4-28 End of Day: Grain Markets Struggle as Planting Progress and Weather Pressure Futures

All Prices as of 2:00 pm Central Time

Grain Market Highlights

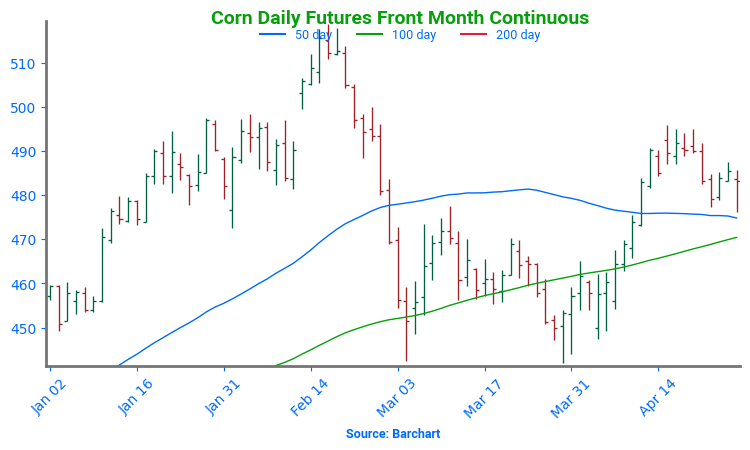

- Corn: Corn futures ended lower Monday, weighed down by spillover selling from wheat and expectations for an accelerated planting pace across the Midwest.

- Soybeans: Soybean futures finished mixed, with front months higher and deferred contracts lower on bull spreading activity.

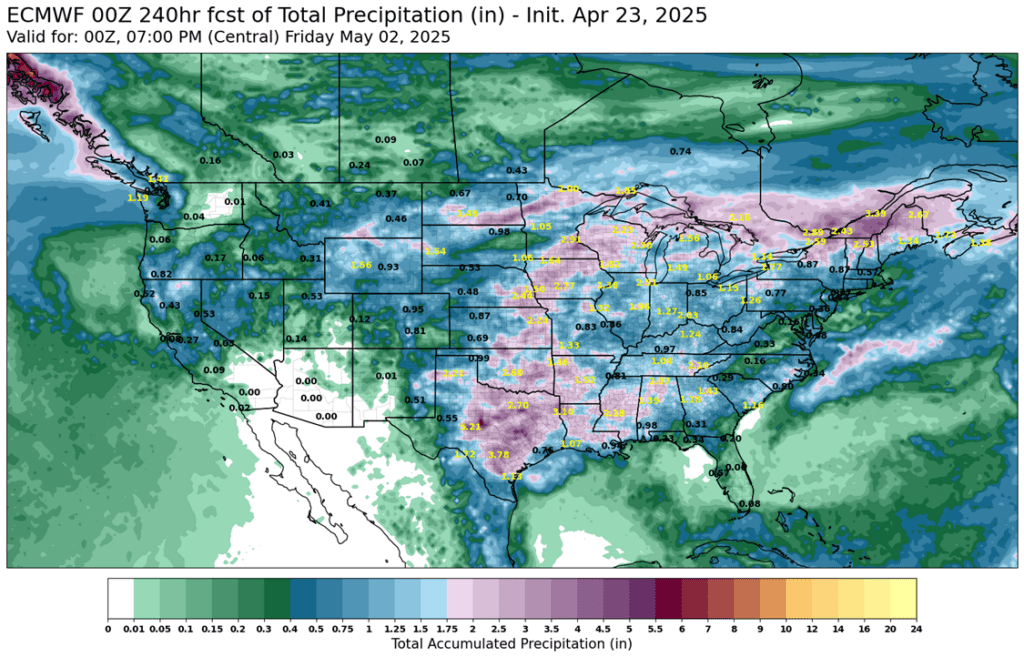

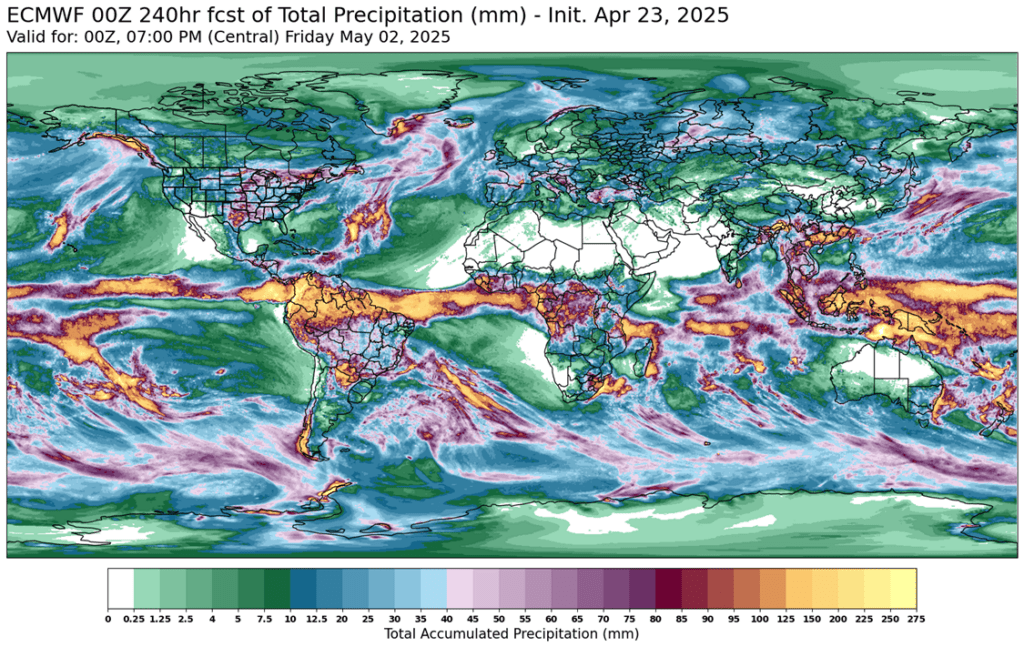

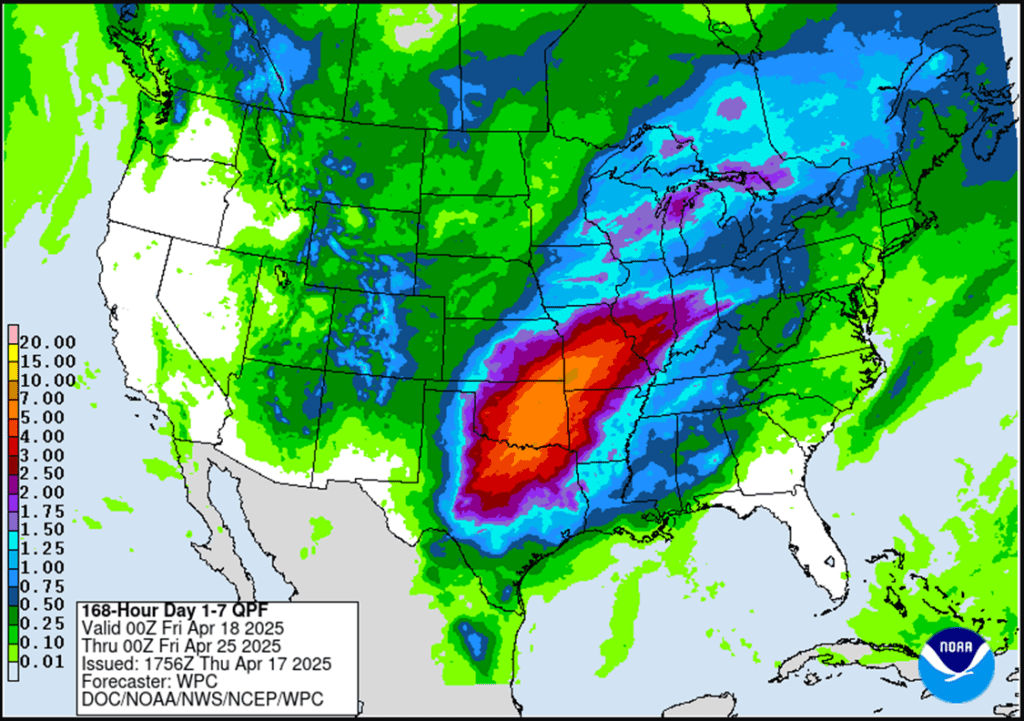

- Wheat: Wheat futures fell across all classes, unable to rebound from early losses tied to forecasts for sustained heavy rainfall in the Southern Plains. Kansas City and Chicago wheat contracts posted fresh lows for the move.

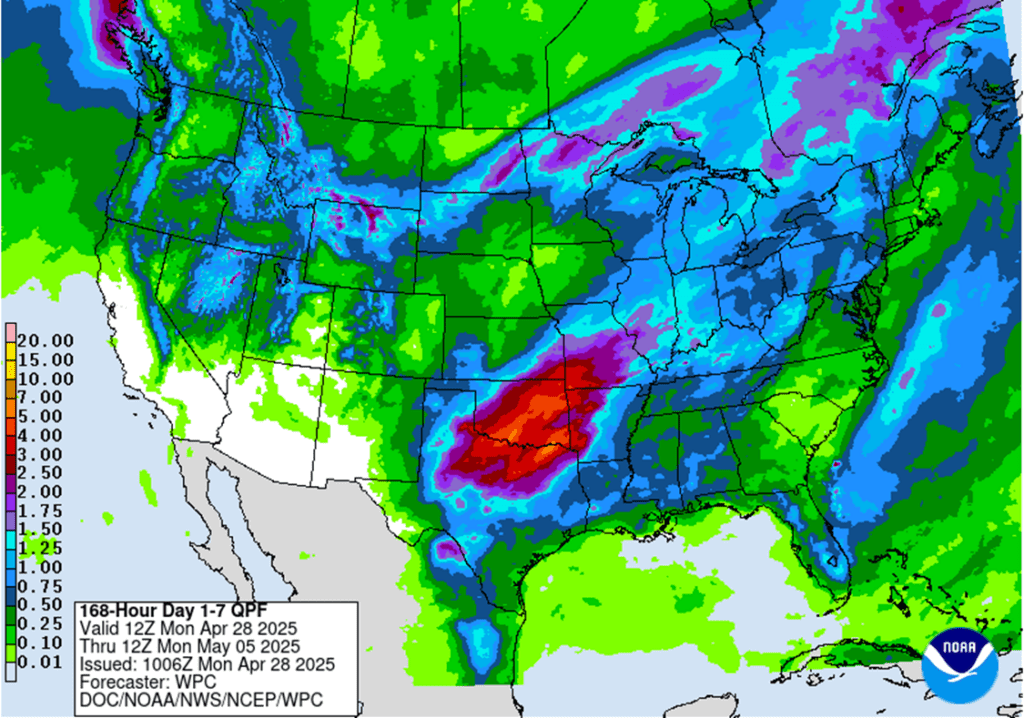

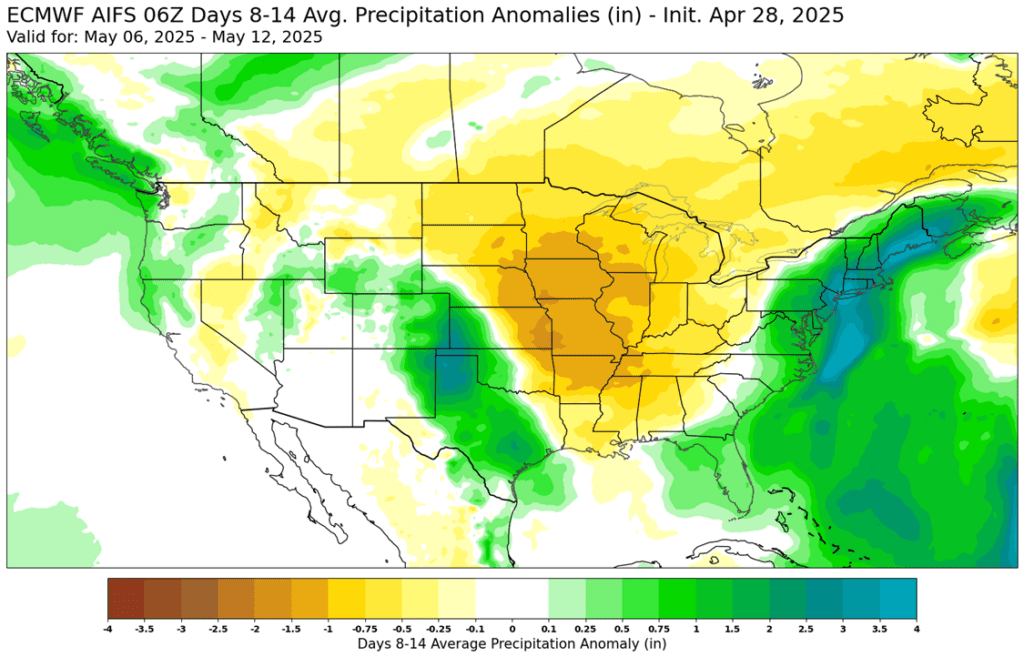

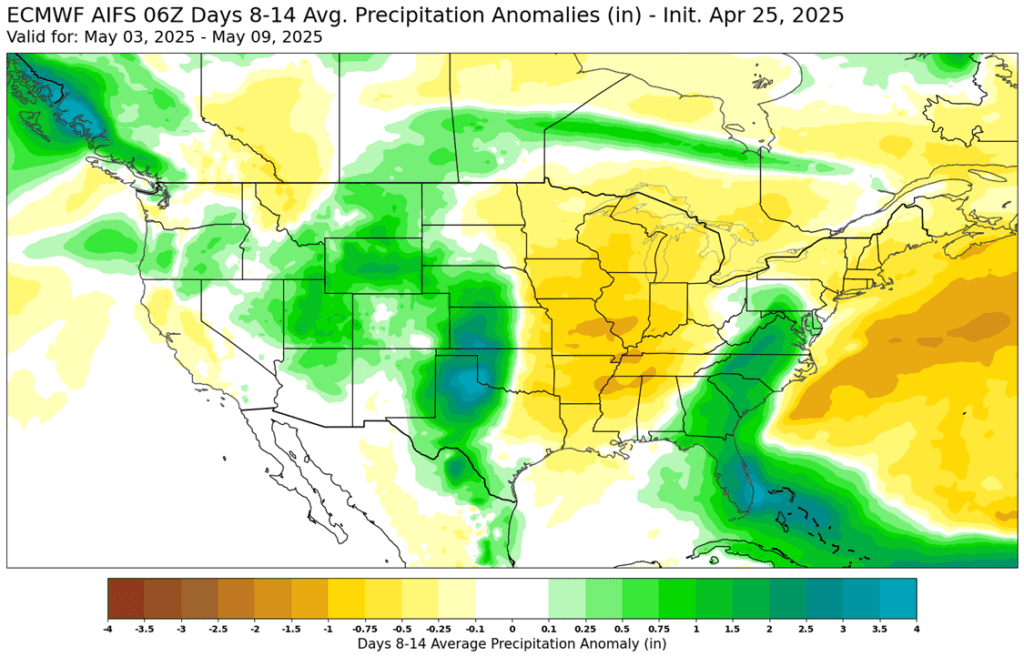

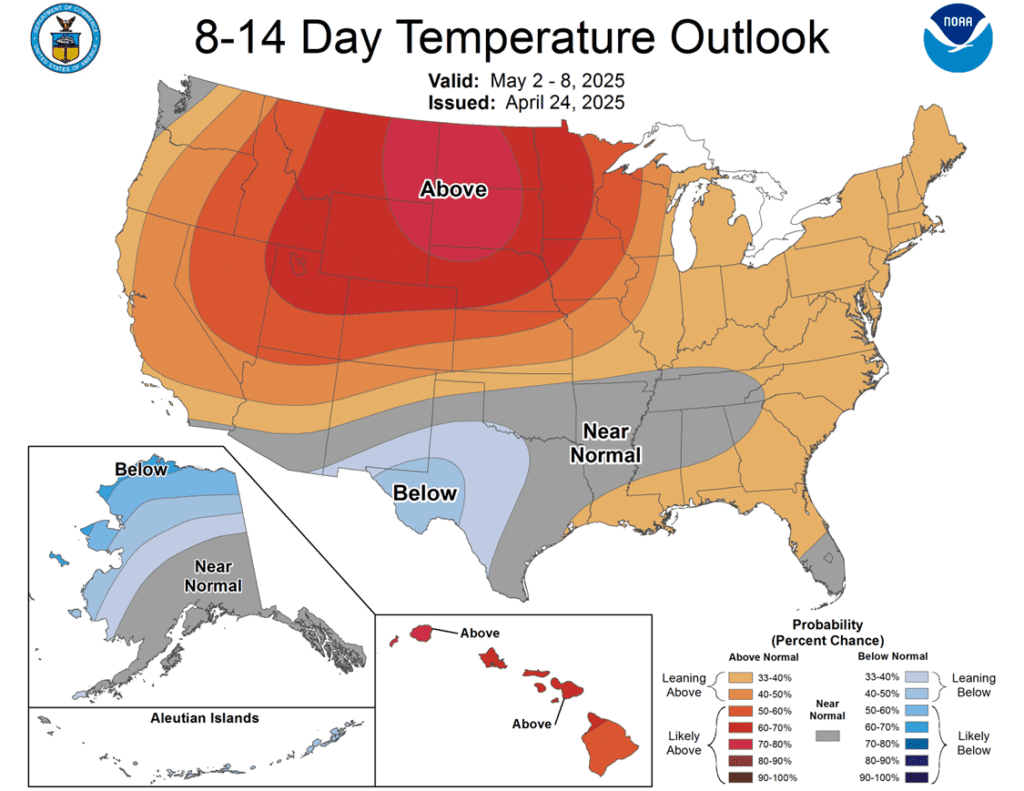

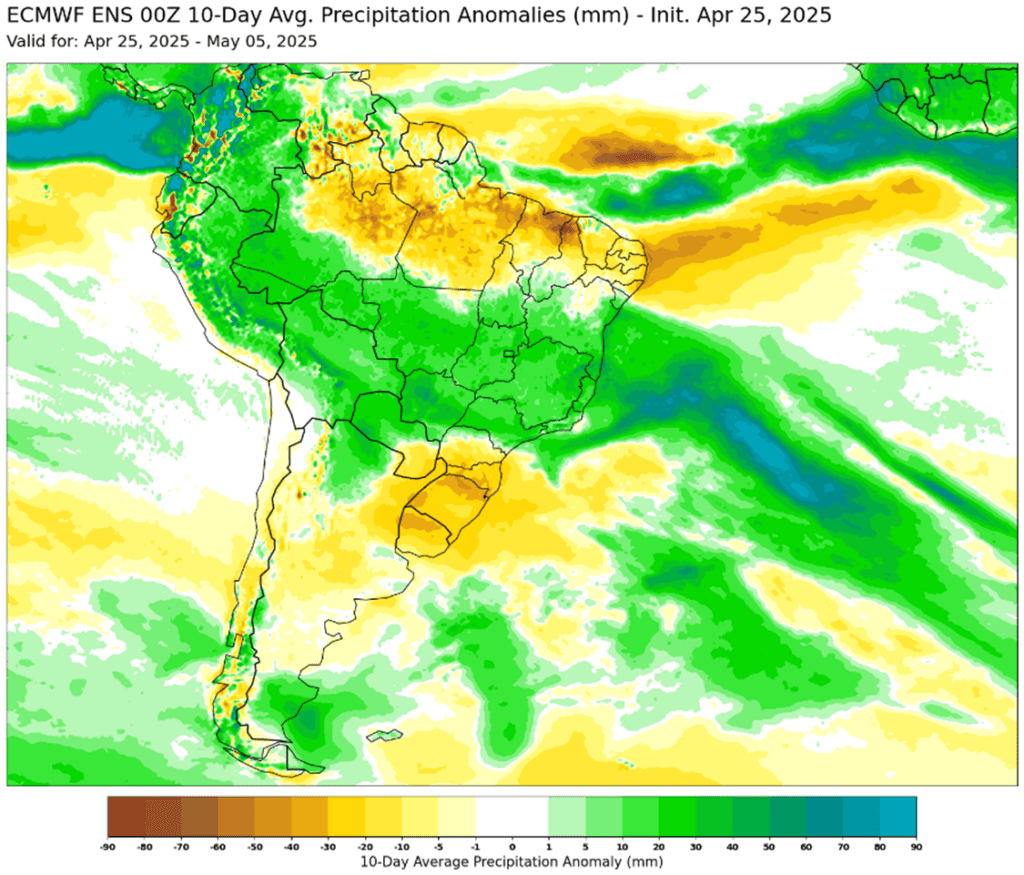

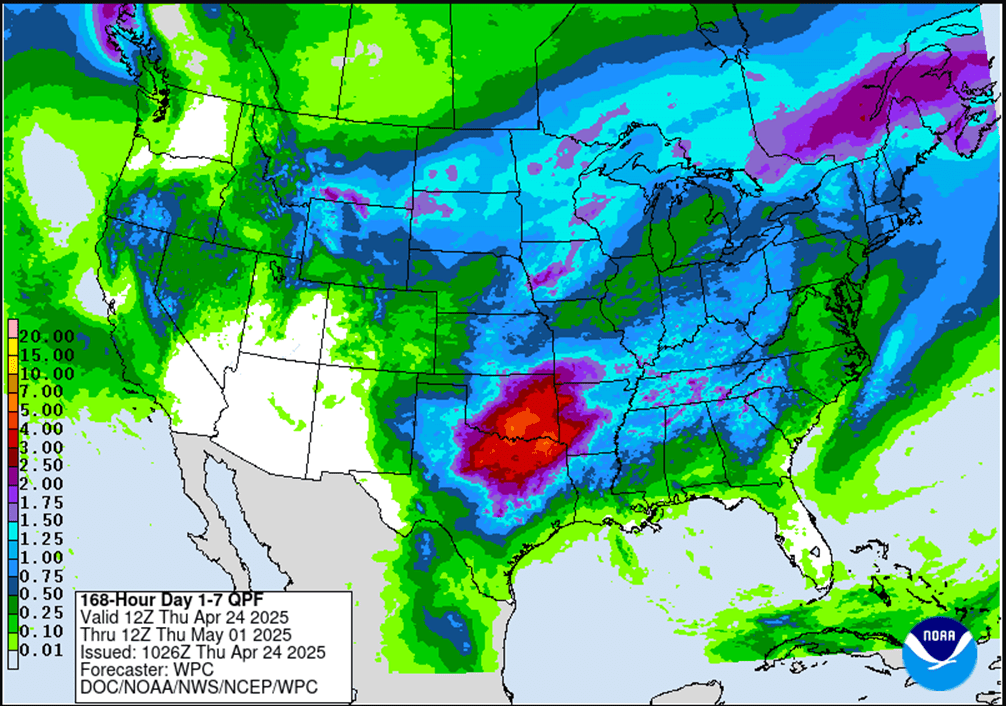

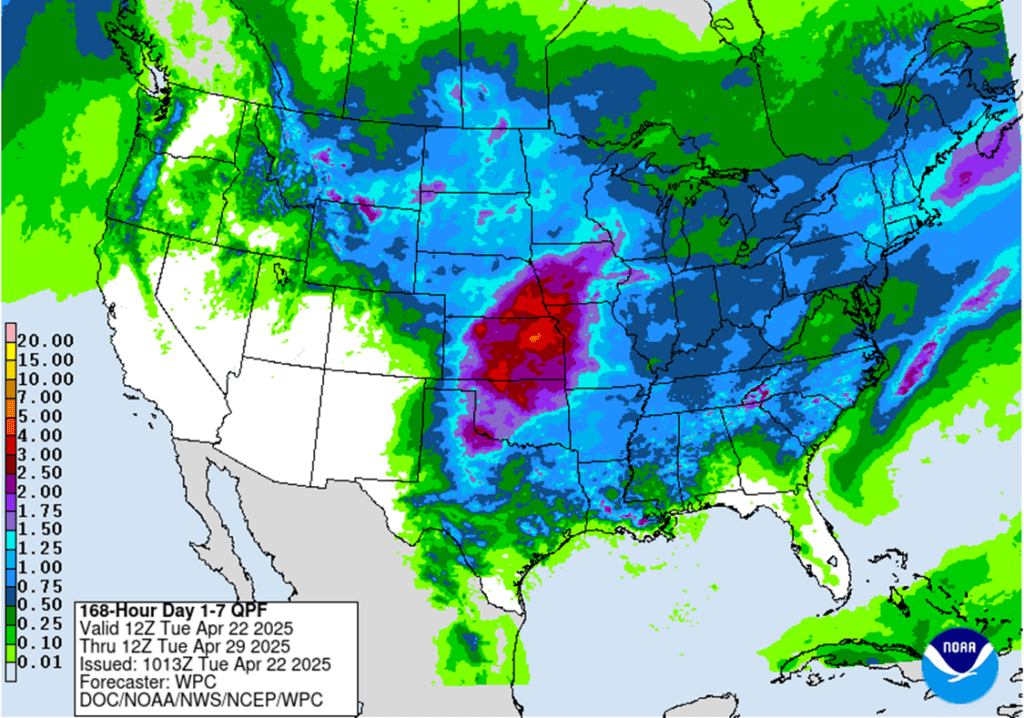

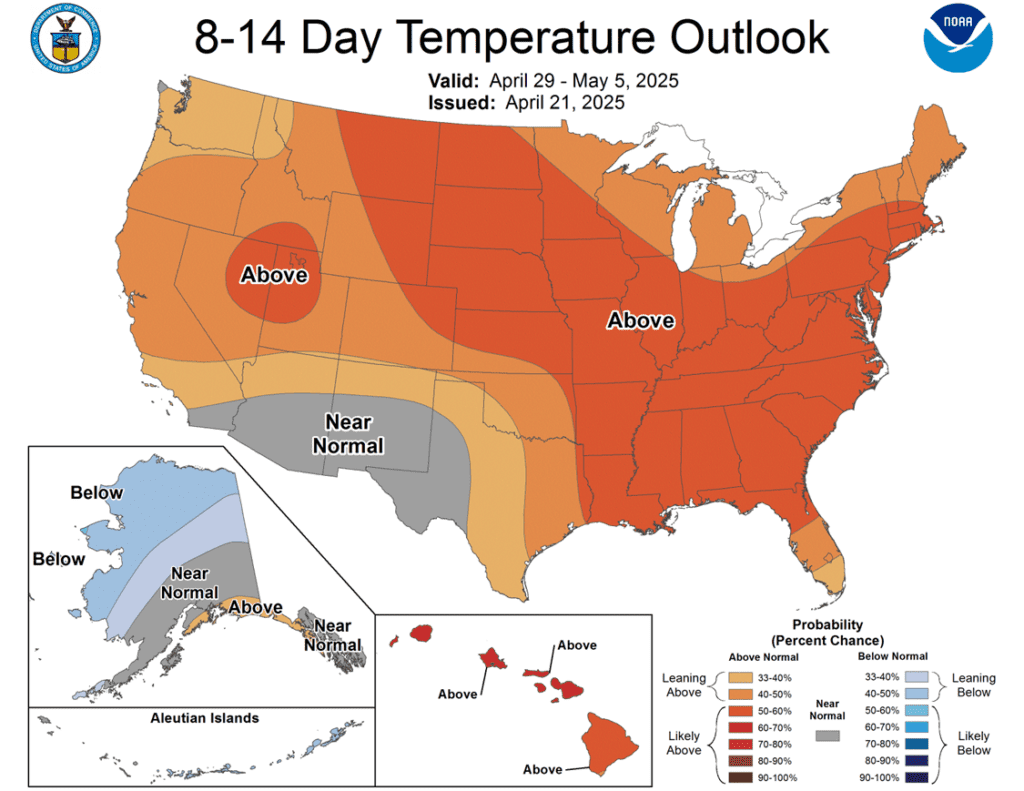

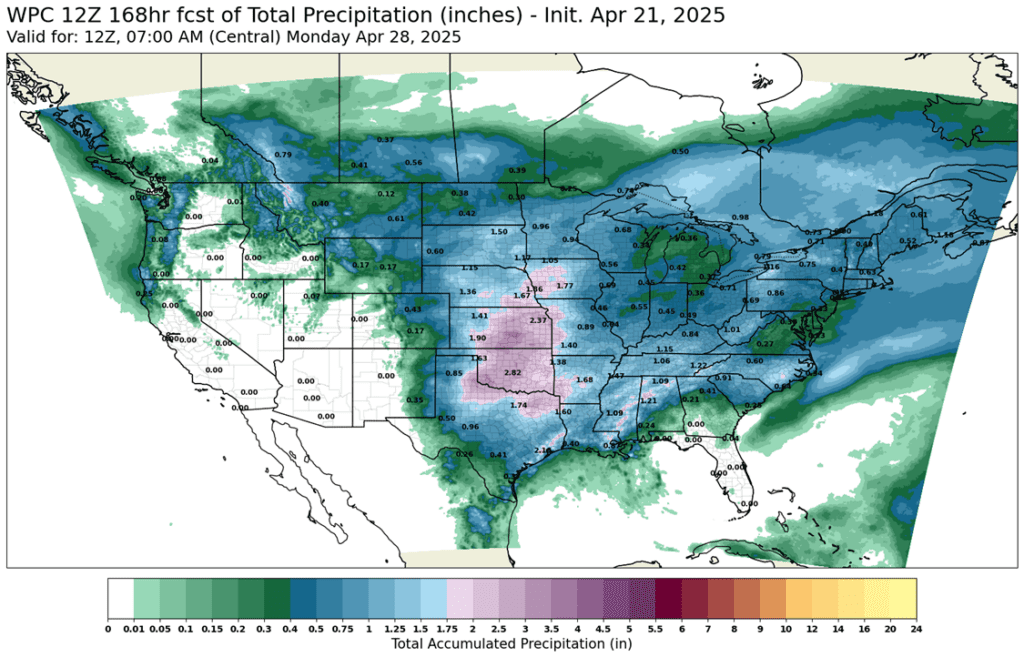

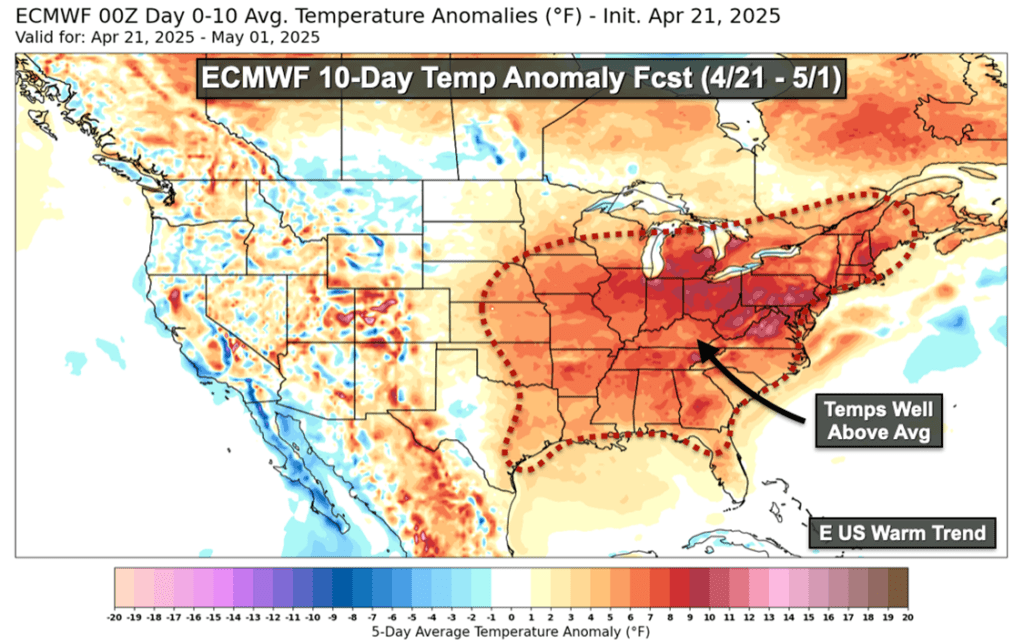

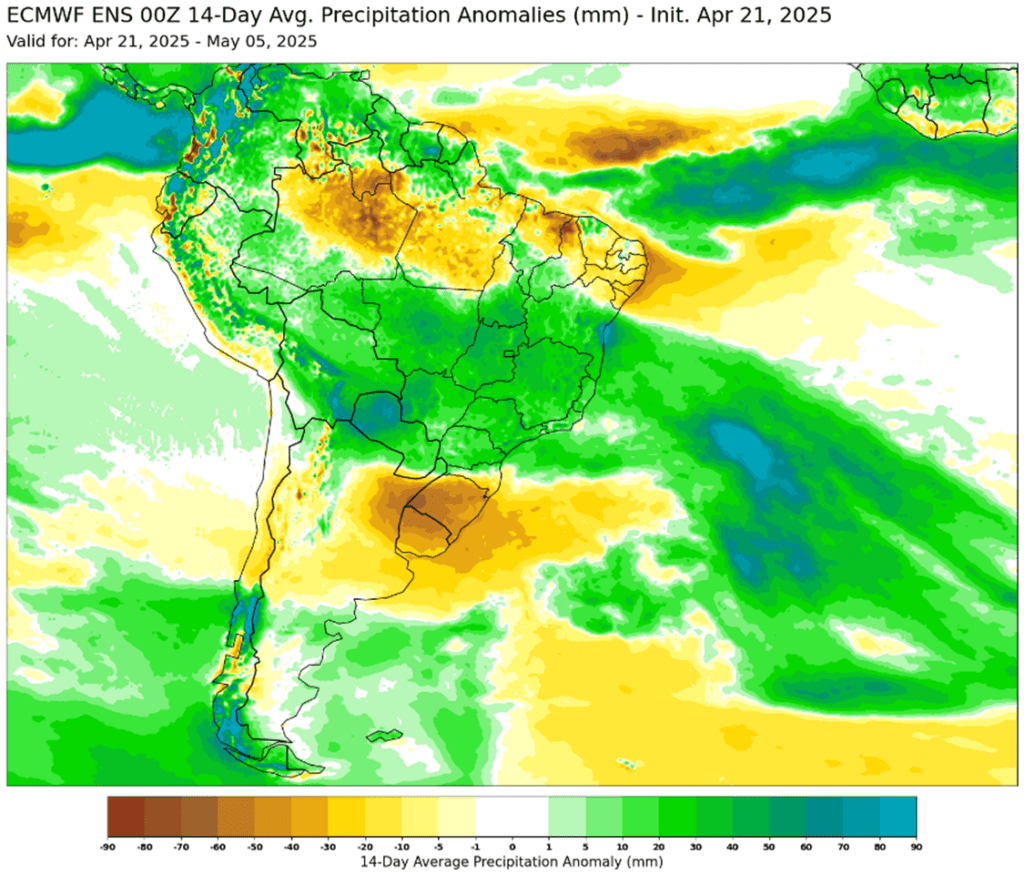

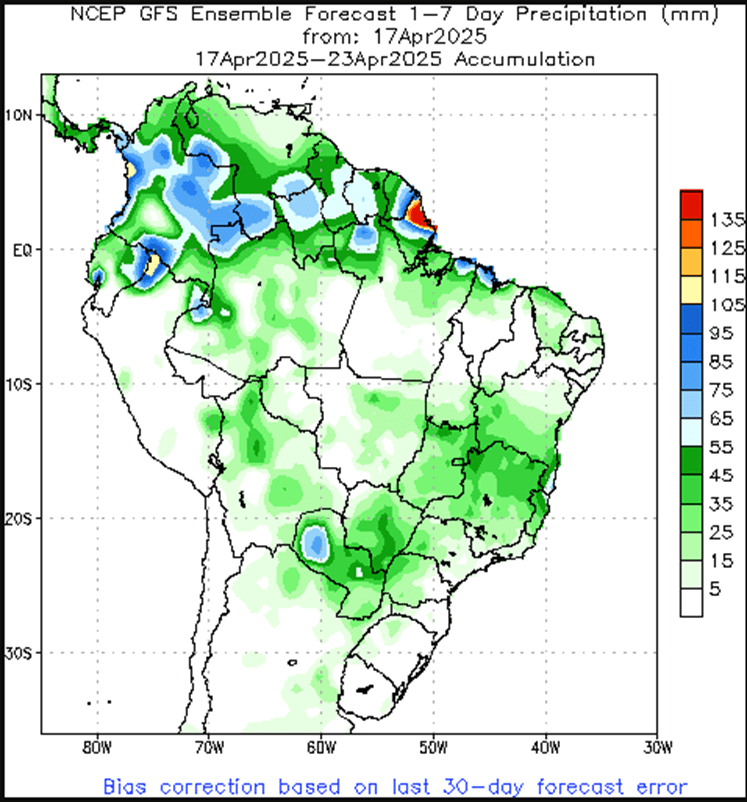

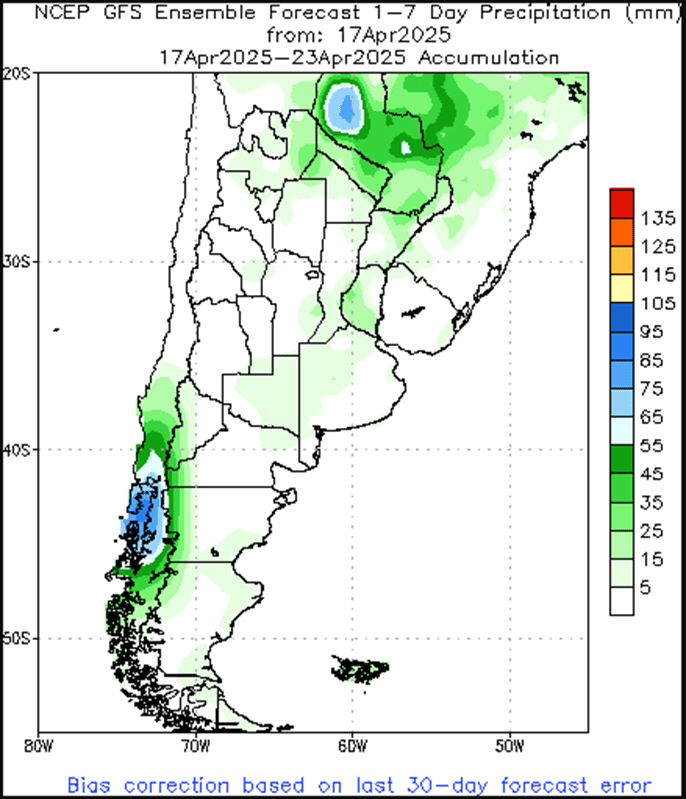

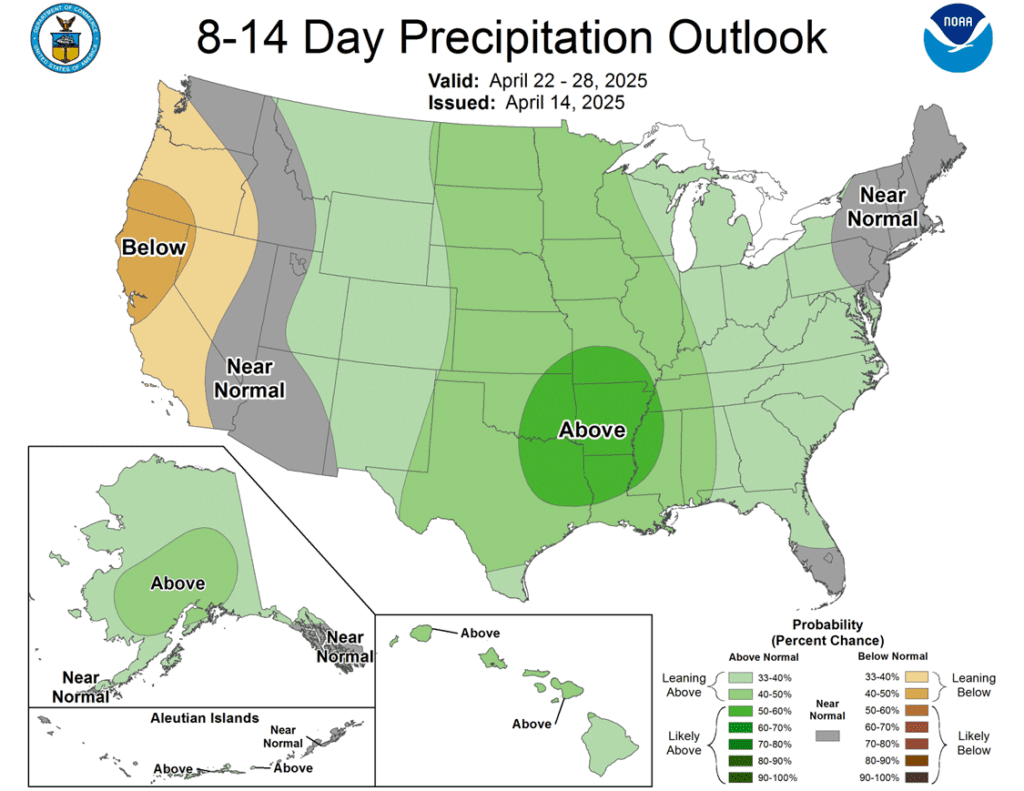

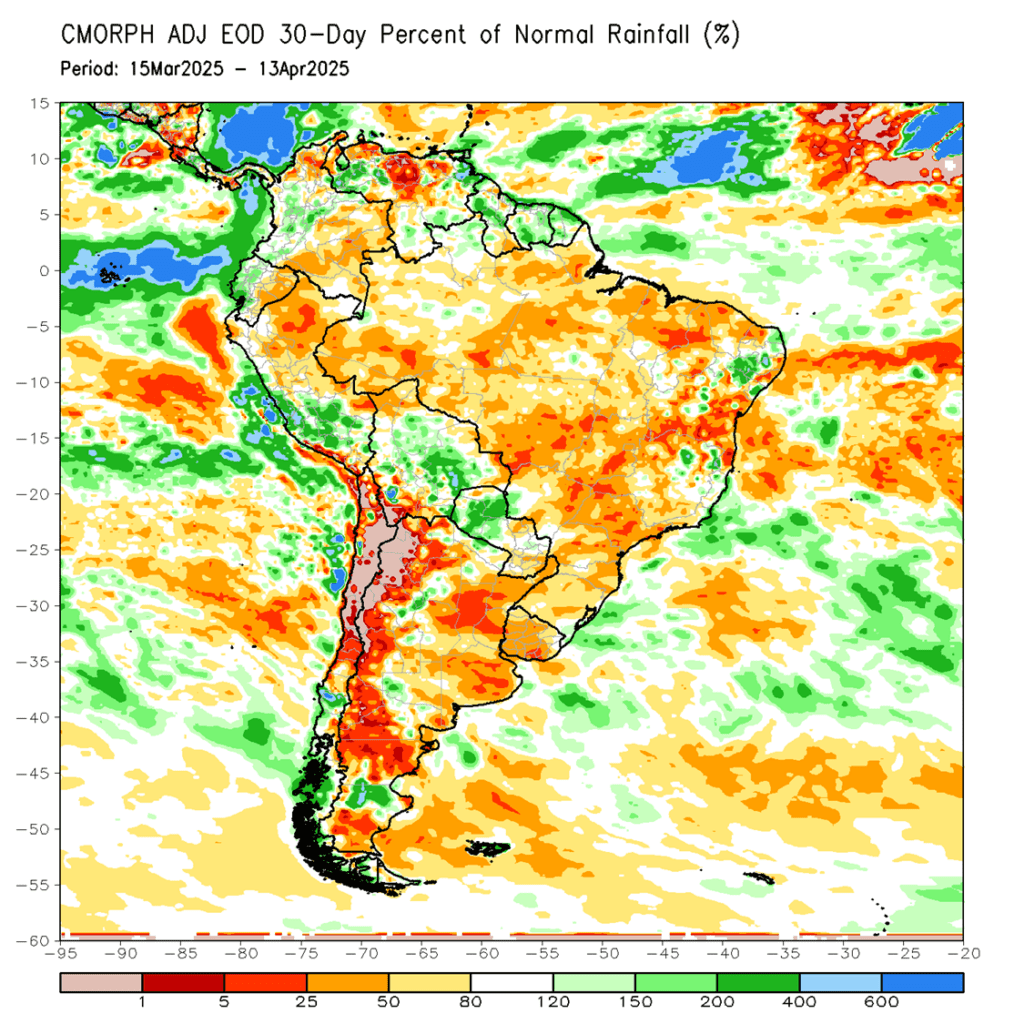

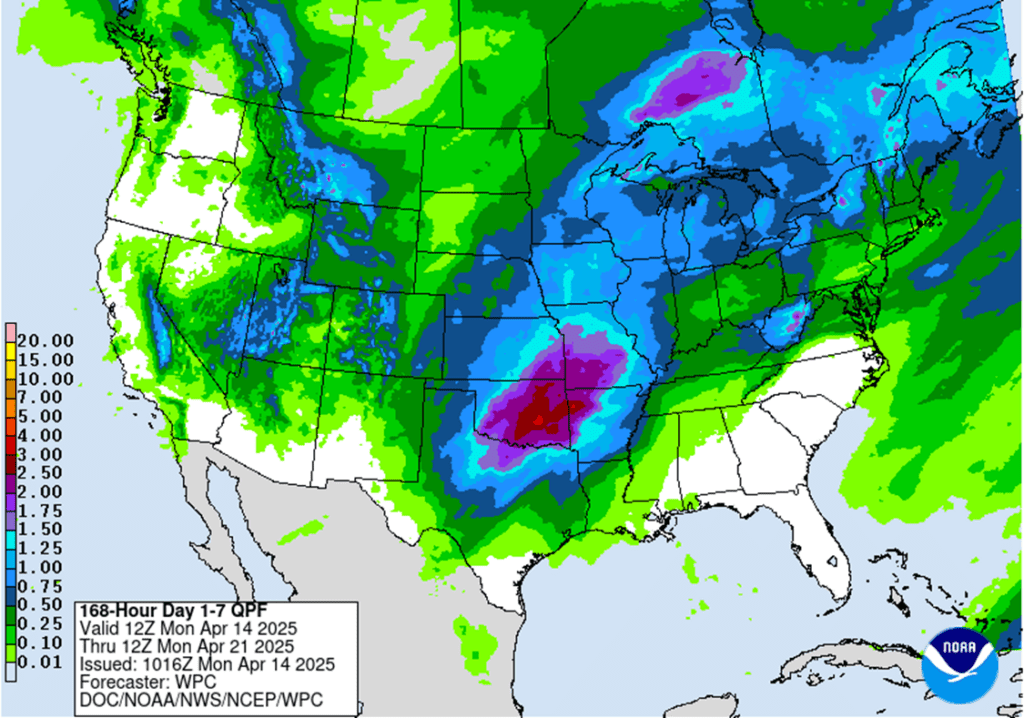

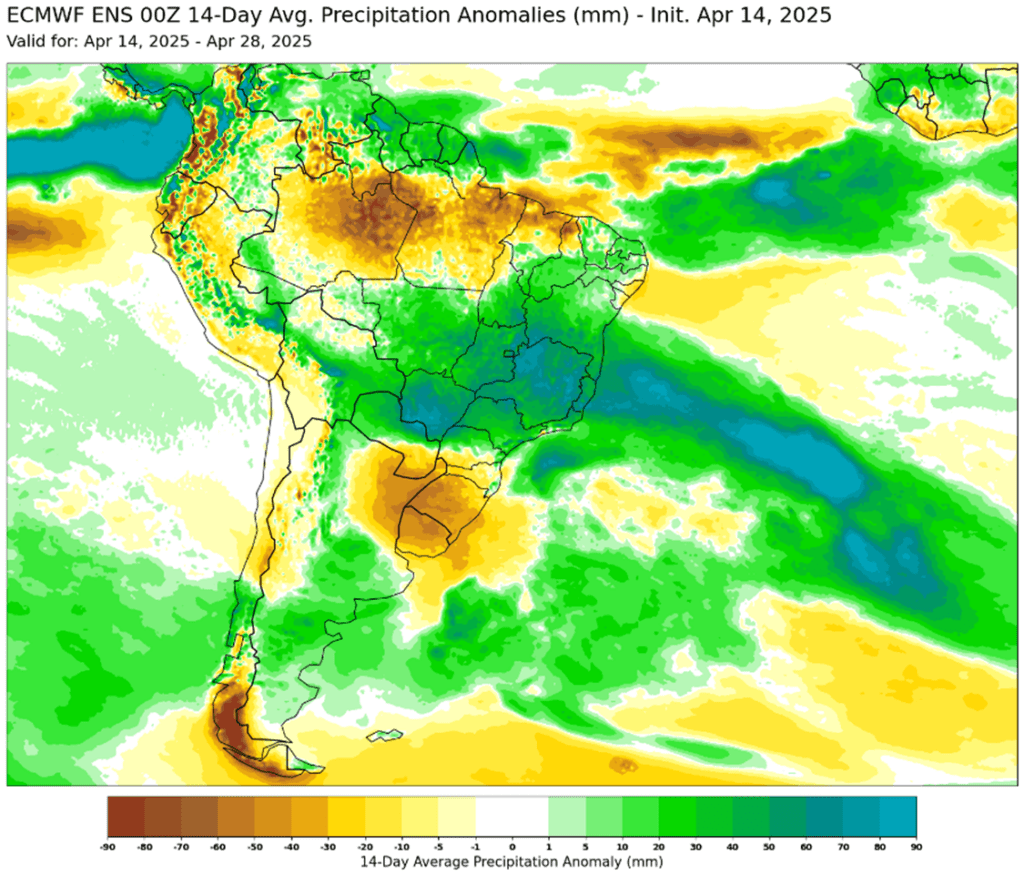

- To see the updated U.S. 7-day precipitation forecast as well as the U.S. 8-14 day precipitation anomaly, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

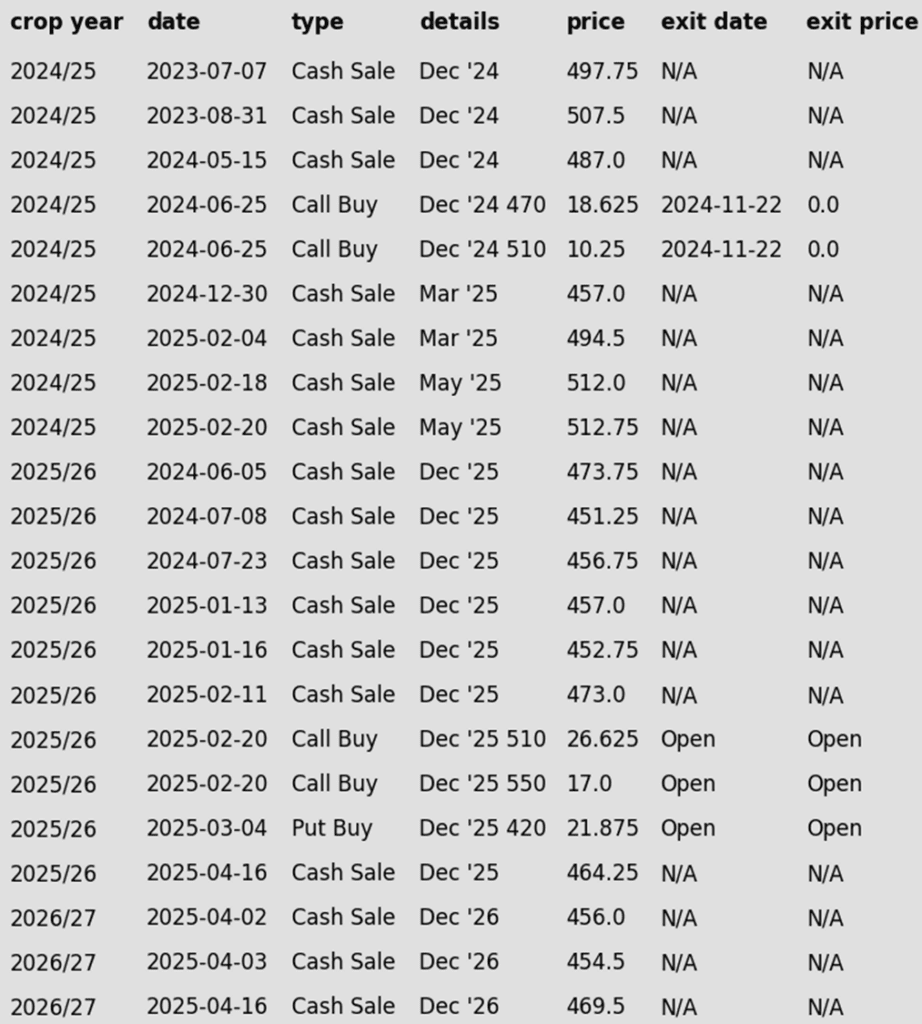

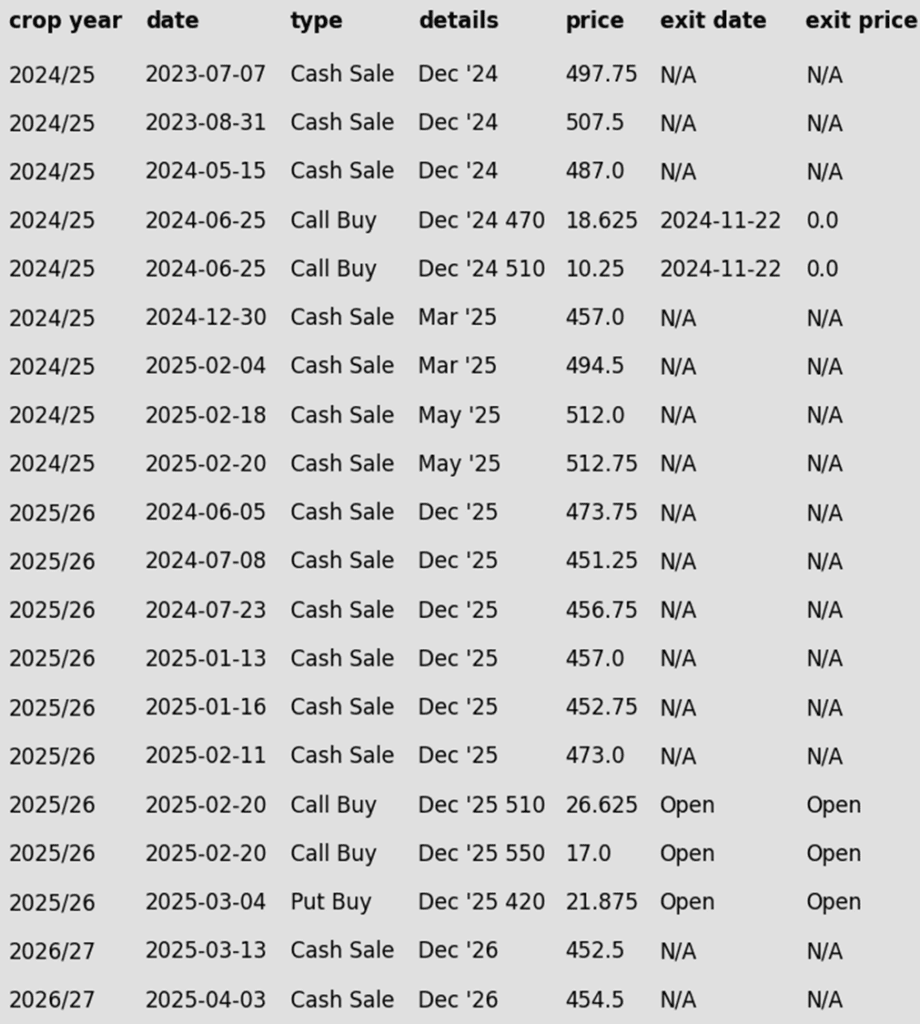

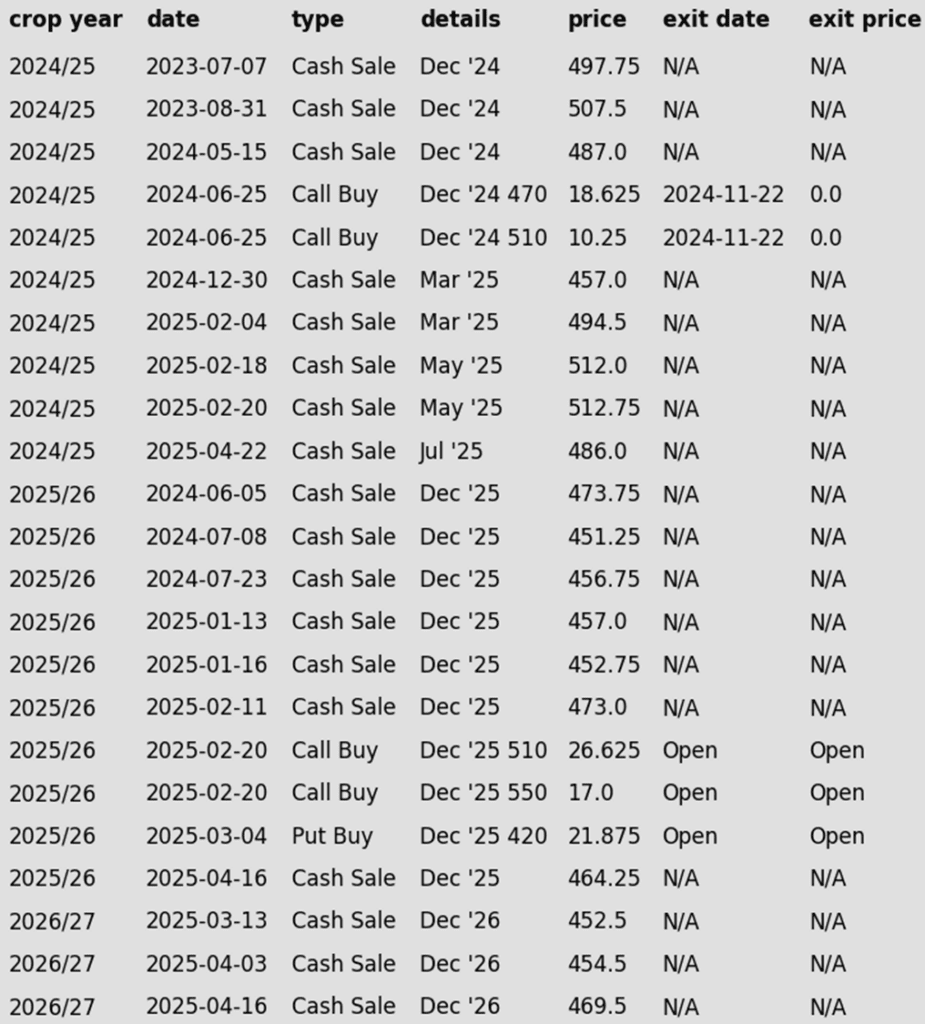

- Sales Recs: Now, eight sales recommendations made to date, with an average price of 494.

- No New Sales Targets: No active sales targets to report.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- No Changes: Still no active sales targets to report. Options targets remain active and unchanged.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- No Changes: No new active sales targets to report.

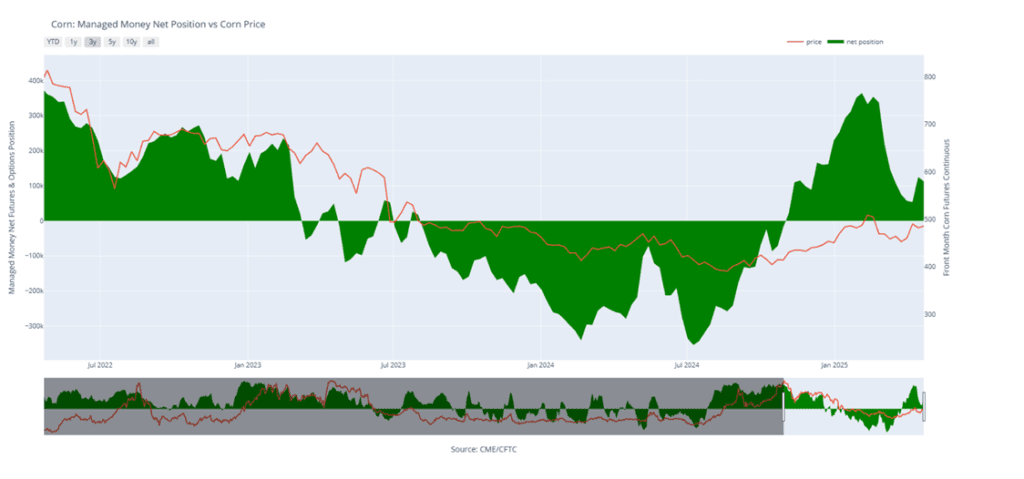

To date, Grain Market Insider has issued the following corn recommendations:

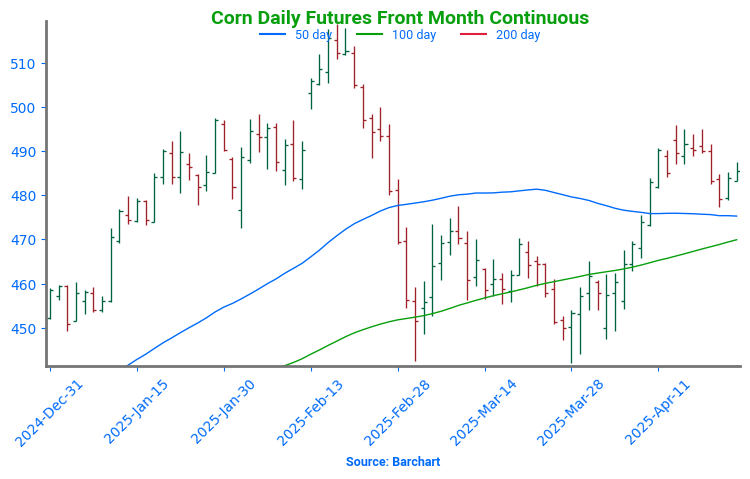

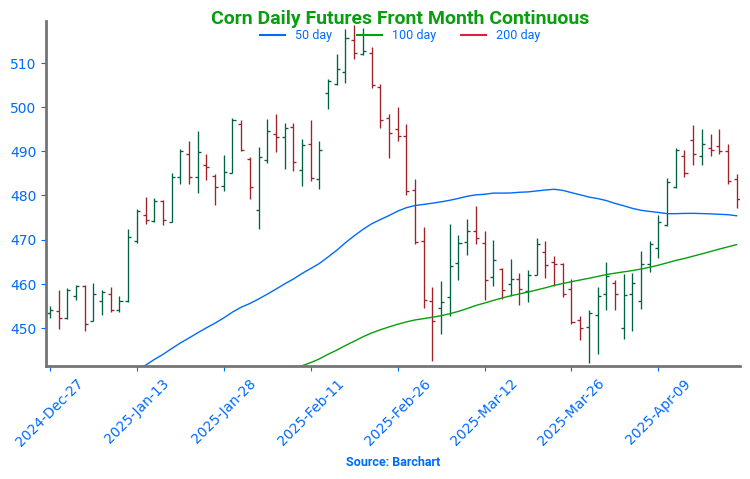

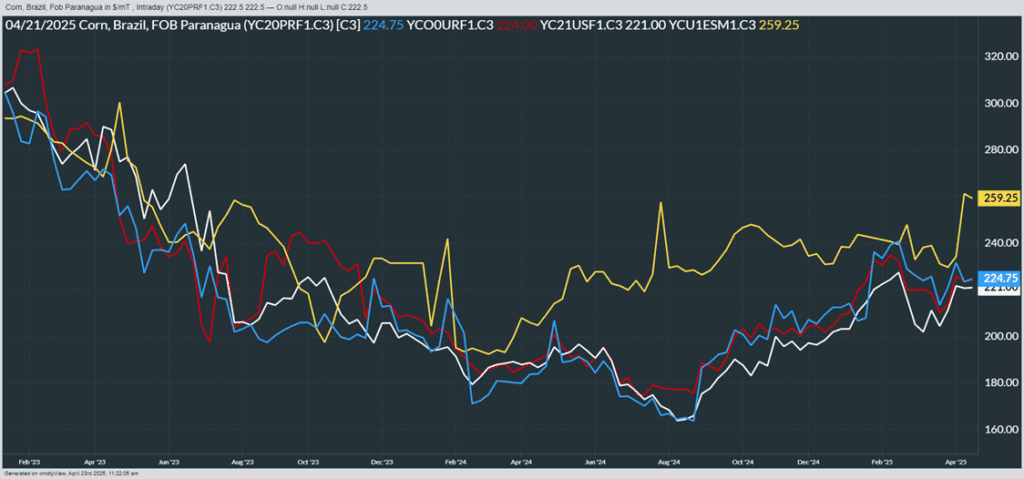

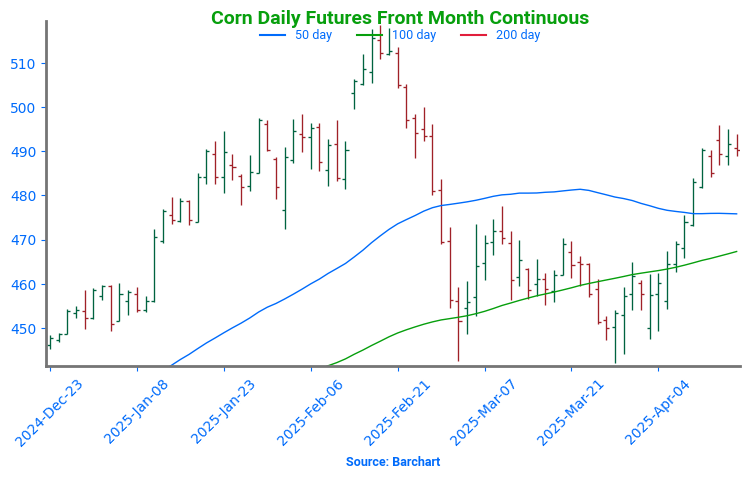

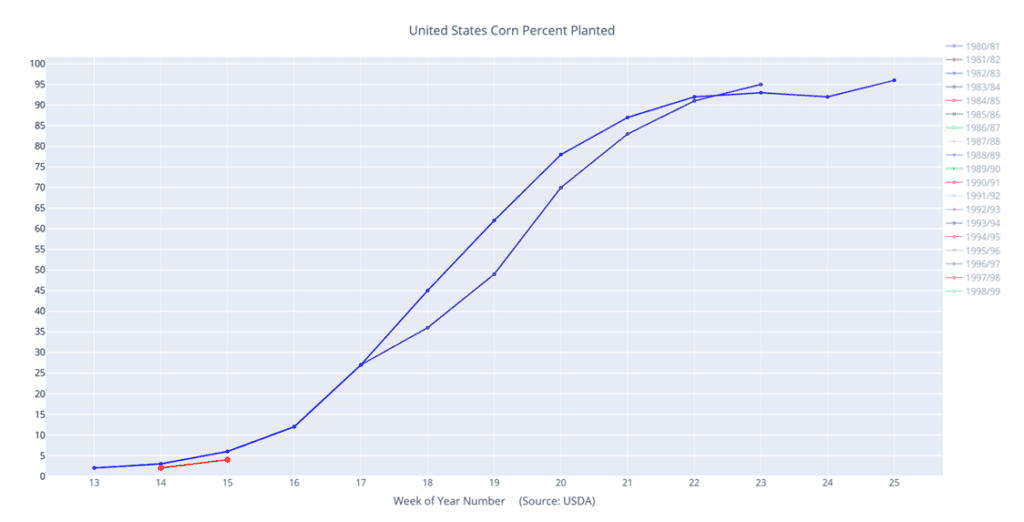

- Corn futures finished softer on the session, weighed by selling pressure spilling over from the wheat market, and the prospects of a strong planting pace for the next corn crop. U.S. corn demand remains strong, but the market is looking for bullish news to push prices higher.

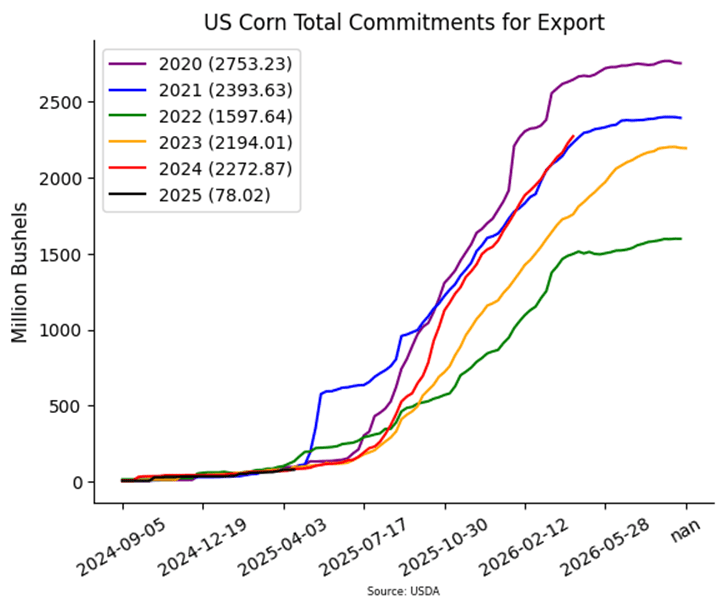

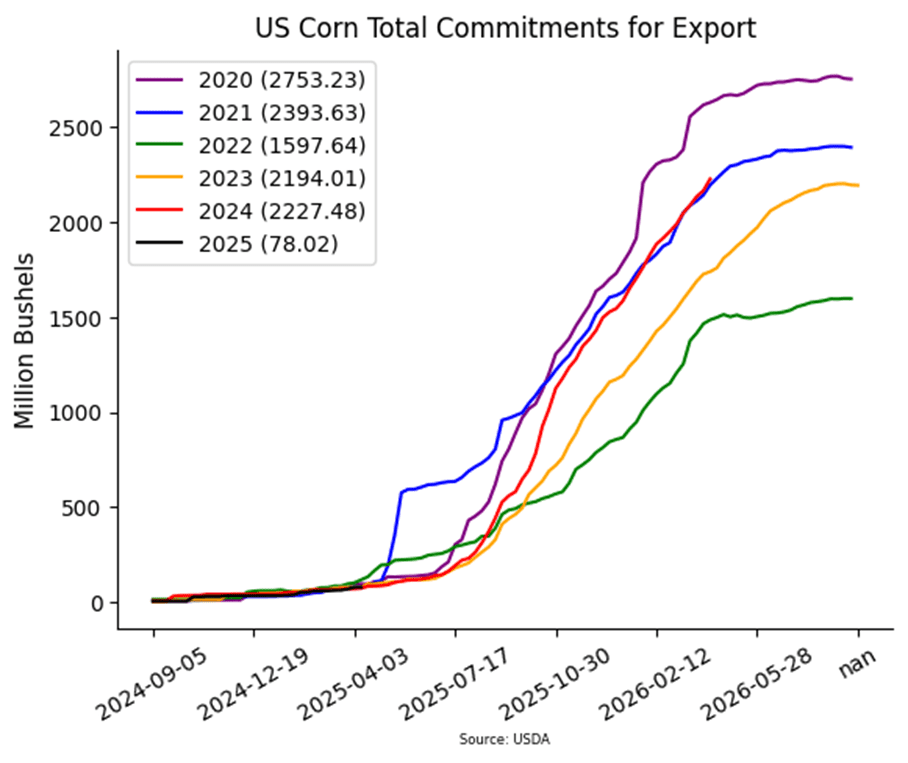

- Weekly corn export inspections remain strong. For the week ending April 24, corn inspections totaled 1.655 MMT (65.1 mb), which was near the top end of expectations. Total corn expectations are up 29% year-over-year, and ahead of the pace needed to reach the USDA export target for the marketing year.

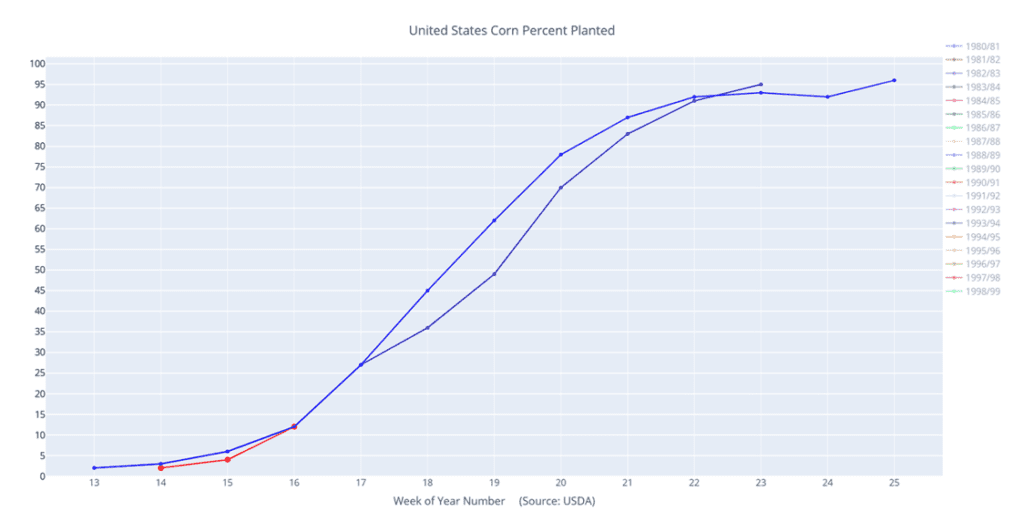

- Monday’s USDA Crop Progress report is expected to show corn planting nearing 25% complete, up from 12% last week and ahead of the five-year average, reinforcing ideas that planted acres could exceed earlier projections.

- The influence of First Notice Day of the May futures likely limited corn prices and added volatility, as traders holding long May positions need to exit or roll those positions to the next contract month or risk delivery.

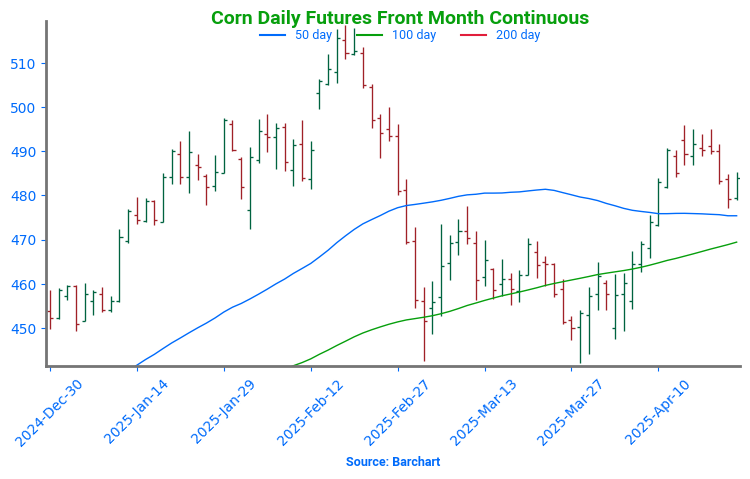

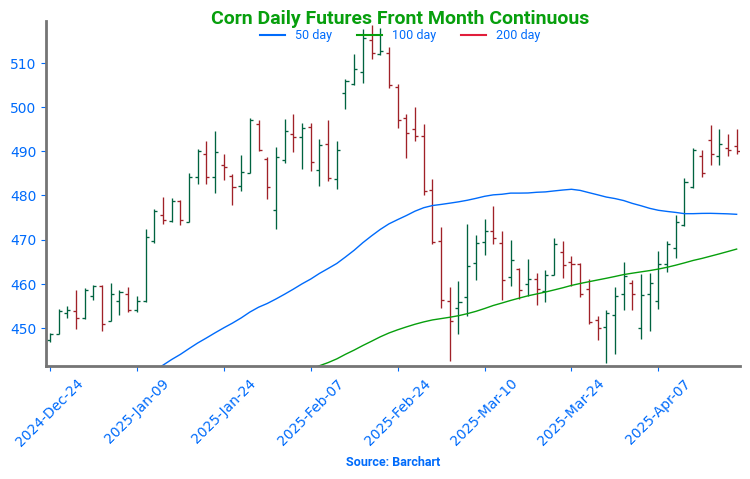

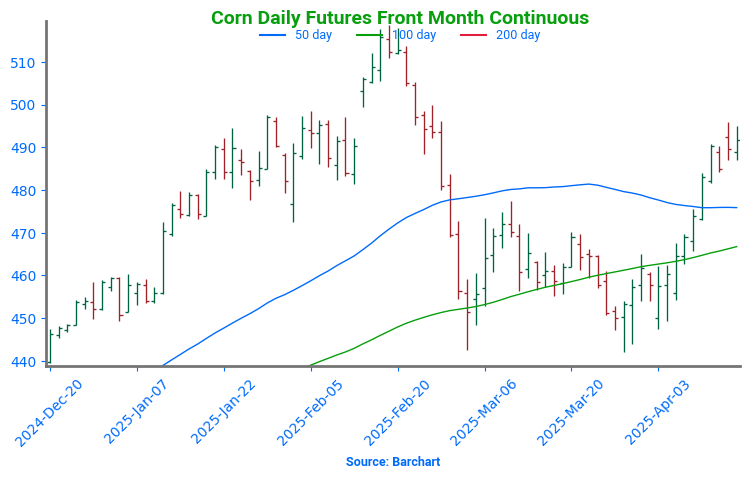

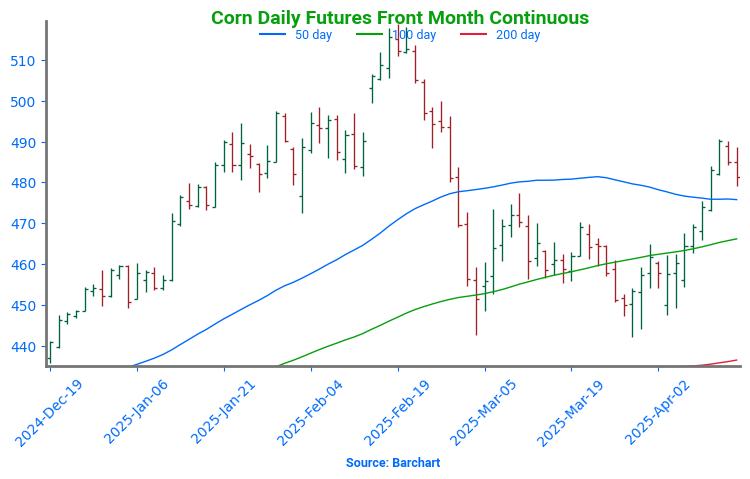

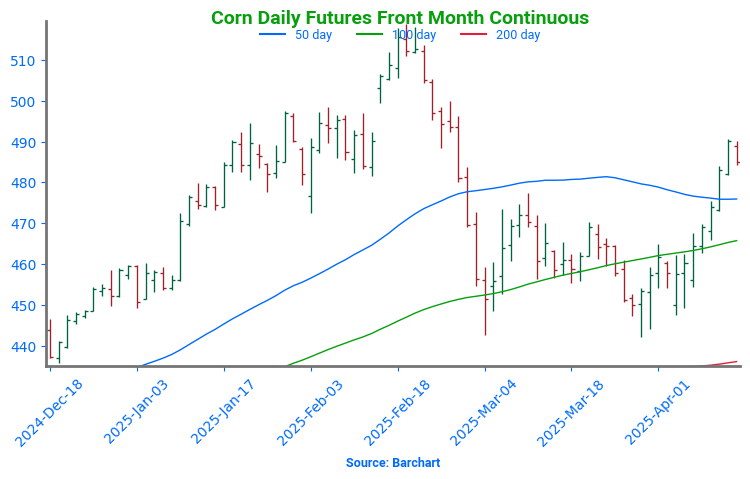

Corn on the Move: Bulls Eye 510+ After Breakout

Corn futures broke out in April after holding key support near 450 through much of March. A bullish April WASDE report highlighting stronger demand sparked the rally, with prices pushing through the 50-day moving average. All eyes now turn to planting progress and demand trends to drive the next move. The February highs just above 510 are the next upside target, while support is firming near 470 at the top of the previous range.

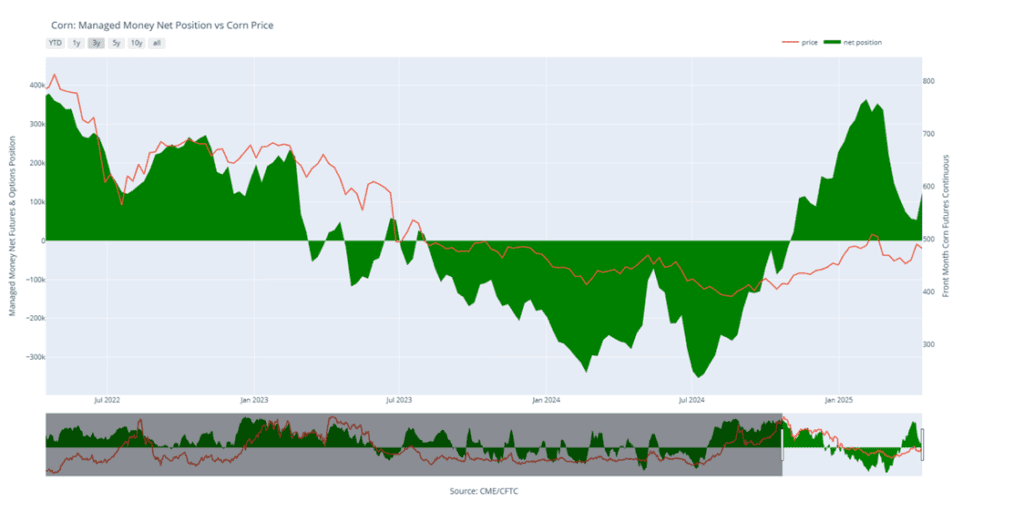

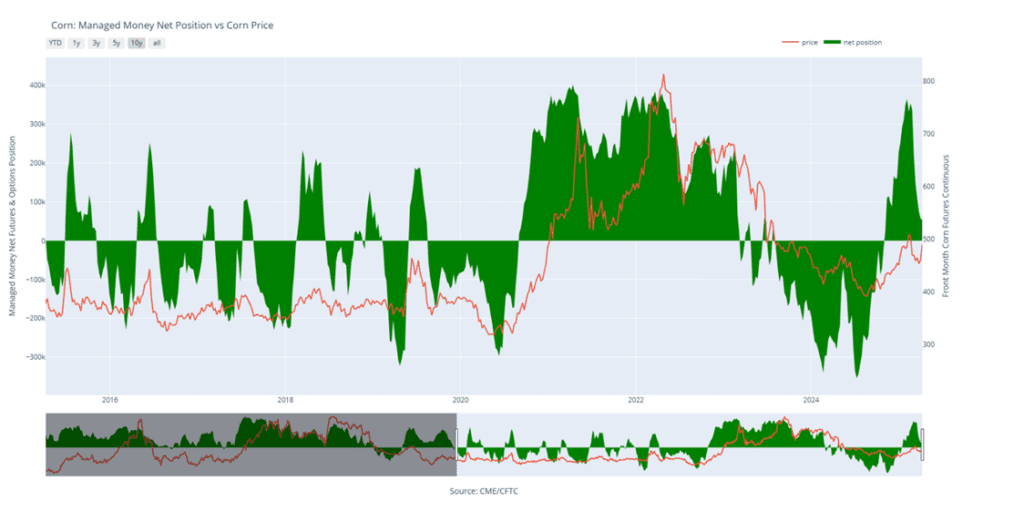

Above: Corn Managed Money Funds net position as of Tuesday, April 22. Net position in Green versus price in Red. Money Managers net sold 11,768 contracts between April 15 – April 22, bringing their total position to a net long 112,805 contracts.

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- No Changes: Continue to target a move to 1107 to make a fourth sale.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- No Changes: If you’re behind on sales, target 1063 vs November for a catch-up opportunity. If you’re in line with current recommendations, Plan A remains to make the next cash sales at 1093 and 1114, while keeping an eye on 1016.75 support as part of Plan B.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The first sales targets may not post until May or later.

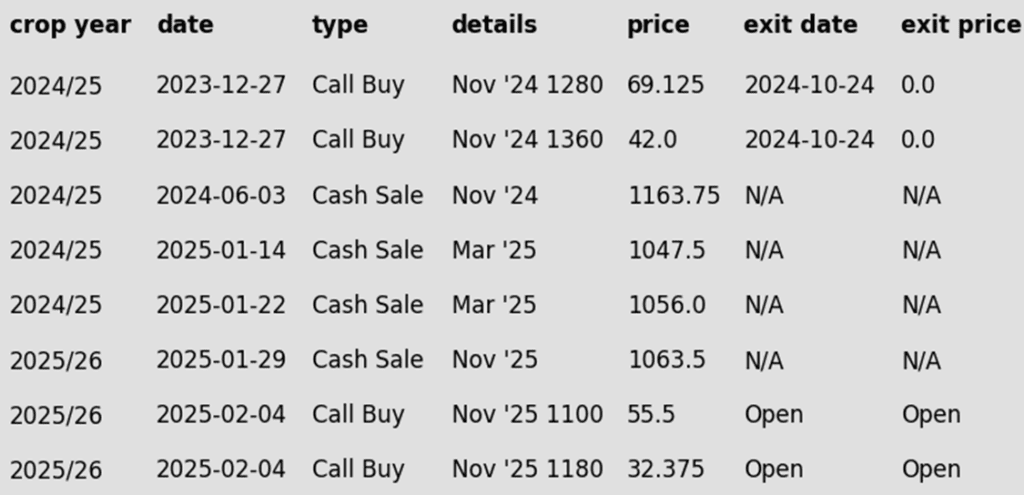

To date, Grain Market Insider has issued the following soybean recommendations:

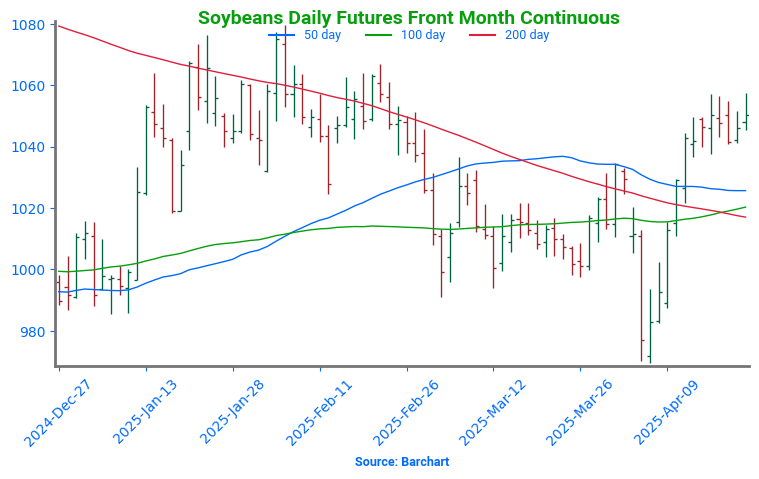

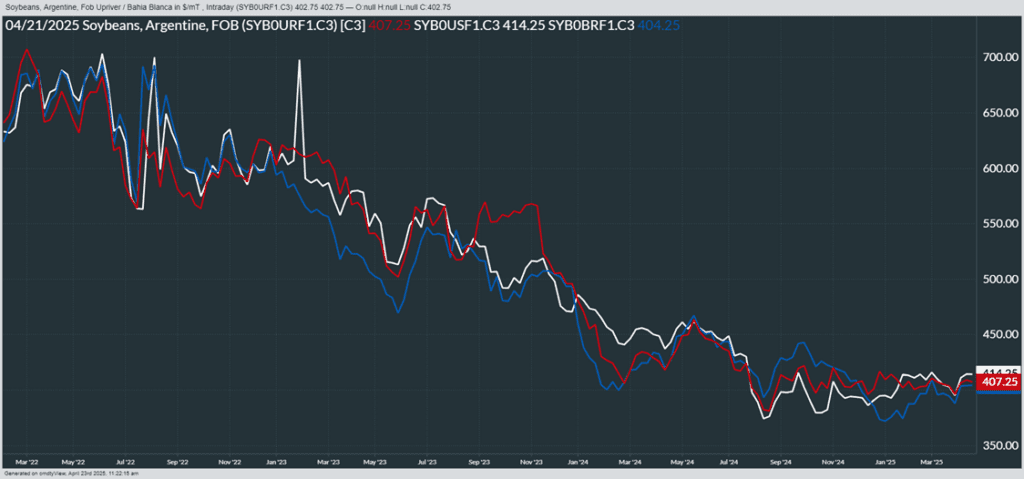

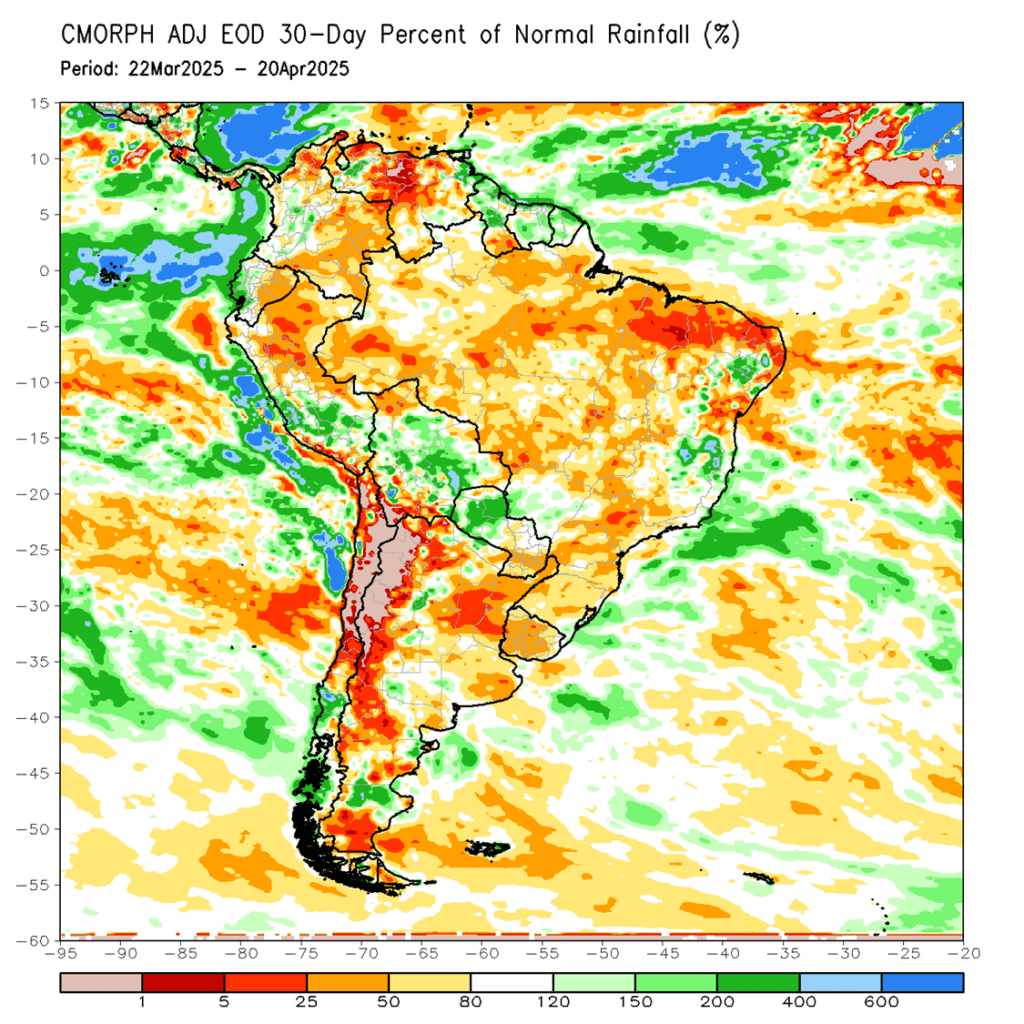

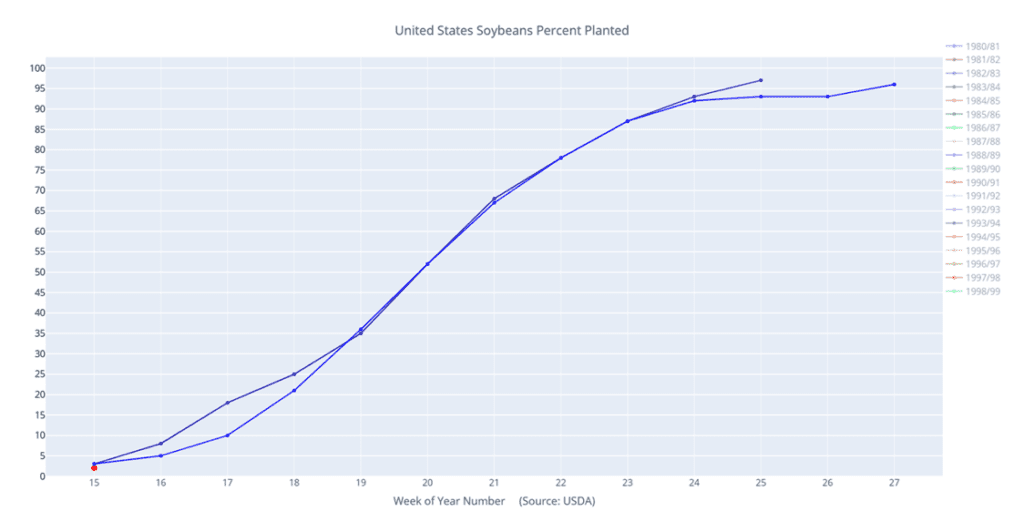

- Soybeans were mixed to end the day with the front months higher and back months lower in bull spreading action. May futures were up 2-1/4 cents while November was down 1/4 cent. Support came from soybean oil, which closed higher, while soybean meal was lower to end the day.

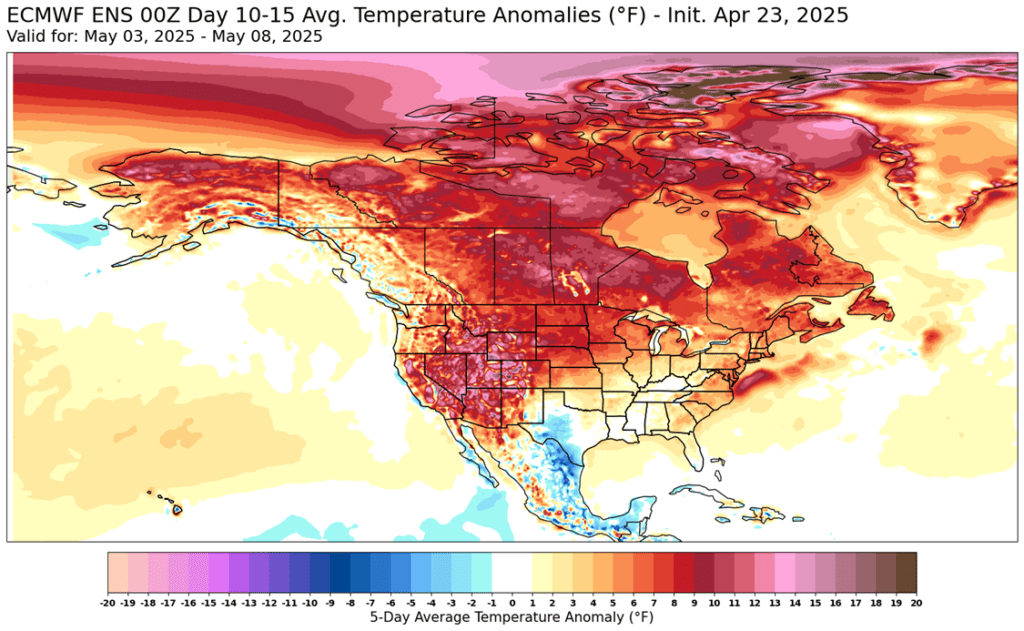

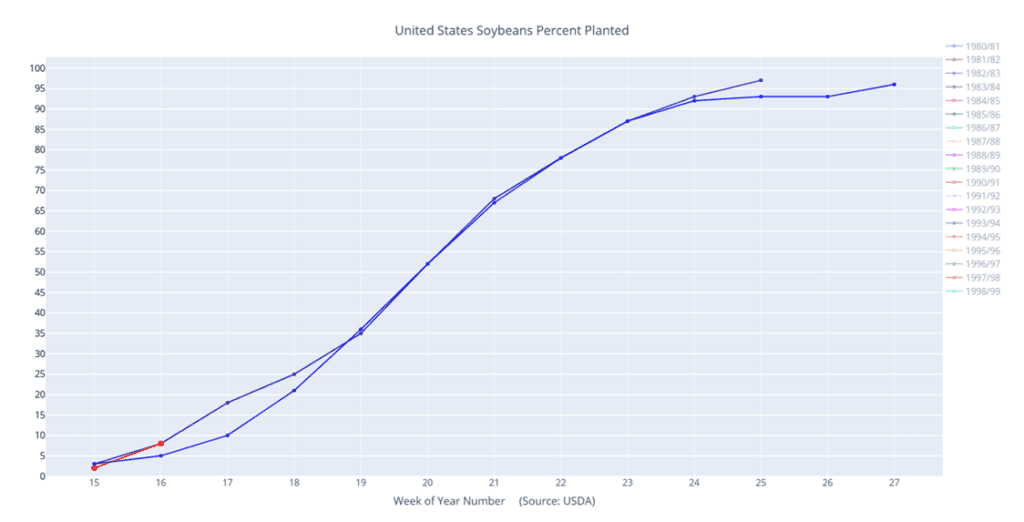

- USDA’s Crop Progress report, due this afternoon, is expected to show soybean planting at 17% complete as of Sunday. Warmer, drier weather in early May should help with emergence for early-planted fields.

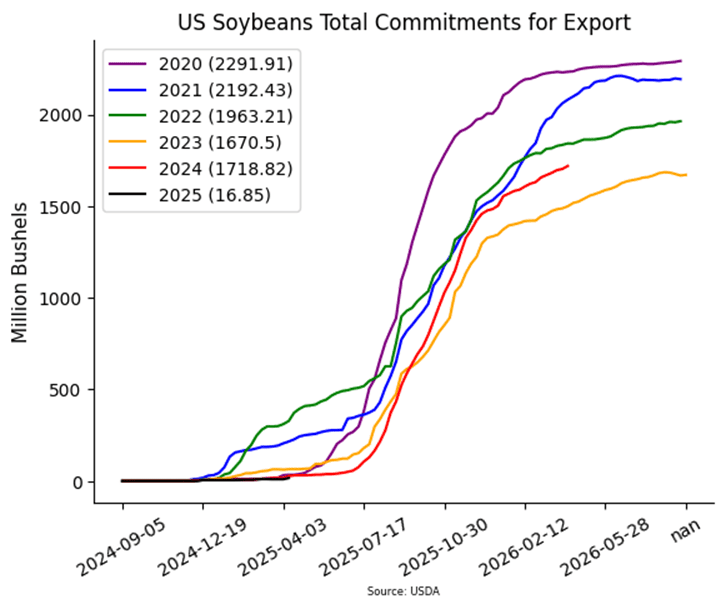

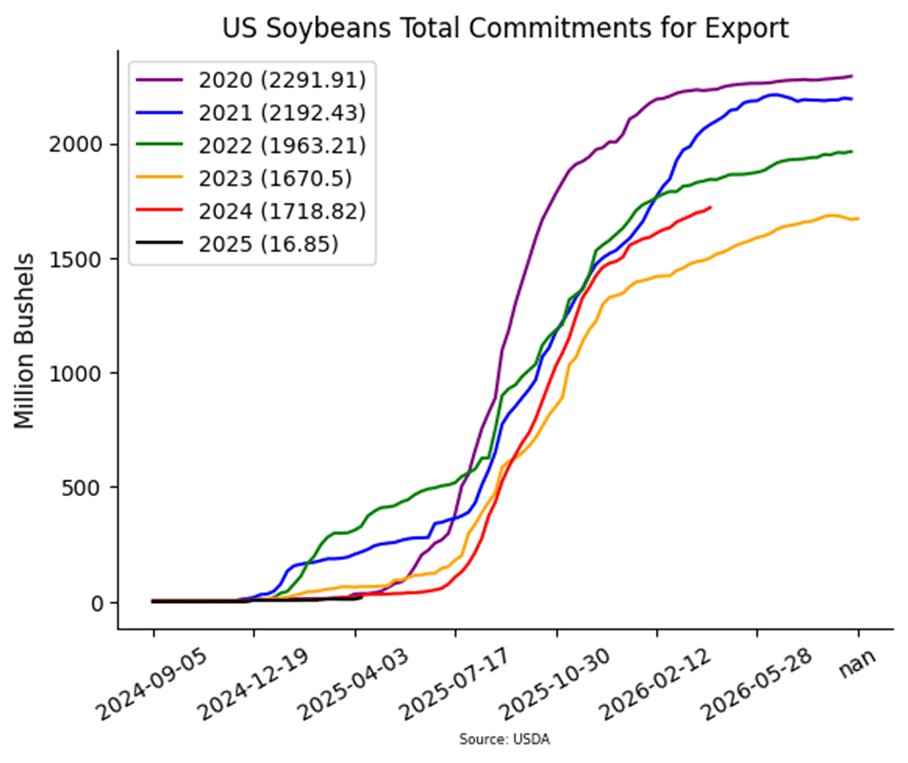

- Today’s export inspections were on the poorer side for soybeans at the low range of analyst estimates. Inspections totaled 16.1 million bushels for the week ending April 24. Total inspections for 24/25 are now at 1.584 billion bushels, which is up 11% from the previous year.

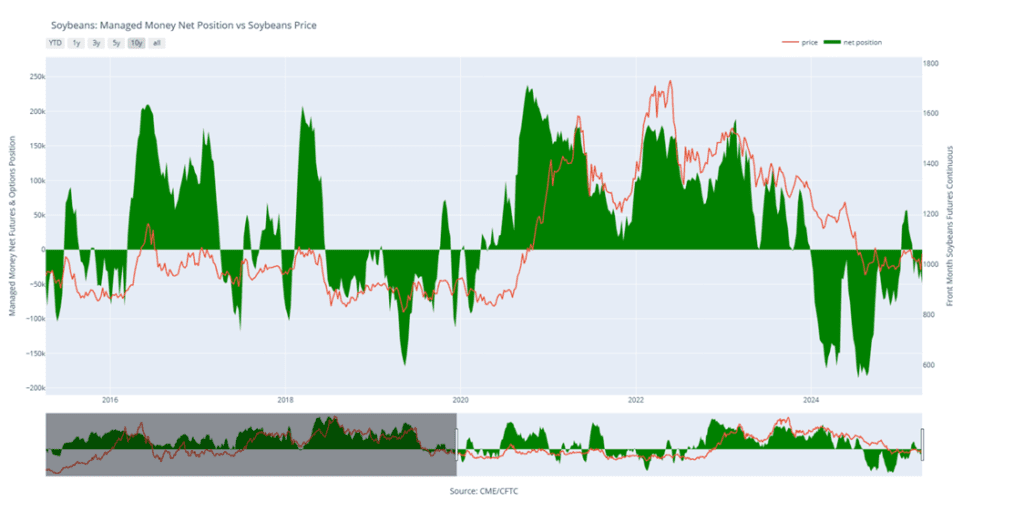

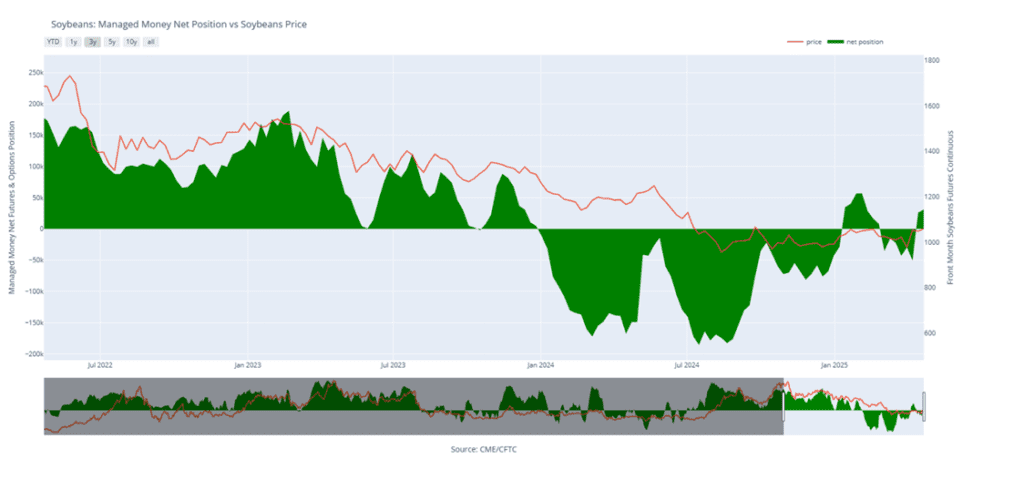

- Friday’s CFTC report saw funds as buyers of soybeans by 4,898 contracts, increasing their net long position to 31,067 contracts. They were buyers of 9,940 contracts of bean oil and sellers of 3,911 contracts of meal.

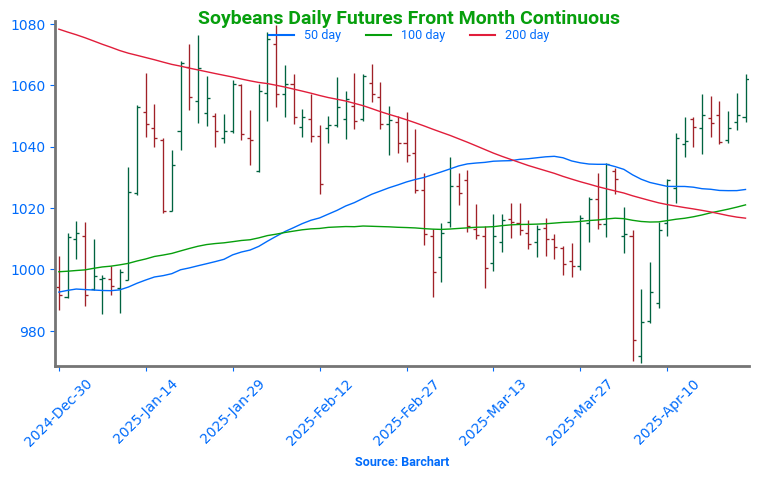

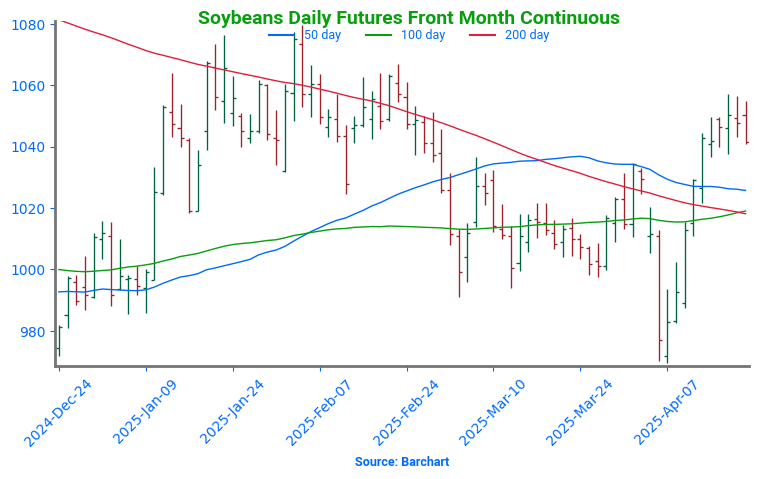

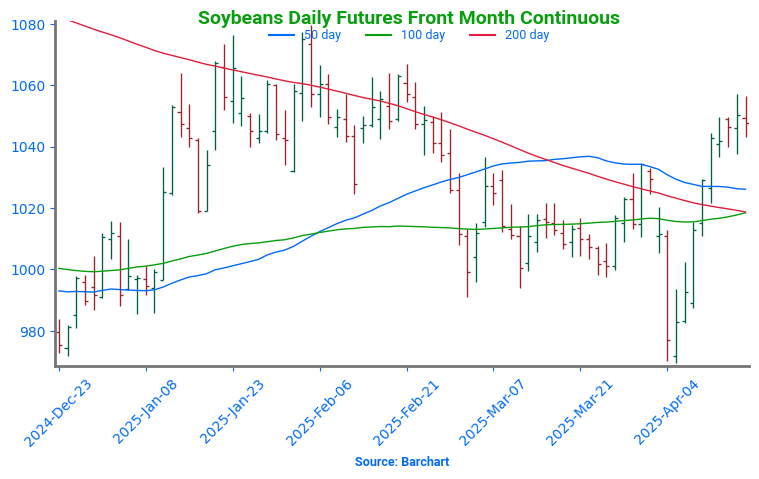

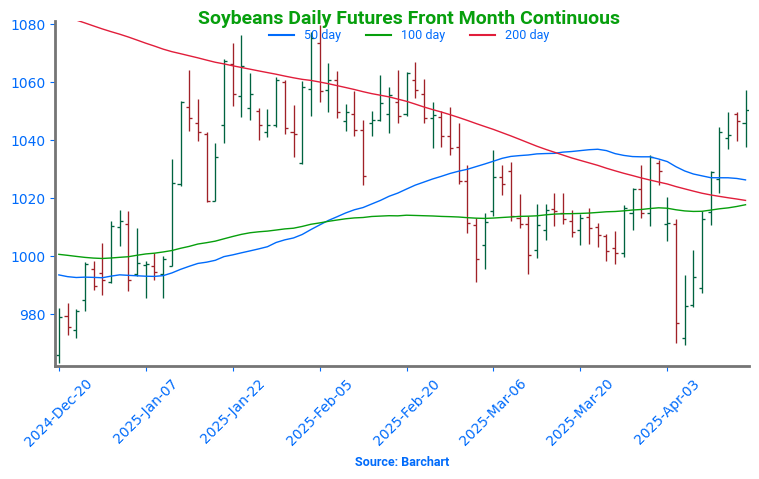

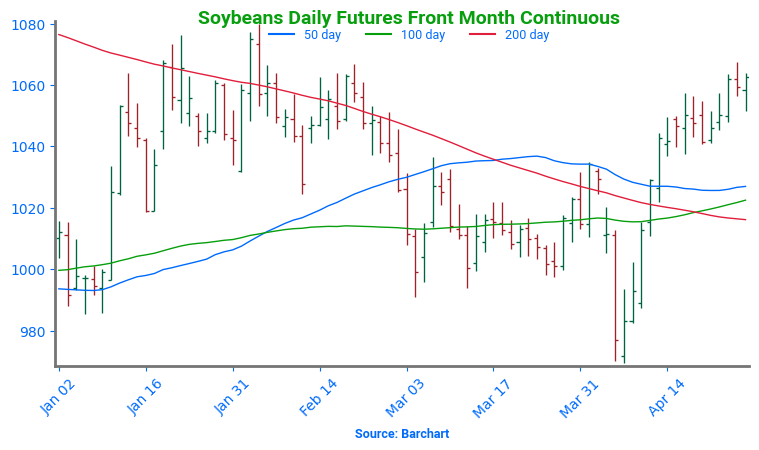

Soybean Futures Rebound: Momentum Builds Above Key Support

Soybean futures dropped sharply in early April after newly announced tariffs triggered a break below key support near 1000, a level that had held firm through March. However, strong buying interest fueled a swift rebound, pushing futures back above the pivotal 1000 mark and reclaiming major moving averages — especially the 200-day, which had capped rallies for the past two years. With momentum rebuilding, the market is now eyeing the February highs near 1080, while the 200-day moving average is expected to provide support on any spring pullbacks.

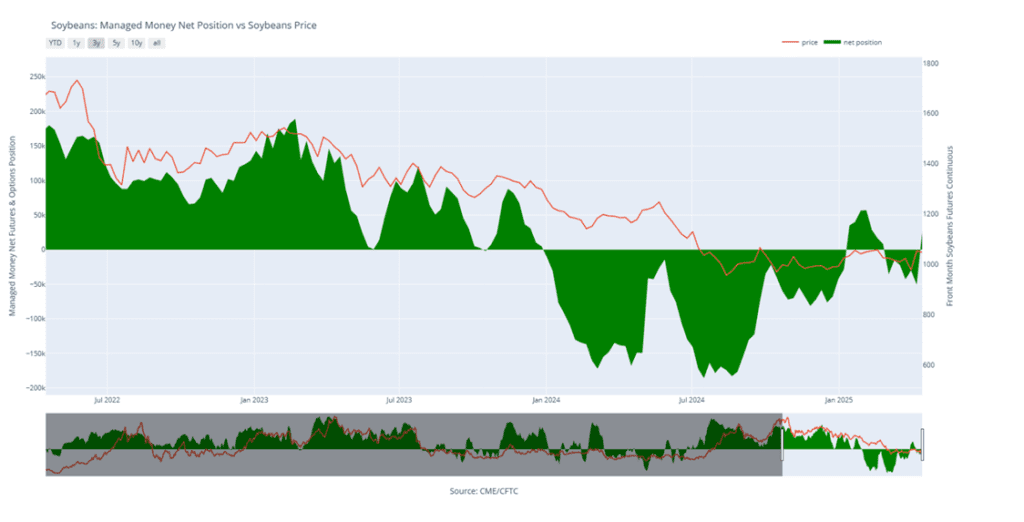

Above: Soybean Managed Money Funds net position as of Tuesday, April 22. Net position in Green versus price in Red. Money Managers net bought 4,898 contracts between April 15 – April 22, bringing their total position to a net long 31,067 contracts.

Wheat

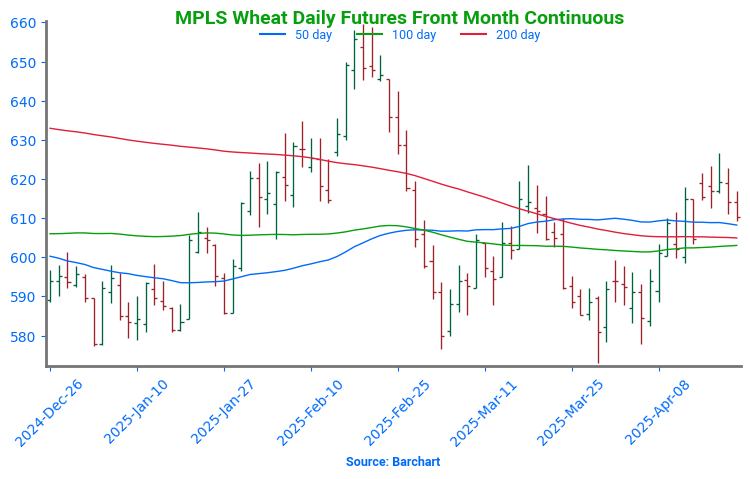

Market Notes: Wheat

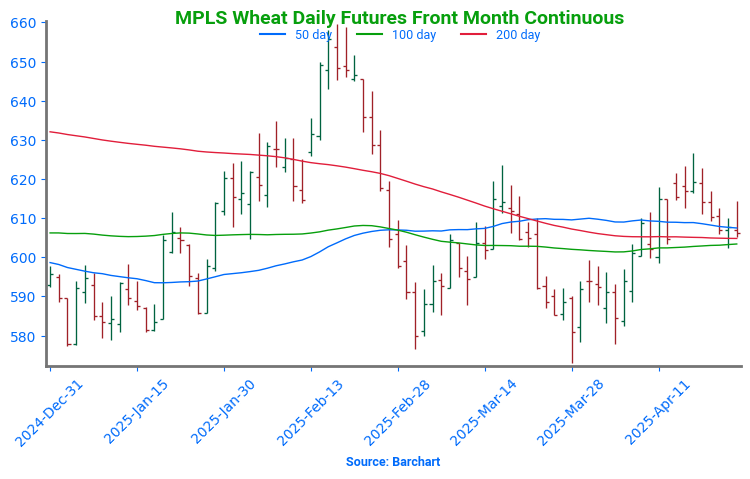

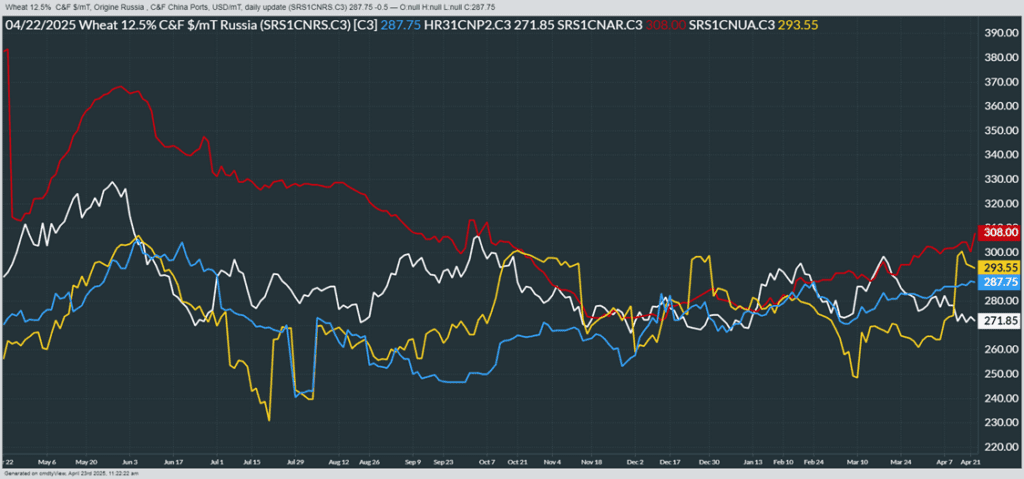

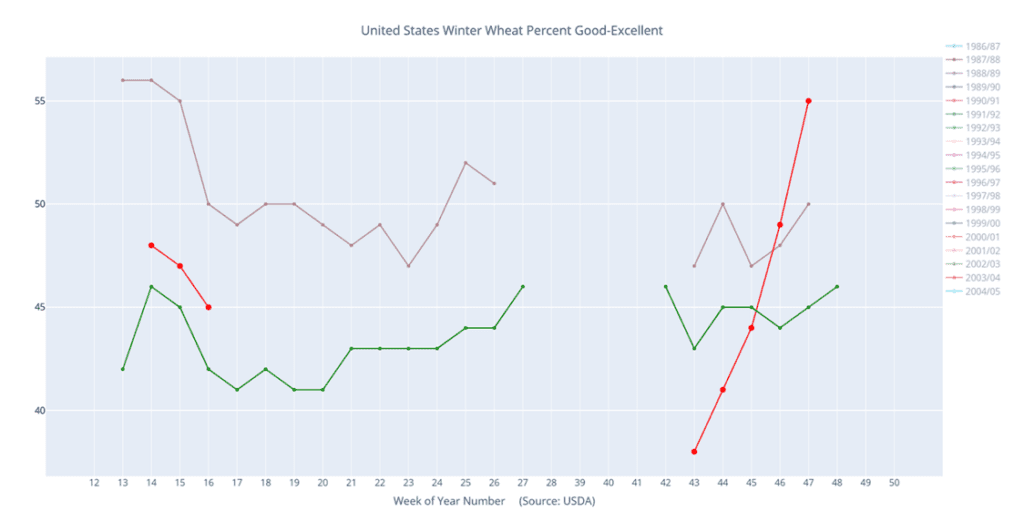

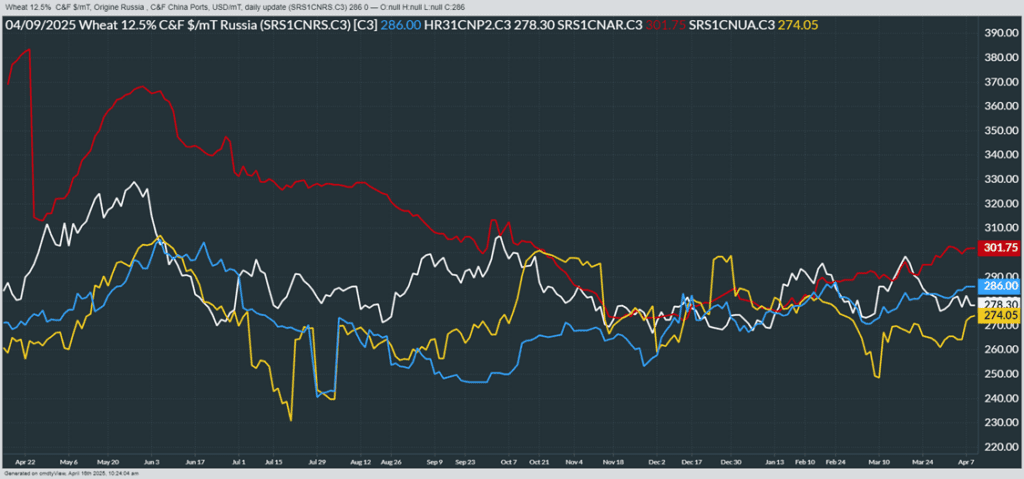

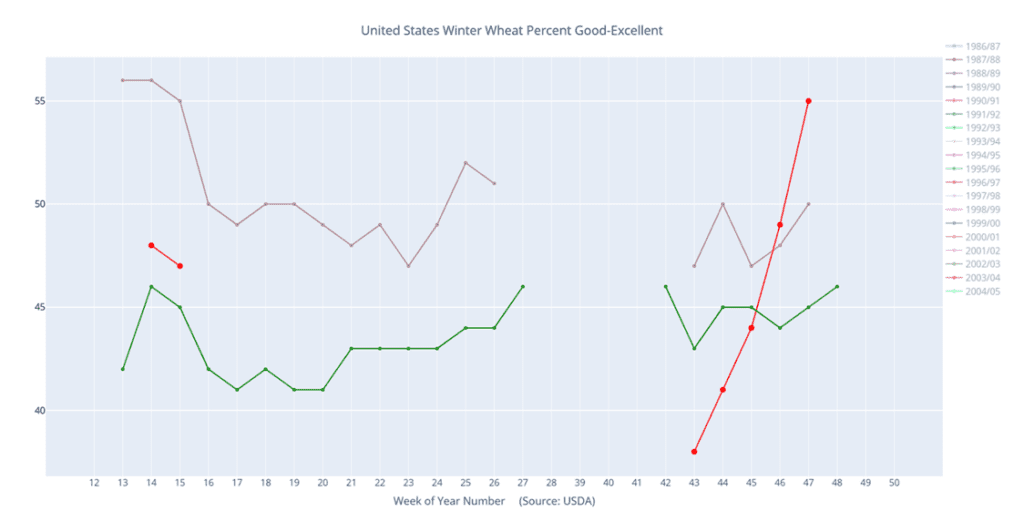

- Wheat markets struggled to recover from a rocky start to the week, ultimately closing lower across all classes on Monday. The downturn was driven by forecasts of continued heavy rainfall across the Southern Plains, which added pressure to prices. Both Kansas City and Chicago wheat contracts hit new lows today.

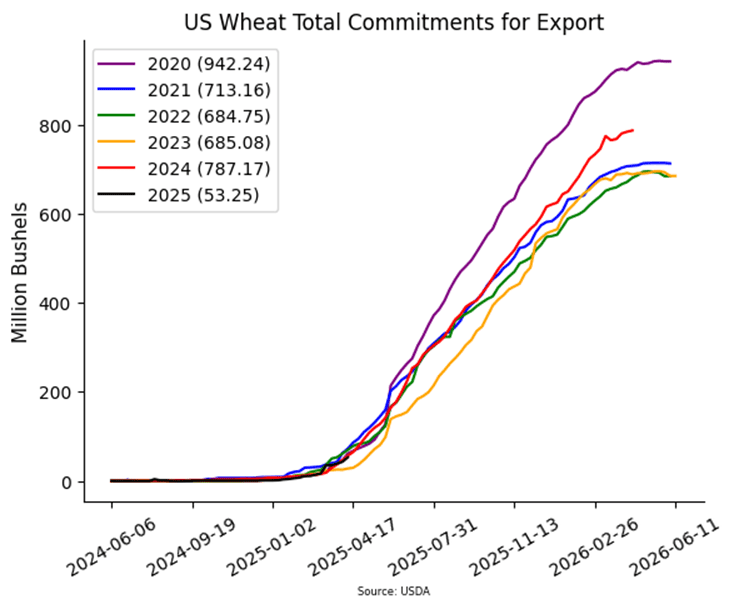

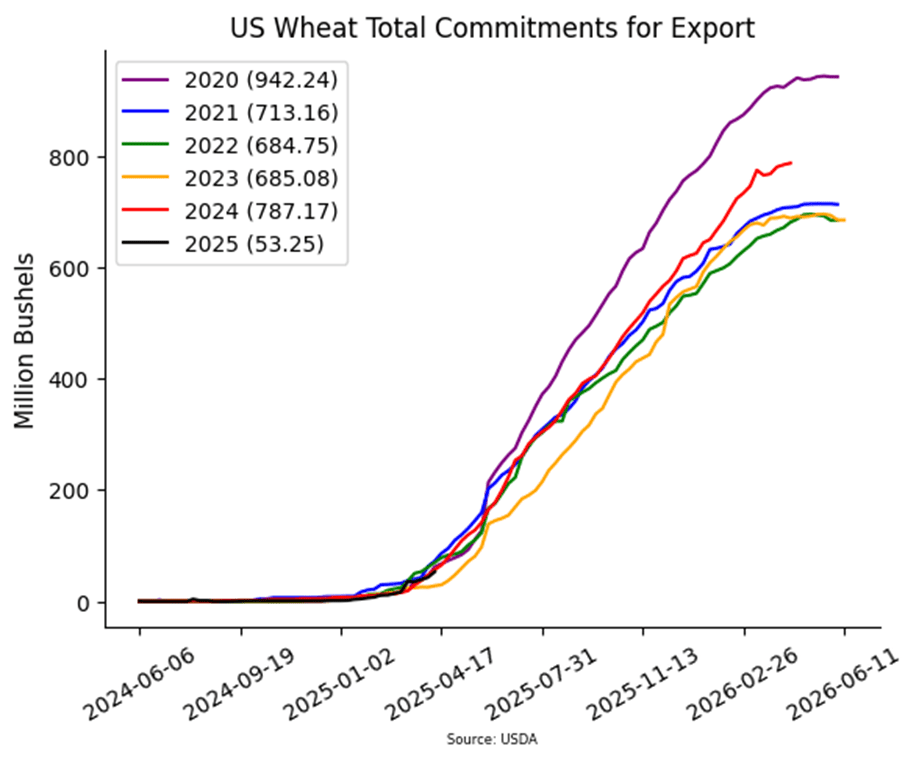

- The USDA released its weekly Export Inspections report this morning for the week ending April 24. Wheat export inspections totaled 24 million bushels, coming in above expectations and reaching a seven-month high. Year-to-date inspections stand at 715 million bushels, up 15% from the same time last year, just below the USDA’s projected 16% increase.

- There were reports of frost across parts of Russia last night, though it remains unclear whether any damage occurred to the wheat crop.

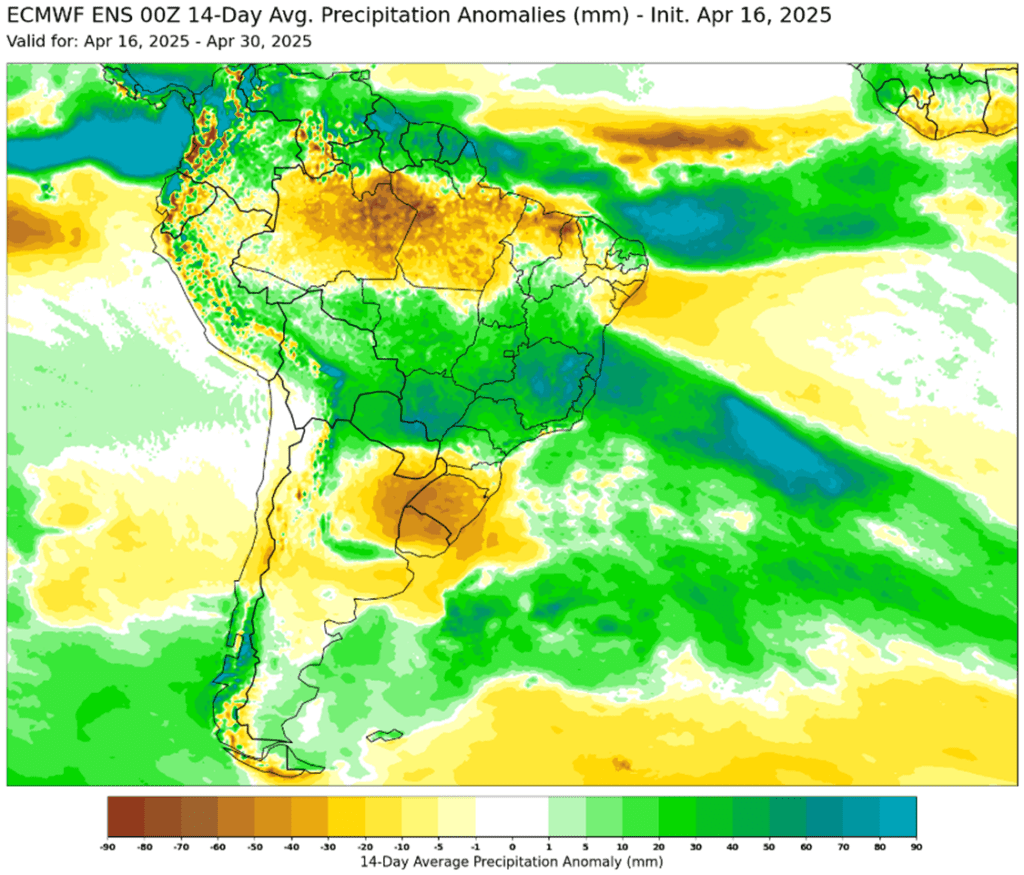

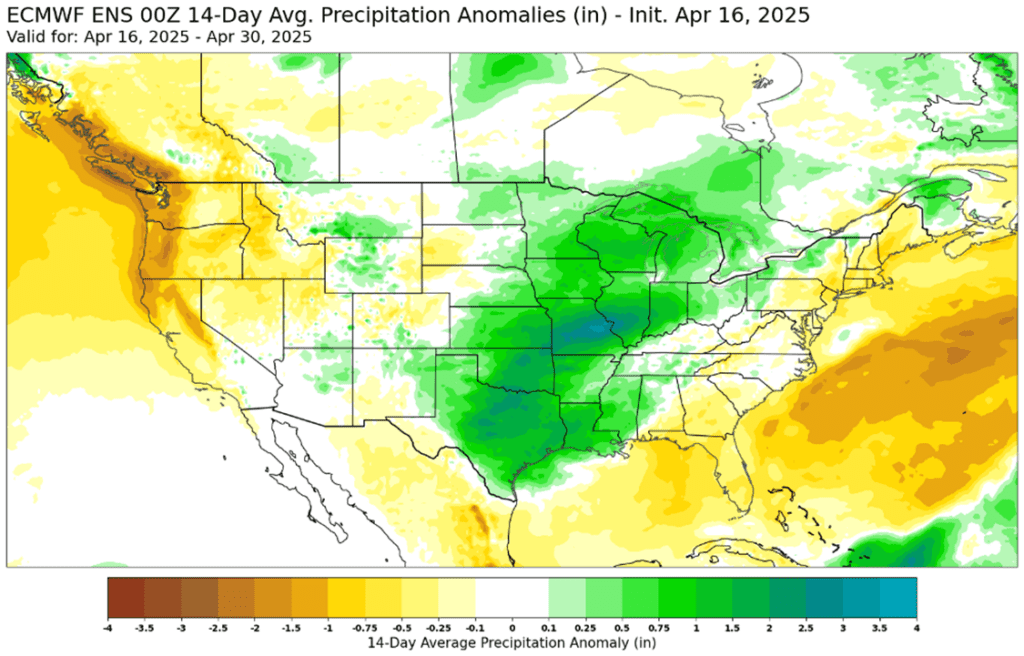

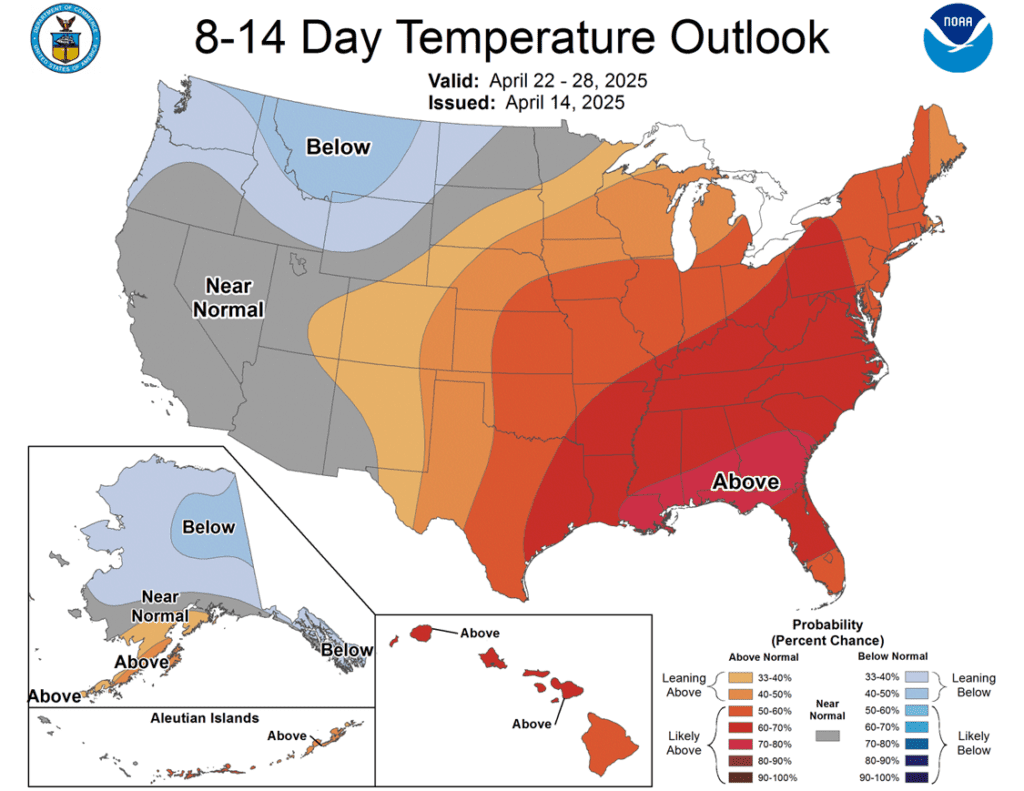

- The two-week weather outlook for parts of the U.S. calls for continued heavy rainfall across the Southern Plains, including Texas and Oklahoma. Traders may begin to shift their perspective, viewing the persistent rains not as beneficial, but as a potential setback for the developing wheat crop.

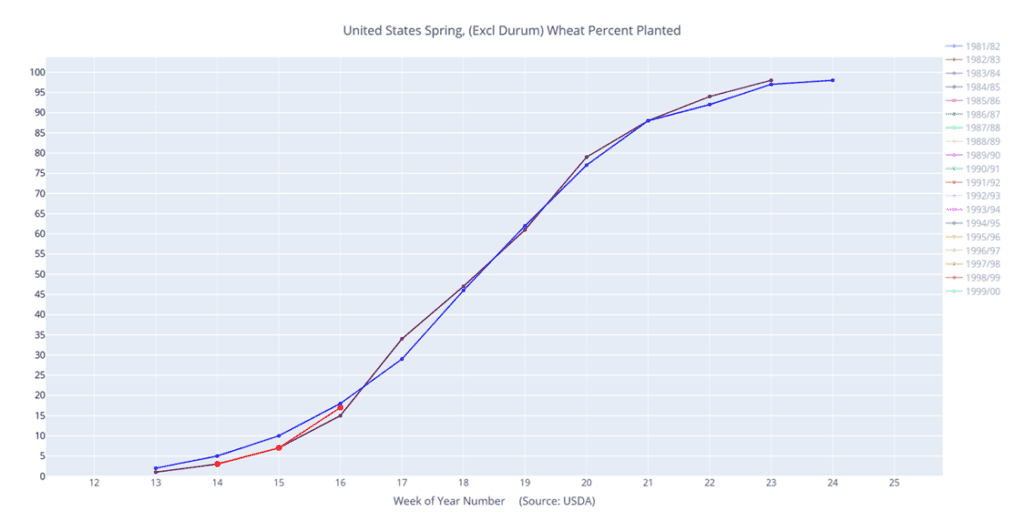

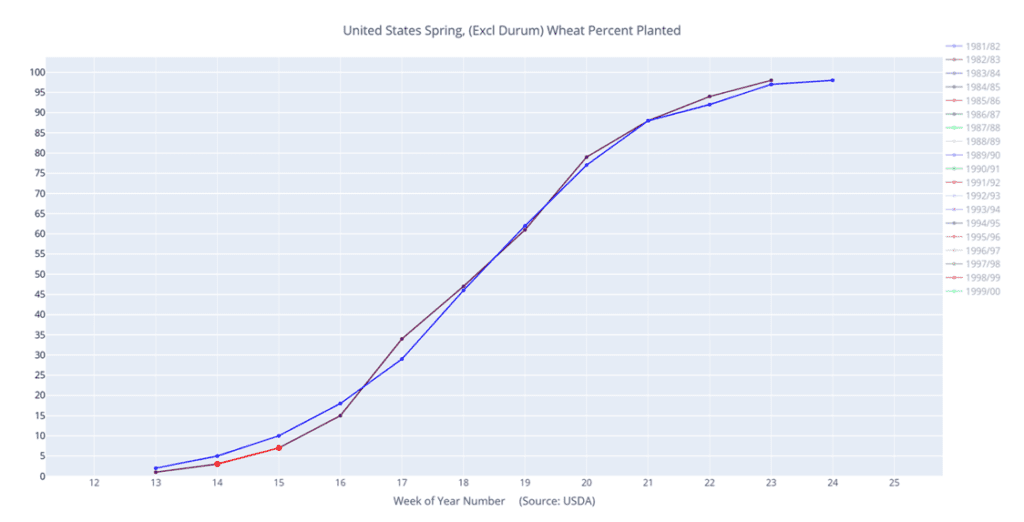

- The weekly Crop Progress report is due out later this afternoon. Wheat conditions are expected to be steady to slightly improved, with spring wheat planting and emergence running just ahead of the five-year average. Estimates suggest planting reached 32% as of Sunday, compared to 31% at this time last year and a five-year average of 21%.

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- No Changes: 701 is still the price target to trigger a fifth sales recommendation.

2025 Crop:

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New: Grain Market Insider originally recommended buying July 620 puts on June 7 of last year and has advised holding onto 25% of that original position. It’s looking likely that a recommendation to exit the final portion will come later this week – potentially Wednesday or Thursday.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- No Changes: 704 is still the price target to trigger a second sales recommendation.

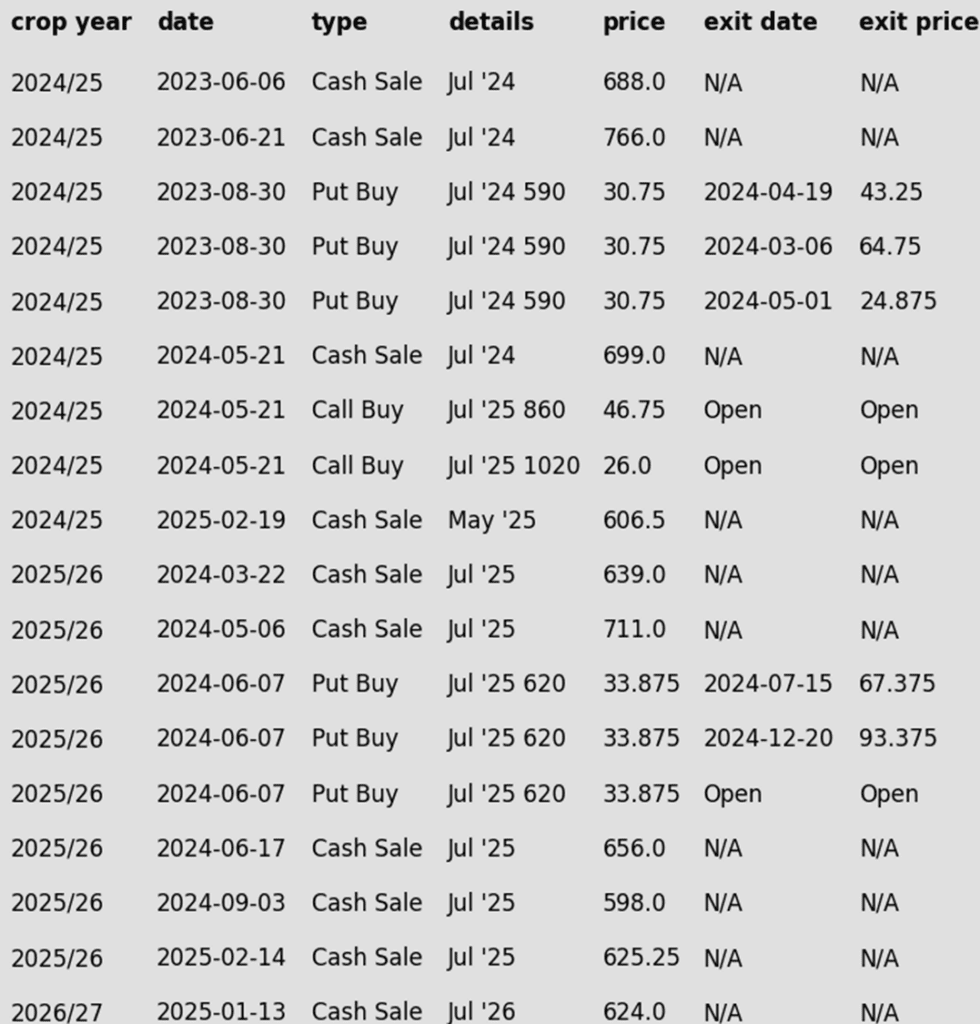

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

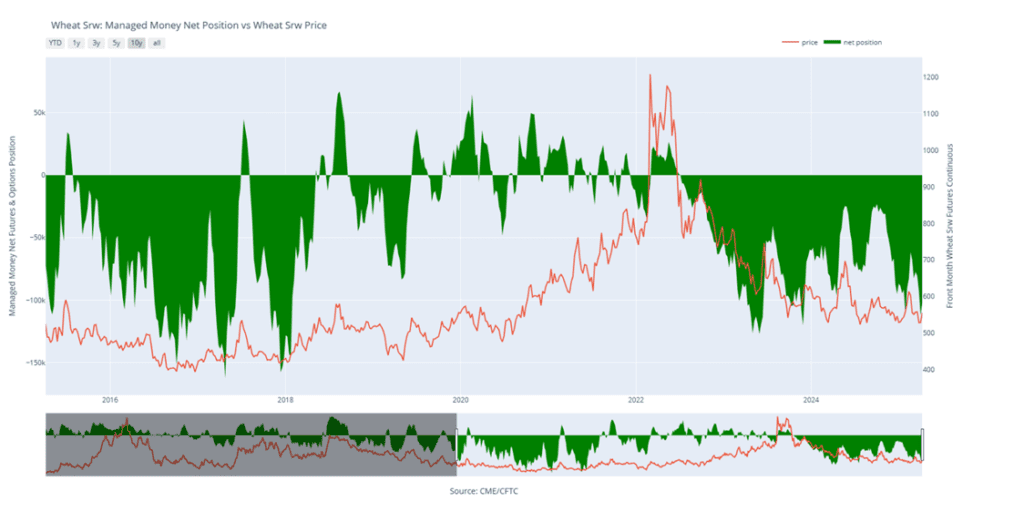

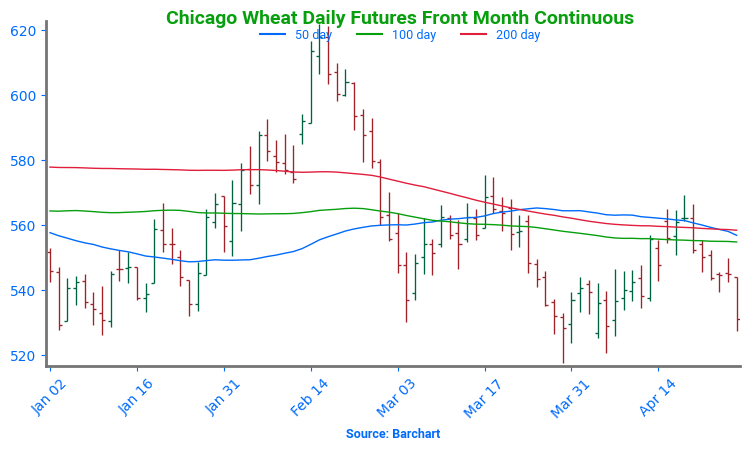

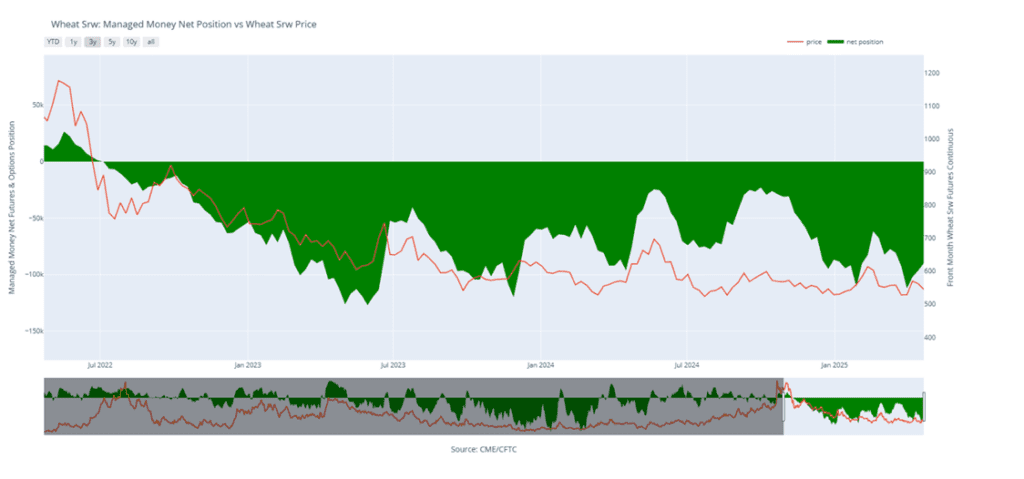

Chicago Wheat Futures Back Near Support

After months of sideways action, Chicago wheat futures broke higher in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, sending futures back into the late 2024 trading range. Support near 530 held firm through March, and should continue to act as support in the near-term. The next key test is the 200-day moving average — a decisive weekly close above it could signal a shift in momentum and potentially kickstart a broader upside trend.

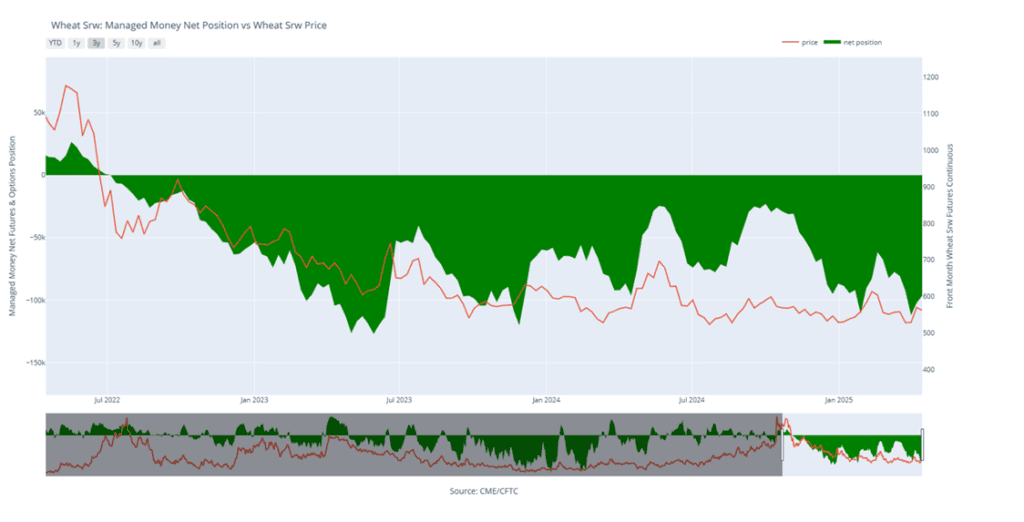

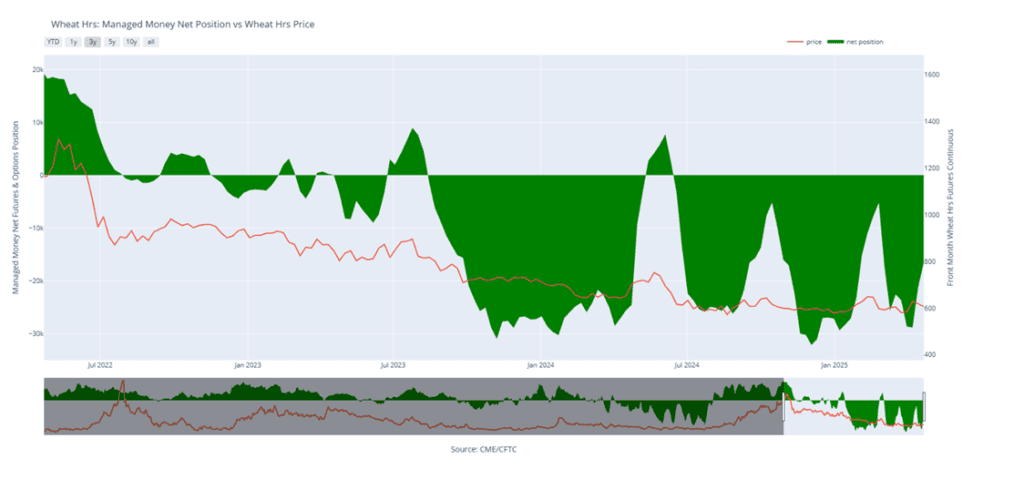

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, April 22. Net position in Green versus price in Red. Money Managers net bought 6,510 contracts between April 15 – April 22, bringing their total position to a net short 89,929 contracts.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- No Changes: Still no active price targets, as the July contract continues to chop around in the 560–580 range.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- New: Grain Market Insider originally recommended buying July 620 puts on June 7 of last year and has advised holding onto 25% of that original position. It’s looking likely that a recommendation to exit the final portion will come later this week – potentially Wednesday or Thursday.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in the May – June timeframe.

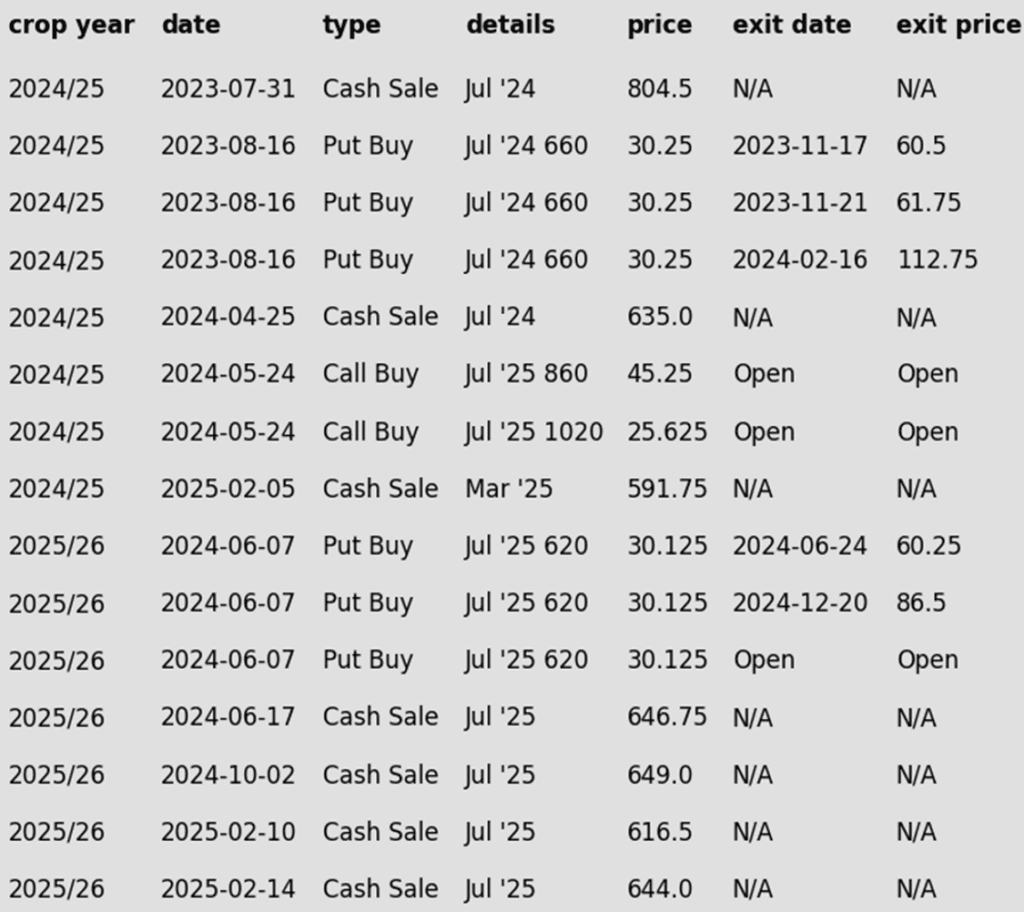

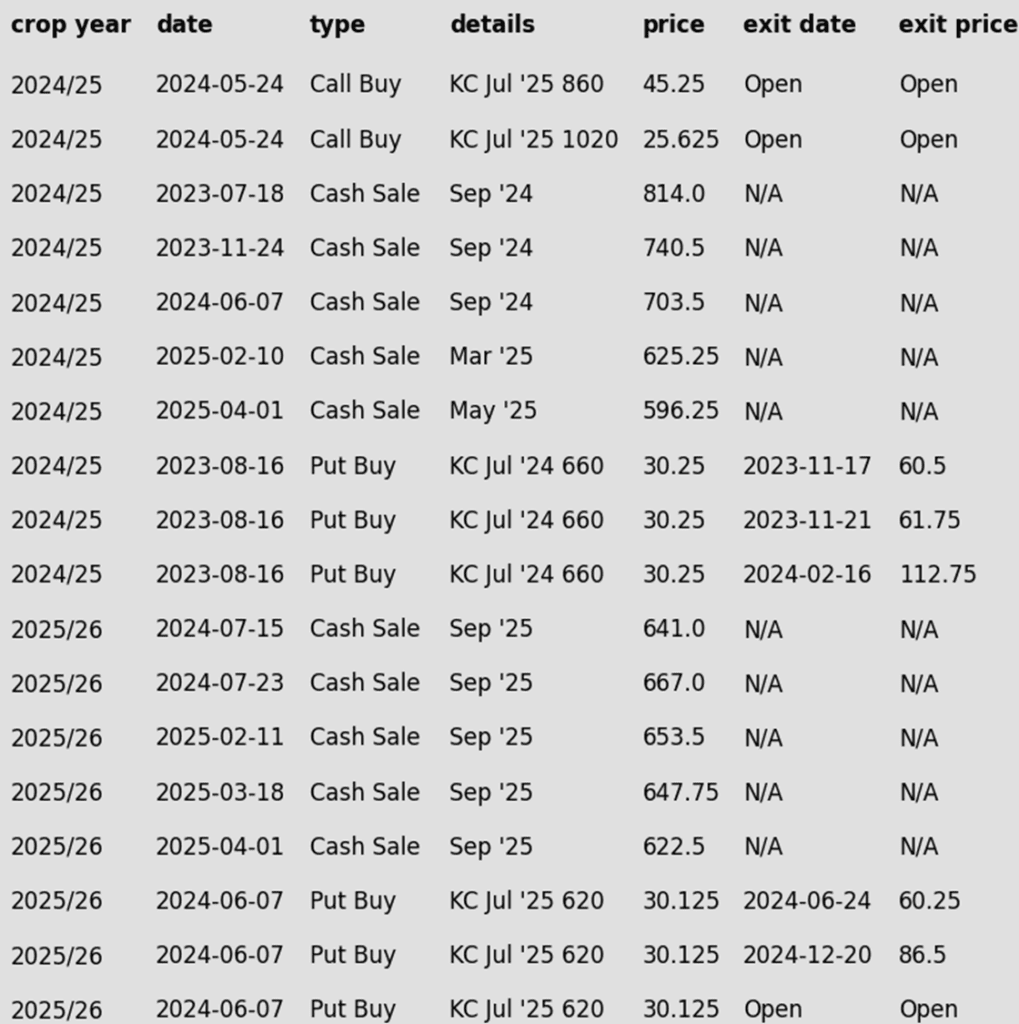

To date, Grain Market Insider has issued the following KC recommendations:

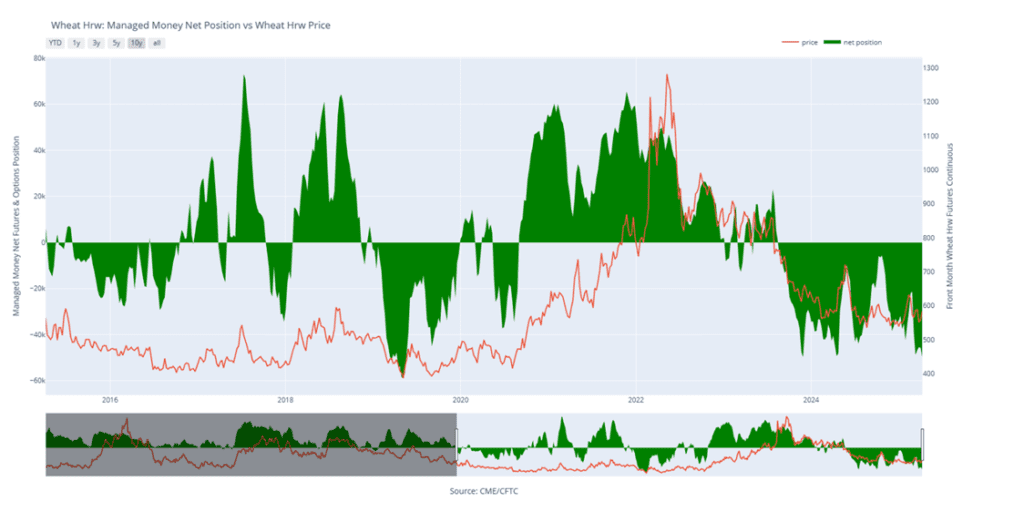

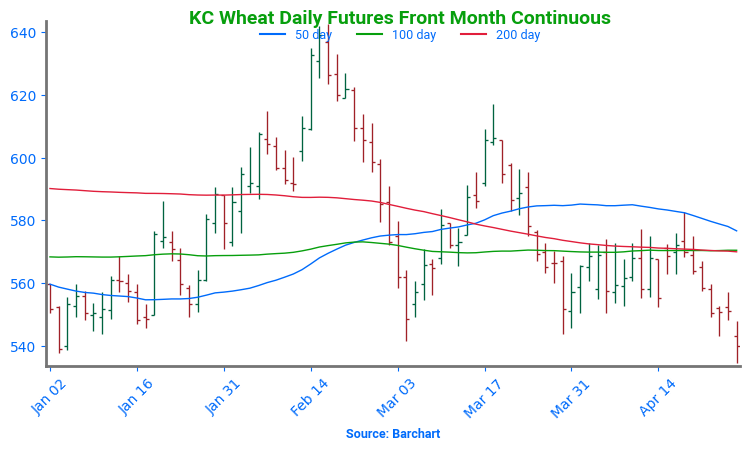

Kansas City Wheat Holding Support, Watching 200-Day Resistance

February was a volatile month for Kansas City wheat, with prices surging higher before tumbling back and ending the month little changed. March and April brought additional weakness, dragging prices near recent lows, but the ability to hold these lows is encouraging. On a rebound, the 200-day moving average will be the first resistance level to watch, with February highs near 640 serving as a more significant upside barrier. On the downside, support near the December lows around 540 should provide a strong floor if selling pressure continues.

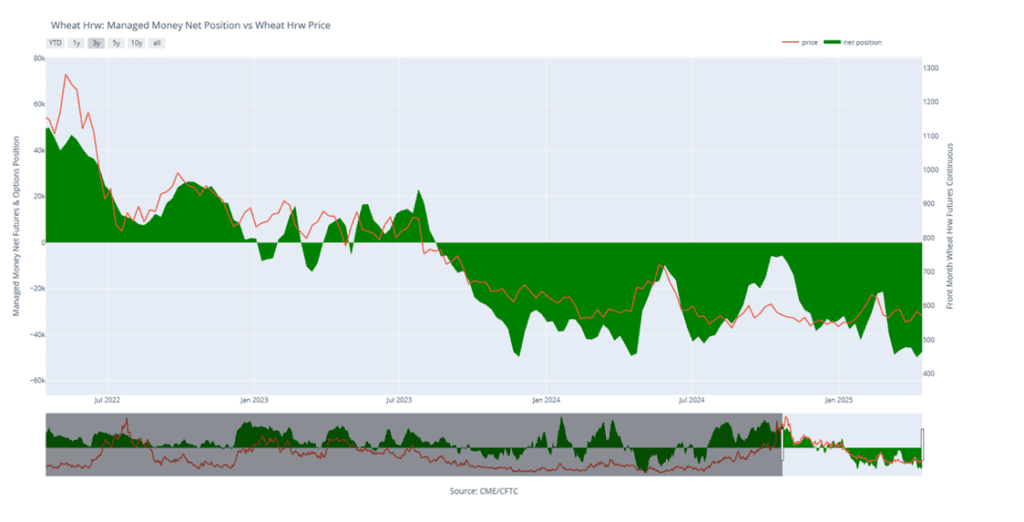

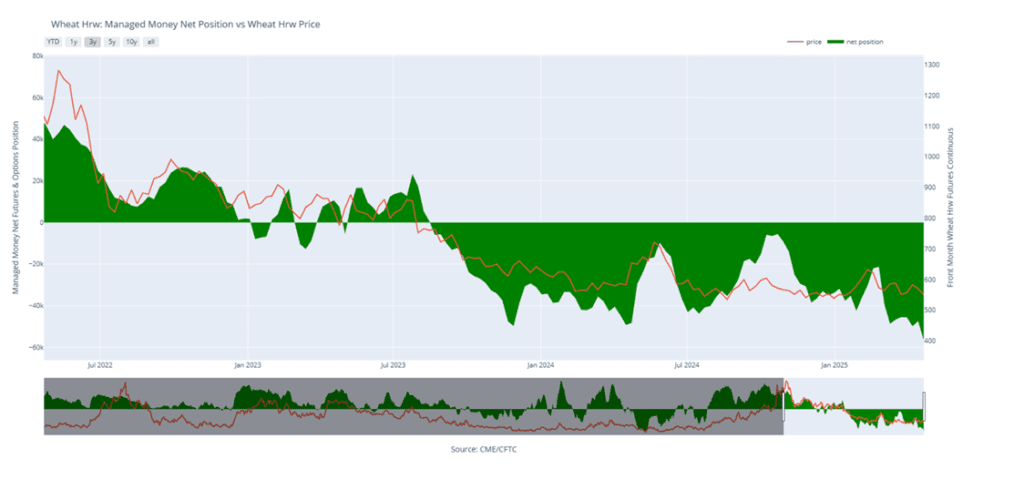

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, April 22. Net position in Green versus price in Red. Money Managers net sold 9,252 contracts between April 15 – April 22, bringing their total position to a net short 56,624 contracts.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- No Changes: No active targets for a sixth sales recommendation at this time.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New: Grain Market Insider originally recommended buying July KC 620 puts on June 7 of last year and has advised holding onto 25% of that original position. It’s looking likely that a recommendation to exit the final portion will come later this week – potentially Wednesday or Thursday.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- No Changes: The expectation is still for targets to begin posting in the June – July timeframe.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

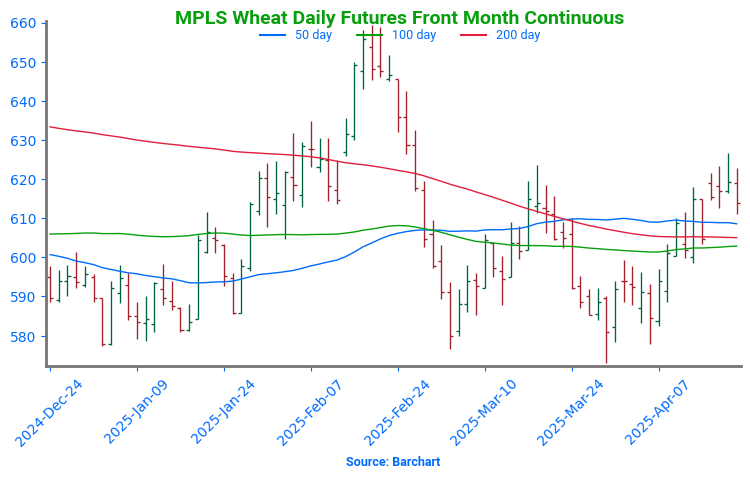

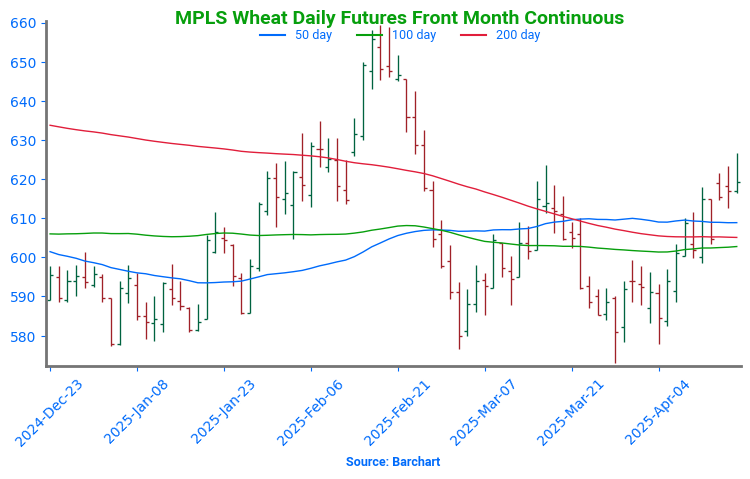

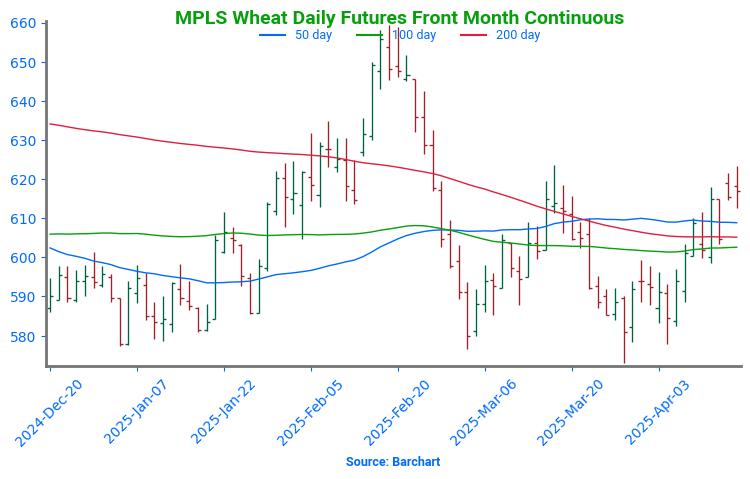

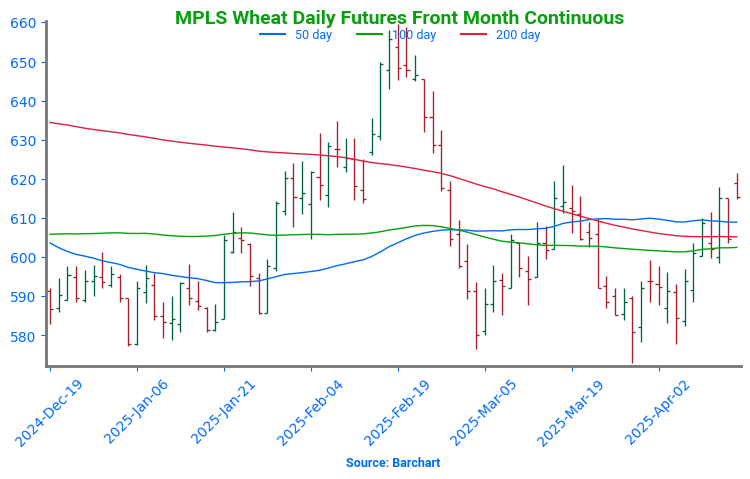

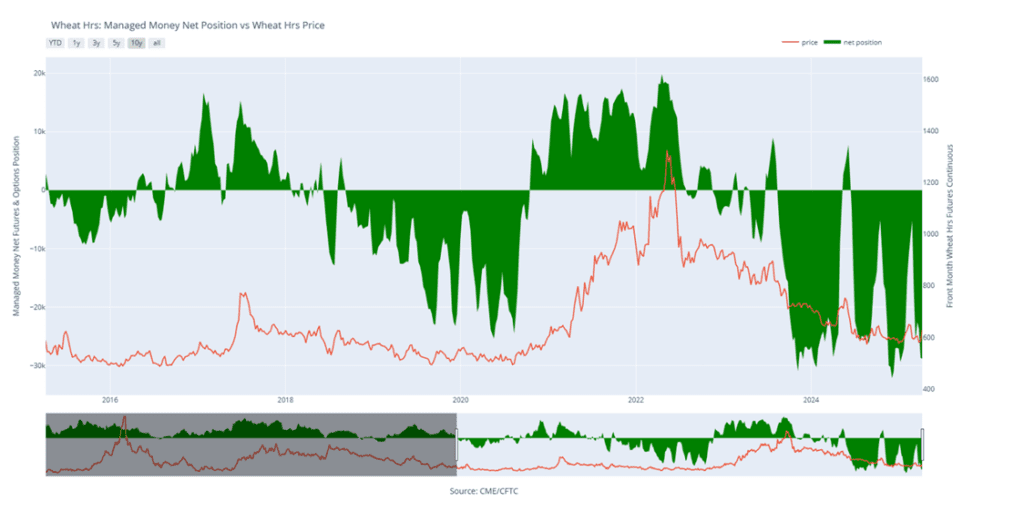

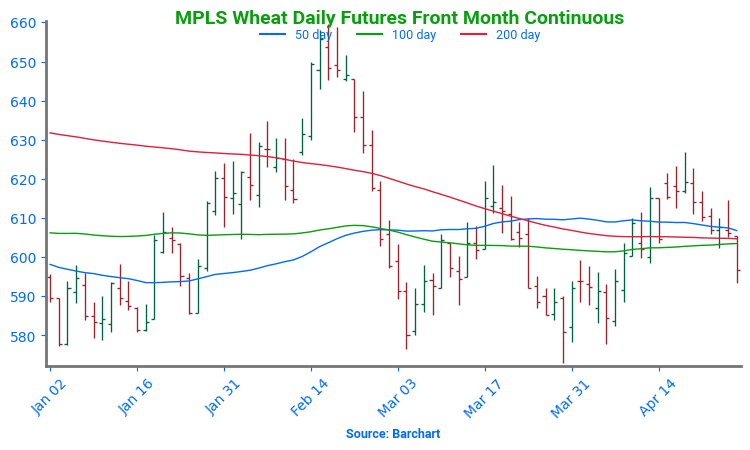

Spring Wheat at a Crossroads

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, though late-month weakness briefly pushed futures back below key technical levels. Unlike the winter wheats, spring wheat has been able to hover near a confluence of moving averages which are acting as support as of now. The next upside target is the February highs near 660. With spring wheat acreage projected to be the lowest in 55 years, weather volatility is likely to play a major role in driving price action this season.

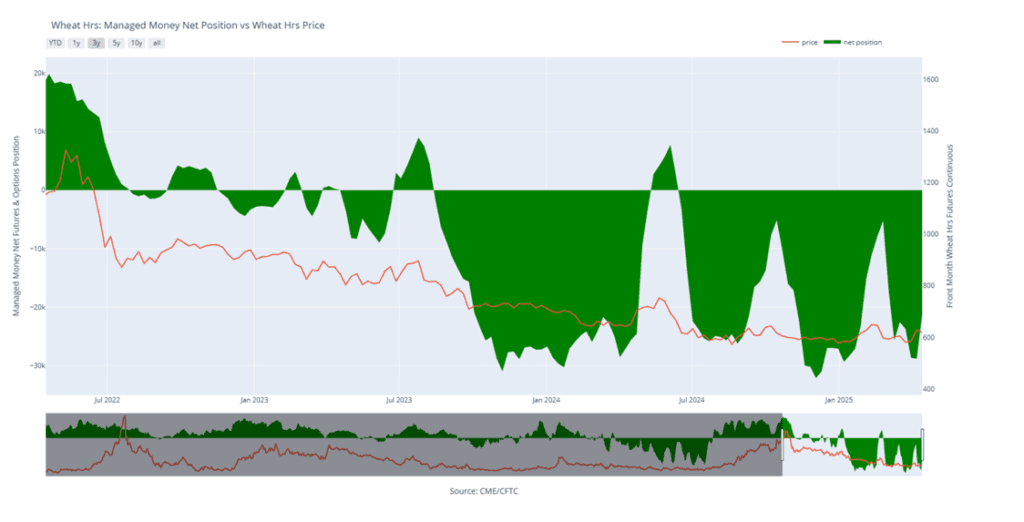

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, April 22. Net position in Green versus price in Red. Money Managers net bought 4,573 contracts between April 15 – April 22, bringing their total position to a net short 16,582 contracts.

Other Charts / Weather