12-31 End of Day: Grains Trade Higher Going into The New Year

FROM ALL OF US AT TOTAL FARM MARKETING, HAVE A HAPPY AND PROSPEROUS NEW YEAR!

TUESDAY, DECEMBER 31: The CME has regular trading hours, and Total Farm Marketing offices will close at 3:00 p.m. (CT).

WEDNESDAY, JANUARY 1: The CME and Total Farm Marketing offices are closed.

WEDNESDAY, JANUARY 1: The CME and Total Farm Marketing offices are closed.

All prices as of 2:00 pm Central Time

Grain Market Highlights

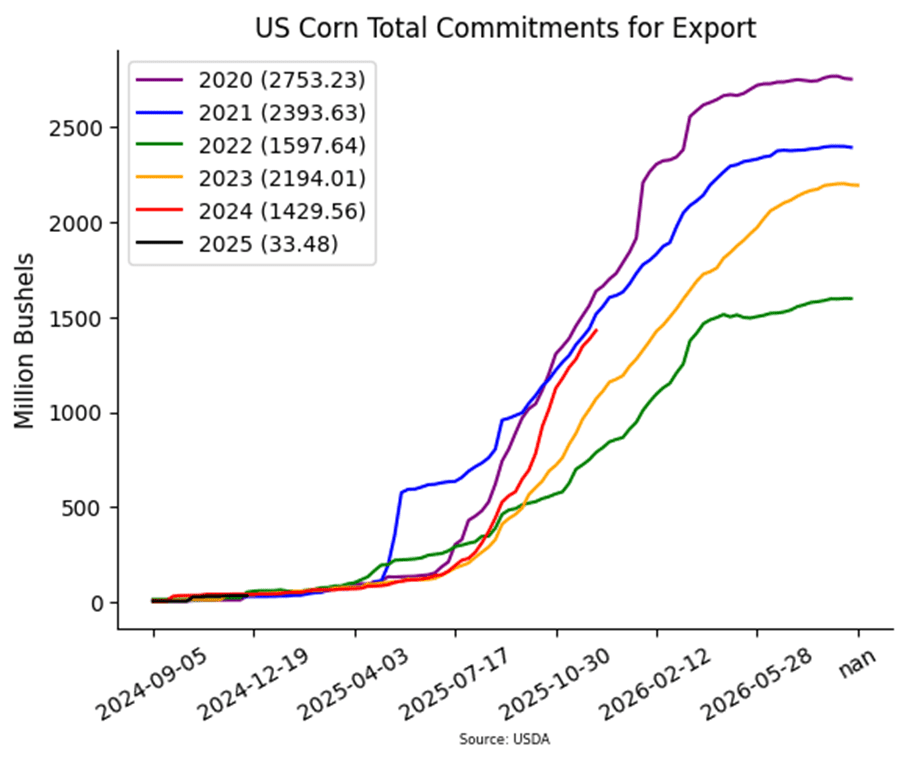

- Corn markets gained strength to close out 2024, with light trading volume and buying momentum in the soybean market helping to drive corn higher.

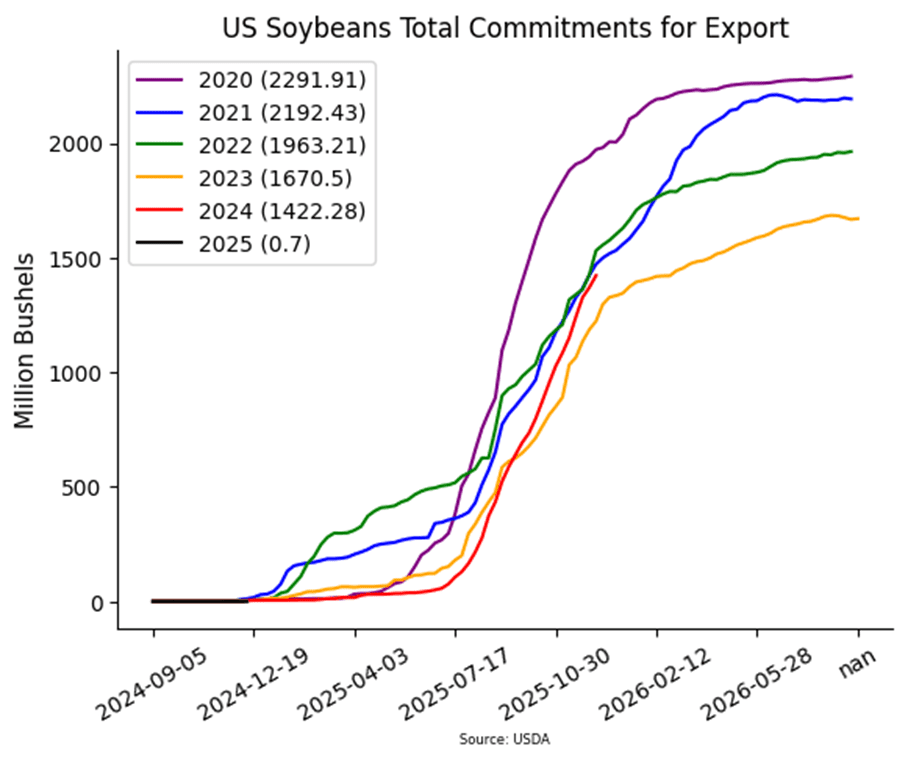

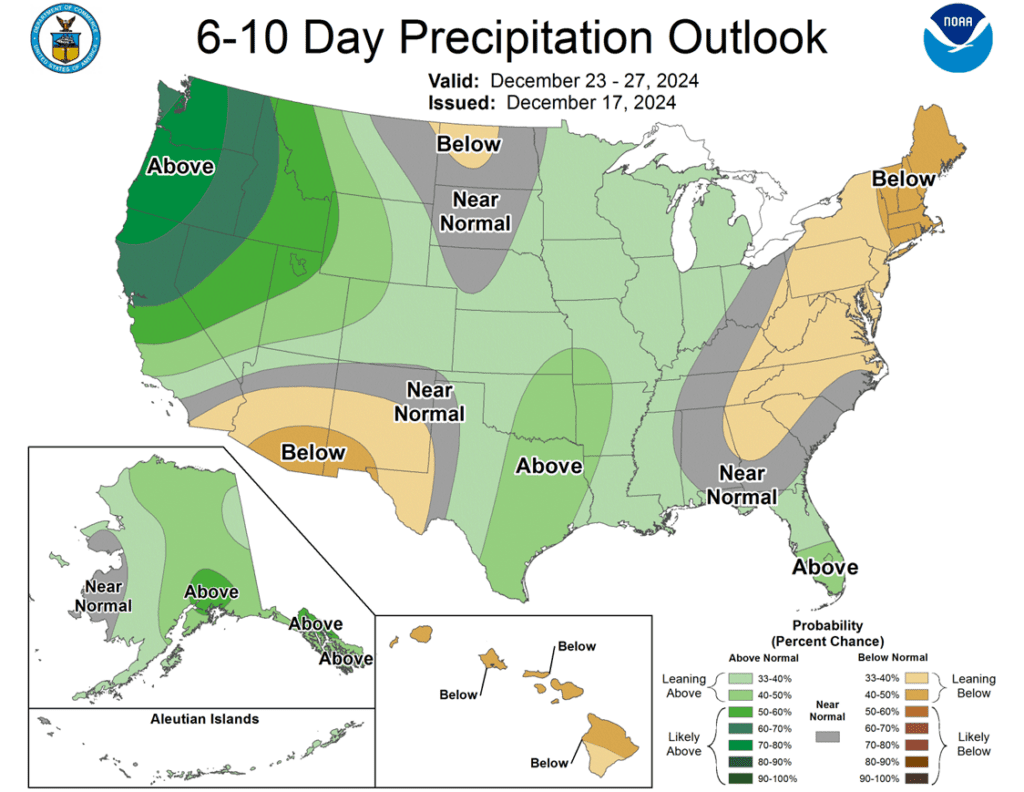

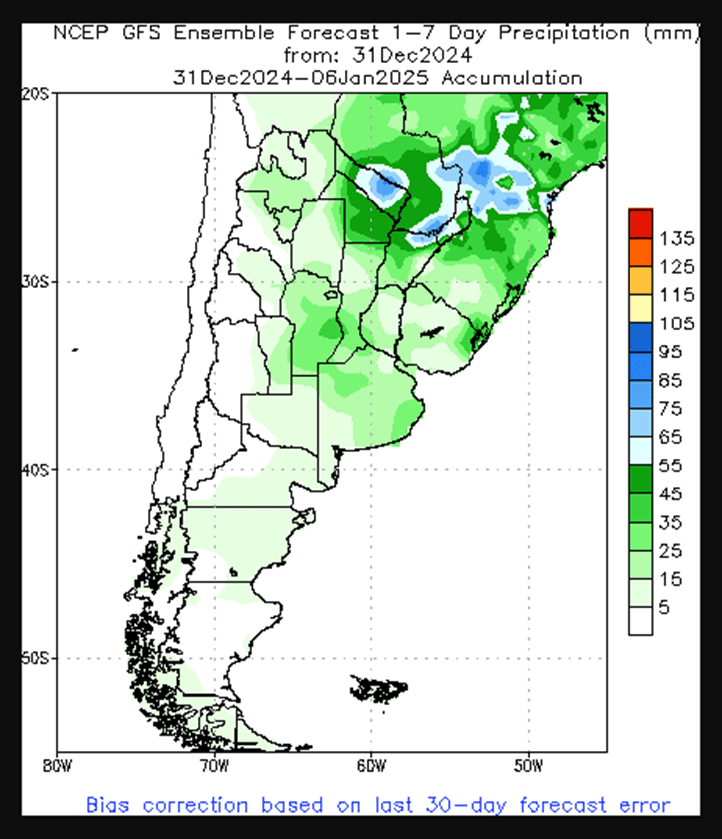

- Soybeans closed higher to end the final trading day of 2024, supported by a drier forecast for Argentina, gains in soybean meal and oil, and some fund profit-taking.

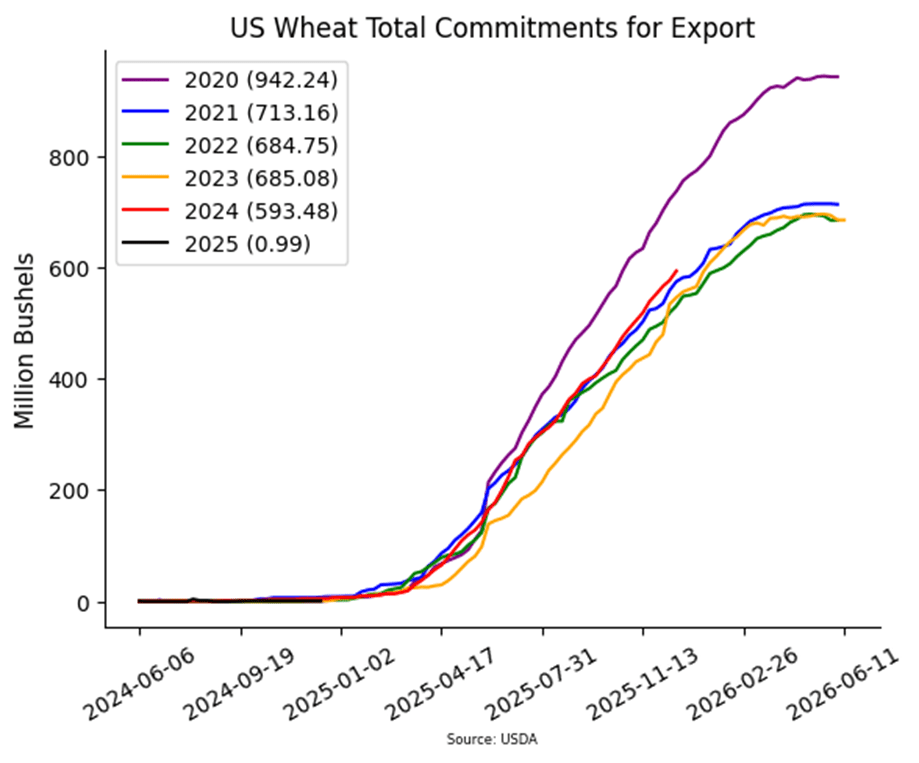

- Wheat pushed higher into the close, supported by stronger corn prices and rising soybeans. Matif wheat also finished strong today.

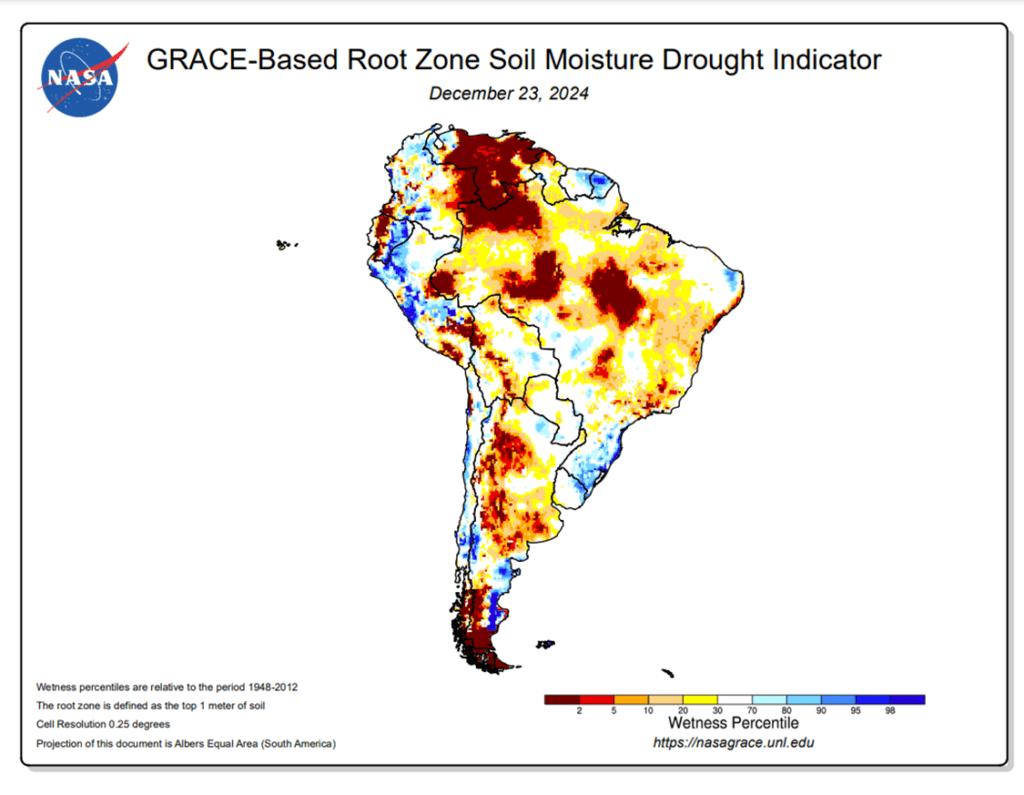

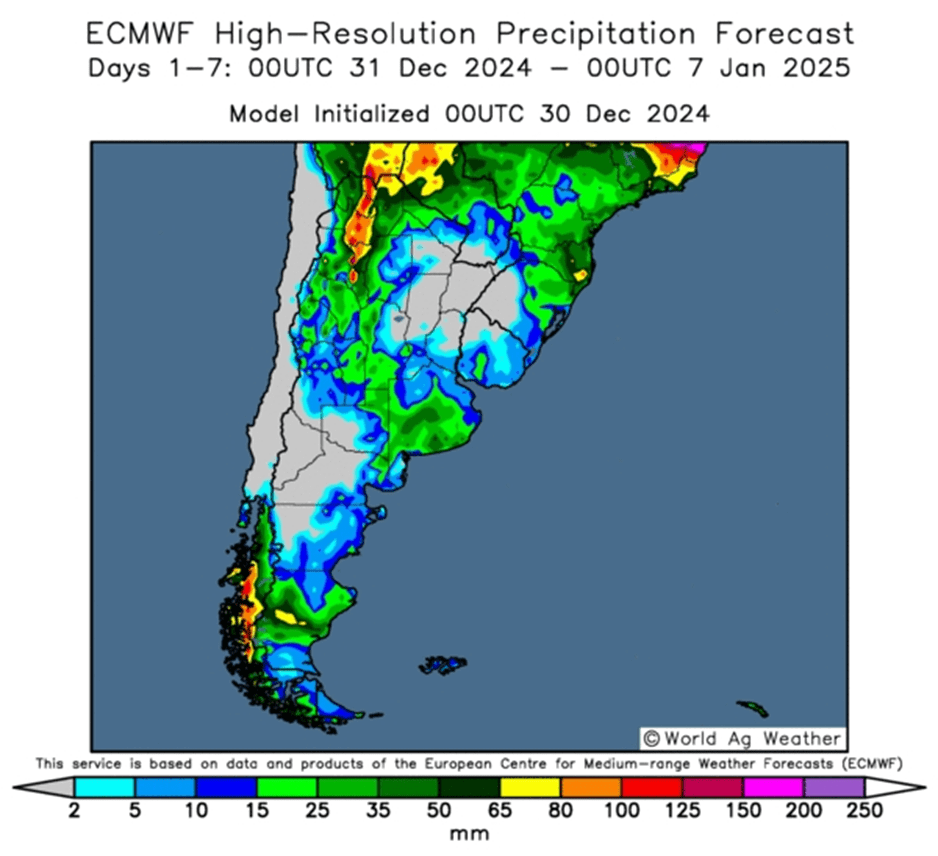

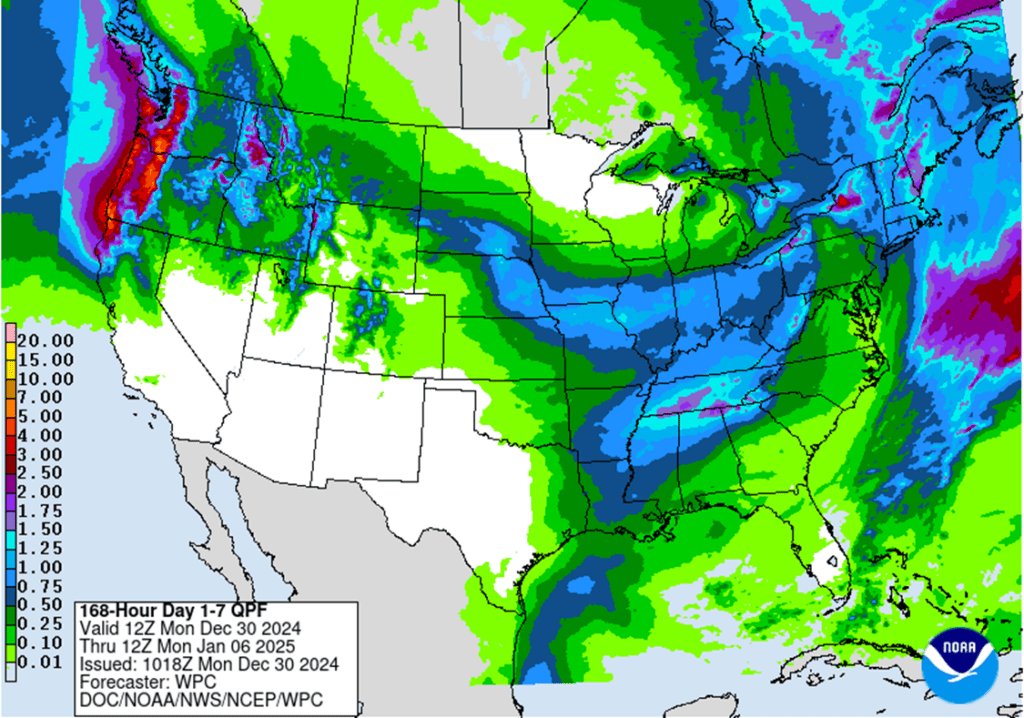

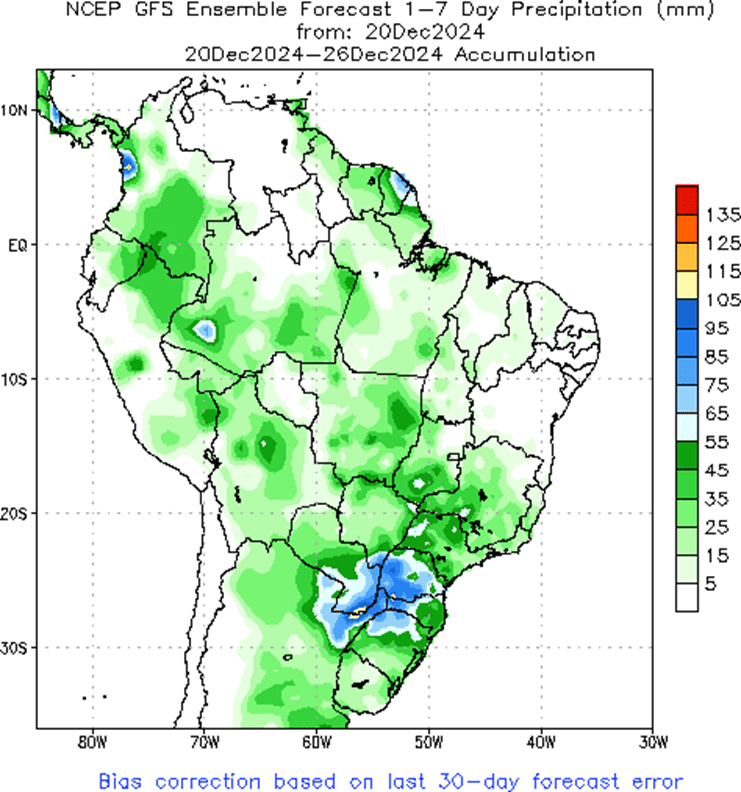

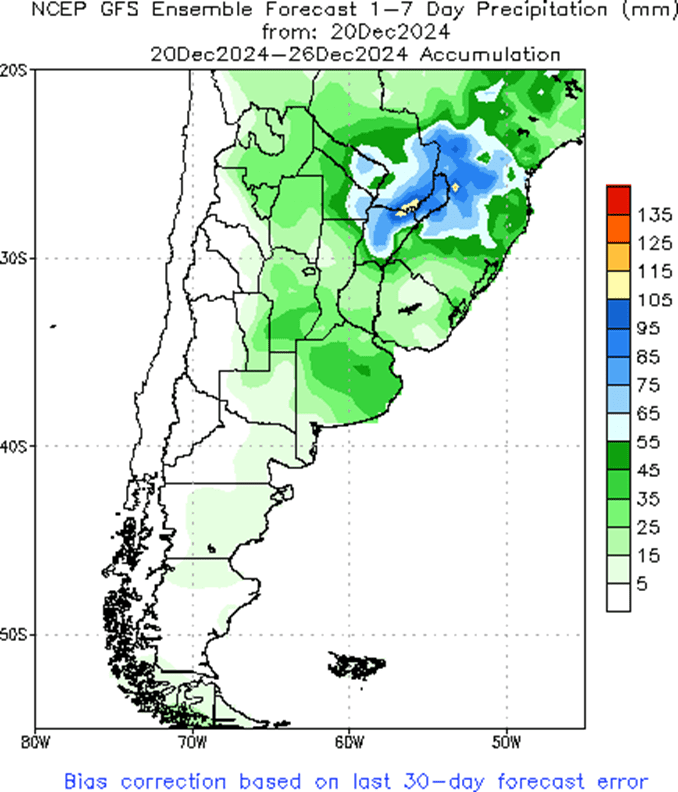

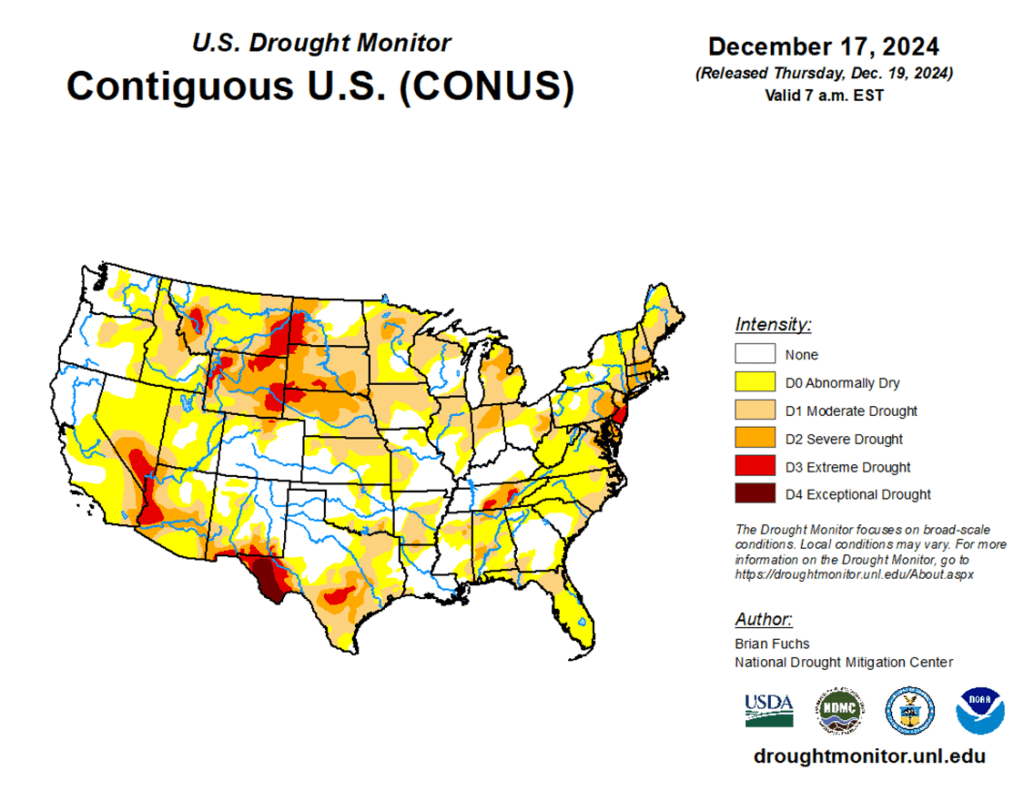

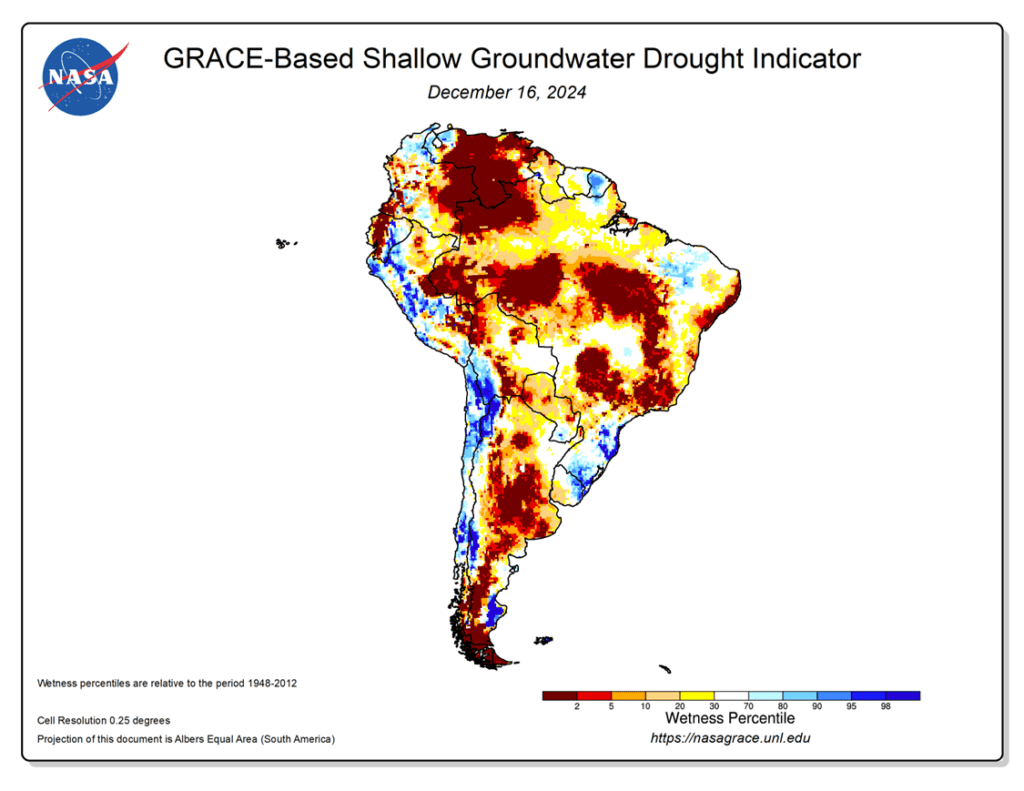

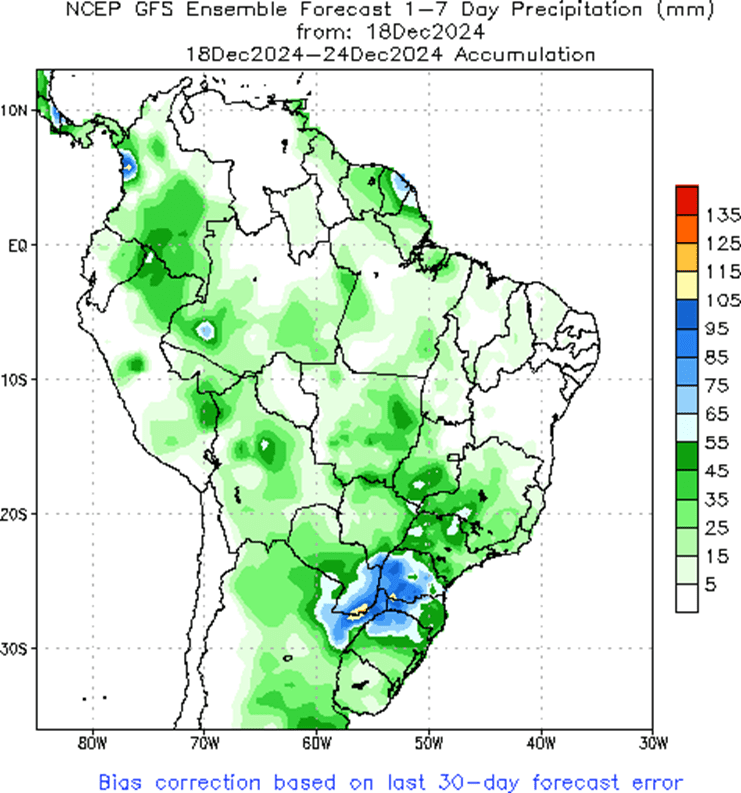

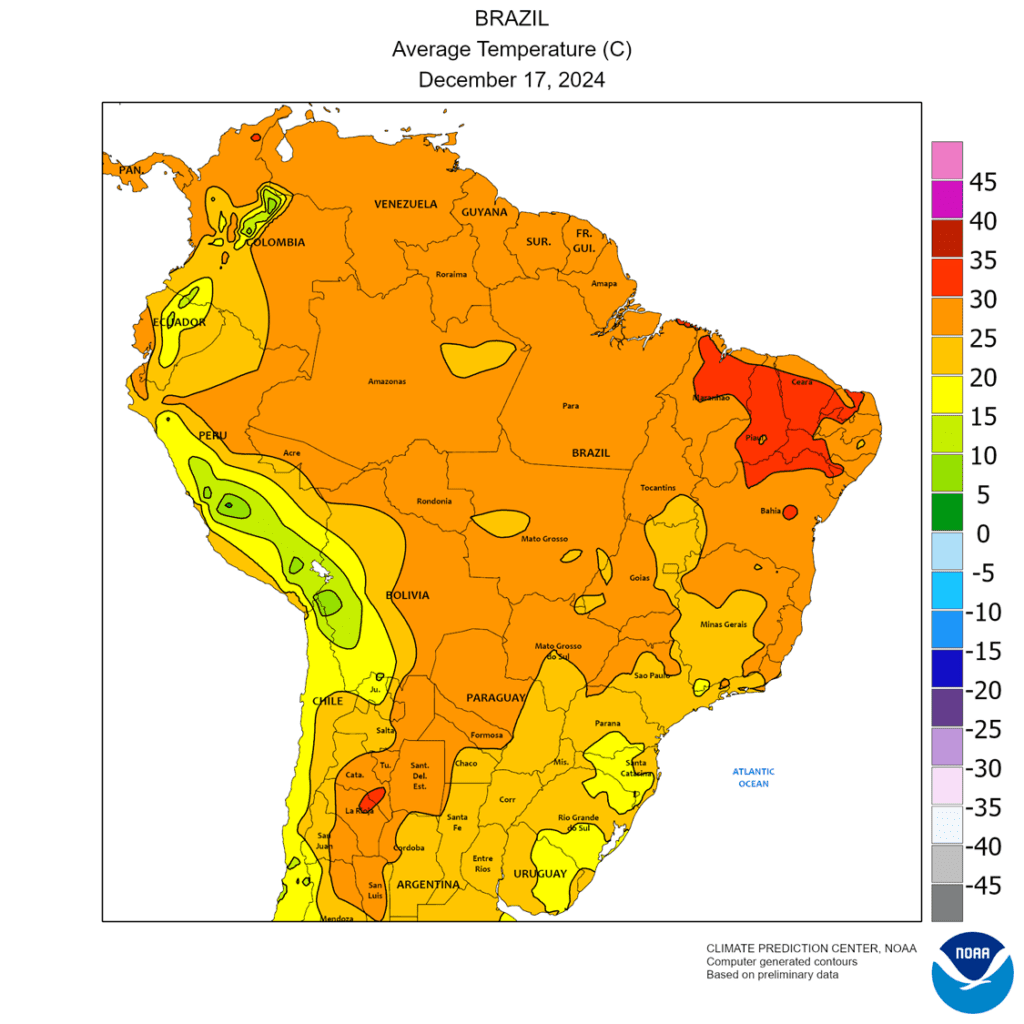

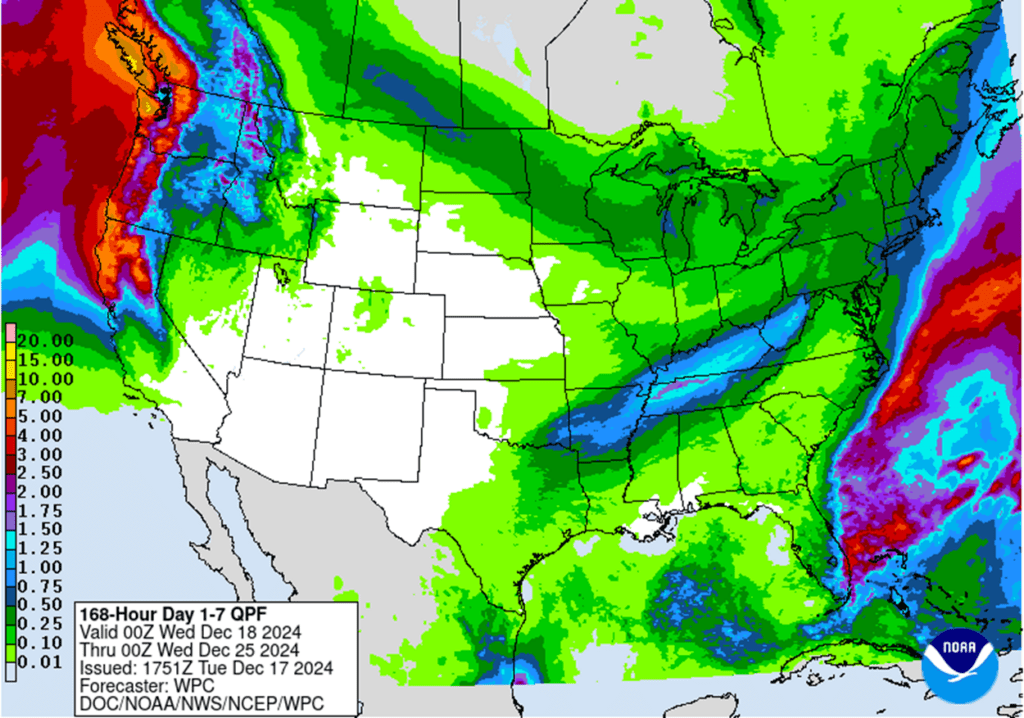

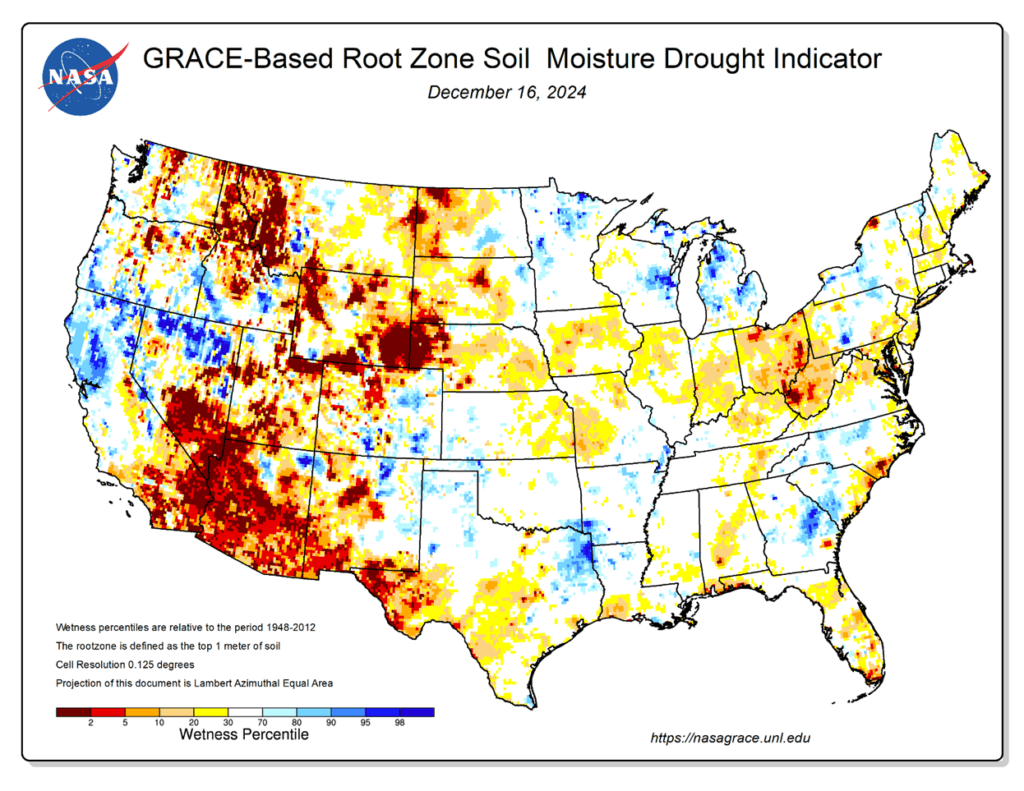

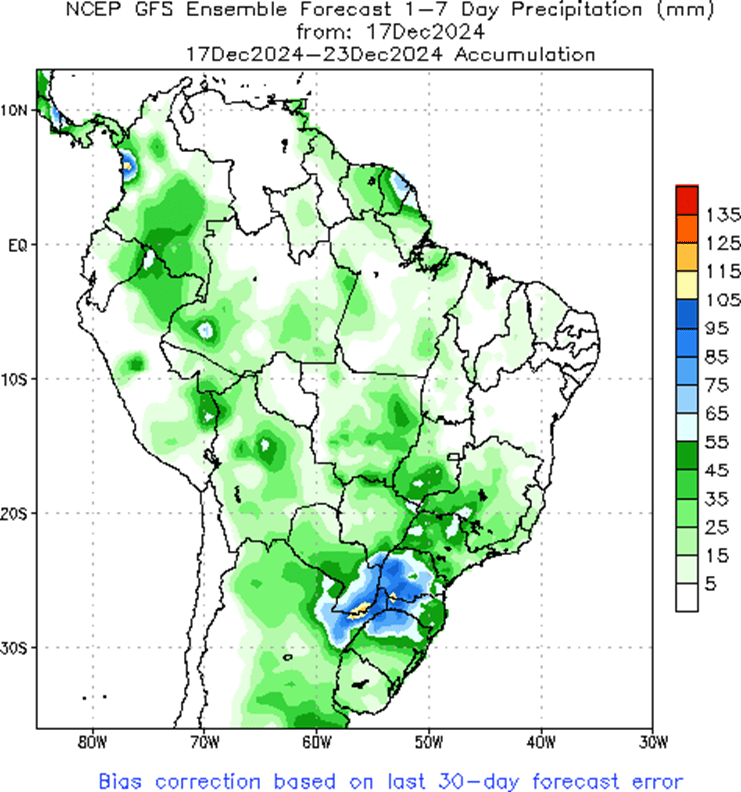

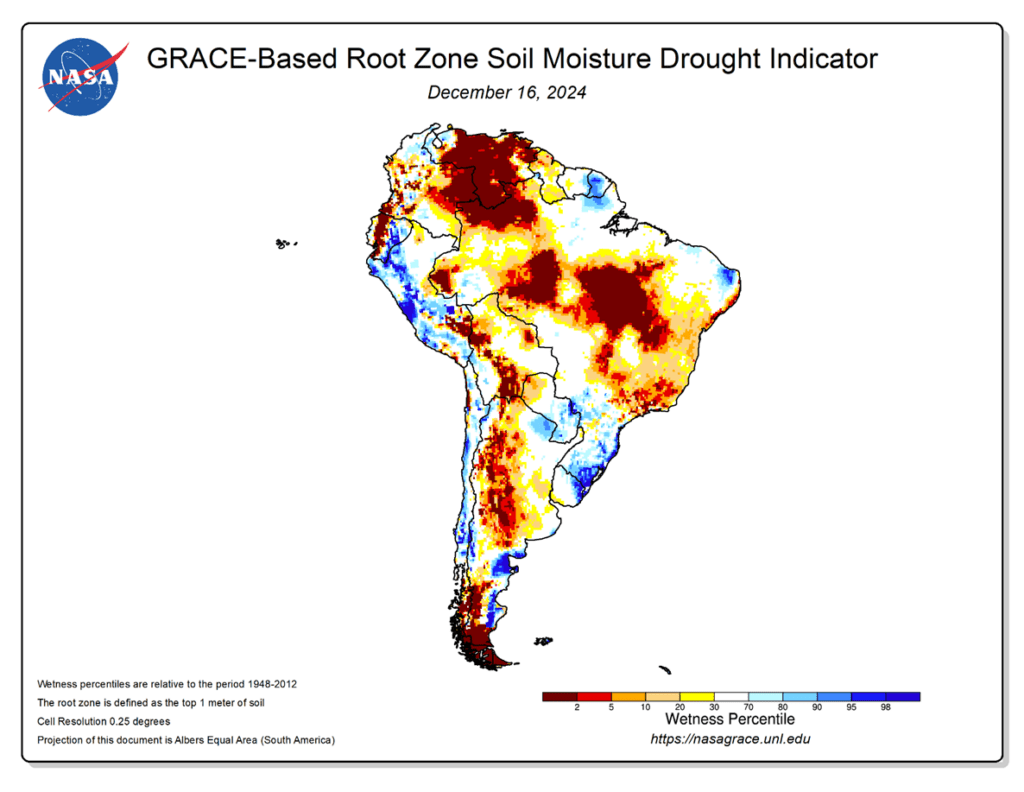

- To see the updated US and South American precipitation forecast, and GRACE-based Drought Indicators, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

2024 Crop:

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 corn crop.

- The March 2024 contract has rallied 30 cents from the Thanksgiving low and has recently traded to its highest level since late June. Looking back even farther, corn is roughly 23% higher than the August low when looking at the continuous corn chart. While strong demand has been a main driver of this rally, we are starting to see corn demand slowing at these higher prices. Therefore, Grain Market Insider sees this as an advantageous area to reward this rally by selling a portion of your 2024 corn crop.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

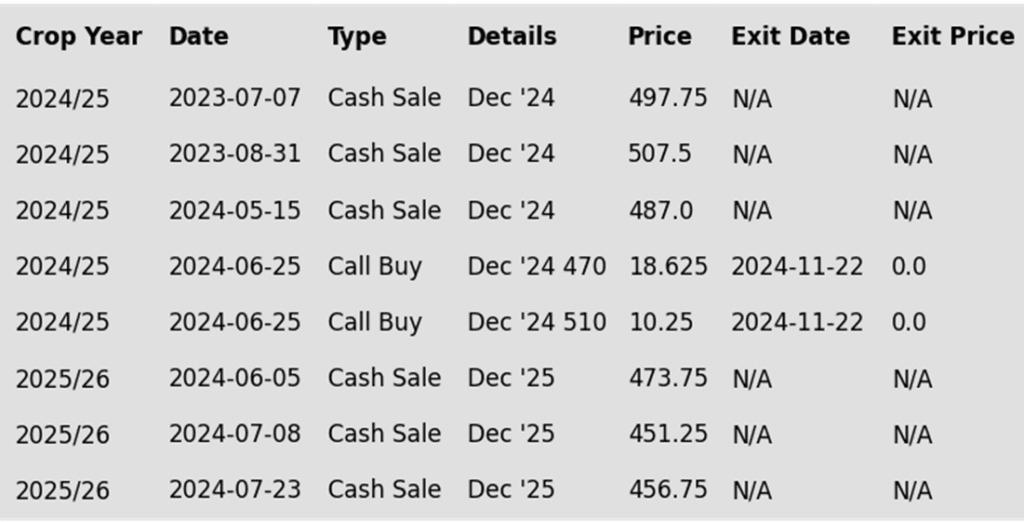

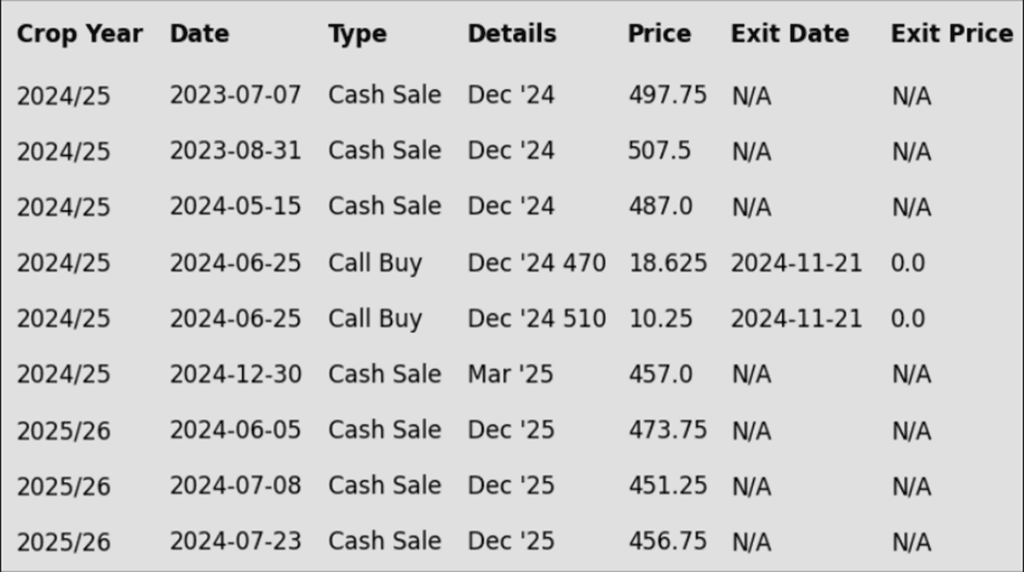

To date, Grain Market Insider has issued the following corn recommendations:

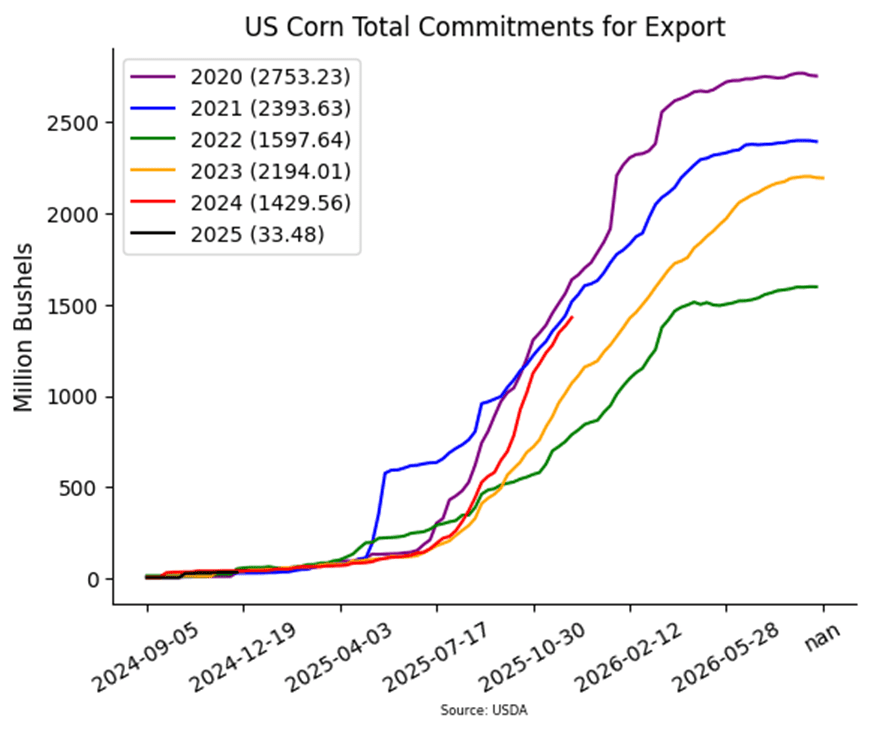

- Grain markets saw additional buying strength to close out 2024, with corn futures benefiting from light trading volume and buying momentum in the soybean market, posting moderate gains. However, the March corn futures closed 56 cents lower compared to the end of 2023.

- The buying strength on Tuesday pushed the corn market past Monday’s potential bearish reversal, trading above Monday’s high. March corn closed Tuesday at its highest price level since June 26.

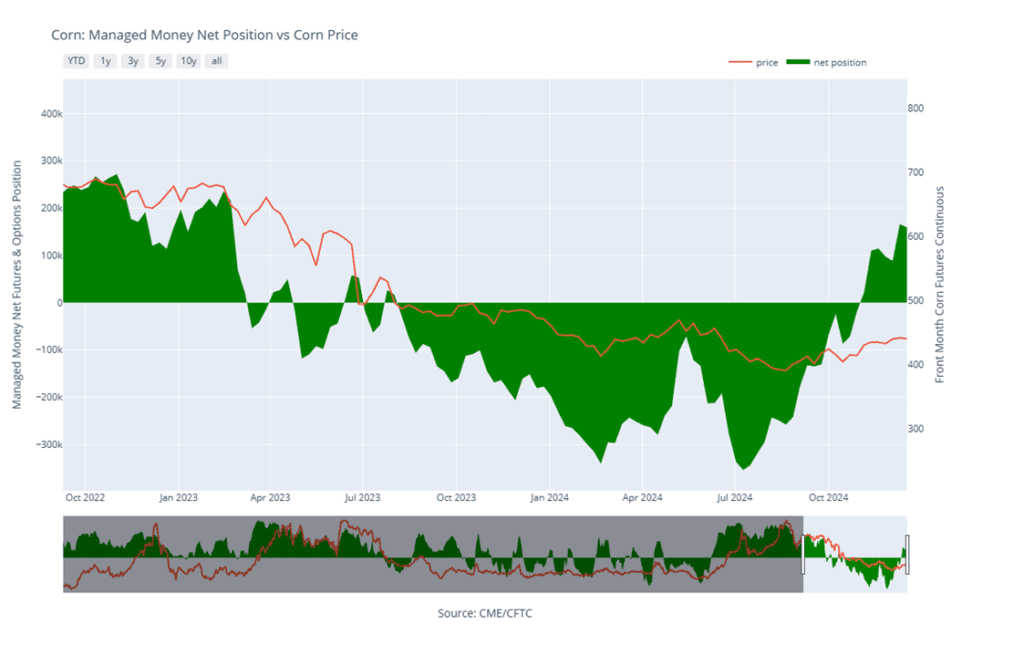

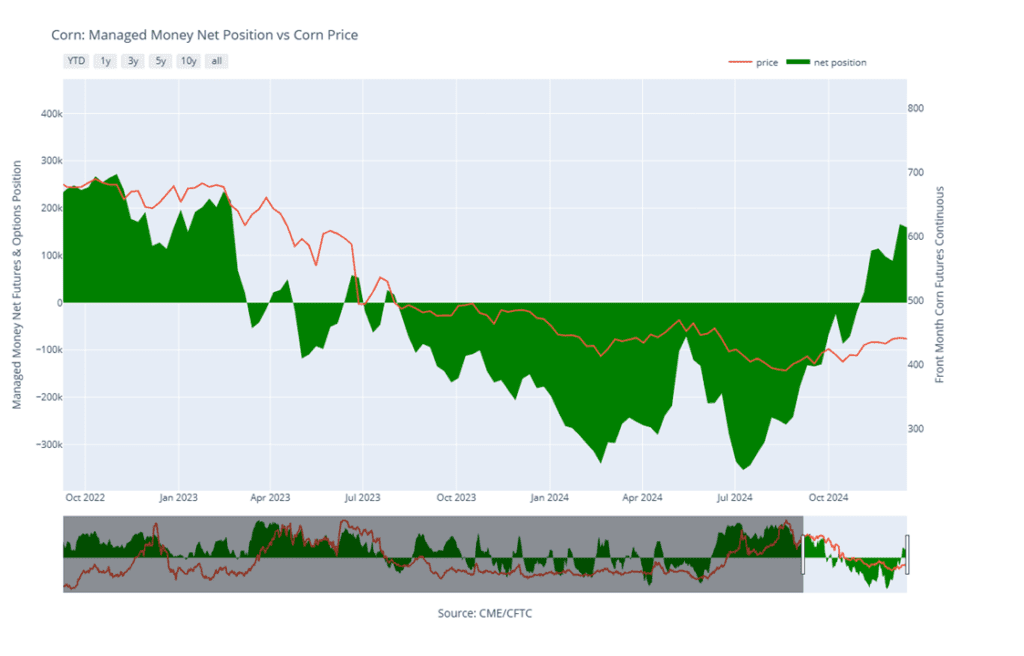

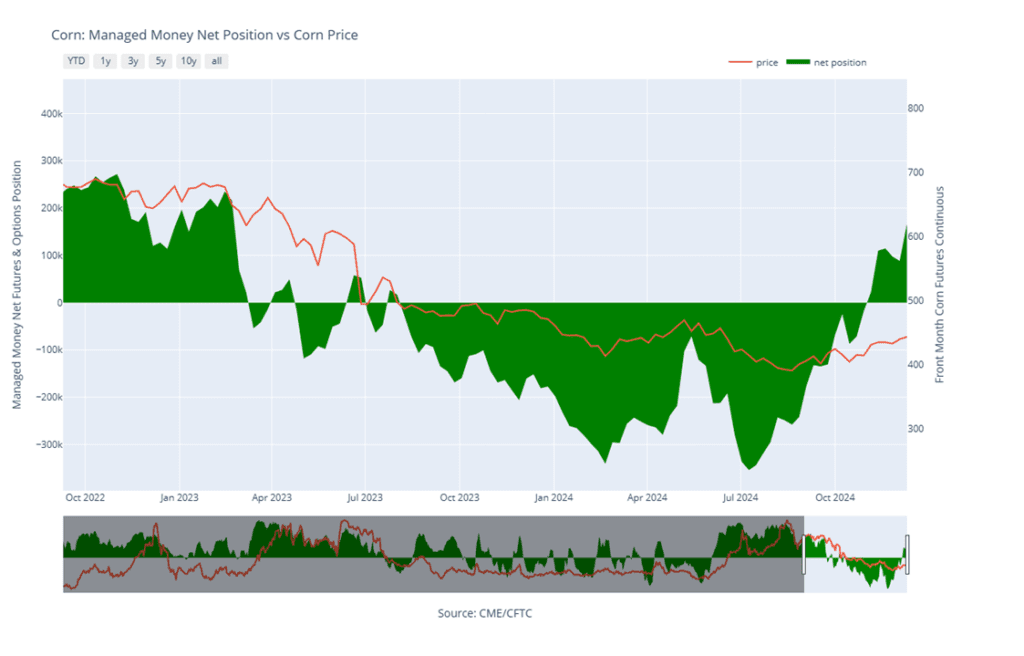

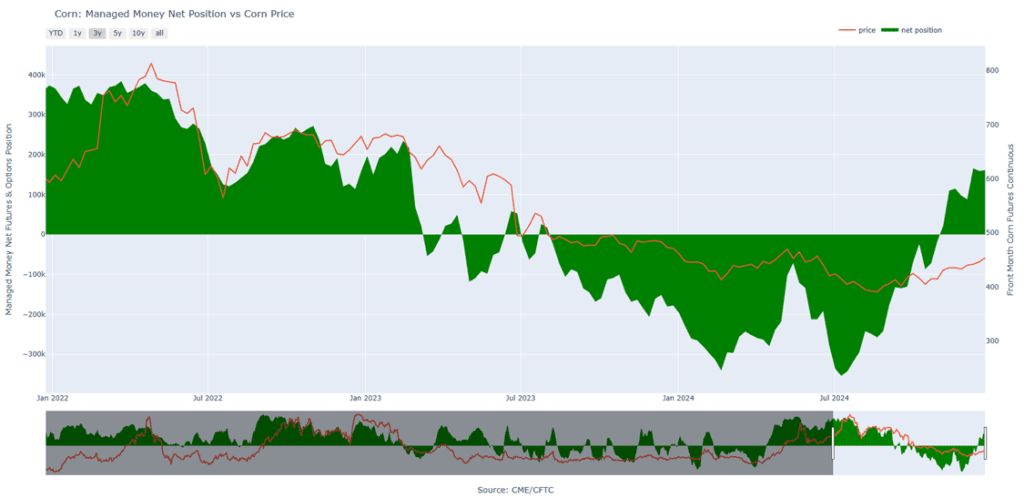

- Managed money is still growing a net long position in the corn market. As of December 24, managed funds were net long 160,947 contracts, adding 1,532 net long positions from the previous week. Analysts estimated that fund length may be closer to 200,000 long contracts given the recent corn market strength as a favorable demand tone has supported the corn market.

- The corn market is likely to start focusing on next Friday’s USDA WASDE report and Quarterly Grain Stocks report, scheduled for release on January 10. Money flow could remain positive, supporting the market amid expectations that strong demand may tighten corn stockpiles for the seventh consecutive month, as current corn ending stocks are nearly 400 mb lower than last year’s totals.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 436, with additional support near 425. Initial overhead resistance comes in near 451 with additional resistance near 465.

Above: Corn Managed Money Funds net position as of Tuesday, December 24th. Net position in Green versus price in Red. Managers net sold 1,532 contracts between December 17 – 24, bringing their total position to a net long 160,947 contracts.

Soybeans

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1100 – 1110 area versus Jan ‘24 to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

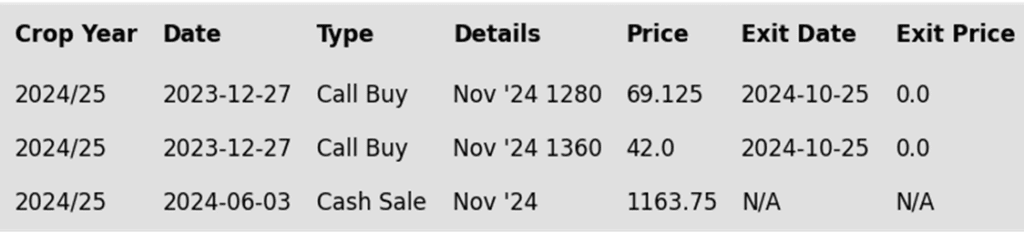

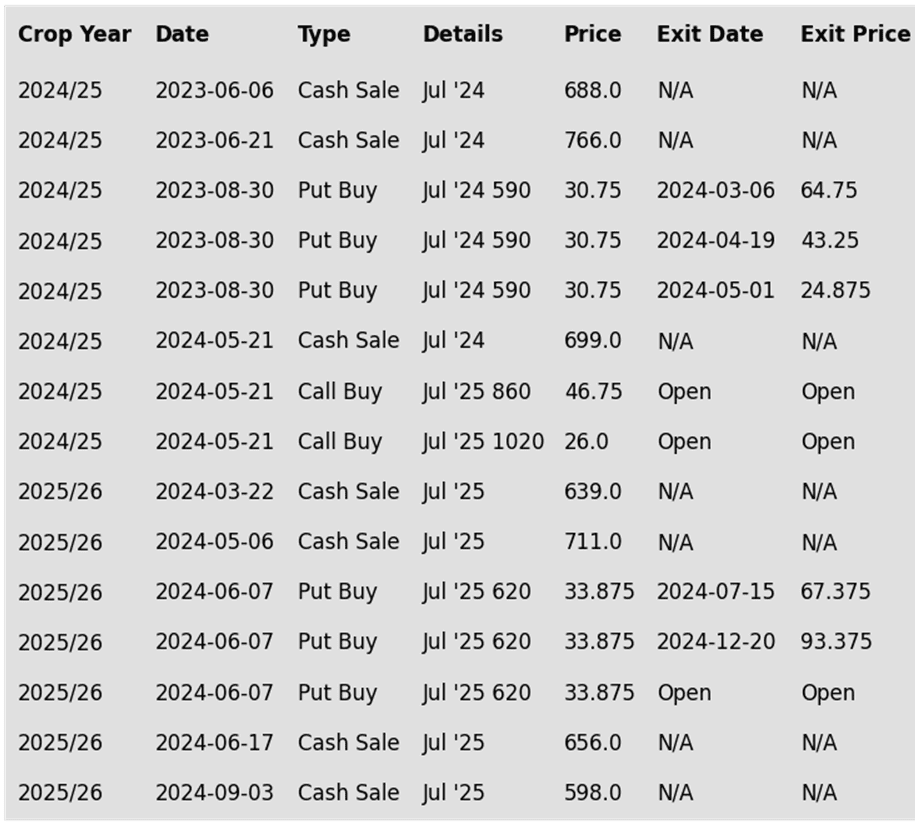

To date, Grain Market Insider has issued the following soybean recommendations:

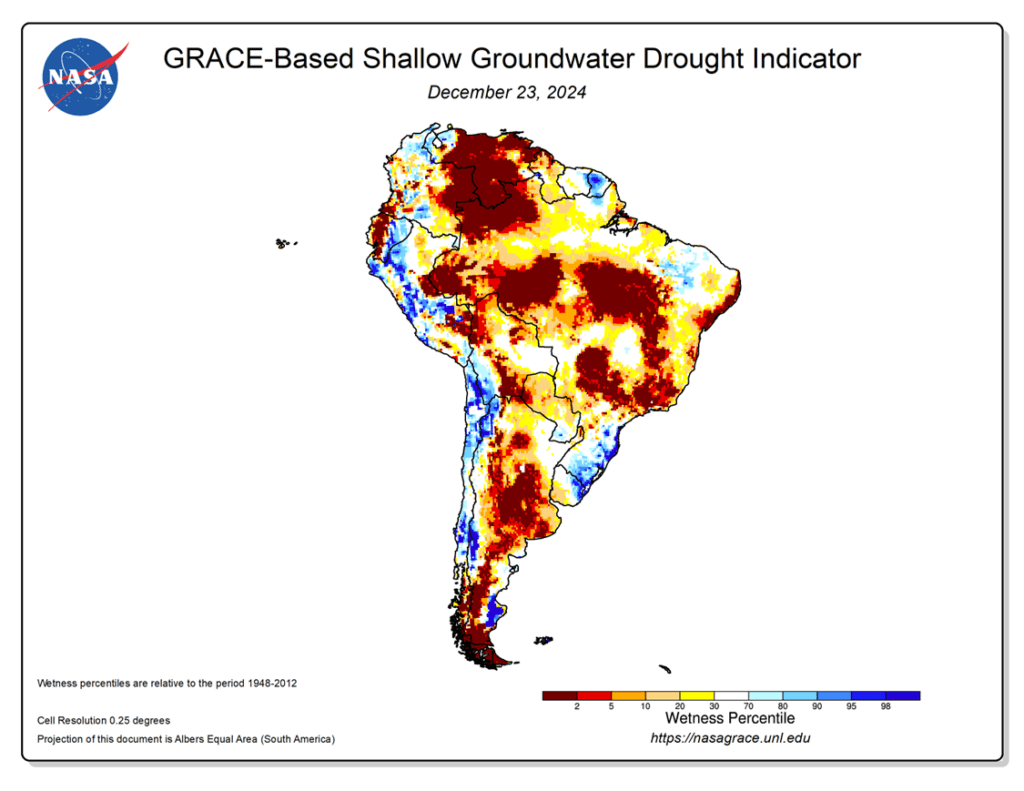

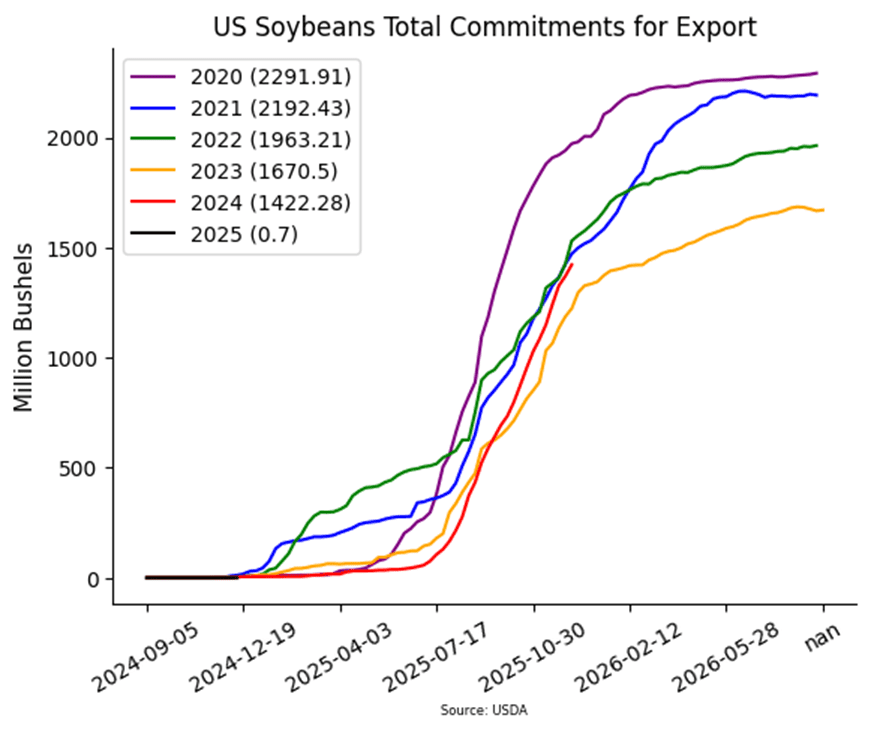

- Soybeans closed sharply higher to wrap up the final trading day of 2024, supported by a drier 10-day forecast for Argentina, gains in soybean meal and oil, and likely some fund profit-taking. Crude oil also ended the day higher, which may have provided additional support to soybean oil.

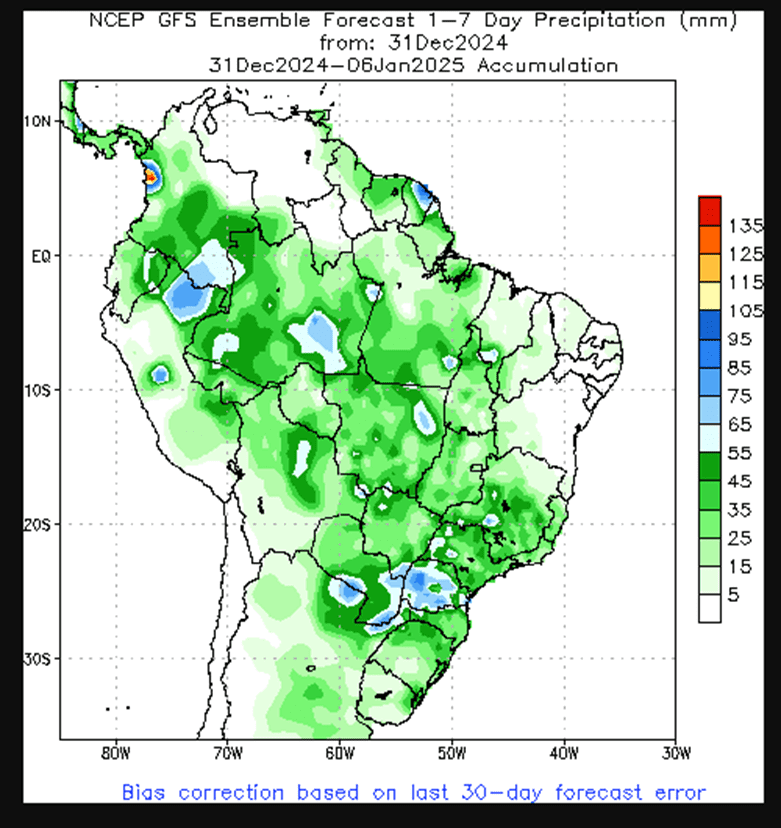

- The USDA attaché in Brazil is now estimating the 24/25 crop in the country at 165 mmt. Planted acreage grew from last year, and crop estimates have continued to grow as the season continues. Brazilian weather forecasts remain favorable while Argentina may see a stretch of drier weather coming up.

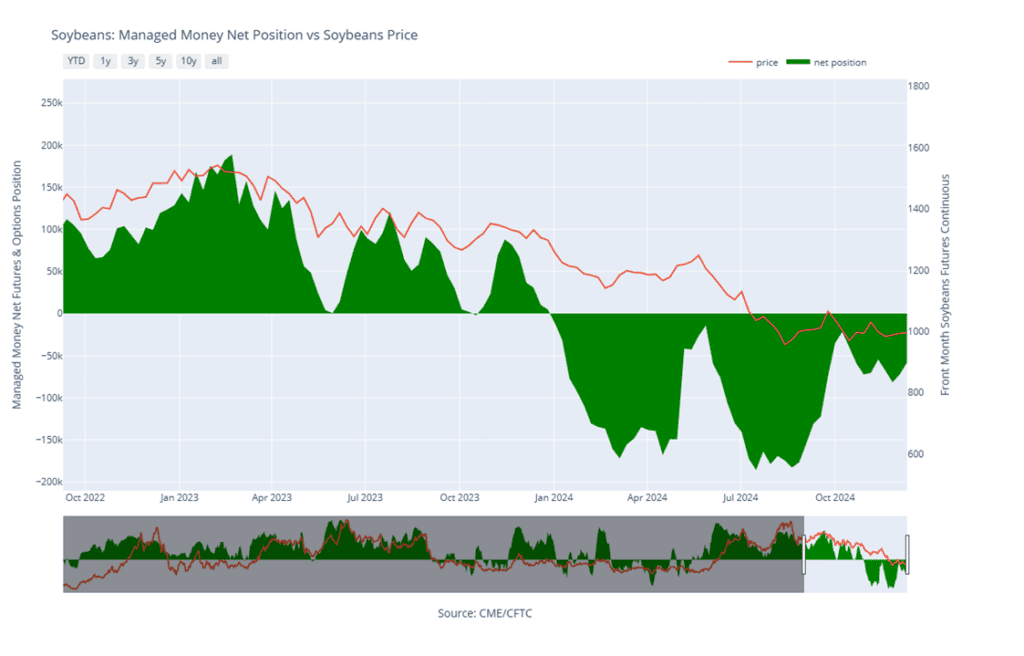

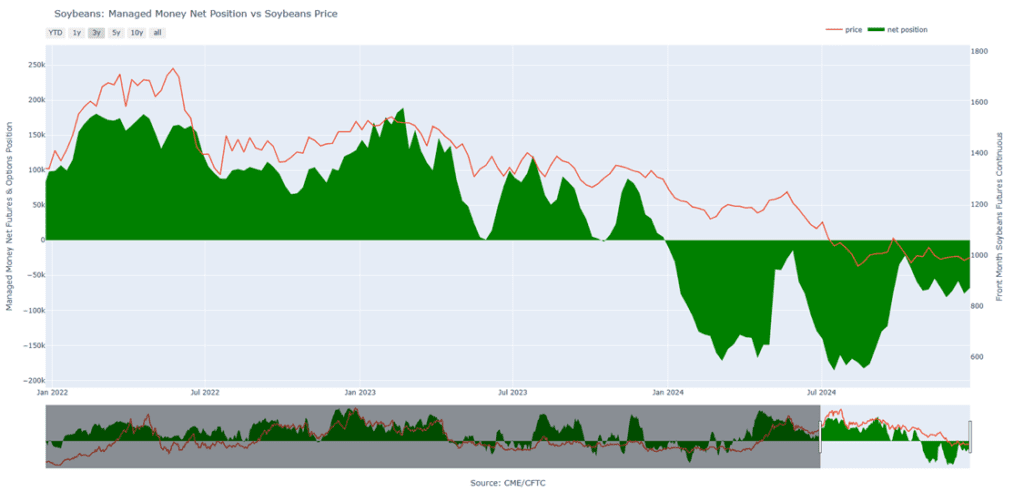

- Yesterday’s CFTC report saw funds as buyers of 8,369 contracts of soybeans as of December 24. This reduced their net short position to 67,883 contracts. With funds currently holding a large net long position in corn but a short position in soybeans, there may be room for funds to continue buying back contracts.

- In Indonesia, the government is planning on raising the biofuel blending requirement to 40% next year. This could cause fuel retailers and palm oil suppliers to face higher costs. The increase in demand for palm oil could be supported to soybean oil.

Above: The recent break in prices found initial support between 950 and 945. Initial overhead resistance lies just above the market near 985 with additional resistance between 990 and 1004.

Above: Soybean Managed Money Funds net position as of Tuesday, December 24. Net position in Green versus price in Red. Money Managers net bought 8,369 contracts between December 17 – 24, bringing their total position to a net short 67,883. contracts.

Wheat

Market Notes: Wheat

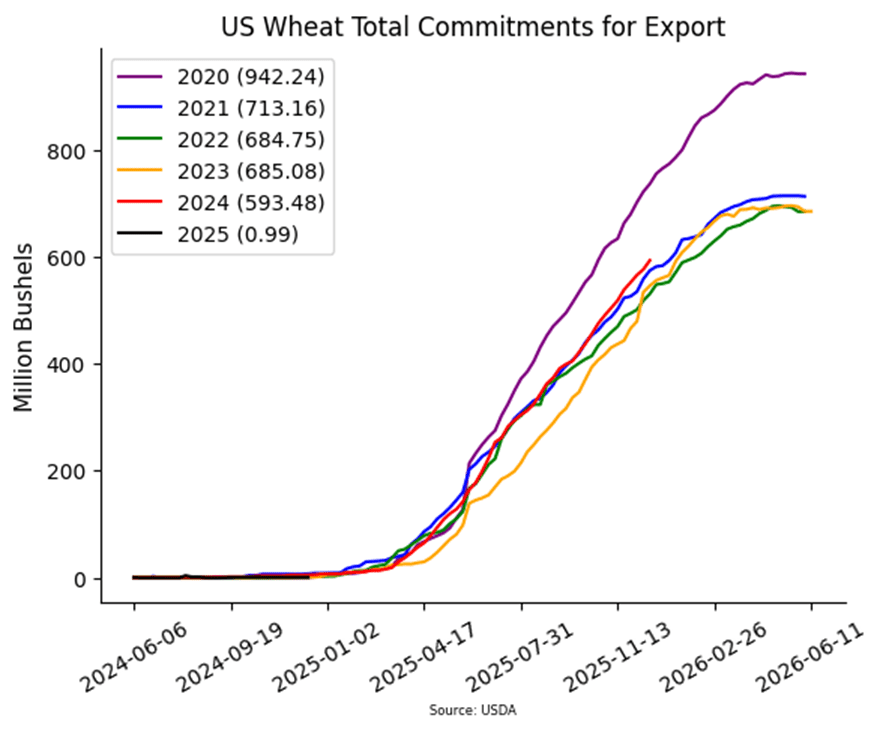

- Wheat managed to grind higher into the close, supported by stronger corn and sharply higher soybeans. Matif wheat also saw a strong close, with the front-month March contract finishing above its 200-day moving average for the first time since October. However, a higher US Dollar Index may have capped the upside for wheat today.

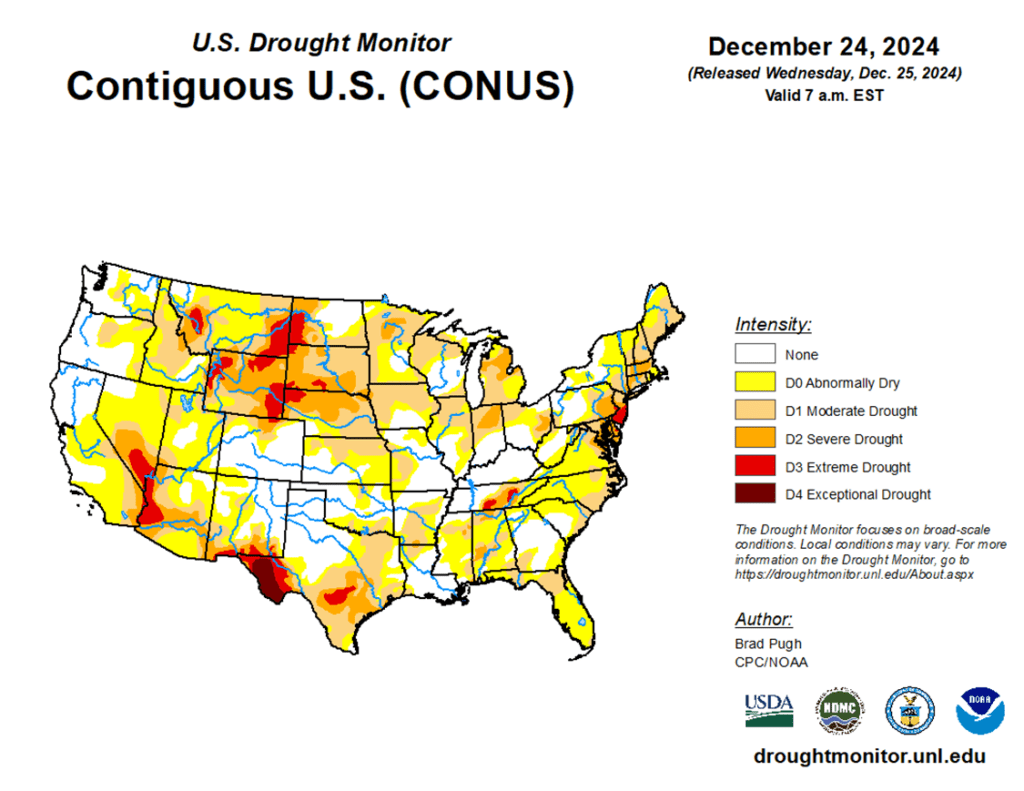

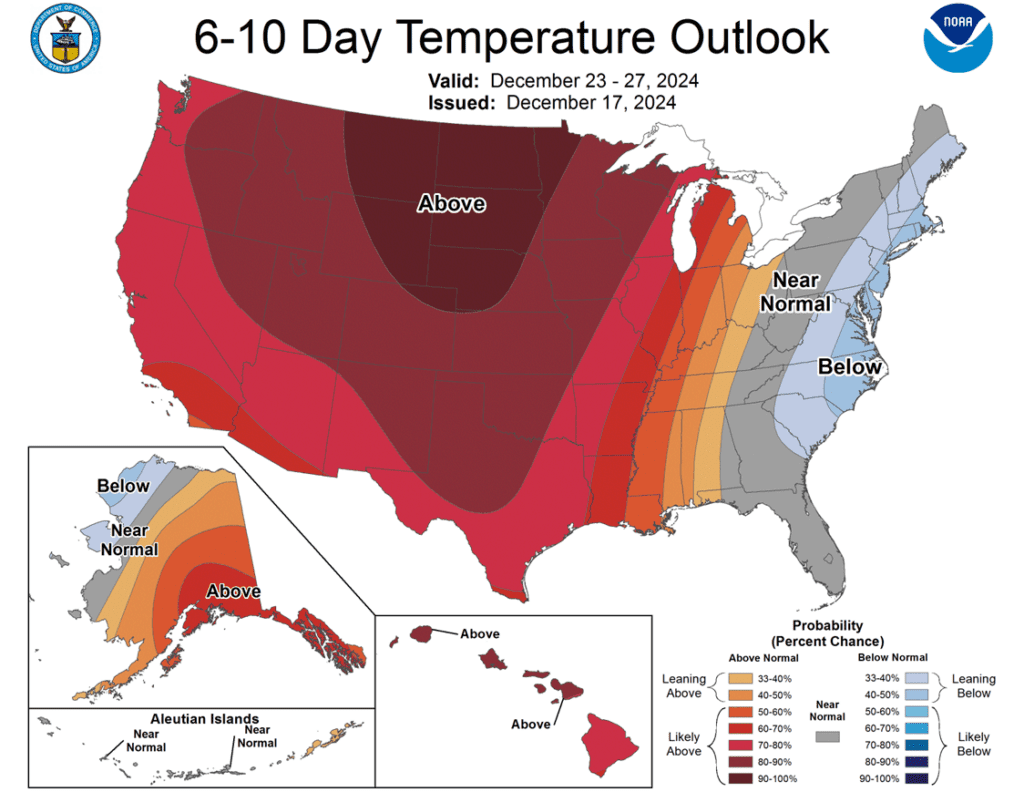

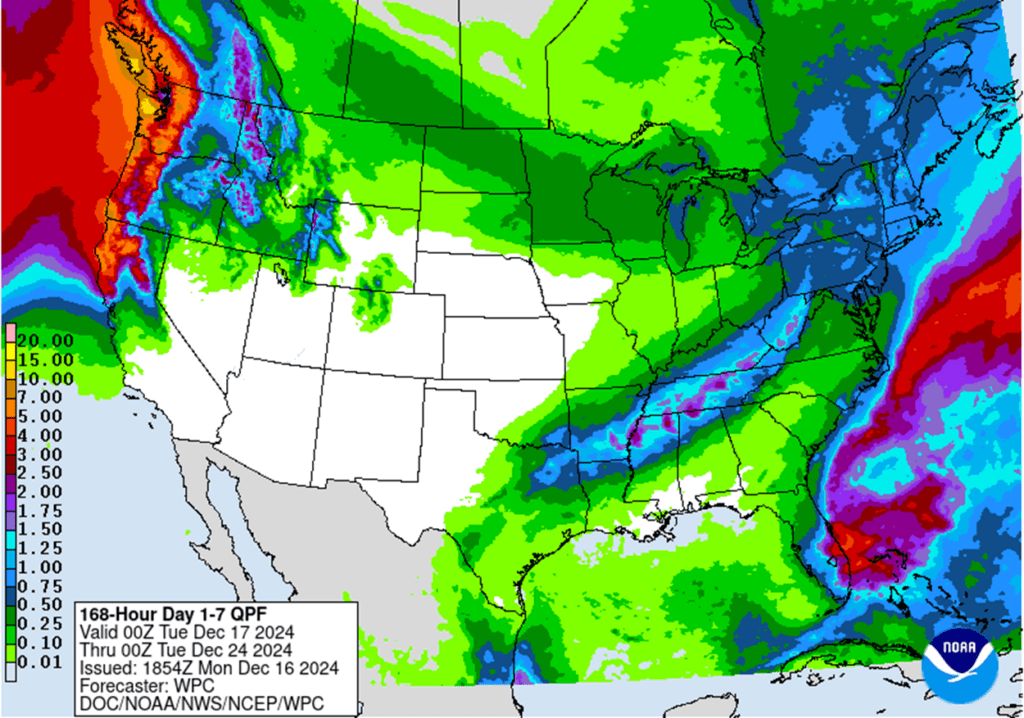

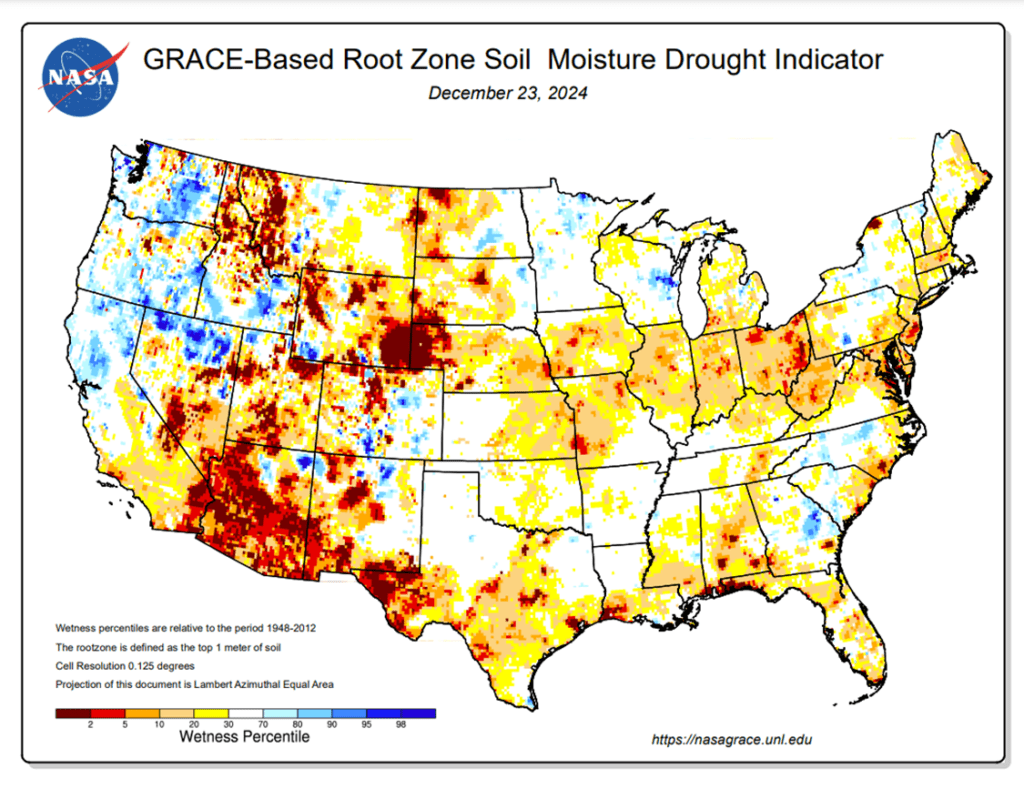

- A ‘polar vortex’ is expected to move into the US this week, potentially bringing below-freezing temperatures. This cold snap could affect southern wheat areas, where there is little to no snow cover. The risk of frost and freeze damage could be bullish for the market.

- According to CONAB, Brazil’s 2024 wheat planted area is approximately 12% smaller than the previous year, totaling 3.061 million hectares. However, production is expected to rise by 13% compared to the last crop, with the 2024 harvest estimated at 8.064 mmt, a slight decrease of just 0.4% from 2023.

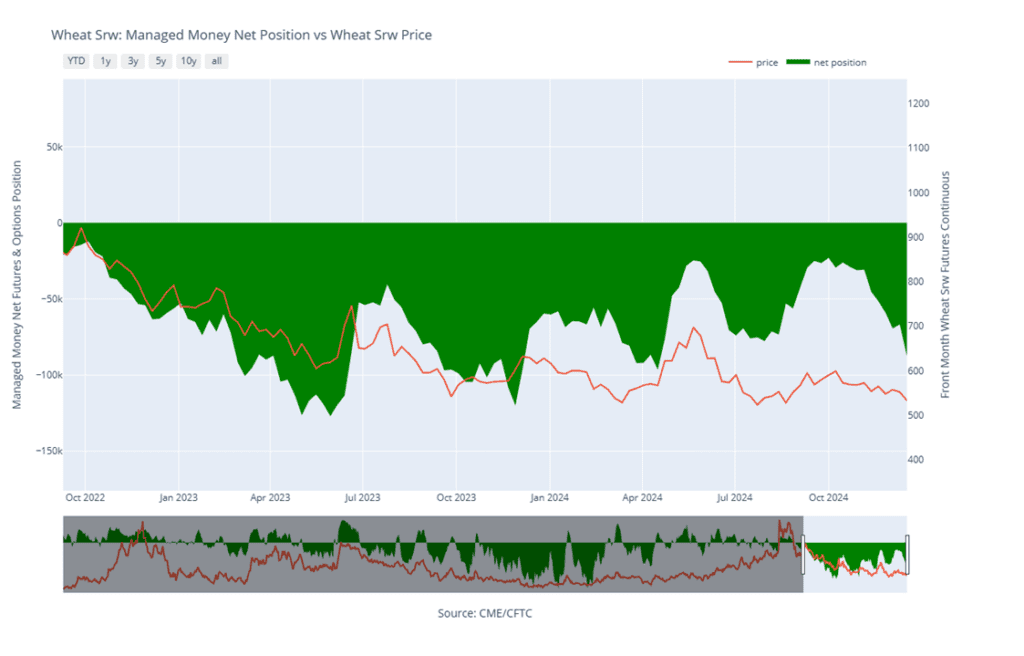

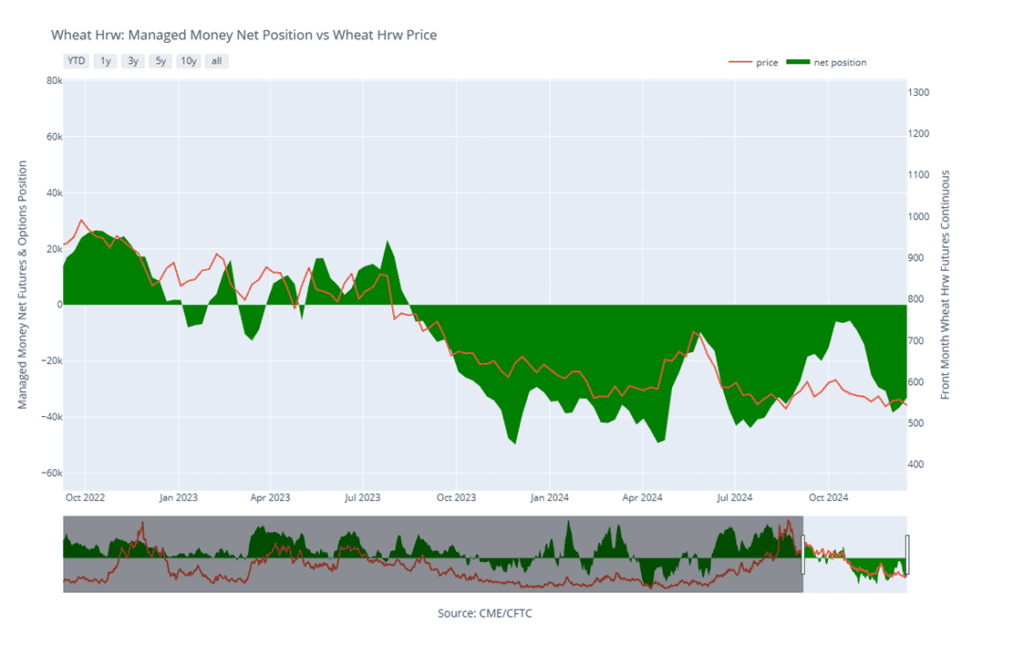

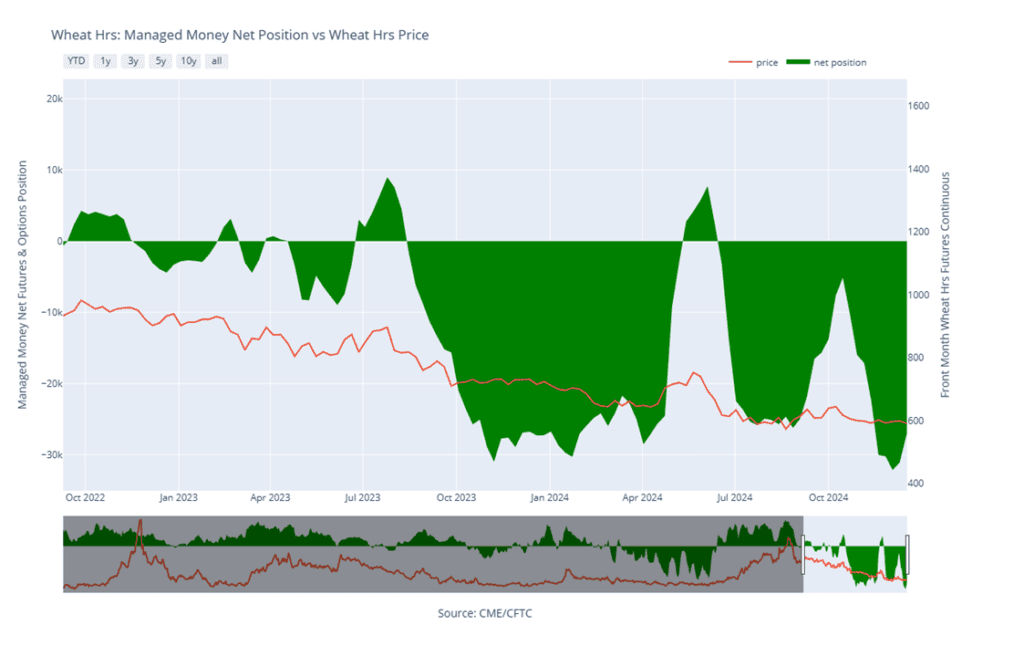

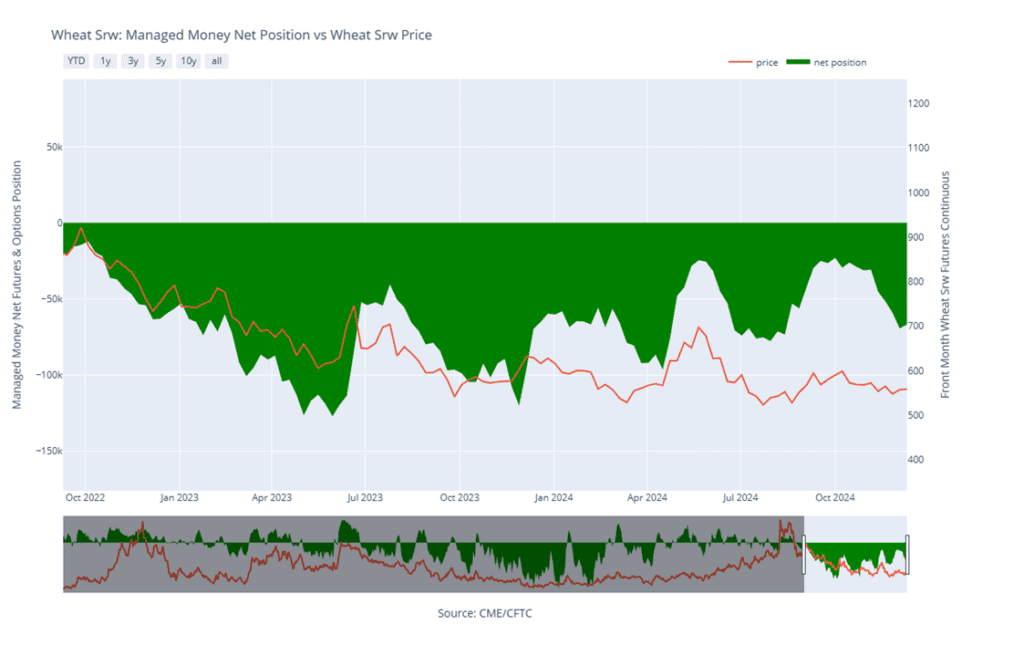

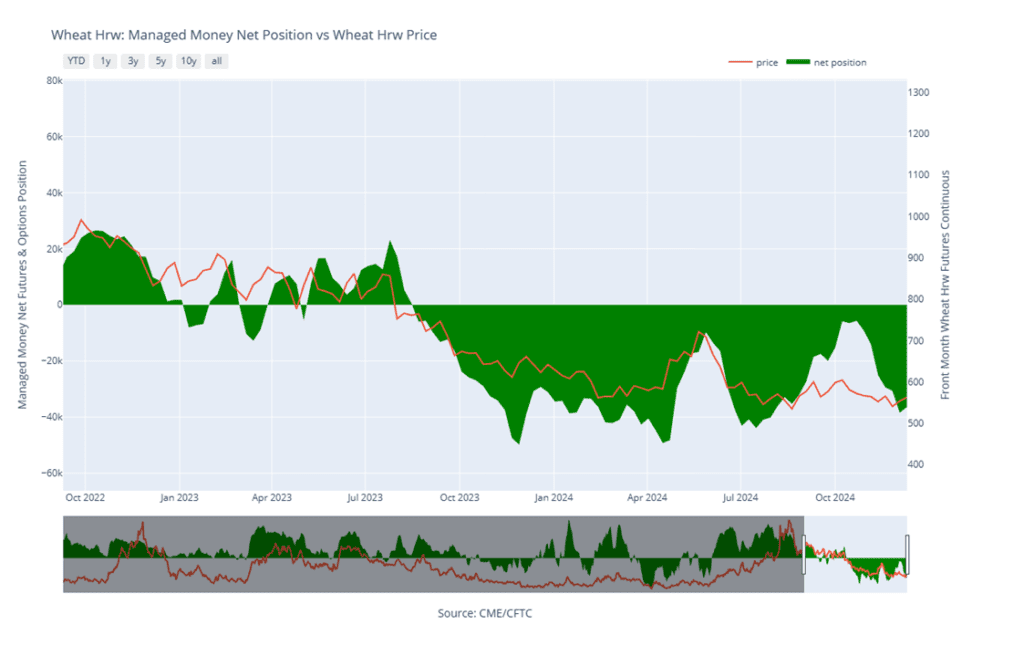

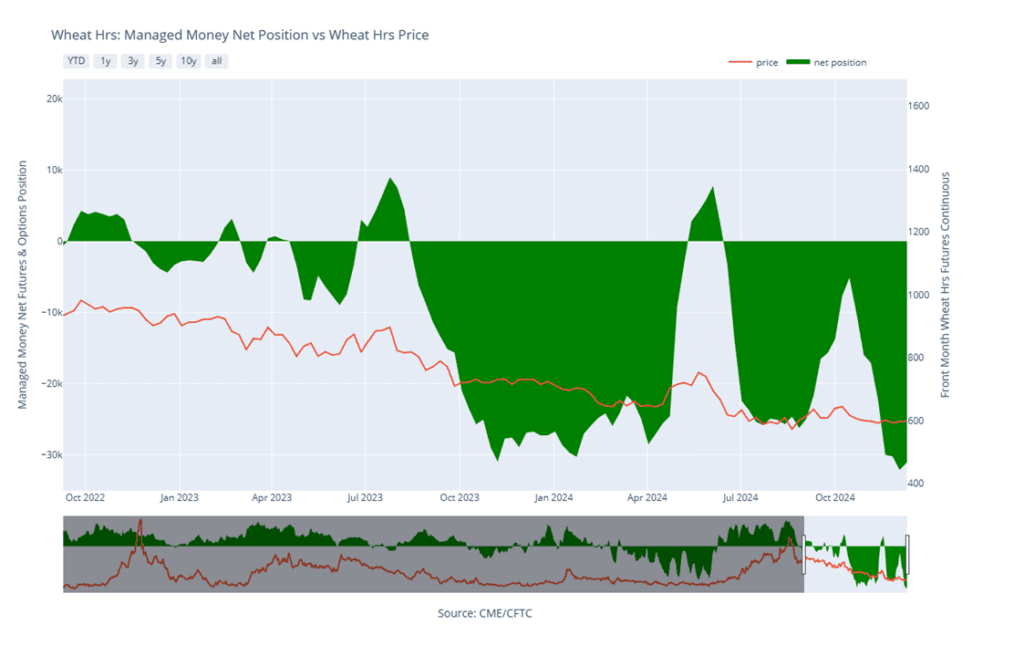

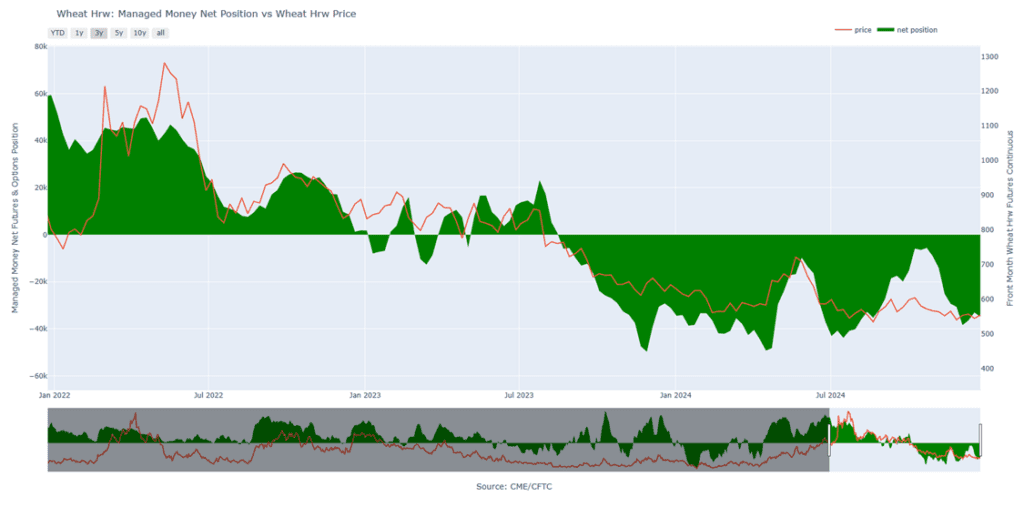

- According to the CFTC’s Commitments of Traders report, managed funds sold approximately 7,600 contracts of Chicago wheat and 1,900 contracts of Kansas City wheat. They were net buyers of a small amount of Minneapolis futures. However, the total short position in wheat, at nearly 157,000 contracts, is the largest in eight months.

Chicago Wheat Action Plan Summary

2024 Crop:

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing. With harvest underway in the southern hemisphere and winter wheat into dormancy in the northern hemisphere, this can historically be a slow time of the year for the wheat market.

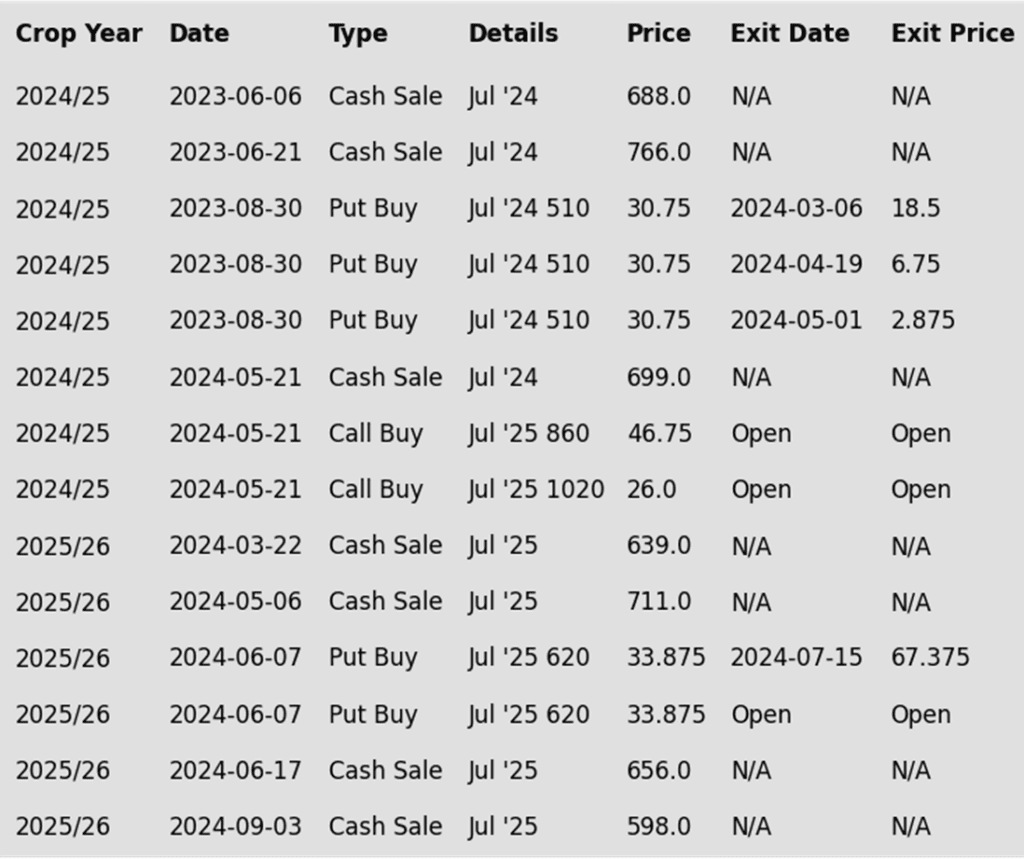

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

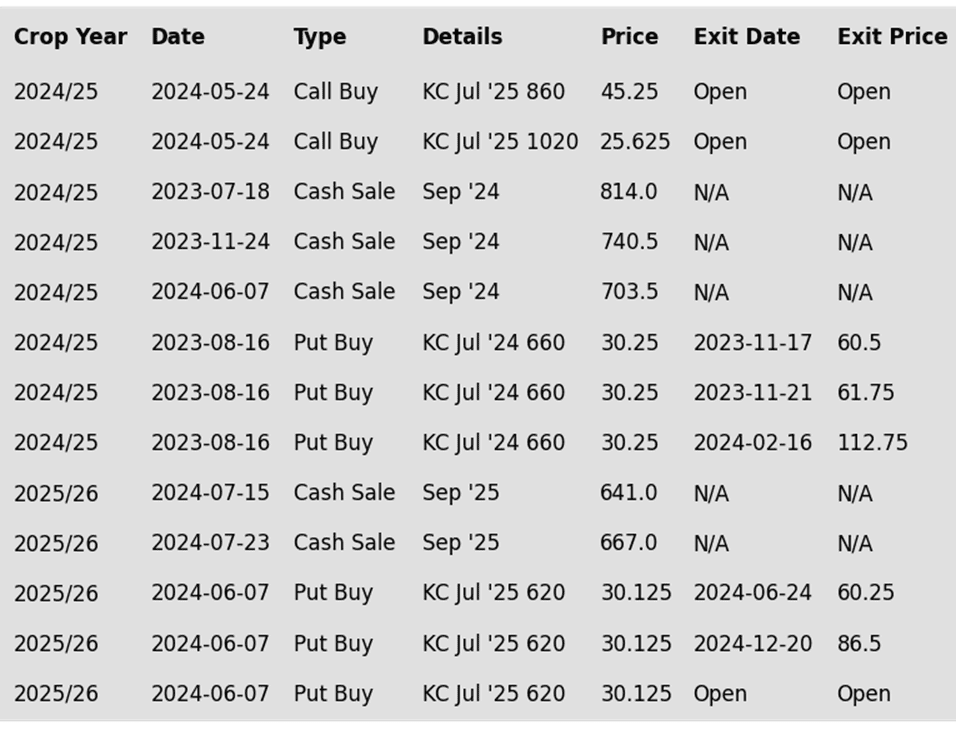

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

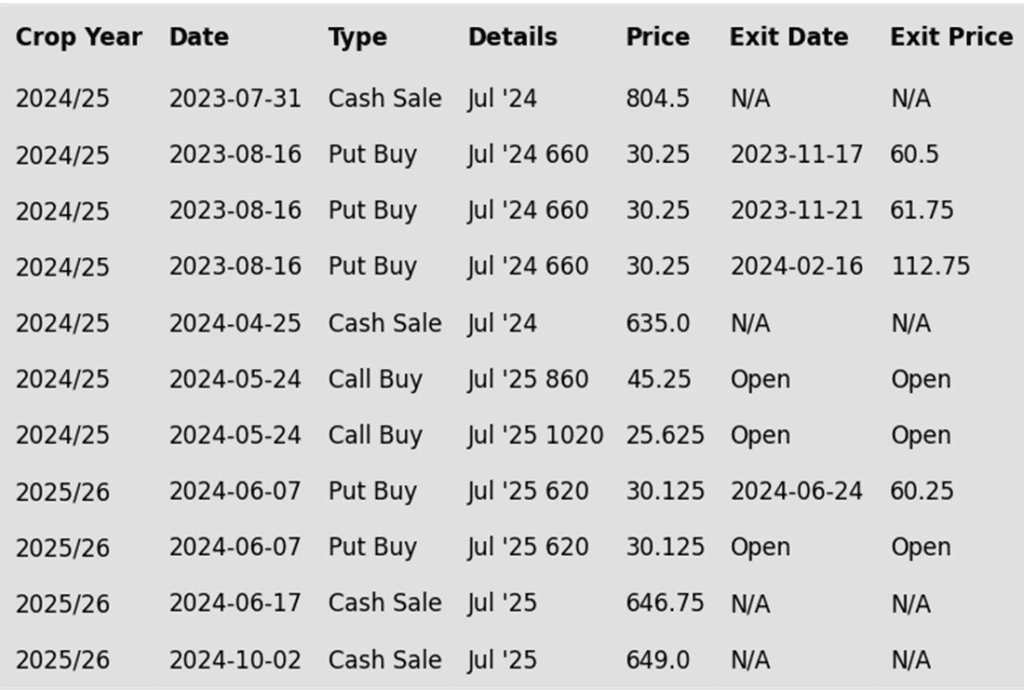

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 20- and 50-day moving averages around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

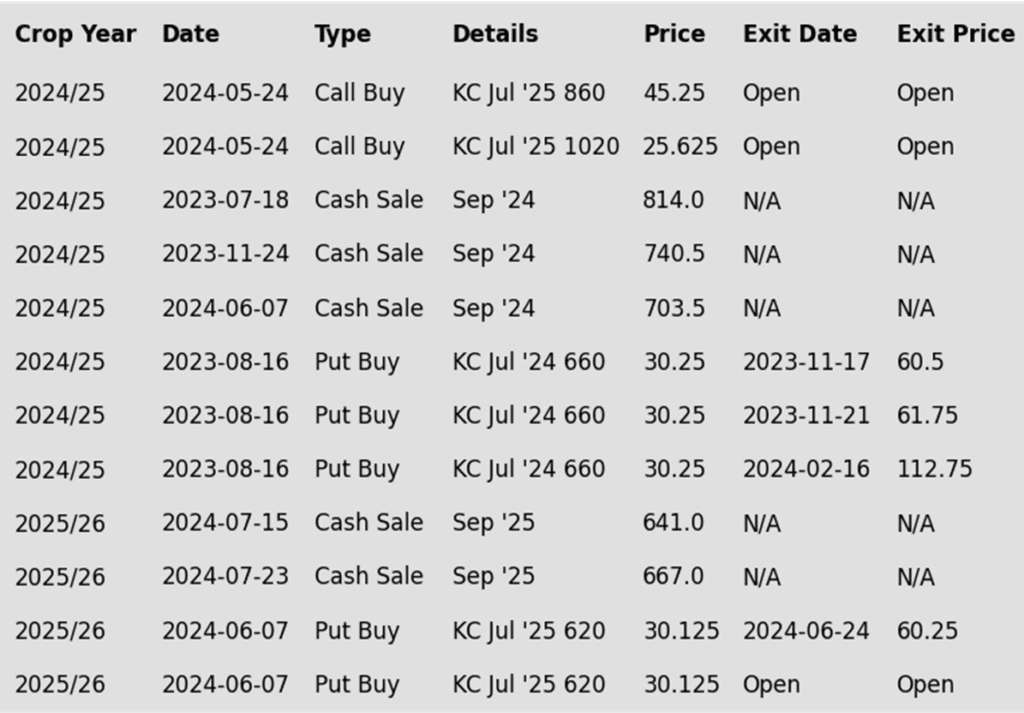

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider sees a continued opportunity to liquidate half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, December 24th. Net position in Green versus price in Red. Money Managers net sold 1,869 contracts between December 17-24, bringing their total position to a net short 34,936 contracts.

Other Charts / Weather

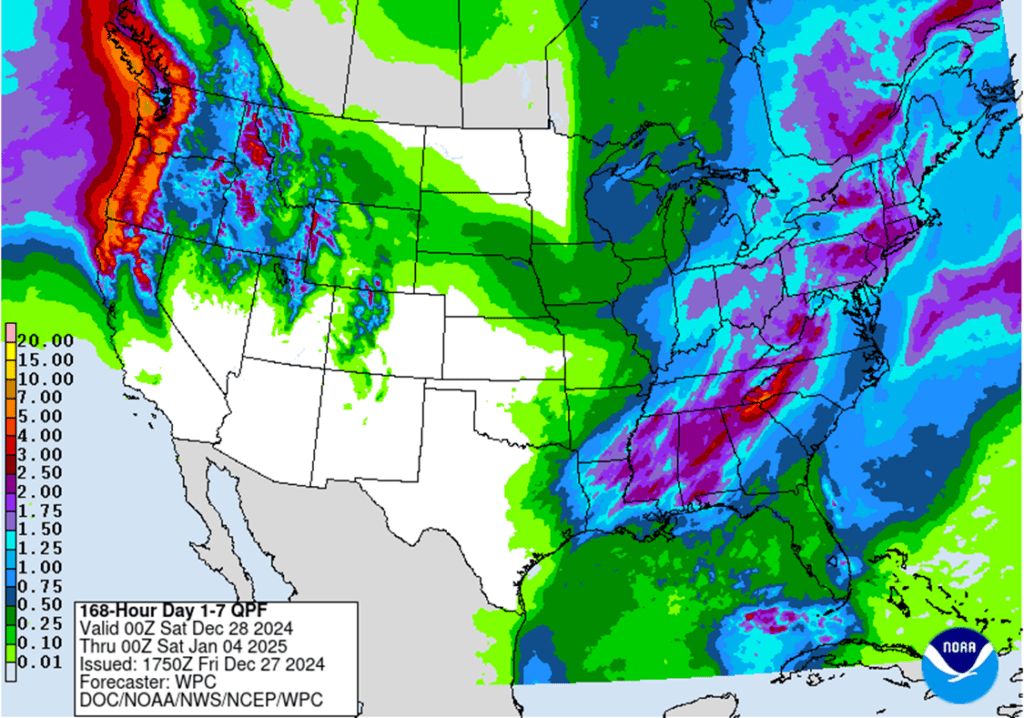

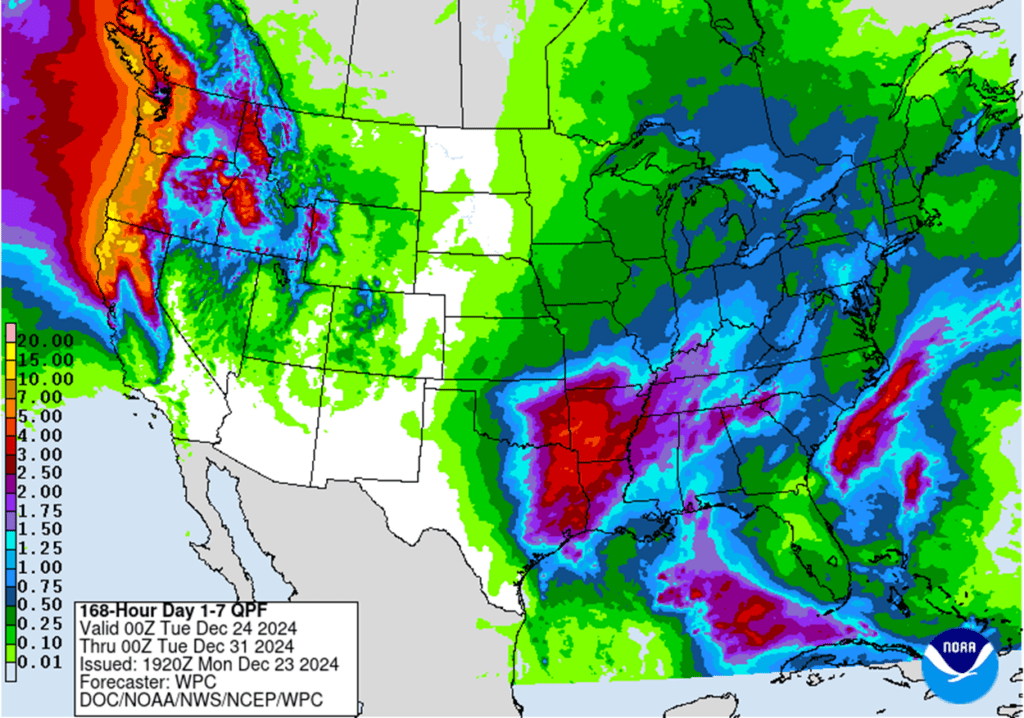

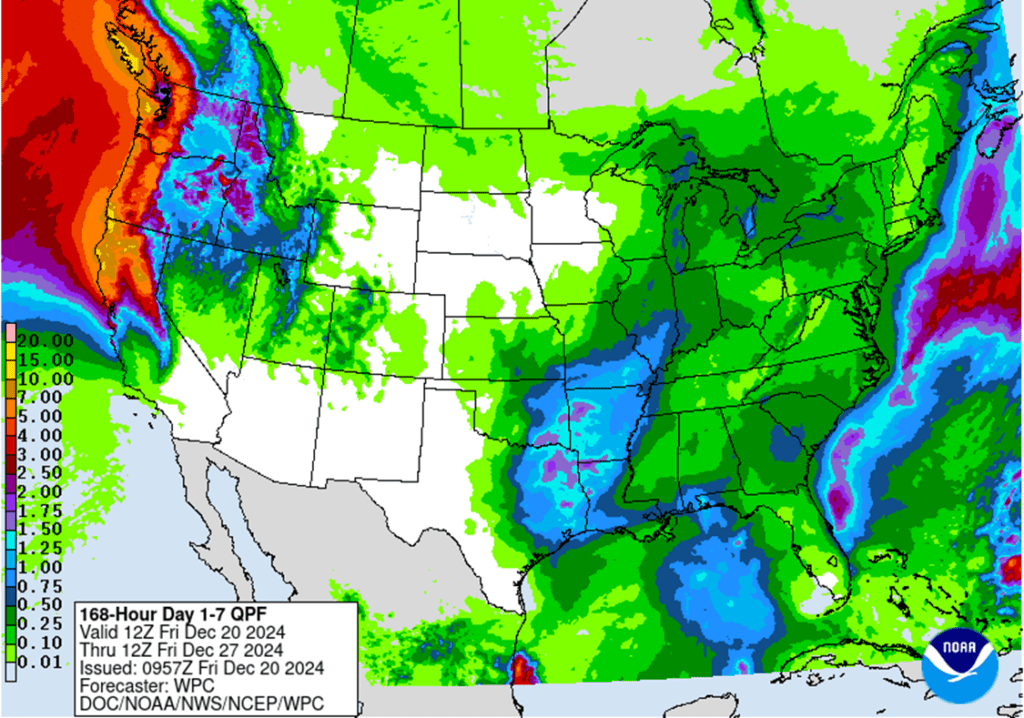

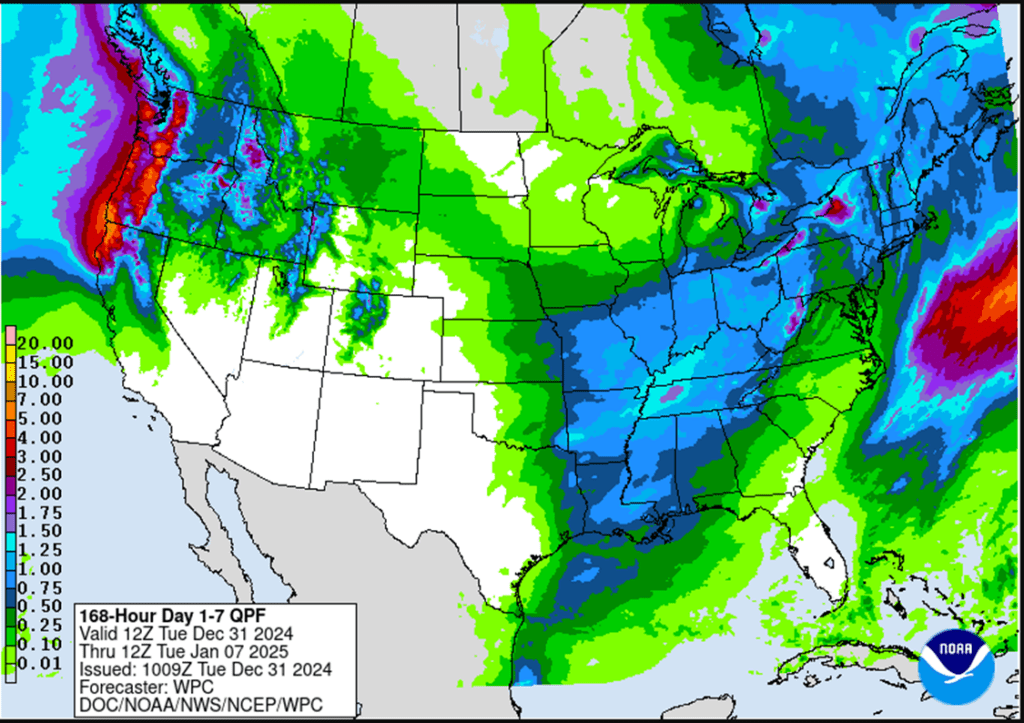

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

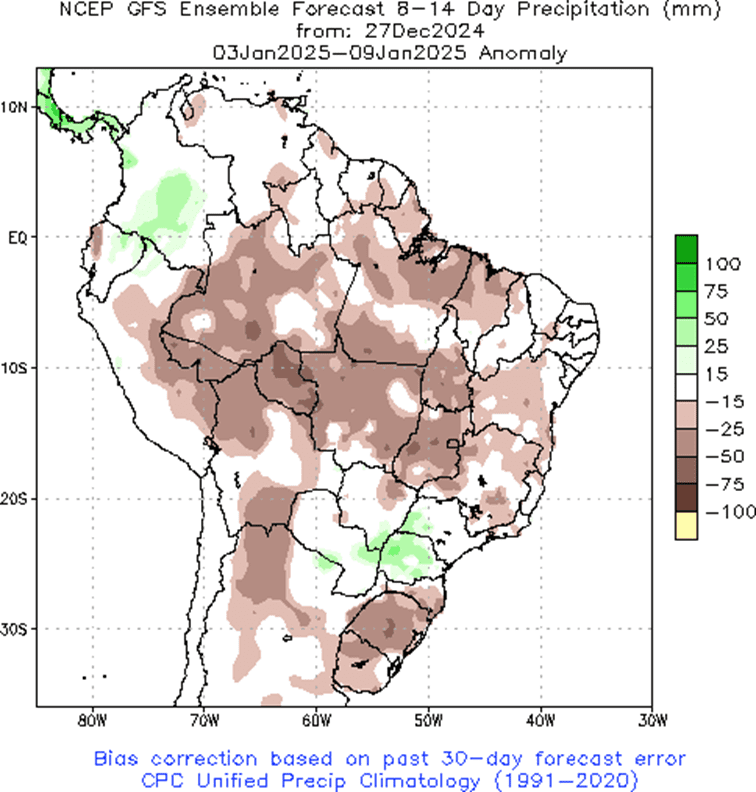

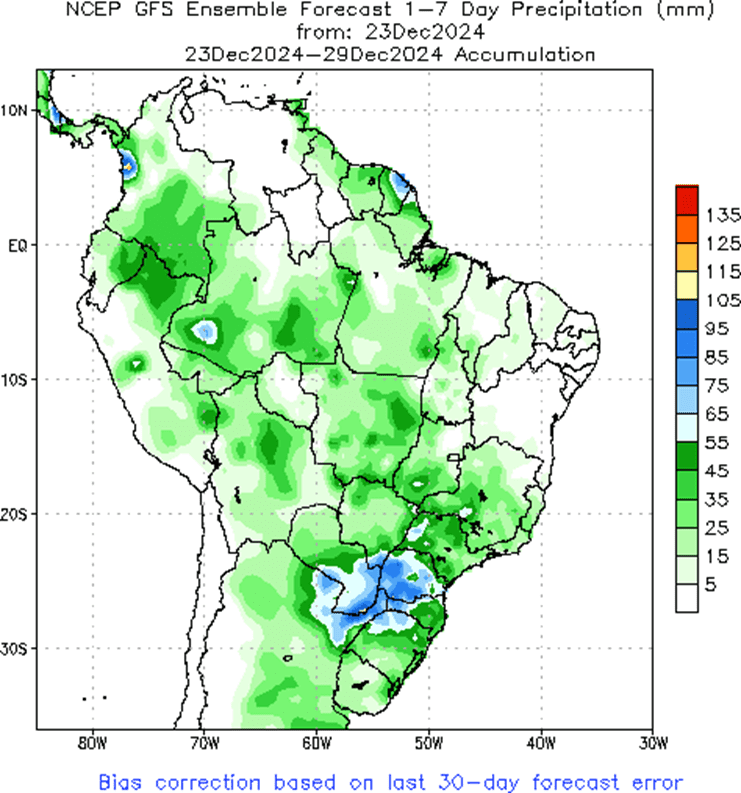

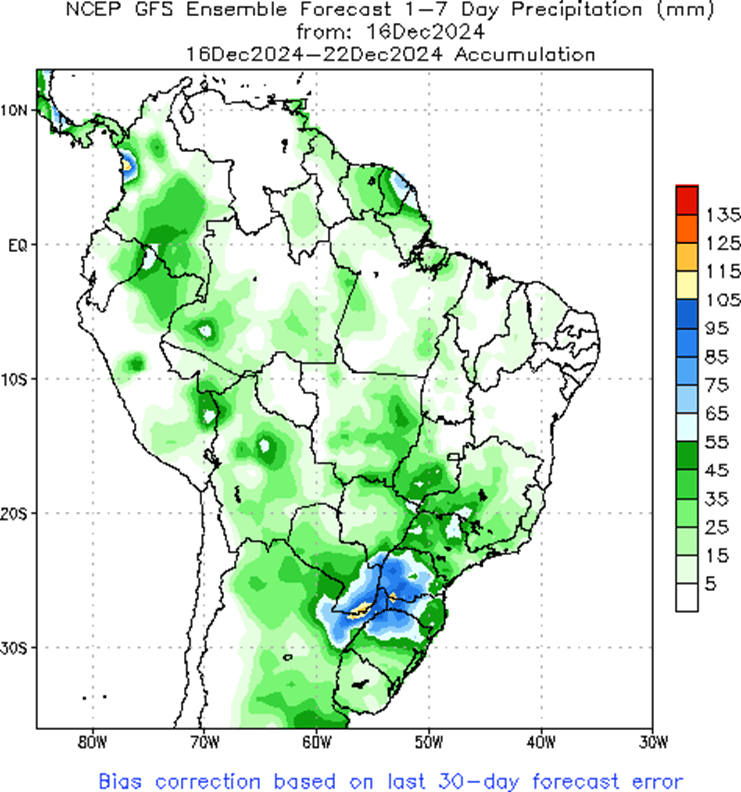

Above: Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

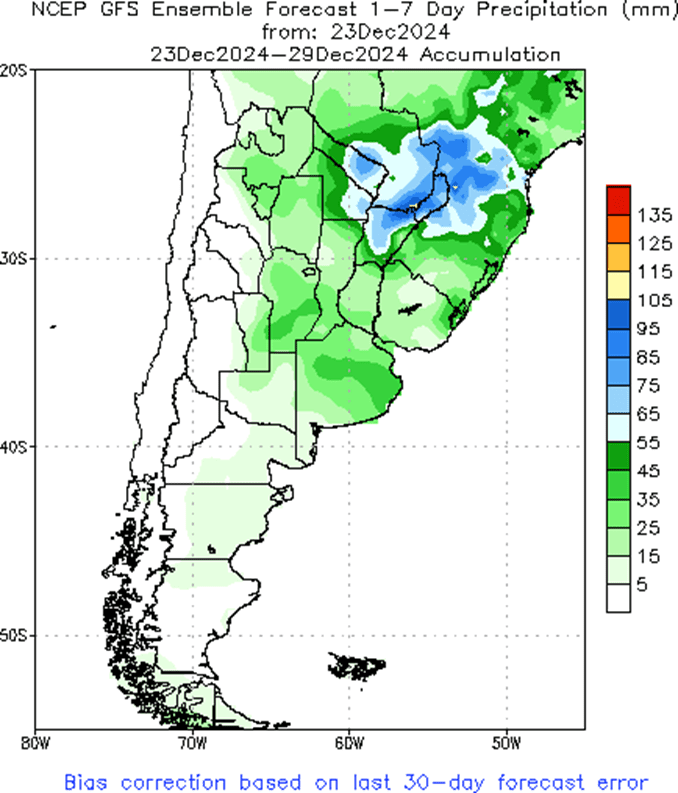

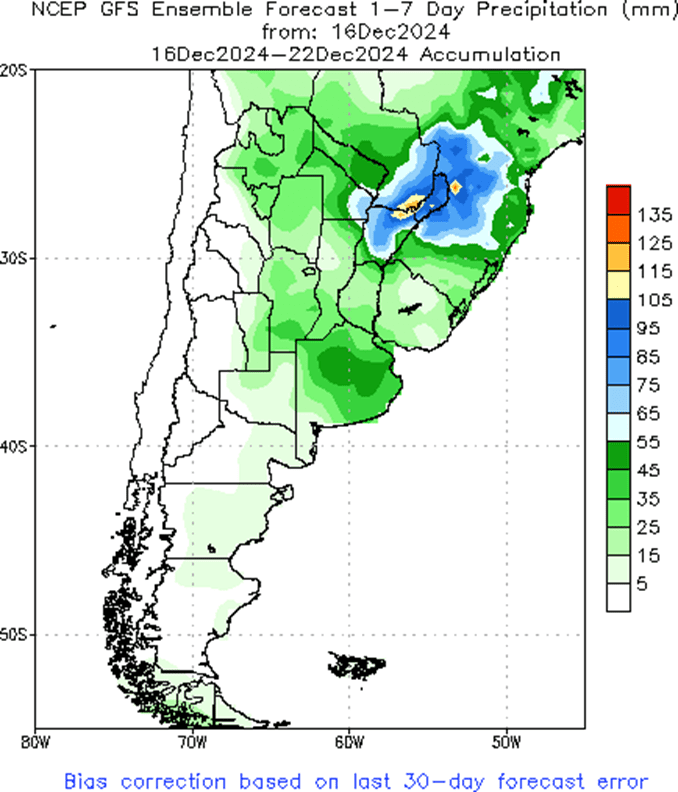

Above: Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.