A Shifting Crop Rotation Approach in the Time of Tariffs?

It’s that time of the year when farmers are once again deciding what adjustments to make to their crop rotation. As always, many factors weigh into your decision-making, like input costs and anticipated demand. Even more unsettling, you’re facing another complication – the threat of tariffs. Obviously, memories of the negative impact of the 2018 Chinese tariffs are enough to give you heartburn at the thought of another round, and many across the ag industry share those concerns as they anticipate an aggregate two to seven-million-acre swing from soybeans to corn. As the drum beats toward a shift away from soybeans, you may feel some pressure to do the same.

Before you start executing wholesale 2025 crop decisions, however, consider that your decision may not be entirely risk-free. Say you make a shift and the tariffs never materialize – would you have made changes only to have been set up for another bad revenue year? And what is happening to the other variables that affect your crop rotation decisions in any year? Remember that one variable alone is almost never the sole predictor of what a market will do, or what makes sense for your operation. With that in mind, let’s take a close look at some of the other factors that may affect prices and your decision-making in 2025.

Increasingly More Soybeans and Less Corn

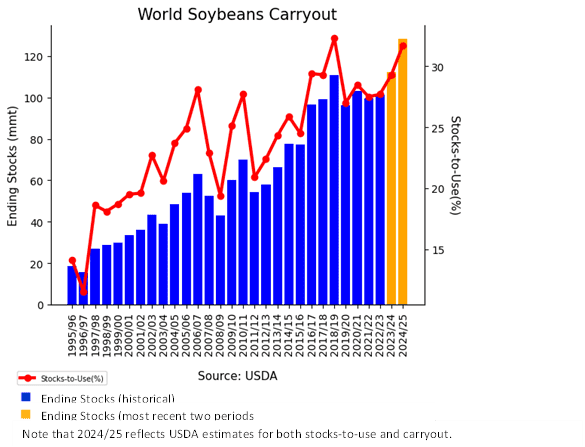

Even if tariffs weren’t looming, the world carryout for soybeans and corn would lead you to consider a shift to corn. Take a look at the World Soybeans Carryout chart below. Per the USDA, carryout rose in the 2023/24 crop year (ending August of 2024), and is estimated to hit a new high in 2024/25. Similarly, the stocks-to-use ratio also rose in 2023/24, and the USDA estimates it will rise again in 2024/25 to just below the 2018/19 high. In layman’s term, this means that the USDA estimates we will have a glut of soybeans through at least 2024/25. Furthermore, a glut in supply correlates to a flat or decreasing price.

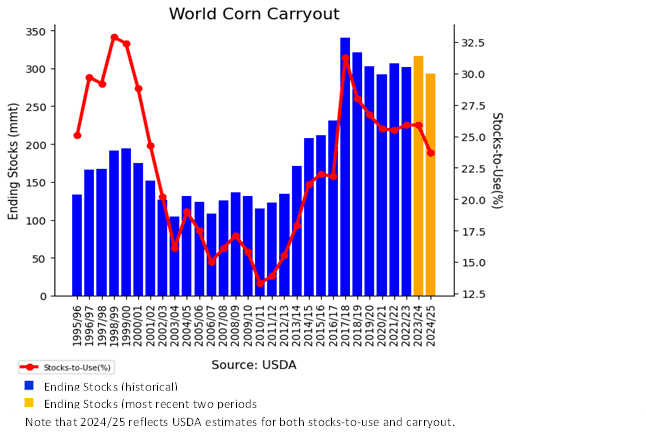

In contrast, look at the World Carryout Chart for corn below. Although ending stocks are far greater than they were prior to 2017/18, ending stocks for 2024/25 are estimated to be roughly flat from the previous number of years. More telling, the stocks-to-use ratio continues to decline, telling us that the amount left over every year is decreasing as a percent of demand. All things being equal, this is an indicator of a stronger price trend. From an apples-to-apples comparison (or to put it more bluntly, even absent a trade war), the two charts together imply stronger performance for corn vs. soybeans from a more global perspective.

Does It Make Sense to Make a Big Shift at the Farm Level?

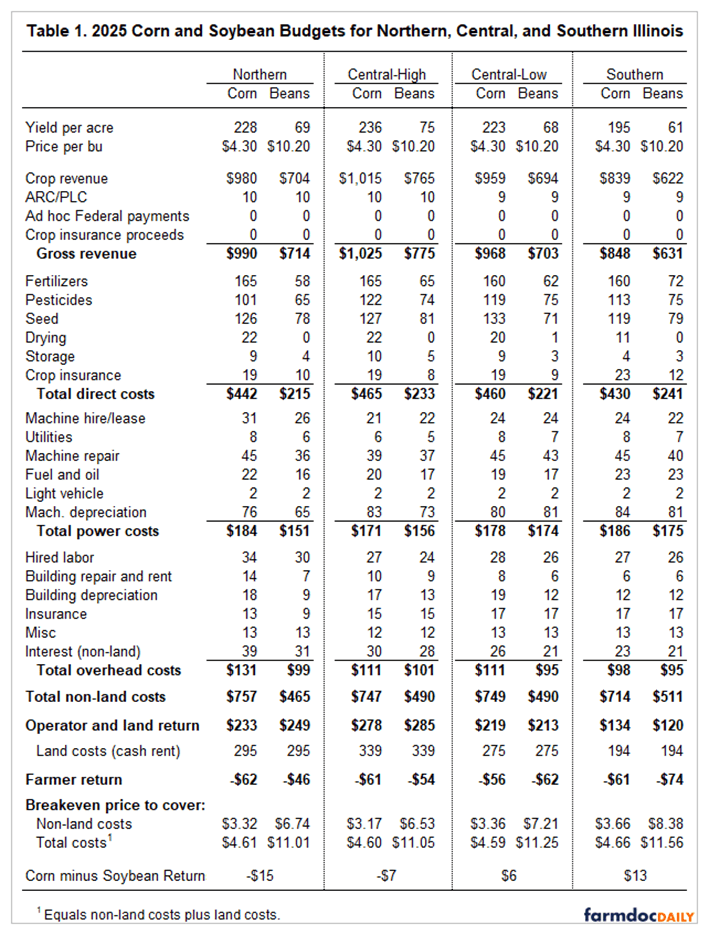

Potential revenue, of course, is only one half of the equation when you’re deciding the best economic strategy for your operation. You also need to consider expenses pertinent to your operation as well as factors such as yields, land rent, and basis, aligned to your location. The 2025 University of Illinois farmdocDaily Corn and Soybean Budgets for Northern, Central, and Southern Illinois (table below) illustrates just how much of a farm’s profitability is affected by the crop rotation choices made.

Very quickly, note that the analysis done by University of Illinois pays attention to comparing corn and soybeans across variables such as yield per crop, direct costs, power costs, overhead costs, and land costs. This is something you can do to help you determine how much your revenue and costs are affected by the choices you make concerning the portion of your acreage devoted to each crop.

Keeping in mind all that’s above, let’s take a longer look at the last line in the table, called Corn minus Soybean Return. University of Illinois estimates that soybeans in northern Illinois will yield $15 more per acre than corn, while in southern Illinois corn yields $13 more per acre than soybeans yield. That’s an incredibly large differential in profitability per acre from the top of the state to the bottom of the state based on the crop. As you head toward the middle of the state, prices tend to even out a little bit, being a bit more suited to soybeans more northerly and more suited to corn more southernly.

The implications from the information above means that, for more northern farms, any movement away from soybeans would be more risky because the farming environment is so biased toward soybeans vs. corn in spite of any potential price advantage for corn. Alternatively, as you move more to the center of the state, a shift in mix away from soybeans toward corn would be a safer crop rotation, as the corn minus soybean return is closer to 0.

Source: Revised 2025 Crop Budgets – farmdoc daily

What Should You Do?

Living with unhappy memories like those from 2018 has the immediate impact of wanting to do something different when the same situation arises; the most logical step seems like it should be changing your crop rotation. This urge is supported by expectations of acreage shifts to corn at the macro level and anticipated price changes. However, it’s also important to make sure that any shift coincides with the economics and realities of YOUR operation. To help you make a decision, make sure you consider the following:

- Put together a budget that borrows from the good work of University of Illinois. Make sure you understand the economics of your operation from the production of both corn and soybeans.

- If your return per acre of corn vs. soybeans are roughly the same, consider some shift in acreage, especially if you think that tariffs will indeed occur.

- Regardless, remember that a well-designed marketing strategy can help protect you in case of adverse market movements. In other words, use hedging tools to protect your price vs. major shifts in the way you make your rotation decisions. This will help you maintain a comfort level with your farming strategy while your marketing strategy works to protect price.

At Grain Market Insider, we help farmers like you make informed marketing decisions every day. Furthermore, we will advise you in a manner that best fits you. That may be one decision at a time or within the context of a multi-year, flexible plan for every commodity on your farm.

This year, Grain Market Insider is celebrating our 40th year helping farmers.

Give us a call at 800.334.9779 to discuss your situation and how we can help you achieve marketing success.