5-12 End of Day: Grains Mixed to Start the Week: Soybeans Soar on Trade Optimism, Corn Steady, Wheat Pressured by Bearish Data

All Prices as of 2:00 pm Central Time

Grain Market Highlights

- 🌽 Corn: The corn market finished mixed on Monday despite a superficially supportive USDA WASDE report and easing U.S.-China trade tensions.

- 🌱 Soybeans: Soybean futures ended sharply higher on the day, buoyed by a wave of bullish headlines including a U.S.-China tariff agreement, a supportive WASDE report, and strength in both soybean oil and meal.

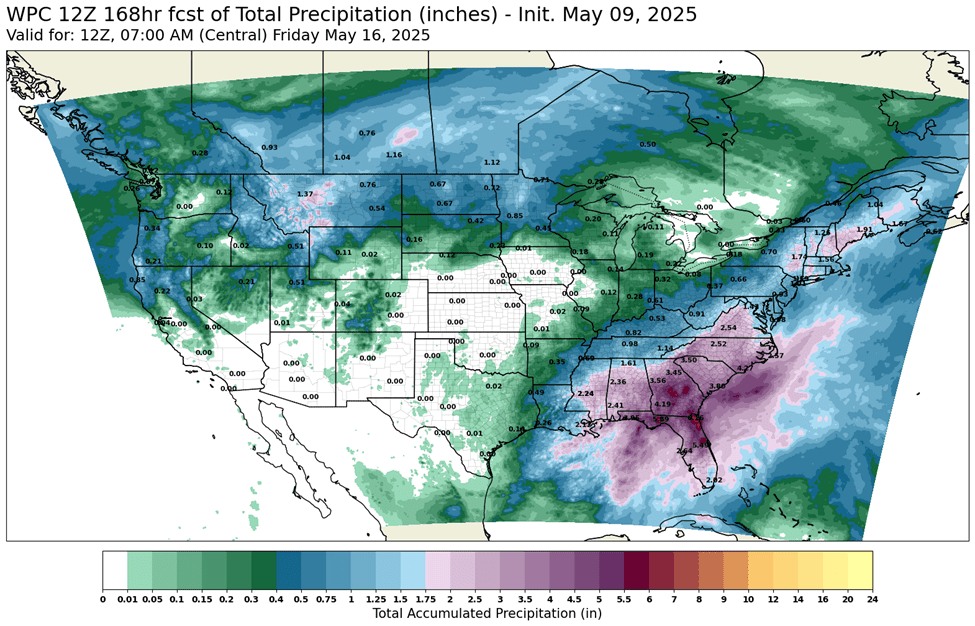

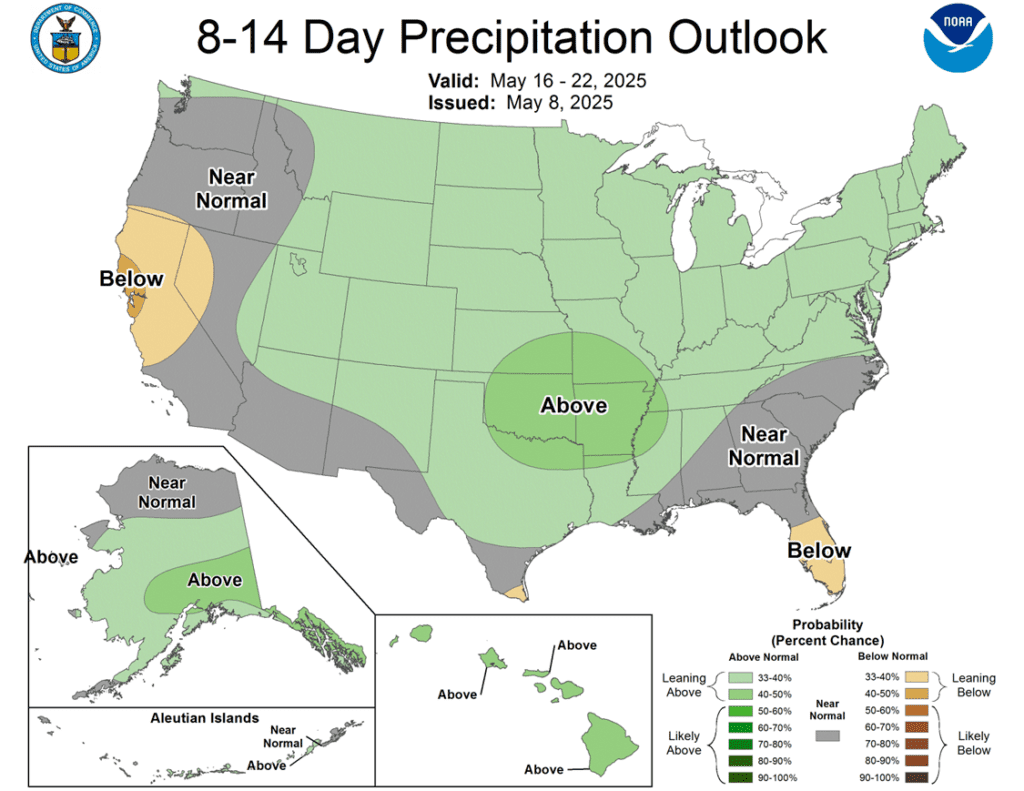

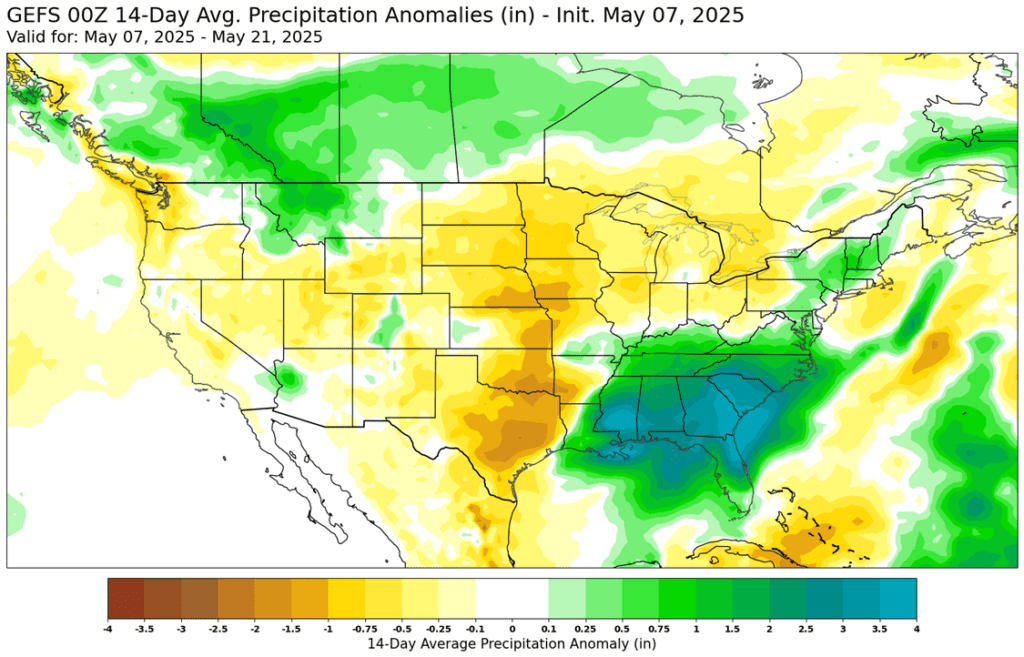

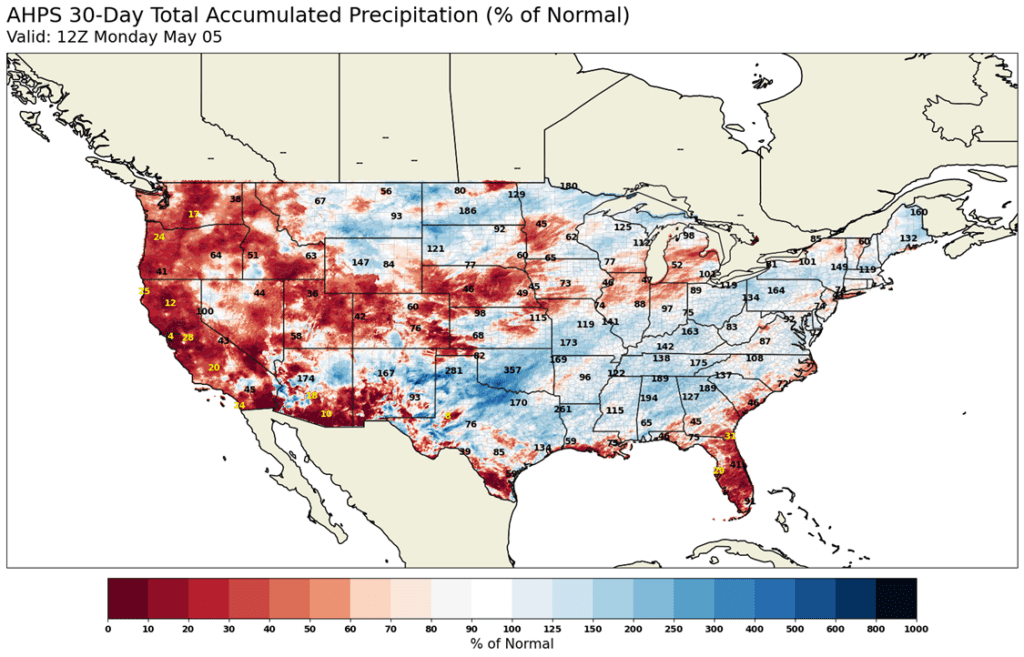

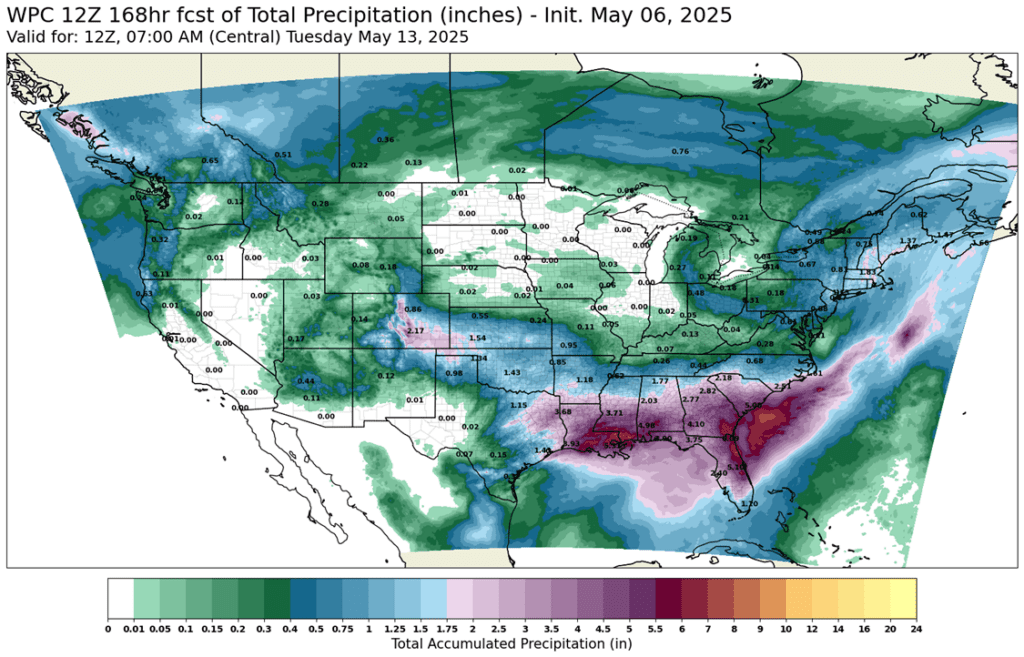

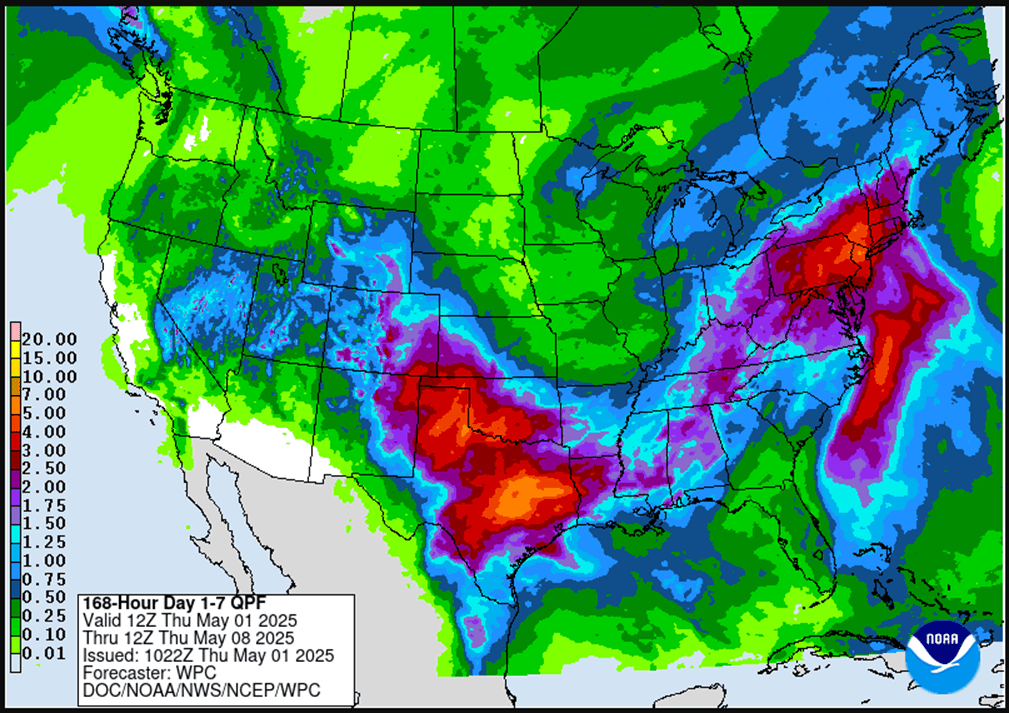

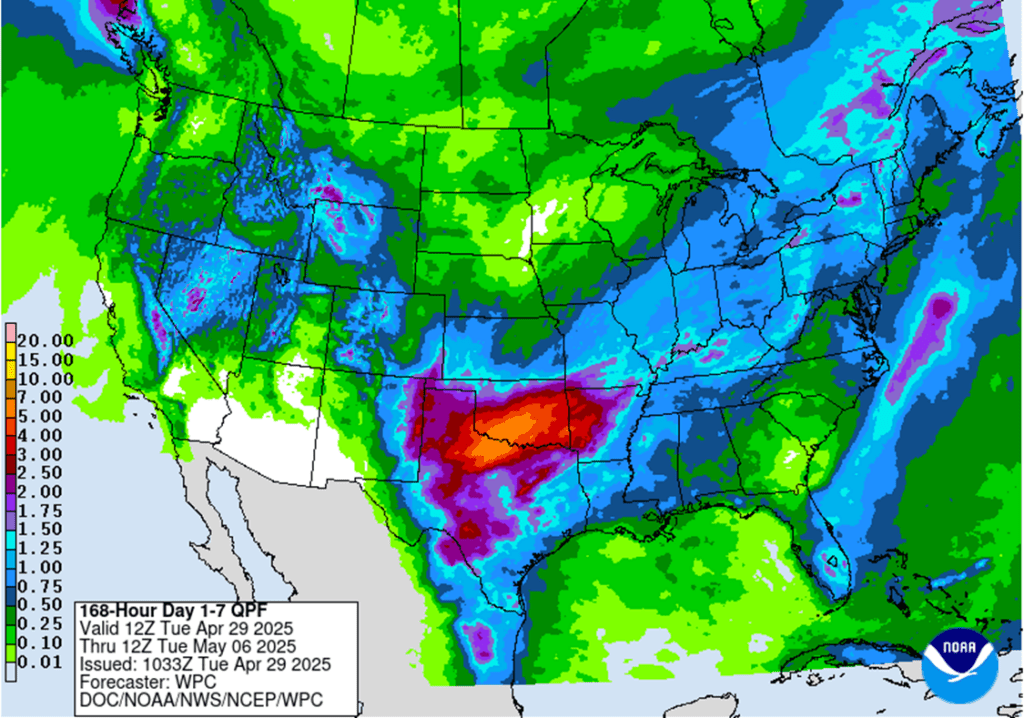

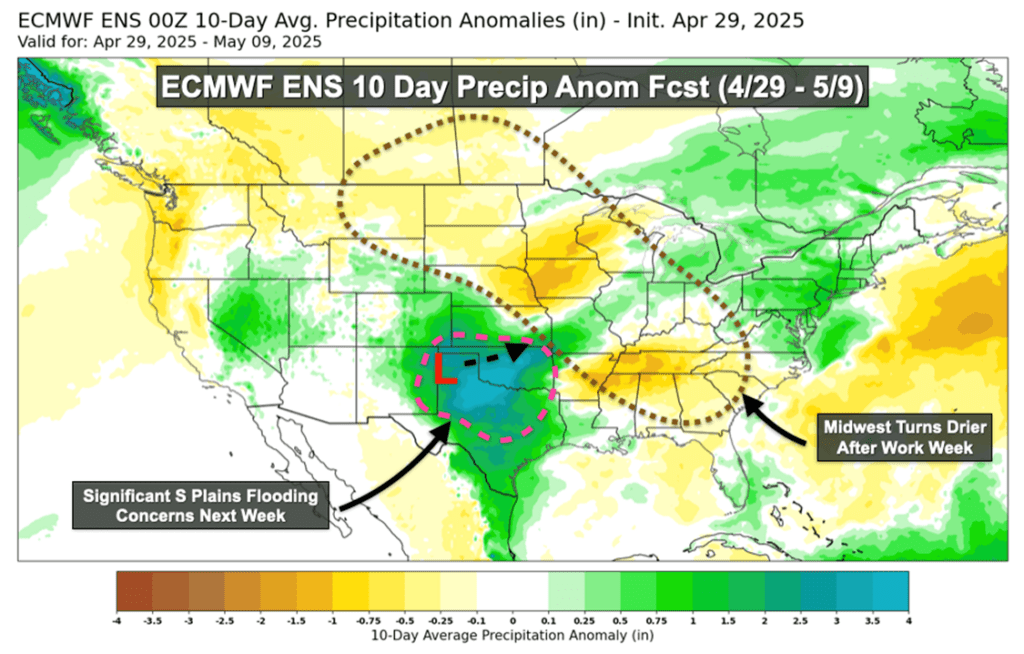

- 🌾 Wheat: A slightly bearish WASDE report and forecasted rains for spring wheat areas pressured wheat futures to start the week.

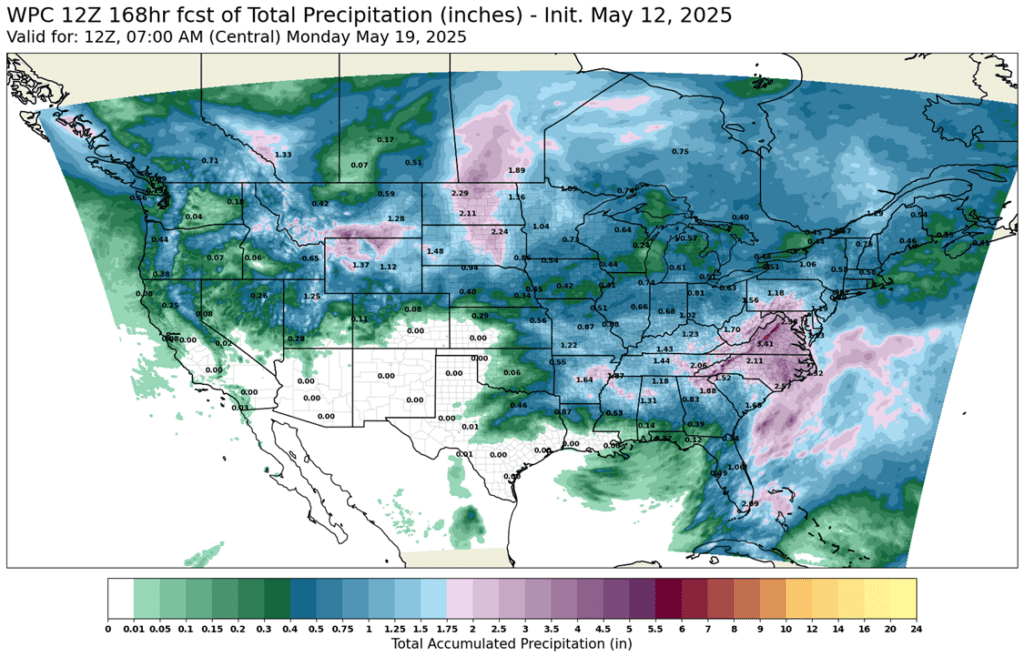

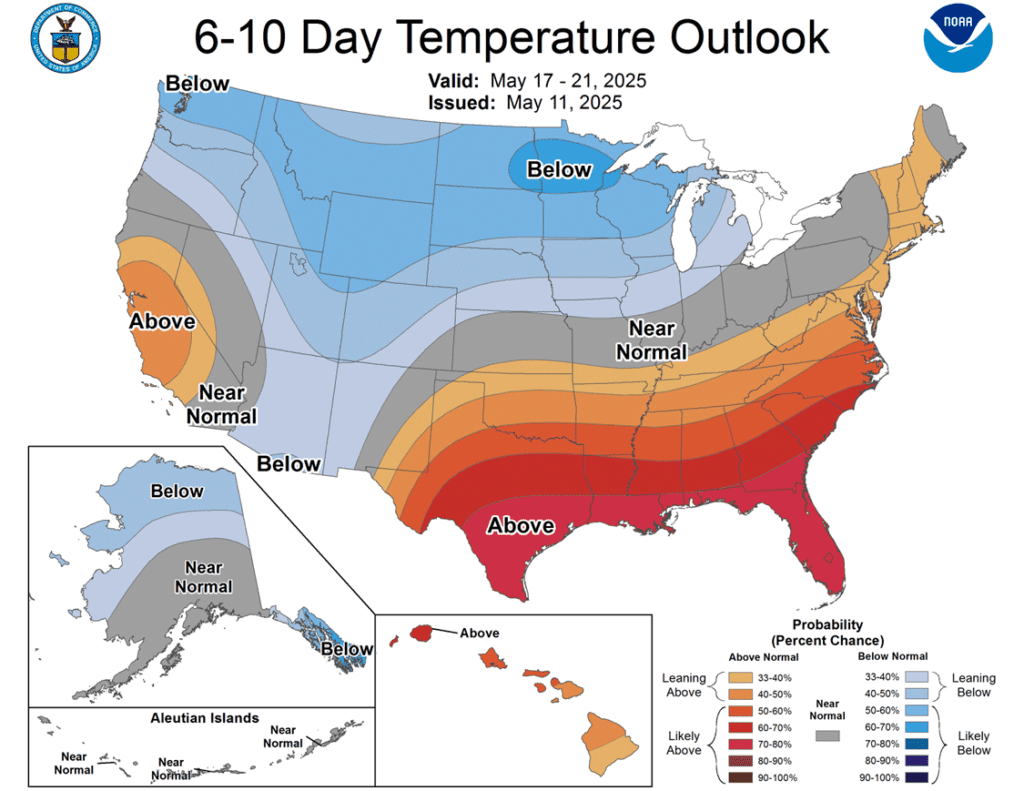

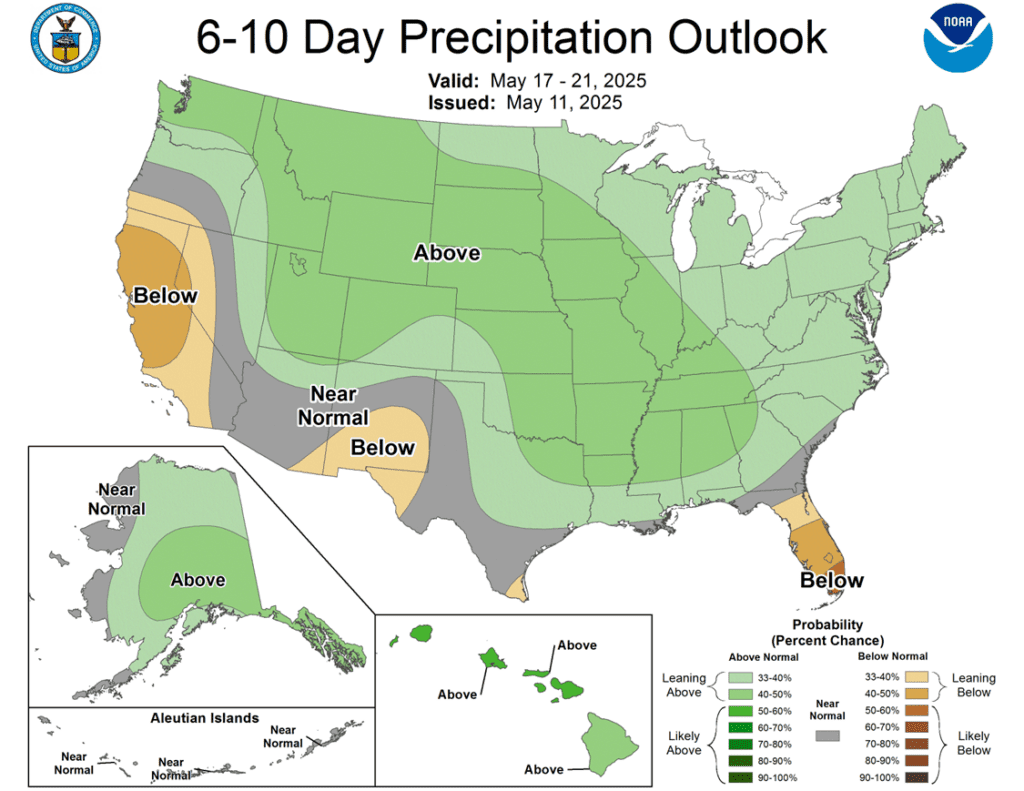

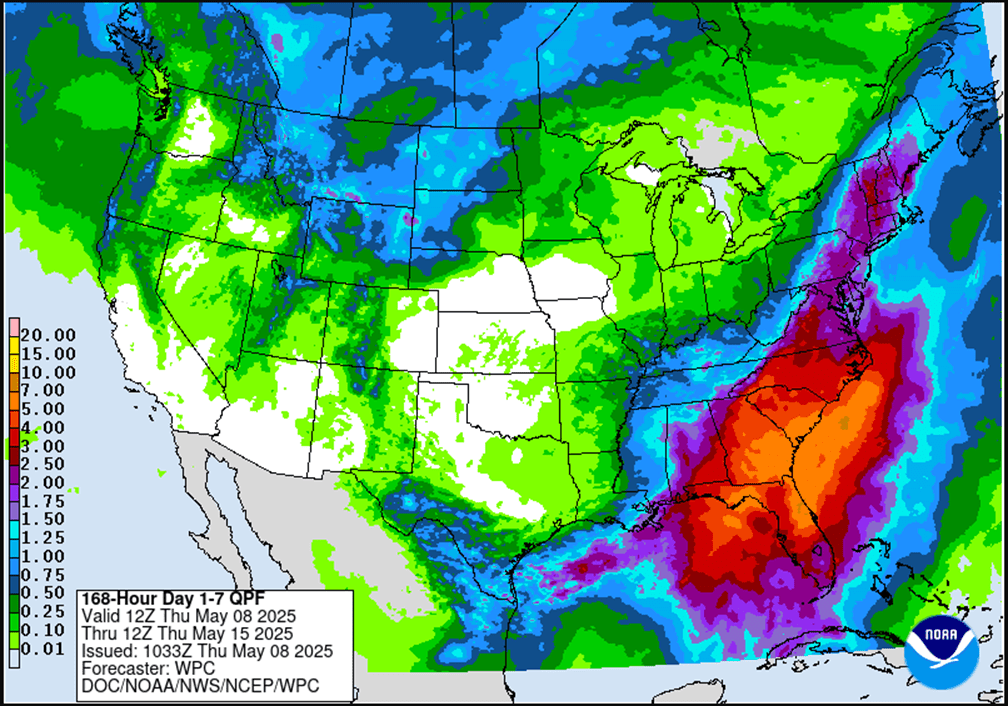

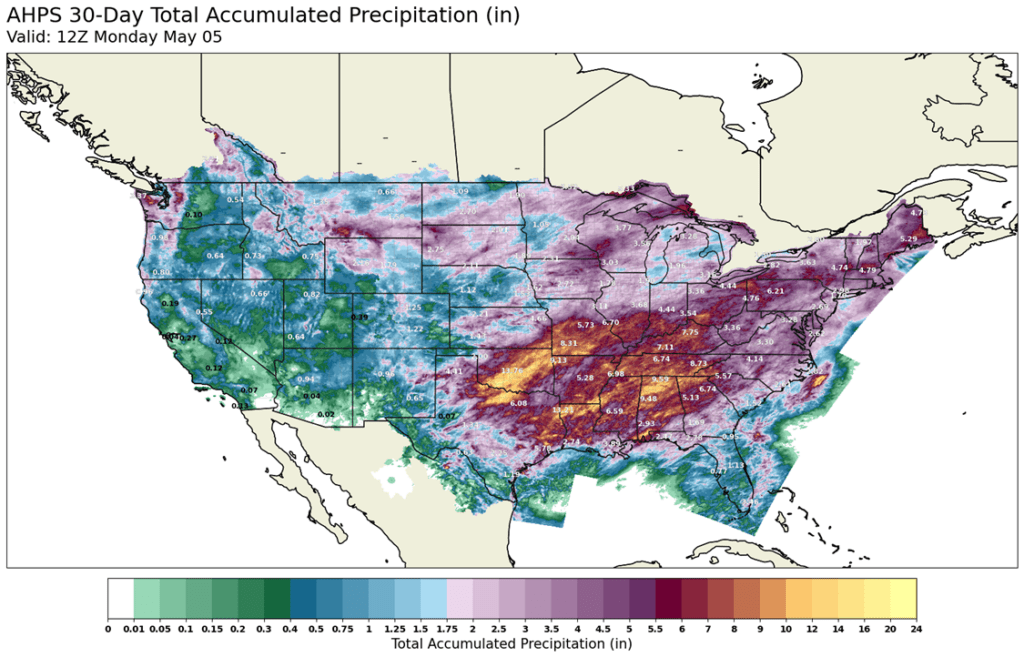

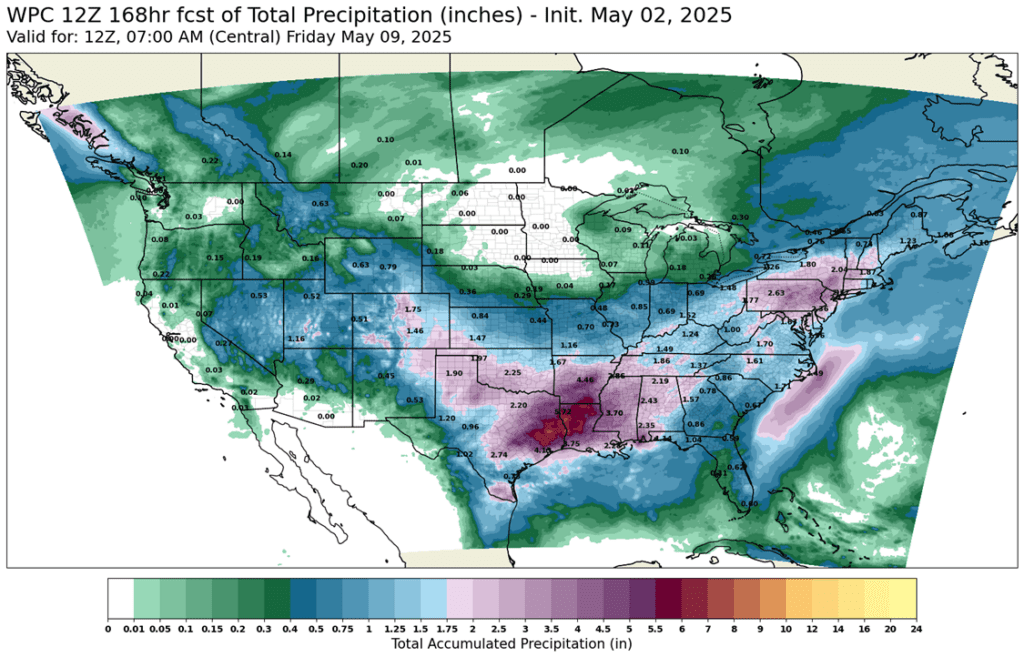

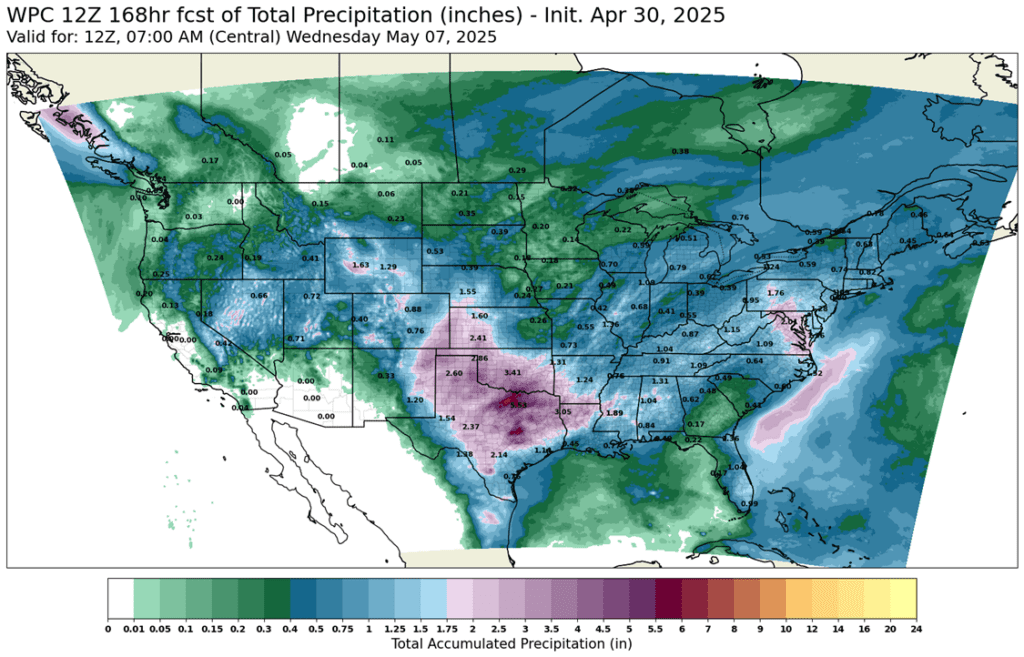

- To see the updated 7-day WPC rainfall forecast for the U.S. and the 6-10-day precipitation and temperature outlooks for the U.S. from the CPC scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

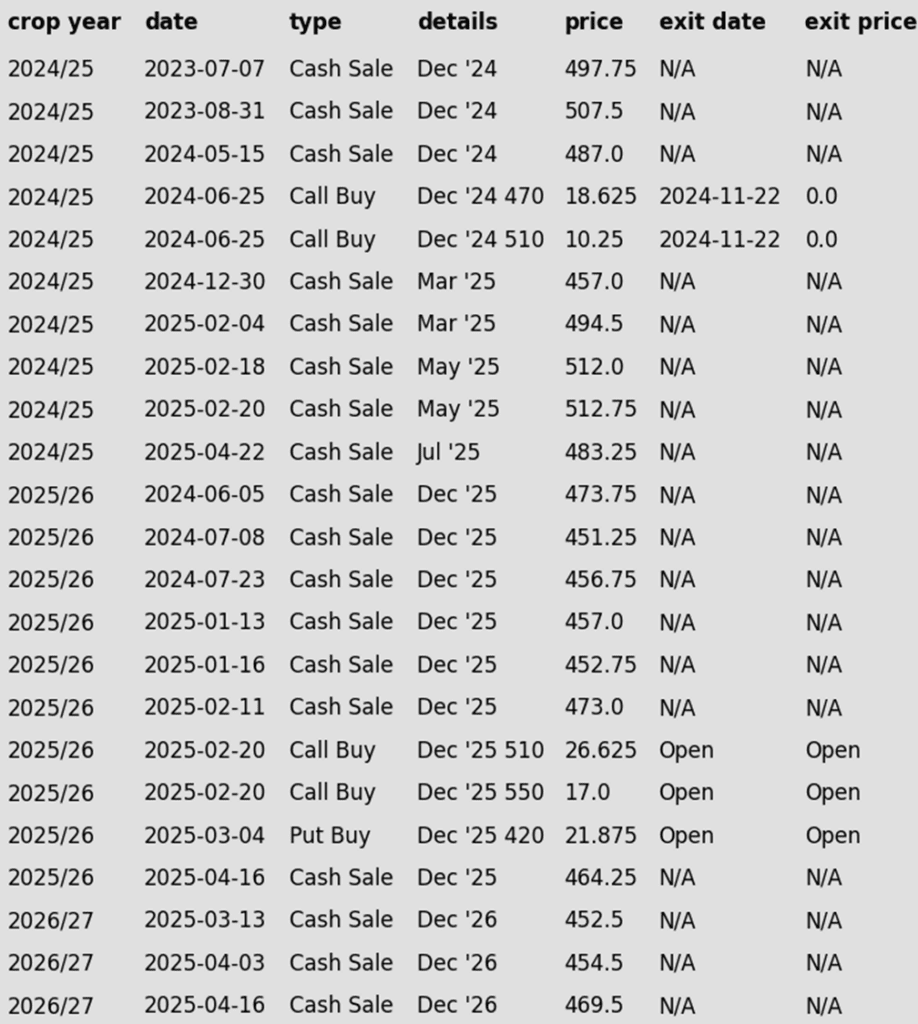

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- No upside targets at this time.

- If July regains upward momentum, a Plan B downside sales stop could be added.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December touches 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

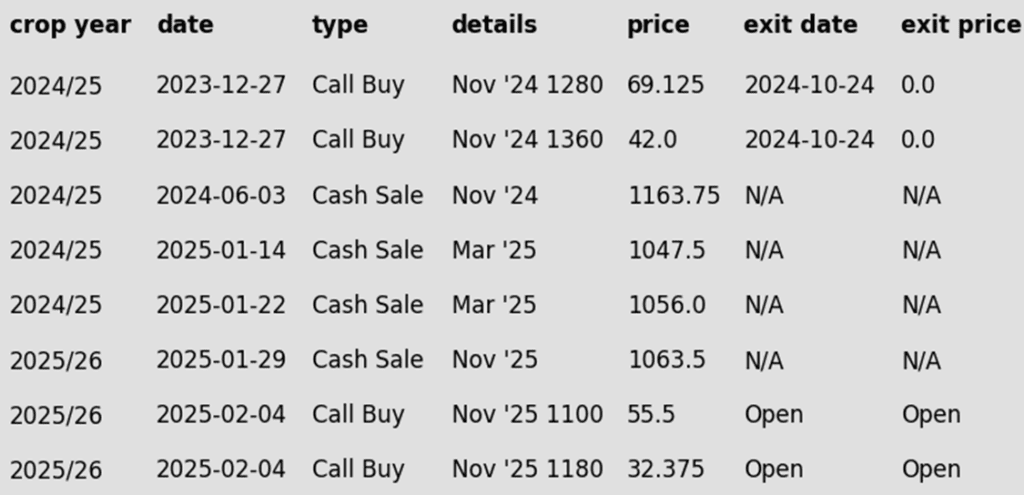

To date, Grain Market Insider has issued the following corn recommendations:

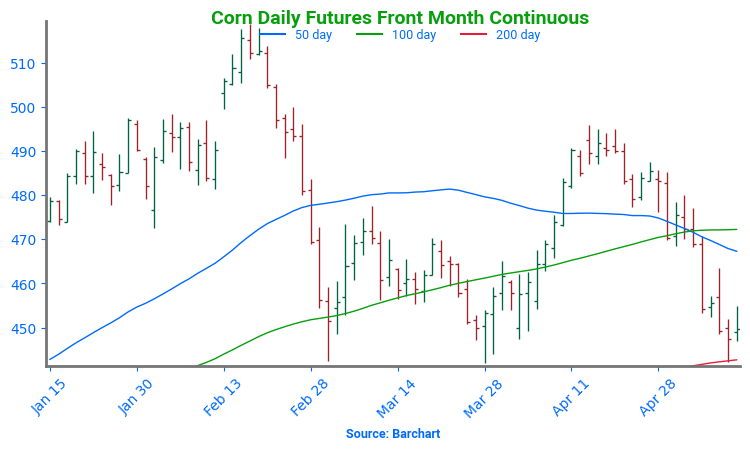

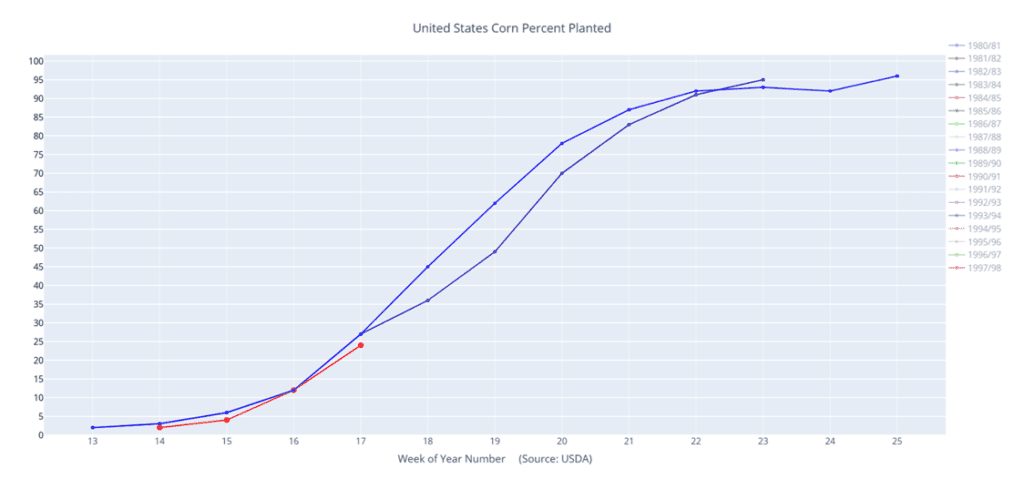

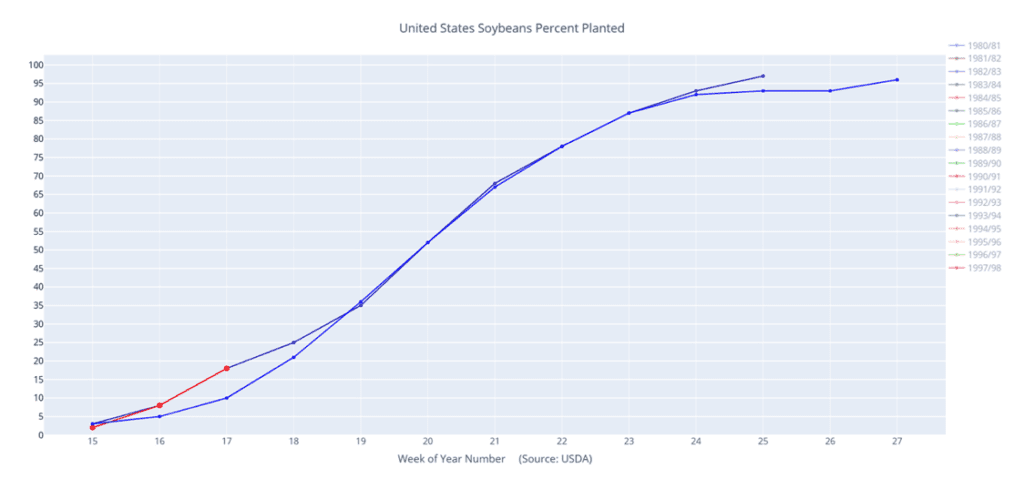

- The corn market finished mixed on the session despite a “on-the-surface” supportive USDA WASDE report and easing U.S.-China trade tensions. Fund selling, rapid U.S. planting progress, and larger global supplies weighed on market sentiment.

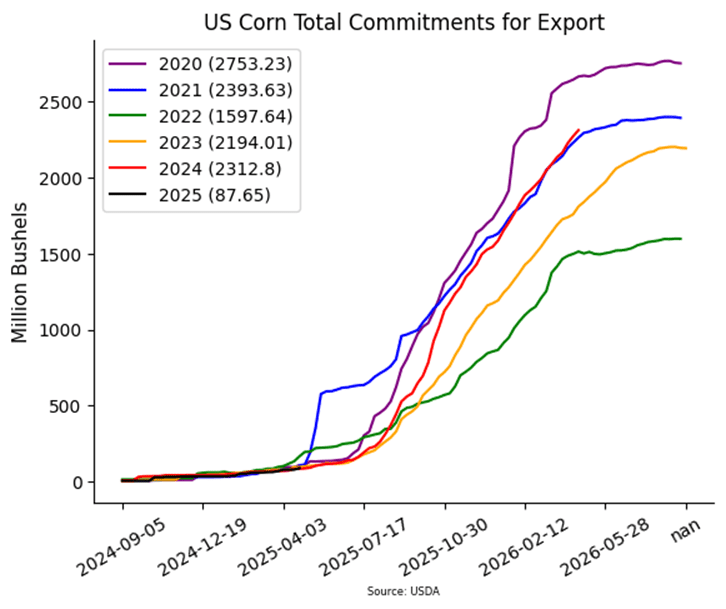

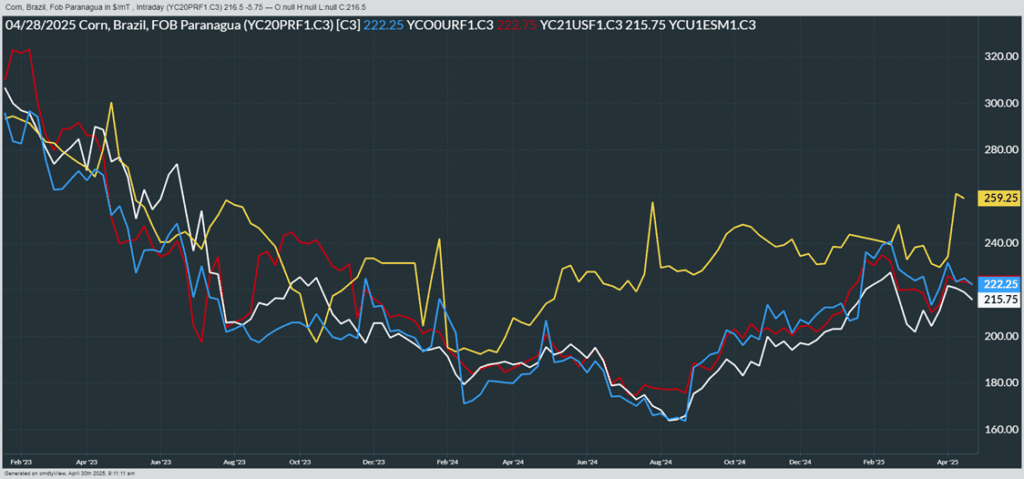

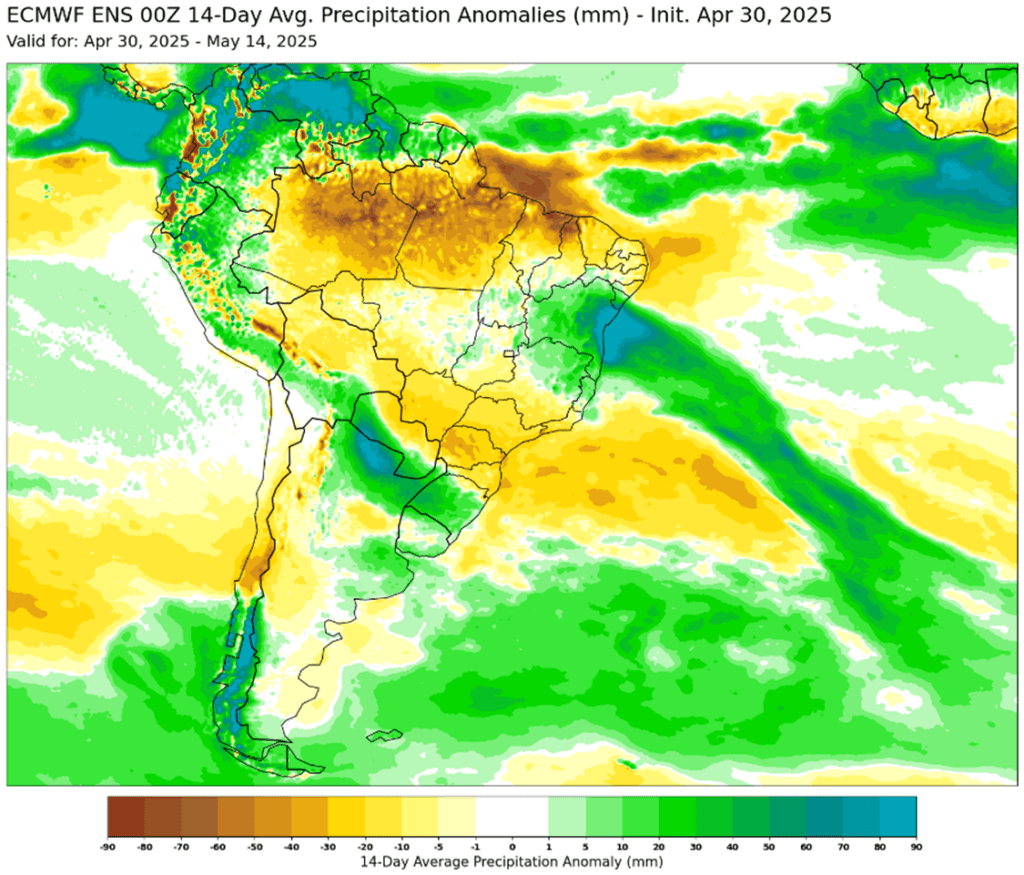

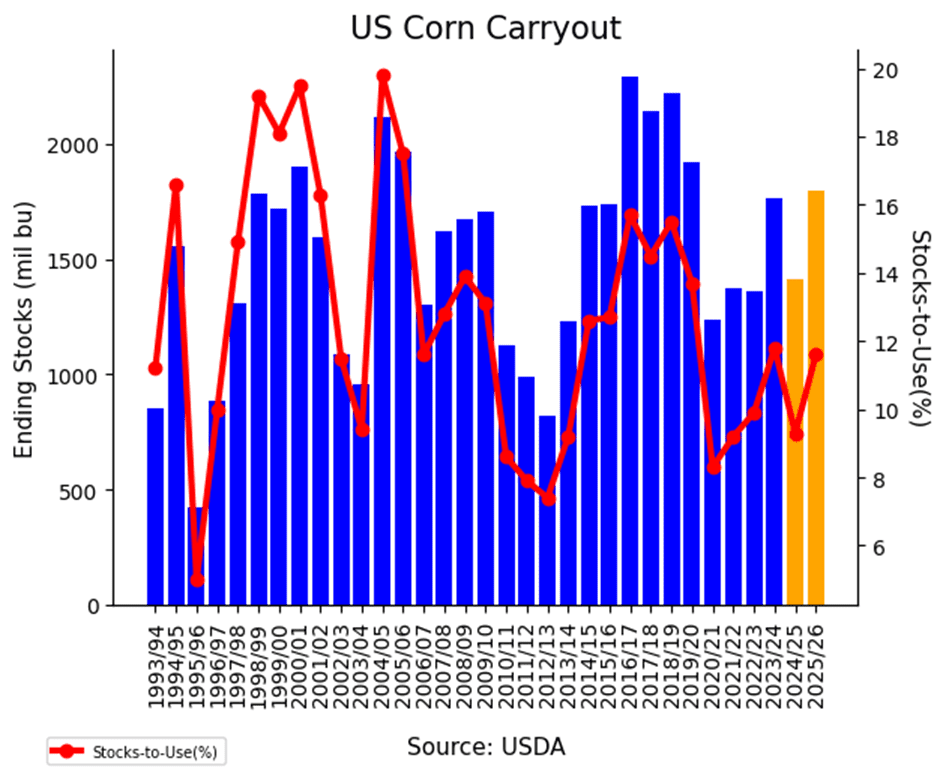

- In the May WASDE, USDA raised old crop corn export demand by 50 million bushels, lowering 2024/25 ending stocks to 1.415 billion bushels—below market expectations. However, a 4 MMT increase in Brazil’s crop estimate to 131 MMT added bearish pressure, reinforcing concerns about global competition.

- USDA also released its first projections for the 2025/26 marketing year. Using March planting intentions (95.7 million acres) and a trendline yield of 181 bu/acre, USDA forecast ending stocks at 1.800 billion bushels—200 mb below pre-report expectations. A notable 150 mb increase in feed demand was included in the new crop outlook. This tighter balance sheet raises the stakes for favorable U.S. weather during the growing season.

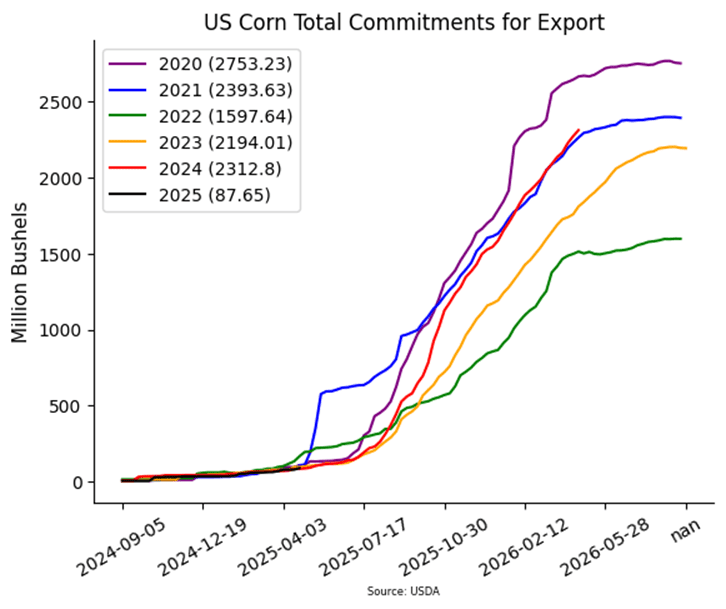

- Weekly corn export inspections totaled 1.224 MMT for the week ending May 8, in line with expectations. Year-to-date export inspections are now 29% higher than the same period last year.

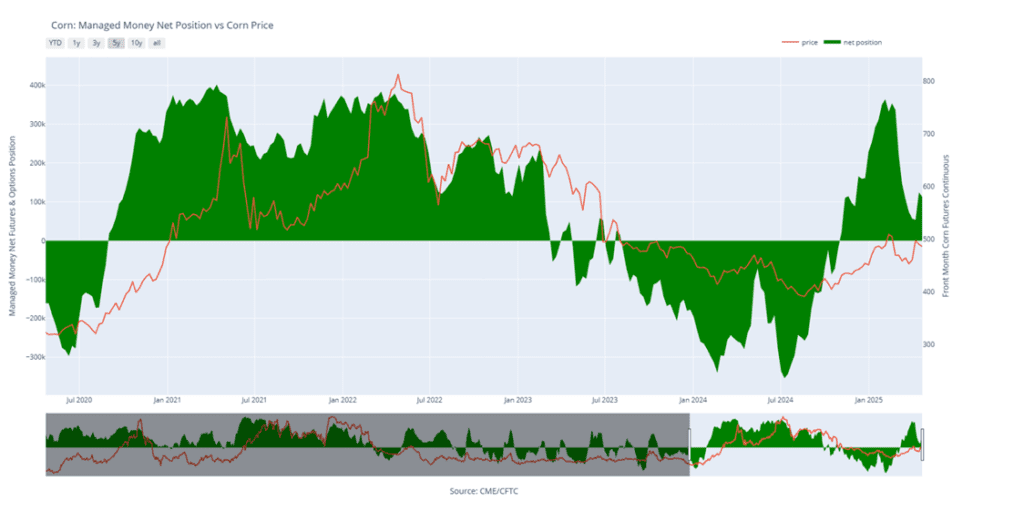

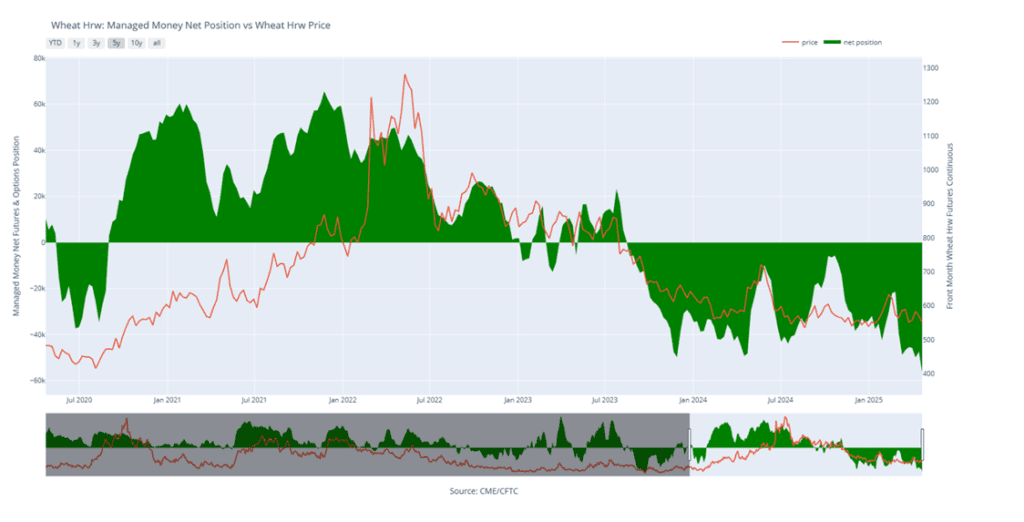

- May corn futures expire on Wednesday, May 14, and could continue to influence the old crop side of the corn market with short-term price movement. Money Managers net sold 57,436 contracts between April 29 – May 6, bringing their total position to a net long 13,893 contracts.

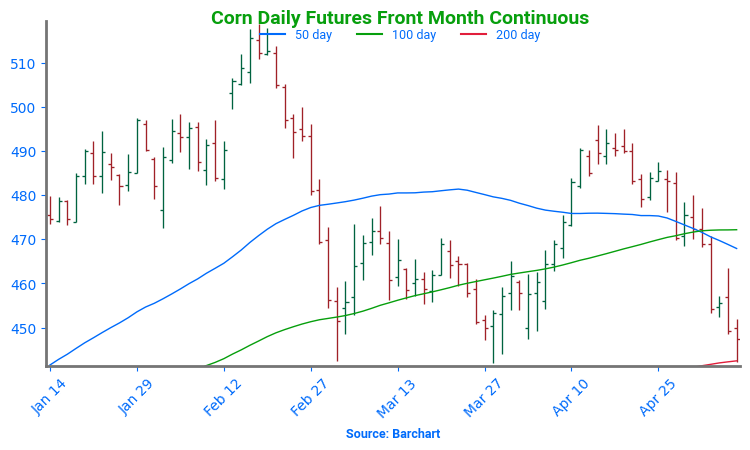

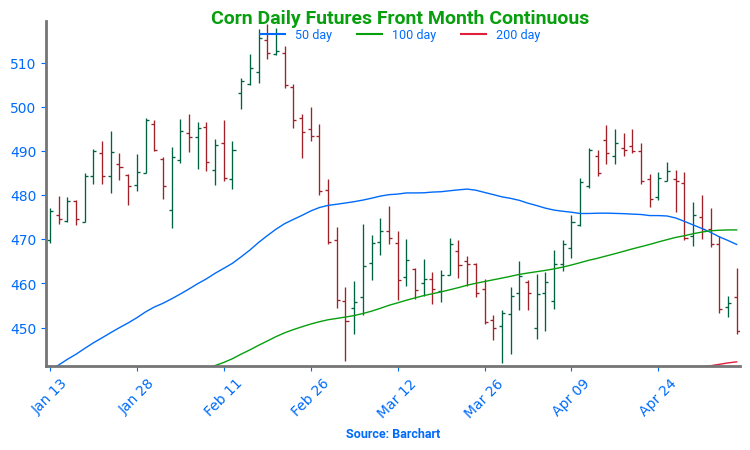

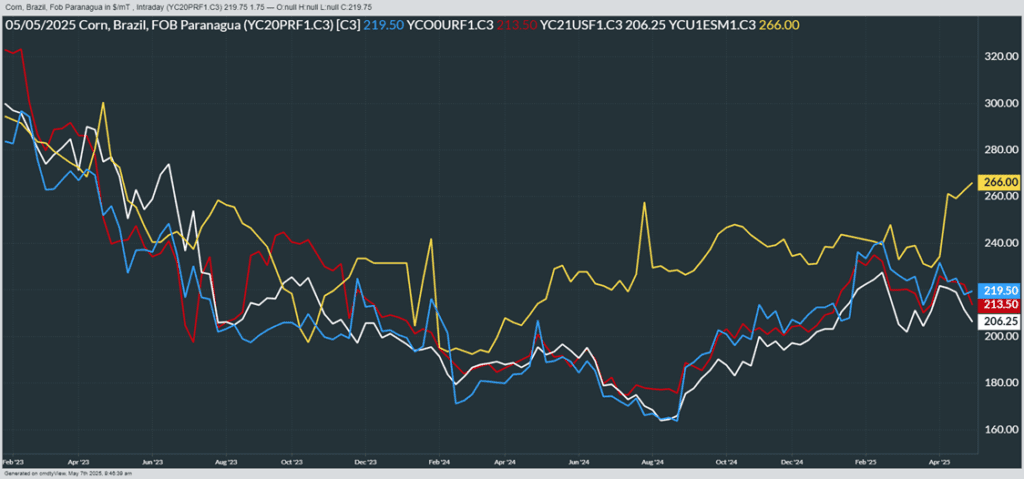

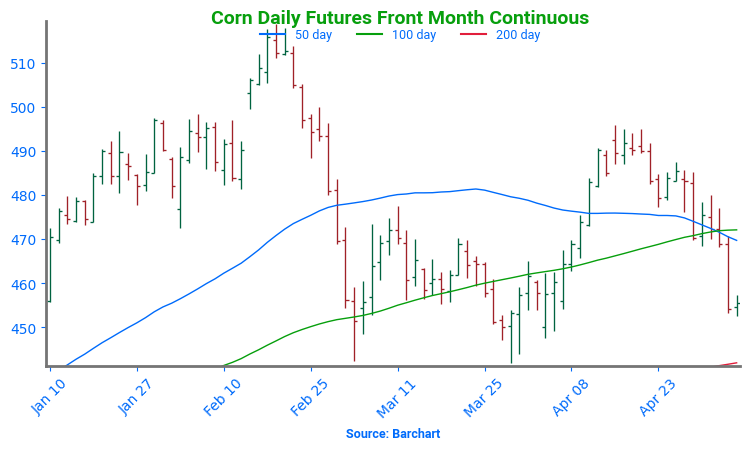

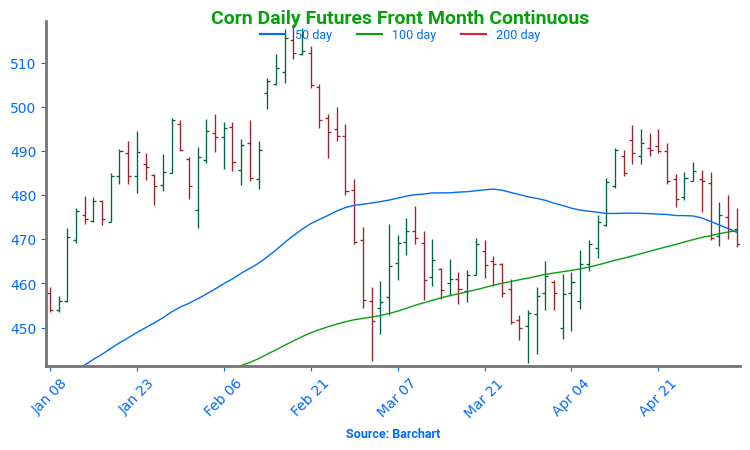

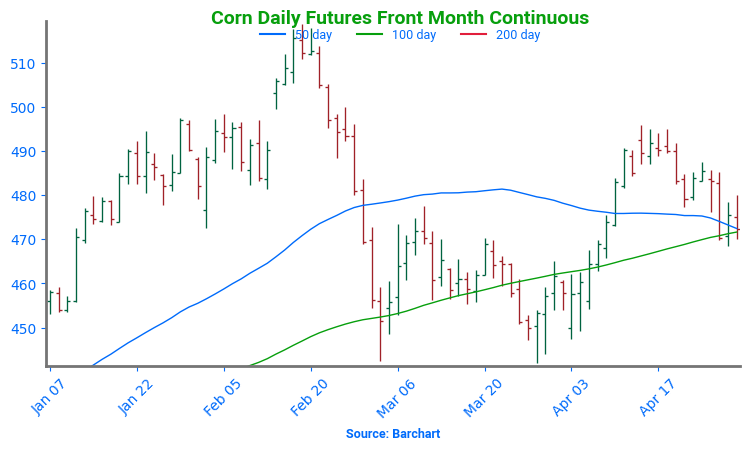

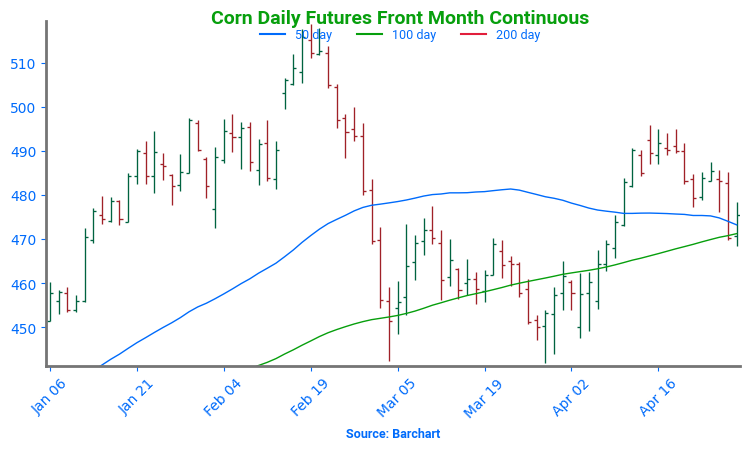

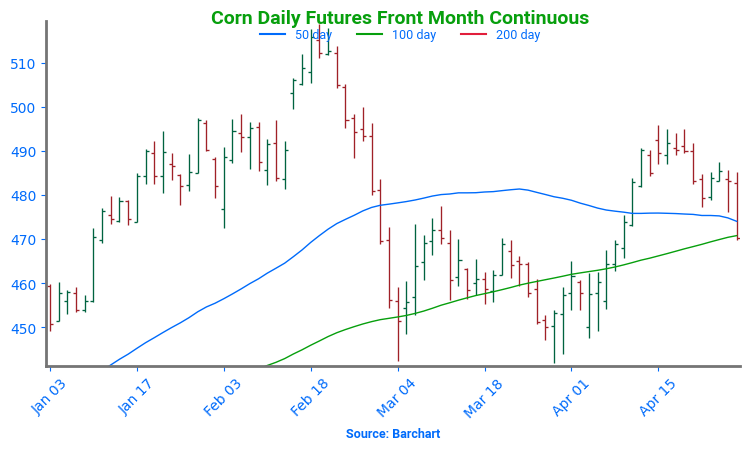

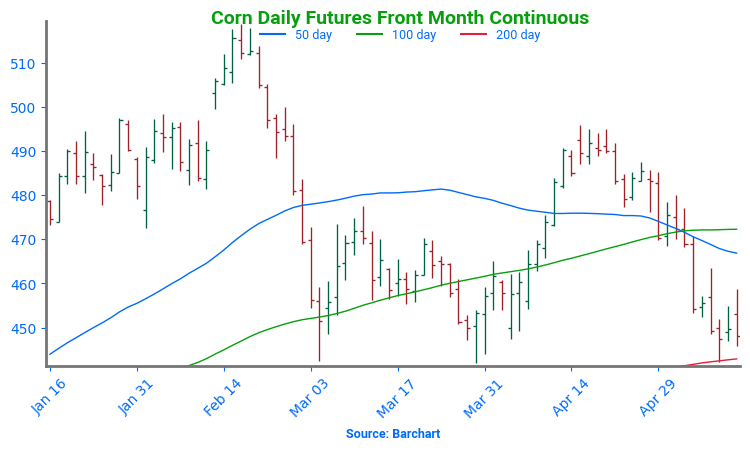

Corn Back Near Calendar Year Lows

Corn futures broke higher in April after repeatedly holding support near 450, with a bullish April WASDE — highlighting stronger demand — fueling the move through the 50-day moving average. As May begins, traders are watching weather developments and demand signals to guide the next leg. February highs above 510 are the next upside target. However, early May weakness has taken out support at 470, setting up a potential retest of the critical 450 zone — the early 2025 low and a key technical floor.

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- CONTINUED OPPORTUNITY – Buy January ‘26 1040 put options for approximately 62 cents in premium, plus fees and commission.

- Since last summer, soybeans have largely traded within a range of 950 to 1060. If this rangebound price action continues, the first risk would be a move back toward the lower end at 950. Seasonally, May and June are key months to secure downside protection. Adding 1040 put options will provide coverage against lower prices while keeping upside potential open and not having to commit any physical bushels.

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

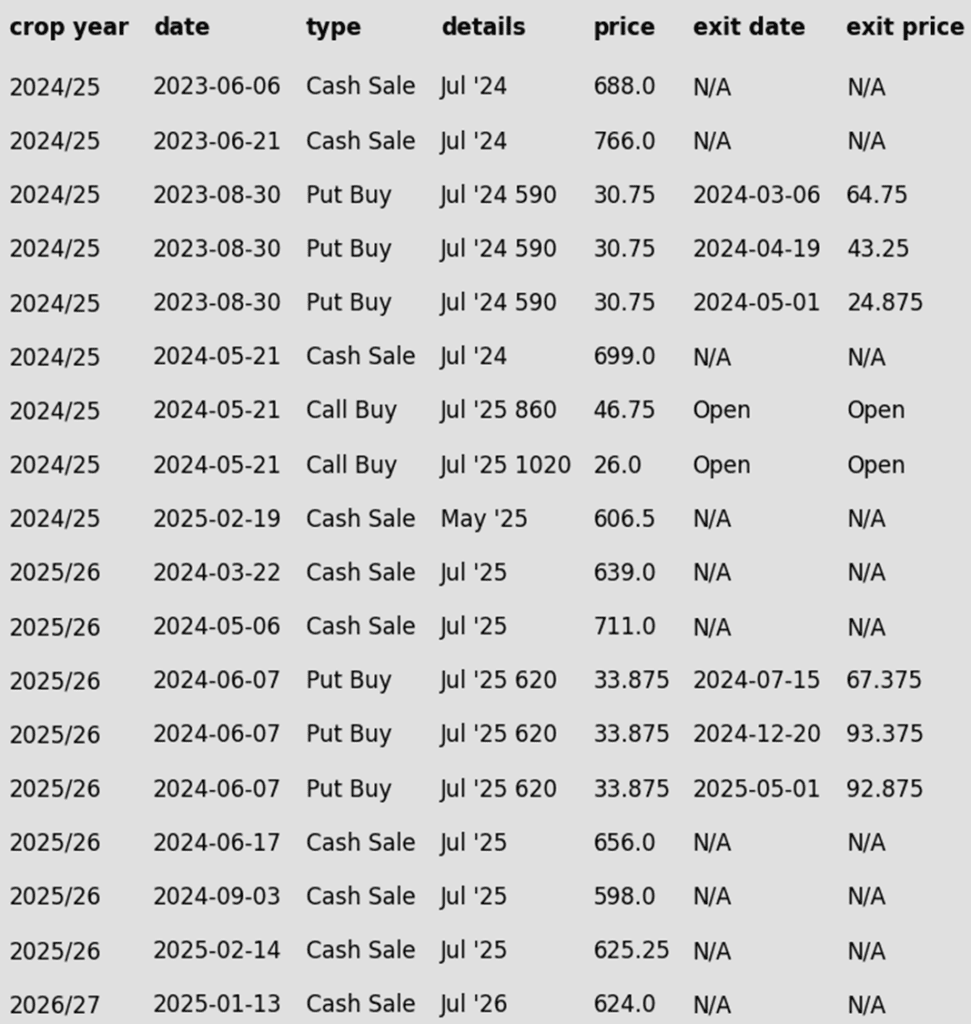

To date, Grain Market Insider has issued the following soybean recommendations:

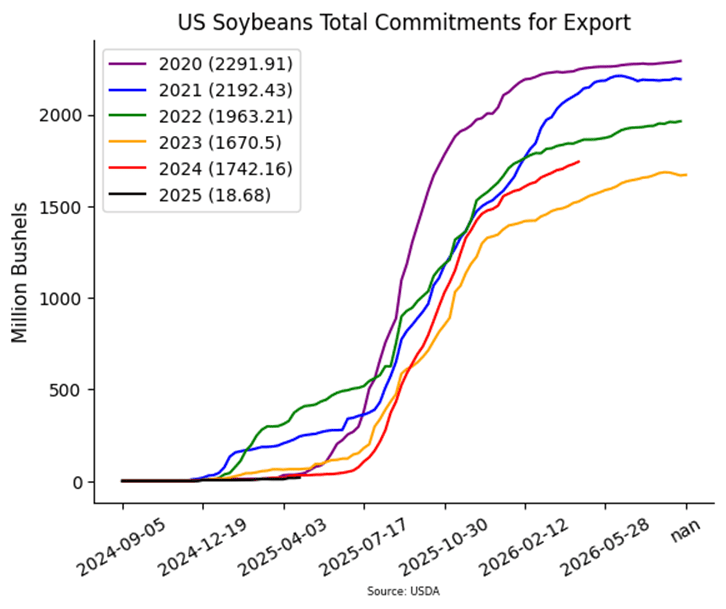

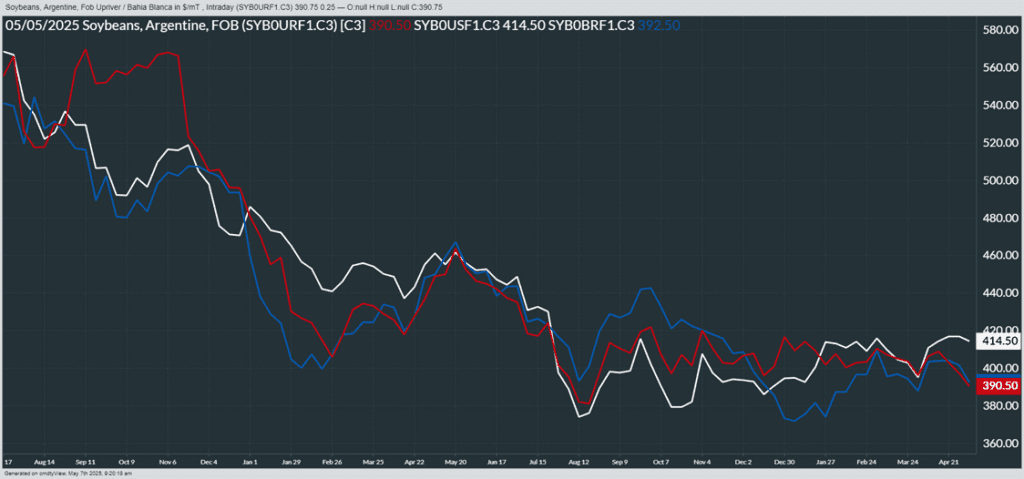

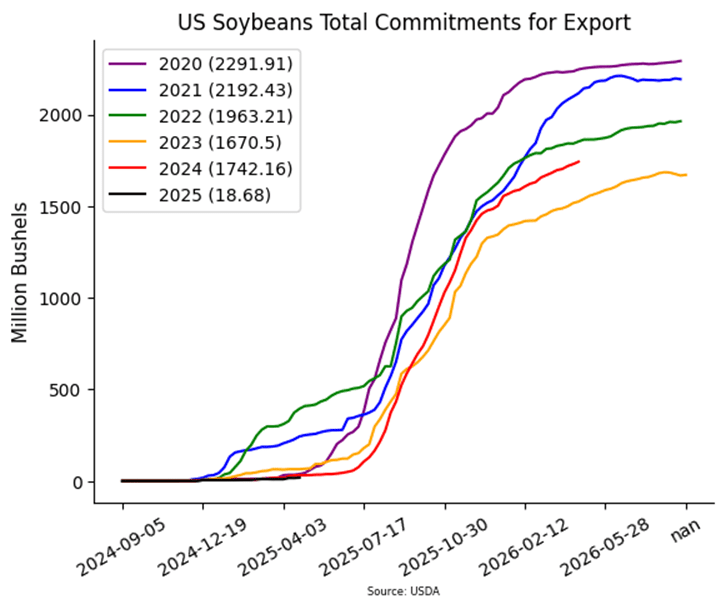

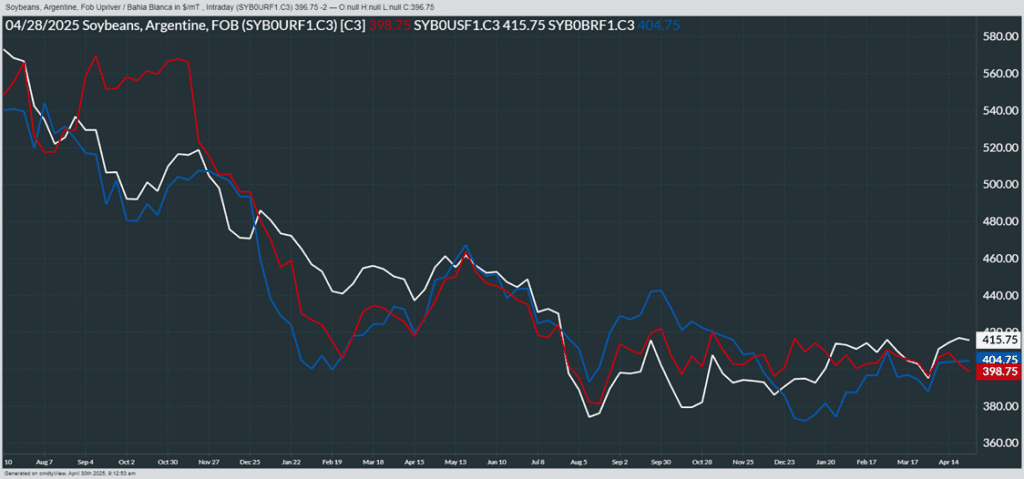

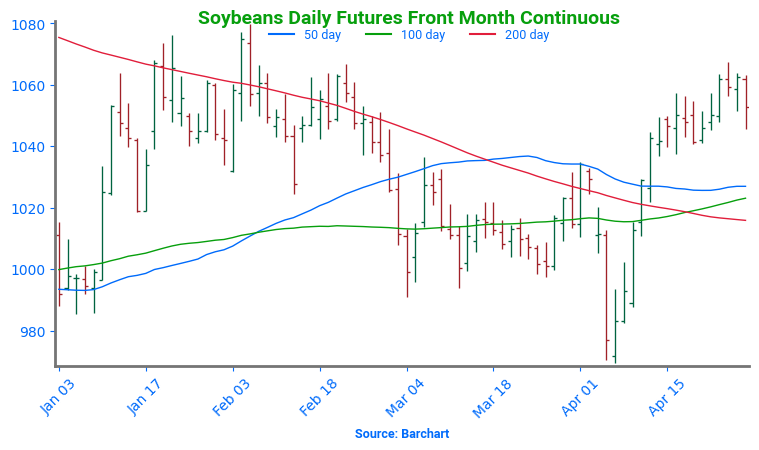

- Soybeans ended the day sharply higher following multiple bullish headlines today. This morning, it was announced that President Trump and China’s President Xi made an agreement to lower tariffs over the next 90 days. This was followed by a friendly WASDE report and higher crude oil that supported soybean oil, and bean meal was higher as well.

- Markets jumped early following news that President Trump and Chinese President Xi reached a 90-day tariff truce, rolling back U.S. soybean tariffs to 30% from 145%, with China cutting its tariffs on U.S. goods to 10% from 125%. The announcement sparked rallies in soybeans, hogs, and equities.

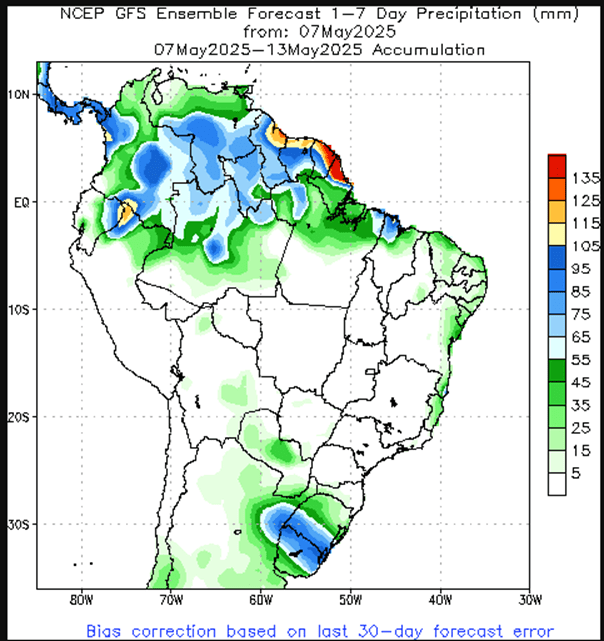

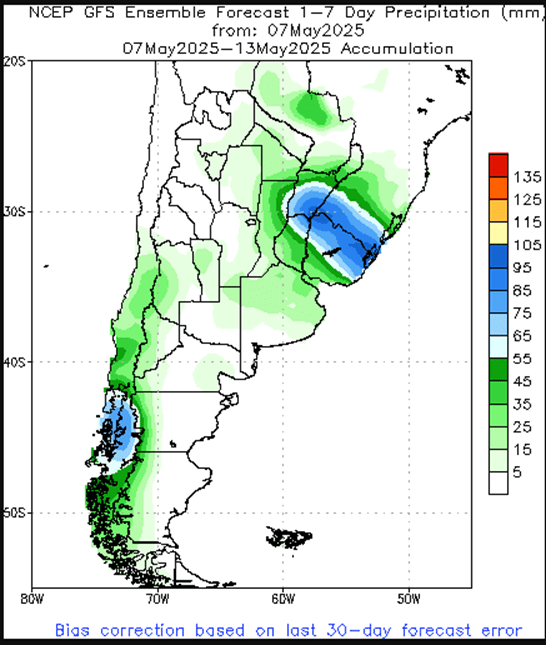

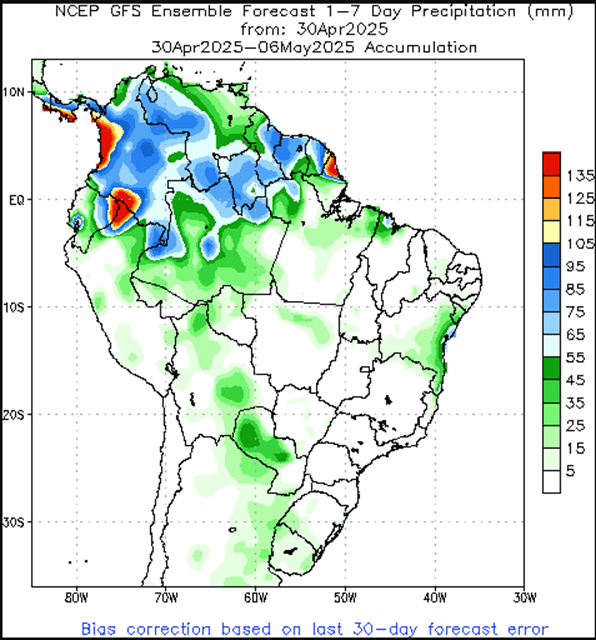

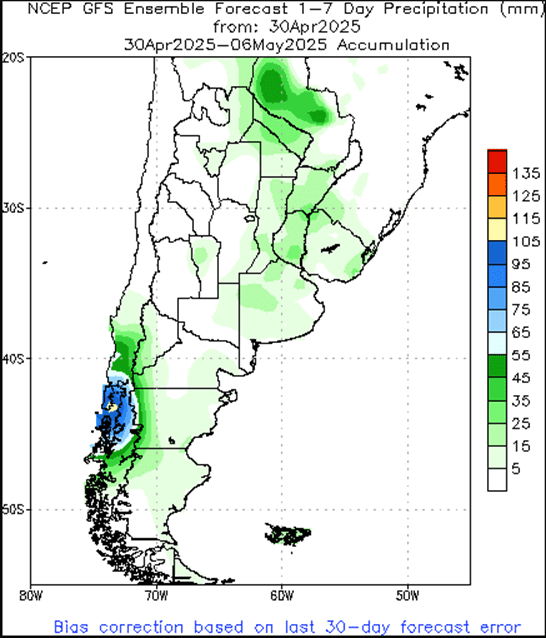

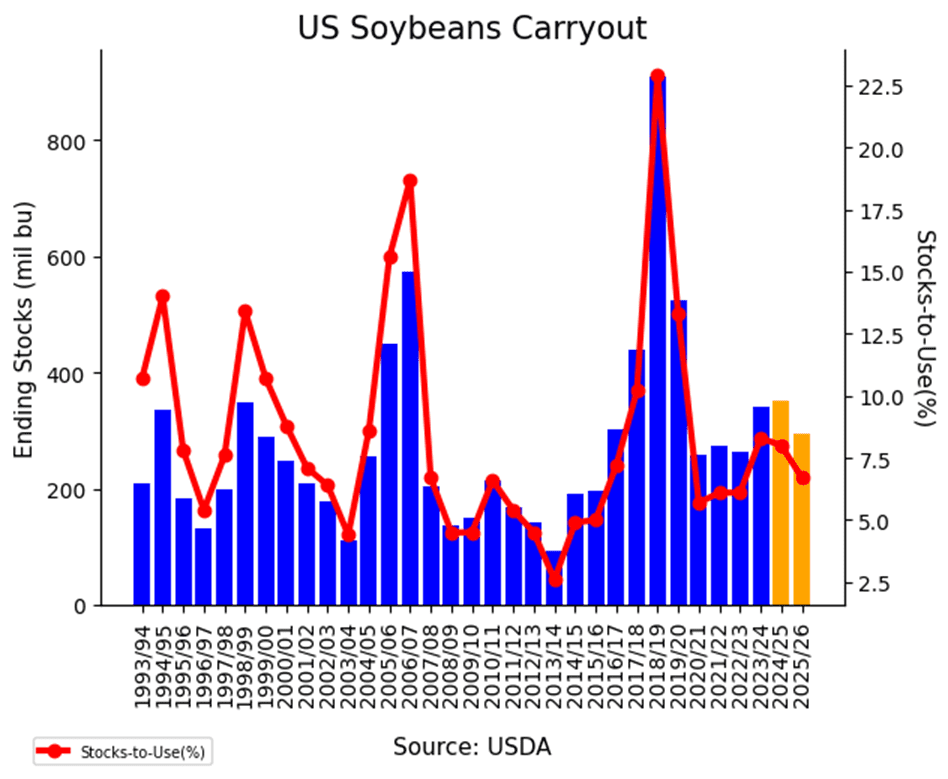

- The USDA’s WASDE report added fuel to the rally, as it lowered 2024/25 soybean ending stocks to 350 million bushels from 375 million last month, and projected 2025/26 carryout at just 295 million bushels—well below trade expectations of 362 million. South American production estimates were unchanged, with Argentina at 50.0 MMT and Brazil at 169.0 MMT.

- Today’s Export Inspections report saw soybean inspections total 15.7 mb for the week ending May 8, and total inspections are now at 1.613 bb, up 11% from the previous year.

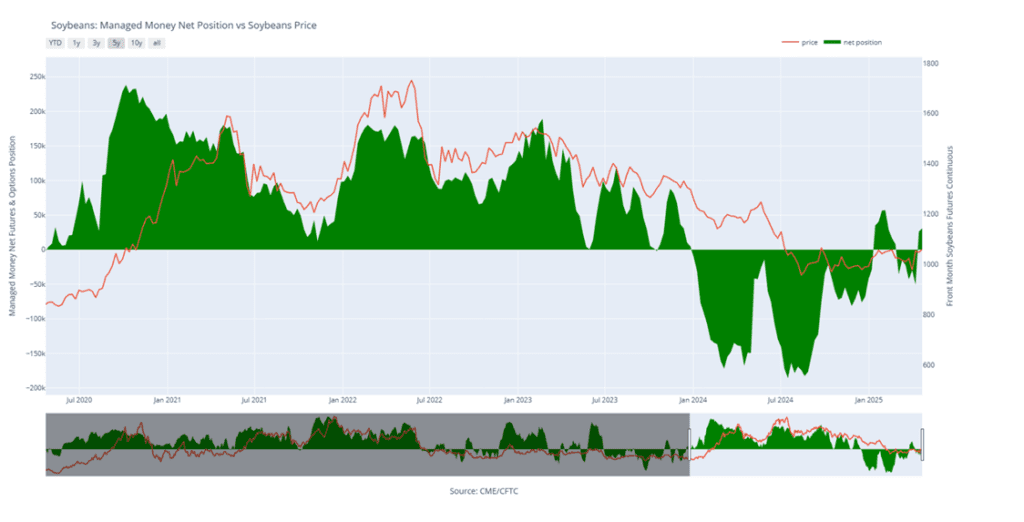

- Friday’s CFTC report saw funds as sellers of soybeans by 16,332 contracts, which left them with a net long position of 21,870 contracts. They sold 6,649 contracts of bean oil, leaving them long 56,738 contracts and sold 5,230 contracts of meal leaving them short 103,457 contracts.

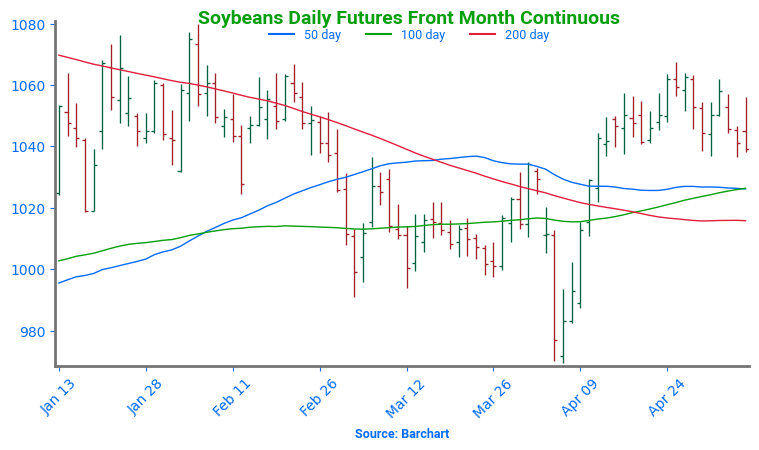

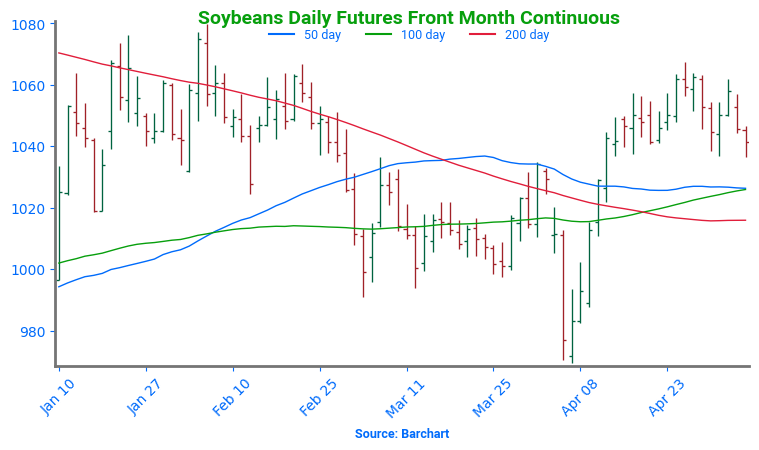

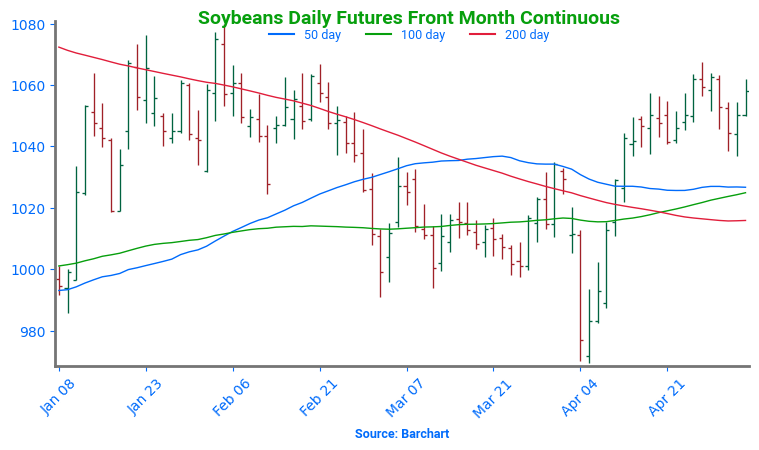

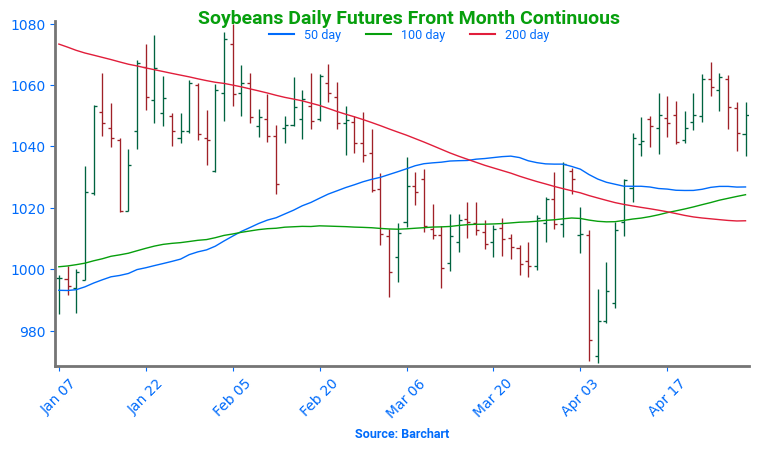

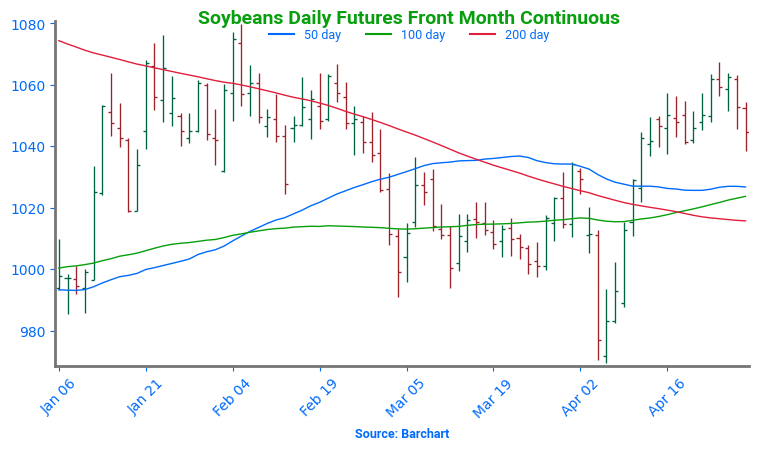

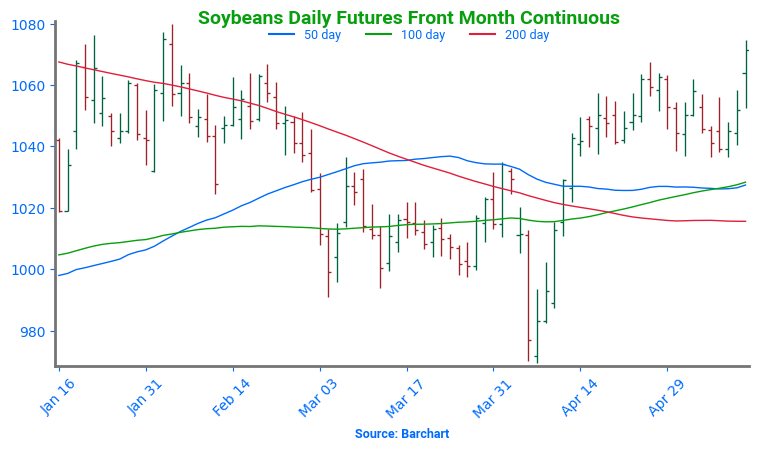

Soybean Futures Drift Near Upper End of Yearly Range

Soybean futures plunged below the critical 1000 level in early April on tariff news, triggering technical selling after a firm March floor gave way. But the drop was short-lived — strong buying quickly reversed the slide, lifting prices back above 1000 and reclaiming major moving averages. Most notably, the 200-day moving average — long a ceiling — was decisively cleared. With momentum shifting higher, the market is eyeing a retest of February’s highs near 1080, while the 200-day average now serves as a key layer of support on any pullbacks.

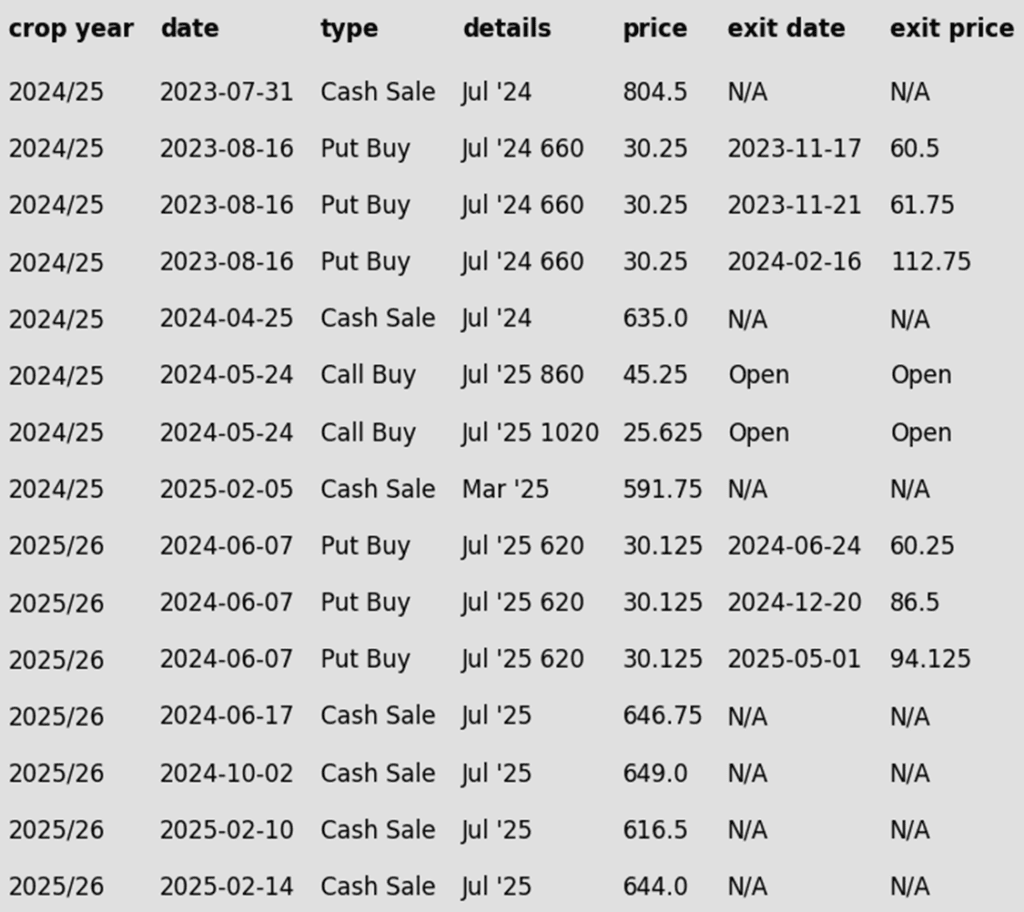

Wheat

Market Notes: Wheat

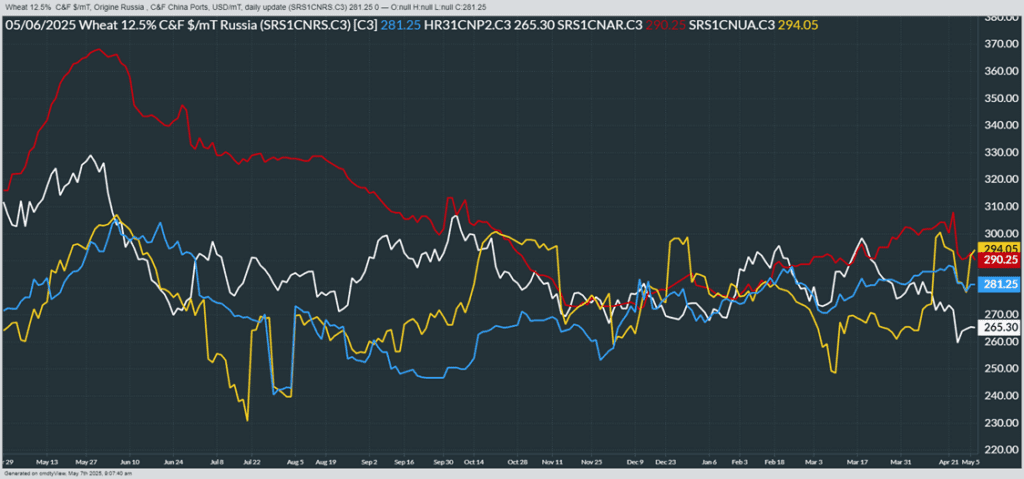

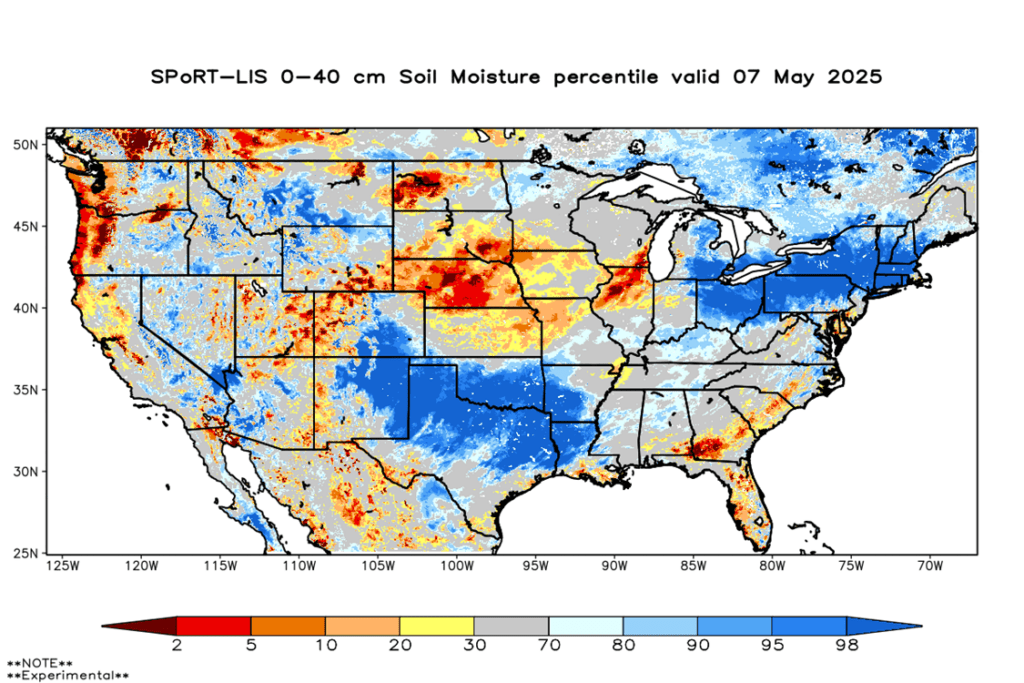

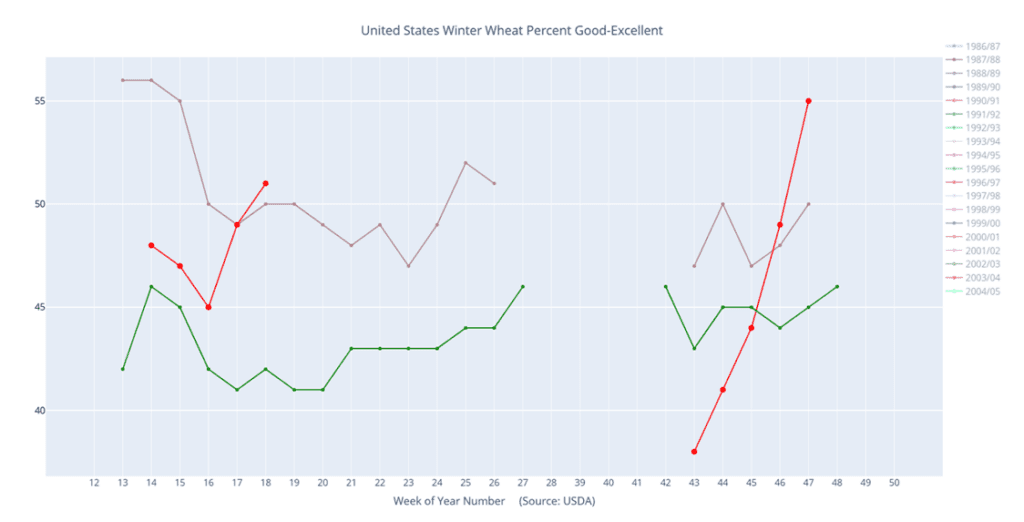

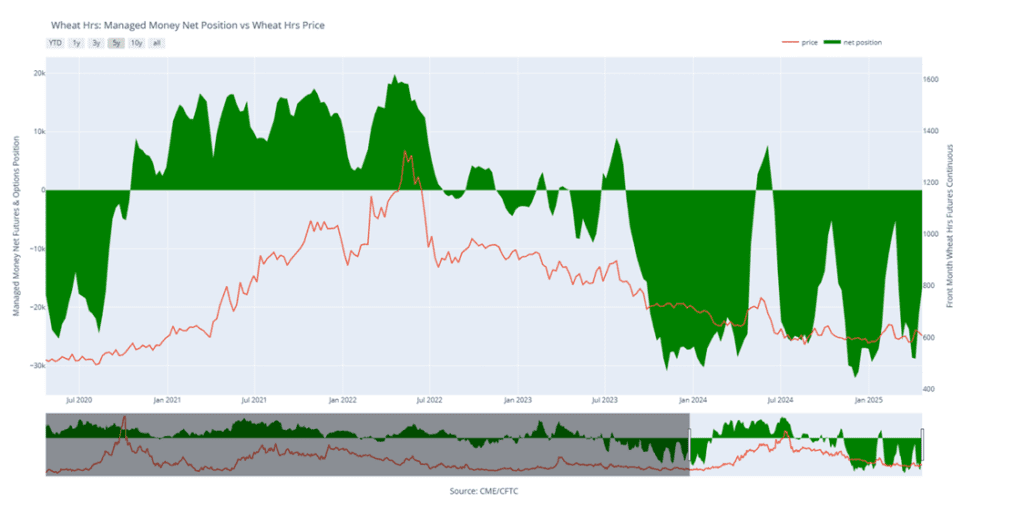

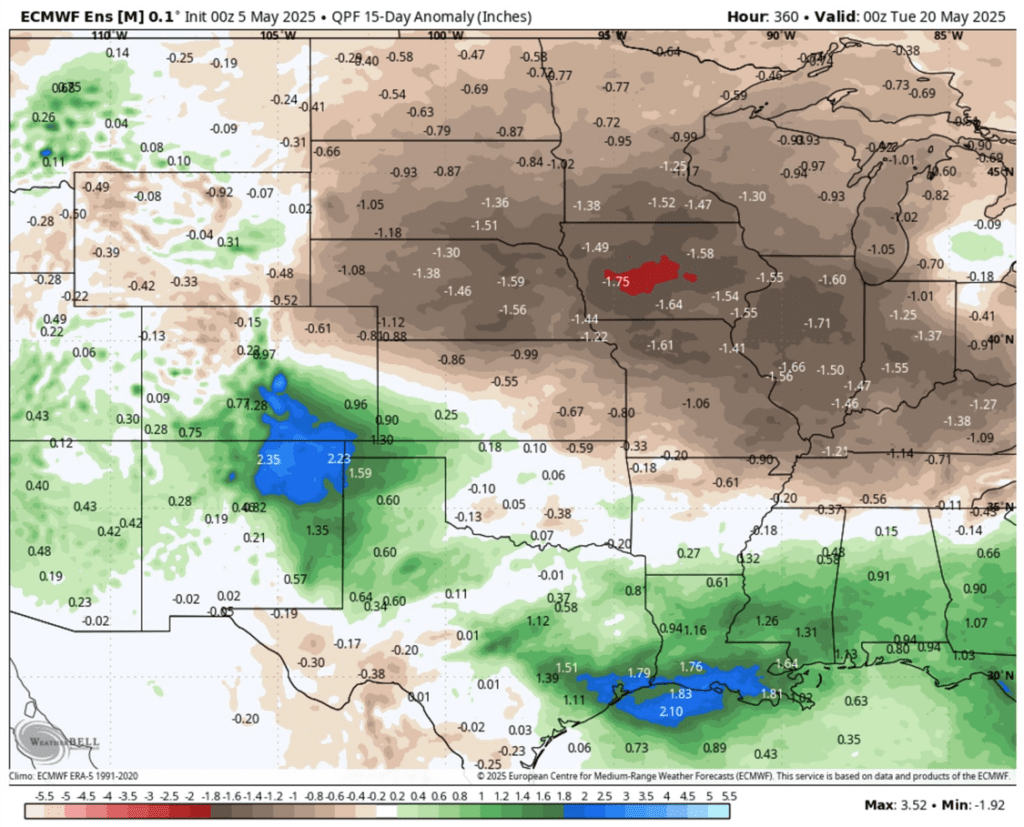

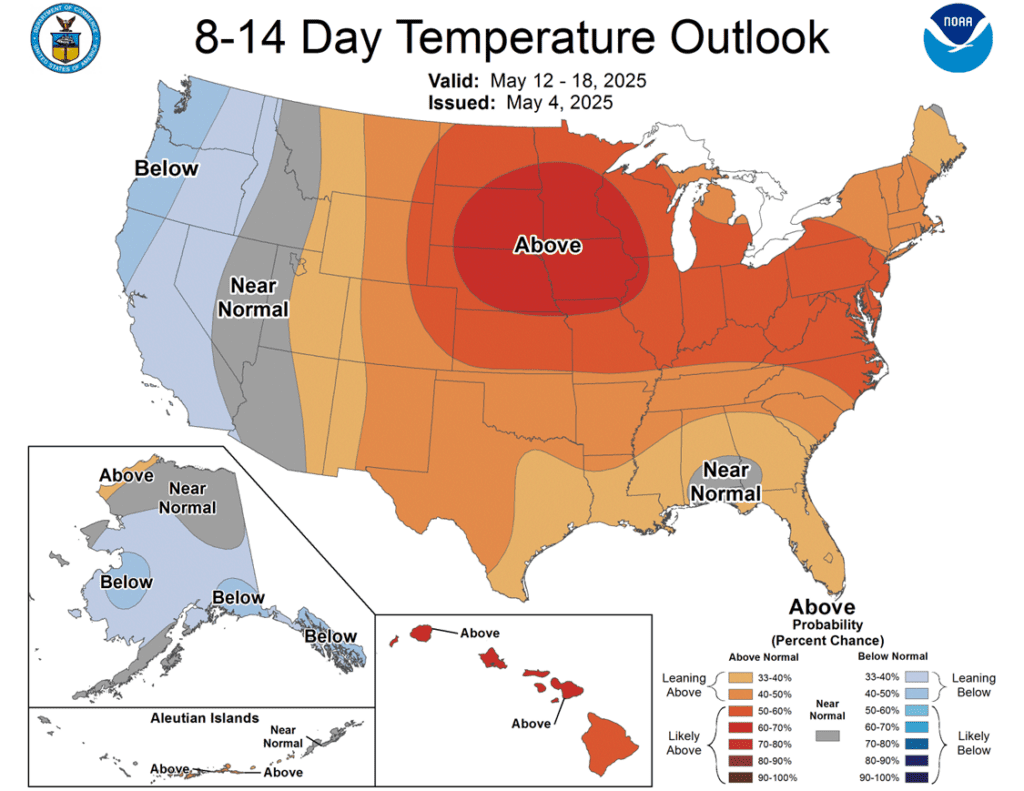

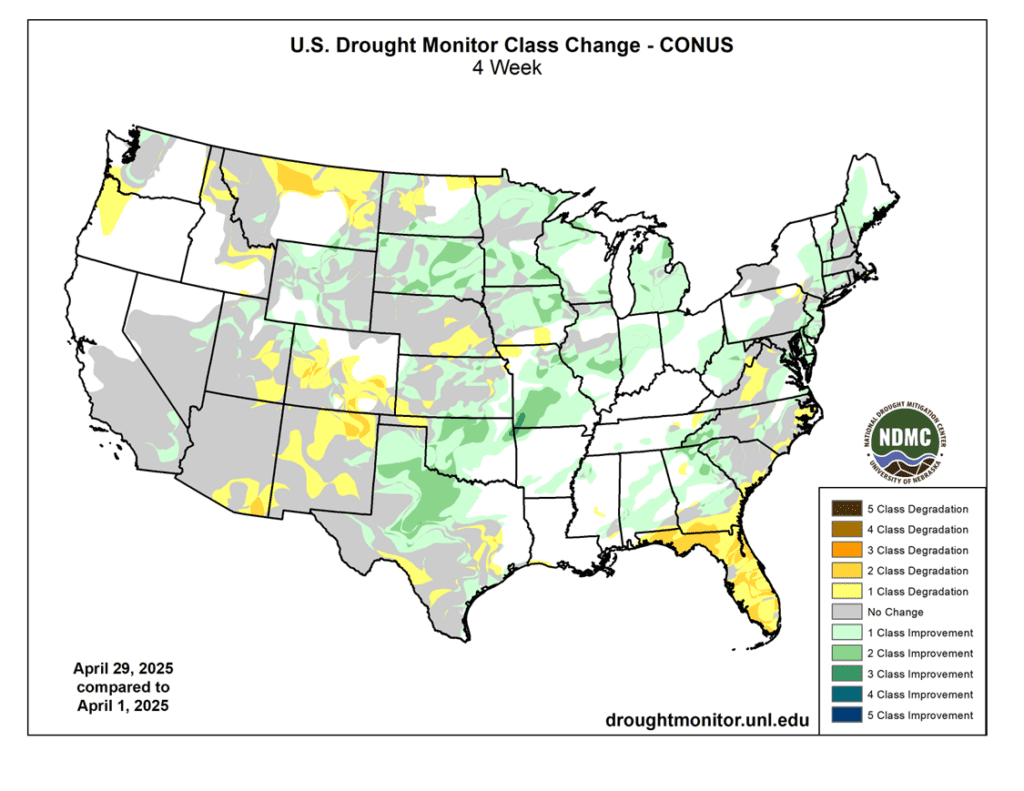

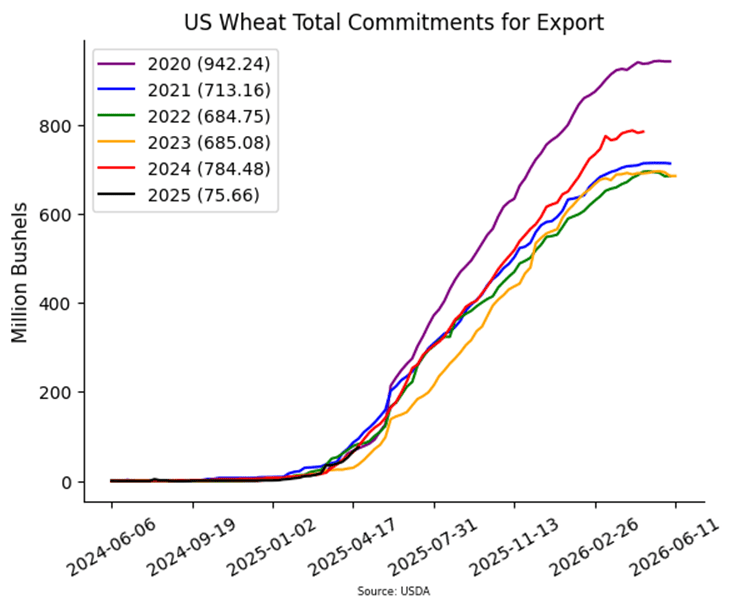

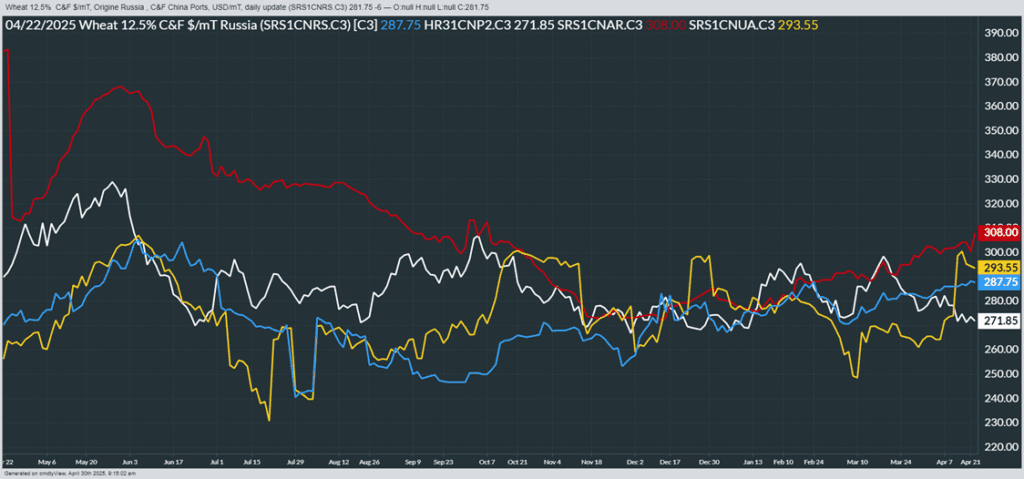

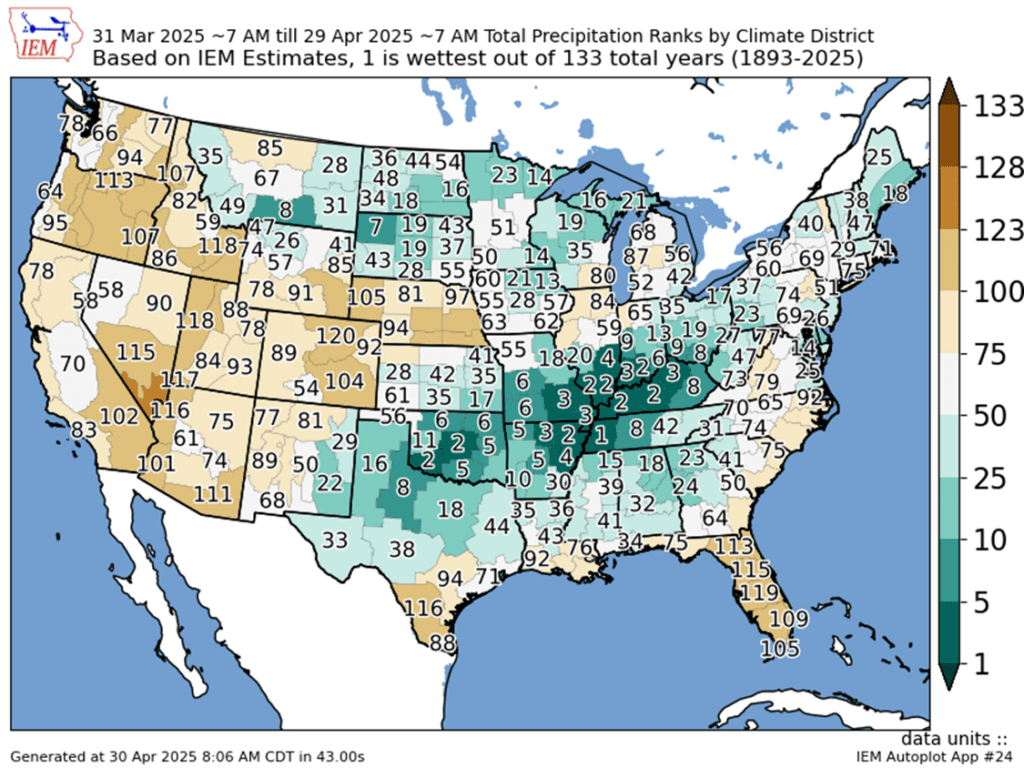

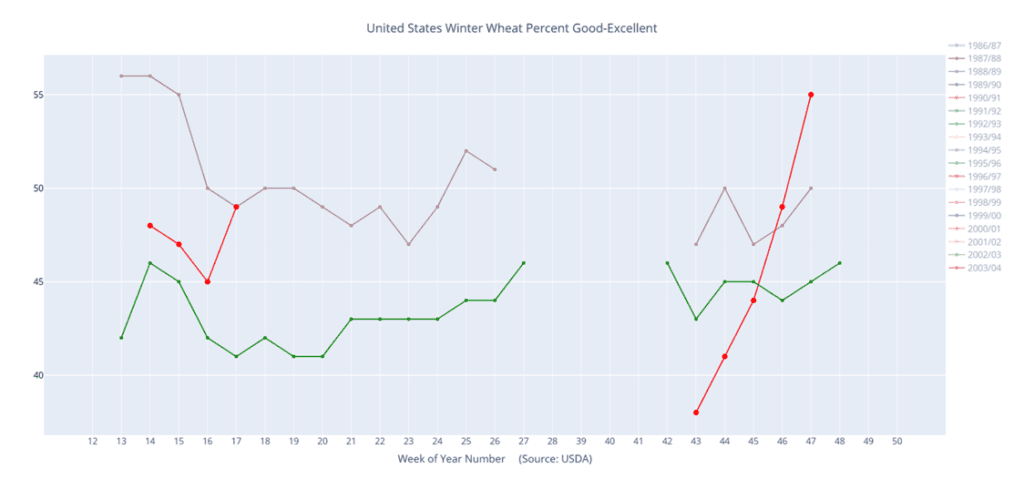

- The wheat complex closed lower across all three classes, with Minneapolis futures leading the decline amid forecasts for rainfall in the U.S. Northern Plains later this week.

- Pressure also came from a bearish tone in the USDA’s WASDE report, which offset optimism from recent U.S.-China trade talks. The wheat market instead focused on a surging U.S. Dollar Index, which reached a one-month high.

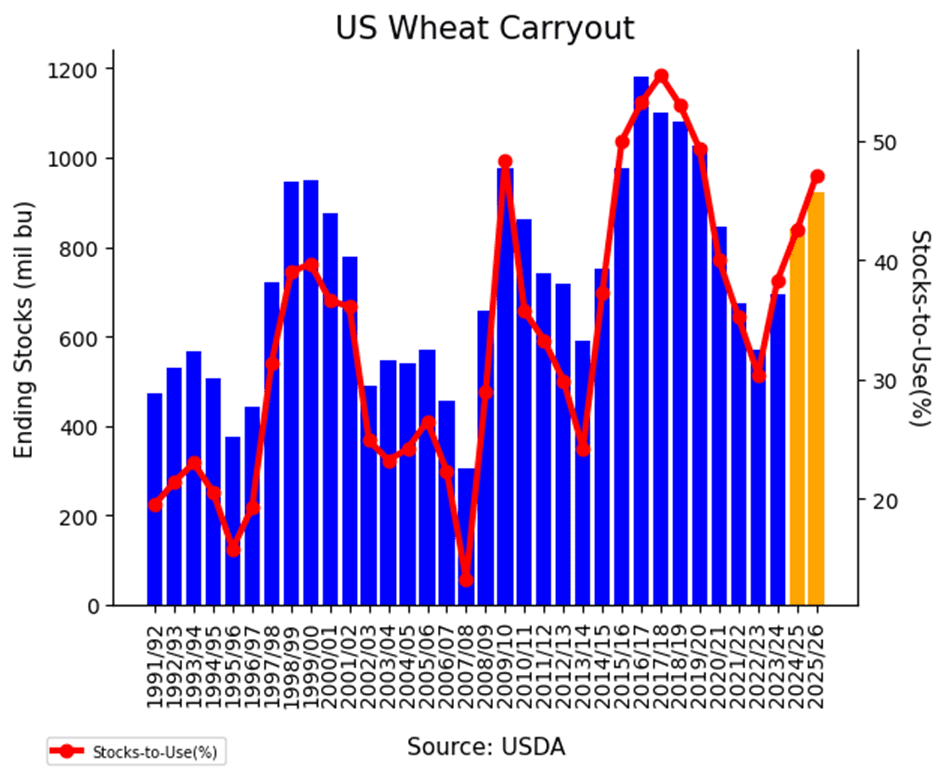

- USDA pegged 2025/26 U.S. all-wheat production at 1.921 billion bushels, down from 1.971 bb in 2024/25 but above the average trade estimate of 1.896 bb. Winter wheat was estimated at 1.349 bb, unchanged from the prior year.

- 2024/25 U.S. wheat ending stocks came in at 841 million bushels, down 5 mb from April, while 2025/26 ending stocks jumped to 923 mb—well above expectations and the high end of pre-report guesses.

- Global 2024/25 wheat carryout was raised to 265.2 million metric tons (mmt) from 260.7 mmt in April. The initial 2025/26 world ending stocks estimate was 265.7 mmt, also above expectations.

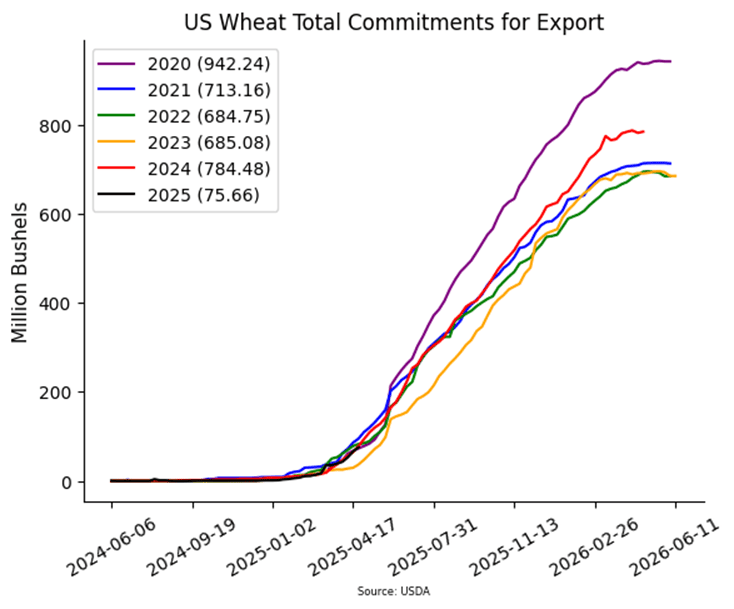

- Weekly wheat export inspections totaled 14.9 mb, bringing cumulative 2024/25 inspections to 745 mb—15% above last year but still slightly behind the pace needed to meet USDA’s unchanged export forecast of 820 mb.

- China has reportedly purchased between 400,000 to 500,000 mt of milling-quality wheat, sourced from Canada and Australia in the past few weeks. Despite being the world’s top wheat producer, China still needs to import wheat to meet demand. And with current heat and dryness in their wheat belt, their imports could increase. For reference, in 2024 China purchased $3.5 billion worth of wheat, totaling 11 mmt.

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- The 701 target was lowered to 699.25.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- The 696 target was lowered to 688.

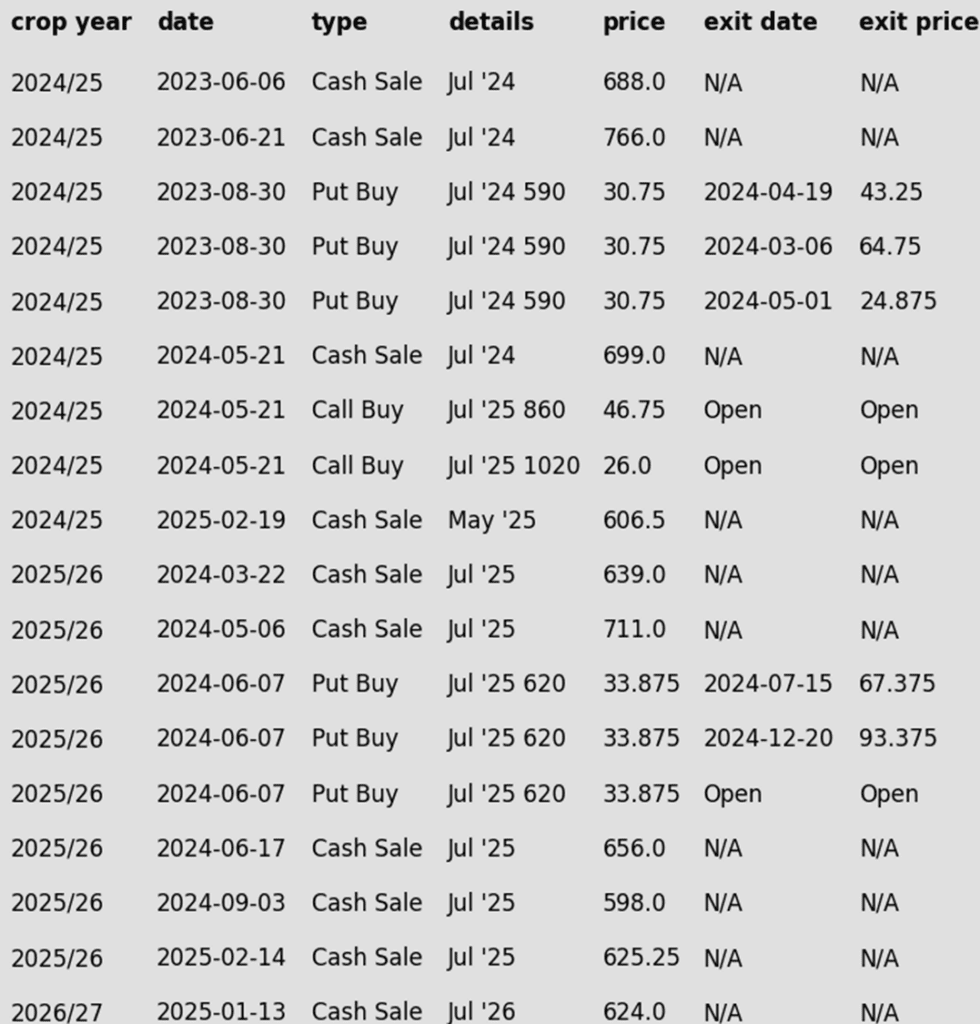

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

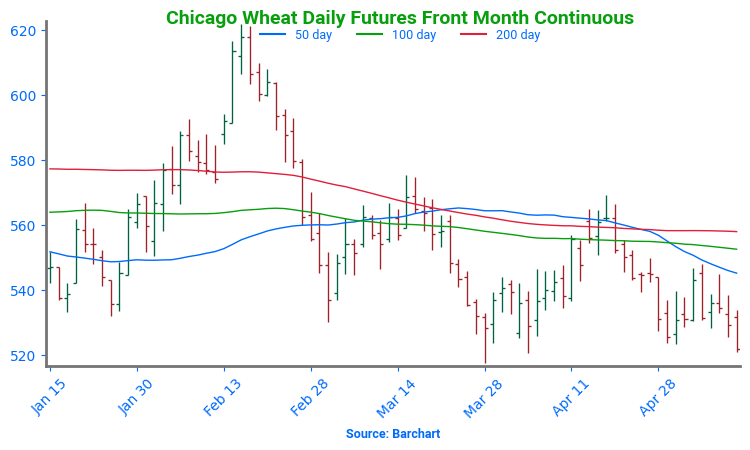

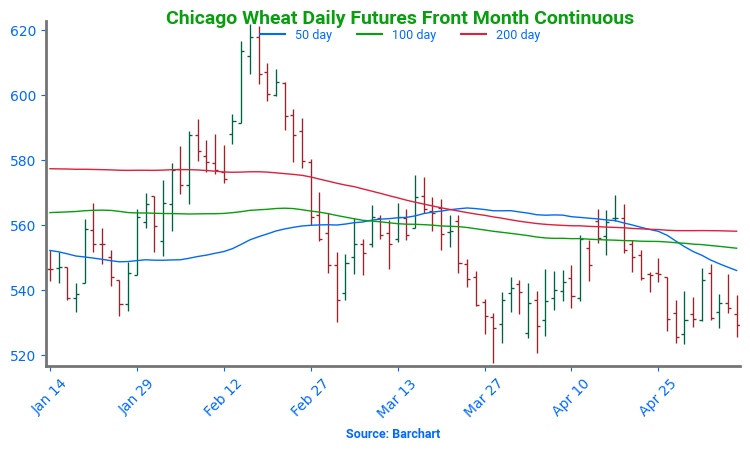

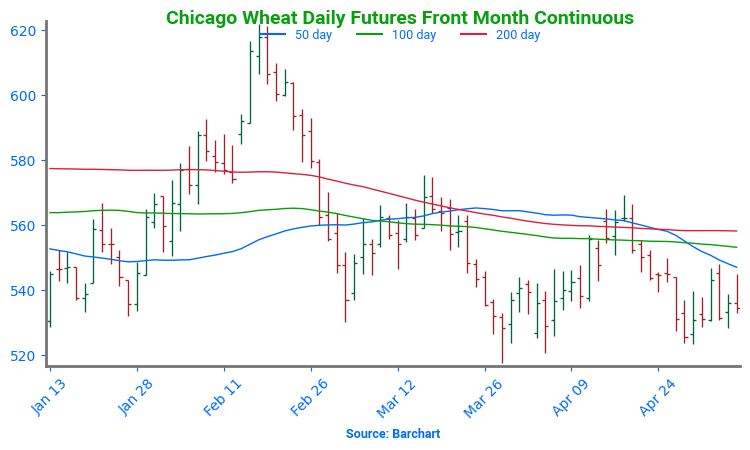

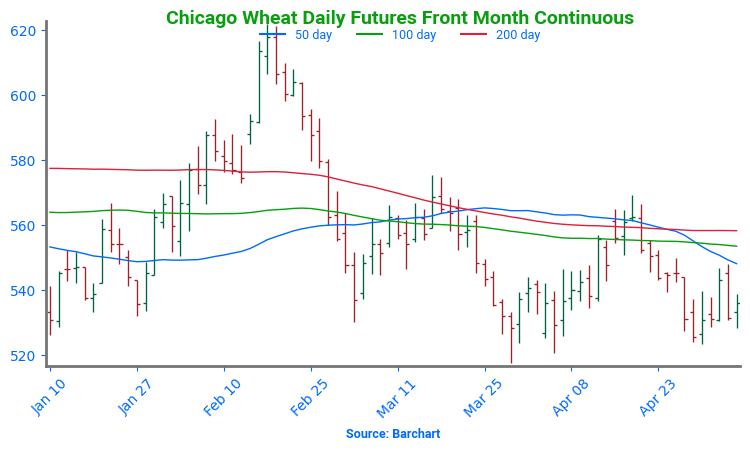

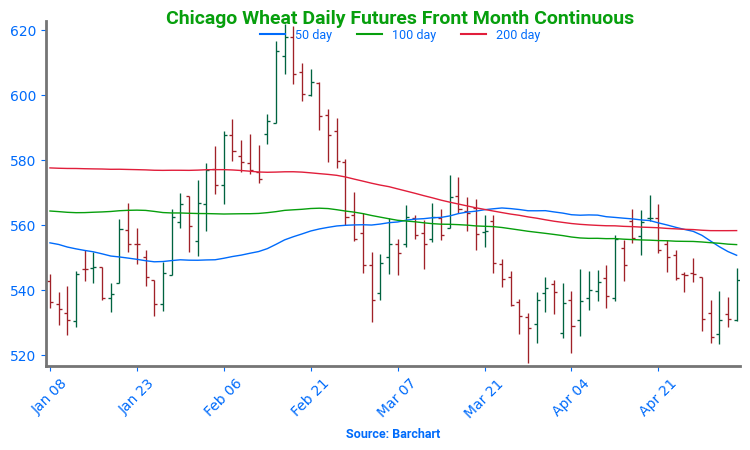

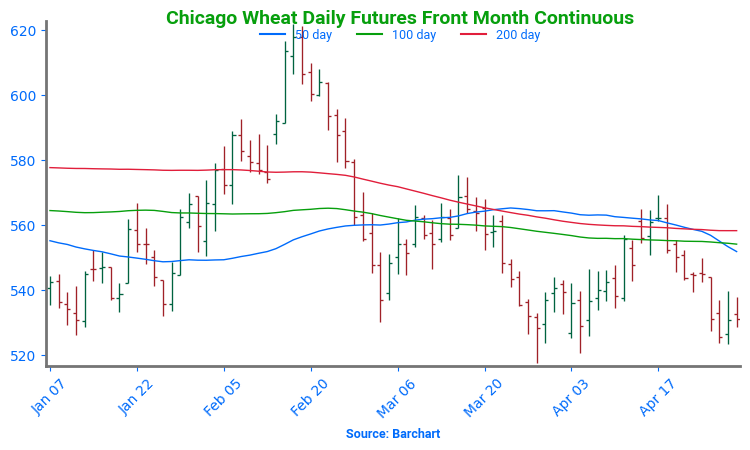

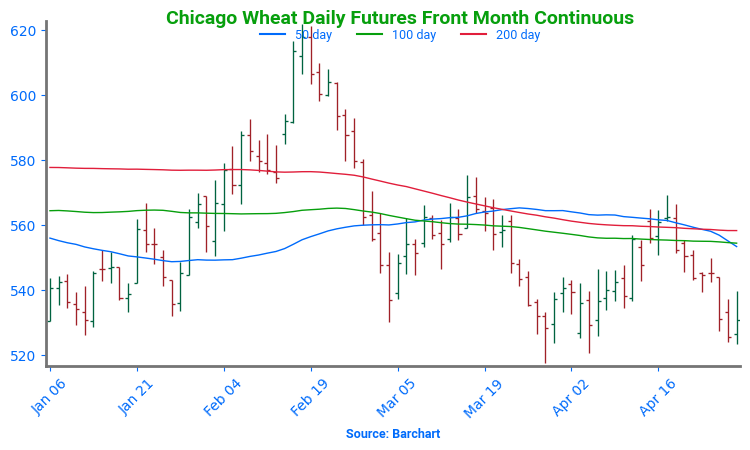

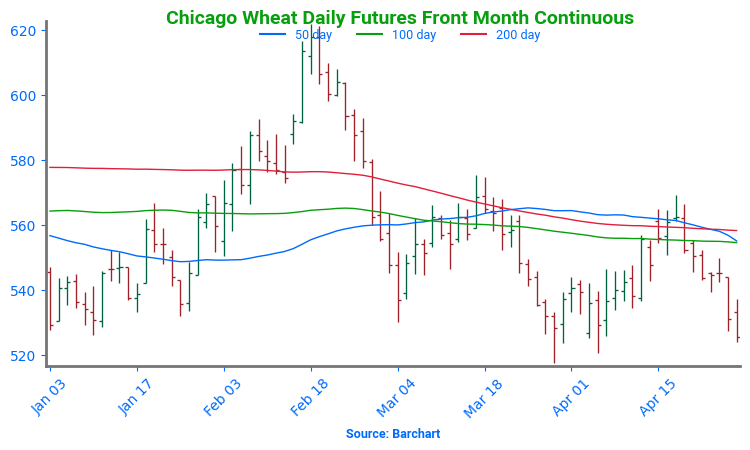

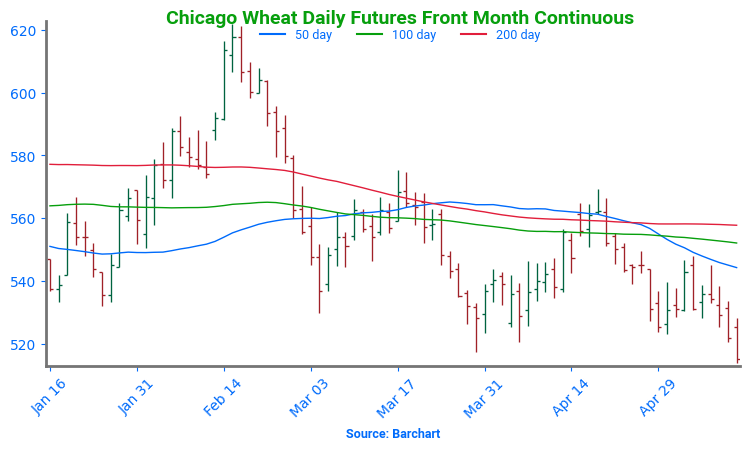

Chicago Wheat Holds Support

After months of range-bound trade, Chicago wheat futures broke out in February, rallying to October highs just above 615. But the rally was short-lived, with prices quickly retreating back into the 2024 range. Solid support near 530 has held through March and early May, reinforcing its importance. The next key hurdle is the 200-day moving average — a firm weekly close above it could mark a turning point and open the door to a broader uptrend.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- The 645 target was cancelled.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

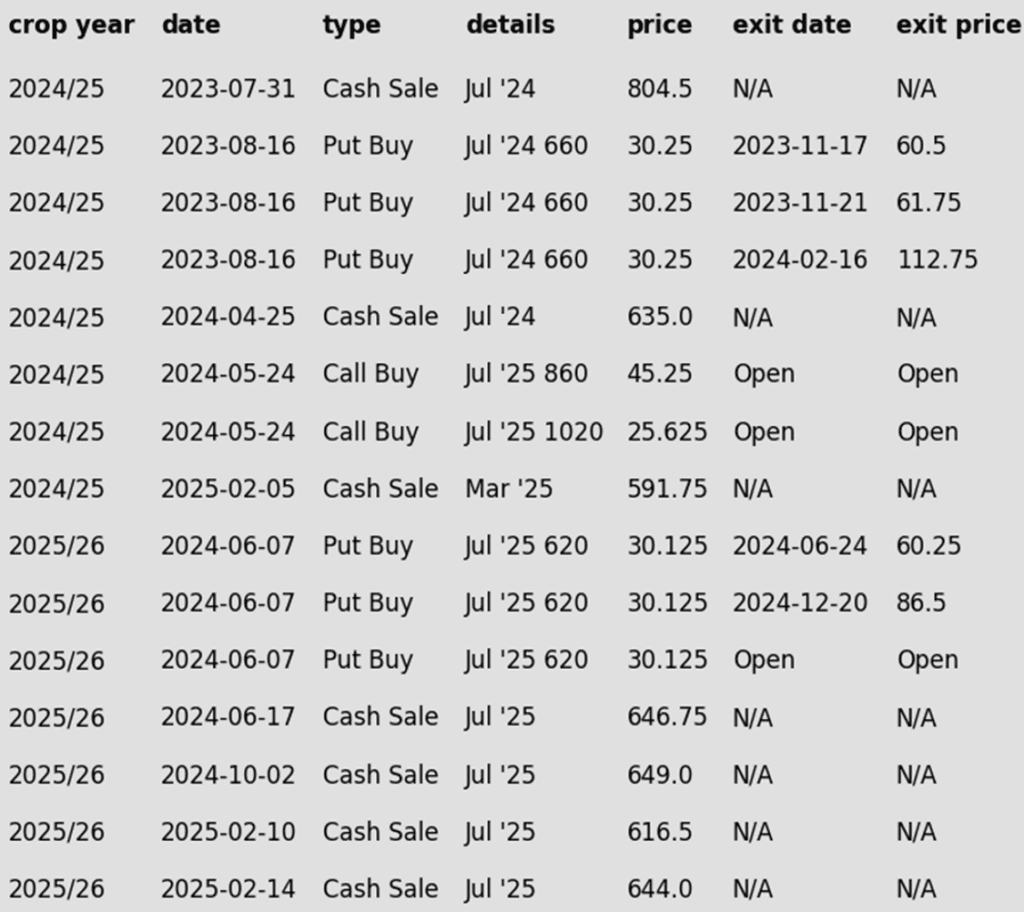

To date, Grain Market Insider has issued the following KC recommendations:

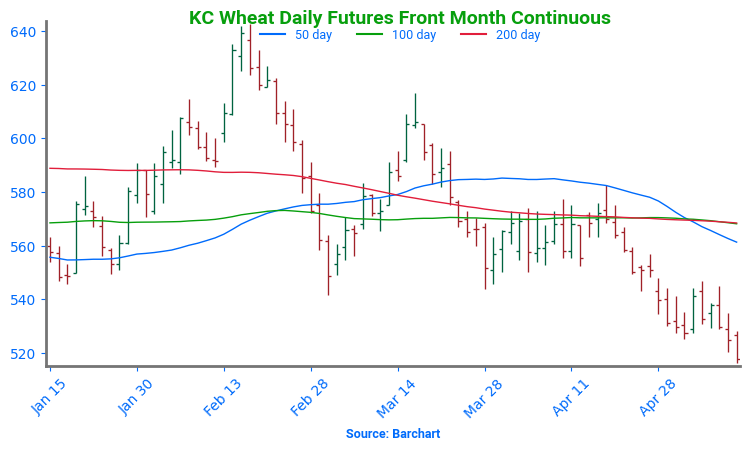

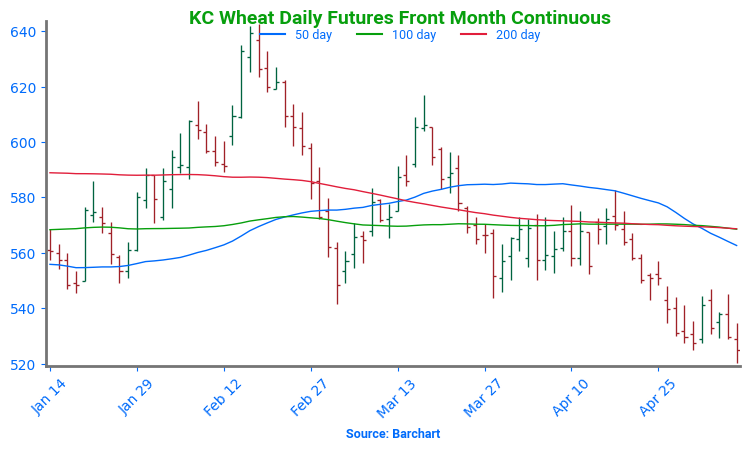

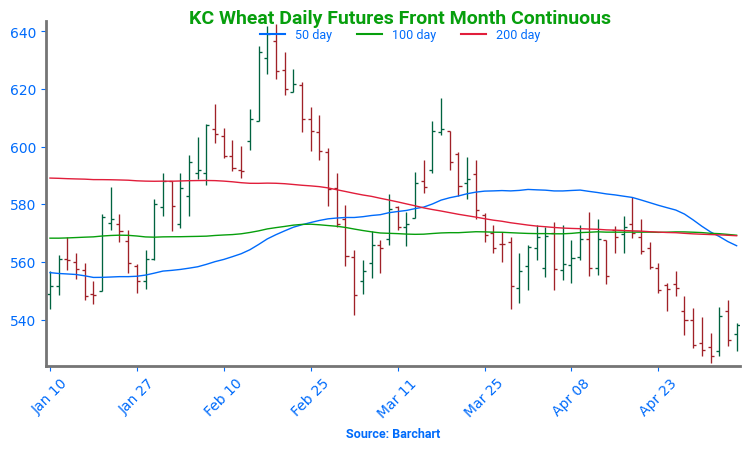

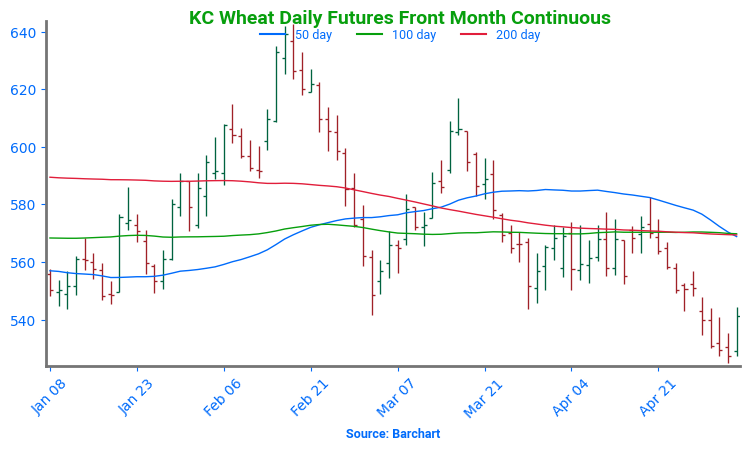

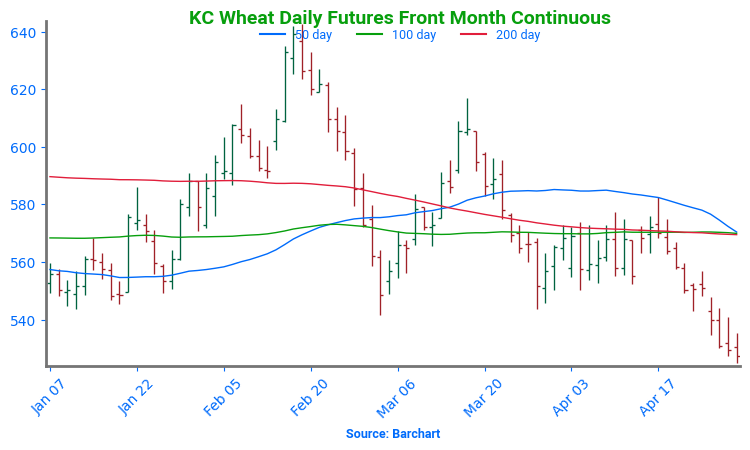

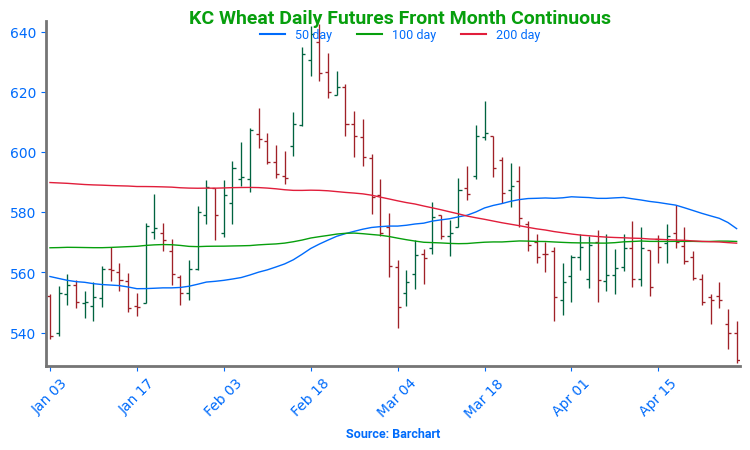

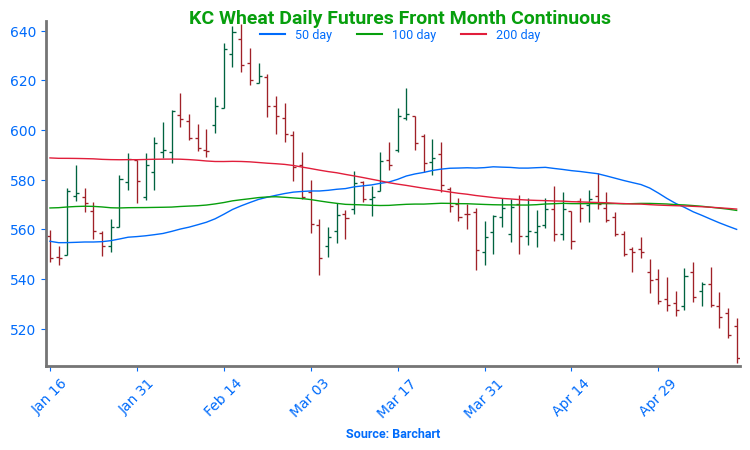

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

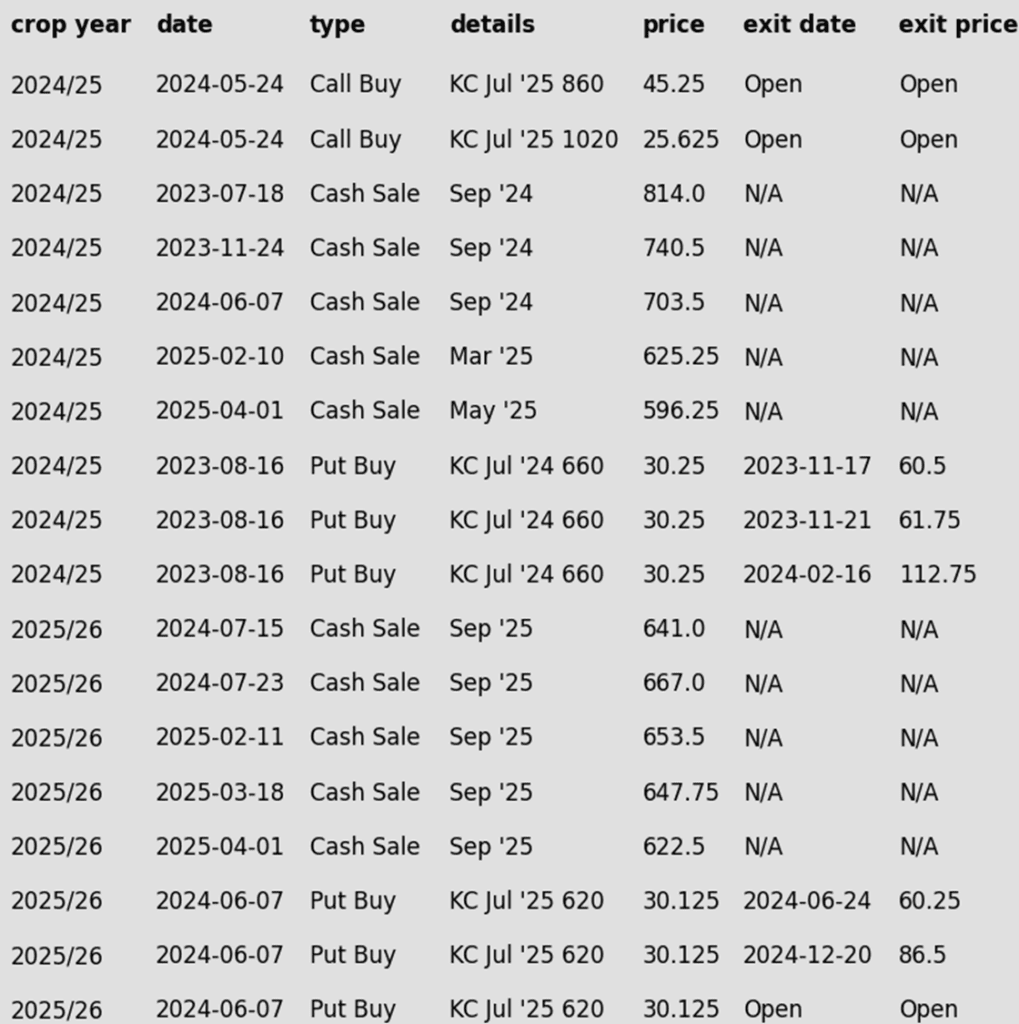

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

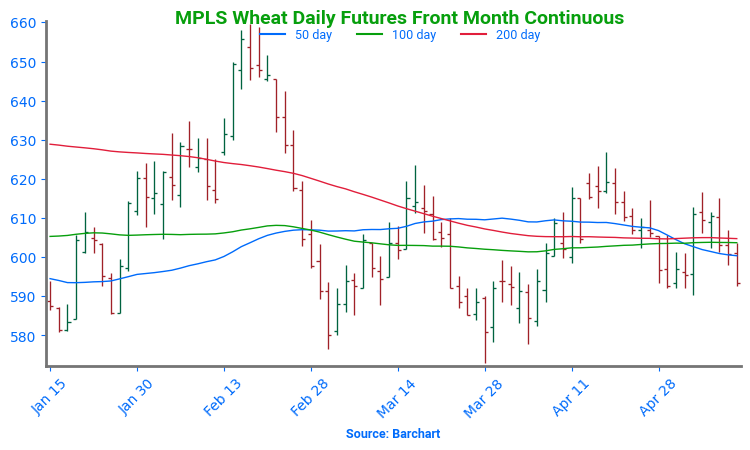

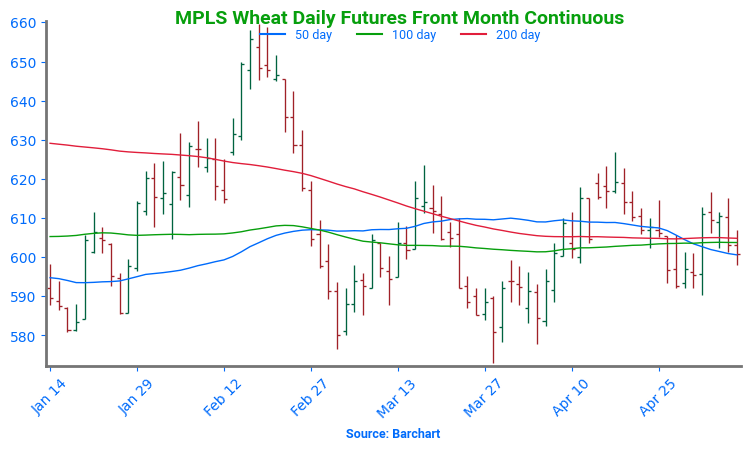

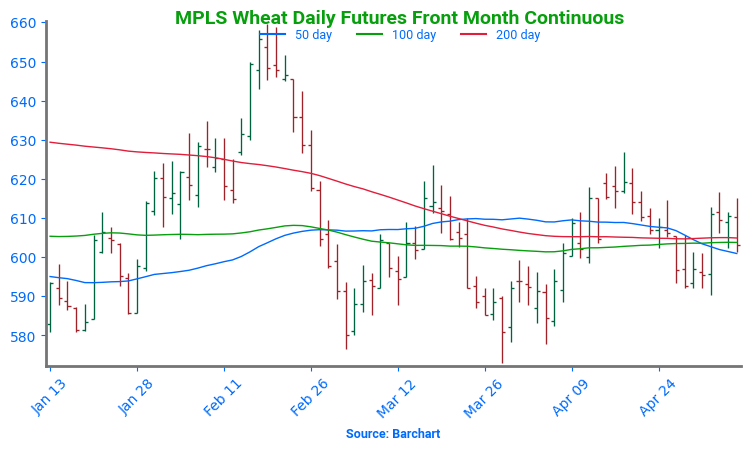

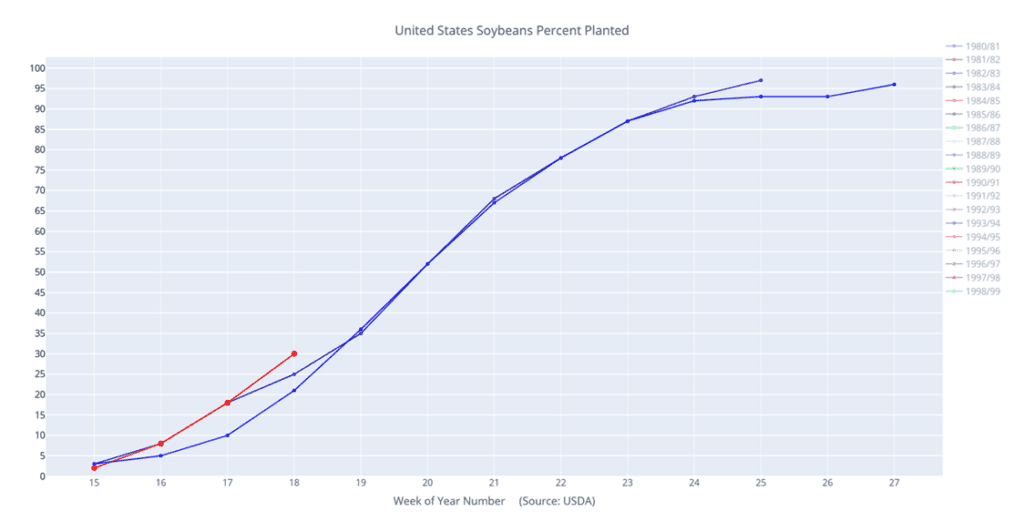

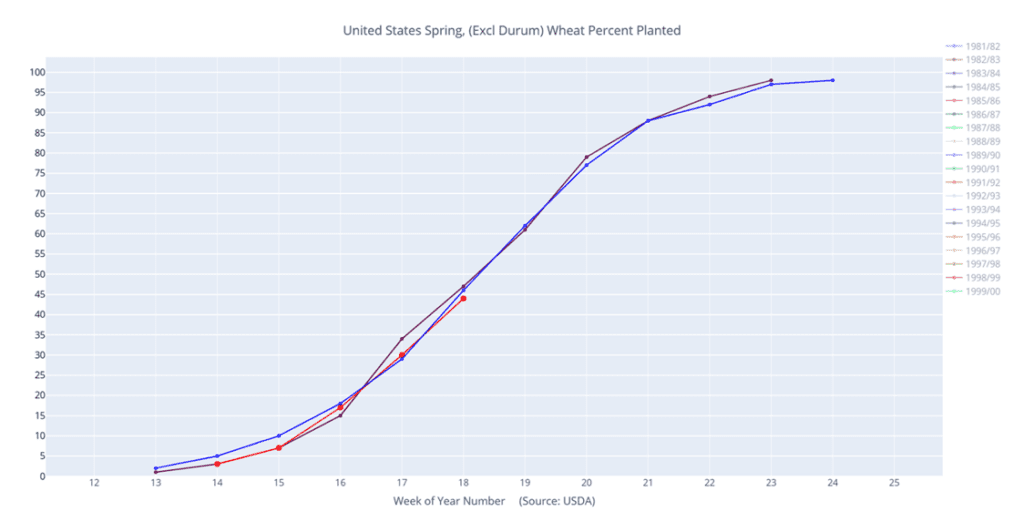

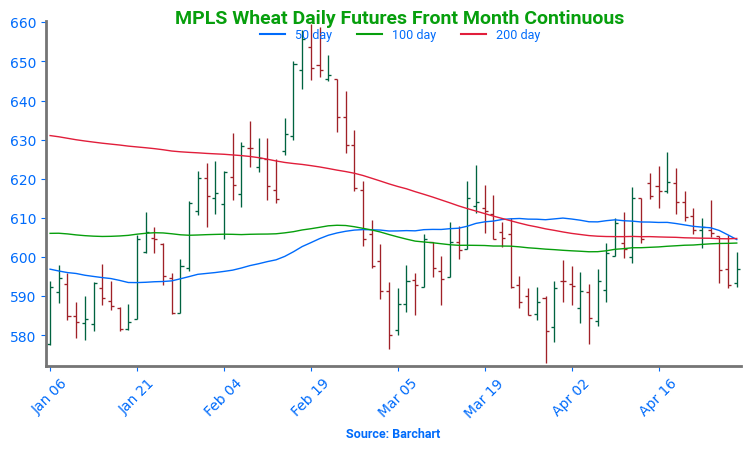

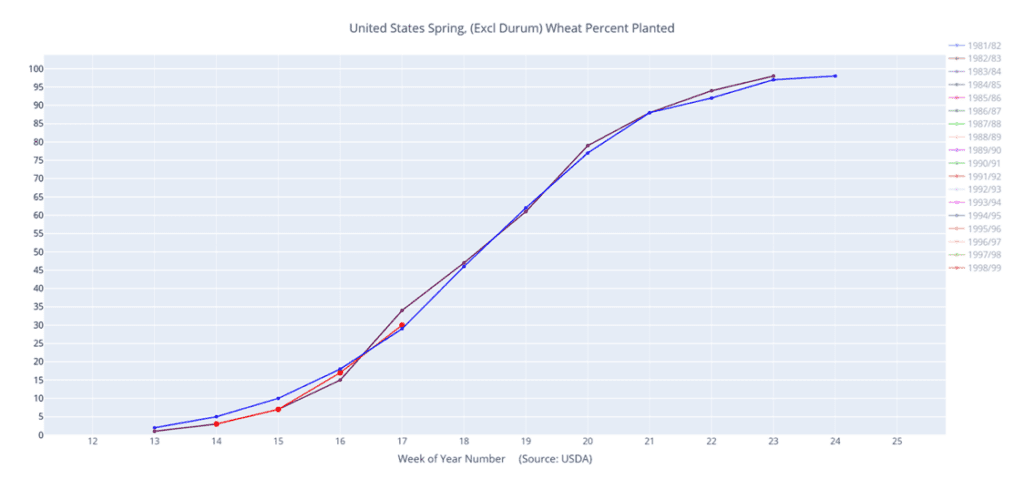

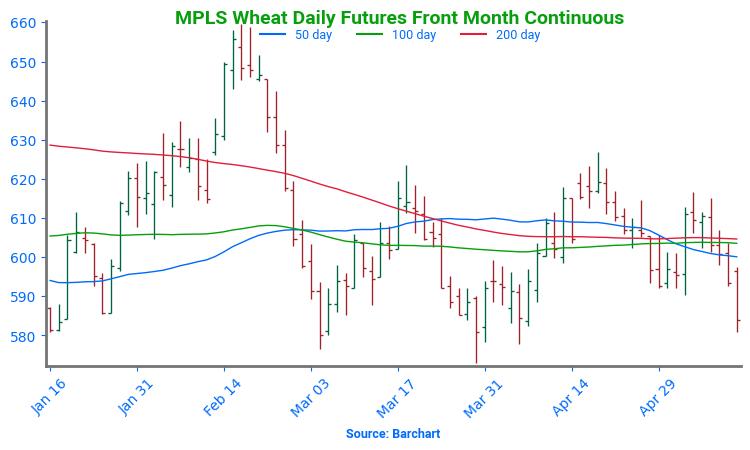

Spring Wheat Holds Ground Amid Historic Acreage Lows

Spring wheat broke out of its prolonged sideways trend in late January, igniting a wave of bullish momentum. The rally accelerated in mid-February with a close above the 200-day moving average, though late-month weakness briefly pulled futures below key support. Unlike winter wheat, spring wheat has managed to consolidate near multiple moving averages, which are currently holding as support. The next upside target is the February high near 660. With spring wheat acreage expected to be the lowest in 55 years, weather will likely be a key driver of price direction this season.

Other Charts / Weather