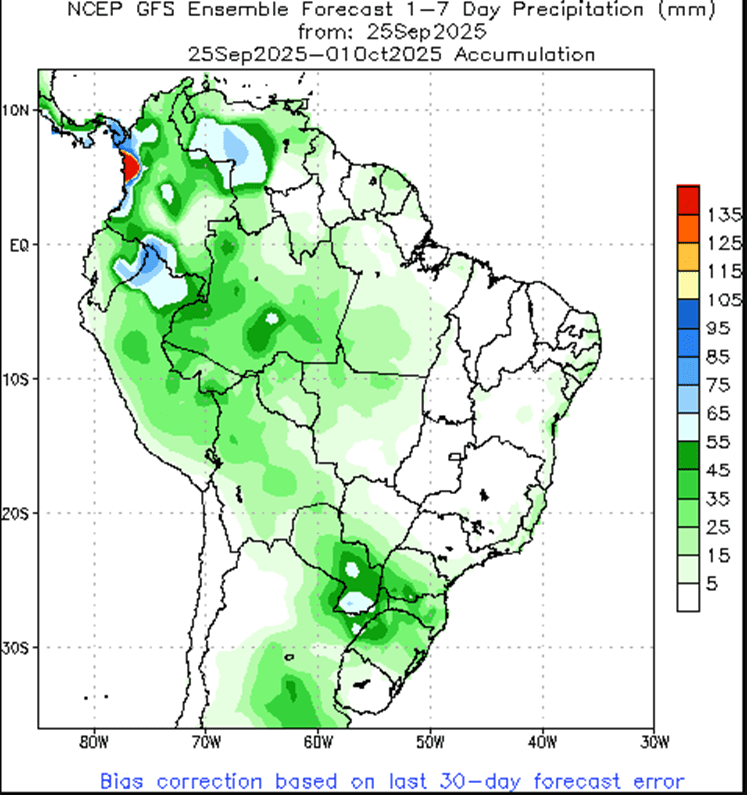

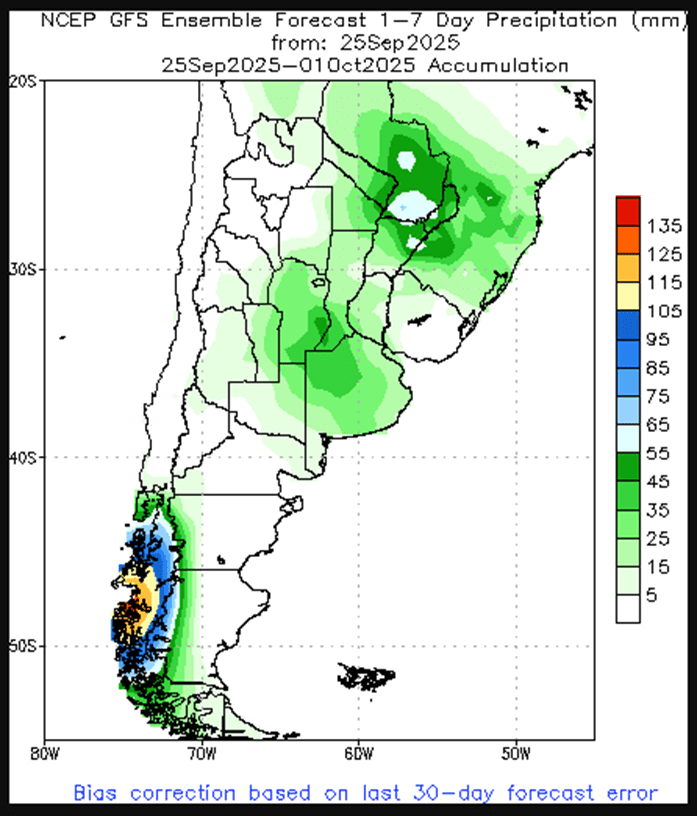

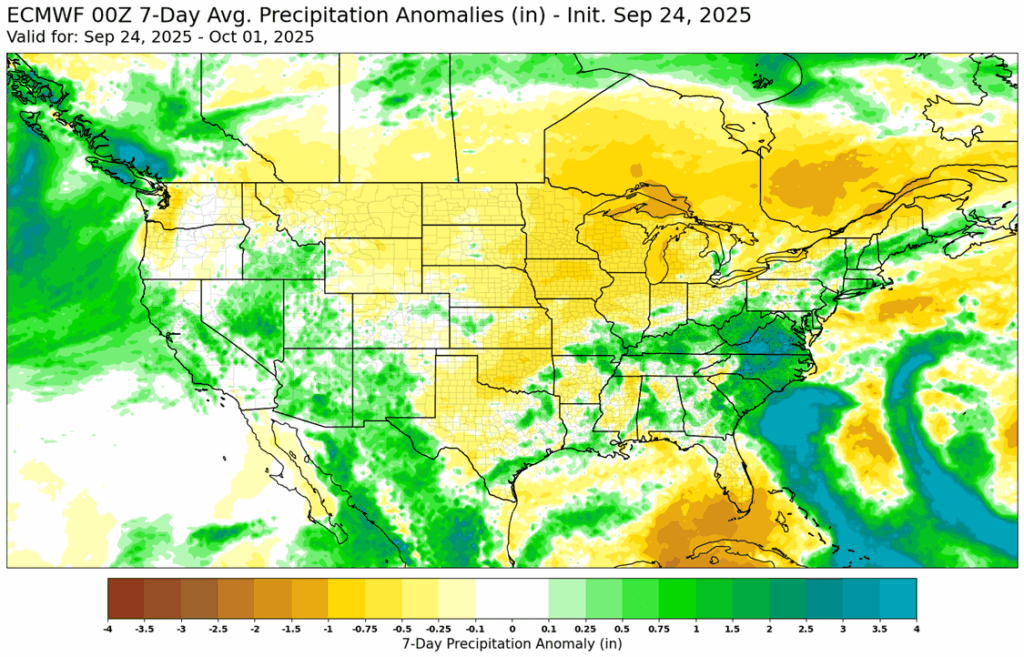

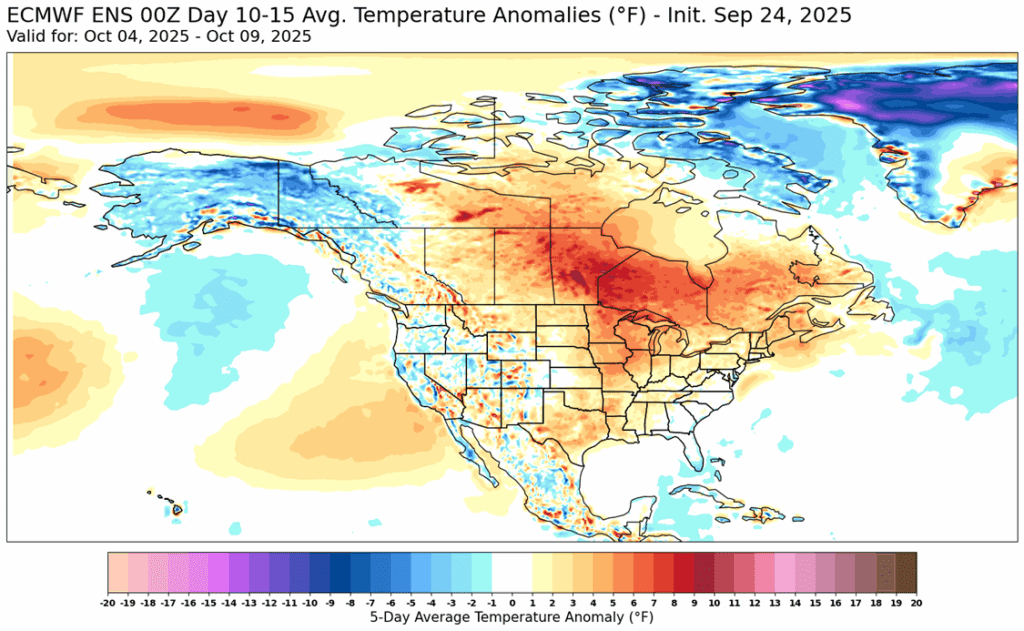

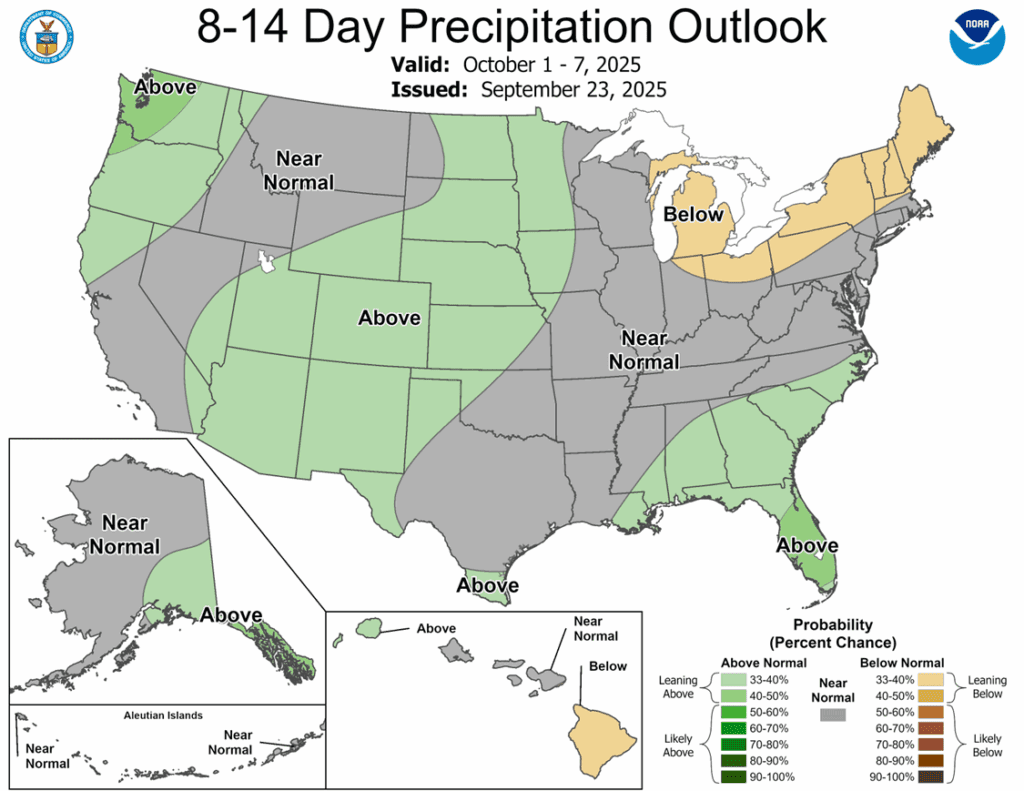

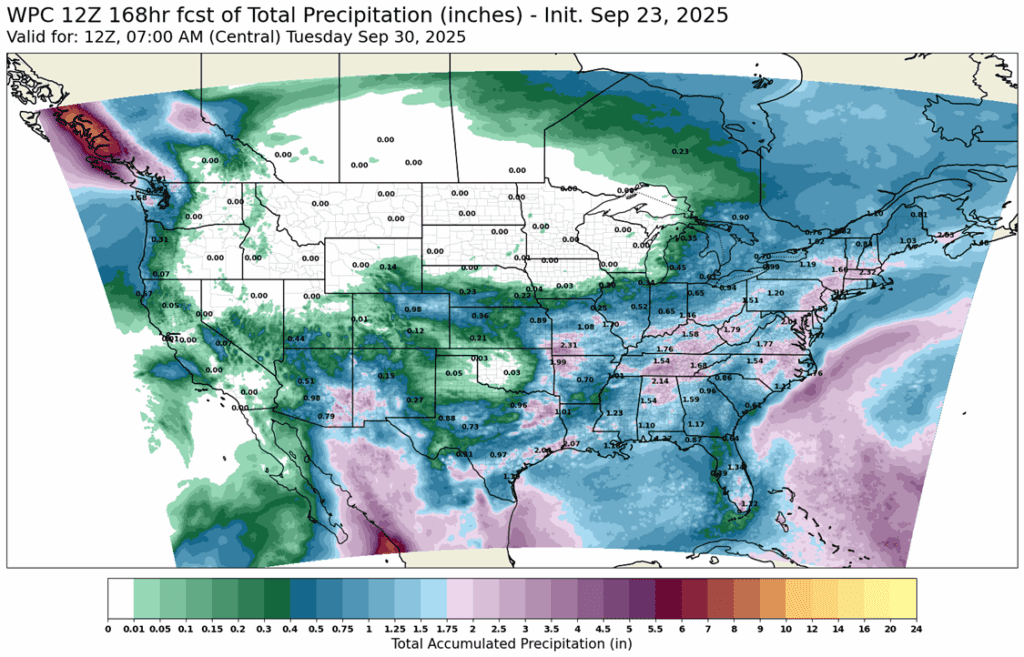

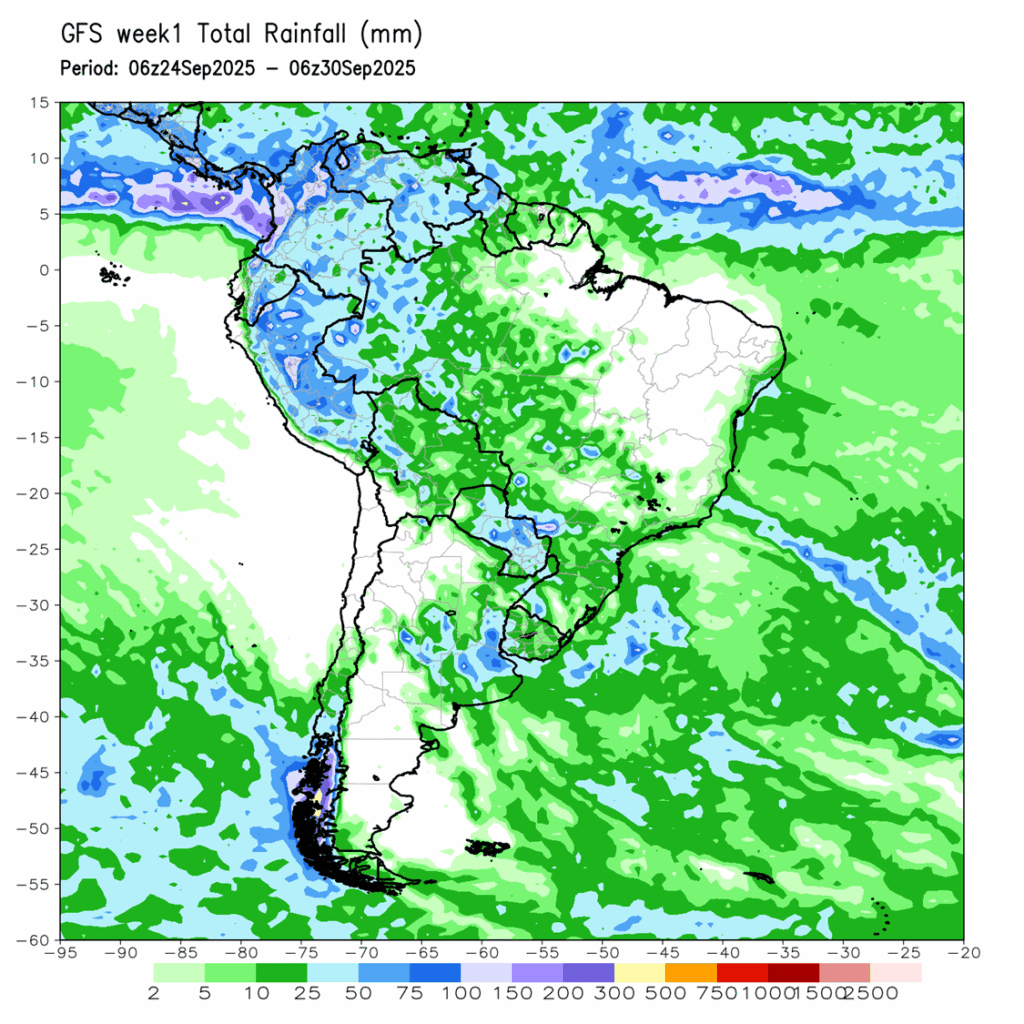

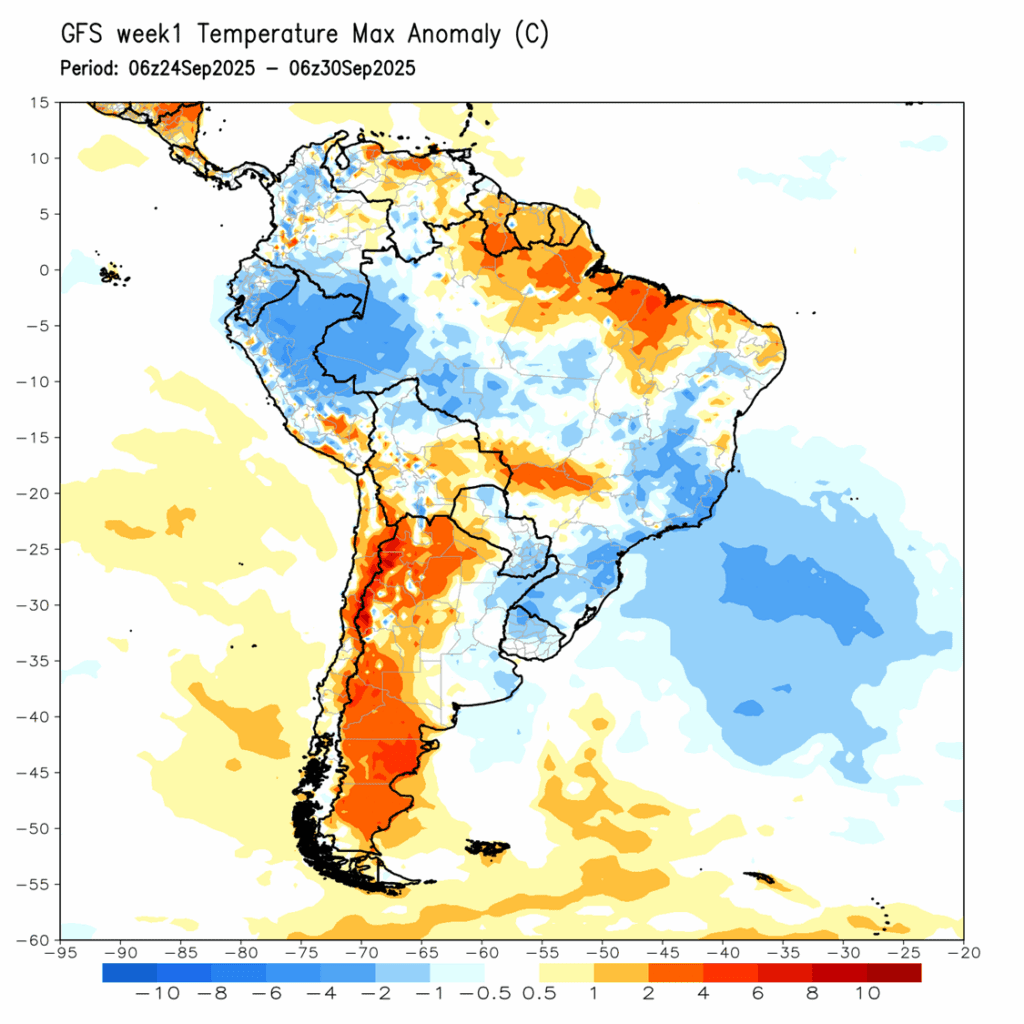

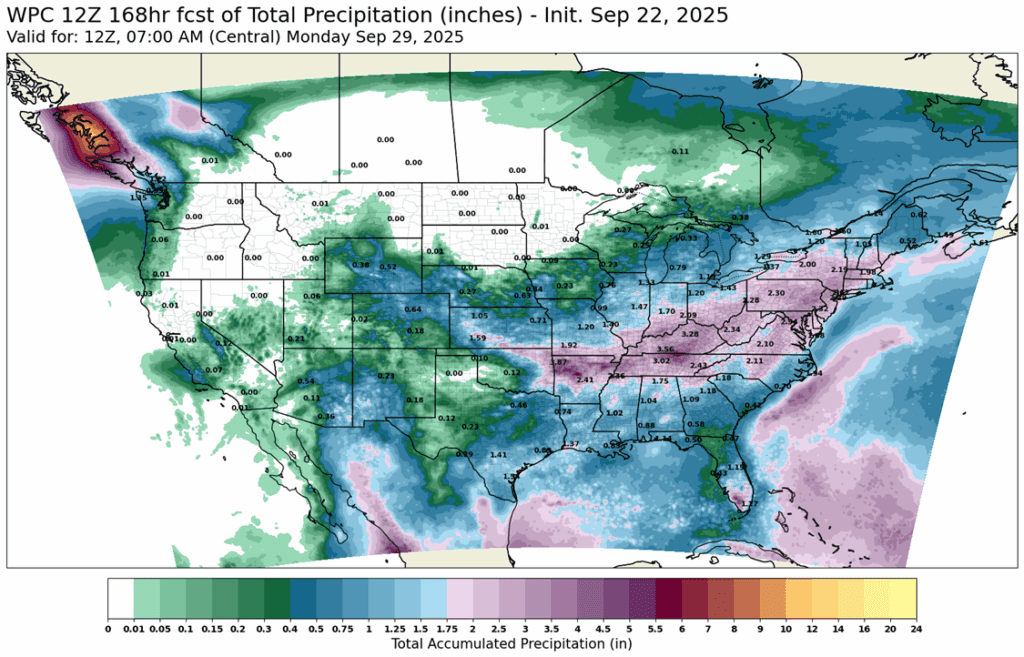

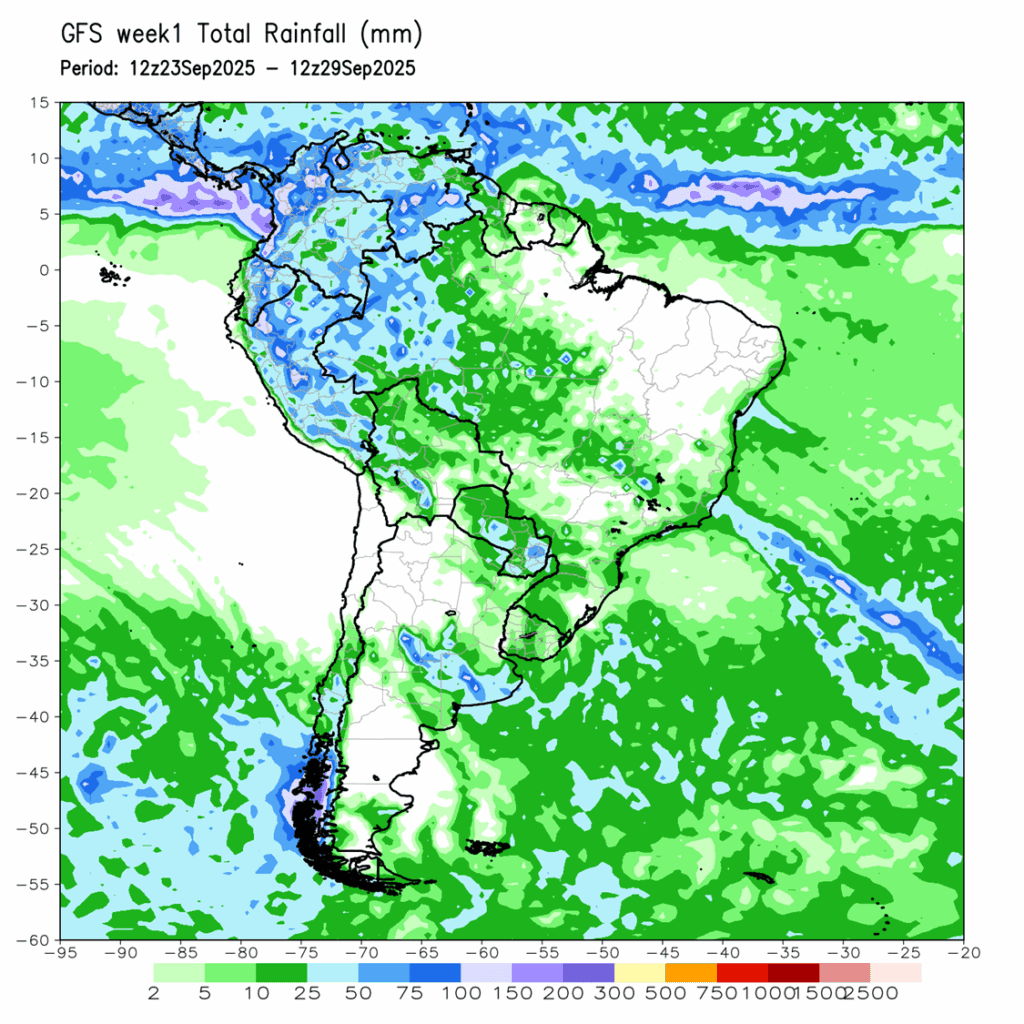

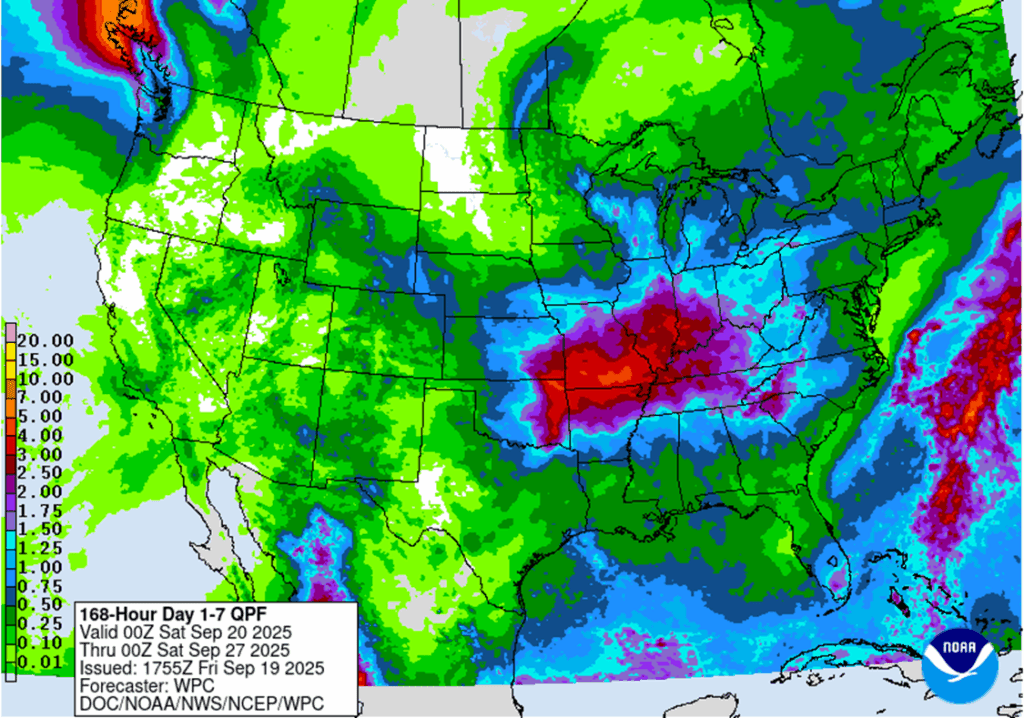

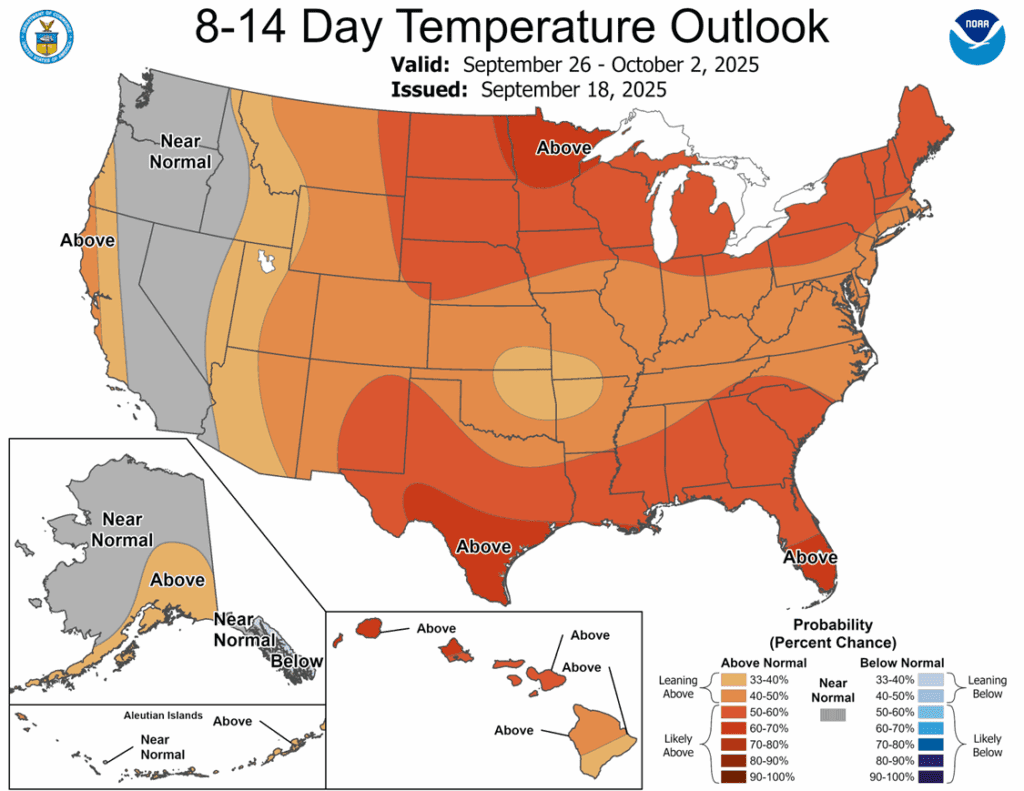

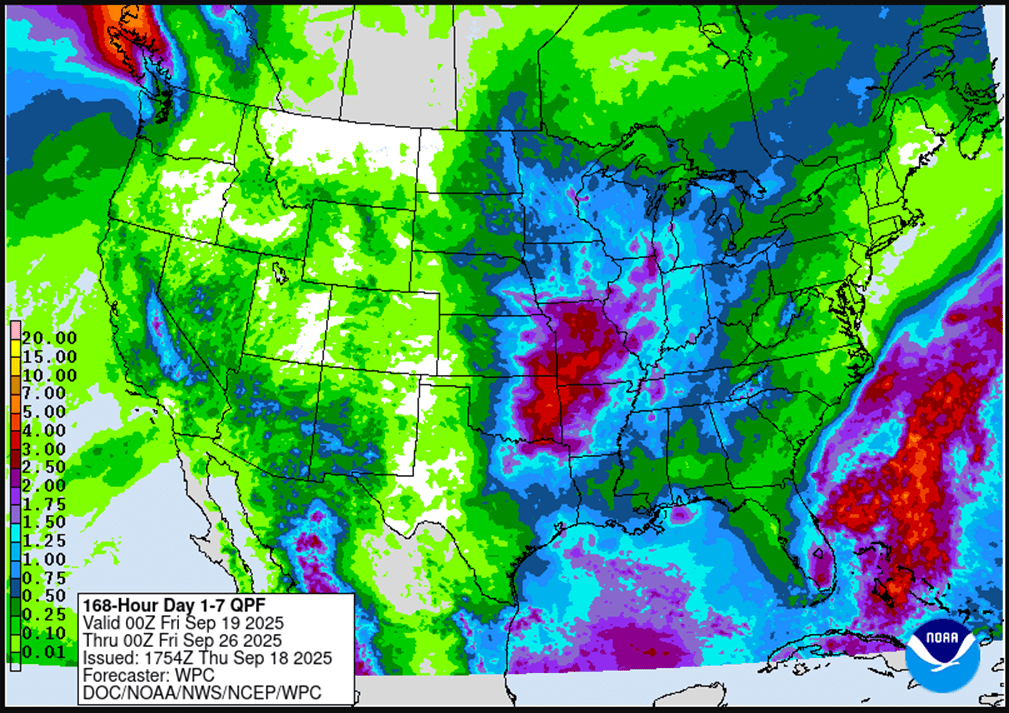

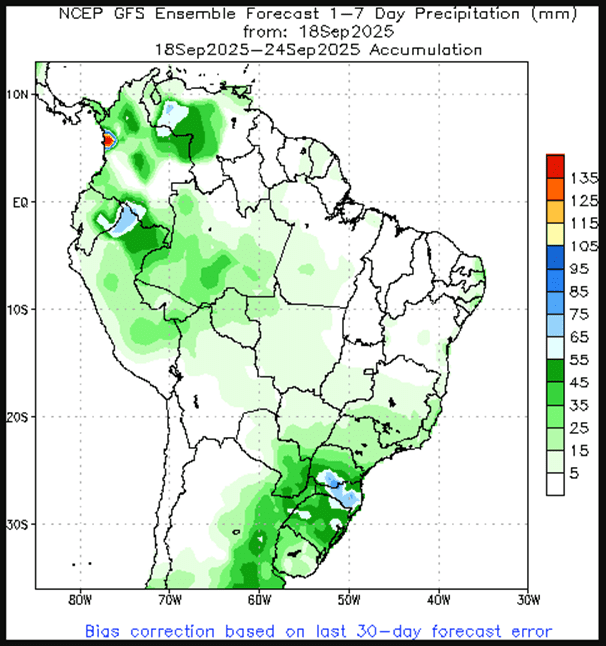

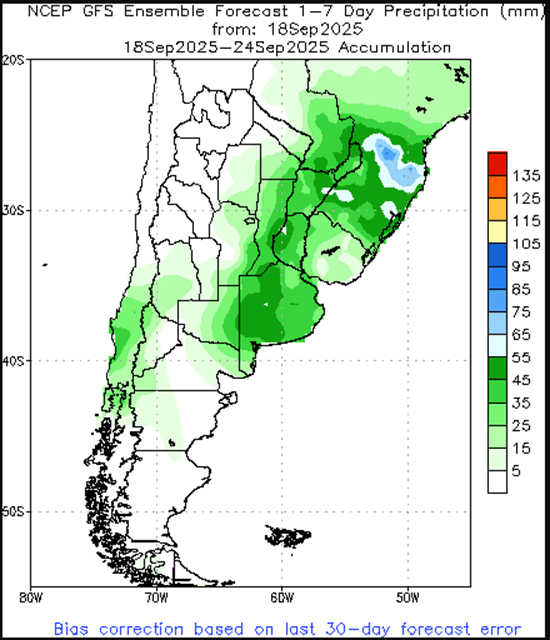

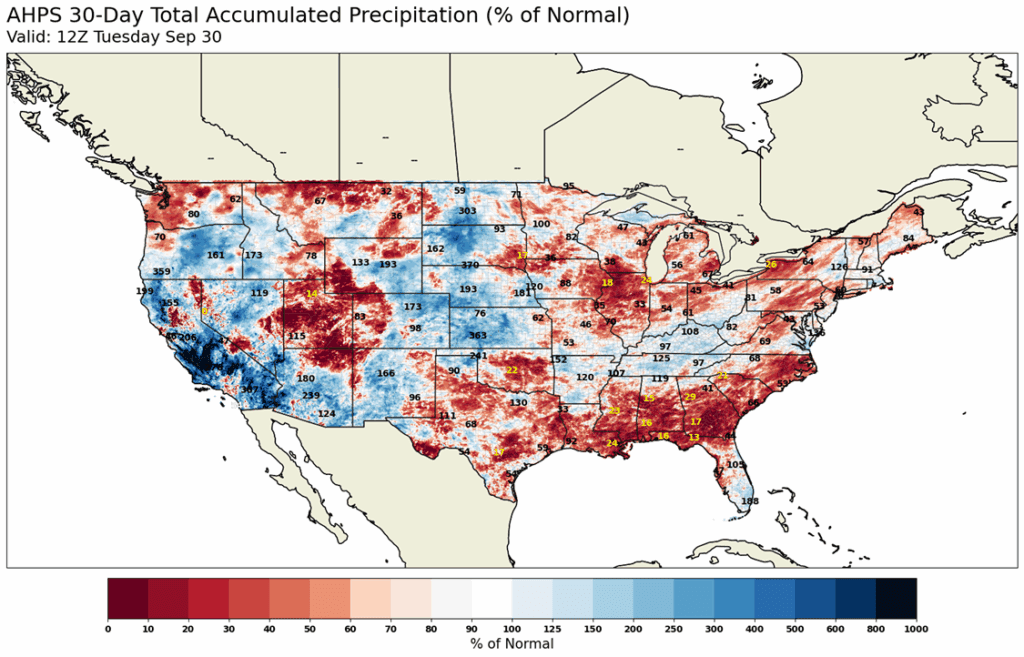

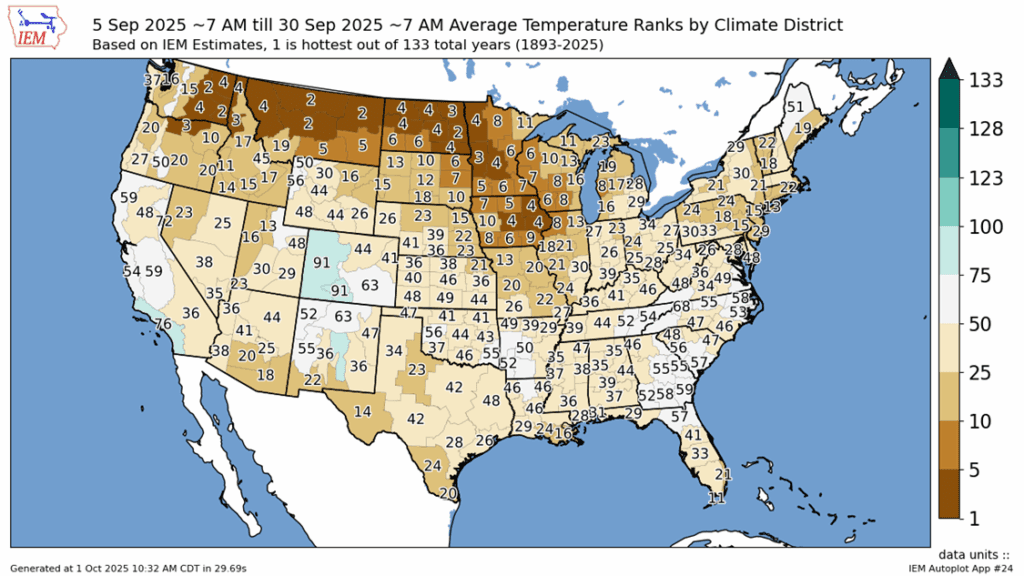

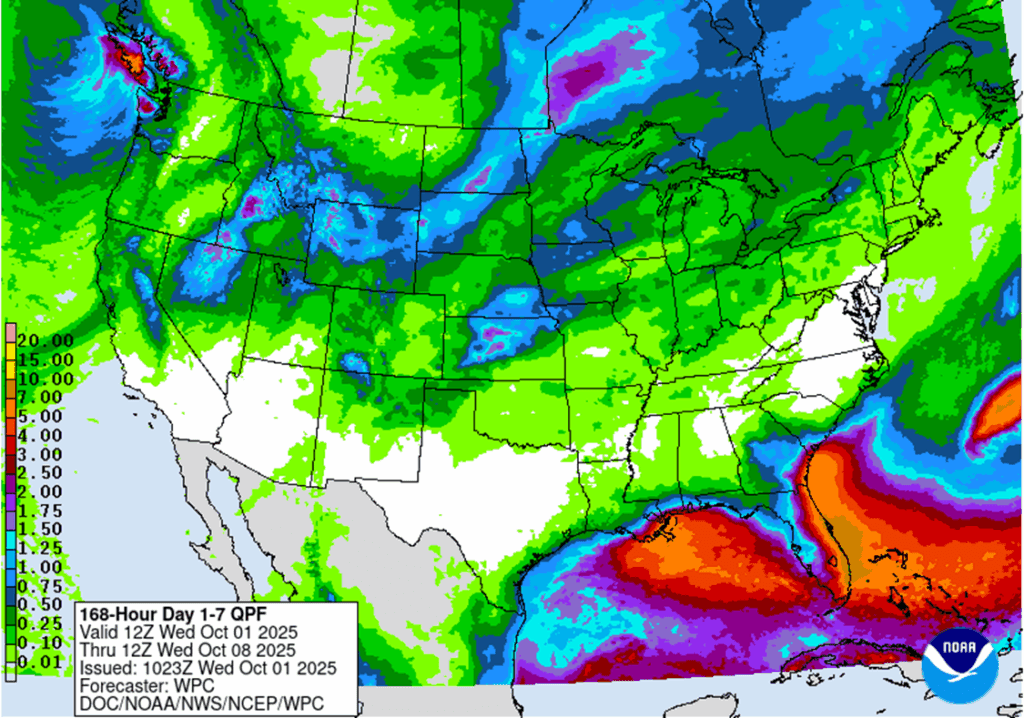

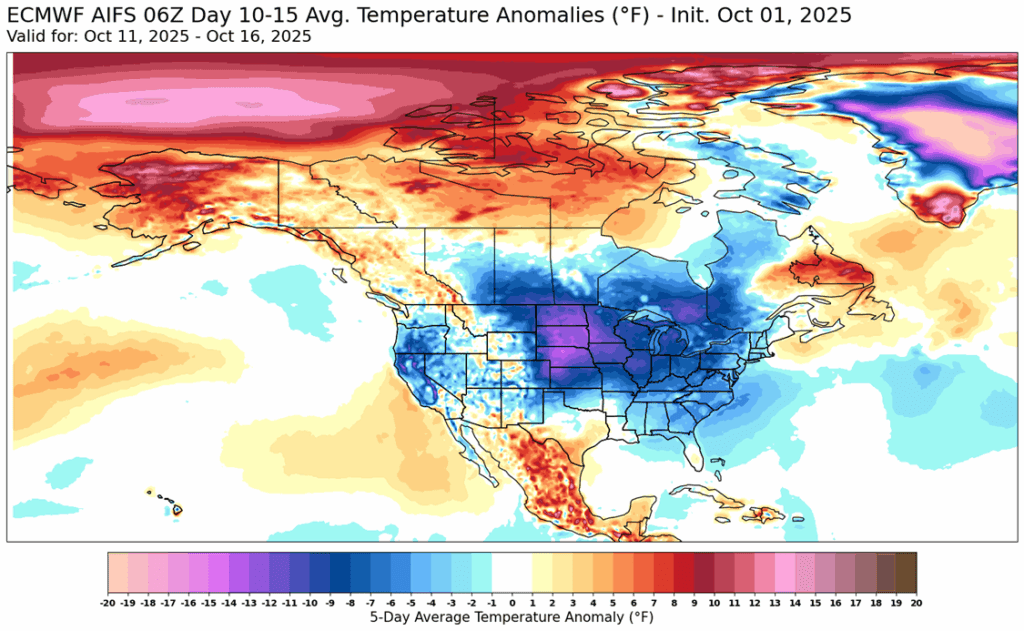

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

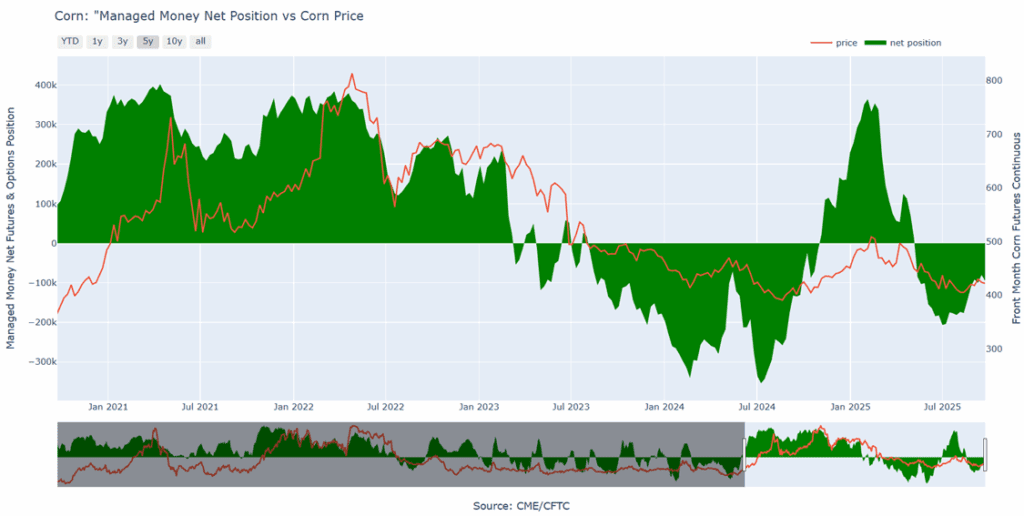

Corn

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

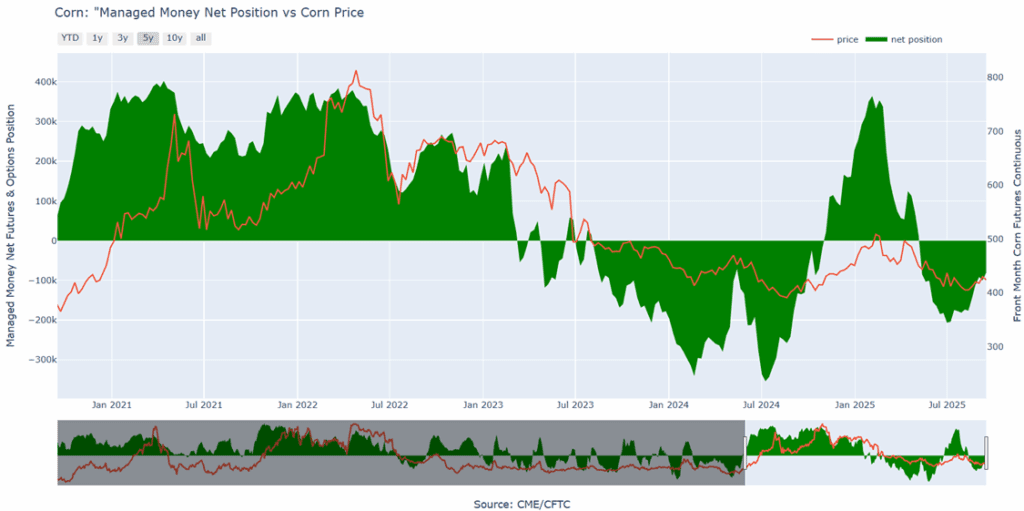

- Corn ended the day with modest gains after a morning of volatility, following yesterday’s bearish stock data from the USDA and favorable weather for the ongoing corn harvest. Despite the fluctuations, the market’s slight recovery suggests a stabilization or correction after the initial reaction to the USDA report. December’s contract closed up 1 cent at $4.16 ½ .

- For the week ending Friday, September 26, ethanol production slipped to 995 tbd, or 292 million gallons, down from 301 million the previous week and 2% below year-ago levels. This is the lowest production level in 4.5 months and fell short of expectations. Corn usage for ethanol production totaled 99 mb, or 14.16 mb per day, well below the 15.4 mbd needed to reach the USDA’s corn usage estimate of 5.6 bb.

- Ethanol margins are expected to remain solid in the near term, supported by the weekly report showing production down 29,000 barrels per day and stocks falling 700,000 barrels.

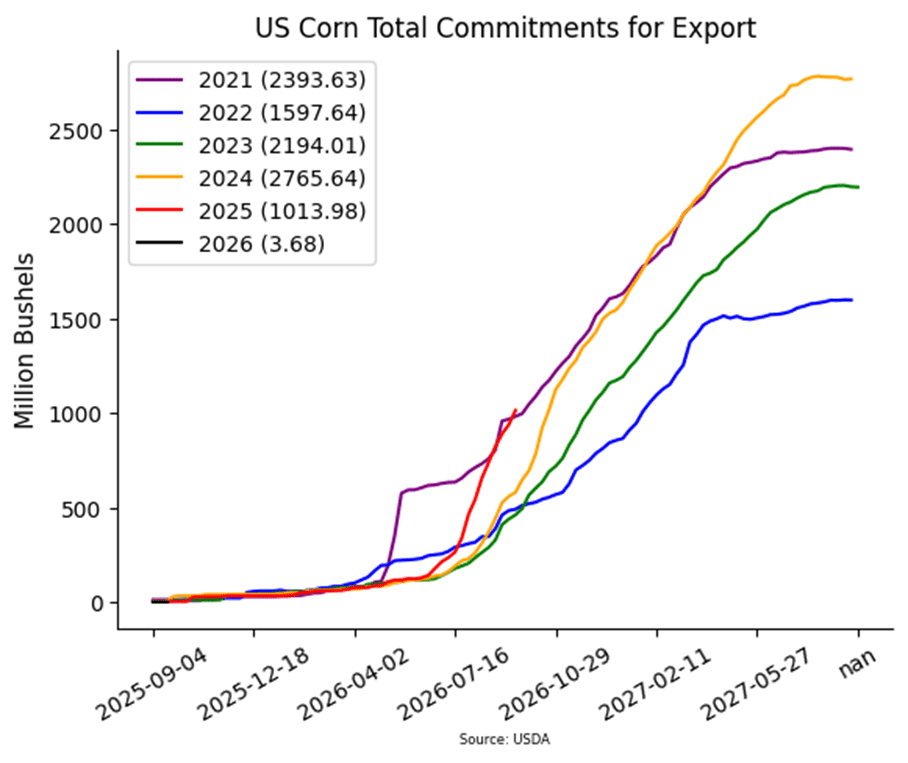

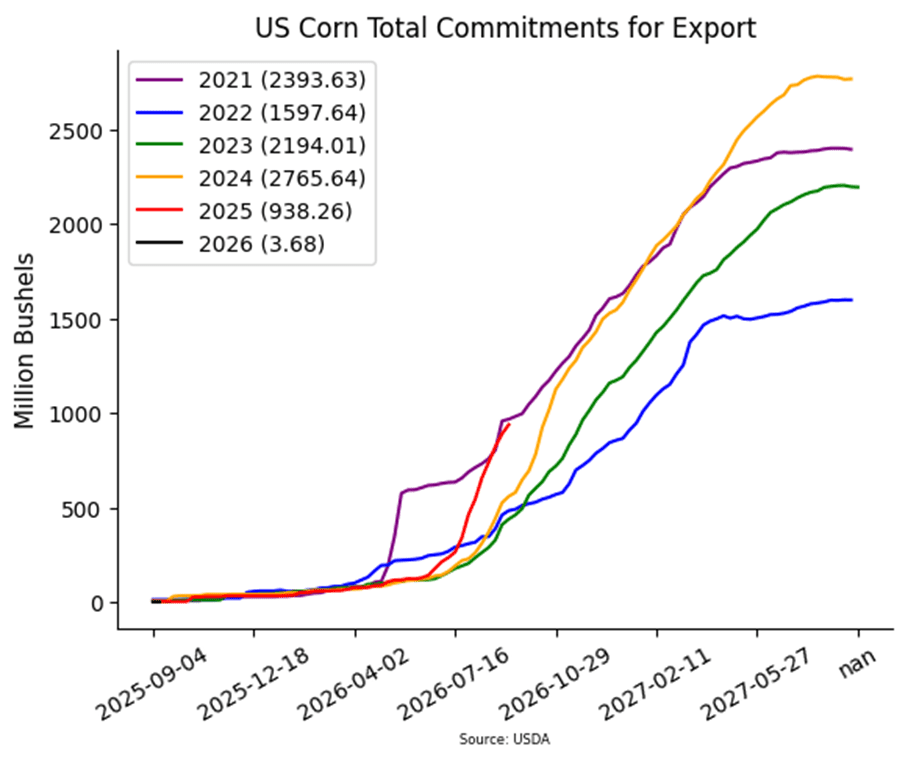

- Daily corn export updates will be suspended for the duration of the government shutdown, leaving traders without official USDA export sales data.

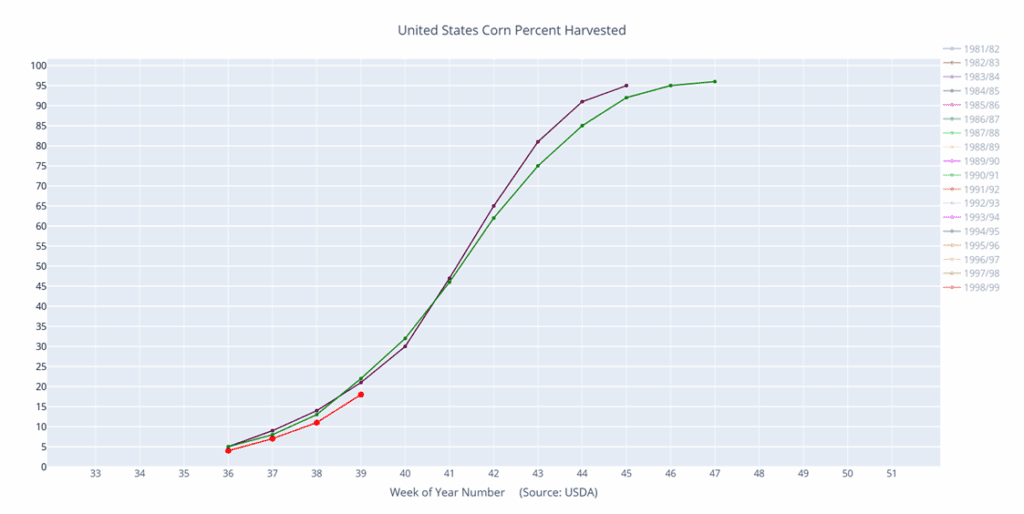

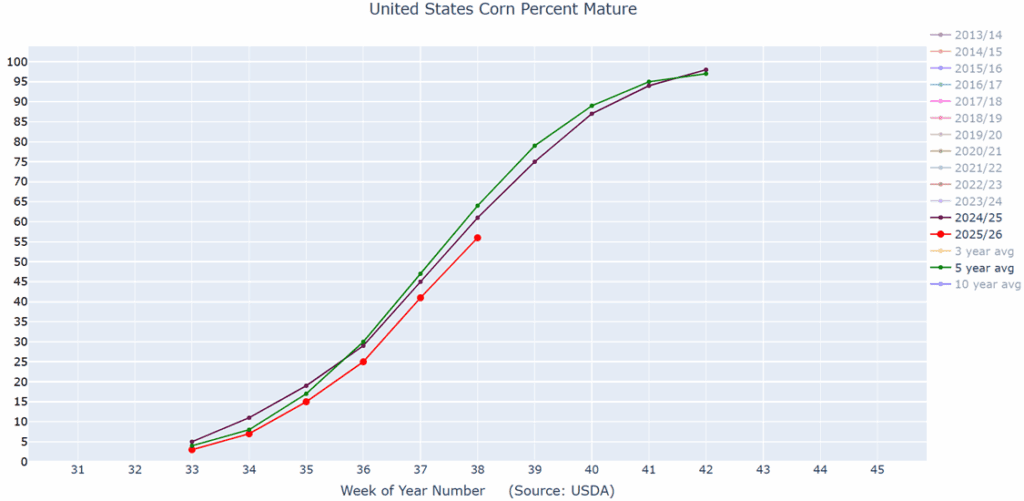

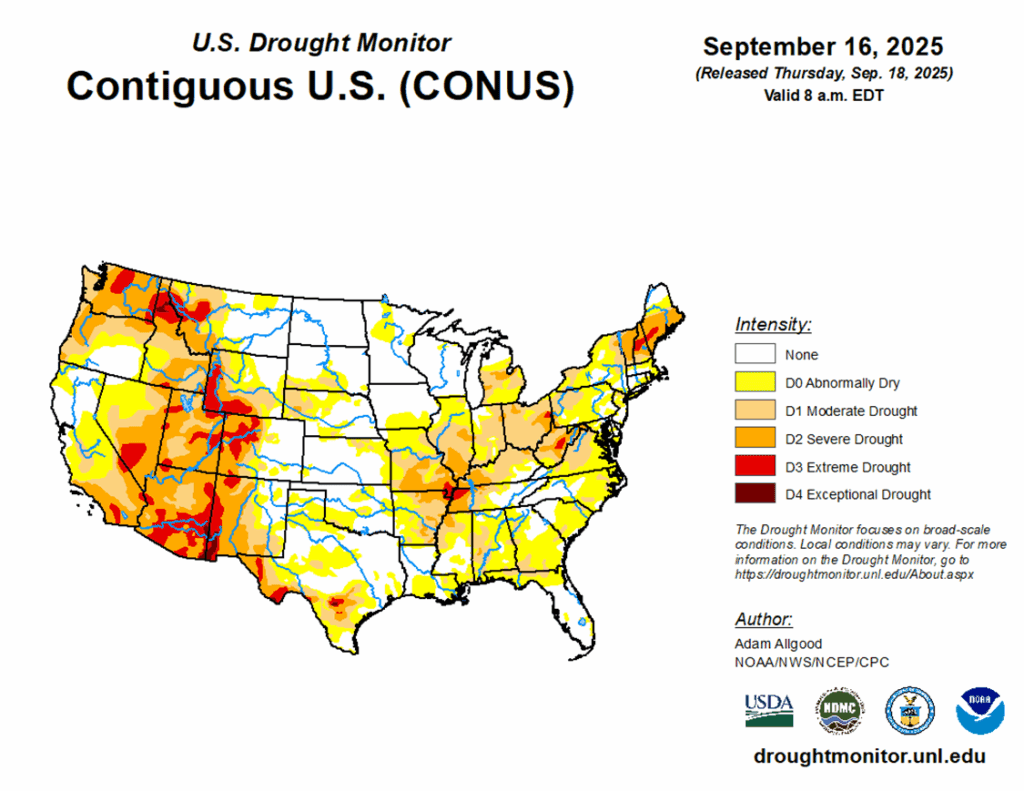

- Favorable weather in the U.S. continues to allow the corn harvest to progress with minimal delays. As the crop comes off, Dr. Cordonnier left his U.S. corn yield estimate unchanged at 182 bpa but noted that southern rust is emerging as a significant concern in parts of the Midwest.

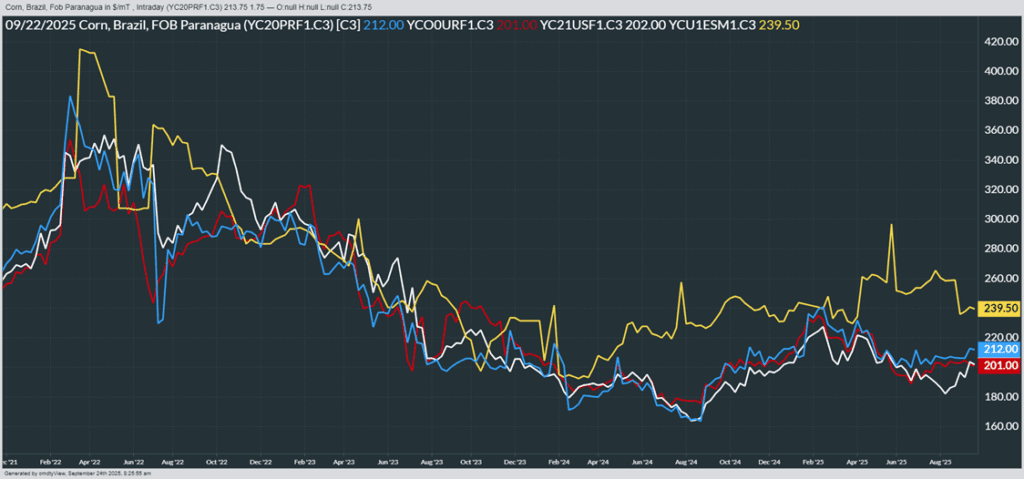

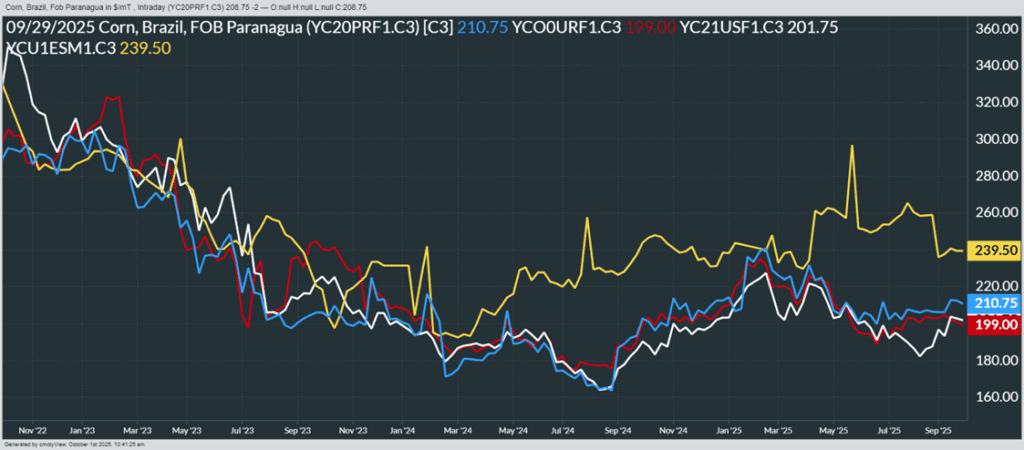

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

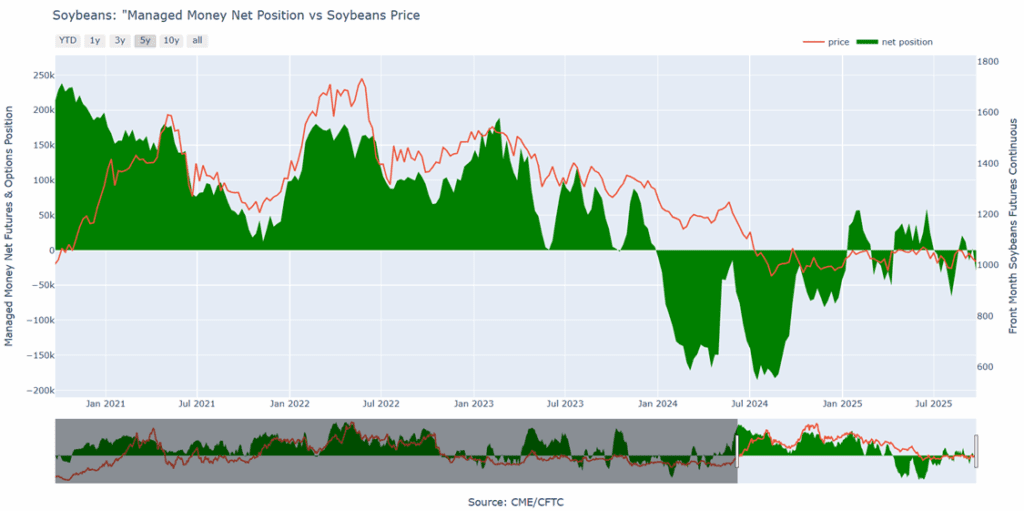

Soybeans

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of the January 1040 puts.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-quarter of the January ‘26 1040 puts has been added. This recommendation has been made to begin reducing the put position in a seasonally weak time period. This means that 25% of the original position should be closed out, leaving 75% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans ended the day higher following a dramatic reversal triggered by a bullish tweet from President Trump. November soybeans gained 11 ¼ cents to $10.13, rebounding from an intraday low of $9.93 ¾. March soybeans rose 10 ½ cents to $10.46 ¼, October soybean meal fell $1.00 to $264.70, and October soybean oil added 0.88 cents to 49.75 cents.

- Earlier today, President Trump tweeted that a small portion of tariff revenue would be allocated to help farmers and that he plans to meet with President Xi of China in four weeks, with soybeans as a “major topic of discussion.” Soybeans immediately rebounded on the news.

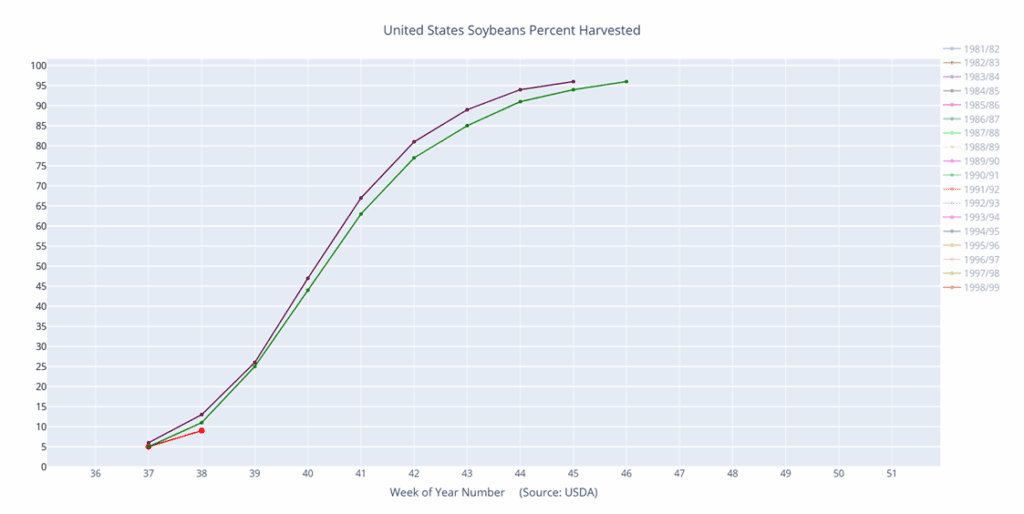

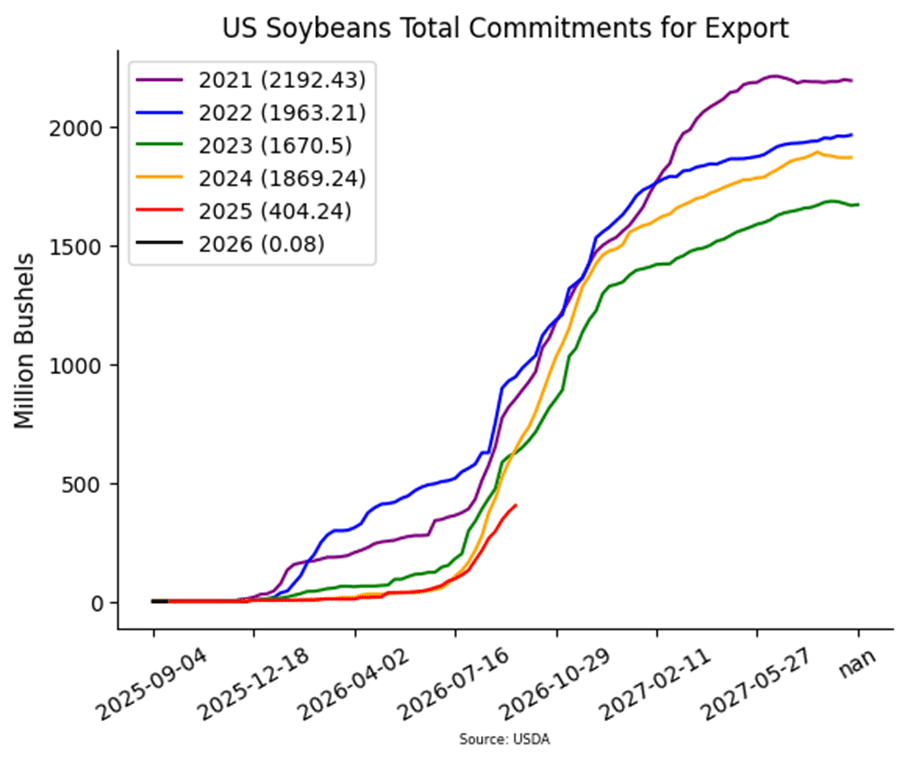

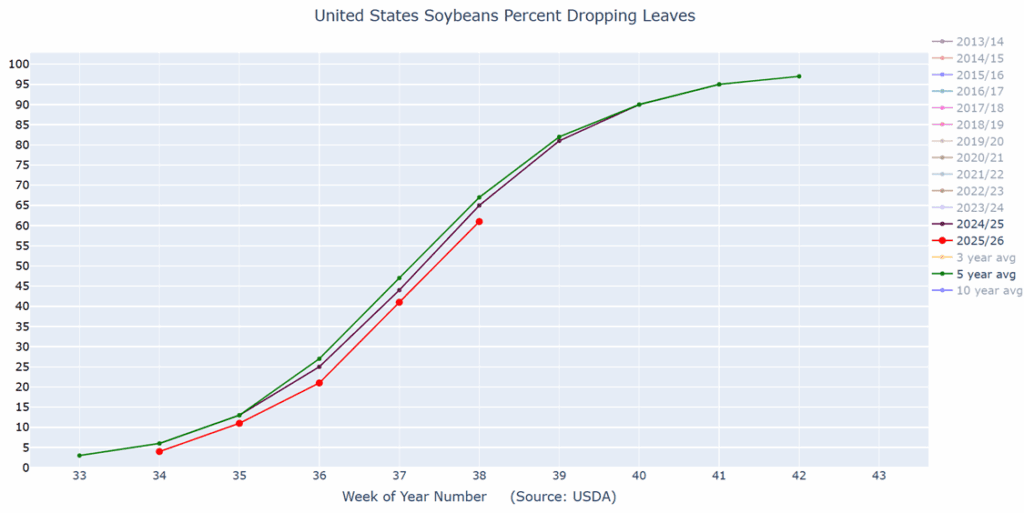

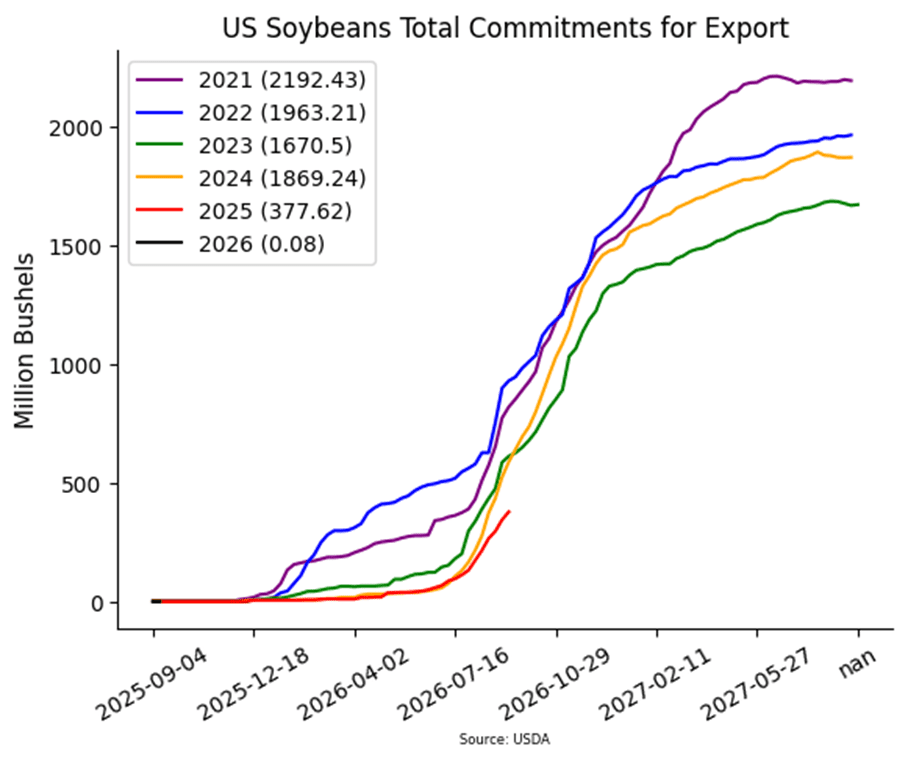

- Yesterday’s Grain Stocks report showed quarterly soybean stocks at 316 million bushels, slightly below the average estimate of 322 million but within the range of 295–347 million bushels and was generally viewed as neutral. With early yield reports looking strong, the market may anticipate higher stock levels moving forward.

- The Buenos Aires Grain Exchange estimates new-crop Brazilian bean production at 48.5 million tons, down from 50.3 million last season, as producers shift acreage toward corn. Their profitability models indicate that corn is currently the more attractive option for the region.

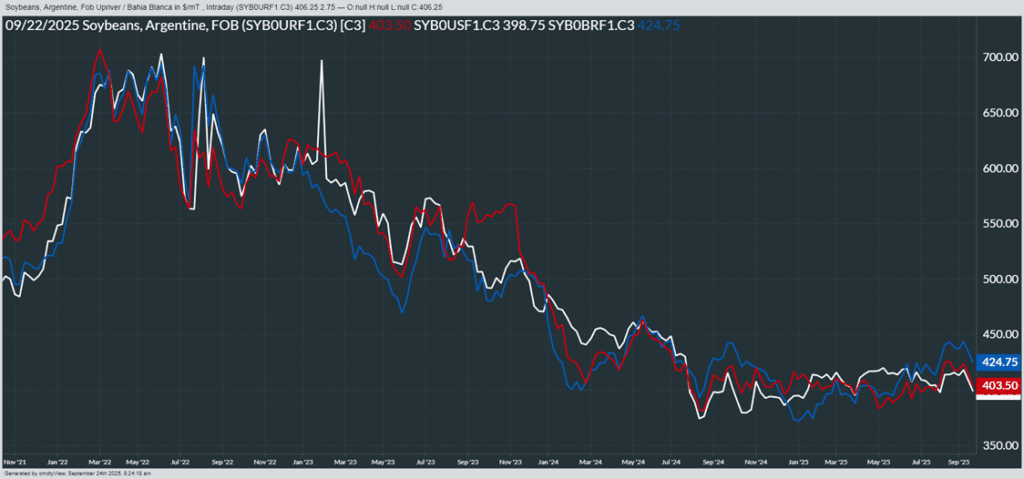

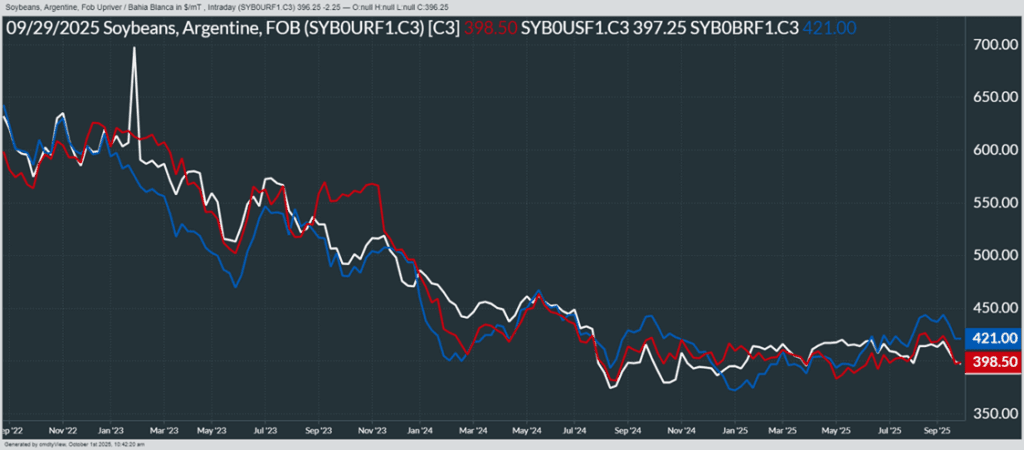

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

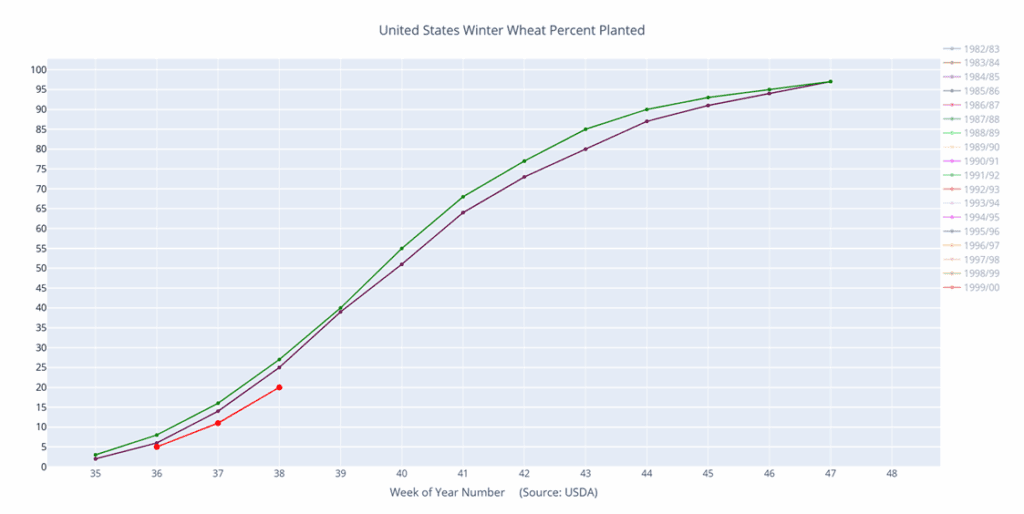

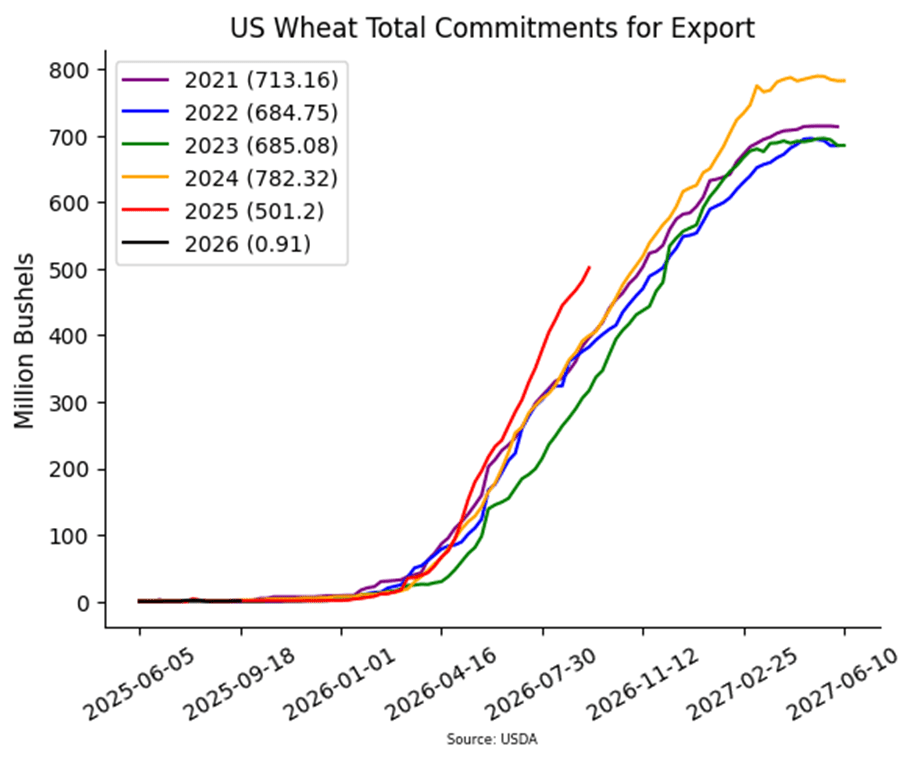

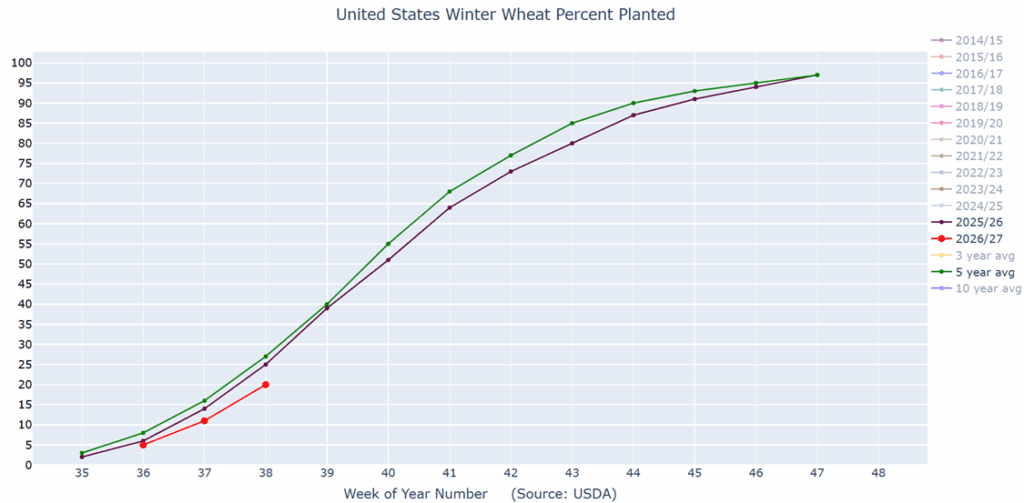

- Chicago wheat futures led the wheat complex today, with the December contract closing 1 ¼ cents higher at $5.09 ¼. December Kansas City wheat fell 2 ¼ cents to $4.95 ½, while December Minneapolis (MIAX) wheat dropped 5 ¾ cents to $5.57 00. The ongoing government shutdown and a weaker dollar weighed on wheat prices.

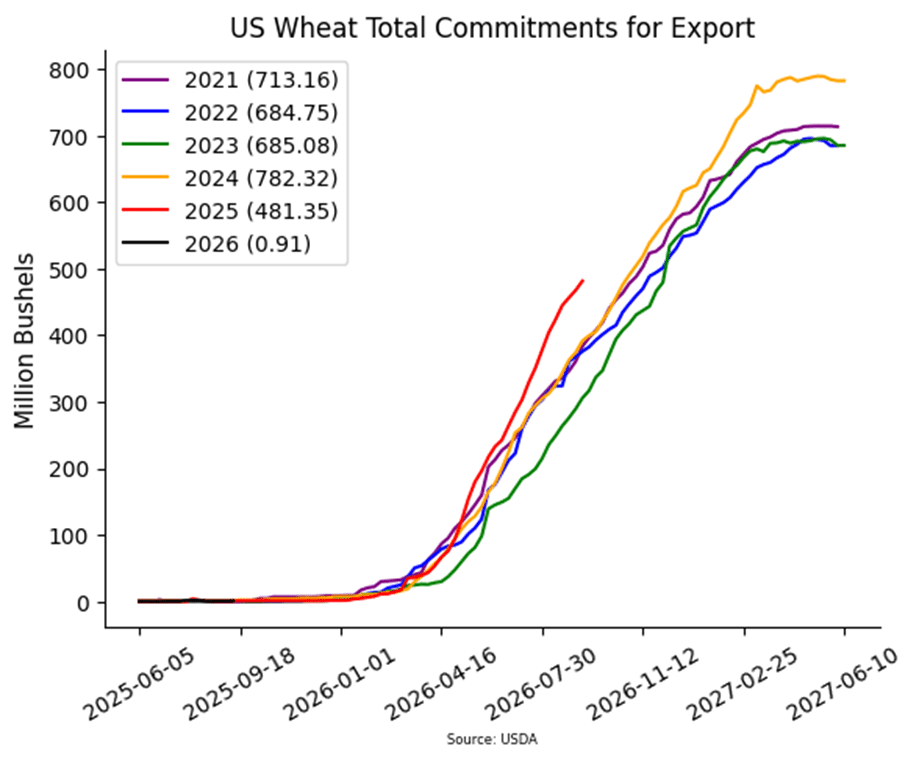

- According to the European Commission, EU soft wheat exports are down 31% year-over-year. The EU’s export season began on July 1, and as of September 28, wheat exports have totaled only 4.37 mmt, compared with 6.36 mmt during the same period last year.

- Russia is expected to lower its wheat export tax to 617.7 rubles per ton, down from 655.6 rubles per ton the previous week.

- The Buenos Aires Grain Exchange has raised their wheat production forecast for Argentina to 22 mmt, up from the group’s previous estimate of 20.5 mmt.

- LSEG has also raised their Canadian wheat production estimate by 4.4% to 36.5 mmt, citing better yields as harvest progresses across the country.

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 606.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 610.25 to 606.75.

- Notes:

- Resistance for the macro trend sits at 606.75 vs December ‘25. A close above 606.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 602 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

2025 Crop:

- Plan A:

- Target 585 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 587 to 585.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 639 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 639.

To date, Grain Market Insider has issued the following KC recommendations:

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

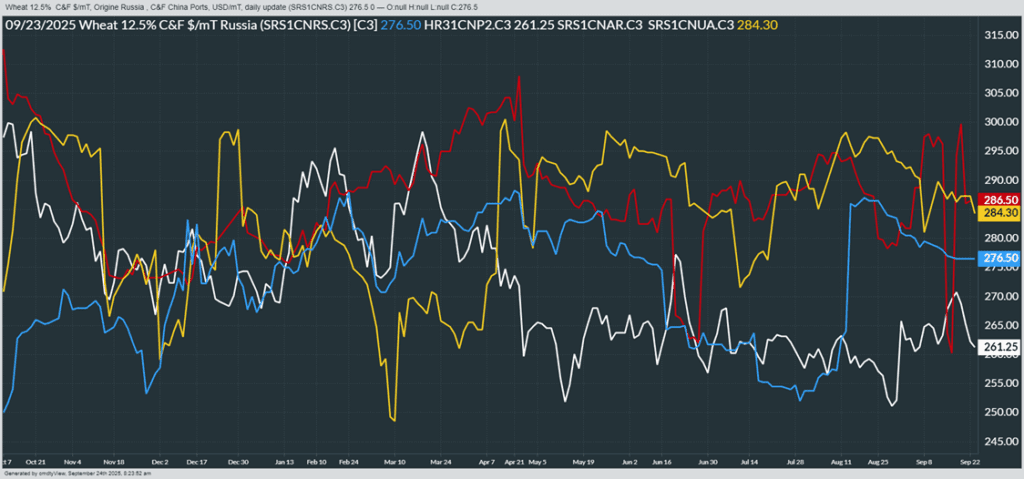

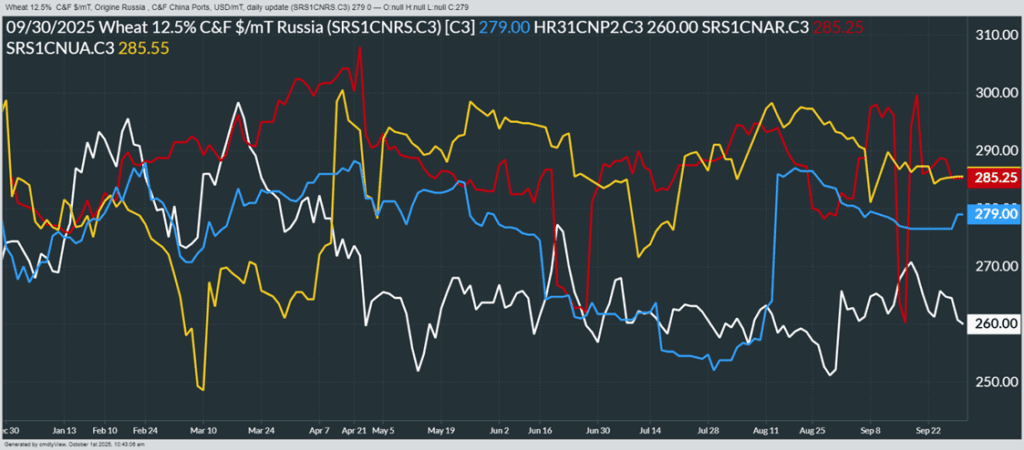

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

Above: From ag-wx.com

Above: From ag-wx.com