10-29 End of Day: Grains Steady Ahead of Trump–Xi Trade Meeting

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended mixed Wednesday as prices consolidated within Tuesday’s range, with bull spreading noted as nearby contracts outperformed deferred.

- 🌱 Soybeans: Soybean futures ended mixed Wednesday following two weeks of strong gains totaling 60 cents. The market paused ahead of the highly anticipated meeting between President Trump and China’s President Xi.

- 🌾 Wheat: Wheat futures ended mixed Wednesday, with light bull spreading noted in both Chicago and Kansas City contracts as buying interest favored the front months.

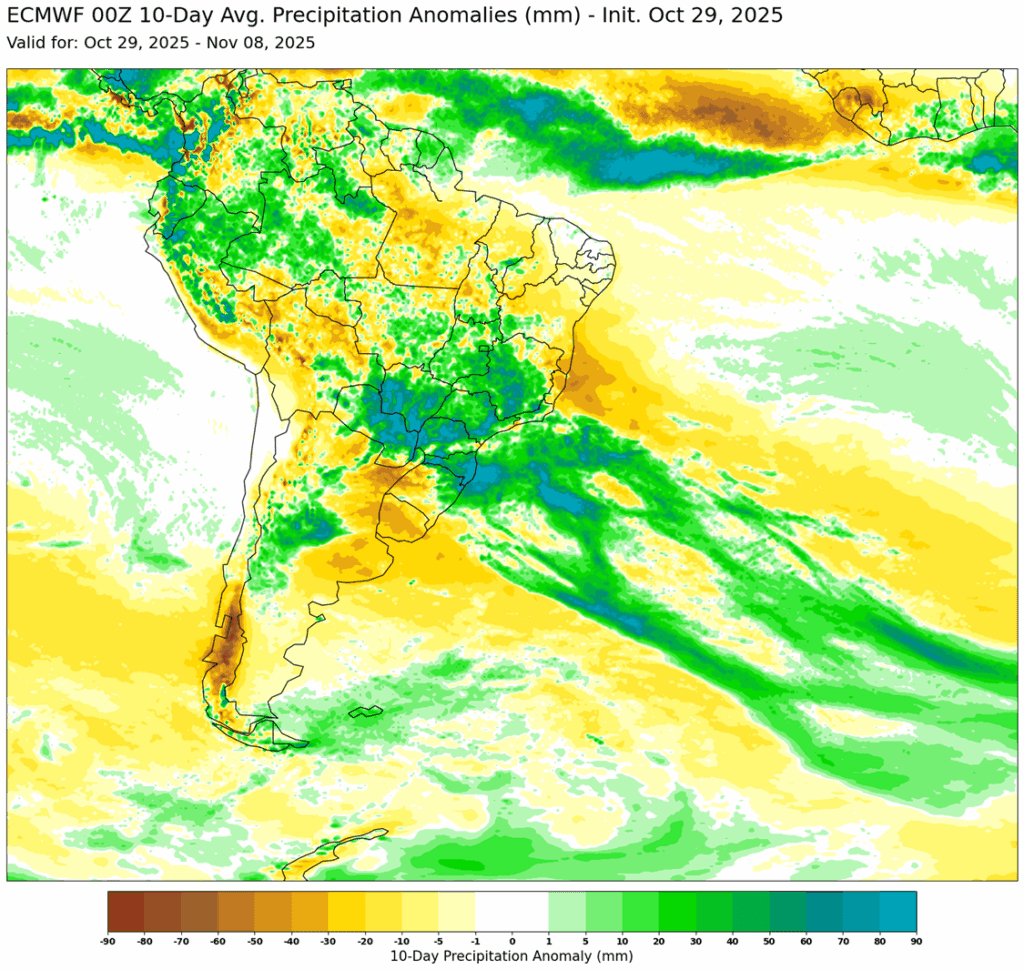

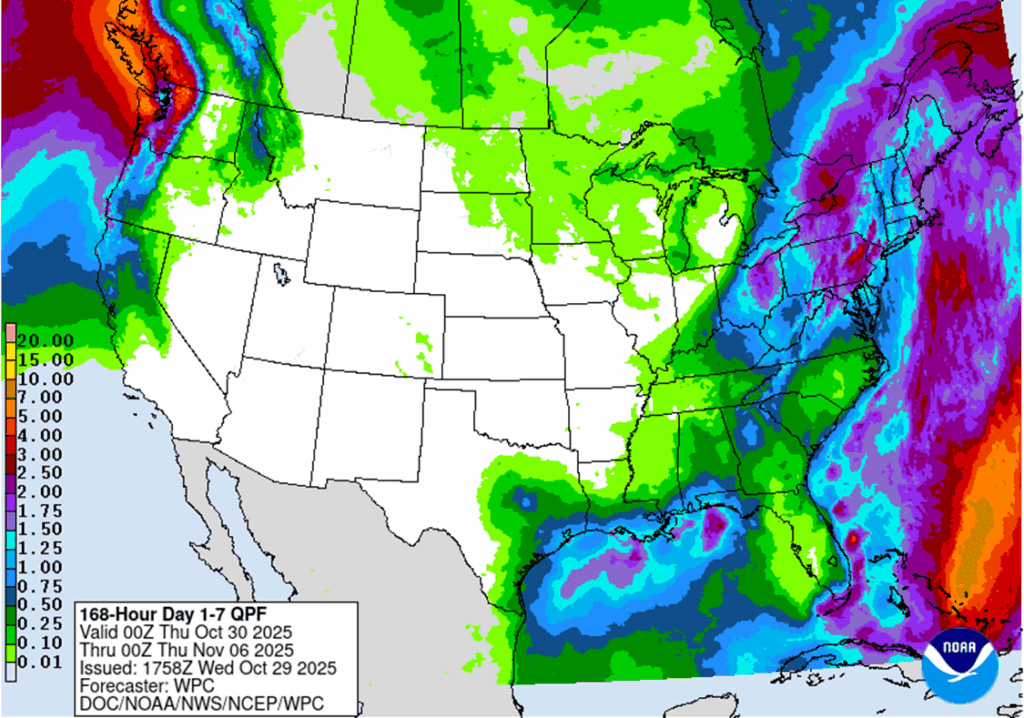

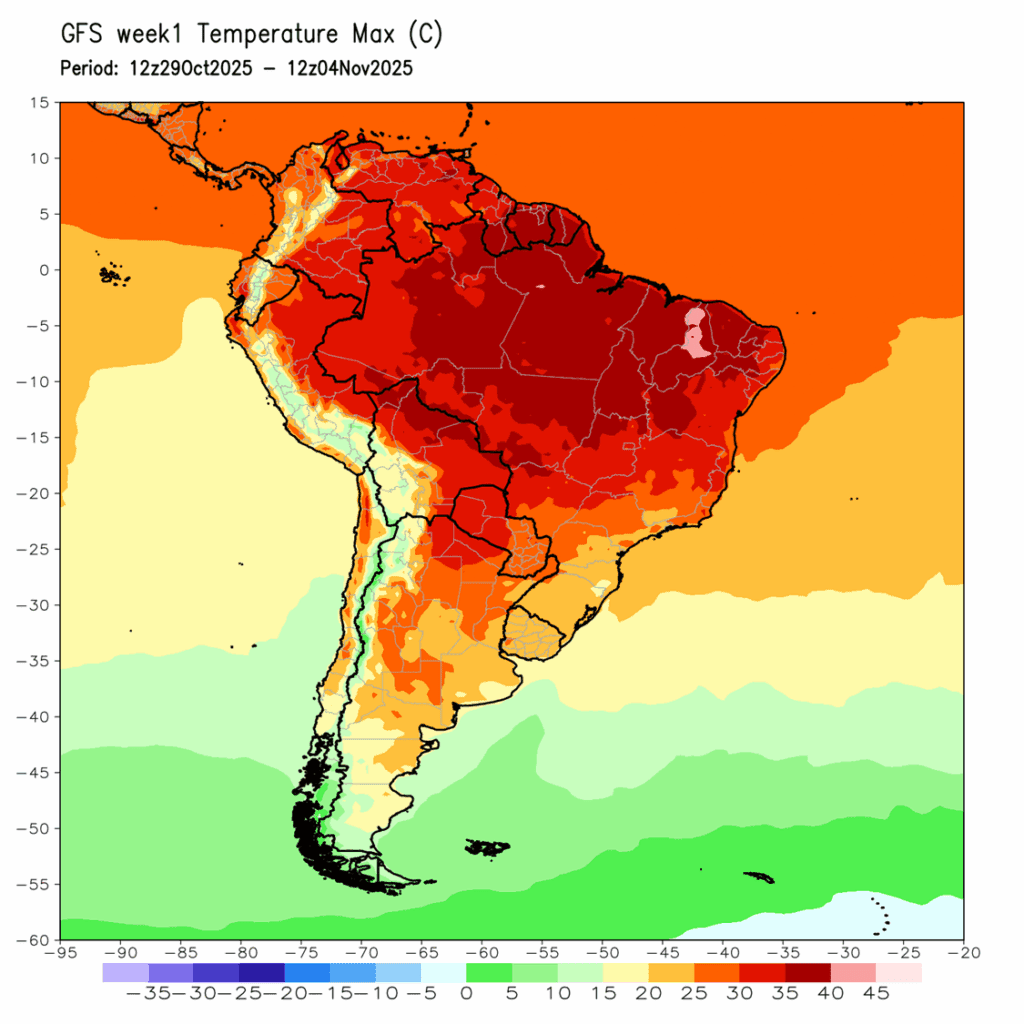

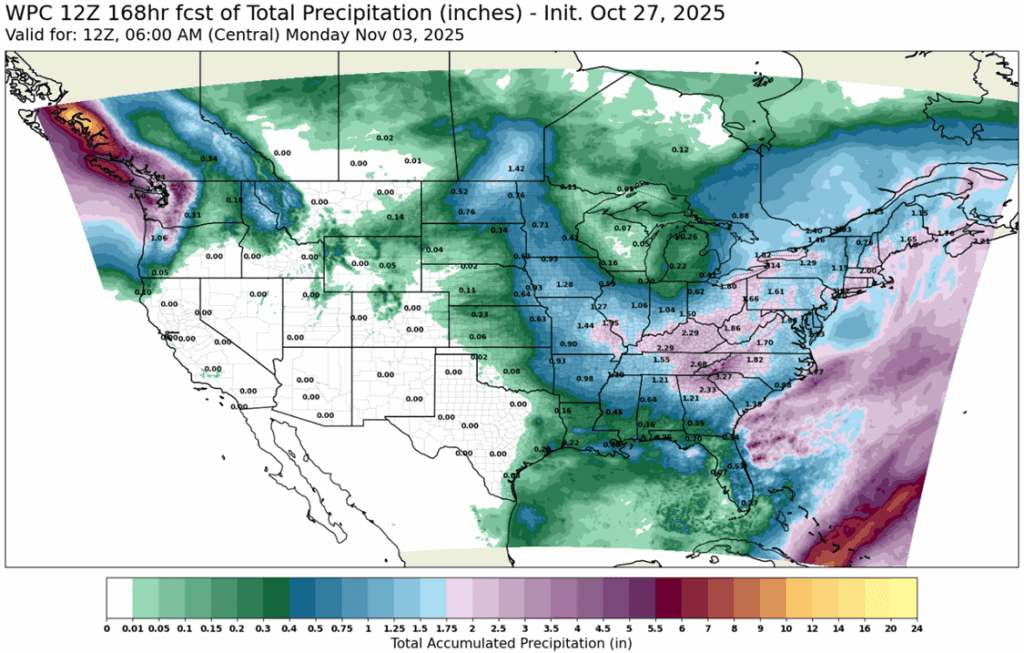

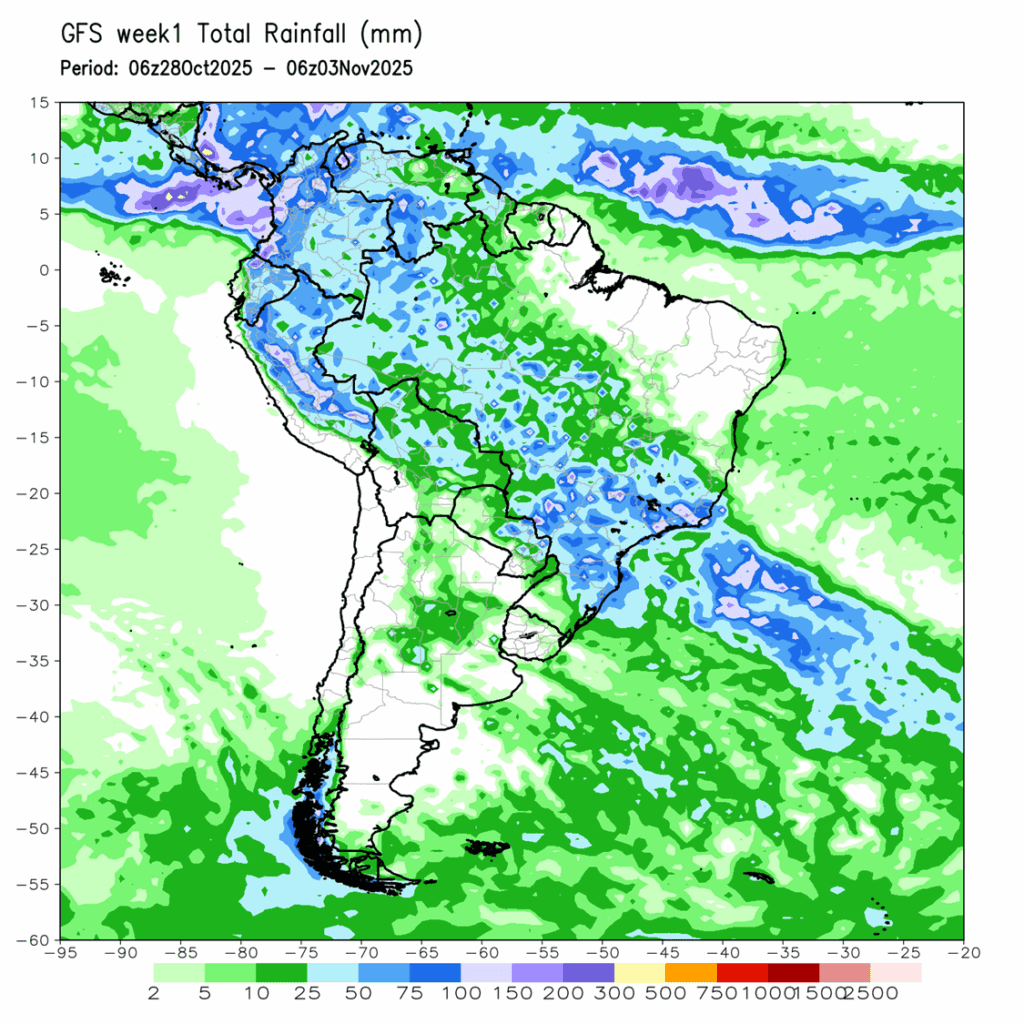

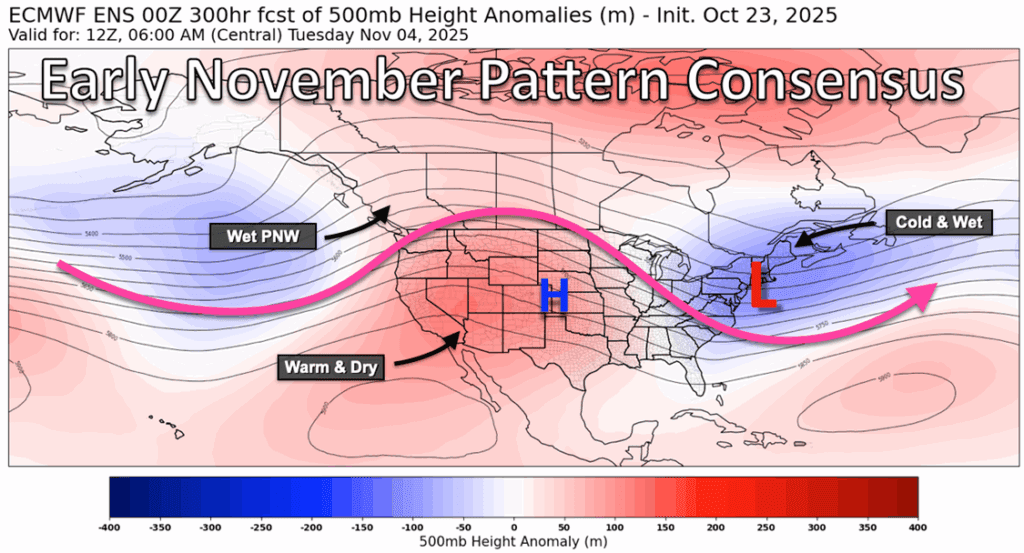

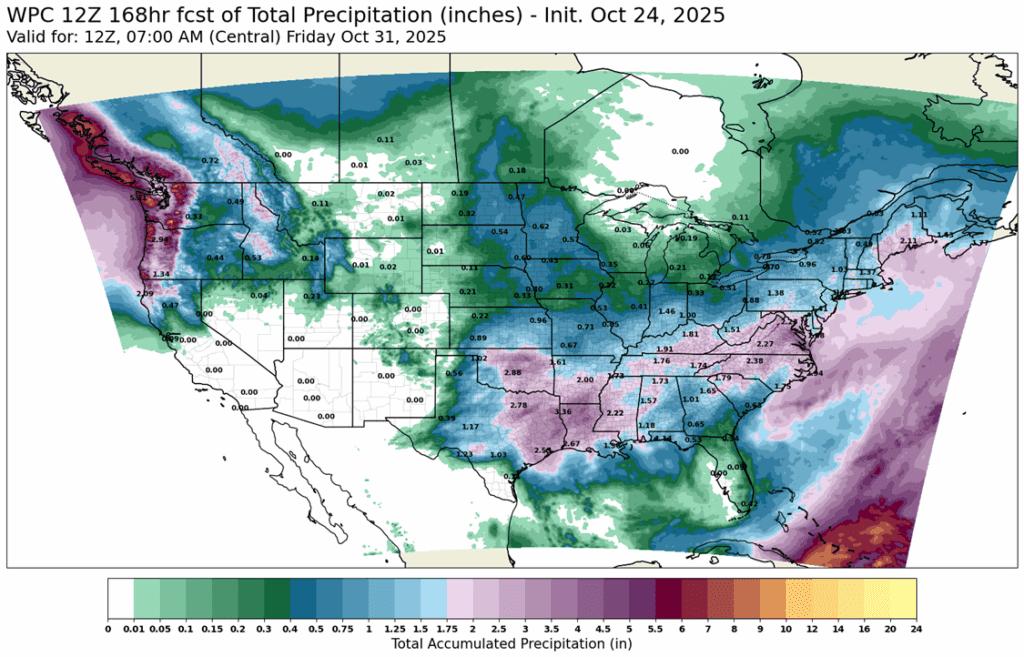

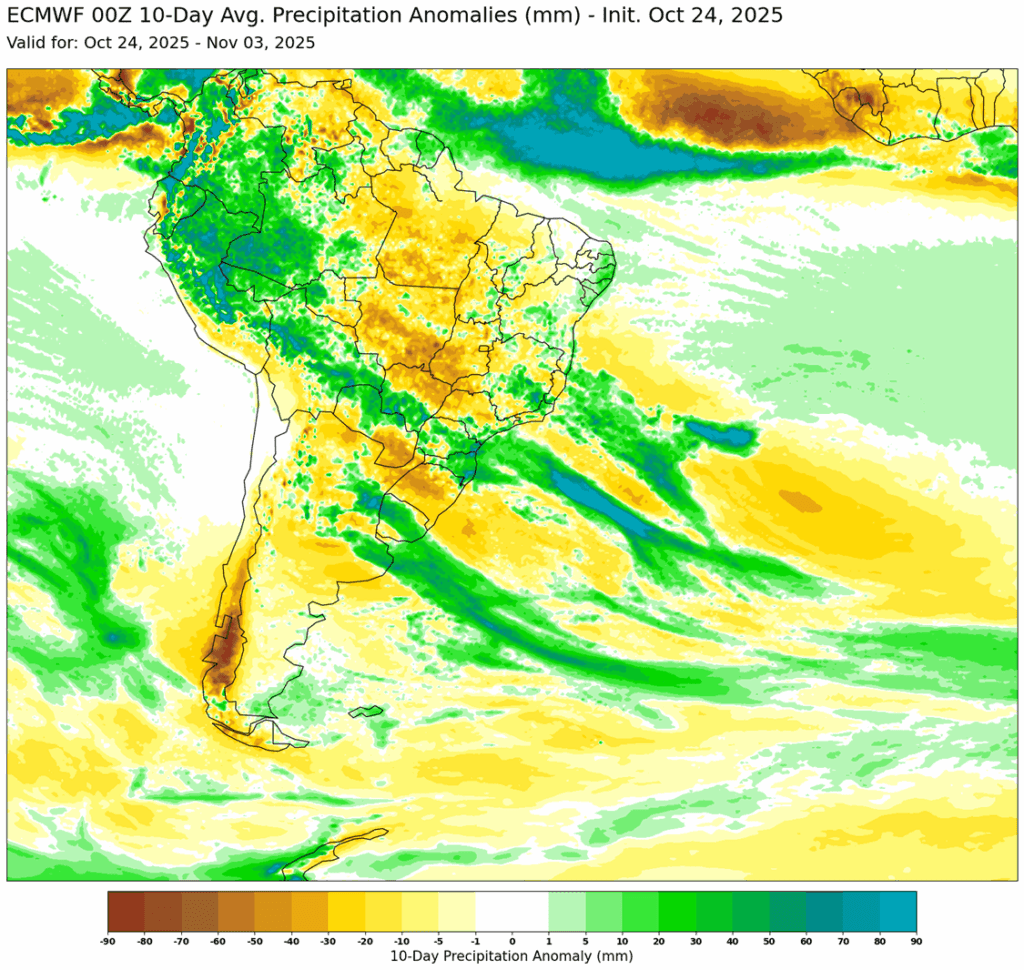

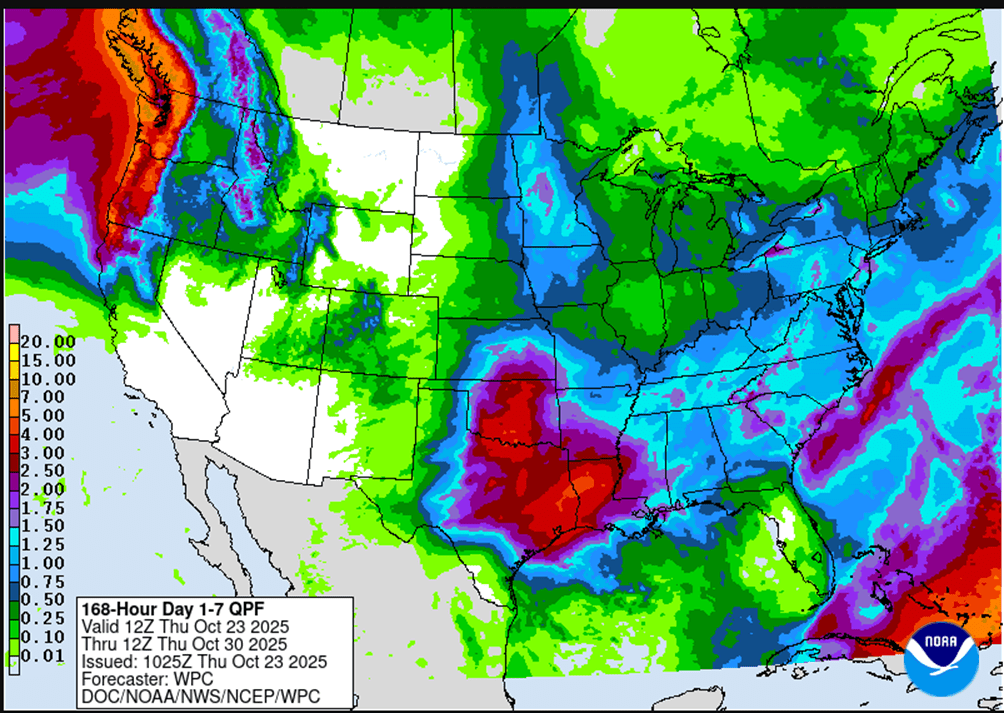

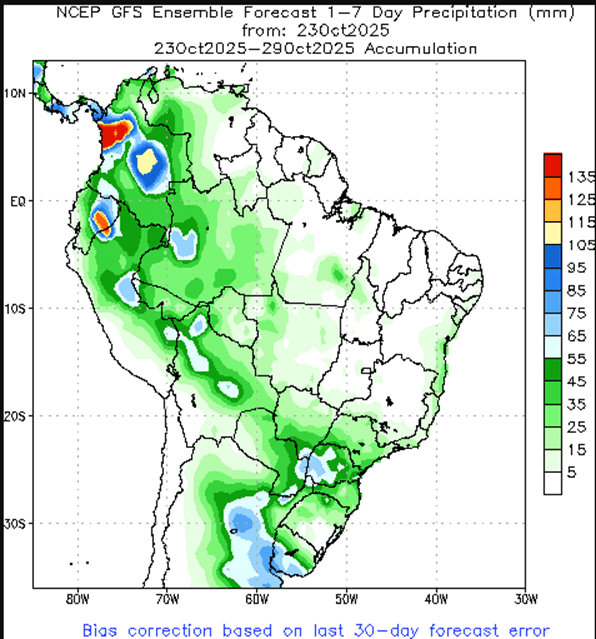

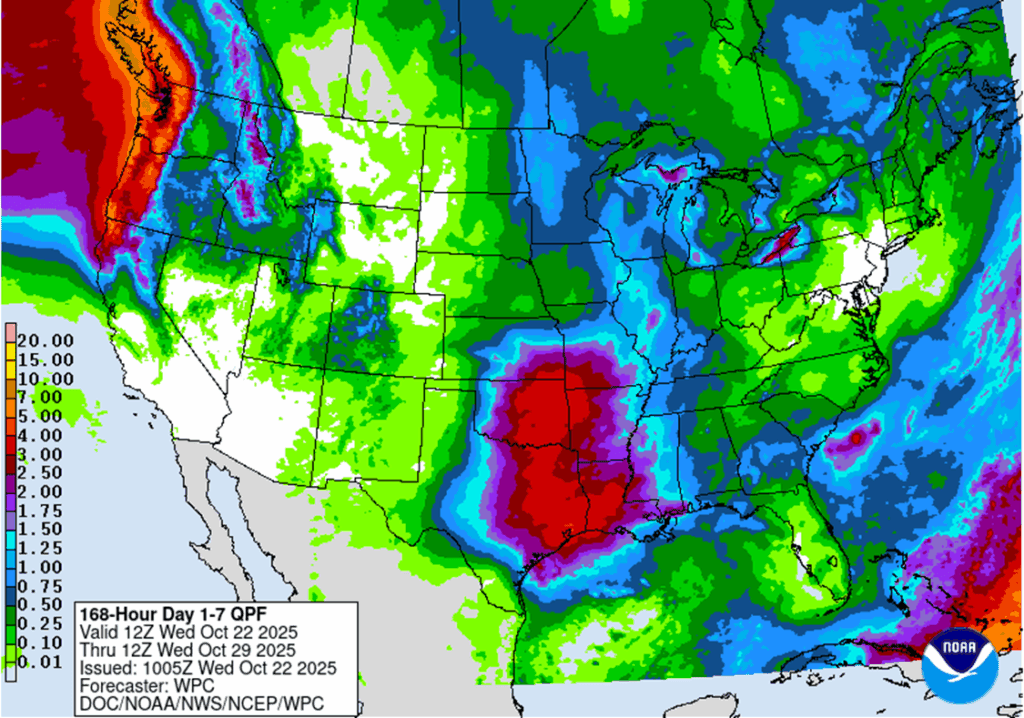

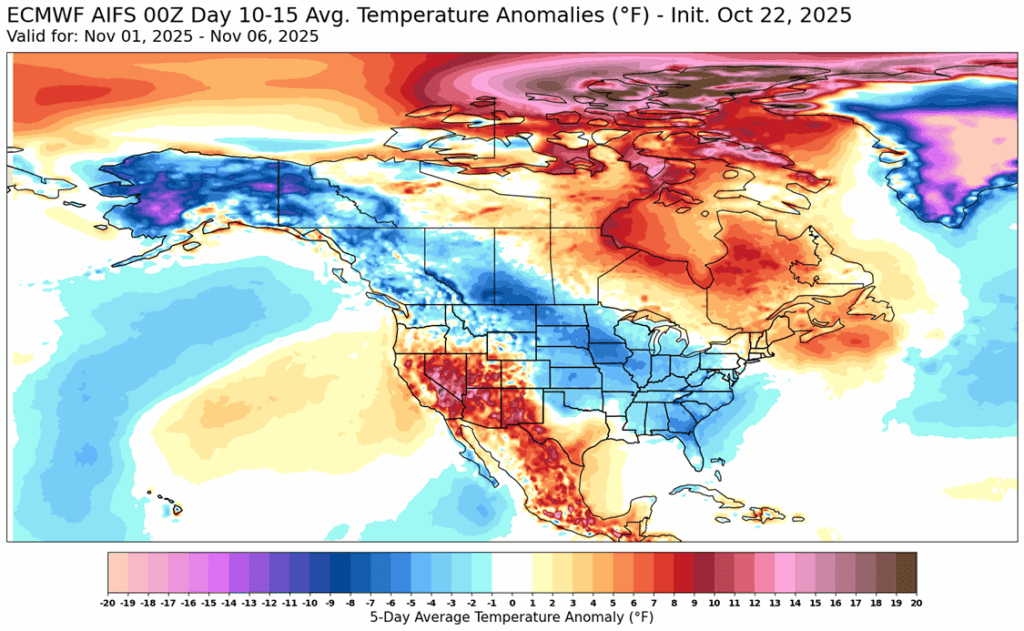

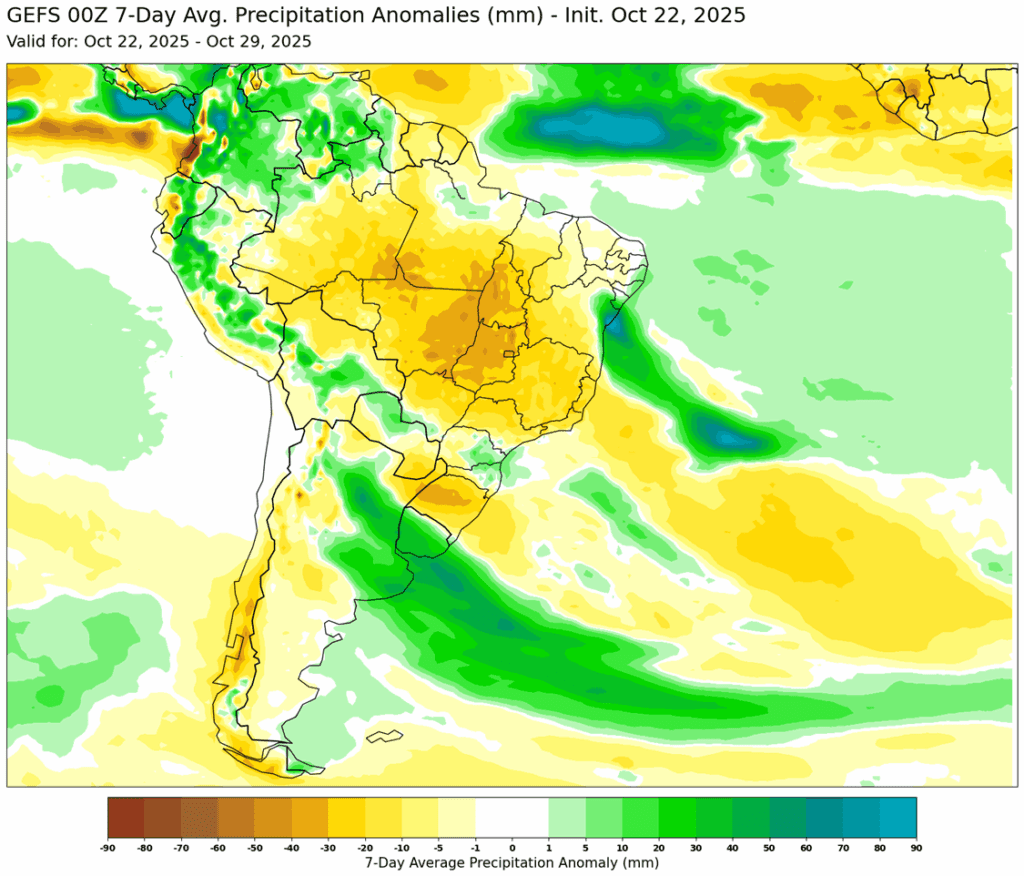

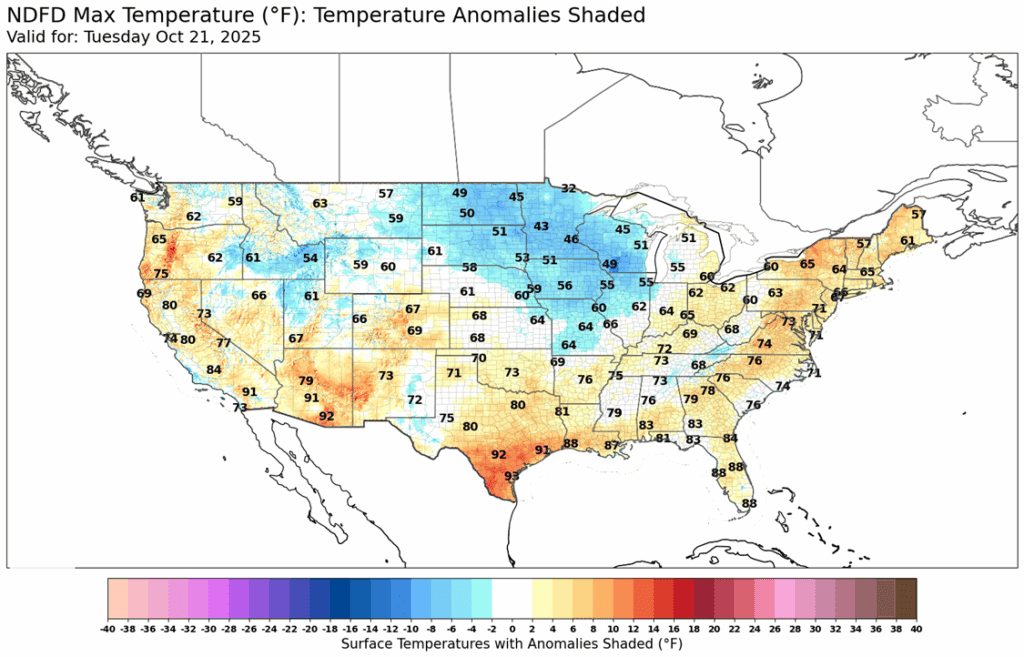

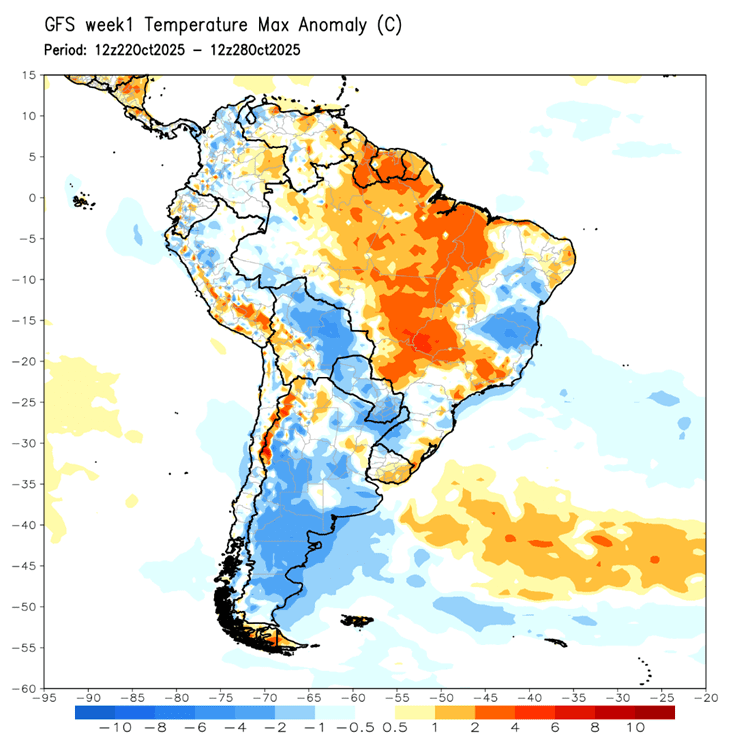

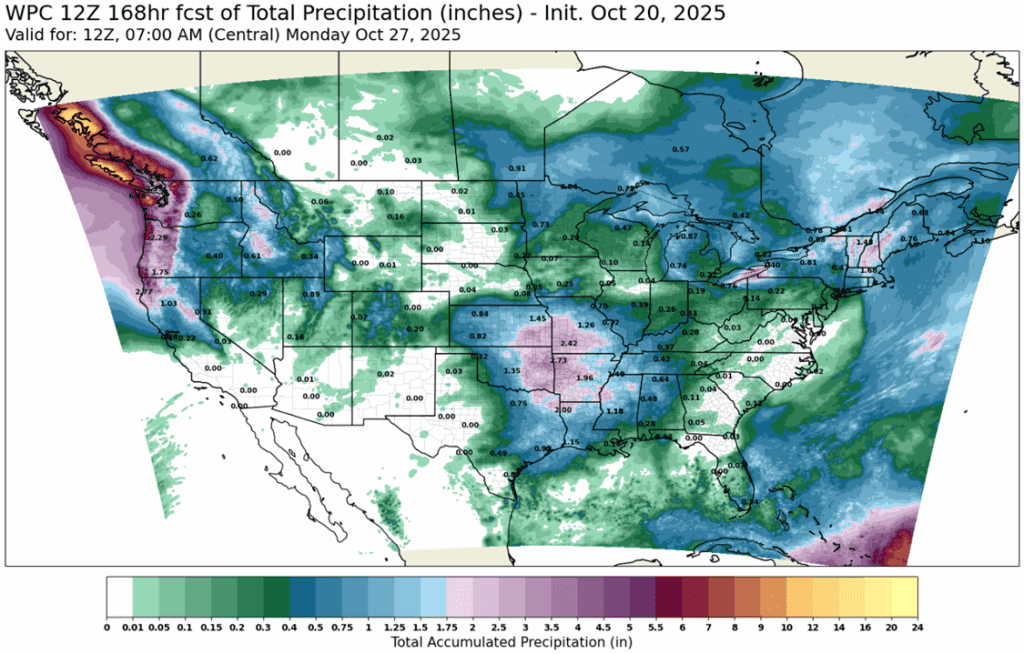

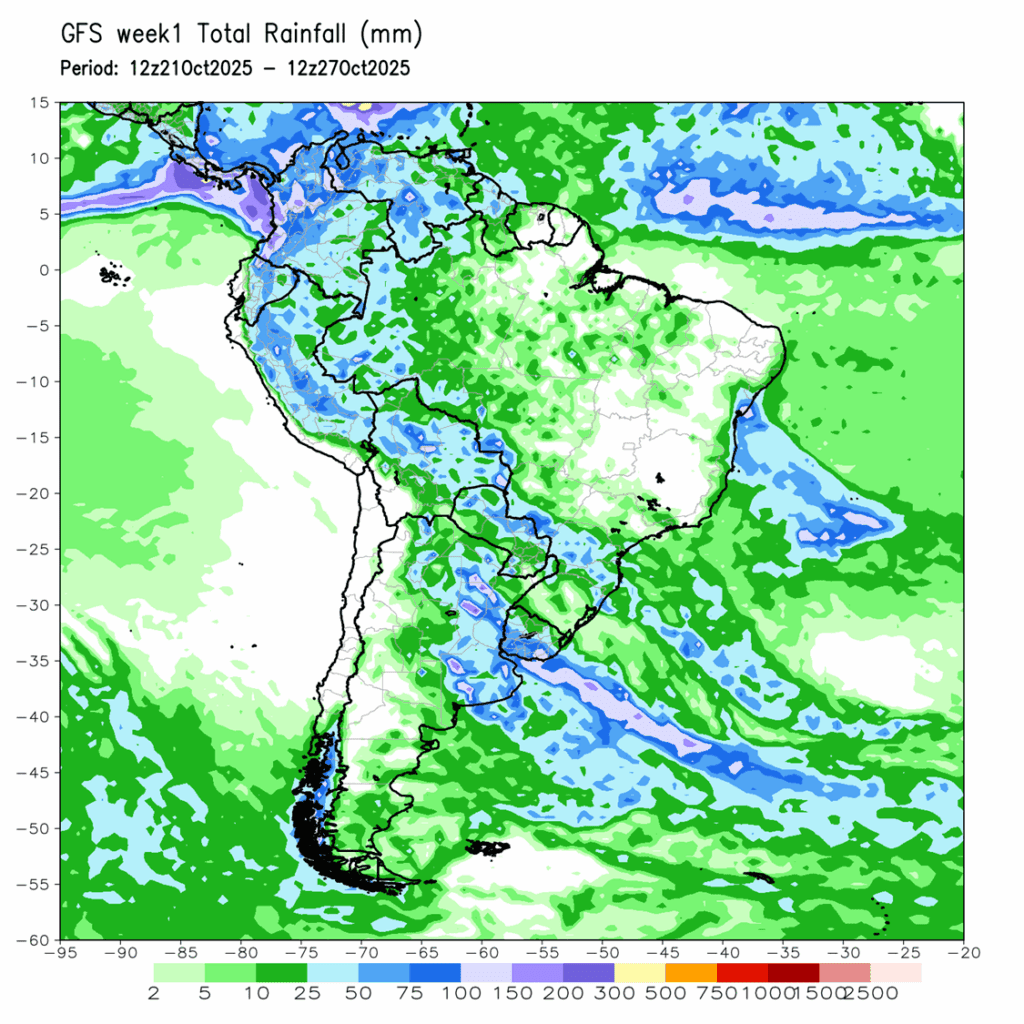

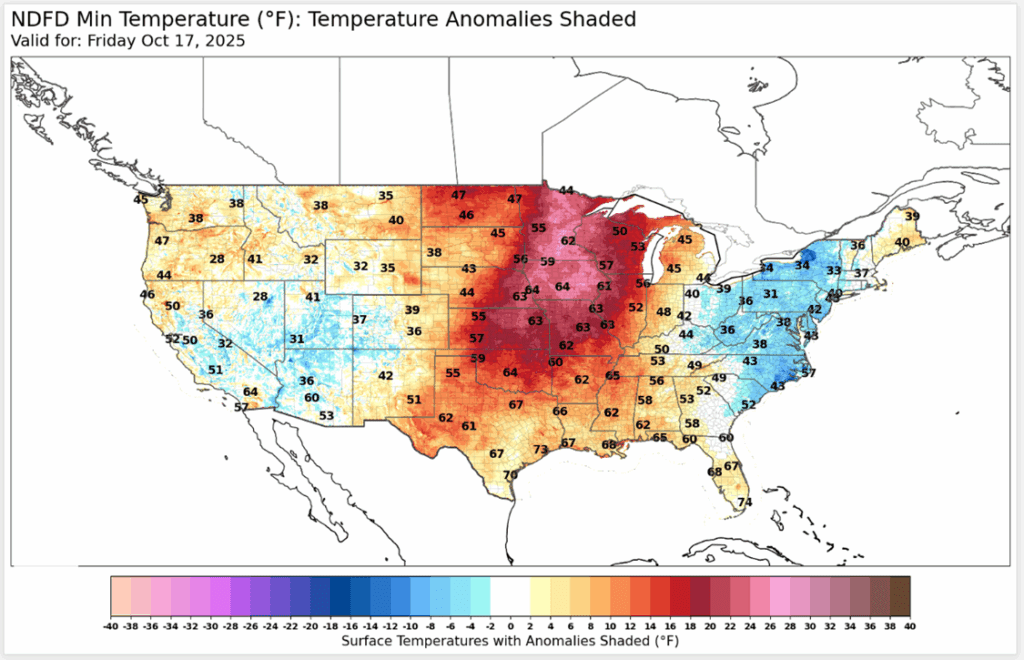

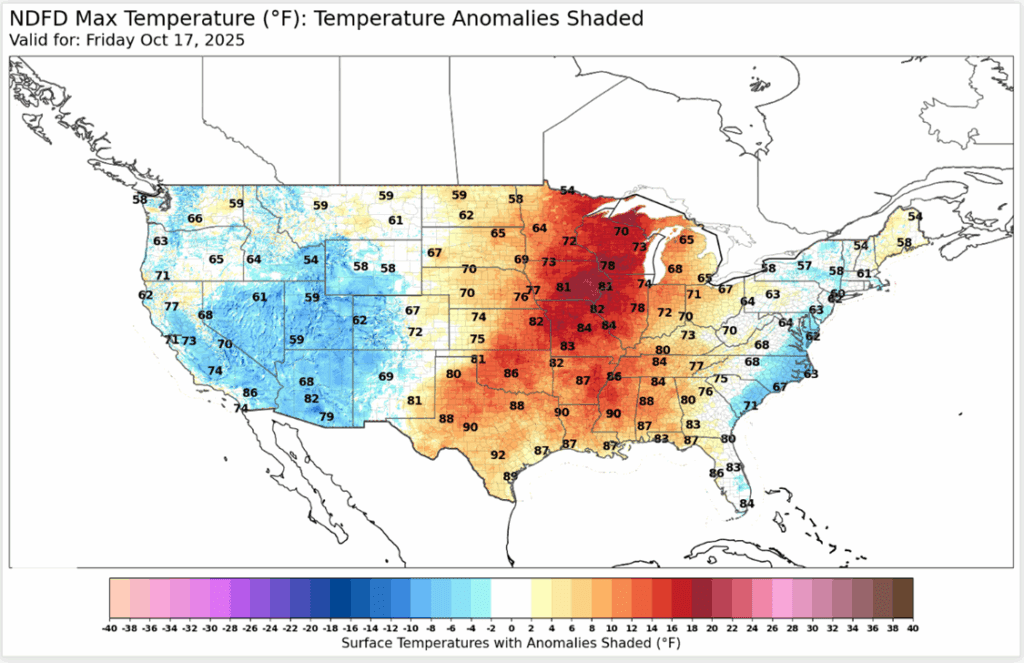

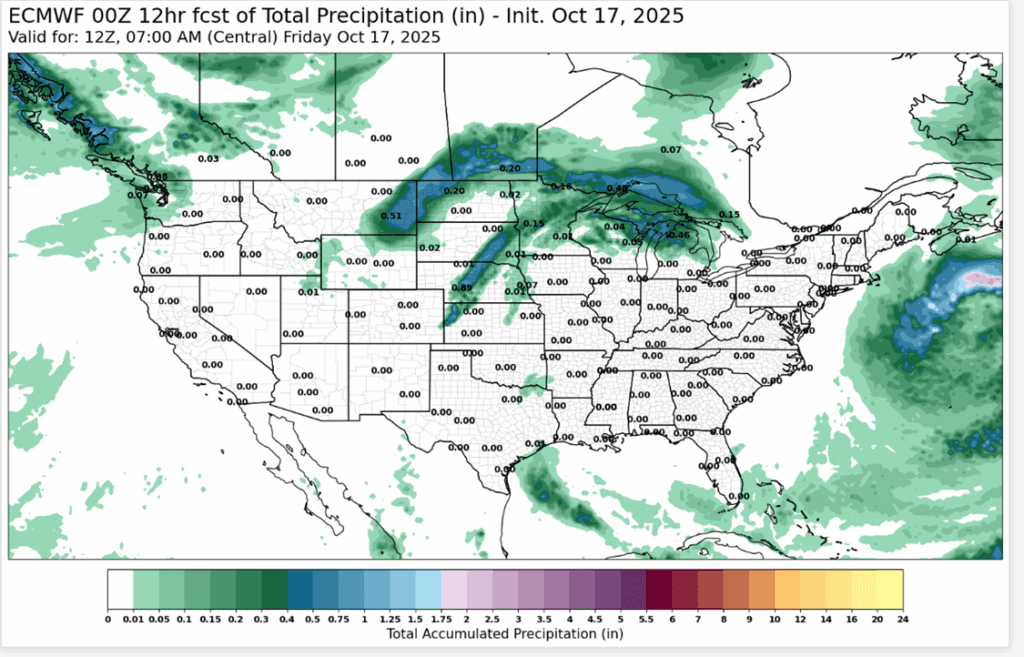

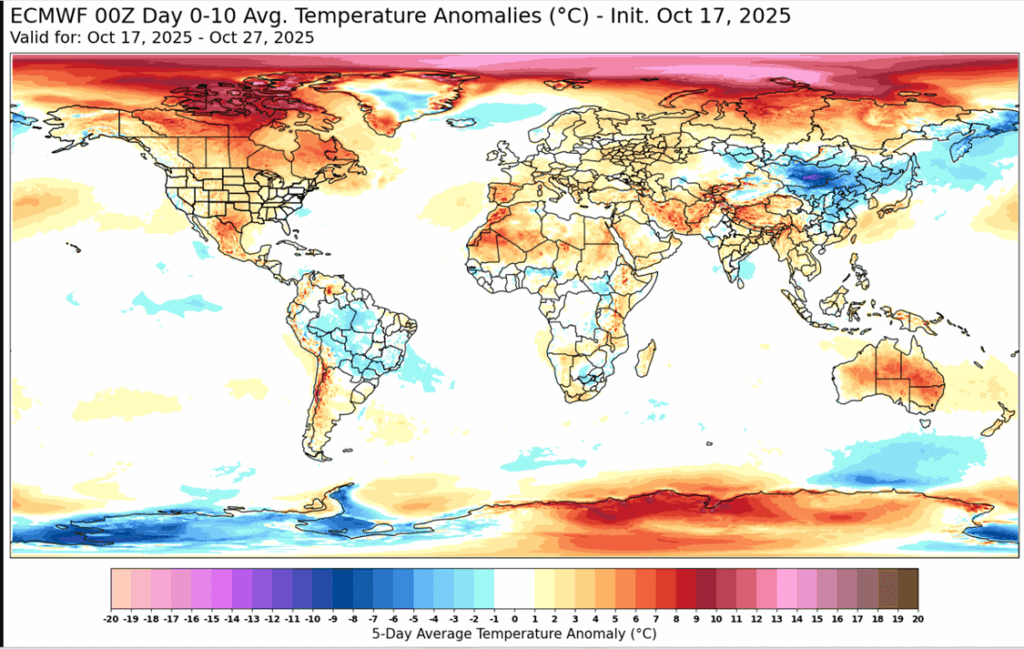

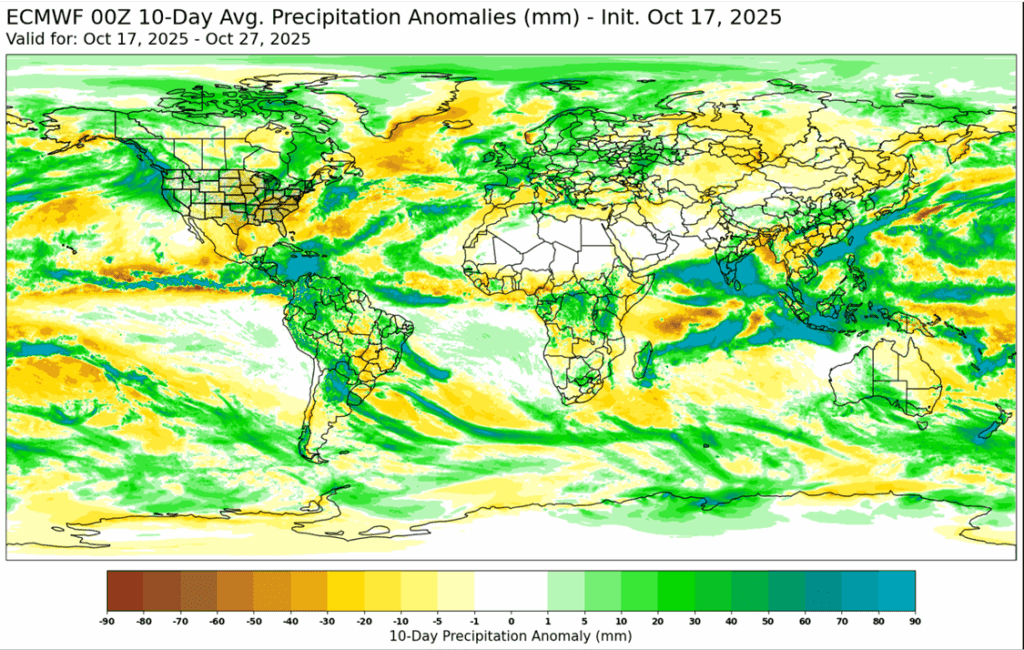

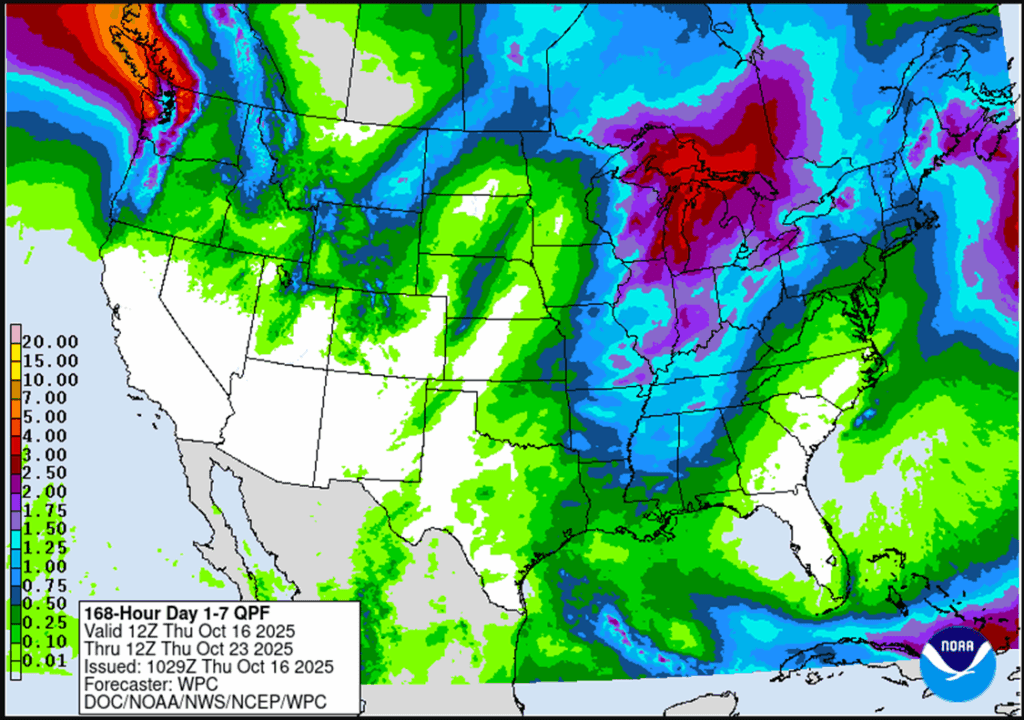

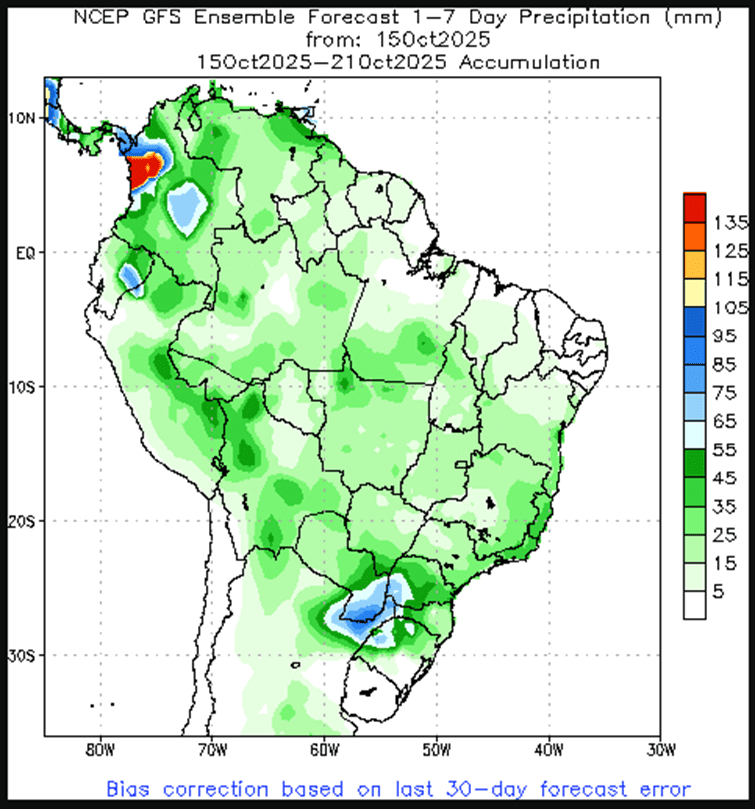

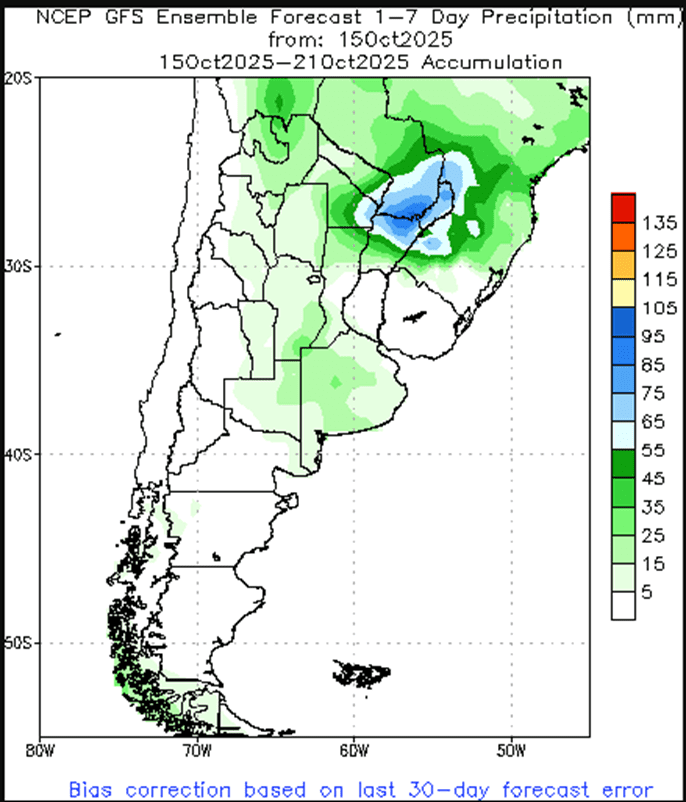

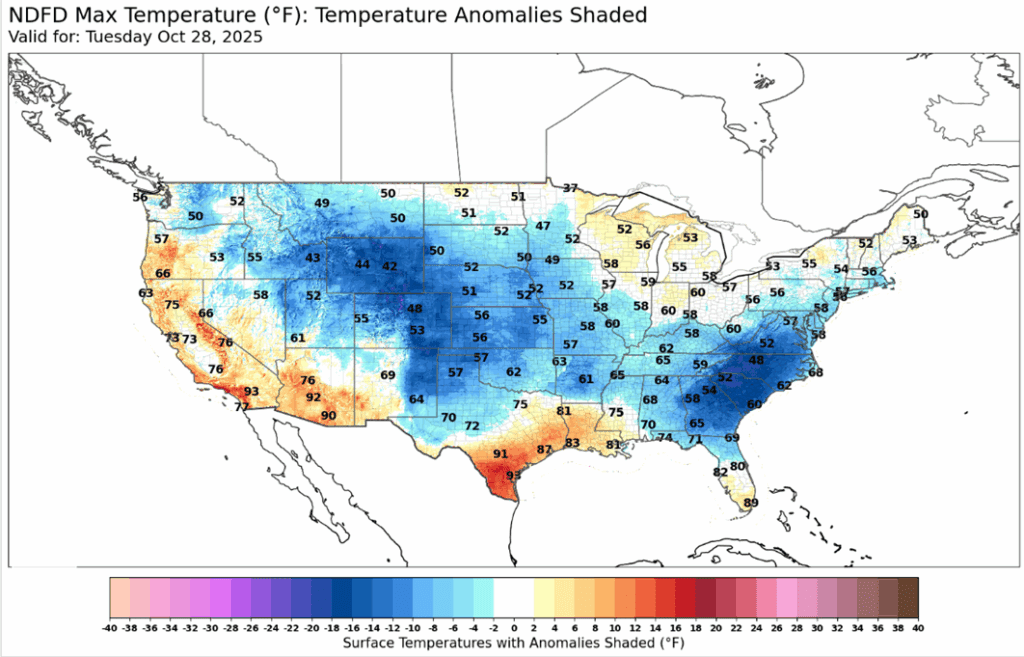

- To see the updated U.S. and South American weather maps, scroll down to the other charts/weather section.

- The release of new crop progress data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if December 2026 futures close above 483 macro resistance.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- The Plan B call option target has been raised from 482 to 483.

- Notes:

- Resistance for the macro trend sits at 483 vs December 2026. A close above 483 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

- The corn market was mixed on Wednesday, as prices consolidated within yesterday’s trading range. The market saw bull spreading with strength in the December contract. December corn futures gained 2 cents to close at 434, and March added ¾ cents to 446 ¾.

- Weekly ethanol production slipped 1.9% week-over-week to 1.091 million barrels/day for the week ending October 24. Production was below expectations. An estimated 109 mb of corn was used last week in ethanol production.

- Technically, the corn market remains supported, though the December contract continues to face resistance near the 200-day moving average at 437.

- A meeting between President Trump and President Xi of China is scheduled for tomorrow. The prospects of a trade deal are helping support grain futures.

- The Federal Reserve’s 0.25% rate cut Wednesday afternoon strengthened the U.S. dollar, which may act as a headwind for grain prices heading into Thursday’s session.

Soybeans

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if January 2026 futures close above 1175 macro resistance.

- Details:

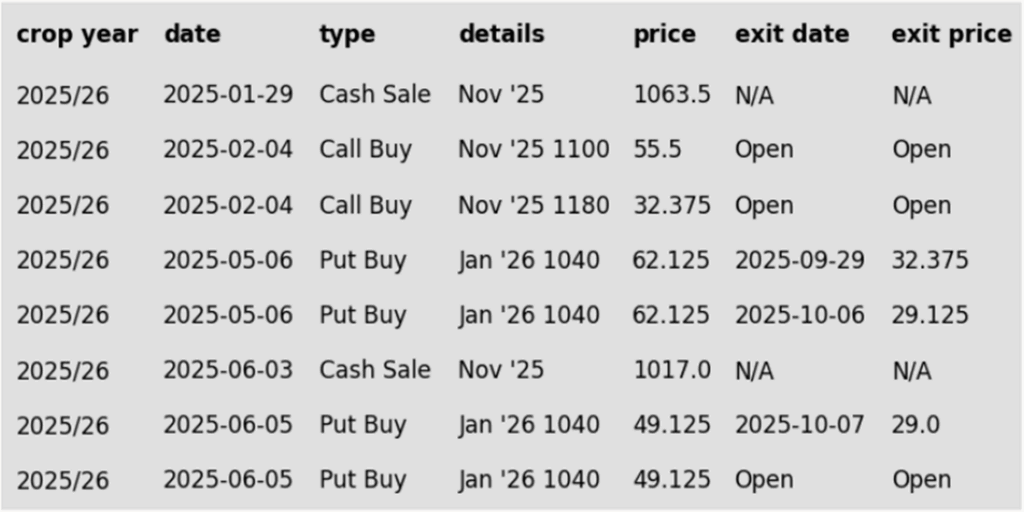

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 1175 vs January 2026. A close above 1175 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Sell the first portion of your crop if November 2026 futures break below 1045.

- Buy call options if November 2026 futures close above 1161 macro resistance.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A Plan B stop sale target has been added.

- Notes:

- Key support for November 2026 futures is at 1045 – a break below this level would indicate the potential for a trend change. A stop is used to allow the current market trend to continue developing and will only trigger a sale recommendation if prices close below this level.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

- Soybeans were mixed to end the day after two days of massive gains and a gain of 60 cents over the past two weeks. Today’s quiet trade comes ahead of the meeting between President Trump and Xi. November soybeans were up 2 cents to $10.80-1/4 while March was down 1-1/2 cents to $11.05-1/4. December bean meal was up $2.20 to $308.70, and December bean oil was down 0.10 cents to 50.16 cents.

- Tomorrow in South Korea, President Trump will meet with Chinese President Xi about a trade agreement. This news will likely come tonight local time due to the time difference. While no details are known, Trade Secretary Scott Bessent has indicated that U.S. farmers would be happy with the deal.

- China reportedly purchased three cargoes of U.S. soybeans yesterday—two out of the Gulf and one from the Pacific Northwest—the first such purchase in months. While the volume was small, it was viewed as an encouraging sign ahead of trade talks. Still, most of China’s near-term soybean needs have already been covered by South American supplies.

- In Brazil, soybean crushing is expected to hit a record high of 177 mmt for 25/26 according to Rabobank, which would be up 3% year to year. Brazilian planted soybean area is estimated at 48.8 million hectares, which would be up 2% from the previous year.

Wheat

Market Notes: Wheat

- Wheat had a mixed close. Light bull spreading was noted in both Chicago and Kansas City futures, in which there was more buying interest in the front months compared to the back months. December Chicago gained 3-1/4 cents to 532-1/4, Kansas City rose 2-3/4 to 522-3/4, while Minneapolis slipped 1-1/4 to 560-1/2. Like soybeans, wheat appears to be in “wait-and-see” mode ahead of the upcoming meeting between President Trump and Chinese President Xi.

- According to the European Commission, EU soft wheat exports as of October 26 totaled 6.2 mmt since the season began on July 1. This represents a 21% decline from the 7.9 mmt shipped during a similar period last year.

- LSEG commodities research has estimated Australian 25/26 wheat production at 34.8 mmt, which is up 2% from the last forecast. This bump is said to largely be supported by satellite imagery, which shows good vegetation density in wheat-growing regions.

- One private estimate has pegged China’s 26/27 wheat production at 141 mmt, with planted area steady with the prior season at 23.62 million hectares. Winter wheat in China is typically planted between September and November, but the planting pace has been delayed due to heavy rains in October.

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- Buy call options if July 2026 futures close above 669 macro resistance.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 669 vs July 2026. A close above 669 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 590.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 590.50.

- Notes:

- Resistance for the macro trend sits at 590.50 vs December ‘25. A close above 590.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- Buy call options if July 2026 closes at or above 648.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase

To date, Grain Market Insider has issued the following KC recommendations:

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 590.50 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 590.50.

- Notes:

- Resistance for the macro trend sits at 590.50 vs December ‘25. A close above 590.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if July 2026 KC wheat closes at or above 648.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day temperature outlook courtesy of ag-wx.com