11-1 End of Day: Firm Close on Friday for Corn, as Beans and Wheat Retreat

All prices as of 2:00 pm Central Time

Grain Market Highlights

- Corn settled near the day’s highs following a day of two-sided trade as the market found support from another large flash sale to Mexico but failed to close above resistance for the fifth consecutive day.

- The soybean market closed with minor losses after failing to maintain its earlier strength from additional flash sales and sharply higher soybean oil, as weakness in meal weighed on prices.

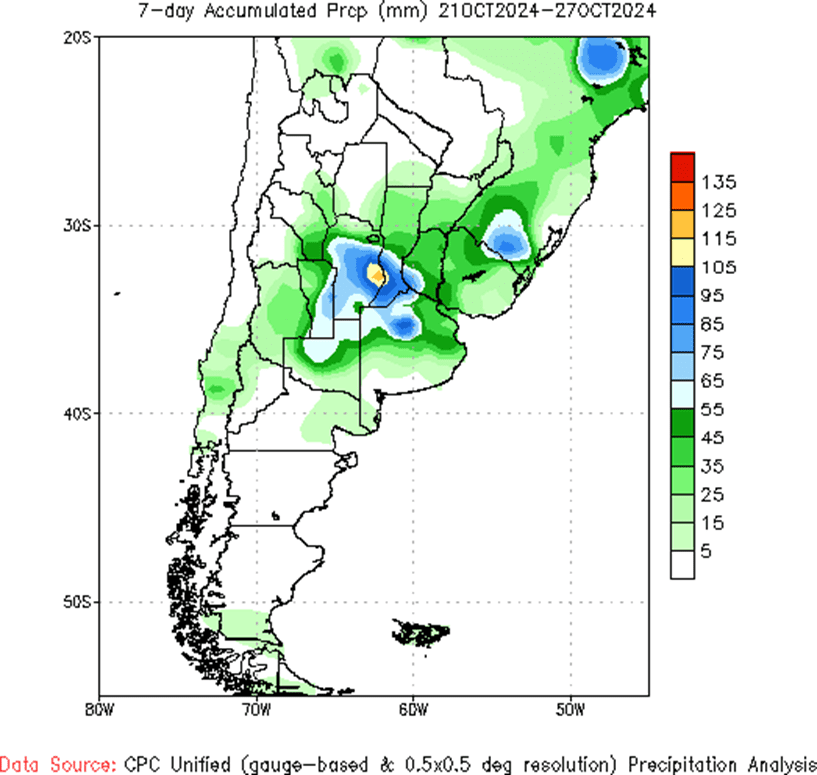

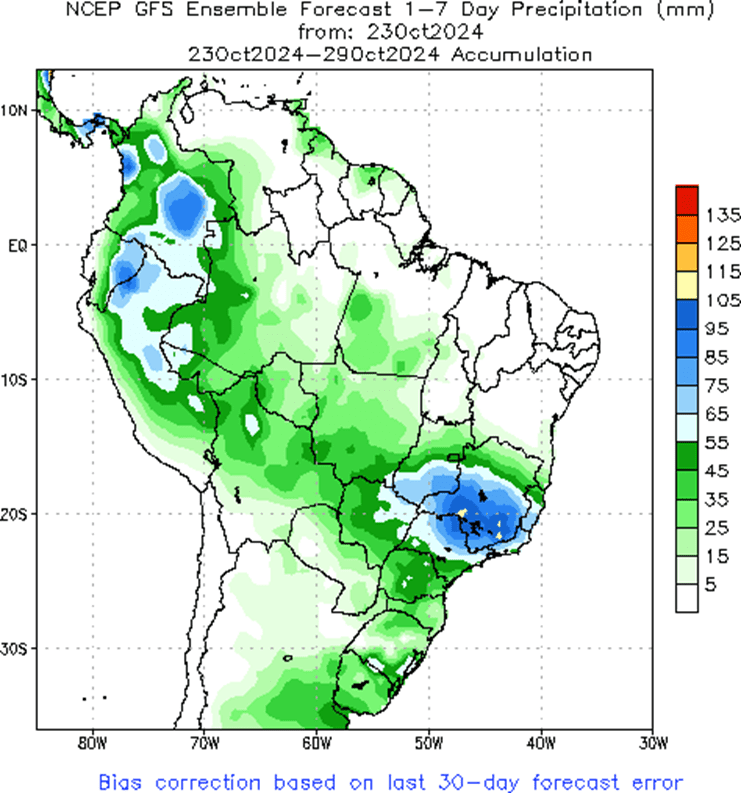

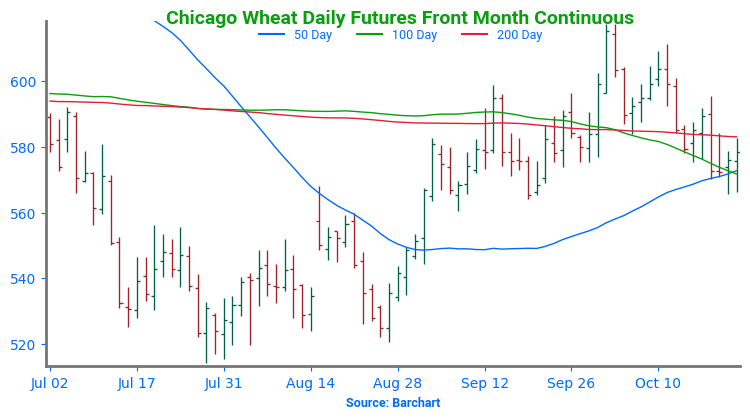

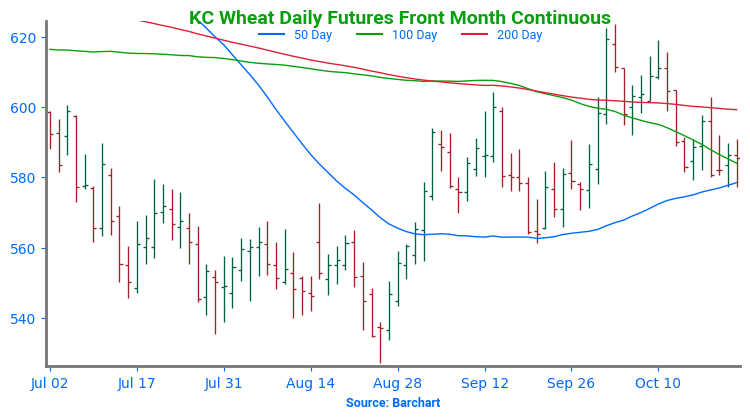

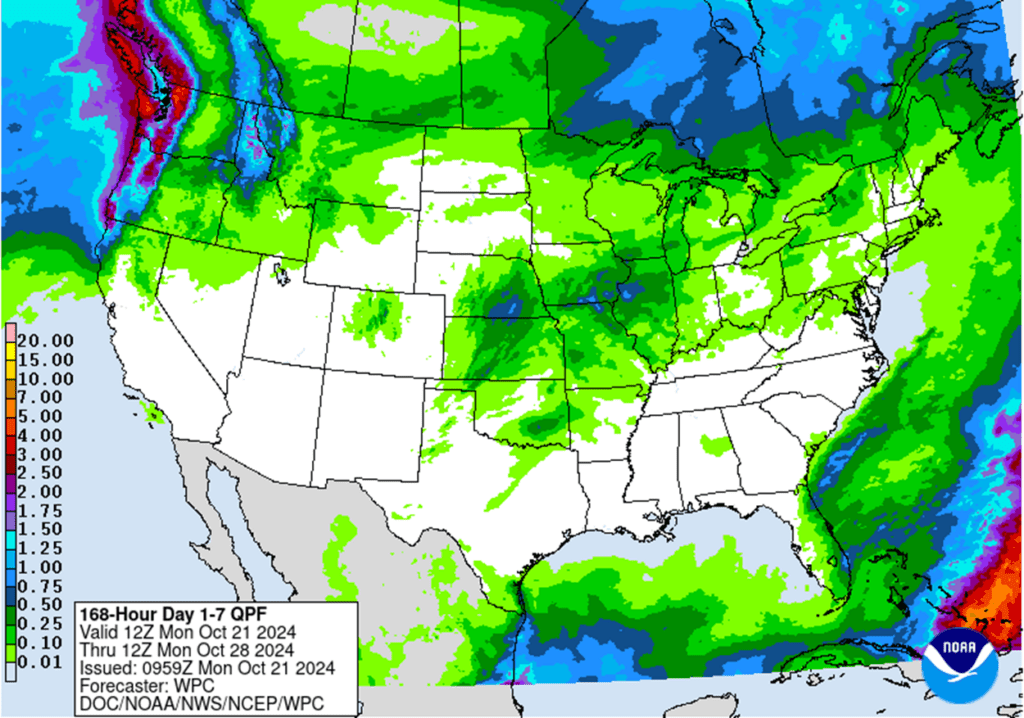

- The wheat complex posted minor losses across all three classes following another day of consolidation and choppy trade, with overhead resistance coming from lower Matif wheat and expectations of much needed rain over the weekend.

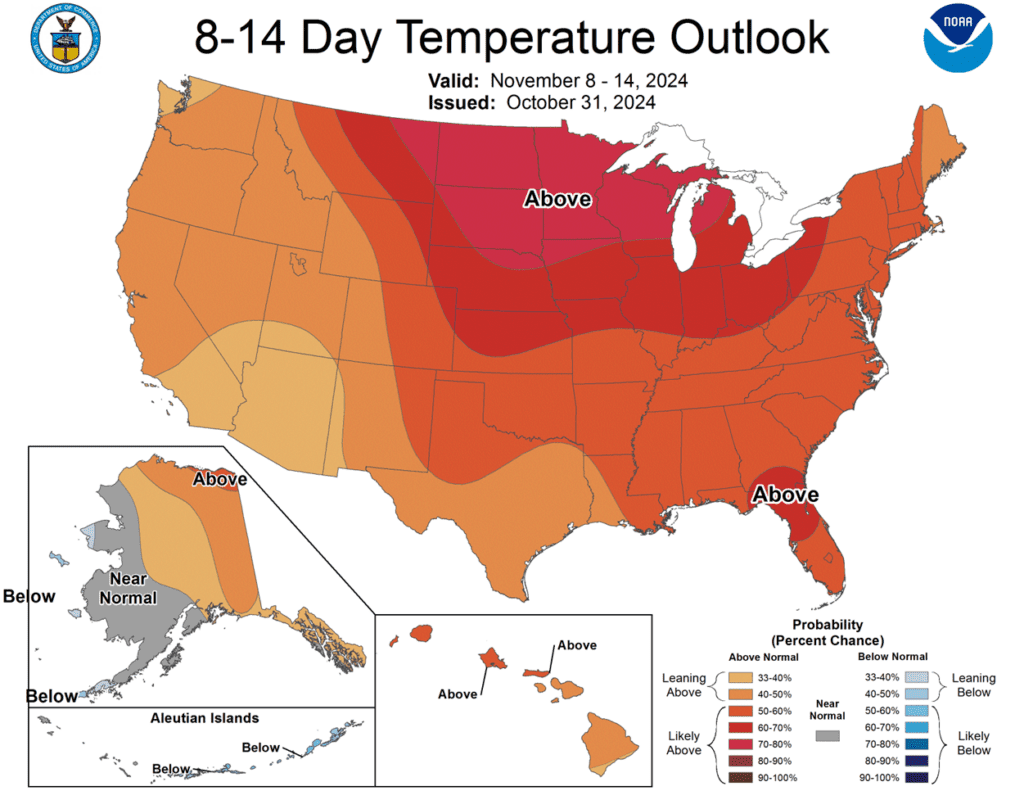

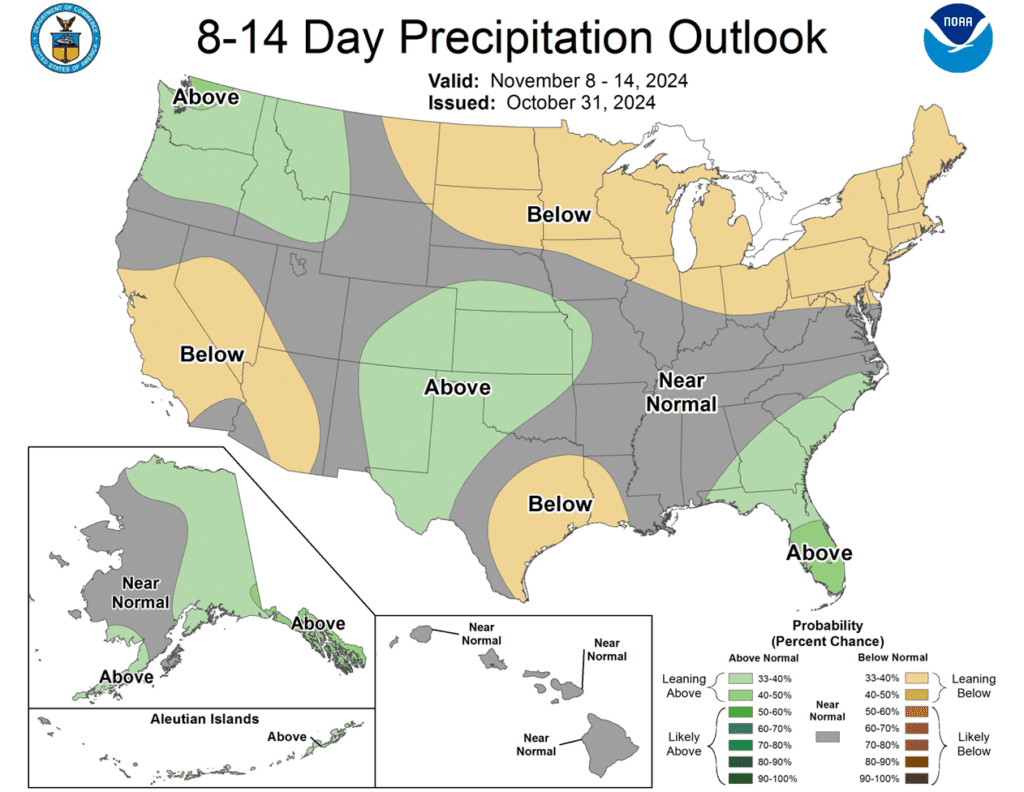

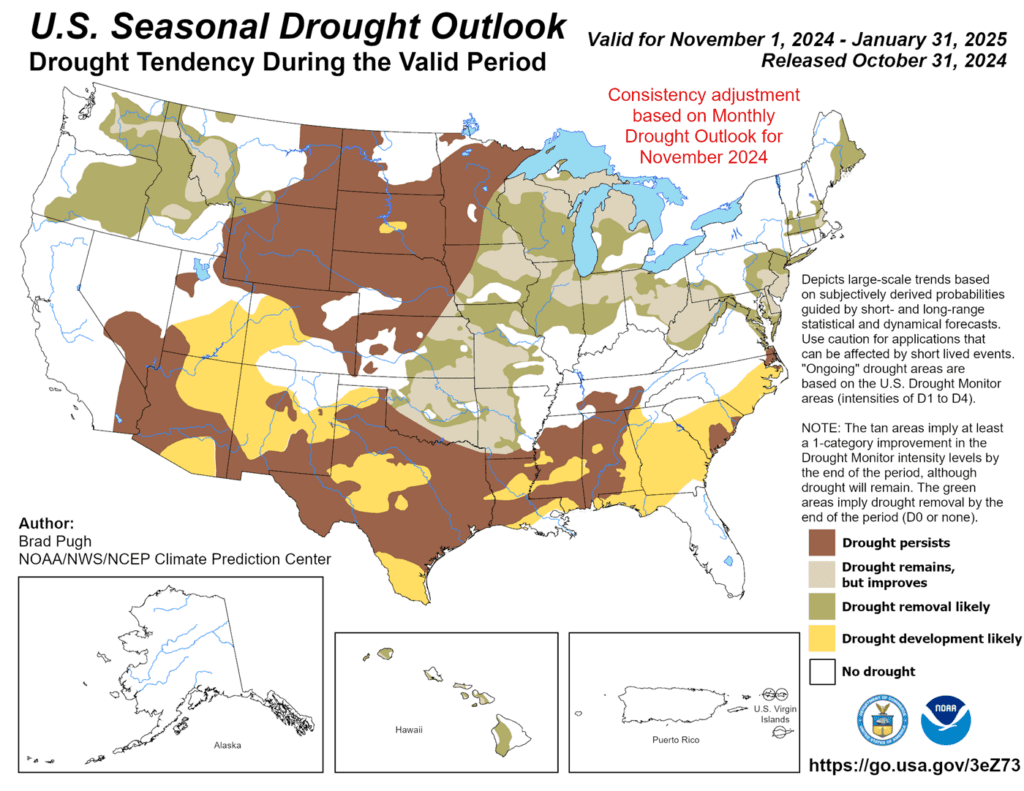

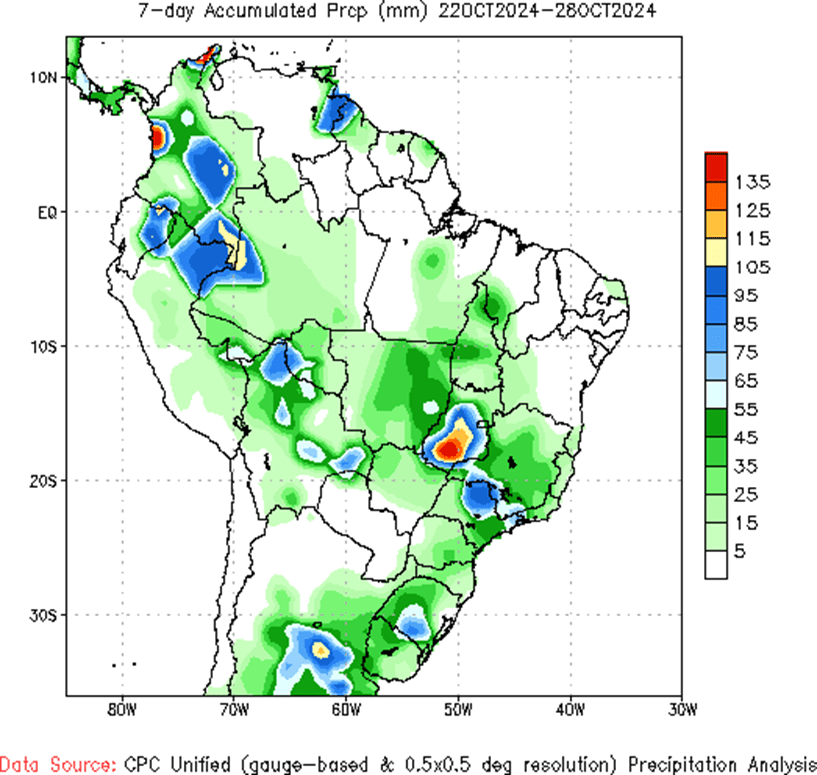

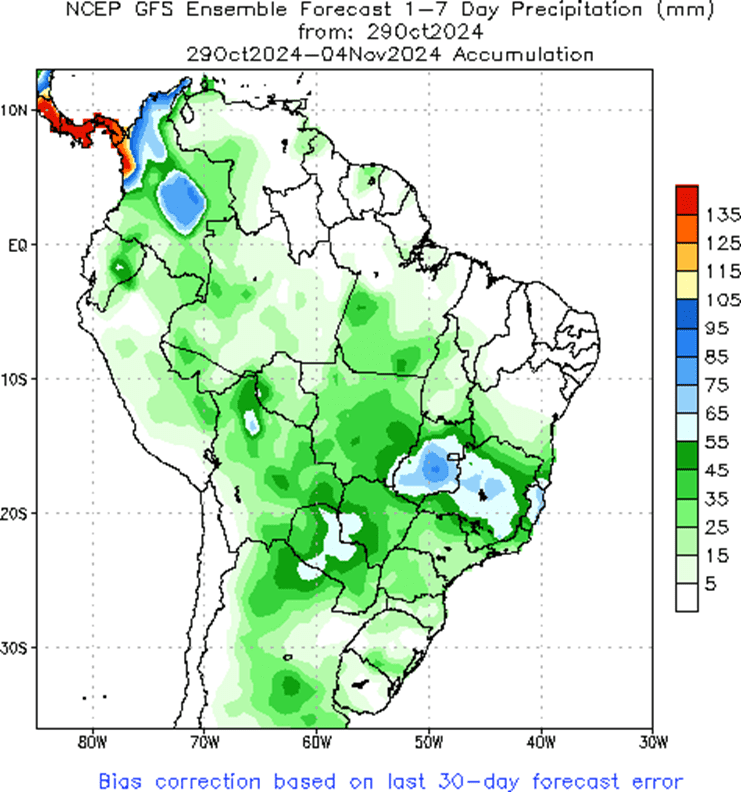

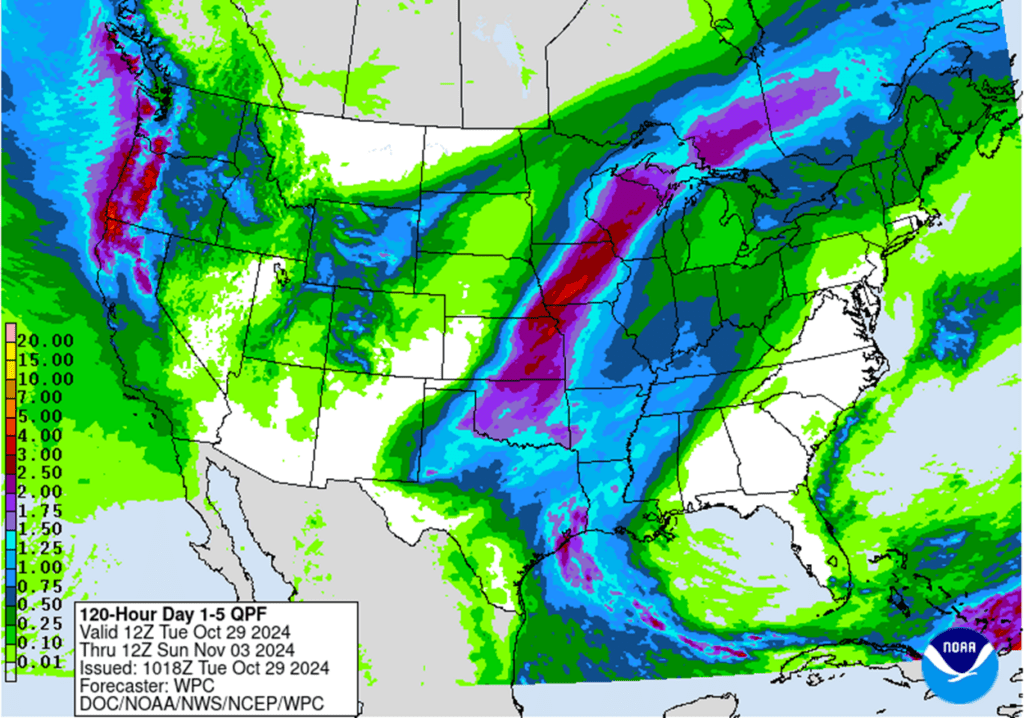

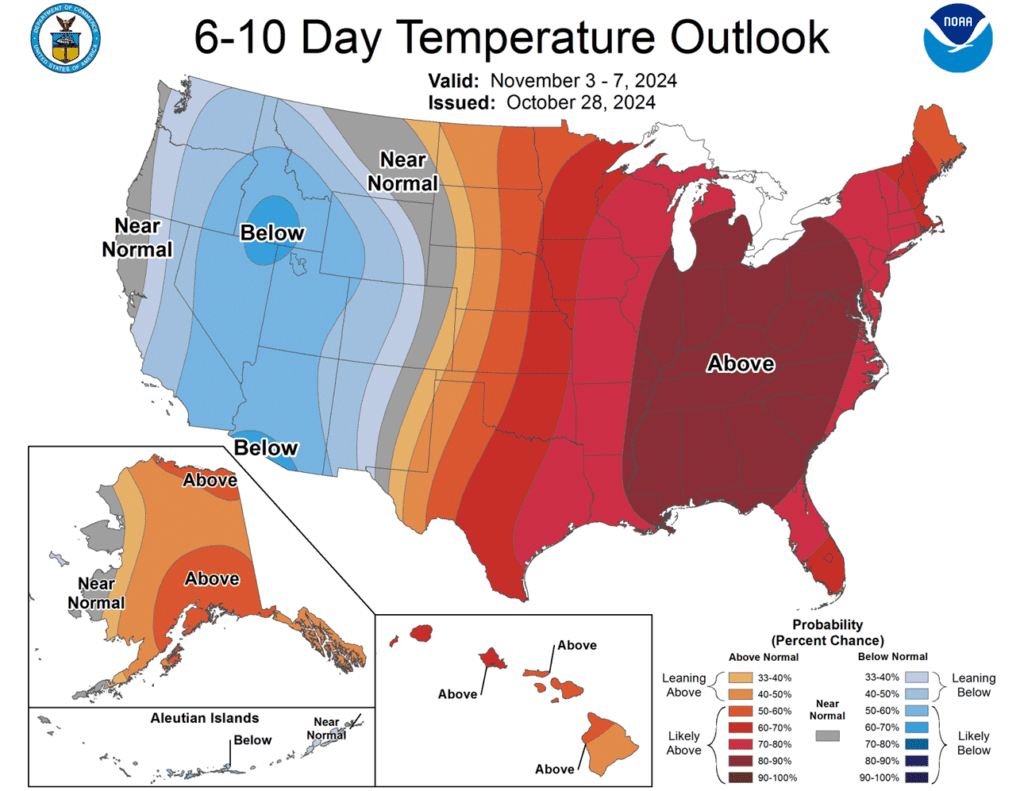

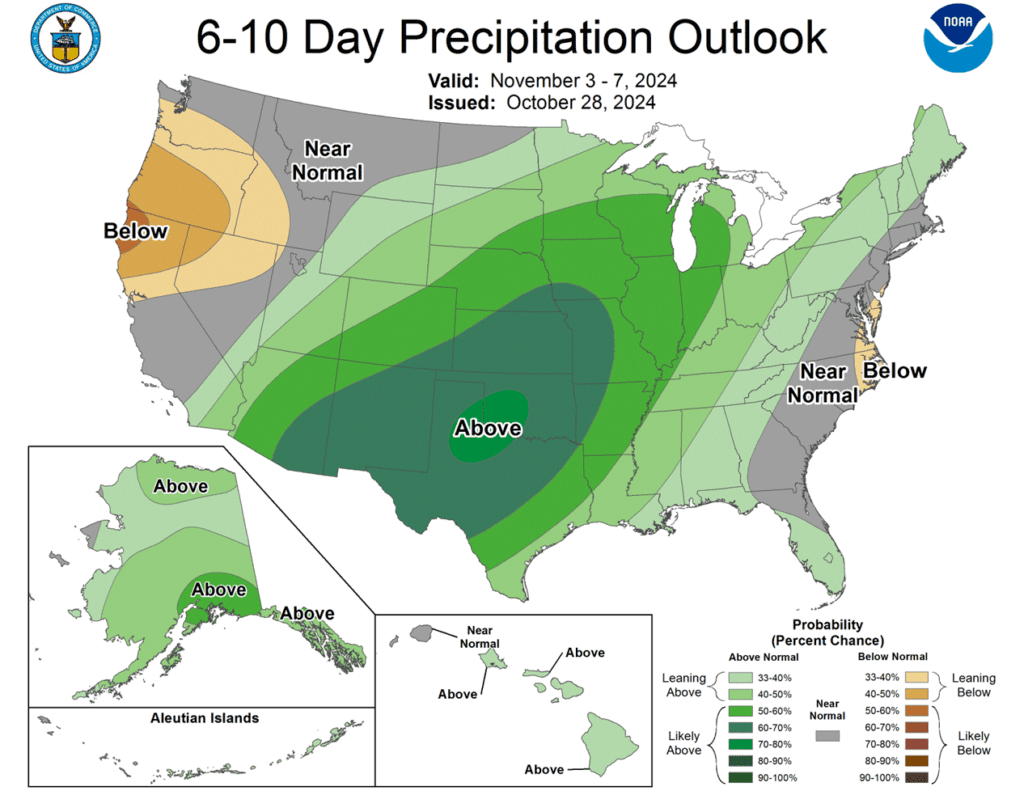

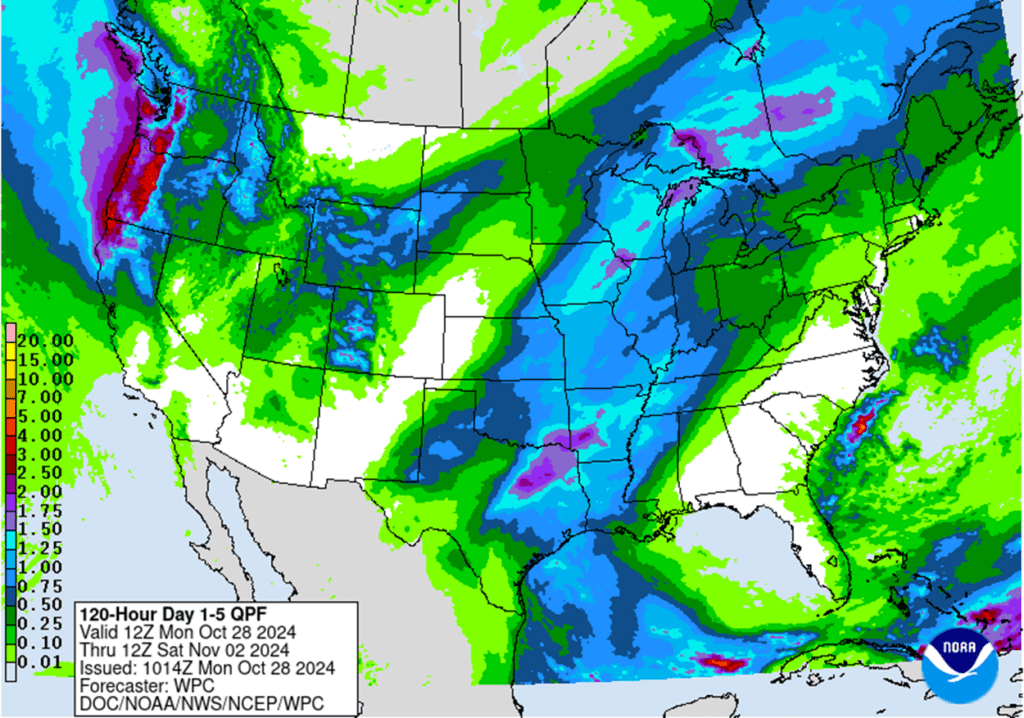

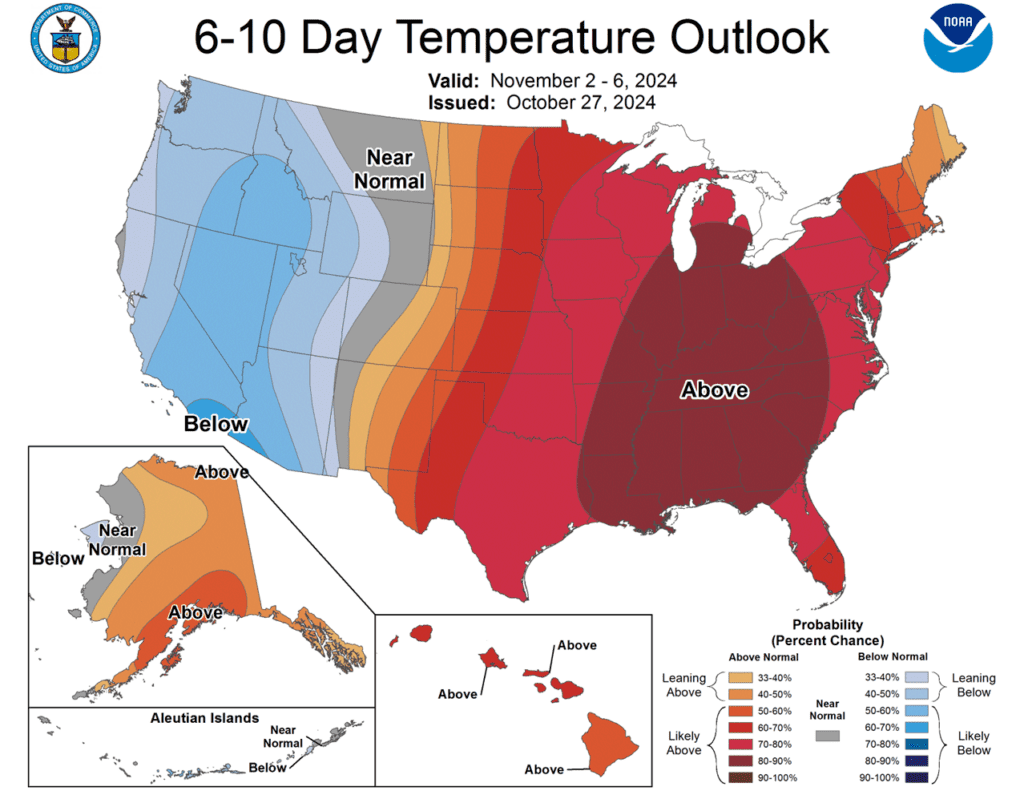

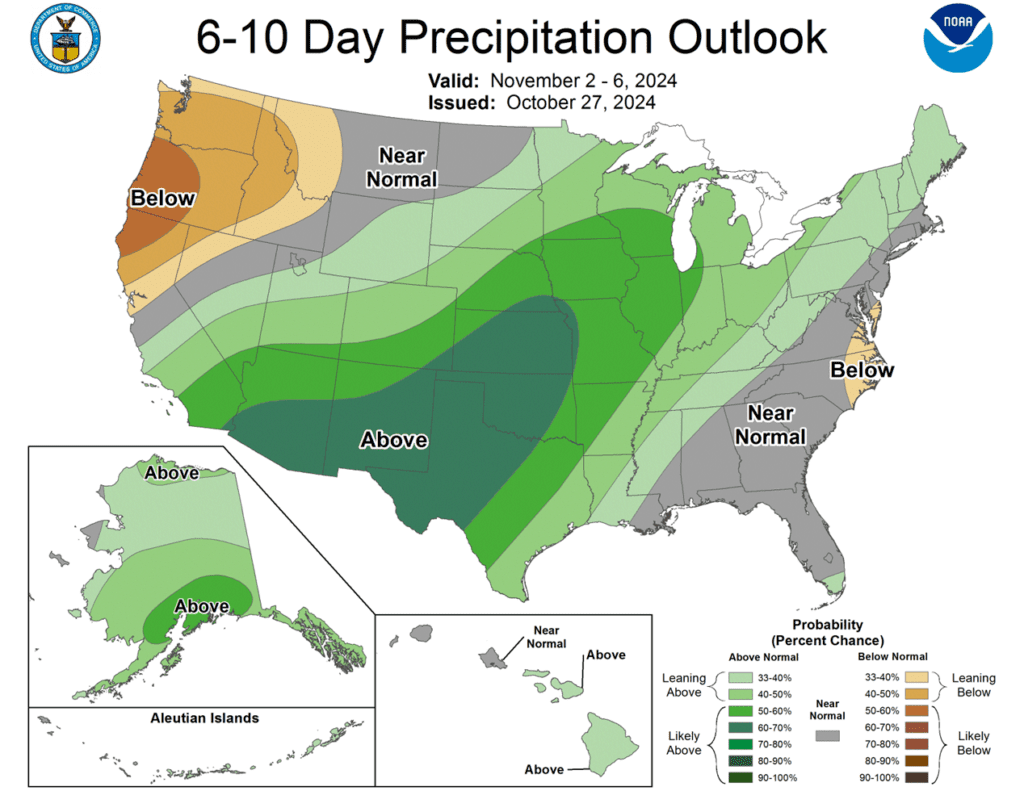

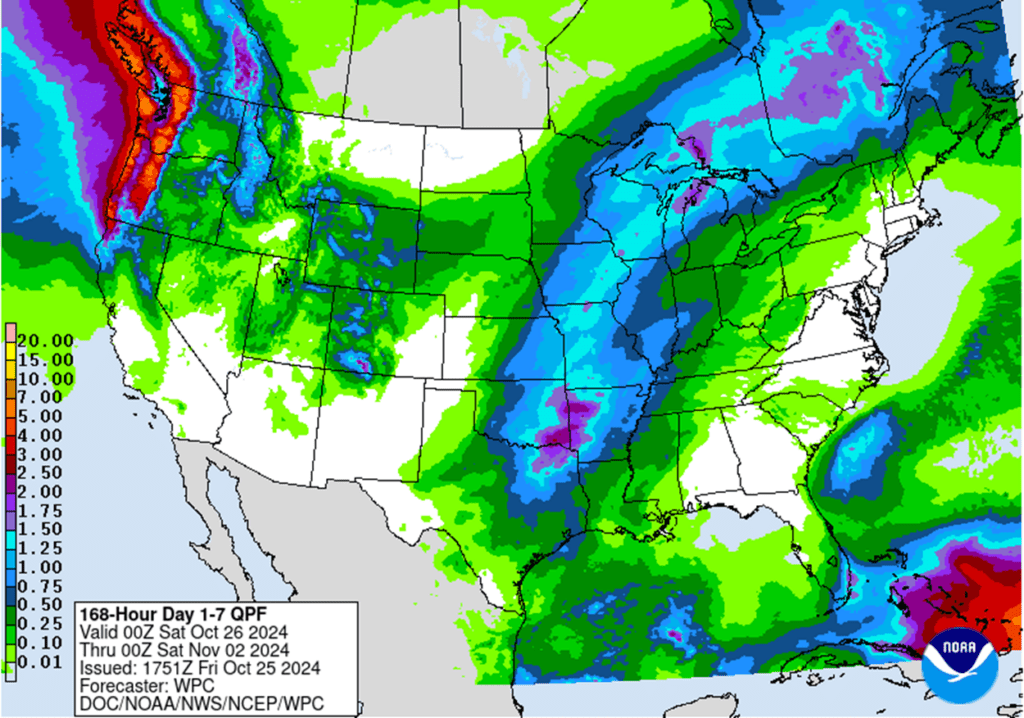

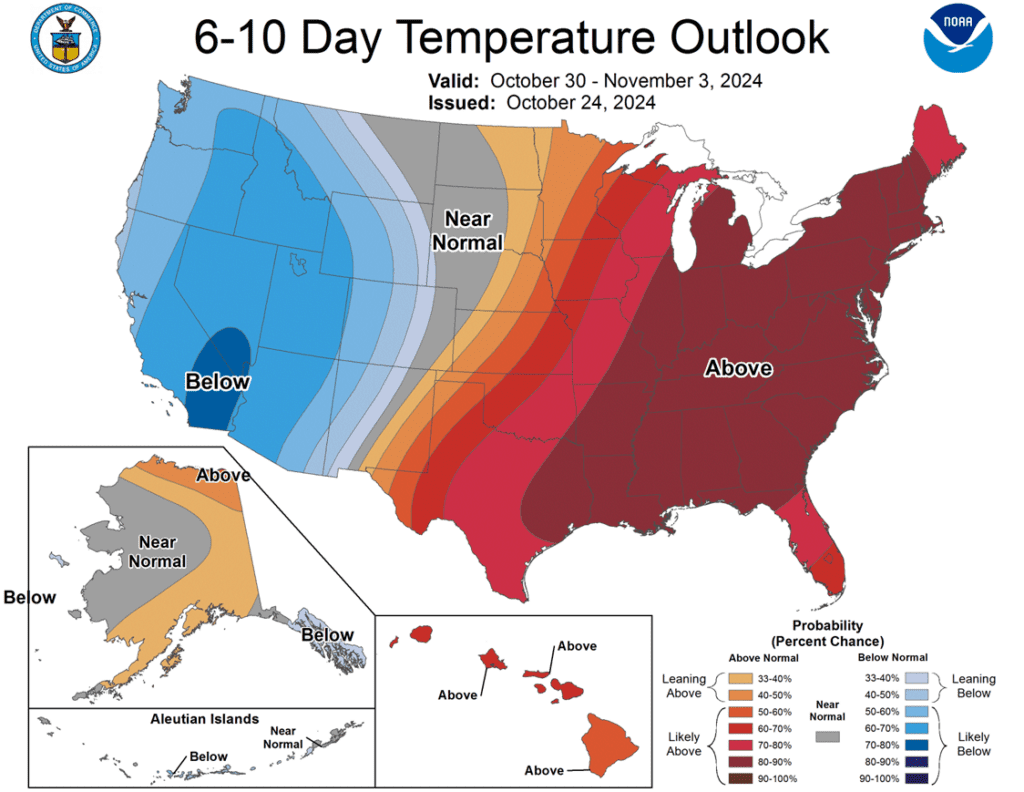

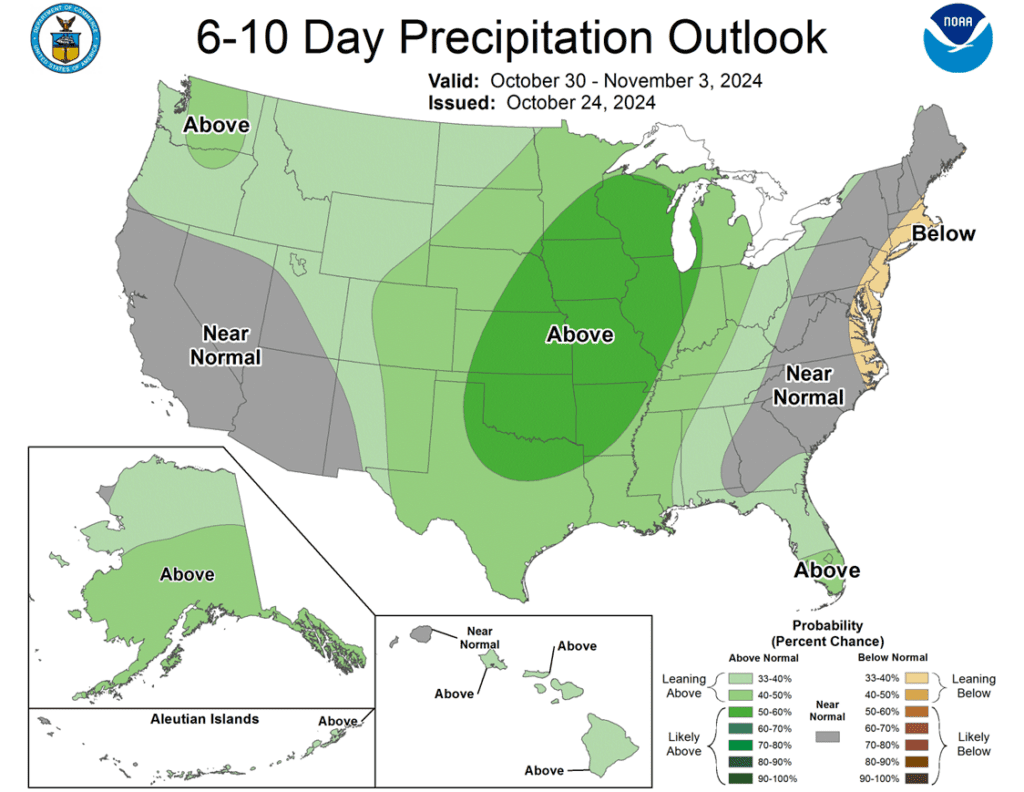

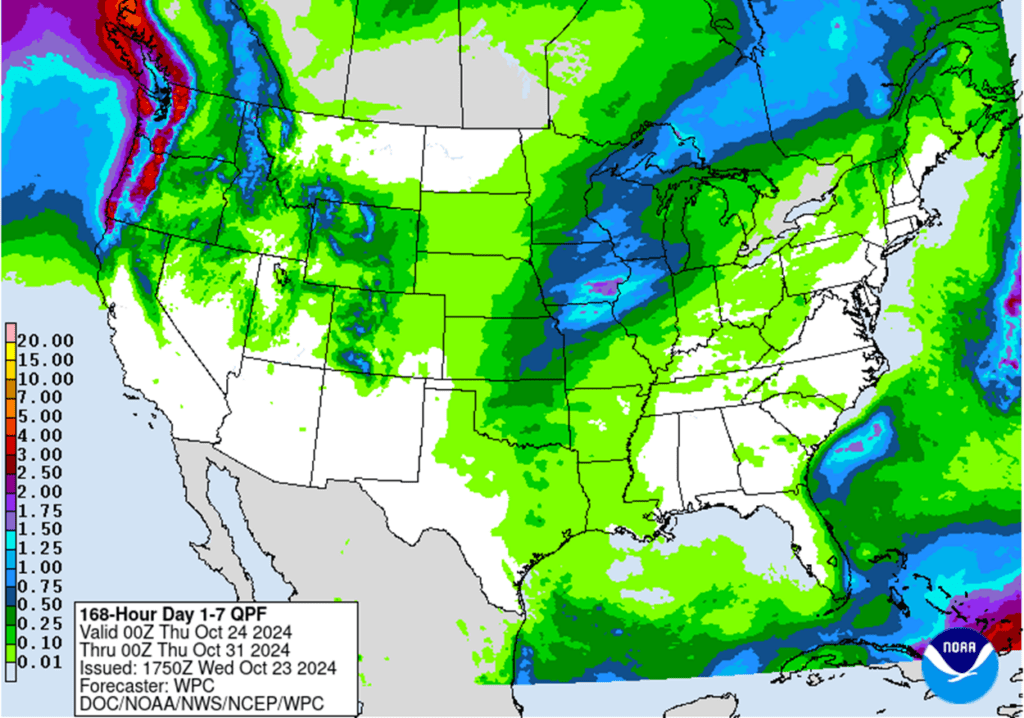

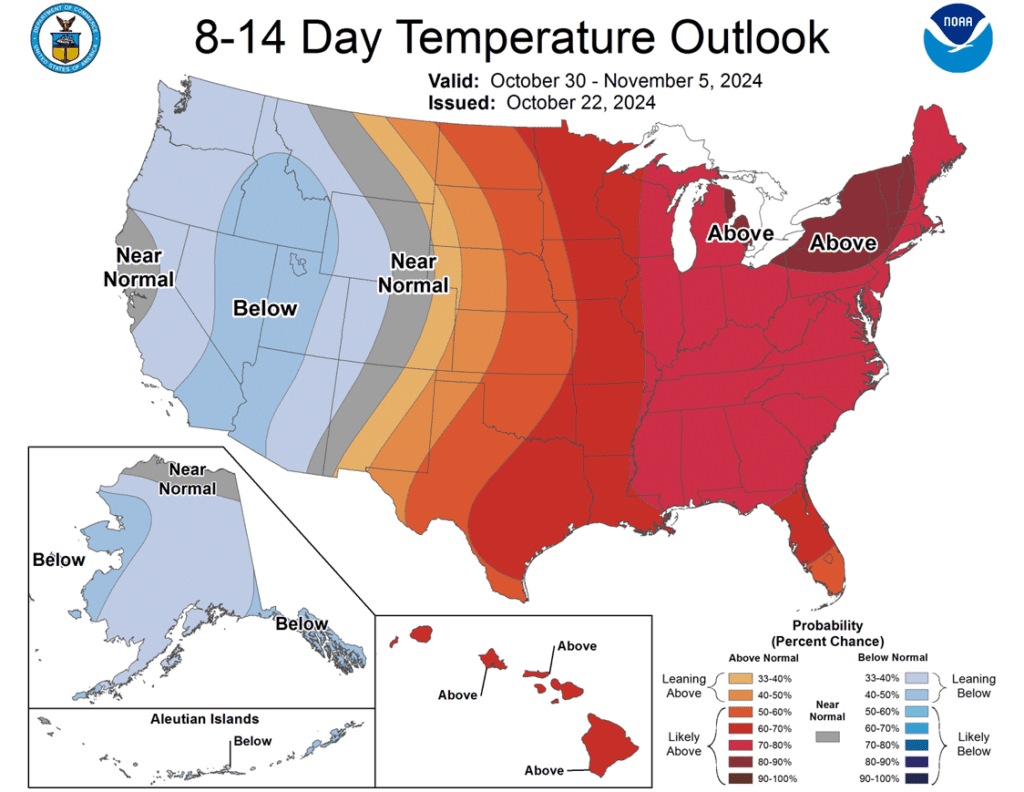

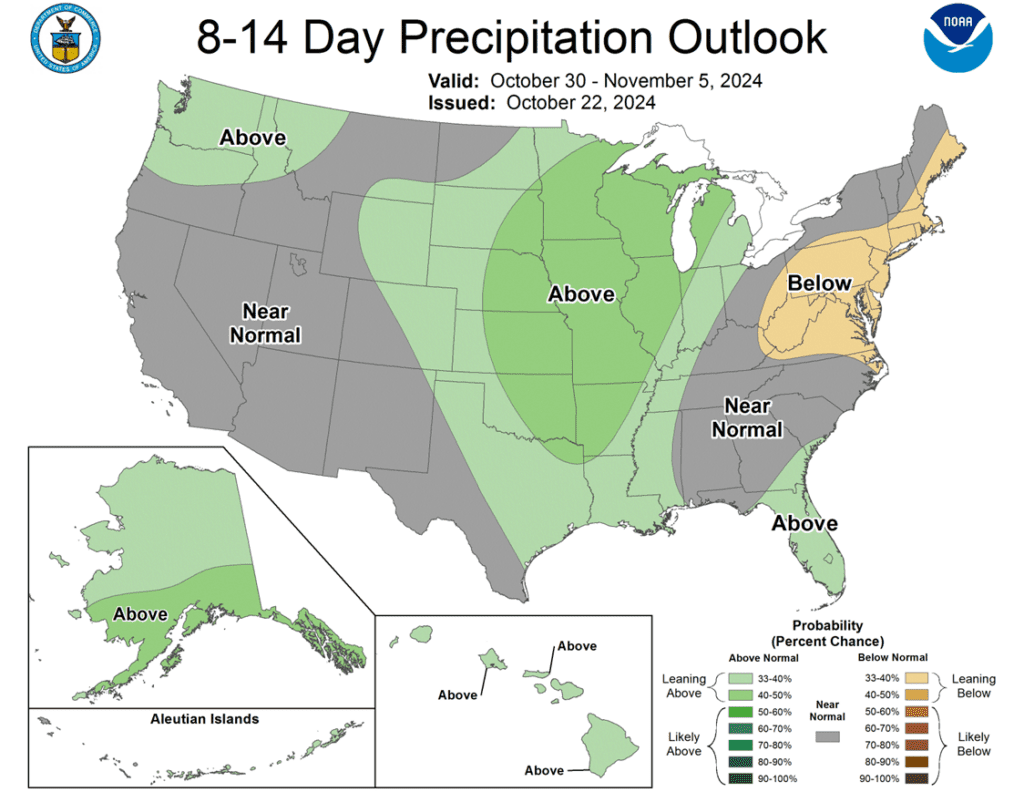

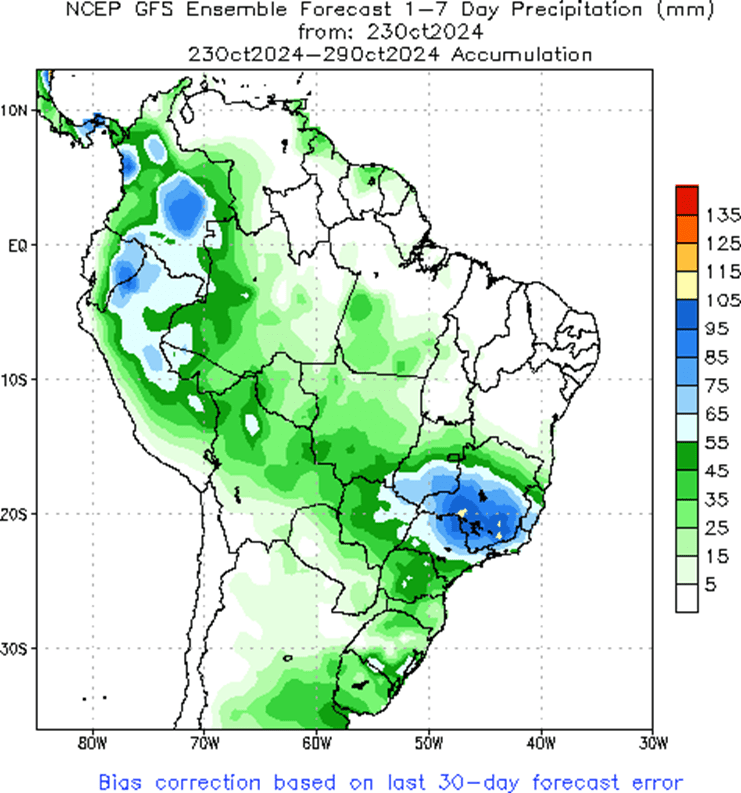

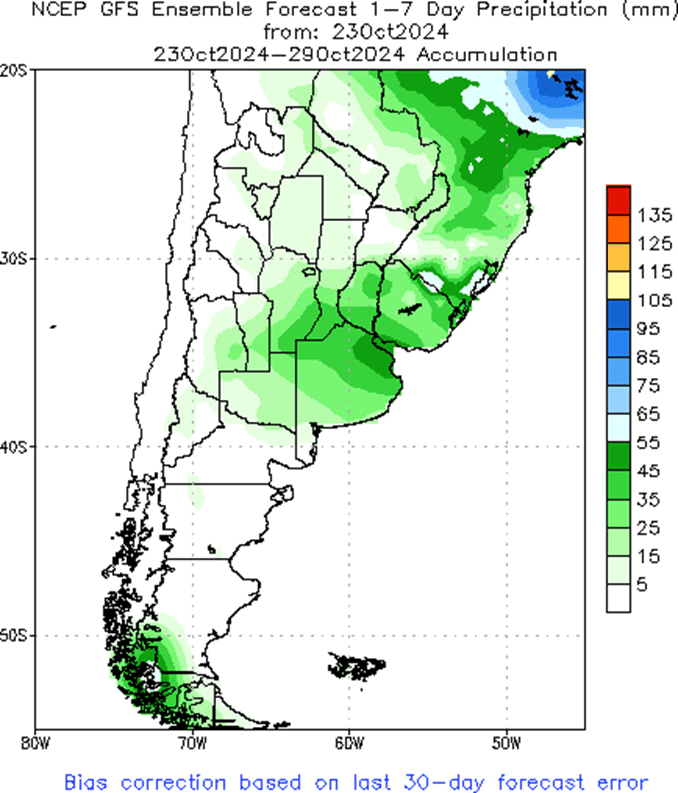

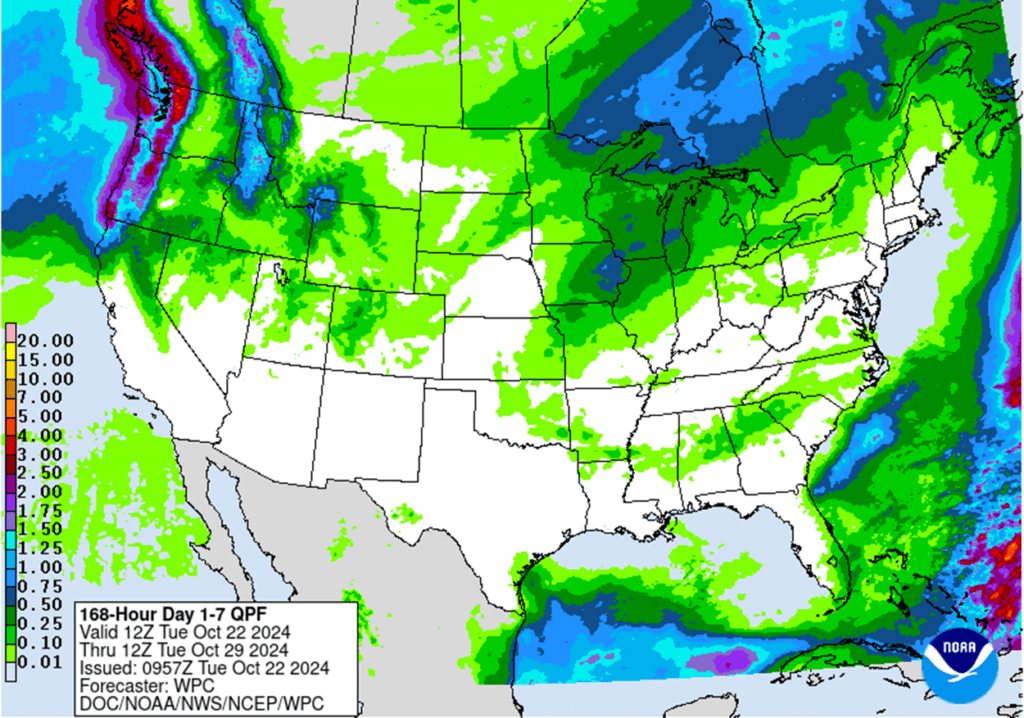

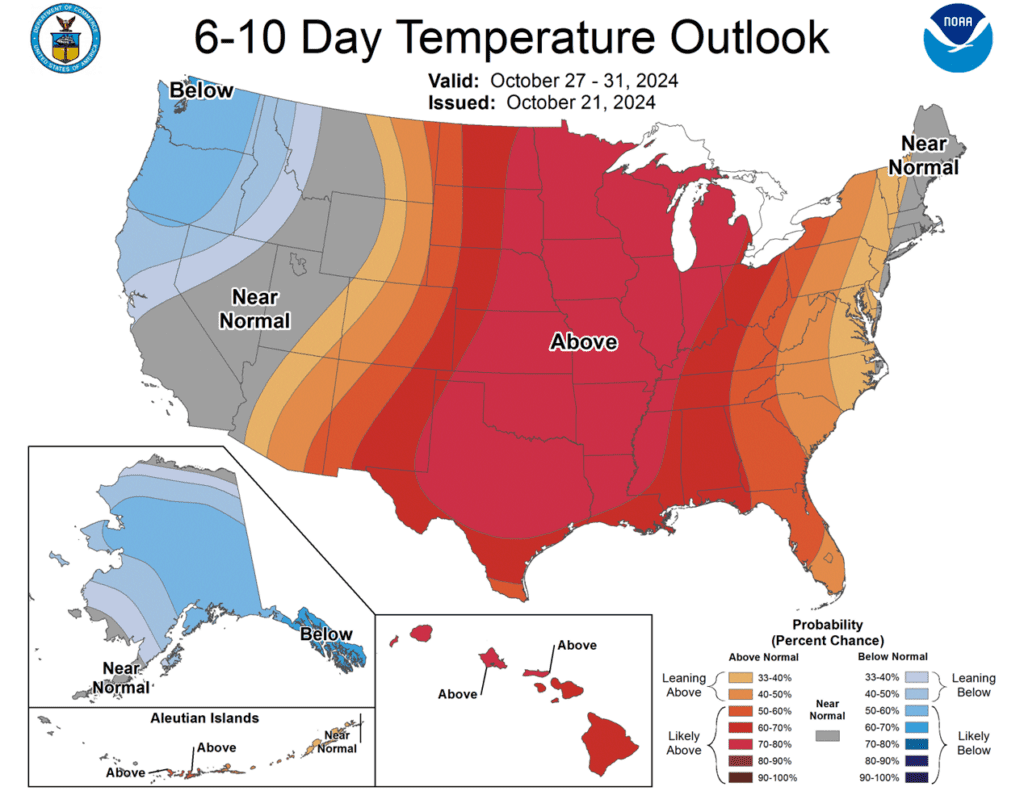

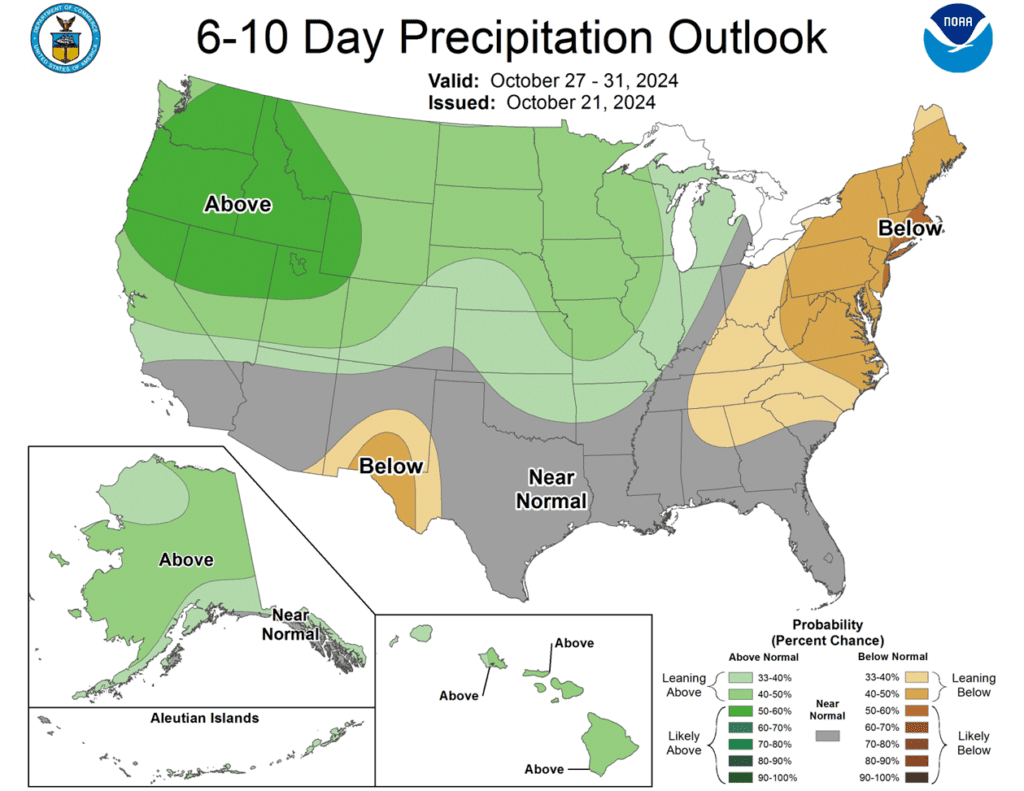

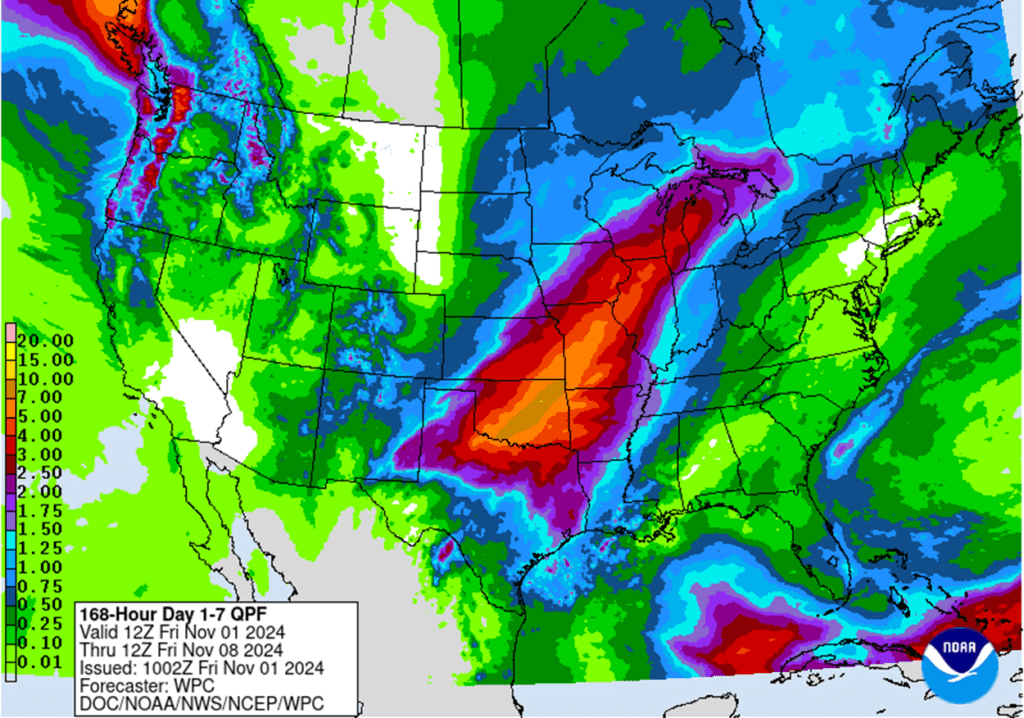

- To see the updated US 7-day precipitation forecast, 8-14 Temperature and Precipitation Outlooks, and the Seasonal Drought Outlook, courtesy of the National Weather Service, Climate Prediction Center, and NDMC, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

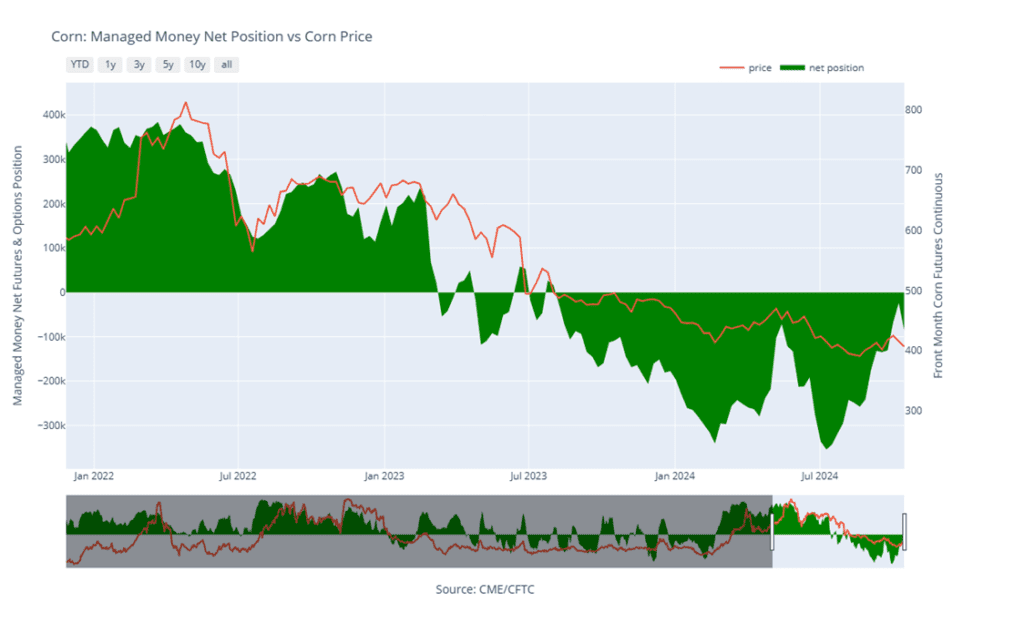

Corn

Corn Action Plan Summary

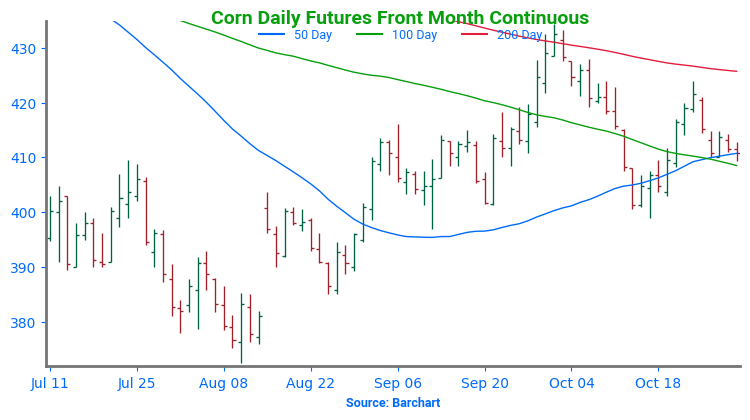

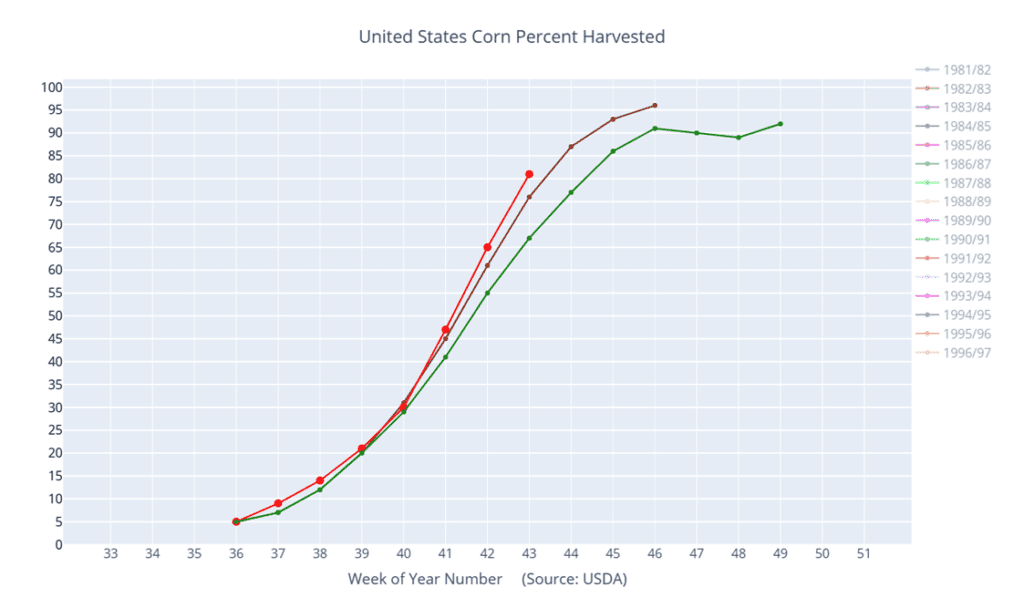

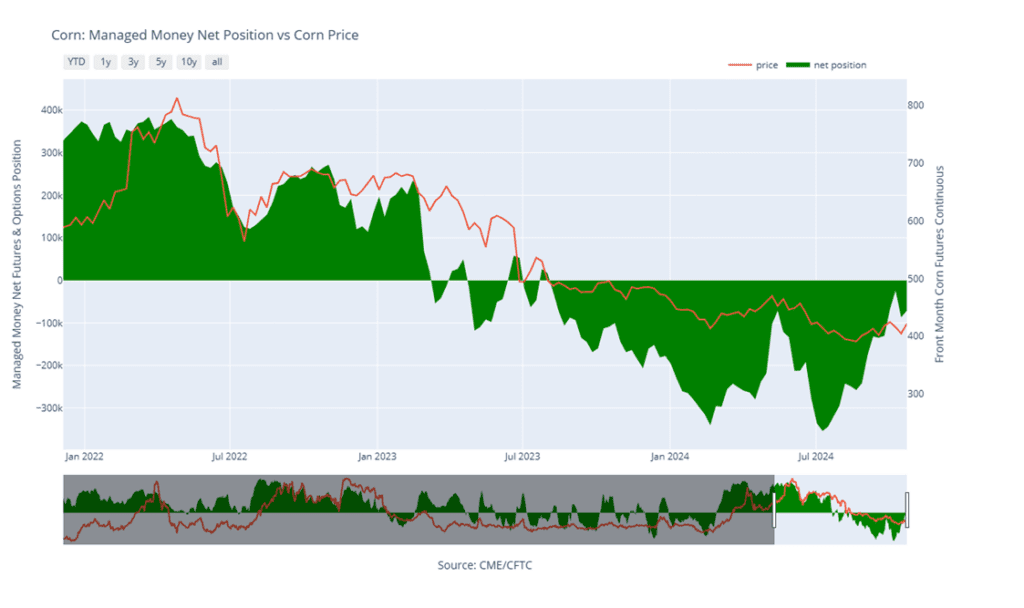

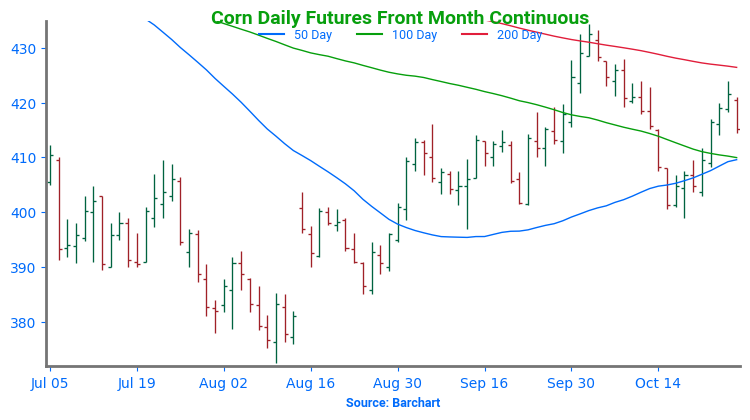

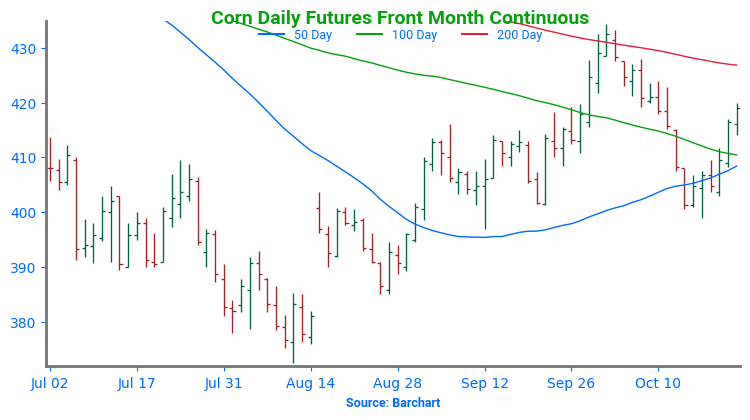

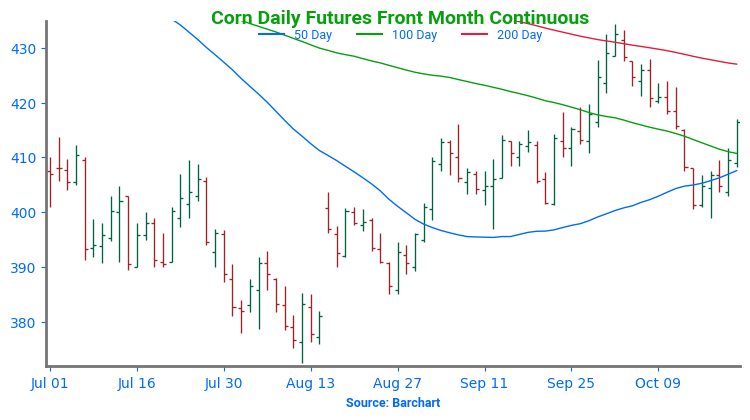

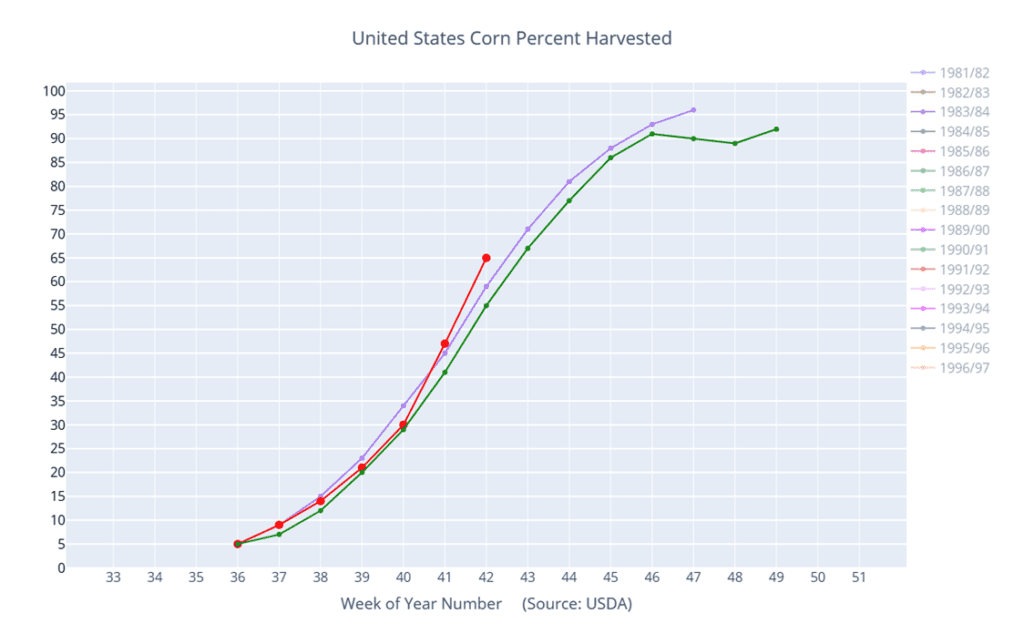

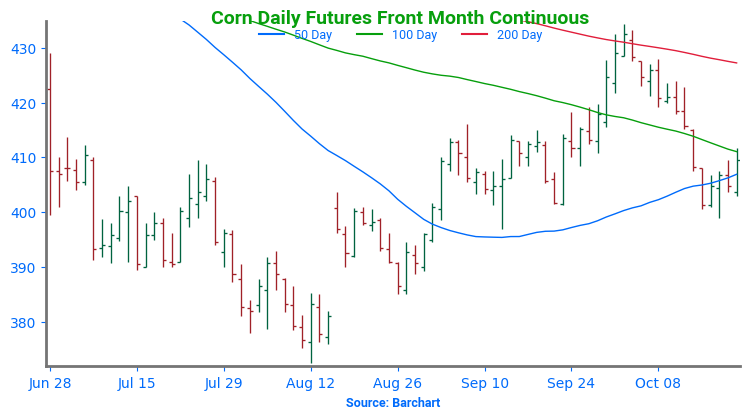

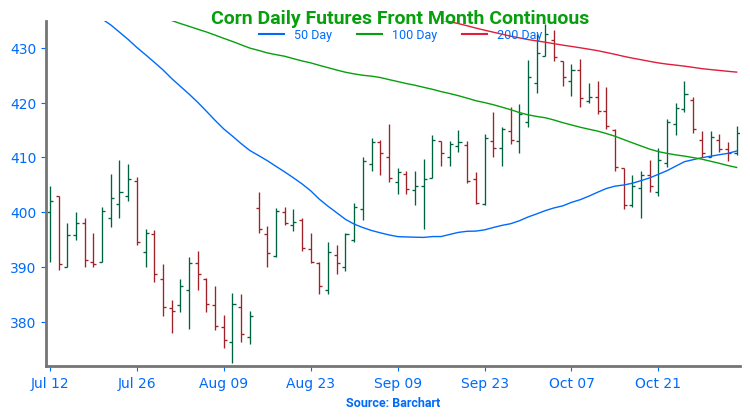

For much of this fall, corn prices — primarily driven by improved export sales and a swift harvest — have largely traded sideways within a broad 400 – 430 range after rebounding from the August low. With the harvest drawing to a close, the market’s focus will shift toward demand and South American production. While expectations remain for large 2024 supplies, strong export and ethanol demand have brought the USDA’s estimated carryout to a less burdensome level, just below two billion bushels. With the upcoming WASDE report, the market may break out of this range depending on any adjustments the USDA decides to make. An increase in demand could push prices back toward the upper end of the range or higher, while minimal or no changes could allow prices to continue drifting sideways or even lower.

- Catch-up sales opportunity for the 2024 crop. If you missed any of our past sales recommendations, there may still be good opportunities to make additional sales for this crop. While this time of year doesn’t often provide the best pricing, a rally back toward the 429 – 460 area versus Dec ’24 could provide a solid opportunity to make any catch-up sales. Also, if storage or capital needs are a concern, you could consider selling additional bushels into market strength. We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

- Catch-up sales opportunity for the 2025 crop. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. If you happened to miss those opportunities and are looking to make additional early sales for next year, you could consider targeting the 455 – 475 area versus Dec ’25 to take advantage of any post-harvest strength. For now, considering the seasonal weakness of the market around harvest time, we will not be posting any targeted areas for new sales until late fall or early winte. Although we are targeting the 470 – 490 area to buy upside calls to protect current sales in case the market experiences an extended rally beyond that point.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

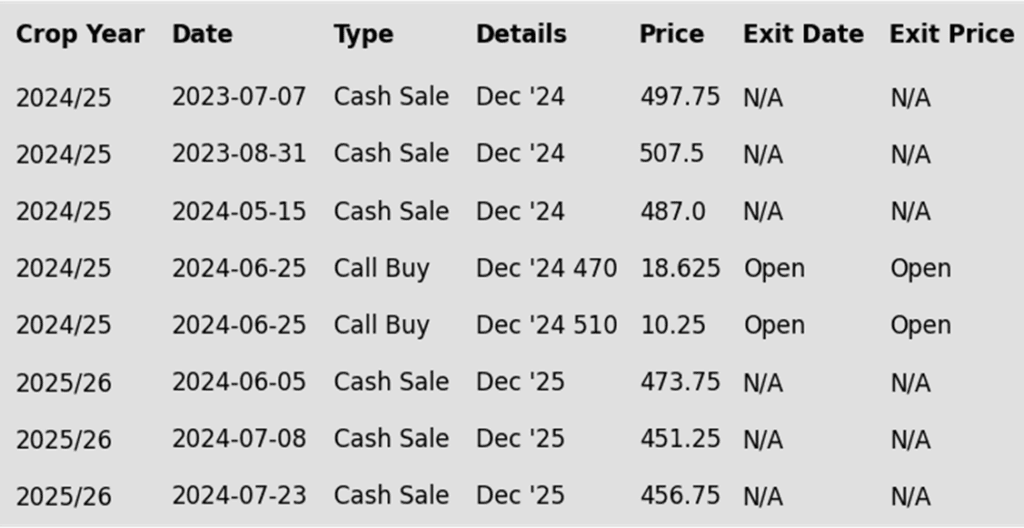

To date, Grain Market Insider has issued the following corn recommendations:

- Corn futures finished the session slightly higher as prices consolidated for the fifth consecutive session. Announced export sales and a strong crude oil market helped support corn futures on the day. For the week, corn futures managed to trade slightly lower, losing ¾ of a cent in a quiet week with a less than 6 cent trading range from high to low.

- Mexico stepped in the US corn export market with a relatively large purchase. The USDA announced that Mexico purchased 781,322 mt of corn. The sales were split, with 715,800 mt for this marketing year and 65,532 mt for next year.

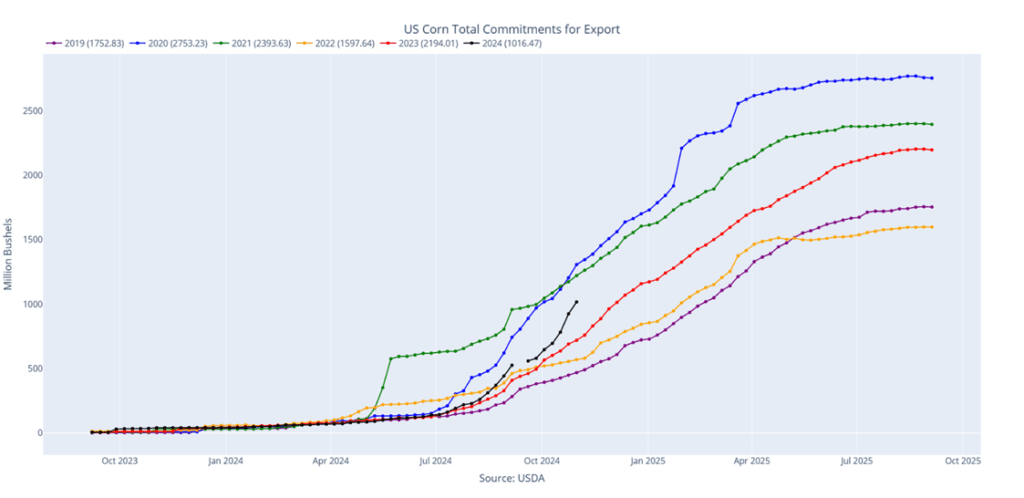

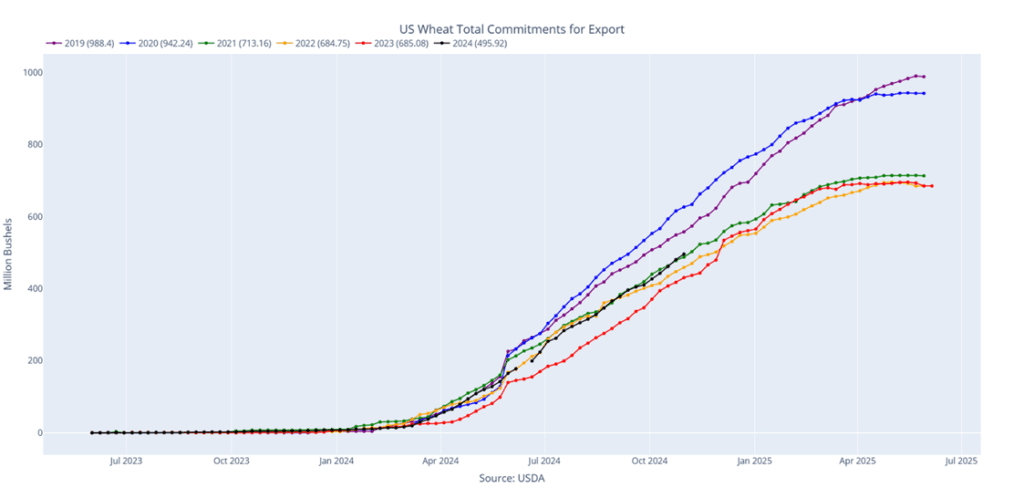

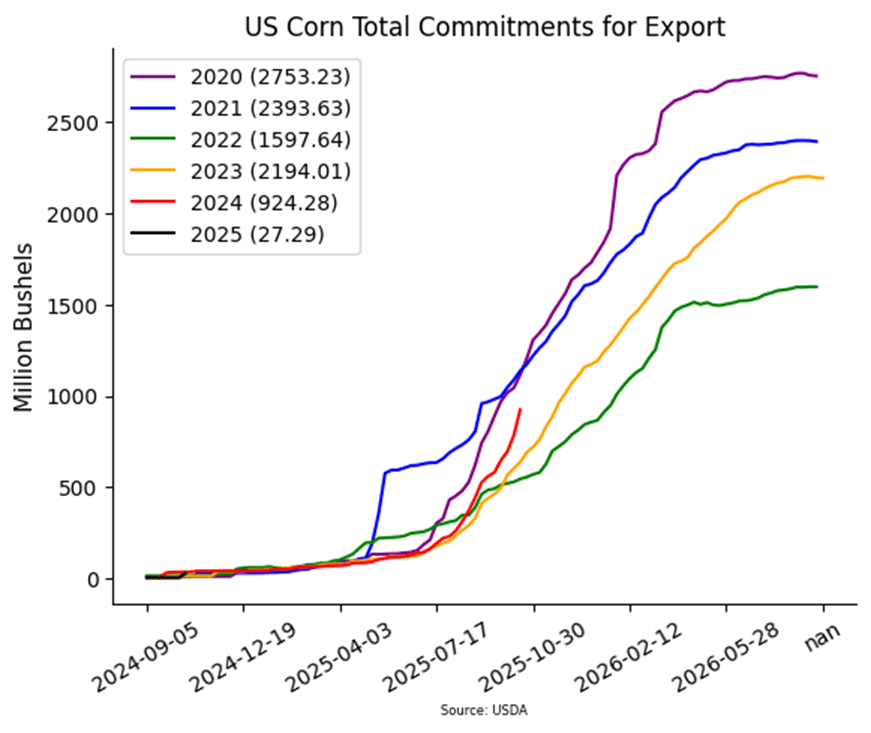

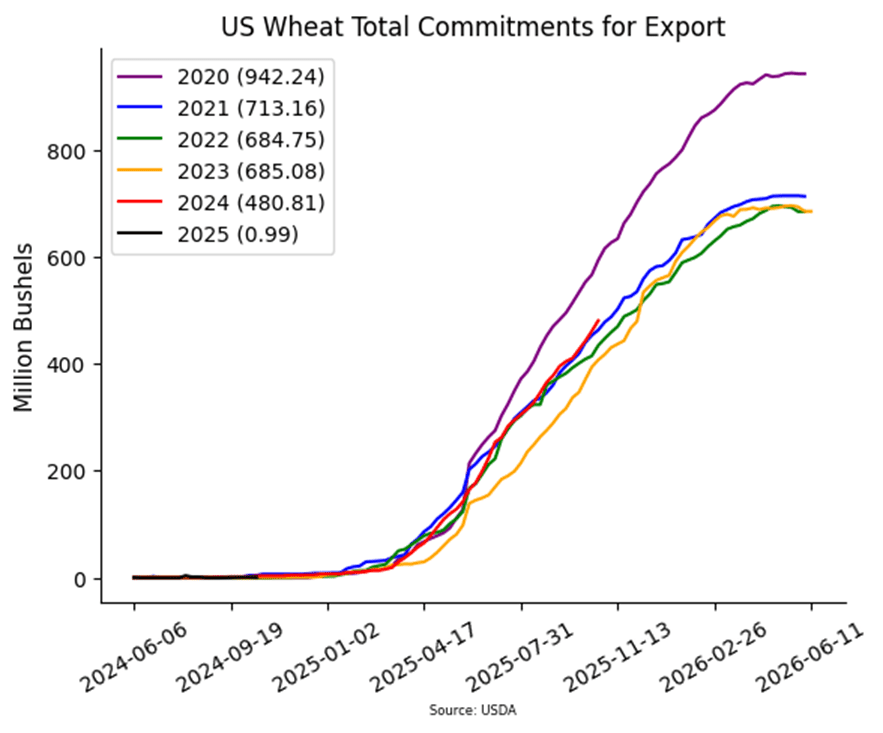

- Corn export sales have remained strong for the first part of the marketing year. Total corn sales commitments for the 24/25 marketing year have reached 1.016 billion bushel in 24/25 and are up 41% from a year ago. This is ahead of the USDA’s projected pace, and the USDA may need to adjust the demand side of the corn balance sheet in future USDA reports.

- As harvest wraps up, November can historically be a challenging month for corn prices, as producers often need to set prices on remaining bushels. With First Notice Day for the December contract approaching on November 29, producers holding basis contracts or storing commercial bushels will need to make pricing decisions beforehand, which often puts pressure on market prices.

- The US presidential election on Tuesday, November 5, could bring volatility to the corn market as it positions itself for election results. Additionally, the November WASDE report, with the next round of crop production estimates for the current marketing year, is set for release on Friday, November 8.

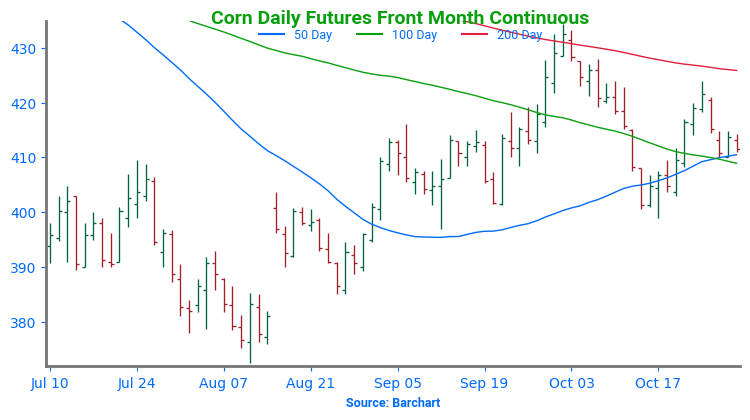

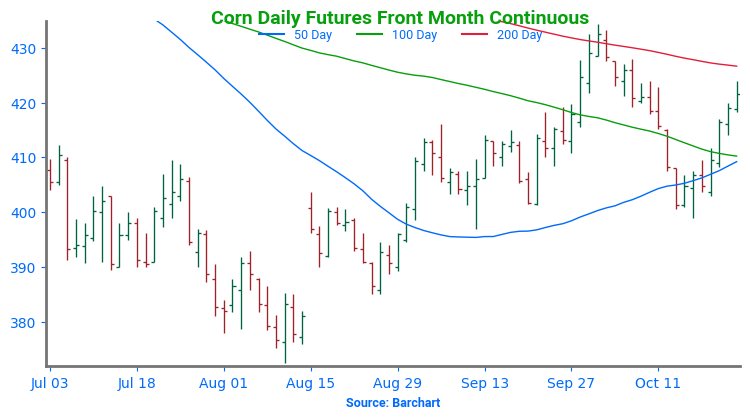

Above: Since early September, the corn market has found support near the 400 area while posting a low of 397 on September 12, and a high of 434 ¼ on October 2. A close above this range could put the market on course for a larger move, potentially to the June high near 465, while a close below 397 could put it on track to test support near 385.

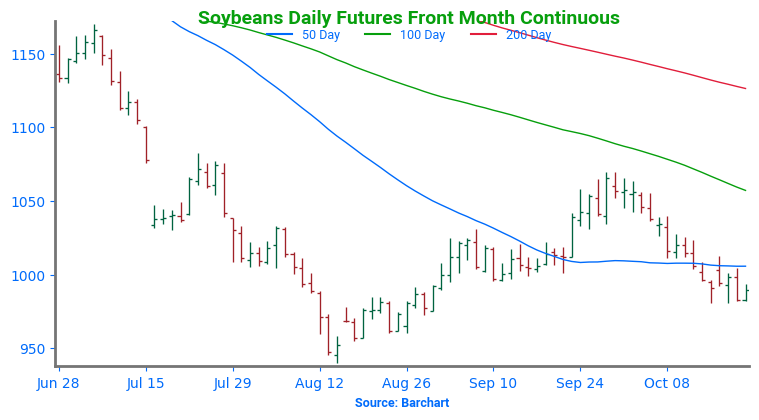

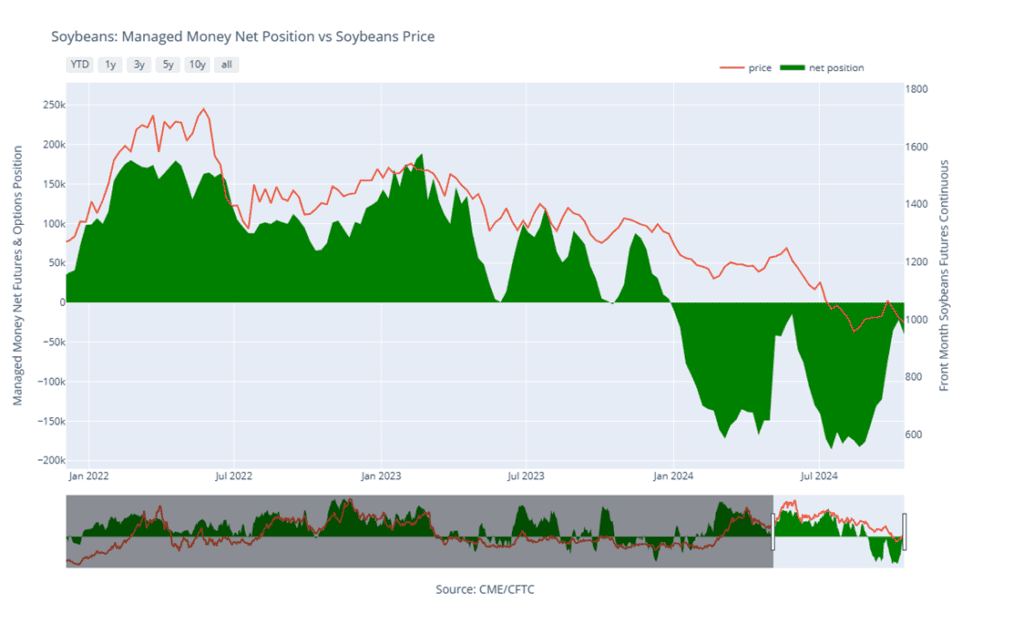

Soybeans

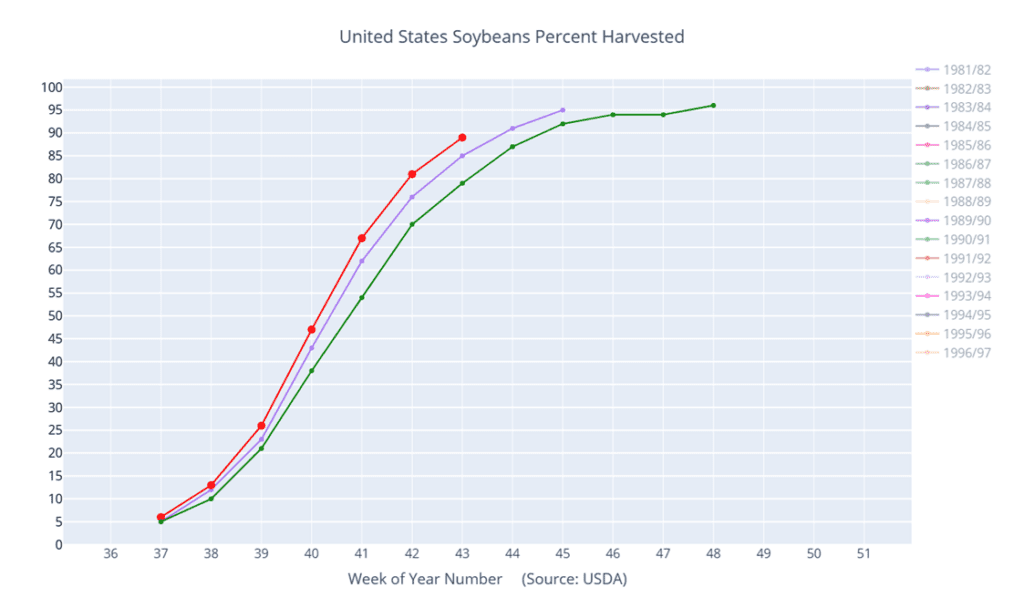

Soybeans Action Plan Summary

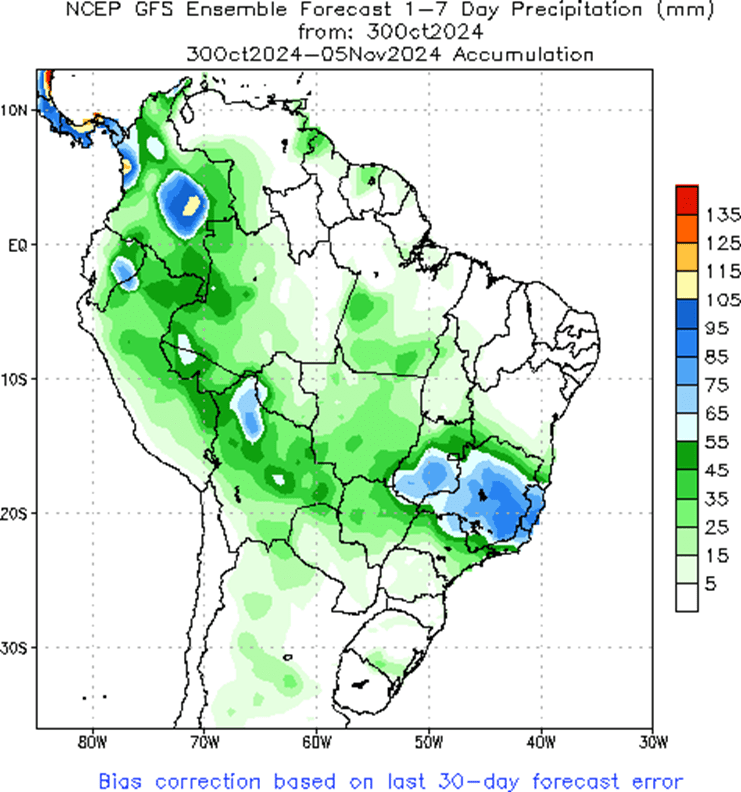

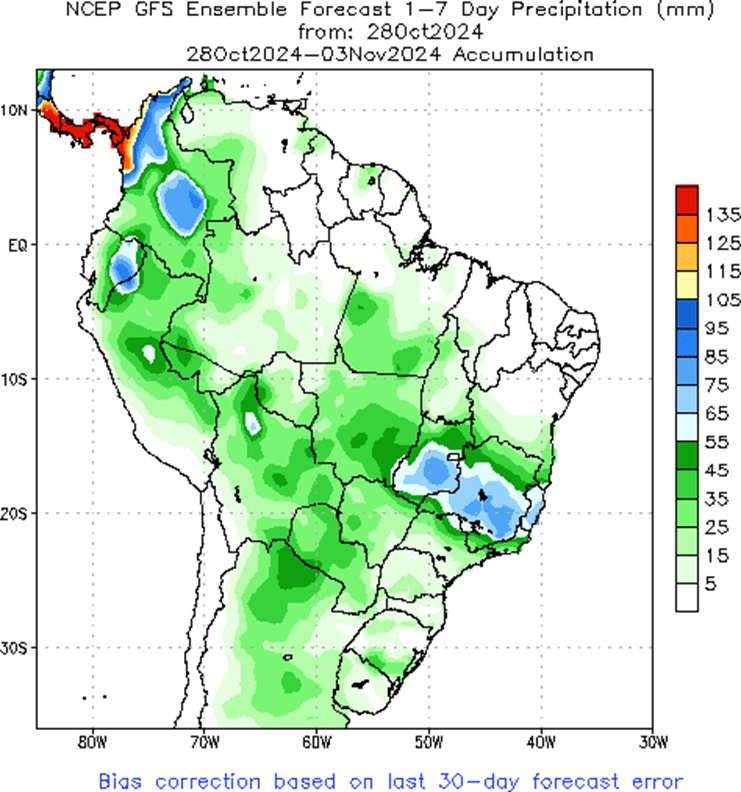

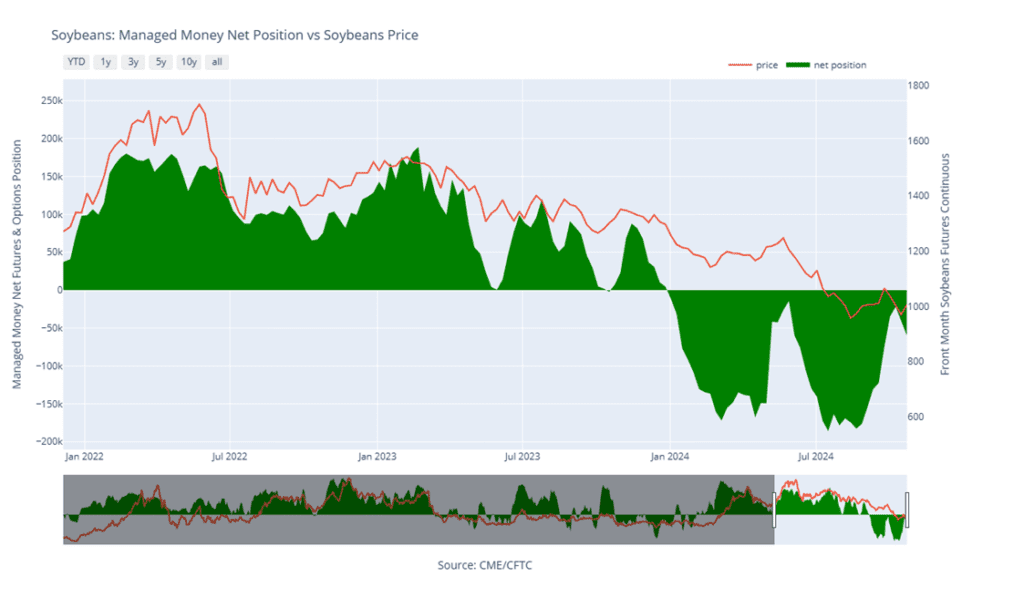

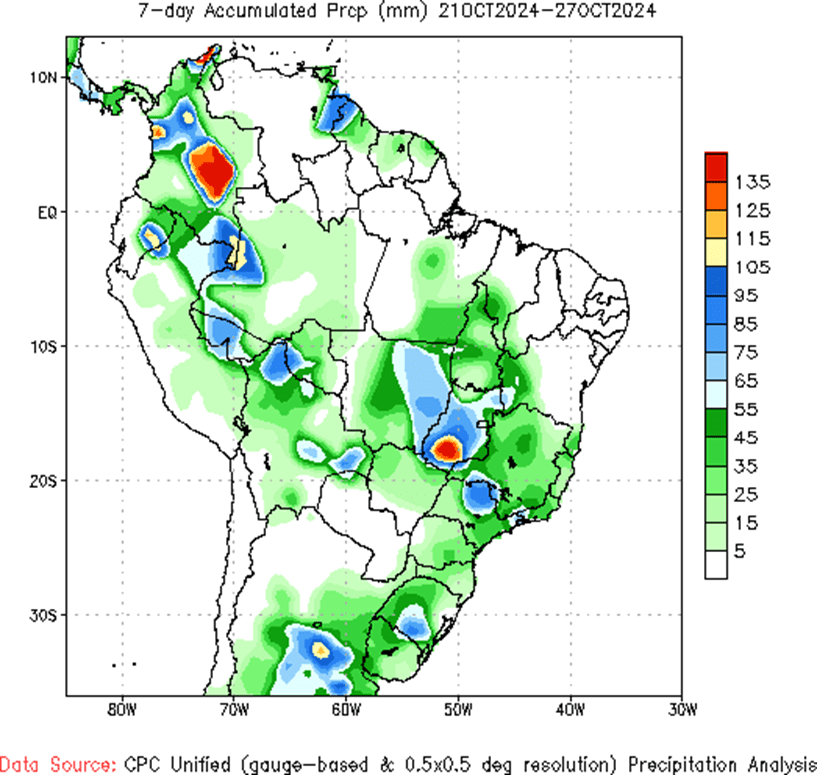

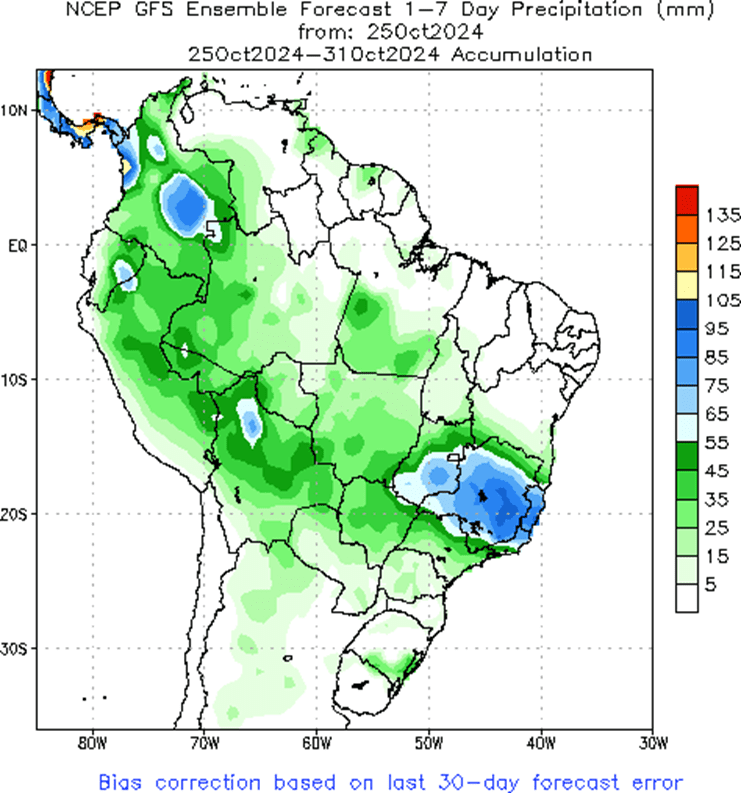

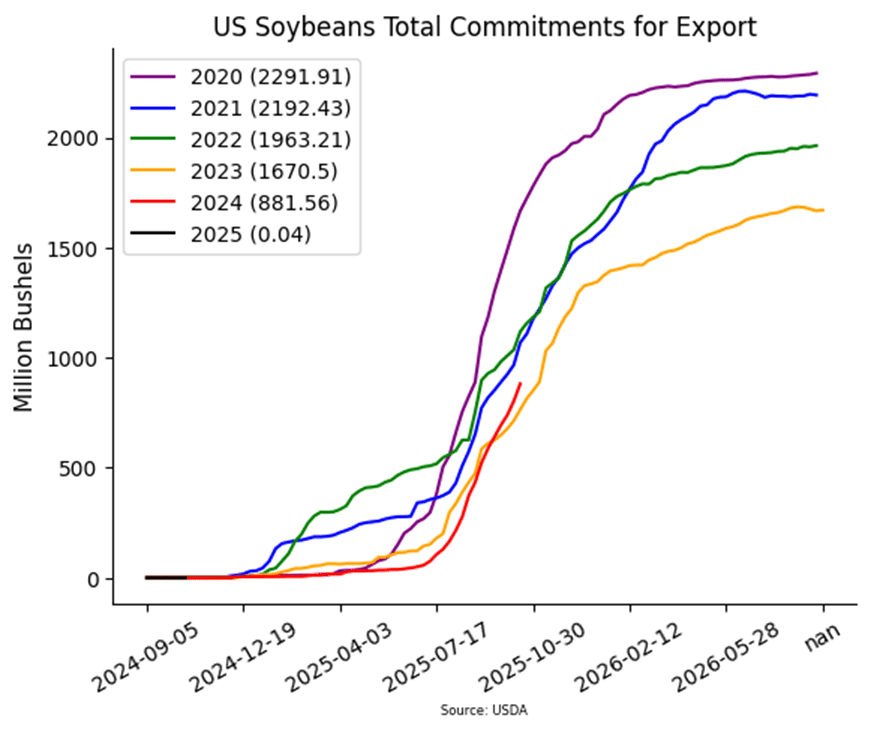

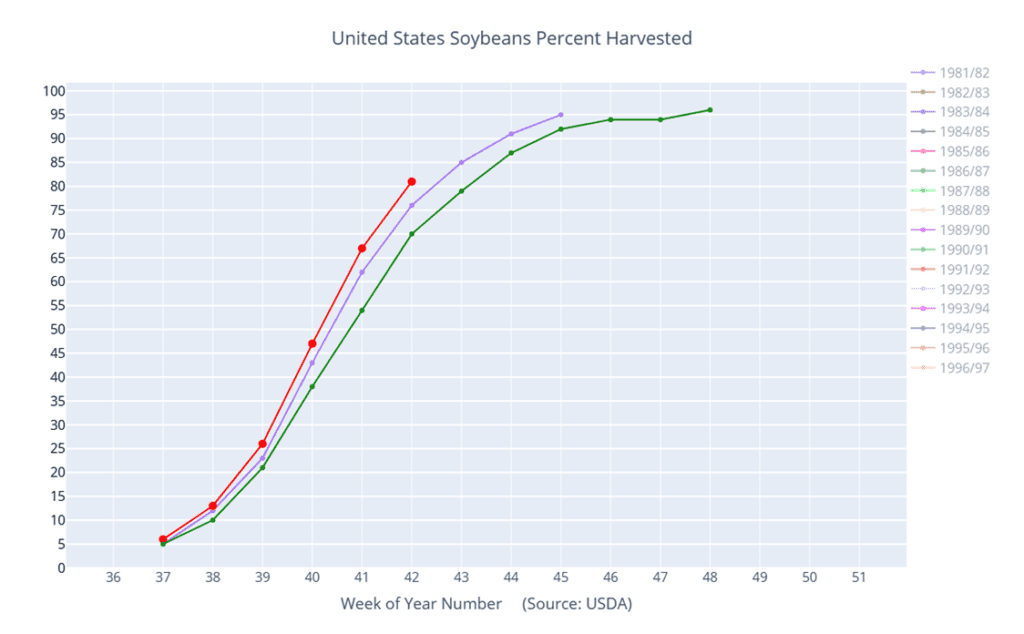

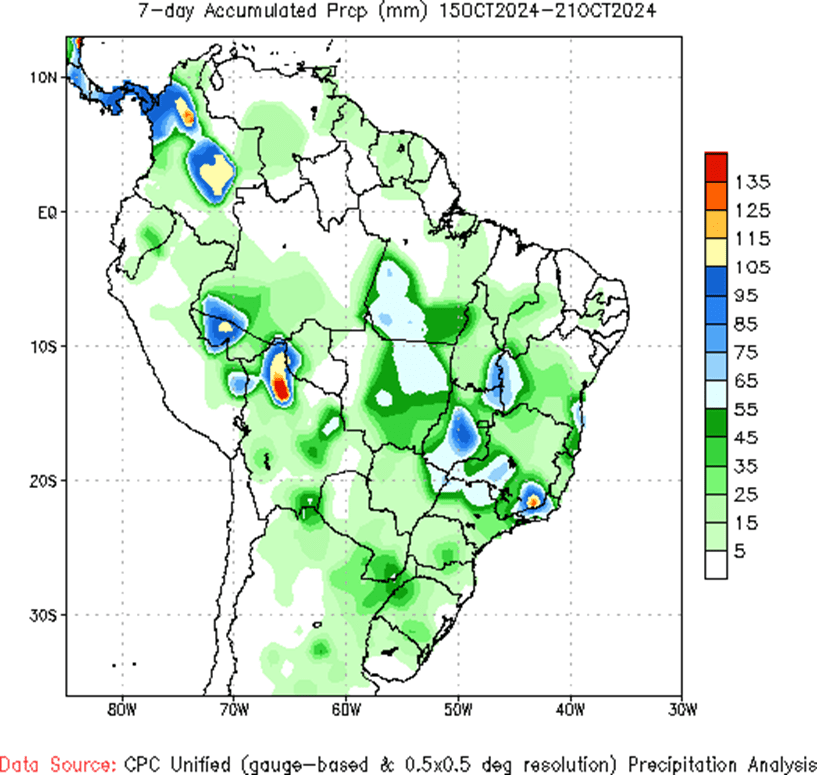

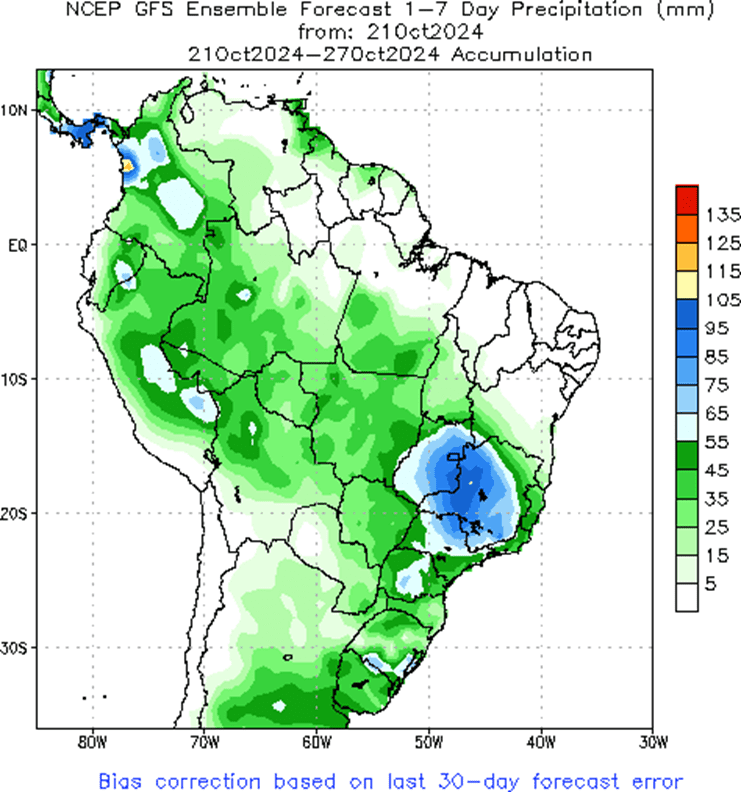

After peaking in early October, the soybean market declined as harvest activity and hedge pressure increased rapidly, driven by warm, dry conditions in the US and improving planting conditions in Brazil. With the harvest now in its final stages, we are entering a period when selling opportunities tend to improve as hedge pressure eases, and South American weather becomes a more dominant factor in their growing season. That said, managed funds hold a relatively small net short position, which creates the potential for volatility in either direction. Prices could rise if South American conditions decline or US demand improves, encouraging further fund buying, or decline if South American conditions improve and US demand remains stagnant, prompting funds to potentially rebuild short positions.

- Catch-up sales opportunity for the 2024 crop. If you missed any of our previous sales recommendations, there may still be an opportunity to make a catch-up sale. While we don’t expect the fall to offer the best pricing, a rally back to the 1050 – 1070 range versus Jan ‘25 could provide a good opportunity. For those with capital needs, consider making these catch-up sales into price strength. If the market rallies further, additional sales can be considered in the 1090 – 1125 range versus Jan ‘25. No further sales recommendations are anticipated until seasonal pricing opportunities improve, likely late fall to early spring.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

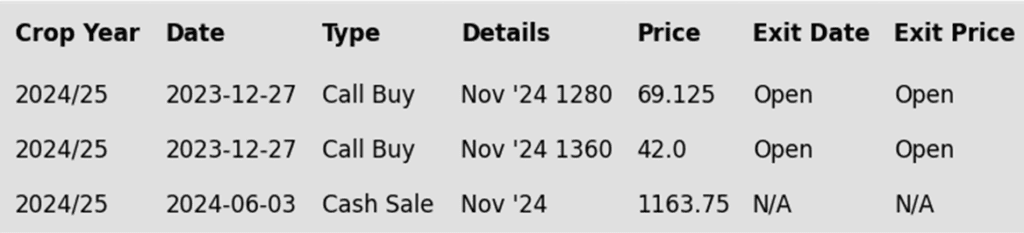

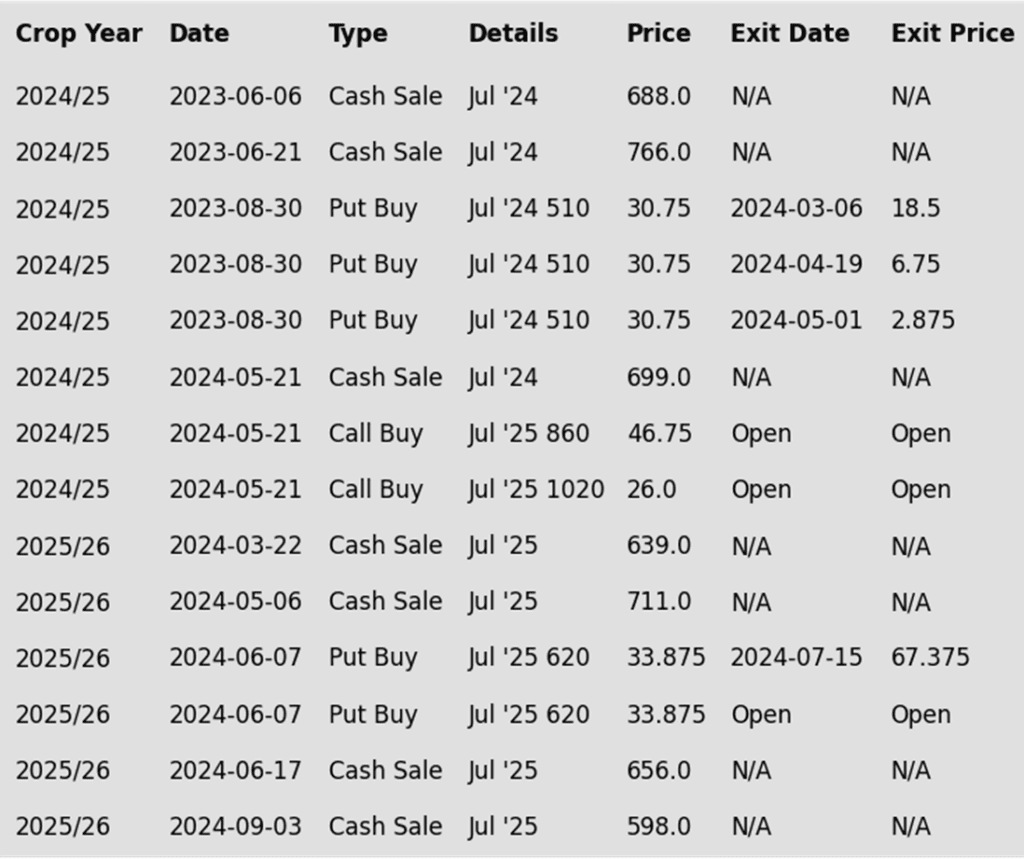

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans ended the day slightly lower after mixed trade. Prices were initially higher overnight and this morning before fading toward the close, dragged down by falling soybean meal. Early support came from large export sales, while soybean oil continued its trend with a higher close today.

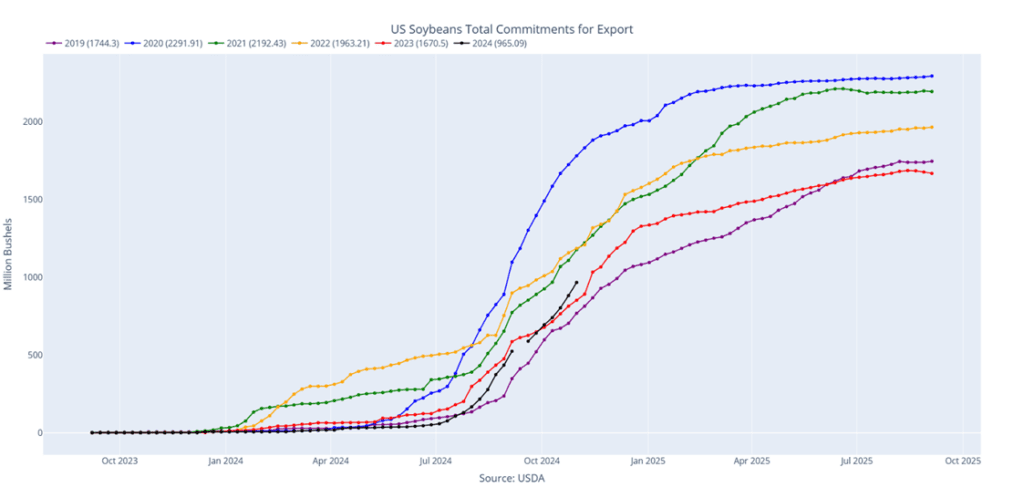

- This morning, the USDA reported multiple private export flash sales. 132,000 metric tons of soybeans were reported for delivery to China for the 24/25 marketing year. Another 198,000 metric tons were sold for delivery to unknown destinations for the 24/25 marketing year, and 30,000 metric tons of soybean oil was sold for delivery to India for 24/25.

- For the week, November soybeans lost 5 ¼ cents to 982 ½ while March soybeans lost just ¾ cent to 1008 ¼. December meal lost $10.50 to $295.30, making new contract lows while soybean oil gained 2.15 cents to 46.30 cents.

- Higher palm oil prices have been the main driver for soybeans and soybean oil recently as energy prices have rebounded. This supports renewable diesel production and has helped world veg oil prices. The downside of this has been that the increase in crush has created an excess of soybean meal.

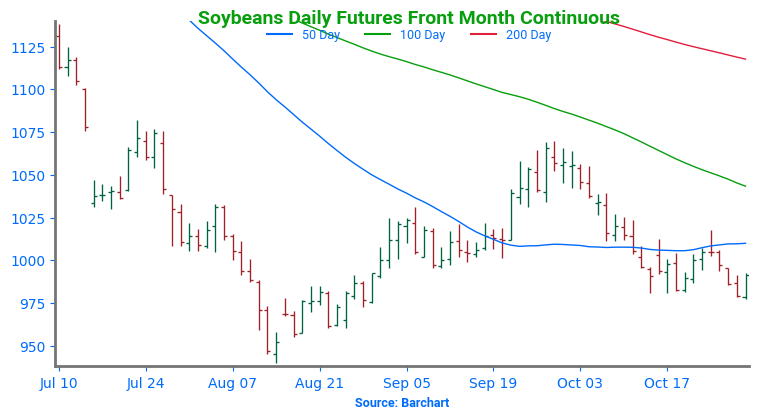

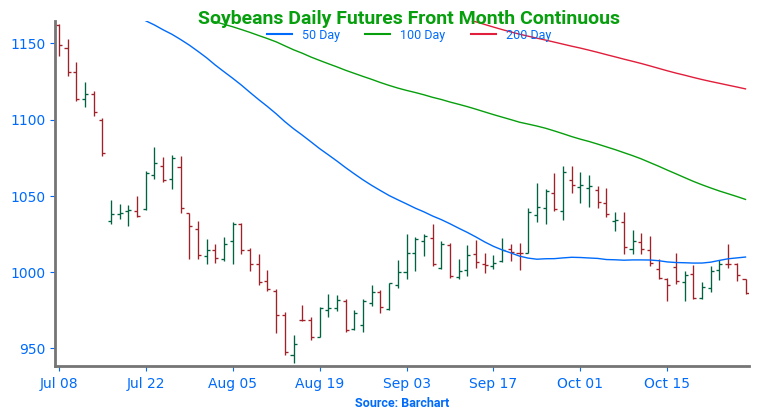

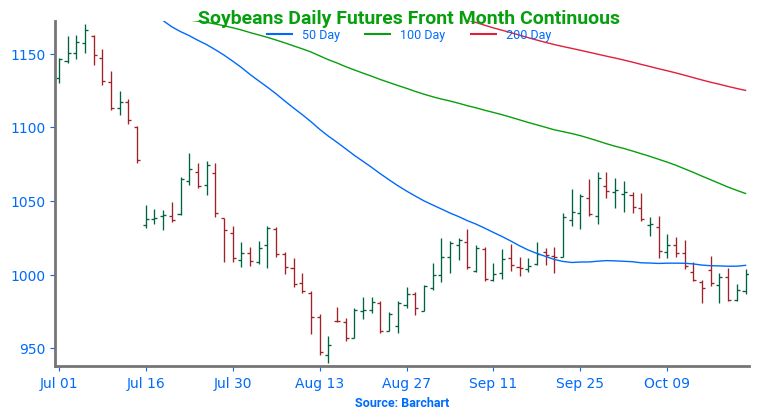

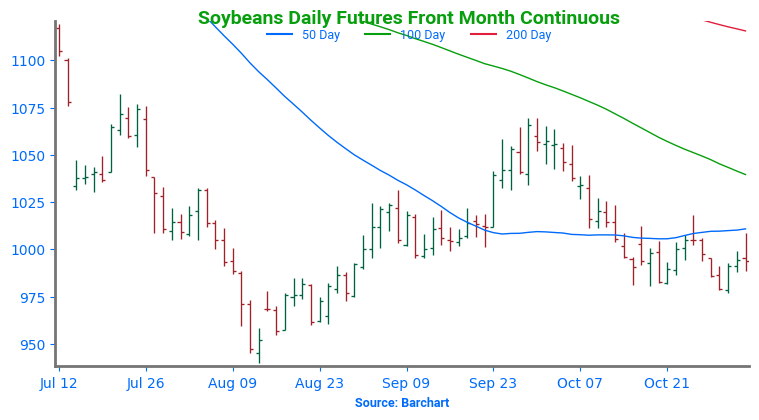

Above: Since mid-October the soybean market has been largely rangebound between 1018 on the topside and 980 down below. A breakout above 1018 could suggest a rally back toward the September highs, with intermediate resistance near the 100-day moving average. Whereas a close below 980 could find additional support near 955 and again around 940.

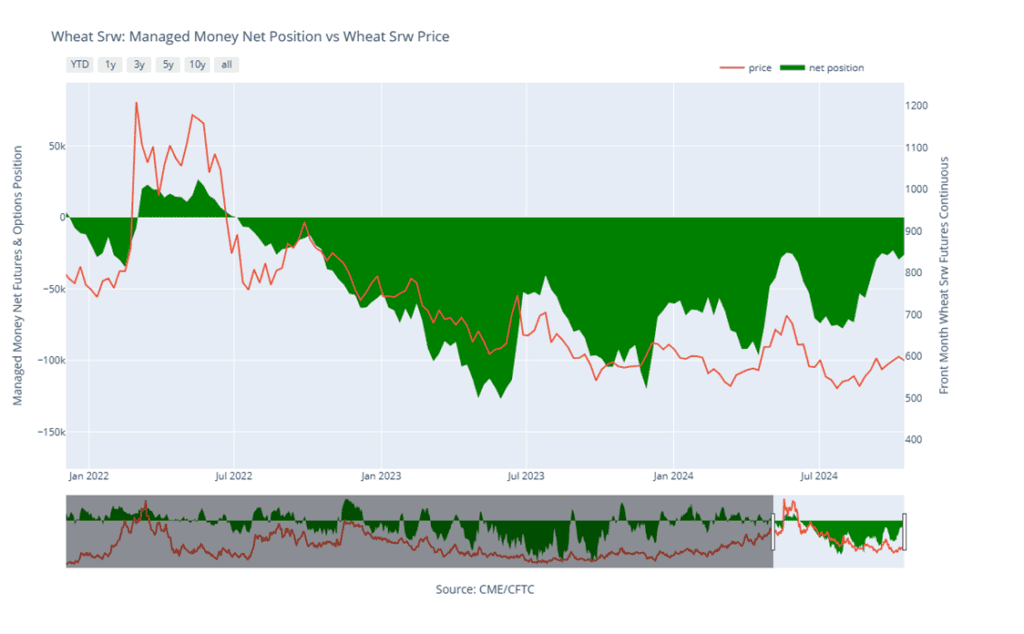

Wheat

Market Notes: Wheat

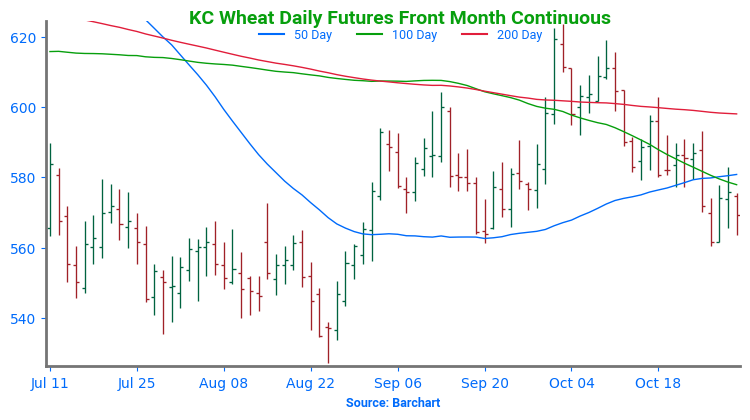

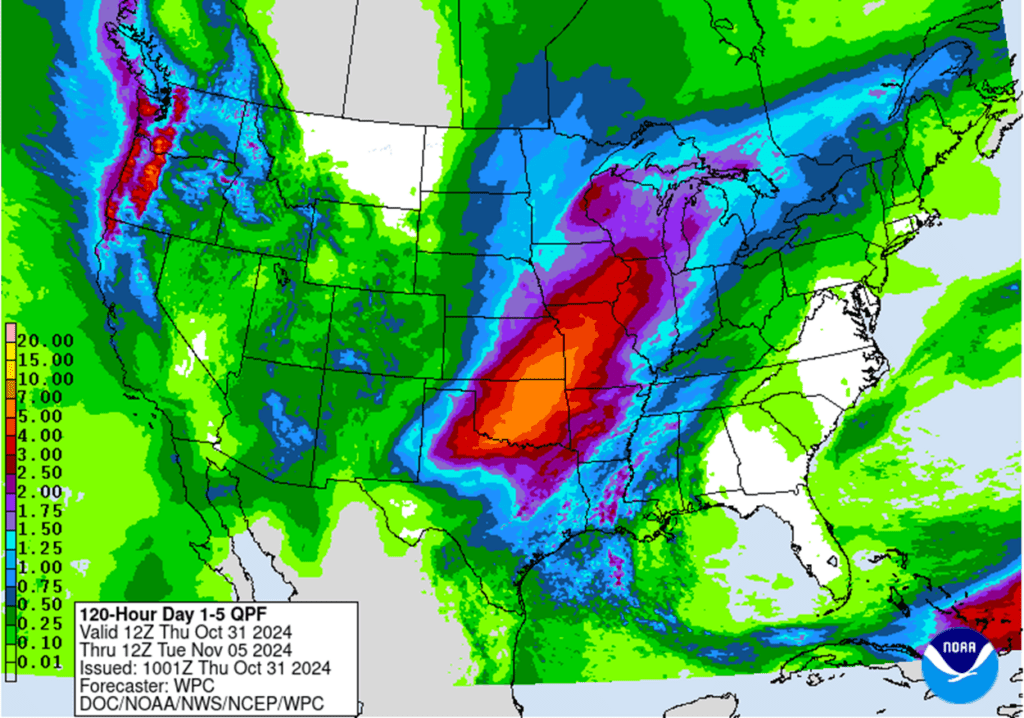

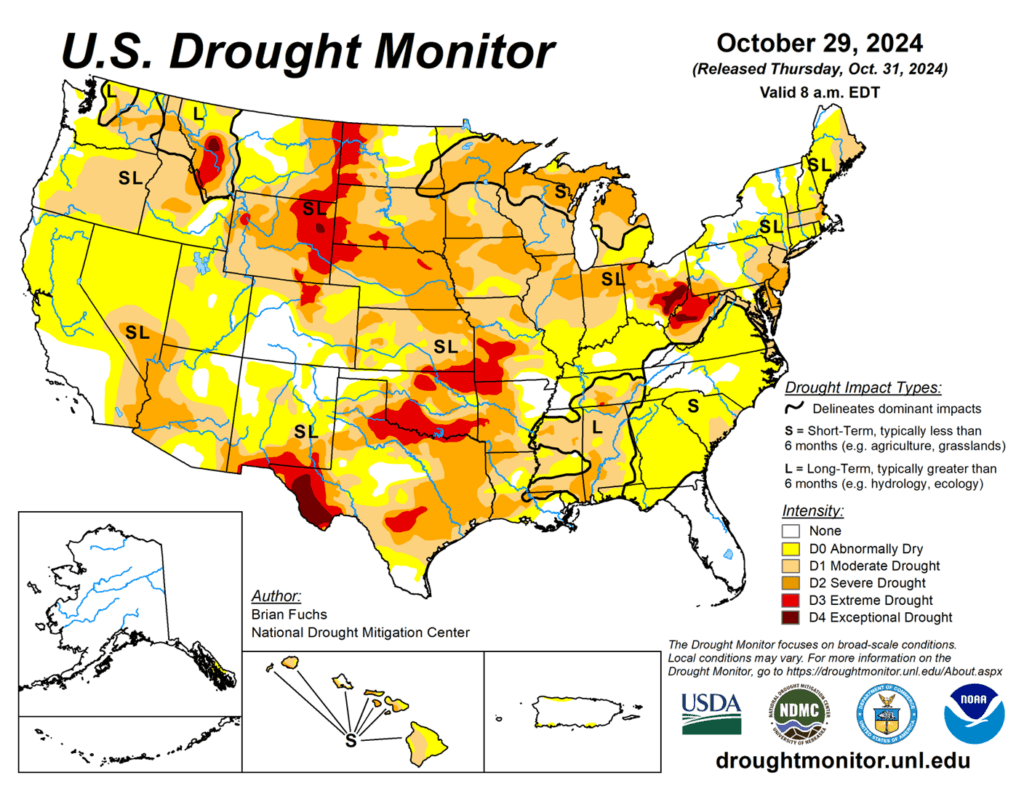

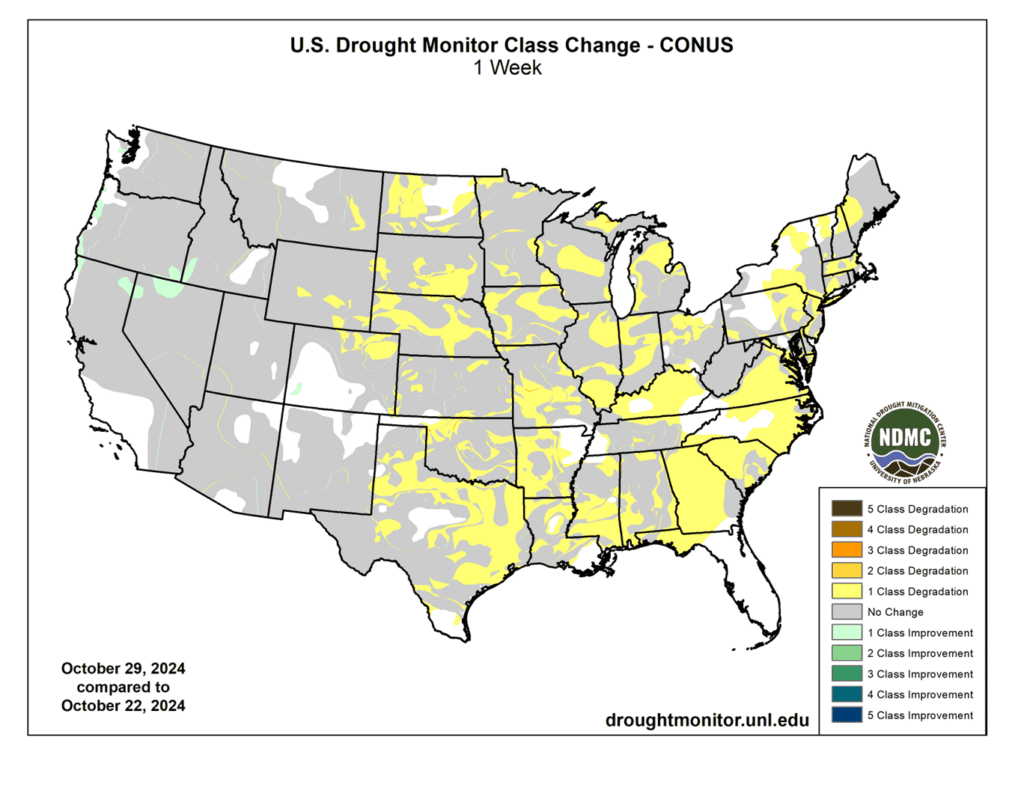

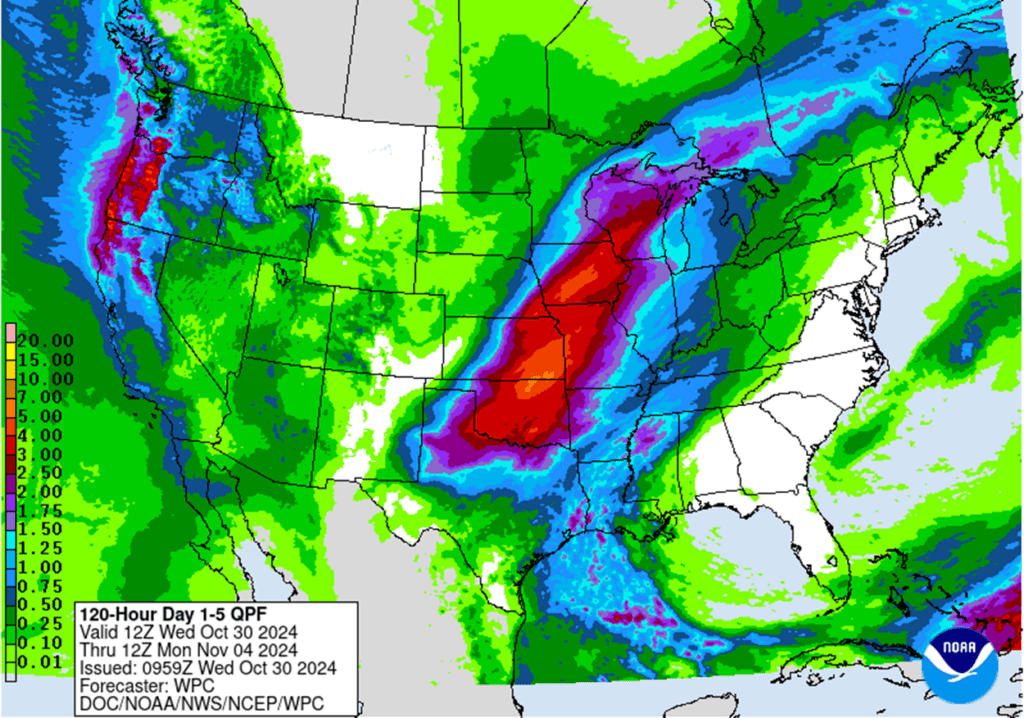

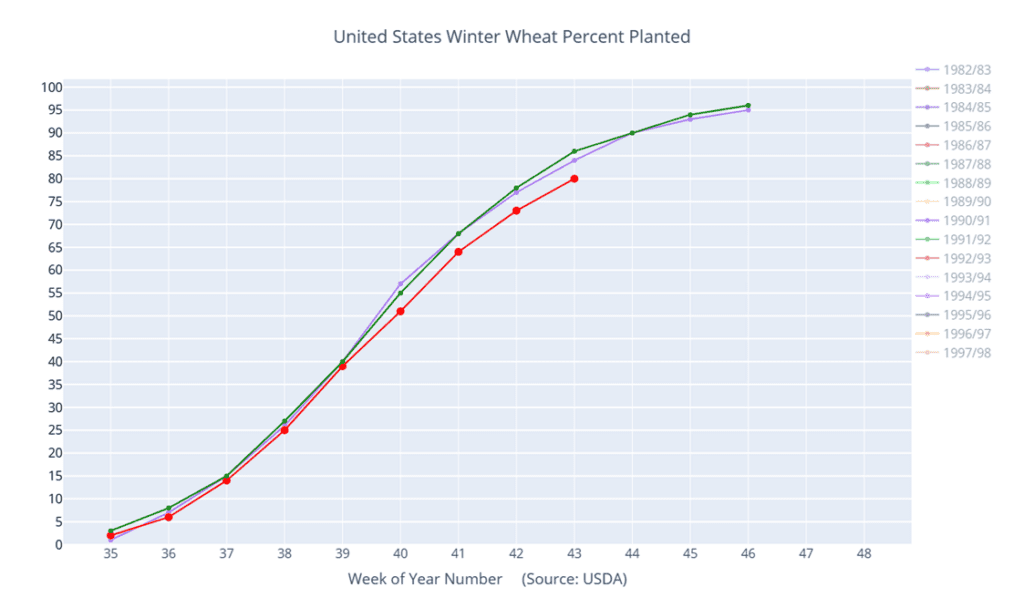

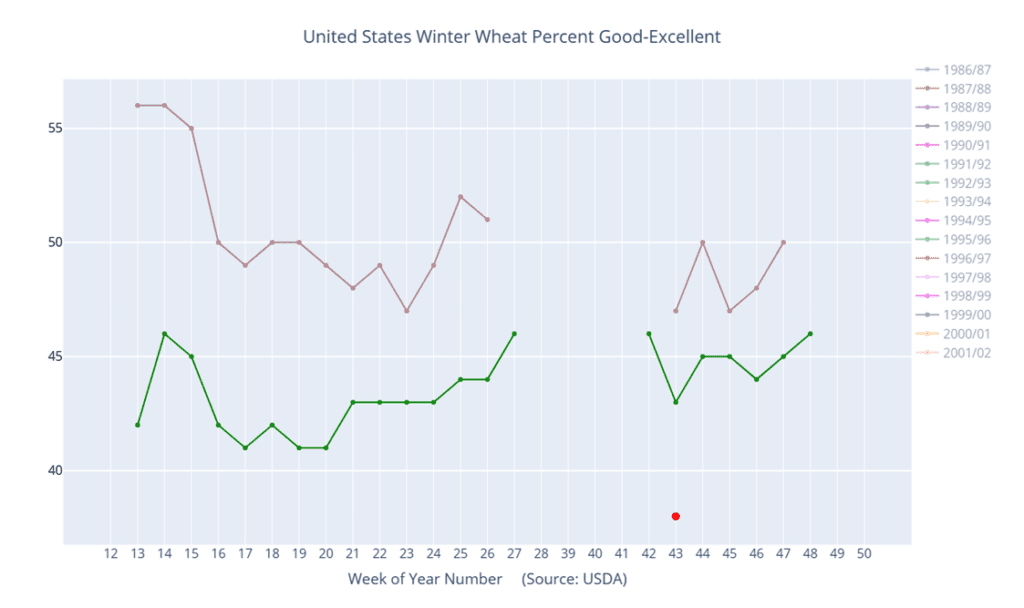

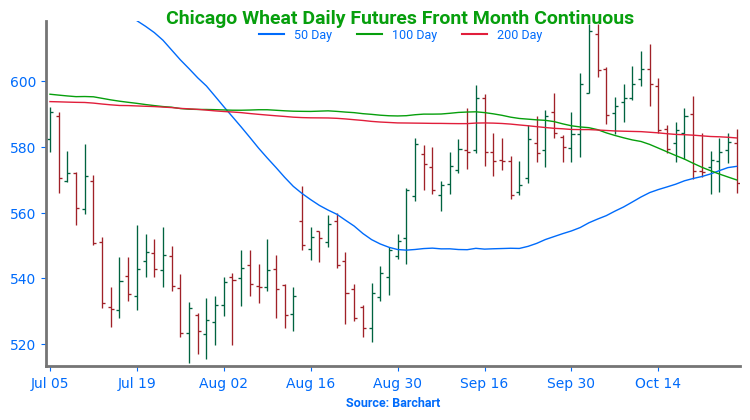

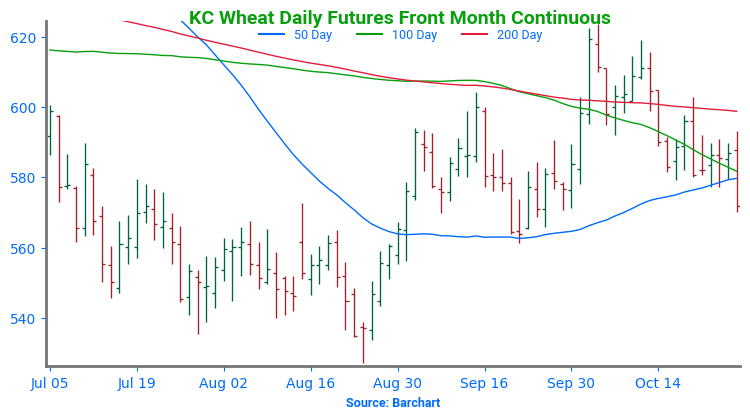

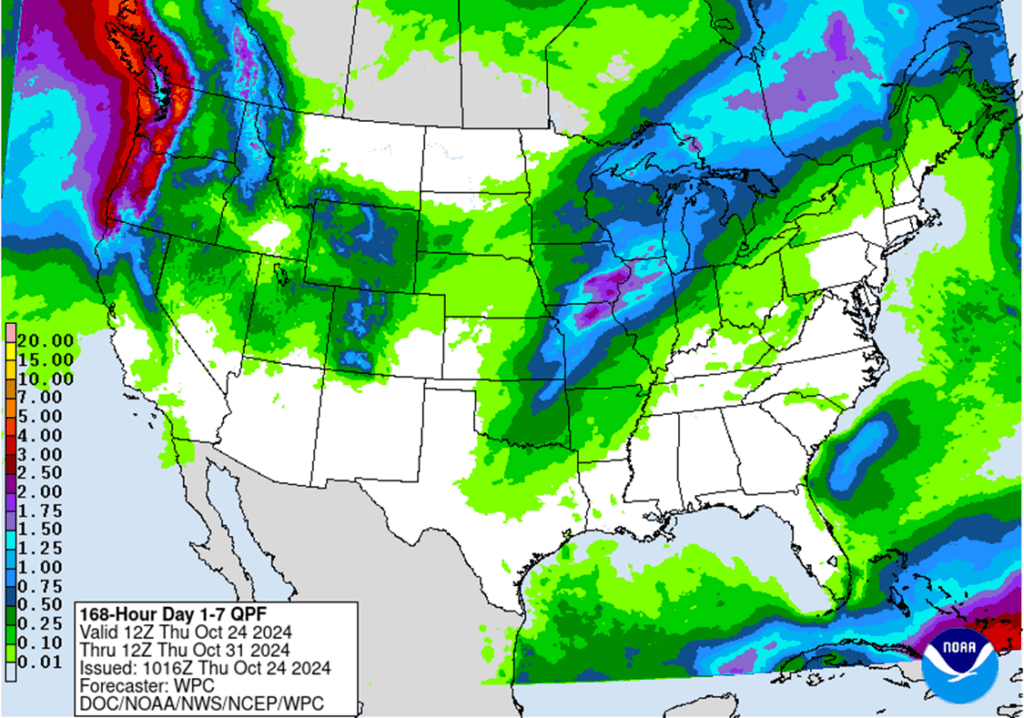

- After a day of two-sided trade, wheat posted small losses across all three classes. In addition to a sharp rebound in the US Dollar Index today, another lower close for Matif wheat also pressured the complex. Furthermore, widespread rain coverage is expected over the weekend for key US wheat-growing areas, which should help improve conditions.

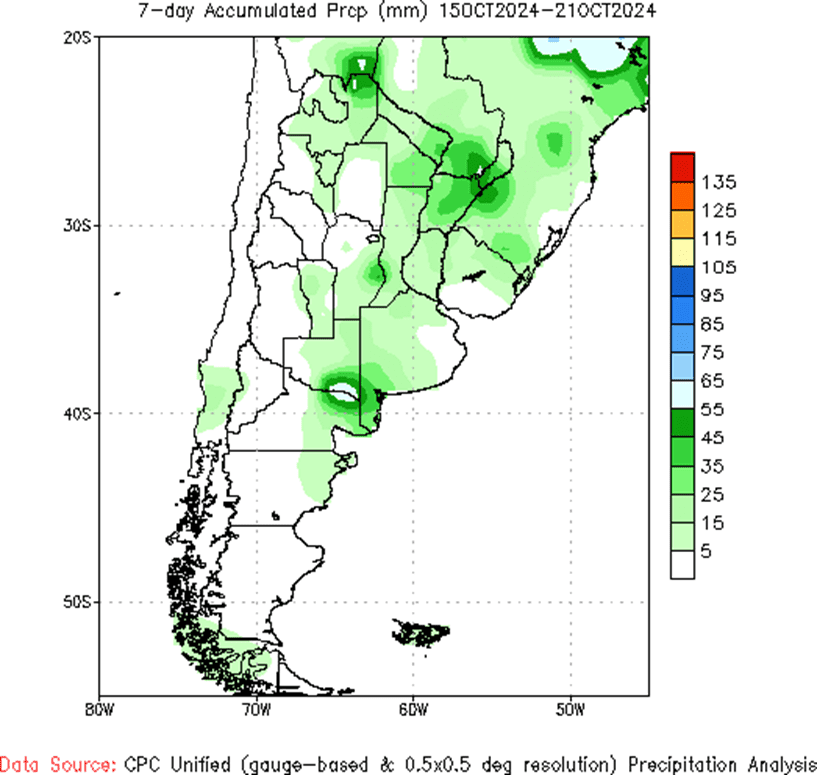

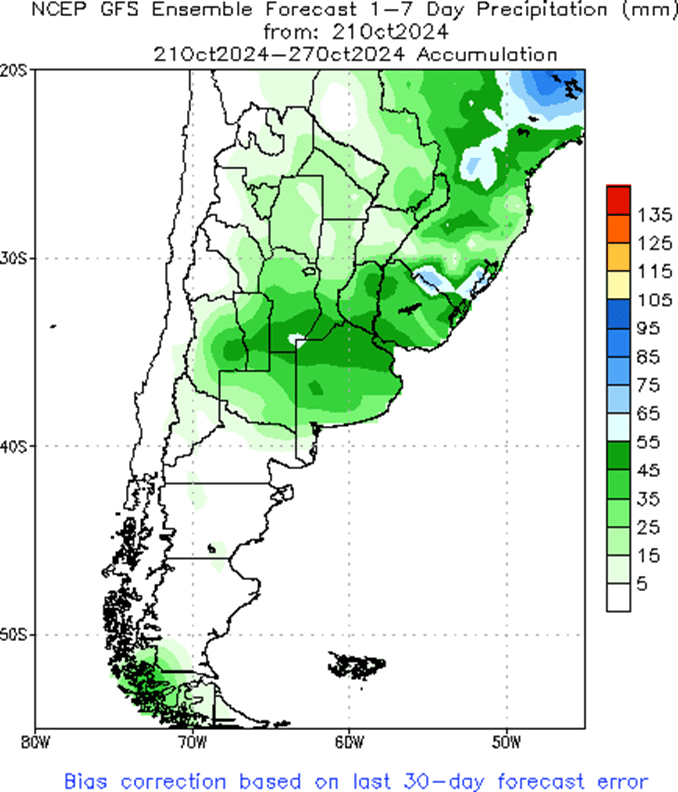

- According to the Buenos Aires Grain Exchange, Argentina’s wheat harvest is now 7.7% complete as of October 31. Additionally, the exchange left their production estimate unchanged at 18.6 mmt, which would exceed last year’s 15.1 mmt wheat crop.

- In a report from the European Commission, the estimate for total EU grain production in 24/25 has been reduced from 260.9 mmt to 255.6 mmt. Corn and soft wheat production saw the largest declines, with the latter dropping from 114.6 mmt to 112.6 mmt. Durum wheat production, however, remains unchanged at 7.2 mmt.

- In June, Turkey implemented a four-month halt on wheat imports. Last month, millers were advised they could import only 15 tons for every 85 tons purchased from the Turkish grain board. However, according to a report by the USDA FAS attaché, Turkey’s import restrictions are likely to continue through year-end, as they work to reduce an overabundance of domestic wheat.

Chicago Wheat Action Plan Summary

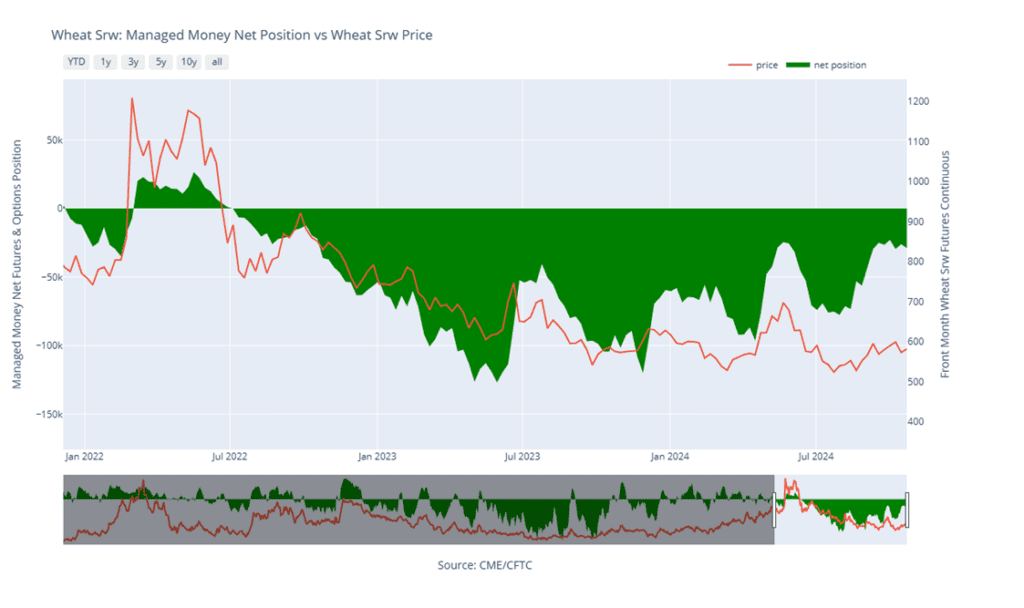

Since reaching its recent high in early October, the Chicago wheat market has gradually moved lower as conditions in the Southern Hemisphere improved. While some production concerns in Australia appear to have eased, dryness remains an issue in the US Plains and the Black Sea region. Despite more competitive Russian and Black Sea wheat prices, US export demand remains firm, though these lower prices may still limit US prices. However, any US crop concerns or increased demand could support higher prices. Additionally, the managed funds’ net short position is much smaller than it was in late July, giving them the flexibility to either extend their shorts or go long, which could amplify market movements in either direction in the coming weeks.

- No new action is recommended for 2024 Chicago wheat. Back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Currently, our strategy remains to target 740 – 760 versus Dec ’24 to recommend further sales. While this range may seem far off, based on our research, it represents the potential opportunity that this crop year can present as we move into the planting and winter dormancy windows of the next crop cycle. Considering this potential, we also continue to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. In September, we recommended taking advantage of the rally in wheat to make additional sales on your anticipated 2025 SRW production. While we continue to recommend holding July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, our Plan A strategy continues to target a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales. Should the market show signs of a potentially extended rally, our Plan B strategy is to protect current sales and target the 745 – 775 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

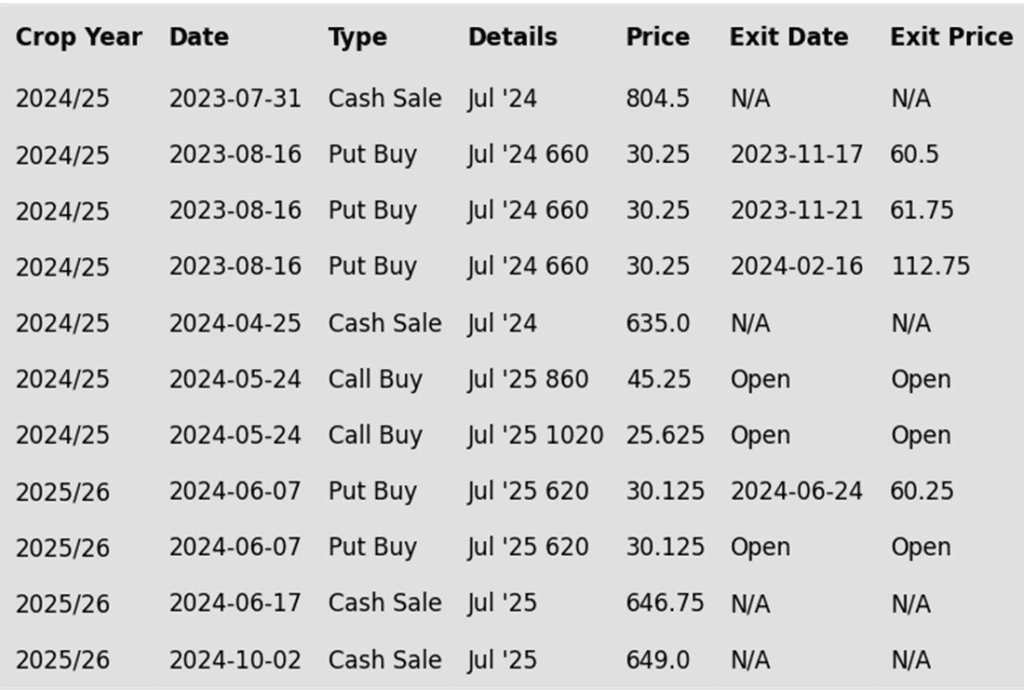

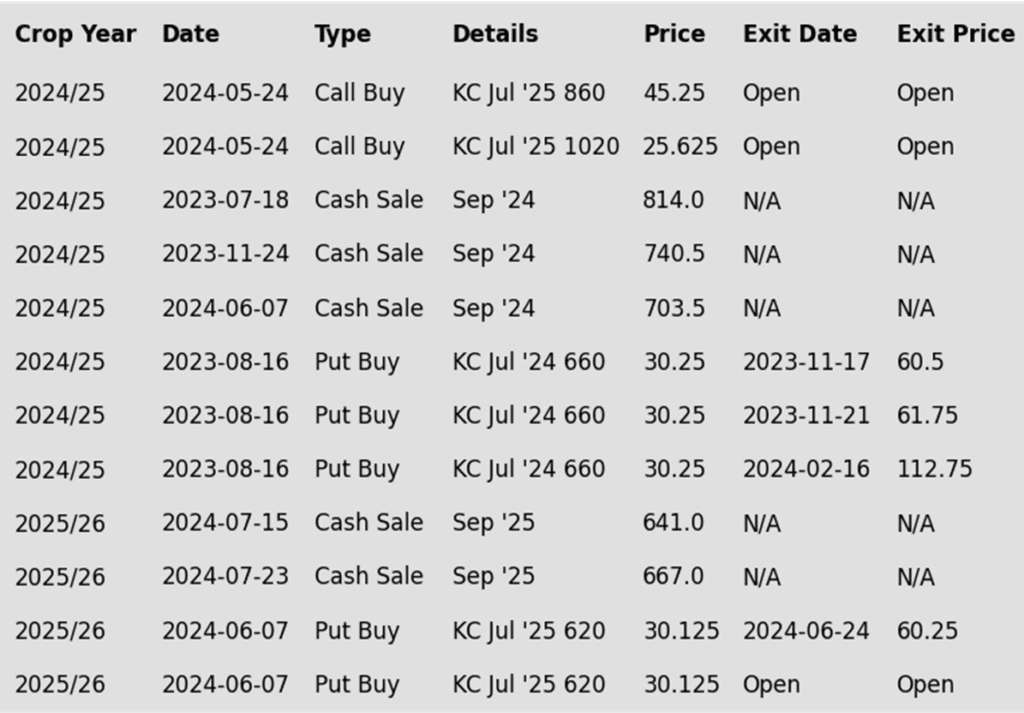

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

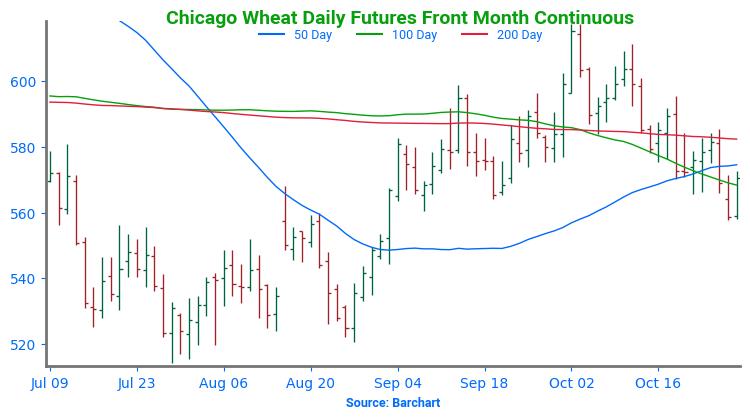

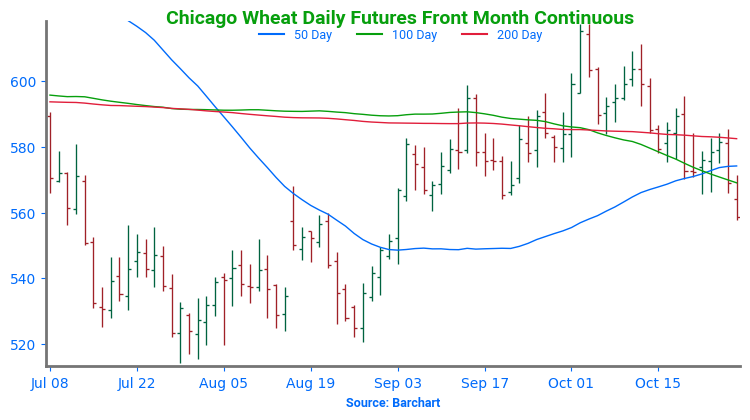

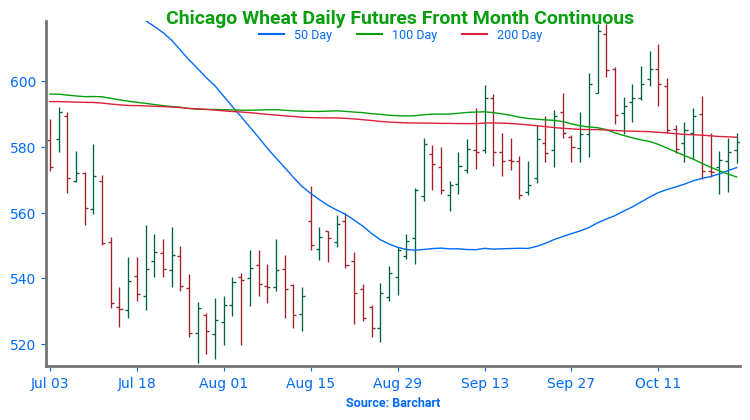

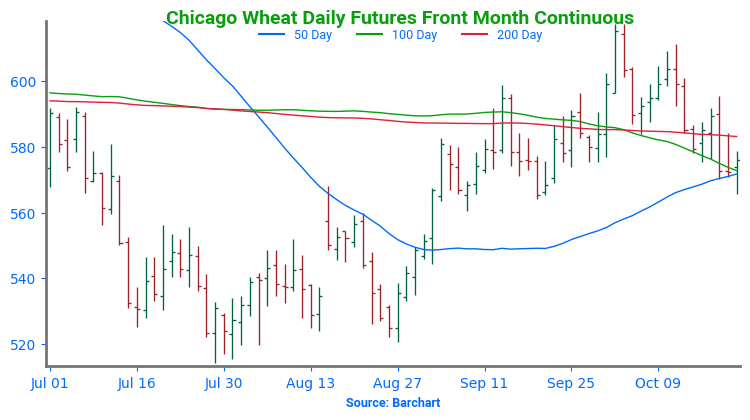

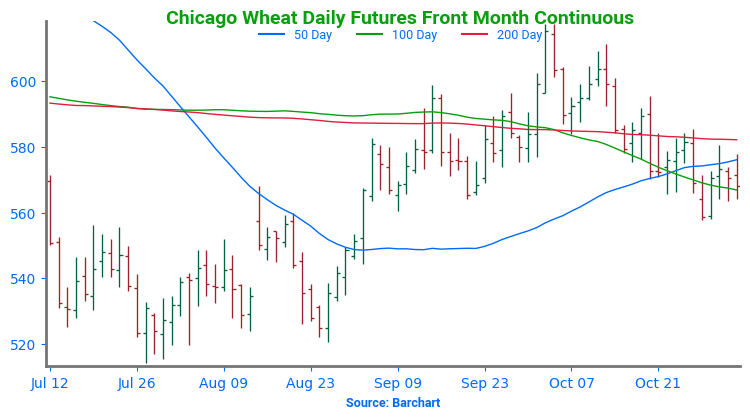

Above: The swift turnaround on October 29 suggests initial support below the market may rest near 558. A close below this level could put the market at risk of trading down toward the 521 – 514 support area, with intermediate support possibly around 544. Overhead, resistance may be found near 595 – 600.

KC Wheat Action Plan Summary

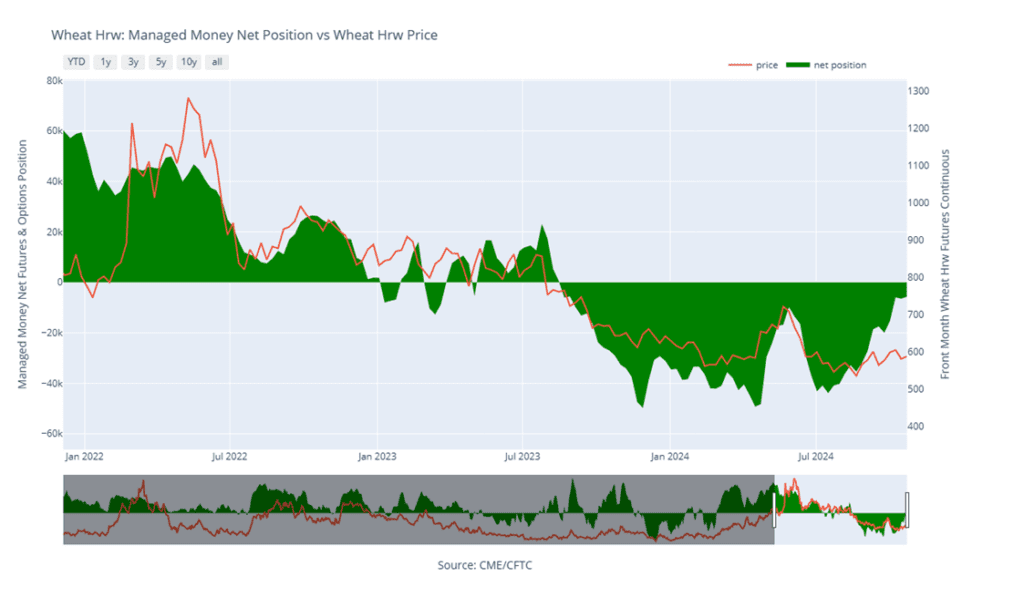

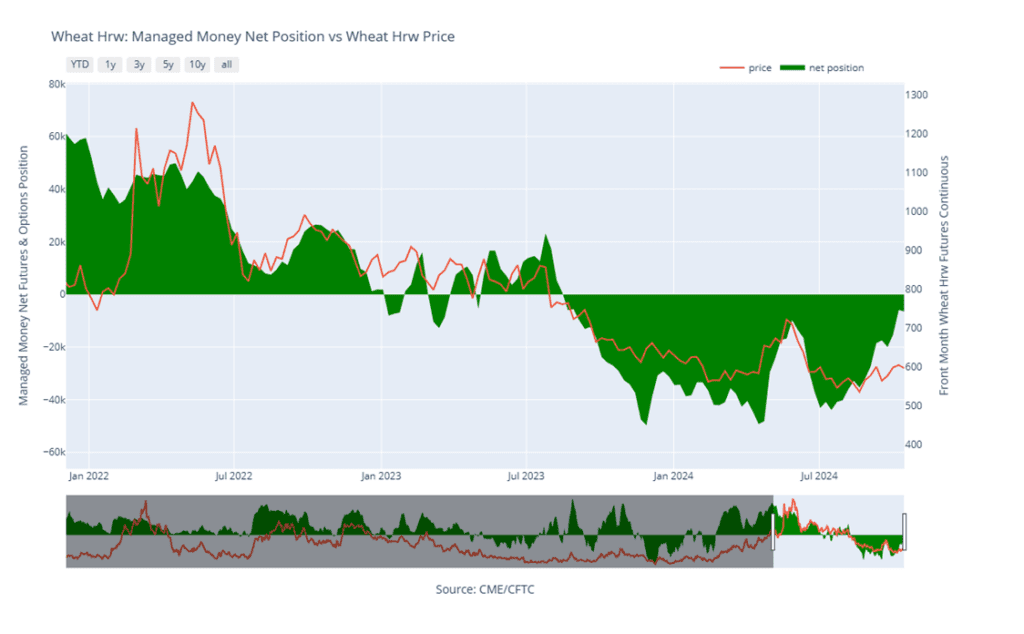

Since peaking in early October, the wheat market has gradually declined, influenced by improved crop conditions in the Southern Hemisphere. Production concerns in Australia have eased somewhat, but dryness remains an issue in the US Plains and the Black Sea region. Although Russian and Black Sea wheat prices are more competitive, US export demand remains steady, though lower global prices could still limit US prices. However, potential issues with the US crop or a rise in demand could push prices higher. Additionally, managed funds’ net positions could now be considered mostly neutral, allowing flexibility to either extend short positions or go long, which could amplify market movements in either direction in the weeks ahead.

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. While we still recommend holding the remaining half of the previously suggested July ’25 620 puts for downside protection on unsold bushels, considering the early October rally, we advised selling another portion of your anticipated 2025 HRW wheat production. Looking ahead, our current Plan A strategy is to target the 640 – 665 range for additional sales, while our Plan B strategies involve targeting the upper 400 range to exit half of the remaining 620 puts if the market turns toward new lows and targeting the 745–770 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

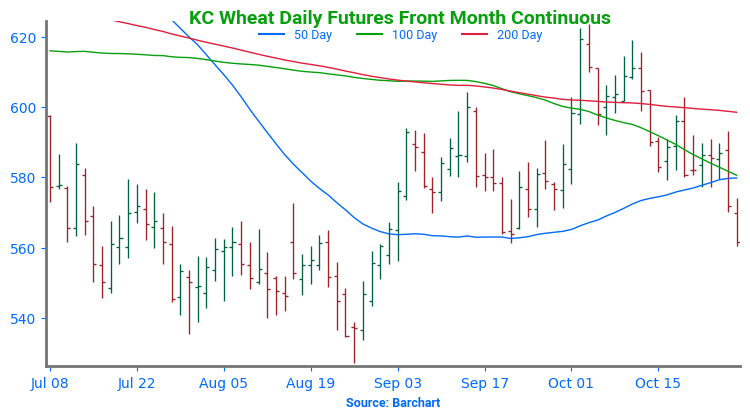

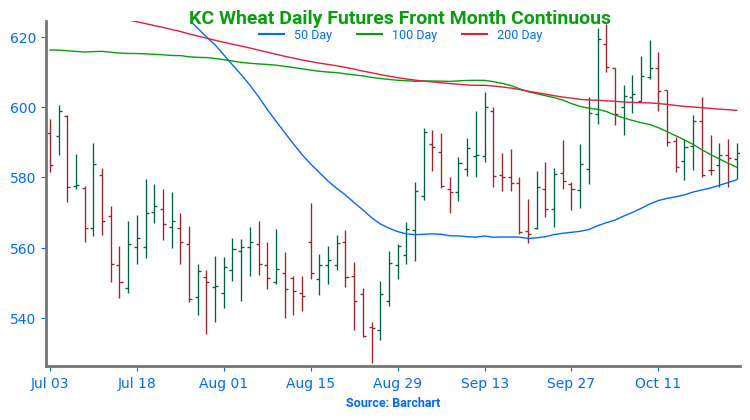

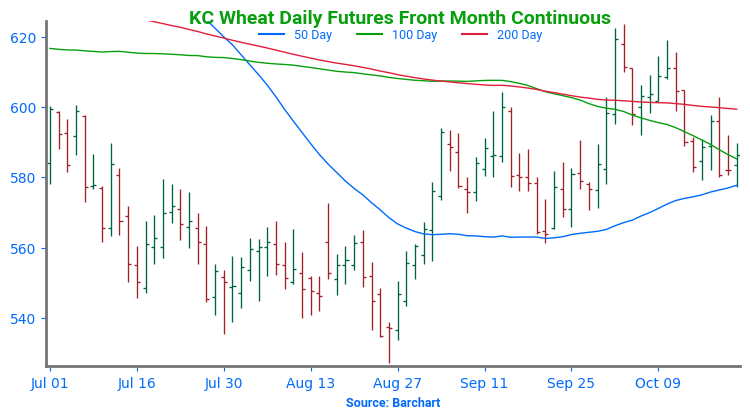

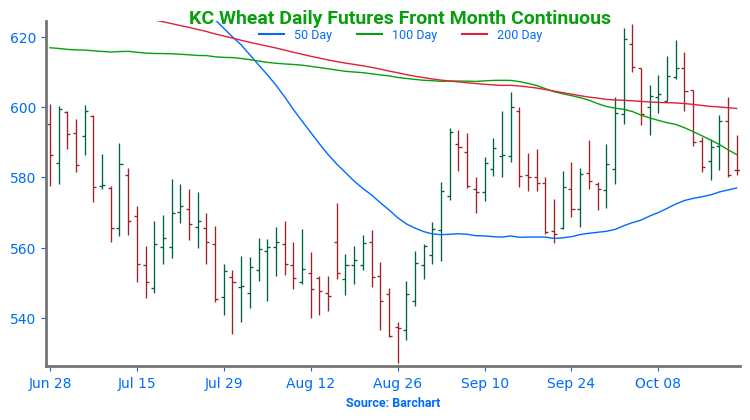

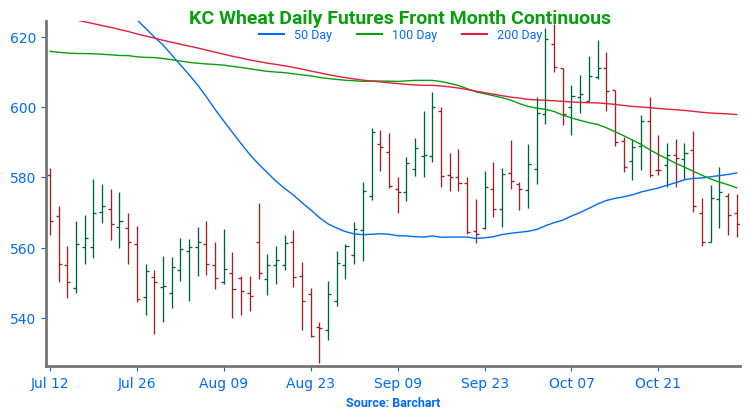

Above: The market’s reversal from the 561 support level could put it on track to test the 593 – 603 resistance area around the 200-day moving average. A break below 561 could find minor support near 555, with major support around the August low of 527.

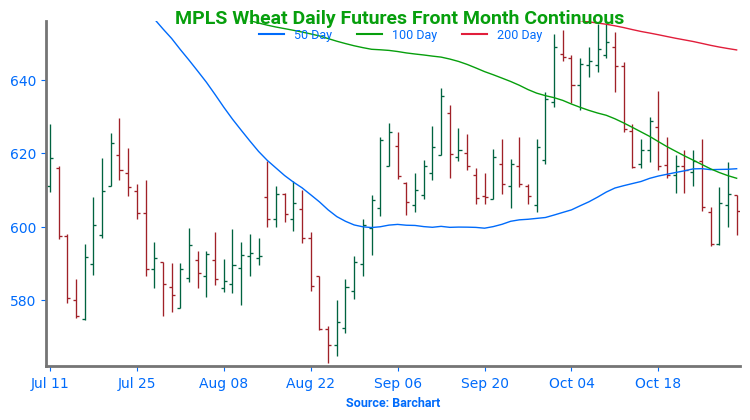

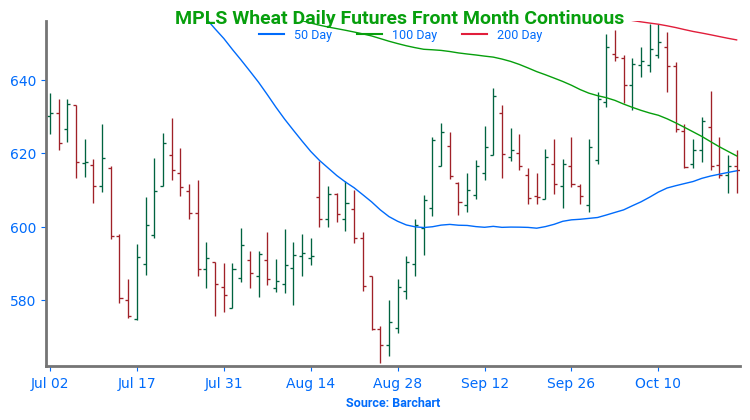

Mpls Wheat Action Plan Summary

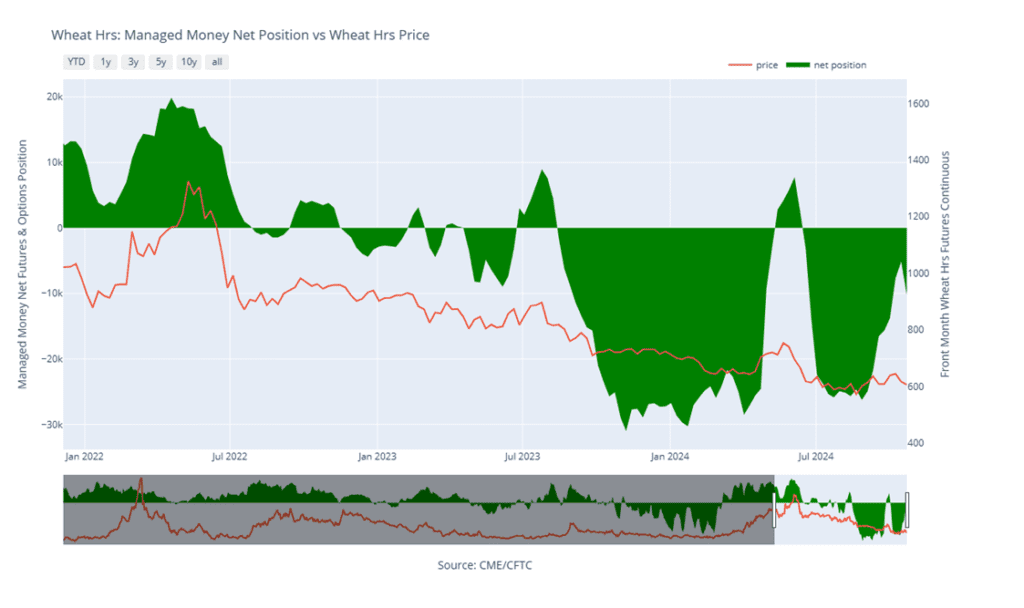

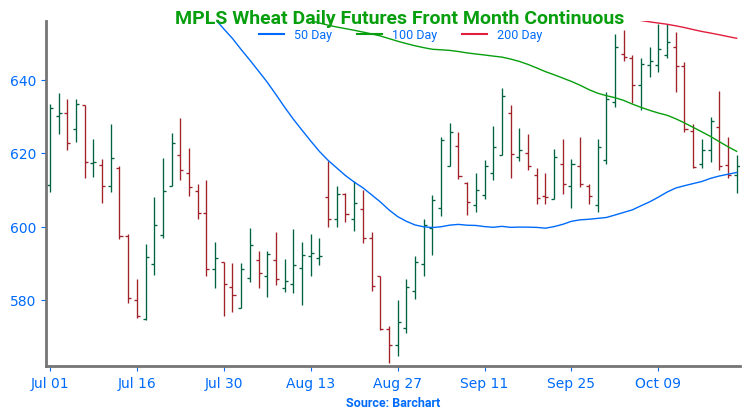

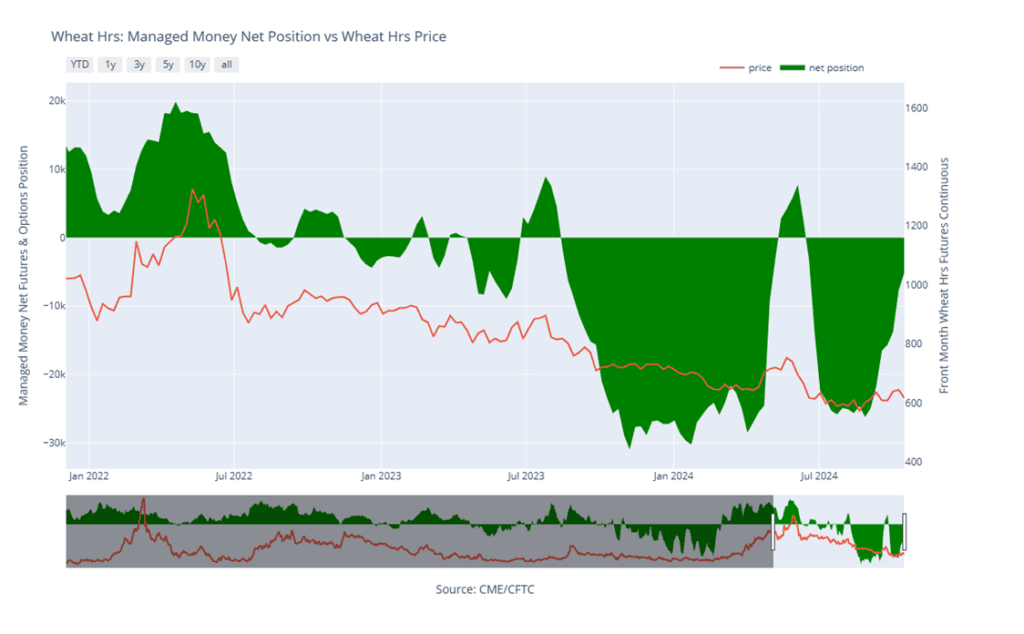

After peaking near the 200-day moving average in early October, Minneapolis wheat has been retreating toward its August low. At the same time, managed funds have started rebuilding some of their net short positions. While more competitive Russian export prices continue to limit upward potential, concerns about global wheat supplies persist, potentially increasing opportunities for US exports and driving prices back higher.

- No new action is recommended for 2024 Minneapolis wheat. Now that we are at the time of year when seasonal price trends tend to become more friendly, we are targeting the 630 – 655 range to recommend making additional sales. Additionally, given the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not target any specific areas for additional sales until November or December, we continue to hold the remaining July ’25 KC 620 puts that were recommended in June for downside protection. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts. Additionally, should the wheat market show signs of an extended rally, we are targeting the 745–770 area in July ’25 KC to buy July ’25 KC upside calls in case the market rallies significantly beyond that point.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

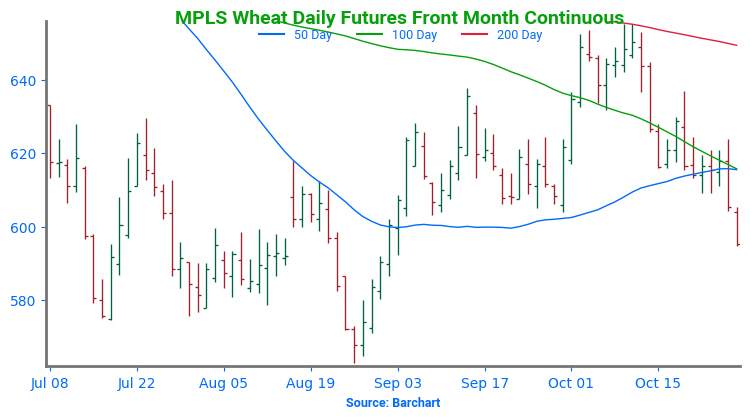

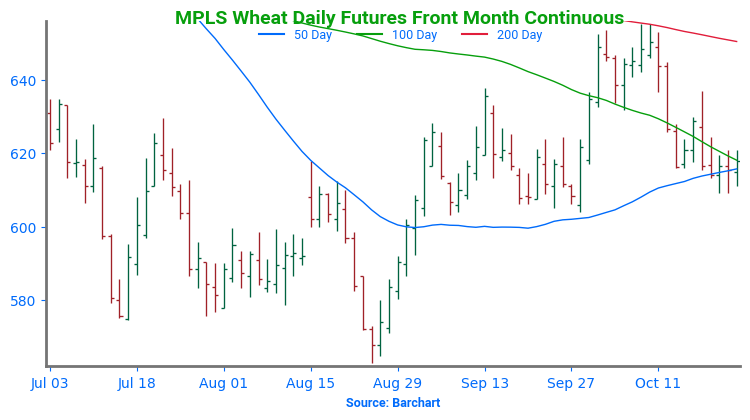

Above: The bullish reversal off the 598 – 595 support level suggests prices could rally back and test the 615 – 624 area. To the downside, a close below 595 could set the market up to break further and test the August low of 563.

Other Charts / Weather

US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.