6-9 End of Day: Grains All Lower

All Prices as of 2:00 pm Central Time

Grain Market Highlights

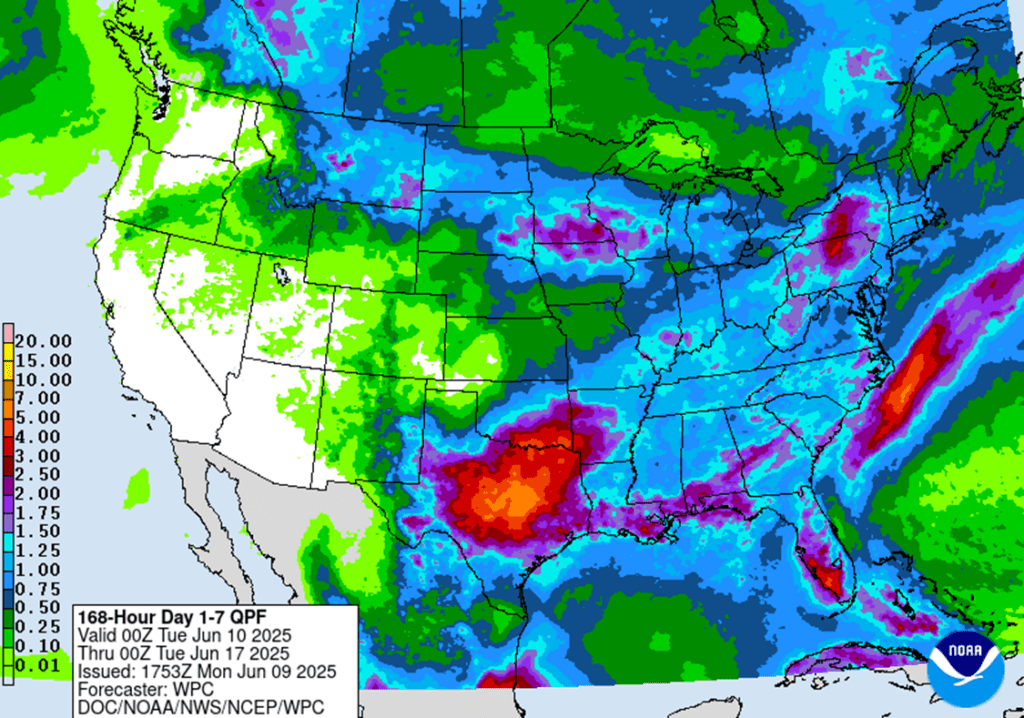

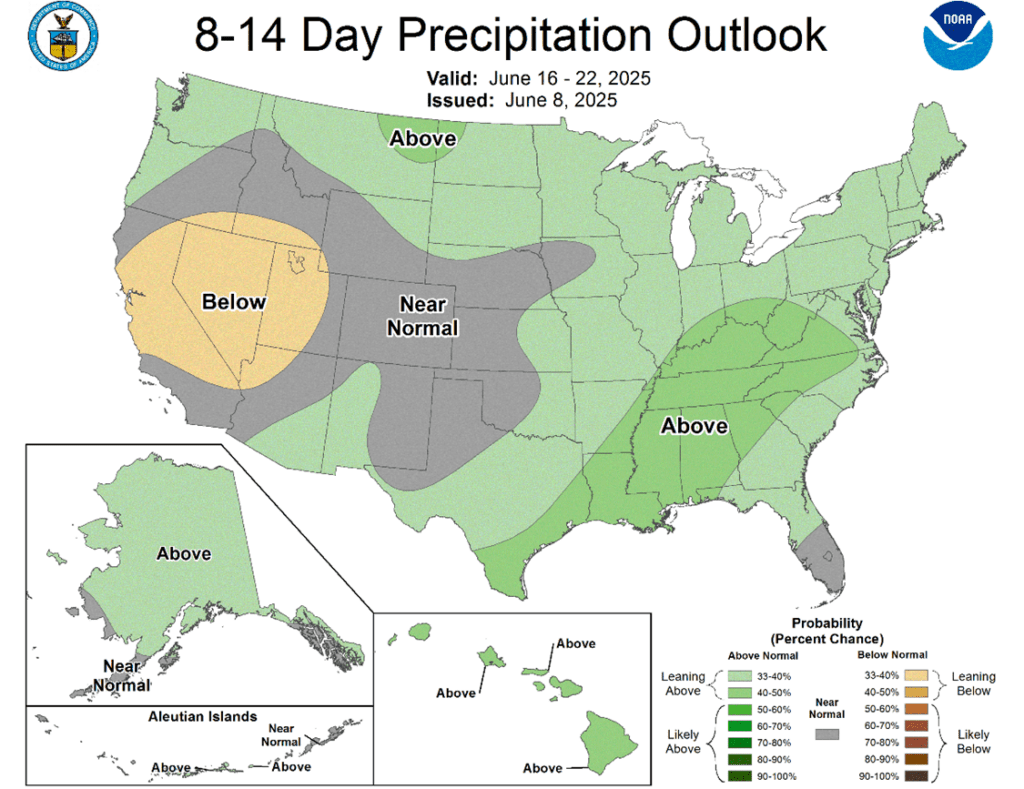

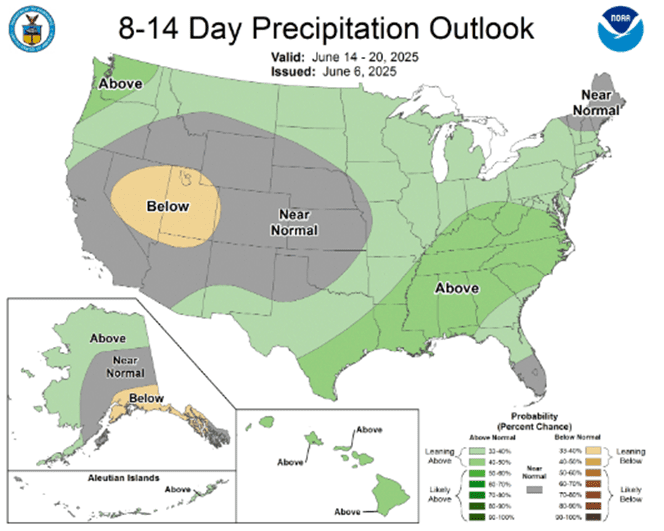

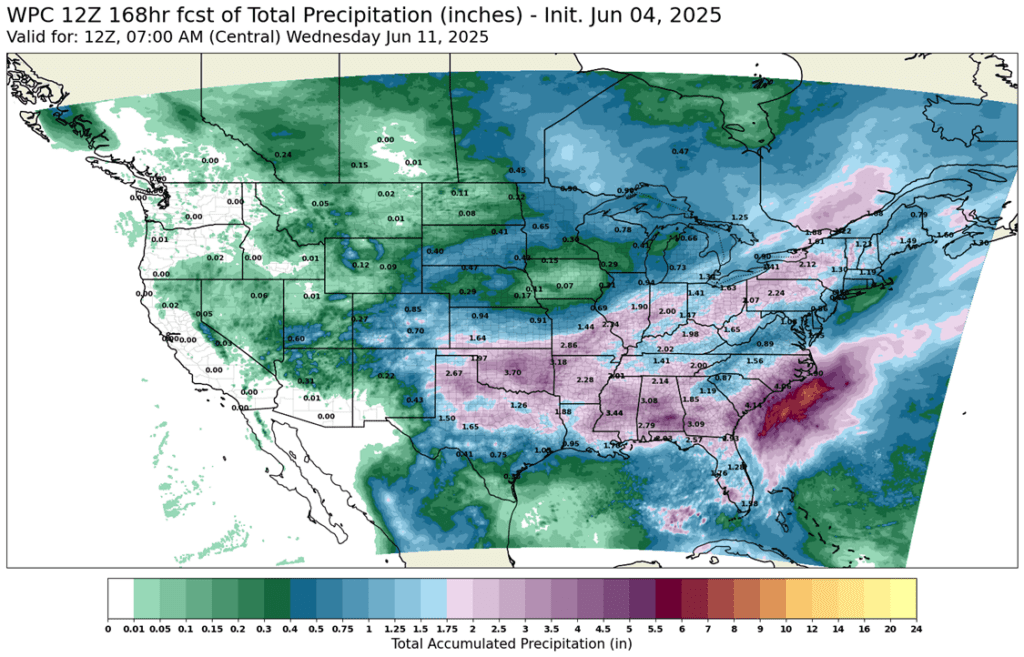

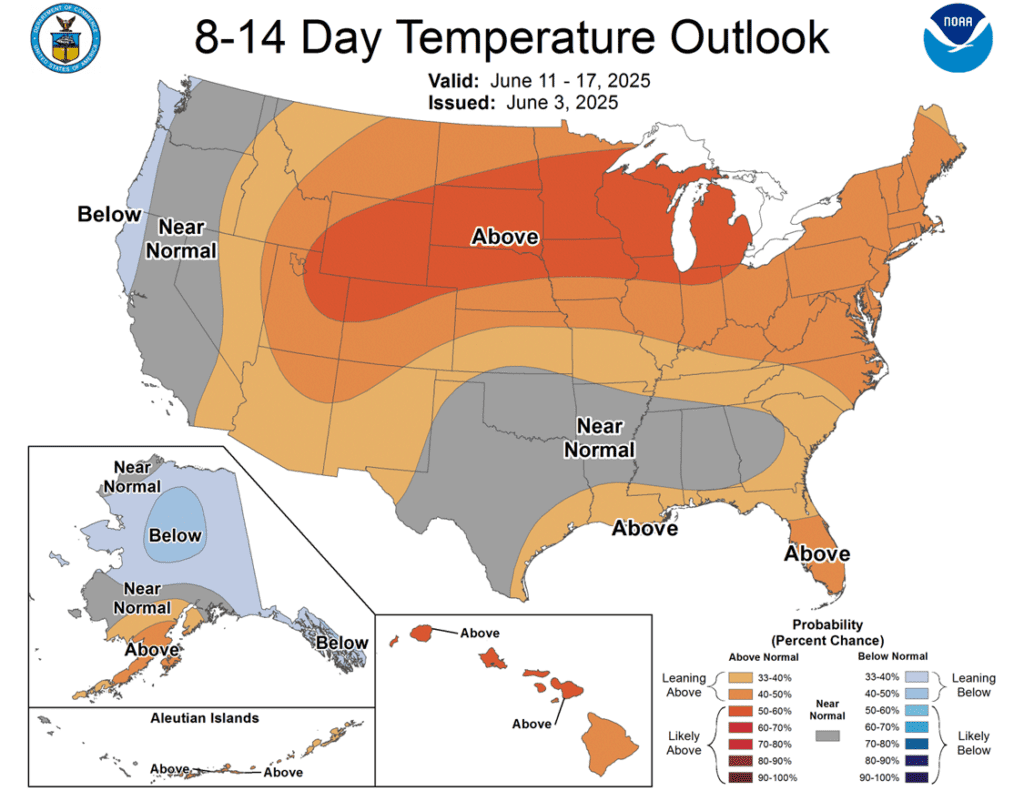

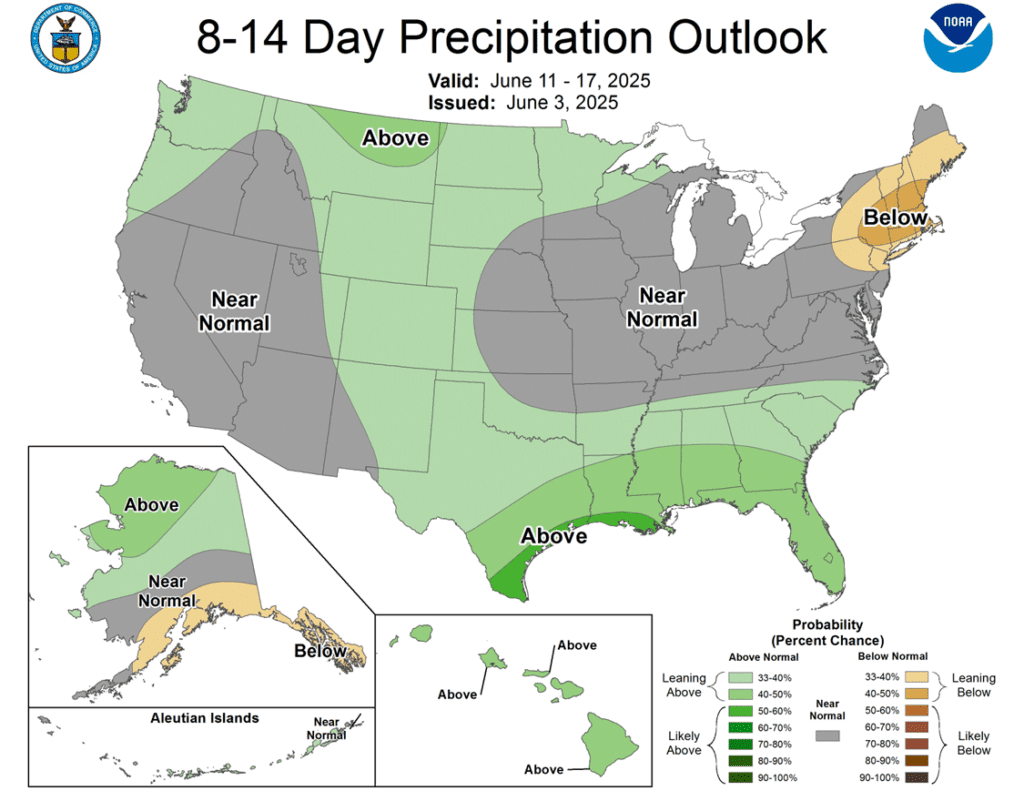

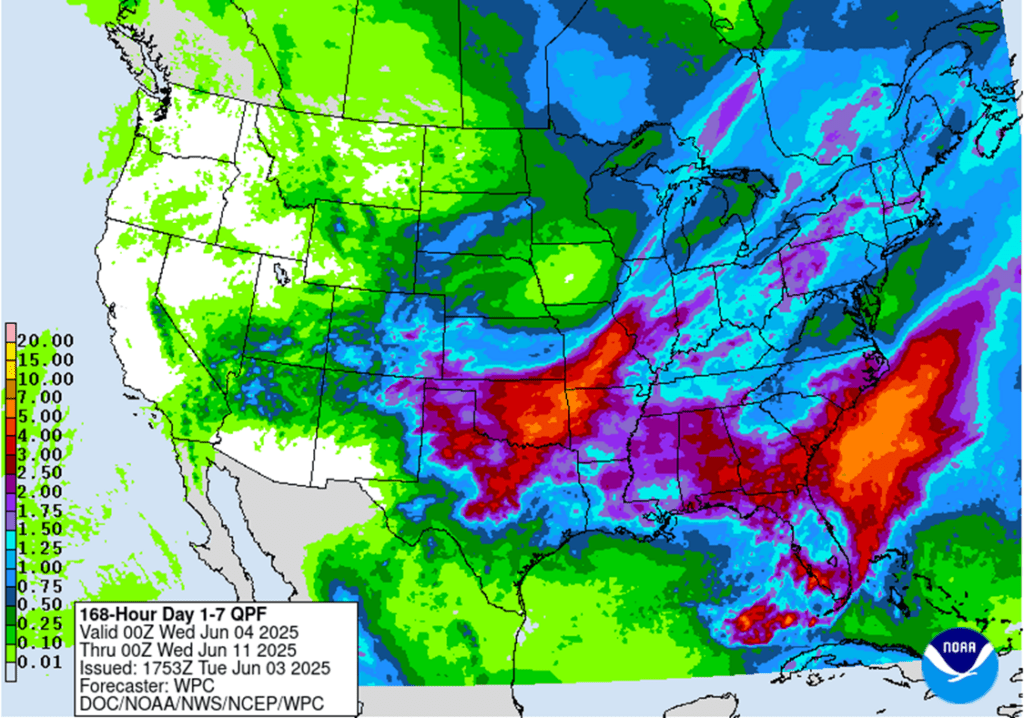

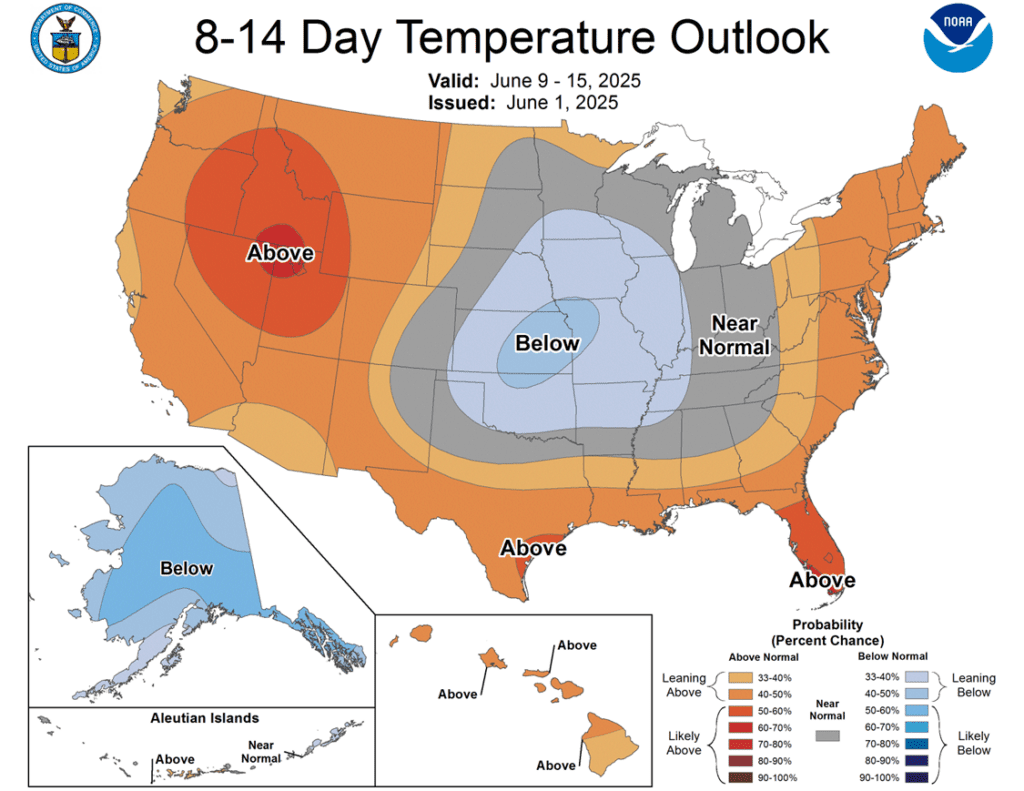

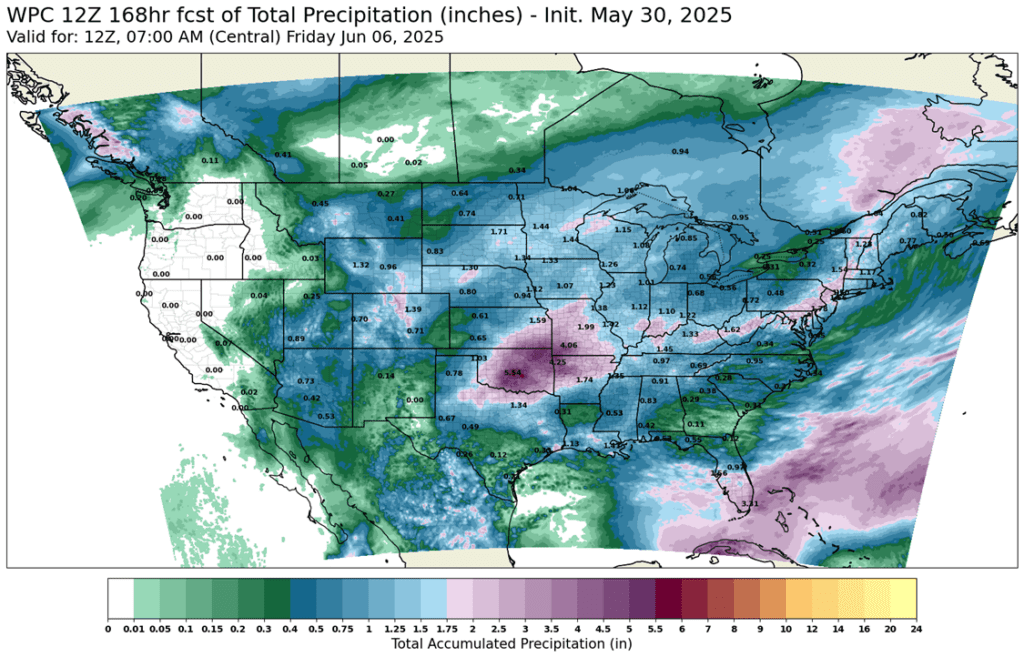

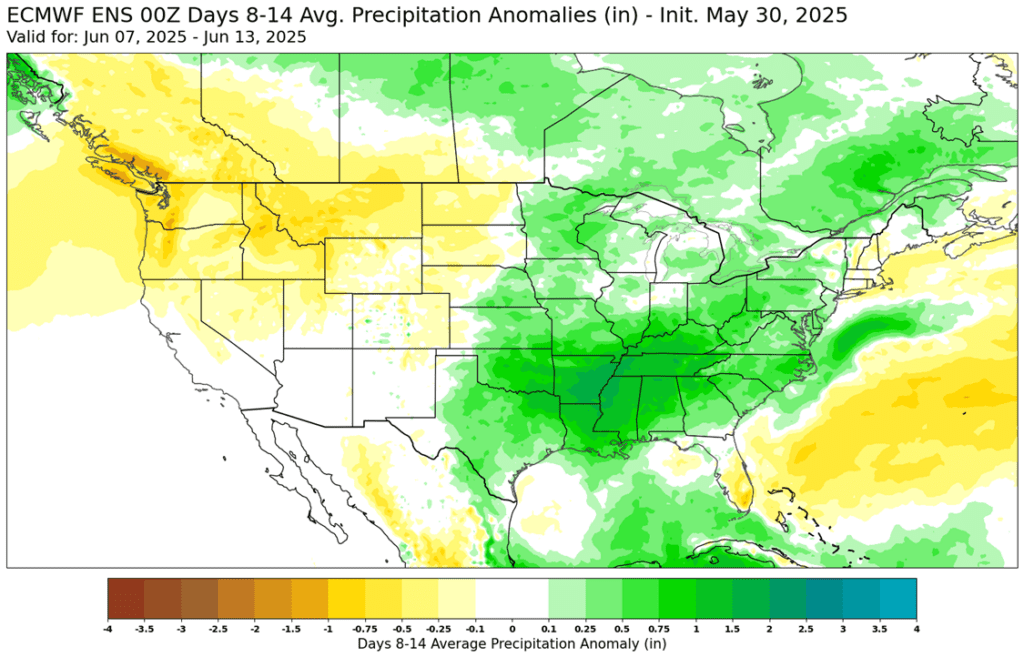

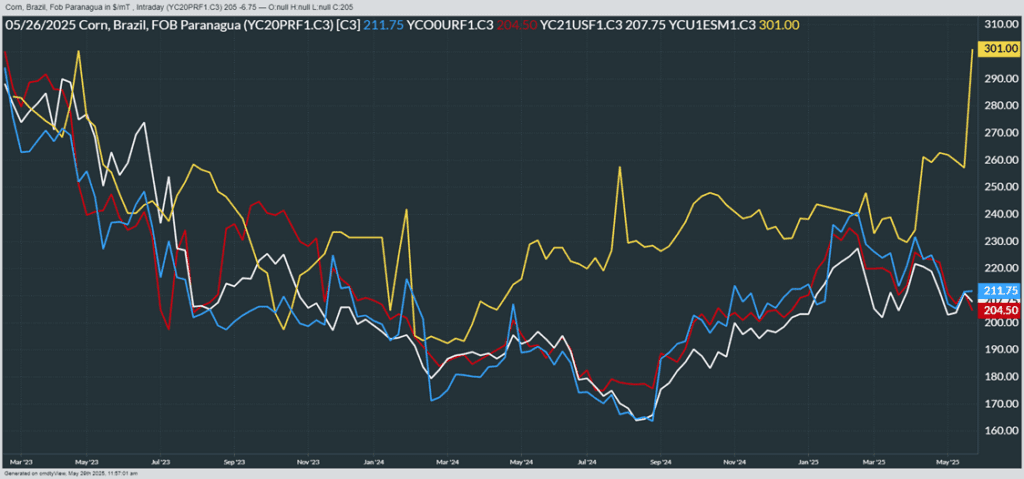

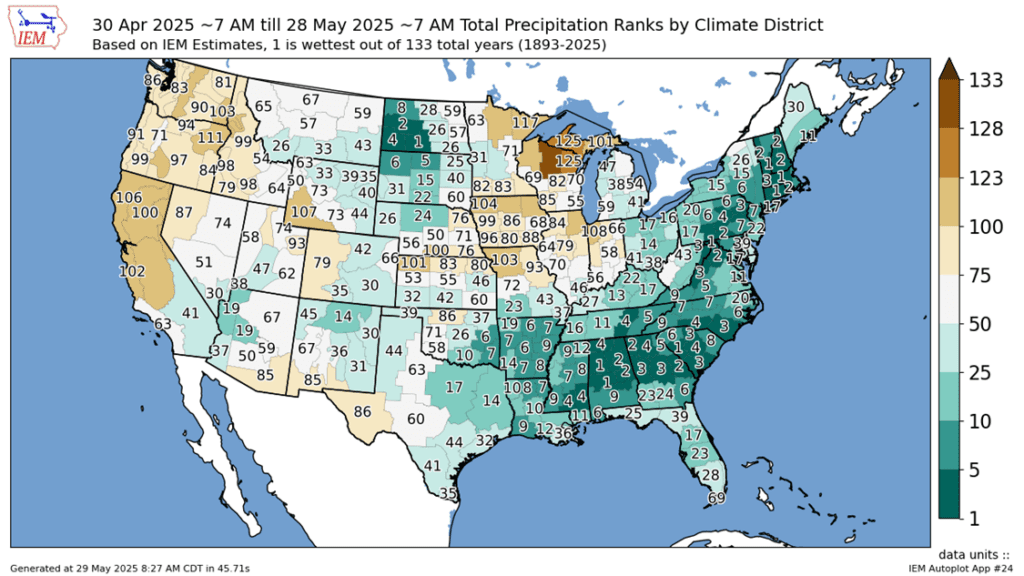

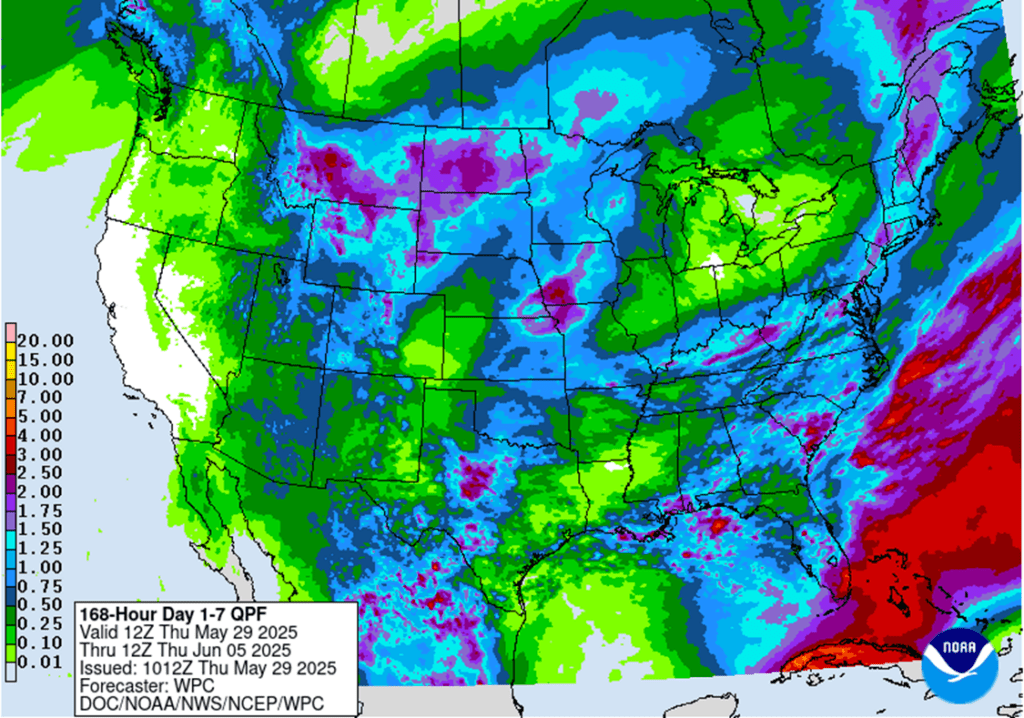

- 🌽 Corn: Corn futures closed sharply lower as long-range weather models turned wetter. The July contract posted its lowest close since October 18, while the December contract gave back all its gains from the previous three trading sessions.

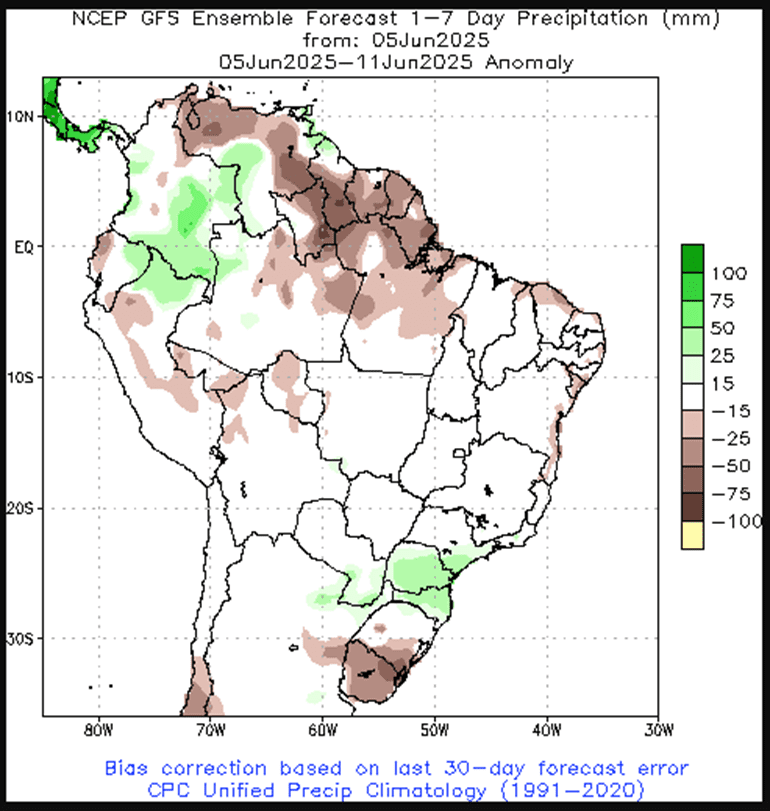

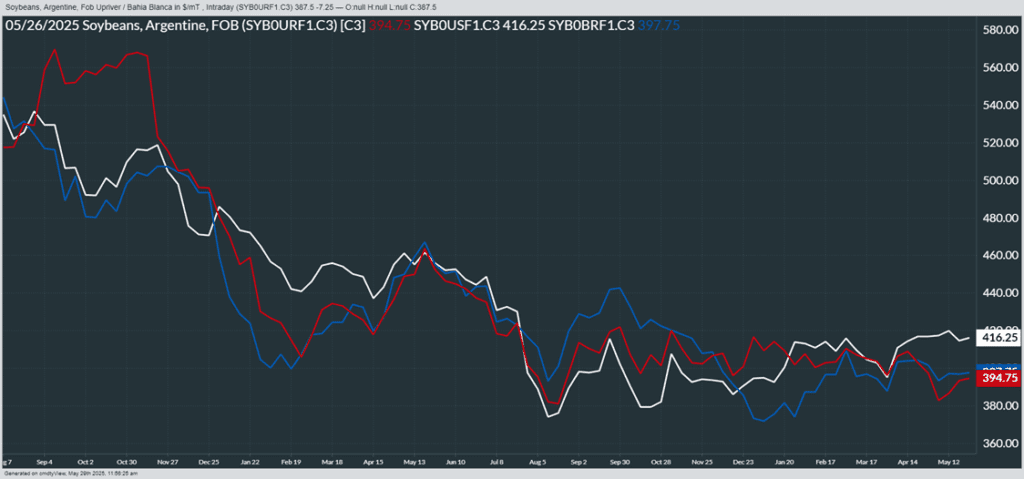

- 🌱 Soybeans: Soybeans closed lower despite better-than-expected export inspections of 20.1 million bushels for the week ended June 5. Both the July and November contracts snapped a four-day winning streak yet remain above their June lows by roughly 30 cents and 15 cents, respectively.

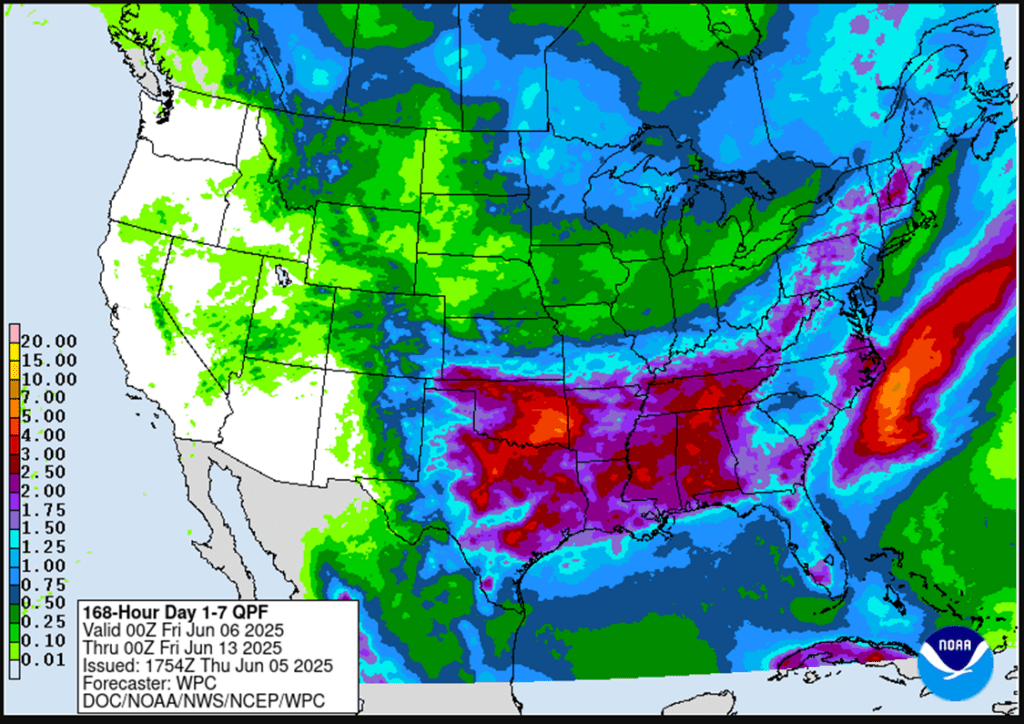

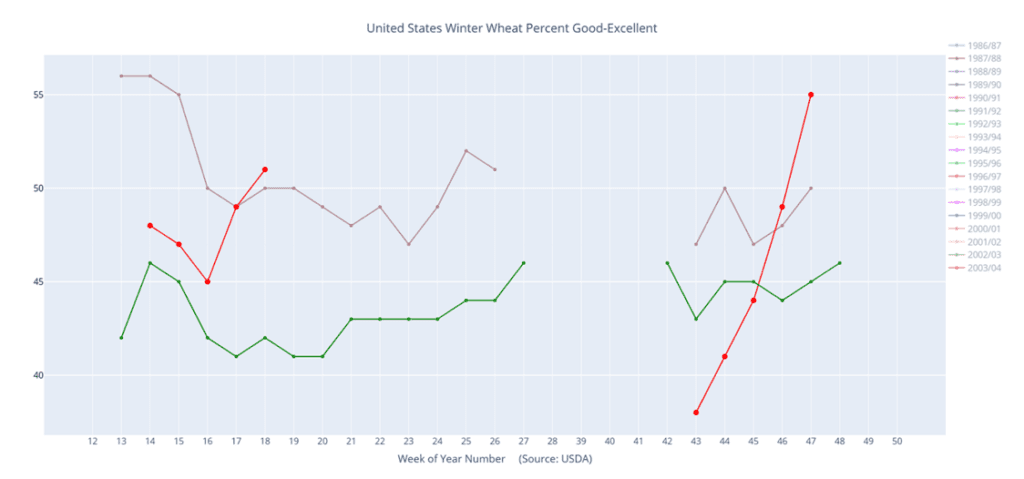

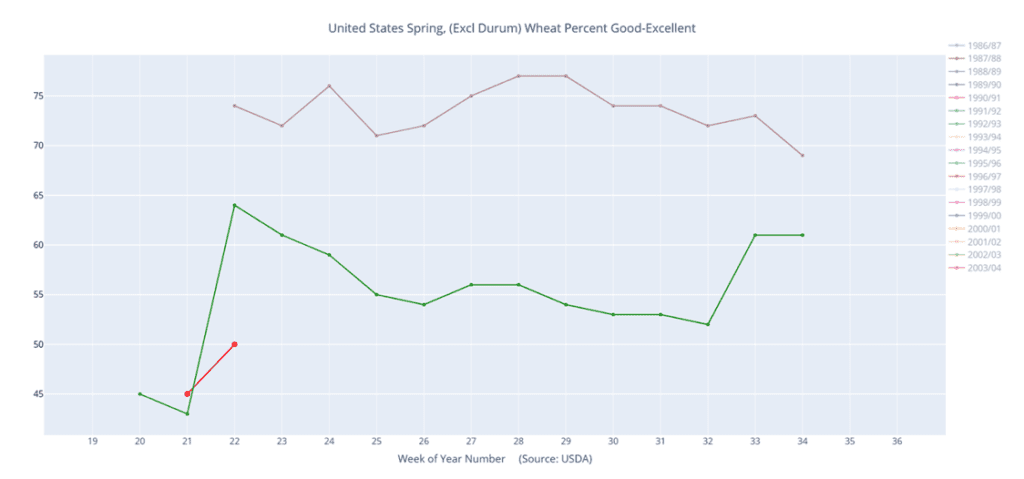

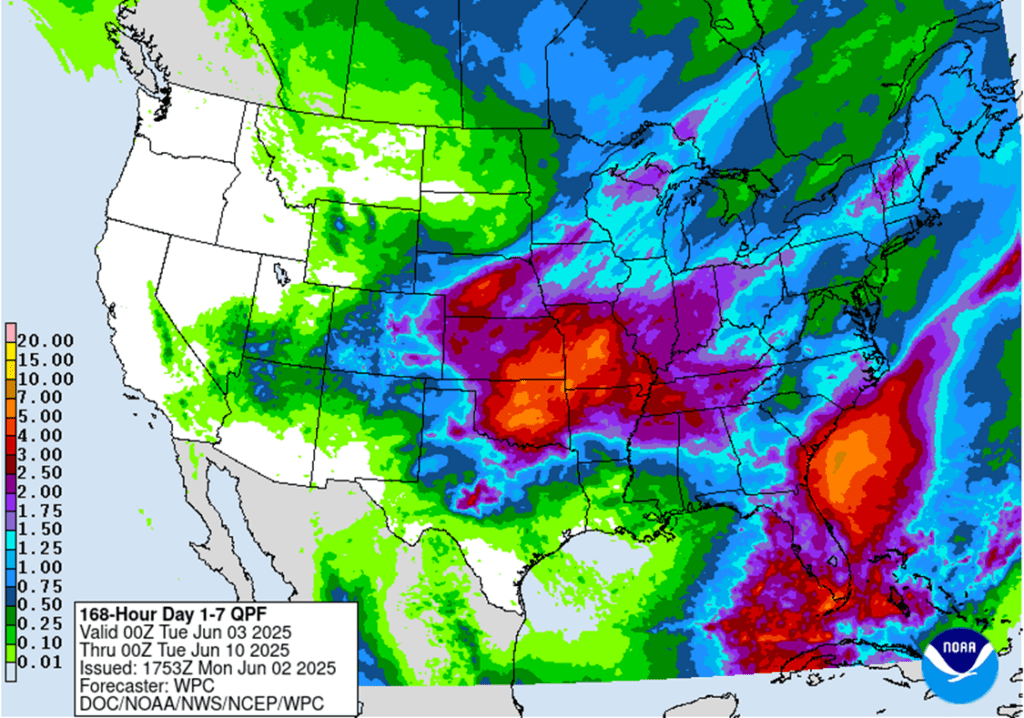

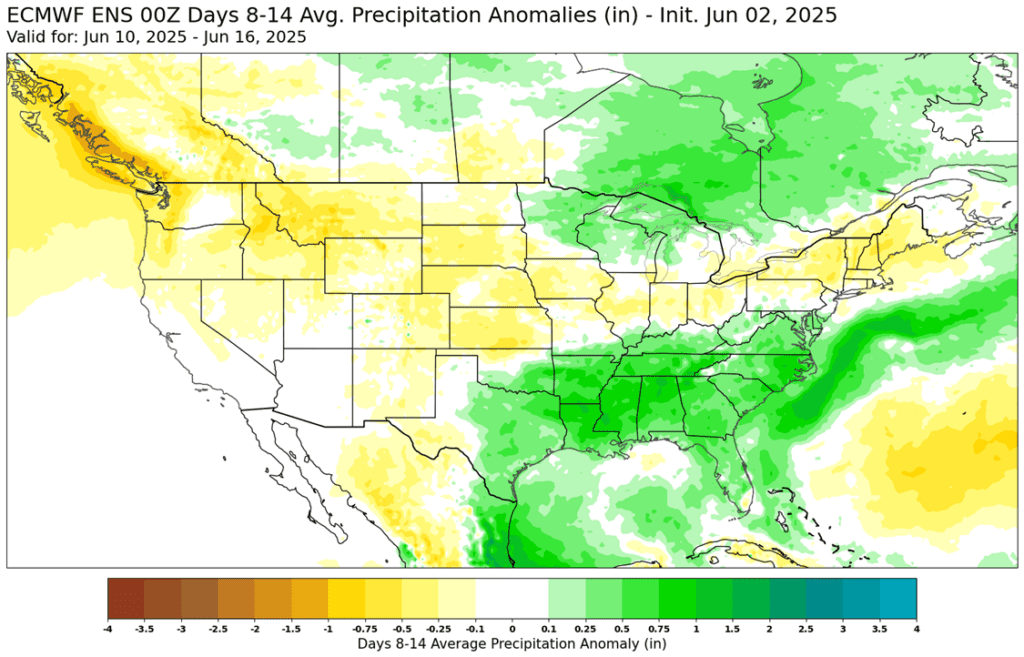

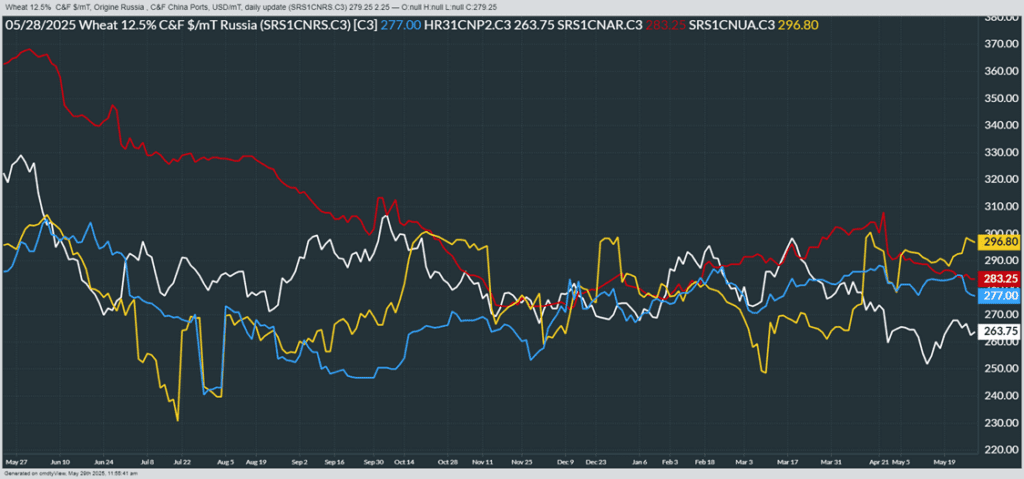

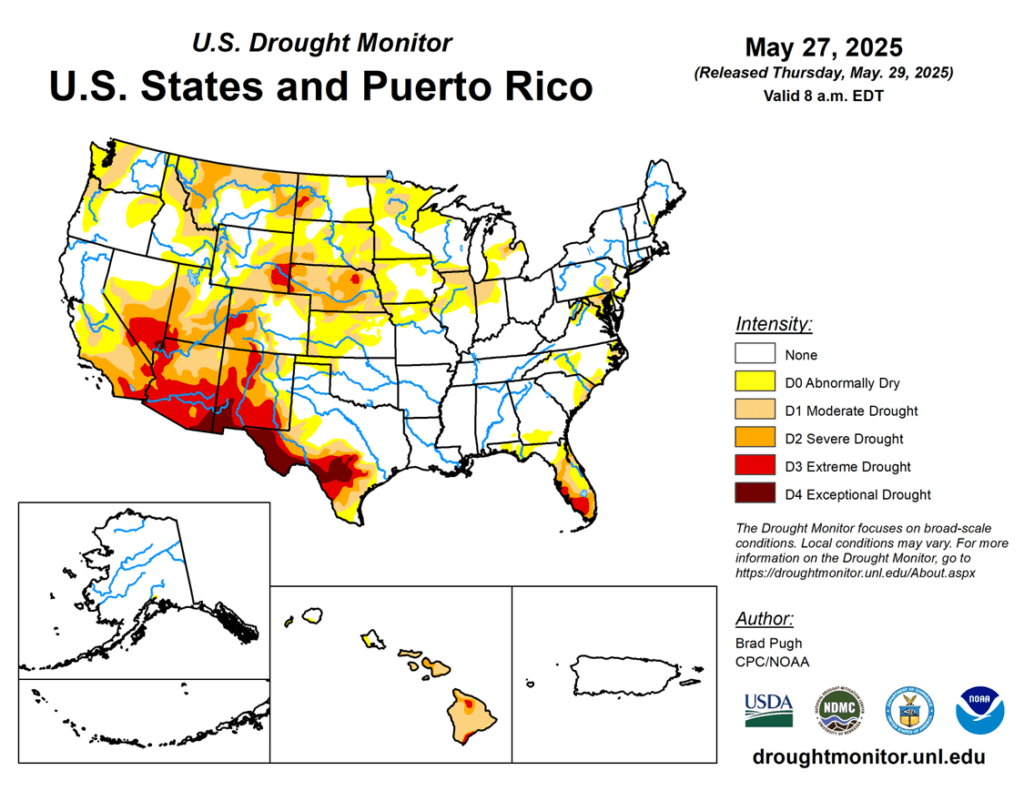

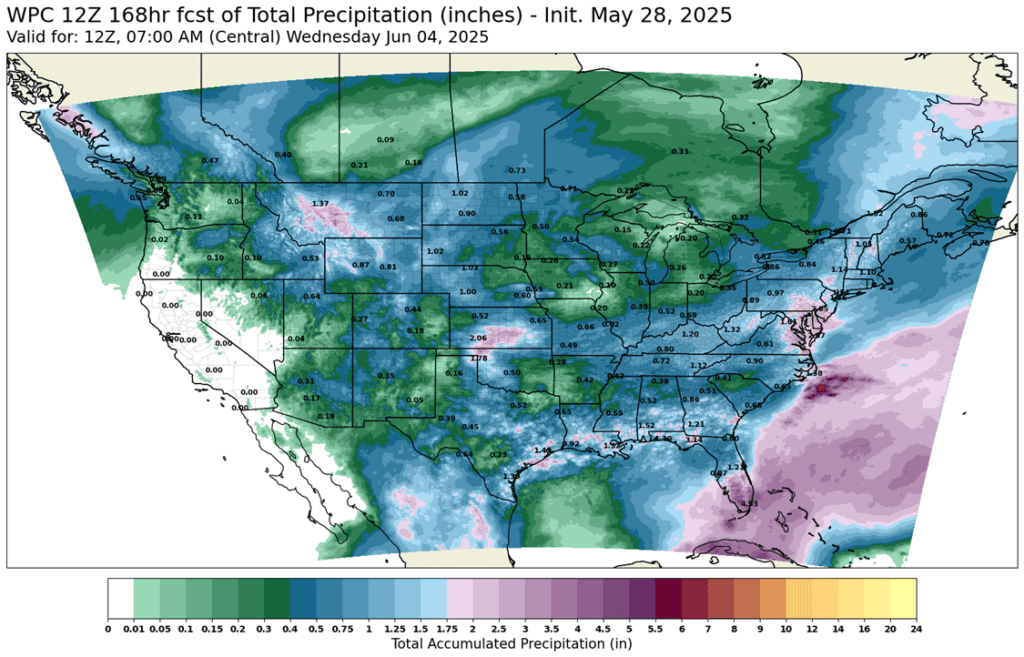

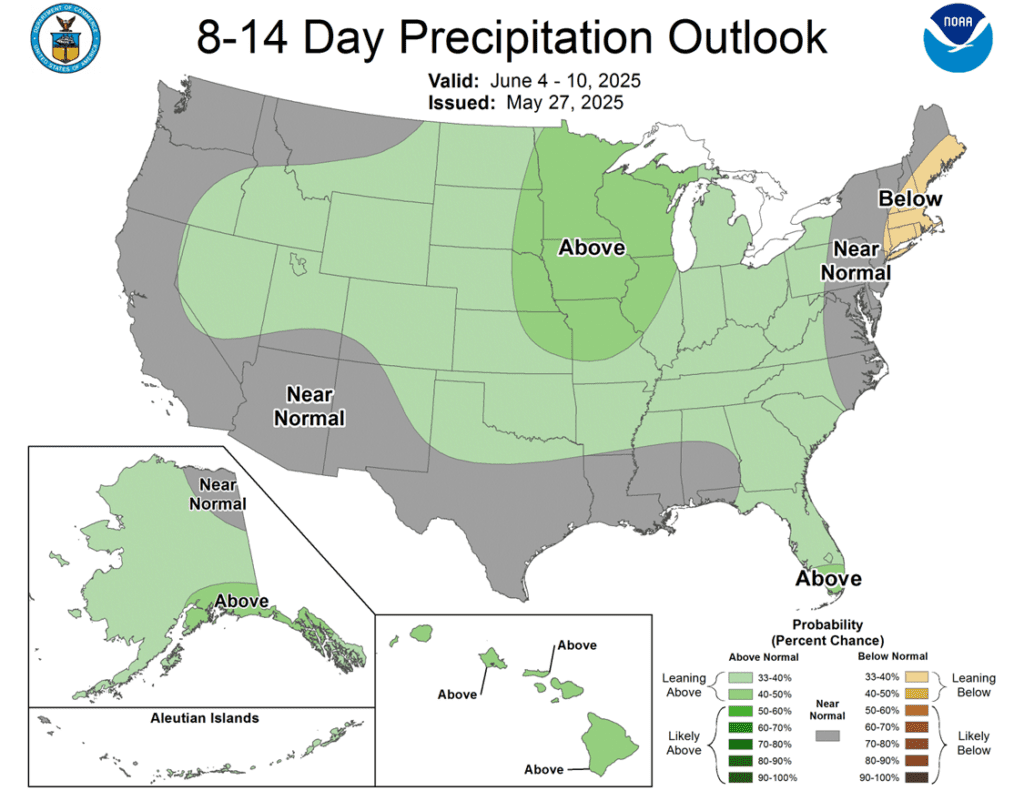

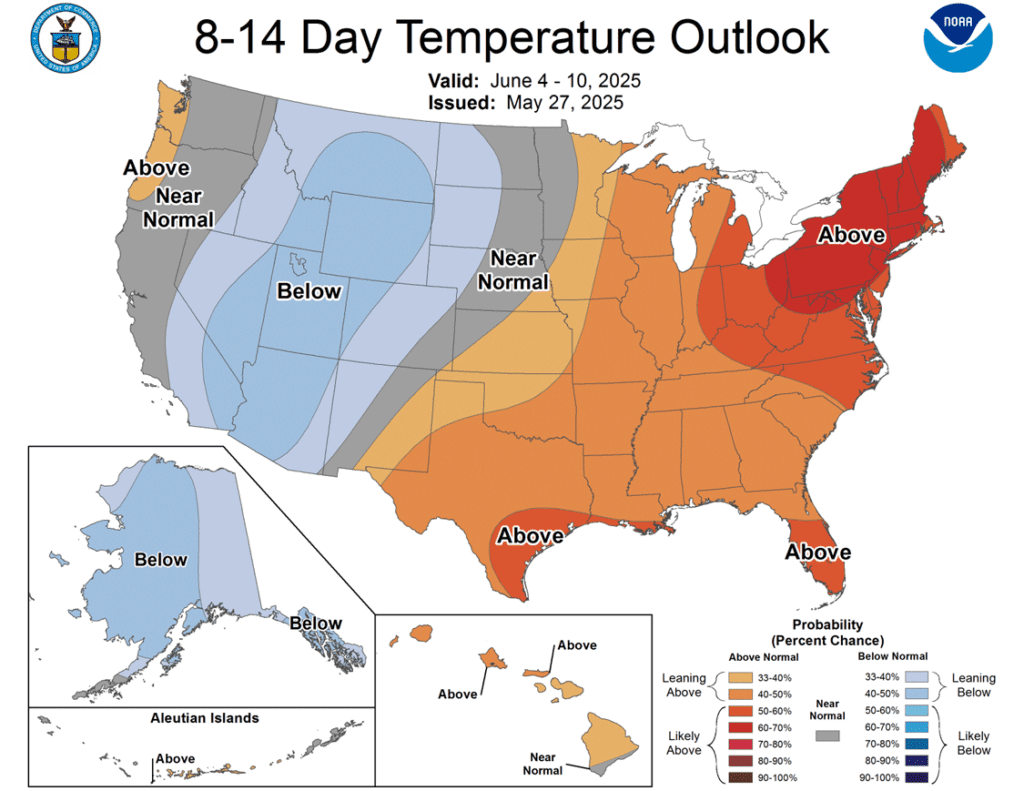

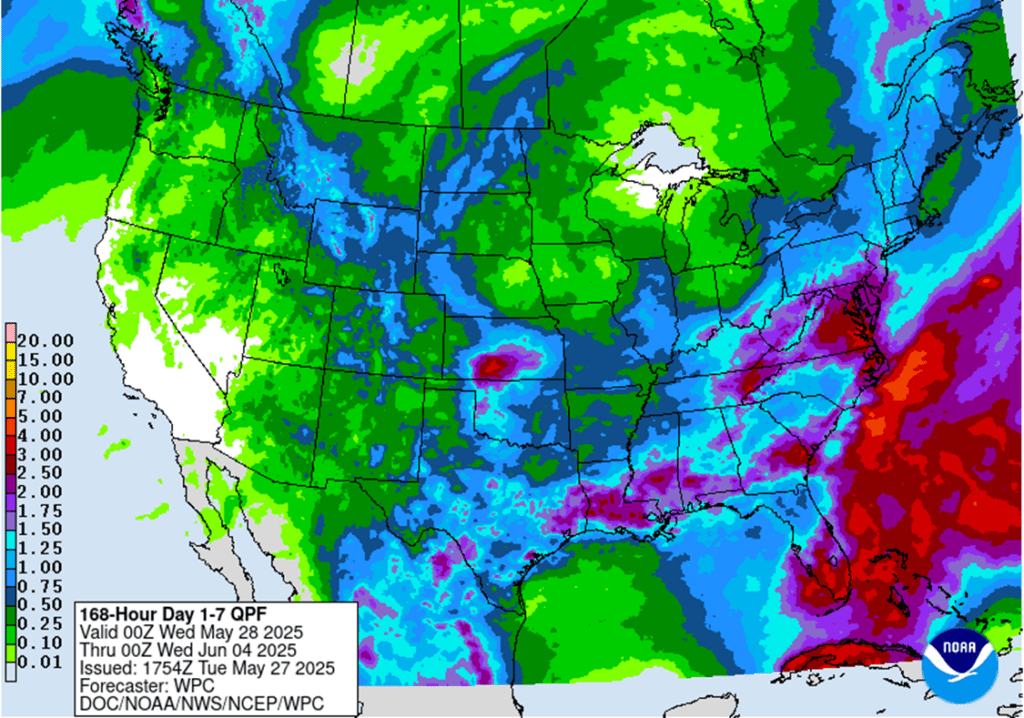

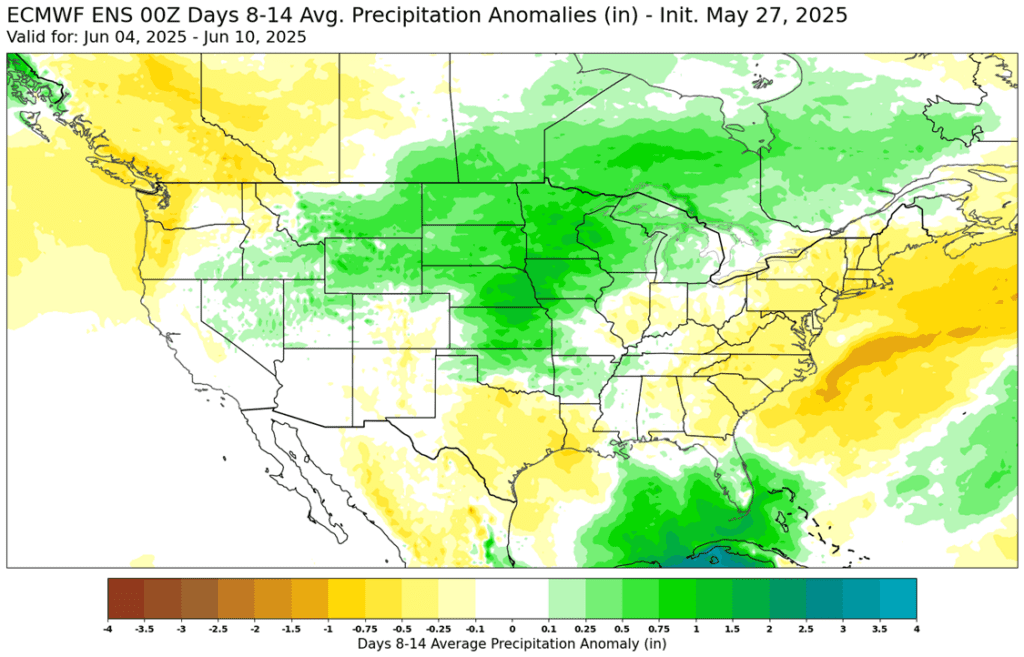

- 🌾 Wheat: All three wheat classes posted their largest one-day losses since May 27. The drop was driven by a combination of harvest pressure, weaker Matif wheat, beneficial weekend rains in Australia, and an improved rainfall outlook for the U.S. Northern Plains.

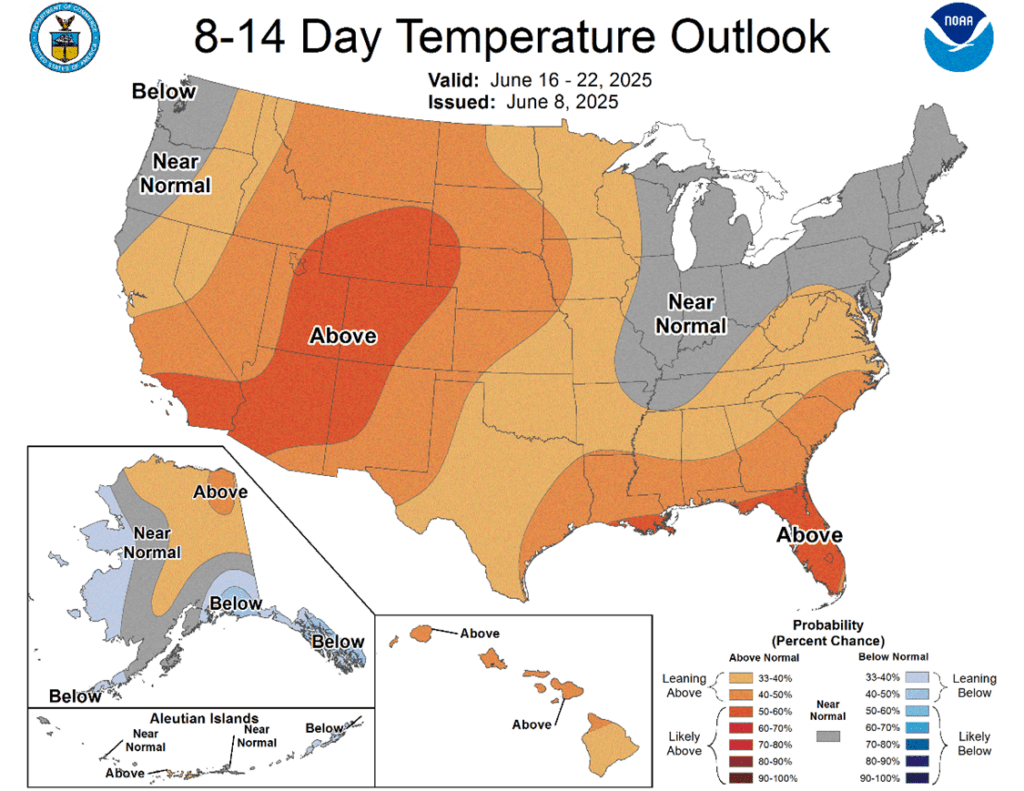

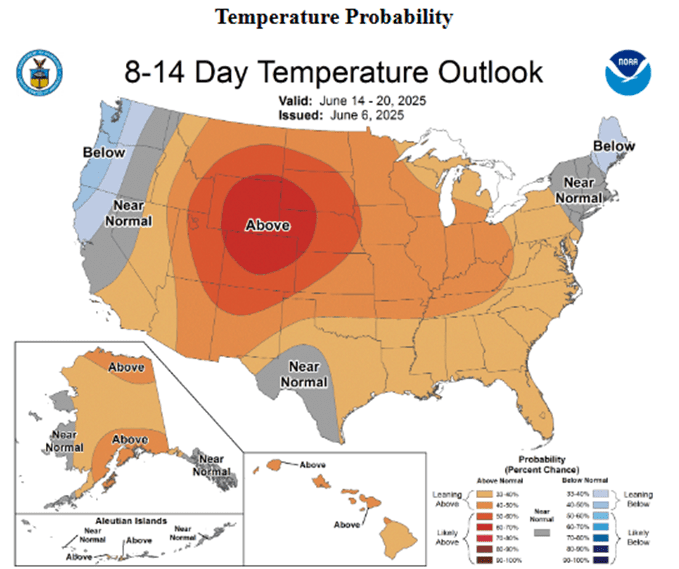

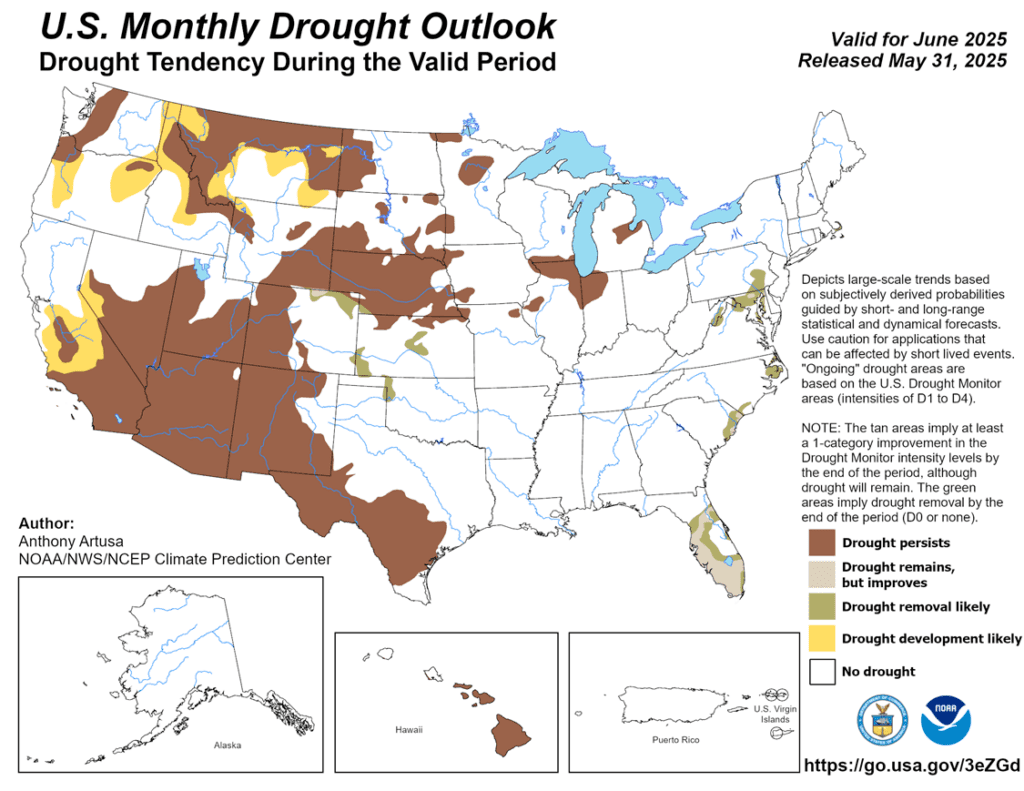

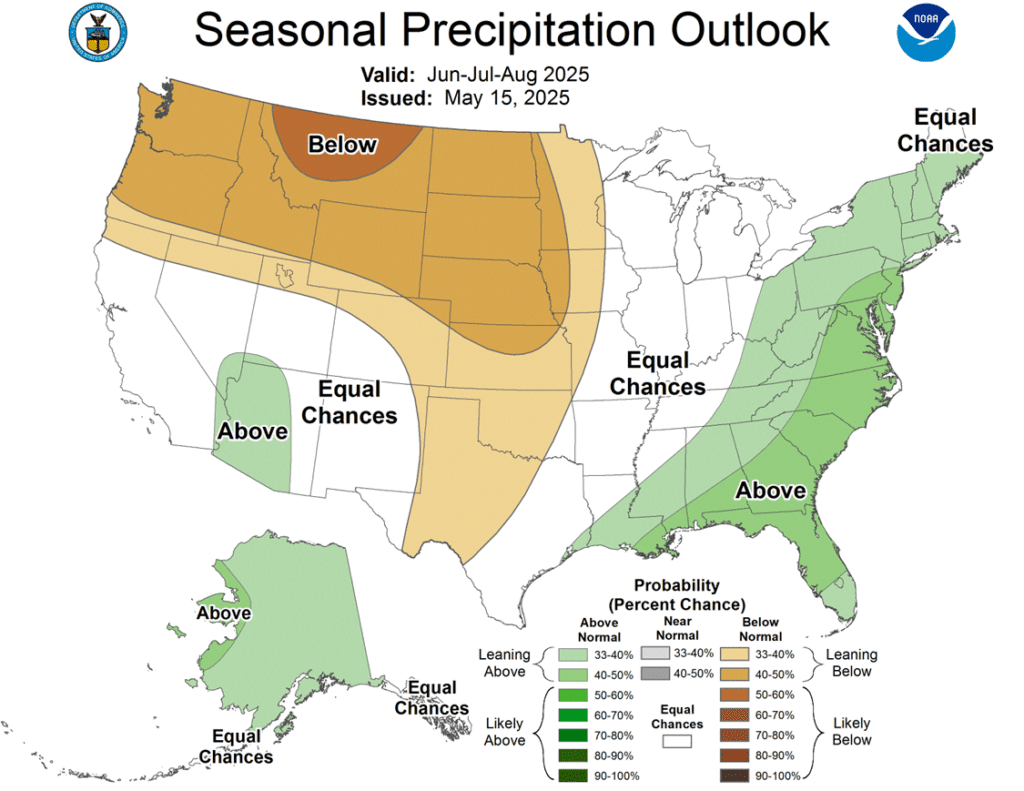

- To see the updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

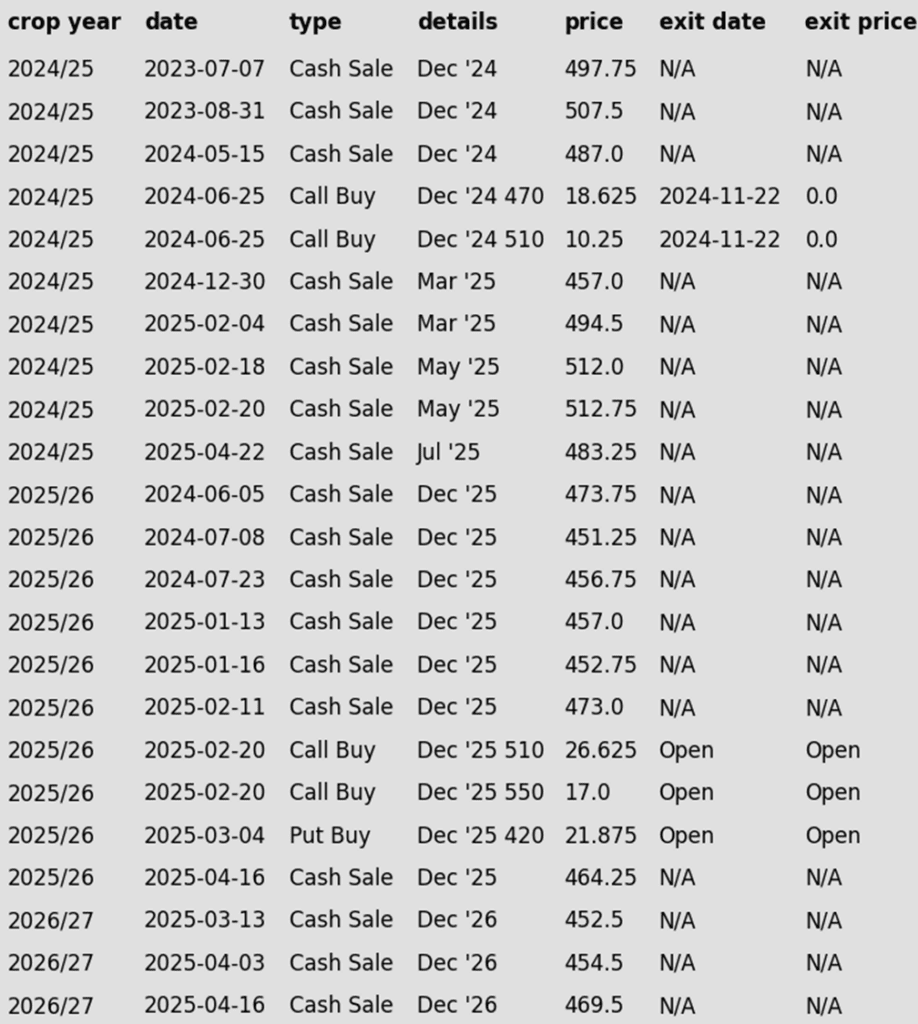

Corn

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- No Action Yet: Still waiting on a potential spring/summer weather volatility rally before recommending the next sale.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Volatility-Ready: Positioned well for potential market swings, with a solid base of sales and open call and put option positions in place. Active targets remain set to begin legging out of options and roll down call options to lower strikes as conditions warrant.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a fourth portion of your 2026 corn. The December ‘26 contract has reached the upside target of 474.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

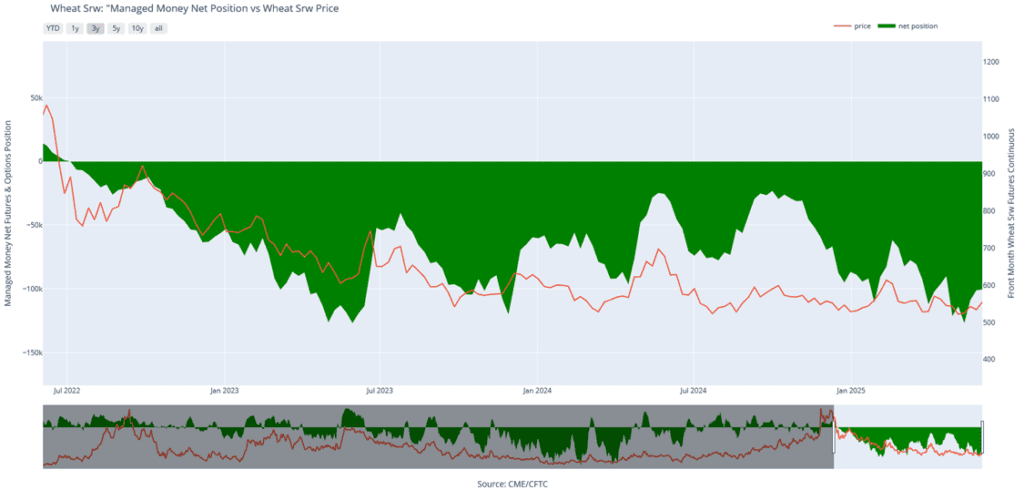

To date, Grain Market Insider has issued the following corn recommendations:

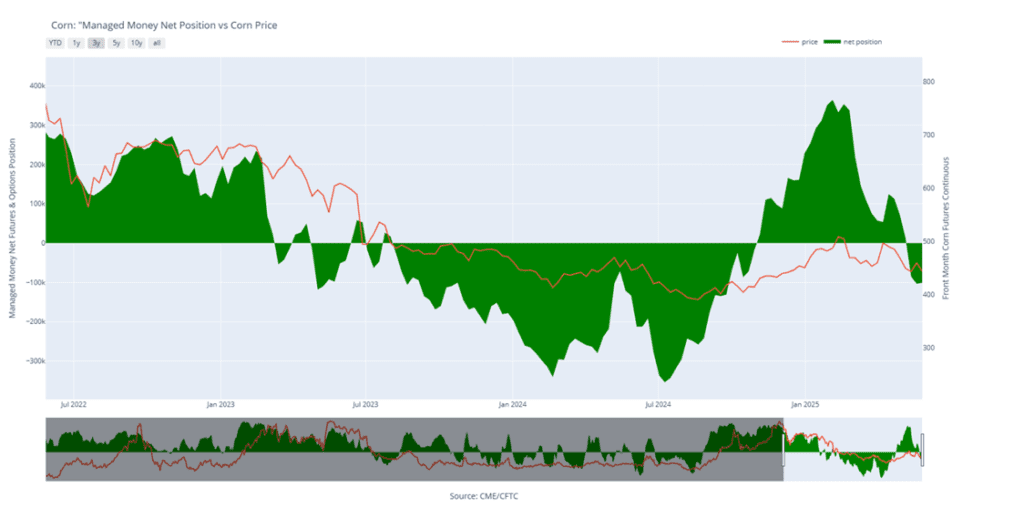

- Disappointing day in the corn market as sellers stepped aggressively back into the corn market. The strong selling pressure eliminated the gains in the Dec corn contract last week and a wetter tone in some forecast and technical selling pressured the market

- Dec corn futures failed to push through the psychological 450 price area. The failure at this level triggered selling pressure as prices continue to drop through levels of support. The weak technical close opens the door for additional selling pressure going into Tuesday.

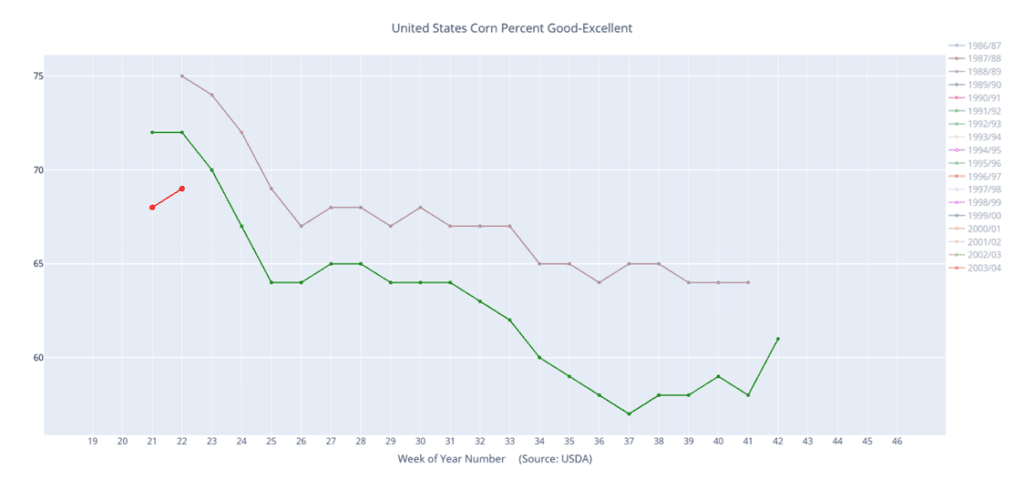

- Long-range weather models turn heavier with precipitation from the end of June into early July, which countered some drier weather talk last week.

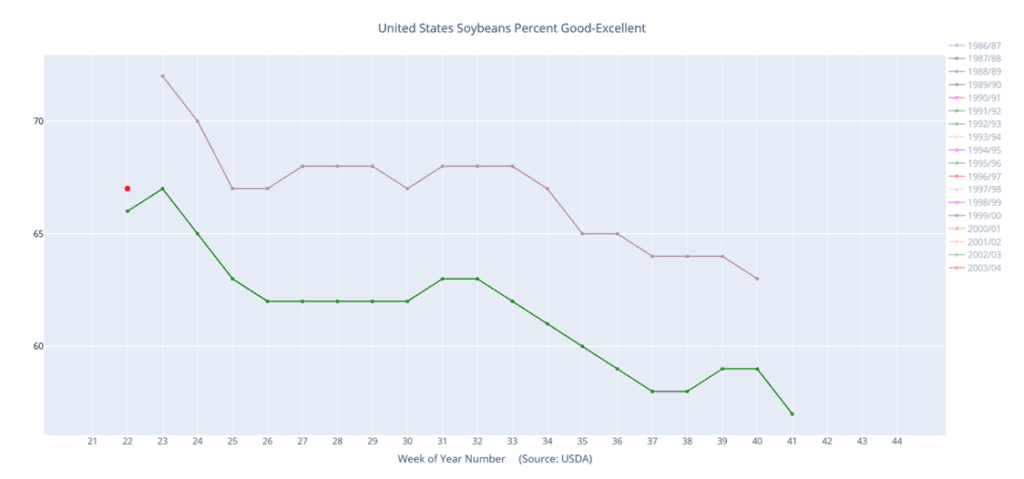

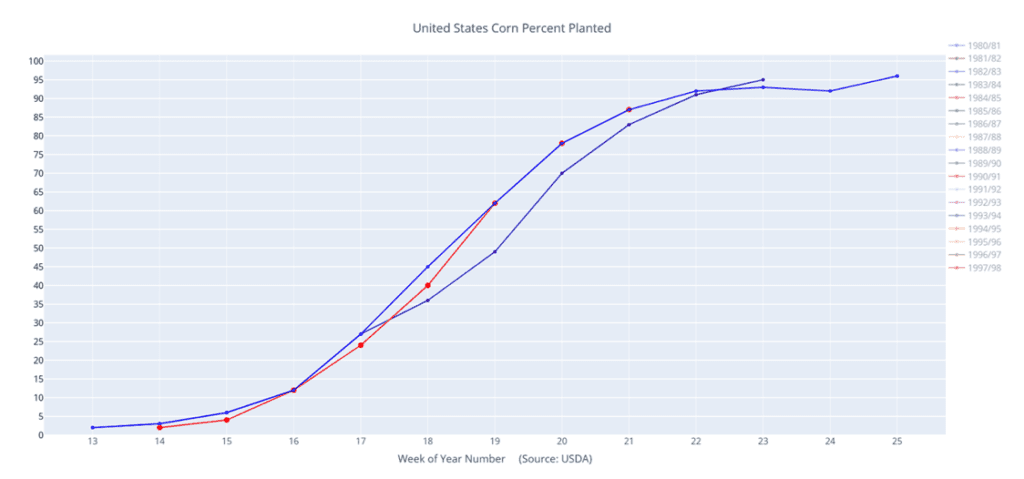

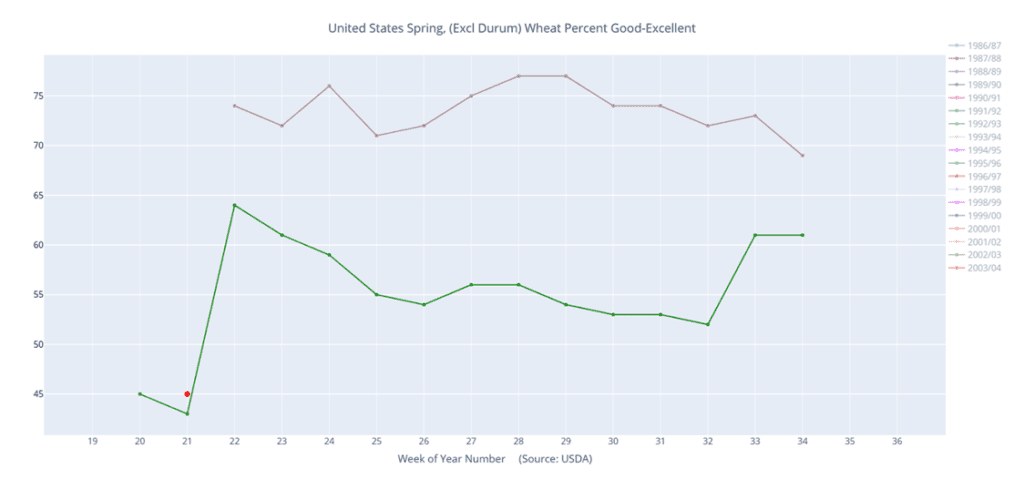

- USDA will release crop progress and condition ratings on Monday afternoon. Expectations are for 97% of the corn crop to be planted. Conditions ratings have been below average, but improved weather is expected to boost the rating to 70% good/excellent, up 1% from last week.

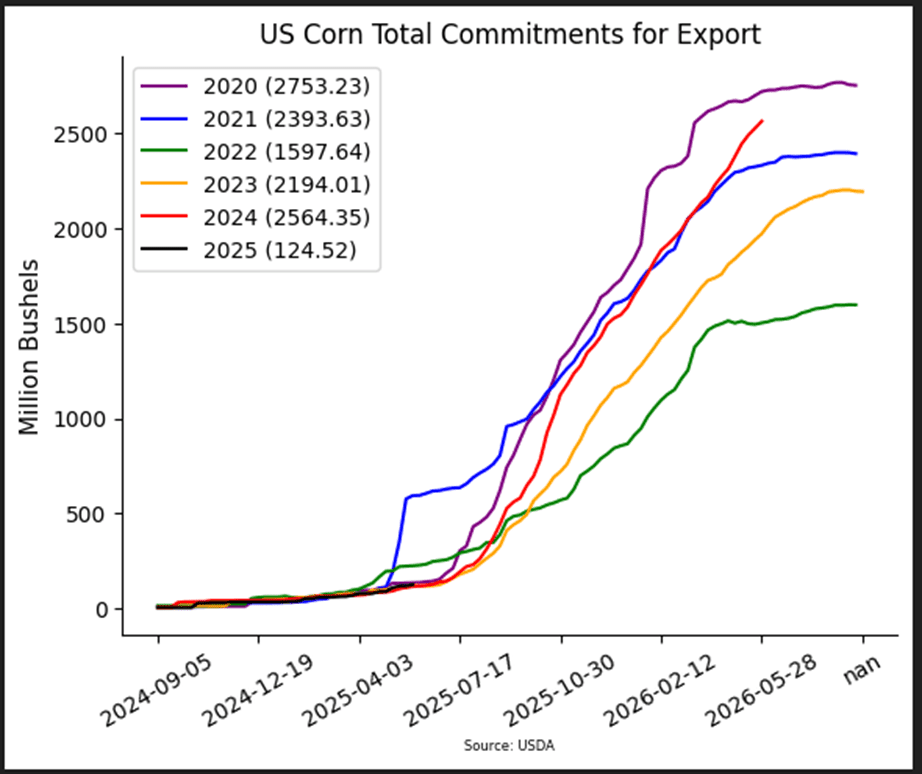

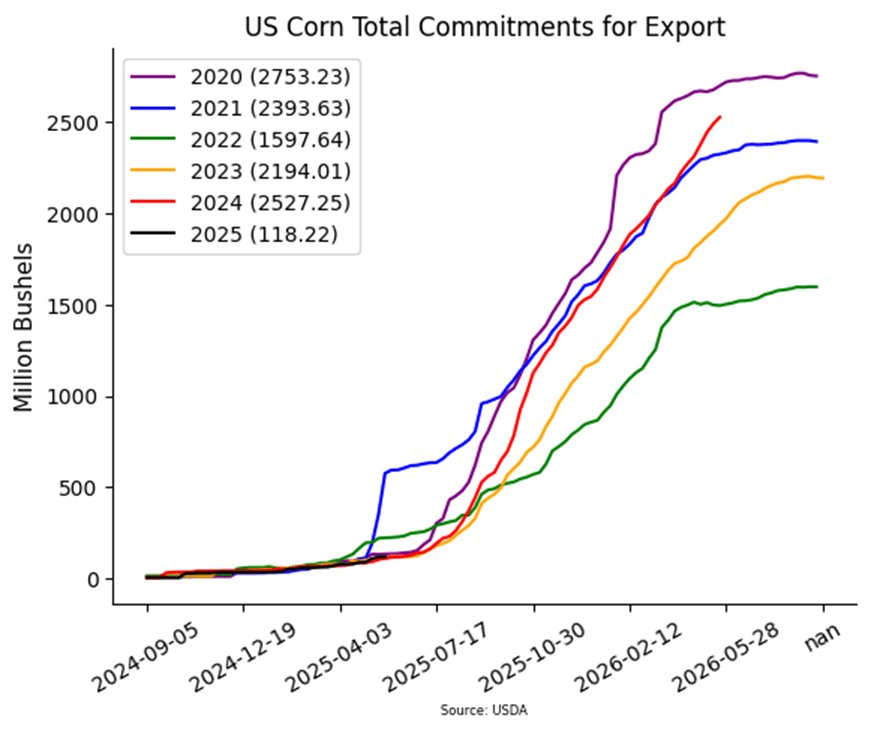

- USDA released weekly export inspections on Monday. Last week, US exporters shipped 1.657 MMT (65.2 mb) of corn. This total was above market expectations. Current corn shipments are up 29% over last year. The current shipment pace is ahead of the pace to reach the USDA marketing year target by approximately 160 mb.

Corn Futures Settle Into a Tight, Five-Day Range

The front-month July contract has settled into a tight five-day trading range, largely between 433 and 445. A close below 433 would open the door to downside risk toward 408, while a close above 445 would point to an upside opportunity near 465.

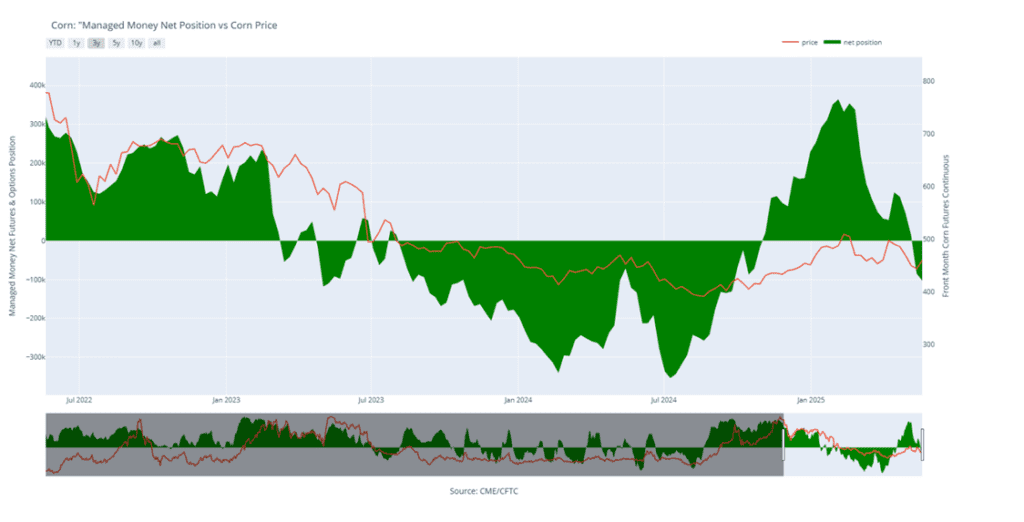

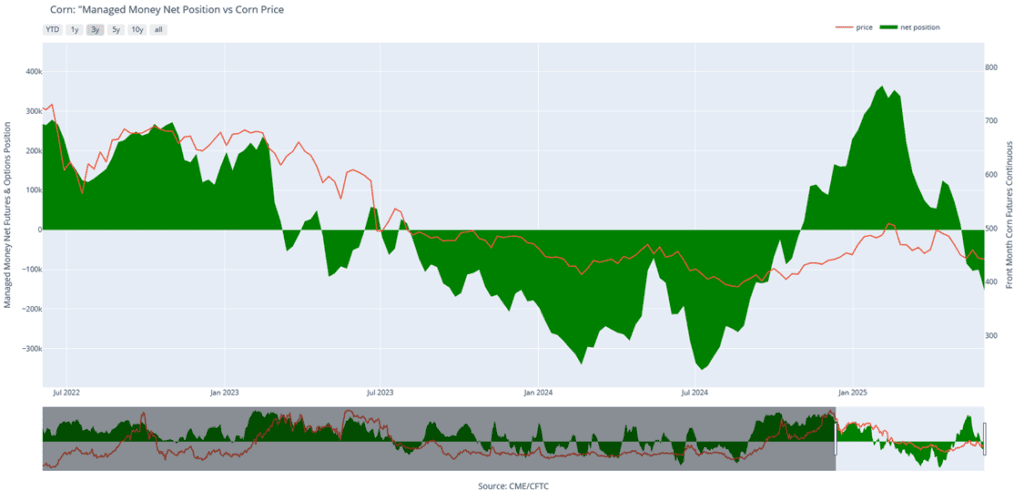

Above: Corn Managed Money Funds net position as of Tuesday, June 3. Net position in Green versus price in Red. Money Managers net sold 53,283 contracts between May 27 – June 3, bringing their total position to a net short 154,043 contracts.

Soybeans

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

- No Changes (for Now): While there are no adjustments at the moment, Monday’s close below 1036 support could prompt a revision to Plan A in the near future. Stay alert for potential updates.

2025 Crop:

- CONTINUED OPPORTUNITIES –

- Buy January ‘26 1040 put options for approximately 49 cents in premium, plus fees and commission. This is a recommendation to purchase a second round of 1040 puts, following the first round advised on May 6.

- Sell another portion of your 2025 soybean crop.

- Plan A:

- No active sales targets.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Now two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- We’re now in the seasonal window where first sales targets for next year’s crop could post at any time. Stay tuned.

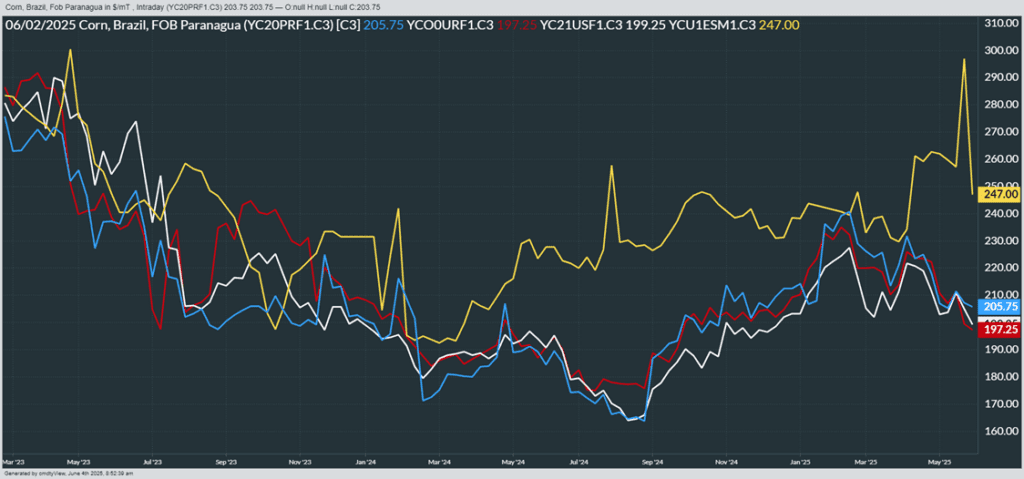

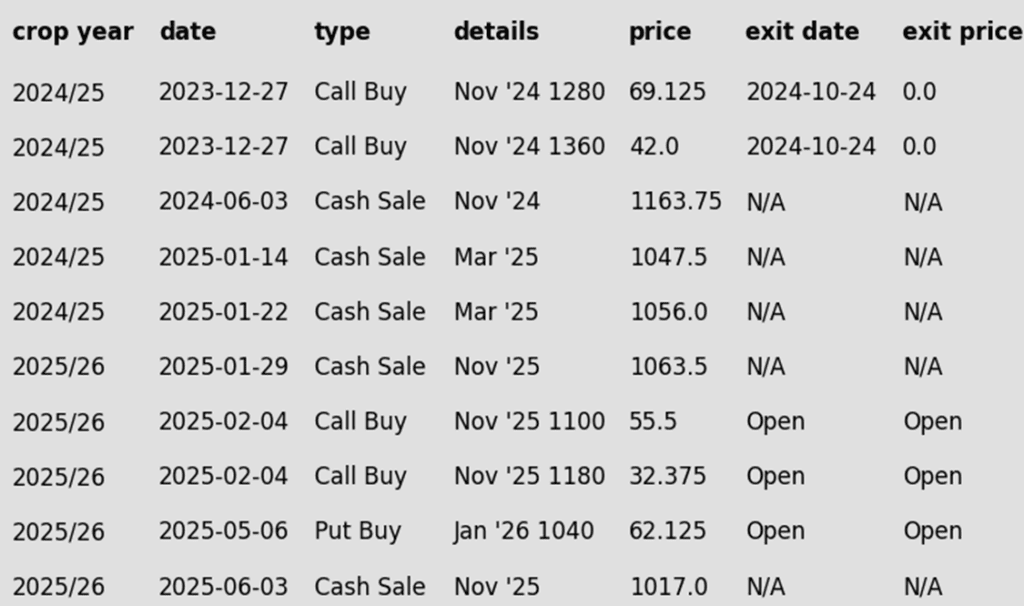

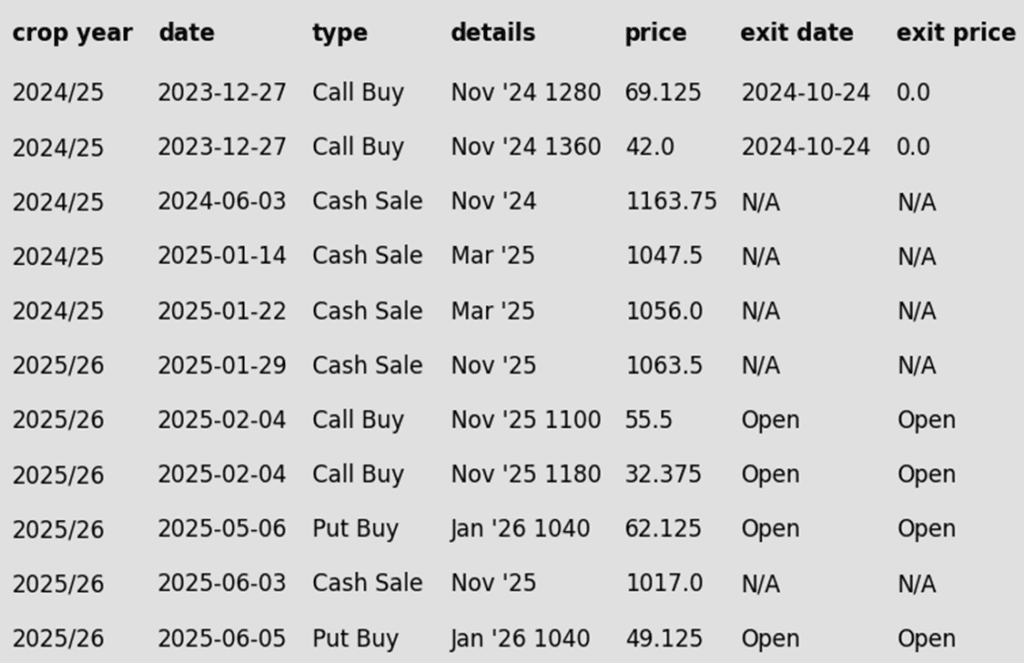

To date, Grain Market Insider has issued the following soybean recommendations:

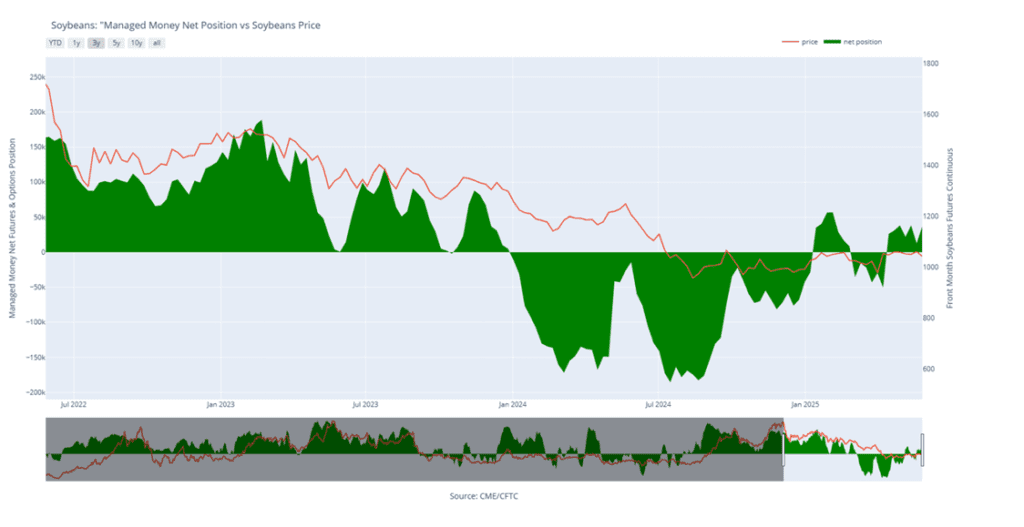

- Soybeans ended the day lower with the deferred contracts posting the larger losses in general weakness across the grain complex. July futures remain above all major moving averages and the 100-day moving average is now acting as support. Both soybean meal and oil ended the day lower as well.

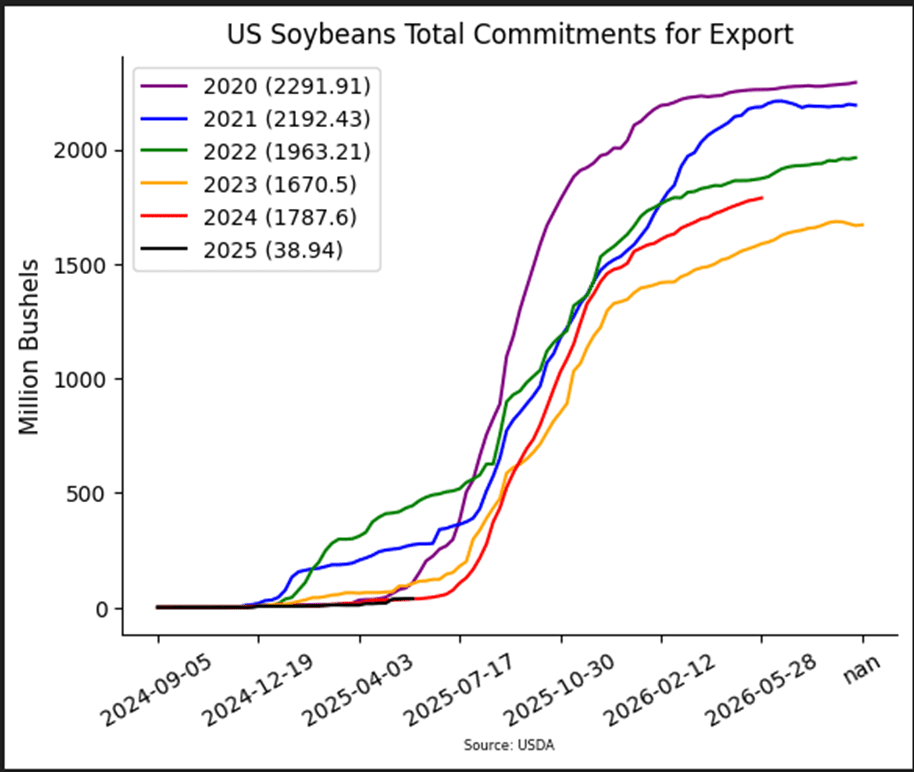

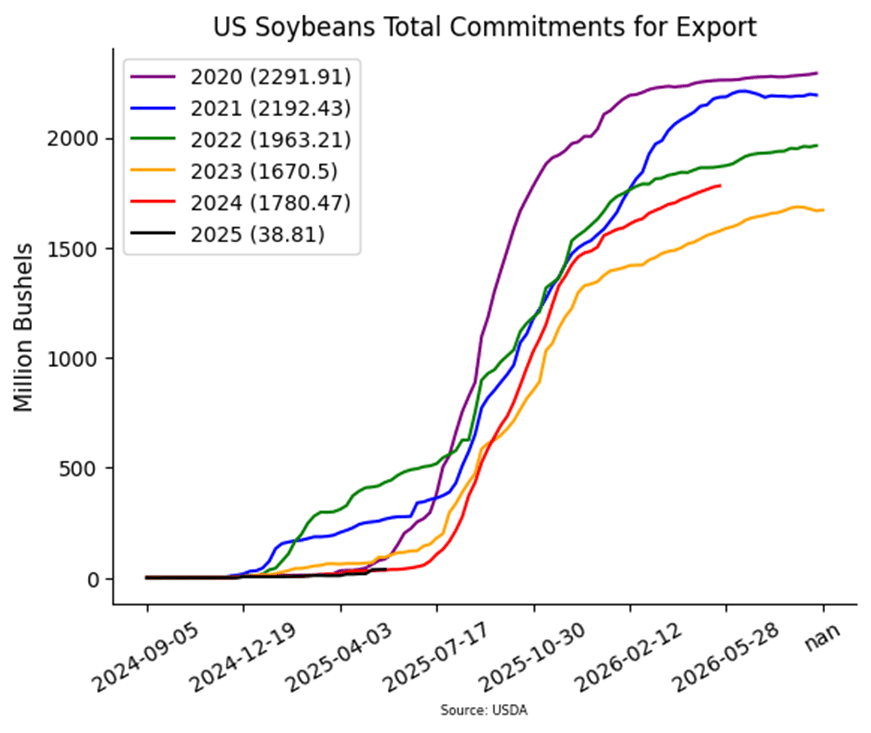

- Today’s export inspections report saw soybean inspections better than expected at 20.1 mb for the week ending June 5. Year-to-date soybean inspections exceed the seasonal pace needed to hit the USDA’s target by 81 mb which was up from 72 mb the previous week.

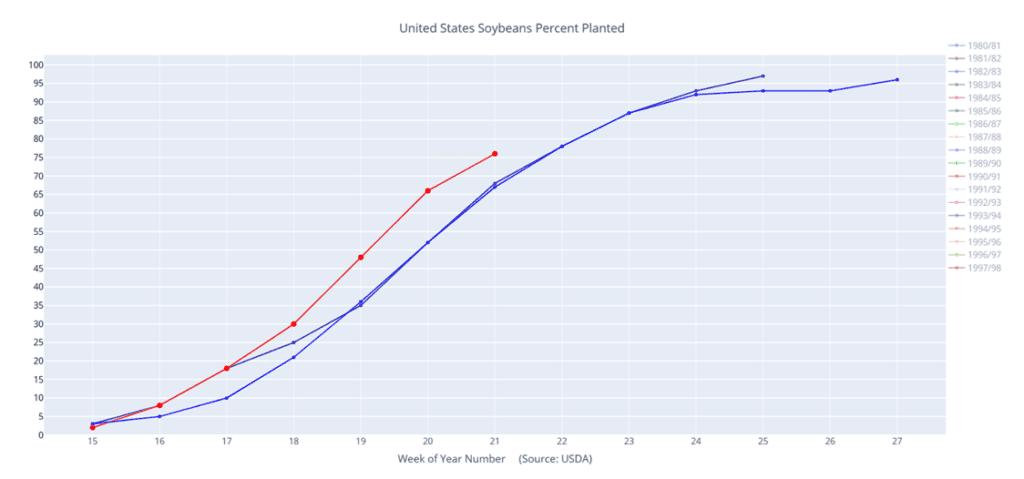

- Drought conditions are still persistent across the soybean belt but were seen shrinking by 1% to 16%. This compares to just 2% during the same period last year.

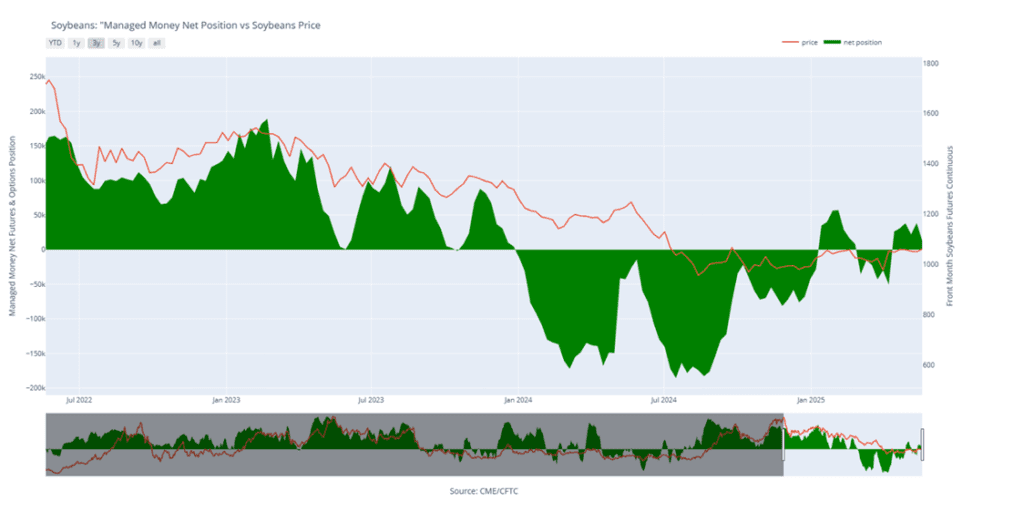

- Friday’s CFTC report saw funds as sellers of soybeans by 28,096 contracts which left them with a long position of 8,601 contracts. They sold 21,998 contracts of oil and 2,932 contracts of meal.

Soybean Futures Stall – Resistance Remains

Last Monday, the July contract closed 8 cents lower, breaking 1036.50 support and posting its lowest close since April 10. Over the next four trading days, July rallied, gaining about 24 cents and finishing the week up 16 cents net. The four-day winning streak pushed July back above all major moving averages, but to break out of the broader sideways trading range that’s held since last summer, the contract still needs to clear the May high of 1082.

Above: Soybean Managed Money Funds net position as of Tuesday, June 3. Net position in Green versus price in Red. Money Managers net sold 28,096 contracts between May 27 – June 3, bringing their total position to a net long 8,601 contracts.

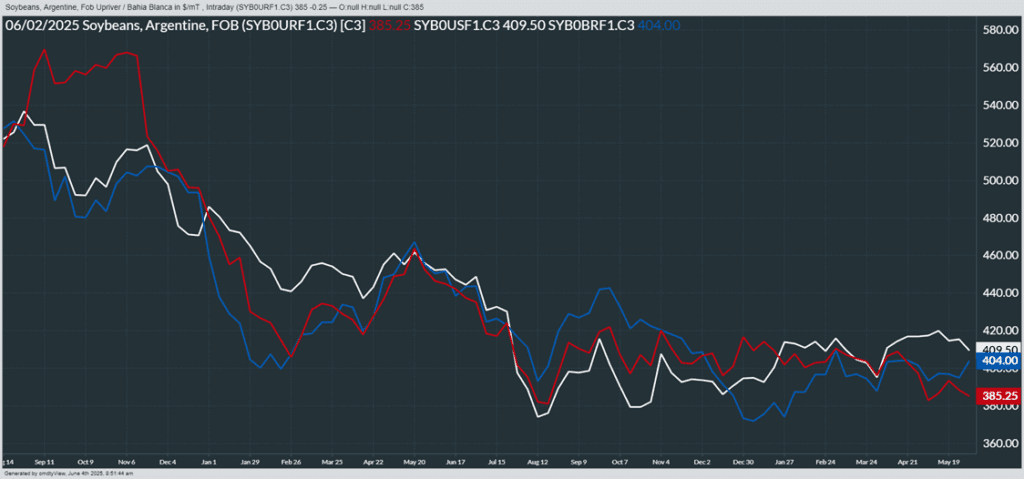

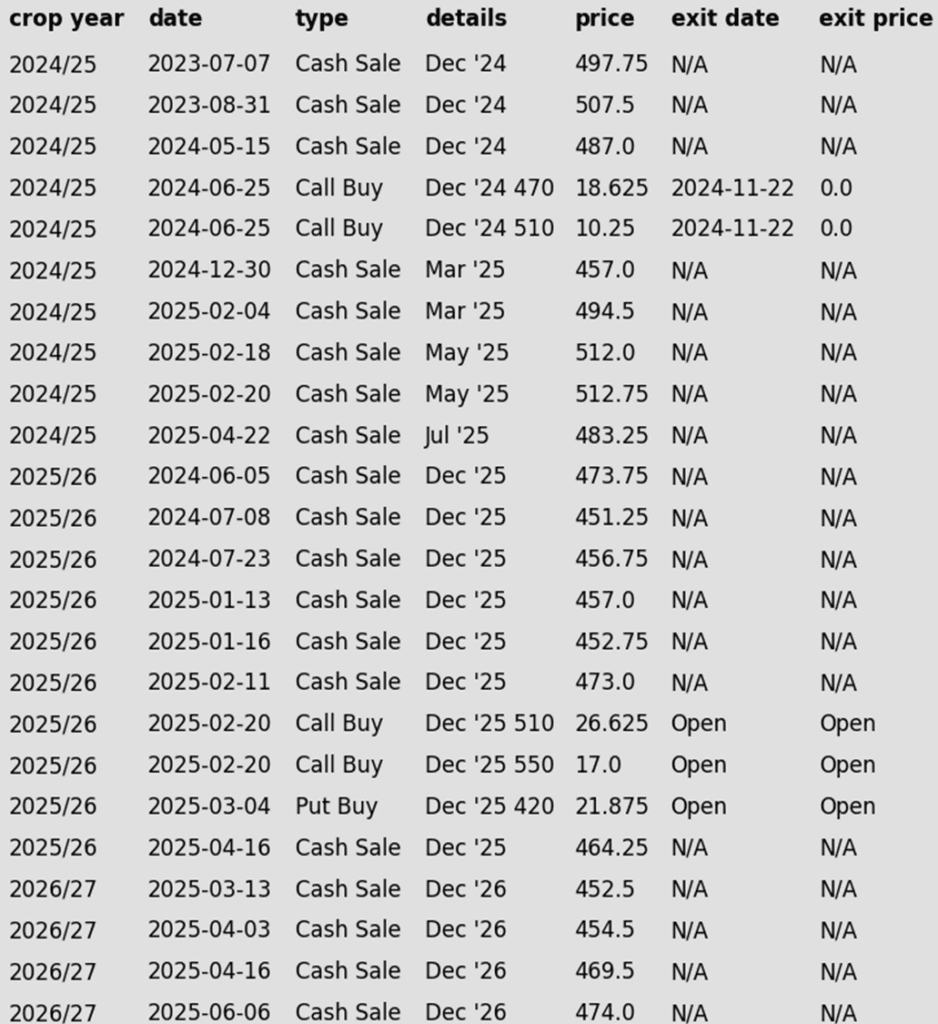

Wheat

Market Notes: Wheat

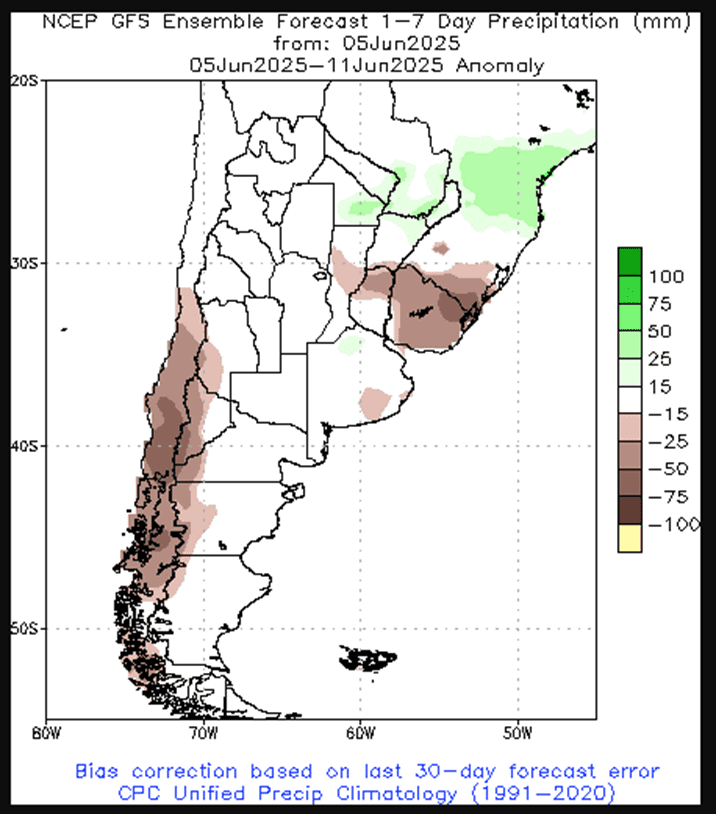

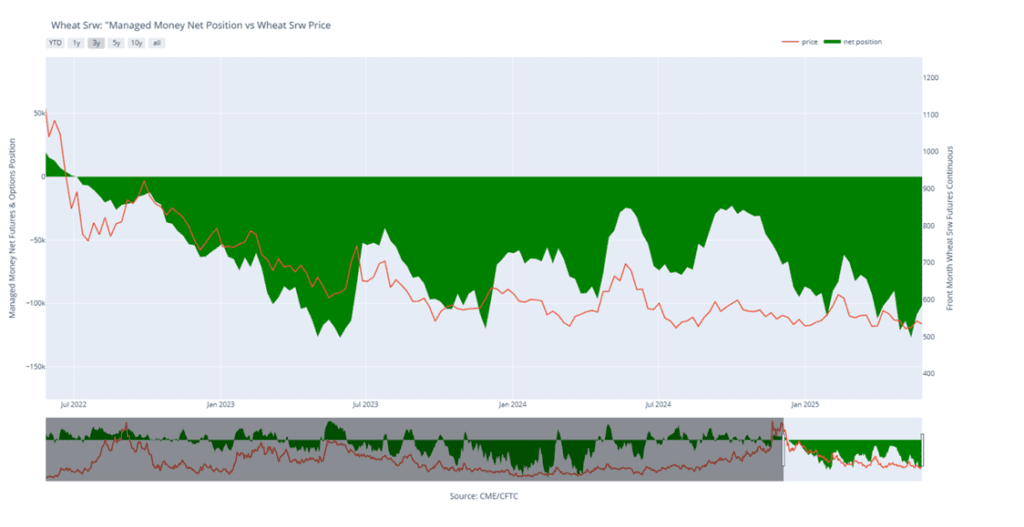

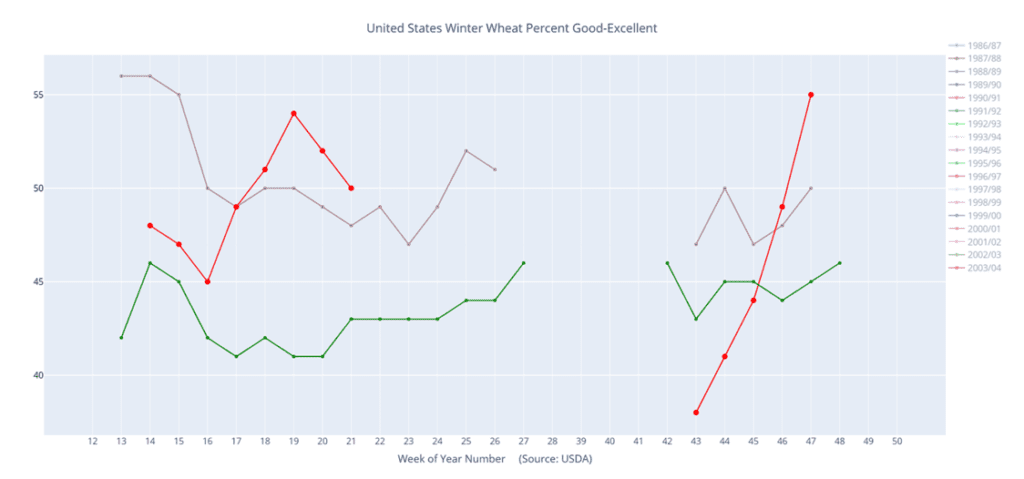

- Wheat began the week with double-digit losses for all three classes by the close as markets took a risk off posture. A combination of harvest pressure and a lower close for Matif wheat added weight to the market today. Additionally, rainfall anticipated this week in the US northern plains as well as for the second week of the outlook in China’s wheat growing areas added to weakness. Australian wheat growing regions received beneficial rains over the weekend too.

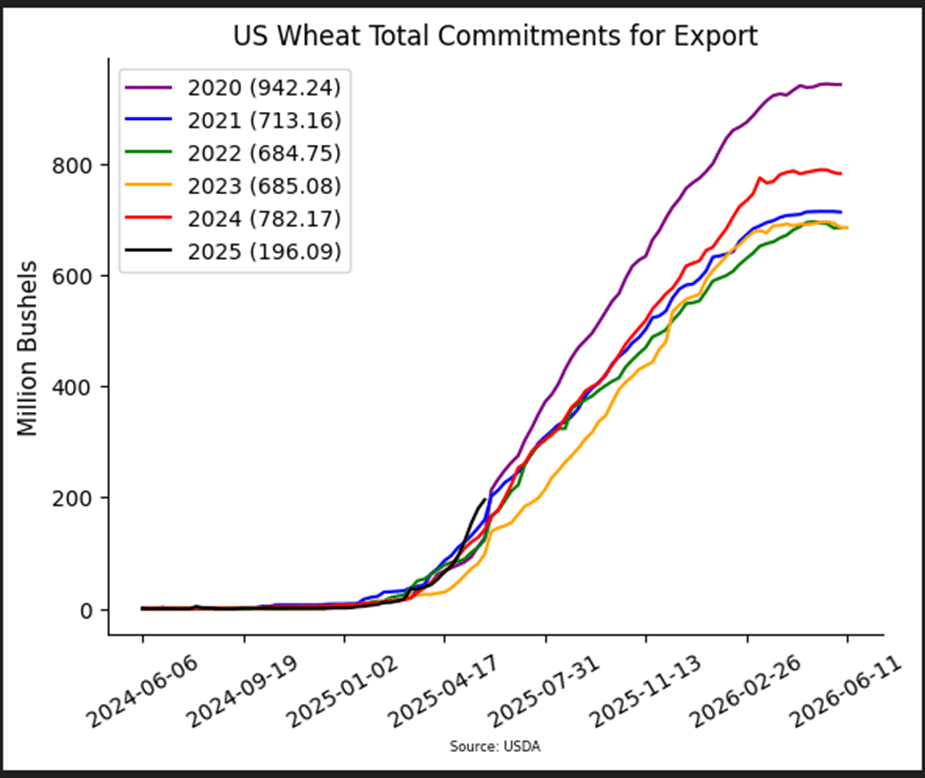

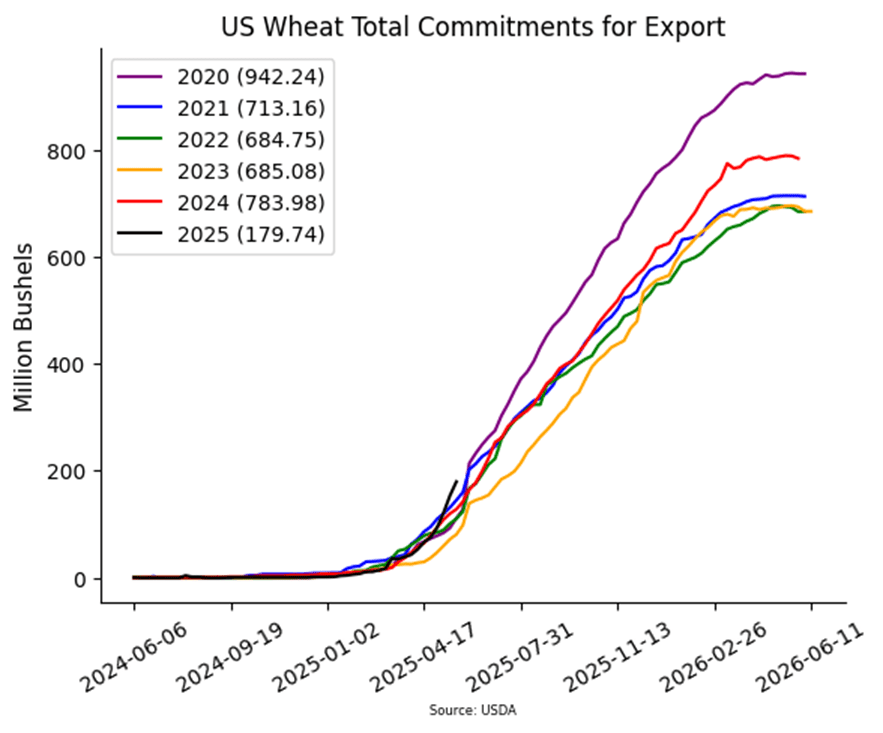

- Weekly wheat inspections totaled 10.7 mb with 4.5 mb of that total for the 24/25 marketing year. For 25/26 total inspections are now at 6 mb, down 43% from last year and running well under the USDA’s estimated pace. They are forecasting 25/26 wheat exports will reach 800 mb, down 3% from the year prior.

- SovEcon has increased their estimate of Russian 2025 wheat production by 1.8 mmt to 82.8 mmt. For reference, the USDA is using a figure of 83 mmt. Additionally, IKAR has said Russian wheat export values finished last week at $225 per mt, unchanged from the week before.

- This Thursday will feature the monthly WASDE report – the average pre-report estimate of 2025 US wheat production comes in at 1.924 bb, up from 1.921 bb in the May report. Of that total, winter wheat is expected to account for 1.389 bb vs 1.382 bb last month.

- Analyst group APK-Inform has reduced their estimate of Ukraine’s 2025 grain production by 4.3% to 52.9 mmt. This is said to be mainly due to smaller corn and wheat harvests. The wheat production estimate in particular was revised down 0.1 mmt from last month to 21.7 mmt.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 693.75 target has been cancelled.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None. Continue to target 675 to make a second sale.

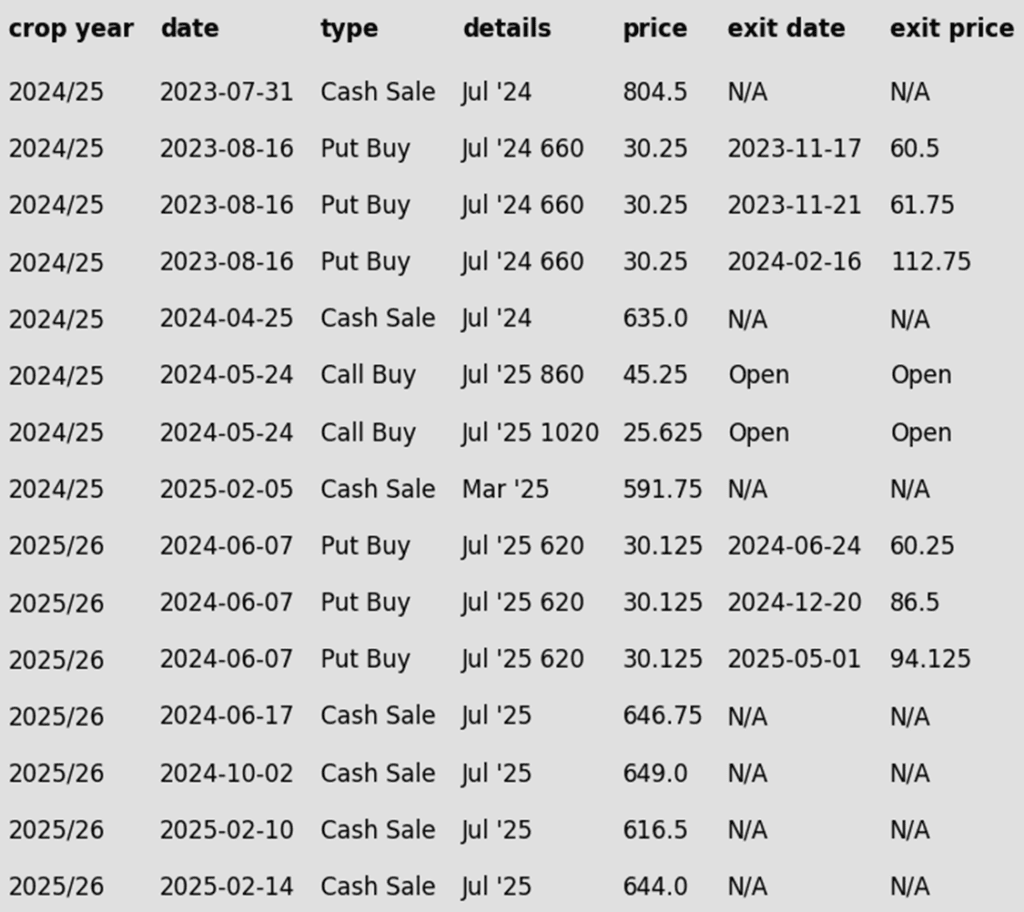

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Hits Resistance

The July contract faced a sharp rejection after testing the 200-day moving average at 557.75. A close above that level could open the door for a broader rally toward the April high of 621.75. However, until that resistance is cleared, the risk remains for sideways-to-lower trade, with 506.25 as the recent downside reference point.

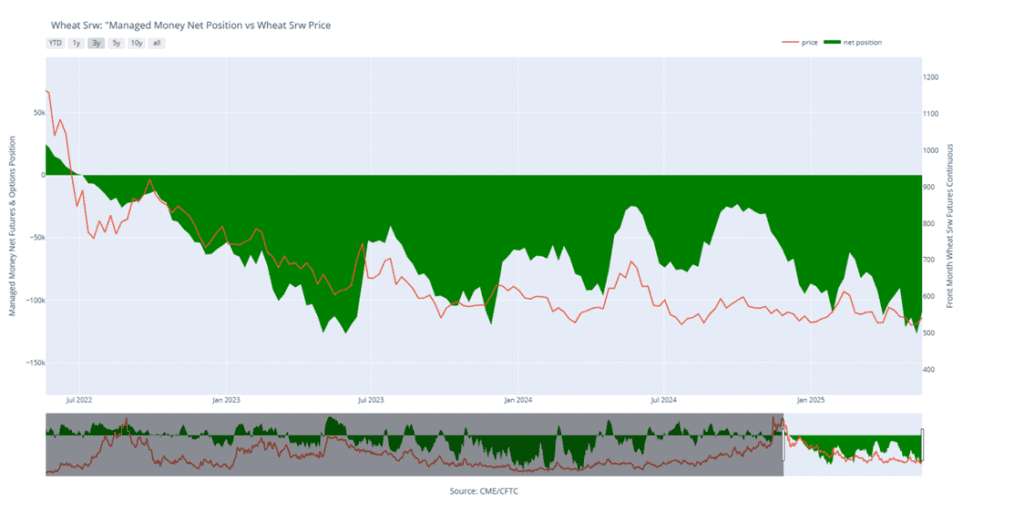

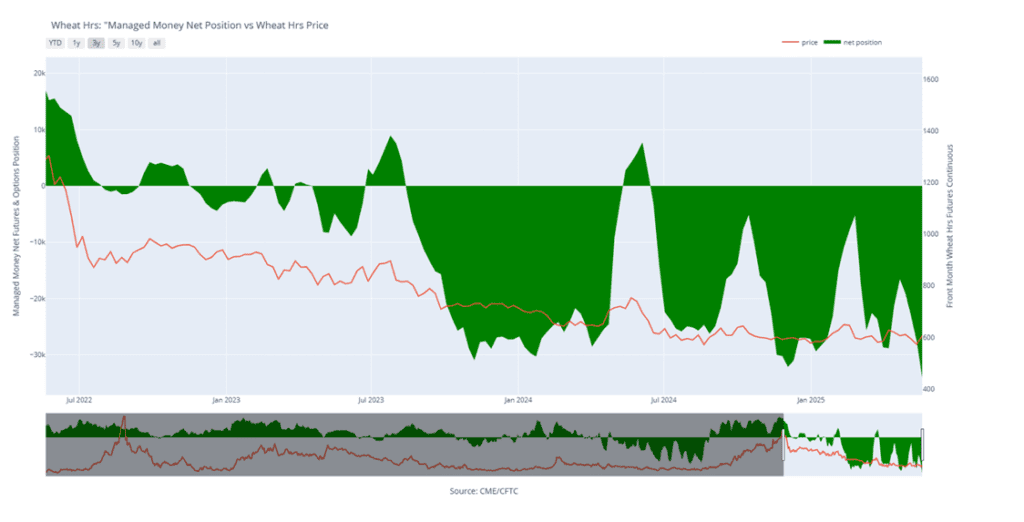

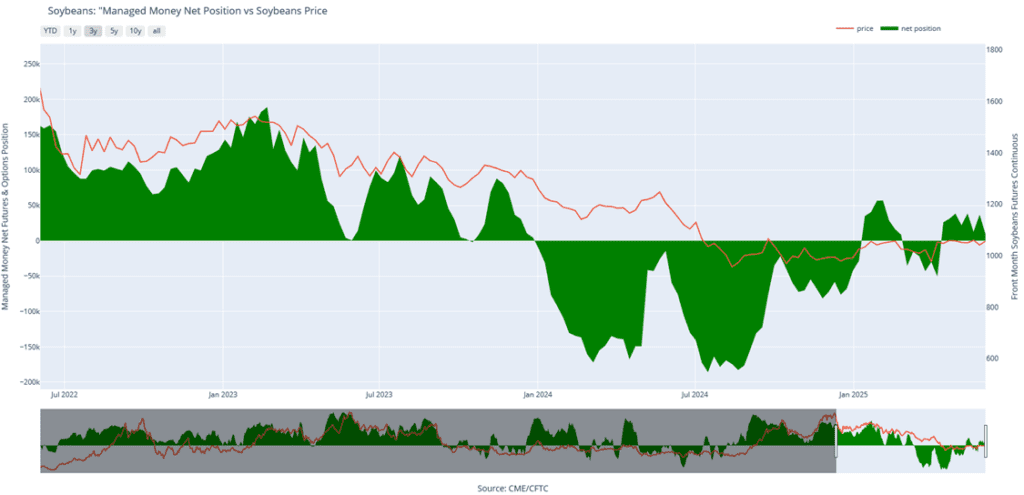

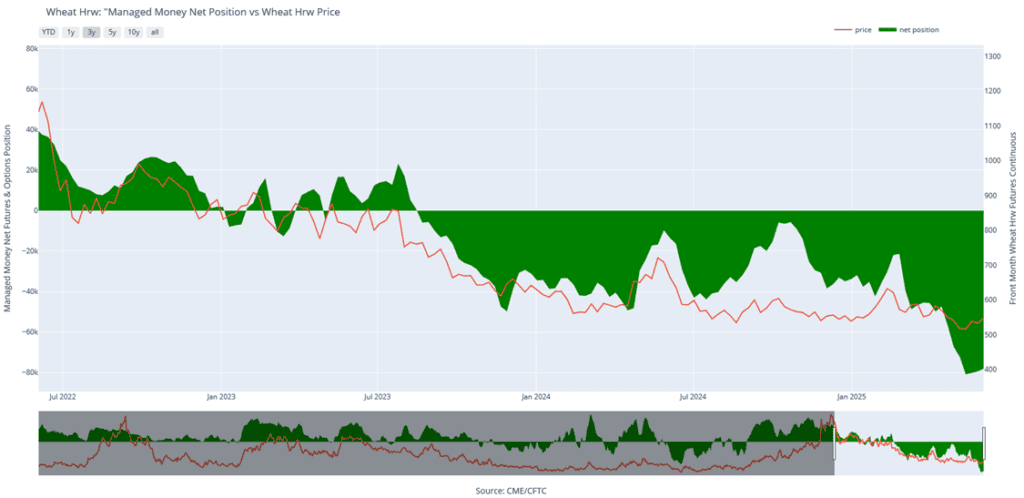

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, June 3. Net position in Green versus price in Red. Money Managers net bought 654 contracts between May 27– June 3, bringing their total position to a net short 100,572 contracts.

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- The first sales targets could post this week — keep checking back for updates.

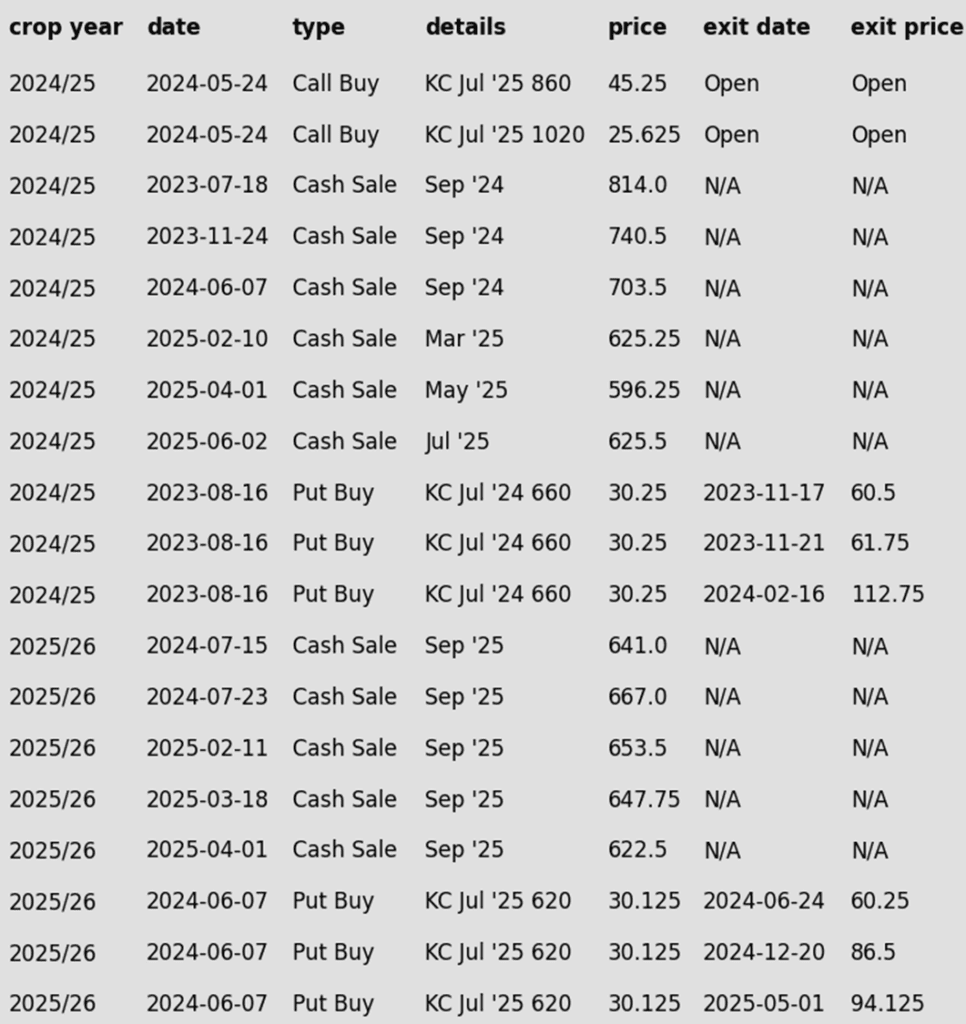

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Resistance At 550

First resistance stands at last week’s high of 550.50. A breakout above that level would shift focus to the 100-day and 200-day moving averages in the 565–567 range. Clearing that secondary resistance could open the door to broader upside potential, with targets in the 600–620 zone — near the early spring highs. On the downside, the May low of 500.25 remains a key support level. Failure to break out above resistance would keep the trend sideways to lower, with that low as the next risk.

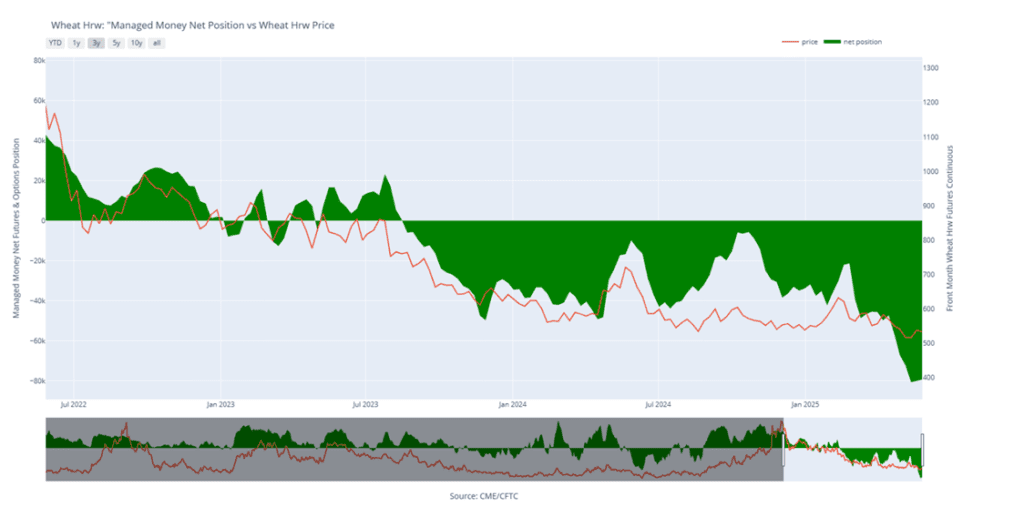

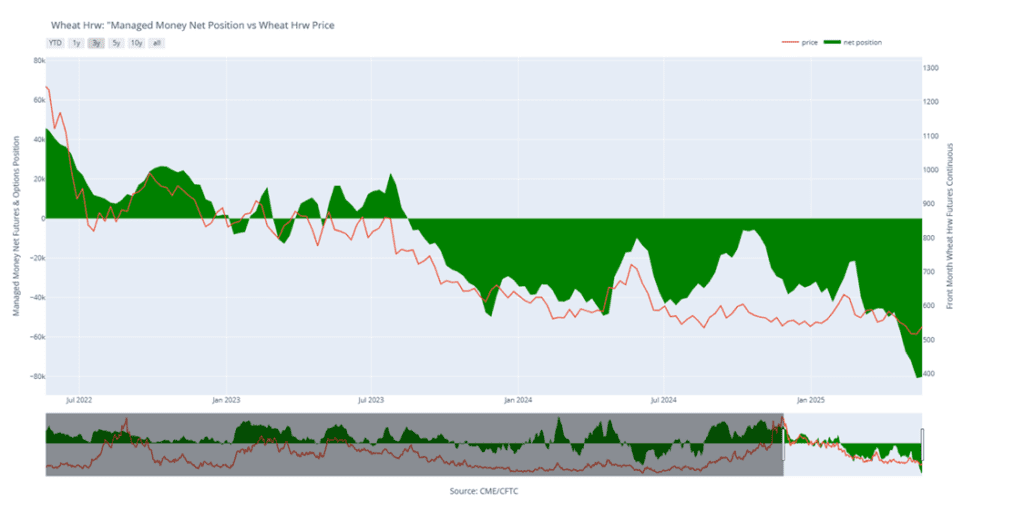

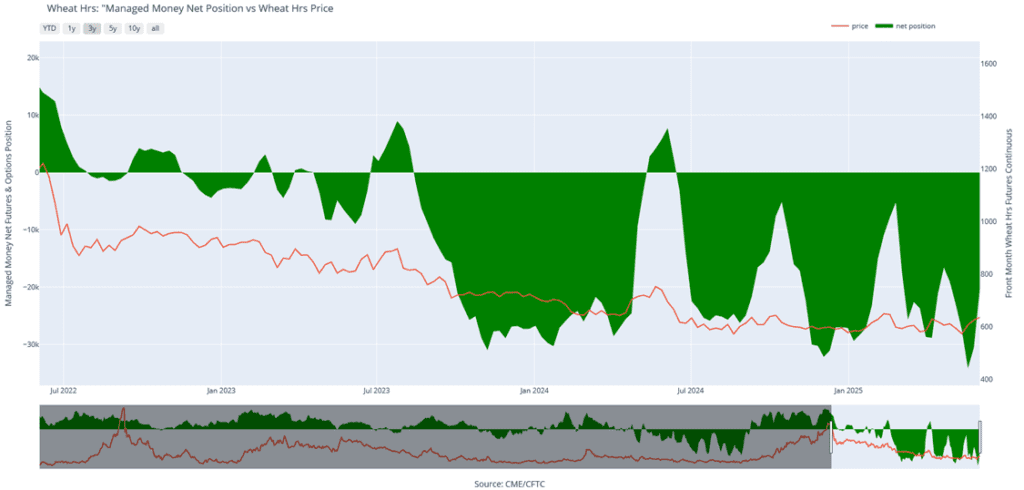

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, June 3. Net position in Green versus price in Red. Money Managers net bought 1333 contracts between May 27– June 3, bringing their total position to a net short 78,028 contracts.

2024 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2024 Minneapolis wheat crop. This marks the sixth sale for the 2024 crop and may well be the final sales recommendation for this marketing year, as Grain Market Insider shifts focus to the 2025 and 2026 crops moving forward. Use this rally as an opportunity to consider pricing any remaining unsold bushels.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now six sales recommendations made to date, with an average price of 684.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Leading the Complex

July spring wheat futures have outperformed both Chicago and KC wheat since all three markets bottomed in mid-May. It is the only July wheat contract currently trading above all three major moving averages — the 50-, 100-, and 200-day — which have now converged in the 605–610 range, establishing a key support zone. A close below 605 would expose the market to downside risk toward 580. However, as long as 605 holds, the broader upside potential remains intact, with room to rally toward the 660 level.

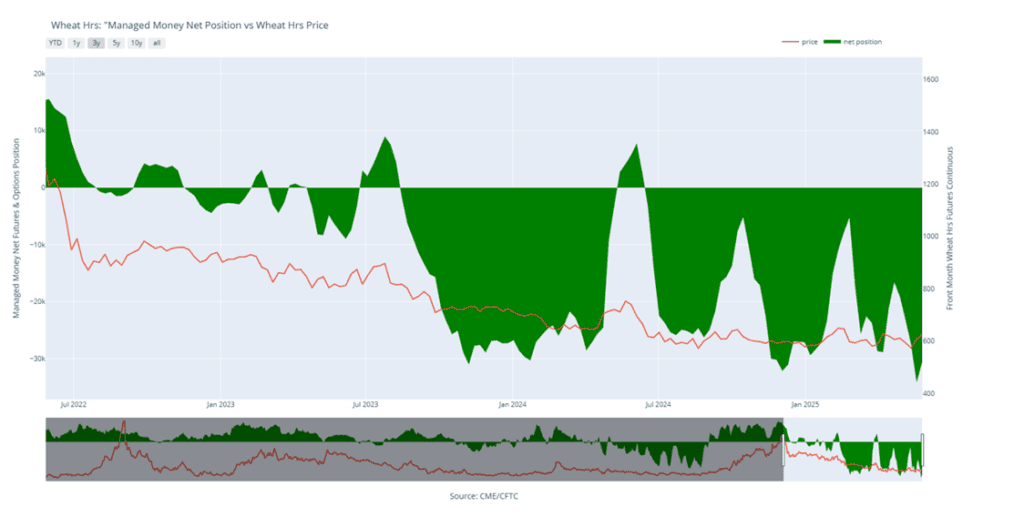

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, June 3. Net position in Green versus price in Red. Money Managers net bought 10,441 contracts between May 27 – June 3, bringing their total position to a net short 20,077 contracts.

Other Charts / Weather