2-28 End of Day: Grain Freefall Continues Friday

All Prices as of 2:00 pm Central Time

Grain Market Highlights

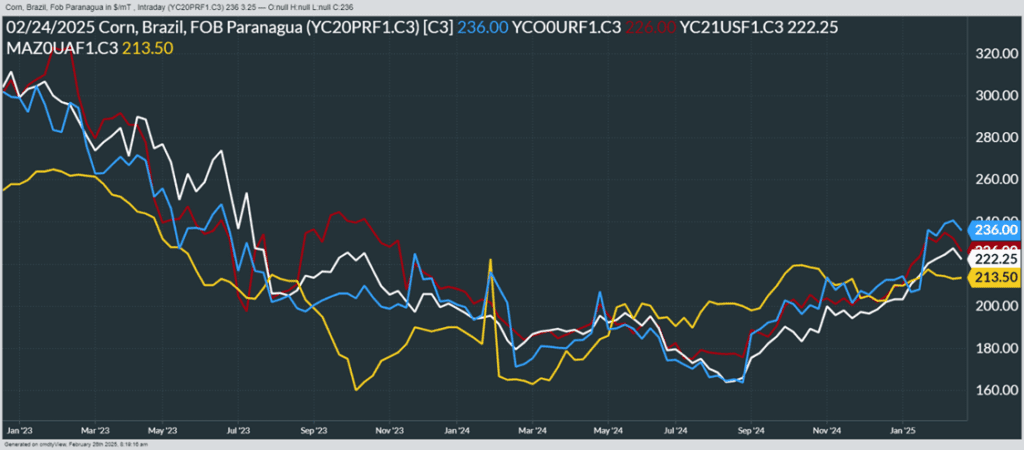

- Corn: Futures tumbled again to end the week, with corn marking its sixth consecutive lower close.

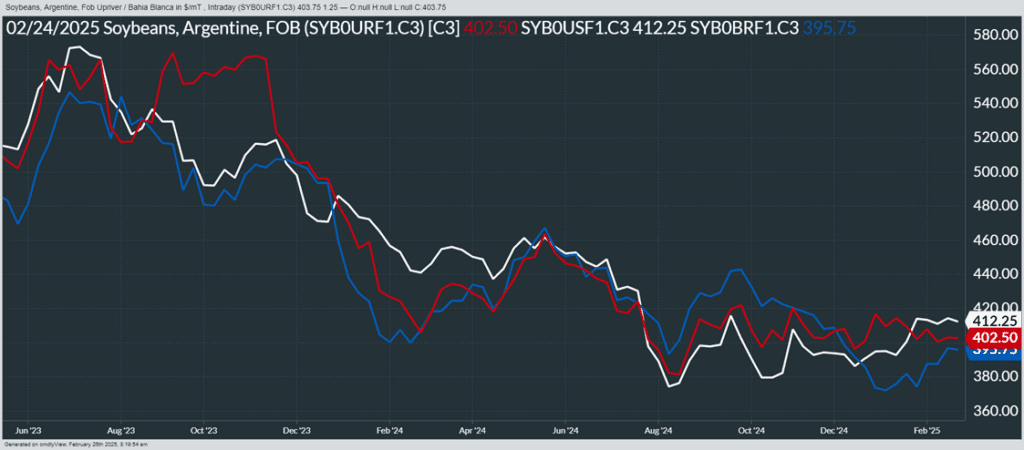

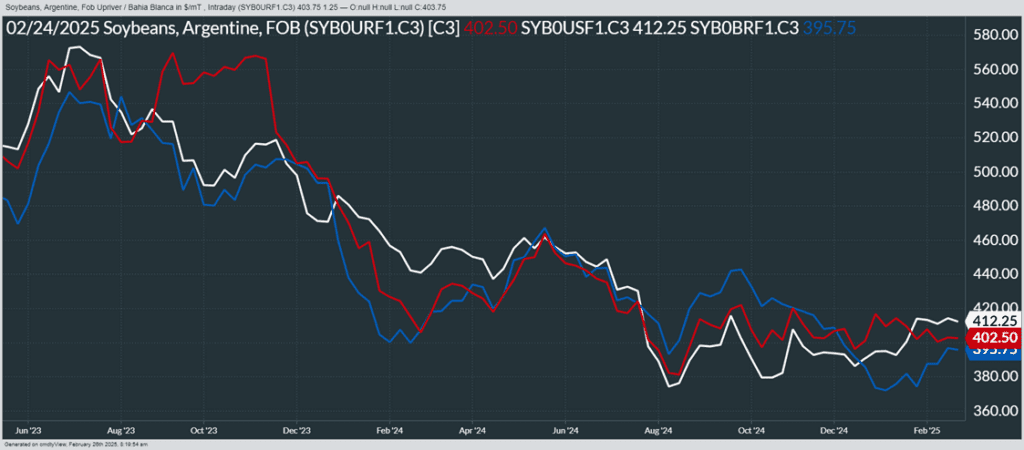

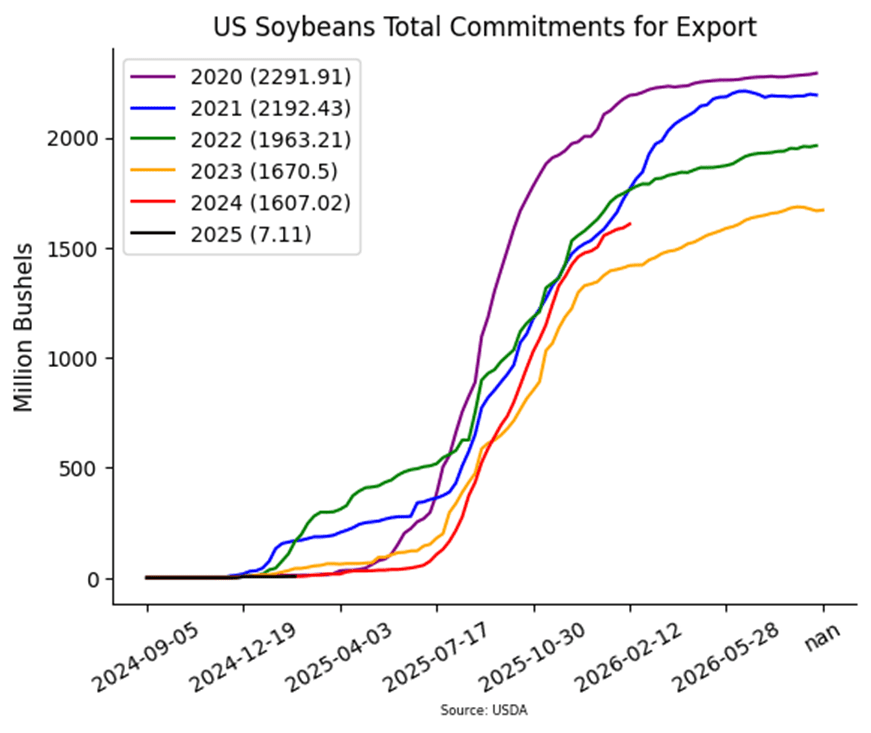

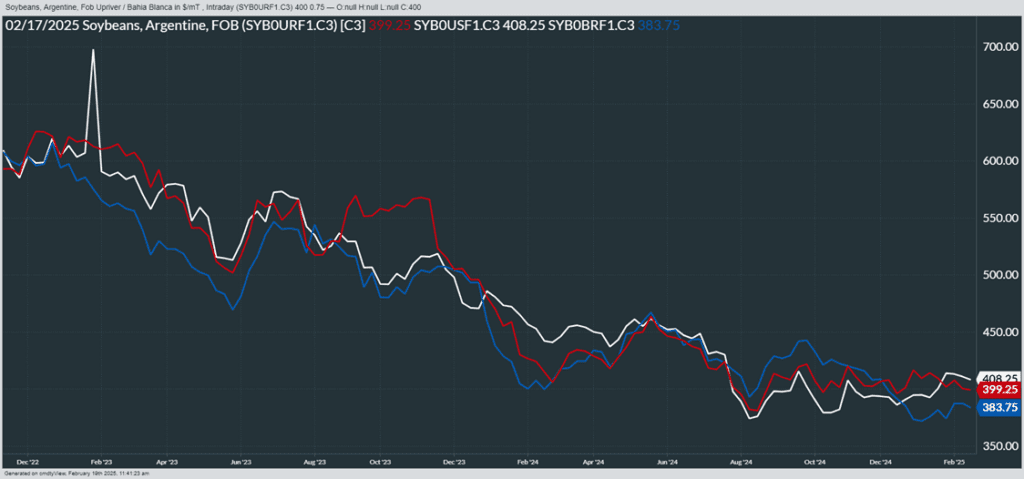

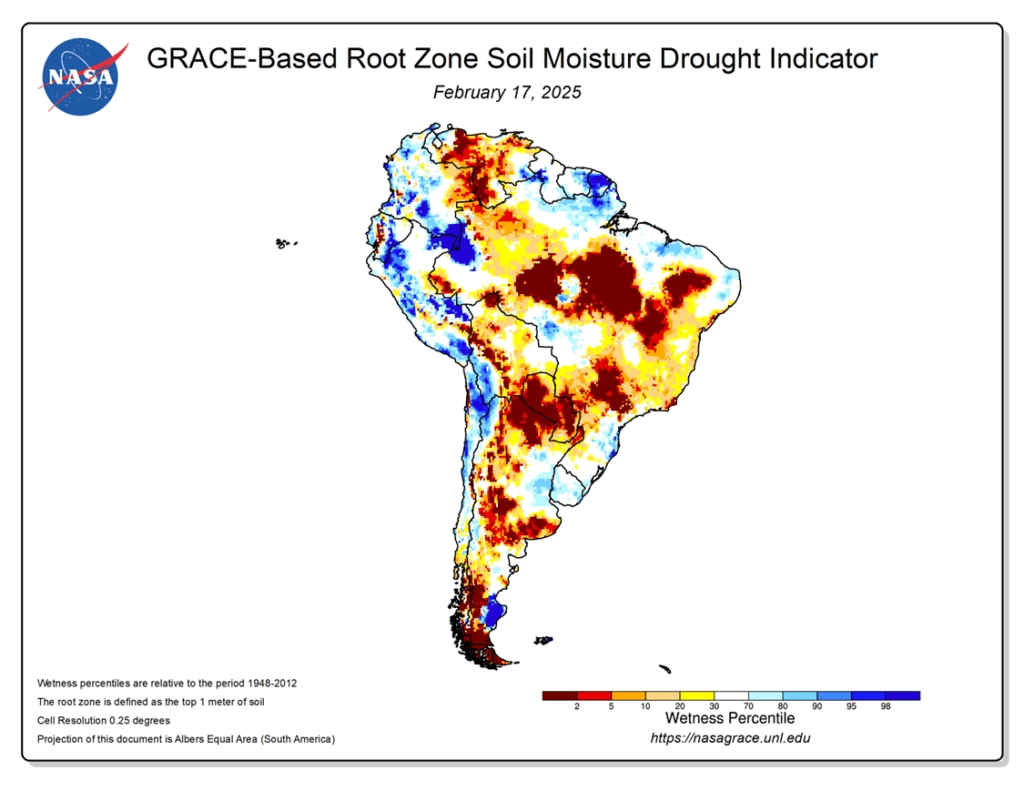

- Soybeans: Weak export sales, Brazilian harvest pressure, and declines in corn and wheat prices weighed on soybeans to end the week.

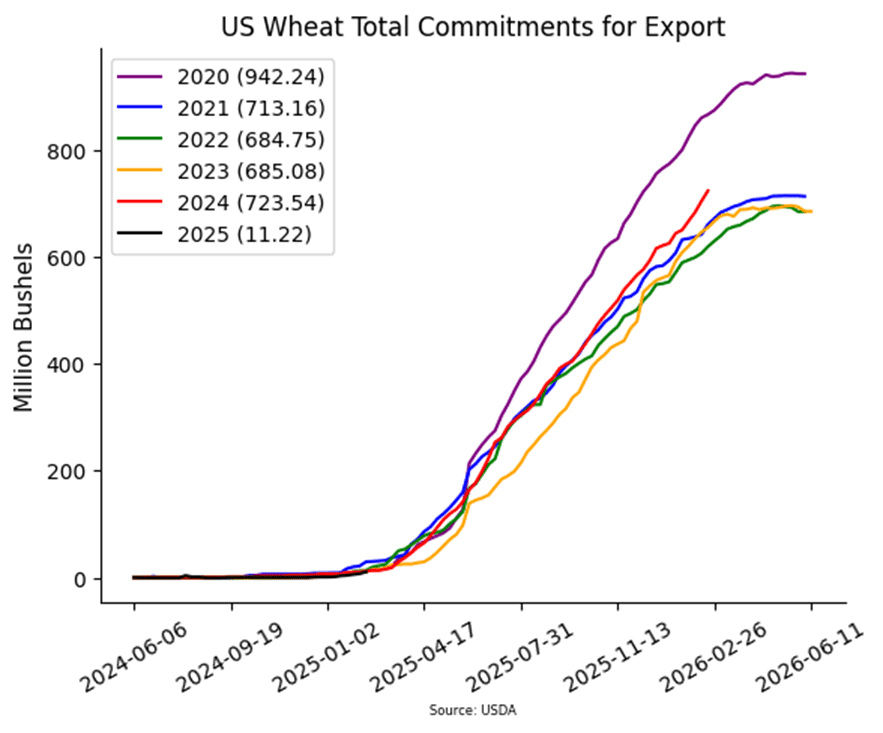

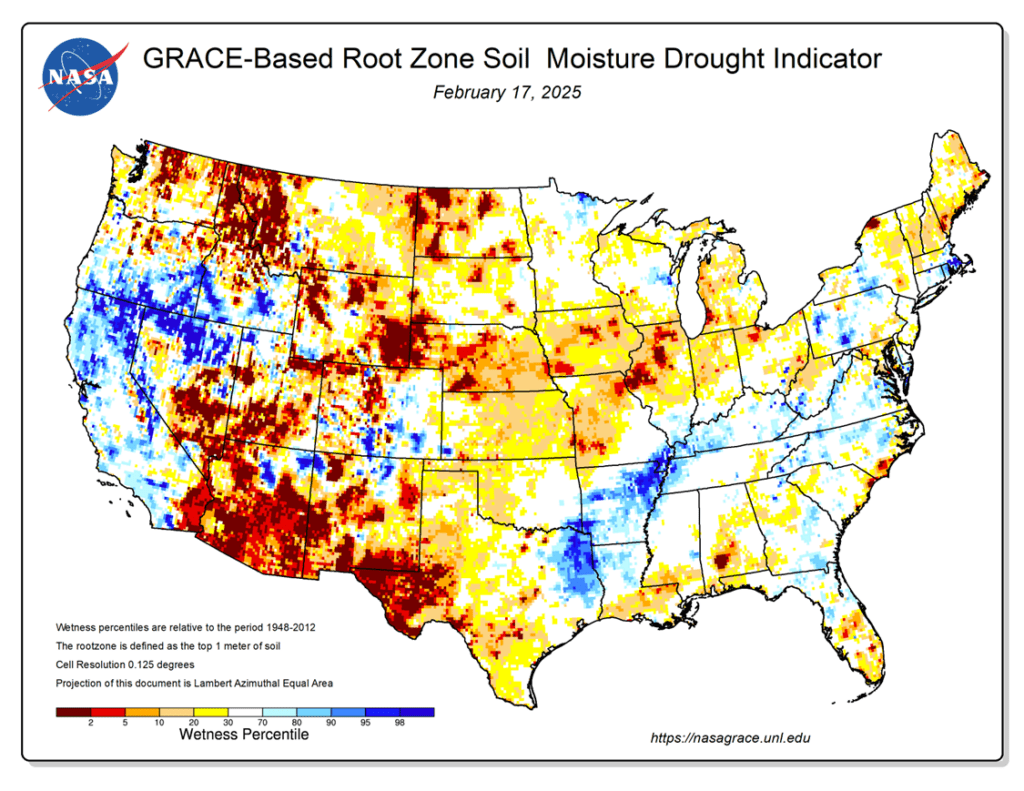

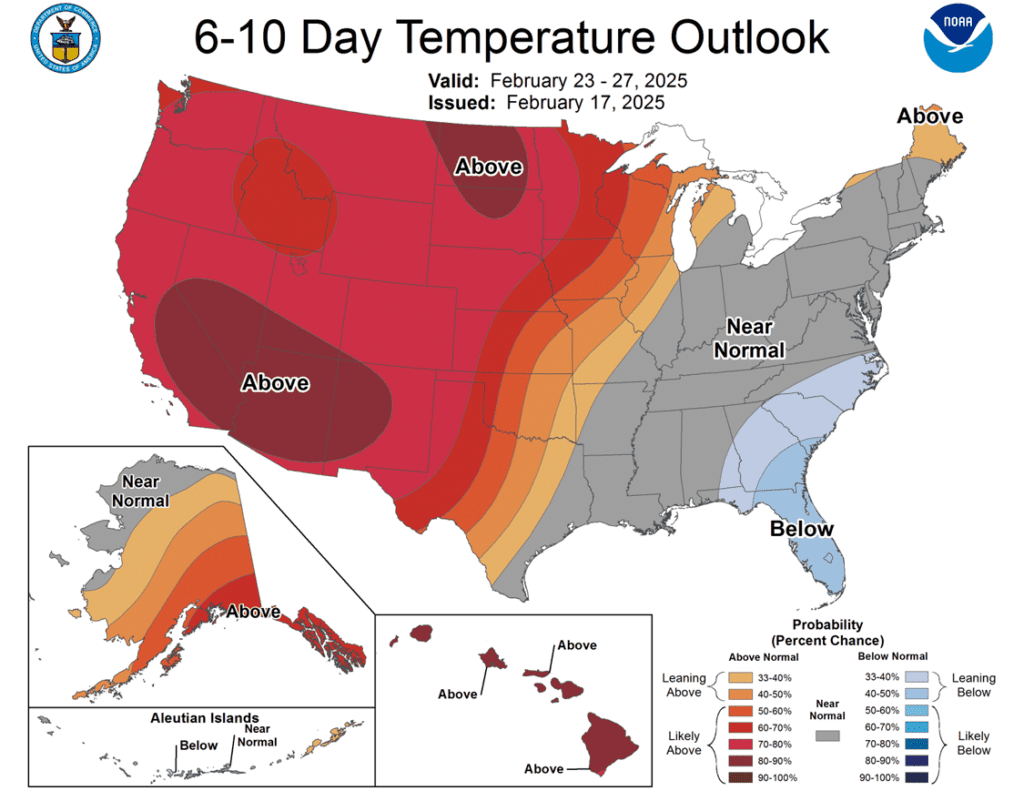

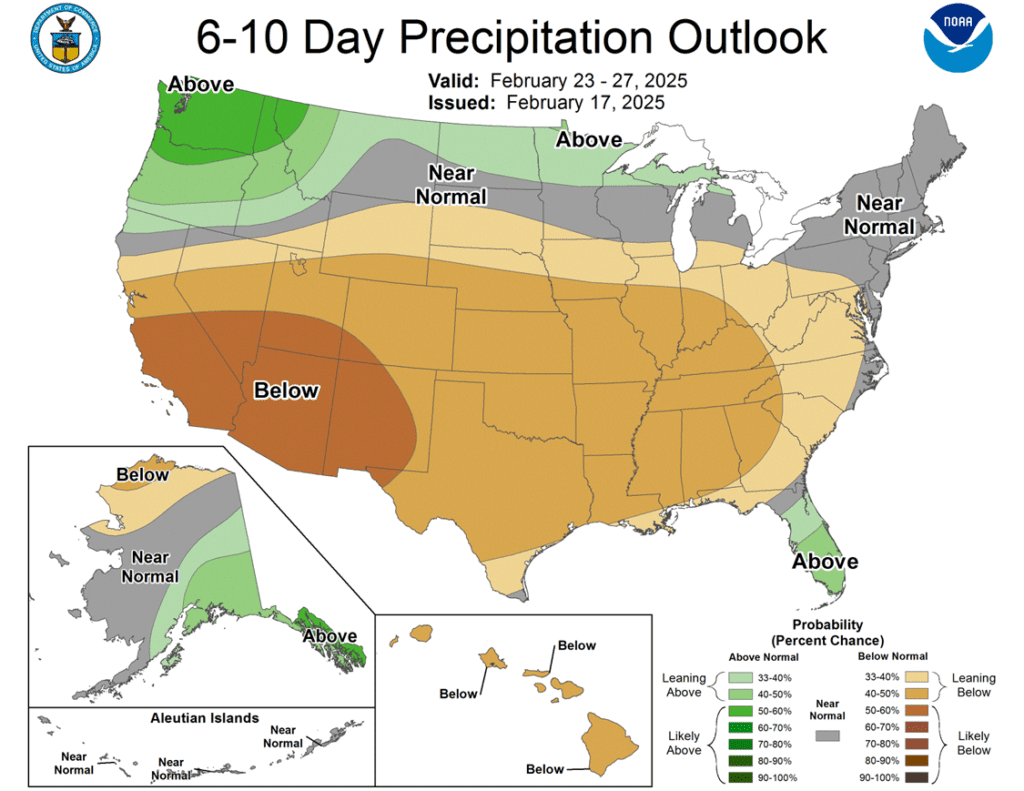

- Wheat: Improved weather in the Plains and continued weakness in corn prices pressured wheat futures lower on Friday. Wheat has now closed lower in seven of the last eight trading sessions.

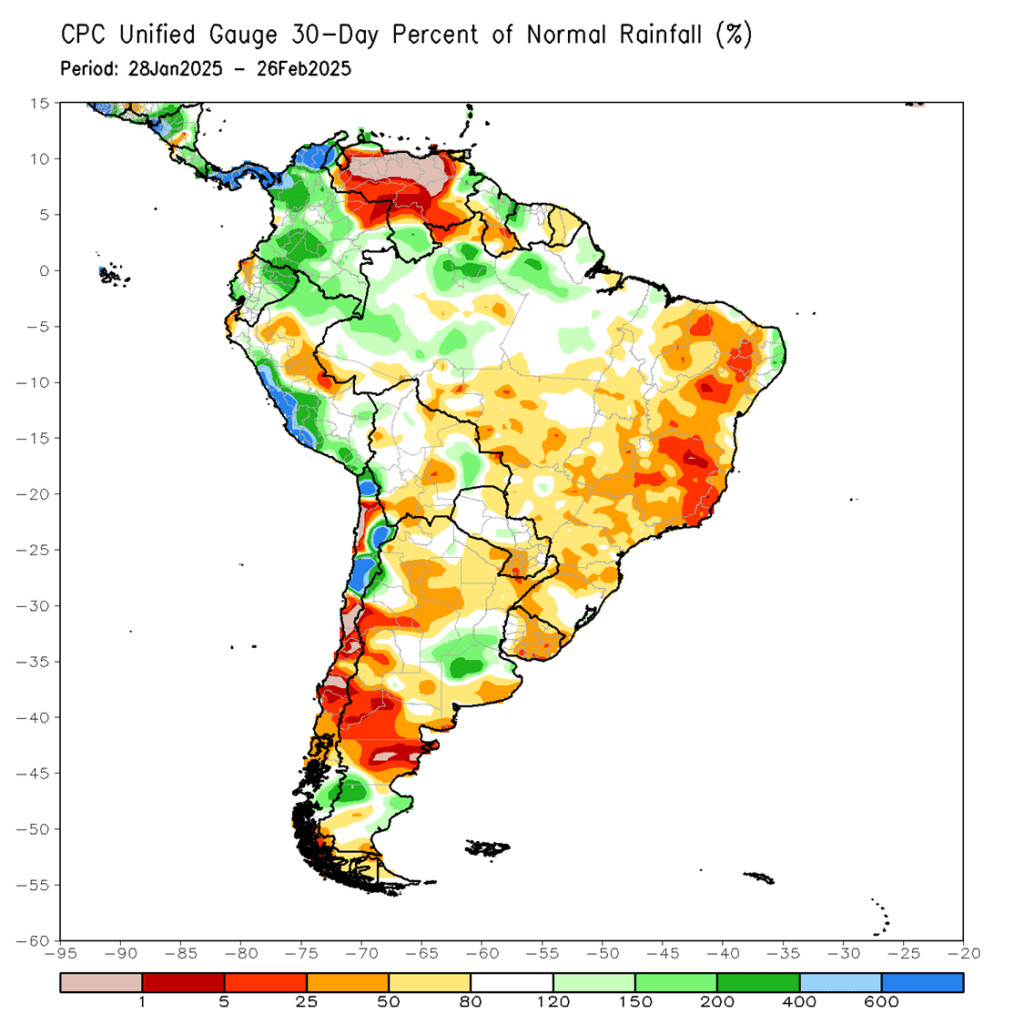

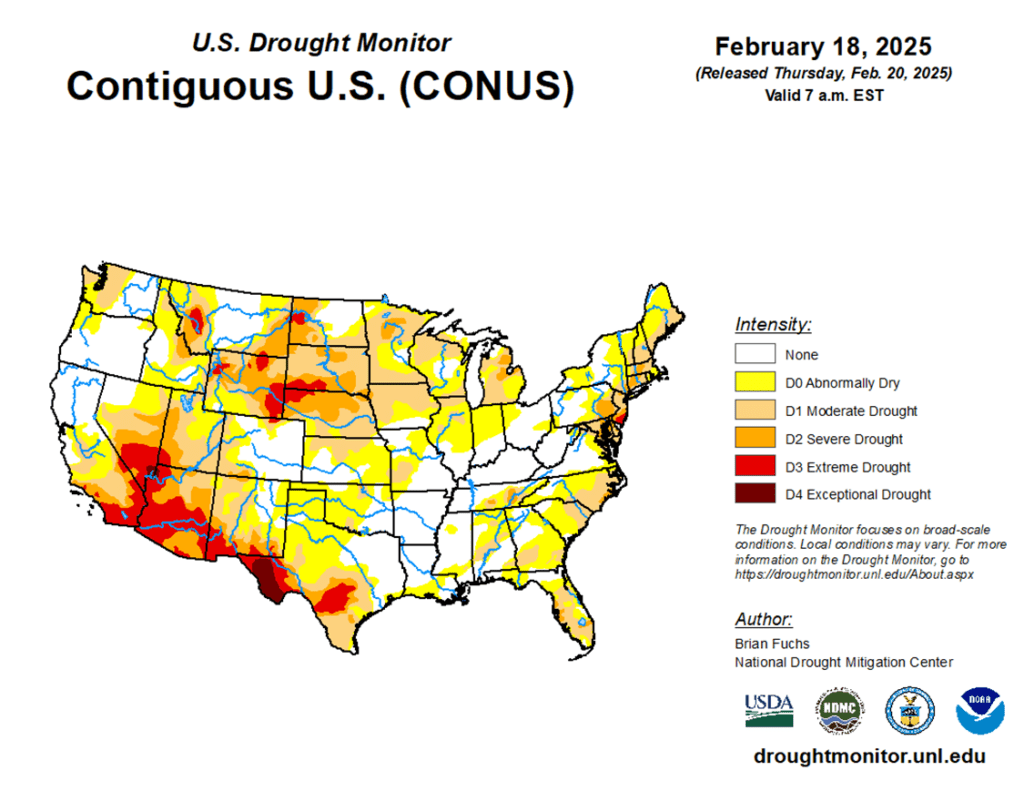

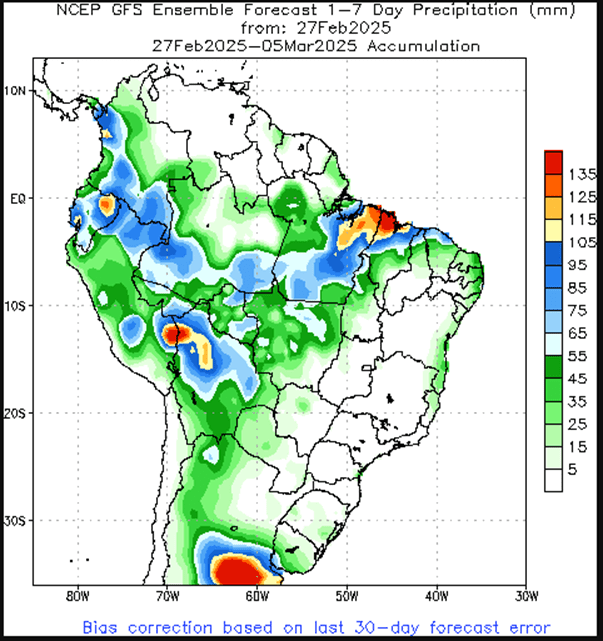

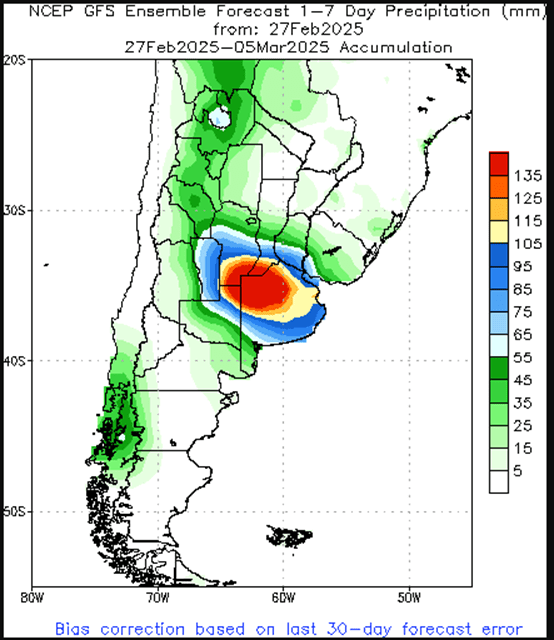

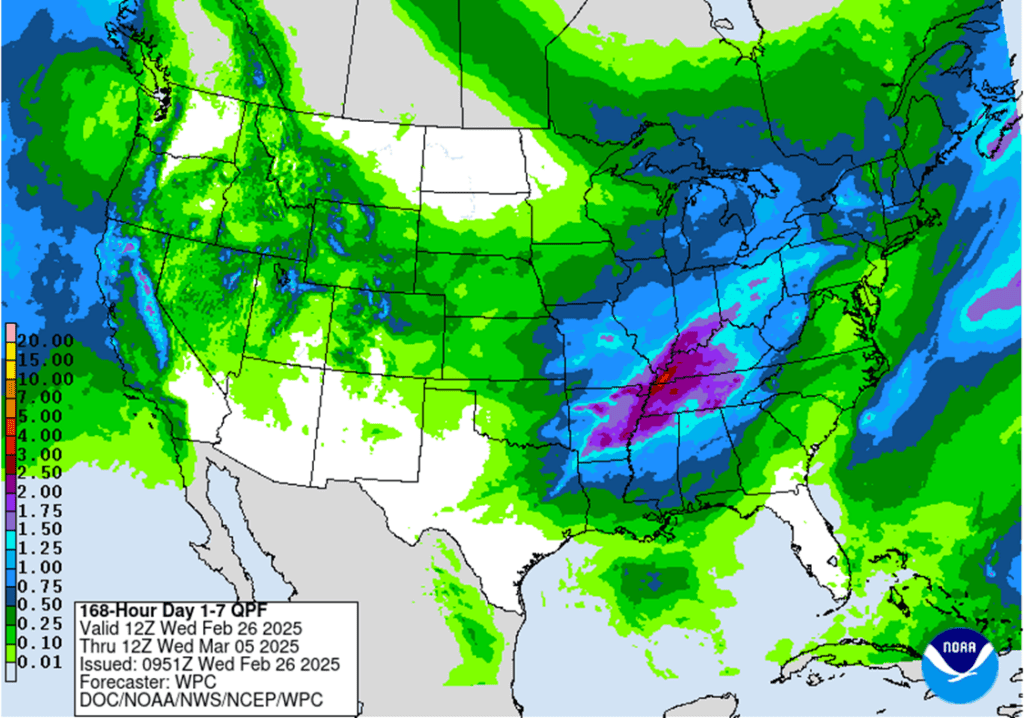

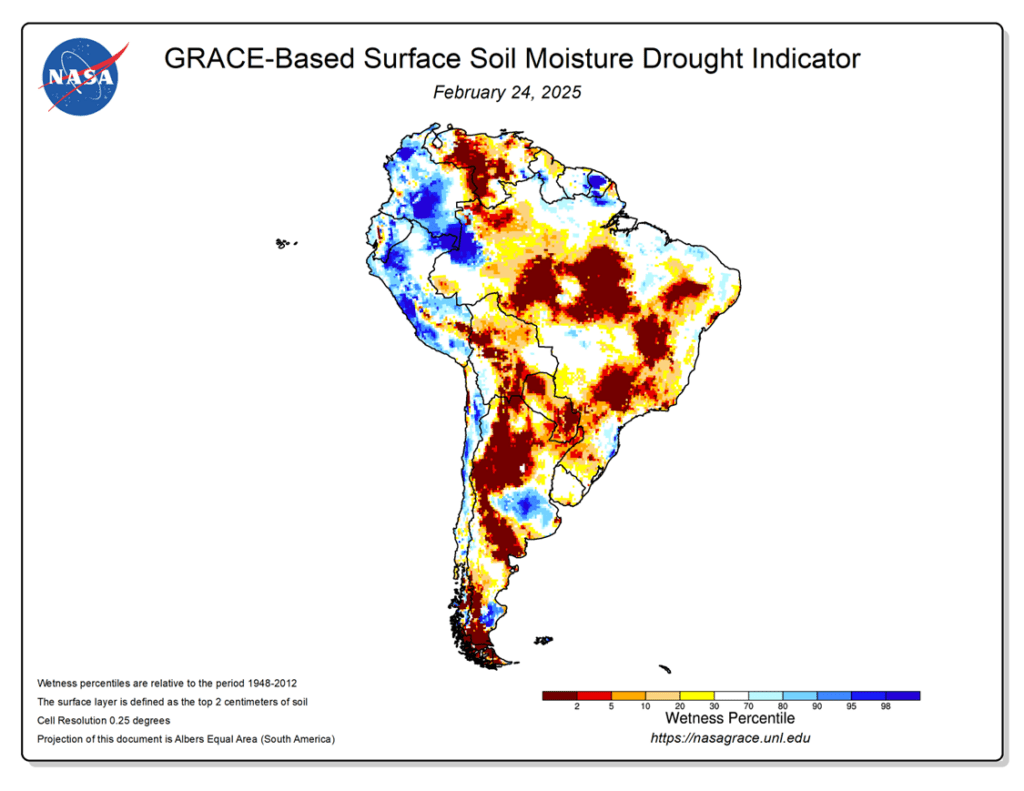

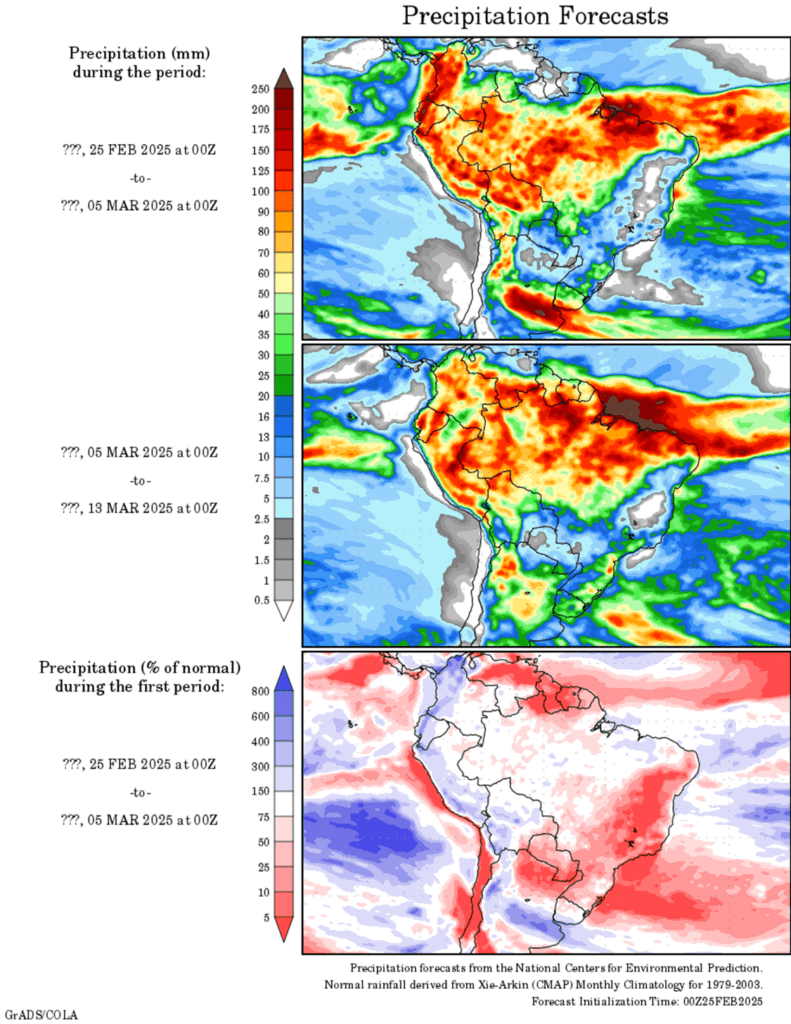

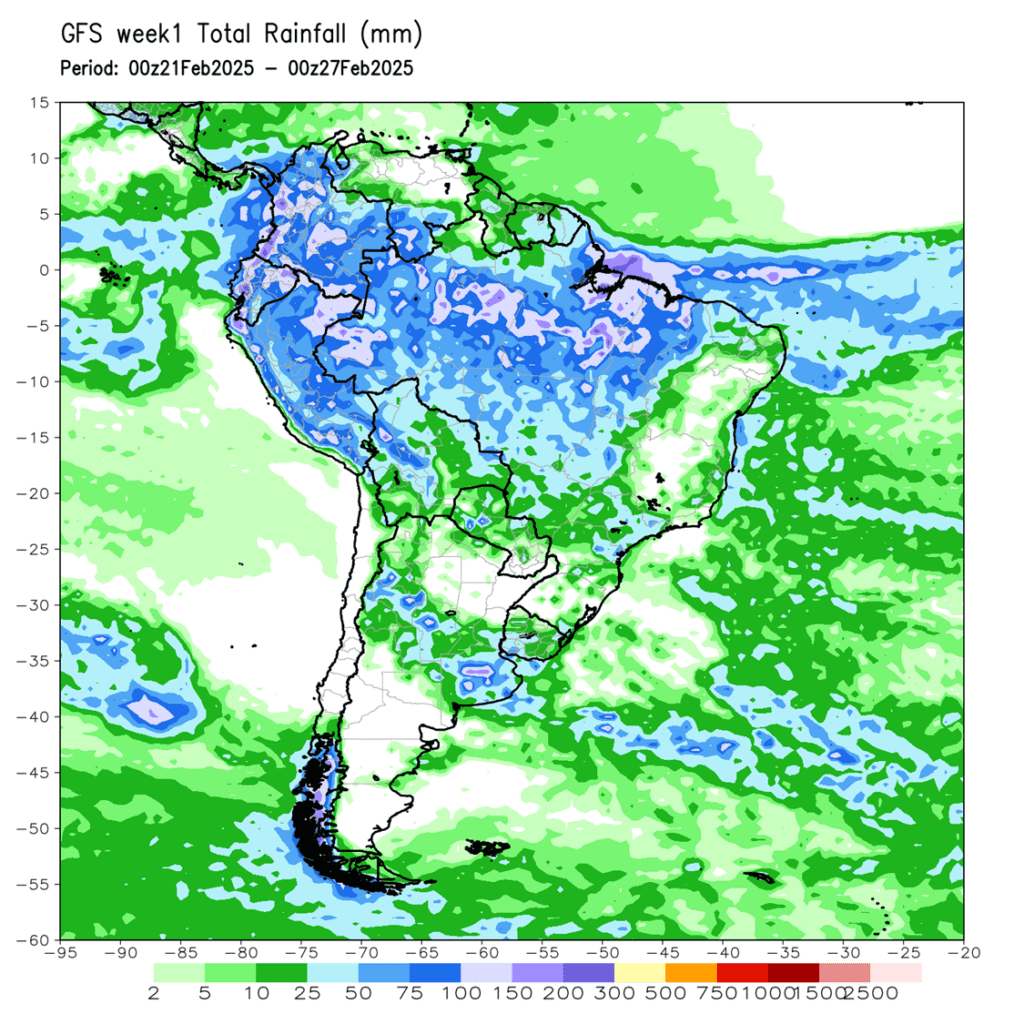

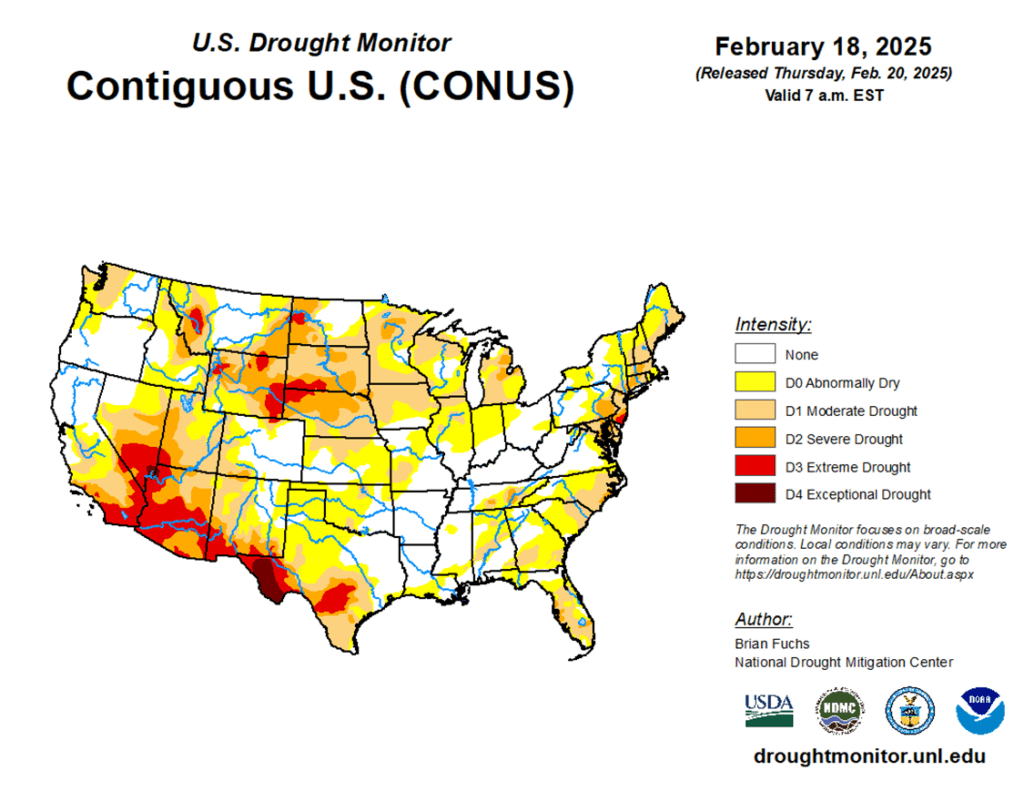

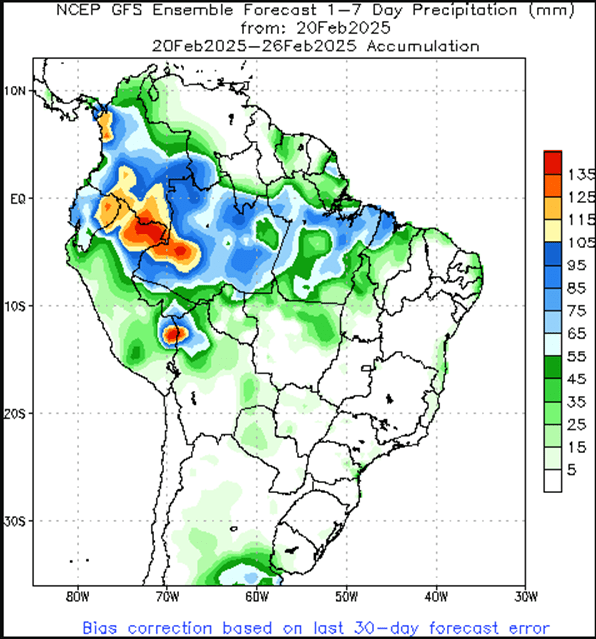

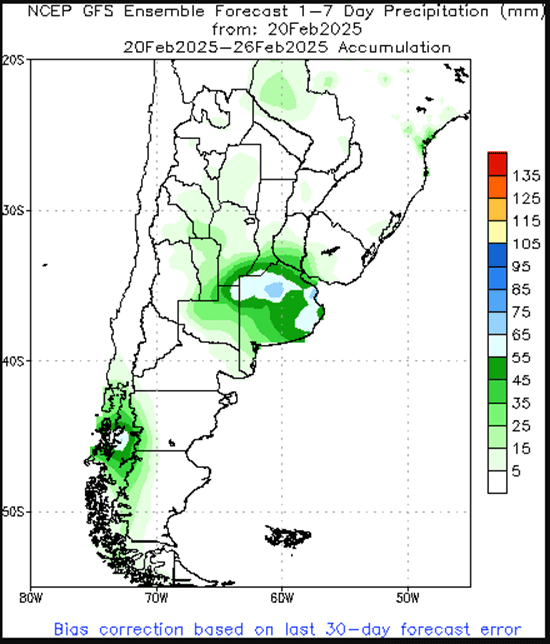

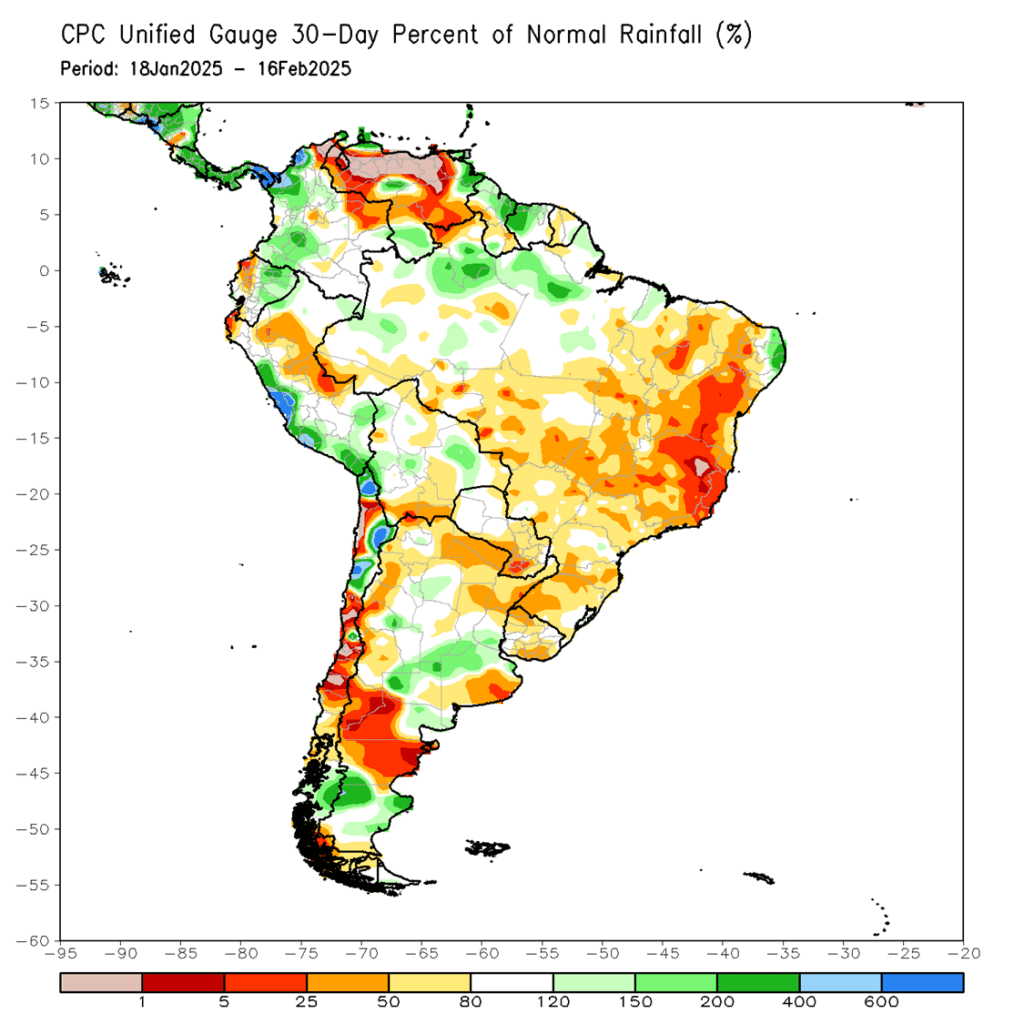

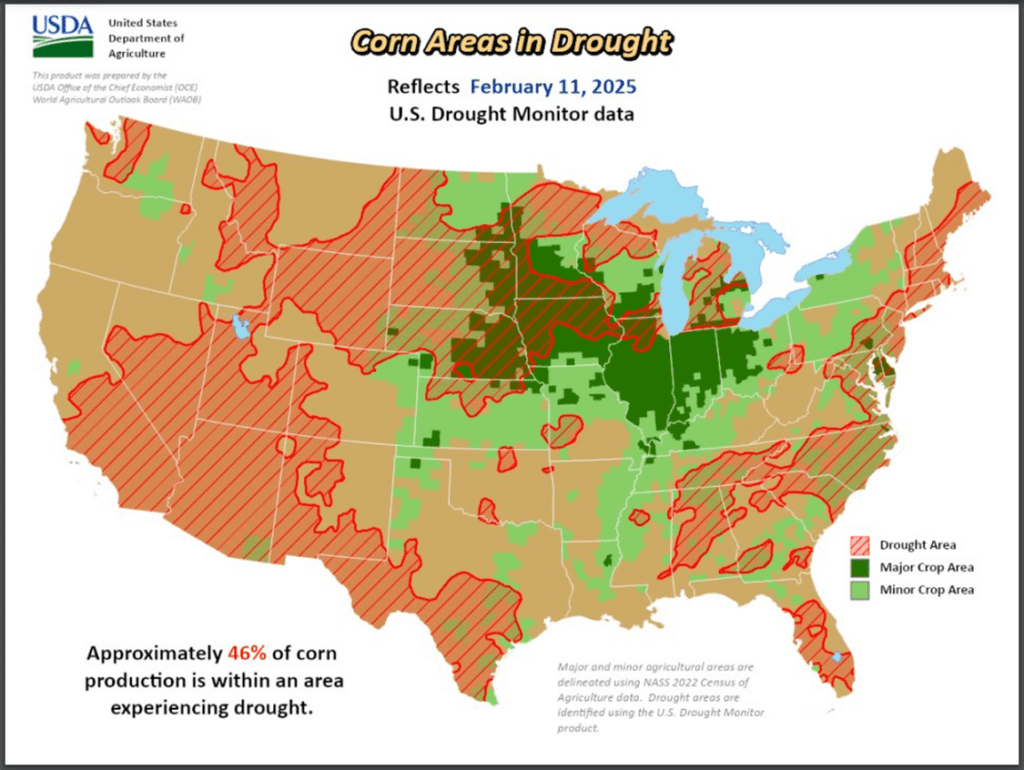

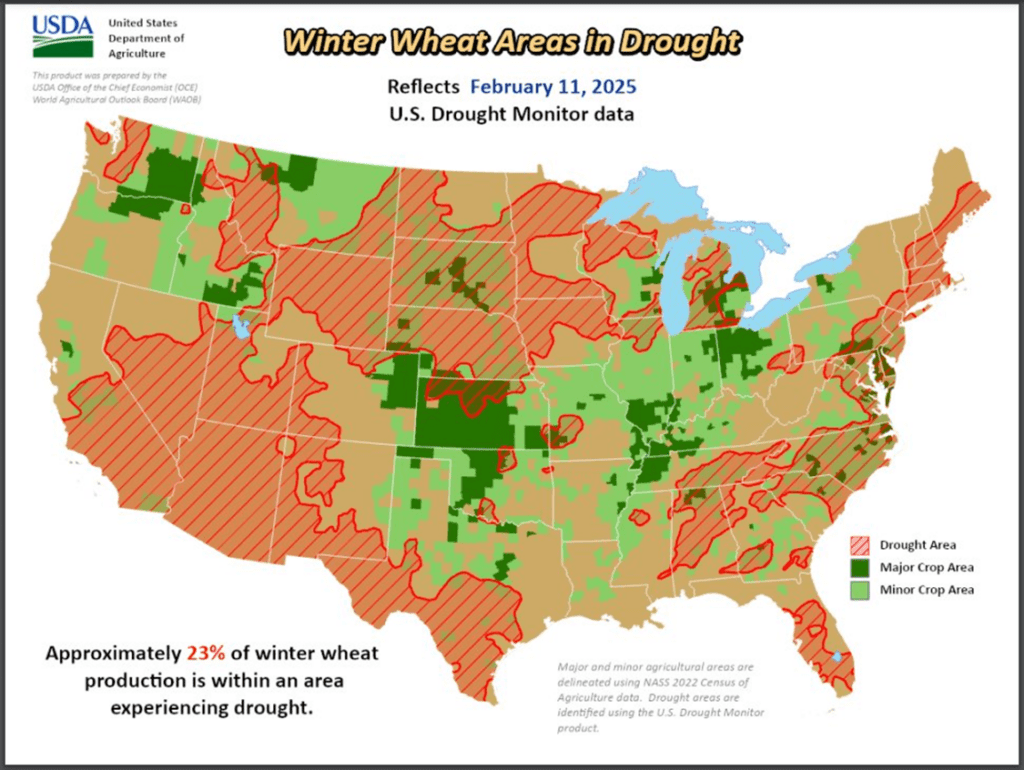

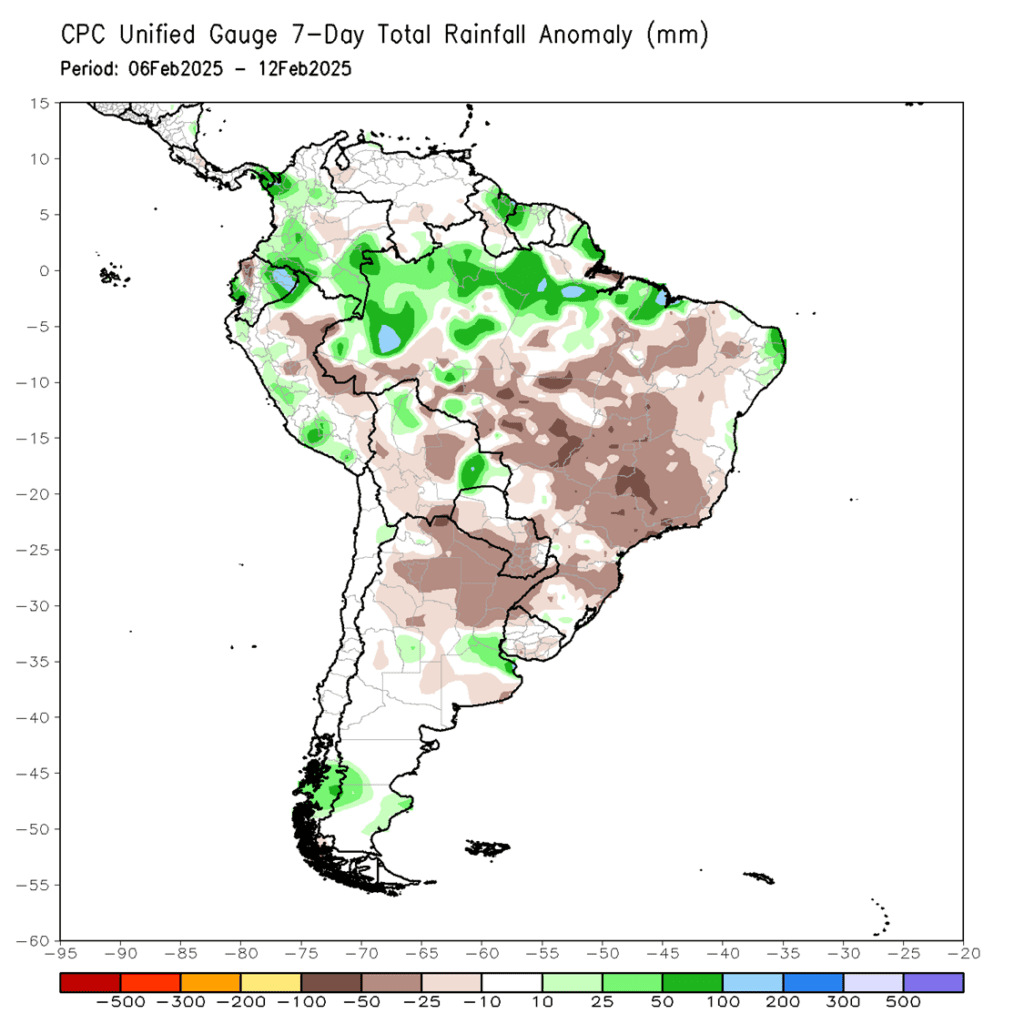

- To see the updated 30-day percent of normal rainfall map for South America as well as the updated U.S. drought monitor, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- Wicked Monthly Bar: Six consecutive down days to close the month have dramatically altered the charts. The monthly chart now has a major bearish reversal, with today’s May close sitting 49.25 cents below the February high of 518.75 on the front-month continuous contract.

- Resistance Concerns: At the start of February, Grain Market Insider flagged the heavy historical resistance clustered between 495–515 and made three sales recommendations on: February 4 at 494.50, February 18 at 512, and February 20 at 512.75.

- Hold: Given the severity of the recent selloff and the three prior sales recommendations, the guidance remains to hold off on making any additional old crop sales.

2025 Crop:

- Scenario Planning: With the existing sales recommendations and the recent call option recommendation, Grain Market Insider aims to be positioned for any market direction. Given the many unpredictable wild cards that will influence the market in the months ahead — especially weather — it is critical to be prepared for both $7–$8 corn on the upside and $3–$4 corn on the downside.

- Balanced Approach: Last week’s sales recommendations provide a stronger buffer against downside price scenarios, while the active call options strategy reopens upside opportunities on those prior sales recommendations. This balanced approach ensures flexibility in an unpredictable market.

- Potential Put Options: Next week, as we enter March, Grain Market Insider may recommend adding December ’25 put options. These options can be a valuable hedging tool, helping to protect against downside risk on bushels that cannot be forward sold before harvest. If put options are recommended, they will combine with the existing call options to form a strategy known as a Strangle — a common approach when a significant price move is expected, but the direction remains uncertain.

2026 Crop:

- Active Window: As we enter March next week, the window opens for the first 2026 corn crop targets to emerge at any time. Stay tuned!

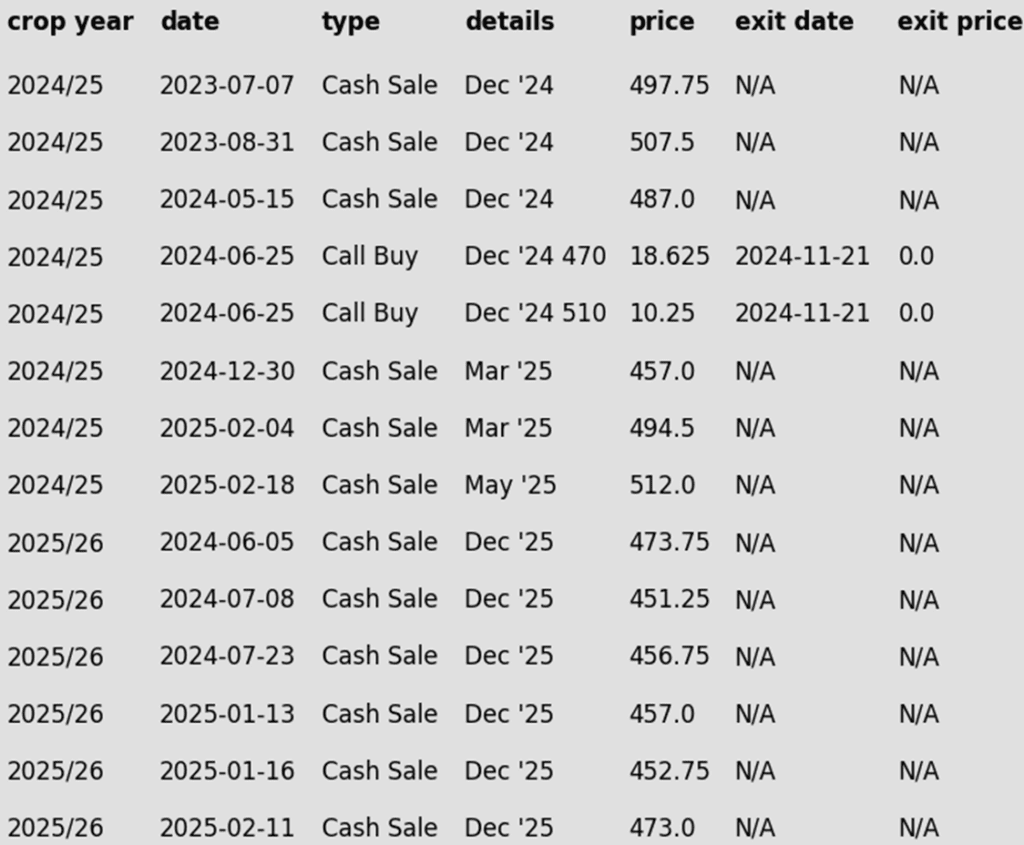

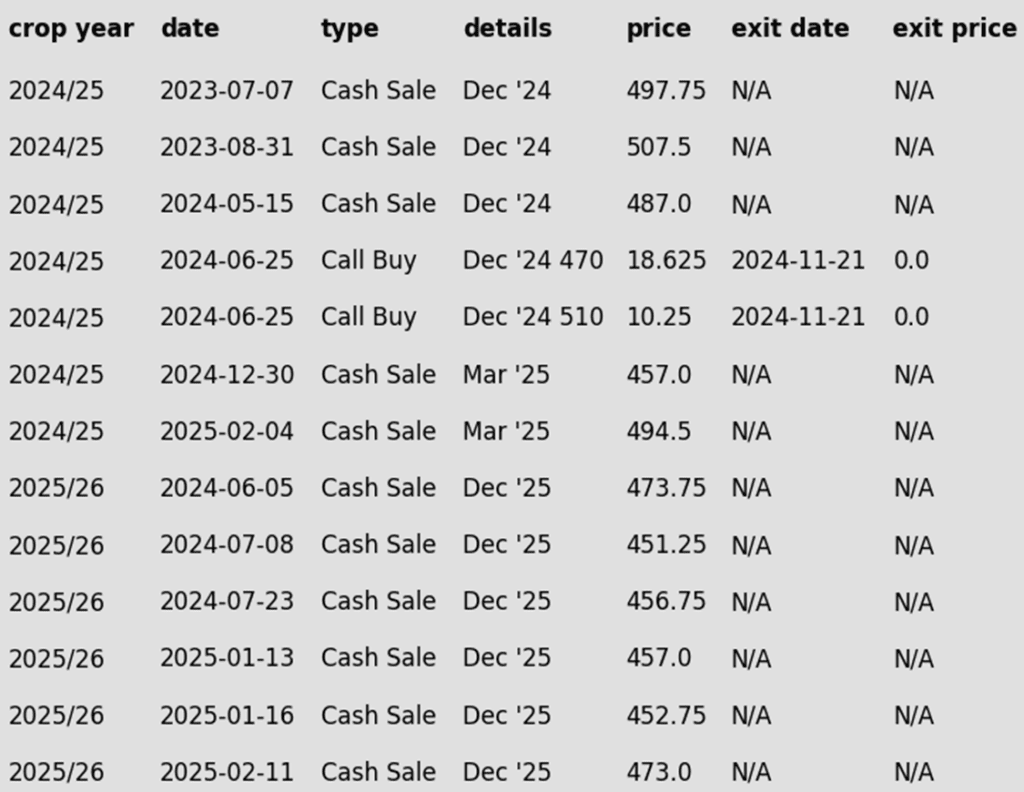

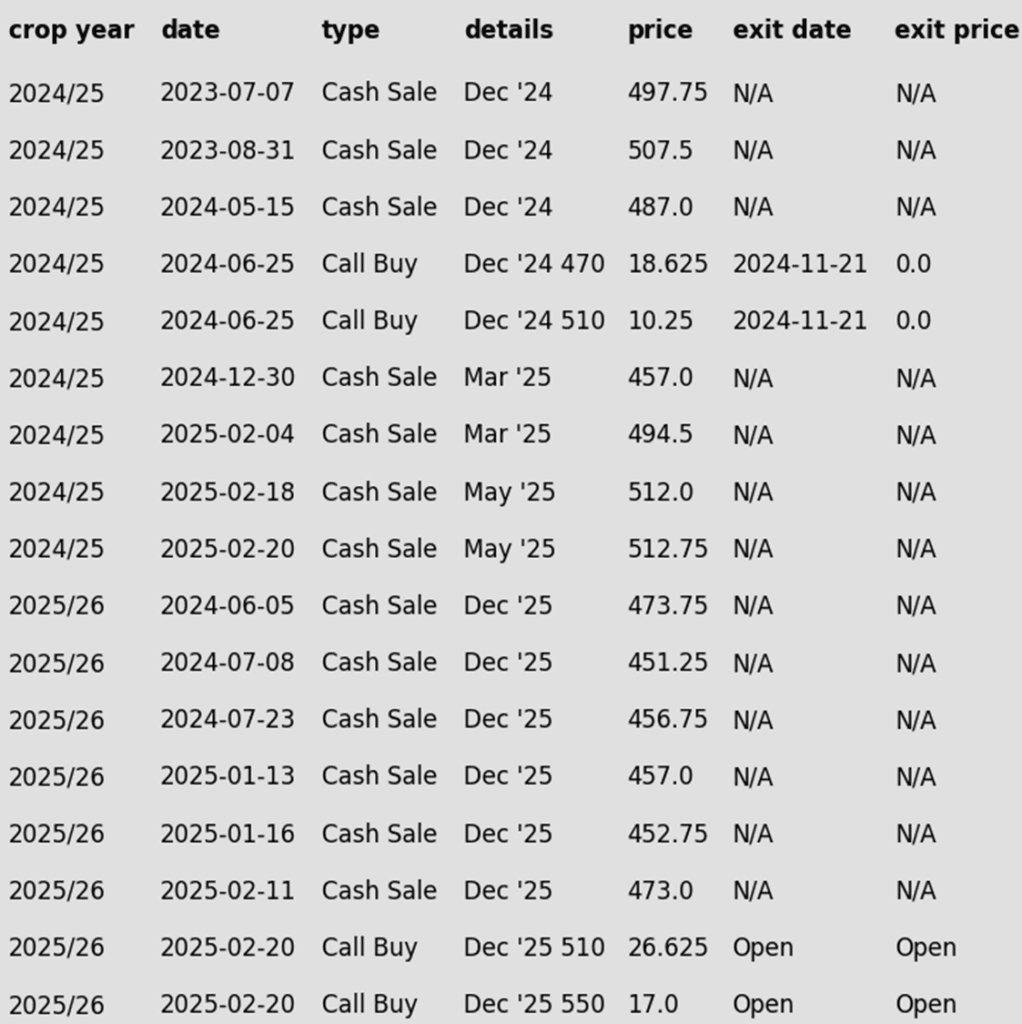

To date, Grain Market Insider has issued the following corn recommendations:

- The end of the month of February saw strong selling pressure and long liquidation in the corn market as prices post sharp losses. The May contract lost 35 ½ cents on the week and closed at its lowest levels since January 9. Corn prices have dropped nearly 50 cents off the high from last week.

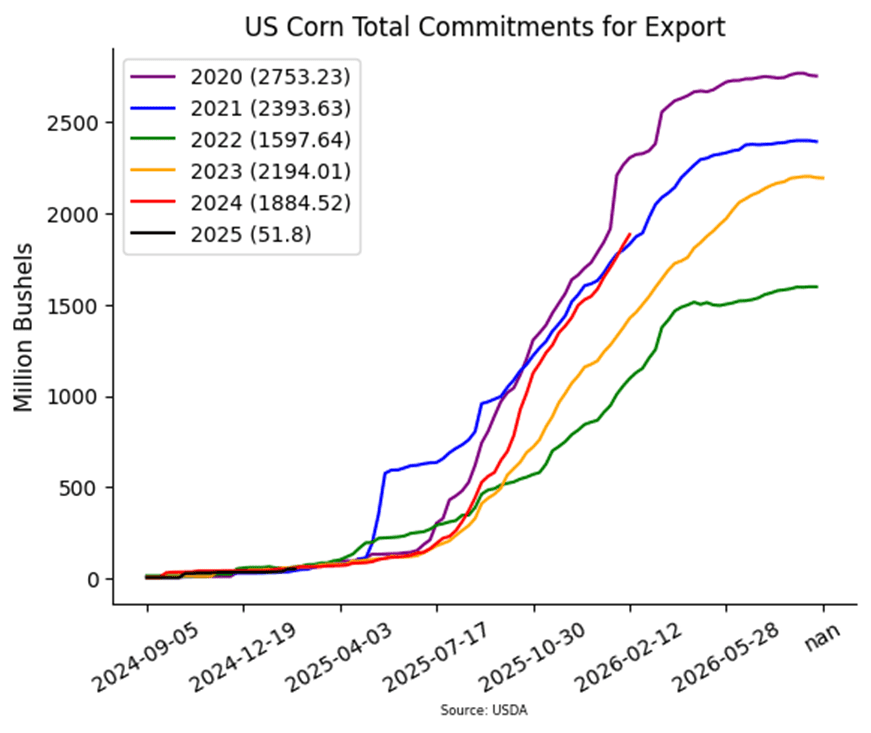

- The proposed 25% tariffs on Mexican and Canadian imports remain scheduled to take effect on March 4. Negotiations between the three countries continue, with the possibility of a resolution over the weekend. Mexico, the largest buyer of U.S. corn, could retaliate with tariffs or reduce purchases, adding uncertainty to the market.

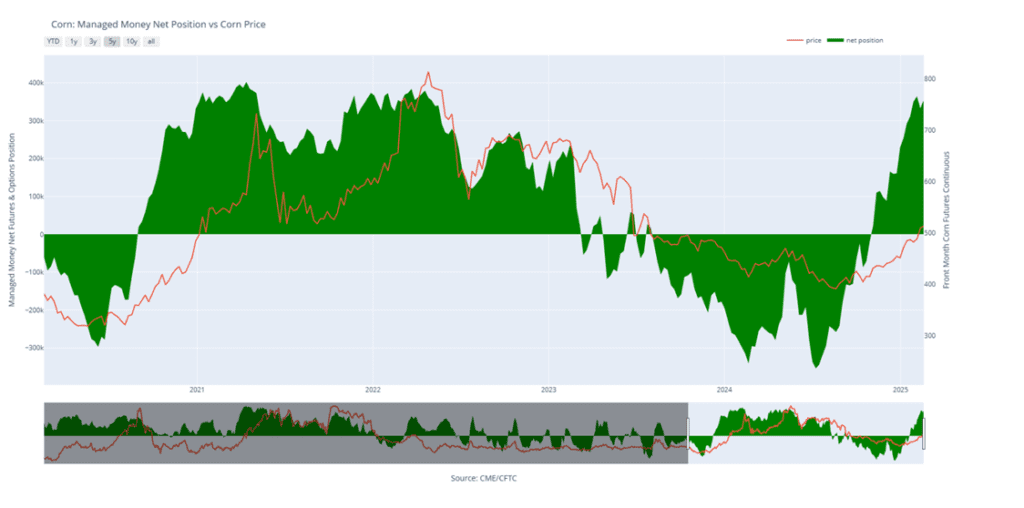

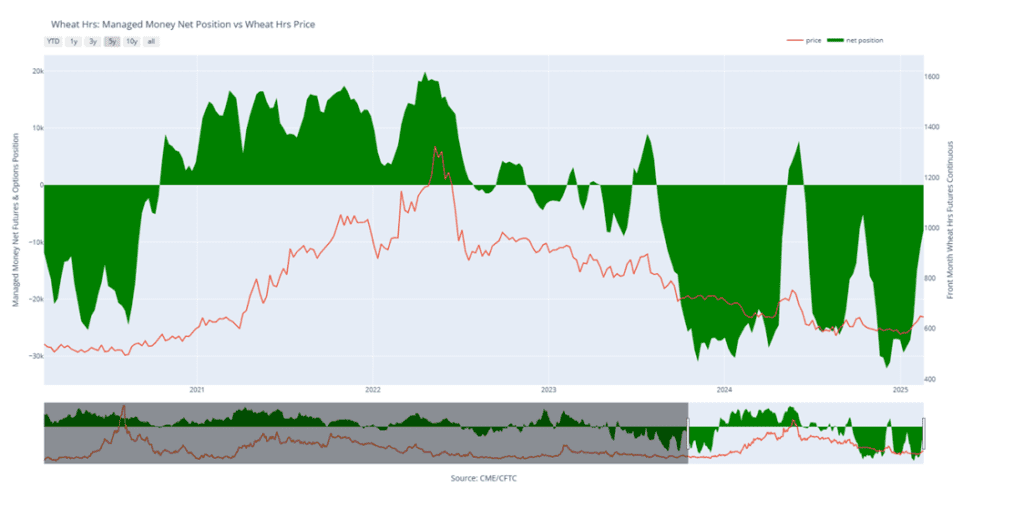

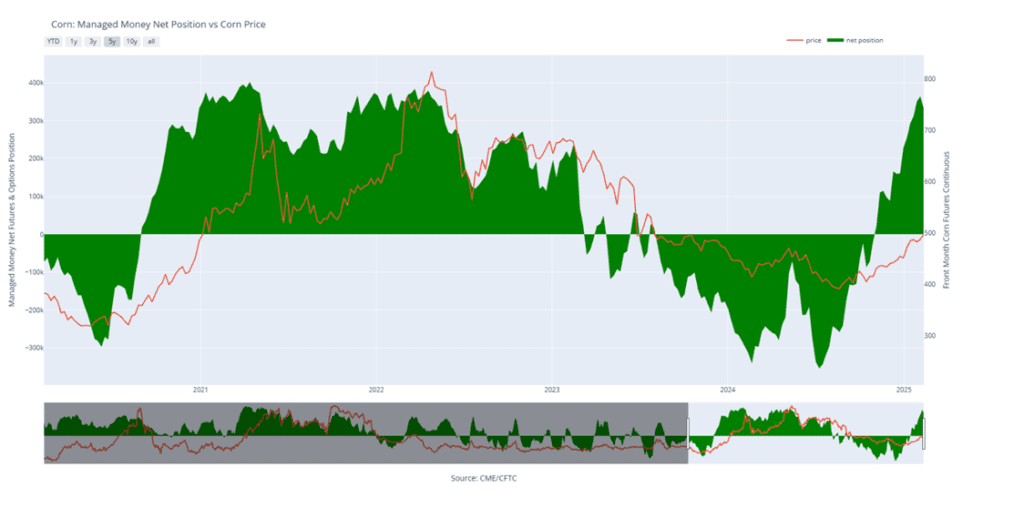

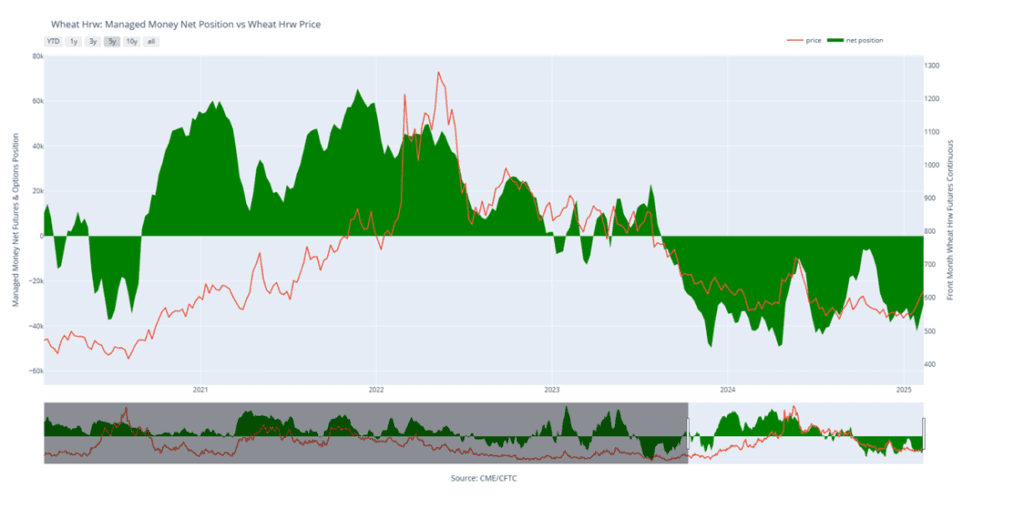

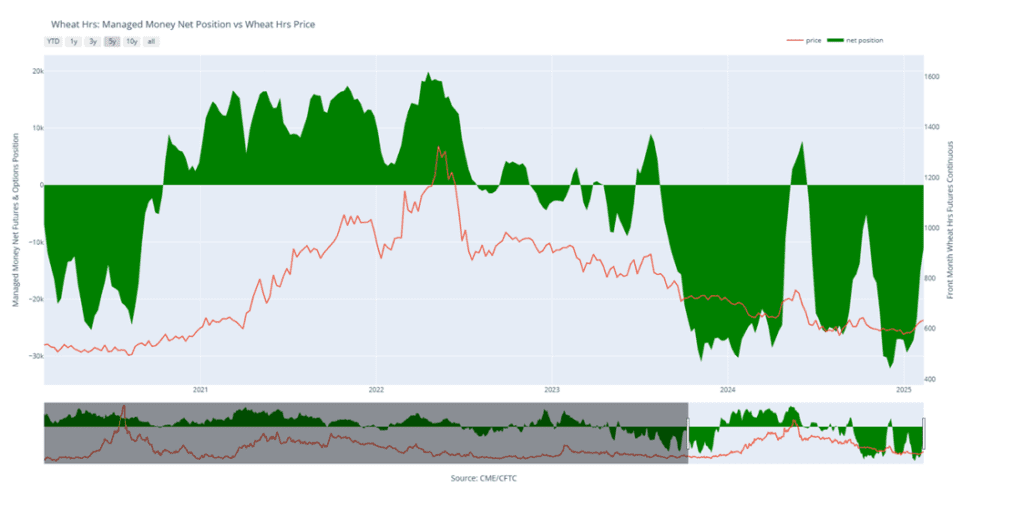

- Managed money entered the week with a near-record long position, leaving the market vulnerable to a correction. Seasonal trends and an overbought market triggered this week’s sell-off, leading to a sharp loss of momentum.

- December 2025 corn futures hit their lowest level since January 17 today, pressured by expectations of larger U.S. corn acres for the 2025-26 marketing year, as outlined in the USDA Outlook Forum.

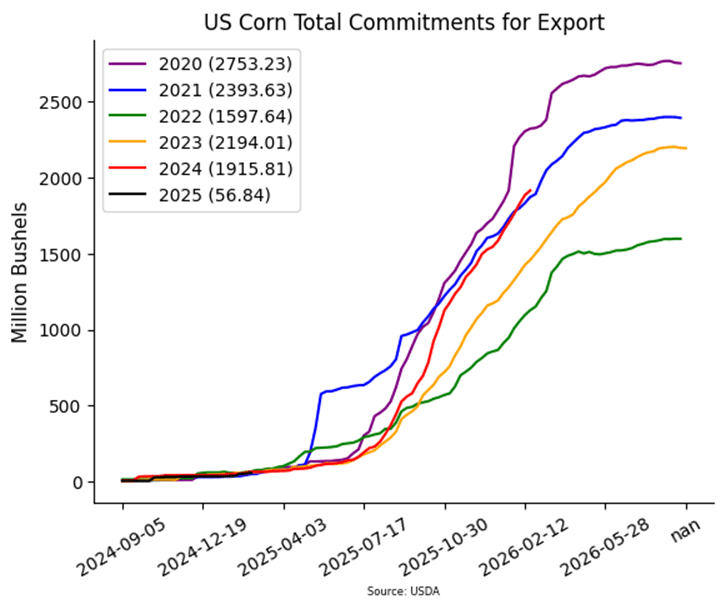

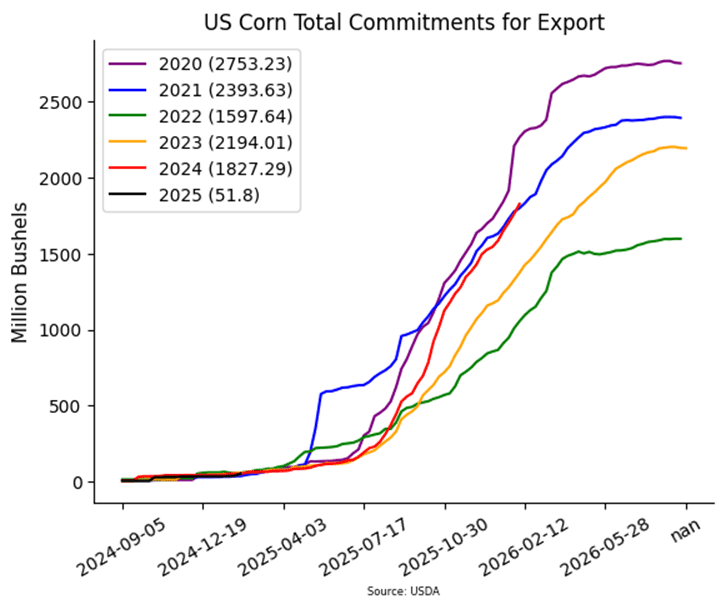

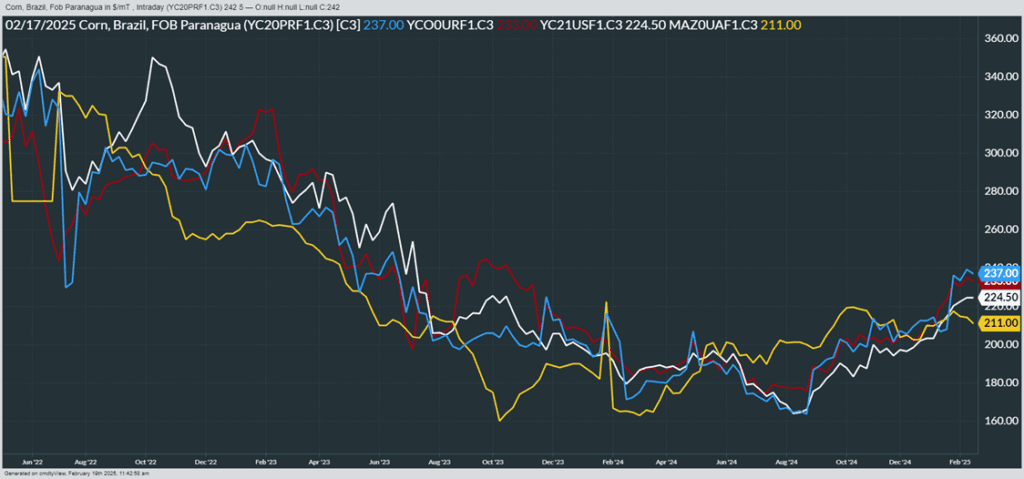

- Despite the downturn, corn demand remains strong, with exports and ethanol production providing support. The recent price drop should help sustain demand as U.S. corn remains competitively priced on the global market.

Corn Rally Pauses

The corn market had been performing well in 2025, with steady demand keeping buyers engaged and driving prices to 16-month highs. Last week, technical indicators reached overbought levels, and without new positive developments, prices began to pull back. Trendline support should come in near 470, with stronger support near 450. On the other hand, if buyers step back in, the next target would be 535, with more significant resistance at the spring 2023 lows near 550.

Soybeans

2024 Crop:

- Similar Monthly Bar as Corn: While soybeans saw less volatility than corn in February, the outcome was much the same. A monthly bearish reversal bar also formed on the front-month continuous chart, with the May contract closing 54 cents below the 1079.75 high.

- Call Strategy Target: February’s close reinforces 1079.75 as a key resistance level. If the May contract stages a strong reversal and closes above 1079.75, Grain Market Insider would recommend a call option strategy to reown previous sales recommendations.

2025 Crop:

- No Changes: The current upside target range remains 1090 – 1125 vs November ‘25.

- It’s Still Early: Grain Market Insider has issued only one sales recommendation for the 2025 crop so far, but there’s still plenty of time. Soybeans often present later seasonal selling opportunities than corn.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on previous sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring at the earliest.

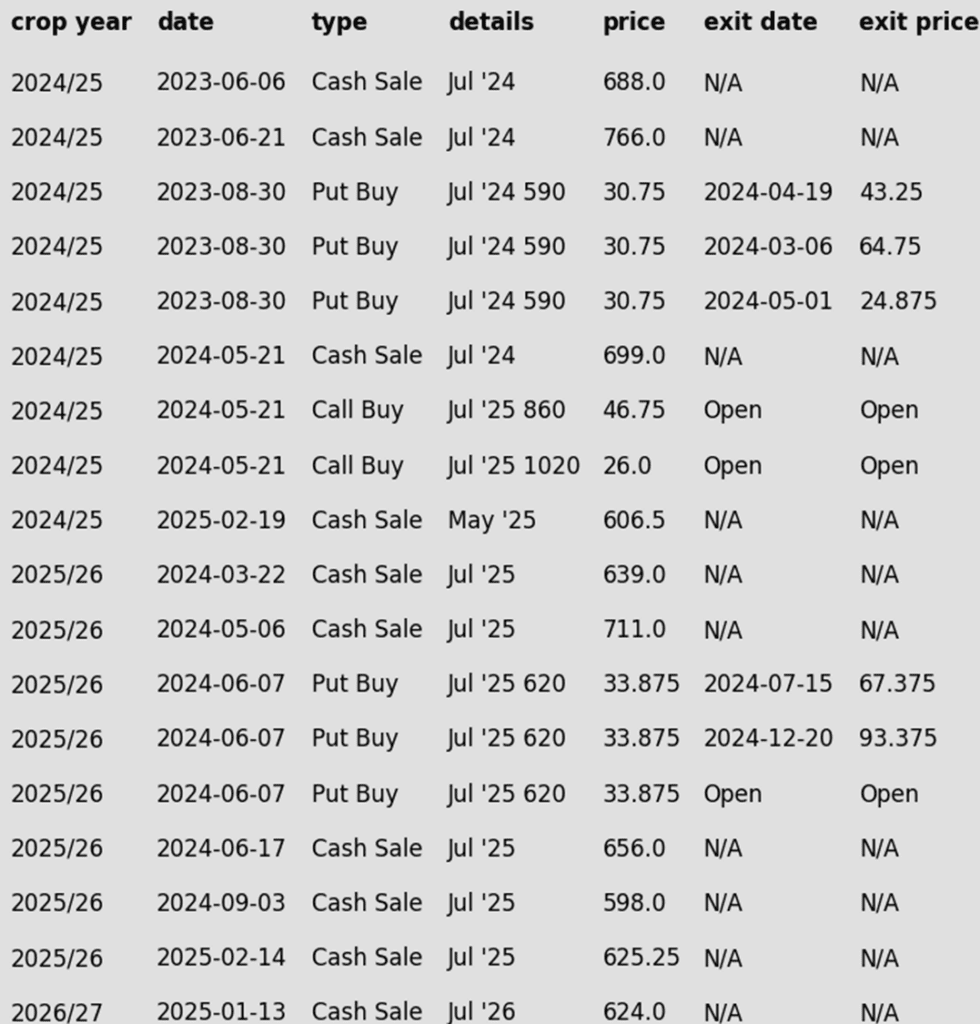

To date, Grain Market Insider has issued the following soybean recommendations:

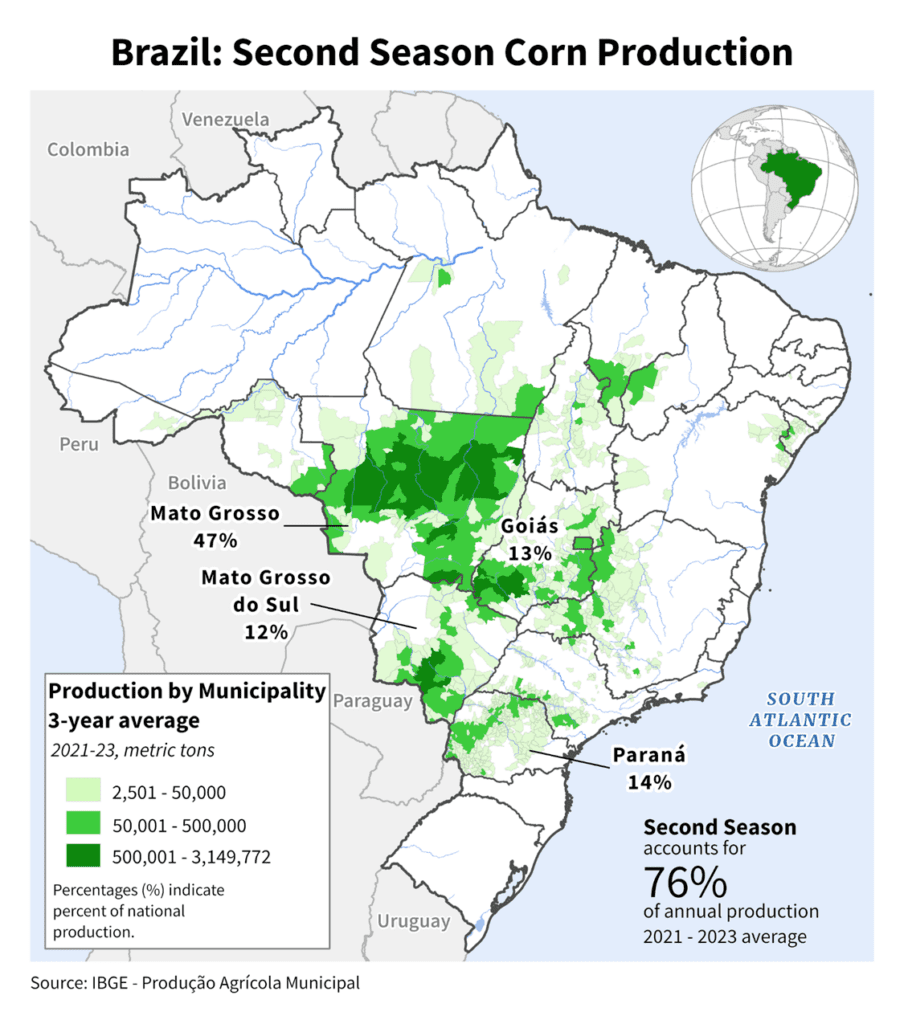

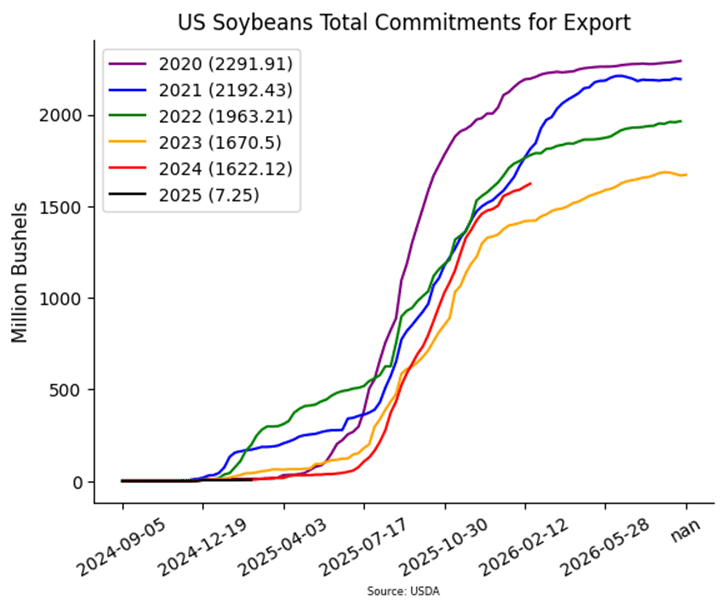

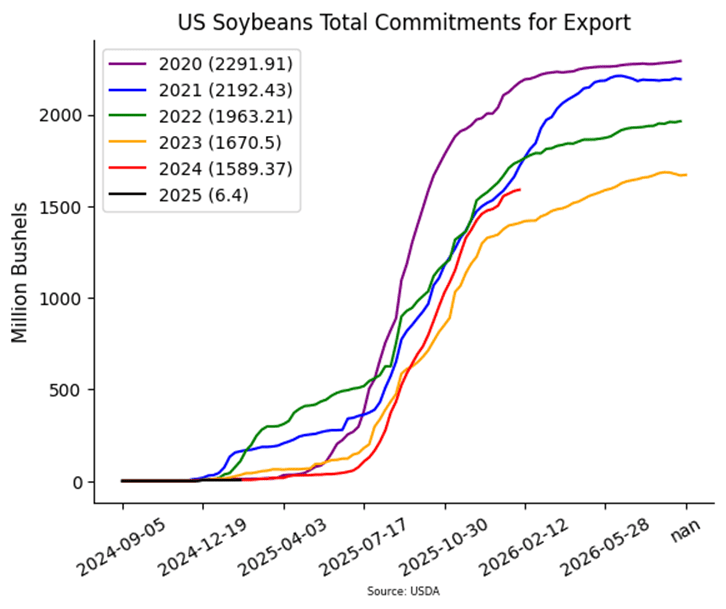

- Soybeans ended the day lower for the third consecutive day despite a friendly acreage number from the USDA Ag Outlook Forum yesterday as poor export sales, Brazilian harvest, and general bearishness weigh on the grain market. Soybean meal was unchanged in the front months but lower in the deferred contracts while soybean oil led the complex lower.

- On March 4, President Trump is expected to implement 25% tariffs on Mexico and Canada after previously delaying them by 30 days. While further negotiations could postpone the tariffs again, the uncertainty is likely to keep the market volatile.

- For the week, May soybeans lost 31-1/2 cents while November soybeans lost 30-1/4. May soybeans lost $3.70 to $300.20 and May soybean oil lost 3.22 cents to 44.12 cents. For the month, May soybeans lost 31-3/4, May soybean meal lost $9.40, and May soybean oil lost 2.40 cents.

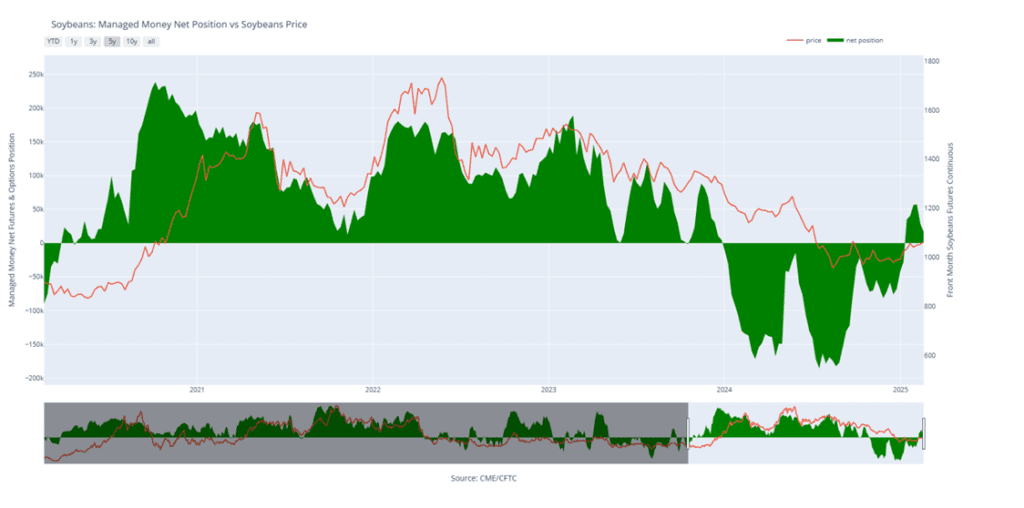

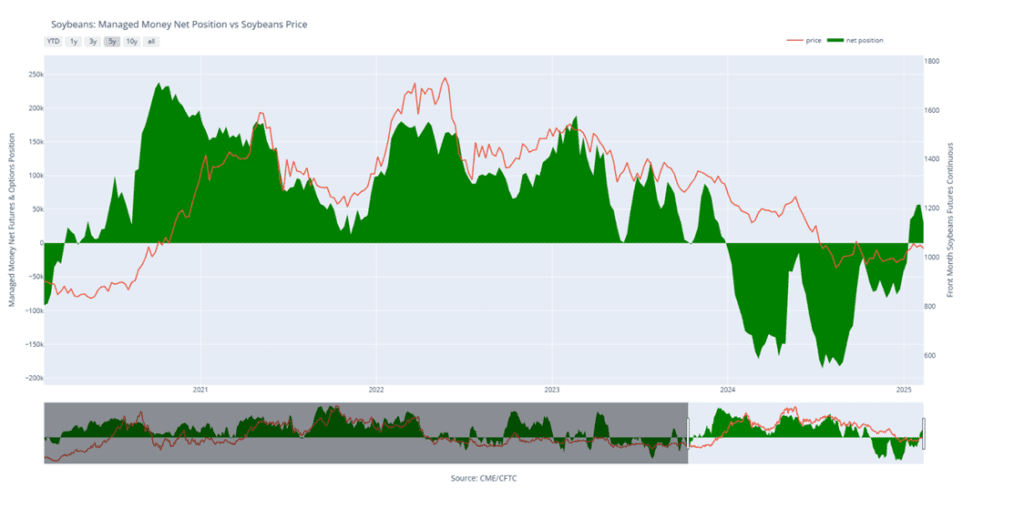

- Since the bullish January WASDE report that saw soybean yields cut by 1 bpa, soybean futures have lost nearly 75% of their gains. Declining export demand has been a large factor with declining numbers since Brazil has begun exporting their crop at a more competitive rate. Support could come later in the year if dry weather continues into planting coupled with fewer soybean acres planted.

Soybeans Continue Sideways Grind

Front-month soybean futures continue to flirt with the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A decisive move past this level could trigger bullish momentum, paving the way for a rise toward the key 1100 mark. Should prices dip, reliable support is expected near 1030, with a more stable floor around 1000.

Wheat

Market Notes: Wheat

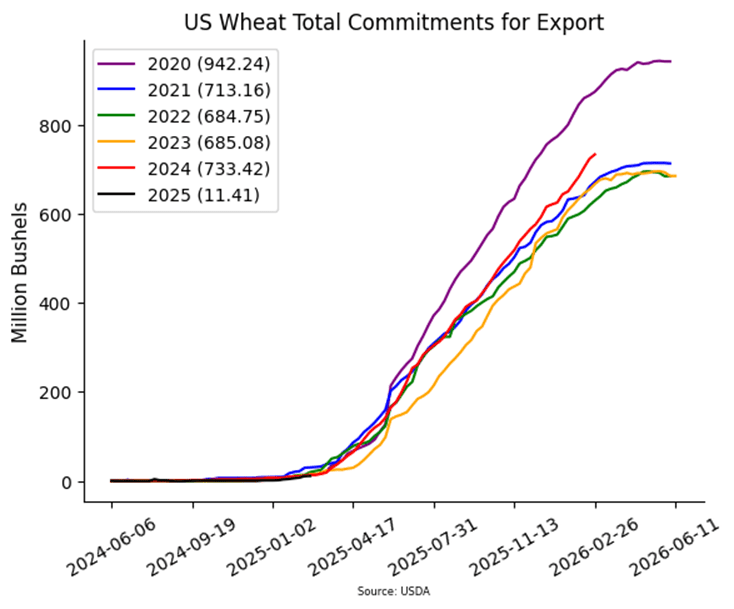

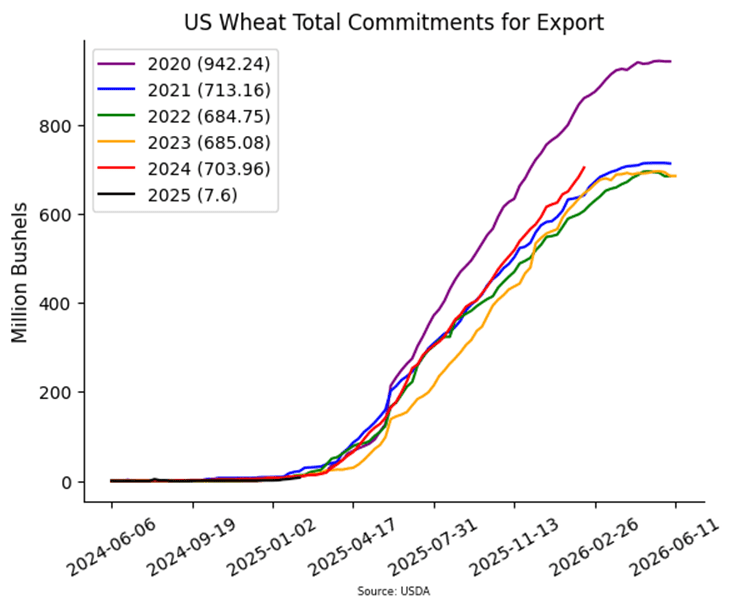

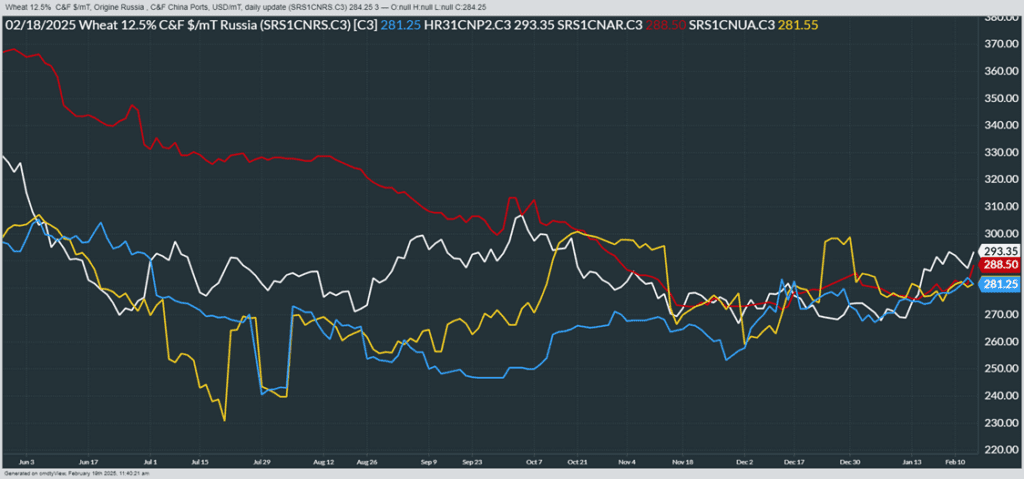

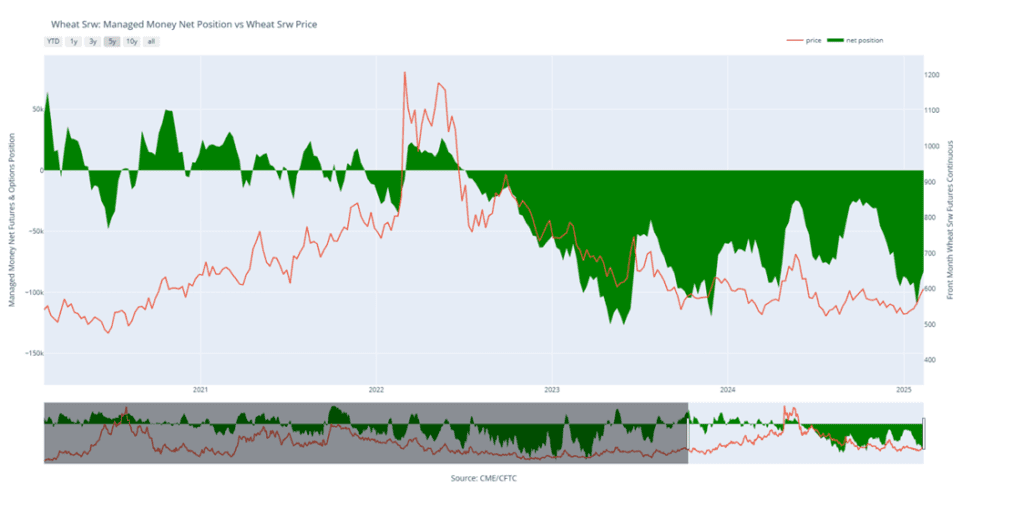

- At the risk of sounding like a broken record, wheat closed lower again today. Kansas City futures were the downside leader. Another move higher for the US Dollar and continued tariff talk did not help the situation. Paris milling wheat futures did close slightly positive, which may signal that wheat is nearing a bottom after several sessions of long liquidation.

- The Russian agriculture ministry decreased their wheat export tax by 21% to 2,178 Rubles to mt, through March 11. However, the Russian wheat export quota that went into effect earlier this month still offers some hope for support in the wheat market.

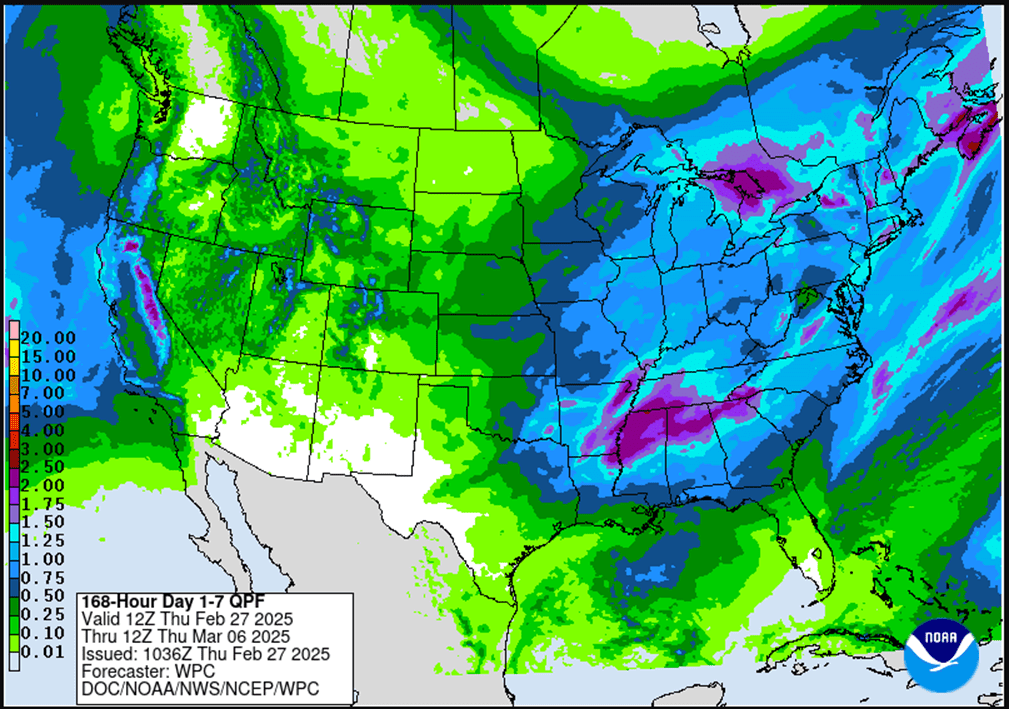

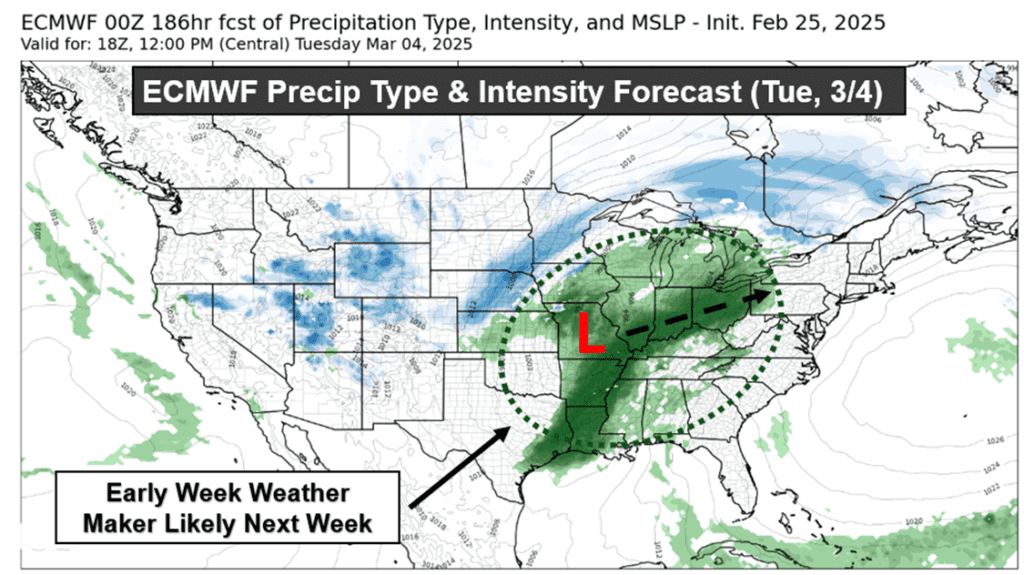

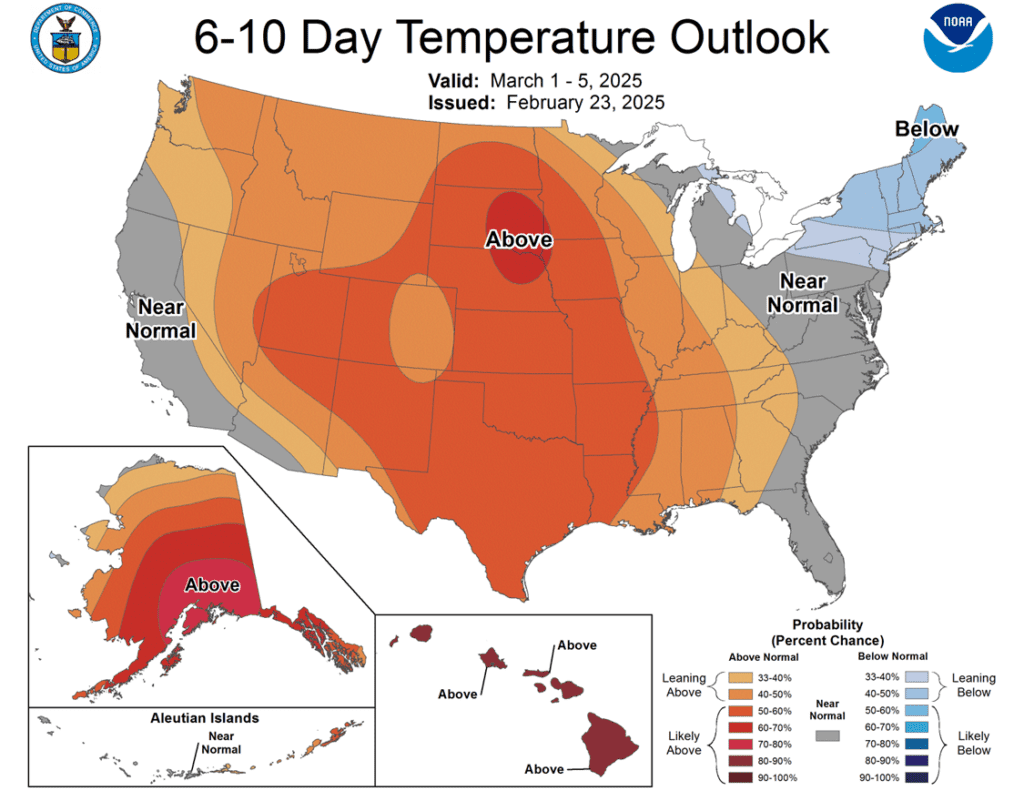

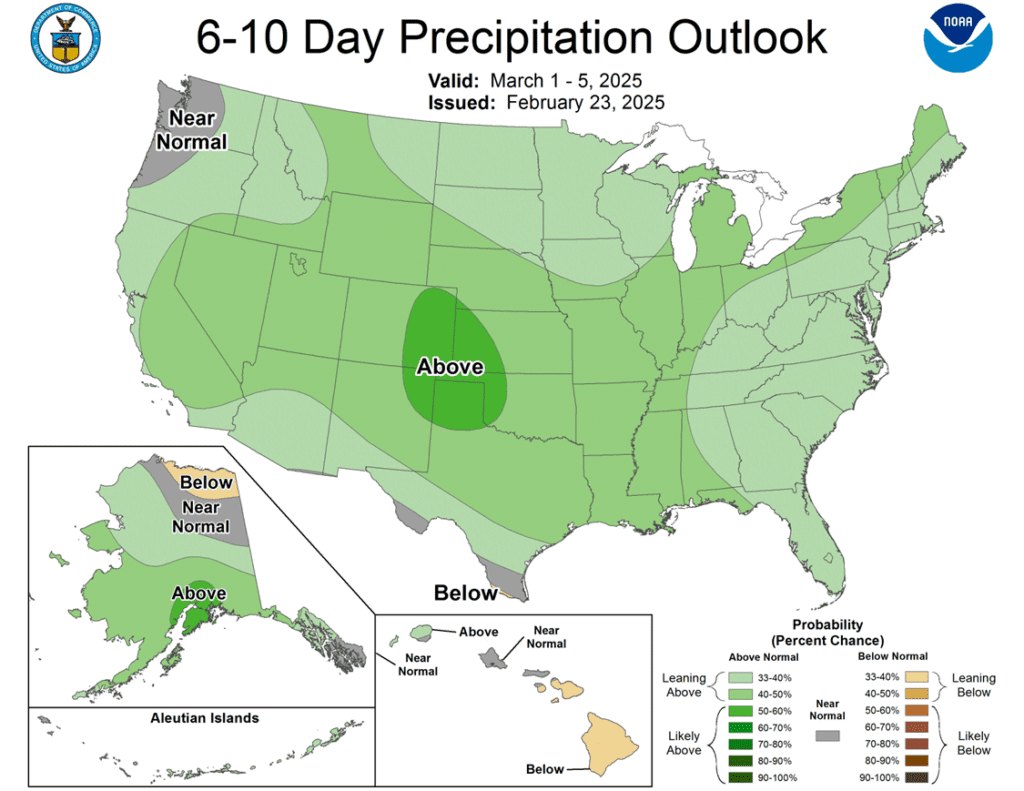

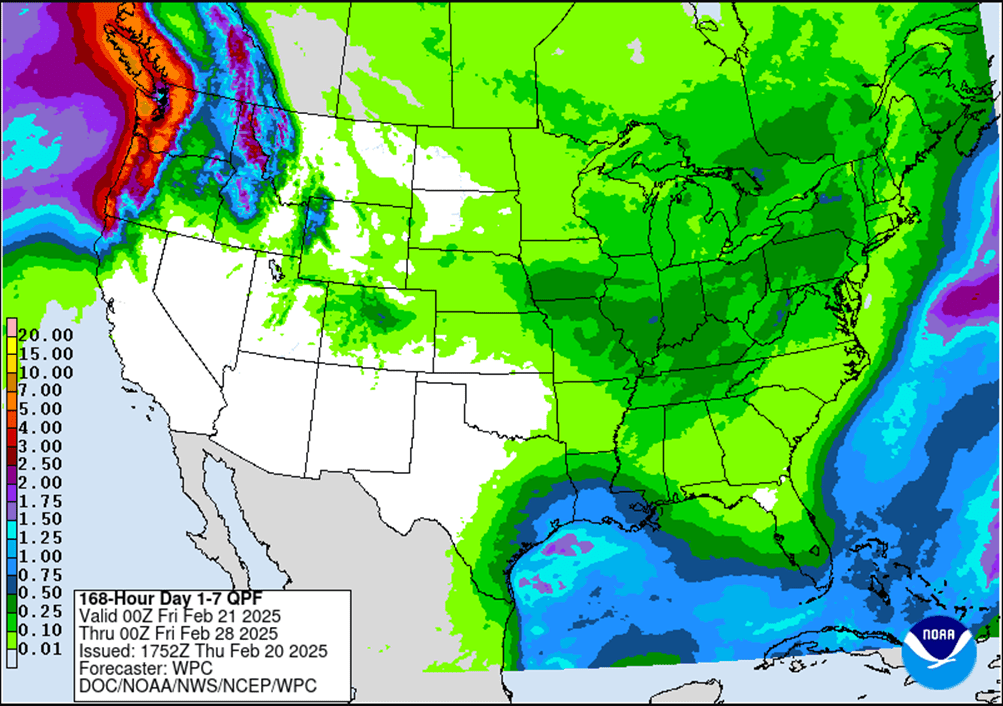

- Warmer temperatures are expected across the U.S. Southern Plains early next week, with a storm system likely to bring beneficial rainfall. This could aid winter wheat emergence from dormancy and may have contributed to the weakness in Kansas City wheat futures.

- According to the European Commission, 24/25 grain production in the EU will fall from 255.8 mmt to 255.2 mmt in their latest estimate. Soft wheat production in particular was revised down 0.1 mmt to 111.8 mmt.

- French soft wheat conditions as of February 24 declined 1% from the week prior to 73% good to very good. For reference, this is above the 68% rating for the same time a year earlier.

- Ukraine’s ag ministry has said that total grain exports since the season began on July 1 have reached about 29 mmt. This is 1% below last year, for the same timeframe. Wheat exports, however, were up 3% year over year at 11.9 mmt.

2024 Crop:

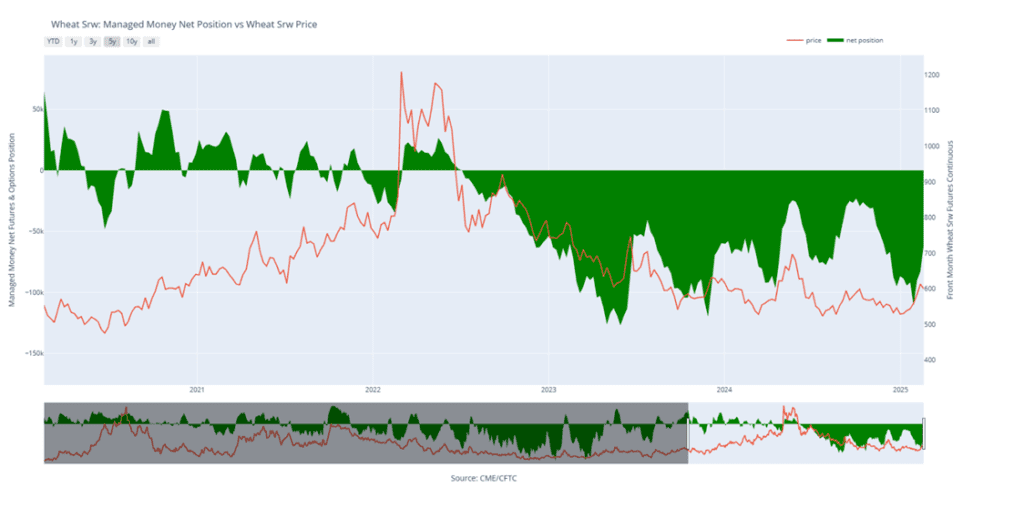

- Gravestone Doji: Unfortunately, Chicago Wheat posted the worst monthly close among all grain markets. On the front-month continuous chart, the May contract formed a Gravestone Doji, a bearish reversal pattern where the closing price nearly matches the opening price for the month — a signal of potential further weakness.

- Seven: The May contract closed 66 cents below its monthly high and has now finished lower in seven of the last eight trading sessions.

- Hold: Grain Market Insider made one old crop sales recommendation in February, selling at 606.50 on February 19. Given the severity of the recent selloff, the guidance is to pause any additional sales for now.

2025 Crop:

- No current targets: The severity of the recent pullback has clouded the trend, making the next move uncertain. Grain Market Insider will hold off on setting new targets until there’s a clearer indication of potential direction. Stay tuned for further updates.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

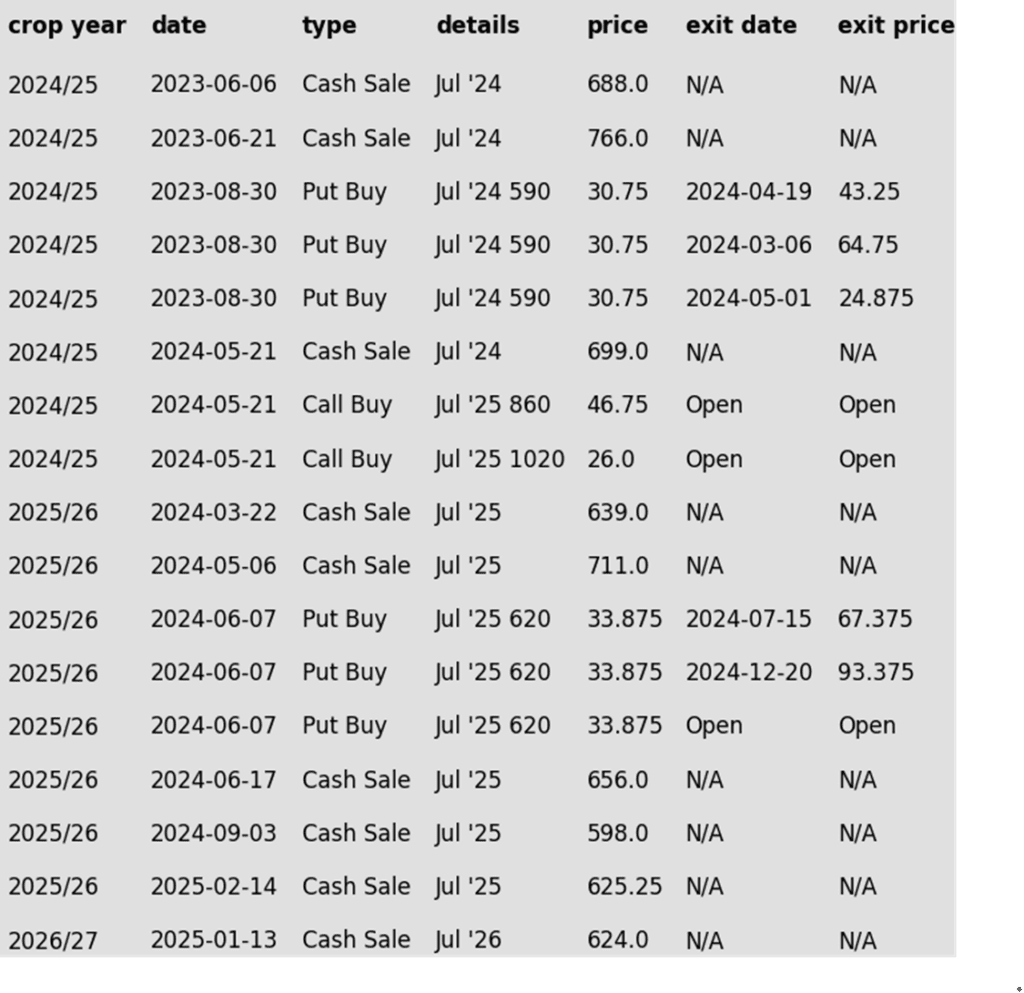

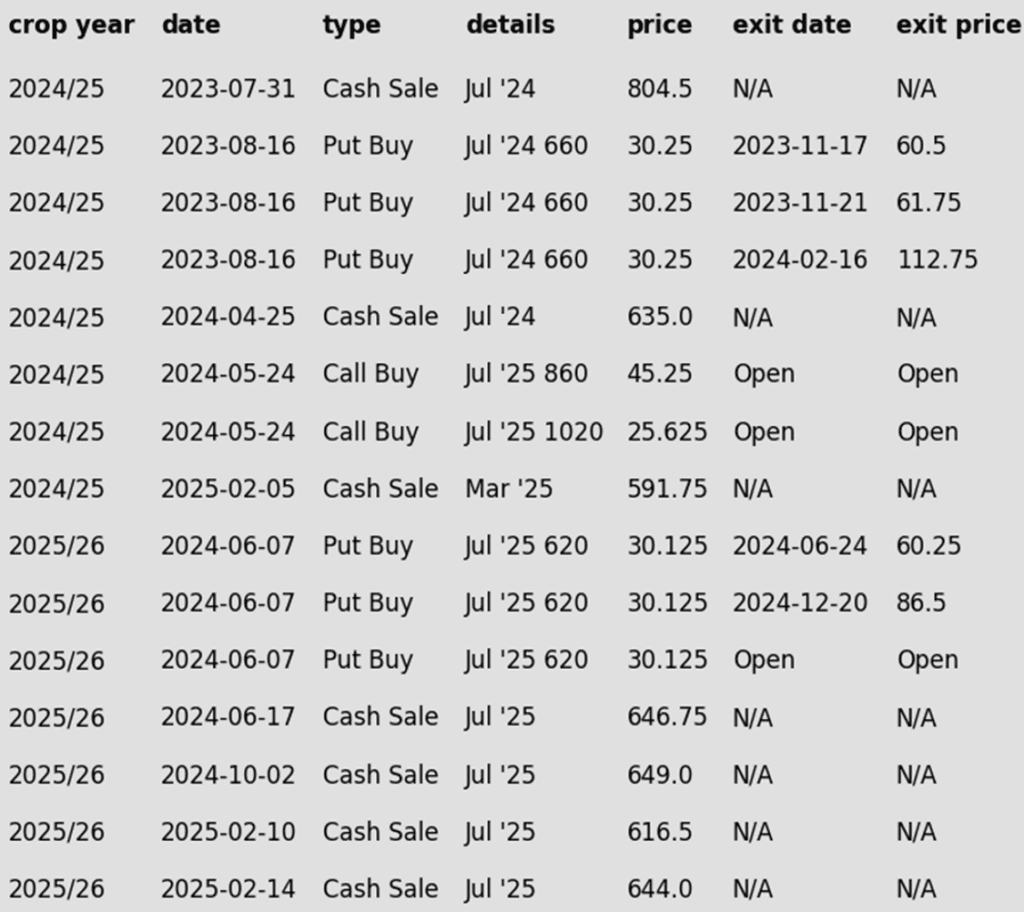

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Head Fake

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, reaching key resistance at the early October highs just above 615. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range that marked the end of 2024. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rebound.

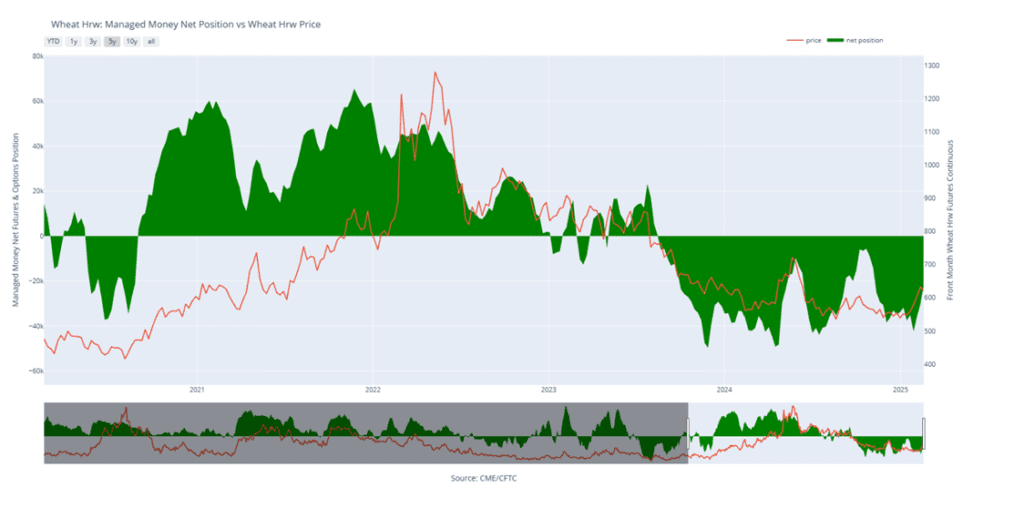

2024 Crop:

- Positive Month: Kansas City wheat was the only grain to finish February in positive territory on the front-month continuous chart. Though modest, the May contract posted a 6.75-cent gain for the month.

- Hold: Despite the monthly gain, the May contract has closed lower in seven of the last eight sessions and is now 69.50 cents below its February high. Given this pullback, the guidance remains to pause any additional old crop sales for now.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- No current targets: The severity of the recent pullback has clouded the trend, making the next move uncertain. Grain Market Insider will hold off on setting new targets until there’s a clearer indication of potential direction. Stay tuned for further updates.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

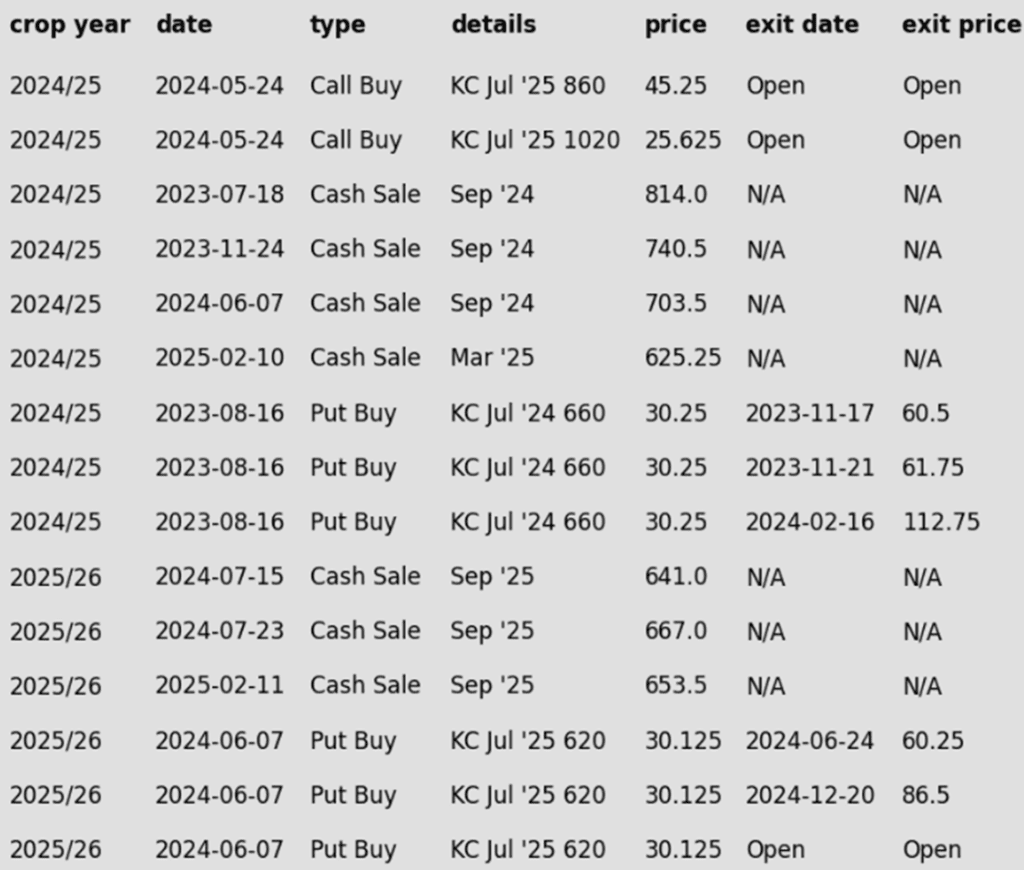

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Breaks Lower Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range. Support is expected near the lower boundary of this range around 560, while the 200-day moving average is likely to act as resistance on any attempted rally.

2024 Crop:

- Bearish Reversal: The front-month contract ended February with a bearish reversal, closing the month down 4.75 cents and 61.75 cents below its monthly high.

- Hold: With the May contract closing lower for eight consecutive sessions, the guidance remains to pause any additional old crop sales for now.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- No current targets: The severity of the recent pullback has clouded the trend, making the next move uncertain. Grain Market Insider will hold off on setting new targets until there’s a clearer indication of potential direction. Stay tuned for further updates.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

February Whipsaw

Spring wheat broke out of its prolonged sideways range in late January, signaling bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, sending futures back below key moving averages. Moving forward, the 200-day MA is likely to serve as upside resistance, while previous lows near 580 should provide support.

Other Charts / Weather