10-18 End of Day: Red Across the Board Going into the Weekend

All prices as of 2:00 pm Central Time

Grain Market Highlights

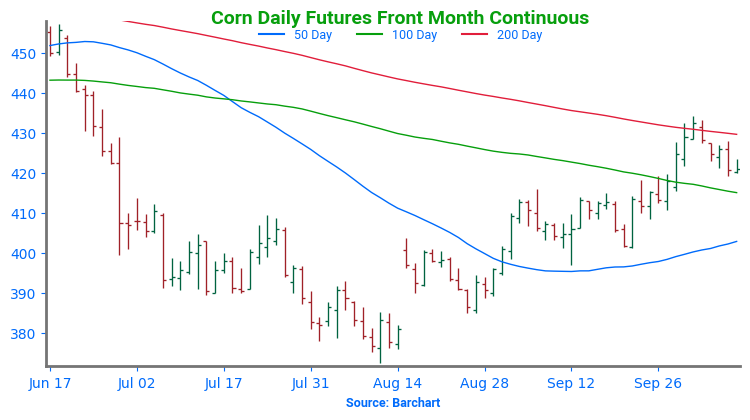

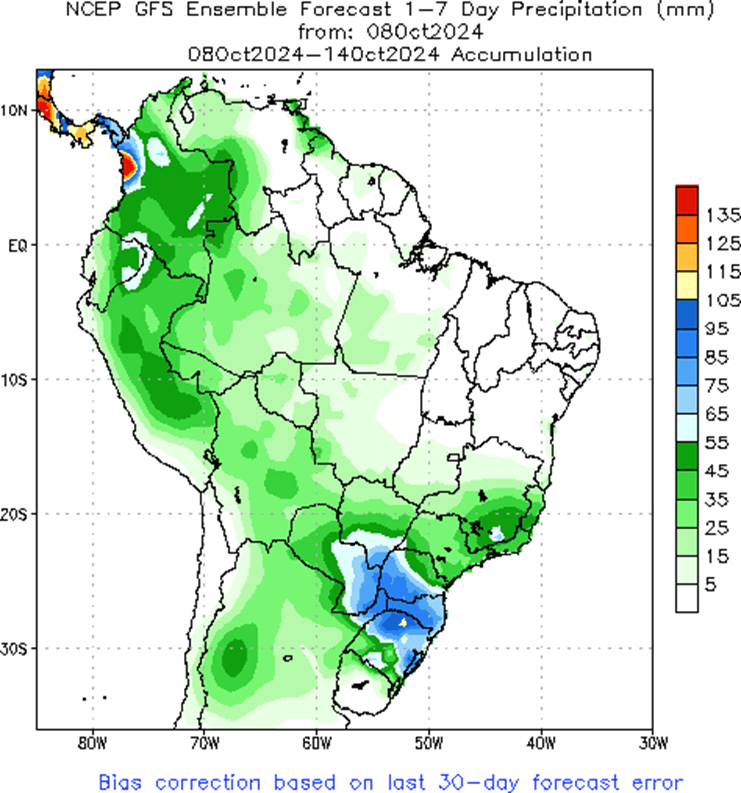

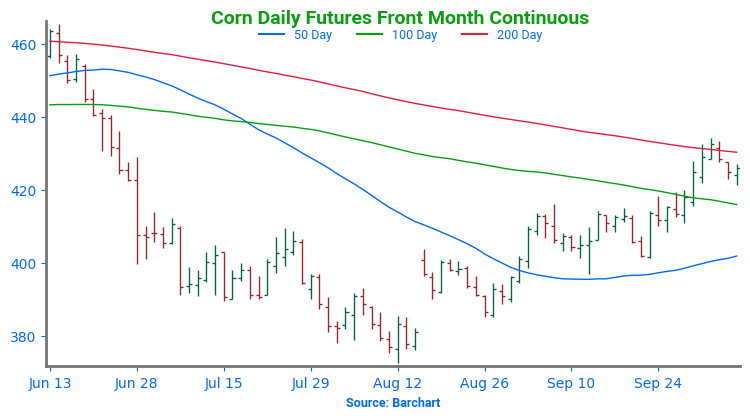

- Despite strong export sales, the corn market was pressured by sharp declines in both soybeans and wheat, along with hedge activity ahead of the weekend, as it failed to advance much above the 408 resistance level (December) before drifting lower to close with small losses.

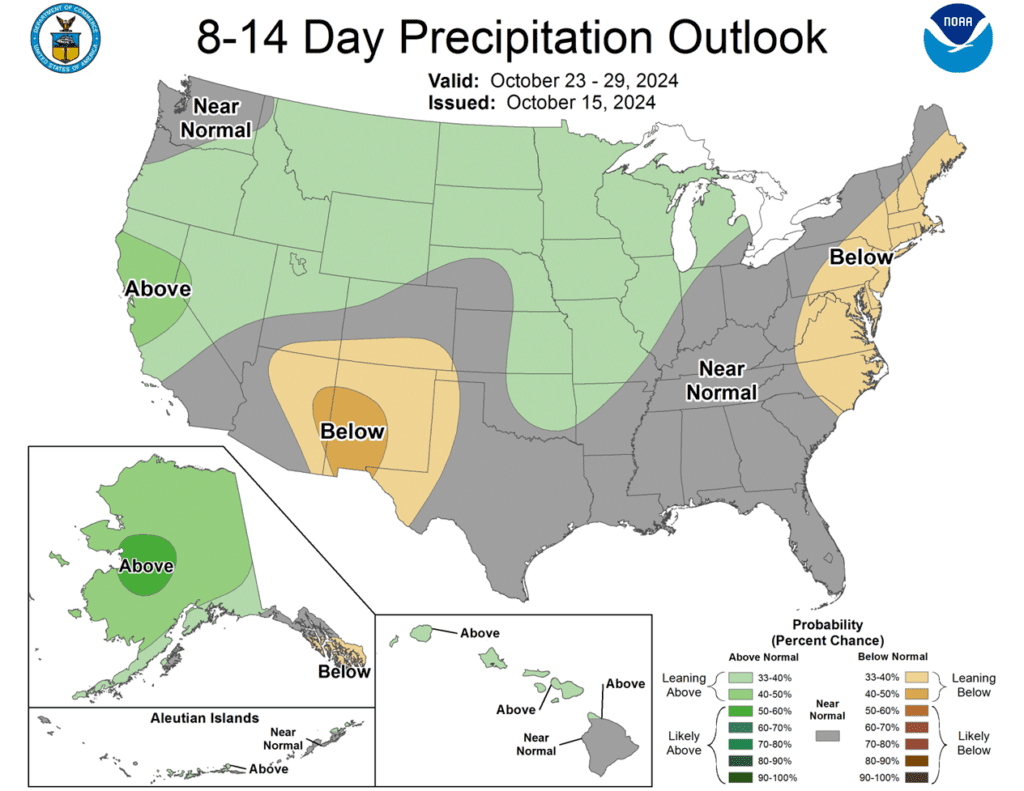

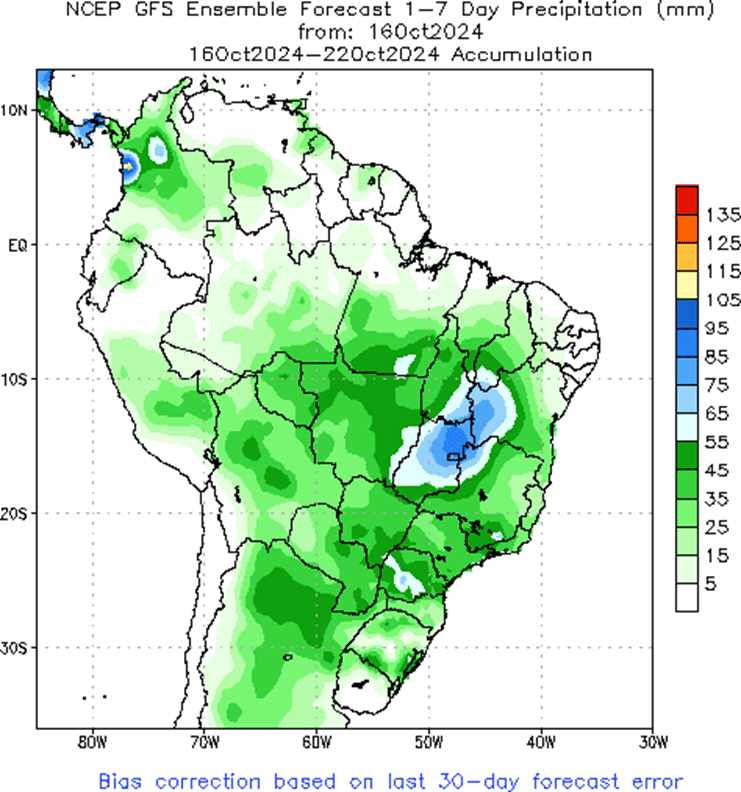

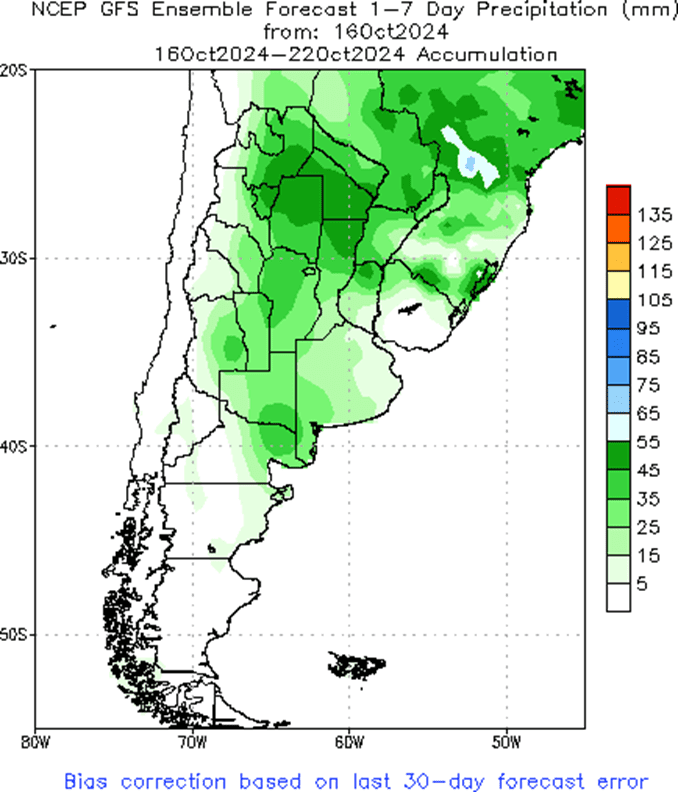

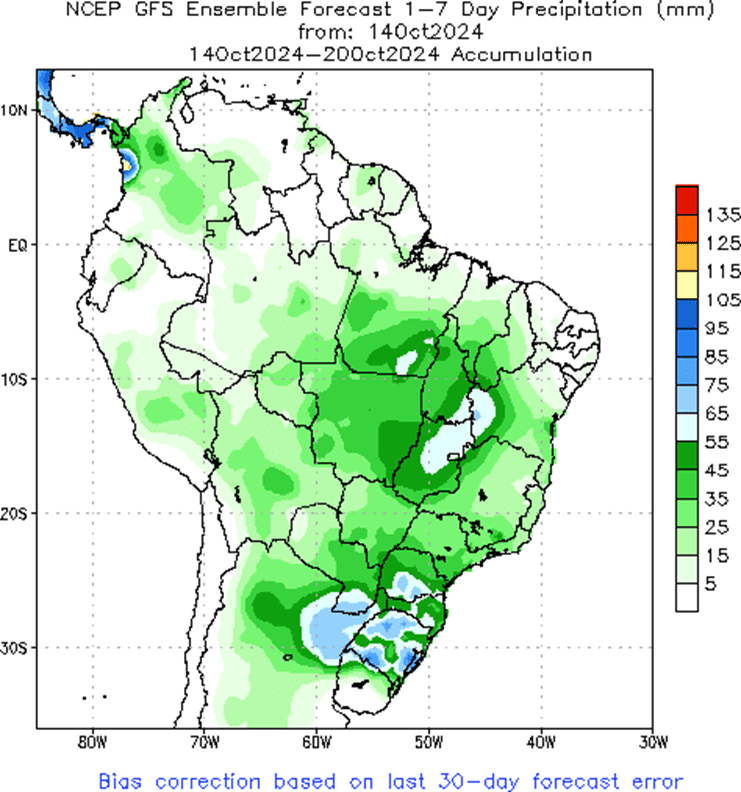

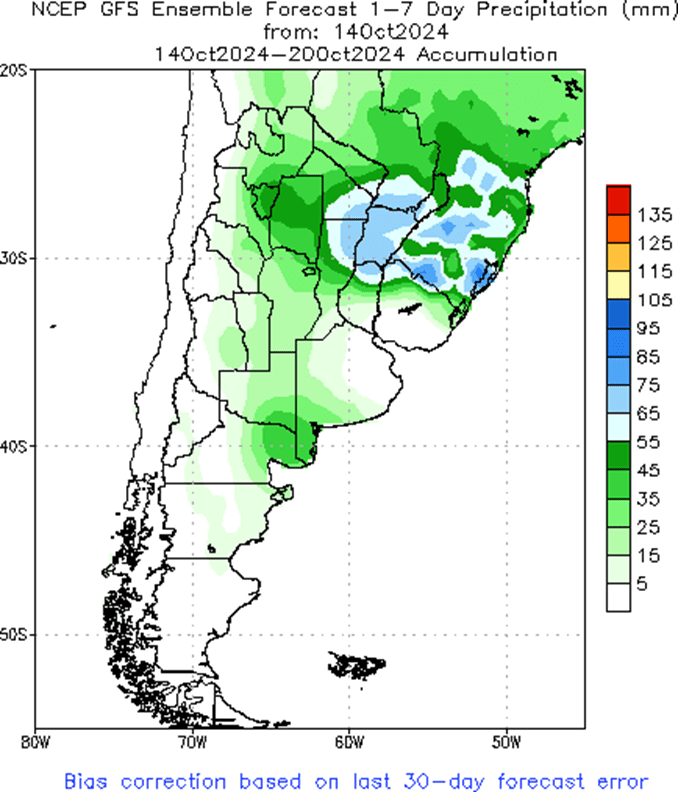

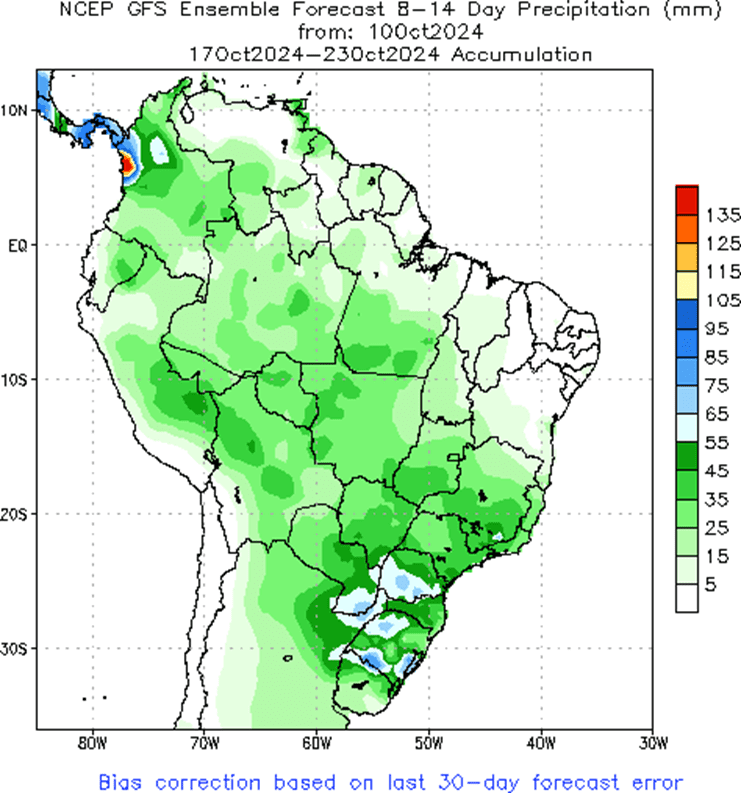

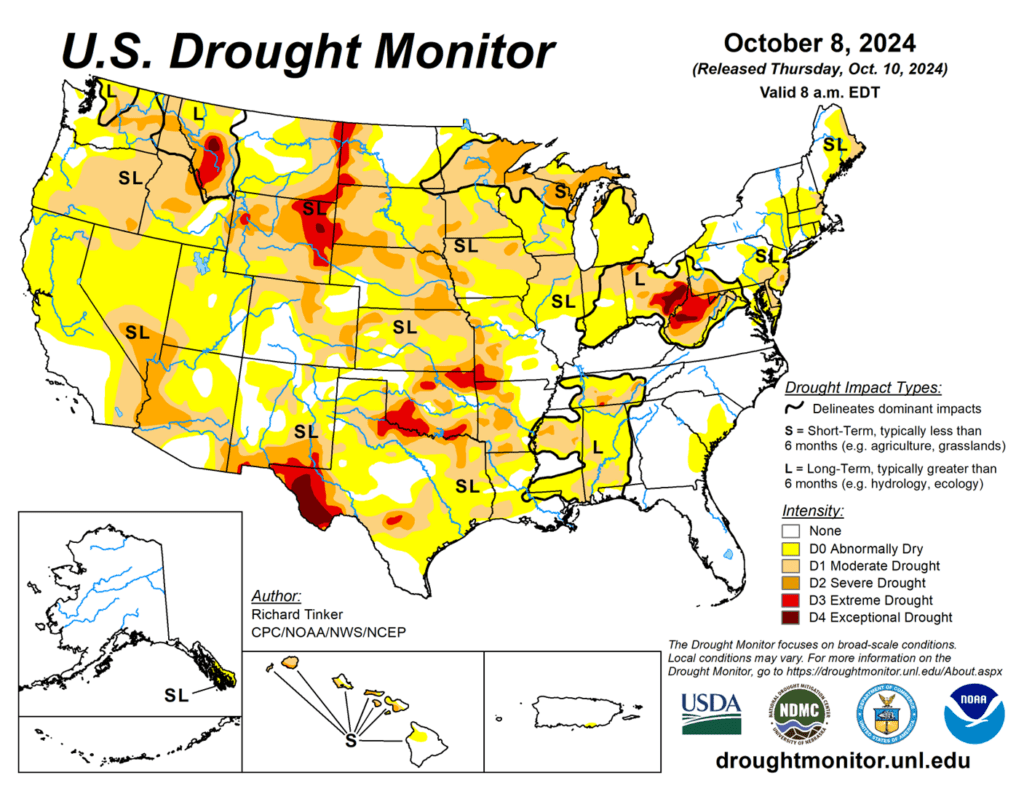

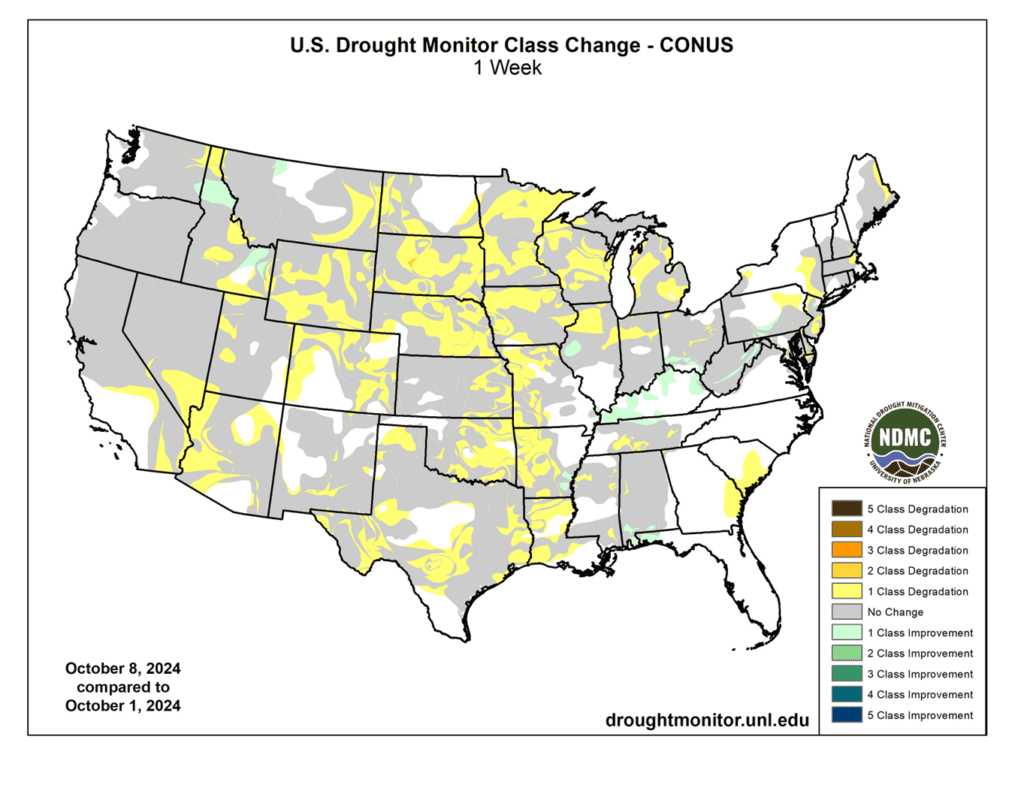

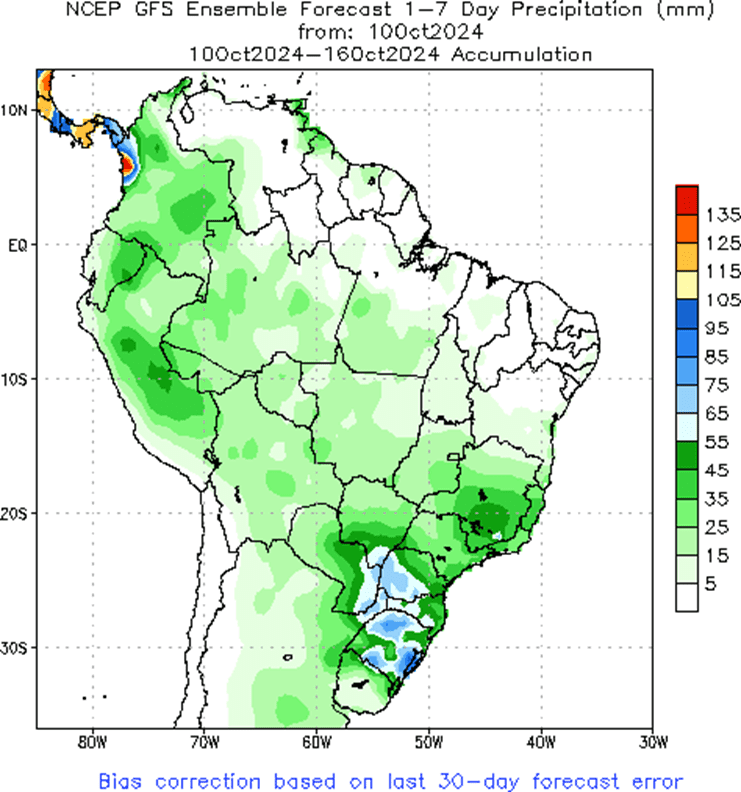

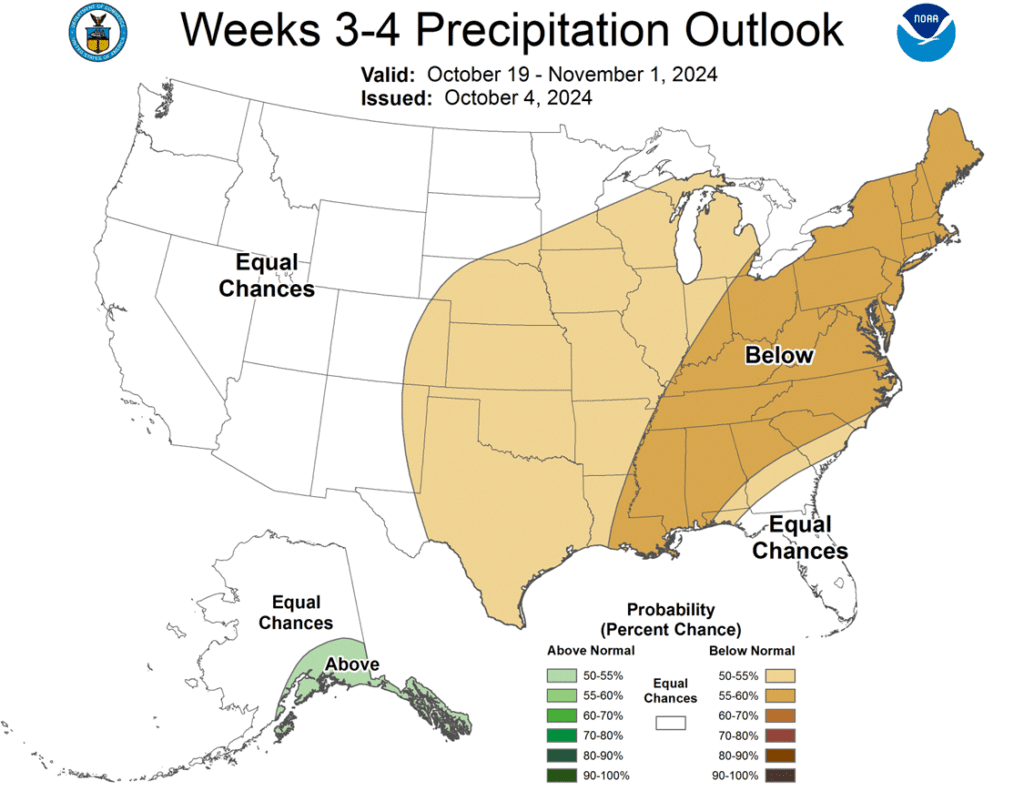

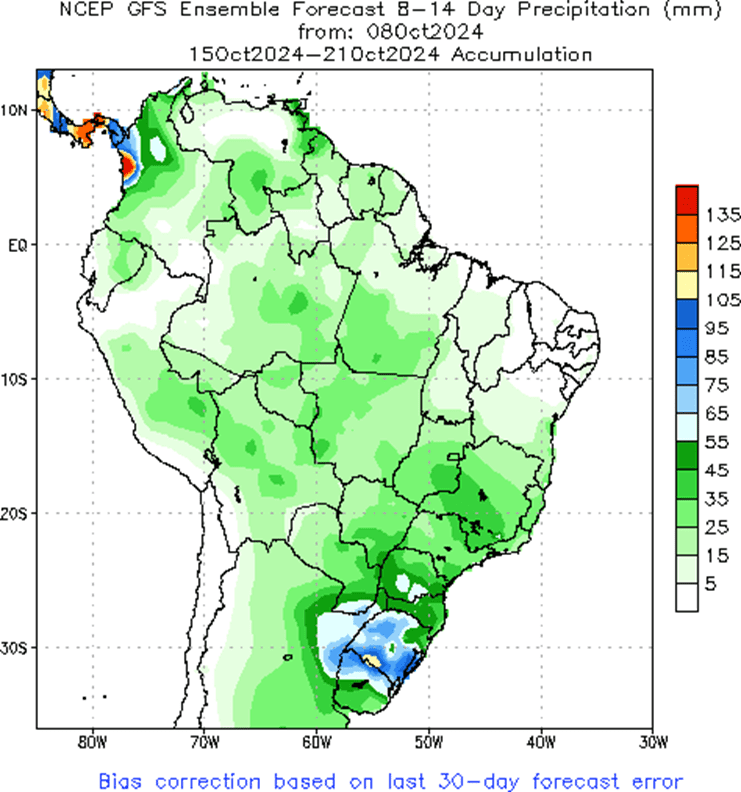

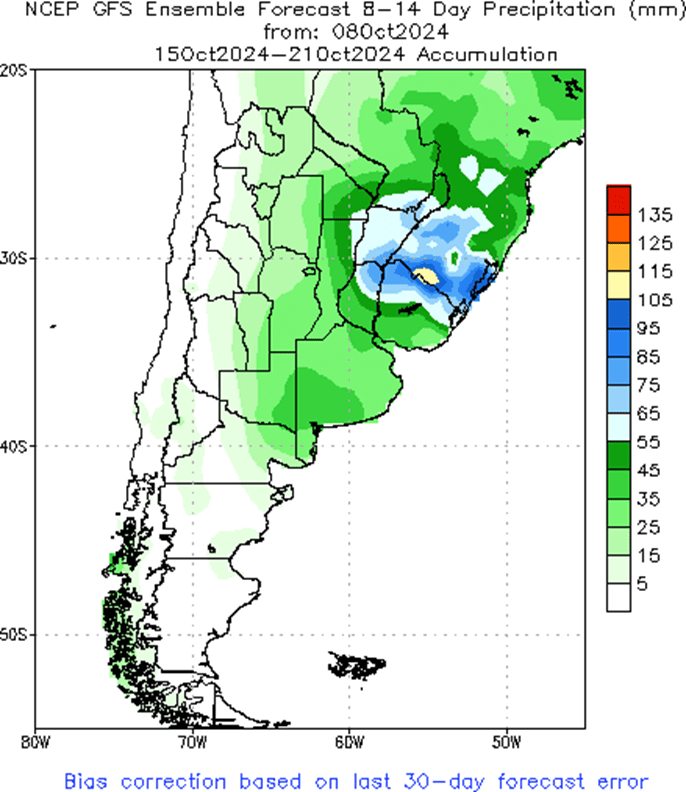

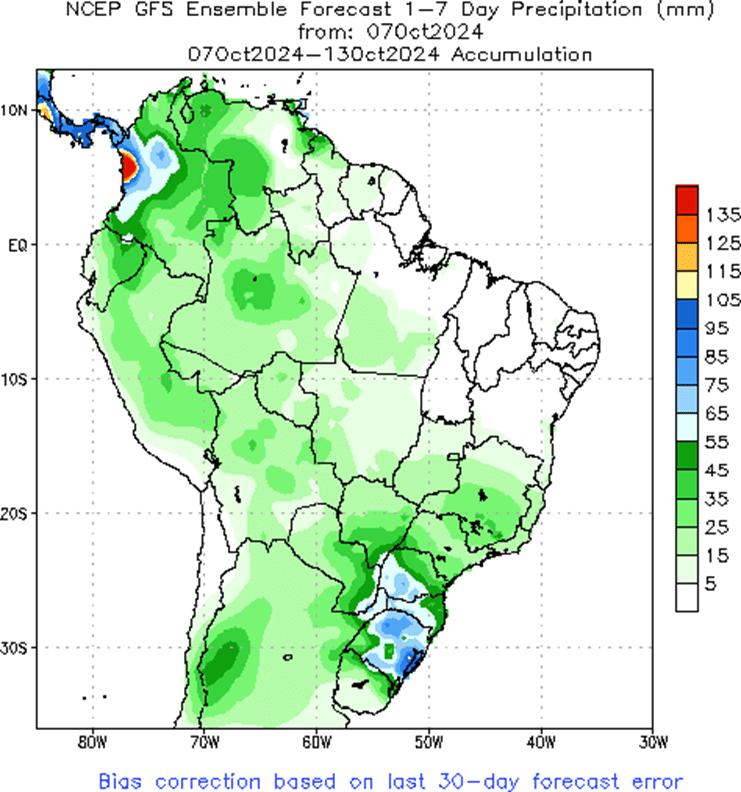

- Soybeans changed course from Thursday to trade lower and close down on the day, pressured by hedging ahead of the weekend’s harvest activity, an improved South American weather outlook, and weakness in both meal and oil.

- All three wheat classes settled lower on the day, with Chicago contracts leading the way down, as the complex came under heavy selling with reports that Russia is seeking to sell wheat to directly to “sovereign buyers,” which may limit US export sales to some key countries.

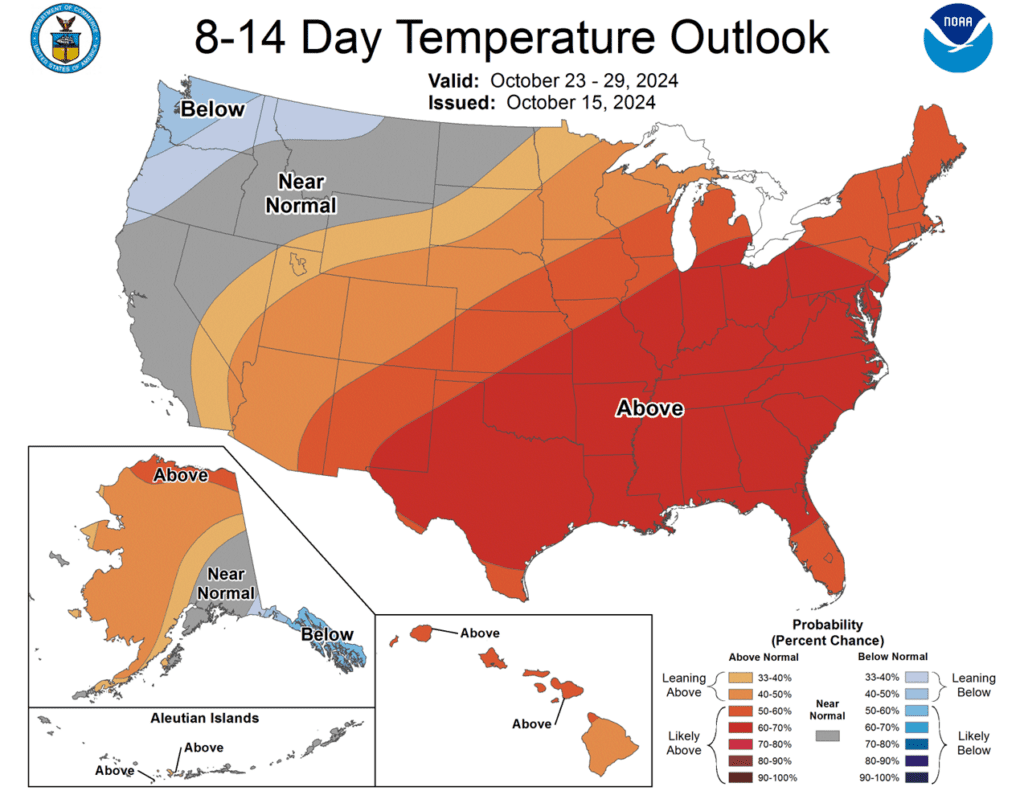

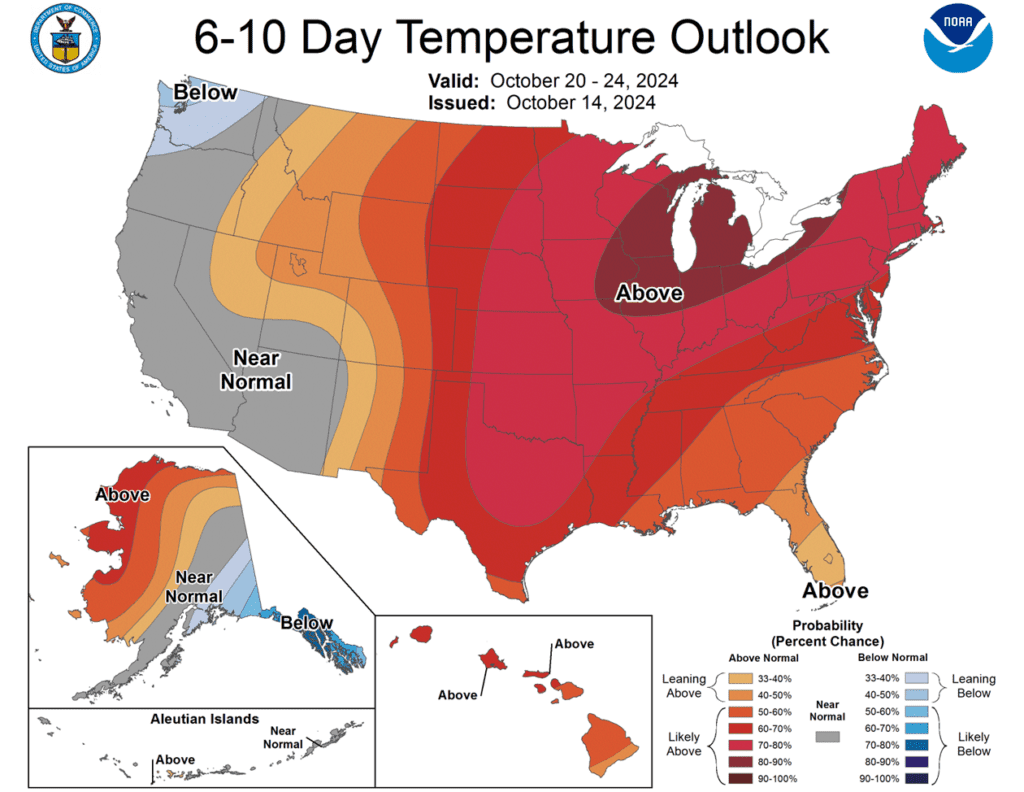

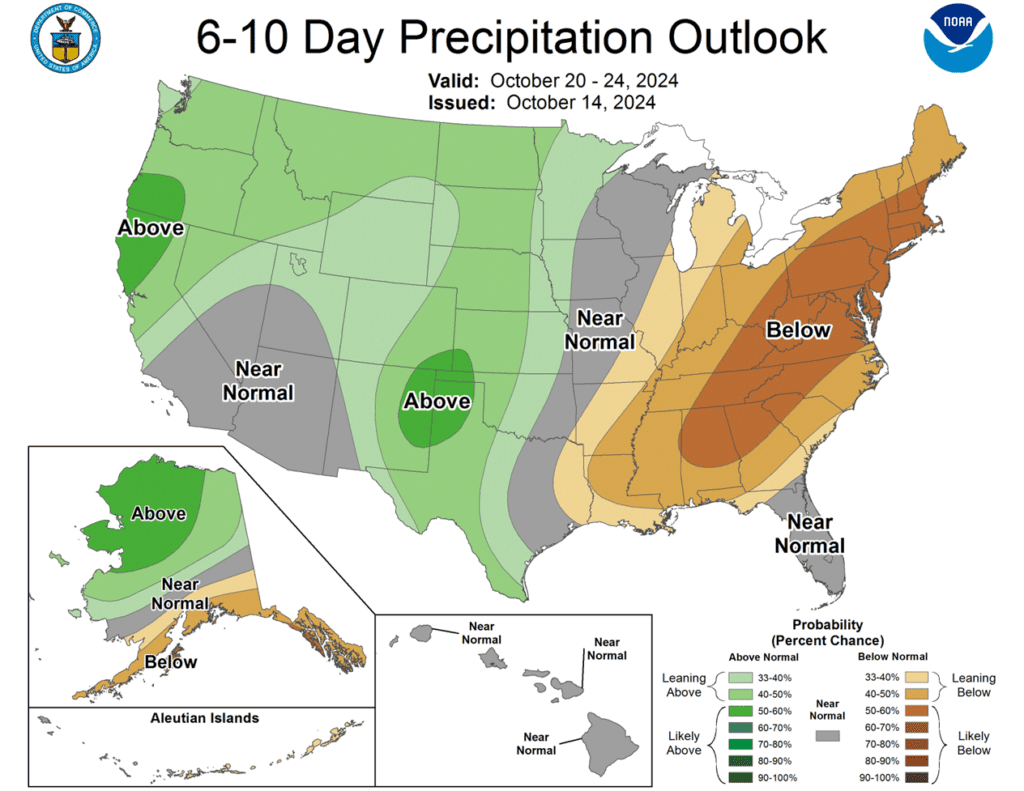

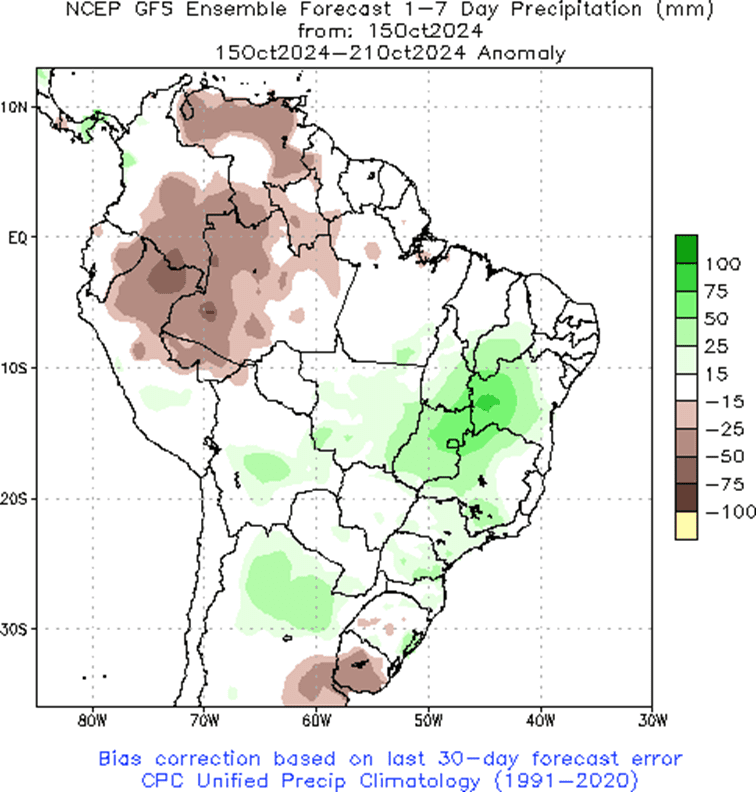

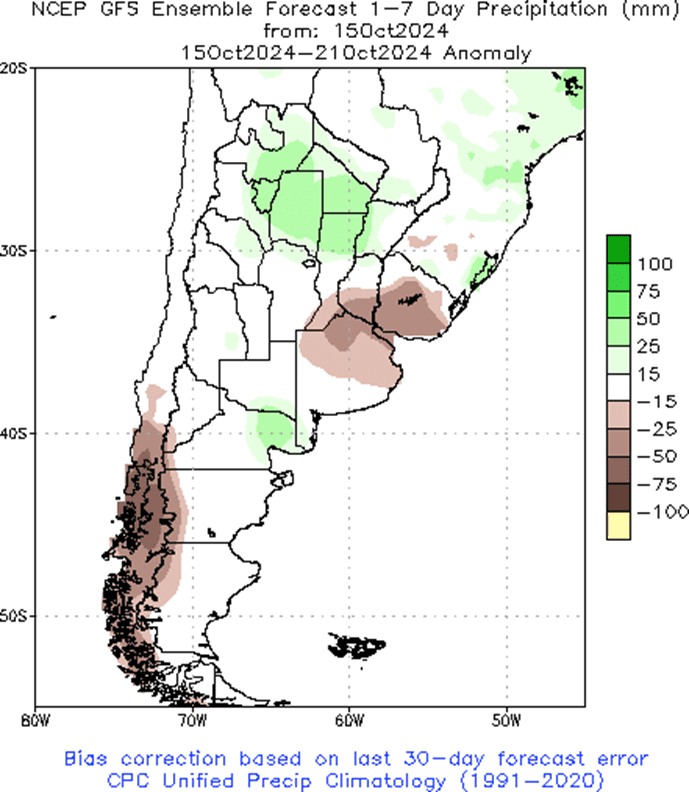

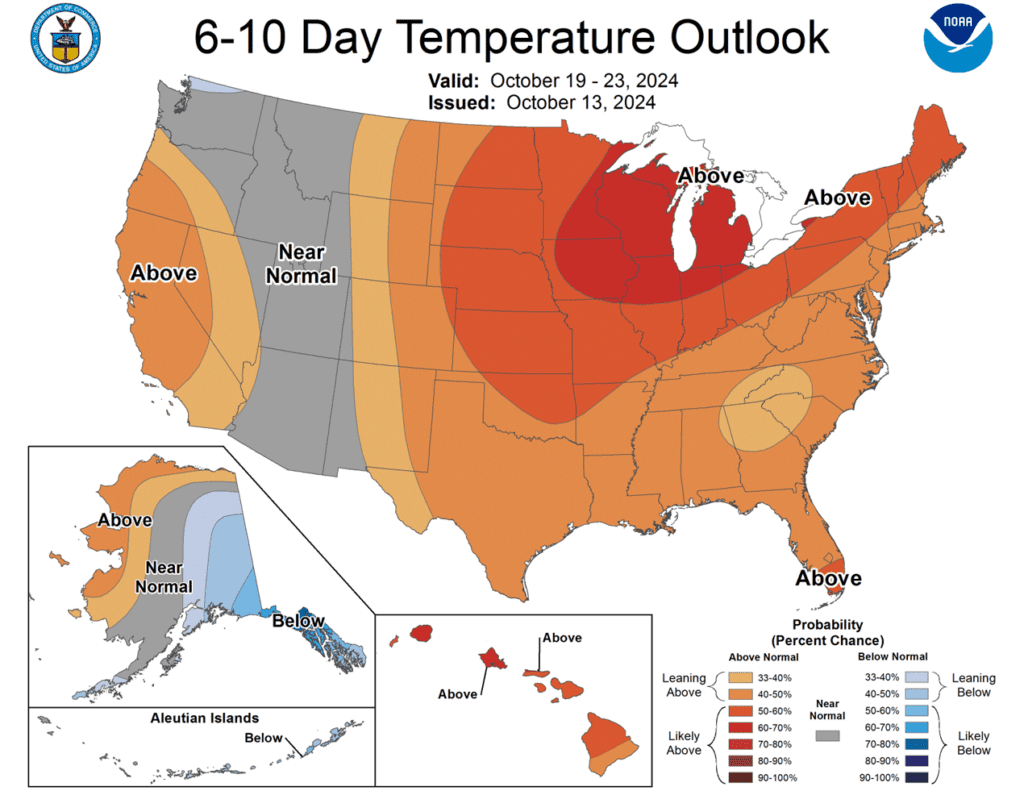

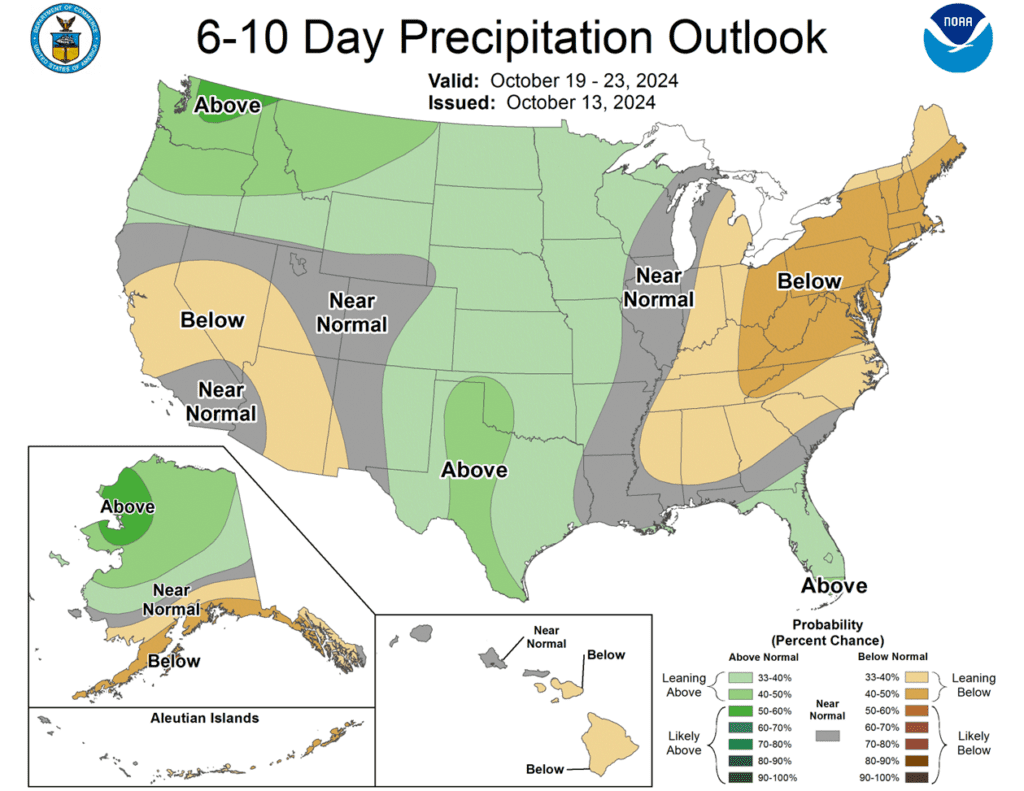

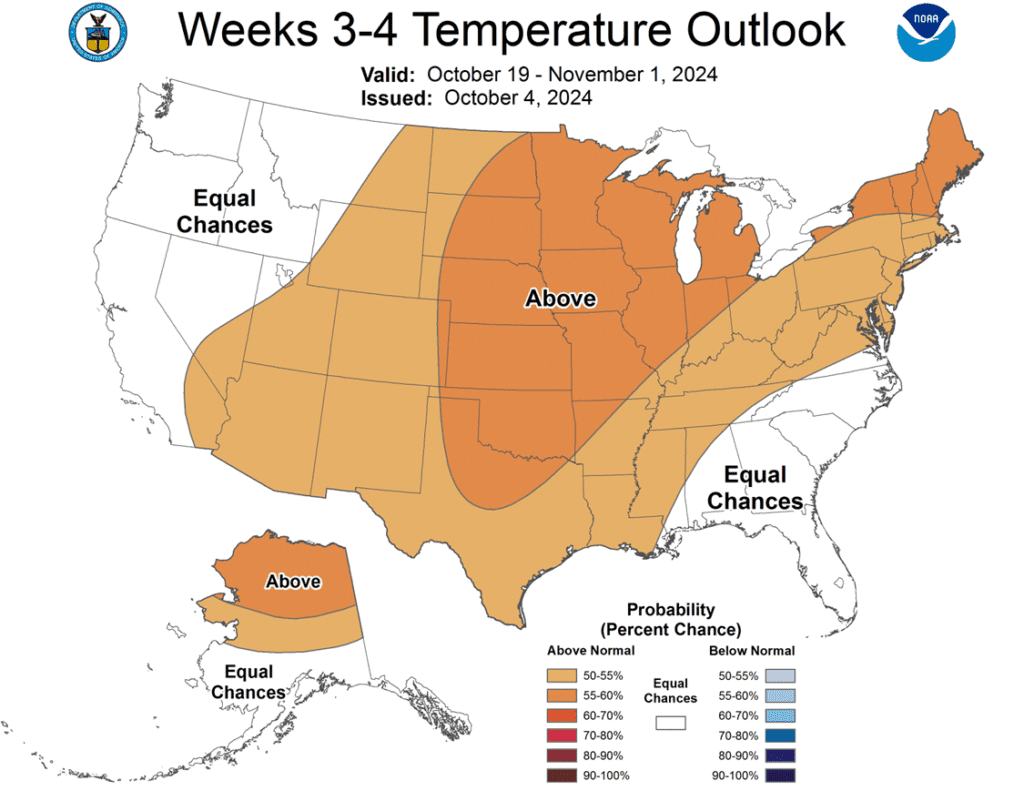

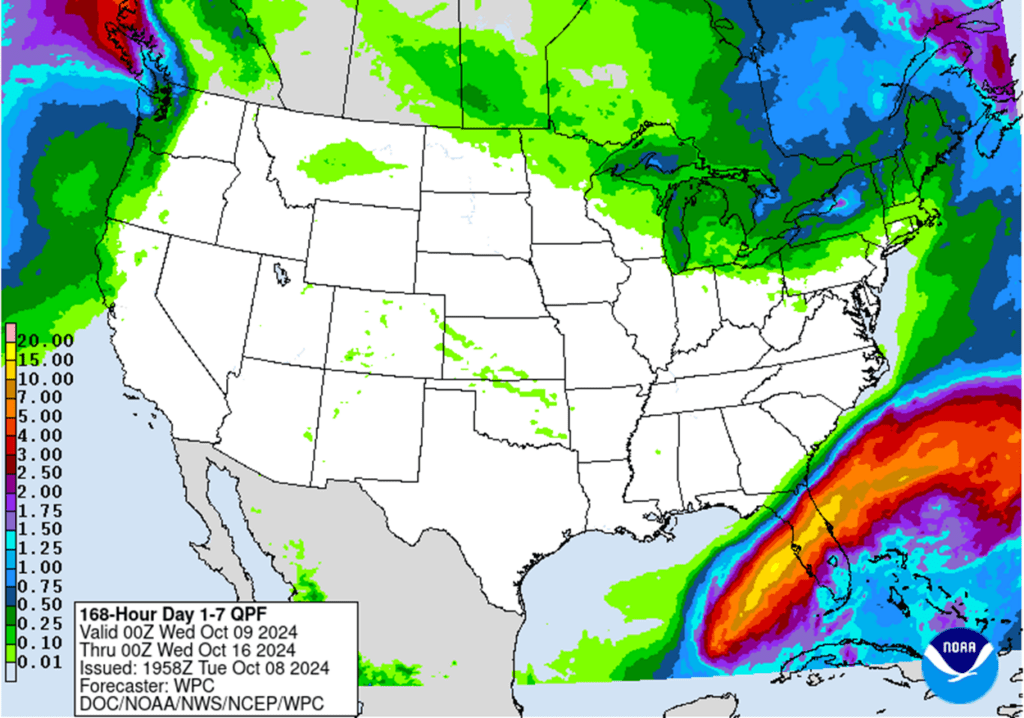

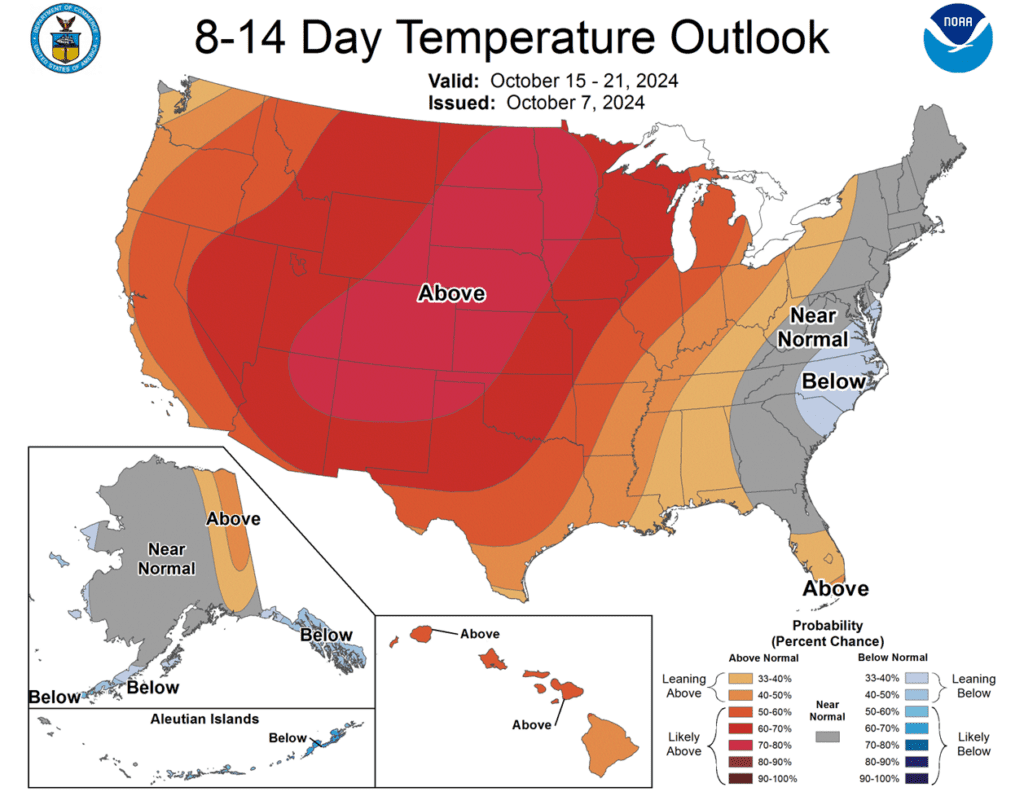

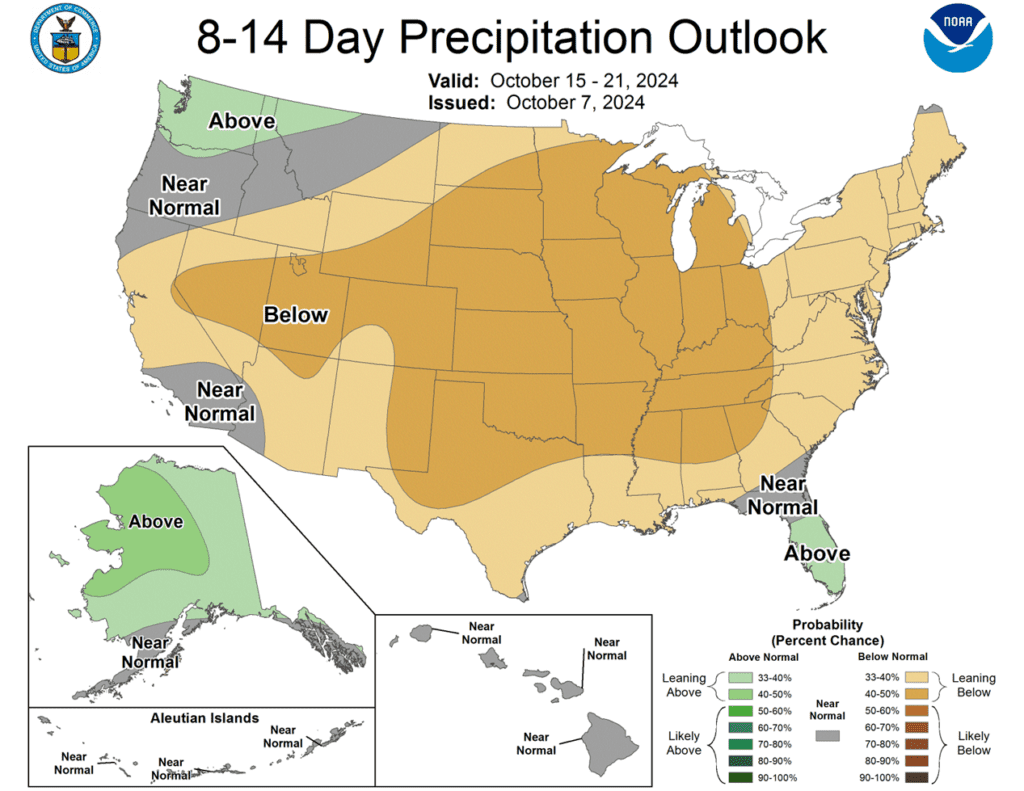

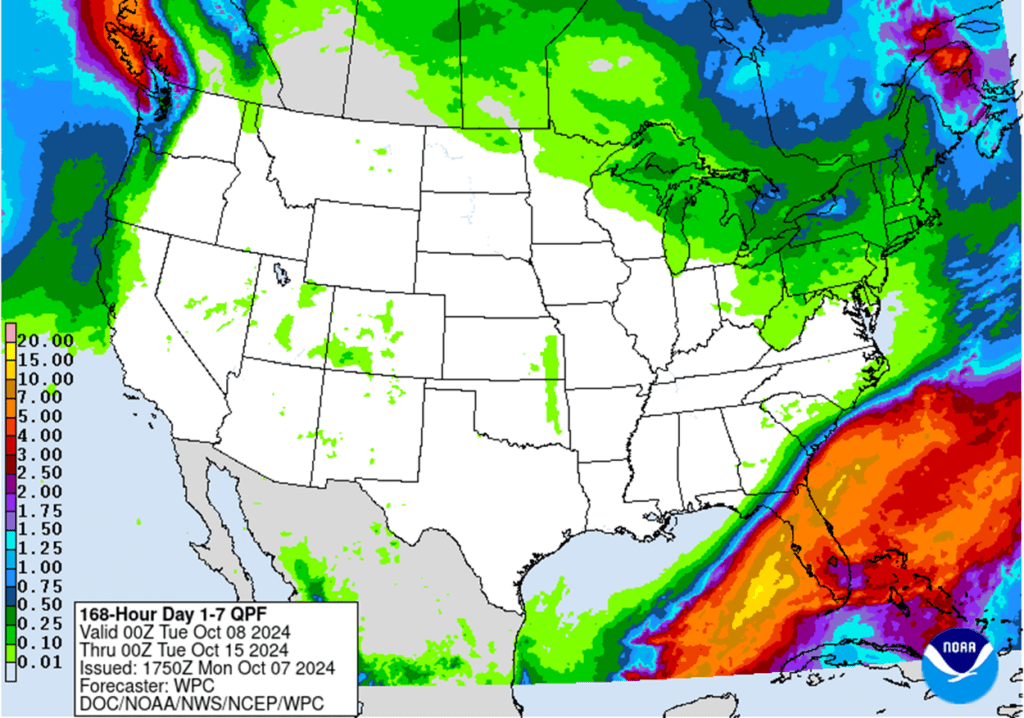

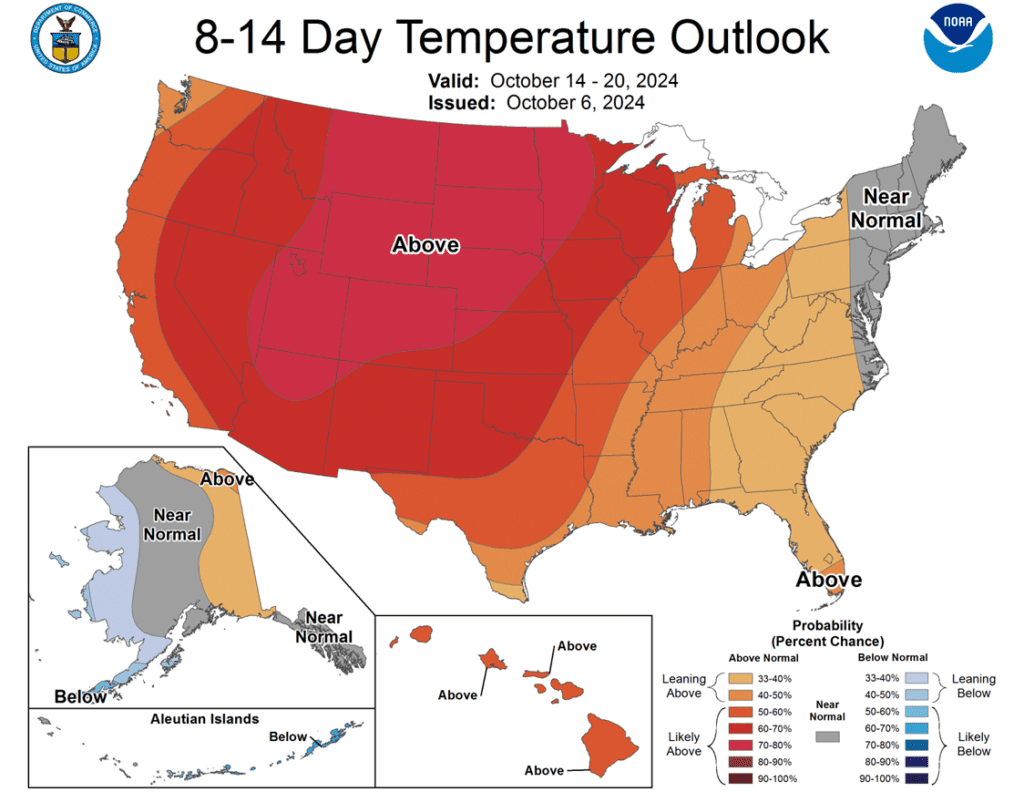

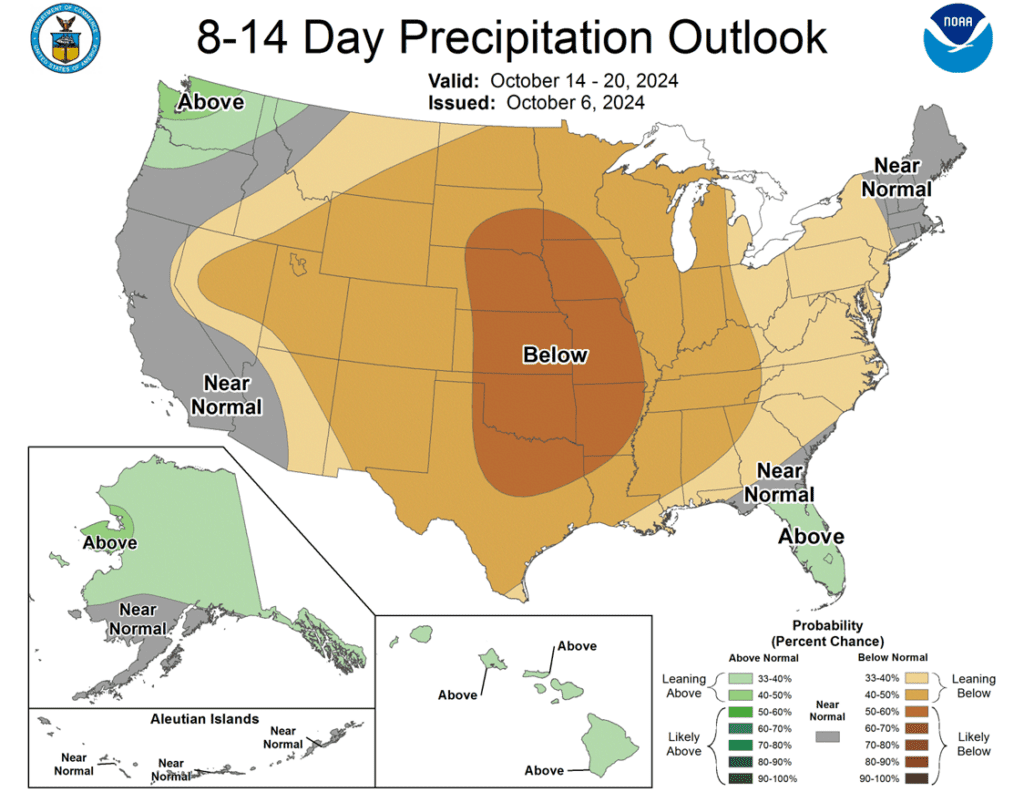

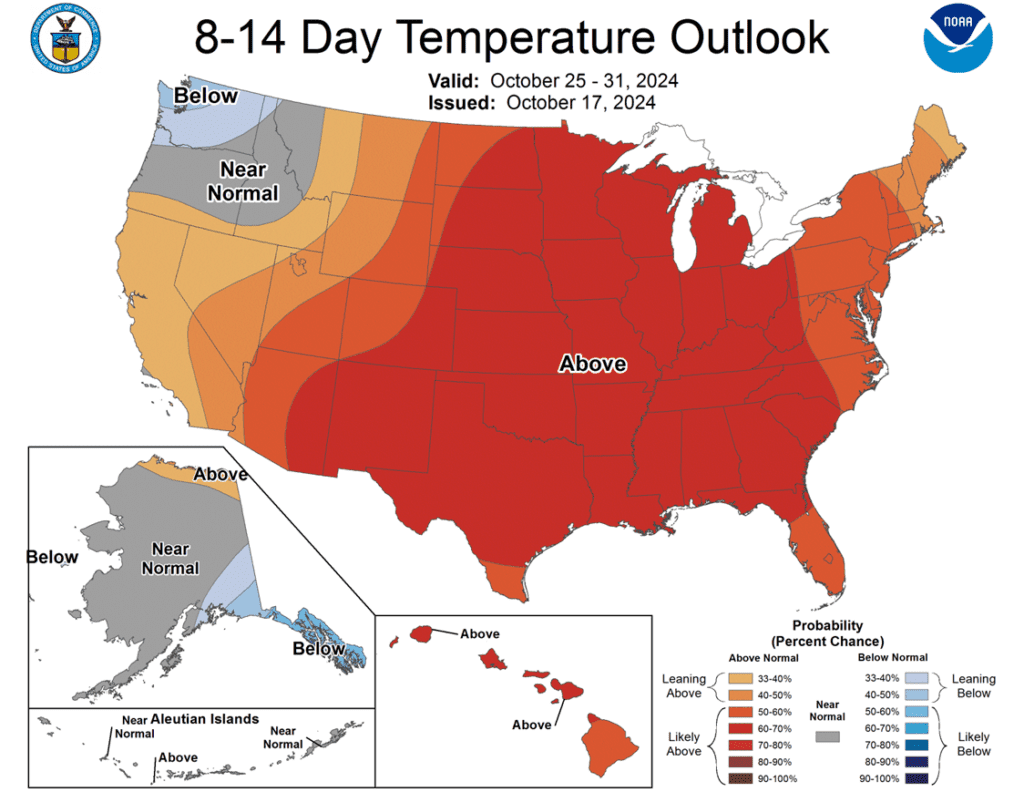

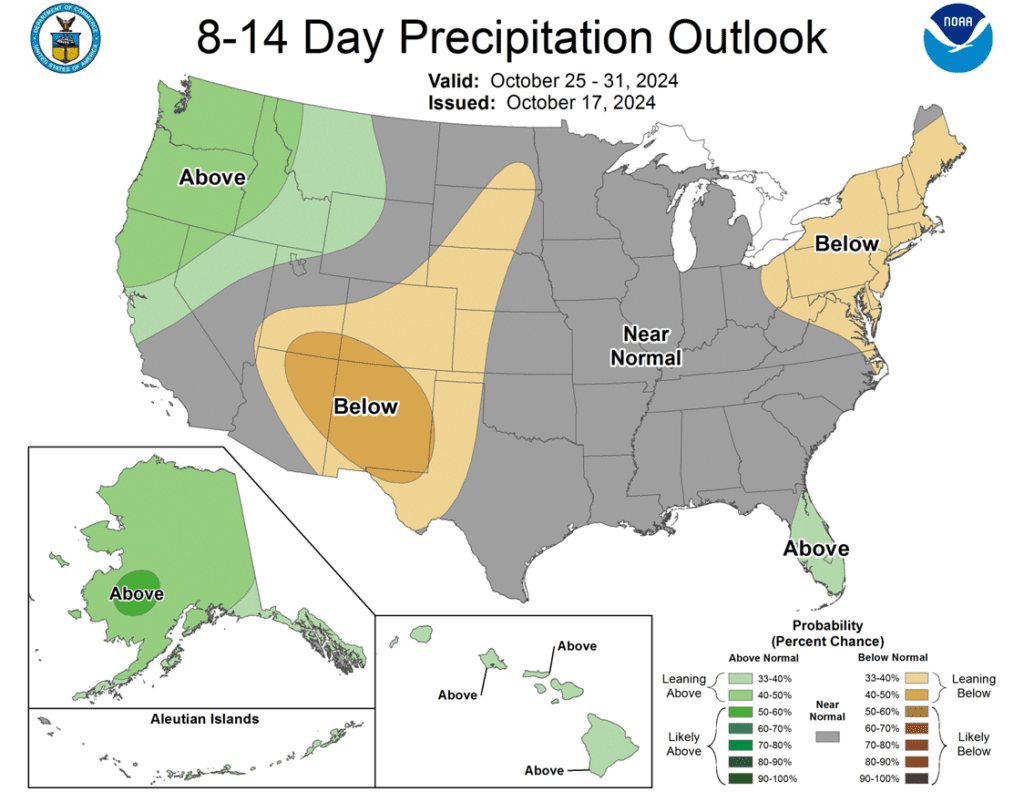

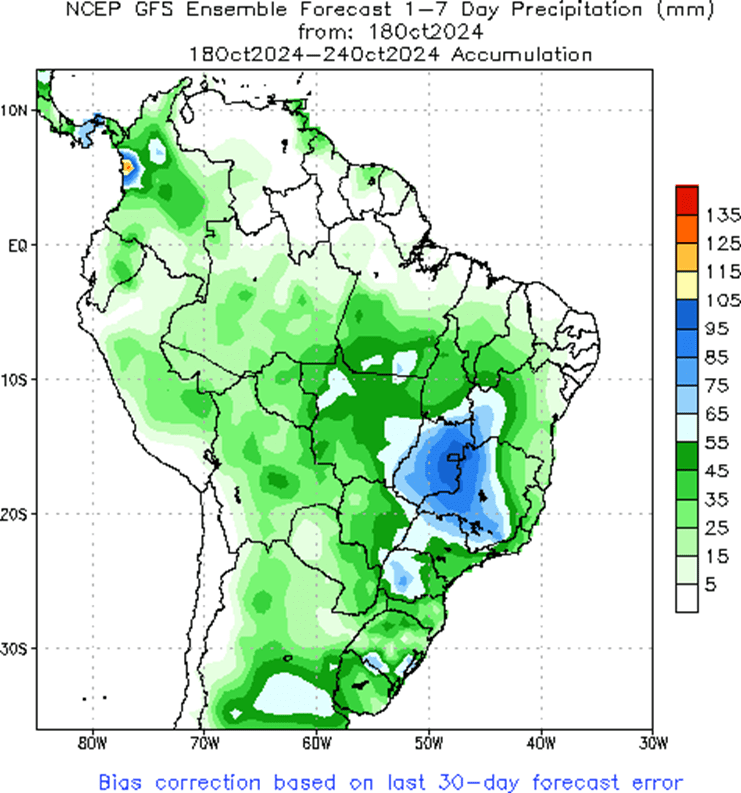

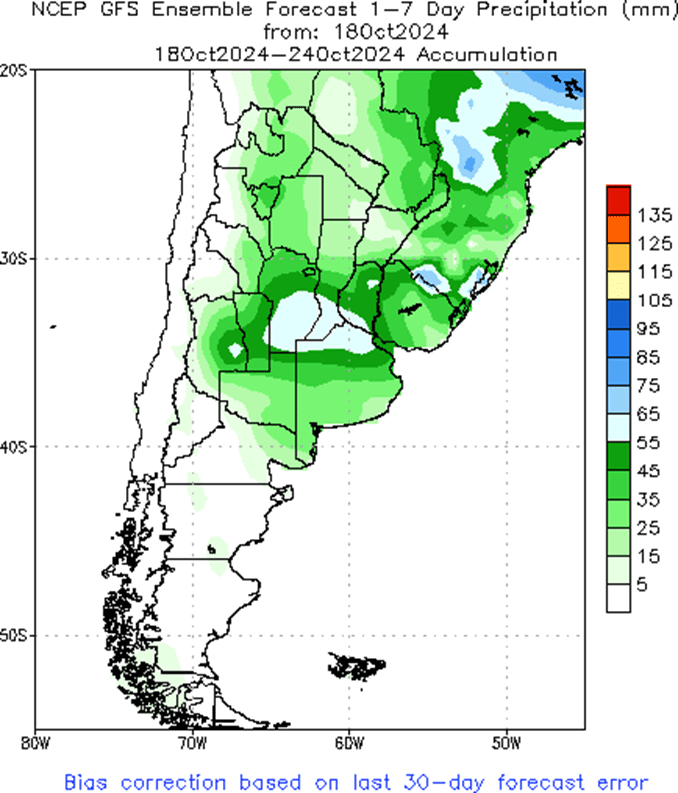

- To see the updated US 7-day precipitation forecast, US 8-14 day Temperature and Precipitation Outlooks, and the South American 1-week forecast total precipitation, courtesy of the National Weather Service, Climate Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

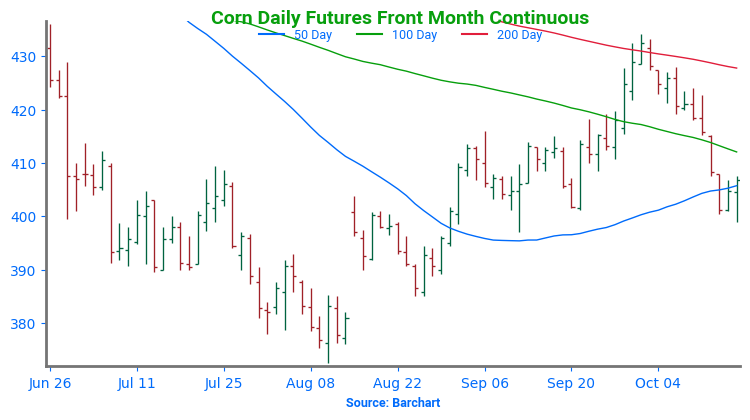

Corn

Corn Action Plan Summary

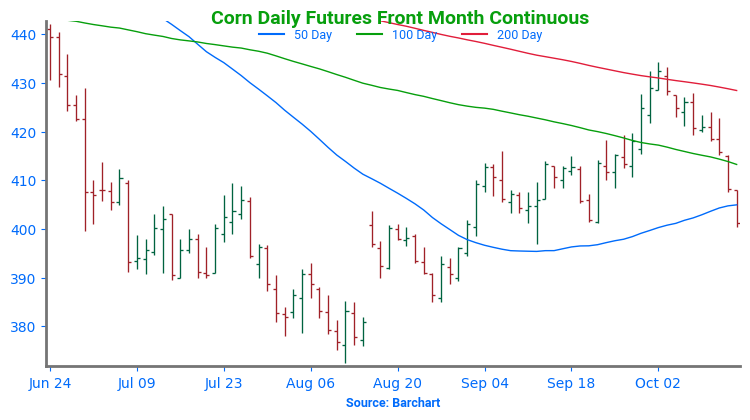

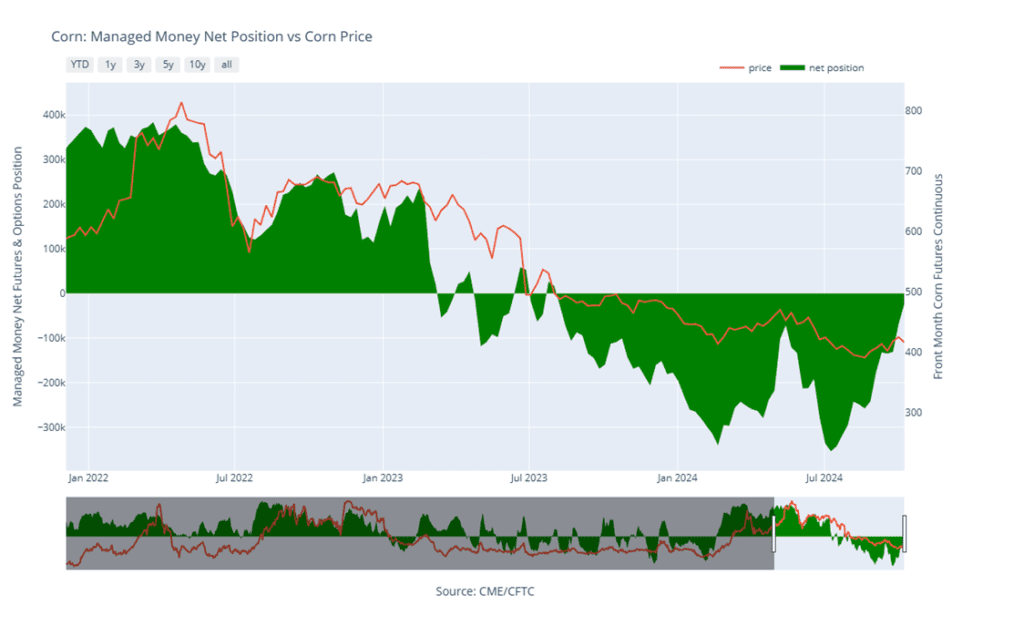

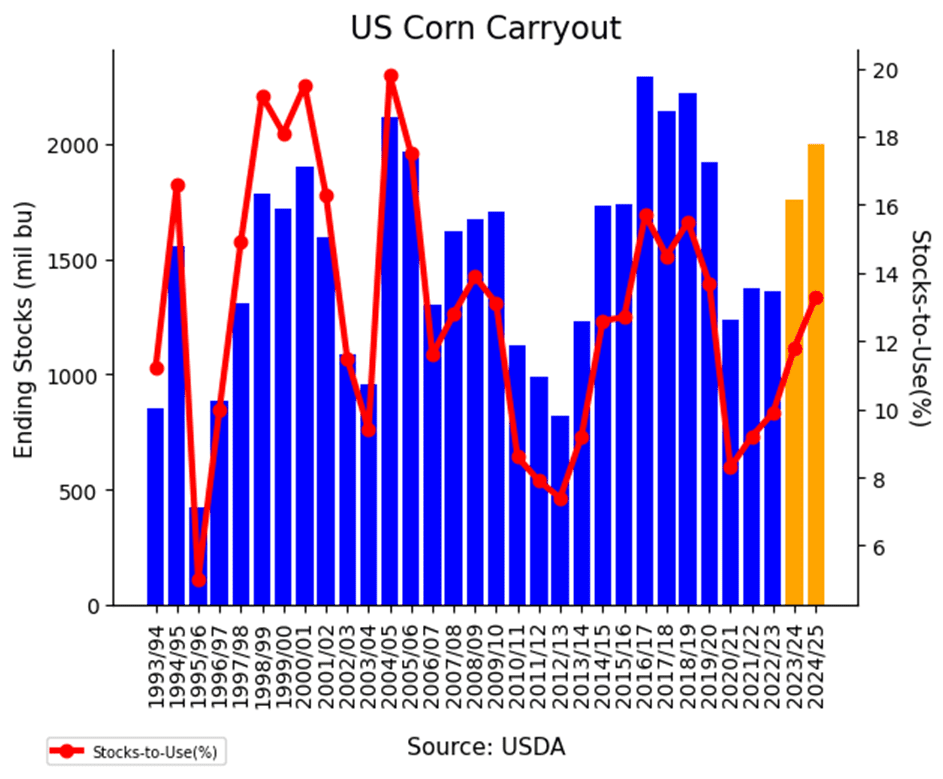

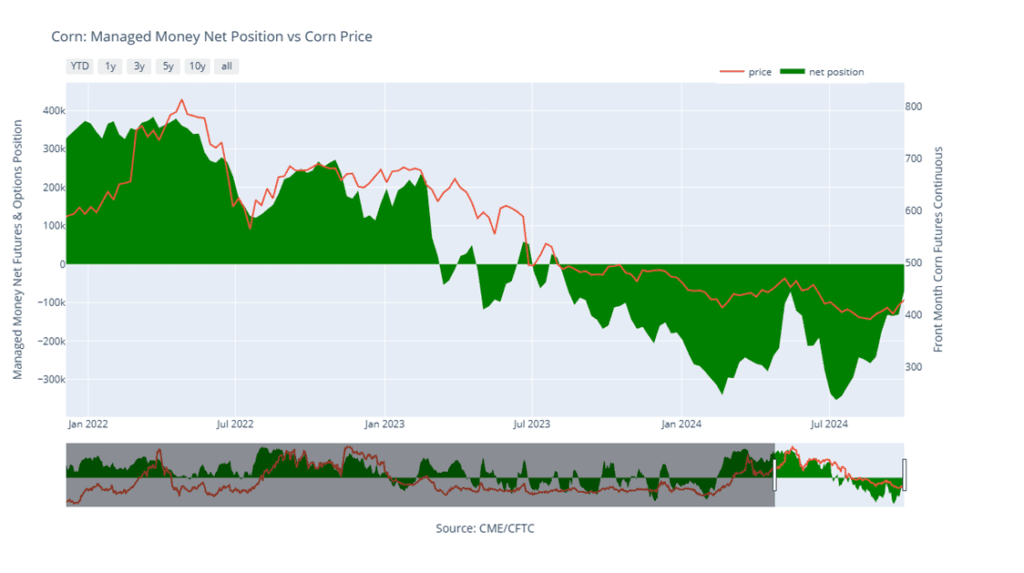

Since hitting a peak in early October, corn prices have fallen off as harvest continues at a rapid pace with record yields according to the USDA, and South American weather has turned more seasonal. Now that managed funds have covered most of their record short positions, they have flexibility to establish net long or net short positions. Any unexpected downward shift in anticipated US supply or deterioration in South American growing conditions could trigger managed funds to continue buying and rally prices further. However, if harvest yields remain strong and South American weather turns more favorable, prices could be at risk of retreating.

- Catch-up sales opportunity for the 2024 crop. If you missed any of our past sales recommendations, there may still be good opportunities to make additional sales for this crop. While this time of year doesn’t often provide the best pricing, a rally back toward the 429 – 460 area versus Dec ’24 could provide a solid opportunity to make any catch-up sales. Also, if storage or capital needs are a concern, you could consider selling additional bushels into market strength. We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market into harvest, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally. Until we post new sales targets, if you are looking to make additional early sales for next year, you could consider targeting the 455 – 475 area versus Dec ’25 to take advantage of any post-harvest strength.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

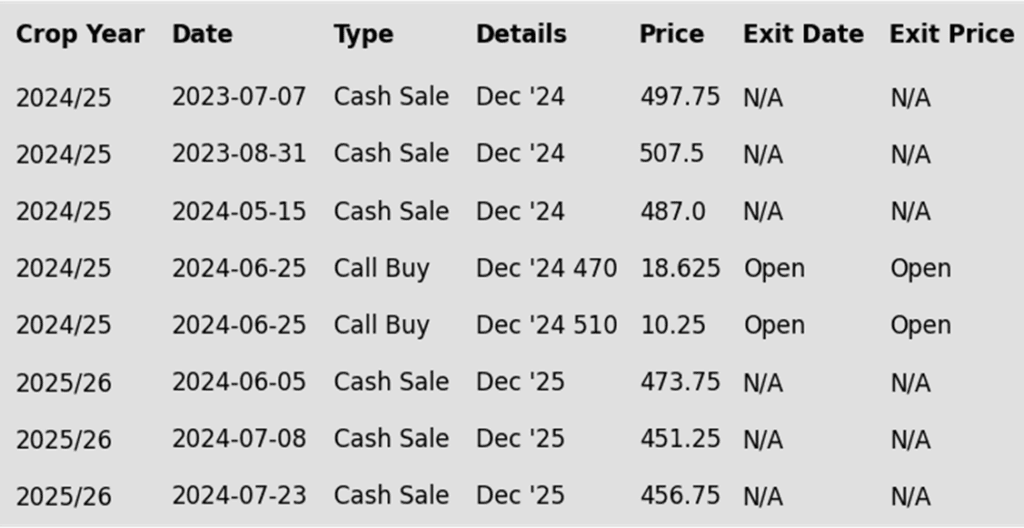

To date, Grain Market Insider has issued the following corn recommendations:

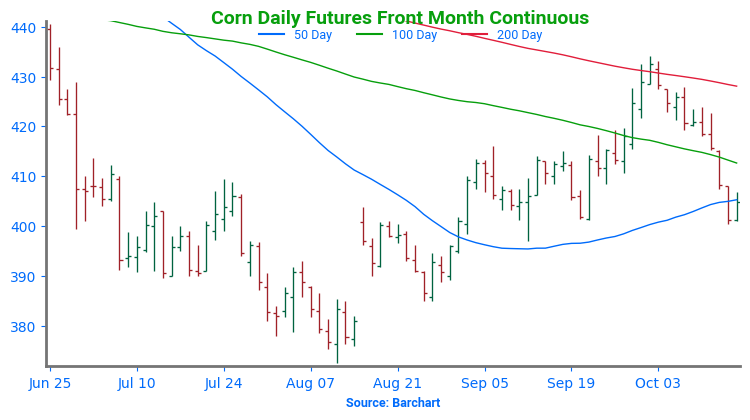

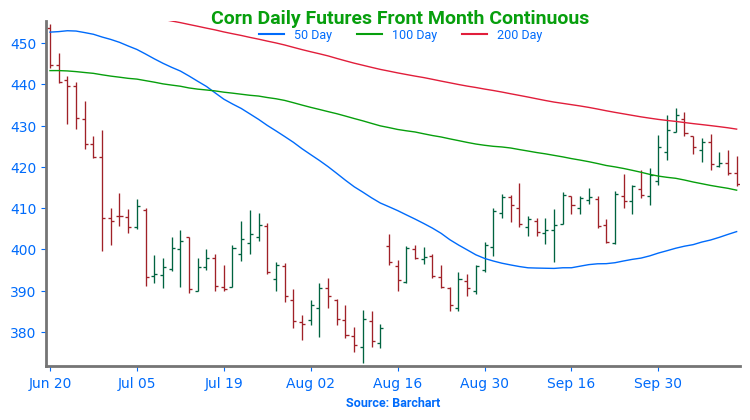

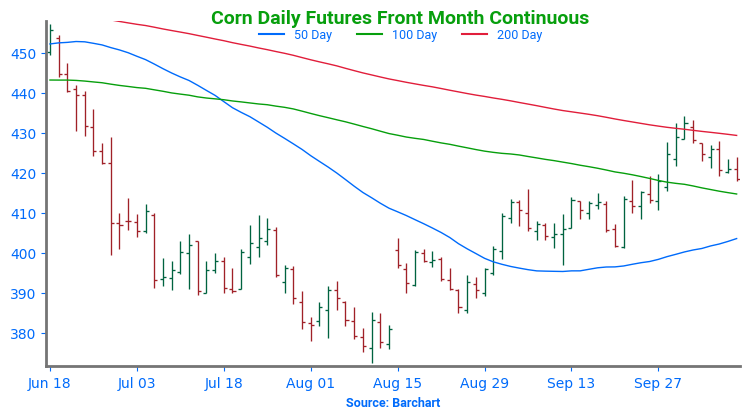

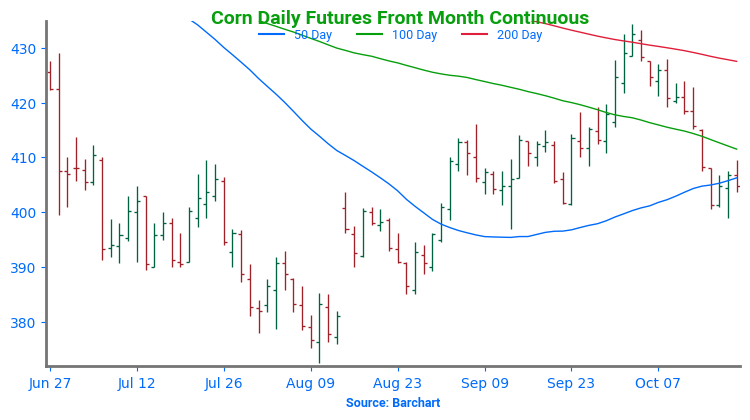

- The corn market failed to follow through on yesterday’s strength as strong selling in the wheat and soybean market limited potential price gains. Price action saw December corn fail at overhead resistance near 408, before slipping lower on the session. For the week, December corn lost 11 cents total.

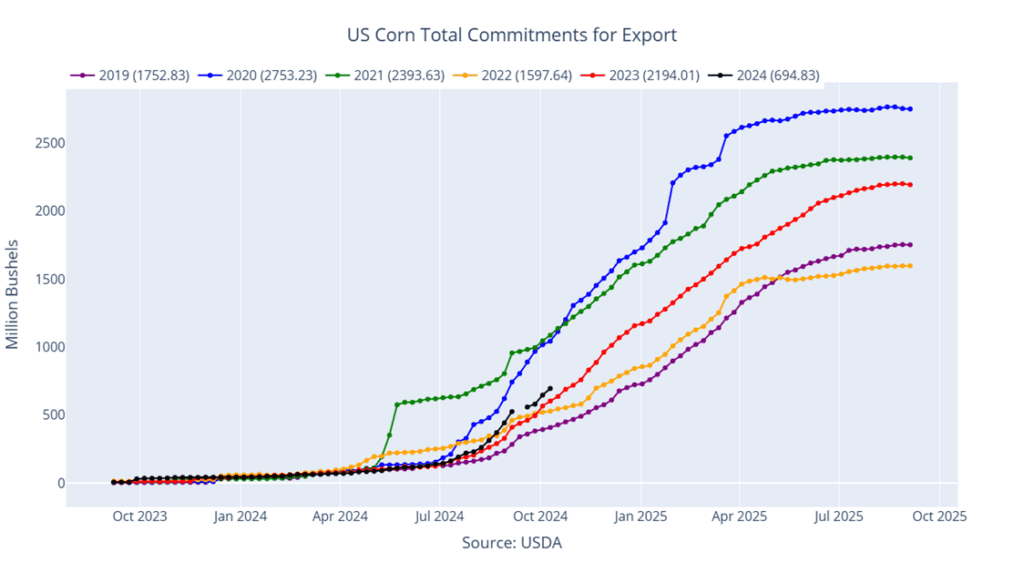

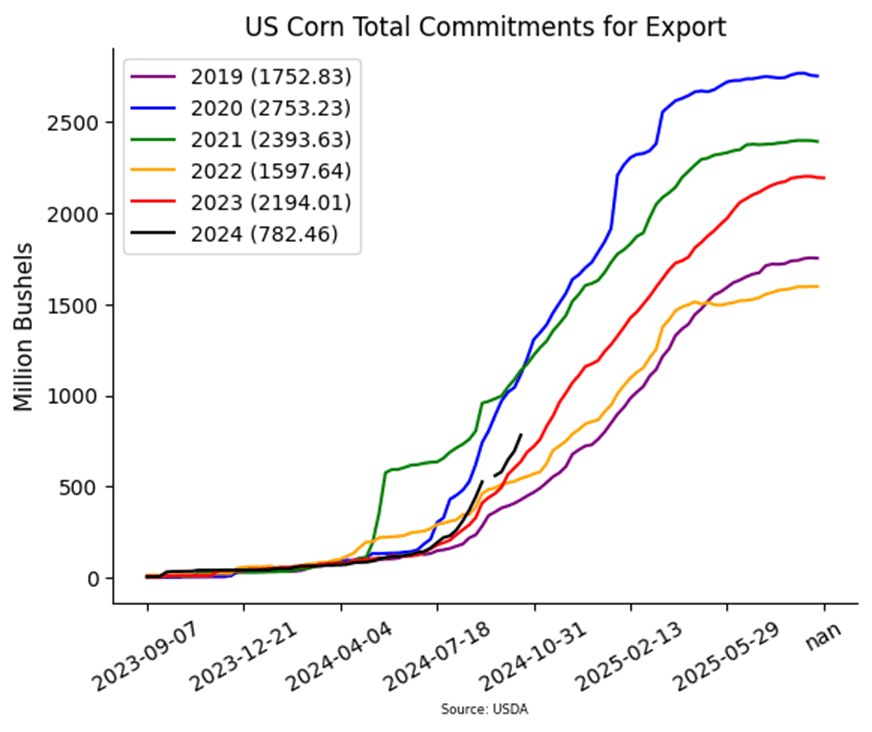

- Weekly export sales were strong for corn at 87.6 mb (2.225 mmt) for the week ending October 10. This total was above the high end of analysts’ expectations. Total sales are up 23% from last year and ahead of the pace to reach USDA 24/25 targets.

- The USDA announced a flash export sale of corn before the session, with 125,000 mt (10.8 mb) purchased by unknown destinations for the current marketing year. This marks the fifth flash sale announced this week, as demand picked up around the 400 December futures price.

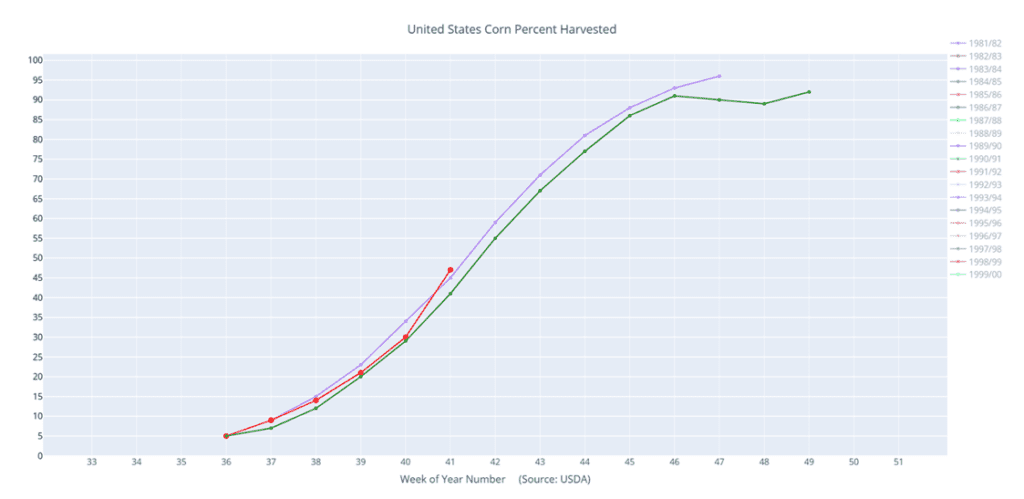

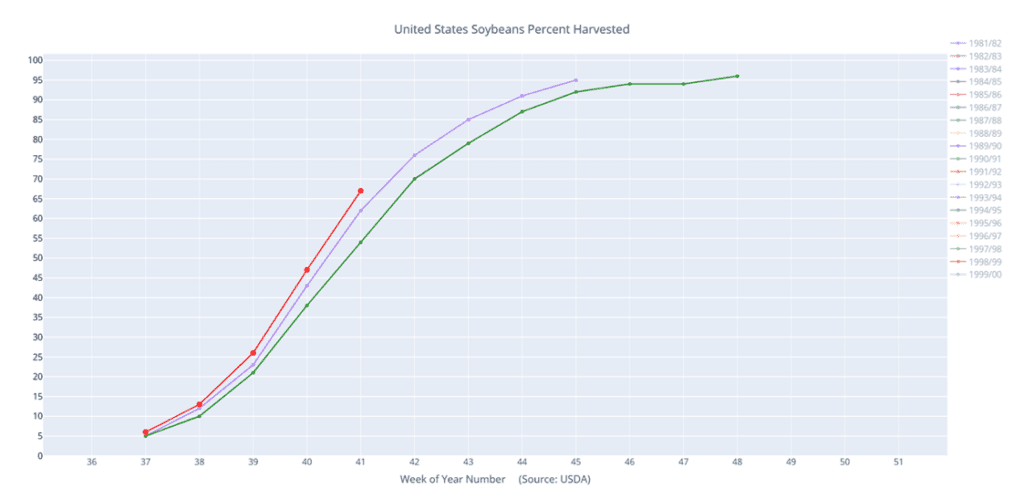

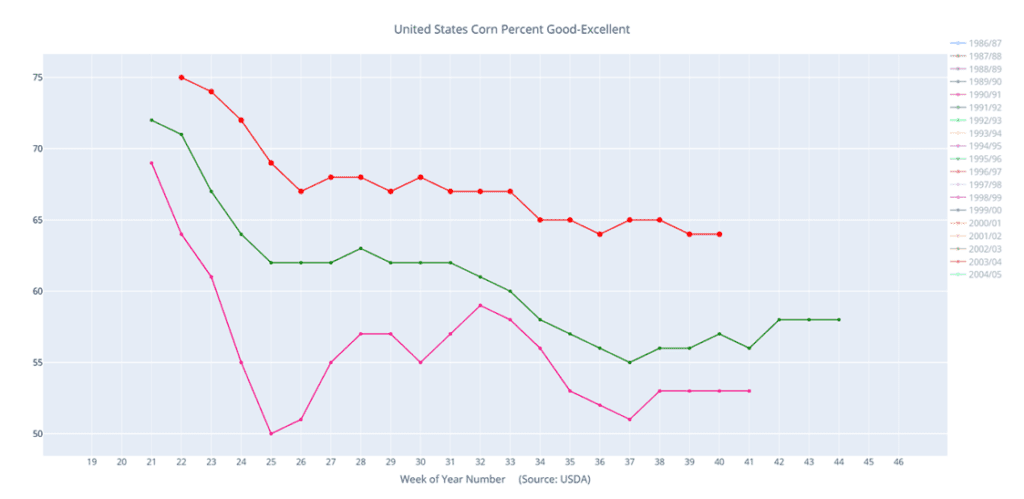

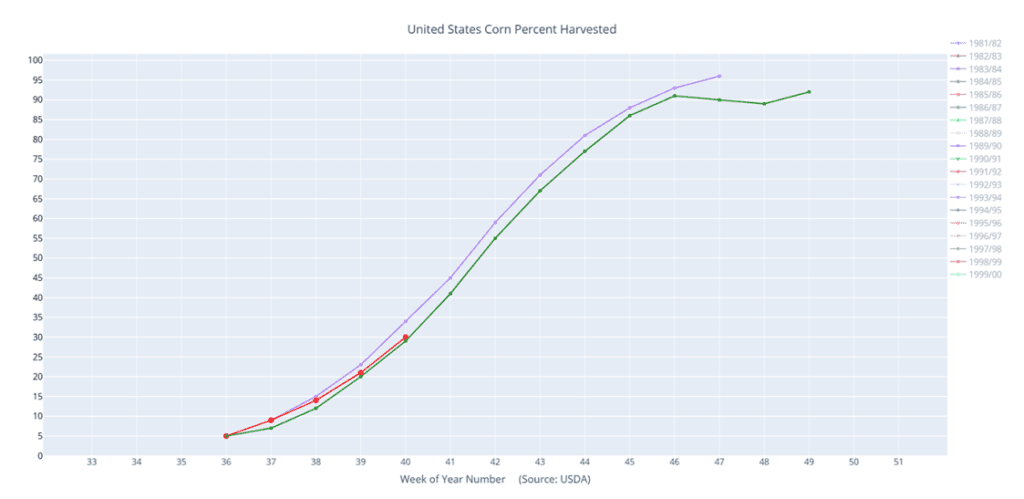

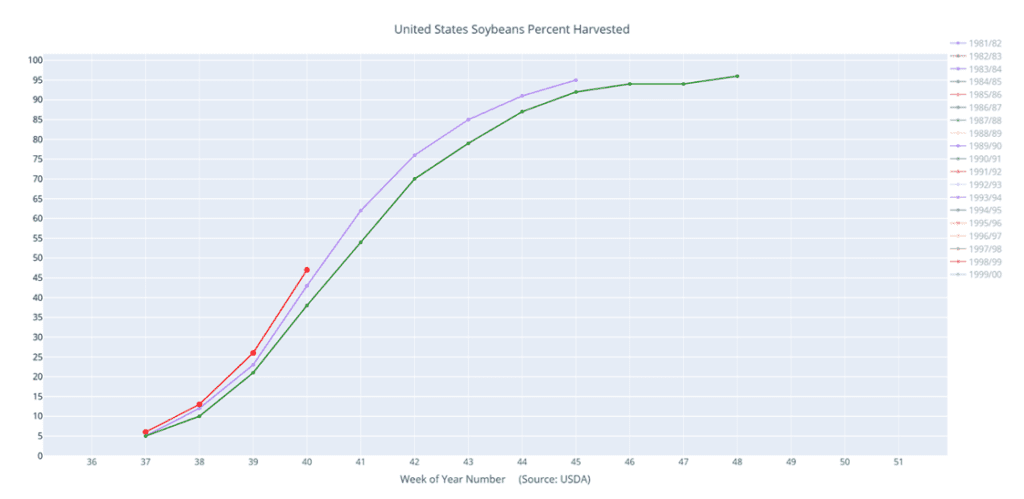

- Corn harvest is expected to progress steadily as favorable weather conditions persist. The influx of new bushels into the pipeline will likely limit upside price potential in the corn market. Last week, the US corn harvest was 47% complete, and that figure is likely to increase again this week.

Above: The recent decline in prices from the early October high has been met with support near the psychologically significant 400 area. If this area holds and prices turn higher, the rally may be met with resistance around 415, with more significant resistance towards 428 – 434. Otherwise, a breach of 400 and close below 397 could signal a further decline with support near 385, and again around 372.

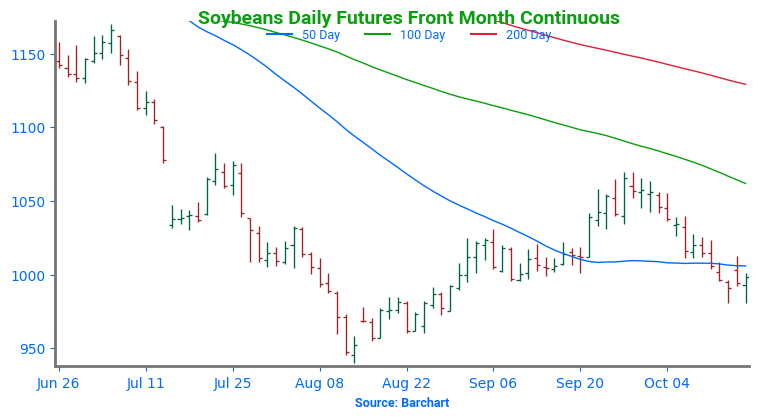

Soybeans

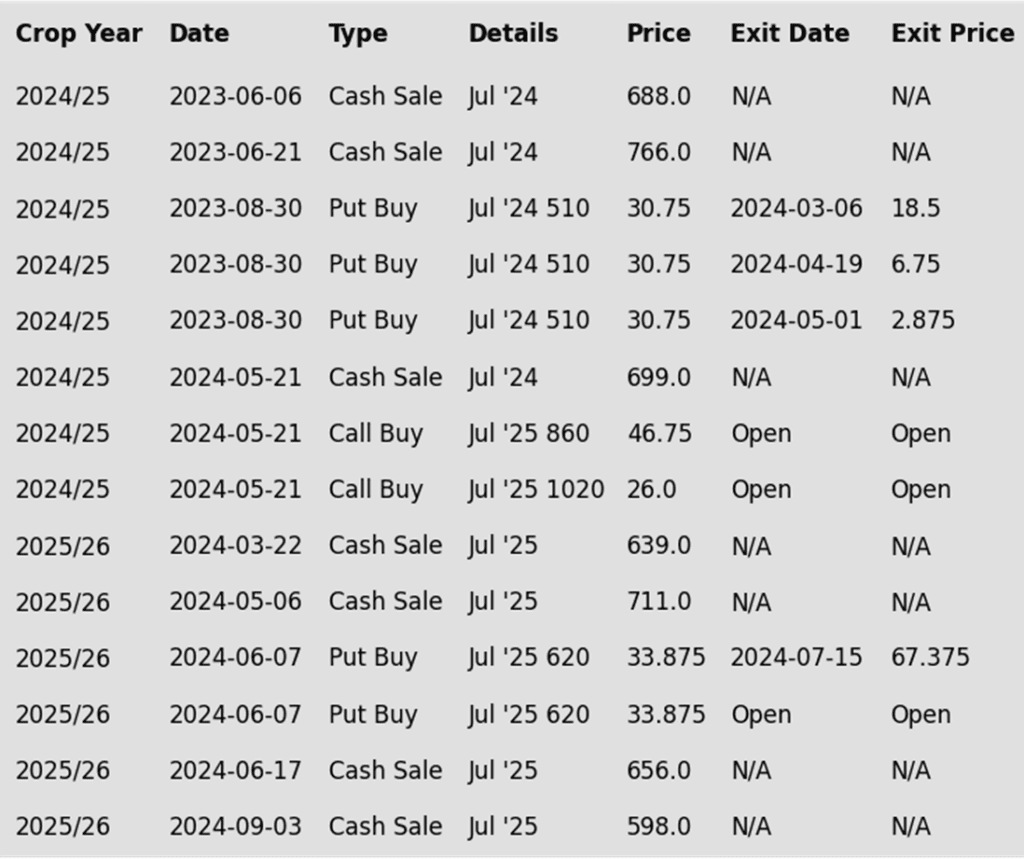

Soybeans Action Plan Summary

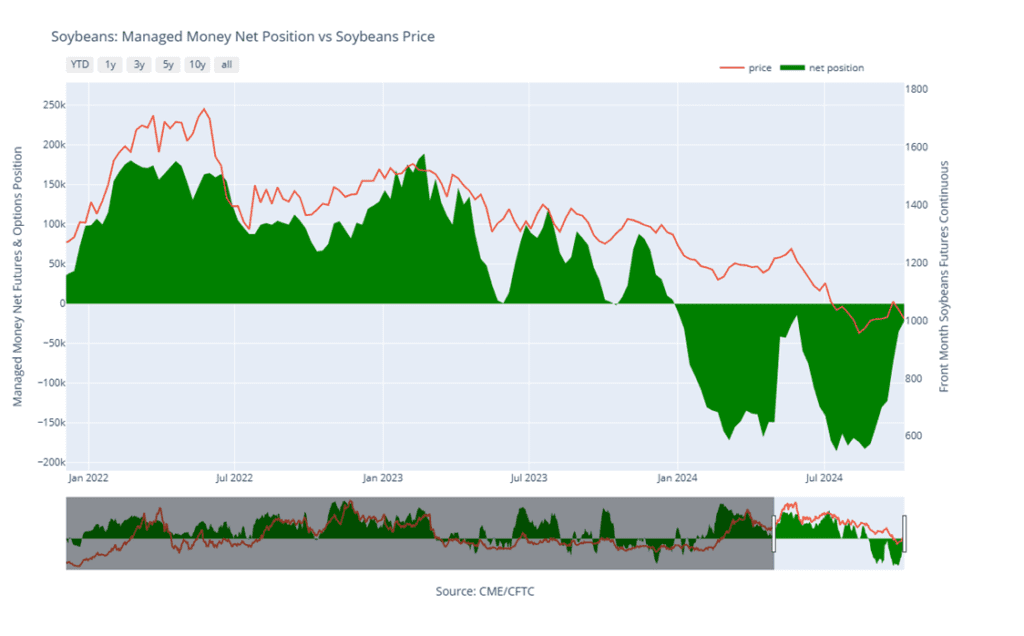

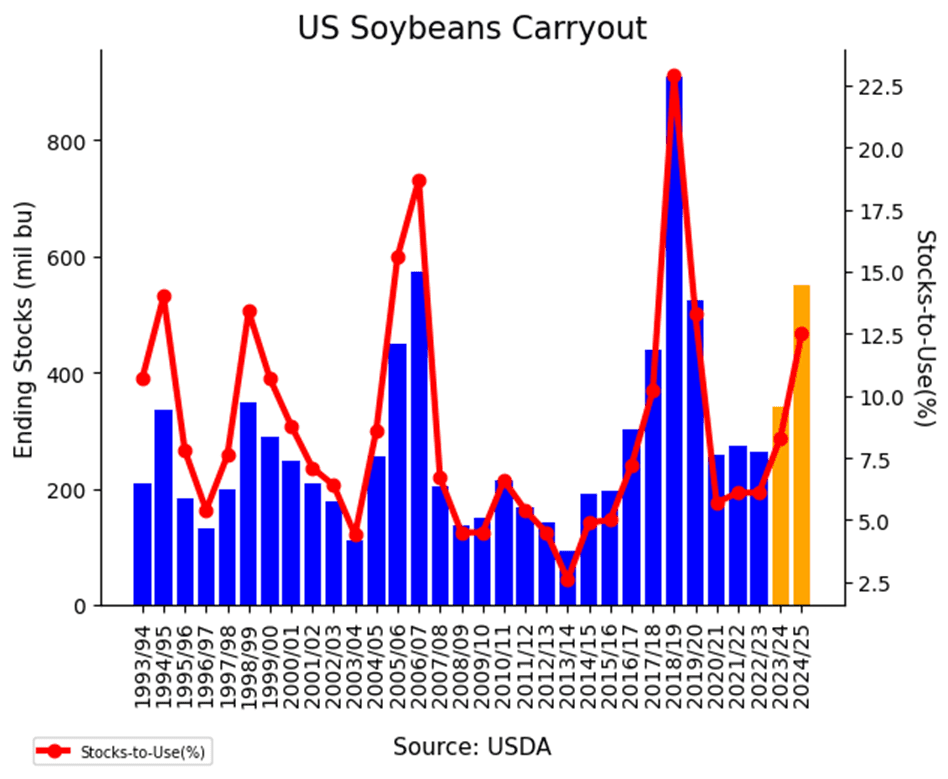

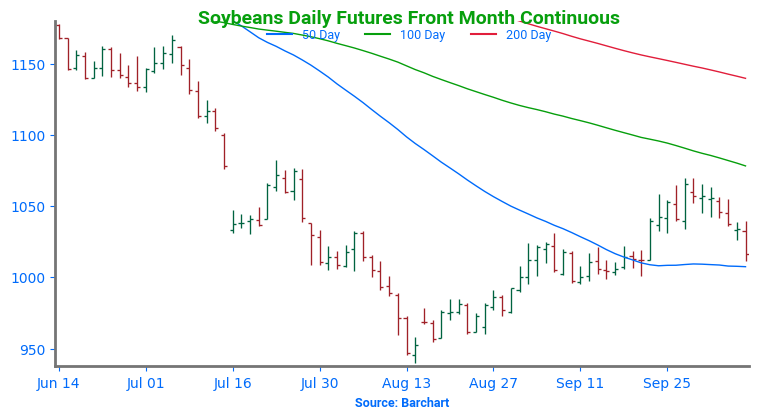

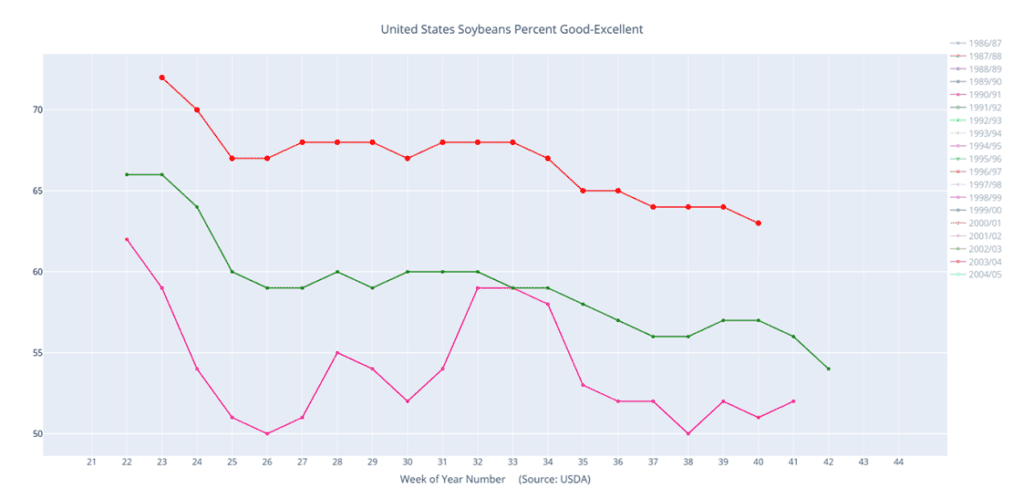

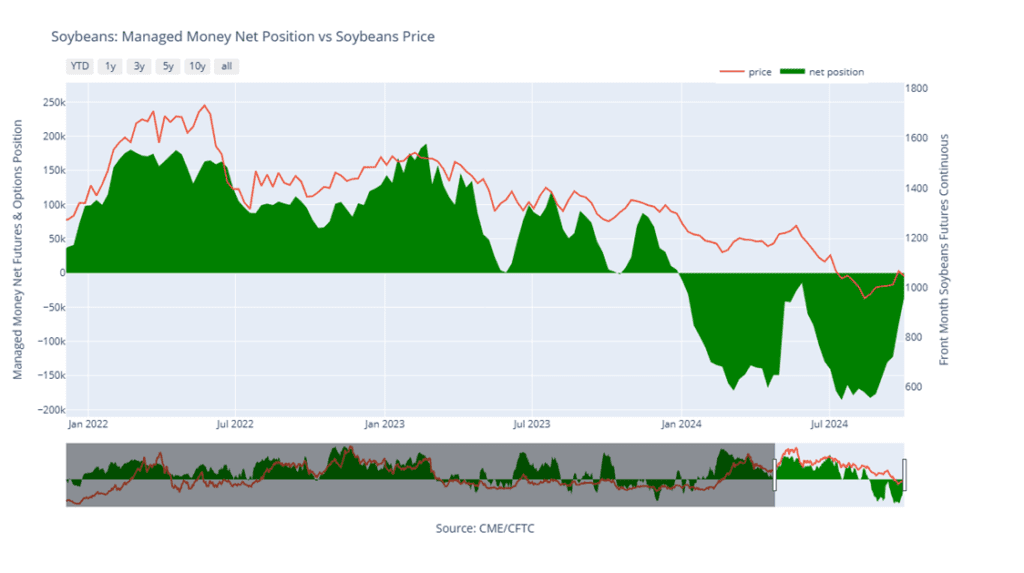

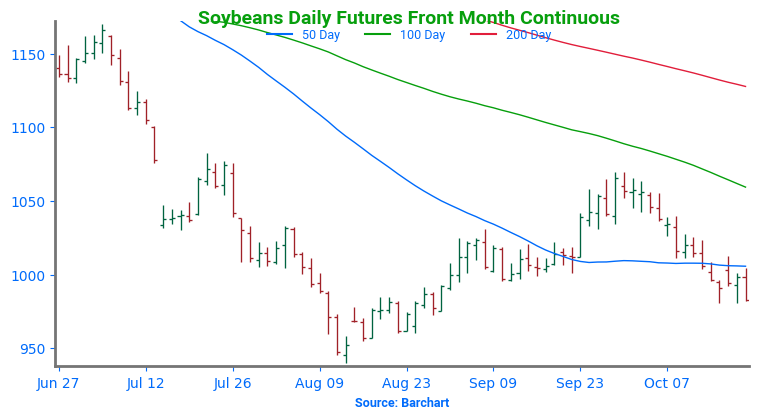

After hitting a seasonal low in mid-August, the soybean market rose steadily, reaching its peak in early October, driven by drier conditions in the US during the later stages of crop development and continued dryness in key soybean-growing regions of South America. During this time, managed funds covered over 80% of their significant short positions, creating the potential for volatility in either direction. Prices could rise if South American conditions worsen, encouraging further fund buying, or decline if conditions improve, prompting funds to potentially rebuild short positions. Seasonally, once harvest is complete, prices tend to firm as hedge pressure subsides and the market begins to price in any potential South American weather premium.

- Catch-up sales opportunity for the 2024 crop. If you missed the June sales recommendation triggered by the market’s close below 1180, there may still be an opportunity to make a catch-up sale. While we don’t expect the current harvest period to offer the best pricing, a rally back to the 1050 – 1070 range versus Nov ’24 could provide a good opportunity. For those with storage or capital needs, consider making these catch-up sales into price strength. If the market rallies further, additional sales can be considered in the 1090 – 1125 range versus Nov ’24. No further sales recommendations are anticipated until seasonal pricing opportunities improve, likely late fall to early spring.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

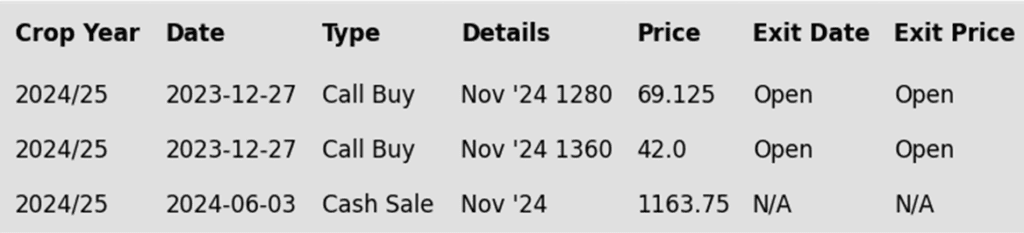

To date, Grain Market Insider has issued the following soybean recommendations:

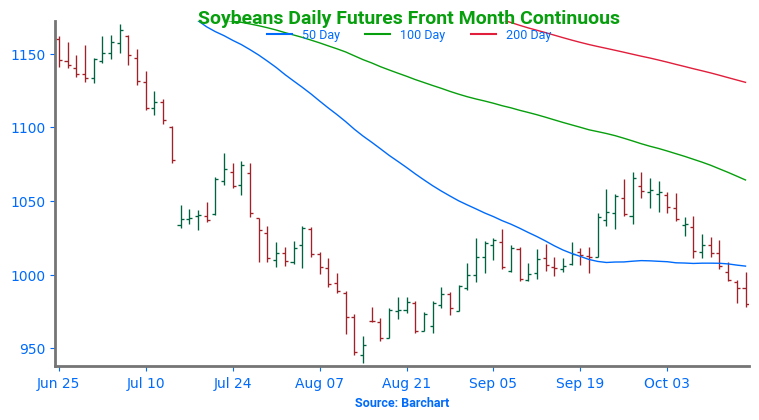

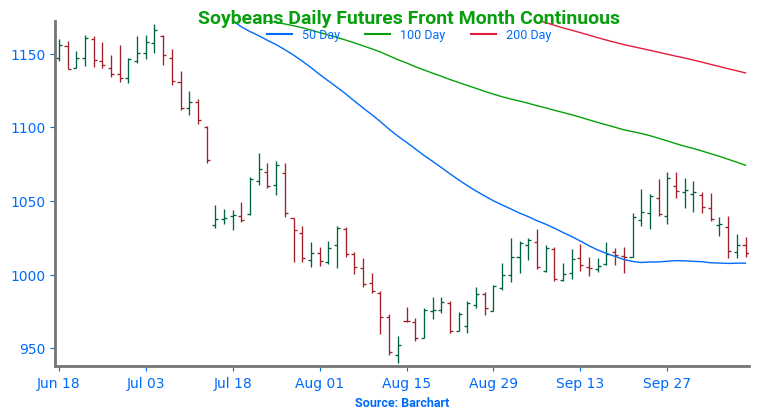

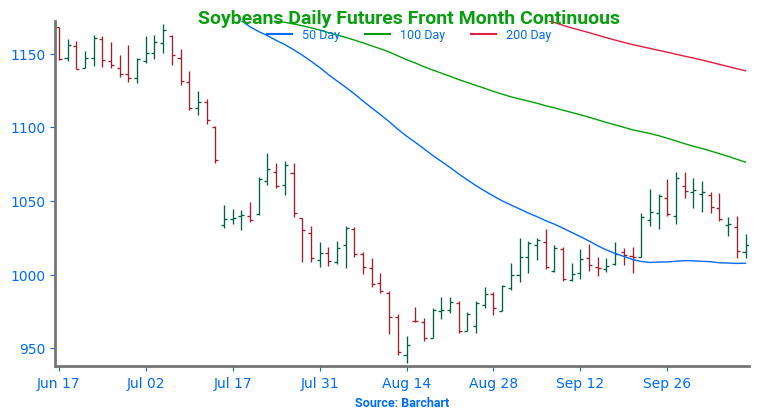

- The soybean market turned lower today, erasing yesterday’s gains but still holding above the November contract’s low of 968 ¼ from yesterday. Hedge pressure heading into the weekend, along with sharply lower soybean oil and a bearish reversal in meal, also contributed to the weakness.

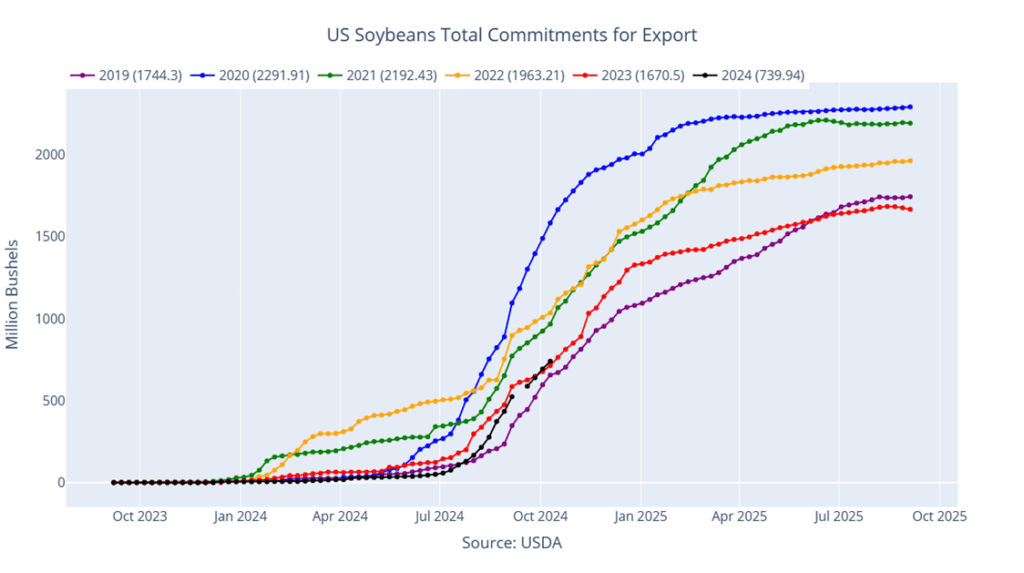

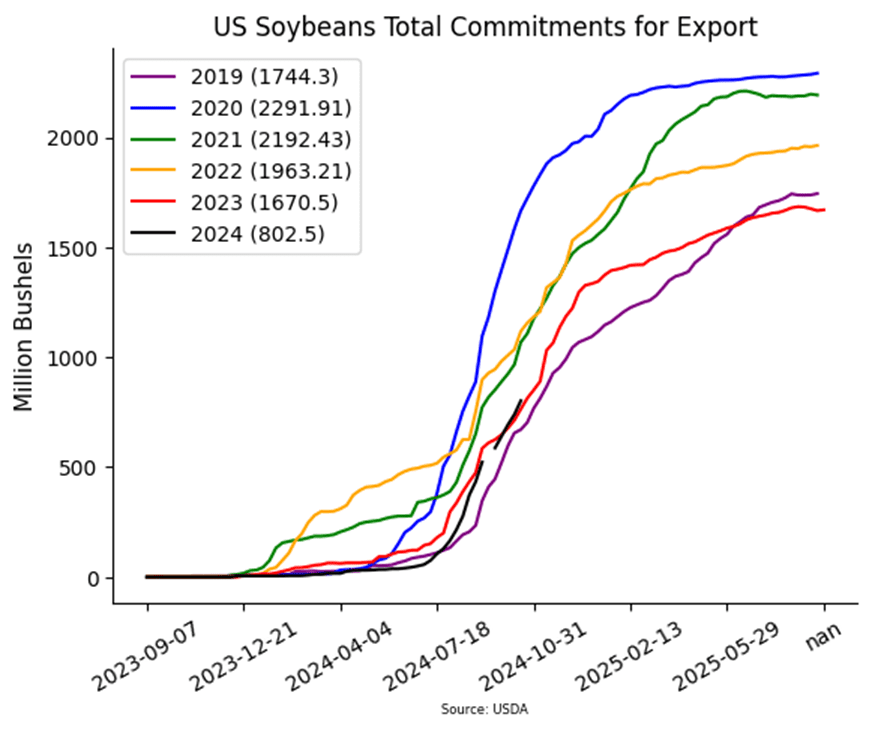

- The USDA’s weekly Export Sales report, released this morning, showed new soybean sales as of October 10 at 62.6 mb (1.703 mmt), with exports totaling 68 mb (1.853 mmt). New sales increased by 35% from the previous week and were 16% above the 4-week average, while exports were up 9% from last week and significantly higher than the 4-week average.

- The USDA also reported private export sales of 21,000 mt of soybean oil to Mexico for delivery in the 24/25 marketing year, along with 292,800 mt of soybeans sold to unknown destinations, also for 24/25 delivery.

- Safras & Mercado increased its Brazilian soybean export estimate by 10 mmt to 107 mmt, just above the USDA’s estimate of 105 mmt. The firm also raised its Brazilian crush estimate to 55.5 mmt versus the USDA’s 54 mmt.

Above: The recent downtrend appears to have found support near 980 on the front month chart, and with the market showing signs of being oversold, prices could rebound toward recent highs near 1070. Before that, prices may encounter resistance around 1025. If prices break the 980 support level in the January contract, they could find additional support near 955 and again around 940.

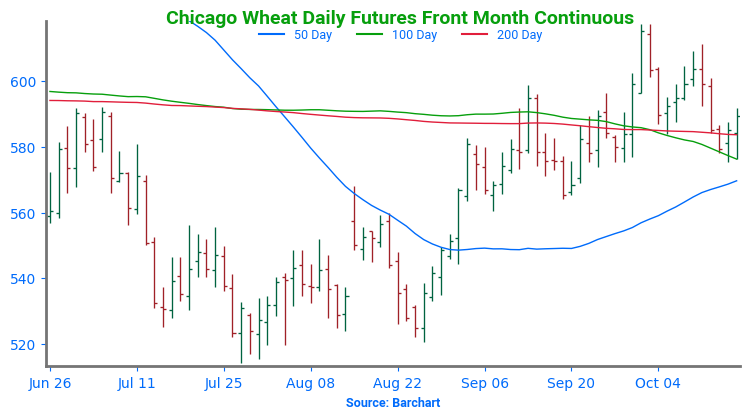

Wheat

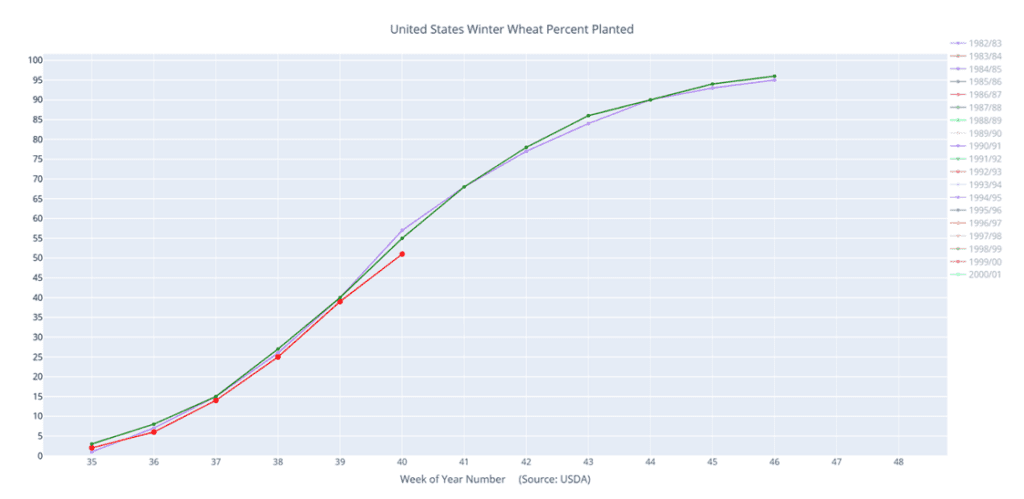

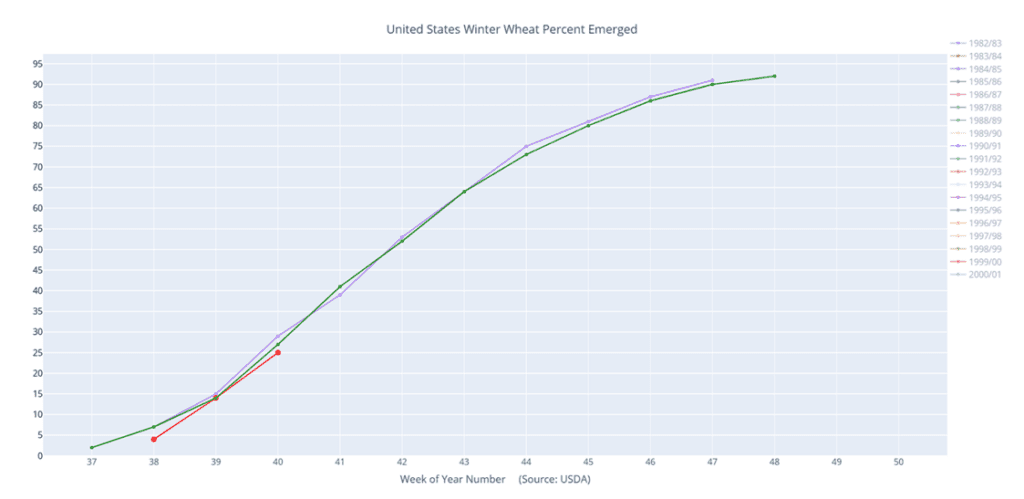

Market Notes: Wheat

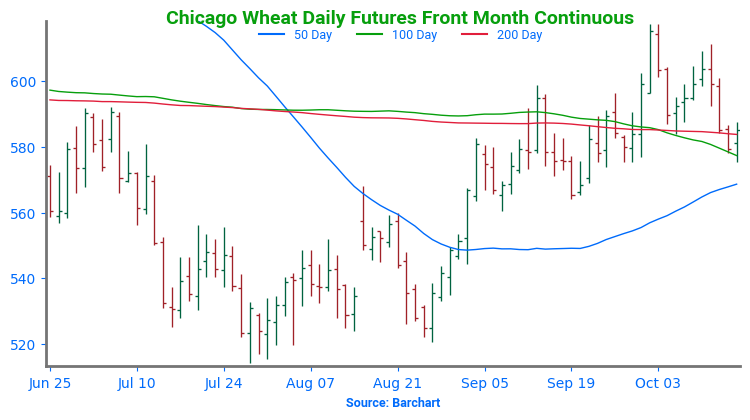

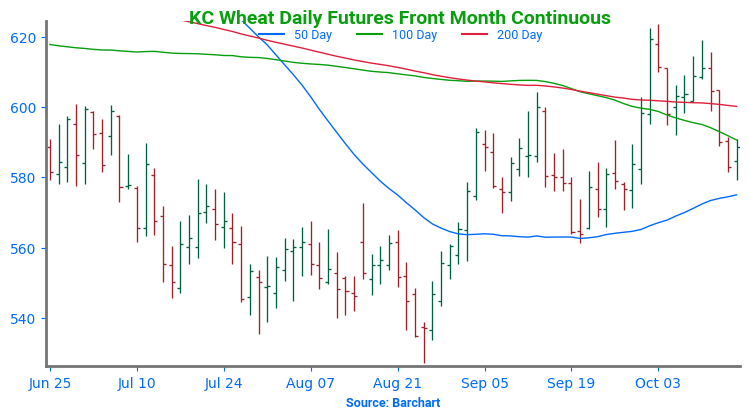

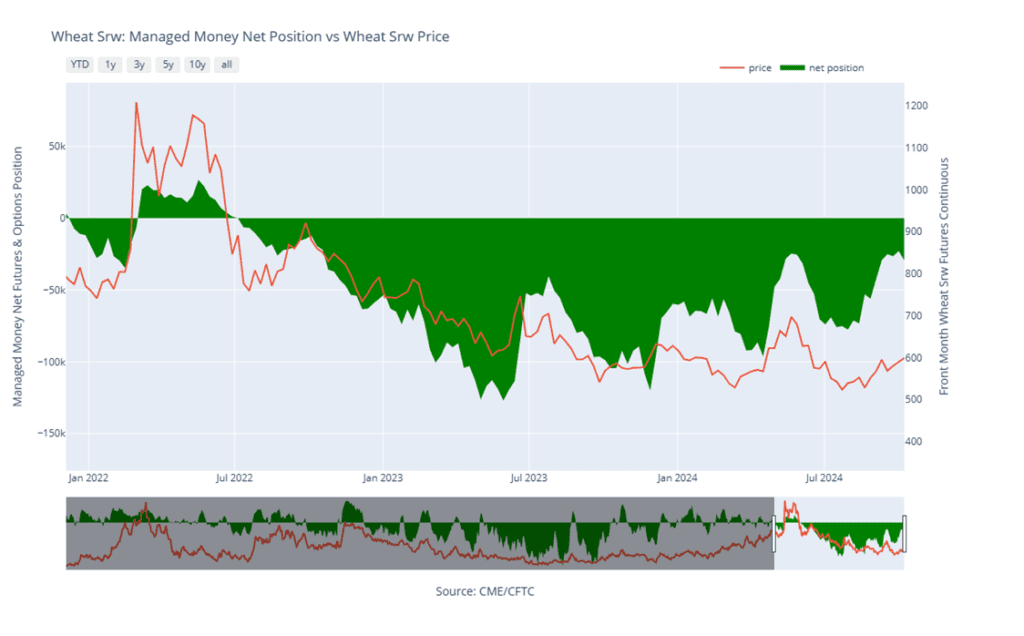

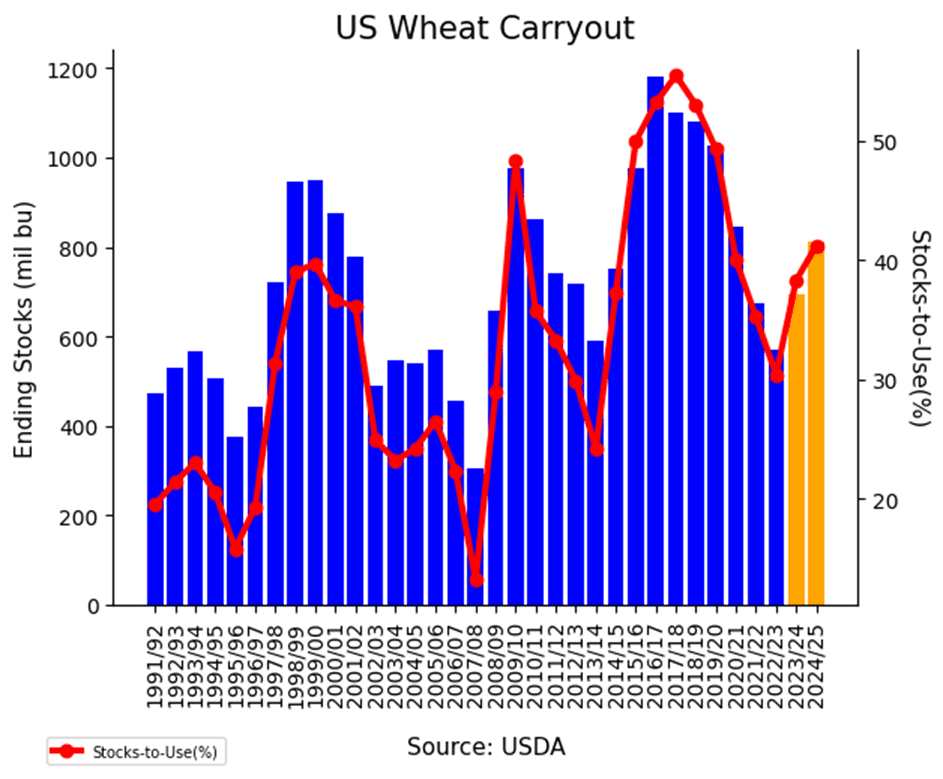

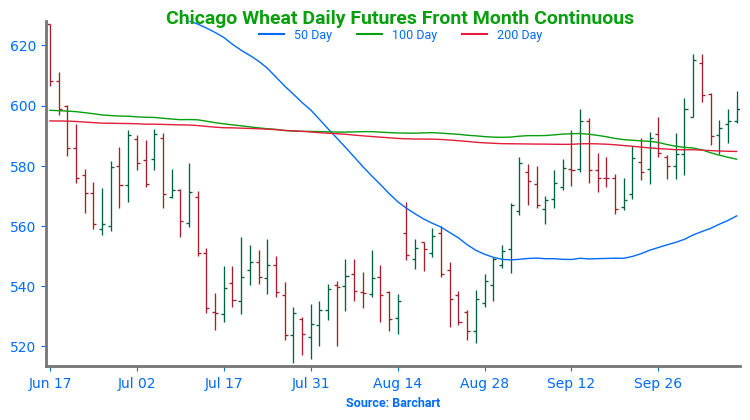

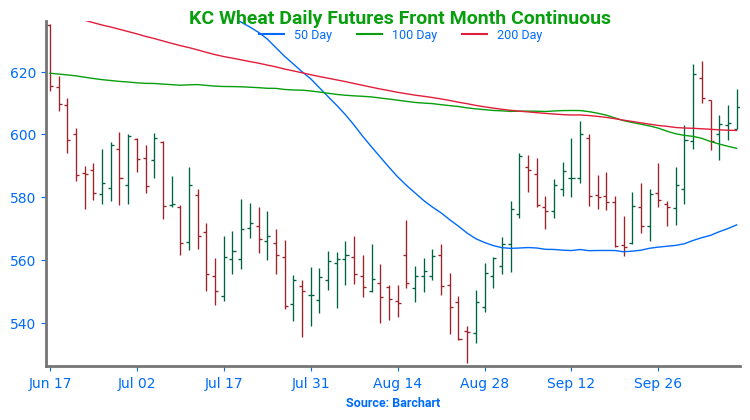

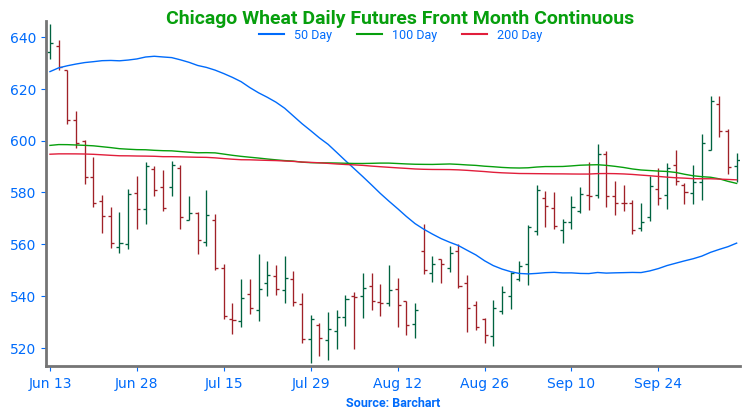

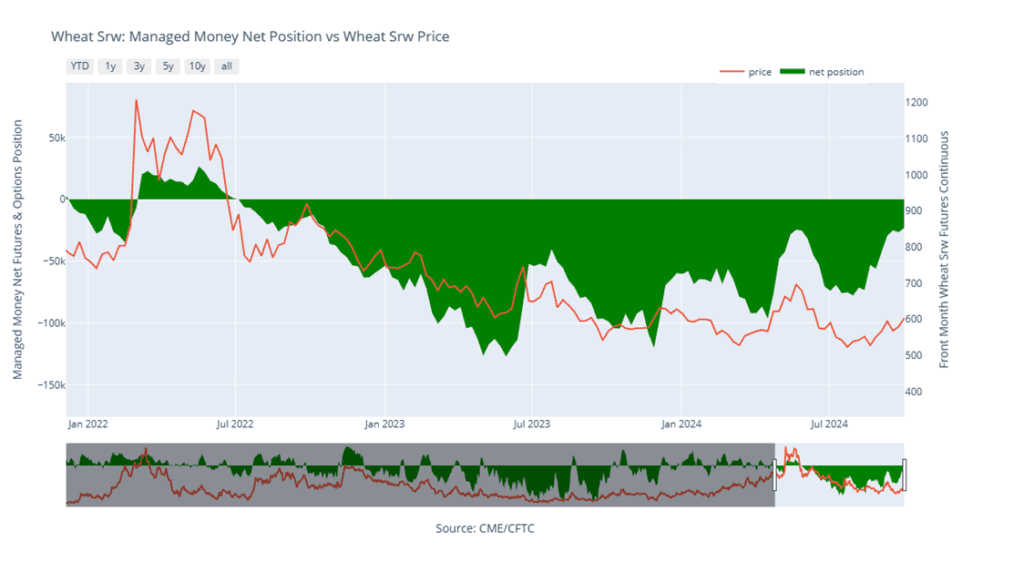

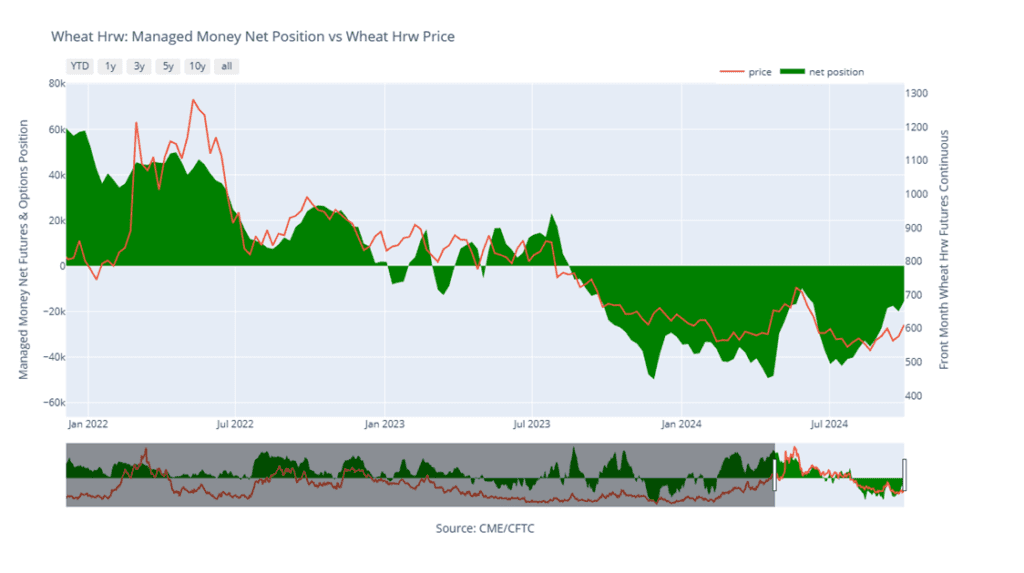

- Wheat closed sharply lower today, led by the Chicago contract and further pressured by lower Paris milling wheat futures. The weakness was driven by news that Russia’s grain exporting union intends to sell wheat directly to “sovereign buyers.” Member companies of Russia’s grain union account for roughly 80% of the country’s grain exports. This announcement could affect 13 countries and potentially limit US sales to these nations. According to Reuters, “non-Russian winners of international tenders will receive Russian grain only if they have long-term off-take agreements with Russian firms.”

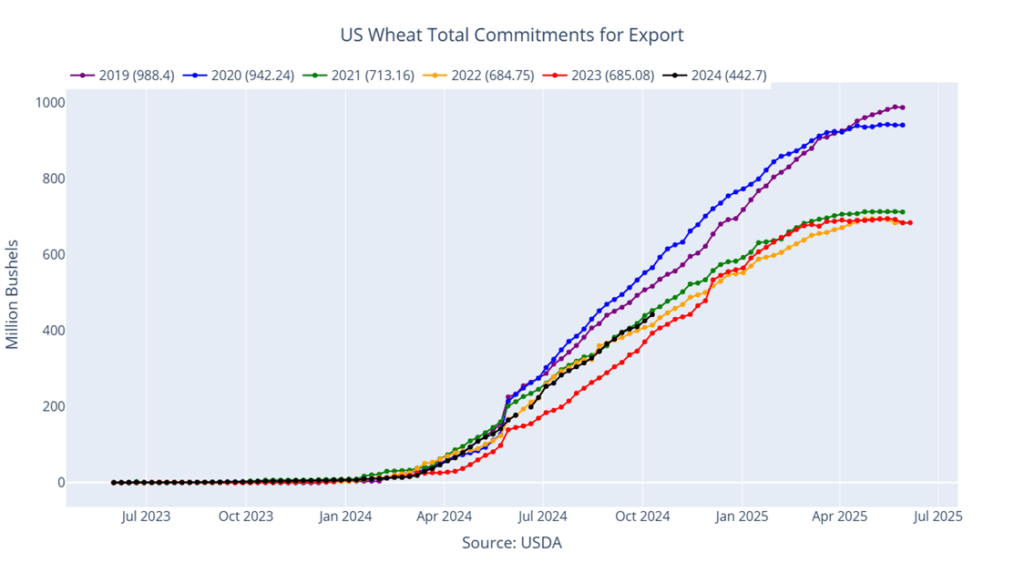

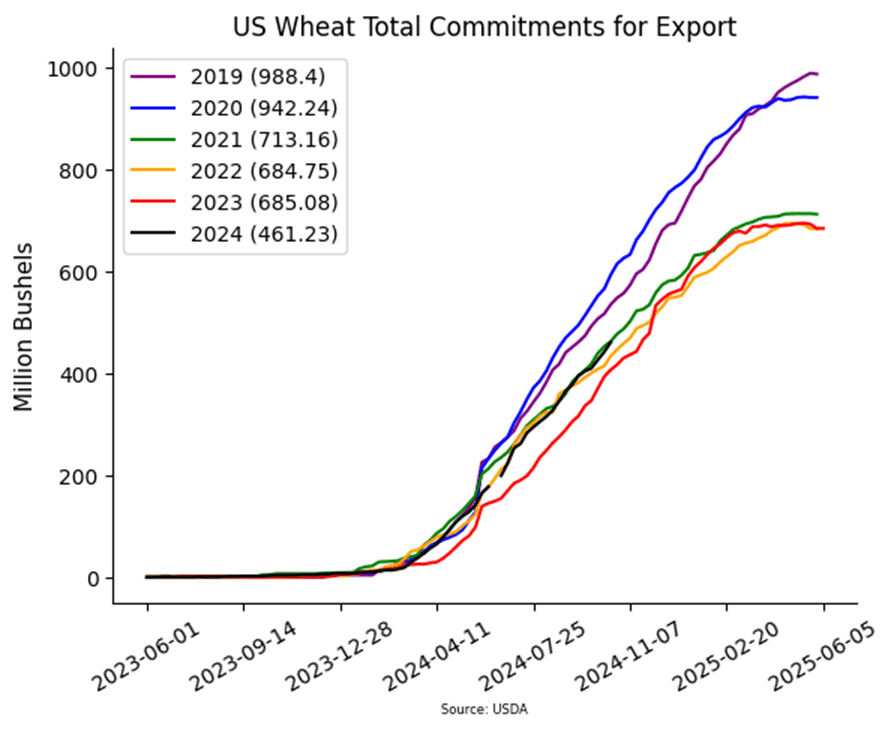

- US weekly wheat export sales were delayed until this morning due to Monday’s Columbus Day holiday. The USDA reported an increase of 18.5 mb of wheat export sales for 24/25. Shipments last week of 14.4 mb fell below the 14.9 mb pace needed per week to reach the USDA’s export goal of 825 mb. Additionally, sales commitments have reached 461 mb, which is up 17% from last year.

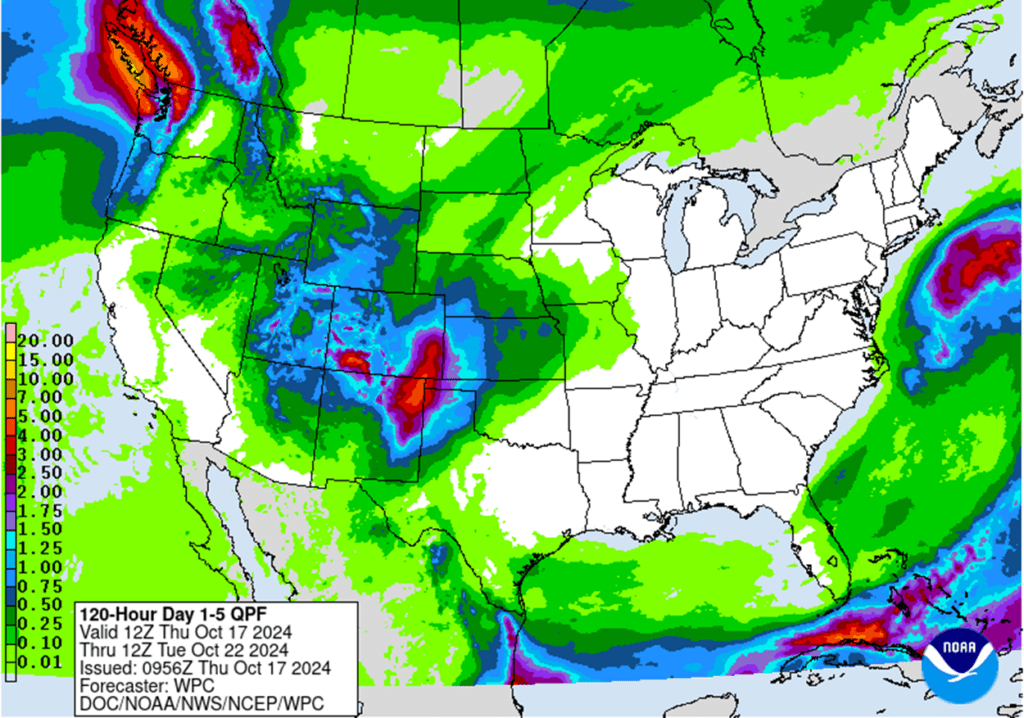

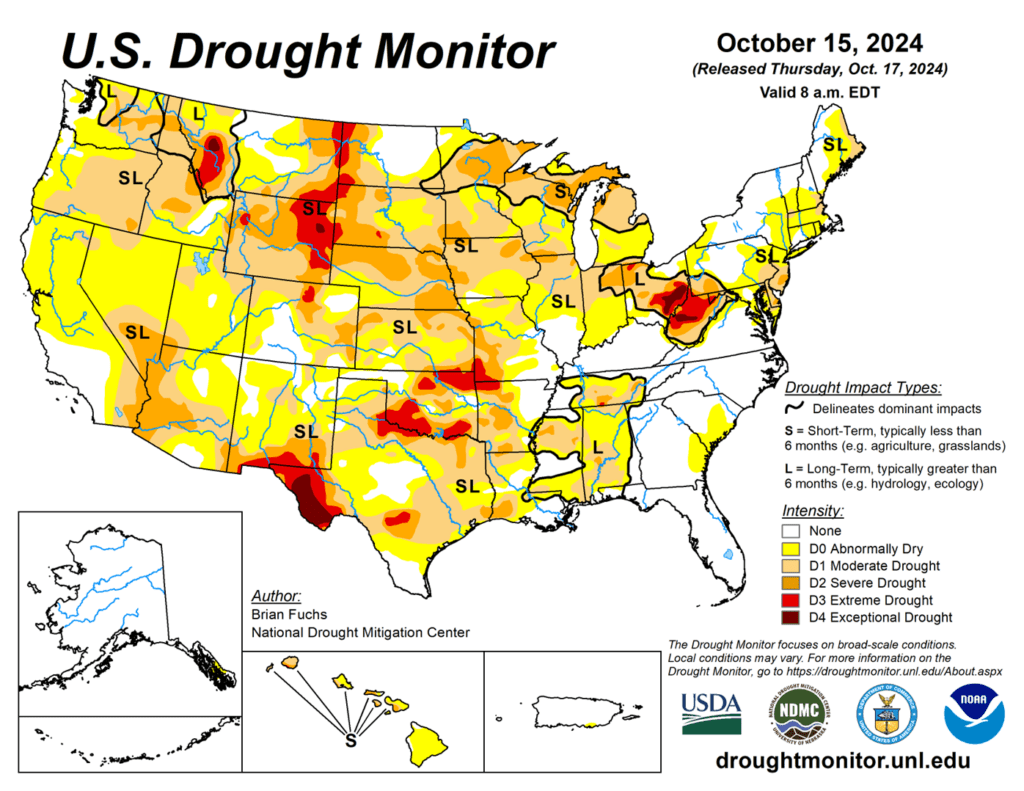

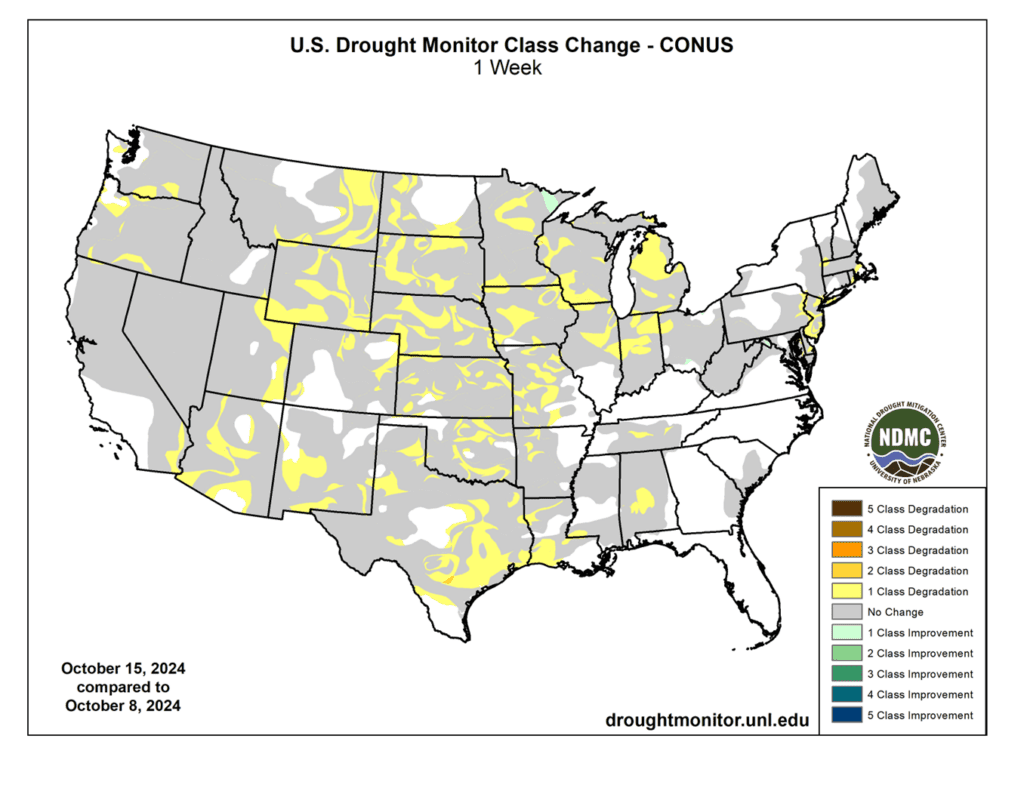

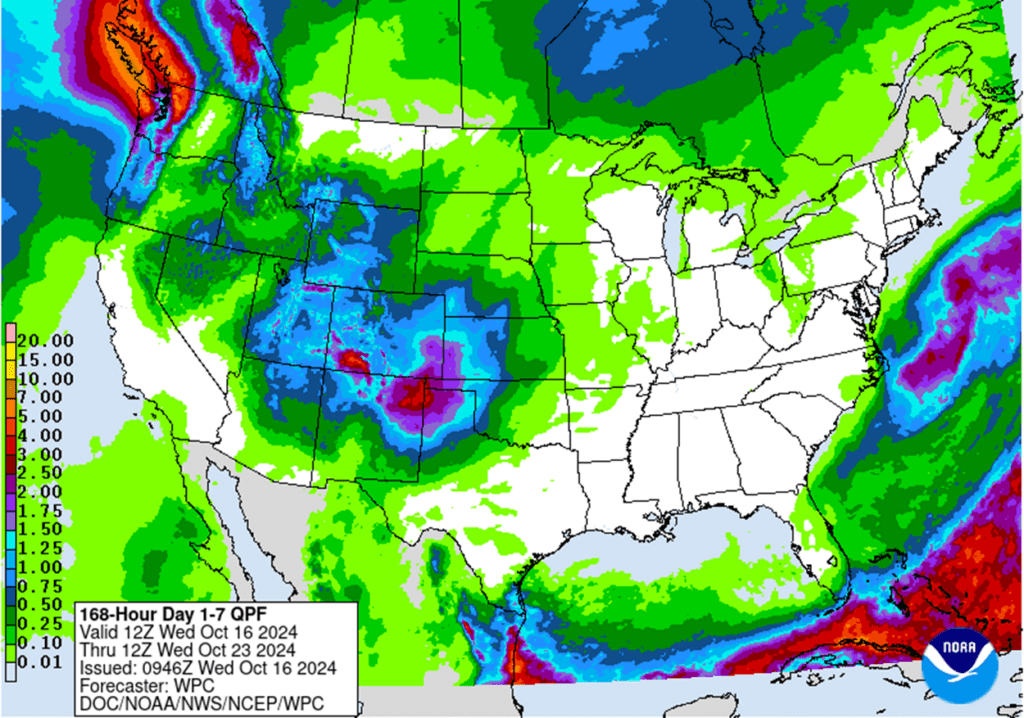

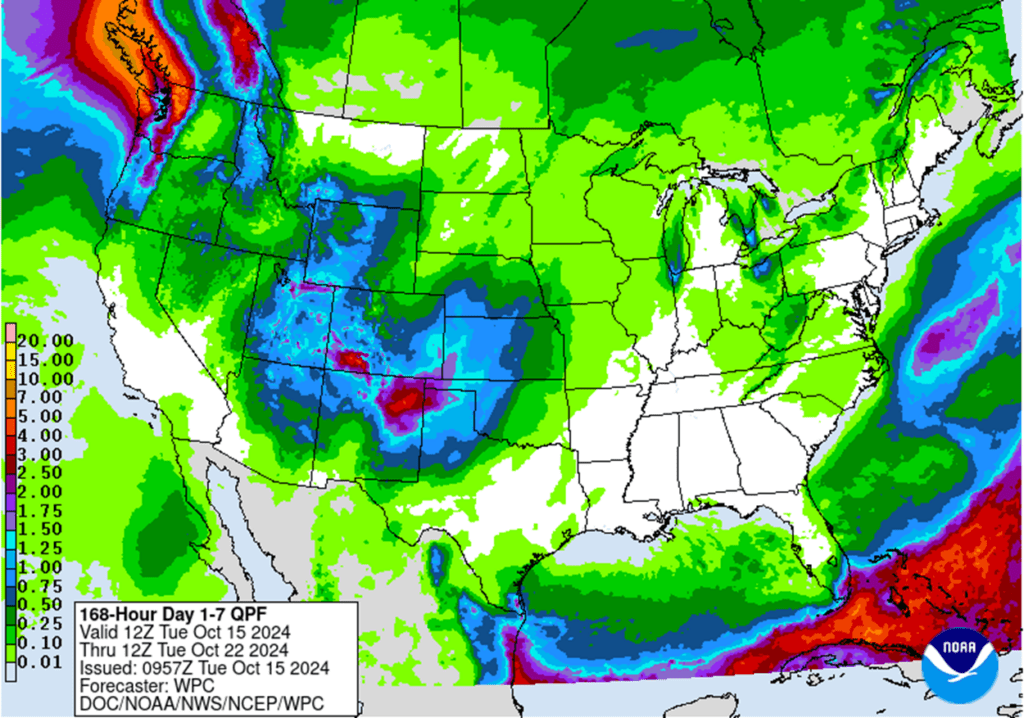

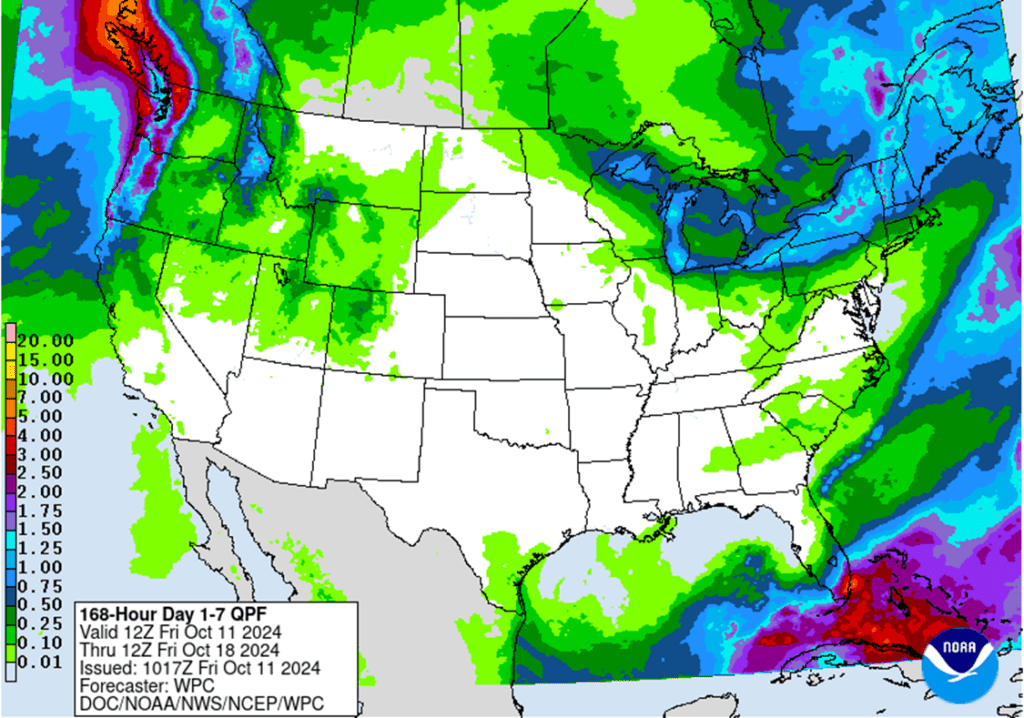

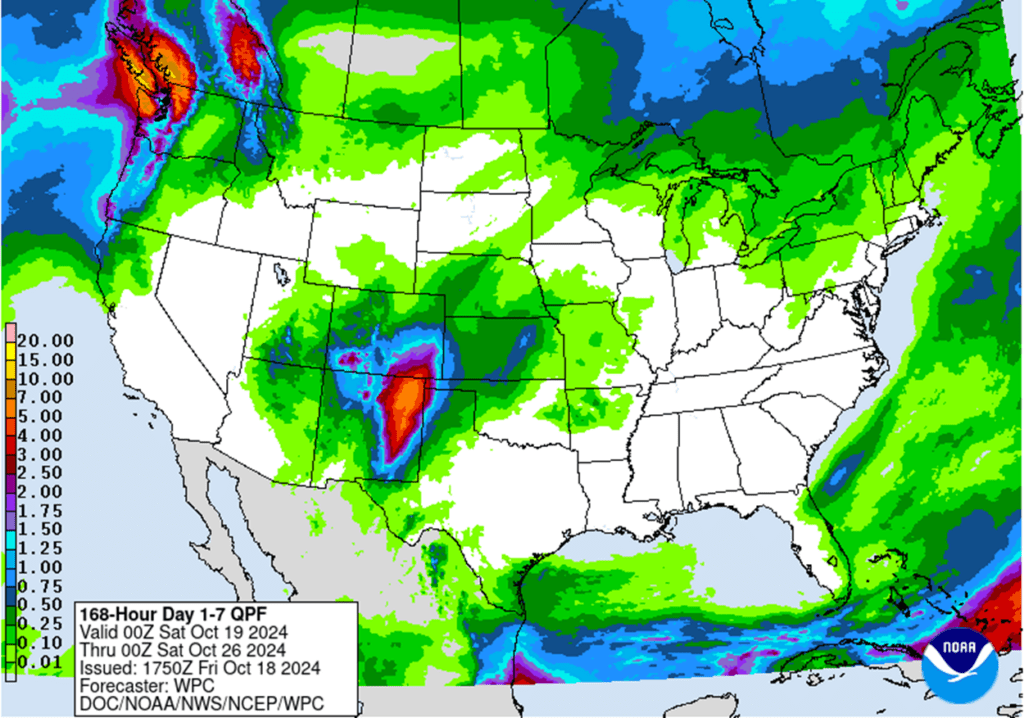

- In other bearish news, Russia may be dumping additional wheat onto the market to avoid a tax hike on exports, and rains are forecasted for the US HRW wheat growing regions. Furthermore, customs data shows that Chinese wheat imports for September totaled 250,000 mt, down 60% year-over-year for that month. However, year-to-date imports are up 5.5% at 10.74 mmt.

- The Grain Industry Association of Western Australia, in their monthly report, has increased their estimate of Western Australia’s 2024 wheat production from 9.3 to 9.91 mmt last month. This state is Australia’s largest wheat production region, and recent rains are cited as the reason for the increase. They also stated that production could continue to grow if conditions remain favorable. Aside from this update, wheat production for the entirety of Australia is expected to increase 18% year over year according to the Commonwealth Bank of Australia. Now estimated at 30.62 mmt, this rise in the estimate is also attributed to favorable rains in both Western Australia and New South Wales.

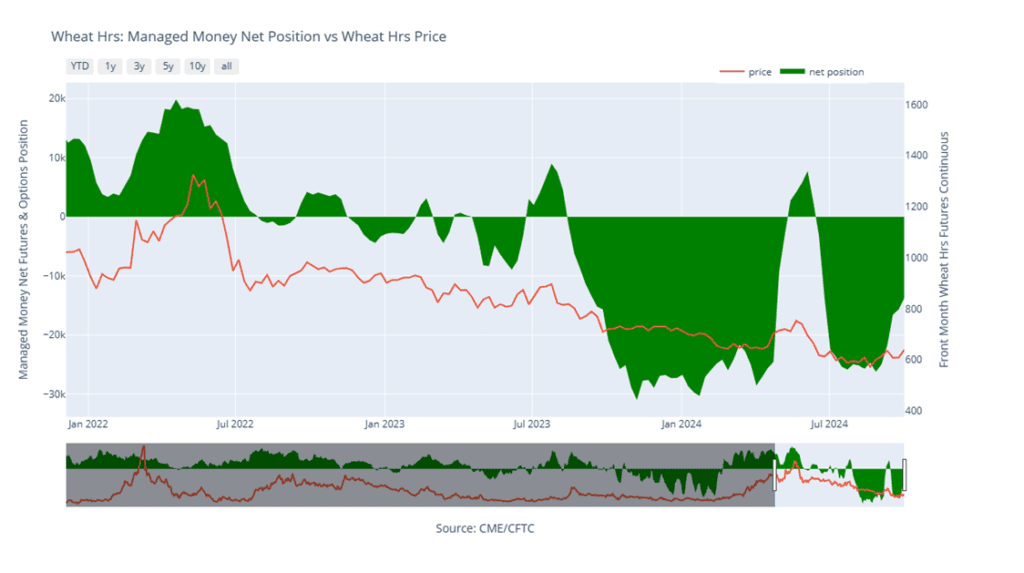

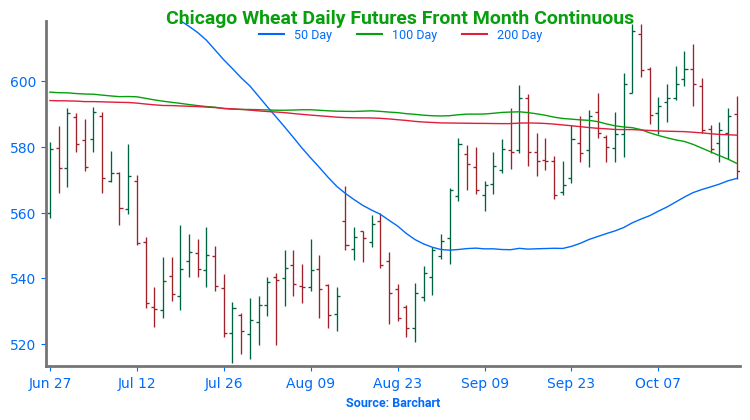

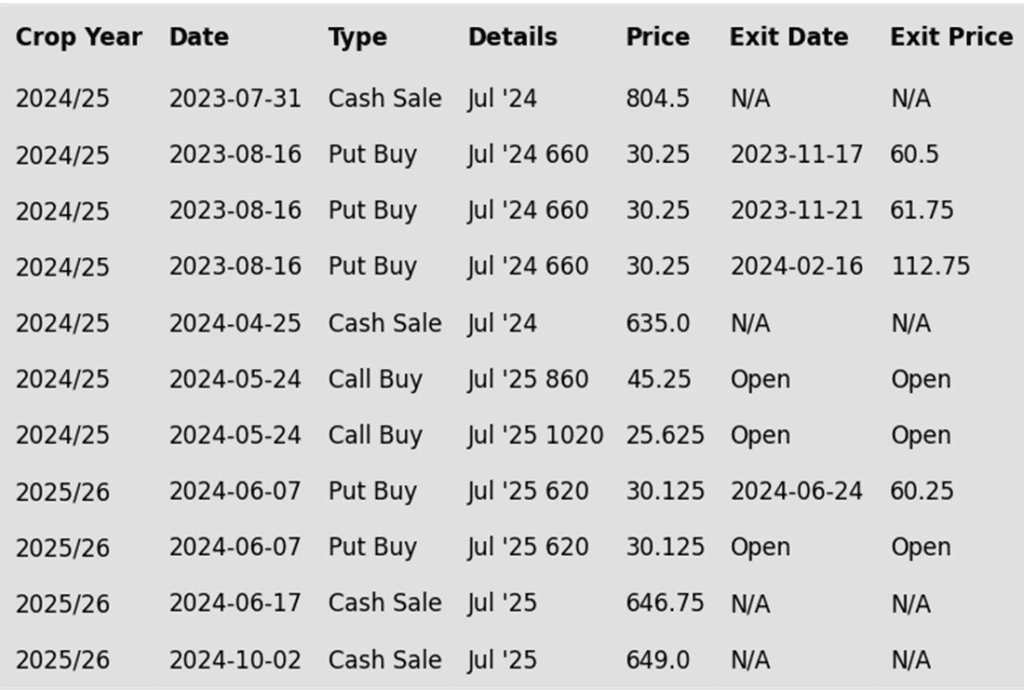

Chicago Wheat Action Plan Summary

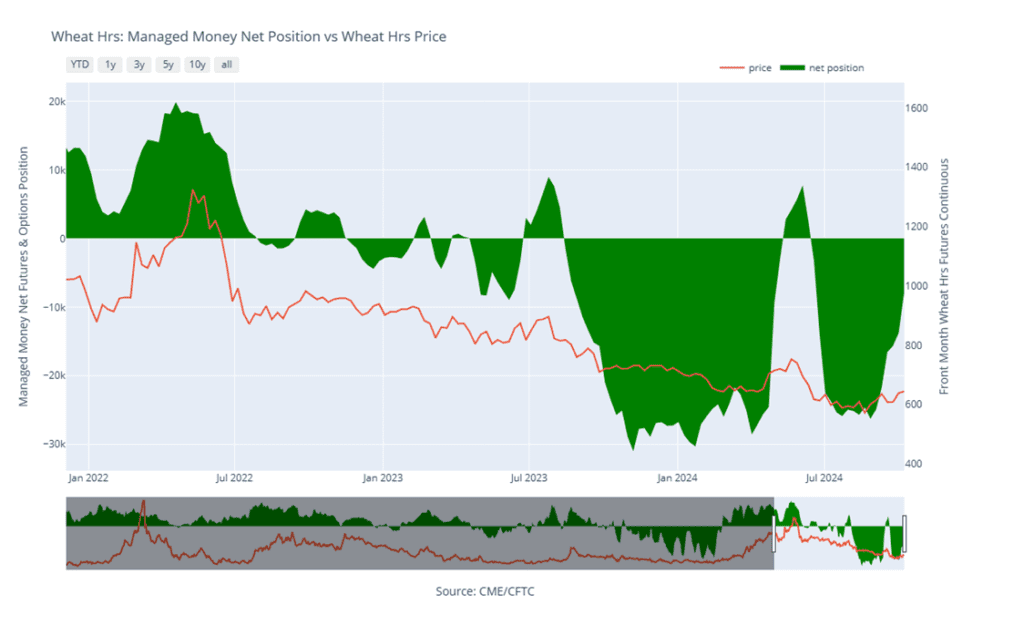

After posting a low in late July, the wheat market staged a rally triggered by crop concerns due to wet conditions in the EU, smaller crops out of Russia and Ukraine, and dryness in the US plains. The nearly 100-cent rally from the August low to October high also saw Managed funds cover about two-thirds of their net short positions. While cheaper Russian export prices continue to be a limiting factor for US prices, a new season is upon us with many uncertainties ahead that could keep volatility in the market. Additionally, US export sales remain ahead of the pace set last year and in 2022, and any increase in demand from lower World supplies could rally prices further.

- No new action is recommended for 2024 Chicago wheat. Considering the rally in wheat back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. Recently, we recommended taking advantage of the wheat rally to sell more of your anticipated 2025 SRW production. While we continue to recommend holding the remaining July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, we are targeting a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

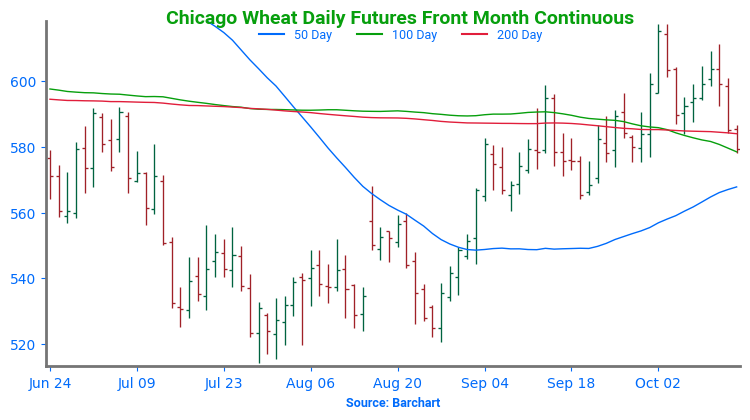

Above: Since hitting resistance near 617, December Chicago wheat has stair-stepped lower to the point of testing the 575 – 560 support area. A close below there could put the market at risk of sliding toward the major support area between 521 and 514. Though intermediate support may be found around 544. Meanwhile, initial overhead resistance may lie between 595 and 600.

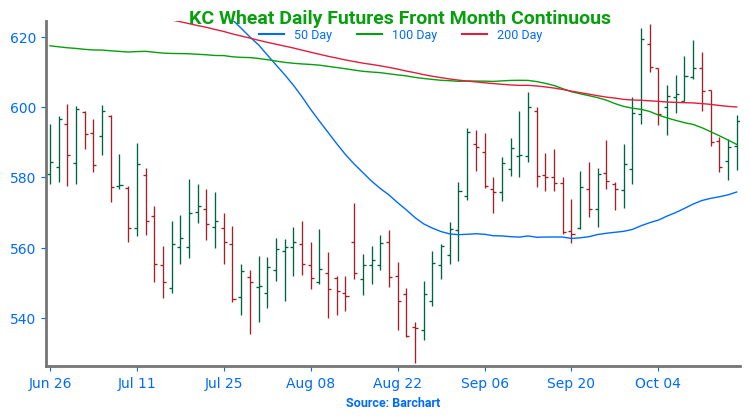

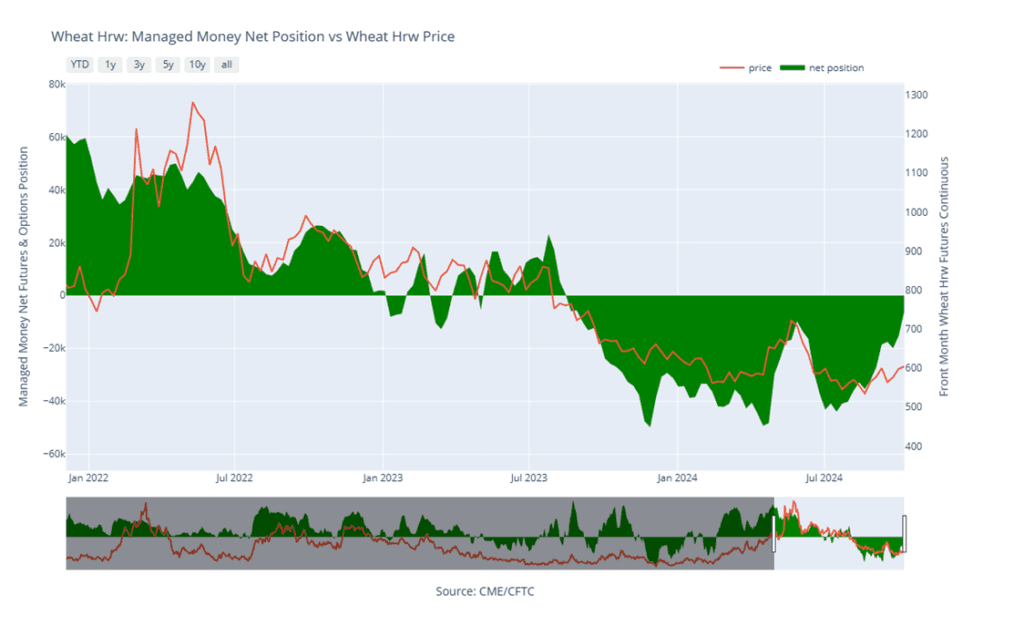

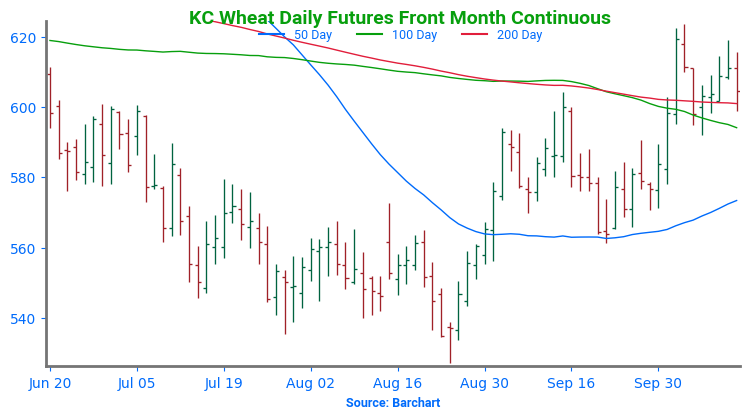

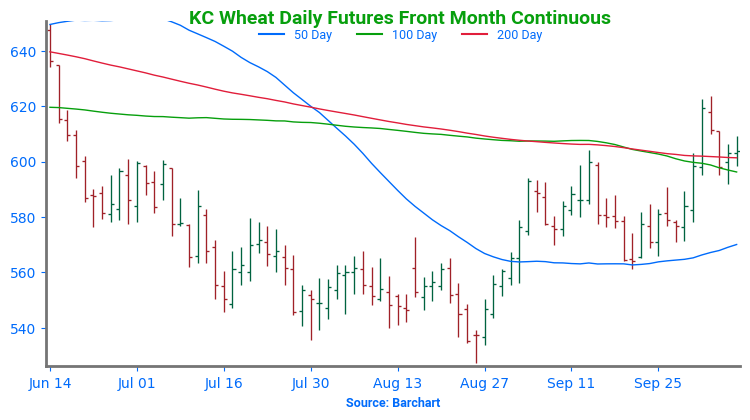

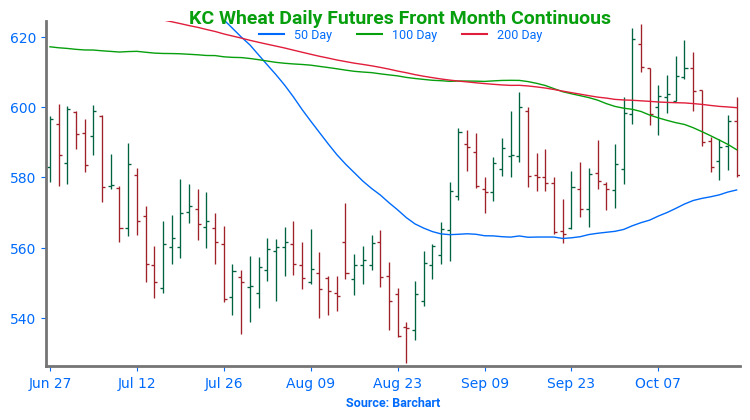

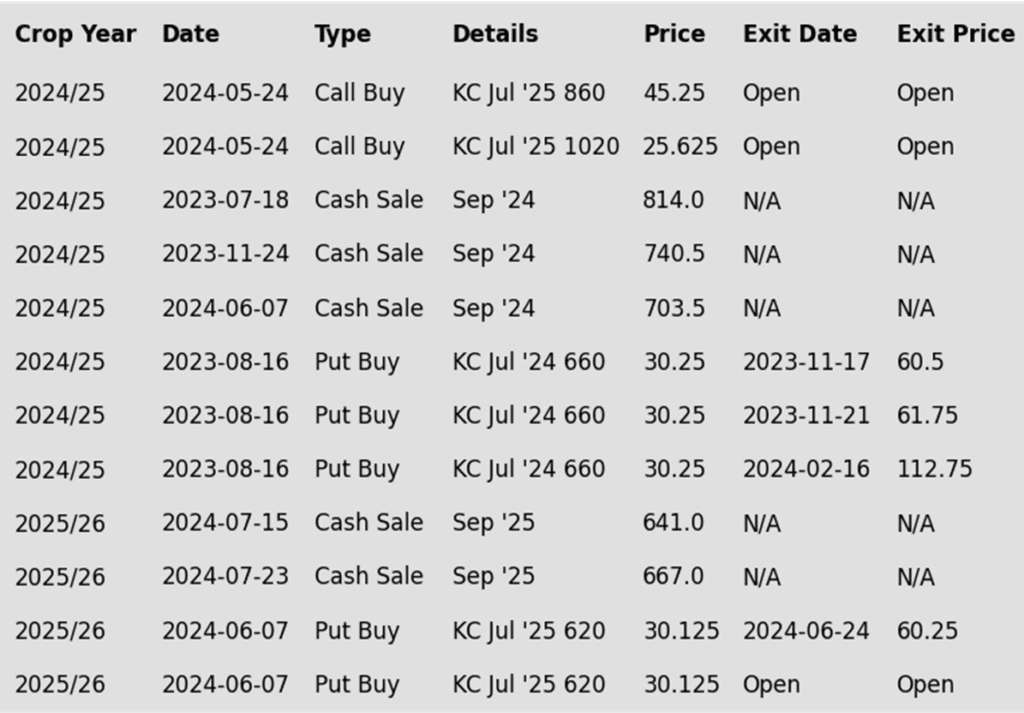

KC Wheat Action Plan Summary

After hitting a market low in late August, the wheat market has rallied driven by crop concerns in the EU and reduced production from Russia and Ukraine. The rise in prices from late August through early October also prompted Managed funds to cover a significant portion of their net short positions. Although more competitive Russian export prices continue to cap potential gains for US wheat, the onset of a new season introduces a range of uncertainties that could fuel market volatility. Moreover, US export sales are currently outpacing last year’s figures and those from 2022, meaning that any uptick in demand due to tighter global supplies could further lift prices.

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. While we still recommend holding the remaining half of the previously suggested July ’25 620 puts for downside protection on unsold bushels, we recently advised selling another portion of your anticipated 2025 HRW wheat production in light of the early fall rally in the wheat market. Looking ahead, our current strategy is to target the 700–725 range for additional sales, while also targeting the upper 400 range to exit half of the remaining 620 puts, in case the market turns toward new lows.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

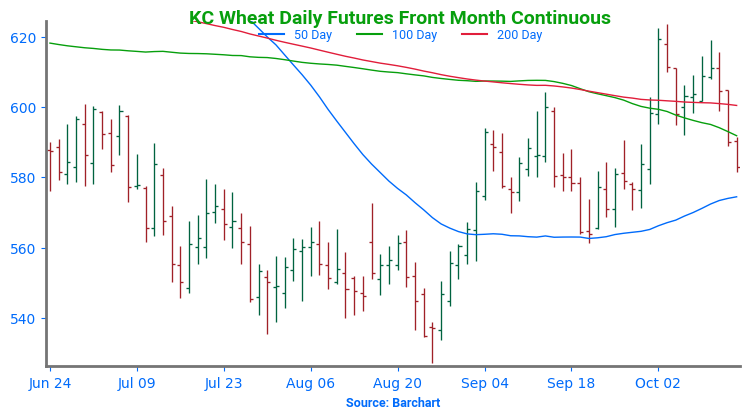

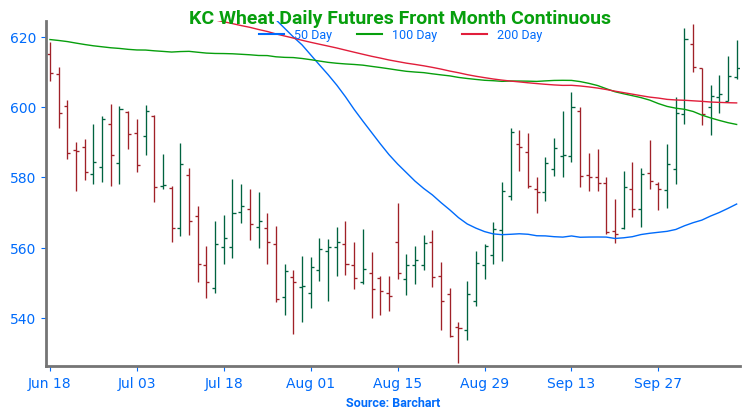

Above: The December contract’s break below 592 suggests that prices could decline further toward 561, with initial support likely around the 50-day moving average before reaching that level. On the upside, initial resistance is expected near 592, with stronger resistance around 623.

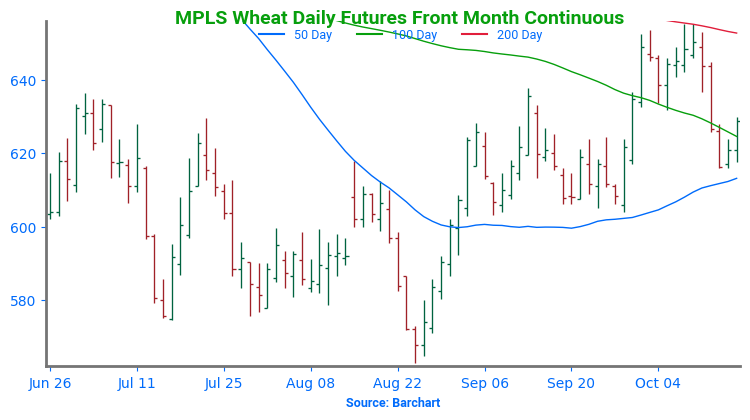

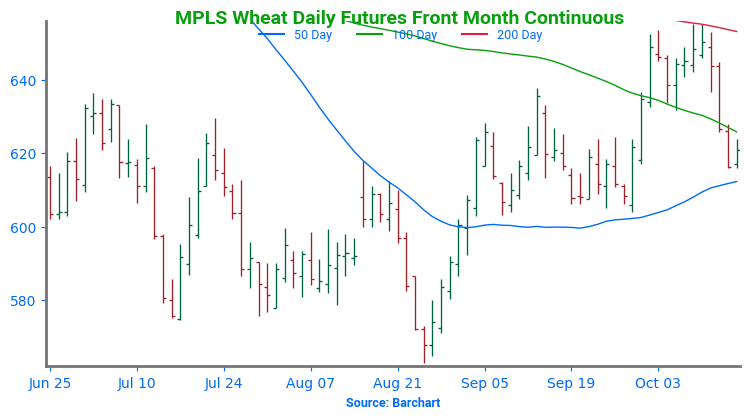

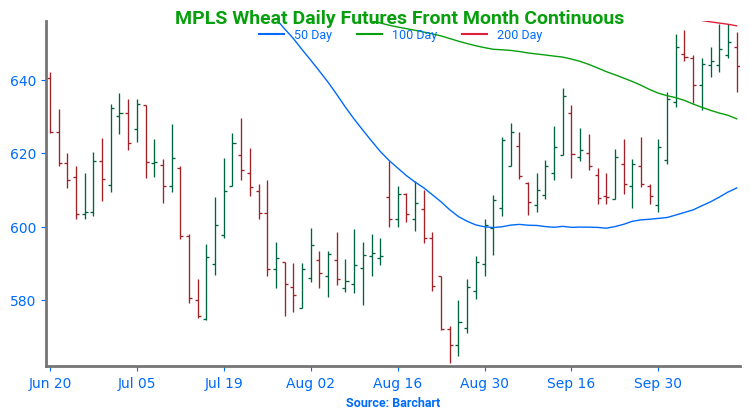

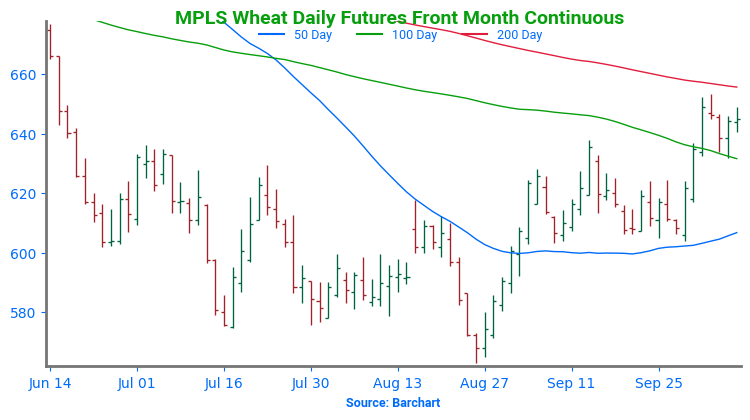

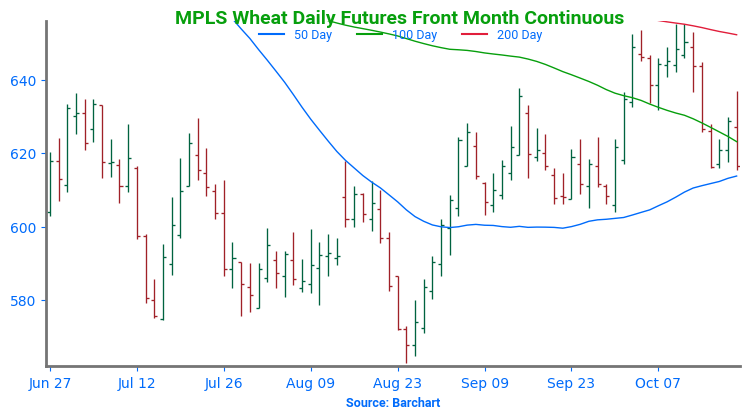

Mpls Wheat Action Plan Summary

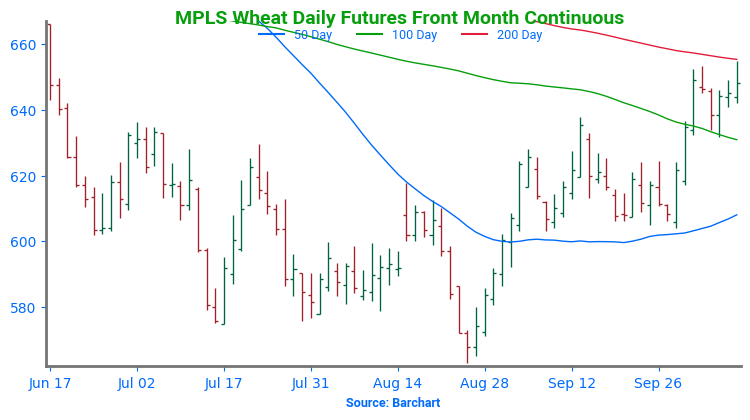

Since posting a seasonal low in late August, Minneapolis wheat has traded up to its 200-day moving average and its highest level since mid-July. During this period, managed funds have covered about 75% of their short positions in Minneapolis wheat. While more competitive export prices out of Russia continue to limit upside opportunities, concerns regarding world wheat supplies remain, which could increase opportunities for US exports and potentially drive prices higher.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. Now that the spring wheat harvest is behind us, and we are at the time of year when seasonal price trends tend to become more friendly, we are targeting the 675 – 700 range to recommend making additional sales.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

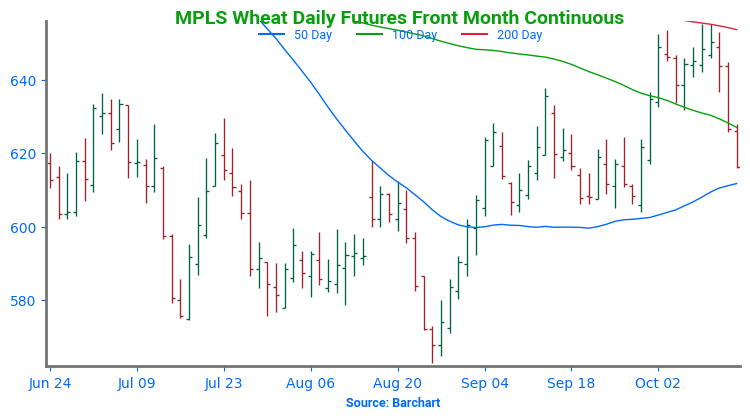

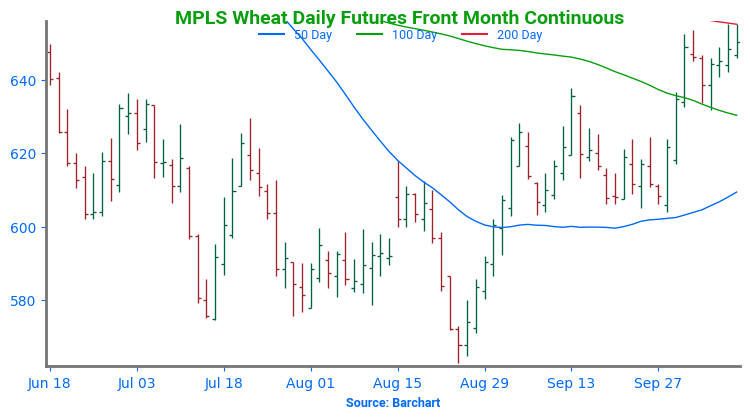

Above: The recent break below the 100-day moving average suggests that prices could drift further toward the 604 support area, with additional support near the 50-day moving average before reaching that level. If prices turn higher, overhead resistance may be around 632, with stronger resistance near 655.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

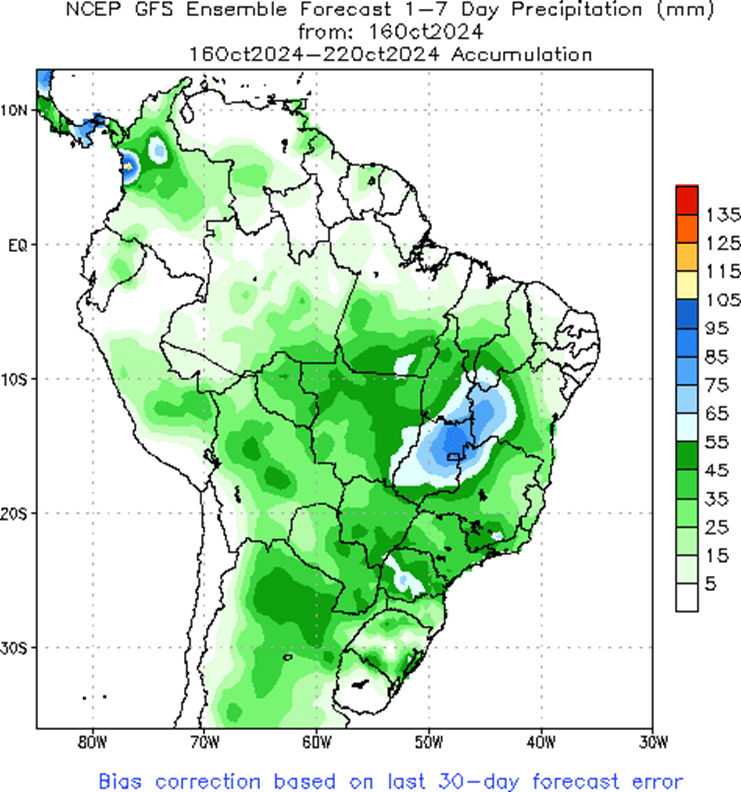

Above: Brazil and N. Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

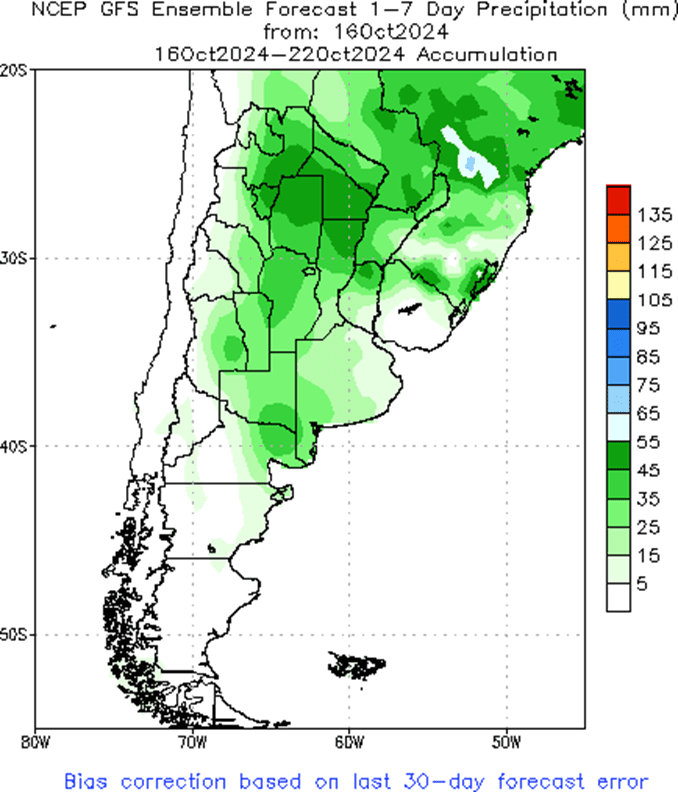

Above: Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.