9-8 End of Day: Grains Add Weather Premium to Start the Week

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures started the week higher as markets added weather premium on a warmer and drier than normal outlook over the next two weeks.

- 🌱 Soybeans: Soybeans started the week higher as weekend frost in the northern Corn Belt likely cut short grain fill in late-developing soybeans.

- 🌾 Wheat: Wheat futures posted gains across all three classes Monday, supported by strong export inspections and a weaker U.S. dollar.

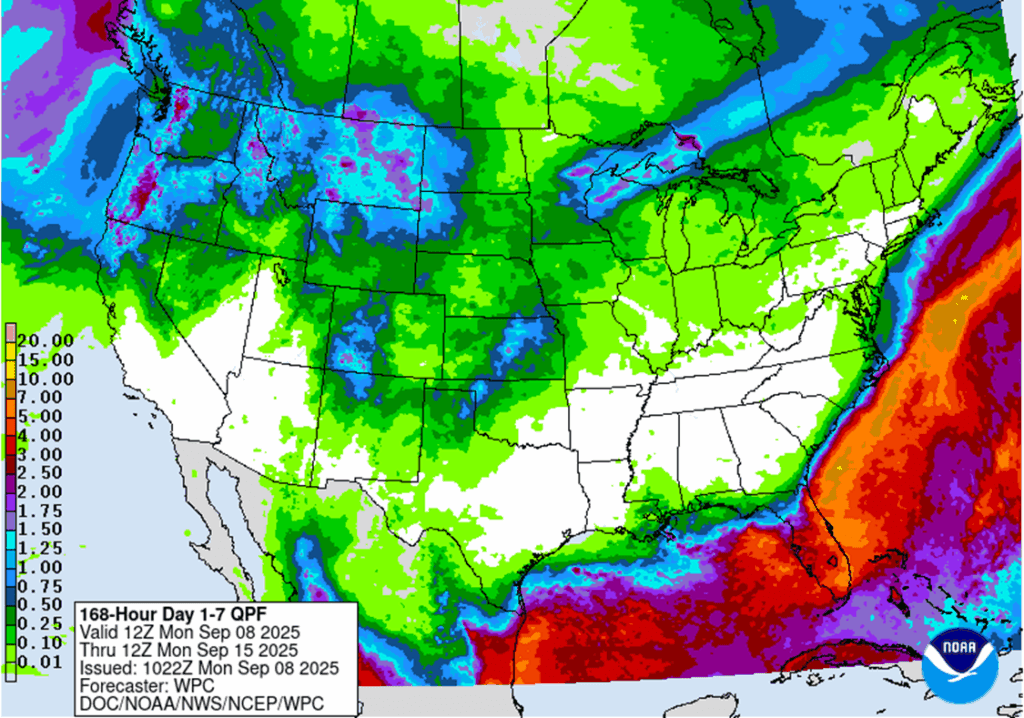

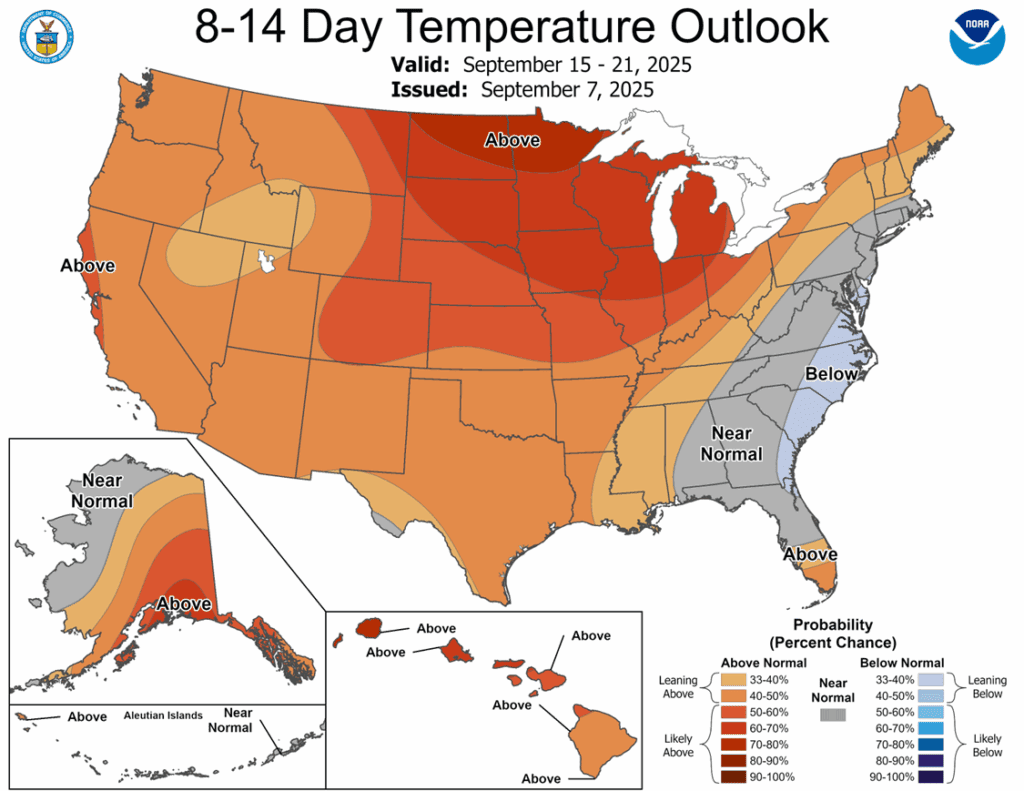

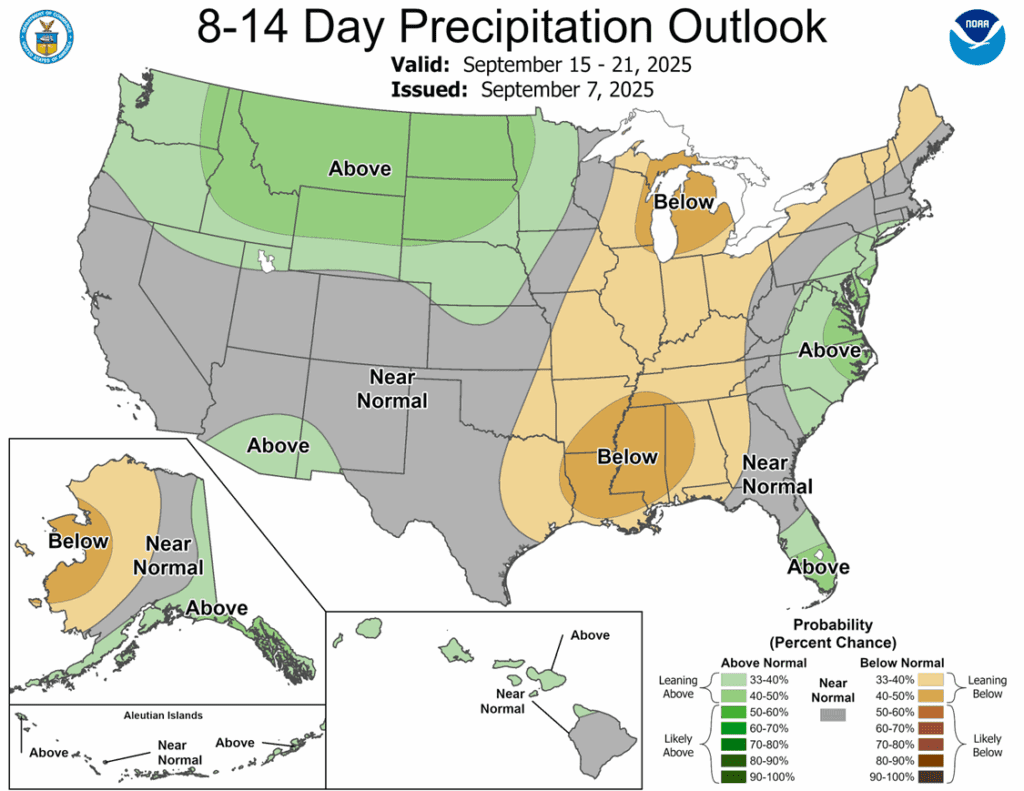

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th DEC ’25 420 Puts ~ 15c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of your December 420 puts today.

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B:

- No active targets.

- Details:

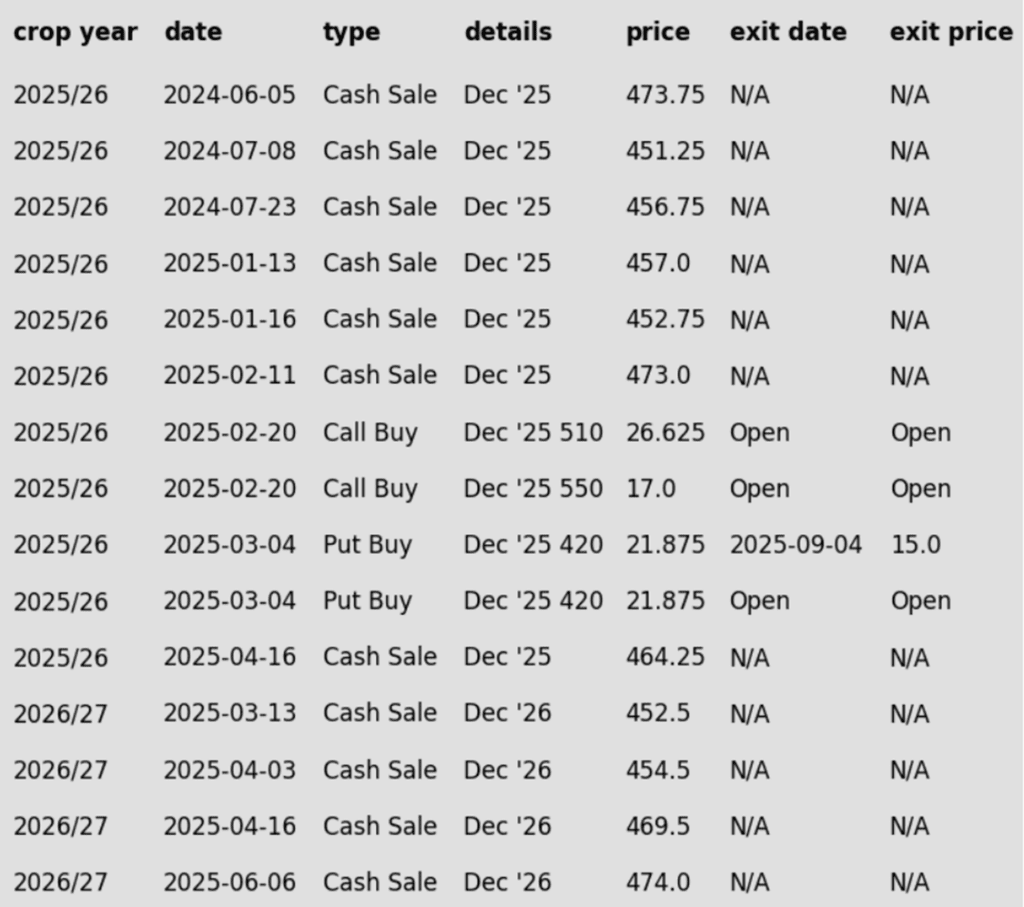

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- One-quarter of your 420 puts should be exited to lighten the position in case upside momentum continues through September. The remaining three-quarters should remain to continue providing downside protection.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures started the week higher, rallying off early session lows. December gained 3 ¾ cents to 421 ¾, while March added 3 cents to 439 ½, supported by demand and weather concerns.

- USDA released weekly export inspections on Monday morning. For the week ending September 4, a total of 56.8 mb were inspected for shipment. Of that total, 25.6 mb were for the 2025-26 marketing year as the old marketing year closed on August 31.

- Grain markets are adding weather premium as long-range forecasts point to above-normal temperatures and below-normal rainfall across much of the Corn Belt into mid-September.

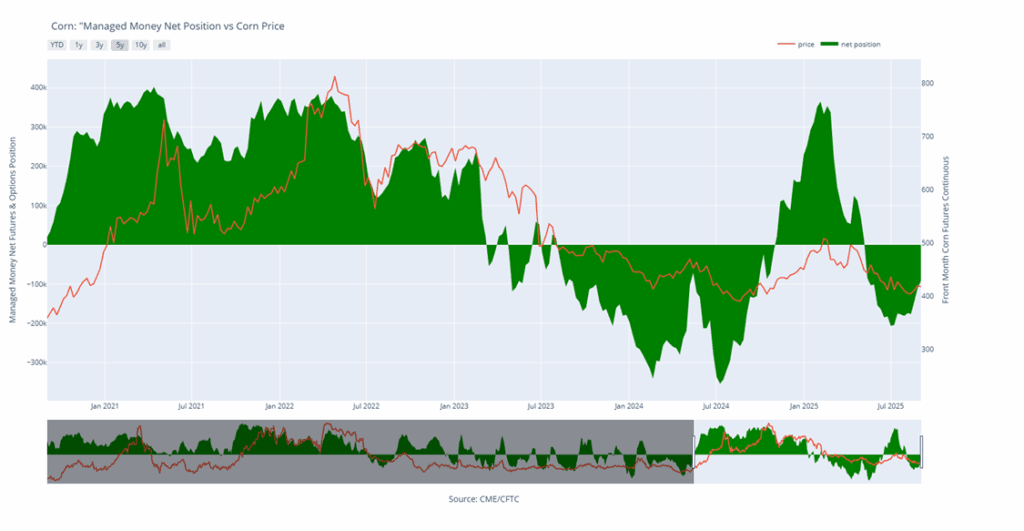

- Managed hedged funds reduced their net short position in the corn market for the third consecutive week. This is the longest “buying” streak since January as the funds reduced their net short position by nearly 19,000 contracts but remain short 91,000 total contracts.

- Brazil’s growing ethanol industry could be long term supportive of the US corn export market. Though down the road, A Brazilian ethanol firm announced plans to build at least 5 ethanol plants in Mato Grasso. The increased domestic usage should limit additional bushels to the export market.

Corn Managed Money Funds net position as of Tuesday, September 2. Net position in Green versus price in Red. Money Managers net bought 19,199 contracts between August 26 – September 2, bringing their total position to a net short 91,487 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- The Plan B target to exit one-quarter of the January 1040 puts options has been removed.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher to start the week as futures slowly climbed higher throughout the day. November soybeans gained 6-3/4 cents to $10.33-3/4 while March gained 7-1/4 cents to $10.68. Soybeans bounced off support at the 50-day moving average again today. October soybean meal gained $1.40 to $281.90 while October soybean oil gained 0.17 cents to 50.98 cents.

- China’s August soybean imports hit a record 12.28 mmt, up 1.2% from last year and above expectations as crushers front-loaded purchases amid stalled U.S.-China trade talks.

- StoneX has revised their estimates for the 25/26 soybean yield lower to 53.2 bpa. This would be slightly below the USDA’s estimate but is on par with Allendale’s last guess of 53.28 bpa. Production is estimated at 4,257 mb, and the USDA will update its estimates this Friday.

- Patchy frost likely hit northern U.S. soybean areas over the weekend, while ongoing and forecasted dryness across the core I-states is adding back weather premium to the market.

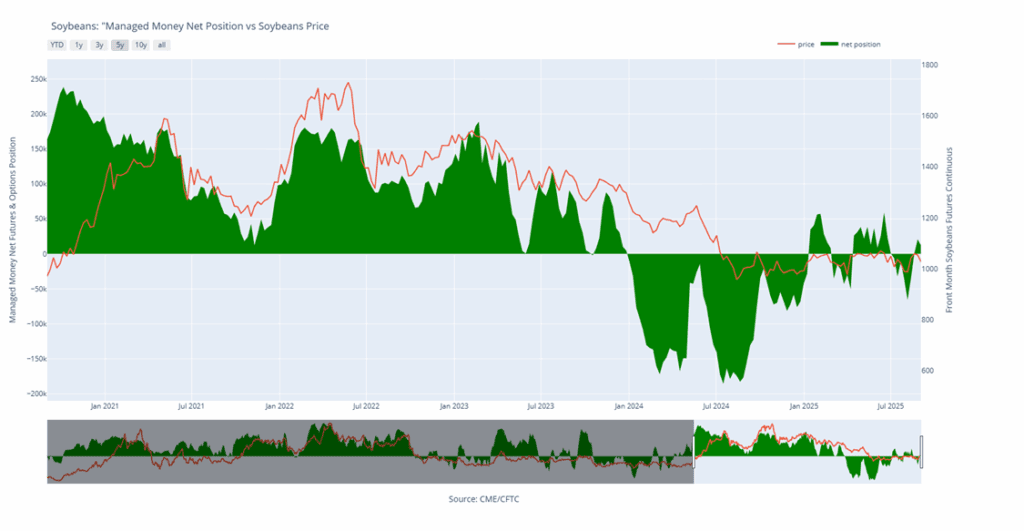

- Friday’s CFTC report saw funds as sellers of soybeans by 8,854 contracts which reduced their net long position to 11,964 contracts. They sold 14,542 contracts of bean oil leaving them long 16,127 contracts and sold 27,811 contracts of meal leaving them short 89,522 contracts.

Soybean Managed Money Funds net position as of Tuesday, September 2. Net position in Green versus price in Red. Money Managers net sold 8,854 contracts between August 26 – September 2, bringing their total position to a net long 11,964 contracts.

Wheat

Market Notes: Wheat

- Wheat futures posted gains across all three classes today, supported by positive export inspection data and a weaker U.S. dollar. December wheat led the way, closing up 4.4 cents at 523 3/4.

- Wheat export inspections this week totaled 16 mb, in line with trade expectations and sufficient to meet the weekly pace needed to reach the USDA’s annual forecast. Year-to-date inspections stand at 260 mb, which is 10% above the seasonal average.

- Fundamentals remain bearish, with ample EU and Black Sea supplies capping rallies. APK-Inform raised Ukraine’s wheat crop estimate to 21.9 mmt (from 19.7) and exports to 15.3 mmt (from 13.9), adding to global pressure.

- Wheat prices in Russia and the EU remain weak, adding to global market pressure. APK-Inform raised Ukraine’s wheat production estimate to 21.9 million metric tons, up from 19.7 million last month. Export projections were also increased, with Ukraine now expected to ship 15.3 million tons, up from the previous forecast of 13.9 million.

- Wet weather across the Plains is expected to slow early planting progress, as the spring wheat harvest nears completion at approximately 80%. Meanwhile, winter wheat planting is just slightly behind the seasonal average.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 605.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 605.75.

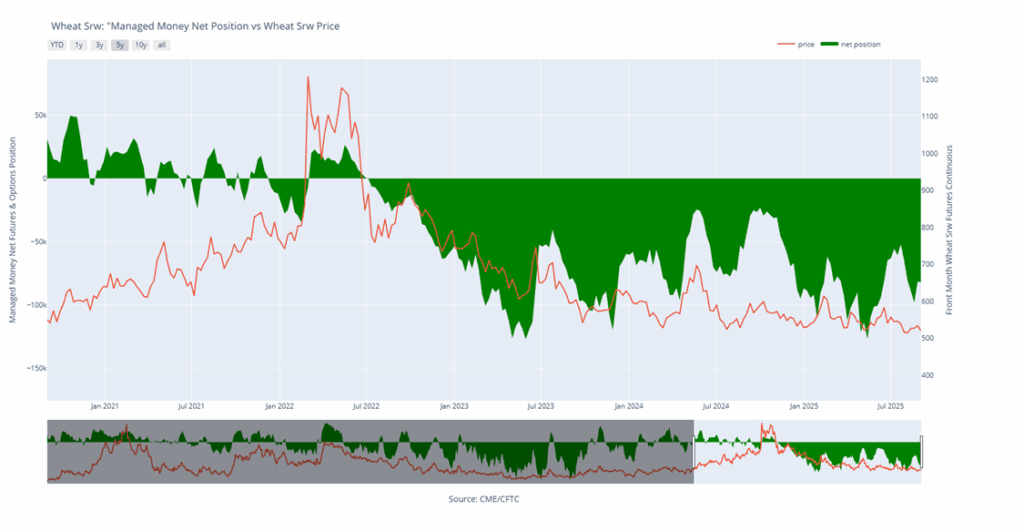

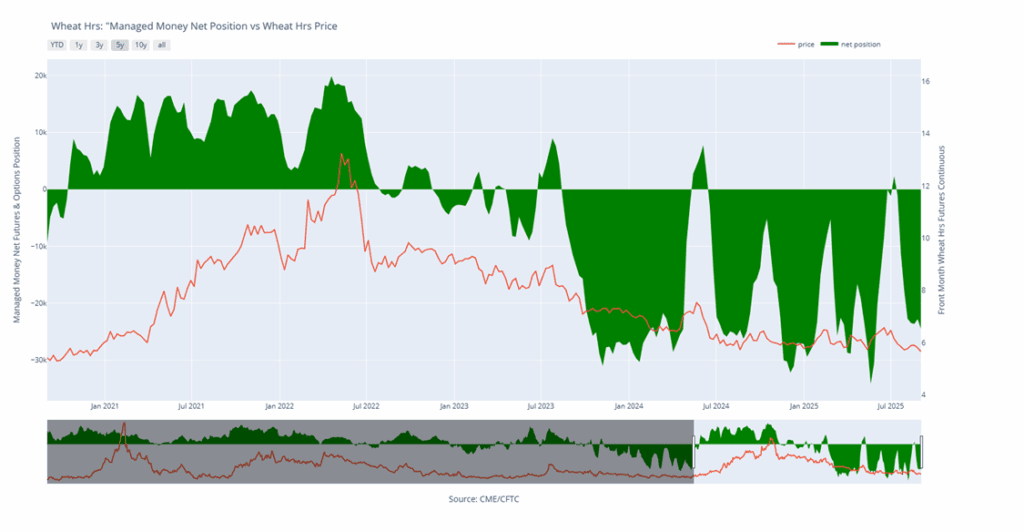

Chicago Wheat Managed Money Funds’ net position as of Tuesday, September 2. Net position in Green versus price in Red. Money Managers net sold 356 contracts between August 26 – September 2, bringing their total position to a net short 81,943 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- A Plan A target of 590 against December 2025 futures has been added.

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 647 target has been lowered to 642.

To date, Grain Market Insider has issued the following KC recommendations:

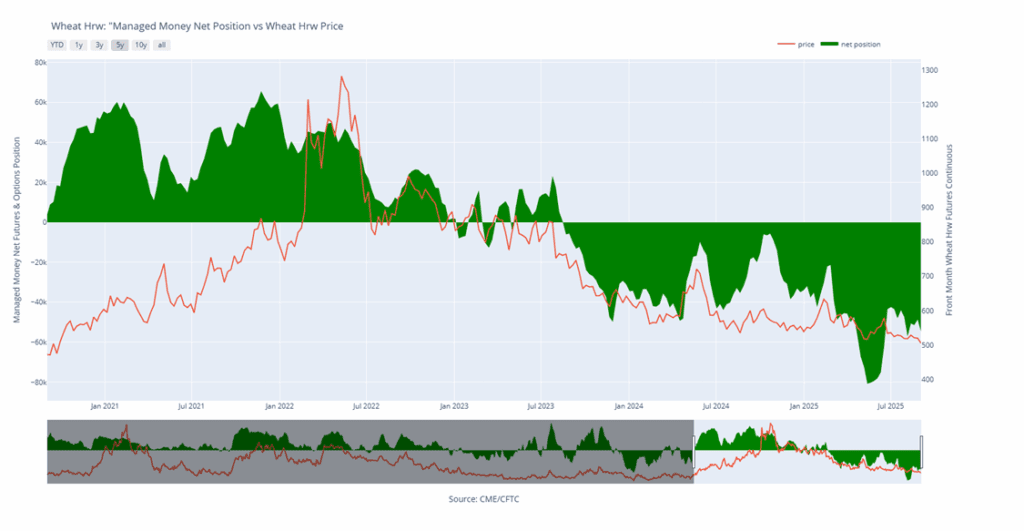

KC Wheat Managed Money Funds’ net position as of Tuesday, September 2. Net position in Green versus price in Red. Money Managers net sold 6,000 contracts between August 26 – September 2, bringing their total position to a net short 54,681 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Continued Opportunity – Sell a second portion of your 2026 Minneapolis wheat crop today.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, September 2. Net position in Green versus price in Red. Money Managers net sold 1,699 contracts between August 26 – September 2, bringing their total position to a net short 24,494 contracts.

Other Charts / Weather