1-15 End of Day: Soybeans Fall, Corn Battles Back on Wednesday

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- Firm crude oil prices and strong ethanol production supported corn futures, pushing prices back near recent highs.

- Soybean futures closed lower as poor technical signals weighed on the market, despite record December soybean crush figures reported by NOPA.

- Wheat futures posted a mixed close for the second straight session, with lower Paris milling wheat futures adding pressure to U.S. wheat markets.

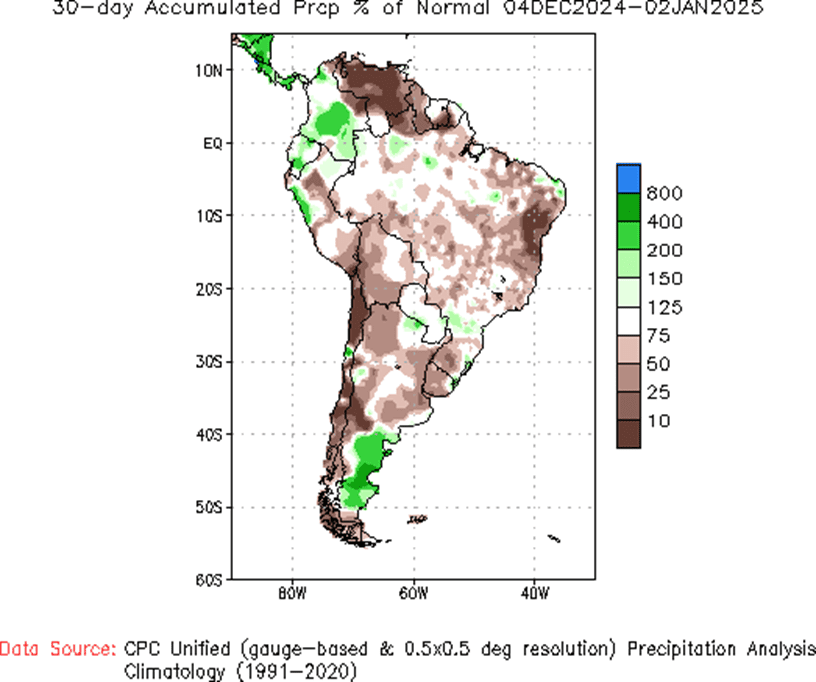

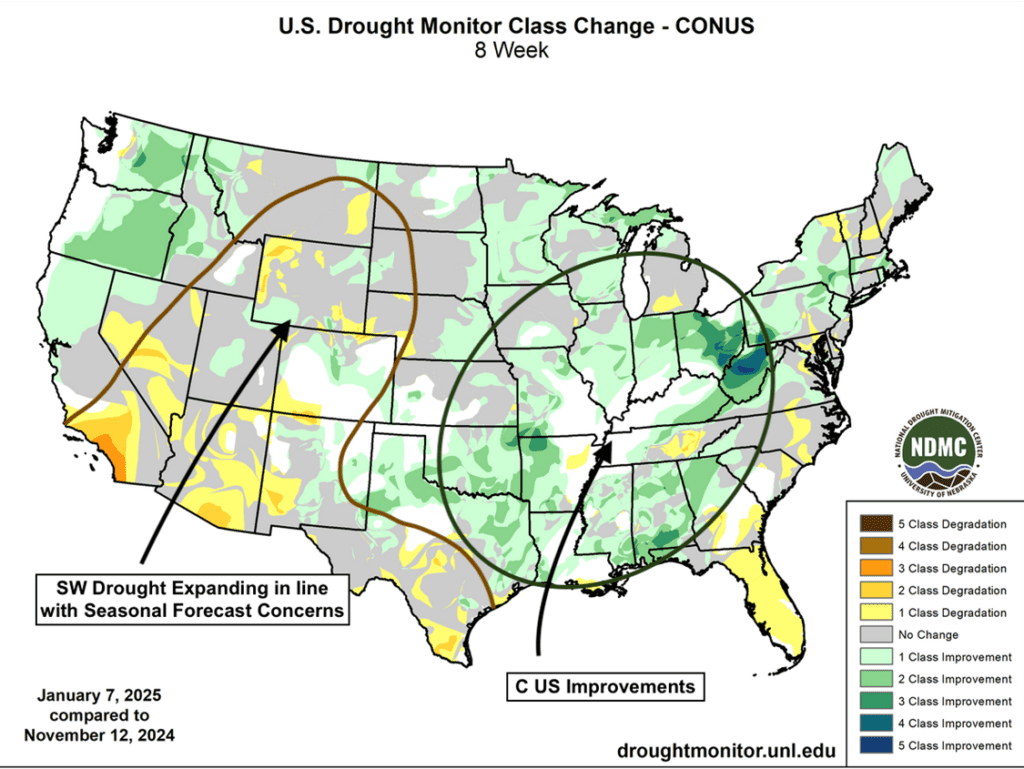

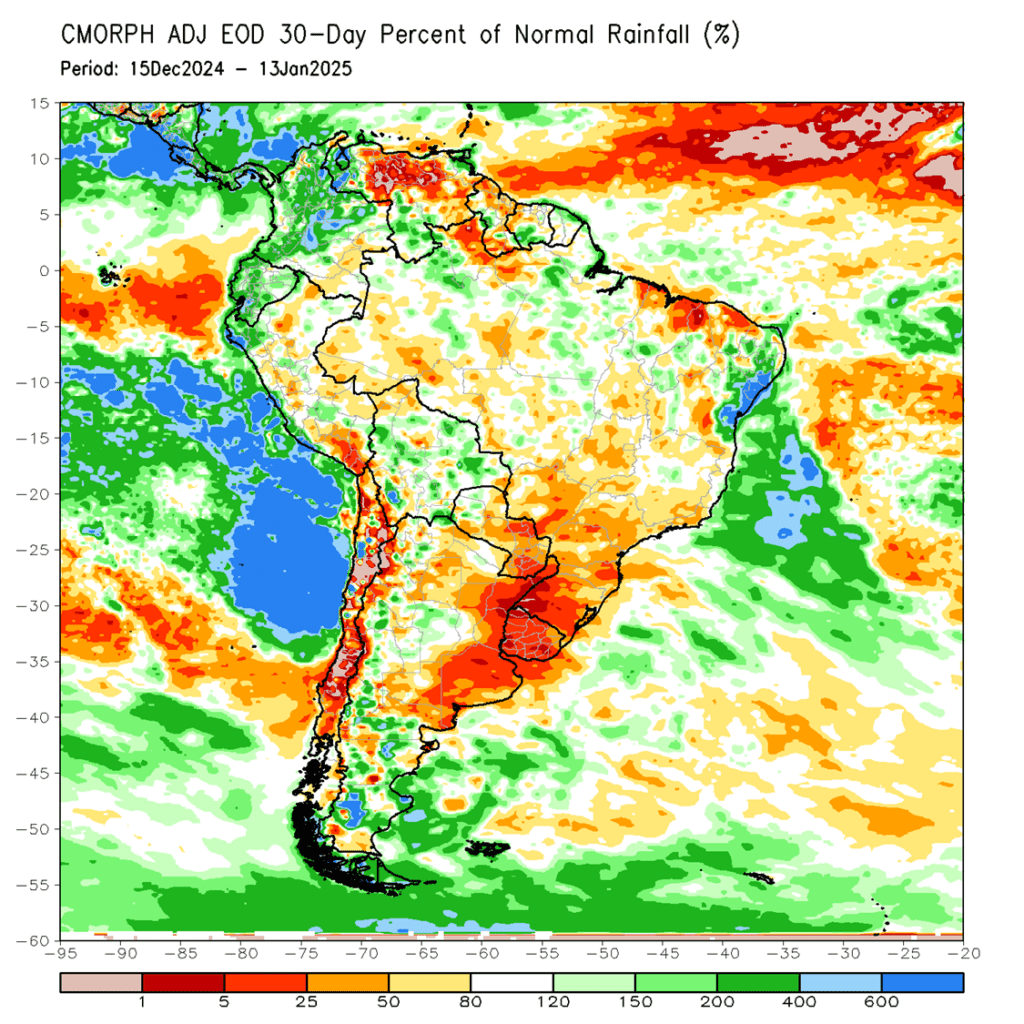

- To see the 8-week U.S. drought monitor class change as well as the 30-day percent of normal precipitation map for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

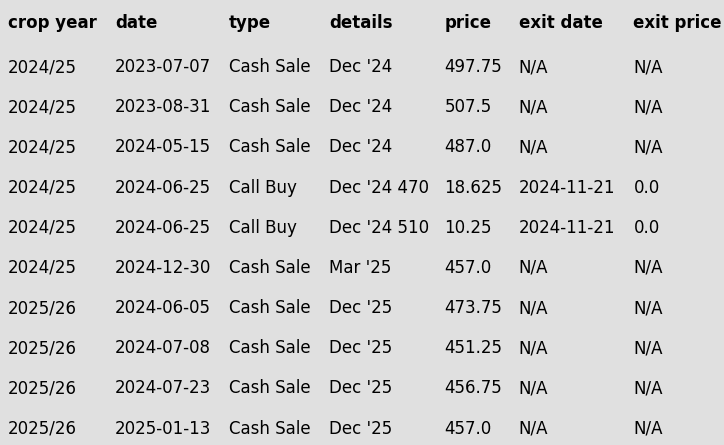

- Grain Market Insider recently recommended selling a portion of your 2024 corn crop.

- With March futures knocking on the door of their highest level since May 2024 and continuous corn up roughly 25% from the pre-harvest low in August, it is time to reward this rally.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell a portion of your 2025 corn crop.

- The December ’25 corn contract has entered the target range of 455–475.

- First resistance is just under 3 cents away at the October 2024 high of 459.75. Selling near this level is advisable in case this resistance halts further gains in the December ’25 contract.

- If the December ’25 contract breaks above 459.75, the next major resistance level is around 480. Selling near 480 would be the next target for a potential sales recommendation.

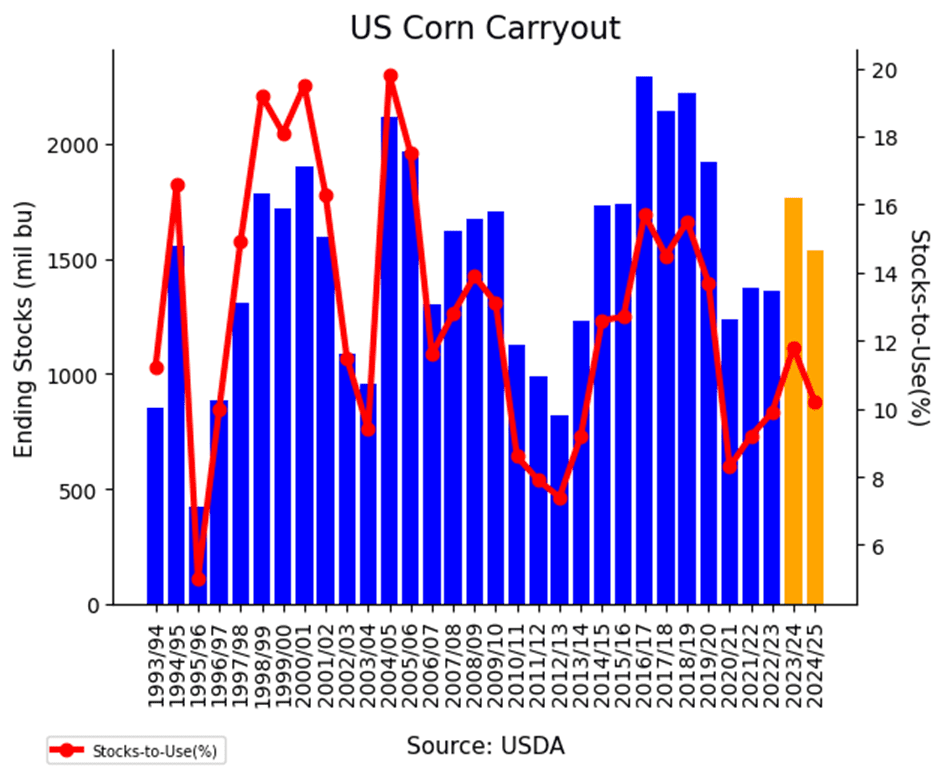

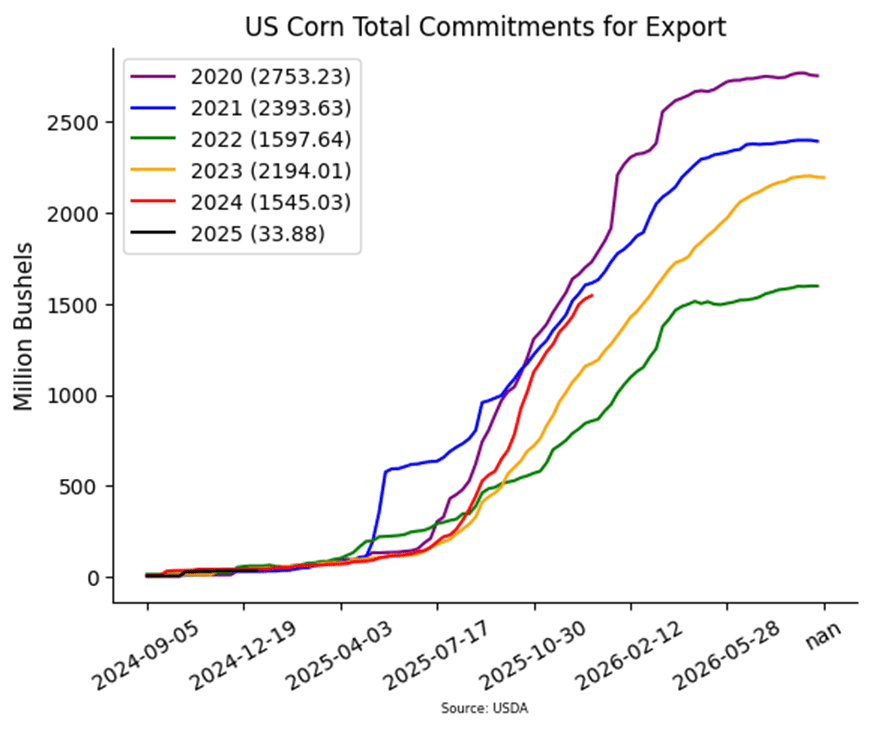

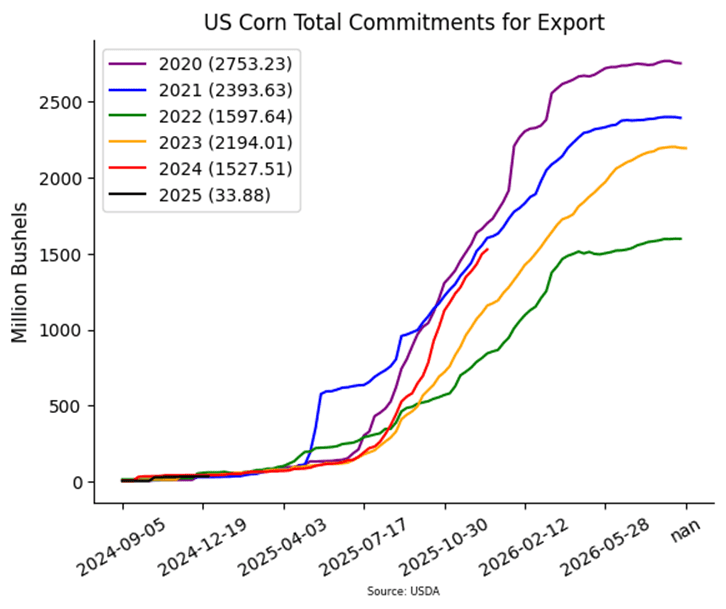

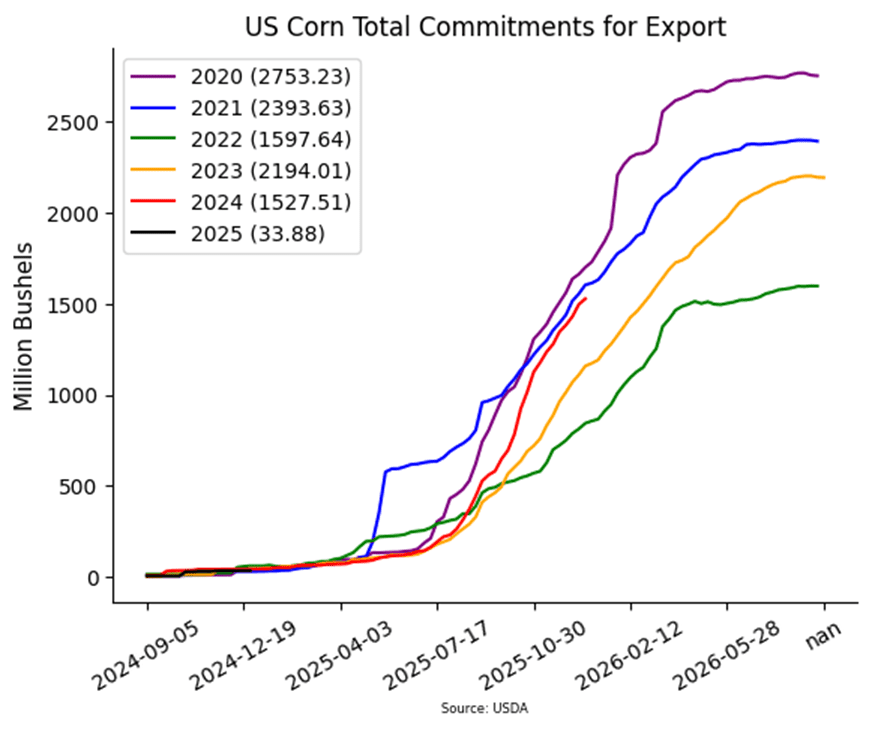

- Strong demand for U.S. corn continues to support the market, but higher prices may incentivize additional planted acres in the U.S. for 2025.

- Keep an eye out for a recommendation to purchase call options if prices close above major resistance. This strategy would protect current sales while allowing you to benefit from any extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

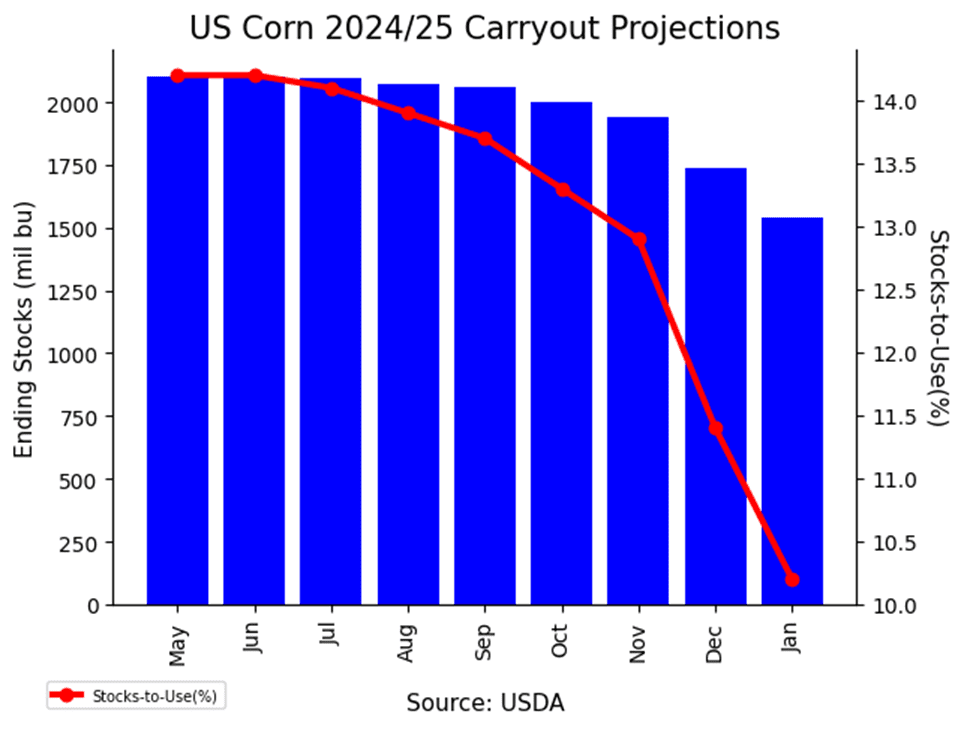

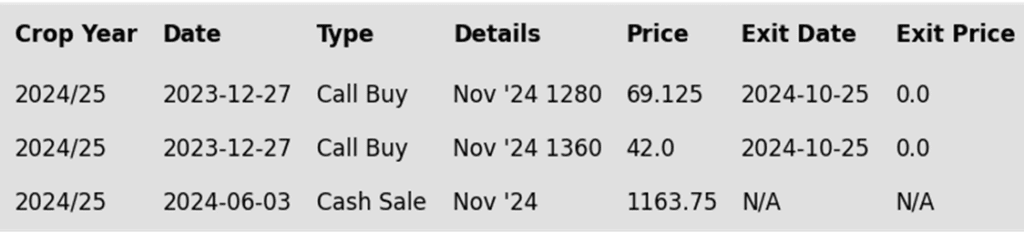

To date, Grain Market Insider has issued the following corn recommendations:

- Corn futures bucked the broader grain market trend on Wednesday, closing with small gains. A strong crude oil market provided support to corn as prices consolidated near the recent rally’s highs.

- Ethanol production declined for the second consecutive week, dropping to 322 million gallons/day, though still 3.9% higher year-over-year. Last week, 111 million bushels of corn were used for ethanol production, remaining ahead of the pace required to meet USDA targets for the marketing year.

- Despite the market strength, average cash basis levels continue to slip in the U.S., impacting the cash market in some areas as producers have been moving bushels into the pipeline on this recent rally.

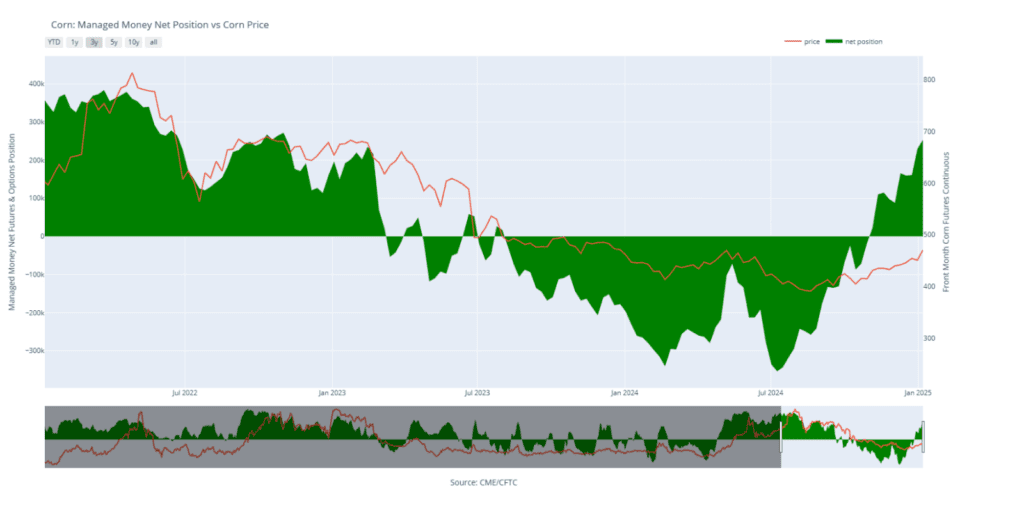

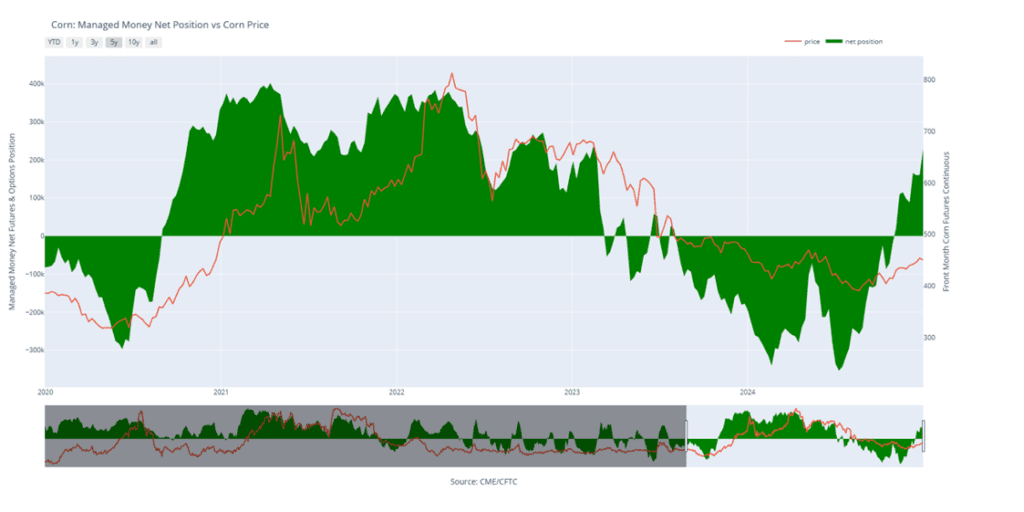

- Managed hedge funds added to their length in the corn market on last week’s Commitment of trader’s report. Funds were a net long approximately 253,000 contracts as of Jan 7. Estimates have the funds holding a net long of 280,000-300,000 contracts going into today’s trade. If realized, this would be the largest net long position since 2022 for this time frame.

- Crude oil prices surged above $80 per barrel for the first time since sanctions on Russian oil tightened supply. The rally in crude has supported the corn market and other commodities.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 460, with additional support near previous resistance at 450. Initial overhead resistance comes in near 480 with larger resistance just below 500.

Soybeans

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell a portion of your 2024 soybean crop.

- The March ’25 contract reached the 1060–1080 target range Tuesday, with an intraday high of 1064.

- At Tuesday’s close of 1047.50, the contract stands one dollar above its December low of 947.00.

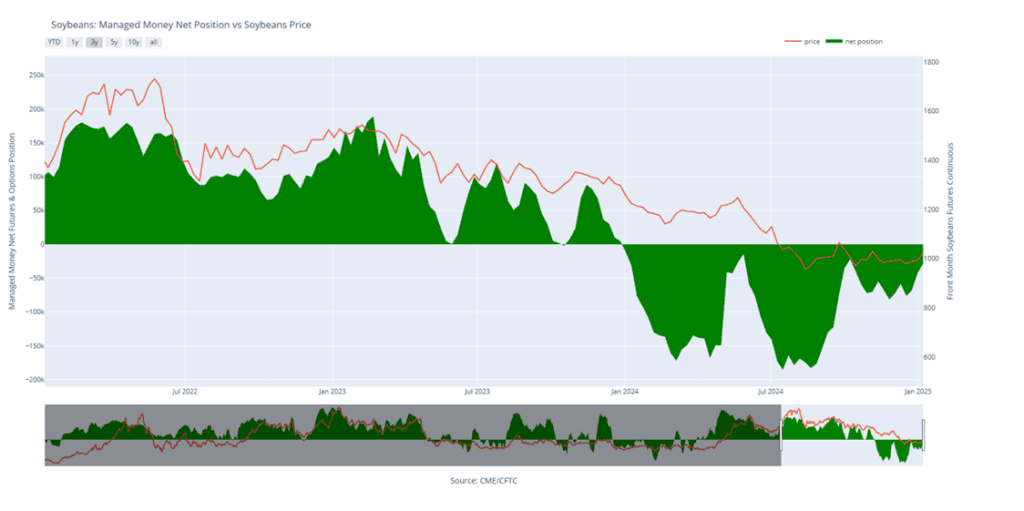

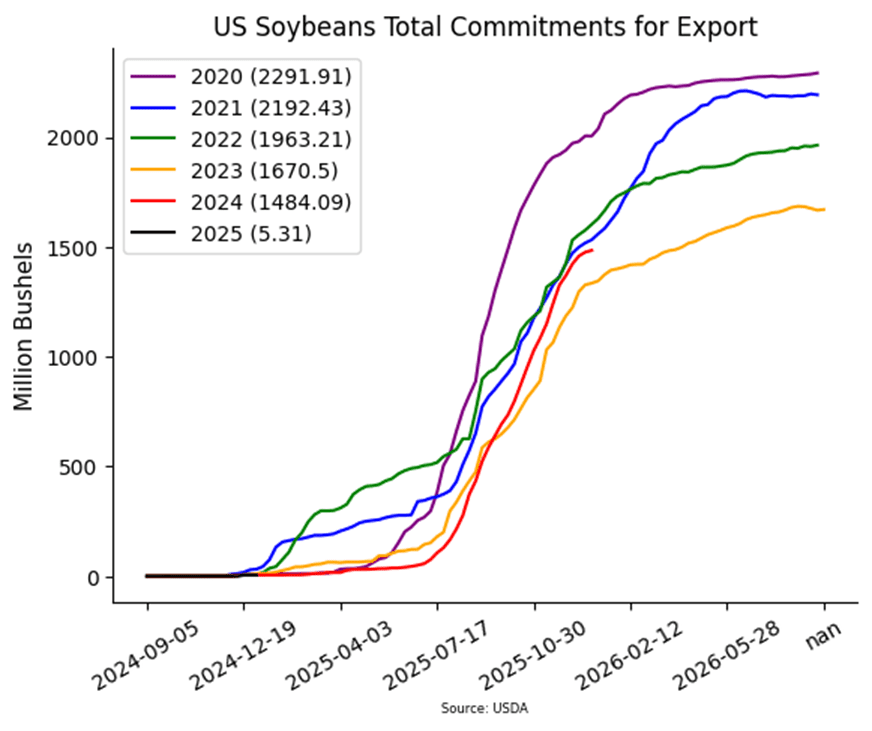

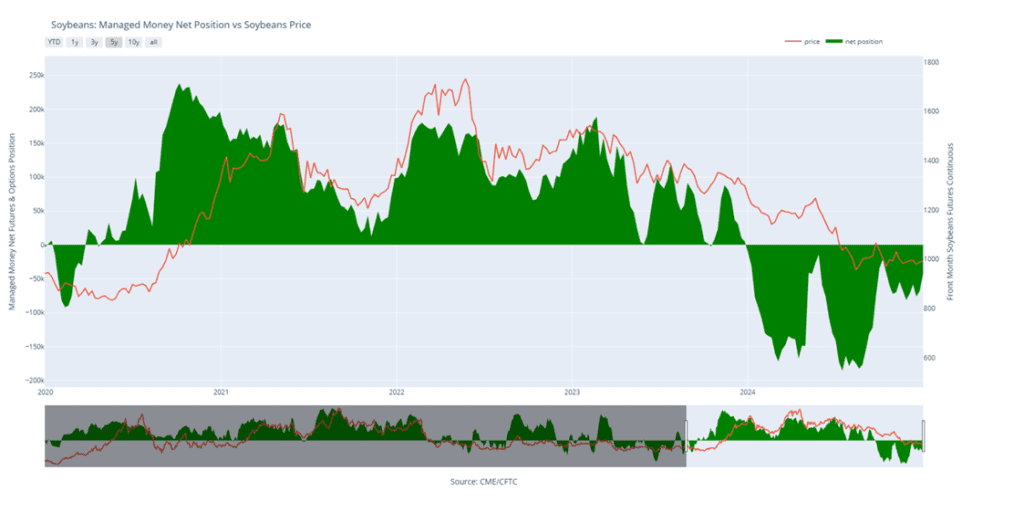

- With Funds covering a significant number of short positions and nearing a net-neutral stance, now is an opportune time to capitalize on the rally.

2025 Crop:

- The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Patience is recommended. No sales recommendations are planned until at least the peak of the U.S. growing season.

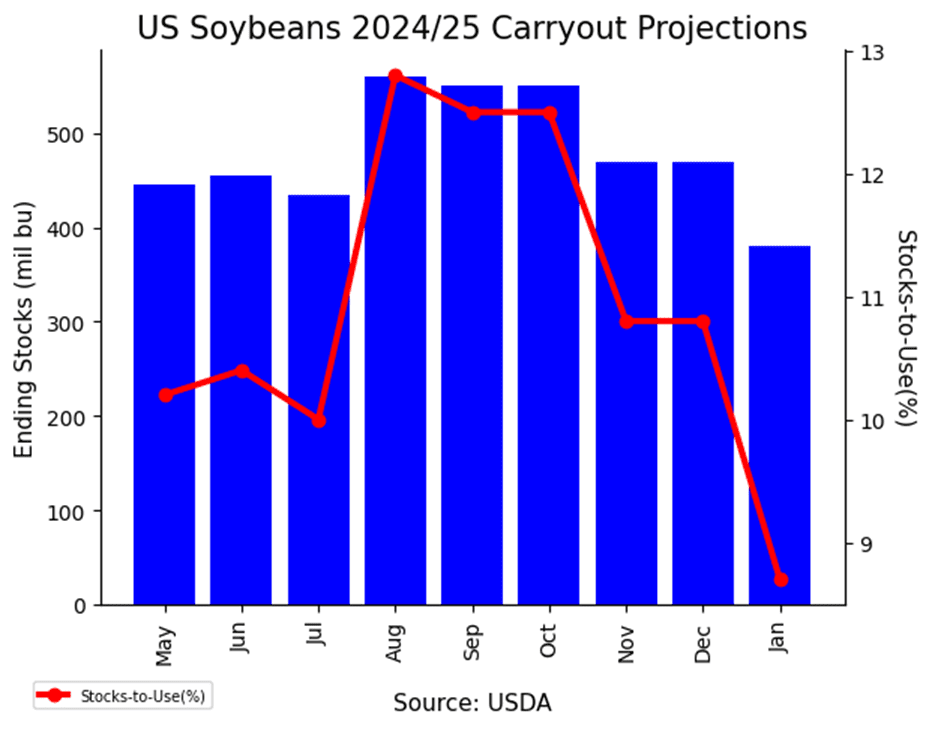

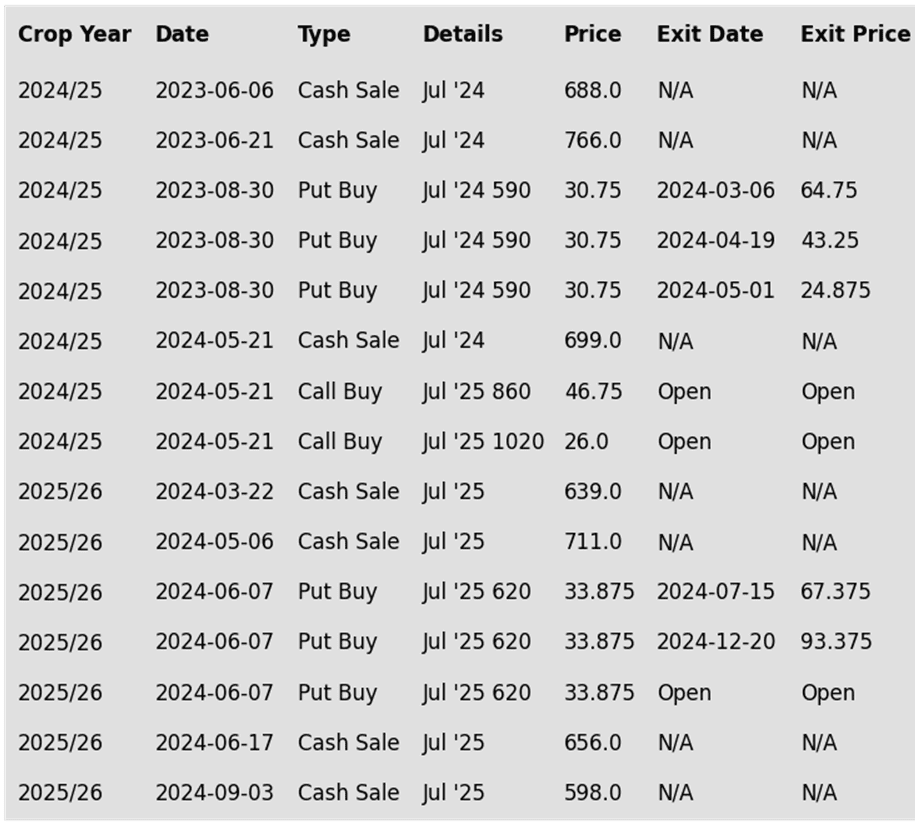

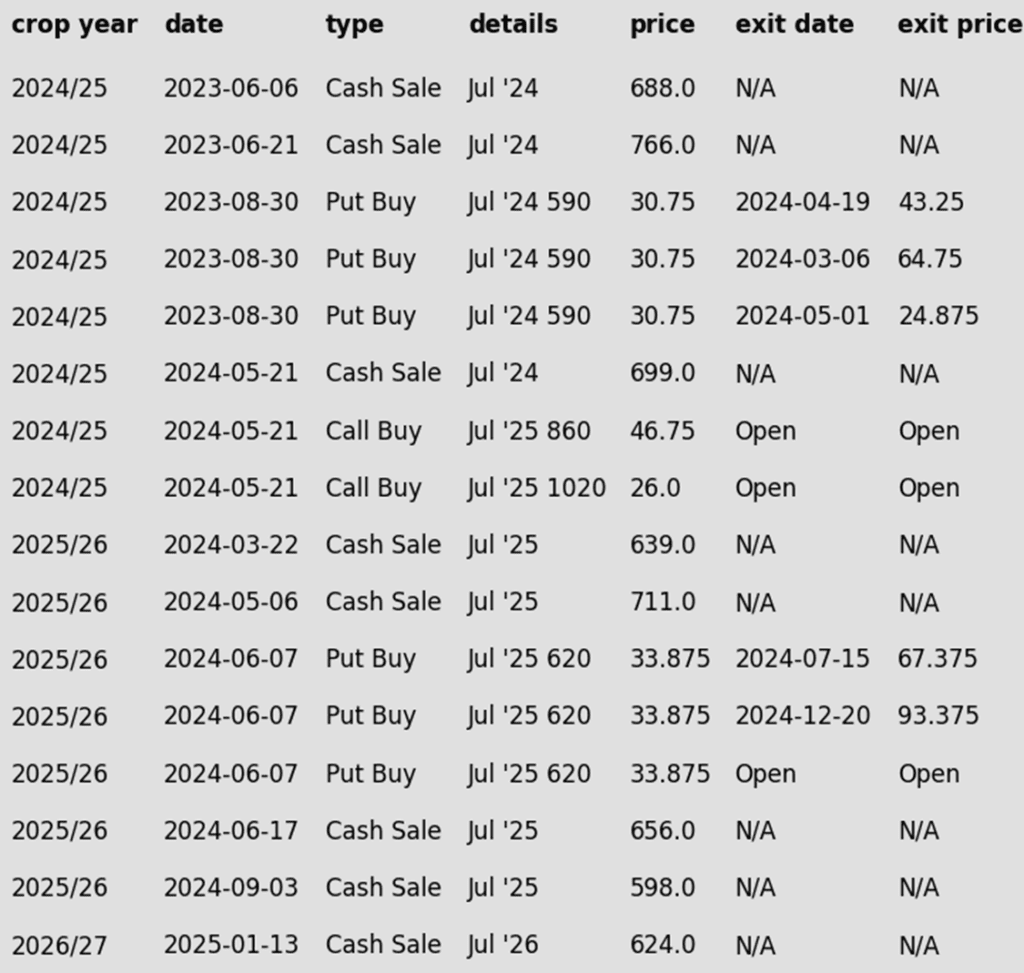

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans closed lower today, extending losses from yesterday as the March contract marked a lower high and lower low. Early gains in soybean oil, driven by bullish biofuel sentiment, provided support, but prices ultimately faded for a modestly higher close, while soybean meal ended the session in the red. Losses in soybeans were concentrated in deferred contracts.

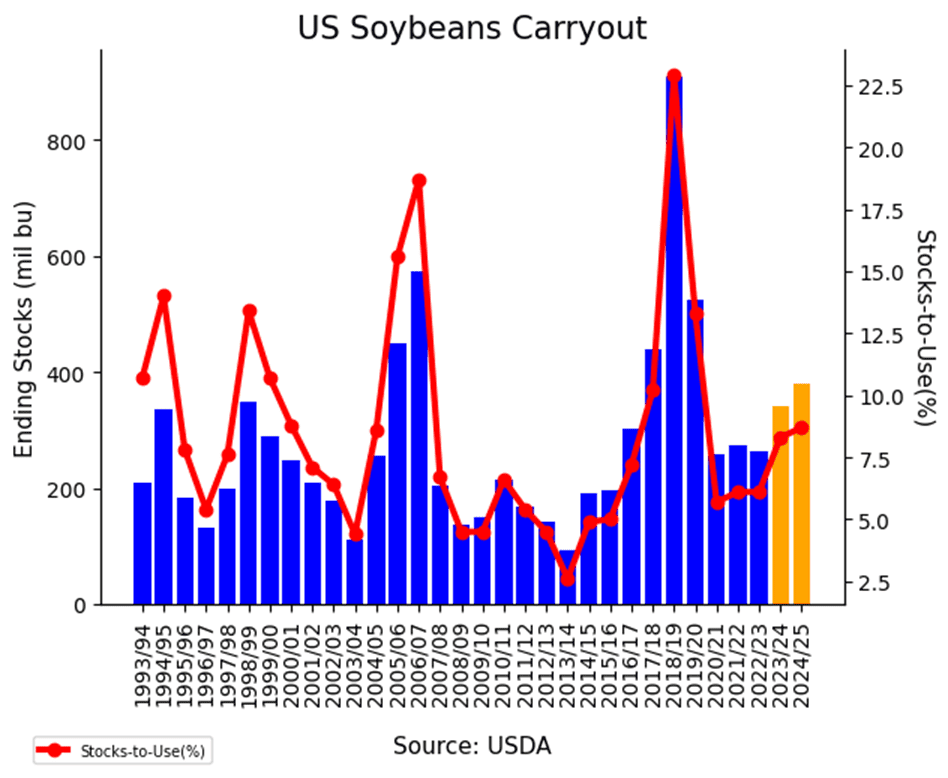

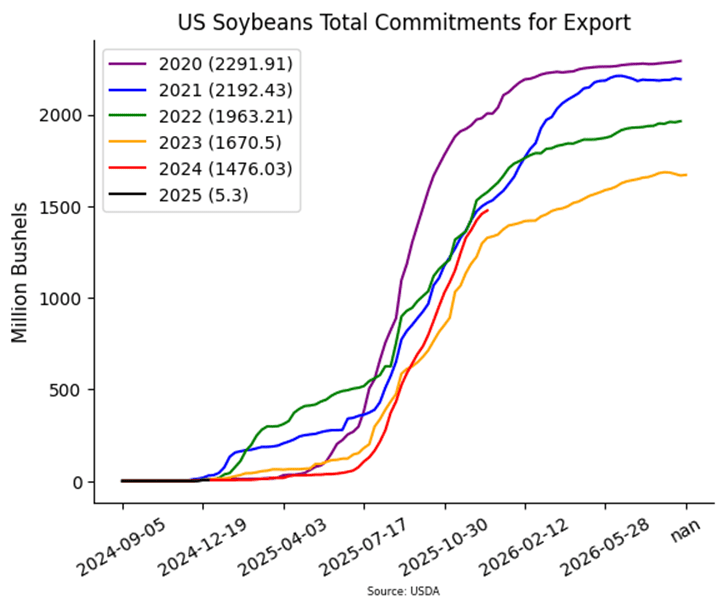

- NOPA reported December soybean crush at 206.60 million bushels, setting a new record for the month as several new processing facilities have begun operations. This exceeded the average trade estimate of 203 million bushels.

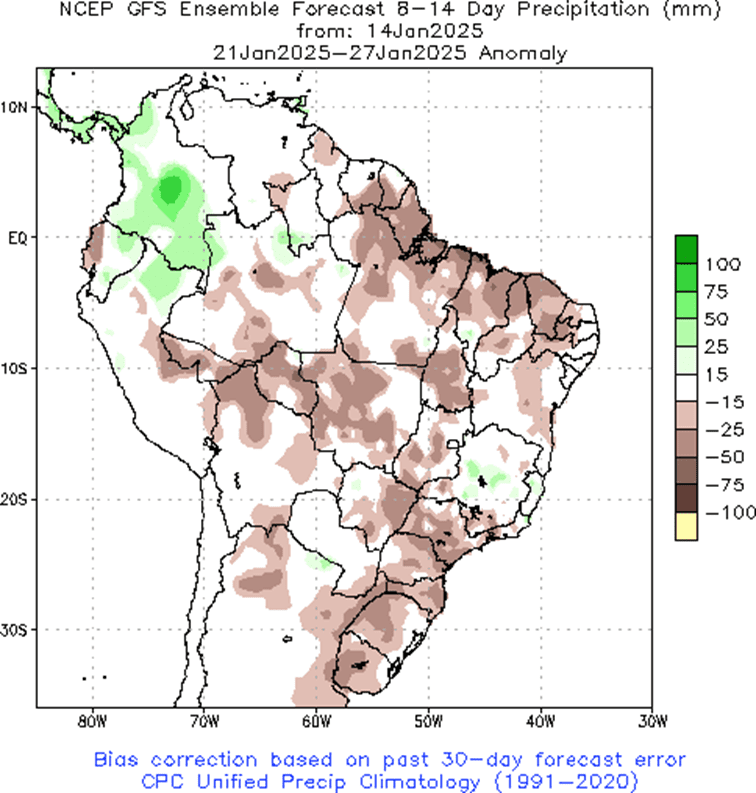

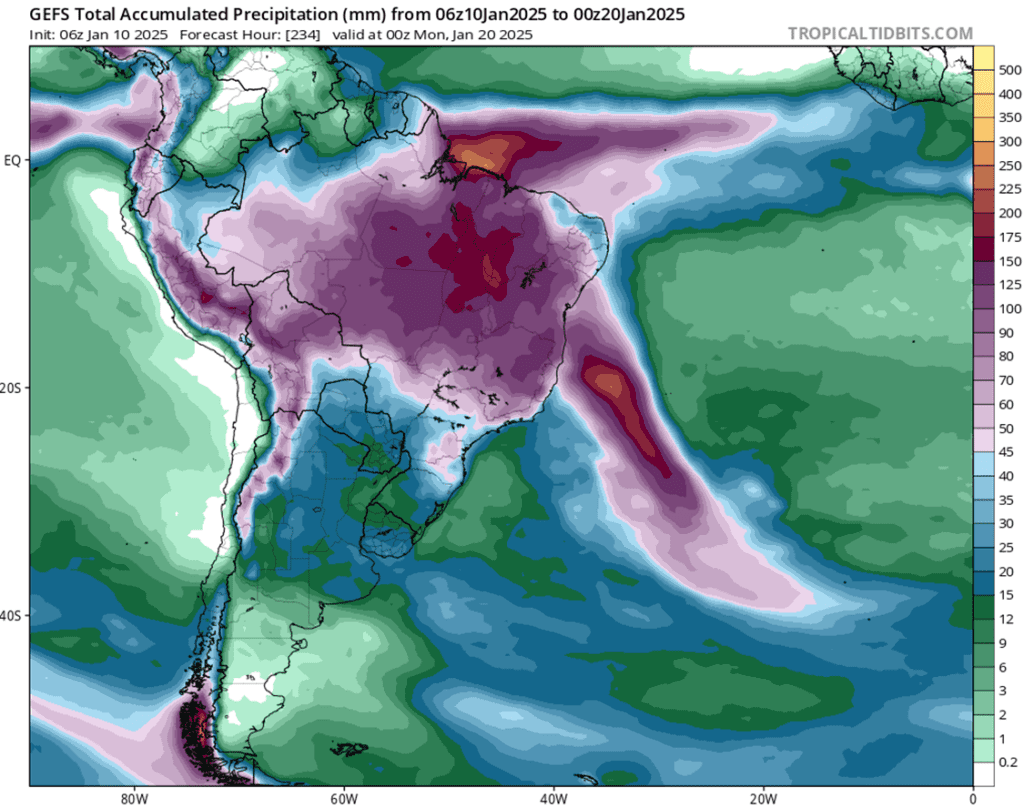

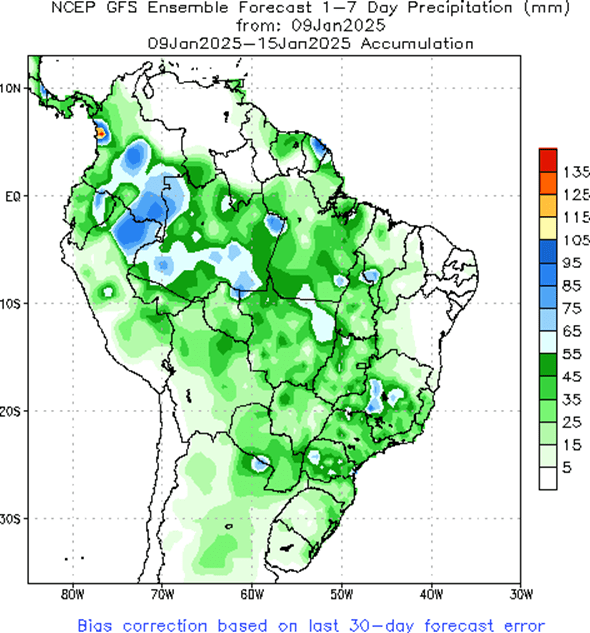

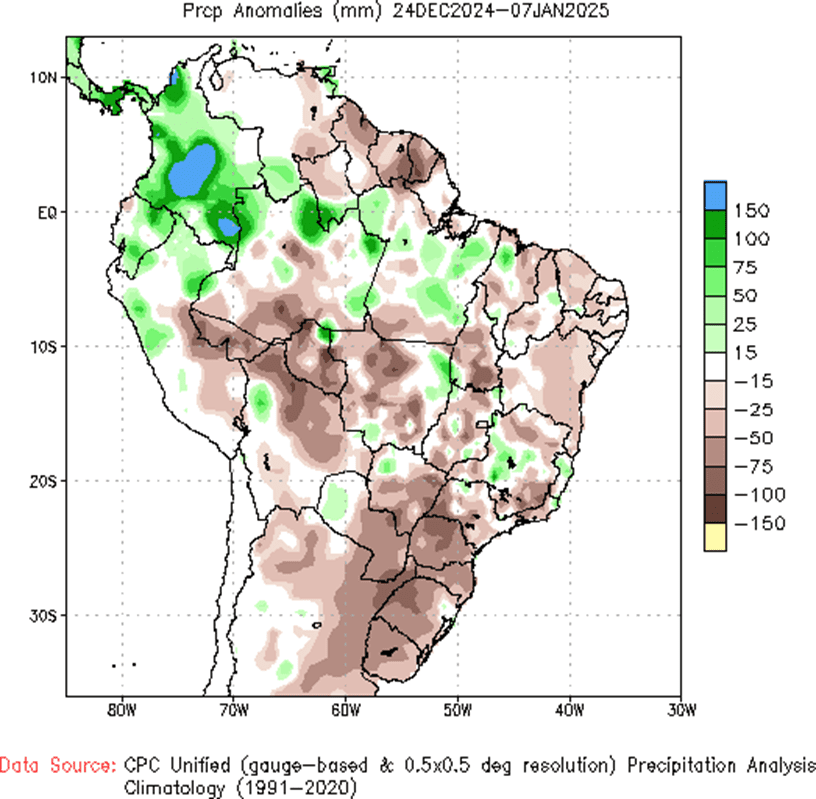

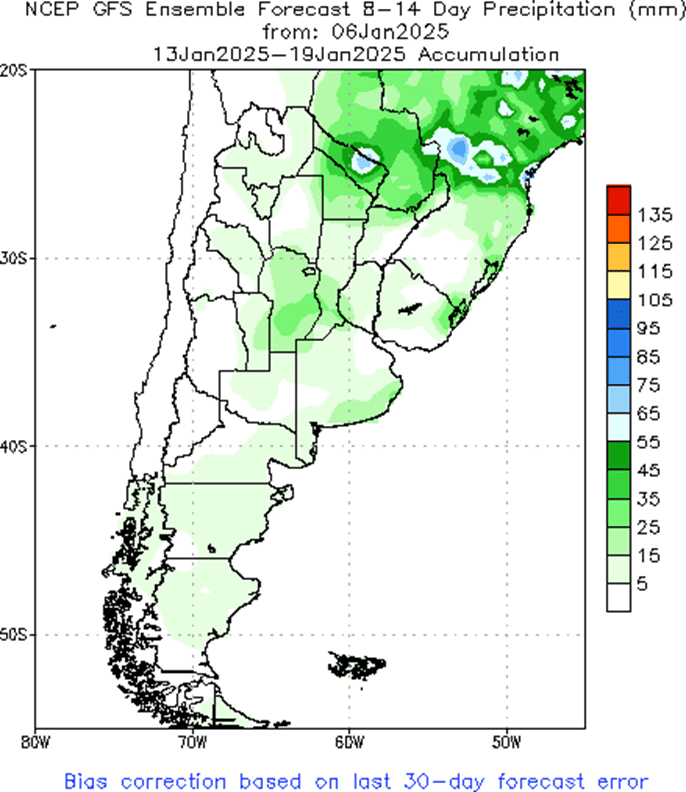

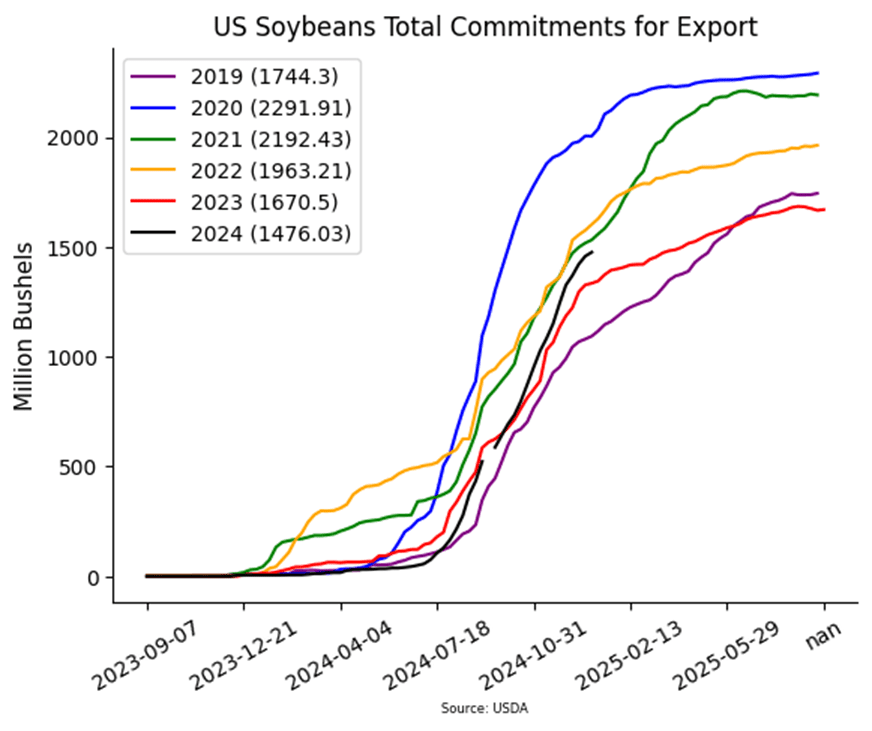

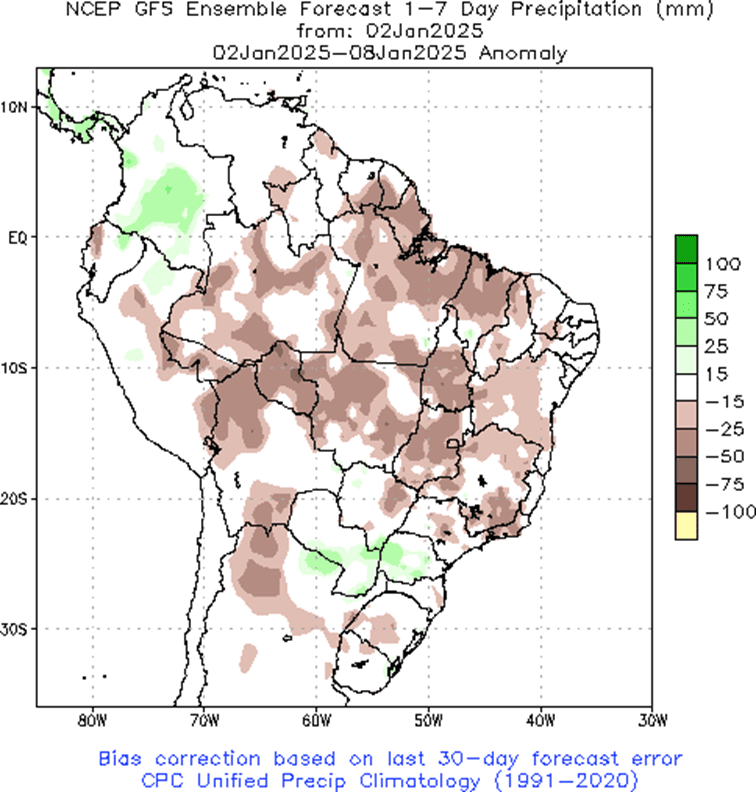

- Yesterday, CONAB raised its soybean production forecast for the current crop year to 166.33 MMT, up slightly from last month. Most analyst have the Brazil soybean crop above 170 MMT for their estimates as the weather continues to be favorable in the country.

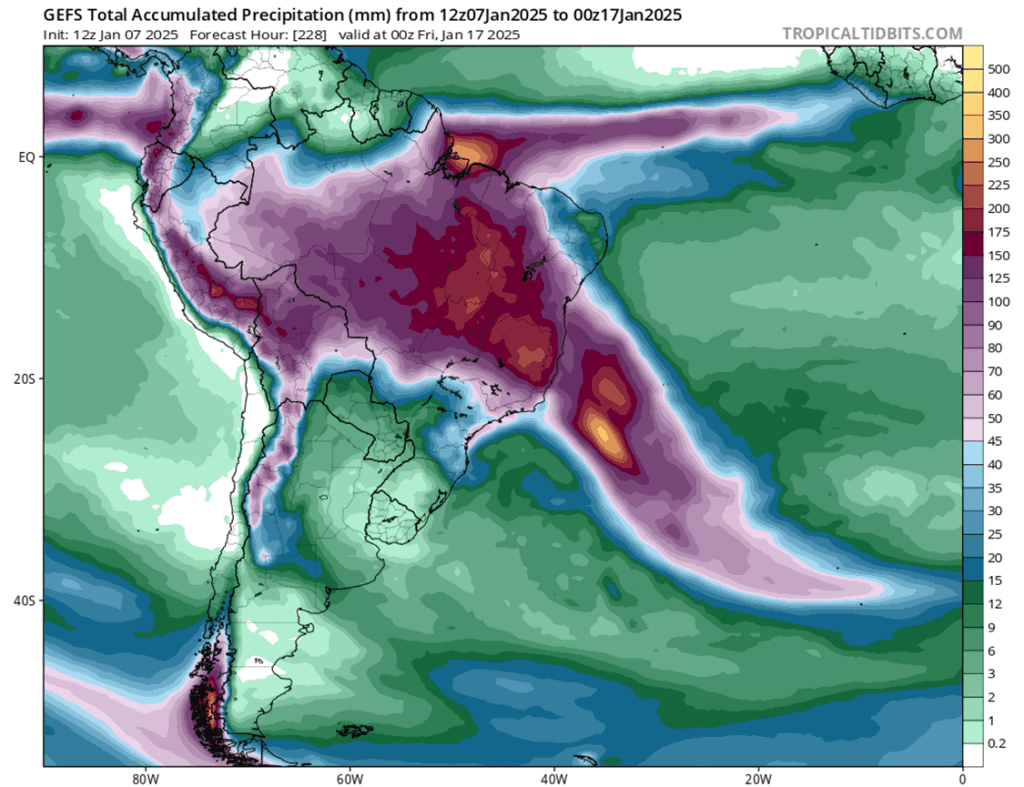

- In Argentina, drier weather persists, and temperatures are expected to heat up over the next two days before rains are expected to fall and provide relief to the soybean crop. Significant rainfall has not fallen in the country since the end of December.

The 1000 level should act as support on a break lower. Initial overhead resistance lies near the last September highs between 1060 and 1075.

Wheat

Market Notes: Wheat

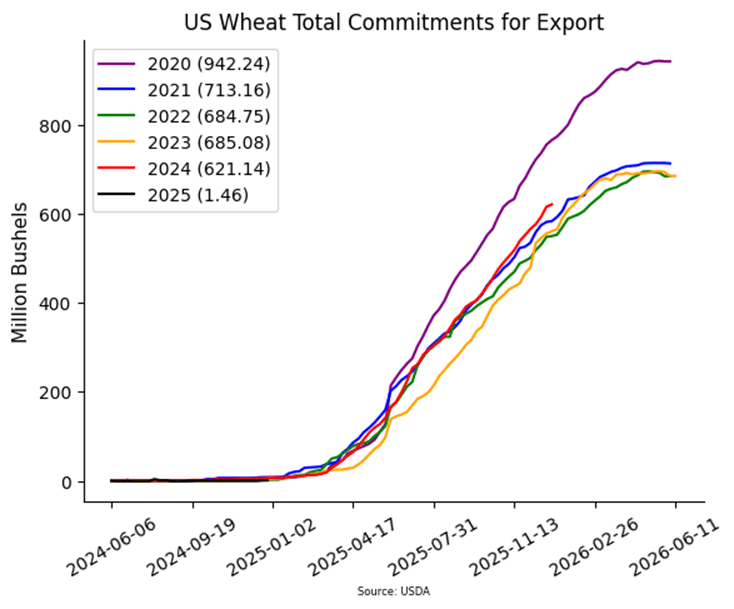

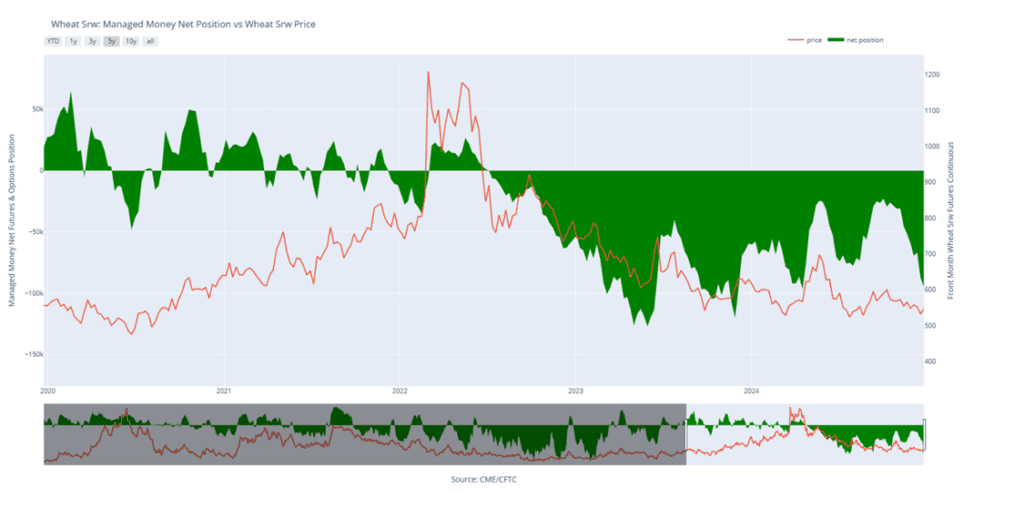

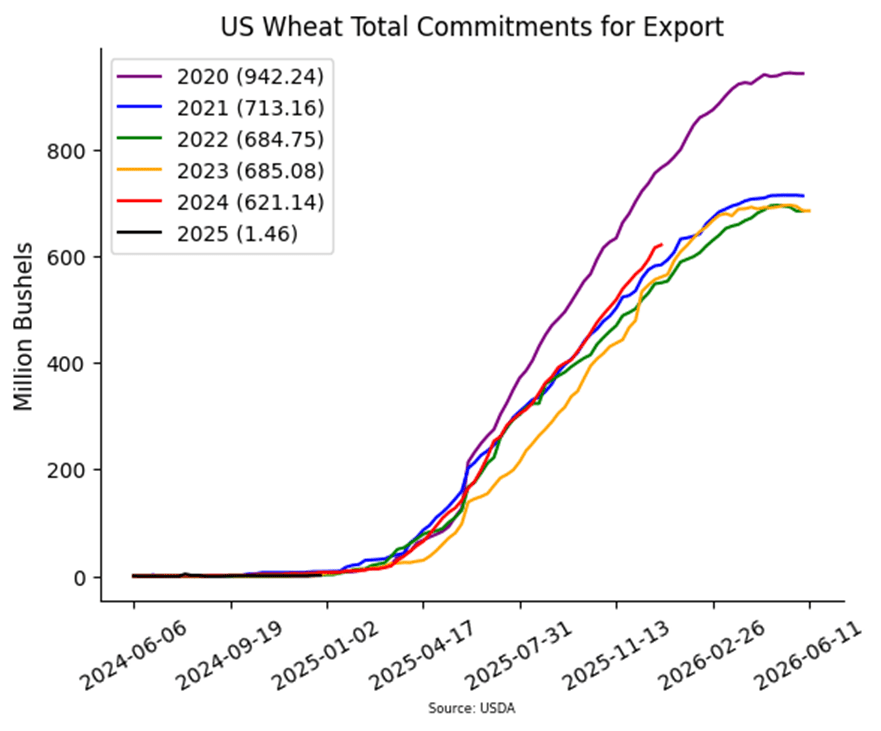

- Wheat futures ended with a mixed close across all three classes. Pressure came from a gap lower and weaker finish in Paris milling wheat futures. However, a slide in the US Dollar Index helped ease some of the selling pressure in the US wheat market.

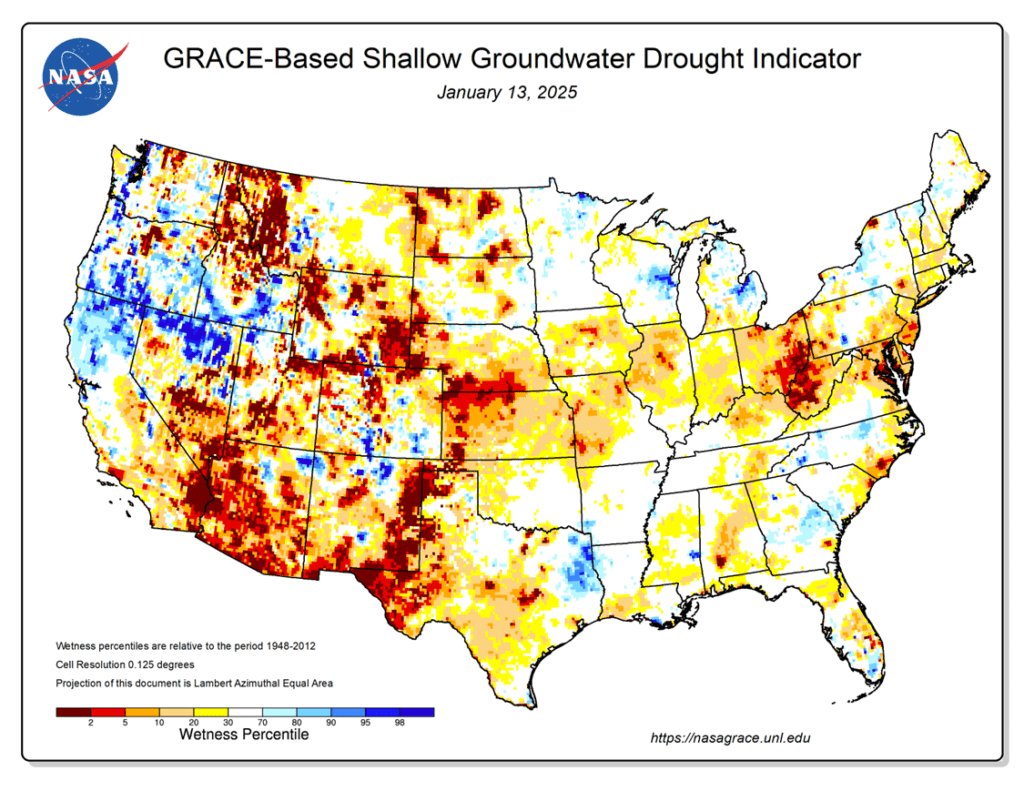

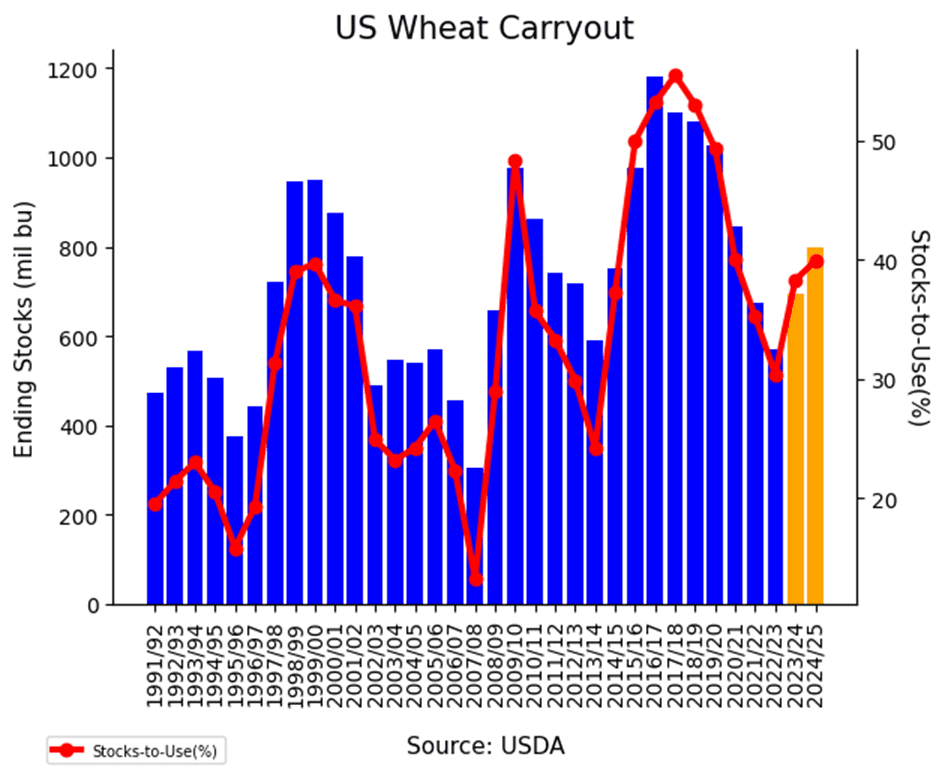

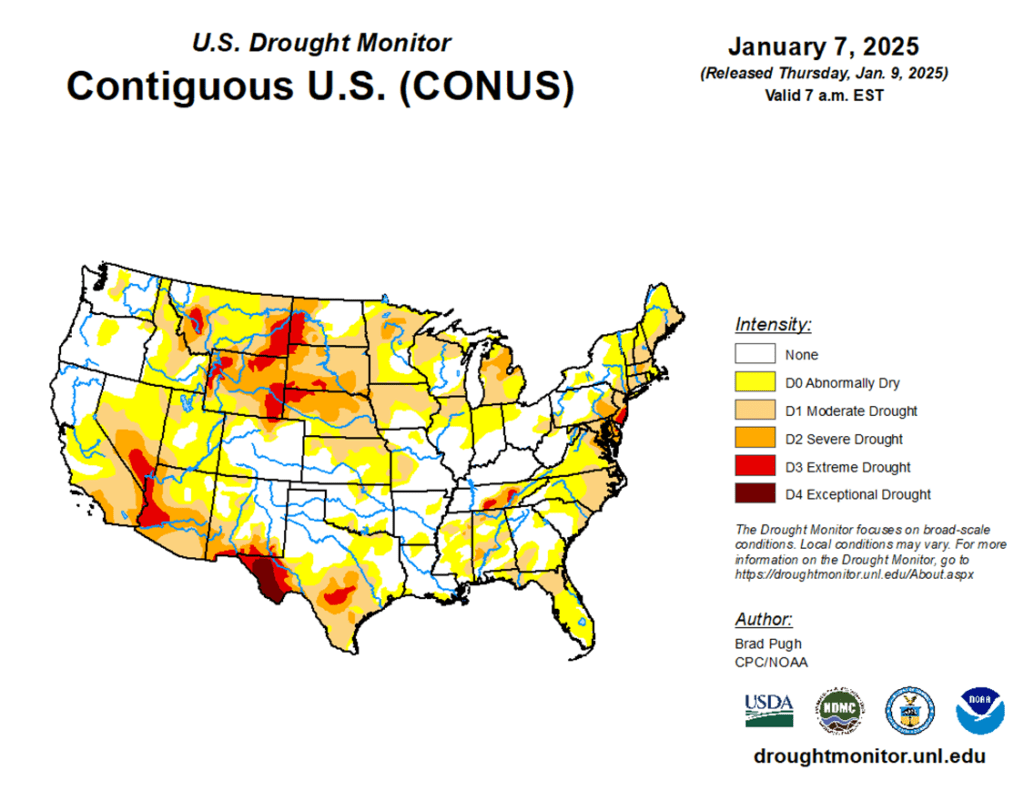

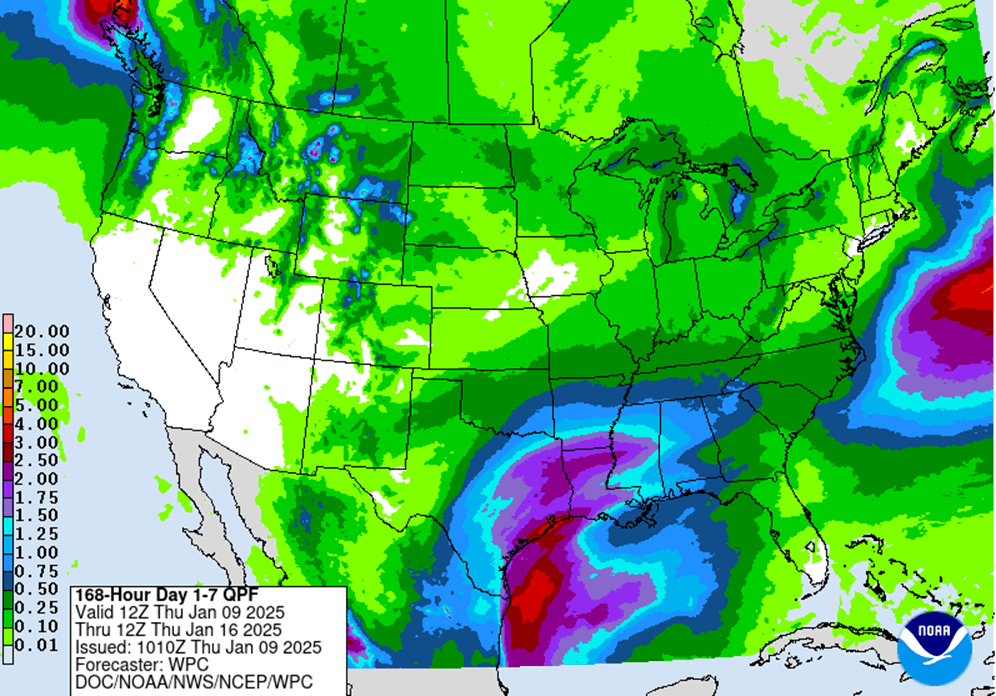

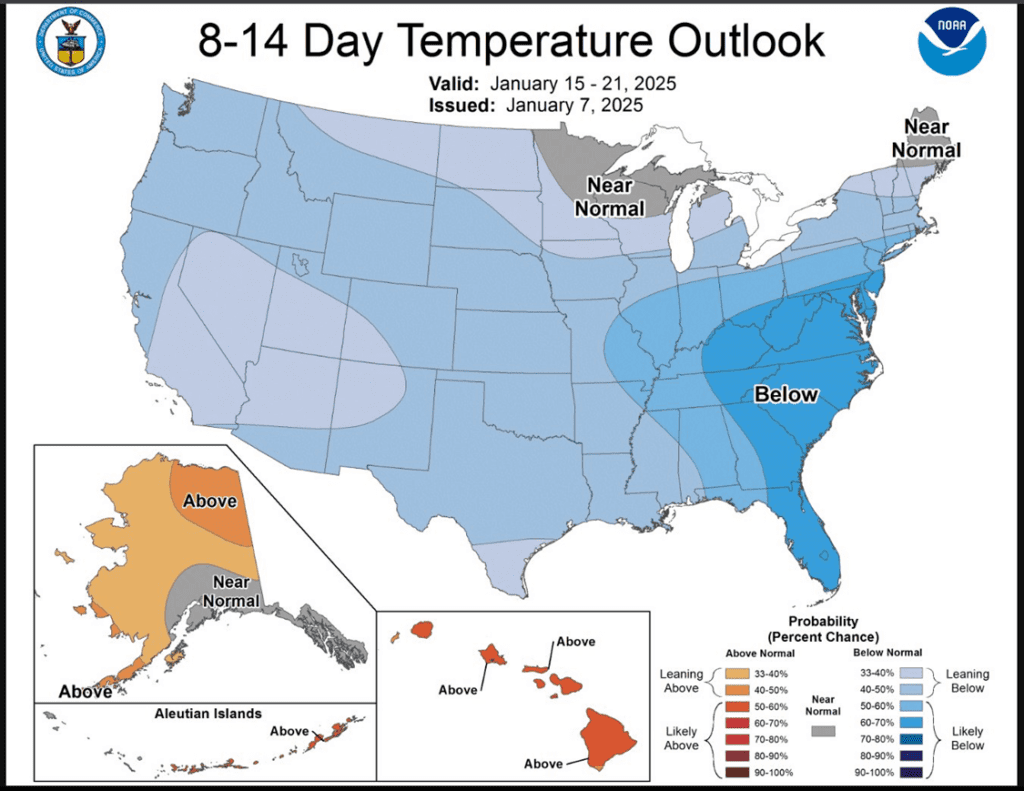

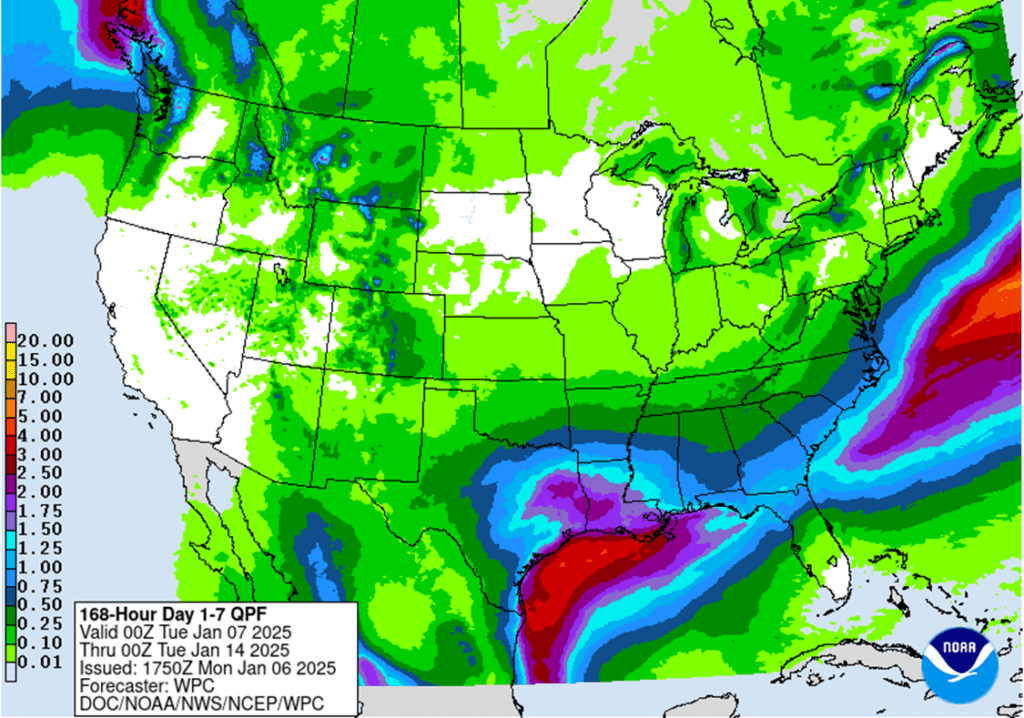

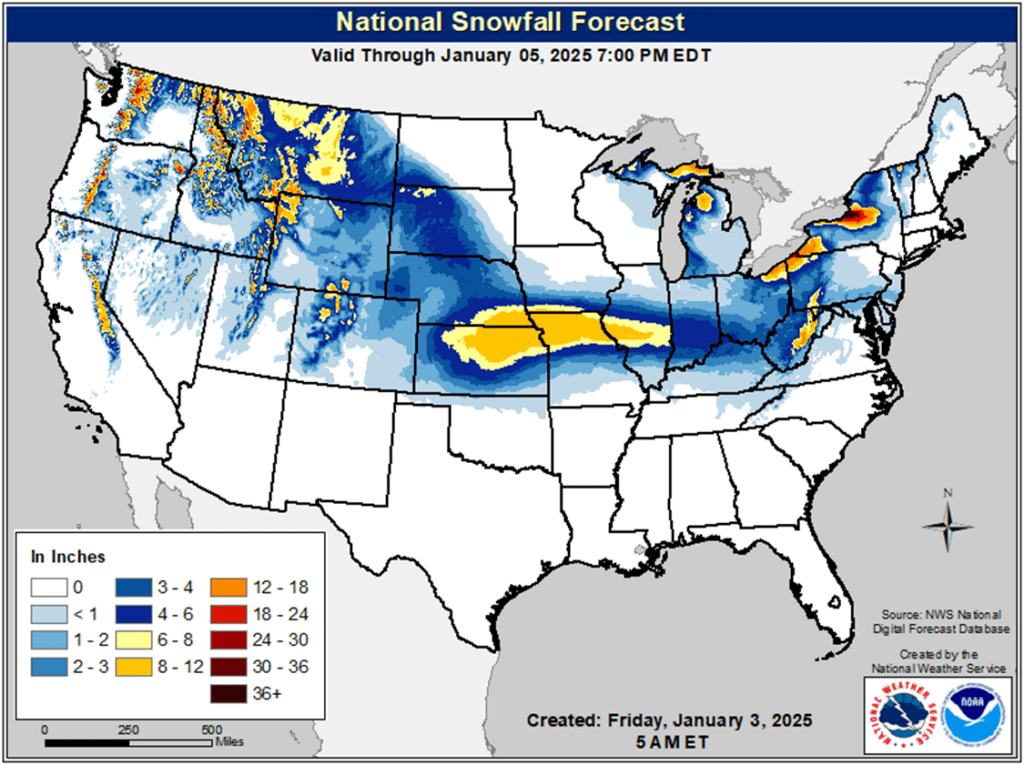

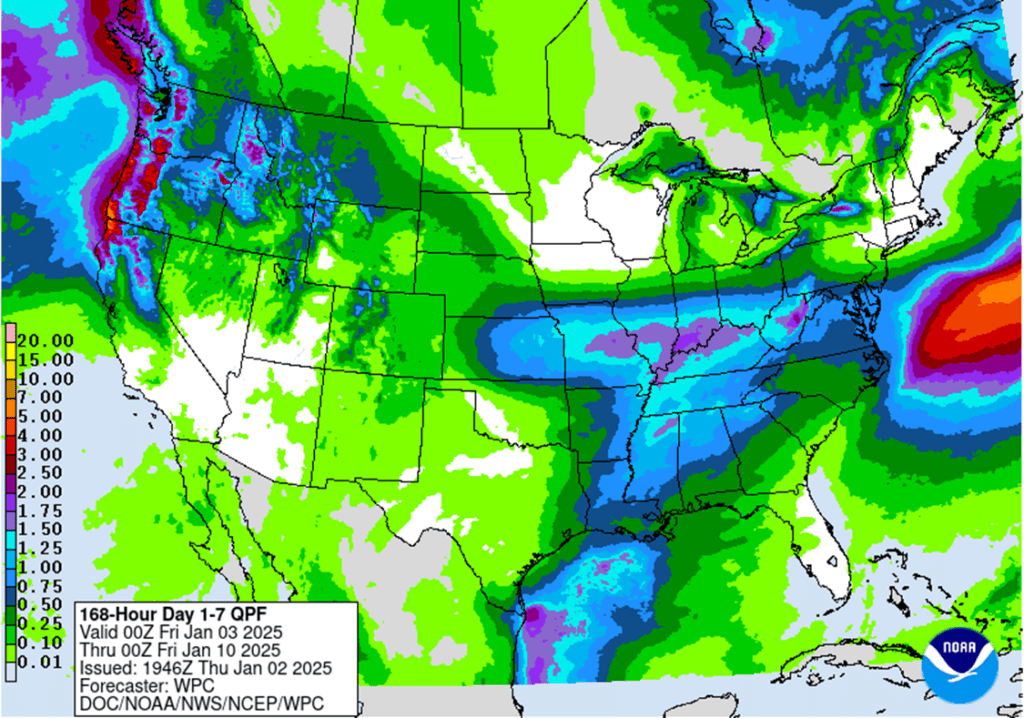

- Drought conditions are expected to expand in the short term across the US southern plains, though longer-range weather models point to increased precipitation for the region in the coming weeks.

- According to the European Commission, EU soft wheat exports have reached 11.5 mmt since the season began on July 1. This represents a 35% drop from the 17.6 mmt shipped for the same timeframe last year.

- Russia’s Deputy Ag Minister has said that due to a smaller harvest, Russia’s wheat exports this year are expected below the record amount shipped in 2024. However, wheat exports in 2025 may be higher than average as a share of total grain exports – this is as a result of export restrictions on corn, barley, and rye in the February to June timeframe.

2024 Crop:

- Target 680 – 705 vs March ‘25 to make the next sale.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Continue holding the remaining quarter of the previously recommended July ’25 Chi wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 Chi wheat to exit these remaining puts if the market makes new lows.

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing.

2026 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell the first portion of your 2026 Chicago wheat crop.

- With daily trading volume in the July ‘26 contract increasing to start the New Year, and nearly 90 cents of carry between the March ‘25 and July ‘26 contracts, we recommend making your first sale for the crop you’ll plant this fall.

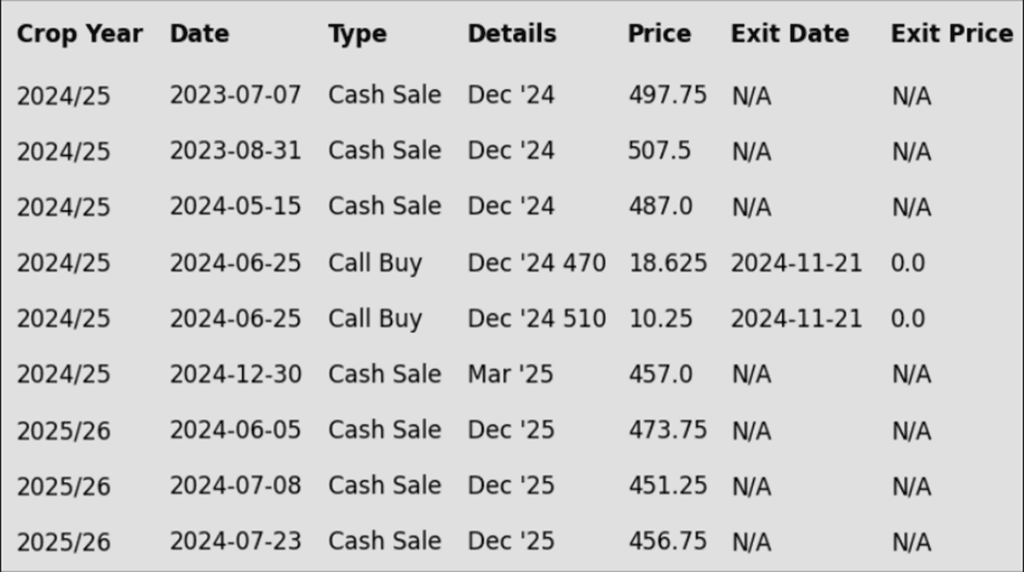

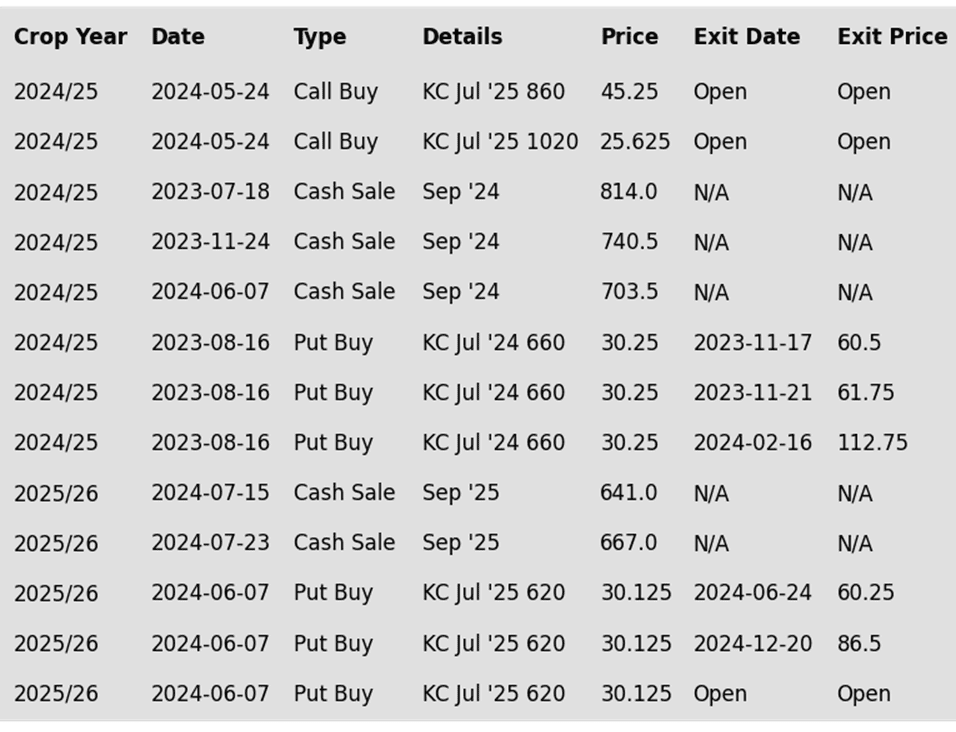

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

2024 Crop:

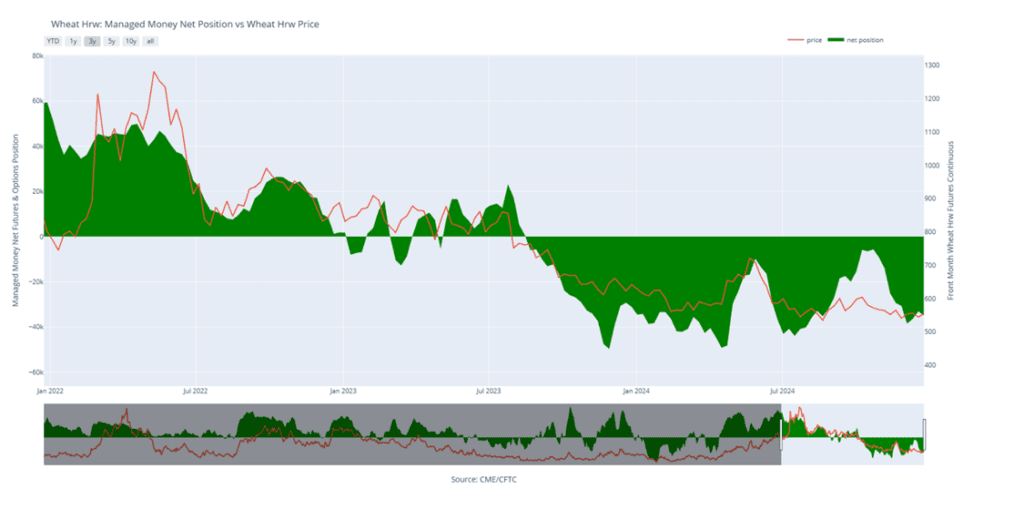

- Target the 650 – 700 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls, target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

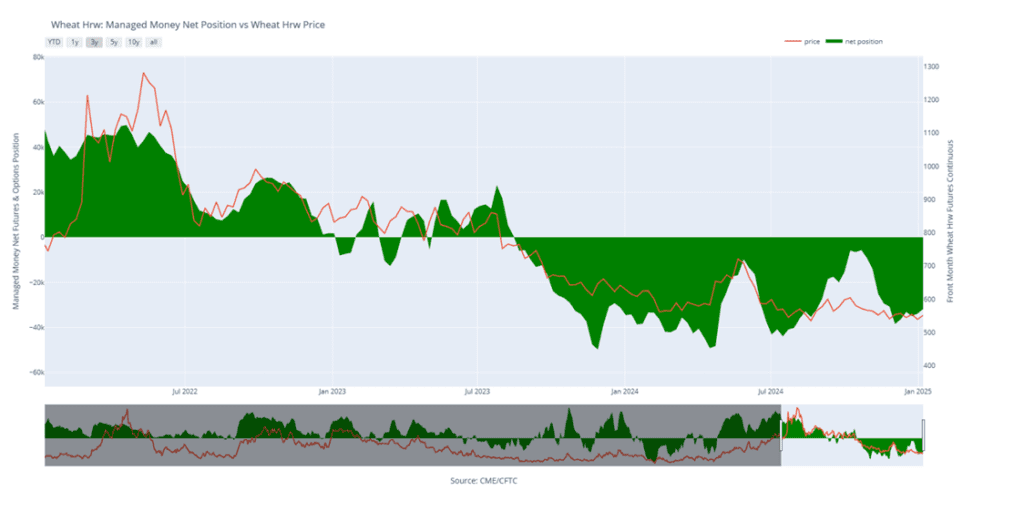

KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

2024 Crop:

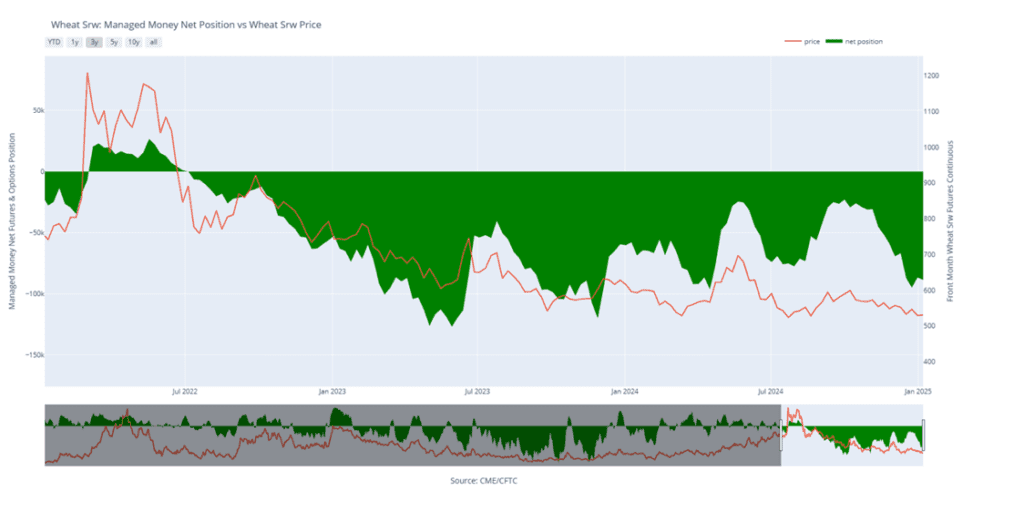

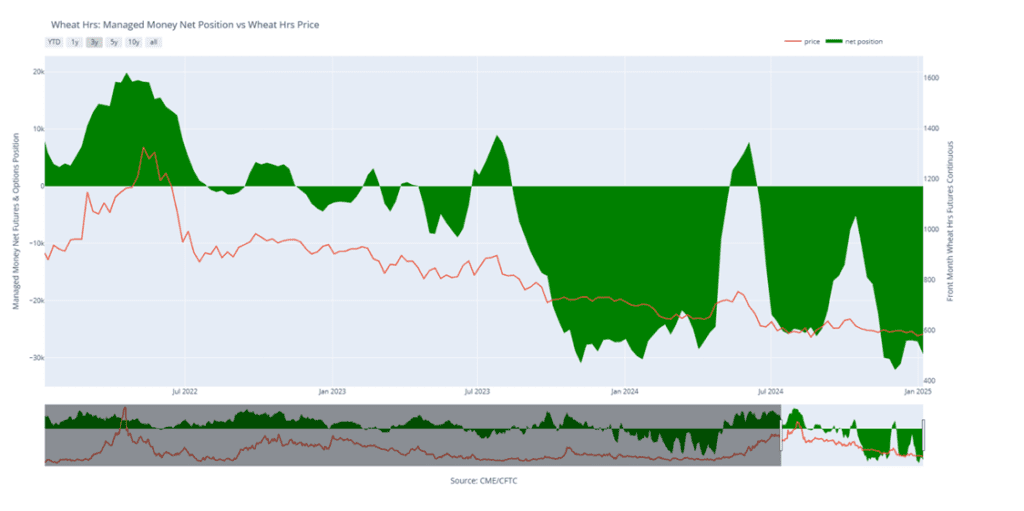

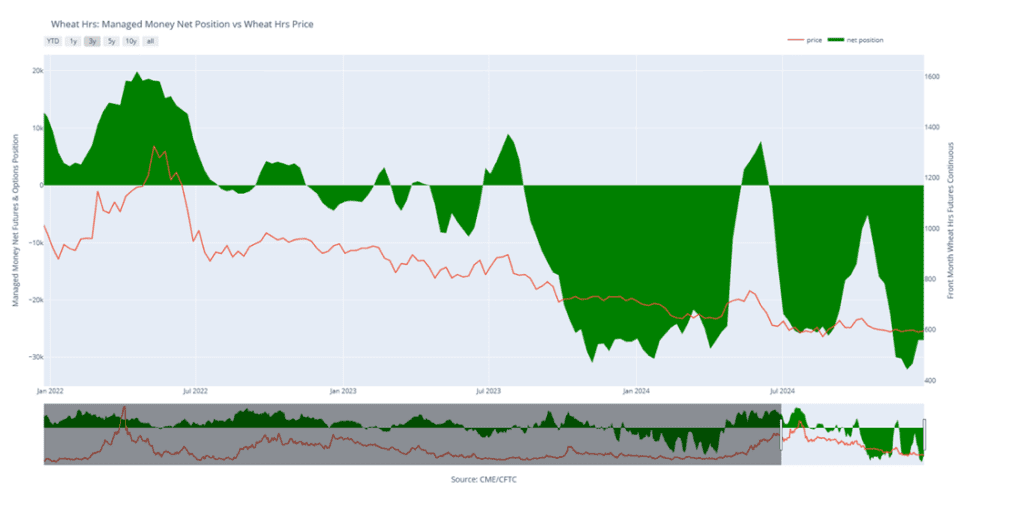

- Potentially targeting a rally to the 610–635 range versus March ’25 for additional sales of your 2024 crop. While this is the initial area of interest, the near-record short position held by the Funds suggests that this target range could shift as future price action develops.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Map from NDMC at Univeristy of Nebreaska, description and drawing courtesy of Conduit Weather.

South America 30-day precipitation, percent of normal, courtesy of the Climate Prediction Center.