9-9 End of Day: Grains Slide Slightly Awaiting USDA Data Friday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn sank slightly lower Tuesday as prices continue to consolidate ahead of the USDA WASDE report Friday.

- 🌱 Soybeans: Soybeans slipped in quiet trade ahead of Friday’s WASDE.

- 🌾 Wheat: Wheat futures closed lower across all three classes, pressured by weakness in corn and soybeans, softer Paris milling wheat, and firmer U.S. Dollar Index.

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th DEC ’25 420 Puts ~ 15c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of your December 420 puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

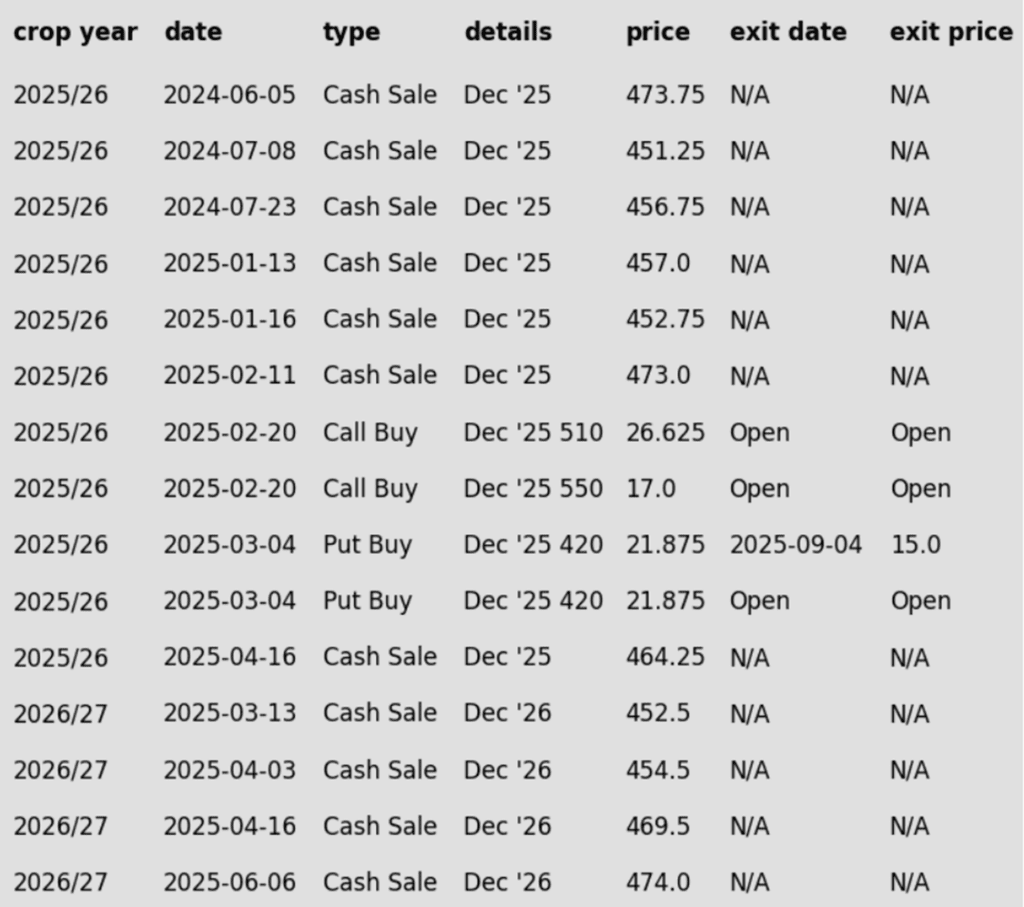

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- The target to exit half of the December 420 put position has been removed.

- One-quarter of your 420 puts should be exited to lighten the position in case upside momentum continues through September. The remaining three-quarters should remain to continue providing downside protection.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures eased slightly on a quiet news day as the market positioned ahead of Friday’s USDA WASDE. December fell 2 cents to 419 ¾, while March slipped 2 cents to 437 ¾.

- Demand remains supportive but may be slowing, with higher prices limiting export business. USDA hasn’t reported a flash export sale since August 22.

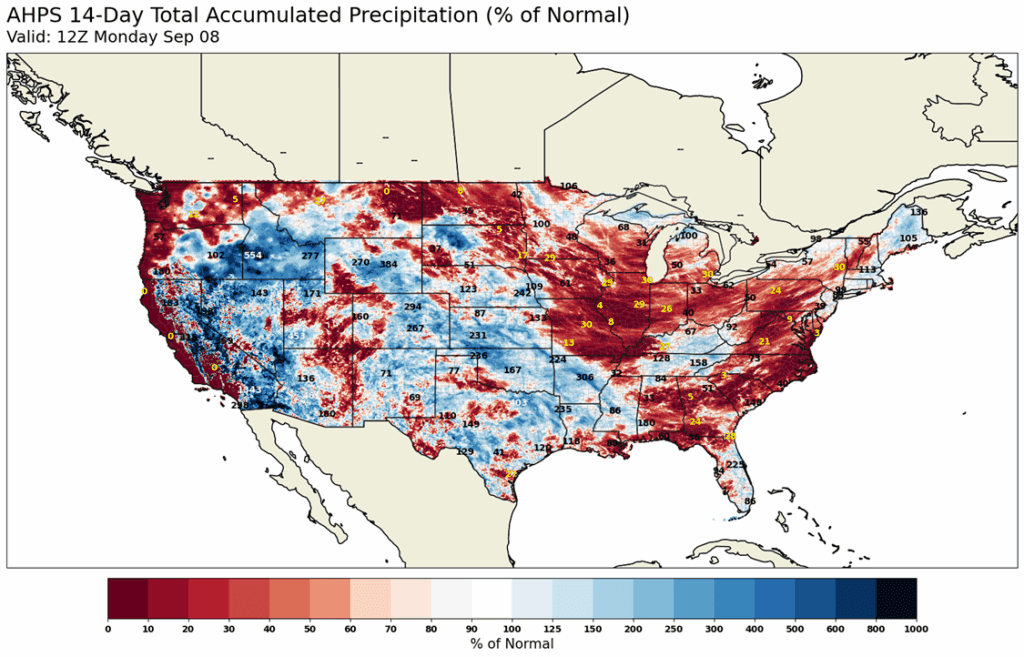

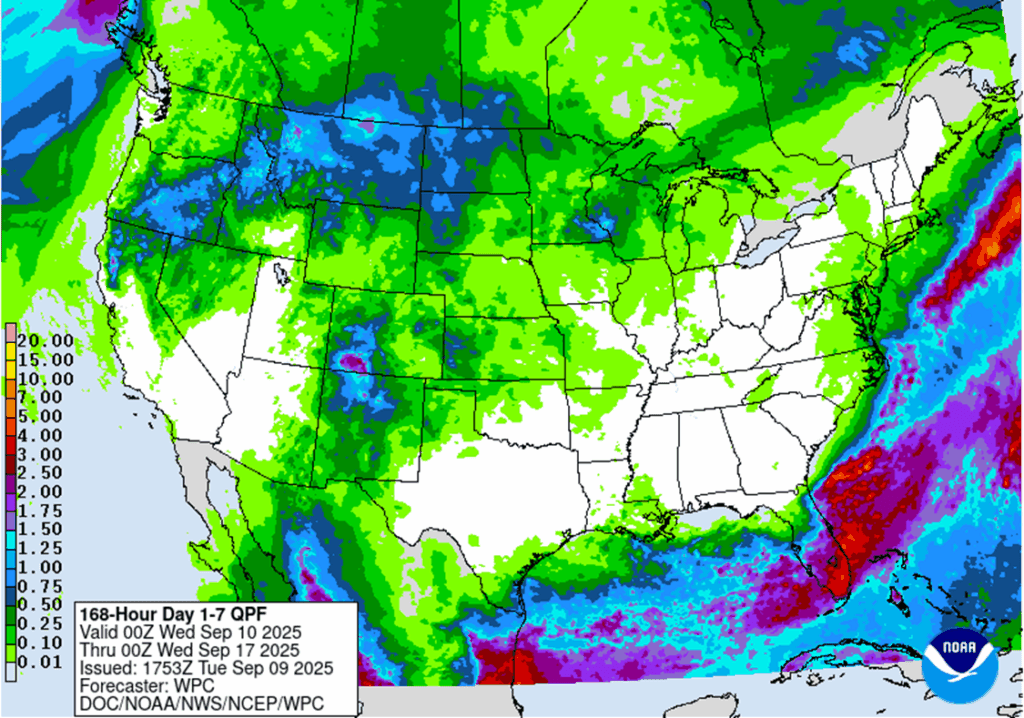

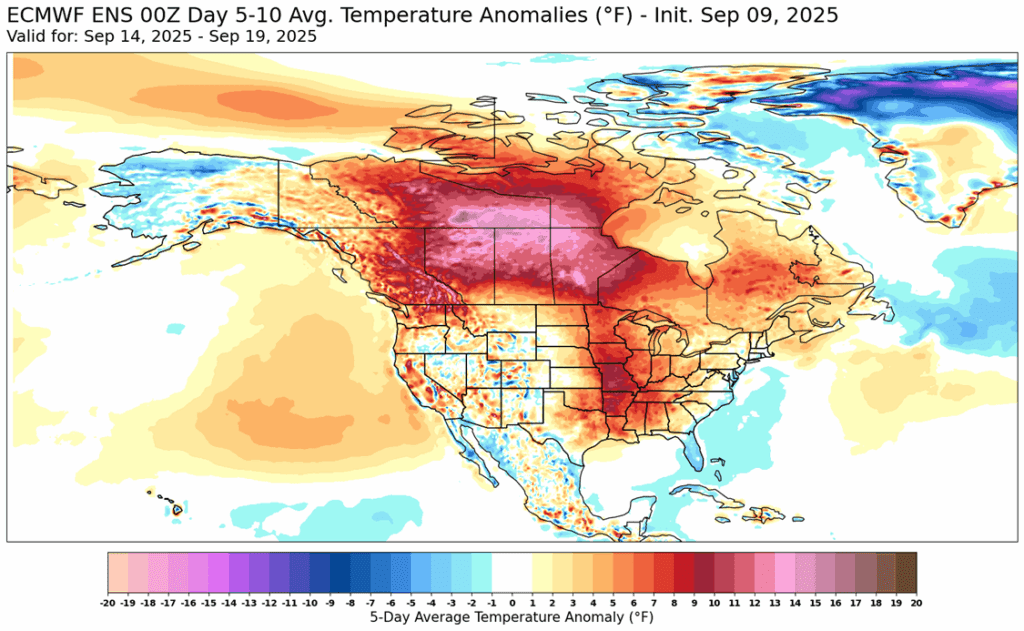

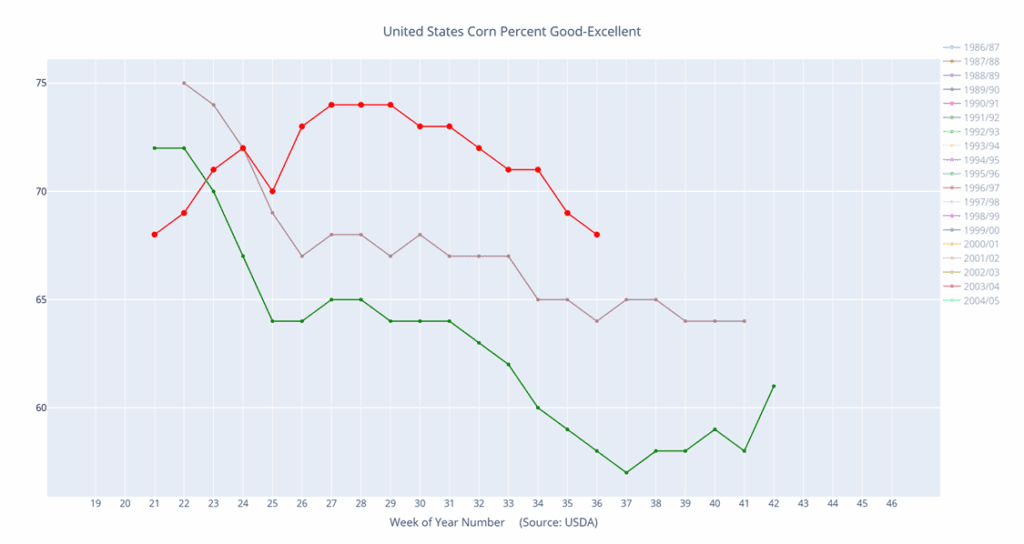

- Grain markets may be looking to add some weather premium. Long-range forecasts point to above-normal temperatures and below-normal rainfall across much of the Corn Belt into mid-September. The ongoing dry conditions could limit final yield totals this fall.

- Harvest pressure is beginning to surface as U.S. corn harvest reached 4% complete. A record crop outlook and fresh supplies could weigh on prices.

- USDA will release the September WASDE on Friday February 12. Expectations are for corn yield to be reduced to 186.0 bu/a according to analyst survey. The 2025-26 corn ending stocks should also be reduced slightly with demand adjustments to near 2.000 bb.

Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- The Plan B target to exit one-quarter of the January 1040 puts options has been removed.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower in quiet trade ahead of Friday’s WASDE report and a lack of fresh news. November soybeans lost 2-1/2 cents to $10.31-1/4 while March soybeans lost 2 cents to $10.66. October soybean meal gained $5.80 to $287.70 and October soybean oil lost 1.05 cents to 49.93 cents.

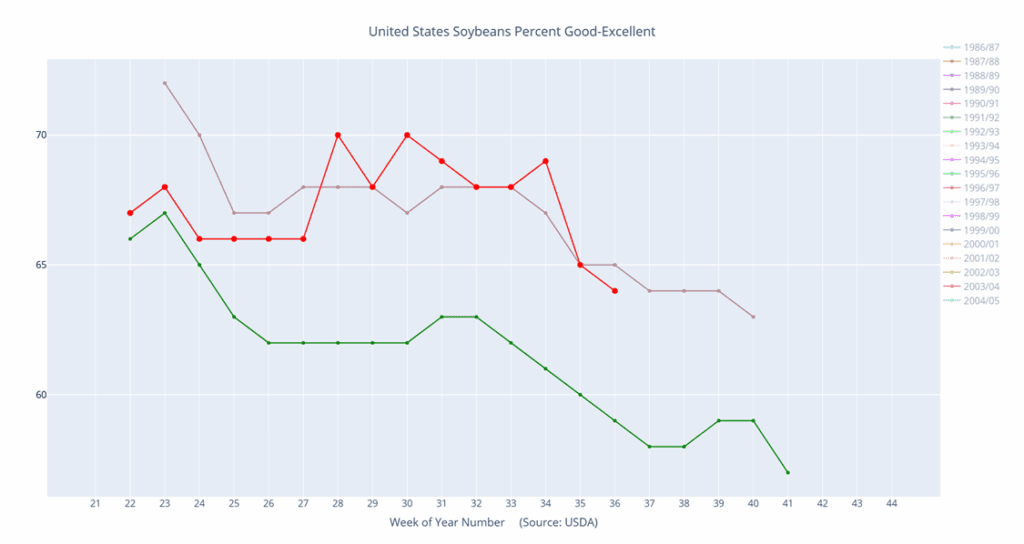

- Crop ratings edged lower, with soybeans at 64% good-to-excellent, down 1 point from last week but 1 point above expectations. Pod-setting is 97% complete and 21% of the crop is dropping leaves, both in line with average pace.

- StoneX has revised their estimates for the 25/26 soybean yield lower to 53.2 bpa. This would be slightly below the USDA’s estimate but is on par with Allendale’s last guess of 53.28 bpa. Production is estimated at 4,257 mb, and the USDA will update its estimates this Friday.

- Estimates for the WASDE report see 25/26 ending stocks slightly lower to unchanged at 287 mb while 24/25 ending stocks are expected to be unchanged. Yield is projected 0.4 bpa lower at 53.2 bpa. There is a possibility that the USDA lowers export demand to account for the lack of Chinese purchases.

Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- Wheat futures closed lower across all three classes, pressured by weakness in corn and soybeans, softer Paris milling wheat, and firmer U.S. Dollar Index. Russian export values fell another $2–$4, adding to U.S. market pressure. December KC led losses, down 7 cents to 510 ¼, while Chicago fell 3 ½ to 520 ¼ and MIAX lost 2 ¾ to 574.

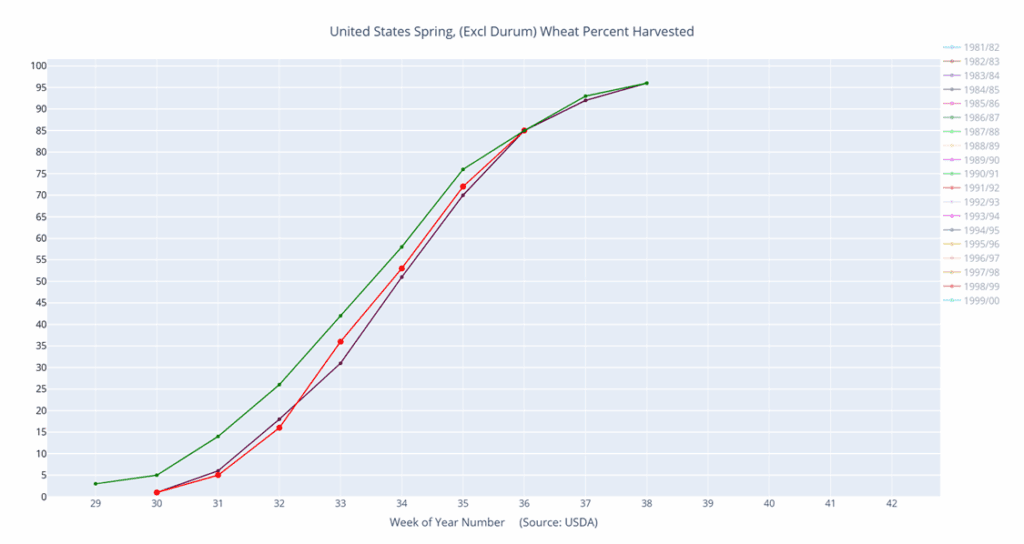

- According to the USDA’s crop progress report, spring wheat harvest is 85% complete as of September 7. This is up 2% from last year’s pace, and 1% from the five-year average. Additionally, the winter wheat crop is now 5% planted, in line with last year and 1% below the five-year average.

- Data from Statistics Canada showed their all-wheat stocks at 4.112 mmt. This fell under expectations for 4.4 mmt and compares with last year’s 4.6 mmt figure. The wheat market seemed to largely ignore this, however, as is evident by the lower trade.

- The economy ministry of Ukraine has stated that their nation intends to up the winter grain planted area for 2026 to 5.43 million hectares. This compares with 5.24 million in 2025. Winter wheat sowing on its own may rise from 4.5 to 4.78 million hectares.

- Russia’s harvest continues to advance, with 105 mmt of grain collected. SovEcon raised its wheat production outlook to 86.1 mmt from 85.4, citing better yields in the Volga Valley.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 605.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 605.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- A Plan A target of 590 against December 2025 futures has been added.

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 647 target has been lowered to 642.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Spring wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Other Charts / Weather