11-29 End of Day: Corn Higher, Soybeans Quiet and Wheat Lower into the Weekend

HAPPY THANKSGIVING FROM ALL OF US AT TOTAL FARM MARKETING!

THURSDAY, NOVEMBER 28: The CME and Total Farm Marketing offices are closed.

FRIDAY, NOVEMBER 29: The CME closes at noon, and Total Farm Marketing closes at 1:00 p.m. (CST).

All prices as of 2:00 pm Central Time

Grain Market Highlights

- Corn futures ended November on a high note finding buying interest to end the week and the month.

- Despite marketing-year high export sales for soybeans last week, futures prices were relatively muted to end the holiday-shortened trading week.

- Wheat futures stumbled into the weekend closing at or near their lows for the week.

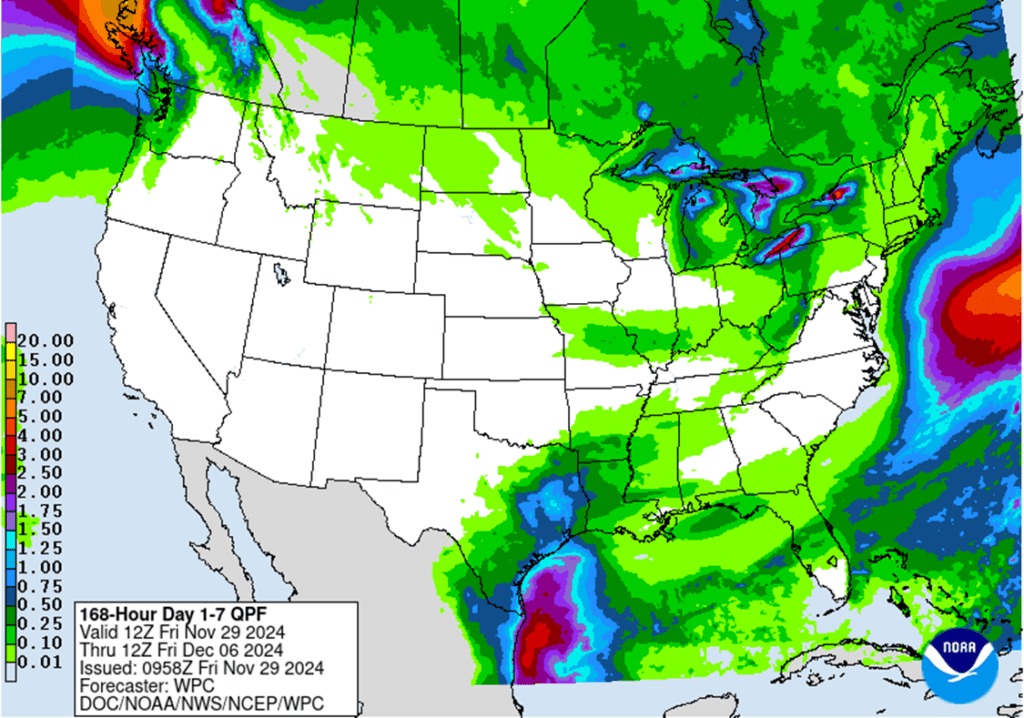

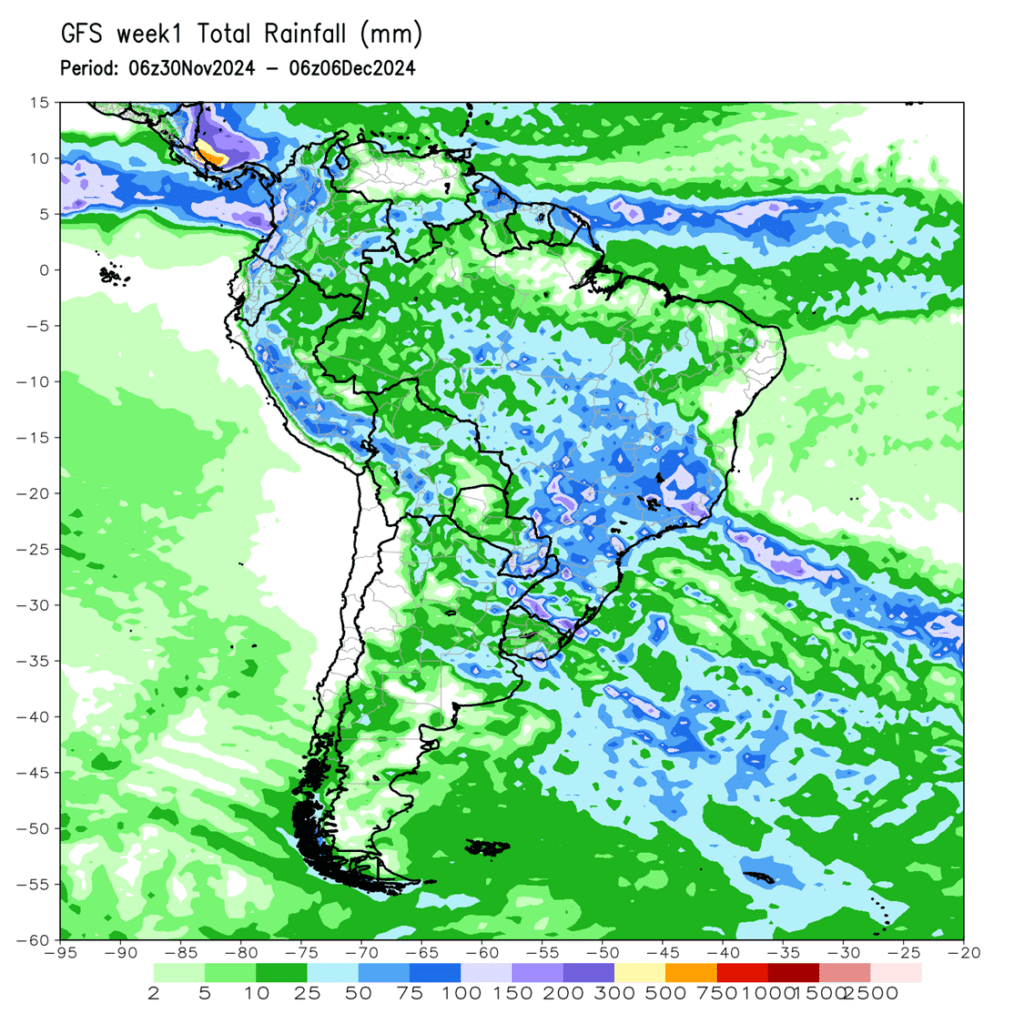

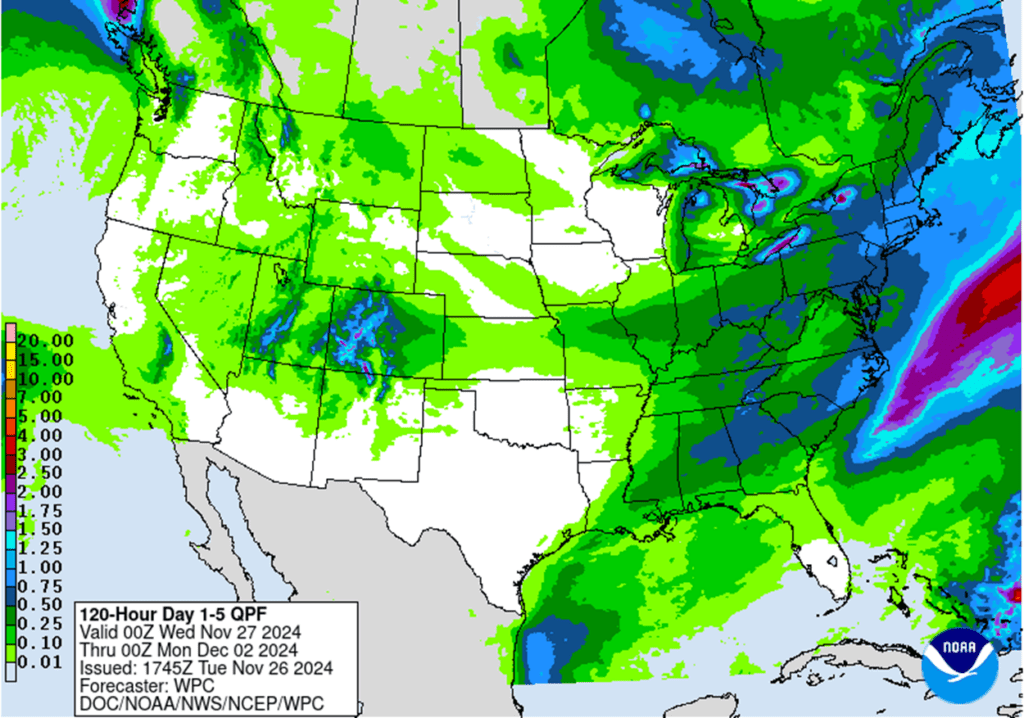

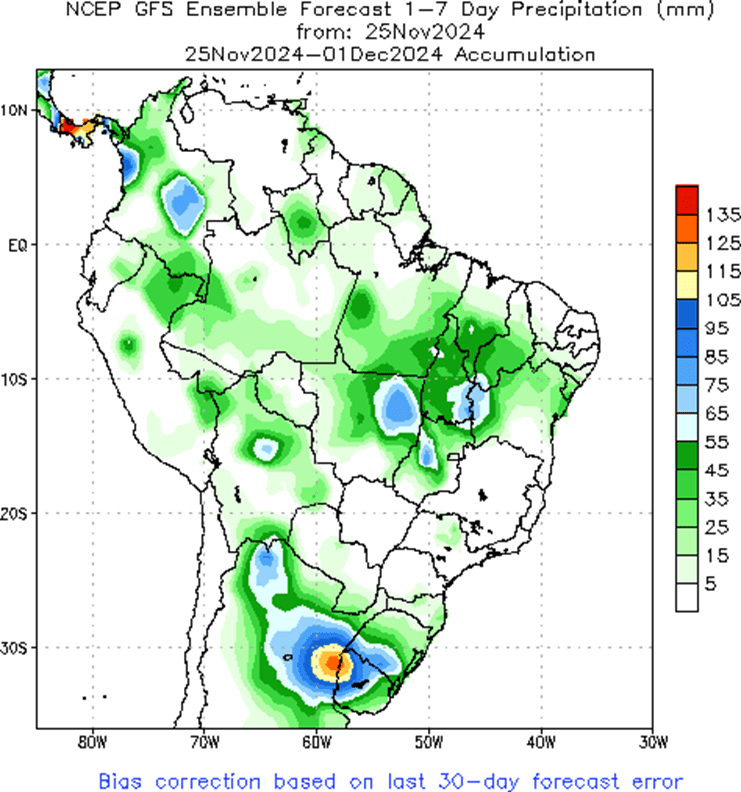

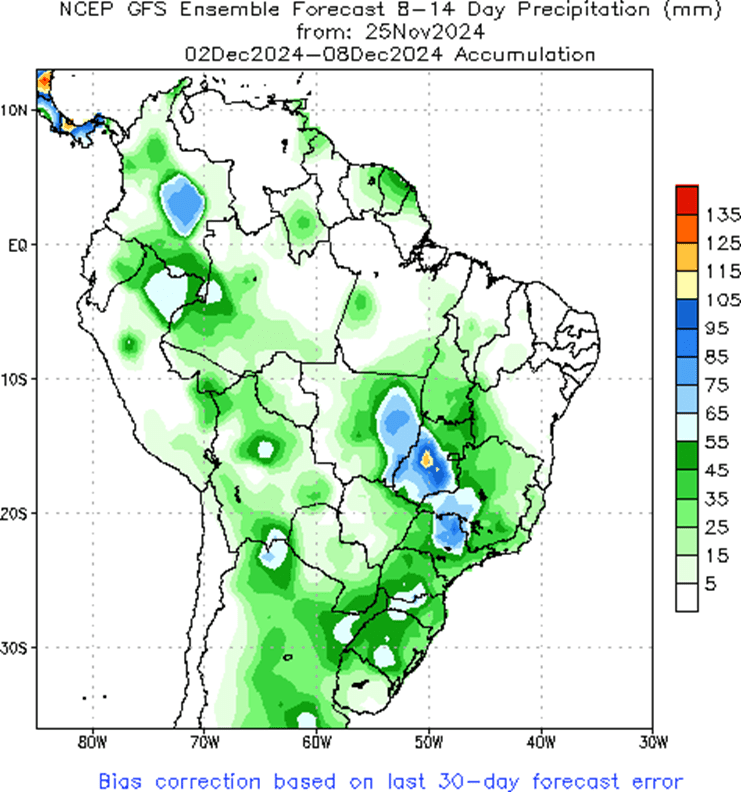

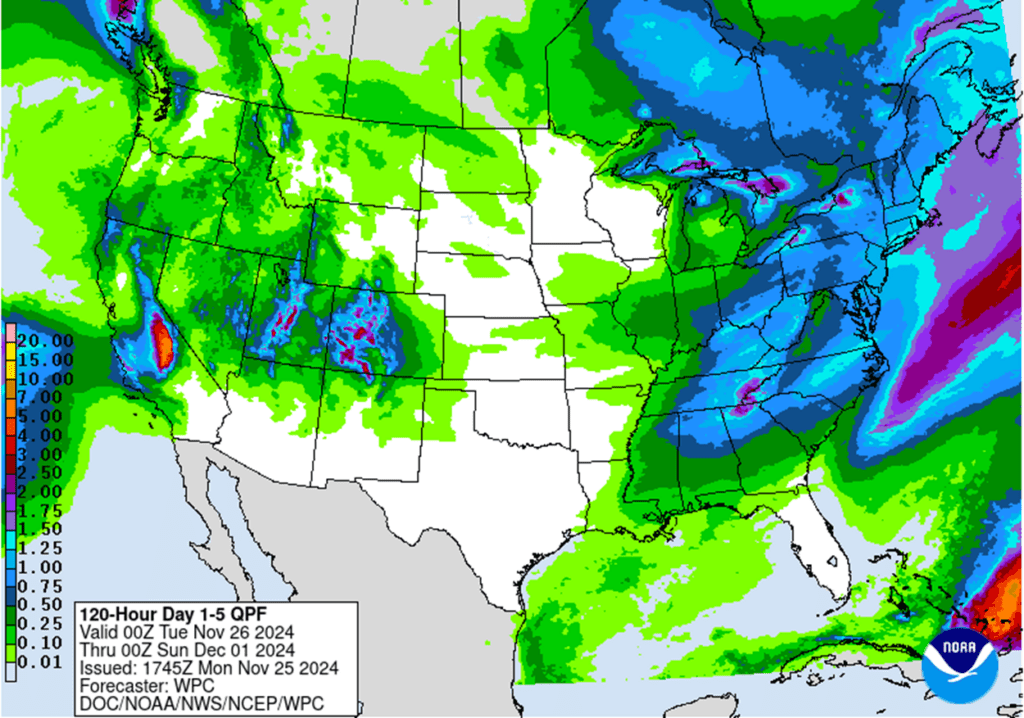

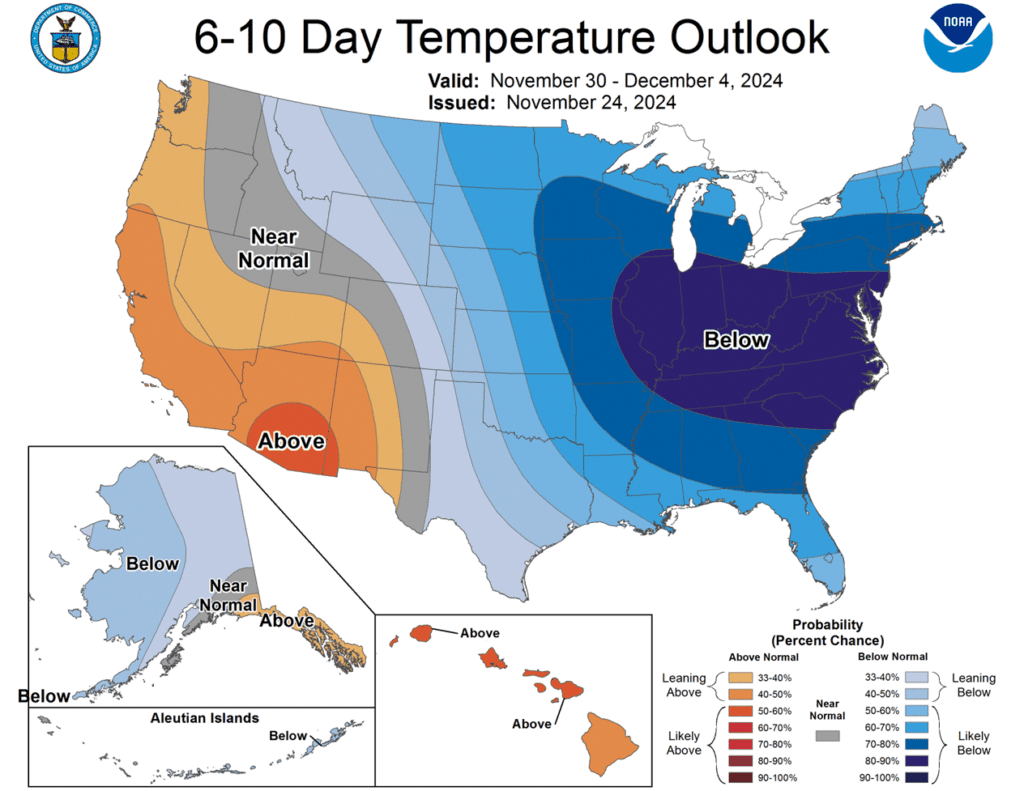

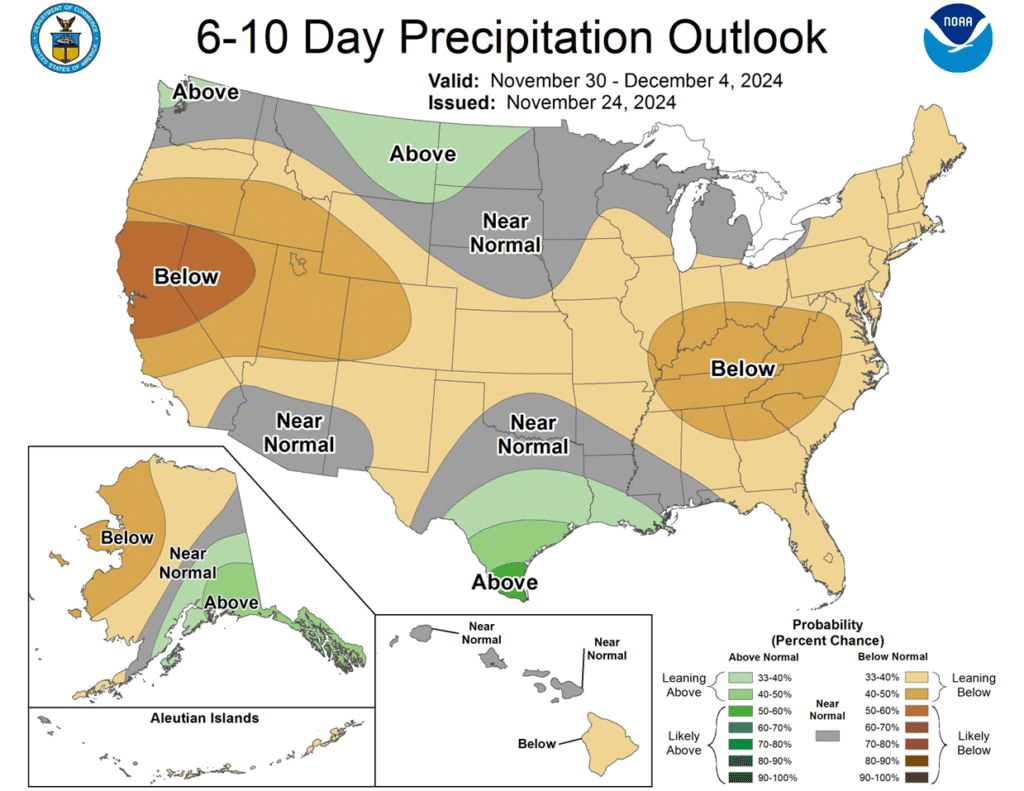

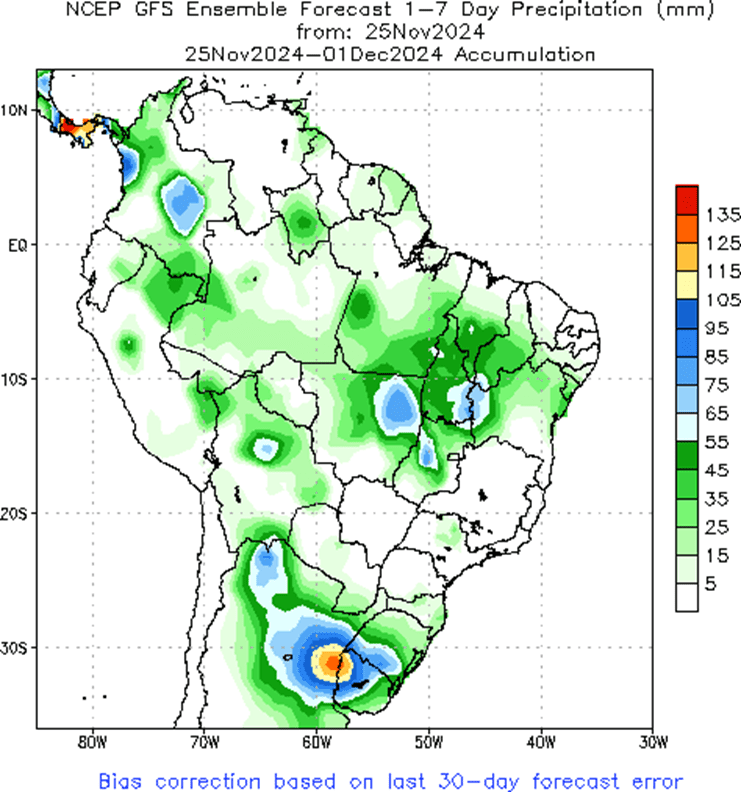

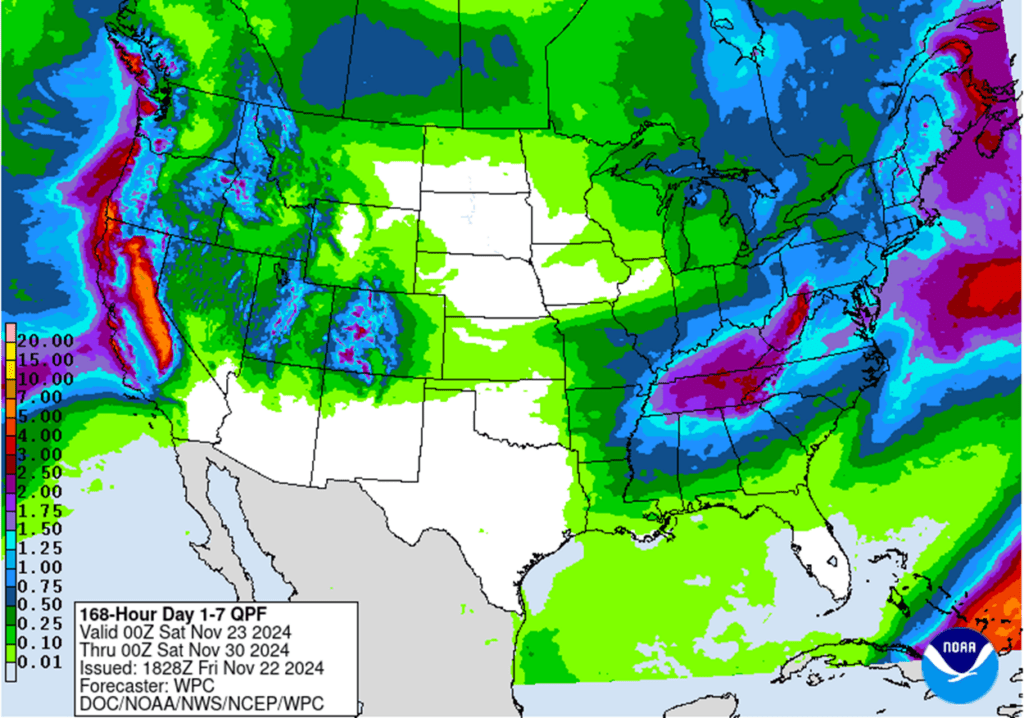

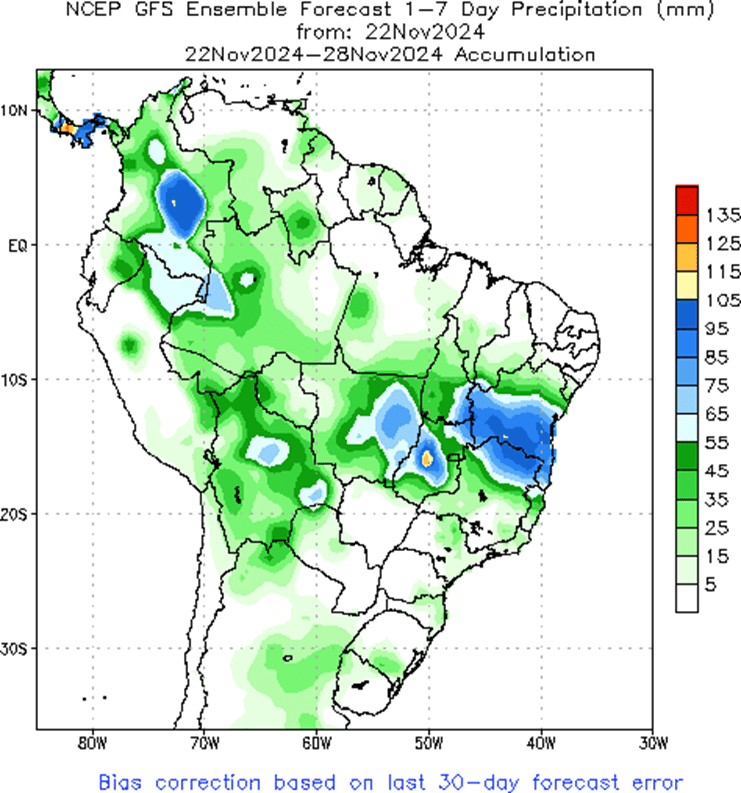

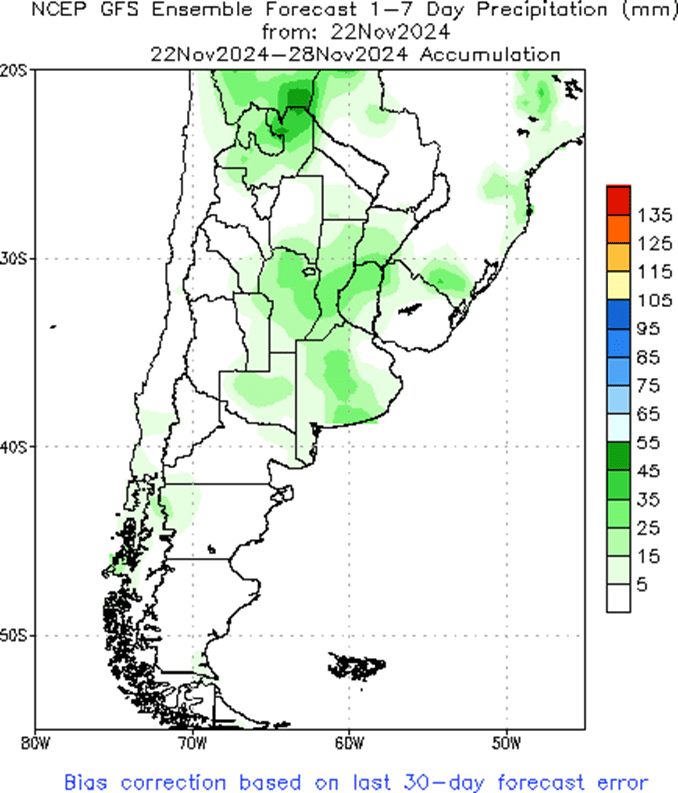

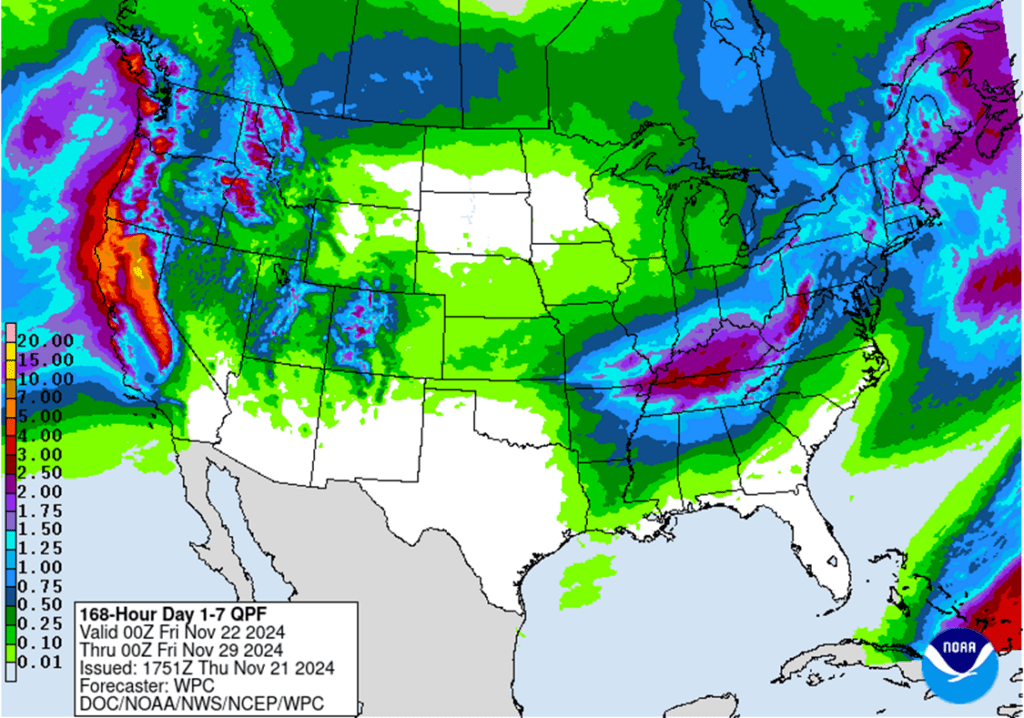

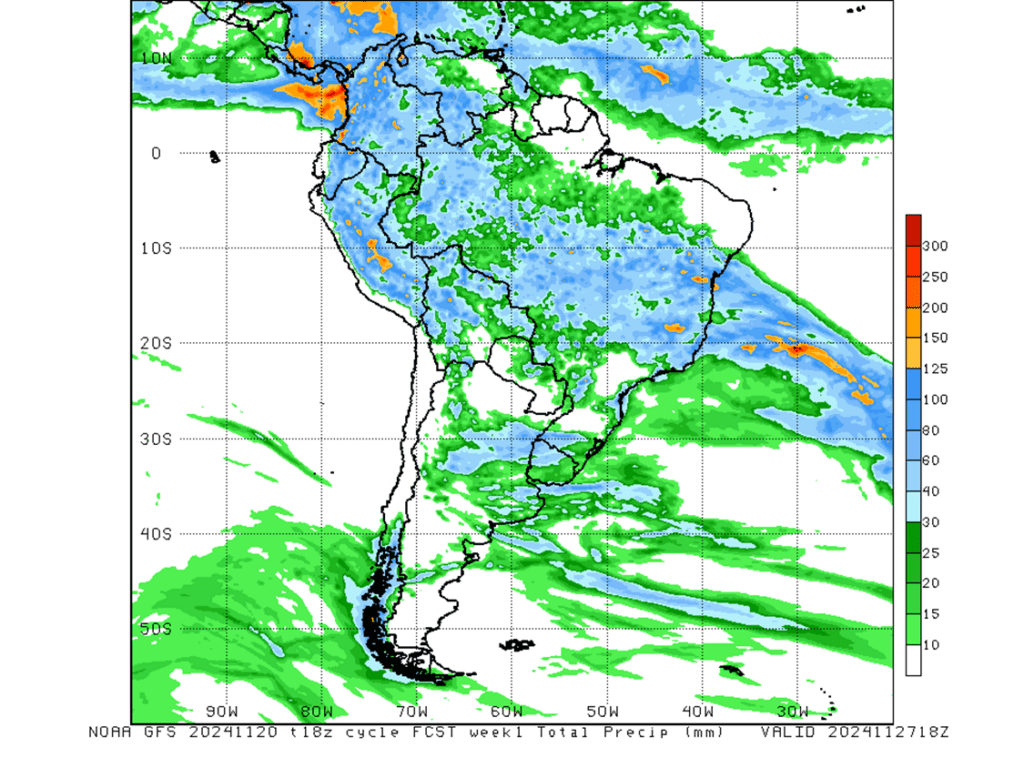

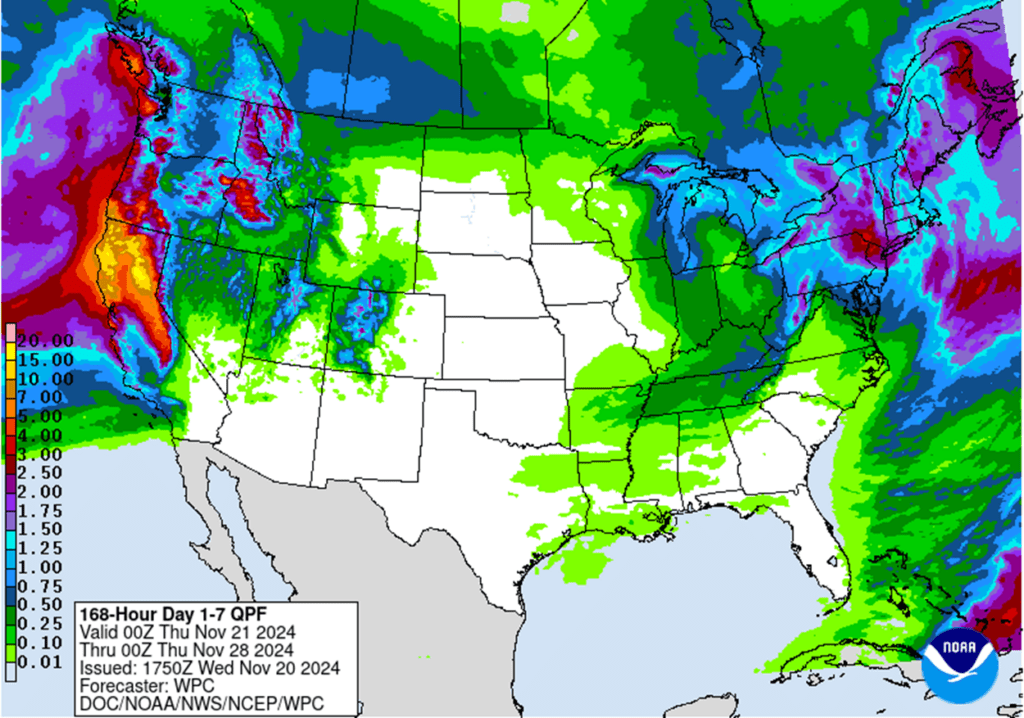

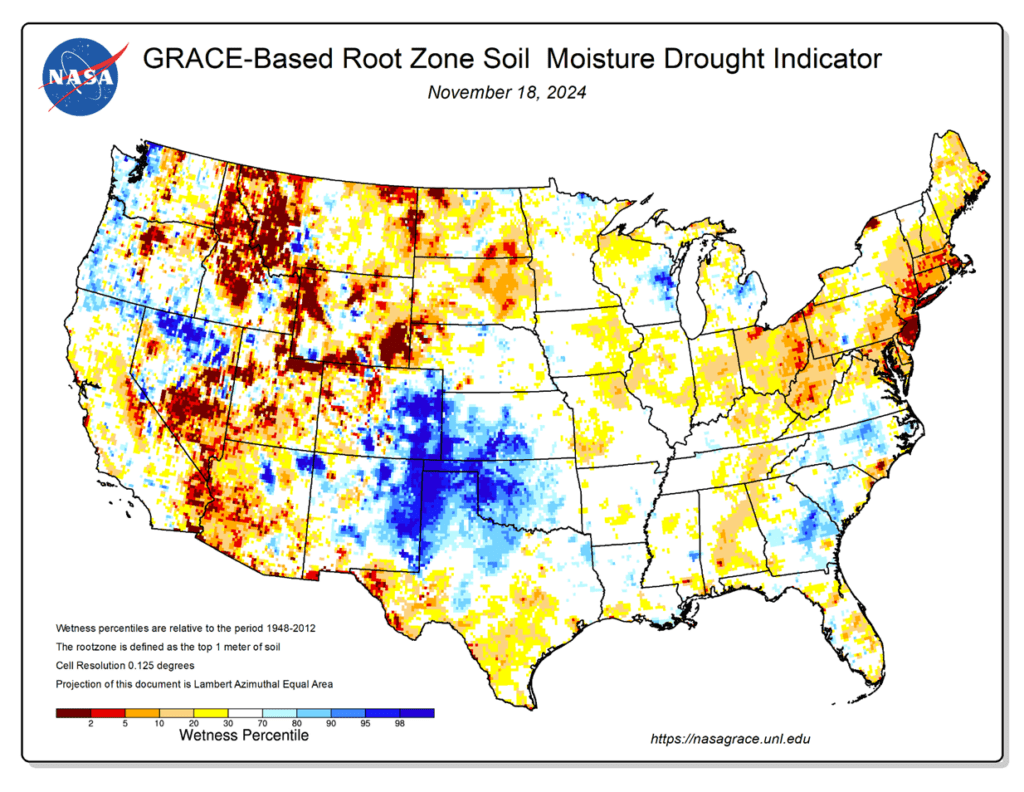

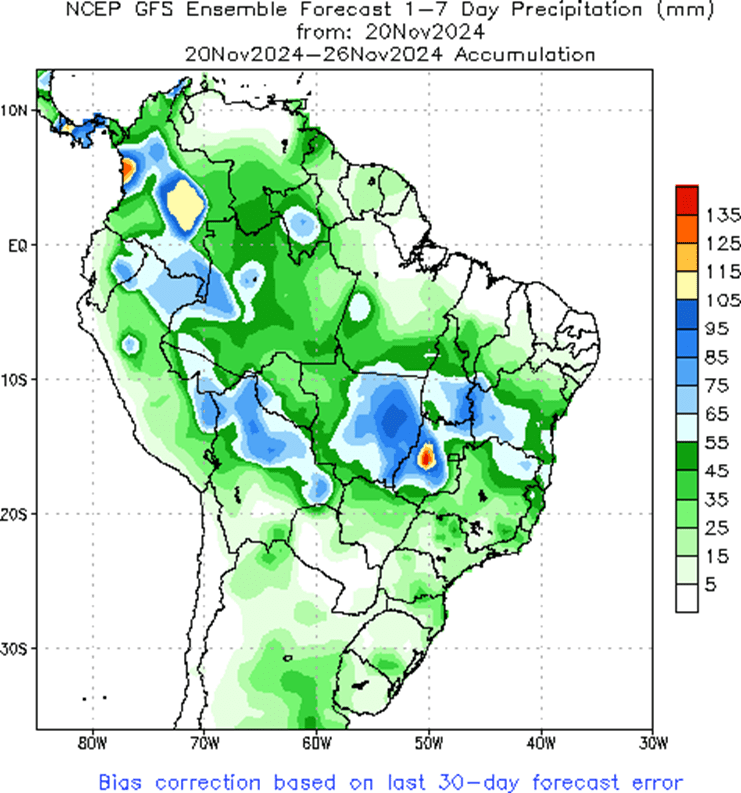

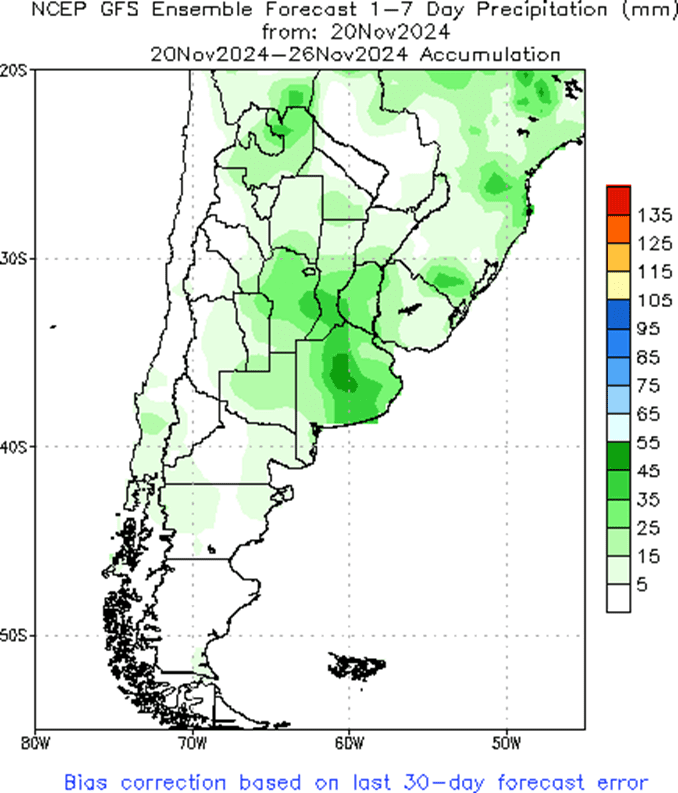

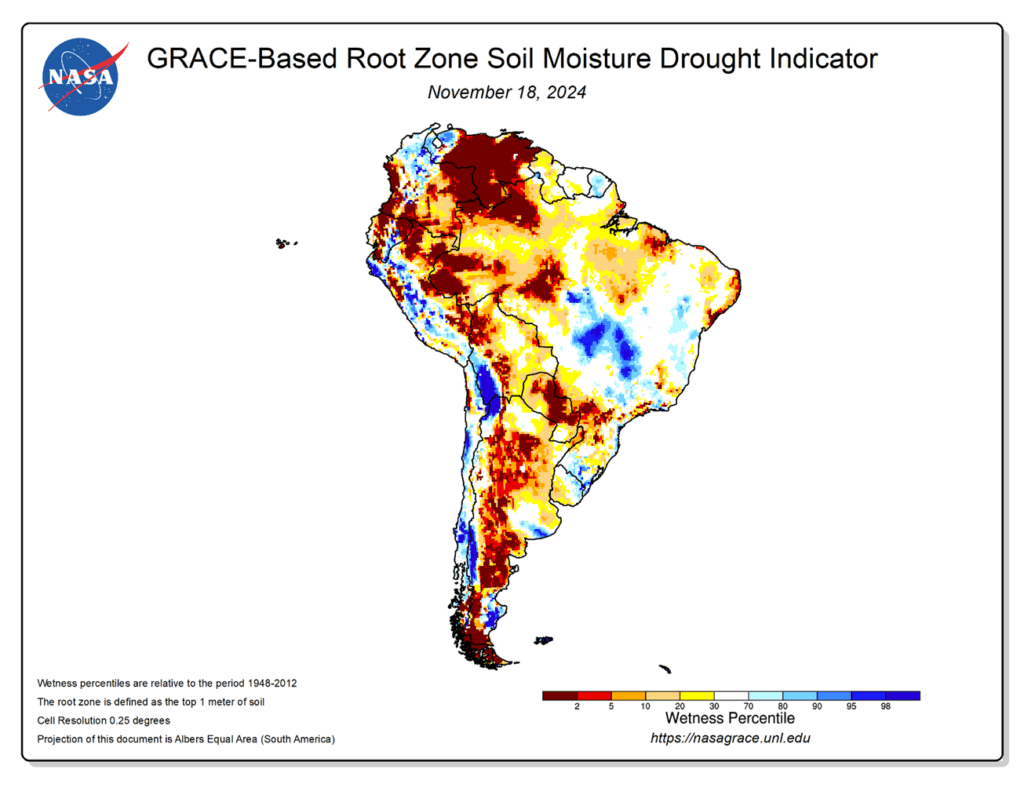

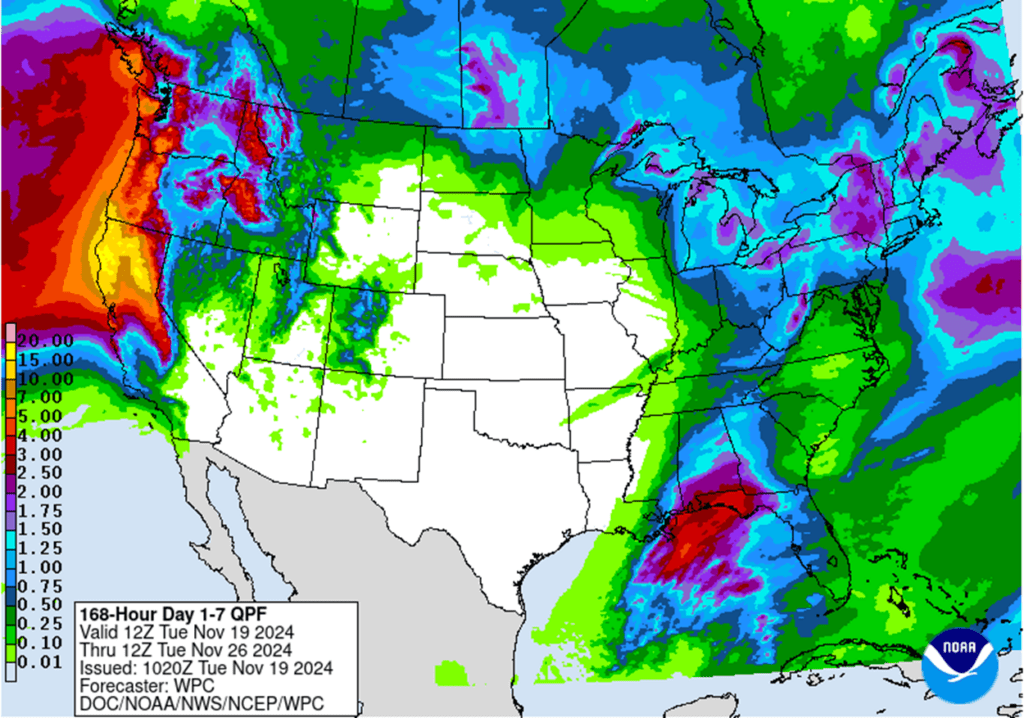

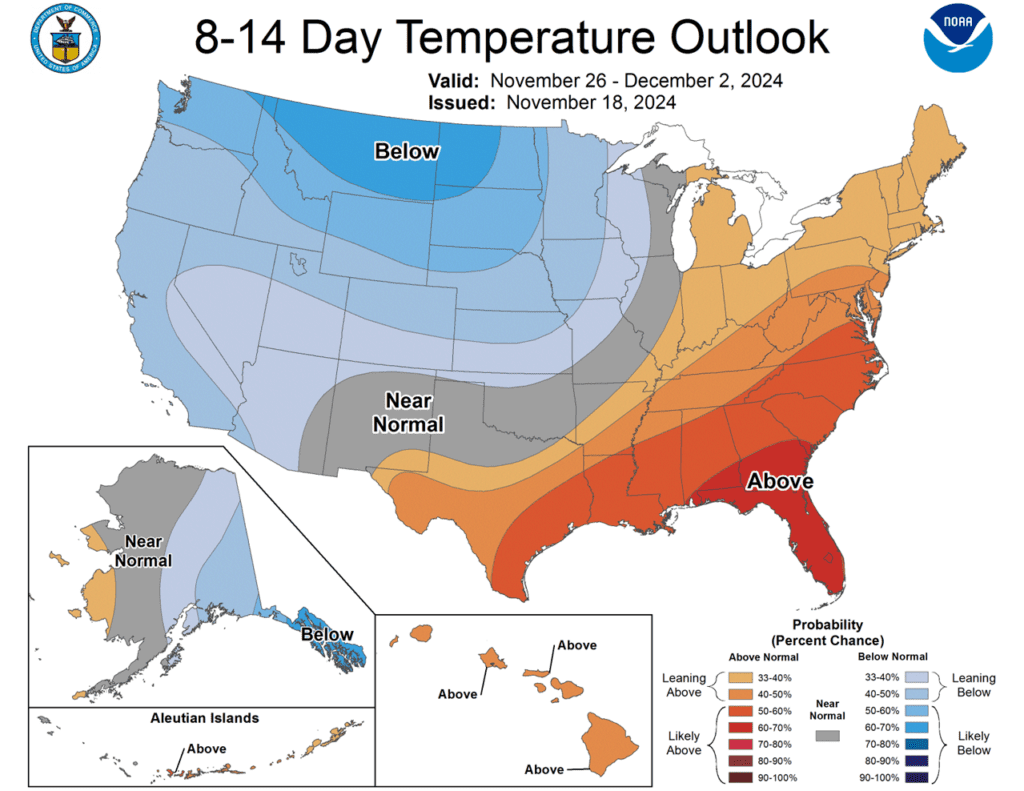

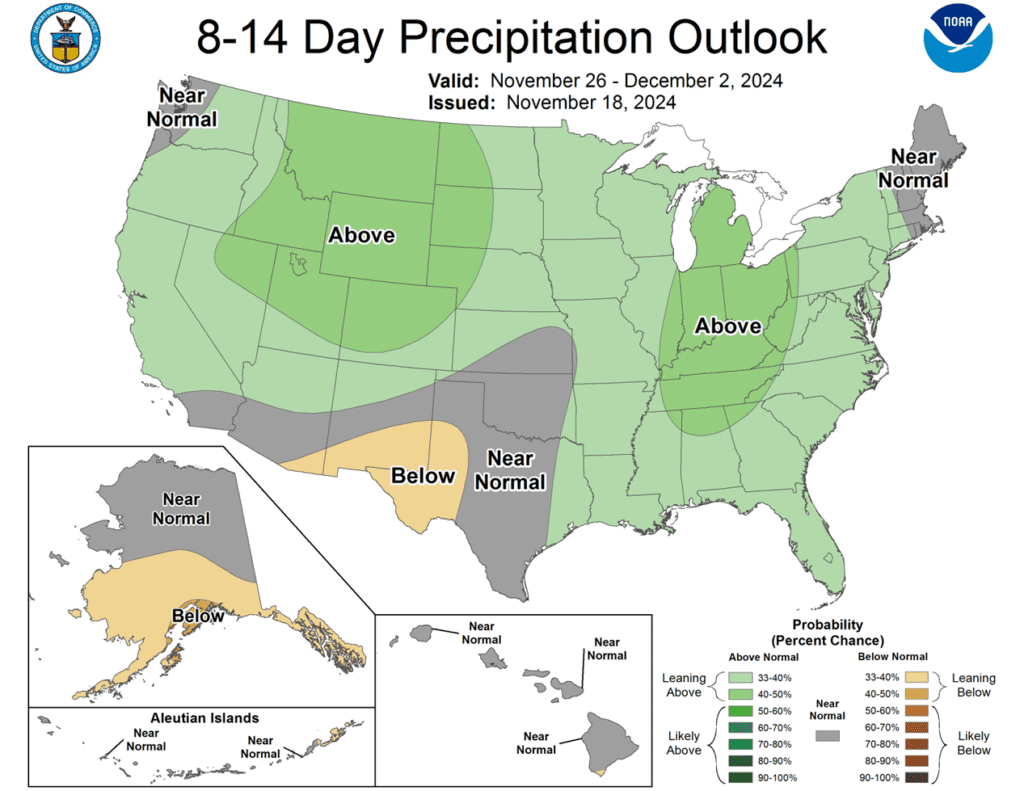

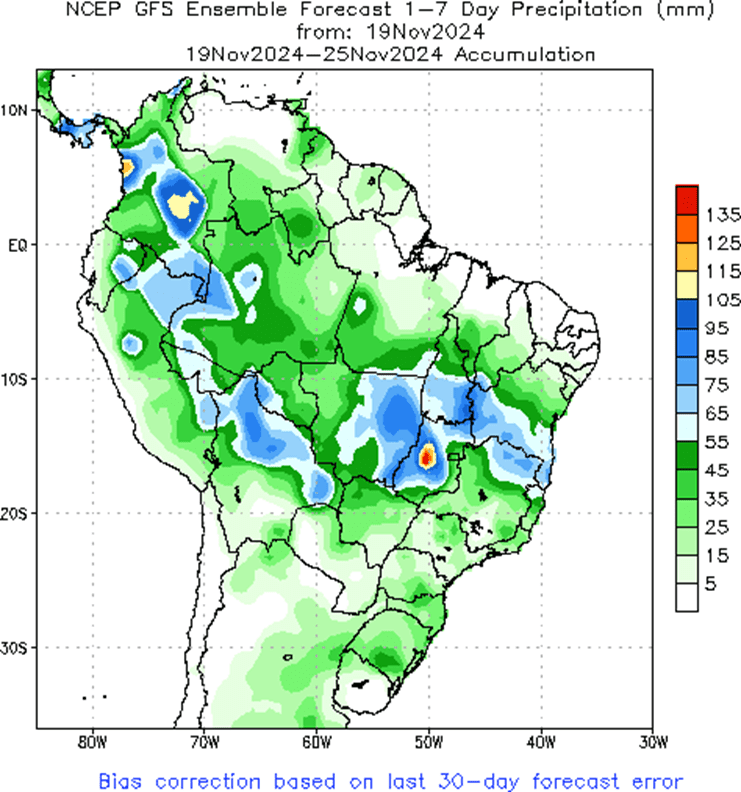

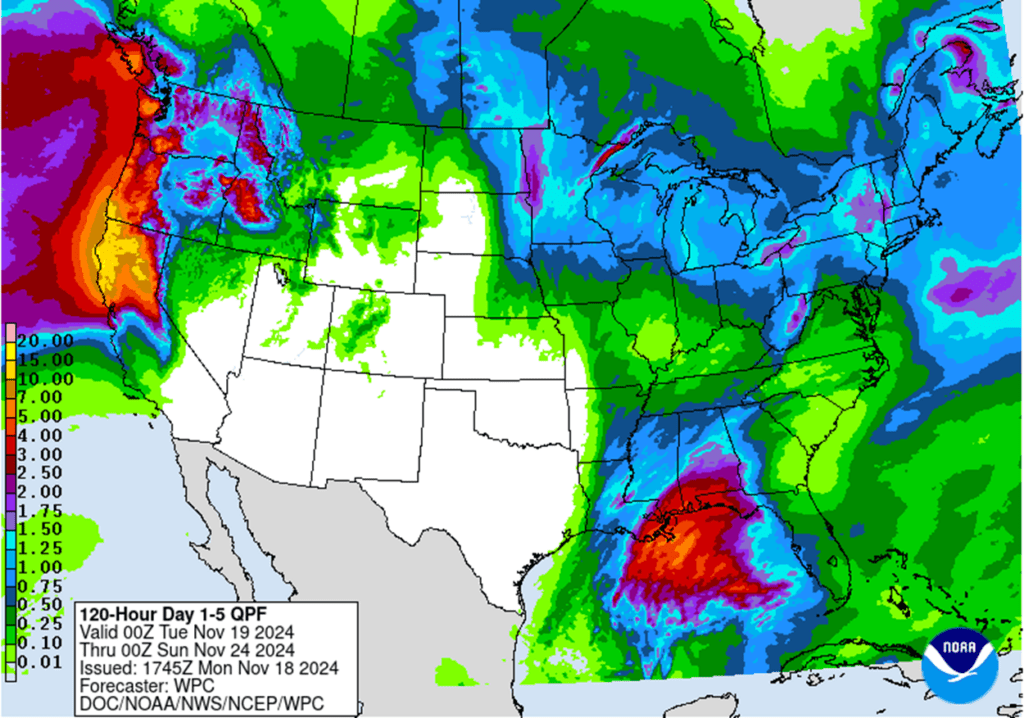

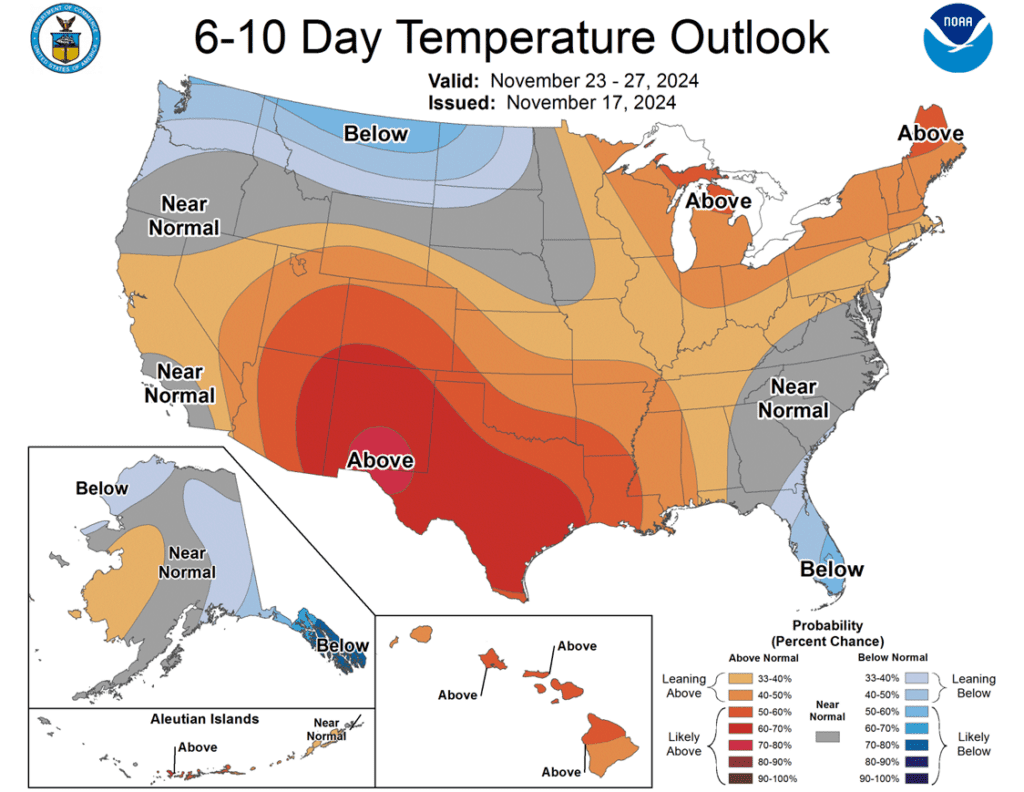

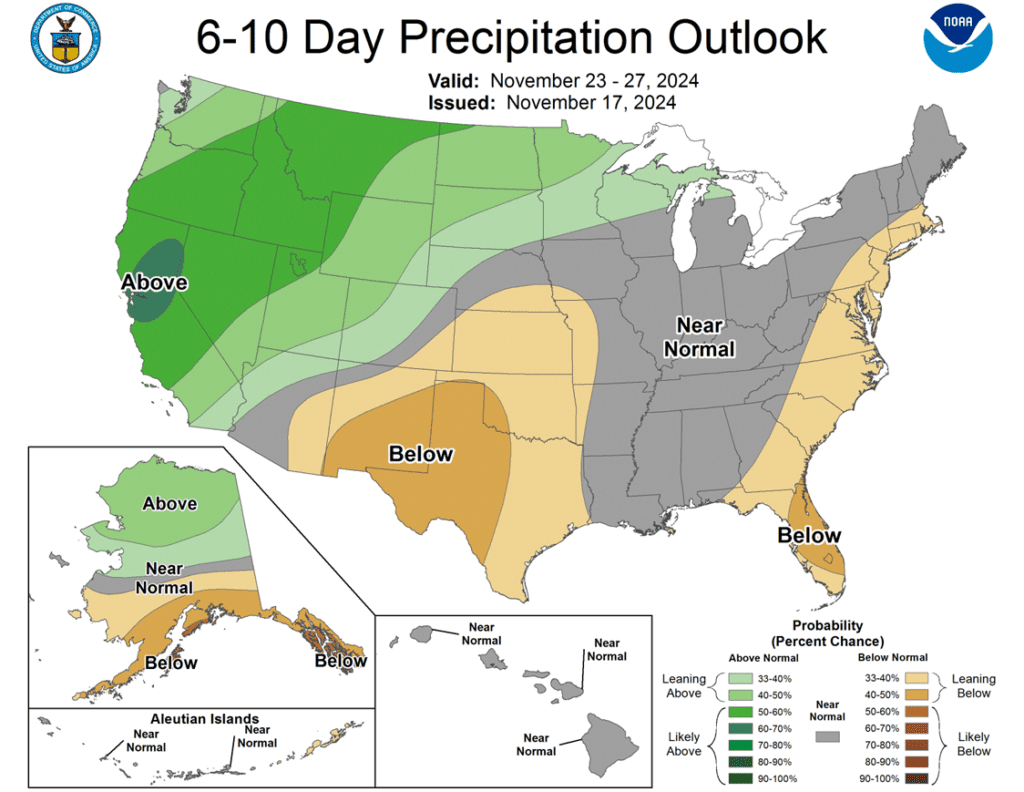

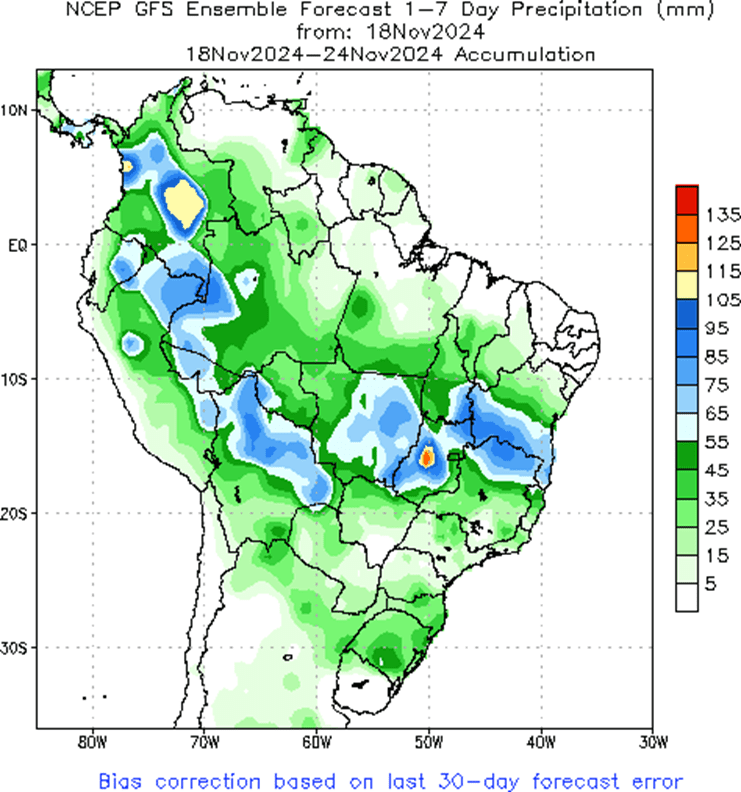

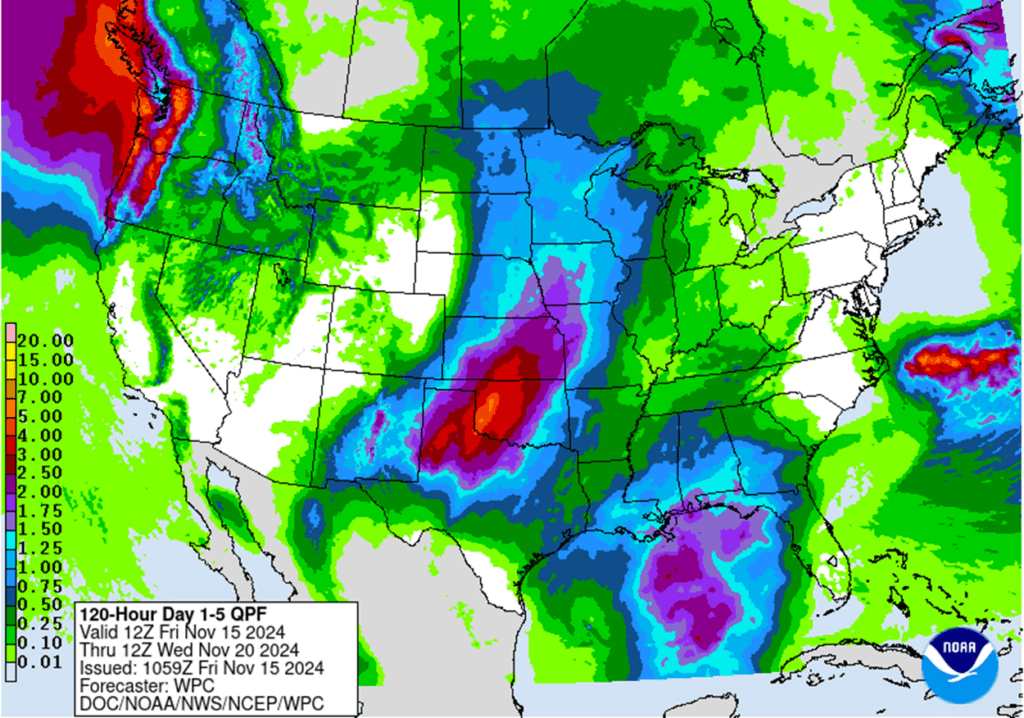

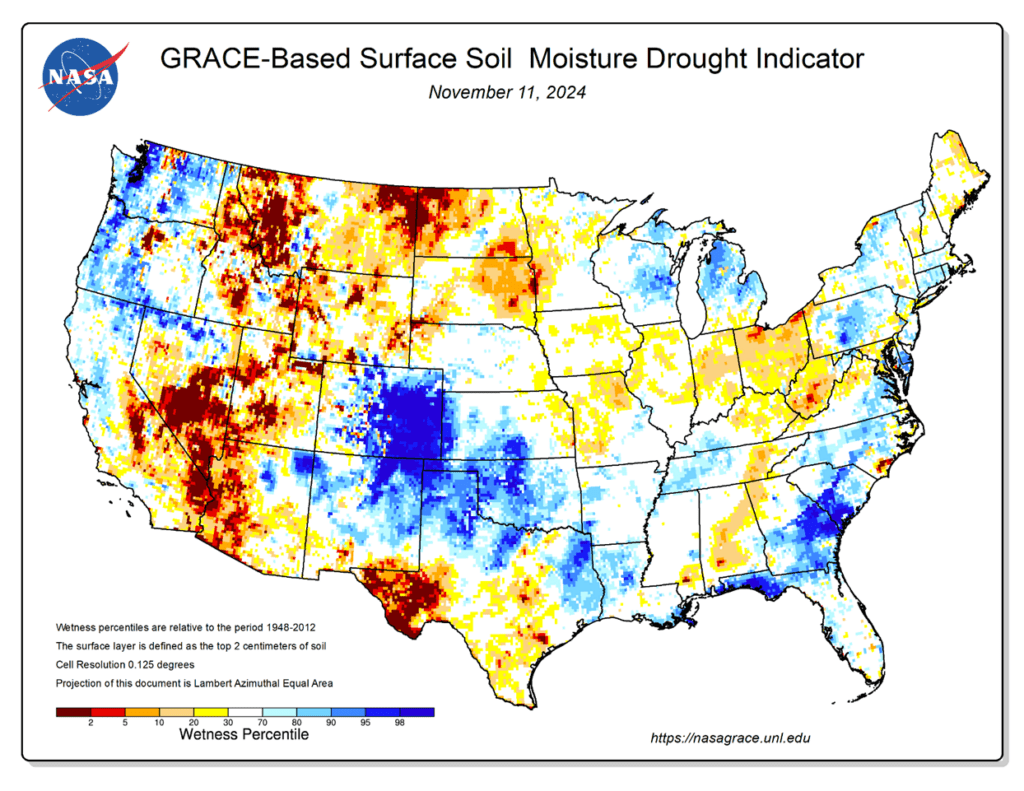

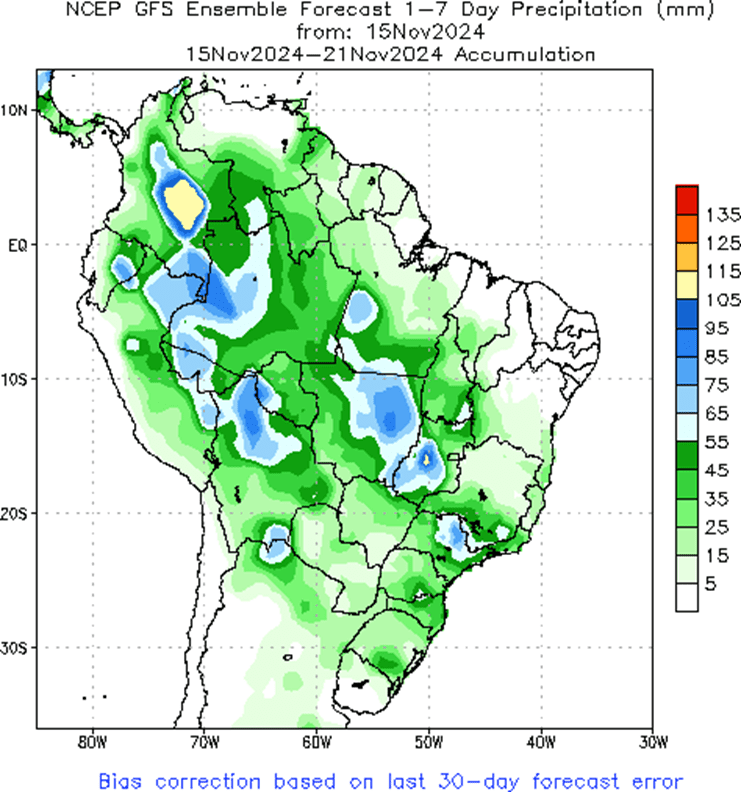

- To see the updated US Seven Day Moisture Outlook and the Week 1 South American Precipitation Forecast, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- Considering seasonal weakness, no new sales recommendations will be issued until opportunities improve, which could be as soon as late fall or as late as early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

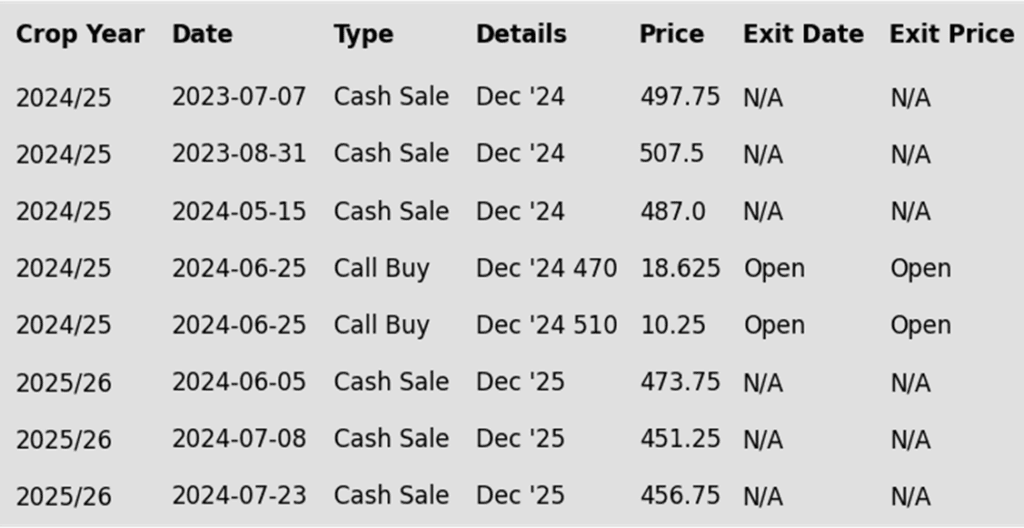

To date, Grain Market Insider has issued the following corn recommendations:

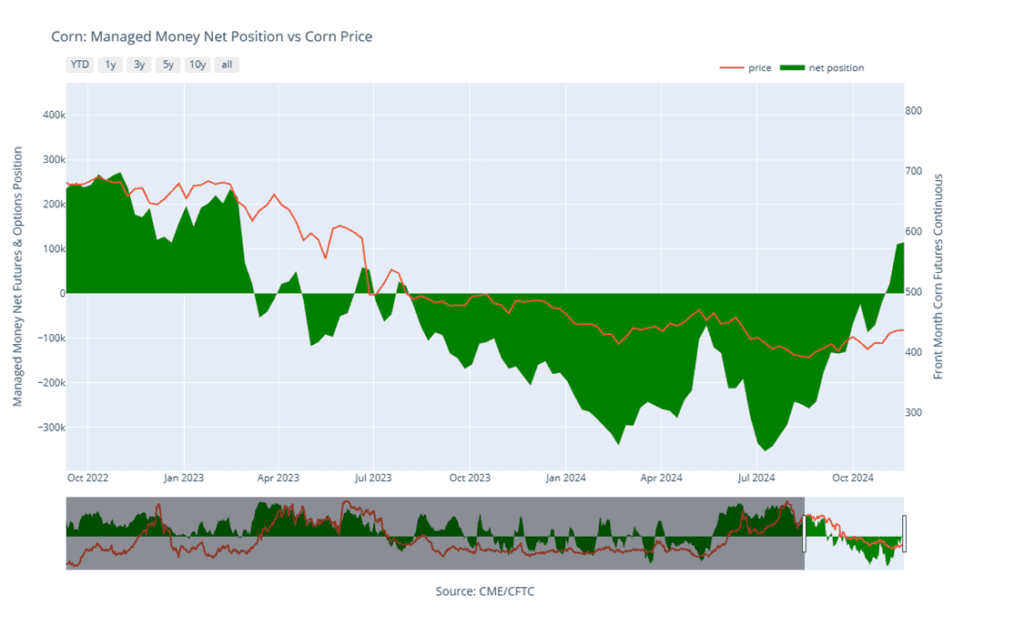

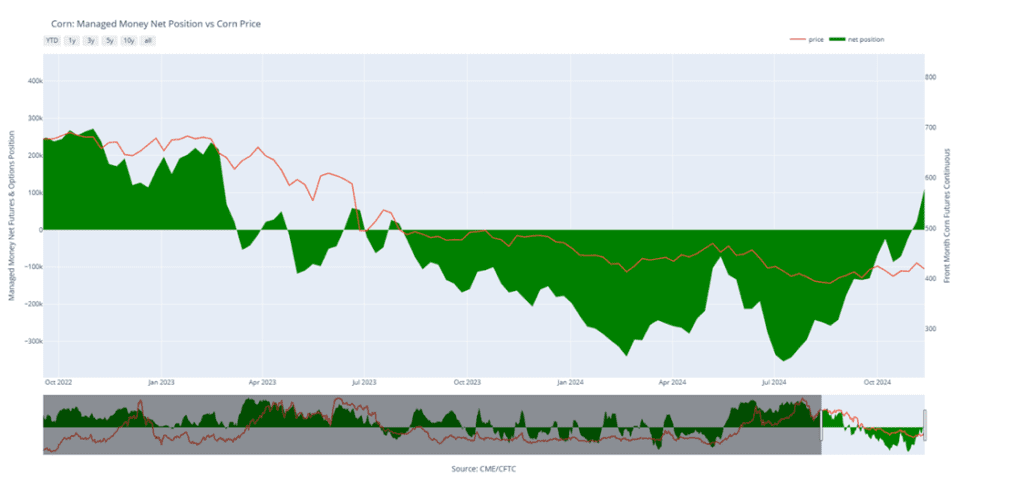

- Corn futures saw buying strength to end November as the December and March contracts saw moderate gains. For the week, December corn finished the week approximately 2 cents lower, but nearly 9 cents off the lows for the week.

- Today was First Notice Day for December corn, and prices bounced as long positions have been removed from the market. Open interest in the December contract has gone from 270,000+ contracts on Monday to less than 20,000 contracts on the open today. With Dec in delivery, traders will shift focus to the most actively traded March contract.

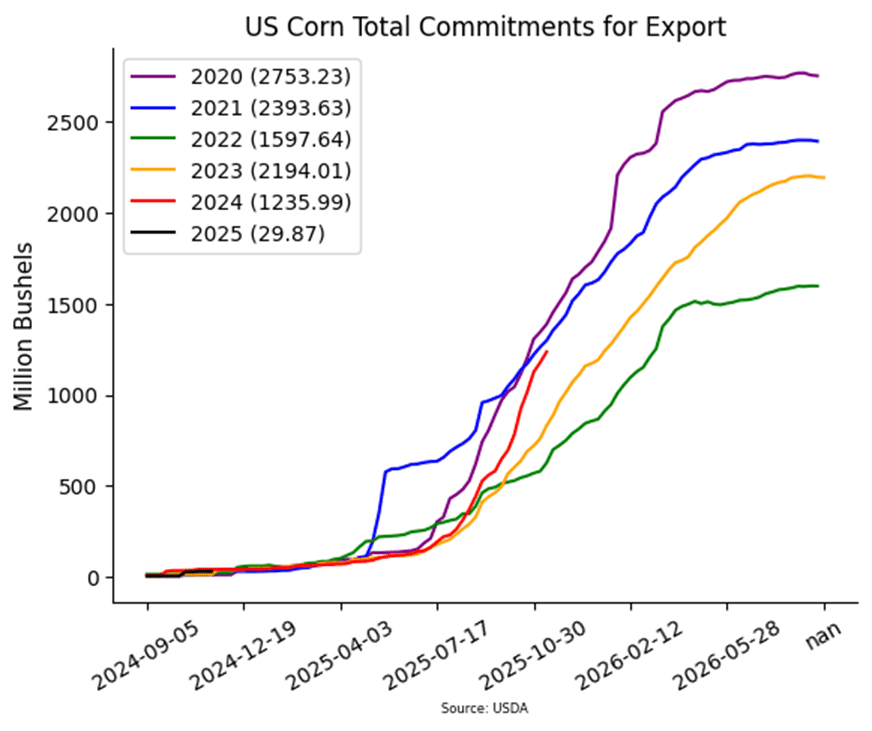

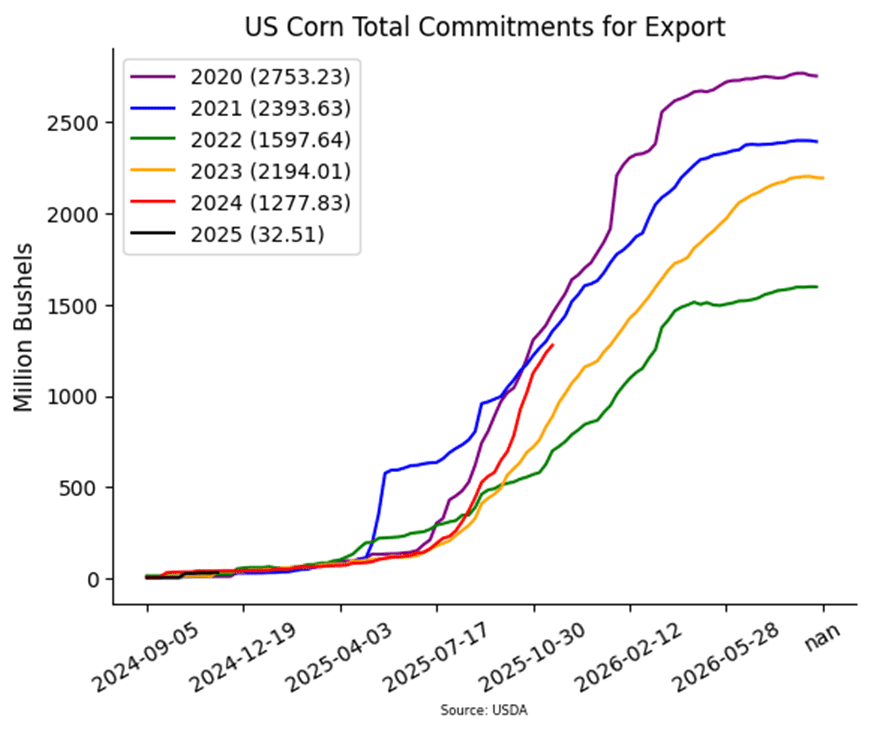

- The USDA released weekly export sales on Friday morning. The USDA reported new corn sales of 1.06 MMT (41.8 mb) for the week ending November 21. This was at the low end of expectations. Total corn sales have been strong, trending 33% above last year’s levels.

- Export demand and ethanol production continue to support corn markets, helping prices recover from recent lows and providing a foundation heading into year-end.

Soybeans

Soybeans Action Plan Summary

2024 Crop:

- If you missed prior sales recommendations, a rally back to the 1050 – 1070 area versus Jan’25 could provide a good opportunity to make catch-up sales. For those with capital needs, consider making these sales into price strength.

- Additional sales could also be considered in the 1090 – 1125 range versus Jan’25 if prices rally beyond the 1070 area.

- New sales recommendations will be issued as seasonal opportunities improve, which could be anytime between late fall and early spring.

2025 Crop:

- Sales targets have not been announced for next year’s crop. Patience is recommended, the earliest they will be set will be late fall or early winter, and early spring at the latest.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

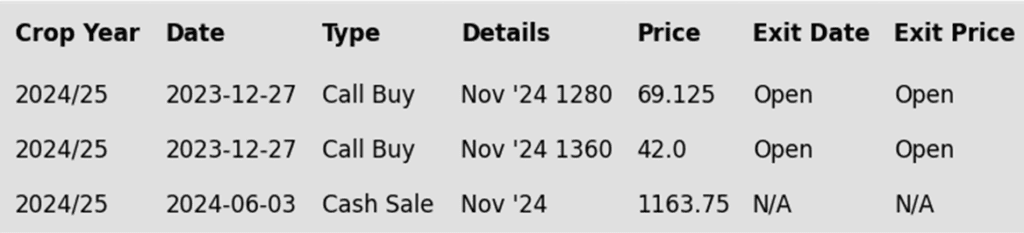

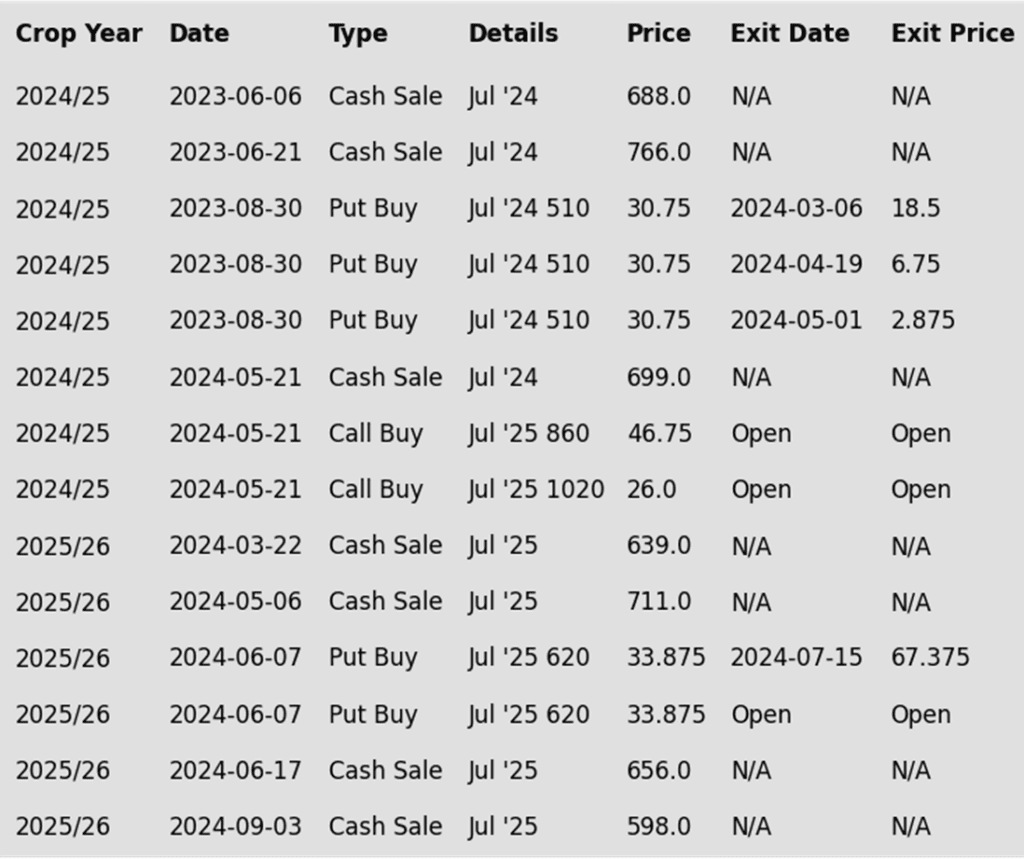

To date, Grain Market Insider has issued the following soybean recommendations:

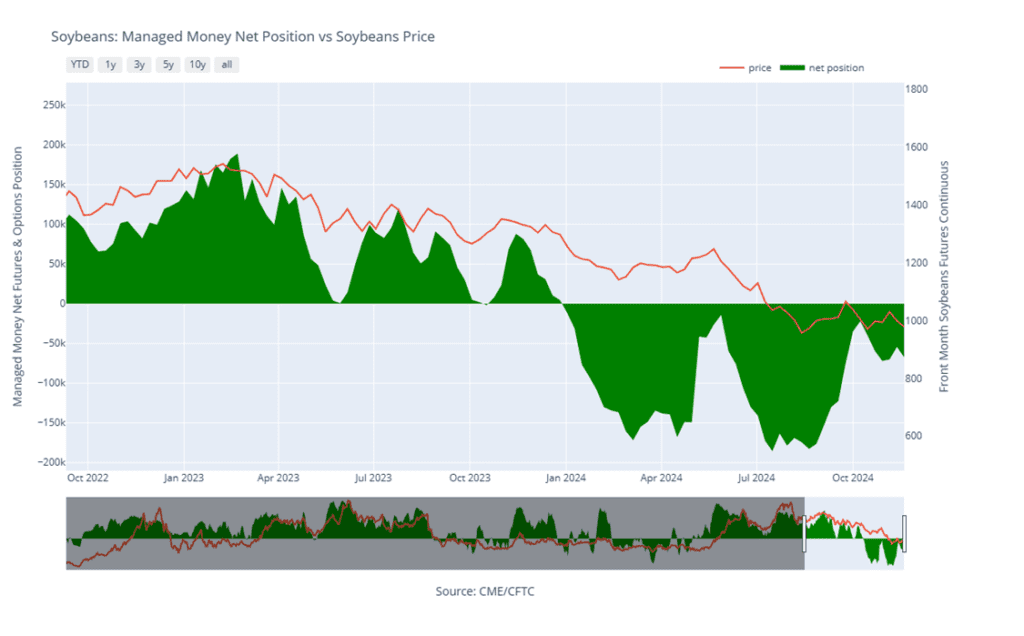

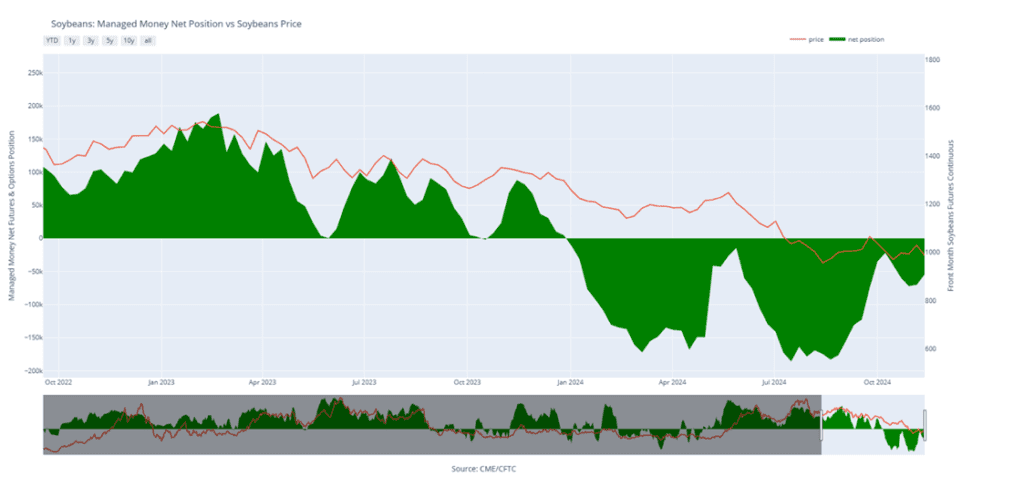

- Soybeans ended the day with front-month gains and deferred-month losses, reflecting a bull spread. Limited carry in the market signals expectations of abundant supplies next year. Soybean meal was lower to end the day while soybean oil finished higher. Strong soybean crush numbers continue to create a glut of bean meal.

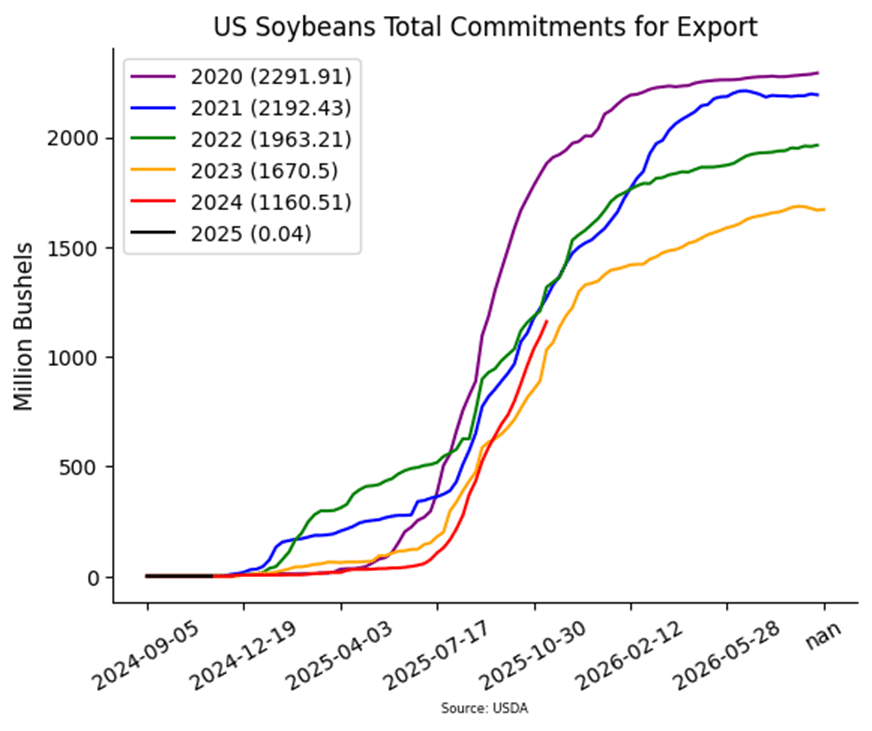

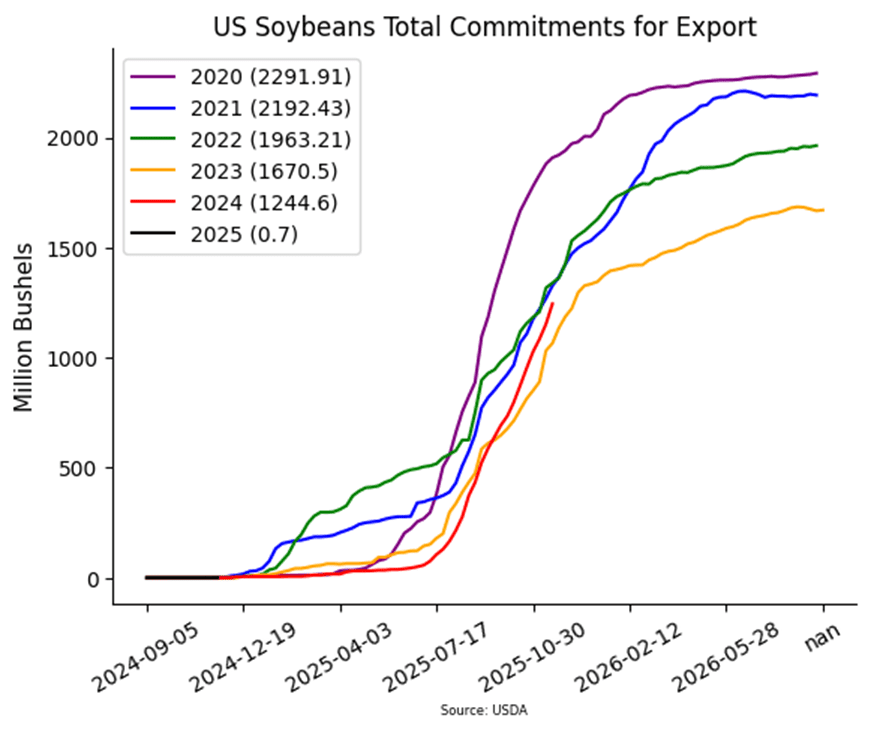

- Today’s Export Sales report was strong for soybeans with the USDA reporting an increase of 91.5 million bushels of soybean export sales for the 24/25 marketing year and 0.7 mb for 25/26. This was above the high end of analyst estimates. Last week’s export shipments of 76.5 mb were well above the 29.5 mb needed each week to meet the USDA’s export estimate. Primary destinations were to China, Mexico, and Germany.

- For the week, January soybeans gained 7-1/4 cents to $9.90-3/4 while March only gained 5 cents. January soybean meal gained $1.70 to $293.20 and January soybean oil lost 0.08 cents to 41.76 cents.

- The USDA announced a large daily export sale for soybeans before the session this morning. The USDA announced sales of 840,000 MT (30.8 mb) and 151,700 MT (5.6 mb) of soybeans for unknown destinations for the 2024-25 marketing year.

Wheat

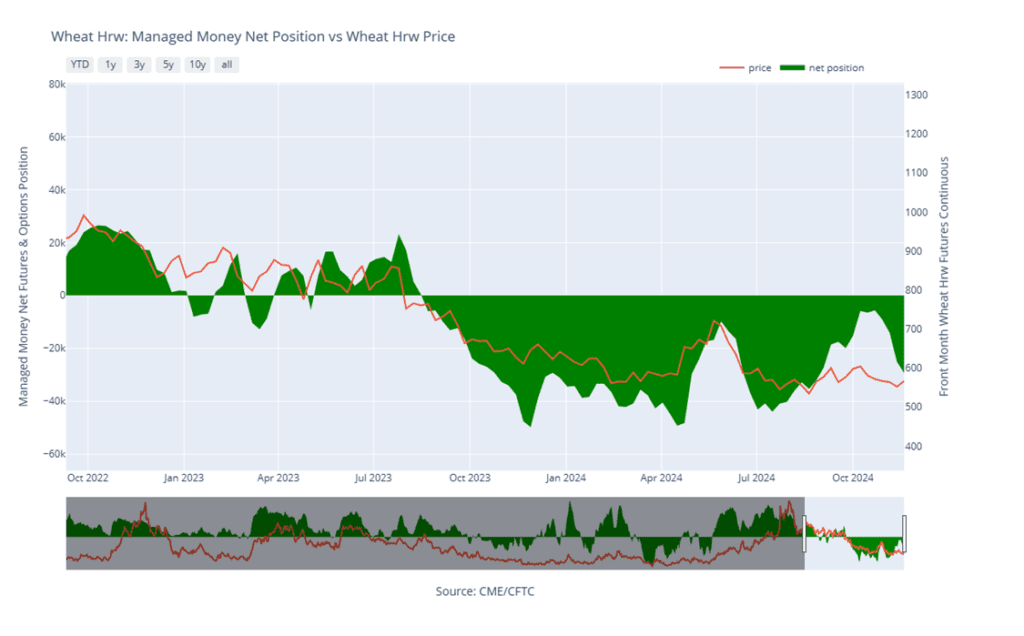

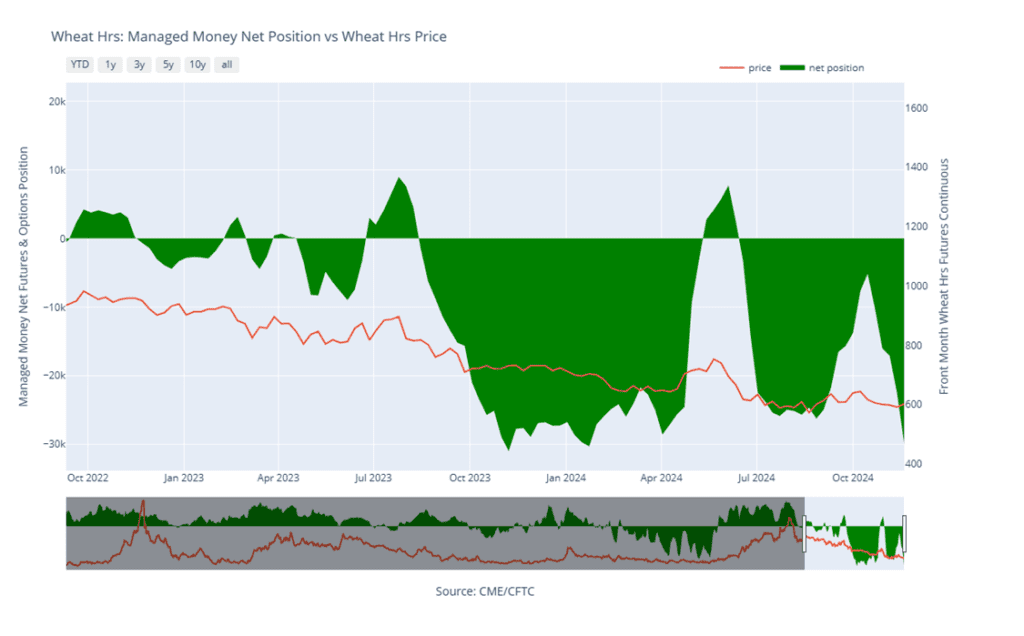

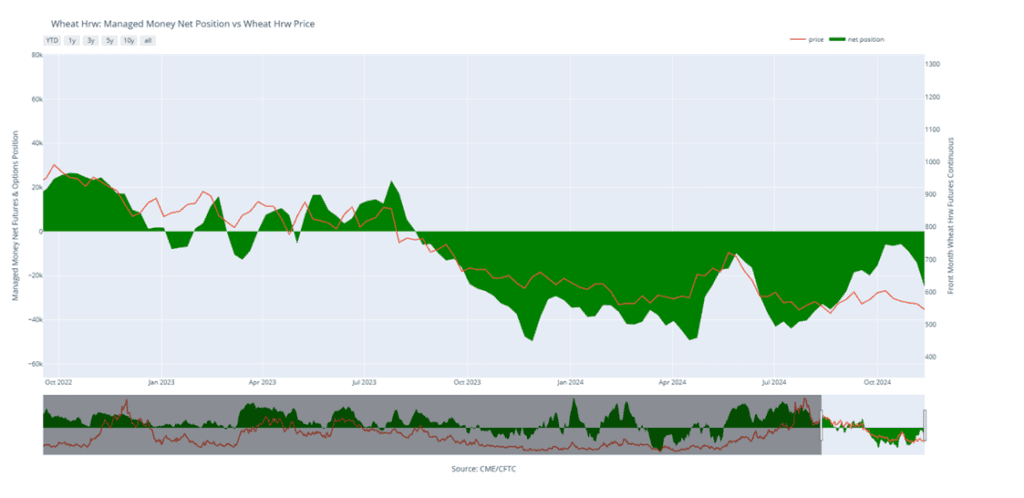

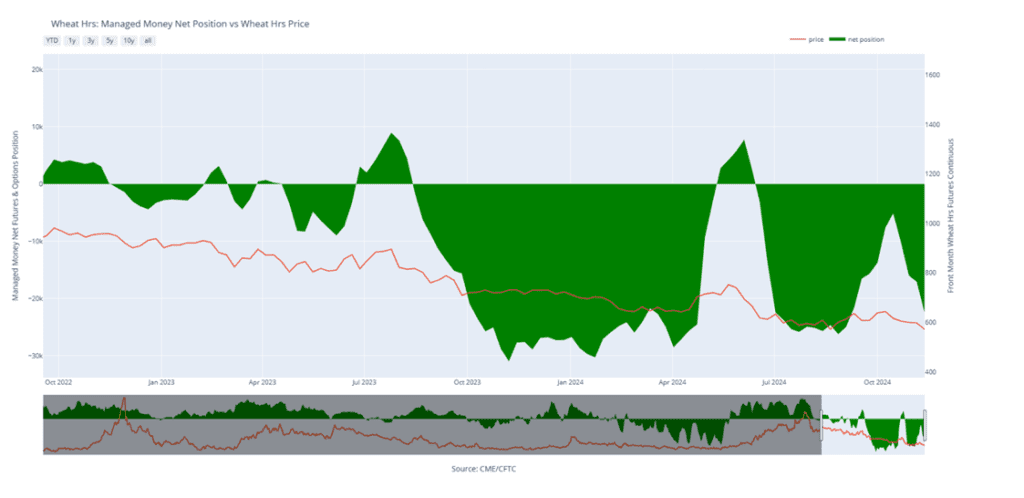

Market Notes: Wheat

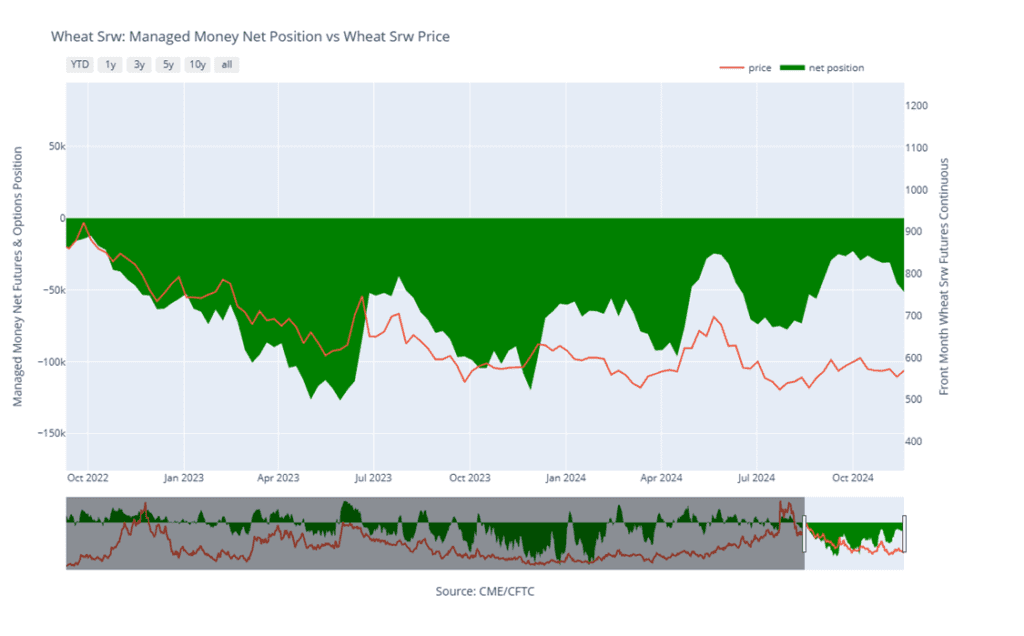

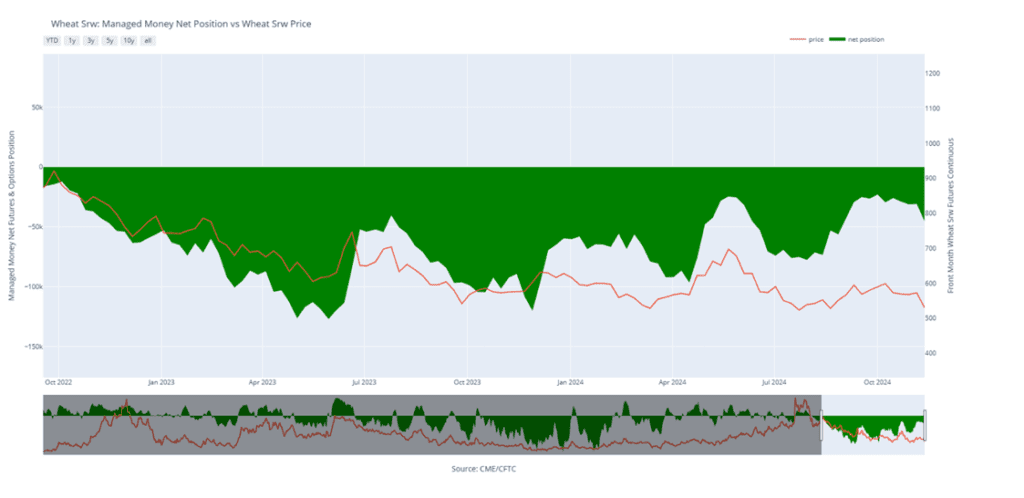

- Wheat ended weaker after mixed trading, following Matif wheat’s third consecutive decline. However, the falling US Dollar Index and oversold technicals may provide support at current levels.

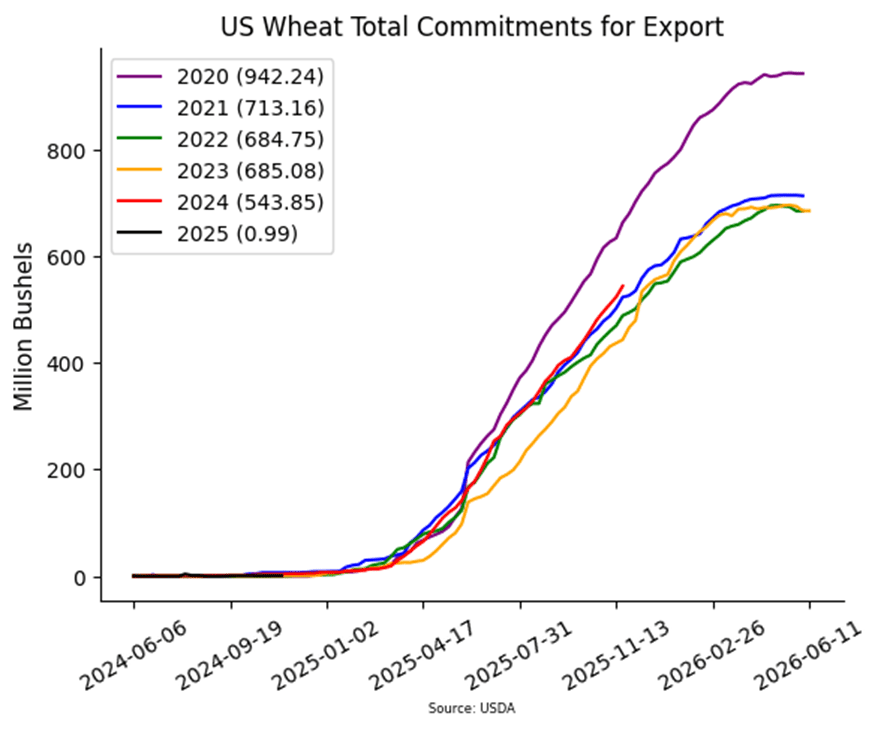

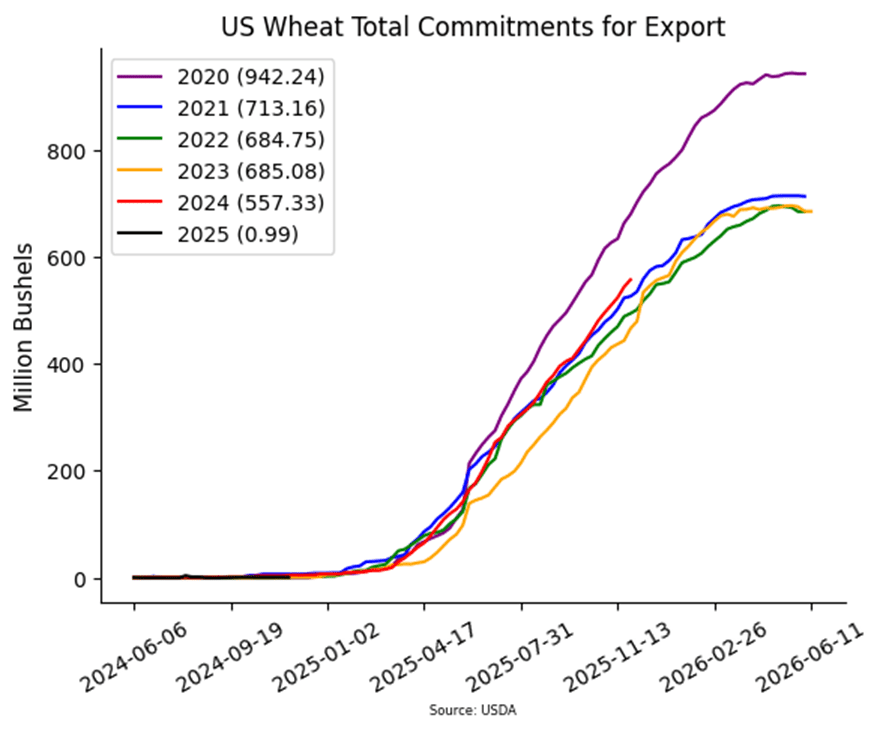

- The USDA reported 13.5 mb of wheat export sales for 24/25, with weekly shipments at 15.9 mb, just below the 16.5 mb needed to meet the 825 mb export goal. Commitments are up 20% year-over-year at 557 mb.

- As reported by Tass, Russian wheat exports are expected to his 25.3 mmt so far this season. That is 1.7 mmt higher than last year. In addition, they are projecting total Russian wheat exports this season at 41.7 mmt.

- According to FranceAgriMer, an estimated 93% of the French soft wheat crop has been planted as of Monday. This is ahead of last year’s 81% pace for the same time period and is also slightly ahead of the 91% five-year average. Of the crop, 87% are rated good or very good, slightly below last year’s 88%.

- The European Commission raised its 24/25 EU grain production forecast to 256.9 mmt from 255.6 mmt in October, while soft wheat was lowered slightly to 112.3 mmt. Durum wheat estimates remain unchanged at 7.2 mmt.

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

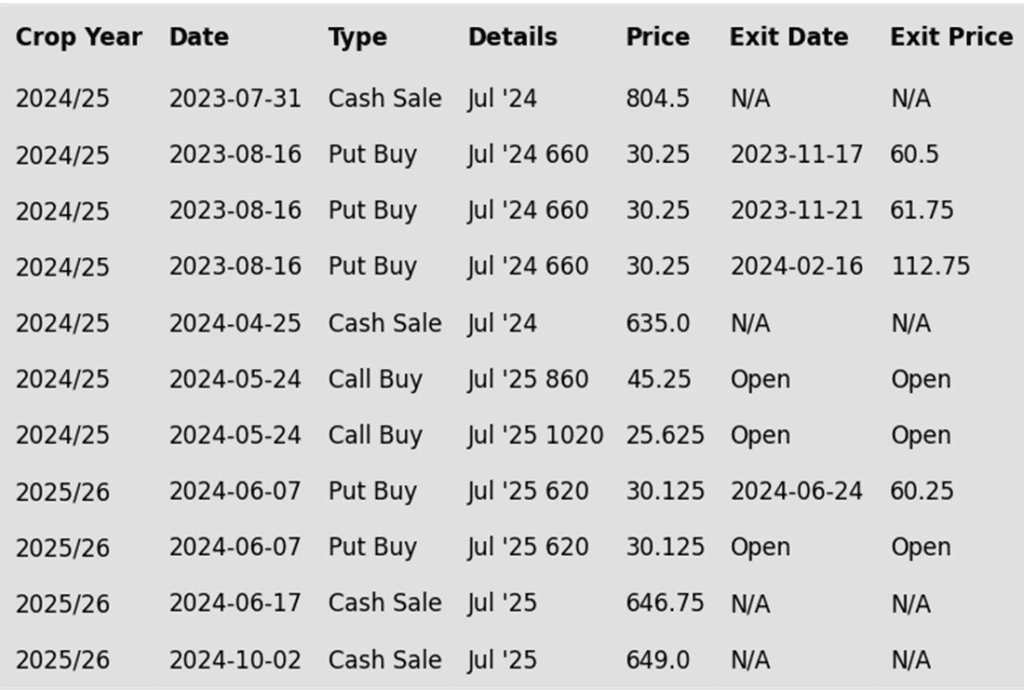

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

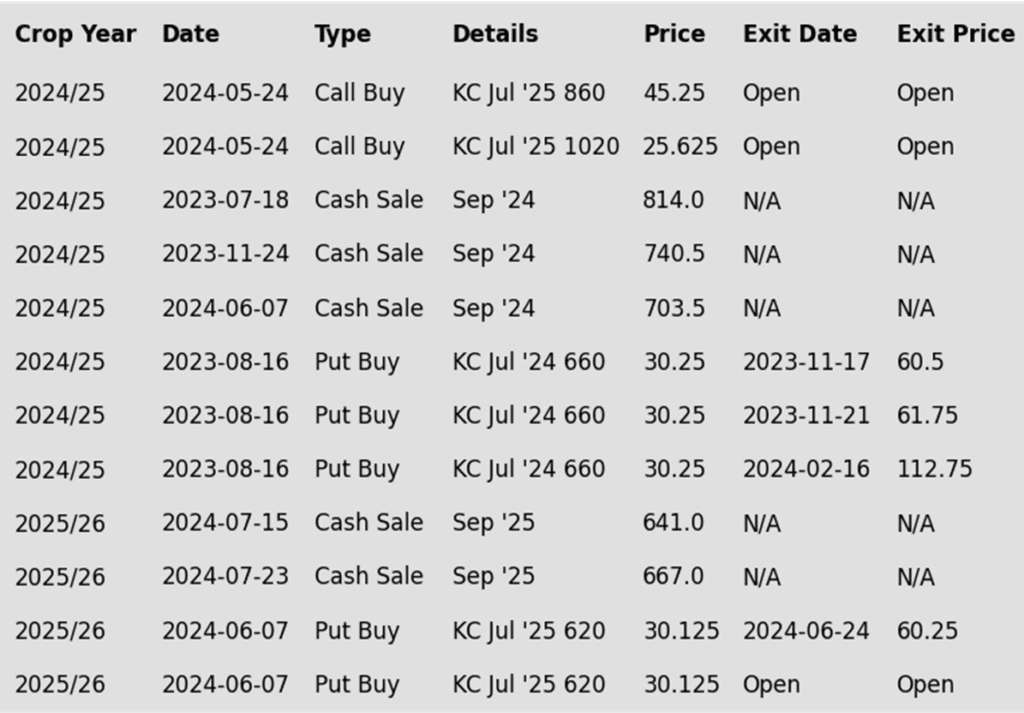

To date, Grain Market Insider has issued the following KC recommendations:

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Target a rally back to the 710 – 735 range versus Sept. ’25 to make additional early sales on your 2025 crop. While this target area may seem far off, it aligns with the market’s potential based on our research. conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Other Charts / Weather