10-30 Opening Update: Soybeans Higher, Corn and Wheat Lower Following Trade Talks

- Corn futures are trading lower to start the day but have worked off their overnight lows and may post gains on the day. December corn is down 2-1/2 cents to $4.31-3/4 while March is down 2-3/4 to $4.44-3/4.

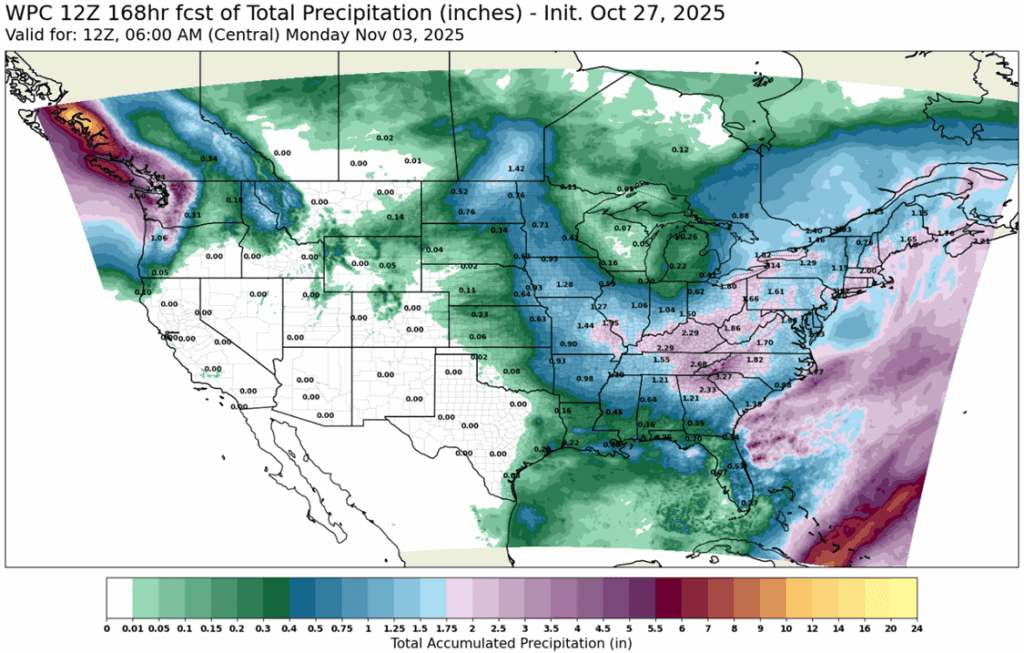

- A Bloomberg survey shows that the estimates for corn export sales for the week ending October 23 are within a range of 1,100k and 2,100k tons with an average guess of 1,475k tons. This would compare to 2,342k tons a year ago.

- The U.S. and Japan finalized and signed a trade agreement on Tuesday. Over the past five years, Japan has imported an average of $14.3 billion in U.S. agricultural products, with corn accounting for roughly 18% of that total.

Corn Futures Close Above Resistance: Corn futures managed to close above structural resistance in a zone between 430 and 432, but did so in a quiet and unconvincing fashion. Minor support has been established at the bottom side of the zone, near 430. Technical resistance can be found above at the 200-day moving average, near 441.

- Soybean futures are trading higher but have been extremely volatile since the Chinese trade talks and have been in a 33 cent trading range overnight. November soybeans are currently up 6-1/2 cents at $10.86-3/4 and have climbed back from a low of $10.57. March soybeans are up 6 cents to $11.11-1/4, December bean meal is up $3.10, and December bean oil is down 0.28 cents to 49.87 cents.

- President Trump and Xi came to some good agreements regarding trade last night with China agreeing to buy 12 mmt of soybeans this season and a minimum of 12 mmt per year for the next 3 years. Each country has lowered tariffs on the other, and the trade truce has been extended for a year.

- Estimates for export sales as of October 23 see soybeans in a range between 700k and 1,600k tons with an average guess of 1,200k which would compare to 2,136k a year ago.

Soybeans Break Higher: Soybean futures secured their second consecutive close above the trading range that has bound prices for over a year. This could encourage additional technical buying. Strong psychological resistance should be expected as prices approach 1100, with support at the gap, near 1063.

- All three wheat classes are trading lower but have come back from overnight lows. December Chicago wheat is down 5 cents to $5.27-1/4, KC is down 6-3/4 to $5.16, and Minn wheat is down 3 cents to $5.57-1/2.

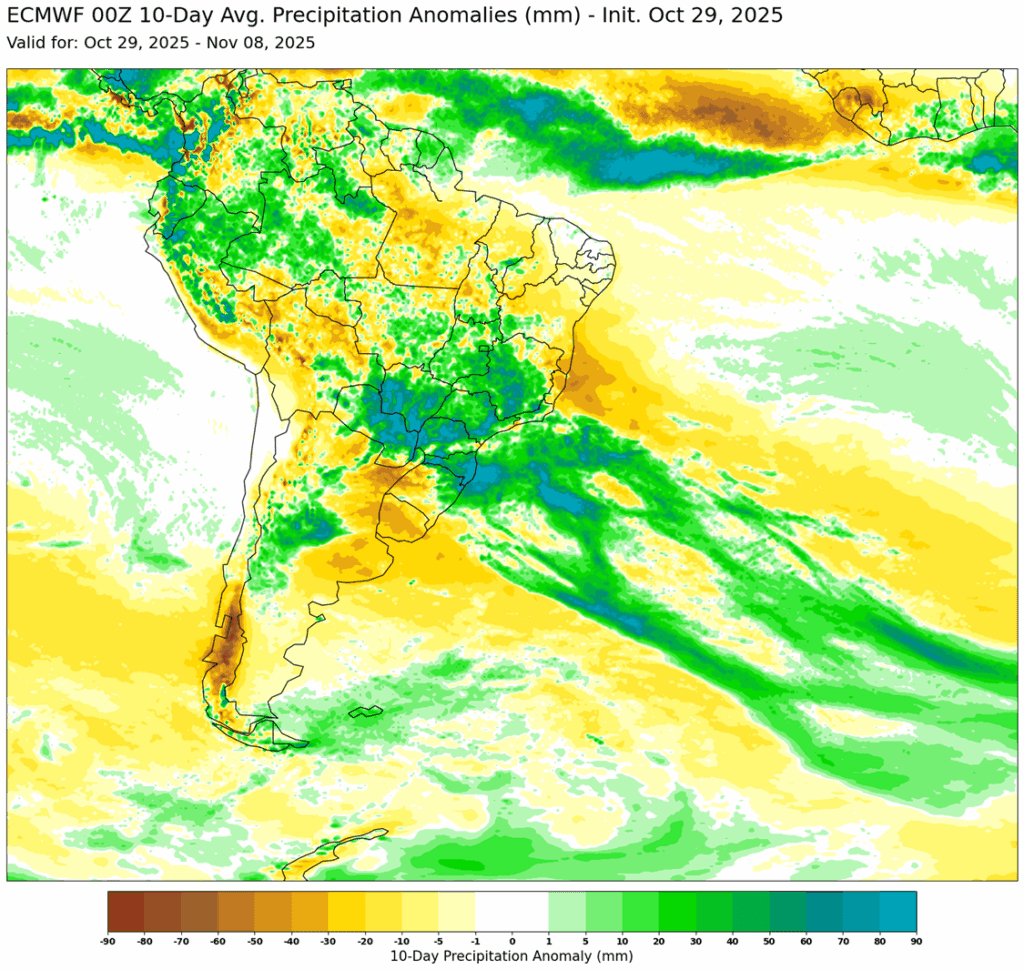

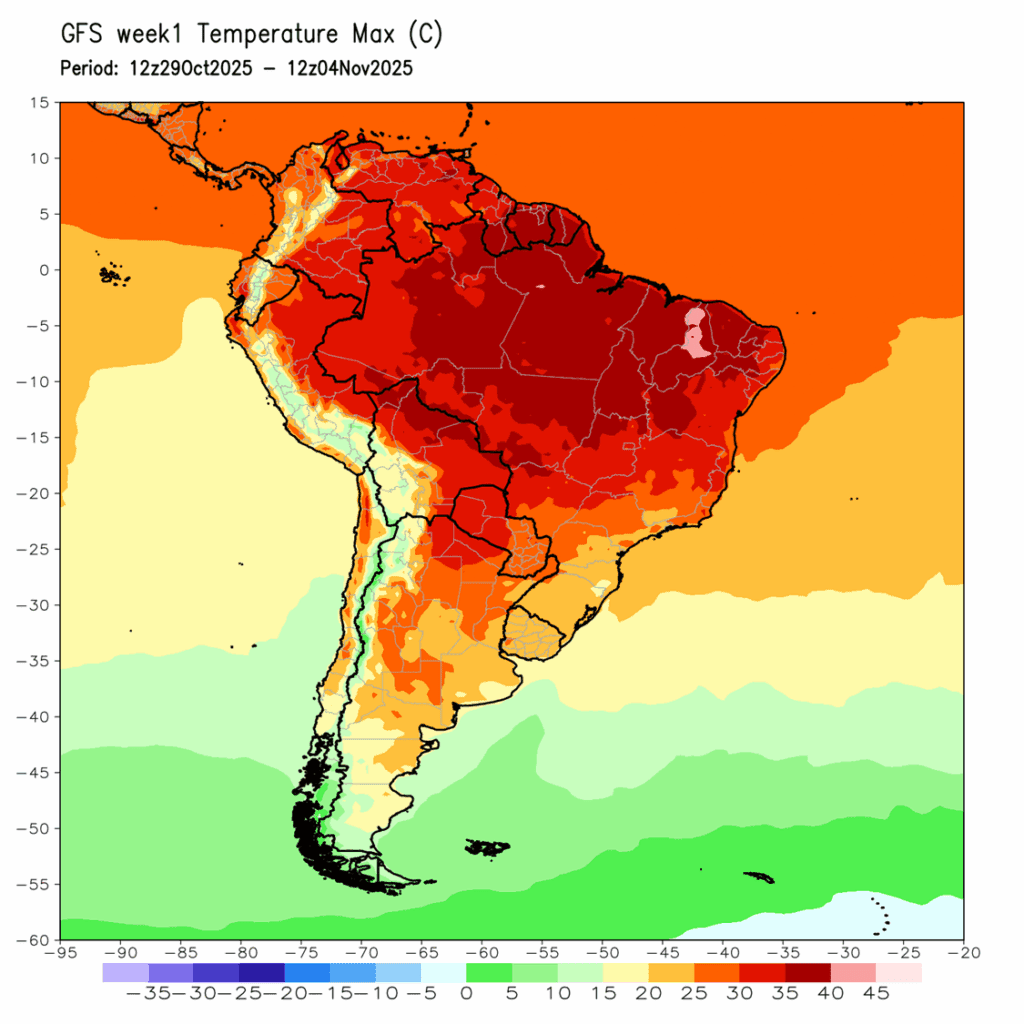

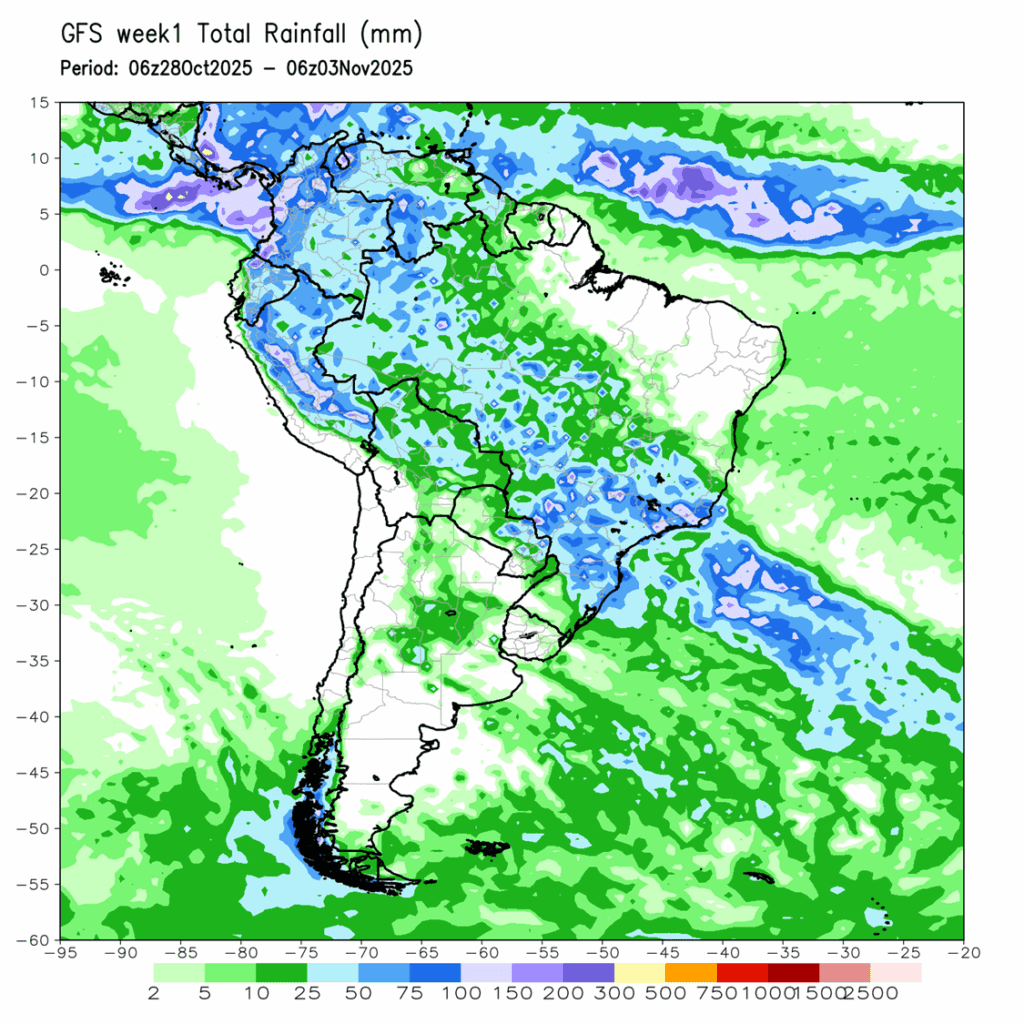

- Argentina and Australia will soon be harvesting record wheat crops. The Argentina crop is estimated near 23 mmt compared to the USDA estimate of 19.5. The Australian crop is estimated at 38 mmt compared to USDA’s estimate of 34.5.

- Estimates for wheat export sales for the week ending October 23 are in a range between 350k and 900k tons with an average guess of 613k tons. This would compare to 411k tons last year.

Chicago Wheat Breaks Higher: Wheat futures broke through key technical resistance at the 100-day moving average. The 100-day moving average had previously capped any price rallies since late July. With the 100-day moving average now serving as support, the first point of technical resistance can be found at the 200-day moving average, near 539.

KC Wheat Continues Higher, Approaches Resistance: KC wheat has trended higher following a strong daily reversal on October 14. Prices have since managed to break through technical resistance at the 50 and 100-day moving averages and are approaching structural resistance from a previous consolidation phase, near 529. Support can be found at the 100-day moving average, near 517.

Spring Wheat Builds Momentum, Tests Resistance: Spring wheat futures found support near 545 and reversed higher with enough momentum to begin retesting resistance at the 50-day moving average, near 566. Prices have not yet been successful in breaking through this level. A second point of resistance can be found at the 100-day moving average, near 586. Support lies below at 545.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.