10-15 End of Day: Government Shutdown Adds Uncertainty, Leaving Grains Mixed

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn closed higher in midweek trading, supported by strong buying activity in the front-month contracts.

- 🌱 Soybeans: Soybeans ended the session modestly higher, with prices reacting to news from China and ongoing uncertainty surrounding the government shutdown.

- 🌾 Wheat: Wheat ended today’s session lower across all three classes, pressured by the absence of market-moving news to spark a rally.

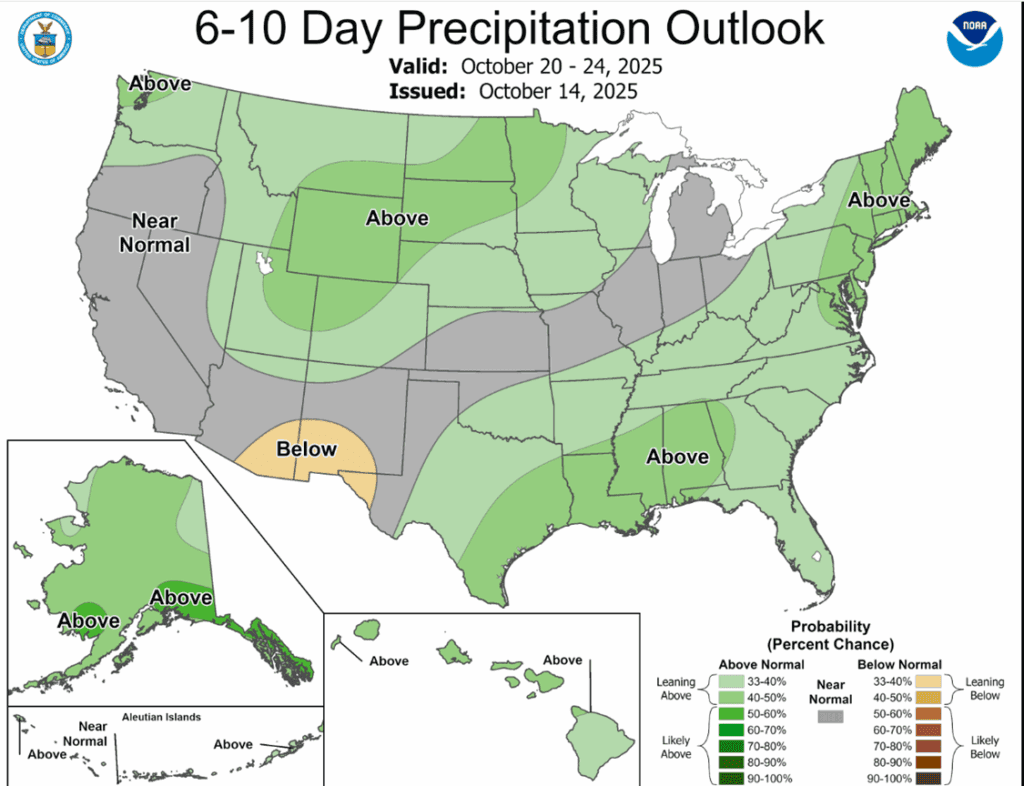

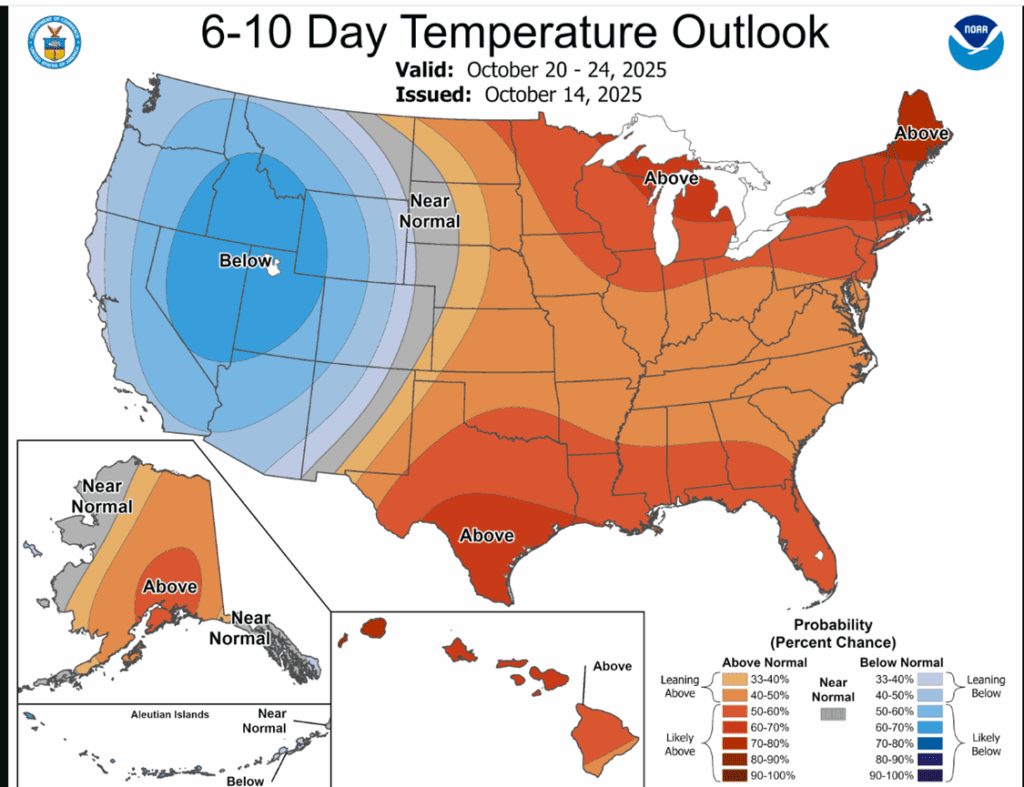

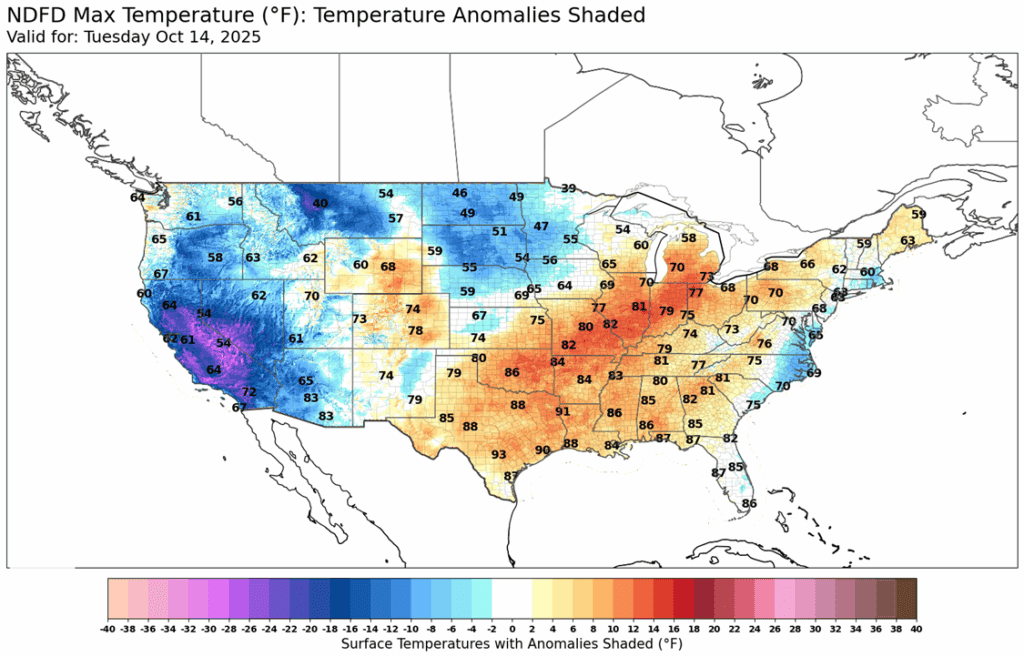

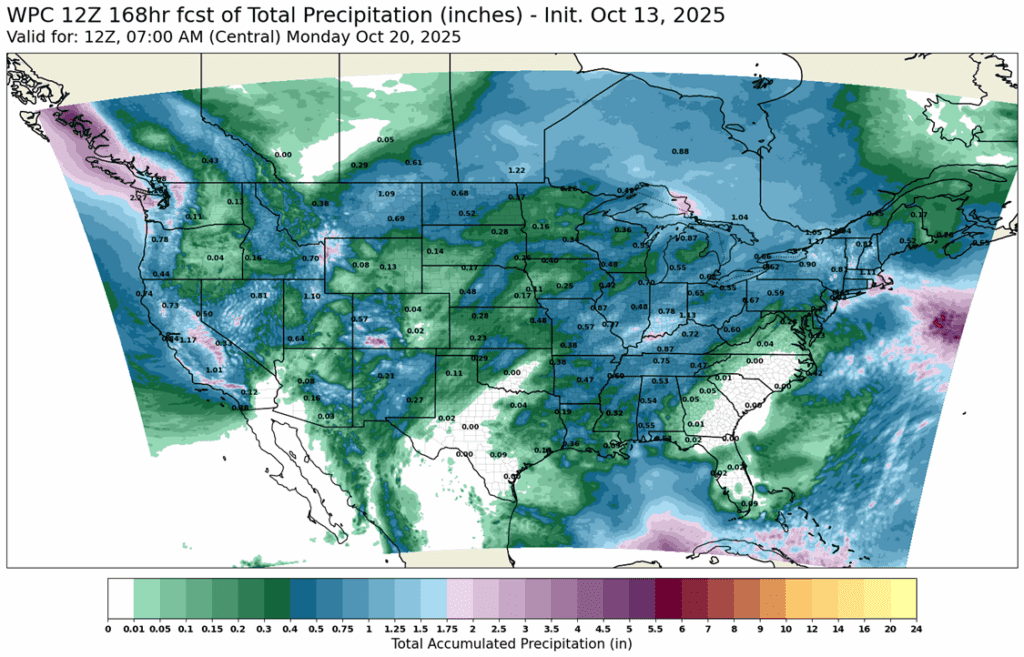

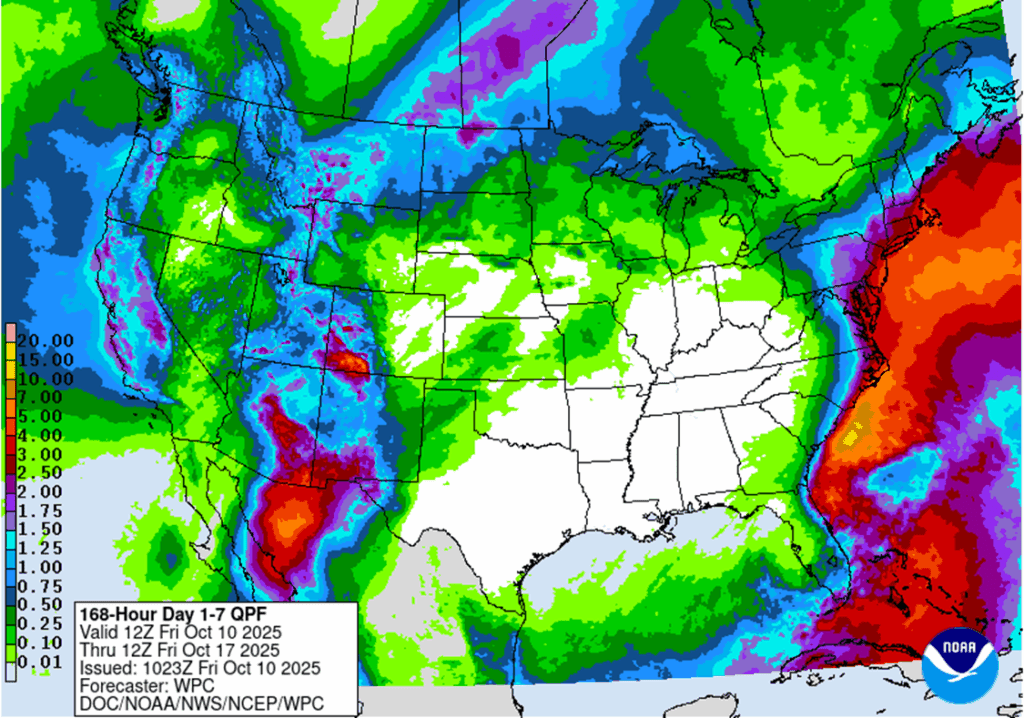

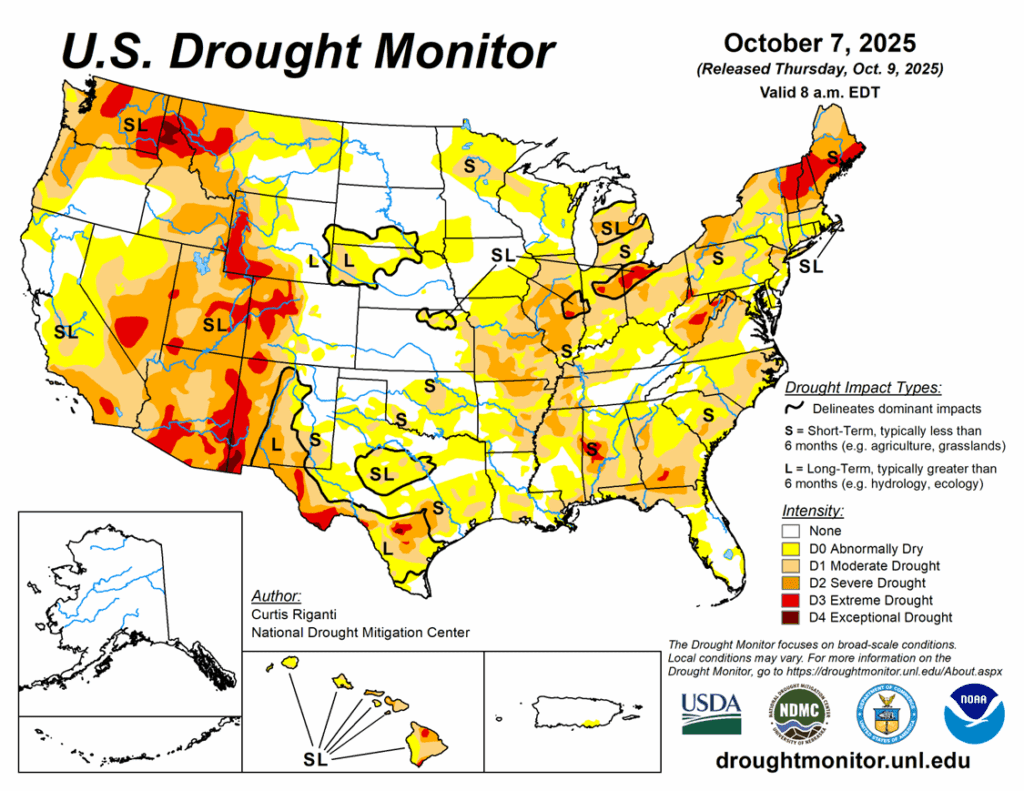

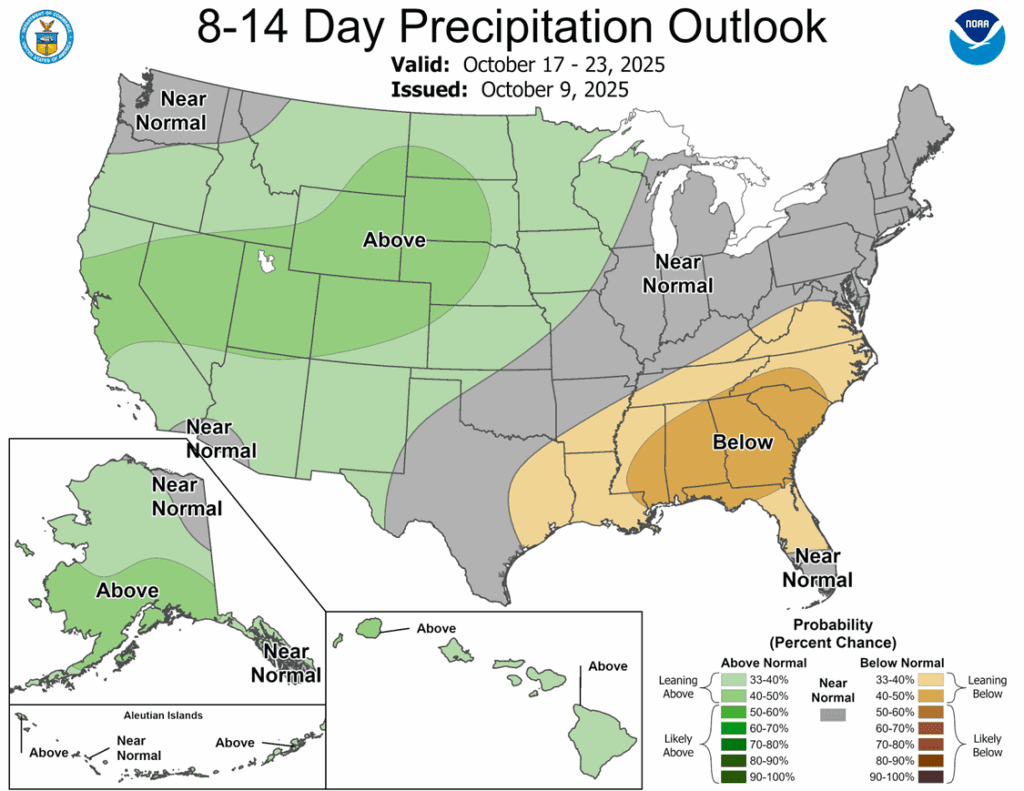

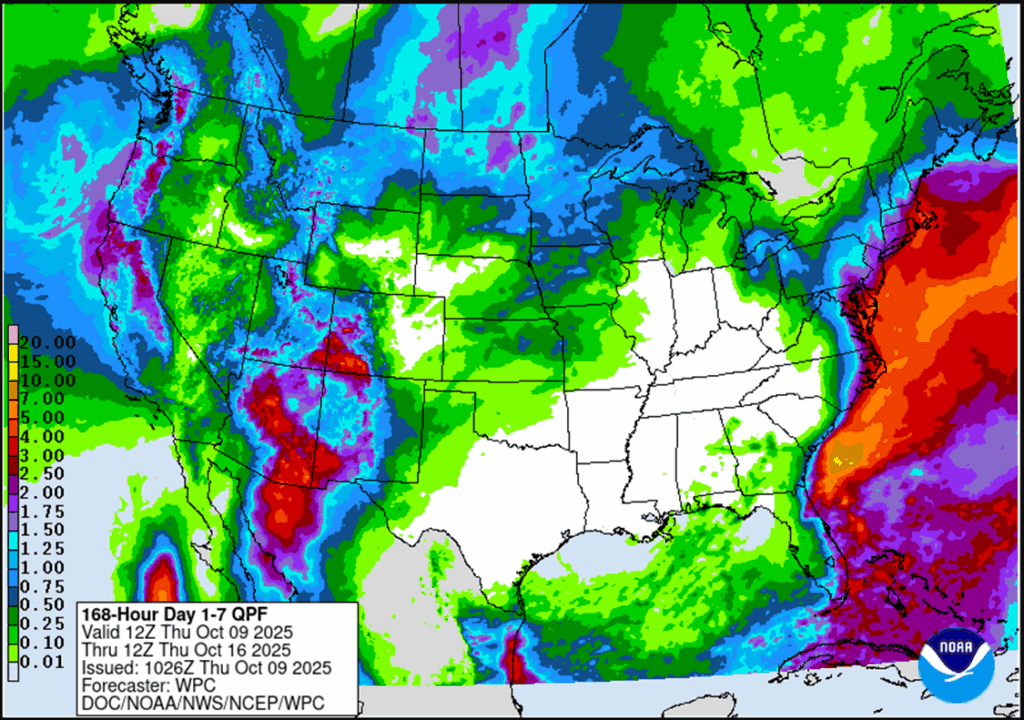

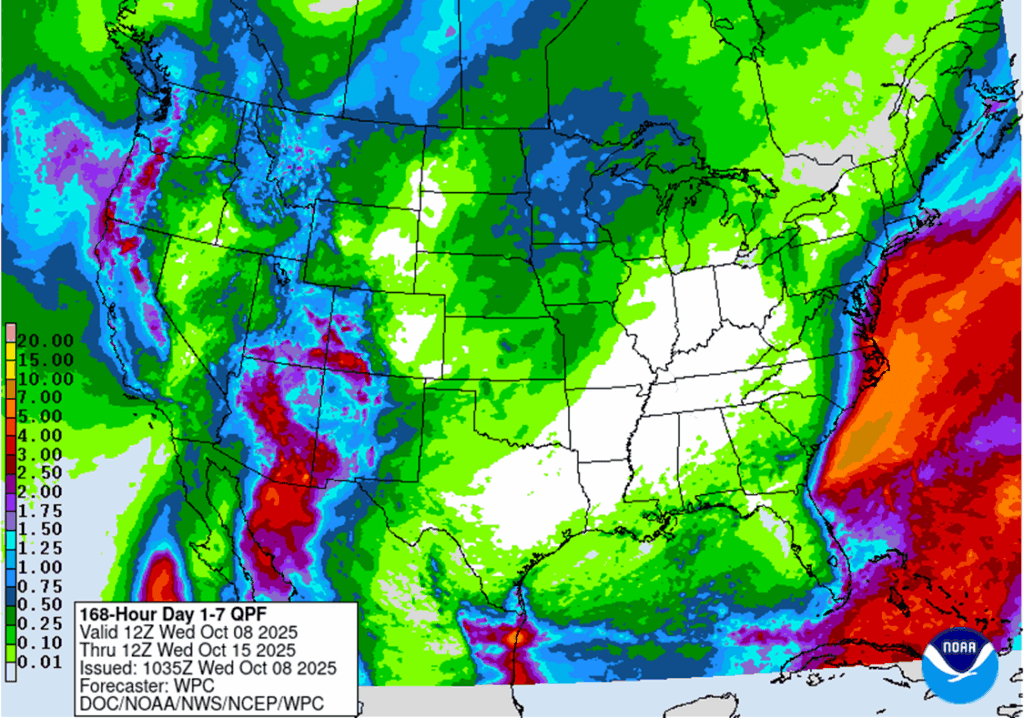

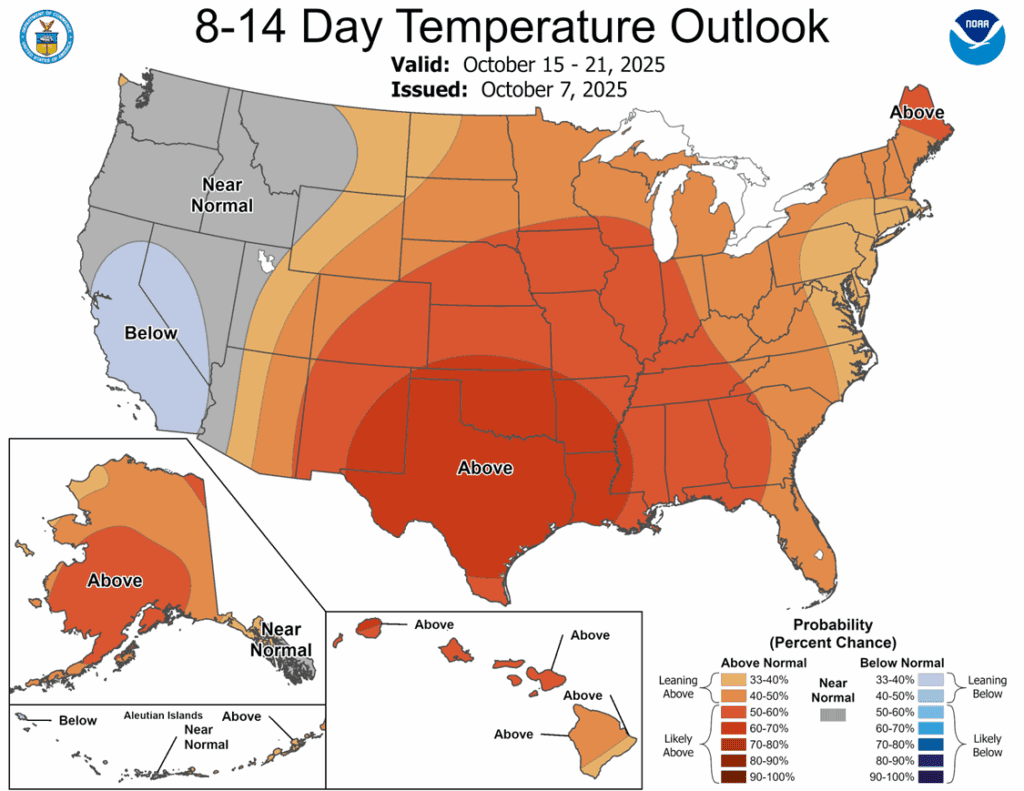

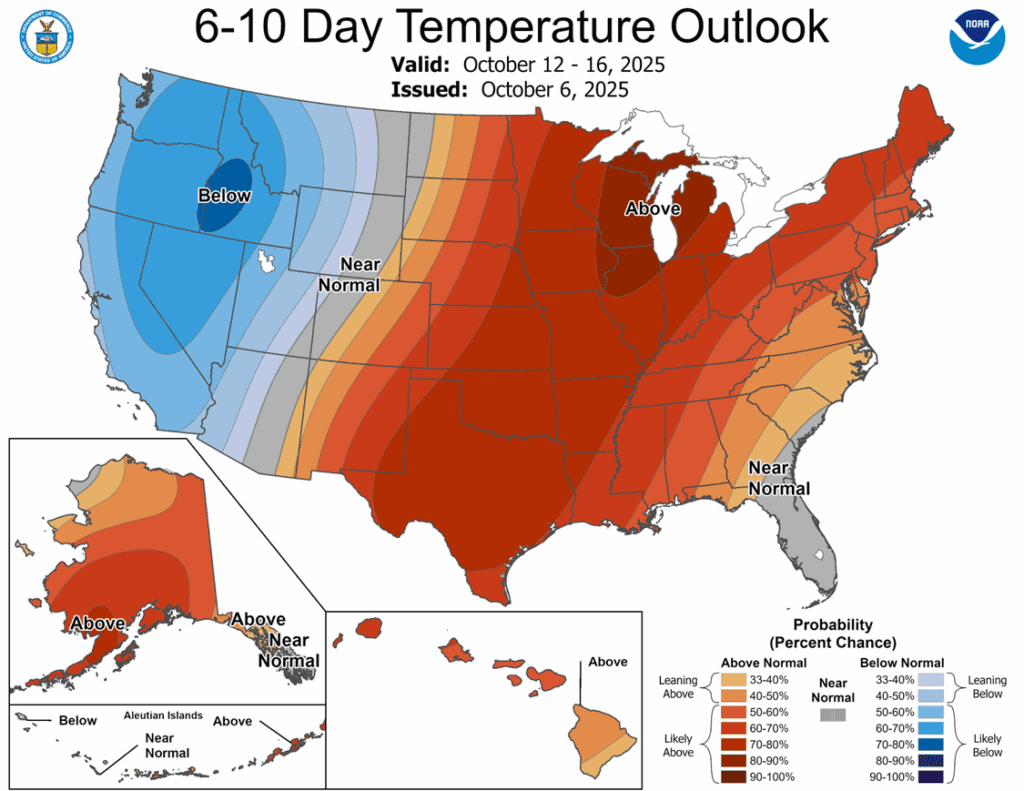

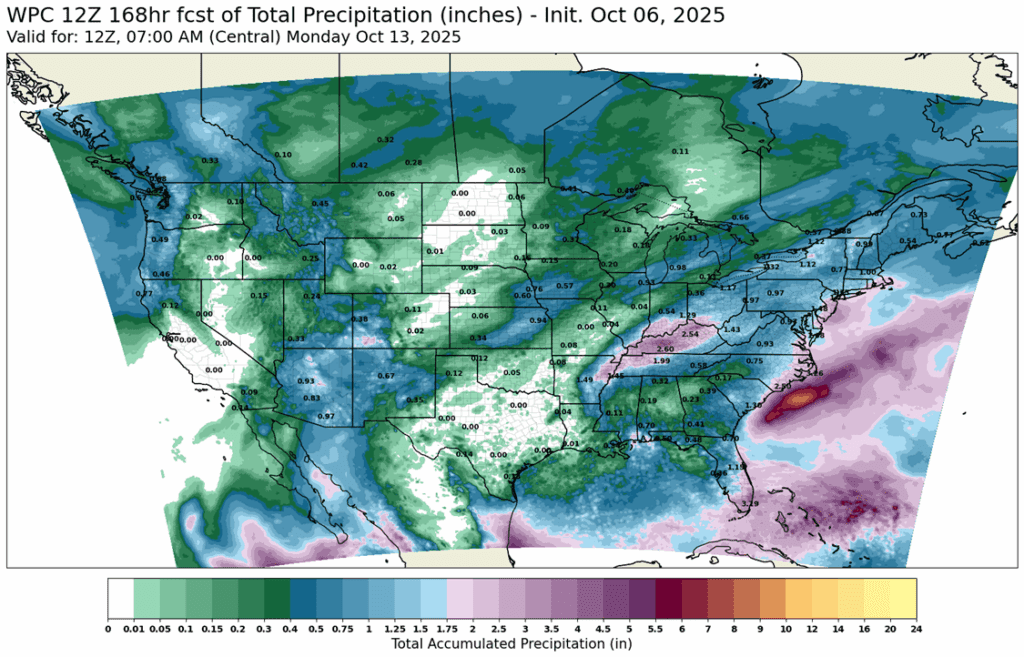

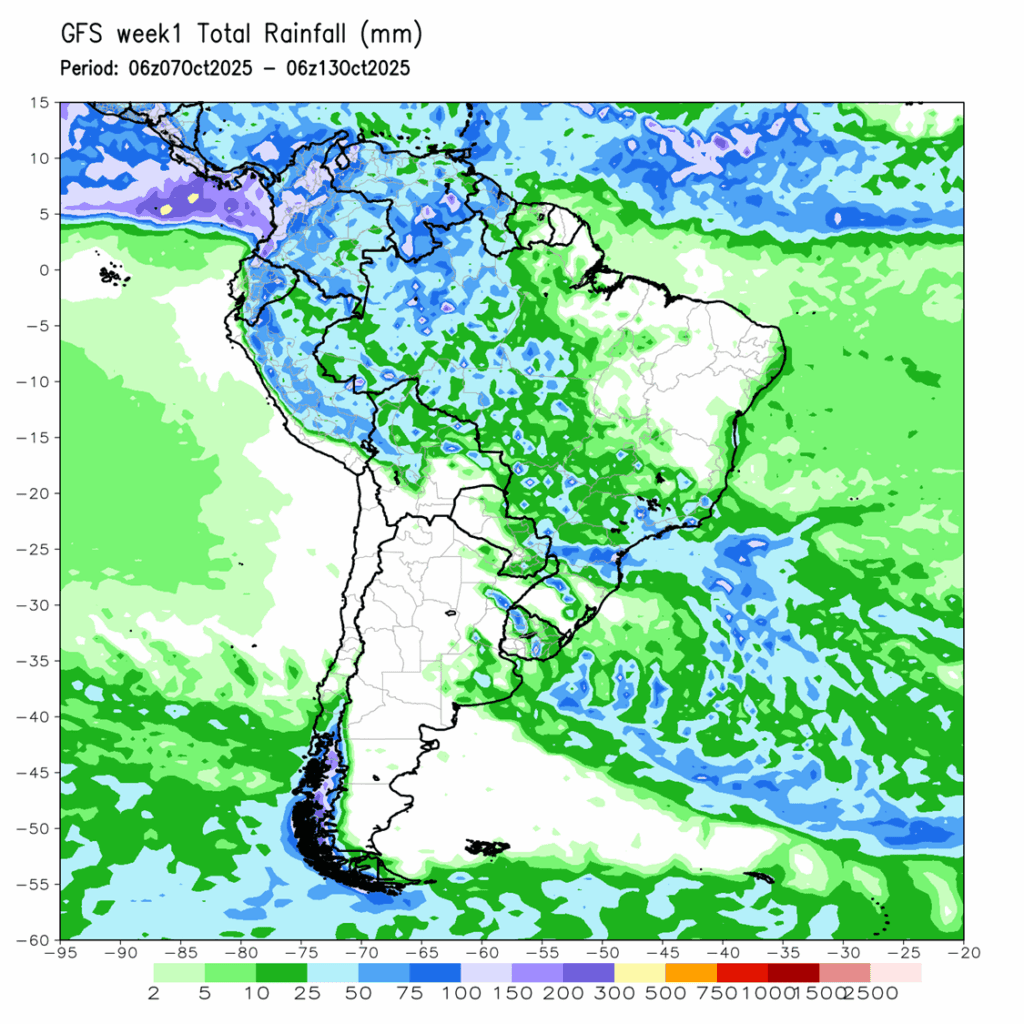

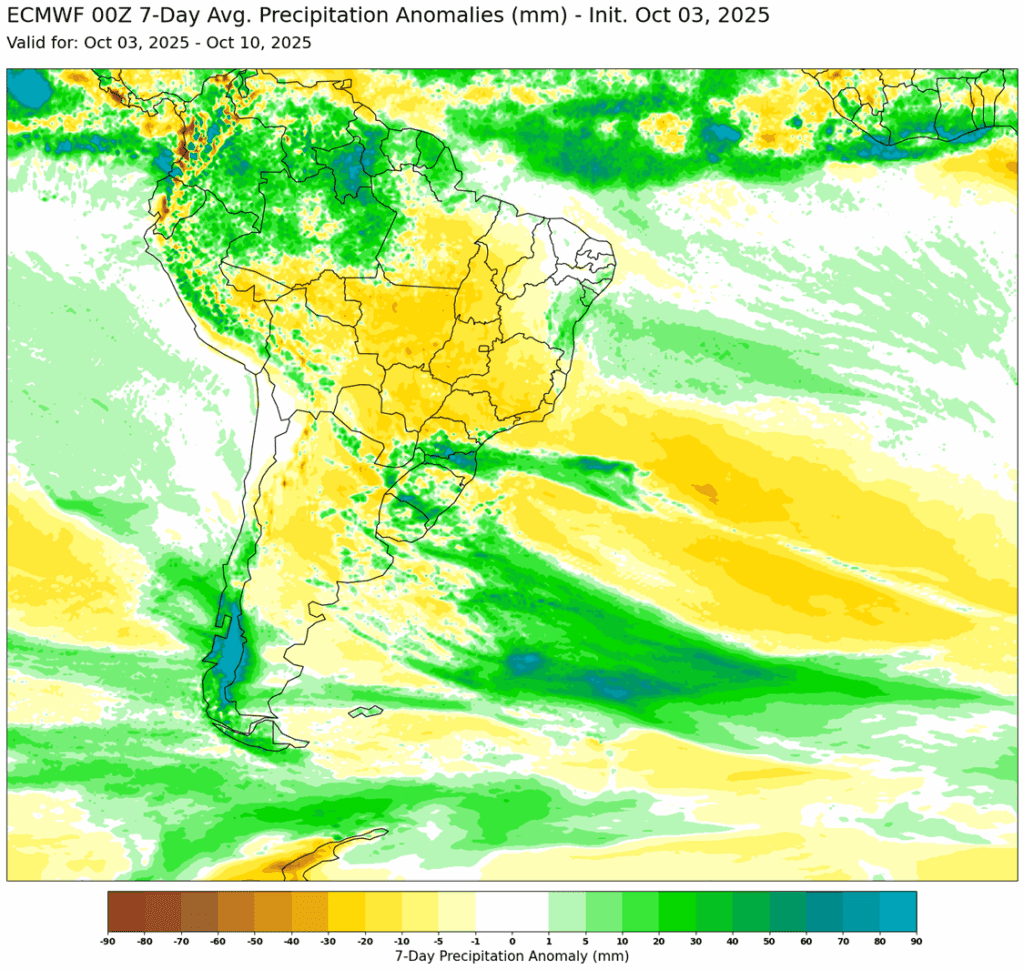

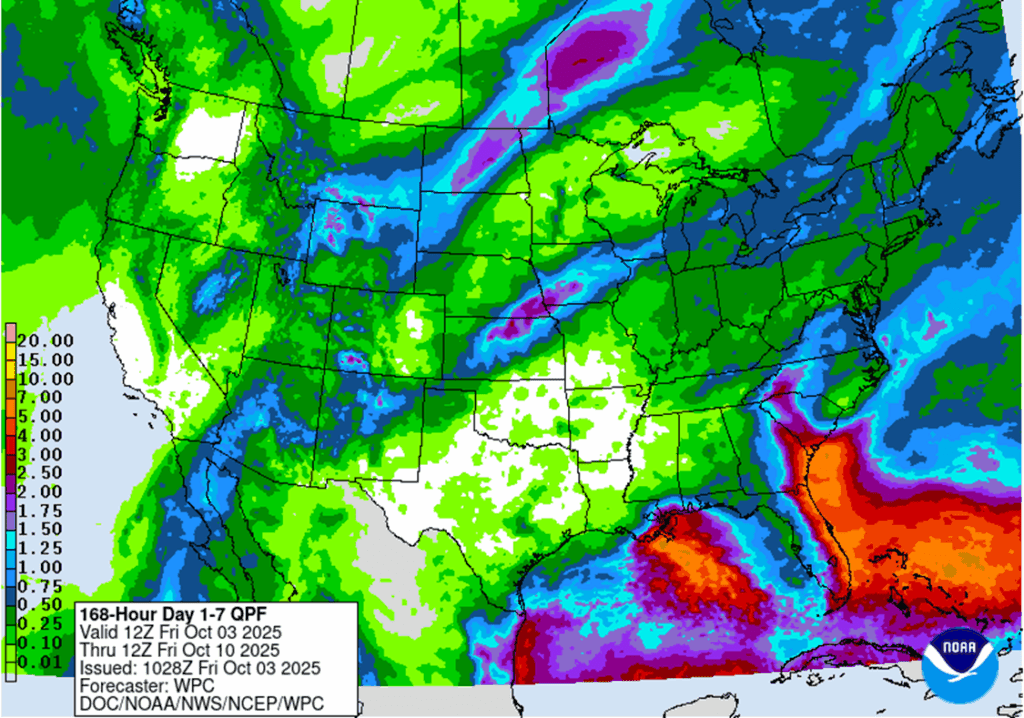

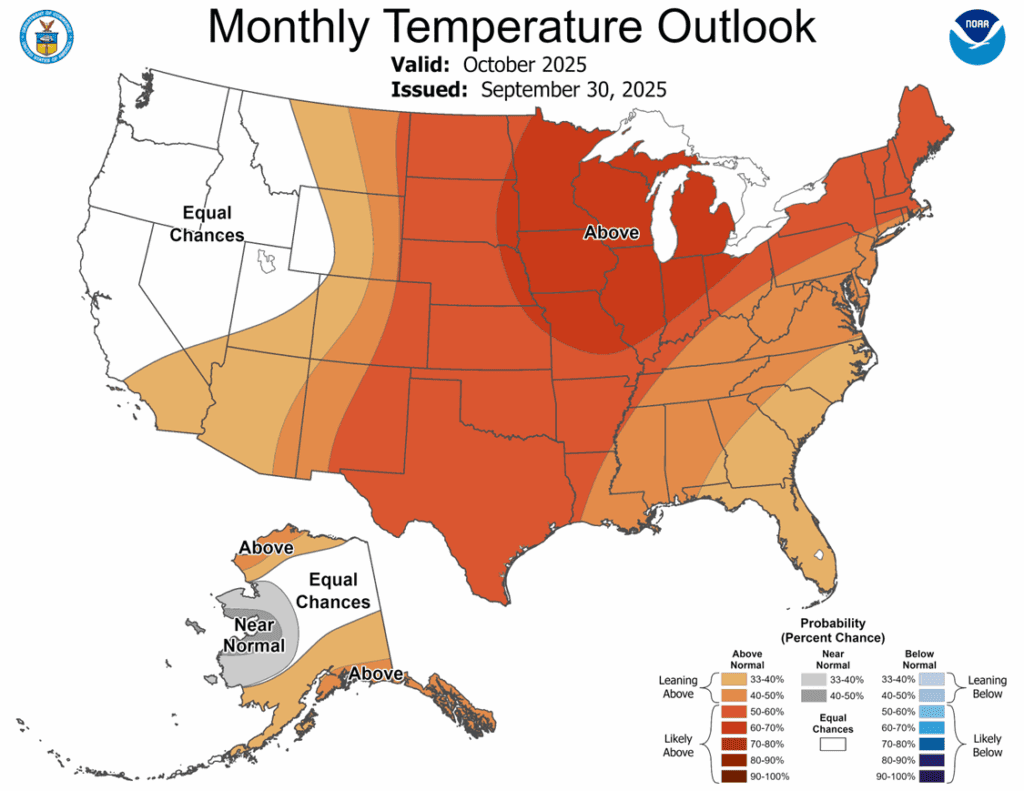

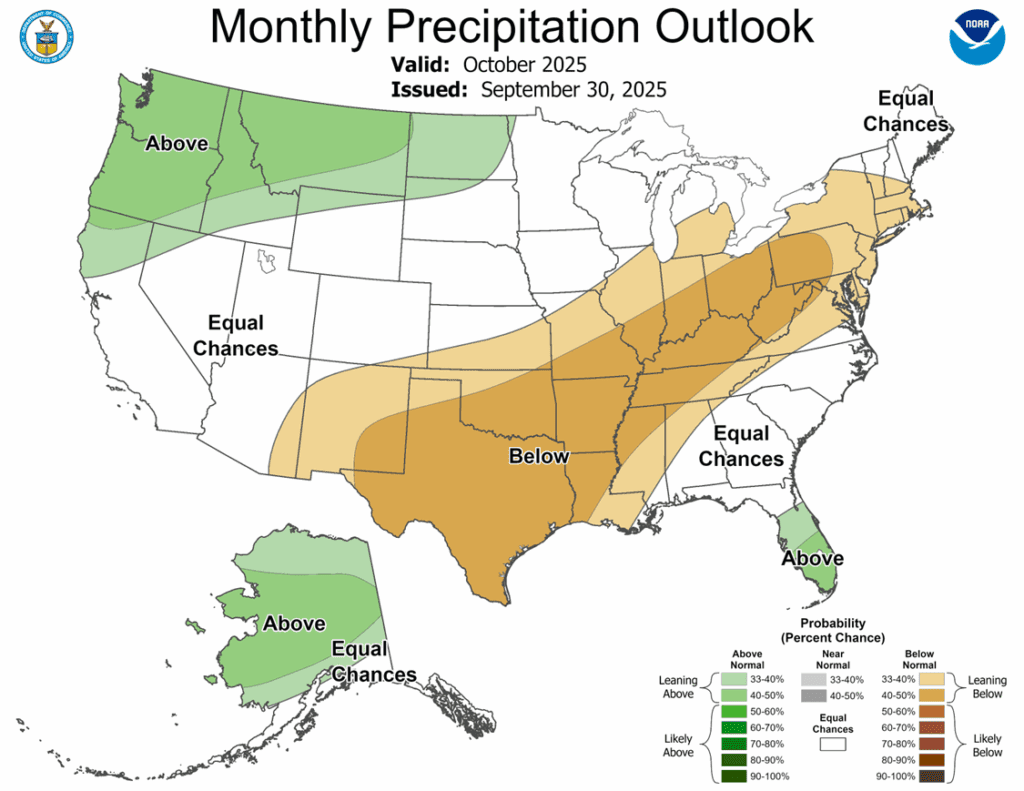

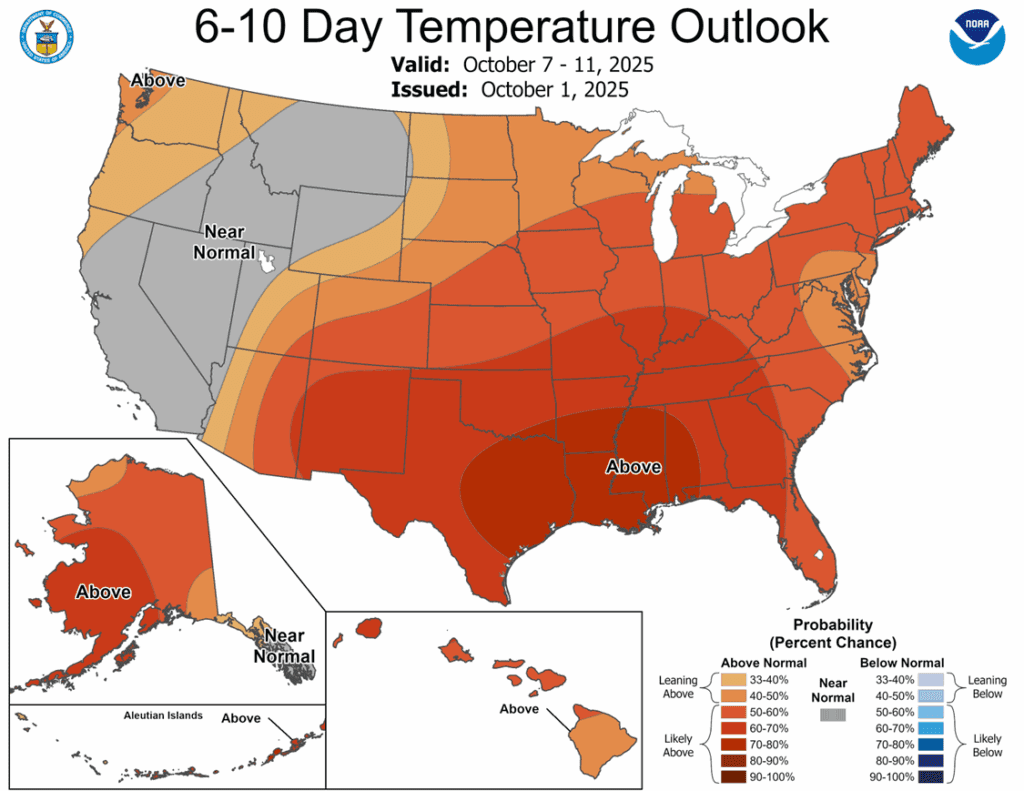

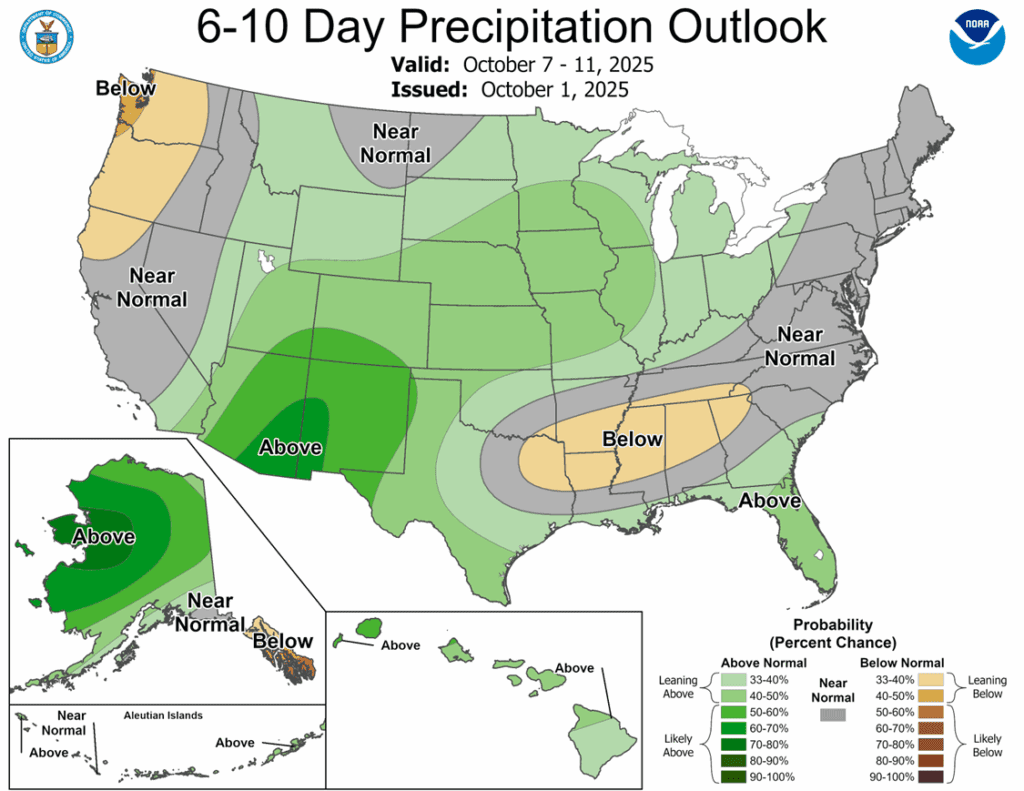

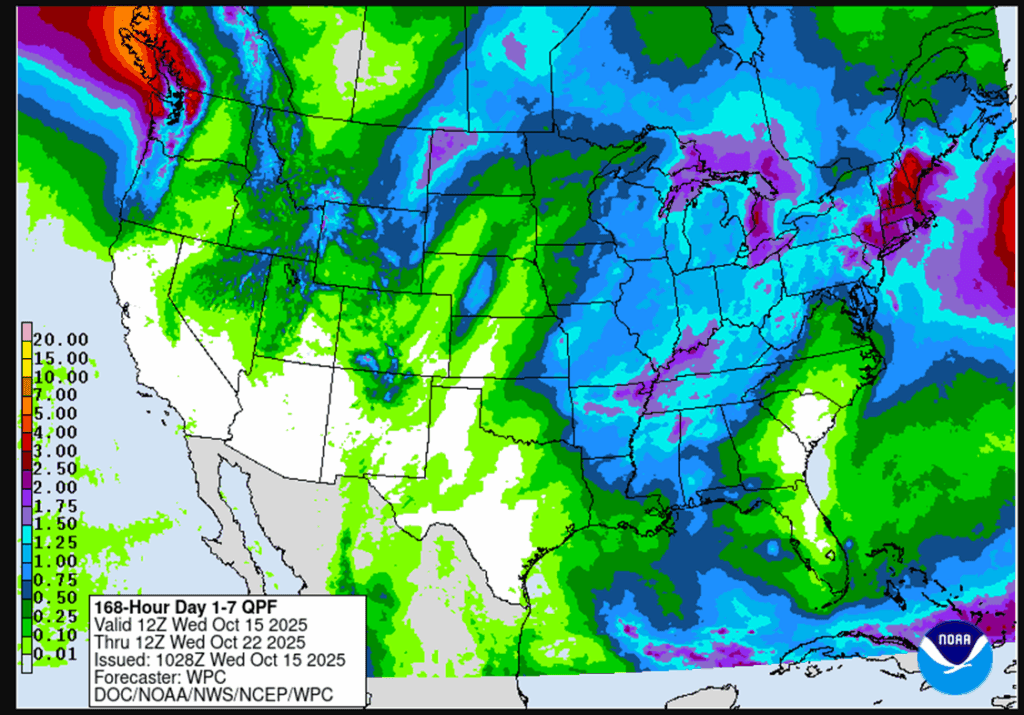

- To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

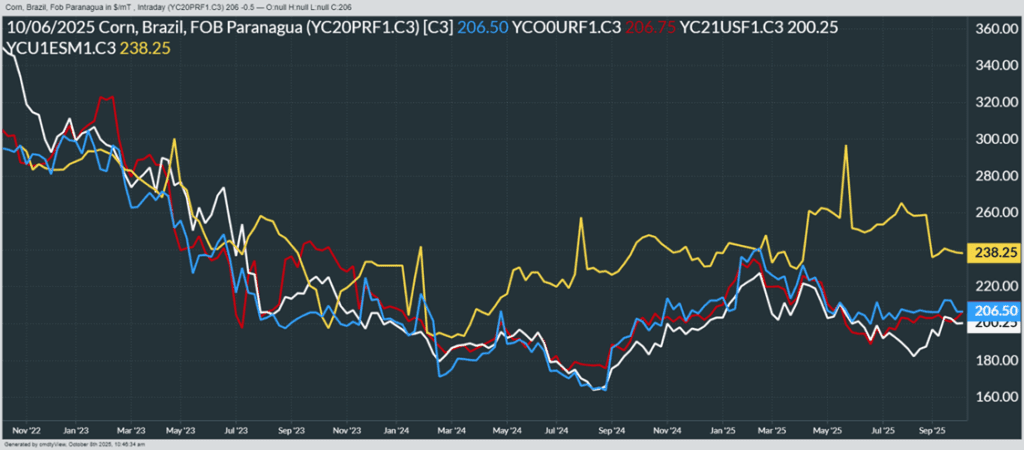

Corn

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

- Corn futures finished higher for the second straight session, following through after Tuesday’s gains. The corn market was led by buying strength in the front end of the market. December corn gained 3 ¾ cents to 416 ¾, and March futures added 3 cents to 432 ¼.

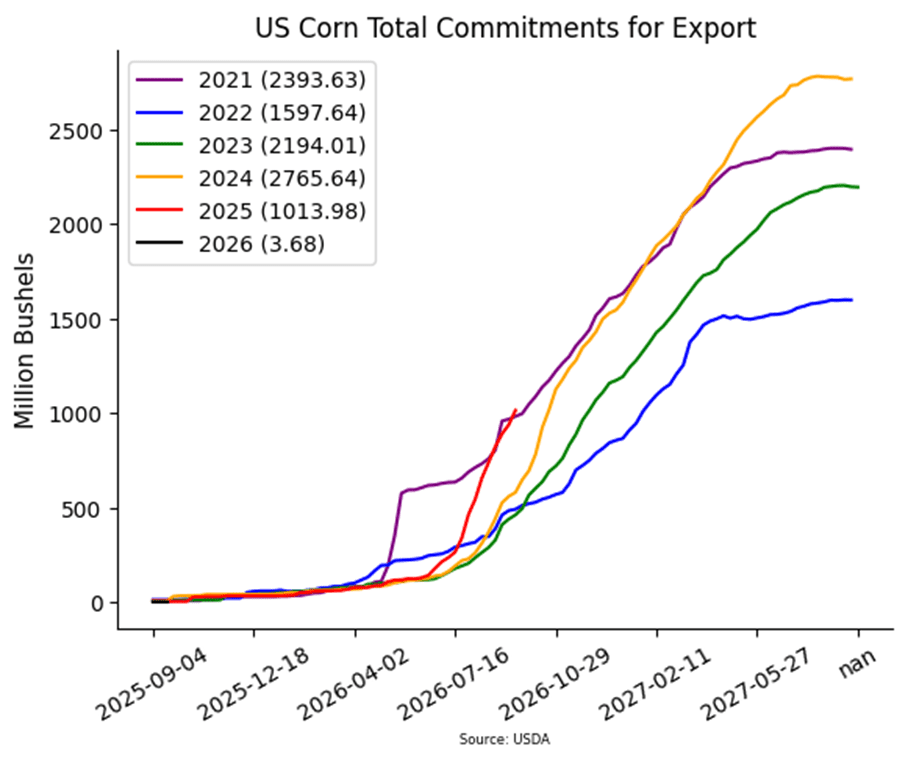

- Bull spreading lifted the front end of the corn market on Tuesday, supported by weekly corn inspections showing a solid shipping pace. End users may be seeking additional supplies to meet export demand.

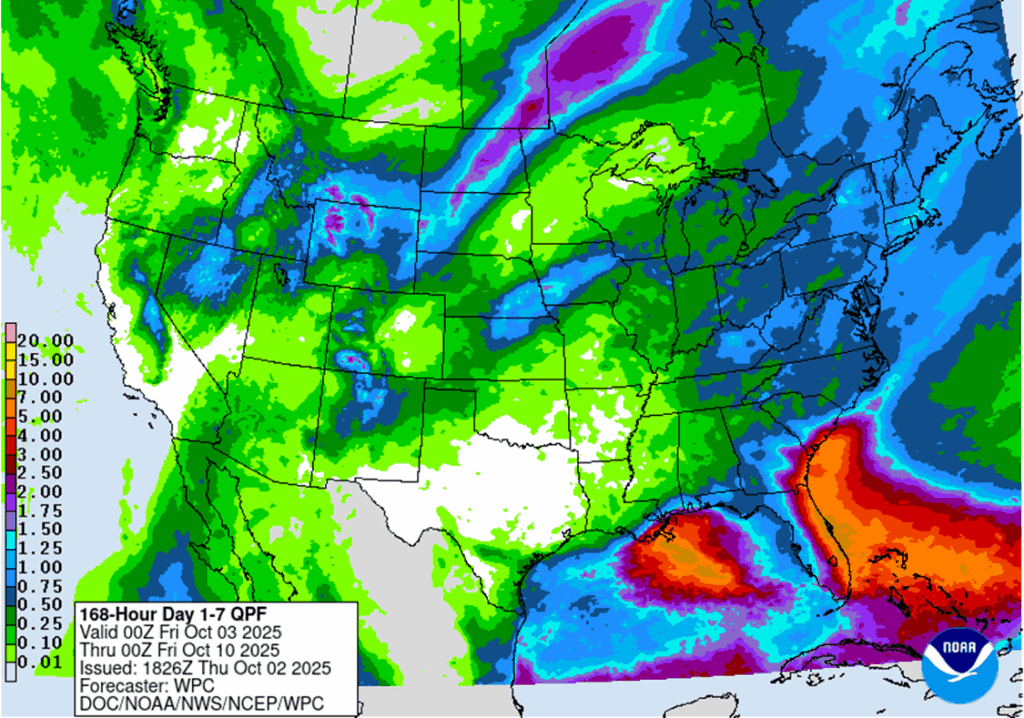

- Increased precipitation outlook into the end of the month may slow corn harvest. Harvest was anticipated to be 44% complete and with good export demand, should help support the cash market.

- France’s Agriculture Ministry raised its 2025 corn production estimate to 13.7 mmt, which is still 7.6% below last year’s. Reduced size of the French corn crop could help support demand for U.S. corn in the long term.

- On-and-off trade tensions with China are keeping grain markets unpredictable. Corn and other grains are responding to headlines as they emerge during the trading day.

Soybeans

Soybeans Action Plan Summary

2025 Crop:

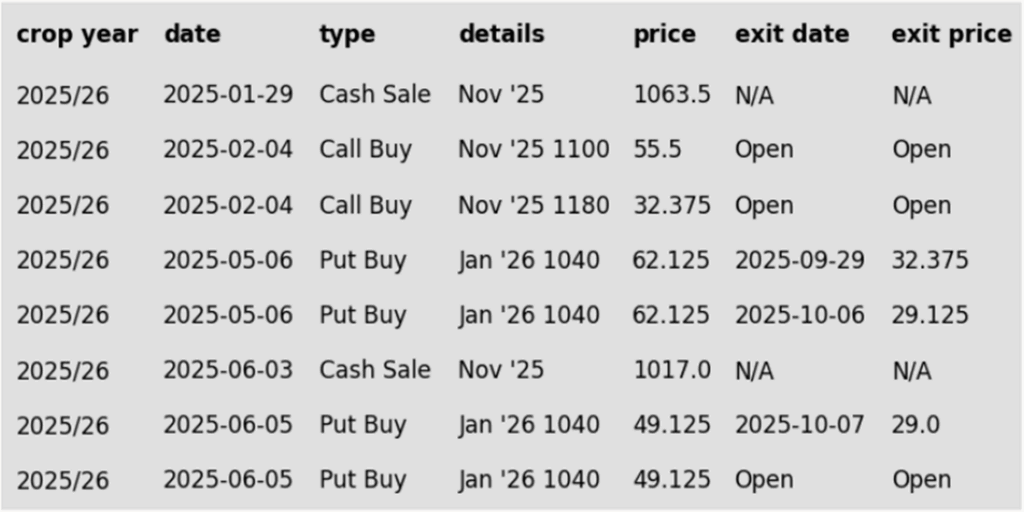

- Continued Opportunity – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

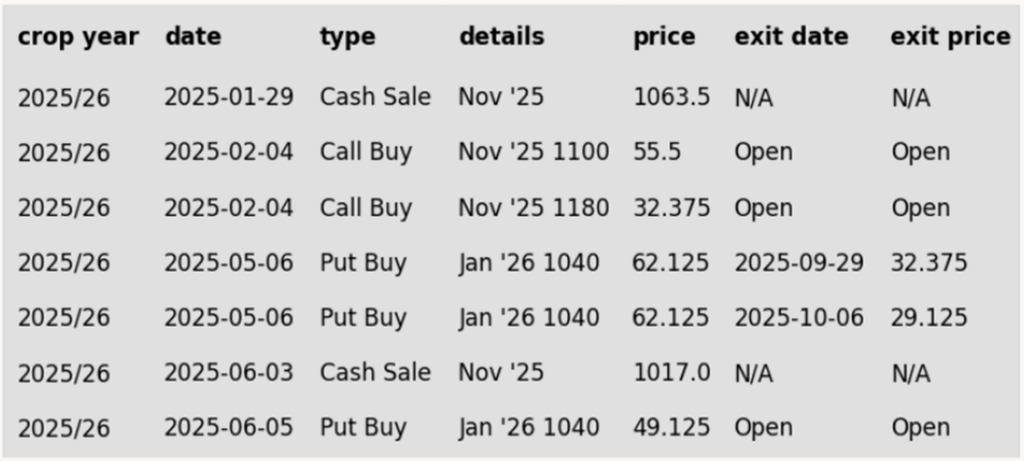

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

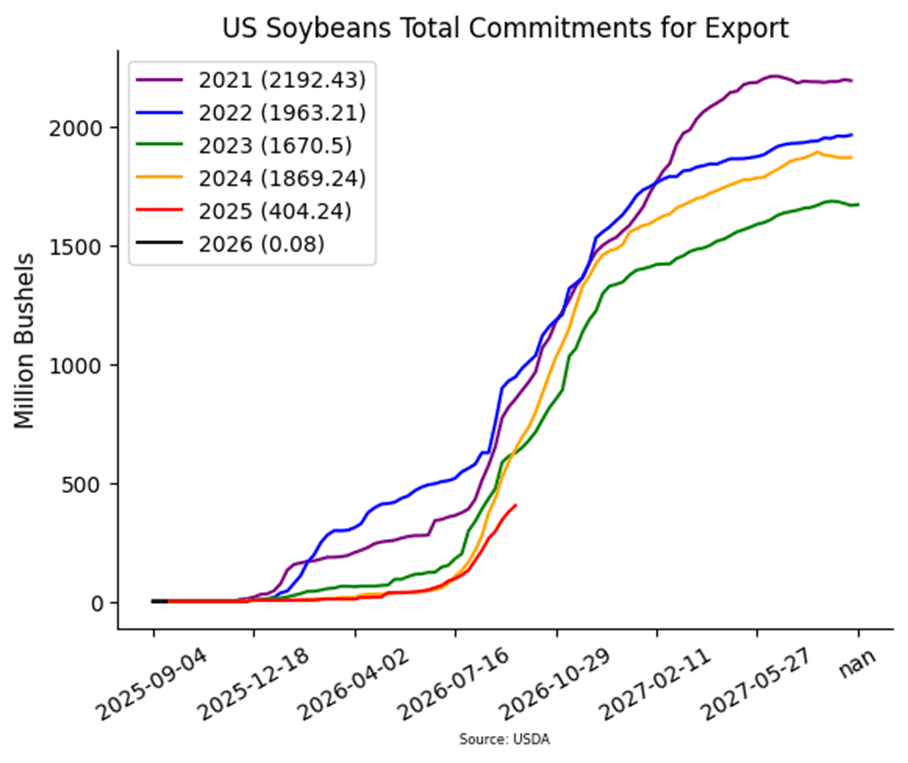

- Soybeans were unchanged to slightly higher to end the day in more quiet trade. President Trump’s tariff and trade threats to China have kept prices lower, along with the government shutdown and lack of data. November was unchanged at $10.06-1/2 while March was up ¼ cent to $10.39-3/4. December meal was up $1.60 to $275.90 and December bean oil was up 0.23 cents to 50.80 cents.

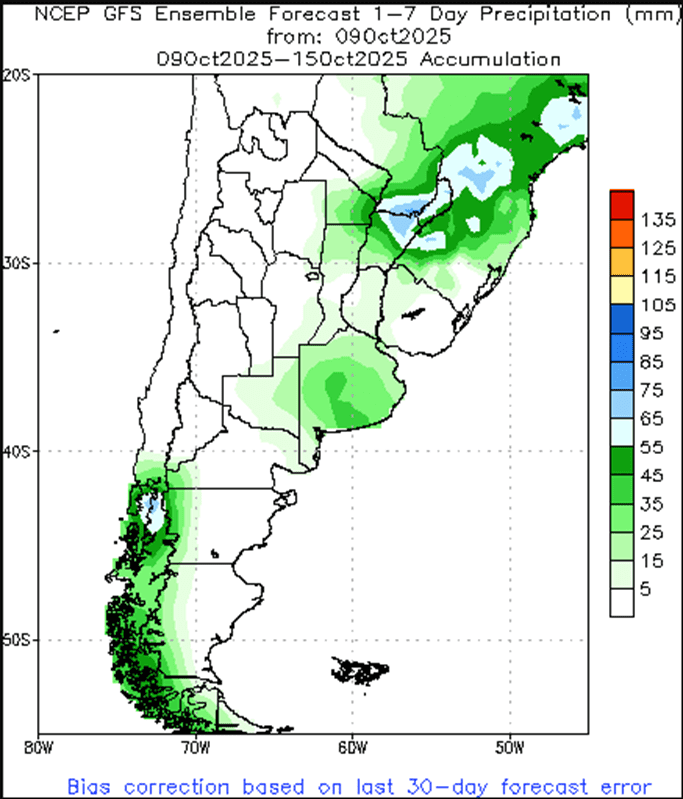

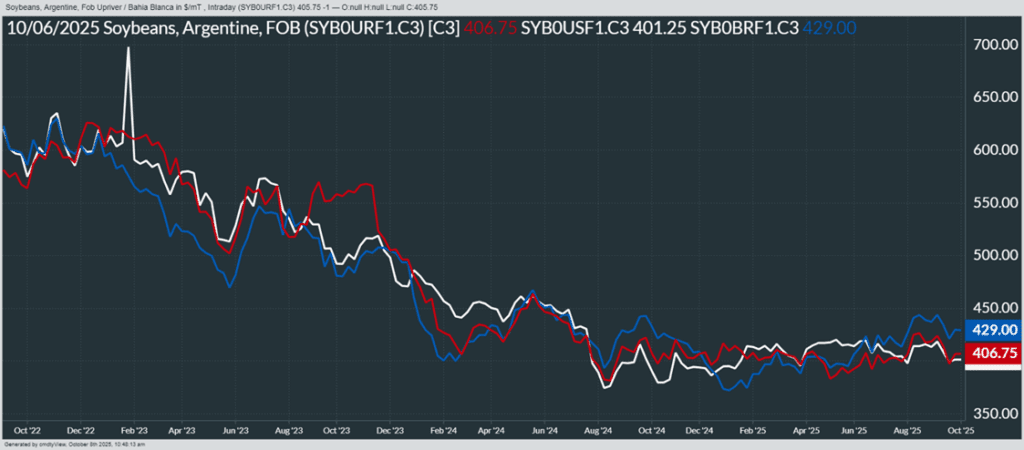

- The U.S. announced it may provide an additional $20 billion in financing to Argentina to ‘help our neighbors.’ The Argentine peso fell slightly on the news, which could make Argentine grains more affordable for importing countries.

- Soybeans have come under pressure following increased rhetoric from President Trump, including suggestions that tariffs on China could rise and that the U.S. may no longer need to buy soybean oil from China, potentially ending that trade.

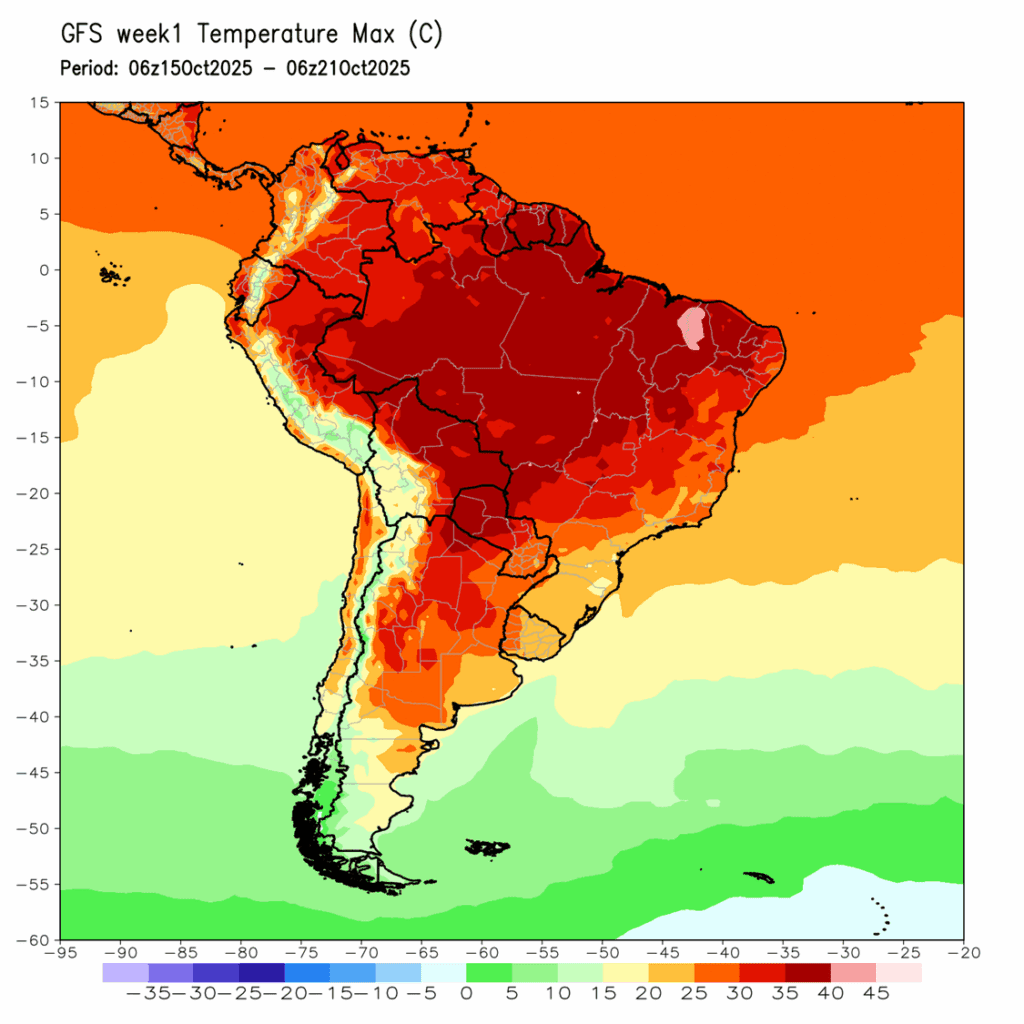

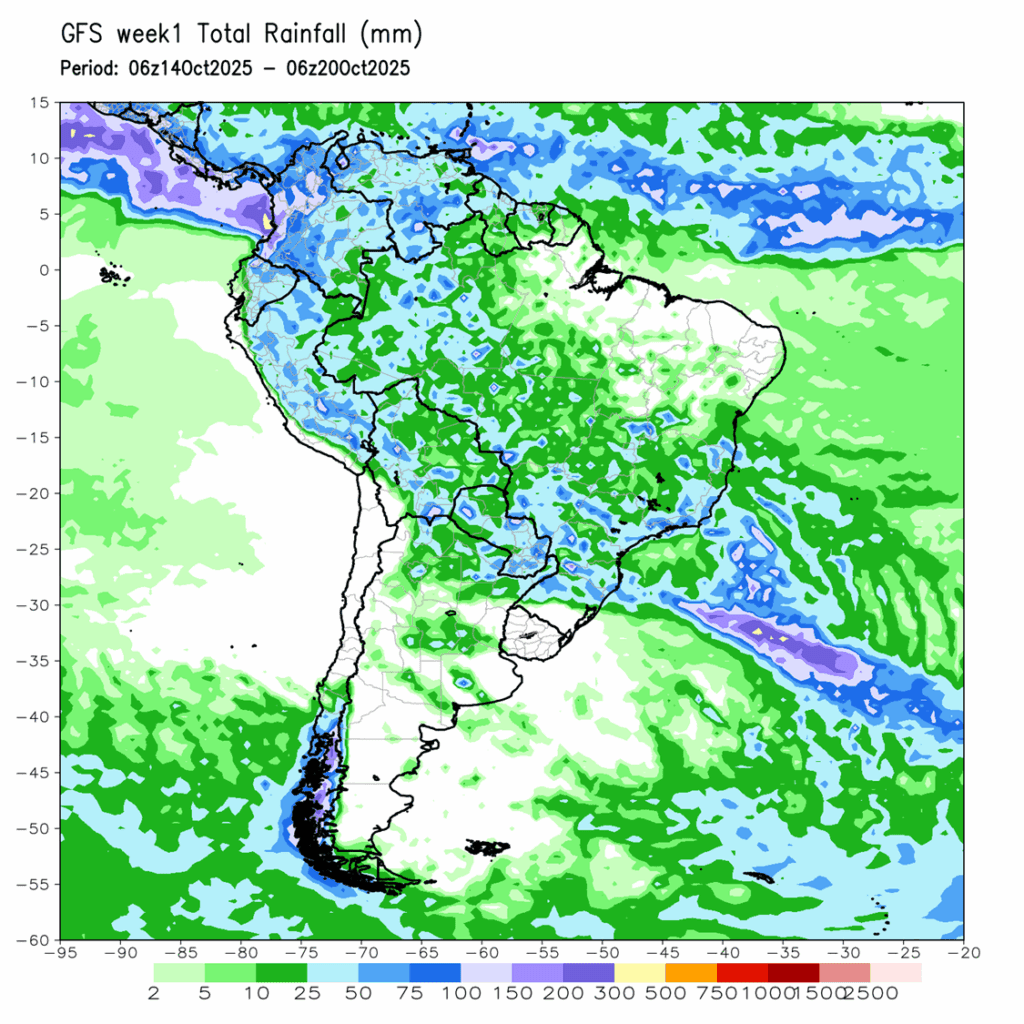

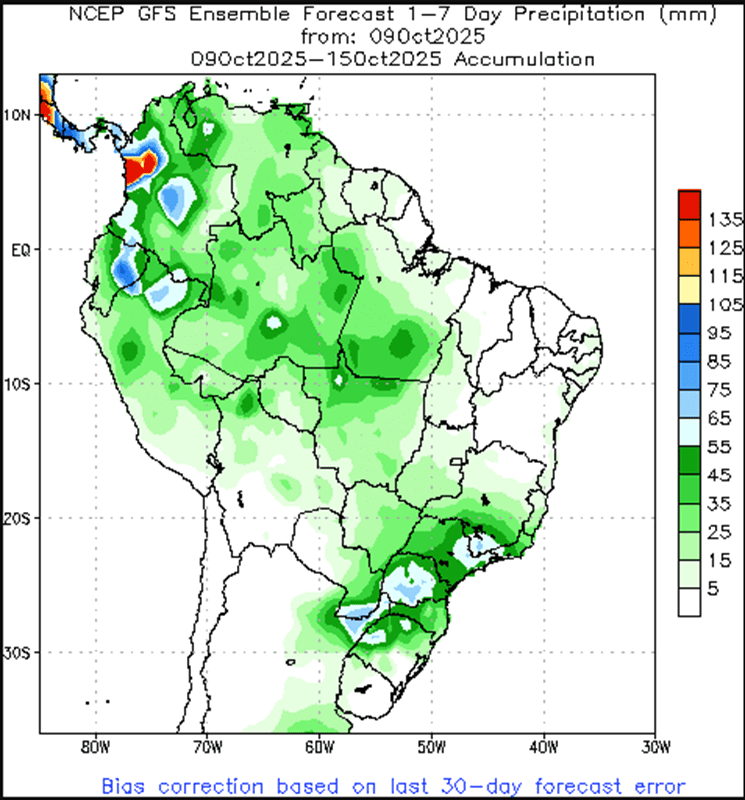

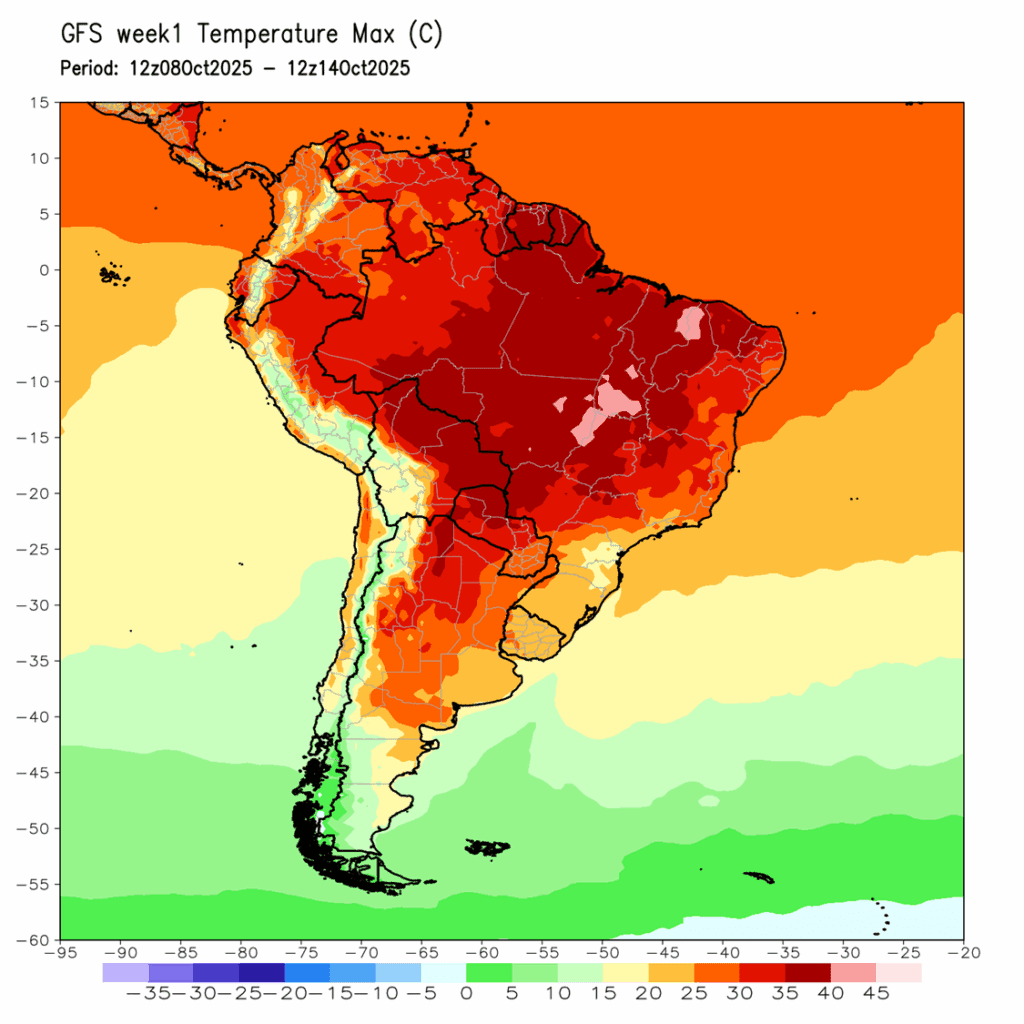

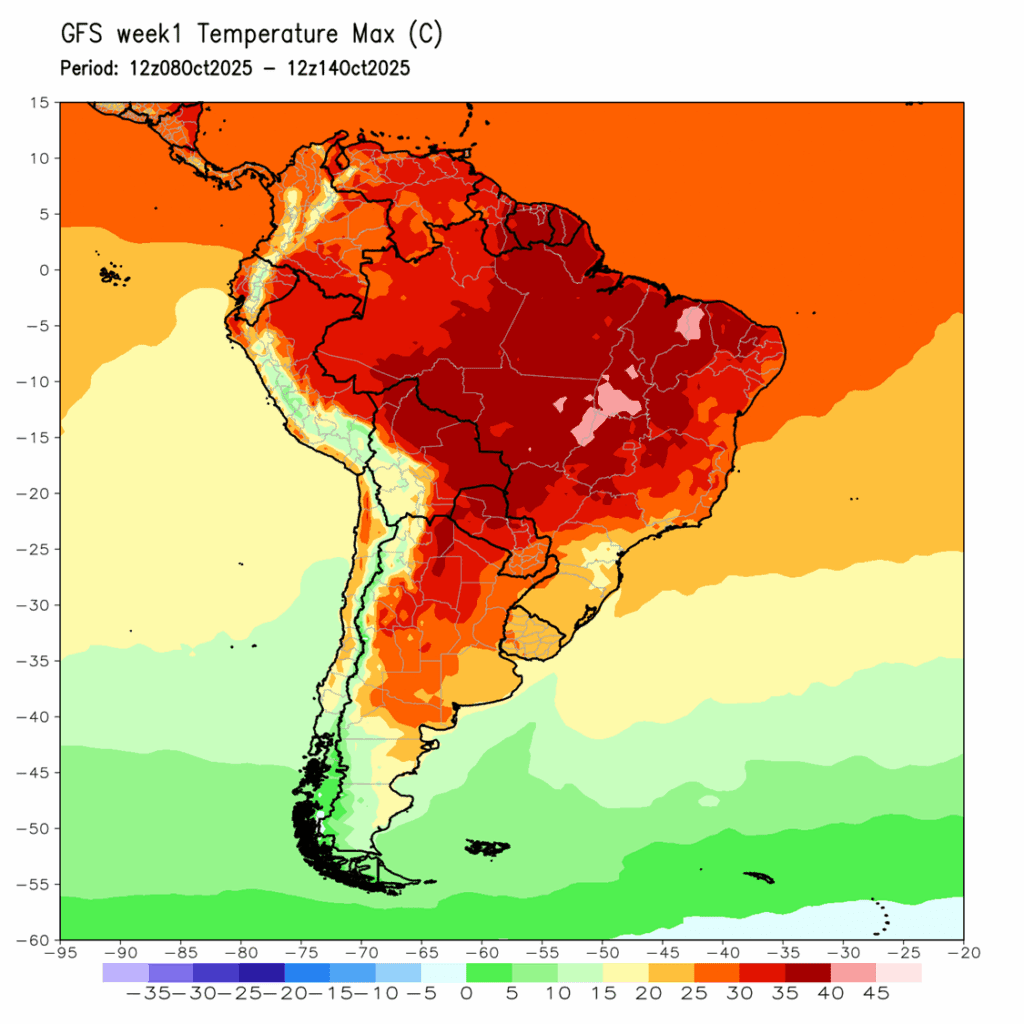

- In Brazil, soybean planting is reportedly 14% complete as of October 9, according to AgRural. This would compare to 9% last week and 8% at this time last year. This is the third fastest planting pace for the country on record for this time of year.

Wheat

Market Notes: Wheat

- Yesterday’s gains didn’t carry over into today, as wheat posted small losses across all categories. Although the market appears technically oversold, there hasn’t been any catalyst to trigger a short-covering rally. December Chi lost 1-1/2 cents to 498-3/4, KC was down 1/4 cent at 488-1/4, and MIAX closed 2-1/2 cents lower to 551.

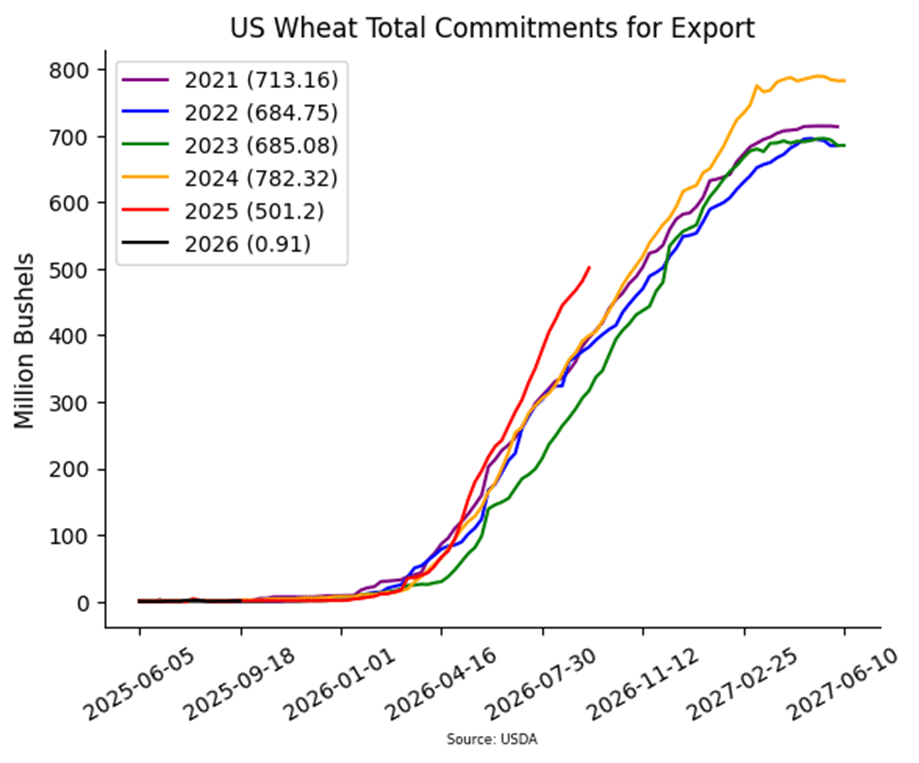

- South Korean flour mills were reported to have purchased 50,000 mt of U.S. wheat in a snap tender. South Korea is said to be seeking 95,000 mt of wheat from the U.S. and Canada on a separate tender.

- According to FranceAgriMer, their 25/26 wheat export estimate outside of the European Union was kept unchanged at 7.85 mmt. However, exports within the EU were increased by 4.5% to 7.04 mmt.

- The European Commission has said that EU soft wheat exports totaled 5.5 mmt between July 1 and October 12. This represents a 23% decline versus last year’s 7.1 mmt that was shipped.

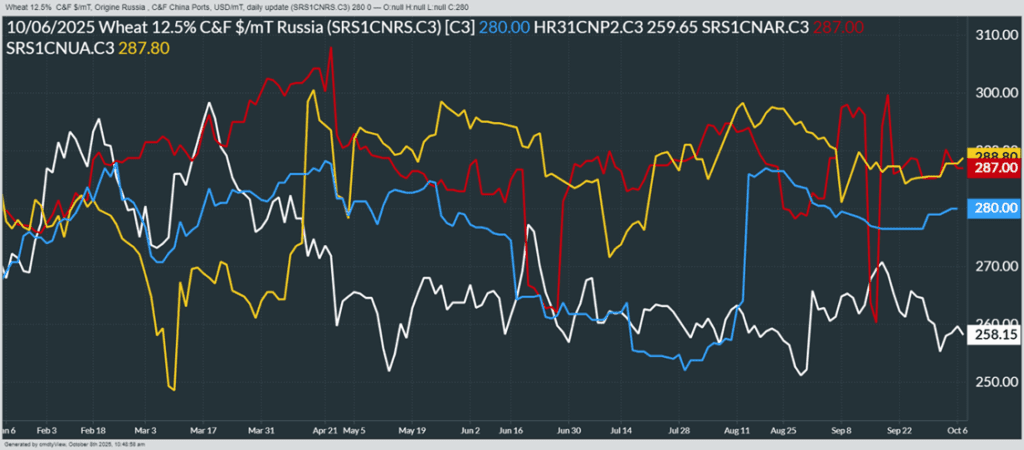

- Russia has reportedly restarted exports of wheat to Indonesia, after a 9-month hiatus. Indonesia is said to have renewed quarantine certificates to allow the imports of 52,000 mt in October. For reference, Indonesia imported 1.3 mmt of Russian wheat in 2024, compared with 123,000 mt so far this year.

- The Ukrainian economy ministry reports that farmers have sown 2.8 million hectares of wheat through October 14. This is roughly 15% less than what was planted in a similar timeframe last year. Planted areas for barley and rapeseed also saw declines.

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 565 to 563.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 617.

To date, Grain Market Insider has issued the following KC recommendations:

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.