9-5 End of Day: Soybeans Close Higher Again, as Corn Fades and Wheat Settles Mixed

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 410.75 | -2 |

| MAR ’25 | 429.25 | -1.75 |

| DEC ’25 | 447.25 | -0.5 |

| Soybeans | ||

| NOV ’24 | 1023.5 | 2 |

| JAN ’25 | 1041.5 | 2.25 |

| NOV ’25 | 1067.25 | 2.25 |

| Chicago Wheat | ||

| DEC ’24 | 574.75 | -6 |

| MAR ’25 | 595 | -5.75 |

| JUL ’25 | 612.25 | -5.5 |

| K.C. Wheat | ||

| DEC ’24 | 588.75 | -4.25 |

| MAR ’25 | 602.25 | -4.25 |

| JUL ’25 | 612.5 | -3.5 |

| Mpls Wheat | ||

| DEC ’24 | 625.75 | 2.25 |

| MAR ’25 | 647 | 1.75 |

| SEP ’25 | 671 | 0.75 |

| S&P 500 | ||

| DEC ’24 | 5584.25 | -4.5 |

| Crude Oil | ||

| NOV ’24 | 68.57 | 0.05 |

| Gold | ||

| DEC ’24 | 2547.1 | 21.1 |

Grain Market Highlights

- For the first time in five sessions the corn market faded and closed lower on the day, as overhead resistance around 411 held and the market begins to show signs of being overbought.

- The soybean market clawed its way back to close higher on the day after trading lower throughout the overnight session and most of the day. Another flash sale to China and unknown destinations lent support along with sharply higher soybean oil, which helped offset losses in meal.

- A resolution between Argentine labor unions and crushers to avoid a strike pressured meal, while a rebound in Malaysian palm oil and canola supported soybean oil.

- While Minneapolis wheat settled in positive territory, Chicago and KC wheat ended their extended streak of higher closes as traders took profits on the tail of weaker settlements across the board in Matif wheat.

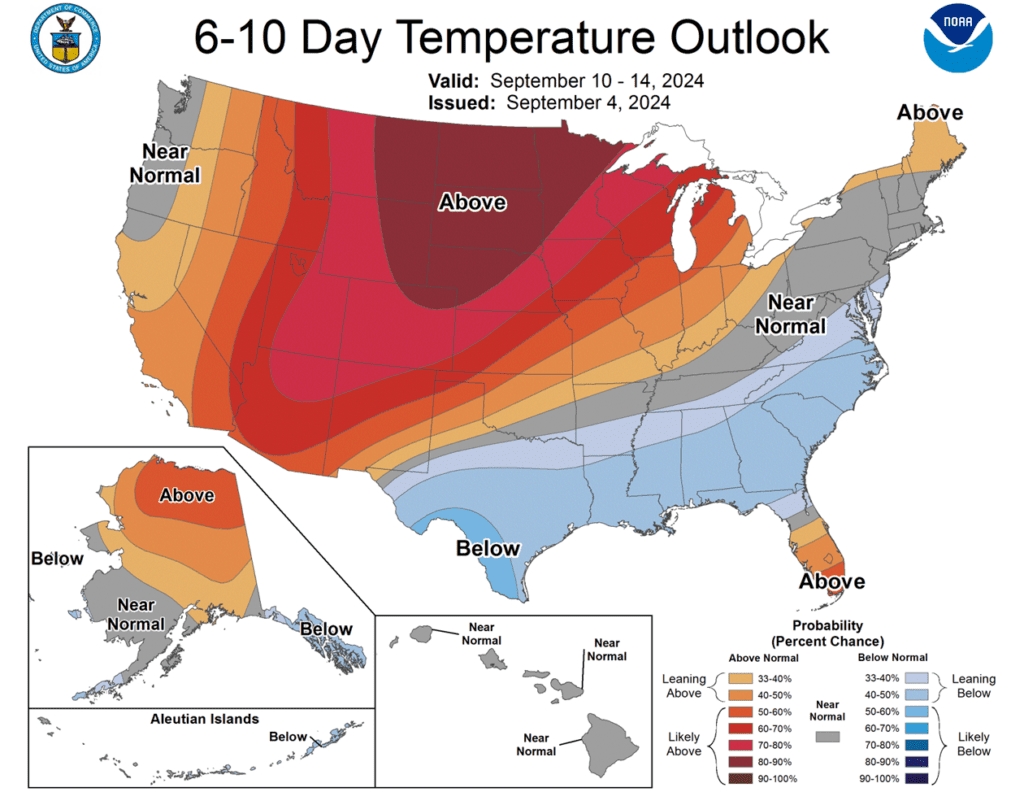

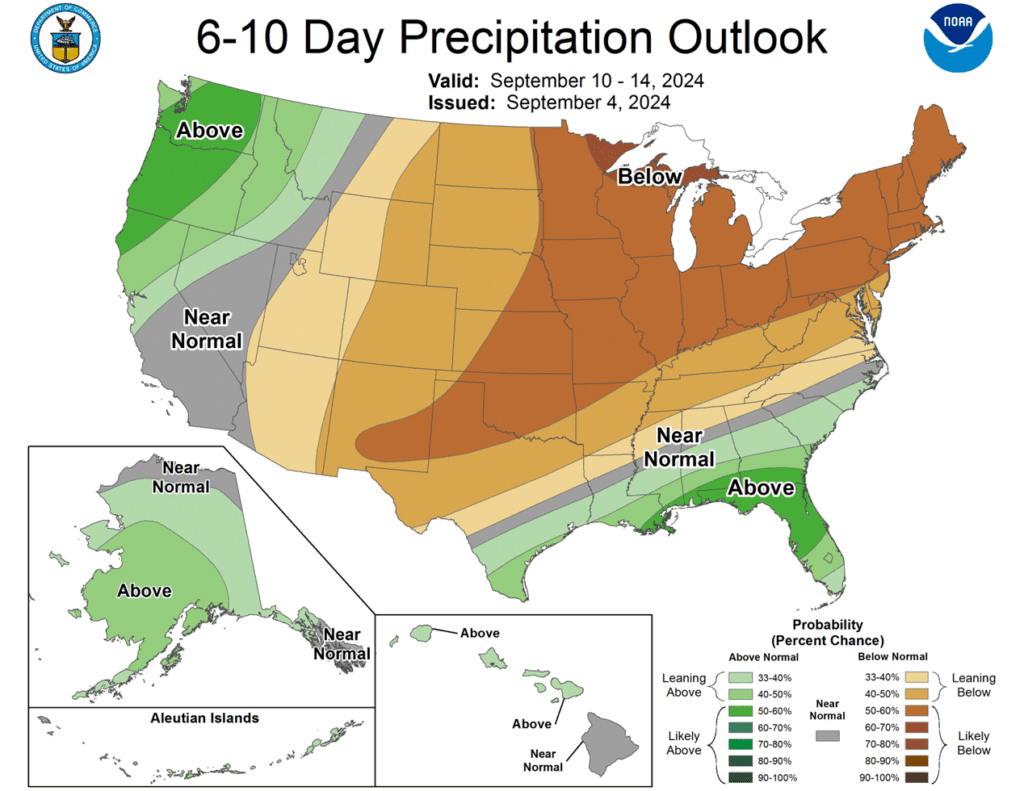

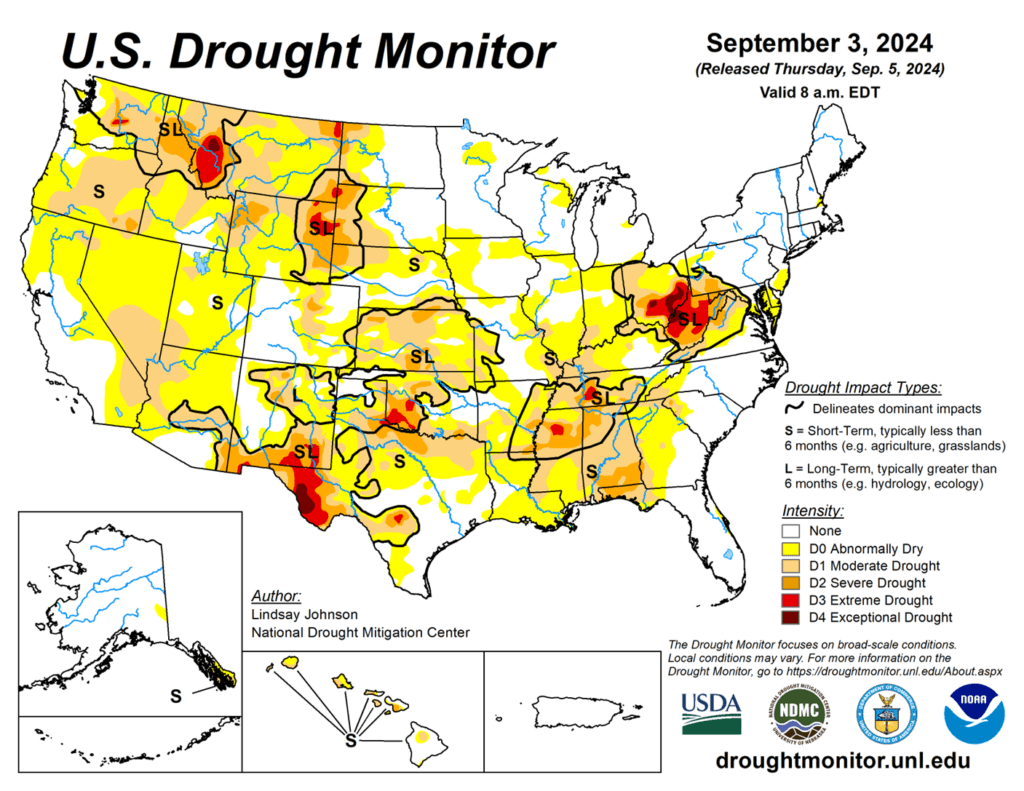

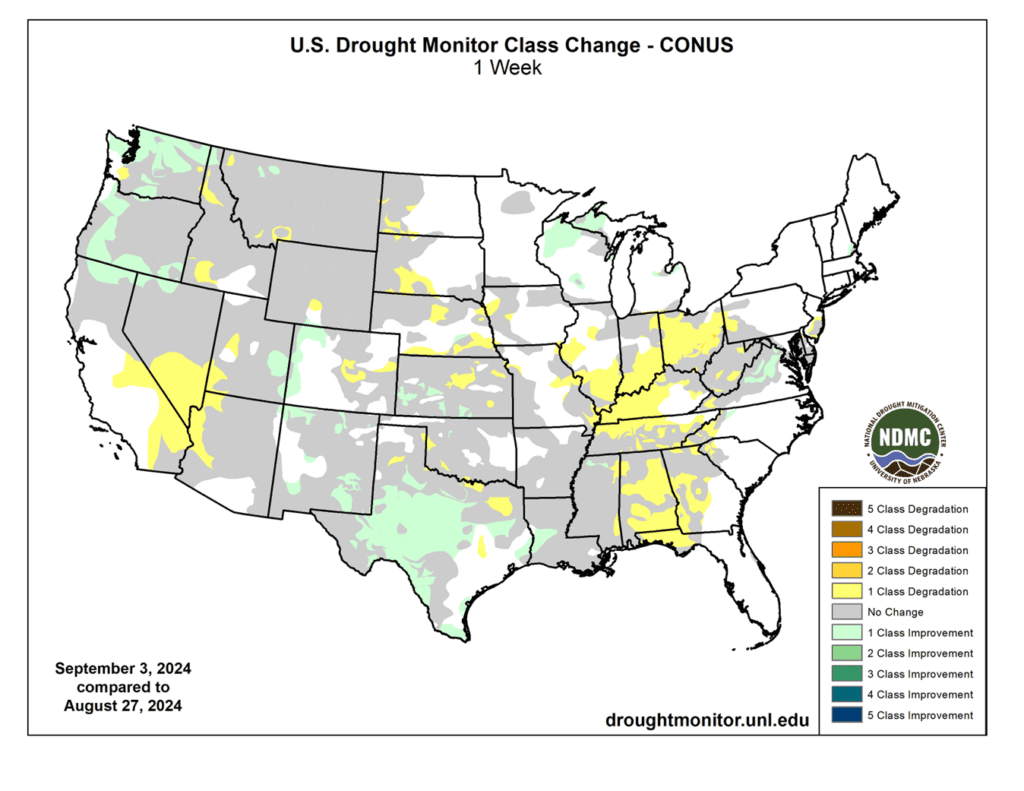

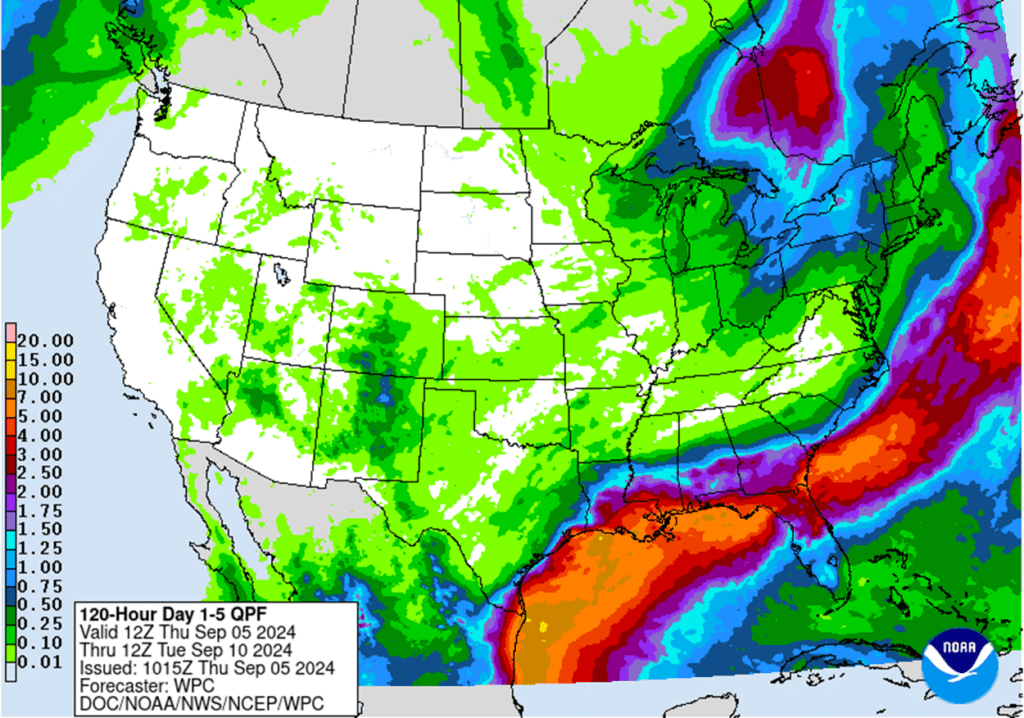

- To see the updated US 5-day precipitation forecast, 6 – 10 day Temperature and Precipitation Outlooks, and US Drought Monitor, courtesy of NOAA, the Weather Prediction Center, and NDMC, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since printing a market low in late August the corn market has rallied largely on fund short covering as the rush of old crop bushels into the market has slowed and demand has picked up. While the upcoming harvest of an expectedly large crop may continue to limit upside potential, it is a good sign that corn buyers are finding value at these multi-year low price levels. Any unexpected downward shift in anticipated supply or increase in demand could trigger managed funds to cover more of their extensive short positions and rally prices further, however, an extended rally is unlikely until after harvest.

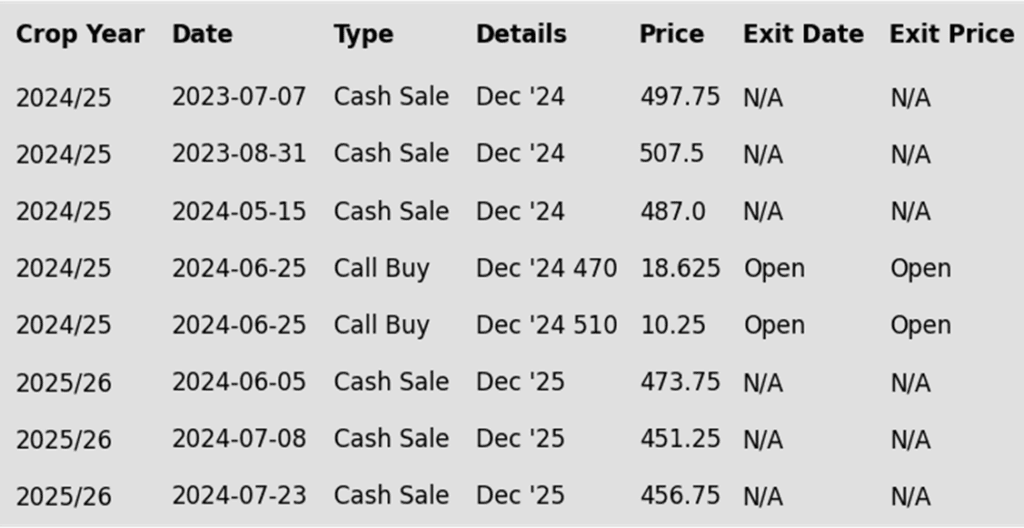

- No new action is recommended for 2024 corn. In June we recommended buying Dec ’24 470 and 510 calls after Dec ’24 closed below 451, for their relative value and because we are at that time of year of high volatility when markets can move swiftly. Moving forward, our current strategy is to target the value of 29 cents to exit the Dec ’24 470 calls. Exiting the 470 calls at 29 cents will allow you to lock in gains in case prices fall back and hold the remaining 510 calls at or near a net neutral cost, which should continue to protect existing sales and give you confidence to make further sales if the market rallies sharply. Additionally, should a contra-seasonal rally occur considering the large net short managed fund position, we continue to target the 470 – 490 area to recommend making additional sales versus Dec ’24.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although, we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market rally took a pause on Thursday and prices finished lower for the first time in 5 sessions. Technical resistance at the 411 level seemed to hold on Thursday, setting up a potential double top on the charts. Friday’s trade action could be key for next week’s price direction.

- USDA will release weekly exports sales on Friday morning. New crop sales are expected to range from 700,000 – 1.4 mmt. Last week, export sales were strong totaling 1.494 mmt. Perceived improved export demand has helped stabilize the corn market, but the USDA has not announced a “flash” sale of corn since the market turned at 385 on August 28.

- Mississippi River levels around Memphis have become increasingly restrictive, with reports of barges running aground as water levels remain low for the third consecutive fall. The combination of higher freight rates and the recent rally in corn prices has made US corn less competitive in the export market.

- South American weather is becoming more of a focus in the corn market. Even though it is Brazil’s dry season, key growing areas are experiencing a strong dry pattern, which could delay the planting of both corn and soybeans. Rainfall chances will likely pick up as Brazil moves closer to its wet season over the next few months.

Above: Since mid-August prices have largely been rangebound between 400 and 390. A close above the 400 – 414 resistance area could set prices up to rally toward the 430 area. Should they break and close below 385 support, they may be at risk of sliding towards the 372 support level.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

Since late May, the soybean market has steadily declined due to sluggish demand for the new crop, favorable growing conditions, and expectations of a large upcoming harvest. Weather forecasts have also generally remained supportive of the crop, while the market has factored in the likelihood of higher yields. With the weather turning drier as the crop enters its final development, the funds have covered some of their extensive short positions and rallied prices. While the market still anticipates a large crop at harvest, which could ultimately weigh on prices, should yields be less than expected, the recent pick up in demand could spur more short covering by the funds.

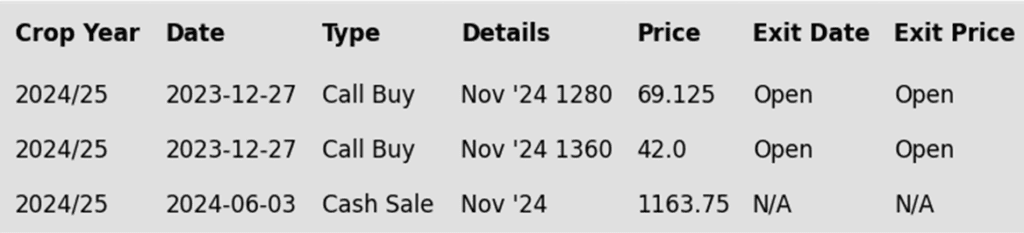

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the amount of uncertainty in the 2024 soybean crop and to give you confidence to make sales and protect those sales in an extended rally. Given that the market has retreated since that time, we are targeting the 1040 – 1070 range versus Nov ’24 futures to exit 1/3 of the 1280 calls to help preserve equity. Additionally in June, the close below 1180 triggered our Plan B strategy, which recommended making additional sales due to the potential change in trend. Should a bullish catalyst enter the market to turn prices higher, we are targeting the 1090 – 1120 range from our Plan A strategy to make additional sales recommendations.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher after lower trade overnight and earlier in the day. There was initial pressure from an increase in yield estimates and scattered rain showers that moved through Iowa earlier today. Soybean meal was lower on the day, while soybean oil was higher.

- This morning, the USDA reported a flash sale of 189,700 metric tons of soybeans to unknown destinations for the 24/25 marketing year and 126,000 mt to China for 24/25. This follows a sale of 131,000 mt earlier this week and confirmed some of yesterday’s rumors that China had purchased more US soybeans.

- Yesterday afternoon, StoneX released their updated estimates for the national US soybean yield which saw the number increase to 53.0 bpa. This is above the most recent USDA estimate, with some other firms like Allendale estimating yield even higher at 53.3 bpa.

- Brazil is only expected to increase its planted soybean acreage by 0.9% this year, the slowest rate of growth in 18 years, but production estimates remain very high at around 168 mmt which would be up 14% from the previous crop.

Above: The recent rally has brought November soybeans into the 1005 – 1040 resistance area. A close above this range could set the market up for a rally toward the July high of 1082 ¼. To the downside, a break below 950 puts the market at risk of sliding down to the 915 – 900 support area.

Wheat

Market Notes: Wheat

- Wheat posted losses in Chicago and Kansas City but managed a positive close for Minneapolis. This ended the six-day winning streak for December Chicago wheat and the seven day stretch for December KC. Some pressure resulted from a lower close across the board for Paris milling wheat futures, which also ended the run of seven consecutive sessions of gains. Profit taking after the run higher could have also played a part in today’s lower closes.

- French farming group, AGPB, estimated that the nation’s 2024 wheat crop would total about 26 mmt. That would be a drop of 26% from the 35.1 mmt crop a year ago. France saw much poorer wheat conditions this season due to wet weather conditions.

- Russia’s agriculture ministry has maintained its 2024 grain production estimate at 132 mmt. So far, 93 mmt of grain has been harvested, with wheat accounting for 70.5 mmt. Meanwhile, Russian wheat export FOB prices remain low, ranging between $216 and $217 per metric ton.

- Despite ongoing drought conditions, Ukraine’s agriculture ministry reported that 27,700 hectares of winter wheat have been planted so far. The total planted area for the 2025 winter wheat harvest could exceed 5 million hectares, up from 4.7 million in 2024, compensating for a reduced area planted with winter rapeseed.

- According to the USDA as of September 3, about 52% of US winter wheat acres are experiencing drought conditions, compared to 47% the previous week. As US winter wheat planting begins, more moisture may be needed to help with establishment of the crop.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on July 29th as managed funds maintained a sizable net short position in Chicago wheat. While slow global import demand and low Russian export prices continue to be a limiting factor in the market, any increase in US demand due to smaller crops in Europe and the Black Sea region could trigger an extended short-covering rally by managed funds.

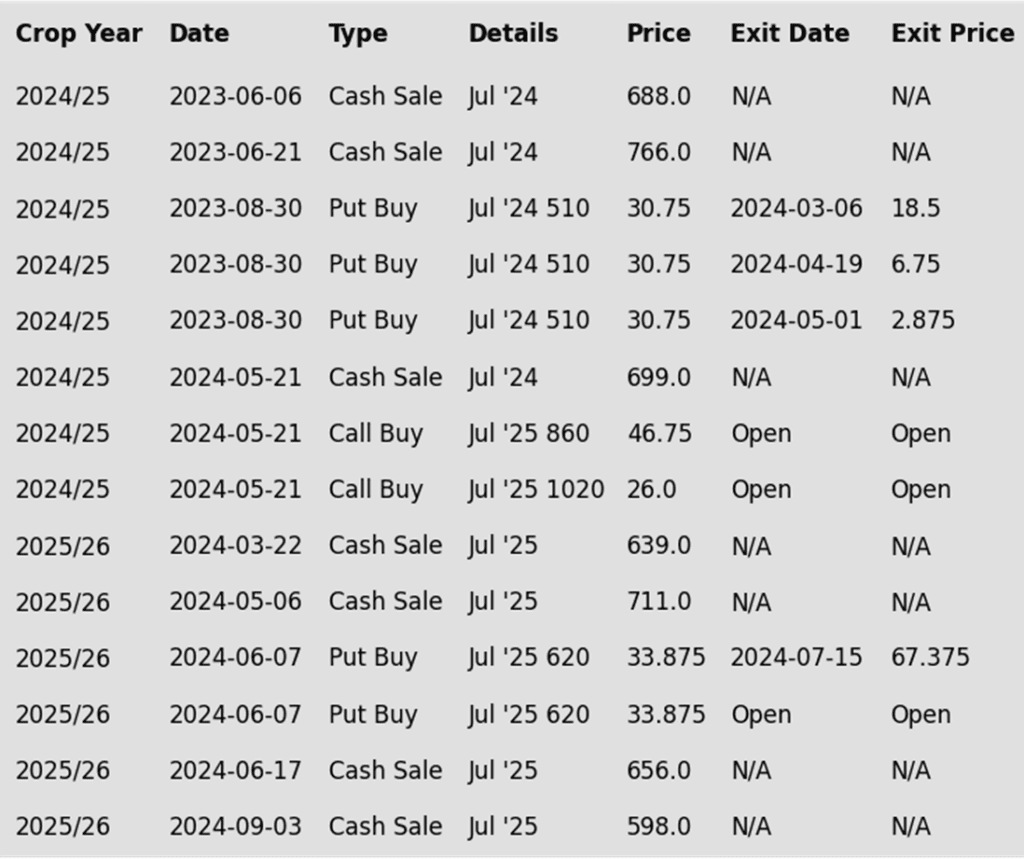

- No new action is recommended for 2024 Chicago wheat. Considering the recent rally in wheat, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Sept ’24 to recommend further sales and to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell another portion of your 2025 SRW wheat crop. Since posting the recent low, July ’25 Chicago wheat prices have rallied about 50 cents and have entered the congestion and resistance area from early July. Considering there may be significant resistance overhead in this area, we recommend taking advantage of this rally to make an additional sale on a portion of your anticipated 2025 soft red winter wheat crop, using either July ’25 Chicago wheat futures, or a July ’25 HTA contract, so basis can be set at a more advantageous time later on.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The market’s close above the 50-day moving average set it up for a potential challenge of the 560 – 570 resistance area, and a rally towards 590 – 595. Should prices reverse and close back below the 50-day moving average, they could again find support near 514, with further support around 500 and 488.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global wheat supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on the front month continuous charts as managed funds maintained a sizable net short position in the wheat markets. While low Black Sea export prices and slow world demand continue to weigh on US prices, the funds’ short position could trigger an extended short covering rally on any increase in US demand as world wheat ending stocks are expected to fall yet again this year.

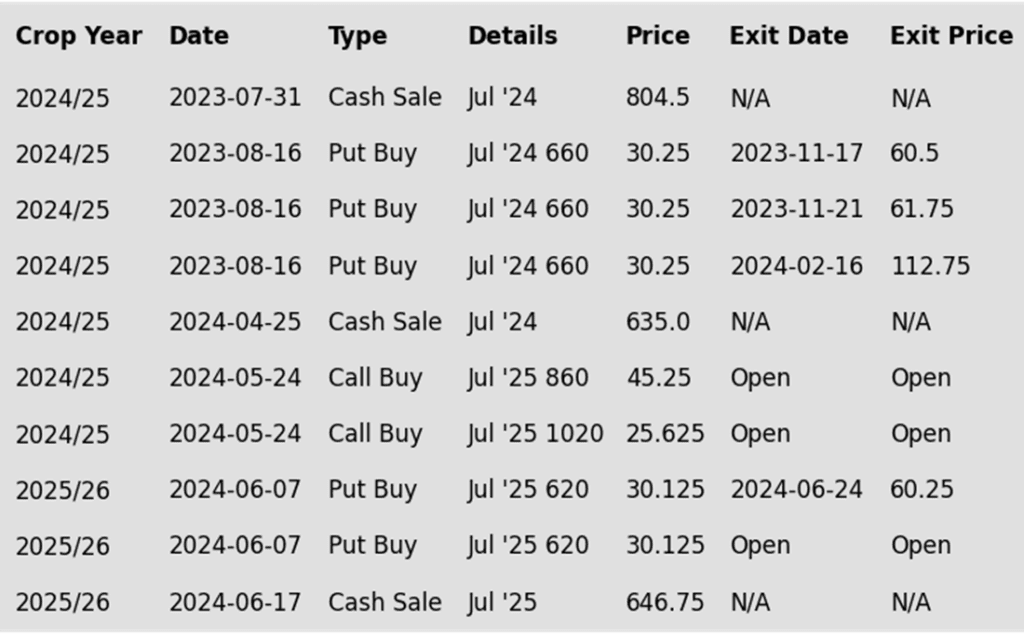

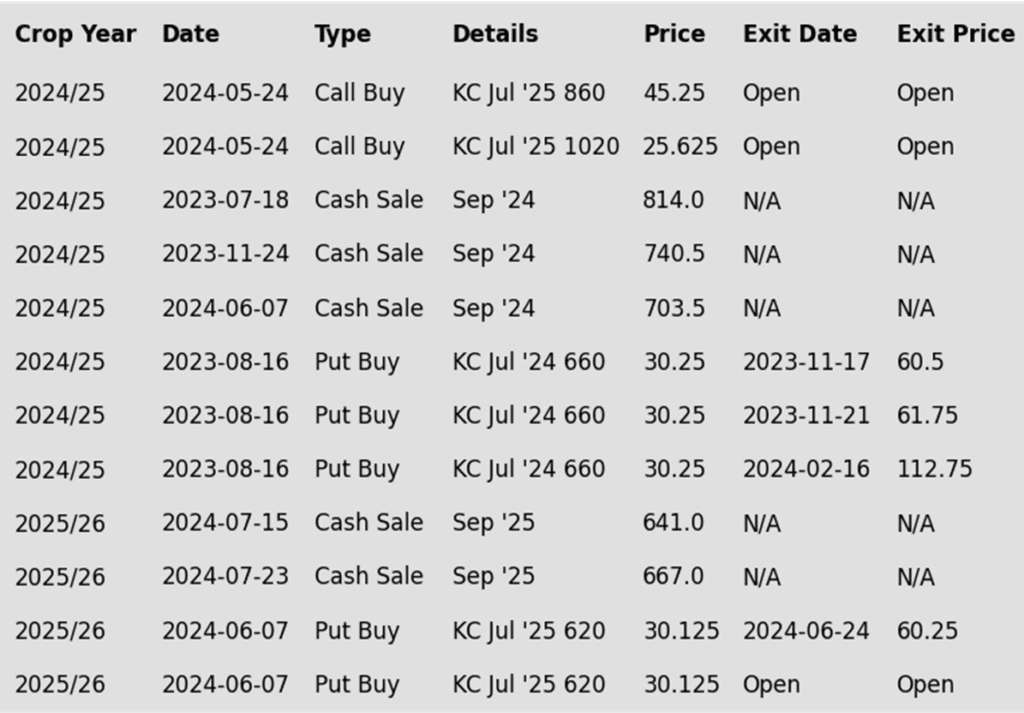

- No new action is recommended for 2024 KC wheat. Considering the recent upside breakout in KC wheat, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 725 – 750 versus Sept ’24 to recommend further sales and to target a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. We recently recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. Looking ahead, our strategy is to target the 640 – 670 range to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

Above: December wheat appears poised to test overhead resistance near 600, with additional moving average resistance just above there between 605 – 610. If the market turns lower, initial support remains near the 50-day moving average, with further support near the recent 527 ¼ low.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since printing a near-term low in mid-July, Minneapolis wheat has trended mostly sideways as the market attempts to balance smaller US and world supplies versus lower world export prices and lower world demand. During this period, managed funds have maintained their sizable, short positions in Minneapolis wheat. Though low Russian export prices continue to keep a lid on US prices, smaller crops in Europe and the Black Sea region could increase US demand, potentially triggering an extended short-covering rally, especially as global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2024 Minneapolis wheat. With the recent close below the 712 support level, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we recently made two separate sales recommendations to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, should the market continue to be weak, we are currently targeting the upper 400 range to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: December Minneapolis wheat appears to have found support near 560. Should prices continue higher, they could encounter resistance in the 617 – 637 area. To the downside, a break below 560 could put the market at risk of a further decline towards support around 540.

Other Charts / Weather

5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.